Gateway Casinos & Entertainment Limited

Notes to Consolidated Financial Statements

December 31, 2017 and 2016

(expressed in thousands of Canadian dollars)

Other income tax matters

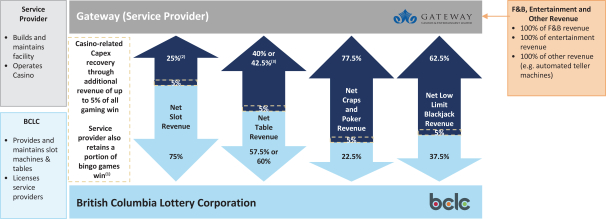

The Canada Revenue Agency (“CRA”) has conducted audits of the Company’s and its subsidiaries Boardwalk Gaming Squamish Inc. and 427967 B.C. Ltd. relating to the taxation years ended December 31, 2010 to 2014. The CRA has taken the view to recharacterize FDC amounts as taxable income, as well as reclassify amounts included in Class 14 as Eligible Capital Property.

For accounting purposes, FDC is recorded as part of revenues in the consolidated statement of operations and comprehensive loss when received. For income tax purposes, based on the underlying operating agreements with the BCLC and the BCLC FDC policy, management believes that FDC received from the BCLC is appropriately characterized under the relevant income tax laws as a reimbursement and a reduction of the cost of the related long-lived asset.

As part of its audit, the CRA has taken the view that FDC was received as service fee income and should be included in taxable income when received instead of being a reimbursement of the BCLC-approved gaming related property, plant and equipment costs as filed by the Company and its subsidiaries. If the CRA’s current views prevail, it would accelerate the timing of when the Company and its subsidiaries recognize taxable income, but would also increase the tax depreciation deduction (capital cost allowance) that the Company could recognize in prior and future years.

During the year ended December 31, 2015, the Company received notices of reassessment and/or notices of determination of loss from the CRA relating to the taxation years ended December 31, 2010 to 2012 inclusive for the Company and December 31, 2011 and 2012 inclusive for its subsidiaries Boardwalk Gaming Squamish Inc. and 427967 B.C. Ltd. During the year ended December 31, 2017, the Company received notices of determination of loss from the CRA relating to the taxation years ended December 31, 2013 to 2014 and a notice of reassessment relating to the taxation years ended December 31, 2015 and 2016 for the Company. The Company also received a notice of determination of loss from the CRA relating to the taxation year ended December 31, 2014 pertaining to Boardwalk Gaming Squamish Inc. and a notice of reassessment from the CRA relating to the taxation year ended December 31, 2014 pertaining to 427967 B.C. Ltd. Subsequent to year end, the Company received a notice of confirmation from the CRA relating to the taxation year ended December 31, 2010 and the taxation years ended December 31, 2012 to 2014 inclusive. The Company also received a notice of confirmation from the CRA relating to the taxation year ended December 31, 2011, 2012 and 2014 pertaining to Boardwalk Gaming Squamish Inc. and 427967 B.C. Ltd, respectively.

The Company and its subsidiaries Boardwalk Gaming Squamish Inc. and 427967 B.C. Ltd. intend to vigorously defend their tax filing and have filed notices of objection to the above notices of reassessments and notices of determination of loss and, if necessary, will file notices of appeal to the Tax Court of Canada. The Company and its subsidiaries Boardwalk Gaming Squamish Inc. and 427967 B.C. Ltd. plan to file a notice of objection to the CRA in response to each notice of reassessment and/or notice of loss determination received for any subsequent years, where appropriate. The Company believes that the filing positions adopted are appropriate and in accordance with the law. The Company also believes it has substantial defences in response to the matters raised by the CRA and will vigorously appeal the reassessments and redeterminations. No provision has been made in these consolidated financial statements for the reassessments. The Company has sufficientnon-capital loss carry-forwards to offset any additional income taxes that are payable as a result of the reassessments. During the year ended December 31, 2015, the CRA accepted the Company’s application ofnon-capital loss carry-forwards for years in which the reassessments resulted in taxable income to eliminate taxes payable and prevent interest and penalties from accruing. According to the notices of reassessment and notices of determination of loss received and the CRA proposed amendments, net income (loss) for tax purposes for the taxation years ended December 31, 2010, 2011, 2012, 2013, 2014, 2015 and 2016 would increase (decrease) by $1,715, $30,908, $31,217, $30,073, $31,840, $28,528 and $28,528, respectively. The likely timing to resolve this matter may take years.

The CRA has conducted excise tax audits of the Company and its subsidiary 7588674 relating to the taxation period of May 18, 2010 to June 30, 2015 and February 1, 2010 to September 16, 2010, respectively. The CRA has taken the view that the Company and its subsidiary were not providing a financial service to their customers in relation to ATM fees collected, and as such, GST and/or HST should have been collected and remitted as the Company and its subsidiary were not providing an exempt supply.

During fiscal 2017, the Company and its subsidiary 7588674 received a proposed reassessment from the CRA relating to the taxation period of May 18, 2010 to June 30, 2015 and February 1, 2010 to September 16, 2010, respectively. In the proposed reassessment, the CRA has proposed an adjustment to the net tax on the Company’s GST/HST returns of $2,534 and an adjustment to the net tax on its subsidiary 7588674’s GST/HST returns of $219. In addition, the CRA has proposed to assess penalties of approximately $634 and $55, respectively.

Subsequent to year end, the Company and its subsidiary 7588674 remitted payment of the net tax owing of $2,563 and $224, respectively. In addition, the Company and its subsidiary 7588674 remitted payment of $641 and $55 in relation to the assessed penalties and $878 and $120 in relation to interest.

F-32