A Global Dental Leader February 2025 Exhibit 99.2

Forward-Looking Statements and Non-GAAP Measures Safe Harbor Statement under the Private Securities Litigation Reform Act of 1995 This presentation contains forward-looking statements within the meaning of federal securities laws, including, among others, any statements about our expectations, plans, intentions, strategies, or prospects. We generally use the words “may,” “will,” “expects,” “believes,” “anticipates,” “plans,” “estimates,” “projects,” “assumes,” “guides,” “targets,” “forecasts,” “sees,” “seeks,” “should,” “could,” “would,” “predicts,” “potential,” “strategy,” “future,” “opportunity,” “work toward,” “intends,” “guidance,” “confidence,” “positioned,” “design,” “strive,” “continue,” “track,” “look forward to,” “optimistic” and similar expressions to identify forward-looking statements. All statements other than statements of historical or current fact are or may be deemed to be forward-looking statements. Such statements are based upon the current beliefs, expectations, and assumptions of management and are subject to significant risks, uncertainties, and changes in circumstances that could cause actual outcomes and results to differ materially from the forward-looking statements. These risks, uncertainties and changes in circumstances include, but are not limited to: dependence on new product development, technological advances and innovation; shifts in the product category or regional sales mix of our products and services; supply and prices of raw materials and products, including impacts from tariffs; pricing pressures from competitors, customers, dental practices and insurance providers; changes in customer demand for our products and services caused by demographic changes or other factors; challenges relating to changes in and compliance with governmental laws and regulations affecting our U.S. and international businesses, including regulations of the U.S. Food and Drug Administration and foreign government regulators, such as more stringent requirements for regulatory clearance of products; competition; the impact of healthcare reform measures; reductions in reimbursement levels by third-party payors; cost containment efforts sponsored by government agencies, legislative bodies, the private sector and healthcare group purchasing organizations, including the volume-based procurement process in China; control of costs and expenses; dependence on a limited number of suppliers for key raw materials and outsourced activities; the ability to obtain and maintain adequate intellectual property protection; breaches or failures of our information technology systems or products, including by cyberattack, unauthorized access or theft; the ability to retain the independent agents and distributors who market our products; our ability to attract, retain and develop the highly skilled employees we need to support our business; the effect of mergers and acquisitions on our relationships with customers, suppliers and lenders and on our operating results and businesses generally; a determination by the Internal Revenue Service that the distribution of our shares of common stock by Zimmer Biomet Holdings, Inc. in 2022 (the "distribution") or certain related transactions should be treated as taxable transactions; financing transactions undertaken in connection with the separation and risks associated with additional indebtedness; the impact of the separation on our businesses and the risk that the separation and the results thereof may be more difficult, time consuming and/or costly than expected, which could impact our relationships with customers, suppliers, employees and other business counterparties; restrictions on activities following the distribution in order to preserve the tax-free treatment of the distribution; the ability to form and implement alliances; changes in tax obligations arising from tax reform measures, including European Union rules on state aid, or examinations by tax authorities; product liability, intellectual property and commercial litigation losses; changes in general industry and market conditions, including domestic and international growth rates; changes in general domestic and international economic conditions, including inflation and interest rate and currency exchange rate fluctuations; and the effects of global pandemics and other adverse public health developments on the global economy, our business and operations and the business and operations of our suppliers and customers, including the deferral of elective procedures and our ability to collect accounts receivable. You are cautioned not to rely on these forward-looking statements, since there can be no assurance that these forward-looking statements will prove to be accurate. Forward-looking statements speak only as of the date they are made, and we expressly disclaim any intention or obligation to update or revise any forward-looking statements, whether as a result of new information, future events, or otherwise. Non-GAAP Financial Measures This presentation contains financial measures which have not been calculated in accordance with United States generally accepted accounting principles (“GAAP”), because they are a basis upon which our management assesses our performance. Although we believe these measures may be useful for investors for the same reason, these financial measures should not be considered as an alternative to GAAP financial measures as a measure of our financial condition, performance or liquidity. In addition, these financial measures may not be comparable to similar measures used by other companies. In the Appendix to this presentation, we provide further descriptions of these non-GAAP measures and reconciliations of these non-GAAP measures to the most directly comparable GAAP measures.

ZimVie: A Global Dental Leader Market-leading portfolio of premium implants, restorative implant solutions, biomaterials solutions, and digital dentistry technologies 8M Only 25% receive tooth replacement Focused on driving greater adoption of dental implants through training, education, and digital workflow Leading with differentiated technology and continuing to invest in innovation U.S. patients seek treatment for tooth loss annually

Dental Implants: Portfolio Overview Premium implant portfolio catering to both routine and complex cases along with a full range of surgical tools and restorative components TSX® Implant System Launched in 2022, TSX Implants are designed to simplify procedures and optimize practice protocols to deliver peri-implant health, crestal bone maintenance, long-term osseointegration, and prosthetic stability. T3® PRO Implant System Launched in 2022, the T3® PRO Implant builds on the proven solutions of the T3 Tapered Implant, providing immediate function and an optimized implant experience for both dentists and patients. Full restorative portfolio range Large restorative portfolio to rebuild the tooth aesthetically and efficiently, including digital and analogue components. Key Products & Brands

Biomaterials: Portfolio Overview Biomaterial solutions that are used for bone and tissue regeneration, helping build a healthy site necessary for dental implant success to deliver aesthetic results Xenograft and Synthetic Bone Grafts Alternative to human-donor sourced bone with both xenograft and synthetic bone material that can be used to create a suitable surface of implantation. Puros® Allograft Bone Block Human-donor sourced bone graft block that is custom shaped to the patient defect for an excellent fit with predictable outcomes that provides a stable surface for implant placement. Puros® Allograft Products Human-donor sourced bone graft material with premium proprietary processing used to replace missing or damaged bone to provide a foundation for the implant and create desirable aesthetic outcomes. Key Products & Brands Barrier Membranes By providing a reliable barrier during the critical phases of wound healing, these membranes help to conceal the site and maintain space to allow bone growth to occur.

Digital: Portfolio Overview End-to-end solutions ranging from intraoral scanning technology to open architecture CAD/CAM systems, guided surgery solutions, and patient-specific restorations BellaTek® Patient Specific Restorative Solutions Patient-specific abutments, bars, implant bridges, and hybrid restorations designed to match each patient’s oral anatomy. RealGUIDE® Software Software suite that offers precise planning, designing, and predictable placement of dental implants and restorations, helping users manage procedural risk more effectively and plan complex cases in a fraction of the time. Implant Concierge Virtual treatment planning through Implant Concierge™ provides outsourced treatment planning services and guided surgery solutions, significantly improving efficiency and workflow in the dental office. Key Products & Brands GenTek™ Digital Restorative Solutions End-to-end prosthetic offerings designed to support CAD/CAM restorations.

