As filed with the U.S Securities and Exchange Commission on July 19, 2023

Registration No. 333-268366

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

AMENDMENT NO. 3

TO

FORM F-1

REGISTRATION STATEMENT UNDER THE SECURITIES ACT OF 1933

ANGKASA-X HOLDINGS CORP.

(Exact name of Registrant as specified in its charter)

(Translation of Registrant’s name into English)

| British Virgin Island | | 4899 | | N/A |

(State or Other Jurisdiction of Incorporation) | | (Primary Standard Classification Code) | | (IRS Employer Identification No.) |

11-06,

Tower A, Ave 3,

Vertical Business Suite,

Jalan Kerinchi Bangsar South, 59200, Kuala Lumpur, Malaysia

Phone +603-2242 1288

Email: ipo@angkasa-x.com

(Address, including zip code, and telephone number, including area code, of Registrant’s principal executive offices)

OMC Chambers, Wickhams Cay 1,

Road Town, Tortola,

British Virgin Islands.

(Name, address, including zip code, and telephone number, including area code, of agent for service)

Copy to:

Sichenzia Ross Ference LLP

1185 Avenue of the Americas, 31st Floor,

New York, NY 10036

Attn: Benjamin Tan, Esq.

Approximate date of commencement of proposed sale to the public: As soon as practicable after this registration statement becomes effective.

If any of the securities being registered on this Form are to be offered on a delayed or continuous basis pursuant to Rule 415 under the Securities Act of 1933, check the following box. ☐

If this Form is filed to register additional securities for an offering pursuant to Rule 462(b) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ☐

If this Form is a post-effective amendment filed pursuant to Rule 462(c) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ☐

If this Form is a post-effective amendment filed pursuant to Rule 462(d) under the Securities Act, check the following box and list the Securities Act registration number of the earlier effective registration statement for the same offering. ☐

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933.

Emerging growth company ☒

If an emerging growth company that prepares its financial statements in accordance with U.S. GAAP, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards† provided pursuant to Section 7(a)(2)(B) of the Securities Act.

† The term “new or revised financial accounting standard” refers to any update issued by the Financial Accounting Standards Board to its Accounting Standards Codification after April 5, 2012.

The registrant hereby amends this registration statement on such date or dates as may be necessary to delay its effective date until the registrant shall file a further amendment which specifically states that this registration statement shall thereafter become effective in accordance with Section 8(a) of the Securities Act of 1933 or until the registration statement shall become effective on such date as the Commission acting pursuant to said Section 8(a), may determine.

The information in this preliminary prospectus is not complete and may be changed. We and the selling shareholders may not sell these securities until the registration statement filed with the Securities and Exchange Commission is effective. This preliminary prospectus is not an offer to sell these securities and it is not soliciting an offer to buy these securities in any state where the offer or sale is not permitted.

| PRELIMINARY PROSPECTUS | | Subject to Completion, dated July 19, 2023 |

30,500,000 Ordinary Shares

ANGKASA-X HOLDINGS CORP.

This is the initial public offering (the “Offering”) of Angkasa-X Holdings Corp., a British Virgin Islands company limited by shares, whose principal place of business is in Malaysia (hereinafter referred to as the “Company”). Angkasa-X Holdings Corp. is offering 12,000,000 Ordinary Shares, par value $0.0001 (“Ordinary Shares”) at a price of $2.00 per Ordinary Share on a self-underwritten, “best efforts”, no minimum basis. There is no minimum number of Ordinary Shares required to be purchased by each investor. Angkasa-X Holdings Corp. will receive the net proceeds from the sale of the Ordinary Shares for cash.

The selling shareholders identified in this prospectus are offering an additional 18,500,000 Ordinary Shares (the “Selling Shareholders”).

Our registration of the Ordinary Shares covered by this prospectus does not mean that the Selling Shareholders will offer or sell any of the shares. The Selling Shareholders may offer and sell or otherwise dispose of our Ordinary Shares described in this prospectus from time to time through public or private transactions at a fixed price of $2.00 per Ordinary Share until our Ordinary Shares are listed on a national securities exchange or quoted on the OTC Bulletin Board, OTCQX, OTCQB or OTC Pink Market, at which time they may be sold at prevailing market prices or in privately negotiated transactions. See “Plan of Distribution” beginning on page 108 for more information.

We will not receive any of the proceeds from the Ordinary Shares sold by the Selling Shareholders.

No underwriter or other person has been engaged to facilitate the sale of Ordinary Shares in this Offering. The Selling Shareholders may be deemed underwriters of the Ordinary Shares that they are offering. We have agreed to pay certain expenses in connection with this registration statement. The Selling Shareholders will pay all underwriting discounts and selling commissions, if any, in connection with the sale of the shares of Ordinary Shares.

Our Ordinary Shares are not traded on any exchange although we plan to apply to list our Ordinary Shares on the OTC Pink Market after our Form F-1 Registration Statement becomes effective.

Investors will own Ordinary Shares in a holding company that does not directly own all of its operations in Malaysia. We are a British Virgin Islands corporation that wholly owns our Labuan subsidiary, Angkasa-X Holdings Corp. Angkasa-X Holdings Corp., our Labuan company through a series of contractual arrangements, manages and controls our operating entity, AngkasaX Innovation Sdn. Bhd. The interests of the shareholders of AngkasaX Innovation Sdn. Bhd., may conflict with yours. Investors are cautioned that you are buying shares of a holding company issuer incorporated in the British Virgin Islands with operating subsidiaries in Malaysia. Investors will not hold direct equity investments in our operating variable interest entity, AngkasaX Innovation Sdn. Bhd and may never have direct ownership in it.

We are both an “emerging growth company” and a “foreign private issuer” as defined under the U.S. federal securities laws and, as such, may elect to comply with certain reduced public company reporting requirements for this and future filings. See “Prospectus Summary — Implications of Being an Emerging Growth Company and a Foreign Private Issuer” for additional information.

We are a “controlled company” under the NASDAQ Stock Market Rules, and may be exempt from certain corporate governance requirements, though we do not intend to rely on such exemptions.

See Unicorn Ventures Limited exercise significant control over the Company through its ownership of 65% of the Company’s shares and will continue to exercise significant control over the Company after this offering. 80% of the shares in See Unicorn Ventures Limited are held by our Chief Executive Officer, director and founder, Dr. Seah Kok Wah, while the remaining 20% of shares in See Unicorn Ventures Limited are held by our Chief Financial Officer, Chief Operating Officer and director, Dr. Lim Kin Wan.

The Holding Foreign Companies Accountable Act, or the HFCA Act, was enacted on December 18, 2020. In accordance with the HFCA Act, trading in securities of any registrant on a national securities exchange or in the over-the-counter trading market in the United States may be prohibited if the Public Company Accounting Oversight Board (the “PCAOB”) determines that it cannot inspect or fully investigate the registrant’s auditor for three consecutive years beginning in 2021, and, as a result, an exchange may determine to delist the securities of such registrant. On June 22, 2021, the U.S. Senate passed the Accelerating Holding Foreign Companies Accountable Act, which, if enacted, would amend the HFCA Act and require the SEC to prohibit an issuer’s securities from trading on any U.S. stock exchanges if its auditor is not subject to PCAOB inspections for two consecutive years instead of three, thus reducing the time period before our securities may be prohibited from trading or delisted if our auditor is unable to meet the PCAOB inspection requirement. Pursuant to the HFCA Act, the PCAOB issued a Determination Report on December 16, 2021 which found that the PCAOB is unable to inspect or investigate completely registered public accounting firms headquartered in: (1) mainland China of the People’s Republic of China because of a position taken by one or more authorities in mainland China; and (2) Hong Kong, a Special Administrative Region and dependency of the PRC, because of a position taken by one or more authorities in Hong Kong. In addition, the PCAOB’s report identified the specific registered public accounting firms which are subject to these determinations. Our registered public accounting firm, JP Centurion & Partners PLT, is not headquartered in mainland China or Hong Kong and was not identified in this report as a firm subject to the PCAOB’s determination. Notwithstanding the foregoing, if the PCAOB is not able to fully conduct inspections of our auditor’s work papers in Malaysia, you may be deprived of the benefits of such inspection which could result in limitation or restriction to our access to the U.S. capital markets and trading of our securities may be prohibited under the HFCA Act. See “Risk Factor — Our Ordinary Shares may be prohibited from being traded on a national exchange under the Holding Foreign Companies Accountable Act if the PCAOB is unable to inspect our auditors for three consecutive years beginning in 2021. The delisting of our Ordinary Shares, or the threat of their being delisted, may materially and adversely affect the value of your investment.”

You should read this prospectus carefully before you invest.

Our business and an investment in our securities involve significant risks. You should read the section entitled “Risk Factors” on page 30 of this prospectus and the risk factors incorporated by reference into this prospectus as described in that section before investing in our securities.

Neither the Securities and Exchange Commission nor any state securities commission has approved or disapproved of these securities or passed upon the adequacy or accuracy of this prospectus. Any representation to the contrary is a criminal offense.

The date of this prospectus is July 19, 2023.

TABLE OF CONTENTS

You should rely only on the information contained in this prospectus, any amendment or supplement to this prospectus or any free writing prospectus prepared by or on our behalf. Neither we, nor the Selling Shareholders, have authorized any other person to provide you with different or additional information. Neither we, nor the Selling Shareholders, take responsibility for, nor can we provide assurance as to the reliability of, any other information that others may provide. The Selling Shareholders are not making an offer to sell these securities in any jurisdiction where the offer or sale is not permitted. The information contained in this prospectus is accurate only as of the date of this prospectus or such other date stated in this prospectus, and our business, financial condition, results of operations and/or prospects may have changed since those dates.

Except as otherwise set forth in this prospectus, neither we nor the Selling Shareholders have taken any action to permit a public offering of these securities outside the United States or to permit the possession or distribution of this prospectus outside the United States. Persons outside the United States who come into possession of this prospectus must inform themselves about and observe any restrictions relating to the offering of these securities and the distribution of this prospectus outside the United States.

TERMS USED IN THIS PROSPECTUS

Unless otherwise indicated or the context requires otherwise, references in this prospectus to:

| | ● | “we”, “us,” “our company,” “our,” “the Company”, “our business”, “AXBVI” and “Angkasa-X” refers to Angkasa-X Holdings Corp., a British Virgin Islands holding company; and |

| | | |

| | ● | “AXLB” refers to Angkasa-X Holdings Corp., our wholly-owned subsidiary in Labuan, Malaysia; |

| | | |

| | ● | “AXSB” refers to AngkasaX Sdn. Bhd., our wholly-owned subsidiary in Malaysia; |

| | | |

| | ● | “AXSpace” refers to AXSpace Sdn. Bhd., our 50% equity interest subsidiary in Malaysia; |

| | | |

| | ● | “AXGlobal” refers to AngkasaX Global Sdn. Bhd., our 51% equity interest subsidiary in Malaysia; |

| | | |

| | ● | “AngkasaX Innovation”, “AXI” or “VIE” refers to AngkasaX Innovation Sdn. Bhd., our variable interest entity; |

| | | |

| | ● | “BIMP-EAGA” refers to Brunei Darussalam–Indonesia–Malaysia–Philippines East ASEAN Growth Area, is a cooperation initiative established by Brunei Darussalam, Indonesia, Malaysia and the Philippines, to spur development in remote and less developed areas in the four participating Southeast Asian countries; |

| | | |

| | ● | “BVI” refers to the British Virgin Islands; |

| | | |

| | ● | “Mercu Tekun” refers to Mercu Tekun Sdn. Bhd., our subsidiary in Malaysia; |

| | | |

| | ● | “MYR” or “Ringgit Malaysia” refer to the lawful currency of Malaysia; |

| | | |

| | ● | “shares”, “Shares” or “Ordinary Shares” refers to the Ordinary Shares of Angkasa-X Holdings Corp., with par value of US$ 0.0001 per share; |

| | | |

| | ● | “VIE Agreements” refers to a series of contractual arrangements, including the Equity Pledge Agreement, Equity Option Agreement, Shareholders’ Voting Rights Proxy Agreement, Business Cooperation Agreement and Consultation and Services Agreement, between Angkasa-X Holdings Corp. and our VIE; |

| | ● | “$” and “U.S. Dollars” refer to the lawful currency of the United States of America. |

PRESENTATION OF FINANCIAL AND OTHER INFORMATION

In this prospectus, references to “$”, “US$” and “U.S. Dollars” are to the lawful currency of the United States of America and references to “MYR” are to the lawful currency of Malaysia.

U.S. GAAP Financial Measures

All of the summary financial information included in the following table, which is the most directly comparable financial measures to the non-GAAP financial measures presented hereafter, is prepared in accordance with U.S. GAAP and denominated in US$.

| | | Year ended

Dec 31, 2022 | | | Year ended

Dec 31, 2021 | |

| | | (Audited) | | | (Audited) | |

| Revenue | | $ | 515,348 | | | $ | 10,782 | |

| Revenue – related parties | | $ | - | | | $ | 62,419 | |

| Net loss | | $ | (1,095,765 | ) | | $ | (330,683 | ) |

Non-GAAP Financial Measures

In this prospectus, we present certain supplemental financial measures that are not recognized by U.S. GAAP. These financial measures are unaudited and have not been prepared in accordance with U.S. GAAP, SEC requirements or the accounting standards of any other jurisdiction. The non-GAAP financial measures used in this prospectus are EBITDA and EBITDA margin. EBITDA margin represents the ratio of EBITDA with revenue. EBITDA is earnings before depreciation, amortization, interest expense and income tax expenses. For additional information on why we present non-GAAP financial measures, the limitations associated with using non-GAAP financial measures and reconciliations of our non- GAAP financial measures to the most comparable applicable U.S. GAAP measure, see “Prospectus Summary—Summary Consolidated Financial Information” and “Management’s Discussion and Analysis of Financial Condition and Results of Operations”.

We use EBITDA and EBITDA margin, each a non-GAAP financial measure, in evaluating our operating results and for financial and operational decision-making purposes.

