Exhibit 99.1

GreenLight Biosciences Announces Second Quarter 2022 Financial

Results and Highlights Recent Company Progress

| | • | | GreenLight raised $108.4 million in private placement led by S2G Ventures with strong participation from existing and new investors with cash expected to fund critical programs through the first half of 2023. |

| | • | | GreenLight and Samsung Biologics completed their first commercial-scale engineering run for mRNA COVID-19 vaccine. |

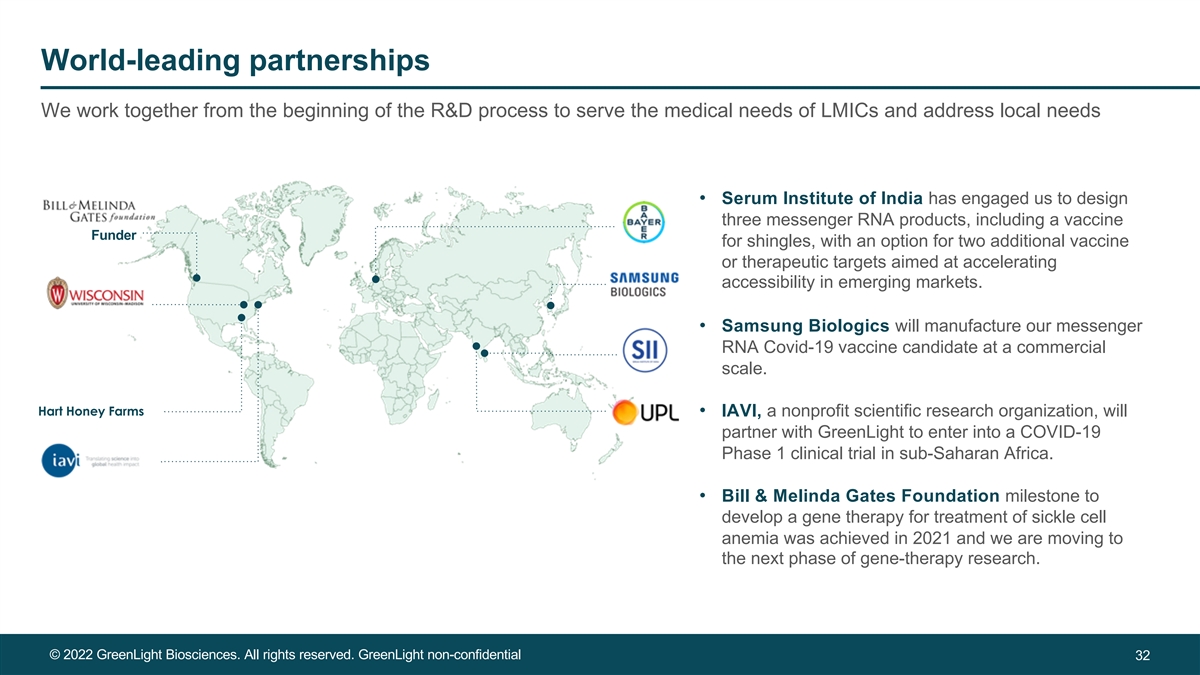

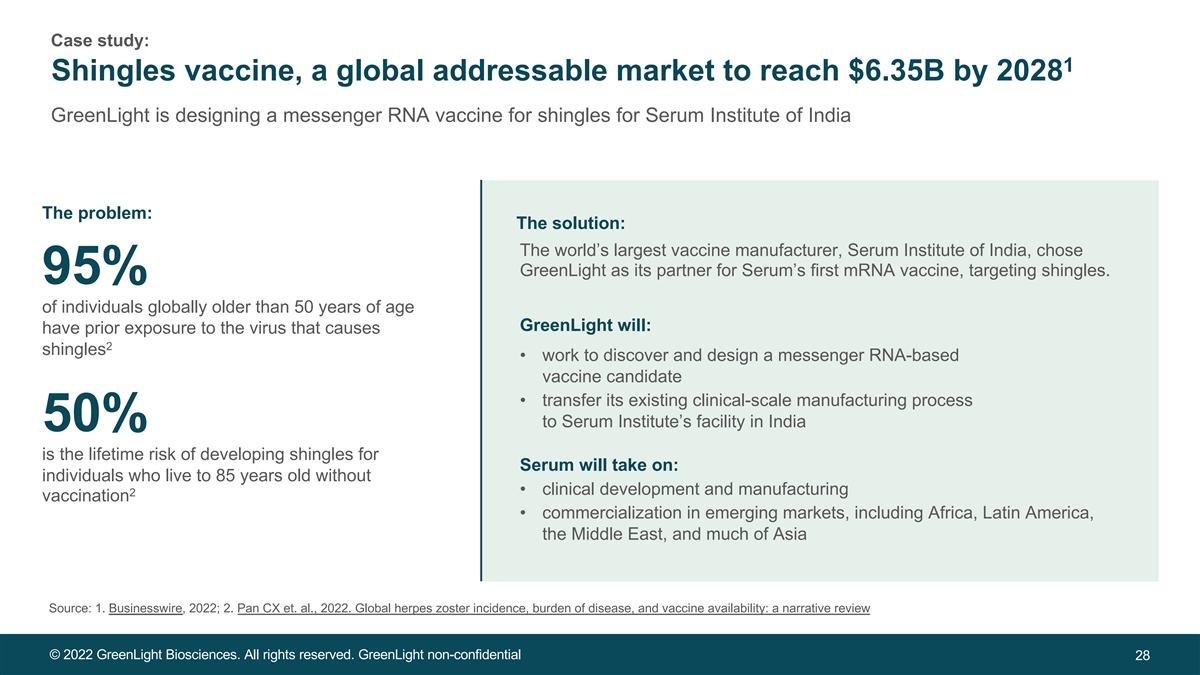

| | • | | Human health partnerships include NIH to support COVID-19 vaccine development against emerging variants and a platform licensing agreement with Serum Institute of India (SII) to develop a vaccine for shingles and up to two other targets. |

| | • | | Key milestones expected across plant health pipeline in 2022: anticipated EPA approval and launch of global-first foliar-applied RNA product Calantha™, a solution for Colorado potato beetle; regulatory submission for a solution to target varroa mites, which are destroying honeybee hives across the world; planning to register seven agricultural products by the end of 2026. |

BOSTON, August 15, 2022—GreenLight Biosciences (Nasdaq: GRNA), a public benefit corporation striving to bring effective and safe solutions to make food clean and affordable for everyone and dedicated to developing health solutions for every person in our planet, today reported operational highlights and financial results for the second quarter ended June 30, 2022.

“GreenLight’s RNA platform has continued to prove its value for developing a wide range of solutions to feeding the world and keeping it healthy. We founded GreenLight to change the world, and we have continued to make progress this quarter,” said Andrey Zarur, CEO of GreenLight. “Today, we are pleased to announce a capital infusion of $108.4 million. We are grateful for the support, continued faith, and trust of our longtime investors. We also welcome new investors who have decided to join GreenLight in our mission to help feed the world and keep it healthy. This will allow us to continue to make progress across our pipeline.

“In recent months, we have demonstrated our ability to manufacture mRNA at a scale that produced material to provide the equivalent of millions of mRNA vaccine doses with Samsung Biologics. We have started animal studies on a shingles vaccine for our partnership with Serum Institute of India, the world’s biggest vaccine producer. We are working on COVID-19 vaccines with the National Institutes of Health that are more broadly protective against new variants and with longer-lasting effects.

“In addition, we anticipate numerous plant health milestones in the coming months, including EPA approval and launch of Calantha™, our solution for Colorado potato beetles and regulatory submission for our solution targeting varroa mites, which are decimating honeybee colonies around the globe. We plan to register seven agricultural products by the end of 2026. We are undertaking field trials for several crop-protection solutions, with results available later this year. And our solutions are sustainable by design and produced in a responsible manner.”

Second Quarter 2022 and Recent Operational Highlights:

PLANT HEALTH PORTFOLIO:

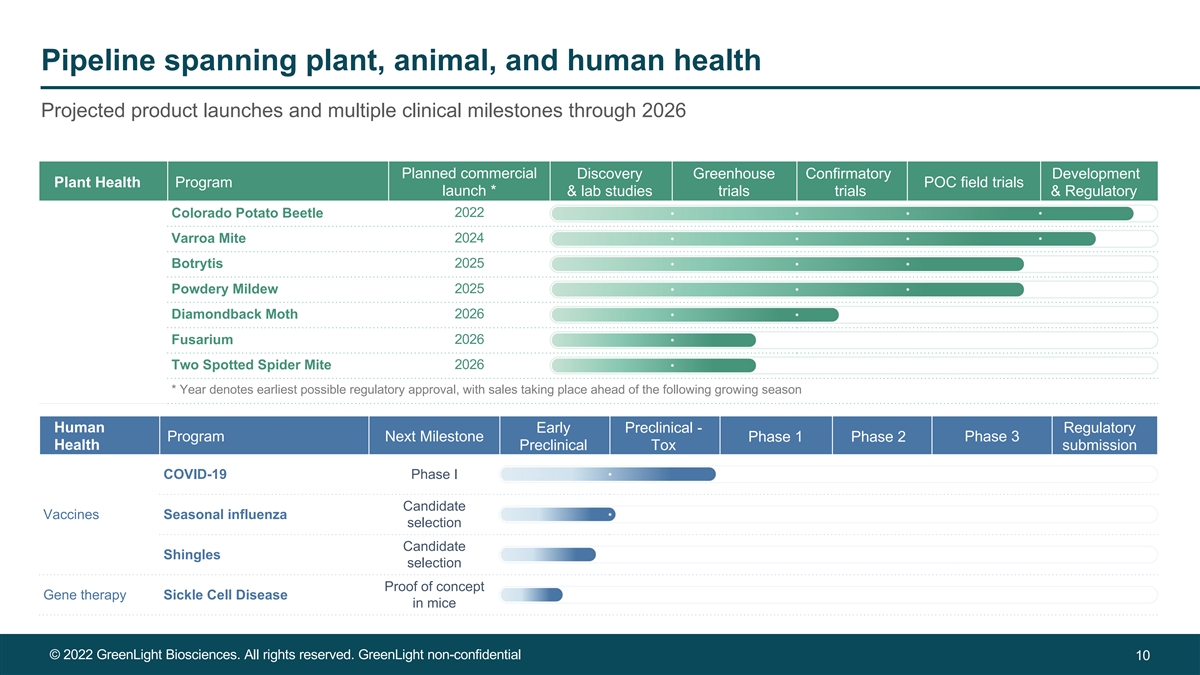

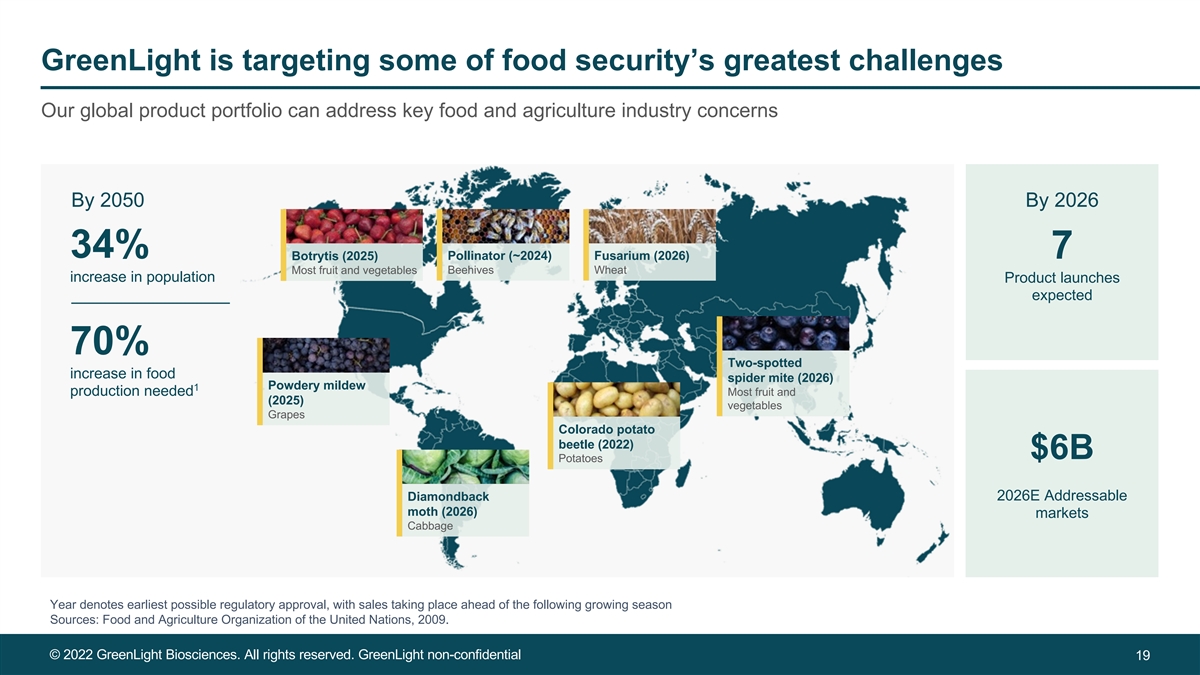

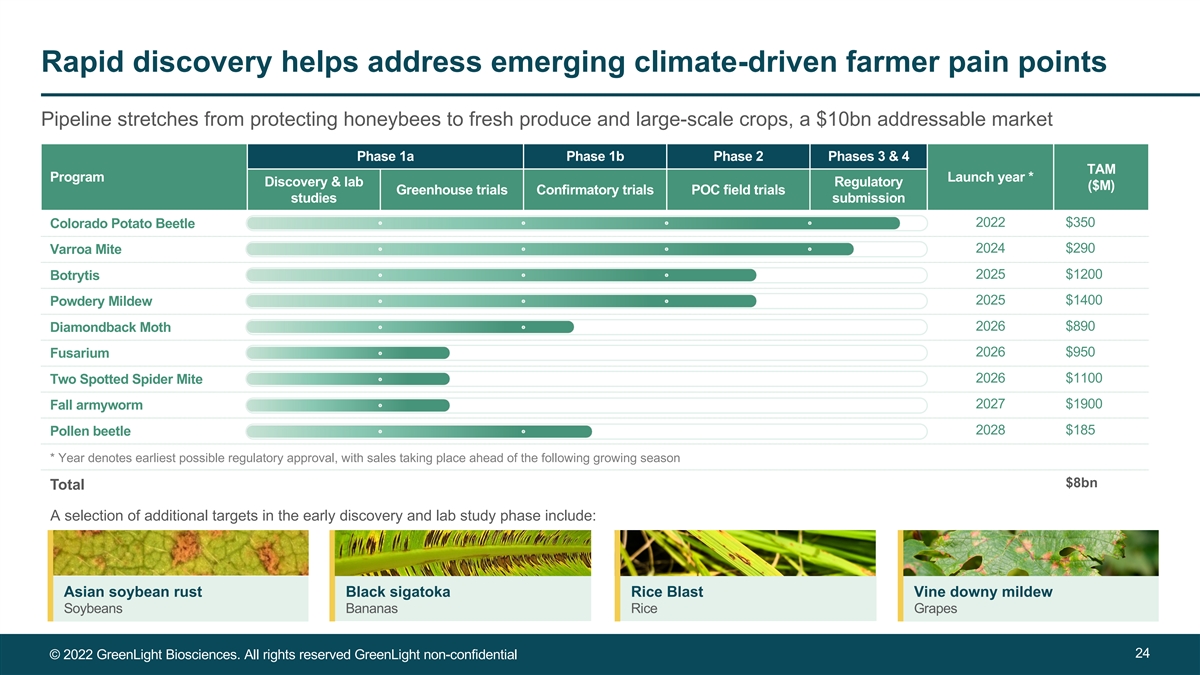

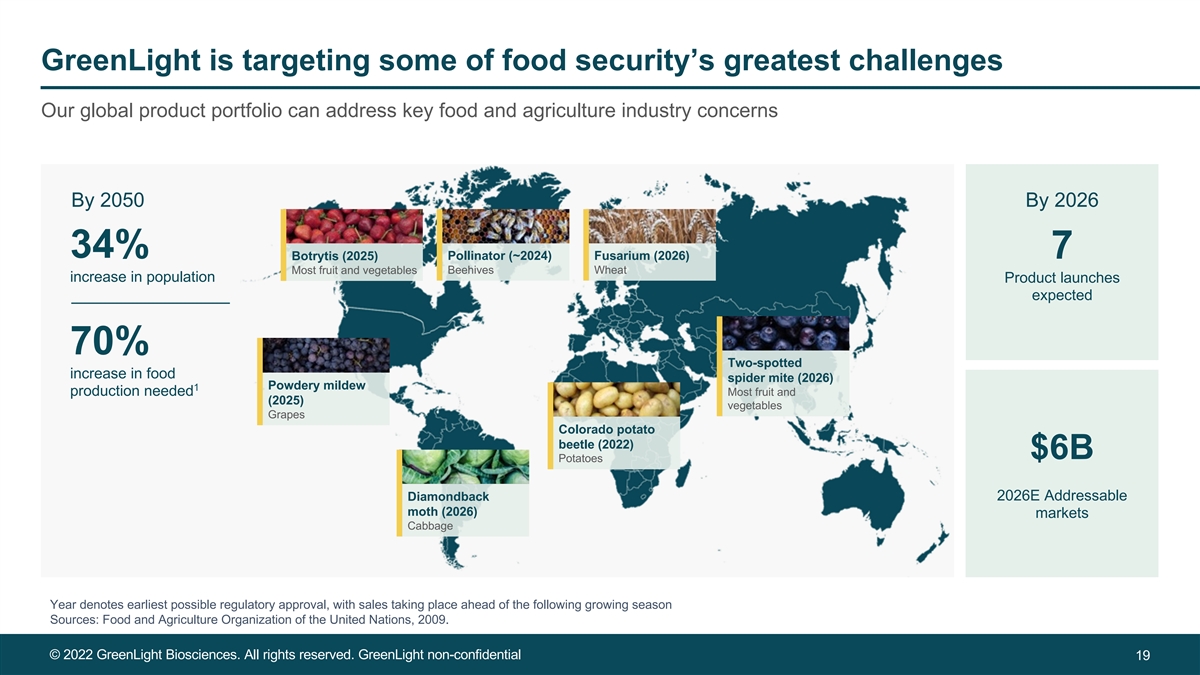

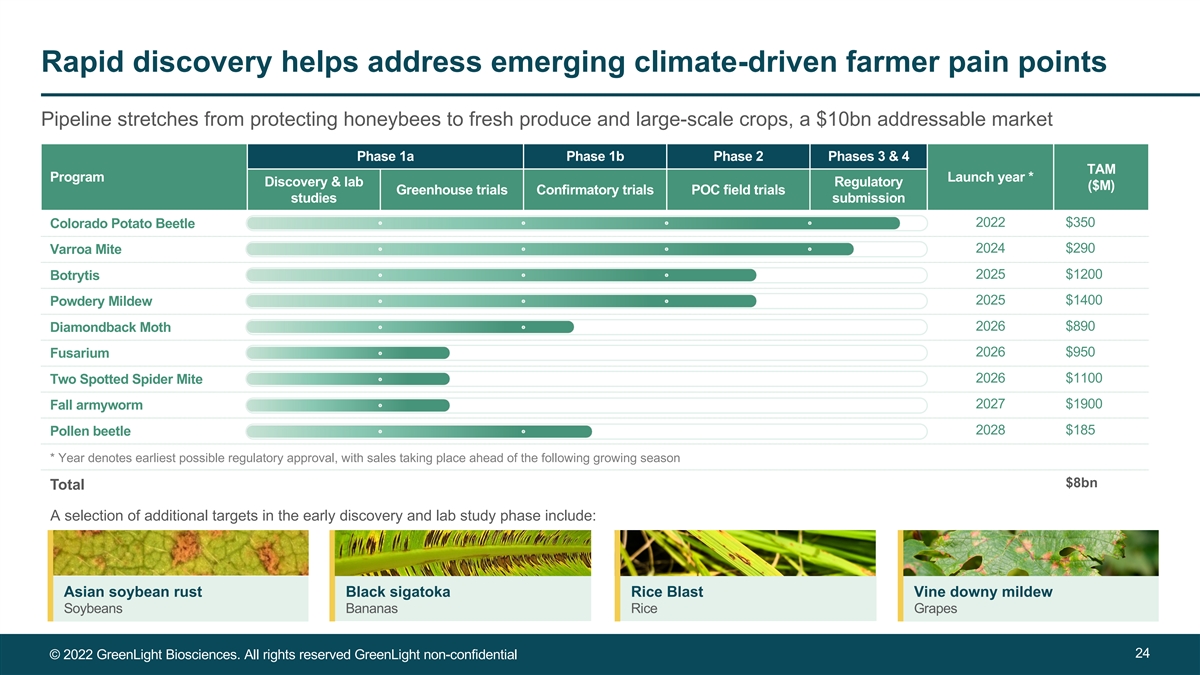

GreenLight is advancing double-stranded RNA (dsRNA) solutions for agricultural applications, including crop protection, designed to control pests and address resistance and residues of chemical alternatives, which affect food security and climate change. The company has seven agricultural products in active development, with an estimated total addressable market of $6 billion, that it plans to launch by 2026.

