UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSRS

CERTIFIED SHAREHOLDER REPORT OF REGISTERED MANAGEMENT

INVESTMENT COMPANIES

Investment Company Act file number 811-23410

FROST FAMILY OF FUNDS

(Exact name of registrant as specified in charter)

One Freedom Valley Drive

Oaks, PA 19456

(Address of Principal Executive Offices, Zip code)

Michael Beattie

c/o SEI Investments

One Freedom Valley Drive

Oaks, PA 19456

(Name and Address of Agent for Service)

Registrant’s telephone number, including area code: 1-877-713-7678

Date of fiscal year end: July 31, 2020

Date of reporting period: January 31, 2020

| Item 1. | Reports to Stockholders. |

A copy of the report transmitted to stockholders pursuant to Rule 30e-1 under the Investment Company Act or 1940, as amended (the “Act”) (17 CFR § 270.30e-1), is attached hereto.

| | |

| FROST FAMILY OF FUNDS | | F R O S T F U N D S | J A N U A R Y 3 1, 2 0 2 0 |

The Funds file their complete schedule of investments of portfolio holdings with the Securities and Exchange Commission (“Commission”) for the first and third quarters of each fiscal year on Form N-PORT within sixty days after period end. The Funds’ Forms N-PORT are available on the Commission’s website at http://www.sec.gov, and may be reviewed and copied at the Commission’s Public Reference Room in Washington, D.C. Information on the operation of the Public Reference Room may be obtained by calling1-800-SEC-0330.

A description of the policies and procedures that the Funds use to determine how to vote proxies relating to portfolio securities, as well as information relating to how the Funds voted proxies relating to portfolio securities during the most recent12-month period ended June 30, is available (i) without charge, upon request, by calling1-877-71-FROST; and (ii) on the Commission’s website at http://www.sec.gov.

| | |

| FROST FAMILY OF FUNDS | | F R O S T F U N D S | J A N U A R Y 3 1, 2 0 2 0 (U n a u d i t e d) |

| | |

| LETTER TO SHAREHOLDERS (Unaudited) | | |

Dear Shareholders:

Following 2018’s fourth-quarter market relapse, global equity returns for 2019 heralded a broad recovery, easily surpassing investor expectations. Although investors have been generally skeptical since the beginning of the market’s decade-long recovery, this distrust was especially appropriate during the last quarter of 2018 on the heels of Fed rate hikes, trade warflare-ups, anemic corporate earnings and polarizing politics. By the close of 2019, a number of issues that were earlier market concerns had been or were being resolved.

There is now a signed agreement with China which should help mitigate simmering trade tensions in Asia, and reduce cross-tariff threats and investor concerns. This agreement followed a recently approved treaty between the U.S., Canada and Mexico, mitigating some uncertainty facing the manufacturing sector in 2020, perhaps helping counter last year’s downward trend in factory output.

Other positive developments included some resolution for Brexit, with the country’smid-December elections reaffirming that the British were indeed exiting the European Union. While the final economic effect is still an unknown, the exit decision has removed one of the unresolved issues impacting markets globally over the pastthree-and-a-half years. Here at home, investors are factoring in the state of monetary policies, manufacturing and our global trading partners, while also gauging the health of the consumer, the improving jobs markets and housing. The housing slowdown of 2018 has turned the corner courtesy of lower interest rates and we also expect that the recent negative turn in corporate earnings will shortly reverse back into positive territory, given signs that the global economy is gaining some traction.

To date, the momentum carrying the markets last year has continued into 2020, despite headwinds wrought by a new viral outbreak from China (Coronavirus). There are still some unknowns, including the ultimate loss of life but past history has shown the effect of these outbreaks are often short-lived and followed by market recoveries. There are also other distinct concerns globally (Russia, Iran and North Korea) and at home (upcoming elections). We continue to see positive economic data relating to the consumer amid still muted inflation fears. As we’ve noted in past commentaries, Frost Investment Advisors will continue to work to provide shareholders with a slate of quality offerings to manage through these challenging markets and economic volatility.

We appreciate your continued confidence in our team.

Sincerely,

Tom Stringfellow

President, Frost Investment Advisors

Past performance does not guarantee future results. The investment performance and principal value of an investment will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost, and current performance may be lower or higher than the performance quoted. Investment performance reflects voluntary fee waivers in effect. Absent these waivers, total return and yield would be reduced. There can be no assurance that Frost Investment Advisors, LLC will continue to waive fees. For performance data current to the most recent month end, please call 877.713.7678.

The information provided in this report should not be considered a recommendation to purchase or sell any particular security. These views are subject to change and are not intended to predict or guarantee the future performance of any individual security or the markets in general. There is no assurance that any securities discussed herein will remain in an account’s portfolio at the time you receive this report or that securities sold have not been repurchased. The securities discussed do not represent an account’s entire portfolio and in the aggregate may represent only a small percentage of an account’s portfolio holdings.

Mutual fund investing involves risk including possible loss of principal. International investments may involve risk of capital loss from unfavorable fluctuation in currency values, from differences in generally accepted accounting principles or from social, economic or political instability in other nations. Bond and bond funds are subject to interest rate risk and will decline in value as interest rates rise. REIT investments are subject to changes in economic conditions, credit risk and interest rate fluctuations. Emerging markets involve heightened risks related to the same factors as well as increased volatility and lower trading volume. Derivatives are often more volatile than other investments and may magnify the Fund’s gains or losses. The primary risk of derivative instruments is that changes in the market value of securities held by the fund and of the derivative instruments relating to those securities may not be proportionate. Derivatives are also subject to illiquidity and counter party risk. Diversification does not protect against market loss.

1

| | |

| FROST FAMILY OF FUNDS | | F R O S T F U N D S | J A N U A R Y 3 1, 2 0 2 0 (U n a u d i t e d) |

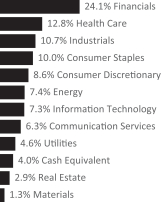

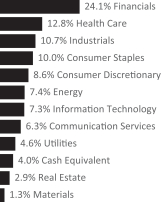

| † | Percentages are based on total investments. |

| | | | | | | | |

| Description | | Shares | | |

Value | |

COMMON STOCK§ — 99.0% | |

|

Communication Services — 13.8% | |

| | |

Alphabet, Cl A* | | | 8,254 | | | $ | 11,826,166 | |

| | |

Alphabet, Cl C* | | | 7,720 | | | | 11,072,256 | |

| | |

Comcast, Cl A | | | 131,000 | | | | 5,657,890 | |

| | |

Electronic Arts* | | | 38,000 | | | | 4,100,960 | |

| | |

Facebook, Cl A* | | | 57,690 | | | | 11,648,188 | |

| | |

Netflix* | | | 13,000 | | | | 4,486,170 | |

| | | | | | | | |

| | | | | | | 48,791,630 | |

| | | | | | | | |

|

Consumer Discretionary — 18.5% | |

| | |

Alibaba Group Holding ADR* | | | 25,000 | | | | 5,164,750 | |

| | |

Amazon.com* | | | 13,121 | | | | 26,356,415 | |

| | |

Booking Holdings* | | | 2,170 | | | | 3,972,294 | |

| | |

Home Depot | | | 43,090 | | | | 9,828,829 | |

| | |

Las Vegas Sands | | | 49,000 | | | | 3,200,190 | |

| | |

NIKE, Cl B | | | 40,000 | | | | 3,852,000 | |

| | |

O’Reilly Automotive* | | | 10,000 | | | | 4,061,000 | |

| | |

Starbucks | | | 52,550 | | | | 4,457,816 | |

| | |

TJX | | | 73,000 | | | | 4,309,920 | |

| | | | | | | | |

| | | | | | | 65,203,214 | |

| | | | | | | | |

|

Consumer Staples — 1.5% | |

| | |

Costco Wholesale | | | 17,132 | | | | 5,234,169 | |

| | | | | | | | |

|

Energy — 1.0% | |

| | |

EOG Resources | | | 46,500 | | | | 3,390,315 | |

| | | | | | | | |

|

Financials — 3.1% | |

| | |

JPMorgan Chase | | | 48,500 | | | | 6,419,460 | |

| | |

Moody’s | | | 17,405 | | | | 4,469,430 | |

| | | | | | | | |

| | | | | | | 10,888,890 | |

| | | | | | | | |

| | | | | | | | |

| Description | | Shares | | |

Value | |

|

Health Care — 15.5% | |

| | |

AbbVie | | | 60,000 | | | $ | 4,861,200 | |

| | |

Becton Dickinson | | | 19,750 | | | | 5,434,805 | |

| | |

Boston Scientific* | | | 155,000 | | | | 6,489,850 | |

| | |

Danaher | | | 43,750 | | | | 7,038,063 | |

| | |

Edwards Lifesciences* | | | 9,500 | | | | 2,088,670 | |

| | |

Humana* | | | 16,000 | | | | 5,379,840 | |

| | |

Merck | | | 65,000 | | | | 5,553,600 | |

| | |

UnitedHealth Group | | | 22,800 | | | | 6,211,860 | |

| | |

Vertex Pharmaceuticals* | | | 29,000 | | | | 6,584,450 | |

| | |

Zoetis, Cl A | | | 36,735 | | | | 4,930,204 | |

| | | | | | | | |

| | | | | | | 54,572,542 | |

| | | | | | | | |

|

Industrials — 5.0% | |

| | |

Canadian Pacific Railway | | | 21,540 | | | | 5,725,547 | |

| | |

Fortive | | | 52,000 | | | | 3,896,360 | |

| | |

Northrop Grumman | | | 12,000 | | | | 4,494,840 | |

| | |

Union Pacific | | | 20,000 | | | | 3,588,400 | |

| | | | | | | | |

| | | | | | | 17,705,147 | |

| | | | | | | | |

|

Information Technology — 36.7% | |

| | |

Adobe* | | | 19,000 | | | | 6,671,660 | |

| | |

Apple | | | 58,396 | | | | 18,074,146 | |

| | |

Applied Materials | | | 90,000 | | | | 5,219,100 | |

| | |

Autodesk* | | | 18,000 | | | | 3,543,300 | |

| | |

Mastercard, Cl A | | | 49,410 | | | | 15,610,595 | |

| | |

Microsoft | | | 180,500 | | | | 30,726,515 | |

| | |

PayPal Holdings* | | | 57,520 | | | | 6,550,953 | |

| | |

salesforce.com* | | | 60,635 | | | | 11,054,367 | |

| | |

ServiceNow* | | | 19,000 | | | | 6,426,370 | |

| | |

Visa, Cl A | | | 84,600 | | | | 16,832,862 | |

| | |

Workday, Cl A* | | | 34,000 | | | | 6,277,420 | |

| | |

Xilinx | | | 28,000 | | | | 2,365,440 | |

| | | | | | | | |

| | | | | | | 129,352,728 | |

| | | | | | | | |

|

Materials — 2.6% | |

| | |

Sherwin-Williams | | | 9,000 | | | | 5,012,910 | |

| | |

Vulcan Materials | | | 30,000 | | | | 4,248,900 | |

| | | | | | | | |

| | | | | | | 9,261,810 | |

| | | | | | | | |

|

Real Estate — 1.3% | |

| | |

American Tower‡ | | | 19,500 | | | | 4,518,930 | |

| | | | | | | | |

| | |

Total Common Stock

(Cost $180,238,219) | | | | | | | 348,919,375 | |

| | | | | | | | |

CASH EQUIVALENT — 1.0% | |

| | |

Federated Government Obligations Fund, Cl I,

1.450%**

(Cost $3,430,139) | | | 3,430,138 | | | | 3,430,138 | |

| | | | | | | | |

| | |

Total Investments — 100.0%

(Cost $183,668,358) | | | | | | $ | 352,349,513 | |

| | | | | | | | |

The accompanying notes are an integral part of the financial statements.

