UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

__________________________

FORM 20-F

__________________________

(Mark One)

☐ REGISTRATION STATEMENT PURSUANT TO SECTION 12(b) OR (g) OF THE SECURITIES EXCHANGE ACT OF 1934

OR

☒ ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For the fiscal year ended December 31, 2021

OR

☐ TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

OR

☐ SHELL COMPANY REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

Date of event requiring this shell company report

For the transition period from ________________________ to ________________________

Commission file number 001-39240 (Telesat Corporation)

Commission file number 333-255518-01 (Telesat Partnership LP)

_______________________

TELESAT CORPORATION

(Exact name of Registrant as specified in its charter)

_______________________

British Columbia, Canada | | 4899 | | Not Applicable |

(Jurisdiction of Incorporation

of Organization) | | (Primary Standard Industrial

Classification Code Number) | | (I.R.S. Employer

Identification Number) |

TELESAT PARTNERSHIP LP (Exact name of Registrant as specified in its charter) |

Ontario, Canada | | 4899 | | Not Applicable |

(Jurisdiction of Incorporation

of Organization) | | (Primary Standard Industrial

Classification Code Number) | | (I.R.S. Employer

Identification Number) |

c/o Telesat Canada

160 Elgin Street

Suite 2100

Ottawa, Ontario, Canada K2P 2P7

Tel: (613) 748-8700

(Address, including zip code, and telephone number, including area code, of Registrant’s principal executive offices)

__________________________

Christopher S. DiFrancesco

Vice President, General Counsel and Secretary

c/o Telesat Canada

160 Elgin Street

Suite 2100

Ottawa, Ontario, Canada K2P 2P7

Tel: (613) 748-8700 ext. 2268

(Name, address, including zip code, and telephone number, including area code, of agent for service)

__________________________

Securities registered or to be registered pursuant to Section 12(b) of the Act:

Title of each class | | Trading Symbol(s) | | Name of each exchange on which registered |

Telesat Corporation Class A Common Shares | | TSAT | | The Nasdaq Stock Market LLC |

Telesat Corporation Class B Variable Voting Shares | | TSAT | | The Nasdaq Stock Market LLC |

Securities registered or to be registered pursuant to Section 12(g) of the Act:

Securities for which there is a reporting obligation pursuant to Section 15(d) of the Act:

Telesat Partnership LP Class A Units and Telesat Partnership LP Class B Units |

(Title of Class) |

__________________________

Indicate the number of outstanding shares of each of the issuer’s classes of capital or common stock as of the close of the period covered by the Annual Report: At December 31, 2021, Telesat Corporation — 11,907,246 Class A Common Shares and Class B Variable Voting Shares, 112,841 Class C Shares, 3 Special Voting Shares, and 1 Golden Share were issued and outstanding; and Telesat Partnership LP 19,428,491 Class A Units and Class B Units and 18,098,362 Class C Units.

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Telesat Corporation ☐ Yes ☒ No Telesat Partnership LP ☐ Yes ☒ No

If this report is an annual or transition report, indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934. Telesat Corporation ☐ Yes ☒ No and Telesat Partnership LP ☐ Yes ☒ No

Note — checking the box above will not relieve any registrant required to file reports pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934 from their obligations under those sections.

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Telesat Corporation ☒ Yes ☐ No and Telesat Partnership LP ☐ Yes ☒ No

Indicate by check mark whether the registrant has submitted electronically every Interactive Data File required to be submitted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit such files). Telesat Corporation ☒ Yes ☐ No and Telesat Partnership LP ☐ Yes ☒ No

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or an emerging growth company. See the definition of “large accelerated filer,” “accelerated filer,” and “emerging growth company” in Rule 12b-2 of the Exchange Act. Telesat Corporation and Telesat Partnership

Large Accelerated Filer ☐ | | Accelerated Filer ☐ | | Non-Accelerated Filer ☒ | | Emerging growth company ☐ |

If an emerging growth company that prepares its financial statements in accordance with U.S. GAAP, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards† provided pursuant to Section 13(a) of the Exchange Act. ☐

Indicate by check mark whether the registrant has filed a report on and attestation to its management’s assessment of the effectiveness of its internal control over financial reporting under Section 404(b) of the Sarbanes-Oxley Act (15 U.S.C. 7262(b)) by the registered public accounting firm that prepared or issued its audit report. ☐

Indicate by check mark which basis of accounting the registrant has used to prepare the financial statements included in this filing:

| | U.S. GAAP ☐ | | International Financial Reporting Standards as issued by the International Accounting Standards Board ☒ | | Other ☐ |

If “Other” has been checked in response to the previous question, indicate by check mark which financial statement item the registrant has elected to follow. ☐ Item 17 ☐ Item 18

If this is an Annual Report, indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Telesat Corporation ☐ Yes ☒ No and Telesat Partnership LP ☐ Yes ☒ No

