FOURTH QUARTER AND FULL YEAR 2024 INVESTOR PRESENTATION

FORWARD-LOOKING STATEMENTS | DISCLAIMER Trinity Capital Inc. (the “Company”) cautions that this presentation may contain forward-looking statements that are based on current expectations and assumptions about future events, and which are not based in historical fact. The forward-looking statements in this presentation are based on current conditions as of the date of this presentation, and include, but are not limited to, statements regarding our financial objectives, beliefs, strategies, anticipated future operating results and cash flows, operating expenses, investment originations and performance, available capital, and payment of future dividends and stockholder returns. Although our management believes that the expectations reflected in any forward-looking statements are reasonable, actual results could differ materially from those expressed or implied in the forward-looking statements. By their nature, these forward-looking statements involve numerous assumptions, uncertainties and risks, both general and specific. The risk exists that these statements may not be fulfilled. We caution readers of this presentation not to place undue reliance on these forward-looking statements, as a number of factors could cause future Company results to differ materially from these statements. Forward-looking statements may be influenced in particular by factors such as fluctuations in interest rates and stock indices, the effects of competition in the areas in which we operate, and changes in economic, political and regulatory conditions. When relying on forward-looking statements to make decisions, investors should carefully consider the aforementioned factors as well as other uncertainties and events. Historical results discussed in this presentation are not indicative of future results. The information disclosed in this presentation is made as of the date hereof and reflects Trinity Capital Inc.’s current assessment of its financial performance for the most recent period reported. Actual financial results filed with the Securities and Exchange Commission in the future may differ from those contained herein in the event of additional adjustments recorded prior to the filing of its financial statements. The information contained in this presentation should be viewed in conjunction with Trinity Capital Inc.'s most recently filed Quarterly Report on Form 10-Q, Annual Report on Form 10-K or Registration Statement on Form 424B1. We undertake no obligation to update the information contained herein to reflect subsequently occurring events or circumstances, except as required by applicable securities laws and regulations. This presentation does not constitute a prospectus and should under no circumstances be understood as an offer to sell or the solicitation of an offer to buy our common stock or any other securities nor will there be any sale of the common stock or any other securities referred to in this presentation in any state or jurisdiction in which such offer, solicitation or sale would be unlawful prior to the registration or qualification under the securities laws of such state or jurisdiction. Nothing in these materials should be construed as a recommendation to invest in any securities that may be issued by Trinity Capital Inc. or as legal, accounting or tax advice.

COMPANY OVERVIEW

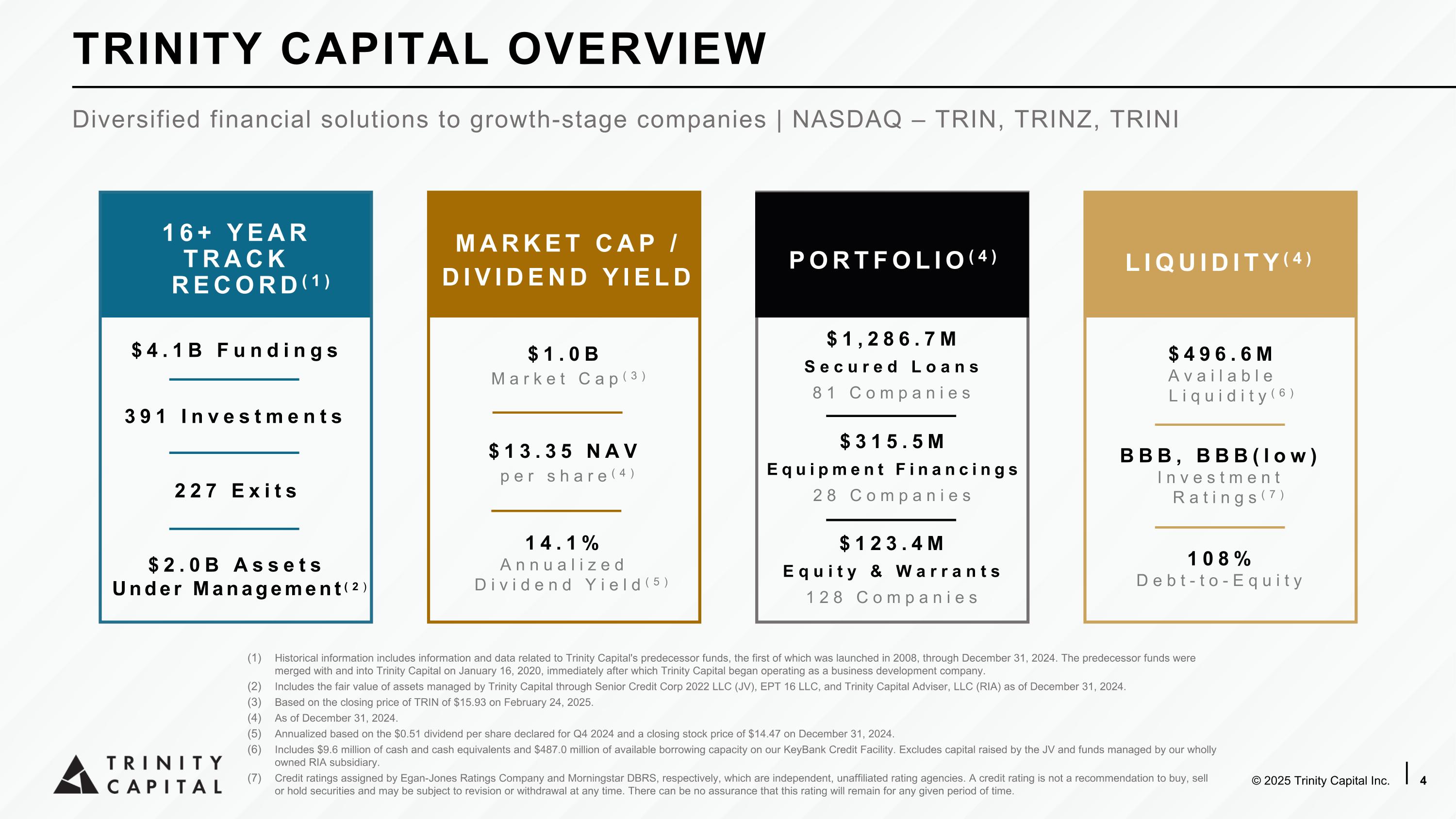

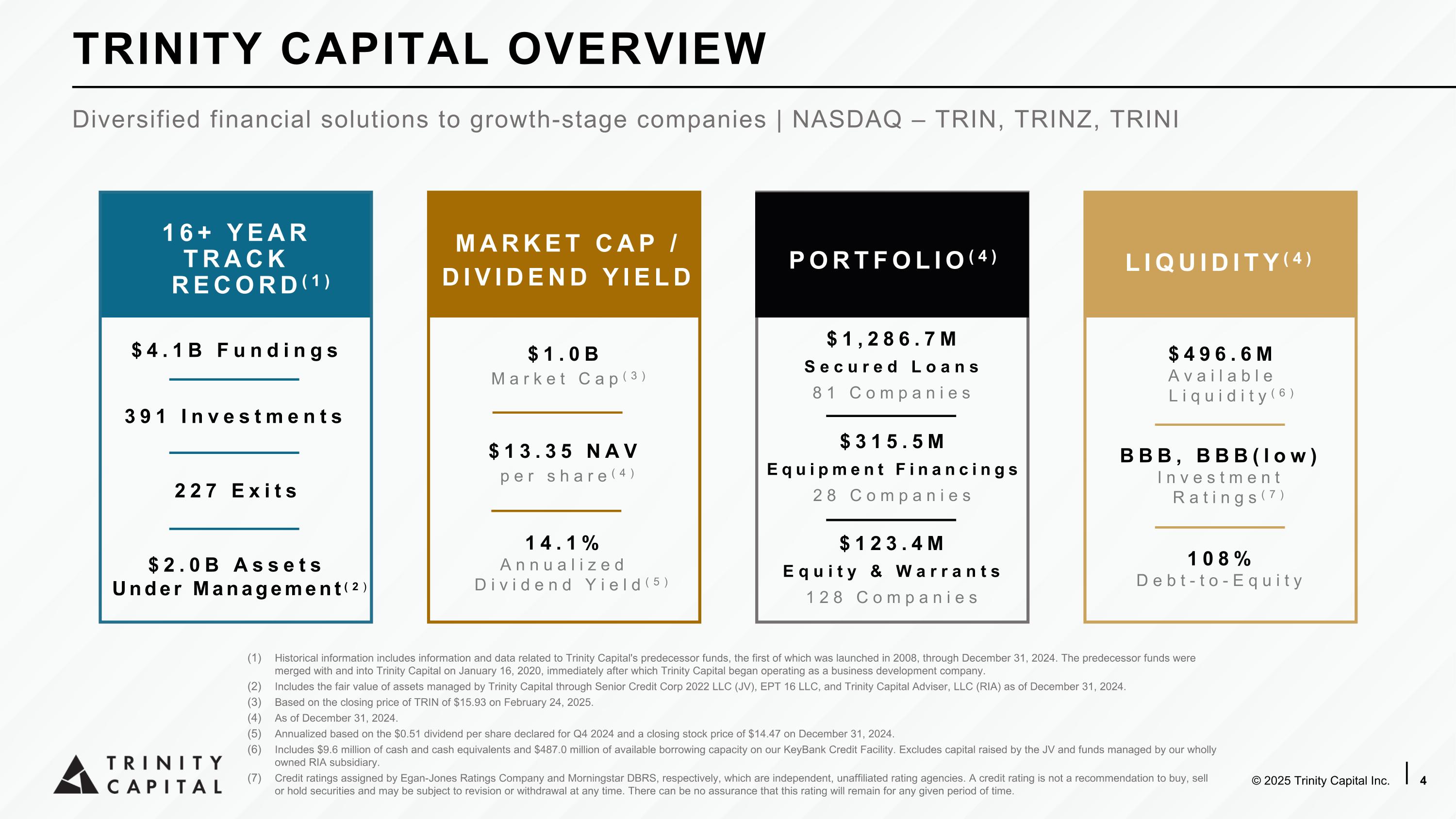

Historical information includes information and data related to Trinity Capital's predecessor funds, the first of which was launched in 2008, through December 31, 2024. The predecessor funds were merged with and into Trinity Capital on January 16, 2020, immediately after which Trinity Capital began operating as a business development company. Includes the fair value of assets managed by Trinity Capital through Senior Credit Corp 2022 LLC (JV), EPT 16 LLC, and Trinity Capital Adviser, LLC (RIA) as of December 31, 2024. Based on the closing price of TRIN of $15.93 on February 24, 2025. As of December 31, 2024. Annualized based on the $0.51 dividend per share declared for Q4 2024 and a closing stock price of $14.47 on December 31, 2024. Includes $9.6 million of cash and cash equivalents and $487.0 million of available borrowing capacity on our KeyBank Credit Facility. Excludes capital raised by the JV and funds managed by our wholly owned RIA subsidiary. Credit ratings assigned by Egan-Jones Ratings Company and Morningstar DBRS, respectively, which are independent, unaffiliated rating agencies. A credit rating is not a recommendation to buy, sell or hold securities and may be subject to revision or withdrawal at any time. There can be no assurance that this rating will remain for any given period of time. TRINITY CAPITAL OVERVIEW Diversified financial solutions to growth-stage companies | NASDAQ – TRIN, TRINZ, TRINI 16+ Year track� Record(1) PORTFOLIO(4) LIQUIDITY(4) 391 Investments 227 Exits $2.0B Assets� Under Management(2) MARKET CAP / DIVIDEND YIELD 14.1%�Annualized � Dividend Yield(5) $1.0B � Market Cap(3) $13.35 NAV � per share(4) $1,286.7M Secured Loans 81 Companies $315.5M Equipment Financings 28 Companies $123.4M Equity & Warrants 128 Companies $4.1B Fundings $496.6M�Available Liquidity(6) BBB, BBB(low)�Investment Ratings(7) 108%�Debt-to-Equity

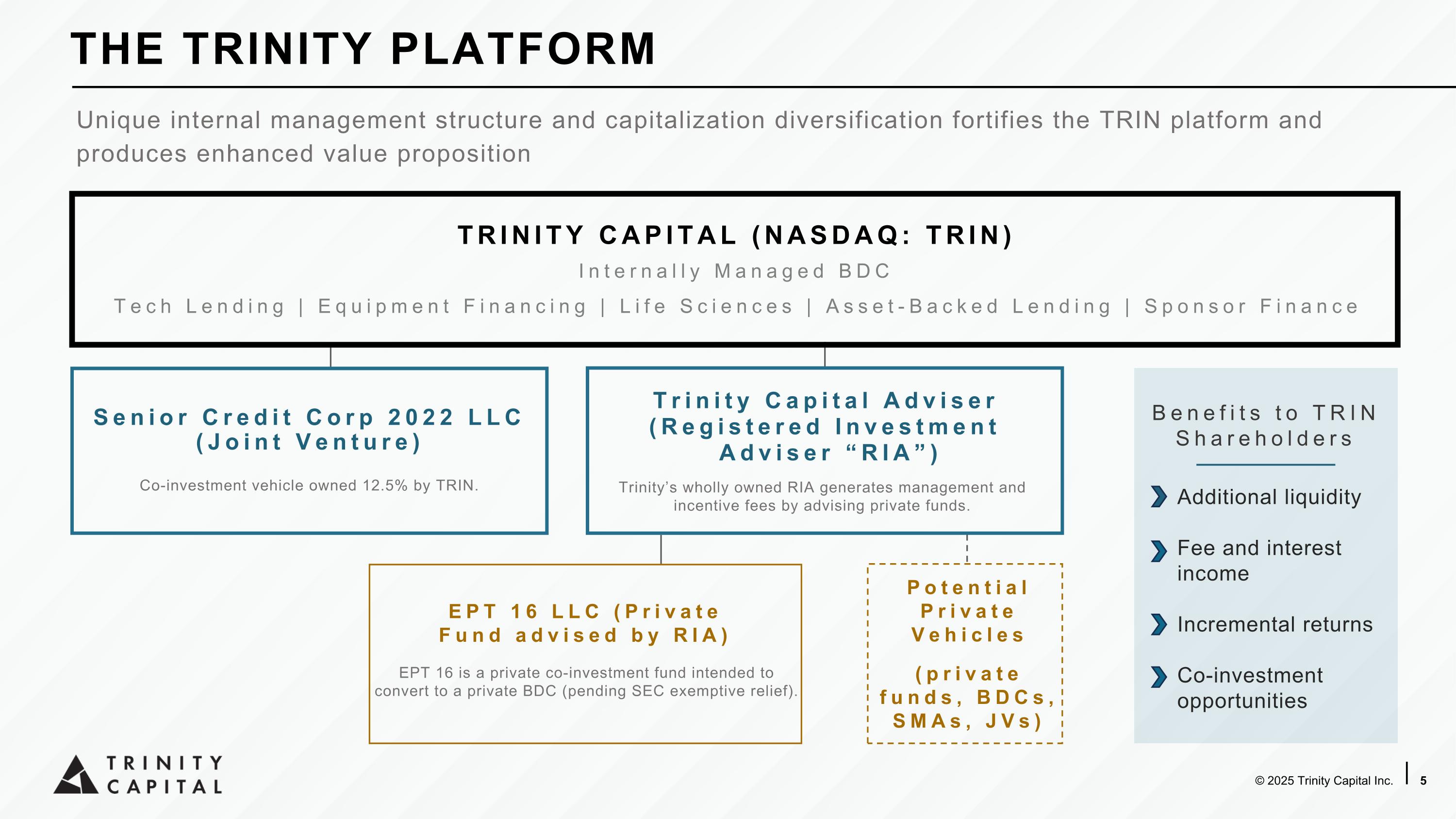

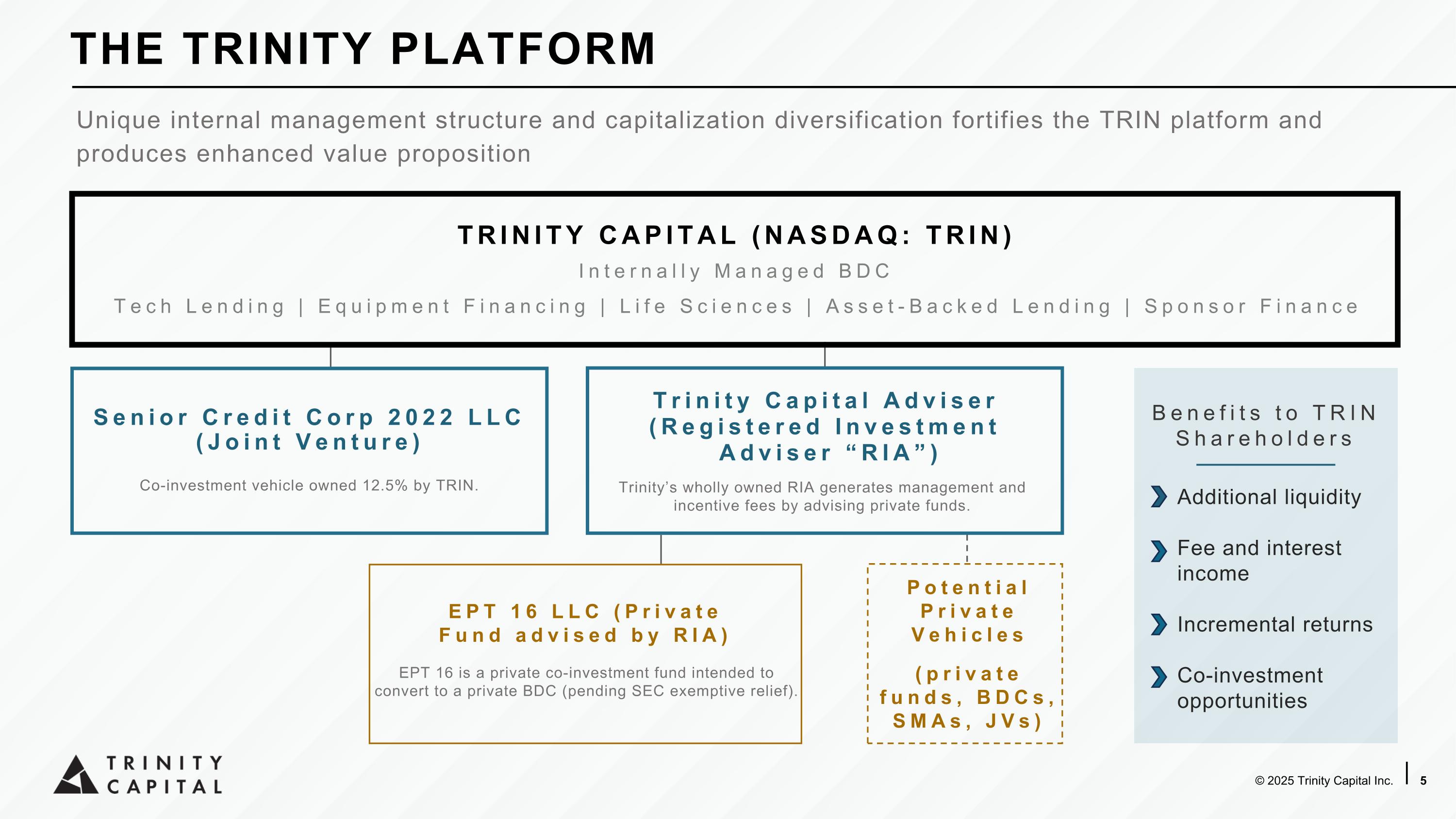

THE TRINITY PLATFORM Unique internal management structure and capitalization diversification fortifies the TRIN platform and produces enhanced value proposition Additional liquidity Fee and interest income Incremental returns Co-investment opportunities TRINITY CAPITAL (NASDAQ: TRIN) Internally Managed BDC Tech Lending | Equipment Financing | Life Sciences | Asset-Backed Lending | Sponsor Finance Senior Credit Corp 2022 LLC (Joint Venture) Co-investment vehicle owned 12.5% by TRIN. Potential Private Vehicles (private funds, BDCs, SMAs, JVs) EPT 16 LLC (Private Fund advised by RIA) EPT 16 is a private co-investment fund intended to convert to a private BDC (pending SEC exemptive relief). Trinity Capital Adviser (Registered Investment Adviser “RIA”) Trinity’s wholly owned RIA generates management and incentive fees by advising private funds. Benefits to TRIN Shareholders

