Exhibit 99.1

Management Proxy Circular

Triple Flag Precious Metals Corp.

Annual Meeting of Shareholders

May 10, 2023

This document contains:

Notice of Annual Meeting of Shareholders

Management Proxy Circular

Letter from the Chair

It gives me great pleasure to look back at Triple Flag’s first full year as a publicly listed company.

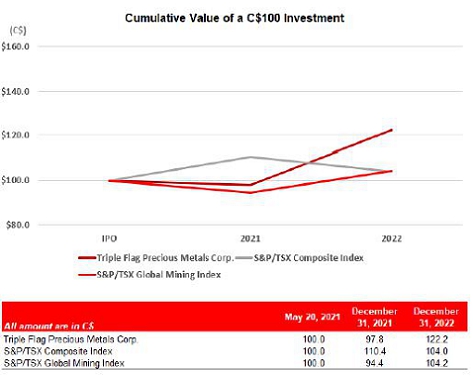

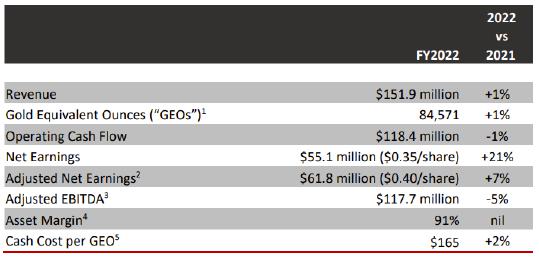

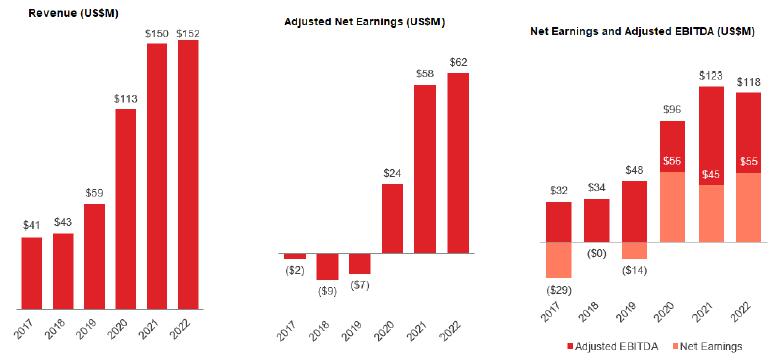

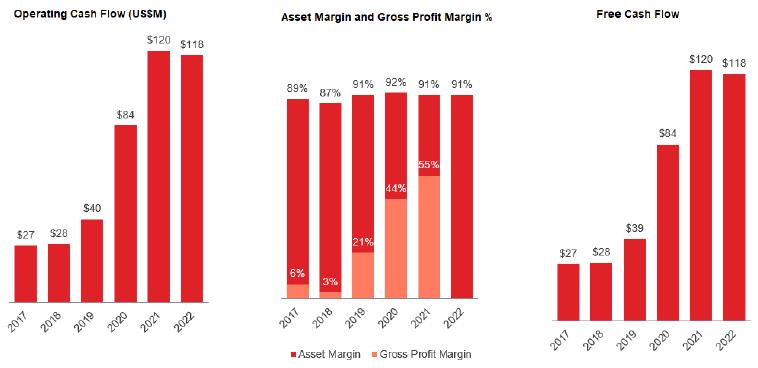

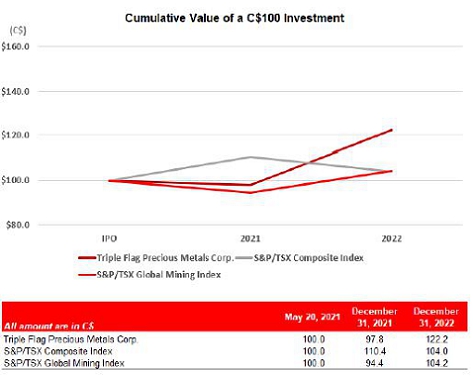

2022 continued Triple Flag’s track record of growth and performance. Highlighted by the acquisition of Maverix Metals, Triple Flag is now the fourth largest precious metals streaming and royalty company globally. The business remains robust amidst a backdrop of global uncertainty, reflected in our strong share price performance and return of capital to shareholders through an increased dividend in the year.

In February 2023, we provided 2023 guidance of between 100,000 and 115,000 gold equivalent ounces, which is an increase in expected gold equivalent ounces of between 26,000 and 41,000 over the record we achieved in 2022. We also reiterated our forecasted five year gold equivalent ounces outlook, to average over 140,000 ounces per year, which importantly requires no further investment from Triple Flag.

I am also pleased to welcome three new directors to Triple Flag’s Board of Directors. Blake Rhodes, Geoff Burns, and Elizabeth Wademan bring their years of experience in mining and the capital markets to our already deep Board. I look forward to working with them on Triple Flag’s next chapter.

Finally, I want to bring attention to Triple Flag’s ESG program, which received many external accolades throughout the year. The team was recognized by Sustainalytics and achieved a ranking of 4th place in the 114 global precious metals peer group, was recognized as a 'Great Place to Work', supported a wide variety of social and environmental partnership programs with our operators, and remained carbon neutral by offsetting Scope 1,2 and 3 emissions throughout the year.

We look forward to continuing to grow Triple Flag in a prudent, sustainable manner, while creating increased value for all stakeholders. We are committed to working for our fellow shareholders in our ongoing development as the premier growth story in the precious metals streaming and royalty sector. Thank you all.

Dawn Whittaker

Director and Chair

“We look forward to continuing to grow Triple Flag in a prudent, sustainable manner, while creating increased value for all stakeholders. We are committed to working for our fellow shareholders in our ongoing development as the premier growth story in the precious metals streaming and royalty sector. ”

ABOUT THE MEETING

NOTICE OF ANNUAL MEETING OF SHAREHOLDERS

The 2023 Annual Meeting of Shareholders (the “Meeting”) of Triple Flag Precious Metals Corp. (the “Company”) will be held on Wednesday, May 10, 2023, at 10 a.m. (Eastern Time) for the following purposes:

| · | to receive the consolidated financial statements for the financial year ended December 31, 2022, and the auditor’s report thereon; |

| · | to elect the directors (see “Election of the Board of Directors” in the Management Proxy Circular (the “Circular”) for additional details); |

| · | to appoint PricewaterhouseCoopers LLP (“PwC”) as our auditor for 2023 and to authorize the directors to fix the auditor’s remuneration (see “Appointment of the Auditor” in the Circular for additional details); |

| · | to vote on the advisory resolution on the approach to executive compensation; and |

| · | to transact such other business as may properly be brought before the Meeting or any adjournment or postponement thereof. |

Only shareholders of record at the close of business on March 21, 2023 will be entitled to vote at the Meeting.

The Meeting will be held in a virtual meeting format only. Shareholders will be able to listen to, participate in and vote at the Meeting in real time through a web-based platform.

You can attend the Meeting by joining the live webcast online https://meetnow.global/MDDH9SN. You should allow ample time to join the Meeting to check compatibility and complete the related procedures. See “How do I attend and participate in the virtual Meeting?” in the Circular for detailed instructions on how to attend and vote at the Meeting.

Notice and Access

Pursuant to an exemption obtained by the Company under the Canada Business Corporations Act (the “CBCA”), the Company is using the “notice and access” procedure adopted by the Canadian Securities Administrators for the delivery of the Circular and the annual consolidated financial statements and management’s discussion and analysis thereon for the year ended December 31, 2022 (the “2022 Annual Report” and together with the Circular, the “Meeting Materials”). Under the notice and access procedure, you are still entitled to receive a form of proxy (or voting instruction form) enabling you to vote at the Meeting. However, instead of receiving paper copies of the Meeting Materials, you are receiving this Notice of Meeting which contains information about how to access the Meeting Materials electronically. The principal benefit of the notice and access procedure is that it reduces costs and the environmental impact of producing and distributing paper copies of documents in large quantities. Shareholders who have consented to electronic delivery of materials are receiving this Notice of Meeting in an electronic format. The Circular and form of proxy (or voting instruction form) for the Common Shares of the Company (the “Common Shares”) provide additional information concerning the matters to be dealt with at the Meeting. You should access and review all information contained in the Circular before voting. See “Notice and Access” in the Circular for additional details.

Shareholders with questions about the notice and access procedure can call Computershare Investor Services Inc. (“Computershare”) toll free at 1-866-964-0492 or by going to: www.computershare.com/noticeandaccess.

Websites Where the Meeting Materials are Posted

The Meeting Materials can be viewed online on the Company’s website, www.tripleflagpm.com, under the Company’s SEDAR profile at www.sedar.com, or on EDGAR at www.sec.gov.

Non-Registered and Registered Shareholders

If you would like a paper copy of the Circular and/or the 2022 Annual Report, you should first determine whether you are: (i) a non-registered shareholder; or (ii) a registered shareholder.

| ü | You are a non-registered shareholder (also known as a beneficial shareholder) if you own Common Shares indirectly and your Common Shares are registered in the name of a bank, trust company, broker or other intermediary. For example, you are a non-registered shareholder if your Common Shares are held in a brokerage account of any type. |

| ü | You are a registered shareholder if you hold a paper share certificate or a direct registration system (DRS) statement and your name appears directly on the share certificate(s) or DRS statement. |

How to Obtain Paper Copies of the Meeting Materials

All shareholders may request that paper copies of the Circular and/or the 2022 Annual Report be mailed to them at no cost for up to one year from the date that the Circular was filed on SEDAR.

