Table of Contents

PRELIMINARY OFFERING CIRCULAR MARCH 15, 2021

SUBJECT TO COMPLETION

SUSTAINABLE WATER SOLUTIONS, INC.

335 Constance Drive

Warminster, PA 18974

215-962-9378

Planned Date of Offering: March 31, 2021

MAXIMUM OFFERING AMOUNT: $75,000,000

Common Stock

This is our initial public offering (the “Offering”) of securities of Sustainable Water Solutions, Inc., a Wyoming corporation (the “Company”). We are offering a maximum of 75,000,000 (Seventy-Five Million) shares (the “Maximum Offering”) of our common stock, par value $.001 (the “Common Stock”) at an offering price of One Dollar ($1.00) per share (the “Shares”) on a “best efforts” basis. This Offering will terminate on the earlier of (i) December 31, 2021, subject to extension for up to one hundred-eighty (180) days in the sole discretion of the Company; or (ii) the date on which the Maximum Offering is sold (in either case, the “Termination Date”). There is no escrow established for this Offering. We will hold closings upon the receipt of investors’ subscriptions and acceptance of such subscriptions by the Company. If, on the initial closing date, we have sold less than the Maximum Offering, then we may hold one or more additional closings for additional sales, until the earlier of: (i) the sale of the Maximum Offering or (ii) the Termination Date. There is no aggregate minimum requirement for the Offering to become effective, therefore, we reserve the right, subject to applicable securities laws, to begin applying “dollar one” of the proceeds from the Offering towards our business strategy, development expenses, offering expenses, and other uses as more specifically set forth in this offering circular (“Offering Circular”). We expect to commence the sale of the Shares as of the date on which the offering statement of which this Offering Circular is a part (the “Offering Statement”) is qualified by the United States Securities and Exchange Commission (the “SEC”).

Investing in our Common Stock involves a high degree of risk. See “Risk Factors” on page 7 for a discussion of certain risks that you should consider in connection with an investment in our Common Stock.

THE U.S. SECURITIES AND EXCHANGE COMMISSION DOES NOT PASS UPON THE MERITS OF OR GIVE ITS APPROVAL TO ANY SECURITIES OFFERED OR THE TERMS OF THE OFFERING, NOR DOES IT PASS UPON THE ACCURACY OR COMPLETENESS OF ANY OFFERING CIRCULAR OR OTHER SOLICITATION MATERIALS. THESE SECURITIES ARE OFFERED PURSUANT TO AN EXEMPTION FROM REGISTRATION WITH THE COMMISSION; HOWEVER, THE COMMISSION HAS NOT MADE AN INDEPENDENT DETERMINATION THAT THE SECURITIES OFFERED ARE EXEMPT FROM REGISTRATION.

| | | Price to

Public | | | Commissions

(1) | | | Proceeds

to the

Company

(2) | |

| Per Share | | $ | 1.00 | | | $ | 0.05 | | | $ | 0.95 | |

| Maximum Offering | | $ | 75,000,000 | | | $ | 2,500,000 | | | $ | 47,500,000 | |

(1) The Company currently intends to use commissioned sales agents or underwriters, commissions are estimated.

(2) Does not reflect payment of expenses of this offering, which are estimated to not exceed $1,000,000 and which include, among other things, legal fees, reproduction expenses, and actual out-of-pocket expenses incurred by the Company.

GENERALLY, NO SALE MAY BE MADE TO YOU IN THIS OFFERING IF THE AGGREGATE PURCHASE PRICE YOU PAY IS MORE THAN TEN PERCENT (10%) OF THE GREATER OF YOUR ANNUAL INCOME OR YOUR NET WORTH. DIFFERENT RULES APPLY TO ACCREDITED INVESTORS AND NON-NATURAL PERSONS. BEFORE MAKING ANY REPRESENTATION THAT YOUR INVESTMENT DOES NOT EXCEED APPLICABLE THRESHOLDS, WE ENCOURAGE YOU TO REVIEW RULE 251(d)(2)(i)(C) OF REGULATION A. FOR GENERAL INFORMATION ON INVESTING, WE ENCOURAGE YOU TO REFER TO WWW.INVESTOR.GOV.

THE SECURITIES UNDERLYING THIS OFFERING STATEMENT MAY NOT BE SOLD UNTIL QUALIFIED BY THE SECURITIES AND EXCHANGE COMMISSION. THIS OFFERING CIRCULAR IS NOT AN OFFER TO SELL, NOR SOLICITING AN OFFER TO BUY, ANY SHARES OF OUR COMMON STOCK IN ANY STATE OR OTHER JURISDICTION IN WHICH SUCH SALE IS PROHIBITED.

INVESTMENT IN SMALL BUSINESS INVOLVES A HIGH DEGREE OF RISK, AND INVESTORS SHOULD NOT INVEST ANY FUNDS IN THIS OFFERING UNLESS THEY CAN AFFORD TO LOSE THEIR ENTIRE INVESTMENT. SEE “RISK FACTORS” FOR A DISCUSSION OF CERTAIN RISKS YOU SHOULD CONSIDER BEFORE PURCHASING ANY SHARES IN THIS OFFERING.

AN OFFERING STATEMENT PURSUANT TO REGULATION A RELATING TO THESE SECURITIES HAS BEEN FILED WITH THE U.S. SECURITIES AND EXCHANGE COMMISSION, WHICH WE REFER TO AS THE COMMISSION. INFORMATION CONTAINED IN THIS PRELIMINARY OFFERING CIRCULAR IS SUBJECT TO COMPLETION OR AMENDMENT. THESE SECURITIES MAY NOT BE SOLD NOR MAY OFFERS TO BUY BE ACCEPTED BEFORE THE OFFERING STATEMENT FILED WITH THE COMMISSION IS QUALIFIED. THIS PRELIMINARY OFFERING CIRCULAR SHALL NOT CONSTITUTE AN OFFER TO SELL OR THE SOLICITATION OF AN OFFER TO BUY NOR MAY THERE BE ANY SALES OF THESE SECURITIES IN ANY STATE IN WHICH SUCH OFFER, SOLICITATION OR SALE WOULD BE UNLAWFUL BEFORE REGISTRATION OR QUALIFICATION UNDER THE LAWS OF ANY SUCH STATE. WE MAY ELECT TO SATISFY OUR OBLIGATION TO DELIVER A FINAL OFFERING CIRCULAR BY SENDING YOU A NOTICE WITHIN TWO (2) BUSINESS DAYS AFTER THE COMPLETION OF OUR SALE TO YOU THAT CONTAINS THE URL WHERE THE FINAL OFFERING CIRCULAR OR THE OFFERING STATEMENT IN WHICH SUCH FINAL OFFERING CIRCULAR WAS FILED MAY BE OBTAINED.

THE COMPANY IS FOLLOWING THE “FORM S-1” FORMAT OF DISCLOSURE UNDER REGULATION A.

The date of this Offering Circular is March 15, 2021.

TABLE OF CONTENTS

SUMMARY AND RISK FACTORS

SUMMARY

This summary highlights selected information contained elsewhere in this Offering Circular. This summary is not complete and does not contain all the information that you should consider before deciding whether to invest in our Common Stock. You should carefully read the entire Offering Circular, including the risks associated with an investment in the Company discussed in the “Risk Factors” section of this Offering Circular, before making an investment decision. Some of the statements in this Offering Circular are forward-looking statements. See the section entitled “Cautionary Statement Regarding Forward-Looking Statements.”

No dealer, salesperson or other person is authorized to give any information or to represent anything not contained in this Offering Circular. You must not rely on any unauthorized information or representations. This Offering Circular is an offer to sell only the shares offered hereby, but only under circumstances and in jurisdictions where it is lawful to do so. The information contained in this Offering Circular is current only as of its date.

We are offering to sell, and seeking offers to buy, our securities only in jurisdictions where such offers and sales are permitted. You should rely only on the information contained in this Offering Circular. We have not authorized anyone to provide you with any information other than the information contained in this Offering Circular. The information contained in this Offering Circular is accurate only as of its date, regardless of the time of its delivery or of any sale or delivery of our securities. Neither the delivery of this Offering Circular nor any sale or delivery of our securities shall, under any circumstances, imply that there has been no change in our affairs since the date of this Offering Circular. This Offering Circular will be updated and made available for delivery to the extent required by the federal securities laws.

