Filed Pursuant to Rule 253(g)(2)

File No. 024-10953

Supplement No. 1 dated September 13, 2019 to the Offering Circular dated July 3, 2019.

HCo Cape May LLC

70,000 Shares of Non-Voting LLC Membership at $500.00 per Share

Minimum Investment: 5 Shares ($2,500.00)

Minimum Offering Amount: $4,750,000.00

Maximum Offering: $35,000,000.00

This document supplements, and should be read in conjunction with, the Offering Circular of HCo Cape May LLC dated July 3, 2019. Unless otherwise defined herein, capitalized terms used in this supplement shall have the same meanings as set forth in the Offering Circular of July 3, 2019.

The purpose of this supplement is to disclose the following items:

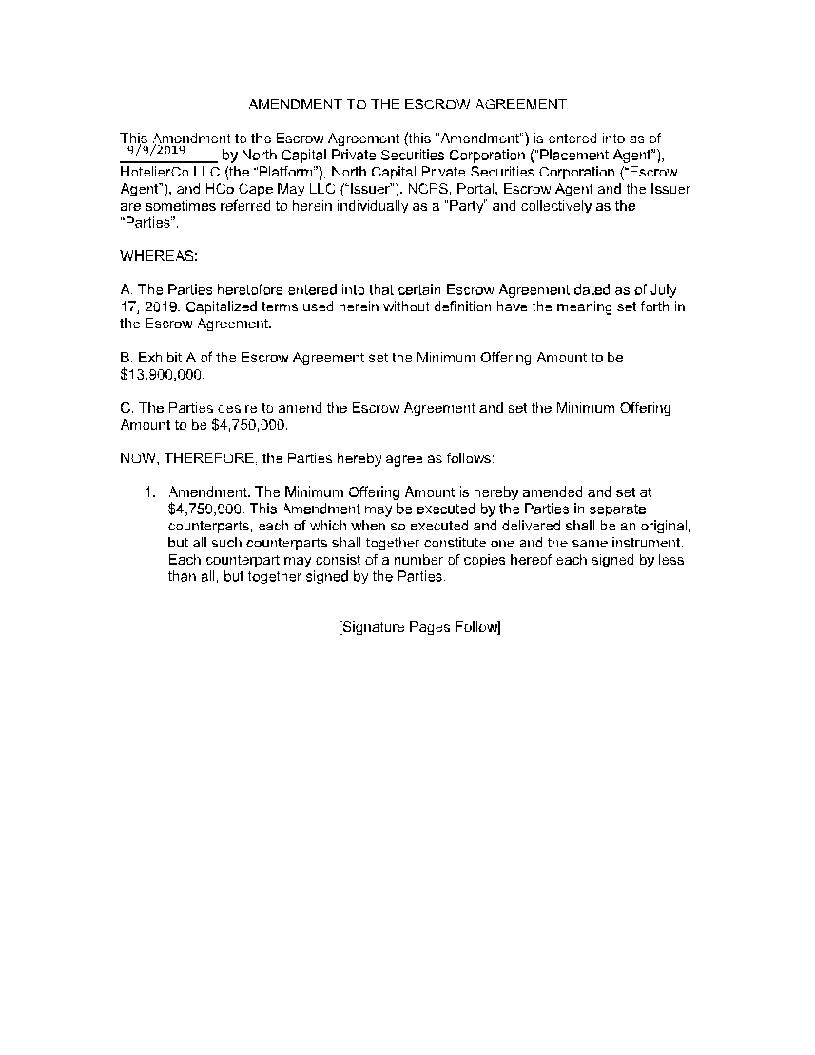

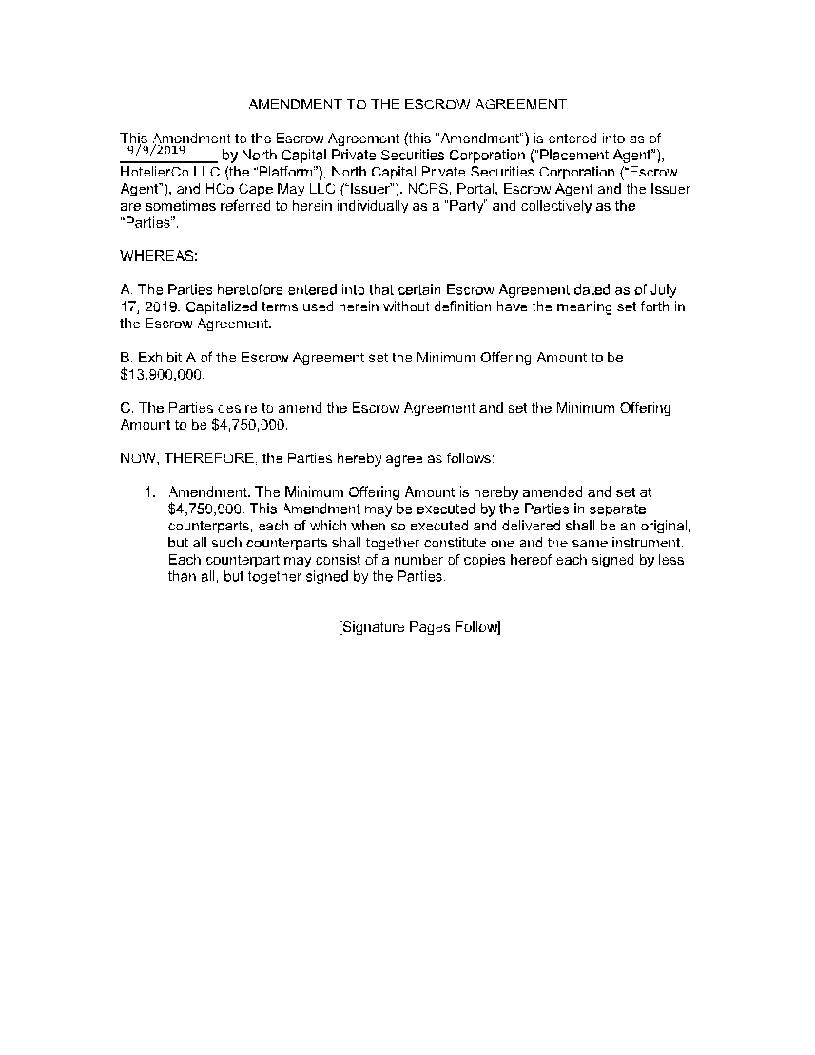

1.The Company has lowered the Minimum Offering Amount from $13,900,000.00 to $4,750,000.00

2.Until the new minimum of $4,750,000.00 of Shares are sold, all subscription payments will be held by the escrow agent in trust for subscriber’s benefit, pending release to the Company. If the Company does not raise gross proceeds of $4,750,000.00 by 12 months from the commencement of the Offering, the Company will promptly return all funds in the escrow account without interest.

3.The previously disclosed dilution tables in the “Dilution” section of the Offering Circular have been updated to reflect the change in Minimum Offering Amount.

4.The “Plan of Distribution” section of the Offering Circular has been updated to reflect the change in Minimum Offering Amount.

5.The Use of Proceeds Table has been updated to reflect the change in Minimum Offering Amount.

6.The Company has had an additional opportunity arise related to its business plan which is explained in updates to the “Plan of Distribution” “Description of the Business” “Description of the Property” “Plan of Operations” and “Interest of Management and Others in Certain Related-Party Transactions” sections.