We believe that EBITDA and EBITDA margin help identify underlying trends in our business that could otherwise be distorted by the effect of the expenses that we include in income from operations. We believe that EBITDA and EBITDA margin provide useful information about our operating results, enhance the overall understanding of our past performance and future prospects and allow for greater visibility with respect to key metrics used by our management in its financial and operational decision-making.

EBITDA and EBITDA margin should not be considered in isolation or construed as an alternative to net income or any other measure of performance or as an indicator of our operating performance. Investors are encouraged to review the historical non-GAAP financial measures to the most directly comparable GAAP measures.

EBITDA and EBITDA margin presented here may not be comparable to similarly titled measures presented by other companies. Other companies may calculate similarly titled measures differently, limiting their usefulness as comparative measures to our data. We encourage investors and others to review our financial information in its entirety and not rely on a single financial measure.

Non-GAAP Measurement Reconciliation

| | | Year ended

Dec 31, 2022 | | | Year ended

Dec 31, 2021 | |

| | | (Audited) | | | (Audited) | |

| Net loss | | $ | (1,095,765 | ) | | $ | (330,683 | ) |

| Add: Provision for income tax expense | | $ | 32 | | | $ | - | |

| Interest expense | | $ | 22,703 | | | $ | - | |

| Depreciation and amortization | | $ | 42,710 | | | $ | 1,579 | |

| EBITDA | | $ | (1,030,320 | ) | | $ | (329,104 | ) |

| | | | | | | | | |

| EBITDA | | $ | (1,030,320 | ) | | $ | (329,104 | ) |

| Divided by: Revenue | | $ | 515,348 | | | $ | 73,201 | |

| EBITDA margin | | | (200 | )% | | | (450 | % |

INDUSTRY AND MARKET DATA

We obtained the industry, market and competitive position data throughout this prospectus from our own internal estimates and research as well as from industry and general publications and research, surveys and studies conducted by third parties not engaged by us. Industry surveys and publications generally state that the information contained therein has been obtained from sources believed to be reliable, but the accuracy and completeness of the information contained in industry publications is not guaranteed. While we believe that each of these studies and publications is reliable, we have not independently verified market and industry data from third-party sources. While we believe our internal company research is reliable and the definitions of our market and industry are appropriate, neither this research nor these definitions have been verified by any independent source. Further, while we believe the market opportunity information included in this prospectus is generally reliable, such information is inherently imprecise. In addition, projections, assumptions and estimates of the future performance of the industry in which we operate and our future performance are necessarily subject to a high degree of uncertainty and risk due to a variety of factors, including those described in “Risk Factors.” These and other factors could cause results to differ materially from those expressed in the estimates made by the independent parties and by us. See “Cautionary Note Regarding Forward-Looking Statements.”

CAUTIONARY NOTE REGARDING FORWARD-LOOKING STATEMENTS

Some of the statements in this prospectus constitute forward-looking statements that do not directly or exclusively relate to historical facts. You should not place undue reliance on such statements because they are subject to numerous uncertainties and factors relating to our operations and business environment, all of which are difficult to predict and many of which are beyond our control. Forward-looking statements include information concerning our possible or assumed future results of operations, including descriptions of our business strategy. These statements often include words such as “may,” “will,” “should,” “believe,” “expect,” “anticipate,” “intend,” “plan,” “estimate” or similar expressions. Forward- looking statements included in this prospectus include statements regarding:

| | ● | our intention to grow our business through our strategic initiatives; |

| | | |

| | ● | our intention to seek additional acquisition opportunities in satellite communications networks and information technology companies and our expectation regarding competition for acquisitions; |

| | | |

| | ● | our beliefs regarding our competitive strengths and ability to successfully compete in the markets in which we participate; |

| | | |

| | ● | our expectations concerning customer demand for our services, our future growth opportunities, market share and sales channels; |

| | | |

| | ● | our future operating and financial performance; |

| | | |

| | ● | the accuracy of our estimates and key judgments regarding certain tax matters and accounting valuations; and |

| | | |

| | ● | our belief regarding our ability to comply with environmental, health and other applicable regulatory matters. |

The forward-looking statements contained in this prospectus are based on assumptions that we have made in light of our management’s experience in the industry as well as our perceptions of historical trends, current conditions, expected future developments and other factors that we believe are appropriate under the circumstances. As you read and consider this prospectus, you should understand that these statements are not guarantees of performance or results. They involve known and unknown risks, uncertainties and assumptions. Although we believe that these forward-looking statements are based on reasonable assumptions, you should be aware that many factors could affect our actual financial results or results of operations and could cause actual results to differ materially from those in these forward-looking statements. These factors include but are not limited to:

| | ● | the loss of any of our executive officers or members of our senior management team or other key employees; |

| | | |

| | ● | the loss of any of our major customers or a decrease in demand for our services; |

| | | |

| | ● | our ability to effectively compete in our markets; |

| | | |

| | ● | changes in consumer preferences and our failure to anticipate and respond to such changes or to successfully develop and renovate services; |

| | | |

| | ● | changes in technology could have a material adverse effect on our business prospects and financial condition; |

| | | |

| | ● | we rely on a limited number of manufacturers for many of our services and devices; |

| | | |

| | ● | If we are unable to maintain relationships with our existing launch partners or enter into relationships with new launch partners, we may not able to reach our targeted annual launch rate, which could have an adverse effect on our ability to grow our business; |

| | ● | our ability to protect our brand names; |

| | | |

| | ● | economic conditions that may affect our future performance including exchange rate fluctuations; |

| | | |

| | ● | our ability to raise sufficient capital to fund the A-SEANSAT and A-SEANLINK Satellite Constellation could have a material adverse effect on our business prospects and financial condition; |

| | | |

| | ● | increases in operating costs, including labor costs, and our ability to manage our cost structure; |

| | | |

| | ● | the incurrence of liabilities not covered by our insurance; |

| | | |

| | ● | the loss of our foreign private issuer status; |

| | | |

| | ● | the effects of reputational damage from unsafe or poor-quality internet connectivity, particularly if such issues involve services we provided; |

| | | |

| | ● | risks related to the novel COVID-19 virus; and |

| | | |

| | ● | our failure to comply with, and liabilities related to, environmental, health and safety laws and regulations; and |

| | | |

| | ● | changes in applicable laws or regulations. |

These and other factors are more fully discussed in the “Risk Factors” section and elsewhere in this prospectus. These risks could cause actual results to differ materially from those implied by forward-looking statements in this prospectus.

All information contained in this prospectus is materially accurate and complete as of the date of this prospectus. You should keep in mind, however, that any forward-looking statement made by us in this prospectus, or elsewhere, speaks only as of the date on which we make it. New risks and uncertainties come up from time to time, and it is impossible for us to predict these events or know how they may affect us. We do not undertake any obligation to update or revise any forward-looking statements after the date of this prospectus, whether as a result of new information, future events or otherwise, except as required by law. In light of these risks and uncertainties, you should keep in mind that any event described in a forward-looking statement made in this prospectus or elsewhere might not occur.

PROSPECTUS SUMMARY

This summary highlights selected information contained elsewhere in this prospectus. This summary does not contain all of the information you should consider before investing in our Ordinary Shares. Before making an investment decision, you should read this entire prospectus carefully, especially “Risk Factors”, “Our Business”, “Management’s Discussion and Analysis of Financial Condition and Results of Operation”, our consolidated financial statements, and each of their respective related notes appearing at the end of this prospectus. Some of the statements in this prospectus constitute forward-looking statements that involve risks and uncertainties. See “Cautionary Note Regarding Forward-Looking Statements” for more information.