2

| | |

| FROST FAMILY OF FUNDS | | F R O S T F U N D S | J A N U A R Y 3 1, 2 0 2 0 (U n a u d i t e d) |

Percentages are based on Net Assets of $352,348,070.

| * | Non-income producing security. |

| ** | Rate shown is the7-day effective yield as of January 31, 2020. |

| § | Narrow industries are utilized for compliance purposes, whereas broad sectors are utilized for reporting. |

| ‡ | Real Estate Investment Trust |

ADR — American Depositary Receipt

Cl — Class

As of January 31, 2020, all of the Fund’s investments in securities were considered Level 1, in accordance with the authoritative guidance on fair value measurements and disclosure under U.S. GAAP.

For the period ended January 31, 2020, there have been no transfers in or out of Level 3.

For more information on valuation inputs, see Note 2 — Significant Accounting Policies in the Notes to Financial Statements.

The accompanying notes are an integral part of the financial statements.

3

| | |

| FROST FAMILY OF FUNDS | | F R O S T F U N D S | J A N U A R Y 3 1, 2 0 2 0 (U n a u d i t e d) |

| † | Percentages are based on total investments. |

| | | | | | | | |

| Description | | Shares | | |

Value | |

COMMON STOCK — 97.1% | |

|

Communication Services — 6.4% | |

| | |

Comcast, Cl A | | | 4,677 | | | $ | 202,000 | |

| | |

Fox | | | 6,746 | | | | 250,142 | |

| | |

Verizon Communications | | | 5,725 | | | | 340,294 | |

| | |

Walt Disney | | | 779 | | | | 107,743 | |

| | | | | | | | |

| | | | | | | 900,179 | |

| | | | | | | | |

|

Consumer Discretionary — 8.7% | |

| | |

Carnival | | | 5,033 | | | | 219,087 | |

| | |

Expedia Group | | | 1,876 | | | | 203,452 | |

| | |

Las Vegas Sands | | | 2,688 | | | | 175,553 | |

| | |

Lowe’s | | | 2,346 | | | | 272,699 | |

| | |

PVH | | | 1,108 | | | | 96,584 | |

| | |

Sony ADR | | | 3,798 | | | | 266,544 | |

| | | | | | | | |

| | | | | | | 1,233,919 | |

| | | | | | | | |

|

Consumer Staples — 10.1% | |

| | |

Constellation Brands, Cl A | | | 1,174 | | | | 221,064 | |

| | |

CVS Health | | | 4,167 | | | | 282,606 | |

| | |

Ingredion | | | 2,554 | | | | 224,752 | |

| | |

Philip Morris International | | | 2,775 | | | | 229,492 | |

| | |

Procter & Gamble | | | 1,643 | | | | 204,751 | |

| | |

Tyson Foods, Cl A | | | 3,230 | | | | 266,895 | |

| | | | | | | | |

| | | | | | | 1,429,560 | |

| | | | | | | | |

|

Energy — 7.5% | |

| | |

Chevron | | | 3,074 | | | | 329,348 | |

| | |

Occidental Petroleum | | | 7,678 | | | | 304,970 | |

| | |

Royal Dutch Shell ADR, Cl B | | | 4,095 | | | | 218,182 | |

| | | | | | | | |

| Description | | Shares | | |

Value | |

| | |

Valero Energy | | | 2,461 | | | $ | 207,487 | |

| | | | | | | | |

| | | | | | | 1,059,987 | |

| | | | | | | | |

|

Financials — 24.3% | |

| | |

American Express | | | 2,674 | | | | 347,272 | |

| | |

American International Group | | | 3,634 | | | | 182,645 | |

| | |

Aon | | | 686 | | | | 151,092 | |

| | |

Bank of America | | | 11,219 | | | | 368,320 | |

| | |

Berkshire Hathaway, Cl B* | | | 1,621 | | | | 363,801 | |

| | |

Capital One Financial | | | 2,487 | | | | 248,203 | |

| | |

Cboe Global Markets | | | 917 | | | | 112,993 | |

| | |

Chubb | | | 932 | | | | 141,655 | |

| | |

Citigroup | | | 2,942 | | | | 218,914 | |

| | |

Fidelity National Financial | | | 6,658 | | | | 324,577 | |

| | |

JPMorgan Chase | | | 3,260 | | | | 431,494 | |

| | |

KeyCorp | | | 7,271 | | | | 136,040 | |

| | |

Nasdaq | | | 1,667 | | | | 194,139 | |

| | |

Progressive | | | 1,500 | | | | 121,035 | |

| | |

Wells Fargo | | | 2,161 | | | | 101,437 | |

| | | | | | | | |

| | | | | | | 3,443,617 | |

| | | | | | | | |

|

Health Care — 12.9% | |

| | |

AbbVie | | | 1,897 | | | | 153,695 | |

| | |

Anthem | | | 1,232 | | | | 326,825 | |

| | |

AstraZeneca ADR | | | 5,777 | | | | 281,340 | |

| | |

Bristol-Myers Squibb | | | 2,251 | | | | 141,700 | |

| | |

Elanco Animal Health* | | | 7,152 | | | | 220,997 | |

| | |

Johnson & Johnson | | | 1,972 | | | | 293,572 | |

| | |

Medtronic | | | 2,204 | | | | 254,430 | |

| | |

Merck | | | 1,808 | | | | 154,475 | |

| | | | | | | | |

| | | | | | | 1,827,034 | |

| | | | | | | | |

|

Industrials — 10.8% | |

| | |

Delta Air Lines | | | 4,549 | | | | 253,561 | |

| | |

Eaton | | | 2,609 | | | | 246,472 | |

| | |

Johnson Controls International | | | 3,851 | | | | 151,922 | |

| | |

Kansas City Southern | | | 892 | | | | 150,472 | |

| | |

L3Harris Technologies | | | 825 | | | | 182,597 | |

| | |

Raytheon | | | 1,487 | | | | 328,538 | |

| | |

Union Pacific | | | 1,169 | | | | 209,742 | |

| | | | | | | | |

| | | | | | | 1,523,304 | |

| | | | | | | | |

| | |

Information Technology — 7.4% | | | | | | | | |

| | |

Cisco Systems | | | 3,163 | | | | 145,403 | |

| | |

Corning | | | 10,854 | | | | 289,693 | |

| | |

Fidelity National Information Services | | | 2,278 | | | | 327,258 | |

| | |

Microsoft | | | 1,626 | | | | 276,794 | |

| | | | | | | | |

| | | | | | | 1,039,148 | |

| | | | | | | | |

The accompanying notes are an integral part of the financial statements.

4

| | |

| FROST FAMILY OF FUNDS | | F R O S T F U N D S | J A N U A R Y 3 1, 2 0 2 0 (U n a u d i t e d) |

| | | | | | | | |

| Description | | Shares | | |

Value | |

| | |

Materials — 1.4% | | | | | | | | |

| | |

DuPont de Nemours | | | 3,901 | | | $ | 199,652 | |

| | | | | | | | |

| | |

Real Estate — 2.9% | | | | | | | | |

| | |

Healthpeak Properties‡ | | | 4,538 | | | | 163,323 | |

| | |

Weyerhaeuser‡ | | | 8,733 | | | | 252,820 | |

| | | | | | | | |

| | | | | | | 416,143 | |

| | | | | | | | |

| | |

Utilities — 4.7% | | | | | | | | |

| | |

Entergy | | | 1,735 | | | | 228,187 | |

| | |

Evergy | | | 3,045 | | | | 219,727 | |

| | |

FirstEnergy | | | 4,244 | | | | 215,553 | |

| | | | | | | | |

| | | | | | | 663,467 | |

| | | | | | | | |

| | |

Total Common Stock

(Cost $12,615,392) | | | | | | | 13,736,010 | |

| | | | | | | | |

CASH EQUIVALENT — 4.0% | | | | | | | | |

| | |

Federated Government Obligations Fund, Cl I, 1.450%**

(Cost $566,548) | | | 566,548 | | | | 566,548 | |

| | | | | | | | |

| | |

Total Investments — 101.1%

(Cost $13,181,940) | | | | | | $ | 14,302,558 | |

| | | | | | | | |

Percentages are based on Net Assets of $14,151,449.

| * | Non-income producing security. |

| ** | Rate shown is the7-day effective yield as of January 31, 2020. |

| ‡ | Real Estate Investment Trust |

ADR — American Depositary Receipt

Cl — Class

As of January 31, 2020, all of the Fund’s investments in securities were considered Level 1, in accordance with the authoritative guidance on fair value measurements and disclosure under U.S. GAAP.

For the period ended January 31, 2020 , there have been no transfers in or out of Level 3.

For more information on valuation inputs, see Note 2 — Significant Accounting Policies in the Notes to Financial Statements.

The accompanying notes are an integral part of the financial statements.

