As confidentially submitted to the Securities and Exchange Commission on May 15, 2015

Registration No. 333-

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM F-1

REGISTRATION STATEMENT

UNDER

THE SECURITIES ACT OF 1933

GC Aesthetics plc*

(Exact name of registrant as specified in its charter)

| | | | |

| Ireland | | 3842 | | Not applicable |

(State or other jurisdiction of incorporation or organization) | | (Primary Standard Industrial Classification Code Number) | | (I.R.S. Employer Identification Number) |

Suite 601, Q House, Furze Road

Sandyford, Dublin 18, Ireland

Telephone: +353 1293 3836

(Address, including zip code, and telephone number, including area code, of registrant’s principal executive offices)

Ayse Kocak

Chief Executive Officer

GC Aesthetics plc

Suite 601, Q House, Furze Road

Sandyford, Dublin 18, Ireland

Telephone: +353 1293 3836

(Name, address, including zip code, and telephone number, including area code, of agent for service)

Copies to:

| | | | |

Scott D. Elliott Michael D. Beauvais Ropes & Gray LLP Prudential Tower 800 Boylston Street Boston, MA 02199 Telephone: (617) 951-7000 | | Ian Crosbie Chief Financial Officer GC Aesthetics plc Suite 601, Q House, Furze Road Sandyford, Dublin 18, Ireland Telephone: +353 1293 3836 | | Michael W. Benjamin Ilir Mujalovic Shearman & Sterling LLP 599 Lexington Avenue New York, NY 10022 Telephone: (212) 848-4000 |

Approximate date of commencement of proposed sale to public: As soon as practicable after this Registration Statement is declared effective.

If any of the securities being registered on this Form are to be offered on a delayed or continuous basis pursuant to Rule 415 under the Securities Act of 1933, check the following box. ¨

If this Form is filed to register additional securities for an offering pursuant to Rule 462(b) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ¨

If this Form is a post-effective amendment filed pursuant to Rule 462(c) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ¨

If this Form is a post-effective amendment filed pursuant to Rule 462(d) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ¨

CALCULATION OF REGISTRATION FEE

| | | | |

|

Title of each class of securities to be registered | | Proposed maximum aggregate offering price(1)(2) | | Amount of registration fee |

Ordinary Shares, par value | | $ | | $ |

|

|

| (1) | Estimated solely for the purpose of calculating the registration fee in accordance with Rule 457(o) of the Securities Act of 1933, as amended. |

| (2) | Includes shares that may be sold upon exercise of the underwriters’ option to purchase additional shares. See “Underwriting.” |

The Registrant hereby amends this Registration Statement on such date or dates as may be necessary to delay its effective date until the Registrant shall file a further amendment which specifically states that this Registration Statement shall thereafter become effective in accordance with Section 8(a) of the Securities Act of 1933 or until the Registration Statement shall become effective on such date as the Securities and Exchange Commission, acting pursuant to said Section 8(a), may determine.

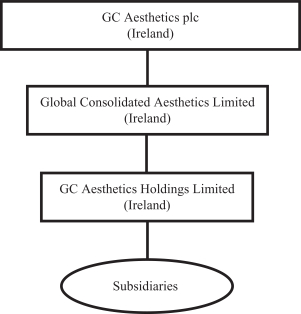

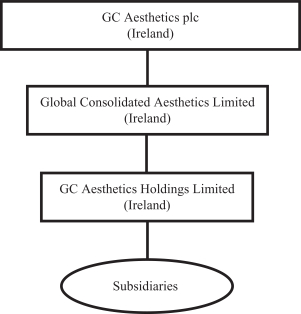

| * | Until immediately prior to the completion of the initial public offering described in this registration statement, GC Aesthetics plc will be a shell company. GC Aesthetics plc will not have conducted any operations (other than activities incidental to its formation, the share-for-share exchange described in the accompanying prospectus and the initial public offering described herein). The separate entity through which we currently operate our business is Global Consolidated Aesthetics Limited, a private limited company organized under the laws of Ireland. Global Consolidated Aesthetics Limited and its subsidiaries will become wholly owned by GC Aesthetics plc pursuant to the share-for-share exchange by which the existing shareholders of Global Consolidated Aesthetics Limited will exchange their shares in Global Consolidated Aesthetics Limited for shares having substantially the same rights in GC Aesthetics plc. Unless otherwise indicated or the context otherwise requires, all references in this registration statement to the “Company,” “GCA,” “we,” “us” and “our” refer to (i) Global Consolidated Aesthetics Limited together with its consolidated subsidiaries, prior to the completion of the share-for-share exchange described above, and (ii) GC Aesthetics plc and its consolidated subsidiaries following such share-for-share exchange, which is expected to occur immediately prior to the completion of this offering. See “Prospectus Summary—Corporate Information.” |

The information in this prospectus is not complete and may be changed. We may not sell these securities until the registration statement filed with the Securities and Exchange Commission is effective. This prospectus is not an offer to sell these securities and it is not soliciting an offer to buy these securities in any jurisdiction where the offer or sale is not permitted.

Subject to Completion

Preliminary Prospectus dated , 2015

PROSPECTUS

Ordinary Shares

GC Aesthetics plc

Ordinary Shares

This is GC Aesthetics plc’s initial public offering. We are selling ordinary shares.

We expect the public offering price to be between $ and $ per ordinary share. Currently, no public market exists for the ordinary shares. After pricing of the offering, we expect that the ordinary shares will trade on the under the symbol “ .”

We are an “emerging growth company” under the federal securities laws and will be subject to reduced public company reporting requirements. See “Prospectus Summary—Implications of Being an Emerging Growth Company.”

Investing in the ordinary shares involves risks that are described in the “Risk Factors” section beginning on page 15 of this prospectus.

| | | | | | | | |

| | | Per Share | | | Total | |

Public offering price | | $ | | | | $ | | |

Underwriting discount(1) | | $ | | | | $ | | |

Proceeds, before expenses, to us | | $ | | | | $ | | |

| | (1) | The underwriters will receive compensation in addition to the underwriting discount. See “Underwriting.” |

The underwriters may also exercise their option to purchase up to an additional ordinary shares from us, at the public offering price, less the underwriting discount, for 30 days after the date of this prospectus.

Neither the Securities and Exchange Commission nor any state securities commission has approved or disapproved of these securities or determined if this prospectus is truthful or complete. Any representation to the contrary is a criminal offense.

The ordinary shares will be ready for delivery on or about , 2015.

Joint Book-Running Managers

| | | | |

| BofA Merrill Lynch | | Deutsche Bank Securities | | Cowen and Company |

William Blair

The date of this prospectus is , 2015.

TABLE OF CONTENTS

We have not, and the underwriters have not, authorized anyone to provide any information or to make any representations other than those contained in this prospectus or in any free writing prospectus prepared by or on behalf of us or to which we have referred you. We take no responsibility for, and can provide no assurance as to the reliability of, any other information that others may give you. This prospectus is an offer to sell only the ordinary shares offered hereby, and only under circumstances and in jurisdictions where it is lawful to do so. The information contained in this prospectus or in any applicable free writing prospectus is current only as of its date, regardless of its time of delivery or any sale of ordinary shares. Our business, financial condition, results of operations and prospects may have changed since that date.

i

PROSPECTUS SUMMARY

This summary highlights information contained in other parts of this prospectus. Because it is only a summary, it does not contain all of the information that you should consider before investing in our ordinary shares and it is qualified in its entirety by, and should be read in conjunction with, the more detailed information appearing elsewhere in this prospectus. You should read the entire prospectus carefully, especially “Risk Factors” and our financial statements and the related notes included elsewhere in this prospectus, before deciding to buy our ordinary shares. Unless otherwise indicated or the context otherwise requires, all references in this prospectus to the “Company,” “we,” “us” and “our” refer to (i) Global Consolidated Aesthetics Limited together with its consolidated subsidiaries, prior to the completion of the share-for-share exchange by which the existing shareholders of Global Consolidated Aesthetics Limited exchange their shares in Global Consolidated Aesthetics Limited for shares having substantially the same rights in GC Aesthetics plc, which is expected to occur immediately prior to the completion of this offering (the “Share-for-Share Exchange”), and (ii) GC Aesthetics plc and its consolidated subsidiaries following the Share-for-Share Exchange.

