Exhibit 99.2

Lombard Medical Technologies Inc. (Nasdaq: EVAR) Jefferies Global Healthcare Conference New York, June 2014

Disclaimer This presentation contains forward‐looking statements as that term is defined in the Private Securities Litigation Reform Act of 1995. These forward‐looking statements are based on current expectations, but are subject to risks and uncertainties, that could cause actual results to differ materially from either historical or anticipated results depending on a variety of factors. All statements contained in this presentation that do not describe historical facts may constitute forward‐looking statements. Statements that address activities, events or developments that we expect or anticipate may occur in the future, including such things as our outlook, future capital expenditures, changes to the composition or level of our revenues, cash flow and liquidity, business strategies, competitive strengths, goals, the benefits of new initiatives, growth of our business and operations, plans and references to future successes, are forward‐looking statements. Also, when we use the words such as “anticipate”, “believe”, “estimate”, “expect”, “intend”, “plan”, “probably”, or similar expressions, we are making forward‐looking statements. The following factors, among others, could cause actual results to differ from those set forth in the forward‐looking statements: risks and uncertainties relating to adverse changes in conditions in the global economy and volatility in the capital markets, the development and commercialization of the Company’s product, the Company’s distribution network, the cost and pricing of the Company’s product, physician education, manufacturing, competition, dependence on collaborative partners and key suppliers, capital spending and funding policies, changes in governmental regulations, intellectual property rights, litigation, and exposure to foreign currency fluctuations and other risk factors discussed from time to time in the Company’s filings with the Securities and Exchange Commission (the “SEC”). These and other factors are identified and described in more detail in the Company’s filings with the SEC, including, without limitation, the Company’s recent Registration Statement on Form F‐1 and the Company’s reports on Form 6‐K. All forward‐looking statements in this presentation are made as of the date of this presentation. We do not undertake, and expressly disclaim, any intent or duty to update these forward‐looking statements whether as a result of new information, future events or changes in expectations, other than as required by law. This presentation is for information purposes only and does not constitute an offer of, or a solicitation to purchase or subscribe for, any securities. You should make your own independent examination of us and consult your own independent counsel, business advisors, tax advisors, investment advisors or other authorized advisors as to the legal, business, tax, investment or any other matters pertaining to us or our securities. CONFIDENTIAL 2

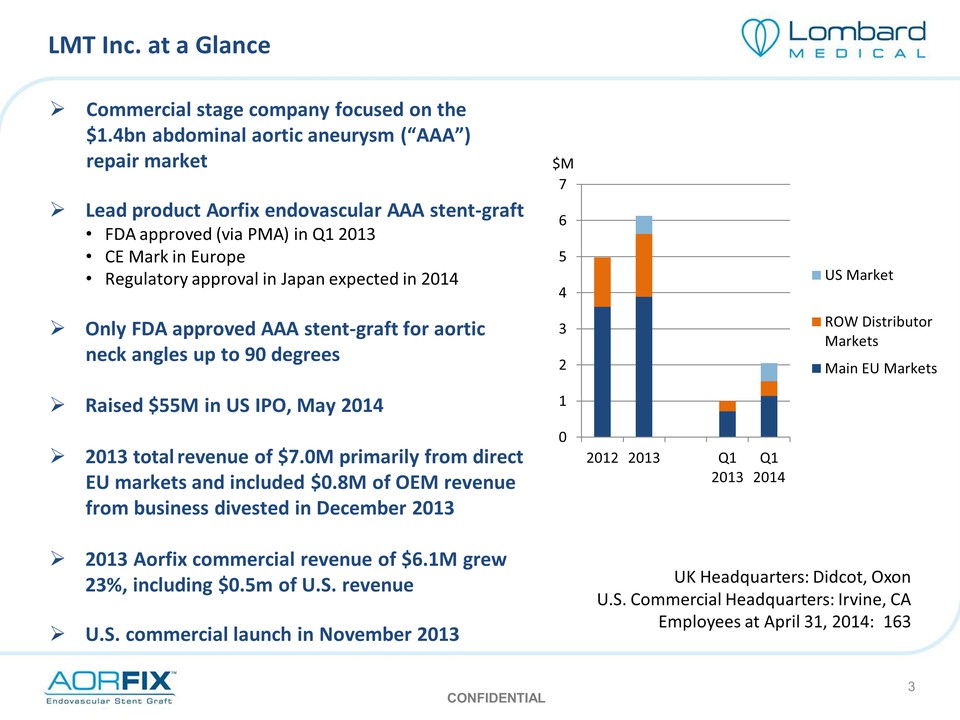

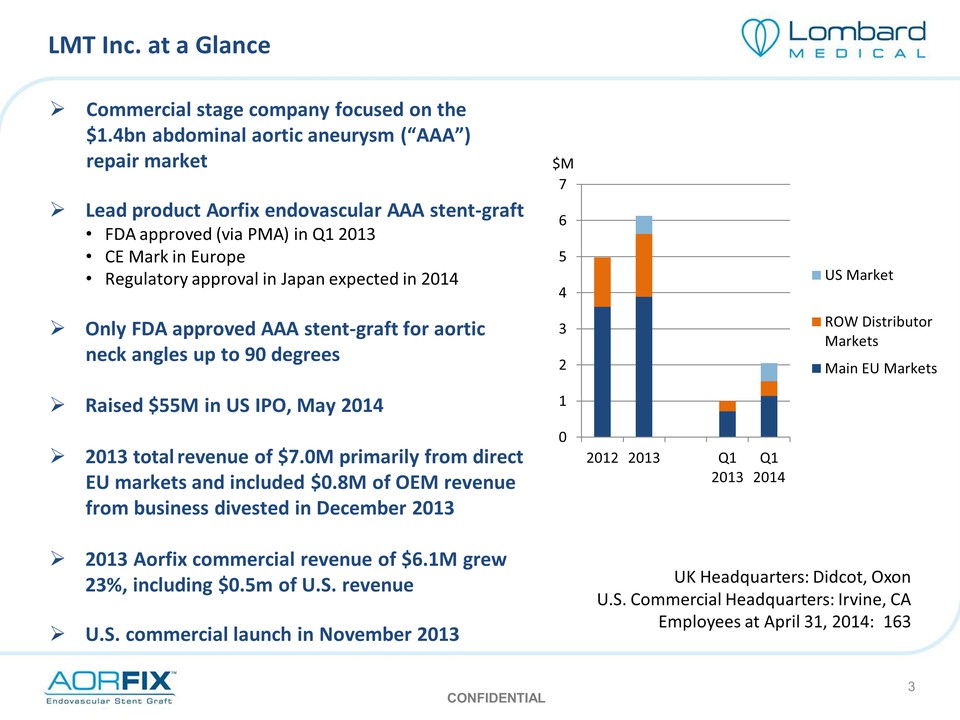

LMT Inc. at a Glance Commercial stage company focused on the $1.4bn abdominal aortic aneurysm (“AAA”) repair market Lead product Aorfix endovascular AAA stent‐graft FDA approved (via PMA) in Q1 2013 CE Mark in Europe Regulatory approval in Japan expected in 2014 Only FDA approved AAA stent‐graft for aortic neck angles up to 90 degrees Raised $55M in US IPO, May 2014 2013 total revenue of $7.0M primarily from direct EU markets and included $0.8M of OEM revenue from business divested in December 2013 2013 Aorfix commercial revenue of $6.1M grew 23%, including $0.5m of U.S. revenue U.S. commercial launch in November 2013 0 1 2 3 4 5 6 7 $M 2012 2013 Q1 2013 Q1 2014 US Market ROW Distributor Markets Main EU Markets UK Headquarters: Didcot, Oxon U.S. Commercial Headquarters: Irvine, CA Employees at April 31, 2014: 163 CONFIDENTIAL 3

