Transfer of the Transferor Interest and Role of Transferor from Chase USA to Chase Card Funding

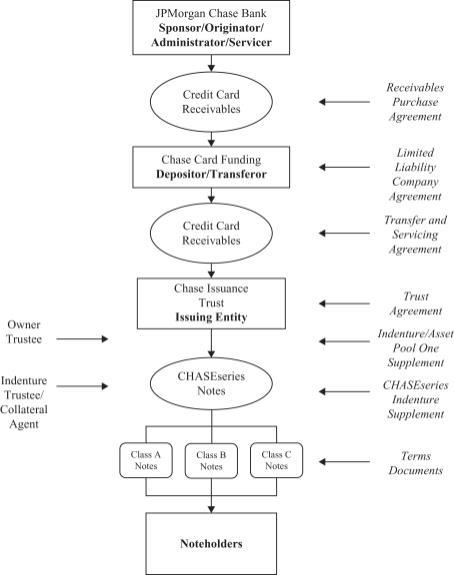

On January 20, 2016, Chase Card Funding took over the role of transferor, and assumed the corresponding covenants and obligations thereto. On that same date, Chase USA, the predecessor to JPMorgan Chase Bank, conveyed the Transferor Certificate and certain tranches of retained subordinated notes to Chase Card Funding. The transfer of such assets may be treated as a capital contribution by JPMorgan Chase Bank to Chase Card Funding or may be paid for by Chase Card Funding in the form of a loan under a subordinated note issued by Chase Card Funding in favor of JPMorgan Chase Bank or a combination thereof.

JPMorgan Chase Bank

General

JPMorgan Chase Bank is the sponsor of, and the servicer for, the issuing entity and is the originator of the credit card receivables. JPMorgan Chase Bank is also the administrator of the issuing entity.

On the Merger Date, Chase USA was merged with and into JPMorgan Chase Bank with JPMorgan Chase Bank as the surviving entity. Prior to the Merger Date, Chase USA was the sponsor, originator administrator and servicer of the issuing entity. On the Merger Date, JPMorgan Chase Bank succeeded Chase USA as sponsor, originator, administrator and servicer of the issuing entity and sole member of Chase Card Funding, the depositor and transferor of the issuing entity.

JPMorgan Chase Bank is a wholly-owned bank subsidiary of JPMorgan Chase, which is a leading global financial services firm and one of the largest banking institutions in the United States, with operations worldwide. JPMorgan Chase Bank is a national banking association that is subject to supervision and regulation by the OCC. JPMorgan Chase Bank’s main office is located in Columbus, Ohio, and it has retail branches in 38 states and Washington, D.C.

JPMorgan Chase Bank operates nationally as well as through non-U.S. bank branches and subsidiaries, and representative offices. JPMorgan Chase Bank either directly or through such branches, subsidiaries and offices offers a wide range of banking services to its U.S. and non-U.S. customers including investment banking, financial services for consumers and small businesses, commercial banking, financial transactions processing and asset management. Under the J.P. Morgan and Chase brands, JPMorgan Chase Bank serves millions of customers in the U.S. and many of the world’s most prominent corporate, institutional and government clients. JPMorgan Chase Bank’s principal operating subsidiary in the U.K. is J.P. Morgan Securities plc.

JPMorgan Chase Bank’s activities that relate to consumer and small business credit card lending and other forms of consumer lending are primarily operated out of its offices located at 201 North Walnut Street, Wilmington, Delaware 19801. JPMorgan Chase Bank is one of the largest issuers of VISA® and Mastercard® credit cards in the United States.

JPMorgan Chase Bank offers a wide variety of bankcard products to targeted segments of creditworthy customers throughout the United States, most of whom are experienced users of general purpose credit products. These products cover a range which includes both Chase-branded products as well as products that are developed and marketed through co-brand partnerships.

JPMorgan Chase Bank markets a variety of bankcard products through multiple distribution channels, including direct mail, the extensive branch network of JPMorgan Chase Bank, an array of websites and other direct response media channels.

The principal executive office of JPMorgan Chase Bank is located at 383 Madison Avenue, New York, New York 10179, and its telephone number is (212) 270-6000.

General Securitization Experience

JPMorgan Chase Bank and its predecessor institutions have been securitizing credit card receivables since 1990. The First USA Credit Card Master Trust was established in September 1992 by First USA Bank, a predecessor of JPMorgan Chase Bank, and was active until it was terminated in December 2013. The Chase Credit Card Master Trust (formerly known as Chemical Master Credit Card Trust I), which was established in October 1995 by Chemical Bank, a predecessor of JPMorgan Chase Bank, was active through August 15, 2017 until it was terminated on May 18, 2019.

JPMorgan Chase Bank securitizes its credit card receivables because the market for securitization of financial assets provides JPMorgan Chase Bank with a diversified source of funding and liquidity among different markets and investors. JPMorgan Chase Bank meets a portion of its funding requirements through securitization of its credit card receivables. JPMorgan Chase Bank participates in the securitization market in the United States.

37