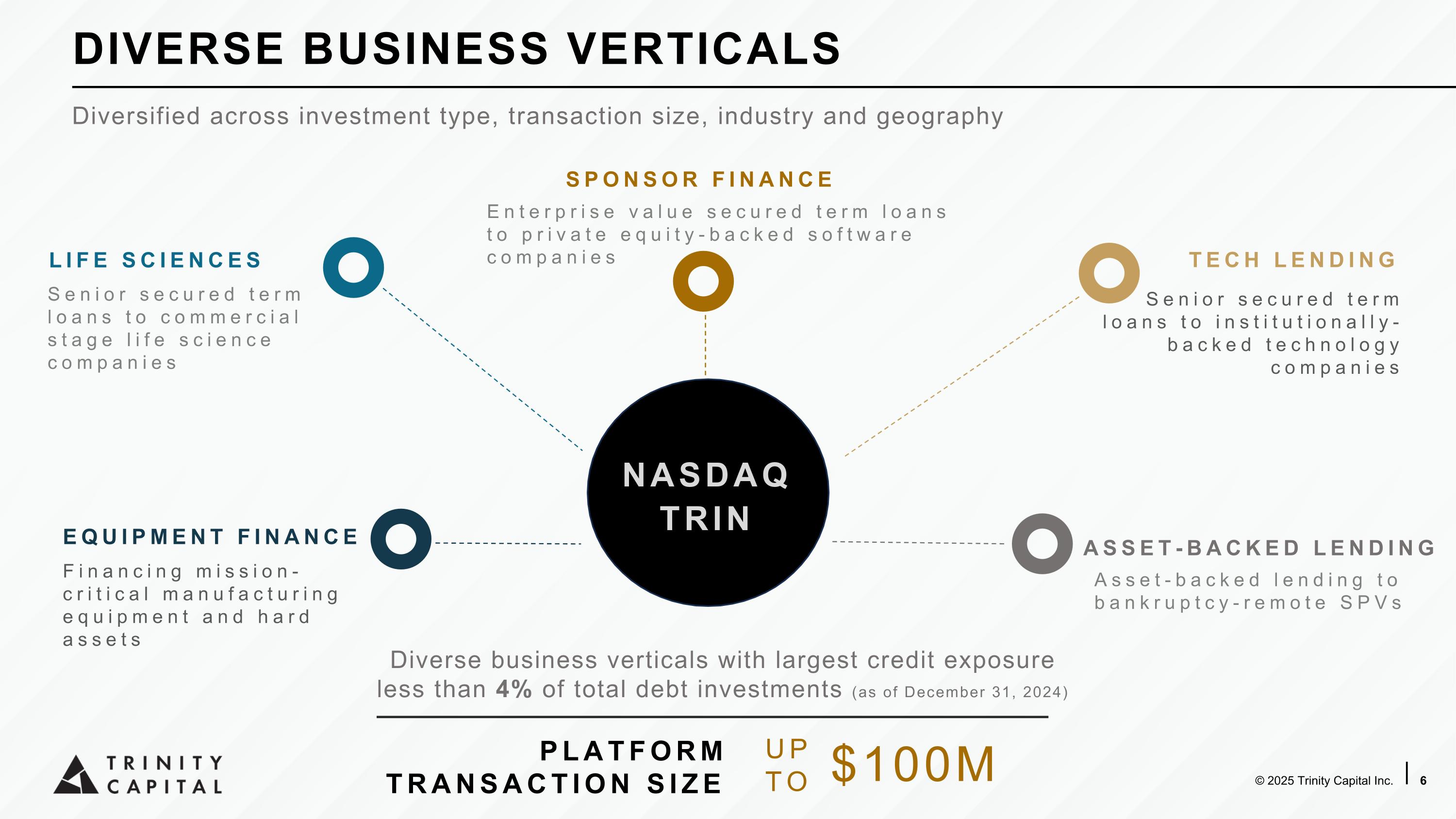

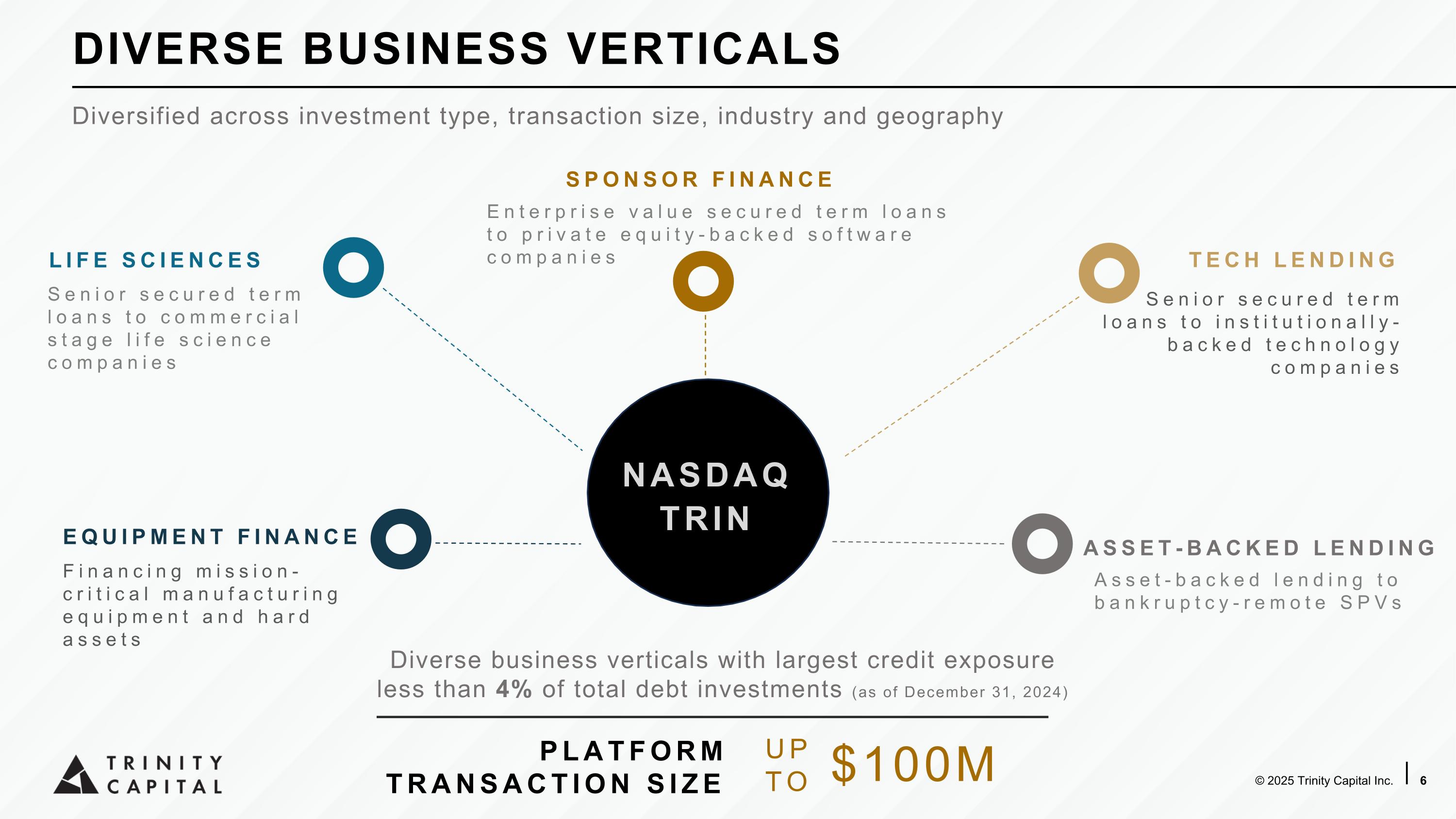

DIVERSE BUSINESS VERTICALS Diversified across investment type, transaction size, industry and geography SPONSOR FINANCE LIFE SCIENCES TECH LENDING EQUIPMENT FINANCE Asset-backed LENDING NASDAQ TRIN Senior secured term loans to institutionally-backed technology companies Financing mission-critical manufacturing equipment and hard assets Senior secured term loans to commercial stage life science companies Enterprise value secured term loans to private equity-backed software companies Asset-backed lending to bankruptcy-remote SPVs UP TO $100M Diverse business verticals with largest credit exposure less than 4% of total debt investments (as of December 31, 2024) PLATFORM TRANSACTION SIZE

With unique capitalization and diversified businesses, we aim to provide investors with stable and consistent returns by offering access to the private credit market Internally Managed BDC Aligned interests between employees and shareholders Management company and a pool of diversified assets Robust & �Scalable Platform Robust and scalable systems for origination, underwriting and monitoring Separation of origination, underwriting and portfolio management duties aids �“positive feedback” loop 88 dedicated professionals with a unique culture built over 16+ years WHY IS TRINITY DIFFERENT Diversified Business Verticals Tech Lending | Life Sciences | Asset-Backed Lending | Sponsor Finance | Equipment Financing Diversification across investment type, industry and geography We maintain full ownership and control of our deal pipeline

Broad origination pipeline of private equity and venture capital firms, tech banks, former clients, service providers and inbound interest Established intercreditor agreements with the banks. Our capital in combination with bank debt results in a lower blended cost to our customers Relationships with top market share banks catering to majority of private equity- and venture capital-backed companies ENTRENCHED INDUSTRY RELATIONSHIPS First-call relationships with top industry-partners cultivated over years of experience

Investor Syndicate Revenue & �Gross Margins Business �Model Includes historical information of Trinity Capital's predecessor funds, the first of which was launched in 2008, through December 31, 2024. Past performance is not indicative of future results. Investment results may vary significantly over any given time period. FINANCIALS DEBT STRUCTURE CAPITALIZATION MANAGEMENT PRODUCT & MARKET Product Differentiation Market �Potential Industry & �Start-up �Experience BOD Make-up Fund Vintage & Dry Capital Collateral Cash Life UNDERWRITING APPROACH AND RISK MITIGATION Disciplined investment approach keeps our annualized loss rate at 23 bps, which is more than offset by realized gains on warrant and equity investments(1)

WHOOP is a leading designer for wearable health and fitness trackers that capture biometric data shown to have the most impact on your health. Investor Syndicate SoftBank Vision Fund, IVP, Cavu Ventures, NextView Ventures Select Examples TECH LENDING Senior secured term loans to institutionally-backed technology companies Empower Finance is helping people find financial security through machine learning models that evaluate creditworthiness. Investor Syndicate Sequoia Capital, Blisce, Icon Ventures, Initialized Capital Term Loans 01 SECURED LOANS Lien on all assets including IP 02 BACKED BY INSTITUTIONAL CAPITAL Companies have raised significant equity 03 GROWTH CAPITAL Debt proceeds used to fuel growth and scale business

Equipment Financings 02 01 03 EQUIPMENT FINANCING Financing mission-critical manufacturing equipment and hard assets Athletic Brewing brews great tasting Non-Alcoholic Craft Beer made with high-quality, all-natural ingredients and low calories for the active lifestyle. Investor Syndicate AG Ventures, Valency Capital, TRB Advisors Rocket Lab delivers reliable launch services, spacecraft components, satellites and other spacecraft to make it faster and easier to access space. Investor Syndicate BlackRock, Space Capital, Vector Capital Select Examples COMPANIES WITH �CAPEX REQUIREMENTS Mission-critical hard assets JUST-IN-TIME CAPITAL Available as needed to meet growing equipment needs EQUIPMENT COLLATERAL Secured by perfected lien on equipment collateral

Term Loans 02 LIFE SCIENCES Senior secured term loans for growth capital to commercial stage life sciences companies RxAnte is a leading predictive analytics and clinical services company dedicated to improving medications use and health outcomes. Investor Syndicate First Trust Capital Partners, UPMC Enterprises Select Examples 01 SECURED LOANS Lien on all assets including IP STRONG CLINICAL DATA PROFILE Established or clear “line of sight” to favorable reimbursement 03 REGULATORY COMPLIANCE Companies received regulatory (FDA or EMA) approval or late-stage clinical trials Shoulder Innovations is a shoulder arthroplasty-focused medical device development company that designs and commercializes products that have the potential for improved patient care and reduced cost to the healthcare system. Investor Syndicate Gilde Healthcare Partners, US Venture Partners, Lightstone, Aperture Venture Partners

ASSET-BACKED LENDING Asset-backed lending to bankruptcy-remote SPVs Denim provides comprehensive financial tools, including invoice audit, a document inbox, TMS integrations, and smart automation technologies to streamline your back-office operations. Investor Syndicate Pelion Venture Partners, Crosslink Capital, Anthemis, FJ Labs Parafin empowers small businesses by providing them customized, embedded financial products through the platforms they already use, such as on-demand marketplaces, point-of-sales solutions, and vertical SaaS. Investor Syndicate GIC, Thrive Capital, Ribbit Capital Select Examples Revolving Credit Lines 01 REVOLVING CREDIT LINE Based on eligible assets in SPV 03 ASSET-BACKED COLLATERAL Borrowing base is comprised of cash flow positive assets 02 BACKED BY INSTITUTIONAL CAPITAL Companies have raised significant equity

01 03 02 Enterprise value secured term loans to private equity-backed software companies SPONSOR FINANCE ServiceTrade streamlines service and project operations to reduce administrative costs, optimizes field performance to increase revenue per technician, and boosts sales and client retention to grow margins. Investor Syndicate JMI Equity Impel offers auto dealers, wholesalers, OEMs, and marketplaces the industry’s most advanced AI-powered customer lifecycle management platform. Investor Syndicate Silversmith Capital Partners Select Examples Term Loans 01 SENIOR SECURED LOANS Lien on all assets including IP MAJORITY CONTROL BY PRIVATE EQUITY Significant cash equity cushion relative to senior debt 03 ESTABLISHED BUSINESSES Well positioned and growing at above market rate, with a fully funded plan

