Confidential Draft Submission No. 2 submitted to the Securities and Exchange Commission on December 17, 2013

This draft registration statement has not been publicly filed with the Securities and Exchange Commission and all information herein remains strictly confidential.

Registration No.

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM S-1

REGISTRATION STATEMENT

UNDER

THE SECURITIES ACT OF 1933

APTALIS HOLDINGS INC.

(Exact name of registrant as specified in its charter)

| | | | |

| Delaware | | 2834 | | 74-3249874 |

(State or other jurisdiction of incorporation or organization) | | (Primary standard industrial classification code number) | | (I.R.S. employer identification number) |

100 Somerset Corporate Boulevard

Bridgewater, NJ 08807

(908) 927-9600

(Address, including zip code, and telephone number, including area code, of registrant’s principal executive offices)

Frank Verwiel, M.D.

Chief Executive Officer

100 Somerset Corporate Boulevard

Bridgewater, NJ 08807

(908) 927-9600

(Name, address, including zip code, and telephone number, including area code, of agent for service)

Copies to:

| | | | |

Patrick O’Brien Ropes & Gray LLP Prudential Tower, 800 Boylston Street Boston, MA 02199-3600 Telephone: (617) 951 7527 Facsimile: (617) 235 0392 | | Richard E. Maroun General Counsel Aptalis Holdings Inc. 100 Somerset Corporate Boulevard Bridgewater, NJ 08807 (908) 927-9600 | | David Lopez Cleary Gottlieb Steen & Hamilton LLP One Liberty Plaza New York, NY 10006 Telephone: (212) 225-2632 Facsimile: (212) 225-3999 |

Approximate date of commencement of proposed sale to the public:

As soon as practicable after this registration statement becomes effective.

If any of the securities being registered on this form are to be offered on a delayed or continuous basis pursuant to Rule 415 under the Securities Act of 1933, check the following box. ¨

If this Form is filed to register additional securities for an offering pursuant to Rule 462(b) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ¨

If this Form is a post-effective amendment filed pursuant to Rule 462(c) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ¨

If this Form is a post-effective amendment filed pursuant to Rule 462(d) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ¨

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See the definitions of “large accelerated filer,” “accelerated filer” and “smaller reporting company” in Rule 12b-2 of the Exchange Act. (Check one).

| | | | | | |

| Large accelerated filer ¨ | | Accelerated filer ¨ | | Non-accelerated filer x | | Smaller reporting company ¨ |

| | | | (Do not check if a smaller reporting company) |

CALCULATION OF REGISTRATION FEE

| | | | |

|

| Title of Each Class of Securities to be Registered | | Proposed Maximum Aggregate Offering Price(1) | | Amount of Registration Fee(2) |

Common Stock, par value $0.001 per share | | $ | | $ |

|

| (1) | Estimated solely for the purpose of calculating the registration fee in accordance with Rule 457(o) of the Securities Act of 1933, amended. |

| (2) | Calculated pursuant to Rule 457(o) under the Securities Act of 1933, as amended. |

The Registrant hereby amends this Registration Statement on such date or dates as may be necessary to delay its effective date until the Registrant shall file a further amendment which specifically states that this Registration Statement shall thereafter become effective in accordance with Section 8(a) of the Securities Act of 1933 or until the Registration Statement shall become effective on such date as the Securities and Exchange Commission, acting pursuant to said Section 8(a), may determine.

The information in this preliminary prospectus is not complete and may be changed. These securities may not be sold until the registration statement filed with the Securities and Exchange Commission is effective. This preliminary prospectus is not an offer to sell these securities nor does it seek an offer to buy these securities in any jurisdiction where the offer or sale is not permitted.

Subject to Completion. Dated December 17, 2013.

Shares

APTALIS HOLDINGS INC.

Common Stock

$ per share

This is an initial public offering of shares of common stock of Aptalis Holdings Inc.

We are offering of the shares to be sold in the offering. The selling stockholders identified in this prospectus are offering an additional shares. We will not receive any of the proceeds from the sale of the shares being sold by the selling stockholders.

Prior to this offering, there has been no public market for our common stock. It is currently estimated that the initial public offering price per share will be between $ and $ . We intend to apply to list our common stock on the NASDAQ Stock Market under the symbol “APTA.”

We are an “emerging growth company” as that term is defined in Section 2(a) of the Securities Act of 1933, as amended, or the Securities Act, and, as such, have elected to comply with certain reduced public company reporting requirements in this prospectus and future filings. See “Prospectus Summary—Implications of Being an Emerging Growth Company.”

See “Risk Factors” beginning on page 18 to read about factors you should consider before buying shares of the common stock.

Neither the Securities and Exchange Commission nor any other regulatory body has approved or disapproved of these securities or passed upon the accuracy or adequacy of this prospectus. Any representation to the contrary is a criminal offense.

| | | | | | | | |

| | | Per Share | | | Total | |

Initial public offering price | | $ | | | | $ | | |

Underwriting discount(1) | | $ | | | | $ | | |

Proceeds, before expenses, to us | | $ | | | | $ | | |

Proceeds, before expenses, to the selling stockholders | | $ | | | | $ | | |

| (1) | We have agreed to reimburse the underwriters for certain FINRA-related expenses. See “Underwriting.” |

To the extent that the underwriters sell more than shares of common stock, the underwriters have the option to purchase up to an additional shares from us and an additional shares from the selling stockholders at the initial public offering price less the underwriting discount.

The underwriters expect to deliver the shares against payment in New York, New York on , .

| | |

| |

| Goldman, Sachs & Co. | | J.P. Morgan |

Prospectus dated , 2013

TABLE OF CONTENTS

Through and including , (the 25th day after the date of this prospectus), all dealers effecting transactions in these securities, whether or not participating in this offering, may be required to deliver a prospectus. This is in addition to a dealer’s obligation to deliver a prospectus when acting as an underwriter and with respect to an unsold allotment or subscription.

We have not authorized anyone to provide any information or to make any representations other than those contained in this prospectus or in any free writing prospectuses we have prepared. We take no responsibility for, and can provide no assurance as to the reliability of, any other information that others may give you. This prospectus is an offer to sell only the shares offered hereby, but only under circumstances and in jurisdictions where it is lawful to do so. The information contained in this prospectus is current only as of its date.

i

About this Prospectus

In this prospectus, unless otherwise stated or the context otherwise requires, references to “Aptalis,” “Axcan,” “Company,” “we,” “us,” “our,” or similar references mean Aptalis Holdings Inc. and its subsidiaries on a consolidated basis. References to “Aptalis Holdings” refer to Aptalis Holdings Inc. on an unconsolidated basis. References to “Aptalis Pharma” refer to Aptalis Pharma Inc., Aptalis Holdings’ wholly-owned subsidiary through which we conduct our operations. References to “TPG Global” are to TPG Global, LLC, and references to “TPG” are to TPG Global and its affiliates. References to the “TPG Funds” are to TPG Partners V, L.P., TPG FOF V-A, L.P., TPG FOF V-B, L.P., TPG Biotechnology Partners II, L.P., TPG Axcan Co-Invest II, LLC and TPG Axcan Co-Invest, LLC. References to our “Sponsors” are to the TPG Funds and Investor Growth Capital, Ltd., collectively our financial sponsors. References to a “fiscal year” refer to the fiscal year ended on September 30 of such year.

The names APTALISTM, ADVATAB®, BIORISE™, CANASA®, CARAFATE®, CITRAFLEET®, DIFFUCAPS®, DIFFUTAB®, DELURSAN®, EURAND®, LACTEOL®, LIQUITARD® MICROCAPS®, ORBEXA®, PANZYTRAT®, PYLERA®, RECTIV®, SALOFALK®, SULCRATE®, ULTRASE®, ULTRESA®, URSO®, VIOKASE®, VIOKACE™, ZENPEP® and are trademarks or registered trademarks owned or used under license by the Company and/or its affiliated companies.