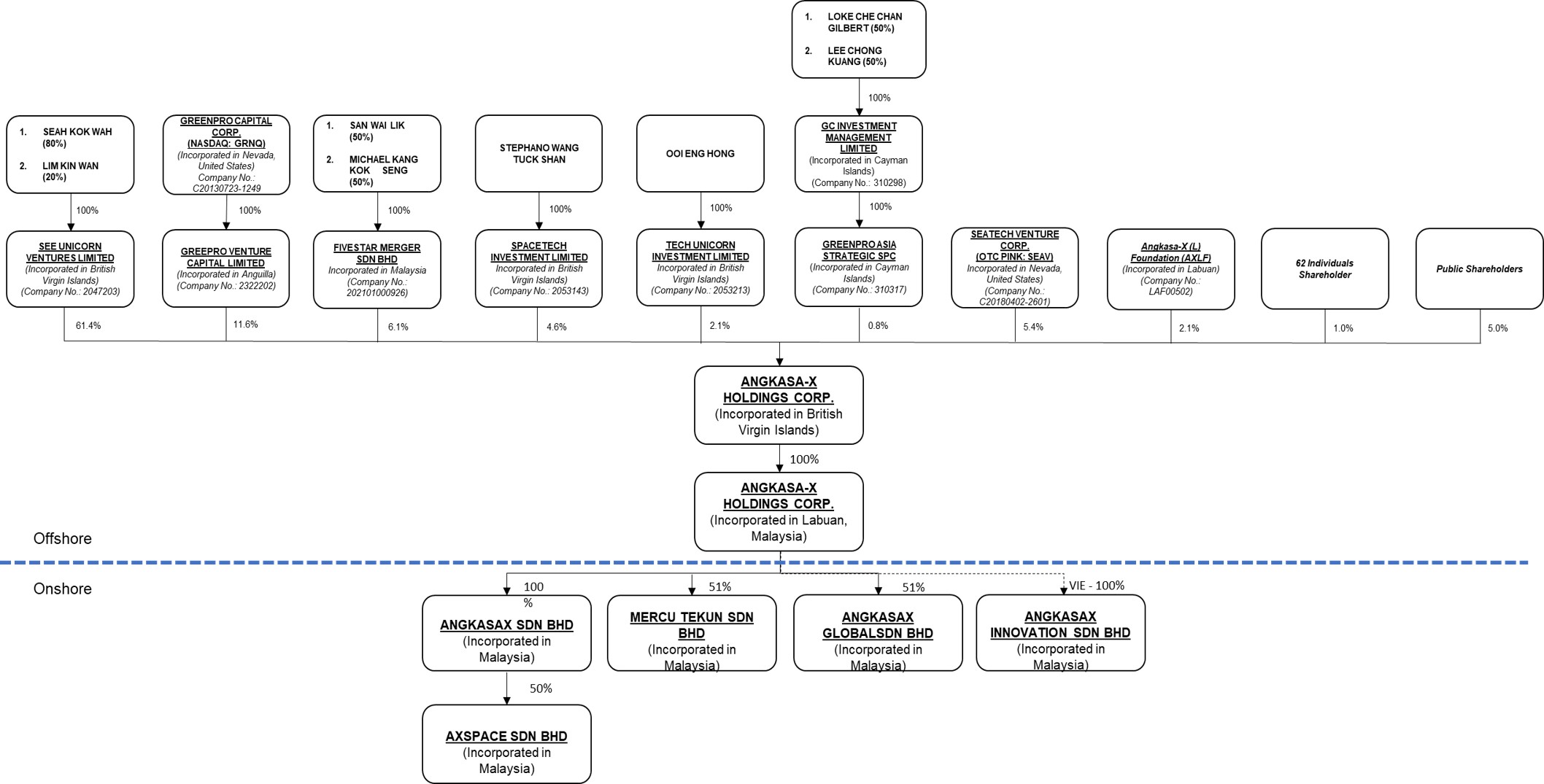

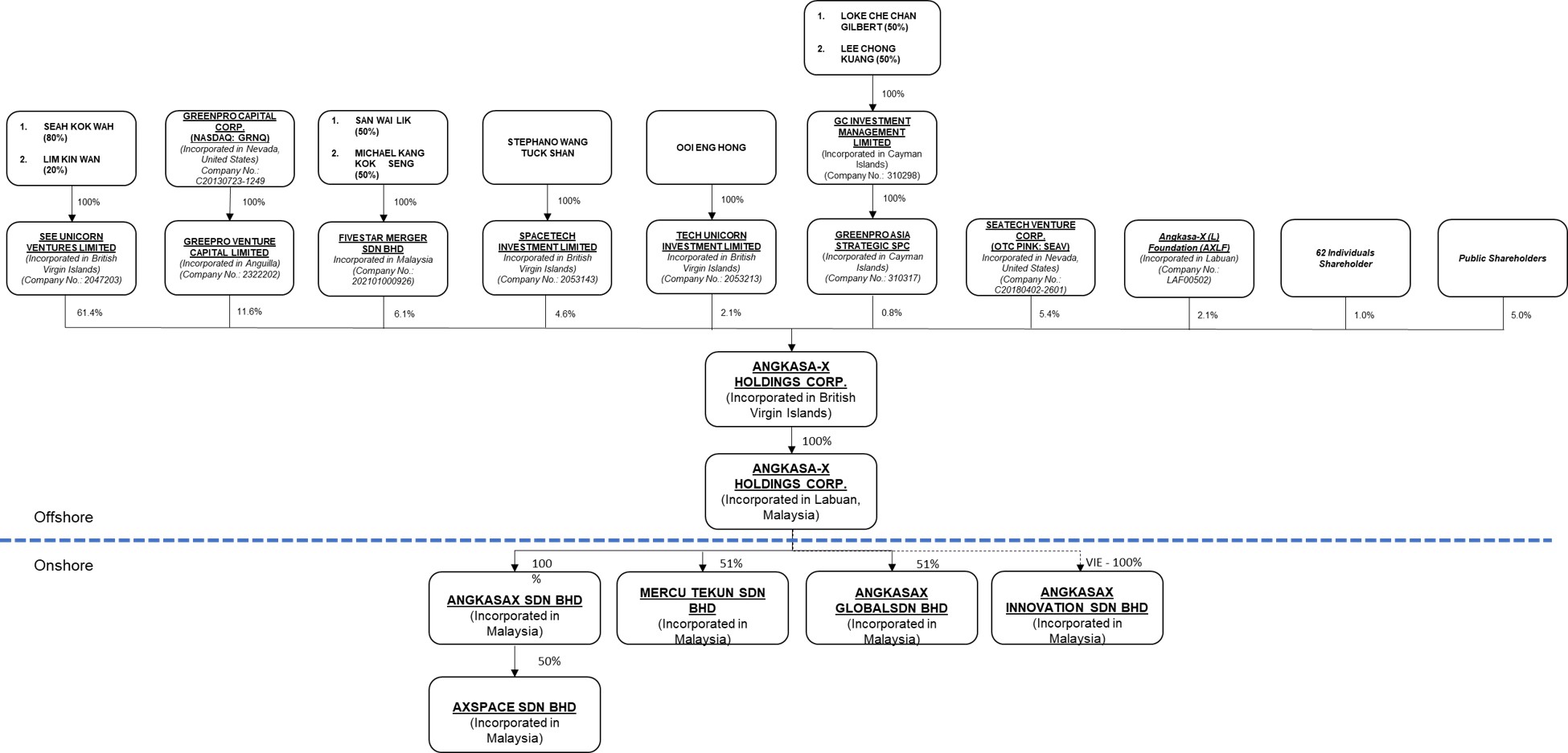

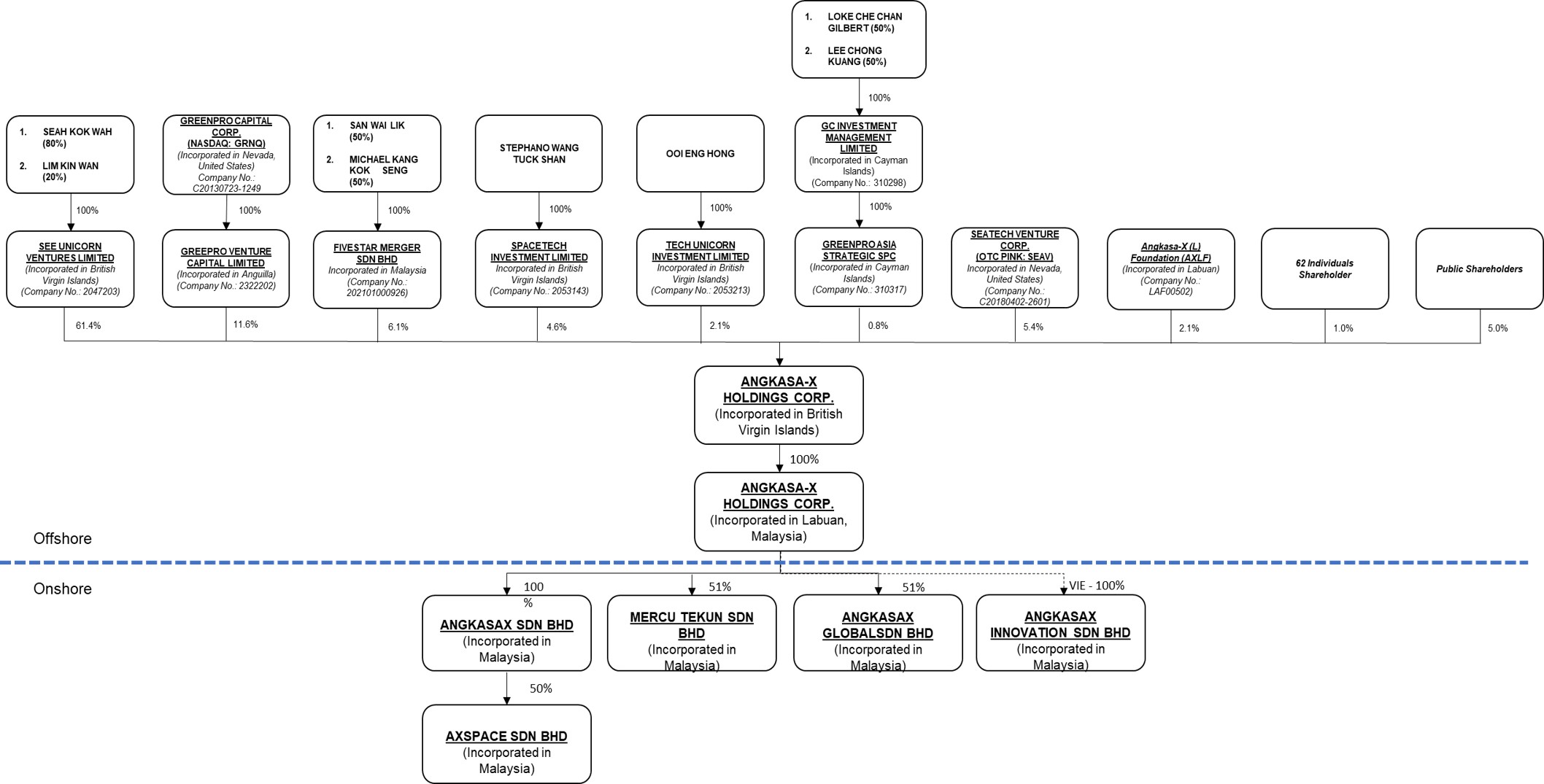

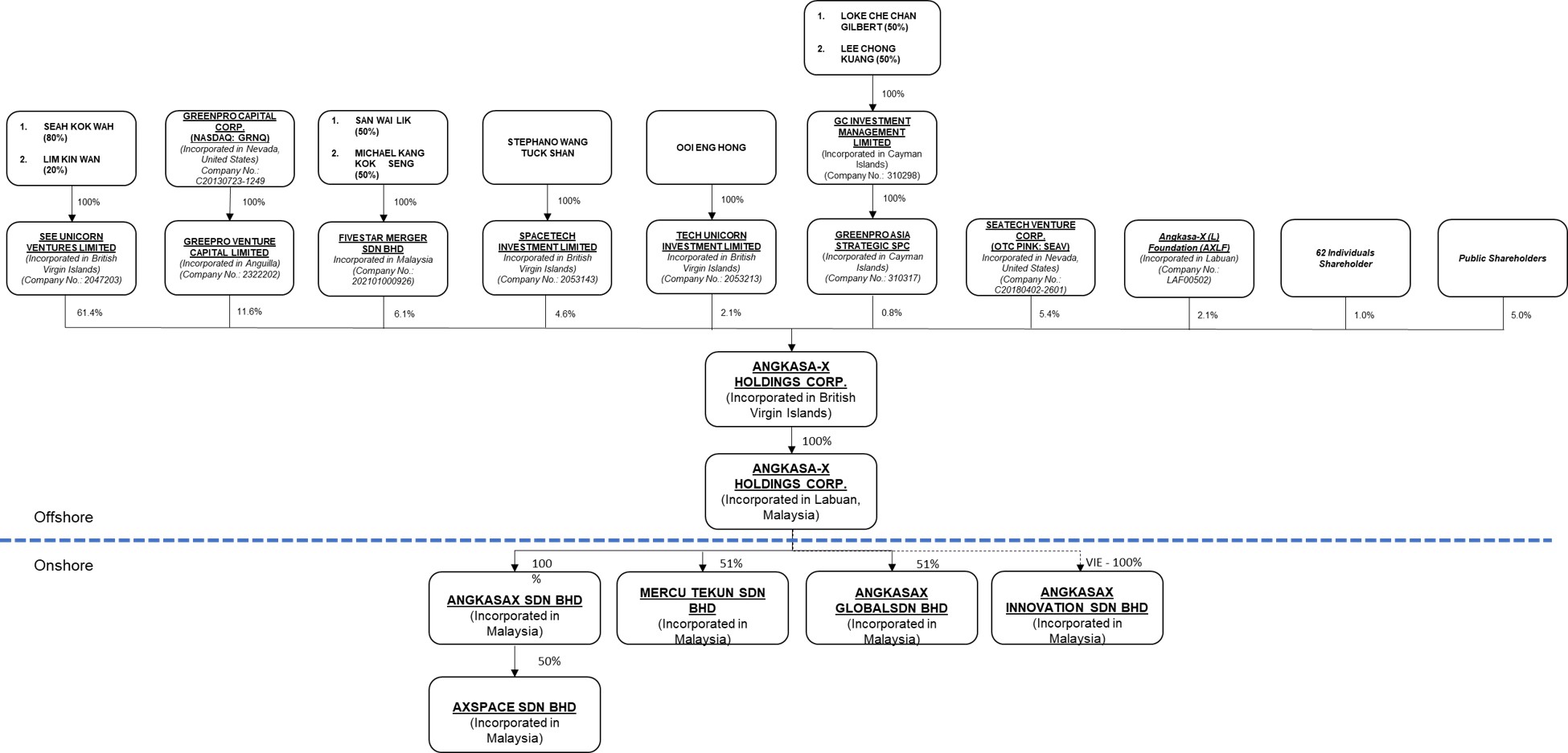

Our Corporate History and Structure

Angkasa-X Holdings Corp. (“Angkasa-X”) is a BVI company incorporated on January 22, 2021, and we conduct our businesses in Malaysia through our subsidiaries, namely AngkasaX Sdn. Bhd., Mercu Tekun Sdn. Bhd., AngkasaX Global Sdn. Bhd., AXSpace Sdn. Bhd., together with our VIE company AngkasaX Innovation Sdn. Bhd. We control and receive the economic benefits of our VIE’s business operations through certain contractual arrangements. Our Ordinary Shares offered in this Offering are shares of Angkasa-X instead of shares of our VIE in Malaysia. For a description of the VIE contractual arrangements, see “Business — Our Corporate History and Structure — VIE Structure and Arrangements” in this prospectus.

On January 27, 2021, our Company acquired Angkasa-X Holdings Corp., a company incorporated in Labuan, Malaysia. In consideration of the equity interests of Angkasa-X Holdings Corp., our Chief Executive Officer and founder, Dr. Seah Kok Wah was compensated $100.

On March 22, 2021, our Company through its subsidiary in Labuan, Angkasa-X Holdings Corp., acquired AngkasaX Sdn. Bhd., a private limited company incorporated in Malaysia. In consideration of the equity interests of AngkasaX Sdn. Bhd., our Chief Executive Officer, Dr. Seah Kok Wah was compensated MYR 100.

On July 8, 2021, our Company through its subsidiary in Labuan, Angkasa-X Holdings Corp., entered into a variable interest entity agreement (“VIE agreement”) with AngkasaX Innovation Sdn. Bhd.

On September 30, 2021, we invested into AngkasaX Sdn. Bhd., a private limited company incorporated in Malaysia, through our Labuan subsidiary, Angkasa-X Holdings Corp., with Silkwave Asia Sdn. Bhd. Angkasa-X Holdings Corp. owns 50% of all AXSpace Sdn. Bhd.’s issued and outstanding shares.

On November 8, 2021, we invested into AngkasaX Global Sdn. Bhd., a private limited company incorporated in Malaysia, through our Labuan subsidiary, Angkasa-X Holdings Corp., with B-Global Sdn. Bhd. Angkasa-X Holdings Corp. owns 51% of all issued and outstanding shares in AngkasaX Global Sdn. Bhd.

On December 29, 2021, our Company through its subsidiary in Labuan, Angkasa-X Holdings Corp., invested MYR 260,205 and subscribed to 260,205 shares in Mercu Tekun Sdn. Bhd., a private limited company incorporated in Malaysia., representing 51% of the total issued shares in Mercu Tekun Sdn. Bhd. The remaining 49% of Mercu Tekun Sdn. Bhd. is owned by Ir. Norhizam Hamzah, who is also our Chief Technology Officer (“CTO”) in AngkasaX Innovation Sdn. Bhd.

See Unicorn Ventures Limited exercise significant control over the Company through its ownership of 65% of the Company’s shares and will continue to exercise significant control over the Company after this offering. 80% of the shares in See Unicorn Ventures Limited are held by our Chief Executive Officer, director and founder, Dr. Seah Kok Wah, while the remaining 20% of shares in See Unicorn Ventures are held by our Chief Financial Officer, Chief Operating Officer and director, Dr. Lim Kin Wan.

Our present corporate structure is as follows as of the date of this prospectus and upon completion of our Offering based on a proposed number of 12,000,000 Ordinary Shares being offered:

Notes to above diagram:

| 1. | Investors will hold Ordinary Shares in Angkasa-X Holdings Corp. a British Virgin Islands company. |

| 2. | The Company’s operations are carried out by all its “Onshore” entities. |

| 3. | The entities that Angkasa-X Holdings Corp. does not hold 100% shareholdings are: |

| | (i) | Mercu Tekun Sdn. Bhd, with 49% of the shareholding belonging to Ir. Norhizam Hamzah who is residing in Malaysia; |

| | (ii) | AngkasaX Global Sdn. Bhd. with 49% of the shareholding belonging to B-Global Sdn. Bhd., a private limited entity incorporated in Malaysia. B-Global Sdn. Bhd is the wholly-owned subsidiary of B-Global Technology Limited. B-Global Technology Limited is a private limited entity incorporated in Hong Kong and solely owned by Matthew O’Malley; |

| | (iii) | AX Space Sdn. Bhd. with 50% of the shareholding belonging to Silkwave Asia Sdn. Bhd., a private limited entity incorporated in Malaysia. Silkwave Asia Sdn. Bhd is wholly owned by Silkwave Asia Limited. |

Our Business

Angkasa-X is a Satellite-as-a-Service (“SaaS”) company that designs, develops, assembles, integrates, tests, launches and manages its proprietary Low Earth Orbit (“LEO”) satellites and operates its own ground station to control its satellites, which will downlink or uplink and process satellite data for its customers.

Our Satellite-as-a-Service consists of the following:

| | ● | Satellite Internet-access (“S-Internet”) |

| | ● | Satellite Automatic Identification Service (“S-AIS”) |

| | ● | Satellite Earth Observation (“S-EO”) |

| | ● | Satellite Internet of Things (“S-IoT”) |

| | ● | Satellite In-Vehicle Infotainment (“S-IVI”) |

| | ● | Satellite Engineering Professional Courses |

| | ● | Satellite Ground Station Turnkey Services |

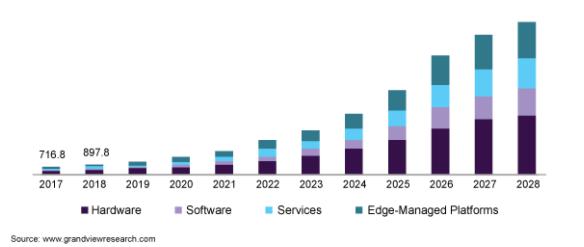

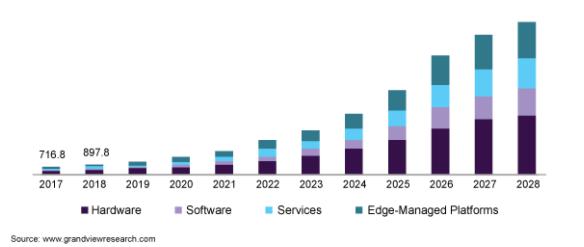

| | ● | Edge Cloud Computing Services |

| | ● | Ground Station Facility Hosting Services |

Presently, we are providing turnkey services, from strategic satellite anchor station solutions, including construction and facility design, and antenna integration to fully deployable, integrated tactical platform solutions through our subsidiary company, Mercu Tekun Sdn. Bhd.