5

| | |

| FROST FAMILY OF FUNDS | | F R O S T F U N D S | J A N U A R Y 3 1, 2 0 2 0 (U n a u d i t e d) |

| | |

| FROST MID CAP EQUITY FUND | | |

| † | Percentages are based on total investments. |

| | | | | | | | |

| Description | |

Shares | | | Value | |

COMMON STOCK — 98.2% | |

|

Communication Services — 2.9% | |

| | |

Omnicom Group | | | 438 | | | $ | 32,986 | |

| | |

Take-Two Interactive Software* | | | 193 | | | | 24,055 | |

| | | | | | | | |

| | | | | | | 57,041 | |

| | | | | | | | |

|

Consumer Discretionary — 10.5% | |

| | |

Advance Auto Parts | | | 135 | | | | 17,786 | |

| | |

Best Buy | | | 148 | | | | 12,534 | |

| | |

Columbia Sportswear | | | 94 | | | | 8,829 | |

| | |

Darden Restaurants | | | 75 | | | | 8,732 | |

| | |

Dollar Tree* | | | 193 | | | | 16,805 | |

| | |

DR Horton | | | 274 | | | | 16,221 | |

| | |

Expedia Group | | | 68 | | | | 7,375 | |

| | |

Garmin | | | 135 | | | | 13,088 | |

| | |

H&R Block | | | 407 | | | | 9,442 | |

| | |

Hilton Worldwide Holdings | | | 94 | | | | 10,133 | |

| | |

Leggett & Platt | | | 303 | | | | 14,420 | |

| | |

MGM Resorts International | | | 407 | | | | 12,641 | |

| | |

Thor Industries | | | 193 | | | | 15,540 | |

| | |

Tractor Supply | | | 270 | | | | 25,097 | |

| | |

Vail Resorts | | | 25 | | | | 5,863 | |

| | |

VF | | | 126 | | | | 10,454 | |

| | | | | | | | |

| | | | | | | 204,960 | |

| | | | | | | | |

|

Consumer Staples — 3.6% | |

| | |

Archer-Daniels-Midland | | | 578 | | | | 25,871 | |

| | |

Church & Dwight | | | 213 | | | | 15,809 | |

| | |

Clorox | | | 68 | | | | 10,697 | |

| | |

Hormel Foods | | | 400 | | | | 18,904 | |

| | | | | | | | |

| | | | | | | 71,281 | |

| | | | | | | | |

| | | | | | | | |

| Description | |

Shares | | | Value | |

|

Energy — 3.0% | |

| | |

Diamondback Energy | | | 220 | | | $ | 16,368 | |

| | |

Noble Energy | | | 848 | | | | 16,765 | |

| | |

Patterson-UTI Energy | | | 1,123 | | | | 8,917 | |

| | |

Williams | | | 773 | | | | 15,993 | |

| | | | | | | | |

| | | | | | | 58,043 | |

| | | | | | | | |

|

Financials — 12.9% | |

| | |

Cboe Global Markets | | | 185 | | | | 22,796 | |

| | |

Cincinnati Financial | | | 389 | | | | 40,825 | |

| | |

Commerce Bancshares | | | 427 | | | | 28,891 | |

| | |

Discover Financial Services | | | 294 | | | | 22,088 | |

| | |

First Republic Bank | | | 83 | | | | 9,203 | |

| | |

M&T Bank | | | 185 | | | | 31,176 | |

| | |

Progressive | | | 565 | | | | 45,590 | |

| | |

Tradeweb Markets, Cl A | | | 337 | | | | 15,563 | |

| | |

Webster Financial | | | 365 | | | | 16,374 | |

| | |

Western Alliance Bancorp | | | 351 | | | | 19,386 | |

| | | | | | | | |

| | | | | | | 251,892 | |

| | | | | | | | |

|

Health Care — 11.4% | |

| | |

ABIOMED* | | | 74 | | | | 13,785 | |

| | |

BioMarin Pharmaceutical* | | | 135 | | | | 11,272 | |

| | |

Cardinal Health | | | 174 | | | | 8,911 | |

| | |

Centene* | | | 468 | | | | 29,395 | |

| | |

Cerner | | | 295 | | | | 21,190 | |

| | |

Charles River Laboratories International* | | | 137 | | | | 21,177 | |

| | |

DENTSPLY SIRONA | | | 213 | | | | 11,928 | |

| | |

Elanco Animal Health* | | | 759 | | | | 23,453 | |

| | |

Exact Sciences* | | | 165 | | | | 15,391 | |

| | |

Neurocrine Biosciences* | | | 85 | | | | 8,507 | |

| | |

Quest Diagnostics | | | 137 | | | | 15,162 | |

| | |

Sage Therapeutics* | | | 193 | | | | 12,792 | |

| | |

Zimmer Biomet Holdings | | | 193 | | | | 28,545 | |

| | | | | | | | |

| | | | | | | 221,508 | |

| | | | | | | | |

| | |

Industrials — 14.1% | | | | | | | | |

| | |

Hexcel | | | 165 | | | | 12,246 | |

| | |

Huntington Ingalls Industries | | | 123 | | | | 32,103 | |

| | |

Ingersoll-Rand | | | 193 | | | | 25,714 | |

| | |

JB Hunt Transport Services | | | 244 | | | | 26,335 | |

| | |

Macquarie Infrastructure | | | 630 | | | | 27,789 | |

| | |

Masco | | | 687 | | | | 32,646 | |

| | |

Parker-Hannifin | | | 176 | | | | 34,442 | |

| | |

Republic Services, Cl A | | | 303 | | | | 28,800 | |

| | |

Robert Half International | | | 687 | | | | 39,963 | |

| | |

Snap-on | | | 94 | | | | 15,005 | |

| | | | | | | | |

| | | | | | | 275,043 | |

| | | | | | | | |

The accompanying notes are an integral part of the financial statements.

6

| | |

| FROST FAMILY OF FUNDS | | F R O S T F U N D S | J A N U A R Y 3 1, 2 0 2 0 (U n a u d i t e d) |

| | |

| FROST MID CAP EQUITY FUND | | |

| | | | | | | | |

| Description | |

Shares | | | Value | |

| | |

Information Technology — 19.1% | | | | | | | | |

| | |

Advanced Micro Devices* | | | 450 | | | $ | 21,150 | |

| | |

Akamai Technologies* | | | 225 | | | | 21,004 | |

| | |

Amphenol, Cl A | | | 138 | | | | 13,727 | |

| | |

ANSYS* | | | 74 | | | | 20,300 | |

| | |

Atlassian, Cl A* | | | 82 | | | | 12,054 | |

| | |

Coherent* | | | 92 | | | | 13,012 | |

| | |

EPAM Systems* | | | 92 | | | | 20,989 | |

| | |

Fiserv* | | | 245 | | | | 29,059 | |

| | |

Global Payments | | | 108 | | | | 21,109 | |

| | |

IAC/InterActiveCorp* | | | 38 | | | | 9,256 | |

| | |

Keysight Technologies * | | | 138 | | | | 12,833 | |

| | |

KLA | | | 82 | | | | 13,591 | |

| | |

Lam Research | | | 48 | | | | 14,314 | |

| | |

Marvell Technology Group | | | 772 | | | | 18,559 | |

| | |

Motorola Solutions | | | 119 | | | | 21,063 | |

| | |

NortonLifeLock | | | 387 | | | | 10,998 | |

| | |

Palo Alto Networks* | | | 38 | | | | 8,922 | |

| | |

Paycom Software* | | | 33 | | | | 10,499 | |

| | |

Splunk* | | | 133 | | | | 20,650 | |

| | |

Square, Cl A* | | | 297 | | | | 22,183 | |

| | |

Synopsys* | | | 138 | | | | 20,356 | |

| | |

Western Digital | | | 274 | | | | 17,947 | |

| | | | | | | | |

| | | | | | | 373,575 | |

| | | | | | | | |

| | |

Materials — 4.4% | | | | | | | | |

| | |

Celanese, Cl A | | | 244 | | | | 25,254 | |

| | |

Newmont Goldcorp | | | 517 | | | | 23,296 | |

| | |

Packaging Corp of America | | | 101 | | | | 9,671 | |

| | |

Vulcan Materials | | | 193 | | | | 27,334 | |

| | | | | | | | |

| | | | | | | 85,555 | |

| | | | | | | | |

| | |

Real Estate — 9.2% | | | | | | | | |

| | |

Apartment Investment & Management, Cl A‡ | | | 517 | | | | 27,251 | |

| | |

AvalonBay Communities‡ | | | 81 | | | | 17,552 | |

| | |

Boston Properties‡ | | | 193 | | | | 27,667 | |

| | |

Digital Realty Trust‡ | | | 193 | | | | 23,737 | |

| | |

Regency Centers‡ | | | 352 | | | | 21,838 | |

| | |

SBA Communications, Cl A‡ | | | 40 | | | | 9,982 | |

| | |

Welltower‡ | | | 303 | | | | 25,728 | |

| | |

WP Carey‡ | | | 303 | | | | 25,488 | |

| | | | | | | | |

| | | | | | | 179,243 | |

| | | | | | | | |

| | |

Utilities — 7.1% | | | | | | | | |

| | |

CenterPoint Energy | | | 848 | | | | 22,455 | |

| | |

Evergy | | | 352 | | | | 25,400 | |

| | |

FirstEnergy | | | 630 | | | | 31,998 | |

| | |

WEC Energy Group | | | 303 | | | | 30,267 | |

| | | | | | | | |

| Description | |

Shares | | | Value | |

| | |

Xcel Energy | | | 407 | | | $ | 28,160 | |

| | | | | | | | |

| | | | | | | 138,280 | |

| | | | | | | | |

Total Common Stock

(Cost $1,745,558) | | | | | | | 1,916,421 | |

| | | | | | | | |

CASH EQUIVALENT — 1.8% | |

| | |

Federated Government Obligations Fund, Cl I, 1.450%**

(Cost $34,522) | | | 34,522 | | | | 34,522 | |

| | | | | | | | |

| | |

Total Investments — 100.0%

(Cost $1,780,080) | | | | | | $ | 1,950,943 | |

| | | | | | | �� | |

Percentages are based on Net Assets of $1,950,357.

| * | Non-income producing security. |

| ** | Rate shown is the7-day effective yield as of January 31, 2020. |

| ‡ | Real Estate Investment Trust |

Cl — Class

As of January 31, 2020, all of the Fund’s investments in securities were considered Level 1, in accordance with the authoritative guidance on fair value measurements and disclosure under U.S. GAAP.

For the period ended January 31, 2020, there have been no transfers in or out of Level 3.

For more information on valuation inputs, see Note 2 — Significant Accounting Policies in the Notes to Financial Statements.

The accompanying notes are an integral part of the financial statements.

7

| | |

| FROST FAMILY OF FUNDS | | F R O S T F U N D S | J A N U A R Y 3 1, 2 0 2 0 (U n a u d i t e d) |

| | |

| FROST TOTAL RETURN BOND FUND | | |

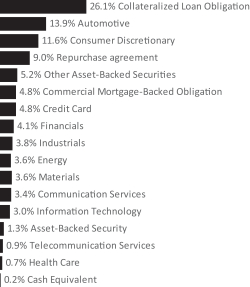

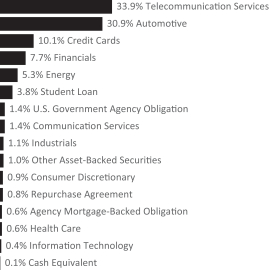

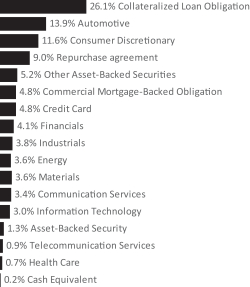

| † | Percentages are based on total investments. |

| | | | | | | | |

| Description | | Face Amount | | |

Value | |

MORTGAGE-BACKED SECURITIES — 25.4% | |

|

Agency Mortgage-Backed Obligation — 12.1% | |

| | |

FHLMC | | | | | | | | |

3.084%, VAR ICE LIBOR USD 12 Month+1.620%, 01/01/45 | | $ | 7,181,470 | | | $ | 7,400,347 | |

3.000%, 07/01/34 | | | 90,893,455 | | | | 93,682,269 | |

2.500%, 07/01/34 | | | 51,550,635 | | | | 52,483,788 | |

2.372%, VAR ICE LIBOR USD 12 Month+1.650%, 06/01/43 | | | 7,861,328 | | | | 7,984,707 | |

1.125%, 08/12/21 | | | 1,000,000 | | | | 995,694 | |

| | |

FHLMC REMIC,

Ser 2010-3747, Cl HX

4.500%, 11/15/39 | | | 14,773,000 | | | | 15,673,428 | |

| | |

FHLMC REMIC,

Ser 2011-3898, Cl FC

2.186%, VAR LIBOR USD

1 Month+0.510%, 11/15/36 | | | 2,038,255 | | | | 2,043,147 | |

| | |

FHLMC,

Ser2012-293, Cl IO, IO

4.000%, 11/15/32 | | | 1,445,679 | | | | 206,235 | |

| | |

FHLMC,

Ser 2012-3996, Cl QL

4.000%, 02/15/42 | | | 9,034,408 | | | | 10,144,803 | |

| | | | | | | | |

| Description | | Face Amount | | |

Value | |

| | |

FHLMC,

Ser 2012-4029, Cl LI, IO

3.000%, 01/15/27 | | $ | 6,115,420 | | | $ | 356,841 | |

| | |

FHLMC,

Ser 2012-4054, Cl HI, IO

3.000%, 05/15/26 | | | 3,364,449 | | | | 119,002 | |

| | |

FHLMC,

Ser 2012-4077, Cl AI, IO

3.000%, 01/15/27 | | | 9,270,318 | | | | 486,094 | |

| | |

FHLMC,

Ser 2012-4106, Cl YI, IO

2.500%, 09/15/27 | | | 3,678,823 | | | | 235,597 | |

| | |

FHLMC,

Ser 2012-4116, Cl MI, IO

4.000%, 10/15/42 | | | 33,068,257 | | | | 4,412,999 | |

| | |

FHLMC,

Ser 2012-4116, Cl PI, IO

4.000%, 10/15/42 | | | 10,618,358 | | | | 1,982,152 | |

| | |

FHLMC,

Ser 2012-4134, Cl BI, IO

2.500%, 11/15/27 | | | 10,501,316 | | | | 653,003 | |

| | |

FHLMC,

Ser 2012-4136, Cl PI, IO

3.000%, 11/15/32 | | | 19,416,002 | | | | 2,005,848 | |

| | |

FHLMC,

Ser 2012-4148, Cl LI, IO

2.500%, 12/15/27 | | | 6,311,744 | | | | 403,532 | |

| | |

FHLMC,

Ser 2013-4213, Cl IG, IO

4.000%, 06/15/43 | | | 17,697,191 | | | | 2,235,789 | |

| | |

FHLMC,

Ser 2014-4349, Cl KI, IO

3.000%, 04/15/33 | | | 11,344,707 | | | | 854,678 | |

| | |

FHLMC,

Ser 2015-4457, Cl EI, IO

3.500%, 02/15/45 | | | 2,116,659 | | | | 181,712 | |

| | |

FHLMC,

Ser 2015-4492, Cl MA

4.000%, 07/15/43 | | | 4,416,679 | | | | 4,610,099 | |

| | |

FHLMC,

Ser 2016-4572, Cl LG

2.500%, 08/15/45 | | | 2,975,607 | | | | 3,050,131 | |

| | |

FHLMC,

Ser 2017-4655, Cl HA

3.500%, 01/15/42 | | | 10,155,891 | | | | 10,399,107 | |

| | |

FHLMC,

Ser 2017-4662, Cl VC

3.500%, 08/15/35 | | | 5,000,000 | | | | 5,285,245 | |

| | |

FHLMC,

Ser 2017-4671, Cl ME

3.000%, 02/15/43 | | | 12,726,000 | | | | 13,019,221 | |

| | |

FHLMC,

Ser 2017-4675, Cl VE

3.500%, 08/15/37 | | | 4,707,000 | | | | 5,062,511 | |

The accompanying notes are an integral part of the financial statements.