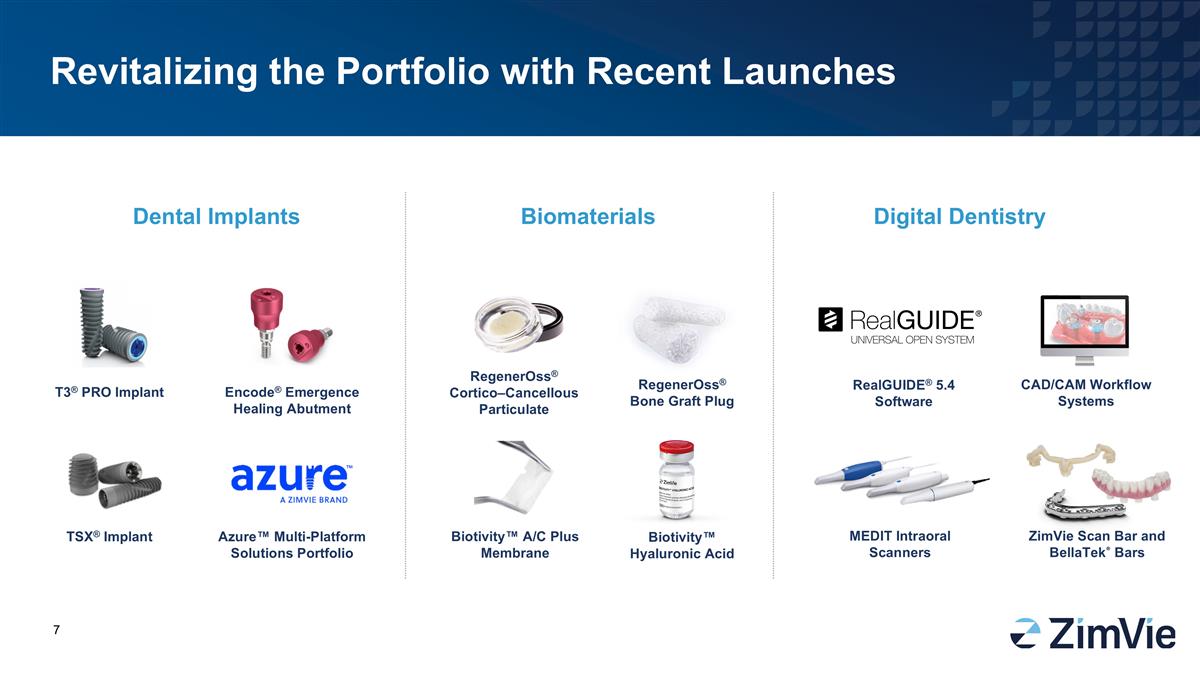

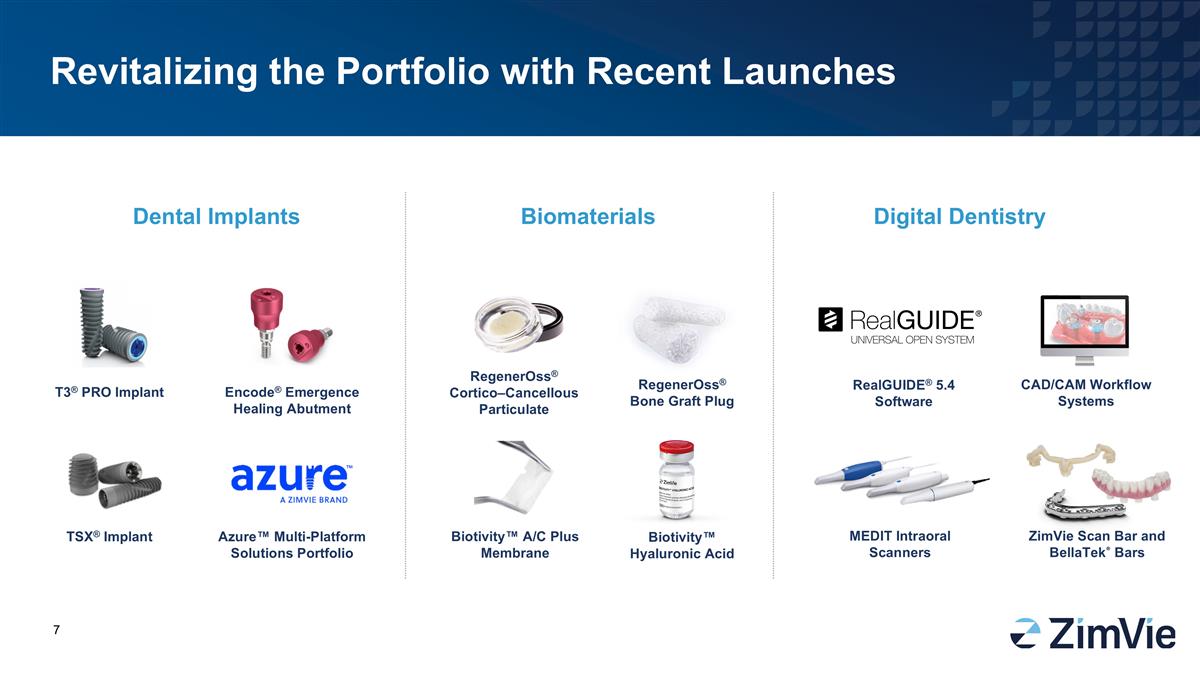

Revitalizing the Portfolio with Recent Launches Dental Implants Biomaterials Digital Dentistry T3® PRO Implant Encode® Emergence Healing Abutment TSX® Implant Azure™ Multi-Platform Solutions Portfolio RegenerOss® Cortico–Cancellous Particulate RegenerOss® Bone Graft Plug Biotivity™ A/C Plus Membrane Biotivity™ Hyaluronic Acid RealGUIDE® 5.4 Software CAD/CAM Workflow Systems MEDIT Intraoral Scanners ZimVie Scan Bar and BellaTek® Bars

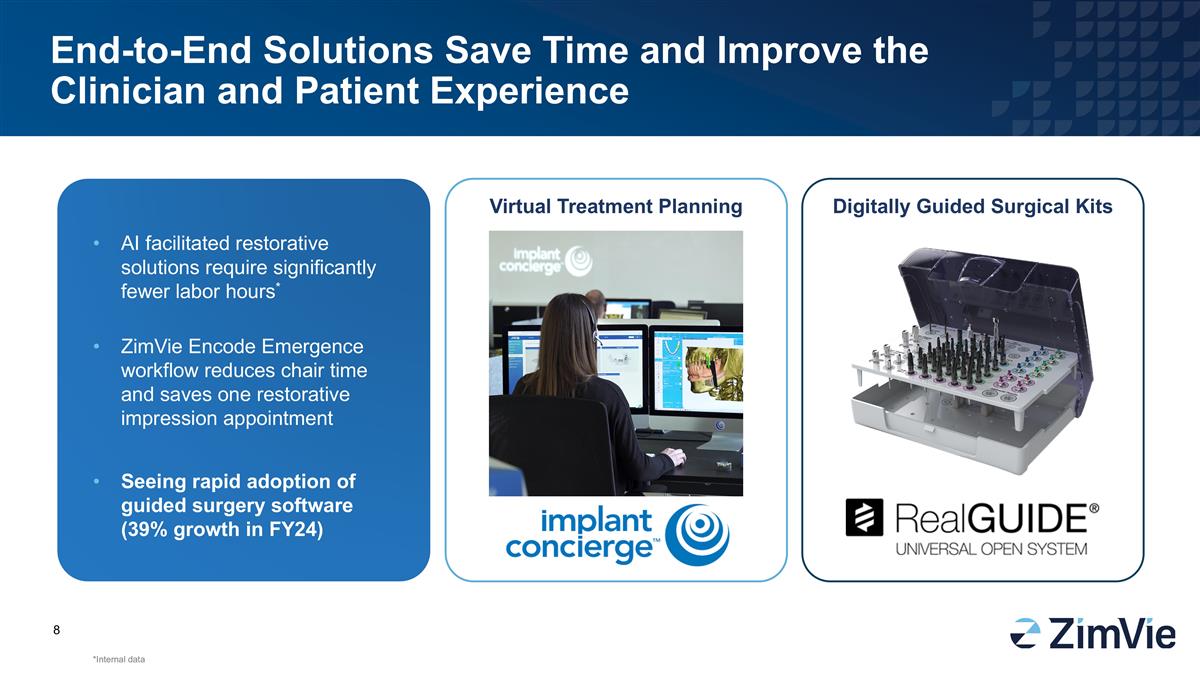

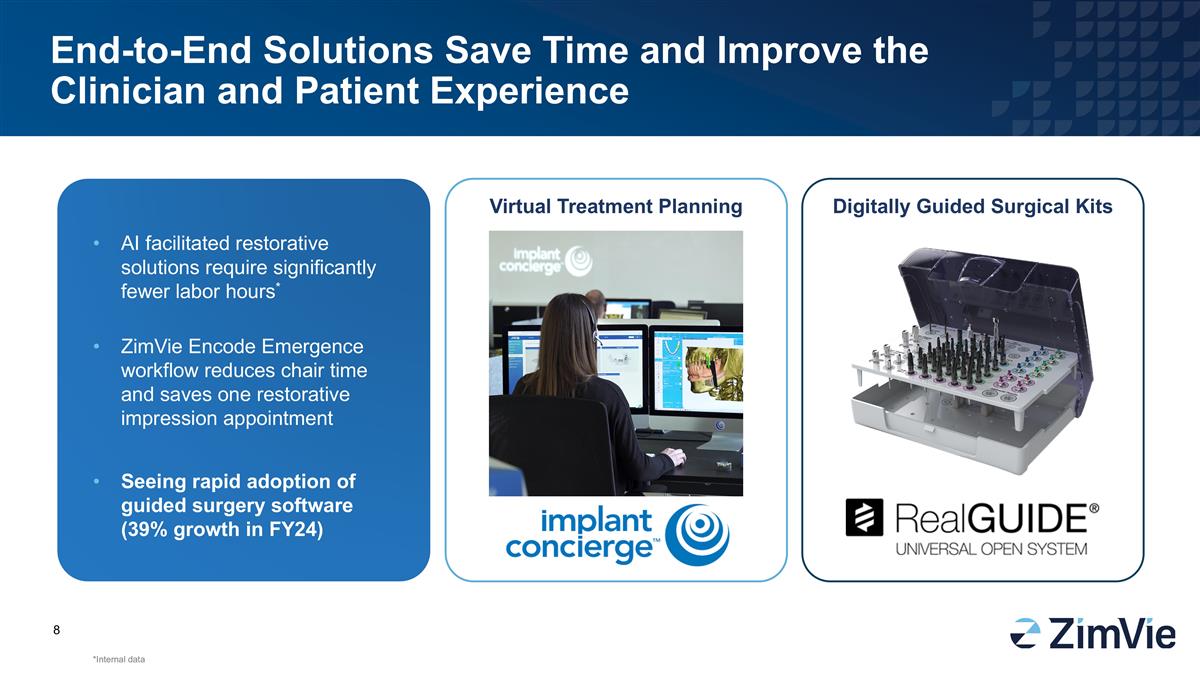

Virtual Treatment Planning Digitally Guided Surgical Kits End-to-End Solutions Save Time and Improve the Clinician and Patient Experience *Internal data AI facilitated restorative solutions require significantly fewer labor hours* ZimVie Encode Emergence workflow reduces chair time and saves one restorative impression appointment Seeing rapid adoption of guided surgery software (39% growth in FY24)