Our target customers are from three major categories, namely, governments, telecommunication companies (“telcos”) and enterprise customers such as internet service providers, maritime regulators and datacentre service providers.

In addition, we are collaborating with Universiti of Sains Malaysia (“USM”) to provide professional satellite engineering courses to engineering students and working adults to develop our pipeline of talent in the SpaceTech industry to complement our satellite businesses.

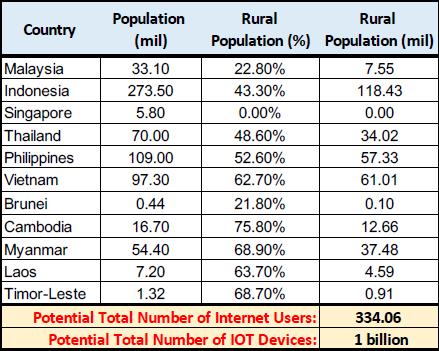

Angkasa-X is a company with a vision of creating a world where connectivity is a basic, affordable necessity for the betterment of mankind through the setting up of two Low Earth Orbit (“LEO”) satellite constellations, namely A-SEANLINK and A-SEANSAT Satellite Constellation with the goal of eradicating poverty and improving living standards in South East Asia, especially for those in the remote rural areas.

Angkasa-X’s vision is in-line with the United Nation’s Sustainable Development Goals (“SDGs”) which are the following: -

| | ● | Goal 1, No Poverty - “End poverty in all its forms everywhere”; |

| | ● | Goal 4, Quality Education – “Ensure inclusive and equitable quality education and promote lifelong learning and opportunities for all”; |

| | ● | Goal 8, Decent Work and Economic Growth - “Promote sustained, inclusive and sustainable economic growth, full and productive employment and decent work for all”; |

| | ● | Goal 9, Industry, Innovation and Infrastructure - “Build resilient infrastructure, promote inclusive and sustainable industrialisation and foster innovation; and |

| | ● | Goal 11, Sustainable Cities and Communities - “Make cities and human settlements inclusive, safe, resilient and sustainable. |

(Source: https://sdgs.un.org/goals)

Angkasa-X mission statements are:

| | | ● | Investment in Research & Development (“R&D”), intellection property (“IP”) creation, component sourcing, assembly-integration-testing (“AIT”), launching and maintaining state-of-the-art Low Earth Orbit (“LEO”) satellites. |

| | | | |

| | | ● | To provide internet connectivity to rural areas in ASEAN countries and the neighbouring regions by offering Satellite-as-a-Service (“SaaS”) to telecommunication, broadcasting and data communication companies via our A-SEANLINK Satellite Constellation. |

| | | | |

| | | ● | To form a Space Science and Tech Ecosystem by setting up an International Space Tech Park in Penang, Malaysia to create job opportunities and attract Foreign Direct Investment in Malaysia. |

We have been an International Telecommunication Union (“ITU”) member since September 2021. We have filed for Advance Publication Information (“API”) approval for the spectrum and frequencies of our proprietary design satellite with ITU. We are also in the midst filing for X-band and S-band radio frequencies licensing in August 2022. Our application for Network Facilities Providers (“NFP”) and Network Service Providers (“NSP”) licences that authorizes us to operate the satellite ground station has been approved by the local Malaysia regulator, Malaysian Communications and Multimedia Commission (“MCMC”).

We have incurred significant losses since our inception. While we have generated limited revenue to date, we have not yet achieved production level satellite manufacturing, launch and data activities, and it is difficult for us to predict our future operating results. Our auditors have also raised substantial doubt about the Company’s ability to continue as a going concern, the details of which can be found in the Financial Statements of this Registration Statement.

For further information, please see the section titled “Business” contained elsewhere in this prospectus.

Our Satellite Constellations and Ground Station

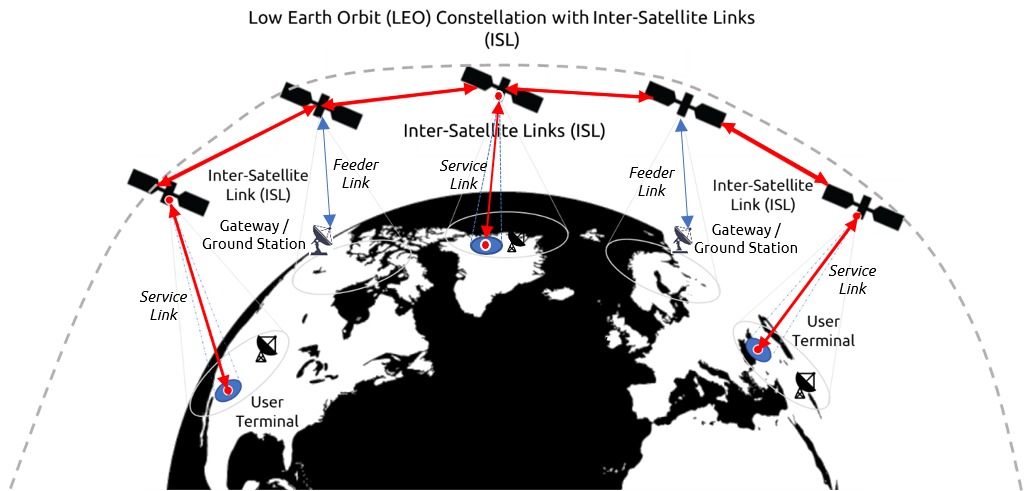

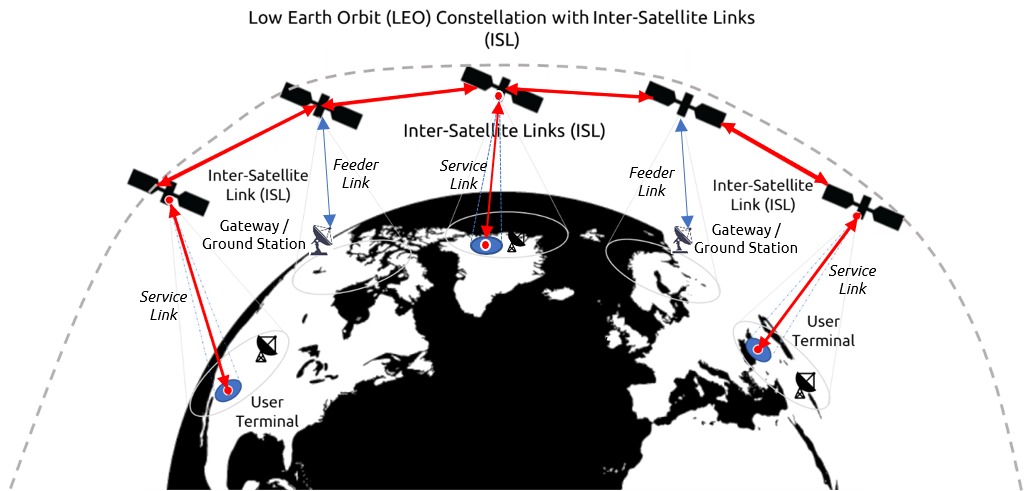

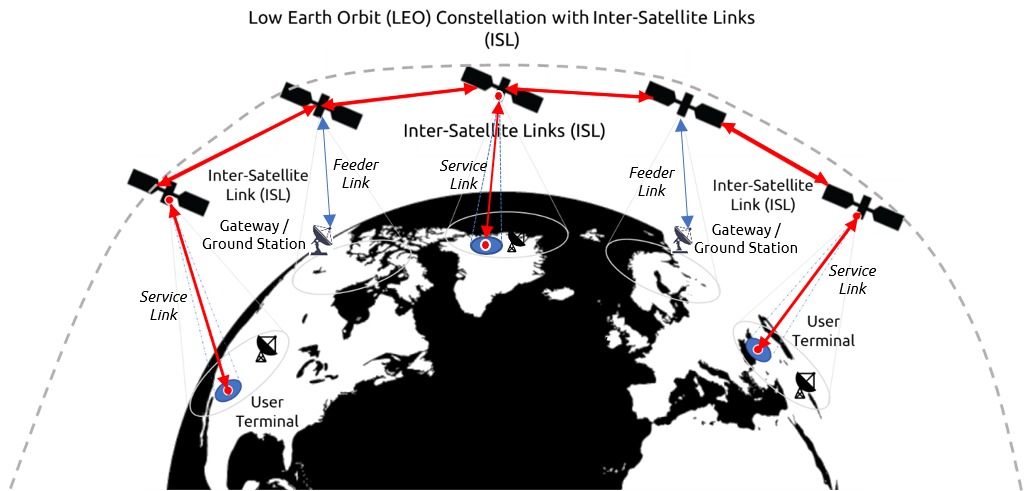

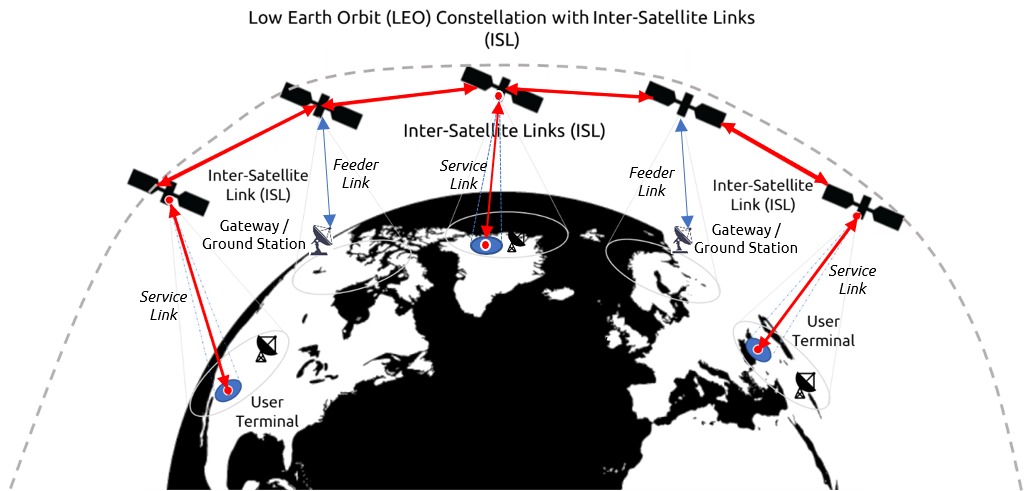

We plan to launch two proprietary design Low Earth Orbit (“LEO”) satellite constellations call the A-SEANLINK and A-SEANSAT that will form our satellites infrastructure assets for providing Satellite-as-a-Service (“SaaS”) to the government, telecommunication companies, network reseller and enterprises in ASEAN countries. We have filed for approval for our first satellite spectrum for inclinations and altitudes between 400 and 600 km to meet our transmission requirements.

For A-SEANLINK constellations, we plan to launch about 500 ASEAN-focused satellites in total and expect our first launch of communication satellite from the year 2024 onward. The A-SEANLINK constellation is planned to be comprised of customized satellites that will utilize Ka-band and Ku-band frequencies in a variety of orbits. It will consist of micro to small class satellites that can provide internet connectivity to facilitate the transfer of data through the use of very small-aperture terminal (“VSAT”) networks, especially for those remote rural area.

For A-SEANSAT constellations, we expect to launch our first nanosatellite call A-SEANSAT-PG1 in year 2023 while we continue to finalize customers for A-SEANSAT. The A-SEANSAT constellation is planned to be comprised of customized satellites that will utilize S-band and X-band frequencies in a variety of orbits. We plan to launch a constellation consisting of multiple LEO nanosatellites into orbit. As our number of satellites grows, the duration and amount of data we collect including satellite revisit rate will increase substantially.

We are currently developing and constructing our first ground station located at Universiti of Sains Malaysia Engineering Campus in Penang, Malaysia. This ground station will provide radio frequency communication access and telemetry tracking and control (“TT&C”) mainly for our own LEO satellites. Furthermore, we plan to use this infrastructure asset of ours to provide ground station facility hosting services and support to other satellite operators around the world. This ground station also serve as our satellite control station to provide access for LEO satellite operators to operate their satellites including Angkasa-X satellite network. This mean our satellite constellation will be supported by our mission operations software and our ground station facilities. Our systems and solutions shall be developed through our discretionary internal research and development (“R&D”) funding. Having our own and self-managed ground station is a complementary to our satellite services segment and, we believe, will create significant synergies in our business and will uniquely position us to drive operational efficiency and cost effectiveness to deliver a diverse portfolio of high-speed, high-quality data communication solutions and applications to our customers.

We estimate the aggregate costs associated with the design, develop, assemble, integrate, test, and launch of A-SEANLINK constellation, A-SEANSAT constellation, our ground station and related infrastructure upgrades to be approximately $3 billion with funding needs spread over a period of 10 years. Our funding plan for these investments, R&D and operational costs shall include the revenue generated by our planned businesses which shall include our current SaaS service offerings, proceeds from our current offering and potentially credit facilities by financial institution in future.

