Filed Pursuant To Rule 433

Registration No. 333-275079

February 22, 2024

Grayscale Crypto Connect February 2024 For financial professional use only

Welcome For financial professional use only

Overview Welcome & Overview John Hoffman, Grayscale The Crypto Inflection Point Dave LaValle, Grayscale Crypto Regulatory Update Craig Salm, Grayscale

Crypto MasterClass Part 1: An Overview Part 2: A Panel with the Grayscale Team Michael Sonnenshein, Grayscale Break Practitioners Panel: The Future of Portfolios Ryan Firth, Mercer Street & Hamiz Mushtaq Awan, Plutus21 Capital with Brooke Stoddard, Grayscale The Business of Bitcoin Mining Jeff Burkey, Foundry Fireside Chat with Tom Lee Tom Lee, Fundstrat & Michael Sonnenshein, Grayscale for financial professional use only

About Grayscale Grayscale enables investors to access the digital economy through a family of future-forward investment products. Founded in 2013, Grayscale has a proven track record and deep expertise as the world’s largest crypto asset manager*. Investors, advisors, and allocators turn to Grayscale for single asset, diversified, and thematic exposure. Certain Grayscale products are distributed by Grayscale Securities, LLC. *Based on AUM as of 01/31/2024 For financial professional use only

Join at slido.com #CryptoConnectDallas For financial professiona

Have you invested in crypto before?

Are you prepared to talk to your clients about crypto?

What are 1-2 words that comes to mind when you think of crypto?

The Crypto Inflection Point Dave Lavalle Global Head of ETFs, Grayscale

Join the conversation by following these three steps or simply scanning this QR code: Open your browser and navigate to slido.com Enter the event code: #CryptoConnectDallas Start participating in polls, Q&A and get access to more information.

Crypto Regulatory Update

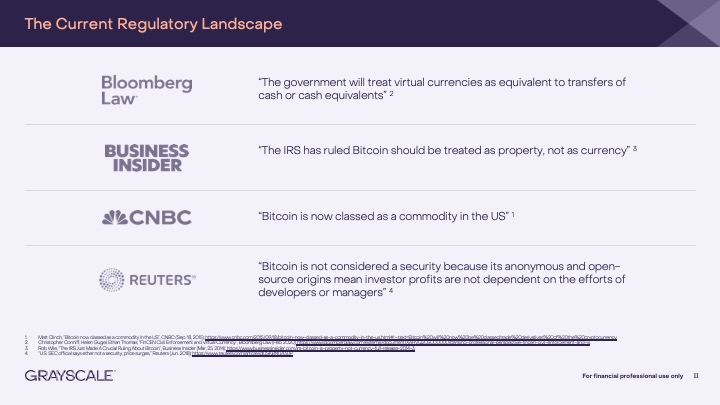

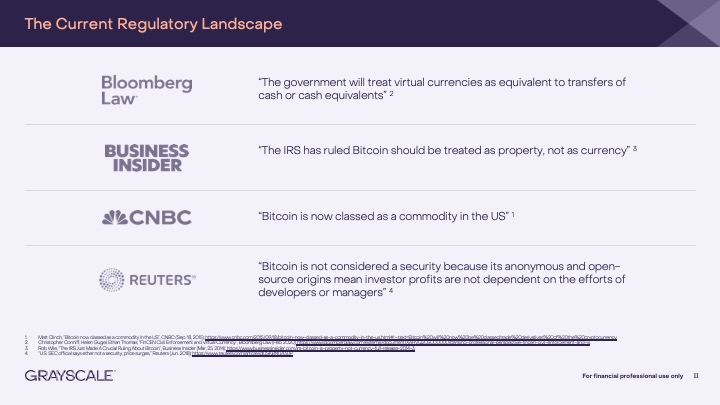

The Current Regulatory Landscape “The government will treat virtual currencies as equivalent to transfers of cash or cash equivalents” 2