All other trademarks or service marks appearing in this prospectus that are not identified as marks owned by us, including ACTIGALL™, ADVIL®, AMRIX®, APRISO®, ASACOL®, CAYSTON®, COLAZAL®, CREON®, DIPENTUM®, eFLOW®, HELIDAC®, KREON®, LAMICTAL® ODT, LIALDA®, MEZAVANT®, PANCREAZE™, PENTASA®, PERTZYE™, PHOTOBARR®, PHOTOFRIN®, PHOSPHO-SODA®, PREVPAC®, ROWASA®, SOLPURA®, TOBI®, TOBI® Podhaler™ and URSOLVAN®, are the property of their respective owners.

ii

PROSPECTUS SUMMARY

This summary highlights information contained elsewhere in this prospectus. This summary does not contain all of the information that you should consider before investing in our common stock. You should read the entire prospectus, including the more detailed information and the financial statements appearing elsewhere in this prospectus.

Our Company

Our mission is to improve health and quality of care by providing specialty therapies for patients around the world. Our vision is to become the reference specialty pharmaceutical company providing innovative, effective therapies for unmet medical needs, including in cystic fibrosis, or CF, and in gastrointestinal, or GI, disorders. We develop, manufacture, license and market a broad range of therapies.

We have built market-leading franchises in CF and GI disorders by growing sales of our products, many of which command a number one or number two position in their respective markets, including ZENPEP, CANASA, CARAFATE, PYLERA and RECTIV. Our revenues are highly diversified, with our largest product accounting for only 21% of our total revenue in fiscal year 2013 and with operations outside the United States accounting for 20% of our total revenue during the same period. The CF and GI markets are each characterized by a concentrated base of high-volume prescribing physicians, which allows our highly efficient and effective sales force of 227 experienced sales specialists, including 155 sales specialists in the United States, to reach substantially all Cystic Fibrosis Foundation care centers and approximately half of the GI physicians in the United States. We have established sales and marketing operations in the United States, Canada, France and Germany and proprietary manufacturing capabilities in North America and Europe. In addition, we have proven product development capabilities and a demonstrated ability to selectively acquire complementary products, product candidates and companies. We believe our pipeline of four clinical product candidates targets major commercial opportunities in the European Union, or EU, and the United States and we have lifecycle management opportunities for our existing products using the proprietary technology platforms of our Pharmaceutical Technologies, or PT, business.

We have generated double-digit revenue growth since the beginning of fiscal year 2011. This strong performance has been achieved by driving continued growth of our market-leading products and by successfully integrating products and companies, including Eurand N.V., or Eurand. Our total revenue has grown from $470.4 million for fiscal year 2011 to $687.9 million for fiscal year 2013, representing a compound annual growth rate, or CAGR, of 20.9%. Revenue from assets acquired or licensed during this period, including ZENPEP, RECTIV and PT, has grown from $122.0 million in fiscal year 2011 to $244.8 million in fiscal year 2013, while the remainder of our portfolio grew at a CAGR of 12.8%, from $348.4 million in fiscal year 2011 to $443.1 million in fiscal year 2013. We had Adjusted EBITDA of $160.0 million in fiscal year 2011 and $314.6 million in fiscal year 2013, Adjusted pre-tax income of $67.5 million in fiscal year 2011 and $241.4 million in fiscal year 2013, and a net loss of $191.6 million in fiscal year 2011 compared to net income of $86.9 million in fiscal year 2013. Adjusted EBITDA and Adjusted pre-tax income are non-GAAP financial metrics. Please see “Selected Consolidated Financial and Operating Data” for reconciliations of Adjusted EBITDA to net (loss) income and Adjusted pre-tax income to income (loss) before income tax.

Our Products

Our portfolio of market-leading products has a demonstrated track record of sustained growth. In addition, we have four clinical product candidates, as well as a number of early-stage projects in

1

development related to our existing products and therapeutic spaces. We also continually seek to enhance our existing promoted and pipeline products by using our proprietary PT platforms. These platforms both support our internal drug development efforts and contribute to our revenue through third-party business-to-business development agreements under which we formulate enhanced pharmaceutical and biopharmaceutical products using novel oral drug delivery technologies.

We believe that our products benefit from one or more intellectual property, regulatory, clinical, sourcing and manufacturing barriers to entry. These include patent protection; data exclusivity under Drug Price Competition and Patent Term Restoration Act of 1984, known as the Hatch-Waxman Act; U.S. Food and Drug Administration, or FDA, requirements for generic entrants to conduct clinical trials with clinical efficacy endpoints; complexity in matching formulation characteristics; proprietary manufacturing processes; difficulty in sourcing certain active pharmaceutical ingredients that must match narrow specifications; and the know-how required to manufacture certain dosage forms.

Our principal products and clinical product candidates are:

| | | | | | | | | | | | | | |

Product | | Summary of Indications | | Commercial

Markets | | Position in Our

Commercial

Markets1 | | Fiscal Year

Ended

September 30,

2013 Net Sales

(in millions) | | | Net Sales CAGR

Fiscal Year

2011-2013

(%) | |

Pancreatic Enzyme Products | |

| | | | | |

ZENPEP | | Treatment of exocrine pancreatic insufficiency, or EPI, due to CF or other conditions | | U.S. | | 2 | | $ | 141 | | | | 49.9 | % |

| | | | | |

ULTRESA | | Treatment of EPI due to CF or other conditions | | U.S. | | Launched December 2012 | | $ | 2 | | | | n.a. | |

| | | | | |

VIOKACE | | In combination with a proton pump inhibitor, VIOKACE is indicated in adults for the treatment of EPI due to chronic pancreatitis or pancreatectomy | | U.S. | | Launched August 2012 | | $ | 3 | | | | n.a. | |

| | | | | |

PANZYTRAT | | Treatment of EPI and pancreatic enzyme deficiency | | Selected EU

countries | | 3 (Germany) | | $ | 11 | | | | (15.3 | )% |

Ulcer Treatments | | | | | | | | | | |

| | | | | |

CARAFATE | | Short-term (up to 8 weeks) treatment of active duodenal ulcers | | U.S. | | 2 | | $ | 145 | | | | 17.0 | % |

| | | | | |

PYLERA | | Treatment of patients with Helicobacter pylori, orH. pylori, infection and duodenal ulcer disease (active or history of within the past five years) to eradicateH. pylori | | U.S./EU | | 2 (United States); Launched January 2013 in Germany; Launched April 2013 in France. | | $ | 21 | | | | 28.0 | % |

Mesalamines | | | | | | | | | | |

| | | | | |

CANASA | | Short-term treatment of mild to moderately active ulcerative proctitis, or UP | | U.S. | | 1 | | $ | 133 | | | | 18.9 | % |

| | | | | |

SALOFALK | | Depending on the dosage form of Salofalk, indications comprise treatment of acute ulcerative colitis, or UC, management of distal UC and prevention of relapse of distal UC. | | Canada | | 1 | | $ | 23 | | | | (0.4 | )% |

Chronic Anal Fissure | | | | | | | | | | |

| | | | | |

RECTIV | | Treatment of moderate to severe pain associated with chronic anal fissure | | U.S. | | 1 | | $ | 16 | | | | n.a. | |

| 1. | Company estimate based on IMS NPA and Insight Health data as of September 30, 2013. |

2

| | | | | | |

Pipeline Product

Candidate | | Summary of Indications | | Jurisdiction | | Stage / Status |

APT-1026 | | Chronic lung infection withPseudomonas aeruginosa in CF | | U.S. / EU / Canada | | Phase III EU study completed. Marketing Authorization Application with EMA submitted in November 2013. EU launch expected in 2015. |

| | | |

| | | | | | Currently in discussions with FDA regarding results of our single U.S. phase III study. |

| | | |

APT-1008 (ZENPEP-EU) | | EPI | | EU | | Phase III EU study enrolled. Completion of study expected in 2014. |

| | | |

APT-1016 | | Bowel cleansing preparation for colonoscopy | | U.S. | | Phase II U.S. study completed. |

| | | |

APT-1011 | | Eosinophilic esophagitis,

or EoE | | U.S. / EU | | Phase IIb study expected to commence in 2014. |

Our Industry

We believe the markets for CF and GI disorders are large and highly attractive, with significant opportunities for specialty pharmaceutical companies to run highly efficient, profitable businesses. These markets are fragmented and underserved by large pharmaceutical companies and are characterized by products used for chronic conditions, leaving significant unmet medical needs. Because the CF and GI specialty physician bases are relatively concentrated, a high percentage of prescriptions are written by a small number of physicians who can be reached effectively by a relatively small sales force. Further, the CF market has a highly organized patient advocacy base, allowing for a targeted and relationship-driven marketing approach by specialty pharmaceutical companies.

