UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number 811-23248

Tortoise Essential Assets Income Term Fund

(Exact name of registrant as specified in charter)

5100 W 115th Place, Leawood, KS 66211

(Address of principal executive offices) (Zip code)

P. Bradley Adams

Diane Bono

5100 W 115th Place, Leawood, KS 66211

(Name and address of agent for service)

913-981-1020

Registrant's telephone number, including area code

Date of fiscal year end: November 30

Date of reporting period: November 30, 2020

Item 1. Report to Stockholders.

Annual Report | November 30, 2020

2020 Annual Report

Closed-End Funds

| Tortoise |

| 2020 Annual Report to Stockholders |

This combined report provides you with a comprehensive review of our funds that span essential assets.

| Table of contents | ||||||

| Closed-end Fund Comparison | 1 | TEAF: Fund Focus | 21 | |||

| Letter to Stockholders | 2 | Financial Statements | 25 | |||

| TYG: | Fund Focus | 6 | Notes to Financial Statements | 64 | ||

| NTG: | Fund Focus | 9 | Report of Independent Registered | |||

| TTP: | Fund Focus | 12 | Public Accounting Firm | 86 | ||

| NDP: | Fund Focus | 15 | Company Officers and Directors | 87 | ||

| TPZ: | Fund Focus | 18 | Additional Information | 89 | ||

| TTP and TPZ distribution policies |

Tortoise Pipeline & Energy Fund, Inc. (“TTP”) and Tortoise Power and Energy Infrastructure Fund, Inc. (“TPZ”) are relying on exemptive relief permitting them to make long-term capital gain distributions throughout the year. Each of TTP and TPZ, with approval of its Board of Directors (the “Board”), has adopted a distribution policy (the “Policy”) with the purpose of distributing over the course of each year, through periodic distributions as nearly equal as practicable and any required special distributions, an amount closely approximating the total taxable income of TTP and TPZ during such year and, if so determined by the Board, all or a portion of the return of capital paid by portfolio companies to TTP and TPZ during such year. In accordance with its Policy, TTP distributes a fixed amount per common share, currently $0.16, each quarter to its common shareholders. Prior to May 2020, the quarterly distribution rate was $0.285. TPZ distributes a fixed amount per common share, currently $0.05, each month to its common shareholders. Prior to June 2020, the monthly distribution rate was $0.125. These amounts are subject to change from time to time at the discretion of the Board. Although the level of distributions is independent of TTP’s and TPZ’s performance, TTP and TPZ expect such distributions to correlate with its performance over time. Each quarterly and monthly distribution to shareholders is expected to be at the fixed amount established by the Board, except for extraordinary distributions in light of TTP’s and TPZ’s performance for the entire calendar year and to enable TTP and TPZ to comply with the distribution requirements imposed by the Internal Revenue Code. The Board may amend, suspend or terminate the Policy without prior notice to shareholders if it deems such action to be in the best interests of TTP, TPZ and their respective shareholders. For example, the Board might take such action if the Policy had the effect of shrinking TTP’s or TPZ’s assets to a level that was determined to be detrimental to TTP or TPZ shareholders. The suspension or termination of the Policy could have the effect of creating a trading discount (if TTP’s or TPZ’s stock is trading at or above net asset value), widening an existing trading discount, or decreasing an existing premium. You should not draw any conclusions about TTP’s or TPZ’s investment performance from the amount of the distribution or from the terms of TTP’s or TPZ’s distribution policy. Each of TTP and TPZ estimates that it has distributed more than its income and net realized capital gains; therefore, a portion of your distribution may be a return of capital. A return of capital may occur, for example, when some or all of the money that you invested in TTP or TPZ is paid back to you. A return of capital distribution does not necessarily reflect TTP’s or TPZ’s investment performance and should not be confused with “yield” or “income.” The amounts and sources of distributions reported are only estimates and are not being provided for tax reporting purposes. The actual amounts and sources of the amounts for tax reporting purposes will depend upon TTP’s and TPZ’s investment experience during the remainder of their fiscal year and may be subject to changes based on tax regulations. TTP and TPZ will send you a Form 1099-DIV for the calendar year that will tell you how to report these distributions for federal income tax purposes.

Tortoise

| 2020 Annual Report | November 30, 2020 |

Closed-end Fund Comparison | |||||||||||

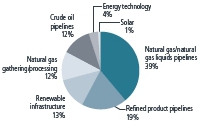

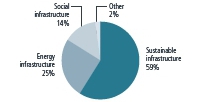

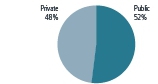

| Name/Ticker | Primary focus | Structure | Total assets ($ millions)1 | Portfolio mix by asset type2 | Portfolio mix by structure2 | ||||||

| Tortoise Energy NYSE: TYG Inception: 2/2004 | Midstream MLPs | C-corp | $446.8 |  |  | |||||

Tortoise Midstream Inception: 7/2010 | Natural gas infrastructure MLPs | C-corp | $220.4 |  |  | ||||||

Tortoise Pipeline NYSE: TTP | North American pipeline companies | Regulated investment company | $68.5 |  |  | ||||||

| Tortoise Energy Inception: 7/2012 | North American oil & gas producers | Regulated investment company | $34.1 |  |  | |||||

| Tortoise Power NYSE: TPZ | Power & energy infrastructure companies (Fixed income & equity) | Regulated investment company | $115.8 |  |  | |||||

| Tortoise Essential NYSE: TEAF Inception: | Essential assets | Regulated investment company | $249.9 |  |  | |||||

| 1 | As of 12/31/2020 |

| 2 | As of 11/30/2020 |

| (unaudited) | |

| Tortoise | 1 |

| Tortoise |

| 2020 Annual Report to closed-end fund stockholders |

Dear stockholder

The 2020 fiscal year, ending on November 30, 2020 was certainly like no other. The COVID-19 global pandemic affected every part of our lives and the essential assets in which Tortoise invests. Energy demand concerns and volatile commodity prices plagued the energy sector. Social impact projects in the education segment were greatly impacted by virtual learning, and senior living facilities literally shut down as they fought to keep residents safe. After a tumultuous year, all of these segments appear to be on their way to recovery with high hopes for 2021. The sustainable infrastructure sector, particularly renewable energy, had a strong year propelled even higher by anticipated Biden Administration energy policy. As we move into 2021, with COVID-19 vaccinations being administered throughout the world driving energy demand toward pre-COVID-19 levels and the push toward cleaner energy gaining momentum, we are optimistic that 2021 will be a strong year for investors in these essential assets sectors.

Energy and power infrastructure

The broader energy sector, as represented by the S&P Energy Select Sector® Index, finished the fourth fiscal quarter ending November 30, 2020 in positive territory, returning 4.9%, bringing fiscal year 2020 performance to -31.7%. Energy markets and prices experienced significant volatility throughout the fiscal year driven by the uncertainty around energy demand due to COVID-19, concerns over the massively oversupplied global oil market in April, and ultimately a recovery in the latter part of 2020. Looking ahead to 2021, all eyes are focused on energy demand and the subsequent rollout of COVID-19 vaccinations. Pfizer and Moderna’s November announcements of positive data regarding their vaccines for COVID-19 led to a stock market surge, with beaten down energy companies leading the charge, along with commodities such as crude oil. With the growing belief in vaccine success and visibility to significantly improved economic activity, 2021 energy demand growth could exceed anything ever seen on a year-over-year basis.

Following the price war between Saudi Arabia and Russia in early March, the Organization of Petroleum Exporting Countries (OPEC) and their Non-OPEC partners (OPEC+) announced deep production cuts with a clear goal of balancing the global crude oil market. The market dramatically shifted from an approximate 20 million barrels per day (b/d) surplus in April to an approximate 4 million b/d deficit in July, providing the path for market rebalancing. Overall adherence to the production cut agreement remained strong in the second half of 2020 leading to inventory draws. Entering 2021, the global crude oil market remains in deficit, supported by the OPEC+ crude oil production cut agreement, and expected inventory draws are expected to continue throughout 2021.

U.S. crude oil production declined in 2020 in response to the supply-demand imbalance resulting from the economic shutdowns and stay-at-home orders in March and April. This resulted in the first annual decline in U.S. production since 2016. Specifically, U.S. crude oil production fell from a record 12.9 million barrels per day (b/d) in November 2019 to 11.2 million b/d in November 20201. EIA forecasts that U.S. crude oil production will average 11.1 million b/d in 2021.

For U.S. producers, 2020 was a year of change. The COVID-19 pandemic accelerated producers’ capital discipline as investors focused on higher free cash flow generation and return of capital to shareholders. This free-cash-flow emphasis led to a host of M&A deals as E&P companies prioritized the importance of scale, diversity and strengthening balance sheets in a challenging oil price environment.

