ClearLight Biotechnologies, Inc.

428 Oakmead Parkway

Sunnyvale, CA 94085-4708.

TEL 800-251-8905

Up to 20,000 shares of Common Stock, par value $0.0001 (the "Offering")

SEE "DESCRIPTION OF CAPITAL STOCK" AT PAGE 44

| Price to Public | Underwriting discount and commissions (1) | Proceeds to issuer |

Per share of Common Stock | $12.00 | 0 | $240,000 |

Total Maximum | | | $240,000(2) |

(1) The issuer does not currently intend to use commissioned sales agents or underwriters. In the event it uses commissioned sales agents or underwriters, it will file an amendment to the Offering Statement of which the Offering Circular forms a part.

(2) Before deducting expenses, estimated to be approximately $50,000 including legal fees, blue sky filing fees and Edgar filing costs. For more details, please see the section of this offering circular captioned "Plan of Distribution." This is a "best efforts" offering. There is no minimum number of shares that must be distributed in this offering.

The offering will commence within two calendar days after the offering statement in which this offering circular is included has been qualified by the US Securities and Exchange Commission (the "Commission" or the "SEC") and includes an amount of shares that we reasonably expect to be offered and sold within two years from the date of initial qualification, unless subsequently amended. The offering will terminate at the earlier of: (1) the date at which the maximum offering amount has been sold, (2) the date which is one year from this offering being qualified by the Commission, or (3) the date at which the offering is earlier terminated by us in our sole discretion.

There is no minimum number of shares that we must sell in order to conduct a closing in the Offering. We have made no arrangements to place subscription funds in an escrow, trust or similar account. Shares issued under this offering will be issued on a continuous basis under Rule 251(d)(3) under the Securities Act, and the Company will have access to such funds from the first dollar invested, even if those proceeds do not cover the costs of this offering. For further details please see the section of this offering circular captioned "Plan of Distribution."

THE UNITED STATES SECURITIES AND EXCHANGE COMMISSION DOES NOT PASS UPON THE MERITS OF OR GIVE ITS APPROVAL TO ANY SECURITIES OFFERED OR THE TERMS OF THE OFFERING, NOR DOES IT PASS UPON THE ACCURACY OR COMPLETENESS OF ANY OFFERING CIRCULAR OR OTHER SELLING LITERATURE. ANY REPRESENTATION TO THE CONTRARY IS UNLAWFUL.

THE SECURITIES HAVE NOT BEEN REGISTERED UNDER THE SECURITIES ACT OF 1933, AS AMENDED (THE "SECURITIES ACT") AND THESE SECURITIES ARE OFFERED PURSUANT TO AN EXEMPTION FROM REGISTRATION WITH THE COMMISSION. HOWEVER, THE COMMISSION HAS NOT MADE AN INDEPENDENT DETERMINATION THAT THE SECURITIES OFFERED HEREUNDER ARE EXEMPT FROM REGISTRATION.

THIS OFFERING CIRCULAR CONTAINS ALL OF THE REPRESENTATIONS BY THE ISSUER CONCERNING THIS OFFERING, AND NO PERSON SHALL MAKE DIFFERENT OR BROADER STATEMENTS THAN THOSE CONTAINED HEREIN. INVESTORS ARE CAUTIONED NOT TO RELY UPON ANY INFORMATION NOT EXPRESSLY SET FORTH IN THIS OFFERING CIRCULAR.

GENERALLY, NO SALE MAY BE MADE TO YOU IN THIS OFFERING IF THE AGGREGATE PURCHASE PRICE YOU PAY IS MORE THAN 10% OF THE GREATER OF YOUR ANNUAL INCOME OR NET WORTH. DIFFERENT RULES APPLY TO ACCREDITED INVESTORS AND NON-NATURAL PERSONS. BEFORE MAKING ANY REPRESENTATION THAT YOUR INVESTMENT DOES NOT EXCEED APPLICABLE THRESHOLDS, WE ENCOURAGE YOU TO REVIEW RULE 251(d)(2)(i)(C) OF REGULATION A. FOR GENERAL INFORMATION ON INVESTING, WE ENCOURAGE YOU TO REFER TO www.investor.gov.

This offering is inherently risky. See "Risk Factors" on page 14.

Sales of these securities will commence on approximately [to be determined].

The issuer is following the Form S-1 format of disclosure under Regulation A.

In the Offering Circular, the terms "ClearLight", "CLB", the "issuer", the "Company", "us" or "we" refers to ClearLight Biotechnologies, Inc.

Statement Regarding Forward-Looking Statements

THIS OFFERING CIRCULAR MAY CONTAIN FORWARD-LOOKING STATEMENTS AND INFORMATION RELATING TO, AMONG OTHER THINGS, THE COMPANY, ITS BUSINESS PLAN AND STRATEGY, AND ITS INDUSTRY. THESE FORWARD-LOOKING STATEMENTS ARE BASED ON THE BELIEFS OF, ASSUMPTIONS MADE BY, AND INFORMATION CURRENTLY AVAILABLE TO THE COMPANY'S MANAGEMENT. WHEN USED IN THE OFFERING MATERIALS, THE WORDS "ESTIMATE," "PROJECT," "BELIEVE," "ANTICIPATE," "INTEND," "EXPECT" AND SIMILAR EXPRESSIONS ARE INTENDED TO IDENTIFY FORWARD-LOOKING STATEMENTS AND WHICH CONSTITUTE FORWARD-LOOKING STATEMENTS. THESE STATEMENTS REFLECT MANAGEMENT'S CURRENT VIEWS WITH RESPECT TO FUTURE EVENTS AND ARE SUBJECT TO RISKS AND UNCERTAINTIES THAT COULD CAUSE THE COMPANY'S ACTUAL RESULTS TO DIFFER MATERIALLY FROM THOSE CONTAINED IN THE FORWARD-LOOKING STATEMENTS. INVESTORS ARE CAUTIONED NOT TO PLACE UNDUE RELIANCE ON THESE FORWARD-LOOKING STATEMENTS, WHICH SPEAK ONLY AS OF THE DATE ON WHICH THEY ARE MADE. THE COMPANY DOES NOT UNDERTAKE ANY OBLIGATION TO REVISE OR UPDATE THESE FORWARD-LOOKING STATEMENTS TO REFLECT EVENTS OR CIRCUMSTANCES AFTER SUCH DATE OR TO REFLECT THE OCCURRENCE OF UNANTICIPATED EVENTS.

Industry and Market Data

Although we are responsible for all disclosure contained in the Offering Circular, in some cases we have relied on certain market and industry data obtained from third-party sources that we believe to be reliable. Market estimates are calculated by using independent industry publications in conjunction with our assumptions regarding the machine vision for the manufacturing industry and market. While we are not aware of any misstatements regarding any market, industry or similar data presented herein, such data involves risks and uncertainties and is subject to change based on various factors, including those discussed under the headings "Statement Regarding Forward-Looking Statements" and "Risk Factors" in the Offering Circular.