FINANCIAL HIGHLIGHTS

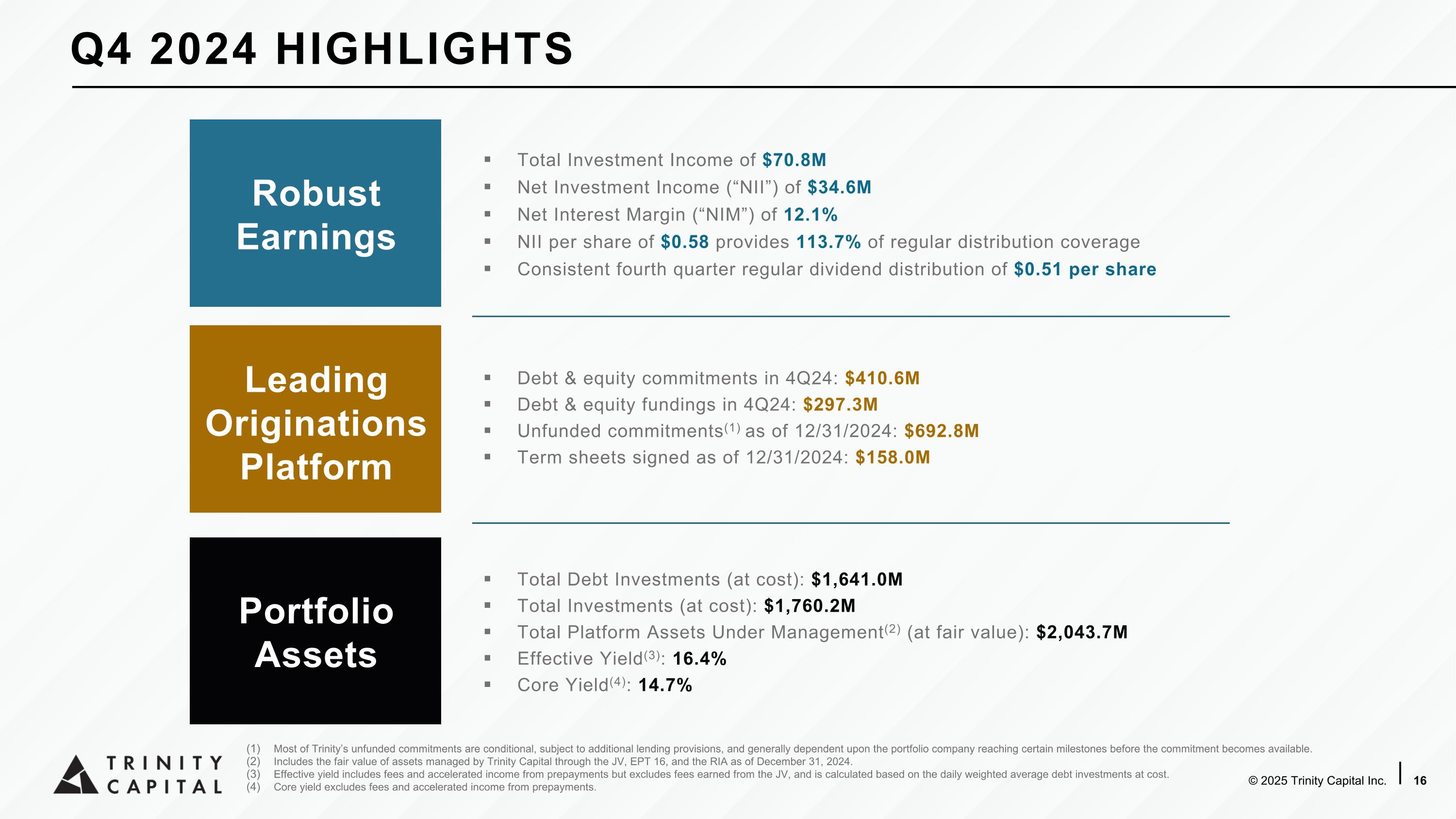

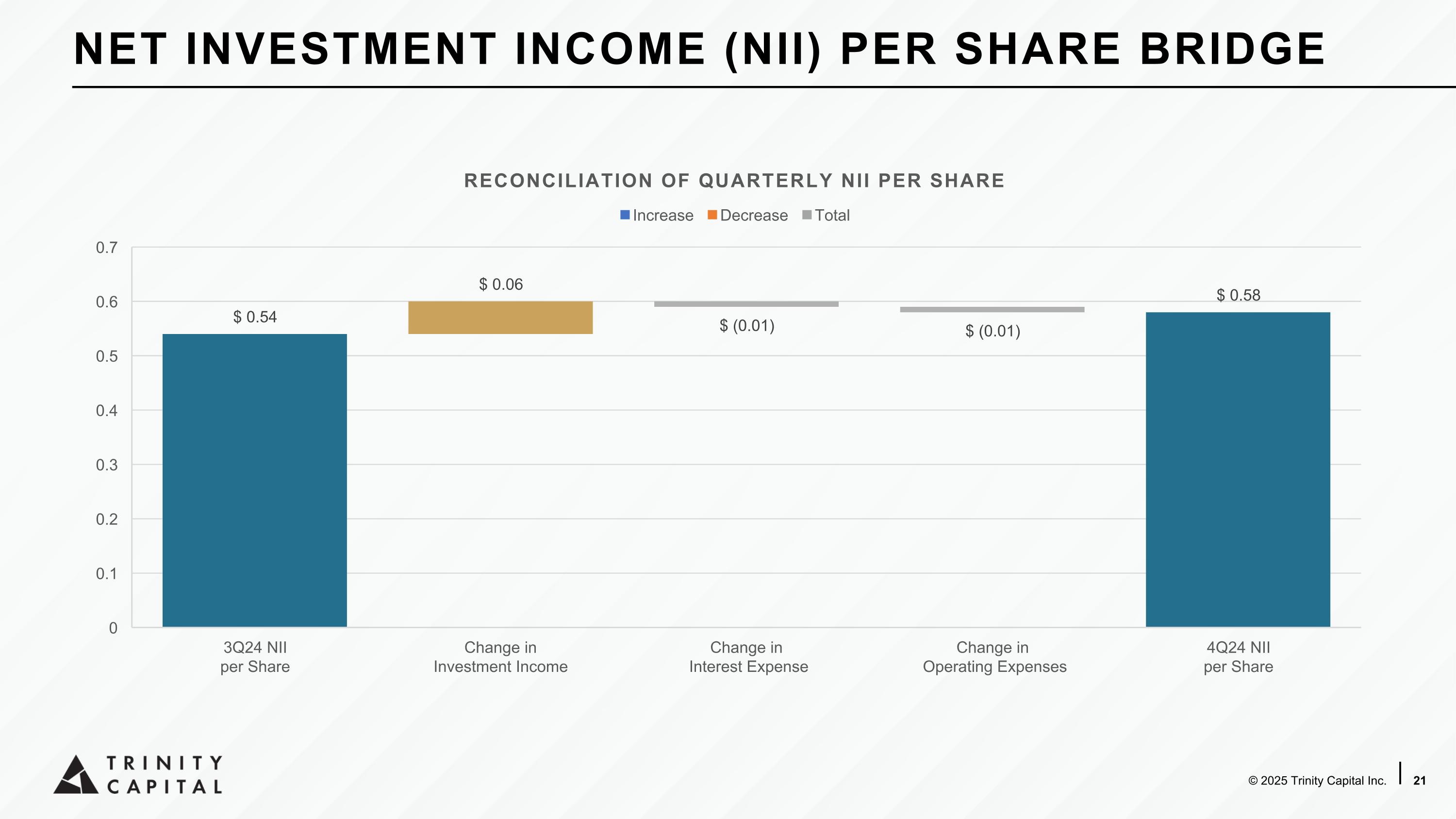

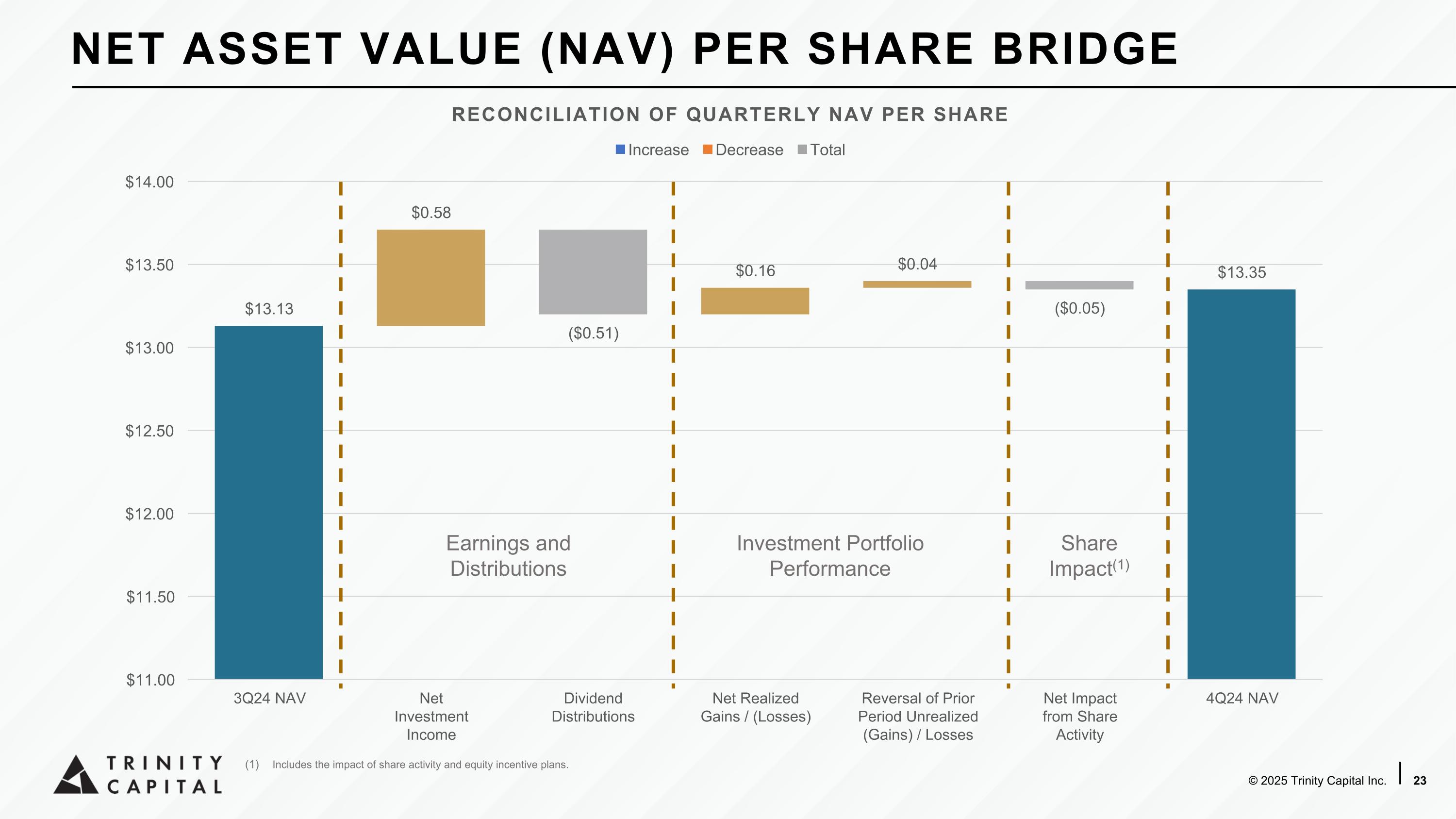

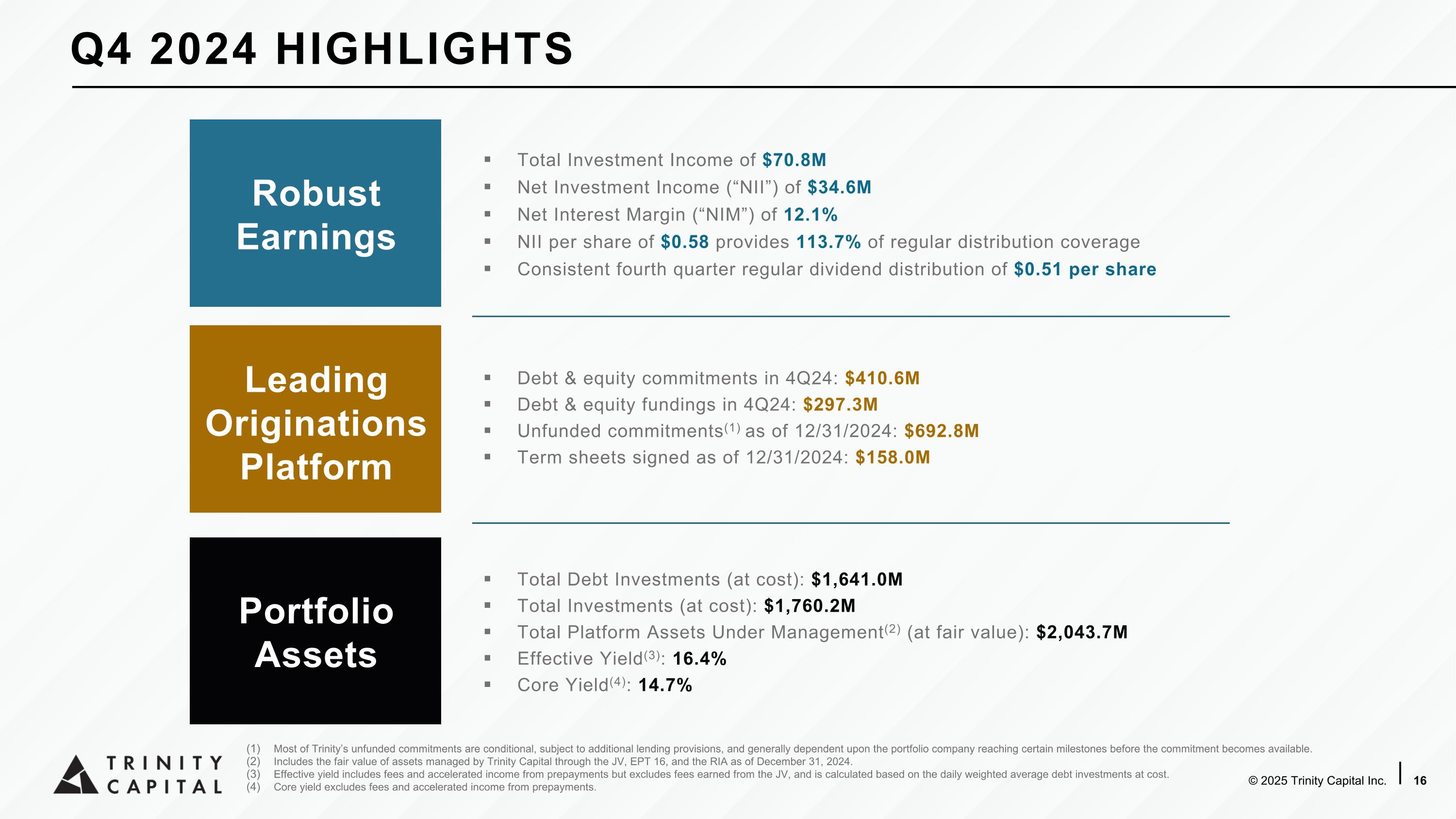

Most of Trinity’s unfunded commitments are conditional, subject to additional lending provisions, and generally dependent upon the portfolio company reaching certain milestones before the commitment becomes available. Includes the fair value of assets managed by Trinity Capital through the JV, EPT 16, and the RIA as of December 31, 2024. Effective yield includes fees and accelerated income from prepayments but excludes fees earned from the JV, and is calculated based on the daily weighted average debt investments at cost. Core yield excludes fees and accelerated income from prepayments. Total Investment Income of $70.8M Net Investment Income (“NII”) of $34.6M Net Interest Margin (“NIM”) of 12.1% NII per share of $0.58 provides 113.7% of regular distribution coverage Consistent fourth quarter regular dividend distribution of $0.51 per share Robust Earnings Total Debt Investments (at cost): $1,641.0M Total Investments (at cost): $1,760.2M Total Platform Assets Under Management(2) (at fair value): $2,043.7M Effective Yield(3): 16.4% Core Yield(4): 14.7% Debt & equity commitments in 4Q24: $410.6M Debt & equity fundings in 4Q24: $297.3M Unfunded commitments(1) as of 12/31/2024: $692.8M Term sheets signed as of 12/31/2024: $158.0M Q4 2024 HIGHLIGHTS Leading Originations Platform Portfolio Assets

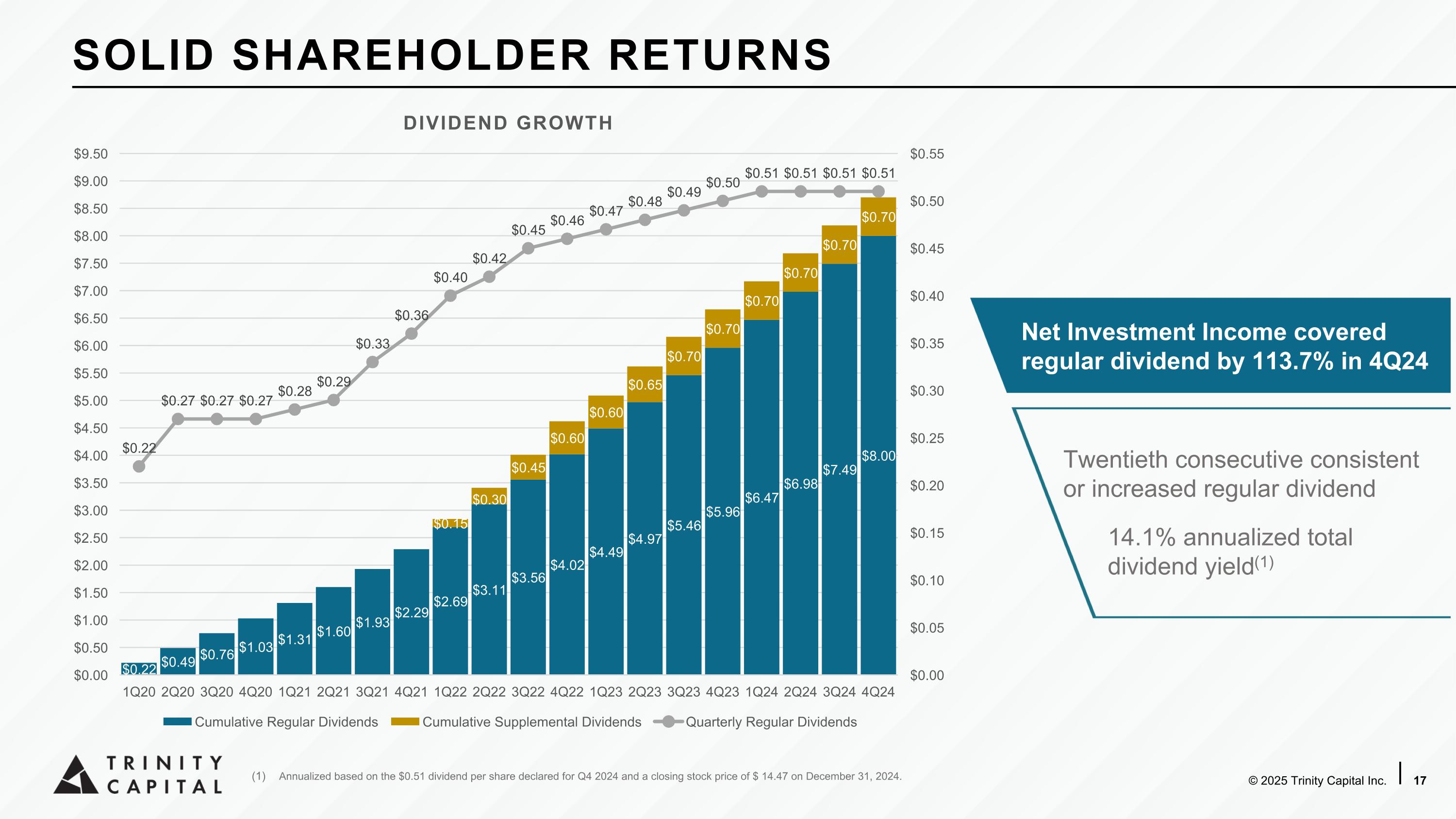

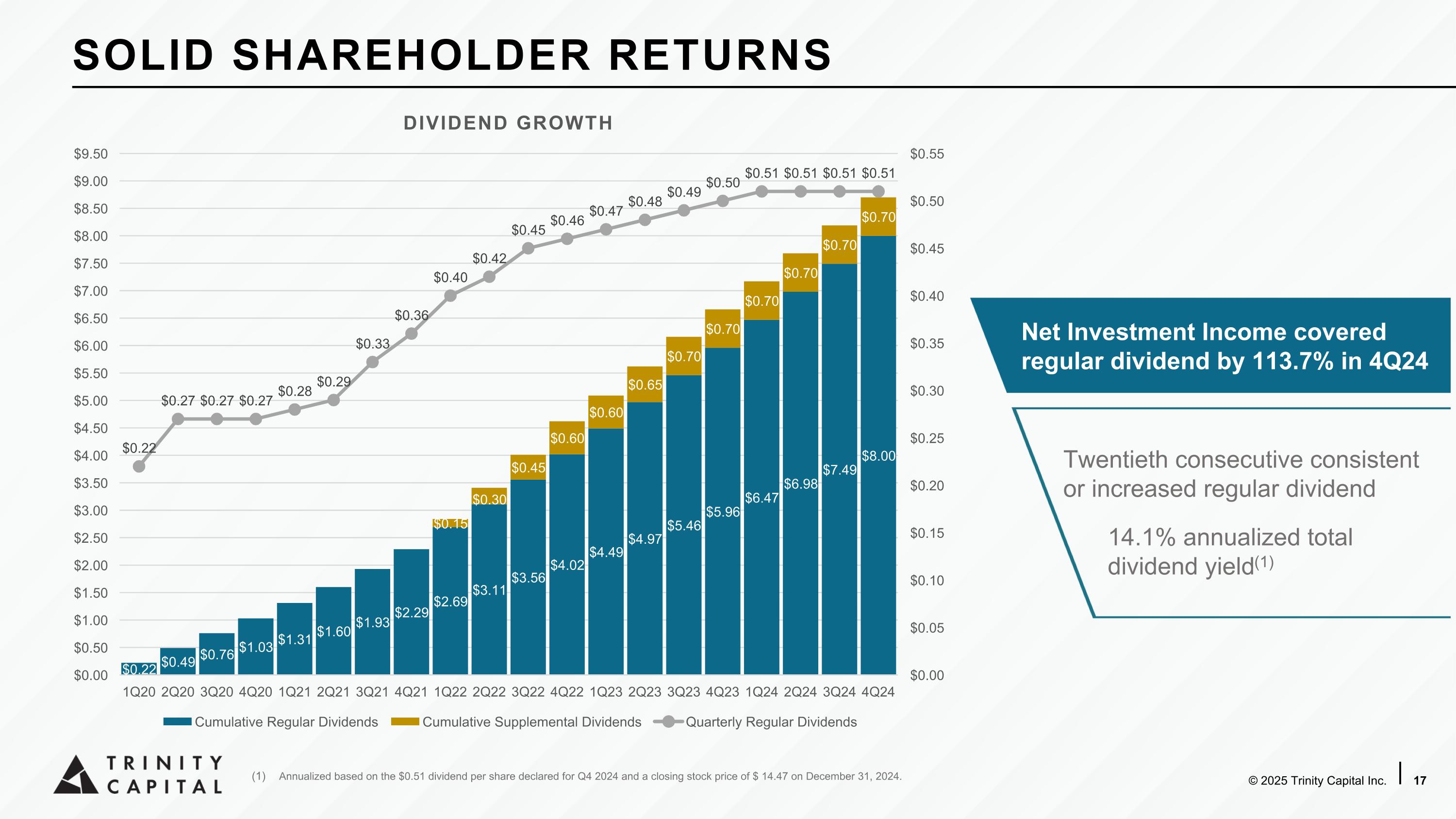

Net Investment Income covered regular dividend by 113.7% in 4Q24 Twentieth consecutive consistent or increased regular dividend 14.1% annualized total dividend yield(1) SOLID SHAREHOLDER RETURNS Annualized based on the $0.51 dividend per share declared for Q4 2024 and a closing stock price of $ 14.47 on December 31, 2024.