Overview

We are a leading pure-play female aesthetics company committed to becoming the trusted brand and partner for women seeking to look healthy, youthful, vibrant and beautiful, and to feel confident about themselves throughout their lifetime. To date, we have generated significant growth by focusing on the development, manufacturing and commercialization of one of the broadest ranges of implant products, principally silicone breast implants. We believe that through our two brands Nagôr and Eurosilicone, which have a combined 60 years of market presence, we have (i) a strong reputation for safety, quality and reliability, as evidenced by the five-year data from our ongoing Eurosilicone safety study, (ii) strong competitive advantages based on our innovative product design features—the result of our focused approach to research and development, which integrates feedback from women and surgeons, and (iii) a differentiated marketing and customer service approach, focusing on the needs of women.

We have developed and marketed our comprehensive range of products, comprising over 1,100 stock keeping units (“SKUs”), to address the different needs and preferences of women and surgeons. All of our implants are manufactured with medical-grade silicone supplied from either NuSil Technology LLC (“NuSil”) or Applied Silicone Corporation (“ASC”), both of which are U.S.-based, International Organization for Standardization (“ISO”) 9001-certified sources. We have manufacturing facilities in the United Kingdom and France and sell our products in 75 countries, with direct sales activities in six countries, including Brazil, the world’s largest medical aesthetics market by total number of plastic surgery procedures.

The global aesthetics products market in 2014 was estimated at $6.5 billion in total sales and is expected to grow at a compound annual growth rate (“CAGR”) of nearly 12%, reaching almost $10.2 billion in total sales by 2018, according to Medical Insight’s “The Global Aesthetic Market Study: Version XII” report (“Medical Insight”). We believe the overall market growth is driven by multiple factors, including a growing middle class in emerging markets, an increase in women’s disposable income, increasing awareness and acceptance of aesthetics procedures, as well as continuous innovation and improved accessibility to aesthetics procedures. While the United States has historically been the largest market for aesthetics products in terms of total revenues, a significant number of markets outside of the United States have been growing faster in terms of revenues and plastic surgeon numbers. For example, Brazil, Mexico and China have experienced faster revenue growth than the aesthetics products market in the United States, providing attractive growth opportunities. The global breast implant market is forecasted to reach nearly $1.3 billion by 2018, with some estimates forecasting the market will reach nearly $1.5 billion by 2019, growing at a CAGR ranging from approximately 4% to 6% from 2014 to 2018.

1

We have a diversified revenue base, with approximately 47% of our 2014 revenues derived from sales in Europe, the Middle East and Africa (“EMEA”) (inclusive of the United Kingdom, Switzerland, Bosnia, the European Economic Area (the “EEA”), the Commonwealth of Independent States (“CIS”) countries, the Middle East and Africa), approximately 42% in Latin America (inclusive of Mexico, the Dominican Republic, Panama and South America) and approximately 11% in Asia-Pacific. Our revenues were approximately $52.8 million for the year ended December 31, 2014, as compared to approximately $44.6 million for the year ended December 31, 2013, an increase of 18.4% at Constant Currency Revenue. For additional information regarding Constant Currency Revenue, which is a non-International Financial Reporting Standards (“IFRS”) measure, including a reconciliation of Constant Currency Revenue to revenue, see “—Summary Consolidated Financial Data” and “Management’s Discussion and Analysis of Financial Condition and Results of Operations—Key Financial Metrics.”

The Global Aesthetics Products Market

The global aesthetics products market in 2014 was estimated at $6.5 billion in total sales and is expected to grow at a CAGR of nearly 12%, reaching almost $10.2 billion in total sales by 2018, according to Medical Insight. We believe the overall market growth is driven by multiple factors, including a growing middle class, increasing female disposable income and increasing awareness and acceptance of aesthetics procedures, as well as continuous innovation and improved accessibility to aesthetics procedures, through an increase in the number of surgeons. The number of middle- and upper-income women globally is forecasted to grow at a CAGR of approximately 5% from 2014 to 2019 to 346 million, according to industry sources.

While the United States has historically been the largest market for aesthetics products in terms of total revenues, a significant number of markets outside the United States have been growing faster in terms of revenues and plastic surgeon numbers. We believe that this growth in markets outside of the United States will continue based on increasing penetration rates in many of those markets, increases in plastic surgeon numbers and favorable demographic and economic trends. For example, in 2013, Brazil surpassed the United States in total number of plastic surgery procedures, accounting for 12.9% of global plastic surgery procedures as compared to 12.5% for the United States, according to the International Society of Aesthetic Plastic Surgeons (“ISAPS”). The international market has also seen significant growth in the number of plastic surgeons. While the number of plastic surgeons in the United States grew at a CAGR of approximately 1% from 2010 to 2013, the number of plastic surgeons in countries outside the United States included in the ISAPS Report grew at an estimated average CAGR of 8% for the same period. For example, China and South Korea grew their plastic surgeon populations at CAGRs of approximately 12% and 18%, respectively, from 2010 to 2013. Brazil’s plastic surgeon population of 5,473 in 2013 is close to that of the United States, at 6,133. We believe the increase in the plastic surgeon population is representative of improved accessibility and a growing infrastructure supportive of further expansion of the overall market.

Overview of the Global Breast Implant Market

Breast augmentation surgery represented the leading aesthetic surgical procedure, with approximately 15% of total aesthetic surgical procedures performed by plastic surgeons in 2013, based on ISAPS. The global breast implant market is forecasted to reach nearly $1.3 billion by 2018, with some estimates forecasting the market will reach nearly $1.5 billion by 2019, growing at a CAGR ranging from approximately 4% to 6% from 2014 to 2018. Breast implant surgery is used to enhance aesthetic appearance and comprises two general categories: (i) breast augmentation procedures for cosmetic purposes and (ii) breast reconstruction procedures to replace breast tissue that has been removed, mainly due to cancer or trauma.

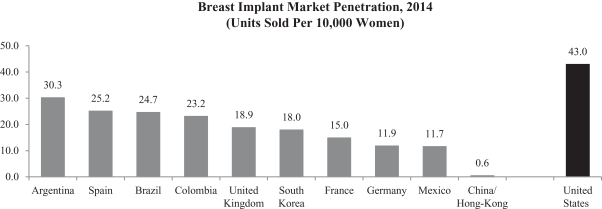

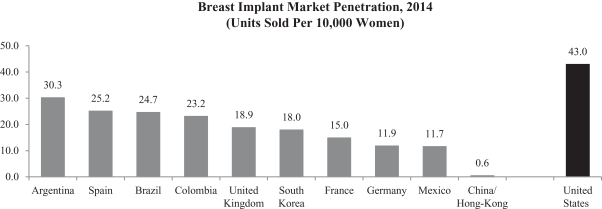

A number of international breast implant markets have recently shown significantly faster growth than the United States and many of the non-U.S. markets are still highly underpenetrated, based on the number of

2

women undergoing breast implant procedures, compared to the penetration of global brands in the United States. We believe that current trends in non-U.S. markets will continue to increase penetration rates in those markets, creating a significant growth opportunity for us, given our global focus.

