0001786108Portfolio Company Warrant Investments- United States Consumer Products & Services Madison Reed, Inc.2024-12-310001786108Portfolio Company Debt Securities- Europe Industrials Aledia, Inc.Type of Investment Equipment Financing Investment Date August 5, 2022 Maturity Date September 1, 2025 Interest Rate Fixed interest rate 10.7%; EOT 7.0%2023-12-310001786108us-gaap:RestrictedStockMembertrin:TwoThousandNineteenLongTermIncentivePlanMember2022-01-012022-12-31

-vpstow20112

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-K

(Mark One)

| |

☒ | ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the Fiscal Year Ended December 31, 2024

OR

| |

☐ | TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

Commission file number: 001-39958

TRINITY CAPITAL INC.

(Exact name of registrant as specified in its charter)

| |

Maryland | 35-2670395 |

(State or other jurisdiction of incorporation or

organization) | (IRS Employer Identification No.) |

| |

1 N. 1st Street

Suite 302

Phoenix, Arizona | 85004 |

(Address of principal executive offices) | (Zip Code) |

(480) 374‑5350

(Registrant’s telephone number, including area code)

Securities registered pursuant to Section 12(b) of the Act:

| | | | |

Title of Each Class |

| Trading Symbol(s) |

| Name of each exchange on which registered |

Common Stock, par value $0.001 per share | | TRIN | | Nasdaq Global Select Market |

7.875% Notes Due 2029 | | TRINZ | | Nasdaq Global Select Market |

7.875% Notes Due 2029 | | TRINI | | Nasdaq Global Select Market |

Securities registered pursuant to Section 12(g) of the Act: None

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes ☐ No ☒

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or 15(d) of the Act. Yes ☐ No ☒

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes No ☐

Indicate by check mark whether the registrant has submitted electronically every Interactive Data File required to be submitted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit such files). Yes No ☐

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company, or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer”, “smaller reporting company” and “emerging growth company” in Rule 12b‑2 of the Exchange Act:

| | | |

Large accelerated filer | ☐ | Accelerated filer | ☒ |

Non-accelerated filer | ☐ | Smaller reporting company | ☐ |

|

| Emerging growth company | ☒ |

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Indicate by check mark whether the registrant has filed a report on and attestation to its management’s assessment of the effectiveness of its internal control over financial reporting under Section 404(b) of the Sarbanes-Oxley Act (15 U.S.C. 7262(b)) by the registered public accounting firm that prepared or issued its audit report. ¨

If securities are registered pursuant to Section 12(b) of the Act, indicate by check mark whether the financial statements of the registrant included in the filing reflect the correction of an error to previously issued financial statements. ¨

Indicate by check mark whether any of those error corrections are restatements that required a recovery analysis of incentive-based compensation received by any of the registrant’s executive officers during the relevant recovery period pursuant to §240.10D-1(b).¨

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b‑2 of the Act). Yes ☐ No ☒

The aggregate market value of the registrant’s common stock ($0.001 par value per share) held by non-affiliates of the registrant as of the last business day of the most recently completed second fiscal quarter was approximately $683,412,981, based on the closing sale price on the Nasdaq Global Select Market on that date of $14.14 per share.

As of February 24, 2025, the registrant had 62,831,103 shares of common stock ($0.001 par value per share) outstanding.

DOCUMENTS INCORPORATED BY REFERENCE

Portions of the registrant’s definitive Proxy Statement for its 2025 Annual Meeting of Stockholders, to be filed with the Securities and Exchange Commission within 120 days following the end of the registrant’s fiscal year, are incorporated by reference into Part III of this annual report on Form 10-K.

| | | | | |

PCAOB Firm Id: | 42 | Auditor Name: | Ernst & Young LLP | Auditor Location: | Los Angeles, CA |

TRINITY CAPITAL INC.

FORM 10‑K

TABLE OF CONTENTS

Cautionary Note Regarding Forward-Looking Statements

This annual report on Form 10-K contains forward-looking statements that involve substantial risks and uncertainties. Such statements involve known and unknown risks, uncertainties and other factors, and undue reliance should not be placed thereon. Any statements about our expectations, beliefs, plans, predictions, forecasts, objectives, assumptions or future events or performance are not historical facts and may be forward-looking. These statements are often, but not always, made through the use of words or phrases such as “anticipate,” “believes,” “can,” “could,” “may,” “predicts,” “potential,” “should,” “will,” “estimate,” “plans,” “projects,” “continuing,” “ongoing,” “expects,” “intends” and similar words or phrases. Accordingly, these statements are only predictions and involve estimates, known and unknown risks, assumptions and uncertainties that could cause actual results to differ materially from those expressed in them. Our actual results could differ materially from those anticipated in such forward-looking statements as a result of several factors discussed under Item 1A. “Risk Factors” of Part I of this annual report on Form 10-K, including, but not limited to, the following:

•our future operating results;

•our dependence upon our management team and key investment professionals;

•our ability to manage our business and future growth;

•risks related to investments in growth-oriented companies, other venture capital-backed companies and generally U.S. companies;

•the ability of our portfolio companies to achieve their objectives;

•risks related to the uncertainty of the value of our portfolio investments;

•changes in political, economic or industry conditions, including as a result of supply chain disruptions, the interest rate and inflation rate environments or conditions affecting the financial and capital markets;

•uncertainty surrounding domestic and/or global financial and/or political stability;

•the dependence of our future success on the general economy and its impact on the industries in which we invest;

•risks related to changes in interest rates and inflation rates, our expenses, and other general economic conditions and the effect on our net investment income;

•the impact of changes in laws or regulations (including the interpretation thereof), including tax laws, on our operations and/or the operations of our portfolio companies;

•risks related to market volatility, including general price and volume fluctuations in stock markets;

•our ability to make distributions; and

•our ability to maintain our status as a business development company (“BDC”) under the Investment Company Act of 1940, as amended (the “1940 Act”), and qualify annually for tax treatment as a regulated investment company (“RIC”) under Subchapter M of the Internal Revenue Code of 1986, as amended (the “Code”).

Additionally, there may be other risks that are otherwise described from time to time in the reports that we file with the U.S. Securities and Exchange Commission (the "SEC"). Any forward-looking statements in this Annual Report on Form 10-K should be considered in light of various important factors, including the risks and uncertainties listed above, as well as others. All forward-looking statements are necessarily only estimates of future results, and there can be no assurance that actual results will not differ materially from expectations, and, therefore, you are cautioned not to place undue reliance on such statements. Any forward-looking statements are qualified in their entirety by reference to the risk factors discussed throughout this annual report on Form 10-K. See “Item 1A. Risk Factors.” Further, any forward-looking statement speaks only as of the date on which it is made, and we undertake no obligation to update any forward-looking statement to reflect events or circumstances after the date on which the statement is made or to reflect the occurrence of unanticipated events. Because we are an investment company, the forward-looking statements and projections contained in this annual report on Form 10-K are excluded from the safe harbor protections provided by Section 27A(b)(2)(B) of the Securities Act of 1933, as amended (the "Securities Act"), and Section 21E of the Securities Exchange Act of 1934, as amended (the “Exchange Act”) (the “safe harbor” provisions of the Private Securities Litigation Reform Act of 1995).

PART I

Except where the context suggests otherwise, the terms “we,” “us,” “our,” and “the Company,” refer to Trinity Capital Inc. and its consolidated subsidiaries.

Item 1. Business

Organization

Trinity Capital Inc. (“Trinity Capital”), incorporated in Maryland on August 12, 2019, is an internally managed, closed-end, non-diversified management investment company that has elected to be regulated as a business development company (“BDC”) under the Investment Company Act of 1940, as amended (the “1940 Act”). Because we are internally managed, all of our executive officers and employees are employed by Trinity Capital. Therefore, we do not pay any external investment advisory fees, but instead directly incur the operating costs associated with employing investment and portfolio management professionals.

We have elected to be treated, currently qualify and intend to qualify annually, as a regulated investment company (“RIC”) under Subchapter M of the Internal Revenue Code of 1986, as amended (the “Code”), for U.S. federal income tax purposes. In order to maintain our treatment as a RIC, we are generally required to distribute at least annually to our stockholders at least the sum of 90% of our investment company taxable income (which generally includes our net ordinary taxable income and realized net short-term capital gains in excess of realized net long-term capital losses) and 90% of our net tax-exempt income (if any). We generally will not be subject to U.S. federal income tax on these distributed amounts but will pay U.S. federal income tax at corporate rates tax on any retained amounts.

On January 16, 2020, we completed a private equity offering (the “Private Common Stock Offering”) of shares of our common stock, pursuant to which we issued and sold 8,333,333 shares of our common stock for total aggregate gross proceeds of approximately $125.0 million, inclusive of an over-allotment option that was exercised in full on January 29, 2020.

Concurrent with the closing of the Private Common Stock Offering, we completed a private debt offering (the “144A Note Offering” and together with the Private Common Stock Offering, the “Private Offerings”) of $125.0 million in aggregate principal amount of our unsecured 7.00% Notes due 2025 (the “2025 Notes”), inclusive of an over-allotment option that was exercised in full on January 29, 2020.

On January 16, 2020, through a series of transactions, we acquired Trinity Capital Investment, LLC, Trinity Capital Fund II, L.P., Trinity Capital Fund III, L.P., Trinity Capital Fund IV, L.P. and Trinity Sidecar Income Fund, L.P. (collectively, the “Legacy Funds”) and all of their respective assets, including their respective investment portfolios (the “Legacy Portfolio”), as well as Trinity Capital Holdings, LLC, a holding company whose subsidiaries managed and/or had the right to receive fees from certain of the Legacy Funds. We used a portion of the proceeds from the Private Offerings to complete these transactions.