We also believe that the ability of generic entrants to obtain approval for many products that treat CF and GI disorders is more difficult than for many other therapeutic areas. In addition to traditional barriers to generic entry, such as intellectual property and data exclusivity, many products that treat CF and GI disorders have features that create additional barriers to generic entry, including:

| | Ÿ | | Insignificant or highly variable absorption into the blood, or bioavailability. Many products in other therapeutic areas act primarily via the drug’s absorption into the blood, leading to the FDA’s requirement that generic entrants demonstrate similar blood levels of drug, or bioequivalence, to gain approval. Because many CF and GI products often show insignificant or highly variable systemic bioavailability, we believe that bioequivalence is difficult to demonstrate and may not be applicable to the FDA’s generic approval process. Therefore, we believe generic manufacturers will be required to conduct full clinical trials with efficacy and safety endpoints for some products, which will increase the cost and risk of generic development. |

| | Ÿ | | Locally acting mechanisms. Because many CF and GI products act locally, delivering drug to the site of the disease is critical for clinical efficacy. Therefore, potential generic entrants will encounter additional clinical risk in demonstrating equivalent levels of both local activity and efficacy in clinical trials. |

| | Ÿ | | Complex formulations. We believe that the complexity of formulations of many CF and GI products, as well as manufacturing know-how and trade secrets, leads to difficulties in demonstrating similar technical specifications, such as dissolution characteristics, which the FDA also typically requires for approval of generic products. |

3

| | Ÿ | | Evolving FDA guidance. FDA guidance on the requirements for approval of generic forms of branded CF and GI products has been evolving. We believe that in certain circumstances this will make it more challenging to develop products and clinical packages which will support generic approvals. |

GI disorders are generally grouped into four categories: functional disorders of the upper GI tract such as gastroesophageal reflux disease, gastroparesis and functional dyspepsia; functional disorders of the lower GI tract such as constipation and irritable bowel syndrome, or IBS; inflammatory/immunologic GI disorders such as Crohn’s disease, EoE and celiac disease; and disorders of organs involved in the digestive process, such as the gallbladder, liver and pancreas. While some of these disorders can be treated through currently available pharmacologic interventions, significant unmet needs still exist, particularly for indications such as IBS, Crohn’s disease, UC and other emerging GI-related disease areas such as EoE and autoimmune hepatitis. According to a 2011 Business Insight report, the worldwide GI drug market was $38 billion in 2010, with the United States accounting for more than 36% of the total.

Based on a 2009 U.S. Department of Health and Human Services report, at least 60 to 70 million Americans are affected each year by GI disorders, placing a burden on society that exceeds $100 billion in direct medical costs in the United States. Annually, in the United States, about 14 million hospitalizations—10% of total hospitalizations—and 15% of all in-patient hospital procedures are attributed to treatment of GI disorders. In addition, in the United States, 105 million doctor visits occur each year for digestive diseases, frequently in response to symptoms such as abdominal pain, diarrhea, vomiting or nausea. GI disorders, even conditions that are not immediately life-threatening, can severely affect a patient’s quality of life and ability to work and engage in daily activities.

CF is a life-threatening genetic disease that begins at birth and, because of one or more defective genes, causes the body to produce faulty proteins that lead to abnormally thick, sticky mucus that clogs the lungs, obstructs ducts in the pancreas and results in a number of other digestive conditions. CF is one of the most prevalent genetic diseases among Caucasians in the United States and can result in a number of related conditions requiring treatment. The disease affects an estimated 30,000 adults and children in the United States and 70,000 patients worldwide, an estimated 85% to 90% of whom suffer from exocrine pancreatic insufficiency, or EPI, and/or chronic lung infections. The sticky mucus that clogs the lungs can lead to serious lung infections, which are becoming increasingly resistant to current antibiotic standards of care. When CF affects the pancreas, the body does not absorb sufficient nutrients to grow and thrive. There is no cure for most forms of CF, necessitating ongoing treatment for chronic concomitant conditions such as EPI and lung infections. These treatments have contributed to increasing life expectancy for CF patients in the United States, from 33 years in 2001 to 37 years in 2011.

Our Competitive Strengths

Focus on High Value Specialty Pharmaceutical Areas with Unmet Needs. We focus on the high value specialty CF and GI markets, which we believe provide opportunities to focus on diseases or disorders with significant unmet needs. Many of our products are used to treat CF and GI disorders that are chronic and treated by a small number of high-volume prescribing physicians, who can be reached by our effective and efficient sales force.

Differentiated and Market-Leading Branded Products. We believe that our products have a compelling value proposition for physicians, patients and payors and are often the first line oftreatment. As a result, we believe that our products experience a high degree of physician and patient loyalty, allowing many of our products to maintain a number one or number two position in their respective markets.

4

Highly Diversified Revenue Base. We have acquired, developed and/or launched nine products since the beginning of fiscal year 2010, which have significantly diversified our revenue base. We currently market branded products that treat a broad range of CF and GI diseases and disorders in North America and Europe. In fiscal year 2013, our largest product accounted for only 21% of our total revenue and operations outside of the United States accounted for 20% of our total revenue. Diversification remains an important part of our ongoing corporate strategy.

Proven Track Record of Acquiring and Integrating Products, Product Candidates and Companies. We have a proven track record of successfully acquiring products and product candidates, including the acquisition of CARAFATE. In addition, we have efficiently integrated, developed and grown the businesses we have acquired, including Eurand (ZENPEP and PT) and Mpex Pharmaceuticals, Inc., or Mpex (APT-1026).

Substantial Development Capabilities and Robust Pipeline. Our pipeline has four clinical product candidates which target major commercial opportunities in the EU and the United States. We have proven research and development capabilities with a track record of developing and gaining regulatory approvals for our product candidates, including obtaining approval for and launching multiple product candidates in a number of markets simultaneously. In addition, we leverage our PT platforms to improve the safety and efficacy, or otherwise develop enhanced formulations, of our products and product candidates.

Sustainable Growth Due to Significant Barriers to Entry. We have demonstrated multiple years of growth for each of our principal products, which we believe is due in part to the fact that many of our products benefit from one or more intellectual property, regulatory, clinical, sourcing and manufacturing barriers to entry. These include patent protection, data exclusivity under the Hatch-Waxman Act, FDA requirements for generic entrants to conduct clinical trials with clinical efficacy endpoints, complexity in matching formulation characteristics, proprietary manufacturing processes, difficulty in sourcing certain active pharmaceutical ingredients that must match narrow specifications, and the know-how required to manufacture certain dosage forms.

Experienced and Dedicated Management Team. We have a highly experienced management team with an average of 26 years of experience in the healthcare industry, as well as a broad spectrum of general business experience. Several members of our management team have devoted large parts of their careers to the CF and GI markets.

Our Growth Strategy

We intend to enhance our position as a leading specialty pharmaceutical company concentrating on the fields of CF and GI by pursuing the following strategic initiatives:

Grow Sales of Existing Products. We intend to grow sales of our products by leveraging the value of our products and our strong relationships in our target markets. We intend to focus and build on our relationships with high-volume prescribers of drugs that treat the diseases and disorders that our products address, as well as our relationships with patients, payors and patient advocacy groups.

Utilize our Commercial Infrastructure to Launch New and Differentiated Products. We have established a comprehensive infrastructure to commercialize products in the United States, Canada, France and Germany. We intend to leverage these capabilities to launch products from our pipeline and from potential future acquisitions.

5

Advance our Pipeline and Enhance our Product Portfolio. We are working to develop the next generation of products to address unmet needs in the CF and GI markets. Currently, our most advanced product candidates are APT-1026 and ZENPEP-EU. We completed a pivotal phase III trialof APT-1026 in the EU in 2012 and we expect to launch in the EU in 2015. We recently completed enrollment for a pivotal phase III clinical trial in the EU for ZENPEP-EU, which is expected to be completed in 2014. In addition, by utilizing our PT capabilities, we expect to continue lifecycle management and enhancement of our current portfolio and pipeline.

Selectively Acquire Complementary Products, Product Candidates and Companies. We seek to selectively acquire or in-license new products and product candidates, or acquire companies, that complement the strategic focus of our existing product portfolio and pipeline. We will also consider the acquisition of products, product candidates and companies in therapeutic areas that we consider adjacent to our core areas of expertise.