Unless otherwise indicated, data contained in this Offering Circular concerning the business of the Company are based on information from various public sources. Although we believe that these data are generally reliable, such information is inherently imprecise, and our estimates and expectations based on these data involve a number of assumptions and limitations. As a result, you are cautioned not to give undue weight to such data, estimates or expectations.

In this Offering Circular, unless the context indicates otherwise, references to “we,” “SWS” the “Company,” “our,” and “us” refer to the activities of and the assets and liabilities of the business and operations of Sustainable Water Solutions, Inc. and its subsidiaries.

CAUTIONARY STATEMENT REGARDING FORWARD-LOOKING STATEMENTS

Some of the statements under “Summary,” “Risk Factors,” “Management’s Discussion and Analysis of Financial Condition and Results of Operations,” "Our Business" and elsewhere in this Offering Circular constitute forward-looking statements. Forward-looking statements relate to expectations, beliefs, projections, future plans and strategies, anticipated events or trends and similar matters that are not historical facts. In some cases, you can identify forward-looking statements by terms such as “anticipate”, “believe,” “could,” “estimate,” “expect,” “intend,” “may,” “plan,” “potential,” “should,” “will” and “would” or the negatives of these terms or other comparable terminology.

You should not place undue reliance on forward-looking statements. The cautionary statements set forth in this Offering Circular, including in “Risk Factors” and elsewhere, identify important factors which you should consider in evaluating our forward-looking statements. The risk factors contained under the headings “Cautionary Statement Regarding Forward-Looking Statements” and “Risk Factors.”

Although the forward-looking statements in this Offering Circular are based on our beliefs, assumptions and expectations, taking into account all information currently available to us, we cannot guarantee future transactions, results, performance, achievements or outcomes. No assurance can be made to any investor by anyone that the expectations reflected in our forward-looking statements will be attained, or that deviations from them will not be material and adverse. We undertake no obligation, other than as may be required by law, to re-issue this Offering Circular or otherwise make public statements updating our forward-looking statements.

INDUSTRY AND MARKET DATA

Although we are responsible for all disclosure contained in this Offering Circular, in some cases we have relied on certain market and industry data obtained from third-party sources that we believe to be reliable. Market estimates are calculated by using independent industry publications in conjunction with our assumptions regarding the machine vision for manufacturing industry and market. While we are not aware of any misstatements regarding any market, industry or similar data presented herein, such data involves risks and uncertainties and is subject to change based on various factors, including those discussed under the headings “Cautionary Statement Regarding Forward-Looking Statements” and “Risk Factors” in this Offering Circular.

Overview of the Company

Sustainable Water Solutions, Inc., (SWS), is a water treatment solutions company focused on implementing a roll-up strategy to deliver water, water technologies, equipment and services to various industries, municipalities, outlets and commercial operations in order to maximize the efficiency and sustainability of the water treatment operations. The Company’s management has over 30 years of business, engineering and operating experience and has acquired the first water company. Additional target acquisitions are in negotiation for the implementation of SWS’ roll-up strategy. SWS will offer sustainable technologies, build equipment and provide localized services and water to its client base.

Additional information on the Company and its acquisition targets can be found within this Offering Circular.

REGULATION A+

We are offering our Common Stock pursuant to recently adopted rules by the Securities and Exchange Commission mandated under the Jumpstart Our Business Startups Act of 2012, or the JOBS Act. These offering rules are often referred to as “Regulation A+.” We are relying upon “Tier 2” of Regulation A+, which allows us to offer of up to $75 million in a 12-month period.

THE OFFERING

| | | |

| Issuer: | | Sustainable Water Solutions, Inc. |

| | | |

| Shares Offered: | | A maximum of Seventy-Five Million (75,000,000) shares of our Common Stock (the “Shares”) at an offering price of One Dollar ($1.00) per share. |

| | | |

| Number of shares of Common Stock Outstanding before the Offering: | | 75,000,000 (Seventy-Five Million) shares of Common Stock |

| | | |

| Number of shares of Common Stock to be Outstanding after the Offering: | | 119,000,000 (One Hundred Nineteen Million) shares of Common Stock if the Maximum Offering is sold. |

| | | |

| Price per Share: | | One Dollar ($1.00). |

| | | |

| Maximum Offering: | | Seventy-Five Million (75,000,000) shares of our Common Stock at an offering price of One Dollar ($1.00) per share, for total gross proceeds of Seventy-Five Million Dollars ($75,000,000) (the “Maximum Offering”). |

| | | |

| Use of Proceeds: | | We will use the net proceeds for working capital, and such other purposes described in the “Use of Proceeds” section of this Offering Circular. |

| | | |

| Risk Factors: | | Investing in our Common Stock involves a high degree of risk. See “Risk Factors.” |

ADDITIONAL INFORMATION ABOUT THE OFFERING

Offering Period and Expiration Date

This Offering will start on or immediately prior to the date on which the SEC initially qualifies this Offering Statement (the “Qualification Date”) and will terminate on the Termination Date (the “Offering Period”).

Procedures for Subscribing

If you decide to subscribe for our Common Stock shares in this Offering, you should:

| | | |

| | 1. | Electronically receive, review, execute, and deliver to us a subscription agreement; and |

| | | |

| | 2. | Deliver funds directly by wire or electronic funds transfer via ACH to the Company’s bank account designated in the Company’s subscription agreement. |

Any potential investor will have ample time to review the subscription agreement, along with their counsel, prior to making any final investment decision. We shall only deliver such subscription agreement upon request after a potential investor has had ample opportunity to review this Offering Circular.

Right to Reject Subscriptions

After we receive your complete, executed subscription agreement and the funds required under the subscription agreement have been transferred to our designated account, we have the right to review and accept or reject your subscription in whole or in part, for any reason or for no reason. We will return all monies from rejected subscriptions immediately to you, without interest or deduction.

Acceptance of Subscriptions

Upon our acceptance of a subscription agreement, we will countersign the subscription agreement and issue the shares subscribed at closing. Once you submit the subscription agreement and it is accepted, you may not revoke or change your subscription or request your subscription funds. All accepted subscription agreements are irrevocable.

Under Rule 251 of Regulation A, non-accredited, investors are subject to the investment limitation and may only invest funds which do not exceed 10% of the greater of the purchaser's revenue or net assets (as of the purchaser's most recent fiscal year end). A non-accredited, natural person may only invest funds, which do not exceed 10% of the greater of the purchaser's annual income or net worth (please see below on how to calculate your net worth).

For the purposes of calculating your net worth, it is defined as the difference between total assets and total liabilities. This calculation must exclude the value of your primary residence and may exclude any indebtedness secured by your primary residence (up to an amount equal to the value of your primary residence). In the case of fiduciary accounts, net worth and/or income suitability requirements may be satisfied by the beneficiary of the account or by the fiduciary, if the fiduciary directly or indirectly provides funds for the purchase of the shares.

In order to purchase shares and prior to the acceptance of any funds from an investor, an investor will be required to represent, to the company's satisfaction, that he is either an accredited investor or is in compliance with the 10% of net worth or annual income limitation on investment in this offering.

Forum Selection Provision

The subscription agreement includes a forum selection provision that requires that, to the fullest extent permitted by applicable law, subscribers bring any claims against the Company based on the subscription agreement in a state or federal court of competent jurisdiction in the State of Pennsylvania. The forum selection provision may limit investors’ ability to bring claims in a judicial forum that they believe is favorable to such disputes and may discourage lawsuits with respect to such claims. The Company has adopted the provision since Florida has a well-developed framework for contract law and seeks to limit the time and expense incurred by its management to challenge any such claims. As a company with a small management team, this provision allows our officers to not lose a significant amount of time travelling to any particular forum so they may continue to focus on operations of the company. The foregoing notwithstanding, if there is an applicable law that does not permit such forum selection (e.g., the Exchange Act or the Securities Act), then the forum selection provision would not be permissible and, therefore, not applicable. We hereby confirm that the forum selection provision in our subscription agreement does not apply to federal securities law claims.