“The IRS has ruled Bitcoin should be treated as property, not as currency” 3 “Bitcoin is now classed as a commodity in the US” 1“Bitcoin is now classed as a commodity in the US” 1Matt Clinch, “Bitcoin now classed as a commodity in the US”, CNBC (Sep. 18, 2015); https://www.cnbc.com/2015/09/18/bitcoin-now-classed-as-a-commodity-in-the-us.html#:~:text=Bitcoin%20will%20now%20be%20classed,trade%20derivatives%20of%20the%20cryptocurrency. Christopher Conniff, Helen Gugel, Ethan Thomas, “FinCEN Civil Enforcement and Virtual Currency”, Bloomberg Law (Feb. 2020); https://www.bloomberglaw.com/external/document/XAHVQ2US000000/banking-professional-perspective-fincen-civil-enforcement-and-vi.

Rob Wile, “The IRS Just Made A Crucial Ruling About Bitcoin”, Business Insider (Mar, 25, 2014); https://www.businessinsider.com/irs-bitcoin-is-property-not-currency-full-release-2014-3. “U.S. SEC official says ether not a security, price surges,” Reuters (Jun. 2018); https://www.reuters.com/article/idUSKBN1JA30P.

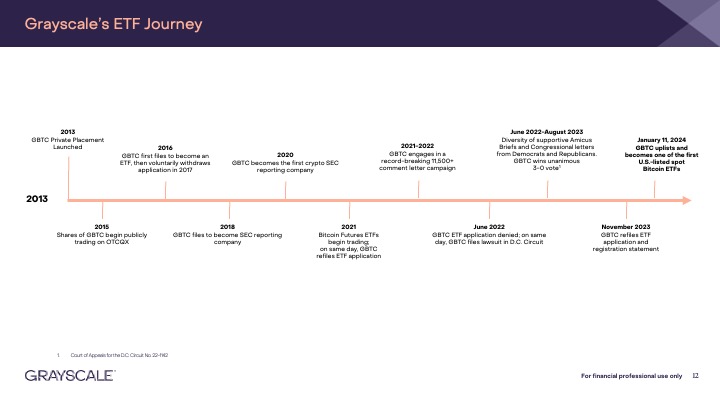

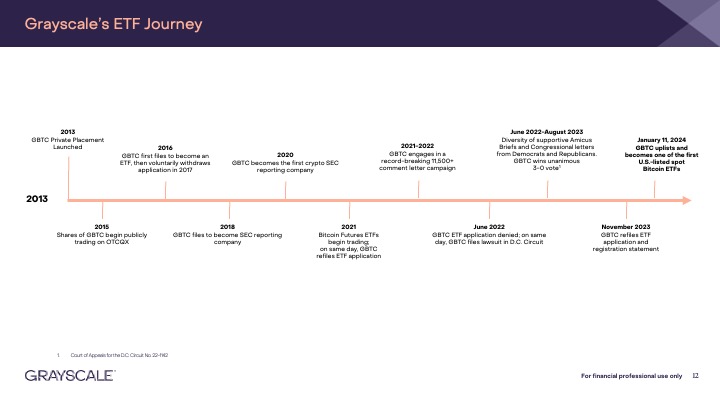

Grayscale’s ETF Journey 2013 GBTC Private Placement Launched 2015 Shares of GBTC begin publicly trading on OTCQX 2016 GBTC first files to become an ETF, then voluntarily withdraws application in 2017 2018 GBTC files to become SEC reporting company 2020 GBTC becomes the first crypto SEC reporting company 2021 Bitcoin Futures ETFs begin trading; on same day, GBTC refiles ETF application 2021-2022 GBTC engages in a record-breaking 11,500+ comment letter campaign June 2022 GBTC ETF application denied; on same day, GBTC files lawsuit in D.C. Circuit June 2022-August 2023 Diversity of supportive Amicus Briefs and Congressional letters from Democrats and Republicans. GBTC wins unanimous 3-0 vote1 November 2023 GBTC refiles ETF application and registration statement January 11, 2024 GBTC uplists and becomes one of the first U.S.-listed spot Bitcoin ETFs 1Court of Appeals for the D.C. Circuit No. 22-1142

Crypto Regulatory Update: Q&A Join the conversation by following these three steps or simply scanning this QR code: Open your browser and navigate to slido.com Enter the event code: #CryptoConnectDallas Start participating in polls, Q&A and get access to more information.

