Filed Pursuant To Rule 433

Registration No. 333-275079

February 12, 2024

"The Case for Bitcoin & GBTC

January 2024

Bitcoin investing begins here"

About Grayscale enables investors to access the digital economy through a family of regulated and future-forward investment products. Founded

in 2013, Grayscale has a proven track record and deep expertise as the world’s largest crypto asset manager*.

Investors, advisors, and allocators turn to Grayscale for single asset, diversified, and thematic exposure. Certain Grayscale products are distributed by Grayscale Securities, LLC (Member FINRA/SIPC).

Grayscale Investments, LLC (“Grayscale”) is the holding company of Grayscale Advisors, LLC, an SEC-registered investment adviser, as well as Grayscale Securities, LLC, a limited-purpose,

SEC-registered broker/dealer and member of FINRA. Grayscale is not registered as an investment adviser under the Investment Advisers Act of 1940 and none of the investment products sponsored or managed by Grayscale are registered under the Investment Company Act of 1940.

*Based on AUM as of 01/11/2024

For financial professional use only

2

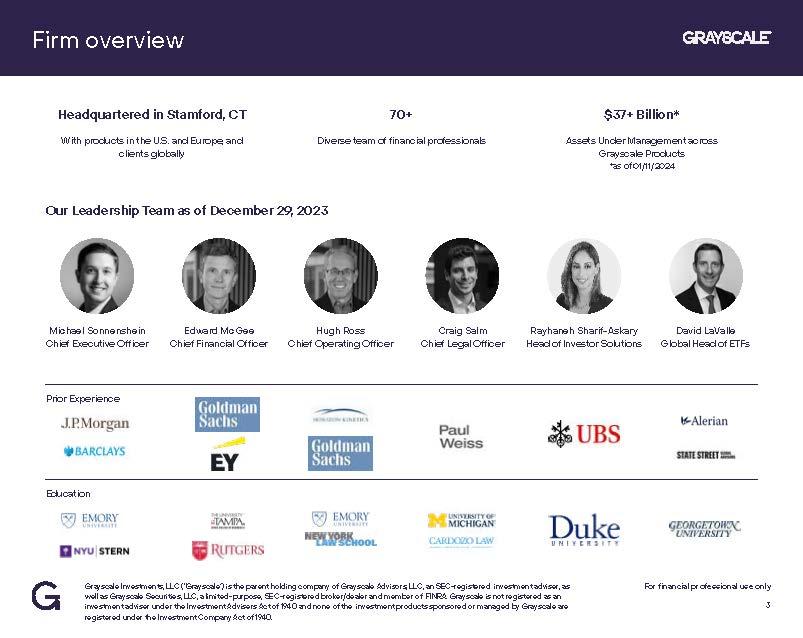

Firm Overview Headquartered in Stamford, CT With products in the U.S. and Europe, and clients globally 70+ Diverse team of financial professionals $37+ Billion* Assets Under Management across Grayscale Products *as of 01/11/2024

Our Leadership Team as of December 29, 2023 Michael Sonnenshein Chief Executive Officer Prior Experience Education Edward McGee Chief Financial Officer Hugh Ross Chief Operating Officer Craig Salm Chief Legal Officer Rayhaneh Sharif-Askary JP Morgan Barclays Goldman Sachs EY UBS Alerian Paul Weiss State Street Emory NYU Stern Rutgers New York Law School Duke Georgetown University University of Michigan Cardozo Law Tampa

Head of Investor Solutions David LaValle Global Head of ETFs Grayscale Investments, LLC (“Grayscale”) is the parent holding company of Grayscale Advisors, LLC, an SEC-registered investment adviser, as well as Grayscale Securities, LLC, a limited-purpose, SEC-registered broker/dealer and member of FINRA. Grayscale is not registered as an investment adviser under the Investment Advisers Act of 1940 and none of the investment products sponsored or managed by Grayscale are registered under the Investment Company Act of 1940. For financial professional use only 3

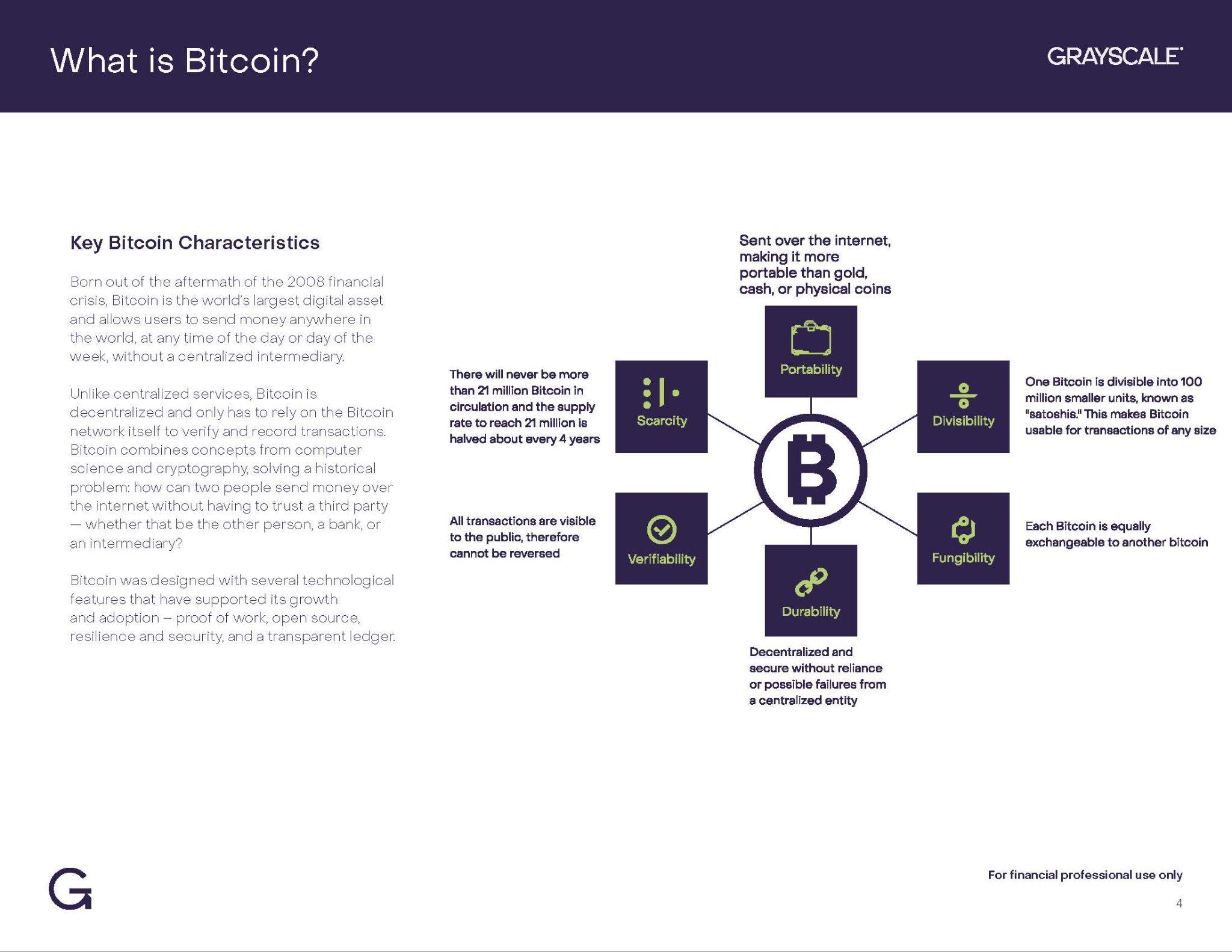

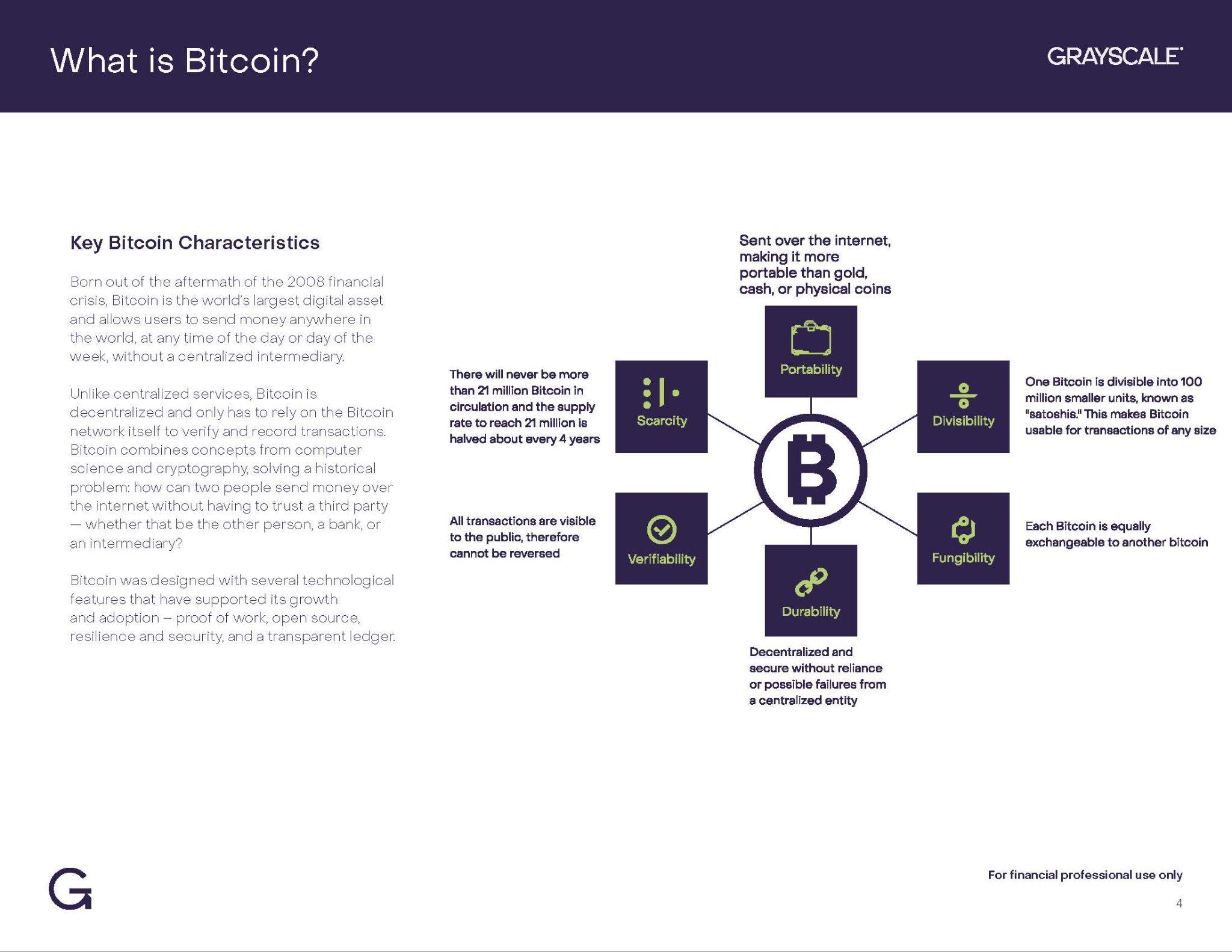

Key Bitcoin Characteristics

Born out of the aftermath of the 2008 financial crisis, Bitcoin is the world’s largest digital asset and allows users to send money anywhere in the world, at any time of the day or day of the week, without a centralized intermediary.

Unlike centralized services, Bitcoin is decentralized and only has to rely on the Bitcoin network itself to verify and record transactions. Bitcoin combines concepts from computer science and cryptography, solving a historical problem: how can two people send money over the internet without having to trust a third party

— whether that be the other person, a bank, or an intermediary? Bitcoin was designed with several technological features that have supported its growth and adoption – proof of work, open source, resilience and security, and a transparent ledger.