Favorable Demographics and Economic Trends for the Global Aesthetics Market

The primary market for aesthetics procedures is comprised of middle- and upper-class women, which BCC Research’s “Medical Aesthetic Devices: Technologies and Global Markets” report (“BCC Research”) defines as women with access to sufficient income to afford such aesthetics procedures. From 2014 to 2019, the global aesthetics products market is estimated to grow at a CAGR of .5% in the United States, in contrast to 11.0%, 8.3% and 8.2% in China, Mexico and Brazil, respectively, according to BCC Research. Moreover, the Company estimates that the global aesthetics products market is projected to grow at a higher CAGR than the world gross domestic product (“GDP”), and, in China, Brazil and Mexico, the aesthetics products market is projected to grow at a higher CAGR than their respective GDPs. In contrast, the U.S. aesthetics products market is projected to grow more slowly than the GDP of the United States. In contrast, the U.S. aesthetics products market is projected to grow more slowly than the GDP of the United States.

Euromonitor projects the global annual disposable income per capita for women will grow at a CAGR of approximately 6% over the next five years. We believe this growth will help drive the expansion of the global aesthetics market. In addition, over the next 20 years, it is estimated that there will be a significant increase in the world’s middle class population, which is expected to account for a significant increase in purchasing power and discretionary spending. We believe much of this growth in purchasing power will come from emerging markets, due to increasing annual disposable incomes in those markets. For example, the Chinese middle- and upper-income female population is expected to reach 78 million by 2019, matching that of the United States. For example, in Brazil, the number of breast implant units sold grew by 11.5% in 2012, according to industry sources, while the country’s GDP growth slowed to only 1.8% over that same period. In Europe, the number of breast implant units sold grew by 12.8% in 2012, according to the same source; in contrast, overall GDP grew by 0.3% over that same period.

Our Opportunity

We believe we have a significant opportunity to capitalize on the favorable trends in the aesthetics market and benefit from the underlying growth in women’s disposable income, particularly in emerging markets, given the strength of our brands, quality and breadth of our product portfolio, differentiated customer service, strong customer relationships, expanding global infrastructure and new product development. Currently, we focus on the breast implant market outside of the United States, as well as other pre- and post-breast implant surgery products globally. We have a significant presence in Europe, Latin America and Asia-Pacific and we intend to continue to further expand in these regions as well as in Russia and the Middle East and into emerging markets, including China, Thailand and additional CIS countries. Beyond breast implant products, we intend to expand our presence in other selected female aesthetics products, including those associated with implant surgery as well as other procedures, such as body sculpting treatments and dermal fillers.

Our Competitive Strengths

We believe our pure-play focus has allowed us to become a leading player in the female aesthetics market. The following are our key competitive strengths:

Highly regarded and trusted brands with a strong safety profile. We have two prominent brands, Nagôr and Eurosilicone, which have a combined 60 years of market presence. Based on a company-sponsored, Eurosilicone breast implant study in Europe with 534 subjects, the peer-reviewed five-year clinical safety data published in the Plastic and Reconstructive Surgery journal of the American Society of Plastic Surgeons (“Plastic and Reconstructive Surgery”) supported the strong safety profile of our breast implant products, with low incidence of rupture and rates of capsular contracture comparable to rates experienced by others in our industry for primary augmentation surgery.

3

Broad product range recognized for quality. Breast implant products and pre- and post-breast implant surgery products are our core competency. Unlike our primary competitors, who generate a very small portion of their total revenue from breast implant products, we generate substantially all of our revenue from our breast implant products and are focused on providing one of the most comprehensive selections of breast implant and other products, including over 1,100 SKUs, for our customers as well as consistently delivering high levels of customer satisfaction.

Global sales and marketing platform. We sell our products in 75 countries and are one of the leading breast implant manufacturers globally by units sold. We believe our strong sales and marketing platform will help us to successfully launch product line extensions and thereby drive additional revenue growth, particularly in rapidly growing emerging markets.

Extensive in-house development and manufacturing capabilities. All of our products have been developed in-house. Our manufacturing operations allow us to rapidly develop new products based on our close relationships with women and surgeons and our extensive industry experience. We have manufacturing facilities in the United Kingdom and France, all of which are ISO certified and are regularly inspected by their respective regulatory bodies.

Focus on integrated marketing and delivering high-quality customer service. We believe that our customer-focused approach to product design, marketing and customer care is a key differentiator. Our integrated marketing approach consists of woman-centric initiatives and surgeon-centric support programs.

Experienced management team. We are led by a proven management team with a successful track record in healthcare and aesthetics. Ayse Kocak is the only female chief executive officer of a breast implant company and has over 20 years of experience in the healthcare industry.

Our Growth Strategies

Our goal is to become the leading pure-play female aesthetics company. We are committed to becoming the trusted brand and partner for women seeking to look healthy, youthful, vibrant and beautiful, and to feel confident about themselves throughout their lifetime. To achieve these objectives, we are pursuing the following growth strategies:

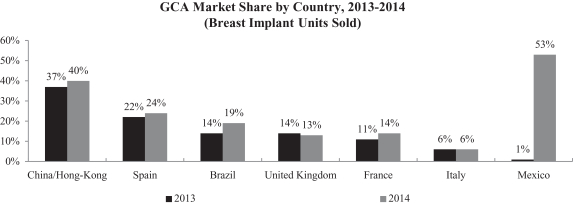

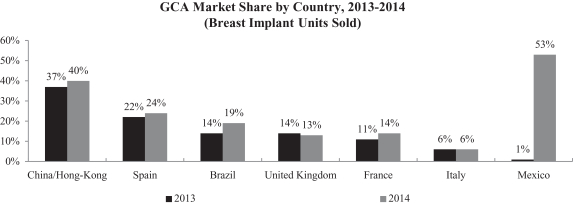

Outperform the competition in existing markets. Our focus on female aesthetics and delivering high-quality service has distinguished our brands and has enabled us to gain market share from our major competitors in key markets, including Brazil and Mexico, the second and third largest markets by number of breast implant units sold. Based on internal estimates, from 2013 to 2014, our global market share outside of North America increased from 18% to 20%, based on breast implant units sold. We believe that as our brand awareness increases and our reputation for quality and service grows, we will be able to achieve additional growth in our existing markets.

Penetrate new geographical markets with a focus on direct operations and commercialize new products. We currently sell our products directly in six countries and through distributors in an additional 69 countries. We intend to increase the number of markets where we sell direct, which we believe will drive gross margin expansion, as our gross margin is higher in markets where we sell direct.

Leverage our surgeon relationships and strong brand recognition to introduce innovative products. By leveraging the established position of our Nagôr and Eurosilicone brands and strong surgeon relationships, we plan to expand our product range in female aesthetics. We plan to continue innovating and introducing new products like IMPLEO to expand our product portfolio to offer the best solutions for our customers.

4

Continue our customer-centric approach and launch additional novel initiatives. Unlike our larger competitors, we are a pure-play female aesthetics company. We intend to continue to effectively engage women and surgeons through an integrated approach that includes direct marketing, distribution partnerships and social media campaigns to help promote the acceptance of breast implants and help patients take action to change the way they feel about themselves.

Selectively pursue strategic acquisitions. We may selectively pursue complementary acquisitions that would allow us to enlarge our female aesthetics product portfolio, go direct in new or existing markets or expand further in existing markets.

Our Products

We have developed and marketed our comprehensive range of products, comprising over 1,100 SKUs, to address the different needs and preferences of women and surgeons. Through integrating our experience of developing, manufacturing and securing regulatory approval for our breast implant products and our close relationship with women and surgeons, we believe that we are well positioned to continue our track record of developing a continuing stream of innovative products.

Breast Augmentation and Breast Reconstruction Products

Breast Implant Products.Our product portfolio addresses a comprehensive range of options:

| | |

Shape | | Round and anatomical (also known as teardrop) |

Texture | | Smooth and three different textures |

Volume | | 100ml to 800ml |

Projection | | Low to extra-high |

Gel cohesivity | | Five different cohesivities |

We recently commenced active promotion of the IMPLEO breast implant product line, which we believe are the first round implants to be soft to the touch, deliver shape maintenance and a range of texturing as well as permitting a small surgical incision due to their unbreakable gel. We believe that through this combination of features, a wider range of surgeons is able to deliver an outcome to women that was previously achievable only by the highest quality surgeons.