Leverage our Platform to Expand Internationally. In addition to our current infrastructures in the United States, Canada, France and Germany, we have partners and distributors in over 50 countries worldwide. We intend to leverage our existing international commercial platform to market and distribute our products, including PYLERA and, if approved in the EU, APT-1026 and ZENPEP-EU. In addition, we will evaluate opportunities to expand our commercial presence in EU countries where we currently operate and to establish commercial operations in selected additional EU countries.

Risk Factors

Our business is subject to numerous risks, including, without limitation, the following:

| | Ÿ | | the pharmaceutical industry is highly competitive, with some of our competitors having more resources than we do, and is subject to rapid and significant change, which could render our products obsolete or uncompetitive; |

| | Ÿ | | the potential for entry of generic versions of our products, particularly those without patent coverage, into the markets in which we operate could lead to price erosion and decreased sales of our products; |

| | Ÿ | | our top three products, ZENPEP, CANASA and CARAFATE, account for a large portion of our revenues and any significant setback with respect to any of them, including setbacks with respect to shipping, supply, generic product entry, and regulatory issues, would have a material adverse effect on our business; |

| | Ÿ | | we have invested significant time and resources in developing our pipeline products and we may be unable to gain regulatory approval for and successfully commercialize any of our pipeline products, or experience significant delays in doing so, which would negatively impact our prospects; |

| | Ÿ | | our business is subject to extensive regulations in the markets in which we operate; |

| | Ÿ | | our product candidates may fail in clinical studies; and |

| | Ÿ | | as of September 30, 2013, on an as adjusted basis after giving effect to the Recapitalization (defined below) and the offering and the application of the proceeds therefrom, we had total indebtedness of $ million and our degree of leverage could adversely affect our ability to raise additional capital to fund our operations and make payments on our indebtedness as well as increase our vulnerability to general economic and industry conditions. |

6

The above list is not exhaustive, and the additional risks and challenges we face are described under the section titled “Risk Factors” beginning on page 18 of this prospectus. These risks and challenges or other unforeseen events could impair our ability to operate our business or inhibit our strategic plans.

Acquisition and Development History

Since our acquisition by TPG in February 2008, we have demonstrated a track record of successful product development and acquisition and integration of major products and companies, including our:

| | Ÿ | | March 2010 acquisition of APT-1016, which has completed phase II studies; |

| | Ÿ | | February 2011 acquisition of Eurand, including ZENPEP and PT; |

| | Ÿ | | August 2011 acquisition of Mpex, including APT-1026, which has completed a pivotal phase III study in the EU and is expected to launch in the EU in 2015; |

| | Ÿ | | 2012 commercial launches of ULTRESA and VIOKACE, which were two internally developed product candidates. |

Our management team has efficiently integrated, developed, and grown the businesses we have acquired, including Eurand. For example, we have grown our ZENPEP franchise, which was launched at the end of 2009, from $46 million in revenue in calendar year 2010 to $141 million in fiscal year 2013. We have also realized significant synergies in excess of our initial internal objectives.

Recent Developments

On October 4, 2013, Aptalis Pharma Inc., or Aptalis Pharma, our wholly-owned subsidiary, and certain of our other wholly-owned subsidiaries effected a refinancing consisting of (i) the repayment, in full, of our outstanding indebtedness, in aggregate principal amount of $926.4 million, under our second amended and restated credit agreement dated April 18, 2012, or the Second A&R Credit Agreement, and termination of our Second A&R Credit Agreement and (ii) the entry into our new senior secured credit facilities providing for senior secured term loans in the amount of $1,250 million and a new senior secured revolving credit facility allowing for borrowings of up to $150 million, which we collectively refer to as the Refinancing. See “Description of Certain Indebtedness—Senior Secured Credit Facilities.”

Following the Refinancing, through a series of transactions, including repayment of intercompany debt, redemptions of subsidiary equity, dividends, distributions and mergers, we made a distribution in aggregate amount of $399.5 million to our shareholders, holders of our restricted stock units and certain holders of options to purchase shares of our common stock, which we refer to as the Distribution. Certain holders of options received an adjustment to the per share exercise price of the options in accordance with the relevant option plan to reflect the effects of the Distribution. The Refinancing, the Distribution and the other transactions referred to above are collectively referred to as the Recapitalization.

On November 8, 2013, in conjunction with the Refinancing, we terminated our existing interest rate swap and interest rate cap agreements and paid a total of $13.5 million to our derivative counterparties. We then entered into two new interest rate cap agreements with an effective date of December 31, 2013. The interest rate caps each have a notional amount of $275.0 million amortizing to $25.0 million by their maturity in December 2019. The interest rate caps are designated as cash flow hedges of interest rate risk and are designated to fix our interest payments on the hedged debt at 6.78%.

7

Our Principal Stockholder

TPG is a leading global private investment firm founded in 1992 with $55.7 billion of assets under management as of September 30, 2013 and offices in San Francisco, Fort Worth, Austin, Beijing, Chongqing, Hong Kong, London, Luxembourg, Melbourne, Moscow, Mumbai, New York, Paris, São Paulo, Shanghai, Singapore and Tokyo. TPG has extensive experience with global public and private investments executed through leveraged buyouts, recapitalizations, spinouts, growth investments, joint ventures and restructurings.

Following the completion of this offering, TPG will own approximately % of our common stock, or % if the underwriters’ option to purchase additional shares of our common stock from us and the selling stockholders is fully exercised. As a result, we expect to be a “controlled company” within the meaning of the corporate governance standards of the NASDAQ Stock Market (“NASDAQ”). on which we intend to apply for our shares to be listed. See “Risk Factors—Risks Relating to our Common Stock and this Offering—TPG will continue to have significant influence over us after this offering, including control over decisions that require the approval of stockholders, which could limit your ability to influence the outcome of matters submitted to stockholders for a vote.”

8

Corporate Information and Structure

The principal executive offices of Aptalis Holdings Inc. are located at 100 Somerset Corporate Boulevard, Bridgewater, NJ 08807. Our website is www.AptalisPharma.com. The information contained in, or accessible through, our website is not deemed to be part of this prospectus, and you should not rely on any such information in connection with your decision regarding whether or not to purchase our common stock.

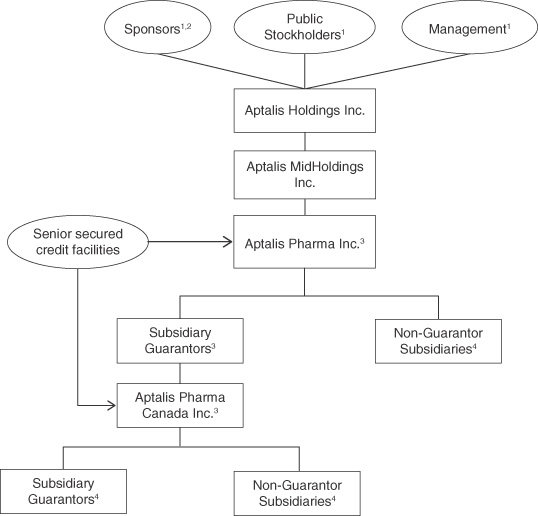

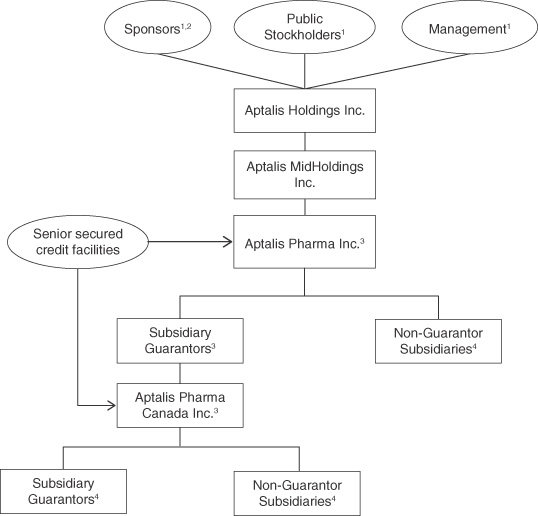

The following charts shows our simplified organizational structure immediately following the consummation of this offering:

| (1) | Represents %, % and % of the total voting power in the Company, respectively. |

| (2) | Sponsors refers to the TPG Funds and Investor Growth Capital, Ltd., collectively. Following the consummation of this offering, the TPG Funds will own % of the total voting power in the Company, or % if the underwriters exercise their option to purchase additional shares, and Investor Growth Capital, Ltd. will own % of the total voting power in the Company or % if the underwriters exercise their option to purchase additional shares. |

| (3) | Co-borrowers under our senior secured credit facilities. |

| (4) | Substantially all of Aptalis Pharma’s domestic 100% owned subsidiaries and certain foreign 100% owned subsidiaries guarantee our senior secured credit facilities. Other subsidiaries, including foreign subsidiaries, do not guarantee our senior secured credit facilities. See “Description of Certain Indebtedness” for more information. |