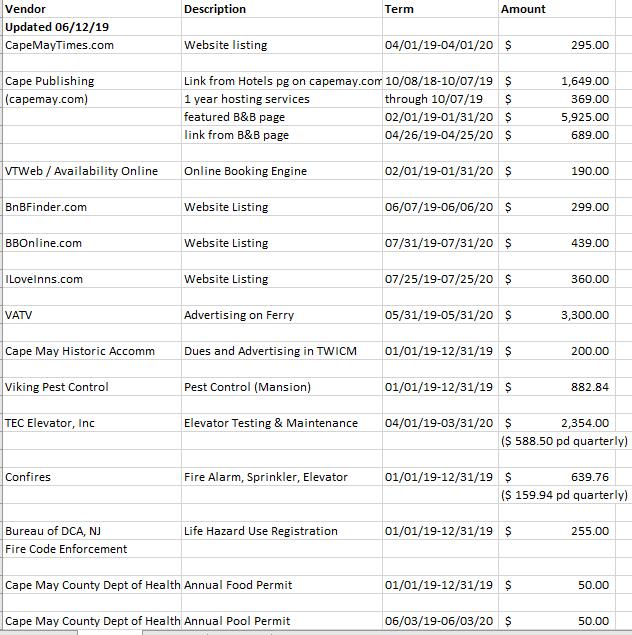

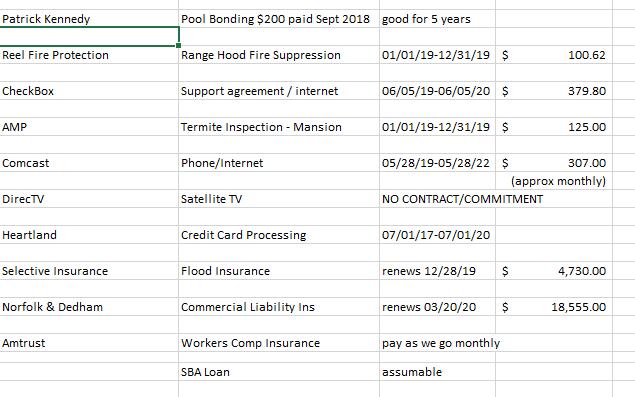

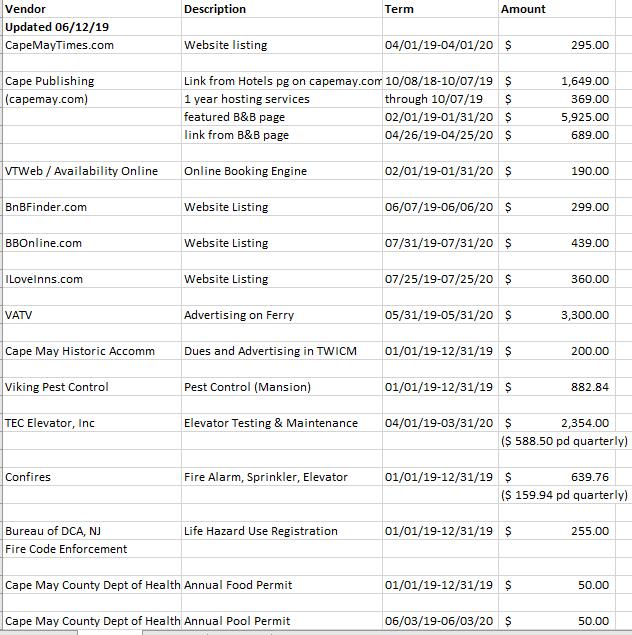

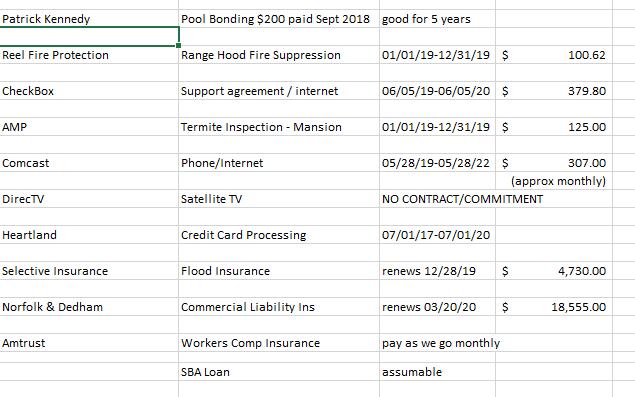

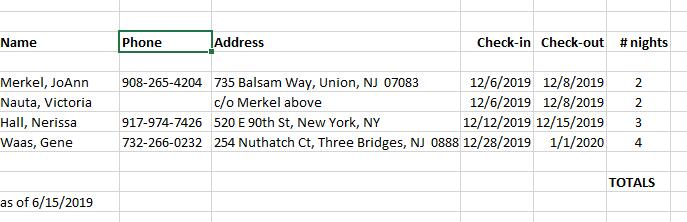

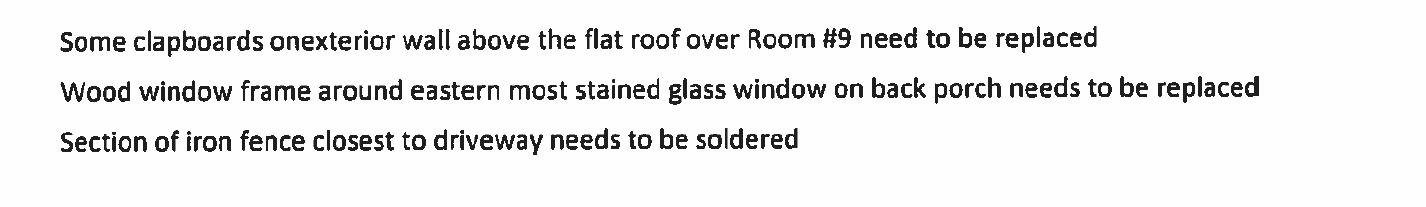

7.The Material Contracts section of the Offering Circular has been updated to include additional Material contracts.

8.The Escrow Agreement section of the Offering Circular has been updated to include an escrow amendment reflecting the new minimum.

1

The updated sections are set out below, and should be substituted in their entirely for the corresponding sections of the Offering Circular dated July 3, 2019. This supplement should be read in conjunction with the Offering Circular dated July 3, 2019, and all sections of the Offering Circular dated July 3, 2019 that are not supplemented below, remain the same in their entirety.

2

Supplemented Cover Page, prior to legends (starting with the legend that begins with “THIS OFFERING CIRCULAR DOES NOT CONSTITUTE AN OFFER OR SOLICITATION IN ANY JURISDICTION IN WHICH SUCH AN OFFER OR SOLICITATION WOULD BE UNLAWFUL”and ending with the start of the Table of Contents,all of which remain the same as previously disclosed in the July 3, 2019 Offering Circular:

PART II – PRELIMINARY OFFERING CIRCULAR - FORM 1-A/A: TIER 2

Dated: July 3, 2019

PURSUANT TO REGULATION A OF THE SECURITIES ACT OF 1933

HCo Cape May LLC

(A Delaware Limited Liability Company)

2100 Powers Ferry Road S.E., Suite 370

Atlanta, Georgia 30339

(833) 426-4260

www.hotelierco.com

70,000 Shares of Non-Voting LLC Membership at $500.00 per Share

Minimum Investment: 5 Shares ($2,500.00)

Minimum Offering Amount: $4,750,000.00

Maximum Offering: $35,000,000.00

See The Offering – Page 13 and Securities Being Offered – Page 56

For Further Details

None of the Securities Offered Are Being Sold By Present Security Holders.

This Offering Will Commence Within Two Calendar Days After The Qualification Date Of This Offering By The Securities And Exchange Commission And Will Terminate 180 Days From

The Date Of Qualification By The Securities And Exchange Commission,

Unless Extended Or Terminated Earlier By The Issuer.

AN OFFERING STATEMENT PURSUANT TO REGULATION A RELATING TO THESE SECURITIES HAS BEEN FILED WITH THE SECURITIES AND EXCHANGE COMMISSION. INFORMATION CONTAINED IN THIS PRELIMINARY OFFERING CIRCULAR IS SUBJECT TO COMPLETION OR AMENDMENT. THESE SECURITIES MAY NOT BE SOLD NOR MAY OFFERS TO BUY BE ACCEPTED BEFORE THE OFFERING STATEMENT FILED WITH THE COMMISSION IS QUALIFIED. THIS PRELIMINARY OFFERING CIRCULAR SHALL NOT CONSTITUTE AN OFFER TO SELL OR THE SOLICITATION OF AN OFFER TO BUY NOR MAY THERE BE ANY SALES OF THESE SECURITIES IN ANY STATE IN WHICH SUCH OFFER, SOLICITATION OR SALE WOULD BE UNLAWFUL BEFORE REGISTRATION OR QUALIFICATION UNDER THE LAWS OF ANY SUCH STATE. WE MAY ELECT TO SATISFY OUR OBLIGATION TO DELIVER A FINAL OFFERING CIRCULAR BY SENDING YOU A NOTICE WITHIN TWO BUSINESS DAYS AFTER THE

3

COMPLETION OF OUR SALE TO YOU THAT CONTAINS THE URL WHERE THE FINAL OFFERING CIRCULAR OR THE OFFERING STATEMENT IN WHICH SUCH FINAL OFFERING CIRCULAR WAS FILED MAY BE OBTAINED.

PLEASE REVIEW ALL RISK FACTORS ON PAGES PAGE 16 THROUGH PAGE 35 BEFORE MAKING AN INVESTMENT IN THIS COMPANY. AN INVESTMENT IN THIS COMPANY SHOULD ONLY BE MADE IF YOU ARE CAPABLE OF EVALUATING THE RISKS AND MERITS OF THIS INVESTMENT AND IF YOU HAVE SUFFICIENT RESOURCES TO BEAR THE ENTIRE LOSS OF YOUR INVESTMENT, SHOULD THAT OCCUR.

THE UNITED STATES SECURITIES AND EXCHANGE COMMISSION DOES NOT PASS UPON THE MERITS OF OR GIVE ITS APPROVAL TO ANY SECURITIES OFFERED OR THE TERMS OF THE OFFERING, NOR DOES IT PASS UPON THE ACCURACY OR COMPLETENESS OF ANY OFFERING CIRCULAR OR OTHER SELLING LITERATURE. THESE SECURITIES ARE OFFERED PURSUANT TO AN EXEMPTION FROM REGISTRATION WITH THE COMMISSION; HOWEVER, THE COMMISSION HAS NOT MADE AN INDEPENDENT DETERMINATION THAT THE SECURITIES OFFERED HEREUNDER ARE EXEMPT FROM REGISTRATION.

Because these securities are being offered on a “minimum-maximum best efforts” basis, the following disclosures are hereby made:

| Price to Public | Commissions (1) | Proceeds to Company (2) | Proceeds to Other Persons (3) |

Per Share | $500.00 | $3.25 | $496.75 | None |

Minimum Investment | $2,500.00 | $16.25 | $2,483.75 | None |

Minimum Offering | $4,750,000.00 | $30,875.00 | $4,719,125.00 | None |

Maximum Offering | $35,000,000.00 | $227,500.00 | $34,772,500.00 | None |

(1) The Company shall pay North Capital Private Securities Corporation (“NCPS”) a cash success fee equivalent to 0.65% of the gross proceeds raised in the Offering. The Company may engage the services of additional FINRA member broker-dealers as part of a selling group, and those additional broker-dealers may be paid additional fees to those disclosed herein. Should such additional broker-dealers be engaged, an amendment to this Offering Circular will be filed disclosing the additional fees. See “Plan of Distribution.”

(2) Does not reflect payment of expenses of this Offering, which are estimated to not exceed $250,000.00 and which include, among other things, legal fees, accounting costs, reproduction expenses, due diligence, marketing, consulting, bank or escrow fees, administrative services, costs of blue sky compliance, and actual out-of-pocket expenses incurred by the Company selling the Shares, but which do not include success fees or commissions paid to NCPS. If the Company engages the services of additional broker-dealers in connection with the Offering, their commissions will be an additional expense of the Offering. See the “Plan of Distribution” for details regarding the compensation payable in connection with this Offering. This amount represents the proceeds of the Offering to the Company, which will be used as set out in “Use of Proceeds.”

(3) There are no finder’s fees or other fees being paid to third parties from the proceeds, other than those disclosed above. See "Plan of Distribution."

4

GENERALLY, NO SALE MAY BE MADE TO YOU IN THIS OFFERING IF THE AGGREGATE PURCHASE PRICE YOU PAY IS MORE THAN 10% OF THE GREATER OF YOUR ANNUAL INCOME OR NET WORTH. DIFFERENT RULES APPLY TO ACCREDITED INVESTORS AND NON-NATURAL PERSONS. BEFORE MAKING ANY REPRESENTATION THAT YOUR INVESTMENT DOES NOT EXCEED APPLICABLE THRESHOLDS, WE ENCOURAGE YOU TO REVIEW RULE 251(D)(2)(I)(C) OF REGULATION A. FOR GENERAL INFORMATION ON INVESTING, WE ENCOURAGE YOU TO REFER TO WWW.INVESTOR.GOV.

This offering consists of Shares (the “Shares” or individually, each a “Share”) that are being offered on a “minimum-maximum best efforts” basis, which means that until the minimum of $4,750,000.00 of Shares are sold, all subscription payments will be placed in an account held by the escrow agent, North Capital, in trust for subscriber’s benefit, pending release to the Company. If the Company does not raise gross proceeds of $4,750,000 prior to the termination of this Offering, the Company will promptly return all funds in the escrow account without interest. The term “Offering” refers to the offer of Shares pursuant to this Offering Circular. The Shares are being offered and sold by HCo Cape May LLC, a Delaware Limited Liability Company (“HCo Cape May”, we”, “our” or the “Company”). There are 70,000 Shares being offered at a price of $500.00 per Share with a minimum purchase of five (5) Shares per investor. The Shares are being offered on a minimum-maximum best efforts basis to an unlimited number of accredited investors and an unlimited number of non-accredited investors only by the Company and through North Capital Private Securities Corporation (“NCPS”), a broker/dealer registered with the Securities and Exchange Commission (the “SEC”) and a member of the Financial Industry Regulatory Authority (“FINRA”). The maximum aggregate amount of the Shares offered is $35,000,000.00 (the “Maximum Offering”).

The Company was formed as HCo Cape May LLC, a Delaware limited liability company, on or about July 30, 2018. The Company was formed for the general purpose of developing a hotel in Cape May, New Jersey, and for any other lawful purpose.

The Shares are being offered pursuant to Regulation A of Section 3(b) of the Securities Act of 1933, as amended, for Tier 2 offerings. The Shares will only be issued to purchasers who satisfy the requirements set forth in Regulation A.