The commercial impact of IMPLEO was significant in certain countries in 2014, its first year of active promotion in these markets; it accounted for approximately 20% of our sales in France and for approximately 56% of our sales in the United Kingdom. IMPLEO is currently available in 44 of the 75 countries in which we sell our products, and we are planning to launch it in almost all of our other markets in 2015, subject to receiving required regulatory approvals.

Breast Sizers.We produce a range of these temporary, single-use products that can be used by surgeons during surgery to help identify the desired style and size of implant for each woman.

Breast Tissue Expanders. These are used in breast reconstruction following cancer and other trauma injuries, and are temporary devices intended to aid in the process of recreating tissue coverage to allow for the placement of an implant to reconstruct the breast.

Other Implants

We offer a range of other implant products, including gluteal, testicular and calf implants, all made from medical-grade silicone. In 2014, these represented 5.5% of our sales.

5

Pre- and Post-Breast Implant Surgery Products

In the second half of 2015, we are planning to launch a range of consumer products to offer a broader solution and reinforce our brand loyalty among women considering breast augmentation and those who have had the procedure, including the following products:

The Enhance Breast Boost Pack. This non-invasive product, comprising a specialized bra and silicone breast forms, allows women to experience the look and feel of fuller breasts instantly, and we believe this will lead to an increase in the number of women considering surgical augmentation and consulting surgeons.

Silgel scar management specialty products. These gel and sheet products minimize the appearance of post-surgery scars, and help us build upon our existing relationships with surgeons and access other market channels.

Our Five-Year Clinical Data

In June 2014, Plastic and Reconstructive Surgery published the peer-reviewed five-year results from an ongoing study to evaluate the safety profile of our Eurosilicone breast implant products. This multi-center, surgeon-led study, sponsored by us, monitors 1,010 Eurosilicone breast implants in 534 subjects who have undergone either augmentation or reconstructive surgery. Each patient had a three-month post-surgery follow-up evaluation and annual follow-ups thereafter. The study’s five-year results demonstrate a low rupture rate and a strong safety profile. For primary augmentation, (i) the total risk of rupture was assessed at 0.8% per patient (only one of the 1,010 implants was found to be ruptured on examination) and (ii) the incidence of severe capsular contracture was 10.7%, which we believe is consistent with rates experienced by others in our industry.

Summary Risk Factors

An investment in our ordinary shares involves a high degree of risk. Any of the factors set forth under “Risk Factors” in this prospectus may limit our ability to successfully execute our business strategy. You should carefully consider all of the information set forth in this prospectus and, in particular, you should evaluate the specific factors set forth under “Risk Factors” in deciding whether to invest in our ordinary shares. Some of the principal risks relating to our business and our ability to execute our business strategy include:

| | • | | We have incurred significant net operating losses and cannot assure you that we will ever achieve or maintain profitability. |

| | • | | Our future profitability depends on the success of our breast implant products. |

| | • | | Any negative publicity concerning our products or our competitors’ products could harm our business and reputation and negatively impact our financial results. |

| | • | | Our success depends on our ability to continue to enhance our existing products and develop or commercialize new products that respond to customer needs and preferences. |

| | • | | The size of the addressable global aesthetics products market, and the breast implant products market in particular, has not been established with precision and may be smaller than we estimate, possibly materially. If our estimates and projections overestimate the size of these markets and the markets for our other products, our revenue and results of operations will be adversely affected. |

| | • | | Each of our brands relies on a single-source supplier for medical-grade silicone, which is the primary constitutive ingredient of our products. These two suppliers are under common ownership, which could result in increased prices when we seek to renew our contracts with these suppliers. |

6

| | • | | Recent studies have called into question the long-term safety of breast implants, which could have a material adverse effect on our business, results of operations and financial condition. |

| | • | | If we acquire or attempt to acquire new businesses or products, we may be unable to complete these acquisitions or to successfully integrate them in a cost-effective and non-disruptive manner, and we may not realize the benefits we anticipate from such acquisitions. |

| | • | | We will need to significantly increase the size of our organization, and we may experience difficulties in managing growth. |

| | • | | Our business could suffer if we lose the services of our senior management or other key personnel or are unable to attract and retain additional qualified personnel. |

| | • | | If we fail to maintain and further develop our direct sales forces and distributor networks, our business could suffer. Additionally, our third-party distributors may not effectively sell our products or may engage in activities that could harm our reputation and sales of our products. |

| | • | | Our results of operations could be materially adversely affected by fluctuations in foreign currency exchange rates. |

| | • | | Any disruption at our manufacturing facilities could adversely affect our business and results of operations. |

| | • | | If we fail to compete effectively against our competitors, many of whom have greater resources than we have, our revenues and results of operations may be negatively affected. |

| | • | | Our medical device products and operations, including manufacturing, are subject to extensive governmental regulation, including health, environmental, safety and anti-corruption and other laws, and our failure to comply with applicable requirements could cause our business to suffer. |

Implications of Being an Emerging Growth Company

As a company with less than $1.0 billion in revenue during our most recently completed fiscal year as of the initial filing date of the registration statement of which this prospectus forms a part, we qualify as an “emerging growth company” as defined in the Jumpstart our Business Startups Act of 2012 (the “JOBS Act”). As an emerging growth company, we may take advantage of specified reduced disclosure and other requirements that are otherwise applicable generally to public companies that are not emerging growth companies. These provisions include:

| | • | | the ability to present more limited financial data, including presenting only two years of audited financial statements and only two years of selected financial data in the registration statement on Form F-1 of which this prospectus is a part; |

| | • | | an exemption from certain disclosure obligations regarding executive compensation in the registration statement on Form F-1 of which this prospectus is a part and in our future periodic reports; |

| | • | | an exception from compliance with the auditor attestation requirements of Section 404 of the Sarbanes-Oxley Act of 2002 (the “Sarbanes-Oxley Act”); and |

| | • | | exemptions from the requirements of holding a non-binding advisory vote on executive compensation and obtaining shareholder approval of any golden parachute payments. |

7

We may take advantage of these exemptions for up to five years or such time that we are no longer an emerging growth company. We would cease to be an emerging growth company if we have more than $1.0 billion in annual revenues as of the end of our fiscal year, we have more than $700 million in market value of our stock held by non-affiliates as of the end of our second fiscal quarter, or we issue more than $1.0 billion of non-convertible debt over a three-year period. We may choose to take advantage of some but not all of these reduced disclosure obligations. We have taken advantage of reduced disclosure obligations regarding financial statements and executive compensation arrangements in this prospectus, and we may choose to take advantage of some but not all of these obligations in future filings. If we do, you may receive different and less information than you might get from other public companies.

We will not take advantage of the extended transition period provided under Section 7(a)(2)(B) of the Securities Act of 1933, as amended (the “Securities Act”), for complying with new or revised accounting standards. Since IFRS as issued by the International Accounting Standards Board (“IASB”) (“IFRS as issued by the IASB”) makes no distinction between public and private companies for purposes of compliance with new or revised accounting standards, the requirements for our compliance as a private company and as a public company are the same.

Implications of Being a Foreign Private Issuer

We are also considered a “foreign private issuer.” In our capacity as a foreign private issuer, we are exempt from certain rules under the U.S. Securities Exchange Act of 1934, as amended (the “Exchange Act”), that impose certain disclosure obligations and procedural requirements for proxy solicitations under Section 14 of the Exchange Act. In addition, our officers, directors and principal shareholders are exempt from the reporting and short-swing profit recovery provisions of Section 16 of the Exchange Act and the rules under the Exchange Act with respect to their purchases and sales of our ordinary shares. Moreover, while we must file an annual report on Form 20-F, we are not required to file periodic reports and financial statements with the Securities and Exchange Commission (“SEC”) as frequently or as promptly as U.S. companies whose securities are registered under the Exchange Act, although we do intend to furnish quarterly reports on Form 6-K. In addition, although we plan to comply with Regulation FD, which restricts the selective disclosure of material non-public information, we are not required to comply with Regulation FD. As a foreign private issuer, we also may elect, and have elected, to follow Irish corporate governance rules to the extent permitted.