Where You Can Find More Information

We have filed with the SEC a Regulation A Offering Statement on Form 1-A under the Securities Act of 1993, as amended, with respect to the shares of Common Stock offered hereby. This Offering Circular, which constitutes a part of the Offering Statement, does not contain all of the information set forth in the Offering Statement or the exhibits and schedules filed therewith. For further information about us and the Common Stock offered hereby, we refer you to the Offering Statement and the exhibits and schedules filed therewith. Statements contained in this Offering Circular regarding the contents of any contract or other document that is filed as an exhibit to the Offering Statement are not necessarily complete, and each such statement is qualified in all respects by reference to the full text of such contract or other document filed as an exhibit to the Offering Statement. Upon the completion of this Offering, we will be required to file periodic reports, proxy statements, and other information with the SEC pursuant to the Securities Exchange Act of 1934. You may read and copy this information at the SEC's Public Reference Room, 100 F Street, N.E., Room 1580, Washington, D.C. 20549. You may obtain information on the operation of the Public Reference Room by calling the SEC at 1-800-SEC-0330. The SEC also maintains an Internet website that contains reports, proxy statements and other information about issuers, including us, that file electronically with the SEC. The address of this site is www.sec.gov.

Incorporation of Information by Reference

The SEC allows us to “incorporate by reference” into this offering circular the information we file with the SEC, which means that we can disclose important information to you by referring you to other documents filed separately with the SEC. The information incorporated by reference is considered part of this offering circular. Any information incorporated by reference will automatically be deemed to be modified or superseded to the extent that information in this offering circular or in a later filed document that is incorporated or deemed to be incorporated herein by reference modifies or replaces such information.

We urge you to carefully read this offering circular and the documents incorporated by reference herein, before purchasing any shares of Common Stock offered under this offering circular. This offering circular may add or update information contained in the documents incorporated by reference herein. To the extent that any statement that we make in this offering circular is inconsistent with statements made in the documents incorporated by reference herein, you should rely on the information in this offering circular and the statements made in this offering circular will be deemed to modify or supersede those made in the documents incorporated by reference herein.

You should rely only on the information contained in this offering circular or incorporated herein by reference. We have not authorized anyone to provide you with different information. No dealer, salesperson or other person is authorized to give any information or to represent anything not contained in this offering circular or incorporated herein by reference. You should not rely on any unauthorized information or representation. This offering circular is an offer to sell only the securities offered hereby, and only under circumstances and in jurisdictions where it is lawful to do so. You should assume that the information in this offering circular is accurate only as of the date on the front of the applicable document and that any information we have incorporated by reference is accurate only as of the date of the document incorporated by reference, regardless of the time of delivery of this offering circular, or any sale of a security.

We further note that the representations, warranties and covenants made by us in any agreement that is filed as an exhibit to any document that is incorporated by reference in this offering circular were made solely for the benefit of the parties to such agreement, including, in some cases, for the purpose of allocating risk among the parties to such agreements, and should not be deemed to be a representation, warranty or covenant to you. Moreover, such representations, warranties or covenants were accurate only as of the date when made. Accordingly, such representations, warranties and covenants should not be relied on as accurately representing the current state of our affairs.

We will provide, without charge and upon oral or written request, to each person, including any beneficial owner, to whom a copy of this offering circular have been delivered, a copy of any of the documents incorporated by reference into this offering circular but not delivered with them. You may obtain a copy of these filings, at no cost, by writing or calling us at Sustainable Water Solutions, Inc., 335 Constance Drive, Warminster, PA 18974, (215) 962-9378. Exhibits to these filings will not be provided unless those exhibits have been specifically incorporated by reference in this offering circular.

RISK FACTORS

An investment in our Common Stock involves a high degree of risk. You should carefully consider the risks described below, together with all of the other information included in this Offering Circular, before making an investment decision. If any of the following risks actually occurs, our business, financial condition, or results of operations could suffer. In that case, the trading price of our shares of Common Stock could decline and you may lose all or part of your investment. See “Cautionary Statement Regarding Forward-Looking Statements” above for a discussion of forward-looking statements and the significance of such statements in the context of this Offering Circular.

Risks Related to Our Business

OUR ABILITY TO CONTINUE AS A GOING CONCERN IS IN SUBSTANTIAL DOUBT ABSENT OBTAINING ADEQUATE NEW DEBT OR EQUITY FINANCINGS.

Our continued existence is dependent upon us obtaining adequate working capital to fund all of our planned operations. Working capital limitations continue to impinge on our day-to-day operations, thus contributing to continued operating losses. Thus, if we are unable to raise funds to fund the assembling and commercialization of our acquisitions solutions, we may not be able to continue as a going concern and you will lose your investment. We have incurred accumulated operating losses since inception and have working capital deficits at the end of 2020, 2019 and 2018. If the Company is able to raise the necessary funds to execute its business plan or if the Company earns any revenues from its business operations, some of these funds will have to be used to pay off the outstanding accounts payable and debt of the Company.

Our independent accounting firm has included in its report the qualification that these conditions raise a substantial doubt about the Company’s ability to continue as a going concern. The report also states that the financial statements do not include any adjustments that might result from the outcome of this uncertainty.

WE NEED ADDITIONAL CAPITAL TO FUND OUR GROWING OPERATIONS, AND WE MAY NOT BE ABLE TO OBTAIN SUFFICIENT CAPITAL AND MAY BE FORCED TO LIMIT THE SCOPE OF OUR OPERATIONS OR CEASE OPERATIONS ALTOGETHER.

We need additional capital to fund our operations and we may not be able to obtain such capital, which would cause us to limit or cease our operations entirely. The conditions of the global credit markets may adversely affect our ability to raise capital in the future. If adequate additional financing is not available on reasonable terms or at all, we may not be able to execute our business plans and may have to modify them accordingly or even suspend them.

Even if we do find a source of additional capital, we may not be able to negotiate favorable terms and conditions for receiving the additional capital. Any future capital investments will dilute or otherwise materially and adversely affect the holdings or rights of our existing shareholders. In addition, new equity or debt securities issued by us to obtain financing could have rights, preferences and privileges senior to our Common Stock. We cannot give you any assurance that any additional financing will be available to us, or if available, will be on terms favorable to us.

LOSS OF KEY PERSONNEL CRITICAL FOR MANAGEMENT DECISIONS WOULD HAVE AN ADVERSE IMPACT ON OUR BUSINESS

Our success depends upon the continued contributions of our executive officers and/or key employees, particularly with respect to providing the critical management decisions and contacts necessary to manage acquisitions, product development, marketing, and growth within our industry. Competition for qualified personnel can be intense and there are a limited number of people with the requisite knowledge and experience. Under these conditions, we could be unable to attract and retain these personnel. The loss of the services of any of our executive officers or other key employees for any reason could have a material adverse effect on our business, operating results, financial condition, and cash flows.

WE EXPECT SIGNIFICANT COMPETITION FOR OUR PRODUCTS AND SERVICES.

Some of our competitors and potential competitors are well established and have substantially greater financial, research and development, technical, manufacturing and marketing resources than we have today. If these larger competitors decide to focus on the acquisition of service and water technology companies, they could have the manufacturing, marketing and sales capabilities to complete research, development and commercialization of these products more quickly and effectively than we can. As of today, there can also be no assurance that current and future competitors will not develop new or enhanced technical services technologies or more cost-effective systems.

INTERNATIONAL REGULATION MAY ADVERSELY AFFECT OUR PLANNED PRODUCT SALES.

As a part of our marketing strategy, we plan to market and sell our technical services and technological solutions internationally. In addition to regulation by the U.S. government, our technological solutions will be subject to environmental and safety regulations in each country in which we market and sell. We anticipate that regulations will vary from country to country and will vary from those of the United States. The difference in regulations and the laws of foreign countries may be significant and, in order to comply with the laws of these foreign countries, our suppliers may have to implement manufacturing changes or alter product design, or we may need to modify our marketing efforts. Any changes in our business practices or products will require response to the laws of foreign countries and may result in additional expense to the Company and either reduce or delay product sales.

UNPREDICTABLE EVENTS, SUCH AS THE COVID-19 OUTBREAK, AND ASSOCIATED BUSINESS DISRUPTIONS COULD SERIOUSLY HARM OUR FUTURE REVENUES AND FINANCIAL CONDITION, DELAY OUR OPERATIONS, INCREASE OUR COSTS AND EXPENSES, AND AFFECT OUR ABILITY TO RAISE CAPITAL.