If you are a non-registered shareholder, a request may be made by going to www.proxyvote.com and entering the 16-digit control number located on your voting instruction form and following the instructions provided. Alternatively, you may submit a request by calling Broadridge Investor Communications Corporation (“Broadridge”) at 1-877-907-7643, or outside Canada and the United States, at 303-562-9305 (English) or 303-562-9306 (French). A request must be received by May 1, 2023 (i.e., at least seven business days in advance of the date and time specified in your voting instruction form as the voting deadline) if you would like to receive the Circular and/or the 2022 Annual Report in advance of the voting deadline and Meeting date.

If you are a registered shareholder, you can request paper copies of the Circular and/or the 2022 Annual Report: (i) in advance of the voting deadline and Meeting date by calling Computershare at 1-866-962-0498; or (ii) after the Meeting date and within one year from the date the Circular was filed on SEDAR by calling Computershare at 1-800-564-6253. A request must be received by May 1, 2023 (i.e., at least seven business days in advance of the date and time specified in your proxy form as the voting deadline) if you would like to receive the Circular and/or the 2022 Annual Report in advance of the voting deadline and Meeting date.

Voting

Non-registered shareholders

Non-registered shareholders are entitled to vote through Broadridge or their intermediary, as applicable, or during the Meeting by online ballot through the live webcast platform. Non-registered shareholders should exercise their right to vote by following the instructions of Broadridge or their intermediary, as applicable, as indicated on their voting instruction form. Voting instruction forms will be provided by Broadridge or your intermediary. Voting instruction forms may be returned as follows:

| INTERNET: | www.proxyvote.com |

| TELEPHONE: | 1-800-474-7493 (English) or 1-800-474-7501 (French) |

| MAIL: | Data Processing Centre, P.O. Box 3700, STN. INDUSTRIAL PARK, Markham, Ontario L3R 9Z9 |

Broadridge or your intermediary, as applicable, must receive your voting instructions at least one business day in advance of the proxy deposit date noted on your voting instruction form. If you are a non-registered shareholder and you wish to attend and vote at the Meeting (or have another person attend and vote on your behalf), you must complete the voting instruction form in accordance with the instructions provided. These instructions include the additional step of registering the person you have designated to attend the Meeting (either yourself or the person you designated to attend on your behalf) with our transfer agent, Computershare, after submitting the form of proxy or voting instruction form. Failure to register the proxyholder you have designated to attend the Meeting with Computershare will result in such proxyholder not receiving a control number to participate in the Meeting and such proxyholder would only be able to attend the Meeting as a guest. Guests will be able to listen to the Meeting but will not be able to ask questions or vote. See “How do I vote if I am a non-registered shareholder?” in the Circular for additional details.

Registered shareholders

Registered shareholders are entitled to vote by proxy or during the Meeting by online ballot through the live webcast platform. Registered shareholders who are unable to attend the Meeting should exercise their right to vote by signing and returning the form of proxy, or voting in advance via the internet, in accordance with the directions on the form. Computershare must receive completed proxies no later than 10:00 a.m. (Eastern Time) on May 8, 2023 or, if the Meeting is adjourned or postponed, 48 hours (excluding Saturdays, Sundays and statutory holidays) before the date of the adjourned or postponed Meeting. See “How do I vote if I am a registered shareholder?” in the Circular for additional details.