We may take advantage of these exemptions until such time as we are no longer a foreign private issuer. We would cease to be a foreign private issuer at such time as more than 50% of our outstanding voting securities are held by U.S. residents and any of the following three circumstances applies: (i) the majority of our executive officers or directors are U.S. citizens or residents, (ii) more than 50% of our assets are located in the United States or (iii) our business is administered principally in the United States.

We have taken advantage of certain reduced reporting and other requirements in this prospectus. Accordingly, the information contained herein may be different than the information you receive from other public companies.

Corporate Information

Global Consolidated Aesthetics Limited was incorporated in December 2007 under the laws of Ireland and is the holding company of Eurosilicone SAS and Nagôr Limited, the main operating entities within our group, which it acquired from Medicor Ltd. (which was in Chapter 11 bankruptcy proceedings) in May 2008. Eurosilicone SAS was incorporated in 1988 under the laws of France. Nagôr Limited was incorporated in 1979 under the laws of the Isle of Man, and operates as the registered branch of an overseas company in the United Kingdom. Global Consolidated Aesthetics Limited’s acquisition of Nagôr Limited and Eurosilicone SAS in

8

May 2008 was funded in part by an equity investment in our ordinary shares led by Oyster Technology Investments Limited (“Oyster”). Montreux Equity Partners IV, L.P. (“Montreux”) first became a shareholder in Global Consolidated Aesthetics Limited pursuant to an investment in October 2010. Both Montreux and Oyster have made significant further equity investments in Global Consolidated Aesthetics Limited since their initial investments. See “Description of Share Capital—History of Security Issuances.”

GC Aesthetics plc was incorporated in April 2015 under the laws of Ireland. Upon the Share-for-Share Exchange, GC Aesthetics plc will become the holding company of Global Consolidated Aesthetics Limited and its subsidiaries. Until immediately prior to the completion of the initial public offering described in this prospectus, GC Aesthetics plc will be a shell company. GC Aesthetics plc will not have conducted any operations (other than activities incidental to its formation, the Share-for-Share Exchange described below and the initial public offering described herein). Global Consolidated Aesthetics Limited is the entity through which the Company currently operates its business. Upon the Share-for-Share Exchange, the historical consolidated financial statements of Global Consolidated Aesthetics Limited included in this prospectus will become the historical consolidated financial statements of GC Aesthetics plc.

Our principal executive offices are located at Suite 601, Q House, Furze Road, Sandyford, Dublin 18, Ireland. Our telephone number at that address is +353 1293 3836. Our website address is www.gcaesthetics.com. Our website and the information contained on our website do not constitute a part of this prospectus.

9

The Offering

Ordinary shares offered by us | ordinary shares. |

Ordinary shares to be outstanding immediately after completion of this offering | ordinary shares ( ordinary shares if the option to purchase additional shares is exercised in full). |

Option to purchase additional ordinary shares | The underwriters have an option for a period of 30 days after the date of this prospectus to purchase up to an additional ordinary shares. |

Use of proceeds | We estimate that the net proceeds from this offering will be approximately $ million, or approximately $ million if the underwriters exercise their option to purchase additional ordinary shares in full, at an assumed initial public offering price of $ per ordinary share, the midpoint of the price range set forth on the cover of this prospectus, after deducting the estimated underwriting discounts and commissions and estimated offering expenses payable by us. We intend to use the net proceeds of this offering to expand our (i) operations into new countries, (ii) product portfolio, (iii) existing commercial infrastructure and (iv) manufacturing capabilities. In addition, we intend to use the net proceeds of this offering to fund potential future acquisitions. We will use any remaining proceeds for working capital and other general corporate purposes. See “Use of Proceeds.” |

Dividend policy | We do not currently expect to pay any dividends on our ordinary shares in the foreseeable future. Additionally, our ability to pay dividends on our ordinary shares is limited by restrictions on our and our subsidiaries’ ability to pay dividends or make distributions, including restrictions under the terms of the agreements governing our indebtedness and under Irish law. |

Risk factors | You should read the “Risk Factors” section of this prospectus for a discussion of factors to consider carefully before deciding to invest in our ordinary shares. |

Listing | We intend to apply to list our ordinary shares on the under the symbol “ .” |

The number of ordinary shares to be outstanding after this offering is based on ordinary shares of Global Consolidated Aesthetics Limited outstanding as of , giving effect to the Share-for-Share Exchange, and excludes ordinary shares of GC Aesthetics plc reserved for future issuance under its equity incentive plan to be adopted in connection with this offering.

10

Unless context otherwise requires, this prospectus reflects and assumes the following:

| | • | | the completion, prior to or simultaneously with the completion of this offering, of the Share-for-Share Exchange; |

| | • | | an initial public offering price of $ per ordinary share (the midpoint of the price range set forth on the front cover of this prospectus); |

| | • | | the adoption of our amended and restated memorandum and articles of association, to be effective upon the completion of this offering; |

| | • | | the exercise of all warrants and the conversion of all of our outstanding A Ordinary Shares, B Preference Shares and C Preference Shares into ordinary shares; and |

| | • | | no exercise by the underwriters of their option to purchase up to additional ordinary shares in this offering. |

11

Summary Consolidated Financial Data

The following summary consolidated financial data has been derived from the audited consolidated statements of operations data of Global Consolidated Aesthetics Limited for the years ended December 31, 2014 and December 31, 2013 and the audited consolidated balance sheet data of Global Consolidated Aesthetics Limited as of December 31, 2014 and December 31, 2013 appearing elsewhere in this prospectus. Our historical results for any prior period are not necessarily indicative of results to be expected in any future period. Our consolidated financial statements are presented in US dollars. However, the Euro is our measurement and functional currency and also that of the majority of our subsidiaries. The presentation currency of the Company is the US dollar. The following information should be read in conjunction with “Risk Factors,” “Capitalization,” “Management’s Discussion and Analysis of Financial Condition and Results of Operations” and our consolidated financial statements and the related notes included elsewhere in this prospectus.