9

Implications of Being an Emerging Growth Company

As a company with less than $1.0 billion in revenue during our most recently completed fiscal year, we qualify as an “emerging growth company” as defined in Section 2(a) of the Securities Act, as modified by the Jumpstart Our Business Startups Act of 2012, or the JOBS Act. As an emerging growth company, we may take advantage of certain reduced disclosures and other requirements that are otherwise unavailable, in general, to public companies that are not emerging growth companies. These provisions include:

| | Ÿ | | reduced disclosures about our executive compensation arrangements; |

| | Ÿ | | no non-binding shareholder advisory votes on executive compensation or golden parachute arrangements; |

| | Ÿ | | exemption from the auditor attestation requirement in the assessment of our internal controls over financial reporting; and |

| | Ÿ | | reduced disclosures of financial information in this prospectus. |

We may take advantage of these exemptions for up to five years or such earlier time that we are no longer an emerging growth company. We would cease to be an emerging growth company if we have more than $1.0 billion in annual revenues as of the end of a fiscal year, if we are deemed to be a large-accelerated filer under the rules of the Securities and Exchange Commission, or SEC, or if we issue more than $1.0 billion ofnon-convertible debt securities over a rolling three-year period.

The JOBS Act permits an emerging growth company to take advantage of an extended transition period to comply with new or revised accounting standards applicable to public companies. We are choosing to “opt out” of this provision.

10

Offering

Common stock offered by us | shares |

Common stock offered by the selling stockholders | shares |

Common stock to be outstanding immediately after this offering | shares ( shares if the underwriters exercise their option to purchase additional shares from us and the selling stockholders in full) |

Option to purchase additional shares | The underwriters have a 30-day option to purchase a maximum of additional shares of common stock from us and additional shares of common stock from the selling stockholders. |

Use of Proceeds | We expect to receive net proceeds, after deducting estimated offering expenses and underwriting discounts and commissions, of approximately $ million (or approximately $ million if the underwriters exercise their option to purchase additional shares in full), based on an assumed offering price of $ per share (the midpoint of the price range set forth on the cover of this prospectus). We intend to use the net proceeds from this offering to repay approximately $ million of the $1,250 million outstanding under our senior secured credit facilities, and the remainder for working capital and general corporate purposes, which may include the repayment of additional indebtedness and the funding of strategic growth opportunities. We will not receive any proceeds from the sale of shares of common stock by the selling stockholders. See “Use of Proceeds.” |

Risk Factors | You should read carefully the “Risk Factors” section beginning on page 18 of this prospectus for a discussion of factors that you should consider before deciding to invest in shares of our common stock. |

Stock Exchange and Listing Symbol | We intend to apply to list our common stock on the NASDAQ under the symbol “APTA.” |

Certain Material U.S. Federal Income and Estate Tax Considerations for Non-U.S. Holders of Shares of Our Common Stock | For a discussion of certain material U.S. federal income and estate tax considerations that may be relevant to certain prospective stockholders who are not individual citizens or residents of the United States, please read “Certain Material U.S. Federal Income and Estate Tax Considerations for Non-U.S. Holders of Shares of Our Common Stock” beginning on page 177. |

11

The number of shares to be outstanding after this offering is based on 67,696,126 shares of common stock outstanding as of September 30, 2013, and the shares of common stock offered pursuant to this prospectus. This number of shares excludes 3,989,250 shares of common stock issuable upon the exercise of outstanding stock options at a weighted-average exercise price of $11.55 per share as of September 30, 2013, of which 2,086,650 were vested and exercisable; 235,842 shares of common stock issuable upon the exercise of outstanding penny stock options, with a grant date exercise price of $0.01 per share, all of which were vested and exercisable; 5,000 restricted stock units, all of which were vested but not yet settled into common stock of the Company as of September 30, 2013; and 893,721 shares of common stock reserved for future issuance under our equity incentive plans.

Except as otherwise indicated herein, all information in this prospectus, including the number of shares that will be outstanding after this offering, assumes:

| | Ÿ | | an initial public offering price of $ per share of common stock, the midpoint of the estimated initial public offering price range set forth on the cover page of this prospectus; |

| | Ÿ | | no exercise of the outstanding options described above; and |

| | Ÿ | | no exercise of the underwriters’ option to purchase additional shares of common stock. |

12

Summary Historical Financial and Other Data

The summary statement of operations data for the fiscal years ended September 30, 2013, 2012 and 2011 and the summary balance sheet data as of September 30, 2013 have been derived from and are qualified by reference to our audited consolidated financial statements and related notes included elsewhere in this prospectus. You should read this data together with our financial statements and related notes included elsewhere in this prospectus and the information under the captions “Selected Consolidated Financial and Operating Data” and “Management’s Discussion and Analysis of Financial Condition and Results of Operations.” Our historical results are not necessarily indicative of our future results.

| | | | | | | | | | | | |

| | | Fiscal Year

Ended

September 30, 2013 | | | Fiscal Year

Ended

September 30, 2012 | | | Fiscal Year

Ended

September 30, 2011 | |

| | | (in millions of U.S. dollars, except per share data) | |

Statement of Operations Data: | | | | |

Net product sales | | $ | 667.7 | | | $ | 600.9 | | | $ | 461.4 | |

Other revenue | | | 20.2 | | | | 14.2 | | | | 9.0 | |

| | | | | | | | | | | | |

Total revenue | | | 687.9 | | | | 615.1 | | | | 470.4 | |

Cost of goods sold(1) | | | 146.6 | | | | 144.2 | | | | 135.4 | |

Selling and administrative expenses(1) | | | 172.5 | | | | 168.8 | | | | 143.5 | |

Management fees | | | 7.0 | | | | 5.7 | | | | 3.6 | |

Research and development expenses(1) | | | 65.5 | | | | 72.6 | | | | 58.0 | |

Acquired in-process research | | | 0.0 | | | | 0.0 | | | | 65.5 | |

Depreciation and amortization | | | 94.7 | | | | 101.7 | | | | 72.8 | |

Loss (gain) on disposal of product line | | | (1.0 | ) | | | 0.0 | | | | 7.4 | |

Transaction, restructuring and integration costs | | | 2.5 | | | | 12.4 | | | | 50.9 | |

Fair value adjustments to intangible assets and contingent consideration | | | 10.0 | | | | (3.4 | ) | | | — | |

| | | | | | | | | | | | |

Operating income (loss) | | | 190.1 | | | | 113.1 | | | | (66.7 | ) |

Financial expenses | | | 68.8 | | | | 80.2 | | | | 89.5 | |

Loss on extinguishment of debt | | | — | | | | 23.1 | | | | 28.3 | |

Other interest income | | | (0.4 | ) | | | (0.2 | ) | | | (0.4 | ) |

Loss on foreign currencies | | | 0.1 | | | | 0.2 | | | | 0.1 | |

| | | | | | | | | | | | |

Income (loss) before income taxes | | | 121.6 | | | | 9.8 | | | | (184.2 | ) |

Income taxes | | | 34.7 | | | | 21.8 | | | | 7.4 | |

| | | | | | | | | | | | |

Net (loss) income | | $ | 86.9 | | | $ | (12.0 | ) | | $ | (191.6 | ) |

| | | | | | | | | | | | |

Earnings per common share attributable to common shareholders: | | | | | | | | | | | | |

