U.S. SECURITIES AND EXCHANGE COMMISSION

Washington D.C. 20549

FORM 6-K

REPORT OF FOREIGN PRIVATE ISSUER PURSUANT TO RULE 13a-16 OR 15d-16

UNDER THE SECURITIES EXCHANGE ACT OF 1934

For the month of November, 2014

Commission File No.:001-04192

MFC Industrial Ltd.

(Translation of Registrant’s name into English)

Suite #1620 - 400 Burrard Street, Vancouver, British Columbia, Canada V6C 3A6

(Address of principal executive office)

Indicate by check mark whether the registrant files or will file annual reports under cover of Form 20-F or Form 40-F.

Indicate by check mark whether the registrant is submitting the Form 6-K in paper as permitted by Regulation S-T Rule 101(b)(1):o

Note: Regulation S-T Rule 101(b)(1) only permits the submission in paper of a Form 6-K if submitted solely to provide an attached annual report to security holders.

Indicate by check mark whether the registrant is submitting the Form 6-K in paper as permitted by Regulation S-T Rule 101(b)(7):o

Note: Regulation S-T Rule 101(b)(7) only permits the submission in paper of a Form 6-K if submitted to furnish a report or other document that the registrant foreign private issuer must furnish and make public under the laws of the jurisdiction in which the registrant is incorporated, domiciled or legally organized (the registrant’s “home country”), or under the rules of the home country exchange on which the registrant’s securities are traded, as long as the report or other document is not a press release, is not required to be and has not been distributed to the registrant’s security holders, and, if discussing a material event, has already been the subject of a Form 6-K submission or other Commission filing on EDGAR.

Indicate by check mark whether by furnishing the information contained in this Form, the registrant is also thereby furnishing the information to the Commission pursuant to Rule 12g3-2(b) under the Securities Exchange Act of 1934.

If “Yes” is marked, indicate below the file number assigned to the Registrant in connection with Rule 12g3-2(b):o

Quarterly Report for the Three and Nine Months Ended September 30, 2014

(November 14, 2014)

The following report and the discussion and analysis of our financial condition and results of operations for the three- and nine-month periods ended September 30, 2014 should be read in conjunction with our unaudited interim financial statements and notes for the three and nine months ended September 30, 2014, our 2013 annual audited financial statements and the notes thereto and our 2013 annual report on Form 20-F filed with the United States Securities and Exchange Commission, referred to as the “SEC”, and Canadian securities regulators. Our financial statements for the three and nine months ended September 30, 2014 have been prepared in accordance with International Financial Reporting Standards, referred to as “IFRS”, as issued by the International Accounting Standards Board, referred to as “IASB”, and may not be comparable to financial statements prepared in accordance with United States generally accepted accounting principles.

Unless otherwise stated, all references to dollar amounts herein are to United States dollars, all references to “C$” herein are to Canadian dollars and all references to “Euro” or “€” herein are to the European Union Euro. As used in this document, the terms “we”, “us” and “our” mean MFC Industrial Ltd. and our subsidiaries, unless otherwise indicated. Due to rounding, numbers presented throughout this document may not add up precisely to totals we provide and percentages may not precisely reflect the absolute figures.

Disclaimer for Forward-Looking Information

Certain statements in this document are forward-looking statements, which reflect our expectations regarding our future growth, results of operations, performance and business prospects and opportunities. Forward-looking statements consist of statements that are not purely historical, including statements regarding the planned integration of newly acquired entities, future business prospects, estimated capital expenditures, the anticipated benefits of new projects and plans regarding our interest in the Wabush mine and any statements regarding beliefs, plans, expectations or intentions regarding the future. While these forward-looking statements, and any assumptions upon which they are based, are made in good faith and reflect our current judgment regarding the direction of our business, actual results will almost always vary, sometimes materially, from any estimates, predictions, projections, assumptions or other future performance suggested herein. No assurance can be given that any of the events anticipated by the forward-looking statements will occur or, if they do occur, what benefits we will obtain from them. These forward-looking statements reflect our current views and are based on certain assumptions and speak only as of the date hereof. These assumptions, which include our current expectations, estimates and assumptions about our business and the markets we operate in, the global economic environment, interest rates, commodities prices, exchange rates, our ability to identify, complete and finance additional acquisitions and sources of supply for our global commodity supply chain business, the plans and decisions of the operator of the Wabush mine and our ability to manage our assets and operating costs, may prove to be incorrect. No forward-looking statement is a guarantee of future results. A number of risks and uncertainties could cause our actual results to differ materially from those expressed or implied by the forward-looking statements, including those described herein and in our 2013 annual report on Form 20-F. Such forward-looking statements should therefore be construed in light of such factors. Investors are cautioned not to place undue reliance on these forward-looking statements. Other than in accordance with our legal or regulatory obligations, we are not under any obligation and we expressly disclaim any intention or obligation to update or revise any forward-looking statements, whether as a result of new information, future events or otherwise. Additional information about these and other assumptions, risks and uncertainties are set out in the “Risk Factors” section of this report and in our annual report on Form 20-F for the year ended December 31, 2013 filed with the SEC and Canadian securities regulators.

Note Regarding Natural Gas Disclosure

Where applicable, barrels of oil equivalent, referred to as “boe”, amounts have been calculated using a conversion ratio of six thousand cubic feet of natural gas to one barrel of oil, which is based on an energy equivalency conversion method primarily applicable at the burner tip and does not represent a value equivalency at the wellhead. Where applicable boe amounts including sulphur have been calculated using a conversion ratio of oneton of sulphur to one barrel of oil. “Boe” amounts may be misleading, particularly if used in isolation.

The following industry specific terms and abbreviations are utilized in this document:

- mbbl – Thousand barrels.

- mboe – Thousand barrels of oil equivalent.

- mcf – Thousand cubic feet.

- mmcf – Million cubic feet.

- mmcf/d – Million cubic feet per day.

- Natural gasor gas – The lighter hydrocarbons and associated non-hydrocarbon substances occurring naturally in an underground reservoir, which under atmospheric conditions are essentially gases, but which may contain natural gas liquids. Natural gas can exist in a reservoir either dissolved in crude oil (solution gas) or in a gaseous form (associated gas or non-associated gas). Non-hydrocarbon substances may include hydrogen sulphide, carbon dioxide and nitrogen.

- NGLor NGLs – Natural gas liquid or natural gas liquids, which are naturally occurring substances found in natural gas, including ethane, butane, isobutane, propane and natural gasoline that can be collectively removed from produced natural gas, separated into these substances and sold.

- Working interest – The interest in a property which gives the owner that share of production from the property. A working interest owner bears that share of the costs of exploration, development and production in return for a share of production. Working interests are typically burdened by overriding royalty interest or other interests.

MFC INDUSTRIAL LTD.’S PRIMARY FOCUS IS THE GLOBAL COMMODITY SUPPLY CHAIN BUSINESS. WE SOURCE, PRODUCE, PROCESS, TRANSPORT, WAREHOUSE, FINANCE AND ASSESS RELATED RISK REGARDING COMMODITIES FOR PRODUCERS AND CONSUMERS AROUND THE WORLD.

OUR INTEGRATED OPERATIONS SPAN A WIDE RANGE OF COMMODITIES SUCH AS METALS, ALLOYS, MINERALS, NATURAL GAS, CHEMICALS, PLASTICS, FOOD AND BEVERAGE ADDITIVES AND WOOD PRODUCTS. THESE ARE SUPPORTED BY OUR CAPTIVE SOURCES ACQUIRED THROUGH STRATEGIC INVESTMENTS, OFFTAKE ARRANGEMENTS AND OTHER SOURCING FROM THIRD PARTIES.

WE ALSO CAPITALIZE ON OPPORTUNITIES BY USING OUR FINANCIAL EXPERTISE, CREATIVITY AND FLEXIBILITY. WE SEEK TO IDENTIFY, ACQUIRE AND UNLOCK LATENT ASSET VALUE, RATIONALIZE INEFFICIENT ASSETS AND ALWAYS FOCUS ON VALUE CREATION.

DEAR FELLOW SHAREHOLDERS

We are pleased to present the results of MFC Industrial Ltd. (“MFC”, the “Company”, “we” or “us”) for the three and nine months ended September 30, 2014 and provide you with an update on our recent corporate developments.(All references to dollar amounts are in United States dollars unless otherwise stated.)

The good news is that revenues for the first nine months of 2014 reached the $1.0 billion mark, an increase of 72% over the same period of 2013. This was primarily due to two acquisitions and some organic growth. What we didn’t see was our net income keep pace with our revenue growth. Some of this was due to certain one-time expenses, a higher tax expense (the majority of which is non-cash utilization of our deferred tax assets) and a reduction in royalty payments. But we still need to improve our supply chain business.