Unpredictable events, such as extreme weather conditions, acts of God and medical epidemics such as the COVID-19 outbreak, and other natural or manmade disasters or business interruptions may cause damage or disruption to our operations, international commerce and the global economy, and thus could have a strong negative effect on us. Our business operations are subject to interruption by natural disasters, fire, power shortages, pandemics and other events beyond our control. In December 2019, a novel strain of coronavirus, COVID-19, was reported in Wuhan, China. The World Health Organization has since declared the outbreak to constitute a pandemic. The extent of the impact of COVID-19 on our operational and financial performance will depend on certain developments, including the duration and spread of the outbreak, impact on our customers and our sales cycles, impact on our customer, employee or industry events, and effect on our vendors, all of which are uncertain and cannot be predicted.

At this point, the extent to which COVID-19 may impact our financial condition or results of operations is uncertain. Additionally, COVID-19 has caused significant disruptions to the global financial markets, which could impact our ability to raise additional capital. There is also a risk that other countries or regions may be less effective at containing COVID-19, or it may be more difficult to contain if the outbreak reaches a larger population or broader geography, in which case the risks described herein could be elevated significantly.

Risks Related to Our Common Stock

THE OFFERING PRICE OF THE SHARES WAS ARBITRARILY DETERMINED, AND THEREFORE SHOULD NOT BE USED AS AN INDICATOR OF THE FUTURE MARKET PRICE OF THE SHARES. THEREFORE, THE OFFERING PRICE BEARS NO RELATIONSHIP TO THE ACTUAL VALUE OF THE COMPANY, AND MAY MAKE OUR SHARES DIFFICULT TO SELL.

Since our Shares have not yet begun to be traded, the offering price of $1.00 per share for the Shares of Common Stock was arbitrarily selected. The offering price bears no relationship to the book value, assets or earnings of the Company or any other recognized criteria of value. The offering price should not be regarded as an indicator of the future market price of the Shares.

OUR STOCK PRICE MAY BE VOLATILE, AND YOU MAY NOT BE ABLE TO SELL YOUR SHARES FOR MORE THAN WHAT YOU PAID OR AT ALL.

Our stock price may be subject to significant volatility, and you may not be able to sell shares of Common Stock at or above the price you paid for them or at all. The trading price of our Common Stock may be subject to fluctuations in in response to various factors.

WE MAY BE SUBJECT TO THE “PENNY STOCK” RULES WHICH WILL ADVERSELY AFFECT THE LIQUIDITY OF OUR COMMON STOCK.

The Securities and Exchange Commission (the “SEC"), has adopted regulations which generally define “penny stock” to be an equity security that has a market price of less than $5.00 per share, subject to specific exemptions. The market price of our Common Stock may be less than $5.00 per share and therefore we will be considered a “penny stock” according to SEC rules. This designation requires any broker-dealer selling these securities to disclose certain information concerning the transaction, obtain a written agreement from the purchaser and determine that the purchaser is reasonably suitable to purchase the securities. These rules limit the ability of broker-dealers to solicit purchases of our Common Stock and therefore reduce the liquidity of the public market for our shares should one develop.

OUR SECURITIES WILL BE TRADED ON THE OTCMARKETS®, WHICH MAY NOT PROVIDE AS MUCH LIQUIDITY FOR OUR INVESTORS AS MORE RECOGNIZED SENIOR EXCHANGES SUCH AS THE NASDAQ STOCK MARKET OR OTHER NATIONAL OR REGIONAL EXCHANGES.

Our current plan is to initially list our Common Stock on the OTCMarkets®, the symbol is in the process of being applied for. The OTC Markets are inter-dealer, over-the-counter markets that provide significantly less liquidity than the NASDAQ Stock Market or other national or regional exchanges. Securities traded on the OTC Markets are usually thinly traded, highly volatile, have fewer market makers and are not followed by analysts. The SEC’s order handling rules, which apply to NASDAQ-listed securities, do not apply to securities quoted on the OTC Markets. Quotes for stocks included on the OTC Markets are not listed in newspapers. Therefore, prices for securities traded solely on the OTC Markets may be difficult to obtain and holders of our securities may be unable to resell their securities at or near their original acquisition price, or at any price.

WE MAY NOT SATISFY NASDAQ’S INITIAL QUOTATION STANDARDS AND, EVEN IF WE DO, WE MAY BE REMOVED FROM QUOTATION IN THE FUTURE.

We hope to eventually apply to quote our Common Stock on NASDAQ. Our Common Stock will not commence trading on NASDAQ until a number of conditions are met, including that we have raised the minimum amount of offering proceeds necessary for us to meet the initial quotation requirements of NASDAQ. There is no guarantee that we will be able to meet all such requirements.

In the event we are able to quote our Common Stock on NASDAQ, we will be required to meet certain financial, public float, bid price and liquidity standards on an ongoing basis in order to continue the quotation of our Common Stock. If we fail to meet these continued listing requirements, our Common Stock may be subject to removal from quotation. If our Common Stock were to no longer be quoted on NASDAQ and we could not list or quote our Common Stock on another national securities exchange, we expect our securities would be quoted on an over-the-counter market. If this were to occur, our stockholders could face significant material adverse consequences, including limited availability of market quotations for our Common Stock and reduced liquidity for the trading of our securities. In addition, we could experience a decreased ability to issue additional securities and obtain additional financing in the future.

FINANCIAL INDUSTRY REGULATORY AUTHORITY (“FINRA”) SALES PRACTICE REQUIREMENTS MAY ALSO LIMIT A STOCKHOLDER’S ABILITY TO BUY AND SELL OUR COMMON STOCK, WHICH COULD DEPRESS THE PRICE OF OUR COMMON STOCK.

FINRA has adopted rules that require a broker-dealer to have reasonable grounds for believing that the investment is suitable for that customer before recommending an investment to a customer. Prior to recommending speculative low-priced securities to their non-institutional customers, broker-dealers must make reasonable efforts to obtain information about the customer’s financial status, tax status, investment objectives, and other information. Under interpretations of these rules, FINRA believes that there is a high probability that speculative low-priced securities will not be suitable for at least some customers. Thus, the FINRA requirements make it more difficult for broker-dealers to recommend that their customers buy our Common Stock, which may limit your ability to buy and sell our shares of Common Stock, have an adverse effect on the market for our shares of Common Stock, and thereby depress our price per share of Common Stock.

BECAUSE DIRECTORS AND OFFICERS CURRENTLY AND FOR THE FORESEEABLE FUTURE WILL CONTINUE TO CONTROL SWS, IT IS NOT LIKELY THAT YOU WILL BE ABLE TO ELECT DIRECTORS OR HAVE ANY SAY IN THE POLICIES OF SWS.

Our shareholders are not entitled to cumulative voting rights. Consequently, the election of directors and all other matters requiring shareholder approval will be decided by majority vote. The directors and officers of SWS beneficially own approximately 67% of our current outstanding Common Stock with the CEO holding the voting control Series A Preferred Shares. Due to such significant ownership position held by our insiders, new investors may not be able to effect a change in our business or management, and therefore, shareholders would have no recourse as a result of decisions made by management. Mr. Donald Keer, our President, Chief Executive Officer and Chairman of the Board, holds all of the Series A Preferred Shares which are the voting control block.

In addition, sales of significant amounts of shares held by our officers and directors, or the prospect of these sales, could adversely affect the market price of our Common Stock. Management’s stock ownership may discourage a potential acquirer from making a tender offer or otherwise attempting to obtain control of us, which in turn could reduce our stock price or prevent our shareholders from realizing a premium over our stock price.

SINCE WE INTEND TO RETAIN ANY EARNINGS FOR DEVELOPMENT OF OUR BUSINESS FOR THE FORESEEABLE FUTURE, YOU WILL LIKELY NOT RECEIVE ANY DIVIDENDS FOR THE FORESEEABLE FUTURE.

We have never declared or paid any cash dividends or distributions on our capital stock. We currently intend to retain our future earnings to support operations and to finance expansion and therefore we do not anticipate paying any cash dividends on our Common Stock in the foreseeable future.

A SIGNIFICANT NUMBER OF OUR SHARES WILL BE ELIGIBLE FOR SALE AND THEIR SALE OR POTENTIAL SALE MAY DEPRESS THE MARKET PRICE OF OUR COMMON STOCK.

