We incurred a reduction in income taxes for the year ended August 31, 2020, to $21,309 as compared to $64,387 for our 2019 fiscal year.

B. Liquidity and Capital Resources

Liquidity

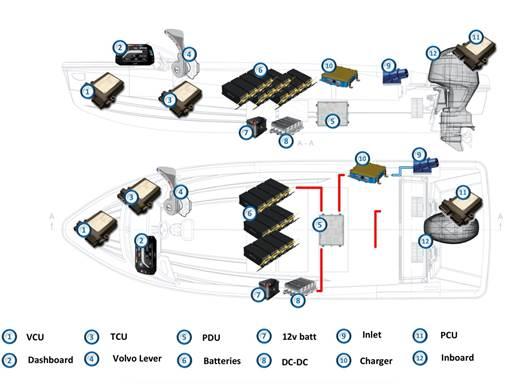

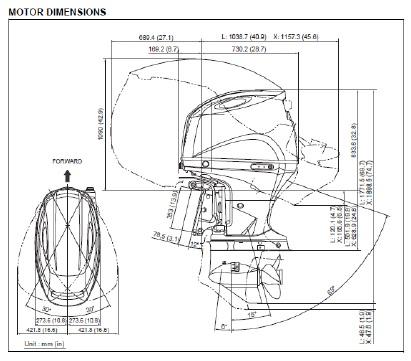

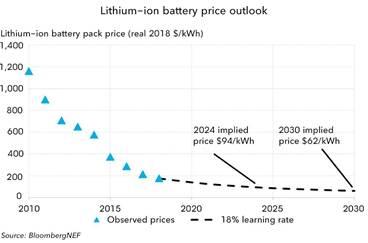

Our operations consist of the designing, developing and manufacturing of electric outboard powertrain systems and electric boats. Our financial success depends upon our ability to market and sell our outboard powertrain systems and electric boats; and to raise sufficient working capital to enable us to execute our business plan. Our historical capital needs have been met by internally generated cashflow from operations and the support of our shareholders. During the year ended August 31, 2021, we raised gross proceeds of US$27,600,000 from our initial public offering on Nasdaq. However, should we need further funding, equity funding might not be possible at the times we require. If no funds can be raised and sales of our outboard powertrain systems and electric boats and our boat rental income does not produce sufficient net cash flow, then we may require a significant curtailing of operations to ensure our survival.

The financial statements have been prepared on a going concern basis which assumes that we will be able to realize our assets and discharge our liabilities in the normal course of business for the foreseeable future. We incurred a net comprehensive loss of $14,725,341 during the year ended August 31, 2021 and had a cash balance and a working capital surplus of $18,147,821 and $18,626,563, respectively, as at August 31, 2021. Our ability to meet our obligations as they fall due and to continue to operate as a going concern depends on the continued financial support of the creditors and the shareholders. In the past, we have relied on the support of our shareholders to meet our cash requirements. There can be no assurance that funding from this or other sources will be sufficient in the future to continue our operations. Even if we are able to obtain new financing, it may not be on commercially reasonable terms or terms that are acceptable to us. Failure to obtain such financing on a timely basis could cause us to reduce or terminate our operations

As of December 1, 2021, the Company had 8,324,861 issued and outstanding shares and 10,135,782 on a fully-diluted basis.

We had $18,626,563, of working capital surplus as at August 31, 2021 compared to $533,760 of working capital surplus as at August 31, 2020. The increase in working capital surplus resulted from the cash used in operations of $8,251,438 (2020: $434,658); cash used in investing activities of $9,468,395 (2020: $37,656) resulting from the additions to property and equipment, investment in debentures; a cash payment of $5,029,416 for the acquisition of 7858078 Canada Inc.; which was offset by financing activities generating cash of $34,570,833, (2020: $1,731,635), due to our initial public offering on Nasdaq, which was partially offset by repayments of our bank indebtedness and the repayment of long-term debt.

Capital Resources

We had cash and cash equivalents of $18,147,821 and $1,296,756 at August 31, 2021 and August 31, 2020.

As of the date of this Annual Report, we have no outstanding commitments, other than rent and lease commitments and purchase commitments as disclosed in Note 15 and 27 of our consolidated financial statements for the year ended August 31, 2021. We have not pledged our assets as security for loans.

Critical Accounting Policies and Estimates

The preparation of financial statements in conformity with IFRS requires our management to make estimates and assumptions that affect the reported amounts of assets, liabilities and contingent liabilities at the date of the financial statements and reported amounts of revenues and expenses during the reporting period. Estimates and judgments are continuously evaluated and are based on management’s experience and other factors, including expectations of future events that are believed to be reasonable under the circumstances. Actual outcomes can differ from these estimates.

Business acquisition fair value

We make a number of estimates when determining the acquisition date fair values of consideration transferred, assets acquired and liabilities assumed in a business acquisition. Fair values are estimated using valuation techniques based on discounted future cash flows. Future cash flows may be influenced by a number of assumptions such as forecasted revenues, royalty rate, selling prices, costs to operate, capital expenditures, growth rate and the discount rate.