Corporate Governance

We use the New York Stock Exchange and SEC standards for determining the independence of our independent directors. Based upon these standards, our board has determined that Catherine Weatherford and Daniel Gray are our only independent directors.

No executive officer or director noted above has, within the last five years, served as a director of any company with a class of securities registered pursuant to Section 12 of the Exchange Act or subject to the requirements of Section 15(d) of such Act or any company registered as an investment company under the Investment Company Act of 1940.

During the past ten years no event has occurred in the lives of the executive officers and directors of Merit that would impinge on the integrity of these persons or their ability to perform their duties.

Control Persons

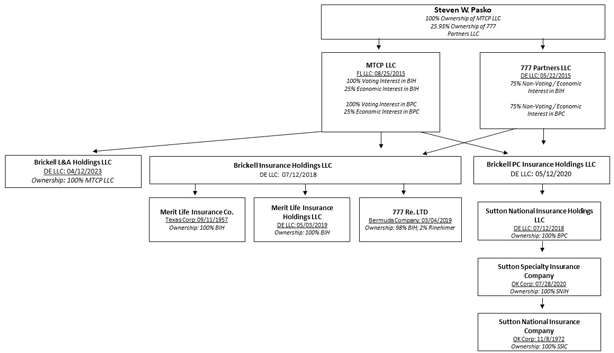

Brickell acquired Merit on December 31, 2019. MTCP LLC (“MTCP”) holds 100% of the voting interest of Brickell. Steven W. Pasko holds 100% of the voting interest of MTCP, therefore, Steven W. Pasko holds the ultimate majority voting and investment control of Merit. There is no expectation of a change of control of Merit.

EXECUTIVE COMPENSATION

Named Executive Officers. This section provides information about all compensation awarded to, earned by, or paid to our Chief Executive Officer and our two other most highly paid executive officers as of December 31, 2022. These individuals are collectively referred to as the “Named Executive Officers” or “NEOs.” The NEOs are:

| | • | | David M. Anderson – President and Chief Executive Officer (Principal Executive Officer) |

| | • | | Martin Woll – Chief Operating Officer |

| | • | | Edward “Cliff” Merrill – Chief Product and Distribution Officer |

Summary Compensation Table. The following table includes the NEOs’ respective compensation for the fiscal years ended December 31, 2022 and 2021, as applicable.

| | | | | | | | | | | | | | | | |

Name & Principal Position | | Year | | | Salary ($) | | | Bonus ($) | | | Total ($) | |

David M. Anderson President and Chief Executive Officer | |

| 2022

2021 |

| |

| 400,000

99,999 |

| |

| 50,000

0 |

| |

| 450,000

99,999 |

|

Edward “Cliff” Merrill Chief Product and Distribution Officer | | | 2022 | | | | 77,692.20 | | | | 100,000 | | | | 177,692.20 | |

Martin Woll Chief Operating Officer | | | 2022 | | | | 139,134.54 | | | | 120,000 | | | | 259,134.54 | |

The Company has entered into a written employment contract with each of its NEOs. Under their respective employment contracts, Mr. Anderson is paid an annual salary and is eligible for an annual discretionary bonus of up to 50% of his annual salary; Mr. Merrill is paid an annual salary, is eligible for an annual discretionary bonus of up to 50% of his annual salary, and receives sales incentive bonuses equal to 0.03% of qualifying new assets invested in the Company’s annuity products; and Mr. Woll is paid an annual salary and is eligible for an annual discretionary bonus of up to 40% of his annual salary.

Discretionary bonuses for all the Company’s executive officers are determined by Brickell, who reviews executive officer compensation annually and makes recommendations to the Company’s Board of Directors for approval. Brickell may consider a variety of factors when assessing whether to grant a discretionary bonus, including individual performance, as well as short- and long-term financial performance of the Company.

The Company does not have a plan for its executive officers that provides for the payment of retirement benefits, or benefits that will be paid primarily following retirement. The Company does not have an agreement or arrangement with any executive officer that provides for payments at, following, or in connection with any resignation, retirement, or other termination or change in control. None of the NEOs’ employment contracts provide for any severance compensation.