Portability Divisibility Fungibility Durability Verifiability Scarcity Sent over the internet, making it more portable than gold, cash, or physical coins One Bitcoin is divisible into 100 million smaller units, known as "satoshis." This makes Bitcoin usable for transactions of any size Decentralized and secure without reliance or possible failures from All transactions are visible to the public, therefore cannot be reversed There will never be more than 21 million Bitcoin in circulation and the supply rate to reach 21 million is halved about every 4 years

For financial professional use only 4

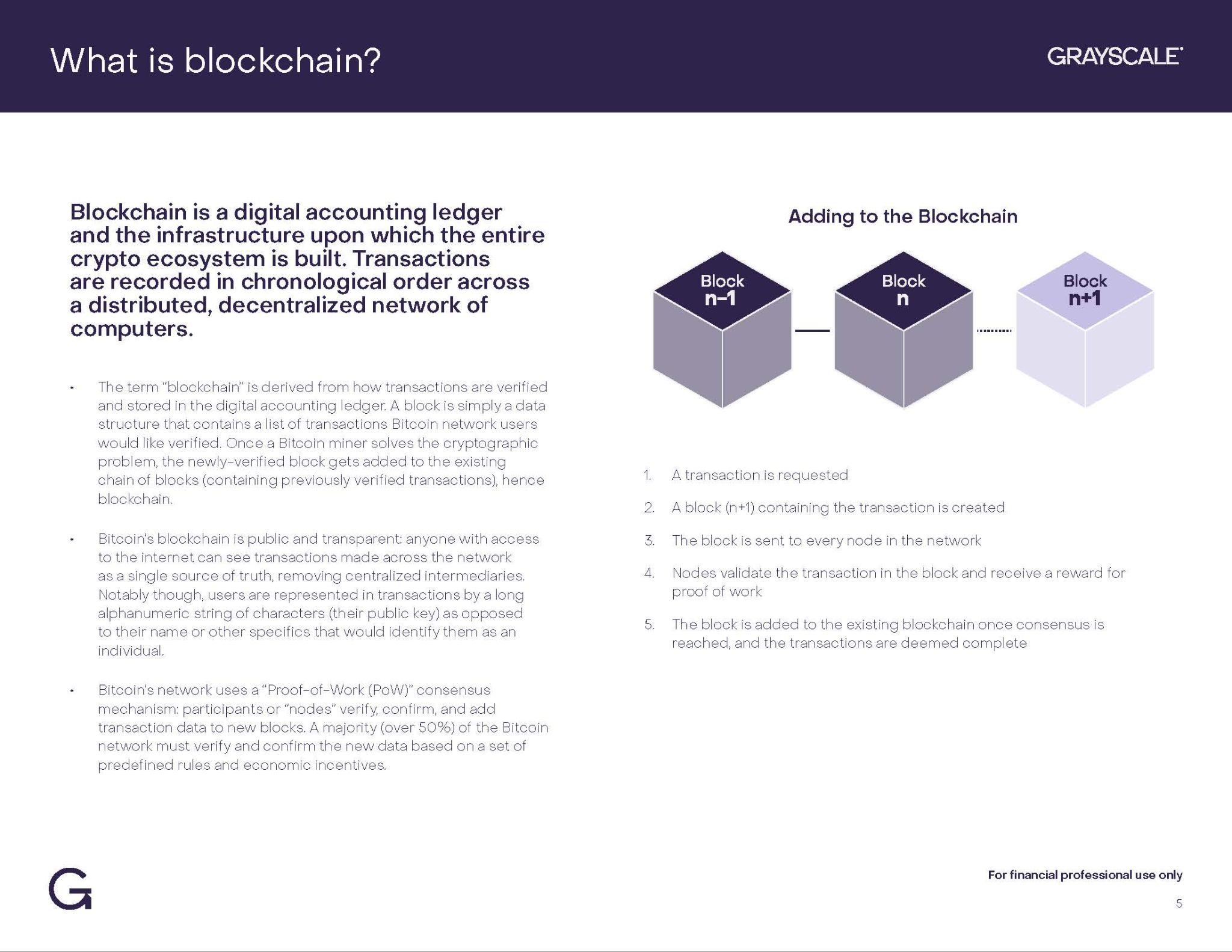

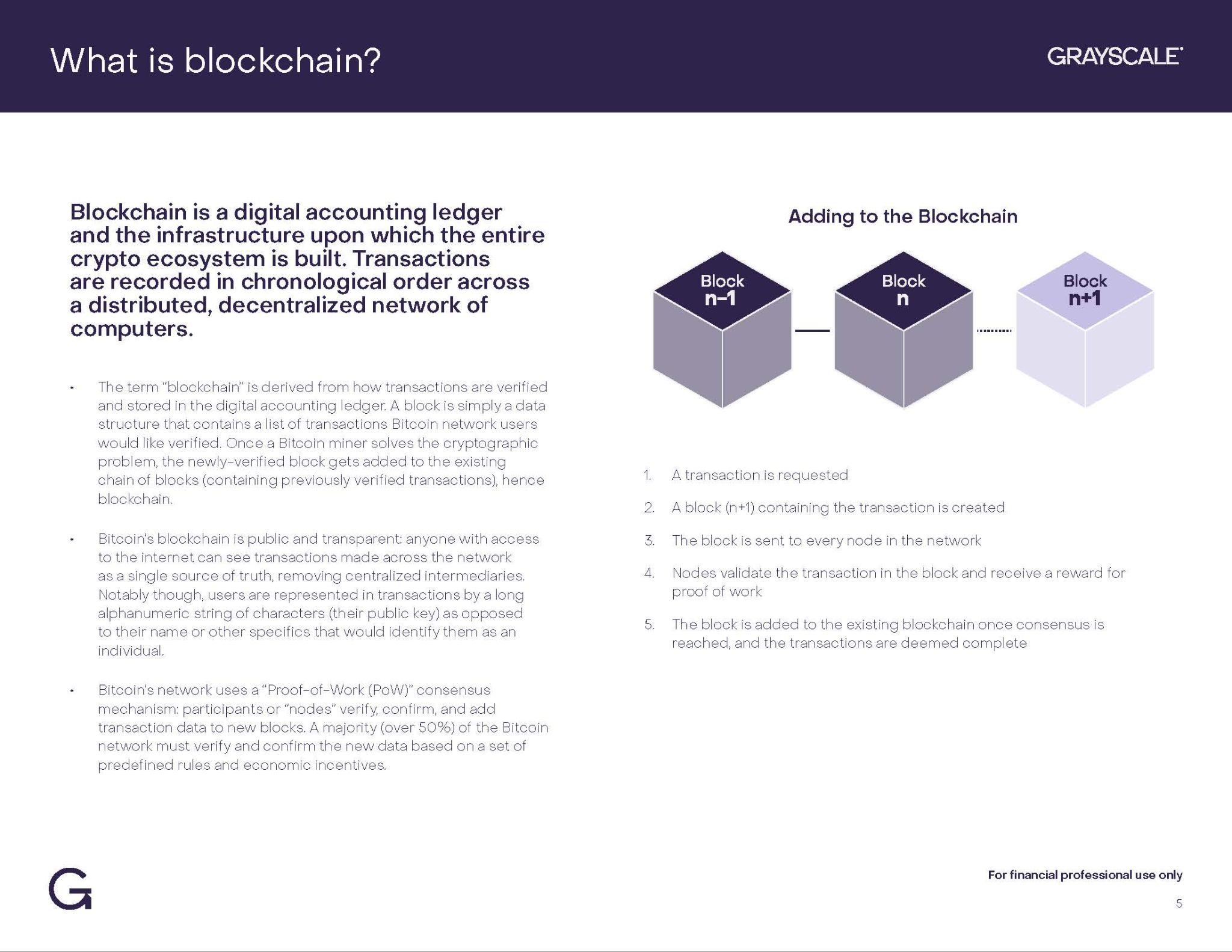

Blockchain is a digital accounting ledger and the infrastructure upon which the entire crypto ecosystem is built. Transactions are recorded in chronological order across a distributed, decentralized network of computers. • The term “blockchain” is derived from how transactions are verified and stored in the digital accounting ledger. A block is simply a data structure that contains a list of transactions Bitcoin network users would like verified. Once a Bitcoin miner solves the cryptographic problem, the newly-verified block gets added to the existing

chain of blocks (containing previously verified transactions), hence blockchain. • Bitcoin’s blockchain is public and transparent: anyone with access to the internet can see transactions made across the network

as a single source of truth, removing centralized intermediaries. Notably though, users are represented in transactions by a long alphanumeric string of characters (their public key) as opposed to their name or other specifics that would identify them as an individual. • Bitcoin’s network uses a “Proof-of-Work (PoW)” consensus mechanism: participants or “nodes” verify, confirm, and add transaction data to new blocks. A majority (over 50%) of the Bitcoin network must verify and confirm the new data based on a set of predefined rules and economic incentives. Adding to the Blockchain Block n-1 Block n Block n+1 1. A transaction is requested 2. A block (n+1) containing the transaction is created 3. The block is sent to every node in the network 4. Nodes validate the transaction in the block and receive a reward for proof of work 5. The block is added to the existing blockchain once consensus is reached, and the transactions are deemed complete For Financial Professional use only 5