While oil dominated the headlines, natural gas continued to provide a cleaner burning source. As a result, we continue to see natural gas as a critical source of energy supply going forward. During the 2020 fiscal year, a reduction in natural gas demand caused by COVID-19 initially resulted in the convergence of global natural gas prices. However, in the final months of the year, LNG exports from the U.S. rapidly shot back up driven by increasing demand for natural gas in Asia and resulting in Asian gas prices trading at a premium relative to the U.S. Henry Hub prices. Domestically, the backdrop of slowing production growth and strong domestic and export demand paints a picture of improving natural gas fundamentals in the future. Rising U.S. energy exports of liquids and natural gas are expected to positively affect the U.S. trade deficit and to ultimately help reduce global CO2 emissions, along with renewables, as they take market share from coal.

Midstream energy outperformed broader energy in the fourth fiscal quarter and the fiscal year with the Tortoise North American Pipeline IndexSM returning 6.3% and the Tortoise MLP Index® returning 11.2%, bringing fiscal year performance to -15.8% and -23.6%, respectively. There were several contributors to midstream energy’s negative performance for the fiscal year including: negative energy sentiment following energy demand uncertainty, excess pipeline takeaway capacity related to the COVID-19 pandemic resulting in lower production, and political rhetoric focused on an energy transition to cleaner energy sources. Midstream companies structured as C-Corporations continued to benefit from several items versus MLPs, including: stronger corporate governance, broad market index inclusion for some companies, lack of K-1s, and a more certain corporate structure.

There were a couple of positive themes standing out for midstream businesses throughout the fiscal year. First, resiliency. Resilient cash flows confirm the essential nature of the assets that midstream businesses operate. Strong contractual obligations (take or pay contracts) and customer profiles (large, investment grade rated counterparties) helped midstream energy companies generate consistent cash flow from operations even in the low and volatile 2020 price environment. At the onset of the COVID-19 pandemic, we forecasted midstream EBITDA declining 5%-10% in 2020. However, heading into the final months of 2020, companies revised their forecasts higher and EBITDA is expected to only be down 4% for the year. Notably, companies with significant natural gas businesses and/or take or pay contracts reaffirmed guidance, whereas others with cash flows tied to wellhead volumes provided a wider range of outcomes.

| (unaudited) | |

| 2 | Tortoise |

| 2020 Annual Report | November 30, 2020 |

The other clear trend in earnings was virtually every midstream energy company transitioning to a capital allocation focused on positive free-cash-flow after dividends. This is a stark change made possible by declining capital expenditures for midstream projects and sale of non-core assets. We forecast growth capex to decline by approximately $16 billion YTD as midstream rationalizes project spending. This shift in spending has allowed the midstream sector to not only be free cash flow positive, but materially so, especially compared to other asset classes and the S&P 500. In 2021, we expect midstream companies to have $8 billion of free cash flow after distributions and by 2024 we expect $21 billion of free cash flow after distributions.

We believe midstream companies will more directly return cash flow to shareholders in the form of dividends, debt reduction and share buybacks. While continuing to pay out very high dividend yields, we are advocating for companies to utilize stock buybacks to create their own flows and help turn the tide on stock performance. The numbers show that this can be achieved while still reducing leverage in a meaningful way.

During the last few months of the fiscal year, the buyback announcements started coming in earnest. In early October, Targa Resources (TRGP) announced a $500 million stock buyback program. MPLX and Plains All American followed suit, announcing significant buyback programs for $1 billion and $500 million, respectively for the three largest during the quarter. In total, 10 midstream companies announced share buyback programs in 2020, including six during the fourth quarter. We believe the forthcoming free cash flow and share buyback themes can help drive sustainable outperformance for the midstream sector.

One of the key regulatory announcements of 2020 was the Army Corps of Engineers announcing it began work on an environmental impact statement for the Dakota Access Pipeline, something the district court requested for the better part of the year. Another requirement of the court was that the Corps determine a remedy for the fact that the pipeline no longer has a permit to cross Federal land. The Corps stated that it would require no immediate action and that it does not think the court has jurisdiction over the matter. We are closely monitoring Dakota Access Pipeline developments as the fate of the pipeline impacts several midstream companies. In other pipeline news, in July, the Supreme Court agreed to reinstate streamlined permitting for pipelines across the country, except for Keystone XL. This is positive for the most notable project under construction, the Mountain Valley Pipeline, Equitrans’ 300+ mile natural gas pipeline which is nearing completion after a series of several delays. Construction of the pipeline continues, and we expect for it to be in service within the next year.

While the 2020 presidential election created headline risks for the energy sector, we believe the consensus path forward for the Biden Administration will focus on getting Americans back to work with supportive policies versus policies aimed at opposing the oil and gas industry or destroying jobs. The predominant theme around Biden’s energy plan is to address climate change and create substantial job opportunities for Americans. The topic of climate change and related opportunities for the overall economy was one of the four pillars of the convention platform, integrated into an overall vision of revitalization of America. We expect market economics to dictate the trajectory of future energy supply and demand. Renewables and natural gas are more economic than coal in generating electricity and will likely continue to take share, while crude oil will likely remain the predominant fuel source in the transportation sector for the near future.

Finally, despite past comments early on during the campaign, we do not expect a ban on fracking. It is worth noting that under the Obama Administration, the ban on crude oil exports was lifted which was supportive of the energy industry. Ironically, regulatory pressures have the potential to tighten new supply, pushing oil and gas prices up, and making existing infrastructure more valuable.

2020 also ushered in continued questions about midstream energy’s role in an energy transition environment. During the fiscal year, there were three oil majors, Shell, Total SE and BP, that openly discussed a path forward around renewable energy. The European Union (EU) moved further towards renewables and 7 of the 10 largest economies stated their intention to have net-zero emissions by 2050. While the energy transition will take time to play out, midstream management teams openly discussed the role their companies could play in such a transition. Pipeline infrastructure, for example, could be repurposed to transport hydrogen. As the world continues to demand more energy and less carbon, we are encouraging midstream companies to view energy transition opportunistically.

Within the downstream portion of the energy value chain, the refining sector remained among the most challenged sectors in 2020 due to the COVID-19 pandemic. Refinery utilization has recovered from the depths of the economic contraction in March and April but remains below 2019 levels. Permanent refinery closures have and should continue to help balance the market from a supply and demand perspective. From a U.S. refined product standpoint, we believe gasoline and diesel will continue to inch towards pre-COVID levels during 2021 while a slower recovery should be expected in jet fuel. As U.S. energy demand recovers in 2021, U.S. refinery utilization and throughput should exhibit strong growth and return to more normalized levels.

Natural gas liquids, unlike the refining sector, has proved resilient despite challenges faced during the COVID-19 pandemic. Strength can be seen in LPGs (liquid petroleum gases) where demand is driven by global population growth and improvements in living standards in Asia, notably in China and India.

Sustainable infrastructure

Renewable energy

2020 started out strong for new renewables installation on the heels of a 2019 that itself was the second and third-strongest years ever for solar and wind, respectively. Like most of the economy, renewables then saw a COVID-driven decline bottom-out during the second quarter, but rebounded substantially in the following months. Utility solar in particular has been only minimally impacted by COVID-19 related construction delays. For solar, more than 19 giga watts (GW) of installations are expected for the full year of 2020 – making it the

| (unaudited) | |

| Tortoise | 3 |

most capacity installed in a single year in the U.S. and an increase of new growth of around 40% over 20192. Activity remains concentrated in the southwest and southeast, with Texas ahead of Florida and California in year-to-date installations2. According to the U.S. Energy Information Administration, wind installation is also expected to see a strong finish to the year with as much as 23 GW of new capacity coming on line in 2020.

The pandemic caused little to no slowdown in new project announcements as growth is expected to continue in the coming years with a backlog of more than 150 GW over the next five years. That includes major announcements we’ve seen this year from the likes of Amazon, Google, and Microsoft, among others, as well as from several individual states. This represents market share gain for renewables as, between them, wind and solar represent more than 70% of all U.S. electricity-generating capacity additions in 20202. This is not surprising, given that on a levelized cost of energy basis (LCOE) wind and utility-scale solar tend to be a cheaper option than building out any new fossil fuel powered options. Support from the incoming Biden Administration should serve to only provide further momentum to this trend.

Sustainable Project Finance

During 2020, the ongoing sustainability trend that is transforming the waste and energy sectors continued to foster strong growth in waste-to-energy and waste-to-value projects, with a potential for accelerated growth in coming years based on new project announcements.