This Offering will be made on a continuous basis and will commence within two calendar days after the qualification date by the Commission and is expected to expire on the first of: (i) all of the Shares offered are sold; or (ii) the close of business 180 days from the date of qualification by the Commission, unless sooner terminated or extended by the Company’s CEO, or (iii) the date upon which a determination is made by the Company to terminate the Offering in the Company’s sole and absolute discretion. The Company reasonably expects the securities to be offered and sold within two years from the initial qualification date, but under no circumstances will the Offering continue if more than three years have elapsed since the initial qualification. Pending each closing, payments for the Shares will be deposited into an escrow account held by the escrow agent, North Capital, in trust for the subscriber’s benefit. If the Company does not raise gross proceeds of $4,750,000.00 prior to the termination of this Offering, all funds in the escrow account will be returned promptly without interest. Funds will also be promptly refunded without interest, for sales

5

that are not consummated. All funds received shall be held only in a non-interest-bearing escrow account. Upon each closing under the terms as set out in this Offering Circular, funds will be immediately transferred to the Company where they will be available for use in the operations of the Company’s business in a manner consistent with the “Use Of Proceeds” in this Offering Circular. Investors whose funds are in escrow that the Company intends to refund (a) as a result of the Company’s dissolution or liquidation, (b) as a result of the Company’s determination not to hold further closings, or (c) the Company’s determination that the investor has not cleared compliance, will be notified via e-mail of any of (a)-(c) above of the determination by the Company that a refund is due and funds will be returned to the investor promptly.

The Company’s website is not incorporated into this Offering Circular.

* * *

OFFERING SUMMARY

The following summary is qualified in its entirety by the more detailed information appearing elsewhere in this Offering Circular and/or incorporated by reference in this Offering Circular. For full offering details, please (1) thoroughly review this Form 1-A/A filed with the Securities and Exchange Commission (2) thoroughly review this Offering Circular and (3) thoroughly review any attached documents to or documents referenced in, this Form 1-A/A and Offering Circular.

Issuer: | HCo Cape May LLC |

Type of Offering: | Shares |

Price Per Share: | $500.00 per Share (70,000 Non-Voting Shares) |

Minimum Investment: | $2,500.00 per investor |

Minimum Offering: | $4,750,000.00. Until the minimum of $4,750,000.00 of Non-Voting Shares are sold, all subscription payments will be placed in an account held by the escrow agent, North Capital, in trust for subscriber’s benefit, pending release to the Company. If the Company does not raise gross proceeds of $4,750,000.00 by 12 months from the commencement of this offering, the Company will promptly return all funds in the escrow account without interest. |

Maximum Offering: | $35,000,000.00 The Company will not accept investments greater than the Maximum Offering amount. |

Maximum Shares Offered: | 70,000 Non-Voting Shares |

Purchasers: | Purchasers may be accredited investors or non-accredited investors. Non-accredited investors are limited in the number of Shares they may purchase. |

Use of Proceeds: | See the description in section entitled “Use of Proceeds” on page 43 herein. |

Voting Rights: | The Shares have no voting rights. See “Voting Rights” section of “Securities Being Offered” below for details. |

6

Length of Offering: | Shares will be offered until either (a) the date upon which the escrow agent confirms that it has received in the escrow account gross proceeds of $35,000,000.00 in deposited funds; (b) the Company does not raise gross proceeds of $4,750,000.00 by 12 months from the commencement of this offering; or (c) the date upon which a determination is made by the Company to terminate the Offering in its sole discretion. |

* * *

The Offering

Voting Shares Outstanding | 112.526 Shares |

Non-Voting Shares Outstanding | 0 Shares |

Voting Shares Committed | 887.474 Shares |

Non-Voting Shares in this Offering (1) | 70,000 Shares |

Total Shares to be outstanding after the Offering (2) | 71,000 Shares |

(1) There are two classes of Shares issued by the Company: Voting Shares and Non-Voting Shares. For a full description of the rights of the Shares, please see the section of this Offering Circular entitled “Securities Being Offered” below. The total number of Non-Voting Shares (70,000) in the chart assumes that the maximum number of Shares are sold in this Offering.

(2) The total number of Shares to be outstanding after the Offering assumes that the Offering is fully subscribed, and this number will be less if the Offering is not fully subscribed.

The Company may not be able to sell the Minimum Offering amount or the Maximum Offering amount. If the Company does not sell the Minimum Offering amount, all investor funds shall be returned to investors from the escrow account in accordance with the Amended and Restated Escrow Agreement (Exhibit 1A-8). The Company will conduct one or more closings on a rolling basis as funds are received from investors, with the first closing not to occur prior to $4,750,000.00 in investment funds for Non-Voting Shares being received. After the initial closing, subsequent closings shall take place every Wednesday until the Offering is terminated, as long as on each Wednesday there are funds that have been cleared in the escrow account for investors who have cleared compliance, and as long as the Offering is completed within three years since the initial qualification. The Company will notify investors who have tendered funds via e-mail within 48 hours of any additional closing date that will affect said investors. The Company will notify investors via e-mail that their subscriptions have been accepted and funds have been distributed from escrow to the Company, within 48 hours of such acceptance of the subscription and distribution of the funds to the Company.

Pending each closing, payments for the Shares will be deposited into an escrow account held by the escrow agent, North Capital, in trust for the subscriber’s benefit. If the Company does not raise gross proceeds of $4,750,000.0 by 12 months from the commencement of this offering, all funds in the escrow account will be returned promptly without interest. Funds will also be promptly refunded without interest, for sales that are not consummated. All funds received shall be held only in a non-interest-bearing escrow account. Upon each closing under the terms as set out in this

7

Offering Circular, funds will be immediately transferred to the Company where they will be available for use in the operations of the Company’s business in a manner consistent with the “Use Of Proceeds” in this Offering Circular.

Funds tendered by investors will be kept in an escrow account until the next closing after they are received by the escrow agent. At each closing, with respect to subscriptions accepted by the Company, funds held in escrow will be distributed to the Company, at which time the Shares will be issued to each investor. Investors may not withdraw their funds tendered from escrow unless the Offering is terminated without a closing having occurred, either before or after the Minimum Offering amount is received and the first closing has occurred. Investors are not entitled to any refund of funds transmitted by any means to the Company, or to the escrow account, for any reason, unless the Investor does not clear compliance by the broker-dealers involved, either before or after the Minimum Offering amount is received and the first closing has occurred, or unless his or her subscription agreement is rejected by the Company for any reason, the Company dissolves or is liquidated, or the Offering is terminated by the Company prior to any closing taking place, in which cases investor funds held in escrow will promptly be refunded to each investor without interest or deductions. Investors whose funds are in escrow that the Company intends to refund (a) as a result of the Company’s dissolution or liquidation, (b) as a result of the Company’s determination not to hold further closings, or (c) the Company’s determination that the investor has not cleared compliance, will be notified via e-mail of any of (a)-(c) above within 48 hours of the determination by the Company that a refund is due and funds will be returned to the investor promptly.

* * *

DILUTION

The term "dilution" refers to the reduction (as a percentage of the aggregate Shares outstanding) that occurs for any given Share when additional Shares are issued. If all of the Shares in this Offering are fully subscribed and sold, the Shares offered herein will constitute approximately 98.6% of the total Shares of the Company.

The type of dilution that negatively affects early-stage investors most occurs when the Company sells more Shares or securities in a “down round,” meaning at a lower valuation than in earlier offerings. This type of dilution might also happen upon conversion of convertible notes into Shares. Typically, the terms of convertible notes issued by early-stage companies provide that in the event of another round of financing, the holders of the convertible notes get to convert their notes into equity at a “discount” to the price paid by the new investors, i.e., they get more Shares than the new investors would for the same price. Additionally, convertible notes may have a “price cap” on the conversion price, which effectively acts as a Share price ceiling. Either way, the holders of the convertible notes get more Shares for their money than would new investors in that subsequent round. In the event that the financing is a “down round” the holders of the convertible notes will dilute existing equity holders, and even more than the new investors do, because they get more Shares for their money. Investors should pay careful attention to the amount of convertible notes that a company has issued and may issue in the future, and the terms of those notes. At present, the Company has not issued any convertible notes, but it is possible that such notes could be issued in the future.

8

If you are making an investment expecting to own a certain percentage of the Company or expecting each Share to hold a certain amount of value, it’s important to realize how the value of those Shares can decrease by actions taken by the Company. Dilution can make drastic changes to the value of each Share, ownership percentage, control, share of revenues and earnings per Share.

If you invest in the Company’s Shares, your interest will be diluted immediately to the extent of the difference between the Offering price per Share and the pro forma net tangible book value per Share after this Offering. As of December 31, 2018, the net tangible book value of the Company was $56,263 since the Company has not generated any revenue to date but had cumulative development expenses equal to $56,263 and $56,263 in paid-in-capital. That equates to a net tangible book value of $500 per Share on a pro forma basis. Net tangible book value per Share consists of Shareholders’ equity adjusted for the retained earnings (deficit), divided by the total number of Shares outstanding. The pro forma net tangible book value, assuming full subscription in this Offering, would be $500 per Share.

If the Offering is fully subscribed, the net tangible book value per Share owned by the Company’s current Shareholders will not increase. The net tangible book value per Share for new investors will remain at $500 per Share. These calculations do not include the costs of the Offering, although the costs of the Offering will be capitalized into the hotel development and as such expenses will not cause dilution.

The following tables illustrate the per Share dilution which would occur under each of the “Use of Proceeds” section scenarios shownbelow (after deducting the appropriate offering expenses for each scenario):

If the total capital raised is $4,750,000 |

Offering price per Share* | $500 |

| |

Net Tangible Book Value per Share before Offering (based on 112.526 Shares) | $500 |

| |

Increase in Net Tangible Book Value per Share Attributable to Shares Offered Hereby (based on 10,087.474 Shares) | $0 |

| |

Net Tangible Book Value per Share after Offering (based on 10,200 Shares) | $500 |

| |

Dilution of Net Tangible Book Value per Share to Purchasers in this Offering | $0 |

*Before deduction of offering expenses. The 10,087.474 Shares includes an additional 587.474 Committed Voting Shares and 9,500 Non-Voting Shares. |

|

9

If the total capital raised is $5,000,000 |

Offering price per Share* | $500 |

| |

Net Tangible Book Value per Share before Offering (based on 112.526 Shares) | $500 |

| |

Increase in Net Tangible Book Value per Share Attributable to Shares Offered Hereby (based on 10,587.474 Shares) | $0 |

| |

Net Tangible Book Value per Share after Offering (based on 10,700 Shares) | $500 |

| |

Dilution of Net Tangible Book Value per Share to Purchasers in this Offering | $0 |

*Before deduction of offering expenses. The 10,587.474 Shares includes an additional 587.474 Committed Voting Shares and 10,000 Non-Voting Shares. |

If the total capital raised is $10,000,000 |

Offering price per Share* | $500 |

| |

Net Tangible Book Value per Share before Offering (based on 112.526 Shares) | $500 |

| |

Increase in Net Tangible Book Value per Share Attributable to Shares Offered Hereby (based on 20,887.474 Shares) | $0 |

| |

Net Tangible Book Value per Share after Offering (based on 21,000 Shares) | $500 |

| |

Dilution of Net Tangible Book Value per Share to Purchasers in this Offering | $0 |

*Before deduction of offering expenses. The 20,887.474 Shares includes the additional 887.474 Committed Voting Shares and 20,000 Non-Voting Shares. |

10

If the total capital raised is $15,000,000 |

Offering price per Share* | $500 |

| |

Net Tangible Book Value per Share before Offering (based on 112.526 Shares) | $500 |

| |

Increase in Net Tangible Book Value per Share Attributable to Shares Offered Hereby (based on 30,887.474 Shares) | $0 |

| |

Net Tangible Book Value per Share after Offering (based on 31,000 Shares) | $500 |

| |

Dilution of Net Tangible Book Value per Share to Purchasers in this Offering | $0 |

