May 29, 2023 Discussion Materials for Project Star Wars ROTH CAPITAL PARTNERS, LLC Member FINRA/SIPC www.roth.com Confidential Roth Capital Partners, LLC Corporate Office: 888 San Clemente Drive, Newport Beach, CA 92660 | 949.720.5700 | 800.678.9147 | www.roth.com | Member SIPC / FINRA Regional Offices: Chicago, IL | Los Angeles, CA | Miami Beach, FL | New York, NY | San Francisco, CA Exhibit (a)(5)(B)

This presentation was prepared by ROTH Capital Partners, LLC (“ROTH MKM”) and provided to the Special Committee of the Board of Directors (the “Special Committee”) of Greenlight Biosciences Holdings, PBC (“GRNA”) in connection with a potential transaction with a consortium of GRNA investors led by Fall Line Capital, LLC, S2G Ventures, Morningside (MVIL LLC), Cormorant Global Healthcare Master Fund, LP and Cormorant Private Healthcare Fund, LP. This presentation has been provided to the Special Committee of GRNA by ROTH MKM and may not be used or relied upon by any other person for any purpose without the written consent of ROTH MKM. The information contained herein is confidential. By accepting this presentation, you agree to use it for informational purposes only and will not disclose any such information to any other party without the written consent of ROTH MKM. This presentation has not been prepared with a view toward public disclosure under state or federal securities laws or otherwise. Reproduction, dissemination, quotation, summarization or reference to this presentation without our written consent is prohibited. The information utilized in preparing this presentation was obtained from GRNA and other public sources. ROTH MKM assumes no responsibility for independent investigation or verification of such information and has relied on such information being complete and accurate in all material respects. To the extent such information includes estimates and/or forecasts of future performance prepared by GRNA, we have assumed that such estimates and forecasts have been reasonably prepared on bases reflecting the best currently available estimates and judgments of GRNA. No representation or warranty, express or implied, is made as to the accuracy or completeness of such information and nothing contained herein is, or shall be relied upon as, a representation, whether as to the past or the future. ROTH MKM has no obligation, express or implied, to update any or all of the information contained in this presentation or to advise you of any changes. Because this presentation was prepared for use in the context of an oral presentation to the Special Committee, which is familiar with the business and affairs of GRNA, ROTH does not take any responsibility for the accuracy or completeness of any of the material included in this presentation if used by persons other than the Special Committee. This presentation is not intended to provide the sole basis for evaluating and should not be considered a recommendation with respect to, any transaction or other matter. Prior to entering into any transaction, GRNA and the Special Committee should determine, without reliance on ROTH MKM, the economic merits and risks as well as the legal, tax and accounting consequences of any such transaction. This presentation does not constitute an opinion, and ROTH MKM’s only opinion is the separate opinion that is to be rendered to the Special Committee. In preparing this presentation, ROTH MKM has made certain assumptions regarding the information contained herein and certain limitations apply to such information. For a detailed description of these assumptions and limitations, we refer you to the written fairness opinion to be delivered to the Special Committee by ROTH MKM.

Situation Overview Valuation Analysis I II Table of Contents

Situation Overview I

Transaction Overview – Scope and Summary of Terms The Special Committee has requested our opinion as to the fairness, from a financial point of view, to holders of common stock, par value $0.0001 per share (“Company Common Stock”), of GreenLight Biosciences Holdings, PBC, a Delaware public benefit corporation (the “Company”), (other than Parent and Merger Sub and their Affiliates, holders of Rollover Shares, and holders of Dissenting Shares), of the Offer Price (as defined below) to be received by such holders pursuant to the terms and conditions set forth in an Agreement and Plan of Merger (the “Merger Agreement”) proposed to be entered into among SW ParentCo, Inc., a Delaware corporation (“Parent”), SW MergerCo, Inc., a Delaware corporation (“Merger Sub”), and the Company. As more fully described in the Merger Agreement, (i) Parent will cause Merger Sub to commence a tender offer (the “Tender Offer”) to purchase all outstanding shares of Company Common Stock (other than shares held by Parent and Merger Sub and their affiliates, holders of Rollover Shares, and holders of Dissenting Shares), at a purchase price of $0.30 per share (the “Offer Price”), net to the seller in cash, without interest and subject to withholding of Taxes, and (ii) subsequent to the consummation of the Tender Offer, Merger Sub will be merged with and into the Company, with the Company as the surviving entity thereof (the “Merger” and, taken together with the Tender Offer as an integrated transaction the “Transaction”), and each outstanding share of Company Common stock not previously tendered in the Tender Offer (other than shares held by Parent and Merger Sub and their Affiliates, holders of Rollover Shares, and holders of Dissenting Shares), will be converted into the right to receive the Offer Price. The terms and conditions of the Transaction are more fully set forth in the Merger Agreement. Capitalized terms in this presentation that are not defined herein shall have the meaning set forth in the Merger Agreement.

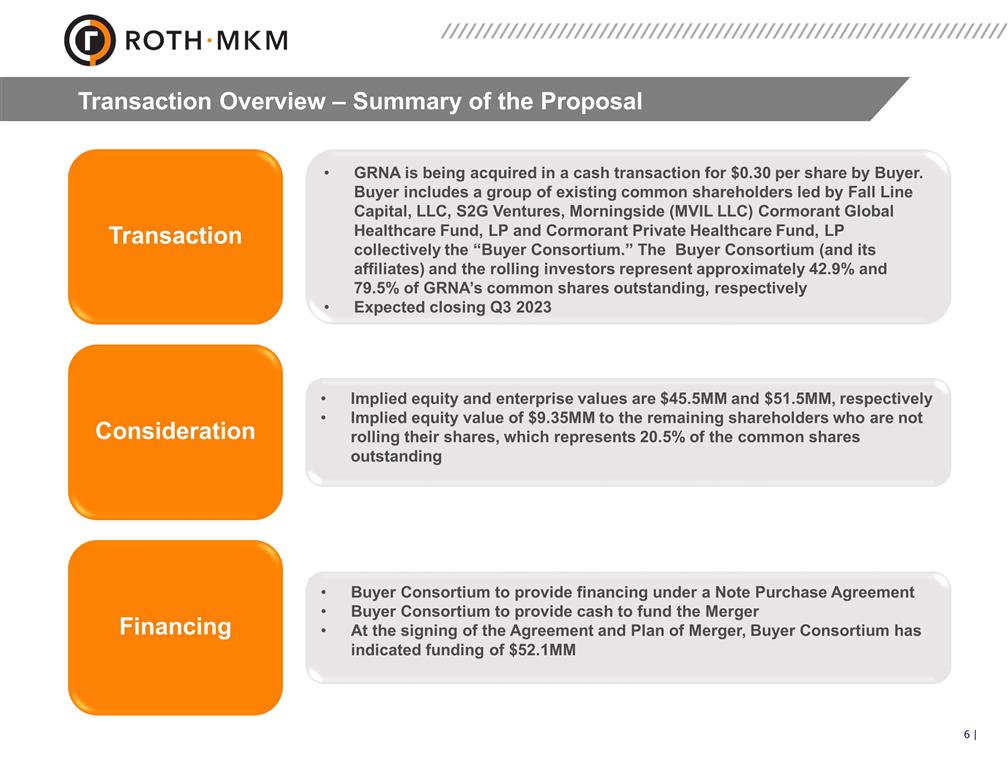

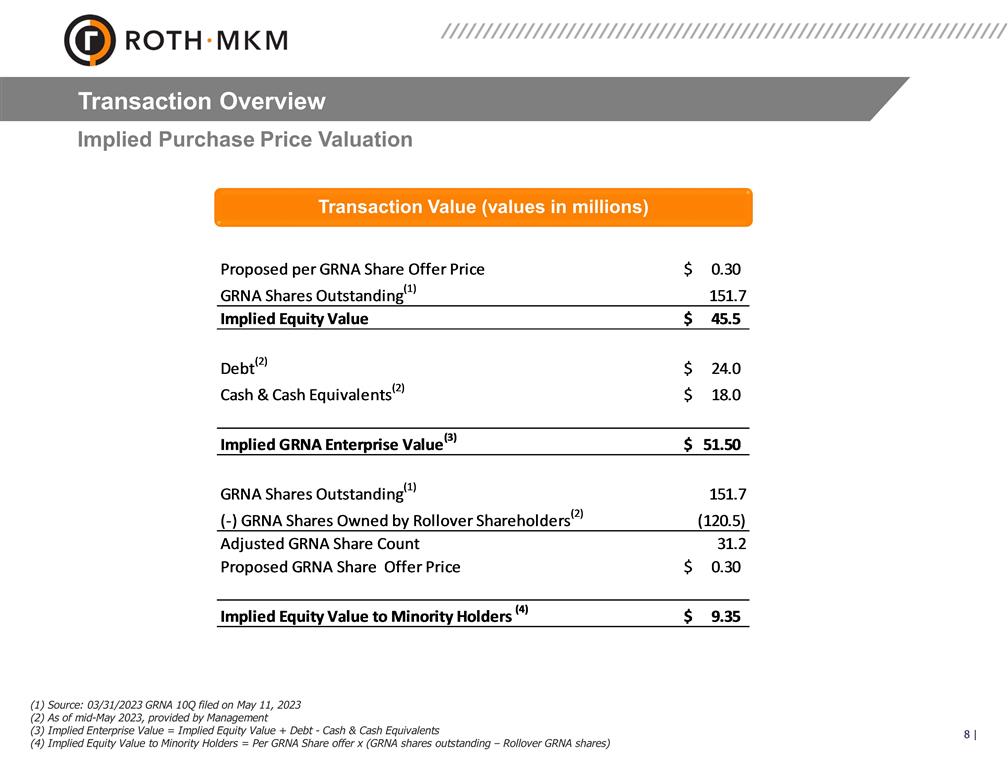

Transaction Overview – Summary of the Proposal Transaction Consideration Financing Implied equity and enterprise values are $45.5MM and $51.5MM, respectively Implied equity value of $9.35MM to the remaining shareholders who are not rolling their shares, which represents 20.5% of the common shares outstanding Buyer Consortium to provide financing under a Note Purchase Agreement Buyer Consortium to provide cash to fund the Merger At the signing of the Agreement and Plan of Merger, Buyer Consortium has indicated funding of $52.1MM GRNA is being acquired in a cash transaction for $0.30 per share by Buyer. Buyer includes a group of existing common shareholders led by Fall Line Capital, LLC, S2G Ventures, Morningside (MVIL LLC) Cormorant Global Healthcare Fund, LP and Cormorant Private Healthcare Fund, LP collectively the “Buyer Consortium.” The Buyer Consortium (and its affiliates) and the rolling investors represent approximately 42.9% and 79.5% of GRNA’s common shares outstanding, respectively Expected closing Q3 2023