Balance Sheet Information |

| |

Cash and Cash Equivalents: | $718,333 |

| | |

Investment Securities: | 0 |

| | |

Accounts and Notes Receivable: | $17,595 |

| | |

Property, Plant and Equipment (PP&E): | $818,271 |

| | |

Total Assets: | $2,072,588 |

| | |

Accounts Payable and Accrued Liabilities: | $500,080 |

| | |

Long Term Debt: | 0 |

| | |

Total Liabilities: | $500,080 |

| | |

Total Stockholders' Equity: | $1,572,508 |

| | |

Total Liabilities and Equity: | $2,072,588 |

| | |

|

| |

Statement of Comprehensive Income Information |

| |

Total Revenues: | $29,874 |

| | |

Costs and Expenses Applicable to Revenues: | $157,760 |

Depreciation and Amortization: | $31,620 |

| | |

Net Income: | ($680,461) |

| | |

Earnings Per Share - Basic: | ($0.73) |

| | |

Earnings Per Share - Diluted: | ($0.73) |

| | |

| |

Name of Auditor (if any): | None |

OFFERING CIRCULAR SUMMARY

This summary highlights selected information contained elsewhere in the Offering Circular. This summary is not complete and does not contain all the information that you should consider before deciding whether to invest in our Common Stock. You should carefully read the entire Offering Circular, including the risks associated with an investment in the Company discussed in the "Risk Factors" section of the Offering Circular, before making an investment decision. Some of the statements in the Offering Circular are forward-looking statements. See the section entitled "Statement Regarding Forward-Looking Statements."

Company Information

ClearLight is an early-stage life sciences tools company. CLB provides tissue processing, imaging, and image analysis services to pharmaceutical, biotechnology and academic researchers. CLB utilizes the patent-protected CLARITY technology, licensed from Stanford University, Palo Alto, CA. The CLARITY technology allows clearing of animal and human tissue so that thick tissue samples can be imaged in three dimensions (3D) with a confocal or light-sheet microscope and then analyzed by a lab scientist in a 3D dataset. The Company is currently developing automated analysis software enabled by artificial intelligence. This software is intended to analyze the large datasets associated with 3D imaging and provide researchers with quantitative spatial data. The images and analysis may allow researchers to See More Biology™ facilitating better understanding of the tissue and tumor microenvironments. We believe this will facilitate discovery of new methods and drugs to diagnose and treat disease.

The Offering

The Company is offering up to 20,000 shares of Common Stock for purchase at $12.00 per share.

Securities offered: | Shares of Common Stock |

Number of outstanding shares of Common Stock before the offering: | 1,134,331 |

Number of shares of Common Stock to be outstanding after the offering: | 1,154,331 |

Price per share: | $12.00 |

Maximum offering amount: | $240,000 |

Use of proceeds: | Working capital for operating expenses and research and development. |

Risk Factors

Our business is subject to a number of risks and uncertainties, including those highlighted in the section titled "Risk Factors" immediately following this summary.

RISK FACTORS

The SEC requires the Company to identify risks that are specific to its business and its financial condition. The Company is still subject to all the same risks that all companies in its business, and all companies in the economy, are exposed to. These include risks relating to economic downturns, political and economic events and technological developments (such as hacking and the Company's ability to detect and prevent such hacking). Additionally, early-stage companies are inherently riskier than more developed companies. You should consider general risks as well as specific risks when deciding whether to invest.

RISKS RELATED TO BUSINESS STRATEGY

We have an evolving business model.

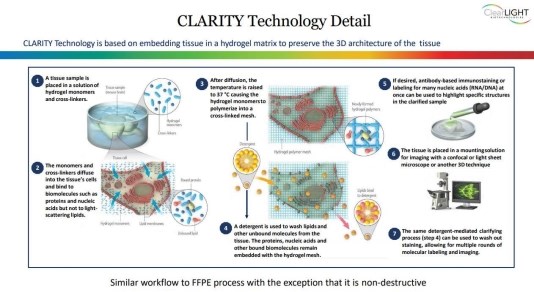

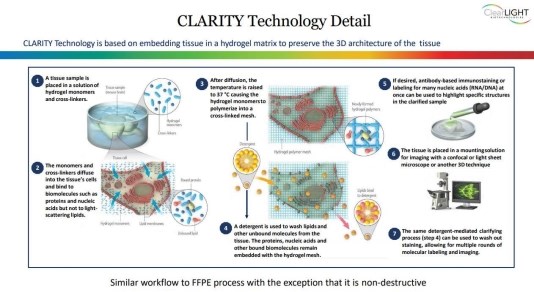

We are developing a technology based on CLARITY, which is an acronym for Clear Lipid-exchanged Acrylamide-hybridized Rigid Imaging/Immunostaining/In situ hybridization-compatible Tissue-hYdrogel. CLARITY technology entails the formation of a hydrogel matrix by cross-linking biological molecules to a 3-D (three-dimensional) network of hydrophilic polymers, followed by lipid removal to generate a transparent and structurally intact tissue.

We currently are offering services to researchers in both academic and commercial labs using our Tru3D® technology platform. We also offer reagents that have been optimized to facilitate the wider use and adoption of CLARITY tissue clearing in research labs. We are also developing software to analyze large 3D datasets that are generated by confocal and light sheet microscopes. We may try to offer additional types of products and services, although we cannot offer any assurance that any of the current of future service and product offerings will be successful. From time to time, we may also modify aspects of our business model relating to our product and service offering mix. We cannot offer any assurance that these or any other modifications will be successful or will not result in harm to the business. Among the risks associated with the introduction of new products and services are related research and development costs, costs associated with launching new products and services, difficulty predicting customer demand and effectively managing inventory levels to ensure adequate supply of a new product and avoid excess supply of a legacy product. We may not be able to manage growth effectively, which could damage our reputation, limit our growth, and negatively affect our operating results.

We may strategically enter into non-cancelable commitments with vendors to purchase materials for our products and services in advance of demand to take advantage of favorable pricing or address concerns about the availability of future supplies or long lead times. This practice may expose us to an increased risk of excess or obsolete inventory and resulting charges if actual demand is lower than anticipated. Our failure to effectively manage product transitions or accurately forecast customer demand may lead to an increased risk of excess or obsolete inventory and resulting charges.

We may use our financial and human resources to pursue a particular product candidate or service offering and fail to capitalize on product or service candidates that may be more profitable or for which there is a greater likelihood of success.

Allocation decisions may cause us to fail to capitalize on viable commercial products and services or other profitable market opportunities. Our spending on existing and future product and service candidates for specific indications may not yield any commercially viable products and services. If we do not accurately evaluate the commercial potential or target market for a particular product or service candidate, we may relinquish valuable rights to that product or service candidate through strategic alliance, licensing or other royalty arrangements in cases in which it would have been more advantageous for us to retain sole development and commercialization rights to such product or service candidate, or we may allocate internal resources to a product or service candidate in which it would have been more advantageous to enter into a partnering arrangement.

There may be implications of being an Emerging Growth company.

As an issuer with less than $1 billion total gross revenues for 2020 and all preceding years, and in fact only $32,000 in total gross revenues for 2020, we will qualify as an "emerging growth company" under the Jumpstart Our Business Startups Act of 2012 (the "JOBS Act"). An emerging growth company may take advantage of certain reduced reporting requirements and is relieved of certain other significant requirements that are otherwise generally applicable to public companies. In particular, as an emerging growth company, even if and when we become registered with the SEC, we:

| ● | Would not be required to obtain audited financial statements; |

| ● | Would not be required to obtain an auditor attestation on our internal control over financial reporting pursuant to the Sarbanes-Oxley Act of 2002; |

| ● | Would not be required to provide a detailed narrative disclosure discussing our compensation principles, objectives and elements and analyzing how those elements fit with our principles and objectives (commonly referred to as "compensation discussion and analysis"); |

| ● | Would not be required to obtain a non-binding advisory vote from our stockholders on executive compensation or golden parachute arrangements (commonly referred to as the "say-on-pay," "say-on-frequency" and "say-on-golden-parachute" votes); |

| ● | Would be exempt from certain executive compensation disclosure provisions requiring a pay-for-performance graph and CEO pay ratio disclosure; |

| ● | Can present only two years of unaudited financial statements and only two years of related Management's Discussion and Analysis of Financial Condition and Results of Operations; |

| ● | Would be eligible to claim longer phase-in periods for the adoption of new or revised financial accounting standards under §107 of the JOBS Act. |

We intend to take advantage of all of these reduced reporting requirements and exemptions, including the longer phase-in periods for the adoption of new or revised financial accounting standards under §107 of the JOBS Act. Our election to use the phase-in periods may make it difficult to compare our financial statements to those of non-emerging growth companies and other emerging growth companies that have opted out of the phase-in periods under §107 of the JOBS Act.