Sales of a significant number of shares of our Common Stock in the public market could harm the market price of our Common Stock. This Offering Circular relates to the sale of up to 75,000,000 shares of our Common Stock, which represents approximately 1.36 times our current issued and outstanding shares of our Common Stock. As additional shares of our Common Stock become available for resale in the public market pursuant to this offering, and otherwise, the supply of our Common Stock will increase, which could decrease its price.

THE LACK OF PUBLIC COMPANY EXPERIENCE OF OUR MANAGEMENT TEAM COULD ADVERSELY IMPACT OUR ABILITY TO COMPLY WITH THE REPORTING REQUIREMENTS OF U.S. SECURITIES LAWS.

Our management team lacks public company experience, which could impair our ability to comply with legal and regulatory requirements. Our senior management has never had responsibility for managing a publicly traded company. Such responsibilities include complying with federal securities laws and making required disclosures on a timely basis. Our senior management may not be able to implement programs and policies in an effective and timely manner that adequately respond to such increased legal, regulatory compliance and reporting requirements, including establishing and maintaining internal controls over financial reporting. Any such deficiencies, weaknesses or lack of compliance could have a materially adverse effect on our ability to comply with the reporting requirements of the Exchange Act, which is necessary to maintain our public company status. If we were to fail to fulfill those obligations, our ability to continue as a U.S. public company would be in jeopardy in which event you could lose your entire investment in the Company.

AN INVESTMENT IN THE COMPANY’S COMMON STOCK IS EXTREMELY SPECULATIVE AND THERE CAN BE NO ASSURANCE OF ANY RETURN ON ANY SUCH INVESTMENT.

Our Common Stock is currently quoted on the OTC Pink Tier maintained by OTC Markets Group, Inc. under the symbol “SWS”; however, an investment in the Company’s Common Stock is extremely speculative and there is no assurance that investors will obtain any return on their investment. Investors will be subject to substantial risks involved in an investment in the Company, including the risk of losing their entire investment. The market price of our Common Stock is subject to significant fluctuations in response to variations in our quarterly operating results, general trends in the market and other factors, many of which we have little or no control over. In addition, broad market fluctuations, as well as general economic, business and political conditions, may adversely affect the market for our Common Stock, regardless of our actual or projected performance.

AS AN “EMERGING GROWTH COMPANY” UNDER THE JOBS ACT, WE ARE PERMITTED TO RELY ON EXEMPTIONS FROM CERTAIN DISCLOSURE REQUIREMENTS.

We qualify as an “emerging growth company” under the JOBS Act. As a result, we are permitted to, and intend to, rely on exemptions from certain disclosure requirements. For so long as we are an emerging growth company, we will not be required to:

| · | Have an auditor report on our internal control over financial reporting pursuant to Section 404(b) of the Sarbanes-Oxley Act; |

| · | Comply with any requirement that may be adopted by the Public Company Accounting Oversight Board regarding mandatory audit firm rotation or a supplement to the auditor’s report providing additional information about the audit and the consolidated financial statements (i.e., an auditor discussion and analysis); |

| · | Submit certain executive compensation matters to stockholder advisory votes, such as “say-on-pay” and “say-on-frequency”; and |

| · | Disclose certain executive compensation related items such as the correlation between executive compensation and performance and comparisons of the chief executive officer’s compensation to median employee compensation. |

In addition, Section 102 of the JOBS Act also provides that an emerging growth company can take advantage of the extended transition period provided in Section 7(a)(2)(B) of the Securities Act for complying with new or revised accounting standards. In other words, an emerging growth company can delay the adoption of certain accounting standards until those standards would otherwise apply to private companies. We have elected to take advantage of the benefits of this extended transition period. Our consolidated financial statements may therefore not be comparable to those of companies that comply with such new or revised accounting standards.

We will remain an “emerging growth company” for up to five years, or until the earliest of (i) the last day of the first fiscal year in which our total annual gross revenues exceed $1 billion, (ii) the date that we become a “large accelerated filer” as defined in Rule 12b-2 under the Exchange Act, which would occur if the market value of our ordinary shares that is held by non-affiliates exceeds $700 million as of the last business day of our most recently completed second fiscal quarter or (iii) the date on which we have issued more than $1 billion in non-convertible debt during the preceding three-year period.

Until such time, however, we cannot predict if investors will find our Common Stock less attractive because we may rely on these exemptions. If some investors find our Common Stock less attractive as a result, there may be a less active trading market for our Common Stock and the price of our securities may be more volatile.

DILUTION

If you purchase shares in this offering, your ownership interest in our Common Stock will be diluted immediately, to the extent of the difference between the price to the public charged for each share in this offering and the net tangible book value per share of our Common Stock after this offering.

Our historical net book value (deficit) as of October 1, 2020 is $1,042,980 or $0.0243 per then-outstanding share of our Common Stock. Historical net tangible book value per share equals the amount of our total tangible assets, less total liabilities, divided by the total number of shares of our Common Stock outstanding, all as of the date specified.

The following table illustrates the per share dilution to new investors discussed above, assuming the sale of, respectively, 100%, 75%, 50% and 25% of the shares offered for sale in this offering (after deducting estimated offering expenses of 0.05% for each investment level):

| Percentage of shares offered that are sold | | 25% | | | 50% | | | 75% | | | 100% | |

| Price to the public charged for each share in this offering | | $ | 1.00 | | | $ | 1.00 | | | $ | 1.00 | | | $ | 1.00 | |

| Net tangible book value per share as of January 1, 2021 (1) | | $ | 0.0243 | | | $ | 0.0243 | | | $ | 0.0243 | | | $ | 0.0243 | |

| Increase (Decrease) in net tangible book value per share attributable to new investors in this offering | | $ | 0.2413 | | | $ | 0.4203 | | | $ | 0.5538 | | | $ | 0.6486 | |

| Net tangible book value per share, after this offering | | $ | 0.2620 | | | $ | 0.4382 | | | $ | 0.5685 | | | $ | 0.6612 | |

| Dilution per share to new investors | | $ | 0.7380 | | | $ | 0.5618 | | | $ | 0.4315 | | | $ | 0.3388 | |

———————

| (1) | Based on net book value (deficit) as of January 1, 2021 of $1,042,980 and 43,000,000 outstanding shares of Common Stock. |

PLAN OF DISTRIBUTION

The shares are being offered by us on a “best-efforts” basis by our officers, directors, and employees, with the assistance of independent consultants, and possibly through registered broker-dealers who are members of the Financial Industry Regulatory Authority (“FINRA”) and finders. As of the date of this Offering Circular, unless otherwise permitted by applicable law, we do not intend to accept subscriptions from investors in this Offering who reside in certain states, unless and until the Company has complied with each such states’ registration and/or qualification requirements or a FINRA-member broker-dealer has been engaged by the Company to consummate and process sales to investors in such states. We reserve the right to temporarily suspend and/or modify this Offering and Offering Circular in the future, during the Offering Period, in order to take such actions necessary to enable the Company to accept subscriptions in this Offering from investors residing in such states identified above.

There is no aggregate minimum to be raised in order for the Offering to become effective and therefore the Offering will be conducted on a “rolling basis.” This means we will be entitled to begin applying “dollar one” of the proceeds from the Offering towards our business strategy, offering expenses, reimbursements, and other uses as more specifically set forth in the “Use of Proceeds” contained elsewhere in this Offering Circular.

We may pay selling commissions to participating broker-dealers who are members of FINRA for shares sold by them, equal to a percentage of the purchase price of the Common Stock shares. We may pay finder’s fees to persons who refer investors to us. We may also pay consulting fees to consultants who assist us with the Offering, based on invoices submitted by them for advisory services rendered. Consulting compensation, finder’s fees and brokerage commissions may be paid in cash, Common Stock, or warrants to purchase our Common Stock. We may also issue shares and grant stock options or warrants to purchase our Common Stock to broker-dealers for sales of shares attributable to them, and to finders and consultants, and reimburse them for due diligence and marketing costs on an accountable or non-accountable basis. We have not entered into selling agreements with any broker-dealers to date, though we may engage a FINRA registered broker-dealer firm for offering administrative services. Participating broker-dealers, if any, and others may be indemnified by us with respect to this offering and the disclosures made in this Offering Circular.