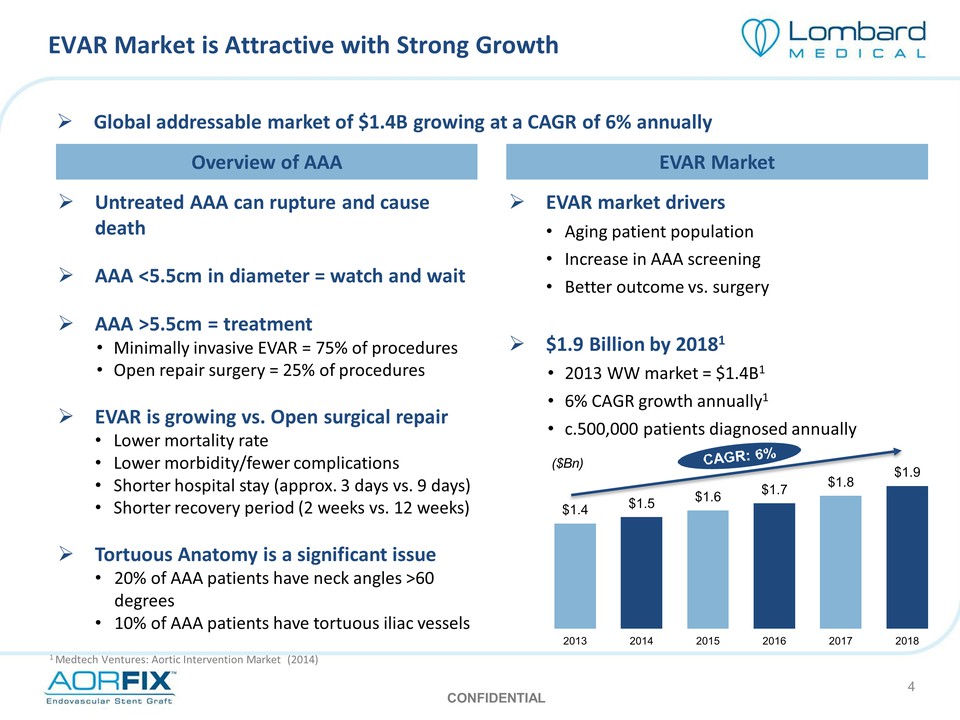

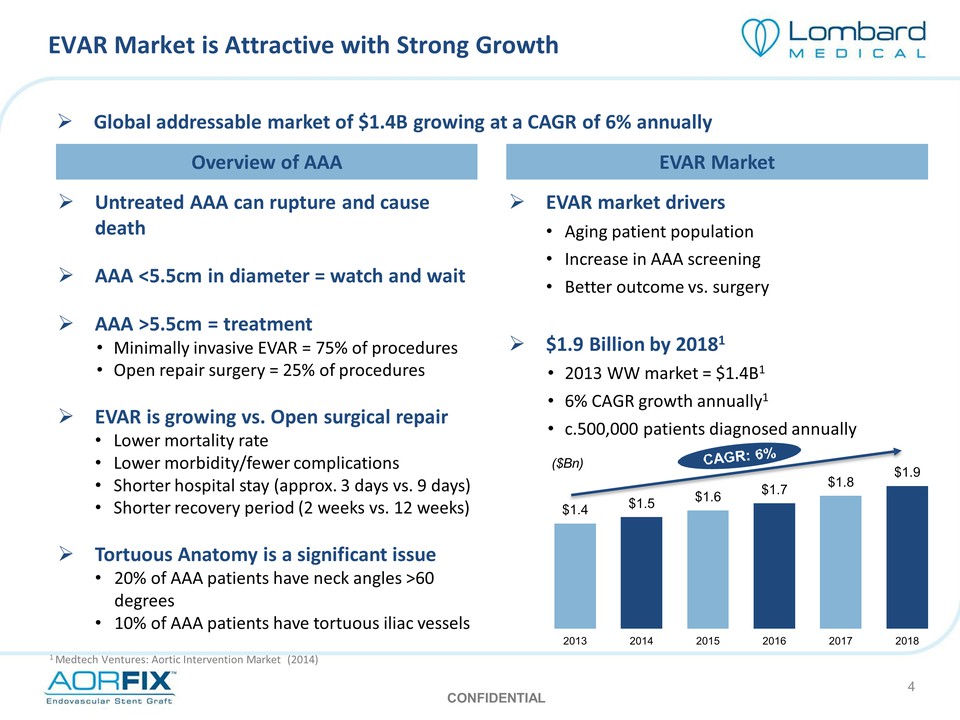

EVAR Market is Attractive with Strong Growth Global addressable market of $1.4B growing at a CAGR of 6% annually Overview of AAA EVAR Market Untreated AAA can rupture and cause death AAA <5.5cm in diameter = watch and wait AAA >5.5cm = treatment Minimally invasive EVAR = 75% of procedures Open repair surgery = 25% of procedures EVAR is growing vs. Open surgical repair Lower mortality rate Lower morbidity/fewer complications Shorter hospital stay (approx. 3 days vs. 9 days) Shorter recovery period (2 weeks vs. 12 weeks) Tortuous Anatomy is a significant issue 20% of AAA patients have neck angles >60 degrees 10% of AAA patients have tortuous iliac vessels EVAR market drivers Aging patient population Increase in AAA screening Better outcome vs. surgery $1.9 Billion by 20181 2013 WW market = $1.4B1 6% CAGR growth annually1 c.500,000 patients diagnosed annually ($Bn) CAGR: 6% $1.4 $1.5 $1.6 $1.7 $1.8 $1.9 2013 2014 2015 2016 2017 2018 1 Medtech Ventures: Aortic Intervention Market (2014) CONFIDENTIAL 4