Waste-to-energy may not be as recognized within the broad renewables sector when compared to more visible solutions such as wind, solar, and hydro. However, bioenergy and biofuel is nearly comparable in size at 44% of U.S. renewable energy consumption, versus 55% for wind, solar, and hydro combined, according to data released in the fourth quarter of 2020 by the U.S. Energy Information Administration. Within the waste-to-energy sector, the strongest growth continues to be within the renewable natural gas (RNG) and renewable diesel sectors as part of ongoing efforts to decarbonize electricity production and transportation fuels.

The number of RNG production facilities operating in the U.S. at year-end increased to 157, up 78% from 2019. In addition, there are 76 new projects under construction and another 79 projects in planning, which suggests continued strong growth in RNG production into 2021. During 2020, more than 20 new waste-to-energy projects were announced for the production of renewable diesel and sustainable aviation fuel (SAF), totaling approximately $4 billion in new project costs. Many of these projects are expected to begin construction during 2021 and 2022.

In the waste-to-value sector, 2020 was a promising year for plastic and food-waste recycling, including targeted corporate sustainability goals, the formation of new recycling alliances, and the development of new technologies for commercial scale-up. Regarding plastics, several new projects were announced for items with low recycling rates, such as polypropylene, polystyrene, and mixed-plastics. Several new projects involving the anaerobic digestion of food waste are also under construction or planned for 2021. These food waste recycling projects typically produce RNG and other value-added co-products, while diverting methane-producing organics from landfills, thereby reducing greenhouse gas emissions.

Social impact

Education

In early Spring, COVID-19 prompted most state and/or municipalities to issue full closure orders prohibiting in-person instruction for all K-12 public school students. As of December 15, 2020, only Washington, DC & Puerto Rico had full closure orders in effect. Four states (TX, FL, AK & IA) had full opening orders in effect that require full-time in-person be available to all K-12 students; seven states (CA, OR, NM, WV, NC, DE & HI) had partial closure orders in effect that prohibit in-person instruction for students in some regions or certain grade levels. For the remaining 39 states, the decisions to make full-time in-person instruction available are being made at the local level3. Many school districts saw their first enrollment declines in decades with families making the decision to transfer students to private schools or shift to home schooling.

In the fourth quarter of 2020, challenges associated with school re-openings, COVID testing and immunization planning and events surrounding the Presidential election shifted the attention of many charter school opponents. Many concerns about the potential for anti-charter school policies from the incoming Biden Administration have been alleviated by the announcement that Connecticut Education Commissioner Miguel Cardona would be the nominee to lead the US Department of Education. While it is highly unlikely that the results of 2020 local, state and national elections will significantly improve the political environment for charter schools, securing federal aid and addressing the tremendous educational inequity spotlighted throughout the pandemic will almost certainly be the primary political focus in K-12 education for the first quarter 2021.

In spite of the uncertainty created by the pandemic, 2020 was another record year for the charter school and K-12 private school bond market with more than 160 offerings and nearly $4 billion in new issuance. While attempts to return to full-time in-person instruction remain controversial in some parts of the country, parental demand for safe, high-quality school facilities has only increased. Overall, there has been no reduction to state and local funding for K-12 public schools during the current school year with many school districts implementing previously approved budgeted increases. While California has indicated that some charter school payment deferrals may be implemented, there are well established options in place to assist schools with any resulting cash flow challenges.

While the challenges in K-12 education in 2020 were unprecedented, the opportunity for investing in facilities for excellent schools has only increased. Relationships with bankers, financial advisors and developers continue to grow stronger as we are seen as one of the go-to solutions for schools that do not have the luxury of off-the-shelf facility financing. As our K-12 portfolio and market presence continues to grow, we believe our ability to find and finance outstanding schools that offer exceptional returns for our investors will continue to improve.

| (unaudited) | |

| 4 | Tortoise |

| 2020 Annual Report | November 30, 2020 |

Senior Living

There’s a common phrase floating around the senior living industry these days; light at the end of the tunnel. While 2020 was a trying year, many of our operators have begun inoculating residents and staff per the CDC’s recommendation that they be among the first recipients of the vaccine. As one can imagine, a vaccine has more than lifted the spirits in many of our communities. Given the salacious headlines and doomsday projections in March 2020, one might have expected senior living to be wiped off the map, but it hasn’t, thanks to the industry’s resilience and federal stimulus dollars.

Regarding the resilience of the senior living industry, the reality is that senior living is a high turnover model that’s enduring, and the average high acuity setting hasn’t seen many more deaths than a typical year. Statistically, through December 2020, nationwide occupancy for independent living and assisted living decreased to 83.5% and 77.7%, respectively. Occupancy has decreased for independent and assisted living, 6.2% and 7.5% since the pandemic began4. The rate of occupancy decline from month to month has been decelerating for both independent and assisted living, and primary markets have seen a higher rate of decline than the secondary markets that we typically invest in.

One reason the senior living industry has weathered the pandemic better than expected, is the Federal stimulus dollars which almost all of our borrowers had access to through the Payroll Protection Program (“PPP”) which provided for 2.5 months of average monthly payroll costs. Additionally, in late September, the Department of Health and Human Services announced that assisted living providers can receive 2% of annual revenue, plus a payment to account for revenue loss and expenses attributable to the pandemic. Applications were due November 6th and should provide timely aid to an industry on the front lines.

From a capital markets perspective, the senior living community has seen the lowest number of financings since the great financial crisis of 2007-08. As of October, $1.5 billion had been publicly issued for a tax-exempt market that normally issues over $4 billion a year5. The senior living capital markets were “frozen” until mid-summer when the first investment grade senior living deal priced. Since then, there has been a slow thaw of the senior living capital markets with a significant portion of banks and equity investors on the “sidelines”. With each passing day, more capital is returning to the space and deals across the spectrum of senior living are crossing the finish line once again. Simultaneously, vaccinations at our senior living communities have created a surge of capital market activity as groups vie for the “first mover’s advantage”.

On a positive note, the pandemic has strengthened the industry’s infectious disease policies and procedures which has brought lasting change for the better. For example, the industry has been remarkably slow to adopt telehealth; however, telehealth visits have gone from approximately 3% pre-COVID-19 to more than 50% currently. The dramatic positive shift was made possible by Congress passing bills in the spring of 2020 which now allow telehealth to be covered by Medicare.

Clearly it will not happen overnight, but we are cautiously optimistic the senior living community is poised to rebound to pre-COVID-19 levels in short order.

Concluding thoughts

We feel strongly that the future of energy will be driven by a combination of natural gas and renewables to meet growing energy demand while simultaneously reducing global CO2 emissions. There are many tailwinds driving the move to cleaner energy with the Biden Administration and the trends toward ESG investing. Although 2020 and the pandemic proved challenging in the education and senior living sectors, we anticipate more of a return to normal during 2021. We are positioning the funds to take advantage of these trends and have an optimistic outlook for 2021 and beyond.

The S&P Energy Select Sector® Index is a capitalization-weighted index of S&P 500® Index companies in the energy sector involved in the development or production of energy products. The Tortoise North American Oil and Gas Producers IndexSM is a float-adjusted, capitalization-weighted index of North American energy companies engaged primarily in the production of crude oil, condensate, natural gas or natural gas liquids (NGLs). The Tortoise North American Pipeline IndexSM is a float adjusted, capitalization-weighted index of energy pipeline companies domiciled in the United States and Canada. The Tortoise MLP Index® is a float-adjusted, capitalization-weighted index of energy master limited partnerships.

The Tortoise indices are the exclusive property of Tortoise Index Solutions, LLC, which has contracted with S&P Opco, LLC (a subsidiary of S&P Dow Jones Indices LLC) to calculate and maintain the Tortoise MLP Index®, Tortoise North American Pipeline IndexSM and Tortoise North American Oil and Gas Producers IndexSM (the “Indices”). The Indices are not sponsored by S&P Dow Jones Indices or its affiliates or its third party licensors (collectively, “S&P Dow Jones Indices LLC”). S&P Dow Jones Indices will not be liable for any errors or omission in calculating the Indices. “Calculated by S&P Dow Jones Indices” and its related stylized mark(s) are service marks of S&P Dow Jones Indices and have been licensed for use by Tortoise Index Solutions, LLC and its affiliates. S&P® is a registered trademark of Standard & Poor’s Financial Services LLC (“SPFS”), and Dow Jones® is a registered trademark of Dow Jones Trademark Holdings LLC (“Dow Jones”).

It is not possible to invest directly in an index.