Telesat Corporation

Table of Contents

i

INTRODUCTION

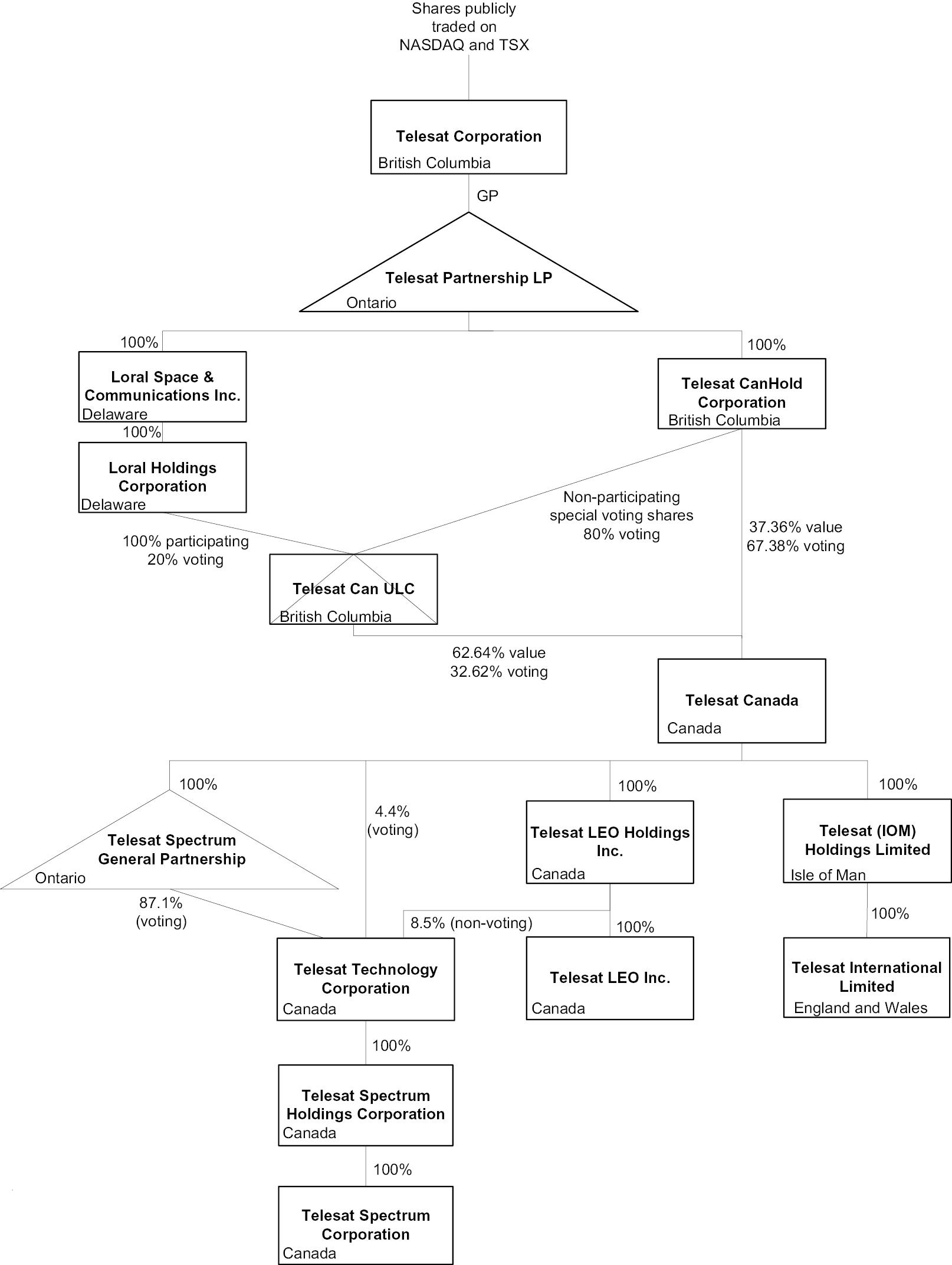

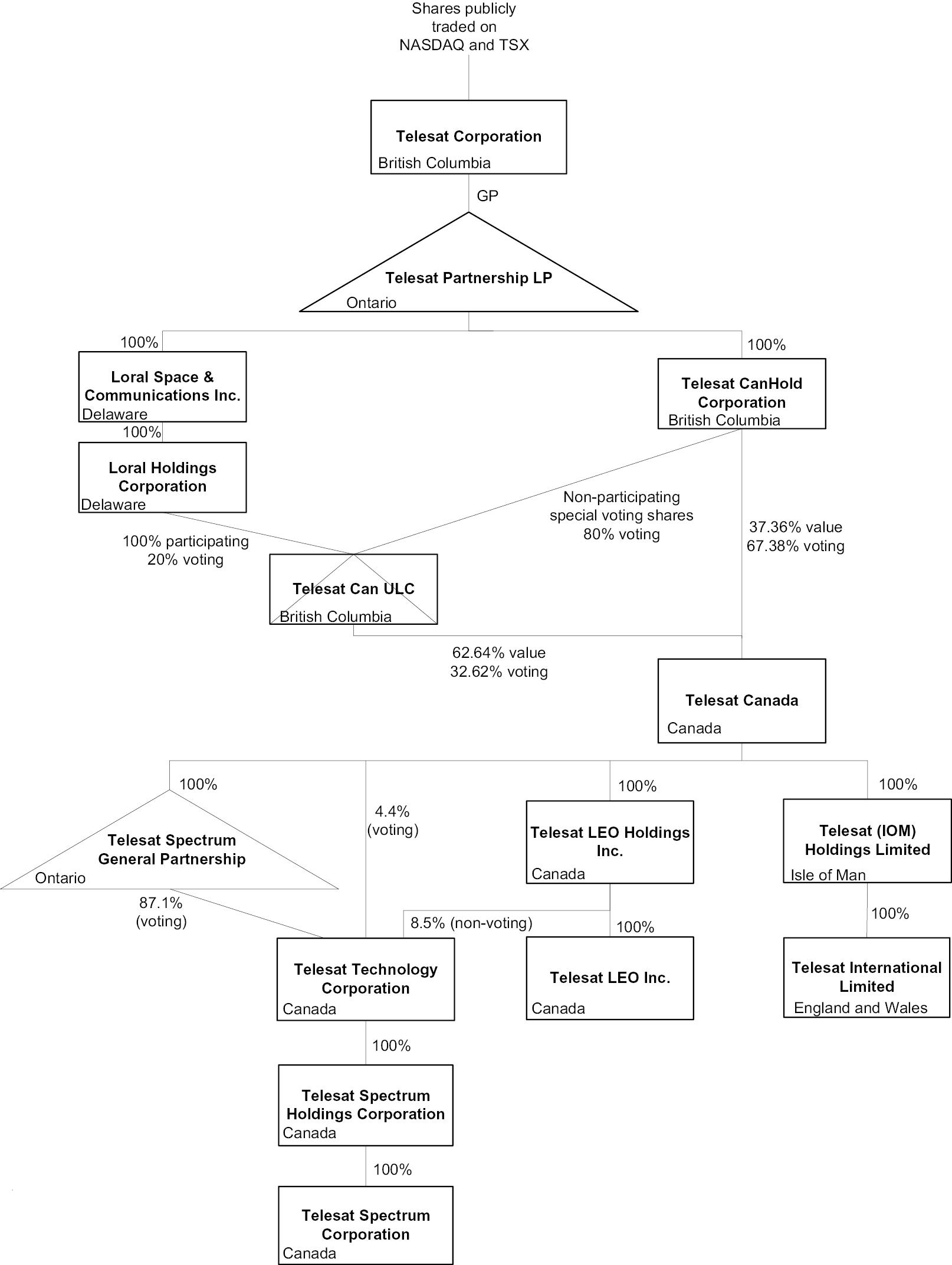

Telesat Corporation was incorporated under the Business Corporations Act (British Columbia) on October 21, 2020. Telesat Corporation is the general partner of Telesat Partnership LP, which was formed under the Limited Partnership Act (Ontario) on November 12, 2020. We directly or indirectly own 100% of all of our operating subsidiaries.

On November 18, 2021 and November 19, 2021, Telesat Corporation (“Telesat” or the “Company”), along with the other parties to the Transaction Agreement (as defined below) consummated the transactions (collectively, the “Transaction”) contemplated by the Transaction Agreement and Plan of Merger (as amended, the “Transaction Agreement”), dated as of November 23, 2020, by and among Telesat, Telesat Canada, a Canadian corporation (“Telesat Canada”), Loral Space & Communications Inc., a Delaware corporation (“Loral”), Telesat Partnership LP, a limited partnership formed under the laws of Ontario, Canada (“Telesat Partnership”), Telesat CanHold Corporation, a corporation incorporated under the laws of British Columbia, Canada (“Telesat CanHoldco”), Lion Combination Sub Corporation, a Delaware corporation and wholly owned subsidiary of Loral (“Merger Sub”), Public Sector Pension Investment Board, a Canadian Crown corporation (“PSP Investments”), and Red Isle Private Investments Inc., a Canadian corporation (“Red Isle”).

The Transaction was effected in accordance with the Transaction Agreement through a series of transactions, including: (i) on November 18, 2021, Red Isle contributing 272,827 Telesat Canada Non-Voting Participating Preferred Shares to Telesat in exchange for Class C fully voting shares of Telesat and the balance of its equity interest in Telesat Canada to Telesat Partnership in exchange for Class C units of Telesat Partnership (“Class C Units”); (ii) on November 18, 2021 and pursuant to stockholder contribution agreements, the contribution by current and former members of management of Telesat Canada of their Telesat Canada Non-Voting Participating Preferred Shares to Telesat in exchange for newly issued Class A common shares of Telesat (the “Class A Common Shares”) if such contributing shareholder was Canadian (as such term is defined in the Investment Canada Act) or newly issued Class B variable voting shares of Telesat (the “Class B Variable Voting Shares”) if such contributing shareholder was not Canadian (as such term is defined in the Investment Canada Act); (iii) on November 18, 2021 and pursuant to the director contribution agreement, the contribution by John Cashman and Clare Copeland of their Telesat Canada Director Voting Preferred Shares to Telesat Partnership in exchange for interests in Telesat Partnership, which were subsequently redeemed by Telesat Partnership for cash on November 19, 2021; (iv) on November 18, 2021 and pursuant to optionholder exchange agreements, the exchange of options, tandem stock appreciation rights and restricted stock units in respect of Telesat Canada for corresponding instruments in Telesat with the same vesting terms and conditions; and (v) on November 19, 2021, the merger of Merger Sub with and into Loral (the “Merger”), with Loral surviving the Merger as a wholly owned subsidiary of Telesat Partnership and the other Loral stockholders receiving shares of Telesat or units of Telesat Partnership as described below.

Under the terms of the Transaction Agreement, at the effective time of the Merger (the “Effective Time”), each share of Loral common stock outstanding immediately prior to the Effective Time was converted into the right to receive (a) if the Loral stockholder validly made an election to receive units of Telesat Partnership pursuant to the Merger (a “Unit Election”), one (1) newly issued Class A unit of Telesat Partnership if such Loral stockholder was Canadian (as such term is defined in the Investment Canada Act), and otherwise one (1) newly issued Class B unit of Telesat Partnership, (b) if the Loral stockholder validly made an election to receive shares of Telesat (a “Shares Election”), one (1) newly issued Class A Common Share if such Loral stockholder was Canadian (as such term is defined in the Investment Canada Act), or (c) if the Loral stockholder validly made a Shares Election and was not Canadian, or did not validly make a Unit Election or a Shares Election, one (1) newly issued Class B Variable Voting Share. Following the Transaction, Telesat Canada became an indirect wholly owned subsidiary of Telesat.

In addition, on November 18, 2021, Telesat entered into a trust agreement and trust voting agreement with Telesat Partnership, TSX Trust Company, as the trustee of Telesat Corporation Trust and, in the case of the trust agreement, Christopher DiFrancesco, effectuating the voting trust relating to the voting rights of units of Telesat Partnership.

Following the completion of the Transaction, our authorized share capital includes Class A Common Shares, Class B Variable Voting Shares (together with the Class A Common Shares, the “Telesat Public Shares”), Class C fully voting shares (the “Class C Fully Voting Shares”), Class C limited voting shares (the “Class C Limited Voting Shares”, and together with the Class C Fully Voting Shares, “Class C Shares”, and the Class C Shares together with the Telesat Public Shares, the “Telesat Corporation Shares”), a Class A Special Voting Share (the “Class A Special Voting Share”), a Class B Special Voting Share (the “Class B Special Voting Share”), a Class C Special Voting Share (the

1

“Class C Special Voting Share”, and together with the Class A Special Voting Share and Class B Special Voting Share, the “Special Voting Shares”), the Golden Share (the “Golden Share”) and “blank check” Class A Preferred Shares (the “Class A Preferred Shares”). The Special Voting Shares and the Golden Share have no material economic rights.

The Telesat Public Shares commenced trading at NASDAQ and the Toronto Stock Exchange under the ticker symbol “TSAT” on November 19, 2021.

EXPLANATORY NOTE

This annual report combines the Annual Reports on Form 20-F (“Annual Report”) for the year ended December 31, 2021, of Telesat Corporation and Telesat Partnership. Unless otherwise stated, references to “Telesat,” the “Company,” “we,” “us” or “our” in this Annual Report refers to Telesat Canada and its subsidiaries before the closing of the Transaction, and to Telesat Corporation and its subsidiaries (including Telesat Canada) and Telesat Partnership after the closing of the Transaction.

We believe it is important to understand the few differences between Telesat Corporation and Telesat Partnership in the context of how we operate as an integrated consolidated company. Telesat Corporation is the publicly traded general partner of Telesat Partnership and is the indirect parent of Telesat Canada. Telesat Corporation’s only material asset is its ownership of partnership interests of Telesat Partnership. As a result, Telesat Corporation does not generally conduct business itself, other than acting as the sole general partner of Telesat Partnership, and the capital required for the business is generated from the operations of Telesat’s subsidiaries or through accessing Telesat Canada’s Credit Facilities and the proceeds of debt securities issued by Telesat Canada.