*Before deduction of offering expenses. The 30,887.474 Shares includes the additional 887.474 Committed Voting Shares and 30,000 Non-Voting Shares. |

If the total capital raised is $20,000,000 |

Offering price per Share* | $500 |

| |

Net Tangible Book Value per Share before Offering (based on 112.526 Shares) | $500 |

| |

Increase in Net Tangible Book Value per Share Attributable to Shares Offered Hereby (based on 40,887.474 Shares) | $0 |

| |

Net Tangible Book Value per Share after Offering (based on 41,000 Shares) | $500 |

| |

Dilution of Net Tangible Book Value per Share to Purchasers in this Offering | $0 |

*Before deduction of offering expenses. The 40,887.474 Shares includes the additional 887.474 Committed Voting Shares and 40,000 Non-Voting Shares. |

11

If the total capital raised is $25,000,000 |

Offering price per Share* | $500 |

| |

Net Tangible Book Value per Share before Offering (based on 112.526 Shares) | $500 |

| |

Increase in Net Tangible Book Value per Share Attributable to Shares Offered Hereby (based on 50,887.474 Shares) | $0 |

| |

Net Tangible Book Value per Share after Offering (based on 51,000 Shares) | $500 |

| |

Dilution of Net Tangible Book Value per Share to Purchasers in this Offering | $0 |

*Before deduction of offering expenses. The 50,887.474 Shares includes the additional 887.474 Committed Voting Shares and 50,000 Non-Voting Shares. |

If the total capital raised is $30,000,000 |

Offering price per Share* | $500 |

| |

Net Tangible Book Value per Share before Offering (based on 112.526 Shares) | $500 |

| |

Increase in Net Tangible Book Value per Share Attributable to Shares Offered Hereby (based on 60,887.474 Shares) | $0 |

| |

Net Tangible Book Value per Share after Offering (based on 61,000 Shares) | $500 |

| |

Dilution of Net Tangible Book Value per Share to Purchasers in this Offering | $0 |

*Before deduction of offering expenses. The 60,887.474 Shares includes the additional 887.474 Committed Voting Shares and 60,000 Non-Voting Shares. |

12

If the total capital raised is $35,000,000 |

Offering price per Share* | $500 |

| |

Net Tangible Book Value per Share before Offering (based on 112.526 Shares) | $500 |

| |

Increase in Net Tangible Book Value per Share Attributable to Shares Offered Hereby (based on 70,887.474 Shares) | $0 |

| |

Net Tangible Book Value per Share after Offering (based on 71,000 Shares) | $500 |

| |

Dilution of Net Tangible Book Value per Share to Purchasers in this Offering | $0 |

*Before deduction of offering expenses. The 70,887.474 includes the additional 887.474 Committed Voting Shares and 70,000 Non-Voting Shares. |

There is not a material disparity between the price of the Shares in this Offering and the effective cost to existing Shareholders for the Voting Shares acquired by them in a transaction during the past year. However, the economic rights associated with the Voting Shares are different than with the Non-Voting Shares being sold hereunder, so there may be a material disparity in excess value created by the Voting Shareholders compared to that received by purchasers of the Non-Voting Shares hereunder.

The 1,000 Voting Shares belong to HotelierCo LLC, Mark Alden Lukas, Edward Celata and Valor Hospitality Holdings, LLC. Total funding provided by these sources from inception through December 31, 2018 amounted to $56,263 for 112.526 Voting Shares at $500 a share. Total contribution from Mark Alden Lukas will be $25,000 worth of Voting Shares. Of these Voting Shares $7,625 was invested on December 31, 2018 and the remainder was invested as a deposit for the acquisition of 119 Myrtle Avenue, West Cape May, NJ 08204 in February, 2019. The $25,000 invested from Mark Alden Lukas is 50 Voting Shares at $500 each.

Total contribution from Edward Celata will be $25,000 worth of Voting Shares. Of these Voting Shares, $7,625.00 was invested on December 31, 2018 and the remainder was invested as a deposit for the acquisition of 123 Broadway, West Cape May, NJ 08204 in February 2019. The $25,000 invested from Mark Alden Lukas is 50 Voting Shares at $500 each.

Total contribution from Valor Hospitality Holdings, LLC will be $150,000.00 worth of Voting Shares. Based on the Technical Services and Pre-Opening Agreement that has been executed, Valor Hospitality Holdings receives compensation of $120,000 for Technical Services and $150,000 for Pre-Opening Services for a total of $270,000. Valor will receive $150,000 of these fees as 300 Voting Shares worth $500 each and the remainder as cash remuneration once the funds have been raised through this Offering.

13

Total contribution from HotelierCo LLC will be worth $300,000.00. Total funding from HotelierCo from inception to December 31, 2018 was $41,013.00 in Voting Shares at $500 each. The remaining Voting Shares will be for further cash contributions and expenses of the Company at $500 per Voting Share and the remainder will be receiving Voting Shares for the development management fee at $500 per Voting Share.

The contribution for Shares acquired by HotelierCo LLC, Mark Alden Lukas, Edward Celata and Valor Hospitality Holdings, LLC is $500 per Voting Share, which is the same as the public contribution under this Offering for the Non-Voting Shares.

* * *

PLAN OF DISTRIBUTION

The Company is offering a Maximum Offering of up to $35,000,000.00 of its Shares. The Offering will require a minimum of 9,500 Shares to break escrow and distribute funds to the Company. The Company will not initially sell the Shares through commissioned broker-dealers other than North Capital, but may do so after the commencement of the offering. Any such arrangement will add to our expenses in connection with the offering. If we engage one or more additional commissioned sales agents or underwriters, we will supplement this Form 1-A/A to describe the arrangement. The Company will undertake one or more closings on a rolling basis as funds are received from investors with the initial closing occurring once $4,750,000 has been raised. After the initial closing, subsequent closings shall take place every Wednesday until the Offering is terminated, as long as on each Wednesday there are funds that have been cleared in the escrow account for investors who have cleared compliance, and as long as the Offering is completed within three years since the initial qualification.

At each closing, funds held in escrow will be distributed to the Company, and the associated Shares will be issued to all investors at the same time following each closing of the Offering. Funds tendered by investors will be kept in an escrow account until the next closing after they are received by the escrow agent. If the Company does not sell the Minimum Offering amount by 12 months from the commencement of sales of the offering, all investor funds shall be promptly returned to investors from the escrow account in accordance with the Amended and Restated Escrow Agreement (Exhibit 1A-8).

All subscribers will be instructed by the Company or its agents to transfer funds by ACH transfer directly to the escrow account established for this Offering which the escrow agent shall deposit into such escrow account and release to the Company at each closing.

Once an investor has submitted his or her subscription agreement and funds, and prior to the time of a closing by the Company in which that investor’s subscription agreement is accepted and Shares are issued, the investor has no right to a return of his or her funds for any reason, unless the subscriber does not pass compliance, his or her subscription agreement is rejected by the Company for any reason, the Company dissolves or is liquidated, or the Offering is terminated by the Company prior to any closing taking place, in which events investor funds held in escrow will promptly be refunded to each investor without interest or deductions. The Company may terminate

14

the Offering at any time for any reason at its sole discretion and may extend the Offering past the planned termination date in the absolutely discretion of the Company.

None of the Shares being sold in this Offering are being sold by existing securities holders. All of the Shares were authorized as of December 31, 2018.

After the Offering Circular has been qualified by the Securities and Exchange Commission (the “SEC”), the Company will accept tenders of funds to purchase the Shares. The Company intends to engage North Capital as escrow agent and the escrow agreement will be filed as Exhibit 1A-8 to this Form 1-A/A of which this Preliminary Offering Circular is a part.

The Company initially will use the website,www.Hotelierco.com, to provide notification of the Offering. This Preliminary Offering Circular will be furnished to prospective investors via download 24 hours per day, 7 days per week on the above-referenced website.

In order to purchase Non-Voting Shares in this Offering, you must take the following steps:

1. Visit HotelierCo.com and sign up for a user account on HotelierCo’s marketplace.

2. Verify your email address and Log in to HotelierCo’s marketplace.

3. Click on “Offerings” which will bring you to the offerings page which will display all the available opportunities to invest.

4. Select “View Details” on the offering you are interested in.

5. Review the offering details displayed on the Offering Details page and make sure to download and review all available documentation.

6. If you are ready to invest, click the “Invest” button on the Offering Details page.

7. Input the number of Non-Voting Shares that you would like to purchase.

8. Enter your banking information for ACH transfer to the offering’s escrow account and confirm your investment.

9. Carefully review and sign the subscription agreement that will be sent to you via DocuSign.

You will be required to complete a subscription agreement in order to invest. The subscription agreement includes a representation that if you are not an “accredited investor” as defined under federal securities law, you are investing an amount that does not exceed the greater of 10% of your annual income or 10% of your net worth, as described in the subscription agreement.

After an investor submits a Subscription Agreement in respect of the Offering, the Company will have thirty (30) business days from receipt of such Subscription Agreement and all other documentation required by the Company to accept the purchase by delivering written notice of acceptance to North Capital Private Securities Corporation (“NCPS” or “North Capital”) a broker-dealer registered with the SEC and a member of the Financial Industry Regulatory Authority (“FINRA”), and the investor. After the expiration of the thirty (30) business pay period, if not accepted by the Company, the attempted purchase will be deemed rejected. If accepted and upon payment in full to the Company for the Shares, pending satisfaction of the $4,750,000 minimum offering amount, the Company will issue the applicable Shares to the investor. All orders to purchase the Company’s Shares received by NCPS, whether initial or additional, and whether solicited or unsolicited, are subject to acceptance by and shall only become effective upon

15

confirmation by the Company.

The Company has agreed to pay NCPS a cash success fee equal to 0.65% on all capital raised in the Offering. In addition to the selling commissions, these fees and expenses include a accountable due diligence fee to North Capital in the amount of $10,000 in due diligence expenses it incurs.

In addition, our Manager will pay installation, licensing and servicing fees to North Capital Investment Technology, Inc., an affiliate of the Dealer Manager, pursuant to a software and services license agreement between North Capital Investment Technology, Inc. and our Manager. Such installation licensing and servicing fees shall be capped at $100,000 for this offering. Our Manager will also be responsible to pay time and material fees and expenses to North Capital Investment Technology, Inc. These time and material fees and expenses are capped at $50,000 for this offering. Investors will not be responsible for reimbursing our Manager for any of these fees paid to the Dealer Manager or North Capital Investment Technology, Inc.

In addition, our Manager will pay to North Capital, as Escrow Agent: an escrow administration fee ($500 for the first 90 days, then $100 per month) and transaction costs ($100 for each additional escrow break).

The Company may engage additional broker-dealers to perform additional services, including possibly joining a syndicate or selling group of broker-dealers for placement agent services. Additional fees to those disclosed in this Offering Circular, may be paid to these additional broker-dealers if they are retained.

This Offering will be made on a continuous basis and will commence within two calendar days after the qualification date by the Securities and Exchange Commission and continue for a period of 180 days from the date of qualification by the Commission, unless sooner terminated or extended by the Company’s CEO, or (iii) the date upon which a determination is made by the Company to terminate the Offering in the Company’s sole and absolute discretion. The Company reasonably expects the securities to be offered and sold within two years from the initial qualification date, but under no circumstances will the Offering continue if more than three years have elapsed since the initial qualification. Funds received from investors will be counted towards the Offering only if the form of payment clears the banking system and represents immediately available funds held by the Company prior to the termination of the subscription period, or prior to the termination of the extended subscription period if extended by the Company, or as otherwise set out herein.