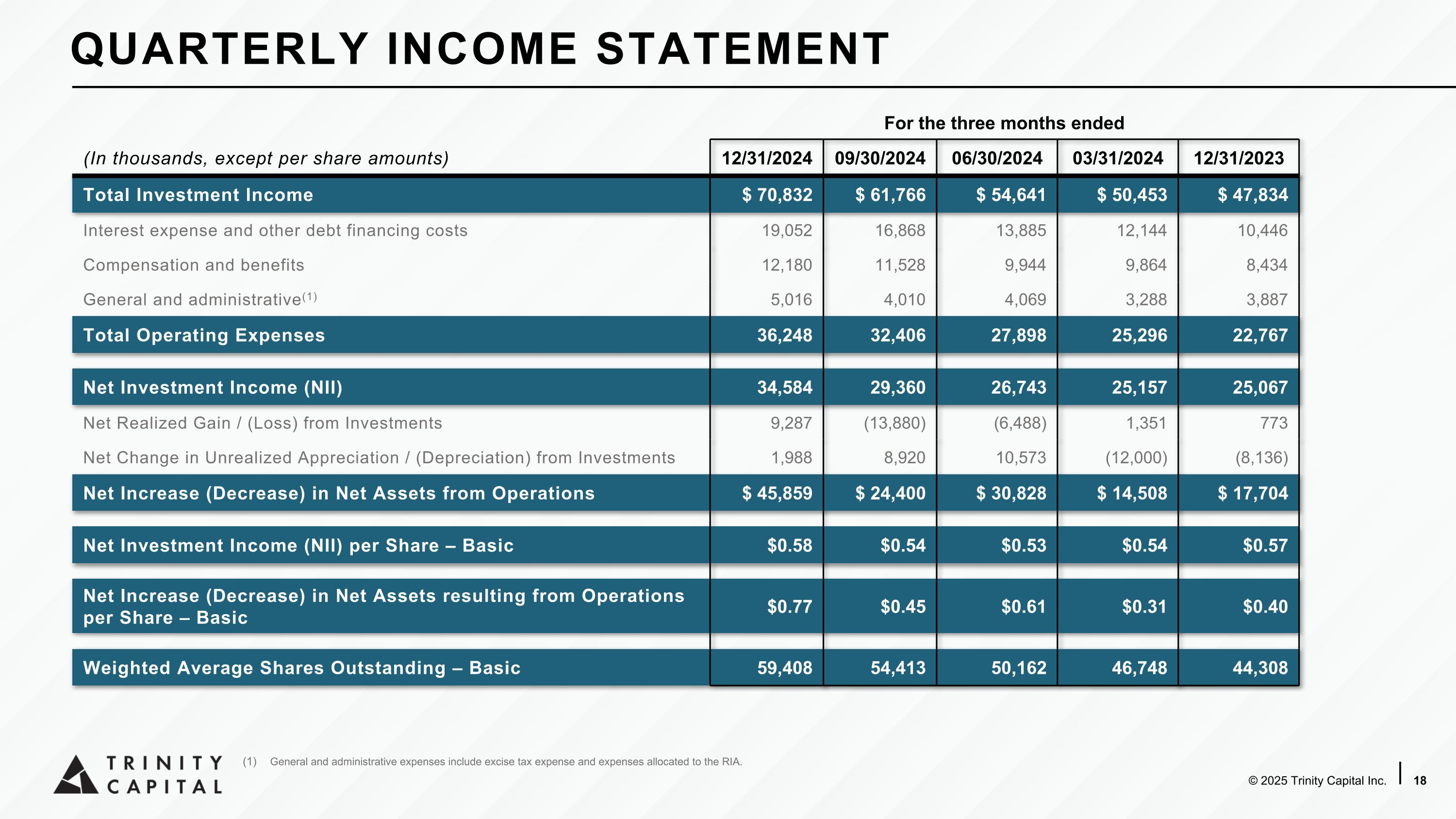

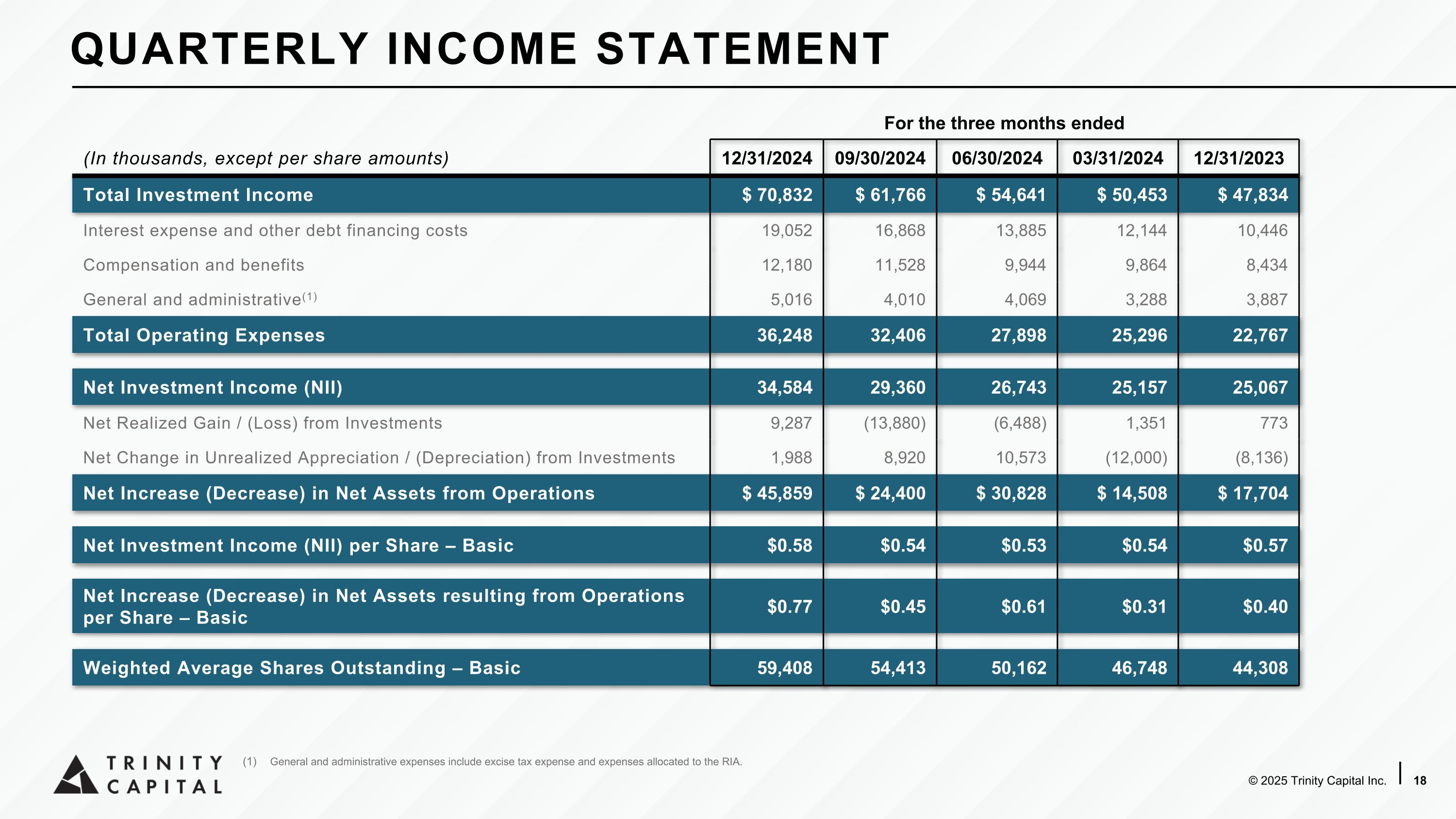

For the three months ended For the three months ended Nine Months Ended September 30 (In thousands, except per share amounts) 12/31/2024 09/30/2024 06/30/2024 03/31/2024 12/31/2023 Total Investment Income $ 70,832 $ 61,766 $ 54,641 $ 50,453 $ 47,834 Interest expense and other debt financing costs 19,052 16,868 13,885 12,144 10,446 Compensation and benefits 12,180 11,528 9,944 9,864 8,434 General and administrative(1) 5,016 4,010 4,069 3,288 3,887 Total Operating Expenses 36,248 32,406 27,898 25,296 22,767 Net Investment Income (NII) 34,584 29,360 26,743 25,157 25,067 Net Realized Gain / (Loss) from Investments 9,287 (13,880) (6,488) 1,351 773 Net Change in Unrealized Appreciation / (Depreciation) from Investments 1,988 8,920 10,573 (12,000) (8,136) Net Increase (Decrease) in Net Assets from Operations $ 45,859 $ 24,400 $ 30,828 $ 14,508 $ 17,704 Net Investment Income (NII) per Share – Basic $0.58 $0.54 $0.53 $0.54 $0.57 Net Increase (Decrease) in Net Assets resulting from Operations per Share – Basic $0.77 $0.45 $0.61 $0.31 $0.40 Weighted Average Shares Outstanding – Basic 59,408 54,413 50,162 46,748 44,308 QUARTERLY INCOME STATEMENT General and administrative expenses include excise tax expense and expenses allocated to the RIA.

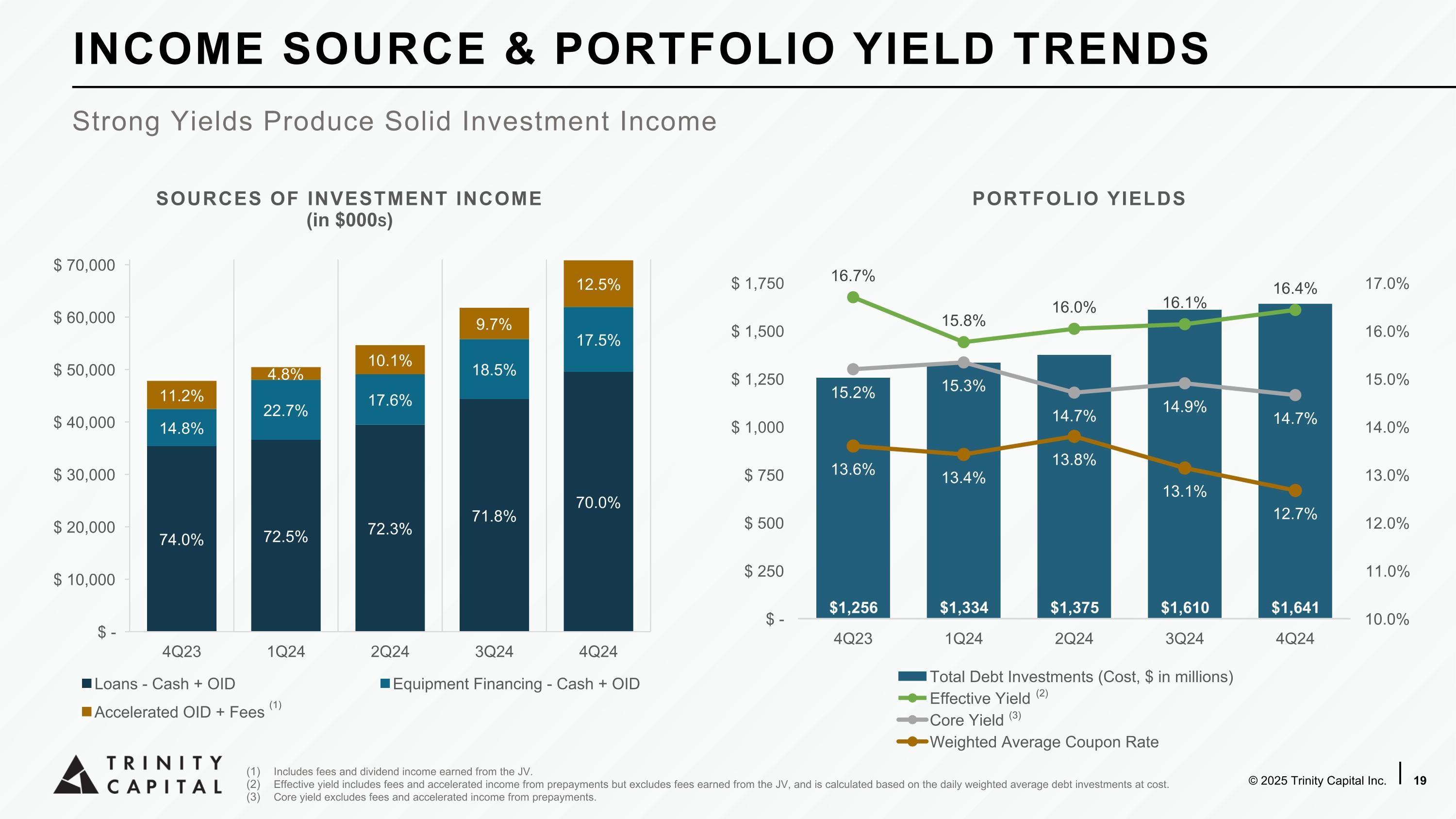

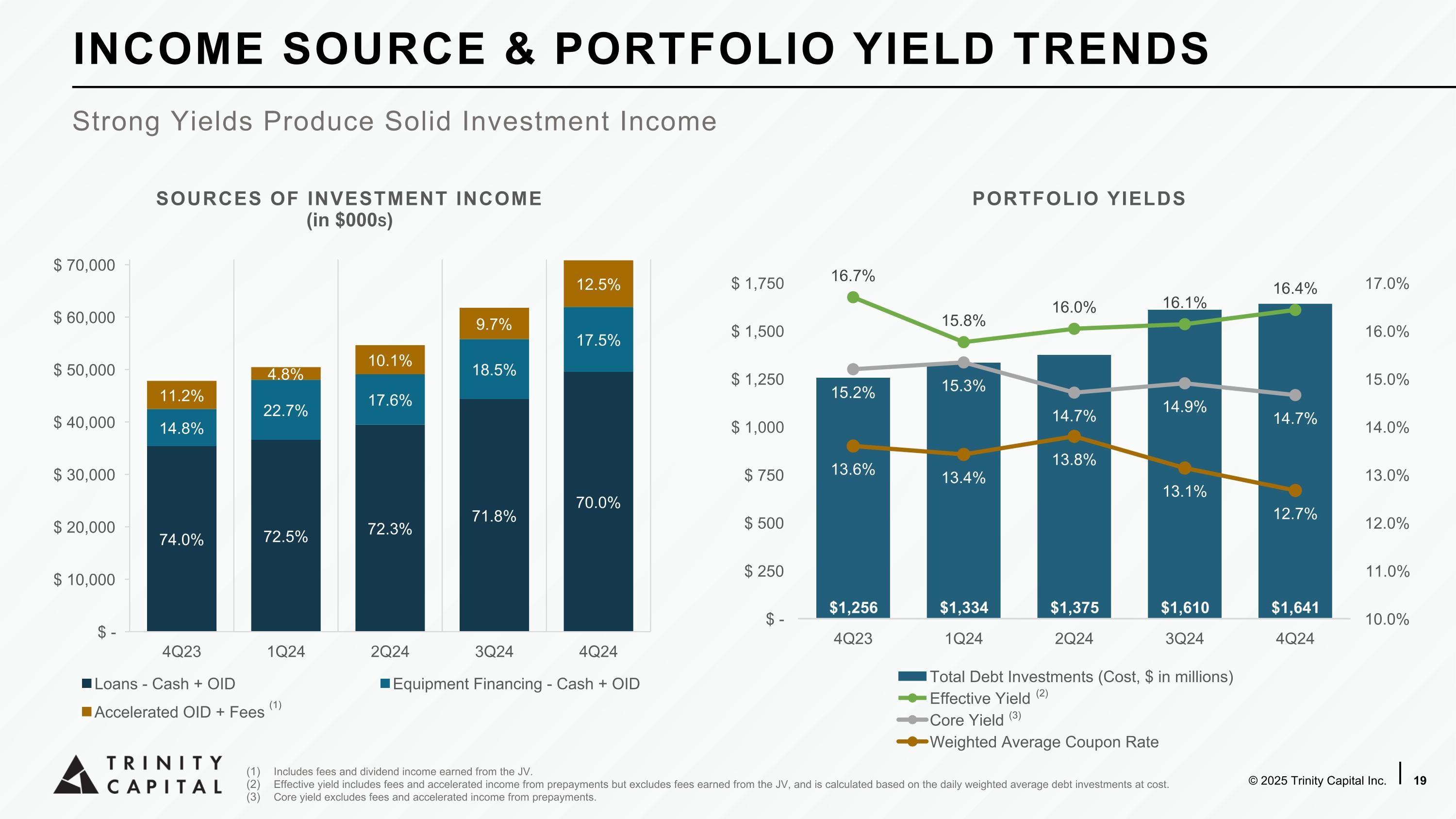

INCOME SOURCE & PORTFOLIO YIELD TRENDS Strong Yields Produce Solid Investment Income Includes fees and dividend income earned from the JV. Effective yield includes fees and accelerated income from prepayments but excludes fees earned from the JV, and is calculated based on the daily weighted average debt investments at cost. Core yield excludes fees and accelerated income from prepayments. (2) (3) (1)