Crypto Masterclass

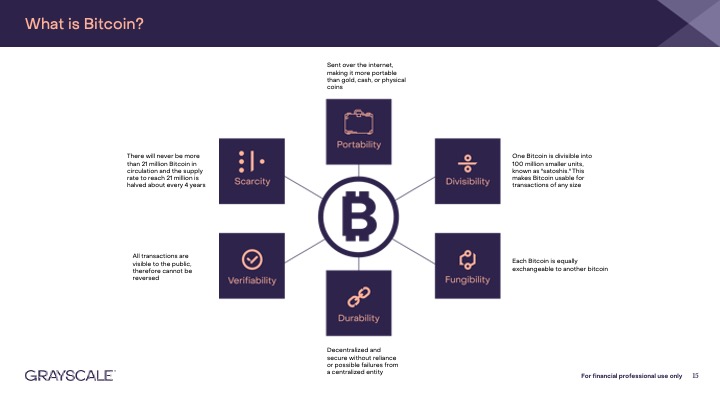

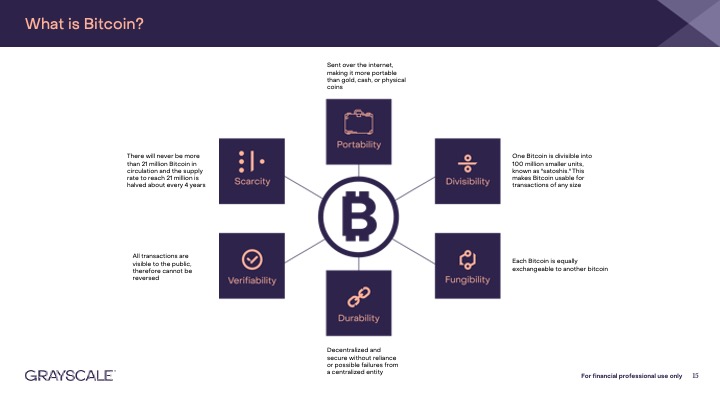

What is Bitcoin Sent over the internet, making it more portable than gold, cash, or physical coins There will never be more than 21 million Bitcoin in circulation and the supply rate to reach 21 million is halved about every 4 years All transactions are visible to the public, therefore cannot be reversed Decentralized and secure without reliance or possible failures from a centralized entity Each Bitcoin is equally exchangeable to another bitcoin One Bitcoin is divisible into 100 million smaller units, known as "satoshis." This makes Bitcoin usable for transactions of any size