8

| | |

| FROST FAMILY OF FUNDS | | F R O S T F U N D S | J A N U A R Y 3 1, 2 0 2 0 (U n a u d i t e d) |

| | |

| FROST TOTAL RETURN BOND FUND | | |

| | | | | | | | |

| Description | | Face Amount | | |

Value | |

| | |

FHLMC,

Ser 2017-4679, Cl HA

4.000%, 06/15/44 | | $ | 4,840,129 | | | $ | 5,015,561 | |

| | |

FHLMC,

Ser 2017-4747, Cl HP

3.500%, 02/15/45 | | | 2,445,019 | | | | 2,542,074 | |

| | |

FHLMC,

Ser 2018-4773, Cl DM

4.000%, 09/15/42 | | | 5,000,000 | | | | 5,212,755 | |

| | |

FHLMC,

Ser 2019-4908, Cl AS, IO

4.424%, VAR ICE LIBOR USD

1 Month+6.100%, 01/25/45 | | | 25,667,243 | | | | 4,631,788 | |

| | |

FNMA | | | | | | | | |

5.500%, 04/01/38 to 05/01/44 | | | 7,405,599 | | | | 8,344,826 | |

4.500%, 08/01/41 | | | 5,479,939 | | | | 5,989,659 | |

4.354%, VAR US Treas Yield Curve Rate T Note Const Mat 1 Yr+2.260%, 01/01/38 | | | 1,841,190 | | | | 1,948,716 | |

4.000%, 03/01/47 | | | 1,748,131 | | | | 1,882,145 | |

3.314%, VAR ICE LIBOR USD 12 Month+1.755%, 02/01/42 | | | 3,585,801 | | | | 3,694,781 | |

3.000%, 10/01/32 to 01/01/50 | | | 66,733,719 | | | | 68,089,304 | |

2.875%, 10/30/20 | | | 5,000,000 | | | | 5,049,310 | |

2.810%, VAR ICE LIBOR USD 12 Month+1.700%, 10/01/42 | | | 4,152,889 | | | | 4,255,715 | |

2.710%, 08/01/23 | | | 265,532 | | | | 273,771 | |

2.500%, 11/01/31 | | | 15,644,413 | | | | 16,029,510 | |

2.250%, 10/30/24 | | | 10,000,000 | | | | 10,397,680 | |

| | |

FNMA REMIC,

Ser2017-52, Cl DI, IO

4.500%, 07/25/47 | | | 15,849,456 | | | | 1,994,155 | |

| | |

FNMA STRIPS,

Ser2009-397, Cl 2, IO

5.000%, 09/25/39 | | | 2,680,107 | | | | 474,468 | |

| | |

FNMA STRIPS,

Ser2009-400, Cl 2, IO

4.500%, 11/25/39 | | | 2,197,157 | | | | 287,535 | |

| | |

FNMA STRIPS,

Ser2010-404, Cl 2, IO

4.500%, 05/25/40 | | | 4,171,852 | | | | 606,852 | |

| | |

FNMA STRIPS,

Ser2010-405, Cl 2, IO

4.000%, 10/25/40 | | | 2,974,690 | | | | 375,894 | |

| | |

FNMA STRIPS,

Ser2011-407, Cl 2, IO

4.000%, 03/25/41 | | | 4,563,635 | | | | 600,840 | |

| | |

FNMA,

Ser2010-155, Cl JC

4.000%, 12/25/39 | | | 23,867,925 | | | | 24,936,903 | |

| | |

FNMA,

Ser2011-103, Cl GI, IO

3.500%, 10/25/26 | | | 2,846,202 | | | | 206,929 | |

| | | | | | | | |

| Description | | Face Amount | | |

Value | |

| | |

FNMA,

Ser2011-146, Cl AY

3.500%, 01/25/32 | | $ | 5,000,000 | | | $ | 5,199,459 | |

| | |

FNMA,

Ser2012-31, Cl LI, IO

4.000%, 07/25/40 | | | 4,461,428 | | | | 228,130 | |

| | |

FNMA,

Ser2012-410, Cl C5, IO

3.500%, 05/25/27 | | | 10,612,877 | | | | 707,899 | |

| | |

FNMA,

Ser2012-61, Cl KI, IO

4.000%, 12/25/41 | | | 14,883,424 | | | | 1,414,291 | |

| | |

FNMA,

Ser2012-68, Cl GY

3.000%, 07/25/32 | | | 5,000,000 | | | | 5,287,998 | |

| | |

FNMA,

Ser2013-104, Cl TI, IO

3.000%, 08/25/32 | | | 8,046,914 | | | | 414,185 | |

| | |

FNMA,

Ser2013-36, Cl MH

2.500%, 12/25/36 | | | 7,985,202 | | | | 8,087,772 | |

| | |

FNMA,

Ser2014-40, Cl GI, IO

3.000%, 06/25/33 | | | 10,216,640 | | | | 1,028,355 | |

| | |

FNMA,

Ser2014-59, Cl CI, IO

3.000%, 08/25/40 | | | 2,994,164 | | | | 180,279 | |

| | |

FNMA,

Ser2015-421, Cl C1, IO

3.000%, 05/25/30 | | | 7,091,956 | | | | 615,560 | |

| | |

FNMA,

Ser2017-4, Cl VD

3.500%, 06/25/37 | | | 10,000,000 | | | | 10,453,234 | |

| | |

FNMA,

Ser2017-53, Cl KA

3.500%, 12/25/43 | | | 5,666,572 | | | | 5,848,483 | |

| | |

FNMA,

Ser2019-44, Cl CI, IO

4.000%, 08/25/59 | | | 14,794,971 | | | | 2,748,910 | |

| | |

FNMA,

Ser2019-44, Cl PI, IO

4.000%, 08/25/49 | | | 17,983,821 | | | | 2,378,956 | |

| | |

GNMA REMIC,

Ser2011-125, Cl BI, IO

4.000%, 12/20/30 | | | 3,899,168 | | | | 114,885 | |

| | |

GNMA,

Ser2013-170, Cl QI, IO

5.500%, 11/20/43 (A) | | | 16,280,914 | | | | 3,398,942 | |

| | |

GNMA,

Ser2013-36, Cl GD

3.000%, 03/20/43 | | | 2,000,000 | | | | 2,105,565 | |

| | |

GNMA,

Ser2013-42, Cl MI, IO

3.500%, 04/20/41 | | | 3,265,125 | | | | 244,595 | |

The accompanying notes are an integral part of the financial statements.

