UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number 811-23080

The Community Development Fund

(Exact name of registrant as specified in charter)

6255 Chapman Field Drive

Miami, Florida 33156

(Address of principal executive offices) (Zip code)

Kenneth H. Thomas. Ph.D.

Community Development Fund Advisors, LLC

6255 Chapman Field Drive

Miami, Florida 33156

(Name and address of agent for service)

Copy To:

John J. O’Brien, Esquire

Morgan, Lewis & Bockius LLP

1701 Market Street

Philadelphia, PA 19103

Registrant’s telephone number, including area code: 1-844-445-4405

Date of fiscal year end: December 31, 2017

Date of reporting period: December 31, 2017

| Item 1. | Reports to Stockholders. |

The registrant’s schedules as of the close of the reporting period, as set forth in §§ 210.12-12 through 210.12-14 of Regulation S-X [17 CFR §§ 210-12.12-12.14], are attached hereto.

The Community Development Fund

Annual Report

December 31, 2017

| | |

| THE COMMUNITY DEVELOPMENT FUND | | |

| | | |

| | | DECEMBER 31, 2017 |

| | | |

The Fund files its complete schedule of investments of fund holdings with the Securities and Exchange Commission (the “Commission”) for the first and third quarters of each fiscal year on Form N-Q within sixty days of the period end. The Fund’s N-Q forms are available on the Commission’s website at http://www.sec.gov, and may be reviewed and copied at the Commission’s Public Reference Room in Washington, DC. Information on the operation of the Public Reference Room may be obtained by calling 1-800-SEC-0330.

A description of the policies and procedures that the Fund uses to determine how to vote proxies relating to fund securities, as well as information relating to how the Fund voted proxies relating to fund securities will be available (i) without charge, upon request, by calling 1-844-445-4405; and (ii) on the Commission’s website at http://www.sec.gov.

This report has been prepared for shareholders and may be distributed to others only if preceded or accompanied by an effective prospectus.

| | |

| THE COMMUNITY DEVELOPMENT FUND | | |

| | | |

| | | DECEMBER 31, 2017 |

| | | |

Dear Shareholders:

On behalf of the Board of Trustees of The Community Development Fund (“Fund”), I am pleased to present the Fund’s Annual Report to Shareholders for the year ended December 31, 2017.

This past year was our first full year of operations, since the Fund was launched on April 29, 2016. As was the case last year, the Fund was successful in identifying and purchasing securities that finance community development activities, most particularly affordable housing, throughout the nation.

At the beginning of 2017, the new Administration’s Treasury Department signaled its desire to reform The Community Reinvestment Act of 1977 (“CRA”). Because of my involvement in the last major CRA reform in 1995, I was asked to meet with Treasury Department officials in this regard. Besides meeting with them in December, I also met with representatives of the Congressional Black Caucus on the same topic. It is expected that some CRA reform proposals will be forthcoming in 2018, and the Fund will certainly monitor these efforts closely.

The Fund’s net assets grew from $29.9 to $46.5 million during 2017, a relative gain of 56%. This growth resulted in more funds available for affordable housing as well as the achievement of greater economies of scale for the Fund.

Most importantly, the Fund’s total return improved from a negative 1.89% for the eight months ending December 31, 2016 to a positive 1.54% for the twelve months ending December 31, 2017.

The Fund’s return of 1.54% for 2017 was below the 3.54% return for the broad Bloomberg Barclays US Aggregate Bond Index (“Index”) over the same period. The main reason for this difference is the fact that the Fund holds almost all (92%) of its assets in AAA-rated investments and cash (5%), compared to the Index with nearly 30% of its assets in AA-rated to BBB-rated investments (and no cash)*. These higher risk investments for the Index compared favorably to the Fund’s investments for the period ending December 31, 2017.

Also, all of the Fund’s non-cash investments are in Mortgage Backed Securities (“MBS”), compared to only 30% for the Index. Because MBS have a negative “convexity,” a measure of interest-rate sensitivity, compared to the positive convexity of the Index, the Fund’s returns were more adversely impacted by the increase in interest rates in 2017.

The Fund’s return of 1.54% for 2017 compares somewhat more favorably versus more narrowly targeted bond indexes. For example, instead of the Bloomberg Barclays US Aggregate Bond Index return of 3.54% for 2017, the return for the

1

| | |

| THE COMMUNITY DEVELOPMENT FUND | | |

| | | |

| | | DECEMBER 31, 2017 |

| | | |

Bloomberg Barclays US Securitized Bond Index for 2017 was 2.51%. An important difference between an index and any fund is that the latter has operating expenses while the former has none.

Both the Fund’s adviser, Community Development Fund Advisors, LLC, and its sub-adviser, Logan Circle Partners L.P., which is now a subsidiary of MetLife, Inc., continue to diligently work together to improve the Fund’s performance in an environment of likely increasing interest rates to meet the Fund’s objectives.

We thank you, our shareholders, for your investment in the Fund, and we genuinely appreciate your continued confidence and support.

Sincerely,

Kenneth H. Thomas, Ph.D.

Chairman, Board of Trustees of the Fund

President, Community Development Fund Advisors, LLC

| * | AAA is the highest possible bond credit quality rating given by two of the three Nationally Recognized Statistical Rating Organizations, namely Moody’s and Fitch: S&P’s rating is AA+. Bond ratings are typically measured from AAA (highest) to D (lowest). For securities rated by more than one agency, the lowest rating assigned is recognized. |

Definition of Comparative Index

Bloomberg Barclays US Aggregate Bond Index is an index generally representing fixed-rate, investment-grade government bonds, corporate debt securities, mortgage-backed securities, and asset-backed securities with minimum maturity dates of at least one year.

This represents the managers’ assessment of the Fund and market environment at a specific point in time and should not be relied upon by the reader as research or investment advice.

The performance data quoted represents past performance and does not guarantee future results. The investment return and principal value of an investment will fluctuate so that an investor’s shares when redeemed may be worth more or less than their original cost and current performance may be lower or higher than the performance quoted. For performance data current to the most recent month end, please call 1-844-445-4405.

2

| | |

| THE COMMUNITY DEVELOPMENT FUND |

| | | |

| | | DECEMBER 31, 2017 |

| | | |

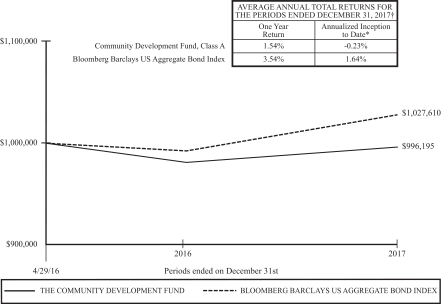

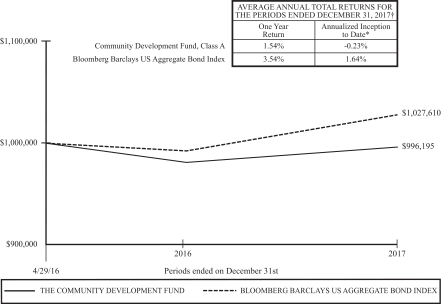

Growth of a $1,000,000 Investment (Unaudited)

| † | If the Adviser had not waived a portion of its fee, the Fund’s return would have been lower. |

| * | The Fund commenced operations on April 29, 2016. |

The performance data quoted herein represents past performance and the return and value of an investment in the Fund will fluctuate so that, when redeemed, may be worth less than its original cost. Past performance is no guarantee of future performance and should not be considered as a representation of the future results of the Fund. The Fund’s performance assumes the reinvestment of all dividends and all capital gains. Index returns assume reinvestment of dividends and, unlike a fund’s returns, do not reflect any fees or expenses. If such fees and expenses were included in the index returns, the performance would have been lower. Please note that one cannot invest directly in an unmanaged index. For performance data current to the most recent month end, please call 1-844-445-4405.

The Gross Operating Expense Ratio is 1.48% and the Net Operating Expense Ratio is 1.00%. Contractual fee waivers to the net expenses are in effect until April 30, 2018. Any additional waivers are voluntary and can be discontinued at any time. In the absence of current fee waivers total return would be reduced.

There are no assurances that the Fund will meet its stated objectives.

The Fund’s holdings and allocations are subject to change because it is actively managed and should not be considered recommendations to buy individual securities.

Returns shown do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares.

