| FREE WRITING PROSPECTUS | ||

| FILED PURSUANT TO RULE 433 | ||

| REGISTRATION FILE NO.: 333-206361-08 | ||

| February [24], 2017 | JPMCC 2017-JP5 |

Free Writing Prospectus Structural and Collateral Term Sheet | ||

JPMCC 2017-JP5

| ||

This material is for your information, and none of J.P. Morgan Securities LLC (“JPMS”), Drexel Hamilton, LLC and Academy Securities, Inc. (each individually, an “Underwriter”, and together, the ‘‘Underwriters’’) are soliciting any action based upon it. This material is not to be construed as an offer to sell or the solicitation of any offer to buy any security in any jurisdiction where such an offer or solicitation would be illegal.

The depositor has filed a registration statement (including a prospectus) with the SEC (SEC File No. 333-206361) for the offering to which this free writing prospectus relates. Before you invest, you should read the prospectus in the registration statement and other documents the depositor has filed with the SEC for more complete information about the depositor, the issuing entity and this offering. You may get these documents for free by visiting EDGAR on the SEC Web site at www.sec.gov. Alternatively, the depositor, any underwriter or any dealer participating in the offering will arrange to send you the prospectus if you request it by calling (866) 669-7629 or by emailing the ABS Syndicate Desk atabs_synd@jpmorgan.com.

Neither this document nor anything contained in this document shall form the basis for any contract or commitment whatsoever. The information contained in this document is preliminary as of the date of this document, supersedes any previous such information delivered to you and will be superseded by any such information subsequently delivered prior to the time of sale. These materials are subject to change, completion or amendment from time to time.

This information is based upon management forecasts and reflects prevailing conditions and management's views as of this date, all of which are subject to change.

J.P. Morgan is the marketing name for the investment banking businesses of JPMorgan Chase & Co. and its subsidiaries worldwide. Securities, syndicated loan arranging, financial advisory and other investment banking activities are performed by JPMS and its securities affiliates, and lending, derivatives and other commercial banking activities are performed by JPMorgan Chase Bank, National Association and its banking affiliates. JPMS is a member of SIPC and the NYSE.

THE UNDERWRITERS MAY FROM TIME TO TIME PERFORM INVESTMENT BANKING SERVICES FOR, OR SOLICIT INVESTMENT BANKING BUSINESS FROM, ANY COMPANY NAMED IN THESE MATERIALS. THE UNDERWRITERS AND/OR THEIR AFFILIATES OR RESPECTIVE EMPLOYEES MAY FROM TIME TO TIME HAVE A LONG OR SHORT POSITION IN ANY CERTIFICATE OR CONTRACT DISCUSSED IN THESE MATERIALS.

| ||

THE INFORMATION IN THIS STRUCTURAL AND COLLATERAL TERM SHEET IS NOT COMPLETE AND MAY BE AMENDED PRIOR TO THE TIME OF SALE. THIS TERM SHEET IS NOT AN OFFER TO SELL THESE SECURITIES AND IT IS NOT A SOLICITATION OF AN OFFER TO BUY THESE SECURITIES IN ANY JURISDICTION WHERE THE OFFER OR SALE IS NOT PERMITTED.

| February [24], 2017 | JPMCC 2017-JP5 |

THE REPUBLIC OF KOREA

THIS PROSPECTUS IS NOT, AND UNDER NO CIRCUMSTANCES IS THIS PROSPECTUS TO BE CONSTRUED AS, A PUBLIC OFFERING OF SECURITIES IN KOREA. NEITHER THE ISSUER NOR ANY OF ITS AGENTS MAKE ANY REPRESENTATION WITH RESPECT TO THE ELIGIBILITY OF ANY RECIPIENTS OF THIS PROSPECTUS TO ACQUIRE THE OFFERED CERTIFICATES UNDER THE LAWS OF KOREA, INCLUDING, BUT WITHOUT LIMITATION, THE FOREIGN EXCHANGE TRANSACTION LAW AND REGULATIONS THEREUNDER (THE “FETL”). THE OFFERED CERTIFICATES HAVE NOT BEEN REGISTERED WITH THE FINANCIAL SERVICES COMMISSION OF KOREA FOR PUBLIC OFFERING IN KOREA, AND NONE OF THE OFFERED CERTIFICATES MAY BE OFFERED, SOLD OR DELIVERED, DIRECTLY OR INDIRECTLY, OR OFFERED OR SOLD TO ANY PERSON FOR RE-OFFERING OR RESALE, DIRECTLY OR INDIRECTLY IN KOREA OR TO ANY RESIDENT OF KOREA EXCEPT PURSUANT TO THE FINANCIAL INVESTMENT SERVICES AND CAPITAL MARKETS ACT AND THE DECREES AND REGULATIONS THEREUNDER (THE “FSCMA”), THE FETL AND ANY OTHER APPLICABLE LAWS, REGULATIONS AND MINISTERIAL GUIDELINES IN KOREA. WITHOUT PREJUDICE TO THE FOREGOING, THE NUMBER OF OFFERED CERTIFICATES OFFERED IN KOREA OR TO A RESIDENT OF KOREA SHALL BE LESS THAN FIFTY AND FOR A PERIOD OF ONE YEAR FROM THE ISSUE DATE OF THE OFFERED CERTIFICATES, NONE OF THE OFFERED CERTIFICATES MAY BE DIVIDED RESULTING IN AN INCREASED NUMBER OF OFFERED CERTIFICATES. FURTHERMORE, THE OFFERED CERTIFICATES MAY NOT BE RESOLD TO KOREAN RESIDENTS UNLESS THE PURCHASER OF THE OFFERED CERTIFICATES COMPLIES WITH ALL APPLICABLE REGULATORY REQUIREMENTS (INCLUDING, BUT NOT LIMITED TO, GOVERNMENT REPORTING APPROVAL REQUIREMENTS UNDER THE FETL AND ITS SUBORDINATE DECREES AND REGULATIONS) IN CONNECTION WITH THE PURCHASE OF THE OFFERED CERTIFICATES.

JAPAN

THE OFFERED CERTIFICATES HAVE NOT BEEN AND WILL NOT BE REGISTERED UNDER THE FINANCIAL INSTRUMENTS AND EXCHANGE LAW OF JAPAN, AS AMENDED (THE “FIEL”), AND DISCLOSURE UNDER THE FIEL HAS NOT BEEN AND WILL NOT BE MADE WITH RESPECT TO THE OFFERED CERTIFICATES. ACCORDINGLY, EACH UNDERWRITER HAS REPRESENTED AND AGREED THAT IT HAS NOT, DIRECTLY OR INDIRECTLY, OFFERED OR SOLD AND WILL NOT, DIRECTLY OR INDIRECTLY, OFFER OR SELL ANY OFFERED CERTIFICATES IN JAPAN OR TO, OR FOR THE BENEFIT OF, ANY RESIDENT OF JAPAN (WHICH TERM AS USED IN THIS PROSPECTUS MEANS ANY PERSON RESIDENT IN JAPAN, INCLUDING ANY CORPORATION OR OTHER ENTITY ORGANIZED UNDER THE LAWS OF JAPAN) OR TO OTHERS FOR REOFFERING OR RE-SALE, DIRECTLY OR INDIRECTLY, IN JAPAN OR TO, OR FOR THE BENEFIT OF, ANY RESIDENT OF JAPAN EXCEPT PURSUANT TO AN EXEMPTION FROM THE REGISTRATION REQUIREMENTS OF, AND OTHERWISE IN COMPLIANCE WITH, THE FIEL AND OTHER RELEVANT LAWS, REGULATIONS AND MINISTERIAL GUIDELINES OF JAPAN. AS PART OF THIS OFFERING OF THE OFFERED CERTIFICATES, THE UNDERWRITERS MAY OFFER THE OFFERED CERTIFICATES IN JAPAN TO UP TO 49 OFFEREES IN ACCORDANCE WITH THE ABOVE PROVISIONS.

THE INFORMATION IN THIS STRUCTURAL AND COLLATERAL TERM SHEET IS NOT COMPLETE AND MAY BE AMENDED PRIOR TO THE TIME OF SALE. THIS TERM SHEET IS NOT AN OFFER TO SELL THESE SECURITIES AND IT IS NOT A SOLICITATION OF AN OFFER TO BUY THESE SECURITIES IN ANY JURISDICTION WHERE THE OFFER OR SALE IS NOT PERMITTED.

| 2 of 125 |

| Structural and Collateral Term Sheet | JPMCC 2017-JP5 | |

| Collateral Characteristics | ||

| Loan Pool | ||

| Initial Pool Balance (“IPB”): | $1,092,982,047 | |

| Number of Mortgage Loans: | 43 | |

| Number of Mortgaged Properties: | 59 | |

| Average Cut-off Date Balance per Mortgage Loan: | $25,418,187 | |

| Weighted Average Current Mortgage Rate: | 4.67097% | |

| 10 Largest Mortgage Loans as % of IPB: | 56.6% | |

| Weighted Average Remaining Term to Maturity: | 112 months | |

| Weighted Average Seasoning: | 2 months | |

| Credit Statistics | ||

| Weighted Average UW NCF DSCR(1)(2): | 1.97x | |

| Weighted Average UW NOI Debt Yield(1): | 11.7% | |

| Weighted Average Cut-off Date Loan-to-Value Ratio (“LTV”)(1)(3): | 59.1% | |

| Weighted Average Maturity Date LTV(1)(2)(3): | 52.5% | |

| Other Statistics | ||

| % of Mortgage Loans with Additional Debt: | 18.3% | |

| % of Mortgaged Properties with Single Tenants: | 13.5% | |

| Amortization | ||

| Weighted Average Original Amortization Term(4): | 355 months | |

| Weighted Average Remaining Amortization Term(4): | 354 months | |

| % of Mortgage Loans with Amortizing Balloon: | 39.2% | |

| % of Mortgage Loans with Partial Interest-Only followed by Amortizing Balloon: | 32.0% | |

| % of Mortgage Loans with Interest-Only: | 28.2% | |

| % of Mortgage Loans with Amortizing, Interest-Only followed by Balloon: | 0.6% | |

| Cash Management(5) | ||

| % of Mortgage Loans with In-Place, CMA Lockboxes: | 54.7% | |

| % of Mortgage Loans with In-Place, Hard Lockboxes: | 20.7% | |

| % of Mortgage Loans with Springing Lockboxes: | 23.2% | |

| % of Mortgage Loans with No Lockboxes: | 1.4% | |

| Reserves | ||

| % of Mortgage Loans Requiring Monthly Tax Reserves: | 77.3% | |

| % of Mortgage Loans Requiring Monthly Insurance Reserves: | 21.7% | |

| % of Mortgage Loans Requiring Monthly CapEx Reserves(6): | 59.0% | |

| % of Mortgage Loans Requiring Monthly TI/LC Reserves(7): | 45.1% | |

| (1) | In the case of Loan Nos. 1, 2, 3, 4, 5 and 8, the UW NCF DSCR, UW NOI Debt Yield, Cut-off Date LTV and Maturity Date LTV calculations include the related Pari Passu Companion Loan(s). In the case of Loan Nos. 1, 2 and 10, the UW NCF DSCR, UW NOI Debt Yield, Cut-off Date LTV and Maturity Date LTV calculations exclude the related Subordinate Companion Loan(s). |

| (2) | In the case of Loan No. 2, the UW NCF DSCR and Maturity Date LTV are calculated using the average of principal and interest payments over the first 12 months following the expiration of the interest-only period based on the assumed principal payment schedule provided on Annex G to the Preliminary Prospectus. Additionally, in the case of Loan No. 10, the UW NCF DSCR and Maturity Date LTV are calculated in accordance with the amortization schedule set forth in Annex [ ] to the Preliminary Prospectus. |

| (3) | In the case of Loan Nos. 2, 12 and 21, the Cut-off Date LTV and the Maturity Date LTV are calculated by using an appraised value based on certain hypothetical assumptions. Refer to “Description of the Mortgage Pool—Assessments of Property Value and Condition” and “—Appraised Value” in the Preliminary Prospectus for additional details. |

| (4) | Excludes seven mortgage loans that are interest-only for the entire term or until the anticipated repayment date. |

| (5) | For a more detailed description of Cash Management, refer to “Description of the Mortgage Pool—Certain Terms of the Mortgage Loans—Mortgaged Property Accounts” in the Preliminary Prospectus. |

| (6) | CapEx Reserves include FF&E reserves for hotel properties. |

| (7) | Calculated only with respect to the Cut-off Date Balance of mortgage loans secured or partially secured by mixed use, retail, industrial and office properties. |

THE INFORMATION IN THIS STRUCTURAL AND COLLATERAL TERM SHEET IS NOT COMPLETE AND MAY BE AMENDED PRIOR TO THE TIME OF SALE. THIS TERM SHEET IS NOT AN OFFER TO SELL THESE SECURITIES AND IT IS NOT A SOLICITATION OF AN OFFER TO BUY THESE SECURITIES IN ANY JURISDICTION WHERE THE OFFER OR SALE IS NOT PERMITTED.

| 3 of 125 |

| Structural and Collateral Term Sheet | JPMCC 2017-JP5 | |

| Collateral Characteristics | ||

Mortgage Loan Seller | Number of | Number of | Aggregate | % of IPB |

| JPMCB(1) | 22 | 22 | $924,280,100 | 84.6% |

| SMF VI | 21 | 37 | 168,701,947 | 15.4 |

| Total: | 43 | 59 | $1,092,982,047 | 100.0% |

| (1) | In the case of Loan No. 1, the whole loan was co-originated by JPMCB, Deutsche Bank AG, New York Branch, Goldman Sachs Mortgage Company, Barclays Bank PLC and Morgan Stanley Bank, N.A. In the case of Loan No. 4, the whole loan was co-originated by JPMCB and Société Générale. |

| Ten Largest Mortgage Loans | |||||||||||

| No. | Loan Name | Mortgage Loan Seller | No. of Prop. | Cut-off Date Balance | % of IPB | SF/Units/ Rooms/Beds | Property Type | UW NCF DSCR(1) | UW NOI Debt Yield(1) | Cut-off Date LTV(1)(2) | Maturity Date LTV(1)(2) |

| 1 | Hilton Hawaiian Village | JPMCB | 1 | $80,000,000 | 7.3% | 2,860 | Hotel | 4.47x | 19.0% | 31.2% | 31.2% |

| 2 | Moffett Gateway | JPMCB | 1 | $80,000,000 | 7.3% | 612,691 | Office | 1.95x | 11.9% | 46.3% | 39.3% |

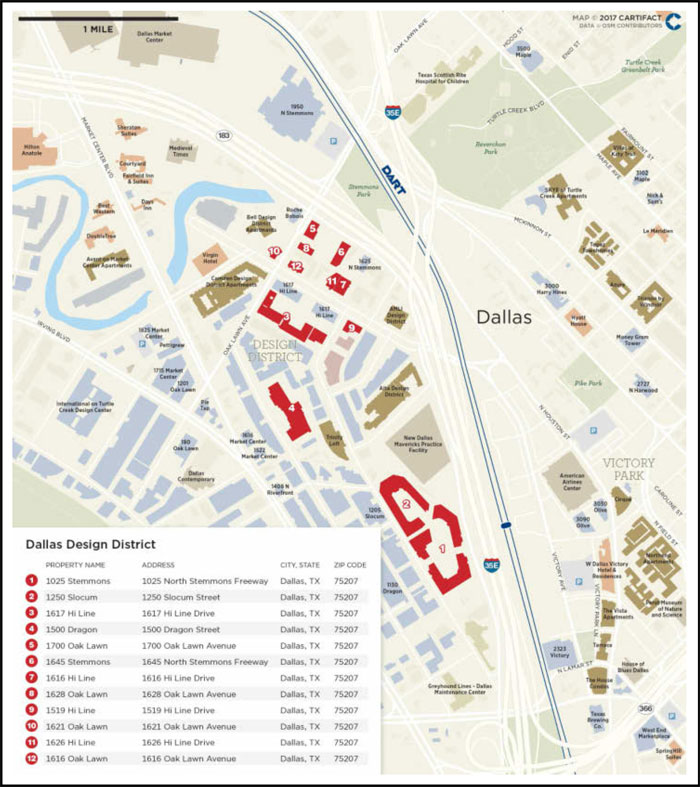

| 3 | Dallas Design District | JPMCB | 1 | $75,000,000 | 6.9% | 728,452 | Industrial | 1.28x | 9.4% | 62.1% | 55.3% |