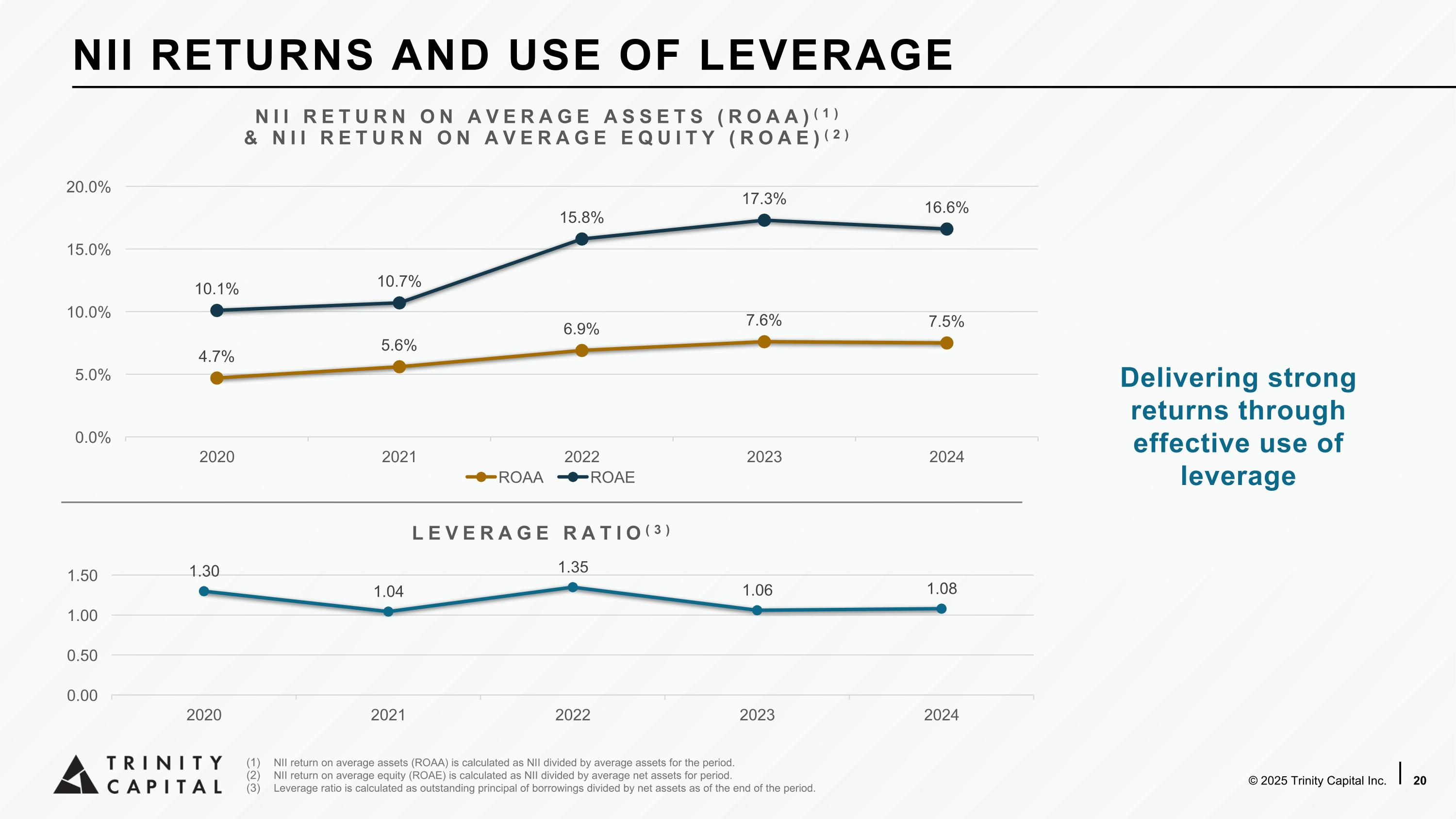

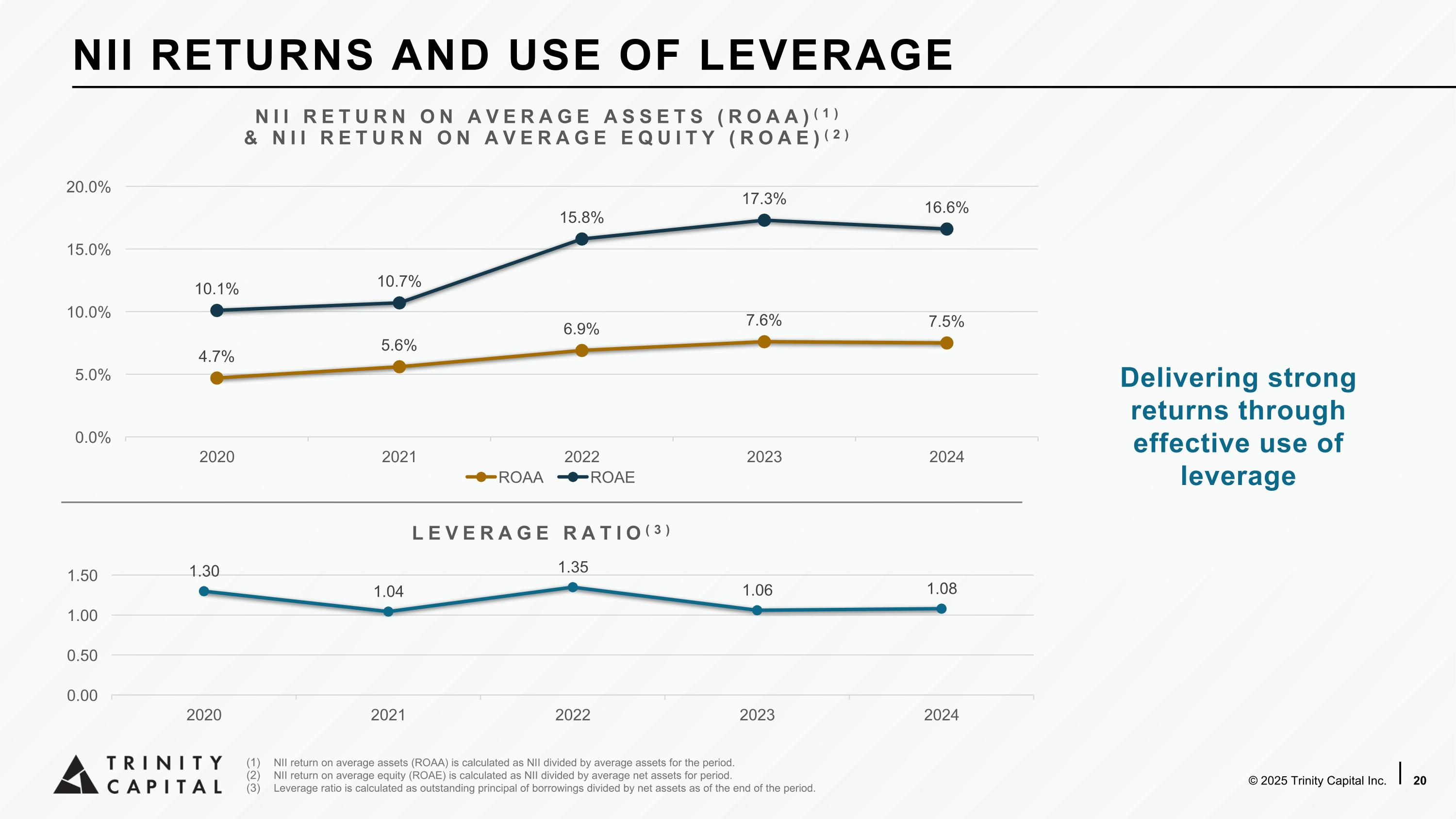

NII RETURNS AND USE OF LEVERAGE Delivering strong returns through effective use of leverage NII return on average assets (ROAA) is calculated as NII divided by average assets for the period. NII return on average equity (ROAE) is calculated as NII divided by average net assets for period. Leverage ratio is calculated as outstanding principal of borrowings divided by net assets as of the end of the period.

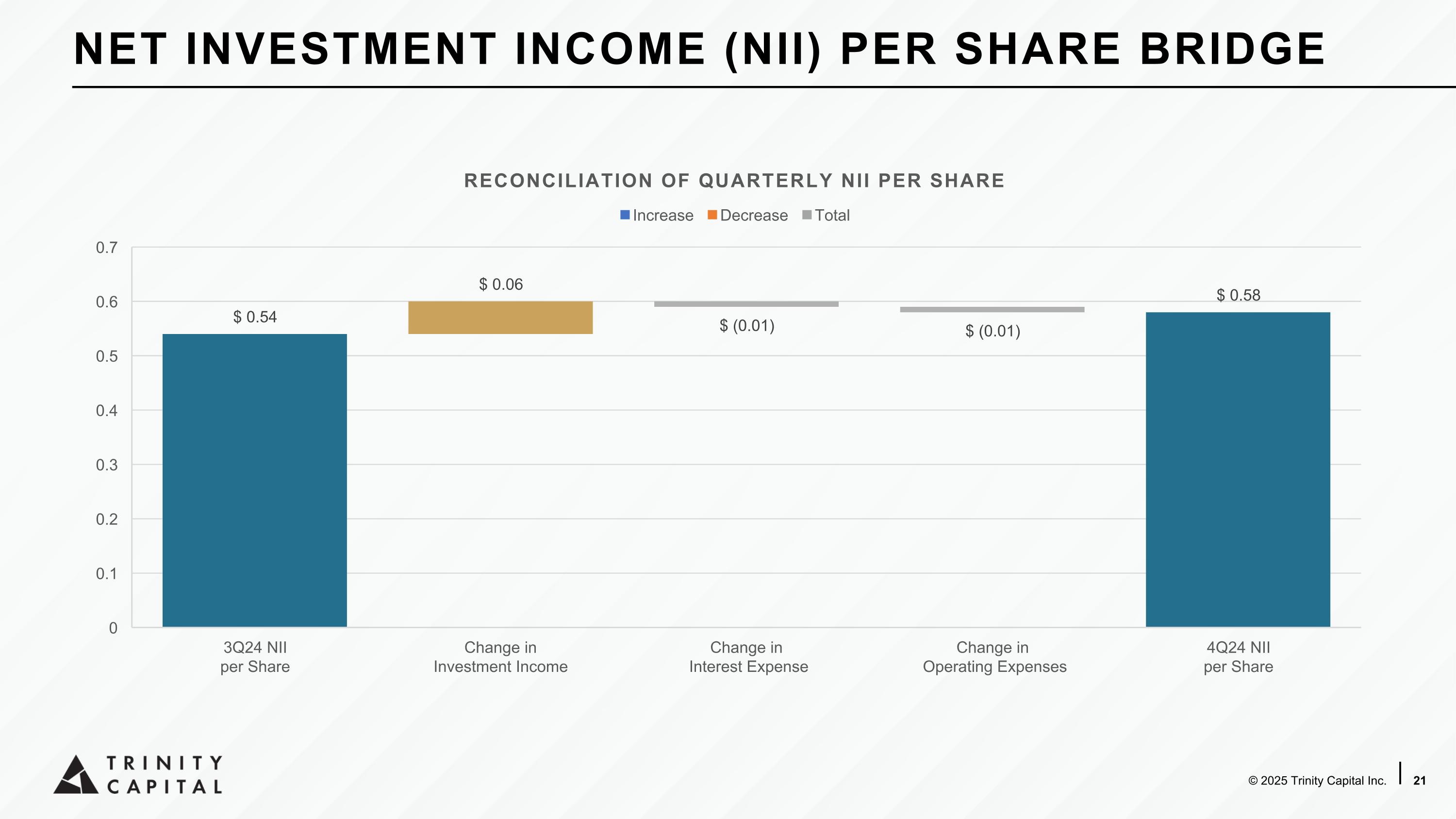

NET INVESTMENT INCOME (NII) PER SHARE BRIDGE

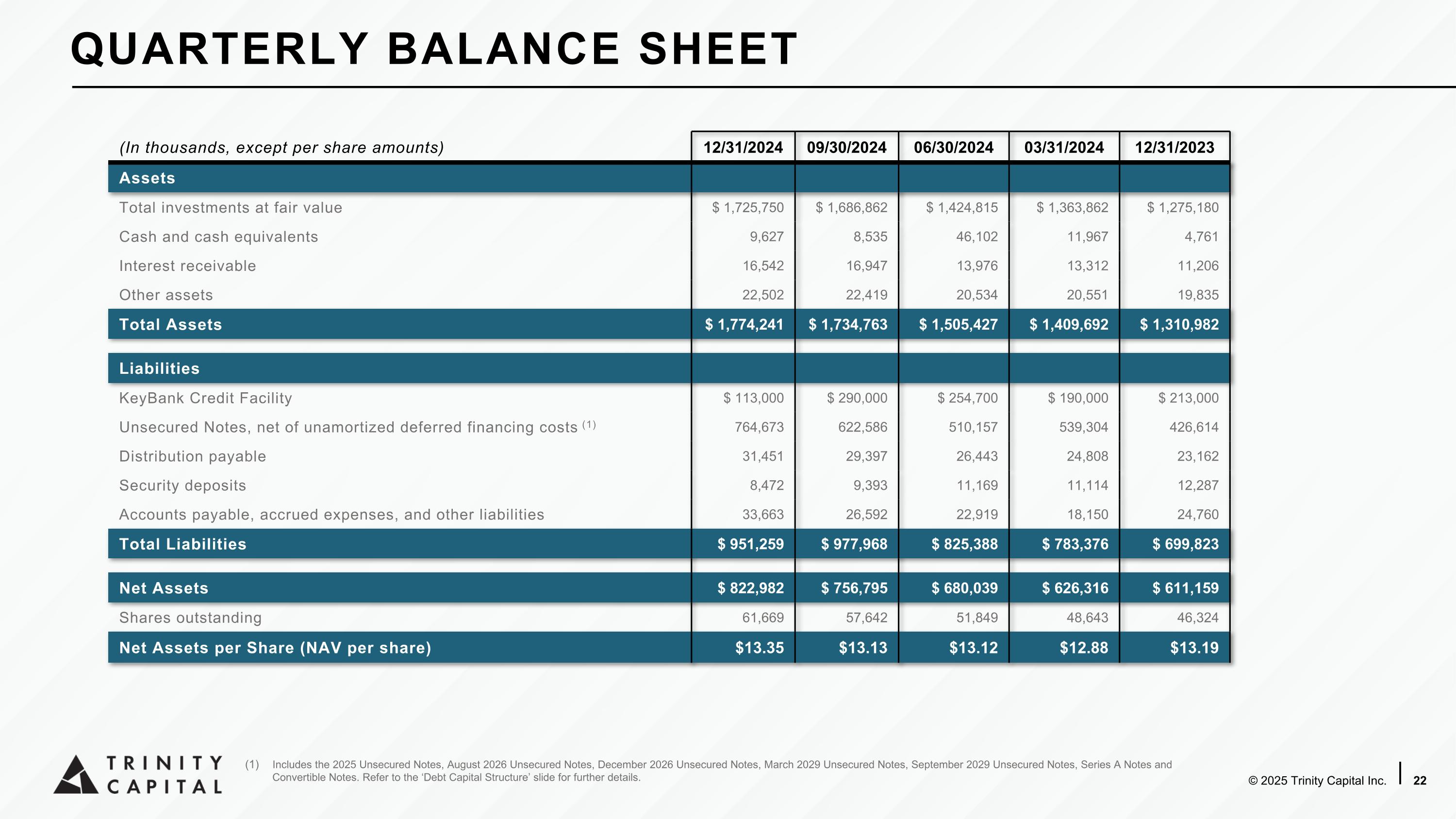

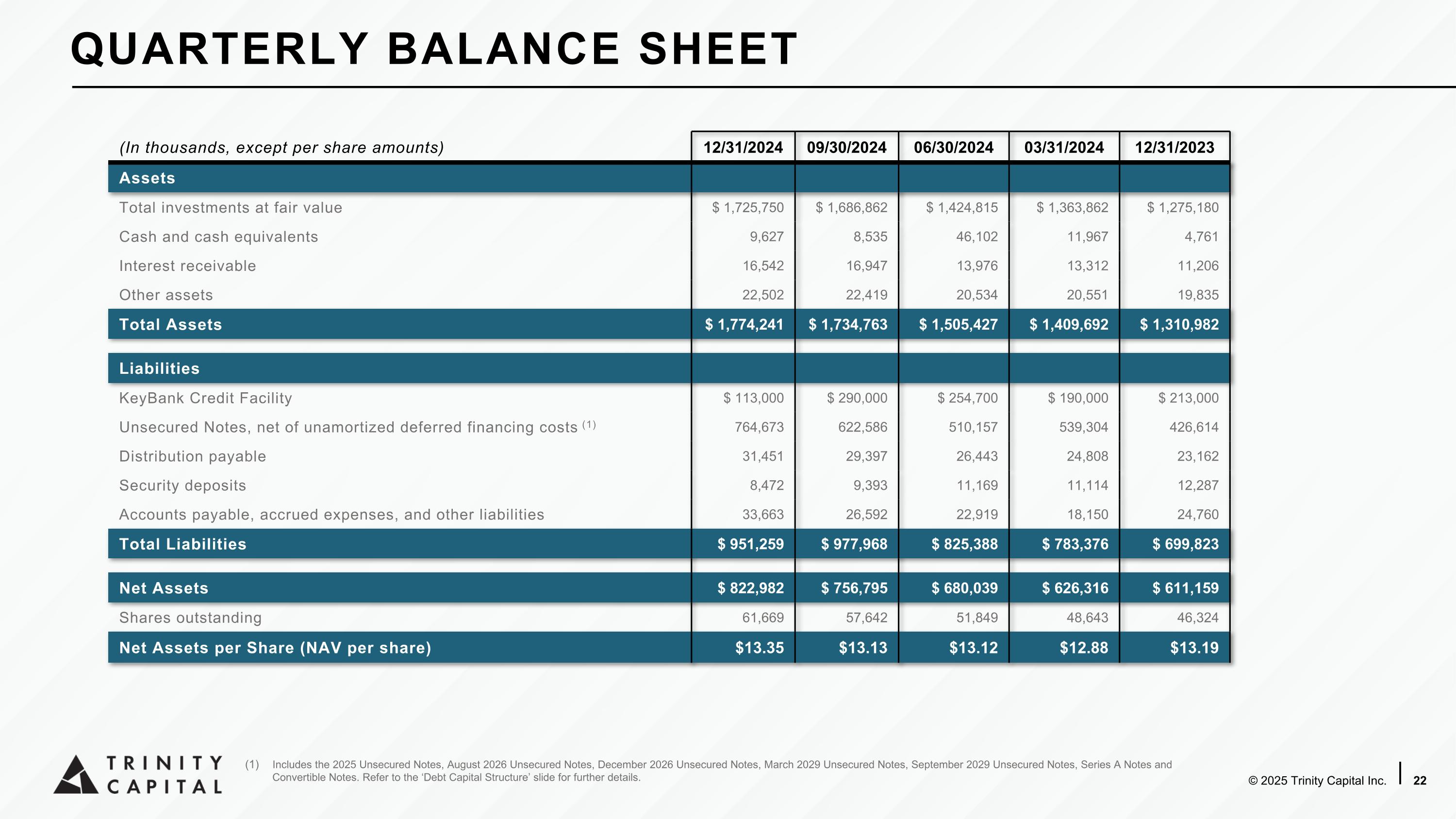

For the three months ended Nine Months Ended September 30 (In thousands, except per share amounts) 12/31/2024 09/30/2024 06/30/2024 03/31/2024 12/31/2023 Assets Total investments at fair value $ 1,725,750 $ 1,686,862 $ 1,424,815 $ 1,363,862 $ 1,275,180 Cash and cash equivalents 9,627 8,535 46,102 11,967 4,761 Interest receivable 16,542 16,947 13,976 13,312 11,206 Other assets 22,502 22,419 20,534 20,551 19,835 Total Assets $ 1,774,241 $ 1,734,763 $ 1,505,427 $ 1,409,692 $ 1,310,982 Liabilities KeyBank Credit Facility $ 113,000 $ 290,000 $ 254,700 $ 190,000 $ 213,000 Unsecured Notes, net of unamortized deferred financing costs (1) 764,673 622,586 510,157 539,304 426,614 Distribution payable 31,451 29,397 26,443 24,808 23,162 Security deposits 8,472 9,393 11,169 11,114 12,287 Accounts payable, accrued expenses, and other liabilities 33,663 26,592 22,919 18,150 24,760 Total Liabilities $ 951,259 $ 977,968 $ 825,388 $ 783,376 $ 699,823 Net Assets $ 822,982 $ 756,795 $ 680,039 $ 626,316 $ 611,159 Shares outstanding 61,669 57,642 51,849 48,643 46,324 Net Assets per Share (NAV per share) $13.35 $13.13 $13.12 $12.88 $13.19 QUARTERLY BALANCE SHEET Includes the 2025 Unsecured Notes, August 2026 Unsecured Notes, December 2026 Unsecured Notes, March 2029 Unsecured Notes, September 2029 Unsecured Notes, Series A Notes and Convertible Notes. Refer to the ‘Debt Capital Structure’ slide for further details.

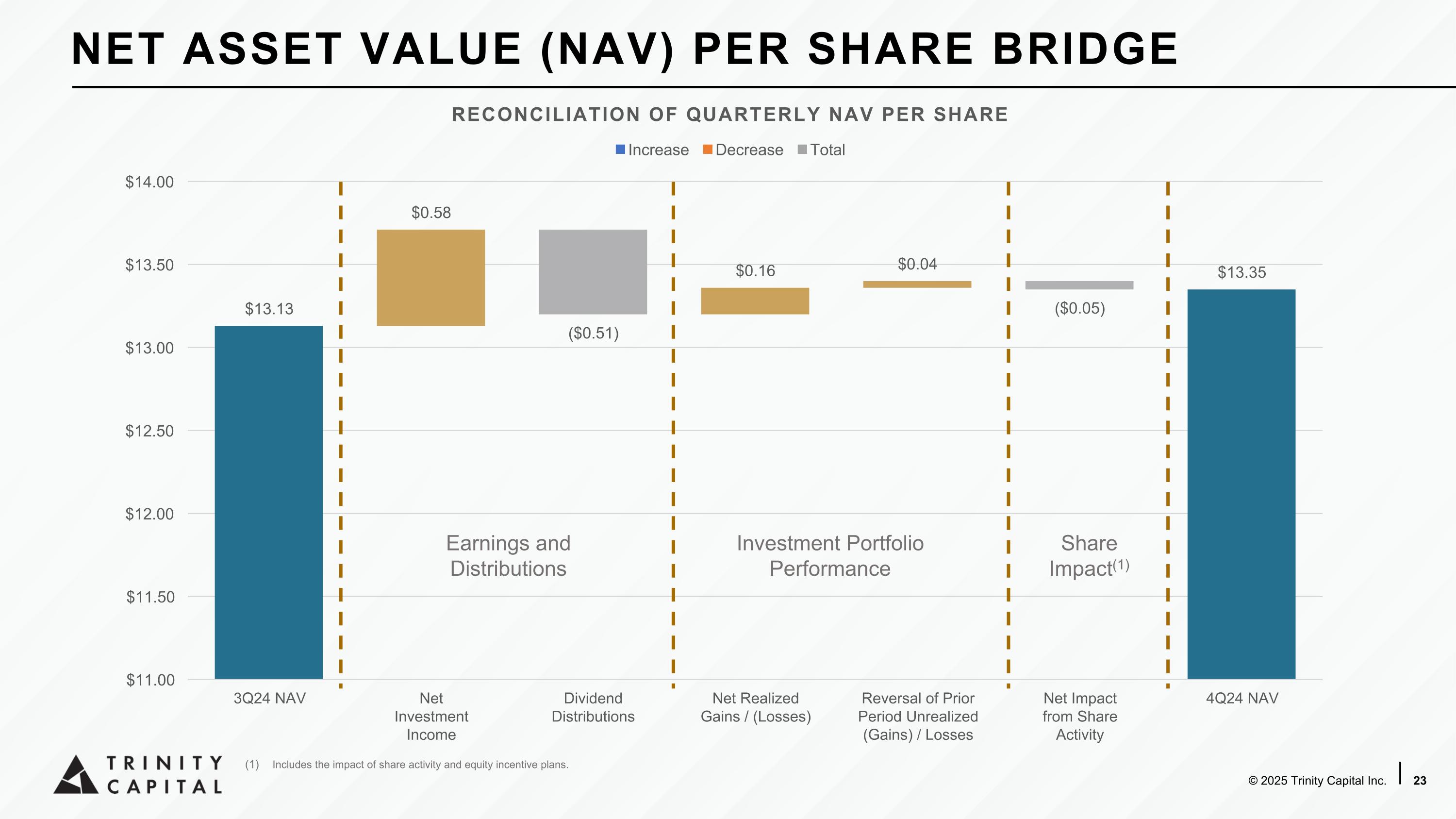

Includes the impact of share activity and equity incentive plans. NET ASSET VALUE (NAV) PER SHARE BRIDGE Earnings and �Distributions Investment Portfolio �Performance Share�Impact(1)