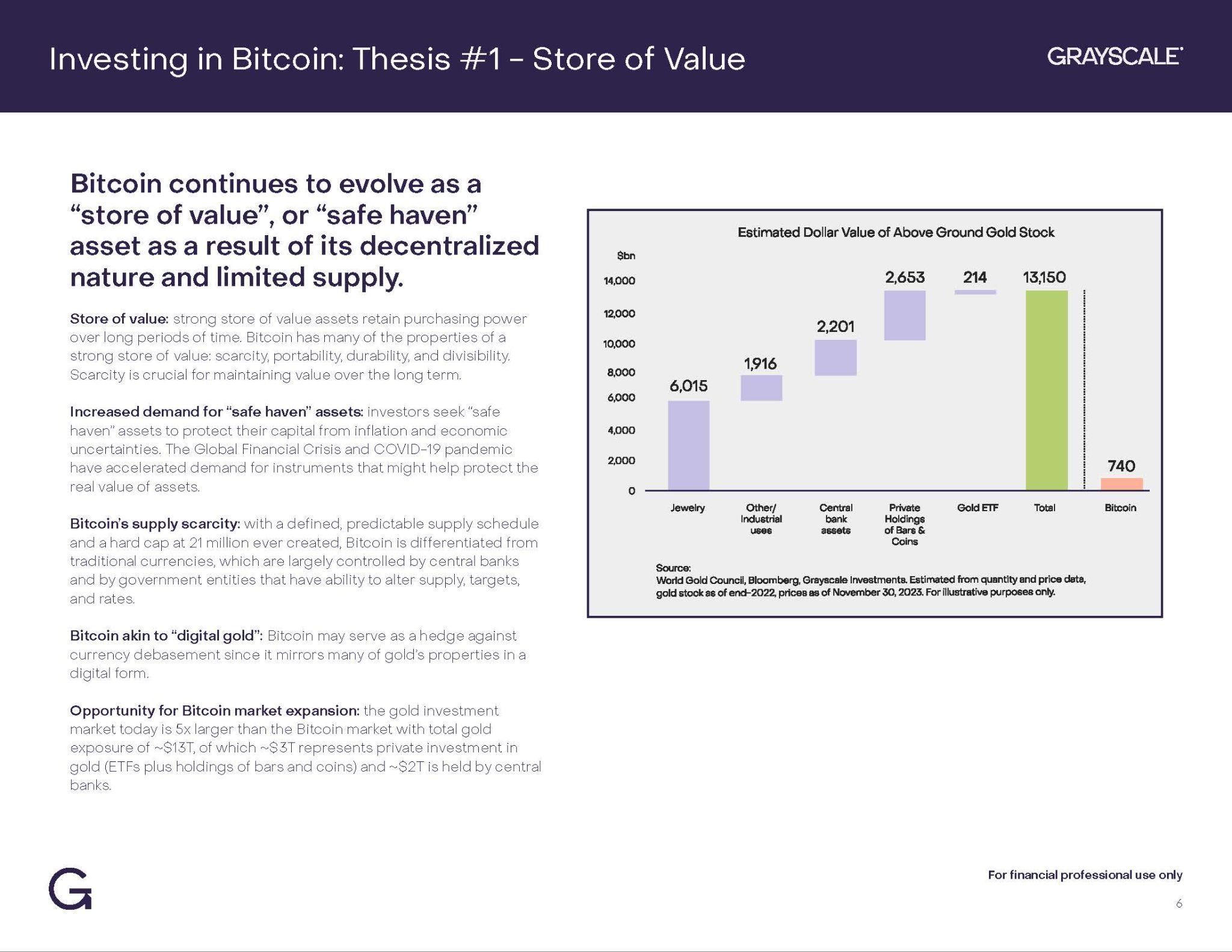

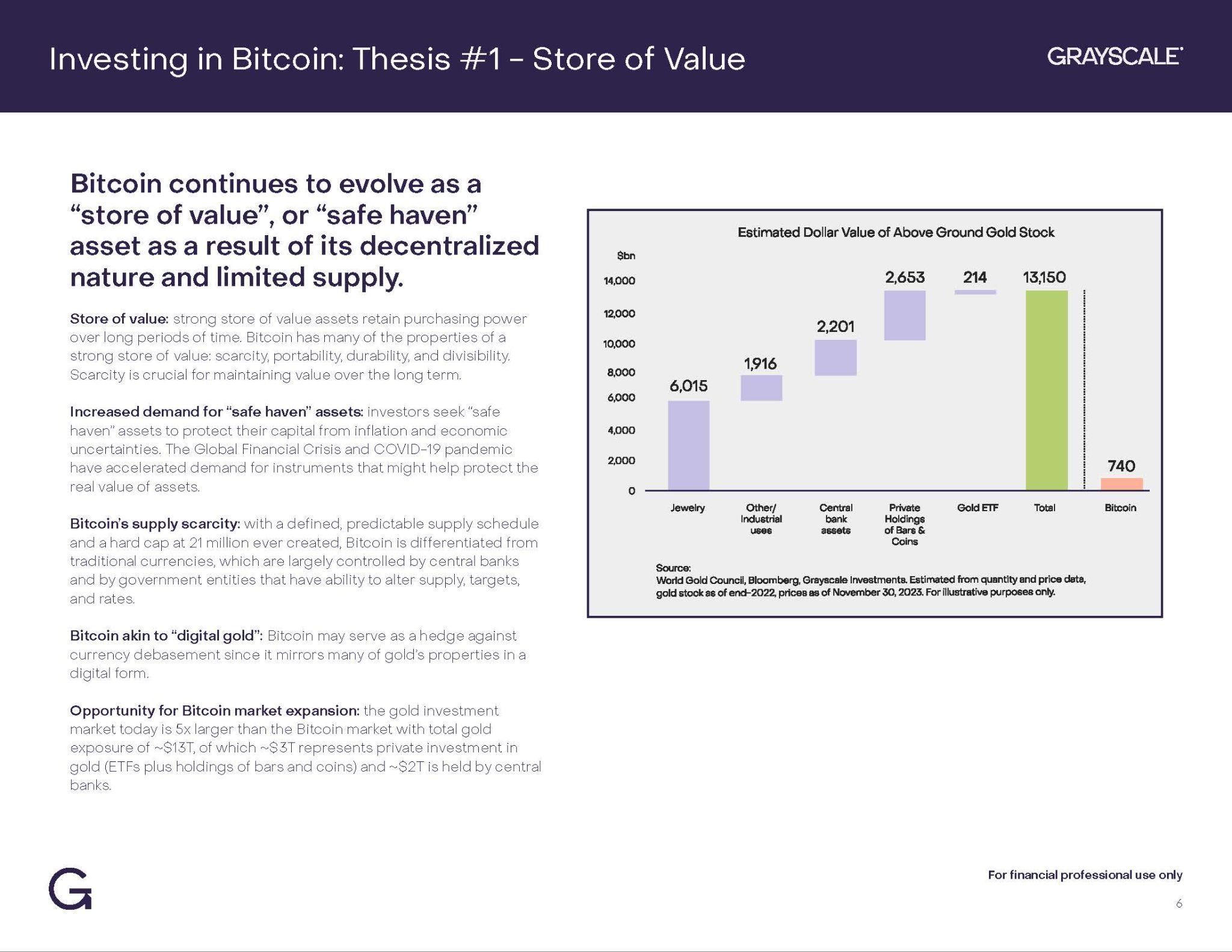

"Estimated Dollar Value of Above Ground Gold Stock $bn 14,000 2,653 214 13,150 12,000 2,201 10,000 1,916 8,000 6,015 6,000 4,000 2,000 740 0 Jewelry Other/ Central Private Gold ETF Total Bitcoin Industrial bank Holdings uses assets of Bars & Coins Source: World Gold Council, Bloomberg,Grayscale Investments. Estimated from quantity and price data, gold stock as of end-2022, prices as of November 30, 2023. For illustrative purposes only." Bitcoin continues to evolve as a “store of value”, or “safe haven” asset as a result of its decentralized nature and limited supply. Store of value: strong store of value assets retain purchasing power over long periods of time. Bitcoin has many of the properties of a strong store of value: scarcity, portability, durability, and divisibility. Scarcity is crucial for maintaining value over the long term. Increased demand for “safe haven” assets: investors seek “safe haven” assets to protect their capital from inflation and economic uncertainties. The Global Financial Crisis and COVID-19 pandemic have accelerated demand for instruments that might help protect the real value of assets. Bitcoin’s supply scarcity: with a defined, predictable supply schedule and a hard cap at 21 million ever created, Bitcoin is differentiated from traditional currencies, which are largely controlled by central banks and by government entities that have ability to alter supply, targets, and rates. Bitcoin akin to “digital gold”: Bitcoin may serve as a hedge against currency debasement since it mirrors many of gold’s properties in a digital form. Opportunity for Bitcoin market expansion: the gold investment market today is 5x larger than the Bitcoin market with total gold exposure of ~$13T, of which ~$3T represents private investment in gold (ETFs plus holdings of bars and coins) and ~$2T is held by central banks. 6

Investing in Bitcoin: Thesis #2 - Means of Payment Today, Bitcoin is also used as a means of payment, void of intermediaries

- often creating efficiencies and savings over traditional means of transferring value.

Bitcoin’s portability: Bitcoin offers users the ability to send value anywhere in the world, at any time of day or day of the week, representing any amount of value. In fact, Bitcoin as a means of remittance is higher

in countries with an unstable domestic currency or banking system e.g., Venezuela, El Salvador.

Eliminating time, fees, and inefficiencies: Bitcoin’s portability further removes barriers for users who typically participate in global remittances. Since Bitcoin is decentralized, removing the traditional intermediary, users can avoid the challenges and expenses associated with international transaction fees and exchange rates.

Bitcoin’s potential to capture a portion of M1 supply: economists typically refer to the nearly $60T supply of transactional money globally as “M1”. Bitcoin has the potential to capture share of high value payments since it can be more cost effective on the Bitcoin network than traditional payment rails.

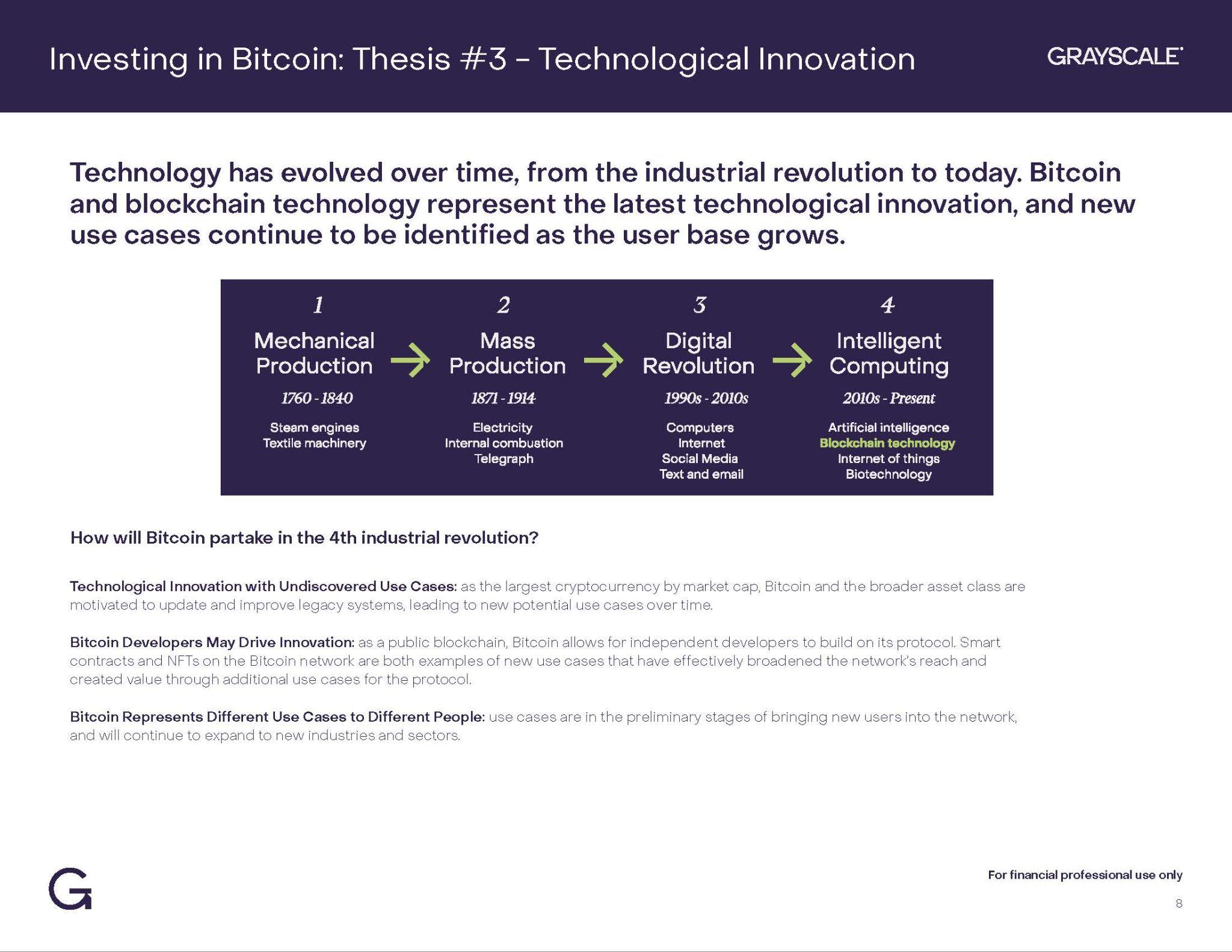

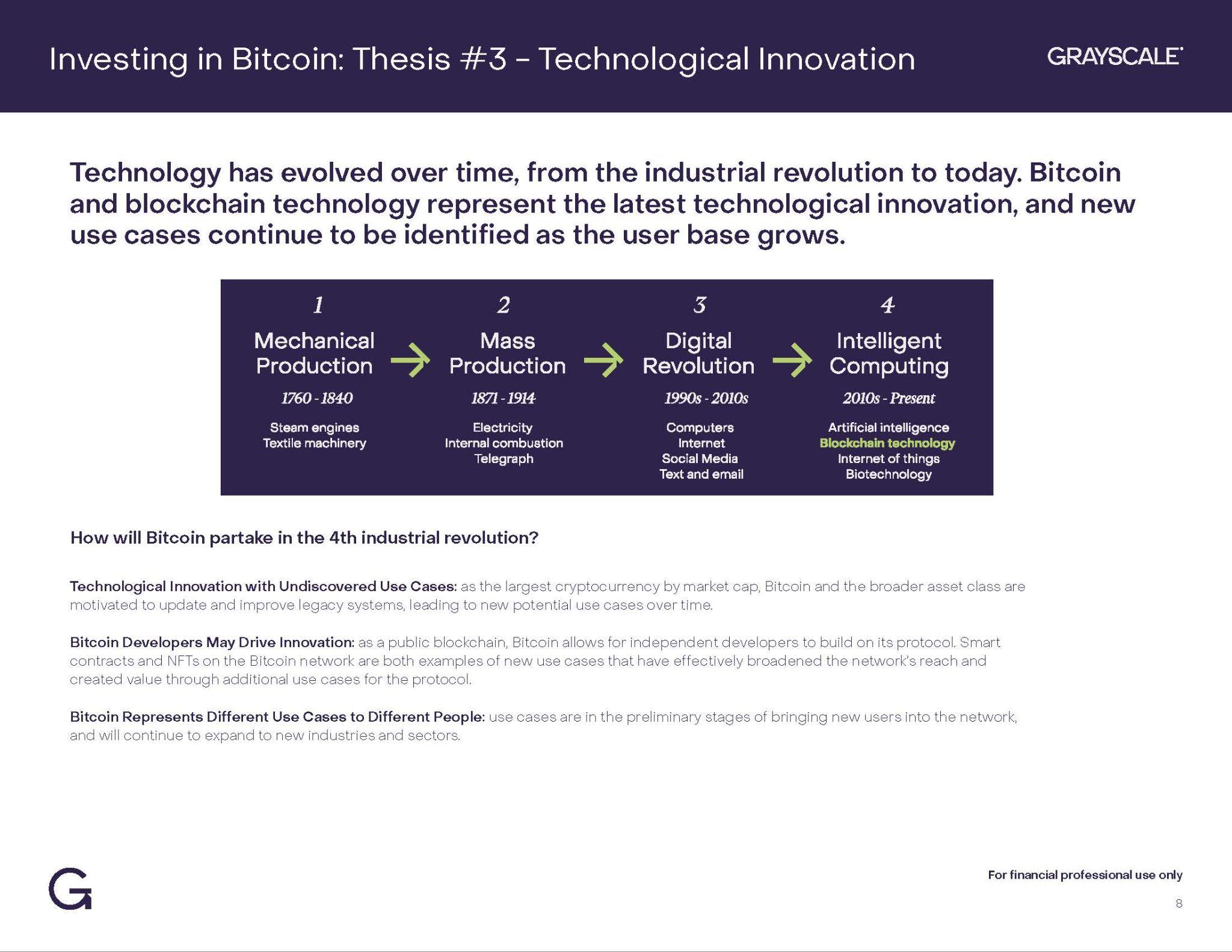

"Investing in Bitcoin: Thesis #3 - Technological Innovation"

"Technology has evolved over time, from the industrial revolution to today. Bitcoin and blockchain technology represent the latest technological innovation, and new use cases continue to be identified as the user base grows."

1 Mechanical production 1760-1840 steam engines textile machinery 2 mass productions 1871-1914 electricity internal combustion telegraph 3 digital revolution 1990s -2010 computers internet social media text and email 4 intelligent computing 2010s-present artificial intelligence internet of things biotechnology

"How will Bitcoin partake in the 4th industrial revolution?"

"Technological Innovation with Undiscovered Use Cases: as the largest cryptocurrency by market cap, Bitcoin and the broader asset class are motivated to update and improve legacy systems, leading to new potential use cases over time.