3

| | |

| THE COMMUNITY DEVELOPMENT FUND | | |

| | | |

| | | DECEMBER 31, 2017 |

| | | |

|

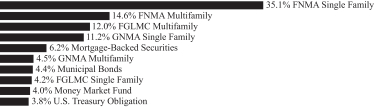

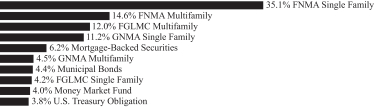

| SECTOR WEIGHTINGS† (Unaudited): |

| † | Percentages based on total investments. |

| | | | | | | | |

| SCHEDULE OF INVESTMENTS | | | | | | |

Description | | Face

Amount | | | Market

Value | |

| U.S. GOVERNMENT & AGENCY OBLIGATIONS — 85.1% | |

| FGLMC Multifamily — 12.5% | |

Pool WN0011, 3.38%, 04/01/2030 | | $ | 795,781 | | | $ | 813,912 | |

Pool WA0500, 3.48%, 03/01/2047 | | | 2,593,627 | | | | 2,611,036 | |

Pool WA3207, 3.60%, 04/01/2030 | | | 2,280,606 | | | | 2,406,991 | |

| | | | | | | | |

| | | | | | | 5,831,939 | |

| | | | | | | | |

| FGLMC Single Family — 4.4% | |

Pool Q41874, 3.00%, 07/01/2046 | | | 2,023,824 | | | | 2,026,860 | |

| | | | | | | | |

| FNMA Multifamily — 15.2% | |

Pool AM0126, 2.68%, 08/01/2022 | | | 1,566,784 | | | | 1,581,102 | |

Pool AN6185, 2.93%, 07/01/2024 | | | 1,330,000 | | | | 1,352,704 | |

Pool AS7653, 3.00%, 07/01/2046 | | | 1,575,406 | | | | 1,578,180 | |

Pool AN5657, 3.30%, 07/01/2032 | | | 387,629 | | | | 396,904 | |

Pool AM5986, 3.44%, 06/01/2026 | | | 1,100,000 | | | | 1,149,099 | |

Pool 469683, 3.54%, 11/01/2021 | | | 404,826 | | | | 420,327 | |

Pool AM5197, 4.20%, 01/01/2030 | | | 558,634 | | | | 609,845 | |

| | | | | | | | |

| | | | | | | 7,088,161 | |

| | | | | | | | |

| FNMA Single Family — 36.6% | |

Pool AS7484, 3.00%, 06/01/2046 | | | 985,706 | | | | 988,015 | |

Pool BC0962, 3.00%, 06/01/2046 | | | 1,979,284 | | | | 1,981,904 | |

Pool AS7476, 3.00%, 07/01/2046 | | | 1,036,732 | | | | 1,038,117 | |

Pool AS7647, 3.00%, 07/01/2046 | | | 1,013,073 | | | | 1,013,588 | |

Pool AS8262, 3.00%, 10/01/2046 | | | 1,014,570 | | | | 1,015,918 | |

Pool BC4723, 3.00%, 10/01/2046 | | | 1,902,611 | | | | 1,903,579 | |

Pool AS8465, 3.00%, 12/01/2046 | | | 991,156 | | | | 992,471 | |

Pool TBA, 3.50%, 01/01/2041 | | | 2,000,000 | | | | 2,053,438 | |

Pool AS8734, 3.50%, 01/01/2047 | | | 1,077,034 | | | | 1,108,073 | |

The accompanying notes are an integral part of the financial statements.

4

| | |

| THE COMMUNITY DEVELOPMENT FUND | | |

| | | |

| | | DECEMBER 31, 2017 |

| | | |

| | | | | | | | |

| SCHEDULE OF INVESTMENTS (continued) | |

Description | | Face

Amount | | | Market

Value | |

| FNMA Single Family — continued | |

Pool AS8771, 3.50%, 02/01/2047 | | $ | 891,840 | | | $ | 920,255 | |

Pool AS9369, 3.50%, 03/01/2047 | | | 1,018,425 | | | | 1,051,102 | |

Pool AS9360, 3.50%, 04/01/2047 | | | 1,858,577 | | | | 1,909,259 | |

Pool CA0819, 3.50%, 11/01/2047 | | | 1,001,536 | | | | 1,028,928 | |

| | | | | | | | |

| | | | | | | 17,004,647 | |

| | | | | | | | |

| GNMA Multifamily — 4.7% | |

Pool 2017-135, 2.60%, 08/16/2058 | | | 996,431 | | | | 972,973 | |

Pool 2017-74, 2.60%, 09/16/2058 | | | 1,265,997 | | | | 1,228,349 | |

| | | | | | | | |

| | | | | | | 2,201,322 | |

| | | | | | | | |

| GNMA Single Family — 11.7% | |

Pool G2 AT5238, 3.00%, 06/20/2046 | | | 1,029,073 | | | | 1,039,179 | |

Pool G2 AU1724, 3.00%, 06/20/2046 | | | 907,166 | | | | 916,058 | |

Pool G2 AU1835, 3.00%, 08/20/2046 | | | 828,570 | | | | 836,707 | |

Pool G2 AS5883, 3.50%, 06/20/2046 | | | 1,109,608 | | | | 1,147,957 | |

Pool G2 AU1762, 3.50%, 07/20/2046 | | | 1,429,706 | | | | 1,479,150 | |

| | | | | | | | |

| | | | | | | 5,419,051 | |

| | | | | | | | |

| |

TOTAL U.S. GOVERNMENT & AGENCY OBLIGATIONS

(COST $40,280,706) | | | | 39,571,980 | |

| | | | | | | | |

| MORTGAGE-BACKED SECURITIES — 6.4% | |

FRESB Multifamily Mortgage Pass-Through Trust

2.61%, 09/25/2022 | | | 1,000,000 | | | | 1,001,595 | |

2.94%, 09/25/2027 (a) | | | 1,000,000 | | | | 997,600 | |

2.96%, 10/25/2027 (a) | | | 999,274 | | | | 996,259 | |

| | | | | | | | |

| |

TOTAL MORTGAGE-BACKED SECURITIES

(COST $3,012,992) | | | | 2,995,454 | |

| | | | | | | | |

| MUNICIPAL BONDS — 4.6% | |

| Massachusetts — 2.6% | |

Massachusetts State, Housing Finance Agency, RB

2.35%, 06/01/2020 | | | 1,000,000 | | | | 997,850 | |

2.60%, 12/01/2039 (b) | | | 240,000 | | | | 240,163 | |

| | | | | | | | |

| | | | | | | 1,238,013 | |

| | | | | | | | |

The accompanying notes are an integral part of the financial statements.

5

| | |

| THE COMMUNITY DEVELOPMENT FUND | | |

| | | |

| | | DECEMBER 31, 2017 |

| | | |

| | | | | | | | |

| SCHEDULE OF INVESTMENTS (continued) | |

Description | | Face

Amount/Shares | | | Market

Value | |

| New York — 2.0% | |

New York City, Housing Development Authority, RB

2.20%, 05/01/2020 | | $ | 750,000 | | | $ | 746,768 | |

2.35%, 11/01/2020 | | | 175,000 | | | | 174,328 | |

| | | | | | | | |

| | | | | | | 921,096 | |

| | | | | | | | |

| |

TOTAL MUNICIPAL BONDS

(COST $2,165,000) | | | | 2,159,109 | |

| | | | | | | | |

| U.S. TREASURY OBLIGATION — 4.0% | |

U.S. Treasury Bills 1.18%, 01/11/2018* | | | 1,850,000 | | | | 1,849,455 | |

| | | | | | | | |

| |

TOTAL U.S. TREASURY OBLIGATION

(COST $1,849,394) | | | | 1,849,455 | |

| | | | | | | | |

| SHORT-TERM INVESTMENT — 4.1% | |

| Money Market Fund — 4.1% | |

Fidelity Institutional Government Portfolio,

Class I, 1.16% (c) | | | 1,923,982 | | | | 1,923,982 | |

| | | | | | | | |

| |

TOTAL SHORT-TERM INVESTMENT

(COST $1,923,982) | | | | 1,923,982 | |

| | | | | | | | |

| TOTAL INVESTMENTS (COST $49,232,074) — 104.2% | | | 48,499,980 | |

| | | | | | | | |

| OTHER ASSETS AND LIABILITIES — (4.2)% | | | (1,976,467) | |

| | | | | |

| NET ASSETS — 100.0% | | | $46,523,513 | |

| | | | | |

A list of the open futures contracts held by the Fund at December 31, 2017, is as follows:

| | | | | | | | | | | | | | | | | | | | |

Type of

Contract | | Number of

Contracts | | | Expiration

Date | | | Notional

Amount | | | Value | | | Unrealized

Appreciation | |

U.S. 10-Year Treasury Note | | | (4 | ) | | | Mar-2018 | | | $ | (498,990 | ) | | $ | (496,187 | ) | | $ | 2,803 | |

U.S. 5-Year Treasury Note | | | (36 | ) | | | Mar-2018 | | | | (4,196,045 | ) | | | (4,181,906 | ) | | | 14,139 | |

U.S. Long Treasury Bond | | | (11 | ) | | | Mar-2018 | | | | (1,683,660 | ) | | | (1,683,000 | ) | | | 660 | |

Ultra 10-Year U.S. Treasury Note | | | (25 | ) | | | Mar-2018 | | | | (3,350,914 | ) | | | (3,339,063 | ) | | | 11,851 | |

| | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | $ | (9,729,609 | ) | | $ | (9,700,156 | ) | | $ | 29,453 | |

| | | | | | | | | | | | | | | | | | | | |

The accompanying notes are an integral part of the financial statements.