As a result of our controlling interest, we consolidate the financial results of Telesat Partnership and record a non-controlling interest for the portion related to the limited partnership units. Net income (loss) attributable to non-controlling interests on the consolidated statements of operations presents the portion of earnings or loss attributable to the economic interest in Partnership owned by the holders of the noncontrolling interests. As sole general partner, we manage all of Partnership’s operations and activities in accordance with the Partnership Agreement.

Non-controlling interest, shareholders’ equity, partners’ capital, partnership units liability and the changes in fair value of partnership units liability are the primary areas of difference between the consolidated financial statements of Telesat Corporation and Telesat Partnership. The limited partnership units of Telesat Partnership are recorded as a liability with changes in fair value recorded through the gains or losses on changes in fair value of partnership units liability. These are recorded as non-controlling interest in the financial statements of Telesat Corporation.

We believe combining the Annual Reports of Telesat and Telesat Partnership into this single Annual Report results in the following benefits:

• enhances stockholders’ understanding of Telesat Corporation and Telesat Partnership by enabling stockholders to view the business as a whole in the same manner that management views and operates the business

• eliminates duplicative disclosure and provides a more streamlined and readable presentation since a substantial portion of the disclosure in this Annual Report applies to both Telesat Corporation and Telesat Partnership and

• creates time and cost efficiencies through the preparation of a single combined Annual Report instead of two separate Annual Reports.

In order to highlight the material differences between Telesat Corporation and Telesat Partnership, this Annual Report includes sections that separately present and discuss areas that are materially different between Telesat Corporation and Telesat Partnership, including:

• The Risks Relating to Tax Matters set out in Item 4D. of this Annual Report;

• The Description of Telesat Partnership Governance at Item 6C. of this Annual Report;

• The Description of Telesat Partnership Units and GP units at Item 10B. of this Annual Report;

• The disclosure related to the tax consequences to holders of Telesat Public Shares and Telesat Partnership Units at Item 10E. of this Annual Report;

2

• The differences from the results of operations and treatment of partnership units liability in Item 5 of this Annual Report;

• the consolidated financial statements in Item 8 of this Annual Report; and

• the Certifications of the Chief Executive Officer and the Chief Financial Officer included as Exhibits 12.3, 12.4, 13.3 and 13.4 to this Annual Report.

In the sections of this Annual Report that combine disclosure for Telesat and Telesat Partnership, this Annual Report refers to actions or holdings as being actions or holdings of the Company. Although Telesat (directly or indirectly through one of its subsidiaries) is generally the entity that enters into contracts, holds assets and issues or incurs debt, management believes this presentation is appropriate for the reasons set forth above and because the business of the Company is a single integrated enterprise operated through Telesat.

In addition, both Telesat Corporation and Telesat Partnership are reporting issuers in each of the provinces and territories of Canada and, as a result, are subject to Canadian continuous disclosure and other reporting obligations under applicable Canadian securities laws. This Annual Report on Form 20-F constitutes Telesat Corporation’s Annual Information Form for purposes of its Canadian continuous disclosure obligations under National Instrument 51-102 – Continuous Disclosure Obligations (“NI 51-102”). Pursuant to an application for exemptive relief made in accordance with National Policy 11-203 – Process for Exemptive Relief Applications in Multiple Jurisdictions, Telesat Partnership has received exemptive relief dated November 16, 2021 from the Canadian securities regulators. This exemptive relief exempts Telesat Partnership from the continuous disclosure requirements of NI 51-102, effectively allowing Telesat Partnership to satisfy its Canadian continuous disclosure obligations by relying on the Canadian continuous disclosure documents filed by Telesat Corporation, for so long as certain conditions are satisfied. See Item 10B. Additional Information under the heading “Disclosures Regarding Exemptions from Canadian Securities Law Requirements”.

We use various trademarks, trade names and service marks in our business, including Telesat and Telesat Lightspeed. For convenience, we may not include the ® or ™ symbols, but such omission is not meant to indicate that we would not protect our intellectual property rights to the fullest extent allowed by law. Any other trademarks, trade names or service marks referred to in this annual report are the property of their respective owners.

Unless otherwise stated, references to “Telesat,” the “Company,” “we,” “us” or “our” in this annual report refers to Telesat Canada and its subsidiaries before the closing of the Transaction, and to Telesat Corporation and its subsidiaries (including Telesat Canada and Telesat Partnership LP) after the closing of the Transaction.

PRESENTATION OF FINANCIAL INFORMATION

Unless we indicate otherwise, financial information in this Annual Report has been prepared in accordance with International Financial Reporting Standards (“IFRS”) as issued by the International Accounting Standards Board (“IASB”). IFRS differs in some respects from United States generally accepted accounting principles, (“U.S. GAAP”), and thus our financial statements may not be comparable to the financial statements of United States companies.

We present our historical financial statements in Canadian dollars, which is the presentation currency of the Company. All figures reported in this Annual Report are in Canadian dollars, except where we indicate otherwise, and are referenced as “$” and “dollars”.

This Annual Report contains a translation of some Canadian dollar amounts into United States dollars at specified exchange rates solely for your convenience. All references to “US$” and “U.S. dollar” refers to United States dollars.

SPECIAL NOTE REGARDING FORWARD-LOOKING STATEMENTS

This Annual Report contains forward-looking statements within the meaning of the U.S. Private Securities Litigation Reform Act of 1995. When used in this document, the words “believes,” “expects,” “plans,” “may,” “will,” “would,” “could,” “should,” “anticipates,” “estimates,” “project,” “intend” or “outlook” or other variations of these words or other similar expressions are intended to identify forward-looking statements and information. In addition, Telesat Corporation or its representatives have made or may make forward- looking statements, orally or in writing, which may be included in, but are not limited to, various filings made from time to time with the SEC, and press releases or oral statements made with the approval of an authorized executive officer of Telesat Corporation. Actual results may differ materially from anticipated results as a result of certain risks and uncertainties which are described in the section of this Annual Report entitled “Risk Factors.” Risks and uncertainties include but are not limited to (1) risks associated with financial factors,

3

including swings in the global financial markets, increases in interest rates and access to capital; (2) risks associated with satellite services, including dependence on large customers, launch delays and failures, in-orbit failures and competition; (3) risks and uncertainties associated with Telesat Lightspeed, including overcoming technological challenges, access to spectrum and markets, governmental restrictions or regulations, supply chain disruptions, raising sufficient capital to design and implement the system and competition from other low earth orbit systems; (4) regulatory risks, such as the effect of industry and government regulations that affect Telesat Corporation; and (5) other risks, including risks relating to and resulting from the COVID-19 pandemic. The foregoing list of important factors is not exclusive. Furthermore, Telesat Corporation operates in an industry sector where securities values may be volatile and may be influenced by economic and other factors beyond Telesat Corporation’s control.

These factors should not be construed as exhaustive and should be read with the other cautionary statements in this annual report. These forward-looking statements are based on our current expectations, estimates, forecasts and projections about our business and the industry in which we operate and management’s beliefs and assumptions, and are not guarantees of future performance or development and involve known and unknown risks, uncertainties and other factors that are in some cases beyond our control. As a result, any or all of our forward-looking statements in this annual report may turn out to be inaccurate. Factors that may cause actual results to differ materially from current expectations include, among other things, those listed under “Risk Factors” and elsewhere in this annual report. Potential investors are urged to consider these factors carefully in evaluating the forward-looking statements. Comparisons of results for current and any prior periods are not intended to express any future trends or indications of future performance, unless specifically expressed as such, and should only be viewed as historical data. These forward-looking statements speak only as at the date of this annual report. Except as required by law, we assume no obligation to update or revise these forward-looking statements for any reason, even if new information becomes available in the future. You should, however, review the factors and risks we describe in the reports we will file from time to time with the SEC and the Canadian securities regulatory authorities, after the date of this annual report.

This Annual Report contains estimates, projections, market research and other information concerning our industry, our business, and the markets for our services. Information that is based on estimates, forecasts, projections, market research or similar methodologies is inherently subject to uncertainties, and actual events or circumstances may differ materially from events and circumstances that are assumed in this information.

Unless otherwise expressly stated, we obtained this industry, business, market and other data from our own internal estimates and research as well as from reports, research surveys, studies and similar data prepared by market research firms and other third parties, industry and general publications, government data and similar sources.

In addition, assumptions and estimates of our and our industry’s future performance are necessarily subject to a high degree of uncertainty and risk due to a variety of factors, including those described in “Risk Factors.” These and other factors could cause our future performance to differ materially from our assumptions and estimates.

Any references to forward-looking statements in this annual report include forward-looking information within the meaning of applicable Canadian securities laws.

INDUSTRY AND MARKET DATA

This annual report includes market data and forecasts with respect to current and projected market sizes for the telecommunications and satellite services sectors. Although we are responsible for all of the disclosure contained in this annual report, in some cases we rely on and refer to market data and certain industry forecasts that were obtained from third party surveys, market research, consultant surveys, publicly available information and industry publications and surveys that we believe to be reliable. Unless otherwise indicated, all market and industry data and other statistical information and forecasts contained in this annual report are based on independent industry publications, reports by market research firms or other published independent sources and other externally obtained data that we believe to be reliable.