Generally, no sale may be made to you in this offering if the aggregate purchase price you pay is more than 10% of the greater of your annual income or net worth. Different rules apply to accredited investors and non-natural persons. Before making any representation that your investment does not exceed applicable thresholds, we encourage you to review Rule 251(d)(2)(i)(C) of Regulation A. For general information on investing, we encourage you to refer to www.investor.gov.

Our Offering will expire on the first to occur of (a) the sale of all 75,000,000 shares of Common Stock offered hereby, (b) 1 year from the date that this Offering Circular is declared effective, subject to extension for up to one hundred-eighty (180) days in the sole discretion of the Company, or (c) when our board of directors elects to terminate the Offering.

USE OF PROCEEDS TO ISSUER

If the Offering is fully subscribed for 75,000,000 shares of Common Stock, we expect that the net proceeds from the sale of shares of Common Stock will be approximately Forty-Eight Million Seven Hundred Fifty Thousand Dollars ($48,750,000), based on the subscription price of $1.00 per share and after all estimated expenses of this Offering and the sale of stock by existing shareholders into the offering. We estimate that the aggregate expenses of this Offering will be approximately $3,7500,000.

We intend to use the net proceeds from this Offering (i) in connection with acquisition of five (5) companies representing $56,000,000 in revenues; (ii) for general corporate purposes, including, without limitation, for working capital purposes, hiring of technical and administrative personnel & enhancing marketing, making payments of accounts payable and pre-payments within our supply chain; (iii) to finance capital expenditures, including without limitation the expansion of premises, acquisition of additional rental equipment and transportation, (iv) the payment of indebtedness, (v) to identify and acquire additional targets and (vi) to otherwise improve our financial position to pursue an up-listing to NASDAQ.

Percentage of Offering Sold

| | | 25% | | | 50% | | | 75% | | | 100% | |

| Offering Amount | | $ | 18,750,000 | | | $ | 37,500,000 | | | $ | 56,250,000 | | | $ | 75,000,000 | |

| Shares Sold Into the Offering by Shareholders | | $ | 5,625,000 | | | $ | 11,250,000 | | | $ | 16,875,000 | | | $ | 22,500,000 | |

| Estimated Offering Expense (1) | | $ | 937,500 | | | $ | 1,875,000 | | | $ | 2,812,500 | | | $ | 3,750,000 | |

| Total Net Proceeds (1) | | $ | 12,187,500 | | | $ | 24,375,000 | | | $ | 36,562,500 | | | $ | 48,750,000 | |

| Acquisitions | | $ | 10,963,125 | | | $ | 17,906,250 | | | $ | 25,684,375 | | | $ | 35,612,500 | |

| Working Capital, Payments of accounts payable and pre-payments within our supply chain | | $ | 609,375 | | | $ | 1,422,000 | | | $ | 1,722,000 | | | $ | 2,022,000 | |

| Hiring of technical and administrative personnel | | $ | 165,000 | | | $ | 300,000 | | | $ | 450,000 | | | $ | 600,000 | |

| Financing of capital expenditures (including without limitation the expansion of premises, acquisition of rental equipment, and transportation) | | $ | 150,000 | | | $ | 800,000 | | | $ | 1,200,000 | | | $ | 1,200,000 | |

| Reduction of Debt (2) | | $ | 300,000 | | | $ | 400,000 | | | $ | 400,000 | | | $ | 400,000 | |

| Capital to pursue an up-listing to NASDAQ | | $ | 0 | | | $ | 3,750,000 | | | $ | 7,000,000 | | | $ | 8,500.000 | |

| | | | | | | | | | | | | | | | | |

———————

| (1) | In the event that our estimated offering expenses are less than the amounts indicated above, any such excess funds shall be applied toward our acquisitions, working capital and other corporate purposes. |

| (2) | Represents net proceeds we intend to prepay a portion of the outstanding principal amount due to existing lines of credit with the acquisition targets. |

The expected use of net proceeds from this Offering represents our intentions based on our current plans and business conditions, which could change in the future as our plans and business conditions evolve and change. As of the date of this offering circular, we cannot specify with certainty all of the particular uses for the net proceeds we will have upon completion of this Offering or the order of priority in which we may use such proceeds. Circumstances that may cause us to alter our anticipated uses and allocations of proceeds from this Offering include (i) the size of the Offering and, (ii) our cash flow from operations during fiscal year 2021. Accordingly, we will retain broad discretion over the use of these proceeds and the Company reserves the right to change the above use of proceeds if management believes it is in the best interests of the Company.

DETERMINATION OF OFFERING PRICE

The shares being offered by the Company will be sold at a fixed price of $1.00 for the duration of this Offering. The offering price of the shares of our Common Stock does not necessarily bear any relationship to our book value, assets, past operating results, financial condition or any other established criteria of value. It has been arbitrarily determined by the Company.

THE BUSINESS

“Water is the most abundant material on the surface of the planet yet less than 2.5% is “freshwater” and less than 0.1% is suitable for use without any treatment.”

The Company Overview

SUSTAINABLE WATER SOLUTIONS, INC. (“SWS”) is a Wyoming based company, having offices in in Warminster, PA, USA, formed to execute a roll-up plan incorporating system integration, significant re-occurring revenues and emerging technologies via strategic acquisitions. The company is poised to capitalize and expand on the many years of expertise in both regional and global markets in the industrial, potable, wastewater and in the specialized water treatment and purification sectors. Three strategic companies have been acquired with negotiations ongoing for the acquisition of 3 additional targets.

With the first acquisition, Altair Equipment Company, Inc., SWS has established itself in the water treatment technologies market.

Altair provides commercially proven industrial equipment designs, systems, technologies and programs and re-occurring revenues that secure its position in that is multi-billion-dollar, global market. The core design technologies, developed by this acquisition, have over 35-years in industry applications. The acquisitions also have a significant portion of their revenues generated service contracts and equipment rentals. Finally, this acquisition has a client base that includes over a dozen Fortune 500® companies. Identifying and commercializing re-occurring revenue opportunities and innovative solutions to provide industrial and potable water solutions worldwide, is one of the main focuses of SWS.

During the COVID-19 shutdowns of 2020 water treatment for generation of power and production of pharmaceuticals was considered essential businesses. Altair was able to remain open during the entire shutdown. The service portion of the business remained stable and revenues only dropped slightly. The capital portion of the business did drop off significantly during the initial shutdown but the demand for new equipment just shifted to the third and fourth quarter of operations.

The issue surrounding water is not the lack of resources but the lack of water that is pure enough to use for its intended purpose. Water is the most abundant material on the surface of the planet yet less than 2.5% is “freshwater” and less than 0.1% is suitable for use without any treatment. According to Research Nester’s September 2018 report:

“The global market of water and wastewater treatment is expected to flourish with significant compound annual growth rate over the forecast period 2018-2027. Factors such as growing demand for drinking water and waste water treatment in commercial and industrial applications are anticipated to generate noteworthy market valuation for water and wastewater treatment market by reaching around USD 704 Billion by the end of 2027.”

The Industrial portion of the market is expected to have annual growth of 9.0% during that period. Most of the growth will occur in developing countries because, as the standard of living rises, the awareness of the health issues associated with untreated water becomes more widespread, industry growth requires high quality water, the energy and power industry will place mare demands on infrastructure and new technologies require purer water. There is also a shift from ground water, which has been filtered by hundreds of feet of porous rock, to surface waters. Surface waters are more easily contaminated by sewage and industrial waste. The global need is for a company that can deliver water treatment technology on a local level, show companies how to treat water as a resource and provide environmentally friendly solutions to contamination issues. SWS has the talent, capabilities and structure to fulfill that need better than much larger companies or any smaller companies.

SWS’s team has the unique ability to execute system integration projects to produce purified water in a cost-effective manner and to evaluate water treatment technologies for their sound engineering as well as their market potential. The team has international experience and research and development experience. SWS, with its acquisitions and future acquisition targets has standard equipment designs, contract manufacturing sources and marketing agreements that will quickly establish a positive and profitable cash flow. This cash flow provides a proof of concept that justifies the acquisition strategy and will support the team’s registration in the public markets allowing for the evaluation and acquisition of key growth technologies.

