As filed with the Securities and Exchange Commission on February 11, 2025.

Registration No. 333-

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM S-1

REGISTRATION STATEMENT

UNDER THE SECURITIES ACT OF 1933

ENVOY TECHNOLOGIES, INC.

(Exact name of registrant as specified in its charter)

| Delaware | | 7372 | | 81-3235132 |

(State or other jurisdiction of

incorporation or organization) | | (Primary SIC Code) | | (IRS Employer

Identification No.) |

Envoy Technologies, Inc.

8575 Washington Blvd.

Culver City, California 90232

(888) 610-0506

(Address, including zip code, and telephone number, including area code, of registrant’s principal executive offices)

Aric Ohana

Chief Executive Officer

Envoy Technologies, Inc.

8575 Washington Blvd.

Culver City, California 90232

(888) 610-0506

(Name, address, including zip code, and telephone number, including area code, of agent for service)

Copies to:

Spencer G. Feldman, Esq.

Dakota J. Forsyth, Esq.

Olshan Frome Wolosky LLP

1325 Avenue of the Americas

New York, New York 10019

(212) 451-2300 | | Aviv Hillo, Esq.

General Counsel

Blink Charging Co.

5081 Howerton Way, Suite A

Bowie, Maryland 20715

(305) 521-0200 | | Mitchell S. Nussbaum, Esq.

David J. Levine, Esq.

Loeb & Loeb LLP

345 Park Avenue

New York, New York 10154

(212) 407-4000 |

Approximate date of commencement of proposed sale to the public:

As soon as practicable after the effective date of this registration statement.

If any of the securities being registered on this Form are to be offered on a delayed or continuous basis pursuant to Rule 415 under the Securities Act of 1933, check the following box. ☒

If this Form is filed to register additional securities for an offering pursuant to Rule 462(b) under the Securities Act, please check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ☐

If this Form is a post-effective amendment filed pursuant to Rule 462(c) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ☐

If this Form is a post-effective amendment filed pursuant to Rule 462(d) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ☐

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer,” “smaller reporting company” and “emerging growth company” in Rule 12b-2 of the Exchange Act.

| Large Accelerated Filer | | ☐ | | Accelerated Filer | | ☐ |

| Non-Accelerated Filer | | ☒ | | Smaller Reporting Company | | ☐ |

| | | | | Emerging Growth Company | | ☒ |

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided to Section 7(a)(2)(B) of the Securities Act. ☐

The Registrant hereby amends this Registration Statement on such date or dates as may be necessary to delay its effective date until the Registrant shall file a further amendment which specifically states that this Registration Statement shall thereafter become effective in accordance with Section 8(a) of the Securities Act of 1933 or until the Registration Statement shall become effective on such date as the Commission, acting pursuant to said Section 8(a), may determine.

EXPLANATORY NOTE

This registration statement contains two prospectuses, as set forth below:

| | ● | Initial Public Offering Prospectus. A prospectus to be used for the initial public offering of __________ shares of common stock of Envoy Technologies, Inc., with such shares to be sold in an underwritten offering through the underwriters named on the cover page of the initial public offering prospectus. |

| | | |

| | ● | Resale Prospectus. A prospectus to be used for the resale from time to time by the selling stockholders named therein of __________ shares of common stock to be issued to such seller stockholders upon the effectiveness of this registration statement, as set forth in the resale prospectus. |

The resale prospectus is substantially identical to the initial public offering prospectus, except for the following principal differences:

| | ● | they contain different outside and inside front cover and back cover pages; |

| | ● | they contain different “Summary of the Offering” sections on page Alt-1; |

| | ● | they contain different “Use of Proceeds” sections on page Alt-2; |

| | ● | no “Dilution” section in the resale prospectus; |

| | ● | a “Selling Stockholders” section is included in the resale prospectus; |

| | ● | a selling stockholders “Plan of Distribution” is included in the resale prospectus in lieu of the section “Underwriting” in the initial public offering prospectus; and |

| | ● | the “Legal Matters” section in the resale prospectus on page Alt-8 deletes the reference to counsel for the underwriters. |

The registrant has included in this registration statement a set of alternate pages after the back cover page of the initial public offering prospectus (the “alternate pages”) to reflect the foregoing differences in the resale prospectus as compared to the initial public offering prospectus. The initial public offering prospectus will exclude the alternate pages and will be used for the initial public offering by the registrant. The resale prospectus will be substantially identical to the initial public offering prospectus except for the addition or substitution of the alternate pages and will be used for the resale offering by the selling stockholders.

The information in this preliminary prospectus is not complete and may be changed. These securities may not be sold until the Registration Statement filed with the Securities and Exchange Commission becomes effective. This preliminary prospectus is not an offer to sell nor does it seek an offer to buy these securities in any jurisdiction where the offer or sale is not permitted.

| PRELIMINARY PROSPECTUS | | SUBJECT TO COMPLETION DATED FEBRUARY 11, 2025 |

__________ Shares

ENVOY TECHNOLOGIES, INC.

Common Stock

This is the initial public offering of common stock of Envoy Technologies, Inc. No public market existed for our common stock before this offering. We are offering ________ shares. We estimate that our common stock’s initial public offering price will be between $____ and $____ per share. We intend to list our shares of common stock for trading on The Nasdaq Capital Market under the symbol “EVOY.” This listing is a condition to completing the offering.

Upon completing this offering, Blink Charging Co., our parent company (“Blink Charging”), will own approximately ___% of the outstanding shares of our common stock (or approximately ___% if the underwriters’ option to purchase additional shares of our common stock is exercised in full). As a result, we will be a “controlled company” within the meaning of the listing standards of Nasdaq and will qualify for exemptions from certain corporate governance requirements. Due to Blink Charging’s majority ownership of our common stock following this offering, Blink Charging will be able to control the outcome of matters requiring stockholder approval, including the election of directors, amendment of organizational documents and approval of major corporate transactions, such as a change in control, merger, consolidation or sale of assets. See “Management — Controlled Company Exemption.”

Concurrently with this offering, we are registering for resale by selling stockholders an aggregate of ________ shares of common stock to be issued to them upon the effectiveness of the registration statement of which this prospectus forms a part. These shares will be issued to the selling stockholders pursuant to an Agreement and Plan of Merger, dated as of April 18, 2023, among Blink Charging, its acquisition subsidiary Blink Mobility LLC (now known as Envoy Mobility, Inc. (“Mobility”)) and our company (the “Envoy Technologies Merger Agreement”), whereby we agreed to issue to the former stockholders of our company $22,500,000 worth of shares of our common stock at the same price as the initial public offering price per share of the common stock in this offering. Certain selling stockholders have agreed to enter into lock-up agreements that restrict the sale of ________ shares being registered for resale by such selling stockholders for a period of 120 days after the date of this prospectus, and such shares will be subject to certain leak-out restrictions thereafter. Sales of these shares, or the potential of such sales, upon expiration of the lock-up period may have an adverse effect on the market price of the shares offered hereby.

Investing in our common stock involves a high degree of risk. See the section titled “Risk Factors” beginning on page 15 of this prospectus to read about factors you should consider before purchasing shares of our common stock.

| | | Per Share | | | Total | |

| Initial public offering price | | $ | | | | $ | | |

| Underwriting discounts and commissions (1) | | $ | | | | $ | | |

| Proceeds to us, before expenses | | $ | | | | $ | | |

| (1) | Please see the section of this prospectus entitled “Underwriting” for additional information regarding compensation payable to the underwriters. |

We have granted a 45-day option to the underwriters to purchase up to ______ additional shares of our common stock, solely to cover over-allotments, if any, at the initial public offering price less underwriting discounts and commissions.

We are an “emerging growth company” as defined under the Jumpstart Our Business Startups Act of 2012 and, as such, have elected to comply with certain reduced public company reporting requirements for this prospectus and may elect to do so after this offering in future filings.