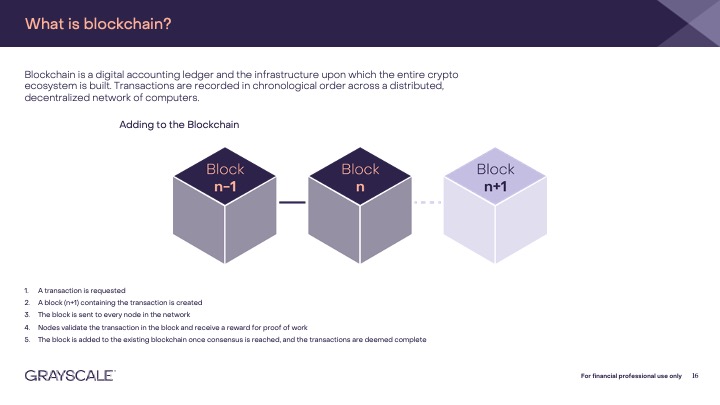

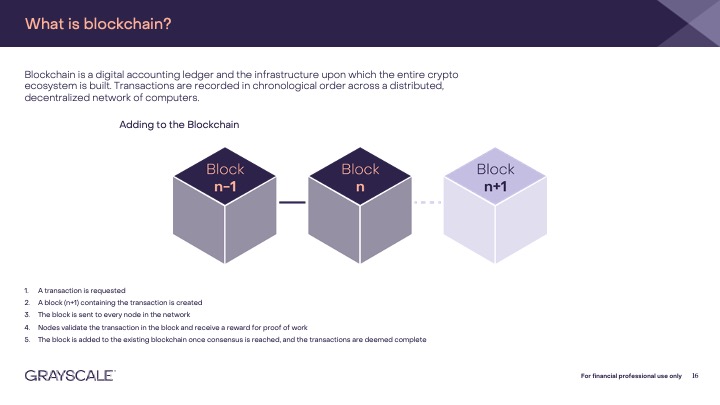

What is blockchain? Blockchain is a digital accounting ledger and the infrastructure upon which the entire crypto ecosystem is built. Transactions are recorded in chronological order across a distributed, decentralized network of computers. Adding to the blockchain block n-1 block n block n+1

A transaction is requested A block (n+1) containing the transaction is created The block is sent to every node in the network Nodes validate the transaction in the block and receive a reward for proof of work The block is added to the existing blockchain once consensus is reached, and the transactions are deemed complete

Investing in Bitcoin: Three Theses Thesis #1: Store of Value Thesis #2: Means of Payment Thesis #3: Technological Innovation Provided for illustrative purposes only.

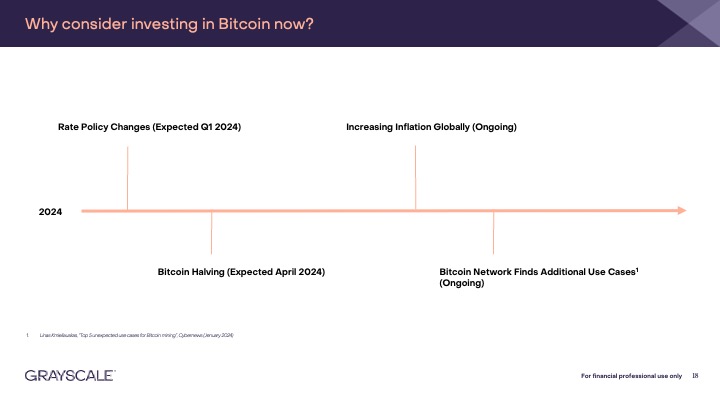

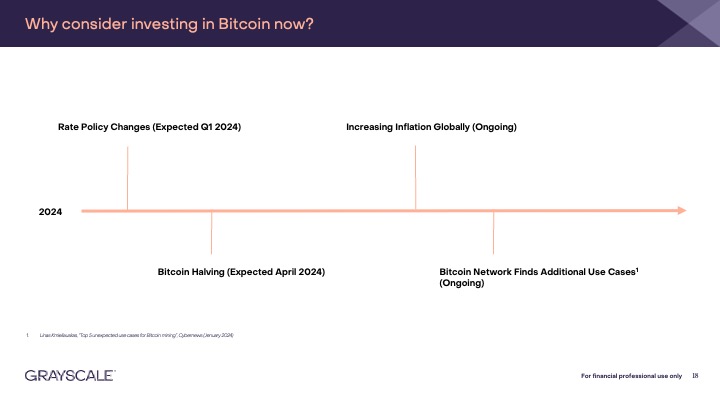

Why consider investing in Bitcoin now?Rate Policy Changes (Expected Q1 2024) Increasing Inflation Globally (Ongoing) Bitcoin Halving (Expected April 2024)