6

| | |

| THE COMMUNITY DEVELOPMENT FUND | | |

| | | |

| | | DECEMBER 31, 2017 |

| | | |

| | | | |

| SCHEDULE OF INVESTMENTS (concluded) |

The Fund has additionally recorded an asset of $526 and a liability of $19,693 related to the current day’s variation margin.

| (a) | | Variable or floating rate security, the interest rate of which adjusts periodically based on changes in current interest rates and prepayments on the underlying pool of assets. |

| (b) | | Variable or floating rate security, the interest rate of which adjusts periodically based prevailing interest rates. |

| (c) | | Rate shown is the 7-day effective yield as of December 31, 2017. |

| * | | Zero Coupon Security — Rate shown is the effective yield at the time of purchase. |

FGLMC — Federal Government Loan Mortgage Corporation

FNMA — Federal National Mortgage Association

GNMA — Government National Mortgage Association

RB — Revenue Bond

TBA — To Be Announced

The following table sets forth information about the level within the fair value hierarchy at which the Fund’s investments and other financial instruments are measured at December 31, 2017:

| | | | | | | | | | | | | | | | |

Investments in Securities | | Level 1 | | | Level 2 | | | Level 3 | | | Total | |

U.S. Government & Agency Obligations | | $ | — | | | $ | 39,571,980 | | | $ | — | | | $ | 39,571,980 | |

Mortgage-Backed Securities | | | — | | | | 2,995,454 | | | | — | | | | 2,995,454 | |

Municipal Bonds | | | — | | | | 2,159,109 | | | | — | | | | 2,159,109 | |

U.S. Treasury Obligation | | | — | | | | 1,849,455 | | | | — | | | | 1,849,455 | |

Short-Term Investment | | | 1,923,982 | | | | — | | | | — | | | | 1,923,982 | |

| | | | | | | | | | | | | | | | |

Total Investments in Securities | | $ | 1,923,982 | | | $ | 46,575,998 | | | $ | — | | | $ | 48,499,980 | |

| | | | | | | | | | | | | | | | |

| | | | |

Other Financial Instruments | | Level 1 | | | Level 2 | | | Level 3 | | | Total | |

Futures Contracts† | | | | | | | | | | | | | | | | |

Unrealized Appreciation | | $ | 29,453 | | | $ | — | | | $ | — | | | $ | 29,453 | |

| | | | | | | | | | | | | | | | |

Total Other Financial Instruments | | $ | 29,453 | | | $ | — | | | $ | — | | | $ | 29,453 | |

| | | | | | | | | | | | | | | | |

| † | | Futures contracts are valued at the unrealized appreciation on the instrument. |

| | | Amounts designated as “—” are $0. |

For the year ended December 31, 2017, there were no transfers between Level 1, Level 2 and Level 3 assets and liabilities. All transfers, if any, are recognized by the Fund at the end of the year.

The accompanying notes are an integral part of the financial statements.

7

| | |

| THE COMMUNITY DEVELOPMENT FUND | | |

| | | |

| | | DECEMBER 31, 2017 |

| | | |

| | | | |

| STATEMENT OF ASSETS AND LIABILITIES | | | |

| |

Assets: | | | | |

Investments (Cost $49,232,074) | | $ | 48,499,980 | |

Interest and dividends receivable | | | 112,882 | |

Cash collateral on futures contracts | | | 105,000 | |

Cash | | | 10,985 | |

Receivable from Investment Adviser (Note 5) | | | 5,214 | |

Variation margin receivable | | | 526 | |

| | | | |

Total assets | | | 48,734,587 | |

| | | | |

Liabilities: | | | | |

Payable for investment securities purchased | | | 2,055,392 | |

Distributions Payable | | | 40,691 | |

Variation margin payable | | | 19,693 | |

Payable due to Administrator (Note 4) | | | 14,167 | |

CRA servicing fees payable (Note 4) | | | 7,899 | |

Payable due to Trustees | | | 1,937 | |

Other accrued expenses | | | 71,295 | |

| | | | |

Total liabilities | | | 2,211,074 | |

| | | | |

Net assets | | $ | 46,523,513 | |

| | | | |

Net assets consist of: | | | | |

Paid-in capital | | $ | 47,646,634 | |

Accumulated net realized loss on investments | | | (420,480 | ) |

Net unrealized depreciation on investments | | | (732,094 | ) |

Net unrealized appreciation on futures contracts | | | 29,453 | |

| | | | |

Net assets | | $ | 46,523,513 | |

| | | | |

Net Asset Value, Offering and Redemption Price Per Share — Class A shares

(unlimited authorization — no par value) ($46,523,513 ÷ 4,827,120 shares) | | $ | 9.64 | |

| | | | |

The accompanying notes are an integral part of the financial statements.

8

| | |

| THE COMMUNITY DEVELOPMENT FUND | | |

| | | FOR THE YEAR ENDED |

| | | DECEMBER 31, 2017 |

| | | |

| | | | |

| STATEMENT OF OPERATIONS | | | |

| |

Investment income | | | | |

Interest | | $ | 935,698 | |

Dividends | | | 19,273 | |

| | | | |

Total investment income | | | 954,971 | |

| | | | |

Expenses | | | | |

Accounting and administration fees (Note 4) | | | 158,333 | |

Investment advisory fees (Note 5) | | | 120,911 | |

CRA servicing fees (Note 4) | | | 80,608 | |

Chief Compliance Officer fees (Note 3) | | | 65,092 | |

Trustees’ fees and expenses | | | 6,000 | |

Legal fees | | | 43,581 | |

Transfer Agent fees | | | 34,992 | |

Printing fees | | | 17,748 | |

Custodian fees | | | 17,455 | |

Audit fees | | | 14,000 | |

Registration fees | | | 2,354 | |

Other | | | 34,159 | |

| | | | |

Total expenses | | | 595,233 | |

| | | | |

Less: | | | | |

Investment advisory fees waived (Note 5) | | | (120,911 | ) |

Reimbursement from Investment Adviser (Note 5) | | | (71,296 | ) |

| | | | |

Net expenses | | | 403,026 | |

| | | | |

Net investment income | | | 551,945 | |

| | | | |

Net realized gain/(loss) on: | | | | |

Investments | | | 70,326 | |

Futures contracts | | | (68,628 | ) |

Net change in unrealized appreciation/(depreciation) on: | | | | |

Investments | | | 13,265 | |

Futures contracts | | | 29,453 | |

| | | | |

Net realized and unrealized gain | | | 44,416 | |

| | | | |

Net increase in net assets resulting from operations | | $ | 596,361 | |

| | | | |

The accompanying notes are an integral part of the financial statements.

9

| | |

| THE COMMUNITY DEVELOPMENT FUND | | |

| | | |

| | | |

| | | |

| | | | | | | | |

| STATEMENTS OF CHANGES IN NET ASSETS | | | | | | |

| | | Year

ended

December 31,

2017 | | | For the

period ended

December 31,

2016* | |

| | |

Operations: | | | | | | | | |

Net investment income | | $ | 551,945 | | | $ | 83,712 | |

Net realized gain on investments and futures contracts | | | 1,698 | | | | 141,014 | |

Net change in unrealized appreciation/(depreciation) on investments and futures contracts | | | 42,718 | | | | (745,359 | ) |

| | | | | | | | |

Net increase/(decrease) in net assets resulting from operations | | | 596,361 | | | | (520,633 | ) |

| | | | | | | | |

Dividends and distributions from: | | | | | | | | |

Net investment income | | | (774,167 | ) | | | (103,138 | ) |

Net realized gains | | | — | | | | (321,623 | ) |

Return of capital | | | (161 | ) | | | — | |

| | | | | | | | |

Total dividends and distributions | | | (774,328 | ) | | | (424,761 | ) |

| | | | | | | | |

Capital share transactions: | | | | | | | | |

Issued | | | 16,500,000 | | | | 30,500,000 | |

Reinvestment of dividends | | | 341,479 | | | | 205,395 | |

| | | | | | | | |

Increase from capital share transactions | | | 16,841,479 | | | | 30,705,395 | |

| | | | | | | | |

Total increase in net assets | | | 16,663,512 | | | | 29,760,001 | |

| | | | | | | | |

Net assets: | | | | | | | | |

Beginning of period | | | 29,860,001 | | | | 100,000 | |

| | | | | | | | |

End of period | | $ | 46,523,513 | | | $ | 29,860,001 | |

| | | | | | | | |

| | |

Shares transactions: | | | | | | | | |

Issued | | | 1,705,158 | | | | 3,055,573 | |

Reinvestment of dividends | | | 35,285 | | | | 21,104 | |

| | | | | | | | |

Net increase in shares outstanding | | | 1,740,443 | | | | 3,076,677 | |

| | | | | | | | |

| * | | The Fund commenced operations on April 29, 2016. |

| | | Amounts designated as “—” are $0 or have been rounded to $0. |

The accompanying notes are an integral part of the financial statements.