Neither the Securities and Exchange Commission nor any state securities commission has approved or disapproved of these securities or determined if this prospectus is truthful or complete. Any representation to the contrary is a criminal offense.

The underwriters expect to deliver the shares of our common stock to purchasers on or about _____, 2025.

Roth Capital Partners

The date of this prospectus is __________, 2025

Envoy Technologies is redefining mobility by leveraging private and public electric car-sharing programs and its proprietary technology to provide innovative, seamless and economically sustainable alternatives to car ownership, empowering communities of all types to embrace a smarter future of shared vehicle access.

ENVOY TECHNOLOGIES, INC.

Table of Contents

About this Prospectus

Neither we nor the underwriters have authorized anyone to provide any information or to make any representations other than those contained in this prospectus. We and the underwriters take no responsibility for, and can provide no assurance as to the reliability of, any other information that others may give you. This prospectus is an offer to sell only the securities offered hereby and only under circumstances and in jurisdictions where it is lawful to do so. No dealer, salesperson or other person is authorized to give any information or to represent anything not contained in this prospectus. You should assume that the information appearing in this prospectus is accurate only as of the date on the front of this prospectus only, regardless of the time of delivery of this prospectus, or any sale of a security. Our business, financial condition, results of operations, and prospects may have changed since those dates.

We are not, and the underwriters are not, offering to sell or seeking offers to purchase these securities in any jurisdiction where the offer or sale is not permitted. We and the underwriters have not done anything that would permit this offering or possession or distribution of this prospectus in any jurisdiction where action for that purpose is required, other than in the United States. Persons outside the United States who come into possession of this prospectus must inform themselves about, and observe any restrictions relating to, the offering of the securities as to distribution of the prospectus outside of the United States.

The industry and market data and certain other statistical information used throughout this prospectus are from our own research, surveys or studies conducted by third parties and industry or general publications. For example, this prospectus contains certain information from a 2024 survey conducted by Full Spectrum Insights, a market research firm engaged by us (“FSI”). Industry publications, third-party research, surveys and studies, including the 2024 survey conducted by FSI, generally indicate that their information has been obtained from sources believed to be reliable. However, they do not guarantee the accuracy or completeness of such information. We are responsible for all of the disclosures in this prospectus, and we believe that these sources are reliable; however, we have not independently verified the information in such publications. While we are not aware of any misstatements regarding any third-party information presented in this prospectus, their estimates, in particular, as they relate to projections, involve numerous assumptions, are subject to risks and uncertainties, and are subject to change based on various factors, including those discussed under the section entitled “Risk Factors” and elsewhere in this prospectus. Some data are also based on our good faith estimates.

The unaudited pro forma financial information of Envoy Technologies, Inc. presented in this prospectus has been derived from the application of pro forma adjustments to the historical consolidated financial statements for the Successor period (from April 18, 2023 through December 31, 2023) and the Predecessor period (from January 1, 2023 through April 17, 2023). These pro forma adjustments give effect to the Envoy Technologies Acquisition, as described in “The Envoy Technologies Acquisition and Stock Issuance”, as if the Envoy Technologies Acquisition had occurred on January 1, 2023 for the unaudited pro forma condensed combined statement of operations for our 2023 fiscal year. See “Unaudited Pro Forma Condensed Combined Financial Information” for a complete description of the adjustments and assumptions underlying the unaudited pro forma financial information included in this prospectus.

PROSPECTUS SUMMARY

This summary highlights information contained in greater detail elsewhere in this prospectus. This summary is incomplete and does not contain all the information you should consider in making your investment decision. You should read the entire prospectus carefully before investing in our common stock. You should carefully consider, among other things, our financial statements and the related notes and the sections entitled “Risk Factors,” “Summary Consolidated Financial Information,” “Unaudited Pro Forma Condensed Consolidated Financial Information” and “Management’s Discussion and Analysis of Financial Condition and Results of Operations” included elsewhere in this prospectus. Unless otherwise indicated or the context otherwise requires, the terms “we,” “us,” “our,” and “our company” refer to Envoy Technologies, Inc., a Delaware corporation.

Our Mission

At Envoy, we redefine mobility by offering innovative alternatives to car ownership. By leveraging private and public electric car-sharing programs and our proprietary technology, we empower communities to embrace a smarter, more convenient and economically sustainable future—where access to personal vehicles is shared, seamless and designed for tomorrow.

We are building sustainable communities of all types, from affordable to luxury, by providing convenient electric mobility solutions. By reducing reliance on private car ownership, we help decrease the cost of living, free up valuable urban space, and shrink carbon footprints—creating smarter, more connected, and more livable cities. The average privately owned car remains idle for approximately 95% of the time, according to an August 2018 Senseable City Lab publication, making it one of the least efficient assets for consumers, while the rising costs of car ownership and transportation have become major financial burdens. Our mission is to transform these inefficiencies into innovative, greener and more cost-effective mobility solutions. As on-demand and shared services become the norm, electric car-sharing (“EV-sharing”) naturally emerges as the next evolution in urban mobility. For over a century, cities have been designed around private car ownership, prioritizing gas-powered vehicles at the expense of space and sustainability. The future of mobility—electric, shared and autonomous—will redefine urban planning, reduce parking dependency and optimize urban design. Our innovative EV-sharing platform enables property owners and communities to offer a practical, sustainable alternative to car ownership.

The impact is clear—over the past year, 65% of our users experienced driving an EV for the first time through our service. Additionally, a 2023 survey conducted by Full Spectrum Insights, a market research firm engaged by us, found that more than 50% of urban respondents would be likely or very likely to consider reducing their number of personal vehicles and using a car-sharing service. We empower two-car households to downsize to one and single-car households to embrace a car-free lifestyle. We envision a future where shared electric mobility enhances lives, reduces urban congestion and fosters more sustainable, people-centric cities. With every shared ride, we move closer to a smarter, cleaner, and more efficient way of living.

Our EV-Sharing Services and Mobility Platform

We are a fast-growing EV-sharing operator and developer of electric fleet technologies based in Los Angeles. We provide electric car-sharing as a premium amenity for private properties like apartment buildings, hotels, and workplaces. We also collaborate with cities, municipalities, and non-profit organizations that fund programs to provide electric car-sharing services to broader public communities. We power our EV-sharing apps in all our operations through our advanced mobility platform. For the nine months ended September 30, 2024 compared to the nine months ended September 30, 2023, revenues from our Envoy Amenity and Envoy City operations (as described below) grew 22.5%, from $2,279,504 to $2,792,920. Under the Envoy Amenity and Envoy City agreements, partner revenue grew 16.8%, from $1,622,361 to $1,894,758, and booking revenue grew 36.7%, from $657,143 to $898,162.