Bitcoin Network Finds Additional Use Cases1 (Ongoing) 1 Linas Kmieliauskas, “Top 5 unexpected use cases for Bitcoin mining”, Cybernews (Jenuary 2024)

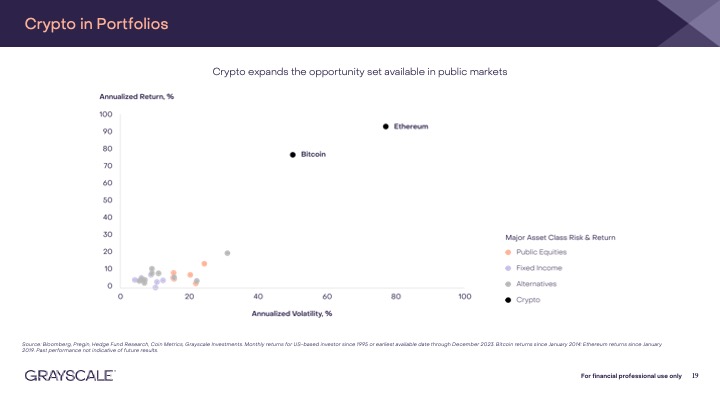

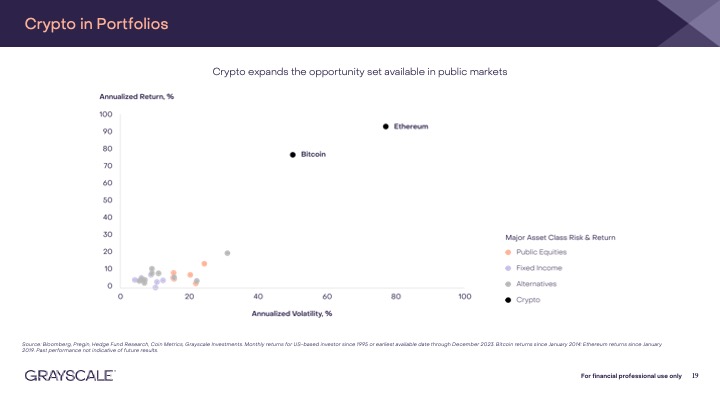

Crypto in Portfolios Crypto expands the opportunity set available in public markets Annualized Return % Annualized Volatility Major Asset Class Risk & Return Public Equities Fixed income Alternaitves Crypto Source: Bloomberg, Pregin, Hedge Fund Research, Coin Metrics, Grayscale Investments. Monthly returns for US-based investor since 1995 or earliest available date through December 2023. Bitcoin returns since January 2014: Ethereum returns since January 2019. Past performance not indicative of future results.