We have made progress in the integration of our new companies into MFC and continue to work on synergies and efficiencies utilizing our geographic diversification and strong customer base to improve our margins. In addition, we are pursuing opportunities to increase the value proposition of our existing businesses by cross-selling supply chain structured solutions and products and increasing logistics and warehousing capabilities.

We are actively evaluating potential investment opportunities in captive commodity sources, off-take agreements and other sourcing agreements from third parties to further diversify our core business both geographically and by product.

We have challenges, but with the right people in place, the assets, the liquidity, a strong customer base, and long standing relationships with financial institutions, we are prepared to capitalize on the opportunities ahead of us.

I

LETTER TO SHAREHOLDERS

| FIRST NINE MONTHS OF 2014 HIGHLIGHTS AND

MAJOR DEVELOPMENTS | |

| | For the nine months ended September 30, 2014 and subsequent events | |

| | | | |

| | ► | Revenues increased to $1,020.5 million for the nine months ended September 30, 2014, representing an increase of 72% over the same period in 2013. Net income for the nine months ended September 30, 2014 decreased to $19.3 million, compared to $22.2 million for the same period in 2013. | |

| | | | |

| | | |

| ► | EBITDA* was $62.3 million for the nine months ended September 30, 2014. | |

| | | | |

| | | |

| ► | We completed the acquisitions of FESIL AS Group (“FESIL”) and F.J. Elsner & Co GmbH (“Elsner”) in April and March, respectively. | |

| | | | |

| | | |

| ► | In late October 2014, Cliffs Natural Resources Inc. (“Cliffs”) announced that it will close the Wabush mine. We are committed to working towards re-commencing operations upon termination of their lease. | |

| | | | |

| | | |

| ► | In March, we announced a cash dividend for 2014 of $0.24 per common share. In April, August and October, we distributed the first three dividend payments. | |

| | | |

| |

| *Note: | EBITDA is not a measure of financial performance under IFRS, has significant limitations as an analytical tool and should not be considered in isolation or as a substitute for analysis of our results as reported under IFRS. See page IV of this Letter to Shareholders for a reconciliation of our net income to EBITDA. |

FINANCIAL

The following table highlights certain selected key numbers and ratios as of September 30, 2014 and December 31, 2013 in order to assist shareholders to better understand our financial position.

| | FINANCIAL HIGHLIGHTS

All amounts in thousands, except per share amount and ratios | | | | | | | |

| | | September 30, 2014 | | December 31, 2013 | |

| | Cash and cash equivalents | | $ | 201,294 | | | $ | 332,173 | |

| | Short-term securities | | | 1,268 | | | | 2,068 | |

| | Trade receivables | | | 175,229 | | | | 115,678 | |

| | Current assets | | | 754,223 | | | | 711,021 | |

| | Total assets | | | 1,386,099 | | | | 1,318,598 | |

| | Current liabilities | | | 356,910 | | | | 314,709 | |

| | Working capital | | | 397,313 | | | | 396,312 | |

| | Current ratio* | | | 2.11 | | | | 2.26 | |

| | Total liabilities | | | 675,495 | | | | 618,857 | |

| | Shareholders’ equity | | | 709,565 | | | | 699,570 | |

| | Equity per common share | | | 11.25 | | | | 11.18 | |

*Note: The current ratio is calculated as current assets divided by current liabilities.

II

LETTER TO SHAREHOLDERS

LIQUIDITY

As at September 30, 2014, we had cash and cash equivalents, short-term deposits and securities of $202.7 million. We monitor our capital on the basis of our net debt-to-equity ratio and long-term debt-to-equity ratio.

| | LIQUIDITY

All amounts in thousands | | | | | | | | | | | | | |

| | | | September 30, 2014 | | | | December 31, 2013 | | |

| Total long-term debt | | | $ | 223,555 | | | | | | $ | 234,740 | | |

| Less: cash and cash equivalents | | | | (201,294 | ) | | | | | | (332,173 | ) | |

| | | | | | | | | | | | | | | |

| Net debt (net of cash & cash equivalents) | | | | 22,261 | | | | | | | (97,433 | ) | |

| Shareholders’ equity | | | | 709,565 | | | | | | | 699,570 | | |

| Net debt-to-equity ratio | | | | 0.03 | | | | | | Not applicable | | |

The long-term debt-to-equity ratio is calculated as long-term debt divided by shareholders’ equity.

| | LONG-TERM DEBT AND DEBT METRICS

All amounts in thousands, except ratio | | | | | | | | | | |

| | | September 30, 2014 | | | December 31, 2013 | |

| Long-term debt, less current portion | | | $ | 186,635 | | | | $ | 189,871 | |

| Shareholders’ equity | | | | 709,565 | | | | | 699,570 | |

| Long-term debt-to-equity ratio | | | | 0.26 | | | | | 0.27 | |

CREDIT FACILITIES

We maintain various kinds of credit lines and facilities with banks. Most of these facilities are short-term and are used for our day-to-day business and structured financing activities in commodities. The amounts drawn under such facilities fluctuate with the type and level of transactions being undertaken.

As at September 30, 2014, we had credit facilities aggregating approximately $773.5 million, comprised of: (i) unsecured revolving credit facilities aggregating $372.1 million from banks; (ii) revolving credit facilities aggregating $103.4 million from banks for structured solutions, a special trade financing where the margin is negotiable when the facility is used; (iii) non-recourse factoring arrangements with a bank for up to an aggregate credit limit of $190.6 million for our commodities activities. We may factor our commodity receivable accounts upon invoicing at the inter-bank rate plus a margin; (iv) a foreign exchange credit facility of $72.4 million with a bank; and (v) secured revolving credit facilities aggregating $35.0 million. All of these facilities are either renewable on a yearly basis or usable until further notice.

RESULTS FOR THE NINE MONTHS ENDED SEPTEMBER 30, 2014

Total revenuesfor the nine months ended September 30, 2014 increased 72% to $1,020.5 million, compared to $591.8 million in first nine months of 2013. Revenues were up for the first nine months of 2014 primarily due to the inclusion of our two new acquisitions, Elsner and FESIL, and increases in natural gas prices and volumes for some of our commodities.

III

LETTER TO SHAREHOLDERS

Income from operationsfor the nine months ended September 30, 2014 increased to $33.8 million, compared to $25.5 million in the same period of 2013.

Net incomefor the nine months ended September 30, 2014 decreased to $19.3 million, or $0.31 per share on a diluted basis, from $22.2 million, or $0.35 per share on a diluted basis, in the same period of 2013. Net income was down primarily due to:

- higher tax expense, the majority of which is non-cash utilization of our deferred tax assets;

- receiving less royalty payments; and

- income from operations being affected by certain one-time expenses, including relocation, legal, employment and restructuring expenses.

The income statement for the nine months ended September 30, 2014 includes non-cash amortization, depletion and depreciation expenses of approximately $18.0 million, representing approximately $0.29 per share on a diluted basis. Depletion and depreciation are non-cash expenses and represent the amortization of the historical cost of our natural gas and other assets over their respective lives.

EBITDA BREAKDOWN

EBITDA is defined as earnings before interest, taxes, depreciation, depletion and amortization. Management uses EBITDA as a measurement of its own operating results. Management considers it to be a meaningful supplement to net income as a performance measurement primarily because we incur significant depreciation and depletion and EBITDA generally represents cash flow from operations.

The following table reconciles our net income to EBITDA for each of the nine months ended September 30, 2014 and 2013.

| | EBITDA (earnings before interest, taxes, depreciation, depletion and amortization)

All amounts in thousands |

| | | September 30, 2014 | | September 30, 2013 | |

| | nine months | | nine months | |

| Net income | | $ | 20,262 | | | | $ | 22,294 | |

| Income taxes | | | 10,823 | | | | | 2,403 | |

| Finance costs | | | 13,280 | | | | | 11,551 | |

| Amortization, depreciation and

depletion | | | 17,950 | | | | | 18,383 | |

| | | | | | | | | | | |

| EBITDA | | $ | 62,315 | | | | $ | 54,631 | |

| | | | | | | | | | | |

RESULTS BY OPERATING SEGMENTS FOR THE NINE MONTHS ENDED SEPTEMBER 30, 2014

Revenues for our commodities and resources businesswere $988.0 million for the nine months ended September 30, 2014, compared to $566.6 million for the same period in 2013.

Revenues from our merchant banking businesswere $10.8 million for the nine months ended September 30, 2014, compared to $8.9 million for the same period in 2013.

All other revenues, which encompass our corporate and other operations, were $21.7 million for the nine months ended September 30, 2014, compared to $16.4 million for the same period in 2013.

Costs of salesincreased to $910.1 million during the first nine months of 2014 from $508.4 million for the same period in 2013, primarily as a result of the consolidation of our two new acquisitions in the second quarter of 2014.