Our Satellite as a Service (“SaaS”)

Angkasa-X, through its subsidiary AngkasaX Innovation Sdn. Bhd., plans to provide various types of satellite services in the form of Satellite-As-A-Service (“SAAS”) to telecommunication companies and enterprises in ASEAN countries as below:

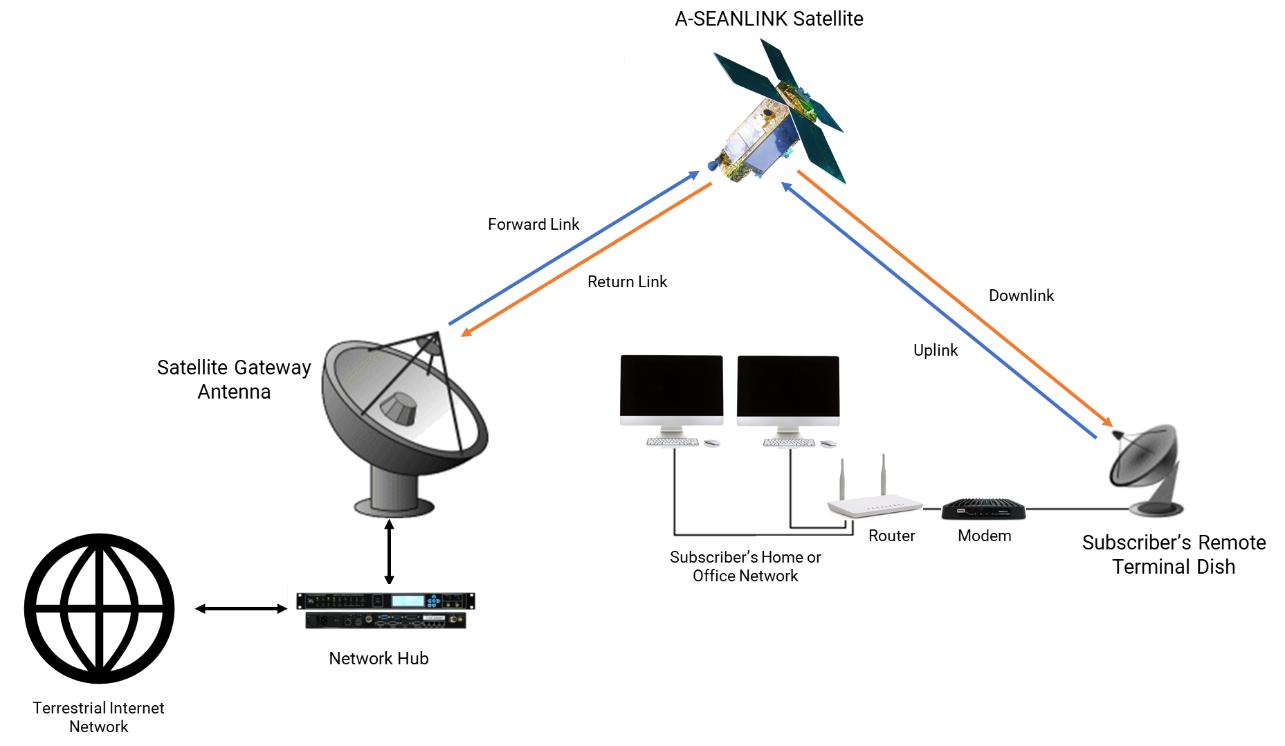

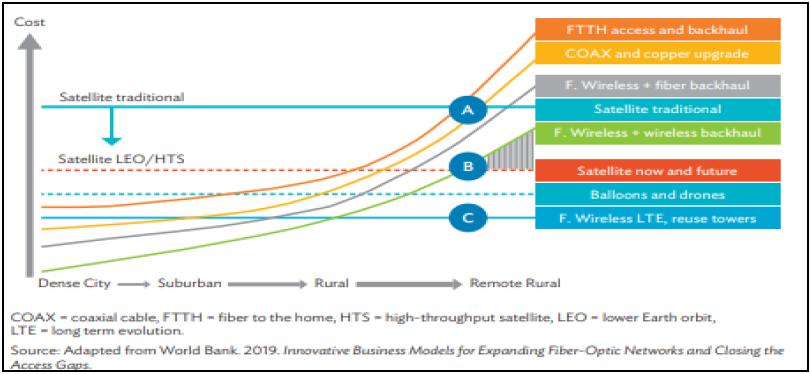

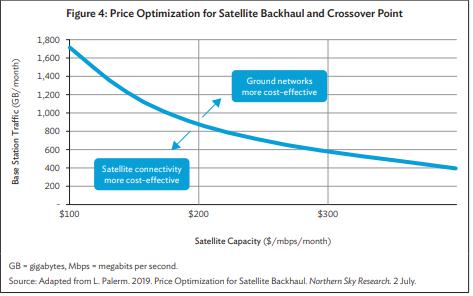

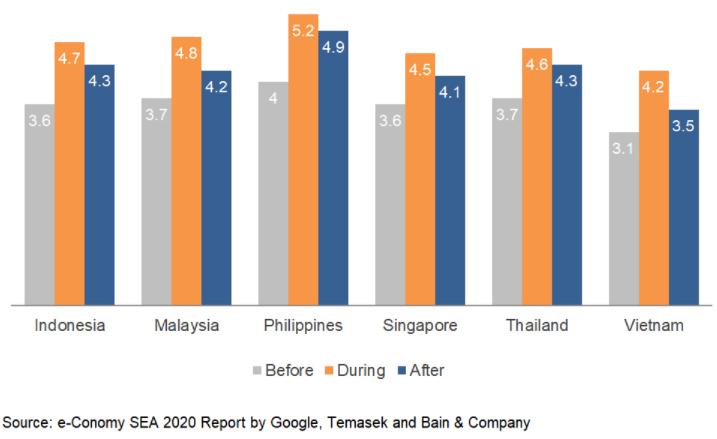

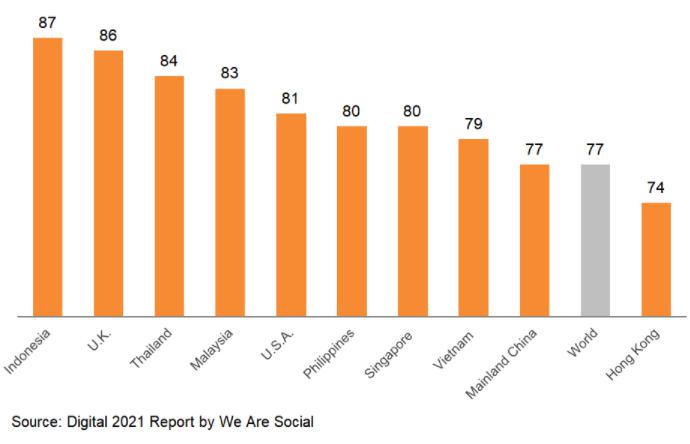

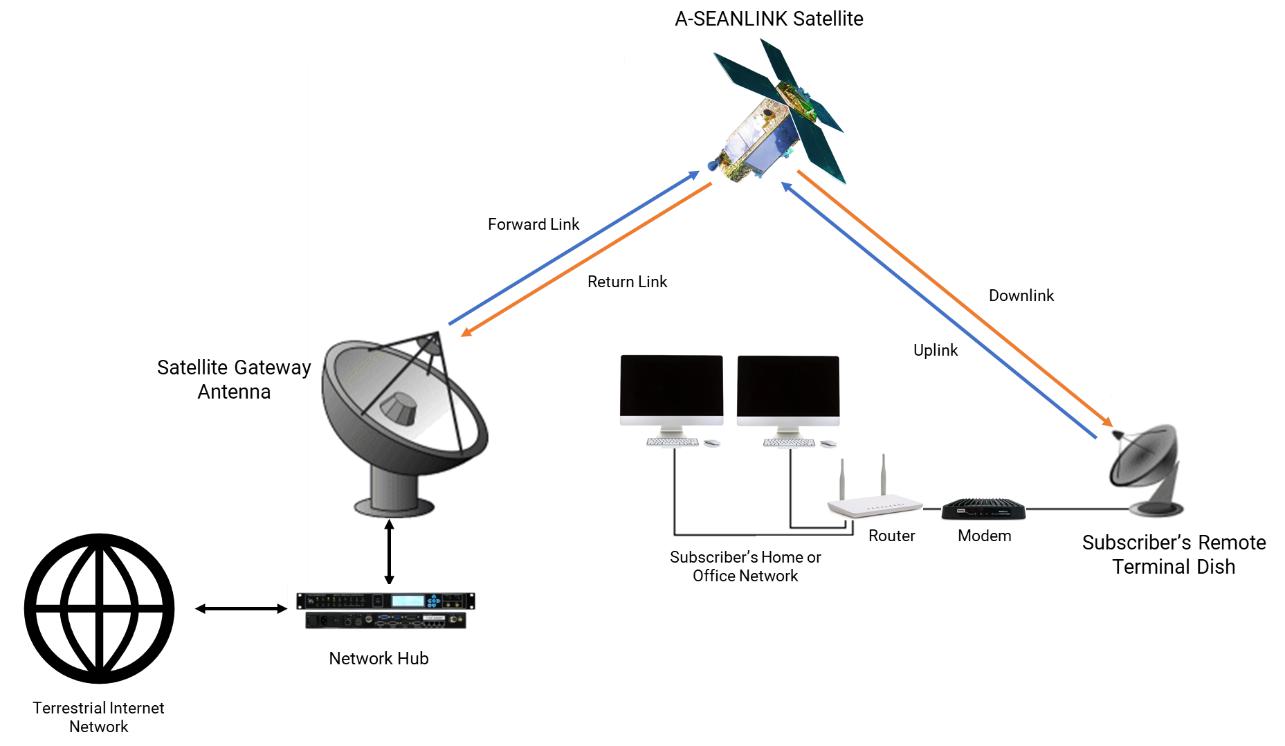

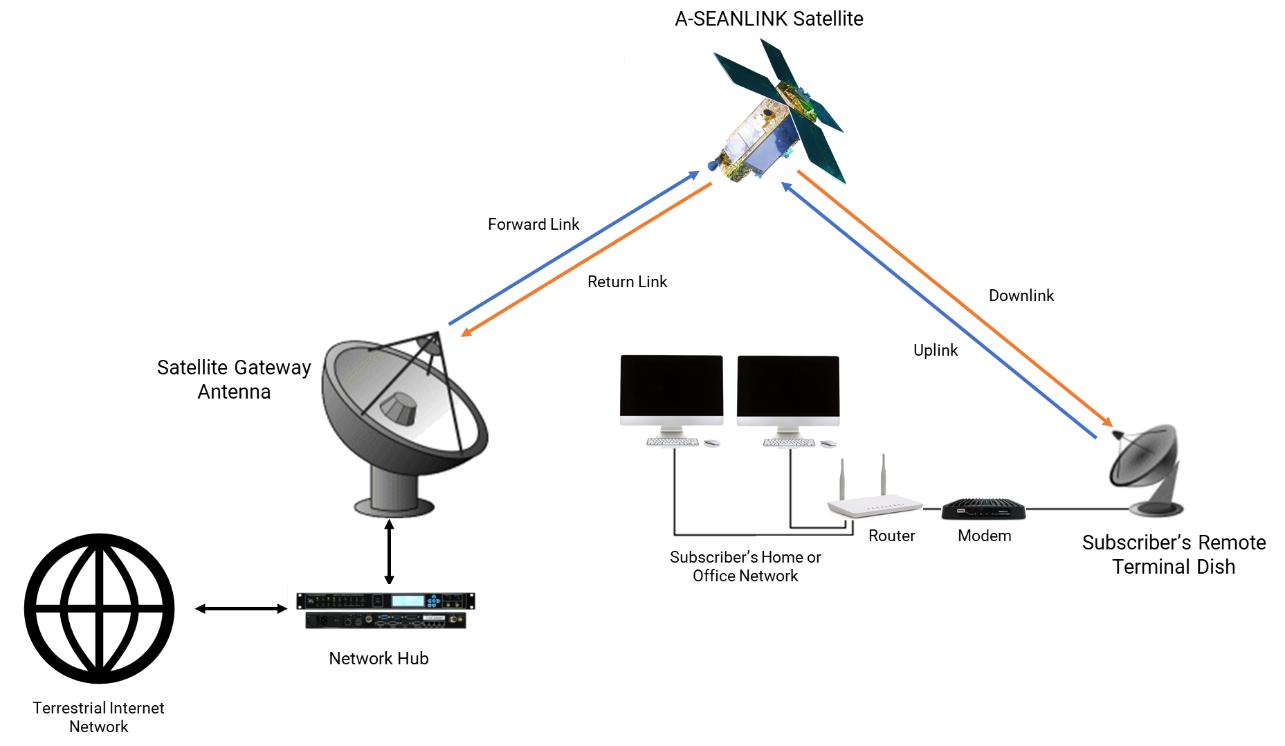

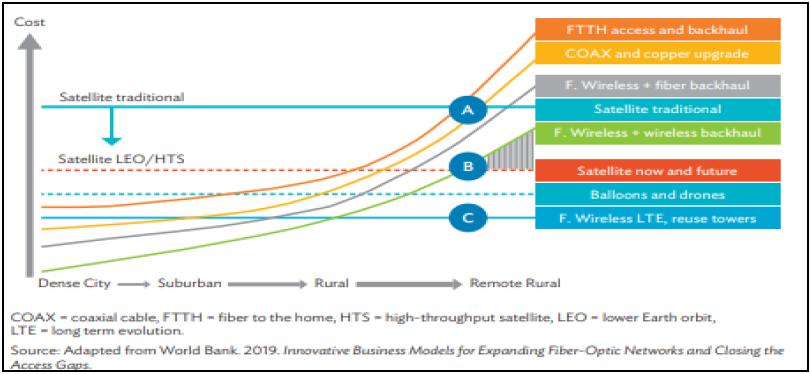

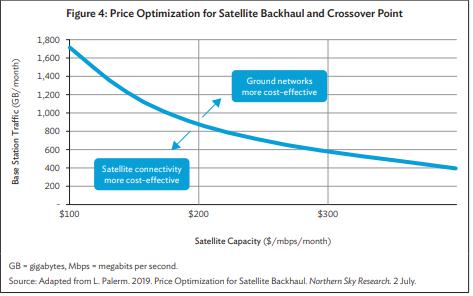

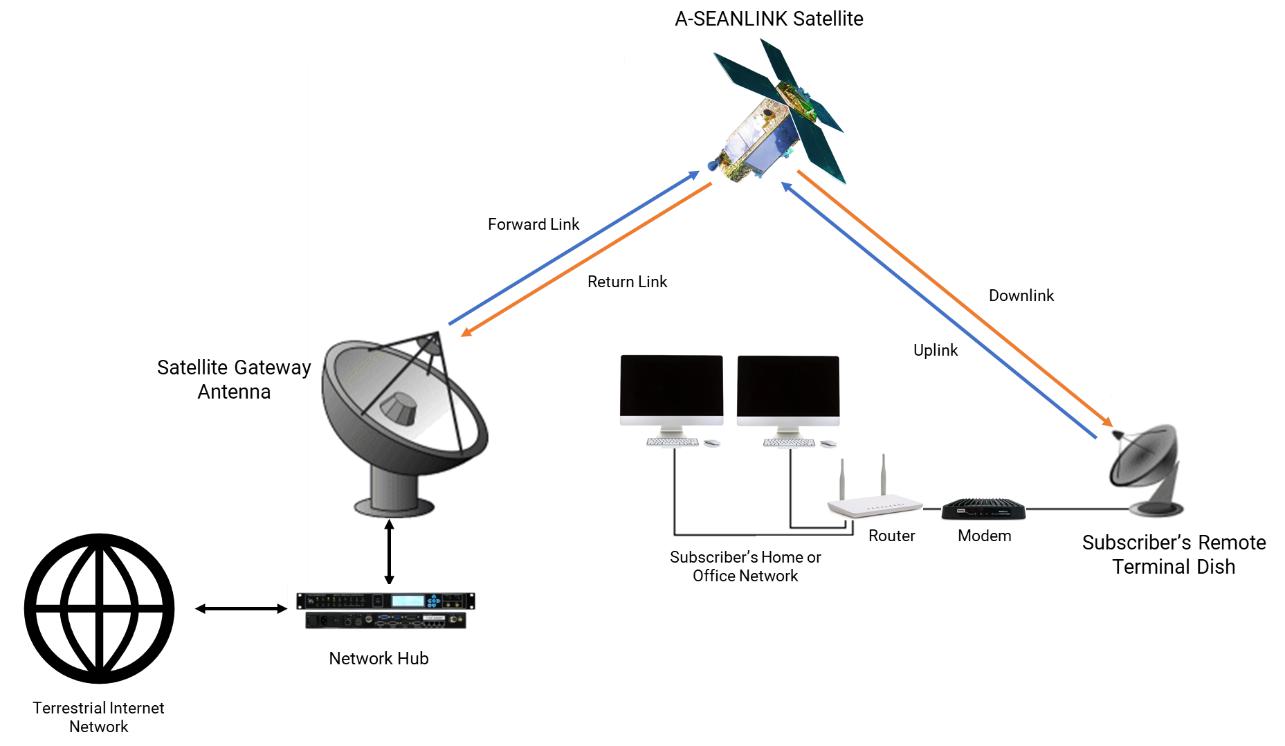

Satellite Internet-access (“S-Internet”)

One of the services is Satellite Internet-access (“S-Internet”) services via our low-latency LEO A-SEANLINK Satellite Constellation to facilitate the transfer of data through the use of very small-aperture terminal (“VSAT”) networks. S-Internet services enable telecommunication companies and