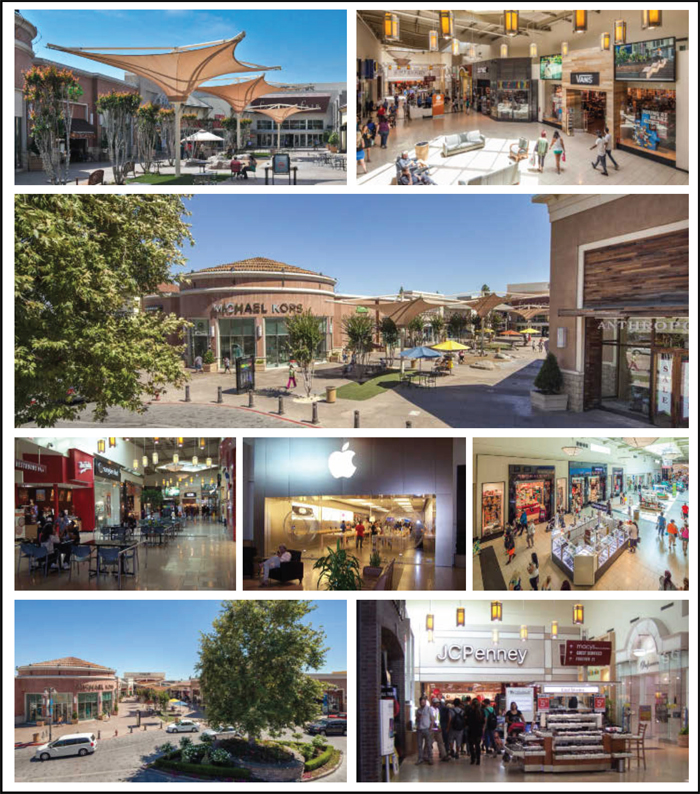

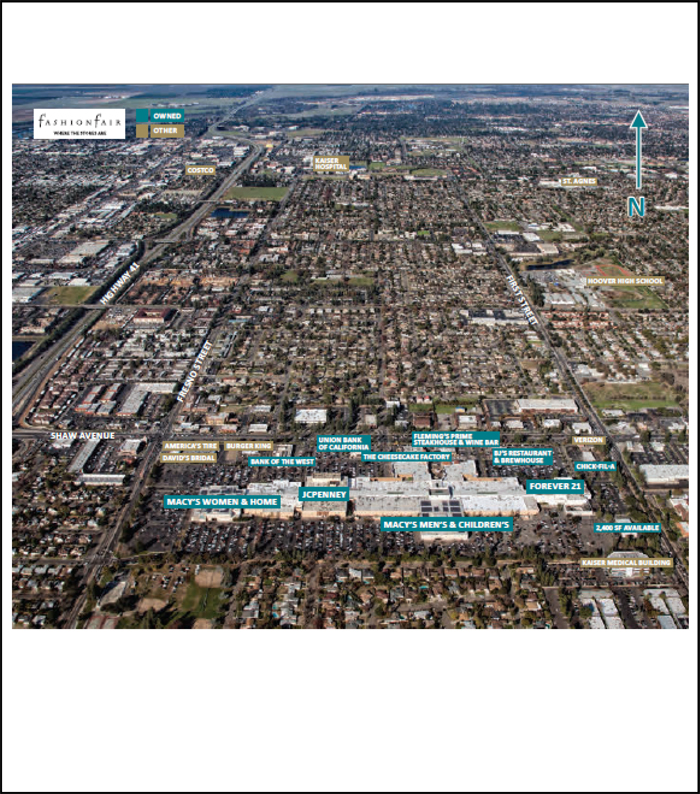

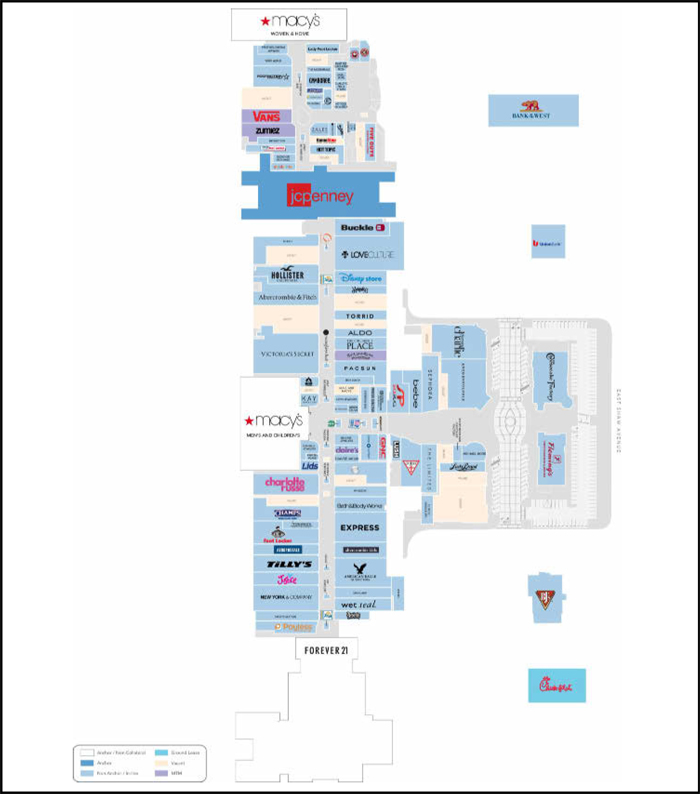

| 4 | Fresno Fashion Fair Mall | JPMCB | 1 | $69,000,000 | 6.3% | 536,106 | Retail | 2.19x | 8.3% | 57.5% | 57.5% |

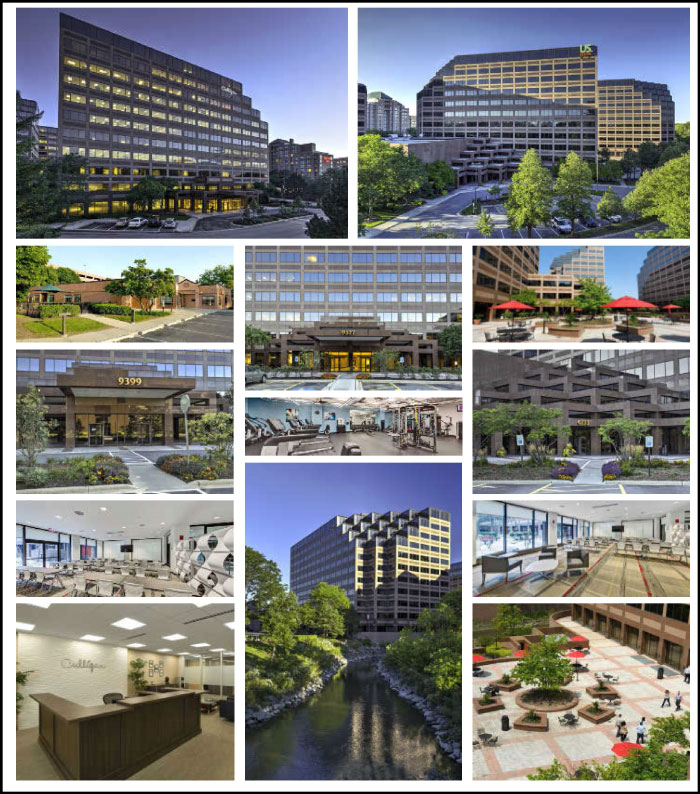

| 5 | Riverway | JPMCB | 1 | $64,763,123 | 5.9% | 869,120 | Office | 1.42x | 10.3% | 72.4% | 59.6% |

| 6 | 55 Hawthorne | JPMCB | 1 | $61,500,000 | 5.6% | 136,432 | Office | 2.61x | 11.8% | 50.0% | 50.0% |

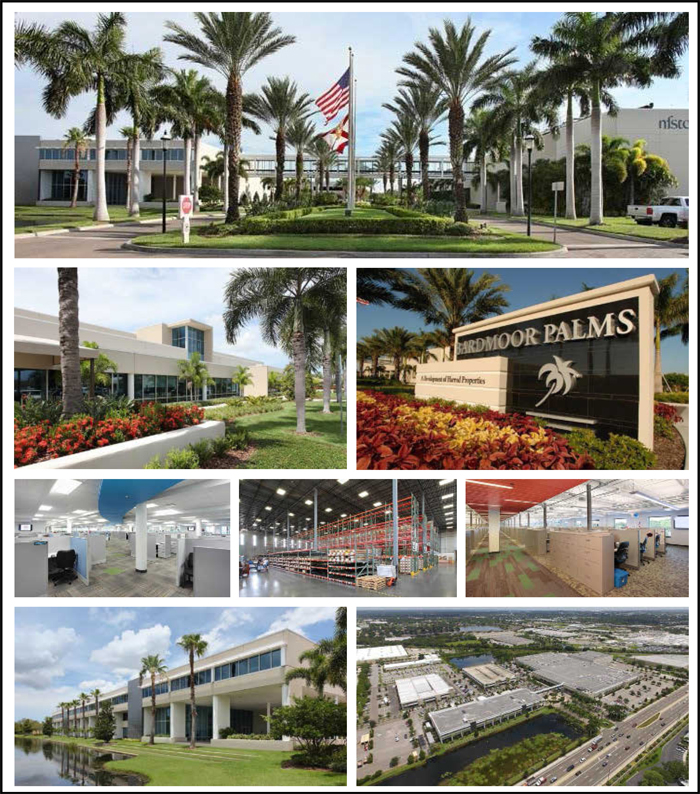

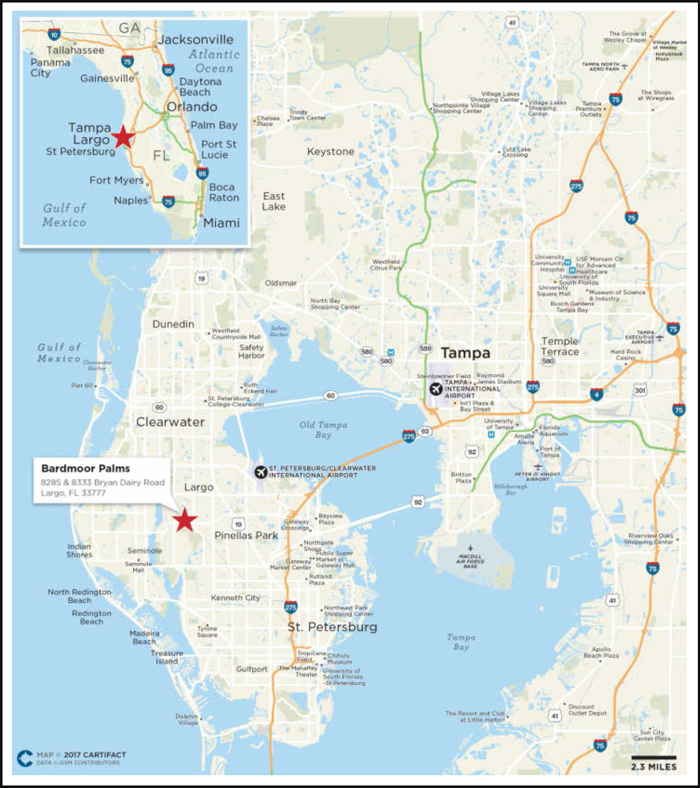

| 7 | Bardmoor Palms | JPMCB | 1 | $55,352,648 | 5.1% | 553,485 | Mixed Use | 1.39x | 9.4% | 73.8% | 60.3% |

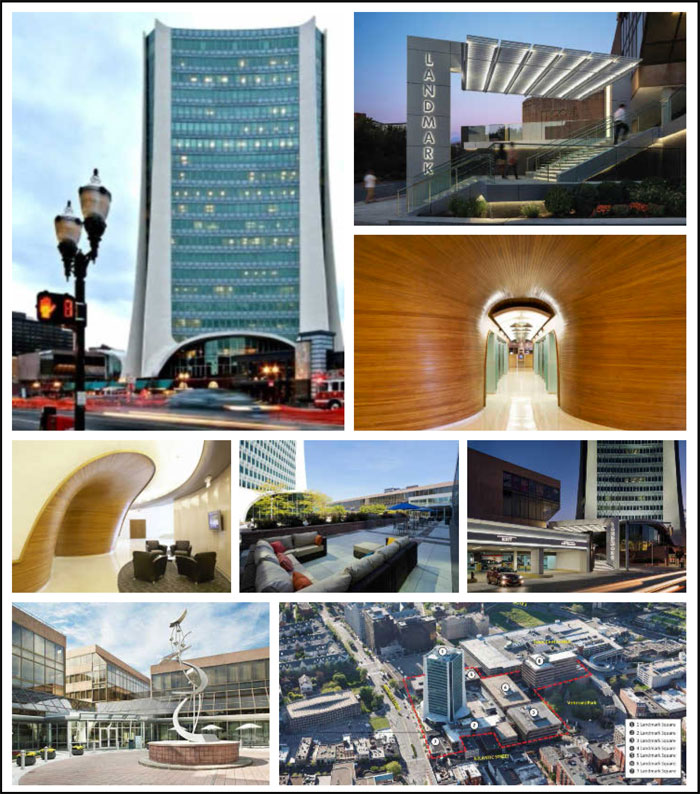

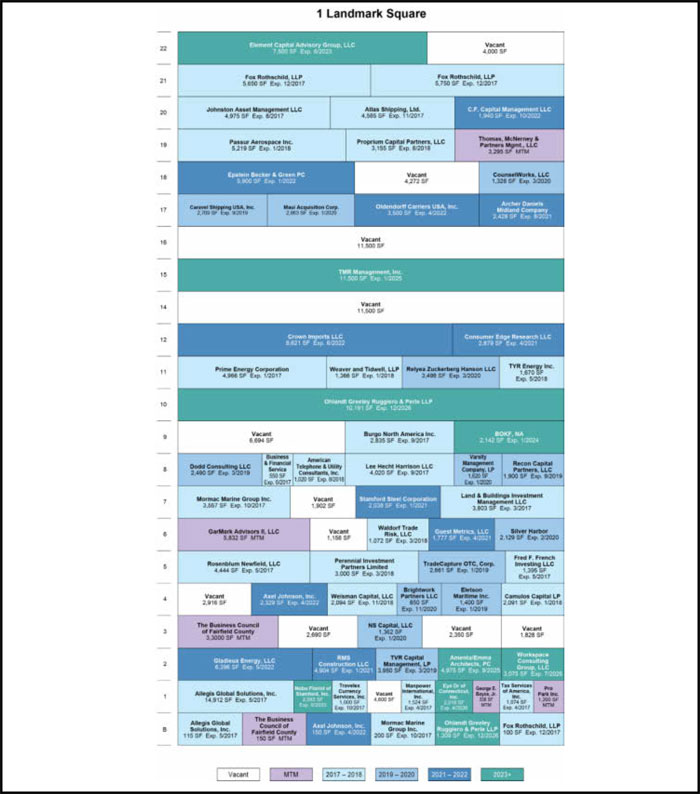

| 8 | Landmark Square | JPMCB | 1 | $51,000,000 | 4.7% | 757,917 | Mixed Use | 2.19x | 12.0% | 56.9% | 56.9% |