10

| | |

| THE COMMUNITY DEVELOPMENT FUND | | |

| | | |

| | | |

| | | |

| | | | | | | | |

| FINANCIAL HIGHLIGHTS | | | | | | |

Selected Per Share Data & Ratios For a Share Outstanding Throughout Each Year/Period | |

| | |

| | | Year ended

December 31,

2017 | | | For the

period ended

December 31,

2016* | |

Net asset value, beginning of year/period | | $ | 9.67 | | | $ | 10.00 | |

| | | | | | | | |

Income/(loss) from operations: | | | | | | | | |

Net investment income(1) | | | 0.13 | | | | 0.03 | |

Net realized and unrealized gain/(loss) on investments | | | 0.02 | | | | (0.22 | ) |

| | | | | | | | |

Total gain/(loss) from operations | | | 0.15 | | | | (0.19 | ) |

| | | | | | | | |

Dividends and distributions from: | |

Net investment income | | | (0.18 | ) | | | (0.04 | ) |

Net realized gains | | | — | | | | (0.10 | ) |

Return of capital | | | (0.00 | )^ | | | (0.00 | )^ |

| | | | | | | | |

Total dividends and distributions | | | (0.18 | ) | | | (0.14 | ) |

| | | | | | | | |

Net asset value, end of year/period | | $ | 9.64 | | | $ | 9.67 | |

| | | | | | | | |

Total return† | | | 1.54 | % | | | (1.89 | )% |

| | | | | | | | |

Ratios and supplemental data | | | | | | | | |

Net assets, end of year/period ($ Thousands) | | $ | 46,524 | | | $ | 29,860 | |

Ratio of expenses to average net assets

(including waivers and reimbursements) | | | 1.00 | % | | | 1.00 | %(2) |

Ratio of expenses to average net assets

(excluding waivers and reimbursements) | | | 1.48 | % | | | 1.93 | %(2) |

Ratio of net investment income to average net assets | | | 1.37 | % | | | 0.47 | %(2) |

Portfolio turnover rate | | | 19 | % | | | 85 | %(3) |

| * | | The Fund commenced operations on April 29, 2016. |

| ^ | | Amount represents less than $(0.005). |

| (1) | | Per share calculations were performed using average shares for the period. |

| (3) | | Portfolio turnover is for the period indicated and has not been annualized. |

| † | | Total return is for the period indicated and has not been annualized. Return shown does not reflect the deductions of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares. Total return would have been lower had the Adviser not waived its fee and/or reimbursed other expenses. |

| | | Amount designated as “—” is $0. |

The accompanying notes are an integral part of the financial statements.

11

| | |

| THE COMMUNITY DEVELOPMENT FUND | | |

| | | |

| | | DECEMBER 31, 2017 |

| | | |

|

| NOTES TO FINANCIAL STATEMENTS |

The Community Development Fund (the “Fund”) is a diversified, open-end investment company that was established as a Delaware statutory trust pursuant to a Certificate of Trust dated August 12, 2011. The Trust’s Agreement and Declaration of Trust permits the Trust to operate separate series (“portfolios”) of units of beneficial interest (“shares”) and separate classes of portfolios. Currently, the Trust offers one class of shares. The investment objectives of the Fund are to provide current income consistent with the preservation of capital and enable institutional investors that are subject to regulatory examination under the Community Reinvestment Act of 1977, as amended, (the “CRA”), to claim favorable regulatory consideration of their investment. Community Development Fund Advisors, LLC (the “Adviser”), was organized under the laws of the State of Delaware as a limited liability company on July 25, 2011, and is also registered with the Securities and Exchange Commission (“SEC”) as an investment adviser under the Investment Advisors Act of 1940 (the “1940 Act”). Logan Circle Partners L.P. (the “Sub-Adviser”) manages the Fund’s assets under the direction of the Adviser.

| 2. | Significant accounting policies |

The following are significant accounting policies, which are consistently followed in the preparation of the financial statements of the Fund. The Fund is an investment company that applies the accounting and reporting guidance issued in Topic 946 by the U.S. Financial Accounting Standards Board (“FASB”).

Use of estimates — The preparation of financial statements in conformity with U.S. generally accepted accounting principles (“U.S. GAAP”) requires management to make estimates and assumptions that affect the fair value of assets, the reported amounts of assets and liabilities and disclosure of contingent assets and liabilities at the date of the financial statements and the reported amount of increases and decreases in net assets from operations during the reporting period. Actual results could differ from those estimates and such differences could be material.

Security valuation — Investments in securities traded on a national securities exchange are valued at the last reported bid price. Debt securities are valued by using market bid quotations or independent pricing services which use bid prices provided by market makers or estimates of values obtained from yield data relating to instruments or securities with similar characteristics.

12

| | |

| THE COMMUNITY DEVELOPMENT FUND | | |

| | | |

| | | DECEMBER 31, 2017 |

| | | |

|

| NOTES TO FINANCIAL STATEMENTS (continued) |

Futures are valued at the settlement price established each day by the board of exchange on which they are traded. The daily settlement prices for financial futures are provided by an independent source. On days when there is excessive volume, market volatility or the future does not end trading by the time a Fund calculates its NAV, the settlement price may not be available at the time at which the Fund calculates its NAV. On such days, the best available price (which is typically the last sales price) may be used to value a Fund’s futures position.

The Fund’s board of trustees has adopted methods for valuing securities including in circumstances in which market quotes are not readily available, and has delegated authority to the Fund’s investment adviser to apply those methods in making fair value determinations, subject to board oversight. The investment adviser has established a Valuation Committee (the “Valuation Committee”) to administer, implement, and oversee the fair valuation process, and to make fair value decisions. The Valuation Committee regularly reviews its own fair value decisions, as well as decisions made under its standing instructions to the investment adviser’s valuation teams. The Valuation Committee reviews changes in fair value measurements from period to period and may, as deemed appropriate, update the fair valuation guidelines to better reflect the results of comparisons of fair value determinations with actual trade prices and address new or evolving issues. The Valuation Committee reports any changes to the fair valuation guidelines to the board of trustees with supplemental information to support the changes. The Fund’s board and audit committee also regularly review reports that describe fair value determinations and methods.

The Fund utilizes various methods to measure the fair value of most of its investments on a recurring basis. GAAP establishes a hierarchy prioritizes inputs to valuation techniques used to measure fair value. The three levels of inputs are as follows:

| | • | | Level 1 — Unadjusted quoted prices in active markets for identical assets or liabilities that the Fund has the ability to access. |

| | • | | Level 2 — Observable inputs other than quoted prices included in Level 1 that are observable for the asset or liability either directly or indirectly. These inputs may include quoted prices for the identical instrument on an inactive market, prices for similar instruments, interest rates, prepayment speeds, credit risk, yield curves, default rates, and similar data. |

13

| | |

| THE COMMUNITY DEVELOPMENT FUND | | |

| | | |

| | | DECEMBER 31, 2017 |

| | | |

|

| NOTES TO FINANCIAL STATEMENTS (continued) |

| | • | | Level 3 — Unobservable inputs for the asset or liability to the extent that relevant observable inputs are not available, representing the Fund’s own assumptions about the assumptions that a market participant would use in valuing the asset or liability, and that would be based on the best information available. |

The availability of observable inputs can vary from security to security and is affected by a wide variety of factors, including, for example, the type of security, whether the security is new and not yet established in the marketplace, the liquidity of markets, and other characteristics particular to the security. To the extent that valuation is based on models or inputs that are less observable or unobservable in the market, the determination of fair value requires more judgment. Accordingly, the degree of judgment exercised in determining fair value is greatest for instruments categorized in Level 3.

The inputs used to measure fair value may fall into different levels of the fair value hierarchy. In such cases, for disclosure purposes, the level in the fair value hierarchy within which the fair value measurement falls in its entirety is determined based on the lowest level input that is significant to the fair value measurement in its entirety.

For the year ended December 31, 2017, there have been no significant changes to the Fund’s fair valuation methodology.

Mortgage-Backed To-Be-Announced Securities — The Fund may enter into mortgage-backed to-be-announced securities (“TBAs”). These derivative financial instruments are subject to varying degrees of market and credit risk. TBAs provide for the delayed delivery of the underlying instrument. The contractual or notional amounts related to these financial instruments adjusted for unrealized market valuation gains or losses are recorded on a trade date basis. The credit risk related to settlements is limited to the unrealized market valuation gains or losses recorded in the statement of operations. Market risk is substantially dependent upon the value of the underlying financial instruments and is affected by market forces such as volatility and changes in interest rates.

Futures contracts — The Fund may use futures contracts for tactical hedging purposes as well as to enhance the Fund’s returns. Initial margin deposits of cash or securities are made upon entering into futures contracts. The contracts are marked to market daily and the resulting changes in value are accounted for as unrealized gains and losses (see Statement of Operations). Variation

14

| | |

| THE COMMUNITY DEVELOPMENT FUND | | |

| | | |

| | | DECEMBER 31, 2017 |

| | | |

|

| NOTES TO FINANCIAL STATEMENTS (continued) |

margin payments are paid or received (see Statement of Assets and Liabilities), depending upon whether unrealized gains or losses are incurred. When the contract is closed, the Fund records a realized gain or loss (see Statement of Operations) equal to the difference between the proceeds from (or cost of) the closing transaction and the amount invested in the contract.