Bitcoin Developers May Drive Innovation: as a public blockchain, Bitcoin allows for independent developers to build on its protocol. Smart contracts and NFTs on the Bitcoin network are both examples of new use cases that have effectively broadened the network’s reach and created value through additional use cases for the protocol.

Bitcoin Represents Different Use Cases to Different People: use cases are in the preliminary stages of bringing new users into the network, and will continue to expand to new industries and sectors."

"For financial professional use only

8"

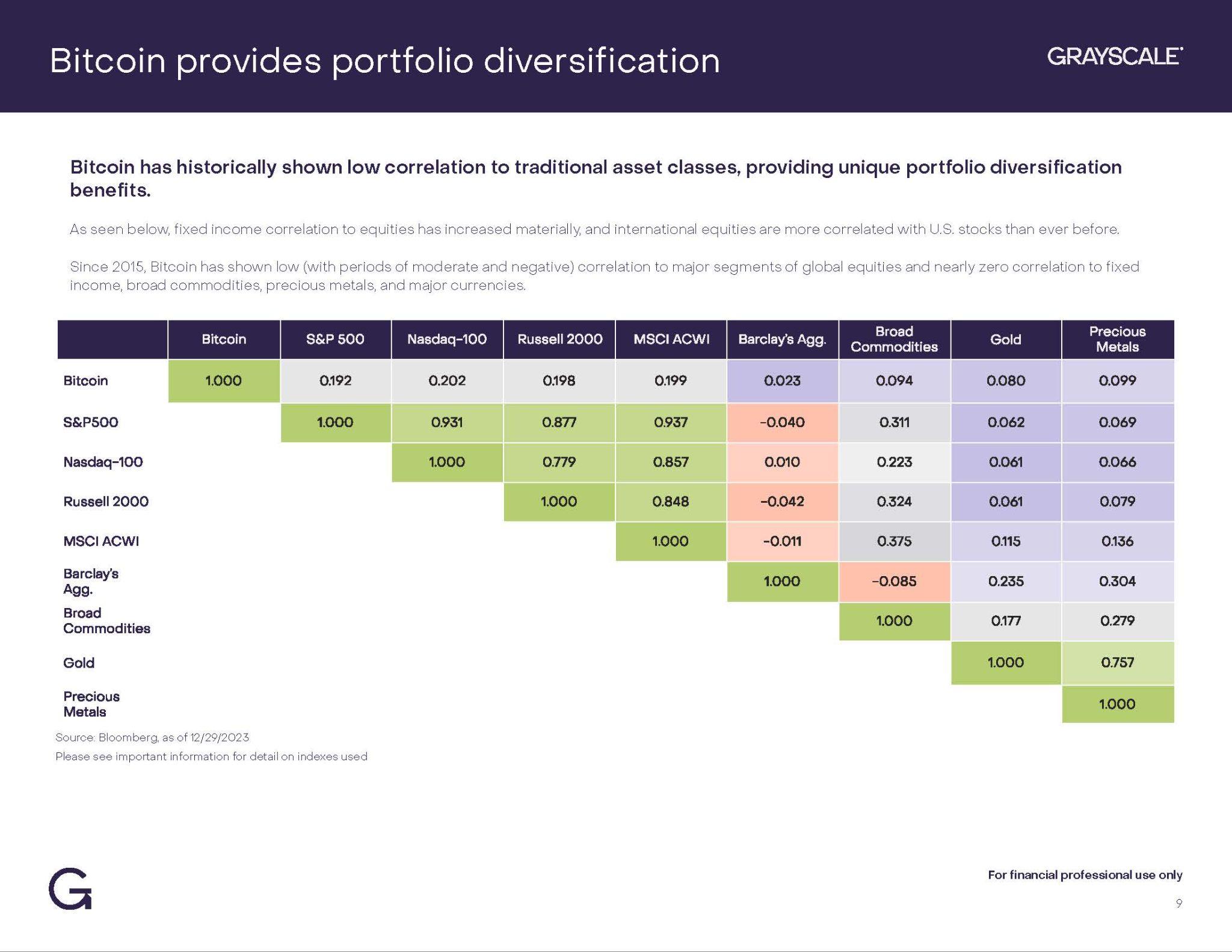

"Bitcoin provides portfolio diversification"

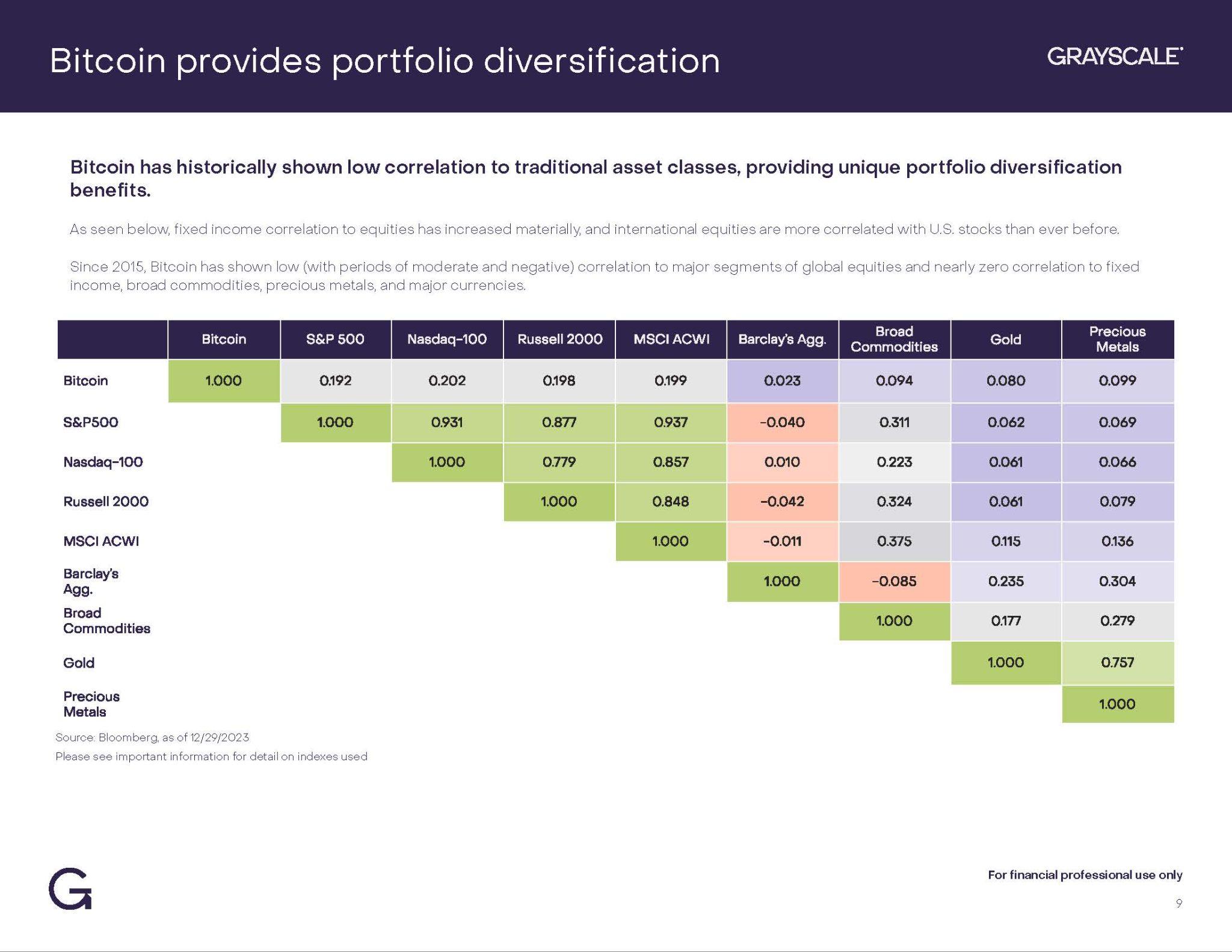

"Bitcoin has historically shown low correlation to traditional asset classes, providing unique portfolio diversification benefits."

"As seen below, fixed income correlation to equities has increased materially, and international equities are more correlated with U.S. stocks than ever before."

"Since 2015, Bitcoin has shown low (with periods of moderate and negative) correlation to major segments of global equities and nearly zero correlation to fixed income, broad commodities, precious metals, and major currencies." "Bitcoin" 1.000 0.192 0.202 "0.198 0.199" 0.023 0.094 0.080 0.099

"S&P500" 1.000 0.931 0.877 0.937 -0.040 0.311 0.062 0.069

"Nasdaq-100" 1.000 0.779 0.857 0.010 0.223 "0.061

0.061" "0.066

0.079"

"Russell 2000" 1.000 0.848 -0.042 0.324

"MSCIACWI" 1.000 -0.011 0.375 0.115 0.136

"Barclay's Agg." 1.000 -0.085 0.235 0.304

"Broad Commodities" 1.000 0.177 0.279

"Gold" 1.000 0.757

"Precious Metals" 1.000

"Source: Bloomberg, as of 12/29/2023

Please see important information for detail on indexes used"

"For financial professional use only

9"