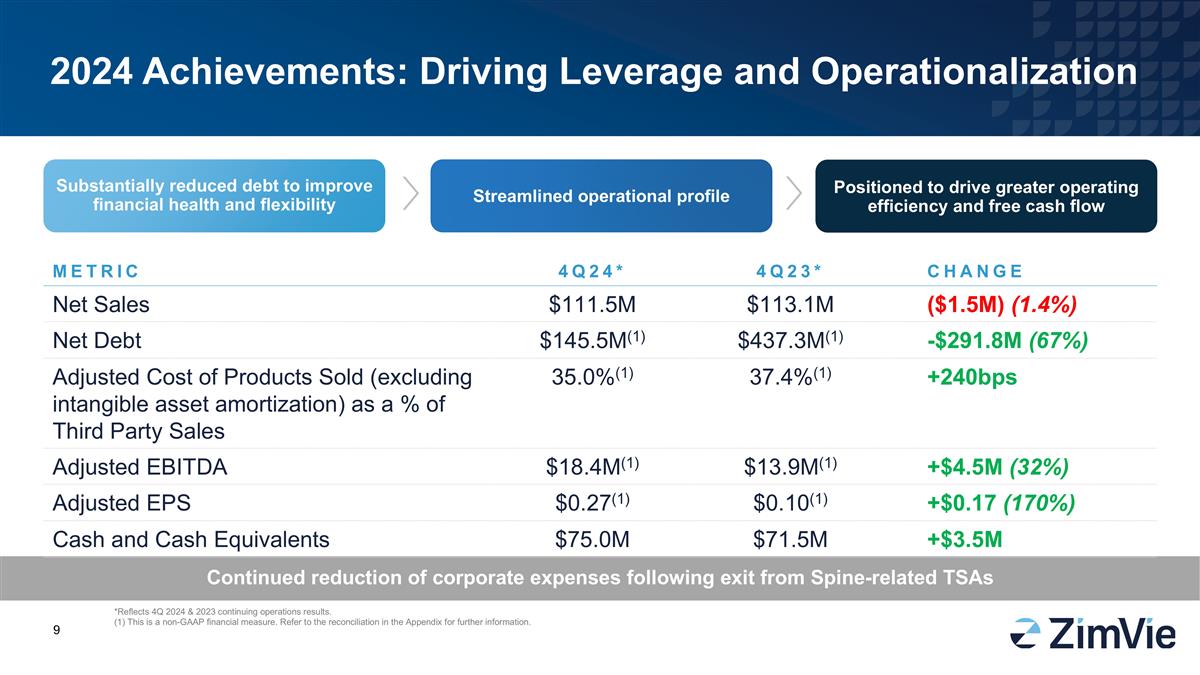

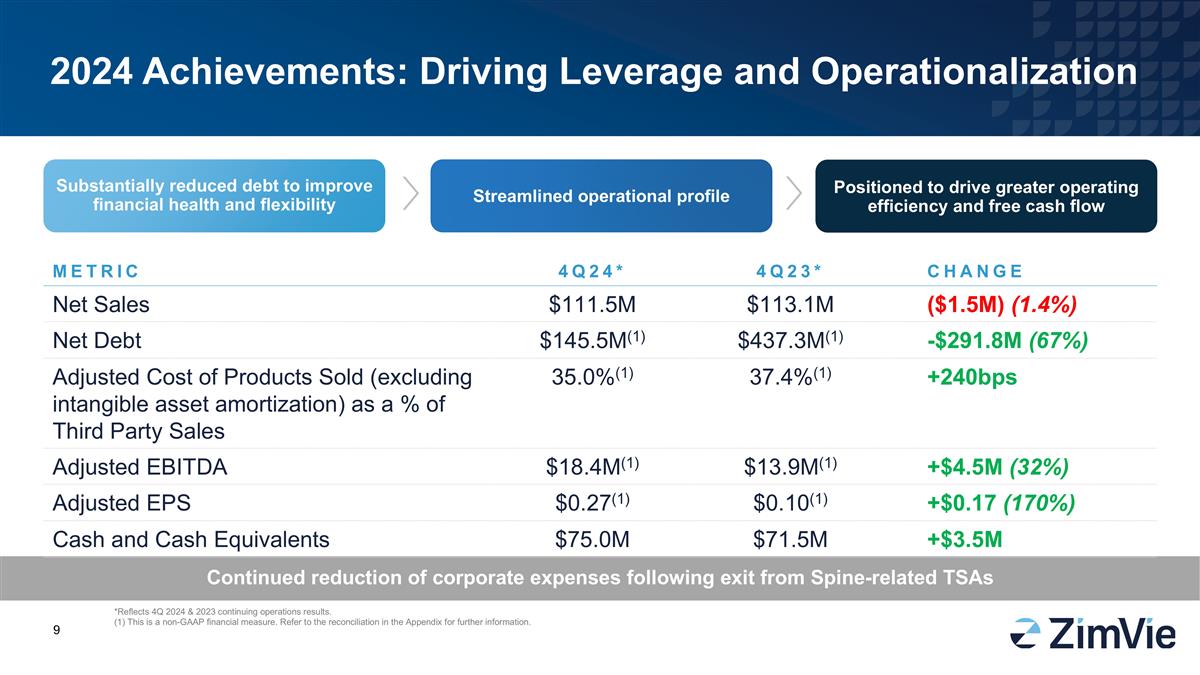

2024 Achievements: Driving Leverage and Operationalization Continued reduction of corporate expenses following exit from Spine-related TSAs Substantially reduced debt to improve financial health and flexibility Streamlined operational profile Positioned to drive greater operating efficiency and free cash flow METRIC 4Q24* 4Q23* CHANGE Net Sales $111.5M $113.1M ($1.5M) (1.4%) Net Debt $145.5M(1) $437.3M(1) -$291.8M (67%) Adjusted Cost of Products Sold (excluding intangible asset amortization) as a % of Third Party Sales 35.0%(1) 37.4%(1) +240bps Adjusted EBITDA $18.4M(1) $13.9M(1) +$4.5M (32%) Adjusted EPS $0.27(1) $0.10(1) +$0.17 (170%) Cash and Cash Equivalents $75.0M $71.5M +$3.5M *Reflects 4Q 2024 & 2023 continuing operations results. (1) This is a non-GAAP financial measure. Refer to the reconciliation in the Appendix for further information.

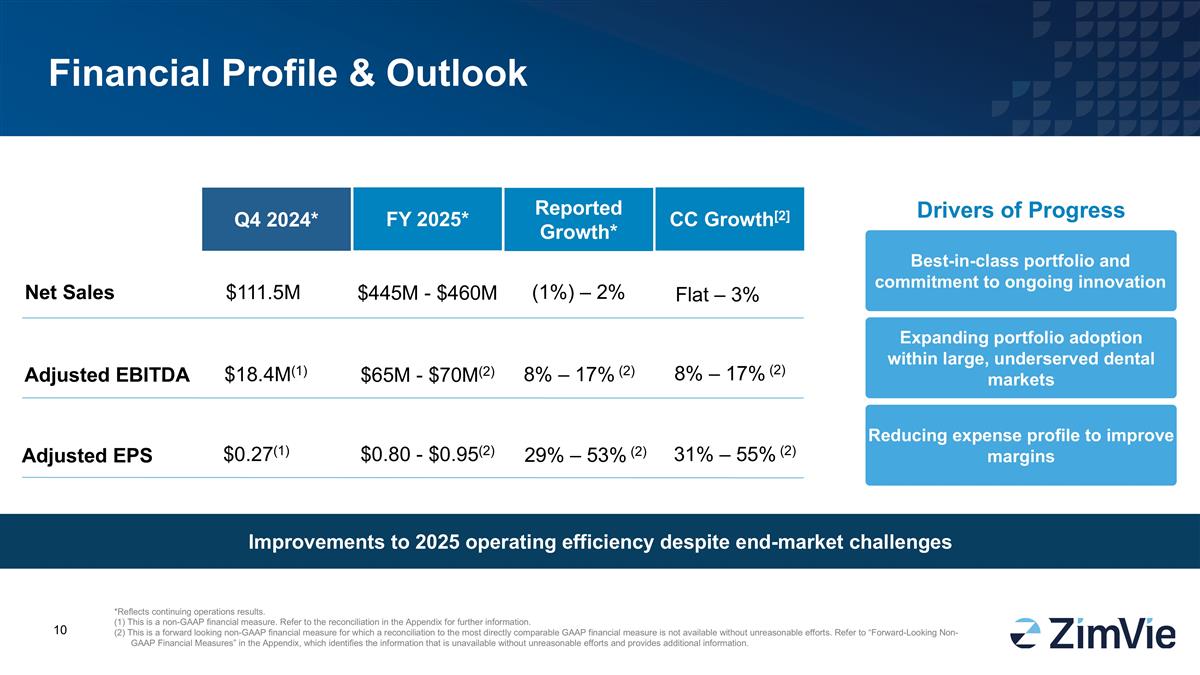

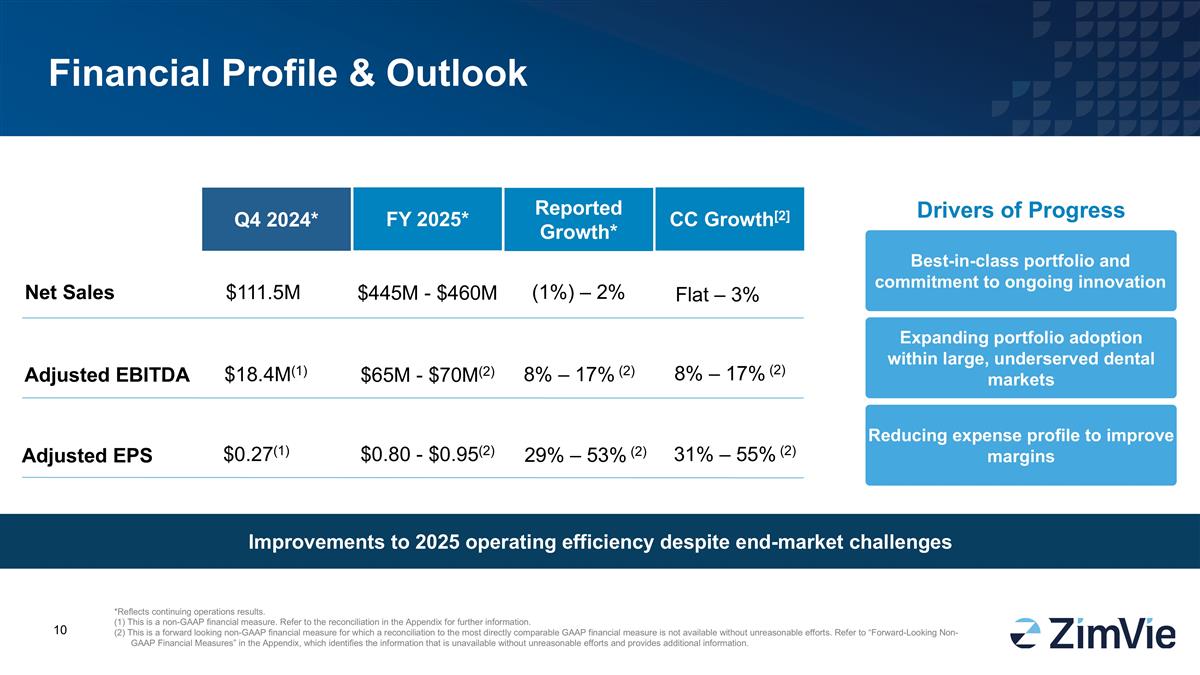

Financial Profile & Outlook Q4 2024* FY 2025* Drivers of Progress Expanding portfolio adoption within large, underserved dental markets Reducing expense profile to improve margins Adjusted EBITDA $18.4M(1) $65M - $70M(2) Net Sales $111.5M $445M - $460M Best-in-class portfolio and commitment to ongoing innovation Improvements to 2025 operating efficiency despite end-market challenges *Reflects continuing operations results. (1) This is a non-GAAP financial measure. Refer to the reconciliation in the Appendix for further information. (2) This is a forward looking non-GAAP financial measure for which a reconciliation to the most directly comparable GAAP financial measure is not available without unreasonable efforts. Refer to “Forward-Looking Non-GAAP Financial Measures” in the Appendix, which identifies the information that is unavailable without unreasonable efforts and provides additional information. Adjusted EPS $0.27(1) $0.80 - $0.95(2) (1%) – 2% Reported Growth* 8% – 17% (2) 29% – 53% (2) CC Growth[2] Flat – 3% 8% – 17% (2) 31% – 55% (2)