9

| | |

| FROST FAMILY OF FUNDS | | F R O S T F U N D S | J A N U A R Y 3 1, 2 0 2 0 (U n a u d i t e d) |

| | |

| FROST TOTAL RETURN BOND FUND | | |

| | | | | | | | |

| Description | | Face Amount | | |

Value | |

| | |

GNMA,

Ser2013-62, Cl NI, IO

4.000%, 08/20/40 | | $ | 7,482,880 | | | $ | 701,636 | |

| | |

GNMA,

Ser2014-151, Cl HI, IO

3.500%, 07/20/39 | | | 4,593,029 | | | | 86,182 | |

| | |

GNMA,

Ser2014-32, Cl CI, IO

4.000%, 03/20/43 | | | 4,503,404 | | | | 468,207 | |

| | |

GNMA,

Ser2014-44, Cl IO, IO

4.000%, 11/16/26 | | | 10,916,079 | | | | 831,112 | |

| | |

GNMA,

Ser2015-17, Cl JI, IO

3.500%, 05/20/28 | | | 10,242,094 | | | | 703,885 | |

| | |

GNMA,

Ser2016-H14, Cl FA

2.494%, VAR ICE LIBOR USD

1 Month+0.800%, 06/20/66 | | | 2,636,665 | | | | 2,654,991 | |

| | |

GNMA,

Ser2017-137, Cl DI, IO

3.000%, 02/20/47 | | | 10,239,165 | | | | 393,137 | |

| | |

GNMA,

Ser 53, Cl A

2.250%, 09/16/44 | | | 4,665,634 | | | | 4,674,632 | |

| | | | | | | | |

| | | | | | | 479,780,430 | |

| | | | | | | | |

|

Commercial Mortgage-Backed Obligation — 10.4% | |

| | |

Banc of America Commercial Mortgage Trust,

Ser2008-1, Cl AJ

6.786%, 02/10/51 (A) | | | 240,943 | | | | 246,203 | |

| | |

Banc of America Commercial Mortgage Trust,

Ser2008-1, Cl B

6.786%, 02/10/51 (A) (B) | | | 4,925,000 | | | | 3,201,250 | |

| | |

BANK,

Ser 2018-BN10, Cl A5

3.688%, 02/15/61 | | | 10,000,000 | | | | 11,117,855 | |

| | |

BANK,

Ser 2018-BN13, Cl A5

4.217%, 08/15/61 (A) | | | 3,000,000 | | | | 3,462,001 | |

| | |

BANK,

Ser 2018-BN14, Cl A3

3.966%, 09/15/60 | | | 10,000,000 | | | | 11,382,164 | |

| | |

BANK,

Ser 2019-BN16, Cl A4

4.005%, 02/15/52 | | | 4,500,000 | | | | 5,147,109 | |

| | |

BBCMS Trust,

Ser2015-STP, Cl D

4.427%, 09/10/28 (A) (B) | | | 5,000,000 | | | | 5,021,806 | |

| | |

Bear Stearns Commercial Mortgage Securities Trust,

Ser2007-T26, Cl AJ

5.561%, 01/12/45 (A) | | | 14,150,000 | | | | 12,217,510 | |

| | | | | | | | |

| Description | | Face Amount | | |

Value | |

| | |

Citigroup Commercial Mortgage Trust,

Ser 2015-GC31, Cl C

4.192%, 06/10/48 (A) | | $ | 5,000,000 | | | $ | 5,269,513 | |

| | |

Citigroup Commercial Mortgage Trust,

Ser2017-P8, Cl A4

3.465%, 09/15/50 | | | 5,000,000 | | | | 5,456,713 | |

| | |

Commercial Mortgage Trust,

Ser 2012- CR2, Cl C

4.992%, 08/15/45 (A) | | | 1,000,000 | | | | 1,037,845 | |

| | |

Commercial Mortgage Trust,

Ser 2012- CR2, Cl D

4.992%, 08/15/45 (A) (B) | | | 224,200 | | | | 231,039 | |

| | |

Commercial Mortgage Trust,

Ser 2014- LC15, Cl D

5.150%, 04/10/47 (A) (B) | | | 9,500,000 | | | | 9,784,747 | |

| | |

Commercial Mortgage Trust,

Ser 2014- UBS6, Cl C

4.597%, 12/10/47 (A) | | | 4,000,000 | | | | 4,154,103 | |

| | |

Commercial Mortgage Trust,

Ser 2015- DC1, Cl D

4.455%, 02/10/48 (A) (B) | | | 9,000,000 | | | | 8,327,981 | |

| | |

Credit Suisse Commercial Mortgage Trust,

Ser2008-C1, Cl D

5.997%, 02/15/41 (A) (B) | | | 4,107,435 | | | | 254,661 | |

| | |

Credit Suisse First Boston Mortgage Securities,

Ser2005-C2, Cl AMFL

1.919%, VAR ICE LIBOR USD

1 Month+0.250%, 04/15/37 | | | 112,303 | | | | 107,731 | |

| | |

Credit Suisse First Boston Mortgage Securities,

Ser2005-C2, Cl AMFX

4.877%, 04/15/37 | | | 10,037 | | | | 9,980 | |

| | |

CSAIL Commercial Mortgage Trust,

Ser2019-C15, Cl A4

4.053%, 03/15/52 | | | 10,000,000 | | | | | |

| | | 11,379,585 | |

| | |

CSMC Trust,

Ser 2019-AFC1, Cl A1

2.573%, 07/25/49 (B) | | | 13,675,030 | | | | 13,738,814 | |

| | |

DBUBS Mortgage Trust,

Ser 2011-LC1A, Cl C

5.878%, 11/10/46 (A) (B) | | | 1,450,000 | | | | 1,484,294 | |

| | |

Deutsche Bank Commercial Mortgage Trust,

Ser2017-C6, Cl A5

3.328%, 06/10/50 | | | 5,000,000 | | | | 5,405,506 | |

| | |

FHLMC Military Housing Bonds Resecuritization Trust Certificates,

Ser2015-R1, Cl C3

8.248%, 11/25/52 (A) (B) | | | 37,278,197 | | | | 37,446,408 | |

The accompanying notes are an integral part of the financial statements.

10

| | |

| FROST FAMILY OF FUNDS | | F R O S T F U N D S | J A N U A R Y 3 1, 2 0 2 0 (U n a u d i t e d) |

| | |

| FROST TOTAL RETURN BOND FUND | | |

| | | | | | | | |

| Description | | Face Amount | | |

Value | |

| | |

FREMF Mortgage Trust,

Ser2011-K15, Cl B

5.129%, 08/25/44 (A) (B) | | $ | 4,000,000 | | | $ | 4,151,494 | |

| | |

FREMF Mortgage Trust,

Ser2012-K21, Cl C

4.068%, 07/25/45 (A) (B) | | | 5,000,000 | | | | 5,194,232 | |

| | |

FREMF Mortgage Trust,

Ser2012-K22, Cl C

3.812%, 08/25/45 (A) (B) | | | 4,500,000 | | | | 4,658,986 | |

| | |

FREMF Mortgage Trust,

Ser2013-K26, Cl C

3.721%, 12/25/45 (A) (B) | | | 5,000,000 | | | | 5,186,688 | |

| | |

FREMF Mortgage Trust,

Ser 2015-K720, Cl B

3.509%, 07/25/22 (A) (B) | | | 5,000,000 | | | | 5,128,831 | |

| | |

FREMF Mortgage Trust,

Ser 2015-K720, Cl C

3.509%, 07/25/22 (A) (B) | | | 8,000,000 | | | | 8,094,055 | |

| | |

FREMF Mortgage Trust,

Ser 2015-K721, Cl C

3.681%, 11/25/47 (A) (B) | | | 14,000,000 | | | | 14,338,337 | |

| | |

FREMF Mortgage Trust,

Ser2016-K54, Cl C

4.189%, 04/25/48 (A) (B) | | | 5,000,000 | | | | 5,285,059 | |

| | |

FREMF Mortgage Trust,

Ser2016-K57, Cl C

4.053%, 08/25/49 (A) (B) | | | 7,840,000 | | | | 8,160,864 | |

| | |

FREMF Mortgage Trust,

Ser2017-K67, Cl B

4.079%, 09/25/49 (A) (B) | | | 2,000,000 | | | | 2,154,546 | |

| | |

FREMF Mortgage Trust,

Ser2017-K70, Cl B

3.934%, 12/25/49 (A) (B) | | | 3,403,000 | | | | 3,650,768 | |

| | |

Galton Funding Mortgage Trust,

Ser 2019- 1, Cl A22

4.000%, 02/25/59 (A) (B) | | | 1,813,196 | | | | 1,849,806 | |

| | |

Galton Funding Mortgage Trust,

Ser 2019- 2, Cl A21

4.000%, 06/25/59 (A) (B) | | | 15,012,805 | | | | 15,358,143 | |

| | |

GS Mortgage Securities Trust,

Ser 2017- G5, Cl AS

3.826%, 03/10/50 (A) | | | 3,500,000 | | | | 3,825,110 | |

| | |

GS Mortgage Securities Trust,

Ser 2017- GS7, Cl A4

3.430%, 08/10/50 | | | 5,000,000 | | | | 5,457,068 | |

| | |

GS Mortgage Securities Trust,

Ser 2018- GS9, Cl A4

3.992%, 03/10/51 (A) | | | 10,000,000 | | | | 11,280,279 | |

| | |

GS Mortgage Securities Trust,

Ser 2019- GC39, Cl A4

3.567%, 05/10/52 | | | 4,000,000 | | | | 4,431,932 | |

| | |

GS Mortgage Securities Trust,

Ser 2019- GC40, Cl A4

3.160%, 07/10/52 | | | 4,000,000 | | | | 4,307,437 | |

| | | | | | | | |

| Description | | Face Amount | | |

Value | |

| | |

GS Mortgage-Backed Securities Trust,

Ser2019-PJ2, Cl A6

4.000%, 11/25/49 (A) (B) | | $ | 5,854,167 | | | $ | 5,886,722 | |

| | |

Homeward Opportunities Fund I Trust,

Ser2019-1, Cl A1

3.454%, 01/25/59 (A) (B) | | | 3,595,854 | | | | 3,638,522 | |

| | |

Homeward Opportunities Fund I Trust,

Ser2019-3, Cl A1

2.675%, 11/25/59 (A) (B) | | | 11,515,442 | | | | 11,600,841 | |

| | |

Hudson Yards Mortgage Trust,

Ser 2019- 30HY, Cl B

3.380%, 07/10/39 (A) (B) | | | 2,500,000 | | | | 2,685,644 | |

| | |

Impact Funding,

Ser2001-AA, Cl C

5.159%, 07/25/33 (A) (B) | | | 56,094 | | | | 55,908 | |

| | |

Impact Funding,

Ser2001-AA, Cl D

5.619%, 07/25/33 (A) (B) | | | 87,994 | | | | 87,642 | |

| | |

JPMDB Commercial Mortgage Securities Trust,

Ser2016-C2, Cl C

3.552%, 06/15/49 (A) | | | 3,328,000 | | | | 3,394,438 | |

| | |

JPMorgan Chase Commercial Mortgage Securities,

Ser 2006-LDP9, Cl AMS

5.337%, 05/15/47 | | | 2,330,460 | | | | 2,270,692 | |

| | |

JPMorgan Chase Commercial Mortgage Securities,

Ser 2007-LD12, Cl AJ

6.651%, 02/15/51 (A) | | | 2,040,761 | | | | 1,942,151 | |

| | |

JPMorgan Chase Commercial Mortgage Securities,

Ser 2007-LD12, Cl J

5.994%, 02/15/51 (A) (B) | | | 111,787 | | | | — | |

| | |

LB-UBS Commercial Mortgage Trust,

Ser2007-C6, Cl AJ

6.470%, 07/15/40 (A) | | | 677,565 | | | | 680,757 | |

| | |

LStar Commercial Mortgage Trust,

Ser2016-4, Cl AS

3.188%, 03/10/49 (B) | | | 3,000,000 | | | | 3,042,893 | |

| | |

Morgan Stanley Bank of America Merrill Lynch Trust,

Ser2016-C29, Cl C

4.907%, 05/15/49 (A) | | | 2,413,000 | | | | 2,594,197 | |

| | |

Morgan Stanley Capital I,

Ser2007-T25, Cl AJ

5.574%, 11/12/49 (A) | | | 118,481 | | | | 119,185 | |

| | |

Morgan Stanley Capital I,

Ser2007-T27, Cl AJ

6.144%, 06/11/42 (A) | | | 6,934,555 | | | | 7,326,594 | |

The accompanying notes are an integral part of the financial statements.