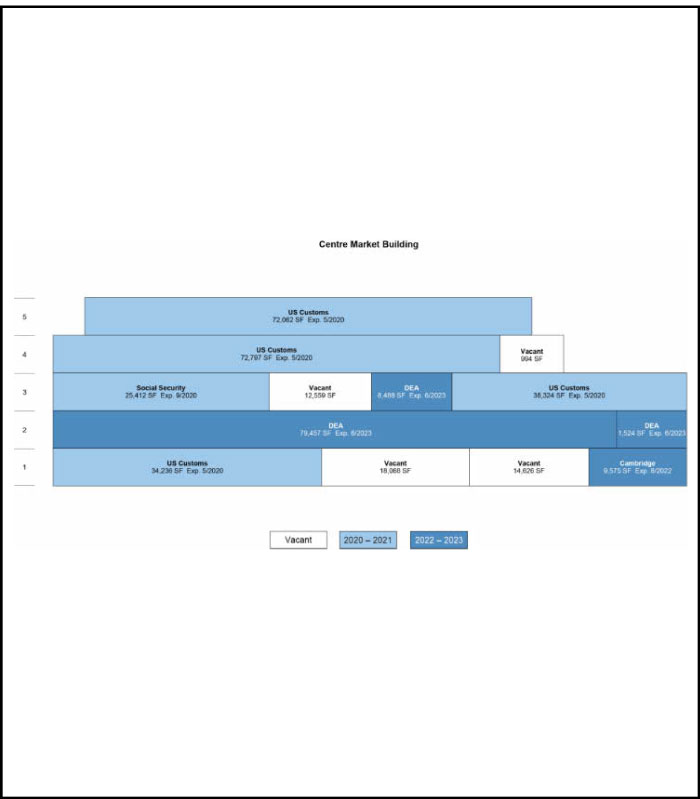

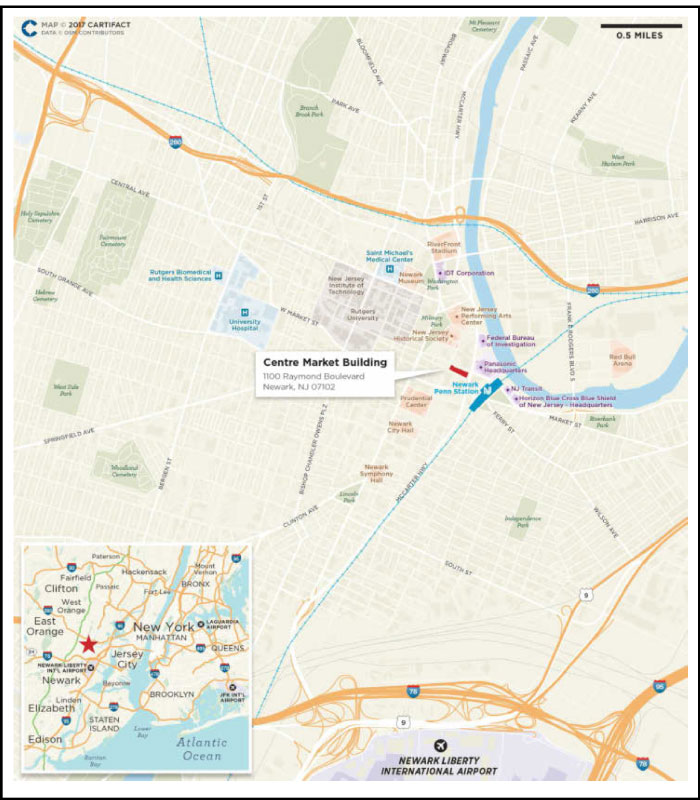

| 9 | Centre Market Building | JPMCB | 1 | $41,842,074 | 3.8% | 388,122 | Office | 2.48x | 18.2% | 47.0% | 34.6% |

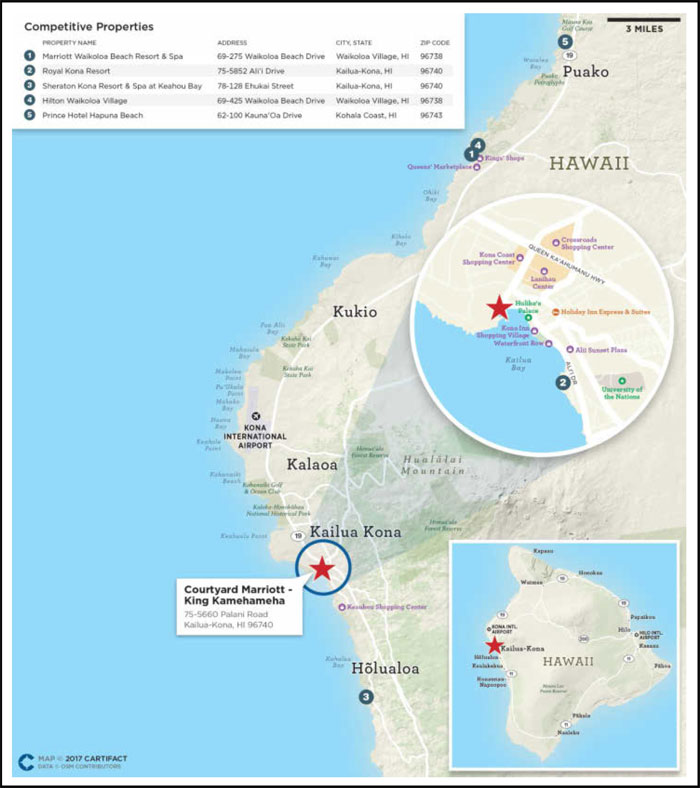

| 10 | Courtyard Marriott - King Kamehameha | JPMCB | 1 | $39,945,058 | 3.7% | 452 | Hotel | 3.06x | 18.6% | 30.0% | 25.3% |

| Top 3 Total/Weighted Average | 3 | $235,000,000 | 21.5% | 2.59x | 13.5% | 46.2% | 41.6% | ||||

| Top 5 Total/Weighted Average | 5 | $368,763,123 | 33.7% | 2.31x | 12.0% | 52.9% | 47.8% | ||||

| Top 10 Total/Weighted Average | 10 | $618,402,903 | 56.6% | 2.31x | 12.6% | 52.9% | 47.5% | ||||

| (1) | In the case of Loan Nos. 1, 2, 3, 4, 5 and 8, the UW NCF DSCR, UW NOI Debt Yield, Cut-off Date LTV and Maturity Date LTV calculations include the related Pari Passu Companion Loan(s). In the case of Loan Nos. 1, 2 and 10, the UW NCF DSCR, UW NOI Debt Yield, Cut-off Date LTV and Maturity Date LTV calculations exclude the related Subordinate Companion Loan(s). |

| (2) | In the case of Loan No. 2, the Cut-off Date LTV and the Maturity Date LTV are calculated by using an appraised value based on certain hypothetical assumptions. Refer to “Description of the Mortgage Pool—Assessments of Property Value and Condition” and “—Appraised Value” in the Preliminary Prospectus for additional details. |

THE INFORMATION IN THIS STRUCTURAL AND COLLATERAL TERM SHEET IS NOT COMPLETE AND MAY BE AMENDED PRIOR TO THE TIME OF SALE. THIS TERM SHEET IS NOT AN OFFER TO SELL THESE SECURITIES AND IT IS NOT A SOLICITATION OF AN OFFER TO BUY THESE SECURITIES IN ANY JURISDICTION WHERE THE OFFER OR SALE IS NOT PERMITTED.

| 4 of 125 |

| Structural and Collateral Term Sheet | JPMCC 2017-JP5 | |

| Collateral Characteristics | ||

| Mortgaged Properties by Type(1) |

Weighted Average | |||||||||

| Property Type | Property Subtype | Number of Properties | Cut-off Date Principal Balance | % of IPB | Occupancy | UW NCF DSCR(2)(3) | UW NOI Debt Yield(2) | Cut-off Date LTV(2)(4) | Maturity Date LTV(2)(3)(4) |

| Office | CBD | 9 | $313,488,123 | 28.7% | 90.4% | 1.65x | 10.8% | 63.1% | 55.6% |

| Suburban | 2 | 103,342,074 | 9.5 | 95.2% | 2.56x | 14.4% | 48.8% | 43.8% | |

| Subtotal: | 11 | $416,830,197 | 38.1% | 91.6% | 1.87x | 11.7% | 59.5% | 52.7% | |

| Retail | Anchored | 6 | $121,813,314 | 11.1% | 94.3% | 1.35x | 9.3% | 68.4% | 58.0% |

| Super Regional Mall | 1 | 69,000,000 | 6.3 | 89.3% | 2.19x | 8.3% | 57.5% | 57.5% | |

| Unanchored | 2 | 7,731,809 | 0.7 | 100.0% | 1.32x | 9.9% | 71.1% | 59.5% | |

| Shadow Anchored | 1 | 6,581,000 | 0.6 | 93.9% | 1.51x | 10.5% | 74.9% | 66.1% | |

| Freestanding | 2 | 6,086,930 | 0.6 | 100.0% | 1.54x | 9.9% | 56.2% | 49.3% | |

| Subtotal: | 12 | $211,213,053 | 19.3% | 93.0% | 1.63x | 9.1% | 64.8% | 57.9% | |

| Hotel | Full Service | 5 | $183,287,842 | 16.8% | 82.9% | 3.20x | 16.1% | 42.1% | 38.3% |

| Limited Service | 2 | 12,505,845 | 1.1 | 71.9% | 1.87x | 13.2% | 65.3% | 52.1% | |

| Extended Stay | 1 | 11,882,296 | 1.1 | 76.7% | 1.70x | 10.9% | 66.7% | 54.8% | |

| Subtotal: | 8 | $207,675,983 | 19.0% | 81.9% | 3.03x | 15.7% | 44.9% | 40.1% | |

| Mixed Use | Office/Retail | 3 | $61,442,484 | 5.6% | 87.1% | 2.05x | 11.6% | 58.9% | 57.0% |

| Office/Industrial | 1 | 55,352,648 | 5.1 | 100.0% | 1.39x | 9.4% | 73.8% | 60.3% | |

| Subtotal: | 4 | $116,795,132 | 10.7% | 93.2% | 1.74x | 10.6% | 66.0% | 58.6% | |

| Industrial | Flex | 3 | $85,950,000 | 7.9% | 98.1% | 1.36x | 9.8% | 62.5% | 56.1% |

| Warehouse | 1 | 14,215,053 | 1.3 | 90.7% | 1.39x | 11.5% | 72.3% | 60.1% | |

| Subtotal: | 4 | $100,165,053 | 9.2% | 97.1% | 1.36x | 10.0% | 63.9% | 56.7% | |

| Multifamily | Garden | 18 | $31,064,623 | 2.8% | 95.6% | 1.52x | 11.0% | 68.4% | 61.4% |

| Mid-Rise | 1 | 6,438,005 | 0.6 | 95.5% | 1.70x | 14.0% | 55.1% | 42.0% | |

| Subtotal: | 19 | $37,502,628 | 3.4% | 95.6% | 1.55x | 11.5% | 66.1% | 58.1% | |

| Manufactured Housing | Manufactured Housing | 1 | $2,800,000 | 0.3% | 77.4% | 1.48x | 10.1% | 71.4% | 60.7% |

| Total / Weighted | 59 | $1,092,982,047 | 100.0% | 90.8% | 1.97x | 11.7% | 59.1% | 52.5% | |

| (1) | Because this table presents information relating to the mortgaged properties and not mortgage loans, the information for mortgage loans secured by more than one mortgaged property is based on allocated loan amounts. |

| (2) | In the case of Loan Nos. 1, 2, 3, 4, 5 and 8, the UW NCF DSCR, UW NOI Debt Yield, Cut-off Date LTV and Maturity Date LTV calculations include the related Pari Passu Companion Loan(s). In the case of Loan Nos. 1, 2 and 10, the UW NCF DSCR, UW NOI Debt Yield, Cut-off Date LTV and Maturity Date LTV calculations exclude the related Subordinate Companion Loan(s). |

| (3) | In the case of Loan No. 2, the UW NCF DSCR and Maturity Date LTV are calculated using the average of principal and interest payments over the first 12 months following the expiration of the interest-only period based on the assumed principal payment schedule provided on Annex G to the Preliminary Prospectus. Additionally, in the case of Loan No. 10, the UW NCF DSCR and Maturity Date LTV are calculated in accordance with the amortization schedule set forth in Annex [ ] to the Preliminary Prospectus. |

| (4) | In the case of Loan Nos. 2, 12 and 21, the Cut-off Date LTV and the Maturity Date LTV are calculated by using an appraised value based on certain hypothetical assumptions. Refer to “Description of the Mortgage Pool—Assessments of Property Value and Condition” and “—Appraised Value” in the Preliminary Prospectus for additional details. |

THE INFORMATION IN THIS STRUCTURAL AND COLLATERAL TERM SHEET IS NOT COMPLETE AND MAY BE AMENDED PRIOR TO THE TIME OF SALE. THIS TERM SHEET IS NOT AN OFFER TO SELL THESE SECURITIES AND IT IS NOT A SOLICITATION OF AN OFFER TO BUY THESE SECURITIES IN ANY JURISDICTION WHERE THE OFFER OR SALE IS NOT PERMITTED.