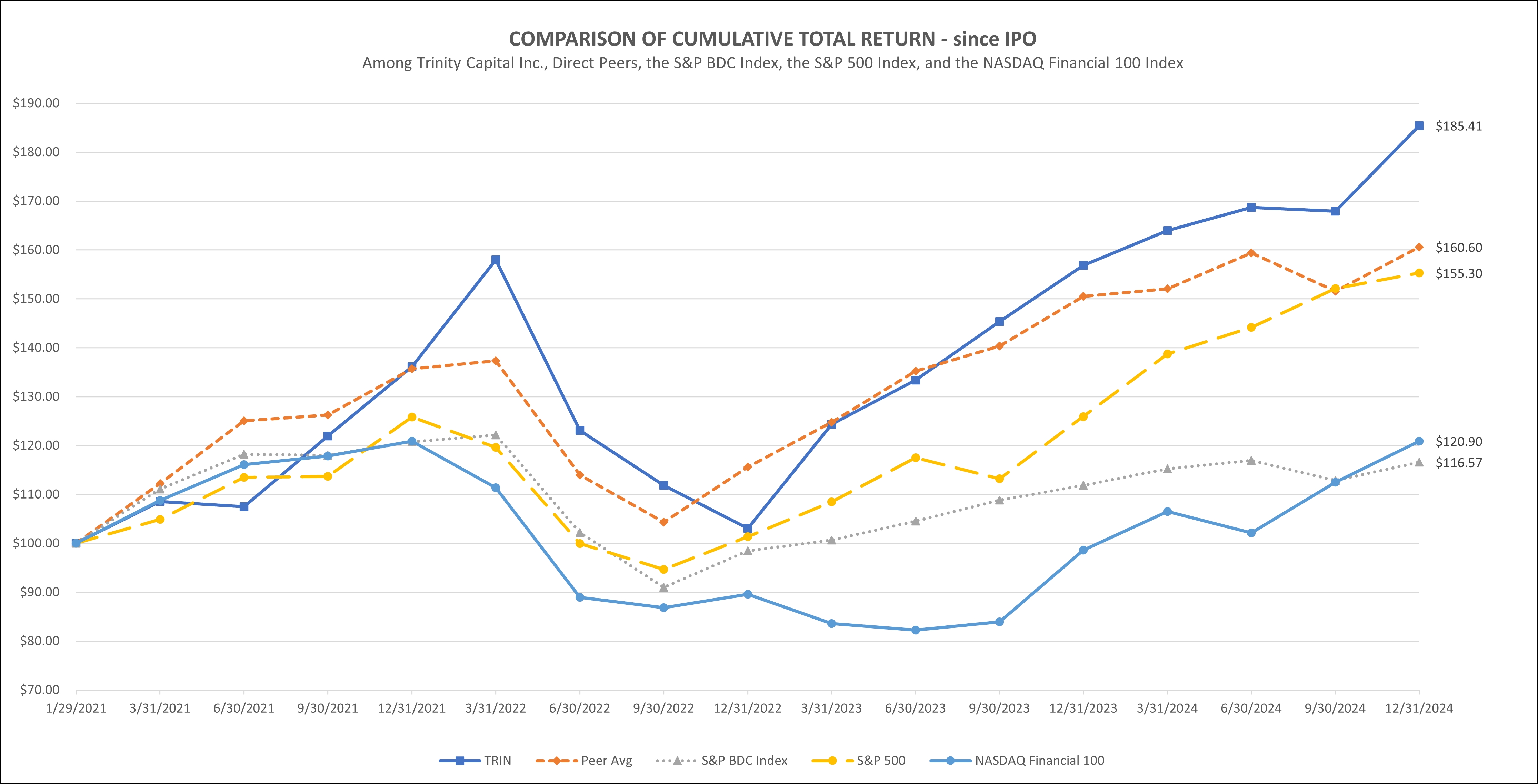

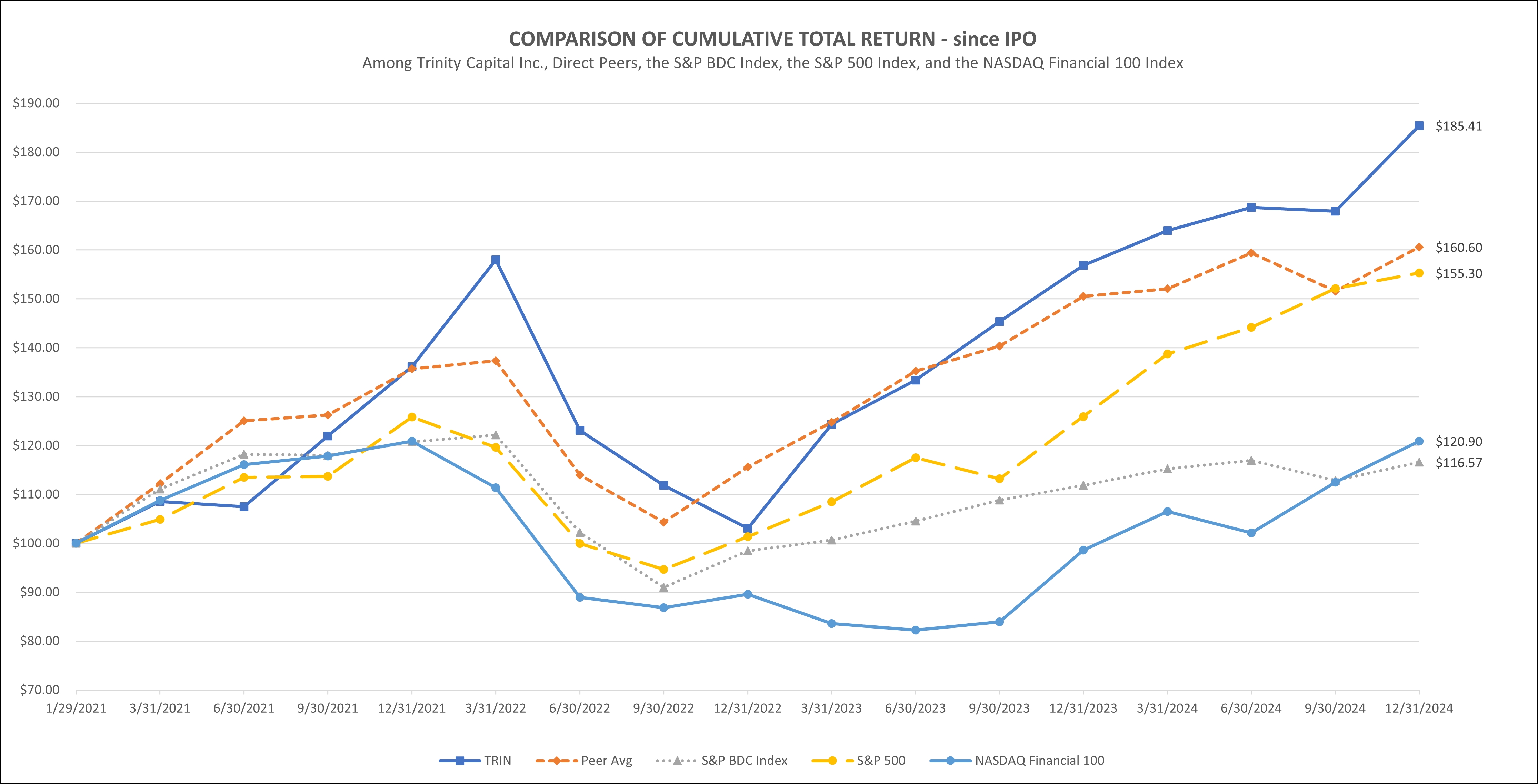

On February 2, 2021, we completed our initial public offering (“IPO”) of 8,006,291 shares of our common stock at a price of $14.00 per share, inclusive of the underwriters’ option to purchase additional shares, which was exercised in full. Our common stock began trading on the Nasdaq Global Select Market on January 29, 2021 under the symbol “TRIN.” Proceeds from this offering were primarily used to pay down a portion of our existing indebtedness outstanding.

TrinCap Funding, LLC (“TCF”), a Delaware limited liability company, was formed on August 5, 2021 as a wholly owned subsidiary of the Company to serve as a bankruptcy-remote entity for purposes of securing lending in conjunction with a credit agreement, as amended, with KeyBank, National Association (“KeyBank”) (such credit facility, as amended, the “KeyBank Credit Facility”). TCF is included as a consolidated subsidiary of the Company in our consolidated financial statements.

On December 5, 2022, we entered into a joint venture agreement with certain funds and accounts managed by a specialty credit manager to co-manage Senior Credit Corp 2022 LLC, a Delaware limited liability company (the “JV”). The JV invests in secured loans and equipment financings to growth-stage companies that have been originated by us.

On March 16, 2023, we formed an unconsolidated wholly owned subsidiary, Trinity Capital Adviser LLC, a Delaware limited liability company (“Adviser Sub”). We were granted exemptive relief by the SEC that permits us to organize, acquire, wholly own and operate the Adviser Sub as an investment adviser registered under the Investment Advisers Act of 1940, as amended (the “Adviser Act”). The Adviser Sub may provide investment advisory and related services to one or more investment vehicles (the “Adviser Funds”) with ownership by one or more unrelated third-party investors and receive fee income for such services.

On June 28, 2024, we and a specialty credit manager each funded a portion of our respective capital commitments to commence operations of a credit fund, EPT 16 LLC, a Delaware limited liability company (“EPT 16”). EPT 16 has acquired and intends to acquire, hold and, as applicable, dispose of investments that have been originated by us.