Appendix

Note on Non-GAAP Financial Measures This presentation includes non-GAAP financial measures that differ from financial measures calculated in accordance with U.S. generally accepted accounting principles (“GAAP”). These non-GAAP financial measures may not be comparable to similar measures reported by other companies and should be considered in addition to, and not as a substitute for, or superior to, other measures prepared in accordance with GAAP. Net debt is a non-GAAP financial measure provided in this presentation for certain periods and is calculated by subtracting cash and cash equivalents on a GAAP basis from the non-current portion of debt on a GAAP basis, as detailed in the reconciliations presented later in this presentation. Adjusted cost of products sold (excluding intangible asset amortization), adjusted R&D and adjusted SG&A (on an actual basis and as a percentage of sales) are non-GAAP financial measures provided in this presentation for certain periods and are calculated by excluding the effects of certain items from cost of products sold (excluding intangible asset amortization), R&D and SG&A, respectively, on a GAAP basis, as detailed in the reconciliations presented later in this presentation. Adjusted EBITDA is a non-GAAP financial measure provided in this presentation for certain periods and is calculated by excluding certain items from net loss from Continuing Operations on a GAAP basis, as detailed in the reconciliations presented later in this presentation. Adjusted EBITDA margin is Adjusted EBITDA divided by third party net sales from Continuing Operations for the applicable period. Adjusted diluted earnings (loss) per share is a non-GAAP financial measure provided in this presentation for certain periods and is calculated by excluding the effects of certain items from diluted earnings (loss) per share on a GAAP basis, as detailed in the reconciliations presented later in this presentation. Reconciliations of these non-GAAP measures to the most directly comparable GAAP financial measures are included in this presentation. Management uses non-GAAP financial measures internally to evaluate the performance of the business. Additionally, management believes these non-GAAP measures provide meaningful incremental information to investors to consider when evaluating the performance of the company. Management believes these measures offer the ability to make period-to-period comparisons that are not impacted by certain items that can cause dramatic changes in reported income (loss) but that do not impact the fundamentals of our operations. The non-GAAP measures enable the evaluation of operating results and trend analysis by allowing a reader to better identify operating trends that may otherwise be masked or distorted by these types of items that are excluded from the non-GAAP measures. Forward-Looking Non-GAAP Financial Measures This presentation also includes certain forward-looking non-GAAP financial measures for the year ending December 31, 2025. We calculate forward-looking non-GAAP financial measures based on internal forecasts that omit certain amounts that would be included in GAAP financial measures. We have not provided quantitative reconciliations of these forward-looking non-GAAP financial measures to the most directly comparable forward-looking GAAP financial measures because the excluded items are not available on a prospective basis without unreasonable efforts. For example, the timing of certain transactions is difficult to predict because management’s plans may change. In addition, the company believes such reconciliations would imply a degree of precision and certainty that could be confusing to investors. It is probable that these forward-looking non-GAAP financial measures may be materially different from the corresponding GAAP financial measures.

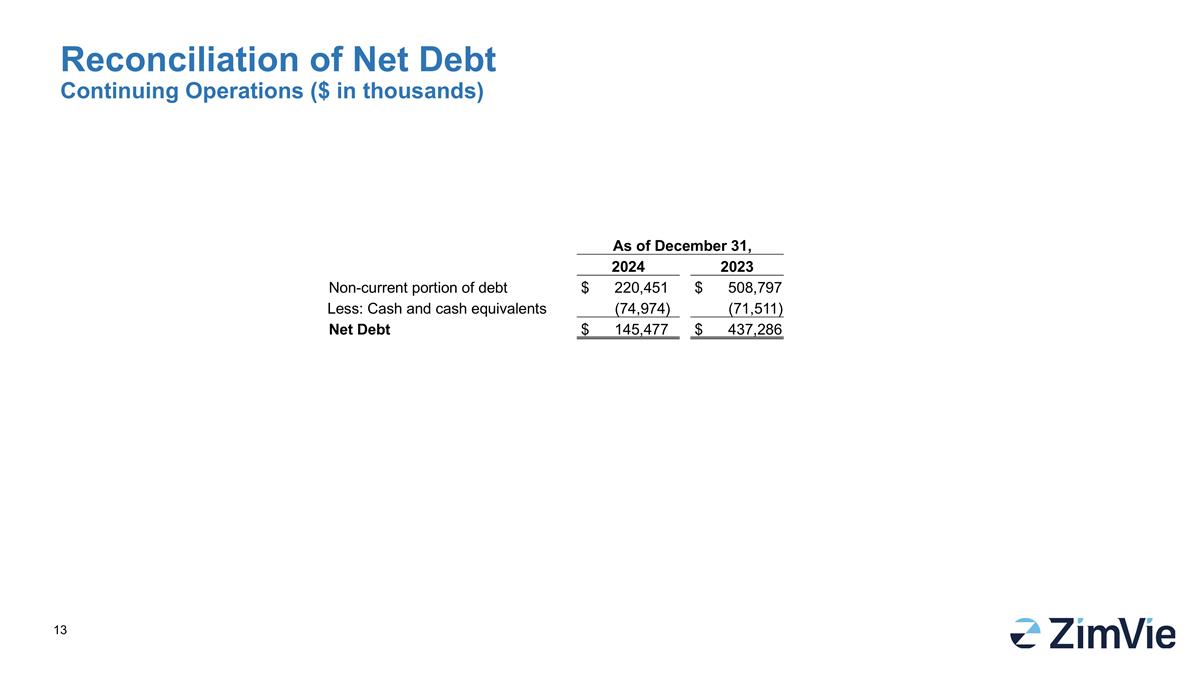

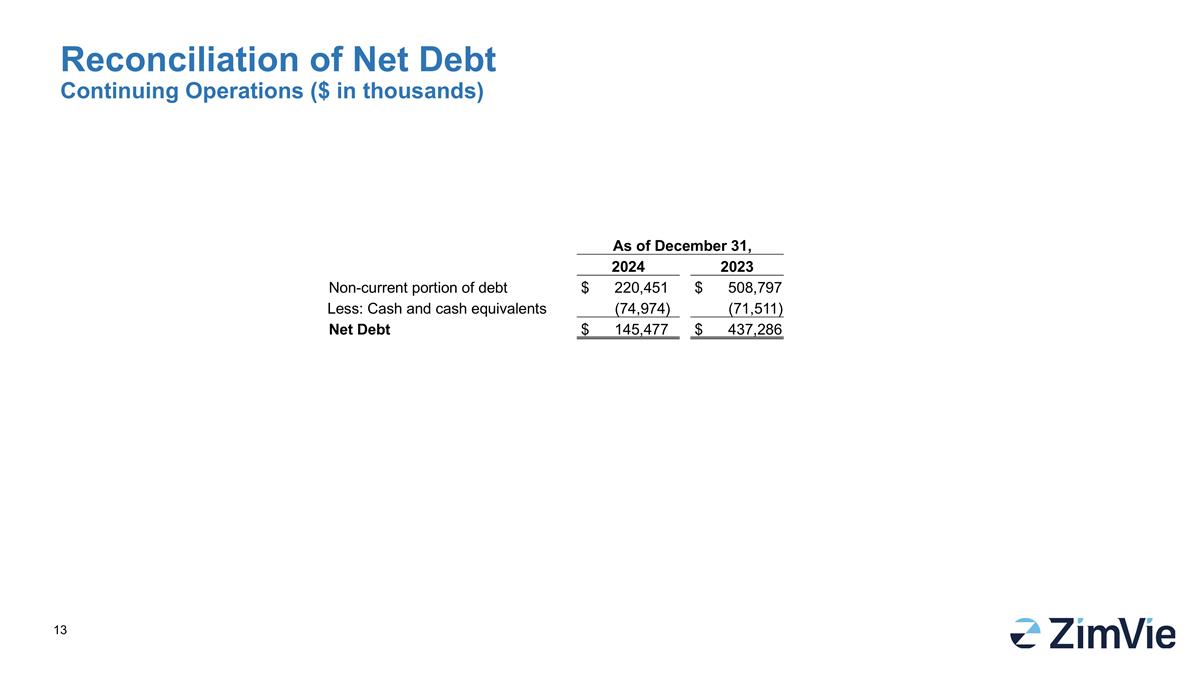

As of December 31, 2024 2023 Non-current portion of debt $ 220,451 $ 508,797 Less: Cash and cash equivalents (74,974) (71,511) Net Debt $ 145,477 $ 437,286 Reconciliation of Net Debt Continuing Operations ($ in thousands)