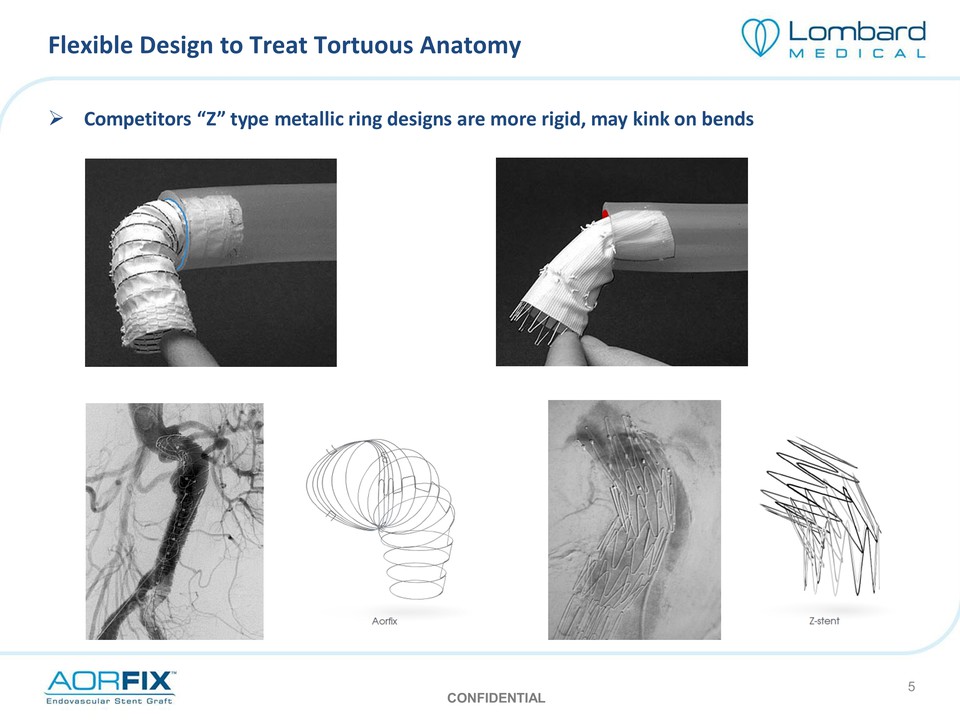

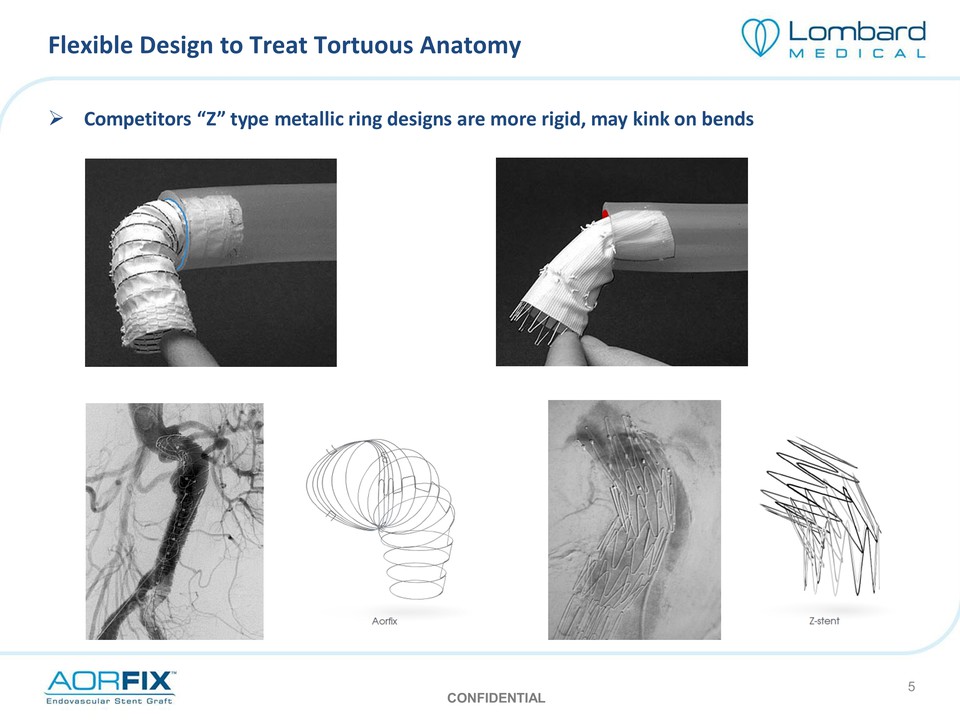

Flexible Design to Treat Tortuous Anatomy Competitors “Z” type metallic ring designs are more rigid, may kink on bends CONFIDENTIAL 5