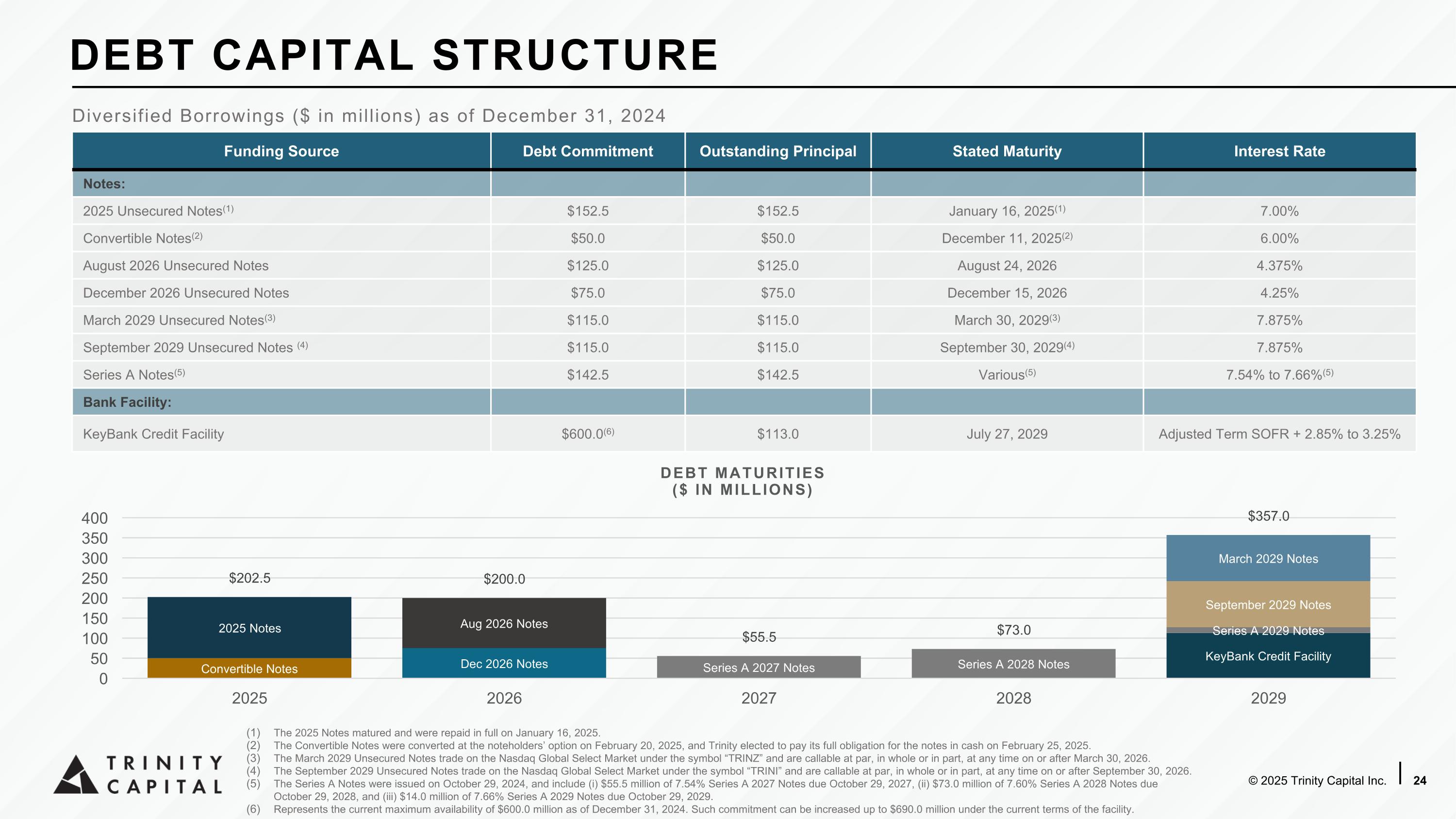

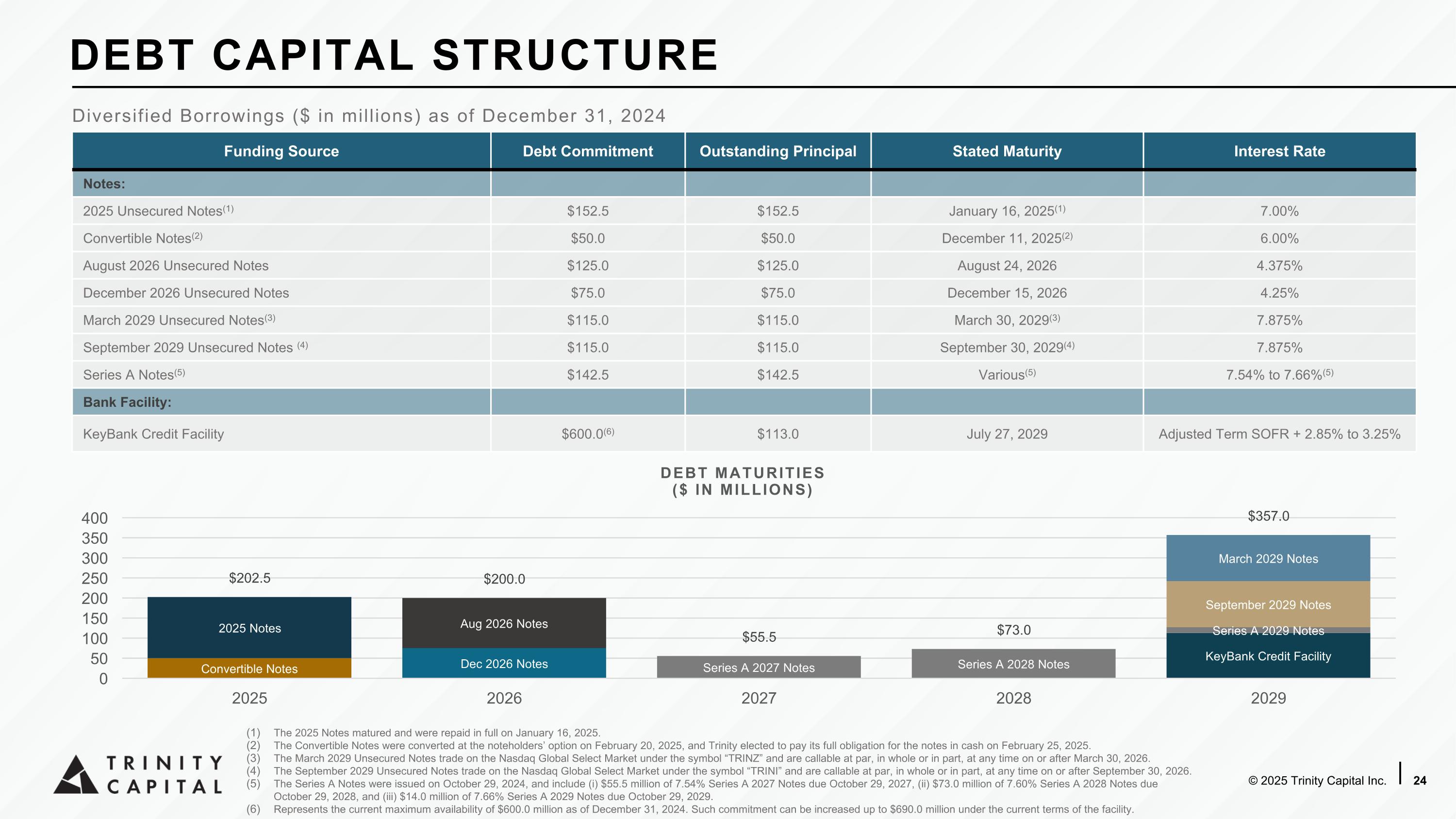

The 2025 Notes matured and were repaid in full on January 16, 2025. The Convertible Notes were converted at the noteholders’ option on February 20, 2025, and Trinity elected to pay its full obligation for the notes in cash on February 25, 2025. The March 2029 Unsecured Notes trade on the Nasdaq Global Select Market under the symbol “TRINZ” and are callable at par, in whole or in part, at any time on or after March 30, 2026. The September 2029 Unsecured Notes trade on the Nasdaq Global Select Market under the symbol “TRINI” and are callable at par, in whole or in part, at any time on or after September 30, 2026. The Series A Notes were issued on October 29, 2024, and include (i) $55.5 million of 7.54% Series A 2027 Notes due October 29, 2027, (ii) $73.0 million of 7.60% Series A 2028 Notes due October 29, 2028, and (iii) $14.0 million of 7.66% Series A 2029 Notes due October 29, 2029. Represents the current maximum availability of $600.0 million as of December 31, 2024. Such commitment can be increased up to $690.0 million under the current terms of the facility. Diversified Borrowings ($ in millions) as of December 31, 2024 DEBT CAPITAL STRUCTURE Funding Source Debt Commitment Outstanding Principal Stated Maturity Interest Rate Notes: 2025 Unsecured Notes(1) $152.5 $152.5 January 16, 2025(1) 7.00% Convertible Notes(2) $50.0 $50.0 December 11, 2025(2) 6.00% August 2026 Unsecured Notes $125.0 $125.0 August 24, 2026 4.375% December 2026 Unsecured Notes $75.0 $75.0 December 15, 2026 4.25% March 2029 Unsecured Notes(3) $115.0 $115.0 March 30, 2029(3) 7.875% September 2029 Unsecured Notes (4) $115.0 $115.0 September 30, 2029(4) 7.875% Series A Notes(5) $142.5 $142.5 Various(5) 7.54% to 7.66%(5) Bank Facility: KeyBank Credit Facility $600.0(6) $113.0 July 27, 2029 Adjusted Term SOFR + 2.85% to 3.25%

PORTFOLIO HIGHLIGHTS

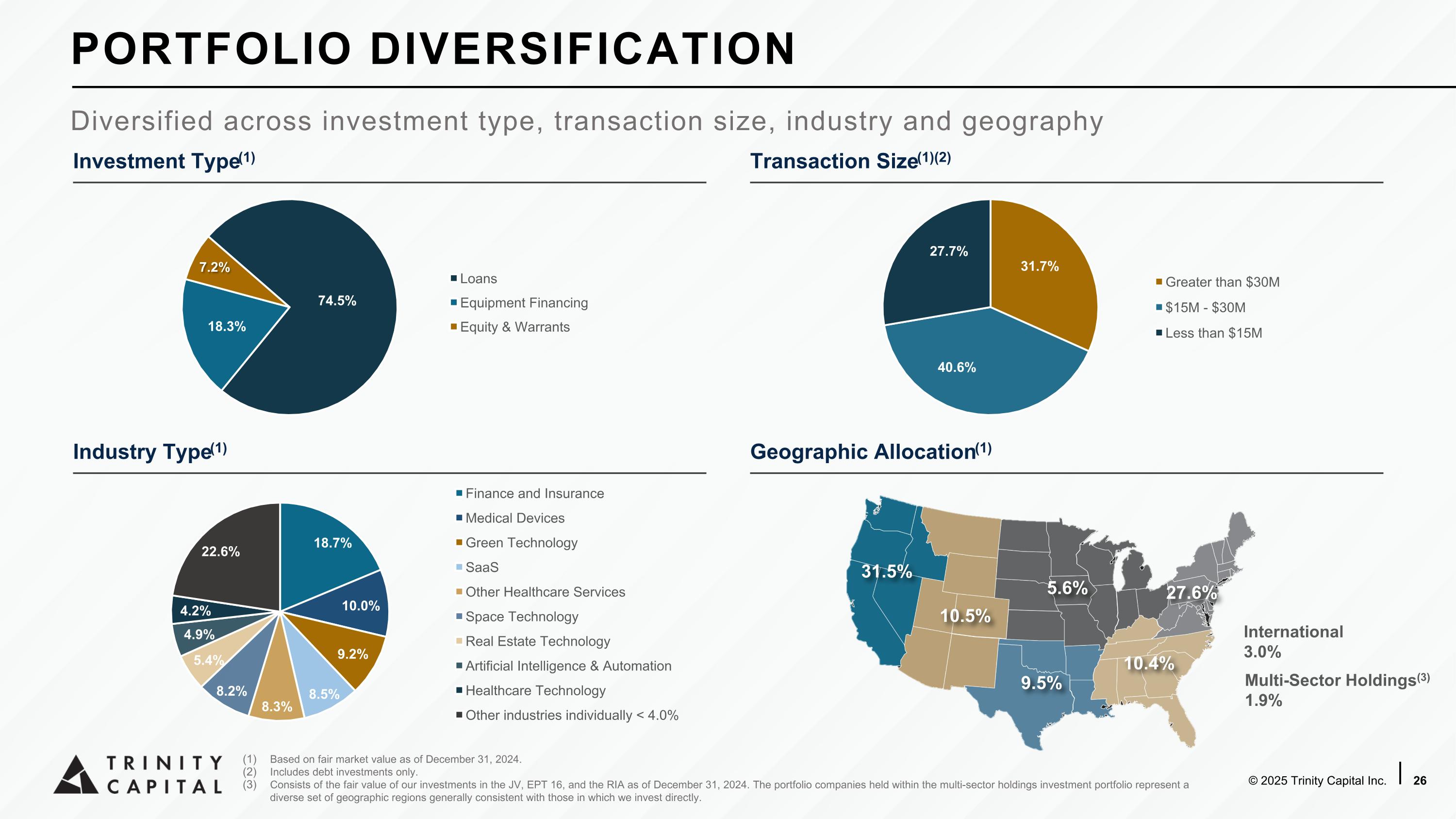

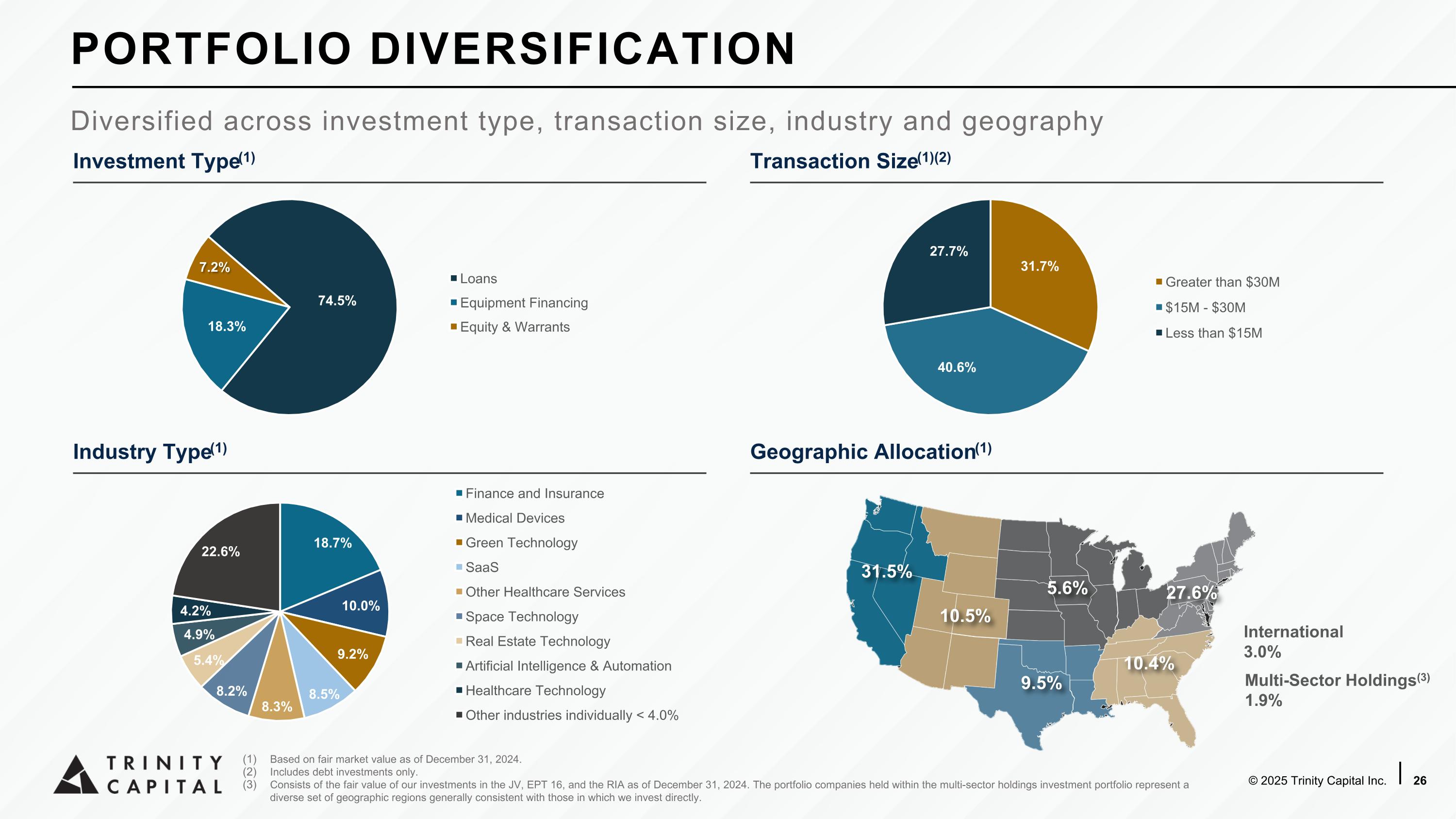

PORTFOLIO DIVERSIFICATION Diversified across investment type, transaction size, industry and geography Based on fair market value as of December 31, 2024. Includes debt investments only. Consists of the fair value of our investments in the JV, EPT 16, and the RIA as of December 31, 2024. The portfolio companies held within the multi-sector holdings investment portfolio represent a diverse set of geographic regions generally consistent with those in which we invest directly. Investment Type(1) Transaction Size(1)(2) Industry Type(1) Geographic Allocation(1) International 3.0% Multi-Sector Holdings(3) 1.9% 31.5% 10.5% 5.6% 9.5% 10.4% 27.6%