BY ORDER OF THE BOARD OF DIRECTORS,

Sheldon Vanderkooy

Chief Financial Officer

March 30, 2023

Toronto, Ontario

TABLE OF CONTENTS

| Page number | |

| 1 | Letter from the Chair |

| 2 | 1. ABOUT THE MEETING |

| 2 | Notice of Annual Meeting of Shareholders |

| 7 | Voting Information |

| 7 | About This Circular and Related Proxy Materials |

| 7 | Notice and Access |

| 12 | General Information |

| 12 | Share Capital and Principal Shareholders |

| 13 | Business to be Transacted at the Meeting |

| 13 | Receive the Financial Statements |

| 13 | Election of the Board of Directors |

| 26 | Appointment of the Auditor |

| 27 | Advisory Resolution on Approach to Executive Compensation |

| 28 | 2. STATEMENT OF CORPORATE GOVERNANCE PRACTICES |

| 28 | Corporate Governance |

| 32 | Disclosure Policy |

| 32 | Anti-Bribery and Anti-Corruption Compliance Policy |

| 32 | Insider Trading and Anti-Hedging Policy |

| 33 | Code of Ethics |

| 33 | Whistleblower Policy |

| 33 | Composition of our Board and Board Committees |

| 34 | Committees of our Board |

| 36 | Director Independence |

| 37 | Meetings of Independent Directors |

| 37 | Majority Voting Policy |

| 37 | Nomination Rights |

| 38 | Director Term Limits and Other Mechanisms of Board Renewal |

| 38 | Mandate of our Board |

| 39 | Orientation and Continuing Education |

| 39 | ESG |

| 41 | Community Involvement |

| 42 | Community Investment Strategy |

| 42 | Human Capital Management |

| 43 | Diversity and Inclusion |

| 44 | Great Place to Work |

| 44 | Human Rights Policy |

| 44 | Environmental Policy |

| 44 | Climate Strategy |

| 46 | 3. COMPENSATION DISCUSSION AND ANALYSIS |

| 47 | Report on Executive Compensation and Equity Ownership |

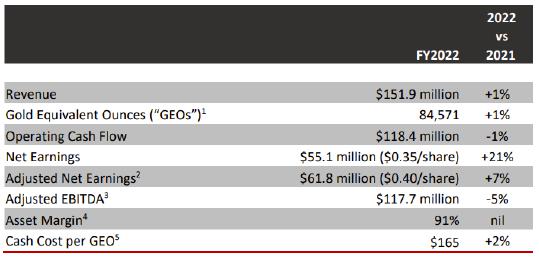

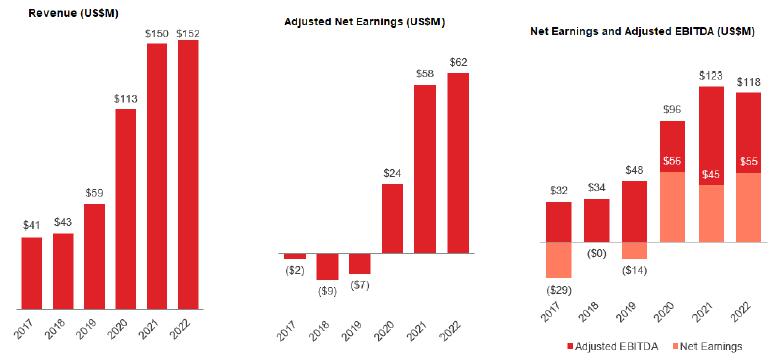

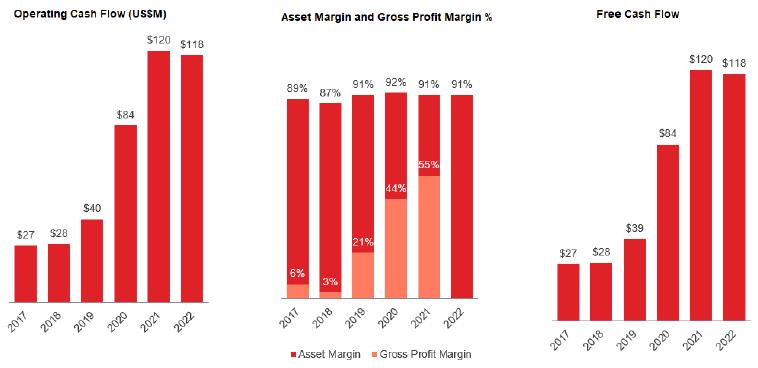

| 54 | 2022 Company Financial Performance Highlights |

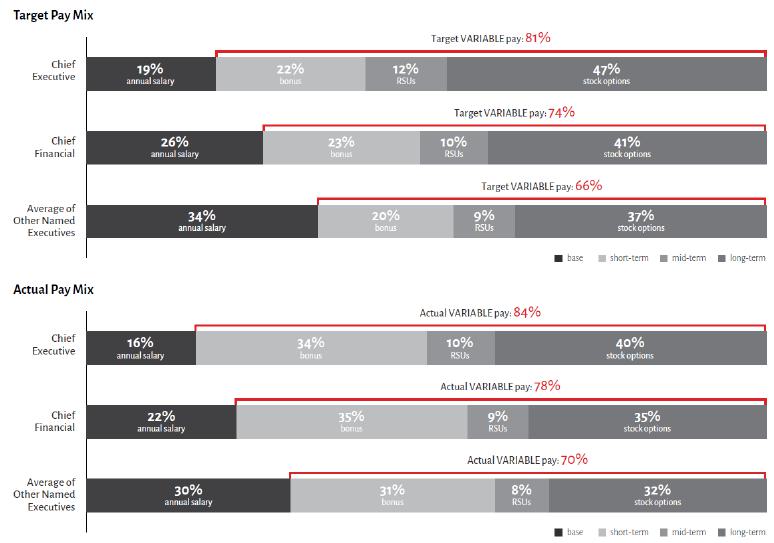

| 56 | 2022 Executive Pay for Performance |

| 57 | Pay Policies and Practices |

| 58 | Compensation-Setting Process |

| 60 | Components of Compensation |

| 66 | 2023 Short-Term Incentive Plan |

| 72 | Risk and Executive Compensation |

| 72 | Executive Share Ownership Guidelines |

| 73 | Compensation Recovery Policy |

| 74 | Summary Compensation Table |

| 75 | Outstanding Share-Based Awards and Option-Based Awards |

| 75 | Incentive Plan Awards – Value Vested or Earned During the Year |

| 77 | Termination and Change of Control Benefits |

| 79 | 4. REPORT ON DIRECTOR COMPENSATION AND EQUITY OWNERSHIP |

| 80 | Director Compensation |

| 80 | Director Share Ownership Guidelines |

| 82 | 5. OTHER INFORMATION |

| 82 | Director and Officer Liability Insurance |

| 82 | Interest of Management and Others in Material Transactions |

| 82 | Interests of Certain Persons or Companies in Matters to be Acted Upon |

| 82 | Indebtedness of Directors and Officers |

| 84 | Normal Course Issuer Bid |

| 84 | Non-IFRS Financial Measures |

| 85 | Additional Information |

| 85 | Shareholder Proposals |

| 85 | Contacting the Board of Directors |

| 86 | Board Approval |

| 86 | APPENDIX A: Board of Directors Mandate |

VOTING INFORMATION

ABOUT THIS CIRCULAR AND RELATED PROXY MATERIALS

Triple Flag Precious Metals Corp. (the “Company” or “Triple Flag”) is providing you with this Management Proxy Circular (this “Circular”) and other proxy materials in connection with the 2023 Annual Meeting of Shareholders (the “Meeting”) of the Company to be held on Wednesday, May 10, 2023, at 10:00 a.m. (Eastern Time). The Meeting will be held in a virtual meeting format only, by way of a live webcast. Shareholders will be able to listen, participate and vote at the meeting in real time through a web-based platform.

This Circular describes the items to be voted on at the Meeting as well as the voting process, and provides information about director and executive compensation, the Company’s corporate governance practices and other relevant matters.

Please see the “Questions and Answers on the Voting Process” section below for an explanation of how you can vote on the matters to be considered at the Meeting, whether or not you decide to attend the Meeting.

Unless otherwise indicated, the information contained in this Circular is given as of March 21, 2023 and all dollar amounts used are in United States dollars, unless otherwise stated.

NOTICE AND ACCESS

The Company is using the notice and access procedure that allows the Company to furnish proxy materials, which includes the annual consolidated financial statements and management’s discussion and analysis for the year ended December 31, 2022 (the “2022 Annual Report”), over the internet instead of mailing paper copies to shareholders. Under the notice and access procedure, the Company will deliver proxy related materials by: (i) posting this Circular and the 2022 Annual Report (and other proxy-related materials) on its website, www.tripleflagpm.com; and (ii) sending the Notice of Meeting informing holders of common shares of the Company (“Common Shares”) that this Circular, the 2022 Annual Report and proxy-related materials have been posted on the Company’s website and explaining how to access them.

On or about April 4, 2023, the Company will send shareholders the Notice of Meeting and the relevant voting document (a form of proxy or a voting instruction form). The Notice of Meeting contains basic information about the Meeting and the matters to be voted on, instructions on how to access the proxy materials, and explains how to obtain a paper copy of this Circular and/or the 2022 Annual Report.

QUESTIONS AND ANSWERS ON THE VIRTUAL MEETING

| Q: | Who can attend and vote at the virtual Meeting? |

| A: | Registered shareholders and duly appointed proxyholders who log in to the Meeting online will be able to listen, ask questions and securely vote through a web-based platform, provided that they are connected to the internet and follow the instructions set out in this Circular. Shareholders who wish to appoint a proxyholder to represent them at the Meeting (including non-registered shareholders who wish to appoint themselves as proxyholder to attend, participate in and vote at the Meeting) must submit their duly completed proxy or voting instruction form AND register the proxyholder with the Company’s registrar and transfer agent, Computershare Investor Services Inc. (“Computershare”) as described below. Failure to register the proxyholder (the person you have designated to attend the Meeting, who could be yourself or another person) with Computershare will result in that proxyholder not receiving a control number to participate in the Meeting and such proxyholder would only be able to attend the Meeting as a guest. |

Non-registered shareholders who have not duly appointed themselves as proxyholder will be able to attend the Meeting as guests. Guests will be able to listen to the Meeting but will not be able to ask questions or vote.

| Q: | How do I attend and participate in the virtual Meeting? |

| A: | How you vote depends on whether you are a registered or a non-registered shareholder. Please read the voting instructions below that are applicable to you. In order to attend the Meeting, registered shareholders, duly appointed proxyholders (including non-registered shareholders who have duly appointed themselves as proxyholder) and guests (including non-registered shareholders who have not duly appointed themselves as proxyholder) must log in online as set out below. |

Step 1: Log in online at https://meetnow.global/MDDH9SN. You will need the latest version of Chrome, Safari, Microsoft Edge or Firefox. Please do not use Internet Explorer as it is not a supported browser for the Meeting. You should allow ample time to join the Meeting to check compatibility and complete the related procedures.

Step 2: Follow the instructions below:

Registered Shareholders: Click “Shareholder” and then enter your “control number”. The control number is located on the form of proxy. If you use your control number to log into the Meeting, any vote you cast at the Meeting will revoke any proxy you previously submitted. If you do not wish to revoke a previously submitted proxy, you should not vote at the Meeting.

Duly appointed proxyholders: Click “Invitation” and then enter your “invite code”. Proxyholders who have been duly appointed and registered with Computershare as described in this Circular will receive an invite code by email from Computershare after the proxy voting deadline has passed.

Guests: Click “Guest” and then complete the online form.

Registered shareholders and duly appointed proxyholders may ask questions at the Meeting and vote by completing a ballot online during the Meeting. If you plan to vote at the Meeting, it is important that you are connected to the internet at all times during the Meeting in order to vote when balloting commences. It is your responsibility to ensure internet connectivity for the duration of the Meeting. You should allow ample time to log in to the Meeting online and complete the check-in procedures.

Non-registered shareholders who have not duly appointed themselves as proxyholders may listen to the Meeting as guests. Guests will not be permitted to ask questions or vote at the Meeting.

QUESTIONS AND ANSWERS ON THE VOTING PROCESS

Q: What items of business am I voting on?

A: You will be voting:

| · | to elect the directors (see “Election of the Board of Directors” for additional details); |

| · | to appoint PwC as our auditor for 2023 and to authorize the directors to fix the auditor’s remuneration (see “Appointment of the Auditor” for additional details); |

| · | to vote on the advisory resolution on the approach to executive compensation; and |

| · | to transact such other business as may properly be brought before the Meeting or any adjournment or postponement thereof. |

Q: Am I entitled to vote?

| A: | You are entitled to vote if you were a holder of Common Shares as at the close of business on March 21, 2023, which is the record date of the Meeting. Each Common Share is entitled to one vote. |

Q: How do I vote?

| A: | How you vote depends on whether you are a registered or a non-registered shareholder. Please read the voting instructions below that are applicable to you. |

Q: Am I a registered shareholder?

| A: | You are a registered shareholder if you hold Common Shares in your own name and you have a share certificate or direct registration system (DRS) statement. As a registered shareholder, you are identified on the share register maintained by Computershare, as being a shareholder. |

Q: Am I a non-registered or beneficial shareholder?

| A: | Most shareholders are non-registered shareholders. You are a non-registered shareholder if your Common Shares are held in an account in the name of an intermediary, such as a bank, broker or trust company. As a non-registered shareholder, you do not have Common Shares registered in your name, but your ownership interest in Common Shares is recorded in an electronic system. As such, you are not identified on the share register maintained by Computershare as being a shareholder. Instead, the Company’s share register shows the shareholder of your Common Shares as being the intermediary or depository through which you own your Common Shares. |

The Company distributes copies of the proxy-related materials in connection with the Meeting to intermediaries so that they may distribute the materials to the non-registered shareholders. Intermediaries often forward the materials to non-registered shareholders through a service company (such as Broadridge Investor Communications Company). The Company pays for an intermediary to deliver the proxy-related materials to all non-registered shareholders.

Q: How do I vote if I am a registered shareholder?

| A: | If you are a registered shareholder, you may vote your Common Shares by proxy or during the Meeting by online ballot through the live webcast platform. |

Voting at the Meeting

If you wish to vote your Common Shares at the Meeting, do not complete or return the form of proxy sent to you. Your vote will be taken and counted at the Meeting through the live webcast platform.

Voting by Proxy

You can vote by proxy whether or not you attend the Meeting. To vote by proxy, please complete the enclosed form of proxy (also available online at www.investorvote.com) and return it by either of the following means: by mail, courier or by hand to Computershare at the address listed below; or by going online at www.investorvote.com. You may authorize the management representatives named in the enclosed proxy form to vote your Common Shares, or you may appoint another person or company to be your proxyholder. The names already inserted on the form of proxy are Shaun Usmar, CEO and Sheldon Vanderkooy, CFO of the Company. Unless you choose another person or company to be your proxyholder, you are giving these persons the authority to vote your Common Shares at the Meeting.

To appoint another person or company to be your proxyholder, you must insert the other person’s or company’s name in the blank space provided. That person or company must attend the Meeting to vote your Common Shares by online ballot through the live webcast platform. If you do not insert a name in the blank space, the management representatives named above are appointed to act as your proxyholder. You may also use a different form of proxy than the one included with the materials sent to you.