IV

LETTER TO SHAREHOLDERS

Selling, general and administrative expenses increased to $62.9 million for the nine months ended September 30, 2014 from $46.3 million for the same period in 2013, primarily due to the consolidation of our two new acquisitions in the second quarter of 2014.

Our total revenues by operating segment for each of the nine months ended September 30, 2014 and 2013 are broken out in the table below.

| | REVENUES

All amounts in thousands | | | | | | | | | | |

| | September 30, 2014(1) | | September 30, 2013 | |

| | nine months | | nine months | |

| Commodities and resources | | | $ | 987,979 | | | | $ | 566,572 | |

| Merchant banking | | | | 10,802 | | | | | 8,880 | |

| All other | | | | 21,689 | | | | | 16,351 | |

| | | | | | | | | | | |

| Total revenues | | | $ | 1,020,470 | | | | $ | 591,803 | |

| | | | | | | | | | | |

| Note: (1) MFC commenced consolidation of the operations of Elsner and FESIL from March 31 and April 1, 2014, respectively. |

Our net income from operations for each of the nine months ended September 30, 2014 and 2013 is broken out in the table below.

| | INCOME FROM OPERATIONS

All amounts in thousands, except per share amounts | | | | | | | | | | | | | |

| | | September 30, 2014(1) | | | September 30, 2013 | | |

| | nine months | | | nine months | | |

| Commodities and resources | | | $ | 25,002 | | | | | | $ | 17,557 | | |

| Merchant banking | | | | 14,259 | | | | | | | 13,579 | | |

| All other | | | | (8,176 | ) | | | | | | (6,439 | ) | |

| | | | | | | | | | | | | | |

| Income before income taxes | | | | 31,085 | | | | | | | 24,697 | | |

| Income tax (expenses) recovery | | | | (8,988 | ) | | | | | | 1,208 | | |

| Resource property revenue tax

expenses | | | | (1,835 | ) | | | | | | (3,611 | ) | |

| Net income attributable to

non-controlling interests | | | | (964 | ) | | | | | | (67 | ) | |

| | | | | | | | | | | | | | | |

| Net income attributable to our

shareholders | | | $ | 19,298 | | | | | | $ | 22,227 | | |

| | | | | | | | | | | | | | | |

| Earnings per share, basic | | | $ | 0.31 | | | | | | $ | 0.36 | | |

| | | | | | | | | | | | | | | |

| Earnings per share, diluted | | | $ | 0.31 | | | | | | $ | 0.35 | | |

| | | | | | | | | | | | | | | |

| Note: (1) MFC commenced consolidation of the operations of Elsner and FESIL from March 31 and April 1, 2014, respectively. |

V

LETTER TO SHAREHOLDERS

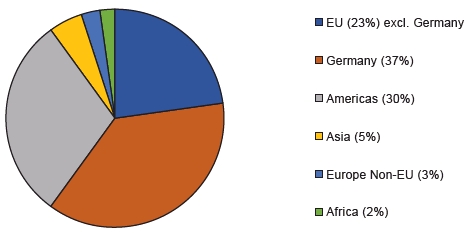

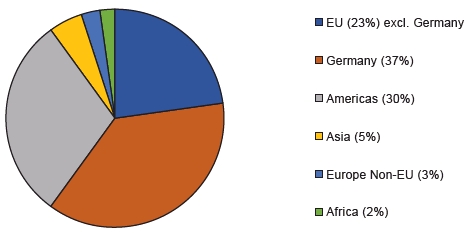

REVENUE BREAKDOWN BY REGION

The following pie chart shows our global revenue by region for the nine months ended September 30, 2014.

| REVENUE BY REGION |

| For the nine months ended September 30, 2014 |

UPDATE ON OUR NATURAL GAS ASSETS & MIDSTREAM FACILITIES

At MFC Energy, our goal is to optimize our declining asset base and capitalize on specified economic opportunities to stimulate production, de-risk our portfolio and develop our undeveloped properties through partnerships and farm-out agreements and minimize structural costs until attractive and sustainable natural gas prices warrant investment in the exploration and exploitation of our hydrocarbons.

The following table sets out our average natural gas and other hydrocarbons sales prices, and related information for the nine months ended September 30, 2014.

NATURAL GAS WELLS (COSTS AND PRODUCTION)

All amounts in Canadian dollars, except production numbers |

| For the nine months ended September 30, 2014 |

| Natural Gas

($/mcf) | NGLs(1)

($/bbl) | Crude Oil

($/bbl) | Total ($/boe)

Hydrocarbons | Total ($/boe)

Incl. Sulphur |

| Price(2) | $ 5.12 | $ 84.36 | $ 94.96 | $ 38.44 | $ 40.34 |

| Royalties | 0.89 | 30.93 | 25.77 | 8.65 | 8.98 |

| Transportation costs | 0.16 | 7.96 | 2.24 | 1.71 | 2.87 |

| Operating costs(3) | — | — | — | 12.99 | 12.99 |

| Production(4) | 12,664 mcf | 243.6 boe | 89.7 mbbl | 2,444.1 mboe | 2,484.3 mboe |

| Notes: | (1) | Does not include sulphur. |

| (2) | Excluding third party processing fees. |

| (3) | A portion of our natural gas production is associated with crude oil production. Operating costs per individual product are not available as they are charged to gas production only and any allocation would be arbitrary. |

| (4) | Net of other working interests. |

VII

LETTER TO SHAREHOLDERS

In addition, we generated third party processing revenues of CDN$3.6 million during the nine months ended September 30, 2014, compared to CDN$3.2 million in the same period of 2013.

Midstream Update

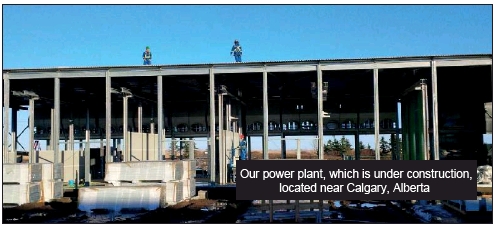

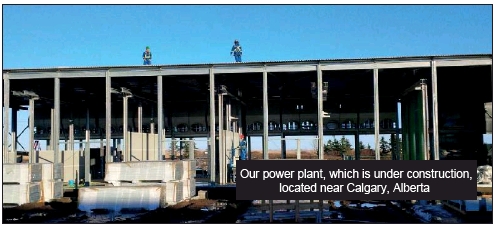

We remain on schedule and on budget in the construction of our 16.5 MW power plant at our Mazeppa Gas Processing Plant in Alberta, which is scheduled for final commissioning in the first half of 2015. Upon completion, the project will supply the facility’s electricity demand, with the majority of the power being sold into the grid at prices based on the Alberta Electricity System Operator’s rates.

In addition, the Alberta electricity market is fully deregulated, which provides us with the option to run our project as a peaking power plant, supplying electricity only when volatile prices are at their highest. We continue to explore other midstream opportunities including projects at our existing gas processing plant.

Niton Update

Our drilling partner has committed to spending a minimum of CDN$50 million to drill at least three new wells per year for a total of 12 net wells during the initial three-year term. To date, they have drilled six gross wells, four of which have been placed into production, with the gas being processed at our Niton facility.

UPDATE ON OUR INTEREST IN THE WABUSH MINE

Wabush has been an important asset to MFC for decades. Wabush is an important asset to MFC today. We are working diligently to ensure that Wabush will be an important asset to MFC for decades to come.

The mining lease which MFC granted to Cliffs is still in effect until Cliffs officially terminates the lease or it is otherwise terminated. MFC will effectively continue to receive a minimum annual lease payment of CDN$3.25 million while we wait for their official termination notice.

Upon such termination, MFC will exercise its rights like any landlord to take back its property. We have announced our intention to restart operations and undertake a capital expenditure program which would be designed to both reduce costs and increase production.

We believe that the Wabush mine presents a relative commercial advantage in comparison to other mines being developed in the region. Given the existing infrastructure and history of operations at the mine, we generally expect that the potential capital costs required at Wabush will be relatively lower than new developments in the region.

Upon formal notice to terminate the lease, Cliffs may remove any of their equipment, buildings or structures from Wabush within a period of six months. However, prior to any such removal, MFC holds the sole and absolute right to purchase any of these assets at a then reasonable market price.

We are moving forward on this project and have received excellent cooperation from various stakeholders.

VIII

LETTER TO SHAREHOLDERS

UPDATE ON OUR RECENT ACQUISITIONS

FESIL, our Norwegian subsidiary, signed a four-year partnership and off-take agreement in 2012 for 60,000 tonnes of standard grade ferrosilicon per annum with a project in Sarawak, Malaysia. The off-take is exclusive for selected European and North African markets. In the third quarter of 2014, the operator realized the first production of ferrosilicon from the new facility. Full-scale commercial operation is expected in the second quarter of 2015.

2014 CASH DIVIDEND

In March 2014, MFC announced a cash dividend in the amount of $0.24 per common share, payable in quarterly installments by the Company. The first three payments of $0.06 per common share each were paid to our shareholders on April 22, August 8 and October 27, 2014.