enterprises in ASEAN countries to provide internet-connectivity to remote rural communities in the ASEAN region, where traditional terrestrial fiber network is very limited, and therefore shall elevate internet accessibility to people living in remote rural areas. Our target customers for this service will be telecommunication companies or network resellers in the region we operate. We will enter into contracts with our customer to provide them satellite internet-access service and derive revenue by enabling data connectivity for their end users. This is sold on a subscription basis for different data size packages. The subscription periods for this service will generally range from three to five years, The subscription fees are typically billed monthly in advance.

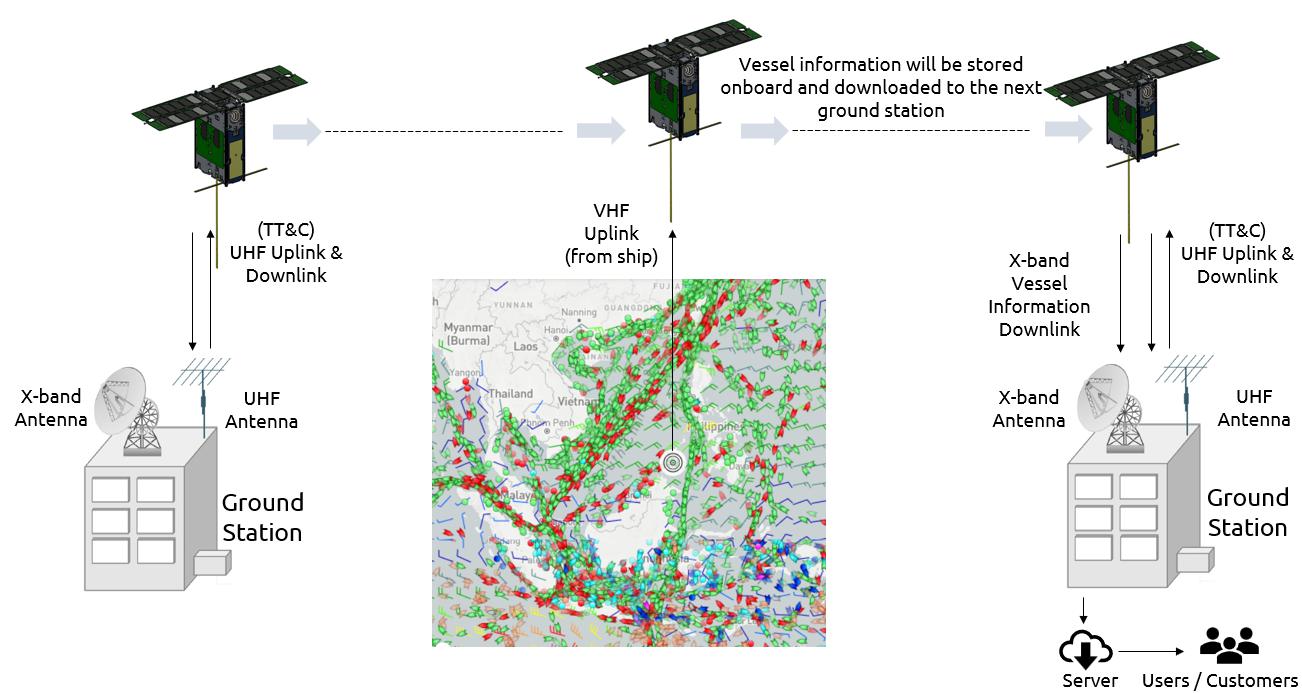

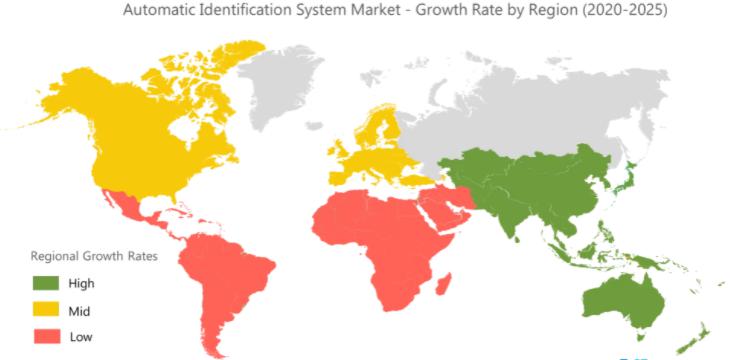

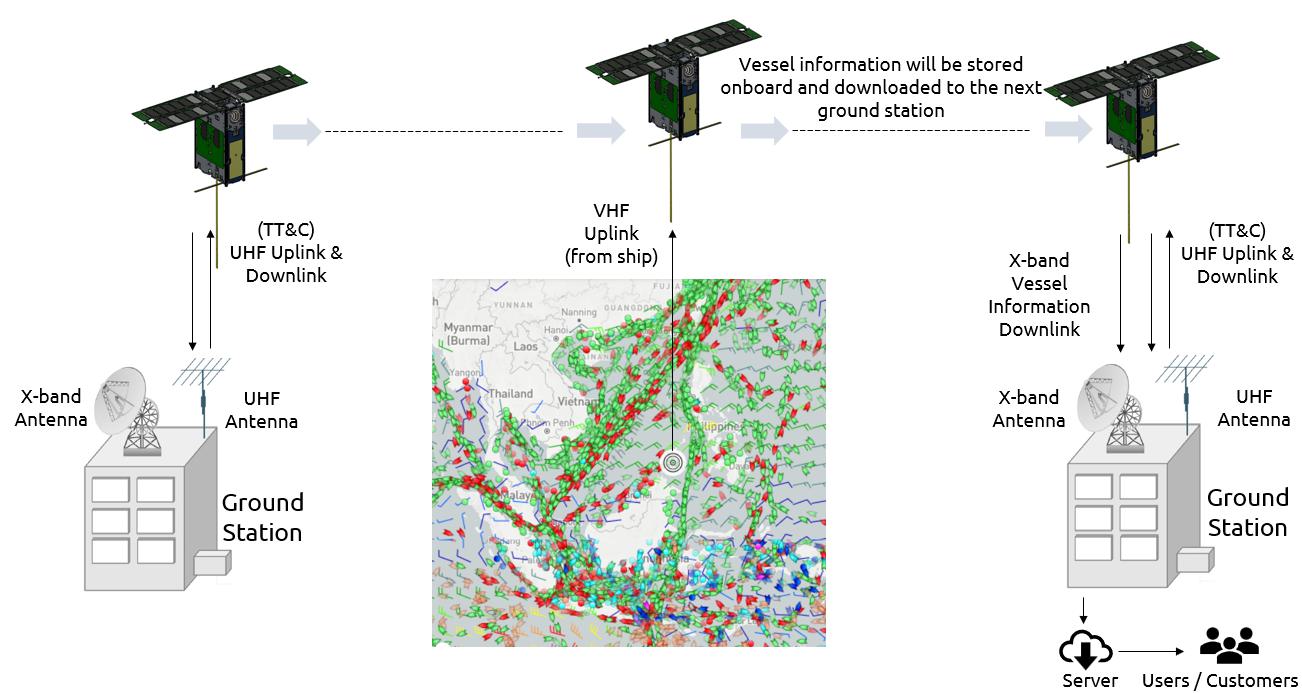

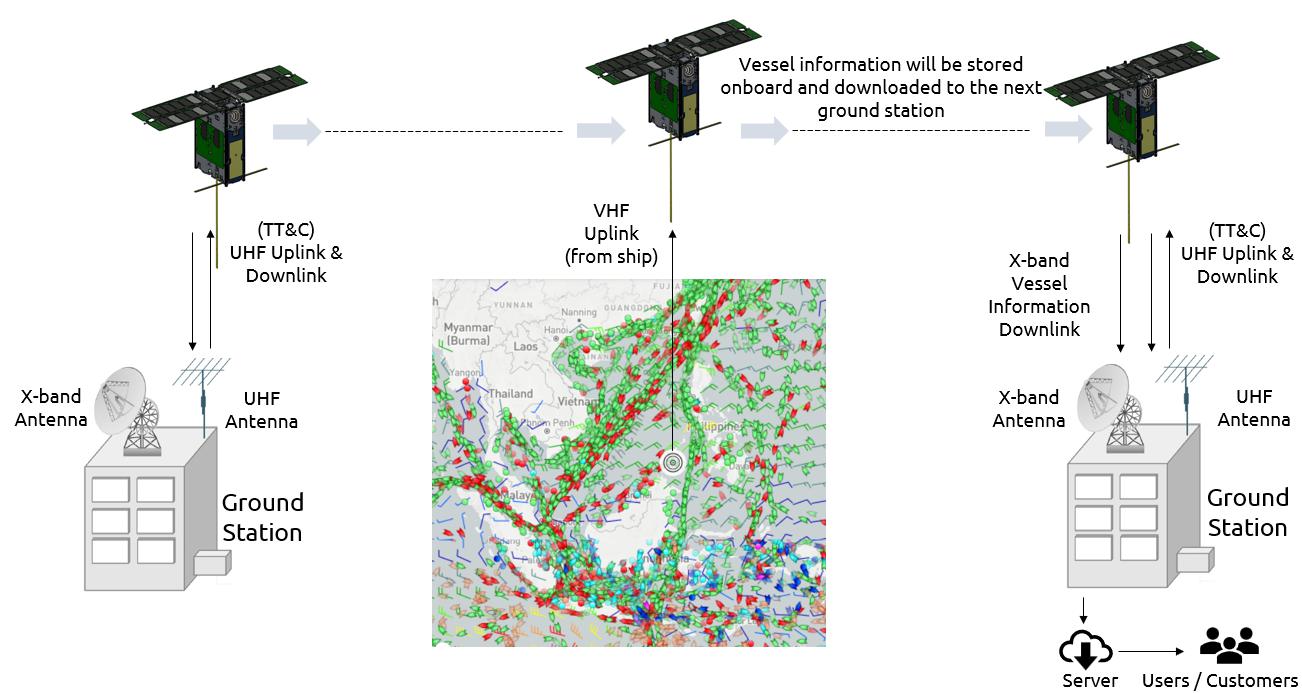

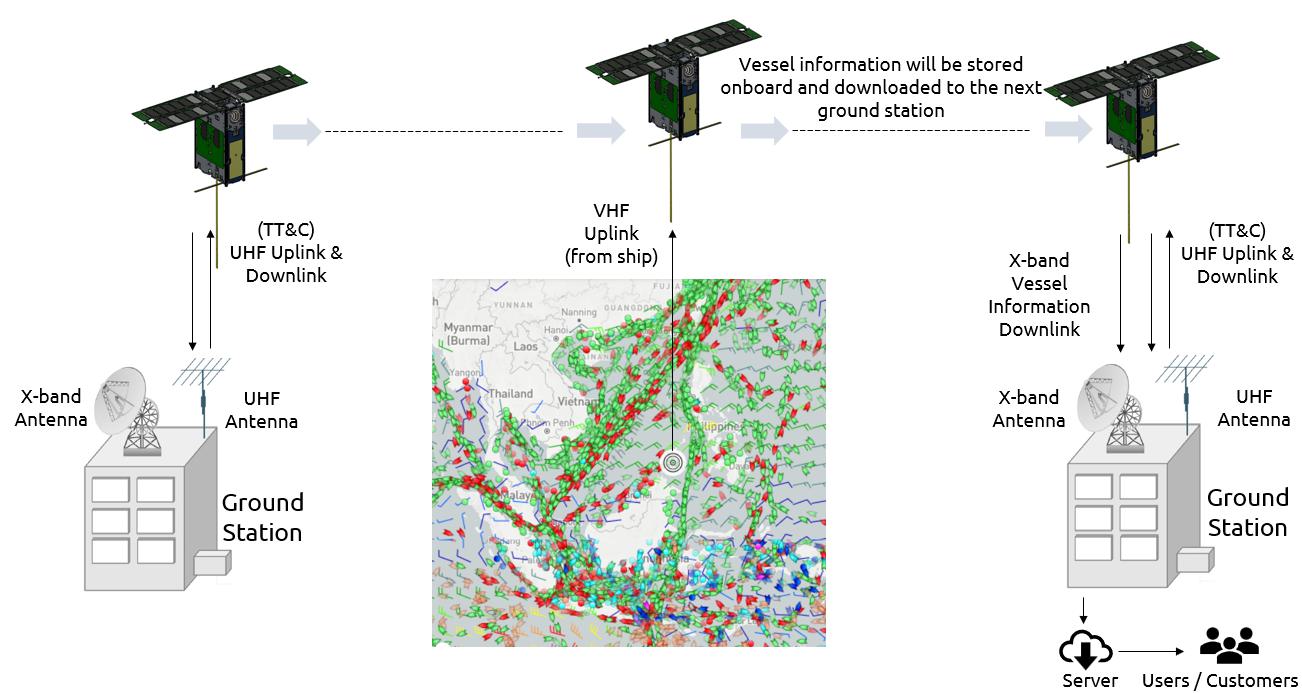

Satellite Automatic Identification Service (“S-AIS”)