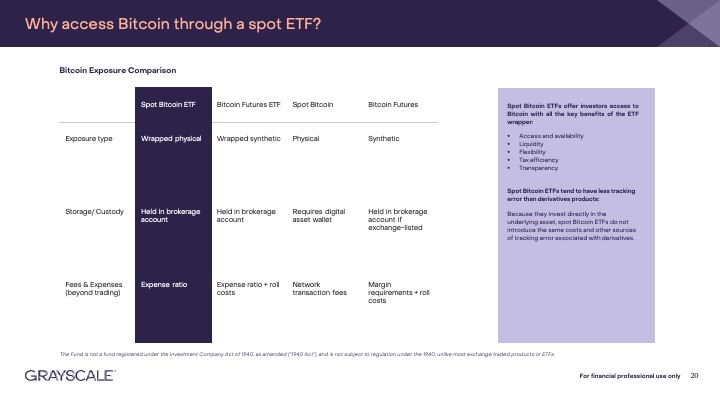

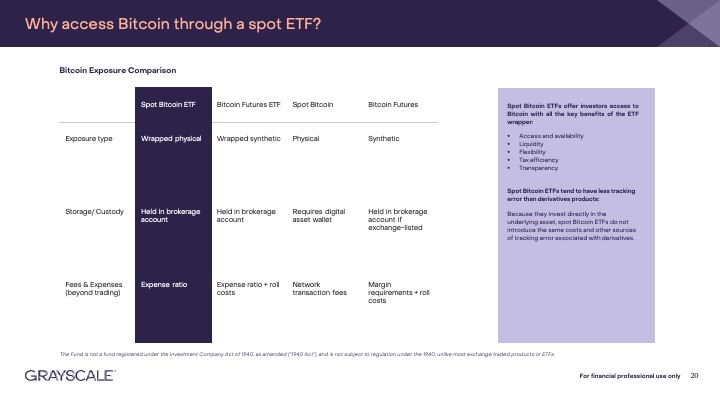

Why access Bitcoin through a spot ETF? Bitcoin Exposure Comparison Exposure type Spot Bitcoin ETF Bitcoin Futures ETF Spot Bitcoin Bitcoin Futures Wrapped physical Wrapped synthetic Physical Synthetic Storage/ Custody Held in brokerage account Held in brokerage account Requires digital asset wallet Held in brokerage account if exchange-listed Fees & Expenses (beyond trading) Expense ratio Expense ratio + roll costs Network transaction fees Margin requirements + roll costs Spot Bitcoin ETFs offer investors access to Bitcoin with all the key benefits of the ETF wrapper: Access and availability Liquidity FlexibilityTax efficiency Transparency Spot Bitcoin ETFs tend to have less tracking error than derivatives products: Because they invest directly in the underlying asset, spot Bitcoin ETFs do not introduce the same costs and other sources of tracking error associated with derivatives. The Fund is not a fund registered under the Investment Company Act of 1940, as amended (“1940 Act”), and is not subject to regulation under the 1940, unlike most exchange traded products or ETFs.

Panel: Crypto Masterclass Michael Sonnenshein CEO, Grayscale Danielle Bibeault Strategic Accounts & Partnerships Michael Zhao Grayscale Research Matt Maximo Grayscale Research Join the conversation by following these three steps or simply scanning this QR code: Open your browser and navigate to slido.com Enter the event code: #CryptoConnectDallas Start participating in polls, Q&A and get access to more information.

10 Minute Break

Panel: The Future of Portfolios Brooke Stoddard Grayscale Investor Relations Hamiz Mushtaq Awan Founder, Plutus21 Capital Ryan Firth Founder, Mercer Street Join the conversation by following these three steps or simply scanning this QR code: Open your browser and navigate to slido.com Enter the event code: #CryptoConnectDallas Start participating in polls, Q&A and get access to more information.

The Business of Bitcoin Mining

The Macro View:

Fireside Chat with Tom Lee

The Macro View: Fireside Chat with Tom Lee Michael Sonnenshein CEO, Grayscale Tom Lee Co-Founder, Fundstrat Join the conversation by following these three steps or simply scanning this QR code: Open your browser and navigate to slido.com Enter the event code: #CryptoConnectDallas Start participating in polls, Q&A and get access to more information.

Closing Remarks

Feedback Survey

Grayscale Bitcoin Trust (BTC) (the “Trust”) has filed a registration statement (including a prospectus) with the SEC for the offering to which this communication relates. Before you invest, you should read the prospectus in that registration statement and other documents the Trust has filed with the SEC for more complete information about the Trust and this offering. You may get these documents for free by visiting EDGAR on the SEC Web site at www.sec.gov. Alternatively, the Trust or any authorized participant will arrange to send you the prospectus (when available) if you request it by calling (833) 903 - 2211 or by contacting Foreside Fund Services, LLC, Three Canal Plaza, Suite 100, Portland, Maine 04101. Foreside Fund Services, LLC is the Marketing Agent for the Trust.

An investment in the Trust involves a high degree of risk, including partial or total loss of invested funds. The Trust holds Bitcoins; however, an investment in the Trust is not a direct investment in Bitcoin. As a non-diversified and single industry fund, the value of the shares may fluctuate more than shares invested in a broader range of industries. Extreme volatility, regulatory changes, and exposure to digital asset exchanges may impact the value of Bitcoin, and consequently the value of the Trust.