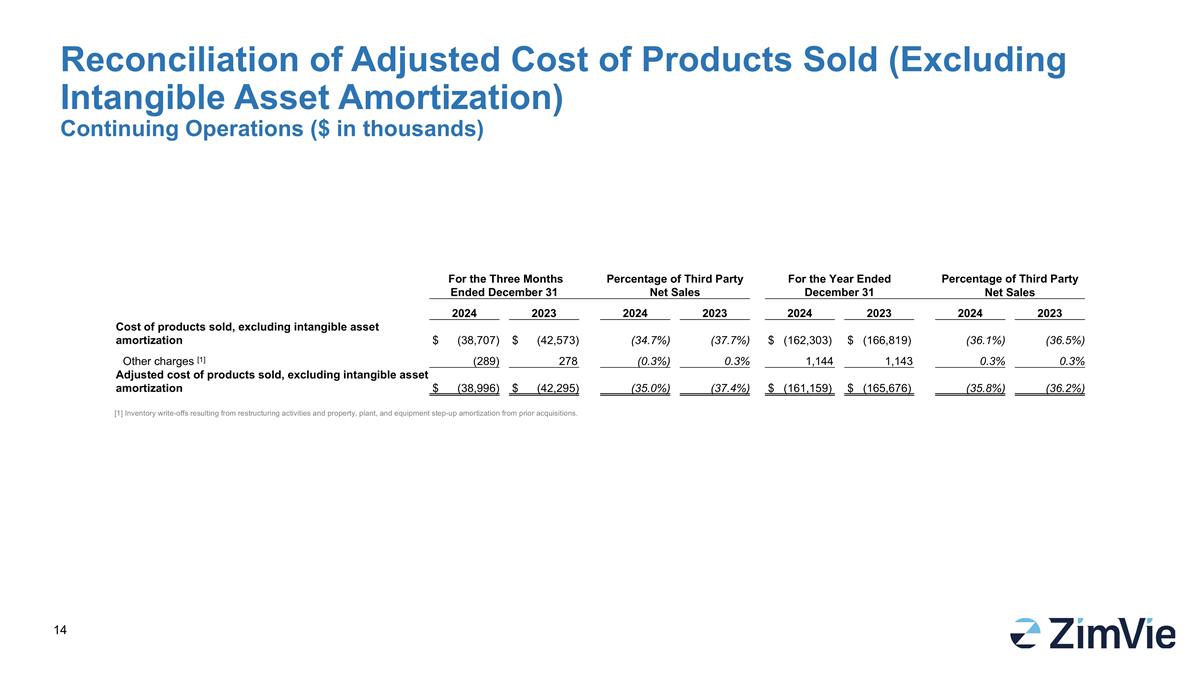

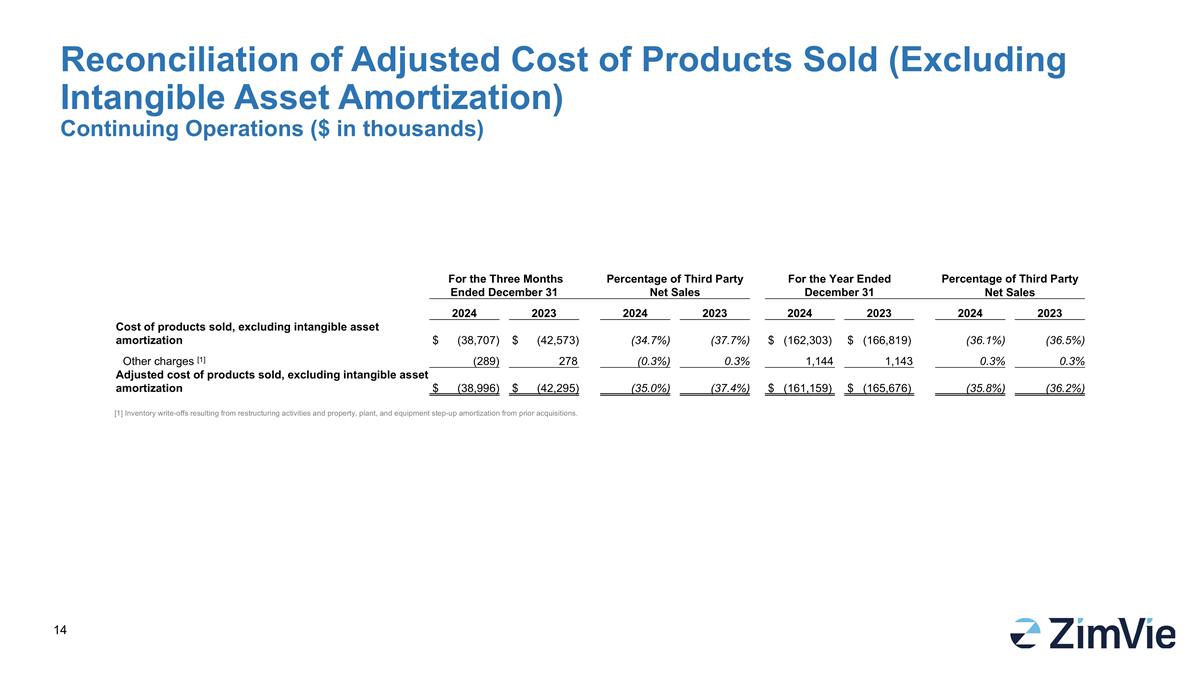

For the Three Months Ended December 31 Percentage of Third Party Net Sales For the Year Ended December 31 Percentage of Third Party Net Sales 2024 2023 2024 2023 2024 2023 2024 2023 Cost of products sold, excluding intangible asset amortization $ (38,707) $ (42,573) (34.7%) (37.7%) $ (162,303) $ (166,819) (36.1%) (36.5%) Other charges [1] (289) 278 (0.3%) 0.3% 1,144 1,143 0.3% 0.3% Adjusted cost of products sold, excluding intangible asset amortization $ (38,996) $ (42,295) (35.0%) (37.4%) $ (161,159) $ (165,676) (35.8%) (36.2%) Reconciliation of Adjusted Cost of Products Sold (Excluding Intangible Asset Amortization) Continuing Operations ($ in thousands) [1] Inventory write-offs resulting from restructuring activities and property, plant, and equipment step-up amortization from prior acquisitions.