If you wish to appoint another person or company to be your proxyholder, you must complete the additional step of registering such proxyholder with Computershare at www.computershare.com/TripleFlag after submitting your form of proxy. Failure to register the proxyholder with Computershare will result in the proxyholder not receiving an invite code to participate in the Meeting and such proxyholder would only be able to attend the Meeting as a guest.

Please note that in order for your vote to be recorded, your proxy must be received by Computershare at 100 University Avenue, 8th Floor, Toronto, Ontario M5J 2Y1 or online by no later than 10:00 a.m. (Eastern Time) on May 8, 2023, or, if the Meeting is adjourned or postponed, 48 hours (excluding Saturdays, Sundays and statutory holidays) before the date of the adjourned or postponed Meeting.

Q: How will my shares be voted?

| A: | On the form of proxy, you can indicate how you want your proxyholder to vote your Common Shares or you can let your proxyholder decide for you. If you have specified on the form of proxy how you want your Common Shares to be voted on a particular issue (by marking FOR, AGAINST or WITHHOLD, as applicable), then your proxyholder must vote your Common Shares accordingly. If you have not specified on the form of proxy how you want your Common Shares to be voted on a particular issue, then your proxyholder can vote your Common Shares as they see fit. |

Unless contrary instructions are provided, Common Shares represented by proxies appointing management as the proxyholder will be voted:

| · | FOR the election of the directors; |

| · | FOR the re-appointment of PwC as the auditor of the Company and the authorization of the directors to fix the auditor’s remuneration; and |

| · | FOR the advisory resolution on the Company’s approach to executive compensation. |

Q: How do I vote if I am a non-registered shareholder?

A: If you are a non-registered shareholder, you may vote your Common Shares in one of the following ways:

Through your intermediary

A voting instruction form will be included with the materials sent to you. The purpose of this form is to instruct your intermediary on how to vote on your behalf. Please follow the instructions provided on the voting instruction form.

Attend the Meeting

If you wish to vote your Common Shares during the Meeting by online ballot through the live webcast platform, you should take these steps:

| - | Step 1: Insert your name in the space provided on the voting instruction form provided by your intermediary and sign and return it in accordance with the instructions provided. By doing so, you are instructing your intermediary to appoint you as proxyholder. Do not otherwise complete the form, as you will be voting at the Meeting. |

| - | Step 2: Register yourself as a proxyholder at www.computershare.com/TripleFlag by no later than 10:00 a.m. (Eastern Time) on May 8, 2023, or, if the Meeting is adjourned or postponed, 48 hours (excluding Saturdays, Sundays and statutory holidays) before the date of the adjourned or postponed Meeting. Failure to register yourself as a proxyholder with Computershare will result in you not receiving an invite code to participate in the Meeting and you would only be able to attend the Meeting as a guest. |

Designate another person to be appointed as your proxyholder

You can choose another person (including someone who is not a shareholder of the Company) to vote for you as a proxyholder. If you appoint someone else, they must attend the Meeting to vote for you. If you wish to appoint a proxyholder, you should insert that person’s name in the space provided on the voting instruction form provided to you by your intermediary and sign and return it in accordance with the instructions provided. By doing so, you are instructing your intermediary to appoint that person as proxyholder. Do not otherwise complete the form, as your proxyholder will be voting at the Meeting. You must also register your proxyholder with Computershare at www.computershare.com/TripleFlag by no later than 10:00 a.m. (Eastern Time) on May 8, 2023, or, if the Meeting is adjourned or postponed, 48 hours (excluding Saturdays, Sundays and statutory holidays) before the date of the adjourned or postponed Meeting. Failure to register the proxyholder you have designated to attend the Meeting on your behalf with Computershare will result in the proxyholder not receiving an invite code to participate in the Meeting and such proxyholder would only be able to attend as a guest.

United States non-registered shareholders

To attend and vote at the virtual Meeting, you must first obtain a valid legal proxy from your broker, bank or other agent and then register in advance to attend the Meeting. Follow the instructions from your broker or bank included with these proxy materials, or contact your broker or bank to request a legal proxy form. After first obtaining a valid legal proxy form from your broker, bank or other agent, to then register to attend the Meeting, you must submit a copy of your legal proxy to Computershare. Requests for registration should be directed to Computershare, 100 University Avenue, 8th Floor, Toronto, Ontario, M5J 2Y1 or by email to uslegalproxy@computershare.com.

Q: If I change my mind, how do I revoke my proxy or voting instructions?

A: Proxies may be revoked in the following ways:

Non-registered shareholders

You may revoke your proxy by sending written notice to your intermediary, so long as the intermediary receives your notice at least seven days before the Meeting (or as otherwise instructed by your intermediary). This gives your intermediary time to submit the revocation to Computershare. If your revocation is not received in time, your intermediary is not required to act on it.

Registered shareholders

You may revoke your proxy or voting instructions in any of the following ways:

| · | By completing and signing a proxy form with a later date than the proxy form you previously returned, and delivering it to Computershare at any time before 10:00 aa.m. (Eastern Time) on May 8, 2023. If the Meeting is adjourned or postponed, the deadline will be no later than 48 hours - (excluding Saturdays, Sundays and statutory holidays) before the date of any adjourned or postponed Meeting; |

| · | By completing a written statement revoking your instructions, which is signed by you or your attorney authorized in writing, and delivering it: |

| o | to the offices of Computershare at any time before 10:00 a.m. (Eastern Time) on May 8, 2023 or, if the Meeting is adjourned or postponed, 48 hours (excluding Saturdays, Sundays and statutory holidays) before the date of the adjourned or postponed Meeting; |

| o | to the Chair of the Meeting before the Meeting starts; or |

| o | in any other manner permitted by law. |

| · | If you use your control number as a username to log into the meeting and you accept the terms and conditions, any vote that you cast at the Meeting will revoke any proxy that you previously submitted. If you do not wish to revoke a previously submitted proxy, you should not vote during the Meeting. |

GENERAL INFORMATION

Q: How many shares are entitled to be voted?

| A: | As of March 21, 2023, there were 200,772,165 Common Shares outstanding. Each Common Share is entitled to one vote on each matter to be voted upon at the Meeting. |

Q: Who counts the vote?

| A: | Votes cast in advance by way of proxy and votes cast at the Meeting through the live webcast platform will be counted by representatives of Computershare who will be appointed as scrutineers at the Meeting. |

Q: Who is soliciting my proxy?

| A: | Management of the Company is soliciting your proxy. Proxies will be solicited primarily by mail, but employees and agents of the Company may also use electronic means. Intermediaries will be reimbursed for their reasonable charges and expenses in forwarding proxy materials to non-registered shareholders. |

The Company will bear the cost of all proxy solicitations on behalf of management of the Company.

Q: Can I access the annual disclosure documents electronically?

| A: | The Company’s 2022 Annual Report, which includes its annual financial statements and notes and management’s discussion and analysis for the year ended December 31, 2022, this Circular and the Annual Information Form (“AIF”), are available for review on its website at www.tripleflagpm.com under the Company’s SEDAR profile at www.sedar.com and on EDGAR at www.sec.gov. |

Q: Who do I contact if I have questions?

A: If you have any questions, you may call Computershare at 1-800-564-6253 for further information.

SHARE CAPITAL AND PRINCIPAL SHAREHOLDERs

As of March 21, 2023, the record date for the Meeting, there were 200,772,165 Common Shares issued and outstanding. Our principal shareholders, Triple Flag Co-Invest Luxembourg Investment Company S.a`r.l (‘‘Co-Invest Luxco’’) and Triple Flag Mining Aggregator S.à r.l. (“Aggregator”) and, together with Co-Invest Luxco, the ("Principal Shareholders"), own a total of 134,587,637 Common Shares representing 67% of the outstanding Common Shares. The Principal Shareholders are indirectly controlled by certain investment funds advised by Elliott Investment Management L.P. and its affiliates. To the knowledge of the Company, no other person beneficially owns, directly or indirectly, or exercises control or direction over 10% or more of the outstanding Common Shares.

BUSINESS TO BE TRANSACTED AT THE MEETING

The following business will be transacted at the Meeting:

| – | RECEIVE THE FINANCIAL STATEMENTS |

| o | Management will present the annual audited consolidated financial statements at the Meeting and shareholders or their proxyholders will be given an opportunity to discuss the financial results with management. |

| – | ELECTION OF THE BOARD OF DIRECTORS |

| o | Nine director nominees are proposed for election to the board of directors of the Company (the “Board”). Shareholders or their proxyholders will vote on the election of the directors. |

| – | APPOINTMENT OF THE AUDITOR |

| o | Shareholders or their proxyholders will vote on the re-appointment of the auditor and the authorization of the Board to fix the auditor’s remuneration. |

| – | VOTING ON THE APPROACH TO EXECUTIVE COMPENSATION |

| o | Shareholders or their proxyholders will vote on the advisory resolution on the Company’s approach to executive compensation, as discussed in more detail under the “Advisory Resolution on Approach to Executive Compensation” section of this Circular. |

The affirmative vote of a majority of the votes cast at the Meeting will constitute approval for each item of business.

RECEIVE THE FINANCIAL STATEMENTS

The Company’s audited consolidated financial statements and management’s discussion and analysis for the year ended December 31, 2022 together with the auditor’s report thereon will be placed before the shareholders at the Meeting. These documents are included in the Company’s 2022 Annual Report. Copies of the 2022 Annual Report in English may be obtained from the Secretary of the Company upon request. The 2022 Annual Report in English is also available under the Company’s SEDAR profile at www.sedar.com or on the Company’s website at www.tripleflagpm.com.