Under the JOBS Act, we may take advantage of the above-described reduced reporting requirements and exemptions for up to five years after our initial sale of common equity pursuant to a registration statement declared effective under the Securities Act, or such earlier time that we no longer meet the definition of an emerging growth Company. Note that this offering, while a public offering, is not a sale of common equity pursuant to a registration statement since the offering is conducted pursuant to an exemption from the registration requirements. In this regard, the JOBS Act provides that we would cease to be an "emerging growth Company" if we have more than $1 billion in annual revenues, have more than $700 million in market value of our Common Stock held by non-affiliates, or issue more than $1 billion in principal amount of non-convertible debt over a three-year period.

Our success depends on the success of CLARITY and Tru3D technology platform and market acceptance. CLARITY or Tru3D may or may not achieve or maintain significant commercial market acceptance.

Our commercial success is dependent upon our ability to continue to successfully market and sell our Tru3D technology platform, of which CLARITY is a significant part. Our ability to achieve and maintain commercial market acceptance of our Tru3D technology platform will depend on a number of factors, including:

| ● | our ability to increase awareness of the capabilities of our technology and solutions; |

| ● | our customers' willingness to adopt new technologies and workflows; |

| ● | whether our platform reliably provides advantages over legacy and other alternative technologies and is perceived by customers to be cost effective; |

| ● | our ability to execute on our strategy to provide multiple channels to access our Tru3D technology platform; |

| ● | the rate of adoption of our platform and solutions by biopharmaceutical companies, academic institutions, and others; |

| ● | prices we charge for a direct purchase of, or other access to, our platform; |

| ● | the relative reliability and robustness of our platform as a whole and the components of our platform, including, for example, CLARITY, immunostaining, imaging, and software (under development); |

| ● | our ability to develop new workflows and solutions for customers; |

| ● | competitors that have a platform that provides services or technology that competes with ours; |

| ● | the timing and scope of any approval that may be required by the U.S. Food and Drug Administration, or FDA, for our next generation products and services, and/or solutions; |

| ● | the impact of our investments in product innovation and commercial growth; |

| ● | negative publicity regarding our or our competitors' and services resulting from defects or errors; and |

| ● | our ability to further validate our technology through research and accompanying publications. |

We cannot assure you that we will be successful in addressing each of these criteria or other criteria that might affect the market acceptance of our products and services. If we are unsuccessful in achieving and maintaining market acceptance of our products and services, our business, financial condition, results of operations and prospects could be adversely affected.

The life sciences technology market is highly competitive, and if we cannot compete successfully in that market, we may be unable to increase or sustain our revenue, or we may be unable to achieve and sustain profitability.

We face significant competition in the life sciences technology market. We currently compete with both established and early-stage life sciences technology companies that design, manufacture and market systems, consumables, reagent kits and software for, among other applications, genomics, single-cell analysis, spatial analysis, and immunology, and/or provide services related to the same. Growing understanding of the importance of single-cell information is leading to more companies offering services related to collecting such information. There are many large and small competitors within our space. In addition, our customers may also elect to develop their workflows on legacy systems rather than new platforms such as ours.

Our competitors and potential competitors may enjoy a number of competitive advantages over us, including:

| ● | longer operating histories; |

| ● | larger customer bases; |

| ● | greater brand recognition and market penetration; |

| ● | greater financial resources; |

| ● | greater technological and research and development resources; |

| ● | better system reliability and robustness; |

| ● | greater selling and marketing capabilities; and |

| ● | better established, larger scale and lower cost manufacturing capabilities. |

As a result, our competitors and potential competitors may be able to respond more quickly to changes in customer requirements, devote greater resources to the development, promotion and sale of their platforms or products than we can or sell their platforms or products, or offer services competitive with our platform and services at prices designed to win significant levels of market share. We may not be able to compete effectively against these organizations.

In addition, competitors may be acquired by, receive investments from, or enter into other commercial relationships with larger, more well-established, and well-financed companies. Certain of our competitors may be able to secure key inputs from vendors on more favorable terms, devote greater resources to marketing and promotional campaigns, adopt more aggressive pricing policies and devote substantially more resources to product development than we can. If we are unable to compete successfully against current and future competitors, we may be unable to increase market adoption and sales of our platform, which could prevent us from increasing our revenue or achieving profitability.

We are currently limited to "research use only" with respect to many of the materials and components used in our services.

Our instruments, consumable products and assays are purchased from suppliers with a restriction that they be used for research use only, or "RUO." While we have focused initially on the life sciences research market and RUO products and services only, part of our business strategy is to expand our service offerings to encompass products and services that are intended to be used for the diagnosis of disease and precision healthcare, either alone or in collaboration with third parties. The use of our products or services for any such diagnostic purposes would require that we obtain regulatory clearance or approval to market our products or services for those purposes and also that we acquire the materials and components used in such products and services from suppliers without an RUO restriction. There can be no assurance that we will be able to acquire these materials and components for use in diagnostic products on acceptable terms, if at all. If we are unable to do so, we would not be able to expand our product offerings beyond RUO, and our business and prospects would suffer.

We may never develop our software.

Our Tru3D technology platform involves the production of large 3D image datasets of customer tissue specimens. We believe this may be useful to researchers trying to understand the biology within the tissue since we believe that researchers increasingly seek quantitative and spatial data that cannot be obtained through traditional 2D fixed formalin paraffin-embedded ("FFPE") analysis [which produces a much lower volume of datasets?]. We are currently developing software that can analyze these large 3D datasets and provide quantitative and spatial data. The software remains under development and there is no assurance that we can develop such software successfully. If we cannot develop the software, we may not generate sufficient revenues to continue our business operations or achieve profitability.

RISKS RELATED TO OUR FINANCIAL CONDITION, LACK OF REVENUES AND OUR CONTINUING NEED FOR CAPITAL

There is substantial doubt about the Company's ability to continue as a going concern.

The Company has been unprofitable since its inception. The financial statements have been prepared assuming that the Company will continue as a going concern. The Company's ability to continue as a going concern is dependent on our ability to raise capital to fund operating losses, which may continue over the next several years. The financial statements provided herein do not include any adjustments to reflect the possible future effects on the recoverability and classification of assets, or the amounts and classification of liabilities that may result if we do not continue as a going concern. Therefore, you should not rely on our balance sheet as an indication of the amount of proceeds that would be available to satisfy claims of creditors, and potentially be available for distribution to stockholders, in the event of liquidation.

We will be required to raise additional funds to finance our operations and remain a going concern; however, we may not be able to do so when necessary, and/or the terms of any financings may not be advantageous to us.