If you decide to subscribe for any Shares in this Offering, you must deliver funds for acceptance or rejection. The minimum investment amount for a single investor is $2,500.00 for 5 Shares unless reduced on a case-by-case basis by the Company. If a subscription is rejected, all funds will be returned to subscribers within ten days of such rejection without deduction or interest. Upon acceptance by the Company of a subscription, a confirmation of such acceptance will be sent to the investor.

The Company maintains the right to accept or reject subscriptions in whole or in part for any reason or for no reason. The Company maintains the right to accept subscriptions below the minimum per

16

share investment amount in its discretion. All monies from rejected subscriptions will be returned by the Company to the investor, without interest or deductions.

This is an offering made under an exemption from registration via “Tier 2” of Regulation A. The Shares will be sold only to a person if the aggregate purchase price paid by such person is no more than 10% of the greater of such person's annual income or net worth, not including the value of his primary residence, as calculated under Rule 501 of Regulation D promulgated under Section 4(a)(2) of the Securities Act of 1933, as amended. In the case of sales to fiduciary accounts (Keogh Plans, Individual Retirement Accounts (IRAs) and Qualified Pension/Profit Sharing Plans or Trusts), the above suitability standards must be met by the fiduciary account, the beneficiary of the fiduciary account, or by the donor who directly or indirectly supplies the funds for the purchase of the Shares. Investor suitability standards in certain states may be higher than those described in this Form 1-A/A and/or Offering Circular. These standards represent minimum suitability requirements for prospective investors, and the satisfaction of such standards does not necessarily mean that an investment in the Company is suitable for such persons. Different rules apply to accredited investors.

Each investor must represent in writing that he/she/it meets the applicable requirements set forth above and in the Subscription Agreement, including, among other things, that (i) he/she/it is purchasing the Shares for his/her/its own account and (ii) he/she/it has such knowledge and experience in financial and business matters that he/she/it is capable of evaluating without outside assistance the merits and risks of investing in the Shares, or he/she/it and his/her/its purchaser representative together have such knowledge and experience that they are capable of evaluating the merits and risks of investing in the Shares. Selling broker-dealers and other persons who may participate in the offering may make additional reasonable inquiries in order to verify an investor's suitability for an investment in the Company. Transferees of the Shares may also be required to meet the above suitability standards or other standards applicable under federal and state securities law/

The Shares may not be offered, sold, transferred, or delivered, directly or indirectly, to any person who (i) is named on the list of “specially designated nationals” or “blocked persons” maintained by the U.S. Office of Foreign Assets Control (“OFAC”) at www.ustreas.gov/offices/enforcement/ofac/sdn or as otherwise published from time to time, (ii) an agency of the government of a Sanctioned Country, (iii) an organization controlled by a Sanctioned Country, or (iv) is a person residing in a Sanctioned Country, to the extent subject to a sanctions program administered by OFAC. A “Sanctioned Country” means a country subject to a sanctions program identified on the list maintained by OFAC and available at www.ustreas.gov/offices/enforcement/ofac/sdn or as otherwise published from time to time. Furthermore, the Shares may not be offered, sold, transferred, or delivered, directly or indirectly, to any person who (i) has more than fifteen percent (15%) of its assets in Sanctioned Countries or (ii) derives more than fifteen percent (15%) of its operating income from investments in, or transactions with, sanctioned persons or Sanctioned Countries.

The sale of Shares of the same class as those to be offered for the period of distribution will be limited and restricted to those sold through this Offering. Because the Shares being sold are not publicly or otherwise traded, the market for the securities offered is presently stabilized.

17

CapShare will serve as transfer agent to maintain Shareholder information.

* * *

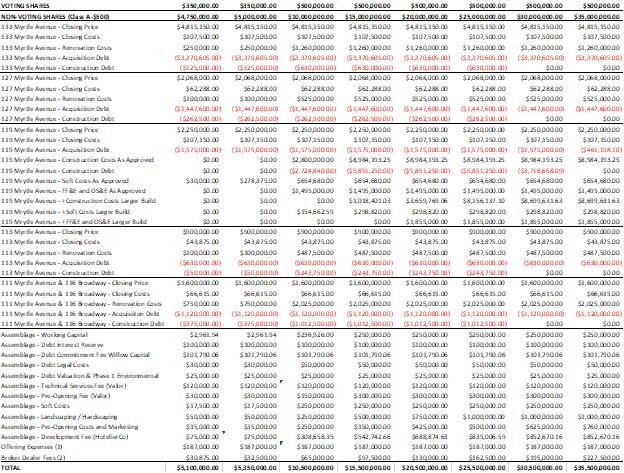

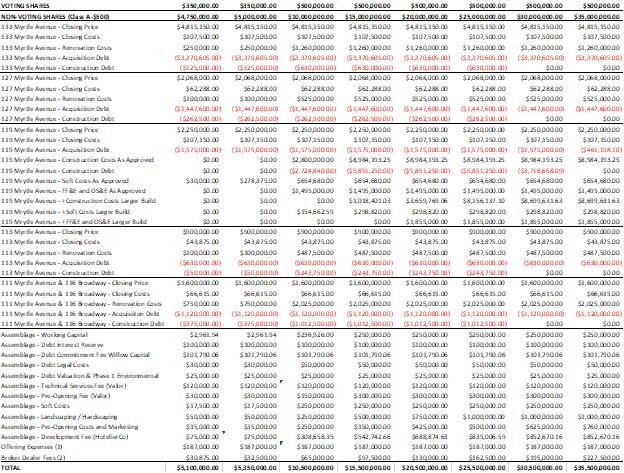

USE OF PROCEEDS

The Use of Proceeds is an estimate based on the Company’s current business plan. The Company may find it necessary or advisable to reallocate portions of the net proceeds reserved for one category to another, or to add additional categories, and the Company will have broad discretion in doing so. the Company will not close the Offering without having raised a minimum of $4,750,000 in Non-Voting Share funds. The amount reflects the expected cost to develop the hotel and cover the costs of the Offering.

The maximum gross proceeds from the sale of the Non-Voting Shares in this Offering are $35,000,000.00. The net proceeds from the Offering, assuming it is fully subscribed, are expected to be approximately $34,522,500.00 after the payment of offering costs including broker-dealer fees. All of the costs associated with the project are included in the sources and uses and will be capitalized against the development project. The estimate of the budget for offering costs is an estimate only and the actual offering costs may differ from those expected by management.

Management of the Company has wide latitude and discretion in the use of proceeds from this Offering. Ultimately, management of the Company intends to use a substantial portion of the net proceeds for construction and general working capital. At present, management’s best estimate of the use of proceeds, at various funding milestones, is set out in the chart below. However, potential investors should note that this chart contains only the best estimates of the Company’s management based upon information available to them at the present time, and that the actual use of proceeds is likely to vary from this chart based upon circumstances as they exist in the future, various needs of the Company at different times in the future, and the discretion of the Company’s management at all times.

A portion of theproceeds from this Offering may be used to compensate or otherwise make payments to officers or directors of the issuer. The officers and directors of the Company may be paid salaries and receive benefits that are commensurate with similar companies, and a portion of the proceeds may be used to pay these ongoing business expenses.

The Company reserves the right to change the use of proceeds set out herein based on the needs of the ongoing business of the Company and the discretion of the Company’s management. The Company may reallocate the estimated use of proceeds among the various categories or for other uses if management deems such a reallocation to be appropriate.

* * *

18

USE OF PROCEEDS TABLE

The Company intends to close on all the parcels of land currently under contract allowing an operation of at least 73 rooms by the Company. As noted above, the Company’s has wide discretion as to the Use of Proceeds and may choose, in its absolute discretion to use the proceeds in another manner in furtherance of the Company’s interests.

(1) The Offering Expenses are estimated at a total of $250,000.00 in the chart above, but may vary from that total. The estimated Offering Expenses in this chart include, among other things, legal fees, accounting costs, reproduction expenses, due diligence, marketing, consulting, broker-dealer retainer and advisory fees, broker-dealer out-of-pocket expenses, administrative services, other costs of blue sky compliance, and actual out-of-pocket expenses incurred by the Company selling the Shares, but which do not include fees to be paid to the escrow agent or technology provider or commissions paid to NCPS.

(2) The Company shall pay North Capital Private Securities Corporation (“NCPS”) a cash success fee equivalent to 0.65% of the gross proceeds raised in the Offering. The Company may engage the services of additional FINRA member broker-dealers as part of a selling group, and those additional broker-dealers may be paid additional fees to those disclosed

19

herein. Should such additional broker-dealers be engaged, an amendment to this Offering Circular will be filed disclosing the additional fees. See “Plan of Distribution.”

* * *

DESCRIPTION OF THE BUSINESS

General

HCo Cape May LLC (the “Company”) is a Delaware Limited Liability Company formed on July 30, 2018. The Company is raising capital in this Offering to purchase a series of real properties and to renovate an existing historic mansion creating a hotel on said property in West Cape May, New Jersey. Plans are for a series of luxury boutique accommodations including a new build hotel, to be called The Ewing, to house 23 rooms, a rooftop pool and a refined restaurant.

The Company believes that the assemblage of property will allow it to operate cash-flowing hotel rooms from acquisition, while proceeding through the development process for The Ewing. The Company will look to provide a master planned development which would require planning to be reapproved by Cape May County. The master planned development would be intended to improve layout and function of the hotel with the assemblage of land under contract.

The Hotel

The assemblage of land will allow for a series of boutique renovated mansions housing hotel rooms operated by the Company as well as a new build hotel, The Ewing. The renovated mansions will provide hotel accommodation that can be part of the overall complex, with the flexibility of whole home rental. The hotel will partner with a quality management service to provide customers with a best of Cape May experience. The hotel project involves renovating a pre-existing historic mansion and constructing a new extension that will house hotel style accommodation.

The accumulation of land is intended to be additive to The Ewing brand and operations.

About Cape May

Cape May is America’s oldest seaside resort. With over 30 miles of beautiful white sandy beaches, this charming, quaint town is perfect for a romantic getaway or a family vacation. The antithesis of the Jersey Shore — instead of nightclubs and tanning parlors, visitors will find Victorian mansions and a famous lighthouse. Cape May is home to a National Historic District with nearly 600 preserved Victorian buildings.

Cape May’s County seal remained relevant in 2018 with agriculture, fishing and maritime activities still attracting visitors to Cape May County, similar to what attracted settlers more than 325 years ago.

About Valor Hospitality Partners (“Valor”)

20

Valor is a hospitality management company. Valor provides hands-on experience developing hotels and resorts, both corporate and independent, which have been recognized as being in the best of their categories not only financially, but critically, from an exemplary guest experience. Valor develop a property strategy to target the delivery of the maximum operating performance.

The Business Plan

The Company’s business plan is to acquire the fee simple interest in seven parcels of land currently under contract by November 29, 2019. Of these, two are entitled to build a 23-room luxury boutique hotel. The Company’s business plan is to acquire an eight parcel of land currently under contract to close on January 3, 2020. Contracts for these acquisition are executed, and included in the Material Contracts section, Exhibit 1A-6.