| 5 of 125 |

| Structural and Collateral Term Sheet | JPMCC 2017-JP5 | |

| Collateral Characteristics | ||

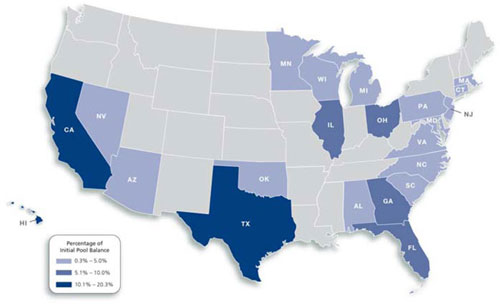

| Mortgaged Properties by Location(1) |

Weighted Average | ||||||||

State | Number of | Cut-off Date | % of | Occupancy | UW | UW | Cut-off Date | Maturity Date |

| California | 4 | $222,350,000 | 20.3% | 96.4% | 2.18x | 10.6% | 51.8% | 48.6% |

| Texas | 9 | 180,293,502 | 16.5 | 89.3% | 1.40x | 9.9% | 66.0% | 58.4% |

| Hawaii | 2 | 119,945,058 | 11.0 | 91.4% | 4.00x | 18.9% | 30.8% | 29.2% |

| Florida | 4 | 94,306,221 | 8.6 | 95.5% | 1.50x | 9.9% | 67.7% | 56.2% |

| Georgia | 4 | 76,332,165 | 7.0 | 82.2% | 1.45x | 10.6% | 67.6% | 61.2% |

| Illinois | 17 | 73,763,123 | 6.7 | 95.1% | 1.47x | 10.6% | 70.5% | 58.8% |

| Connecticut | 1 | 51,000,000 | 4.7 | 84.9% | 2.19x | 12.0% | 56.9% | 56.9% |

| New Jersey | 1 | 41,842,074 | 3.8 | 88.1% | 2.48x | 18.2% | 47.0% | 34.6% |

| Virginia | 1 | 38,000,000 | 3.5 | 85.6% | 2.18x | 10.4% | 62.1% | 62.1% |

| Massachusetts | 1 | 33,424,589 | 3.1 | 98.1% | 1.21x | 8.6% | 71.0% | 59.9% |

| Maryland | 1 | 33,250,000 | 3.0 | 79.0% | 1.45x | 10.1% | 73.7% | 64.9% |

| Ohio | 3 | 28,102,500 | 2.6 | 93.9% | 1.47x | 11.6% | 67.6% | 55.4% |

| Michigan | 1 | 21,100,000 | 1.9 | 71.7% | 1.50x | 12.0% | 63.9% | 55.6% |

| Nevada | 1 | 19,750,000 | 1.8 | 100.0% | 1.33x | 9.3% | 64.8% | 56.1% |

| North Carolina | 1 | 16,475,654 | 1.5 | 69.2% | 1.89x | 12.2% | 65.1% | 53.6% |

| Alabama | 1 | 8,850,000 | 0.8 | 94.5% | 1.34x | 9.8% | 74.5% | 65.1% |

| Oklahoma | 1 | 6,581,000 | 0.6 | 93.9% | 1.51x | 10.5% | 74.9% | 66.1% |

| Pennsylvania | 2 | 6,385,157 | 0.6 | 97.8% | 1.33x | 10.0% | 66.4% | 55.7% |

| Wisconsin | 1 | 6,335,152 | 0.6 | 100.0% | 1.28x | 9.3% | 73.1% | 64.2% |

| South Carolina | 1 | 6,170,852 | 0.6 | 79.2% | 1.91x | 14.1% | 68.6% | 52.4% |

| Total / Weighted Average: | 59 | $1,092,982,047 | 100.0% | 90.8% | 1.97x | 11.7% | 59.1% | 52.5% |

| (1) | Because this table presents information relating to the mortgaged properties and not mortgage loans, the information for mortgage loans secured by more than one mortgaged property is based on allocated loan amounts. |

| (2) | In the case of Loan Nos. 1, 2, 3, 4, 5 and 8, the UW NCF DSCR, UW NOI Debt Yield, Cut-off Date LTV and Maturity Date LTV calculations include the related Pari Passu Companion Loan(s). In the case of Loan Nos. 1, 2 and 10, the UW NCF DSCR, UW NOI Debt Yield, Cut-off Date LTV and Maturity Date LTV calculations exclude the related Subordinate Companion Loan(s). |

| (3) | In the case of Loan No. 2, the UW NCF DSCR and Maturity Date LTV are calculated using the average of principal and interest payments over the first 12 months following the expiration of the interest-only period based on the assumed principal payment schedule provided on Annex G to the Preliminary Prospectus. Additionally, in the case of Loan No. 10, the UW NCF DSCR and Maturity Date LTV are calculated in accordance with the amortization schedule set forth in Annex [ ] to the Preliminary Prospectus. |

| (4) | In the case of Loan Nos. 2, 12 and 21, the Cut-off Date LTV and the Maturity Date LTV are calculated by using an appraised value based on certain hypothetical assumptions. Refer to “Description of the Mortgage Pool—Assessments of Property Value and Condition” and “—Appraised Value” in the Preliminary Prospectus for additional details. |

THE INFORMATION IN THIS STRUCTURAL AND COLLATERAL TERM SHEET IS NOT COMPLETE AND MAY BE AMENDED PRIOR TO THE TIME OF SALE. THIS TERM SHEET IS NOT AN OFFER TO SELL THESE SECURITIES AND IT IS NOT A SOLICITATION OF AN OFFER TO BUY THESE SECURITIES IN ANY JURISDICTION WHERE THE OFFER OR SALE IS NOT PERMITTED.

| 6 of 125 |

| Structural and Collateral Term Sheet | JPMCC 2017-JP5 | |

| Collateral Characteristics | ||

| Cut-off Date Principal Balance |

Weighted Average | |||||||||||

| Range of Cut-off Date Principal Balances | Number of Loans | Cut-off Date Principal Balance | % of IPB | Mortgage Rate | Remaining Loan Term | UW NCF DSCR(1)(2) | UW NOI DY(1) | Cut-off Date LTV(2)(3) | Maturity Date LTV(1)(2)(3) | ||

| $2,786,930 | - | $9,999,999 | 17 | $99,526,292 | 9.1% | 5.32565% | 118 | 1.58x | 11.3% | 66.7% | 57.1% |

| $10,000,000 | - | $19,999,999 | 8 | 124,002,796 | 11.3 | 5.04839% | 110 | 1.53x | 10.7% | 67.3% | 57.5% |

| $20,000,000 | - | $24,999,999 | 2 | 44,600,000 | 4.1 | 4.98130% | 119 | 1.39x | 10.4% | 69.6% | 60.2% |

| $25,000,000 | - | $49,999,999 | 8 | 288,237,188 | 26.4 | 4.83256% | 98 | 1.90x | 12.3% | 58.7% | 51.8% |

| $50,000,000 | - | $80,000,000 | 8 | 536,615,771 | 49.1 | 4.34975% | 118 | 2.24x | 11.7% | 55.1% | 50.2% |

| Total / Weighted Average: | 43 | $1,092,982,047 | 100.0% | 4.67097% | 112 | 1.97x | 11.7% | 59.1% | 52.5% | ||

| Mortgage Interest Rates |

Weighted Average | |||||||||||

| Range of Mortgage Interest Rates | Number of Loans | Cut-off Date Principal Balance | % of IPB | Mortgage Rate | Remaining Loan Term | UW NCF DSCR(1)(2) | UW NOI DY(1) | Cut-off Date LTV(2)(3) | Maturity Date LTV(1)(2)(3) | ||

| 3.31940% | - | 3.99999% | 2 | $149,000,000 | 13.6% | 3.44332% | 119 | 2.06x | 10.2% | 51.5% | 47.7% |

| 4.00000% | - | 4.49999% | 4 | 221,342,074 | 20.3 | 4.23041% | 111 | 3.18x | 15.4% | 44.7% | 42.4% |

| 4.50000% | - | 4.99999% | 14 | 406,872,933 | 37.2 | 4.84369% | 112 | 1.70x | 11.2% | 64.6% | 56.1% |

| 5.00000% | - | 5.75200% | 23 | 315,767,040 | 28.9 | 5.33653% | 109 | 1.44x | 10.3% | 65.7% | 57.2% |

| Total / Weighted Average: | 43 | $1,092,982,047 | 100.0% | 4.67097% | 112 | 1.97x | 11.7% | 59.1% | 52.5% | ||

| Original Term to Maturity in Months |

Weighted Average | |||||||||

| Original Term to Maturity in Months | Number of Loans | Cut-off Date Principal Balance | % of IPB | Mortgage Rate | Remaining Loan Term | UW NCF DSCR(1)(2) | UW NOI DY(1) | Cut-off Date LTV(2)(3) | Maturity Date LTV(1)(2)(3) |

| 60 | 3 | $88,006,451 | 8.1% | 5.17654% | 58 | 1.41x | 10.0% | 68.0% | 64.0% |

| 84 | 1 | 38,000,000 | 3.5 | 4.20000% | 81 | 2.18x | 10.4% | 62.1% | 62.1% |

| 120 | 38 | 886,975,596 | 81.2 | 4.76289% | 118 | 2.02x | 11.9% | 59.2% | 52.1% |

| 126 | 1 | 80,000,000 | 7.3 | 3.31940% | 121 | 1.95x | 11.9% | 46.3% | 39.3% |

| Total / Weighted Average: | 43 | $1,092,982,047 | 100.0% | 4.67097% | 112 | 1.97x | 11.7% | 59.1% | 52.5% |

| Remaining Term to Maturity in Months | |||||||||

| Weighted Average | |||||||||||||||

| Range of Remaining Term to Maturity in Months | Number of Loans | Cut-off Date Principal Balance | % of IPB | Mortgage Rate | Remaining Loan Term | UW NCF DSCR(1)(2) | UW NOI DY(1) | Cut-off Date LTV(2)(3) | Maturity Date LTV(1)(2)(3) | ||||||

| 58 | - | 114 | 4 | $126,006,451 | 11.5% | 4.88204% | 65 | 1.64x | 10.1% | 66.2% | 63.4% | ||||

| 115 | - | 121 | 39 | 966,975,596 | 88.5 | 4.64347% | 118 | 2.02x | 11.9% | 58.2% | 51.1% | ||||

| Total / Weighted Average: | 43 | $1,092,982,047 | 100.0% | 4.67097% | 112 | 1.97x | 11.7% | 59.1% | 52.5% | ||||||

| (1) | In the case of Loan Nos. 1, 2, 3, 4, 5 and 8, the UW NCF DSCR, UW NOI Debt Yield, Cut-off Date LTV and Maturity Date LTV calculations include the related Pari Passu Companion Loan(s). In the case of Loan Nos. 1, 2 and 10, the UW NCF DSCR, UW NOI Debt Yield, Cut-off Date LTV and Maturity Date LTV calculations exclude the related Subordinate Companion Loan(s). |

| (2) | In the case of Loan No. 2, the UW NCF DSCR and Maturity Date LTV are calculated using the average of principal and interest payments over the first 12 months following the expiration of the interest-only period based on the assumed principal payment schedule provided on Annex G to the Preliminary Prospectus. Additionally, in the case of Loan No. 10, the UW NCF DSCR and Maturity Date LTV are calculated in accordance with the amortization schedule set forth in Annex [ ] to the Preliminary Prospectus. |

| (3) | In the case of Loan Nos. 2, 12 and 21, the Cut-off Date LTV and the Maturity Date LTV are calculated by using an appraised value based on certain hypothetical assumptions. Refer to “Description of the Mortgage Pool—Assessments of Property Value and Condition” and “—Appraised Value” in the Preliminary Prospectus for additional details. |

THE INFORMATION IN THIS STRUCTURAL AND COLLATERAL TERM SHEET IS NOT COMPLETE AND MAY BE AMENDED PRIOR TO THE TIME OF SALE. THIS TERM SHEET IS NOT AN OFFER TO SELL THESE SECURITIES AND IT IS NOT A SOLICITATION OF AN OFFER TO BUY THESE SECURITIES IN ANY JURISDICTION WHERE THE OFFER OR SALE IS NOT PERMITTED.

| 7 of 125 |

| Structural and Collateral Term Sheet | JPMCC 2017-JP5 | |

| Collateral Characteristics | ||

| Original Amortization Term in Months |

| Weighted Average | |||||||||

| Original Amortization Term in Months | Number of Loans | Cut-off Date Principal Balance | % of IPB | Mortgage Rate | Remaining Loan Term | UW NCF DSCR(1)(2) | UW NOI DY(1) | Cut-off Date LTV(2)(3) | Maturity Date LTV(1)(2)(3) |

| Interest Only | 7 | $308,500,000 | 28.2% | 4.20527% | 112 | 2.86x | 12.7% | 49.6% | 49.6% |

| 300 | 5 | 63,117,927 | 5.8 | 4.80092% | 118 | 2.21x | 16.5% | 52.7% | 39.3% |

| 360 | 31 | 721,364,119 | 66.0 | 4.85877% | 111 | 1.58x | 10.8% | 63.7% | 54.9% |

| Total / Weighted Average: | 43 | $1,092,982,047 | 100.0% | 4.67097% | 112 | 1.97x | 11.7% | 59.1% | 52.5% |

| Remaining Amortization Term in Months |

| Weighted Average | |||||||||||

| Range of Remaining Amortization Term in Months | Number of Loans | Cut-off Date Principal Balance | % of IPB | Mortgage Rate | Remaining Loan Term | UW NCF DSCR(1)(2) | UW NOI DY(1) | Cut-off Date LTV(2)(3) | Maturity Date LTV(1)(2)(3) | ||

| Interest Only | 7 | $308,500,000 | 28.2% | 4.20527% | 112 | 2.86x | 12.7% | 49.6% | 49.6% | ||

| 297 | - | 356 | 5 | 63,117,927 | 5.8 | 4.80092% | 118 | 2.21x | 16.5% | 52.7% | 39.3% |

| 357 | - | 360 | 31 | 721,364,119 | 66.0 | 4.85877% | 111 | 1.58x | 10.8% | 63.7% | 54.9% |

| Total / Weighted Average: | 43 | $1,092,982,047 | 100.0% | 4.67097% | 112 | 1.97x | 11.7% | 59.1% | 52.5% | ||

| Amortization Types |

Weighted Average | |||||||||

| Amortization Types | Number of Loans | Cut-off Date Principal Balance | % of IPB | Mortgage Rate | Remaining Loan Term | UW NCF DSCR(1)(2) | UW NOI DY(1) | Cut-off Date LTV(2)(3) | Maturity Date LTV(1)(2)(3) |

| Balloon | 21 | $428,540,895 | 39.2% | 5.01381% | 111 | 1.72x | 11.9% | 62.9% | 52.1% |

| IO-Balloon | 14 | 349,606,000 | 32.0 | 4.64629% | 112 | 1.51x | 10.5% | 62.6% | 55.4% |

| Interest Only | 7 | 308,500,000 | 28.2 | 4.20527% | 112 | 2.86x | 12.7% | 49.6% | 49.6% |

| Amortizing-IO-Balloon | 1 | 6,335,152 | 0.6 | 5.52000% | 118 | 1.28x | 9.3% | 73.1% | 64.2% |

| Total / Weighted Average: | 43 | $1,092,982,047 | 100.0% | 4.67097% | 112 | 1.97x | 11.7% | 59.1% | 52.5% |

| Underwritten Net Cash Flow Debt Service Coverage Ratios(1)(2) |

| Weighted Average | |||||||||||

| Range of Underwritten Net Cash Flow Debt Service Coverage Ratios | Number of Loans | Cut-off Date Principal Balance | % of IPB | Mortgage Rate | Remaining Loan Term | UW NCF DSCR(1)(2) | UW NOI DY(1) | Cut-off Date LTV(2)(3) | Maturity Date LTV(1)(2)(3) | ||

| 1.21x | - | 1.24x | 1 | $33,424,589 | 3.1% | 5.75200% | 118 | 1.21x | 8.6% | 71.0% | 59.9% |

| 1.25x | - | 1.74x | 28 | 539,643,591 | 49.4 | 5.03256% | 108 | 1.41x | 10.1% | 68.3% | 59.0% |

| 1.75x | - | 2.24x | 10 | 296,626,735 | 27.1 | 4.14102% | 114 | 2.06x | 11.0% | 56.0% | 52.3% |

| 2.25x | - | 2.74x | 2 | 103,342,074 | 9.5 | 4.26552% | 118 | 2.56x | 14.4% | 48.8% | 43.8% |

| 2.75x | - | 4.47x | 2 | 119,945,058 | 11.0 | 4.40281% | 117 | 4.00x | 18.9% | 30.8% | 29.2% |

| Total / Weighted Average: | 43 | $1,092,982,047 | 100.0% | 4.67097% | 112 | 1.97x | 11.7% | 59.1% | 52.5% | ||

| (1) | In the case of Loan Nos. 1, 2, 3, 4, 5 and 8, the UW NCF DSCR, UW NOI Debt Yield, Cut-off Date LTV and Maturity Date LTV calculations include the related Pari Passu Companion Loan(s). In the case of Loan Nos. 1, 2 and 10, the UW NCF DSCR, UW NOI Debt Yield, Cut-off Date LTV and Maturity Date LTV calculations exclude the related Subordinate Companion Loan(s). |

| (2) | In the case of Loan No. 2, the UW NCF DSCR and Maturity Date LTV are calculated using the average of principal and interest payments over the first 12 months following the expiration of the interest-only period based on the assumed principal payment schedule provided on Annex G to the Preliminary Prospectus. Additionally, in the case of Loan No. 10, the UW NCF DSCR and Maturity Date LTV are calculated in accordance with the amortization schedule set forth in Annex [ ] to the Preliminary Prospectus. |

| (3) | In the case of Loan Nos. 2, 12 and 21, the Cut-off Date LTV and the Maturity Date LTV are calculated by using an appraised value based on certain hypothetical assumptions. Refer to “Description of the Mortgage Pool—Assessments of Property Value and Condition” and “—Appraised Value” in the Preliminary Prospectus for additional details. |