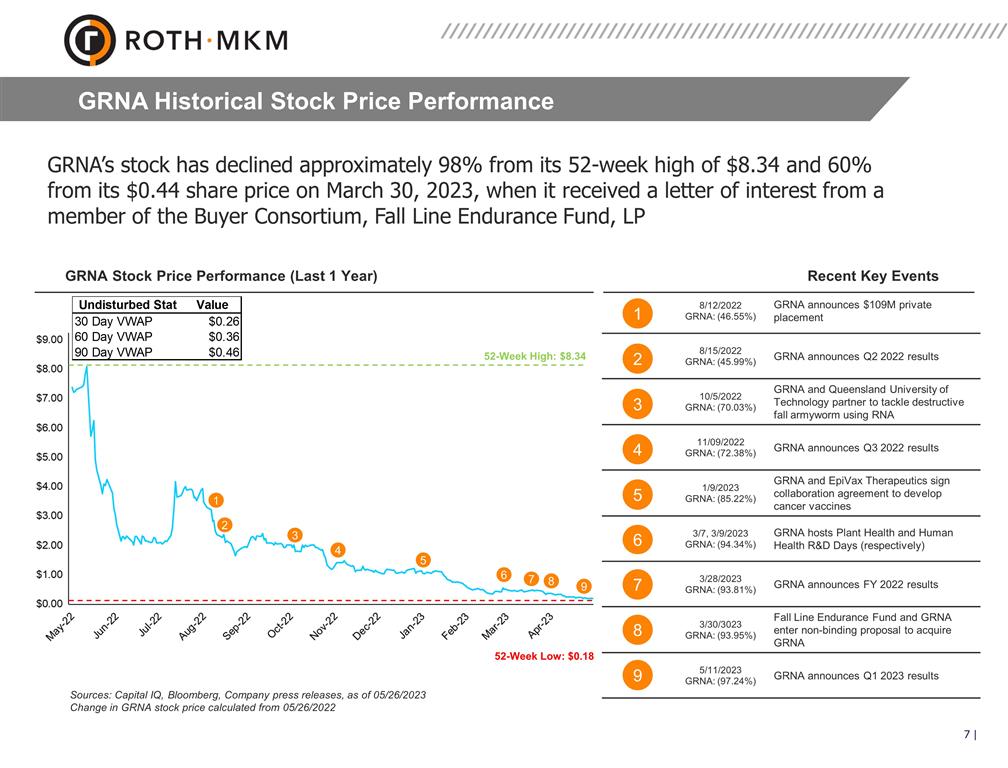

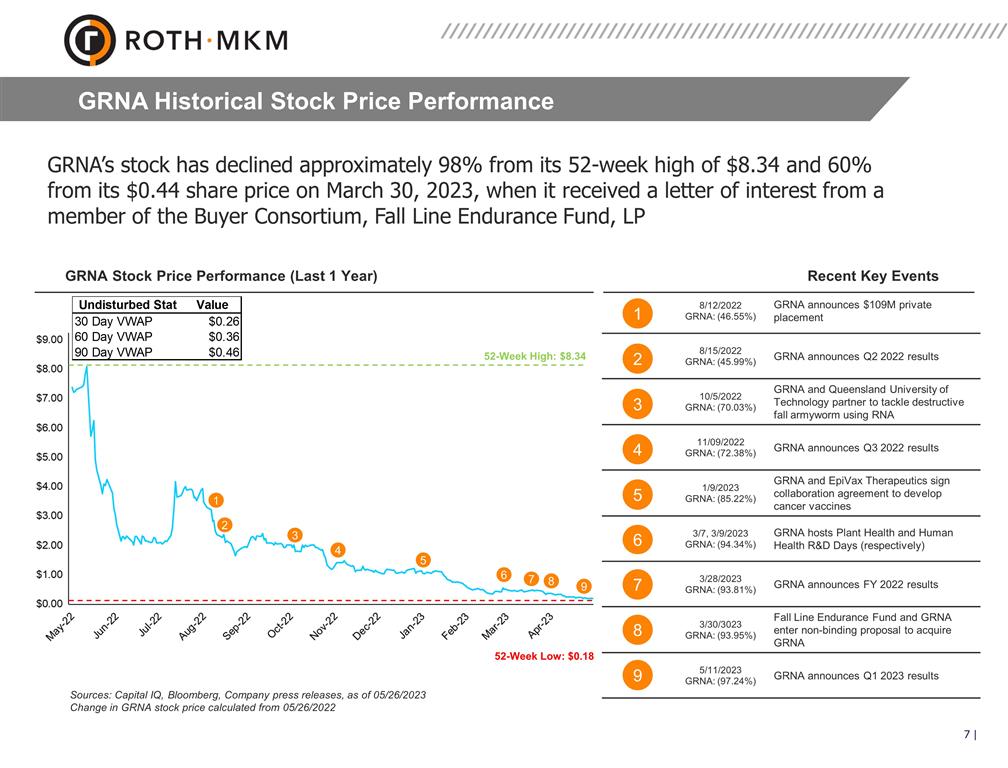

GRNA Stock Price Performance (Last 1 Year) Recent Key Events 8/12/2022 GRNA: (46.55%) GRNA announces $109M private placement 8/15/2022 GRNA: (45.99%) GRNA announces Q2 2022 results 10/5/2022 GRNA: (70.03%) GRNA and Queensland University of Technology partner to tackle destructive fall armyworm using RNA 11/09/2022 GRNA: (72.38%) GRNA announces Q3 2022 results 1/9/2023 GRNA: (85.22%) GRNA and EpiVax Therapeutics sign collaboration agreement to develop cancer vaccines 3/7, 3/9/2023 GRNA: (94.34%) GRNA hosts Plant Health and Human Health R&D Days (respectively) 3/28/2023 GRNA: (93.81%) GRNA announces FY 2022 results 3/30/3023 GRNA: (93.95%) Fall Line Endurance Fund and GRNA enter non-binding proposal to acquire GRNA 5/11/2023 GRNA: (97.24%) GRNA announces Q1 2023 results 52-Week High: $8.34 52-Week Low: $0.18 1 2 3 4 5 6 7 8 1 2 4 5 6 7 8 9 Sources: Capital IQ, Bloomberg, Company press releases, as of 05/26/2023 Change in GRNA stock price calculated from 05/26/2022 9 3 GRNA Historical Stock Price Performance GRNA’s stock has declined approximately 98% from its 52-week high of $8.34 and 60% from its $0.44 share price on March 30, 2023, when it received a letter of interest from a member of the Buyer Consortium, Fall Line Endurance Fund, LP

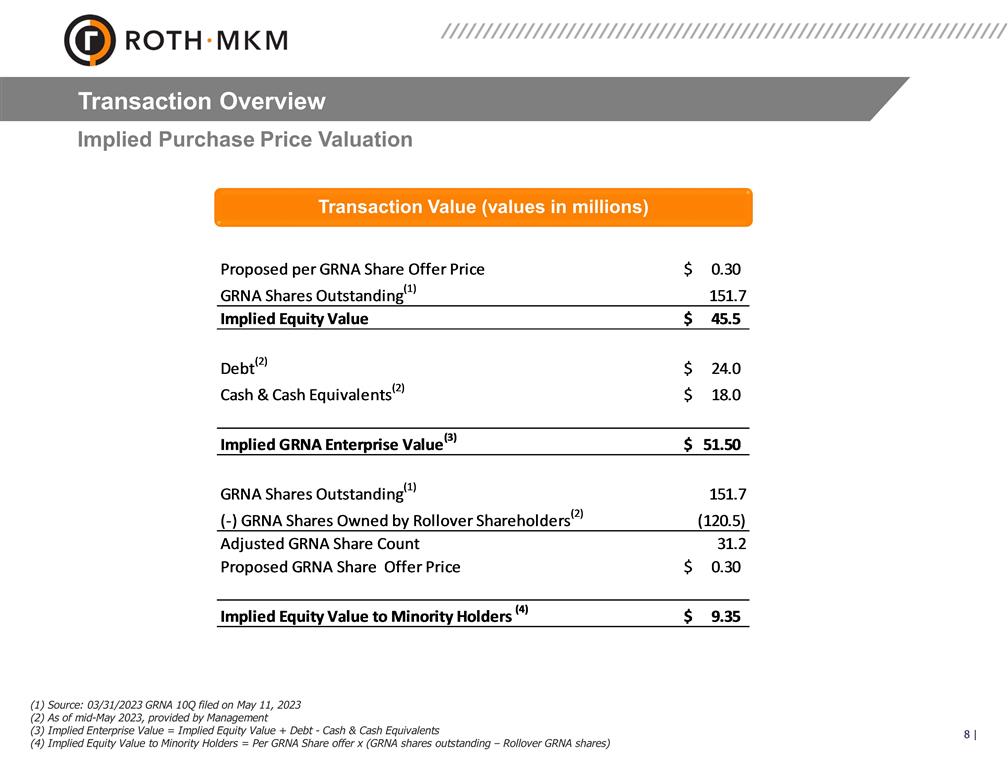

Transaction Overview Implied Purchase Price Valuation Transaction Value (values in millions) (1) Source: 03/31/2023 GRNA 10Q filed on May 11, 2023 (2) As of mid-May 2023, provided by Management (3) Implied Enterprise Value = Implied Equity Value + Debt - Cash & Cash Equivalents (4) Implied Equity Value to Minority Holders = Per GRNA Share offer x (GRNA shares outstanding – Rollover GRNA shares)