| | • | | Calantha: In 2022, GreenLight anticipates U.S. Environmental Protection Agency (EPA) approval of the company’s lead product, Calantha™, a foliar-applied dsRNA pesticide to protect against the Colorado potato beetle, a pest that has developed resistance to currently available chemical products. Pending approval, the company plans to launch commercially later this year. |

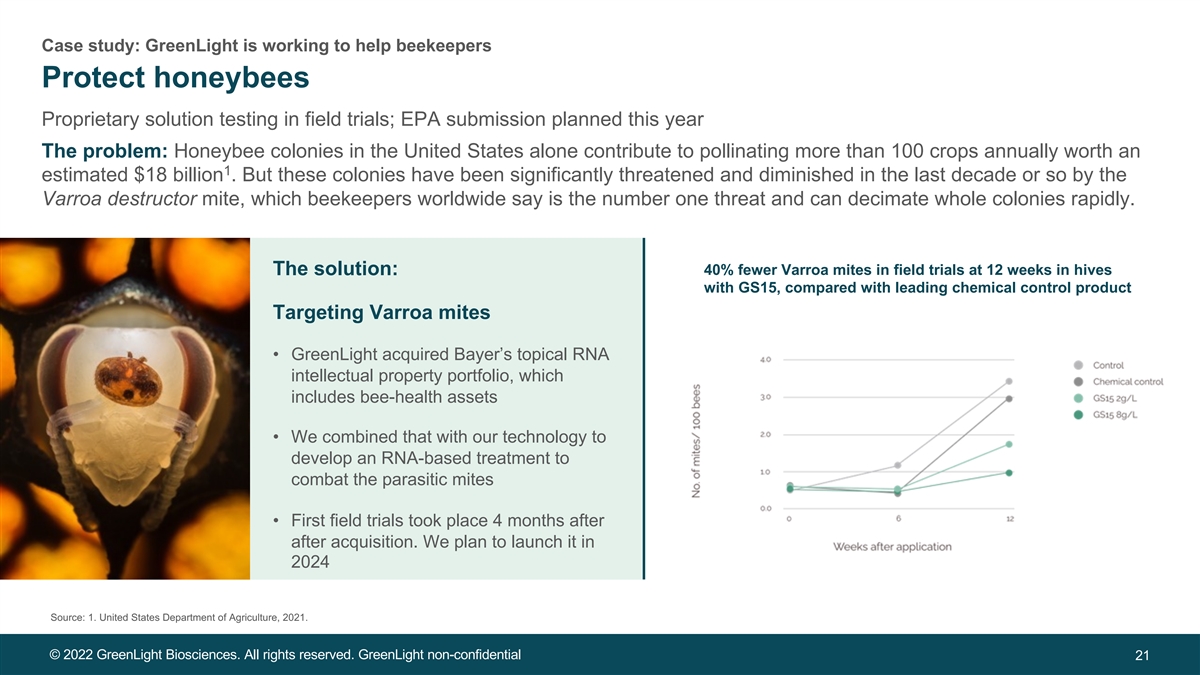

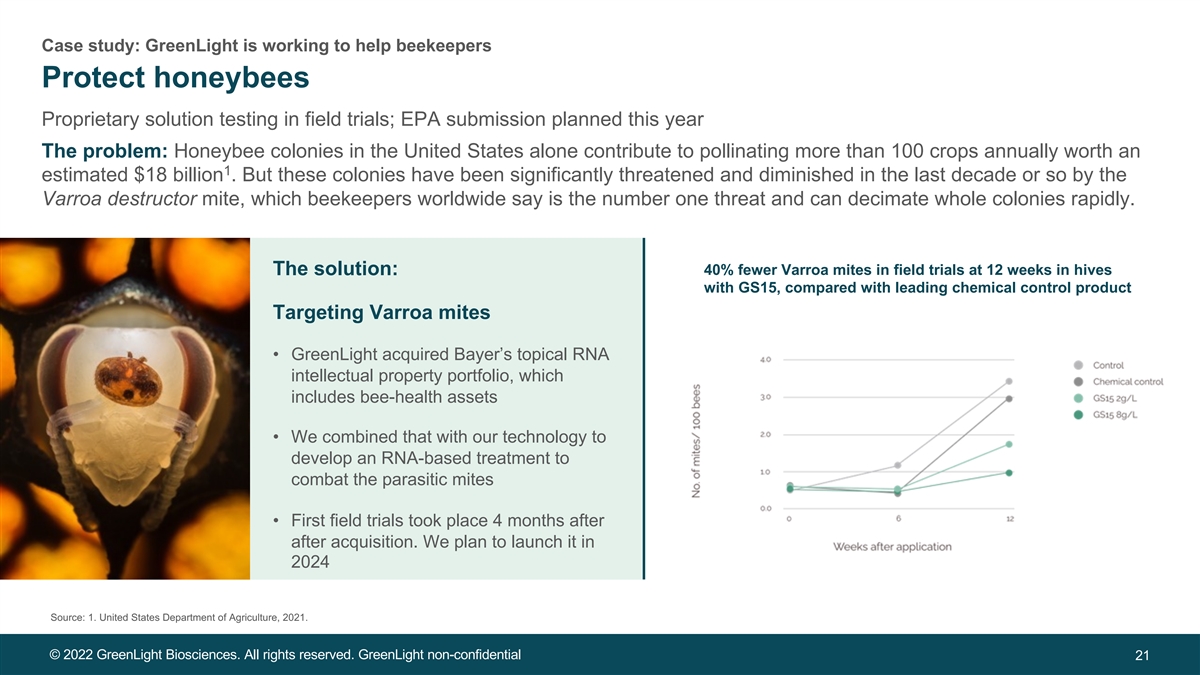

| | • | | Honeybee Pollinator: GreenLight is actively conducting field trials for its topical RNA solution for varroa destructor mites, which decimate honeybee hives worldwide that pollinate more than 100 crops annually. In the second half of 2022, the company anticipates submitting a regulatory application to the EPA to support a planned 2024 launch, pending approval. |

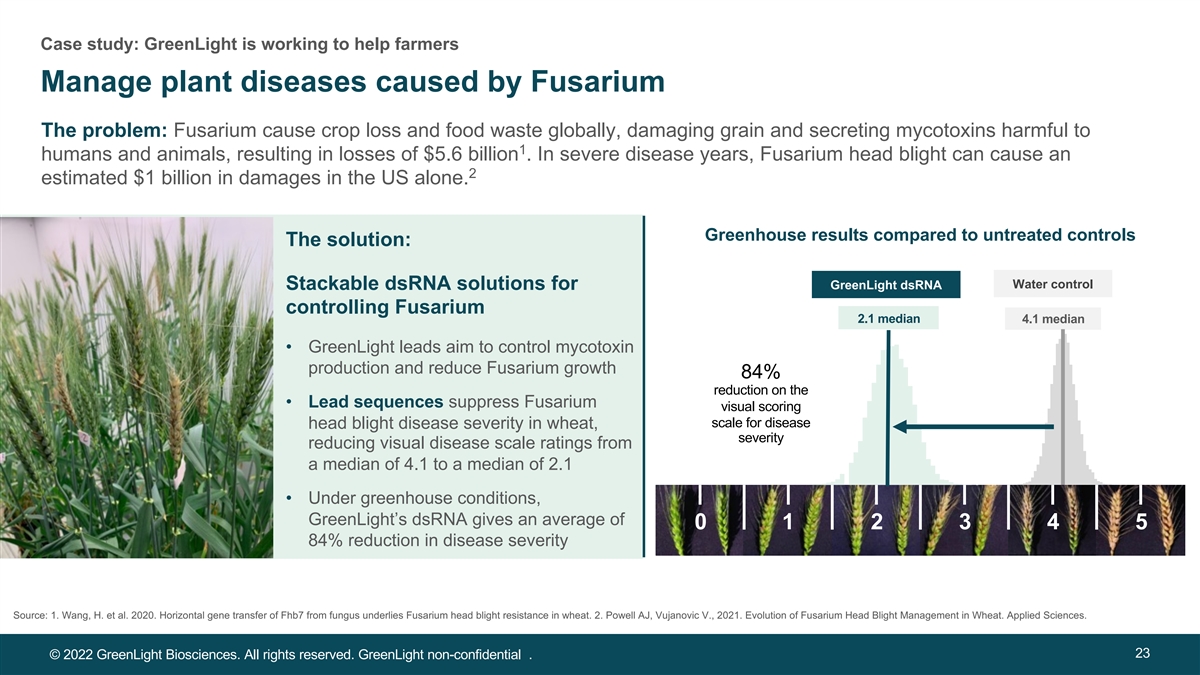

| | • | | Additional programs: The company is currently conducting confirmatory trials for Botrytis and Powdery Mildew programs, for which regulatory studies are expected to launch by the second half of 2023, and Fusarium, for which regulatory studies are expected to launch by the first half of 2024. The company also expects to launch greenhouse trials for its Diamondback Moth and broader Lepidoptera program in 2023. |

HUMAN HEALTH PORTFOLIO:

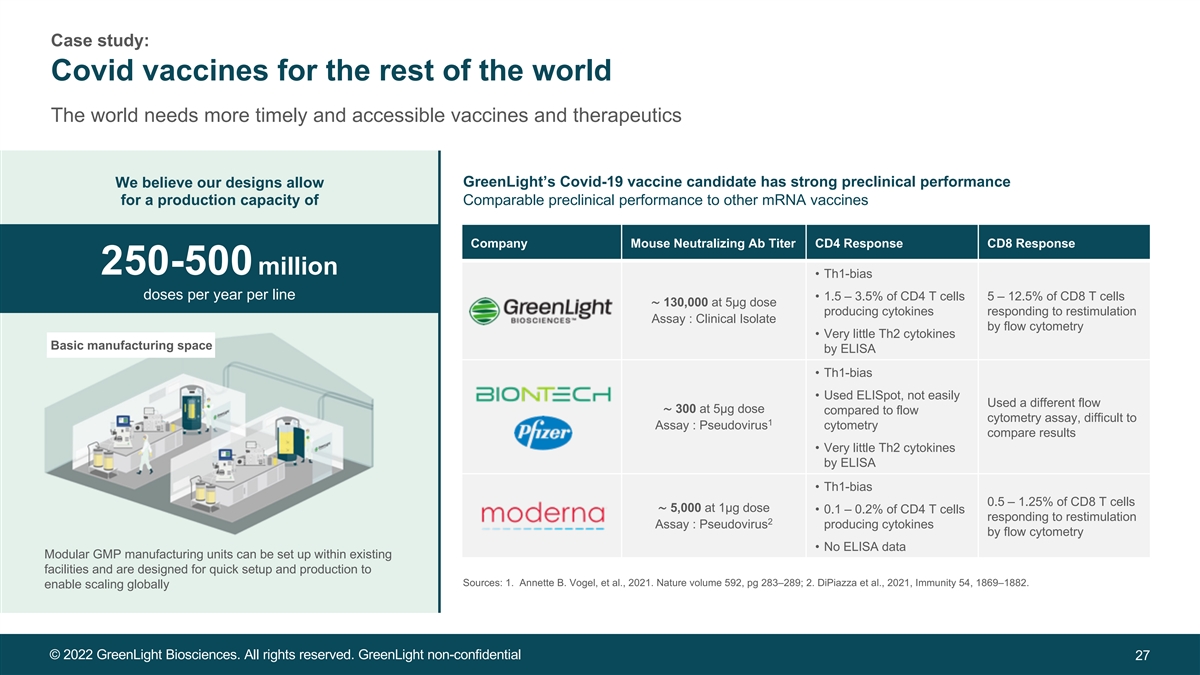

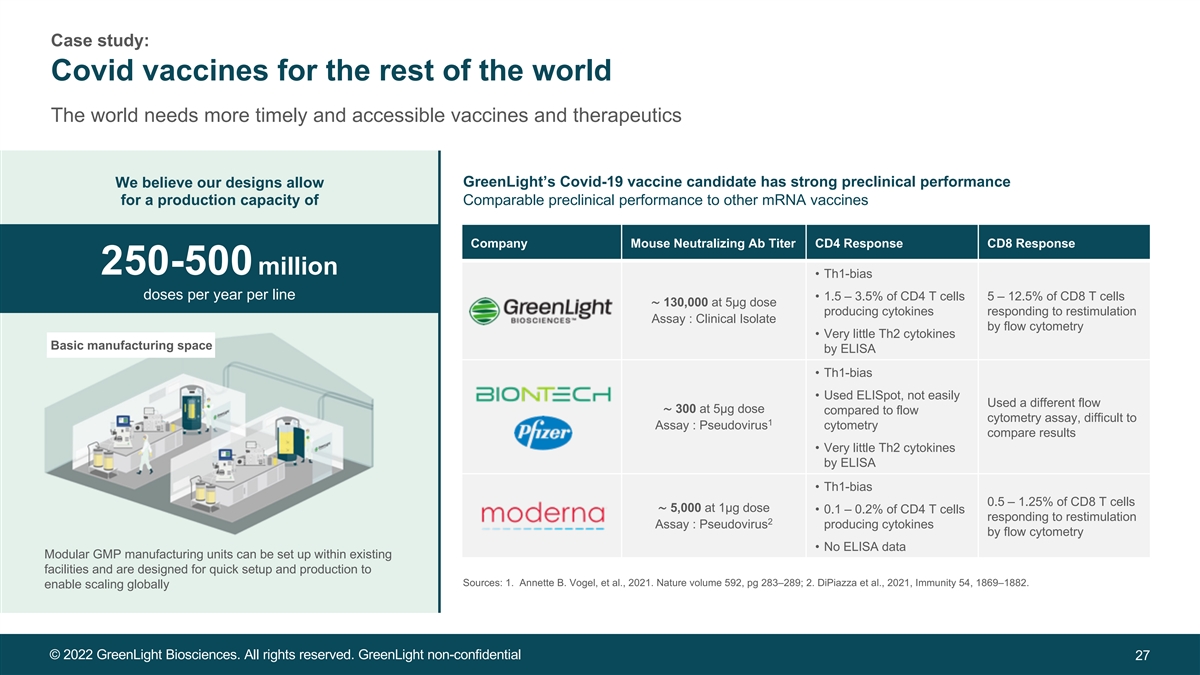

COVID-19 Vaccine Program: The company’s COVID-19 vaccine candidate has shown a promising antibody response and cell-mediated immunity in mice, induced humoral responses exceeding standards set by the World Health Organization (WHO), and protected against morbidity in pre-clinical studies. GreenLight and IAVI, a non-profit scientific research organization, are pursuing a Phase I clinical trial, for which IAVI is responsible for clinical trial management in collaboration with its network of clinical research center partners.

| | • | | In July 2022, GreenLight announced a collaboration with the National Institutes of Health (NIH) to develop next-generation COVID-19 vaccines that are more broadly protective against new variants and with longer-lasting effects. GreenLight, in collaboration with the Vaccine Research Center (VRC), part of NIH’s National Institute of Allergy and Infectious Diseases (NIAID), will co-design and test mRNA vaccines against coronaviruses with the goal of developing vaccines that confer a more durable immune response than current vaccines. The company expects to nominate a development candidate and initiate toxicology studies in 2H 2023. |

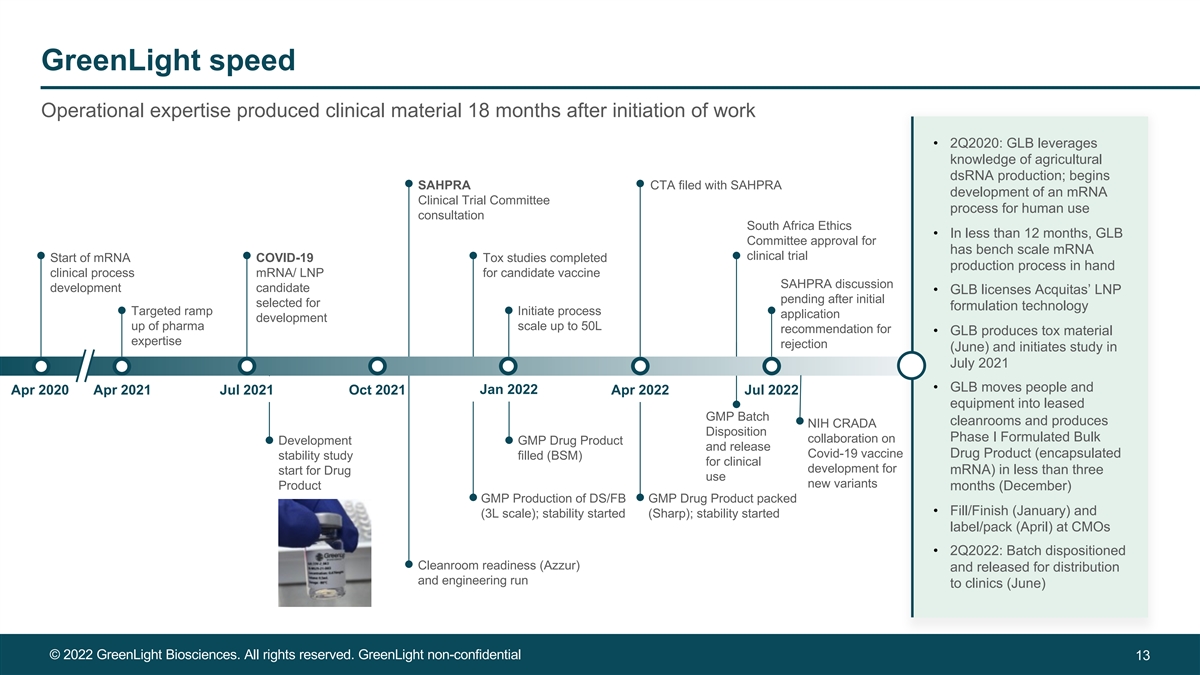

| | • | | In August 2022, GreenLight and Samsung Biologics, a leading global contract development and manufacturing service provider, completed the first engineering run of their mRNA production partnership, which supports commercial-scale manufacturing of GreenLight’s mRNA COVID-19 vaccine candidate as well as future vaccine candidates. GreenLight’s mRNA synthesis reaction had a titer of 12g/L at a commercial scale and |

| | produced 650g of mRNA. All comparability data was in line with expected outcomes, indicating successful scale up and fit of GreenLight’s process to Samsung Biologics’ Songdo facility. The collaboration with Samsung leverages GreenLight’s existing manufacturing process, with technology transfer from GreenLight to Samsung having occurred in seven months, and accelerates GreenLight’s COVID-19 vaccine candidate at commercial scale. |

| | • | | Our COVID-19 vaccine candidate, GLB-CoV-2-043, which is based on the original “Wuhan” strain of the COVID-19 virus has successfully completed preclinical testing and we are pursuing approval to begin clinical trials. In April of 2022, we applied for a Clinical Trials Application, or CTA, with the South African Health Products Regulatory Authority, or SAHPRA for a phase I/II single-vaccination booster study. That application was rejected with the recommendation that the resubmission include more detail on the specific benefits our testing efforts and a resulting vaccine will bring to South Africa considering the ready availability of other COVID-19 vaccines in that country. We plan on amending and resubmitting our CTA with that data in August and are also reviewing other countries in which to begin clinical trials and whether to do so in combination with a US-based Investigational New Drug, or IND, application with the FDA. |

| | • | | Assuming regulatory clearance by October, the company continues to plan for initial data from this program in 2023. Following clinical proof-of-concept, GreenLight would seek a development partner to advance this program into pivotal studies. |