THE INFORMATION IN THIS STRUCTURAL AND COLLATERAL TERM SHEET IS NOT COMPLETE AND MAY BE AMENDED PRIOR TO THE TIME OF SALE. THIS TERM SHEET IS NOT AN OFFER TO SELL THESE SECURITIES AND IT IS NOT A SOLICITATION OF AN OFFER TO BUY THESE SECURITIES IN ANY JURISDICTION WHERE THE OFFER OR SALE IS NOT PERMITTED.

| 8 of 125 |

| Structural and Collateral Term Sheet | JPMCC 2017-JP5 | |

| Collateral Characteristics | ||

| LTV Ratios as of the Cut-off Date(1)(3) |

| Weighted Average | |||||||||||

| Range of Cut-off Date LTVs | Number of Loans | Cut-off Date Principal Balance | % of IPB | Mortgage Rate | Remaining Loan Term | UW NCF DSCR(1)(2) | UW NOI DY(1) | Cut-off Date LTV(2)(3) | Maturity Date LTV(1)(2)(3) | ||

| 30.0% | - | 49.9% | 5 | $245,087,132 | 22.4% | 4.07363% | 118 | 3.04x | 16.4% | 38.9% | 33.7% |

| 50.0% | - | 59.9% | 6 | 226,891,578 | 20.8 | 4.29886% | 118 | 2.19x | 10.7% | 55.6% | 53.5% |

| 60.0% | - | 64.9% | 10 | 227,389,053 | 20.8 | 5.02665% | 104 | 1.57x | 10.2% | 62.8% | 56.5% |

| 65.0% | - | 69.9% | 8 | 112,843,468 | 10.3 | 5.02968% | 97 | 1.52x | 10.9% | 68.0% | 59.5% |

| 70.0% | - | 74.9% | 14 | 280,770,817 | 25.7 | 5.06088% | 114 | 1.38x | 9.8% | 73.1% | 62.0% |

| Total / Weighted Average: | 43 | $1,092,982,047 | 100.0% | 4.67097% | 112 | 1.97x | 11.7% | 59.1% | 52.5% | ||

| LTV Ratios as of the Maturity Date(1)(2)(3) |

Weighted Average | |||||||||||

| Range of Maturity Date/ARD LTVs | Number of Loans | Cut-off Date Principal Balance | % of IPB | Mortgage Rate | Remaining Loan Term | UW NCF DSCR(1)(2) | UW NOI DY(1) | Cut-off Date LTV(2)(3) | Maturity Date LTV(1)(2)(3) | ||

| 25.3% | - | 44.9% | 5 | $248,225,137 | 22.7% | 4.09476% | 119 | 3.02x | 16.4% | 39.2% | 33.7% |

| 45.0% | - | 49.9% | 3 | 36,040,502 | 3.3 | 4.74159% | 119 | 1.56x | 10.2% | 59.3% | 48.8% |

| 50.0% | - | 54.9% | 9 | 144,039,098 | 13.2 | 4.67208% | 118 | 2.12x | 11.8% | 58.2% | 51.7% |

| 55.0% | - | 59.9% | 11 | 398,494,206 | 36.5 | 4.89623% | 113 | 1.61x | 9.9% | 63.8% | 57.5% |

| 60.0% | - | 69.6% | 15 | 266,183,105 | 24.4 | 4.86093% | 100 | 1.51x | 10.0% | 71.1% | 63.5% |

| Total / Weighted Average: | 43 | $1,092,982,047 | 100.0% | 4.67097% | 112 | 1.97x | 11.7% | 59.1% | 52.5% | ||

| Prepayment Protection |

Weighted Average | |||||||||

| Prepayment Protection | Number of Loans | Cut-off Date Principal Balance | % of IPB | Mortgage Rate | Remaining Loan Term | UW NCF DSCR(1)(2) | UW NOI DY(1) | Cut-off Date LTV(2)(3) | Maturity Date LTV(1)(2)(3) |

| Defeasance(5) | 29 | $584,071,768 | 53.4% | 4.69163% | 113 | 1.77x | 11.0% | 61.6% | 54.6% |

| Yield Maintenance | 10 | 323,684,625 | 29.6 | 4.93902% | 108 | 1.72x | 11.9% | 61.2% | 52.6% |

| Defeasance or Yield Maintenance | 4 | 185,225,654 | 16.9 | 4.13740% | 117 | 3.06x | 13.4% | 47.6% | 45.6% |

| Total / Weighted Average: | 43 | $1,092,982,047 | 100.0% | 4.67097% | 112 | 1.97x | 11.7% | 59.1% | 52.5% |

| Loan Purpose |

Weighted Average | |||||||||

| Loan Purpose | Number of Loans | Cut-off Date Principal Balance | % of IPB | Mortgage Rate | Remaining Loan Term | UW NCF DSCR(1)(2) | UW NOI DY(1) | Cut-off Date LTV(2)(3) | Maturity Date LTV(1)(2)(3) |

| Refinance | 25 | $688,580,039 | 63.0% | 4.75054% | 114 | 2.05x | 12.4% | 56.3% | 49.0% |

| Acquisition | 16 | 326,402,008 | 29.9 | 4.71603% | 106 | 1.77x | 10.8% | 65.3% | 58.8% |

| Recapitalization | 2 | 78,000,000 | 7.1 | 3.78004% | 116 | 2.15x | 8.8% | 57.5% | 57.0% |

| Total / Weighted Average: | 43 | $1,092,982,047 | 100.0% | 4.67097% | 112 | 1.97x | 11.7% | 59.1% | 52.5% |

| (1) | In the case of Loan Nos. 1, 2, 3, 4, 5 and 8, the UW NCF DSCR, UW NOI Debt Yield, Cut-off Date LTV and Maturity Date LTV calculations include the related Pari Passu Companion Loan(s). In the case of Loan Nos. 1, 2 and 10, the UW NCF DSCR, UW NOI Debt Yield, Cut-off Date LTV and Maturity Date LTV calculations exclude the related Subordinate Companion Loan(s). |

| (2) | In the case of Loan No. 2, the UW NCF DSCR and Maturity Date LTV are calculated using the average of principal and interest payments over the first 12 months following the expiration of the interest-only period based on the assumed principal payment schedule provided on Annex G to the Preliminary Prospectus. Additionally, in the case of Loan No. 10, the UW NCF DSCR and Maturity Date LTV are calculated in accordance with the amortization schedule set forth in Annex [ ] to the Preliminary Prospectus. |

| (3) | In the case of Loan Nos. 2, 12 and 21, the Cut-off Date LTV and the Maturity Date LTV are calculated by using an appraised value based on certain hypothetical assumptions. Refer to “Description of the Mortgage Pool—Assessments of Property Value and Condition” and “—Appraised Value” in the Preliminary Prospectus for additional details. |

THE INFORMATION IN THIS STRUCTURAL AND COLLATERAL TERM SHEET IS NOT COMPLETE AND MAY BE AMENDED PRIOR TO THE TIME OF SALE. THIS TERM SHEET IS NOT AN OFFER TO SELL THESE SECURITIES AND IT IS NOT A SOLICITATION OF AN OFFER TO BUY THESE SECURITIES IN ANY JURISDICTION WHERE THE OFFER OR SALE IS NOT PERMITTED.

| 9 of 125 |

| Structural and Collateral Term Sheet | JPMCC 2017-JP5 | |

| Collateral Characteristics | ||

| Previous Securitization History(1) |

| No. | Loan Name | Location | Property Type | Previous Securitization |

| 1 | Hilton Hawaiian Village | Honolulu, HI | Hotel | HILT 2013-HLT |

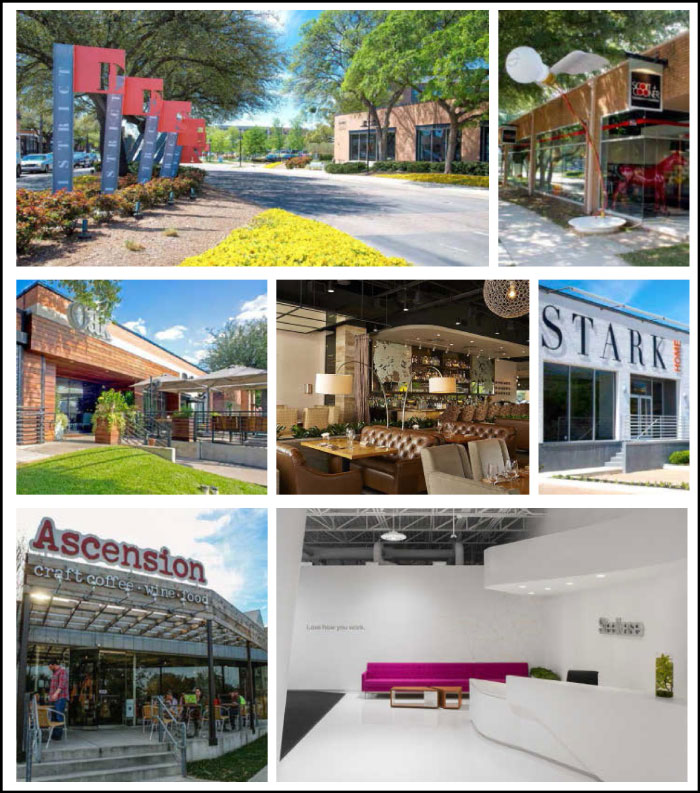

| 3 | Dallas Design District | Dallas, TX | Industrial | JPMCC 2015-FL7 |

| 6 | 55 Hawthorne | San Francisco, CA | Office | LBUBS 2006-C6 |

| 9 | Centre Market Building | Newark, NJ | Office | JPMBB 2012-CBX |

| 10 | Courtyard Marriott - King Kamehameha | Kailua-Kona, HI | Hotel | MSBAM 2014-C17 |

| 13 | Orchard Hill Park | Leominster, MA | Retail | COMM 2006-C8 |

| 15 | Marriott Galleria | Houston, TX | Hotel | BCMS 2007-BBA8 |

| 16 | Royal Oaks Plaza | Houston | Retail | JPMCC 2007-CB19 |

| 17 | Las Palmas | San Antonio, TX | Retail | JPMCC 2007-CB19 |

| 18 | Liberty Center | Troy, MI | Office | MSC 2007-IQ14 |

| 19 | Ocotillo Plaza | Las Vegas, NV | Retail | GECMC 2007-C1 |

| 23 | Partridge Inn Augusta | Augusta, GA | Hotel | GCCFC 2007-GG9 |

| 25 | TownePlace Suites Dallas Las Colinas | Irving, TX | Hotel | CDGJ 2014-BXCH |

| 29 | Montgomery Triangle Gateway | Cincinnati, OH | Mixed Use | MSC 2007-IQ16 |

| 30 | Neilson Square | Enid, OK | Retail | CWCI 2007-C2 |

| 32.02 | St. Albans Circle | Newton Square, PA | Mixed Use | JPMCC 2006-CB16 |

| 33 | Lake Geneva Commons | Lake Geneva, WI | Retail | JPMCC 2007-CB20 |

| 35 | Holiday Inn Express Orangeburg | Orangeburg, SC | Hotel | MSC 2007-HQ11 |

| (1) | The table above represents the properties for which the previously existing debt was most recently securitized, based on information provided by the related borrower or obtained through searches of a third-party database. |

THE INFORMATION IN THIS STRUCTURAL AND COLLATERAL TERM SHEET IS NOT COMPLETE AND MAY BE AMENDED PRIOR TO THE TIME OF SALE. THIS TERM SHEET IS NOT AN OFFER TO SELL THESE SECURITIES AND IT IS NOT A SOLICITATION OF AN OFFER TO BUY THESE SECURITIES IN ANY JURISDICTION WHERE THE OFFER OR SALE IS NOT PERMITTED.

| 10 of 125 |

| Structural and Collateral Term Sheet | JPMCC 2017-JP5 | |

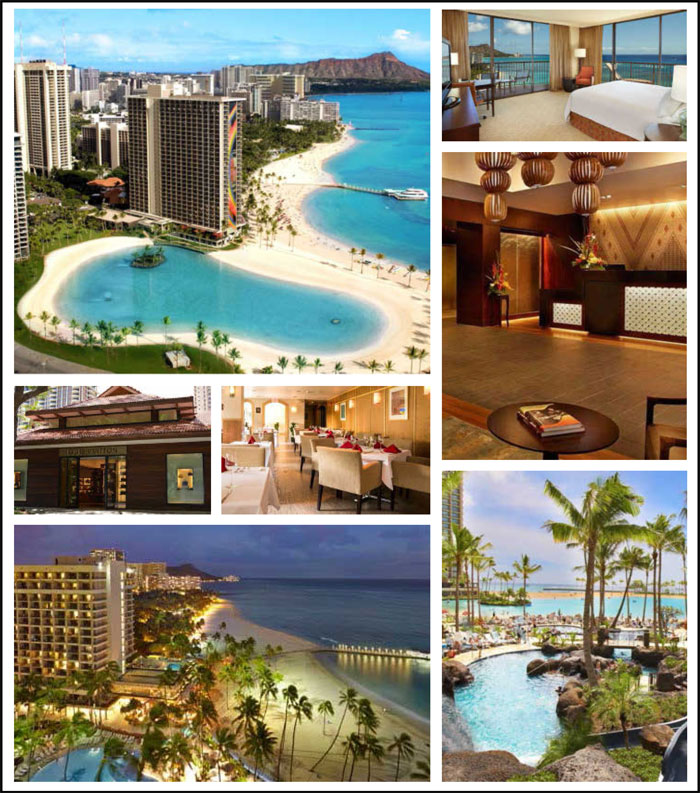

| Hilton Hawaiian Village | ||

THIS TERM SHEET IS NOT AN OFFER TO SELL THESE SECURITIES AND IT IS NOT A SOLICITATION OF AN OFFER TO BUY THESE SECURITIES IN ANY JURISDICTION WHERE THE OFFER OR SALE IS NOT PERMITTED.

| 11 of 125 |

| Structural and Collateral Term Sheet | JPMCC 2017-JP5 | |

| Hilton Hawaiian Village | ||

THIS TERM SHEET IS NOT AN OFFER TO SELL THESE SECURITIES AND IT IS NOT A SOLICITATION OF AN OFFER TO BUY THESE SECURITIES IN ANY JURISDICTION WHERE THE OFFER OR SALE IS NOT PERMITTED.

| 12 of 125 |

| Structural and Collateral Term Sheet | JPMCC 2017-JP5 | |

| Hilton Hawaiian Village | ||

THIS TERM SHEET IS NOT AN OFFER TO SELL THESE SECURITIES AND IT IS NOT A SOLICITATION OF AN OFFER TO BUY THESE SECURITIES IN ANY JURISDICTION WHERE THE OFFER OR SALE IS NOT PERMITTED.