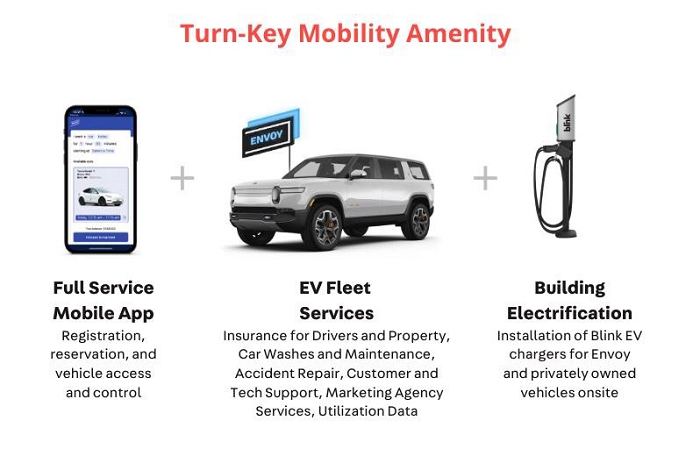

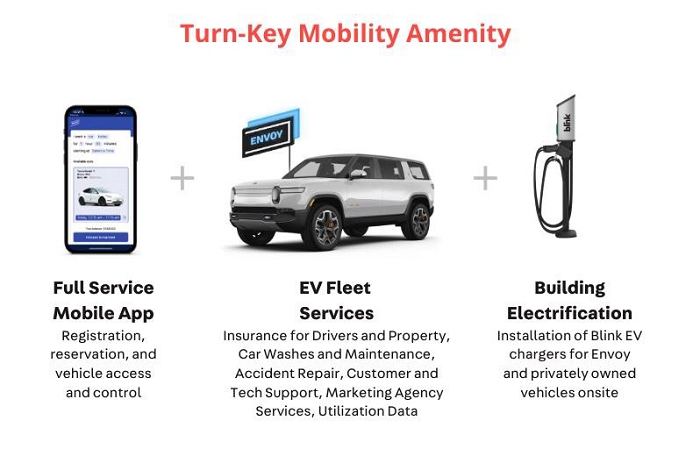

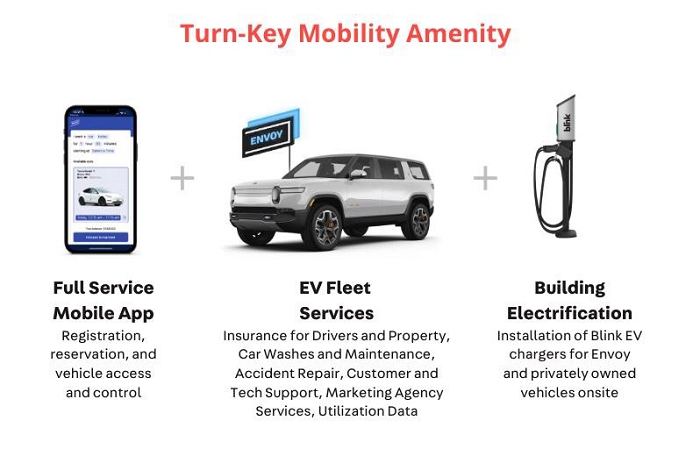

Envoy - Mobility as an Amenity®

In our Envoy Mobility as an Amenity operations, which we refer to as Envoy Amenity, we enter into long-term strategic agreements with national and local property owners and real estate developers (“private mobility partners”) to offer exclusive access to private EV-sharing services to their residents, tenants, and guests available only to those connected to the property as a premium amenity. We tailor the vehicle selection to fit the unique needs of each community, offering a diverse range of both economy and luxury EVs. Our EVs are conveniently parked onsite with dedicated chargers and are exclusively available to residents and guests. Drivers can easily reserve and access EVs through our intuitive mobile app, available on both iOS and Android, all powered by Envoy’s advanced technology for a seamless experience.

Our Envoy Amenity service eliminates the hassles and the irritating and expensive inconveniences of car ownership. We handle everything from car registration to cleaning and maintenance, while offering comprehensive auto and liability insurance, plus a dedicated 24/7 support team. This makes sustainable mobility not only more affordable but also far more convenient for residents and guests.

We generate revenue from our private mobility partners through start-up fees, monthly service fees, and end-user bookings. Start-up fees cover our cost of equipping the vehicle with our hardware and delivering it to client sites. Monthly service fees typically cover our monthly amortized costs for the vehicle, including insurance, car cleaning, and maintenance. Additionally, we earn revenue from residents, tenants, and guests (the “end-users”) who book on-demand or schedule an hourly, daily or weekly rate. See “Our Revenue Model” for more information.

We leverage revenue-sharing models to create novel income opportunities for our private mobility partners while fostering customer loyalty and boosting brand recognition. This approach is reshaping how commercial real estate developers and property owners assess and optimize their properties and parking facilities. Moreover, our platform provides private mobility partners with granular real-time usage statistics and analytics, empowering them to evaluate and optimize the performance of their investments. Partnering with Envoy Amenity also helps property owners qualify for financial incentives and achieve sustainability goals. For example, including EV-sharing and charging services in property development plans provides development incentives and parking reduction opportunities and contributes to LEED (leadership in energy and environmental design) green building certification by the U.S. Green Building Council, aligning with environmental, social and corporate-governance (“ESG”) goals. We believe Envoy Amenity is a cost-effective revenue-sharing model, delivering an environmentally impactful and useful service with minimal financial and administrative burdens.

As of February 11, 2025, Envoy Amenity’s customer base consisted of approximately 100 private mobility partners covering more than 150 locations, including some of the nation’s largest developers and owners of residential multi-family apartment buildings, hotels, and workplaces, such as the property management groups of Douglas Elliman Inc., Greystar Global Enterprise, LLC, LeFrak Organization Inc., and The Related Companies L.P. We operate in more than 50 U.S. cities across 23 states, including Los Angeles, San Francisco, Miami, New York, and Chicago, focusing on large, densely populated metropolitan areas with high parking costs and an elevated cost of living. Our standard strategic agreements with private mobility partners have a 36-month term, with an average remaining contract duration of approximately 21 months.

In October 2024, we partnered with several property management companies to expand exclusive access to our EV fleets for residents of luxury apartment complexes. In California, we partnered with The Holland Group and Brookfield Properties to install a fleet of Lucid Motors EVs at three properties located in Santa Clara and Los Angeles. Residents can now book Lucid Air electric vehicles through our mobility platform and have access to dedicated ground-level onsite charging stations. In addition, we partnered with UNLMTD Real Estate Group, LLC to introduce an onsite fleet of electric Fiat 500e vehicles at FIAT House, a luxury residential property in Fort Lee, New Jersey. Exclusive access to these vehicles through our mobile app grants residents the flexibility to book zero-emission transportation by the hour or for days at a time. Through these strategic private partnerships, we provide sustainable transportation options to residents via turnkey access to a variety of EVs.

Envoy - City Public Partnerships

Envoy City is our dedicated public partnership initiative, where we collaborate with city municipalities, political subdivisions, government agencies, public utility companies, non-profits, and other transportation providers (“public partners”) to offer sustainable EV-sharing services. Through these collaborations, we aim to serve broader underserved communities, such as low-income, disadvantaged communities, effectively making the need for a privately-owned car obsolete. Offering affordable, eco-friendly EV-sharing – whether for round trips or one-way journeys – provides a new public transportation option that reduces the number of gas-powered vehicles on the road, in addition to freeing up more parking spaces. This helps ease the strain on in-city traffic and lowers pollution, while promoting greener and more sustainable living spaces. Nearly 17,000 drivers in select U.S. cities have used our car-sharing services since June 2017.

Our Envoy City public partners seek innovative solutions to allocate resources effectively, enhance community mobility, and drive EV adoption initiatives. We believe our experience, expertise, and track record of facilitating effective public EV-sharing services will further increase our ability to penetrate urban areas. We have a strong history of collaborating with community leaders bringing our services to underserved areas. In addition, we believe our platform offers a distinct advantage in terms of upfront infrastructure investment and operational management compared to other public transit services. Our comprehensive approach encompasses advanced technology and operational support. We believe our solution simplifies the process for our public partnerships, streamlining their efforts to provide efficient and accessible transportation solutions to their communities.

To generate revenue from our Envoy City operations, we work with public, non-profit and private partners that provide us with subsidies and grants to cover the direct costs of our EV-sharing services. These programs are designed and budgeted by us to ensure that the revenue generated from such programs exceeds the variable costs associated with the operations. Depending on the program, additional revenue is generated from end-users who book on-demand or schedule an hourly, daily, or weekly rate. See “Our Revenue Model” for more information.

