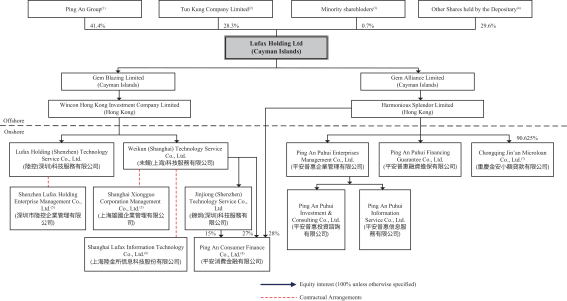

HISTORY AND CORPORATE STRUCTURE

Convertible Promissory Notes Issued to Ping An Overseas Holdings and An Ke Technology

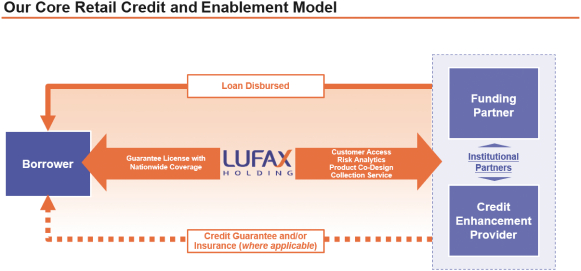

In October 2015, in connection with our acquisition of the retail credit and enablement business from Ping An Insurance, we issued the Ping An Convertible Promissory Notes. The acquisition was consummated in May 2016. In October 2015, Ping An Overseas Holdings agreed to transfer US$937.8 million of the outstanding principal amount of the Ping An Convertible Promissory Notes and all rights, benefits and interests attached thereunder to An Ke Technology.

In December 2022, the Company, Ping An Overseas Holdings and An Ke Technology entered into an amendment and supplemental agreement to amend the terms of the Ping An Convertible Promissory Notes (the “Amendment and Supplemental Agreement”), pursuant to which (i) the parties agreed to extend the maturity date from October 8, 2023 to October 8, 2026 and the commencement date of the conversion period from April 30, 2023 to April 30, 2026 for the remaining 50% outstanding Ping An Convertible Promissory Notes, and (ii) 50% of the outstanding principal amount of the Ping An Convertible Promissory Notes shall be deemed redeemed from the effective date of the Amendment and Supplemental Agreement. As a result, each of these Ping An Convertible Promissory Notes bears interest from the date of issuance, unless otherwise agreed, at the rate of 0.7375% per annum of the principal amount of each of the Ping An Convertible Promissory Notes outstanding from time to time, which will be payable by us semi-annually until the eleventh anniversary of the issuance date of the Ping An Convertible Promissory Notes. The remaining 50% outstanding Ping An Convertible Promissory Notes which were not redeemed can be converted, in whole or in part, into the Shares (or the ADSs) at any time from April 30, 2026 until the date which is five business days before (and excluding) October 8, 2026, at an initial conversion price of US$14.8869 per ordinary share subject to certain adjustments as set forth in the terms and conditions of each of the Ping An Convertible Promissory Notes. The Ping An Convertible Promissory Notes can be converted into an aggregate of 72,631,970 ordinary shares, representing approximately 6.3% of the total issued and outstanding Shares as of the Latest Practicable Date. Unless converted or purchased and canceled prior to October 8, 2026, the Company will redeem the remaining 50% outstanding principal amount of the Ping An Convertible Promissory Notes together with accrued interests on October 8, 2026. The holders of the Ping An Convertible Promissory Notes shall have the right (but not obligation) to require the Company to redeem the outstanding principal amount of the Ping An Convertible Promissory Notes and accrued interests after the occurrence of an event of default under the Ping An Convertible Promissory Notes and the Company fails to take any remedial steps within 45 days after the receipt of the written notice served by the holders of the Ping An Promissory Notes specifying the occurrence of any of the events of defaults.

In consideration of the above redemption and the extension of the maturity date and taking into account the fair market value of the Ping An Convertible Promissory Notes determined by the independent valuers, pursuant to the Amendment and Supplemental Agreement, the Company agreed to pay Ping An Overseas Holdings and An Ke Technology a total amount of approximately US$1,071.1 million (the “Consideration”) together with the unpaid interest accrued on the redeemed notes up to and including the effective date of the Amendment and Supplemental Agreement. The first tranche payment of the Consideration in the total amount of approximately US$535.53 million was paid in December 2022. It is expected that the remaining Consideration will be paid in March 2023 or such other date(s) within one year after the effective date of the Amendment and Supplemental Agreement as mutually agreed by the Company, Ping An Overseas Holdings and An Ke Technology.

As of December 31, 2022, the outstanding principal amount of the Ping An Convertible Promissory Notes amounted to RMB6,803.7 million.

Change of Authorized Share Capital

On October 18, 2018, our authorized share capital was re-classified to US$50,000 divided into 5,000,000,000 shares of par value of US$0.00001 each, of which 4,000,000,000 shares were designated as Class A ordinary shares, 500,000,000 shares were designated as Class B ordinary shares, and 500,000,000 shares were designated as Class C ordinary shares.

Class C Ordinary Shares

On November 29, 2018 and January 31, 2019, we issued a total of 46,949,725 Class C ordinary shares for a total consideration of approximately US$1,411.9 million to our C-round investors and purchasers, namely, F3 Holding LLC, DIC Holding LLC, HS Investments AP13 Limited, HS Investments (A) L.P., HS Investments (C) Limited, So Cheung Wing, Lux Holdings Limited, LionRock LJS L.P. (formerly known as LionRock Money L.P.), All-Stars PESP V Limited, Macquarie Capital Asian Fintech Investments Holdings LP, SBI Hong Kong Holdings Co., Limited, SBI AI&Blockchain Investment LPS, J.P. Morgan Securities LLC, UBS AG, London Branch, Hermitage Galaxy Fund SPC (on behalf of, Hermitage Fund Four SP), Broad Street Principal Investments L.L.C., United Overseas Bank Limited, Bangkok Bank Public Company Limited, Saber Capital (Mauritius) Limited.

– 89 –