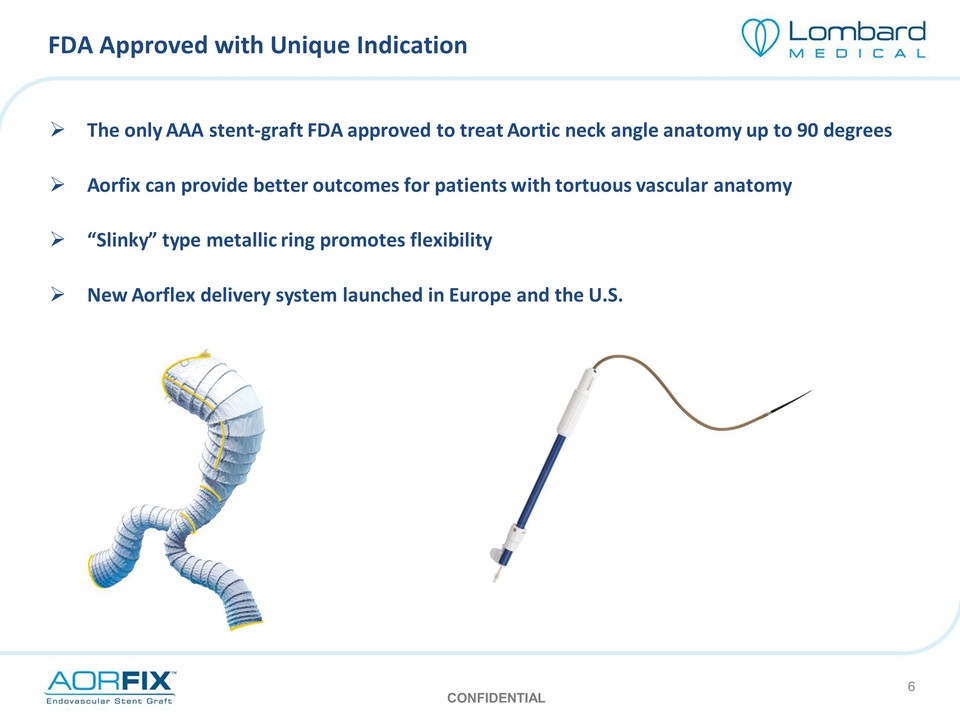

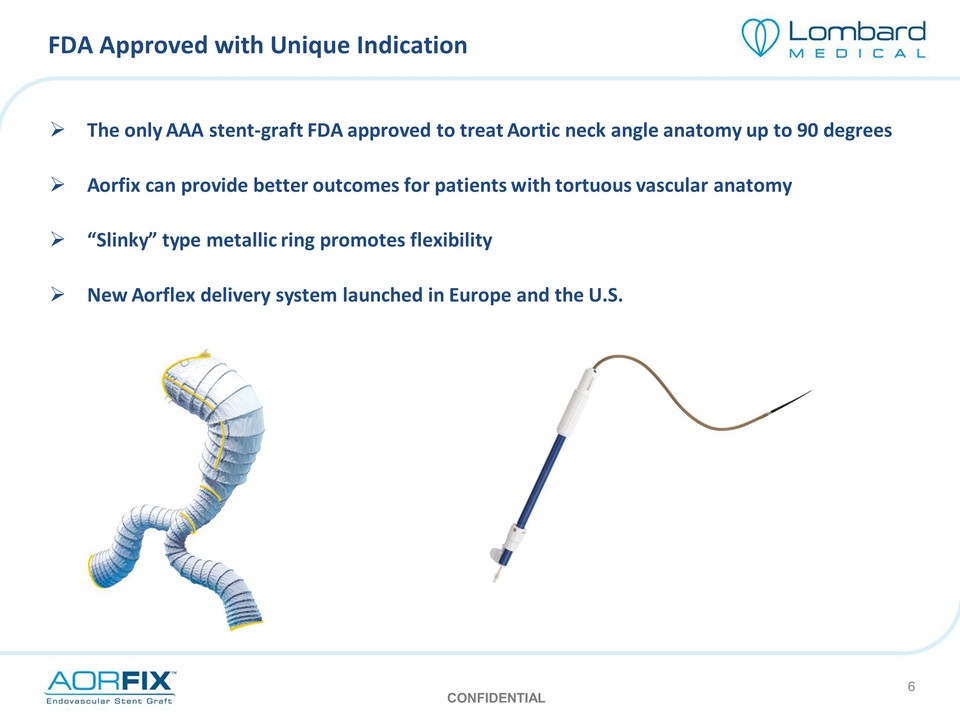

FDA Approved with Unique Indication The only AAA stent‐graft FDA approved to treat Aortic neck angle anatomy up to 90 degrees Aorfix can provide better outcomes for patients with tortuous vascular anatomy “Slinky” type metallic ring promotes flexibility NewAorflex delivery system launched in Europe and the U.S. Aorflex Delivery System CONFIDENTIAL 6

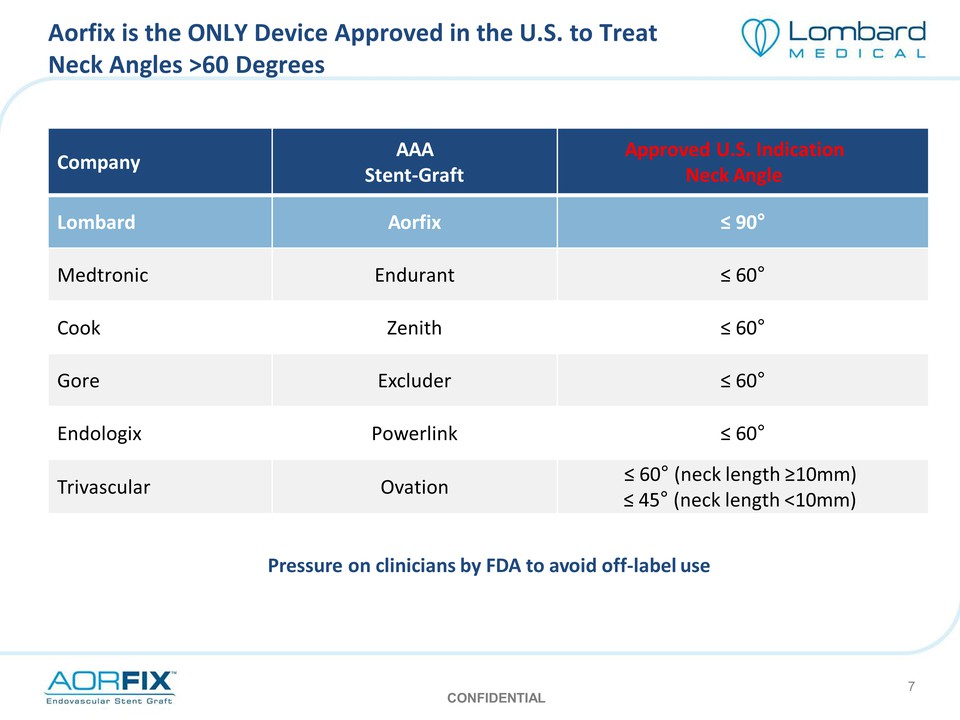

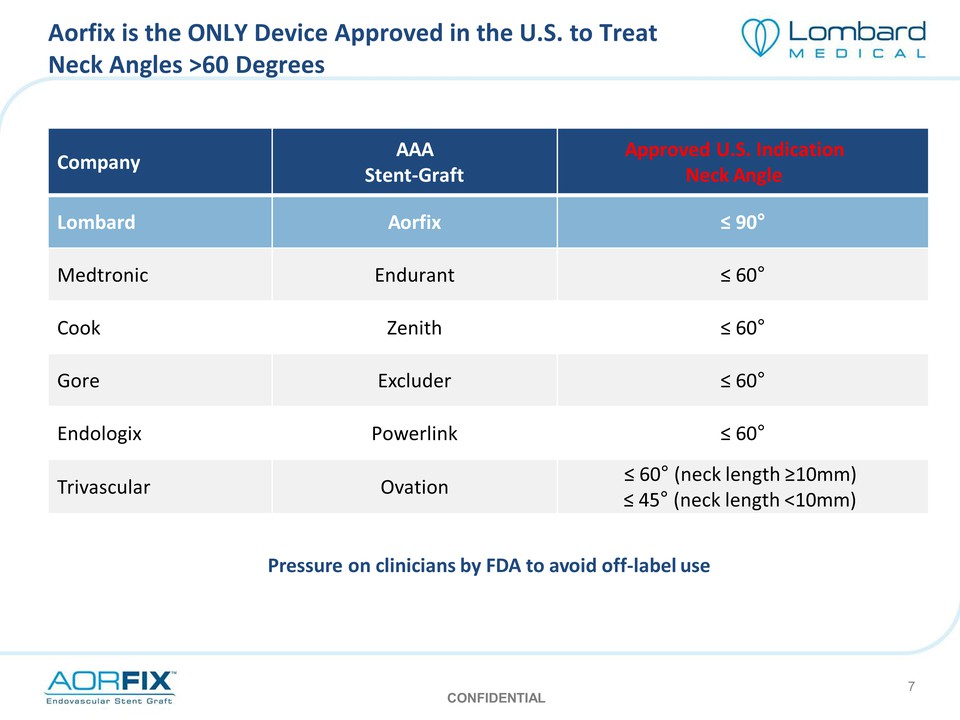

Aorfix is the ONLY Device Approved in the U.S. to Treat Neck Angles >60 Degrees Company AAA Stent‐Graft Approved U.S. Indication Neck Angle Lombard Aorfix ≤ 90° Medtronic Endurant ≤ 60° Cook Zenith ≤ 60° Gore Excluder ≤ 60° Endologix Powerlink ≤ 60° Trivascular Ovation ≤ 60° (neck length ≥10mm) ≤ 45° (neck length <10mm) Pressure on clinicians by FDA to avoid off‐label use CONFIDENTIAL 7