Risks of entering into futures contracts include the possibility that there will be an imperfect price correlation between the futures and the underlying securities. Second, it is possible that a lack of liquidity for futures contracts could exist in the secondary market, resulting in an inability to close a position prior to its maturity date. Third, the futures contract involves the risk that the Fund could lose more than the original margin deposit required to initiate a futures transaction.

Finally, the risk exists that losses could exceed amounts disclosed on the Statement of Assets and Liabilities. Refer to the Fund’s Schedule of Investments for details regarding open futures contracts as of December 31, 2017.

The following table discloses the volume of the Fund’s futures contracts activity during the year ended December 31, 2017:

| | | | |

| | | Interest

Rate

Contracts | |

Futures Contracts: | | | | |

Average Notional Balance Long | | $ | 75,134 | |

Average Notional Balance Short | | | 8,393,669 | |

Ending Notional Balance Long | | | — | |

Ending Notional Balance Short | | | 9,729,609 | |

Security transactions, dividend and investment income — Security transactions are accounted for on the date the securities are purchased or sold. Realized gains and losses on sales of investments are determined on the basis of the identified cost for both financial statement and federal income tax purposes. Dividend income is recognized on the ex-dividend date or as soon as information is available to the Fund. Interest income is recognized on an accrual basis.

Amortization and accretion are calculated using the effective interest method. Amortization of premiums and discounts are included in interest income.

Determination of Net Asset Value and calculation of expenses — In calculating the net asset value (“NAV”) per share of the Fund, investment income,

15

| | |

| THE COMMUNITY DEVELOPMENT FUND | | |

| | | |

| | | DECEMBER 31, 2017 |

| | | |

|

| NOTES TO FINANCIAL STATEMENTS (continued) |

realized and unrealized gains and losses, and expenses are allocated daily to each share based upon the proportion of net assets of each share.

Federal income taxes — It is the Fund’s intention to qualify as a regulated investment company for Federal income tax purposes by complying with the appropriate provisions of Subchapter M of the Code. Accordingly, no provision for Federal income taxes has been made in the financial statements.

The Fund evaluates tax positions taken or expected to be taken in the course of preparing the Fund’s tax returns to determine whether it is “more-likely-than-not” (i.e., greater than 50-percent) that each tax position will be sustained upon examination by a taxing authority based on the technical merits of the position. Tax positions deemed to meet the more-likely-than-not threshold are recorded as a tax benefit in the current year. The Fund did not record any tax provision in the current period. However, management’s conclusions regarding tax positions taken may be subject to review and adjustment at a later date based on factors including, but not limited to, examination by tax authorities (i.e., the initial open tax year end and current tax year end, as applicable), on-going analysis of and changes to tax laws, regulations and interpretations thereof.

As of and during the year ended December 31, 2017, the Fund did not have a liability for any unrecognized tax benefits. The Fund recognizes interest and penalties, if any, related to unrecognized tax benefits as income tax expense in the Statement of Operations. During the year ended December 31, 2017, the Fund did not incur any interest or penalties.

Dividends and distributions to shareholders — Dividends from net investment income are declared and paid monthly. Distributable net realized capital gains, if any, are declared and distributed at least annually. Distributions to shareholders are recorded on the ex-dividend date. Income and capital gain distributions are determined in accordance with income tax regulations, which may differ from U.S. GAAP.

Securities purchased on a delayed delivery basis — The Fund may purchase securities on a delayed delivery basis, with payment and delivery scheduled for a future date. These transactions are subject to market fluctuations and are subject to the risk that the value at delivery may be more or less than the trade date purchase price. Although the Fund will generally purchase these securities with the intention of holding the securities, it may sell the securities before the

16

| | |

| THE COMMUNITY DEVELOPMENT FUND | | |

| | | |

| | | DECEMBER 31, 2017 |

| | | |

|

| NOTES TO FINANCIAL STATEMENTS (continued) |

settlement date. The Fund will set aside liquid assets, or engage in other appropriate measures, to cover its obligations with respect to these securities.

| 3. | Transactions with affiliates |

Certain officers of the Trust are also officers of SEI Investments Global Funds Services (the “Administrator”), a wholly owned subsidiary of SEI Investments Company, and/or Foreside Fund Officer Services, LLC, an affiliate of the Distributor. Such officers are paid no fees by the Trust, other than the Chief Compliance Officer (“CCO”), as described below, for serving as officers of the Trust.

A portion of the services provided by the CCO and his staff, who are employees of Foreside Fund Officer Services, LLC, are paid for by the Trust as incurred. The services include regulatory oversight of the Trust’s advisors and service providers, as required by SEC regulations. The CCO’s services and fees have been approved by and are reviewed by the Board.

| 4. | Administration, CRA Servicing, Distribution, Custodian and Transfer Agent Agreements |

The Fund and the Administrator are parties to an Administration Agreement under which the Administrator provides administrative services to the Fund. For these services, the Administrator is paid an asset based fee, which will vary depending on the number of share classes and the average daily net assets of the Fund, subject to a minimum. For the year ended December 31, 2017, the Fund paid $158,333 for these services.

The Fund has adopted a CRA servicing plan (the “CRA Servicing Plan”) with respect to Class A Shares that allows such shares to pay the Adviser a fee in connection with the ongoing CRA recordkeeping and compliance services provided to shareholders at an annual rate of up to 0.20% of average daily net assets of the Class A Shares. For the year ended December 31, 2017, the Class A Shares incurred $80,608 of CRA servicing fees, an effective rate of 0.20%.

The Fund has adopted a Distribution Plan pursuant to Rule 12b-1 under the 1940 Act, with respect to its Class A Shares. The Distribution Plan allows the Fund to pay fees for the sale and distribution of Class A Shares and for shareholder services provided to the holders of Class A Shares. Under the Distribution Plan, the Fund may pay its distributor up to 0.25% per year of the Fund’s average daily net assets attributable to its Class A Shares. For the year ended December 31, 2017, the Class A Shares did not incur any Distribution fees.

17

| | |

| THE COMMUNITY DEVELOPMENT FUND | | |

| | | |

| | | DECEMBER 31, 2017 |

| | | |

|

| NOTES TO FINANCIAL STATEMENTS (continued) |

UMB Bank, N.A., (the “Custodian”), serves as the Fund’s Custodian pursuant to a custody agreement. UMB Fund Services, Inc. (the “Transfer Agent”), serves as the Fund’s Transfer Agent pursuant to a transfer agency agreement.

| 5. | Investment advisory agreement |

Under the terms of an investment advisory agreement, the Adviser provides or arranges for a third-party sub-adviser to provide investment advisory services to the Fund. For its advisory services, the Adviser receives a fee, which is calculated daily and paid monthly, at an annual rate of 0.30% of the Fund’s average daily net assets. The Adviser has contractually agreed to reduce fees and reimburse expenses to the extent necessary to keep Total Annual Fund Operating Expenses (excluding interest, taxes, brokerage commissions, and other costs and expenses relating to the securities that are purchased and sold by the Fund, acquired fund fees and expenses, and other non-routine expenses not incurred in the ordinary course of such Fund’s business (collectively, “excluded expenses”)) from exceeding 1.00% of the Fund’s average daily net assets until April 30, 2018 (the “expense cap”). In addition, if at any point Total Annual Fund Operating Expenses (not including excluded expenses) are below the expense cap, the Adviser may recover all or a portion of its fee reductions or expense reimbursements within a three-year period from the year in which the Adviser reduced its fee or reimbursed expenses if the Fund’s Total Annual Fund Operating Expenses are below the expense cap that was in place at the time of such fee reductions or expense reimbursements. This agreement may be terminated: (i) by the Board for any reason at any time; or (ii) by the Adviser, upon ninety (90) days’ prior written notice to the Trust, effective as of the close of business on April 30, 2018. For year ended December 31, 2017, the Fund paid $120,911 for these services. As of December 31, 2017, fees which were previously waived and/or reimbursed by the Adviser which may be subject to possible future reimbursement, up to the expense cap in place at the time the expenses were waived and/or reimbursed to the Adviser were $192,207 and $167,597, expiring in 2020 and 2019, respectively.

The Adviser pays the Sub-Adviser a fee out of its advisory fee which is based on a percentage of the average monthly market value of the assets managed by the Sub-Adviser.

18

| | |

| THE COMMUNITY DEVELOPMENT FUND | | |

| | | |

| | | DECEMBER 31, 2017 |

| | | |

|

| NOTES TO FINANCIAL STATEMENTS (continued) |

| 6. | Investment transactions |

The aggregate purchases and sales and maturities of investments, excluding short-term investments, by the Fund for the year ended December 31, 2017, were as follows:

| | | | |

Purchases: | | | | |

U.S. Government | | $ | 18,316,309 | |

Other | | | 10,372,666 | |

Sales and Maturities: | | | | |

U.S. Government | | $ | 3,870,247 | |

Other | | | 3,525,773 | |

| 7. | Federal tax information |

The amount and character of income and capital gain distributions to be paid, if any, are determined in accordance with Federal income tax regulations, which may differ from U.S. GAAP. As a result, net investment income/(loss) and net realized gain/(loss) on investment transactions for a reporting period may differ significantly from distributions during such period. These book/tax differences may be temporary or permanent. To the extent these differences are permanent in nature, they are charged or credited to undistributed net investment income/(loss), accumulated net realized gain/(loss) or paid-in capital, as appropriate, in the period that the differences arise.