11

| | |

| FROST FAMILY OF FUNDS | | F R O S T F U N D S | J A N U A R Y 3 1, 2 0 2 0 (U n a u d i t e d) |

| | |

| FROST TOTAL RETURN BOND FUND | | |

| | | | | | | | |

| Description | | Face Amount | | |

Value | |

| | |

Morgan Stanley Capital I,

Ser2007-T27, Cl B

6.144%, 06/11/42 (A) (B) | | $ | 500,000 | | | $ | 528,155 | |

| | |

Morgan Stanley Capital I,

Ser2011-C1, Cl C

5.554%, 09/15/47 (A) (B) | | | 2,000,000 | | | | 2,049,205 | |

| | |

UBS Commercial Mortgage Trust,

Ser2012-C1, Cl C

5.756%, 05/10/45 (A) (B) | | | 9,160,000 | | | | 9,653,770 | |

| | |

UBS-Barclays Commercial Mortgage Trust,

Ser2012-C2, Cl D

5.047%, 05/10/63 (A) (B) | | | 7,095,000 | | | | 7,034,901 | |

| | |

UBS-Barclays Commercial Mortgage Trust,

Ser2012-C2, Cl E

5.047%, 05/10/63 (A) (B) | | | 15,339,806 | | | | 12,896,258 | |

| | |

UBS-Barclays Commercial Mortgage Trust,

Ser2012-C3, Cl C

5.198%, 08/10/49 (A) (B) | | | 3,000,000 | | | | 3,176,275 | |

| | |

UBS-Barclays Commercial Mortgage Trust,

Ser2012-C4, Cl D

4.626%, 12/10/45 (A) (B) | | | 13,384,000 | | | | 13,364,364 | |

| | |

Wells Fargo Commercial Mortgage Trust,

Ser2016-C32, Cl C

4.877%, 01/15/59 (A) | | | 5,000,000 | | | | 5,341,207 | |

| | |

Wells Fargo Commercial Mortgage Trust,

Ser2016-C32, Cl D

3.788%, 01/15/59 (A) (B) | | | 2,000,000 | | | | 1,917,915 | |

| | |

Wells Fargo Commercial Mortgage Trust,

Ser2016-C34, Cl B

4.089%, 06/15/49 | | | 5,000,000 | | | | 5,292,128 | |

| | |

Wells Fargo Commercial Mortgage Trust,

Ser2017-C39, Cl A5

3.418%, 09/15/50 | | | 3,500,000 | | | | 3,804,450 | |

| | |

Wells Fargo Commercial Mortgage Trust,

Ser2017-RC1, Cl A4

3.631%, 01/15/60 | | | 3,788,000 | | | | 4,162,244 | |

| | |

Wells Fargo Commercial Mortgage Trust,

Ser2018-AUS, Cl A

4.194%, 08/17/36 (A) (B) | | | 5,000,000 | | | | 5,641,311 | |

| | |

Wells Fargo Commercial Mortgage Trust,

Ser2018-C43, Cl A4

4.012%, 03/15/51 (A) | | | 6,000,000 | | | | 6,763,042 | |

| | |

Wells Fargo Mortgage Backed Securities Trust,

Ser2019-3, Cl A1

3.500%, 07/25/49 (A) (B) | | | 10,115,804 | | | | 10,324,696 | |

| | | | | | | | |

| Description | | Face Amount | | |

Value | |

| | |

WFRBS Commercial Mortgage Trust,

Ser 2013-UBS1, Cl C

4.897%, 03/15/46 (A) | | $ | 3,000,000 | | | $ | 3,198,140 | |

| | |

WFRBS Commercial Mortgage Trust,

Ser2014-C25, Cl D

3.803%, 11/15/47 (A) (B) | | | 7,310,000 | | | | 6,967,012 | |

| | | | | | | | |

| | | | | | | 415,839,712 | |

| | | | | | | | |

|

Non-Agency Residential Mortgage-Backed Obligation — 2.9% | |

| | |

Arroyo Mortgage Trust,

Ser2018-1, Cl A1

3.763%, 04/25/48 (A) (B) | | | 13,514,983 | | | | 13,685,459 | |

| | |

Arroyo Mortgage Trust,

Ser2019-2, Cl A2

3.498%, 04/25/49 (A) (B) | | | 9,387,876 | | | | 9,531,528 | |

| | |

Carrington Mortgage Loan Trust,

Ser 2007-FRE1, Cl M8

2.461%, VAR ICE LIBOR USD

1 Month+2.250%, 02/25/37 | | | 1,000,000 | | | | — | |

| | |

CSAIL Mortgage Trust,

Ser 2018-CX11, Cl A5

4.033%, 04/15/51 | | | 10,000,000 | | | | 11,275,406 | |

| | |

Deephaven Residential Mortgage Trust,

Ser2018-2A, Cl A1

3.479%, 04/25/58 (A) (B) | | | 2,241,683 | | | | 2,262,208 | |

| | |

FirstKey Mortgage Trust,

Ser2015-1, Cl A3

3.500%, 03/25/45 (A) (B) | | | 4,205,948 | | | | 4,284,109 | |

| | |

Flagstar Mortgage Trust,

Ser2018-2, Cl A6

3.500%, 04/25/48 (A) (B) | | | 5,241,568 | | | | 5,336,008 | |

| | |

JPMorgan Mortgage Trust,

Ser2016-4, Cl A3

3.500%, 10/25/46 (A) (B) | | | 1,546,921 | | | | 1,583,661 | |

| | |

JPMorgan Mortgage Trust,

Ser2017-1, Cl A3

3.500%, 01/25/47 (A) (B) | | | 1,647,886 | | | | 1,687,206 | |

| | |

JPMorgan Mortgage Trust,

Ser2019-1, Cl A3

4.000%, 05/25/49 (A) (B) | | | 5,544,011 | | | | 5,651,426 | |

| | |

Sequoia Mortgage Trust,

Ser2013-4, Cl AIO1, IO

0.895%, 04/25/43 (A) (B) | | | 180,545,461 | | | | 4,669,863 | |

| | |

Sequoia Mortgage Trust,

Ser2017-2, Cl A4

3.500%, 02/25/47 (A) (B) | | | 2,579,499 | | | | 2,650,334 | |

| | |

Sequoia Mortgage Trust,

Ser2017-6, Cl A4

3.500%, 09/25/47 (A) (B) | | | 4,974,056 | | | | 5,105,675 | |

| | |

Sequoia Mortgage Trust,

Ser2017-CH1, Cl A2

3.500%, 08/25/47 (A) (B) | | | 1,561,077 | | | | 1,598,053 | |

The accompanying notes are an integral part of the financial statements.

12

| | |

| FROST FAMILY OF FUNDS | | F R O S T F U N D S | J A N U A R Y 3 1, 2 0 2 0 (U n a u d i t e d) |

| | |

| FROST TOTAL RETURN BOND FUND | | |

| | | | | | | | |

| Description | | Face Amount | | |

Value | |

| | |

Sequoia Mortgage Trust,

Ser2018-3, Cl A4

3.500%, 03/25/48 (A) (B) | | $ | 2,987,359 | | | $ | 3,034,253 | |

| | |

Sequoia Mortgage Trust,

Ser2018-CH4, Cl A2

4.000%, 10/25/48 (A) (B) | | | 2,844,749 | | | | 2,902,384 | |

| | |

Sequoia Mortgage Trust,

Ser2019-CH1, Cl A1

4.500%, 03/25/49 (A) (B) | | | 2,799,666 | | | | 2,865,343 | |

| | |

Wells Fargo Mortgage Backed Securities Trust,

Ser2019-1, Cl A1

4.000%, 11/25/48 (A) (B) | | | 9,299,397 | | | | 9,514,445 | |

| | |

Wells Fargo Mortgage Backed Securities Trust,

Ser2019-2, Cl A1

4.000%, 04/25/49 (A) (B) | | | 8,605,828 | | | | 8,804,838 | |

| | |

Wells Fargo Mortgage Backed Securities,

Ser2018-1, Cl A7

3.500%, 07/25/47 (A) (B) | | | 4,816,869 | | | | 4,869,780 | |

| | |

WinWater Mortgage Loan Trust,

Ser 2014- 1, Cl A1

3.835%, 06/20/44 (A) (B) | | | 2,619,042 | | | | 2,688,853 | |

| | |

WinWater Mortgage Loan Trust,

Ser 2014- 2, Cl A1

4.000%, 09/20/44 (A) (B) | | | 1,595,049 | | | | 1,646,140 | |

| | |

WinWater Mortgage Loan Trust,

Ser 2014- 3, Cl A3

3.500%, 11/20/44 (A) (B) | | | 2,239,958 | | | | 2,296,727 | |

| | |

WinWater Mortgage Loan Trust,

Ser 2015- 2, Cl A11

3.500%, 02/20/45 (A) (B) | | | 3,106,938 | | | | 3,184,127 | |

| | |

WinWater Mortgage Loan Trust,

Ser 2015- 3, Cl A3

3.500%, 03/20/45 (A) (B) | | | 3,538,092 | | | | 3,634,284 | |

| | | | | | | | |

| | | | | | | 114,762,110 | |

| | | | | | | | |

| | |

Total Mortgage-Backed Securities

(Cost $1,018,112,847) | | | | | | | 1,010,382,252 | |

| | | | | | | | |

CORPORATE OBLIGATIONS — 18.4% | |

|

Communication Services — 1.2% | |

| | |

AT&T 4.350%, 03/01/29 | | | 5,000,000 | | | | 5,639,716 | |

4.300%, 02/15/30 | | | 12,905,000 | | | | 14,596,649 | |

| | |

Frontier Communications

8.500%, 04/15/20 | | | 54,892,000 | | | | 25,936,470 | |

| | | | | | | | |

| | | | | | | 46,172,835 | |

| | | | | | | | |

|

Consumer Discretionary — 2.8% | |

| | |

Block Financial

4.125%, 10/01/20 | | | 5,000,000 | | | | 5,057,827 | |

| | |

Capitol Investment Merger Sub 2

10.000%, 08/01/24 (B) | | | 13,000,000 | | | | 13,503,750 | |

| | | | | | | | |

| Description | | Face Amount | | |

Value | |

| | |

Choice Hotels International

3.700%, 12/01/29 | | $ | 8,000,000 | | | $ | 8,209,680 | |

| | |

Ford Motor Credit

4.375%, 08/06/23 | | | 2,000,000 | | | | 2,096,018 | |

| | |

General Motors Financial

4.000%, 01/15/25 | | | 15,126,000 | | | | 16,036,008 | |

| | |

Jaguar Land Rover Automotive

4.500%, 10/01/27 (B) | | | 6,000,000 | | | | 5,502,000 | |

| | |

L Brands

6.950%, 03/01/33 | | | 8,150,000 | | | | 7,335,000 | |

| | |

Lear 5.250%, 01/15/25 | | | 1,500,000 | | | | 1,543,411 | |

| | |

McDonald’s MTN

2.625%, 01/15/22 | | | 3,000,000 | | | | 3,053,872 | |

| | |

Panther BF Aggregator 2

8.500%, 05/15/27 (B) | | | 16,000,000 | | | | 17,200,000 | |

| | |

Tupperware Brands

4.750%, 06/01/21 | | | 2,000,000 | | | | 1,974,144 | |

| | |

Under Armour

3.250%, 06/15/26 | | | 3,200,000 | | | | 3,127,779 | |

| | |

VistaJet Malta Finance

10.500%, 06/01/24 (B) | | | 29,129,000 | | | | 27,599,727 | |

| | | | | | | | |

| | | | | | | 112,239,216 | |

| | | | | | | | |

|

Energy — 4.2% | |

| | |

Antero Midstream Partners

5.750%, 01/15/28 (B) | | | 15,000,000 | | | | 11,665,500 | |

| | |

Apache

7.750%, 12/15/29 | | | 4,138,000 | | | | 5,268,669 | |

| | |

Baytex Energy

8.750%, 04/01/27 (B) | | | 4,000,000 | | | | 3,895,000 | |

| | |

Lukoil International Finance BV

4.563%, 04/24/23 | | | 3,000,000 | | | | 3,176,250 | |

| | |

Noble Holding International

6.050%, 03/01/41 | | | 13,462,000 | | | | 4,442,460 | |

4.625%, 03/01/21 | | | 44,470,000 | | | | 37,354,800 | |

| | |

NuStar Logistics

6.000%, 06/01/26 | | | 1,000,000 | | | | 1,052,200 | |

| | |

Petrobras Global Finance BV

8.750%, 05/23/26 | | | 2,000,000 | | | | 2,613,000 | |

| | |

Petroleos Mexicanos

6.840%, 01/23/30 (B) | | | 4,000,000 | | | | 4,334,000 | |

5.350%, 02/12/28 | | | 7,000,000 | | | | 7,063,350 | |

| | |

Seadrill New Finance

12.000% cash/0% PIK, 07/15/25 (B) (C) | | | 51,526,251 | | | | 42,251,526 | |

| | |

Suriname Government International Bond

9.875%, 12/30/23 (B) | | | 8,000,000 | | | | 7,730,000 | |

| | |

Talen Energy Supply

7.250%, 05/15/27 (B) | | | 2,000,000 | | | | 2,050,000 | |

| | |

Teekay

9.250%, 11/15/22 (B) | | | 10,250,000 | | | | 10,660,000 | |

| | |

Transocean

7.250%, 11/01/25 (B) | | | 5,000,000 | | | | 4,712,500 | |

6.500%, 11/15/20 | | | 19,277,000 | | | | 19,566,155 | |

The accompanying notes are an integral part of the financial statements.