Most of our grant funding is obtained as part of a six to 12-month request for proposal process conducted by city and state governmental agencies and non-profits which solicit applications and competitively select projects based on specific evaluation criteria and program priorities. Examples include our collaborations with the Los Angeles Cleantech Incubator, a private non-profit incubator for cleantech startups (“LACI”), and the California Air Resources Board – as well as housing authorities such as the Housing Authority of the City of Los Angeles (“HACLA”) and the Sacramento Housing and Redevelopment Agency. In March 2024, we partnered with HACLA and LACI to provide residents of Rancho San Pedro public housing with access to our service platform as part of an existing electric car share program. We have also launched innovative rebate programs with utility companies, including the Anaheim Public Utilities, the Los Angeles Department of Water and Power, and Austin Energy, incentivizing private property owners to install EV charging infrastructure.

In March 2023, we were awarded $8.5 million, combined, to develop electric car-sharing programs in New Jersey, to be funded by the State of New Jersey’s Region Greenhouse Gas Initiative. With this award, we plan to launch a statewide publicly accessible electric car-sharing program featuring car-sharing services at subsidized rates in overburdened communities. We also anticipate deploying roughly 16 EVs for a car-sharing pilot serving affordable housing units in Jersey City and other nearby cities, covering six buildings. Both projects are currently in the planning phase. We expect the projects to be launched and funded later in 2025, which will further expand our nationwide reach.

Grant funding from municipalities and other public partners typically includes material obligations that we must satisfy to remain in compliance with the programs. While these obligations vary by grant, they generally require us to deliver our EV-sharing services—such as mobile applications, fleet management, and customer support—within a specified geographic area, adhere to the program’s approved budget, provide regular reports on key metrics (e.g., usage rates, environmental impact such as emissions reductions, and user demographics), and ensure the program is accessible to underserved communities or other target populations. Although we have not yet entered into a grant agreement with respect to New Jersey’s Regional Greenhouse Gas Initiative, we expect such an agreement will contain the material obligations outlined above.

Since 2017, Envoy City has been awarded approximately $13 million in grant funding from various state and local government programs. Envoy City has and will continue to leverage state and local government grants and subsidies for proposed expansion.

Electric Car-Sharing and EV Fleet Technology Platform

Our proprietary technology platform, developed and refined through extensive experience over eight years of operations, is purpose-built using a scalable, modern technology stack to deliver a complete, secure end-to-end driver experience for the shared mobility space. The platform provides a mobile-centric driver experience on the Android and iOS platforms for sign-up, vehicle reservations, keyless vehicle access (lock and unlock), and payment systems. Leveraging our insights from over a decade of combined experiences, our dynamic platform accommodates both round-trip and one-way EV-sharing, offering drivers the flexibility to reserve an electric vehicle instantly or for future use, and allowing them to drive to their destination without having to return to their original pick-up location. Currently, there are a total of approximately 300 EVs registered on the platform, all of which are used as part of our private mobility or city public service.

In addition to the driver experience, the platform provides real-time analytics and integration with payment systems, charging stations, and individual automakers’ EV software systems to round out all the features available to meet the demands of modern consumers seeking user-friendly experiences. We have simplified the process to provide users with an easier platform to find and reserve a vehicle, resulting in a hassle-free experience that promotes customer satisfaction and loyalty.

Our platform incorporates an advanced fleet management system, which is central to our business. It is designed to optimize operations while maintaining service standards, leveraging telematics for real-time vehicle diagnostic monitoring. In addition to our technical advantages, we prioritize security and trust. Robust user verification and end-to-end encryption safeguard user personal data, ensuring that operations are coupled with a commitment to user protection. Our platform integrates seamlessly with the Blink Charging network, offering a unified solution for managing EV charging infrastructure, electric fleets, and drivers. This integration underscores our commitment to innovation, operational efficiency, and growth.

Our full-stack technology platform for EV fleet management is versatile and can be deployed for a wide range of vehicles and fleet types worldwide, available for use by other car-sharing operators or fleet managers under a franchise or licensing fee structure. Our platform currently services a total of approximately 300 EVs, which are managed by us, Kowa America (our licensed partner) and BlueLA (a public car-sharing affiliate). We believe we can leverage our platform for use by other third-party operators and fleet managers for a fee in the future. We recognize the growing demand from riders and individual operators seeking to share vehicles, and our platform is designed to support this shift in mobility to services including, but not limited to, EV fleet sharing, peer-to-peer sharing, and private fleet management.

By enabling seamless virtual connectivity, our platform also empowers end-users to participate in the “gig economy,” such as leveraging our vehicles for work with third-party service providers like Uber, UberEats, and Lyft, thereby broadening its application across a diverse shared mobility sector.

Private Mobility Partners and City Public Partnerships

From June 2017 through January 2025, our private mobility and public end-users collectively booked over 1,100,000 hours and embarked on approximately 200,000 trips using our platform. Over the past three years, end-users booked 21,701 trips in 2022, 31,774 trips in 2023, and 56,375 trips in 2024, amounting to 175,508 hours, 265,318 hours, and 241,633 hours of usage, respectively. Usage hours increased by 37.7% and trip bookings increased by 159.8% from 2022 to 2024.

This diverse group of private mobility and public end-users represents various demographics, socioeconomic backgrounds, and community types, all of whom book EVs for everything from grocery runs, medical appointments, leisure getaways, and temporary and permanent car replacements, to income-generating usage for food delivery services and extended “try-before-you-buy” test drives. Our EVs are regularly customized with a car door decal bearing the name of the private mobility partner or the name of the sponsoring municipality.

Our Revenue Model

We believe our car-sharing services present a sustainable, cost saving alternative to car ownership, ride-hailing, and traditional car rentals while maintaining the autonomy of driving on demand. Our value proposition extends to our users, property owners, and the communities in which we operate, offering significant advantages to attract and retain tenants, and reduce parking demands, thereby easing car traffic congestion and lowering emissions. Our revenue was $2,862,101 for the nine months ended September 30, 2024, $3,231,225 for the pro forma (which represents the combination of Predecessor and Successor (each as defined below) information) year ended December 31, 2023, and $3,236,327 for the year ended December 31, 2022.

Our net losses were $3,626,050, $8,461,017, and $4,568,926 for the same periods, respectively, which raised substantial doubt about our ability to continue as a going concern. Consequently, our independent auditor has included a going concern qualification in its report with respect to our audited financial statements for the years ended December 31, 2023 and 2022.

In our Envoy Amenity operations, we generate revenue through long-term agreements with national and local property owners and real estate developers. Our private mobility partners agree to pay a monthly service fee to us in order to have dedicated community vehicles. In addition, our private mobility partners typically pay an initial start-up fee. The start-up fee covers our cost of equipping the vehicle with our hardware and delivering it to the site. The service fee typically covers our monthly amortized costs for the vehicle, including insurance, car cleaning, and maintenance. The property owner also provides parking and electricity to charge the vehicles. These service arrangements with property owners yield positive gross margins for us. We lease vehicles only after we have contracted with the property owner and generally do not hold vehicles in inventory, resulting in a capital-light business model. Additional revenue is generated by the end-users who book on-demand or schedule an hourly, daily or weekly rate. We will typically share with our private mobility partners 50% of the revenue generated from end-users to assist them with reducing their operating costs. Revenues from our Envoy Amenity operations represented 95%, 80% and 96% for the nine months ended September 30, 2024, the pro forma year ended December 31, 2023 and the year ended December 31, 2022, respectively.

For our Envoy City operations, we work with public, non-profit and private partners that provide us with subsidies and grants to cover the direct costs of our EV-sharing services. These programs are designed and budgeted by us to ensure that the revenue generated from such programs exceeds the variable costs associated with the operations. Depending on the program, additional revenue is generated from end-users who book on-demand or schedule an hourly, daily, or weekly rate. We will not typically share any revenue generated from end-users who book through these programs. Revenues from our Envoy City operations represented 2%, 9% and 2% for the nine months ended September 30, 2024, the pro forma year ended December 31, 2023 and the year ended December 31, 2022, respectively.