The total cost to close on the eight parcels of land (seven on November 29, 2019 and one on January 3, 2020), including closing costs, will be approximately $12,020,578.00. To close on the land, The Company has received a term sheet from Willow Capital Group who intend to provide up to $8,143,205.00 in debt for the assemblage of the parcels of land.

The Company plans to operate approximately 48 guest rooms following the assemblage to generate revenue for The Company while renovating a pre-existing historic mansion and building out a similar structure to house the new hotel rooms to an accommodation quality well exceeding anything in the current market. The construction will also include the demolition and removal of an old building on the second parcel of land to allow the development of a zone conforming carpark for hotel guests and restaurant patrons.

Note that all projections and forecasts made by the Company are estimates only reflecting the Company’s current expectations, and are not based on actual operating results of the Company, and as a result involve risks and uncertainties. Actual results may differ materially due to a number of factors, including those discussed in the section entitled “Risk Factors” and elsewhere in this Offering Circular.

* * *

DESCRIPTION OF PROPERTY

The Company owns no real property. The Company is under contract to purchase the following real properties. For details of the purchase agreement, and further details relating to the real property to be purchased, see the Contract For Purchase and Sale of Real Estate in the Material Contracts section, Exhibit 1A-6.

The eight real properties to be purchased are:

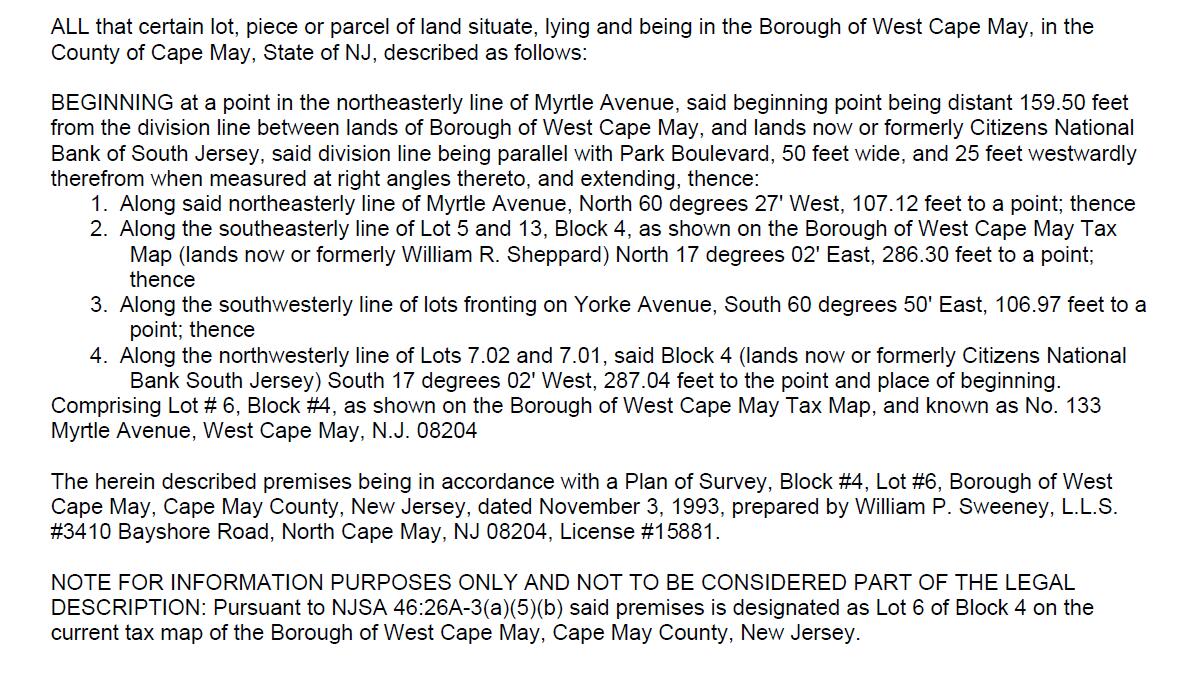

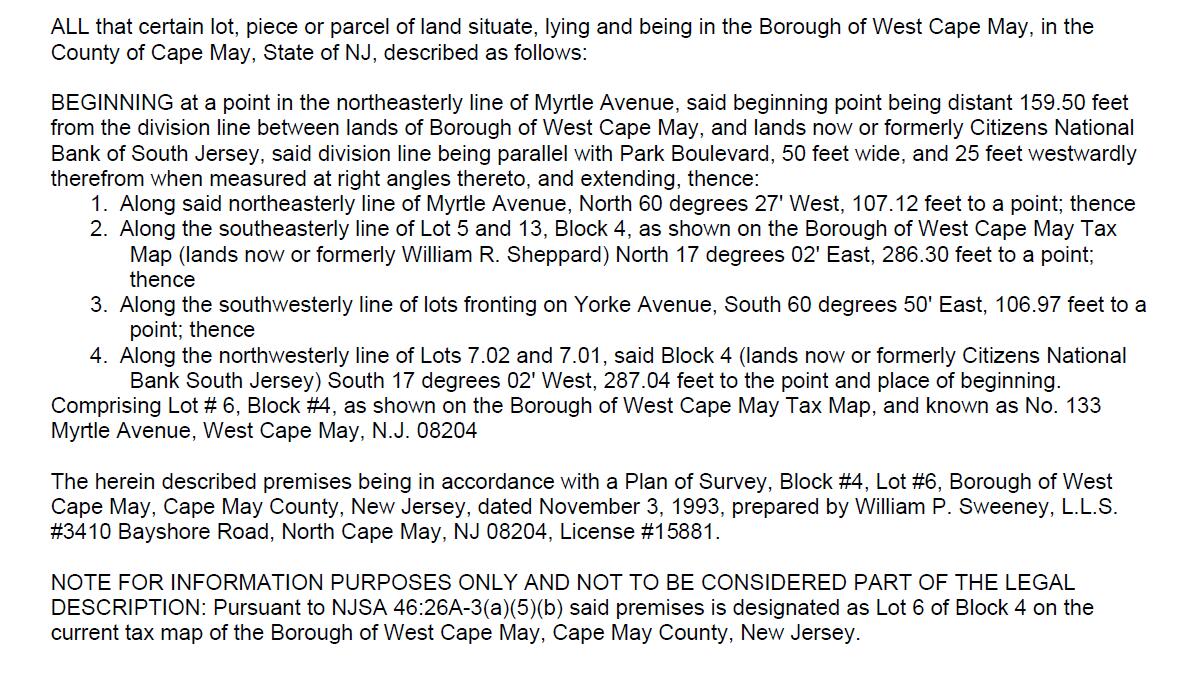

133 Myrtle Avenue, West Cape May, NJ 08204 consisting of 34,521 square feet known as Block 4, Lot 6, located in the Borough of West Cape May, Cape May County, New Jersey as well as all easements, appurtenances, rights and privileges as contained in or in any way pertaining to or beneficial thereto, and

21

127 Myrtle Avenue, West Cape May, NJ 08204 consisting of 17,932 square feet as Block 4, Lot 5, located in the Borough of West Cape May, Cape May County, New Jersey as well as all easements, appurtenances, rights and privileges as contained in or in any way pertaining to or beneficial thereto, and

119 Myrtle Avenue, West Cape May, NJ 08204 consisting of 0.55 acres known as Block 4, Lot 4, located in the Borough of West Cape May, Cape May County, New Jersey as well as all easements, appurtenances, rights and privileges as contained in or in any way pertaining to or beneficial thereto, and

113 Myrtle Avenue, West Cape May, NJ 08204 consisting of 14,375 square feet known as Block 4, Lot 3, located in the Borough of West Cape May, Cape May County, New Jersey as well as all easements, appurtenances, rights and privileges as contained in or in any way pertaining to or beneficial thereto, and

111 Myrtle Avenue, West Cape May, NJ 08204 consisting of 14,695 square feet (square feet total includes Block 4, Lot 1.01) known as Block 4, Lot 1.02, located in the Borough of West Cape May, Cape May County, New Jersey as well as all easements, appurtenances, rights and privileges as contained in or in any way pertaining to or beneficial thereto, and

115 Broadway, West Cape May, NJ 08204 consisting of 14,695 square feet (square feet total includes Block 4, Lot 1.02) known as Block 4, Lot 1.01, located in the Borough of West Cape May, Cape May County, New Jersey as well as all easements, appurtenances, rights and privileges as contained in or in any way pertaining to or beneficial thereto, and

116 Broadway, West Cape May, NJ 08204 consisting of 6,694 square feet known as Block 34, Lot 15, located in the Borough of West Cape May, Cape May County, New Jersey as well as all easements, appurtenances, rights and privileges as contained in or in any way pertaining to or beneficial thereto, and

123 Broadway, West Cape May, NJ 08204 consisting of 0.17 acres known as Block 4, Lots. 20.01 and 20.02, located in the Borough of West Cape May, Cape May County, New Jersey as well as all easements, appurtenances, rights and privileges as contained in or in any way pertaining to or beneficial thereto.

* * *

Plan of Operations

The Company's plan of operation for the 12 months following the commencement of this Offering is to complete the transaction on the land to acquire the eight West Cape May properties listed under Description of Property.

Following acquisition, 48 of the existing rooms will be renovated and put into operation by Valor Hospitality to start generating revenue for the Company as soon as practicable. While these rooms are in operation, a masterplan for the site will be prepared to determine best location for the hotel

22

services including restaurant(s), pool(s) and other guest amenities. A final set of construction plans then needs to be developed and delivered to go to market for a general contractor to price and negotiate the final construction package. The intent is to have this process completed before mid-2020. Once the final construction price is determined, the project will be underwritten based on market at the time and ensure that the investment still meets similar investment hurdles before proceeding.

The intent will be to then mobilize the construction team and general contractor to start the development of The Ewing Hotel.