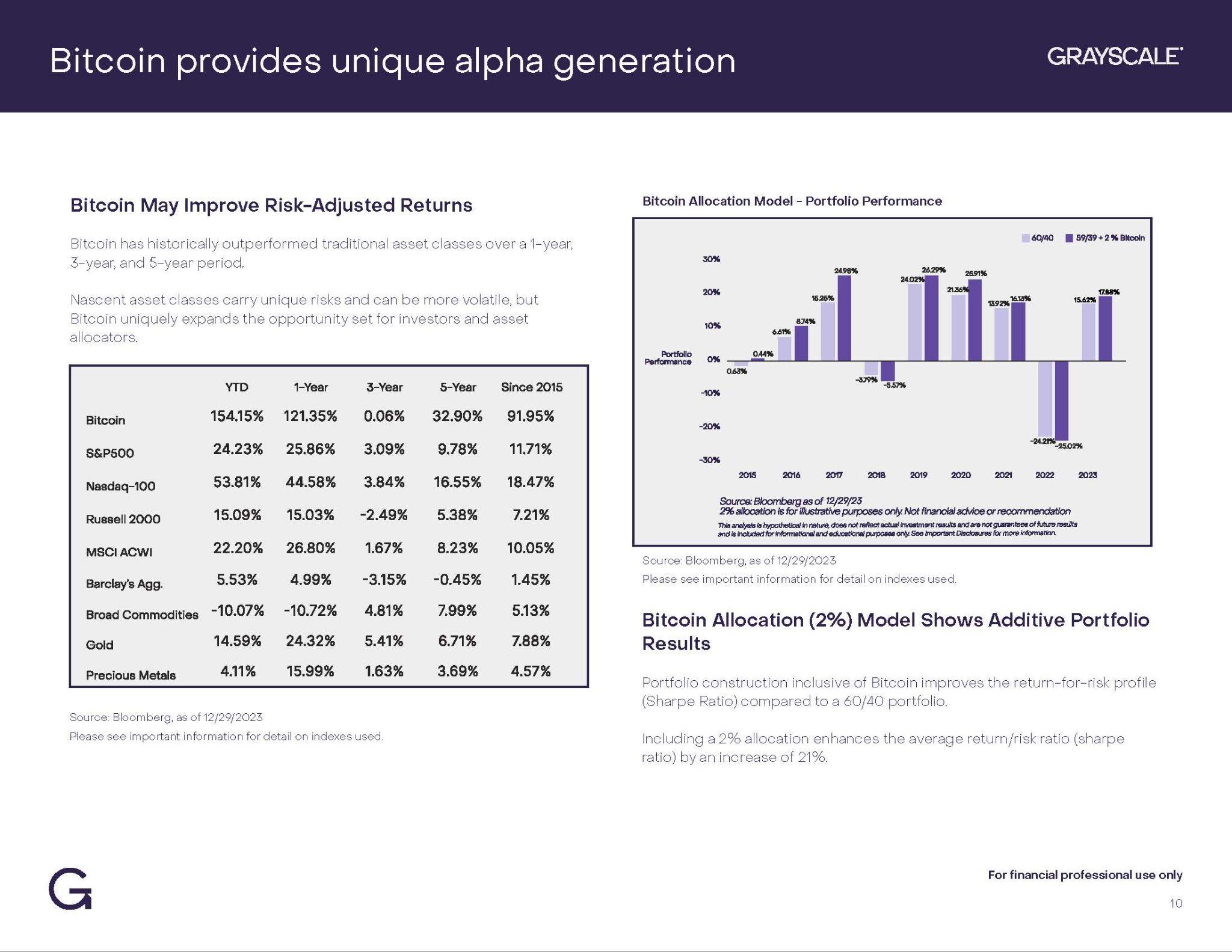

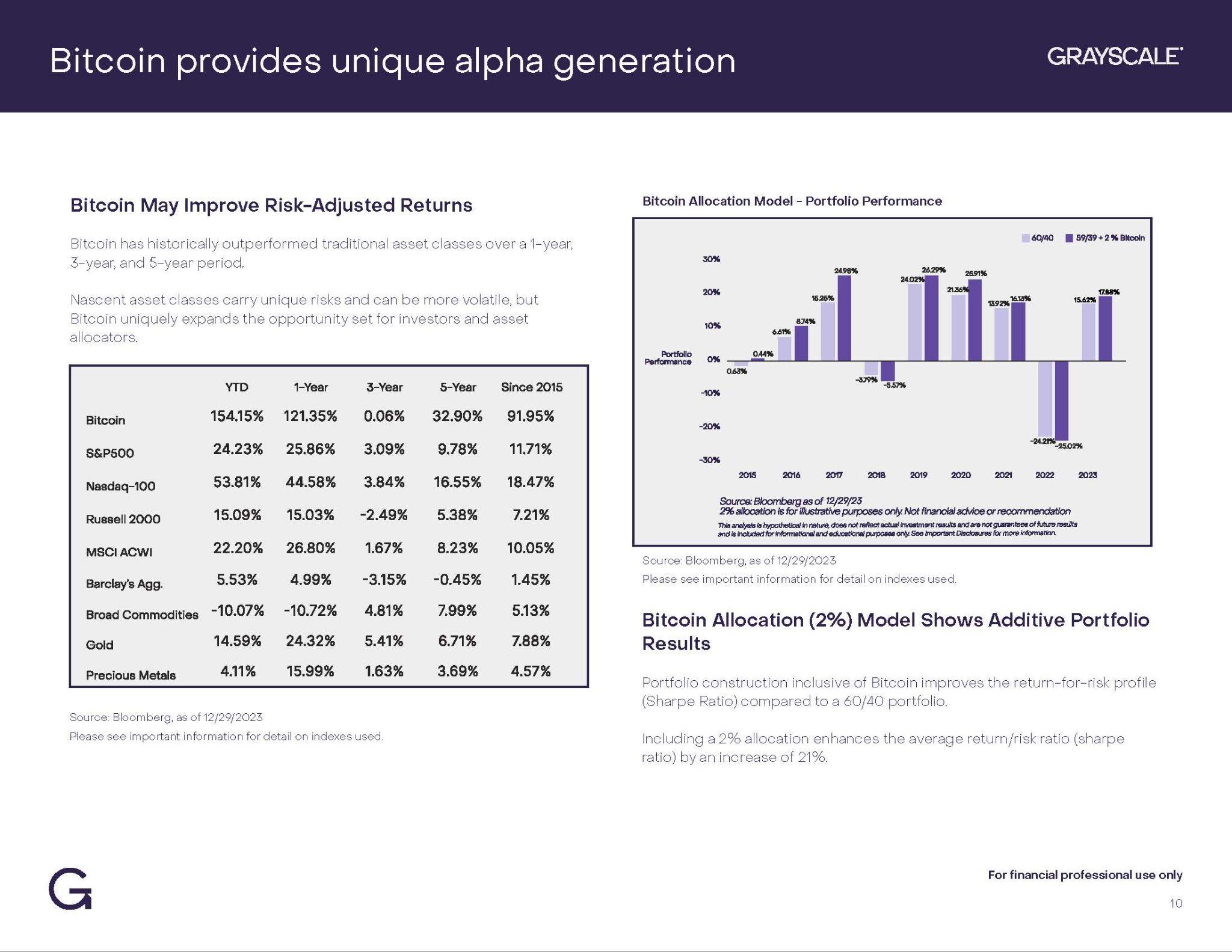

"Bitcoin provides unique alpha generation"

"Bitcoin May Improve Risk-Adjusted Returns"

"Bitcoin Allocation Model - Portfolio Performance"

"Bitcoin has historically outperformed traditional asset classes over a 1-year,

3-year, and 5-year period."

"Nascent asset classes carry unique risks and can be more volatile, but Bitcoin uniquely expands the opportunity set for investors and asset

allocators."

"YTD" "1-Year" "3-Year" "5-Year" "Since 2015"

"Bitcoin" 1.541500 1.213500 0.000600 0.329000 0.919500

"S&PS00" 0.242300 0.258600 0.030900 0.097800 0.117100

"Nasdaq-100" 0.538100 0.445800 0.038400 0.165500 0.184700

"Russell 2000" 0.150900 0.150300 -0.024900 0.053800 0.072100

"MSCIACWI" 0.222000 0.268000 0.016700 0.082300 0.100500

"Barclay's Agg." 0.055300 0.049900 -0.031500 -0.004500 0.014500

"Broad Commodities" -0.100700 -0.107200 0.048100 0.079900 0.051300

"Gold" 0.145900 0.243200 0.054100 0.067100 0.078800

"Precious Metals" 0.041100 0.159900 0.016300 0.036900 0.045700

"Source: Bloomberg, as of 12/29/2023

Please see important information for detail on indexes used.

Bitcoin Allocation (2%) Model Shows Additive Portfolio Results" "Portfolio construction inclusive of Bitcoin improves the return-for-risk profile (Sharpe Ratio) compared to a 60/40 portfolio. Including a 2% allocation enhances the average return/risk ratio (sharpe ratio) by an increase of 21%."

"Source: Bloomberg, as of 12/29/2023 Please see important information for detail on indexes used.""For financial professional use only

10"

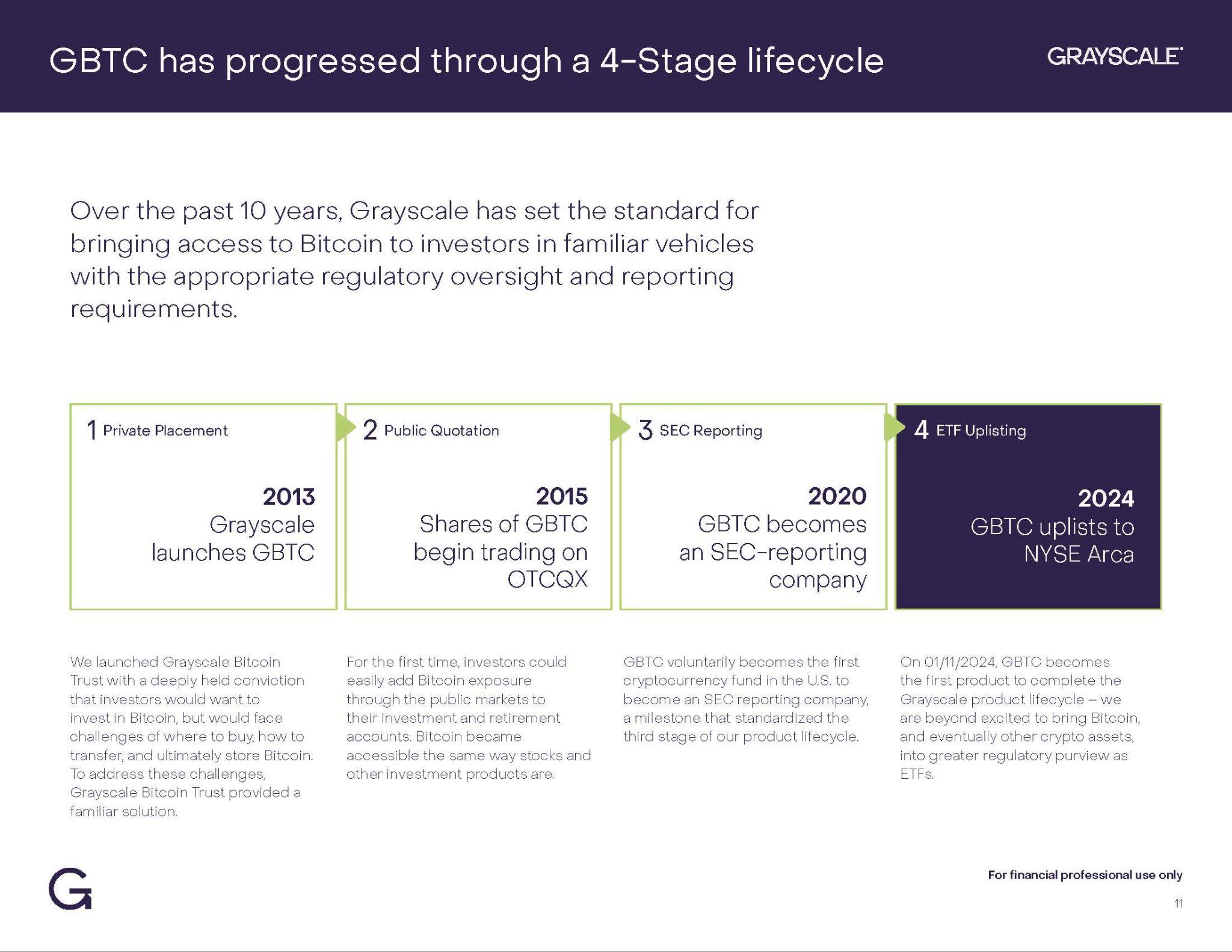

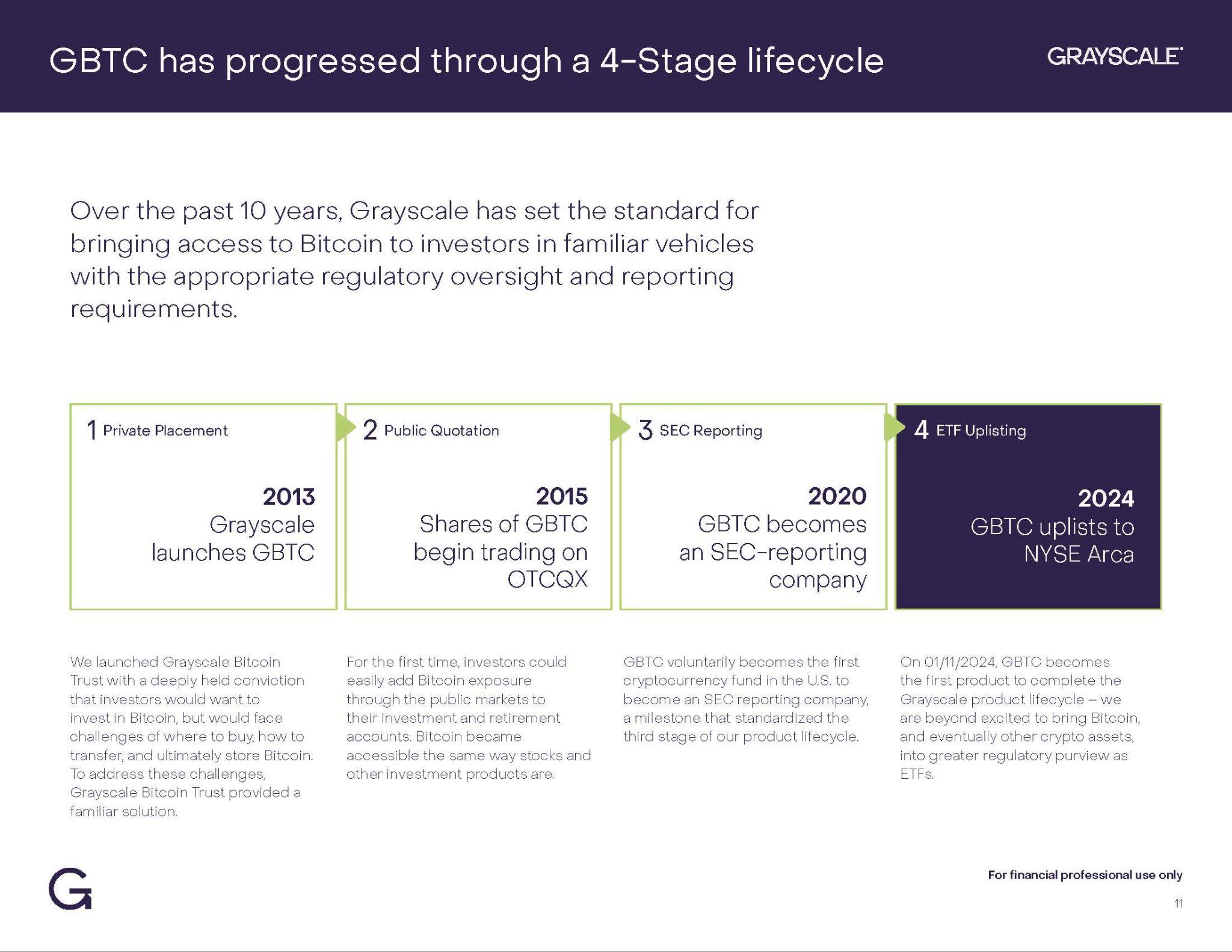

"GBTC has progressed through a 4-Stage lifecycle"

"Over the past 10 years, Grayscale has set the standard for bringing access to Bitcoin to investors in familiar vehicles with the appropriate regulatory oversight and reporting requirements."