Performance data quoted represent past performance; past performance does not guarantee future results. Like any other stock, total return and market value will fluctuate so that an investment, when sold, may be worth more or less than its original cost.

| 1. | Energy Information Administration, December 2020 STEO |

| 2. | Solar Market Insight Report, 2020 Q4 |

| 3. | CNN “Where Schools are Reopening in the U.S.”, December 15, 2020 |

| 4. | NIC |

| 5. | Ziegler |

| (unaudited) | |

| Tortoise | 5 |

| Tortoise |

| Energy Infrastructure Corp. (TYG) |

Fund description

TYG seeks a high level of total return with an emphasis on current distributions paid to stockholders. TYG invests primarily in equity securities of master limited partnerships (MLPs) and their affiliates that transport, gather, process or store natural gas, natural gas liquids (NGLs), crude oil and refined petroleum products.

Fund performance

There were several contributors to midstream energy’s negative performance for the fiscal year including volatile commodity prices and negative energy sentiment, energy demand concerns and excess takeaway capacity related to the COVID-19 pandemic, as well as political rhetoric and uncertainty related to the 2020 U.S. presidential election, regulatory concerns around pipeline permitting, and concerns around midstream’s role in the evolving energy transition. Beyond this, one positive theme stood out for midstream businesses throughout the fiscal year — resiliency. Resilient cash flows confirm the essential nature of the assets that midstream businesses operate. Strong contractual obligations (take or pay contracts) and customer profiles (large, investment grade rated counterparties) helped midstream energy companies generate consistent cash flow from operations even in the low and volatile 2020 price environment. The average leverage for the fund’s portfolio companies was 3.41x in the fourth fiscal quarter. Since the fund’s inception, it has paid out more than $144 in cumulative distributions to stockholders. Leverage drastically impacted the fund’s returns throughout the period. The fund’s use of leverage drove outperformance compared to the index during the strong fourth fiscal quarter with market-based and NAV-based returns of 17.8% and 12.4%, respectively (including the reinvestment of distributions). Conversely, the required deleveraging during the weak market earlier in the year magnified negative performance with 2020 fiscal year returns of -69.7% and -61.7%, respectively. The Tortoise MLP Index® returned 11.2% and -23.6% during the same periods, respectively.

| 2020 fiscal year summary | |||

| Distributions paid per share (fiscal year 2020) | $2.1800 | (1) | |

| Distributions paid per share (4th quarter 2020) | $0.3000 | ||

| Distribution rate (as of 11/30/2020) | 6.3% | ||

| Quarter-over-quarter distribution increase (decrease) | 0.0% | ||

| Year-over-year distribution increase (decrease) | (88.5)% | (1) | |

| Cumulative distributions paid per share to | |||

| stockholders since inception in February 2004 | $144.9900 | (1) | |

| Market-based total return | (69.7)% | ||

| NAV-based total return | (61.7)% | ||

| Premium (discount) to NAV (as of 11/30/2020) | (23.2)% |

| (1) | Includes impact of reverse stock split. |

Key asset performance drivers

| Top five contributors | Company type | Performance driver | ||

| Sunnova Energy International Inc. | Solar company | Positive solar growth fundamentals and lower financing costs | ||

| Targa Resources Corp. – Preferred Shares A | Midstream gathering and processing company | Convertible debt structure provided downside protection | ||

| DCP Midstream LP | Natural gas pipeline MLP | Strong operating performance and improved NGL price outlook | ||

| Sunnova Energy International Inc. – Convertible Notes 9.750% Due 4/30/2025 | Solar company | Positive solar growth fundamentals and lower financing costs | ||

| Altus Midstream Company Preferred | Natural gas pipeline company | Preferred structure outperformed equity midstream equity performance | ||

| Bottom five contributors | Company type | Performance driver | ||

| Energy Transfer LP | Natural gas pipeline MLP | Concern Dakota Access Pipeline operations may be halted due to potential need for Environmental Impact Statement | ||

| Targa Resources Corp. | Midstream gathering and processing company | Concern about prolonged slowdown in production growth | ||

| ONEOK, Inc. | Midstream natural gas/natural gas liquids pipeline company | Concern about declining crude oil volumes negatively impacting natural gas and natural gas liquids (NGL) | ||

| Plains All American Pipeline, L.P. | Midstream crude oil pipeline MLP | Concerns regarding excess capacity for Permian crude pipelines | ||

| Enterprise Products Partners L.P. | Midstream natural gas/natural gas liquids pipeline MLP | Concerns of lower U.S.and global energy demand due to slower than expected recovery |

Unlike the fund return, index return is pre-expenses and taxes.

Performance data quoted represent past performance; past performance does not guarantee future results. Like any other stock, total return and market value will fluctuate so that an investment, when sold, may be worth more or less than its original cost. Portfolio composition is subject to change due to ongoing management of the fund. References to specific securities or sectors should not be construed as a recommendation by the fund or its adviser. See Schedule of Investments for portfolio weighting at the end of the fiscal quarter.

| (unaudited) | |

| 6 | Tortoise |

| 2020 Annual Report | November 30, 2020 |

Fund structure and distribution policy

The fund is structured as a corporation and is subject to federal and state income tax on its taxable income. The fund has adopted a distribution policy in which the Board of Directors considers many factors in determining distributions to stockholders, including NAV performance and distributable cash flow (DCF). The fund’s Board of Directors reviews the distribution rate at least quarterly, and may adjust the quarterly distribution throughout the year. Although the level of distributions is independent of the funds’ performance in the short term, the fund expects such distributions to correlate with its performance over time.

Distributable cash flow and distributions

DCF is distributions received from investments less expenses. The total distributions received from investments include the amount received as cash distributions from investments, paid-in-kind distributions, and dividend and interest payments. Income also includes the premiums received from sales of covered call options, net of amounts paid to buy back out-of-the-money options. The total expenses include current or anticipated operating expenses, leverage costs and current income taxes. Current income taxes include taxes paid on net investment income, in addition to foreign taxes, if any. Taxes incurred from realized gains on the sale of investments, expected tax benefits and deferred taxes are not included in DCF.

Income from investments increased slightly as compared to 3rd quarter 2020. Operating expenses, consisting primarily of fund advisory fees, decreased approximately 5.7% during the quarter due mainly to lower asset-based fees. Overall leverage costs decreased approximately 3.1% as compared to 3rd quarter 2020 due primarily to lower interest rates during the period. As a result of the changes in income and expenses, DCF increased approximately 2.8% as compared to 3rd quarter 2020. The fund paid a quarterly distribution of $0.30 per share during the quarter, no change from the distribution paid from the prior quarter and a decrease of approximately 88.5% from the distribution paid in Q3 2019. The fund has paid cumulative distributions to stockholders of $144.99 per share since its inception in Feb. 2004.

The Key Financial Data table discloses the calculation of DCF and should be read in conjunction with this discussion. The difference between distributions received from investments in the DCF calculation and total investment income as reported in the Statement of Operations, is reconciled as follows: the Statement of Operations, in conformity with U.S. generally accepted accounting principles (GAAP), recognizes distribution income from MLPs and other investments on their ex-dates, whereas the DCF calculation may reflect distribution income on their pay dates; GAAP recognizes that a significant portion of the cash distributions received from MLPs and other investments are characterized as a return of capital and therefore excluded from investment income, whereas the DCF calculation includes the return of capital (net of any distributions deemed to be return of principal); and distributions received from investments in the DCF calculation include the value of dividends paid-in-kind (additional stock or MLP units), whereas such amounts may not be included as income for GAAP purposes and includes distributions related to direct investments when the purchase price is reduced in lieu of receiving cash distributions. Net premiums on options written (premiums received less amounts paid to buy back out-of-the-money options) with expiration dates during the fiscal quarter are included in the DCF calculation, whereas GAAP recognizes the net effect of options written as realized and unrealized gains (losses). Income for DCF purposes is reduced by amortizing the cost of certain investments that may not have a residual value after a known time period and by distributions received from investments deemed to be return of principal. The treatment of expenses in the DCF calculation also differs from what is reported in the Statement of Operations. In addition to the total operating expenses, including fee waiver, as disclosed in the Statement of Operations, the DCF calculation reflects interest expense, realized and unrealized gains (losses) on interest rate swap settlements, distributions to preferred stockholders, other recurring leverage expenses, as well as taxes paid on net investment income.