Some market and industry data, and statistical information and forecasts, are also based on management’s estimates. Any such market data, information or forecast may prove to be inaccurate because of the method by which we obtain it or because it cannot always be verified with complete certainty given the limits on the availability and reliability of raw data, the voluntary nature of the data gathering process and other limitations and uncertainties, including those discussed under the captions “Risk Factors” and “Special Note Regarding Forward-Looking Statements.”

4

FREQUENTLY USED TERMS

This annual report generally does not use technical defined terms, but a few frequently used terms may be helpful for you to have in mind at the outset. Unless otherwise specified or if the context so requires, the following terms have the meanings set forth below for purposes of this annual report:

“2026 Senior Secured Notes” means the 5.625% Senior Secured Notes due in December 2026 issued by Telesat Canada and Telesat LLC, as the co-issuer.

“5% Holder” means, with respect to a person, that such person, together with its affiliates, beneficially owns 5% or more of the fully diluted Telesat Corporation Shares.

“8.875% Senior Notes” means the 8.875% Senior Notes originally due in November 2024 issued by Telesat Canada and Telesat LLC, as the co-issuer, which were repaid in October 2019.

“BCBCA” means the Business Corporations Act (British Columbia). “CBCA” means the Canada Business Corporations Act.

“Change of Control” means (i) any person who, together with its affiliates and associates, acquires beneficial ownership of at least a majority of the Telesat Corporation Shares on a fully diluted basis, including by way of any arrangement, amalgamation, merger, consolidation, combination or acquisition of Telesat Corporation with, by or into another corporation, entity or person in one or more related transactions, or (ii) the sale of all or substantially all of the assets of Telesat Corporation to a third party.

“Class A Shares” means the Class A common shares of Telesat Corporation.

“Class A Special Voting Share” means the Class A Special Voting Share of Telesat Corporation.

“Class A Units” means the Class A units of Telesat Partnership.

“Class B Variable Voting Shares” means the Class B variable voting shares of Telesat Corporation.

“Class B Special Voting Share” means the Class B Special Voting Share of Telesat Corporation.

“Class B Units” means the Class B units of Telesat Partnership.

“Class C Fully Voting Shares” means the Class C fully voting shares of Telesat Corporation.

“Class C Limited Voting Shares” means the Class C limited voting shares of Telesat Corporation.

“Class C Shares” means, together, the Class C Fully Voting Shares and the Class C Limited Voting Shares.

“Class C Special Voting Share” means the Class C Special Voting Share of Telesat Corporation.

“Class C Units” means the Class C units of Telesat Partnership.

“Closing” means the consummation of the transactions occurring on the First Closing Day (November 18, 2021) and the Second Closing Day (November 19, 2021).

“Commissioner of Competition” means the Commissioner of Competition appointed pursuant to the Competition Act (Canada) or a person designated or authorized pursuant to the Competition Act (Canada) to exercise the powers and perform the duties of the Commissioner of Competition.

“Golden Share” means the Golden Share without par value in the capital of Telesat Corporation.

“IFRS” means the International Financing Reporting Standards as issued by the International Accounting Standards Board.

“Independent Audit Committee Director” means a director who (i) satisfies the independence requirements of the applicable U.S. and/or Canadian securities exchanges on which the Telesat Public Shares are listed, (ii) is “independent” of Telesat Corporation within the meaning of National Instrument 52-110 — Audit Committees of the Canadian Securities Administrators and (iii) is “independent” of Telesat Corporation within the meaning of Section 10A(m)(3)(B) of the United States Securities Exchange Act of 1934.

5

“Investor Rights Agreements” means, together, the two separate investor rights agreements entered into between Telesat Corporation and each of MHR and PSP Investments on November 23, 2020.

“Lock-Up Period” means six months following the consummation of the Transaction on November 19, 2021.

“Loral Non-Voting Common Stock” means the Non-Voting Common Stock of Loral, US$0.01 par value per share, as defined in the Certificate of Incorporation of Loral.

“Loral Voting Common Stock” means the Voting Common Stock of Loral, US$0.01 par value per share, as defined in the Certificate of Incorporation of Loral.

“Partnership Agreement” means the amended and restated limited partnership agreement of Telesat Partnership, entered into between Telesat Corporation, Red Isle, PSP Investments, Henry Intven, John Cashman, Clare Copeland and each other person who was admitted to Telesat Partnership as a limited partner in accordance with the provisions thereof on the First Closing Day.

“Registration Rights Agreement” means the registration rights agreement entered into between Telesat Corporation, MHR and certain of its affiliates and PSP Investments in connection with the Transaction.

“SEC” means the U.S. Securities and Exchange Commission.

“Senior Notes” means the 6.5% Senior Notes due in 2027 issued by Telesat Canada and Telesat LLC, as the co-issuer.

“Senior Secured Credit Facilities” means the two outstanding secured credit facilities comprising a revolving facility maturing in 2024 and Term Loan B maturing in 2026.

“Senior Secured Notes” means the 4.875% Senior Secured Notes due in 2027 issued by Telesat Canada and Telesat LLC, as the co-issuer.

“Special Nomination Termination Date” means the earlier of: (i) Telesat Corporation’s annual meeting of shareholders held in calendar year 2024 (unless that meeting is held more than 30 days prior to the one- year anniversary of Telesat Corporation’s annual meeting of shareholders held in calendar year 2023, in which case, Telesat Corporation’s annual meeting of shareholders held in calendar year 2025), and (ii) the Special Board Date (as defined under the section “Description of Telesat Partnership Units and GP Units — Amendments to the Partnership Agreement”).

“Special Voting Shares” means, together, the Class A Special Voting Share, the Class B Special Voting Share and the Class C Special Voting Share.

“Specially Designated Director” means a person who:

(i) is designated as a director pursuant to Article 10.2(a)(iii) of the Telesat Articles;

(ii) meets the criteria for an Independent Audit Committee Director;

(iii) is not an affiliate or associate of PSP Investments, MHR or their permitted assignees (or any of their respective affiliates);

(iv) together with such person’s immediate family and affiliates, has not received compensation or payments from PSP Investments, MHR or their permitted assignees (or any of their respective affiliates) in any of the past three (3) years in an amount in excess of US$120,000 per annum, excluding for these purposes any directors’ fees; and

(v) is Canadian.

“Telesat-to-Telesat Corporation Exchange Ratio” means 0.4136 Telesat Corporation Shares for each Telesat Common Share, Telesat Non-Voting Participating Preferred Share or Telesat Voting Participating Preferred Share (including all outstanding shares in the capital of Telesat underlying Telesat Options, Telesat Tandem SARs and Telesat RSUs).

“Telesat Articles” means the Articles of Amalgamation of Telesat Canada dated January 1, 2017.

6

“Telesat Common Shares” means the Common Shares of Telesat Canada as defined in the Telesat Articles.

“Telesat Control Transaction” means the consummation of a merger, amalgamation, arrangement or consolidation of Telesat Corporation, other than any transaction which would result in the holders of outstanding voting securities of Telesat Corporation (assuming the exchange of all outstanding Telesat Partnership Units for Telesat Corporation Shares) immediately prior to such transaction having at least a majority of the total voting power represented by the voting securities of the surviving entity outstanding immediately after such transaction, with the voting power of each such continuing holder relative to other continuing holders not being altered substantially in such transaction.

“Telesat Corporation Articles” means the organizational documents of Telesat Corporation, as amended and restated.

“Telesat Corporation Board” means the board of directors of Telesat Corporation.

“Telesat Corporation Shares” means, collectively, the Class A Shares, Class B Variable Voting Shares and Class C Shares of Telesat Corporation.

“Telesat Director Voting Preferred Shares” means the Director Voting Preferred Shares of Telesat Canada as defined in the Telesat Articles.

“Telesat Non-Voting Participating Preferred Shares” means the Non-Voting Participating Preferred Shares of Telesat Canada as defined in the Telesat Articles.

“Telesat Options” means options to purchase Telesat Non-Voting Participating Preferred Shares.

“Telesat Partnership Election” means an election by a Loral stockholder to receive units of Telesat Partnership pursuant to the Transaction Agreement.

“Telesat Partnership GP Units” means the general partnership units of Telesat Partnership.

“Telesat Partnership Units” means, together, the Class A Units, Class B Units and Class C Units of Telesat Partnership.

“Telesat Public Shares” means, together, the Class A Shares and Class B Variable Voting Shares of Telesat Corporation.

“Telesat RSUs” means restricted stock units that represent the right to receive Telesat Non-Voting Participating Preferred Shares.

“Telesat Tandem SARs” means tandem stock appreciation rights accompanying certain Telesat Options.

“Telesat Voting Participating Preferred Shares” means the Voting Participating Preferred Shares of Telesat as defined in the Telesat Articles.

“Trust” means the Telesat Corporation Trust, an irrevocable trust formed under the laws of the Province of Ontario pursuant to the Trust Agreement.

“Trust Agreement” means the trust agreement establishing the Trust, entered into between the settlor of the Trust and the Trustee on the First Closing Day.

“Trust Voting Agreement” means the voting agreement entered into between the Trustee, Telesat Corporation and Telesat Partnership on the First Closing Day.

“Trustee” means the trustee of the Trust, as determined from time to time in accordance with the Trust Agreement, who will initially be TSX Trust Company.

“TSX” means the Toronto Stock Exchange.