13

| | |

| FROST FAMILY OF FUNDS | | F R O S T F U N D S | J A N U A R Y 3 1, 2 0 2 0 (U n a u d i t e d) |

| | |

| FROST TOTAL RETURN BOND FUND | | |

| | | | | | | | |

| Description | | Face Amount | | |

Value | |

| | |

Weatherford International

11.000%, 12/01/24 (B) | | $ | 584,000 | | | $ | 620,074 | |

| | | | | | | | |

| | | | | | | 168,455,484 | |

| | | | | | | | |

| | |

Financials — 6.2% | | | | | | | | |

| | |

Assured Guaranty US Holdings

5.000%, 07/01/24 | | | 7,272,000 | | | | 8,154,962 | |

| | |

Bank of Nova Scotia

3.125%, 04/20/21 | | | 6,300,000 | | | | 6,419,042 | |

| | |

Barclays MTN

4.972%, VAR ICE LIBOR USD

3 Month+1.902%, 05/16/29 | | | 2,000,000 | | | | 2,319,301 | |

| | |

Capital One Financial

3.800%, 01/31/28 | | | 5,000,000 | | | | 5,444,326 | |

| | |

Commonwealth Bank of Australia NY

2.550%, 03/15/21 | | | 10,390,000 | | | | 10,493,012 | |

| | |

Deutsche Bank

7.500%, VAR USD Swap Semi 30/360 5 Yr

Curr+5.003%, 04/30/68 | | | 2,000,000 | | | | 2,082,500 | |

| | |

Deutsche Bank NY

3.150%, 01/22/21 | | | 85,847,000 | | | | 86,578,557 | |

| | |

Enova International

8.500%, 09/15/25 (B) | | | 15,000,000 | | | | 14,884,950 | |

| | |

Farmers Exchange Capital

7.050%, 07/15/28 (B) | | | 6,075,000 | | | | 7,630,139 | |

| | |

First American Financial

4.300%, 02/01/23 | | | 1,000,000 | | | | 1,046,935 | |

| | |

Genworth Holdings

7.625%, 09/24/21 | | | 8,000,000 | | | | 8,440,000 | |

| | |

Navient

5.000%, 03/15/27 | | | 1,000,000 | | | | 997,500 | |

3.914%, VAR CPI

YOY+2.150%, 12/15/20 | | | 3,525,000 | | | | 3,502,969 | |

| | |

PNC Bank

3.250%, 01/22/28 | | | 5,000,000 | | | | 5,385,065 | |

| | |

Royal Bank of Canada MTN

10.000%, 08/14/20 | | | 25,000,000 | | | | 25,875,000 | |

9.000%, 06/10/20 | | | 5,000,000 | | | | 3,992,500 | |

7.375%, 05/29/20 | | | 10,000,000 | | | | 6,570,000 | |

| | |

Royal Bank of Scotland Group

7.500%, VAR USD Swap Semi 30/360 5 Yr

Curr+5.800%, 09/30/68 | | | 4,000,000 | | | | 4,092,000 | |

| | |

Societe Generale

5.000%, 01/17/24 (B) | | | 4,025,000 | | | | 4,392,236 | |

| | |

Synchrony Financial

4.500%, 07/23/25 | | | 9,905,000 | | | | 10,766,698 | |

4.375%, 03/19/24 | | | 1,000,000 | | | | 1,074,248 | |

2.700%, 02/03/20 | | | 10,155,000 | | | | 10,155,000 | |

| | |

TMX Finance

11.125%, 04/01/23 (B) | | | 12,250,000 | | | | 11,438,437 | |

| | |

Wachovia

6.605%, 10/01/25 | | | 5,650,000 | | | | 6,886,572 | |

| | | | | | | | |

| | | | | | | 248,621,949 | |

| | | | | | | | |

| | | | | | | | |

| Description | | Face Amount | | |

Value | |

|

Health Care — 0.0% | |

| | |

CHS

5.125%, 08/01/21 | | $ | 1,000,000 | | | $ | 1,000,800 | |

| | | | | | | | |

|

Industrials — 1.0% | |

| | |

Burlington Northern Santa Fe

7.290%, 06/01/36 | | | 5,000,000 | | | | 7,573,192 | |

| | |

FedEx

3.100%, 08/05/29 | | | 12,000,000 | | | | 12,280,808 | |

| | |

Flowserve

4.000%, 11/15/23 | | | 1,000,000 | | | | 1,046,702 | |

| | |

General Electric MTN

5.875%, 01/14/38 | | | 4,377,000 | | | | 5,614,457 | |

5.300%, 02/11/21 | | | 8,000,000 | | | | 8,244,176 | |

| | |

Great Lakes Dredge & Dock

8.000%, 05/15/22 | | | 1,410,000 | | | | 1,480,500 | |

| | |

Hertz

5.500%, 10/15/24 (B) | | | 1,000,000 | | | | 1,014,580 | |

| | |

Owens Corning

3.950%, 08/15/29 | | | 3,000,000 | | | | 3,253,056 | |

| | | | | | | | |

| | | | | | | 40,507,471 | |

| | | | | | | | |

|

Information Technology — 1.8% | |

| | |

Amkor Technology

6.625%, 09/15/27 (B) | | | 1,900,000 | | | | 2,063,875 | |

| | |

Apple

3.200%, 05/13/25 | | | 17,712,000 | | | | 18,980,459 | |

| | |

Jabil

3.600%, 01/15/30 | | | 3,000,000 | | | | 3,081,509 | |

| | |

Juniper Networks

3.750%, 08/15/29 | | | 10,000,000 | | | | 10,628,144 | |

| | |

Keysight Technologies

4.550%, 10/30/24 | | | 1,000,000 | | | | 1,107,191 | |

3.000%, 10/30/29 | | | 2,000,000 | | | | 2,061,856 | |

| | |

Micron Technology

4.185%, 02/15/27 | | | 10,000,000 | | | | 10,892,803 | |

| | |

Motorola Solutions

4.600%, 05/23/29 | | | 21,435,000 | | | | 24,103,169 | |

| | | | | | | | |

| | | | | | | 72,919,006 | |

| | | | | | | | |

|

Materials — 0.6% | |

| | |

First Quantum Minerals

7.250%, 05/15/22 (B) | | | 20,920,000 | | | | 20,867,700 | |

7.000%, 02/15/21 (B) | | | 1,077,000 | | | | 1,077,969 | |

| | | | | | | | |

| | | | | | | 21,945,669 | |

| | | | | | | | |

| | |

Real Estate — 0.2% | | | | | | | | |

| | |

Brookfield Property

5.750%, 05/15/26‡ (B) | | | 2,000,000 | | | | 2,086,860 | |

| | |

CBL & Associates

5.250%, 12/01/23‡ | | | 4,881,000 | | | | 2,928,600 | |

4.600%, 10/15/24‡ | | | 2,000,000 | | | | 1,080,000 | |

| | | | | | | | |

| | | | | | | 6,095,460 | |

| | | | | | | | |

|

Sovereign — 0.4% | |

| | |

Andina de Fomento

2.750%, 01/06/23 | | | 5,000,000 | | | | 5,095,050 | |

The accompanying notes are an integral part of the financial statements.

14

| | |

| FROST FAMILY OF FUNDS | | F R O S T F U N D S | J A N U A R Y 3 1, 2 0 2 0 (U n a u d i t e d) |

| | |

| FROST TOTAL RETURN BOND FUND | | |

| | | | | | | | |

| Description | | Face Amount | | |

Value | |

| | |

Kreditanstalt fuer Wiederaufbau

2.125%, 01/17/23 | | $ | 10,000,000 | | | $ | 10,215,535 | |

| | | | | | | | |

| | | | | | | 15,310,585 | |

| | | | | | | | |

| | |

Total Corporate Obligations

(Cost $763,428,170) | | | | | | | 733,268,475 | |

| | | | | | | | |

U.S. TREASURY OBLIGATIONS — 18.0% | |

| | |

U.S. Treasury Inflationary Protection Securities

1.125%, 01/15/21 | | | 5,878,950 | | | | 5,922,367 | |

1.000%, 02/15/46 to 02/15/48 | | | 16,943,420 | | | | 20,114,918 | |

0.875%, 01/15/29 | | | 30,559,200 | | | | 33,309,751 | |

| | |

U.S. Treasury Notes

2.875%, 05/15/28 | | | 200,000,000 | | | | 221,781,250 | |

2.375%, 08/15/24 to 05/15/29 | | | 180,000,000 | | | | 192,033,593 | |

2.250%, 11/15/24 to 08/15/49 | | | 80,000,000 | | | | 83,442,383 | |

1.625%, 03/15/20 to 08/15/29 | | | 60,000,000 | | | | 60,424,962 | |

1.500%, 01/15/23 to 08/15/26 | | | 50,000,000 | | | | 50,264,648 | |

1.375%, 02/15/20 | | | 50,000,000 | | | | 49,995,838 | |

| | |

U.S. Treasury STRIPS

3.287%, 02/15/46 (D) | | | 2,000,000 | | | | 1,143,670 | |

| | | | | | | | |

| | |

Total U.S. Treasury Obligations

(Cost $677,120,215) | | | | | | | 718,433,380 | |

| | | | | | | | |

ASSET-BACKED SECURITIES — 16.7% | |

|

Asset Backed Securities — 4.4% | |

| | |

American Credit Acceptance Receivables Trust,

Ser2017-4, Cl C

2.940%, 01/10/24 (B) | | | 515,700 | | | | 516,444 | |

| | |

American Credit Acceptance Receivables Trust,

Ser2017-4, Cl D

3.570%, 01/10/24 (B) | | | 1,952,000 | | | | 1,976,354 | |

| | |

American Credit Acceptance Receivables Trust,

Ser2019-3, Cl C

2.760%, 09/12/25 (B) | | | 6,500,000 | | | | 6,592,947 | |

| | |

Apidos CLO XI,

Ser2019-11A, Cl BRR

3.536%, VAR ICE LIBOR USD

3 Month+1.700%, 10/17/30 (B) | | | 15,000,000 | | | | 15,022,425 | |

| | |

BCC Funding XVI,

Ser2019-1A, Cl B

2.640%, 09/20/24 (B) | | | 6,000,000 | | | | 6,029,125 | |

| | |

BCC Funding XVI,

Ser2019-1A, Cl C

2.950%, 09/20/24 (B) | | | 500,000 | | | | 502,601 | |

| | |

BlueMountain CLO,

Ser2019-2A, Cl A2R

3.699%, VAR ICE LIBOR USD

3 Month+1.800%, 08/20/32 (B) | | | 23,000,000 | | | | 22,976,701 | |

| | | | | | | | |

| Description | | Face Amount | | |

Value | |

| | |

Capital One Prime Auto Receivables Trust,

Ser2019-2, Cl A2

2.060%, 09/15/22 | | $ | 8,000,000 | | | $ | 8,024,638 | |

| | |

Drive Auto Receivables Trust,

Ser2017-3, Cl D

3.530%, 12/15/23 (B) | | | 1,000,000 | | | | 1,010,500 | |

| | |

Drive Auto Receivables Trust,

Ser2018-2, Cl C

3.630%, 08/15/24 | | | 1,548,762 | | | | 1,558,681 | |

| | |

Drive Auto Receivables Trust,

Ser2018-3, Cl D

4.300%, 09/16/24 | | | 7,966,000 | | | | 8,214,848 | |

| | |

Drive Auto Receivables Trust,

Ser2019-1, Cl C

3.780%, 04/15/25 | | | 2,230,000 | | | | 2,274,321 | |

| | |

Drive Auto Receivables Trust,

Ser2019-2, Cl B

3.170%, 11/15/23 | | | 4,750,000 | | | | 4,810,174 | |

| | |

DT Auto Owner Trust,

Ser2017-3A, Cl D

3.580%, 05/15/23 (B) | | | 495,000 | | | | 498,408 | |

| | |

DT Auto Owner Trust,

Ser2018-2A, Cl C

3.670%, 03/15/24 (B) | | | 1,000,000 | | | | 1,009,093 | |

| | |

Exeter Automobile Receivables Trust,

Ser2018-4A, Cl C

3.970%, 09/15/23 (B) | | | 5,350,000 | | | | 5,452,475 | |

| | |

Flagship Credit Auto Trust,

Ser2017-4, Cl C

2.920%, 11/15/23 (B) | | | 4,466,000 | | | | 4,525,510 | |

| | |

Flagship Credit Auto Trust,

Ser2019-2, Cl D

3.530%, 05/15/25 (B) | | | 5,190,000 | | | | 5,355,635 | |

| | |

Master Credit Card Trust II,

Ser2019-2A, Cl B

2.390%, 01/21/23 (B) | | | 5,582,000 | | | | 5,599,309 | |

| | |

Master Credit Card Trust II,

Ser2019-2A, Cl C

2.830%, 01/21/23 (B) | | | 1,509,000 | | | | 1,513,523 | |

| | |

Oaktree CLO,

Ser2019-3A, Cl B

3.819%, VAR ICE LIBOR USD

3 Month+2.000%, 07/20/31 (B) | | | 13,500,000 | | | | 13,520,291 | |

| | |

Oaktree CLO,

Ser2019-4A, Cl B

3.919%, VAR ICE LIBOR USD

3 Month+2.000%, 10/20/32 (B) | | | 25,000,000 | | | | 25,044,750 | |

| | |

Pawnee Equipment Receivables

Series, Ser2019-1, Cl A1

2.294%, 10/15/20 (B) | | | 1,327,889 | | | | 1,328,193 | |

| | |

Pawnee Equipment Receivables

Series, Ser2019-1, Cl E

3.800%, 01/15/26 (B) | | | 2,500,000 | | | | 2,512,319 | |

The accompanying notes are an integral part of the financial statements.