What Sets Us Apart

We believe that we set ourselves apart from our competition and have been able to grow our business as a result of the following competitive strengths:

Our EV Expertise — Our team’s working experience in electric car-sharing spans over a decade, setting us apart as industry pioneers. We have been at the forefront of the industry since the early days when electric car ranges were below 95 miles, and we have spearheaded educational, marketing, and outreach initiatives to facilitate drivers’ transition to electric vehicles. We have made substantial strides, installing hundreds of electric vehicle chargers and deploying EVs in more than 50 U.S. cities across 23 states despite the backdrop of a global pandemic and the closure of most competitors. We believe our success is driven by our focus on unit economics and sustainable business models, among other things.

We possess proprietary data from over 15 million miles driven by EVs on our platform. Our extensive dataset, which includes telematics, gives us unique and invaluable insights into how our vehicles are used in various communities and demographics. We rely on our dataset to continually enhance our platform to respond to market-specific demands, allowing us to tailor customized incentives for drivers in local markets.

Our Proprietary Technology — Using our advanced proprietary technology platform, developed entirely in-house since 2016, we provide our customers with turnkey car-sharing solutions that include an app to register, book, and access our EVs, use EV chargers, the ability to obtain driver insurance, and a connection to a 24 hours a day, 7 days a week live mobility concierge service for roadside assistance, maintenance, and similar services. We collect and utilize telematics and additional data to optimize our operations and track deep insights into localized mobility trends.

Our Strategic Partnerships — Over the past five years, we have built strategic alliances with leading real estate firms, government entities and other significant partners across the United States. Examples include our collaborations with the property management groups at Douglas Elliman Inc., Greystar Global Enterprise, LLC, LeFrak Organization Inc., The Related Companies L.P., the LACI, the California Air Resources Board, the Housing Authority of the City of Los Angeles, the Sacramento Housing and Redevelopment Agency, the Anaheim Public Utilities, the Los Angeles Department of Water and Power, and Austin Energy.

In March 2023, we were awarded $8.5 million, combined, to develop electric car-sharing programs in New Jersey, to be funded by the State of New Jersey’s Region Greenhouse Gas Initiative. With this funding, we plan to launch a statewide publicly accessible electric car-sharing program featuring car-sharing services at subsidized rates in overburdened communities. We also anticipate deploying roughly 16 electric vehicles for a car-sharing pilot serving affordable housing units in Jersey City and other nearby cities, covering six buildings. Both projects are currently in the planning phase. We expect the projects to be launched and funded later in 2025, which will further expand our nationwide reach.

We have also entered into strategic agreements with licensees, enabling them to operate under our trusted Envoy brand within a designated territory. For example, in June 2021, Envoy entered into a license agreement with Kowa America Corp. to develop a community-based EV-sharing service in Hawaii. The license permits Kowa America to utilize our full technology platform and brand in connection with the Hawaii operations (“Envoy Hawaii operations”), for which it is responsible for obtaining, maintaining, and insuring the EVs. Under the agreement, we received an upfront license fee to set up in-vehicle hardware and embedded software, branding, and signage, and we receive a monthly per-vehicle license fee and minority share of the car-sharing booking fees. The initial four-year term of the agreement expires in June 2025, and Kowa America can extend the term for another four years, subject to having achieved annual minimum numbers of vehicles deployed on our platform or paying a fee if it falls short of the annual minimums. We expect this agreement and other strategic partnerships to become a more important part of our business in future periods.

Strategic partnerships like our agreement with Kowa America are built on adhering to our branding guidelines and exclusive use of our proprietary platform and advanced technologies. The essence of this collaboration lies in its asset-light nature, with our licensees shouldering the responsibility for operational costs, including fleet procurement, insurance, and maintenance, while committing to minimum levels of EV deployments during the contract term. This model empowers both parties to grow together, expanding our reach and delivering exceptional mobility solutions to communities worldwide. It also demonstrates the demand for our platform and technologies for a shared economy application.

Our EV at a partner hotel property in Hawaii, operated by Kowa America

Finally, we have an exclusive alliance with Blink Charging for EV chargers. We have agreed to procure essential charging station requirements, including hardware, network services, operational infrastructure, and comprehensive support, exclusively from Blink Charging. The term of this reseller agreement will extend for five years after the closing date of this offering.

Our Advanced Platform — We continually enhance our platform with new capabilities and features that make it easier to use and set new benchmarks in the industry. We believe that customer demands will continue to evolve and require different solutions. We expect our technology (and further investment in our technology) to continue providing us with a competitive edge. We also believe that self-driving cars are a part of our future and that these autonomous vehicles will likely be fleet-owned EVs – providing a unique opportunity for property owners and cities to leverage their parking infrastructure. We believe our innovation-driven, continually improving platform is well-positioned to play a key role in this autonomous vehicle future.

Our Strong Alignment with Blink Charging — We believe a strong alignment of interests exists between Blink Charging and investors in this offering through the ownership of a significant percentage of our outstanding shares by Blink Charging immediately following this offering and, after the potential distribution by Blink Charging of a substantial portion of its shares in our company, by all Blink Charging stockholders. Two of our directors will also be affiliates of Blink Charging. Since our acquisition by Blink Charging in April 2023, Blink Charging has financed our company. Blink Charging shares the same strategic vision and commitment to market expansion and continued growth of the U.S. and global EV infrastructure. Blink Charging will enter into a transition services agreement upon completing this offering to provide us with experienced personnel and related resources in connection with administrative, management, and technical services, as well as all our charging station requirements, incentivizing and supporting our continued focus on optimizing our company’s performance. By providing strategic, structural, and economic alignment with the performance of our company, the continuing controlling interests of Blink Charging and its stockholders are directly aligned with those of our investors.

Our EV that was recently launched at FIAT House in Fort Lee, New Jersey

Our Growth Strategies

We anticipate a significant increase in demand from state and local governmental bodies for accessible, affordable, and environmentally friendly mobility alternatives. We intend to utilize a portion of the net proceeds of this offering to deploy our Mobility as an Amenity service in many multi-family dwellings, office buildings, hotels, and private communities. To fully capitalize on this opportunity, we are pursuing the following growth strategies:

Pursue a Combined Organic and Acquisition Growth Path — Our strategic blueprint calls for organic expansion and acquisition growth in favorable territories across the United States, Canada, and potentially certain European cities. We are increasing our focus on developing a pipeline of commercial opportunities with real estate developers and government organizations. We also believe expanding our business through potential opportunistic acquisitions of existing EV and conventional car-sharing companies and businesses will accelerate the scaling of our operations, allowing us to gain access to new markets and enrich the array of services we offer. Such acquisitions will provide an opportunity to consolidate the market and enhance our position while leveraging the expertise of acquired teams and their technology and infrastructure, strengthening our overall value proposition.

Increase Marketing to Further Penetrate Existing Markets — Our sales and marketing strategy involves an intensified focus on digital marketing to expand our reach within established markets. We plan to utilize a portion of the net proceeds of this offering to increase our digital marketing efforts to reach a broader audience through social media, online advertising, and search engine optimization to attract new building owners and public partners. We will launch targeted promotions and referral programs to incentivize existing users to refer new customers, fostering word-of-mouth growth and building a loyal community of electric car-sharing enthusiasts. By enhancing our marketing communication and highlighting the unique benefits of our sustainable service, we aim to strengthen our brand presence, attract new users, enhance usage (and associated usage fees), and solidify our position in the car-sharing market.

Develop Car-Sharing Territorial Franchising Opportunities — We intend to develop a new facet of our business after this offering, similar to what we have in Hawaii, where we would franchise our EV-sharing platform business. By offering franchise opportunities, we believe we can leverage local entrepreneurs’ expertise and resources to roll-out our business model in new territories without significant capital investment. This strategy is designed for scalability and would allow us to rapidly expand our footprint, reach a broader audience, and promote the adoption of EV-sharing on a larger scale.