ELECTION OF THE BOARD OF DIRECTORS

The Board has determined that nine director nominees will be elected at the Meeting. All nine nominees are currently directors of the Company and all the nominees have established their eligibility and willingness to serve on the Board for the next annual term. Management does not believe that any of the nominees will be unable to serve as a director, but if that should occur for any reason prior to the Meeting, the proxyholder may vote for another nominee at the proxyholder’s discretion. At the Meeting, the nominees will be voted on individually, and in accordance with applicable Canadian securities legislation, the voting results for each nominee will be publicly disclosed. The persons named in the enclosed form of proxy intend to vote for the election of each of the director nominees. Each director will be elected to hold office until the next annual meeting of shareholders or until such office is earlier vacated.

Advance Notice Provisions

Our by-laws include certain advance notice provisions with respect to the election of our directors (the ‘‘Advance Notice Provisions’’). The Advance Notice Provisions are intended to: (i) facilitate orderly and efficient annual general meetings or, where the need arises, special meetings; (ii) ensure that all shareholders receive adequate notice of Board nominations and sufficient information with respect to all nominees; and (iii) allow shareholders to register an informed vote. Only persons who are nominated by shareholders in accordance with the Advance Notice Provisions will be eligible for election as directors at any annual meeting of shareholders, or at any special meeting of shareholders if one of the purposes for which the special meeting was called was the election of directors.

Under the Advance Notice Provisions, a shareholder wishing to nominate a director would be required to provide us notice, in the prescribed form, within the prescribed time periods. These time periods include, (i) in the case of an annual meeting of shareholders (including annual and special meetings), not less than 30 days prior to the date of the annual meeting of shareholders; provided, that if the first public announcement of the date of the annual meeting of shareholders (the ‘‘Notice Date’’) is less than 50 days before the meeting date, not later than the close of business on the 10th day following the Notice Date; and (ii) in the case of a special meeting (which is not also an annual meeting) of shareholders called for any purpose which includes electing directors, not later than the close of business on the 15th day following the date on which the first public announcement of the date of the special meeting of shareholders was made.

A copy of our by-laws is available on the Company’s website at www.tripleflagpm.com, under the Company’s SEDAR profile at www.sedar.com and on EDGAR at www.sec.gov.

As of the date hereof, no director nominations have been received by the Company from any shareholder in respect of the Meeting.

Nominees

The director nominee profiles, provided below under “Director Profiles”, tell you about each director nominee’s experience and other important information to consider, including how much equity they own in the Company, and any other public company boards they sit on. We believe our Board nominees must strike the right balance between those who have skills and experience necessary to ensure our business can secure its license to operate, and those who have technical and operating expertise and financial and business acumen.

The director nominees have been selected based on their sound leadership and professional reputation and their collective ability to address the broad range of issues the Board considers when overseeing the Company’s business and affairs. As a group, the director nominees complement each other in respect of their respective skills, experience and diversity of perspectives.

The Board recommends a vote FOR all nominees listed below.

Additional biographical information for each individual is provided below under “Director Profiles”. Directors will serve until the next annual meeting of shareholders or until their successors are elected or appointed, unless their office is earlier vacated.

| Name and Place of Residence | Principal Position/Title1 |

Dawn Whittaker4,5 Ontario, Canada | Director and Board Chair |

Susan Allen2,5 Ontario, Canada | Director and Audit & Risk Committee Chair |

Tim Baker 3,4,5,6 British Columbia, Canada | Director and Governance & Sustainability Committee Chair |

Peter O’Hagan2,3,5,6 New York, United States | Director and Compensation & Talent Committee Chair |

Geoff Burns4, 5 British Columbia, Canada | Director |

Mark Cicirelli6 New York, United States | Director |

Blake Rhodes3, 5 Colorado, United States | Director |

Shaun Usmar Ontario, Canada | Director and Chief Executive Officer |

Elizabeth Wademan2, 3, 5 Ontario, Canada | Director |

| 1 | Mark Cicirelli and Shaun Usmar were first elected on October 10, 2019. Each of Dawn Whittaker, Susan Allen, Tim Baker, and Peter O’Hagan was first elected on May 7, 2021. Geoff Burns and Blake Rhodes were appointed on January 19, 2023, with Mr. Burns filling the vacancy left following Sir Michael Davis’ retirement from the Board on January 19, 2023. Elizabeth Wademan was appointed on February 21, 2023. |

| 2 | Member of our Audit & Risk Committee. |

| 3 | Member of our Compensation & Talent Committee. |

| 4 | Member of our Governance & Sustainability Committee. |

| 5 | Independent director. See “Statement of Corporate Governance Practices — Director Independence”. |

| 6 | Nominee of our Principal Shareholders. See “Nomination Rights”. |

Director Profiles

The following profiles present information about each of the nominees for election as director. Our directors are elected annually, individually, and by majority vote. On August 31, 2022, amendments to the CBCA and the Canada Business Corporation Regulations, 2001 came into force which introduced a statutory voting requirement for uncontested director elections. Under the CBCA amendments, shareholders are allowed to vote “for” or “against” (as opposed to “for” and “withhold”) nominees for election to our Board of Directors. If a nominee does not receive a majority of the votes cast for their election, the nominee will not be elected and the Board of Directors position will remain open or, in the case of incumbent directors (which comprise all of the nominees for election to our Board of Directors at the Meeting), such director may continue in office until the earlier of (i) the 90th day after the election, or (ii) the day on which his or her successor is appointed or elected. On March 28, 2023, the Company repealed its majority voting policy which was no longer necessary in light of the CBCA amendments.

Other than the Investor Rights Agreement (as defined herein), there are no contracts, arrangements, or understandings between any director or executive officer, or any other person, pursuant to which any of the nominees has been nominated for election as a director of the Company.

All other director information can be found in “Report on Director Compensation and Equity Ownership”, and “Committees of our Board” of this Circular. All amounts in this Management Proxy Circular are in U.S. dollars unless otherwise indicated. References to “US$”, “$” or “dollars” are to United States dollars, references to “C$” are to Canadian dollars and references to “A$” are to Australian dollars.

Dawn Whittaker:

Ms. Whittaker is a seasoned capital markets lawyer with more than 30 years of experience in mergers and acquisitions, corporate finance and corporate governance. She is currently a member of the Board of Directors of Sierra Metals Inc. and the Chair of the Corporate Governance and Nomination Committee, and is a former member of the Board of Directors at Detour Gold, where she served as Chair of the Corporate Governance and Nominating Committee, and as an interim Chair of the Board. Ms. Whittaker is a former director of Kirkland Lake Gold where she was the Chair of the Corporate Governance Committee, and was the Chair of Kirkland Lake Gold’s Special Committee in connection with the company’s merger with Newmarket Gold. She is currently the Vice President of the Board of Directors of The Badminton and Racquet Club of Toronto and a former member of the Board of Directors of the Canadian Mental Health Association, Ontario Division.

Prior to her retirement in 2018, she was a senior partner at Norton Rose Fulbright, a global law firm, where she was the national leader of the firm’s Mining and Commodities Team in Canada from 2012 to 2015 and a member of the firm’s Canadian Partnership Committee (board) from 2014 to 2017. Ms. Whittaker also previously served on the Continuous Disclosure Advisory Committee of the Ontario Securities Commission.

She has received the National Association of Corporate Directors certification and holds a Bachelor of Arts (Honours) and an LL.B. from Queen’s University.

| Director since: May 2021 | Areas of Expertise |

| Residence: Ontario, Canada | Investment Banking/M&A |

| Age: 62 | Financial Literacy/Accounting |

| Nationality: Canadian | Governance/Board/Risk Mitigation |

| | HR/Compensation |

| | Legal & Compliance |

Other Public Boards During Past Five Years (as at March 2, 2023)

| Sierra Metals Inc. | | | 2022–present | |

| Detour Gold Corporation | | | 2018–2020 | |

| Kirkland Lake Gold | | | 2012-2016 | |

| 2022 | |

| Board and Committee Membership | | Attendance | | Cash Retainer | | | DSUs1 | |

| Board of Directors | | 8 of 8 – 100% | | | | | US$ | 200,000 | |

| Board Chair | | | | | | | US$ | 100,000 | |

| Audit Committee2 | | 4 of 4 – 100% | | | | | | |

| 1) | Ms. Whittaker elected prior to the start of 2022 to have all of her compensation allocated in DSUs |

| 2) | Effective March 6, 2023, the Audit Committee was renamed the Audit & Risk Committee. |

2023

Board and Committee Membership

Board of Directors (Chair)

Governance & Sustainability Committee

Securities Held as at March 2, 2023

| Common Shares | | | 23,000 | |

| DSUs | | | 44,574 | |

Exceeds Director share ownership requirement

Prior Year Meeting

Voting Results | | Votes For | | | Votes Against | |

| 2021 | | | 146,614,435 | | | | 10,600 | |

| | | | (99.99 | )% | | | (0.01 | )% |

Susan Allen:

Ms. Allen has been a member of the Board of Directors of Triple Flag Precious Metals since its 2021 initial public offering, and serves as Chair of the Audit & Risk Committee. She also serves as Trustee or Director and Audit Committee Chair on the boards of Richards Packaging Income Trust and EcoSynthetix, Inc., each TSX listed companies, and serves as a Director of Conavi Medical Inc., a private Canadian medical device company.