“Net Investment Income (Loss), before Income Taxes” on the Statement of Operations is adjusted as follows to reconcile to DCF for YTD and 4th quarter 2020 (in thousands):

| YTD 2020 | 4th Qtr 2020 | |||||||

| Net Investment Loss, | ||||||||

| before Income Taxes | $ | (15,465 | ) | $ | (2,805 | ) | ||

| Adjustments to reconcile to DCF: | ||||||||

| Distributions characterized as | ||||||||

| return of capital, net | 61,794 | 9,292 | ||||||

| Premiums on redemption of | ||||||||

| senior notes and MRP stock | 3,659 | — | ||||||

| Other | 652 | 441 | ||||||

| DCF | $ | 50,640 | $ | 6,928 | ||||

Leverage

The fund’s leverage utilization decreased $8.4 million during 4th quarter 2020 and represented 29.3% of total assets at November 30, 2020. At year-end, the fund was in compliance with applicable coverage ratios, 100% of the leverage cost was fixed, the weighted-average maturity was 2.8 years and the weighted-average annual rate on leverage was 3.84%. These rates will vary in the future as a result of changing floating rates, utilization of the fund’s credit facility and as leverage and swaps mature or are redeemed. During the quarter, $4.8 million of Senior Notes were paid in full upon maturity.

Income taxes

As of November 30, 2020, the fund’s deferred tax asset was zero. The fund had capital loss carryforwards of $572.0 million for federal income tax purposes, which can be used to offset prior or future capital gains. To the extent that the fund has taxable income, it will owe federal and state income taxes. Tax payments can be funded from investment earnings, fund assets, or borrowings.

Please see the Financial Statements and Notes to Financial Statements for additional detail regarding critical accounting policies, results of operations, leverage, taxes and other important fund information.

For further information regarding the calculation of distributable cash flow and distributions to stockholders, as well as a discussion of the tax impact on distributions, please visit www.tortoiseecofin.com.

| (unaudited) | |

| Tortoise | 7 |

| TYG Key Financial Data (supplemental unaudited information) |

| (dollar amounts in thousands unless otherwise indicated) |

The information presented below regarding Distributable Cash Flow and Selected Financial Information is supplemental non-GAAP financial information, which the fund believes is meaningful to understanding operating performance. The Distributable Cash Flow Ratios include the functional equivalent of EBITDA for non-investment companies, and the fund believes they are an important supplemental measure of performance and promote comparisons from period-to-period. This information is supplemental, is not inclusive of required financial disclosures (e.g. Total Expense Ratio), and should be read in conjunction with the full financial statements

| Year Ended November 30, | 2019 | 2020 | |||||||||||||||||||||||||||||||||

| 2019 | 2020 | Q4(1) | Q1(1) | Q2(1) | Q3(1) | Q4(1) | |||||||||||||||||||||||||||||

| Total Income from Investments | |||||||||||||||||||||||||||||||||||

| Distributions and dividends | |||||||||||||||||||||||||||||||||||

| from investments | $ | 174,696 | $ | 68,737 | $ | 44,074 | $ | 40,436 | $ | 10,138 | $ | 8,982 | $ | 9,181 | |||||||||||||||||||||

| Dividends paid in kind | 801 | 357 | 300 | 178 | 179 | — | — | ||||||||||||||||||||||||||||

| Interest earned on corporate bonds | 467 | 2,283 | 348 | 712 | 604 | 547 | 420 | ||||||||||||||||||||||||||||

| Premiums on options written | 3,267 | 250 | 714 | 250 | — | — | — | ||||||||||||||||||||||||||||

| Total from investments | 179,231 | 71,627 | 45,436 | 41,576 | 10,921 | 9,529 | 9,601 | ||||||||||||||||||||||||||||

| Operating Expenses Before Leverage | |||||||||||||||||||||||||||||||||||

| �� Costs and Current Taxes | |||||||||||||||||||||||||||||||||||

| Advisory fees | 19,522 | 7,259 | 4,479 | 4,143 | 1,373 | 923 | 820 | ||||||||||||||||||||||||||||

| Other operating expenses | 1,624 | 1,342 | 382 | 407 | 313 | 294 | 328 | ||||||||||||||||||||||||||||

| 21,146 | 8,601 | 4,861 | 4,550 | 1,686 | 1,217 | 1,148 | |||||||||||||||||||||||||||||

| Distributable cash flow before | |||||||||||||||||||||||||||||||||||

| leverage costs and current taxes | 158,085 | 63,026 | 40,575 | 37,026 | 9,235 | 8,312 | 8,453 | ||||||||||||||||||||||||||||

| Leverage costs(2) | 25,956 | 12,386 | 6,347 | 5,878 | 3,409 | 1,574 | 1,525 | ||||||||||||||||||||||||||||

| Current income tax expense(3) | — | — | — | — | — | — | — | ||||||||||||||||||||||||||||

| Distributable Cash Flow(4) | $ | 132,129 | $ | 50,640 | $ | 34,228 | $ | 31,148 | $ | 5,826 | $ | 6,738 | $ | 6,928 | |||||||||||||||||||||

| Net realized gain (loss), net of | |||||||||||||||||||||||||||||||||||

| income taxes, for the period | $ | 29,053 | $ | (632,460 | ) | $ | (6,537 | ) | $ | (17,195 | ) | $ | (572,057 | ) | $ | (34,087 | ) | $ | (9,121 | ) | |||||||||||||||

| As a percent of average total assets(5) | |||||||||||||||||||||||||||||||||||

| Total from investments | 8.55 | % | 8.11 | % | 9.71 | % | 10.04 | % | 5.58 | % | 8.02 | % | 8.95 | % | |||||||||||||||||||||

| Operating expenses before | |||||||||||||||||||||||||||||||||||

| leverage costs and current taxes | 1.03 | % | 1.01 | % | 1.04 | % | 1.10 | % | 0.86 | % | 1.02 | % | 1.07 | % | |||||||||||||||||||||

| Distributable cash flow before | |||||||||||||||||||||||||||||||||||

| leverage costs and current taxes | 7.52 | % | 7.10 | % | 8.67 | % | 8.94 | % | 4.72 | % | 7.00 | % | 7.88 | % | |||||||||||||||||||||

| As a percent of average net assets(5) | |||||||||||||||||||||||||||||||||||

| Total from investments | 14.51 | % | 14.67 | % | 17.12 | % | 16.87 | % | 14.35 | % | 12.31 | % | 13.97 | % | |||||||||||||||||||||

| Operating expenses before | |||||||||||||||||||||||||||||||||||

| leverage costs and current taxes | 1.76 | % | 1.84 | % | 1.83 | % | 1.85 | % | 2.22 | % | 1.57 | % | 1.67 | % | |||||||||||||||||||||

| Leverage costs and current taxes | 2.16 | % | 2.64 | % | 2.39 | % | 2.38 | % | 4.48 | % | 2.03 | % | 2.22 | % | |||||||||||||||||||||

| Distributable cash flow | 10.59 | % | 10.19 | % | 12.90 | % | 12.64 | % | 7.65 | % | 8.71 | % | 10.08 | % | |||||||||||||||||||||

| Selected Financial Information | |||||||||||||||||||||||||||||||||||

| Distributions paid on common stock | $ | 140,588 | $ | 28,912 | $ | 35,195 | $ | 21,224 | $ | — | $ | 3,979 | $ | 3,709 | |||||||||||||||||||||

| Distributions paid on common stock | |||||||||||||||||||||||||||||||||||

| per share(7) | 10.4800 | 2.1800 | 2.6200 | 1.5800 | — | 0.3000 | 0.3000 | ||||||||||||||||||||||||||||

| Total assets, end of period(6) | 1,680,775 | 455,839 | 1,680,775 | 1,416,246 | 508,235 | 450,671 | 455,839 | ||||||||||||||||||||||||||||

| Average total assets during period(6)(8) | 2,044,102 | 847,473 | 1,876,534 | 1,665,499 | 778,359 | 472,659 | 431,543 | ||||||||||||||||||||||||||||

| Leverage(9) | 623,900 | 133,427 | 623,900 | 565,300 | 129,100 | 125,067 | 133,427 | ||||||||||||||||||||||||||||

| Leverage as a percent of total assets | 37.1 | % | 29.3 | % | 37.1 | % | 39.9 | % | 25.4 | % | 27.8 | % | 29.3 | % | |||||||||||||||||||||

| Net unrealized depreciation, | |||||||||||||||||||||||||||||||||||

| end of period | (543,310 | ) | (473,357 | ) | (543,310 | ) | (662,820 | ) | (526,684 | ) | (513,439 | ) | (473,357 | ) | |||||||||||||||||||||

| Net assets, end of period | 930,286 | 305,628 | 930,286 | 769,227 | 334,413 | 294,394 | 305,628 | ||||||||||||||||||||||||||||

| Average net assets during period(10) | 1,203,943 | 468,705 | 1,064,735 | 991,440 | 302,755 | 307,880 | 276,337 | ||||||||||||||||||||||||||||

| Net asset value per common share(7) | 69.24 | 24.95 | 69.24 | 57.28 | 25.08 | 22.52 | 24.95 | ||||||||||||||||||||||||||||

| Market value per share(7) | 67.28 | 19.16 | 67.28 | 50.60 | 18.70 | 16.50 | 19.16 | ||||||||||||||||||||||||||||