Angkasa-X through its subsidiary AngkasaX Innovation Sdn. Bhd., intends to offer Satellite Automatic Identification Service (“S-AIS”) via its LEO A-SEANSAT Satellite Constellation to assist in precision vessel navigation and asset tracking to improve maritime safety. Our key target customers for this segment are those in the maritime, logistics and government. We will derive our revenue from providing data insights, and access to our cloud-based technology platform sold on a subscription basis. We will bill our customers either on a monthly or quarterly basis, and occasionally charge for on demand services (mostly in case of government customers) or based on contract pricing (shipping or app developer) entered into with our client. Some of the key applications for these services are as follows:

| | ● | Tracking vessels globally - Precise vessel tracking using AIS data helps owners and operators know where vessels are located; |

| | ● | Monitoring illegal activities and compliances - Near real-time solutions help facilitate organizations to secure fishing territories, protect submarine assets, and analyze maritime incidents; |

| | ● | Analyzing commodity trading - Fuel, grain, building materials, and precious metals are all traded by sea. We constantly track what, where, and by whom commodities are being traded. We use location data and maritime intelligence in combination with trade data to visualize the global commodity flow and identify patterns. |

| | ● | Maritime security services - for support of security operations, vessel traffic or navigation monitoring, vessel traffic management, support of safety operations; |

| | ● | Law-enforcement services - anti-piracy, illegal fishing, enforcement of international/ national regulations, support of enforcement operations; |

| | ● | Search and Rescue (“SAR”) services; |

| | ● | Maritime surveillance services - monitoring of vessels in sensitive areas, anti-drug smuggling, border control; |

| | ● | Environmental services - hazardous cargos monitoring, prevention of pollution caused by ships, pollution response; and |

| | ● | Fleet management services for commercial users (shipping companies and ship owners). |

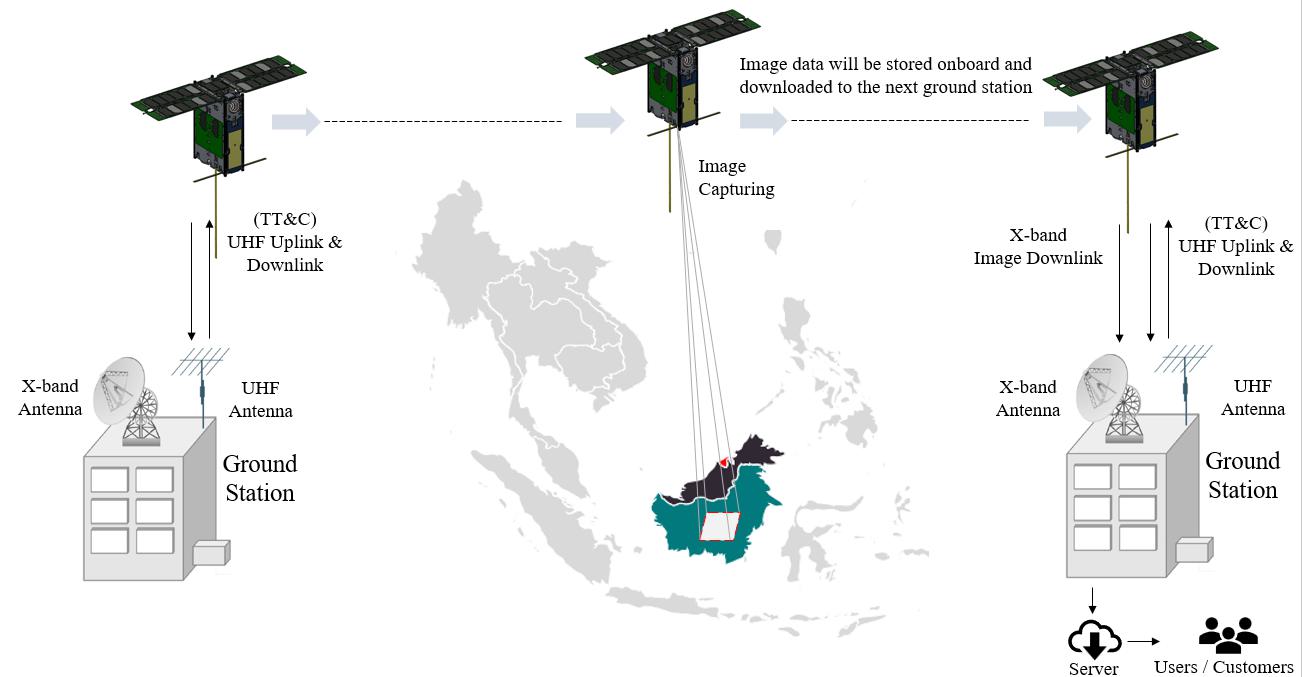

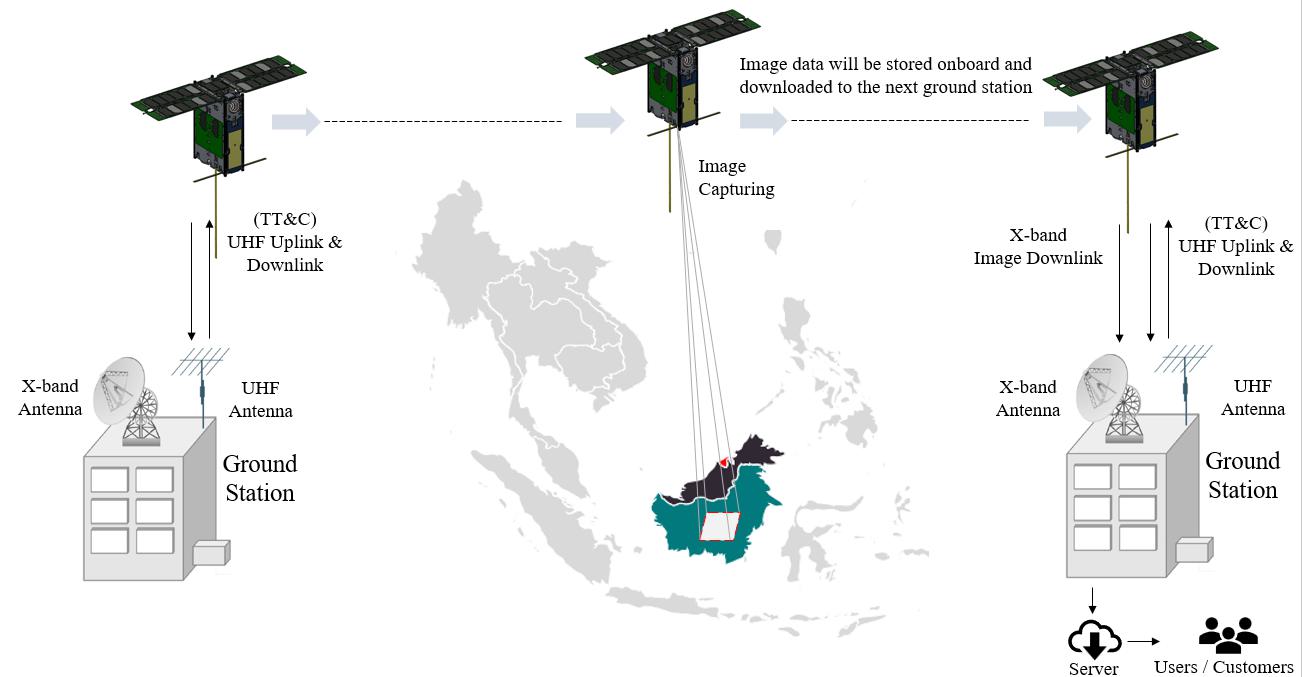

Satellite Earth Observation (“S-EO”)

Angkasa-X through its subsidiary AngkasaX Innovation Sdn. Bhd., plans to design its LEO satellites that will be integrated with high-resolution cameras for Satellite Earth Observation (“S-EO”) imaging. Our satellite optical imager has a resolution range from 0.5-meter to 5-meter ground sampling distance between 400-600 km altitude. This can be used for environment monitoring, agriculture, water resources, urban planning, rural development, mineral prospecting, forestry, ocean resources and disaster management. We plan to sell to local or foreign government or through resellers to government customers throughout Southeast Asia. Customers can rely on our proprietary satellite constellation to collect and deliver imagery over specific locations, sites, and regions that are critical to their operations. We plan to offer customers several service options that include basic plans for on-demand tasking or multi-year subscription access, where customers can secure priority access and imaging capacity over a region of interest on a take or pay basis.

We will derive revenue by providing our client a number of images, and in different resolutions. Some of the applications that will benefit from the image are as follows:

| | ● | Mapping - Satellites imagery from space can be used to update topographic and thematic maps and databases. |

| | ● | Environment monitoring - Changes in the Earth’s flora, atmospheric trace gas concentration, sea status, ocean color, and ice fields may all be detected by satellites, which can help with environmental monitoring. |

| | ● | Disaster monitoring – In a wildfire situation, user can rely satellites imaginary provider to provide significant hotspot information, that is to detect fire hotspots as precisely as possible and to distinguish critical hotspots among detected hotspots. This information will then be sent to firefighters to help them in extinguishing wildfires. |

| | ● | Raw mineral prospecting - The mapping of hydrothermal alteration is based on the examination of the spectral signatures of the mineral veins. It is now known that certain minerals associated with hydrothermal alterations have unique spectral features that allow them to be remotely identified and detected. |