23

___________________________________________________________

EXHIBIT 1A-6

MATERIAL CONTRACTS

___________________________________________________________

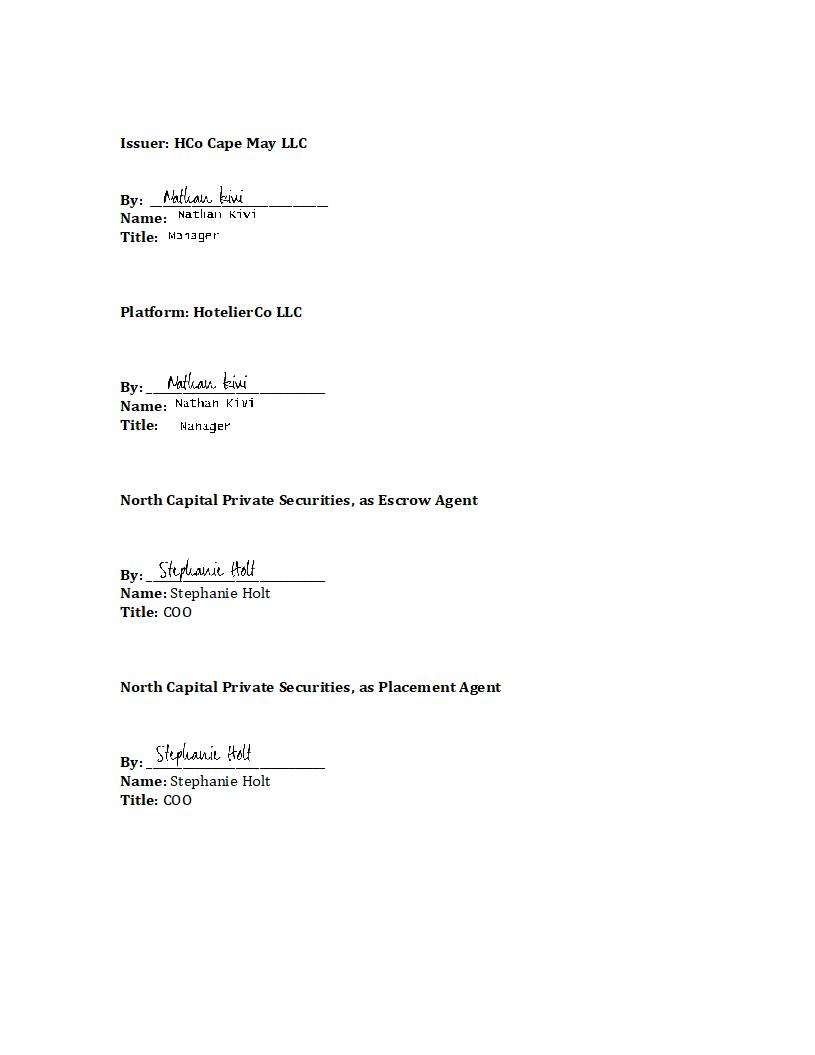

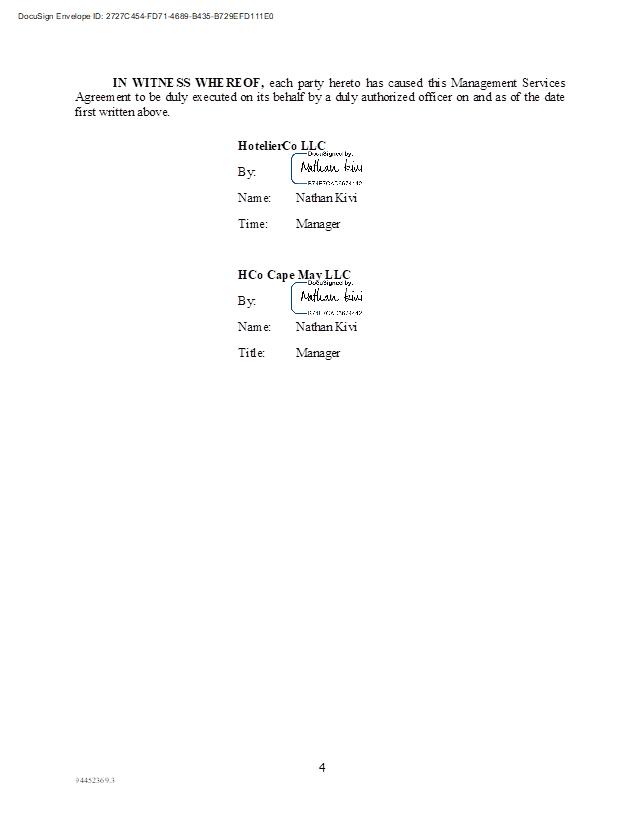

MANAGEMENT SERVICES AGREEMENT

ThisMANAGEMENT SERVICES AGREEMENT (the “Agreement”) is made and entered into as of 14 December, 2018, by and between HotelierCo LLC, a Delaware Limited Liability Company (the “Manager”), and HCo Cape May LLC, a Delaware Limited Liability Company (the “Company”).

BACKGROUND

The Company owns (or is expected to own, directly or indirectly) interests in real property, specifically a hotel contemplated to be constructed on about 119 Myrtle Avenue, West Cape May, NJ 08204 and 123 Broadway, West Cape May, NJ 08204 and potentially adjoining properties (the “Hotel Project”). It is expected that the Company will have a material role in matters concerning the design and construction of the Hotel and the retention and monitoring of the expected direct physical operator of the property (currently anticipated to be Valor Hospitality).

The Manager is currently one of several Members of the Company.

The Company desires to obtain the Manager’s expertise and management skills in connection with the Company’s role in the management and operation of the Company and, indirectly, the Hotel Project.

AGREEMENT

NOW, THEREFORE, for good and valuable consideration, the receipt and sufficiency of which is hereby acknowledged, the parties intending to be legally bound, hereby agree as follows:

1.Appointment of Manager. The Company hereby appoints the Manager as its agent with regard to Hotel Project matters. It is understood that the Manager will act in concert with the “Manager” of the Company (as defined in the Limited Liability Company Agreement of the Company (the “LLC Agreement”) and hereinafter, the “Company Manager”), with the understanding that the Company Manager may also be the Manager.

2.Authority of Manager. The Manager shall have full authority to conduct the day-to-day operations of the Company (in coordination with the Company Manager, if any). The authority of the Manager shall be subject only to the limitations set forth in this Agreement and the LLC Agreement.

3.Management Fee and Reimbursable Expenses.

A.Management Fee. The Company shall pay to the Manager a quarterly management fee (the “Management Fee”) equal to .375% (approximately 1.5% annualized) of the Company’s value, as may be assessed from time to time by the Company in consultation

with the Manager (as computed not less than annually in a manner generally consistent generally accepted accounting principles). Until and unless there is a formal assessment, the value of the Company’s assets shall be deemed to be the value of the assets contributed to or invested into the Company by its Members. The Management Fee will be paid, in arrears, on a quarterly basis (pro-rated for partial periods).

B.Reimbursable Expenses. The Company shall reimburse the Manager, without markup, interest or premium of any type, for all costs and expenses actually and reasonably incurred by the Manager relating to the services expected to be supplied under this Agreement (the “Reimbursable Expenses”). Without limiting the generality of the foregoing, the following costs and expenses arising from or relating to the Rehabilitation Business shall be Reimbursable Expenses: (i) reasonable travel expenses incurred personnel in the Manager’s employ for the purpose of making on-site visits to the Hotel Project and actual or potential service providers to the Hotel Project; (ii) outside counsel fees and expenses relating directly to matters arising out of expected services; and (iii) payments for goods or services furnished by unaffiliated parties for the benefit of the Company or its investors as a whole. Reimbursable Expenses shall not include, and Manager shall not be reimbursed by the Company for, any indirect or overhead expenses of Manager or its affiliates. For absence of doubt, items such as

(a) Company related account maintenance costs involving transfer agent(s), (b) ACH transfer fees between the Company and investors in the Company, and (c) any other cost fee or expense required or deemed beneficial for the Company’s operations, are a cost, fee or expense of the Company and not the Manager (except as specifically agreed to by the Manager in writing). To the extent (without a witten agreement to the contrary) should he Manager pay for such a cost, fee, or expense, such amount will be a reimbursable expense under this Section 3B.

4.Term; Termination.

A.Term. The term of the Agreement shall be for a period of the life of the Company unless terminated earlier on not less than one hundred twenty (120) days advanced written notice by the Company or the Manager to each other.

5.Indemnification. Each party (the “Indemnifying Party”) shall indemnify, hold harmless, and defend the other party, and its shareholders, members, directors, managers, officers, employees, affiliates, agents, successors and assigns (each of them being an “Indemnified Party”) from and against any and all claims, suits, damages, fines, penalties, liabilities and expenses (including reasonable attorneys’ fees) resulting from or arising out of the gross negligence, willful misconduct, or illegal activity of, or the breach of this Agreement by, the Indemnifying Party or its shareholders, members, directors, managers, officers, employees, affiliates, agents, successors and assigns. The obligation of any Indemnifying Party under this Section 5 shall be reduced by any insurance recovery received by the Indemnified Party with respect to the claim for which it is seeking indemnity and, if such recovery is received by the Indemnified Party after a claim for indemnity has been paid by

the Indemnifying Party, the Indemnified Party shall remit such insurance recovery to the Indemnifying Party to the extent it had previously paid such indemnity claim.

6.Additional Provisions.

A.Assignability. Neither party to this Agreement may assign its rights and obligations under this Agreement without the prior written consent of the other, which consent shall not be unreasonably withheld; provided, however, that either party may assign its rights and obligations under this Agreement to any entity with which it is affiliated or any non-affiliated entity in connection with a merger, consolidation or sale of substantially all of its assets and business. Subject to the foregoing, the terms of this Agreement shall inure to the benefit of, and shall be binding upon, the parties hereto and their respective successors and assigns.

B.Subcontracting. The Manager may carry out the duties of this Agreement, in whole or in part, through a subcontract with any entity with which it is affiliated upon prior written notice to the Company.

C.Third Party Beneficiaries. There are no third party beneficiaries of or to this Agreement.

D.Governing Law. This Agreement will be governed by and construed in accordance with the laws of the State of Delaware without regard to its principles of conflicts of laws.

E.Headings. The headings of this Agreement are for convenience only and are not intended to define, limit or describe the scope or intent of any provision of this Agreement.

F.Entire Agreement; Amendments. This Agreement contains all the terms, conditions and understandings agreed upon by the parties and no other agreements, oral or otherwise, regarding the subject matter of this Agreement will be deemed to exist or to bind either of the parties hereto. This Agreement cannot be altered, modified or changed except by another agreement signed by each party.

G.Counterparts. This Agreement may be executed in two or more counterparts, each and all of which will be deemed an original and all of which, when taken together, will constitute but one and the same instrument.

[SIGNATURE PAGE FOLLOWS]

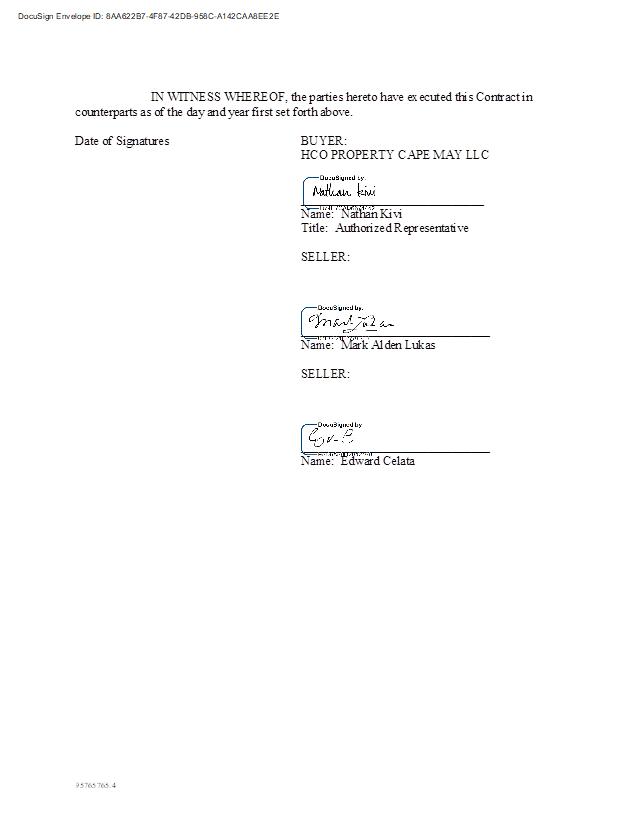

CONTRACT FOR SALE AND PURCHASE OF REAL ESTATE

THIS CONTRACT FOR SALE AND PURCHASE CONTRACT OF REAL

ESTATE (this “Contract”) is made as of this 14th day of December 2018, by and between Mark Alden Lukas, with an address of 119 Myrtle Avenue, West Cape May, New Jersey 08204, and Edward Celata, with an address of 123 Broadway, West Cape May, New Jersey 08204 (together “Seller”) and HCo Property Cape May LLC with an address of 2100 Powers Ferry Road, Suite 370, Atlanta, GA 30339, (“Buyer”).