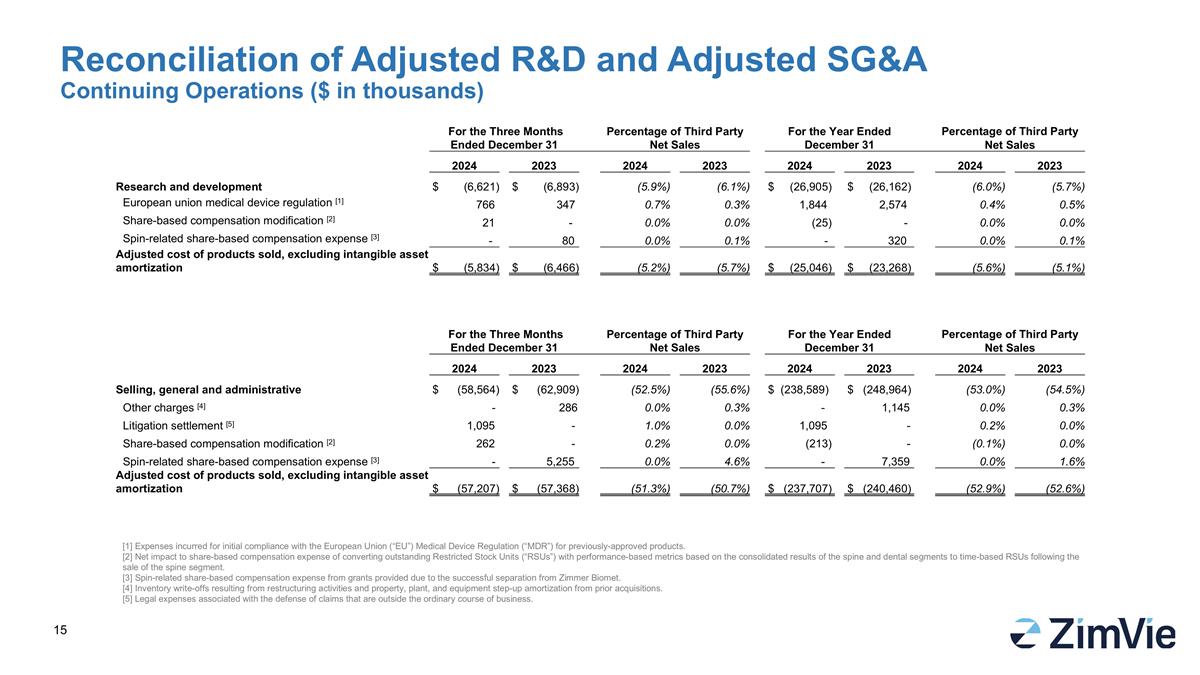

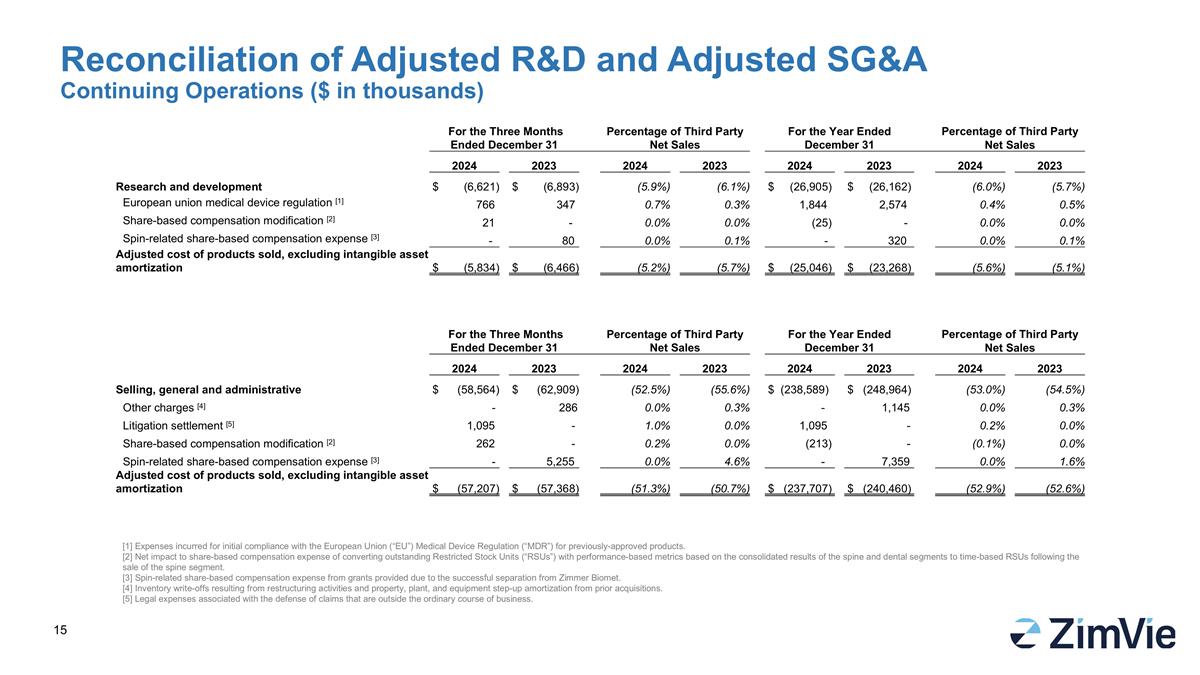

For the Three Months Ended December 31 Percentage of Third Party Net Sales For the Year Ended December 31 Percentage of Third Party Net Sales 2024 2023 2024 2023 2024 2023 2024 2023 Research and development $ (6,621) $ (6,893) (5.9%) (6.1%) $ (26,905) $ (26,162) (6.0%) (5.7%) European union medical device regulation [1] 766 347 0.7% 0.3% 1,844 2,574 0.4% 0.5% Share-based compensation modification [2] 21 - 0.0% 0.0% (25) - 0.0% 0.0% Spin-related share-based compensation expense [3] - 80 0.0% 0.1% - 320 0.0% 0.1% Adjusted cost of products sold, excluding intangible asset amortization $ (5,834) $ (6,466) (5.2%) (5.7%) $ (25,046) $ (23,268) (5.6%) (5.1%) Reconciliation of Adjusted R&D and Adjusted SG&A Continuing Operations ($ in thousands) [1] Expenses incurred for initial compliance with the European Union (“EU”) Medical Device Regulation (“MDR”) for previously-approved products. [2] Net impact to share-based compensation expense of converting outstanding Restricted Stock Units (“RSUs”) with performance-based metrics based on the consolidated results of the spine and dental segments to time-based RSUs following the sale of the spine segment. [3] Spin-related share-based compensation expense from grants provided due to the successful separation from Zimmer Biomet. [4] Inventory write-offs resulting from restructuring activities and property, plant, and equipment step-up amortization from prior acquisitions. [5] Legal expenses associated with the defense of claims that are outside the ordinary course of business. For the Three Months Ended December 31 Percentage of Third Party Net Sales For the Year Ended December 31 Percentage of Third Party Net Sales 2024 2023 2024 2023 2024 2023 2024 2023 Selling, general and administrative $ (58,564) $ (62,909) (52.5%) (55.6%) $ (238,589) $ (248,964) (53.0%) (54.5%) Other charges [4] - 286 0.0% 0.3% - 1,145 0.0% 0.3% Litigation settlement [5] 1,095 - 1.0% 0.0% 1,095 - 0.2% 0.0% Share-based compensation modification [2] 262 - 0.2% 0.0% (213) - (0.1%) 0.0% Spin-related share-based compensation expense [3] - 5,255 0.0% 4.6% - 7,359 0.0% 1.6% Adjusted cost of products sold, excluding intangible asset amortization $ (57,207) $ (57,368) (51.3%) (50.7%) $ (237,707) $ (240,460) (52.9%) (52.6%)