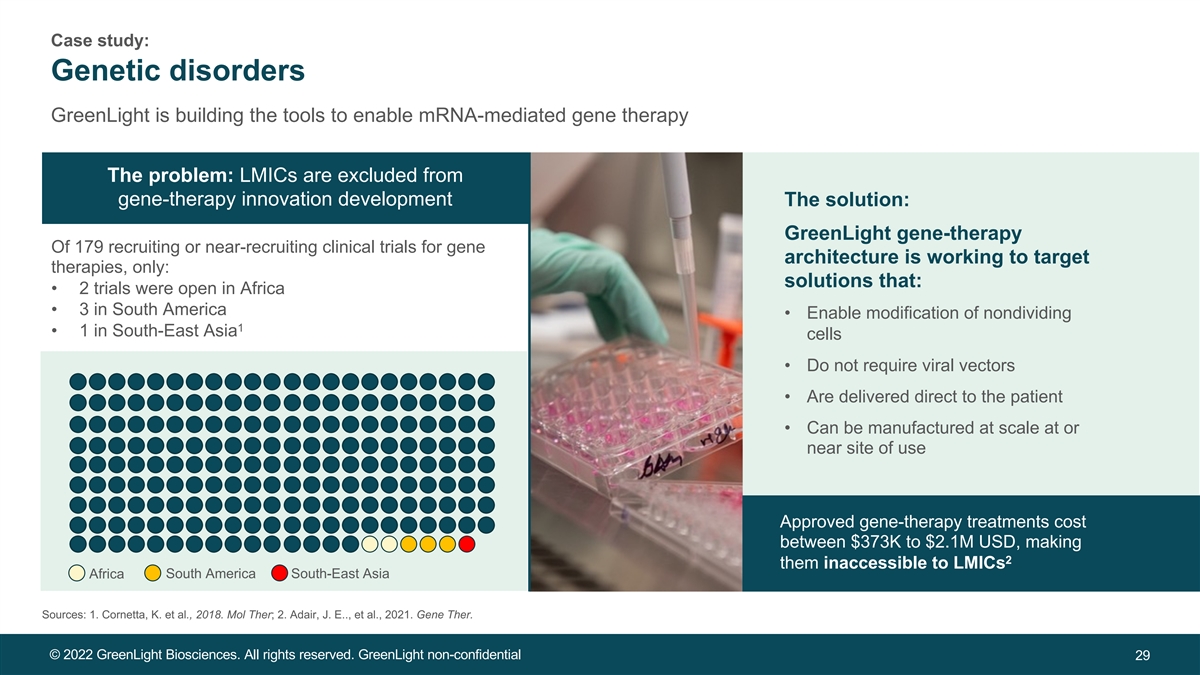

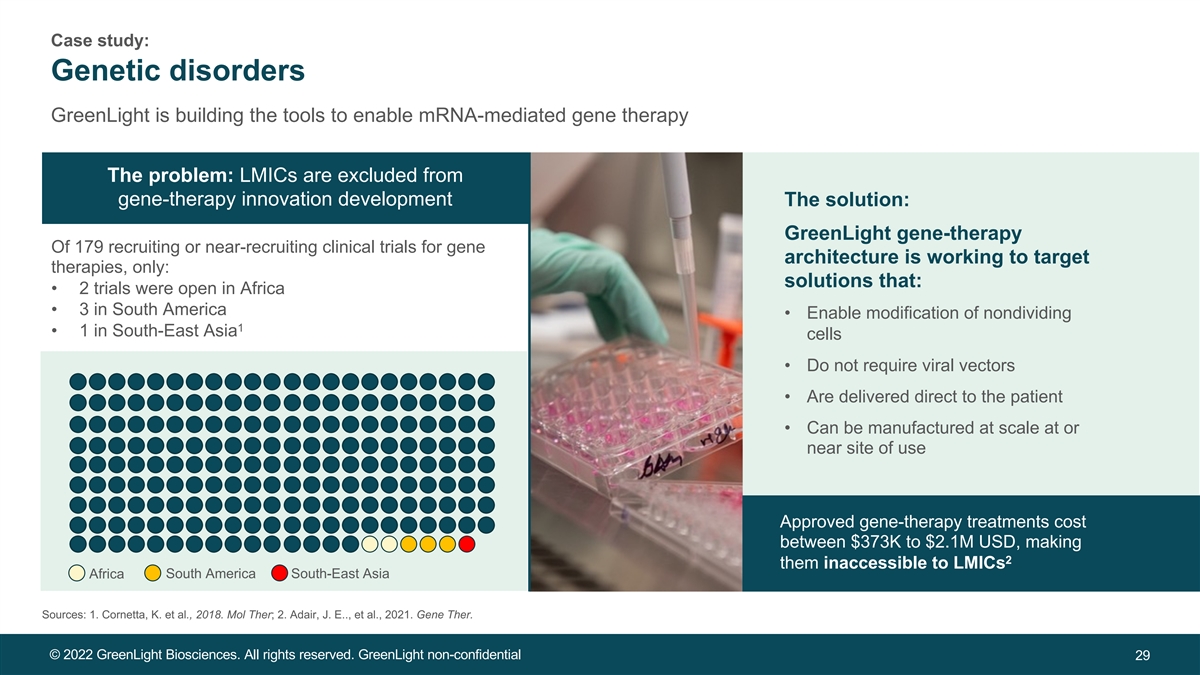

Additional programs: GreenLight is applying its mRNA platform technology to develop additional vaccine candidates that confer protection against prevalent infectious diseases and gene therapies for simple delivery of RNA-encoded instructions that carry out genomic edits in stem cells. Programs are focused on diseases prevalent in underserved and emerging markets, particularly in lower- and middle-income countries, and are currently in research and early preclinical stages of development.

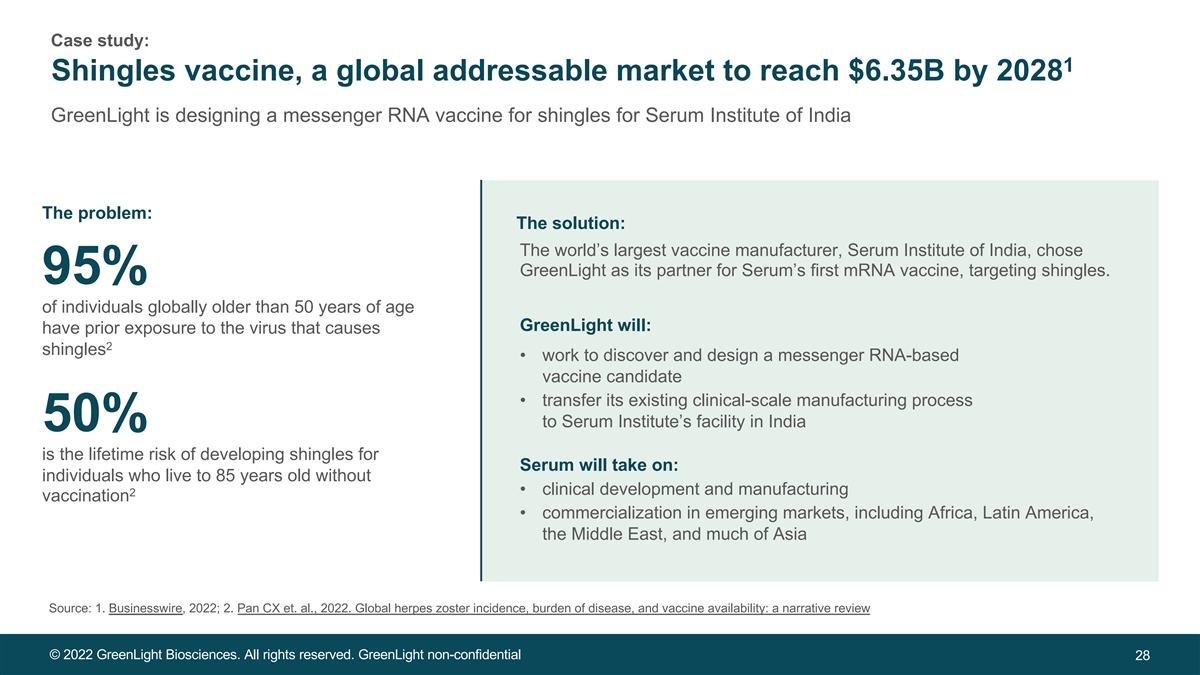

| | • | | In March 2022, GreenLight and Serum Institute, the world’s largest vaccine manufacturer by number of doses produced and sold, announced a multi-target licensing agreement aimed at accelerating accessibility to mRNA products in emerging markets globally. The agreement grants Serum Institute rights to develop, manufacture, and commercialize a low-cost, easily stored mRNA vaccine for shingles, and an option to pursue two additional vaccine or therapeutic targets, in Africa, Latin America, the Middle East, and Asia, excluding China, Japan, and South Korea. In exchange, GreenLight is responsible for the discovery and design of vaccine candidates and received an upfront payment as well as eligibility for potential downstream development milestones and royalties on any commercial sales deriving from this agreement, while retaining rights in other regions. The companies expect to nominate a development candidate for shingles in 1H 2023. |

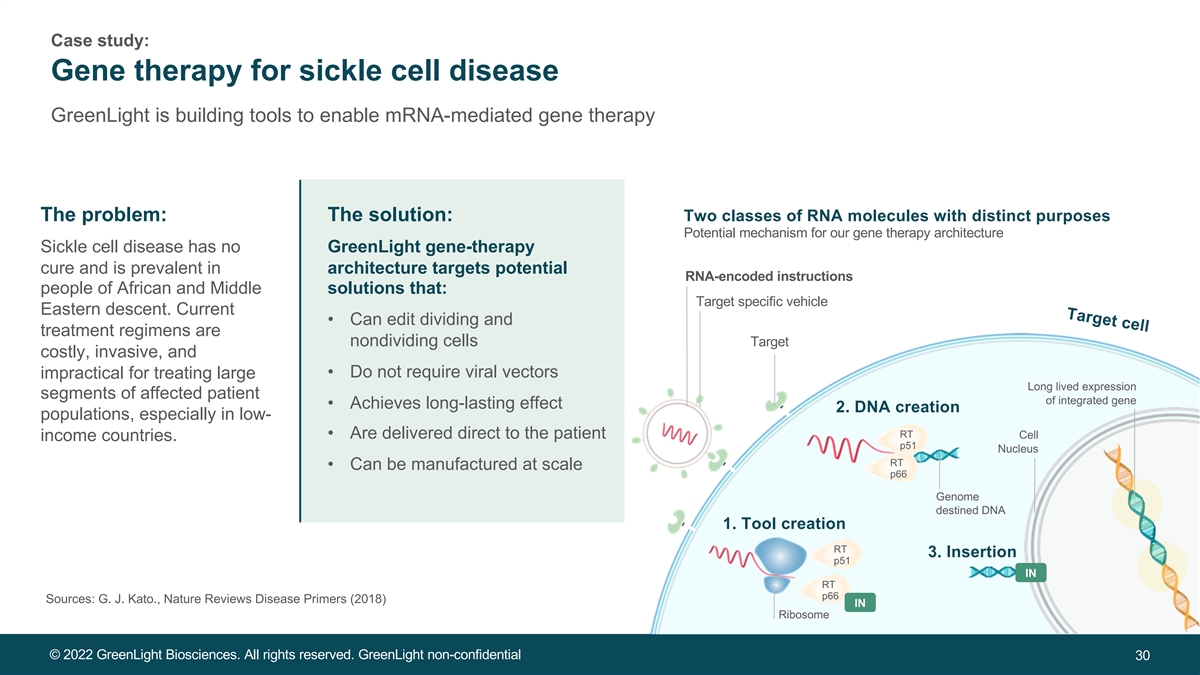

| | • | | GreenLight is pausing its gene therapy program, in development for sickle cell anemia, due to prioritization of its advanced-stage portfolio amid budget considerations. Research for this program was initially conducted with support from the Bill & Melinda Gates Foundation. |

Corporate Updates:

| | • | | Today, the company announced approximately $109 million in private placement fundraise led by S2G Ventures with strong participation from existing and new investors, with cash expected to fund critical programs through the first half of 2023. Investors also include BNP Paribas Ecosystem Restoration Fund, Continental Grain Company, Cormorant Asset Management, the Cummings Foundation, Fall Line Capital, the FTX Foundation, Insud Pharma, Morningside Venture Investments, Rivas Capital, Sigmas Group, SymBiosis and certain directors and executive officers of GreenLight. |

| | • | | In March 2022, Barney Graham, MD, PhD., joined GreenLight’s Human Health Scientific Advisory Board. Dr. Graham was the former deputy director of the NIAID Vaccine Research Center, with an extensive background in basic and translational research applied to vaccine development. He is best known for his research on respiratory syncytial virus (RSV), influenza, coronaviruses, HIV, and other emerging viral diseases. |

Second Quarter 2022 Financial Results

| | • | | Cash Position: Cash, cash equivalents, and marketable securities were $44.1 million as of June 30, 2022, compared to $31.4 million as of December 31, 2021. The increase was primarily driven by proceeds received from the close of the business combination and concurrent PIPE financing. This increase was offset in part by cash used to fund operations of approximately $72.2 million. |

| | • | | Collaboration Revenue: Collaboration revenue increased to $1.7 million during the second quarter of 2022, compared to $0 during the second quarter of 2021. This revenue was primarily related to the delivery of research services, which includes manufacturing technology transfer services, in connection with the March 2022 collaboration agreement with Serum Institute. |

| | • | | R&D Expenses: Research and development expenses increased by $22.1 million to $44.2 million during the second quarter of 2022, compared to $22.0 million during the second quarter of 2021. This increase was primarily related to increased program costs related to pre-clinical trial activities and personnel expenses, as well as facilities costs such as rent and depreciation expenses. Included in the R&D expense in Q2 2022 was approximately $15.0 million in costs related to materials purchased and fees for the manufacturing scale up at Samsung Biologics. |

| | • | | G&A Expenses: General and administrative expenses increased by $4.7 million to $9.6 million during the second quarter of 2022, compared to $4.9 million during the second quarter of 2021. This increase was primarily related to an increased level of support required for the growth of the company’s programs and pipelines and public company requirements. |

| | • | | Net Loss: The company’s net loss was $51.9 million for the second quarter of 2022, compared to $27.2 million during the second quarter of 2021. |

Financial Guidance:

The company expects its cash and equivalents of $44.1 million as of June 30, 2022, taken together with $108.4 million in proceeds from the PIPE financing announced today, will be sufficient to fund planned operating expenses and capital expenditures, through the first half of 2023. The company will continue to evaluate a range of opportunities to extend cash runway, including management of program spending, platform licensing collaborations, and potential financing activities.

About GreenLight:

Founded in 2008, GreenLight aims to address some of the world’s biggest problems by delivering on the full potential of RNA for human health and agriculture. In human health, this includes messenger RNA vaccines and therapeutics. In agriculture, this includes RNA to protect honeybees and a range of crops. The company’s breakthrough cell-free RNA platform, which is protected by numerous patents, allows for cost-effective production of RNA. GreenLight’s human health product candidates are in the pre-clinical stage, and its product candidates for the agriculture market are in the early stages of development or regulatory review. GreenLight is a public benefit corporation that trades under the ticker GRNA on Nasdaq. For more information, including our latest investor presentation and other materials, please visit https://www.greenlightbiosciences.com/.

Forward-Looking Statements:

This press release includes “forward-looking statements” within the meaning of the Private Securities Litigation Reform Act of 1995 with respect to GreenLight’s future finances, operations, or scientific developments. These forward-looking statements generally are identified by the words “aim to”, “believe,” “project,” “target”, “potential”, “expect,” “anticipate,” “estimate,” “intend,” “strategy,” “future,” “opportunity,” “plan,” “may,” “should,” “will,” “would,” “will be,” “will continue,” “will likely result” and similar expressions. Many factors could cause actual future events to differ materially from the forward-looking statements in this document, including failure to receive regulatory approval, the evolution of the Covid-19 pandemic and therapies to address that pandemic, our ability to raise and productively deploy capital and the rate at which we can successfully bring products to market. The important factors that could cause actual operating results to differ significantly from those expressed or implied by such forward-looking statements include, but are not limited to, risks and uncertainties detailed from time to time in the Company’s reports that it files with the SEC, including its Annual Report on Form 10-K for the year ended December 31, 2021, filed on March 31, 2022 with the SEC, as well as its Quarterly Reports on Form 10-Q and periodic filings on Form 8-K. The Company disclaims any intention or obligation to update or revise any forward-looking statements, whether as a result of new information, future events, or otherwise, unless required by law. For additional information on GreenLight and potential risks associated with investing, please see our public filings at

https://www.sec.gov/edgar/browse/?CIK=1822691&owner=exclude.

| | | | | | | | | | | | | | | | |

| | | THREE MONTHS ENDED

JUNE 30, | | | SIX MONTHS ENDED

JUNE 30, | |

| Condensed Consolidated Statements of Operations (unaudited) | | 2022 | | | 2021 | | | 2022 | | | 2021 | |

REVENUE: | | | | | | | | | | | | | | | | |

License and collaboration revenue | | $ | 1,748 | | | $ | — | | | $ | 1,748 | | | $ | — | |

Grant revenue | | | 20 | | | | 493 | | | | 277 | | | | 818 | |

| | | | | | | | | | | | | | | | |

Total revenue | | | 1,768 | | | | 493 | | | | 2,025 | | | | 818 | |

OPERATING EXPENSES: | | | | | | | | | | | | | | | | |

Research and development | | | 44,151 | | | | 22,009 | | | | 71,432 | | | | 39,420 | |

General and administrative | | | 9,577 | | | | 4,933 | | | | 19,332 | | | | 8,831 | |

| | | | | | | | | | | | | | | | |

Total operating expenses | | | 53,728 | | | | 26,942 | | | | 90,764 | | | | 48,251 | |

| | | | | | | | | | | | | | | | |

LOSS FROM OPERATIONS | | | (51,960 | ) | | | (26,449 | ) | | | (88,739 | ) | | | (47,433 | ) |

OTHER INCOME (EXPENSE) | | | | | | | | | | | | | | | | |

Interest income | | | 57 | | | | 5 | | | | 61 | | | | 16 | |

Interest and other expense | | | (1,338 | ) | | | (529 | ) | | | (2,411 | ) | | | (840 | ) |

Change in fair value of warrant liabilities | | | 1,315 | | | | (201 | ) | | | 956 | | | | (200 | ) |

| | | | | | | | | | | | | | | | |

Total other income (expense), net | | | 34 | | | | (725 | ) | | | (1,394 | ) | | | (1,024 | ) |

| | | | | | | | | | | | | | | | |

Net loss attributable to common stockholders | | $ | (51,926 | ) | | $ | (27,174 | ) | | $ | (90,133 | ) | | $ | (48,457 | ) |

| | | | | | | | | | | | | | | | |

Net loss per share available to common stockholders—basic and diluted | | $ | (0.42 | ) | | $ | (0.28 | ) | | $ | (0.76 | ) | | $ | (0.50 | ) |

| | | | | | | | | | | | | | | | |

Weighted-average common stock outstanding—basic and diluted | | | 123,249,757 | | | | 96,327,956 | | | | 118,430,851 | | | | 96,314,179 | |

| | | | | | | | | | | | | | | | |

| | | | | | | | |

| Condensed Consolidated Balance Sheets (unaudited) | | JUNE 30,

2022 | | | DECEMBER 31,

2021 | |

Cash and cash equivalents | | $ | 44,132 | | | $ | 31,446 | |

Accounts receivable | | | 10,000 | | | | — | |

Prepaid expenses | | | 9,870 | | | | 2,331 | |

Restricted cash | | | 1,321 | | | | 362 | |

Property and equipment, net | | | 32,085 | | | | 23,399 | |

Deferred offering costs | | | — | | | | 4,099 | |

Other assets | | | 1,402 | | | | 1,420 | |

| | | | | | | | |

TOTAL ASSETS | | $ | 98,810 | | | $ | 63,058 | |

| | | | | | | | |

Accounts payable | | $ | 4,155 | | | $ | 7,551 | |

Accrued expenses | | | 30,427 | | | | 14,624 | |

Convertible debt | | | — | | | | 31,691 | |

Long-term debt, current portion | | | 11,402 | | | | 7,234 | |

Deferred revenue, current portion | | | 8,939 | | | | 963 | |

Other current liabilities | | | 294 | | | | 278 | |

Warrant liabilities | | | 470 | | | | 2,105 | |

Long-term debt, net of current portion | | | 20,156 | | | | 27,152 | |

Other liabilities | | | 9,242 | | | | 1,435 | |

| | | | | | | | |

TOTAL LIABILITIES | | | 85,085 | | | | 93,033 | |

| | | | | | | | |

TOTAL STOCKHOLDERS’ EQUITY (DEFICIT) | | | 13,725 | | | | (29,975 | ) |

| | | | | | | | |

TOTAL LIABILITIES AND STOCKHOLDERS’ EQUITY | | $ | 98,810 | | | $ | 63,058 | |

| | | | | | | | |

Media contact:

David Pesci

Head of Media Relations

GreenLight Biosciences

dpesci@greenlightbio.com

press@greenlightbio.com

Investor contact:

investors@greenlightbio.com

https://investors.greenlightbio.com/

One tool for One Health: Healthy people and planet through RNA innovation August 2022

Forward-Looking Statements This presentation contains and our officers, directors and employees may make “forward-looking statements” within the meaning of the safe harbor provisions of the U.S. Private Securities Litigation Reform Act of 1995, with respect to GreenLight’s future operations, scientific developments or financial results. These forward-looking statements generally are identified by the words “aim to”, “believe,” “project,” target , potential , “expect,” “anticipate,” “estimate,” “intend,” “strategy,” “future,” “opportunity,” “plan,” “may,” “should,” “will,” “would,” “will be,” “will continue,” “will likely result” and similar expressions. Many factors could cause actual future events to differ materially from the forward-looking statements in this presentation, including the evolution of the Covid-19 pandemic, the acceptance of RNA-based technologies by regulators and the public, our ability to raise and productively deploy capital and the rate and which we can successfully bring products to market. Readers are cautioned not to put undue reliance on forward-looking statements. GreenLight assumes no obligation to update or revise these forward-looking statements, whether as a result of new information, future events or otherwise. For additional information on GreenLight and potential risks associated with investing, please see our public filings at https://www.sec.gov/edgar/browse/?CIK=1822691&owner=exclude. This presentation contains references to other entities which are not intended to imply any endorsement or sponsorship of the Company by those entities. © 2022 GreenLight Biosciences. All rights reserved. GreenLight non-confidential 2

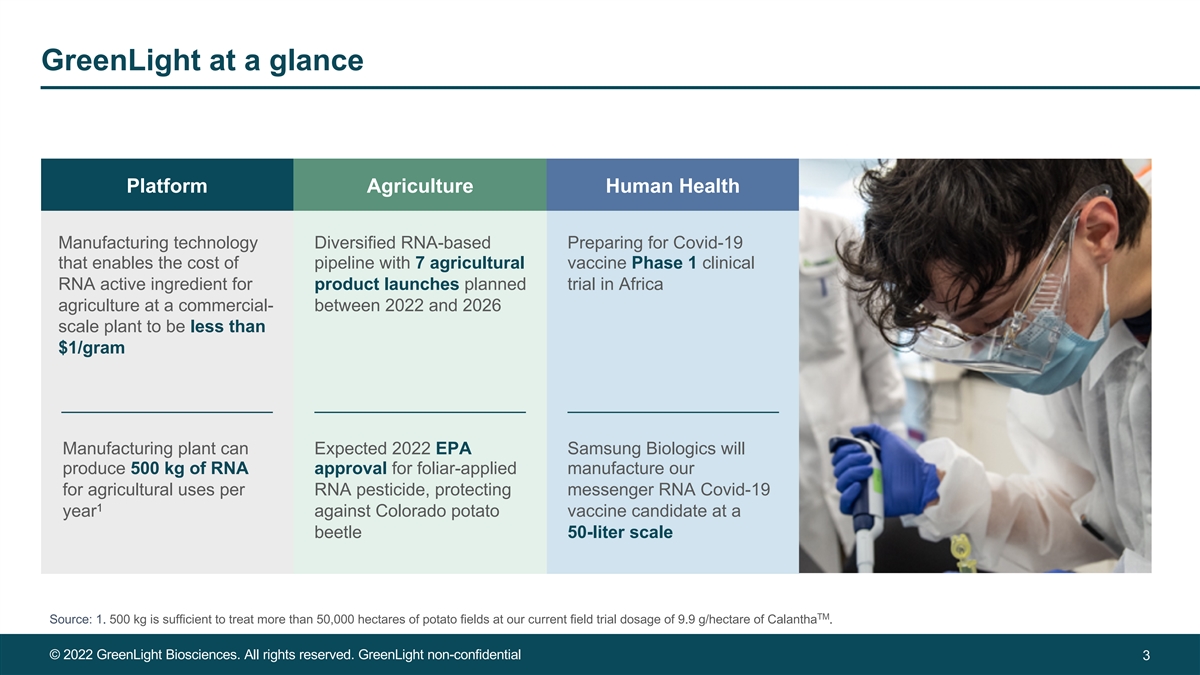

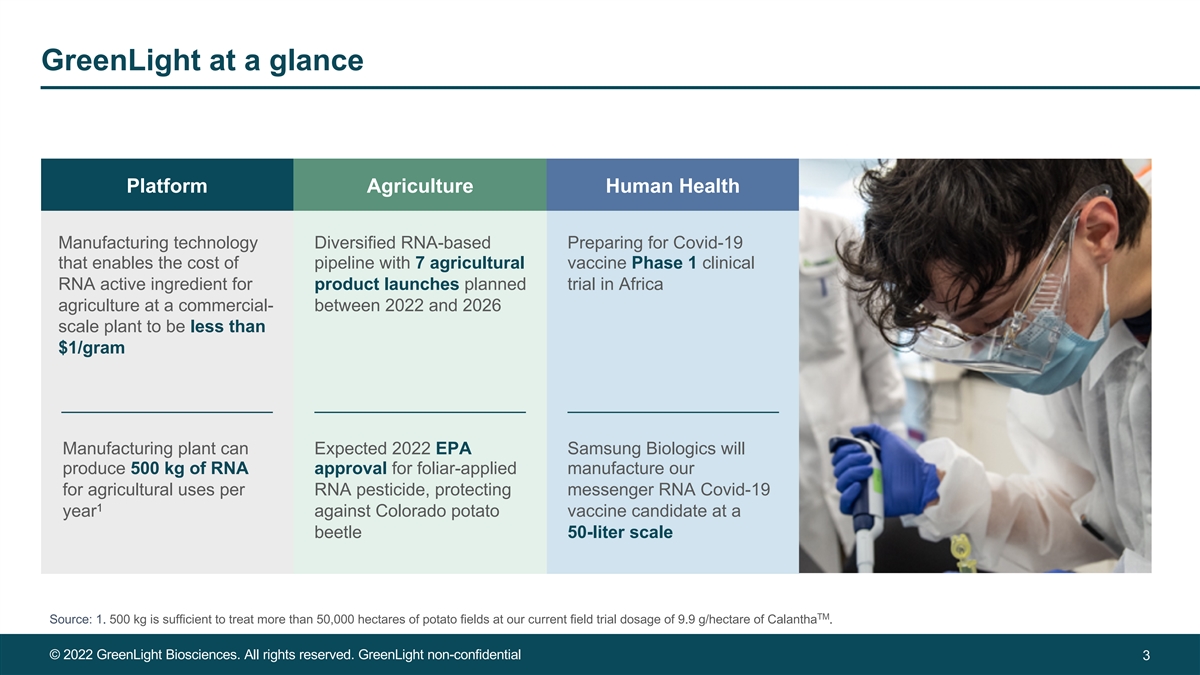

GreenLight at a glance Platform Agriculture Human Health Manufacturing technology Diversified RNA-based Preparing for Covid-19 that enables the cost of pipeline with 7 agricultural vaccine Phase 1 clinical RNA active ingredient for product launches planned trial in Africa agriculture at a commercial- between 2022 and 2026 scale plant to be less than $1/gram Manufacturing plant can Expected 2022 EPA Samsung Biologics will produce 500 kg of RNA approval for foliar-applied manufacture our for agricultural uses per RNA pesticide, protecting messenger RNA Covid-19 1 year against Colorado potato vaccine candidate at a beetle 50-liter scale TM Source: 1. 500 kg is sufficient to treat more than 50,000 hectares of potato fields at our current field trial dosage of 9.9 g/hectare of Calantha . © 2022 GreenLight Biosciences. All rights reserved. GreenLight non-confidential 3

Mission To solve some of the world’s largest and most difficult problems. • Food Security • Global Health Strategy • Climate Change We aim to address these problems, profitably, sustainably, and equitably by delivering on the full potential of RNA. • Control pests using double-stranded RNA • Replace chemical products with RNA solutions designed to have no off-target effects • Develop messenger RNA vaccines and therapeutics to promote global health • Own proprietary manufacturing © 2022 GreenLight Biosciences. All rights reserved. GreenLight non-confidential 4

Our largest challenges are inextricably linked GreenLight offers global, targeted, environmentally-sound solutions on Threats to food security Pandemics and global health Population growth and climate change © 2022 GreenLight Biosciences. All rights reserved. GreenLight non-confidential 5

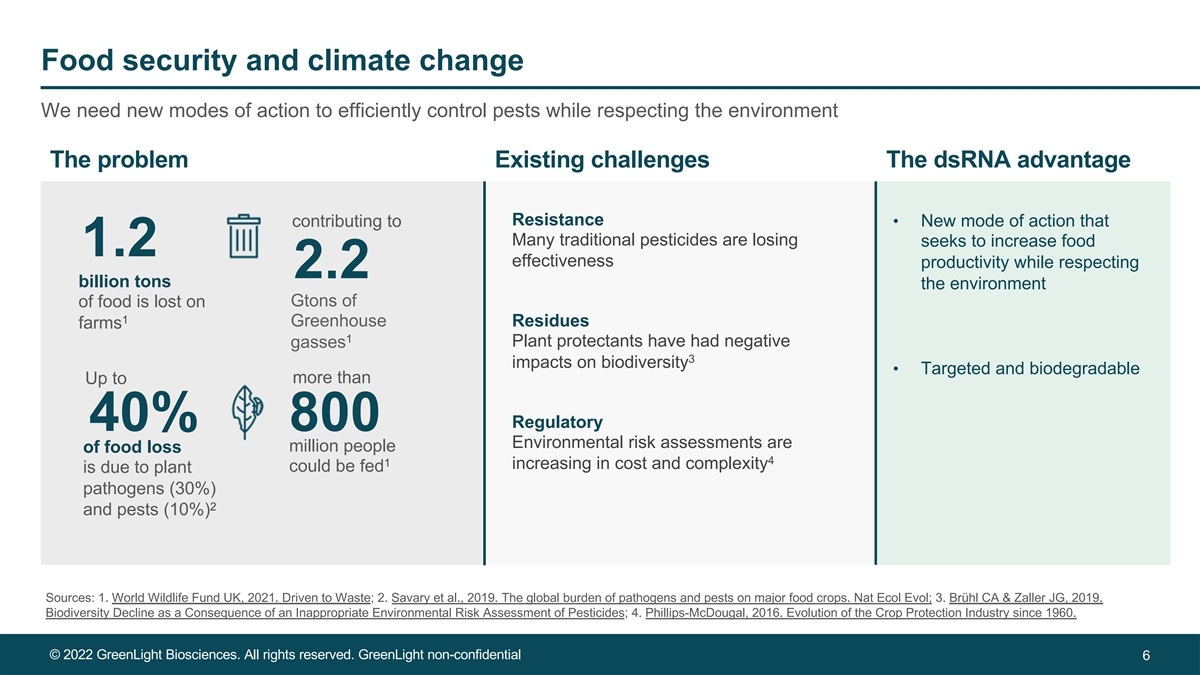

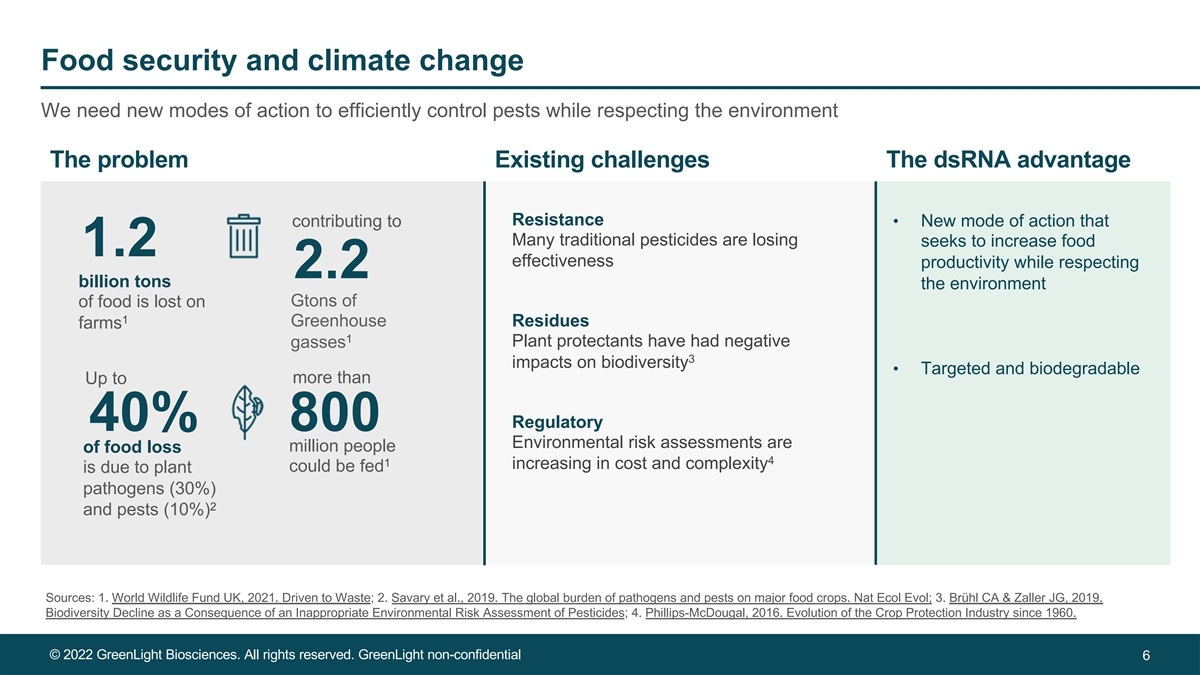

Food security and climate change We need new modes of action to efficiently control pests while respecting the environment The problem Existing challenges The dsRNA advantage Resistance • New mode of action that contributing to Many traditional pesticides are losing seeks to increase food 1.2 effectiveness productivity while respecting 2.2 billion tons the environment Gtons of of food is lost on 1 Greenhouse Residues farms 1 Plant protectants have had negative gasses 3 impacts on biodiversity • Targeted and biodegradable Up to more than Regulatory 40% 800 Environmental risk assessments are million people of food loss 4 1 increasing in cost and complexity could be fed is due to plant pathogens (30%) 2 and pests (10%) Sources: 1. World Wildlife Fund UK, 2021. Driven to Waste; 2. Savary et al., 2019. The global burden of pathogens and pests on major food crops. Nat Ecol Evol; 3. Brühl CA & Zaller JG, 2019. Biodiversity Decline as a Consequence of an Inappropriate Environmental Risk Assessment of Pesticides; 4. Phillips-McDougal, 2016. Evolution of the Crop Protection Industry since 1960. © 2022 GreenLight Biosciences. All rights reserved. GreenLight non-confidential 6

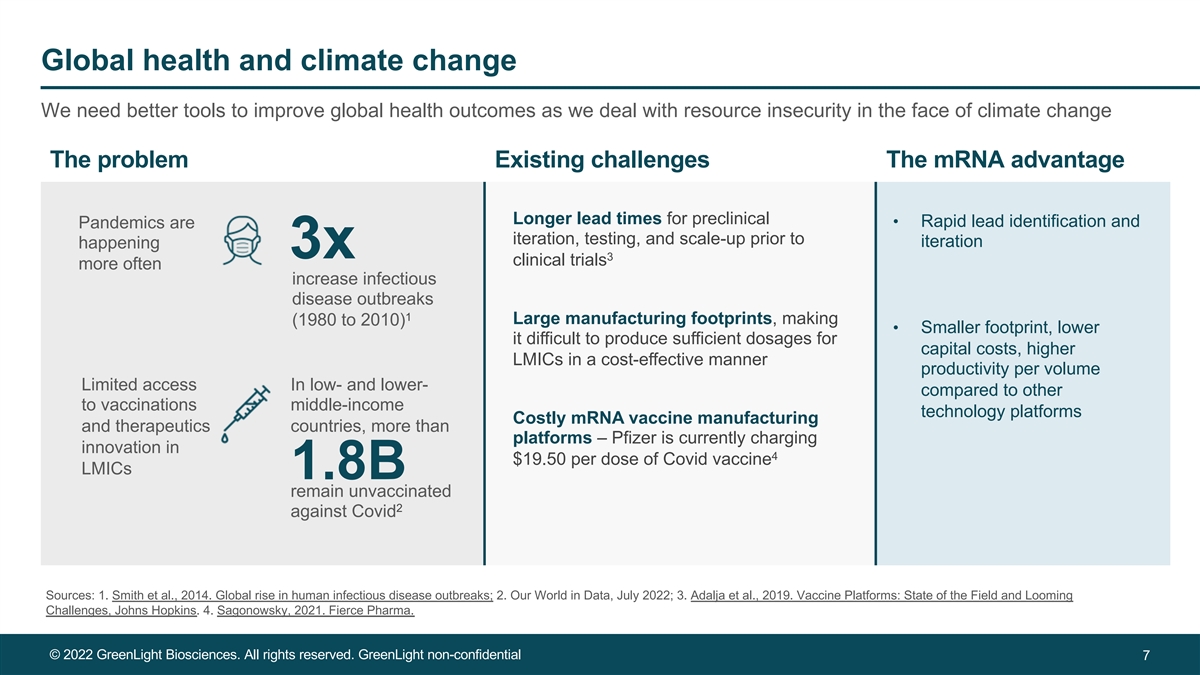

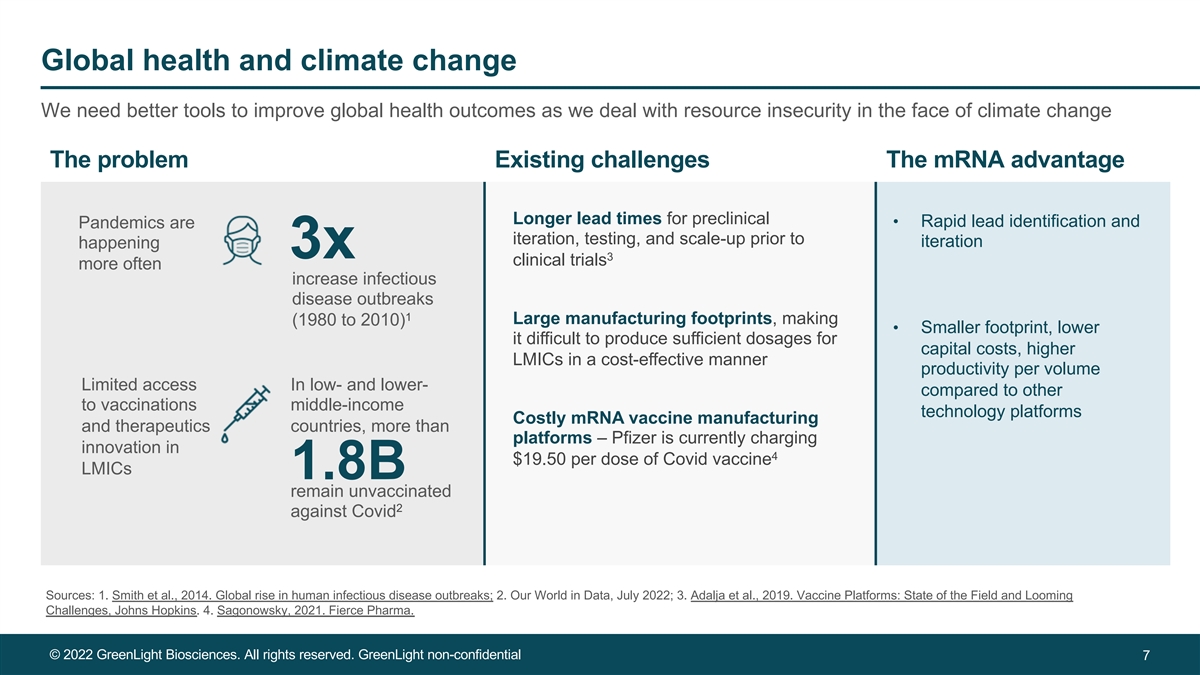

Global health and climate change We need better tools to improve global health outcomes as we deal with resource insecurity in the face of climate change The problem Existing challenges The mRNA advantage Longer lead times for preclinical • Rapid lead identification and Pandemics are iteration, testing, and scale-up prior to iteration happening 3x 3 clinical trials more often increase infectious disease outbreaks 1 Large manufacturing footprints, making (1980 to 2010) • Smaller footprint, lower it difficult to produce sufficient dosages for capital costs, higher LMICs in a cost-effective manner productivity per volume Limited access In low- and lower- compared to other to vaccinations middle-income technology platforms Costly mRNA vaccine manufacturing and therapeutics countries, more than platforms – Pfizer is currently charging innovation in 4 $19.50 per dose of Covid vaccine LMICs 1.8B remain unvaccinated 2 against Covid Sources: 1. Smith et al., 2014. Global rise in human infectious disease outbreaks; 2. Our World in Data, July 2022; 3. Adalja et al., 2019. Vaccine Platforms: State of the Field and Looming Challenges, Johns Hopkins. 4. Sagonowsky, 2021. Fierce Pharma. © 2022 GreenLight Biosciences. All rights reserved. GreenLight non-confidential 7