“Unwind Transaction” means, collectively, (i) the conversion of all of the Class B Variable Voting Shares into Class A Shares and (ii) the other transactions, events and occurrences specified in the Telesat Corporation Articles to occur upon an Unwind Trigger, including the redemption of the Golden Share and the Special Voting Shares and the expiration of the provisions in Part 24 of the Telesat Corporation Articles.

7

“Unwind Trigger” means the occurrence of both clauses (i) and (ii): (i) the occurrence of any one of the following: (A) the election of Telesat Corporation (which election, until the Special Board Date, must be made with the approval of the majority of the Specially Designated Directors then in office) to effect the Unwind Transaction, if: (a) no person who is not a Canadian, or any voting group comprised of any persons who are not Canadians, in each case, beneficially owns or controls, directly or indirectly, one-third or more of the fully diluted Telesat Corporation Shares, (b) Telesat Corporation becomes widely held, such that at least 70% of the fully diluted Telesat Corporation Shares are held by holders that do not beneficially own or control, directly or indirectly (and are not members of any group that beneficially owns or controls, directly or indirectly), 10% or more of the fully diluted Telesat Corporation Shares, collectively, or are entitled to report their ownership interest in Telesat Corporation for purposes of U.S. federal securities laws on (i) Form 13F or (ii) Schedule 13G pursuant to Rule 13d-1(b) or Rule 13d-1(c) promulgated under the Exchange Act, and (c) a majority of the members of the Telesat Corporation Board remain Canadian (as defined in the Investment Canada Act) at the time of the Unwind Transaction or (B) a Change of Control; and (ii) both (1) the absence of any determination by the Telesat Corporation Board that the Unwind Transaction would constitute a breach of, or an acceleration of the performance of any obligation under, any material agreement of Telesat Corporation, in each case, within 60 days of written notice to the Telesat Corporation Board of the occurrence of any event set forth in (i) above; provided, however, that in the event of the occurrence of a Change of Control, the fact that such occurrence could be deemed as a Change of Control under Telesat Corporation’s outstanding indebtedness or other material agreements shall be excluded for purposes of this subclause (1) if such indebtedness is refinanced or intended to be refinanced in connection with the occurrence of such Change of Control; and (2) receipt by Telesat Corporation of all required governmental authorizations for the Unwind Transaction.

8

PART I

ITEM 1. IDENTITY OF DIRECTORS, SENIOR MANAGEMENT AND ADVISERS

Not applicable.

ITEM 2. OFFER STATISTICS AND EXPECTED TIMETABLE

Not applicable.

ITEM 3. KEY INFORMATION

A. Selected Financial Data

Reserved.

B. Capitalization and Indebtedness

Not applicable.

C. Reasons for the Offer and Use of Proceeds

Not applicable.

D. Risk Factors

RISK FACTORS

Investing in our Telesat Public Shares involves a high degree of risk. You should carefully consider the risks and uncertainties described below, together with all of the other information contained in this annual report, including our consolidated financial statements and the related notes appearing at the end of this annual report, before deciding to invest in our Telesat Public Shares. Other risks and uncertainties that we do not presently consider to be material, or of which we are not presently aware, may become important factors that affect our future financial condition and financial performance. If any of those or the following risks actually occur, our business, financial condition, financial performance, liquidity and prospects could suffer materially, the trading price of our Telesat Public Shares could decline and you could lose all or part of your investment. See also “Special Note Regarding Forward-Looking Statements.”

Summary Risks

Risks Relating to the Business of Telesat

• Telesat’s in-orbit satellites may fail to operate as expected due to operational anomalies resulting in lost revenues, increased costs and/or termination of contracts.

• Changes in consumer demand for traditional television services and expansion of terrestrial networks have adversely impacted the growth in subscribers to direct-to-home (“DTH”) television services in North America, which may adversely impact future revenues. Fluctuations in available satellite capacity could also adversely affect Telesat’s results.

• Significant and intensifying competition in the satellite industry and from other providers of communications capacity could result in a loss of revenues and a decline in profitability of Telesat if it fails to compete effectively.

• Changes in technology could have a material adverse effect on Telesat’s results.

Risks Relating to Telesat’s Lightspeed Constellation

• There are numerous risks and uncertainties associated with Telesat’s planned Lightspeed constellation. Failure to develop significant commercial and service operational capabilities in connection with the Lightspeed constellation could prevent it from achieving commercial viability. Telesat may proceed with the Lightspeed

9

constellation and it may not be successful, Telesat may ultimately choose to not proceed with the Lightspeed constellation or Telesat may be unable to raise sufficient capital to fund the Lightspeed constellation, any of which could have a material adverse effect on Telesat’s results of operations, business prospects and financial condition. In addition, any equity financing of the Lightspeed constellation will result in dilution to the shareholders of Telesat Corporation and holders of Telesat Partnership Units and any debt financing of the Lightspeed constellation may result in Telesat incurring a significant degree of leverage.

• Telesat’s Lightspeed constellation will depend on the use of spectrum; regulations governing non-geostationary orbit (“NGSO”) spectrum rights, including requirements to share spectrum, could materially impact the Lightspeed constellation’s system capacity.

Risks Relating to Regulatory Matters

• Telesat’s operations may be limited or precluded by the rules or processes of the International Telecommunication Union (“ITU”), and it is required to coordinate its operations with those of other satellite operators.

• Telesat operates in a highly regulated industry and government regulations may adversely affect its ability to sell its services, or increase the expense of such services or otherwise limit its ability to operate or grow its business.

Risks Relating to Telesat’s Liquidity and Capital Resources

• Telesat’s level of indebtedness may increase and reduce its financial flexibility.

• Telesat’s business is capital intensive, and restrictions on its ability to incur additional debt and to take other actions may significantly impair its ability to obtain other financing.

Risks Relating to Tax Matters

• The acquisition, ownership and disposition of Telesat Public Shares and Telesat Partnership Units may have adverse U.S. tax consequences for shareholders of Telesat Corporation, including: Telesat Corporation may have been a passive foreign investment company (a “PFIC”) for 2021 and could be classified as a PFIC in 2022 and subsequent taxable years; Telesat Corporation or Telesat Partnership could be treated as a U.S. corporation or as a surrogate foreign corporation for U.S. federal income tax purposes and Loral could be treated as an expatriated entity; the IRS could recharacterize the receipt of Telesat Partnership Units as a receipt of Telesat Public Shares; and Non-U.S. Holders of Telesat Partnership Units will generally be subject to U.S. withholding with respect to dividends received by Telesat Partnership from Loral.

• The acquisition, ownership and disposition of Telesat Public Shares and Telesat Partnership Units may have adverse Canadian tax consequences for shareholders of Telesat Corporation and partners of Telesat Partnership.

Risks Relating to the Ownership of Telesat Public Shares and Telesat Partnership Units

• Each of MHR and PSP Investments have substantial governance rights over Telesat, and their interests may differ from the interests of the other Telesat Corporation shareholders.

• Telesat may raise additional equity capital to fund Telesat Lightspeed which could result in potential substantial ownership dilution to the shareholders of Telesat Corporation and holders of Telesat Partnership Units.

• Telesat has certain indemnification and post-Closing obligations to PSP Investments, which in certain circumstances will be uncapped and may result in dilution to the other shareholders of Telesat Corporation and holders of Telesat Partnership Units.

10

Risks Relating to the Business of Telesat Corporation

Telesat Corporation’s in-orbit satellites may fail to operate as expected due to operational anomalies resulting in lost revenues, increased costs and/or termination of contracts.

Satellites utilize highly complex technology and operate in the harsh environment of space and therefore are subject to significant operational risks while in orbit. These risks include in-orbit equipment failures, malfunctions and other kinds of problems commonly referred to as anomalies. Satellite anomalies include, for example, circuit failures, transponder failures, solar array failures, telemetry subsystem failures, battery cell and other power system failures, satellite control system failures and propulsion system failures. Some of Telesat Corporation’s satellites have had malfunctions and other anomalies in the past. See “— Some of Telesat Corporation’s satellites have experienced in-orbit anomalies and may in the future experience further anomalies that may affect their performance.” Acts of war, terrorism, magnetic, electrostatic or solar storms, space debris, satellite conjunctions or micrometeoroids could also damage satellites.

Satellite anomalies are likely to be experienced in the future, and may include the types of anomalies described above or may arise from failures in other systems or components. Despite working closely with satellite manufacturers to determine the causes of anomalies and mitigate them in new satellites and to provide for intra-satellite redundancies for certain critical components to minimize or eliminate service disruptions in the event of failure, Telesat Corporation cannot assure you that, in these cases, it will be possible to restore normal operations. Where service cannot be restored, the failure could cause the satellite to have less capacity available for sale, to suffer performance degradation or to cease operating prematurely, either in whole or in part.

Any single anomaly or series of anomalies or other failure (whether full or partial) of any of Telesat Corporation’s satellites could cause revenues, cash flows and backlog to decline materially, could require Telesat Corporation to repay prepayments made by customers of the affected satellite and could have a material adverse effect on relationships with current customers and Telesat Corporation’s ability to attract new customers for satellite services. A failure could result in a customer terminating its contract for service on the affected satellite. If Telesat Corporation is unable to provide alternate capacity to an affected customer, the customer may decide to procure all or a portion of its future satellite services from an alternate supplier or the customer’s business may be so adversely affected by the satellite failure that it may not have the financial ability to procure future satellite services. It may also require that Telesat Corporation expedite a satellite replacement program, adversely affecting Telesat Corporation’s profitability, increasing its financing needs and limiting the availability of funds for other business purposes. Finally, the occurrence of anomalies may adversely affect Telesat Corporation’s ability to insure satellites at commercially reasonable premiums, if at all, and may cause insurers to demand additional exclusions in policies they issue.