Valuation Analysis II

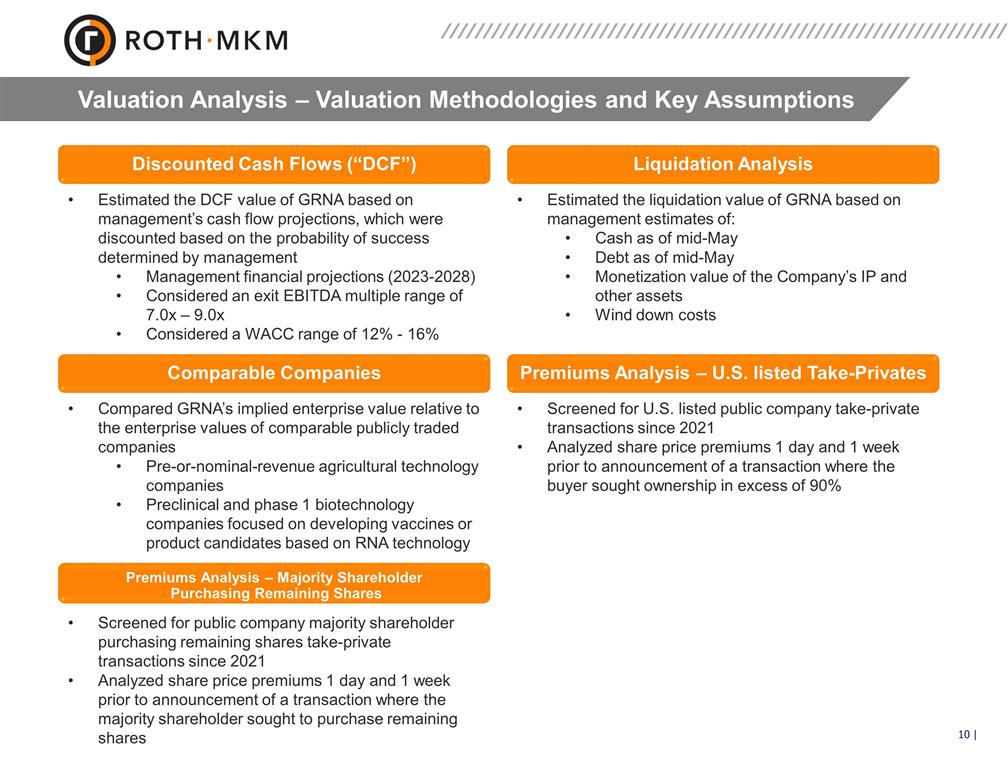

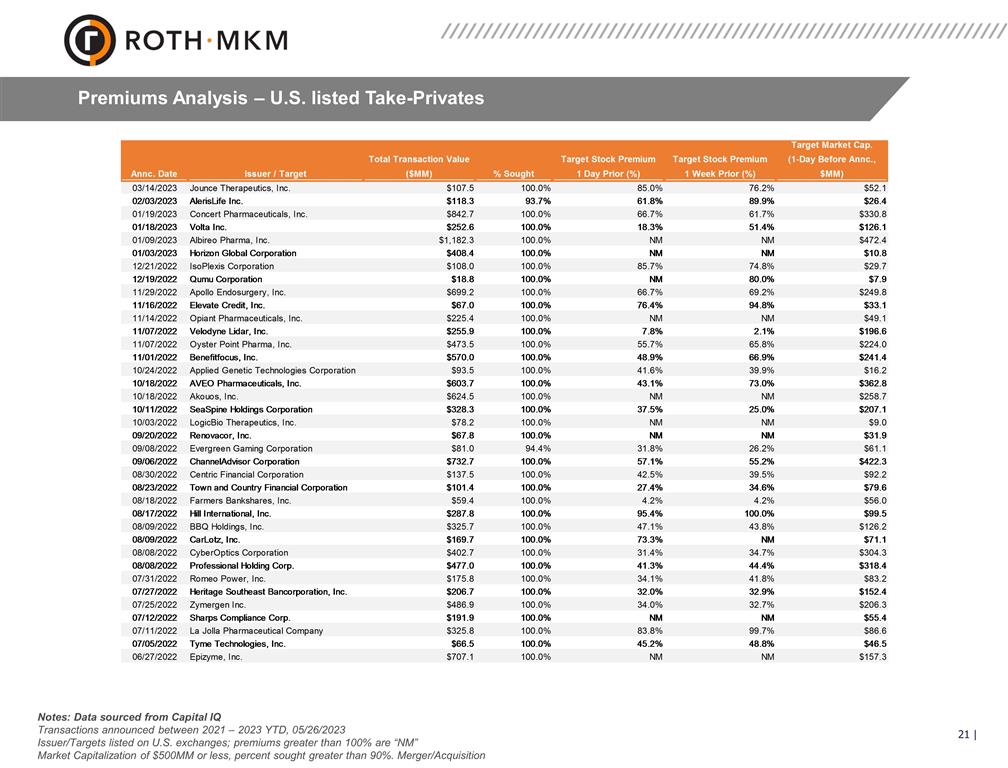

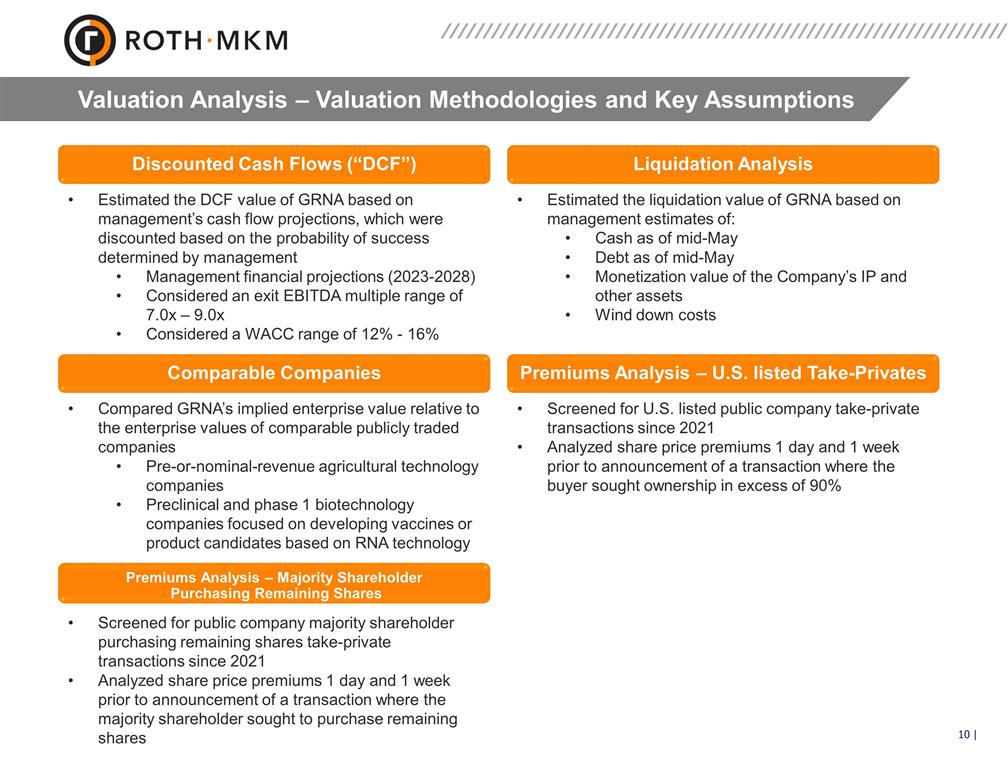

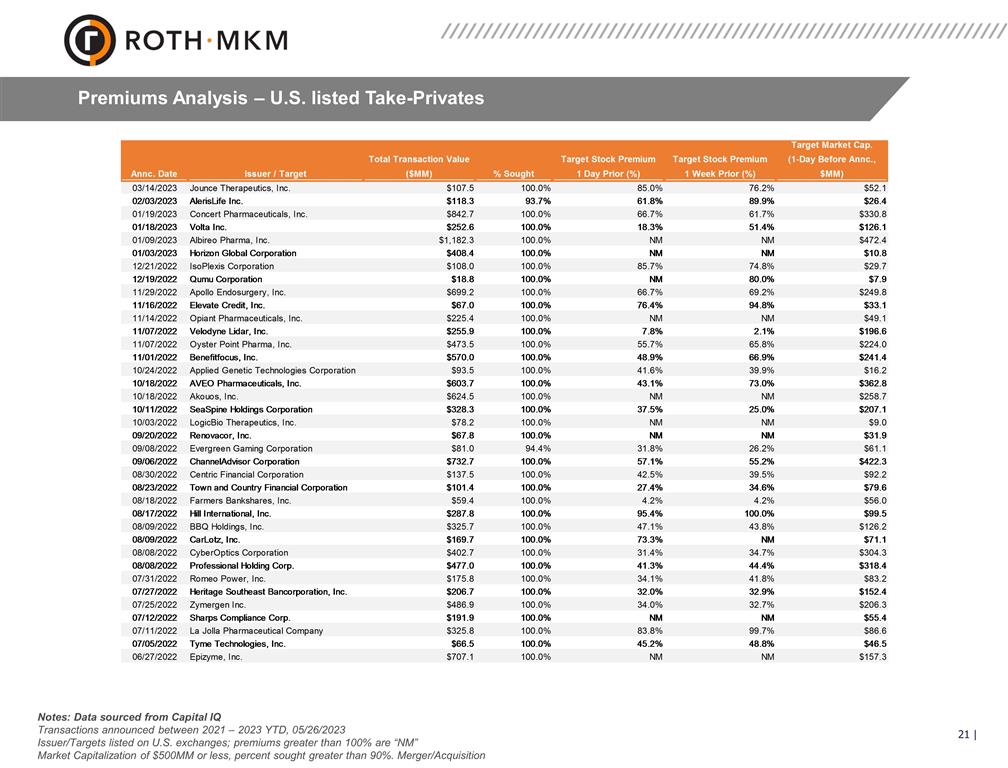

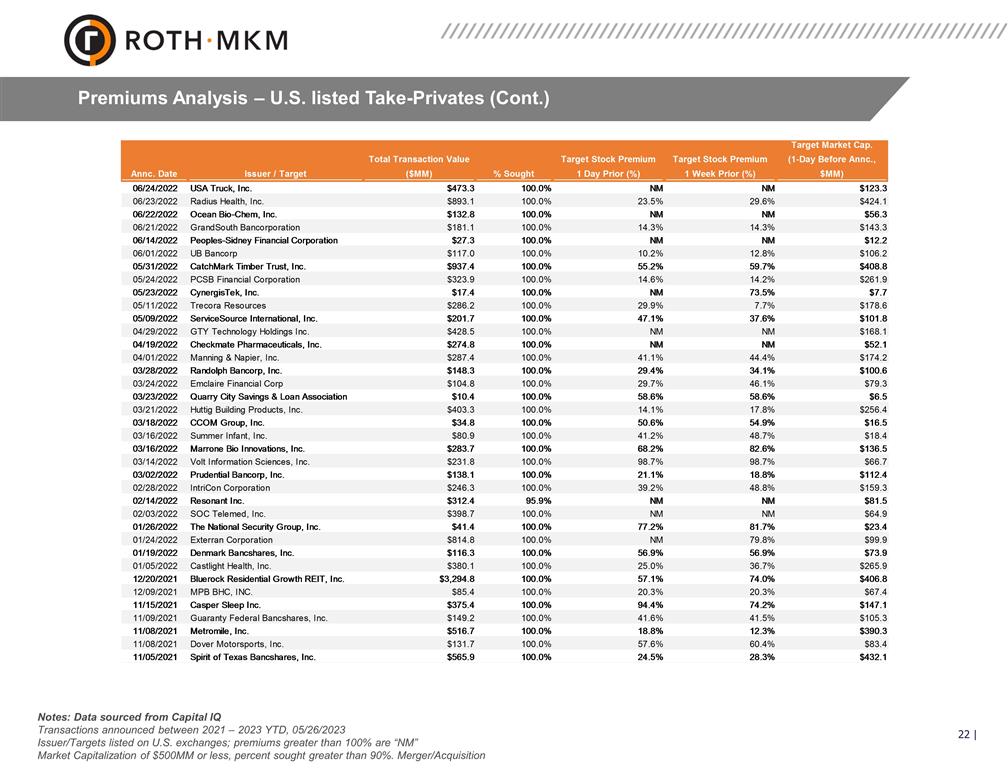

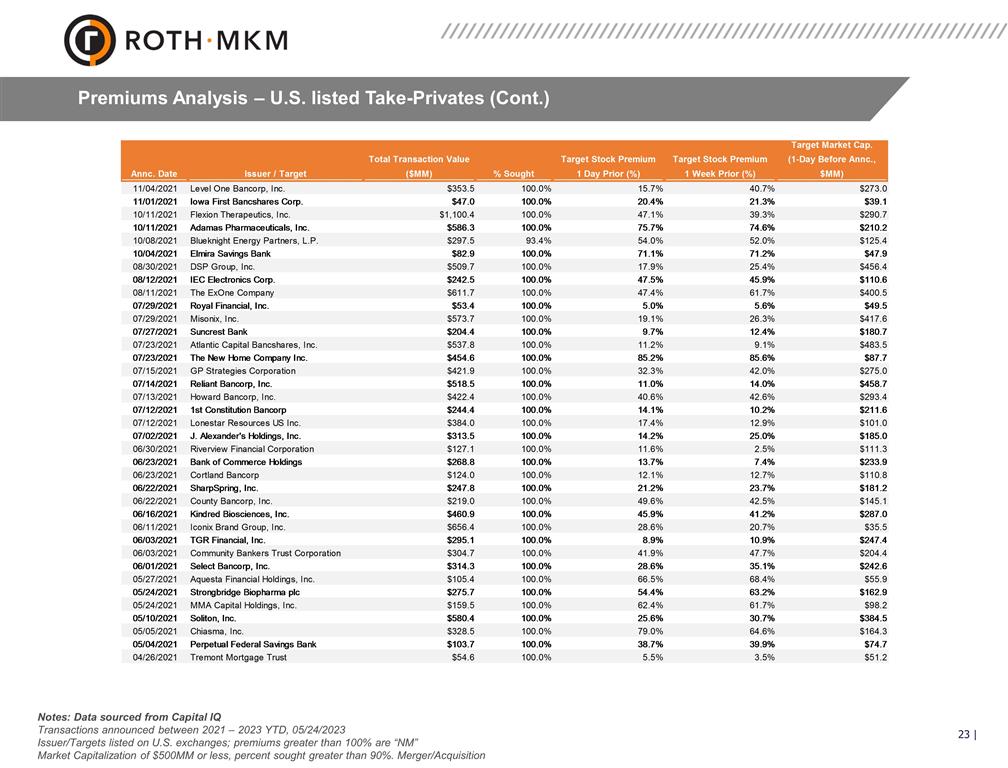

Valuation Analysis – Valuation Methodologies and Key Assumptions Comparable Companies Compared GRNA’s implied enterprise value relative to the enterprise values of comparable publicly traded companies Pre-or-nominal-revenue agricultural technology companies Preclinical and phase 1 biotechnology companies focused on developing vaccines or product candidates based on RNA technology Discounted Cash Flows (“DCF”) Estimated the DCF value of GRNA based on management’s cash flow projections, which were discounted based on the probability of success determined by management Management financial projections (2023-2028) Considered an exit EBITDA multiple range of 7.0x – 9.0x Considered a WACC range of 12% - 16% Liquidation Analysis Estimated the liquidation value of GRNA based on management estimates of: Cash as of mid-May Debt as of mid-May Monetization value of the Company’s IP and other assets Wind down costs Premiums Analysis – U.S. listed Take-Privates Screened for U.S. listed public company take-private transactions since 2021 Analyzed share price premiums 1 day and 1 week prior to announcement of a transaction where the buyer sought ownership in excess of 90% Premiums Analysis – Majority Shareholder Purchasing Remaining Shares Screened for public company majority shareholder purchasing remaining shares take-private transactions since 2021 Analyzed share price premiums 1 day and 1 week prior to announcement of a transaction where the majority shareholder sought to purchase remaining shares

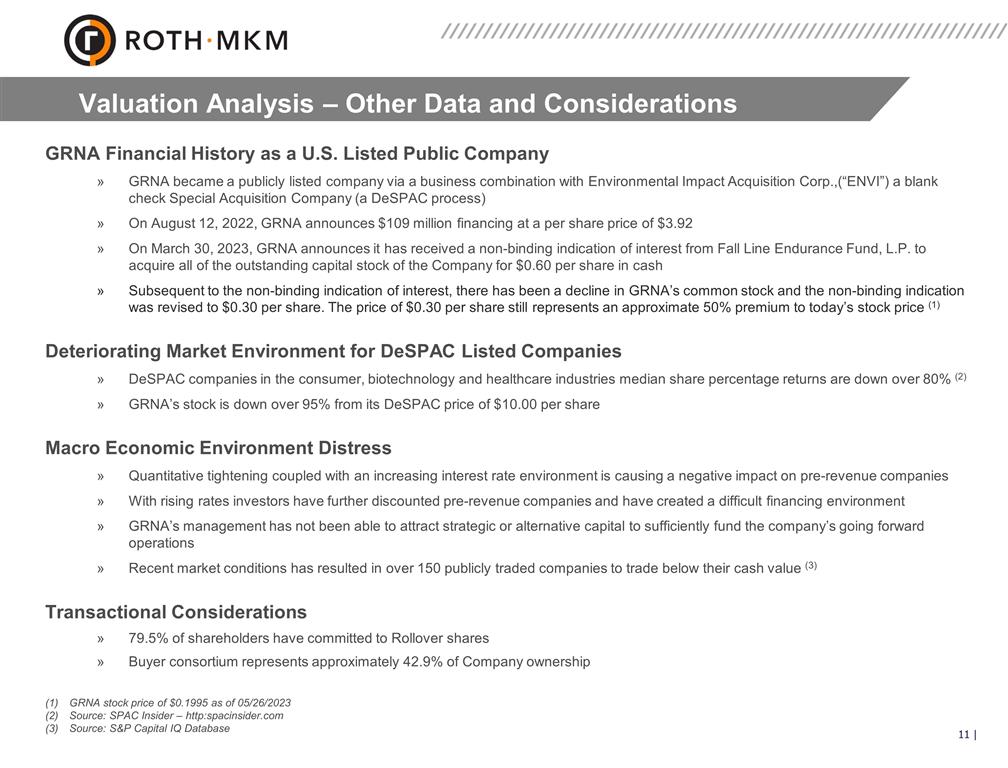

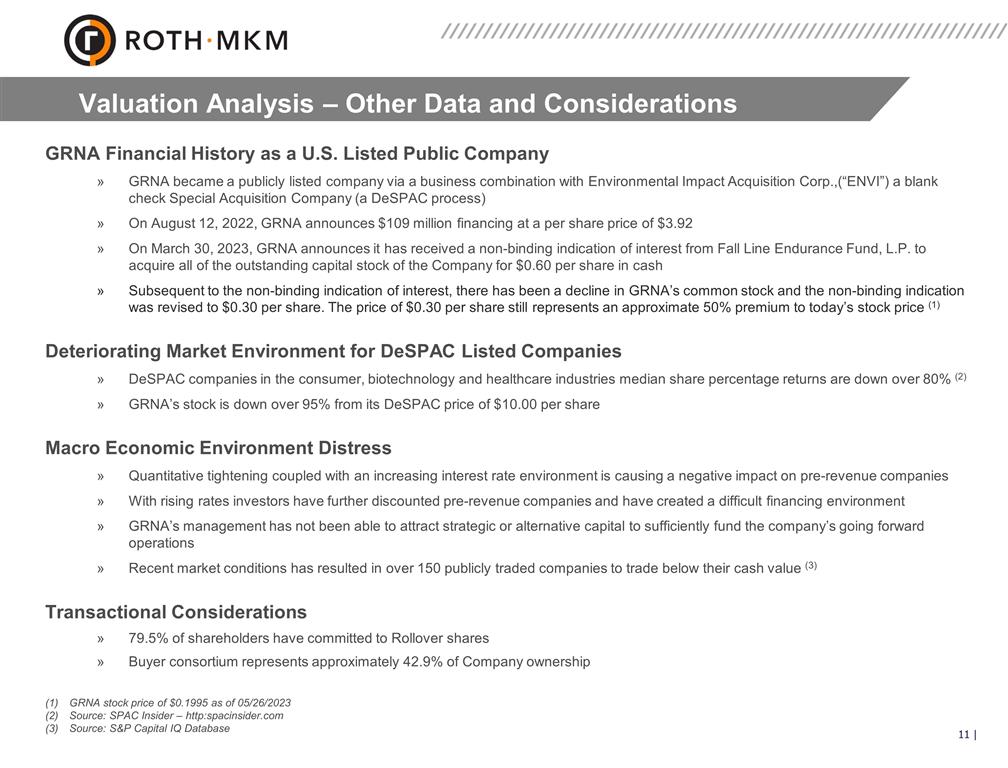

Valuation Analysis – Other Data and Considerations GRNA Financial History as a U.S. Listed Public Company GRNA became a publicly listed company via a business combination with Environmental Impact Acquisition Corp.,(“ENVI”) a blank check Special Acquisition Company (a DeSPAC process) On August 12, 2022, GRNA announces $109 million financing at a per share price of $3.92 On March 30, 2023, GRNA announces it has received a non-binding indication of interest from Fall Line Endurance Fund, L.P. to acquire all of the outstanding capital stock of the Company for $0.60 per share in cash Subsequent to the non-binding indication of interest, there has been a decline in GRNA’s common stock and the non-binding indication was revised to $0.30 per share. The price of $0.30 per share still represents an approximate 50% premium to today’s stock price (1) Deteriorating Market Environment for DeSPAC Listed Companies DeSPAC companies in the consumer, biotechnology and healthcare industries median share percentage returns are down over 80% (2) GRNA’s stock is down over 95% from its DeSPAC price of $10.00 per share Macro Economic Environment Distress Quantitative tightening coupled with an increasing interest rate environment is causing a negative impact on pre-revenue companies With rising rates investors have further discounted pre-revenue companies and have created a difficult financing environment GRNA’s management has not been able to attract strategic or alternative capital to sufficiently fund the company’s going forward operations Recent market conditions has resulted in over 150 publicly traded companies to trade below their cash value (3) Transactional Considerations 79.5% of shareholders have committed to Rollover shares Buyer consortium represents approximately 42.9% of Company ownership GRNA stock price of $0.1995 as of 05/26/2023 Source: SPAC Insider – http:spacinsider.com Source: S&P Capital IQ Database