"1 Private Placement 2013 Grayscale launches GBTC" "2 Public Quotation 2015

Shares of GBTC begin trading on OTCQX" "3 SEC Reporting

2020 GBTC becomes an SEC-reporting company" "4 ETF Uplisting 2024 GBTC uplists to NYSE Arca"

"We launched Grayscale Bitcoin Trust with a deeply held conviction that investors would want to

invest in Bitcoin, but would face challenges of where to buy, how to transfer, and ultimately store Bitcoin. To address these challenges, Grayscale Bitcoin Trust provided a familiar solution. For the first time, investors could easily add Bitcoin exposure through the public markets to their investment and retirement accounts. Bitcoin became accessible the same way stocks and other investment products are. "GBTC voluntarily becomes the first cryptocurrency fund in the U.S. to become an SEC reporting company, a milestone that standardized the third stage of our product lifecycle." "On 01/11/2024, GBTC becomes the first product to complete the Grayscale product lifecycle – we

are beyond excited to bring Bitcoin, and eventually other crypto assets, into greater regulatory purview as

ETFs." "For financial professional use only11"

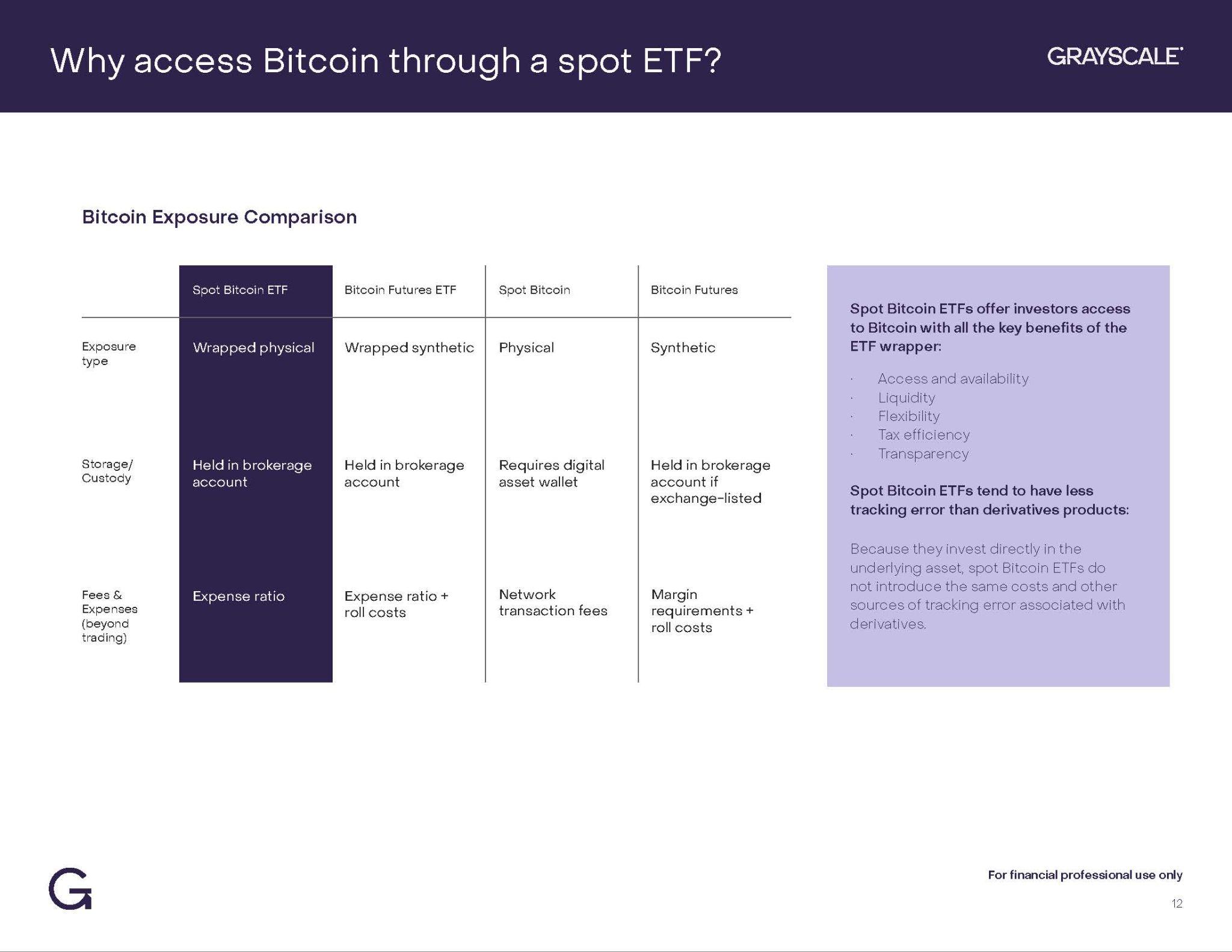

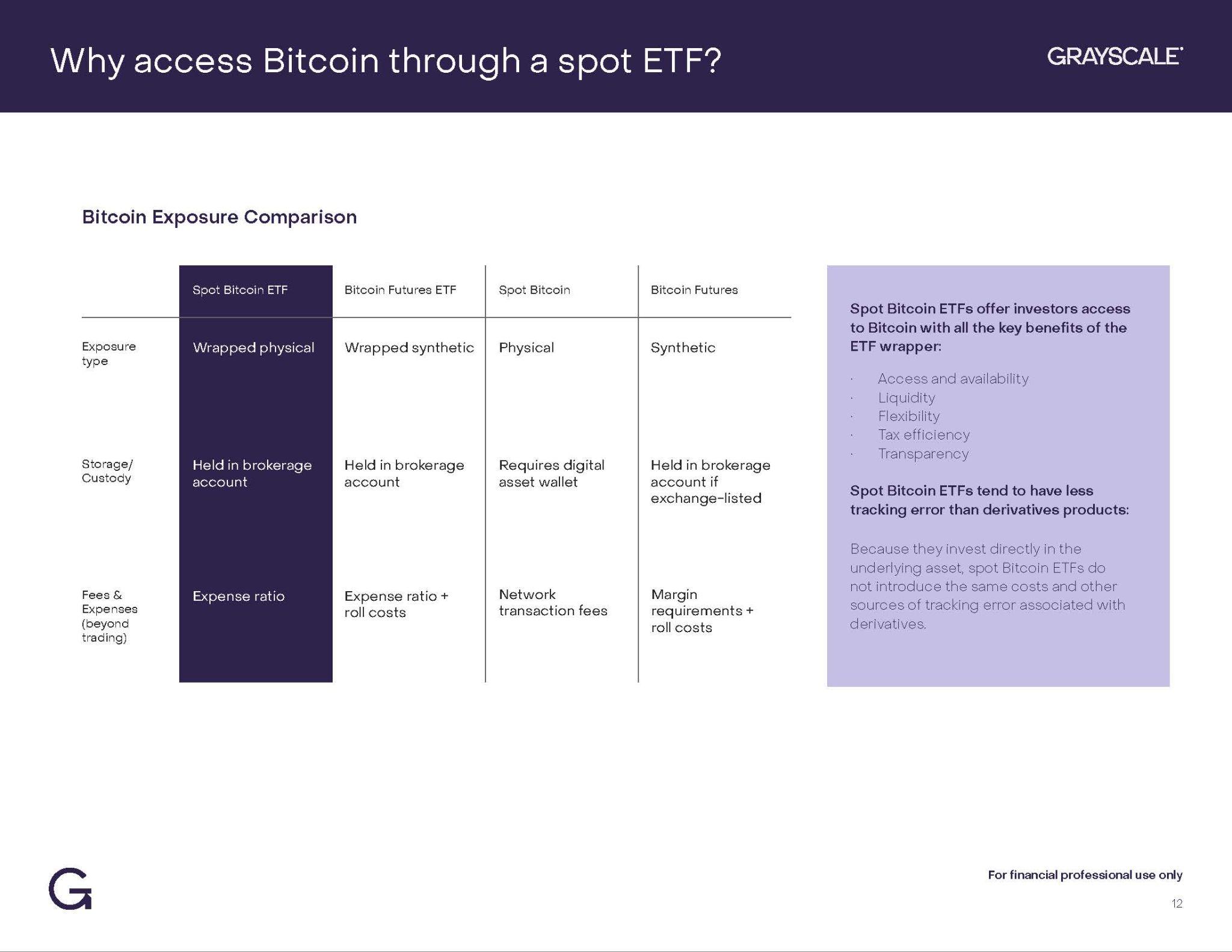

"Why access Bitcoin through a spot ETF?"

"Bitcoin Exposure Comparison" "Spot Bitcoin ETF" "Bitcoin Futures ETF" "Spot Bitcoin" "Bitcoin Futures" "Spot Bitcoin ETFs offer investors access to Bitcoin with all the key benefits of the ETF wrapper:

• Access and availability

• Liquidity

• Flexibility

• Tax efficiency

• Transparency

Spot Bitcoin ETFs tend to have less tracking error than derivatives products:

Because they invest directly in the underlying asset, spot Bitcoin ETFs do not introduce the same costs and other sources of tracking error associated with derivatives."

"Exposure type" "Wrapped physical" "Wrapped synthetic" "Physical" "Synthetic"

"Storage/ Custody" "Held in brokerage account" "Held in brokerage account" "Requires digital asset wallet" "Held in brokerage account if exchange-listed"

"Fees & Expenses (beyond trading)" "Expense ratio" "Expense ratio + roll costs" "Network transaction fees" "Margin requirements + roll costs" "For financial professional use only" 12