Because Telesat Corporation’s satellites are complex and are deployed in complex environments, Telesat Corporation’s satellites may have defects that are discovered only after full deployment, which could seriously harm Telesat Corporation’s business.

Telesat Corporation produces highly complex satellites that incorporate leading-edge technology. Telesat Corporation’s products are complex and are designed to be deployed across complex networks, which in some cases may include over a million users. Because of the nature of these satellites, there is no assurance that Telesat Corporation’s pre-launch testing programs will be adequate to detect all defects. As a result, Telesat Corporation’s customers may discover errors or defects in its satellites, or Telesat Corporation’s satellites may not operate as expected, after they have been launched and entered service. If Telesat Corporation is unable to resolve an anomaly, Telesat Corporation could experience damage to its reputation, reduced customer satisfaction, loss of existing customers and failure to attract new customers, failure to achieve market acceptance, cancellation of orders, loss of revenues, reduction in backlog and market share, increased service and warranty costs, diversion of development resources, legal actions by Telesat Corporation’s customers, issuance of credit to customers and increased insurance costs. Defects, integration issues or other performance problems in Telesat Corporation’s satellites could also result in financial or other damages to Telesat Corporation’s customers. Telesat Corporation’s customers could seek damages for related losses from Telesat Corporation, which could seriously harm Telesat Corporation’s business, financial condition and results of operations. The occurrence of any of these problems would seriously harm Telesat Corporation’s business, financial condition and results of operations.

11

Some of Telesat Corporation’s satellites have experienced in-orbit anomalies and may in the future experience further anomalies that may affect their performance.

A number of Telesat Corporation’s in-orbit satellites have experienced anomalies and may in the future experience further anomalies that may affect their performance. Past anomalies include:

Nimiq Satellites:

A number of Lockheed Martin’s A2100 series satellites have suffered in-orbit failures of circuits on their solar arrays. Lockheed Martin has determined that Nimiq 2 is in the family of spacecraft that is susceptible to this anomaly.

In February 2003, Nimiq 2 experienced an anomaly affecting the available power on the satellite. Lockheed Martin concluded the most likely cause of this anomaly was an electrical short-circuit caused by foreign object debris located in a single power-carrying connector. As a result of this anomaly, the south solar array power cannot be recovered. In addition, Nimiq 2 has experienced solar array circuit failures, resulting in a significant reduction of available power. These failures have substantially reduced the number of transponders Telesat Corporation can operate at saturation and it is currently expected that the available capacity will be further reduced over time. In April 2005, another satellite operator reported that a satellite of the same series as Nimiq 2 suffered a solar array anomaly that resulted in the complete loss of one array and a corresponding 50% reduction in available satellite power. Lockheed Martin, the manufacturer, has traced the most likely cause of this failure to a component on the solar array drive. Nimiq 2 has this component in its remaining functioning solar array. If this same component were to fail on the functioning array of Nimiq 2, it would result in a total loss of service of the satellite.

Anik Satellites:

Anik F1 was designed with the capability to cover both North America and South America from the 107.3° WL orbital location. In August 2001, Boeing, the manufacturer of the Anik F1 satellite, advised Telesat Corporation of a gradual decrease in available power on-board the satellite. Boeing investigated the cause of the power loss and reported that the power will continue to degrade. Telesat Corporation procured a replacement satellite, Anik F1R, which was launched in 2005. The North American traffic on Anik F1 was transferred to Anik F1R. Anik F1 continued to provide coverage of South America until December 2020. Anik F1 was recently moved to the 109.2° WL orbital location where it commenced inclined orbit operations.

Telesat Corporation has experienced and continues to experience intermittent anomalies with certain amplifiers in the Ka-band and Ku-band payloads on Anik F2. Boeing, the manufacturer, has completed its investigation of these anomalies. The majority of the affected Ka-band units continue to remain in service through modifying operational configurations. The Ku-band traveling-wave-tube amplifiers (“TWTAs”) that were affected as a result of these anomalies have failed. All but two of the failed transponders were replaced using spares and many of the Ku-band TWTAs currently in service have no further spares left to replace them should they fail. Anik F2 has experienced an anomaly with one of its two telemetry transmitters. While the failure of a single telemetry transmitter does not impact satellite operations or the service Telesat Corporation provides to its customers, in the event Telesat Corporation is unable to restore any redundancy and the second telemetry transmitter were to fail, Telesat Corporation would cease receiving important information from the satellite regarding its position in orbit and health and Telesat Corporation’s ability to operate the satellite would be adversely affected. A software patch for the satellite was developed by Boeing to provide telemetry to support operations in the event of a failure of the second transmitter and was implemented on the satellite in February 2013. Telesat Corporation’s Anik F2 satellite has also experienced anomalies on two of the station-keeping thrusters. One of the thrusters has failed while the second continues to support operations with some constraints. These thruster anomalies have had no impact on service. Alternative operational methods have been implemented to enable continued operations utilizing the remaining thrusters. The alternative operational methods are less fuel efficient and they will adversely impact the lifetime of the satellite. The evaluation of the lifetime impact is ongoing. In the event of another thruster failure or failure of the second telemetry transmitter, the satellite will need to commence inclined orbit operations and we would be unable to support the existing services on the satellite. There is a small Ka-band payload on Anik F3 which experienced an anomaly following launch. Telesat Corporation implemented a plan to remedy the effect of this anomaly and the Ka-band payload is currently operational.

12

Telstar Satellites:

Telstar 12 VANTAGE began to suffer from degraded performance of four channels in late December 2016 due to increased noise levels. Following an investigation with the satellite manufacturer, the root cause of the anomaly was determined. As a result of this degradation, two channels on T12V are no longer usable. In 2017, Telesat Corporation received insurance proceeds in connection with this anomaly. Degradation of performance was observed on additional channels in May 2018 due to increased noise levels. The satellite manufacturer investigation concluded that the root cause of the anomaly was similar to that of the 2016 anomaly. The channels continue to support service. In the event of further degradation, Telesat Corporation may lose the capability to continue to use two channels.

Telstar 14R/Estrela do Sul 2’s North solar array was damaged after launch and only partially deployed, diminishing the power and expected orbital maneuver life of the satellite. In July 2011, the satellite began commercial service with substantially reduced available transponder capacity and with an expected end-of-orbital maneuver life reduced to 2025. It is currently expected that the available transponder capacity will be reduced over time. If the damaged solar array on Telstar 14R/Estrela do Sul 2 were to unexpectedly deploy in the future this could result in a loss of capability to provide service. In September 2016, the primary gyro utilized to maintain operational pointing of the satellite exhibited degraded performance. The backup gyro unit was switched into service and is currently in operation. A ground-based system has been implemented, which provides the capability to operate the satellite in the absence of a functioning on-board gyro. This system will reduce the demands on the backup gyro unit and provide redundancy.

Telstar 19 VANTAGE has suffered a number of failures of heaters that support the operation of two of the three battery packs on the satellite. The satellite manufacturer conducted an investigation and determined the root cause of the anomaly. There is a risk that the satellite may experience additional heater failures. The functionality of the batteries and services on Telstar 19 VANTAGE have not been impacted by the failures thus far. Tests performed in orbit and on the ground have validated operational workarounds that Telesat Corporation can implement to maintain battery function in the event Telstar 19 VANTAGE were to suffer additional heater failures on the batteries.

In general, Telesat Corporation’s satellites are exposed to the potential risk of financial loss. See “— Telesat Corporation’s in-orbit satellites may fail to operate as expected due to operational anomalies resulting in lost revenues, increased costs and/or termination of contracts.”

The actual orbital maneuver lives of Telesat Corporation satellites may be shorter than it anticipates, and it may be required to reduce available capacity on its satellites prior to the end of their orbital maneuver lives.

For all but one of Telesat Corporation’s GEO satellites, the current expected end-of-orbital maneuver life date goes beyond the manufacturer’s end-of-service life date. A number of factors will affect the actual commercial service lives of Telesat Corporation satellites, including: the amount of propellant used in maintaining the satellite’s orbital location or relocating the satellite to a new orbital location (and, for newly-launched satellites, the amount of propellant used during orbit raising following launch); the durability and quality of their construction; the performance of their components; conditions in space such as solar flares and space debris; operational considerations, including operational failures and other anomalies; and changes in technology which may make all or a portion of its satellite fleet obsolete.

Telesat Corporation has been forced to remove satellites from service prematurely in the past due to an unexpected reduction in their previously anticipated end-of-orbital maneuver life. It is possible that the actual orbital maneuver lives of one or more of the existing satellites may also be shorter than currently anticipated. Further, on some of the satellites it is anticipated that the total available payload capacity may need to be reduced prior to the satellite reaching its end-of-orbital maneuver life.

Telesat Corporation periodically reviews the expected orbital maneuver life of each of its satellites using current engineering data. A reduction in the orbital maneuver life of any of the satellites could result in a reduction of the revenues generated by that satellite, the recognition of an impairment loss and an acceleration of capital expenditures. To the extent Telesat Corporation is required to reduce the available payload capacity prior to the end of a satellite’s orbital maneuver life, revenues from the satellite would be reduced.