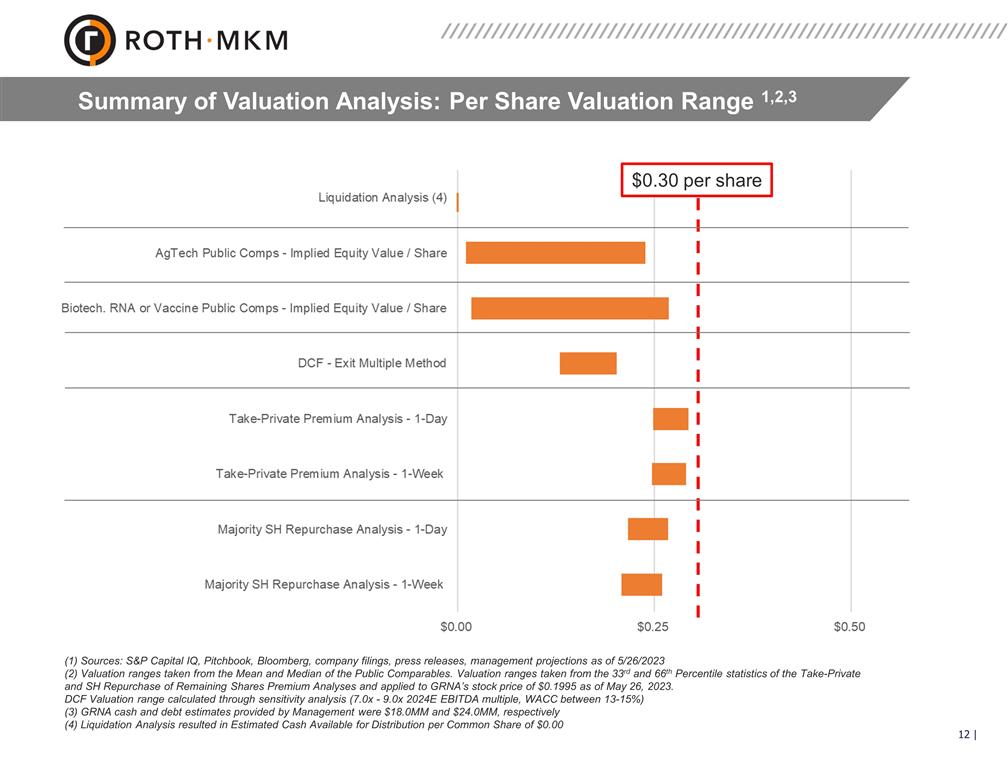

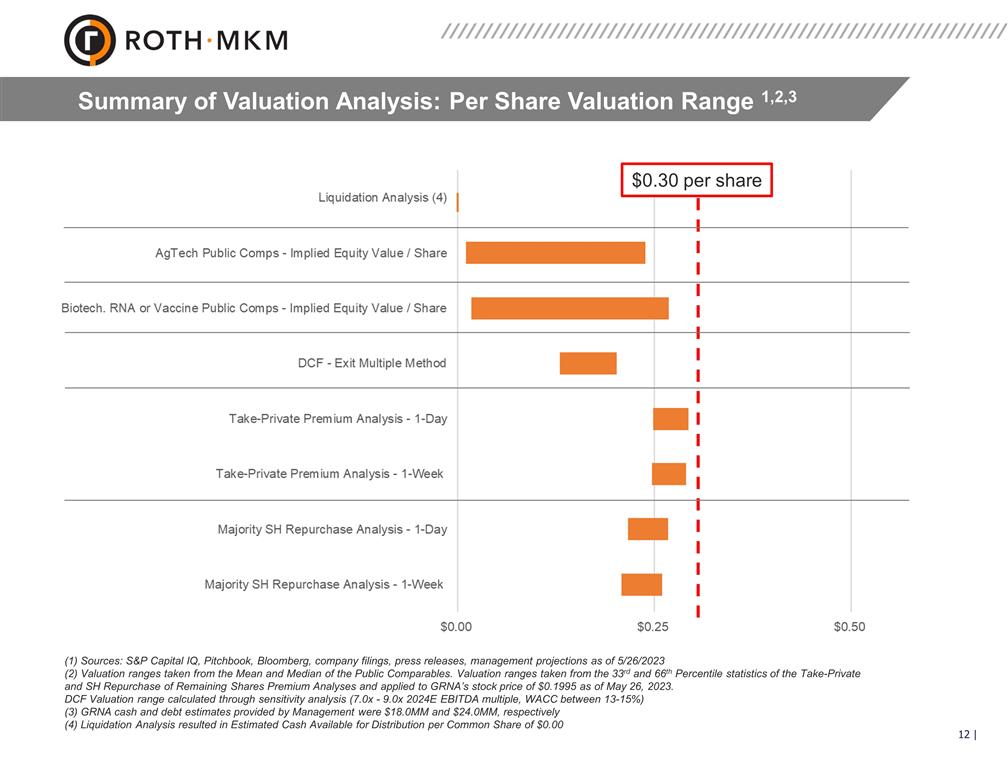

Summary of Valuation Analysis: Per Share Valuation Range 1,2,3 (1) Sources: S&P Capital IQ, Pitchbook, Bloomberg, company filings, press releases, management projections as of 5/26/2023 (2) Valuation ranges taken from the Mean and Median of the Public Comparables. Valuation ranges taken from the 33rd and 66th Percentile statistics of the Take-Private and SH Repurchase of Remaining Shares Premium Analyses and applied to GRNA’s stock price of $0.1995 as of May 26, 2023. DCF Valuation range calculated through sensitivity analysis (7.0x - 9.0x 2024E EBITDA multiple, WACC between 13-15%) (3) GRNA cash and debt estimates provided by Management were $18.0MM and $24.0MM, respectively (4) Liquidation Analysis resulted in Estimated Cash Available for Distribution per Common Share of $0.00 $0.30 per share

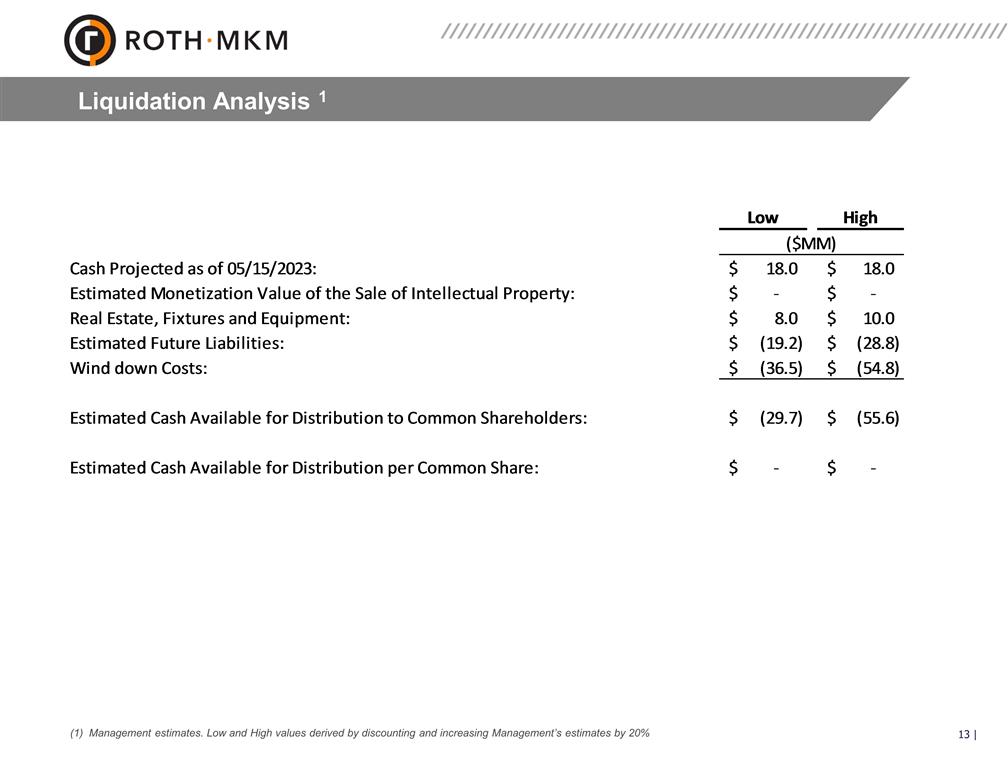

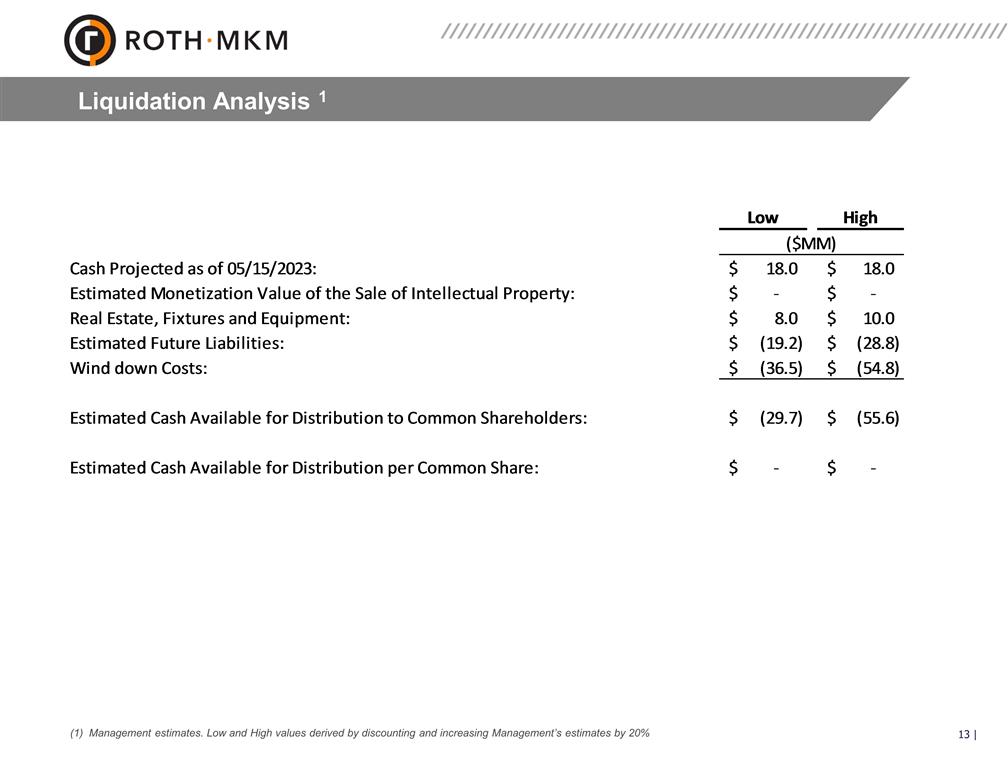

Liquidation Analysis 1 (1) Management estimates. Low and High values derived by discounting and increasing Management’s estimates by 20%

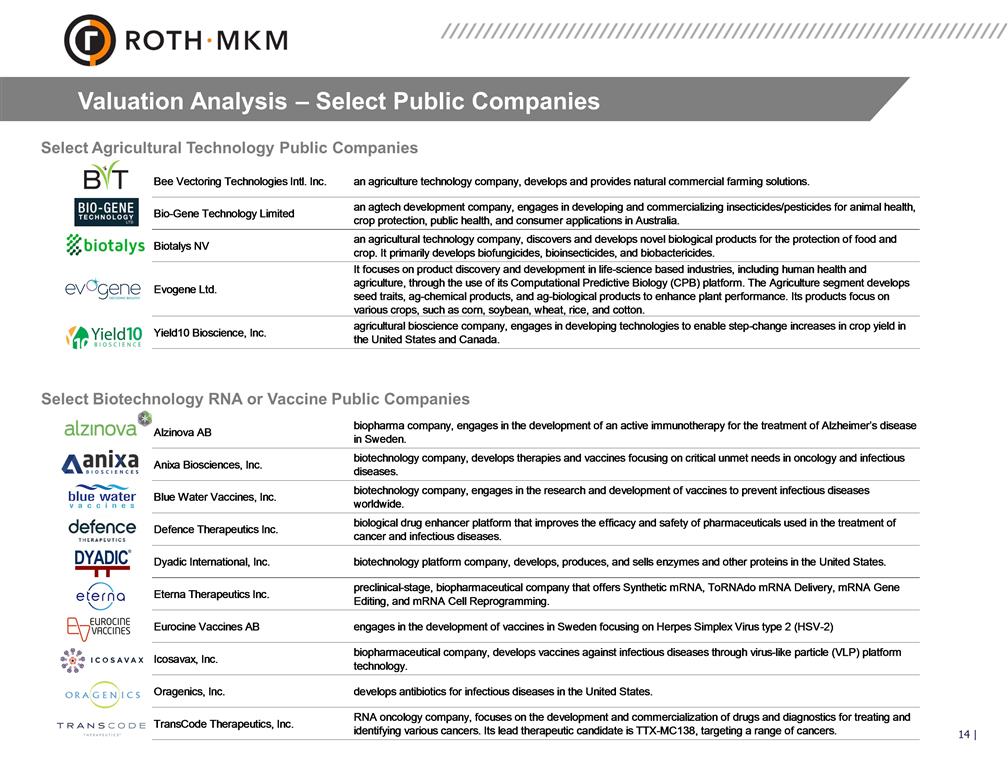

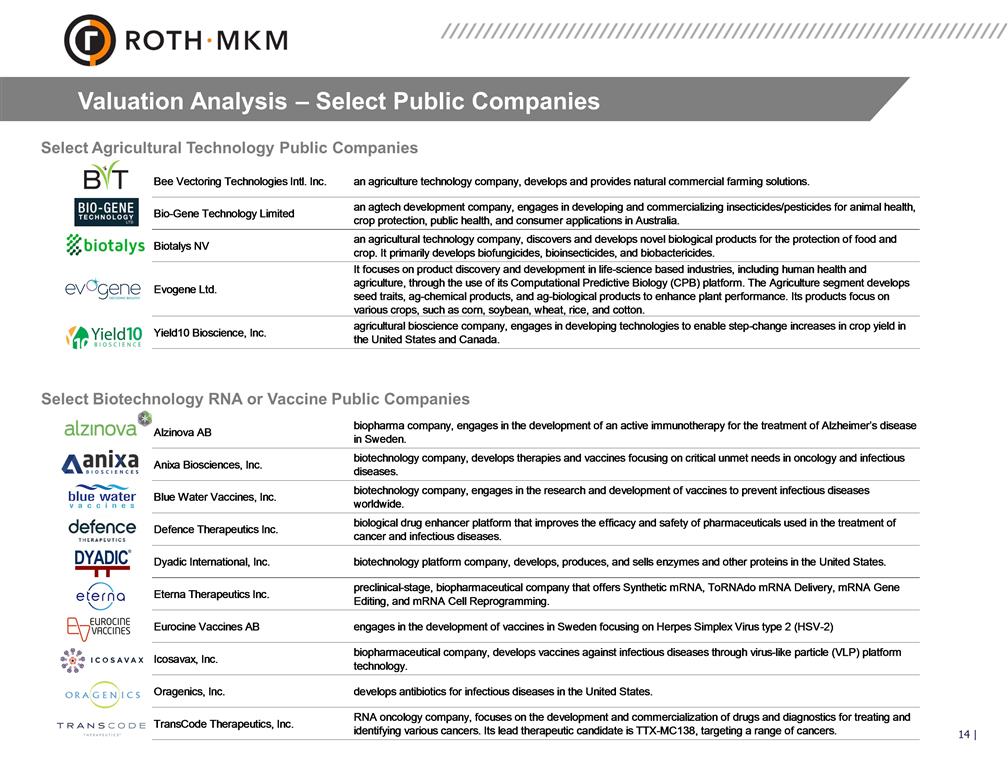

Valuation Analysis – Select Public Companies Select Agricultural Technology Public Companies Select Biotechnology RNA or Vaccine Public Companies