Basic earnings per share | | $ | 1.28 | | | $ | (0.18 | ) | | $ | (3.32 | ) |

Diluted earnings per share | | $ | 1.26 | | | $ | (0.18 | ) | | $ | (3.32 | ) |

Weighted average common shares outstanding: | | | | | | | | | | | | |

Basic | | | 67,987,312 | | | | 67,699,784 | | | | 57,742,284 | |

Diluted | | | 69,174,681 | | | | 67,699,784 | | | | 57,742,284 | |

13

| | | | | | | | | | | | |

| | | Fiscal Year

Ended

September 30, 2013 | | | Fiscal Year

Ended

September 30, 2012 | | | Fiscal Year

Ended

September 30, 2011 | |

| | | (in millions of U.S. dollars, except per share data) | |

As Adjusted Data(3)(4)(5)(6): | | | | | | | | | | | | |

Net (loss) income | | $ | | | | | | | | | | |

Basic earnings per common share | | $ | | | | | | | | | | |

Diluted earnings per common share | | $ | | | | | | | | | | |

Weighted average common shares outstanding: | | | | | | | | | | | | |

Basic | | | | | | | | | | | | |

Diluted | | | | | | | | | | | | |

Other Financial Data: | | | | | | | | | | | | |

EBITDA(2)(7) | | $ | 284.7 | | | $ | 191.5 | | | $ | (22.3 | ) |

Adjusted EBITDA(2)(7) | | $ | 314.6 | | | $ | 244.9 | | | $ | 160.0 | |

Adjusted pre-tax income (2)(7) | | $ | 241.4 | | | $ | 161.6 | | | $ | 67.5 | |

| | | | | | |

| | | September 30, 2013 |

| | | Actual | | | As Adjusted (3)(4)(5) |

| | | (in millions of U.S. dollars) |

Balance Sheet Data (at period end): | | | | | | |

Cash and cash equivalents | | $ | 229.9 | | | |

Short-term investments, available for sale | | | — | | | |

Total current assets | | | 401.2 | | | |

Total assets | | | 1,341.2 | | | |

Total short-term borrowings | | | 9.5 | | | |

Total current liabilities | | | 261.6 | | | |

Total long-term debt | | | 911.8 | | | |

Total liabilities | | | 1,294.6 | | | |

Total shareholders’ equity | | | 46.6 | | | |

| (1) | Exclusive of depreciation and amortization which is separately reported in the Statement of Operations. |

| (2) | EBITDA, Adjusted EBITDA and Adjusted pre-tax income are financial measures that are not defined under generally accepted accounting principles in the United States, or GAAP, and are presented in this prospectus because our management considers them important supplemental measures of our performance and believes that they provide greater transparency into our results of operation and are frequently used by investors in the evaluation of companies in the industry. In addition, our management believes that EBITDA, Adjusted EBITDA and Adjusted pre-tax income are useful financial metrics to assess our operating performance from period to period by excluding certain material non-cash items, unusual or non-recurring items that we do not expect to continue in the future and certain other adjustments we believe are not reflective of our ongoing operations and our performance. |

| | None of EBITDA, Adjusted EBITDA or Adjusted pre-tax income are measures of net income, operating income or any other performance measure derived in accordance with GAAP, and each is subject to important limitations. EBITDA, as we use it, is net income before financial expenses, interest income, income taxes and depreciation and amortization. Adjusted EBITDA, as we use it, is EBITDA adjusted to exclude certain non-cash charges, unusual or nonrecurring items, impact of discontinued operations, impairment of intangible assets, restructuring activities, litigation settlements and contingencies, upfront and development milestone payments, stock-based compensation and other adjustments set forth below. Adjusted pre-tax income, as we use |

14

| | it, is income before income taxes as reported under GAAP, adjusted to exclude certain non-cash charges, unusual or nonrecurring items, impact of discontinued operations, impairment of intangible assets, restructuring activities, litigation settlements and contingencies, upfront and development milestone payments, stock-based compensation and other adjustments set forth below. |

| | We understand that although EBITDA, Adjusted EBITDA and Adjusted pre-tax income are frequently used by securities analysts, investors and others in their evaluation of companies, they have limitations as analytical tools, and you should not consider them in isolation, or as a substitute for analysis of our results as reported under GAAP. Some of these limitations are: |

| | Ÿ | | EBITDA, Adjusted EBITDA and Adjusted pre-tax income do not reflect all cash expenditures, future requirements for capital expenditures, or contractual commitments; |

| | Ÿ | | EBITDA, Adjusted EBITDA and Adjusted pre-tax income do not reflect changes in, or cash requirements for, working capital needs; |

| | Ÿ | | EBITDA and Adjusted EBITDA do not reflect the significant interest expense, or the cash requirements necessary to service interest or principal payments, on our debt; |

| | Ÿ | | EBITDA, Adjusted EBITDA and Adjusted pre-tax income do not reflect expenditures related to current business development and product acquisition activities, including payments due under existing agreements related to products in various stages of development or contingent payments tied to the achievement of sales milestones; |

| | Ÿ | | although depreciation and amortization are non-cash charges, the assets being depreciated and amortized will often have to be replaced in the future, and EBITDA, Adjusted EBITDA and Adjusted pre-tax income do not reflect any cash requirements for such replacements; |

| | Ÿ | | EBITDA, Adjusted EBITDA and Adjusted pre-tax income exclude income tax payments that represent a reduction in cash available to us; |

| | Ÿ | | EBITDA, Adjusted EBITDA and Adjusted pre-tax income do not reflect the impact of earnings or charges resulting from matters we consider not to be indicative of our ongoing operations; and |

| | Ÿ | | other companies in our industry may calculate EBITDA, Adjusted EBITDA and Adjusted pre-tax income differently than we do, limiting their usefulness as comparative measures. |

| | Because of these limitations, EBITDA, Adjusted EBITDA and Adjusted pre-tax income should not be considered as measures of discretionary cash available to us to invest in our business. Our management compensates for these limitations by relying primarily on our GAAP results and using EBITDA, Adjusted EBITDA and Adjusted pre-tax income as supplemental information. Investors and potential investors are encouraged to review the reconciliations of EBITDA, Adjusted EBITDA and Adjusted pre-tax income to our closest reported GAAP measures contained within “Selected Consolidated Financial and Operating Data” included elsewhere in this prospectus. |

| (3) | As adjusted consolidated financial data reflects (i) the Recapitalization, including (a) the distribution in aggregate amount of $399.5 million to our shareholders, holders of our restricted stock units and certain holders of options to purchase shares of our common stock on October 7, 2013, and (b) the refinancing of our previously existing credit facilities, which were replaced with our senior secured credit facilities providing for senior secured term loans in the amount of $1,250 million and a senior secured revolving credit facility allowing for borrowings of up to $150 million; (ii) the elimination of fees paid under our management agreements with our Sponsors; (iii) the offering of million shares of common stock by us in this offering, assuming an initial public offering price of $ per share, the midpoint of the price range set forth on the cover page of this prospectus, after deducting underwriting discounts and commissions and estimated offering |

15

| | expenses payable by us; and (iv) the application of the estimated proceeds of the offering as described in “Use of Proceeds.” This as adjusted consolidated financial data is presented for informational purposes only and does not purport to represent what our consolidated results of operations or financial position actually would have been had the transactions reflected occurred on the date indicated or to project our financial condition as of any future date or results of operations for any future period. |

| (4) | A $1.00 increase (decrease) in the assumed initial public offering price of $ per share, the midpoint of the price range set forth on the cover of this prospectus, would increase (decrease) the as adjusted amount of each of cash and cash equivalents, total current assets, total assets and total shareholders’ equity by approximately $ million, assuming that the number of shares offered by us, as set forth on the cover of this prospectus, remains the same and after deducting underwriting discounts and commissions and estimated offering expenses payable by us. |

A share increase in the number of shares offered by us together with a concomitant $1.00 increase in the assumed initial public offering price of $ per share, the midpoint of the price range set forth on the cover of this prospectus, would increase the as adjusted amount of each of cash and cash equivalents, total current assets and total assets by approximately $ million after deducting underwriting discounts and commissions and any estimated offering expenses payable by us. Conversely, a share decrease in the number of shares offered by us together with a concomitant $1.00 decrease in the assumed initial public offering price of $ per share, the midpoint of the price range set forth on the cover of this prospectus, would decrease the as adjusted amount of each of cash and cash equivalents, total current assets and total assets by approximately $ million after deducting underwriting discounts and commissions and any estimated offering expenses payable by us.

| (5) | As adjusted information is unaudited. |

| (6) | As adjusted earnings per share. |

The as adjusted earnings per share gives effect to (a) the Recapitalization, (b) the elimination of fees paid under our management agreements with our Sponsors (which will be terminated in connection with the offering) and (c) the issuance of shares of our common stock offered by this prospectus and the use of the proceeds therefrom as described in “Use of Proceeds,” as if each had occurred on October 1, 2012.