CORPORATE TAXATION

We are a company that strives to be fiscally responsible. The corporate income tax paid in cash was approximately $2.1 million for the nine month ended September 30, 2014.

Respectfully submitted,

President and CEO

X

LETTER TO SHAREHOLDERS

BOARD OF DIRECTORS | | OFFICES AND SUBSIDIARIES | | |

| | | | | |

Peter R. Kellogg

Chairman since 2013 Indrajit Chatterjee*

Director since 2005 Silke S. Stenger*

Director since 2013 Michael J. Smith

Director since 1987 William C. Horn III*

Director since 2013 Dr. Shuming Zhao

Director since 2014 Gerardo Cortina

Director since 2014 * Member of the Audit Committee AUDITORS

PricewaterhouseCoopers LLP

Suite 700

250 Howe Street

Vancouver, BC V6C 3S7

Canada

Telephone: 1 (604) 806 7000

www.pwc.com/ca STOCK LISTING

New York Stock Exchange

11 Wall Street

New York, NY 10005

Telephone: 1 (212) 656 3000

Email: nyselistings@nyse.com Trading Symbol: MIL WEBSITE www.mfcindustrial.com | | AUSTRIA Millennium Tower, 21st Floor

Handelskai 94-96

1200 Vienna, Austria

Telephone: (43) 1 24025 0

Email: office@mfc-commodities.com MEXICO Bosques de Alisos No. 47B

Officina A1 - 01

Bosques de las Lomas, Cuajimalpa

Mexico D.F. C.P. 05120, Mexico

Telephone: (52) 55 9177 7440

Email: jcortina@possehl.com.mx CANADA 400 Burrard Street, Suite 1620

Vancouver, BC Canada V6C 3A6

Telephone: 1 (604) 683 8286

Email: rrandall@bmgmt.com CANADA 1035 7th Ave S.W., Suite 400

Calgary, AB Canada T2P 3E9

Telephone: 1 (403) 237 9400

Email: mfc@mfcrp.com UNITED STATES 393 Vanadium Road, Suite 201

Pittsburgh, PA 15243 USA

Telephone: 1 (412) 279 9130

Email: inquiry@specialtysuperalloys.com CHINA Room 2409, Shanghai Mart Tower

2299 Yan An Road West

Changning District

Shanghai, P.R. China 200336

Telephone: (86) 21 6115 6996

Email: office@mfc-china.com GERMANY Schifferstr. 200

47059 Duisburg, Germany

Telephone: (49) 203 30 00 70

Email: info@fesil-sales.de | | CHINA Beijing International Club

Room 111,

Jianguomenwali Dajei 21

Beijing, P.R. China 100020

Telephone: (86) 10 653 25 928

Email: huleilei@elsner.at ARGENTINA Avenida Alicia Moreau Justo 1750

Buenos Aires, Argentina

Telephone: (54) 11 5238 7788

Email: info@accr.com NORWAY Vikelvfaret 4

C7054 Ranheim

Norway

Telephone: (47) 73 87 7900

Email: post@fesil.no LUXEMBOURG 469 route de Thionville

5887 Alzinge, G.D. Luxembourg

Telephone: (352) 26 51 521

Email: info@fesil-sales.com CORPORATE CONTACT Rene Randall

400 Burrard Street, Suite 1620

Vancouver, BC Canada V6C 3A6

Telephone: 1 (604) 683 8286

Email: rrandall@bmgmt.com TRANSFER AGENT Computershare

480 Washington Blvd, 27th Floor

Newport Office Center VII

Jersey City, NJ 07310, USA

Telephone: 1 (888) 478 2338

www.computershare.com |

XI

LETTER TO SHAREHOLDERS

Nature of Business

We are a global commodities supply chain company, which sources and delivers commodities and materials to clients, with expertise in financing and risk management. Our global business activities are supported by our captive commodities sources and commodities secured from third parties.

As a supplement to our internal growth initiatives, we seek out and evaluate strategic acquisition and investment candidates to further expand our global commodities supply chain and merchant banking businesses.

Recent Developments

We indirectly derive royalty revenue from a mining sub-lease of the lands upon which the Wabush iron ore mine is situated in Newfoundland and Labrador, Canada. This sub-lease commenced in 1956 and expires in 2055. The lessor is Knoll Lake Minerals Ltd., which holds a direct mining lease from the Province. The mine is operated by Cliffs Natural Resources Inc., referred to as “Cliffs”. On February 11, 2014, Cliffs announced that it planned to idle the Wabush mine and subsequently announced that the mine was idled during the period. In the third quarter of 2014, Cliffs announced that it would be closing the Wabush mine.

Pursuant to the sub-lease, we will effectively continue toreceive minimum payments of C$3.25 millionper year until termination thereof. In the event that Cliffs terminates the sub-lease, we intend to take over the mine property pursuant to the terms thereof. In such event, we have certain rights under the terms of the sub-lease to elect to acquire all or part of buildings, plant, machinery and other items on the property prior to their removal at a then reasonable market price. There can be no assurance as to when and if the operator will provide notice of such termination. We are currently exploring opportunities for this asset with stakeholders and third parties. Please see Note 7 of our unaudited consolidated financial statements for the three and nine months ended September 30, 2014 for further information.

Investors are cautioned that we have not completed any technical reports, including reserve or resource estimates under Canadian National Instrument 43-101, referred to as “NI 43-101”, with respect to the mine. No final production decision has been made regarding the project in the event we take over the mine property and any such decision will be based on studies demonstrating economic and technical viability.

Business Segments

Our business is divided into three operating segments: (i) commodities and resources, which includes our commodities activities; (ii) merchant banking, which includes structured solutions, financial services and proprietary investing activities; and (iii) all other, which encompasses our corporate and other investments and business interests, including our medical supplies and servicing business.

Commodities and Resources

Our commodity supply chain business is globally focused and includes our integrated commodities operations and interests. We conduct such operations primarily through our subsidiaries based in Austria, Germany, Luxembourg, Norway, the United States, Latin America and Canada and we supply various commodities, including minerals, ferrous and non-ferrous metals, chemicals, plastics, refractory and ceramic materials and wood products. Our commodities originate either from our directly or indirectly held interests in resource projects or are secured by us from third parties. We also derive revenue from a mining sub-lease.

Since entering the global supply chain business in 2010, we have implemented a long-term growth strategy to achieve critical mass by increasing our commodities revenues through expanding our geographic reach and diversifying our product offerings. Over the last three years, we completed several strategic acquisitions to support this long-term strategy, including the acquisitions of:

- MFC Energy Corporation (formerly Compton Petroleum Corporation), referred to as “MFC Energy”, in September 2012, which expanded our commodities portfolio into the production and processing of natural gas;

- MFC Resources Inc. (formerly ACC Resources Co., L.P.), referred to as “MFCR”, and Possehl Mexico S.A de C.V., referred to as “Possehl”, which increased our global exposure and presence in the North American and Latin American markets and expanded our commodities platform to include refractory and ceramic materials and other products;

1

- F.J. Elsner & Co., referred to as“Elsner”, in March 2014, which further increased the footprint of our global commodity supply chain business through its offices in Austria, China, Dubai, Croatia, Albania, Serbia and the United States and increased our product offerings to include steel and related products; and

- The FESIL A.S. Group, referred to as “FESIL”, in April 2014, which included its ferrosilicon production plant in Mo i Rana, Norway and further expanded our sales presence in Europe, the United States and China through its various sales offices and longstanding relationships with customers that include established steelworks, aluminum and iron foundries and chemical groups.

Our commodities operations include sourcing and supplying commodities. To a lesser extent, we also act as an agent for our clients. Our commodities operations often utilize innovative trading strategies and financing structures. We currently engage in purchases and sales with producers who are unable to effectively realize sales due to their specific circumstances.

In some circumstances, we may purchase or produce the underlying commodity and sell it to an end buyer or exchange it for another commodity, which will subsequently be sold. Further, commodity producers and end customers often work with us to better manage their internal supply chain, distribution risk and currency and capital requirements. In such commodities operations, we try to capture various commodities, financing and currency spreads. Through our operations, we have been able to develop long-standing relationships with commodity producers, end customers and financiers and integrate them into our financial activities.

We generally source commodities from Asia, Africa, Europe, North America and the Middle East and we sell our commodities in global markets.

We provide logistics, supply chain management and other services to producers and consumers of commodities. These activities provide cost effective and efficient transportation, as well as payment terms accommodating working capital requirements for our customers and partners. They are supported by strategic direct and indirect investments in natural resource assets operating in our core commodities.