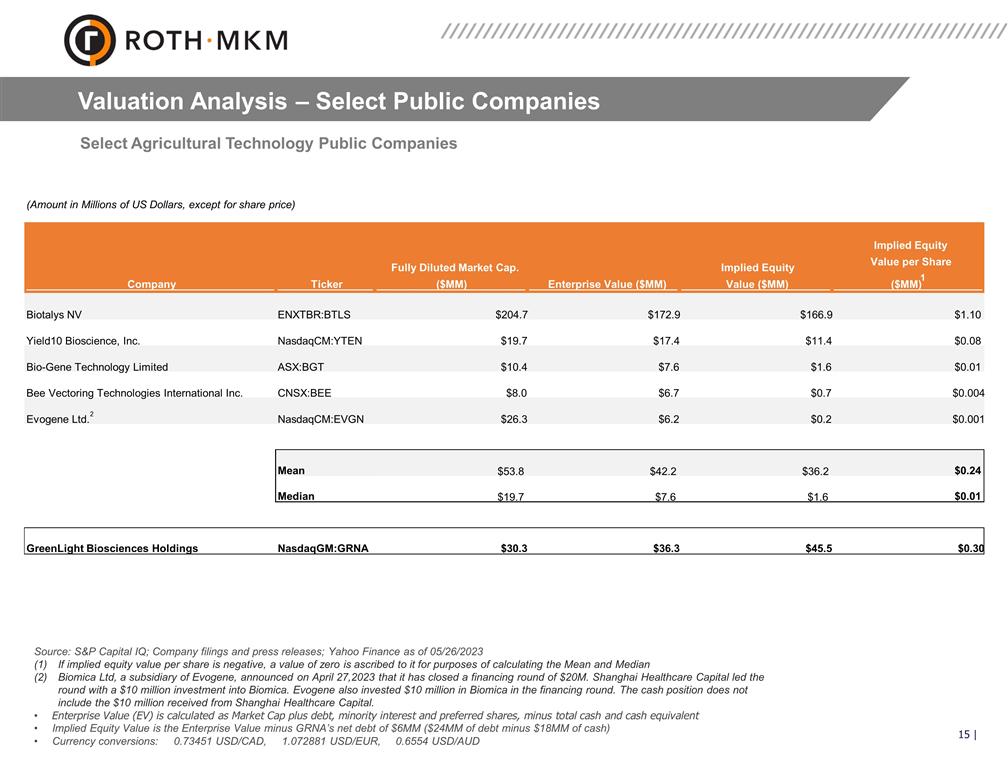

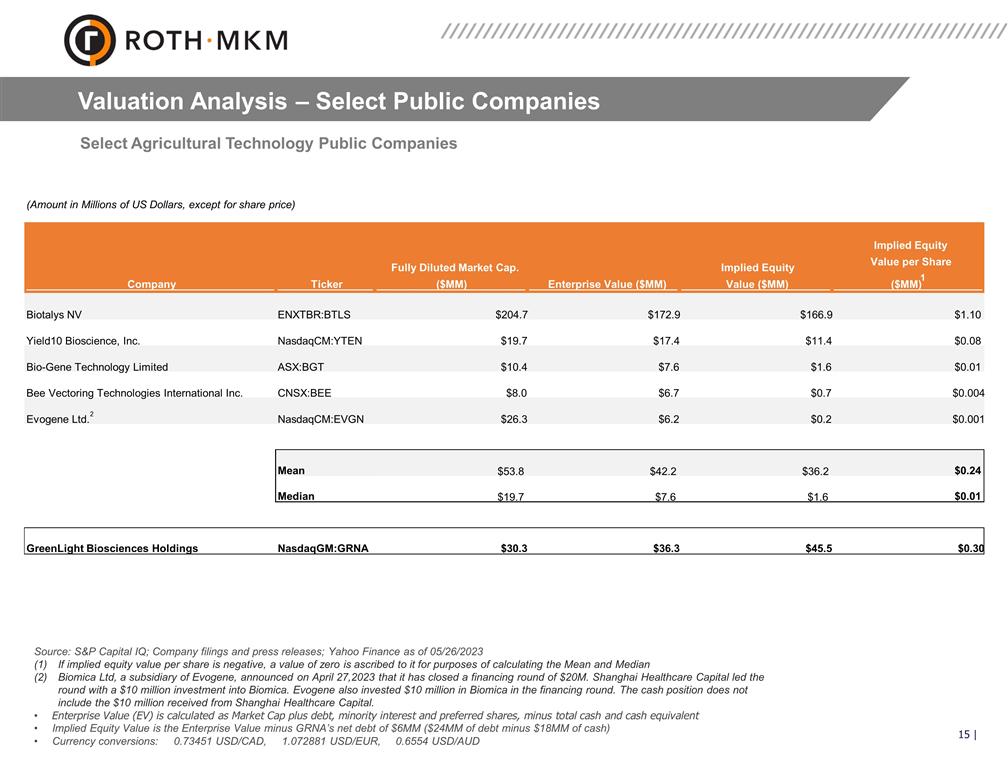

Select Agricultural Technology Public Companies Valuation Analysis – Select Public Companies Source: S&P Capital IQ; Company filings and press releases; Yahoo Finance as of 05/26/2023 If implied equity value per share is negative, a value of zero is ascribed to it for purposes of calculating the Mean and Median Biomica Ltd, a subsidiary of Evogene, announced on April 27,2023 that it has closed a financing round of $20M. Shanghai Healthcare Capital led the round with a $10 million investment into Biomica. Evogene also invested $10 million in Biomica in the financing round. The cash position does not include the $10 million received from Shanghai Healthcare Capital. Enterprise Value (EV) is calculated as Market Cap plus debt, minority interest and preferred shares, minus total cash and cash equivalent Implied Equity Value is the Enterprise Value minus GRNA’s net debt of $6MM ($24MM of debt minus $18MM of cash) Currency conversions: 0.73451 USD/CAD, 1.072881 USD/EUR, 0.6554 USD/AUD (Amount in Millions of US Dollars, except for share price) Company Ticker Fully Diluted Market Cap. ($MM) Enterprise Value ($MM) Implied Equity Value ($MM) Implied Equity Value per Share ($MM) 1 Biotalys NV ENXTBR:BTLS $204.7 $172.9 $166.9 $1.10 Yield10 Bioscience, Inc. NasdaqCM:YTEN $19.7 $17.4 $11.4 $0.08 Bio-Gene Technology Limited ASX:BGT $10.4 $7.6 $1.6 $0.01 Bee Vectoring Technologies International Inc. CNSX:BEE $8.0 $6.7 $0.7 $0.004 Evogene Ltd. 2 NasdaqCM:EVGN $26.3 $6.2 $0.2 $0.001 Mean $53.8 $42.2 $36.2 $0.24 Median $19.7 $7.6 $1.6 $0.01 GreenLight Biosciences Holdings NasdaqGM:GRNA $30.3 $36.3 $45.5 $0.30

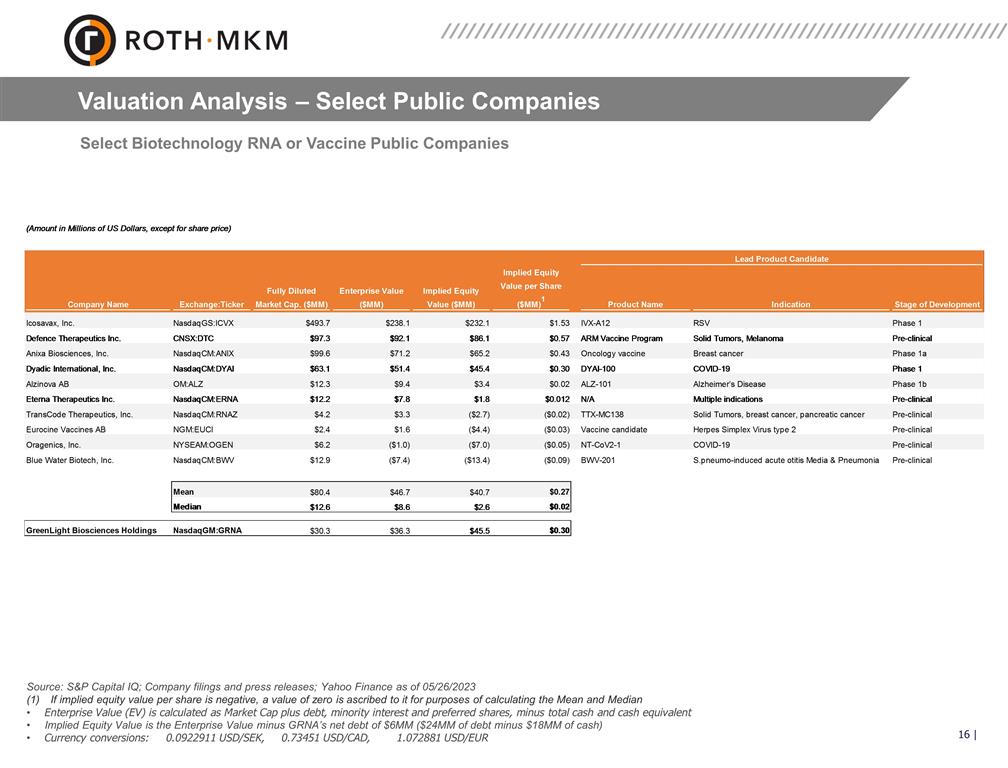

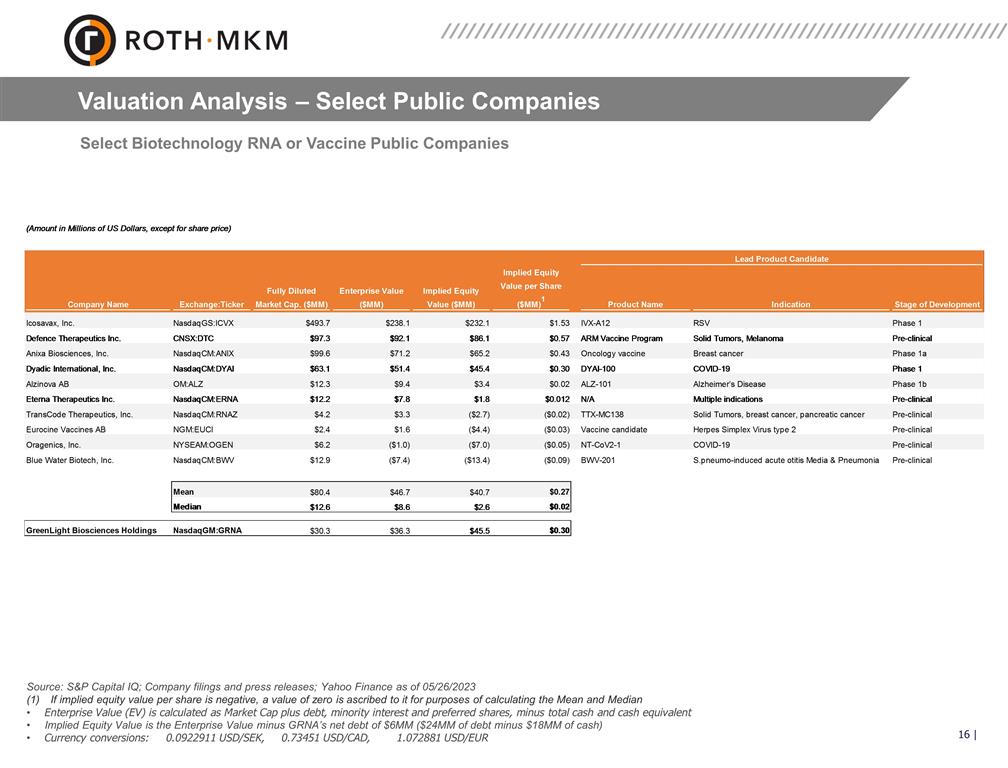

Select Biotechnology RNA or Vaccine Public Companies Valuation Analysis – Select Public Companies Source: S&P Capital IQ; Company filings and press releases; Yahoo Finance as of 05/26/2023 If implied equity value per share is negative, a value of zero is ascribed to it for purposes of calculating the Mean and Median Enterprise Value (EV) is calculated as Market Cap plus debt, minority interest and preferred shares, minus total cash and cash equivalent Implied Equity Value is the Enterprise Value minus GRNA’s net debt of $6MM ($24MM of debt minus $18MM of cash) Currency conversions: 0.0922911 USD/SEK, 0.73451 USD/CAD, 1.072881 USD/EUR