| Shares outstanding (000’s) | 53,732 | 12,250 | 53,732 | 53,732 | 13,334 | 13,072 | 12,250 | ||||||||||||||||||||||||||||

| (1) | Q1 is the period from December through February. Q2 is the period from March through May. Q3 is the period from June through August. Q4 is the period from September through November. |

| (2) | Leverage costs include interest expense, distributions to preferred stockholders, interest rate swap expenses and other recurring leverage expenses. |

| (3) | Includes taxes paid on net investment income and foreign taxes, if any. Taxes related to realized gains are excluded from the calculation of Distributable Cash Flow (“DCF”). |

| (4) | “Net investment income (loss), before income taxes” on the Statement of Operations is adjusted as follows to reconcile to DCF: increased by the return of capital on distributions, the dividends paid in stock and increased liquidation value, the premium on dividends paid in kind, the net premiums on options written and amortization of debt issuance costs; and decreased by realized and unrealized gains (losses) on interest rate swap settlements, distributions received that are excluded for DCF purposes and amortization on certain investments. |

| (5) | Annualized for periods less than one year. |

| (6) | Includes deferred issuance and offering costs on senior notes and preferred stock. |

| (7) | Adjusted to reflect 1 for 4 reverse stock split effective May 1, 2020. |

| (8) | Computed by averaging month-end values within each period. |

| (9) | Leverage consists of senior notes, preferred stock and outstanding borrowings under credit facilities. |

| (10) | Computed by averaging daily net assets within each period. |

| 8 | Tortoise |

2020 Annual Report | November 30, 2020 |

| Tortoise |

| Midstream Energy Fund, Inc. (NTG) |

Fund description

NTG seeks to provide stockholders with a high level of total return with an emphasis on current distributions. NTG invests primarily in midstream energy equities that own and operate a network of pipeline and energy related logistical infrastructure assets with an emphasis on those that transport, gather, process and store natural gas and natural gas liquids (NGLs). NTG targets midstream energy equities, including MLPs benefiting from U.S. natural gas production and consumption expansion, with minimal direct commodity exposure.

Fund performance

There were several contributors to midstream energy’s negative performance for the fiscal year including volatile commodity prices and negative energy sentiment, energy demand concerns and excess takeaway capacity related to the COVID-19 pandemic as well as political rhetoric and uncertainty related to the 2020 U.S. presidential election, regulatory concerns around pipeline permitting, and concerns around midstream’s role in the evolving energy transition. Beyond this, one positive theme stood out for midstream businesses throughout the fiscal year — resiliency. Resilient cash flows confirm the essential nature of the assets that midstream businesses operate. Strong contractual obligations (take or pay contracts) and customer profiles (large, investment grade rated counterparties) helped midstream energy companies generate consistent cash flow from operations even in the low and volatile 2020 price environment. The average leverage for the fund’s portfolio companies was 3.35x in the fourth fiscal quarter. Leverage drastically impacted the fund’s performance throughout the period. The fund’s use of leverage drove outperformance compared to the index during the strong fiscal quarter with market-based and NAV-based returns of fiscal quarter ending November 30, 2020 were 17.6% and 13.9%, respectively (including the reinvestment of distributions). Conversely, the required deleveraging during the weak market earlier in the year magnified negative performance with 2020 fiscal year returns of -78.8% and -73.9%, respectively. The Tortoise MLP Index® returned 11.2% and -23.6% during the same periods, respectively.

| 2020 fiscal year summary | ||||

| Distributions paid per share (fiscal year 2020) | $ | 2.9700 | (1) | |

| Distributions paid per share (4th quarter 2020) | $ | 0.3100 | ||

| Distribution rate (as of 11/30/2020) | 6.4% | |||

| Quarter-over-quarter distribution increase (decrease) | 0.0% | |||

| Year-over-year distribution increase (decrease) | (92.7)% | (1) | ||

| Cumulative distributions paid per share to | ||||

| stockholders since inception in July 2010 | $ | 157.5700 | (1) | |

| Market-based total return | (78.8)% | |||

| NAV-based total return | (73.9)% | |||

| Premium (discount) to NAV (as of 11/30/2020) | (23.9)% |

| (1) | Includes impact of reverse stock split. |

Key asset performance drivers

| Top five contributors | Company type | Performance driver | ||

| MPLX LP | Refined products pipeline MLP | Protection from minimum volume commitments and business diversification with Northeast midstream business | ||

| Sunnova Energy International Inc. | Solar company | Positive solar growth fundamentals and lower financing costs | ||

| DCP Midstream LP | Natural gas pipeline MLP | Strong operating performance and improved natural gas liquids price outlook | ||

| Altus Midstream Company Preferred | Natural gas pipeline company | Preferred structure outperformed equity midstream equity performance | ||

| Targa Resources Corp. – Preferred Shares A | Midstream gathering and processing company | Convertible debt structure provided downside protection | ||

| Bottom five contributors | Company type | Performance driver | ||

| Energy Transfer LP | Natural gas pipeline MLP | Concern Dakota Access Pipeline operations may be halted due to potential need for Environmental Impact Statement | ||

| Targa Resources Corp. | Midstream gathering and processing company | Concern about prolonged slowdown in production growth | ||

| Enterprise Products Partners L.P. | Midstream natural gas/natural gas liquids pipeline MLP | Concerns of lower U.S. and global energy demand due to slower than expected recovery | ||

| Plains All American Pipeline, L.P. | Midstream crude oil pipeline MLP | Concerns regarding excess capacity for Permian crude pipelines | ||

| Phillips 66 Partners LP | Midstream refined product pipeline MLP | Concern Dakota Access Pipeline operations may be halted due to potential need for Environmental Impact Statement |

Unlike the fund return, index return is pre-expenses and taxes.

Performance data quoted represent past performance; past performance does not guarantee future results. Like any other stock, total return and market value will fluctuate so that an investment, when sold, may be worth more or less than its original cost. Portfolio composition is subject to change due to ongoing management of the fund. References to specific securities or sectors should not be construed as a recommendation by the fund or its adviser. See Schedule of Investments for portfolio weighting at the end of the fiscal quarter.

| (unaudited) | |

| Tortoise | 9 |

| Tortoise |

| Midstream Energy Fund, Inc. (NTG) (continued) |

Fund structure and distribution policy

The fund is structured as a corporation and is subject to federal and state income tax on its taxable income. The fund has adopted a distribution policy in which the Board of Directors considers many factors in determining distributions to stockholders, including NAV performance and distributable cash flow (DCF). The fund’s Board of Directors reviews the distribution rate at least quarterly, and may adjust the quarterly distribution throughout the year. Although the level of distributions is independent of the funds’ performance in the short term, the fund expects such distributions to correlate with its performance over time.

Distributable cash flow and distributions

DCF is distributions received from investments less expenses. The total distributions received from investments include the amount received as cash distributions from MLPs, paid-in-kind distributions, and dividend and interest payments. Income also includes the premiums received from sales of covered call options, net of amounts paid to buy back out-of-the-money options. The total expenses include current or anticipated operating expenses, leverage costs and current income taxes. Current income taxes include taxes paid on net investment income in addition to foreign taxes, if any. Taxes incurred from realized gains on the sale of investments, expected tax benefits and deferred taxes are not included in DCF.

Income from investments decreased approximately 9.1% as compared to 3rd quarter 2020 primarily due to lower distributions from investments within the fund’s portfolio. Operating expenses, consisting primarily of fund advisory fees, increased slightly during the quarter. Leverage costs decreased approximately 11% as compared to 3rd quarter 2020 due to lower interest rates during the quarter. As a result of the changes in income and expenses, DCF decreased approximately 11% as compared to 3rd quarter 2020. The fund paid a quarterly distribution of $0.31 per share during the quarter, no change from the distribution paid in the prior quarter and a decrease of approximately 93% from the distribution paid in Q4 2019. The fund has paid cumulative distributions to stockholders of $157.57 per share since its inception in July 2010.

The Key Financial Data table discloses the calculation of DCF and should be read in conjunction with this discussion. The difference between distributions received from investments in the DCF calculation and total investment income as reported in the Statement of Operations, is reconciled as follows: the Statement of Operations, in conformity with U.S. generally accepted accounting principles (GAAP), recognizes distribution income from MLPs, common stock and other investments on their ex-dates, whereas the DCF calculation may reflect distribution income on their pay dates; GAAP recognizes that a significant portion of the cash distributions received from MLPs, common stock and other investments are characterized as a return of capital and therefore excluded from investment income, whereas the DCF calculation includes the return of capital; and distributions received from investments in the DCF calculation include the value of dividends paid-in-kind (additional stock or MLP units), whereas such amounts may not be included as income for GAAP purposes, and includes distributions related to direct investments when the purchase price is reduced in lieu of receiving cash distributions. Net premiums on options written (premiums received less amounts paid to buy back out-of-the-money options) with expiration dates during the fiscal quarter are included in the DCF calculation, whereas GAAP recognizes the net effect of options written as realized and unrealized gains (losses). The treatment of expenses in the DCF calculation also differs from what is reported in the Statement of Operations. In addition to the total operating expenses, including fee waiver, as disclosed in the Statement of Operations, the DCF calculation reflects interest expense, distributions to preferred stockholders, other recurring leverage expenses, as well as taxes paid on net investment income.