16

The following presents the computation of as adjusted basic and diluted earnings per share:

| | | | |

| | | Fiscal Year Ended

September 30, 2013 | |

| | | (in millions of U.S.

dollars, except per

share data) | |

Numerator: | | | | |

Net income as reported | | $ | | |

Net income as adjusted adjustments: | | | | |

Interest expense, net of tax(a) | | | | |

Amortization of debt issuance costs and discount, net of tax(a) | | | | |

Reduction of management fees, net of tax(b) | | | | |

As adjusted net income | | $ | | |

Denominator: | | | | |

Weighted average common shares used in computing basic income per common share | | | | |

Adjustment for common stock assumed issued in this offering | | | | |

As adjusted basic common shares outstanding(c) | | | | |

As adjusted basic earnings per share | | $ | | |

Weighted average common shares used in computing diluted income per common share outstanding | | | | |

Adjustment for common stock assumed issued in this offering | | | | |

As adjusted diluted common shares outstanding(c) | | | | |

As adjusted diluted earnings per share | | $ | | |

| | (a) | These adjustments reflect the change to historical interest expense and amortization of debt issuance costs and discount (net of tax at an applicable blended statutory rate of % for the fiscal year ended September 30, 2013) after reflecting the Refinancing and use of proceeds from this offering to repay $ million of our senior secured credit facilities. |

| | (b) | After the offering, we will no longer incur expenses under the management agreements with our Sponsors, resulting in the elimination of management fees of $ million, net of tax at an applicable blended statutory rate of % for the fiscal year ended September 30, 2013. This as adjusted calculation does not include the approximately $ million expense to be paid to the Sponsors as a fee in connection with the termination of the management agreements, as these costs will not have a continuing impact on our consolidated results of operations. |

| | (c) | The as adjusted basic and diluted earnings per share is calculated based upon the weighted-average common shares outstanding during the period including the issuance of common stock in this offering as if the offering occurred on October 1, 2012. We also assume that the underwriters of the offering do not exercise their option to purchase up to $ million additional common stock from us and the selling stockholders. |

| (7) | For a reconciliation of EBITDA and Adjusted EBITDA to Net (loss) income and Adjusted pre-tax income to income before income tax, see “Selected Consolidated Financial and Operating Data.” |

17

RISK FACTORS

Investing in our common stock involves a high degree of risk. You should carefully consider the risks and uncertainties described below, as well as all of the other information contained in this prospectus, including our consolidated financial statements and the notes thereto and the “Cautionary Note Regarding Forward-Looking Statements,” before making an investment decision. The risks described below are those which we believe are the material risks that we face. Any of the following risks and uncertainties and those discussed elsewhere in this prospectus could materially adversely affect our business, financial condition or results of operations. In such case, the trading price of our common stock may decline and you may lose all or part of your original investment.

Risks Related to Our Business

The pharmaceutical industry is highly competitive and is subject to rapid and significant change, which could render our products obsolete or uncompetitive.

Competition in our industry is intense and characterized by extensive research efforts and rapid technological progress. Technological developments by competitors, regulatory approval for marketing competitive products, including potential generic or over-the-counter products, or competitors’ superior marketing resources could adversely affect the commercial potential of our products and could have a material adverse effect on our revenue and results of operations. We are aware that there are numerous pharmaceutical and biotechnology companies, including large, well-known pharmaceutical companies, as well as academic research groups, throughout the world, engaged in research and development efforts with respect to pharmaceutical products targeted at CF and GI disorders addressed by our current and potential products. Competitors might overcome the significant barriers to entry described in the “Business” section of this prospectus and develop products that render our current products and pipeline product candidates obsolete or uncompetitive. They may complete development and regulatory approval processes sooner, whether by virtue of their greater experience in clinical testing and human clinical trials of pharmaceutical products or otherwise, and, therefore, market their products earlier than we can. They may also succeed in developing products that are more effective or less expensive to use than any that we may develop or license. These developments would limit the demand for our products and have a material adverse effect on our business and financial results.

The entry of generic versions of our products into the market could have a material adverse impact on our financial position, cash flows and results of operations.

The entry of generic and unbranded competitors to branded products leads to price erosion and decreased sales of the branded product. For example, during the fiscal years ended September 30, 2012 and September 30, 2013, generic competitors of DELURSAN 250mg entered the market in France, which we believe contributed to a reduction in revenue from sales of DELURSAN 250mg from $26.2 million in fiscal year 2011 to $14.7 million in fiscal year 2013. In addition, generic competitors of URSO entered the U.S. market during the fiscal year ended September 30, 2010, which we believe contributed to a reduction in revenue from sales of URSO from $50.0 million in fiscal year 2009 to $12.3 million in fiscal year 2013. The Company is at risk of further erosion of its net sales for its products that face generic competition. We have no patent protection for certain of our products, such as ULTRESA, VIOKACE and CARAFATE, which could make it easier for generic competitors to enter the market. While we believe our products benefit from a variety of intellectual property, regulatory, clinical, sourcing and manufacturing barriers to competitive entry, there can be no assurance that these barriers will be effective in preventing generic versions of our products from being approved. See “Business—Our Products” for an additional description of certain of these barriers. Some of these barriers depend upon the FDA or other regulatory agencies following guidance or practice they have previously issued and followed. Typically such guidance and practice is not binding on the regulatory

18

agency and is subject to change and varying interpretation. For example, in March 2013, the FDA revised its draft guidance with respect to determining bioequivalency of mesalamine rectal suppository products. In its revised draft guidance, the FDA now recommends in vivo and in vitro studies to demonstrate the bioequivalency of generic mesalamine rectal suppositories with pharmacokinetic endpoints and comparative in vitro studies, rather than clinical trials with clinical efficacy endpoints as previous FDA guidance had provided.

Particularly in the United States, government and commercial payors often provide significant financial incentives to encourage patients to purchase generic products instead of branded products as a way to reduce healthcare costs, and pharmacists may substitute generic or unbranded products for our products even if physicians prescribe our products by name. Governmental and other pressures toward the dispensing of generic or biosimilar products may rapidly and significantly reduce, or slow the growth in, the sales and profitability of our products and may adversely affect our future results and financial condition.

We have received letters from two parties indicating that each party had filed an Abbreviated New Drug Application, or ANDA, seeking approval to market a generic version of CANASA. In July 2013, we filed patent infringement lawsuits against each party, alleging infringement of certain of our patents and seeking, among other things, injunctive relief. See “Business—Legal Proceedings” for more information regarding the infringement suits. We believe the ANDAs were filed before the patents covering CANASA were listed in the FDA’s publication, “Approved Drug Products with Therapeutics Evaluations” (commonly referred to as the “Orange Book”), which generally means that we are not entitled to the 30-month stay of the approval of these ANDAs provided for by the Hatch-Waxman Act.

In October 2013, we also filed a citizen’s petition to request that the FDA require any ANDAs for a generic version of CANASA to demonstrate bioequivalence to CANASA using a clinical endpoint study, as opposed to a confirmation of quantitative and qualitative equivalence and limited physical testing along with a pharmacokinetics assessment. We believe that a clinical endpoint study is necessary due to mesalamine’s drug release characteristics and the kinetics of drug disposition at the local site. We can offer no assurances as to whether the FDA will grant our petition, nor can we predict the impact, if any, the petition will have on the FDA’s consideration of any pending or future ANDAs relating to CANASA.

We can offer no assurance as to when the pending litigation will be resolved, whether the lawsuit will be successful or that a generic equivalent of CANASA will not be approved and enter the market. The launch of generic versions of any of our products would likely reduce prices and unit sales and could have a material adverse impact on our financial position, cash flows and results of operations.

Our top three products account for a large portion of our revenues; any significant setback with respect to any of these products could have a material adverse effect on our business.