Our operations to date have consumed substantially all of the funds we have been able to raise. Negative cash flows from our operations are expected to continue over at least the next several years. Our cash utilization amount is highly dependent on the success of our service offering and future product and service offerings. Our current unrestricted cash and cash equivalents will not be sufficient to fund future losses or the development of our products and services utilizing our technologies.

Our financial summary expresses substantial doubt about our ability to continue as a going concern, which may hinder our ability to obtain future financing.

Our financial summary will be prepared assuming that we would continue as a going concern. Our ability to continue as a going concern is an issue raised as the Company has limited operations and no established source of significant revenue. Our ability to continue as a going concern is subject to our ability to obtain necessary funding from outside sources, including obtaining additional funding from the sale of our securities, obtaining loans and grants from various institutions where possible. Our continued net operating losses increase the difficulty in meeting such goals and there can be no assurances that such methods will prove successful. We are in the process of applying for Small Business Innovation Research grants with the National Institute of Health and the National Science Foundation. Such grants are very difficult to obtain and there can be no assurance that any application will be approved.

Significant revenues from service sales are not in the foreseeable future, if at all.

To obtain significant revenues from sales of our services, we must succeed, either alone or with third parties, in promoting our current service offering and developing our software. The pathology market is very slow to adopt new technology. We may never succeed in these activities, and we may not generate sufficient revenues to continue our business operations or achieve profitability.

We may need to implement additional finance and accounting systems, procedures, and controls as we grow our business and organization and to satisfy reporting requirements.

We are required to comply with a variety of reporting, accounting, and other rules and regulations and those rules and requirements will become more extensive if we become a public Company. Compliance with existing requirements is expensive. Further requirements may increase our costs and require additional management time and resources. We may need to implement additional finance and accounting systems, procedures, and controls to satisfy our reporting requirements. If our internal controls over financial reporting are determined to be ineffective, such failure could cause investors to lose confidence in our reported financial information, negatively affect the market price of our Common Stock, subject us to regulatory investigations and penalties, and adversely impact our business and financial condition.

We have not conducted an evaluation of the effectiveness of our internal control over financial reporting and will not be required to do so until well after we are a public company. If we are unable to implement and maintain effective internal control over financial reporting investors may lose confidence in the accuracy and completeness of our financial reports and the market price of our Common Stock may be negatively affected.

In the future, we hope to list as a public company or apply to trade it in the over-the-counter market. At that time various accounting rules applicable to public companies may apply to us. We can make no assurances that we have the procedures in place to make sure we meet those requirements, and compliance will be a burden. If and when required, an independent registered public accounting firm is unable to express an opinion as to the effectiveness of our internal control over financial reporting, at that time, investors may lose confidence in the accuracy and completeness of our financial reports and the market price of our Common Stock could be negatively affected, and we could become subject to investigations by the stock exchange on which our securities are listed, the SEC, or other regulatory authorities, which could require additional financial and management resources.

RISKS RELATED TO OWNERSHIP OF OUR COMMON STOCK

We have not paid cash dividends on Common Stock in the past and do not expect to pay dividends in the future. Any return on investment or return of investment may be limited to the value of our Common Stock, if any.

We have never paid cash dividends on our Common Stock and do not anticipate doing so in the foreseeable future. The payment of dividends on our Common Stock will depend on earnings, financial condition and other business and economic factors affecting us at such time as our board of directors may consider relevant. If we do not pay dividends, our Common Stock may be less valuable because a return on your investment will only occur if our stock price appreciates.

There is currently no trading market for our Common Stock, and we cannot ensure that one will ever develop or be sustained.

There is no current market for any of our shares of stock and a market may not develop. We hope to eventually apply to trade our Common Stock on the over-the-counter market to the extent any demand exists. Even if quoted on the OTCQB, OTCQX or the Pink Sheets, a liquid trading market may not develop. Investors should assume that they may not be able to liquidate their investment for some time, or they may not be able to pledge their shares as collateral. Even if traded, we may be subject to the penny stock rules and may not be able to have our stock accepted by many brokerage firms as a result. The Company intends to apply to trade its shares on the Pink Sheets following the Offering, but there is no assurance that it will accomplish this goal.

You will likely experience future dilution as a result of future equity offerings.

We may in the future offer additional shares of our Common Stock or other securities convertible into or exchangeable for our Common Stock. Although no assurances can be given that we will consummate a financing, in the event we do, or in the event we sell shares of Common Stock or other securities convertible into shares of our Common Stock in the future, additional and substantial dilution may occur. In addition, investors purchasing shares of Common Stock or other securities in the future could have rights superior to investors in the Offering. Subsequent offerings at a lower price (a "down round") could result in additional dilution.

Our stock price may experience significant volatility.

In recent years, stock markets in general, and the market for life sciences technology companies in particular (including companies in the genomics, biotechnology, diagnostics, and related sectors), have experienced significant price and volume fluctuations that have often been unrelated or disproportionate to changes in the operating performance of the companies whose stock is experiencing those price and volume fluctuations. Broad market and industry factors may seriously affect the market price of our common stock, regardless of our actual operating performance. These fluctuations may be even more pronounced in the trading markets for our stock shortly following this offering. Following periods of such volatility in the market price of a Company's securities, securities class action litigation has often been brought against that Company. Because of the potential volatility of our Common Stock price, we may become the target of securities litigation in the future. Securities litigation could result in substantial costs and divert management's attention and resources from our business.

Raising additional capital may cause dilution to our existing stockholders or restrict our operations.

We anticipate that we will seek additional capital through a combination of public and private equity offerings, debt financings, strategic partnerships and alliances and licensing arrangements in the future to fund our operations. We, and indirectly, our stockholders, will bear the cost of issuing and servicing such securities. Because our decision to issue debt or equity securities in any future offering will depend on market conditions and other factors beyond our control, we cannot predict or estimate the amount, timing, or nature of any future offerings. Our decision to issue debt or equity securities will also depend on contractual, legal, and other restrictions that may limit our ability to raise additional capital. To the extent that we raise additional capital through the sale of equity or debt securities, your ownership interest will be diluted, and the terms may include liquidation or other preferences that adversely affect your rights as a stockholder. The incurrence of indebtedness in the future could result in fixed payment obligations and could involve restrictive covenants, such as limitations on our ability to incur additional debt, limitations on our ability to acquire, sell or license intellectual property rights and other operating restrictions that could adversely impact our ability to conduct our business. Certain of the foregoing transactions may require us to obtain stockholder approval, which we may not be able to obtain.

If securities or industry analysts do not publish research or reports about our business or publish negative reports about our business, our share price and trading volume could decline.

The trading market for our Common Stock may depend in the future on the research and reports that securities or industry analysts publish about us or our business. We do not and will not have any control over these analysts. If one or more of the analysts who may cover us downgrade our shares or change their opinion of our Common Stock, our share price would likely decline. If one or more of these analysts cease coverage of our Company or fail to regularly publish reports on us, we could lose visibility in the financial markets, which could cause our Common Stock price or trading volume to decline.

RISKS RELATED TO MANUFACTURING AND SUPPLY

Our technology requires specific chemicals and other materials and use of specialized laboratory equipment and the inability to obtain those materials and to gain access to such equipment may have a material adverse effect on our ability to develop Tru3D technology platform.