| | | | | | | | |

| | | Year Ended | |

| | | December 31, 2014 | | | December 31,

2013 | |

| | | (in thousands) | |

Statements of operations and comprehensive loss: | | | | | | | | |

Revenue | | $ | 52,804 | | | $ | 44,630 | |

Cost of sales | | | (26,038 | ) | | | (22,548 | ) |

Operating expenses | | | (41,835 | ) | | | (30,858 | ) |

| | | | | | | | |

Operating loss | | | (15,069 | ) | | | (8,776 | ) |

Other (expense)(1) | | | (74,958 | ) | | | (9,711 | ) |

Income tax credit | | | 600 | | | | 1,195 | |

| | | | | | | | |

Net loss | | $ | (89,427 | ) | | $ | (17,292 | ) |

| | | | | | | | |

Basic and diluted loss per ordinary share | | $ | (18.74 | ) | | $ | (3.91 | ) |

| | |

Balance sheet data (at period end): | | | | | | | | |

Cash and cash equivalents | | $ | 10,616 | | | $ | 4,519 | |

Total current assets | | | 46,988 | | | | 30,576 | |

Total assets | | | 79,150 | | | | 69,726 | |

Total current liabilities | | | 19,592 | | | | 42,885 | |

Loans and borrowings | | | 51,457 | | | | 19,759 | |

Total non-current liabilities | | | 196,538 | | | | 92,243 | |

Total liabilities | | | 216,130 | | | | 135,128 | |

Accumulated deficit | | | (183,489 | ) | | | (94,062 | ) |

Total equity / (deficiency) | | | (136,980 | ) | | | (65,402 | ) |

| | |

Other financial data (unaudited): | | | | | | | | |

Constant Currency Revenue(2) | | $ | 52,804 | | | $ | 44,607 | |

Adjusted Gross Profit(3) | | | 27,788 | | | | 23,134 | |

Adjusted EBITDA(4) | | | (8,112 | ) | | | (3,385 | ) |

Adjusted Interest Expense(5) | | | (6,202 | ) | | | (3,564 | ) |

| (1) | Other (expense) includes the following expenses: |

| | | | | | | | |

| | | Year Ended December 31, | |

| | | 2014 | | | 2013 | |

| | | (in thousands) | |

Net interest (Expense) income | | $ | (33,746 | ) | | $ | (6,877 | ) |

Loss on conversion of shareholder loans | | | (27,737 | ) | | | — | |

Gain (Loss) on equity derivatives | | | 5,182 | | | | (4,828 | ) |

(Loss) Gain on foreign exchange | | | (18,657 | ) | | | 1,994 | |

12

| (2) | Constant Currency Revenue is defined as revenue calculated by translating revenues for both 2014 and 2013 using the average exchange rates for 2014 of the Euro, Sterling and the Brazilian Real, respectively, to one US dollar, our financial reporting currency. We believe that Constant Currency Revenue is a useful measure, indicating the actual growth of our operations, excluding the impact of foreign currency exchange rates changes. Constant Currency Revenue is not calculated in accordance with IFRS. This calculation may differ from similarly titled measures used by others and, accordingly, Constant Currency Revenue is not meant to be a substitution for revenues presented in conformity with IFRS nor should such non-IFRS financial measure be considered in isolation. Moreover, the presentation of Constant Currency Revenue is not necessarily indicative of historical or future results of operations. Currency fluctuations affect general economic and business conditions, including, for example, a country’s inflation and international trade competitiveness and, as a result, a company’s performance cannot be evaluated solely on the basis of a constant currency presentation. |

The following table reconciles Constant Currency Revenues to revenues, the most comparable IFRS measure, for each of the periods indicated:

| | | | | | | | |

| | | Year Ended December 31, | |

| | | 2014 | | | 2013 | |

| | | (in thousands) | |

Reconciliation of Constant Currency Revenue to Revenue: | | | | | | | | |

Revenue | | $ | 52,804 | | | $ | 44,630 | |

Effect of movement in exchange rates(1) | | | — | | | | (23 | ) |

| | | | | | | | |

Constant Currency Revenue | | $ | 52,804 | | | $ | 44,607 | |

| | | | | | | | |

| | (1) | Constant Currency Revenue is calculated by converting revenues for both 2014 and 2013 using the average exchange rates for 2014 of the Euro, to one US dollar. | |

| (3) | Adjusted Gross Profit is defined as gross profit excluding depreciation that is included in the cost of sales. We believe that Adjusted Gross Profit is a useful measure, indicating the actual profitability of our production excluding these non-cash charges. Adjusted Gross Profit is not calculated in accordance with IFRS. |

The following table reflects the reconciliation of Adjusted Gross Profit to gross profit, the most comparable IFRS measure, for each of the periods indicated:

| | | | | | | | |

| | | Year Ended December 31, | |

| | | 2014 | | | 2013 | |

| | | (in thousands) | |

Reconciliation of Adjusted Gross Profit to Gross Profit: | | | | | | | | |

Gross profit | | $ | 26,766 | | | $ | 22,082 | |

Depreciation included in cost of sales | | | 1,022 | | | | 1,052 | |

| | | | | | | | |

Adjusted Gross Profit | | $ | 27,788 | | | $ | 23,134 | |

| | | | | | | | |

| (4) | Adjusted EBITDA is defined as operating loss, adjusted for other expenses, depreciation, amortization and share-based and other equity-related compensation. We believe that Adjusted EBITDA is a useful metric for investors to understand and evaluate our operating results and ongoing profitability because it permits investors to evaluate our recurring profitability from our ongoing operating activities. Adjusted EBITDA is not calculated in accordance with IFRS. In addition, our calculation of Adjusted EBITDA may not be comparable to similar measures that other companies report because other companies may not calculate Adjusted EBITDA in the same manner as we do. |

By providing this non-IFRS financial measure, together with a reconciliation to IFRS results, we believe we are enhancing investors’ understanding of our business and our results of operations, as well as assisting investors in evaluating how we are executing strategic initiatives. We believe Adjusted EBITDA is widely used by investors and securities analysts as a supplemental measure to evaluate the overall operating

13

performance of companies in our industry without regard to items, such as interest expense, provision for income taxes and depreciation and amortization expense, that can vary substantially from company to company depending upon their financing and accounting methods, the book value of their assets, their capital structures and the method by which their assets were acquired.

Management uses Adjusted EBITDA:

| | • | | as a measurement used in comparing our operating performance on a consistent basis; |

| | • | | for planning purposes, including the preparation of our internal annual operating budget and financial projections; and |

| | • | | to evaluate the performance and effectiveness of our operational strategies. |

Although we use Adjusted EBITDA as a measure to assess the operating performance of our business, Adjusted EBITDA has limitations as an analytical tool, and you should not consider it in isolation, or as a substitute for analysis of our results as reported under IFRS. Because of these limitations, management does not view Adjusted EBITDA in isolation or as a primary performance measure.

The following table reconciles Adjusted EBITDA to operating loss, the most comparable IFRS measure, for each of the periods indicated:

| | | | | | | | |

| | | Year Ended December 31, | |

| | | 2014 | | | 2013 | |

| | | (in thousands) | |

Reconciliation of Adjusted EBITDA to Operating Loss: | | | | | | | | |

Operating loss | | $ | (15,069 | ) | | $ | (8,776 | ) |

Add: | | | | | | | | |

Other expenses | | | — | | | | 183 | |

Depreciation | | | 1,123 | | | | 1,175 | |

Amortization | | | 3,990 | | | | 4,033 | |

Share-based and other equity-related compensation | | | 1,844 | | | | — | |

| | | | | | | | |

Adjusted EBITDA | | $ | (8,112 | ) | | $ | (3,385 | ) |

| | | | | | | | |

| (5) | Adjusted Interest Expense is defined as interest expense adjusted for non-cash charges related to effective interest on our B Preference Shares and C Preference Shares. The B Preference Shares and C Preference Shares will convert into ordinary shares in connection with this offering; as a result, no further charges in respect thereof will be incurred in future periods. However, we believe Adjusted Interest Expense is a useful metric for investors to understand and evaluate our results of operations as it permits investors to evaluate the cash costs of servicing our debt in prior periods. Adjusted Interest Expense is not calculated in accordance with IFRS. |

The following table reconciles Adjusted Interest Expense to interest expense, the most comparable IFRS measure, for each of the periods indicated:

| | | | | | | | |

| | | Year Ended December 31, | |

| | | 2014 | | | 2013 | |

| | | (in thousands) | |

Reconciliation of Adjusted Interest Expense to Interest Expense: | | | | | | | | |

Interest expense | | $ | (33,746 | ) | | $ | (6,877 | ) |

Non-cash charges related to effective interest on B Preference Shares and C Preference Shares | | | 27,544 | | | | 3,313 | |

| | | | | | | | |

Adjusted Interest Expense | | $ | (6,202 | ) | | $ | (3,564 | ) |

| | | | | | | | |

14

RISK FACTORS

Investing in our ordinary shares involves a high degree of risk. You should carefully consider the risks and uncertainties described below together with all of the other information contained in this prospectus, including our consolidated financial statements and the related notes appearing at the end of this prospectus, before deciding to invest in our ordinary shares. If any of the following risks actually occurs, our business, prospects, results of operations and financial condition could suffer materially, the trading price of our ordinary shares could decline and you could lose all or part of your investment. The risks and uncertainties described below are not the only ones we face. Additional risks and uncertainties not presently known to us or that we currently believe to be immaterial may also adversely affect our business.