15

| | |

| FROST FAMILY OF FUNDS | | F R O S T F U N D S | J A N U A R Y 3 1, 2 0 2 0 (U n a u d i t e d) |

| | |

| FROST TOTAL RETURN BOND FUND | | |

| | | | | | | | |

| Description | | Face Amount | | |

Value | |

| | |

Pretium Mortgage Credit Partners I,

Ser 2019-NPL3, Cl A1

3.105%, 07/27/59 (B) | | $ | 6,169,066 | | | $ | 6,173,656 | |

| | |

Skopos Auto Receivables Trust,

Ser 2019- 1A, Cl C

3.630%, 09/16/24 (B) | | | 2,300,000 | | | | 2,316,530 | |

| | |

Venture 35 CLO,

Ser2018-35A, Cl BL

3.652%, VAR ICE LIBOR USD

3 Month+1.850%, 10/22/31 (B) | | | 20,000,000 | | | | 20,008,340 | |

| | |

Westlake Automobile Receivables Trust,

Ser2018-1A, Cl C

2.920%, 05/15/23 (B) | | | 310,000 | | | | 310,644 | |

| | | | | | | | |

| | | | | | | 174,678,435 | |

| | | | | | | | |

|

Automotive — 8.7% | |

| | |

Ally Auto Receivables Trust,

Ser2019-2, Cl A2

2.340%, 06/15/22 | | | 2,236,881 | | | | 2,243,496 | |

| | |

American Credit Acceptance Receivables Trust,

Ser2016-3, Cl C

4.260%, 08/12/22 (B) | | | 1,797,021 | | | | 1,802,539 | |

| | |

American Credit Acceptance Receivables Trust,

Ser2017-1, Cl E

5.440%, 03/13/24 (B) | | | 1,000,000 | | | | 1,022,701 | |

| | |

American Credit Acceptance Receivables Trust,

Ser2017-2, Cl C

2.860%, 06/12/23 (B) | | | 852,223 | | | | 852,860 | |

| | |

American Credit Acceptance Receivables Trust,

Ser2017-3, Cl C

2.720%, 06/10/22 (B) | | | 291,785 | | | | 291,837 | |

| | |

American Credit Acceptance Receivables Trust,

Ser2017-3, Cl E

5.170%, 06/10/24 (B) | | | 2,180,000 | | | | 2,220,220 | |

| | |

American Credit Acceptance Receivables Trust,

Ser2018-1, Cl D

3.930%, 04/10/24 (B) | | | 4,200,000 | | | | 4,271,282 | |

| | |

American Credit Acceptance Receivables Trust,

Ser2018-4, Cl D

4.400%, 01/13/25 (B) | | | 17,605,000 | | | | 18,238,440 | |

| | |

American Credit Acceptance Receivables Trust,

Ser2019-1, Cl C

3.500%, 04/14/25 (B) | | | 4,600,000 | | | | 4,683,876 | |

| | |

AmeriCredit Automobile Receivables Trust,

Ser2017-2, Cl D

3.420%, 04/18/23 | | | 8,570,000 | | | | 8,751,768 | |

| | | | | | | | |

| Description | | Face Amount | | |

Value | |

| | |

Canadian Pacer Auto Receivables Trust,

Ser2019-1A, Cl A4

2.960%, 06/19/24 (B) | | $ | 5,000,000 | | | $ | 5,166,416 | |

| | |

CarMax Auto Owner Trust,

Ser2016-4, Cl D

2.910%, 04/17/23 | | | 3,500,000 | | | | 3,522,302 | |

| | |

CarMax Auto Owner Trust,

Ser2017-3, Cl D

3.460%, 10/16/23 | | | 5,250,000 | | | | 5,339,285 | |

| | |

Carnow Auto Receivables Trust,

Ser 2017- 1A, Cl C

5.750%, 10/16/23 (B) | | | 2,000,000 | | | | 2,025,406 | |

| | |

Carnow Auto Receivables Trust,

Ser 2019- 1A, Cl A

2.720%, 11/15/22 (B) | | | 10,283,517 | | | | 10,304,537 | |

| | |

Carvana Auto Receivables Trust,

Ser 2019- 1A, Cl E

5.640%, 01/15/26 (B) | | | 5,000,000 | | | | 5,281,554 | |

| | |

Carvana Auto Receivables Trust,

Ser 2019- 2A, Cl B

2.740%, 12/15/23 (B) | | | 9,000,000 | | | | 9,110,590 | |

| | |

CPS Auto Receivables Trust,

Ser2014-D, Cl E

6.210%, 02/15/22 (B) | | | 4,000,000 | | | | 3,999,662 | |

| | |

CPS Auto Receivables Trust,

Ser2015-C, Cl E

6.540%, 08/16/21 (B) | | | 5,250,000 | | | | 5,383,920 | |

| | |

CPS Auto Receivables Trust,

Ser2016-A, Cl E

7.650%, 12/15/21 (B) | | | 6,000,000 | | | | 6,242,498 | |

| | |

CPS Auto Receivables Trust,

Ser2016-A, Cl F

7.650%, 03/15/23 (B) | | | 10,540,000 | | | | 10,782,248 | |

| | |

CPS Auto Receivables Trust,

Ser2016-B, Cl C

4.220%, 03/15/22 (B) | | | 1,203,155 | | | | 1,207,462 | |

| | |

CPS Auto Receivables Trust,

Ser2016-B, Cl E

8.140%, 05/15/23 (B) | | | 6,500,000 | | | | 6,851,871 | |

| | |

CPS Auto Receivables Trust,

Ser2016-D, Cl E

6.860%, 04/15/24 (B) | | | 8,000,000 | | | | 8,337,604 | |

| | |

CPS Auto Receivables Trust,

Ser2017-B, Cl D

3.950%, 03/15/23 (B) | | | 3,500,000 | | | | 3,553,374 | |

| | |

CPS Auto Receivables Trust,

Ser2019-B, Cl F

7.480%, 06/15/26 (B) | | | 6,055,000 | | | | 6,353,359 | |

| | |

Diamond Resorts Owner Trust,

Ser 2019- 1A, Cl A

2.890%, 02/20/32 (B) | | | 4,234,280 | | | | 4,293,874 | |

| | |

Drive Auto Receivables Trust,

Ser 2016- BA, Cl D

4.530%, 08/15/23 (B) | | | 1,298,643 | | | | 1,312,444 | |

The accompanying notes are an integral part of the financial statements.

16

| | |

| FROST FAMILY OF FUNDS | | F R O S T F U N D S | J A N U A R Y 3 1, 2 0 2 0 (U n a u d i t e d) |

| | |

| FROST TOTAL RETURN BOND FUND | | |

| | | | | | | | |

| Description | | Face Amount | | |

Value | |

| | |

Drive Auto Receivables Trust,

Ser2018-1, Cl D

3.810%, 05/15/24 | | $ | 7,835,000 | | | $ | 7,979,618 | |

| | |

DT Auto Owner Trust,

Ser2016-4A, Cl E

6.490%, 09/15/23 (B) | | | 3,520,000 | | | | 3,604,648 | |

| | |

DT Auto Owner Trust,

Ser2017-2A, Cl E

6.030%, 01/15/24 (B) | | | 2,750,000 | | | | 2,871,283 | |

| | |

DT Auto Owner Trust,

Ser2019-4A, Cl C

2.730%, 07/15/25 (B) | | | 2,000,000 | | | | 2,029,635 | |

| | |

DT Auto Owner Trust,

Ser2020-1A, Cl E

3.480%, 02/16/27 (B) | | | 4,500,000 | | | | 4,513,751 | |

| | |

Exeter Automobile Receivables Trust,

Ser2015-3A, Cl D

6.550%, 10/17/22 (B) | | | 5,000,000 | | | | 5,031,363 | |

| | |

Exeter Automobile Receivables Trust,

Ser2016-1A, Cl C

5.520%, 10/15/21 (B) | | | 404,224 | | | | 405,139 | |

| | |

Exeter Automobile Receivables Trust,

Ser2017-1A, Cl B

3.000%, 12/15/21 (B) | | | 165,025 | | | | 165,094 | |

| | |

Exeter Automobile Receivables Trust,

Ser2018-1A, Cl D

3.530%, 11/15/23 (B) | | | 5,500,000 | | | | 5,616,671 | |

| | |

Exeter Automobile Receivables Trust,

Ser2019-3A, Cl C

2.790%, 05/15/24 (B) | | | 7,000,000 | | | | 7,103,676 | |

| | |

Exeter Automobile Receivables Trust,

Ser2020-1A, Cl D

2.730%, 12/15/25 (B) | | | 2,500,000 | | | | 2,530,306 | |

| | |

First Investors Auto Owner Trust,

Ser2019-1A, Cl D

3.550%, 04/15/25 (B) | | | 1,700,000 | | | | 1,753,447 | |

| | |

Flagship Credit Auto Trust,

Ser2015-3, Cl D

7.120%, 11/15/22 (B) | | | 5,000,000 | | | | 5,111,196 | |

| | |

Flagship Credit Auto Trust,

Ser2016-1, Cl D

8.590%, 05/15/23 (B) | | | 15,380,000 | | | | 16,017,340 | |

| | |

Flagship Credit Auto Trust,

Ser2016-3, Cl D

3.890%, 11/15/22 (B) | | | 5,000,000 | | | | 5,106,169 | |

| | |

Flagship Credit Auto Trust,

Ser2018-2, Cl C

3.890%, 09/16/24 (B) | | | 11,286,000 | | | | 11,642,226 | |

| | | | | | | | |

| Description | | Face Amount | | |

Value | |

| | |

Ford Credit Auto Owner Trust,

Ser2018-A, Cl A3

3.030%, 11/15/22 | | $ | 6,360,447 | | | $ | 6,425,866 | |

| | |

Ford Credit Auto Owner Trust,

Ser2019-A, Cl B

3.020%, 10/15/24 | | | 15,000,000 | | | | 15,572,736 | |

| | |

Foursight Capital Automobile Receivables Trust,

Ser2017-1, Cl C

3.470%, 12/15/22 (B) | | | 2,200,000 | | | | 2,223,630 | |

| | |

Foursight Capital Automobile Receivables Trust,

Ser2018-2, Cl D

4.330%, 07/15/24 (B) | | | 4,650,000 | | | | 4,852,520 | |

| | |

GLS Auto Receivables Trust,

Ser2016-1A, Cl D

9.130%, 01/18/22 (B) | | | 7,075,000 | | | | 7,323,894 | |

| | |

GM Financial Consumer Automobile Receivables Trust,

Ser2019-3, Cl B

2.320%, 12/16/24 | | | 2,250,000 | | | | 2,285,983 | |

| | |

Marlette Funding Trust,

Ser2020-1A, Cl D

3.540%, 03/15/30 (B) | | | 1,500,000 | | | | 1,516,265 | |

| | |

Master Credit Card Trust II,

Ser2020-1A, Cl C

2.590%, 09/23/24 (B) | | | 2,000,000 | | | | 2,015,146 | |

| | |

MelTel Land Funding,

Ser2019-1A, Cl B

4.701%, 04/15/49 (B) | | | 1,300,000 | | | | 1,348,829 | |

| | |

Octane Receivables Trust2019-1,

Ser2019-1A, Cl A