Ms. Allen has over 10 years’ experience with executive board roles held in various not for profit entities, and previously served on global and Canadian boards of PwC. As a former PwC assurance partner with 34 years’ experience, she has extensive international business, audit, board and governance experience, and has advised companies on valuations, acquisitions, carve-outs, going public and internal control systems.

With both the Women’s Executive Network (‘WXN’) ‘Diversity 50’ Champion distinction and the ICD.D designation, Ms. Allen has also served on numerous board committees. Ms. Allen is author of Count Me In – A Trailblazer’s Triumph in a World not Built for Her to help professional women in business. She is a recipient of Catalyst Canada’s “Business Champion” award and was named one of WXN’s “Top 100 Most Powerful Women in Canada” for her leadership role and impact on diversity initiatives. Ms. Allen is a graduate of the University of Toronto, with a Bachelor of Arts degree and holds both her U.S. CPA and Canadian FCPA (FCA) designations.

| Director since: May 2021 | Areas of Expertise |

| Residence: Ontario, Canada | Managing or Leading Growth |

| Age: 65 | International |

| Nationality: Canadian | Financial Literacy/Accounting |

| | Governance/Board/Risk Mitigation |

| | HR/Compensation |

| | Legal & Compliance |

Other Public Boards During Past Five Years (as at March 2, 2023)

| Richards Packaging Income Trust | | | 2018–present | |

| EcoSynthetix Inc. | | | 2018–present | |

| 2022 | |

| Board and Committee Membership | | Attendance | | Cash Retainer | | | DSUs | |

| Board of Directors | | 8 of 8 – 100% | | US$ | 40,000 | | | US$ | 160,000 | |

| Audit Committee Chair1 | | 4 of 4 – 100% | | US$ | 25,000 | | | | |

2023

Board and Committee Membership

Board of Directors

Audit & Risk Committee Chair1

1 Effective March 6, 2023, the Audit Committee was renamed the Audit & Risk Committee.

Securities Held as at March 2, 2023

| Common Shares | | | 15,541 | |

| DSUs | | | 25,522 | |

Exceeds Director share ownership requirement

Prior Year Meeting

Voting Results | | Votes For | | | Votes Against | |

| 2021 | | | 146,613,535 | | | | 11,500 | |

| | | | (99.99 | )% | | | (0.01 | )% |

Peter O'Hagan:

Mr. O’Hagan’s career spans over 30 years in commodities and natural resource investing and operations, beginning at Phibro in 1987. He worked at Goldman Sachs from 1991 to 2013, where he was a partner from 2002-2013 and most recently co-headed the commodities sales, trading and investing business. From 2016 to 2019, Mr. O’Hagan was a Managing Director at The Carlyle Group, a global investment firm where he focused on industrial and commodity-related investments within the Equity Opportunity Fund. Immediately prior to joining Carlyle, he was an operating advisor at KKR & Co. in the Energy and Real Assets group.

Mr. O’Hagan is a member of the board of directors of IAMGOLD and chairman of the Nominating and Governance Committee. He is a member of the board of Rigel Resource Acquisition Corp. and chairman of the Audit Committee. From 2015 to 2017, Mr. O’Hagan was a board member and Chair of the Compensation Committee of Stillwater Mining until its sale to Sibanye Gold.

He is a graduate of the University of Toronto, Trinity College (BA) and holds an MA from the Johns Hopkins University School of Advanced International Studies (SAIS). He serves on the advisory board of Johns Hopkins SAIS and is a board member of World Bicycle Relief, a social enterprise operating in sub-Saharan Africa.

| Director since: May 2021 | Areas of Expertise |

| Residence: New York, USA | Managing or Leading Growth |

| Age: 60 | International |

| Nationality: American | Investment Banking/M&A |

| | Financial Literacy/Accounting |

| | Governance/Board/Risk Mitigation |

| | HR/Compensation |

| | Business Development & Marketing |

Other Public Boards During Past Five Years (as at March 2, 2023)

| IAMGOLD Corporation | | | 2022-present | |

| Rigel Resource Acquisition Group | | | 2021–present | |

| Stillwater Mining | | | 2015–2017 | |

| 2022 | |

| Board and Committee Membership | | Attendance | | | Cash Retainer | | | | DSUs | |

| Board of Directors | | 8 of 8 – 100% | | | US$ | 40,000 | | | | US$ | 160,000 | |

| Compensation & ESG Committee1 | | 7 of 7 – 100% | | | | | | | | |

| Audit Committee2 | | 4 of 4 – 100% | | | | | | | | |

2023

Board and Committee Membership

Board of Directors

Compensation & Talent Committee1

Audit & Risk Committee2

| 1 | Effective March 6, 2023 the Compensation & ESG Committee was split into two committees – the Compensation & Talent Committee and the Governance & Sustainability Committee. |

| 2 | Effective March 6, 2023, the Audit Committee was renamed the Audit & Risk Committee. |

Securities Held as at March 2, 2023

| Common Shares | | | 20,000 | |

| DSUs | | | 25,522 | |

Exceeds Director share ownership requirement

Prior Year Meeting

Voting Results | | Votes For | | | Votes Against | |

| 2021 | | | 146,520,035 | | | | 105,000 | |

| | | | (99.93 | )% | | | (0.07 | )% |

Tim Baker:

Mr. Baker has over 30 years of global mining project development and operational experience and has held executive and board roles at some of the world’s largest gold and copper producers. He previously served as non-Executive Chairman of Golden Star Resources Ltd. before its acquisition by Chifeng Jilong Gold. Prior to joining the Board of Golden Star Resources Ltd., he served as the Chief Operating Officer and Executive Vice President of Kinross Gold Corporation from June 2006 to November 2010.

His experience includes operating mines and projects in Chile, the United States, Africa and the Dominican Republic. Mr. Baker currently serves as an independent director of MAG Silver Corp. and previously served as an independent director of Sherritt International Corporation from May 2014 to February 2021, Augusta Resources Corporation from September 2008 to September 2014, Eldorado Gold Corporation from May 2011 to December 2012, Pacific Rim Mining Corp. from March 2012 to November 2013, Rye Patch Gold Corp. from December 2016 to May 2018, Alio Gold Inc. from May 2018 to June 2019 and Antofagasta PLC from March 2011 to May 2020.

Mr. Baker joined the boards of MAG Silver Corp. and RCF Acquisition Corp., both in 2021. He holds a Bachelor of Science in geology from Edinburgh University.

| Director since: May 2021 | Areas of Expertise |

| Residence: British Columbia, Canada | Managing or Leading Growth |

| Age: 71 | International |

| | CEO/President/General Management |

| | Operations/Industry Expertise/ Mining |

| | HSE&S/Reputation |

| | Governance/Board/Risk Mitigation |

| | HR/Compensation |

| Nationality: Canadian | |

Other Public Boards During Past Five Years (as at March 2, 2023)

| MAG Silver Corp. | | | 2021–present | |

| RCF Acquisition Corp. | | | 2021–present | |

| Golden Star Resources Ltd. | | | 2013–2022 | |

| Sherritt International Corporation | | | 2014–2021 | |

| Antofagasta PLC | | | 2011–2020 | |

| Alio Gold Inc. | | | 2018-2019 | |

| Rye Patch Gold Corp. | | | 2016–2018 | |

| 2022 | | | 2023 |

| Board and Committee Membership | | | Attendance | | | | Cash

Retainer | | | | DSUs | | | Board and Committee Membership |

| Board of Directors | | | 8 of 8 – 100% | | | | US$ | 40,000 | | | | US$ | 160,000 | | | Board of Directors |

| Compensation & ESG Committee1 | | | 7 of 7 – 100% | | | | NA | | | | NA | | | Compensation & Talent Committee1 |

Securities Held as at March 2, 2023

| Common Shares | | | 22,338 | |

| DSUs | | | 25,522 | |

| | | | | |

| Exceeds Director share ownership requirement | | | | |

Prior Year Meeting

Voting Results | | Votes For | | | Votes Against | |

| 2021 | | | 146,521,135 | | | | 103,900 | |

| | | | (99.93 | )% | | | (0.07 | )% |

(1) Effective March 6, 2023 the Compensation & ESG Committee was split into two committees – the Compensation & Talent Committee and the Governance & Sustainability.

Geoff Burns:

Mr. Burns co-founded Maverix Metals Inc. in 2016 and served as the Chair of Maverix’s Board of Directors and Compensation Committee since its inception until its sale to Triple Flag in 2023. Previously, he served as President and CEO of Pan American Silver Corp. for 12 years and was also a member of the Board of Directors. At the time of his retirement from Pan American in 2016, the Company employed in excess of 6,000 people at 7 operating mines located throughout North and South America.

In his over 35 years in the precious metals mining industry, Mr. Burns gathered extensive experience in precious metal mine operations and project development, having participated in multiple mine development and construction projects from feasibility study through to continuous operation and ultimately into reclamation. Throughout his career he has led or been a part of numerous capital market transactions raising more than $1.3 billion in equity, debt and convertible debt, while completing M&A transactions in excess of $3.0 billion.