Reagents, chemicals and biological materials needed for development of our Tru3D technology platform tool may be difficult to procure, requiring in-house production or preventing development of our platform and our ability to offer our services to our customers. Inability to obtain these materials and may slow down or negatively impact the development of our Tru3D technology platform, which will limit or prevent our ability to develop a useful technology for 3-D tissue analysis.

RISKS RELATED TO INTELLECTUAL PROPERTY RIGHTS AND LITIGATION

If we fail to successfully protect our intellectual property, our competitive position and operating results could suffer.

We rely on our Tru3D technology platform (including the CLARITY technology licensed from Stanford University), as well as the technical expertise, creativity, and knowledge of our personnel to maintain our position as a leading technology provider of 3D tissue analysis technology to facilitate pre-clinical and clinical research applications. Technology piracy and reverse engineering, specifically from companies in Russia and Asia, may result in counterfeit products and services that are misrepresented in the market as Tru3D products and services. To protect our intellectual property, we keep product development in-house, we limit the amount of reagents provided to clients, partners, and collaborators, and we include other preventative measures against technology piracy. We also rely on patent, trademark, copyright, and trade secret protection, as well as non-disclosure agreements with customers, suppliers, employees, and consultants as well as restricting access to our proprietary information by a combination of technical and internal security measures. These measures, however, may not be adequate to:

| ● | Protect our proprietary technology, |

| ● | Protect our patents from challenge, invalidation, or circumvention, or |

| ● | Ensure that our intellectual property will provide us with competitive advantages. |

From time to time, we may be subject to various claims and lawsuits by competitors, customers, or other parties arising in the ordinary course of business, including lawsuits charging patent infringement, or claims and lawsuits instituted by us to protect our intellectual property or for other reasons. These matters can be time-consuming, divert management's attention and resources, and cause us to incur significant expenses, regardless of the merit of a particular lawsuit or the eventual outcome. Furthermore, the results of any of these actions may have a material adverse effect on our operating results.

If we fail to successfully maintain our licensed technology, the license for our technology relating to CLARITY could be terminated by Stanford University. As a result, our competitive position and operating results could suffer.

Any of the following adverse circumstances could have a material adverse effect on our operating results:

Stanford University could terminate our license for CLARITY:

(1) if the Company is delinquent on any report or payment;

(2) if the Company is not diligently developing and commercializing the licensed technology;

(3) if the Company misses a milestone;

(4) if the Company is in breach of any provision of the License Agreement; or

(5) if the Company provides any false report

The Company may be subject to milestones which we may not be able to meet under the Stanford University License Agreement.

If we are unable to obtain and maintain sufficient intellectual property protection for our products and product candidates that we may identify, or if the scope of the intellectual property protection obtained is not sufficiently broad, our competitors could develop and commercialize products similar or identical to ours, and our ability to successfully commercialize our products and product candidates that we may pursue may be impaired.

As is the case with other companies in the biopharmaceutical sector, our success depends in large part on our ability to obtain and maintain protection of the intellectual property we may own or license from others, particularly patents, in the United States and other countries with respect to our product candidates and technology.

Obtaining and enforcing patents is costly, time consuming and complex, and we may not be able to file and prosecute all necessary or desirable patent applications, or maintain, enforce, and license any patents that may issue from such patent applications, at a reasonable cost or in a timely manner. It is also possible that we will fail to identify patentable aspects of our research and development output before it is too late to obtain patent protection. We may not have the right to control the preparation, filing and prosecution of patent applications, or to maintain the rights to patents licensed from third parties.

The patent position of companies in the biotechnology and pharmaceutical sector generally is highly uncertain, involves complex legal, technological, and factual questions and has in recent years been the subject of much litigation. In addition, the laws of foreign countries may not protect our rights to the same extent as the laws of the United States, or vice versa. Further, we may not be aware of all third-party intellectual property rights potentially relating to our product candidates. We cannot know with certainty whether we were the first to make the inventions claimed in our patents or pending patent applications, or that we were the first to file for patent protection of such inventions. As a result, the issuance, scope, validity, enforceability and commercial value of our patent rights are highly uncertain. Our pending and future patent applications may not result in patents being issued that protect our products and product candidates, in whole or in part, or which effectively prevent others from commercializing competitive products. Even if our patent applications issue as patents, they may not issue in a form that will provide us with any meaningful protection, prevent competitors from competing with us or otherwise provide us with any competitive advantage. Our competitors may be able to circumvent our patents by developing similar or alternative product candidates in a non-infringing manner.

Moreover, we may be subject to a third-party pre-issuance submission of prior art to the United States Patent and Trademark Office, or the USPTO, or become involved in opposition, derivation, reexamination, inter partes review, post-grant review or interference proceedings challenging our patent rights or the patent rights of others. An adverse determination in any such submission, proceeding or litigation could reduce the scope of, or invalidate, our patent rights, allow third parties to commercialize our product candidates and compete directly with us, without payment to us, or result in our inability to manufacture or commercialize drugs without infringing third-party patent rights. In addition, if the breadth or strength of protection provided by our patents and patent applications is threatened, regardless of the outcome, it could dissuade companies from collaborating with us to license, develop or commercialize current or future product candidates.

In addition, the issuance of a patent is not conclusive as to its inventorship, scope, validity or enforceability, and our patents may be challenged in the courts or patent offices in the United States and abroad. Such challenges may result in loss of exclusivity or freedom to operate or in patent claims being narrowed, invalidated, or held unenforceable, in whole or in part, which could limit our ability to stop others from using or commercializing similar or identical product candidates, or limit the duration of the patent protection of our product candidates. Given the amount of time required for the development, testing and regulatory review of new product candidates, patents protecting such candidates might expire before or shortly after such candidates are commercialized. As a result, our patent portfolio may not provide us with sufficient rights to exclude others from commercializing drugs similar or identical to ours.

If we fail to comply with our obligations in the agreements under which we license intellectual property rights from third parties or otherwise experience disruptions to our business relationships with our licensors, we could lose intellectual property rights that are important to our business.

We are a party to an exclusive license agreement with Stanford and may need to obtain additional licenses from others to advance our research and development activities or allow the commercialization of our products and product candidates. Our license agreement with Stanford imposes, and we expect that future license agreements will impose, various development, diligence, commercialization, and other obligations on us. For example, under our license agreement with Stanford we are required to use commercially reasonable efforts to engage in various development and commercialization activities with respect to licensed products, and to satisfy specified milestone and royalty payment obligations. In spite of our efforts, our licensors might conclude that we have materially breached our obligations under such license agreements and might therefore terminate the license agreements, thereby removing or limiting our ability to develop and commercialize products and technology covered by these license agreements. If these licenses are terminated, or if the underlying patents fail to provide the intended exclusivity, competitors or other third parties would have the freedom to market products identical to ours, and we may be required to cease development and commercialization of our products and product candidates. Any of the foregoing could have a material adverse effect on our competitive position, business, financial conditions, results of operations, and prospects.