Overview

We are a specialty lending company that provides debt, including loans, equipment financings and asset-based lending, to growth-oriented companies, including institutional investor-backed companies. Our investment objective is to generate current income and, to a lesser extent, capital appreciation through our investments across five distinct vertical markets. We seek to achieve our investment objective by making investments consisting of term loans, equipment financings and asset-based lending and, to a lesser extent, working capital loans, equity and equity-related investments. Our equipment financings involve loans for general or specific use, including acquiring equipment, that are secured by the equipment or other assets of the portfolio company. In addition, we may obtain warrants or contingent exit fees at funding from many of our portfolio companies, providing an additional potential source of investment returns. The warrants entitle us to purchase preferred or common ownership shares of a portfolio company, and we typically target the amount of such warrants to scale in proportion to the amount of the debt or equipment financing. Contingent exit fees are cash fees payable upon the consummation of certain trigger events, such as a successful change of control or initial public offering of the portfolio company. In addition, we may obtain rights to purchase additional shares of our portfolio companies in subsequent equity financing rounds.

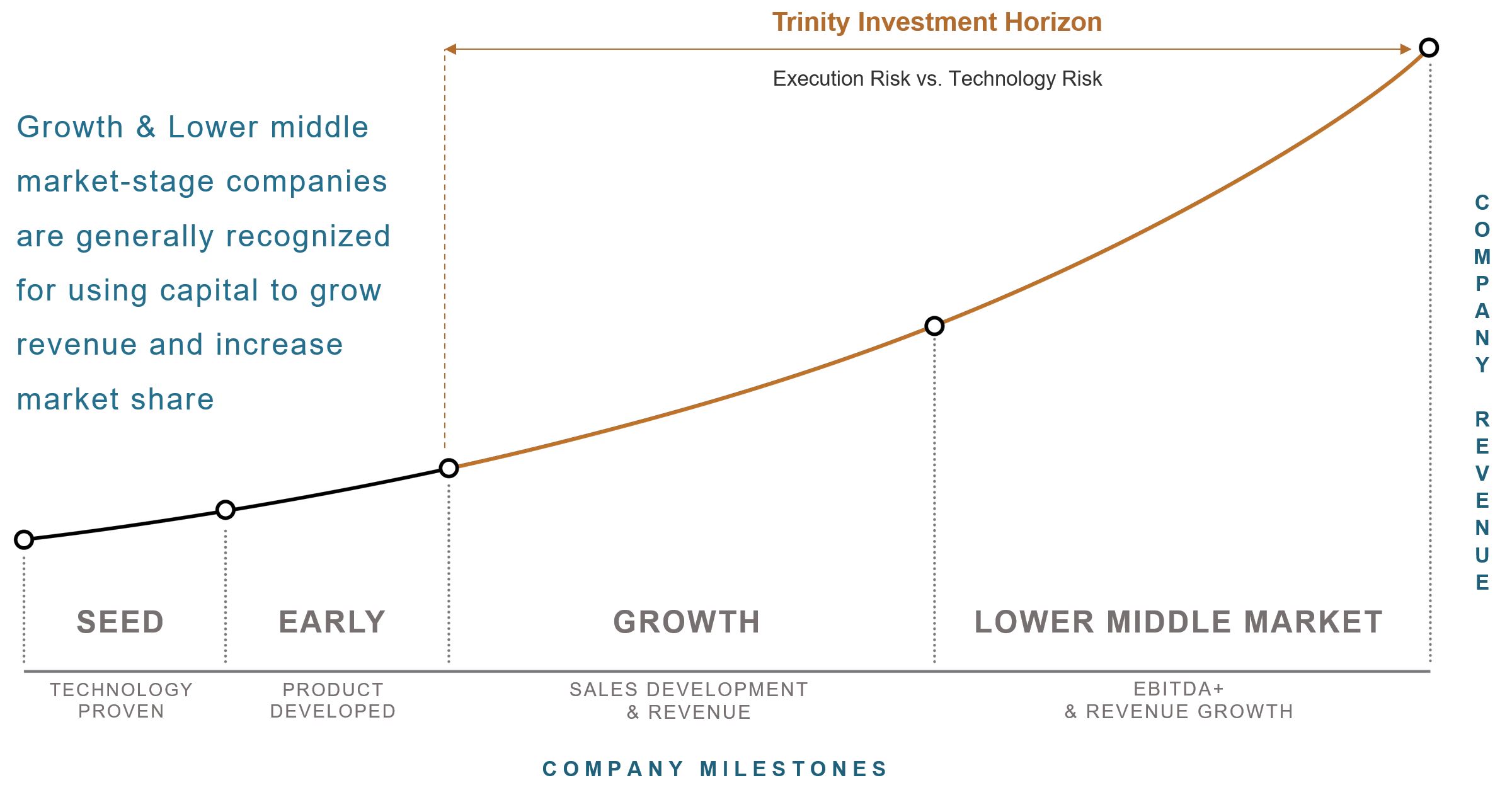

We target investments in growth-oriented companies with institutional investor support, experienced management teams, promising products and offerings, and large expanding markets. We define “growth-oriented companies” as companies that have significant ownership and active participation by sponsors and expected annual revenues of up to $100 million. These companies typically are private companies that have begun to have success selling their products to the market and need additional capital to expand their operations and sales. Despite often achieving growing revenues, these types of companies typically have limited financing options to fund their growth. Equity, being dilutive in nature, is generally the most expensive form of capital available, while traditional bank financing is rarely available, given the lifecycle stage of these companies. Financing from us bridges this financing gap, providing companies with growth capital, which may result in improved profitability, less dilution for all equity investors, and increased enterprise value. Subject to the requirements of the 1940 Act, we are not limited to investing in any particular industry or geographic area and seek to invest in under-financed segments of the private credit markets.

Our loans generally may have initial interest-only periods of up to 24 months, and our equipment financings generally begin amortizing immediately. Our loans and equipment financings generally have a total term of up to 60 months. These investments are typically secured by a blanket first position lien, a specific asset lien on mission-critical assets and/or a blanket second position lien. We may also make a limited number of direct equity and equity-related investments in conjunction with our debt investments. We target growth-oriented companies that have recently issued equity to raise cash to offset potential cash flow needs related to projected growth, have achieved positive cash flow to cover debt service, or have institutional investors committed to providing additional funding. A loan or equipment financing may be structured to tie the amortization of the loan or equipment financing to the portfolio company’s projected cash balances while cash is still available for operations. As such, the loan or equipment financing may have a reduced risk of default. We believe that the amortizing nature of our investments will mitigate risk and significantly reduce the risk of our investments over a relatively short period. We focus on protecting and recovering principal in each investment and structure our investments to provide downside protection.

Our loans and equipment financings generally range from $5 million to $50 million, and we generally limit each loan or equipment financing to approximately five percent or less of our total assets. We believe investments of this scale are generally sufficient to support near-term growth needs of most growth-oriented companies.

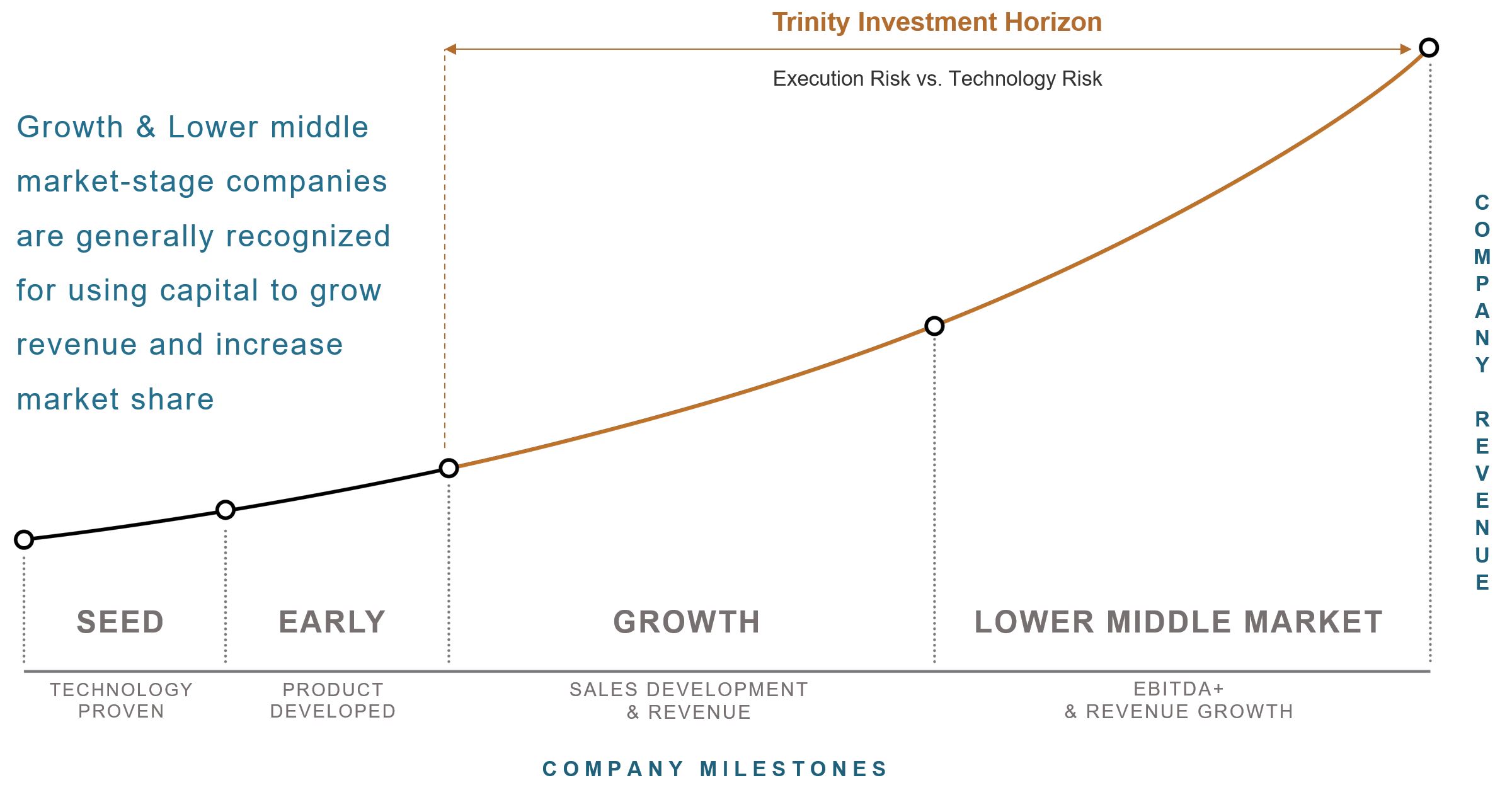

The following illustrates the lifecycle stage at which we seek to invest in our portfolio companies, although we may, at our discretion, invest in other lifecycle stages.