The investment objective is to roll-up approximately $100 million in annual revenues with a 40-50% reoccurring revenue base and developing technologies to attract and acquisition partner for a corporate buy-out.

Mission Statement

To acquire companies that manufacture, design, service and sell innovative and sustainable water products for consumption and the treatment of water for consumption, recycle, return to the environment and industry. The Company will maintain profitability and financial balance while efficiently and effectively building the business by through acquisitions and synergistic growth. Return to investors and shareholders is through acquisition of SWS by a larger firm or by listing on one of the major exchanges.

Business Objectives

The primary objectives of our organization are to:

| a) | Take advantage of the trend in the water treatment market to fill a vacuum between the largest competitors and the small regional companies. This void in the market supply will permit lower costs of supply and larger return to investors. |

| b) | Provide a local delivery/service alternative to the traditional large, centralized water treatment approach. |

| c) | Acquire new emerging technologies where a proof of concept can be performed with Fortune 500 companies. Technologies will focus on environmentally friendly and water recovery opportunities. |

| d) | Acquire component companies, companies that supply components common to all water treatment system integrators’ equipment. |

| e) | Aggressively acquire companies that have environmental permits for ion exchange resin regeneration. |

| f) | Change the market perception of water as a resource and expendable to an asset. |

| g) | Utilize access to the World Bank and United Nations to penetrate and support developing countries at minimal financial risk. |

| h) | Utilize the manufacturing expertise to offer equipment and services to the various agencies within the United States Federal Government. |

SWS Acquisitions

Altair Equipment Company, Inc. (Complete)

Company Description – Altair Equipment Company is a regional water treatment company that has traditionally operated in Mid-Atlantic Region of the United States. The company maintains numerous component designs used for potable and industrial applications. The Company was founded in the 1985. The Company’s client base includes the US Government, military and Fortune 500 companies. Specific current clients include:

SHAW INDUSTRIES

BRISTOL-MYERS/SQUIBB

EXXON/MOBIL

MOHAWK INDUSTRIES

NORTHERN BOILER

FORD MOTOR CO.

HAYES WHEELS CORP. - ROMULUS, MI.

EAST KENTUCKY POWER COOP

GENERAL MOTORS

DETROIT EDISON

CONSOLIDATED EDISON

INTERNATIONAL PAPER

WESTROCK PAPER

MINNESOTA POWER

SUEZ WATER

VINCINITY POWER

BASIN ELECTRIC – WHEATLAND, WY

FLORIDA FOODS

Facility – 40,000 square foot facility since 1999 which includes water supply, effluent permits and chemical storage permits.

Technology – Altair maintains designs for filters, softeners and membrane equipment. Altair is also experienced with the assembly and deployment of containerized systems that are monitored using remote communications. Altair holds environmental permits for the regeneration of ion exchange resin, this process is chemically intensive and requires acid and caustic. Altair’s warehouse has been expanded from 10,000 square feet to 40,000 square feet. This facility and the environmental permits are available for an additional $2.5 million.

Synergy – Altair’s manufacturing and service expertise will be expanded and used for the assembly of equipment and containerized systems. The Company will also be the center of the service operations. A central communications hub will be established to monitor and coordinate the maintenance of the remote installations.

SWS Future Acquisitions

SWS’ growth plan starts with the acquisition of Altair. The long-term growth is dependent upon the acquisition of other companies that provide products to other water treatment operators and those that have a strong service base. Three companies are in negotiations and will be completed after the registration of SWS.

Fabrication Company is a tank and heat exchanger manufacturer located in West Warwick Rhode Island. The company provides large steel tanks and heat exchangers used in the water treatment industry by numerous companies. They also have the capability to design and build large heat exchangers used in waste water treatment. Estimated revenues are $6 million.

Water Technology Company is a component company that provides technologically advanced and proven equipment to numerous small water system integrators. The company has a strong relationship with Chinese manufacturing to assemble components and have them imported into the USA. Estimated revenues are $12 million.

Government Contracting Company is a large military supplier of water treatment equipment. The company has a GSA contract and can offer other products from the SWS acquisitions to the US Government. Estimated revenues are $20 million.

Localized service organizations will be targeted to support regional service and sales.

Management Team

This management team has a proven record of accomplishment and the technical, engineering and scientific support to succeed. The strength of the management team stems from combined expertise in both management and technical areas together with industry contacts.

Mr. Donald R. Keer, P.E., Esq. – CEO/President, Director

Mr. Keer is one of the founders of SWS. He has over 35 years of business, engineering, construction and legal experience. The past 20 years were focused on the business and legal aspects of the water treatment industry where he has performed everything from President/CEO. M&A, Expert Witness and Corporate Counsel. From mid-1997 to the end of 1999 he was the President/CEO of M2 Innovative Solutions, a company focused on the delivery of high purity water to the medical, pharmaceutical and biotechnology industries. In 18 months Mr. Keer increased sales two and one-half times to US$2.2 million with no independent financial investment. In early 2000 he sold the company to Ionics, Inc. a NYSE listed company. M2 became the life science division and the center piece of its East Coast Operations. During the next 3 years sales increased to over US$10 million.

Mr. Keer continues to be active as an attorney and expert witness for the industry. In addition to the life sciences industry he is experienced in the sale, construction and operation of potable water systems, commercial water treatment, power industry water requirements and wastewater treatment. His clients include Merck & Co., CDM Engineering, Fluor Daniel, Huntsman Chemical, Bristol Meyer Squibb, Chevron and National Institutes of Health.

Mr. Keer holds a Professional Engineering License for Chemical Engineering, an MBA in Finance and Operations and a JD focusing on business and construction issues. He is also a licensed attorney in Pennsylvania with a practice in business and Securities and Exchange Commission issues.

Richard E. Krager – Director Altair Equipment and Large Equipment Sales

Mr. Krager is the President of Altair Equipment Company. He has managed the Company’s operations since taking over for his father in 1979. He has over 45 years of experience in water treatment and operations. He has managed the design, sales and marketing of Altair for 30 years. His leadership has led the company to the award of multiple government and Fortune 500 contracts. He also has supervised the Company’s administrative growth.

E. Wayne Krager – Director Service and Rental

Mr. Krager is the Vice President of Operations of Altair Equipment Company. He has supervised the client interaction, continued operations and growth of service based business. He has developed system monitoring procedures and service systems which support the Company’s growth and client satisfaction. He has also interfaced and developed expansion programs and permitting with the local government to allow for the continued growth of Altair Equipment Company.

Greg Brown – Corporate Sales and Marketing

Mr. Brown has over 15 years of experience managing business development, sales engineering, and field support in the water & process chemical services market. His expertise spans all heavy industry markets including oil & gas, power generation, chemical processing, hydrocarbon processing, finished fuels, steel, automotive, and all aspects of water treatment.

Mr. Brown has worked with a manufacturer’s representative company and managed sales of ion-exchange resins, membranes, activated carbon, and water treatment equipment. He was an Area Manager for GE Water & Process Technologies (currently Suez) where he managed direct sales reports and worked with direct, large clients. Lastly, he worked in the chemical portion of the industry establishing operations in new territories.

Mr. Brown will be in the corporate management staff integrating sales across acquisitions, industries and technologies.

Market Analysis - The Underlying Drivers for Water Investing

No other industry rivals the global water industry in terms of the strong and credible drivers propelling its growth. While each of the manifest drivers are worthy of detailed discussion, it would require a great many pages of information to do so. Thus, in the interest of brevity, we have labored below to reduce the discussion of the drivers to an outline that gives the reader a good basis for understanding why we believe the global water industry will be an investment leader for decades to come.

The increasing dominance of the drivers listed below will continue to create enormous investment opportunities in water infrastructure firms, water and wastewater utilities, and water industrials of all types.