Our commodities and resources business employs personnel worldwide and our main marketing office is located in Vienna, Austria. We also maintain offices in Canada, the United States, Mexico, Argentina, China, Dubai, Croatia, Albania, Serbia, Norway, Germany, Luxembourg and Spain. In addition, we establish relationships with and seek to further market our products through agents located worldwide. Our marketing and investment activities in the commodities and resource sector are supported by a global network of agents and relationships, which provides us with worldwide sourcing and distribution capabilities.

In April 2014, we acquired FESIL, a vertically integrated commodity supply chain company and one of the world’s leading producers of ferrosilicon, an essential alloy in the production of steel, stainless steel and cast iron. The ferrosilicon production facility is located in Mo i Rana, Norway and produces a range of ferrosilicon products, including granulated and refined qualities. The plant’s annual capacity is approximately 80,000 tonnes of ferrosilicon and 23,000 tonnes of microsilica.

We indirectly derive royalty and other revenue from a mining sub-lease of the lands upon which the Wabush iron ore mine is situated in Newfoundland and Labrador, Canada. Please see “Recent Developments” for further information.

In the third quarter of 2012, we expanded our commodities activities to the energy sector. These activities include the development, production and processing of natural gas, NGLs and, to a far lesser degree, crude oil in Canada. The majority of such operations are located in the central fairway of the Western Canada Sedimentary Basin, primarily situated in the Province of Alberta. As at December 31, 2013, we had an interest in 1,436 producing natural gas wells, 3 non-producing natural gas wells, 112 producing oil wells, 3 non-producing oil wells and a land position that included 268,875 net working interest undeveloped acres. Our assets are situated in the following areas of the Western Canada Sedimentary Basin: (i) the Rock Creek sands and other Cretaceous sands in the Niton area of central Alberta; (ii) the Cretaceous and Tertiary sands in Okotoks and Southern Alberta; (iii) the Mannville sands in the High River area of southern Alberta; and (iv) the deeper, Belly River sands in the Callum area of southern Alberta.

2

The Niton area includes multi-zone, liquids-rich, tight gas plays with production to date primarily coming from Rock Creek and Ellerslie sandstones. We have a large number of mineral agreements that cover specific zonal rights in this area. As at December 31, 2013, we had an average 72% working interest in 86,000 gross acres of land to the base of the Rock Creek Member of the Fernie Group. The Niton area has other productive zones that provide opportunities to expand our development base by moving into other geological horizons. These zones lie above the Rock Creek and include the Wilrich and Notikewin sandstones of the Upper Mannville and Spirit River Group.

The Southern Plains is comprised primarily of multi Belly River sands along with upper Edmonton Group coal bed methane formations. As well, in select areas of Southern Alberta, there are productive Mannville sands. As at December 31, 2013, we controlled 411,400 gross acres of land at an average 87% working interest, which provides a significant multi-year, low risk natural gas drilling inventory. Infrastructure is in place in the area for future production increases.

Our High River asset is primarily a low to medium permeability Basal Quartz channel sandstone pool, which is the southern Alberta extension of the Lower Cretaceous Deep Basin gas trend.

We also have interests in substantial established infrastructure, which allows flexibility to effectively manage area development and adjust operations accordingly. Overall, we operate over 50,000 horsepower of compression totaling 200 mmcf/d of available field compression capacity, having over 85 mmcf/d of operated processing capacity and over 2,000 km of pipeline infrastructure in place. Key facilities are as follows:

- MFC Sour Gas Processing Plant – We own the MFC sour gas processing plant and gas gathering system through our ownership of MFC Processing Partnership, referred to as “MPP”. The MPP sour gas processing plant is located in the High River area and currently has production capacity of 90 mmcf/d (licensed plant capacity) of sour natural gas and 45 mmcf/d of sweet natural gas. Additionally, in April 2014, we entered into an agreement with a contractor for the design, construction, supply and installation of a 16.5 MW natural gas power project at the processing plant.

- High River – In the High River area there is 9,150 horsepower installed with a gas compression capacity of 42.5 mmcf/d and 270 km of pipeline infrastructure in place. Volumes are all produced through the MPP gas gathering system and sour gas processing plant.

- Southern Alberta Foothills – The Callum and Cowley gas processing plants with 100% plant ownership are currently capable of compressing 19 mmcf/d and ultimately processing 50 mmcf/d through the two existing facilities with the addition of field and/or plant compression. There is currently over 60 km of pipeline infrastructure in the operating area with minimal third party infrastructure in place.

- Edson, Niton, and McLeod – This foothills area property has compression capacity of 23 mmcf/d utilizing over 6,400 horsepower, including the MFC Energy McLeod River gas processing plant with 23 mmcf/d of capacity with 100% plant ownership. Additionally, there is over 185 km of pipeline infrastructure in the area.

- Shallow Gas Properties – Our shallow gas infrastructure consists of over 110 mmcf/d of compression capacity utilizing 30,000 horsepower with over 1,200 km of pipeline infrastructure in place. Final processing gas volumes are linked into the Nova/TransCanada pipeline systems at multiple sales locations.

In the second quarter of 2014, we entered into an agreement with a contractor for the design, construction, supply and installation of a 16.5 MW natural gas power project at our sour gas processing plant. Upon completion, the project will supply our processing plant’s electrical needs, with excess power being sold into the grid based on Alberta Electricity System Operator’s rates. We currently expect the project will cost approximately C$25.2 million, with final commissioning expected to occur in the first half of 2015.

In the nine months ended September 30, 2014, we produced 12,665 mmcf of natural gas, 244 mboe of NGLs and 90 mbbl of crude oil, for total production of hydrocarbons of 2,444 mboe, compared to 13,054 mmcf of natural gas, 269 mboe of NGLs and 86 mbbl of crude oil, for total production of hydrocarbons of 2,531 mboe on a net working interest basis in the same period of 2013. We also produced 40,000tons of sulphur as a byproduct of our hydrocarbon production activities in the nine months ended September 30, 2014, compared to 37,000tons for the same period of 2013. Our total production, including hydrocarbons and sulphur, was 2,484 mboe on a net working interest basis for the nine months ended September 30, 2014, compared to 2,568 mboe for the same period in 2013. Total production of natural gas, NGLs and crude oil decreased due to natural decline rates. We did not engage in any drilling or exploration activity in the nine months ended September 30, 2014.

3

The following table sets forth our average sales prices, operating costs, royalty amounts and transportation costs for each of the periods indicated:

| | Nine Months Ended September 30, |

| | 2014 | | 2013 |

| | | | | | | | Total | | | | | | | | | | | | Total | | | | |

| | | | | | Crude | | Hydro- | | | | | | | | | | Crude | | Hydro- | | | | |

| | Natural Gas | | NGLs | | Oil | | carbons | | Sulphur | | Total(1) | | Natural Gas | | NGLs | | Oil | | carbons | | Sulphur | | Total(1) |

| Area | | | (C$/mcf) | | (C$/bbl) | | (C$/bbl) | | (C$/boe) | | (C$/ton) | | (C$/boe) | | (C$/mcf) | | (C$/bbl) | | (C$/bbl) | | (C$/boe) | | (C$/ton) | | (C$/boe) |

| Price(2) | | C$5.12 | | C$ 84.36 | | C$ 94.96 | | C$ 38.44 | | C$156.41 | | C$40.34 | | C$3.34 | | C$ 79.35 | | C$ 87.36 | | C$ 28.63 | | C$ 71.54 | | C$29.25 |

| Royalties | | 0.89 | | 30.93 | | 25.77 | | 8.65 | | 29.40 | | 8.98 | | 0.63 | | 27.70 | | 20.88 | | 6.89 | | 11.75 | | 6.96 |

| Operating costs(3) | | N/A | | N/A | | N/A | | 12.99 | | N/A | | 12.99 | | N/A | | N/A | | N/A | | 13.48 | | N/A | | 13.48 |

| Transportation costs | | 0.16 | | 7.96 | | 2.24 | | 1.71 | | 73.41 | | 2.87 | | 0.14 | | 5.24 | | 2.55 | | 1.36 | | — | | 1.34 |

____________________

Notes: |

| (1) | | Includes hydrocarbons and sulphur. |

| | |

| (2) | | Excludes third-party processing fees. |

| | |

| (3) | | A portion of our natural gas production is associated with crude oil production. As a result, per unit operating costs for each product reflect the allocation of certain common costs. |

In addition, we generated third party processing revenues of C$3.6 million during the nine months ended September 30, 2014, compared to C$3.2 million in the same period of 2013.

Transportation costs per boe in the current period increased, primarily as a result of higher gas transmission rates, trucking NGL volumes large distances due to processing constraints and incremental sulphur shipping costs due to sales occurring “FOB” Vancouver versus at the plant gate in 2013.