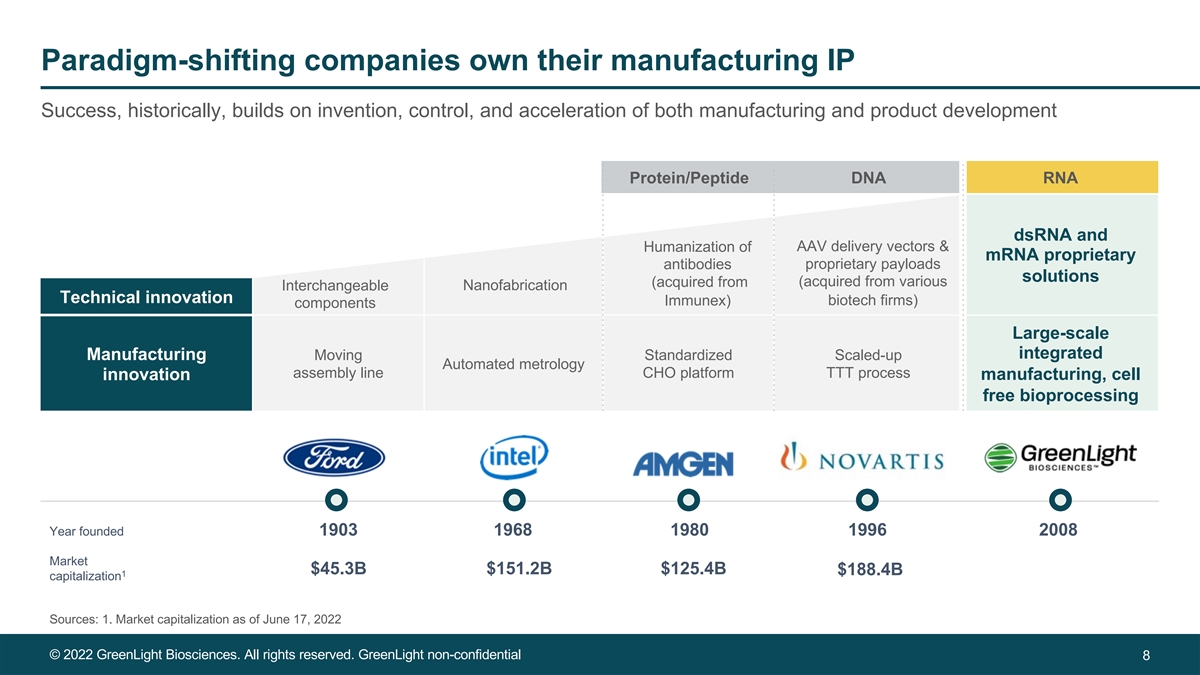

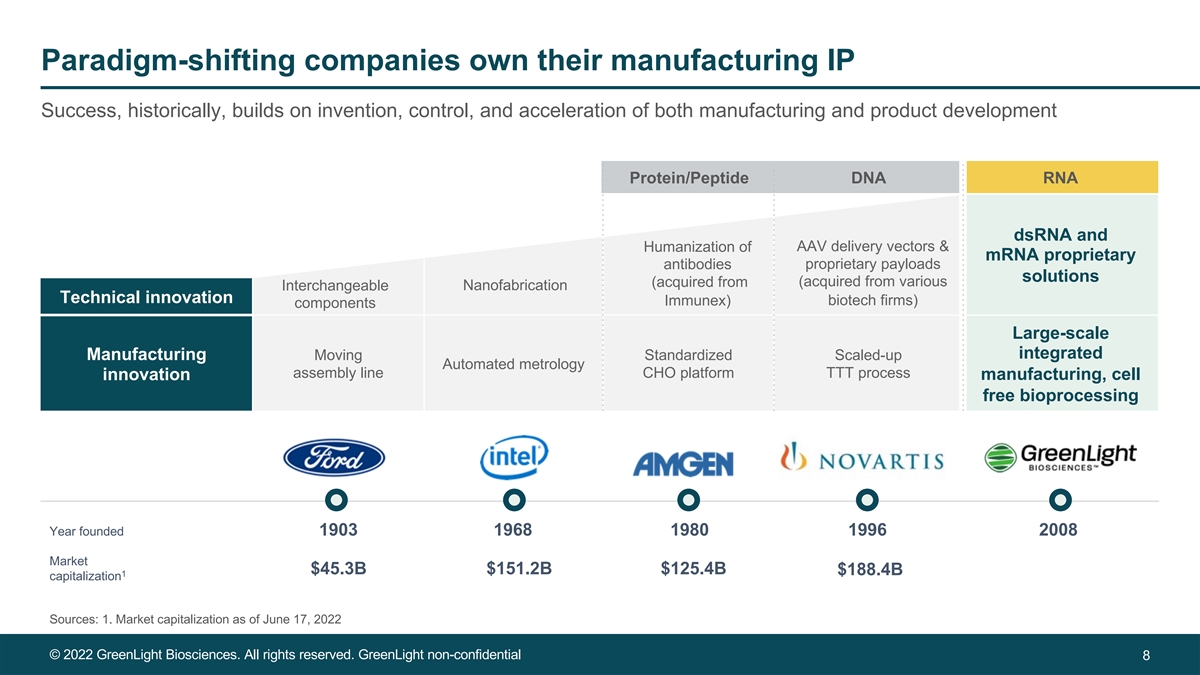

Paradigm-shifting companies own their manufacturing IP Success, historically, builds on invention, control, and acceleration of both manufacturing and product development Protein/Peptide DNA RNA dsRNA and AAV delivery vectors & Humanization of mRNA proprietary proprietary payloads antibodies solutions (acquired from various (acquired from Nanofabrication Interchangeable Technical innovation biotech firms) Immunex) components Large-scale integrated Manufacturing Moving Standardized Scaled-up Automated metrology assembly line CHO platform TTT process innovation manufacturing, cell free bioprocessing Year founded 1903 1968 1980 1996 2008 Market $45.3B $151.2B $125.4B $188.4B 1 capitalization Sources: 1. Market capitalization as of June 17, 2022 © 2022 GreenLight Biosciences. All rights reserved. GreenLight non-confidential 8

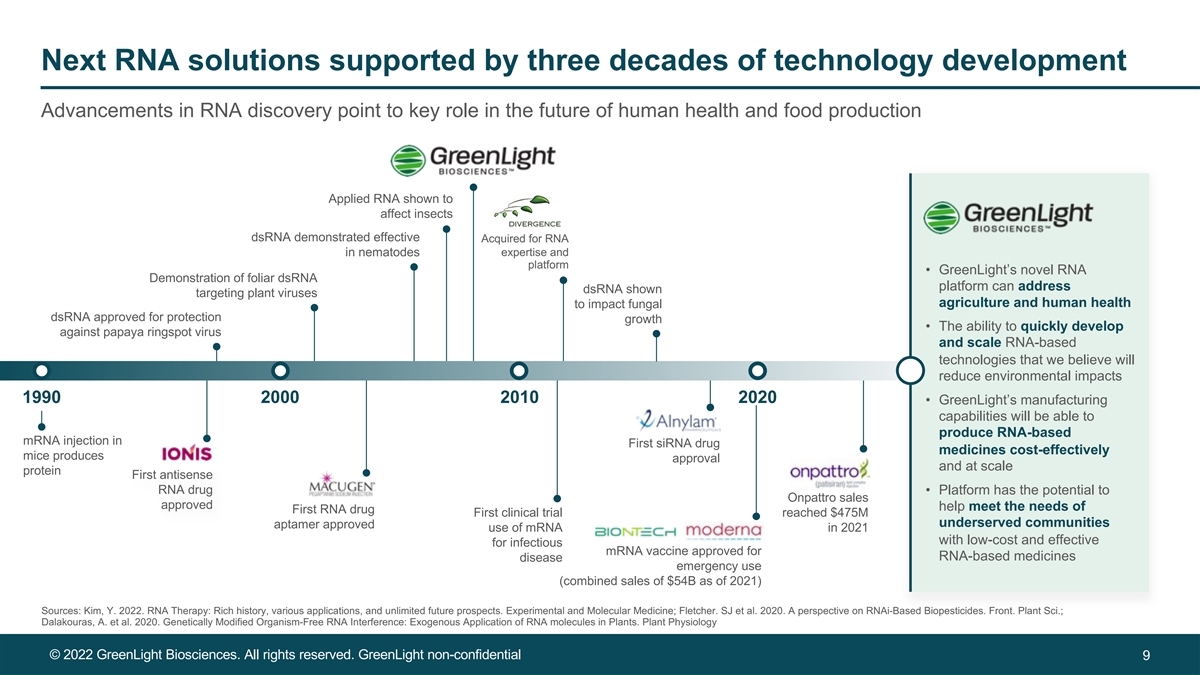

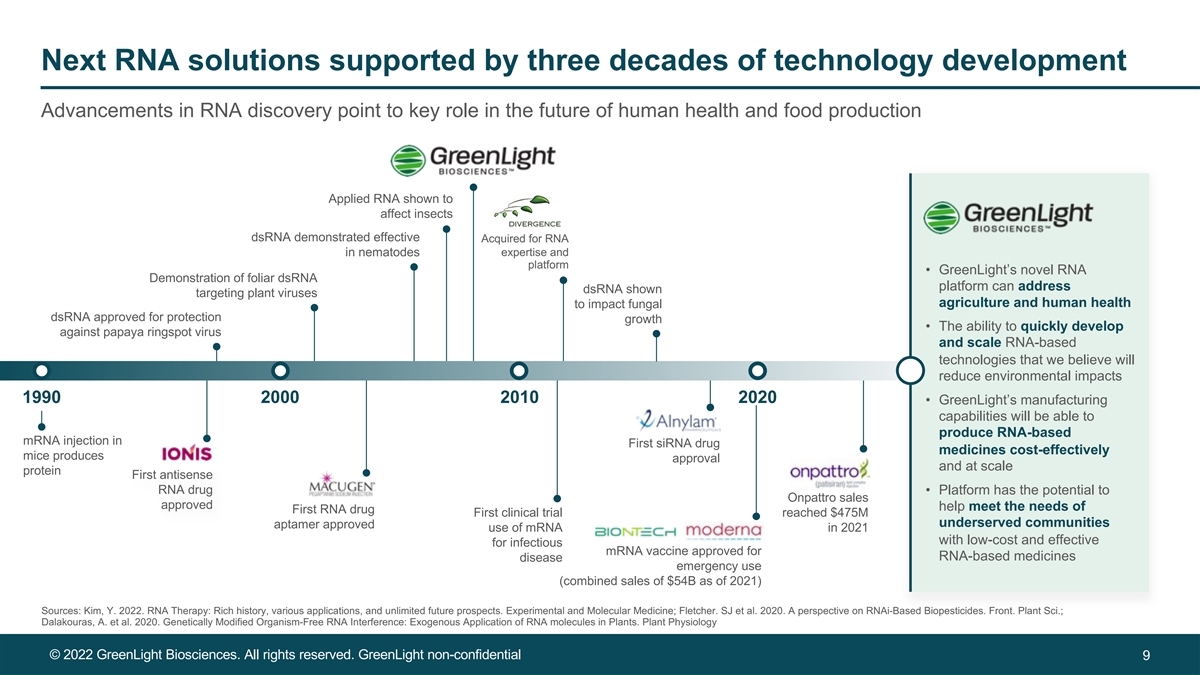

Next RNA solutions supported by three decades of technology development Advancements in RNA discovery point to key role in the future of human health and food production Applied RNA shown to affect insects dsRNA demonstrated effective Acquired for RNA in nematodes expertise and platform • GreenLight’s novel RNA Demonstration of foliar dsRNA platform can address dsRNA shown targeting plant viruses agriculture and human health to impact fungal dsRNA approved for protection growth • The ability to quickly develop against papaya ringspot virus and scale RNA-based technologies that we believe will reduce environmental impacts 1990 2000 2010 2020 • GreenLight’s manufacturing capabilities will be able to produce RNA-based mRNA injection in First siRNA drug medicines cost-effectively mice produces approval and at scale protein First antisense RNA drug • Platform has the potential to Onpattro sales approved help meet the needs of First RNA drug First clinical trial reached $475M underserved communities aptamer approved use of mRNA in 2021 with low-cost and effective for infectious mRNA vaccine approved for RNA-based medicines disease emergency use (combined sales of $54B as of 2021) Sources: Kim, Y. 2022. RNA Therapy: Rich history, various applications, and unlimited future prospects. Experimental and Molecular Medicine; Fletcher. SJ et al. 2020. A perspective on RNAi-Based Biopesticides. Front. Plant Sci.; Dalakouras, A. et al. 2020. Genetically Modified Organism-Free RNA Interference: Exogenous Application of RNA molecules in Plants. Plant Physiology © 2022 GreenLight Biosciences. All rights reserved. GreenLight non-confidential 9

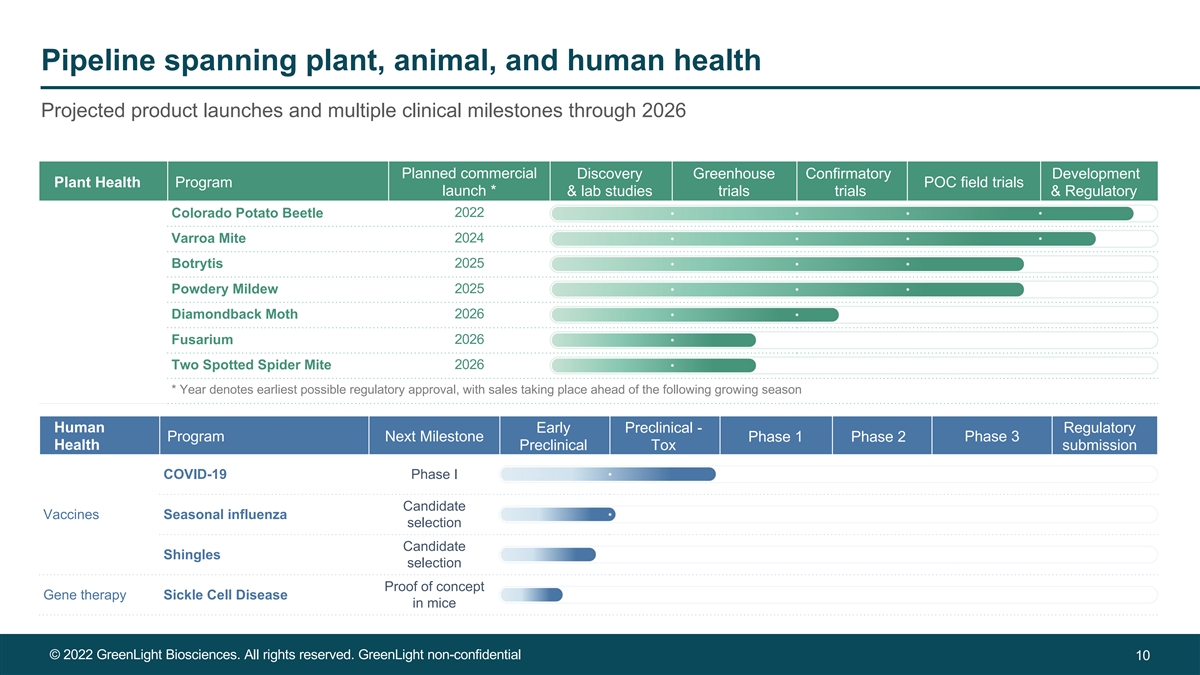

Pipeline spanning plant, animal, and human health Projected product launches and multiple clinical milestones through 2026 Planned commercial Discovery Greenhouse Confirmatory Development Plant Health Program POC field trials launch * & lab studies trials trials & Regulatory Colorado Potato Beetle 2022 Varroa Mite 2024 2025 Botrytis Powdery Mildew 2025 Diamondback Moth 2026 2026 Fusarium 2026 Two Spotted Spider Mite * Year denotes earliest possible regulatory approval, with sales taking place ahead of the following growing season Human Early Preclinical - Regulatory Program Next Milestone Phase 3 Phase 1 Phase 2 Health Preclinical Tox submission COVID-19 Phase I Candidate Vaccines Seasonal influenza selection Candidate Shingles selection Proof of concept Gene therapy Sickle Cell Disease in mice © 2022 GreenLight Biosciences. All rights reserved. GreenLight non-confidential 10

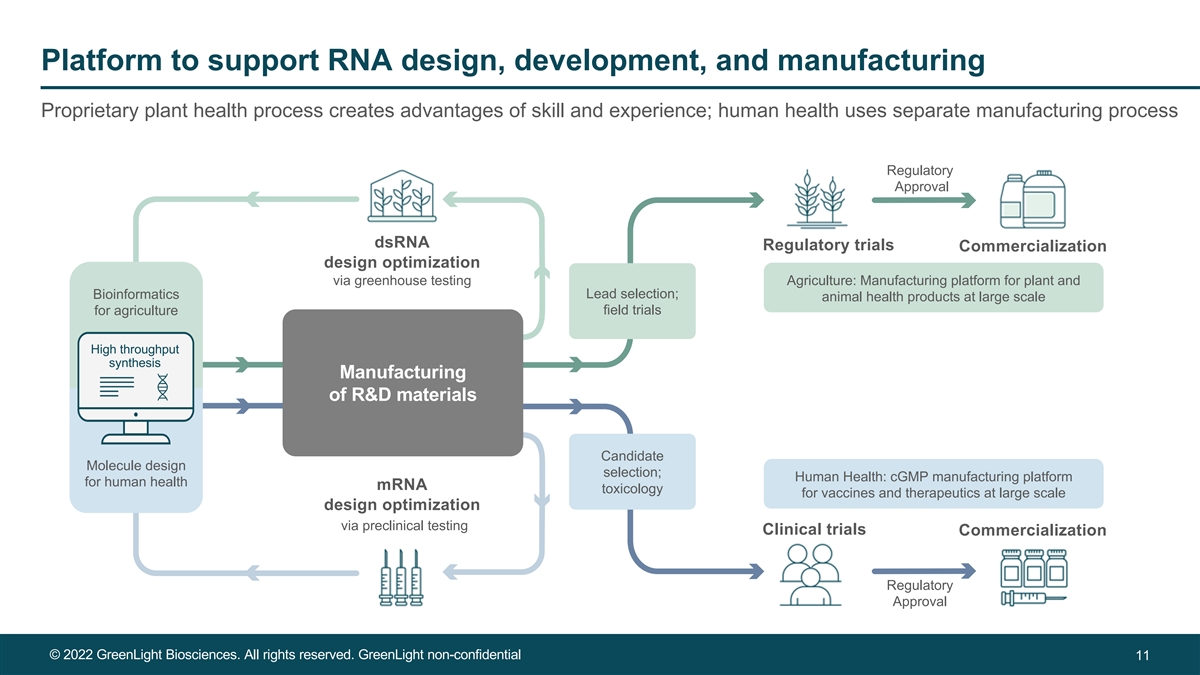

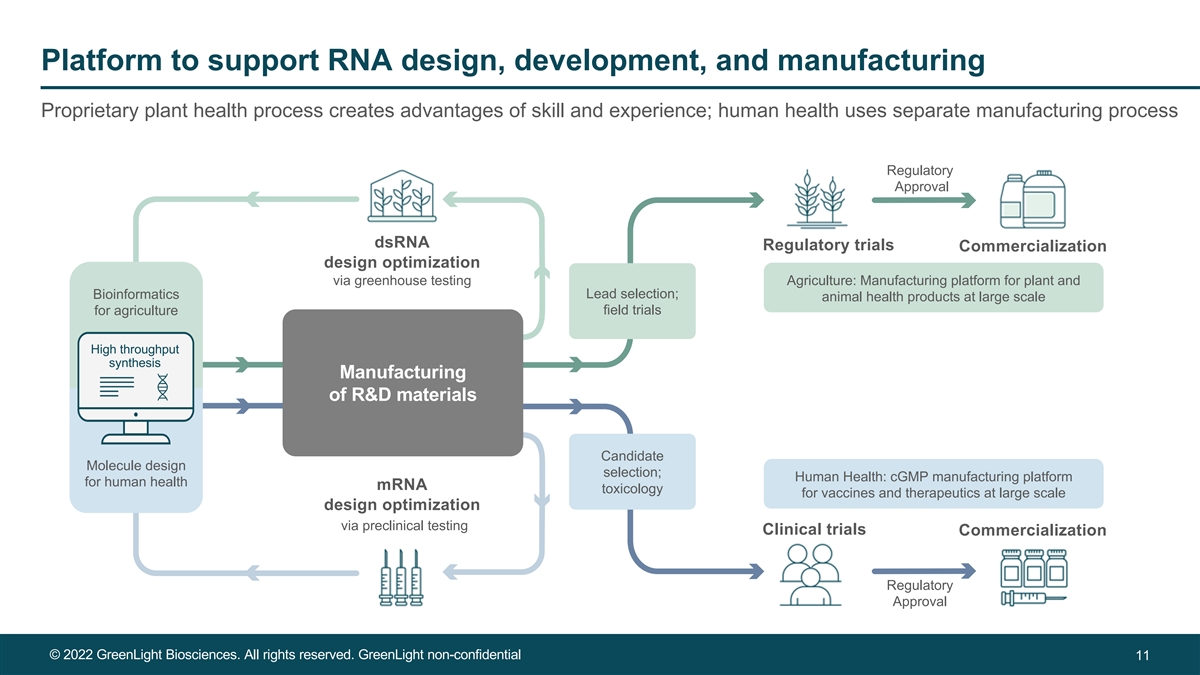

Platform to support RNA design, development, and manufacturing Proprietary plant health process creates advantages of skill and experience; human health uses separate manufacturing process Regulatory Approval dsRNA Regulatory trials Commercialization design optimization via greenhouse testing Agriculture: Manufacturing platform for plant and Bioinformatics Lead selection; animal health products at large scale for agriculture field trials High throughput synthesis Manufacturing of R&D materials Candidate Molecule design selection; Human Health: cGMP manufacturing platform for human health mRNA toxicology for vaccines and therapeutics at large scale design optimization via preclinical testing Clinical trials Commercialization Regulatory Approval © 2022 GreenLight Biosciences. All rights reserved. GreenLight non-confidential 11