Human Capital Resources and Management Team

We are an internally managed BDC employing 88 dedicated professionals as of December 31, 2024, including 58 investment, origination and portfolio management professionals, all of whom have experience working on investment and financing transactions for growth- and early-stage companies. All of our employees are located in the United States.

Our management team has prior management experience, including with early-stage tech startups, and employs a highly systematized investment approach. Our senior management team, led by Kyle Brown, comprises the majority of the senior management team that managed the Legacy Funds and sourced the Legacy Portfolio, and we believe is well positioned to take advantage of potential investment opportunities available in the marketplace.

•Kyle Brown, our Chief Executive Officer, President and Chief Investment Officer, has been with Trinity since 2015 and is responsible for managing Trinity’s investment activities. He has historically managed relationships with potential investment partners, including venture capital firms and technology bank lenders, allowing us to nearly triple the number of investment opportunities reviewed by our senior management after Mr. Brown joined the senior management of Trinity.

•Steven L. Brown, our founder, is our Executive Chairman and has over 25 years of experience in venture equity and venture debt investing and working with growth-stage companies.

•Gerald Harder, our Chief Operating Officer, has been with Trinity since 2016, and we believe his prior 30 years of engineering and operations experience adds significant value in guiding the Company’s operations team and steward strategy.

•Ron Kundich, our Chief Credit Officer, is responsible for overseeing the Company’s lending, underwriting and credit processes.

•Michael Testa, our Chief Financial Officer and Treasurer, has over 20 years of finance and accounting experience, having worked both at a credit-focused asset manager and a large global accounting firm.

All investment decisions are made by our investment committee (the “Investment Committee”), whose members consist of Steven L. Brown, Gerald Harder, Kyle Brown, Ron Kundich and a vertical market leader (on a rotating basis throughout the year). We consider these individuals to be our portfolio managers. The Investment Committee approves proposed investments by majority consent in accordance with investment guidelines and procedures established by the Investment Committee.

Our employees drive the success of our business and investment strategy, including achieving our investment objective. We offer competitive compensation, benefits and training programs to develop our employees’ skills and expertise. We are committed to providing a safe, harassment-free work environment guided by principles of fair and equal treatment and focused on employee engagement.

Potential Competitive Advantages

We believe that we are one of only a select group of specialty lenders that has our depth of knowledge, experience, and track record in lending to growth-oriented companies. Further, we are one of an even smaller subset of specialty lenders that offers both loans and equipment financings. Our other potential competitive advantages include:

· In-house engineering and operations expertise to evaluate growth-oriented companies’ business products and plans.

We have a history of employing technology experts, including those with engineering and operations expertise, who have developed proven technology and hold patents in their names, as well as executives and other employees who have experience with the products and business plans of growth-oriented companies. The expertise, knowledge and experience of these individuals allows them to understand and evaluate the business plans, products and financing needs of growth-oriented companies, including the risks related thereto.

· Direct origination networks that benefit from relationships with venture banks, institutional equity investors and entrepreneurs built during the term of operations of the Legacy Funds, which began in 2008.

We seek to be the first contact for venture bankers who focus on growth-oriented companies and who have a portfolio company that would benefit from term debt or equipment financings. We have established relationships with the major technology banks over the last 10 years in every major market across the United States and have established standard intercreditor and subordination agreements, which we believe make working with technology banks seamless in most regions across the United States. These banks often will provide revolving credit facilities to growth-oriented companies and we seek to provide term debt and/or equipment financings to their portfolio companies.

We also focus on sourcing deals from the partners of growth-oriented institutional investors, including growth-oriented venture capital firms and private equity firms. We focus on building relationships with investors who have raised recent funds and have the ability to provide ongoing support to their portfolio companies.

We receive referrals directly to the executive officers of growth-oriented companies from these various stakeholders. Most of these stakeholders have board seats on the portfolio companies referred to us, are intimately involved in the business of such portfolio companies and generally serve as our advocates when term sheets are negotiated. We also receive introductions to companies for potential investment opportunities from executive officers with whom we have had business relationships at former portfolio companies.

· A dedicated staff of professionals covering credit origination and underwriting, as well as portfolio management functions.

We have a broad team of professionals focused on every aspect of the investment lifecycle. We have a credit origination and underwriting team that manages and oversees our investment process from identification of investment opportunity through negotiations of final term sheet and investment in a portfolio company. Our investment management and oversight activities are separate from our origination and underwriting activities. The team members serving our investment management and oversight functions have significant operating experience and are not associated with our origination function to avoid any biased views of performance. This structure helps our originators focus on identifying investment opportunities and building relationships with our portfolio companies.

· A proprietary credit rating system and regimented process for evaluating and underwriting prospective portfolio companies.

Historically, our management team has received significant prospective investment opportunities. In order to quickly review investment opportunities and evaluate risks, we have developed a detailed and consistent credit rating system. This system allows our analysts to receive a full set of financial statements and projections and quickly fill out a rating sheet for each potential investment, which includes using a series of weighted calculations to provide an initial “pass” or “fail” rating on the potential investment, as well as identifying specific risks for further consideration.

· Scalable software platforms developed during the term of operations of the Legacy Funds, which support our underwriting processes and loan monitoring functions.

We have an internally developed pipeline management tool which gives us a detailed look at our performance in real time. We believe our historical metrics generally predict our quarterly funding needs based upon the number of prospective investment opportunities we have at varying stages of our origination process. We believe this granular look at our underwriting process gives us the ability to increase or decrease marketing efforts in order to manage available capital and achieve our deployment goals.

Market Opportunity

We believe that an attractive market opportunity exists for providing debt and equipment financings to growth-oriented companies for the following reasons:

•growth-oriented companies have generally been underserved by traditional lending sources.

•Unfulfilled demand exists for loans and equipment financings to growth-oriented companies due to the complexity of evaluating risk in these investments.

•Debt investments with warrants are less dilutive than traditional equity financing and complement equity financing from venture capital and private equity funds.

•Equity funding of growth-oriented companies, including venture capital backed companies, has increased steadily over the last ten years, resulting in new lending and equipment financing opportunities.

•The annual venture debt market in the U.S. surpassed $30 billion for the fourth consecutive year in 2024. We believe that the equipment financing market is even more fragmented, with the majority of equipment financing providers unable to fund investments for more than $10 million. We believe there are significant growth opportunities for us to expand our market share in the venture debt market and become a one-stop shop for loans and equipment financings for growth-oriented companies.

Growth-Oriented Companies are Underserved by Traditional Lenders.

We believe many viable growth-oriented companies have been unable to obtain sufficient growth financing from traditional lenders, including financial services companies such as commercial banks and finance companies, because traditional lenders have continued to consolidate and have adopted a more risk-averse approach to lending. More importantly, we believe traditional lenders are typically unable to underwrite the risk associated with these companies effectively.

The cash flow characteristics of many growth-oriented companies include significant research and development expenditures and high projected revenue growth, thus often making such companies difficult to evaluate from a credit perspective. In addition, the balance sheets of many of these companies often include a disproportionately large amount of intellectual property assets, which can be difficult to value. Finally, the speed of innovation in technology and rapid shifts in consumer demand and market share add to the difficulty in evaluating these companies.

Due to the difficulties described above, we believe traditional lenders generally refrain from lending and/or providing equipment financing to growth-oriented companies, instead preferring the risk-reward profile of traditional fixed asset-based lending. We believe traditional lenders generally do not have flexible product offerings that meet the needs of growth-oriented companies. The financing products offered by traditional lenders typically impose restrictive covenants and conditions on borrowers, including limiting cash outflows and requiring a significant depository relationship to facilitate rapid liquidation.

Unfulfilled Demand for Loans and Equipment Financings to Growth-Oriented Companies.

Private capital in the form of loans and equipment financings from specialty finance companies continues to be an important source of funding for growth-oriented companies. We believe that the level of demand for loans and equipment financings is a function of the level of annual venture equity investment activity and can be as much as 20% to 30% of such investment activity. We believe this market is largely served by a handful of venture banks, with whom our products generally do not compete, and a relative few term lenders and lessors.