Moreover, disputes may arise regarding intellectual property subject to a licensing agreement, including:

● | the scope of rights granted under the license agreement and other interpretation-related issues; |

● | the extent to which our product candidates, technology and processes infringe on intellectual property of the licensor that is not subject to the licensing agreement; |

● | the sublicensing of patent and other rights under our collaborative development relationships; |

● | our diligence obligations under the license agreement and what activities satisfy those diligence obligations; |

● | the inventorship and ownership of inventions and know-how resulting from the joint creation or use of intellectual property by our licensors and us and our partners; and |

● | the priority of invention of patented technology. |

In addition, the agreements under which we currently license intellectual property or technology from third parties are complex, and certain provisions in such agreements may be susceptible to multiple interpretations. The resolution of any contract interpretation disagreement that may arise could narrow what we believe to be the scope of our rights to the relevant intellectual property or technology, or increase what we believe to be our financial or other obligations under the relevant agreement, either of which could have a material adverse effect on our business, financial condition, results of operations, and prospects. Moreover, if disputes over intellectual property that we have licensed prevent or impair our ability to maintain our current licensing arrangements on commercially acceptable terms, we may be unable to successfully develop and commercialize the affected product candidates, which could have a material adverse effect on our business, financial conditions, results of operations, and prospects.

Third-party claims of intellectual property infringement may prevent or delay our development and commercialization efforts.

Our commercial success depends in part on our avoiding infringement of the patents and proprietary rights of third parties. However, our research, development and commercialization activities may be subject to claims that we infringe or otherwise violate patents or other intellectual property rights owned or controlled by third parties. There is a substantial amount of litigation, both within and outside the United States, involving patent and other intellectual property rights in the biotechnology industry, including patent infringement lawsuits, interferences, oppositions and inter partes reexamination proceedings before the USPTO, and corresponding foreign patent offices. Numerous U.S. and foreign issued patents and pending patent applications, which are owned by third parties, exist in the fields in which we are pursuing development candidates, and we may be subject to claims of infringement of the patent rights of third parties.

Third parties may assert that we are employing their proprietary technology without authorization. There may be third-party patents or patent applications with claims to materials, methods, or methods of manufacture related to the use or manufacture of our products and product candidates. Because patent applications can take many years to issue, there may be currently pending patent applications which may later result in issued patents that our products and product candidates may infringe. In addition, third parties may obtain patents in the future and claim that use of our technologies infringes upon these patents. If any third-party patents were held by a court of competent jurisdiction to cover our products, their use, or their manufacture, the holders of any such patents may be able to block our ability to commercialize such product candidate unless we obtained a license under the applicable patents, or until such patents expire. Such a license may not be available on commercially reasonable terms or at all, or it may be non-exclusive, which could result in our competitors gaining access to the same intellectual property.

Parties making claims against us may obtain injunctive or other equitable relief, which could effectively block our ability to further develop and commercialize our products and product candidates. Defense of these claims, regardless of their merit, would involve substantial litigation expense and would be a substantial diversion of employee resources from our business. In the event of a successful claim of infringement against us, we may have to pay substantial damages, including treble damages and attorneys' fees for willful infringement, pay royalties, redesign our infringing products or obtain one or more licenses from third parties, which may be impossible or require substantial time and monetary expenditure.

Parties making claims against us may be able to sustain the costs of complex patent litigation more effectively than we can because they have substantially greater resources. Furthermore, because of the substantial amount of discovery required in connection with intellectual property litigation or administrative proceedings, there is a risk that some of our confidential information could be compromised by disclosure. In addition, any uncertainties resulting from the initiation and continuation of any litigation could have material adverse effect on our ability to raise additional funds or otherwise have a material adverse effect on our business, results of operations, financial condition, and prospects.

Patent terms may be inadequate to protect our competitive position on our product candidates for an adequate amount of time.

Patents have a limited lifespan. In the United States, if all maintenance fees are timely paid, the natural expiration of a patent is generally 20 years from its earliest U.S. non-provisional filing date. Various extensions may be available, but the life of a patent, and the protection it affords, is limited. Even if patents covering our products and product candidates are obtained, once the patent life has expired, we may be open to competition from competitive products. As a result, our patent portfolio may not provide us with sufficient rights to exclude others from commercializing products similar or identical to ours.

If we are unable to protect the confidentiality of our trade secrets, the value of our technology could be materially adversely affected, and our business would be harmed.

We seek to protect our confidential proprietary information, in part, by confidentiality agreements and invention assignment agreements with our employees, consultants, scientific advisors, contractors and collaborators. These agreements are designed to protect our proprietary information. However, we cannot be certain that such agreements have been entered into with all relevant parties, and we cannot be certain that our trade secrets and other confidential proprietary information will not be disclosed or that competitors will not otherwise gain access to our trade secrets or independently develop substantially equivalent information and techniques. For example, any of these parties may breach the agreements and disclose our proprietary information, including our trade secrets, and we may not be able to obtain adequate remedies for such breaches. We also seek to preserve the integrity and confidentiality of our confidential proprietary information by maintaining physical security of our premises and physical and electronic security of our information technology systems, but it is possible that these security measures could be breached. If any of our confidential proprietary information were to be lawfully obtained or independently developed by a competitor, we would have no right to prevent such competitor from using that technology or information to compete with us, which could harm our competitive position.

Although we are not currently involved in any litigation, we may become involved in lawsuits to protect or enforce our patents or other intellectual property, which could be expensive, time consuming and unsuccessful.

Competitors may infringe our patents or other intellectual property. If we or one of our licensing partners initiated legal proceedings against a third party to enforce a patent covering one of our products or product candidates, the defendant could counterclaim that the patent covering our product or product candidate is invalid and/or unenforceable. In patent litigation in the United States, defendant counterclaims alleging invalidity and/or unenforceability are commonplace. Grounds for a validity challenge could be an alleged failure to meet any of several statutory requirements, including lack of novelty, obviousness, or non-enablement. Grounds for an unenforceability assertion could be an allegation that someone connected with prosecution of the patent withheld relevant information from the USPTO, or made a misleading statement, during prosecution. Third parties may also raise similar claims before administrative bodies in the United States or abroad, even outside the context of litigation. Such mechanisms include re-examination, post grant review, and equivalent proceedings in foreign jurisdictions (e.g., opposition proceedings). Such proceedings could result in revocation or amendment to our patents in such a way that they no longer cover our product candidates. The outcome following legal assertions of invalidity and unenforceability is unpredictable. With respect to the validity question, for example, we cannot be certain that there is no invalidating prior art, of which we and the patent examiner were unaware during prosecution. If a defendant were to prevail on a legal assertion of invalidity and/or unenforceability, we would lose at least part, and perhaps all, of the patent protection on our product candidates. Such a loss of patent protection would have a material adverse impact on our business.

Interference or derivation proceedings provoked by third parties or brought by us or declared by the USPTO may be necessary to determine the priority of inventions with respect to our patents or patent applications. An unfavorable outcome could require us to cease using the related technology or to attempt to license rights to it from the prevailing party. Our business could be harmed if the prevailing party does not offer us a license on commercially reasonable terms or at all, or if a non-exclusive license is offered and our competitors gain access to the same technology. Our defense of litigation or interference or derivation proceedings may fail and, even if successful, may result in substantial costs and distract our management and other employees. In addition, the uncertainties associated with litigation could have a material adverse effect on our ability to raise the funds necessary to continue our clinical trials, continue our research programs, license necessary technology from third parties, or enter into development partnerships that would help us bring our product candidates to market.

Furthermore, because of the substantial amount of discovery required in connection with intellectual property litigation, there is a risk that some of our confidential information could be compromised by disclosure during this type of litigation. There could also be public announcements of the results of hearings, motions, or other interim proceedings or developments. If securities analysts or investors perceive these results to be negative, it could have a material adverse effect on the price of our common stock.

We may be subject to claims challenging the inventorship of our patents and other intellectual property.