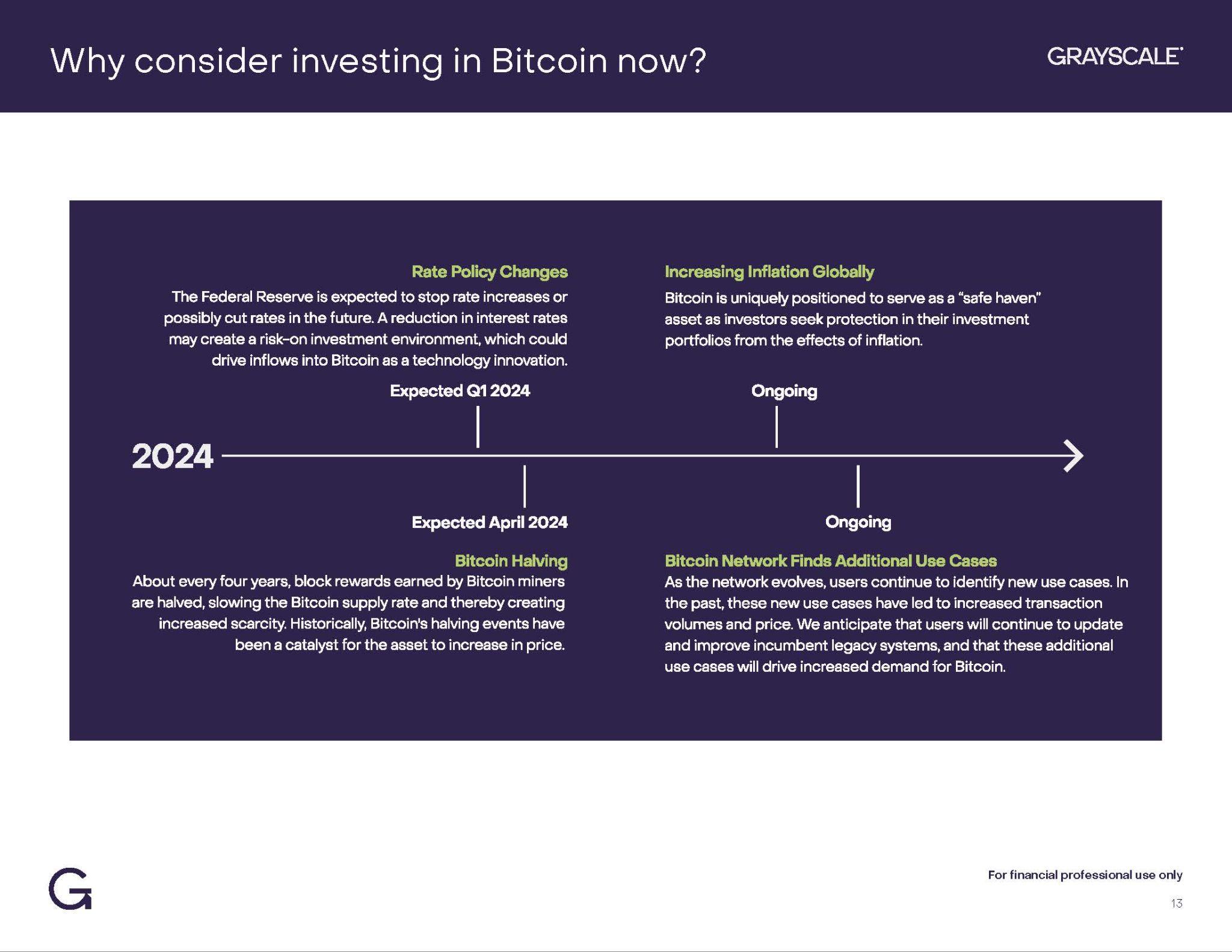

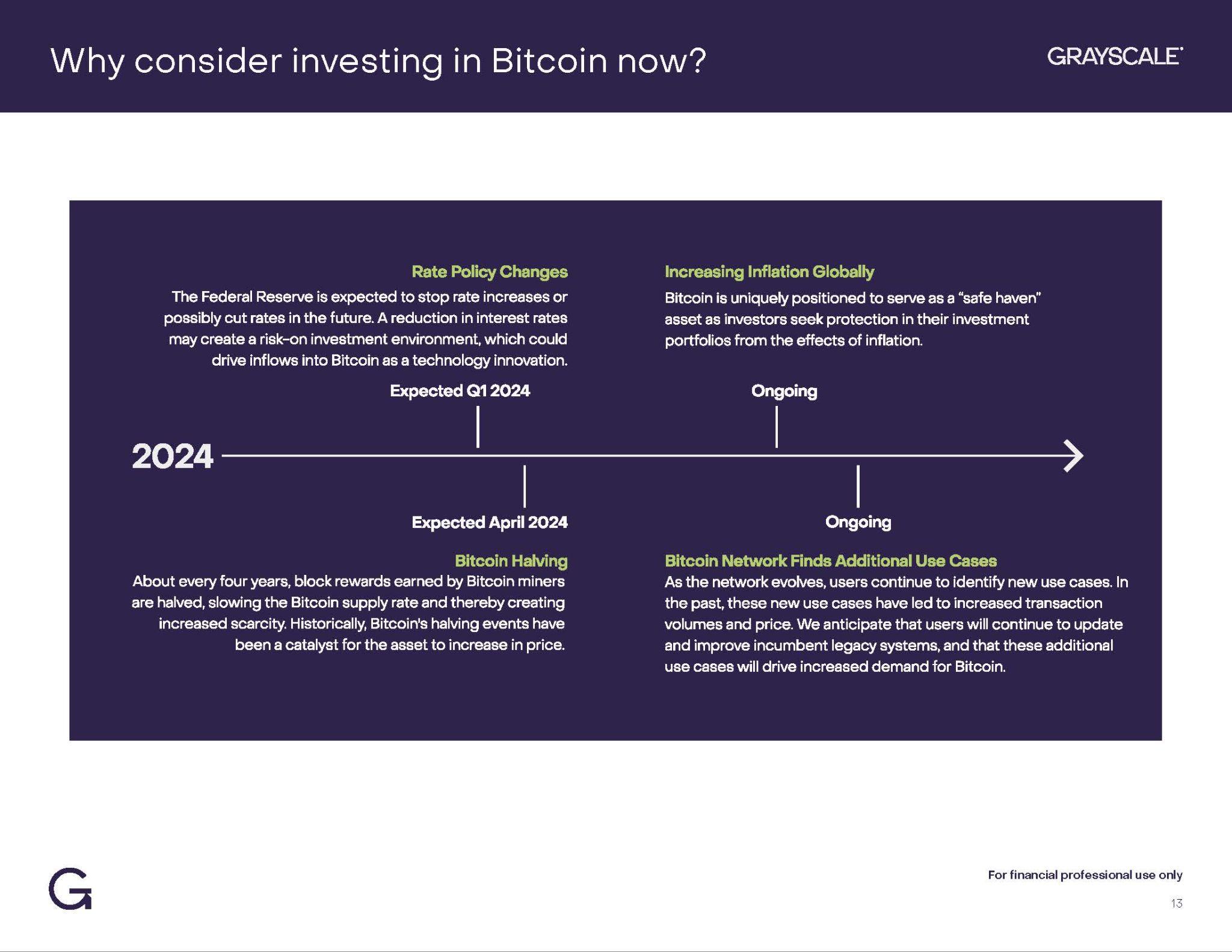

"Why consider investing in Bitcoin now?"

"Rate Policy Changes The Federal Reserve is expected to stop rate increases or possibly cut rates in the future. A reduction in interest rates may create a risk-on investment environment, which could drive inflows into Bitcoin as a technology innovation. Increasing Inflation Globally Bitcoin is uniquely positioned to serve as a “safe haven”

asset as investors seek protection in their in their investment portfolios from the effects of inflation. Bitcoin Halving About every four years, block rewards earned by Bitcoin miners are halved, slowing the Bitcoin supply rate and thereby creating increased scarcity. Historically, Bitcoin's halving events have been a catalyst for the asset to increase in price. Bitcoin Network Finds Additional Use Cases" As the network evolves, users continue to identify new use cases. In the past, these new use cases have led to increased transaction volumes and price. We anticipate that users will continue to update and improve incumbent legacy systems, and that these additional use cases will drive increased demand for Bitcoin.Expected Q1 2024 Ongiong Expected April 2024

"For financial professional use only"

13

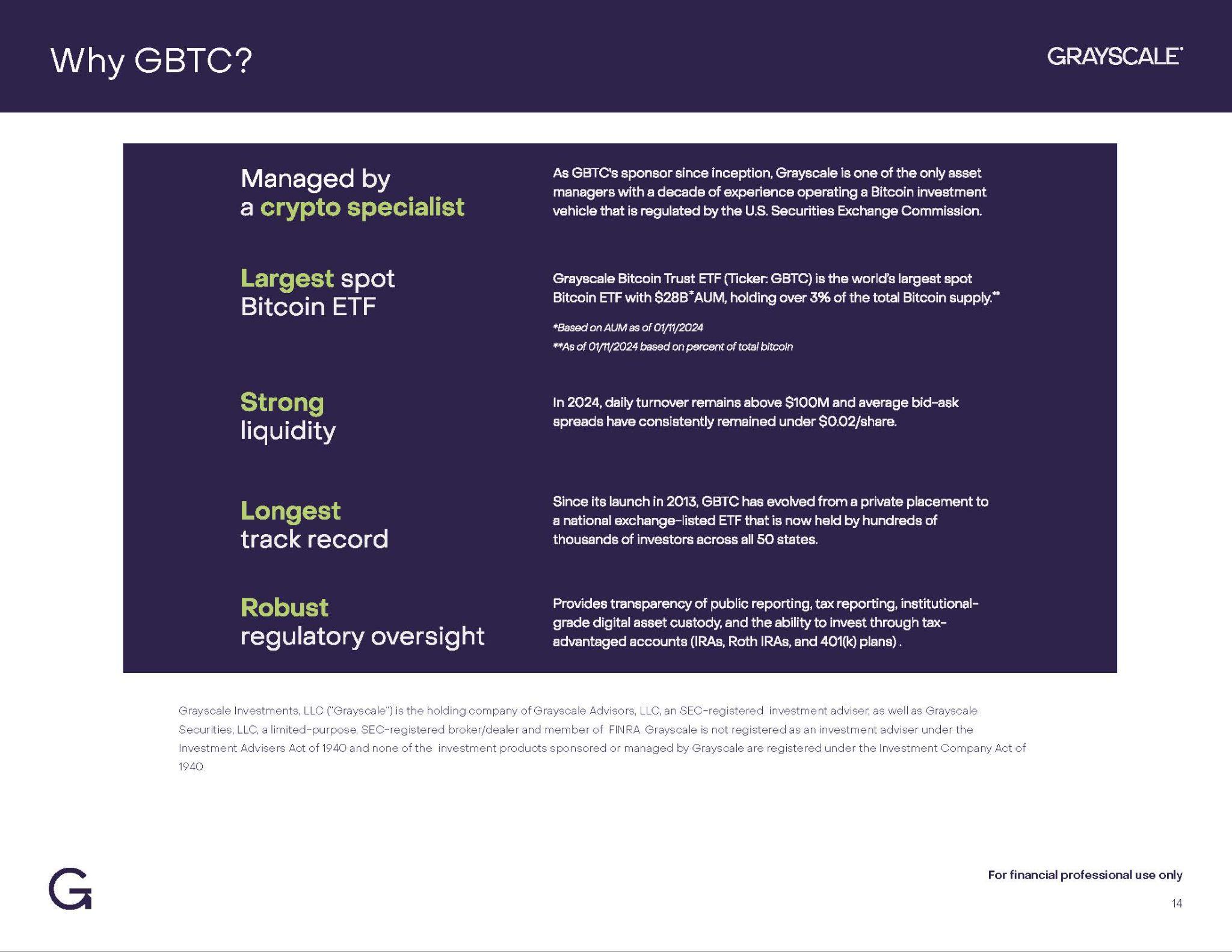

"Why GBTC?" Managed by a crypto specialist As GBTC's sponsor since inception, Grayscale is one of the only asset managers with a decade of experience operating a Bitcoin investment vehicle that is regulated by the U.S. Securities Exchange Commission. Largest spot Bitcoin ETF Grayscale Bitcoin Trust ETF Ticker GBTC is the world’s largest spot Bitcoin ETF with $28B* AUM, holding over 3% of the total Bitcoin supply. *Based on AUM as of 01/11/2024 **As of 01/11/2024 based on percent of total bitcoin Strong liquidity In 2024, daily turnover remains above $100M and average bid-ask spreads have consistently remained under $0.02/share. Longest track record Since its launch in 2013, GBTC has evolved from a private placement to a national exchange-listed ETF that is now held by hundreds of thousands of investors across all 50 states. Robust regulatory oversight Provides transparency of public reporting, tax reporting, institutional-grade digital asset custody, and the ability to invest through tax-advantaged accounts (IRAs, Roth IRAsm and 401(k) plans).

"Grayscale Investments, LLC (“Grayscale”) is the holding company of Grayscale Advisors, LLC, an SEC-registered investment adviser, as well as Grayscale Securities, LLC, a limited-purpose, SEC-registered broker/dealer and member of FINRA. Grayscale is not registered as an investment adviser under the Investment Advisers Act of 1940 and none of the investment products sponsored or managed by Grayscale are registered under the Investment Company Act of 1940."

"For financial professional use only"