Mr. Burns holds a BSc. degree in Geology from McMaster University and an MBA from York University.

| Director since: January 2023 | Areas of Expertise |

| Residence: British Columbia, Canada | Managing or Leading Growth |

| Age: 63 | International |

| Nationality: Canadian | CEO/President/General Management |

| | Operations/Industry Expertise/Mining |

| | Investment Banking/M&A |

| | Financial Literacy/Accounting |

| | HSE&S/Reputation |

| | Governance/Board/Risk Mitigation |

| | HR/Compensation |

| | Government Relations |

| | Business Development & Marketing |

Other Public Boards During Past Five Years (as at March 2, 2023)

| Elevation Gold Mining Corporation | | | 2019-current | |

| Maverix Metals Inc. | | | 2016-January, 2023 | |

| Taseko Mines Limited | | | 2016-2019 | |

| Pan American Silver Corp. | | | 2004-2016 | |

| 2022 |

| Board and Committee Membership | | | Attendance1 | |

| NA | | | NA | |

2023

Board and Committee Membership

Board of Directors

Governance & Sustainability Committee2

| (1) | Mr. Burns joined the Board January 19, 2023. |

| (2) | Effective March 6, 2023 the Compensation & ESG Committee was split into two Committees – the Compensation & Talent Committee and the Governance & Sustainability Committee. |

Securities Held as at March 2, 2023

| Common Shares | | | 2,106,581 | |

| DSUs | | | NA | |

Exceeds Director share ownership requirement

Mark Cicirelli:

Mr. Cicirelli is a Portfolio Manager and Global Head of Insurance at Elliott Investment Management L.P., which he joined in 2005. Previously he worked at TH Lee Putnam Ventures, a private equity fund, and at J.P. Morgan & Company. Mr. Cicirelli is Director of the Prosperity Life Insurance Group and also serves on the board of Aeolus Capital Management and the New York Board of the non-profit All Stars Project. Mr. Cicirelli graduated from Dartmouth with a Bachelor of Arts in government and economics, and from Harvard with a Master of Business Administration.

| Director since: October 2019 | Areas of Expertise |

| Residence: New York, USA | Investment Banking/M&A |

| Age: 48 | Financial Literacy/Accounting |

| Nationality: American | Governance/Board/Risk Mitigation |

| | HR/Compensation |

Other Public Boards During Past Five Years (as at March 2, 2023)

| 2022(1) | |

| Board and Committee Membership | | Attendance | | | Cash Retainer | | | | DSUs | |

| Board of Directors | | 8 of 8 – 100% | | | NA | | | | NA | |

(1) As further described in the Report on Director Compensation and Equity Ownership, Mr. Cicirelli is an employee of an affiliated entity of the Principal Shareholders and, as such, does not receive any compensation for his role on the Board

2023

Board and Committee Membership

Board of Directors

Securities Held as at March 2, 2023

Prior Year Meeting

Voting Results | | Votes For | | | Votes Against | |

| 2021 | | | 146,623,935 | | | | 1,100 | |

| | | | (100 | )% | | | (0 | )% |

Blake Rhodes:

Mr. Rhodes retired from Newmont Corporation in April 2022, where he was the Senior Vice President of Strategic Development and a member of the executive leadership team. Mr. Rhodes’ career at Newmont spanned over 25 years, during which he served in a legal capacity as General Counsel, in operations as Senior Vice President of Indonesia, and led Newmont’s mergers and acquisitions team as SVP of Strategic Development. Mr. Rhodes has extensive transactional and international business experience, having worked and lived in Jakarta, Adelaide, and Singapore, and played key roles in Newmont’s significant transactions, including the acquisition of Goldcorp Inc. and the formation of the Nevada Gold Mines joint venture.

He graduated from Iowa State University with a Bachelor’s degree in Business Administration and holds a Doctor of Jurisprudence degree from the University of Pennsylvania.

| Director since: January 2023 | Areas of Expertise |

| Residence: Colorado, United States | Managing or Leading Growth |

| Age: 56 | International |

| Nationality: American | CEO/President/General Management |

| | Operations/Industry Expertise/Mining |

| | Investment Banking/M&A |

| | Financial Literacy/Accounting |

| | HSE&S/Reputation |

| | Governance/Board/Risk Mitigation |

| | Legal & Compliance |

Other Public Boards During Past Five Years (as at March 2, 2023)

| Maverix Metals | | | 2018 – January 2023 | |

| 2022 | |

| Board and Committee Membership | | | Attendance1 | |

| NA | | | NA | |

2023

Board and Committee Membership

Board of Directors

Compensation & Talent Committee2

Securities Held as at March 2, 2023

| Common Shares | | | 3,600 | |

| DSUs | | | NA | |

Has until 2028 to meet Director share ownership requirement

| (1) | Mr. Rhodes joined the Board January 19, 2023. |

| (2) | Effective March 6, 2023 the Compensation & ESG Committee was split into two Committees – the Compensation & Talent Committee and the Governance & Sustainability Committee. |

Shaun Usmar:

Mr. Usmar is an international mining executive with 30 years of experience working around the globe in operational, financial and executive leadership roles in some of the world’s largest and fastest growing mining companies. Prior to founding Triple Flag, Mr. Usmar served as Senior Executive Vice President and Chief Financial Officer of Barrick Gold Corporation, from 2014 to 2016, where he helped restructure the company.

He joined Xstrata in 2002 as an early senior executive member of the management team that grew the company into one of the world’s largest diversified miners at the time of its acquisition by Glencore in 2013. His roles at Xstrata included General Manager of Business Development in London, Chief Financial Officer of Xstrata’s global Ferro-Alloys business in South Africa, and Chief Financial Officer of Xstrata’s global Nickel business in Canada. Prior to joining Xstrata, Mr. Usmar worked at BHP Billiton in Corporate Finance in London, and started his career in mining in operations in the steel and aluminum industries as a production engineer. Mr. Usmar serves as Chair of Make-A-Wish Canada, and chairs the Audit Committee of the World Gold Council.

He holds a Bachelor of Science Engineering in Metallurgy and Materials from the University of Witwatersrand in South Africa, and an MBA from the Kellogg Graduate School of Management at Northwestern University, both with distinction.

| Director since: October 2019 | Areas of Expertise |

| Residence: Ontario, Canada | Managing or Leading Growth |

| Age: 53 | International |

| Nationality: South African | CEO/President/General Management |

| | Operations/Industry Expertise/Mining |

| | Investment Banking/M&A |

| | Financial Literacy/Accounting |

| | HSE&S/Reputation |

| | Governance/Board/Risk Mitigation |

| | Government Relations |

| | Business Development & Marketing |

Other Public Boards During Past Five Years (as at March 2, 2023)

| 2022(1) | |

| Board and Committee Membership | | Attendance | | Cash Retainer | | | DSUs | |

| Board of Directors | | 8 of 8 – 100% | | NA | | | | NA | |

2023

Board and Committee Membership

Board of Directors

Securities Held as at March 2, 2023

| Common Shares | | | 2,476,847 | |

| RSUs | | | 71,482 | |

| Stock Options(2) | | | 1,567,503 | |

Exceeds Chief Executive Officer share ownership requirement

| (1) | Mr. Usmar receives compensation for his role as CEO of the Company, which is described in the Compensation Discussion and Analysis section of this Circular. Mr. Usmar does not receive additional compensation for his role on the Board. |

| (2) | Not included in share ownership calculation. |

Prior Year Meeting

Voting Results | | Votes For | | | Votes Against | |

| 2021 | | | 146,624,035 | | | | 1,000 | |

| | | | (100) | % | | | (0) | % |

Elizabeth Wademan:

Ms. Wademan is a corporate executive and director with over 24 years of capital markets and operational experience as a senior executive. Ms. Wademan is currently President and CEO of Canada Development Investment Corporation (“CDEV”). Prior to joining CDEV, Ms. Wademan was a senior investment banker and capital markets executive, with a long career in investment banking, as Managing Director for BMO Capital Markets, one of Canada’s largest investment banks. She was one of the firm's most senior professionals and was Head, Global Metals & Mining Equity Capital Markets, where she advised on many of the most formative and transformational transactions in the resource sector on the continent.

Ms. Wademan is also an experienced corporate director with extensive public company board experience. Ms. Wademan holds a Bachelor of Commerce (Finance & International Business) from McGill University and CFA & ICD.D designations.

| Director since: February 2023 | Areas of Expertise |

| Residence: Toronto, Canada | Managing or Leading Growth |

| Age: 47 | CEO/President/General Management |

| Nationality: Canadian | Operations/Industry Expertise/Mining |

| | Investment Banking/M&A |

| | Financial Literacy/Accounting |

| | Governance/Board/Risk Mitigation |

| | HR/Compensation |

| | Government Relations |

| | Business Development & Marketing |

Other Public Boards During Past Five Years (as at March 2, 2023)

| Torex Gold Resources Inc. | | | 2016-current | |

| BSR Real Estate Investment Trust | | | 2018-current | |

| 2022 | |

| Board and Committee Membership | | | Attendance1 | |

| NA | | | NA | |

2023

Board and Committee Membership

Board of Directors

Compensation & Talent Committee2

Audit & Risk Committee3

Securities Held as at March 2, 2023

Has until 2028 to meet Director share ownership requirement

| (1) | Ms. Wademan joined the Board February 21, 2023. |

| (2) | Effective March 6, 2023 the Compensation & ESG Committee was split into two Committees – the Compensation & Talent Committee and the Governance & Sustainability Committee. |

| (3) | Effective March 6, 2023, the Audit Committee was renamed the Audit & Risk Committee. |

Public Company Board Memberships

Our directors are not restricted from serving on the boards of other public or private companies so long as their commitments do not materially interfere with or are not incompatible with, their ability to fulfill their duties as a member of our Board. Directors must, however, receive prior written approval of the Board Chair, except in the case of the Chair, who must receive prior written approval of the Governance & Sustainability Committee, before accepting an invitation to serve on the board of another public company.