“Net Investment Income (Loss), before Income Taxes” on the Statement of Operations is adjusted as follows to reconcile to DCF for YTD and 4th quarter 2020 (in thousands):

| YTD 2020 | 4th Qtr 2020 | |||||||

| Net Investment Loss, | ||||||||

| before Income Taxes | $ | (10,472 | ) | $ | (2,086 | ) | ||

| Adjustments to reconcile to DCF: | ||||||||

| Distributions characterized as | ||||||||

| return of capital (ROC) | 39,828 | 5,192 | ||||||

| Premiums on redemption of | ||||||||

| senior notes and MRP stock | 4,081 | — | ||||||

| Prior year ROC re-class | (1,606 | ) | — | |||||

| Other | 888 | 372 | ||||||

| DCF | $ | 32,719 | $ | 3,478 | ||||

Leverage

The fund’s leverage utilization increased approximately $17 million during 4th quarter 2020 and represented 30.0% of total assets at November 30, 2020. At year-end, the fund was in compliance with applicable coverage ratios, 100% of the leverage cost was fixed, the weighted-average maturity was 1.5 years and the weighted-average annual rate on leverage was 2.39%. These rates will vary in the future as a result of changing floating rates, utilization of the fund’s credit facility and as leverage matures or is redeemed. During the quarter, $22.9 million of Senior Notes were paid in full upon maturity.

Income taxes

As of November 30, 2020, the fund’s deferred tax asset was zero. The fund had capital loss carryforwards of $550.7 million for federal income tax purposes, which can be used to offset future capital gains. To the extent that the fund has taxable income, it will owe federal and state income taxes. Tax payments can be funded from investment earnings, fund assets, or borrowings.

Please see the Financial Statements and Notes to Financial Statements for additional detail regarding critical accounting policies, results of operations, leverage, taxes and other important fund information.

For further information regarding the calculation of distributable cash flow and distributions to stockholders, as well as a discussion of the tax impact on distributions, please visit www.tortoiseecofin.com.

| (unaudited) | |

| 10 | Tortoise |

2020 Annual Report | November 30, 2020 |

| NTG Key Financial Data (supplemental unaudited information) |

| (dollar amounts in thousands unless otherwise indicated) |

The information presented below regarding Distributable Cash Flow and Selected Financial Information is supplemental non-GAAP financial information, which the fund believes is meaningful to understanding operating performance. The Distributable Cash Flow Ratios include the functional equivalent of EBITDA for non-investment companies, and the fund believes they are an important supplemental measure of performance and promote comparisons from period-to-period. This information is supplemental, is not inclusive of required financial disclosures (e.g. Total Expense Ratio), and should be read in conjunction with the full financial statements.

| Year Ended November 30, | 2019 | 2020 | |||||||||||||||||||||||||||||||||

| 2019 | 2020 | Q4(1) | Q1(1) | Q2(1) | Q3(1) | Q4(1) | |||||||||||||||||||||||||||||

| Total Income from Investments | |||||||||||||||||||||||||||||||||||

| Distributions and dividends | |||||||||||||||||||||||||||||||||||

| from investments | $ | 125,782 | $ | 44,780 | $ | 31,315 | $ | 28,806 | $ | 6,309 | $ | 5,045 | $ | 4,620 | |||||||||||||||||||||

| Dividends paid in kind | 518 | 257 | 200 | 127 | 130 | — | — | ||||||||||||||||||||||||||||

| Interest earned on corporate bonds | 315 | 1,194 | 230 | 489 | 317 | 222 | 166 | ||||||||||||||||||||||||||||

| Premiums on options written | 3,300 | 216 | 941 | 216 | — | — | — | ||||||||||||||||||||||||||||

| Total from investments | 129,915 | 46,447 | 32,686 | 29,638 | 6,756 | 5,267 | 4,786 | ||||||||||||||||||||||||||||

| Operating Expenses Before Leverage | |||||||||||||||||||||||||||||||||||

| Costs and Current Taxes | |||||||||||||||||||||||||||||||||||

| Advisory fees, net of fees waived | 13,531 | 4,665 | 3,145 | 2,868 | 873 | 482 | 442 | ||||||||||||||||||||||||||||

| Other operating expenses | 1,271 | 944 | 301 | 321 | 156 | 207 | 260 | ||||||||||||||||||||||||||||

| 14,802 | 5,609 | 3,446 | 3,189 | 1,029 | 689 | 702 | |||||||||||||||||||||||||||||

| Distributable cash flow before | |||||||||||||||||||||||||||||||||||

| leverage costs and current taxes | 115,113 | 40,838 | 29,240 | 26,449 | 5,727 | 4,578 | 4,084 | ||||||||||||||||||||||||||||

| Leverage costs(2) | 20,121 | 8,119 | 4,859 | 4,428 | 2,402 | 683 | 606 | ||||||||||||||||||||||||||||

| Current income tax expense(3) | — | — | — | — | — | — | — | ||||||||||||||||||||||||||||

| Distributable Cash Flow(4) | $ | 94,992 | $ | 32,719 | $ | 24,381 | $ | 22,021 | $ | 3,325 | $ | 3,895 | $ | 3,478 | |||||||||||||||||||||

| Net realized gain (loss), net of | |||||||||||||||||||||||||||||||||||

| income taxes, for the period | $ | (35,176 | ) | $ | (561,915 | ) | $ | (8,640 | ) | $ | (6,917 | ) | $ | (518,170 | ) | $ | (28,505 | ) | $ | (8,323 | ) | ||||||||||||||

| As a percent of average total assets (5) | |||||||||||||||||||||||||||||||||||

| Total from investments | 8.69 | % | 8.59 | % | 9.96 | % | 10.37 | % | 5.77 | % | 9.32 | % | 9.29 | % | |||||||||||||||||||||

| Operating expenses before | |||||||||||||||||||||||||||||||||||

| leverage costs and current taxes | 1.02 | % | 1.08 | % | 1.05 | % | 1.12 | % | 0.88 | % | 1.22 | % | 1.36 | % | |||||||||||||||||||||

| Distributable cash flow before | |||||||||||||||||||||||||||||||||||

| leverage costs and current taxes | 7.67 | % | 7.51 | % | 8.91 | % | 9.25 | % | 4.89 | % | 8.10 | % | 7.93 | % | |||||||||||||||||||||

| As a percent of average net assets(5) | |||||||||||||||||||||||||||||||||||

| Total from investments | 14.43 | % | 15.49 | % | 17.18 | % | 16.80 | % | 16.18 | % | 13.90 | % | 14.47 | % | |||||||||||||||||||||

| Operating expenses before | |||||||||||||||||||||||||||||||||||

| leverage costs and current taxes | 1.70 | % | 1.94 | % | 1.81 | % | 1.81 | % | 2.46 | % | 1.82 | % | 2.12 | % | |||||||||||||||||||||

| Leverage costs and current taxes | 2.31 | % | 2.81 | % | 2.55 | % | 2.51 | % | 5.75 | % | 1.80 | % | 1.83 | % | |||||||||||||||||||||

| Distributable cash flow | 10.42 | % | 10.74 | % | 12.82 | % | 12.48 | % | 7.97 | % | 10.28 | % | 10.52 | % | |||||||||||||||||||||

| Selected Financial Information | |||||||||||||||||||||||||||||||||||

| Distributions paid on common stock | $ | 106,822 | $ | 18,638 | $ | 26,705 | $ | 14,854 | $ | — | $ | 1,952 | $ | 1,832 | |||||||||||||||||||||

| Distributions paid on common stock | |||||||||||||||||||||||||||||||||||

| per share(7) | 16.9000 | 2.9700 | 4.2250 | 2.3500 | — | 0.3100 | 0.3100 | ||||||||||||||||||||||||||||

| Total assets, end of period(6) | 1,163,500 | 226,449 | 1,163,500 | 964,276 | 239,673 | 212,560 | 226,449 | ||||||||||||||||||||||||||||