13

Telesat Corporation’s insurance will not protect it against all satellite-related losses. Further, Telesat Corporation may not be able to renew insurance on its existing satellites or obtain insurance on future satellites on acceptable terms or at all, and, for certain of its existing satellites, Telesat Corporation has elected to forego obtaining insurance.

Telesat Corporation’s current satellite insurance does not protect it against all satellite-related losses that it may experience, and it does not have in-orbit insurance coverage for all of the satellites in its fleet. As of December 31, 2021, the total net book value of Telesat Corporation’s five in-orbit GEO satellites for which Telesat Corporation does not have insurance (Nimiq 2, Anik F1, Anik F1R, Anik F2, and ViaSat-1) was approximately $19.3 million. Telesat Corporation’s insurance does not protect it against business interruption, loss of revenues or delay of revenues. Telesat Corporation’s existing launch and in-orbit insurance policies include specified exclusions, deductibles and material change limitations, and future insurance policies are expected to continue to include such features. Typically, these insurance policies exclude coverage for damage or losses arising from acts of war, antisatellite devices, electromagnetic or radio frequency interference and other similar potential risks for which exclusions are customary in the industry at the time the policy is written. In addition, they typically exclude coverage for satellite health-related problems affecting the satellites that are known at the time the policy is written or renewed. Any claims under existing policies are subject to settlement with the insurers and may, in some instances, be payable to Telesat Corporation’s customers.

The price, terms and availability of satellite insurance has fluctuated significantly in recent years. These fluctuations may be affected by recent satellite launch or in-orbit failures and general conditions in the insurance industry. Launch and in-orbit policies on satellites may not continue to be available on commercially reasonable terms or at all. To the extent Telesat Corporation experiences a launch or in-orbit failure that is not fully insured, or for which insurance proceeds are delayed or disputed, Telesat Corporation may not have sufficient resources to replace the affected satellite. In addition, higher premiums on insurance policies increase costs, thereby reducing profitability. Future insurance policies may also have higher deductibles, shorter coverage periods, higher loss percentages required for constructive total loss claims and additional satellite health-related policy exclusions, all of which would reduce Telesat Corporation’s expected profitability. There can be no assurance that, upon the expiration of an in-orbit insurance policy, which typically has a term of one year, Telesat Corporation will be able to renew the policy on terms acceptable to it.

Telesat Corporation may elect to reduce or eliminate insurance coverage for certain of its existing satellites, or elect not to obtain insurance policies for its future satellites, especially if exclusions make such policies ineffective, the costs of coverage make such insurance impractical or self-insurance is deemed more cost effective.

Telesat Corporation derives a substantial amount of its revenues from only a few of its customers. A loss of, or default by, one or more of these major customers, or a material adverse change in any such customer’s business or financial condition, could materially reduce Telesat Corporation’s future revenues and contracted backlog.

For the year ended December 31, 2021, Telesat Corporation’s top five customers together accounted for approximately 64% of its revenues. As at December 31, 2021, Telesat Corporation’s top five backlog customers together accounted for approximately 84% of its backlog. If any of its major customers choose not to renew their contracts at the expiration of the existing terms or seek to negotiate concessions, particularly on price, it could have a material adverse effect on results of operations, business prospects and financial condition. Telesat Corporation customers could experience a downturn in their business or find themselves in financial difficulties, which could result in their ceasing or reducing their use of Telesat Corporation services or becoming unable to pay for services they had contracted to buy. In addition, some of Telesat Corporation’s customers’ industries are undergoing significant consolidation, and Telesat Corporation customers may be acquired by each other or other companies, including by Telesat Corporation competitors. Such acquisitions could adversely affect Telesat Corporation’s ability to sell services to such customers and to any end-users whom they serve. Some customers have in the past defaulted, and customers may in the future default, on their obligations to Telesat Corporation due to bankruptcy, lack of liquidity, operational failure or other reasons. Such defaults could adversely affect revenues, operating margins and cash flows. If Telesat Corporation’s contracted revenue backlog is reduced due to the financial difficulties of its customers, revenues, operating margins and cash flows would be further negatively impacted.

14

Telesat Corporation’s business is capital intensive and it may not be able to raise adequate capital to finance its business strategies, or it may be able to do so only on terms that significantly restrict its ability to operate its business.

Implementation of Telesat Corporation’s business strategy requires a substantial outlay of capital. As it pursues its business strategies and seeks to respond to developments in its business and opportunities and trends in its industry, Telesat Corporation’s actual capital expenditures may differ from expected capital expenditures. There can be no assurance that Telesat Corporation will be able to satisfy capital requirements in the future. In addition, if one of its satellites fails unexpectedly, there is no assurance of insurance recovery or the timing thereof and Telesat Corporation may need to exhaust or significantly draw upon its Amended Revolving Credit Facility or obtain additional financing to replace the satellite. If Telesat Corporation determines it needs to obtain additional funds through external financing and is unable to do so, it may be prevented from fully implementing its business strategy.

The availability and cost to Telesat Corporation of external financing depends on a number of factors, including its credit rating and financial performance and general market conditions. Telesat Corporation’s ability to obtain financing generally may be influenced by the supply and demand characteristics of the telecommunications sector in general and of the satellite services sector in particular. Declines in expected future revenues under contracts with customers and challenging business conditions faced by Telesat Corporation customers are among the other factors that may adversely affect Telesat Corporation’s credit and access to the capital markets. Other factors that could impact Telesat Corporation’s credit rating include the amount of debt in its current or future capital structure, activities associated with strategic initiatives, the health of its satellites, the success or failure of its planned launches, its expected future cash flows and the capital expenditures required to execute its business strategy. The overall impact on its financial condition of any transaction that it pursues may be negative or may be negatively perceived by the financial markets and rating agencies and may result in adverse rating agency actions with respect to Telesat Corporation’s credit rating and access to the capital markets. Long-term disruptions in the capital or credit markets as a result of uncertainty or recession, changing or increased regulation or failures of significant financial institutions could adversely affect its access to capital. A credit rating downgrade or deterioration in Telesat Corporation’s financial performance or general market conditions could limit its ability to obtain financing or could result in any such financing being available only at greater cost or on more restrictive terms than might otherwise be available and, in either case, could result in Telesat Corporation deferring or reducing capital expenditures, including on new or replacement satellites.

Telesat Corporation satellite launches may be delayed, it may suffer launch failures or its satellites may fail to reach their planned orbital locations. Any such issue could result in the loss of a satellite or cause significant delays in the deployment of the satellite which could have a material adverse effect on results of operations, business prospects and financial condition.

Delays in launching satellites and in the deployment of satellites are not uncommon and result from construction delays, the unavailability of reliable launch opportunities with suppliers, delays in obtaining required regulatory approvals and launch failures. If satellite construction schedules are not met, a launch opportunity may not be available at the time the satellite is ready to be launched. Satellites are also subject to certain risks related to failed launches. Launch vehicles may fail. Launch failures result in significant delays in the deployment of satellites because of the need to construct replacement satellites, which can take up to 30 months or longer, and to obtain another launch vehicle. A delay or perceived delay in launching a satellite, or replacing a satellite, may cause Telesat Corporation’s current customers to move to another satellite provider if they determine that the delay may cause an interruption in continuous service. In addition, Telesat Corporation’s contracts with customers who purchase or reserve satellite capacity may allow the customers to terminate their contracts in the event of a delay. Any such termination would require Telesat Corporation to refund any prepayment it may have received, and would result in a reduction in its contracted backlog and would delay or prevent it from securing the commercial benefits of the new satellite.

Replacing a satellite upon the end of its service life will require Telesat Corporation to make significant expenditures and may require it to obtain shareholder approval and Telesat Corporation may choose not to, or be unable to, replace some of its satellites upon their end of life.

To ensure no disruption in its GEO business and to prevent loss of customers, Telesat Corporation will be required to commence construction of a replacement satellite approximately three to five years prior to the expected end of service life of the satellite then in orbit. Typically, the construction, launch and insurance of a GEO satellite costs in the range of US$250,000,000 to US$300,000,000. There is no assurance that Telesat Corporation will have sufficient cash, cash flow or be able to obtain third-party or shareholder financing to fund such expenditures on

15

favorable terms, if at all. Moreover, the Telesat Corporation Articles provide that the power of Telesat Corporation’s board to issue securities of Telesat Corporation cannot be delegated to a committee, and, consequently, so long as designees of PSP Investments and MHR hold a combined majority of the seats on Telesat Corporation’s board, the approval of at least the designees of PSP Investments or of MHR is required for Telesat Corporation to issue securities. In the event that Telesat Corporation determines to finance expenditures to replace satellites by issuing securities, such designees could block such a financing.

Certain of Telesat Corporation’s satellites are nearing their expected end-of-orbital maneuver lives.

Should Telesat Corporation not have sufficient funds available to replace those satellites or Telesat Corporation be unable to finance such replacements, because of PSP Investments’ and MHR’s determining not to approve such financing or otherwise, it could have a material adverse effect on Telesat Corporation’s results of operations, business prospects and financial condition.

In order to justify the cost of replacing a satellite at the end of its life, there must be sufficient demand for services, and sufficient spectrum available to Telesat Corporation to provide those services, such that a reasonable business case can be made for its replacement. If there is insufficient demand for a replacement, or if Telesat Corporation does not have sufficient spectrum available to it, as a result of the repurposing of C-band and/or Ka-band spectrum for terrestrial use or otherwise, Telesat Corporation may choose not to replace a satellite at the end of its life.