GreenLight’s platform adaptability and scalability validated at Samsung Technology transfer and scale-up from lab bench to commercial facility were completed in 7 months • Commercial-scale Engineering Run 1 (ER1) successfully completed at • Our mRNA synthesis reaction had Samsung Biologics a titer of 12g/L at a commercial scale and produced 650g of mRNA • ER2 to start in August, to • ER1 demonstrated production—in a single facility—of Drug Substance implement improvements indicated and LNP formulation to produce bulk Drug Product by first run and to demonstrate repeatability at scale • Tech transfer and scale-up from lab bench to commercial CMO • Our clinical-scale process shown to completed in 7 months, demonstrating adaptability and scalability of be readily transferable and GreenLight process adaptable to large-scale equipment and CMO facilities • To date, all data conforms with expected outcomes, indicating successful scale up and fit of GreenLight process to Samsung facility, leveraging existing equipment and infrastructure with no customization required © 2022 GreenLight Biosciences. All rights reserved. GreenLight non-confidential 12

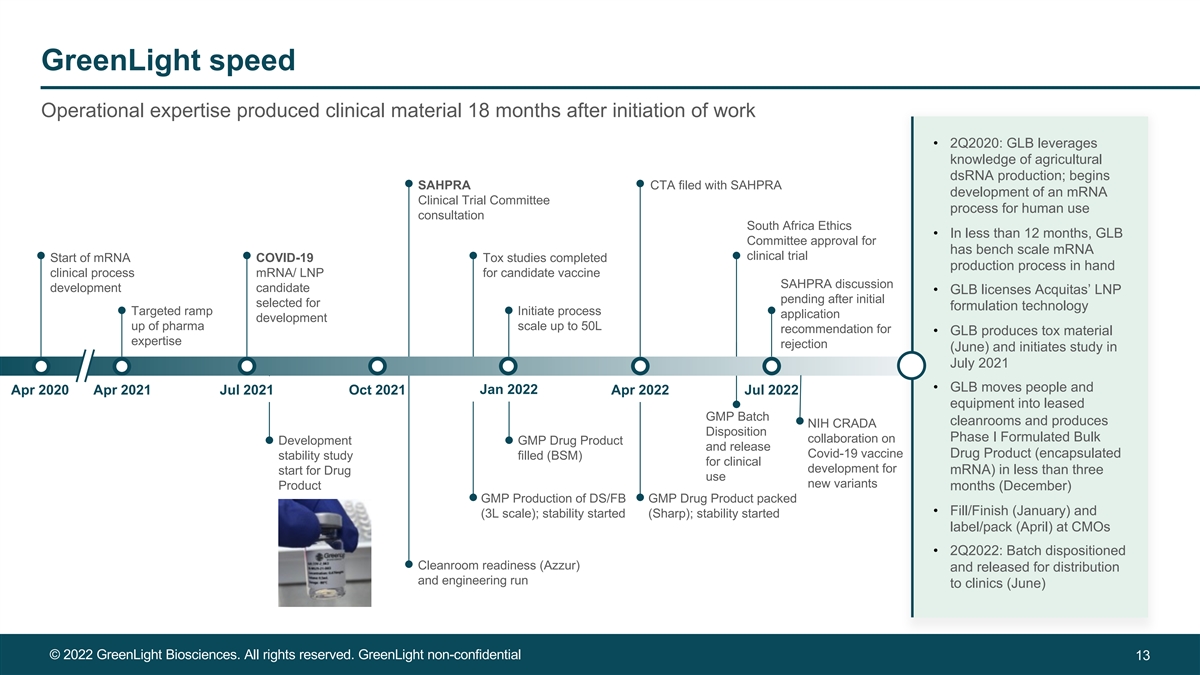

GreenLight speed Operational expertise produced clinical material 18 months after initiation of work • 2Q2020: GLB leverages knowledge of agricultural dsRNA production; begins SAHPRA CTA filed with SAHPRA development of an mRNA Clinical Trial Committee process for human use consultation South Africa Ethics • In less than 12 months, GLB Committee approval for has bench scale mRNA clinical trial Start of mRNA COVID-19 Tox studies completed production process in hand clinical process mRNA/ LNP for candidate vaccine SAHPRA discussion development candidate • GLB licenses Acquitas’ LNP pending after initial selected for formulation technology Targeted ramp Initiate process application development up of pharma scale up to 50L recommendation for • GLB produces tox material expertise rejection (June) and initiates study in July 2021 • GLB moves people and Jan 2022 Apr 2020 Apr 2021 Jul 2021 Oct 2021 Apr 2022 Jul 2022 equipment into leased GMP Batch cleanrooms and produces NIH CRADA Disposition Phase I Formulated Bulk collaboration on Development GMP Drug Product and release Covid-19 vaccine Drug Product (encapsulated stability study filled (BSM) for clinical development for mRNA) in less than three start for Drug use new variants Product months (December) GMP Production of DS/FB GMP Drug Product packed • Fill/Finish (January) and (3L scale); stability started (Sharp); stability started label/pack (April) at CMOs • 2Q2022: Batch dispositioned Cleanroom readiness (Azzur) and released for distribution and engineering run to clinics (June) © 2022 GreenLight Biosciences. All rights reserved. GreenLight non-confidential 13

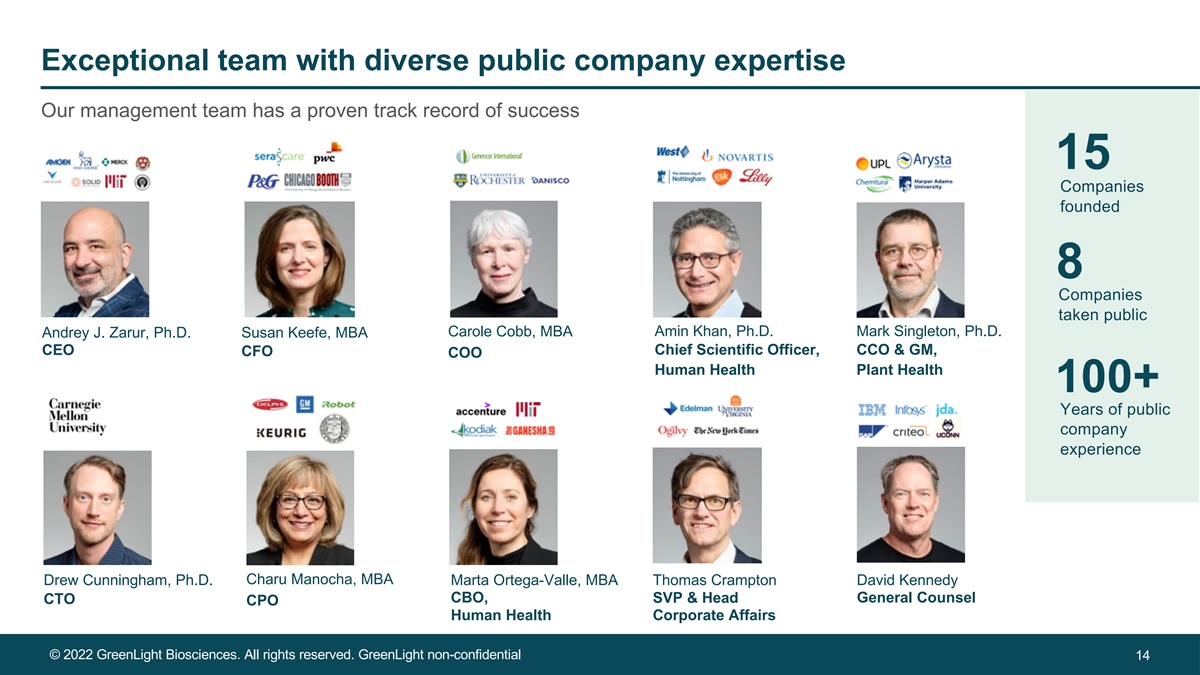

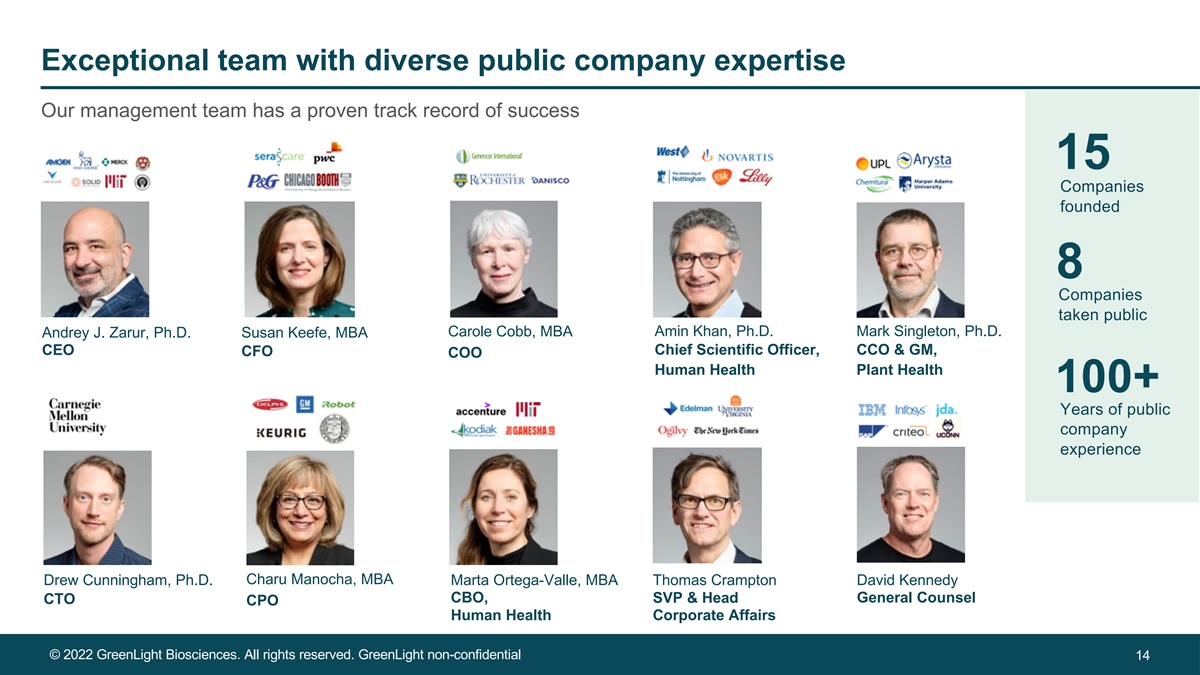

Exceptional team with diverse public company expertise Our management team has a proven track record of success 15 Companies founded 8 Companies taken public Carole Cobb, MBA Amin Khan, Ph.D. Mark Singleton, Ph.D. Andrey J. Zarur, Ph.D. Susan Keefe, MBA CEO Chief Scientific Officer, CCO & GM, CFO COO Human Health Plant Health 100+ Years of public company experience Drew Cunningham, Ph.D. Charu Manocha, MBA Marta Ortega-Valle, MBA Thomas Crampton David Kennedy CBO, SVP & Head General Counsel CTO CPO Human Health Corporate Affairs © 2022 GreenLight Biosciences. All rights reserved. GreenLight non-confidential 14

Plant and animal health © 2022 GreenLight Biosciences. All rights reserved. GreenLight non-confidential 15

Farmers are losing crop-protection tools faster than they are being replaced EU re-registration process led to removal of the majority of existing actives; innovation has declined by 70% since the 1990s Tightening EU regulation (1991) resulted in 59% of crop- Number of new active ingredients introduced per decade: protection products being removed from the market and 1 1950s to present day 1 continues to limit new product registration 600 140 120 500 100 400 70% decrease 80 300 60 200 40 100 20 0 0 As of 1991 Post-1991 1950s 1960s 1970s 1980s 1990s 2000s 2010s Approved Pending Rejected Herbicides Insecticides Fungicides Others Source: 1. Philips-McDougall, 2018. Evolution of the crop protection industry since 1960. © 2022 GreenLight Biosciences. All rights reserved. GreenLight non-confidential 16

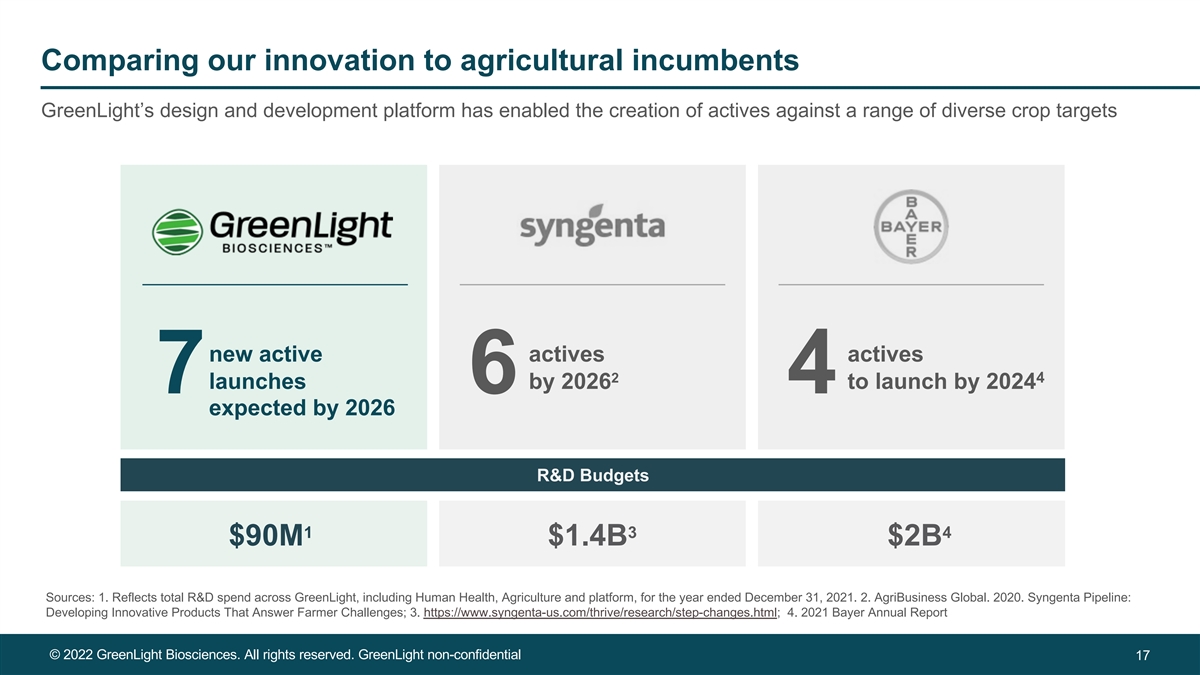

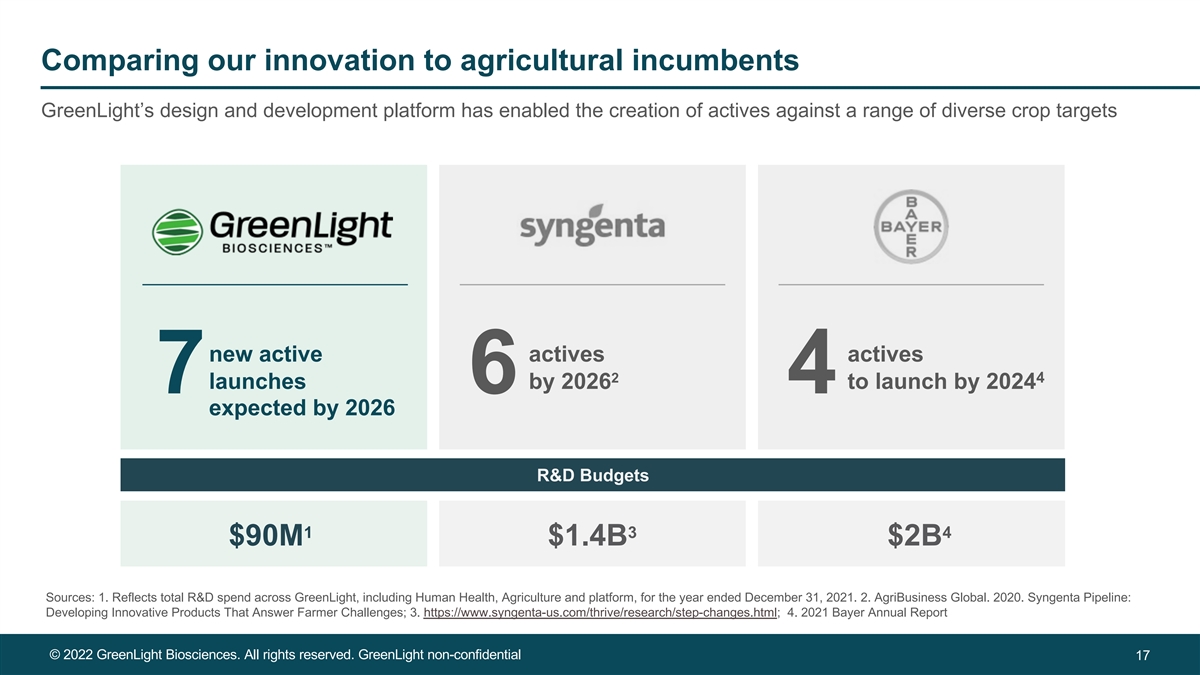

Comparing our innovation to agricultural incumbents GreenLight’s design and development platform has enabled the creation of actives against a range of diverse crop targets new active actives actives 2 4 launches by 2026 to launch by 2024 7 6 4 expected by 2026 R&D Budgets 1 3 4 $90M $1.4B $2B Sources: 1. Reflects total R&D spend across GreenLight, including Human Health, Agriculture and platform, for the year ended December 31, 2021. 2. AgriBusiness Global. 2020. Syngenta Pipeline: Developing Innovative Products That Answer Farmer Challenges; 3. https://www.syngenta-us.com/thrive/research/step-changes.html; 4. 2021 Bayer Annual Report © 2022 GreenLight Biosciences. All rights reserved. GreenLight non-confidential 17