Risks Relating to Our Business and Our Industry

We have incurred significant net operating losses and cannot assure you that we will ever achieve or maintain profitability.

We have incurred significant net operating losses. As of December 31, 2014, we had an accumulated deficit of $183.5 million. To date, we have financed our operations primarily through sales of our products, cash flow from operations, issuances of ordinary shares, preferred stock and convertible loan notes and borrowings under shareholder and bank loans and under an Amended and Restated Credit Agreement (the “Credit Facility”) with Royalty Opportunities S.À R.L. (“OrbiMed”), an affiliate of OrbiMed Advisors LLC. We have devoted substantial resources to developing, manufacturing and obtaining regulatory approval for our products, the commercial launch of our products, the development of a sales force, marketing team and management team for our business.

For the year ended December 31, 2014, our gross profit was $26.8 million. However, although we have achieved a positive gross profit, we still operate at a substantial net loss. Following this offering, we expect that our operating expenses will continue to increase as we continue to build our commercial infrastructure, develop, enhance and commercialize new products and incur additional operational costs associated with being a public company. The extent of our future net operating losses and the timing of profitability are uncertain. We will need to increase our sales significantly to achieve profitability, and we might not be able to do so. Even if we do significantly increase sales, we might not be able to achieve, sustain or increase profitability on a quarterly or annual basis in the future. If we do not achieve profitability, it will be more difficult for us to finance our business, accomplish our strategic objectives and our financial performance and results of operations may be materially adversely affected.

Our future profitability depends on the success of our breast implant products.

Sales of our breast implant products accounted for 91.3% and 90.9% of our revenues for the years ended December 31, 2014 and December 31, 2013, respectively. We expect our revenues to continue to be substantially based on sales of our breast implant products. Any product liability lawsuits, introduction of competitive products by our competitors and other third parties, the loss of market acceptance or regulatory approval of our breast implant products, adverse rulings by regulatory authorities, adverse publicity or other adverse events relating to us or our breast implant products may significantly impact our sales and profitability, which would adversely affect our business, financial condition and results of operations.

Our business depends on maintaining and strengthening our brand and generating and maintaining ongoing, profitable customer demand for our products, and a significant reduction in such demand could materially affect our results of operations.

Our success depends on the reputation of our brands, which, in turn, depends on factors such as the safety and quality of our products, our communication activities, including marketing and education efforts, and our management of the customer experience, including through our Experience Centres and GCA Comfort Guarantee. Maintaining, promoting and positioning our brands are important to expanding our customer base,

15

and will depend largely on the success of our education and marketing efforts and our ability to provide a consistent, high-quality customer experience. We may need to make substantial investments in these areas in order to maintain and enhance our brand, and such investments may not be successful. Ineffective marketing, negative publicity, significant discounts by our competitors, product defects, counterfeit products, unfair labor practices and failure to protect the intellectual property rights in our brands are some of the potential threats to the strength of our business. To protect our brands’ status, we may need to make substantial expenditures to mitigate the impact of such threats. We believe that maintaining and enhancing our brands in the countries in which we currently sell our products and in new countries where we have limited brand recognition is important to expanding our customer base. If we are unable to maintain or enhance the strength of our brands in the countries in which we currently sell our products or new countries, then our growth strategy could be adversely affected.

Any negative publicity concerning our products or our competitors’ products could harm our business and reputation and negatively impact our financial results.

The responses of potential patients, physicians, the news media, legislative, regulatory and physician bodies and others to information about quality or complications or alleged complications of our products or our competitors’ products could result in negative publicity and could materially reduce market acceptance of our products. These responses or any investigations and potential resulting negative publicity may have a material adverse effect on our business and reputation and negatively impact our financial condition, results of operations or the market price of our ordinary shares. In addition, significant negative publicity could result in an increased number of product liability claims against us, which could materially adversely affect our business, financial condition and results of operations.

Our success depends on our ability to continue to enhance our existing products and develop or commercialize new products that respond to customer needs and preferences.

We may not be able to compete effectively with our competitors, and ultimately satisfy the needs and preferences of our customers, unless we can continue to enhance existing products and develop or acquire new innovative products. Product development requires the investment of significant financial, technological and other resources. Product improvements and new product introductions also require significant planning, design, development and testing at the technological, product and manufacturing process levels and we may not be able to timely or effectively develop product improvements or new products. Likewise, we may not be able to acquire new products on terms that are acceptable to us, or at all. Further, in most countries, we need to obtain regulatory approval in order to market and sell our products, which may limit our ability to act quickly in scaling commercialization in those countries. Our competitors’ new products may beat our products to market, be more effective with new features, obtain better market acceptance or render our products obsolete. Any new or modified products that we develop may not receive regulatory clearance or approval, or achieve market acceptance or otherwise generate any meaningful sales or profits for us relative to our expectations. Similarly, quality issues may arise with our products and although we have established internal procedures to minimize risks that may arise from quality issues, there can be no assurance that we will be able to eliminate or mitigate occurrences of these issues and associated liabilities. If we are unable to continue to enhance our existing products, develop or acquire new products, maintain the quality of our products or achieve market acceptance for our products, then our sales and profitability could be negatively impacted, which would adversely affect our business, financial condition and results of operations.

The size of the addressable global aesthetics products market, and the breast implant products market in particular, has not been established with precision and may be smaller than we estimate, possibly materially. If our estimates and projections overestimate the size of these markets and the markets for our other products, our revenue and results of operations will be adversely affected.

Our estimates of the addressable global aesthetics products market and the global breast implant market are based on a number of internal and third-party studies, reports and estimates, including, without limitation, the number of implants sold, the number of women and surgeons in the global market, third-party estimates regarding the number of certain types of aesthetics procedures performed annually, growth trends in the global

16

aesthetics products industry, regulatory trends, the increase in women’s purchasing power and the number of middle- and upper- income women in the global market. In addition, different industry sources define the global aesthetics products market differently. Our definition of the global aesthetics products market includes the following segments: breast implant products, skin tightening and body shaping, energy devices, neuromodulators, dermal fillers, chemical peels, liposuctions, self- and physician-dispensed topicals and injectables, removal of localized fat deposits, device-based alternatives to toxins for wrinkle reduction and therapy treatments for hair loss, excessive sweating (hyperhidrosis), malfunctioning veins (sclerotherapy) and scars. While we do not currently compete in all of these segments in the global aesthetics products market, we believe these studies and estimates have historically provided and may continue to provide us with effective tools in estimating the total global aesthetics products market and the global breast implant products market. Nevertheless, these estimates may not be correct and the conditions supporting our estimates may change at any time, thereby reducing the predictive accuracy of these underlying factors. As a result, our estimates of the global aesthetics products market and the global breast implant products market may prove to be incorrect. If the actual number of customers who would elect to purchase our products and the annual total addressable market for our products is smaller than we have estimated, it may impair our projected revenue growth and have an adverse impact on our business.

Each of our brands relies on a single-source supplier for medical-grade silicone, which is the primary constitutive ingredient of our products. These two suppliers are under common ownership, which could result in increased prices when we seek to renew our contracts with these suppliers.

We rely on NuSil and ASC as the sole suppliers of the medical-grade silicone used in each of our two brands’ products. NuSil and ASC are separate legal entities under the common ownership of NuSil Investments LLC. If NuSil or ASC becomes unable or unwilling to supply medical-grade silicone for our products, we will not be able to replace NuSil or ASC quickly, and any replacement supplier would have to be qualified with the relevant regulatory authorities, which is an expensive and time-consuming process during which we may experience a supply interruption. We may also be unsuccessful in negotiating favorable terms with such a supplier. As a result, our financial position and results of operations may be adversely affected. There is also no guarantee that NuSil or ASC will be able to meet our demand to produce sufficient quantities of medical-grade silicone in a timely manner.