| 13 of 125 |

| Structural and Collateral Term Sheet | JPMCC 2017-JP5 | |

| Hilton Hawaiian Village | ||

| Mortgage Loan Information | Property Information | |||

| Mortgage Loan Seller: | JPMCB | Single Asset / Portfolio: | Single Asset | |

| Credit Assessment | Title: | Fee / Leasehold | ||

| (Moody’s/Fitch/KBRA)(2): | Aa3 / BBB- / BBB+ | Property Type - Subtype: | Hotel – Full Service | |

| Original Principal Balance(3): | $80,000,000 | Net Rentable Area (Rooms)(6): | 2,860 | |

| Cut-off Date Principal Balance(3): | $80,000,000 | Location: | Honolulu, HI | |

| % of Pool by IPB: | 7.3% | Year Built / Renovated: | 1961 / 2016 | |

| Loan Purpose(4): | Refinance | Occupancy / ADR / RevPAR: | 94.6% / $250.09 / $236.65 | |

| Borrower: | Hilton Hawaiian Village LLC | Occupancy / ADR / RevPAR Date: | 9/30/2016 | |

| Sponsor: | Park Intermediate Holdings LLC | Number of Tenants: | N/A | |

| Interest Rate: | 4.19950% | 2013 NOI: | $110,964,835 | |

| Note Date: | 10/24/2016 | 2014 NOI: | $119,860,819 | |

| Maturity Date: | 11/1/2026 | 2015 NOI: | $128,737,723 | |

| Interest-only Period: | 120 months | Most Recent NOI (as of 9/2016) | $131,893,120 | |

| Original Term: | 120 months | UW Occupancy / ADR / RevPAR: | 94.6% / $250.09 / $236.65 | |

| Original Amortization: | None | UW Revenues: | $374,437,742 | |

| Amortization Type: | Interest Only | UW Expenses: | $241,850,768 | |

| Call Protection(5): | L(28),DeforGrtr1%orYM(85),O(7) | UW NOI: | $132,586,975 | |

| Lockbox: | CMA | UW NCF: | $132,586,975 | |

| Additional Debt: | Yes | Appraised Value / Per Room: | $2,230,000,000 / $779,720 | |

| Additional Debt Balance: | $616,600,000 / $578,400,000 | Appraisal Date: | 8/30/2016 | |

| Additional Debt Type: | Pari Passu / Subordinate Debt | |||

| Escrows and Reserves(7) | Financial Information(3) | ||||||

| Initial | Monthly | Initial Cap | Pari Passu Debt | Whole Loan | |||

| Taxes: | $0 | Springing | N/A | Cut-off Date Loan / Room: | $243,566 | $445,804 | |

| Insurance: | $0 | Springing | N/A | Maturity Date Loan / Room: | $243,566 | $445,804 | |

| FF&E: | $0 | Springing | N/A | Cut-off Date LTV: | 31.2% | 57.2% | |

| TI/LC: | $0 | $0 | N/A | Maturity Date LTV: | 31.2% | 57.2% | |

| Other: | $0 | $0 | N/A | UW NCF DSCR: | 4.47x | 2.44x | |

| UW NOI Debt Yield: | 19.0% | 10.4% | |||||

| Sources and Uses | ||||||

| Sources | Proceeds | % of Total | Uses | Proceeds | % of Total | |

| Mortgage Loan(3) | $1,275,000,000 | 100.0% | Payoff Existing Debt | $1,255,912,700 | 98.5% | |

| Excess Loan Proceeds(4) | 10,621,760 | 0.8 | ||||

| Closing Costs | 8,465,540 | 0.7 | ||||

| Total Sources | $1,275,000,000 | 100.0% | Total Uses | $1,275,000,000 | 100.0% | |

| (1) | The Hilton Hawaiian Village Whole Loan was co-originated by JPMCB, Deutsche Bank AG, New York Branch, Goldman Sachs Mortgage Company, Barclays Bank PLC and Morgan Stanley Bank, N.A. |

| (2) | Moody’s, Fitch and KBRA have confirmed that the Hilton Hawaiian Village Mortgage Loan has, in the context of its inclusion in the mortgage pool, credit characteristics consistent with an investment grade obligation. |

| (3) | The Hilton Hawaiian Village Mortgage Loan is part of a whole loan comprised of (i) the mortgage loan (comprised of one senior note with an outstanding principal balance as of the Cut-off Date of $80.0 million), (ii) two companion loans, each of which ispari passu with respect to the Hilton Hawaiian Village Mortgage Loan (such companion loans being comprised of 15pari passu notes) with an aggregate outstanding principal balance as of the Cut-off Date of $616.6 million and (iii) a subordinate companion loan (comprised of fivepari passu notes) with an aggregate outstanding principal balance as of the Cut-off Date of $578.4 million. The Pari Passu Debt Financial Information presented in the chart above reflects the $696.6 million aggregate Cut-off Date balance of the Hilton Hawaiian Village Mortgage Loan and the Hilton Hawaiian Village Pari Passu Companion Loan, excluding the Hilton Hawaiian Village Subordinate Companion Loan. The Whole Loan Financial Information presented in the chart above reflects the Cut-off Date balance of the $1.275 billion Hilton Hawaiian Village Whole Loan, as defined in“The Loan” below. |

| (4) | Excess Loan Proceeds were distributed by the borrower to its member and thereafter utilized by affiliates of Park Hotels & Resorts to prepay other outstanding CMBS loans. |

| (5) | The lockout period will be at least 28 payment dates beginning with and including the first payment date of December 1, 2016. Defeasance of the full $1.275 billion Hilton Hawaiian Village Whole Loan is permitted after the date that is the earlier of (i) May 1, 2019 and (ii) two years from the closing date of the securitization that includes the last note to be securitized (the “REMIC Prohibition Period”). If the borrower has not previously elected to defease the Hilton Hawaiian Village Whole Loan, the borrower is also permitted to prepay the Hilton Hawaiian Village Whole Loan in whole, but not in part, after the expiration of the REMIC Prohibition Period with the payment of a yield maintenance premium. |

| (6) | The Hilton Hawaiian Village property also includes approximately 130,489 square feet of commercial/retail space leased to more than 100 tenants. Additionally, the property includes the 25-story Kalia Tower which is subject to a condominium regime. Kalia Tower contains six floors totaling 72 timeshare units that are not part of the collateral for the loan. |

THIS TERM SHEET IS NOT AN OFFER TO SELL THESE SECURITIES AND IT IS NOT A SOLICITATION OF AN OFFER TO BUY THESE SECURITIES IN ANY JURISDICTION WHERE THE OFFER OR SALE IS NOT PERMITTED.

| 14 of 125 |

| Structural and Collateral Term Sheet | JPMCC 2017-JP5 | |

| Hilton Hawaiian Village | ||

| (7) | For a full description of Escrows and Reserves, please refer to“Escrows and Reserves”below. |

The Loan.The Hilton Hawaiian Village loan is secured by a first mortgage lien on the borrower’s fee and leasehold interests in a 2,860-room luxury full-service destination resort located in Honolulu, Hawaii. The whole loan was co-originated by JPMCB, Deutsche Bank AG, New York Branch, Goldman Sachs Mortgage Company, Barclays Bank PLC and Morgan Stanley Bank, N.A. and has an outstanding principal balance as of the Cut-off Date of $1.275 billion (the “Hilton Hawaiian Village Whole Loan”). The Hilton Hawaiian Village Whole Loan is comprised of (i) a senior loan, comprised of 16pari passu notes, with an aggregate outstanding principal balance of $696.6 million (one of which, Note A-2-A-2, will be contributed to the JPMCC 2017-JP5 Trust, the “Hilton Hawaiian Village Mortgage Loan” and the remaining notes, collectively, the “Hilton Hawaiian Village Pari Passu Companion Loan”) and (ii) a subordinate companion loan, comprised of fivepari passu notes, with an aggregate outstanding principal balance of $578.4 million (collectively, the “Hilton Hawaiian Village Subordinate Companion Loan”), each as described below. The Hilton Hawaiian Village Mortgage Loan and the Hilton Hawaiian Village Pari Passu Companion Loan arepari passu in right of payment with each other and are generally senior in right of payment to the Hilton Hawaiian Village Subordinate Companion Loan as and to the extent described in “Description of the Mortgage Pool—The Whole Loans—The Non-Serviced Whole Loans—The Hilton Hawaiian Village Whole Loan” in the Preliminary Prospectus. The senior Note A-1-A was contributed to the Hilton USA Trust 2016-HHV securitization that governs the servicing and administration of the Hilton Hawaiian Village Whole Loan and is the controlling note under the related intercreditor agreement, the rights of which will be exercised by the related trustee (or, prior to the occurrence and continuance of a control termination event under the related trust and servicing agreement (the “Hilton USA Trust 2016-HHV and Servicing Agreement”), the directing certificateholder under the Hilton USA Trust 2016-HHV and Servicing Agreement). However, the JPMCC 2017-JP5 Trust will be entitled, under certain circumstances, to be consulted with respect to certain major decisions (which rights will be exercised by the Directing Certificateholder prior to a Control Termination Event). The Hilton Hawaiian Village Whole Loan has a 10-year term and will be interest-only for the term of the loan. The Hilton Hawaiian Village property was previously securitized in the Hilton USA Trust 2013-HLT trust.

| Whole Loan Summary |

The Borrower.The borrowing entity for the Hilton Hawaiian Village Whole Loan is Hilton Hawaiian Village LLC, a Hawaii limited liability company and special purpose entity.

The Loan Sponsor.The loan sponsor and nonrecourse carve-out guarantor is Park Intermediate Holdings LLC. Park Intermediate Holdings LLC is a wholly owned subsidiary of Park Hotels & Resorts Inc. (“Park Hotels & Resorts”), one of two spin-offs announced by Hilton Worldwide Holdings Inc. (“Hilton”). On February 26, 2016, Hilton announced plans to separate into three independent, publicly traded companies: Park Hotels & Resorts (NYSE: PK), Hilton Grand Vacations Inc. (NYSE: HGV) and Hilton (NYSE: HLT). The spin-offs were completed in January 2017. Park Hotels & Resorts now owns most of Hilton’s owned and leased real estate properties and, with over 35,000 rooms and 67 hotels, is the second-largest publicly traded real estate investment trust in the lodging industry. Hilton Grand Vacations Inc. owns and operates Hilton’s timeshare business, while Hilton retains its core management and franchise business and continues to trade on the NYSE as a leading global hospitality company. In connection with the proposed restructuring, at origination, the borrower signed an operating lease with an affiliate, which is also a signatory to the loan documents (other than the promissory notes) as a co-obligor. The operating lease automatically became effective upon consummation of the restructuring. The borrower also delivered a substitute management agreement. The aggregate liability of the guarantor with respect to all full recourse carve-outs in the Hilton Hawaiian Village Whole Loan documents may not exceed an amount equal to 10.0% of the principal balance of the Hilton Hawaiian Village Whole Loan outstanding at the time of the occurrence of such event, plus any and all reasonable third-party collection costs actually incurred by the lender. In addition, the guarantor is not a party to the environmental indemnity. In lieu of the guarantor signing the indemnity, the Hilton Hawaiian Village Whole Loan documents require the borrower to obtain environmental insurance. At origination, the borrower obtained an environmental insurance policy with (i) a term of 10 years, (ii) limits of $10,000,000 per occurrence and $25,000,000 in the aggregate and (iii) a $25,000 deductible.

THIS TERM SHEET IS NOT AN OFFER TO SELL THESE SECURITIES AND IT IS NOT A SOLICITATION OF AN OFFER TO BUY THESE SECURITIES IN ANY JURISDICTION WHERE THE OFFER OR SALE IS NOT PERMITTED.

| 15 of 125 |

| Structural and Collateral Term Sheet | JPMCC 2017-JP5 | |

| Hilton Hawaiian Village | ||

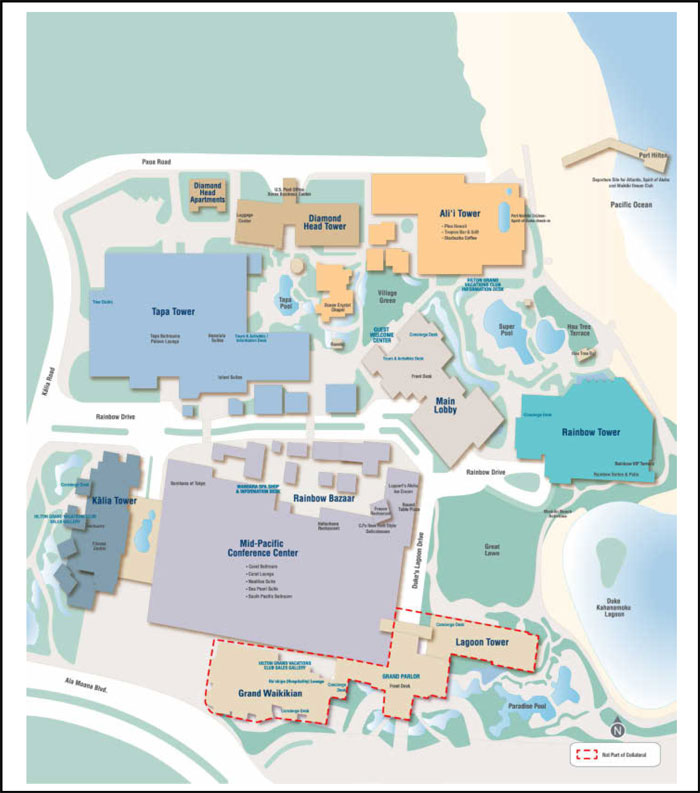

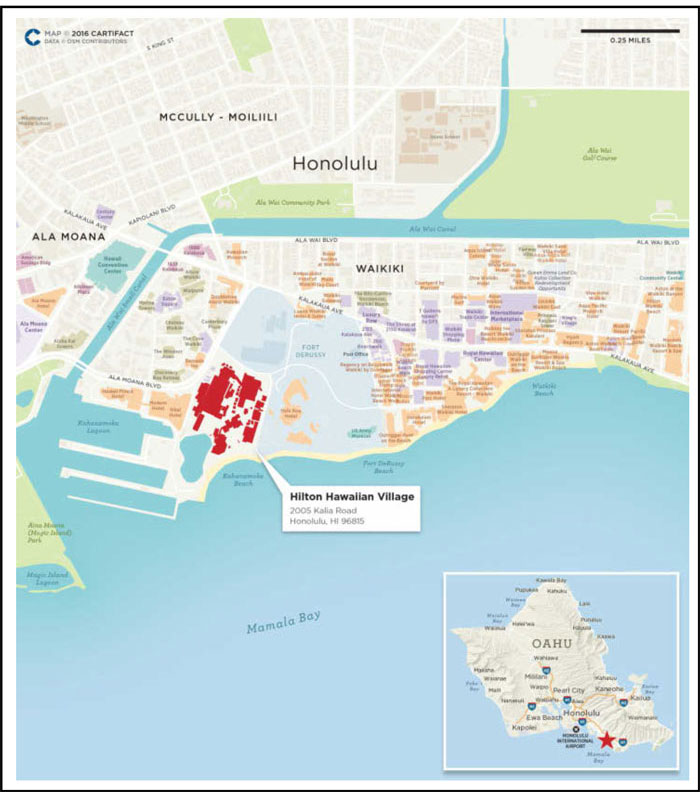

The Property. The Hilton Hawaiian Village property is a 2,860-room, full-service luxury resort located on the island of Oahu in Honolulu, Hawaii. The Hilton Hawaiian Village is one of Hawaii’s premier urban resort destinations, situated on an entire city block overlooking Waikiki Beach. The property is situated on an approximately 22-acre site, the majority of which is fee-owned. The property is comprised of 2,860 guest rooms spread across five towers: the Ali’i Tower (348 rooms), Diamond Head Tower (380 rooms), Rainbow Tower (796 rooms), Kalia Tower (315 rooms) and Tapa Tower (1,021 rooms). The towers each offer unique guest room accommodations and are situated on ocean-front property, offering views of Waikiki Beach, Diamond Head and downtown Honolulu. The property is the only self-contained destination resort in Waikiki and offers the largest guest room inventory in the state of Hawaii, as well as the most meeting space within its competitive set. The property offers a host of resort-style amenities and services, including 20 food and beverage outlets, over 150,000 square feet of flexible indoor and outdoor function space, three conference centers, five swimming pools, a saltwater lagoon, spa grottos, the Mandara Spa and Fitness Center, a chapel and a retail component comprised of over 100 retail tenants.