BACKGROUND

WHEREAS, Mark Alden Lukas is the owner of a parcel of real property 119 Myrtle Avenue, West Cape May, NJ 08204 consisting of 0.55 acres known as Block 4, Lot 4, located in the Borough of West Cape May, Cape May County, New Jersey ("Parcel 1") as more particularly described in the attached Exhibit "A-1” as well as all easements, appurtenances, rights and privileges as contained in or in any way pertaining to or beneficial thereto; and

WHEREAS, Edward Celata is the owner of a parcel of real property 123 Broadway, West Cape May, NJ 08204 consisting of 0.17 acres known as Block 4, Lots. 20.01 and 20.02, located in the Borough of West Cape May, Cape May County, New Jersey ("Parcel 2") as more particularly described in the attached Exhibit "A-2” as well as all easements, appurtenances, rights and privileges as contained in or in any way pertaining to or beneficial thereto; and

WHEREAS, Parcel 1 and Parcel 2 shall be together referred to herein as the

“Property” and

WHEREAS, “Seller” shall collectively refer to Mark Alden Lukas and Edward Celata unless the context clearly indicates otherwise; and

WHEREAS, Seller desires to sell and Buyer desires to buy the Property for the consideration and on the terms and conditions hereinafter set forth.

NOW THEREFORE, in consideration of the promises and the mutual covenants and conditions herein contained, and intending to be legally bound hereby, Seller hereby agrees to sell and Buyer hereby agrees to buy the Property in accordance with the following terms and conditions:

1.Purchase Price: Deposit. The purchase price for the Property shall be Two Million Two Hundred Fifty Thousand ($2,250,000.00) Dollars ("Purchase Price"). The Purchase Price shall be payable by Buyer to Seller as follows:

a.With respect to Parcel 1, an earnest money deposit of Twenty Five Thousand ($25,000.00) Dollars ("Deposit") shall be delivered in escrow to Buyer's attorneys,

Drinker Biddle & Reath LLP, (in such capacity, "Escrow Agent") within five (5) business days after the date of this Contract, which shall be deposited in an interest-bearing account.

b.With respect to Parcel 2, an earnest money deposit of Twenty Five Thousand ($25,000.00) Dollars ("Deposit") shall be delivered in escrow to Buyer's attorneys, Drinker Biddle & Reath LLP, (in such capacity, "Escrow Agent") within five (5) business days after the date of this Contract, which shall be deposited in an interest-bearing account.

c.The balance of the Purchase Price (subject to prorations and adjustments set forth herein) shall be payable on the date of Closing of title to the Property by cashier's or certified check payable to Seller or by attorney trust fund or title company check payable to Seller, or, at Seller's election, by wire transfer to a financial institution designated by Seller.

d.All parties agree to be bound by the attached “Joinder by Escrow Agent” to be executed by Escrow Agent following the parties execution of this contract.

e.The Purchase Price shall be allocated between Parcel 1 and Parcel 2 as follows:

Parcel 1 $1,550,000.

Parcel 2 $700,000.

2.Survey. Within sixty (60) days from the date of this Contract, Buyer shall obtain a current boundary survey of the Property, together with a legal description thereof, prepared by a land surveyor licensed in the State of New Jersey and certified to Buyer and to the Title Company (as hereinafter defined) as made in accordance with the Minimum Standard Detail Requirements for Land Title Surveys (1997) jointly adopted by the American Land Title Association and the American Congress of Surveying and Mapping (the "Survey"). Upon receipt of the Survey, the description of the Property set forth in Exhibits "A-1” and “A-2" shall be deemed supplemented and such land as described on the Survey shall constitute the Property. Seller shall provide to Buyer all environmental reports, surveys, titles, and similar materials relating to the Property ("Seller's Materials"), as exist and are in Seller's or their agents' possession.

3.Title Evidence, Title and Survey Review. Buyer shall, at Buyer’s expense, order an owner’s title insurance commitment for the Property (“Commitment”) from a reputable title insurance company licensed in New Jersey (“Title Company”). Within fifteen (15) days from the date on which Buyer has received both the Commitment and the Survey, but not more than ninety (90) days from the date hereof ("Title Objection Period"), Buyer shall provide true copies to Seller and shall examine the Survey and the Commitment to determine the nature of any defects in title and/or state of facts disclosed by the Survey. If the title to all or part of the Property is subject to liens, encroachments, encumbrances, easements, conditions or restrictions not satisfactory to Buyer, or if the survey is in any way unsatisfactory to Buyer (in each case a “Defect”), Buyer shall give written notice to Seller of its objections

to the state of the title or the survey prior to the expiration of the Title Objection Period and Seller shall have ten (10) days after receipt of such notice in which to proceed diligently to remedy or remove any such Defect; provided, that where a lien or encumbrance can be satisfied and removed by the payment of money, and the proceeds of sale will be sufficient for that purpose, Seller may pay and satisfy such liens or encumbrances with closing proceeds. Except for Defects arising or appearing of

record after Buyer’s receipt of the Commitment or Survey, as applicable, (in which case, notwithstanding anything to the contrary, Buyer may, at its option, (i) elect to have Seller cure such Defect at Seller’s cost or (ii) terminate the Contract) any defect to which Buyer does not object to on or before the expiration of the Title Objection Period shall be deemed waived. In the event Seller fails to remove any defect objected to by Buyer as provided above, Buyer shall have the option of either accepting the title subject to such defect or terminating this Contract and receiving a refund of the Deposit, whereupon neither party shall have any further rights or obligations hereunder.

4.Inspection Period.

a.Buyer shall have until 5:00 p.m. Eastern Standard Time on the 60th day after the date of this Contract (“Inspection Period”) to inspect and review, at Buyer's sole cost and expense (“Due Diligence Review”) the condition of the Property including without limitation the plumbing, electrical, heating and air conditioning systems and the environmental condition of the Property and whether the building located thereon is suitable for Buyer’s intended use. Seller shall provide reasonable access to the Property to Buyer and Buyer's agents and employees during the Inspection Period, subject to the terms and conditions herein.

b.Buyer shall be responsible for any and all losses, damages, charges and other costs associated with its Due Diligence Review and Buyer covenants and agrees to return the Property to the same condition as existed prior to any inspections and studies. Buyer agrees not to allow any liens to arise against the Property as a result of such inspections and studies or Buyer's access to the Property and agrees to indemnify, defend and hold Seller harmless from and against any and all claims, charges, actions, costs, expenses (including attorneys fees), suits, damages, injuries, or other liabilities which arise, either directly or indirectly, from Buyer's or its agent's, employee's or contractor's entry onto the Property or for any testing or inspections related thereto. This provision shall survive Closing or termination of this Contract for any reason.

c.Prior to the expiration of the Inspection Period, Buyer may terminate this Contract, in its sole and absolute discretion, upon notice to Seller of Buyer's decision to terminate this Contract because of unsatisfactory results of the Due Diligence Review. Upon such termination, the Deposit shall be returned to Buyer, and thereafter Seller and Buyer shall have no further obligations or liabilities one to the other hereunder. If Buyer fails to deliver to Seller any written notice of termination prior to the expiration of the Inspection Period, and if this Contract is not otherwise terminated pursuant to the provisions hereof, then this Contract shall remain in full force and effect and Buyer shall be deemed to have accepted the

condition of and state of title to the Property, as of 5:01 P.M. Eastern Standard Time on the last day of the Due Diligence Period.

d.Upon the expiration of the Inspection Period, the sole obligation of the Seller with respect to the physical condition of the Property shall be to deliver possession of the Property to Buyer in substantially the same physical condition (excluding normal wear and tear and casualty damage) as existed on the last day of the Inspection Period and Buyer has agreed to close title on the Property on the closing date, except as set forth herein.

5.Intentionally Omitted.

.6.Maintenance Prior to Closing. Until the time of Closing, each Seller shall, as the portion of the Property owned by it: (a) maintain the Property in substantially the same manner as it is currently being maintained and operated; (b) not make any substantial alterations or changes to the Property other than ordinary and necessary maintenance and repairs, without Buyer's prior written approval; (c) maintain in effect all policies of Property, casualty and liability insurance or similar policies of insurance, with no less than the limits of coverage now carried with respect to the Property; (d) timely pay all taxes, assessments, utility charges and rents and other charges affecting the Property; and (e) not to appeal any Property tax assessments. Notwithstanding the provisions of (a) through (e) above, Seller may change or modify any rights, obligations or contracts relating to the Property as necessary or proper in the ordinary course of conduct of the Seller's business upon prior notice to Buyer and approved by Buyer, not to be unreasonably withheld or delayed. Nothing contained herein shall prevent Seller from acting to prevent loss of life, personal injury or Property damage in emergency situations, or prevent Seller from performing any act with respect to the Property which may be required by any applicable law, rule or governmental regulation. Until the time of Closing, Seller shall not enter into any leases with respect to any portion of the Property without Buyer's prior written consent.

7.Seller's Representations. Each Seller, as to itself and the portion of the Property owned by it represents and warrants to Buyer that:

a.Seller holds good and marketable fee simple title to the Property and there are no leases, contracts or other agreements with respect to the sale or use of the Property with any other party.

b.The Seller has full, unconditional power, authority and right to enter into this Contract, to perform, carry out and fulfill its obligations hereunder, and, in connection with the transaction contemplated hereby, to convey the Property to the Buyer as herein provided and no approval of any Court is a prerequisite thereto. Neither the execution of, nor the delivery of this Contract, nor the performance hereof by the Seller, will award, judgment or decree to which the Seller is or has been a party, or result in a breach of any term, condition or provision of or constitute a default under any contract, indenture, mortgage or deed of trust to which the Seller is a party or by which Seller is bound, or conflict with, violate or result in the breach of any law binding upon the Seller or result in the creation or imposition of any

security interest, mortgage lien, change or encumbrance upon the Seller’s properties or assets. Except as contemplated in this Contract, no consent, authorization or approval of, or exemption by, any governmental or public body or authority that has not been obtained is required to enable the Seller to execute, deliver or perform this Contract. Seller is duly formed in its sale of formation and is validly existing in good standing.

c.Seller is not aware of nor has received any notice of any violations of any law, ordinance, order or requirement of any governmental body with respect to the Property.

d.Seller has no knowledge of any pending or threatened condemnation proceeding, taking by eminent domain or special assessment with respect to the Property, Seller or any third party relating to or affecting the Property.

e.There are no liabilities of any kind (including Federal, state, county, municipal or other governmental or quasi-governmental law) which could or would affect or result in any claim, lien, judgment or other encumbrance upon or against the Property (which could not be fully satisfied as of the Closing Date) or the Buyer’s rights under this Contract except as state and local income tax returns in connection with the Property, and there are no claims for any deficiencies pending, or to the Seller’s knowledge, any basis for such a claim by any taxing authority.

f.The Seller will not create or suffer to exist any manner of lien or encumbrance upon or affecting title to the Property that would not be satisfied at Closing on the Closing Date.

g.The Property and the use thereof does not violate any Federal, state, county, municipal or other governmental or quasi-governmental law, ordinance code, order, regulation, moratorium or other requirement.

h.Title to the Property has not been acquired or derived by adverse or color of title possession, Martin Act proceedings or any act for sale of land for the non-payment of municipal taxes or assessments.