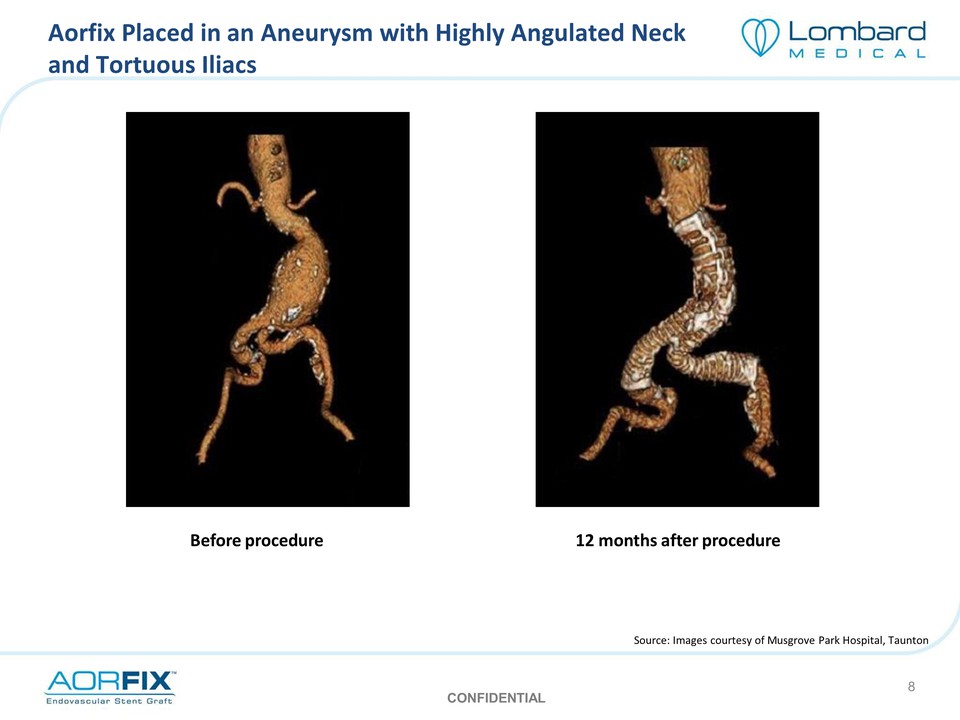

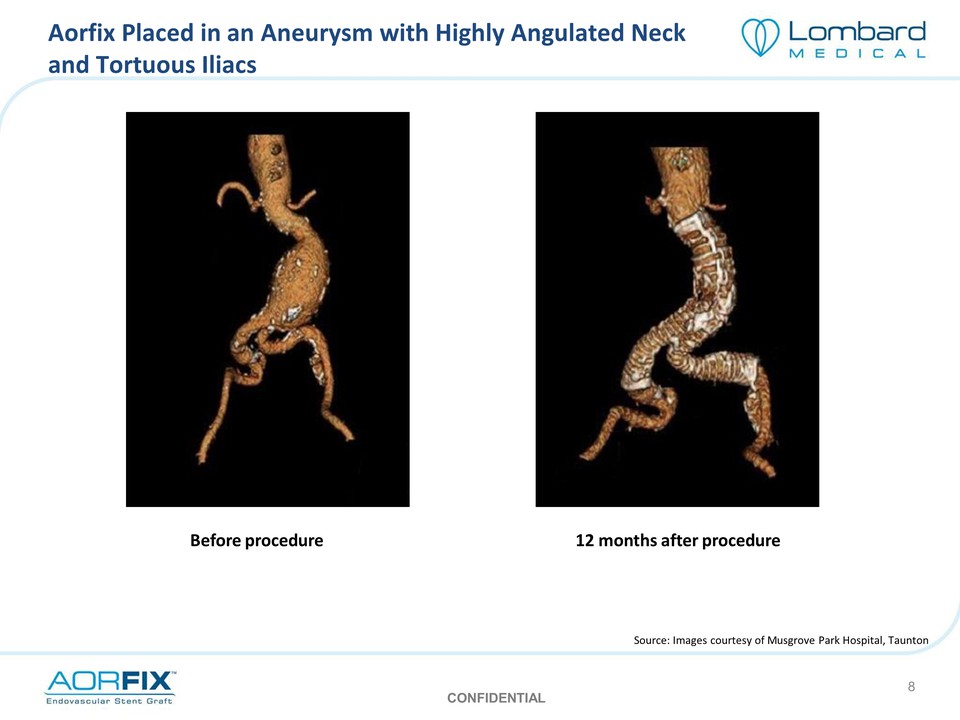

Aorfix Placed in an Aneurysm with Highly Angulated Neck and Tortuous Iliacs Before procedure 12 months after procedure Source: Images courtesy of Musgrove Park Hospital, Taunton CONFIDENTIAL 8