The property was initially constructed by Hilton in 1961 and has undergone several extensive renovations throughout its existence. According to the sponsor, since 2008, the loan sponsor has invested approximately $232.2 million (approximately $81,188 per room) in capital expenditures spread across all segments of the property. Most recently, the loan sponsor completed a full-scale renovation of its premier luxury guest room tower, the Ali’i Tower, in 2012, updating the guest rooms and suites, main lobby and library at an estimated cost of approximately $20.6 million. Additionally, the loan sponsor completed a comprehensive renovation of the Diamond Head Tower in 2014 at an estimated cost of approximately $17.9 million.

| Historical Capital Expenditures(1) | ||||||||||

| 2008 | 2009 | 2010 | 2011 | 2012 | 2013 | 2014 | 2015 | YTD 2016(2) | Total | |

| Capital Expenditures(3) | $22,216 | $16,509 | $8,834 | $56,117 | $42,568 | $28,138 | $32,965 | $15,559 | $9,293 | $232,198 |

| Per Room | $7,768 | $5,772 | $3,089 | $19,621 | $14,884 | $9,838 | $11,526 | $5,440 | $3,249 | $81,188 |

| (1) | Based on actual capital expenditures as provided by the loan sponsor. |

| (2) | YTD 2016 Capital Expenditures are as of September 30, 2016. |

| (3) | Capital Expenditures are presented in (000)’s. |

The property offers approximately 150,000 square feet of indoor and outdoor meeting and function space, which is split between three primary locations: the second floor of the Tapa Tower, the base of the Kalia Tower and the Mid-Pacific Conference Center. The property features over 65,000 square feet of indoor meeting space spread throughout four buildings, as well as two outdoor lawns: the Lagoon Green and the Village Green. The Mid-Pacific Conference Center, a stand-alone building, underwent a full-scale refurbishment in 2013 and features 35,000 square feet of meeting/event space, including the 24,840 square foot Coral Ballroom, which is divisible into five separate breakout rooms. It is among the largest conference centers in the Hawaiian Islands and offers the largest capacity ballroom, accommodating up to 2,600 guests.

The property features approximately 130,489 square feet of leased retail and restaurant space, which was 78.5% occupied by over 100 tenants as of September 2016. The retail component of the property generated TTM September 2016 sales of approximately $136.1 million for reporting tenants. For the trailing 12-month period ending September 30, 2016, the retail component of the property generated approximately $20.8 million in retail revenue (retail revenue is inclusive of reimbursements for common area maintenance, taxes and marketing expenses, as provided by the loan sponsor) which, net of undistributed expenses attributable to the retail component (as estimated by the loan sponsor), accounts for approximately 13.1% of net cash flow, providing diversity to traditional hotel revenue streams. While the majority of the property’s leased space is made up of traditional retail and restaurant tenants, the hotel also leases some office space to Hilton Grand Vacations and third-party travel wholesalers, such as Kintetsu and JTB. The hotel’s Ocean Crystal Chapel and Lagoon Chapel are also leased to a third-party operator.

| Historical Retail Component Sales(1) | ||||

| 2013 | 2014 | 2015 | TTM(2) | |

| Total Sales | $130,613,993 | $141,808,186 | $137,316,925 | $136,055,744 |

| Sales PSF | $1,552 | $1,651 | $1,590 | $1,496 |

| (1) | Historical Sales for reporting tenants were provided by the loan sponsor. |

| (2) | TTM is as of September 30, 2016. |

THIS TERM SHEET IS NOT AN OFFER TO SELL THESE SECURITIES AND IT IS NOT A SOLICITATION OF AN OFFER TO BUY THESE SECURITIES IN ANY JURISDICTION WHERE THE OFFER OR SALE IS NOT PERMITTED.

| 16 of 125 |

| Structural and Collateral Term Sheet | JPMCC 2017-JP5 | |

| Hilton Hawaiian Village | ||

Collateral Tenant Summary(1) | ||||||||

| Tenant | Ratings(2) Moody’s/S&P/Fitch | Net Rentable Area (SF) | % of Total NRA | Lease Expiration Date | Base Rent PSF | % of Total Base Rent | Most Recent Sales(3) | Most Recent Sales PSF(3) |

| Mandara Spa | NA / NA / NA | 12,583 | 9.6% | 8/31/2017 | $53.61 | 3.9% | $2,903,709 | $231 |

| Hatsuhana Hawaii | NA / NA / NA | 6,026 | 4.6% | 11/30/2018 | $52.38 | 1.8% | $2,969,958 | $493 |

| Fresco | NA / NA / NA | 5,983 | 4.6% | 12/31/2018 | $58.38 | 2.0% | $3,331,316 | $557 |

| Benihana of Tokyo | NA / NA / NA | 5,300 | 4.1% | 5/31/2021 | $127.6 | 3.9% | $6,561,789 | $1,238 |

| Best Bridal - Lagoon Chapel | NA / NA / NA | 4,755 | 3.6% | 10/31/2022 | $57.45 | 1.6% | $520,020 | $109 |

| Watabe Wedding(4) | NA / NA / NA | 4,158 | 3.2% | 1/14/2019 | $63.93 | 1.5% | $167,697 | $40 |

| ABC Stores - Tapa Tower | NA / NA / NA | 3,500 | 2.7% | 8/31/2022 | $384.2 | 7.7% | $12,225,380 | $3,493 |

| Louis Vuitton | NA / A+ / NA | 3,500 | 2.7% | 8/18/2023 | $146.7 | 2.9% | $7,978,397 | $2,280 |

| Lamonts & Whalers General Store | NA / NA / NA | 2,800 | 2.1% | MTM | $163.1 | 2.6% | $1,856,972 | $663 |

| ABC Discount Store | NA / NA / NA | 2,145 | 1.6% | 12/31/2018 | $812.2 | 10.0% | $14,519,183 | $6,769 |

| (1) | Based on the underwritten rent roll. |

| (2) | Ratings provided are for the parent company of the entity listed in the “tenant” field whether or not the parent company guarantees the lease. |

| (3) | Most Recent Sales and Most Recent Sales PSF for reporting tenants were provided by the loan sponsor as of September 30, 2016. |

| (4) | Most Recent Sales and Most Recent Sales PSF for Watabe Wedding represent only partial year performance as the venue opened in 2016. |

The Hilton Hawaiian Village property is located in Honolulu, Hawaii, in the greater Oahu lodging market and the Waikiki submarket. The island of Oahu serves as an economic center of the Hawaiian Islands. Oahu maintains its status as one of the world’s foremost tourist destinations, with cultural venues, golf courses, restaurants, retail and recreational attractions. In 2015, approximately 5.3 million tourists, or 62.4% of Hawaii’s total air tourists, visited the island of Oahu, making it the most popular destination in the Hawaiian Islands. The total number of air visitors has increased by 435,867 from 2012 to 2015, which represents a 2.9% year-over-year increase. International travel to Oahu represented 46.3% of Oahu’s 5.3 million air visitors in 2015 and was marginally unchanged from 2014. Additionally, visitor expenditures in Oahu totaled $7.4 billion in 2015, which represents 49.3% of total expenditures by air visitors in 2015. Honolulu is the strongest lodging market in Oahu and all of the eight Hawaiian Islands, a status attributable to a temperate year-round climate, popularity as one of the leading group and leisure destinations of Hawaii, superior visitor infrastructure and high barriers to new supply. Honolulu encompasses more than 24,000 guest rooms in 74 properties and consistently achieved occupancy rates in the mid 70% to 80% range, never dropping below 74%, between 2009 and 2015. During this same period, RevPAR in Honolulu increased at an average annual rate of 9.5%, ending 2015 at $190, while the average daily rate achieved a premium of $69 over 2009. The market’s RevPAR in 2009, which represented the trough during the downturn, reflects a 14.6% decline relative to 2007, less than other leading markets.

The appraisal identified two hotels either recently opened or currently under construction in the Waikiki submarket that are expected to have some degree of competitive interaction with the Hilton Hawaiian Village property. The 623-room Hilton Garden Inn (Ohana Waikiki West Redevelopment) opened in June 2016, while the 230-room boutique Hyatt Centric (Waikiki Trade Center Redevelopment) is expected to open in March 2017. Though offered at a competitive price-point with national brand affiliations, the appraisal notes that both options are non-beachfront locations with select-service product offerings. Additionally, the appraisal notes significant barriers to entry, including nearly no developable ocean-front land and prohibitively high costs.

Historical Occupancy, ADR, RevPAR(1) | |||||||||

| Competitive Set(2) | Hilton Hawaiian Village(3) | Penetration Factor(4) | |||||||

| Year | Occupancy | ADR | RevPAR | Occupancy | ADR | RevPAR | Occupancy | ADR | RevPAR |

| 2013 | 89.0% | $248.36 | $221.07 | 89.9% | $237.77 | $213.84 | 101.0% | 95.7% | 96.7% |

| 2014 | 87.8% | $250.07 | $219.50 | 90.7% | $238.34 | $216.26 | 103.4% | 95.3% | 98.5% |

| 2015 | 89.0% | $256.75 | $228.38 | 94.4% | $240.62 | $227.20 | 106.2% | 93.7% | 99.5% |

| TTM(5) | 89.9% | $259.08 | $232.92 | 94.6% | $250.09 | $236.65 | 105.3% | 96.5% | 101.6% |

| (1) | Variances between the underwriting, the appraisal and the above table with respect to Occupancy, ADR and RevPAR at the Hilton Hawaiian Village property are attributable to variances in reporting methodologies and/or timing differences. |

| (2) | Data provided by STR. The competitive set contains the following properties: Sheraton Waikiki, Marriott Waikiki Beach Resort & Spa, Hyatt Regency Waikiki Beach Resort & Spa, Westin Moana Surfrider, Sheraton Hotel Princess Kaiulani, Outrigger Reef Waikiki Beach Resort and Outrigger Waikiki Beach Resort. |

| (3) | Based on operating statements provided by the borrower, with the exception of 2013 and 2014 which have been adjusted by STR for both ADR and RevPAR in order to normalize for a change in accounting methodology in 2015. Prior to 2015, borrower operating statements presented ADR and RevPAR inclusive of resort fees. For all years presented above, ADR and RevPAR are calculated exclusive of resort fees. |

| (4) | Penetration Factor is calculated based on data provided by STR for the competitive set and borrower-provided operating statements for the property. |

| (5) | TTM represents the trailing 12-month period ending on September 30, 2016. |

THIS TERM SHEET IS NOT AN OFFER TO SELL THESE SECURITIES AND IT IS NOT A SOLICITATION OF AN OFFER TO BUY THESE SECURITIES IN ANY JURISDICTION WHERE THE OFFER OR SALE IS NOT PERMITTED.

| 17 of 125 |

| Structural and Collateral Term Sheet | JPMCC 2017-JP5 | |

| Hilton Hawaiian Village | ||

| Competitive Hotels Profile(1) | |||||||||

| 2015 Estimated Market Mix | 2015 Estimated Operating Statistics | ||||||||

| Property | Rooms | Year Opened | Meeting Space (SF) | Wholesale | Transient | Meeting & Group | Occupancy | ADR | RevPAR |

| Hilton Hawaiian Village(2) | 2,860 | 1961 | 150,000 | 37% | 44% | 19% | 94.4% | $240.62 | $227.20 |

| Primary Competitors | |||||||||

| Sheraton Waikiki | 1,636 | 1971 | 48,210 | 65% | 15% | 20% | 90-95% | $300-325 | $280-290 |

| Marriott Waikiki Beach Resort & Spa | 1,310 | 1971 | 55,000 | 20% | 60% | 20% | 85-90% | $210-220 | $180-190 |

| Hyatt Regency Waikiki Beach Resort & Spa | 1,230 | 1976 | 23,130 | 60% | 25% | 15% | 85-90% | $250-260 | $220-230 |

| Westin Moana Surfrider | 791 | 1901-1969 | 23,612 | 60% | 30% | 10% | 85-90% | $350-375 | $300-325 |

| Secondary Competitors | |||||||||

| Sheraton Hotel Princess Kaiulani | 1,000 | 1955 | 14,000 | 65% | 25% | 10% | 85-90% | $150-160 | $130-140 |

| Outrigger Reef Waikiki Beach Resort | 635 | 1956 | 9,600 | 55% | 40% | 5% | 85-90% | $250-260 | $220-230 |

| Outrigger Waikiki Beach Resort | 524 | 1967 | 5,000 | 50% | 40% | 10% | 80-85% | $260-270 | $220-230 |

| Total(3) | 7,126 | ||||||||

| (1) | Based on the appraisal. |

| (2) | Occupancy, ADR and RevPAR are based on operating statements provided by the borrower. |

| (3) | Excludes the Hilton Hawaiian Village property. |

Operating History and Underwritten Net Cash Flow | |||||||

| 2013 | 2014 | 2015 | TTM(1) | Underwritten | Per Room(2) | % of Total Revenue(3) | |

| Occupancy | 89.9% | 90.7% | 94.4% | 94.6% | 94.6% | ||

| ADR(4) | $247.48 | $259.85 | $240.62 | $250.09 | $250.09 | ||

| RevPAR(4) | $222.57 | $235.77 | $227.20 | $236.65 | $236.65 | ||

| Room Revenue | $232,345,007 | $246,124,088 | $237,172,233 | $247,711,744 | $247,034,700 | $86,376 | 66.0% |

| Resort Fee(4) | 0 | 0 | 22,462,635 | 22,641,808 | 22,752,381 | 7,955 | 6.1% |

| Food and Beverage Revenue | 56,844,007 | 62,740,100 | 70,771,369 | 69,023,623 | 68,996,667 | 24,125 | 18.4% |

| Retail Revenue(5) | 19,071,361 | 20,048,658 | 20,582,018 | 20,786,062 | 19,162,812 | 6,700 | 5.1% |

| Other Departmental Revenue | 16,714,514 | 17,176,781 | 15,802,967 | 16,824,201 | 16,491,183 | 5,766 | 4.4% |

| Total Revenue | $324,974,888 | $346,089,627 | $366,791,222 | $376,987,438 | $374,437,742 | $130,922 | 100.0% |

| Room Expense | $55,976,889 | $59,766,137 | $62,515,991 | $64,556,543 | $64,380,098 | $22,511 | 26.1% |

| Food and Beverage Expense | 45,055,100 | 48,831,676 | 56,658,889 | 56,716,914 | 56,028,348 | 19,590 | 81.2% |

| Other Departmental Expense | 7,418,538 | 7,148,334 | 7,483,496 | 6,425,274 | 6,371,608 | 2,228 | 38.6% |

| Departmental Expenses | $108,450,526 | $115,746,148 | $126,658,376 | $127,698,731 | $126,780,054 | $44,329 | 33.9% |

| Departmental Profit | $216,524,362 | $230,343,479 | $240,132,846 | $249,288,707 | $247,657,688 | $86,594 | 66.1% |

| Operating Expenses | $61,997,168 | $64,229,329 | $62,250,540 | $64,897,454 | $62,099,714 | $21,713 | 16.6% |

| Gross Operating Profit | $154,527,194 | $166,114,150 | $177,882,306 | $184,391,253 | $185,557,974 | $64,880 | 49.6% |

| Management Fee | $9,159,509 | $9,759,316 | $10,366,617 | $11,551,940 | $10,658,248 | $3,727 | 2.8% |

| Incentive Management Fee | 7,542,587 | 8,134,544 | 8,776,701 | 9,141,675 | 9,344,215 | 3,267 | 2.5% |

| Retail Management Fee | 1,081,185 | 1,142,850 | 1,168,053 | 1,174,867 | 1,053,955 | 369 | 0.3% |

| Property Taxes | 8,335,725 | 9,129,497 | 10,512,964 | 11,773,676 | 12,249,130 | 4,283 | 3.3% |

| Property Insurance | 3,138,410 | 3,058,106 | 2,452,071 | 2,579,098 | 3,343,630 | 1,169 | 0.9% |

| Ground Rent & Other Expense | 1,305,948 | 1,185,432 | 1,196,527 | 1,197,379 | 1,344,312 | 470 | 0.4% |

| FF&E | 12,998,996 | 13,843,585 | 14,671,649 | 15,079,498 | 14,977,510 | 5,237 | 4.0% |

| Total Other Expenses | $43,562,359 | $46,253,331 | $49,144,583 | $52,498,133 | $52,971,000 | $18,521 | 14.1% |

| Net Operating Income | $110,964,835 | $119,860,819 | $128,737,723 | $131,893,120 | $132,586,975 | $46,359 | 35.4% |

| Net Cash Flow | $110,964,835 | $119,860,819 | $128,737,723 | $131,893,120 | $132,586,975 | $46,359 | 35.4% |

| (1) | TTM represents the trailing 12-month period ending on September 30, 2016. |

| (2) | Per Room values based on 2,860 guest rooms. |

| (3) | % of Total Revenue for Room Expense, Food and Beverage Expense and Other Departmental Expenses is based on their corresponding revenue line items. |

| (4) | Prior to a change in industry accounting methodology in 2015, resort fees were accounted for as a component of Room Revenue and included in ADR and RevPAR calculations. Since 2014, resort fees have been netted out of Room Revenue and shown separately in the Resort Fee category. ADR and RevPAR are shown net of resort fees for 2015 and all future years. |

| (5) | Retail tenant spaces are occupied pursuant to partial net leases. Retail Revenue is inclusive of reimbursements associated with shared common area maintenance, tax and marketing expenses. Related expenses attributable to the retail component are included in undistributed Operating Expenses for the overall property. |