Accordingly, the following permanent differences primarily attributable to the reclassification of paydowns have been reclassified to/(from) the following accounts during the year ended December 31, 2017:

| | | | |

Undistributed Net Investment Income | | $ | 222,222 | |

Accumulated Realized Loss | | | (222,222 | ) |

The tax character of dividends and distributions declared during the last two fiscal years were as follows:

| | | | | | | | | | | | |

| | | Ordinary

Income | | | Return

of

Capital | | | Total | |

2017 | | $ | 774,167 | | | $ | 161 | | | $ | 774,328 | |

2016 | | | 424,761 | | | | — | | | | 424,761 | |

As of December 31, 2017, the components of accumulated losses on a tax basis were as follows:

| | | | |

Capital Loss Carryforwards Short-Term | | $ | (309,106 | ) |

Capital Loss Carryforwards Long-Term | | | (81,858 | ) |

Unrealized Depreciation | | | (732,157 | ) |

| | | | |

Total Accumulated Losses | | $ | (1,123,121 | ) |

| | | | |

19

| | |

| THE COMMUNITY DEVELOPMENT FUND | | |

| | | |

| | | DECEMBER 31, 2017 |

| | | |

|

| NOTES TO FINANCIAL STATEMENTS (continued) |

For Federal income tax purposes, capital losses may be carried forward and applied against future capital gains. Net capital losses earned may be carried forward indefinitely and must retain the character of the original loss.

The Federal tax cost and aggregate gross unrealized appreciation and depreciation for the investments held by the Fund at December 31, 2017, were as follows:

| | | | | | | | | | | | | | |

Federal

Tax Cost | | | Aggregate

Gross

Unrealized

Appreciation | | | Aggregate

Gross

Unrealized

Depreciation | | | Net

Unrealized

Depreciation | |

| $ | 39,531,981 | | | $ | 44,144 | | | $ | (776,301 | ) | | $ | (732,157 | ) |

| 8. | Risks associated with financial instruments |

As with investing in all mutual funds, investing in the Fund involves risk, and there is no guarantee that the Fund will achieve the Fund’s investment goals. You could lose money on your investment in the Fund, just as you could with other investments. As described in the Fund’s Prospectus, the Fund is subject to the following risks noted below, any of which may adversely affect the Fund’s net asset value and ability to meet the Fund’s investment objective:

| | |

| Asset-Backed Securities Risk | | Investment Style Risk |

| Convertible Securities Risk | | Leverage Risk |

| Corporate Fixed Income Securities Risk | | Liquidity Risk |

| Credit Risk | | Market Risk |

| Derivatives Risk | | Mortgage-Backed Securities Risk |

| Exchange-Traded Funds Risk | | Prepayment Risk |

| Extension Risk | | Regional Focus Risk |

| Fixed Income Market Risk | | Repurchase Agreement Risk |

| Interest Rate Risk | | U.S. Government Securities Risk |

Please refer to the Fund’s Prospectus for a description of each of these Fund principal risks set forth above.

In the normal course of business, the Fund enters into contracts that provide general indemnifications. The Fund’s maximum exposure under these arrangements is dependent on future claims that may be made against the Fund and, therefore, cannot be established; however, based on experience, the risk of loss from such claims is considered remote.

20

| | |

| THE COMMUNITY DEVELOPMENT FUND | | |

| | | |

| | | DECEMBER 31, 2017 |

| | | |

|

| NOTES TO FINANCIAL STATEMENTS (concluded) |

| 10. | Underlying investment in other investment companies |

The Fund currently invests a portion of its assets in the Fidelity Institutional Government Portfolio, Class I (the “Fidelity Fund”). The Fidelity Fund invests at least 99.5% of its total assets in cash, U.S. Government securities, and/or repurchase agreements that are collateralized fully. The investment objective of the Fidelity Fund is current income with liquidity and stability of principal. The Fund may redeem its investment from the Fidelity Fund at any time if the Advisor determines that it is in the best interest of the Fund and its shareholders to do so.

The performance of the Fund may be directly affected by the performance of the Fidelity Fund. The financial statements of the Fidelity Fund, including the portfolio of investments, can be found at the Security and Exchange Commission’s website www.sec.gov and should be read in conjunction with the Fund’s financial statements. As of December 31, 2017, the percentage of the Funds’ net assets invested in the Fidelity Fund was 4.1%.

At December 31, 2017, 54% of total shares outstanding were held by 3 record shareholders each owning 10% or greater of the aggregate total shares outstanding. These shareholders were comprised of omnibus accounts that were held on behalf of various shareholders.

In October 2016, the U.S. Securities and Exchange Commission adopted new rules and amended existing rules (together, final rules) intended to modernize the reporting and disclosure of information by registered investment companies. In part, the final rules amended Regulation S-X and require standardized, enhanced disclosures about derivatives in investment company financial statements, as well as other amendments. As of August 1, 2017, management has implemented the amendments to Regulation S-X, which did not have a material impact on the Fund’s financial statements and related disclosures or impact the Fund’s net assets or results of operations.

The Fund has evaluated the need for disclosures and/or adjustments resulting from subsequent events through the date the financials were issued. Based on this evaluation, no disclosures and/or adjustments were required to the financial statements.

21

| | |

| THE COMMUNITY DEVELOPMENT FUND | | |

| | | |

| | | DECEMBER 31, 2017 |

| | | |

|

| REPORT OF INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM |

To the Shareholders and Board of Trustees

of The Community Development Fund

Opinion on the Financial Statements

We have audited the accompanying statement of assets and liabilities of The Community Development Fund, including the schedule of investments, as of December 31, 2017, the related statement of operations for the year then ended, and the statements of changes in net assets and the financial highlights for the year then ended and for the period April 29, 2016 (commencement of operations) to December 31, 2016, and the related notes (collectively referred to as the “financial statements”). In our opinion, the financial statements present fairly, in all material respects, the financial position of The Community Development Fund as of December 31, 2017, the results of its operations for the year then ended, and the changes in its net assets and the financial highlights for the year then ended and for the period April 29, 2016 to December 31, 2016, in conformity with accounting principles generally accepted in the United States of America.

Basis for Opinion

These financial statements are the responsibility of the Fund’s management. Our responsibility is to express an opinion on the Fund’s financial statements based on our audits. We are a public accounting firm registered with the Public Company Accounting Oversight Board (United States) (“PCAOB”) and are required to be independent with respect to the Fund in accordance with the U.S. federal securities laws and the applicable rules and regulations of the Securities and Exchange Commission and the PCAOB. We have served as the Fund’s auditor since 2016.

We conducted our audits in accordance with the standards of the PCAOB. Those standards require that we plan and perform the audit to obtain reasonable assurance about whether the financial statements are free of material misstatement, whether due to error or fraud. The Fund is not required to have, nor were we engaged to perform, an audit of its internal control over financial reporting. As part of our audits we are required to obtain an understanding of internal control over financial reporting, but not for the purpose of expressing an opinion on the effectiveness of the Fund’s internal control over financial reporting. Accordingly, we express no such opinion.

Our audits included performing procedures to assess the risks of material misstatement of the financial statements, whether due to error or fraud, and performing procedures that respond to those risks. Such procedures included examining, on a test basis, evidence regarding the amounts and disclosures in the financial statements. Our audits also included evaluating the accounting principles used and significant estimates made by management, as well as evaluating the overall presentation of the financial statements. Our procedures included confirmation of securities owned as of December 31, 2017 by correspondence with the custodian and brokers; when replies were not received from brokers, we performed other auditing procedures. We believe that our audits provide a reasonable basis for our opinion.