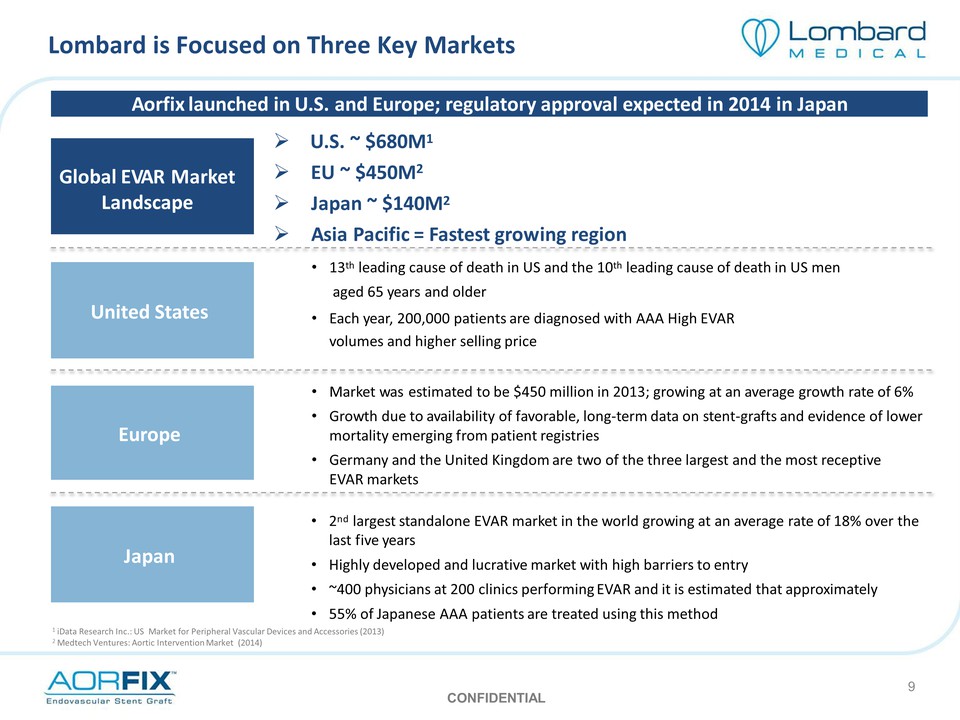

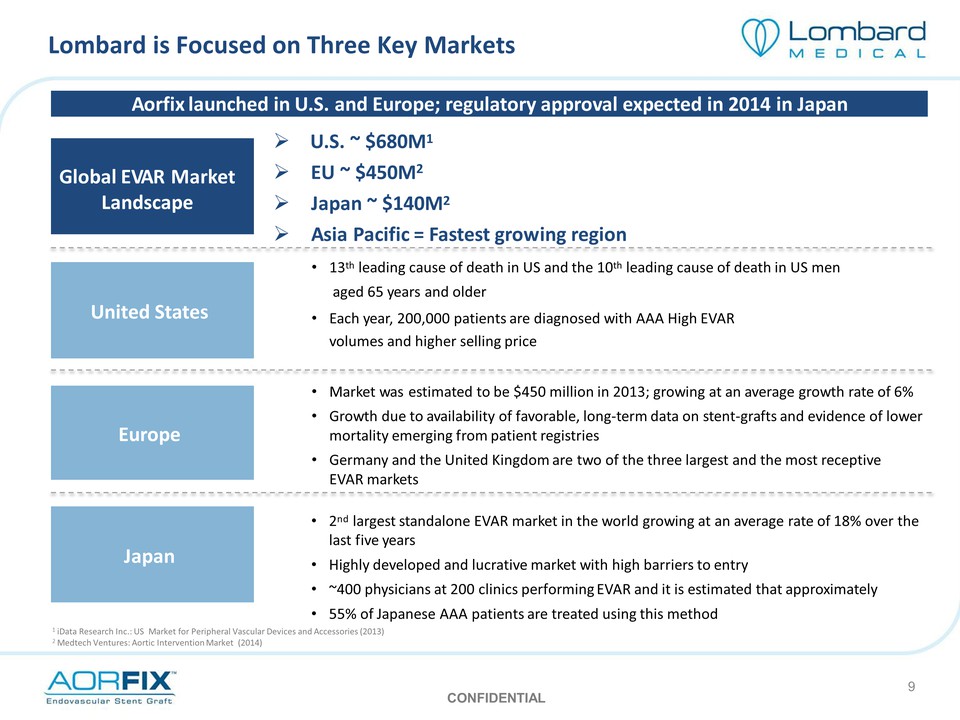

Lombard is Focused on Three Key Markets Aorfix launched in U.S. and Europe; regulatory approval expected in 2014 in Japan Global EVAR Market Landscape U.S. ~ $680M1 EU ~ $450M2 Japan ~ $140M2 Asia Pacific = Fastest growing region United States 13th leading cause of death in US and the 10th leading cause of death in US men aged 65 years and older Each year, 200,000 patients are diagnosed with AAA High EVAR volumes and higher selling price Europe Market was estimated to be $450 million in 2013; growing at an average growth rate of 6% Growth due to availability of favorable, long‐termdata on stent‐grafts and evidence of lower mortality emerging frompatient registries Germany and the United Kingdom are two of the three largest and the most receptive EVAR markets Japan 2nd largest standalone EVAR market in the world growing at an average rate of 18% over the last five years Highly developed and lucrative marketwith high barriers to entry ~400 physicians at 200 clinics performing EVAR and it is estimated that approximately 55% of Japanese AAA patients are treated using this method 1 iData Research Inc.: US Market for Peripheral Vascular Devices and Accessories (2013) 2 Medtech Ventures: Aortic InterventionMarket (2014) CONFIDENTIAL 9

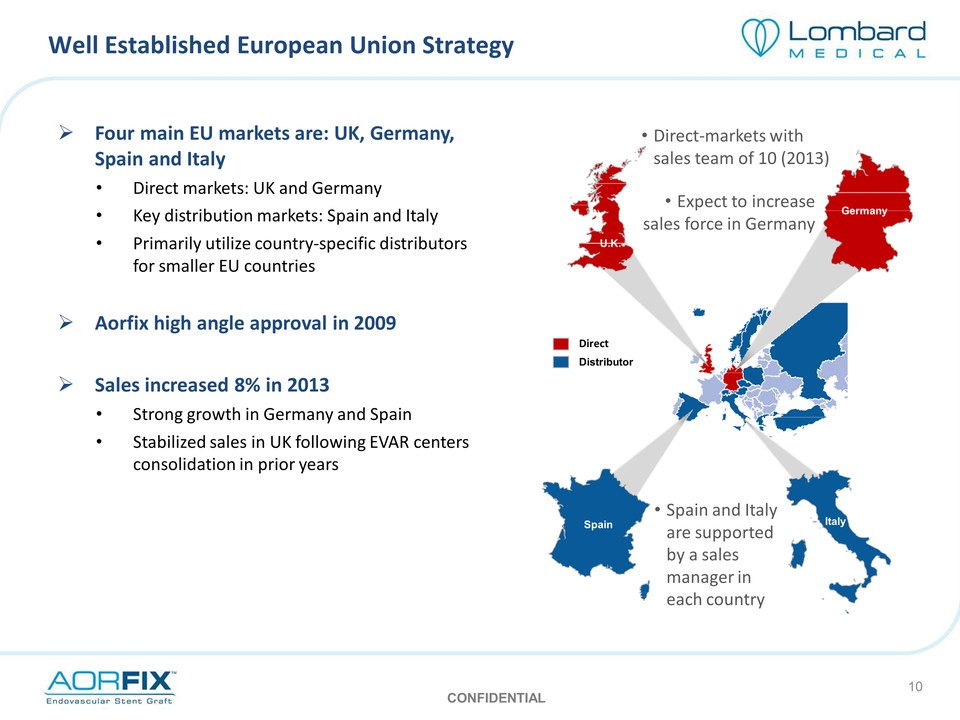

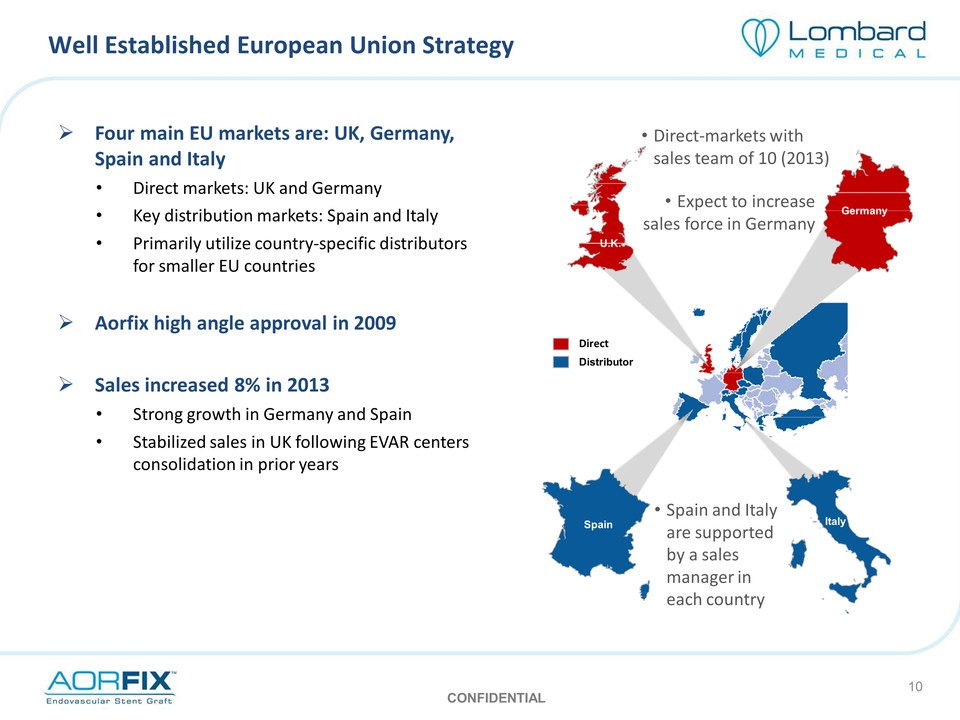

Well Established European Union Strategy Four main EU markets are: UK, Germany, Spain and Italy Direct markets: UK and Germany Key distribution markets: Spain and Italy Primarily utilize country‐specific distributors for smaller EU countries Aorfix high angle approval in 2009 Sales increased 8% in 2013 Strong growth in Germany and Spain Stabilized sales in UK following EVAR centers consolidation in prior years Direct‐markets with sales team of 10 (2013) Expect to increase sales force in Germany Spain and Italy are supported by a sales manager in each country Direct Distributor Spain U.K. Germany Italy CONFIDENTIAL 10