In November 2013, we entered into an agreement, referred to as the “Participation Agreement”, with an established oil and gas operator. Pursuant to the Participation Agreement, the third-party operator has committed to spending a minimum of C$50.0 million to drill a total of 12 net wells over an initial three-year term, with such drilling being primarily focused on our undeveloped oil and gas properties located in the Niton area of Alberta, Canada. Under the terms of the Participation Agreement, the third-party operator will pay 100% of the costs required to drill and complete each well. If any of the initial 12 net wells achieves continuous production, we may elect to: (i) participate for up to a 30% interest in the well by reimbursing the operator 25% of the costs of such well; or (ii) receive a 10% gross royalty on production. Additionally, any gas produced from a large proportion of these wells will be processed exclusively by our existing processing facility in the area. We believe that this arrangement provides us with the opportunity to further our undeveloped properties at minimal investment risk and, at the same time, provide a potential source of revenue expansion through royalty and processing arrangements. The operator commenced its program under the Participation Agreement in the first quarter of 2014 and has drilled and completed six gross wells on MFC Energy’s lands in the Niton area, with four such wells having been tied in with production from such wells flowing through MFC Energy’s facilities in the area and in respect of which we elected to receive the 10% gross royalty on production.

Merchant Banking

Our merchant banking operations include merchant banking and financial services, third-party financing and other services, proprietary investing and our real property. We seek to invest in many industries, emphasizing those business opportunities where the perceived intrinsic value is not properly recognized.

We use our financial and management expertise to add or unlock value within a relatively short timeframe. Our merchant banking activity is generally not passive and we seek investments where our financial expertise and management can add or unlock value. Proprietary investments are generated and made as part of our overall merchant banking activities and are realized upon over time, sometimes taking more than one year. In addition, we often seek to acquire interests or establish relationships with commodity producers to realize upon potential synergies. Such interests can be acquired through purchases of, or investments in, commodity producers or through contractual arrangements with them, including off-take agreements. The investments we make in commodity producers are part of our merchant banking strategy. To a degree, our merchant banking and commodities and resources businesses supplement each other, which results in synergies in our overall business activities.

Our activities include making proprietary investments through investing our own capital and utilizing our expertise to capture investment opportunities. We seek to invest in businesses or assets whose intrinsic value is not properly reflected in their share or other price. Often such investments are in companies or assets that are

4

under financial, legal or regulatory distress and our services include resolving such distress. Our investing takes many forms and can include acquiring entire businesses or portions thereof, investing in equity or investing in the existing indebtedness (secured and unsecured) of a business or in new equity or debt issues. Our investing is generally not passive and we invest where we believe our expertise in financial restructuring and management and complementary trading and corporate finance capabilities can add or unlock value. Our investing in distressed businesses and/or assets can result in complex and intricate legal issues relating to priorities, claims and other rights of stakeholders. Such issues can result in our being involved in legal and other claims as a result of our overall proprietary investment strategy. Our proprietary investments are often made as a part of, or complementary to, our commodities and resources activities.

We consider investment opportunities where: (i) our existing participation in the marketing and production of commodities provides expert insight; (ii) we can obtain a satisfactory return of future capital investment; and (iii) such investment has synergistic benefits with our existing business. Our philosophy is to utilize our financial strength to realize the commercial potential of assets in markets where we have a comprehensive understanding of the drivers of value.

In addition, we utilize our established relationships with international financial institutions, insurers and factoring companies to provide flexible, customized financial tools, extensive credit and risk management and structured solutions for our customers. Working closely with our customers, our professional staff arranges support for hedging and trading of materials, financing and risk management solutions.

Our merchant banking activities also include leveraging our trading and financial experience and relationships to provide trading services and trade finance services to our customers.

Our merchant banking business generates revenues in the form of corporate and trade finance service fees and interest income. We also realize gains from time to time on our proprietary investments upon their sale, the execution of an equity or debt restructuring or the completion of other forms of divestment.

All Other

Our all other segment includes our corporate and other operating segments and investments, which include financing joint ventures through our China-based subsidiaries and providing medical services, equipment and supplies.

Cash Dividend

In 2011, 2012 and 2013, we declared and paid quarterly cash dividends aggregating $0.20, $0.22 and $0.24 per common share, respectively.

On March 24, 2014, we declared a cash dividend for 2014 of $0.24 per common share, payable in quarterly installments. The first three installments of $0.06 per common share were paid to shareholders on April 22, August 8 and October 27, 2014.

Discussion of Operations

The following discussion and analysis of our financial condition and results of operations for the three and nine months ended September 30, 2014 and 2013 should be read in conjunction with our unaudited condensed consolidated financial statements and related notes. As a result of an error correction in 2012, retained earnings as of September 30, 2013 were restated. Please see Note 16 of our unaudited condensed consolidated financial statements for the three and nine months ended September 30, 2014 for further information.

General

We are a global commodities supply chain company which sources and delivers commodities and materials to clients, with a special expertise in financing and risk management. We also commit our own capital to promising enterprises and invest and otherwise capture investment opportunities for our own account. We seek to invest in businesses or assets whose intrinsic value is not properly reflected in their share price or value. Our investing is generally not passive. We actively seek investments where our financial expertise and management can add or unlock value.

5

Our results of operations have been and may continue to be affected by many factors of a global nature, including economic and market conditions, the availability of capital, the level and volatility of equity prices and interest rates, currency values, commodity prices and other market indices, technological changes, the availability of credit, inflation and legislative and regulatory developments. Our results of operations may also be materially affected by competitive factors. Our competitors include firms traditionally engaged in merchant banking and financial services such as merchant and investment banks, along with other capital sources such as hedge funds, private equity firms, insurance companies and other trade companies engaged in commodities activities in Europe, Asia and globally.

Our results of operations for any particular period may also be materially affected by our realization on proprietary investments. These investments are made to maximize total return through long-term appreciation and recognized gains on divestment. We realize on our proprietary investments through a variety of methods including sales, capital restructuring or other forms of divestment.

A majority of our revenues is derived from our global commodity supply chain operations. The remaining portions are generally derived from financial services, sales of properties and net gains on securities.

We view our net book value per share as a key indicator of our overall financial performance. Our net book value as at the dates indicated is set forth below:

| September 30, | | December 31, |

| 2014 | | 2013 |

| (United States dollars in thousands, |

| except per share amounts) |

| Net book value | | $ | 709,565 | | | | $ | 699,570 | |

| Net book value per share | | | 11.25 | | | | | 11.18 | |

Business Environment

Our financial performance is, and our consolidated results in any period can be, materially affected by global economic conditions and financial markets generally.

A favourable business environment is characterized by many factors, including a stable geopolitical climate, transparent financial markets, low inflation, low interest rates, availability of credit, low unemployment, strong business profitability and high business and investor confidence. Unfavourable or uncertain economic and market conditions can be caused by declines in economic growth, business activity or investor or business confidence, limitations on the availability or increase in the cost of credit and capital, increases in inflation, interest rates, exchange rate volatility, outbreaks of hostilities or other geopolitical instability, corporate, political or other scandals that reduce investor confidence in the capital markets or a combination of these or other factors.

While the global economic outlook has improved, ongoing global economic conditions and uncertainties, including slower economic growth in China and the current crises in the Ukraine and the Middle East, continued to impact markets and cause significant volatility in commodity prices, which continued into the third quarter of 2014. For example, the steel sector has seen a drop in producer stocks, which has negatively impacted prices and supply chain volumes.

In the third quarter of 2014, AECO prices averaged approximately 65% higher than the comparative period of 2013 and approximately 14% lower than the second quarter of 2014. Strong demand for natural gas, stemming from a colder-than-normal winter, negatively impacted storage inventories and resulted in a sharp price increase in the first quarter of 2014. During the third quarter of 2014, natural gas storage inventories remained below the five year averages, and prices remained strongly above the comparable period in 2013, while declining from the previous quarter. From time to time, we may enter into hedging transactions to manage pricing risks for our commodities. In December 2013, to hedge the volatility and the organically long nature of our natural gas subsidiary, we entered into a short position of long-term NYMEX natural gas futures with a notional value of approximately $50 million. In January and February of 2014, as natural gas prices continued to rise, we increased our position using shorter-duration derivatives. During the second and third quarters of 2014, these positions were covered as natural gas prices declined and, as at September 30, 2014, we no longer had such position.