| Average total assets during period(6)(8) | 1,447,092 | 521,028 | 1,316,053 | 1,149,464 | 466,040 | 224,762 | 207,191 | ||||||||||||||||||||||||||||

| Leverage(9) | 462,600 | 68,021 | 462,600 | 409,500 | 50,900 | 50,900 | 68,021 | ||||||||||||||||||||||||||||

| Leverage as a percent of total assets | 39.8 | % | 30.0 | % | 39.8 | % | 42.5 | % | 21.2 | % | 23.9 | % | 30.0 | % | |||||||||||||||||||||

| Net unrealized appreciation | |||||||||||||||||||||||||||||||||||

| (depreciation), end of period | (64,329 | ) | 14,962 | (64,329 | ) | (157,875 | ) | (22,960 | ) | (11,035 | ) | 14,962 | |||||||||||||||||||||||

| Net assets, end of period | 667,708 | 149,407 | 667,708 | 549,293 | 162,369 | 141,403 | 149,407 | ||||||||||||||||||||||||||||

| Average net assets during period(10) | 871,496 | 289,147 | 762,956 | 709,609 | 166,096 | 150,772 | 132,986 | ||||||||||||||||||||||||||||

| Net asset value per common share(7) | 105.60 | 25.56 | 105.60 | 86.90 | 25.69 | 22.76 | 25.56 | ||||||||||||||||||||||||||||

| Market value per common share(7) | 98.80 | 19.46 | 98.80 | 78.00 | 20.95 | 16.79 | 19.46 | ||||||||||||||||||||||||||||

| Shares outstanding (000’s) | 63,208 | 5,846 | 63,208 | 63,208 | 6,321 | 6,214 | 5,846 | ||||||||||||||||||||||||||||

| (1) | Q1 is the period from December through February. Q2 is the period from March through May. Q3 is the period from June through August. Q4 is the period from September through November. |

| (2) | Leverage costs include interest expense, distributions to preferred stockholders and other recurring leverage expenses. |

| (3) | Includes taxes paid on net investment income and foreign taxes, if any. Taxes related to realized gains are excluded from the calculation of Distributable Cash Flow (“DCF”). |

| (4) | “Net investment income (loss), before income taxes” on the Statement of Operations is adjusted as follows to reconcile to DCF: increased by the return of capital on distributions, the dividends paid in stock and increased liquidation value, the premium on dividends paid in kind and amortization of debt issuance costs. |

| (5) | Annualized for periods less than one year. |

| (6) | Includes deferred issuance and offering costs on senior notes and preferred stock. |

| (7) | Adjusted to reflect 1 for 10 reverse stock split effective May 1, 2020. |

| (8) | Computed by averaging month-end values within each period. |

| (9) | Leverage consists of senior notes, preferred stock and outstanding borrowings under the credit facility. |

| (10) | Computed by averaging daily net assets within each period. |

| Tortoise | 11 |

| Tortoise |

| Pipeline & Energy Fund, Inc. (TTP) |

Fund description

TTP seeks a high level of total return with an emphasis on current distributions paid to stockholders. TTP invests primarily in equity securities of North American pipeline companies that transport natural gas, natural gas liquids (NGLs), crude oil and refined products and, to a lesser extent, in other energy infrastructure companies.

Fund performance

There were several contributors to midstream energy’s negative performance for the fiscal year including volatile commodity prices and negative energy sentiment, energy demand concerns and excess takeaway capacity related to the COVID-19 pandemic as well as political rhetoric and uncertainty related to the 2020 U.S. presidential election, regulatory concerns around pipeline permitting, and concerns around midstream’s role in the evolving energy transition. Beyond this, one positive theme stood out for midstream businesses throughout the fiscal year — resiliency. Resilient cash flows confirm the essential nature of the assets that midstream businesses operate. Strong contractual obligations (take or pay contracts) and customer profiles (large, investment grade rated counterparties) helped midstream energy companies generate consistent cash flow from operations even in the low and volatile 2020 price environment. Leverage impacted the fund’s performance throughout the period. The fund’s use of leverage drove outperformance compared to the index during the strong fiscal quarter with market-based and NAV-based returns of 8.4% and 6.9%, respectively (including the reinvestment of distributions). Conversely, the required deleveraging during the weak market earlier in the year magnified negative performance with 2020 fiscal year returns of -64.7% and -58.6%, respectively. The Tortoise North American Pipeline Index returned 6.3% and -15.8% during the same periods, respectively.

| 2020 fiscal year summary | ||||

| Distributions paid per share (fiscal year 2020) | $ | 1.6200 | (1) | |

| Distributions paid per share (4th quarter 2020) | $ | 0.1600 | ||

| Distribution rate (as of 11/30/2020) | 4.2% | |||

| Quarter-over-quarter distribution increase (decrease) | 0.0% | |||

| Year-over-year distribution increase (decrease) | (86.0)% | (1) | ||

| Cumulative distributions paid per share to | ||||

| stockholders since inception in October 2011 | $ | 54.0700 | (1) | |

| Market-based total return | (64.7)% | |||

| NAV-based total return | (58.6)% | |||

| Premium (discount) to NAV (as of 11/30/2020) | (24.1)% |

| (1) | Includes impact of reverse stock split. |

Please refer to the inside front cover of the report for important information about the fund’s distribution policy.

The fund utilizes a covered call strategy when appropriate, which seeks to generate income while reducing overall volatility. No covered calls were written during the quarter.

Key asset performance drivers

| Top five contributors | Company type | Performance driver | ||

| Tallgrass Energy LP | Midstream natural gas/natural gas liquids pipeline company | Acquisition by Blackstone | ||

| Semgroup Corp | Midstream crude oil pipeline company | Acquisition by Energy Transfer | ||

| Nextera Energy Partners LP | Downstream power company | Positive solar and wind growth fundamentals | ||

| Equitrans Midstream Corporation | Midstream gathering and processing company | Relatively steady natural gas outlook amid market volatility | ||

| Targa Resources Corp. – Preferred Shares A | Midstream gathering and processing company | Convertible debt structure provided downside protection | ||

| Bottom five contributors | Company type | Performance driver | ||

| ONEOK, Inc. | Midstream natural gas/natural gas liquids pipeline company | Concern about declining crude oil volumes negatively impacting natural gas and natural gas liquids (NGL) | ||

| Plains GP Holdings, L.P. | Midstream crude oil pipeline company | Reduced crude oil volume outlook | ||

| Targa Resources Corp. | Midstream gathering and processing company | Concern about prolonged slowdown in production growth | ||

| Energy Transfer LP | Midstream natural gas/natural gas liquids pipeline MLP | Concern Dakota Access Pipeline operations may be halted due to potential need for Environmental Impact Statement | ||

| Kinder Morgan Inc. | Midstream natural gas/natural gas liquids pipeline company | Slower improvement in refined product demand following COVID-19 than expected |

Unlike the fund return, index return is pre-expenses.

Performance data quoted represent past performance; past performance does not guarantee future results. Like any other stock, total return and market value will fluctuate so that an investment, when sold, may be worth more or less than its original cost. Portfolio composition is subject to change due to ongoing management of the fund. References to specific securities or sectors should not be construed as a recommendation by the fund or its adviser. See Schedule of Investments for portfolio weighting at the end of the fiscal quarter.

| (unaudited) | |

| 12 | Tortoise |

2020 Annual Report | November 30, 2020 |

Fund structure and distribution policy

The fund is structured to qualify as a Regulated Investment Company (RIC) allowing it to pass-through to shareholders income and capital gains earned, thus avoiding double-taxation. To qualify as a RIC, the fund must meet specific income, diversification and distribution requirements. Regarding income, at least 90 percent of the fund’s gross income must be from dividends, interest and capital gains. The fund must meet quarterly diversification requirements including the requirement that at least 50 percent of the assets be in cash, cash equivalents or other securities with each single issuer of other securities not greater than 5 percent of total assets. No more than 25 percent of total assets can be invested in any one issuer other than government securities or other RIC’s. The fund must also distribute at least 90 percent of its investment company income. RIC’s are also subject to excise tax rules which require RIC’s to distribute approximately 98 percent of net income and net capital gains to avoid a 4 percent excise tax.

The fund has adopted a distribution policy which is included on the inside front cover of this report. To summarize, the fund intends to distribute an amount closely approximating the total taxable income for the year and, if so determined by the Board, distribute all or a portion of the return of capital paid by portfolio companies during the year. The fund may designate a portion of its distributions as capital gains and may also distribute additional capital gains in the last calendar quarter of the year to meet annual excise distribution requirements. Distribution amounts are subject to change from time to time at the discretion of the Board. Although the level of distributions is independent of the funds’ performance in the short term, the fund expects such distributions to correlate with its performance over time.

Distributable cash flow and distributions