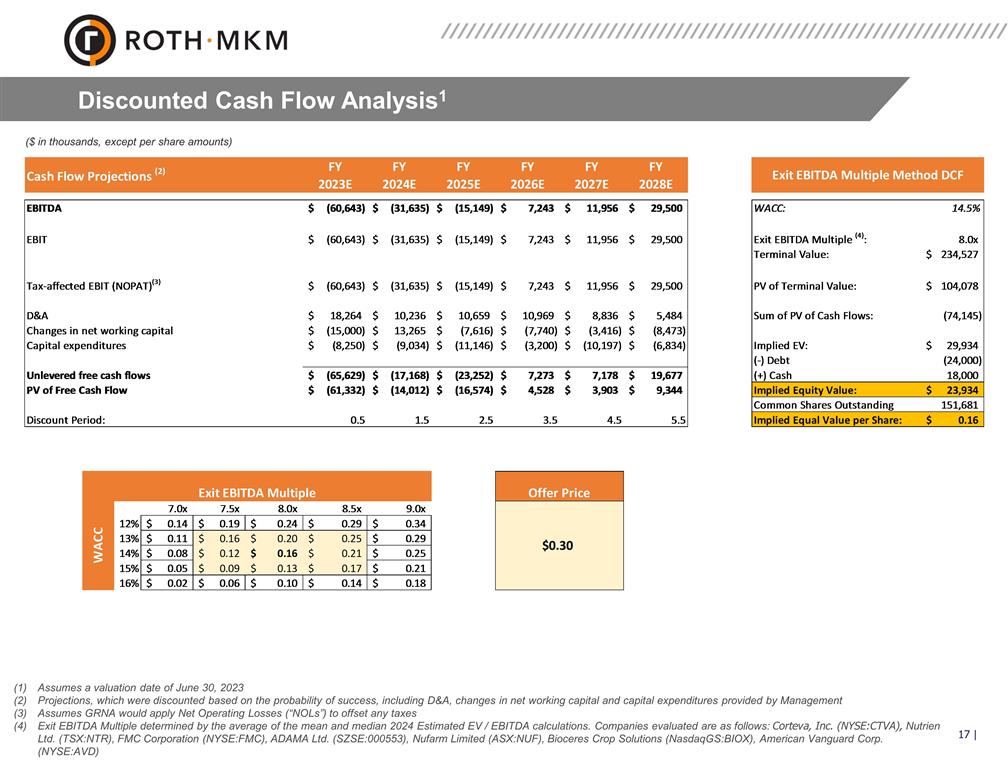

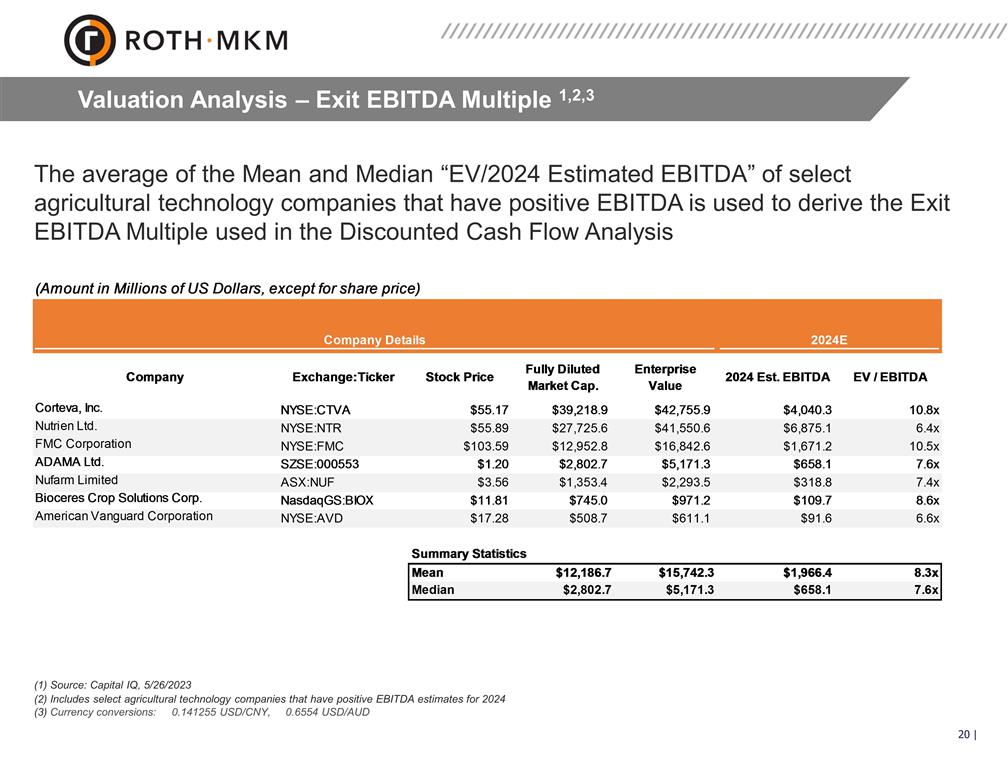

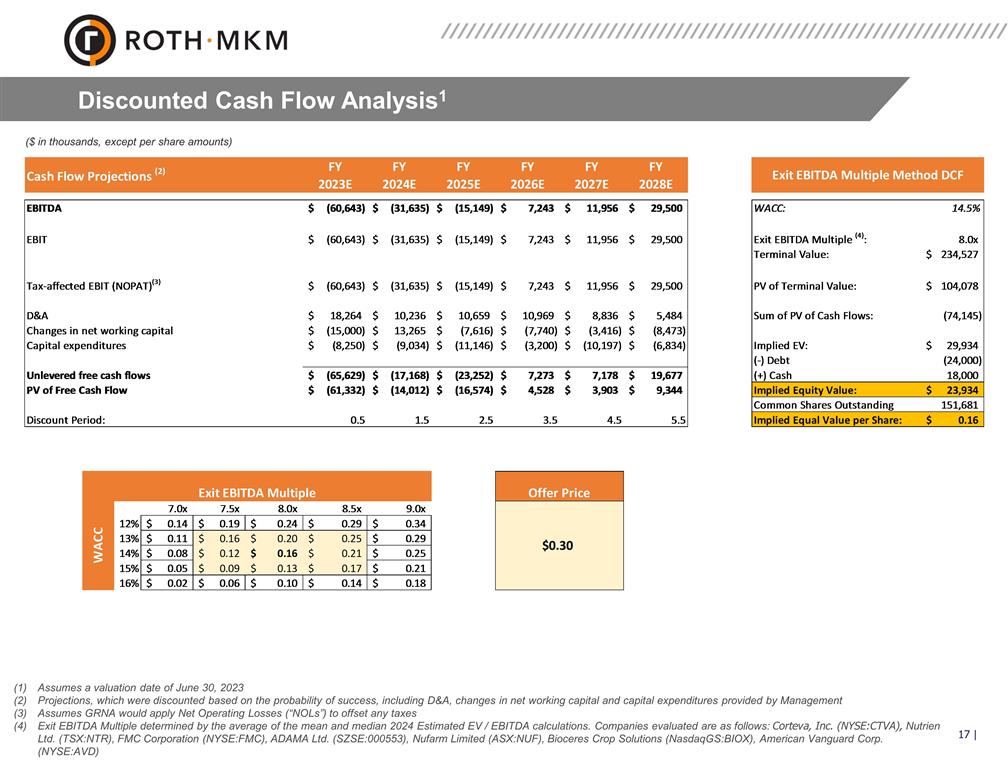

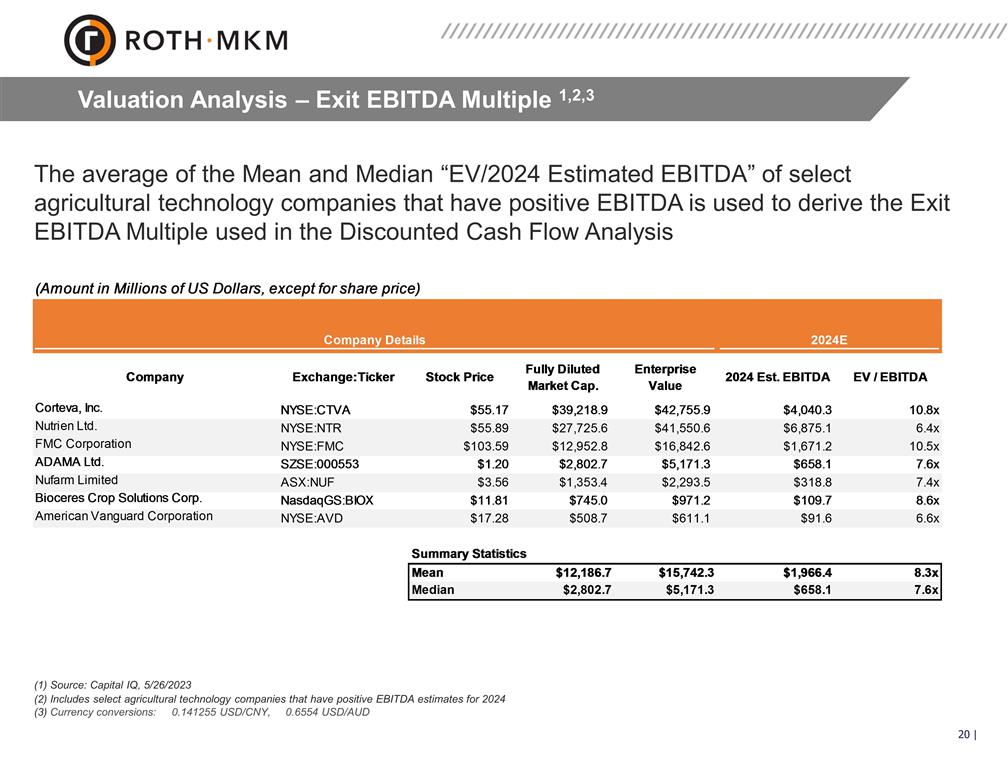

Discounted Cash Flow Analysis1 Assumes a valuation date of June 30, 2023 Projections, which were discounted based on the probability of success, including D&A, changes in net working capital and capital expenditures provided by Management Assumes GRNA would apply Net Operating Losses (“NOLs”) to offset any taxes Exit EBITDA Multiple determined by the average of the mean and median 2024 Estimated EV / EBITDA calculations. Companies evaluated are as follows: Corteva, Inc. (NYSE:CTVA), Nutrien Ltd. (TSX:NTR), FMC Corporation (NYSE:FMC), ADAMA Ltd. (SZSE:000553), Nufarm Limited (ASX:NUF), Bioceres Crop Solutions (NasdaqGS:BIOX), American Vanguard Corp. (NYSE:AVD) ($ in thousands, except per share amounts)

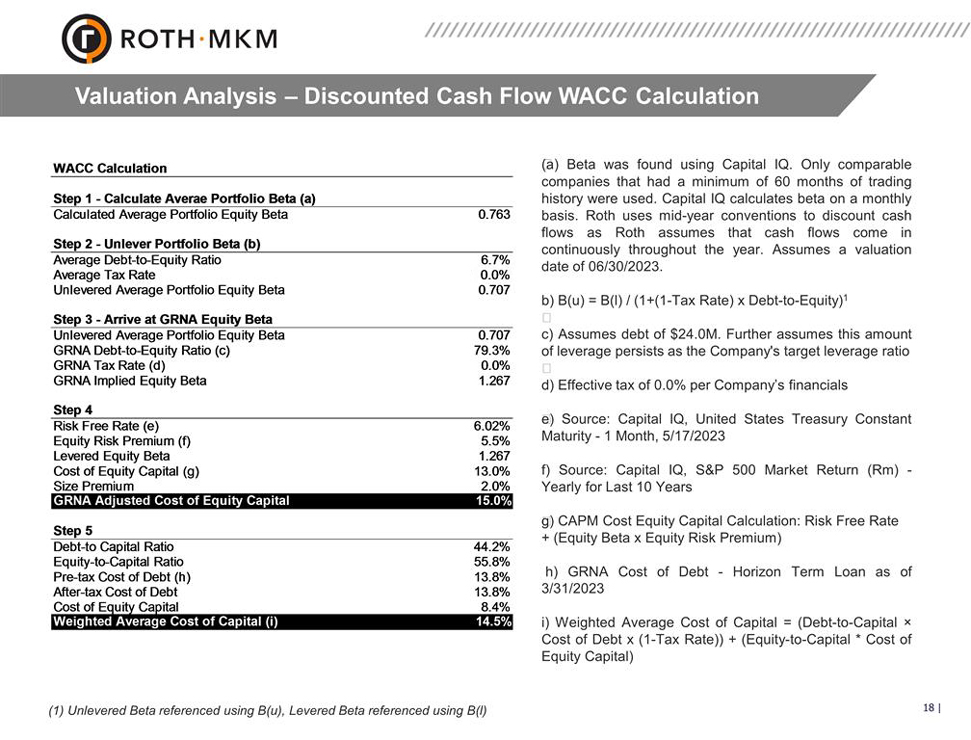

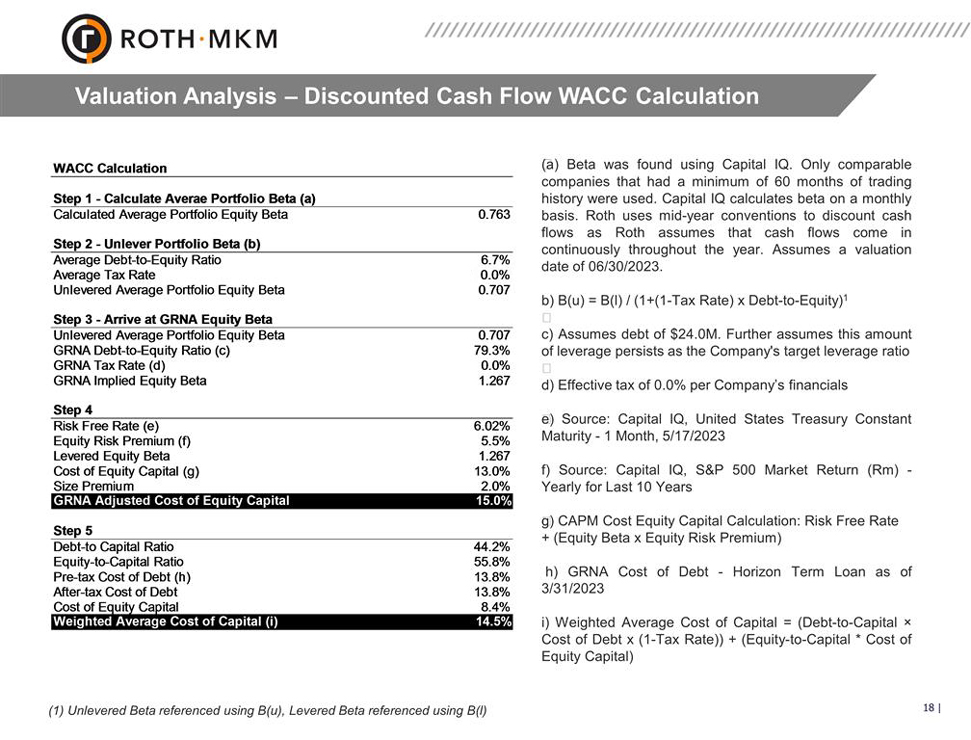

Valuation Analysis – Discounted Cash Flow WACC Calculation (a) Beta was found using Capital IQ. Only comparable companies that had a minimum of 60 months of trading history were used. Capital IQ calculates beta on a monthly basis. Roth uses mid-year conventions to discount cash flows as Roth assumes that cash flows come in continuously throughout the year. Assumes a valuation date of 06/30/2023. b) B(u) = B(l) / (1+(1-Tax Rate) x Debt-to-Equity)1 c) Assumes debt of $24.0M. Further assumes this amount of leverage persists as the Company's target leverage ratio d) Effective tax of 0.0% per Company’s financials e) Source: Capital IQ, United States Treasury Constant Maturity - 1 Month, 5/17/2023 f) Source: Capital IQ, S&P 500 Market Return (Rm) - Yearly for Last 10 Years g) CAPM Cost Equity Capital Calculation: Risk Free Rate + (Equity Beta x Equity Risk Premium) h) GRNA Cost of Debt - Horizon Term Loan as of 3/31/2023 i) Weighted Average Cost of Capital = (Debt-to-Capital × Cost of Debt x (1-Tax Rate)) + (Equity-to-Capital * Cost of Equity Capital) (1) Unlevered Beta referenced using B(u), Levered Beta referenced using B(l)