6

Results of Operations

Summary of Quarterly Results

The following tables provide selected unaudited financial information for the most recent eight quarters:

| September 30, | | June 30, | | March 31, | | December 31, |

| 2014(1) | | 2014(1) | | 2014 | | 2013 |

| (United States dollars in thousands, |

| except per share amounts) |

| Net sales | | $ | 389,423 | | | $ | 394,042 | | $ | 229,147 | | $ | 220,707 | |

| Equity income | | | 2,336 | | | | 3,294 | | | 2,228 | | | 1,428 | |

| Total revenues | | | 391,759 | | | | 397,336 | | | 231,375 | | | 222,135 | |

| Net income (loss)(2) | | | 6,419 | | | | 7,078 | | | 5,801 | | | (12,562 | )(3) |

| Basic earnings (loss), per share | | | 0.10 | | | | 0.11 | | | 0.09 | | | (0.20 | )(3) |

| Diluted earnings (loss), per share | | | 0.10 | | | | 0.11 | | | 0.09 | | | (0.20 | )(3) |

____________________

Notes: |

| (1) | | We commenced consolidation of the operations of Elsner and FESIL from March 31 and April 1, 2014, respectively. |

| | |

| (2) | | Net income attributable to our shareholders. |

| | |

| (3) | | Includes an impairment of interests in resource projects of $6.1 million. |

| September 30, | | June 30, | | March 31, | | December 31, |

| 2013 | | 2013 | | 2013 | | 2012 |

| (United States dollars in thousands, |

| except per share amounts) |

| Net sales | | $ | 213,418 | | | $ | 166,974 | | $ | 205,732 | | $ | 110,416 | |

| Equity income | | | 2,198 | | | | 1,959 | | | 1,522 | | | 1,347 | |

| Total revenues | | | 215,616 | | | | 168,933 | | | 207,254 | | | 111,763 | |

| Net income (loss)(1) | | | 6,977 | | | | 6,811 | | | 8,439 | | | (45,498 | )(2) |

| Basic earnings (loss), per share | | | 0.11 | | | | 0.11 | | | 0.13 | | | (0.73 | )(2) |

| Diluted earnings (loss), per share | | | 0.11 | | | | 0.11 | | | 0.13 | | | (0.73 | )(2) |

____________________

Notes: |

| (1) | | Net income attributable to our shareholders. |

| | |

| (2) | | Includes a total impairment and write-down of $48.2 million, or $0.77 per share on a basic and diluted basis, net of income tax recovery, on a subsidiary in India, which was subsequently sold in 2013. |

7

Three Months Ended September 30, 2014 Compared to Three Months Ended September 30, 2013

The following table sets forth our selected operating results and other financial information for each of the periods indicated:

| Three Months Ended September 30, |

| 2014(1) | | 2013 |

| (United States dollars in thousands, |

| except per share amounts) |

| Net sales | | $ | 389,423 | | | | $ | 213,418 | |

| Gross revenues | | | 391,759 | | | | | 215,616 | |

| Costs and expenses | | | 378,698 | | | | | 211,392 | |

| Costs of sales | | | 355,292 | | | | | 194,811 | |

| Selling, general and administrative expenses | | | 18,903 | | | | | 12,961 | |

| Finance costs | | | 4,503 | | | | | 3,620 | |

| Income from operations | | | 13,061 | | | | | 4,224 | |

| Net income(2) | | | 6,419 | | | | | 6,977 | |

| Earnings per share: | | | | | | | | | |

| Basic | | | 0.10 | | | | | 0.11 | |

| Diluted | | | 0.10 | | | | | 0.11 | |

____________________

Notes: |

| (1) | | We commenced consolidation of the operations of Elsner and FESIL from March 31 and April 1, 2014, respectively. |

| | |

| (2) | | Net income attributable to our shareholders. |

The following is a breakdown of our total revenues by activity for each of the periods indicated:

| Three Months Ended September 30, |

| 2014 | | 2013 |

| (United States dollars in thousands) |

| Gross Revenues: | | | | | | | | | |

| Commodities and resources | | $ | 382,437 | | | | $ | 205,962 | |

| Merchant banking | | | 1,425 | | | | | 2,663 | |

| All other | | | 7,897 | | | | | 6,991 | |

| | $ | 391,759 | | | | $ | 215,616 | |

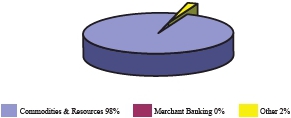

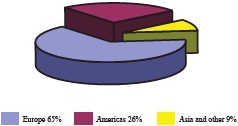

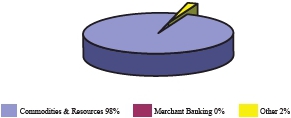

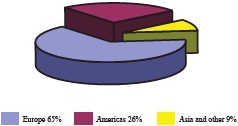

The following charts illustrate our revenues by business segment and geographic distribution in the three months ended September 30, 2014:

| Revenues by Business Segment | Revenues by Region |

| |

|  |

Based upon the average exchange rates for the three months ended September 30, 2014, the United States dollar increased by approximately 0.1% and increased by approximately 4.9% in value against the Euro and the Canadian dollar, respectively, compared to the average exchange rates for the same period in 2013. As at September 30, 2014, the United States dollar had increased by approximately 9.1% against the Euro and 5.4% against the Canadian dollar since December 31, 2013.

Revenues for the third quarter of 2014 increased to $391.8 million (consisting of net sales of $389.4 million and equity income from medical joint ventures of $2.3 million) from $215.6 million (consisting of net sales of $213.4 million and equity income of $2.2 million) in the same period of 2013, primarily as a result of an overall

8

increase in commodities revenues (see below) stemming from the consolidation of our recent acquisitions in the second quarter of 2014 and an increase in natural gas prices. As the Euro was relatively stable during the third quarter of 2014 as compared to the same period in 2013, currency fluctuations had no material impact on our revenues when Euro-denominated revenues were translated into U.S. dollars.

Revenues for our commodities and resources business were $382.4 million for the third quarter of 2014, compared to $206.0 million in the same period in 2013, primarily as a result of the consolidation of our recent acquisitions in the second quarter of 2014. In addition, higher natural gas prices during the period and increased revenues from wood products were partially offset by lower revenues from our royalty interest in a mining sub-lease and the negative impact of the higher U.S. dollar against the Canadian dollar.

Revenues for our merchant banking business decreased to $1.4 million in the third quarter of 2014 from $2.7 million for the same period in 2013.

Revenues for our all other segment were $7.9 million for the third quarter of 2014, compared to $7.0 million for the same period in 2013.

Costs of sales increased to $355.3 million during the third quarter of 2014 from $194.8 million for the same period in 2013, primarily as a result of the consolidation of our recent acquisitions in the second quarter of 2014. The following is a breakdown of our costs of sales for each of the periods indicated:

| Three Months Ended September 30, |

| 2014 | | 2013 |

| (United States dollars in thousands) |

| Commodities and resources | | $ | 357,107 | | | | | $ | 191,971 | | |

| Credit losses on loans and receivables | | | 3,014 | | | | | | 28 | | |

| Gain on derivative contracts, net | | | (9,707 | ) | | | | | (962 | ) | |

| Market value decrease on commodities | | | 1,251 | | | | | | 597 | | |

| Other | | | 3,627 | | | | | | 3,177 | | |

| Total cost of sales | | $ | 355,292 | | | | | $ | 194,811 | | |

The gain on derivative contracts of $9.7 million in the third quarter of 2014 stemmed from commodity and currency derivatives and our natural gas futures (see “Discussion of Operations — Business Environment” for additional information).

Credit losses on loans and receivables, which resulted from financial difficulties experienced by a steel production partner and financial difficulties in the trade sector, were $3.0 million in the third quarter of 2014, compared to $28,000 in the same period of 2013.

Selling, general and administrative expenses increased to $18.9 million for the third quarter of 2014 from $13.0 million for the same period of 2013, primarily as a result of the consolidation of our recent acquisitions in the second quarter of 2014 and certain restructuring and severance expenses.

In the third quarter of 2014, we incurred finance costs of $4.5 million, compared to $3.6 million in the same period of 2013. The increase was primarily a result of higher borrowings.

In the third quarter of 2014, we recognized a net foreign currency transaction loss of $1.3 million (which arose from the monetary assets and liabilities held by our companies that are denominated in currencies that differ from their functional currencies), compared to a gain of $2.6 million in the same period of 2013.

We recognized an income tax expense (other than resource property revenue taxes) of $3.7 million during the third quarter of 2014, compared to a recovery of income taxes (other than resource property revenue taxes) of $2.7 million during the same period of 2013. Our statutory tax rate was 26% during the third quarter of 2014, compared to 25% during the same period of 2013, and our effective tax rates are lower than our statutory tax rates in the current period. The income tax paid in cash (excluding resource property revenue taxes) during the third quarter of 2014 was $0.3 million, compared to $0.2 million in the same period of 2013.

We recognized resource property revenue taxes of $1.3 million during the third quarter of 2014, compared to $2.1 million during the same period of 2013. The resource property revenue tax rate was 20% on our gross royalty revenue from our royalty interest in a mining sub-lease, deducted at source, which is reduced by 20% of deductible expenses. During the third quarter of 2014, proceeds from such interest, net of resource property revenue tax, were C$5.0 million, compared to C$8.8 million in the same period of 2013.

Overall, we recognized an income tax expense of $5.0 million (provision for income taxes of $3.7 million and resource property revenue taxes of $1.3 million) during the third quarter of 2014, compared to a recovery of income taxes $0.7 million (recovery of income taxes of $2.7 million and provision for resource property revenue taxes of $2.1 million) in the same period of 2013.