Any factor that adversely affects the sale or price of our principal products could significantly decrease our sales and profits. ZENPEP, CANASA and CARAFATE sales accounted for 21%, 19% and 21%, respectively, of our total revenue for fiscal 2013 and 20%, 19% and 20%, respectively, of our total revenue for fiscal year 2012 and 13%, 20% and 22%, respectively, of our total revenue for fiscal year 2011. Any significant setback with respect to any one of these three products, including setbacks with respect to shipping, manufacturing, supply, regulatory issues, product safety, marketing, government licenses and approvals, intellectual property rights, formulary losses, or generic or other forms of competition related to these products could have a material adverse effect on our financial position, cash flows or overall trends in results of operations.

19

If we are unable to gain regulatory approval for and successfully commercialize any of our pipeline products, or experience significant delays in doing so, our growth prospects will be materially harmed.

We have invested significant time and financial resources in the development of our pipeline products, including APT-1026, ZENPEP-EU, APT-1016 and APT-1011, and impediments or delays in gaining regulatory approval or commercializing any of our pipeline product candidates would materially harm our prospects.

The commercial success of any of our product candidates for which we obtain marketing approval from the FDA, Health Canada’s Therapeutic Products Directorate, or the TPD, the European Medicines Agency, or the EMA, or other regulatory authorities will depend upon the acceptance of these products by the medical community, including physicians, patients and payors. The degree of market acceptance of any of our approved products will depend on a number of factors, including:

| | Ÿ | | demonstration of clinical safety and efficacy and obtaining regulatory approval in the jurisdictions where we operate; |

| | Ÿ | | the relative convenience and ease of administration; |

| | Ÿ | | the expectedness, incidence and severity of any adverse side effects; |

| | Ÿ | | limitations or warnings contained in a product’s FDA-, TPD- or EMA- approved labeling; |

| | Ÿ | | the availability of alternative treatments for the indications we target; |

| | Ÿ | | pricing and comparative effectiveness to competing products, particularly generic products and the current standard of care; |

| | Ÿ | | the effectiveness of our sales and marketing strategies; |

| | Ÿ | | the effectiveness of our supply arrangements and manufacturing and distribution plants, and the continued operation of our and our suppliers’ facilities in compliance with current good manufacturing practices, or cGMPs; |

| | Ÿ | | our ability to supply the evidence required to obtain timely and sufficient third-party coverage and reimbursement; and |

| | Ÿ | | the willingness of patients to pay out-of-pocket costs for co-insurance or higher co-pays, or in the absence of third-party coverage. |

If any of our product candidates are approved but do not achieve an adequate level of acceptance by physicians, payors and patients, we may not generate sufficient revenue from these products for such products to become or remain profitable. In addition, our efforts to educate the medical community and payors on the benefits of our product candidates may require significant resources and may not be successful.

Our initial analysis of the data on the placebo-controlled phase III clinical trial for U.S. approval for APT-1026 indicates that the clinical trial did not meet its primary endpoint, time to exacerbation, but did demonstrate efficacy in key secondary endpoints, including superiority over placebo in improving lung function. We are currently in discussions with the FDA to explore alternatives to advanceAPT-1026 in the United States. We can give no assurance that our applications for approval in the EU and Canada will be successful, or that we will seek or receive regulatory approval for APT-1026 in the United States or in any other jurisdiction. Our ability to develop and commercialize APT-1026 will depend on numerous factors, including those listed above. Failure to achieve any of these requirements for the successful development and commercialization of APT-1026 could prevent us from commercializing APT-1026 in the timeframe anticipated, or at all, and would materially harm our prospects and have an

20

adverse effect on our business. Even if we do receive regulatory approval for APT-1026, commercial success depends on a variety of factors, some of which are beyond our control, and we can provide no assurance as to the revenue we will realize from APT-1026.

Our business could suffer as a result of adverse drug reactions to the products we market.

Unexpected adverse drug reactions by patients to any of our products could negatively impact utilization or market availability of our product. Patients taking our principal products have experienced adverse events, the most common of which include, in the case of ZENPEP, abdominal pain, flatulence, headache, cough, decreased weight, early satiety and confusion, in the case of CARAFATE, constipation, and, in the case of CANASA, dizziness, rectal pain, fever, rash, acne and colitis. If the incidence or severity of adverse drug reactions to the products we market increases substantially or if previously unknown problems with any of our approved commercial products, manufacturers or manufacturing processes are discovered, we will suffer reputational harm and we could be subject to administrative or judicially imposed sanctions or other setbacks, including:

| | Ÿ | | restrictions on the products, manufacturers or manufacturing processes; |

| | Ÿ | | civil penalties and criminal prosecutions and penalties; |

| | Ÿ | | product seizures or detentions; |

| | Ÿ | | import or export bans or restrictions; |

| | Ÿ | | extensive warnings on product labels; |

| | Ÿ | | imposition of restricted distribution programs; |

| | Ÿ | | risk evaluation mitigation and risk management strategies; |

| | Ÿ | | voluntary or mandatory product recalls and related publicity requirements; |

| | Ÿ | | suspension or withdrawal of regulatory approvals; |

| | Ÿ | | total or partial suspension of production; and |

| | Ÿ | | refusal to approve pending applications for marketing approval of new products or of supplements to approved applications. |

Any of these could have an adverse impact on our financial condition or results of operations.

The publication of negative results of studies or clinical trials may adversely impact our sales revenue.

We, academics, government agencies and others conduct studies or clinical trials on various aspects of pharmaceutical products. The results of these studies or trials may have a dramatic effect on the market for the pharmaceutical product that is the subject of the study. The publication of negative results of studies or clinical trials related to our products or the therapeutic areas in which our products compete could adversely affect our sales, the prescription trends for our products and the reputation of our products. In the event of the publication of negative results of studies or clinical trials related to our products or the therapeutic areas in which our products compete, our business, financial condition, results of operations and cash flows could be materially adversely affected.

21

Any difficulties with or interruptions in our own manufacturing operations could delay output of products, which would have a material adverse effect on our business.

Any difficulties with or interruptions in our proprietary manufacturing operations could delay our output of products. We rely on production capabilities at our manufacturing facilities in Pessano, Italy, San Guiliano, Italy, Houdan, France, Mont St. Hilaire, Canada and Vandalia, Ohio. Due to regulatory and technical requirements, we have limited ability to shift production among our facilities or to outsource any part of our manufacturing activities to third parties in order to avoid disruptions in supply of our products. Delays in site transfers or scale-up of production to commercial quantities could delay clinical studies, regulatory submissions and approvals and commercialization or continued commercialization of our products and product candidates. Damage to any of our manufacturing facilities caused by human error, physical or electronic security breaches, power loss or other failures or circumstances beyond our control, including acts of God, fire, explosion, flooding, war, insurrection or civil disorder, acts of, or authorized by, any government, terrorism, accidents, labor troubles or shortages, or the inability to obtain material, equipment or transportation, could interrupt or delay our manufacturing operations. Likewise, natural disasters could interrupt supply of our manufacturing operations. Any interruption in our own manufacturing, whether due to limitations in manufacturing capacity or arising from factors outside our control, could impede our ability to produce sufficient supplies of our products for clinical studies or commercial distribution, which would have a material adverse effect on our business.

We depend on third-party providers, including sole-source suppliers, to manufacture our products and the active pharmaceutical ingredient for our products. We may not be able to maintain these relationships and could experience supply disruptions outside of our control.

We rely on a network of third-party providers to manufacture certain of our finished products or supply the active pharmaceutical ingredient for our products. As a result of our reliance on these third-party providers, including sole-source suppliers of certain components of our products and product candidates, we could be subject to significant supply disruptions outside of our control.

Damage to any of our third-party providers’ manufacturing facilities caused by human error, physical or electronic security breaches, power loss or other failures or circumstances beyond our control, including acts of God, fire, explosion, flooding, war, insurrection or civil disorder, acts of, or authorized by, any government, terrorism, accidents, labor troubles or shortages, or the inability to obtain material, equipment or transportation, could interrupt or delay their manufacturing operations. Likewise, natural disasters could interrupt supply of our third-party providers manufacturing operations. Any such disruptions could disrupt sales of our products and/or the timing of our clinical trials. Any such disruptions could have a material adverse effect on our sales and revenue.