THIS TERM SHEET IS NOT AN OFFER TO SELL THESE SECURITIES AND IT IS NOT A SOLICITATION OF AN OFFER TO BUY THESE SECURITIES IN ANY JURISDICTION WHERE THE OFFER OR SALE IS NOT PERMITTED.

| 18 of 125 |

| Structural and Collateral Term Sheet | JPMCC 2017-JP5 | |

| Hilton Hawaiian Village | ||

Property Management. The property is currently managed by Hilton Management LLC, a Delaware limited liability company and subsidiary of Hilton. The current management agreement expires on December 31, 2047, with two 20-year extension options, and provides for (i) a base management fee equal to 3.0% of gross revenue (less revenue from the retail component of the property), (ii) an incentive management fee equal to 6.0% of adjusted gross profit (exclusive of the retail component of the property), (iii) a management fee equal to 5.5% of net retail income with respect to the retail component of the property and (iv) monthly FF&E deposits equal to 4.0% of gross revenue.

Escrows and Reserves. No upfront reserves were taken at origination.

Tax Escrows - The requirement for the borrower to make monthly deposits to the tax escrow is waived so long as the borrower has reserved such amounts with the property manager or the manager pays such taxes, in each case pursuant to the management agreement. In the event that the borrower is no longer required to reserve such amounts with the property manager, on each payment date, the borrower will be required to deposit 1/12 of annual estimated taxes upon the occurrence of a Trigger Period (as defined below).

Insurance Escrows - The requirement for the borrower to make monthly deposits to the insurance escrow is waived so long as the borrower has reserved such amounts with the property manager or the manager pays such premiums, in each case pursuant to the management agreement. In the event that the borrower is no longer required to reserve such amounts with the property manager, on each payment date, the borrower will be required to deposit 1/12 of annual estimated insurance premiums upon the occurrence of a Trigger Period. In addition, provided that no event of default has occurred and is continuing, the requirement to deposit such amounts is waived so long as the property is insured under a blanket policy reasonably acceptable to the lender insuring substantially all of the real property owned, directly or indirectly, by the guarantor.

Replacement Reserves -The requirement for the borrower to make monthly deposits for replacements reserves is waived so long as the borrower has reserved such amounts with the property manager pursuant to the management agreement. In the event that the borrower is no longer required to reserve such amounts with the property manager, on each payment date, the borrower will be required to deposit 4.0% of gross income for the calendar month that is two months prior to the applicable payment date (as calculated in the loan documents).

Lockbox / Cash Management.The loan is structured with a CMA lockbox. All revenues will be deposited into segregated property accounts maintained by the property manager on behalf of the borrower and the operating lessee, as applicable, and controlled by the lender (the “Property Accounts”). All revenues in the Property Accounts (less any account charges payable to the bank at which the Property Accounts are maintained and less any required minimum peg balance) will be transferred on each business day to accounts maintained by the property manager on behalf of the borrower and the operating lessee, as applicable (each, an “Operating Account”). Funds on deposit in the Operating Accounts will be disbursed in an amount equal to the monthly replacement reserve deposit into the manager replacement reserve account (the “Manager FF&E Reserve Account”) (each of the Manager FF&E Reserve Account, the Operating Account and the Property Account are referred to as “Manager Accounts”). The property manager will be required to apply such funds to the payment of real property taxes and insurance, ground rent, debt service (but only prior to the restructuring), management fees, capital expenditures and reserves for the same, operating expenses, emergency repairs, tenant improvement costs and leasing commissions, working capital reserves, sales and use taxes owed to governmental authorities, custodial funds and required monthly reserves, in each case in accordance with the management agreement (the “Required Payments”). The lender will not require any reserves with respect to any Required Payments which are to be paid directly by or reserved by the property manager pursuant to the management agreement. On a monthly basis, the property manager will deposit all funds remaining in the Operating Accounts after the payment of the Required Payments (“Excess Cash”) into a lender-controlled account as additional collateral for the mortgage loan (the “Cash Management Account”). So long as no Trigger Period is continuing, all funds in the Cash Management Account after payment of debt service, required reserves and operating expenses will be released to the operating lessee and/or the borrower, as applicable, not later than the business day immediately following the date such funds are deposited by the property manager. During a Trigger Period, all funds in the Cash Management Account will be deposited into the excess cash accounts and held as additional collateral for the Hilton Hawaiian Village Whole Loan. The operating lessee and/or the borrower, as applicable, is required to grant a security interest in all Manager Accounts (and the property manager will consent to the same); provided, that such amounts on deposit in the Manager Accounts will be available for use by the property manager in accordance with the management agreement following an event of default and the lender will not apply such amounts on deposit in the Manager Accounts to Hilton Hawaiian Village Whole Loan.

A “Trigger Period” will commence upon the occurrence of: (i) an event of default or (ii) the date that the debt yield (as calculated in the loan documents) is less than 7.0%.

A Trigger Period will end when, if caused by (a) clause (i) above, the respective event of default has been cured or waived or (b) clause (ii) above, the debt yield (as calculated in the loan documents) exceeds 7.0% for two consecutive quarters.

THIS TERM SHEET IS NOT AN OFFER TO SELL THESE SECURITIES AND IT IS NOT A SOLICITATION OF AN OFFER TO BUY THESE SECURITIES IN ANY JURISDICTION WHERE THE OFFER OR SALE IS NOT PERMITTED.

| 19 of 125 |

| Structural and Collateral Term Sheet | JPMCC 2017-JP5 | |

| Hilton Hawaiian Village | ||

Partial Releases.The borrower is permitted to release (i) the ground leased parcel, (ii) the retail component and/or (iii) certain other parcels of property that do not materially and adversely affect the ongoing operations of the remaining property, other than the lost income associated with the released parcels, in each case through a partial prepayment of the Hilton Hawaiian Village Whole Loan at any time after the expiration of the lockout period upon certain terms and conditions contained in the loan documents (including, without limitation, payment of the yield maintenance premium, if applicable). Please see “Description of the Mortgage Pool—Certain Terms of the Mortgage Loans—Partial Releases” in the Preliminary Prospectus for additional details.

THIS TERM SHEET IS NOT AN OFFER TO SELL THESE SECURITIES AND IT IS NOT A SOLICITATION OF AN OFFER TO BUY THESE SECURITIES IN ANY JURISDICTION WHERE THE OFFER OR SALE IS NOT PERMITTED.

| 20 of 125 |

| Structural and Collateral Term Sheet | JPMCC 2017-JP5 | |

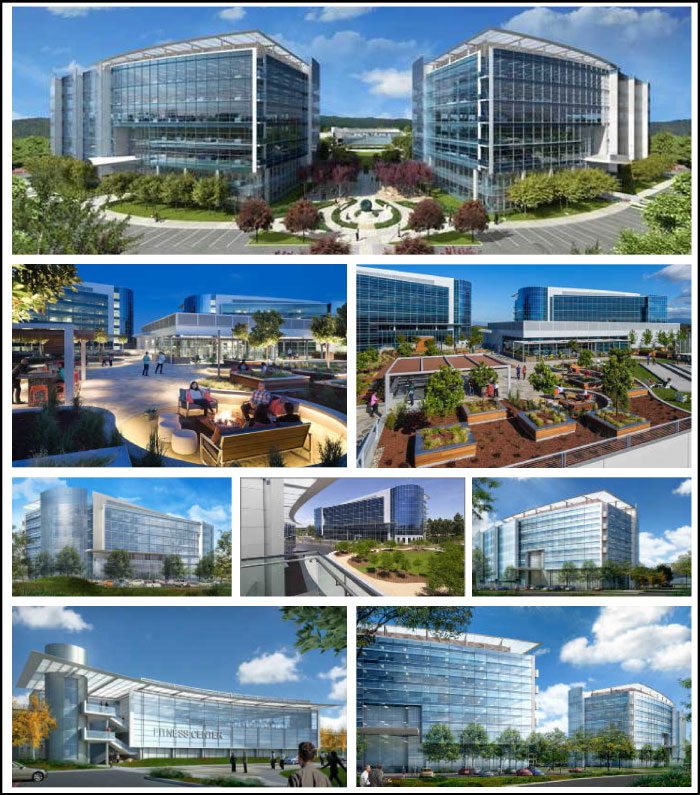

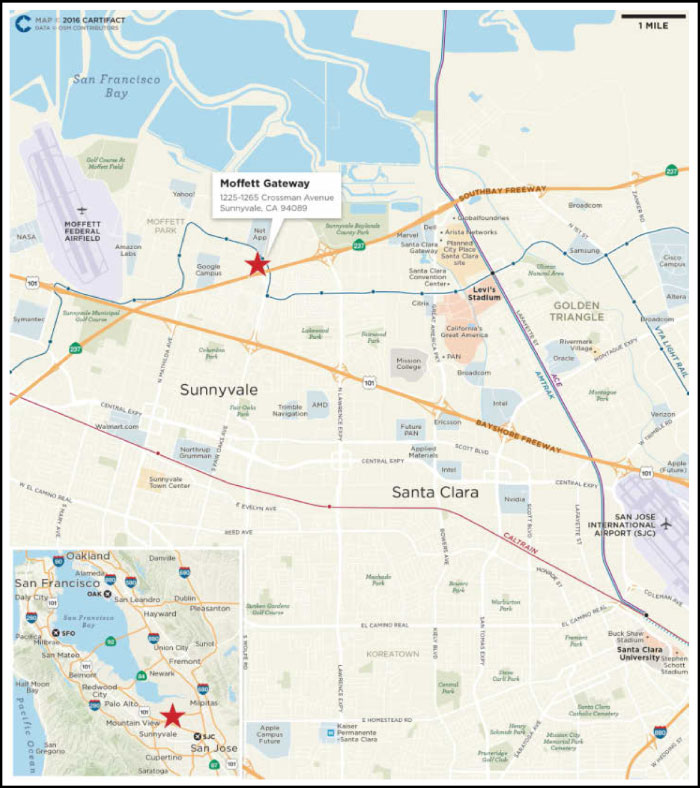

| Moffett Gateway | ||

THIS TERM SHEET IS NOT AN OFFER TO SELL THESE SECURITIES AND IT IS NOT A SOLICITATION OF AN OFFER TO BUY THESE SECURITIES IN ANY JURISDICTION WHERE THE OFFER OR SALE IS NOT PERMITTED.

| 21 of 125 |

| Structural and Collateral Term Sheet | JPMCC 2017-JP5 | |

| Moffett Gateway | ||

THIS TERM SHEET IS NOT AN OFFER TO SELL THESE SECURITIES AND IT IS NOT A SOLICITATION OF AN OFFER TO BUY THESE SECURITIES IN ANY JURISDICTION WHERE THE OFFER OR SALE IS NOT PERMITTED.

| 22 of 125 |

| Structural and Collateral Term Sheet | JPMCC 2017-JP5 | |

| Moffett Gateway | ||

THIS TERM SHEET IS NOT AN OFFER TO SELL THESE SECURITIES AND IT IS NOT A SOLICITATION OF AN OFFER TO BUY THESE SECURITIES IN ANY JURISDICTION WHERE THE OFFER OR SALE IS NOT PERMITTED.

| 23 of 125 |

| Structural and Collateral Term Sheet | JPMCC 2017-JP5 | |

| Moffett Gateway | ||

| Mortgage Loan Information | Property Information | |||

| Mortgage Loan Seller: | JPMCB | Single Asset / Portfolio: | Single Asset | |

| Credit Assessment (Fitch)(1) | BBB- | Title: | Fee | |

| Original Principal Balance(2): | $80,000,000 | Property Type - Subtype: | Office – Suburban | |

| Cut-off Date Principal Balance(2): | $80,000,000 | Net Rentable Area (SF): | 612,691 | |

| % of Pool by IPB: | 7.3% | Location: | Sunnyvale, CA | |

| Loan Purpose: | Refinance | Year Built / Renovated: | 2016 / N/A | |

| Borrower: | 441 Real Estate LLC | Occupancy(6): | 100.0% | |

| Sponsor(3): | Joseph K. Paul | Occupancy Date: | 2/1/2017 | |

| Interest Rate: | 3.319403% | Number of Tenants: | 1 | |

| Note Date: | 9/22/2016 | 2013 NOI(7): | N/A | |

| Maturity Date: | 4/1/2027 | 2014 NOI(7): | N/A | |

| Interest-only Period: | 60 months | 2015 NOI(7): | N/A | |

| Original Term: | 126 months | TTM NOI(7): | N/A | |

| Original Amortization(4): | 360 months | UW Economic Occupancy: | 95.0% | |

| Amortization Type: | IO-Balloon | UW Revenues: | $35,097,235 | |

| Call Protection(5): | L(29),Def(90),O(7) | UW Expenses: | $6,170,971 | |

| Lockbox: | Hard | UW NOI: | $28,926,265 | |

| Additional Debt: | Yes | UW NCF: | $27,631,280 | |

| Additional Debt Balance(2): | $163,000,000 / $102,000,000 / | Appraised Value / Per SF(8): | $525,000,000 / $857 | |

| $50,000,000 | Appraisal Date: | 7/20/2016 | ||

| Additional Debt Type: | Pari Passu / B-Note / | |||

| Mezzanine Loan | ||||

| Escrows and Reserves(9) | Financial Information(2) | |||||||

| Initial | Monthly | Initial Cap | A-Notes | Whole Loan | ||||

| Taxes: | $180,864 | $180,864 | N/A | Cut-off Date Loan / SF: | $397 | $563 | ||