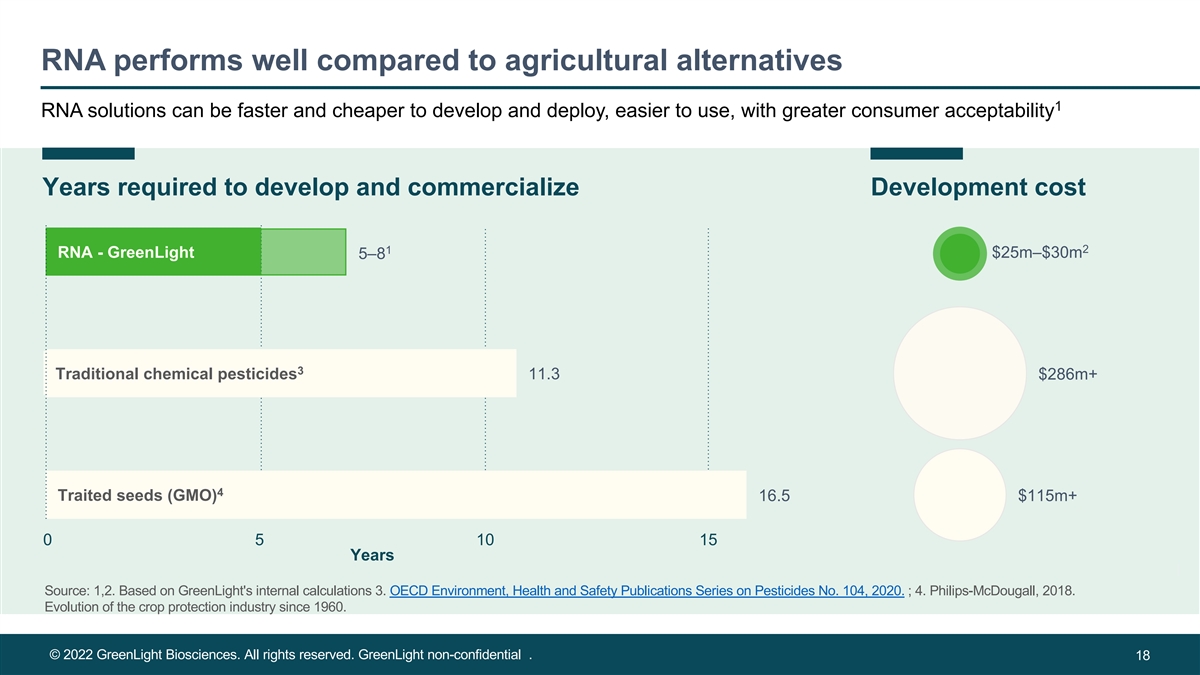

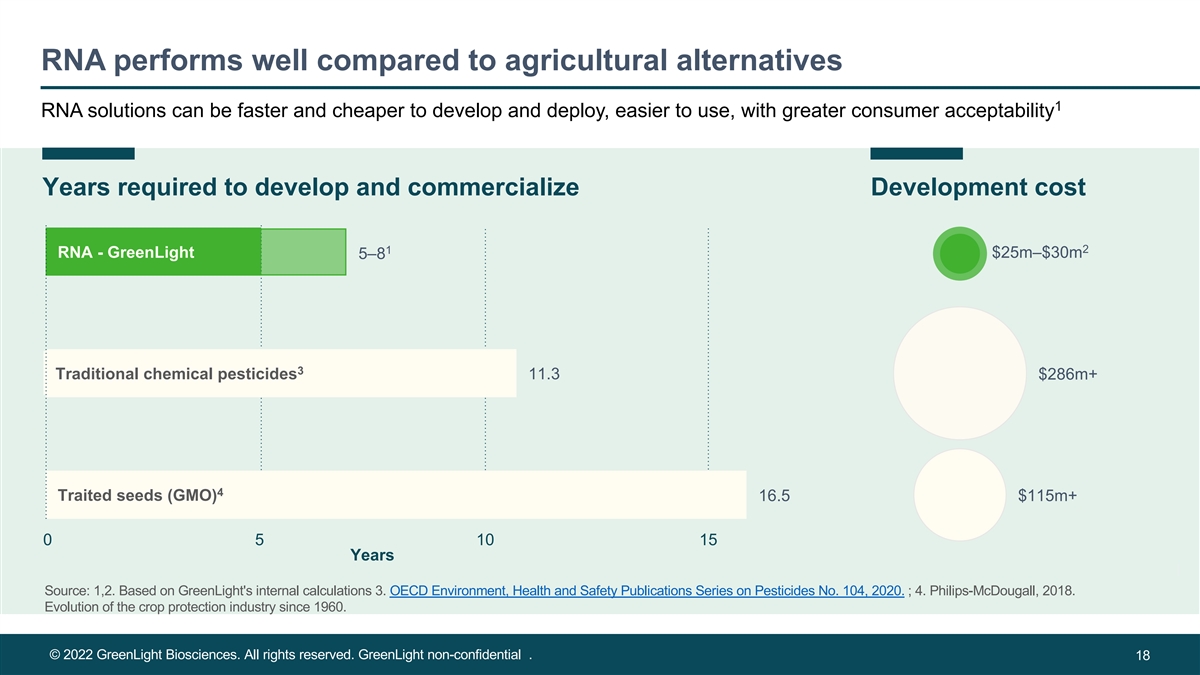

RNA performs well compared to agricultural alternatives 1 RNA solutions can be faster and cheaper to develop and deploy, easier to use, with greater consumer acceptability Years required to develop and commercialize Development cost 1 2 RNA - GreenLight $25m–$30m 5–8 3 Tr Tra adi dittiio ona nal lch che em m ica icla p l e pe sts ici tid ce ide s s 11.3 $286m+ 4 Traited seeds (GMO) 16.5 $115m+ 0 5 10 15 Years Source: 1,2. Based on GreenLight's internal calculations 3. OECD Environment, Health and Safety Publications Series on Pesticides No. 104, 2020. ; 4. Philips-McDougall, 2018. Evolution of the crop protection industry since 1960. © 2022 GreenLight Biosciences. All rights reserved. GreenLight non-confidential . 18

GreenLight is targeting some of food security’s greatest challenges Our global product portfolio can address key food and agriculture industry concerns By 2050 By 2026 34% 7 Botrytis (2025) Pollinator (~2024) Fusarium (2026) Most fruit and vegetables Beehives Wheat increase in population Product launches expected 70% Two-spotted increase in food spider mite (2026) Powdery mildew 1 production needed Most fruit and (2025) vegetables Grapes Colorado potato beetle (2022) $6B Potatoes Diamondback 2026E Addressable moth (2026) markets Cabbage Year denotes earliest possible regulatory approval, with sales taking place ahead of the following growing season Sources: Food and Agriculture Organization of the United Nations, 2009. © 2022 GreenLight Biosciences. All rights reserved. GreenLight non-confidential 19

Case study: GreenLight is working to help farmers Protect potatoes RNA solution using foliar application; expected EPA approval this year; sales taking place ahead of the following growing season 1 The problem: Colorado potato beetle causes hundreds of millions of damage a year and develops rapid resistance. The solution: TM Calantha Potato fields protected in 2020 field trials • On track to be cost competitive to other 9.9 g of GreenLight premium solutions Untreated, 30 days RNA per hectare • Compatible with farmers’ standard operating procedures • Low risk for operators and consumers • Low to no detectable residue CPB has a long history of resistance development and has documented insensitivity to 54 different active ingredients in nearly all existing insecticide 2,3 MoA groups. Sources: 1. Science Daily, 2020; 2. Alyokhin, A et al. 2008a. Colorado potato beetle resistance to insecticides. Am. J. Potato Res; 3. Whalon M. 2013. Arthropod pesticide resistance database © 2022 GreenLight Biosciences. All rights reserved. GreenLight non-confidential 20

Case study: GreenLight is working to help beekeepers Protect honeybees Proprietary solution testing in field trials; EPA submission planned this year The problem: Honeybee colonies in the United States alone contribute to pollinating more than 100 crops annually worth an 1 estimated $18 billion . But these colonies have been significantly threatened and diminished in the last decade or so by the Varroa destructor mite, which beekeepers worldwide say is the number one threat and can decimate whole colonies rapidly. The solution: 40% fewer Varroa mites in field trials at 12 weeks in hives with GS15, compared with leading chemical control product Targeting Varroa mites • GreenLight acquired Bayer’s topical RNA intellectual property portfolio, which includes bee-health assets • We combined that with our technology to develop an RNA-based treatment to combat the parasitic mites • First field trials took place 4 months after after acquisition. We plan to launch it in 2024 Source: 1. United States Department of Agriculture, 2021. © 2022 GreenLight Biosciences. All rights reserved. GreenLight non-confidential 21

Case study: GreenLight is working to help farmers Reduce crop loss caused by fungal pathogens 1 2 The problem: Fungal pathogens account for 30% of crop losses globally –enough to feed 600 million people . Botrytis cinerea The solution: • Causes disease in more than Current strategies involve frequent spraying of these crops with 500 species of plants grown traditional chemical-based pesticides, leaving significant residues. 3 worldwide GreenLight is developing an RNA anti-fungal solution that has • It can result in up to 30% yield undergone initial field trials in the U.S. and Europe. loss in fresh fruits and Our testing shows a reduction in disease severity compared to untreated 4 vegetables plants. We anticipate this product will be available in-season earliest • Attacks food both in the field 2026. as well as after harvest Untreated check RNA solution • Victims of botrytis include soft fruit such as strawberries and grapes, as well as onions, tomatoes, sweet potatoes, and other food crops Sources: 1. Savary et al., 2019. The global burden of pathogens and pests on major food crops. Nat Ecol Evol; 2. Davies et. al., 2021. Evolving challenges and strategies for fungal control in the food supply chain, Fungal Biology Reviews; 3. Li Hua et. al., 2018. Pathogenic mechanisms and control strategies of Botrytis cinerea causing post-harvest decay in fruits and vegetables, Food Quality and Safety; 4. Dalphy O.C. Harteveld, Tobin L. Peever, Department of Plant Pathology, Washington State University © 2022 GreenLight Biosciences. All rights reserved. GreenLight non-confidential 22

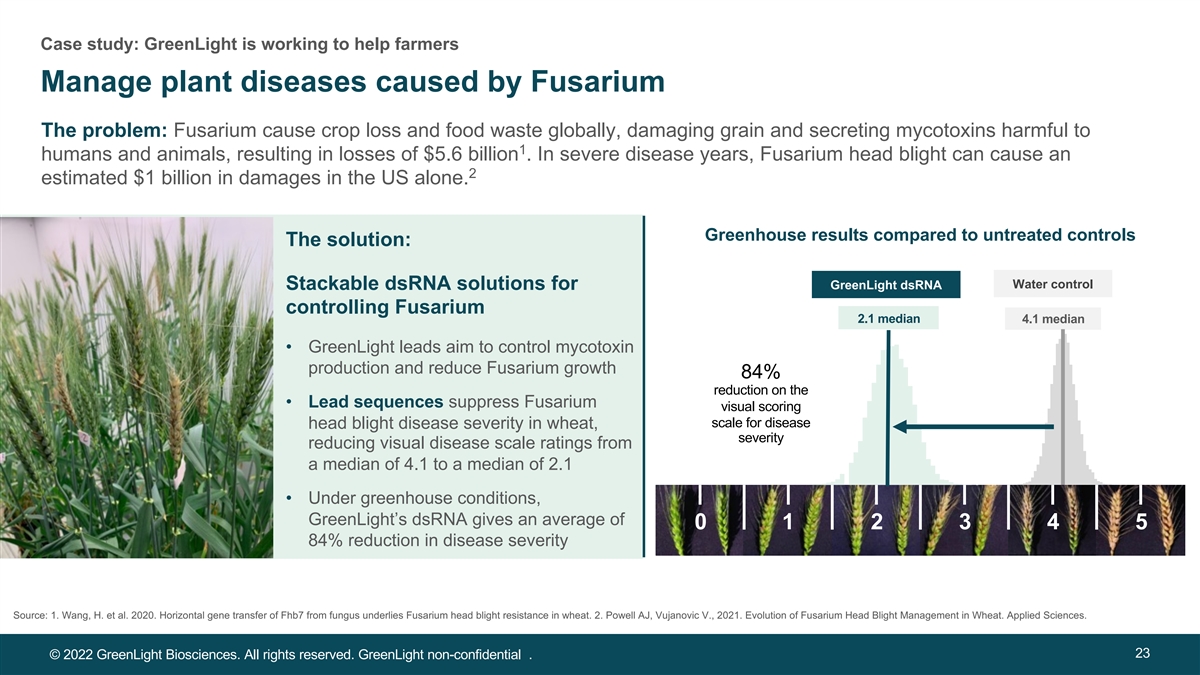

Case study: GreenLight is working to help farmers Manage plant diseases caused by Fusarium The problem: Fusarium cause crop loss and food waste globally, damaging grain and secreting mycotoxins harmful to 1 humans and animals, resulting in losses of $5.6 billion . In severe disease years, Fusarium head blight can cause an 2 estimated $1 billion in damages in the US alone. Greenhouse results compared to untreated controls The solution: Wa Wat te er r c co on nt tr ro oll Stackable dsRNA solutions for Gr Gre ee en nL Lig igh ht t ds dsR RN NA A controlling Fusarium 2.1 median 4.1 median • GreenLight leads aim to control mycotoxin production and reduce Fusarium growth 84% reduction on the • Lead sequences suppress Fusarium visual scoring scale for disease head blight disease severity in wheat, severity reducing visual disease scale ratings from a median of 4.1 to a median of 2.1 • Under greenhouse conditions, GreenLight’s dsRNA gives an average of 0 1 2 3 4 5 0 1 2 3 4 5 84% reduction in disease severity Source: 1. Wang, H. et al. 2020. Horizontal gene transfer of Fhb7 from fungus underlies Fusarium head blight resistance in wheat. 2. Powell AJ, Vujanovic V., 2021. Evolution of Fusarium Head Blight Management in Wheat. Applied Sciences. 23 © 2022 GreenLight Biosciences. All rights reserved. GreenLight non-confidential .

Rapid discovery helps address emerging climate-driven farmer pain points Pipeline stretches from protecting honeybees to fresh produce and large-scale crops, a $10bn addressable market Phase 1a Phase 1b Phase 2 Phases 3 & 4 TAM Program Launch year * Discovery & lab Regulatory ($M) Greenhouse trials Confirmatory trials POC field trials studies submission 2022 $350 Colorado Potato Beetle 2024 $290 Varroa Mite 2025 $1200 Botrytis 2025 $1400 Powdery Mildew 2026 $890 Diamondback Moth 2026 $950 Fusarium 2026 $1100 Two Spotted Spider Mite 2027 $1900 Fall armyworm 2028 $185 Pollen beetle * Year denotes earliest possible regulatory approval, with sales taking place ahead of the following growing season $8bn Total A selection of additional targets in the early discovery and lab study phase include: Asian soybean rust Black sigatoka Rice Blast Vine downy mildew Soybeans Bananas Rice Grapes 24 © 2022 GreenLight Biosciences. All rights reserved GreenLight non-confidential

Human health © 2022 GreenLight Biosciences. All rights reserved. GreenLight non-confidential 25

GreenLight is targeting global human health challenges mRNA design flexibility coupled with our production capability can enable rapid development of vaccines and therapies $36B 1 3 pre-Covid vaccine Gene therapy Vaccine market + gene (*) Gene program programs therapy market Therapy (SCD) GreenLight Human Health pipeline Funder progression Shingles • Partnership with Serum institute of India for shingles vaccine • Partnership with Samsung Biologics for Covid mRNA manufacturing Clinical trial Influenza • Commercial mRNA manufacturing engineering runs scheduled in 2022 Dates denote anticipated clinical development start date (*) Sources: World Health Organization and MI4A, Global Vaccine Market Report, (2020); Grandview Research: “Gene Therapy Market Size, Share & Trends Analysis Report, 2021 – 2028” © 2022 GreenLight Biosciences. All rights reserved. GreenLight non-confidential 26

Case study: Covid vaccines for the rest of the world The world needs more timely and accessible vaccines and therapeutics We believe our designs allow GreenLight’s Covid-19 vaccine candidate has strong preclinical performance for a production capacity of Comparable preclinical performance to other mRNA vaccines Company Mouse Neutralizing Ab Titer CD4 Response CD8 Response 250-500 million • Th1-bias doses per year per line • 1.5 – 3.5% of CD4 T cells 5 – 12.5% of CD8 T cells ∼ 130,000 at 5µg dose producing cytokines responding to restimulation Assay : Clinical Isolate by flow cytometry • Very little Th2 cytokines Basic manufacturing space by ELISA • Th1-bias • Used ELISpot, not easily Used a different flow ∼ 300 at 5µg dose compared to flow cytometry assay, difficult to 1 Assay : Pseudovirus cytometry compare results • Very little Th2 cytokines by ELISA • Th1-bias 0.5 – 1.25% of CD8 T cells ∼ 5,000 at 1µg dose • 0.1 – 0.2% of CD4 T cells responding to restimulation 2 Assay : Pseudovirus producing cytokines by flow cytometry • No ELISA data Modular GMP manufacturing units can be set up within existing facilities and are designed for quick setup and production to Sources: 1. Annette B. Vogel, et al., 2021. Nature volume 592, pg 283–289; 2. DiPiazza et al., 2021, Immunity 54, 1869–1882. enable scaling globally © 2022 GreenLight Biosciences. All rights reserved. GreenLight non-confidential 27

Case study: 1 Shingles vaccine, a global addressable market to reach $6.35B by 2028 GreenLight is designing a messenger RNA vaccine for shingles for Serum Institute of India The problem: The solution: The world’s largest vaccine manufacturer, Serum Institute of India, chose GreenLight as its partner for Serum’s first mRNA vaccine, targeting shingles. 95% of individuals globally older than 50 years of age GreenLight will: have prior exposure to the virus that causes 2 shingles • work to discover and design a messenger RNA-based vaccine candidate • transfer its existing clinical-scale manufacturing process to Serum Institute’s facility in India 50% is the lifetime risk of developing shingles for Serum will take on: individuals who live to 85 years old without • clinical development and manufacturing 2 vaccination • commercialization in emerging markets, including Africa, Latin America, the Middle East, and much of Asia Source: 1. Businesswire, 2022; 2. Pan CX et. al., 2022. Global herpes zoster incidence, burden of disease, and vaccine availability: a narrative review © 2022 GreenLight Biosciences. All rights reserved. GreenLight non-confidential 28

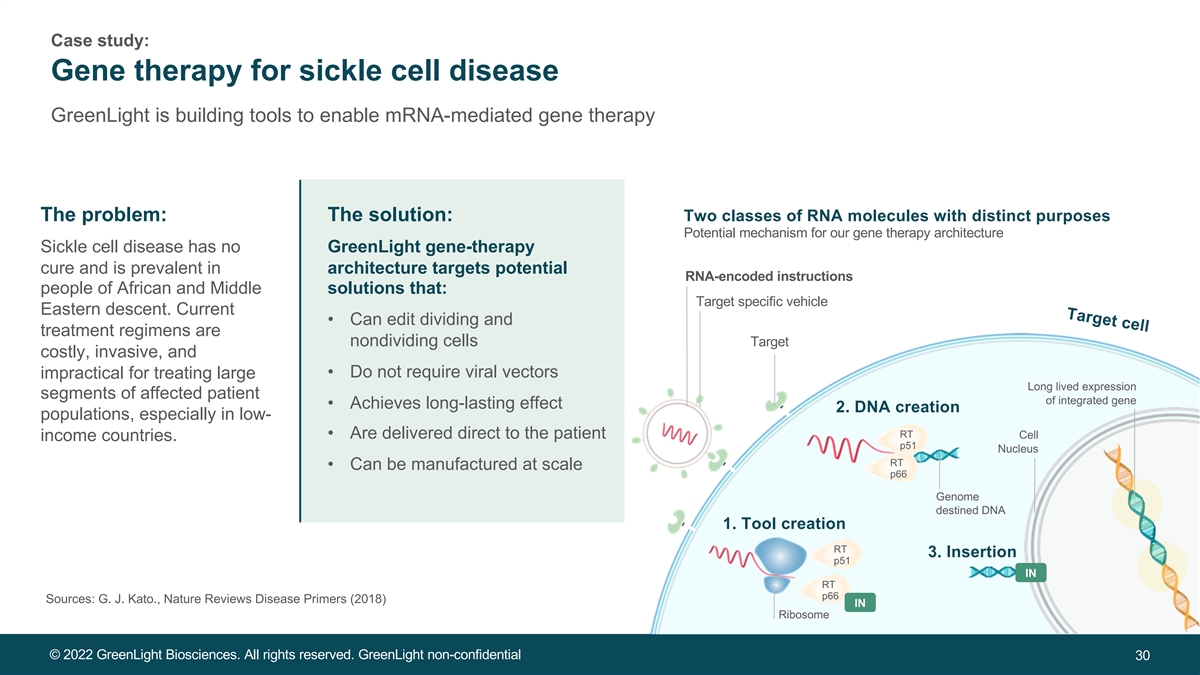

Case study: Genetic disorders GreenLight is building the tools to enable mRNA-mediated gene therapy The problem: LMICs are excluded from gene-therapy innovation development The solution: GreenLight gene-therapy Of 179 recruiting or near-recruiting clinical trials for gene architecture is working to target therapies, only: solutions that: • 2 trials were open in Africa • 3 in South America • Enable modification of nondividing 1 • 1 in South-East Asia cells • Do not require viral vectors • Are delivered direct to the patient • Can be manufactured at scale at or near site of use Approved gene-therapy treatments cost between $373K to $2.1M USD, making 2 them inaccessible to LMICs Africa South America South-East Asia Sources: 1. Cornetta, K. et al., 2018. Mol Ther; 2. Adair, J. E.., et al., 2021. Gene Ther. © 2022 GreenLight Biosciences. All rights reserved. GreenLight non-confidential 29