We or our licensors may be subject to claims that former employees, collaborators or other third parties have an interest in our owned or in-licensed patents, trade secrets, or other intellectual property as an inventor or co-inventor. For example, we or our licensors may have inventorship disputes arise from conflicting obligations of employees, consultants or others who are involved in developing our product candidates. Litigation may be necessary to defend against these and other claims challenging inventorship or our or our licensors' ownership of our owned or in-licensed patents, trade secrets or other intellectual property. If we or our licensors fail in defending any such claims, in addition to paying monetary damages, we may lose valuable intellectual property rights, such as exclusive ownership of, or right to use, intellectual property that is important to our product candidates. Even if we are successful in defending against such claims, litigation could result in substantial costs and be a distraction to management and other employees. Any of the foregoing could have a material adverse effect on our business, financial condition, results of operations and prospects.

We may be subject to claims that our employees, consultants, or independent contractors have wrongfully used or disclosed confidential information of third parties or that our employees have wrongfully used or disclosed alleged trade secrets of their former employers.

As is common in the biotechnology industry, we employ individuals who were previously employed at universities or other biotechnology companies. Although we try to ensure that our employees, consultants, and independent contractors do not use the proprietary information or know-how of others in their work for us, we may be subject to claims that we or our employees, consultants or independent contractors have inadvertently or otherwise used or disclosed intellectual property, including trade secrets or other proprietary information, of any of our employee's former employer or other third parties. Litigation may be necessary to defend against these claims. If we fail in defending any such claims, in addition to paying monetary damages, we may lose valuable intellectual property rights or personnel, which could adversely impact our business. Even if we are successful in defending against such claims, litigation could result in substantial costs and be a distraction to management and other employees.

Obtaining and maintaining our patent protection depends on compliance with various procedural, document submission, fee payment and other requirements imposed by governmental patent agencies, and our patent protection could be reduced or eliminated for non-compliance with these requirements.

Periodic maintenance fees, renewal fees, annuity fees and various other governmental fees on patents and/or applications will be due to be paid to the USPTO and various governmental patent agencies outside of the United States in several stages over the lifetime of the patents and/or applications. We have systems in place to remind us to pay these fees, and we employ an outside firm and rely on our licensor to pay these fees due to non-U.S. patent agencies. The USPTO and various non-U.S. governmental patent agencies require compliance with a number of procedural, documentary, fee payment and other similar provisions during the patent application process. We employ reputable law firms and other professionals to help us comply, and in many cases, an inadvertent lapse can be cured by payment of a late fee or by other means in accordance with the applicable rules. However, there are situations in which non-compliance can result in abandonment or lapse of the patent or patent application, resulting in partial or complete loss of patent rights in the relevant jurisdiction. In such an event, our competitors might be able to enter the market and this circumstance would have a material adverse effect on our business.

We may not be able to protect our intellectual property rights throughout the world.

Filing, prosecuting, and defending patents on our product candidates in all countries throughout the world would be prohibitively expensive, and our intellectual property rights in some countries outside the United States can be less extensive than those in the United States or non-existent. In addition, the laws of some foreign countries do not protect intellectual property rights to the same extent as federal and state laws in the United States. Consequently, we may not be able to prevent third parties from practicing our inventions in all countries outside the United States, or from selling or importing products made using our inventions in and into the United States or other jurisdictions. Competitors may use our technologies in jurisdictions where we have not obtained patent protection to develop their own products and may also export infringing products to territories where we have patent protection, but enforcement is not as strong as that in the United States. These products may compete with our products, and our patents or other intellectual property rights may not be effective or sufficient to prevent them from competing.

Changes in U.S. patent law could diminish the value of patents in general, thereby impairing our ability to protect our products.

Changes in either the patent laws or interpretation of the patent laws in the United States could increase the uncertainties and costs surrounding the prosecution of patent applications and the enforcement or defense of issued patents. Assuming that other requirements for patentability are met, prior to March 2013, in the United States, the first to invent the claimed invention was entitled to the patent, while outside the United States, the first to file a patent application was entitled to the patent. After March 2013, under the Leahy-Smith America Invents Act, or the America Invents Act, enacted in September 2011, the United States transitioned to a first inventor to file system in which, assuming that other requirements for patentability are met, the first inventor to file a patent application will be entitled to the patent on an invention regardless of whether a third party was the first to invent the claimed invention. A third party that files a patent application in the USPTO after March 2013, but before us could therefore be awarded a patent covering an invention of ours even if we had made the invention before it was made by such third party. This will require us to be cognizant of the time from invention to filing of a patent application. Since patent applications in the United States and most other countries are confidential for a period of time after filing or until issuance, we cannot be certain that we or our licensors were the first to either (i) file any patent application related to our product candidates or (ii) invent any of the inventions claimed in our or our licensor's patents or patent applications.

The America Invents Act also includes a number of significant changes that affect the way patent applications will be prosecuted and also may affect patent litigation. These include allowing third party submission of prior art to the USPTO during patent prosecution and additional procedures to attack the validity of a patent by USPTO administered post-grant proceedings, including post-grant review, inter partes review, and derivation proceedings. Because of a lower evidentiary standard in USPTO proceedings compared to the evidentiary standard in United States federal courts necessary to invalidate a patent claim, a third party could potentially provide evidence in a USPTO proceeding sufficient for the USPTO to hold a claim invalid even though the same evidence would be insufficient to invalidate the claim if first presented in a district court action. Accordingly, a third party may attempt to use the USPTO procedures to invalidate our patent claims that would not have been invalidated if first challenged by the third party as a defendant in a district court action. Therefore, the America Invents Act and its implementation could increase the uncertainties and costs surrounding the prosecution of our owned or in-licensed patent applications and the enforcement or defense of our owned or in-licensed issued patents, all of which could have a material adverse effect on our business, financial condition, results of operations, and prospects.

In addition, the patent positions of companies in the development and commercialization of biotechnology products are particularly uncertain. Recent U.S. Supreme Court rulings have narrowed the scope of patent protection available in certain circumstances and weakened the rights of patent owners in certain situations. This combination of events has created uncertainty with respect to the validity and enforceability of patents, once obtained. Depending on future actions by the U.S. Congress, the federal courts, and the USPTO, the laws and regulations governing patents could change in unpredictable ways that could have a material adverse effect on our existing patent portfolio and our ability to protect and enforce our intellectual property in the future.

Some intellectual property that we have in-licensed may have been discovered through government funded programs and thus may be subject to federal regulations such as "march-in" rights, certain reporting requirements and a preference for U.S.-based companies. Compliance with such regulations may limit our exclusive rights, and limit our ability to contract with non-U.S. manufacturers.