Enter into SaaS Platform Licenses with Third Parties — We intend to develop another facet of our business after this offering, where we would license our software platform to other companies as a subscription-based, enterprise software-as-a-service (“SaaS”) solution, eliminating the need for third parties to buy, maintain and upgrade their software on-premises or for their end-users. This approach would provide us with access to new markets and demographics that would otherwise not be available to us independently. This would allow us to leverage a strategic partner’s strengths, increase adoption of our technology, and foster potential co-marketing initiatives to drive growth. Licensing also enhances our brand visibility as an innovator in the EV-sharing industry and reinforces our commitment to shaping the future of sustainable mobility solutions.

Industry Trends and Opportunities

We believe our fully developed car-sharing platform positions our company to capitalize on accelerating trends that favor the adoption of sustainable shared transportation solutions, while also navigating the challenges inherent in this rapidly evolving industry. While our current focus is exclusively on electric car-sharing, our platform is designed to be flexible and can support various vehicle types, regardless of their fuel source, allowing us to adapt to changing demands.

Evolving Consumer and Worker Expectations on Mobility

Consumer demands and work dynamics constantly evolve with mobility services and technology improvements.

| ● | Modern consumers increasingly prioritize accessibility and experiences, such as those offered by EV-sharing, over long-term commitments, such as car ownership. |

| | | |

| ● | Smartphones have fundamentally altered how consumers engage with services where people are accustomed to on-demand solutions catering to their every need – including mobility – with just a button. We believe this dynamic is a driving force behind the growth of our EV-sharing platform. |

| | | |

| | ● | Car ownership is often the second-highest expense for most households, trailing only behind rent or mortgage payments. Recognizing this financial strain, more people are turning to shared mobility solutions – such as our EV-sharing service – for significant cost-of-living reductions. |

| | | |

| ● | A 2023 survey conducted by Full Spectrum Insights, a market research firm engaged by us, revealed significant shifts in consumer attitudes about car ownership. For example, among urban respondents, 57% expressed that they would be likely or very likely to consider reducing their number of personal vehicles and using a car-sharing service when needed. Further, 76% of respondents residing in households with more than two cars would be likely or very likely to consider reducing the number of cars in their household and using a car-sharing service when needed. We believe our convenient EV-sharing platform provides a desirable means to achieve those goals. |

| ● | The Covid-19 pandemic has reshaped work dynamics, with many employers embracing remote work. According to data from the U.S. Census Bureau’s Household Pulse Survey (2023) and the Survey of Working Arrangements and Attitudes (Barrero et al., 2023), full days worked from home accounted for 28% of paid workdays in October 2023, four times the estimated share for 2019. As the need for daily commuting diminishes, the necessity of car ownership as a means of transportation to work fades. Flexible work arrangements allow EV-sharing to grow as a compelling alternative, aligning with today’s workforce’s evolving preferences and lifestyles. |

Additionally, concerns about the desirability, safety, or reliability of EVs can undermine their appeal to key stakeholders, including local governments, property owners, and end-users. Negative perceptions may reduce interest in EV-sharing services, hinder adoption rates, and complicate efforts to secure partnerships or funding. Addressing these challenges requires demonstrating the safety and reliability of EV technology and fostering positive experiences through our offerings.

Rapid Changes in the Real Estate Industry

The real estate industry, particularly in urban residential developments, is experiencing transformative trends that present significant growth opportunities.

| ● | Property owners are engaged in an amenity battle to differentiate themselves from competitors. Offering an exclusive EV-sharing amenity appeals to apartment owners and renters. |

| | | |

| ● | Challenging interest rates and occupancy challenges have compelled the real estate industry to become more budget-sensitive by trimming expenses and replacing costly expenditures with differentiating services – such as Envoy’s Mobility as an Amenity – that enrich residents’ experiences while fostering longer-term customer retention with minimal cost. |

| | | |

| ● | The property technology sector is undergoing meaningful growth. Real estate market participants increasingly recognize the profound impact of technology and data on their business strategies. The data generated from our services, in particular, offers property owners invaluable insights into customer movement patterns and preferences. |

| | | |

| ● | Real estate developers are actively exploring strategies to meet the growing demand for electric vehicle charging solutions among residents and tenants. |

| | | |

| ● | The substantial expense associated with parking spaces, which can escalate to as much as $75,000 per stall in dense urban areas according to the article “Calculating the Cost of Excess Parking in Transit-Oriented Developments,” Urban Land Institute (February 2017), compels real estate developers to seek alternatives. Car-sharing initiatives, such as our services, maximize current spots while mitigating the demand for excess parking spaces. |

| | | |

| ● | Today’s real estate customers increasingly prioritize environmentally conscious living. They are drawn to communities with green initiatives, incentivizing the real estate industry to deploy sustainable initiatives to highlight their sustainability commitment. |

| | | |

| ● | Evolving building codes increasingly focus on EV charging infrastructure, parking requirements, and EV mobility plans, according to the 2024 Model Energy Conservation Code of the International Code Council, the largest global developer of model building codes adopted by state and local governments and private companies. Some cities, like San Francisco, now mandate on-site car-sharing for all new residential developments. This trend is exemplified by developments like Culdesac in Tempe, Arizona, which boasts zero residential parking, relying exclusively on our on-site electric cars and other on-demand mobility options. We believe this trend to create EV-ready requirements for buildings is rapidly gaining momentum and impacting the future of real estate development. |

| | | |

| | ● | Offering exclusive car-sharing as an amenity can increase a property’s value by enhancing its appeal to tech-savvy and eco-conscious tenants. In addition, properties that feature forward-thinking, modern amenities are often perceived as more desirable, helping to command higher rents and attract premium tenants. |

| | | |

| ● | Younger generations, particularly millennials and Gen Z, are less likely to own cars due to environmental concerns, high ownership costs, and the availability of alternative mobility solutions. Providing an EV-sharing service addresses the transportation needs of these groups, helping developers tap into a growing demographic that prioritizes convenience and sustainability. |

| | | |

| ● | EV-sharing fosters a sense of community by promoting shared resources and encouraging social interaction. Offering this amenity not only appeals to eco-conscious renters but also strengthens tenant loyalty and increases retention rates. By addressing residents’ mobility needs conveniently and cost-effectively, developers create a more positive living experience, leading to higher satisfaction and longer-term tenancy. |

| | | |

| ● | Real estate developers that invest in innovative amenities like electric car-sharing can leverage this investment as a key differentiator in their marketing and branding strategies. By highlighting a commitment to sustainability, modern living solutions, and convenience, developers can enhance their brand image and attract media coverage, setting themselves apart from competitors. |

| | | |

| ● | Car-sharing platforms can easily scale to meet the needs of different property types, from luxury high-rises to mixed-use developments and affordable housing projects. This scalability allows developers to integrate car-sharing services across their entire portfolio, creating a consistent, high-quality experience for tenants while optimizing operating costs. |

Support for EV Adoption

Federal, state, and local governments have allocated funding or grants to support the adoption of electric mobility. However, the regulatory landscape is evolving, with changes that may affect the timing and availability of certain funding sources. For example, recent policy decisions have placed a temporary pause on the approval of some federal grants for highway EV charging infrastructure. Despite these shifts, other funding sources remain available, including utility company rebates for charging infrastructure, regional cap-and-trade funds, municipal sustainability grants, and support from private or non-profit organizations.

In 2024, new EV sales increased 7.3% and accounted for approximately 8.1% of total U.S. market share, according to Cox Automotive. Car manufacturers face significant challenges in meeting U.S. and global government objectives and convincing customers to test drive and purchase battery electric vehicles. These challenges encompass both education and the development of EV charging infrastructure. Our on-demand service provides users with a “try-before-you-buy” opportunity, enabling those individuals to immerse themselves in real-world EV experiences. In doing so, we help them overcome the hurdle of “range anxiety” and contribute to the successful adoption of EVs in alignment with these objectives.