Diminishing Water Supplies Confronted with Exploding Demand

Global Water Supply

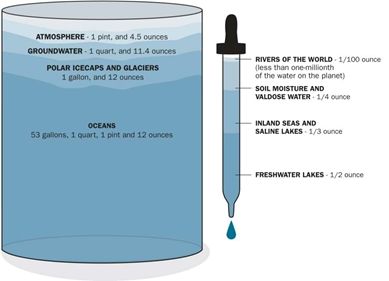

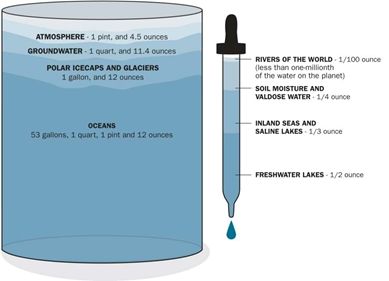

Source: U.S. Department of Commerce – National Oceanic & Atmospheric Administration

| • | The available supply of fresh water to the world’s water as represented by a fifty-five gallon drum. Not to scale. meet all human (and the ecosystem’s) needs amount to only one half of one percent of all water on earth. Amazingly, rivers and lakes make up less than 1/100th of this already minute amount. |

| | |

| • | Fresh water supplies are being destroyed at an alarming rate as surface water supplies are polluted and groundwater supplies, which make up 99% of available freshwater, are mined beyond their natural rate of replenishment. In Northern China for example, the water table is dropping by 3 meters per year. |

| | |

| • | Global warming further exacerbates the supply issue as climatic changes disrupt weather patterns causing drought and desertification. |

| | |

| • | It took mankind 10,000 years to reach a total population of 1 billion. One hundred fifty years later (1950) the population had doubled. In 2000, the global population stood at 6 billion people. By 2025, it is estimated that the global population will reach 8 billion. This exponential population growth and ensuing industrial expansion will continue to place an unrelenting demand on an already scarce and fixed water supply. |

| | |

| • | Not only are more people demanding water, but they are demanding more of it. In 1900 the global annual water use per capita was 350 cubic meters. In 2000, that number had grown to 642 cubic meters. |

| | |

| • | Global water usage increased six-fold during the 20th century, twice the rate of population. In the U.S. alone, water demand tripled in the past thirty years, while population growth has been just 50%. |

| | |

| • | To feed the growing population, the world will need 55% more food by 2030. This translates into an increasing demand for irrigation, which already claims nearly 70% of all fresh water currently used on a global basis. It takes 1,900 liters of water to produce 1 kg of rice. It takes a whopping 15,000 liters of water to produce 1 kg of beef. |

Geographic Imbalances Exist Between Water Sources and Use

| • | Water is not evenly distributed around the globe: Fewer than 10 countries possess 60% of the world’s available fresh water supply. China for example makes up 21% of the world’s population, but possesses only 7% of the renewable water resources. Or consider the situation in Africa, a water-stressed continent whose population doubles every 20 years. |

| • | Half of humanity currently lives in towns and cities. This number is however increasing as populations from more rural and arid areas migrate to these urban hubs to escape water scarcity. By 2030, it is expected that nearly two-thirds of the world’s population will exist in these urban areas, resulting in dramatically increased water demand on an already overstressed infrastructure system. |

| • | Water Stress occurs when the demand for water exceeds the available supply during a certain period or when poor quality restricts its use. Currently 25% of the world’s population is experiencing water stress. Another 8% is experiencing more severe water scarcity issues, whereby less than 1 cubic meter of water exists on a renewable basis per person per year. |

| • | As water resources become scarce, tensions among different users may intensify, both at the national and international level. Over 260 river basins are shared by two or more countries. In the absence of strong institutions and agreements, changes within a basin can lead to trans-boundary tensions. When major projects proceed without regional collaboration, they can become a point of conflict, heightening instability. |

| • | Currently, 20% of the world’s population (1.1 billion people) does not have access to an adequate supply of drinking water and some 2.6 billion do not have access to basic sanitation. By 2025 it is estimated that one-third of the world’s population will not have access to adequate drinking water. By 2050, more than 4 billion people – nearly half the world’s population – are expected to live in countries that are chronically short of water. |

Increasingly Stringent Regulatory Environment

| • | Legislation in the U.S. such as the Clean Water Act and the Safe Drinking Water Act continue to increase regulatory standards, driving new capital investments in monitoring and treatment technologies and services. |

| • | While many countries around the world have since developed regulatory standards similar to those of the U.S., some are only now beginning to enforce them. |

Heightened Awareness and Perception of an Impending Water Crisis

| • | From television, to newspapers and magazines, to the internet – the level of attention being given to water issues is at an all time high. Both conservative and liberal media alike are feverishly reporting on the global water situation. |

| • | The financial/business world is beginning to come up the learning curve on water investment opportunities. |

| • | As of recent, the global warming dialog has also aided in extending the exposure of water knowledge to the general public. |

One of the world’s most abundant materials has always been a precious and scarce commodity. If the entire world’s water resources were poured into a liter-sized bottle of water, only half a teaspoon would be fresh, drinking water. The rest of it is too brackish, too dirty, too hard to reach, or undrinkable seawater. So, the key issue is not where to find water, its how to render what is available suitable for its intended purpose.

In many regions of the world, fresh water, both groundwater and surface water, is being used faster than it can be replaced. Population growth combined with industrialization leads to high demand and contamination of water that is available. West Asia faces the greatest threat. Over 90 percent of the region's population is experiencing severe water stress. But the problem is not confined to the developing world. In the United States, 400 million cubic meters of groundwater is being removed from aquifers annually in Arizona; about double the amount being replaced by recharge from rainfall. Over use of groundwater leads to subsidence and the failure of building foundations. The ground elevation in Houston, Texas has dropped between 1 and 3 feet over the past 20 years.

This situation has lead to restrictions on groundwater removal thus relying on surface waters which are more susceptible to contamination and pollution.

The major aspects of the water crisis are overall scarcity of usable water and water pollution. Waterborne diseases and the absence of sanitary domestic water is the leading cause of death worldwide and may account for up to 80 percent of human disease. As this crisis looms, governments have a fiduciary duty to provide a source of potable water to their citizens. As the citizens of developing countries become more aware and have a greater standard of living one of the main requirements they have is the supply of safe potable water.

Key Statistics

| • | According to the UN, six thousand people die every day due to lack of clean, drinking water |

| • | In the past 10 years, water-related diseases have amounted to more deaths among children than the combination of all the deaths attributed to armed conflict since the Second World War. |

| • | On average, Americans consume slightly over 1 gallon (140 ounces) per person per day of beverages such as bottled water, soda, coffee, tea and soups. |

| • | Water supplies are falling while the demand is dramatically growing at an unsustainable rate. Over the next 20 years, the average supply of water worldwide per person is expected to drop by a third. |

| • | By the 2050, seven billion people in 60 countries will face dramatic water scarcity. |

| | • | One liter of waste water pollutes about eight liters of freshwater. |

| • | At least one in three Asians has no access to safe, drinking water. Asian rivers are the most polluted in the world, with 20 times more lead than those of industrialized countries and three times as many bacteria from human waste as the global average. |

| • | People already use over half the world’s accessible freshwater, and may use nearly three quarters by 2025. |

Water issues are not limited to potable water. Developing countries have increasing sophisticated industries. These operations require consistent water quality. They are also under pressure from Governments and the growing citizens to treat the water that leaves their facilities. This means that not only do opportunities exist to grow with the population in many countries but SWS can grow with the industrial base too.

Major competitors and participants

The marketplace is dominated by extremely large companies and very small regional companies. The large companies include well-known names such as GE, Siemens and Veolia. All of these companies carry overheads equal to their size. The large overhead requires that they focus on very large projects. The ideal project for these companies is a US$100 million build-own-operate facility that includes a 20 year operating contract. They cannot effectively supply and support a smaller local project.

The smaller regional companies vary in size from US$1,000,000 to US$10,000,000. These companies focus on regional coverage and service. They typically purchase components and assemble them. A large portion of their revenues are generated by local service contracts. They have no brand awareness beyond their region and lack the capital to execute the intermediate project, especially if that project is located outside of the region they service.

SWS’s team has the unique ability to execute system integration projects to produce purified water in a cost-effective manner and to evaluate water treatment technologies for their sound engineering as well as their market potential. The team has international experience and research and development experience. H2O SI has standard equipment designs, contract manufacturing sources and marketing agreements that will quickly establish a positive and profitable cash flow. This cash flow will support the team while allowing for the evaluation and acquisition of key growth technologies.

DESCRIPTION OF PROPERTY

SWS and Altair currently lease 335 Constance Drive, Warminster, PA 18974 from Krager & Associates.

MANAGEMENT'S DISCUSSION & ANALYSIS OF

FINANCIAL CONDITION & RESULTS OF OPERATIONS