Many of the intellectual property rights we have licensed are generated through the use of U.S. government funding and are therefore subject to certain federal regulations. As a result, the U.S. government may have certain rights to intellectual property embodied in our current or future product candidates pursuant to the Bayh-Dole Act of 1980, or Bayh-Dole Act, and implementing regulations. These U.S. government rights in certain inventions developed under a government-funded program include a non-exclusive, non-transferable, irrevocable worldwide license to use inventions for any governmental purpose. In addition, the U.S. government has the right to require us or our licensors to grant exclusive, partially exclusive, or non-exclusive licenses to any of these inventions to a third party if it determines that: (i) adequate steps have not been taken to commercialize the invention; (ii) government action is necessary to meet public health or safety needs; or (iii) government action is necessary to meet requirements for public use under federal regulations (also referred to as "march-in rights"). The U.S. government also has the right to take title to these inventions if we, or the applicable licensor, fail to disclose the invention to the government and fail to file an application to register the intellectual property within specified time limits. These time limits have recently been changed by regulation, and may change in the future. Intellectual property generated under a government funded program is also subject to certain reporting requirements, compliance with which may require us or the applicable licensor to expend substantial resources. In addition, the U.S. government requires that any products embodying the subject invention or produced through the use of the subject invention be manufactured substantially in the United States. The manufacturing preference requirement can be waived if the owner of the intellectual property can show that reasonable but unsuccessful efforts have been made to grant licenses on similar terms to potential licensees that would be likely to manufacture substantially in the United States or that under the circumstances domestic manufacture is not commercially feasible. This preference for U.S. manufacturers may limit our ability to contract with non-U.S. product manufacturers for products covered by such intellectual property. To the extent any of our current or future intellectual property is generated through the use of U.S. government funding, the provisions of the Bayh-Dole Act may similarly apply. We may be exposed to product liability claims and may not be able to obtain or maintain adequate product liability insurance.

RISKS RELATED TO GOVERNMENT REGULATION

If the FDA determines that our products are medical devices or if we seek to market our products or services for clinical, diagnostic or health screening use, we will be required to obtain regulatory clearance(s) or approval(s), and may be required to cease or limit sales of our then marketed products, which could materially and adversely affect our business, financial condition, and results of operations. Any such regulatory process would be expensive, time-consuming, and uncertain, both in timing and in outcome.

We have focused initially on the life sciences research market. This includes laboratories associated with academic and governmental research institutions, as well as pharmaceutical, biotechnology and contract research companies. Accordingly, our products are labeled as "Research Use Only," or RUO, and are not intended for diagnostic use. While we have focused initially on the life sciences research market and RUO products only, our strategy is to expand our product line to encompass products that are intended to be used for the diagnosis of disease, either alone or in collaboration with third parties. Such in-vitro diagnostic, or IVD, products will be subject to regulation by the FDA as medical devices, or comparable international agencies, including requirements for regulatory clearance or approval of such products before they can be marketed. If the FDA were to determine that our products are intended for clinical use or if we decided to market our products for such use, we would be required to obtain FDA 510(k) clearance or premarket approval in order to sell our products in a manner consistent with FDA laws and regulations. Such regulatory approval processes or clearances are expensive, time-consuming, and uncertain; our efforts may never result in any approved premarket approval application, or PMA, or 510(k) clearance for our products; and failure by us or a collaborator to obtain or comply with such approvals and clearances could have an adverse effect on our business, financial condition, or operating results.

IVD products may be regulated as medical devices by the FDA and comparable international agencies and may require either clearance from the FDA following the 510(k) pre-market notification process or PMA from the FDA, in each case prior to marketing. If we or our collaborators are required to obtain a PMA or 510(k) clearance for products based on our technology, we or they would be subject to a substantial number of additional requirements for medical devices, including establishment registration, device listing, Quality Systems Regulations which cover the design, testing, production, control, quality assurance, labeling, packaging, servicing, sterilization (if required), and storage and shipping of medical devices (among other activities), product labeling, advertising, recordkeeping, post-market surveillance, post-approval studies, adverse event reporting, and correction and removal (recall) regulations. One or more of the products we or a collaborator may develop using our technology may also require clinical trials in order to generate the data required for PMA approval. Complying with these requirements will be time-consuming and expensive. We or our collaborators would be required to expend significant resources to ensure ongoing compliance with the FDA regulations and/or take satisfactory corrective action in response to enforcement action, which may have a material adverse effect on the ability to design, develop, and commercialize products using our technology as planned. Failure to comply with these requirements may subject us or a collaborator to a range of enforcement actions, such as warning letters, injunctions, civil monetary penalties, criminal prosecution, recall and/or seizure of products, and revocation of marketing authorization, as well as significant adverse publicity. If we or our collaborators fail to obtain, or experience significant delays in obtaining, regulatory approvals for IVD products, such products may not be able to be launched or successfully commercialized in a timely manner, or at all.

Laboratory developed tests, or LDTs, are a subset of IVD tests that are designed, manufactured, and used within a single laboratory. The FDA maintains that LDTs are medical devices and has for the most part exercised enforcement discretion for most LDTs. A significant change in the way that the FDA regulates any LDTs that we, our collaborators, or our customers develop using our technology could affect our business. If the FDA requires laboratories to undergo premarket review and comply with other applicable FDA requirements in the future, the cost and time required to commercialize an LDT will increase substantially and may reduce the financial incentive for laboratories to develop LDTs, which could reduce demand for our instruments and our other products. In addition, if the FDA were to change the way that it regulates LDTs to require that we undergo pre-market review or comply with other applicable FDA requirements before we can sell our instruments or our other products to clinical laboratories, our ability to sell our instruments and other products to this addressable market would be delayed, thereby impeding our ability to penetrate this market and generate revenue from sales of our instruments and our other products.

Failure to comply with applicable FDA requirements could subject us to misbranding or adulteration allegations under the Federal Food, Drug, and Cosmetic Act. We could be subject to a range of enforcement actions, including warning letters, injunctions, civil monetary penalties, criminal prosecution, and recall and/or seizure of products, as well as significant adverse publicity. In addition, changes to the current regulatory framework, including the imposition of additional or new regulations, could arise at any time during the development or marketing of our products, which may negatively affect our ability to obtain or maintain FDA or comparable regulatory approval of our products, if required.

Foreign jurisdictions have laws and regulations similar to those described above, which may adversely affect our ability to market our products as planned in such countries. The number and scope of these requirements are increasing. As in the U.S., the cost and time required to comply with regulatory requirements may be substantial, and there is no guarantee that we will obtain the necessary authorization(s) required to make our products commercially viable. As a result, the imposition of foreign requirements may also have a material adverse effect on the commercial viability of our operations.

Our biotech tool candidates are unproven and may not be approved by the FDA. We are committing a majority of our resources to the development of biotech tools to disrupt the diagnostic, prognostic, and predictive treatment of disease through technology that will non-destructively and digitally analyze diseased and normal tissue in 3D. Currently, our focus is on the life sciences research use only (RUO) market, where FDA clearance or approval is not required. However, in the future, we may develop products or services for clinical use. If so, these products and services may require FDA clearance or approval. There can be no assurance that any product or service candidate will meet FDA's standards for commercial distribution. Further, there can be no assurance that other product candidates that may be developed will achieve the targeted end points in the required clinical studies or perform as intended in other pre-clinical and clinical studies or lead to a submission or filing acceptance. Our failure to successfully develop and achieve final FDA approval of our product candidates may then have a material adverse effect on our financial condition.

Our operations are subject to environmental, health and safety, and other laws and regulations, with which compliance is costly and which exposes us to penalties for non-compliance.

Our business, properties and product candidates are subject to federal, state and local laws and regulations relating to the protection of the environment, natural resources and worker health and safety and the use, management, storage and disposal of hazardous substances, waste and other regulated materials. Various environmental laws also may impose liability on us for the costs of cleaning up and responding to hazardous substances that may have been released on our property, including releases unknown to us. These environmental laws and regulations also could require us to pay for environmental remediation and response costs at third-party locations where we dispose of or recycle hazardous substances. The costs of complying with these various environmental requirements, as they now exist or may be altered in the future, could adversely affect our financial condition and results of operations.

Future legislation may increase the difficulty and cost for us, to obtain, or prevent us from obtaining, marketing approval of and commercialize our product and service candidates and affect the prices we may obtain.