Political and regulatory changes, such as the reduction or elimination of EV-related grants and subsidies, or shifts in environmental, energy, or trade policies, can increase costs and impact the financial viability of EV initiatives. These changes may create uncertainty for businesses and slow the adoption of EVs, making it more difficult to scale EV-focused mobility solutions. However, private mobility partners typically integrate EV amenities and infrastructure costs into broader property development budgets or operating expenses, reducing direct reliance on government funding. Private mobility partners view EV amenities as value-added features that enhance property appeal and align with sustainability goals, making them less dependent on external funding to implement these solutions.

For our Envoy City initiative, we remain well-positioned to leverage a diverse array of alternative funding sources to support public EV-sharing programs. These include state and local incentives, utility rebates for charging infrastructure, regional cap-and-trade programs, municipal sustainability grants, and contributions from private and non-profit organizations. Additionally, while federal funding for certain EV infrastructure projects is under review, other national initiatives focused on clean energy and sustainable transportation may still provide support. By fostering strategic partnerships and staying ahead of evolving policies, we are committed to ensuring access to these resources and driving the growth of sustainable mobility solutions.

The Envoy Technologies Acquisition and Stock Issuance

On April 18, 2023, Blink Charging acquired all of our outstanding shares of capital stock from the former Envoy Technologies stockholders pursuant to an Agreement and Plan of Merger, dated as of April 18, 2023, among Blink Charging, its acquisition subsidiary Blink Mobility LLC (now known as Envoy Mobility, Inc. (“Mobility”)), and our company (the “Envoy Technologies Merger Agreement”), which resulted in our company becoming a wholly-owned subsidiary of Mobility and an indirect wholly owned subsidiary of Blink Charging (the “Envoy Technologies Acquisition”).

Under the terms of the Envoy Technologies Merger Agreement, Mobility paid $6,000,000 in cash, of which approximately $2,600,000 was retained to repay the outstanding convertible and other notes payable held by Blink Charging, and delivered to the former Envoy Technologies stockholders two promissory notes: (i) a promissory note in the principal amount of $5,000,000 due on the earlier of April 18, 2024 and the closing date of a “qualified IPO,” and (ii) a promissory note in the principal amount of $2,000,000 due on the earlier of October 18, 2024 and the closing date of a “qualified IPO.” In April 2024, Mobility repaid the full principal and accrued interest owing under both promissory notes.

Additionally, Mobility agreed that in the event an initial public offering or a direct listing occurred on or before August 18, 2024, to issue $18,500,000 of shares of its common stock or of its successor’s common stock to the former Envoy Technologies stockholders (the “Envoy Acquisition Stock Issuance”). The dollar amount value of shares of common stock would increase to $21,000,000 or $22,500,000 worth of shares if the offering or listing occurs after August 18, 2024 through December 18, 2024 or after December 18, 2024 through April 18, 2025, respectively. We are the issuer in this offering as the successor of the EV-sharing business and assets of Mobility and have entered into an Intracompany Transfer Agreement with Blink Charging and other subsidiaries to consolidate all of the properties, assets, business and goodwill relating to EV-sharing into our company. The payment of shares of our common stock will be at the same price as the initial public offering price per share of the common stock in this offering and will be issued upon the effectiveness of the registration statement of which this prospectus forms a part. Among the larger former Envoy Technologies stockholders receiving shares include venture capital and strategic investors General Motors Ventures LLC, The Goodyear Tire & Rubber Company, Built Environment Innovation Fund, L.P., Denso Corporation, New Valley Ventures, and Shell Ventures.

In the event we consummate our initial public offering or a direct listing on or before April 18, 2025, we will issue 2,812,500 shares of our common stock to the former Envoy Technologies stockholders contemporaneously with this offering or a direct listing, assuming an initial public offering price or direct listing reference price of $8.00 per share. In the event we do not consummate our initial public offering or a direct listing on or before April 18, 2025, Blink Charging may be required to issue $22,500,000 worth of its shares of common stock based on the 60-day VWAP of Blink Charging’s common stock immediately prior to issuance. We reasonably believe we can consummate our initial public offering or a direct listing on or before April 18, 2025. If we anticipate not being able to meet this deadline, we believe, based on discussions with the representative of the former Envoy Technologies stockholders, that we will reach an agreement with the former Envoy Technologies stockholders to extend the April 18, 2025 deadline. However, there can be no assurance that such an agreement will be reached.

The shares of our common stock to be issued to the former Envoy Technologies stockholders will initially be “restricted securities” and issued in reliance upon the exemption from registration provided by Section 4(a)(2) of the Securities Act and are being registered for resale by the selling stockholders identified in the accompanying resale prospectus concurrently with this offering. Certain selling stockholders have agreed to enter into lock-up agreements that restrict the sale of ________ shares being registered for resale by such selling stockholders for a period of 120 days after the date of this prospectus. Such selling stockholders have also agreed to a leak-out restriction, upon expiration of the 120-day lock-up period, pursuant to which each such stockholder has agreed to only sell up to 1% of the shares issued to such stockholder on any trading day and up to 20% of the shares issued to such stockholder during any given month.

Our Planned Separation from Blink Charging

Since April 18, 2023, we have been an indirect wholly owned subsidiary of Blink Charging. Blink Charging owns all the outstanding shares of common stock of Mobility, which in turn owns all our outstanding shares of common stock.

Before the closing of this offering, we will enter into a transition services agreement with Blink Charging under which Blink Charging will provide us with experienced personnel and related resources in connection with administrative, management, and technical services, as may be necessary or desirable, or as we may reasonably request or require, in connection with the business and operations of our company as a stand-alone public entity, for up to 12 months following the closing date of this offering. We refer to the separation of our business from Blink Charging, our continuation as a stand-alone public entity and the related transactions as the “Separation.”

Additionally, before the closing of this offering, we will enter into an exclusivity agreement to procure essential charging station requirements, including hardware, network services, operational infrastructure, and comprehensive support, exclusively from Blink Charging. The term of this agreement will extend for five years after the closing date of this offering.

The Planned Distribution

Blink Charging has informed us that, following the completion of this offering, it may make a tax-free distribution to its stockholders of a portion of its remaining common stock ownership in our company, which may include one or more distributions effected as a dividend to all Blink Charging stockholders, one or more distributions in exchange for Blink Charging shares or other securities, or any combination thereof. We refer to any such potential distribution as the “Distribution.” The Distribution will occur if and when Blink Charging determines to spin-off a portion of its continuing ownership of our shares to Blink Charging’s stockholders but not before the completion of this offering. Notwithstanding the foregoing, Blink Charging has agreed not to effect the Distribution for a period of 60 days after the date of this prospectus without the prior written consent of the representative of the several underwriters of this offering. See “Underwriting.”

Blink Charging has no obligation to pursue or consummate any disposition of its common stock ownership in our company, including through the Distribution, by any specified date or at all. If pursued, the Distribution may be subject to various conditions, including receipt of any necessary regulatory or other approvals, the existence of satisfactory market conditions and the receipt of a private letter ruling from the Internal Revenue Service, and favorable opinions of Blink Charging’s tax advisors or counsel to the effect that the Distribution will qualify as a transaction that is tax-free to Blink Charging and its stockholders for U.S. federal income tax purposes. The conditions to the Distribution may not be satisfied, Blink Charging may decide not to consummate the Distribution even if the conditions are satisfied or Blink Charging may decide to waive one or more of these conditions and consummate the Distribution even if all the conditions are not satisfied.