Digital assets are not suitable for an investor that cannot afford loss of the entire investment. There is no guarantee that a market for the shares will be available which will adversely impact the liquidity of the Trust. The value of the Trust relates directly to the value of the underlying digital asset, the value of which may be highly volatile and subject to fluctuations due to a number of factors.

We use the generic term “ETF” to refer to exchange-traded investment vehicles, including those that are required to register under the Investment Company Act of 1940, as amended (the “40 Act”), as well as other exchange-traded products which are not subject to the registration of the ‘40 Act. The Fund is not registered under the 1940 Act and is not subject to regulation under the 1940 Act, unlike most exchange traded products or ETFs.

Grayscale Investments, LLC (“Grayscale”) is the sponsor of GBTC. Grayscale is not registered as an investment adviser under the Investment Advisers Act of 1940 and GBTC is not registered under the Investment Company Act of 1940.GBTC is subject to the rules and regulations of the Securities Act of 1933.

Investments involve risk. Principal loss is possible. Unlike mutual funds, ETFs may trade at a premium or discount to their net asset value. These funds are new and have limited operating history to judge.

The ETFs rely on third party service providers to perform certain functions essential to the affairs of the funds and the replacement of such service providers could pose a challenge to the safekeeping of the digital asset and to the operations of the ETFs.

If an active trading market for the Shares does not develop or continue to exist, the market prices and liquidity of the Shares may be adversely affected.

This information should not be relied upon as research, investment advice, or a recommendation regarding any products, strategies, or any security in particular. This material is strictly for illustrative, educational, or informational purposes and is subject to change.

Extreme volatility of trading prices that many digital assets, including Bitcoin, have experienced in recent periods and may continue to experience, could have a material adverse effect on the value of GBTC and the shares could lose all or substantially all of their value.

Digital assets represent a new and rapidly evolving industry. The value of GBTC depends on the acceptance of the digital assets, the capabilities and development of blockchain technologies and the fundamental investment characteristics of the digital asset.

Digital asset networks are developed by a diverse set of contributors and the perception that certain high-profile contributors will no longer contribute to the network could have an adverse effect on the market price of the related digital asset.

Digital assets may have concentrated ownership and large sales or distributions by holders of such digital assets could have an adverse effect on the market price of such digital assets.

The value of GBTC relates directly to the value of the underlying digital asset, the value of which may be highly volatile and subject to fluctuations due to a number of factors.

Spot Bitcoin: Direct Bitcoin exposure

Physical: Direct investment in an asset, as opposed to accessing exposure to the asset through a derivative vehicle

Synthetic: Indirect investment in an asset through a derivative vehicle

Roll Costs: Transactions fees involved in trading out of expiring futures contracts and reinvesting into new ones

Network Transaction Fees: Charges incurred when taking an action with a digital asset (for example, buying or selling) on the blockchain

Margin Requirements: A portion of open notional value which an investor must pay in cash.

A substantial direct investment in digital assets may require expensive and sometimes complicated arrangements in connection with the acquisition, security and safekeeping of the digital asset and may involve the payment of substantial acquisition fees from third party facilitators through cash payments of U.S. dollars. Because the value of GBTC is correlated with the value of Bitcoin, it is important to understand the investment attributes of, and the market for, the underlying digital asset. Please consult with your financial professional.

Prior to 01/11/2024, shares of Grayscale Bitcoin Trust (BTC) (the “Trust”) were offered only in private placement transactions exempt from registration under the Securities Act of 1933, as amended (the “Securities Act”), and were quoted on the OTCQX® Best Market. The Trust did not have an ongoing share creation and redemption program. Effective as of the open of business on 01/11/2024, the shares of the Trust were listed on to NYSE Arca as an exchange-traded product, the Trust established an ongoing share creation and redemption program and the shares are being offered on a registered basis pursuant to a Registration Statement on Form S-3.