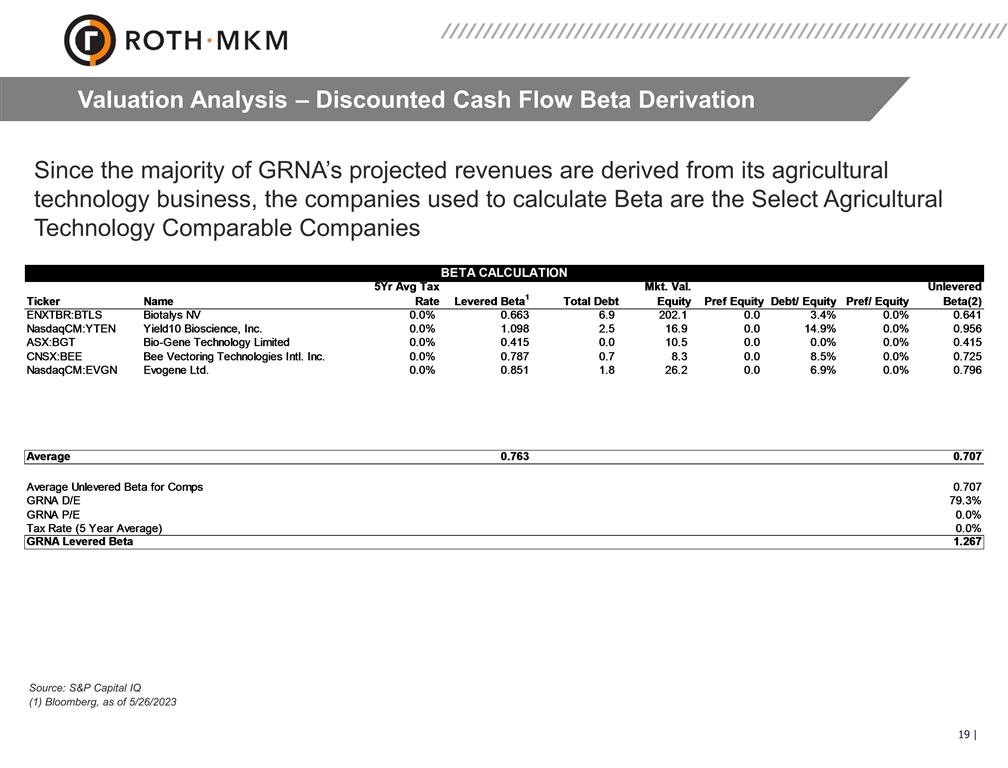

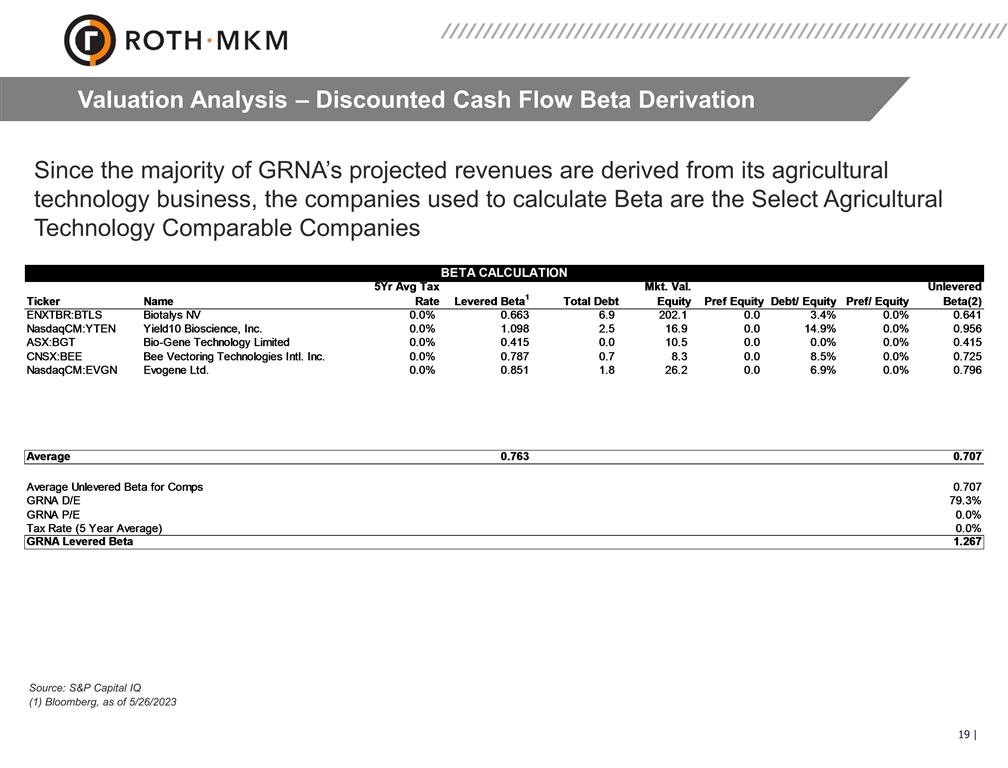

Valuation Analysis – Discounted Cash Flow Beta Derivation Source: S&P Capital IQ (1) Bloomberg, as of 5/26/2023 Since the majority of GRNA’s projected revenues are derived from its agricultural technology business, the companies used to calculate Beta are the Select Agricultural Technology Comparable Companies

Valuation Analysis – Exit EBITDA Multiple 1,2,3 (1) Source: Capital IQ, 5/26/2023 (2) Includes select agricultural technology companies that have positive EBITDA estimates for 2024 (3) Currency conversions: 0.141255 USD/CNY, 0.6554 USD/AUD The average of the Mean and Median “EV/2024 Estimated EBITDA” of select agricultural technology companies that have positive EBITDA is used to derive the Exit EBITDA Multiple used in the Discounted Cash Flow Analysis

Premiums Analysis – U.S. listed Take-Privates Notes: Data sourced from Capital IQ Transactions announced between 2021 – 2023 YTD, 05/26/2023 Issuer/Targets listed on U.S. exchanges; premiums greater than 100% are “NM” Market Capitalization of $500MM or less, percent sought greater than 90%. Merger/Acquisition

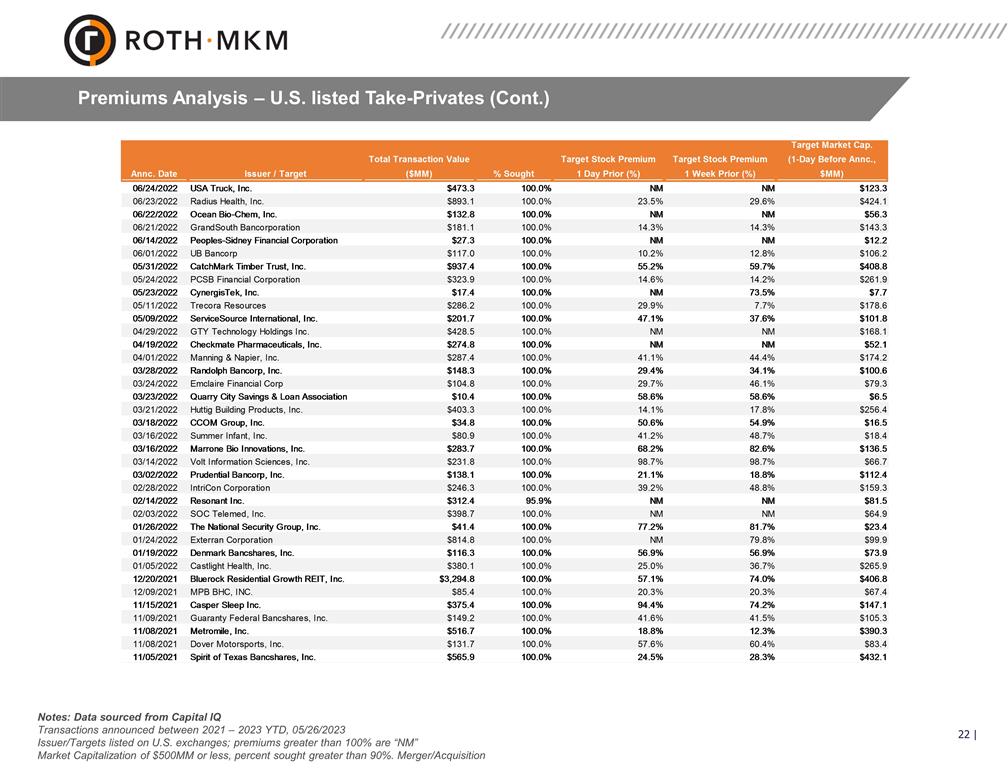

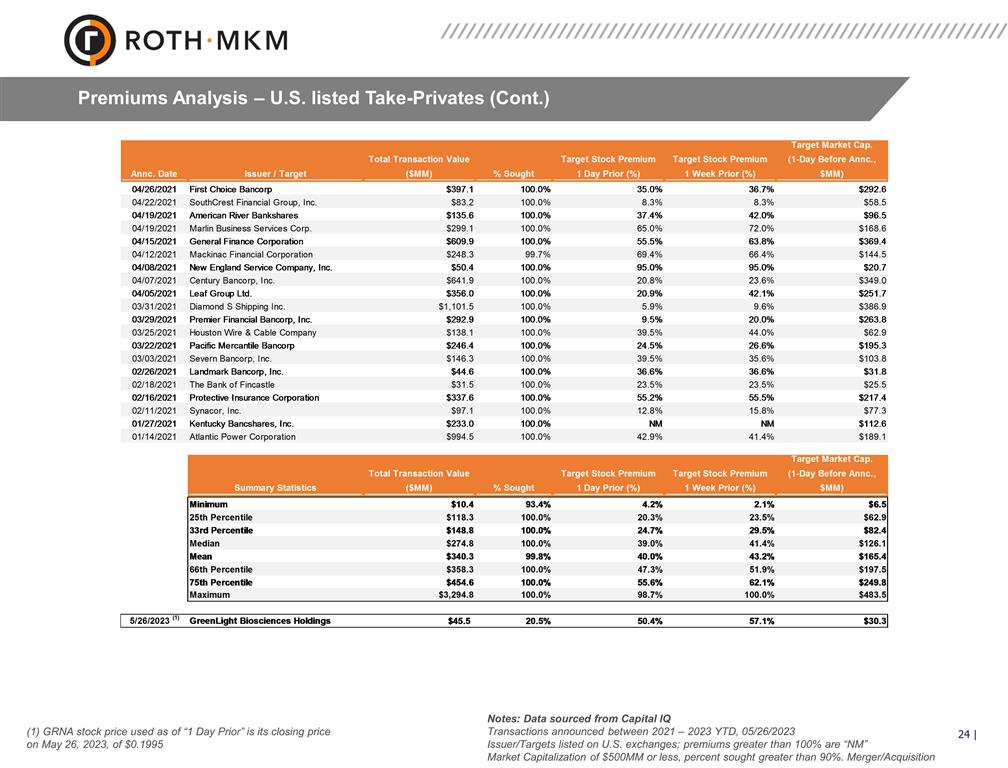

Premiums Analysis – U.S. listed Take-Privates (Cont.) Notes: Data sourced from Capital IQ Transactions announced between 2021 – 2023 YTD, 05/26/2023 Issuer/Targets listed on U.S. exchanges; premiums greater than 100% are “NM” Market Capitalization of $500MM or less, percent sought greater than 90%. Merger/Acquisition