TAIT, WELLER & BAKER LLP

Philadelphia, Pennsylvania

February 27, 2018

22

| | |

| THE COMMUNITY DEVELOPMENT FUND |

| | | |

| | | DECEMBER 31, 2017 |

| | | |

|

| TRUSTEES AND OFFICERS OF THE FUND (Unaudited) |

Information pertaining to the Trustees and Officers of the Trust is set forth below. Trustees who are not deemed to be “interested persons” of the Trust as defined in the 1940 Act are referred to as “Independent Trustees.” The Trust’s Statement of Additional Information (“SAI”) includes additional information about the Trustees and Officers. The SAI may be obtained without charge by calling 1-844-445-4405.

| | | | | | | | | | | | |

Name, Address, Year of Birth | | Position(s)

Held with the

Company | | Term of

Office and

Length of Time Served1 | | Principal Occupation(s) During Past Five Years | | Number of

Portfolios

in Trust

Complex

Overseen

by Trustee | | | Other Directorships Held by Trustee |

INTERESTED TRUSTEE |

Kenneth H. Thomas, Ph.D. (1947) | | President, Chief Executive Officer and Secretary | | Since 2015 | | Bank Consultant (August 1975 – Present). | | | 1 | | | Board member of the NorthEast Community Bank, NorthEast Community Bancorp, Inc., and NorthEast Community Bancorp, MHC. |

INDEPENDENT TRUSTEES | | | | | | | | | | |

Antonio L. Argiz (1952) | | | | Since 2015 | | Chairman of the Board and CEO of Morrison, Brown, Argiz & Farra, LLC (“MBAF”). | | | 1 | | | Board member of Continental National Bank. |

Ronald Lindhart (1956) | | | | Since 2015 | | Chief Executive, Banking Strategies International, LLC, Since 2012. | | | 1 | | | Board member of City National Bank of Florida |

| 1 | Each Trustee shall hold office during the lifetime of this Trust until the election and qualification of his or her successor, or until he or she sooner dies, resigns or is removed in accordance with the Trust’s Declaration of Trust. |

23

| | |

| THE COMMUNITY DEVELOPMENT FUND |

| | | |

| | | DECEMBER 31, 2017 |

| | | |

|

| TRUSTEES AND OFFICERS OF THE FUND (concluded) (Unaudited) |

| | | | | | | | | | | | |

Name, Address, Year of Birth | | Position(s)

Held with the

Company | | Term of

Office and

Length of Time Served1 | | Principal Occupation(s) During Past Five Years | | Number of

Portfolios

in Trust

Complex

Overseen

by Trustee | | | Other Directorships Held by Trustee |

OFFICERS | | | | | | | | | | |

Kenneth H. Thomas, Ph.D. (1947) | | President, Chief Executive Officer and Secretary | | Since 2015 | | Bank Consultant (August 1975 – Present). | | | N/A | | | Board member of the NorthEast Community Bank, NorthEast Community Bancorp, Inc., and NorthEast Community Bancorp, MHC. |

James Nash (1981) | | Chief Compliance Officer and Anti-Money Laundering Officer | | Since 2015 | | Foreside Fund Officer Services, LLC, Fund Chief Compliance Officer (January 2016 – Present); JPMorgan Chase & Co., Senior Associate, Regulatory Administration Advisor (June 2014 – January 2016); and Linedata Services, Product Analyst

(July 2011 – June 2014). | | | N/A | | | None. |

Eric Kleinschmidt (1968) | | Treasurer

and Chief Financial Officer | | Since 2015 | | Director of Fund Accounting, SEI Investments

(2004 – Present). | | | N/A | | | None. |

| 1 | Each Trustee shall hold office during the lifetime of this Trust until the election and qualification of his or her successor, or until he or she sooner dies, resigns or is removed in accordance with the Trust’s Declaration of Trust. |

24

| | |

| THE COMMUNITY DEVELOPMENT FUND |

| | | |

| | | DECEMBER 31, 2017 |

| | | |

|

| DISCLOSURE OF FUND EXPENSES (Unaudited) |

All mutual funds have operating expenses. As a shareholder of a mutual fund, your investment is affected by these ongoing costs, which include (among others) costs for fund management, administrative services, and shareholder reports like this one. It is important for you to understand the impact of these costs on your investment returns.

Operating expenses such as these are deducted from the mutual fund’s gross income and directly reduce its final investment return. These expenses are expressed as a percentage of the mutual fund’s average net assets; this percentage is known as the mutual fund’s expense ratio.

The following examples use the expense ratio and are intended to help you understand the ongoing costs (in dollars) of investing in your Fund and to compare these costs with those of other mutual funds. The examples are based on an investment of $1,000 made at the beginning of the period shown and held for the entire period from July 1, 2017 to December 31, 2017.

The table on the next page illustrates your Fund’s costs in two ways:

| • | | Actual Fund Return. This section helps you to estimate the actual expenses after fee waivers that your Fund incurred over the period. The “Expenses Paid During Period” column shows the actual dollar expense cost incurred by a $1,000 investment in the Fund, and the “Ending Account Value” number is derived from deducting that expense cost from the Fund’s gross investment return. |

You can use this information, together with the actual amount you invested in the Fund, to estimate the expenses you paid over that period. Simply divide your ending starting account value by $1,000 to arrive at a ratio (for example, an $8,600 account value divided by $1,000 = 8.6), then multiply that ratio by the number shown for your Fund under “Expenses Paid During Period.”

| • | | Hypothetical 5% Return. This section helps you compare your Fund’s costs with those of other mutual funds. It assumes that the Fund had an annual 5% return before expenses during the year, but that the expense ratio (Column 3) for the period is unchanged. This example is useful in making comparisons because the Securities and Exchange Commission requires all mutual funds to make this 5% calculation. You can assess your Fund’s comparative cost by comparing the hypothetical result for your Fund in the “Expenses Paid During Period” column with those that appear in the same charts in the shareholder reports for other mutual funds. |

25

| | |

| THE COMMUNITY DEVELOPMENT FUND |

| | | |

| | | DECEMBER 31, 2017 |

| | | |

|

| DISCLOSURE OF FUND EXPENSES (concluded) (Unaudited) |

Note: Because the return is set at 5% for comparison purposes — NOT your Fund’s actual return — the account values shown may not apply to your specific investment.

| | | | | | | | | | | | | | | | | | | | |

| | | Beginning

Account

Value

7/1/17 | | Ending

Account

Value

12/31/17 | | Annualized

Expense

Ratios | | Expenses

Paid

During

Period* |

Actual Fund Return | |

Class A Shares | | | $ | 1,000.00 | | | | $ | 1,007.40 | | | | | 1.00 | % | | | $ | 5.06 | |

Hypothetical 5% Return | |

Class A Shares | | | | 1,000.00 | | | | | 1,020.16 | | | | | 1.00 | | | | | 5.09 | |

| * | Expenses are equal to the Fund’s annualized expense ratio multiplied by the average account value over the period, multiplied by 184/365 (to reflect the one-half year period). |

26

| | |

| THE COMMUNITY DEVELOPMENT FUND |

| | | |

| | | DECEMBER 31, 2017 |

| | | |

|

| APPROVAL OF INVESTMENT SUB-ADVISORY AGREEMENT (Unaudited) |

Pursuant to Section 15 of the Investment Company Act of 1940 (the “1940 Act”), the Fund’s investment sub-advisory agreement must be approved: (i) by a vote of a majority of the shareholders of the Fund; and (ii) by the vote of a majority of the members of the Board of Trustees (the “Board” or the “Trustees”) of the Fund who are not parties to the agreement or “interested persons” of any party thereto, as defined in the 1940 Act (the “Independent Trustees”), cast in person at a meeting called for the purpose of voting on such approval.

On September 15, 2017, Logan Circle Partners L.P. (“Logan Circle”), the investment sub-adviser of the Fund, was acquired by MetLife, Inc. from Fortress Investment Group LLC (the “Transaction”). The Transaction resulted in a change in “control” of Logan Circle (as that term is defined under the 1940 Act), which was deemed to be an “assignment” and automatic termination of the investment sub-advisory agreement between Community Development Fund Advisors, LLC, the investment adviser to the Fund (the “Adviser”) and Logan Circle (the “Prior Sub-Advisory Agreement”), pursuant to Section 15(a)(4) of the 1940 Act. In anticipation of the Transaction, a Board meeting was held on September 13, 2017 (the “September 13, 2017 Meeting”) to decide whether to approve an interim investment sub-advisory agreement for a term of up to 150 days (the “Interim Sub-Advisory Agreement”) and a Board meeting was held on September 26, 2017 (the “September 26, 2017 Meeting,” and, together with the September 13, 2017 Meeting, the “September 2017 Meetings”) to decide whether to approve a new investment sub-advisory agreement for an initial term of two years (the “New Sub-Advisory Agreement”) for the Fund.

At the September 2017 Meetings, in connection with its approval of the Interim Sub-Advisory Agreement and the New Sub-Advisory Agreement, the Board considered materials provided by Logan Circle and reviewed by the Board in advance of the September 2017 Meetings that detailed, among other things, the terms and conditions of the Transaction, the reasons that Logan Circle was undergoing the Transaction, the implications of the Transaction on Logan Circle’s business, and the pre- and post-Transaction structure of Logan Circle. The materials provided by Logan Circle addressed Logan Circle as it was expected to exist after the consummation of the Transaction. Representatives of Logan Circle had previously met with the Board to provide further detail on the Transaction and responded to questions from the Board. The Board, in considering the New Sub-Advisory Agreement in the context of the Transaction, relied upon representations from Logan Circle that: (i) the Transaction was not expected to result in any material changes to the nature, quality and extent of services provided to the Fund by Logan

27

| | |

| THE COMMUNITY DEVELOPMENT FUND |

| | | |

| | | DECEMBER 31, 2017 |

| | | |

|

| APPROVAL OF INVESTMENT SUB-ADVISORY AGREEMENT (continued) (Unaudited) |

Circle that are discussed below; (ii) after the Transaction, Logan Circle would become subject to MetLife, Inc.’s Code of Ethics and Code of Conduct; (iii) Logan Circle did not anticipate any material changes to its compliance program in connection with the Transaction; and (iv) the portfolio manager for the Fund was not expected to change in connection with the Transaction.