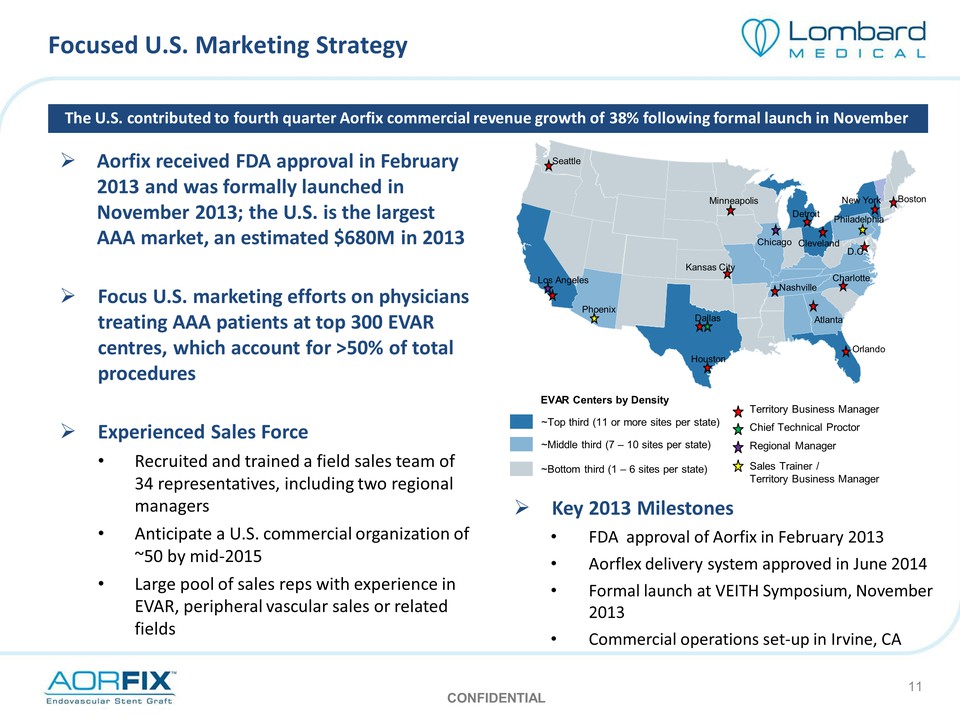

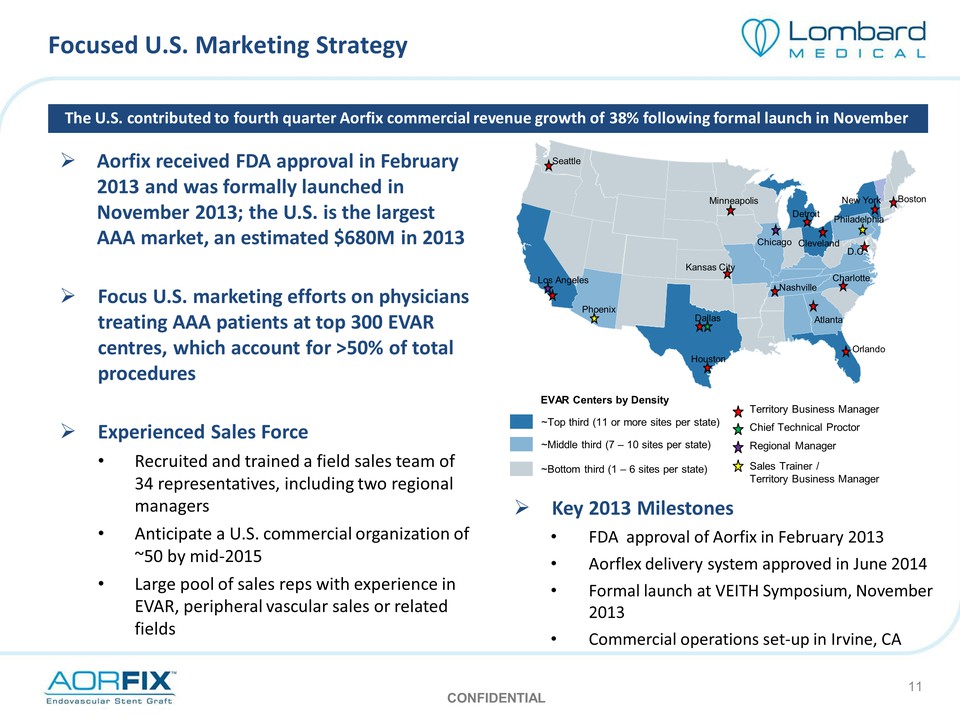

Focused U.S. Marketing Strategy The U.S. contributed to fourth quarter Aorfix commercial revenue growth of 38% following formal launch in November Aorfix received FDA approval in February 2013 and was formally launched in November 2013; the U.S. is the largest AAA market, an estimated $680M in 2013 Focus U.S. marketing efforts on physicians treating AAA patients at top 300 EVAR centres, which account for >50% of total procedures Experienced Sales Force Recruited and trained a field sales team of 34 representatives, including two regional managers Anticipate a U.S. commercial organization of ~50 by mid‐2015 Large pool of sales reps with experience in EVAR, peripheral vascular sales or related fields EVAR Centers by Density ~Top third (11 or more sites per state) ~Middle third (7 – 10 sites per state) ~Bottom third (1 – 6 sites per state) Territory Business Manager Chief Technical Proctor Regional Manager Sales Trainer / Territory Business Manager Los Angeles Phoenix Dallas Houston Seattle Minneapolis Detroit Chicago Cleveland Kansas City Nashville Atlanta Charlotte Orlando D.C. New York Philadelphia Boston Key 2013 Milestones FDA approval of Aorfix in February 2013 Aorflex delivery system approved in June 2014 Formal launch at VEITH Symposium, November 2013 Commercial operations set‐up in Irvine, CA CONFIDENTIAL 11

Japanese Commercial Strategy Japanese Market Dynamics Commercial endovascular aortic stent‐grafts first approved in mid‐2006 Current government set price for an aortic endograft, irrespective of manufacturer, is ~$18,0001 Launch of Aorfix in Japan Partnered with Medico’s Hirata Medico’s Hirata has significant experience in EVAR and a direct sales force trained in the Japanese AAA market due to a prior relationship with another AAA stent‐graft company Anticipate Japanese regulatory approval for Aorfix to treat angulation <90 degrees in 2014 Key Terms of the Medico’s Hirata Agreement Responsible for pursuing and obtaining marketing approval for Aorfix from the Japanese Ministry of Health, Labor andWelfare Required to purchase fromLombard all of its requirements for commercialization of Aorfix in Japan Initial term of seven years from the date Aorfix receives marketing approval in Japan Term may be extended for up to an additional seven years at the option of Medico’s Hirata 1 Medtech Ventures: Aortic InterventionMarket (2014) CONFIDENTIAL 12