9

In the third quarter of 2014, our income attributable to shareholders was $6.4 million, or $0.10 per share on a basic and diluted basis, compared to $7.0 million, or $0.11 per share on a basic and diluted basis, for the same period in 2013.

Nine Months Ended September 30, 2014 Compared to Nine Months Ended September 30, 2013

The following table sets forth our selected operating results and other financial information for each of the periods indicated:

| Nine Months Ended September 30, |

| 2014(1) | | 2013 |

| (United States dollars in thousands, |

| except per share amounts) |

| Net sales | | $ | 1,012,612 | | | | $ | 586,124 | |

| Gross revenues | | | 1,020,470 | | | | | 591,803 | |

| Costs and expenses | | | 986,659 | | | | | 566,290 | |

| Costs of sales | | | 910,093 | | | | | 508,446 | |

| Selling, general and administrative expenses | | | 62,903 | | | | | 46,293 | |

| Finance costs | | | 13,280 | | | | | 11,551 | |

| Income from operations | | | 33,811 | | | | | 25,513 | |

| Net income(2) | | | 19,298 | | | | | 22,227 | |

| Earnings per share: | | | | | | | | | |

| Basic | | | 0.31 | | | | | 0.36 | |

| Diluted | | | 0.31 | | | | | 0.35 | |

____________________

Notes: |

| (1) | | We commenced consolidation of the operationsof Elsner and FESIL from March 31 and April 1, 2014, respectively. |

| | |

| (2) | | Net income attributable to our shareholders. |

The following is a breakdown of our total revenues by activity for each of the periods indicated:

| Nine Months Ended September 30, |

| 2014 | | 2013 |

| (United States dollars in thousands) |

| Gross Revenues: | | | | | | | | | |

| Commodities and resources | | $ | 987,979 | | | | $ | 566,572 | |

| Merchant banking | | | 10,802 | | | | | 8,880 | |

| All other | | | 21,689 | | | | | 16,351 | |

| | $ | 1,020,470 | | | | $ | 591,803 | |

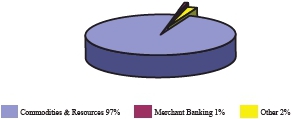

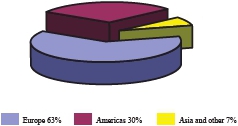

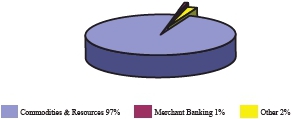

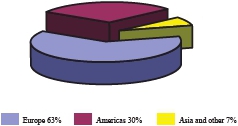

The following charts illustrate our revenues by business segment and geographic distribution in the nine months ended September 30, 2014:

Revenues by Business Segment | Revenues by Region |

| | |

|  |

Based upon the average exchange rates for the nine months ended September 30, 2014, the United States dollar decreased by approximately 2.8% and increased by approximately 6.9% in value against the Euro and the Canadian dollar, respectively, compared to the average exchange rates for the same period in 2013. As at September 30, 2014, the United States dollar had increased by approximately 9.1% against the Euro and 5.4% against the Canadian dollar since December 31, 2013.

10

Revenues for the nine months ended September 30, 2014 increased to $1,020.5 million (consisting of net sales of $1,012.6 million and equity income from medical joint ventures of $7.9 million) from $591.8 million (consisting of net sales of $586.1 million and equity income of $5.7 million) in the same period of 2013, primarily as a result of an overall increase in commodities revenues (see below) stemming from the consolidation of our recent acquisitions in the second quarter of 2014 and an increase in natural gas prices. As the Euro was relatively stable during the nine months ended September 30, 2014 as compared to the same period in 2013, currency fluctuations had no material impact on our revenues when Euro-denominated revenues were translated into U.S. dollars.

Revenues for our commodities and resources business were $988.0 million for the nine months ended September 30, 2014, compared to $566.6 million in the same period in 2013, primarily as a result of the consolidation of our recent acquisitions in the second quarter of 2014. In addition, higher natural gas prices during the period and increased revenues from wood products were partially offset by lower revenues from our royalty interest in a mining sub-lease and the negative impact of the higher U.S. dollar against the Canadian dollar.

Revenues for our merchant banking business were $10.8 million for the nine months ended September 30, 2014, compared to $8.9 million for the same period in 2013, primarily as a result of an accounting gain on the sale of subsidiaries.

Revenues for our all other segment were $21.7 million for the nine months ended September 30, 2014, compared to $16.4 million for the same period in 2013.

Costs of sales increased to $910.1 million during the nine months ended September 30, 2014 from $508.4 million for the same period in 2013, primarily as a result of the consolidation of our recent acquisitions in the second quarter of 2014. The following is a breakdown of our costs of sales for each of the periods indicated:

| | | | Nine Months Ended September 30, |

| | | 2014 | | 2013 |

| | | (United States dollars in thousands) |

| Commodities and resources | | $ | 905,906 | | | $ | 512,644 | |

| | Credit losses on loans and receivables | | | 2,973 | | | | 78 | |

| Gain on derivative contracts, net | | | (9,849 | ) | | | (5,297 | ) |

| Market value decrease (increase) on commodities | | | 2,334 | | | | (6,463 | ) |

| Other | | | 8,729 | | | | 7,484 | |

| Total cost of sales | | $ | 910,093 | | | $ | 508,446 | |

The gain on derivative contracts of $9.8 million in the nine months ended September 30, 2014 stemmed from commodity and currency derivatives and our natural gas futures (see “Discussion of Operations — Business Environment” for additional information).

Selling, general and administrative expenses increased to $62.9 million in the nine months ended September 30, 2014 from $46.3 million for the same period of 2013, primarily as a result of the consolidation of our recent acquisitions in the second quarter of 2014 and certain restructuring and severance expenses.

In the nine months ended September 30, 2014, we incurred finance costs of $13.3 million, compared to $11.6 million in the same period of 2013. The increase was primarily a result of higher borrowings.

In the nine months ended September 30, 2014, we recognized $0.4 million of share-based compensation expense as a result of the granting of stock options to employees during the period, compared to $nil in the same period of 2013.

In the nine months ended September 30, 2014, we recognized a net foreign currency transaction loss of $2.6 million (which arose from the monetary assets and liabilities held by our companies that are denominated in currencies that differ from their functional currencies), compared to a net foreign currency transaction gain of $0.1 million in the same period of 2013. A substantial amount of the exchange loss in the current period was attributable to an intercompany settlement in support of fiscally responsible strategies.

We recognized an income tax expense (other than resource property revenue taxes) of $9.0 million during the nine months ended September 30, 2014, compared to a recovery of income taxes (other than resource property revenue taxes) of $1.2 million during the same period of 2013. Our statutory tax rate was 26% for the nine months ended September 30, 2014, compared to 25% during the same period of 2013, and our effective tax rates are lower than our statutory tax rates in the current period. The income tax paid in cash (excluding resource property revenue taxes) during the nine months ended September 30, 2014 was $2.1 million, compared to $2.3 million in the same period of 2013.

11

We recognized resource property revenue taxes of $1.8 million during the nine months ended September 30, 2014, compared to $3.6 million during the same period of 2013. The resource property revenue tax rate was 20% on our gross royalty revenue from our royalty interest in a mining sub-lease, deducted at source, which is reduced by 20% of deductible expenses. During the nine months ended September 30, 2014, proceeds from such interest, net of resource property revenue tax, were C$7.6 million, compared to C$15.2 million in the same period of 2013.

Overall, we recognized an income tax expense of $10.8 million (provision for income taxes of $9.0 million and resource property revenue taxes of $1.8 million) during the nine months ended September 30, 2014, compared to $2.4 million (a recovery of income taxes of $1.2 million and provision for resource property revenue taxes of $3.6 million) in the same period of 2013.

In the nine months ended September 30, 2014, our income attributable to shareholders was $19.3 million, or $0.31 per share on a basic and diluted basis, compared to $22.2 million, or $0.36 and $0.35 per share on a basic and diluted basis, respectively, for the same period in 2013.

Liquidity and Capital Resources

General

Liquidity is of importance to companies in our businesses, as insufficient liquidity often results in underperformance.

Our objectives when managing capital are: (i) to safeguard our ability to continue as a going concern so that we can continue to provide returns for shareholders and benefits for other stakeholders; (ii) to provide an adequate return to our shareholders by pricing products and services commensurately with the level of risk; and (iii) to maintain a flexible capital structure that optimizes the cost of capital at acceptable risk. We set the amount of capital in proportion to risk. We manage our capital structure and make adjustments to it in the light of changes in economic conditions and the risk characteristics of the underlying assets. In order to maintain or adjust this capital structure, we may adjust the amount of dividends paid to shareholders, return capital to shareholders, issue new shares or sell assets to reduce debt.