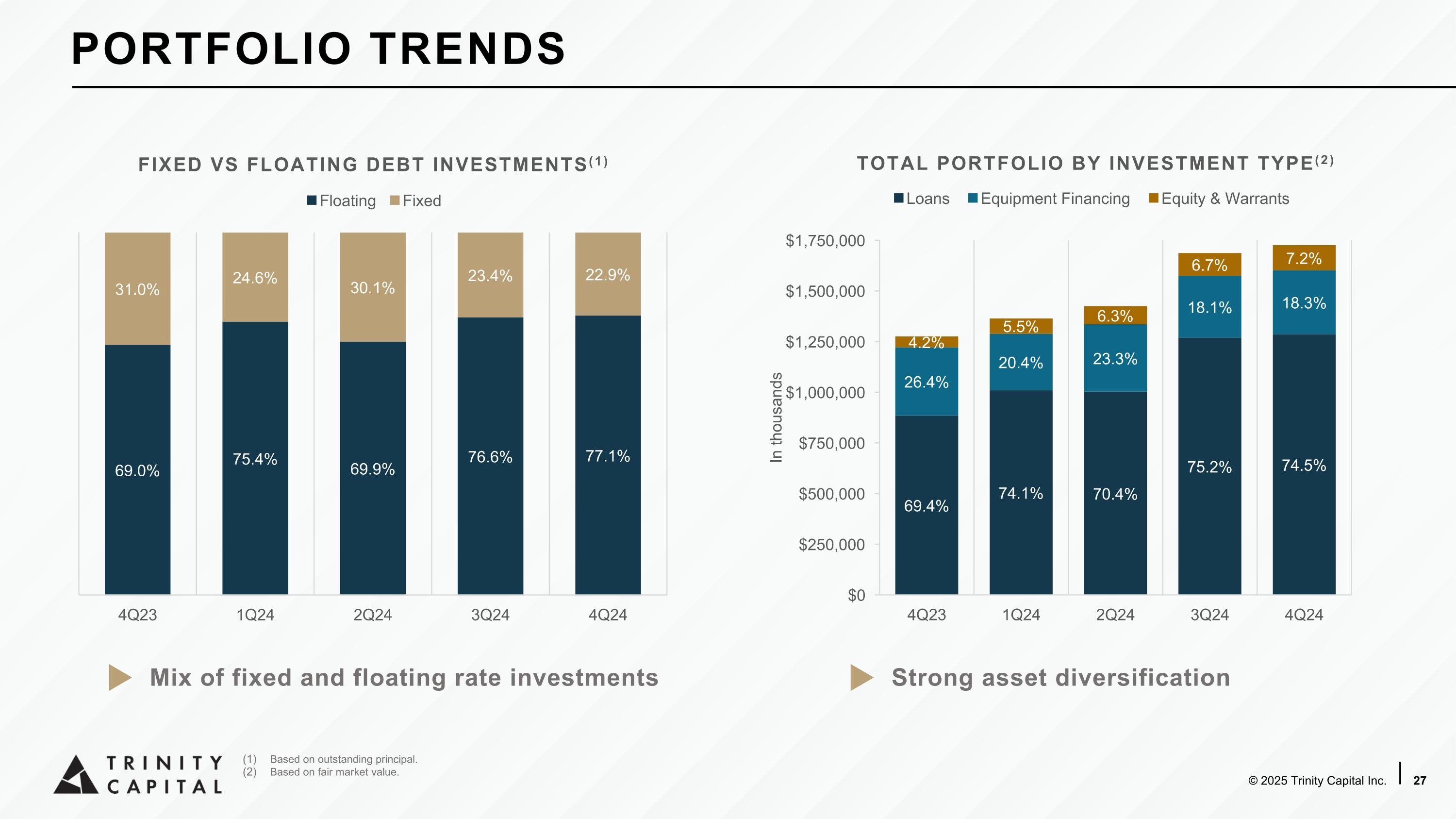

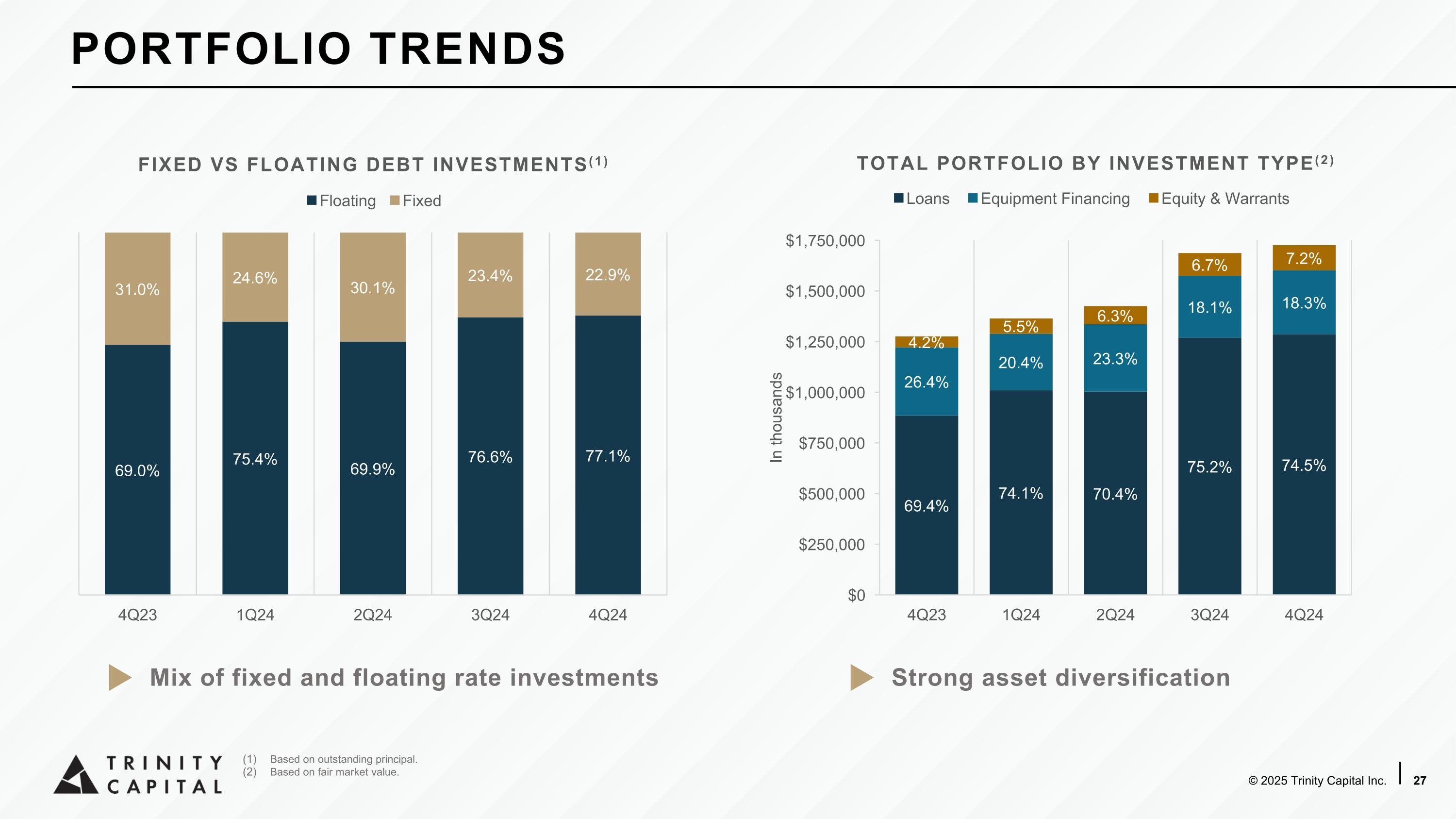

Based on outstanding principal. Based on fair market value. Mix of fixed and floating rate investments Strong asset diversification PORTFOLIO TRENDS

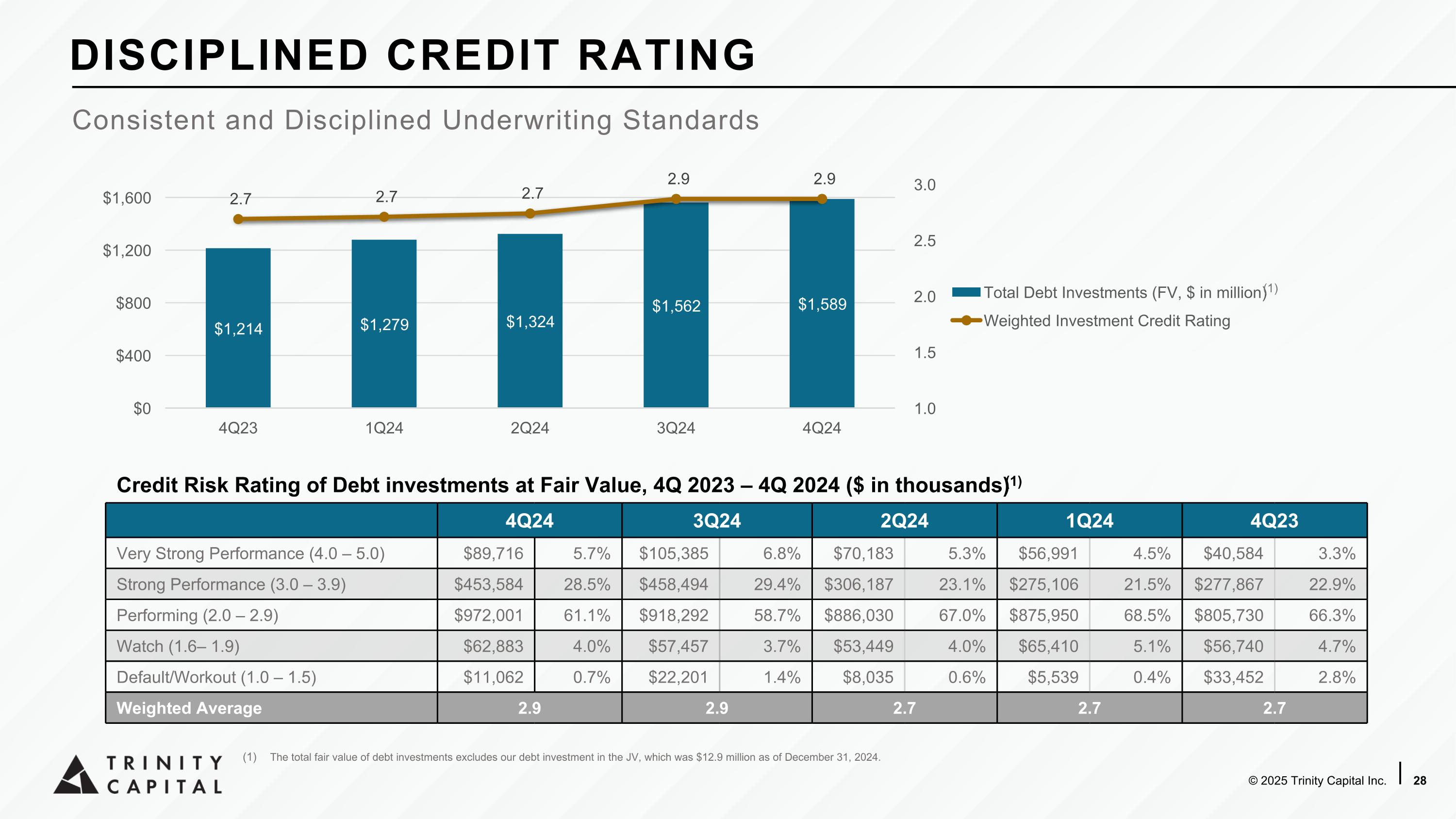

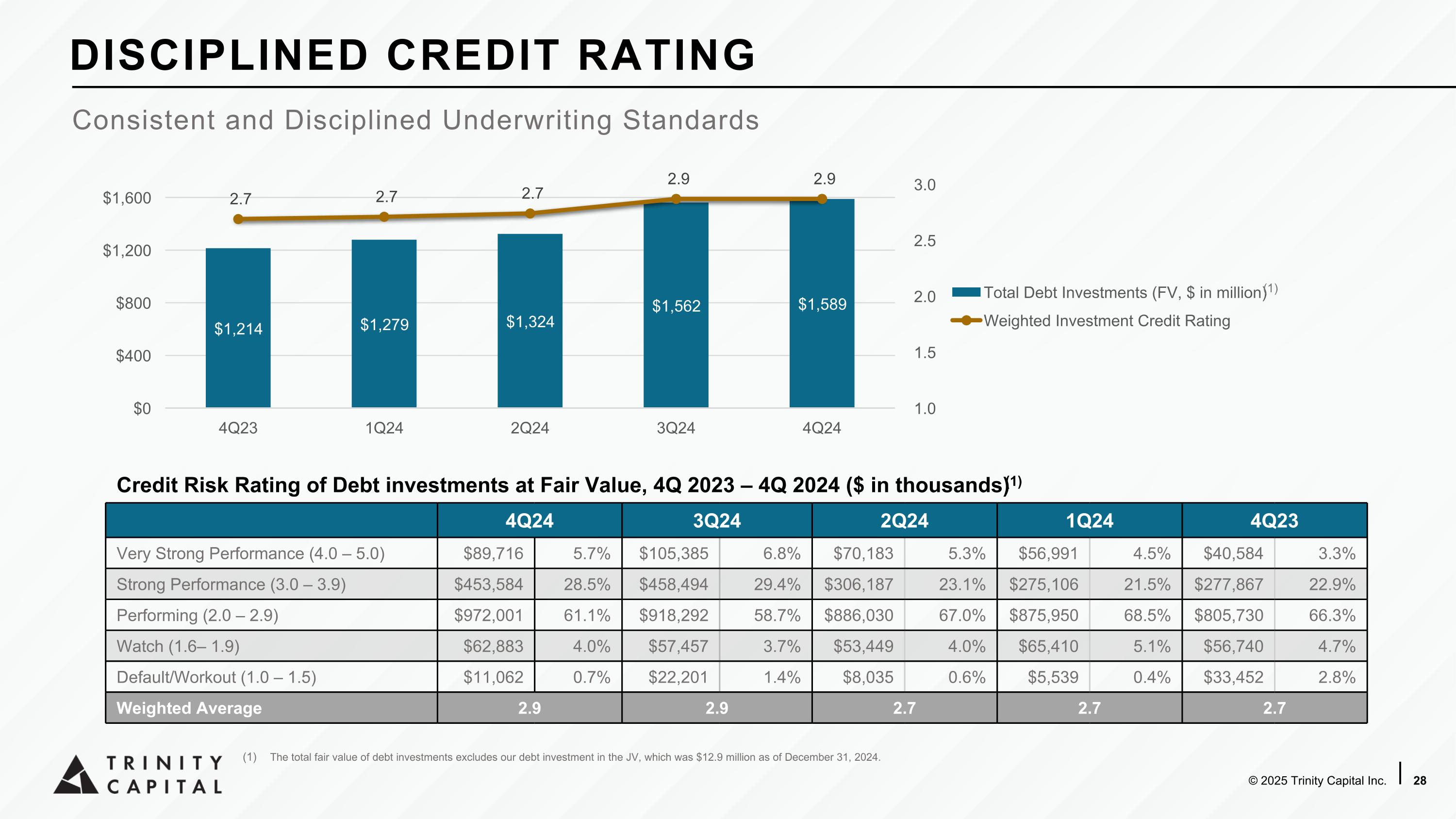

4Q24 3Q24 2Q24 1Q24 4Q23 Very Strong Performance (4.0 – 5.0) $89,716 5.7% $105,385 6.8% $70,183 5.3% $56,991 4.5% $40,584 3.3% Strong Performance (3.0 – 3.9) $453,584 28.5% $458,494 29.4% $306,187 23.1% $275,106 21.5% $277,867 22.9% Performing (2.0 – 2.9) $972,001 61.1% $918,292 58.7% $886,030 67.0% $875,950 68.5% $805,730 66.3% Watch (1.6– 1.9) $62,883 4.0% $57,457 3.7% $53,449 4.0% $65,410 5.1% $56,740 4.7% Default/Workout (1.0 – 1.5) $11,062 0.7% $22,201 1.4% $8,035 0.6% $5,539 0.4% $33,452 2.8% Weighted Average 2.9 2.9 2.7 2.7 2.7 Credit Risk Rating of Debt investments at Fair Value, 4Q 2023 – 4Q 2024 ($ in thousands)(1) Consistent and Disciplined Underwriting Standards DISCIPLINED CREDIT RATING The total fair value of debt investments excludes our debt investment in the JV, which was $12.9 million as of December 31, 2024. (1)

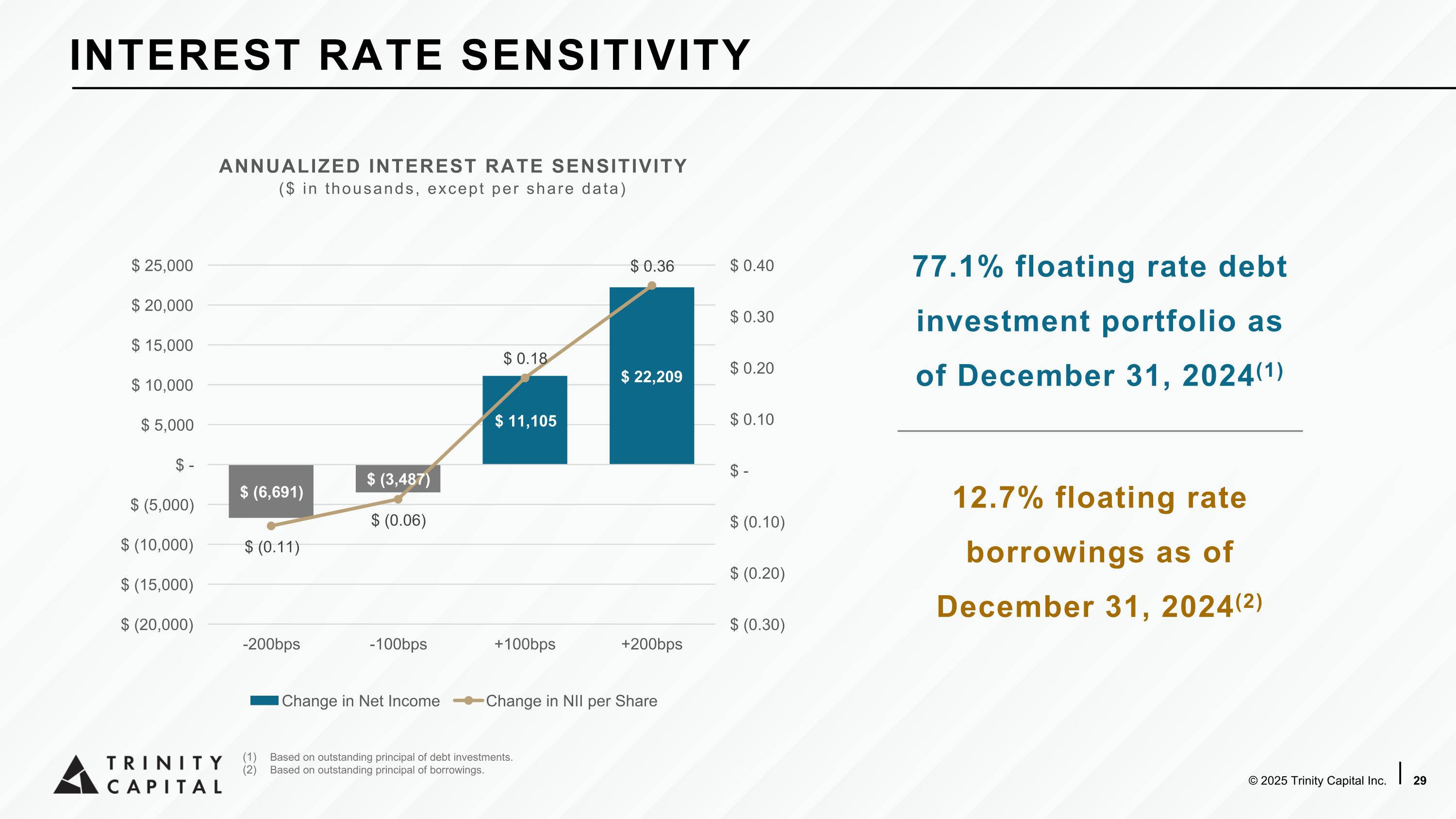

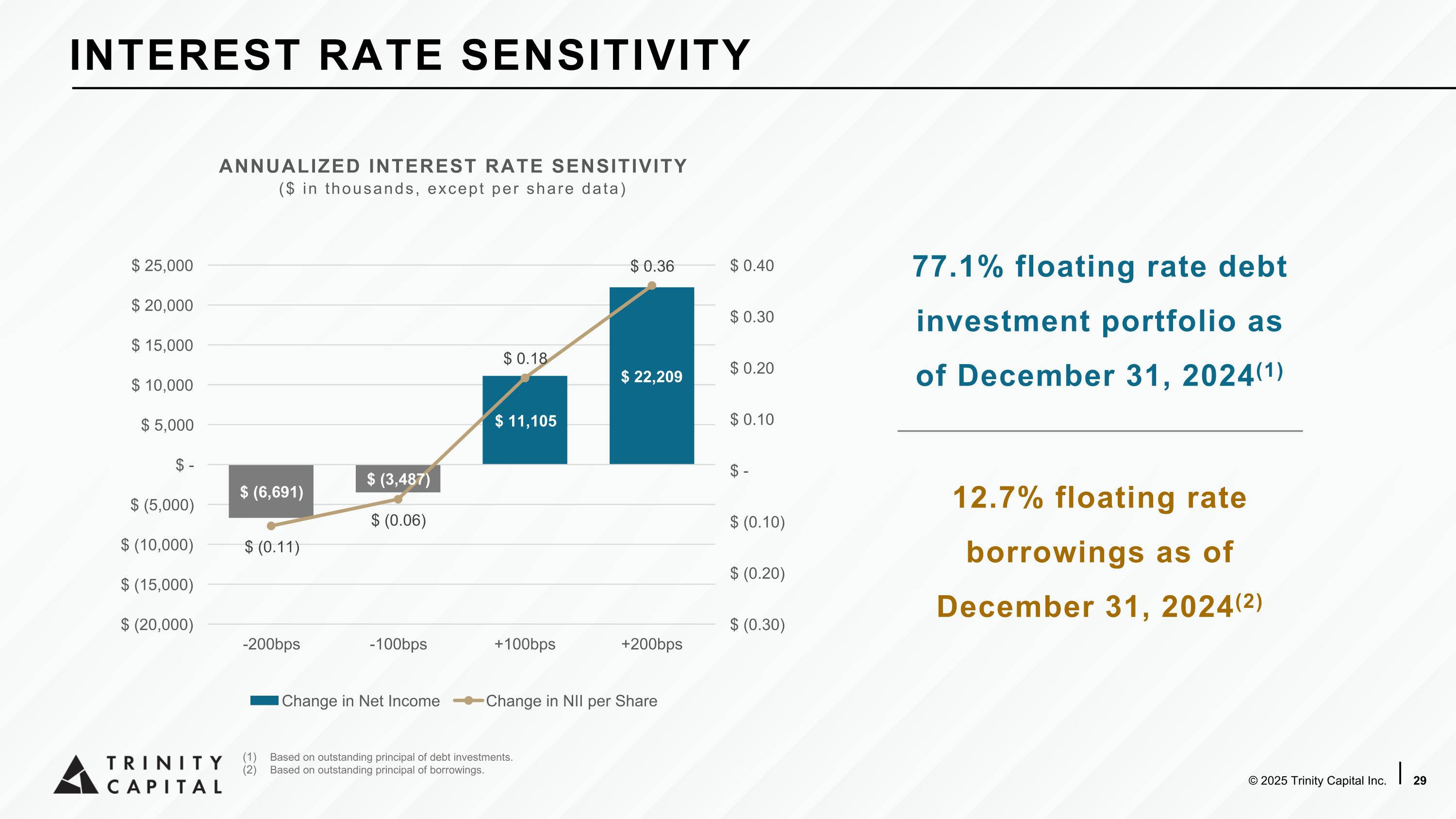

INTEREST RATE SENSITIVITY 77.1% floating rate debt investment portfolio as of December 31, 2024(1) 12.7% floating rate borrowings as of December 31, 2024(2) Based on outstanding principal of debt investments. Based on outstanding principal of borrowings.