Target cell Case study: Gene therapy for sickle cell disease GreenLight is building tools to enable mRNA-mediated gene therapy The problem: The solution: Two classes of RNA molecules with distinct purposes Potential mechanism for our gene therapy architecture Sickle cell disease has no GreenLight gene-therapy cure and is prevalent in architecture targets potential RNA-encoded instructions people of African and Middle solutions that: Target specific vehicle Eastern descent. Current • Can edit dividing and treatment regimens are nondividing cells Target costly, invasive, and • Do not require viral vectors impractical for treating large Long lived expression segments of affected patient of integrated gene • Achieves long-lasting effect 2. DNA creation populations, especially in low- RT • Are delivered direct to the patient Cell income countries. p51 Nucleus RT • Can be manufactured at scale p66 Genome destined DNA 1. Tool creation RT 3. Insertion p51 IN RT p66 Sources: G. J. Kato., Nature Reviews Disease Primers (2018) IN Ribosome © 2022 GreenLight Biosciences. All rights reserved. GreenLight non-confidential 30

An expanding Human Health pipeline Our design and manufacturing capabilities enable development of vaccines and therapies Clinical Development Early Application Program Collaborator Pre-clinical Toxicity Phase 1 | Phase 2 | Phase 3 pre-clinical SARS-CoV-2 Vaccine (Covid-19) Seasonal Academic Vaccine influenza Partner Vaccine Shingles Serum Institute of India Antibody Antibody Academic Partner therapy (Undisclosed) Sickle Cell Gene therapy Disease (Funder) © 2022 GreenLight Biosciences. All rights reserved. GreenLight non-confidential 31

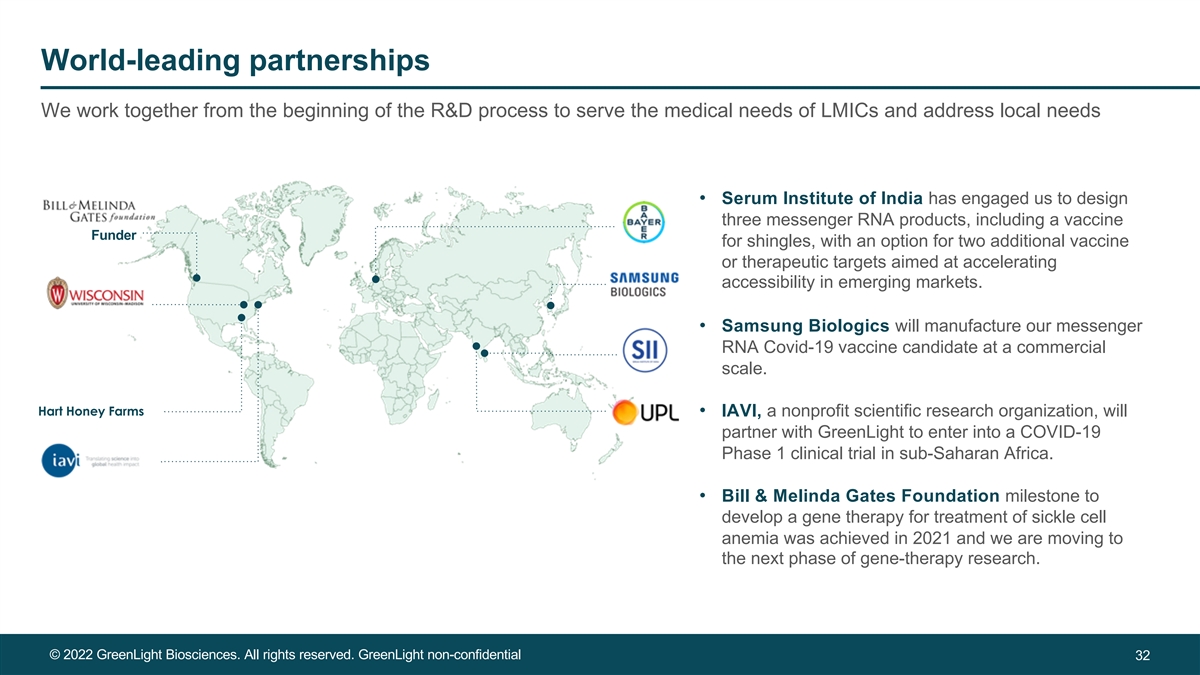

World-leading partnerships We work together from the beginning of the R&D process to serve the medical needs of LMICs and address local needs • Serum Institute of India has engaged us to design three messenger RNA products, including a vaccine Funder for shingles, with an option for two additional vaccine or therapeutic targets aimed at accelerating accessibility in emerging markets. • Samsung Biologics will manufacture our messenger RNA Covid-19 vaccine candidate at a commercial scale. Hart Honey Farms • IAVI, a nonprofit scientific research organization, will partner with GreenLight to enter into a COVID-19 Phase 1 clinical trial in sub-Saharan Africa. • Bill & Melinda Gates Foundation milestone to develop a gene therapy for treatment of sickle cell anemia was achieved in 2021 and we are moving to the next phase of gene-therapy research. © 2022 GreenLight Biosciences. All rights reserved. GreenLight non-confidential 32

Greenlight Biosciences: healthy people and planet through RNA innovation Raising to provide capital to execute on upcoming value-creation milestones Plant Health Human Health • Calantha™ registration with EPA (H2 2022) • Covid-19 Phase 1 clinical-trial data (2023) • Commercial launch of Calantha™, first foliar • Shingles candidate selected with Serum Institute dsRNA product (Q4 2022) of India (H1 2023) • Regulatory submission on varroa mite control for • NIH collaboration for next-generation Covid bees with EPA (Q4 2022) vaccine candidate selected and ready for toxicological studies (H2 2023) • Regulatory studies underway for Powdery Mildew and Botrytis (H2 2023) Additional funds will enable further milestones across plant health and human health programs. GreenLight intends to concurrently seek partnerships and nondilutive capital to enable additional milestones. 33 © 2022 GreenLight Biosciences. All rights reserved. GreenLight non-confidential.

Promoting environmental and global health through RNA innovation We are committed to ESG responsibilities and to measuring our impact profitably, sustainably, and equitably Platform Agriculture Human Health Manufacturing technology that enables Diversified RNA-based pipeline with 7 Preparing for Covid-19 vaccine Phase 1 the cost of RNA active ingredient for agricultural product launches planned clinical trial in South Africa agriculture at a commercial-scale plant to between 2022 and 2026 Samsung Biologics will manufacture our be less than $1/gram Expected 2022 EPA approval for foliar- messenger RNA Covid-19 vaccine Manufacturing plant can produce 500 kg applied RNA pesticide, protecting candidate at a 50-liter scale 1 of RNA for agricultural uses per year. against Colorado potato beetle As a public benefit corporation, we are structured and governed to focus on our community, employees, partners, and society generally, as well as shareholders. Underlying everything we do as a publicly traded public benefit corporation is a commitment to Environmental, Social, and GreenLight supports the United Nations’ Sustainable Development 2 Governance responsibilities. Goals (SDGs), and our work aligns to goals 2, 3, 5, 9, 12, 15, and 17. TM Sources: 1. 500 kg is sufficient to treat more than 50,000 hectares of potato fields at our current field trial dosage of 9.9 g/hectare of Calantha .; 2. SDGs, United Nations © 2022 GreenLight Biosciences. All rights reserved. GreenLight non-confidential 34

Thank you 20220614

Appendix 20220614

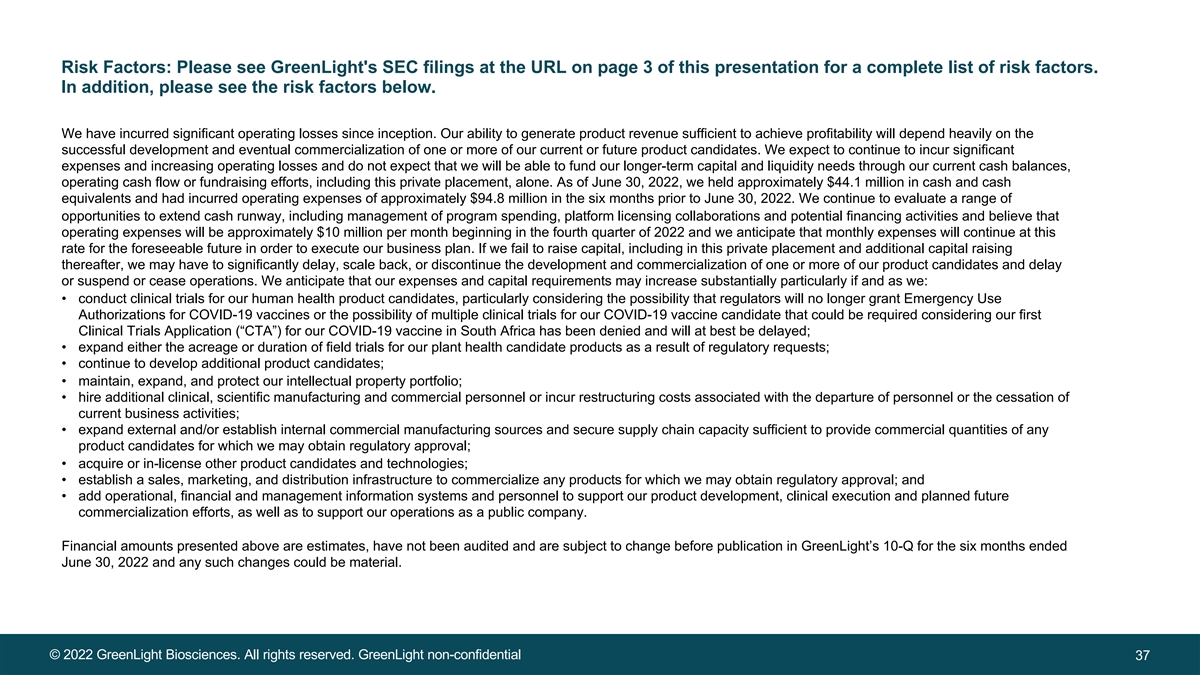

Risk Factors: Please see GreenLight's SEC filings at the URL on page 3 of this presentation for a complete list of risk factors. In addition, please see the risk factors below. We have incurred significant operating losses since inception. Our ability to generate product revenue sufficient to achieve profitability will depend heavily on the successful development and eventual commercialization of one or more of our current or future product candidates. We expect to continue to incur significant expenses and increasing operating losses and do not expect that we will be able to fund our longer-term capital and liquidity needs through our current cash balances, operating cash flow or fundraising efforts, including this private placement, alone. As of June 30, 2022, we held approximately $44.1 million in cash and cash equivalents and had incurred operating expenses of approximately $94.8 million in the six months prior to June 30, 2022. We continue to evaluate a range of opportunities to extend cash runway, including management of program spending, platform licensing collaborations and potential financing activities and believe that operating expenses will be approximately $10 million per month beginning in the fourth quarter of 2022 and we anticipate that monthly expenses will continue at this rate for the foreseeable future in order to execute our business plan. If we fail to raise capital, including in this private placement and additional capital raising thereafter, we may have to significantly delay, scale back, or discontinue the development and commercialization of one or more of our product candidates and delay or suspend or cease operations. We anticipate that our expenses and capital requirements may increase substantially particularly if and as we: • conduct clinical trials for our human health product candidates, particularly considering the possibility that regulators will no longer grant Emergency Use Authorizations for COVID-19 vaccines or the possibility of multiple clinical trials for our COVID-19 vaccine candidate that could be required considering our first Clinical Trials Application (“CTA”) for our COVID-19 vaccine in South Africa has been denied and will at best be delayed; • expand either the acreage or duration of field trials for our plant health candidate products as a result of regulatory requests; • continue to develop additional product candidates; • maintain, expand, and protect our intellectual property portfolio; • hire additional clinical, scientific manufacturing and commercial personnel or incur restructuring costs associated with the departure of personnel or the cessation of current business activities; • expand external and/or establish internal commercial manufacturing sources and secure supply chain capacity sufficient to provide commercial quantities of any product candidates for which we may obtain regulatory approval; • acquire or in-license other product candidates and technologies; • establish a sales, marketing, and distribution infrastructure to commercialize any products for which we may obtain regulatory approval; and • add operational, financial and management information systems and personnel to support our product development, clinical execution and planned future commercialization efforts, as well as to support our operations as a public company. Financial amounts presented above are estimates, have not been audited and are subject to change before publication in GreenLight’s 10-Q for the six months ended June 30, 2022 and any such changes could be material. © 2022 GreenLight Biosciences. All rights reserved. GreenLight non-confidential 37

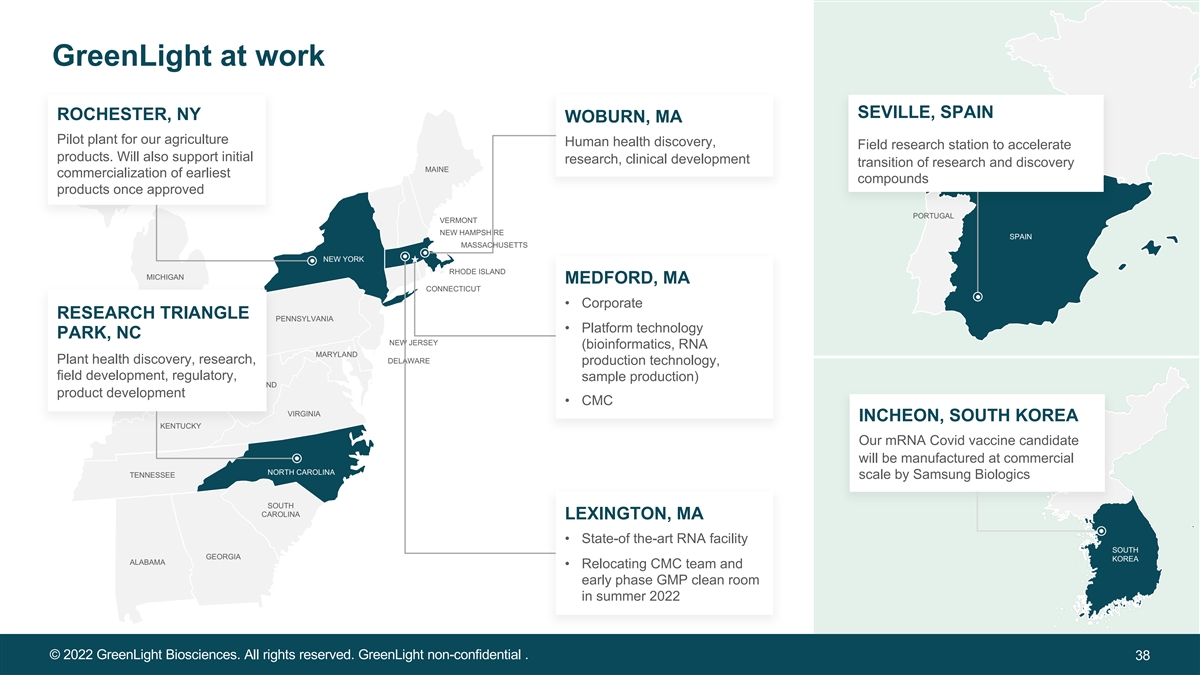

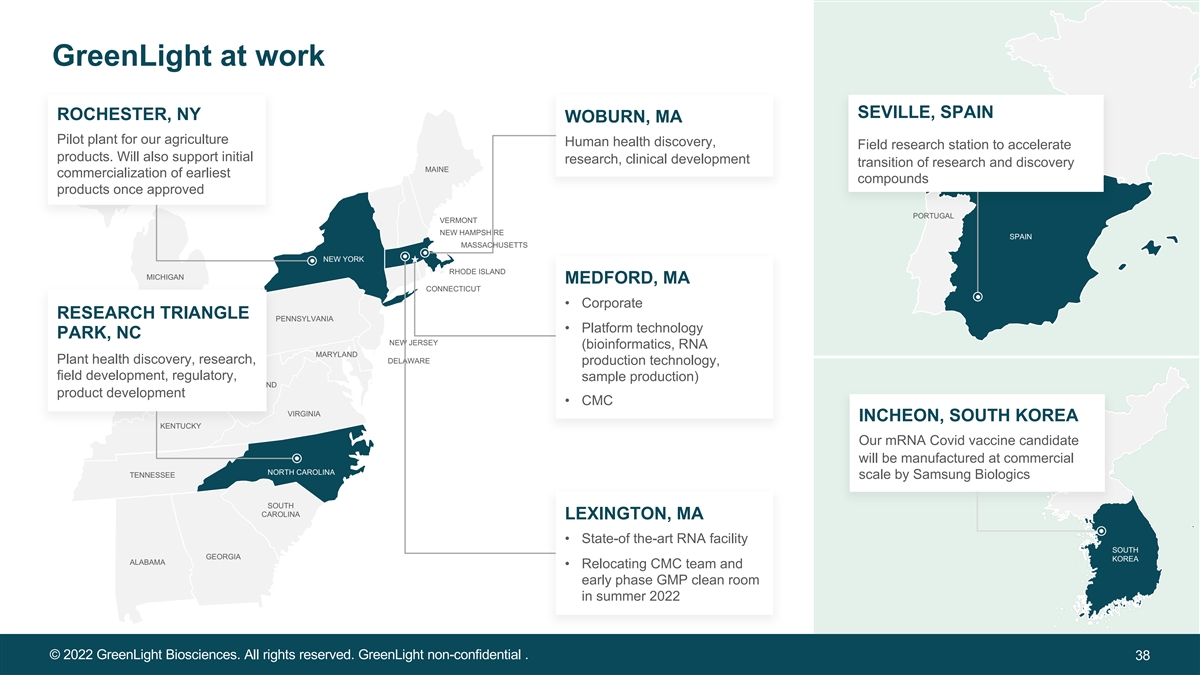

GreenLight at work SEVILLE, SPAIN ROCHESTER, NY WOBURN, MA Pilot plant for our agriculture Human health discovery, Field research station to accelerate products. Will also support initial research, clinical development transition of research and discovery MAINE commercialization of earliest compounds products once approved PORTUGAL VERMONT NEW HAMPSHIRE SPAIN MASSACHUSETTS NEW YORK RHODE ISLAND MICHIGAN MEDFORD, MA CONNECTICUT • Corporate RESEARCH TRIANGLE PENNSYLVANIA • Platform technology PARK, NC NEW JERSEY (bioinformatics, RNA OHIO MARYLAND Plant health discovery, research, DELAWARE production technology, INDIANA field development, regulatory, sample production) MARYLAND product development • CMC VIRGINIA INCHEON, SOUTH KOREA KENTUCKY Our mRNA Covid vaccine candidate will be manufactured at commercial NORTH CAROLINA TENNESSEE scale by Samsung Biologics SOUTH CAROLINA LEXINGTON, MA • State-of the-art RNA facility SOUTH GEORGIA KOREA ALABAMA • Relocating CMC team and early phase GMP clean room in summer 2022 © 2022 GreenLight Biosciences. All rights reserved. GreenLight non-confidential . 38

End 20220614