Selected Risks Associated with Our Business

An investment in our common stock involves a high degree of risk. Our ability to execute on our growth strategies is also subject to certain risks. The risks described under the heading “Risk Factors” immediately following this prospectus summary may have an adverse effect on our business, cash flows, financial condition, and results of operations or may cause us to be unable to execute all or part of these strategies successfully. Below are the principal factors that make an investment in our company speculative or risky:

| ● | We have a history of net losses, and we may be unable to achieve or sustain profitability in the future. |

| | | |

| ● | The car-sharing industry is dynamic and evolves rapidly, making it difficult to evaluate our current business and future prospects, which may increase the risk of your investment. |

| | | |

| ● | If we fail to retain existing private mobility partners and public partners, add new private mobility partners and public partners, or increase EV reservations and use, our business, results of operations, reputation, and financial condition will be materially and adversely affected. |

| | | |

| ● | Because many of our expenses are fixed, we may be unable to limit our losses if we fail to achieve our forecasted revenue. |

| | | |

| ● | We face intense competition and may not be able to compete successfully with current or future competitors in the car-sharing business, which could negatively impact our financial condition and results of operations. |

| | | |

| ● | Our customer support function is critical to the success of our business, and any failure to provide high-quality service could affect our ability to retain and attract real estate owners, public partners, and users. |

| ● | If our efforts to build a strong brand identity and maintain a high level of user satisfaction and loyalty are unsuccessful, we may not be able to attract or retain users, and our operating results may be adversely affected. |

| | | |

| ● | We face significant risks as we expand our operations in the United States, which could harm our business, operating results, and financial condition. |

| | | |

| ● | Future acquisitions could disrupt our business and harm our financial condition and operating results. |

| | | |

| ● | We face risks related to liabilities resulting from the use of our EVs by users. |

| | | |

| ● | Our business depends on attracting and retaining capable management and operating personnel. |

| | | |

| ● | Our efforts to minimize the likelihood and impact of adverse cybersecurity incidents and to protect data and intellectual property may not be successful, and our business, operations, and reputation could be negatively affected by a cyberattack, security incident, or other operational disruption. |

| | | |

| ● | Failure to adequately protect our intellectual property could substantially harm our business and operating results. |

| | | |

| ● | We may not realize the anticipated benefits of the Separation from Blink Charging, and the Separation could harm our business. |

| | | |

| ● | We have no history of operating as an independent company, and our historical and unaudited pro forma financial information does not necessarily represent the results we would have achieved as an independent, publicly traded company and may not be a reliable indicator of our future results. |

| | | |

| ● | Until the completion of the Distribution, Blink Charging will control the direction of our business, and its concentrated ownership of our common stock will prevent you and other stockholders from influencing significant decisions. |

| | | |

| ● | After the Separation, some of our directors and officers may have actual or potential conflicts of interest because of their equity ownership in Blink Charging, and some of our directors may have actual or potential conflicts of interest because they also serve as directors or officers of Blink Charging. |

| | | |

| ● | An active trading market for our common stock may not develop, and you may be unable to resell your shares at or above the initial public offering price. |

| | | |

| ● | The Distribution or future sales by Blink Charging or others of our common stock, or the perception that the Distribution or such sales may occur, could depress our common stock price. |

Implications of Being an Emerging Growth Company

We qualify as an “emerging growth company” as defined in the Jumpstart Our Business Startups Act of 2012 (the “JOBS Act”). We may take advantage of specified reduced reporting requirements and other burdens that generally apply to other public companies as long as we remain an emerging growth company. These provisions include, but are not limited to:

| ● | reduced obligations with respect to financial data, including presenting only two years of audited financial statements and selected financial data, and only two years of related Management’s Discussion and Analysis of Financial Condition and Results of Operations disclosure in our initial registration statement; |

| | | |

| ● | an exemption from the auditor attestation requirement in the assessment of our internal control over financial reporting pursuant to the Sarbanes-Oxley Act of 2002, as amended; |

| | | |

| ● | reduced disclosure about executive compensation arrangements in our periodic reports, registration statements, and proxy statements; and |

| ● | exemptions from the requirements to seek non-binding advisory votes on executive compensation or stockholder approval of any golden parachute arrangements. |

For example, we have taken advantage of the reduced reporting requirements with respect to disclosure regarding our executive compensation arrangements, have presented only two years of audited financial statements and only two years of related “Management’s Discussion and Analysis of Financial Condition and Results of Operations” disclosure in this prospectus, and have taken advantage of the exemption from auditor attestation on the effectiveness of our internal control over financial reporting. To the extent that we take advantage of these reduced burdens, the information we provide stockholders may be different than you might obtain from other public companies where you hold shares.

In addition, the JOBS Act permits emerging growth companies to take advantage of an extended transition period to comply with new or revised accounting standards applicable to public companies. We have elected to use this extended transition period. As a result of this election, our timeline to comply with new or revised accounting standards will, in many cases, be delayed as compared to other public companies that are not eligible to take advantage of this election or have not made this election. Therefore, our financial statements may not be comparable to those of companies that comply with the public company effective dates for these accounting standards.

We will remain an emerging growth company until the earliest of (i) the last day the fiscal year following the fifth anniversary of the completion of this offering, (ii) the last day of the first fiscal year in which our annual gross revenues exceed $1.235 billion, (iii) the date on which we have, during the immediately preceding three-year period, issued more than $1.0 billion in non-convertible debt securities and (iv) the date on which we are deemed to be a large accelerated filer under the SEC’s rules.

Status as a Controlled Company

Upon the completion of this offering, we will be considered a “controlled company” within the meaning of Nasdaq’s listing standards. Under these rules, a “controlled company” may elect not to comply with certain corporate governance requirements, including the requirement to have a board that is composed of a majority of independent directors, a nominating and corporate governance committee that is composed entirely of independent directors, and a compensation committee that is composed entirely of independent directors. We intend to take advantage of these exemptions following the completion of this offering. These exemptions do not modify the independence requirements for our audit committee, and we intend to comply with the applicable requirements of the Sarbanes-Oxley Act and rules with respect to our audit committee within the applicable time frame. Additionally, due to Blink Charging’s majority ownership of our common stock following the offering, Blink Charging will be able to control the outcome of matters requiring stockholder approval, including the election of directors, amendment of organizational documents and approval of major corporate transactions, such as a change in control, merger, consolidation, or sale of assets. Upon completion of the Distribution, we will no longer qualify as a controlled company and will be required to fully implement Nasdaq corporate governance requirements within one year of the Distribution. For more information, see “Management – Controlled Company Exemption.”

Corporate Information

We were incorporated on July 11, 2016 as a Delaware corporation. On April 18, 2023, Blink Charging acquired, through an acquisition subsidiary, all our outstanding shares of capital stock from the former Envoy Technologies stockholders. We have been since then, and through the closing of this offering will be, an indirect wholly owned subsidiary of Blink Charging.

Our principal executive office is located at 8575 Washington Blvd., Culver City, California 90232, and our telephone number is (888) 610-0506. Our website address is www.envoytechnologies.com.

Channels for Disclosure of Information

Investors and others should note that we use social media to communicate about our company, car-sharing services, new business developments, and other matters with the public. Any information we consider to be material to an evaluation of our company will be included in filings on the SEC website, http://www.sec.gov, and may also be disseminated using our investor relations website, which can be found at http://www.envoytechnologies.com, and press releases. However, we also encourage investors, the media, and others interested in our company also to review our social media channels.

The information contained on, or that can be accessed through, our website is not incorporated by reference into this prospectus, and you should not consider any information contained on, or that can be accessed through, our website as part of this prospectus or in deciding whether to purchase our common stock.

Summary of the Offering

| Common stock offered | | __________ shares (_______ shares if the underwriters exercise their option to purchase additional shares in full). |

| | | |

| Common stock outstanding immediately before this offering | |

__________ shares. |

| | | |

| Common stock to be outstanding immediately after this offering and the Envoy Acquisition Stock Issuance | |

__________ shares (_______ shares if the underwriters’ option to purchase additional shares is exercised in full).(1)(2) |

| | | |

| Common stock to be held by Blink Charging immediately after this offering | | __________ shares. |

| | | |

| Underwriters’ option to purchase additional shares | |