At the September 2017 Meetings, the Board also considered the terms of the Interim Sub-Advisory Agreement and the New Sub-Advisory Agreement and noted that the terms of the Interim Sub-Advisory Agreement were substantially the same as those of the Prior Sub-Advisory Agreement, except for the date and certain provisions that are required by law, and that the terms of the New Sub-Advisory Agreement were identical in all material respects to those of the Prior Sub-Advisory Agreement except for the effective date. The Board also determined that it was reasonable to take into account the conclusions the Board made when considering and evaluating the approval of the Prior Sub-Advisory Agreement, which occurred at a Board meeting held on December 5, 2015 (the “December 2015 Meeting”), as part of its considerations to approve the Interim Sub-Advisory Agreement and the New Sub-Advisory Agreement and recommend the approval of the New Sub-Advisory Agreement to the Fund’s shareholders.

The discussion immediately below outlines certain materials and information presented to the Board in connection with the Board’s approval of the Prior Sub-Advisory Agreement at the December 2015 Meeting, and the conclusions made by the Board when determining to approve the Prior Sub-Advisory Agreement for an initial two-year term.

In preparation for the December 2015 Meeting, the Trustees requested that the Adviser and Logan Circle furnish information necessary to evaluate the terms of the Prior Sub-Advisory Agreement. The Trustees used this information, as well as other information that the Adviser, Logan Circle and other service providers of the Fund presented or submitted to the Board at the December 2015 Meeting, to help them decide whether to approve the Prior Sub-Advisory Agreement for an initial two-year term.

Specifically, the Board requested and received written materials from the Adviser, Logan Circle and other service providers of the Fund regarding: (i) the nature, extent and quality of the services to be provided by Logan Circle; (ii) Logan Circle’s investment management personnel; (iii) Logan Circle’s operations; (iv) Logan Circle’s brokerage practices (including any soft dollar arrangements) and investment strategies; (v) the proposed sub-advisory fee to be paid to Logan Circle;

28

| | |

| THE COMMUNITY DEVELOPMENT FUND |

| | | |

| | | DECEMBER 31, 2017 |

| | | |

|

| APPROVAL OF INVESTMENT SUB-ADVISORY AGREEMENT (continued) (Unaudited) |

(vi) Logan Circle’s compliance program, including a description of material compliance matters and material compliance violations; (vii) Logan Circle’s policies on and compliance procedures for personal securities transactions; and (viii) Logan Circle’s investment experience.

Representatives from the Adviser and Logan Circle, along with other Fund service providers, presented additional information and participated in question and answer sessions at the December 2015 Meeting to help the Trustees evaluate Logan Circle’s services, fee and other aspects of the Prior Sub-Advisory Agreement. Kenneth H. Thomas, Ph.D., on behalf of the Adviser, attended the December 2015 Meeting in person and representatives from Logan Circle attended the December 2015 Meeting via video conference, which permitted the Independent Trustees, Dr. Thomas and the representatives from Logan Circle to communicate in real time and ask questions of one another. The Independent Trustees received advice from Fund counsel and met in executive session outside the presence of Fund management and the Adviser and Logan Circle.

At the December 2015 Meeting, the Trustees, including all of the Independent Trustees, based on their evaluation of the information provided by the Adviser, Logan Circle and other service providers of the Fund, approved the Prior Sub-Advisory Agreement. In considering the approval of the Prior Sub-Advisory Agreement, the Board considered various factors that they determined were relevant, including: (i) the nature, extent and quality of the services to be provided by Logan Circle; and (ii) the fee to be paid to Logan Circle.

In approving the Interim Sub-Advisory Agreement and the New Sub-Advisory Agreement at the September 2017 Meetings, the Board reconsidered all of the information that the Board had considered in connection with approving the Prior Sub-Advisory Agreement and considered how Logan Circle had performed as sub-adviser to the Fund since the Prior Sub-Advisory Agreement was approved.

Nature, Extent and Quality of Services Provided by Logan Circle

In considering the nature, extent and quality of the services to be provided by Logan Circle under the Interim Sub-Advisory Agreement and the New Sub-Advisory Agreement, the Board reviewed the portfolio management services that have been provided by Logan Circle to the Fund, including the quality and continuity of Logan Circle’s portfolio management personnel, the resources of Logan Circle, and Logan Circle’s compliance history and compliance program. The Trustees also reviewed Logan Circle’s investment and risk management approaches for the Fund.

29

| | |

| THE COMMUNITY DEVELOPMENT FUND |

| | | |

| | | DECEMBER 31, 2017 |

| | | |

|

| APPROVAL OF INVESTMENT SUB-ADVISORY AGREEMENT (continued) (Unaudited) |

The Trustees also considered other services provided to the Fund by Logan Circle under the Prior Sub-Advisory Agreement, such as selecting broker-dealers for executing portfolio transactions, monitoring adherence to the Fund’s investment restrictions, and monitoring compliance with various Fund policies and procedures and with applicable securities laws and regulations. Based on the factors above, as well as those discussed below, the Board concluded, within the context of its full deliberations, that the nature, extent and quality of the services to be provided to the Fund by Logan Circle under the Interim Sub-Advisory Agreement and the New Sub-Advisory Agreement would be satisfactory.

Cost of Sub-Advisory Services

In considering the sub-advisory fee payable by the Adviser to Logan Circle under the Interim Sub-Advisory Agreement and the New Sub-Advisory Agreement, the Trustees reviewed, among other things, the sub-advisory fee paid to Logan Circle under the Prior Sub-Advisory Agreement. The Trustees also considered that the Adviser, not the Fund, would pay Logan Circle, consistent with the Prior Sub-Advisory Agreement and that the fee payable to Logan Circle would reflect an arms-length negotiation between the Adviser and Logan Circle. The Board also considered Logan Circle’s commitment to sub-advising the Fund. The Board concluded, within the context of its full deliberations, that the sub-advisory fee was reasonable in light of the nature and quality of the services expected to be rendered by Logan Circle.

Performance and Economies of Scale

Although the Fund is still relatively new, at the September 2017 Meetings the Board considered the Fund’s limited investment performance record with Logan Circle as sub-adviser and considered the possible extent to which economies of scale could be realized by Logan Circle as the assets of the Fund grow. The Board concluded, within the context of its full deliberations, that the sub-advisory fee was reasonable in light of the Fund’s investment performance, Logan Circle’s profitability, and the extent to which economies of scale could be realized as the assets of the Fund grow.

Approval of Interim Sub-Advisory Agreement and the New Sub-Advisory Agreement

Based on the Board’s deliberations and its evaluation of the information described above and other factors and information it believed relevant in the exercise of its reasonable business judgment, the Board, including all of the Independent Trustees,

30

| | |

| THE COMMUNITY DEVELOPMENT FUND |

| | | |

| | | DECEMBER 31, 2017 |

| | | |

|

| APPROVAL OF INVESTMENT SUB-ADVISORY AGREEMENT (concluded) (Unaudited) |

with the assistance of Fund counsel, unanimously concluded that the terms of the Interim Sub-Advisory Agreement and the New Sub-Advisory Agreement, including the fees to be paid thereunder, were fair and reasonable and agreed to approve the Interim Sub-Advisory Agreement for a term of up to 150 days, approve the New Sub-Advisory Agreement for an initial term of two years and recommend the approval of the New Sub-Advisory Agreement to the Fund’s shareholders. In its deliberations, the Board did not identify any absence of information as material to its decision, or any particular factor (or conclusion with respect thereto) or single piece of information that was all-important, controlling or determinative of its decision, but considered all of the factors together, and each Trustee may have attributed different weights to the various factors (and conclusions with respect thereto) and information.

31

| | |

| THE COMMUNITY DEVELOPMENT FUND |

| | | |

| | | DECEMBER 31, 2017 |

| | | |

|

| APPROVAL OF INVESTMENT ADVISORY AGREEMENT (Unaudited) |

Pursuant to Section 15 of the 1940 Act, the Fund’s advisory agreement (the “Advisory Agreement”) must be renewed at least annually after its initial two-year term: (i) by the vote of the Board or by a vote of a majority of the shareholders of the Fund; and (ii) by the vote of a majority of the Independent Trustees, cast in person at a meeting called for the purpose of voting on such renewal.

A Board meeting was held on December 11, 2017 (the “December 2017 Meeting”) to decide whether to renew the Advisory Agreement for an additional one-year term. In preparation for the December 2017 Meeting, the Trustees requested that the Adviser furnish information necessary to evaluate the terms of the Advisory Agreement. Prior to the December 2017 Meeting, the Independent Trustees of the Fund reviewed the information provided. The Trustees used this information, as well as other information that the Adviser and other service providers of the Fund presented or submitted to the Board at the December 2017 Meeting and other meetings held during the prior year, to help them decide whether to renew the Advisory Agreement for an additional year.