14

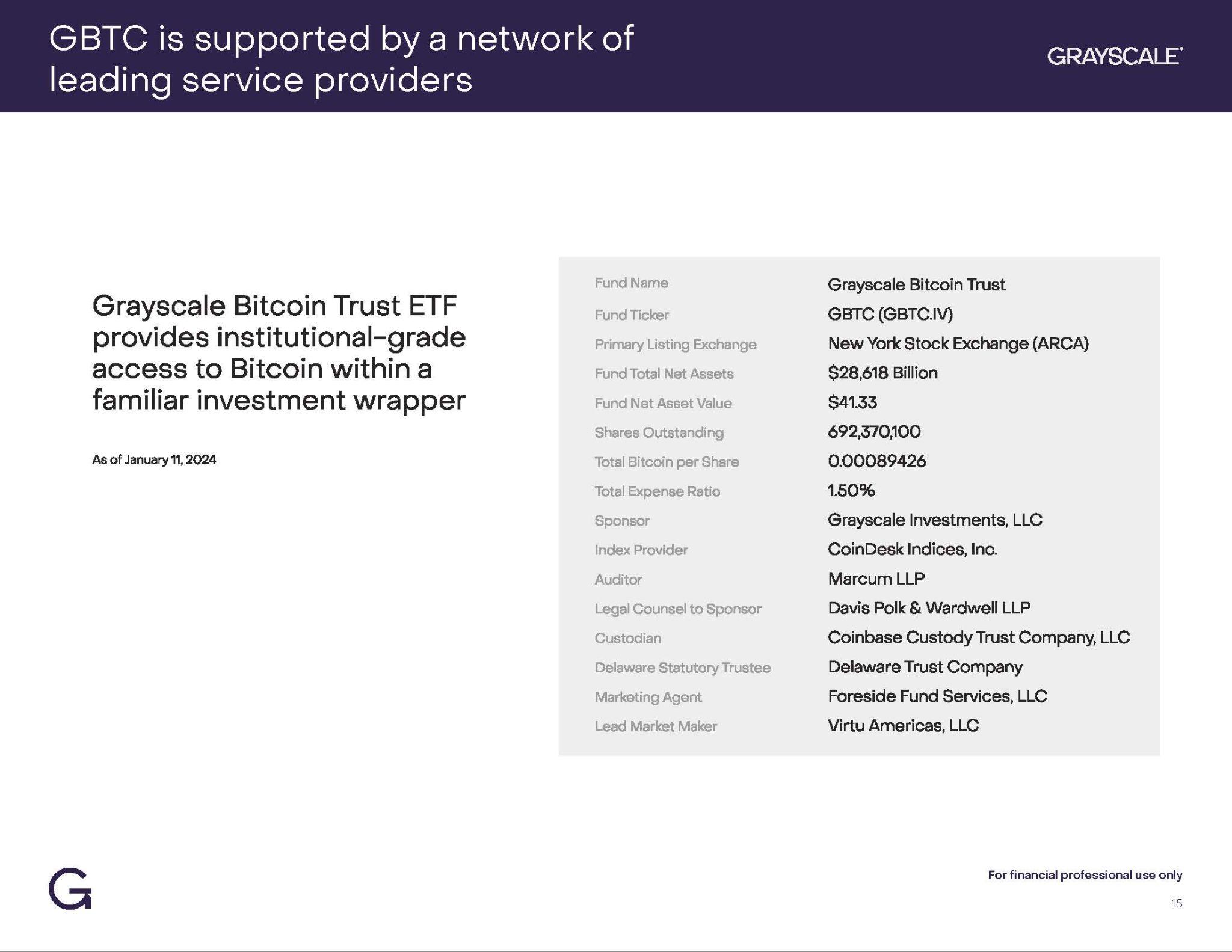

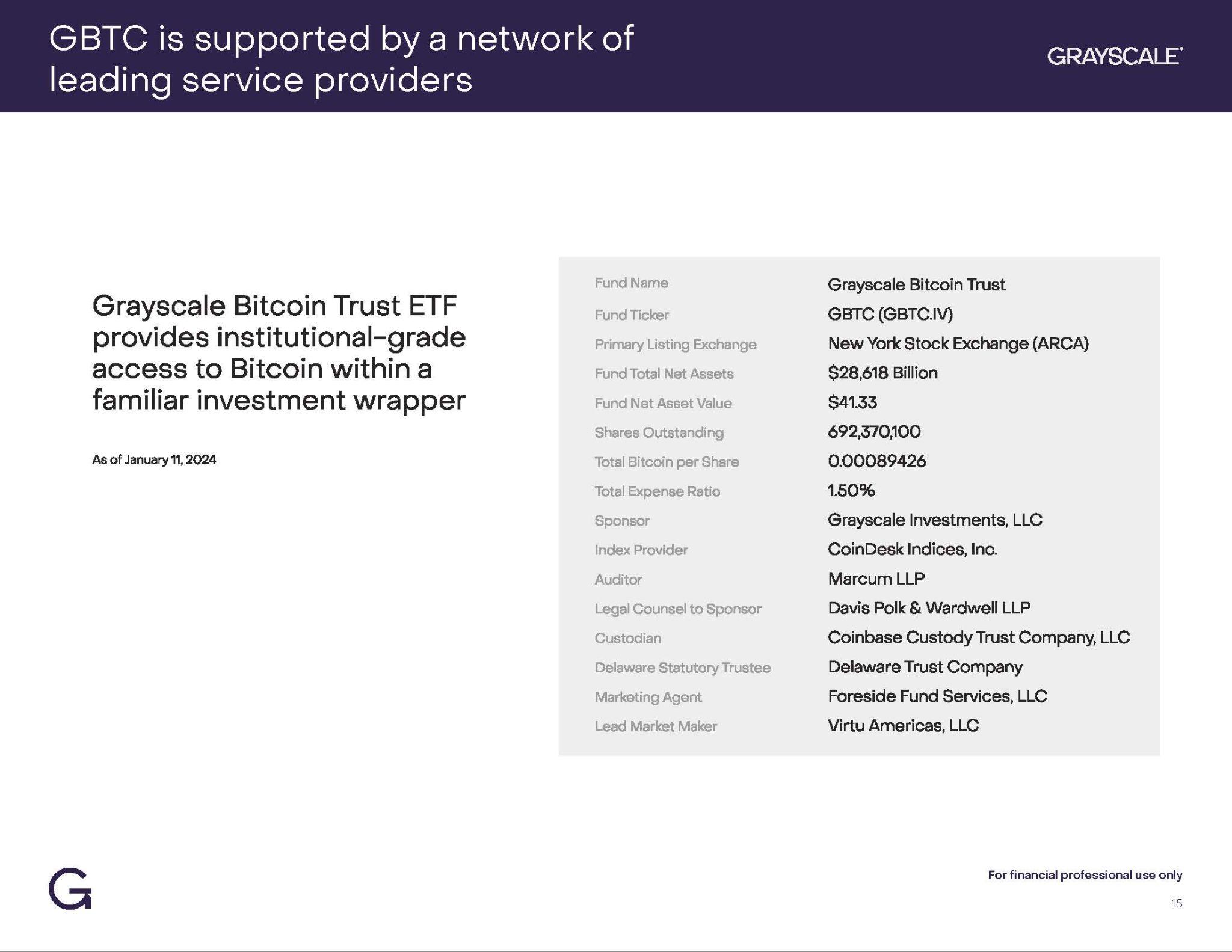

GBTC is supported by a network of leading service providers Grayscale Bitcoin Trust ETF provides institutional-grade access to Bitcoin within a familiar investment wrapper

As of January 11, 2024 Grayscale Bitcoin Trust Fund Name Fund Ticker GBTC (GBTC.IV) Primary Listing Exchange New York Stock Exchange (ARCA) Fund Total Net Assets $28,618 Billion Fund Net Asset Value $41.33 Shares Outstanding 692,370,100 Total Bitcoin per Share 0.00089426 Total Expense Ratio 1.50% Sponsor Grayscale Investments, LLC Index Provider CoinDesk Indices, Inc. Auditor Marcum LLP Legal Counsel to Sponsor Davis Polk & Wardwell LLP Custodian Coinyase Custody Trust Company, LLC Delaware Statutory Trustee Delaware Trust Company Marketing Agent Foreside Fund Services, LLC Lead Market Maker Virtu Americas, LLC

For financial professional Use only 15

Important Disclosures

Grayscale Bitcoin Trust (BTC) (the “Trust”) has filed a registration statement (including a prospectus) with the SEC for the offering to which this communication relates. Before you

invest, you should read the prospectus in that registration statement and other documents the Trust has filed with the SEC for more complete information about the Trust and this

offering. You may get these documents for free by visiting EDGAR on the SEC Web site at www.sec.gov. Alternatively, the Trust or any authorized participant will arrange to send you

the prospectus (when available) if you request it by calling (833) 903 - 2211 or by contacting Foreside Fund Services, LLC, Three Canal Plaza, Suite 100, Portland, Maine 04101. Foreside

Fund Services, LLC is the Marketing Agent for the Trust.

An investment in the Trust involves risks, including possible loss of principal. The Trust holds Bitcoin; however, an investment in the Trust is not a direct investment in Bitcoin. As a nondiversified

and single industry fund,the value of the shares may fluctuate more than shares invested in a broader range of industries. Extreme volatility, regulatory changes, and

exposure to digital asset exchanges may impact the value of Bitcoin, and consequently the value of the Trust.

Grayscale Investments, LLC (“Grayscale”) is the sponsor of GBTC. Grayscale is not registered as an investment adviser under the Investment Advisers Act of 1940 and GBTC is not

registered under the Investment Company Act of 1940.GBTC is subject to the rules and regulations of the Securities Act of 1933.

Investments involve risk. Principal loss is possible. Unlike mutual funds, ETFs may trade at a premium or discount to their net asset value. These funds are new and have limited

operating history to judge.

The ETFs rely on third party service providers to perform certain functions essential to the affairs of the funds and the replacement of such service providers could pose a challenge

to the safekeeping of the digital asset and to the operations of the ETFs.

This information should not be relied upon as research, investment advice, or a recommendation regarding any products, strategies, or any security in particular. This material is strictly

for illustrative, educational, or informational purposes and is subject to change.

Extreme volatility of trading prices that many digital assets, including Bitcoin, have experienced in recent periods and may continue to experience, could have a material adverse

effect on the value of GBTC and the shares could lose all or substantially all of their value.

Digital assets represent a new and rapidly evolving industry. The value of GBTC depends on the acceptance of the digital assets, the capabilities and development of blockchain

technologies and the fundamental investment characteristics of the digital asset.

For financial professional use only

16

Important Disclosures

Digital asset networks are developed by a diverse set of contributors and the perception that certain high-profile contributors will no longer contribute to the network could have an

adverse effect on the market price of the related digital asset.

Digital assets may have concentrated ownership and large sales or distributions by holders of such digital assets could have an adverse effect on the market price of such digital

assets.

The value of GBTC relates directly to the value of the underlying digital asset, the value of which may be highly volatile and subject to fluctuations due to a number of factors.

A substantial direct investment in digital assets may require expensive and sometimes complicated arrangements in connection with the acquisition, security and safekeeping of the

digital asset and may involve the payment of substantial acquisition fees from third party facilitators through cash payments of U.S. dollars. Because the value of GBTC is correlated

with the value of Bitcoin, it is important to understand the investment attributes of, and the market for, the underlying digital asset. Please consult with your financial professional.

Prior to 01/11/2024, shares of Grayscale Bitcoin Trust (BTC) (the “Trust”) were offered only in private placement transactions exempt from registration under the Securities Act of 1933,

as amended (the “Securities Act”), and were quoted on the OTCQX® Best Market. The Trust did not have an ongoing share creation and redemption program. Effective as of the

open of business on 01/11/2024, the shares of the Trust were listed on to NYSE Arca as an exchange-traded product, the Trust established an ongoing share creation and redemption

program and the shares are being offered on a registered basis pursuant to a Registration Statement on Form S-3.

The Trust’s investment objective both before and after 01/11/2024 has remained constant, namely to reflect the value of Bitcoin held by the Trust, less the Trust’s expenses and other

liabilities. However prior to 01/11/2024, the Trust did not meet its investment objective and the Trust’s shares traded at both premiums and discounts to such value, which at times

were substantial, in part due to the lack of an ongoing redemption program. Furthermore, the Trust’s performance prior to 01/11/2024 is based on market-determined prices on the

OTCQX, while the Trust’s performance following such date is based on market-determined prices on NYSE Arca. As a result, the Trust’s historical data prior to 01/11/2024 is not directly

comparable to, and should not be used to make conclusions in conjunction with, the Trust’s performance following that date. The performance of the Trust before and after 01/11/2024

may differ significantly.

For financial professional use only

17

Important Disclosures and Definitions

Bitcoin Allocation Model - Portfolio Performance Disclosures

**To estimate the optimal share of crypto assets in a portfolio we ran Monte Carlo simulations of hypothetical portfolios including a classic 60/40 mix of large cap equities and government bonds paired with

Bitcoin. The 60/40 portfolio is based on the S&P 500 and the Bloomberg-Barclays US Treasury Total Return Index. Bitcoin returns are based on the spot price. Asset returns, volatilities, and correlations were

measured from 2014 to 2023, the period when Bitcoin was more widely available through regulated investment vehicles. Under these assumptions, the portfolio that maximizes the potential risk-adjusted

return would own approximately 5% of Bitcoin and 95% of the 60/40 portfolio. This analysis does not include fees. Fees could have an impact on investor returns if they were significantly different across assets

(i.e. stocks, bonds, or Bitcoin).

This analysis is hypothetical in nature, does not reflect actual investment results and are not guarantees of future results and is included for informational and educational purposes only.

The CoinDesk Bitcoin Price Index (XBX) leverages real-time prices from multiple constituent exchanges to provide a representative spot price of Bitcoin in US dollars and is calculated once per second. Each

constituent exchange is weighted proportionally to its trailing 24-hour liquidity with adjustments for price variance and inactivity.

The S&P 500 Index is a market-capitalization-weighted index that measures the performance of 500 of the largest publicly traded companies in the United States.

The Nasdaq 100 Index is a stock index of the 100 largest companies by modified market capitalization trading on Nasdaq exchanges.

The Russell 2000 Index is composed of the smallest 2000 companies in the Russell 3000 Index, representing approximately 8% of the Russell 3000 total market capitalization.

The MSCI ACWI captures large and mid cap representation across 23 Developed Markets (DM) and 24 Emerging Markets (EM) countries. With 2,946 constituents, the index covers approximately 85% of the

global investable equity opportunity set.

The Barclays Global Aggregate Index is a market-weighted index of global government, government-related agencies, corporate and securitized fixed-income investments.

The LBMA Gold and Silver Price benchmarks are the global benchmark prices for unallocated gold and silver delivered in London, and are administered by ICE Benchmark Administration Limited.

BCOMPR Index, Formerly known as Dow Jones-UBS Precious Metals Subindex (DJUBSPR), the index is a commodity group subindex of the Bloomberg CI. It is composed of futures contracts on gold and silver.

It reflects the return of underlying commodity futures price movements only and is quoted in USD.

The abbreviation USD/JPY represents the currency exchange rate for the U.S. dollar and the Japanese yen. The pair shows how many yen are required to buy one U.S. dollar—the quote currency and base

currency respectively.

© 2024 Grayscale Investments, LLC. All trademarks, service marks and/or trade names (e.g., BITCOIN INVESTING BEGINS HERE, DROP GOLD, G, GRAYSCALE, GRAYSCALE CRYPTO SECTORS, and GRAYSCALE

INVESTMENTS) are owned and/or registered by Grayscale Investments, LLC. All of the content on our site - including text, software, scripts, code, designs, graphics, photos, sounds, music, videos, applications,

interactive features, articles, news stories, sketches, animations, stickers, general artwork and other content (“Content”) - is owned by Grayscale Investments, LLC or others we license Content from, and is

protected by copyright, patent and other laws. Grayscale Investments, LLC reserves all rights not expressly described herein.

For financial professional use only

18

Grayscale Bitcoin Trust (BTC) (the “Trust”) has filed a registration statement (including a prospectus) with the SEC for the offering to which this communication relates. Before you invest, you should read the prospectus in that registration statement and other documents the Trust has filed with the SEC for more complete information about the Trust and this offering. You may get these documents for free by visiting EDGAR on the SEC Web site at www.sec.gov. Alternatively, the Trust or any authorized participant will arrange to send you the prospectus (when available) if you request it by calling (833) 903 - 2211 or by contacting Foreside Fund Services, LLC, Three Canal Plaza, Suite 100, Portland, Maine 04101.