In the event we are unable or choose not to replace a satellite at the end of its life, we will need to provide our customers with alternate capacity in order to maintain our customers and the revenue associated therewith. We do not intend to replace all our satellites that are nearing their end of life. While we are currently considering the potential to extend the life of certain of our satellites nearing their end of life, there can be no assurance that we will acquire any life extension services or that such life extension services would be successful. For some satellites, we intend to provide continuity of service to our customers at the end of life of those satellites by transitioning services to our Lightspeed constellation. Given that the entry into service of our Lightspeed constellation has been delayed we may be unable to provide many of our customers on satellites nearing their end of life with continuity of service. If we are unable to provide continuity of service to our customers by extending the life of such satellites, providing alternate capacity on other satellites, inducing our Lightspeed constellation, our revenue would decline.

Telesat Corporation may experience a failure of ground operations infrastructure or interference with its satellite signals that impairs the commercial performance of, or the services delivered over, its satellites or the satellites of other operators for whom it provides ground services, which could result in a material loss of revenues.

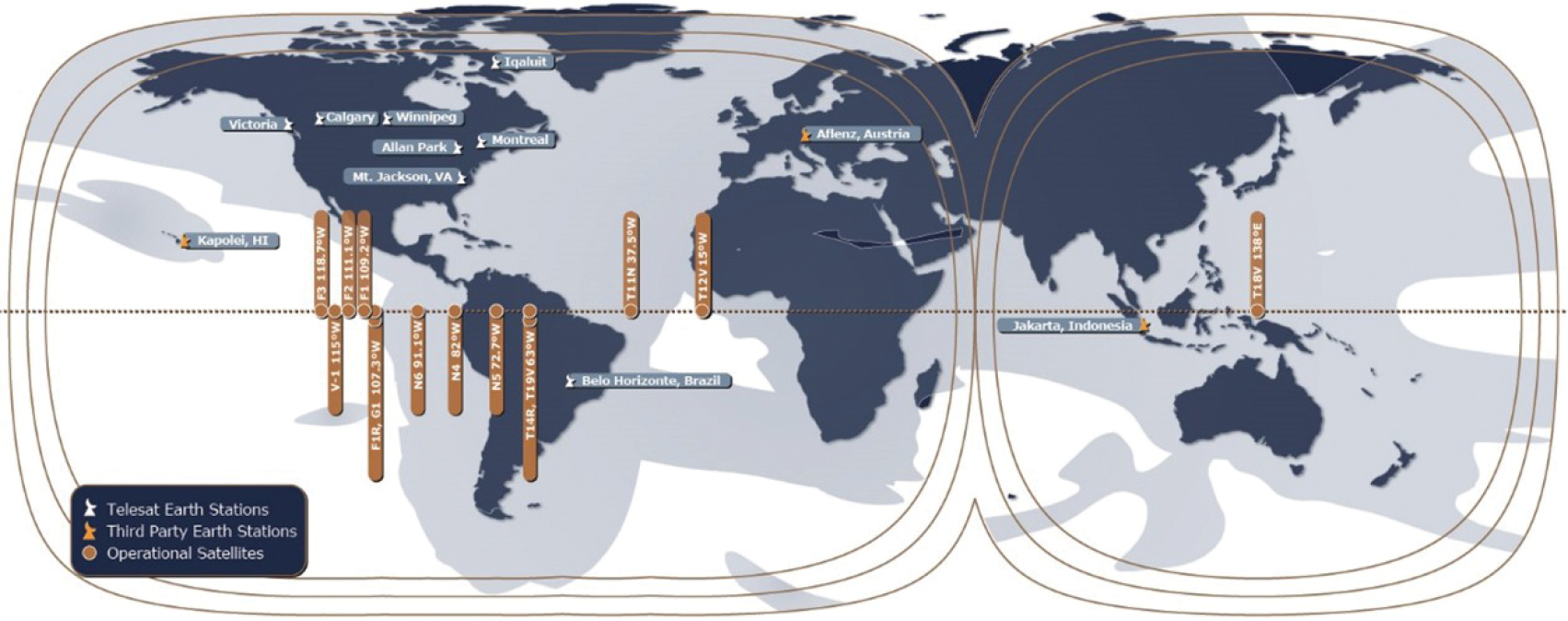

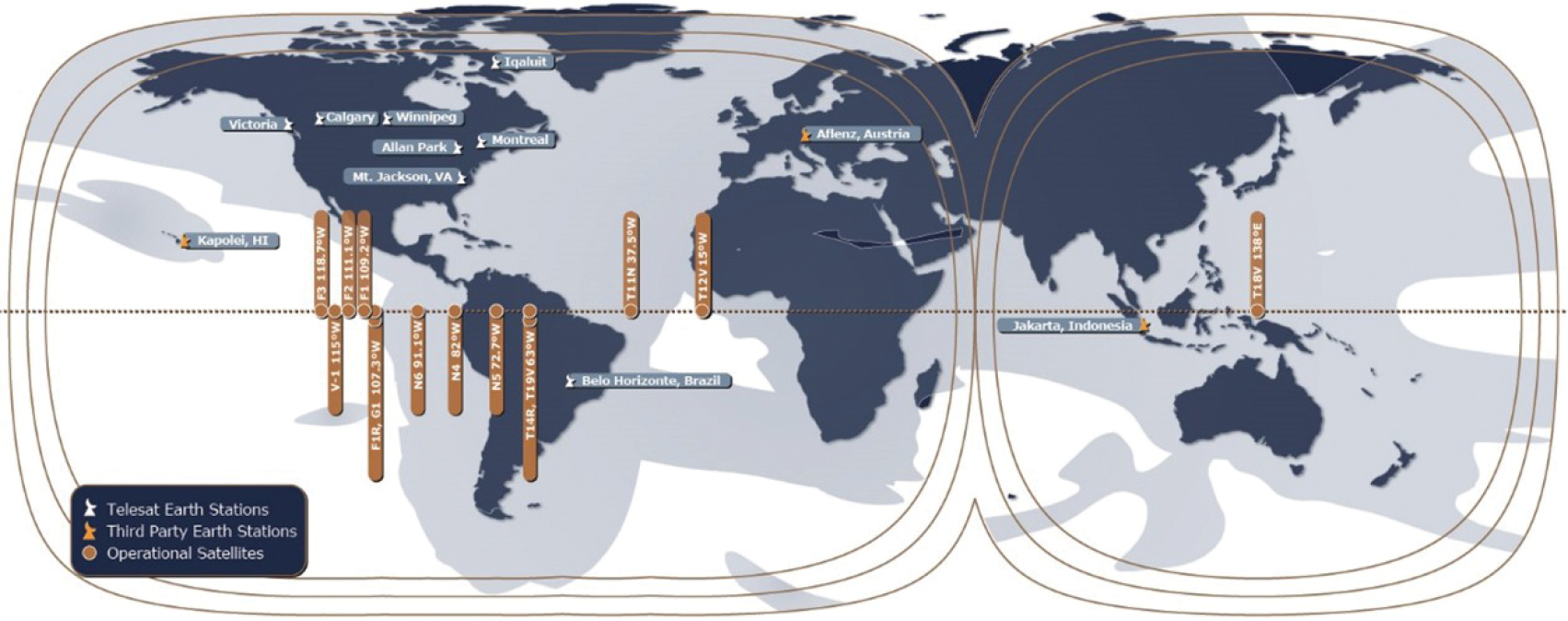

Telesat Corporation operates an extensive ground infrastructure including its satellite control centre in Ottawa, its main earth station and back up satellite control facility at Allan Park, nine earth stations throughout Canada, two teleports in the U.S. and one teleport located in Brazil. These ground facilities are used for controlling Telesat Corporation’s satellites and/or for the provision of end-to-end services to its customers.

Telesat Corporation may experience a partial or total loss of one or more of these facilities due to natural disasters (tornado, flood, hurricane or other such acts of God), fire, acts of war or terrorism or other catastrophic events. A failure at any of these facilities would cause a significant loss of service for its customers. Additionally, it may experience a failure in the necessary equipment at the satellite control center, at the back-up facility, or in the communications links between these facilities and remote earth station facilities. A failure or operator error affecting tracking, telemetry and control operations might lead to a breakdown in the ability to communicate with one or more satellites or cause the transmission of incorrect instructions to the affected satellite(s), which could lead to a temporary or permanent degradation in satellite performance or to the loss of one or more satellites. Intentional or non-intentional electromagnetic or radio frequency interference could result in a failure of its ability to deliver satellite services to customers. A failure at any of Telesat Corporation’s facilities or in the communications links between facilities or interference with its satellite signal could cause revenues and backlog to decline materially and could adversely affect its ability to market its services and generate future revenues and profit.

Telesat Corporation purchases equipment from third-party suppliers and depends on those suppliers to deliver, maintain and support these products to the contracted specifications in order for it to meet its service commitments to its customers. Telesat Corporation may experience difficulty if these suppliers do not meet their obligations to deliver and support this equipment. Telesat Corporation may also experience difficulty or failure when implementing, operating and maintaining this equipment, or when providing services using this equipment. This difficulty or failure

16

may lead to delays in implementing services, service interruptions or degradations in service, which could cause revenues and backlog to decline materially and could adversely affect Telesat Corporation’s ability to market its services and generate future revenues and profit.

Telesat Corporation’s dependence on outside contractors could result in delays related to the design, manufacture and launch of new satellites, or could limit its ability to sell its services, which could adversely affect operating results and prospects.