The Trust’s investment objective both before and after 01/11/2024 has remained constant, namely to reflect the value of Bitcoin held by the Trust, less the Trust’s expenses and other liabilities. However prior to 01/11/2024, the Trust did not meet its investment objective and the Trust’s shares traded at both premiums and discounts to such value, which at times were substantial, in part due to the lack of an ongoing redemption program. Furthermore, the Trust’s performance prior to 01/11/2024 is based on market-determined prices on the OTCQX, while the Trust’s performance following such date is based on market-determined prices on NYSE Arca. As a result, the Trust’s historical data prior to 01/11/2024 is not directly comparable to, and should not be used to make conclusions in conjunction with, the Trust’s performance following that date.

The performance of the Trust before and after 01/11/2024 may differ significantly.

The CoinDesk Bitcoin Price Index (XBX) leverages real-time prices from multiple constituent exchanges to provide a representative spot price of Bitcoin in US dollars and is calculated once per second. Each constituent exchange is weighted proportionally to its trailing 24-hour liquidity with adjustments for price variance and inactivity.

The S&P 500 Index is a market-capitalization-weighted index that measures the performance of 500 of the largest publicly traded companies in the United States.

The Nasdaq 100 Index is a stock index of the 100 largest companies by modified market capitalization trading on Nasdaq exchanges.

The Russell 2000 Index is composed of the smallest 2000 companies in the Russell 3000 Index, representing approximately 8% of the Russell 3000 total market capitalization.

The MSCI ACWI captures large and mid cap representation across 23 Developed Markets (DM) and 24 Emerging Markets (EM) countries. With 2,946 constituents, the index covers approximately 85% of the global investable equity opportunity set.

The Barclays Global Aggregate Index is a market-weighted index of global government, government-related agencies, corporate and securitized fixed-income investments.

The LBMA Gold and Silver Price benchmarks are the global benchmark prices for unallocated gold and silver delivered in London, and are administered by ICE Benchmark Administration Limited.

BCOMPR Index, Formerly known as Dow Jones-UBS Precious Metals Subindex (DJUBSPR), the index is a commodity group subindex of the Bloomberg CI. It is composed of futures contracts on gold and silver. It reflects the return of underlying commodity futures price movements only and is quoted in USD.

The abbreviation USD/JPY represents the currency exchange rate for the U.S. dollar and the Japanese yen. The pair shows how many yen are required to buy one U.S. dollar—the quote currency and base currency respectively.

© 2024 Grayscale Investments, LLC. All trademarks, service marks and/or trade names (e.g., BITCOIN INVESTING BEGINS HERE, DROP GOLD, G, GRAYSCALE, GRAYSCALE CRYPTO SECTORS, and GRAYSCALE INVESTMENTS) are owned and/or registered by Grayscale Investments, LLC. All of the content on our site - including text, software, scripts, code, designs, graphics, photos, sounds, music, videos, applications, interactive features, articles, news stories, sketches, animations, stickers, general artwork and other content (“Content”) - is owned by Grayscale Investments, LLC or others we license Content from, and is protected by copyright, patent and other laws. Grayscale Investments, LLC reserves all rights not expressly described herein.

Grayscale Bitcoin Trust (BTC) (the “Trust”) has filed a registration statement (including a prospectus) with the SEC for the offering to which this communication relates. Before you invest, you should read the prospectus in that registration statement and other documents the Trust has filed with the SEC for more complete information about the Trust and this offering. You may get these documents for free by visiting EDGAR on the SEC Web site at www.sec.gov. Alternatively, the Trust or any authorized participant will arrange to send you the prospectus (when available) if you request it by calling (833) 903 - 2211 or by contacting Foreside Fund Services, LLC, Three Canal Plaza, Suite 100, Portland, Maine 04101.