Director Qualifications

The Board comprises nine directors, seven of whom are independent and two of whom are not independent. The composition of the Board is designed to bring an optimal balance of competencies, knowledge and experience to successfully promote achievement of the Company’s strategic objectives and effective corporate governance and oversight. Outlined below are the individual attributes that each director brings to the Board:

| Skill/Director | | D. Whittaker | | S. Allen | | T. Baker | | P. O’Hagan | | G. Burns | | M. Cicirelli | | B. Rhodes | | S. Usmar | | E. Wademan |

| Managing or Leading Growth | | | | x | | x | | x | | x | | | | x | | x | | x |

| International | | | | x | | x | | x | | x | | | | x | | x | | |

| CEO/President/General Management | | | | | | x | | | | x | | | | x | | x | | x |

| Operations/Industry Expertise/Mining | | | | | | x | | | | x | | | | x | | x | | x |

| Investment Banking/M&A | | x | | | | | | x | | x | | x | | x | | x | | x |

| Financial Literacy/Accounting | | x | | x | | | | x | | x | | x | | x | | x | | x |

| Health, Safety, Environment & Security (HSE&S)/Reputation | | | | | | x | | | | x | | | | x | | x | | |

| Governance/Board/Risk Mitigation | | x | | x | | x | | x | | x | | x | | x | | x | | x |

| HR/Compensation | | x | | x | | x | | x | | x | | x | | | | | | x |

| Government Relations | | | | | | | | | | x | | | | | | x | | x |

| Legal & Compliance | | x | | x | | | | | | | | | | x | | | | |

| Business Development & Marketing | | | | | | | | x | | x | | | | | | x | | x |

Director Share Ownership Multiples

The ownership guidelines establish minimum equity ownership levels for each Non-Executive Director based on a multiple of their annual cash retainer, which is currently set at 10 times their annual cash retainer. See Director Share Ownership Guidelines. The following table shows the ownership multiples for the Non-Executive Directors and their current ownership, illustrated as multiples of their cash retainer:

| | | Cash Retainer | | | Current Ownership | | | Underlying equity | |

| Executive | | Multiple | | | Multiple1 | | | Common Shares | | | DSUs2 | |

| Dawn Whittaker | | | 10 | x | | | 23.2 | x | | | 23,000 | | | | 44,574 | |

| Susan Allen | | | 10 | x | | | 14.1 | x | | | 15,541 | | | | 25,522 | |

| Peter O’Hagan | | | 10 | x | | | 15.7 | x | | | 20,000 | | | | 25,522 | |

| Tim Baker | | | 10 | x | | | 16.5 | x | | | 22,338 | | | | 25,522 | |

| Geoff Burns | | | 10 | x | | | 724.7 | x | | | 2,106,581 | | | | NA | |

| Blake Rhodes | | | 10 | x | | | 1.2 | x | | | 3,600 | | | | NA | |

| Elizabeth Wademan | | | 10 | x | | | NA | | | | Nil | | | | NA | |

1 The value of the ownership is calculated based on the closing price of a Common Share on the NYSE on December 30, 2022, being US$13.76.

2 Messrs. Burns and Rhodes and Ms. Wademan were not yet Directors of Triple Flag as at December 31, 2022, and therefore had not received any DSU grants. They have until 2028 to reach their share ownership multiples.

APPOINTMENT OF THE AUDITOR

The auditor of the Company is PwC. The Board, on the recommendation of the Audit & Risk Committee, recommends that PwC be reappointed as the auditor of the Company to hold office until the next annual meeting of shareholders of the Company and that the directors be authorized to fix PwC’s remuneration. The persons named in the accompanying form of proxy intend to vote FOR the appointment of PwC as the Company’s auditor until the next annual meeting of shareholders. PwC has served as the auditor of the Company and its predecessor since 2018.

Audit and Other Service Fees

The Audit & Risk Committee oversees the fees paid to the independent auditor, PwC, for audit and non-audit services. The following table sets forth the aggregate fees billed for professional services rendered by PwC, for the fiscal years 2022 and 2021, respectively:

| | | 2022 | | | 2021 | |

| Audit Fee1 | | $ | 470,000 | | | $ | 441,517 | |

| Tax Fees2 | | | 193,738 | | | | 69,794 | |

| All other fees3 | | | 61,950 | | | | 126,321 | |

| Total | | $ | 725,688 | | | $ | 637,686 | |

(1) Audit fees include the audit of the year-end financial statements.

(2) Tax fees related to tax compliance services.

(3) All other fees are the aggregate fees paid for products and services other than those reported above, which comprise mainly prospectus and translation related services incurred by PwC in relation to certain required procedures undertaken in connection with our IPO and NYSE listing.

As part of the Company’s corporate governance practices, the Audit & Risk Committee has adopted a policy prohibiting the auditor from providing non-audit services to the Company or its subsidiaries unless the services are approved in advance by the Chair of the Audit & Risk Committee. The auditor is required to report directly to the Audit & Risk Committee.

ADVISORY RESOLUTION ON APPROACH TO EXECUTIVE COMPENSATION

At the Meeting, the shareholders will be asked to consider an advisory resolution (the “Say on Pay Resolution”) regarding the Company’s approach to executive compensation, which is described in detail in the section of this Circular entitled “Compensation Discussion and Analysis”. Pay for performance is a cornerstone of the Company’s compensation philosophy, which is intended to align the interests of the Company’s executives with those of its shareholders. This compensation philosophy enables the Company to attract and retain high-performing executives who will be motivated to create value for shareholders.

The Board and management of the Company recommend that the shareholders vote FOR the adoption of the advisory Say on Pay Resolution. The persons named in the accompanying form of proxy intend to vote FOR the adoption of the Say on Pay Resolution.

Votes on the Say on Pay Resolution are advisory and will not be binding on the Board or the Company. However, the Governance & Sustainability Committee will review and analyze the results of the vote and take them into consideration when reviewing the Company’s executive compensation philosophy.

The form of Say on Pay Resolution to be submitted to the shareholders at the Meeting, subject to such amendments, variations or additions as may be approved at the Meeting, is set forth below:

BE IT RESOLVED THAT on an advisory basis and not to diminish the role and responsibilities of the Board of Directors, the shareholders accept the approach to executive compensation disclosed in the Circular, delivered in advance of the Meeting.

STATEMENT OF CORPORATE GOVERNANCE PRACTICES

Corporate Governance

The Company’s Board and management are dedicated to strong corporate governance practices designed to maintain high standards of oversight, accountability, integrity and ethics while promoting long-term growth and complying with the Canadian Securities Administrators’ Corporate Governance Guidelines. The Company’s strong governance practices are reflected in its approach and application of policies and practices, some of which are outlined below:

| GOVERNANCE | | | |

| Guidance | Reference | Overview | Application |

| Majority Voting Policy | see p. 39 of the Circular | Annual election of Directors by Shareholders Any Director who receives a greater number of votes withheld must tender resignation | 2022 was the Company’s first director election vote The policy was repealed on March 28, 2023, given it became redundant in light of the amendments to the CBCA related to the election of Directors |

| Director Independence | see p. 37 of the Circular | Determination of independence of Board members | 77% of the Triple Flag Board are deemed to be independent Directors All committees are comprised entirely of independent directors |

| Board Effectiveness | see p. 36 of the Circular | Ensure that the Board and its Committees are functioning at optimal levels | Annual review of the effectiveness and performance of the Board and its Committees and Chairs Independent Chair to provide strong independent Board oversight |

| Share Ownership Guidelines | see p. 73 of the Circular Full guidelines posted on the Triple Flag website | Aligns the interests of Directors and executives with those of Shareholders Applies to each Director and executive at the SVP level and higher | 5 of 7 Independent Directors satisfy the required level of share ownership; the remaining Directors are in process and have until Q1 2028 to comply All NEOs satisfy the required level of share ownership |

| Orientation & Continuing Education | see p. 40 of the Circular | Ensuring relevant continuing education sessions are provided to Directors | 3 Director Development sessions were offered to the Board in 2022 |

| Director Term Limits & Other Mechanisms of Board Renewal | see p. 39 of the Circular | To support a Diverse Board membership | No Director term limits, mandatory retirement age or other automatic mechanisms of board renewal 100% of Directors have tenure 1–4 years |

| Conflicts of Interest | see p. 84 of the Circular | Directors and officers are obligated to act at all times in good faith and in the interest of the Company and to disclose any conflicts Governance & Sustainability Committee reviews interlocking Directors | There are no existing potential conflicts of interest among the Directors |

| Related Party Transactions | see p. 37 of the Circular | Oversight of related party transactions rests with the Audit & Risk Committee The Board, through the Audit & Risk Committee, reviews and approves significant related party transactions | Quarterly reports on related party transactions provided to the Audit & Risk Committee There were no related party transactions in 2022 |

| Meeting of Independent Directors | see p. 38 of the Circular | Open and candid discussion among independent directors to facilitate independent judgment | Each meeting agenda includes in-camera sessions; with only the independent directors in attendance |

| Advisory Vote on Executive Compensation (Say on Pay) | see p. 28 of the Circular | Providing Shareholders with an opportunity to cast advisory votes on the Company’s approach to executive compensation | Advisory vote will be held annually at the Company’s Annual Meeting 2022 advisory vote result was 99.46% in favor of our say on pay resolution |