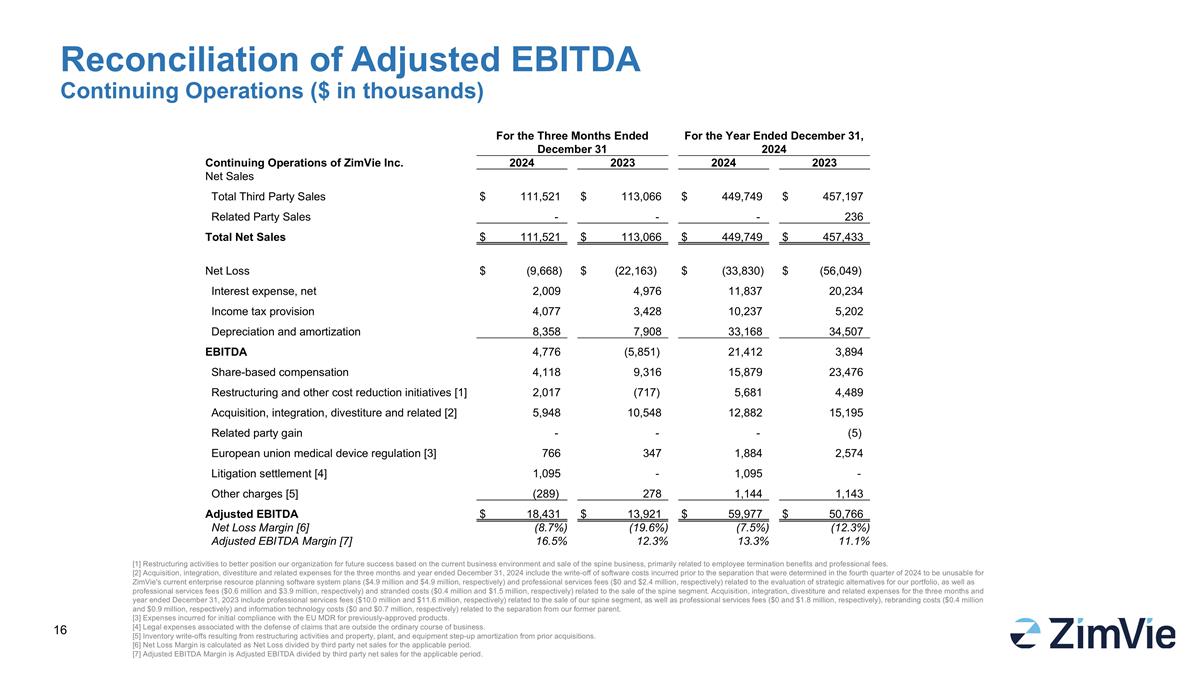

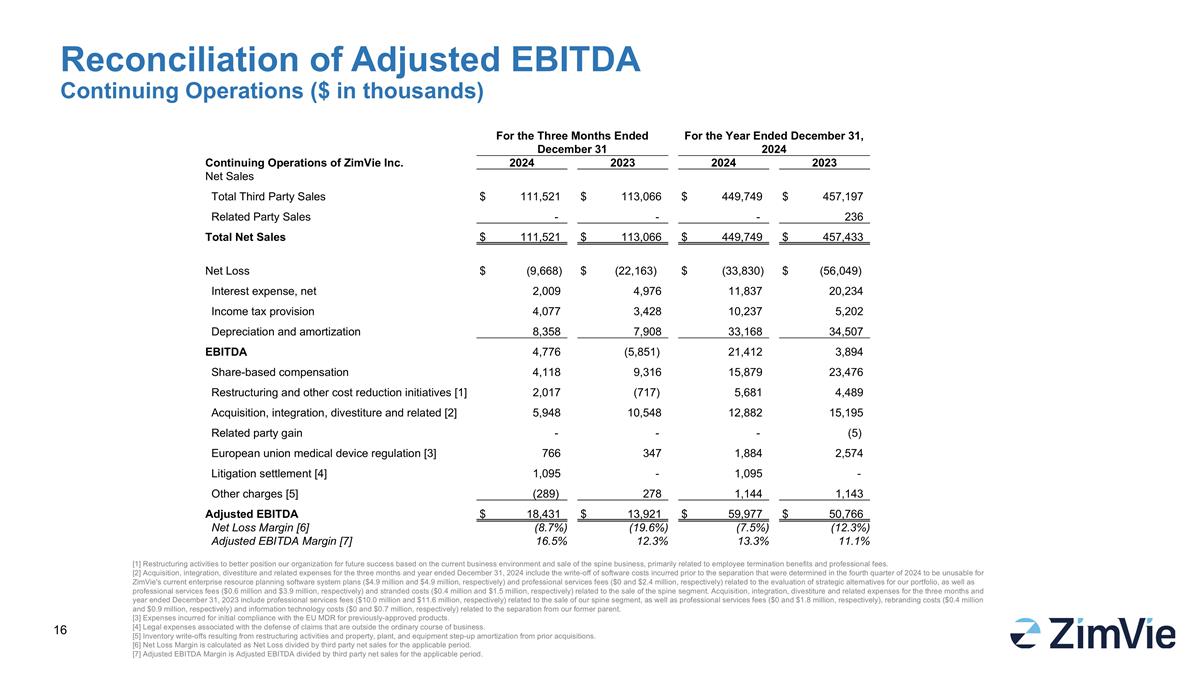

Reconciliation of Adjusted EBITDA Continuing Operations ($ in thousands) For the Three Months Ended December 31 For the Year Ended December 31, 2024 Continuing Operations of ZimVie Inc. 2024 2023 2024 2023 Net Sales Total Third Party Sales $ 111,521 $ 113,066 $ 449,749 $ 457,197 Related Party Sales - - - 236 Total Net Sales $ 111,521 $ 113,066 $ 449,749 $ 457,433 Net Loss $ (9,668) $ (22,163) $ (33,830) $ (56,049) Interest expense, net 2,009 4,976 11,837 20,234 Income tax provision 4,077 3,428 10,237 5,202 Depreciation and amortization 8,358 7,908 33,168 34,507 EBITDA 4,776 (5,851) 21,412 3,894 Share-based compensation 4,118 9,316 15,879 23,476 Restructuring and other cost reduction initiatives [1] 2,017 (717) 5,681 4,489 Acquisition, integration, divestiture and related [2] 5,948 10,548 12,882 15,195 Related party gain - - - (5) European union medical device regulation [3] 766 347 1,884 2,574 Litigation settlement [4] 1,095 - 1,095 - Other charges [5] (289) 278 1,144 1,143 Adjusted EBITDA $ 18,431 $ 13,921 $ 59,977 $ 50,766 Net Loss Margin [6] (8.7%) (19.6%) (7.5%) (12.3%) Adjusted EBITDA Margin [7] 16.5% 12.3% 13.3% 11.1% [1] Restructuring activities to better position our organization for future success based on the current business environment and sale of the spine business, primarily related to employee termination benefits and professional fees. [2] Acquisition, integration, divestiture and related expenses for the three months and year ended December 31, 2024 include the write-off of software costs incurred prior to the separation that were determined in the fourth quarter of 2024 to be unusable for ZimVie's current enterprise resource planning software system plans ($4.9 million and $4.9 million, respectively) and professional services fees ($0 and $2.4 million, respectively) related to the evaluation of strategic alternatives for our portfolio, as well as professional services fees ($0.6 million and $3.9 million, respectively) and stranded costs ($0.4 million and $1.5 million, respectively) related to the sale of the spine segment. Acquisition, integration, divestiture and related expenses for the three months and year ended December 31, 2023 include professional services fees ($10.0 million and $11.6 million, respectively) related to the sale of our spine segment, as well as professional services fees ($0 and $1.8 million, respectively), rebranding costs ($0.4 million and $0.9 million, respectively) and information technology costs ($0 and $0.7 million, respectively) related to the separation from our former parent. [3] Expenses incurred for initial compliance with the EU MDR for previously-approved products. [4] Legal expenses associated with the defense of claims that are outside the ordinary course of business. [5] Inventory write-offs resulting from restructuring activities and property, plant, and equipment step-up amortization from prior acquisitions. [6] Net Loss Margin is calculated as Net Loss divided by third party net sales for the applicable period. [7] Adjusted EBITDA Margin is Adjusted EBITDA divided by third party net sales for the applicable period.

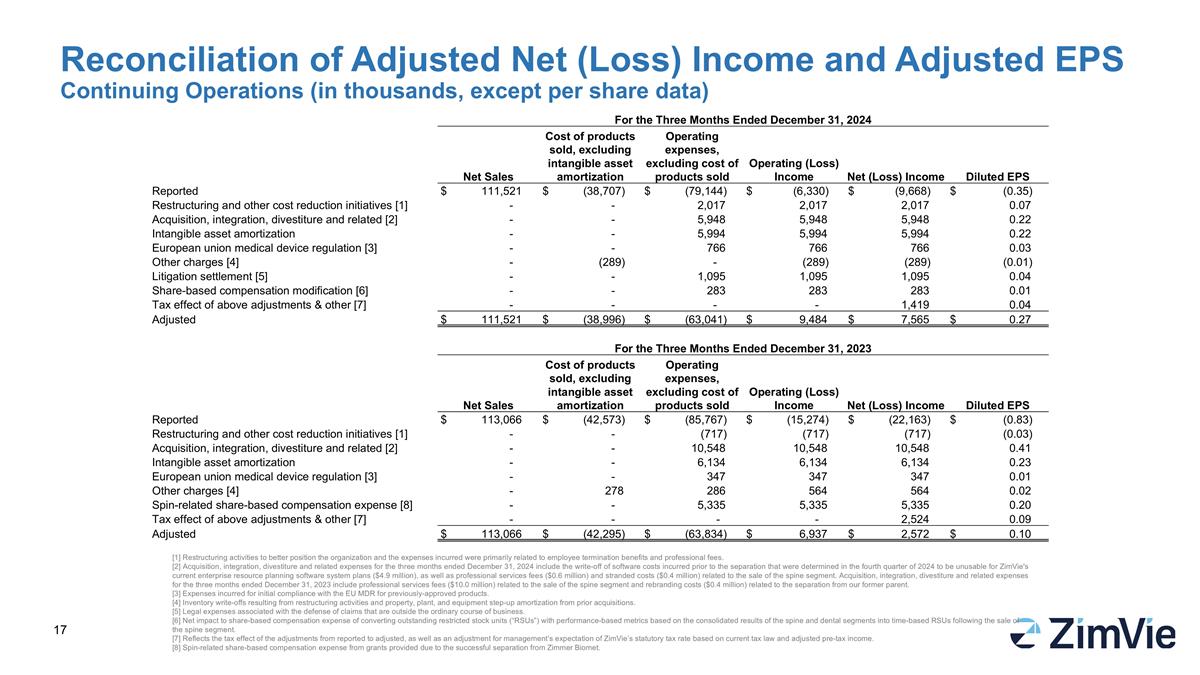

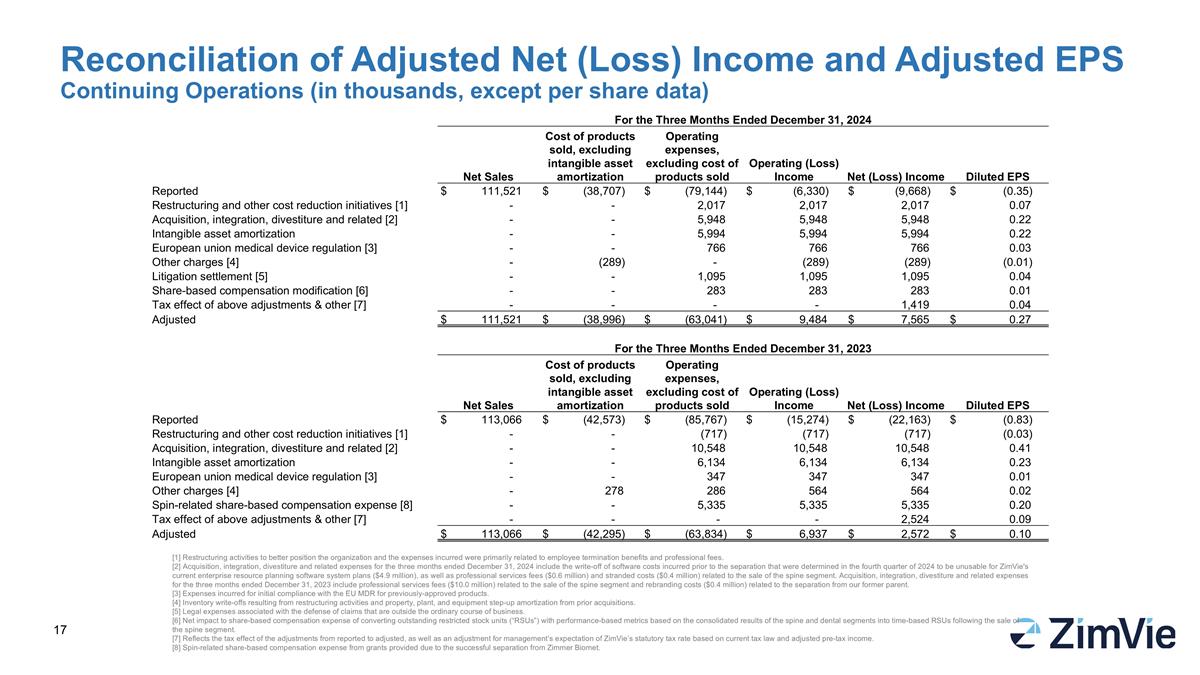

Reconciliation of Adjusted Net (Loss) Income and Adjusted EPS Continuing Operations (in thousands, except per share data) [1] Restructuring activities to better position the organization and the expenses incurred were primarily related to employee termination benefits and professional fees. [2] Acquisition, integration, divestiture and related expenses for the three months ended December 31, 2024 include the write-off of software costs incurred prior to the separation that were determined in the fourth quarter of 2024 to be unusable for ZimVie's current enterprise resource planning software system plans ($4.9 million), as well as professional services fees ($0.6 million) and stranded costs ($0.4 million) related to the sale of the spine segment. Acquisition, integration, divestiture and related expenses for the three months ended December 31, 2023 include professional services fees ($10.0 million) related to the sale of the spine segment and rebranding costs ($0.4 million) related to the separation from our former parent. [3] Expenses incurred for initial compliance with the EU MDR for previously-approved products. [4] Inventory write-offs resulting from restructuring activities and property, plant, and equipment step-up amortization from prior acquisitions. [5] Legal expenses associated with the defense of claims that are outside the ordinary course of business. [6] Net impact to share-based compensation expense of converting outstanding restricted stock units (“RSUs”) with performance-based metrics based on the consolidated results of the spine and dental segments into time-based RSUs following the sale of the spine segment. [7] Reflects the tax effect of the adjustments from reported to adjusted, as well as an adjustment for management’s expectation of ZimVie’s statutory tax rate based on current tax law and adjusted pre-tax income. [8] Spin-related share-based compensation expense from grants provided due to the successful separation from Zimmer Biomet. For the Three Months Ended December 31, 2024 Net Sales Cost of products sold, excluding intangible asset amortization Operating expenses, excluding cost of products sold Operating (Loss) Income Net (Loss) Income Diluted EPS Reported $ 111,521 $ (38,707) $ (79,144) $ (6,330) $ (9,668) $ (0.35) Restructuring and other cost reduction initiatives [1] - - 2,017 2,017 2,017 0.07 Acquisition, integration, divestiture and related [2] - - 5,948 5,948 5,948 0.22 Intangible asset amortization - - 5,994 5,994 5,994 0.22 European union medical device regulation [3] - - 766 766 766 0.03 Other charges [4] - (289) - (289) (289) (0.01) Litigation settlement [5] - - 1,095 1,095 1,095 0.04 Share-based compensation modification [6] - - 283 283 283 0.01 Tax effect of above adjustments & other [7] - - - - 1,419 0.04 Adjusted $ 111,521 $ (38,996) $ (63,041) $ 9,484 $ 7,565 $ 0.27 For the Three Months Ended December 31, 2023 Net Sales Cost of products sold, excluding intangible asset amortization Operating expenses, excluding cost of products sold Operating (Loss) Income Net (Loss) Income Diluted EPS Reported $ 113,066 $ (42,573) $ (85,767) $ (15,274) $ (22,163) $ (0.83) Restructuring and other cost reduction initiatives [1] - - (717) (717) (717) (0.03) Acquisition, integration, divestiture and related [2] - - 10,548 10,548 10,548 0.41 Intangible asset amortization - - 6,134 6,134 6,134 0.23 European union medical device regulation [3] - - 347 347 347 0.01 Other charges [4] - 278 286 564 564 0.02 Spin-related share-based compensation expense [8] - - 5,335 5,335 5,335 0.20 Tax effect of above adjustments & other [7] - - - - 2,524 0.09 Adjusted $ 113,066 $ (42,295) $ (63,834) $ 6,937 $ 2,572 $ 0.10