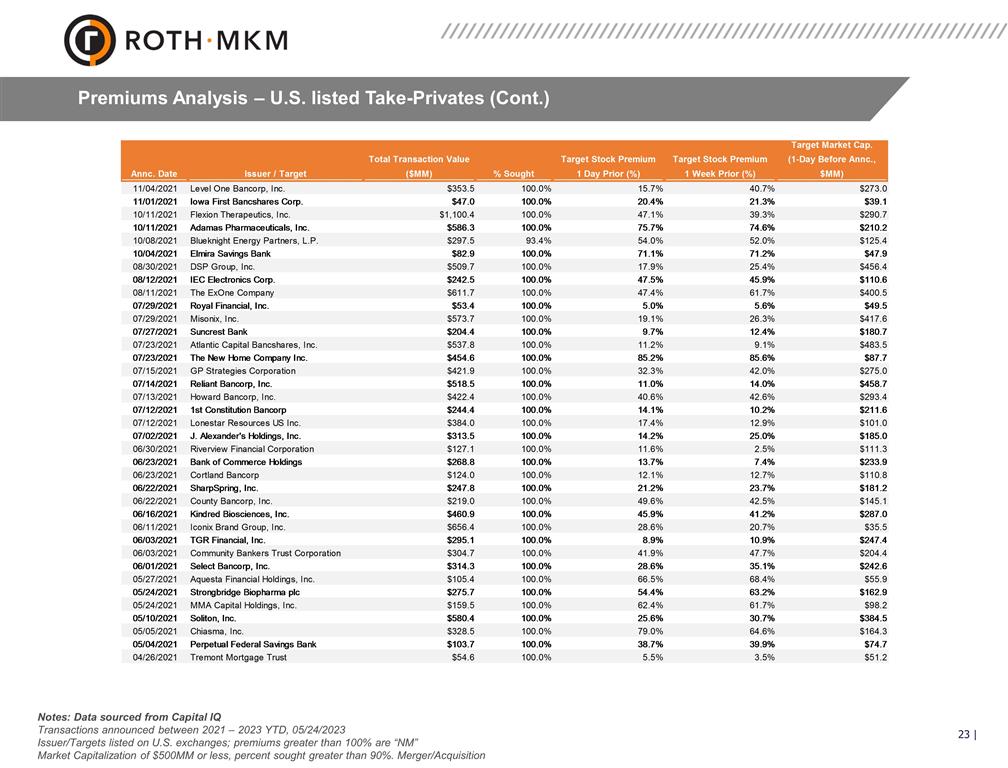

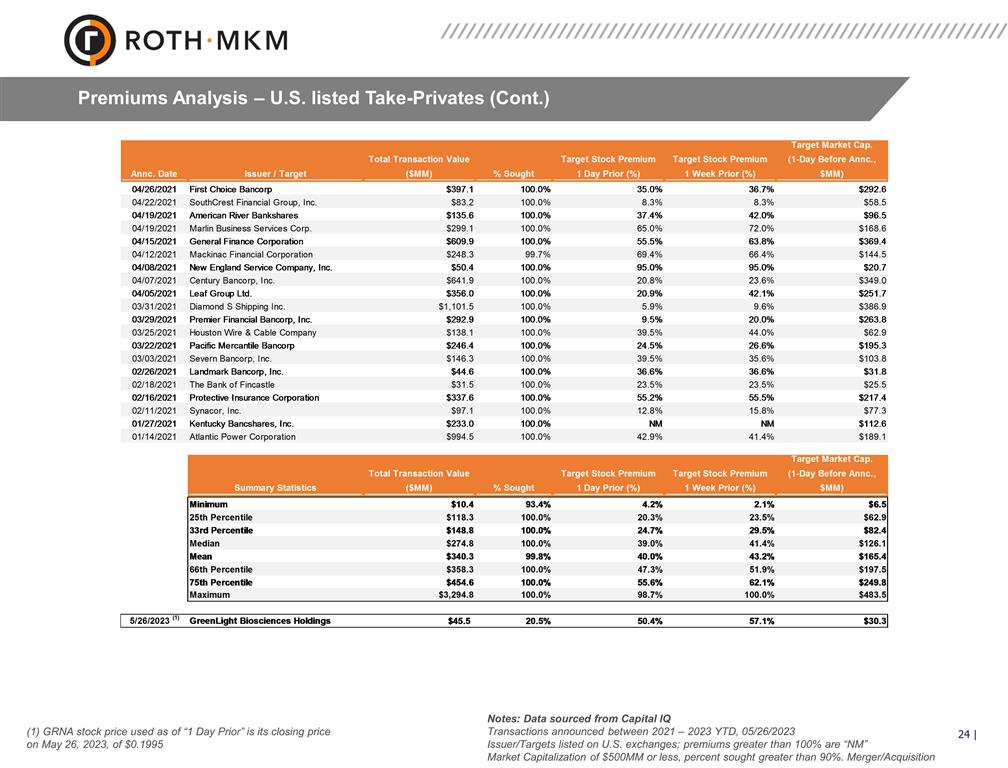

Premiums Analysis – U.S. listed Take-Privates (Cont.) Notes: Data sourced from Capital IQ Transactions announced between 2021 – 2023 YTD, 05/24/2023 Issuer/Targets listed on U.S. exchanges; premiums greater than 100% are “NM” Market Capitalization of $500MM or less, percent sought greater than 90%. Merger/Acquisition

Premiums Analysis – U.S. listed Take-Privates (Cont.) (1) GRNA stock price used as of “1 Day Prior” is its closing price on May 26, 2023, of $0.1995 Notes: Data sourced from Capital IQ Transactions announced between 2021 – 2023 YTD, 05/26/2023 Issuer/Targets listed on U.S. exchanges; premiums greater than 100% are “NM” Market Capitalization of $500MM or less, percent sought greater than 90%. Merger/Acquisition

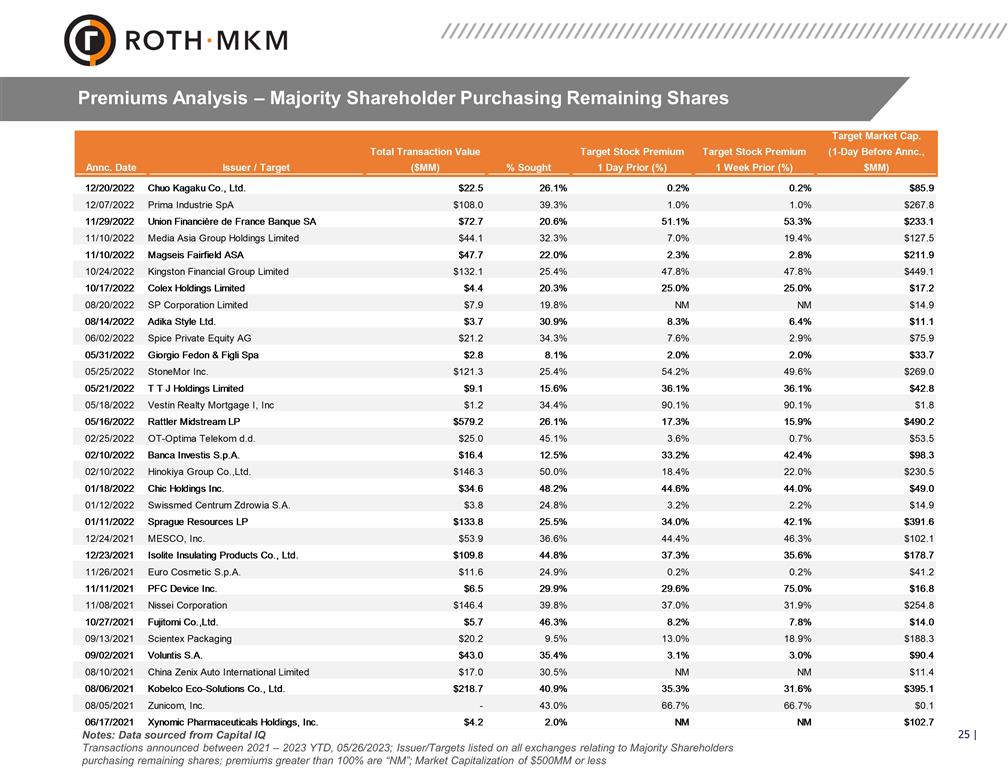

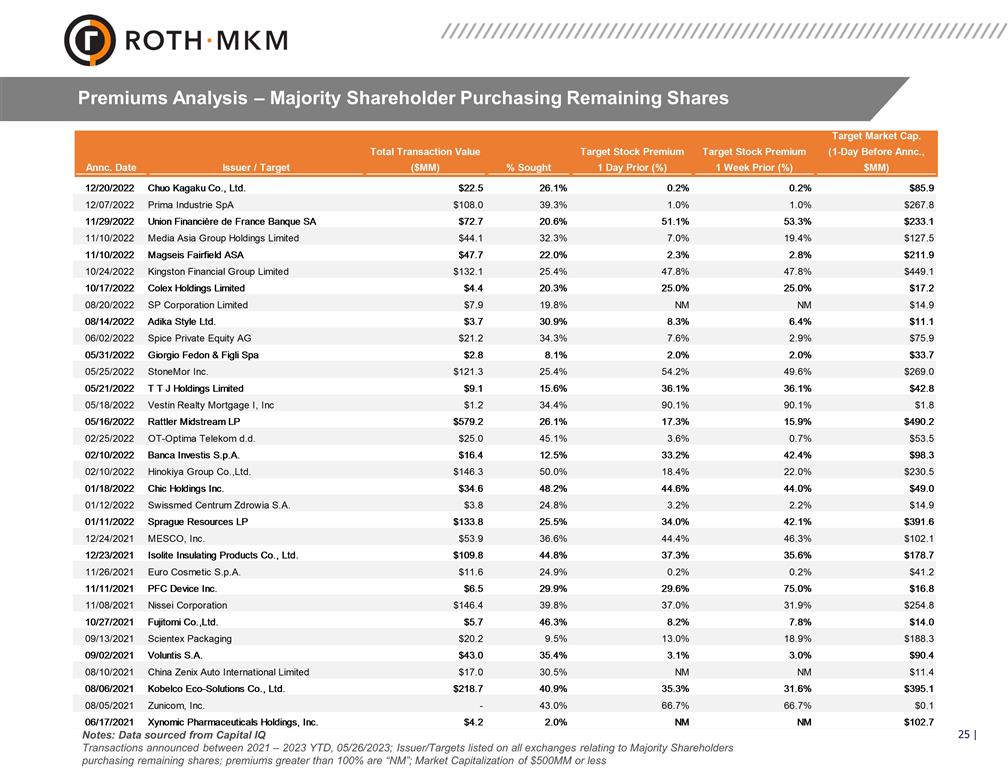

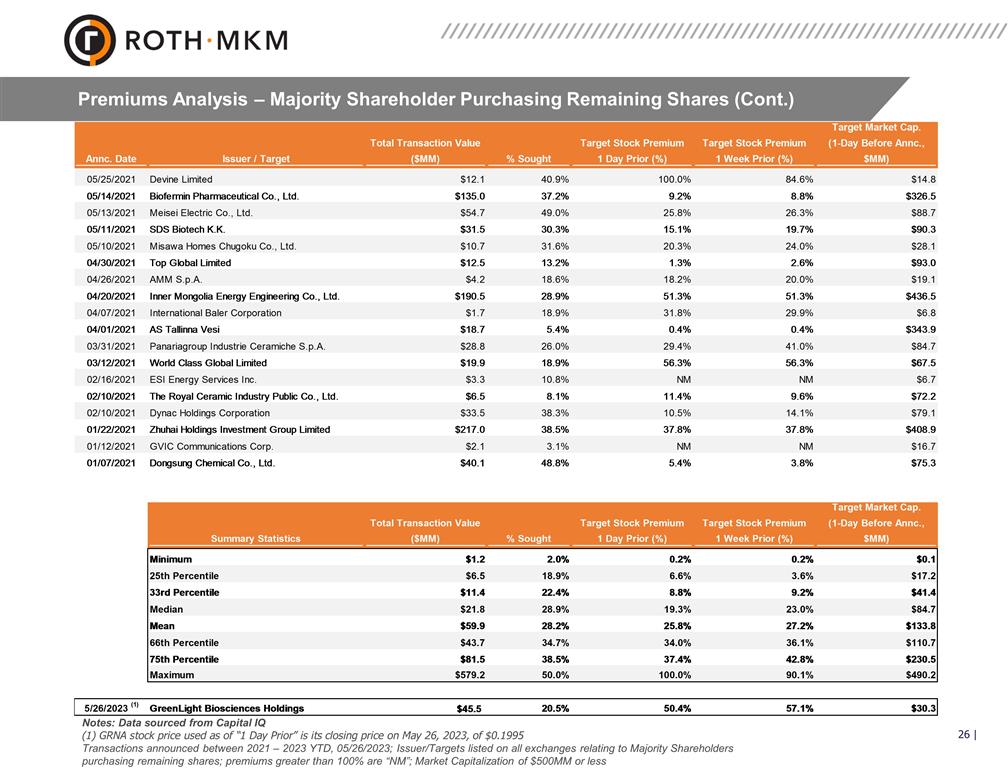

Premiums Analysis – Majority Shareholder Purchasing Remaining Shares Notes: Data sourced from Capital IQ Transactions announced between 2021 – 2023 YTD, 05/26/2023; Issuer/Targets listed on all exchanges relating to Majority Shareholders purchasing remaining shares; premiums greater than 100% are “NM”; Market Capitalization of $500MM or less

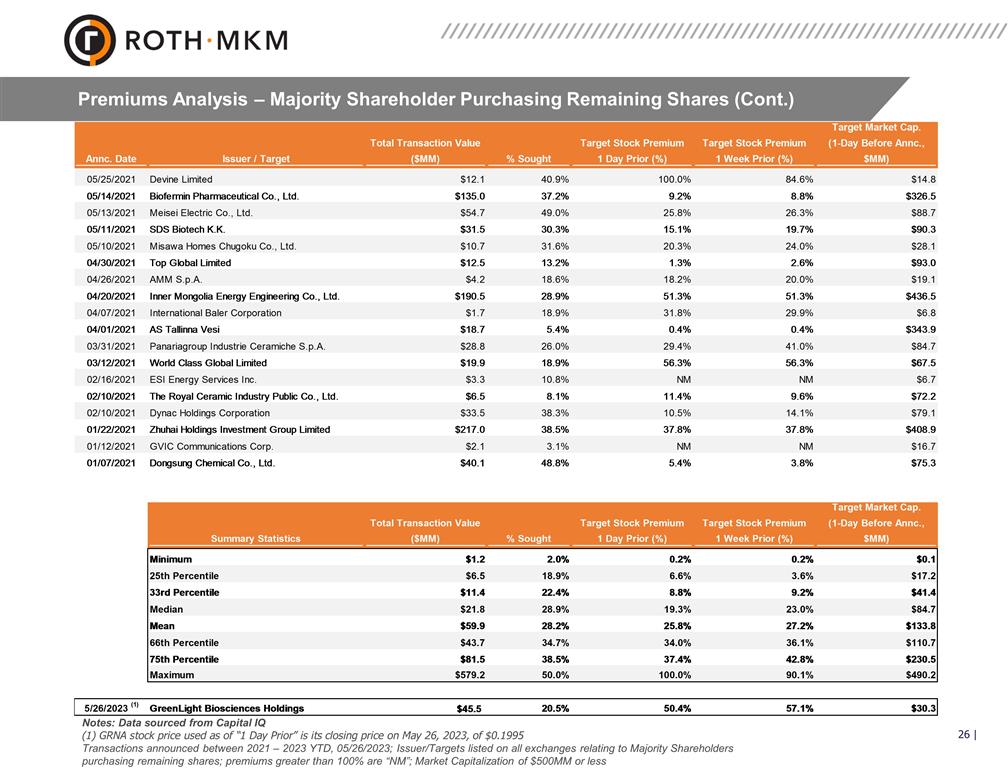

Premiums Analysis – Majority Shareholder Purchasing Remaining Shares (Cont.) Notes: Data sourced from Capital IQ (1) GRNA stock price used as of “1 Day Prior” is its closing price on May 26, 2023, of $0.1995 Transactions announced between 2021 – 2023 YTD, 05/26/2023; Issuer/Targets listed on all exchanges relating to Majority Shareholders purchasing remaining shares; premiums greater than 100% are “NM”; Market Capitalization of $500MM or less

* The material, information and facts discussed in this presentation other than the information regarding ROTH Capital Partners, LLC (“ROTH MKM”) and its affiliates, are from sources believed to be reliable, but are in no way guaranteed to be complete or accurate. This presentation should not be used as a complete analysis of any companies, securities or topics discussed herein. Additional information is available upon request. Past performance is not a guarantee of future results. Any opinions or estimates in this presentation are subject to change without notice. No part of this presentation may be reproduced in any form without the express written permission of ROTH MKM. Copyright 2023.