We believe that demand for loans and equipment financings to growth-oriented companies is currently underserved, given the high level of activity in venture capital equity market for the growth-oriented companies in which we invest. We believe certain venture lending companies have begun to focus on larger investment opportunities, potentially creating additional opportunities for us in the near term. Our senior management team has seen a significant increase in the number of potential investment opportunities over the last ten years.

Debt Investments with Warrants Complement Equity Financing from Venture Capital and Private Equity Funds.

We believe that growth-oriented companies and their financial sponsors will continue to view debt, including loans and equipment financings, as an attractive source of capital because it augments the capital provided by venture capital and private equity funds. We believe that our debt investments, including loans and equipment financings, will provide access to growth capital that otherwise may only be available through incremental equity investments by new or existing equity investors. As such, we intend to provide portfolio companies and their financial sponsors with an opportunity to diversify their capital sources. Generally, we believe many growth-oriented companies target a portion of their capital to be debt and equipment financing in an attempt to minimize ownership dilution to existing investors and company founders. In addition, because growth-oriented companies generally reach a more mature stage prior to reaching a liquidity event, we believe our investments could provide the capital needed to grow or recapitalize during the extended growth period sometimes required prior to liquidity events.

Investment Philosophy, Strategy and Process

Overview

We lend money in the form of term loans and equipment financings and, to a lesser extent, working capital loans to growth-oriented companies. Investors may receive returns from three sources — the loan’s interest payments or equipment financing payments and the associated contractual fees; the final principal payment; and, contingent upon a successful change of control or IPO, proceeds from the equity positions or contingent exit fees obtained at loan or equipment financing origination.

We primarily seek to invest in loans and equipment financings to growth-oriented companies that have generally completed product development and are in need of capital to fund revenue growth. We believe a lack of profitability often limits these companies’ ability to access traditional bank financing and our in-house engineering and operations experience allows us to better understand this risk and earn what we believe to be higher overall returns and better risk-adjusted returns than those associated with traditional bank loans. Leveraging the experience of our investment professionals, we seek to target companies at their growth-oriented of development and seek to identify financing opportunities ignored by the traditional direct lending community.

Subject to the requirements under the 1940 Act, which require that we invest at least 70% of our total assets in qualifying assets, we may also engage in other lending activities by investing in assets that are not qualifying assets under the requirements of the 1940 Act, including asset-backed lending, which may constitute up to 30% of our total assets.

We believe good candidates for loans and equipment financings appear in all business sectors. We are not limited to investing in any particular industry or geographic area and seek to invest in under-financed segments of the private credit markets. We believe in diversification and do not intend to specialize in any one sector. Our portfolio companies are selected from a wide range of industries, technologies and geographic regions. Since we focus on investing in portfolio companies alongside venture capital firms and technology banks, we anticipate that most of our opportunities will come from sectors that those sources finance.

Characteristics of Target Portfolio Companies

We seek to invest in a cross-section of growth-oriented companies. In addition to the criteria discussed in this annual report on Form 10-K, we may consider other factors such as portfolio company size, industry, historical revenue growth, management’s revenue growth projections, relevant operating margins, competition, management capabilities and geographic concentration. We will evaluate prospective portfolio companies quantitatively and qualitatively, and determine investments based on the key factors, including the following items:

•Recent, concurrent, or future funding by a venture capital firm;

•Strong, experienced and flexible management team;

•Successful, market-proven product and/or service with some proprietary characteristics;

•Application of proven technologies that enable their customers to reduce costs, improve strategic positioning or fundamentally change the competitive nature of their industries;

•Detailed business plan with multi-year projections that cover the full term of our investment; and

•A defined exit strategy with identified potential acquirers.

Investment Structure

We seek to structure portfolio investments to mitigate risk and provide attractive risk-adjusted returns for our investors while meeting portfolio companies financing needs. Typically, our loans, equipment financings and equity and equity-related investments take one of the following forms:

•Term Debt and Working Capital Loans. Term debt and working capital loans typically have initial interest-only periods of up to 24 months and may then fully amortize over a total term of up to 60 months. The annual stated interest rate on these loans typically has ranged from 8% to 16%.

•Equipment Financings. Typically, an equipment financing is structured as fully amortizing over a period of up to 60 months. The specific terms of each equipment financing depend on the creditworthiness of the portfolio company and the projected value of the financed assets. Occasionally, we offer an initial period at a lower finance factor to companies with stronger creditworthiness, which is analogous to an interest-only period on a term loan. Annual interest rates on equipment financings typically have ranged from 7% to 16%.

•Additional Deal Considerations. Additional deal considerations typically have included upfront fees of up to 2% of the invested principal, upfront structuring fees of approximately one-half month of finance payments for equipment financings, an upfront deposit of up to three months for equipment financings, and final payments of up to 15% of invested principal.

•Equity and Equity-Related Securities. We may also seek to obtain warrants entitling us to purchase preferred or common ownership shares of a portfolio company. We typically target the amount of such warrants to scale in proportion to the amount of the debt or equipment financing. We also attempt to structure such warrants so that the exercise price of the warrants will either be the price paid by venture capital investors in the most recent financing round or a current option price set by the portfolio company. Our typical exercise period for warrants is seven to 10 years. In addition, we may obtain rights to purchase additional shares of our portfolio companies in subsequent equity financing rounds.

Concentration Limits; Security

We endeavor to maintain reasonable limits of concentration to specific industries, technologies and geographic regions. By their nature, these limits are subjective and are applied solely at the discretion of management.

In all our loans, we seek to take a security position in all of the assets of the portfolio company, including intellectual property, if available. From time to time, we may agree to take a security position in less than the total amount of assets. In the case of equipment financings, for instance, the security interest may extend only to the asset(s) financed.

In addition, we seek to enter into standard intercreditor agreements with the major technology banks that we anticipate engaging with, making workout situations easier and less contentious. Where and when possible, we will execute deposit account control agreements with our portfolio companies for purposes of ensuring access to our collateral in a default. In all cases, we seek to put in place Uniform Commercial Code filings to perfect our security position, and to update these filings as necessary to reflect changes in our collateral.

Investment Process

Investment Originations; New Deals Referred

We have a multi-channel sourcing strategy focused primarily on growth-oriented venture capital firms, private equity firms, technology banks and, to a lesser extent, brokers who focus on our business. We have established relationships with the major technology banks and have established standard intercreditor and subordination agreements, which make working with technology banks seamless in most regions across United States.

We continue to expand our originations team internally in order to continue to focus on building relationships with individuals at top-tier venture capital firms as well as building out connections to a nationwide network of technology bankers. We have developed proprietary internal systems and technology to give our originations and marketing team real time information about the broader market and our investment pipeline, which we leverage to attempt to become and maintain our relationship as the first call for our referral sources.

Initial Rating

Our initial rating of every opportunity is primarily based on six factors, as well as other items that are deemed to be relevant by the due diligence team:

•Investor Syndicate: the portfolio company’s investors, specifically their ability and likelihood to provide ongoing financial support as needed;

•Management Team: the experience and strength of the portfolio company’s management team and board of directors;

•Product and Industry: the portfolio company’s products or services and the market needs that they fulfill;

•Financial Performance: the portfolio company’s historical and projected financial performance, including revenue potential, growth, gross margins and other metrics;

•Debt and Debt Structure: capital structure and cash life; and

•Collateral and Security: type and value of collateral (e.g., mission-critical assets), liens and other forms of security.

Investment opportunities that score an acceptable initial rating are moved on for further consideration.

Preliminary Due Diligence and Executive Summary

The next phase of the due diligence process involves a structured call with the management team of the prospective portfolio company. Following the management call, if the opportunity still appears to be worthy of consideration, an executive summary memorandum is prepared by the due diligence team for consideration and voting by the Investment Committee. The executive summary memorandum is distributed to the Investment Committee, and the deal terms for the investment are defined. If approved by the Investment Committee, we issue a term sheet to the prospective portfolio company.

Confirmatory Due Diligence and On-Site Meeting

If the term sheet offered by us is accepted by the prospective portfolio company, the process of obtaining additional confirmatory due diligence begins. The confirmatory due diligence process typically includes calls with the venture capital partners responsible for the equity financing of the portfolio company, as well as key customers, suppliers, partners, or other stakeholders as may be deemed relevant by the due diligence team. Additional financial analysis is performed, in order to confirm the cash life assumptions that were made prior to term sheet issuance. In the case of an equipment financing, or term loan in which fixed assets make up a significant portion of our collateral, the due diligence team completes an analysis of the equipment or fixed assets being financed, which may include calls to the original manufacturer and/or any dealers, resellers, or refurbishing companies, to evaluate the value of the equipment at inception, as well as the useful life and anticipated value throughout the life of our holding period. Occasionally, we may engage the assistance of an appraiser to assist in valuations.

The final step in the confirmatory diligence process generally involves an on-site meeting, at which members of our due diligence team meet with the management team of the prospective portfolio company for a final review of the portfolio company’s financial performance and forward-looking plans. This meeting is typically held at the business offices of the portfolio company; however, occasionally the meeting will be held via video teleconference if travel to the portfolio company is not possible. One or more members of the Investment Committee will attend the on-site meeting if possible.

Underwriting Report and Investment Committee Vote

Assuming that the confirmatory due diligence process reveals no issues that would cause the due diligence team to recommend against the proposed investment, the due diligence team prepares an Investment Underwriting Report (“IUR”), which is distributed to the Investment Committee. The Investment Committee then meets to discuss and review the deal terms and IUR regarding the proposed investment and a vote takes place. A majority of the Investment Committee is required to approve the transaction.