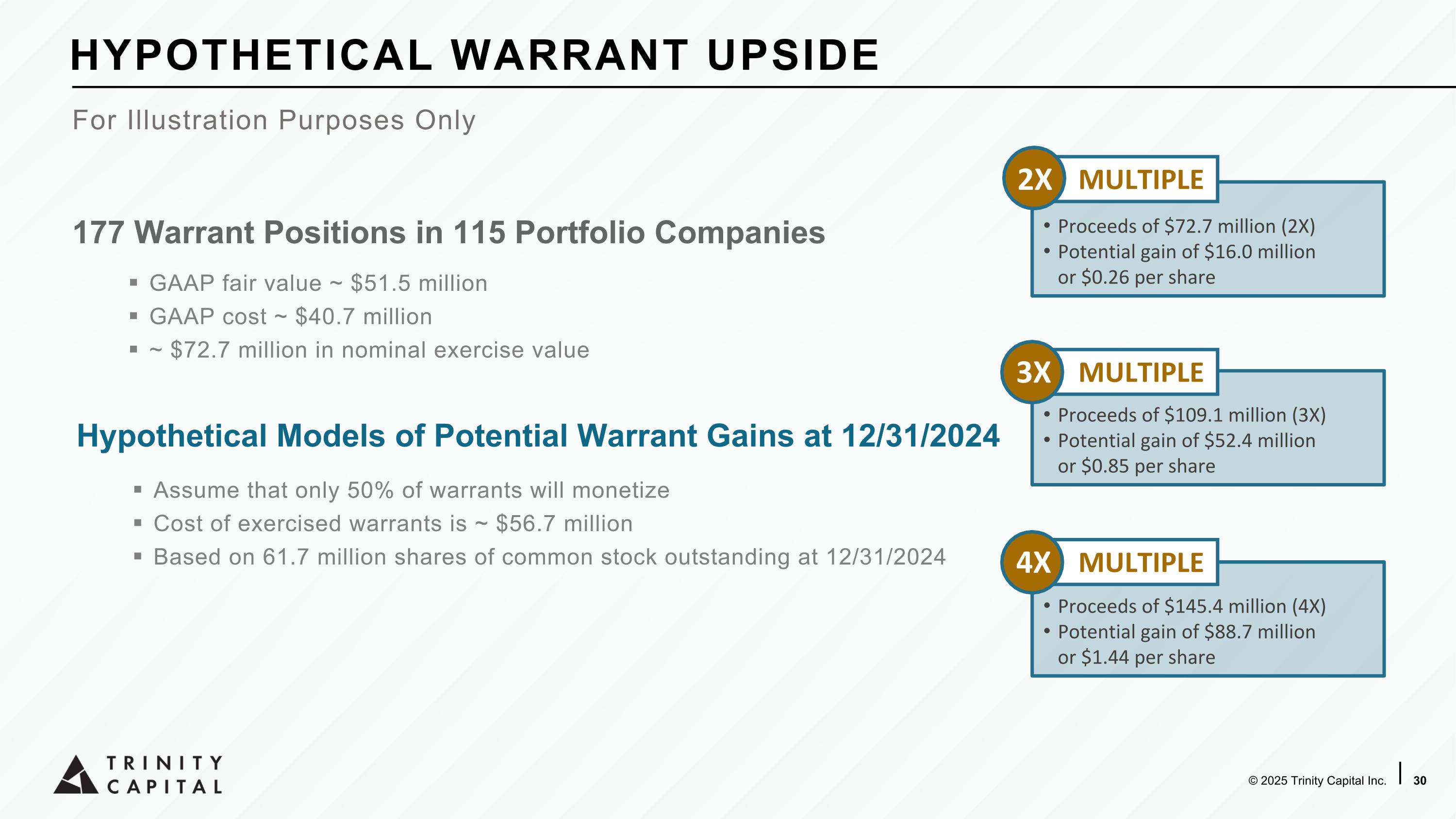

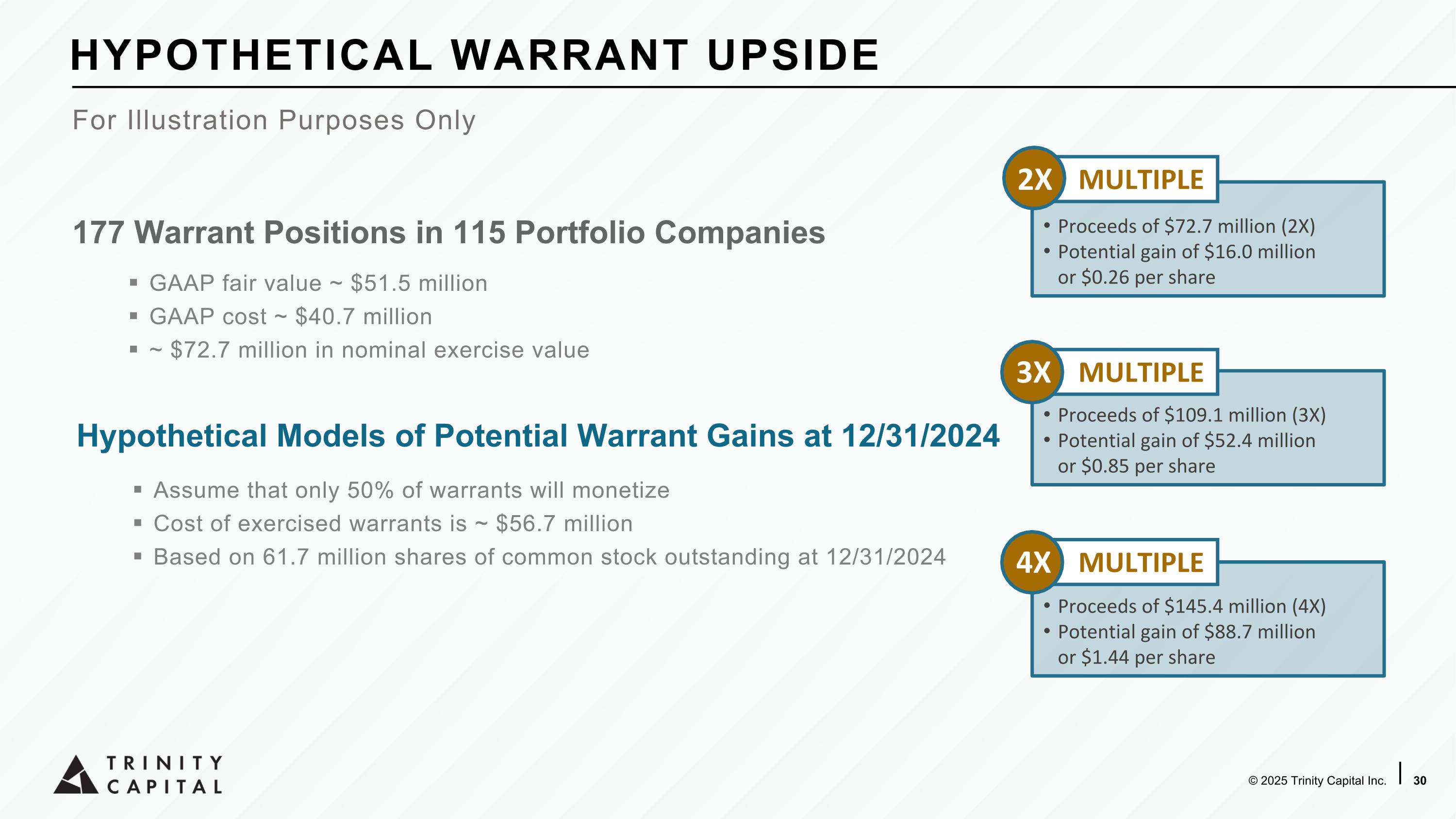

HYPOTHETICAL WARRANT UPSIDE Proceeds of $72.7 million (2X) Potential gain of $16.0 million�or $0.26 per share Proceeds of $109.1 million (3X) Potential gain of $52.4 million�or $0.85 per share Proceeds of $145.4 million (4X) Potential gain of $88.7 million�or $1.44 per share 177 Warrant Positions in 115 Portfolio Companies GAAP fair value ~ $51.5 million GAAP cost ~ $40.7 million ~ $72.7 million in nominal exercise value Hypothetical Models of Potential Warrant Gains at 12/31/2024 Assume that only 50% of warrants will monetize Cost of exercised warrants is ~ $56.7 million Based on 61.7 million shares of common stock outstanding at 12/31/2024 MULTIPLE MULTIPLE MULTIPLE 2X 3X 4X For Illustration Purposes Only

Select List of Current & Historical Investments DIVERSIFIED PORTFOLIO

ANALYST COVERAGE

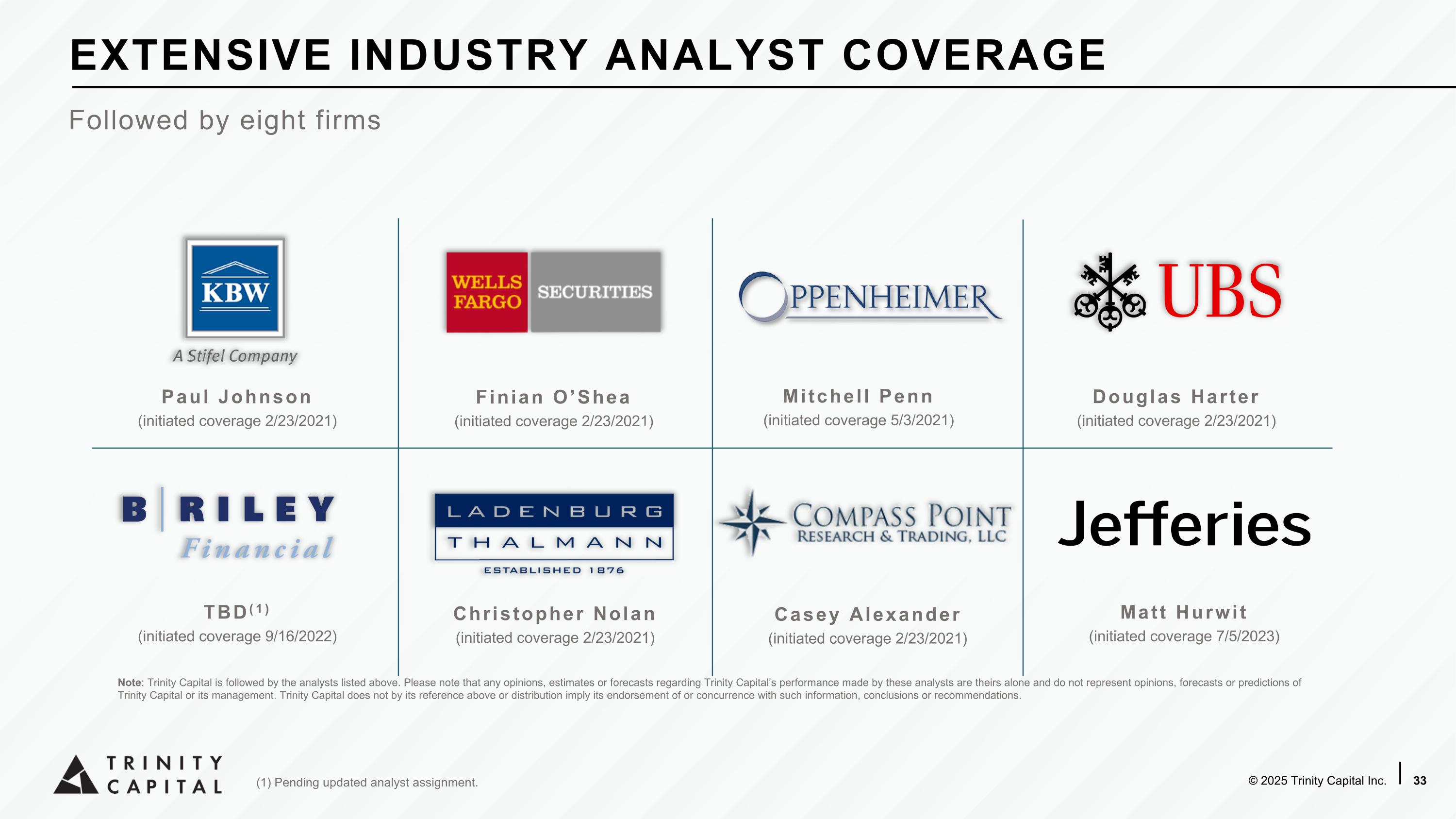

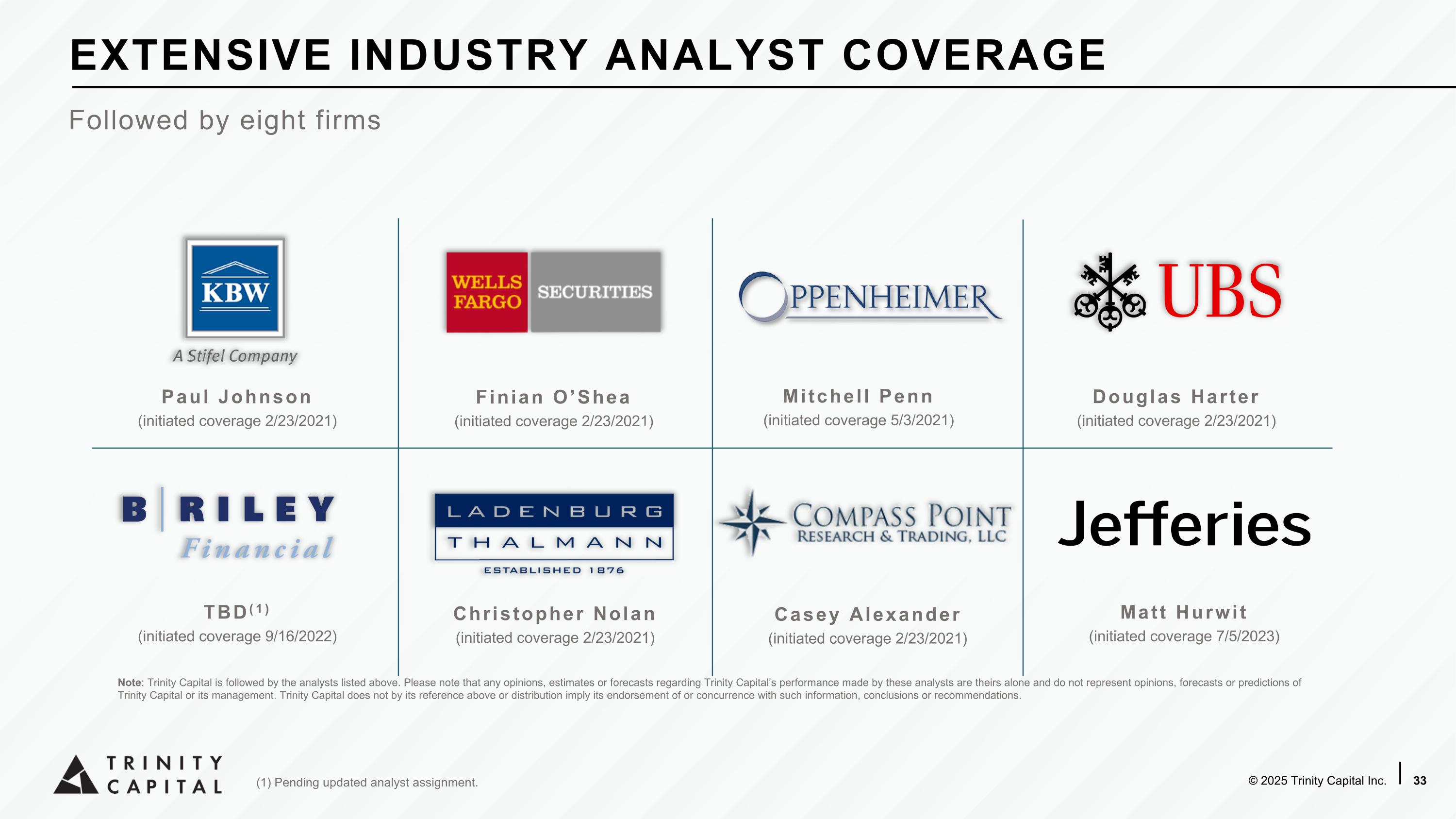

EXTENSIVE INDUSTRY ANALYST COVERAGE Followed by eight firms Paul Johnson (initiated coverage 2/23/2021) Finian O’Shea (initiated coverage 2/23/2021) Douglas Harter (initiated coverage 2/23/2021) TBD(1) (initiated coverage 9/16/2022) Casey Alexander (initiated coverage 2/23/2021) Christopher Nolan (initiated coverage 2/23/2021) Mitchell Penn (initiated coverage 5/3/2021) Note: Trinity Capital is followed by the analysts listed above. Please note that any opinions, estimates or forecasts regarding Trinity Capital’s performance made by these analysts are theirs alone and do not represent opinions, forecasts or predictions of Trinity Capital or its management. Trinity Capital does not by its reference above or distribution imply its endorsement of or concurrence with such information, conclusions or recommendations. Matt Hurwit (initiated coverage 7/5/2023) (1) Pending updated analyst assignment.

SUPPLEMENTAL INFORMATION

BUSINESS DEVELOPMENT COMPANY (BDC) REGULATED INVESTMENT COMPANY (RIC) Trinity Capital Inc. is an Internally Managed BDC regulated under the 1940 Act and has elected to be treated as a RIC for Federal Income Tax Purposes beginning with its Taxable Year ending December 31, 2020 Regulated by the SEC under the Investment Company Act of 1940 (the “1940 Act”) Leverage limited to approximately 2:1 debt-to-equity Investments are required to be carried at fair value Majority of Board of Directors must be independent Must offer managerial assistance to portfolio companies Must distribute at least 90% of taxable income as dividend distributions to shareholders, subject to approval by Board of Directors Mandates asset diversification Eliminates corporate taxation Allows for the retention of capital gains and/or spillover of taxable income REGULATION & STRUCTURE