Our current agreements with NuSil and ASC expire in April 2018 and December 2016, respectively. There can be no assurance that NuSil and/or ASC will agree to continue to supply us with medical-grade silicone following the expiration of our contracts on terms that are acceptable to us, or at all, which would have a material adverse effect on our business, financial condition and results of operations for the reasons set forth above.

In addition, our reliance on NuSil and ASC involves a number of other risks, including, among others, that:

| | • | | our medical-grade silicone may not be manufactured in accordance with agreed upon specifications or in compliance with regulatory requirements, or our suppliers’ manufacturing facilities may not be able to maintain compliance with regulatory requirements; |

| | • | | we may not be able to timely respond to unanticipated changes in customer orders, and if orders do not match forecasts, we may have excess or inadequate inventory of materials and components; |

| | • | | we may be subject to price fluctuations when a supply agreement is renegotiated or if our existing contract is not renewed; |

| | • | | NuSil or ASC may lose access to critical services and components, resulting in an interruption in the manufacture or shipment of medical-grade silicone or a shutdown of their facilities; |

| | • | | we may be required to obtain regulatory approvals related to any change in our supply chain; |

17

| | • | | NuSil or ASC may wish to discontinue supplying products to us; and |

| | • | | NuSil, ASC or their parent entity may encounter financial or other hardships unrelated to our demand for products, which could inhibit their ability to fulfill our orders and meet our requirements. |

If any of these risks materializes, it could significantly increase our costs, disrupt our manufacturing process, our ability to generate revenues would be impaired, market acceptance of our products could be adversely affected and customers may instead purchase or use our competitors’ products, which could materially adversely affect our business, financial condition and results of operations.

Recent studies have called into question the long-term safety of breast implants, which could have a material adverse effect on our business, results of operations and financial condition.

Although silicone breast implants have received regulatory approval, including from the U.S. Food and Drug Administration (the “FDA”), in recent years, silicone breast implants have been linked to a rare type of cancer, anaplastic large-cell lymphoma (“ALCL”). In January 2011, the FDA indicated that there was a possible association between saline and silicone gel-filled breast implants and ALCL. The review indicated that those with implants may have a very small but increased risk of ALCL. In March 2015, France’s national cancer institute (“NCI”) noted that there is a clearly established link between ALCL and breast implants, but NCI did not recommend suspension of marketing approval of the implants. In their statement, NCI stated that implants with macrotexture were used in most women found with ALCL. We do not produce macrotexture implants. An article published in March 2015, Plastic and Reconstructive Surgery reported the results of a study of 173 cases of ALCL occurring in women with breast implants. Of these 173 cases, the manufacturer of the implant was known in 112 cases. Nagôr was the manufacturer in three cases reported in this study; Eurosilicone was not the manufacturer in any case reported in this study. We are separately aware of two cases of ALCL involving Eurosilicone implants; there may be additional cases of ALCL involving our products of which we are not yet aware. Future studies or clinical experience may indicate that breast implants, including our products, expose individuals to a more substantial risk of developing ALCL or other unexpected complications. As a result, we may be exposed to potential class actions and other lawsuits from any individual who may develop ALCL after using our products, which would have a significant negative impact our revenues and could prevent us from achieving our forecasted revenue targets or achieving or sustaining profitability. Moreover, if long-term results and clinical experience indicate that our products cause unexpected or serious complications, we could be subject to mandatory product recalls, suspension or withdrawal of regulatory clearances and approvals and significant legal liability.

If we acquire or attempt to acquire new businesses or products, we may be unable to complete these acquisitions or to successfully integrate them in a cost-effective and non-disruptive manner, and we may not realize the benefits we anticipate from such acquisitions.

Our success depends on our ability to continually enhance and broaden our product offerings in response to changing customer demands, competitive pressures and innovation. We may consider opportunities to partner with or acquire other businesses, products or technologies that may enhance our product platform or technology, expand the breadth of our operations or customer base or advance our business strategies. We do not know if we will be able to identify acquisitions or joint ventures we deem suitable or to successfully complete any future acquisitions or joint ventures, or whether we will be able to successfully integrate any acquired business, product or technology or retain any key employees related thereto. Integrating any business, product or technology we acquire could be expensive and time-consuming, disrupt our ongoing business, impact our liquidity and distract our management. If we are unable to integrate any acquired businesses, products or technologies effectively, our business may suffer. Whether as a result of unsuccessful integration, unanticipated costs, including those associated with assumed liabilities and indemnification obligations, or other factors, we may not realize the economic benefits we anticipate from acquisitions. In addition, any amortization or charges resulting from the costs of acquisitions could increase our expenses.

18

We will need to significantly increase the size of our organization, and we may experience difficulties in managing growth.

As of March 31, 2015, we had 437 employees. Effectively executing our growth strategy requires that we increase revenues through expanded sales and marketing activities, recruit and retain additional employees, increase production and continue to improve our operational, financial and management controls, reporting systems and procedures. Such growth could place a strain on our administrative and operational infrastructure and we may not be able to make improvements to our management information and control systems in an efficient or timely manner and may discover deficiencies in existing systems and controls. Our management, personnel, systems and facilities currently in place may not be adequate to support this future growth. If we are not able to effectively expand our organization to manage and support our growth strategy, we may not be able to successfully execute our growth strategy, and our business, financial condition and results of operations may suffer and we may be exposed or subject to increased unforeseen or undisclosed liabilities as well as increased levels of indebtedness.

Our business could suffer if we lose the services of our senior management or other key personnel or are unable to attract and retain additional qualified personnel.

We are dependent upon the continued services of key personnel, including the members of our executive management team, who have extensive experience in our industry. The loss of any of these individuals could disrupt our operations or our strategic plans. Additionally, our future success will depend on, among other things, our ability to continue to hire and retain the necessary qualified sales, marketing, manufacturing, regulatory, development and managerial personnel, for whom we compete with numerous other companies, academic institutions and organizations. Competition for qualified management in our industry is intense and many of the companies with which we compete for management personnel have greater financial and other resources to dedicate to attracting and retaining personnel. The loss of key personnel or our inability to attract or retain other qualified personnel could have a material adverse effect on our business, results of operations and financial condition.

Although it will be subject to the underwriters’ lock-up arrangements and other restrictions on trading, a portion of the equity of our management team will not contain other contractual transfer restrictions at the time of this offering and is expected to become tradable after the expiration of the 180-day lock-up agreement with the underwriters. This liquidity will in many cases represent material wealth of such individuals that may impact retention and focus of existing key members of management.

If we fail to maintain and further develop our direct sales forces and distributor networks, our business could suffer. Additionally, our third-party distributors may not effectively sell our products or may engage in activities that could harm our reputation and sales of our products.

We have direct sales forces for our products in Brazil, France, Germany, Italy, Spain and the United Kingdom. We utilize a network of third-party distributors to sell our products in 69 additional countries and we also use agents and sub-distributors to supplement our direct sales forces in most of the countries where we sell directly. As we continue to expand into different countries and increase our marketing efforts, we will need to grow our distributor, sub-distributor and agent network and increase the size of our direct sales force. There is significant competition for sales personnel experienced in relevant medical device sales. If we are unable to attract, motivate, develop and retain qualified sales personnel, and thereby grow our direct sales forces in Europe, Latin America and Asia, or to expand our distributor, sub-distributor and agent network, we may not be able to maintain or increase our revenues. In addition, if our third-party distributors do not effectively sell our products, we may not be able to maintain or increase our revenues or expand into new countries. If a third-party distributor engages in certain activities, we may lose the ability to sell our products in certain countries or expand into new marks, which could adversely affect our reputation and our revenues.

19

We lack direct sales and marketing capabilities in many countries, and are wholly dependent on our distributors for the commercialization of our products in these countries. If we are unable to maintain or establish sales capabilities on our own or through third parties, we may not be able to commercialize any of our products in those countries.