Furthermore, the Company offers a 401(k) plan to provide all employees with the opportunity to save for retirement on a tax-advantaged basis. To maintain QACA safe harbor status, the Company may make a safe harbor matching contribution equal to 100% of their salary deferrals that do not exceed 1% of their compensation plus 50% of their salary deferrals between 1% and 6% of their compensation.

Director Compensation

The following table provides information about all compensation paid to our Directors, during the fiscal year ended December 31, 2022, for their services as Directors of the Company. Please note that only our Independent Directors are compensated for serving as Directors. Independent Directors receive a flat fee annually pursuant to the Company’s independent director compensation plan.

| | | | | | | | |

Name | | Fees Earned or Paid in Cash

($) | | | Total

($) | |

David M. Anderson | | | 0 | | | | 0 | |

Steven W. Pasko | | | 0 | | | | 0 | |

Catherine Weatherford | | | 40,000 | | | | 40,000 | |

Daniel L. Gray | | | 40,000 | | | | 40,000 | |

Corwin Zass | | | 0 | | | | 0 | |

SECURITY OWNERSHIP OF CERTAIN BENEFICIAL OWNERS AND MANAGEMENT

| | | | | | | | |

(1) Title Of Class | | (2)

Name And

Address

Of Beneficial

Owner | | (3)

Amount

And Nature Of

Beneficial

Ownership | | (4)

Percent

Of Class | |

Common Stock | | Brickell Insurance Holdings LLC* | | Direct | | | 100 | * |

| * | MTCP LLC (“MTCP”) holds 100% of the voting interest of Brickell. Steven W. Pasko holds 100% of the voting interest of MTCP, therefore, Steven W. Pasko holds the ultimate majority voting and investment control of Merit. |

RELATED PARTY TRANSACTIONS

We have implemented policies and procedures that set forth standards for ensuring that intercompany and other related party transactions are done on an arms’-length basis and otherwise in compliance with management’s objectives, applicable accounting principles and applicable laws. This Policy outlines the procedures to be followed when initiating, accounting for and settling intercompany transactions that arise in the ordinary course of day-to-day business.

Our legal and compliance team, in close coordination with management, is primarily responsible for developing and implementing processes to obtain the necessary information and for determining, based on the facts and circumstances, whether a party should be considered a related party for purposes of our policies and procedures. Related party transactions may be subject to regulatory approval as well as approval of the Board of Directors. The Board will approve or ratify the transaction only if certain criteria are met. Among other criteria, the Board may consider whether such transactions are on terms that are no less favorable to the Company than those that could reasonably be obtained in a comparable arms’-length transaction with a person other than the related party. Such review also considers established conflict of interest guidelines with respect to the Company and its affiliates.

Provided below is a brief description of related party transactions involving the Company since December 31, 2020, as well as existing agreements or arrangements of the Company that may involve related party transactions in the future:

| | • | | On February 6, 2020, 777 entered into a Capital Maintenance Agreement with Merit, the purpose of which is to ensure Company Action Level Risk Based Capital of 350%. 777 owns 75 percent of Brickell. The amount that 777 may need to provide pursuant to this agreement is dependent on all of the factors that may affect the capital level of Merit, including business volume, interest rates, the investment performance of the Accounts of purchasers of Contracts, the investment performance of the general account of Merit, and others. As of December 2022, Brickell contributed capital of $6,200,000 to Merit. In March 2023, Brickell contributed capital of $780,000 to Merit. |

| | • | | The Company has a services agreement with Brickell. We receive human resources, legal, compliance, accounting and administrative services and support pursuant to this agreement. In 2020, the Company paid approximately $420,000. In 2021, the Company paid approximately $793,992. In 2022, the Company paid approximately $594,000. We do not expect a material increase in the amounts payable for these services in 2023. |

| | • | | Mr. Zass, Director and Appointed Actuary, head of Actuarial Risk Management LTD, provides to Merit actuarial services that cost approximately $1,122,000 in 2022, $1,100,000 in 2021, and $1,257,645 in 2020. |

48