Investment Management and Oversight

Our investment management and oversight activities are separate from our origination and underwriting activities. The team members serving our investment management and oversight functions have significant operating experience and are not associated with our origination function to avoid any biased views of performance. Beyond the dedicated portfolio management team, all of our management team members and investment professionals are typically involved at various times with our portfolio companies and investments. Our portfolio management team reviews our portfolio companies’ monthly or quarterly financial statements and compares actual results to the portfolio companies’ projections. Additionally, the portfolio management team may initiate periodic calls with the portfolio company’s venture capital partners and its management team and may obtain observer rights on the portfolio company’s board of directors. Our management team and investment professionals anticipate potential problems by monitoring reporting requirements and having frequent calls with the management teams of our portfolio companies.

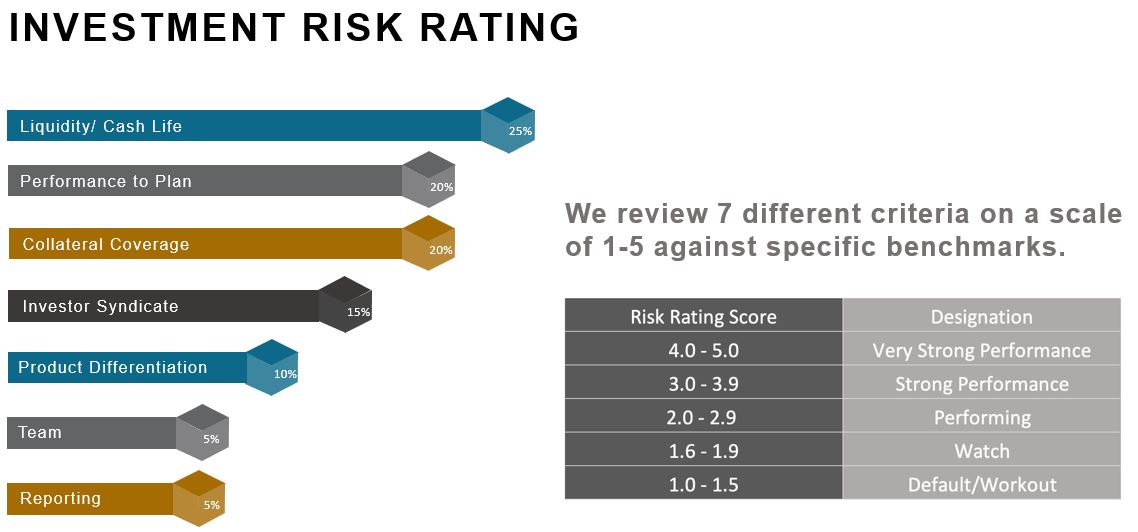

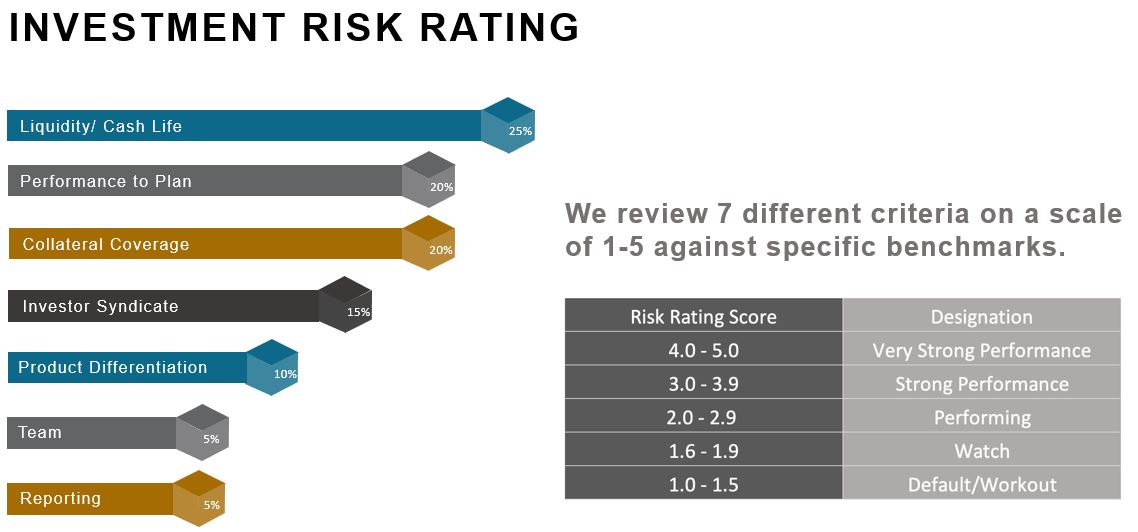

Investment Risk Rating System

Our portfolio management team uses an ongoing investment risk rating system to characterize and monitor our outstanding loans and equipment financings. Our portfolio management team monitors and, when appropriate, recommends changes to the investment risk ratings. Our Investment Committee reviews the recommendations and/or changes to the investment risk ratings, which are submitted on a quarterly basis to the Audit Committee (the “Audit Committee”) of our Board of Directors (the “Board”).

From time to time, we will identify investments that require closer monitoring or become workout assets. We will develop a workout strategy for workout assets and our Investment Committee will monitor the progress against the strategy. We may incur losses from our investing activities; however, we work with our troubled portfolio companies in order to recover as much of our investments as is practicable, including possibly taking control of the portfolio company. The risk rating system allows for early detection of issues and escalation to avoid credit losses.

For our investment risk rating system, we review seven different criteria and, based on our review of such criteria, we assign a risk rating on a scale of 1 to 5, as set forth in the following illustration.

As of December 31, 2024, the Company’s debt investment portfolio had a weighted average risk rating score of 2.9.

Competition

Our prospective markets are highly competitive and are characterized by competitive factors that vary based upon product and geographic region. Competitors vary and may include captive and independent finance companies, other BDCs, equity and debt focused public and private funds, commercial banks and thrift institutions, industrial banks, community banks, leasing companies, hedge funds, insurance companies, mortgage companies, manufacturers and vendors, and other financing providers. There has been substantial competition for attractive investment opportunities in the venture capital business, in particular.

These lenders will typically offer lower finance rates than non-bank finance companies (including us), but will require cash depository relationships, blanket liens and will often have certain performance and cash covenants, all of which make their lending program less flexible and, we believe, less attractive to borrowers. We compete, in part, on the basis of pricing, terms and structure. For additional information concerning the competitive risks we face, refer to “Item 1A. Risk Factors – Risks Relating to Our Business and Structure – We operate in a highly competitive market for investment opportunities, which could reduce returns and result in losses.”

Regulation

Emerging Growth Company

We are an emerging growth company as defined in the Jumpstart Our Business Startups Act of 2012 (the “JOBS Act”) and are eligible to take advantage of certain specified reduced disclosure and other requirements that are otherwise generally applicable to public companies that are not “emerging growth companies” including not being required to comply with the auditor attestation requirements of Section 404 of the Sarbanes-Oxley Act of 2002 (the “Sarbanes-Oxley Act”). Although we have not made a determination whether to take advantage of any or all of these exemptions, we expect to remain an emerging growth company for up to five years following the completion of our IPO or until the earliest of:

•the last day of the first fiscal year in which our annual gross revenues exceed $1.235 billion;

•December 31 of the fiscal year that we become a “large accelerated filer” as defined in Rule 12b-2 under the Exchange Act, which would occur if the market value of the shares of our common stock that is held by non-affiliates exceeds $700.0 million as of the last business day of our most recently completed second fiscal quarter and we have been publicly reporting for at least 12 months; or

•the date on which we have issued more than $1.0 billion in non-convertible debt securities during the preceding three-year period.

In addition, we will take advantage of the extended transition period provided in Section 7(a)(2)(B) of the Securities Act for complying with new or revised accounting standards.

Regulation as a Business Development Company

We have elected to be regulated as a BDC under the 1940 Act. The 1940 Act contains prohibitions and restrictions relating to transactions between BDCs and their affiliates, principal underwriters and affiliates of those affiliates or underwriters. The 1940 Act requires a majority of the members of the board of directors of a BDC be persons other than “interested persons,” as that term is defined in the 1940 Act. In addition, the 1940 Act provides that we may not change the nature of our business so as to cease to be, or to withdraw our election as, a BDC unless approved by a majority of our outstanding voting securities.

The 1940 Act defines “a majority of the outstanding voting securities” as the lesser of (i) 67% or more of the voting securities present at a meeting if the holders of more than 50% of our outstanding voting securities are present or represented by proxy or (ii) more than 50% of our outstanding voting securities.

Qualifying Assets. Under the 1940 Act, a BDC may not acquire any asset other than assets of the type listed in Section 55(a) of the 1940 Act, which are referred to as qualifying assets, unless, at the time the acquisition is made, qualifying assets represent at least 70% of the BDC’s total assets. The principal categories of qualifying assets relevant to our business are any of the following:

(1)Securities purchased in transactions not involving any public offering from the issuer of such securities, which issuer (subject to certain limited exceptions) is an eligible portfolio company, or from any person who is, or has been during the preceding 13 months, an affiliated person of an eligible portfolio company, or from any other person, subject to such rules as may be prescribed by the SEC. An eligible portfolio company is defined in the 1940 Act as any issuer which:

a.is organized under the laws of, and has its principal place of business in, the United States;

b.is not an investment company (other than a small business investment company wholly owned by the BDC) or a company that would be an investment company but for certain exclusions under the 1940 Act; and

c.satisfies any of the following:

i.does not have any class of securities that is traded on a national securities exchange;

ii.has a class of securities listed on a national securities exchange, but has an aggregate market value of outstanding voting and non-voting common equity of less than $250 million;

iii.is controlled by a BDC or a group of companies including a BDC and the BDC has an affiliated person who is a director of the eligible portfolio company; or

iv.is a small and solvent company having total assets of not more than $4 million and capital and surplus of not less than $2 million;

(2)Securities of any eligible portfolio company controlled by us;

(3)Securities purchased in a private transaction from a U.S. issuer that is not an investment company or from an affiliated person of the issuer, or in transactions incident thereto, if the issuer is in bankruptcy and subject to reorganization or if the issuer, immediately prior to the purchase of its securities was unable to meet its obligations as they came due without material assistance other than conventional lending or financing arrangements;

(4)Securities of an eligible portfolio company purchased from any person in a private transaction if there is no ready market for such securities and we already own 60% of the outstanding equity of the eligible portfolio company;

(5)Securities received in exchange for or distributed on or with respect to securities described in (1) through (4) above, or pursuant to the exercise of warrants or rights relating to such securities; or

(6)Cash, cash equivalents, U.S. government securities or high-quality debt securities maturing in one year or less from the time of investment.