Integrated Scalable Platform with Next Generation Delivery Systems on Track New Product Development Next generation delivery systems Exchange sheath – reduce vessel trauma Lower profile design – treat patients with narrow access vessels Intuitive & compact – ease of use Provides physicians and AAA patients with an enhanced treatment option Size range extensions for Aorfix underway Ability to treat patients with larger / smaller anatomies Made available in EU in H2 2013 as custom devices Clinical study to support application for regulatory approval of extended size range expected to start in late‐2014 / early‐2015 Thoracic stent‐graft Opportunity to extend technology to treat Thoracic Aneurysms (TEVAR) CONFIDENTIAL 13

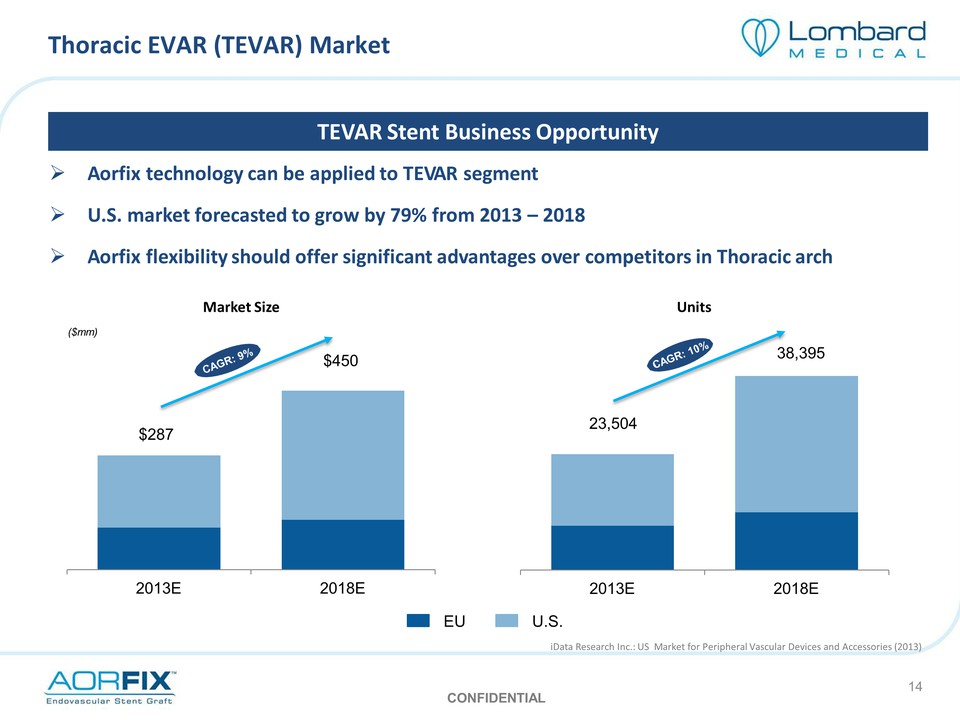

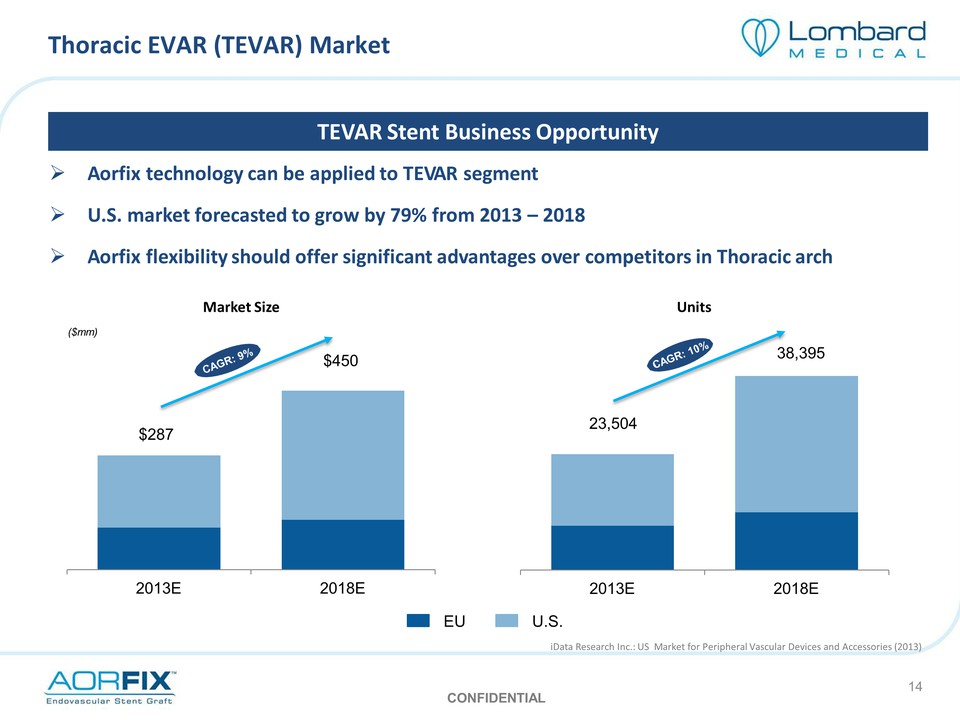

Thoracic EVAR (TEVAR) Market TEVAR Stent Business Opportunity Aorfix technology can be applied to TEVAR segment U.S. market forecasted to grow by 79% from 2013 – 2018 Aorfix flexibility should offer significant advantages over competitors in Thoracic arch Market Size ($mm) CAGR: 9% $287 $450 2013E 2018E Units CAGR: 10% 23,504 38,395 2013E 2018E EU U.S. iData Research Inc.: US Market for Peripheral Vascular Devices and Accessories (2013) CONFIDENTIAL 14

Financial Highlights Q1 2014 Aorfix Commercial Sales grew 104% to $2.0 million compared (Q1 2013: $1.0 million) US sales grew 72% sequentially to $0.5 million in the first quarter compared (Q4 2013: $0.3 million) Main European markets sales grew 59% to $1.1 million compared (Q1 2013: $0.7 million) Rest‐of‐World distributor markets grew 44% to $0.4 million compared (Q1 2013: $0.3 million) Total sales grew 64% to $2.0 million compared (Q1 2013: $1.3 million) Lower growth reflected the divestment of the Company’s OEM business in December 2013 Net loss for the first quarter of 2014 was $6.9 million, compared (Q1 2013: $3.0 million) The increased loss was principally due to on‐going investments in a US based Operation Cash at March 31, 2014 of $33.4 million (December 31, 2013: $40.9 million) Proceeds from the US initial public offering (IPO) on April 25, 2014, after expenses will add approximately $48 million of cash in the second quarter of 2014 CONFIDENTIAL 15

Conclusion: A Differentiated Growth Opportunity in AAA Large Addressable Market Opportunity Focused on attractive $1.4bn global EVAR market forecast to grow at 6% CAGR Approved and Highly Differentiated Product Aorfix is the only FDA‐approved endovascular stent‐graft for neck angulations up to 90° Aorfix is already approved and launched in the U.S. and Europe Strong Supporting Clinical Data Strong clinical data from U.S. IDE study (PYTHAGORAS) Strong Financial Profile Strong Aorfix revenue growth Public market track record and $81 in cash (Q1 2014 adjusted for IPO net proceeds) Clear Strategy for Growth Geography – expand U.S. sales force and accelerate roll out; approval and launch in Japan Product – Enhanced Aorfix delivery systems; thoracic stent graft Experienced Management Team Highly experienced management team with significant medtech experience CONFIDENTIAL 16