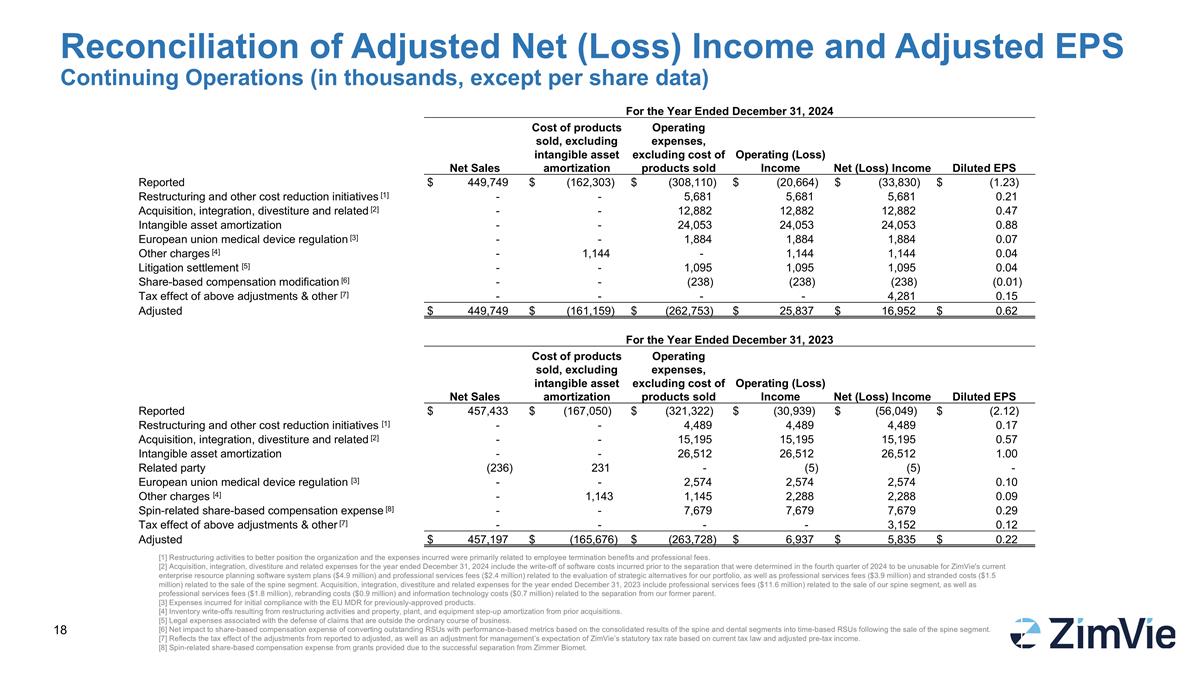

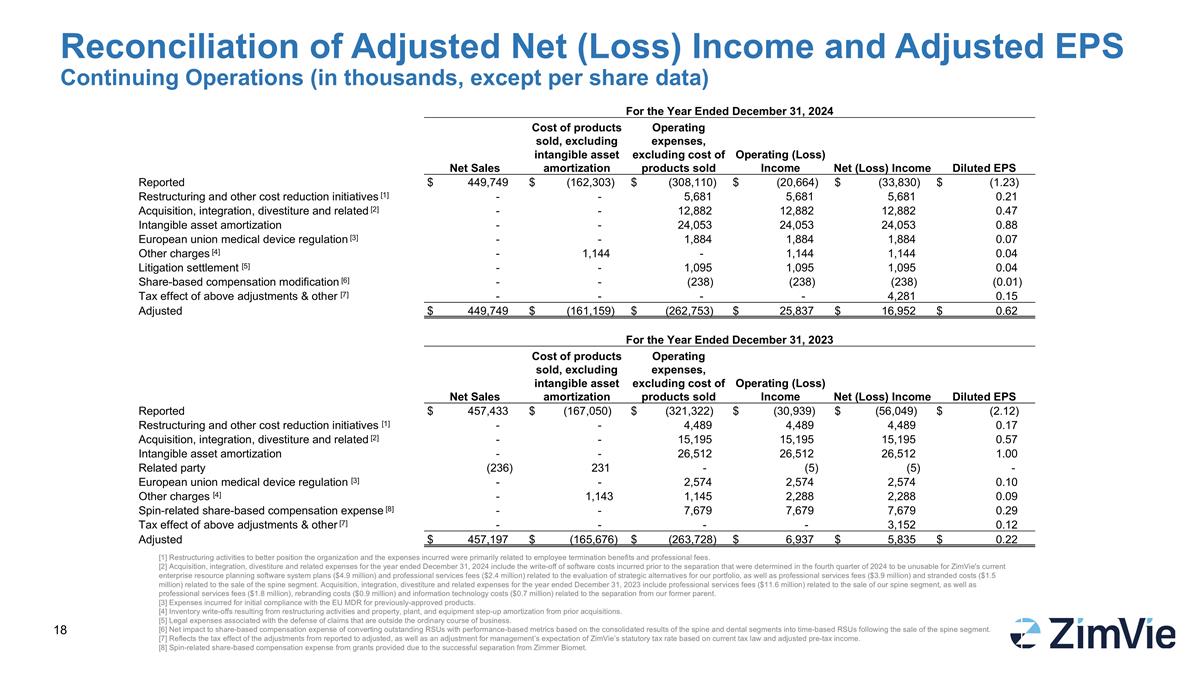

Reconciliation of Adjusted Net (Loss) Income and Adjusted EPS Continuing Operations (in thousands, except per share data) [1] Restructuring activities to better position the organization and the expenses incurred were primarily related to employee termination benefits and professional fees. [2] Acquisition, integration, divestiture and related expenses for the year ended December 31, 2024 include the write-off of software costs incurred prior to the separation that were determined in the fourth quarter of 2024 to be unusable for ZimVie's current enterprise resource planning software system plans ($4.9 million) and professional services fees ($2.4 million) related to the evaluation of strategic alternatives for our portfolio, as well as professional services fees ($3.9 million) and stranded costs ($1.5 million) related to the sale of the spine segment. Acquisition, integration, divestiture and related expenses for the year ended December 31, 2023 include professional services fees ($11.6 million) related to the sale of our spine segment, as well as professional services fees ($1.8 million), rebranding costs ($0.9 million) and information technology costs ($0.7 million) related to the separation from our former parent. [3] Expenses incurred for initial compliance with the EU MDR for previously-approved products. [4] Inventory write-offs resulting from restructuring activities and property, plant, and equipment step-up amortization from prior acquisitions. [5] Legal expenses associated with the defense of claims that are outside the ordinary course of business. [6] Net impact to share-based compensation expense of converting outstanding RSUs with performance-based metrics based on the consolidated results of the spine and dental segments into time-based RSUs following the sale of the spine segment. [7] Reflects the tax effect of the adjustments from reported to adjusted, as well as an adjustment for management’s expectation of ZimVie’s statutory tax rate based on current tax law and adjusted pre-tax income. [8] Spin-related share-based compensation expense from grants provided due to the successful separation from Zimmer Biomet. For the Year Ended December 31, 2024 Net Sales Cost of products sold, excluding intangible asset amortization Operating expenses, excluding cost of products sold Operating (Loss) Income Net (Loss) Income Diluted EPS Reported $ 449,749 $ (162,303) $ (308,110) $ (20,664) $ (33,830) $ (1.23) Restructuring and other cost reduction initiatives [1] - - 5,681 5,681 5,681 0.21 Acquisition, integration, divestiture and related [2] - - 12,882 12,882 12,882 0.47 Intangible asset amortization - - 24,053 24,053 24,053 0.88 European union medical device regulation [3] - - 1,884 1,884 1,884 0.07 Other charges [4] - 1,144 - 1,144 1,144 0.04 Litigation settlement [5] - - 1,095 1,095 1,095 0.04 Share-based compensation modification [6] - - (238) (238) (238) (0.01) Tax effect of above adjustments & other [7] - - - - 4,281 0.15 Adjusted $ 449,749 $ (161,159) $ (262,753) $ 25,837 $ 16,952 $ 0.62 For the Year Ended December 31, 2023 Net Sales Cost of products sold, excluding intangible asset amortization Operating expenses, excluding cost of products sold Operating (Loss) Income Net (Loss) Income Diluted EPS Reported $ 457,433 $ (167,050) $ (321,322) $ (30,939) $ (56,049) $ (2.12) Restructuring and other cost reduction initiatives [1] - - 4,489 4,489 4,489 0.17 Acquisition, integration, divestiture and related [2] - - 15,195 15,195 15,195 0.57 Intangible asset amortization - - 26,512 26,512 26,512 1.00 Related party (236) 231 - (5) (5) - European union medical device regulation [3] - - 2,574 2,574 2,574 0.10 Other charges [4] - 1,143 1,145 2,288 2,288 0.09 Spin-related share-based compensation expense [8] - - 7,679 7,679 7,679 0.29 Tax effect of above adjustments & other [7] - - - - 3,152 0.12 Adjusted $ 457,197 $ (165,676) $ (263,728) $ 6,937 $ 5,835 $ 0.22