In addition, a BDC must be operated for the purpose of making investments in the types of securities described in (1), (2) or (3) above.

Significant Managerial Assistance. A BDC must have been organized and have its principal place of business in the United States and must be operated for the purpose of making investments in the types of securities described above. However, in order to count portfolio securities as qualifying assets for the purpose of the 70% test, the BDC must either control the issuer of the securities or must offer to make available to the issuer of the securities (other than small and solvent companies described above) significant managerial assistance. However, where the BDC purchases such securities in conjunction with one or more other persons acting together, one of the other persons in the group may make available such managerial assistance. Making available significant managerial assistance means, among other things, any arrangement whereby the BDC, through its directors, officers or employees, offers to provide and, if accepted, does so provide, significant guidance and counsel concerning the management, operations or business objectives and policies of a portfolio company through monitoring of portfolio company operations, selective participation in board and management meetings, consulting with and advising a portfolio company’s officers or other organizational or financial guidance. We may, from time to time, receive fees for these services. In the event that such fees are received, we expect that they will be incorporated into our operating income and passed through to our stockholders, given the nature of our structure as an internally managed BDC.

Temporary Investments. Pending investment in other types of qualifying assets, as described above, our investments can consist of cash, cash equivalents, U.S. government securities or high quality debt securities maturing in one year or less from the time of investment, which are referred to herein, collectively, as temporary investments, so that 70% of our assets would be qualifying assets.

Issuance of Derivative Securities. Under the 1940 Act, a BDC is subject to restrictions on the issuance, terms and amount of warrants, options, restricted stock or rights to purchase shares of capital stock that it may have outstanding at any time. In particular, the amount of capital stock that would result from the conversion or exercise of all outstanding warrants, options or rights to purchase capital stock cannot exceed 25% of the BDC’s total outstanding shares of capital stock. This amount is reduced to 20% of the BDC’s total outstanding shares of capital stock if the amount of warrants, options or rights issued pursuant to an executive compensation plan would exceed 15% of the BDC’s total outstanding shares of capital stock. We have received exemptive relief from the SEC to permit us to issue restricted stock and stock options to our employees, officers and directors subject to the above conditions and the conditions of such exemptive relief, among others. See “—SEC Exemptive Application and Relief” below and “Note 8. Equity Incentive Plans” to our consolidated financial statements included with this annual report on Form 10-K for additional information.

Senior Securities; Coverage Ratio. We are generally permitted, under specified conditions, to issue multiple classes of indebtedness and one class of stock senior to our Common Stock if our asset coverage, as defined in the 1940 Act, is at least equal to 150% immediately after each such issuance. In connection with the organization of the Company, the Board and our initial sole stockholder authorized us to adopt the 150% asset coverage ratio. This means we are permitted to borrow $2 for investment purposes for every $1 of investor equity. For a discussion of the risks associated with leverage refer to "Item 1A. Risk Factors — Risks Relating to Our Business and Structure — Regulations governing our operation as a BDC affect our ability to, and the way in which we, raise additional capital.”

Code of Ethics. We have adopted a code of ethics pursuant to Rule 17j-1 under the 1940 Act that establishes procedures for personal investments and restricts certain personal securities transactions. Personnel subject to the code are permitted to invest in securities for their personal investment accounts, including securities that may be purchased or held by us, so long as such investments are made in accordance with the code’s requirements.

Affiliated Transactions. We are prohibited under the 1940 Act from conducting certain transactions with our affiliates without the prior approval of our directors who are not interested persons and, in some cases, the prior approval of the SEC.

Other. We will be periodically examined by the SEC for compliance with the 1940 Act and be subject to the periodic reporting and related requirements of the Exchange Act.

We are also required to provide and maintain a bond issued by a reputable fidelity insurance company to protect against larceny and embezzlement. Furthermore, as a BDC, we are prohibited from protecting any director or officer against any liability to stockholders arising from willful misfeasance, bad faith, gross negligence or reckless disregard of the duties involved in the conduct of such person’s office.

We are also required to designate a chief compliance officer and to adopt and implement written policies and procedures reasonably designed to prevent violation of the federal securities laws and to review these policies and procedures annually for their adequacy and the effectiveness of their implementation.

SEC Exemptive Application and Relief

On May 27, 2021, we received exemptive relief from the SEC that allows us to issue (i) restricted stock and stock options to our employee directors, executive officers and other employees under the 2019 Trinity Capital Inc. Long-Term Incentive Plan and (ii) restricted stock to our non-employee directors under the Trinity Capital Inc. 2019 Non-Employee Director Restricted Stock Plan, subject to the terms and conditions of such exemptive relief and such equity incentive plans. These equity incentive plans were initially approved by our Board on October 17, 2019, and by our stockholders on June 17, 2021 at our 2021 Annual Meeting of Stockholders, and our Board approved amendments to increase the shares available for issuance under each plan on April 23, 2024, and our stockholders approved such amendments on June 12, 2024 at our 2024 Annual Meeting of Stockholders. See “Note 8. Equity Incentive Plans” to our consolidated financial statements included with this annual report on Form 10-K for additional information.

On December 14, 2022, we received exemptive relief from the SEC that allows us to organize, acquire, wholly own and operate the Adviser Sub, as an investment adviser registered under the Investment Advisers Act of 1940, as amended, pursuant to which the Adviser Sub will provide investment management and other services to one or more privately-offered pooled investment vehicles, registered management investment companies, BDCs and/or investment accounts, and receive advisory fees for such services.

Certain U.S. Federal Income Tax Considerations

Taxation as a Regulated Investment Company

We have elected to be treated, currently qualify, and intend to operate in a manner so as to qualify annually, as a RIC for U.S. federal income tax purposes under Subchapter M of the Code. As a RIC, we generally will not be subject to U.S. federal income tax on any net ordinary income or capital gains that we timely distribute to stockholders as distributions. To qualify as a RIC, we must, among other things, meet certain source-of-income and asset diversification requirements (as described below). In addition, in order to obtain RIC tax benefits, we generally must timely distribute to stockholders, for each taxable year, at least 90% of our “investment company taxable income,” which is generally ordinary income plus the excess of realized net short-term capital gains over realized net long-term capital losses (the “Annual Distribution Requirement”).

If we qualify as a RIC and satisfy the Annual Distribution Requirement, then we will not be subject to U.S. federal income tax on the portion of income we timely distribute (or are deemed to distribute) to stockholders. We will be subject to U.S. federal income tax at the regular corporate rates on any income or capital gains not distributed (or deemed distributed) to stockholders.

We will be subject to a 4% nondeductible U.S. federal excise tax on certain undistributed income unless we distribute in a timely manner an amount at least equal to the sum of (i) 98% of net ordinary income for each calendar year, (ii) 98.2% of capital gain net income (adjusted for certain ordinary losses) for the one-year period ending October 31 in that calendar year and (iii) any net ordinary income and capital gain net income that we recognized in preceding years, but were not distributed during such years, and on which we paid no U.S. federal income tax (the “Excise Tax Avoidance Requirement”). While we intend to distribute any net ordinary income and capital gain net income in order to avoid imposition of this 4% U.S. federal excise tax, we may not be successful in avoiding entirely the imposition of this tax. In that case, we will be liable for the tax only on the amount by which we do not meet the foregoing distribution requirement.

In order to qualify as a RIC for U.S. federal income tax purposes, we must, among other things:

•continue to qualify as a BDC under the 1940 Act at all times during each taxable year;

•derive in each taxable year at least 90% of gross income from dividends, interest, payments with respect to loans of certain securities, gains from the sale of stock or other securities or foreign currencies, net income from certain “qualified publicly traded partnerships,” or other income derived with respect to the business of investing in such stock or securities (the “90% Income Test”); and

•diversify our holdings so that at the end of each quarter of the taxable year:

oat least 50% of the value of our assets consists of cash, cash equivalents, U.S. Government securities, securities of other RICs, and other securities if such other securities of any one issuer do not represent more than 5% of the value of our assets or more than 10% of the outstanding voting securities of the issuer; and

ono more than 25% of the value of our assets is invested in the (i) securities, other than U.S. government securities or securities of other RICs, of one issuer, (ii) securities, other than securities of other RICs, of two or more issuers that are controlled, as determined under applicable Code rules, by us and that are engaged in the same or similar or related trades or businesses or (iii) securities of one or more “qualified publicly traded partnerships” (the “Diversification Tests”).

We may be required to recognize taxable income in circumstances in which we do not receive cash. For example, if we hold debt obligations that are treated under applicable tax rules as having original issue discount (such as debt instruments with payment-in-kind, or PIK, interest or, in certain cases, increasing interest rates or issued with warrants), we must include in income each year a portion of the original issue discount that accrues over the life of the obligation, regardless of whether cash representing such income is received by us in the same taxable year. We may also have to include in income other amounts that we have not yet received in cash, such as PIK interest and deferred loan origination fees that are paid after origination of the loan. Because any original issue discount or other amounts accrued will be included in our investment company taxable income for the year of accrual, we may be required to make a distribution to stockholders in order to satisfy the Annual Distribution Requirement, even though we will not have received the corresponding cash amount.

Although we do not presently expect to do so, we are authorized to borrow funds, to sell assets and to make taxable distributions of our stock and debt securities in order to satisfy distribution requirements. Our ability to dispose of assets to meet distribution requirements may be limited by (i) the illiquid nature of our portfolio and/or (ii) other requirements relating to our status as a RIC, including the Diversification Tests. If we dispose of assets in order to meet the Annual Distribution Requirement or the Excise Tax Avoidance Requirement, we may make such dispositions at times that, from an investment standpoint, are not advantageous. If we are unable to obtain cash from other sources to satisfy the Annual Distribution Requirement, we may fail to maintain our qualification for tax treatment as a RIC and become subject to U.S. federal income tax at corporate rates.

Under the 1940 Act, we are not permitted to make distributions to our stockholders while debt obligations and other senior securities are outstanding unless certain “asset coverage” tests are met. In addition, we may be prohibited under the terms of any existing or future credit facilities from making distributions unless certain conditions are satisfied. If we are prohibited from making distributions, we may fail to qualify for tax treatment as a RIC and become subject to U.S. federal income tax at corporate rates.

Certain of our investment practices may be subject to special and complex U.S. federal income tax provisions that may, among other things: (i) disallow, suspend or otherwise limit the allowance of certain losses or deductions; (ii) convert lower taxed long-term capital gain into higher taxed short-term capital gain or ordinary income; (iii) convert an ordinary loss or a deduction into a capital loss (the deductibility of which is more limited); (iv) cause us to recognize income or gain without a corresponding receipt of cash; (v) adversely affect the time as to when a purchase or sale of securities is deemed to occur; (vi) adversely alter the characterization of certain complex financial transactions; and (vii) produce income that will not be qualifying income for purposes of the 90% Income Test described above. We will monitor our transactions and may make certain tax decisions in order to mitigate the potential adverse effect of these provisions.

A RIC is limited in its ability to deduct expenses in excess of its “investment company taxable income” (which is, generally, ordinary income plus the excess of net short-term capital gains over net long-term capital losses). If our expenses in a given year exceed investment company taxable income, we would experience a net operating loss for that year. However, a RIC is not permitted to carry forward net operating losses to subsequent years. In addition, expenses can be used only to offset investment company taxable income, not net capital gain. Due to these limits on the deductibility of expenses, we may, for U.S. federal income tax purposes, have aggregate taxable income for several years that we are required to distribute and that is taxable to stockholders even if such income is greater than the aggregate net income we actually earned during those years. Such required distributions may be made from cash assets or by liquidation of investments, if necessary. We may realize gains or losses from such liquidations. In the event we realize net capital gains from such transactions, a stockholder may receive a larger capital gain distribution than it would have received in the absence of such transactions.

Failure to Qualify as a RIC

If we are unable to qualify for treatment as a RIC in the future, and certain remedial procedures are not satisfied, we would be subject to U.S. federal income tax on such income at regular corporate rates (and also would be subject to any applicable state and local taxes), regardless of whether we make any distributions to stockholders. We would not be able to deduct distributions to stockholders, nor would distributions be required to be made. Distributions, including distributions of net long-term capital gain, would generally be taxable to stockholders as ordinary dividend income to the extent of our current and accumulated earnings and profits. Subject to certain holding period requirements and other limitations under the Code, corporate stockholders may be eligible to claim a dividend received deduction with respect to such dividend; non-corporate stockholders may be able to treat such distributions as “qualified dividend income,” which is subject to reduced rates of U.S. federal income tax. Distributions in excess of current and accumulated earnings and profits would be treated first as a return of capital to the extent of the stockholder’s adjusted tax basis, and any remaining distributions would be treated as a capital gain. In order to requalify as a RIC, in addition to the other requirements discussed above, we would be required to distribute all previously undistributed earnings attributable to the period during which we failed to qualify as a RIC by the end of the first year that we intend to requalify as a RIC. If we fail to requalify as a RIC for a period greater than two taxable years, we may be subject to U.S. federal income tax at regular corporate rates on any net built-in gains with respect to certain assets that we elect to recognize on requalification or when recognized over the next five years.

Corporate Information

Our principal executive offices are located at 1 N 1st Street, Suite 302, Phoenix, AZ 85004. We maintain a website on the Internet at www.trinitycapital.com. We make available, free of charge, on our website our proxy statement, annual report on Form 10-K, quarterly reports on Form 10-Q, current reports on Form 8-K and amendments to those reports as soon as reasonably practicable after we electronically file such material with, or furnish it to, the SEC. Information contained on our website is not incorporated by reference into this annual report on Form 10-K, and you should not consider that information to be part of this annual report on Form 10-K.

We file annual, quarterly and current periodic reports, proxy statements and other information with the SEC under the Exchange Act. In addition, the SEC maintains an Internet website at www.sec.gov that contains reports, proxy and information statements, and other information regarding issuers, including us, who file documents electronically with the SEC.

Item 1A. Risk Factors

You should carefully consider the risks and uncertainties described below, together with all of the other information in this annual report on Form 10-K, including “Item 7. Management’s Discussion and Analysis of Financial Condition and Results of Operations” and our consolidated financial statements and related notes. Our business, operating results, financial condition, or prospects could be materially and adversely affected by any of these risks and uncertainties. If any of these risks occurs, the trading price, if any, of our securities could decline, and you might lose all or part of your investment. Our business, operating results, financial performance, or prospects could also be harmed by risks and uncertainties not currently known to us or that we currently do not believe are material.

Summary of Principal Risk Factors

The following is a summary of the principal risks that you should carefully consider before investing in our securities and is followed by a more detailed discussion of the material risks related to us and an investment in our securities.

We are subject to risks related to our business and structure, including, but not limited to the following:

•We depend upon our senior management team and investment professionals, including the members of our Investment Committee, for our success.

•Our business model depends, to a significant extent, upon strong referral relationships with venture capital sponsors, and our inability to develop or maintain these relationships, or the failure of these relationships to generate investment opportunities, could adversely affect our business.

•Global economic, political and market conditions, including uncertainty about the financial stability of the United States, could have a significant adverse effect on our business, financial condition and results of operations.

•Regulations governing our operations as a BDC affect our ability to and the way in which we raise additional capital.

•Changes in laws or regulations governing our operations may adversely affect our business or cause us to alter our business strategy.

•Provisions in our existing and future credit facilities may limit our operations.

•We are exposed to risks associated with changes in interest rates and inflation rates.

•Most or a substantial portion of our portfolio investments will be recorded at fair value as determined in good faith by the Board and, as a result, there may be uncertainty as to the value of our portfolio investments.

•The Board may change our investment objective, operating policies and strategies without prior notice or stockholder approval, the effects of which may be adverse.

•Internal and external cybersecurity threats, as well as other disasters, may adversely affect our business or the business of our portfolio companies by impairing our ability to conduct business effectively.

We are subject to risks related to our investments, including, but not limited to the following:

•Our investments are very risky and highly speculative and a lack of liquidity in our investments may adversely affect us.

•Our investment strategy focuses on growth-oriented companies which are subject to many risks, including dependence on the need to raise additional capital, volatility, intense competition, shortened product life cycles, changes in regulatory and governmental programs, periodic downturns, below investment grade ratings, which could cause you to lose all or part of your investment in us.

•The equipment financing industry is highly competitive and competitive forces could adversely affect the financing rates and resale prices that we may realize on our equipment financing investment portfolio and the prices that we have to pay to acquire our investments.

•Economic recessions or downturns could impair our portfolio companies and harm our operating results.

•Our investments are geographically concentrated, which may result in a single occurrence in a particular geographic area having a disproportionate negative impact on our investment portfolio.

•We may be subject to risks associated with our investments in senior loans, junior debt securities and covenant-lite loans.

•We are subject to risks associated with investing alongside other third parties.

Risks related to an investment in our securities include, but are not limited to, the following:

•We may not be able to pay distributions, our distributions may not grow over time and/or a portion of our distributions may be a return of capital.

•Investing in our common stock may involve an above-average degree of risk, including the risk of dilution.

•The market value of our securities may fluctuate significantly, which may make it difficult to resell our securities, including at an attractive price.

•We may borrow money, which may magnify the potential for gain or loss and may increase the risk of investing in us.

•Our 4.375% Notes due 2026 (the “August 2026 Notes”), our 4.25% Notes due 2026 (the “December 2026 Notes”), our 7.875% Notes due March 2029 (the “March 2029 Notes”), our 7.875% Notes due September 2029 (the “September 2029 Notes”), and our 7.54% Series A Senior Notes, Tranche A, due October 29, 2027 (the “Series A 2027 Notes”), 7.60% Series A Senior Notes, Tranche B, due October 29, 2028 (the “Series A 2028 Notes”) and our 7.66% Series A Senior Notes, Tranche C, due October 29, 2029 (the “Series A 2029 Notes” and together with the Series A 2027 Notes and Series A 2028 Notes, the “Series A Notes”) are each unsecured and therefore effectively subordinated to any secured indebtedness we currently have outstanding or may incur in the future and rank pari passu, or equal in right of payment, with all outstanding and future unsecured unsubordinated indebtedness issued by us and our general liabilities.