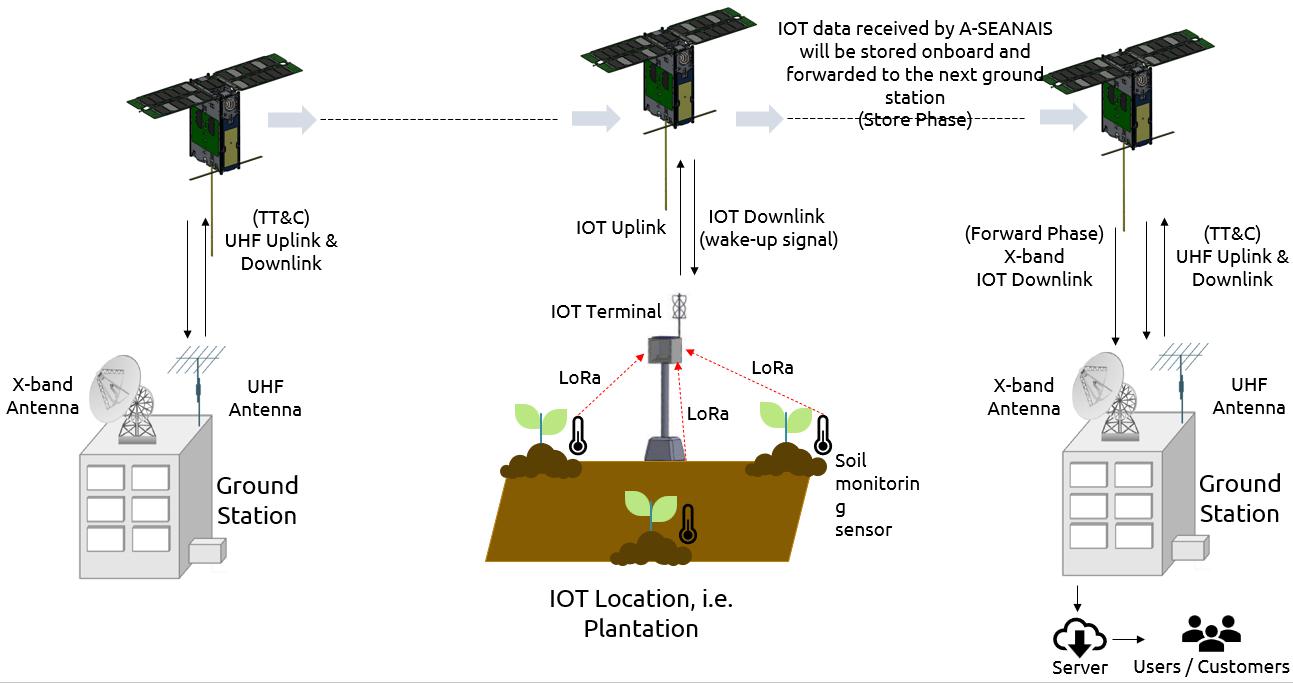

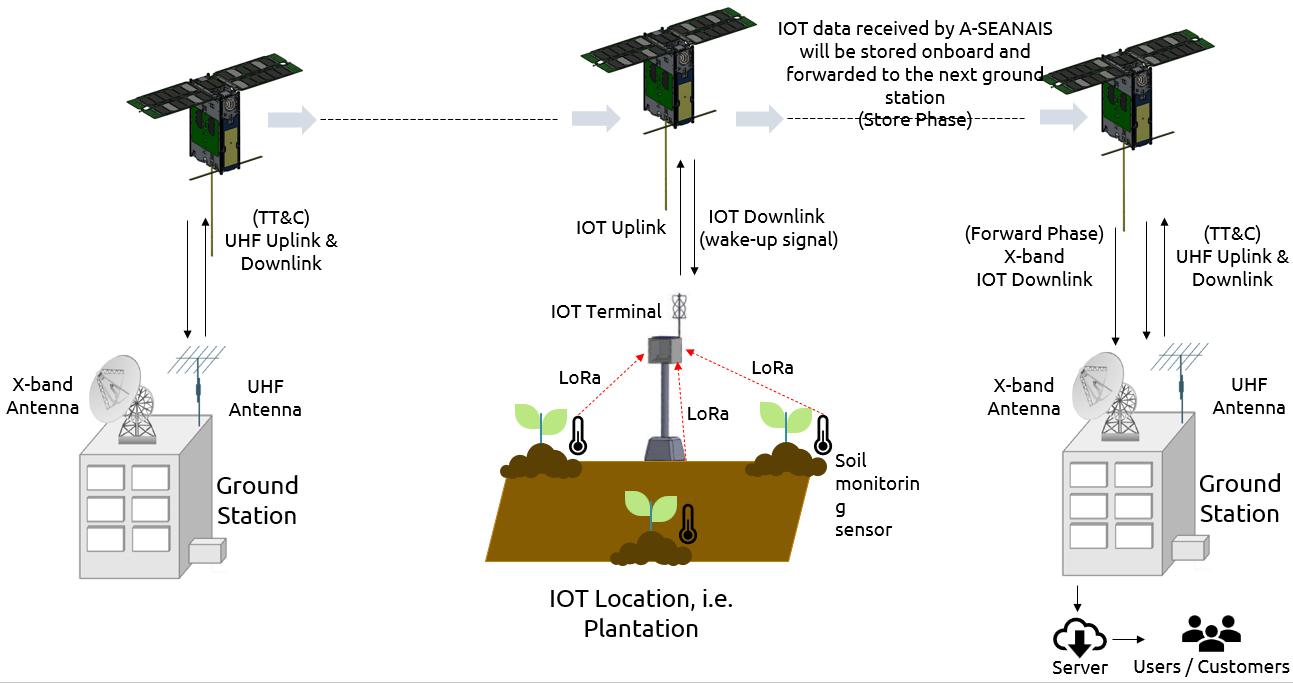

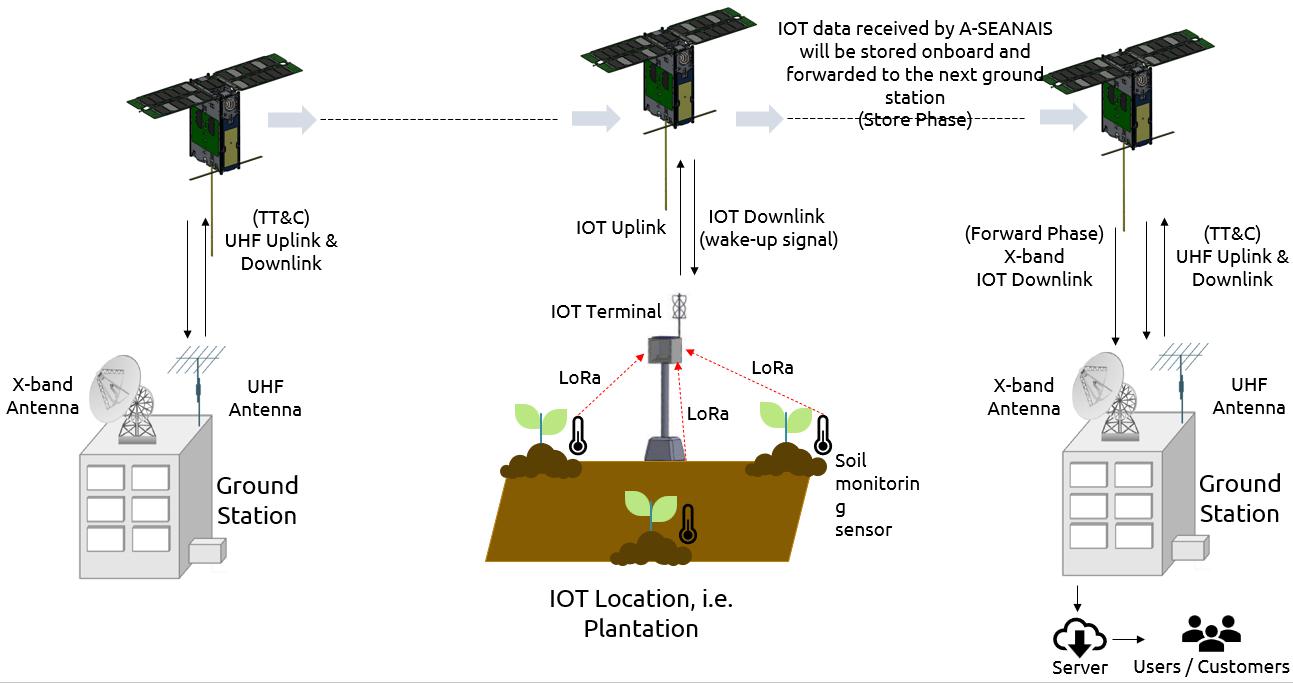

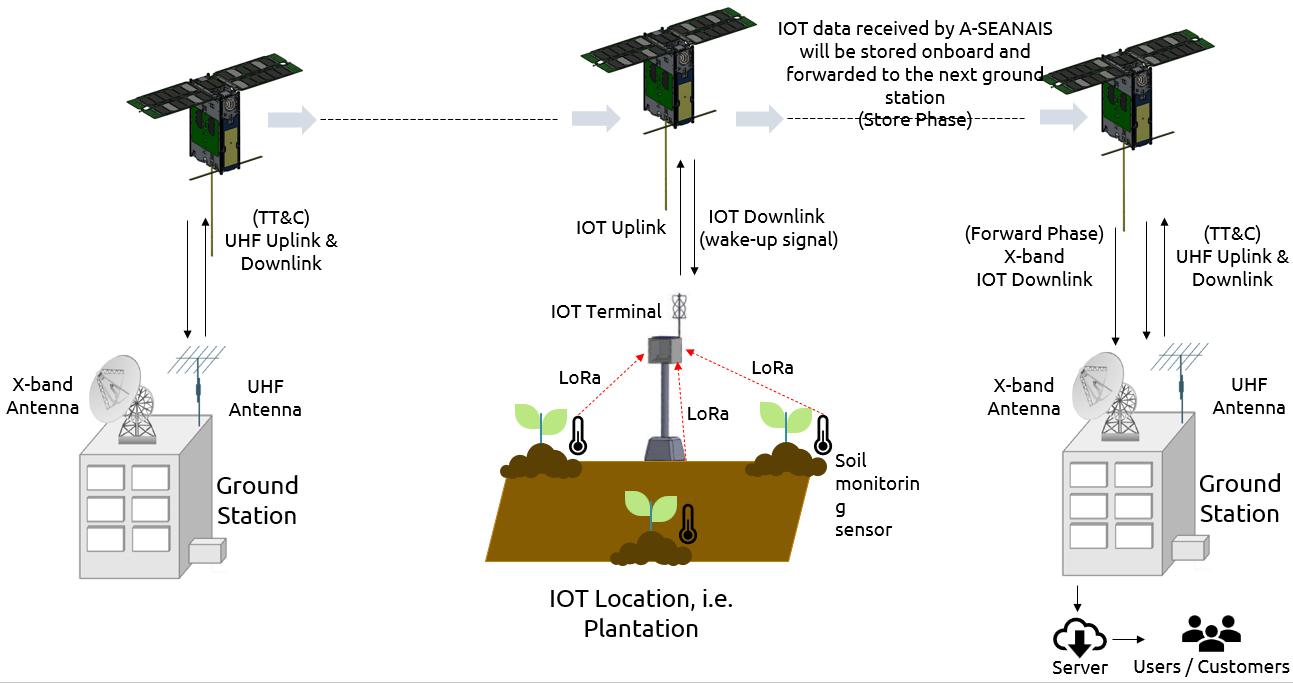

Satellite Internet of Things (“S-IoT”)

Through AngkasaX Innovation Sdn. Bhd., Angkasa-X intends to provide Satellite Internet of Things (“S-IoT”) services via our LEO A-SEANSAT Satellite Constellation, connecting remote rural areas that lack terrestrial infrastructure or cellular access. Our S-IoT services enable solutions, including network connectivity, devices management and reporting applications software through tracking, monitoring and control of a variety of our customers’ assets and rural smart-agriculture. Our satellite will transmit and receive IoT signals from designated terminals and/or ground stations. Our services are to be sold direct as well as through a network of telecommunication companies, independent agents, dealers and resellers. We will offer customers multi-year subscription access for our service. For example, some of the key applications of our S-IoT services are as follows:

| | ● | Unpowered assets - An example of this application is in the monitoring of halal goods in transport or other unpowered transport units as GSM networks do not provide global coverage. |

| | ● | Smart-agriculture - Through the implementation of IoT sensors, a significant amount of data can be obtained on the state and stages of soil. Information such as soil moisture, level of acidity, the presence of certain nutrients, temperature and many other chemical characteristics, help farmers control irrigation, make water use more efficient, specify the best times to start sowing, and even discover the presence of diseases in plants and soil. |

| | ● | Public infrastructure - Monitoring and controlling operations of urban and rural infrastructures like bridges, railway tracks, on- and offshore- wind-farms is a key application of the IoT. The IoT infrastructure can be used for monitoring any events or changes in structural conditions that can compromise safety and increase risk. It can also be used for scheduling repair and maintenance activities in an efficient manner, by coordinating tasks between different service providers and users of these facilities. |

| | ● | Energy and Utilities - Integration of sensing and actuation systems, connected to the Internet, is likely to optimize energy consumption as a whole. It is expected that IoT devices will be integrated into all forms of energy consuming devices (switches, power outlets, bulbs, televisions, etc.) and be able to communicate with the utility supply company in order to effectively balance power generation and energy usage. Such devices would also offer the opportunity for users to remotely control their devices, or centrally manage them via a cloud-based interface, and enable advanced functions like scheduling (e.g., remotely powering on or off heating systems, controlling ovens, changing lighting conditions etc.) |

Satellite In-Vehicle Infotainment (“S-IVI”)

Angkasa-X has formed a joint venture company, AXSpace Sdn. Bhd. with Silkwave Asia Sdn. Bhd.(“Silkwave”), a wholly owned subsidiary company of Silkwave Holdings Limited. This joint venture company, AXSpace Sdn. Bhd. will provide GEO-LEO integrated satellite network infrastructure in the South East Asia Region. Its services to be offered will include Satellite In-Vehicle Infotainment (“S-IVI”) that combines mobile satellite broadcasting and supplemental terrestrial cellular connectivity through its innovative Converged™ network to deliver high-quality, low-cost, live, and on-demand multimedia and data services. This service is currently under development and we plan to commercialize this after completion of research and development (“R&D”) within three years. This service will be provided by the telecommunication company through their local network of resellers. We expect to derive revenue based on the number of subscriptions provided by the telco’s network of resellers, and we will bill the telecommunication companies on monthly basis. A key application of this service is to allow entertainment platforms like video on demand to deliver their content into a vehicle, even while in motion and that provides Malaysian drivers a connected experience in their cars.

Satellite Engineering Professional Courses

AngkasaX Innovation Sdn. Bhd. has entered into an agreement with the Universiti Sains Malaysia (“USM”) to jointly develop Professional Satellite Engineering Courses. AngkasaX Innovation Sdn. Bhd. shall provide licensed, certified, valid courseware and relevant satellite equipment to USM. This includes train-the-trainer program where the instructors and lecturers involved are from USM, so that USM can provide the professional satellite engineering courses to their students in the future. Together with USM, Angkasa-X will jointly promote and market these satellite engineering professional courses to all qualified students and qualified working adults. USM is responsible for collecting fee from each student and qualified working adult enrolled in the Professional Satellite Engineering Course. We will derive our revenue on a revenue sharing basis with USM. The main components of the course are:

| | ● | Practical Training Course on learning to program satellite on Raspberry; |

| | ● | Practical Training Course on how to work with CubeSat payload; |

| | ● | Practical Training Course on how to work with Nanosatellite Platform; |

| | ● | Practical Training Course on how to work with Radio Station & Spacecraft; |

| | ● | Practical Training Course on how to work with Satellite Design Kit & Earth Simulator; |

| | ● | Practical Training Course on how to work with Satellite Test Bench; and |

| | ● | Practical Training Course on how to work with Radio Station for Transmission |

Satellite Ground Station Turnkey Services

Through Angkasa-X’s Malaysia subsidiary company, Mercu Tekun Sdn. Bhd. (“Mercu Tekun”), we are currently offering a broad range of services from turnkey, strategic satellite anchor station solutions, including construction and facility design, and antenna integration; to fully deployable, integrated tactical platform solutions. These services are typically sold to enterprise and government customers on a project basis under fixed price contracts over a period of months to years. In our commercial networks segment, we also act as both a prime contractor and subcontractor for equipment solutioning and integration services.

Edge Cloud Computing Services

With S-Internet services, we plan to roll out our Edge Cloud Computing Services via deployment of mobile datacentre to facilitate the setting up of infrastructures for smart-cities and digital-villages in remote rural areas in ASEAN for rapid digital economy transformation. We expect to own the mobile datacentre and lease it to the target customer in the telecommunication and/or data centre industries with a combination of one time set up fee and monthly billing for customers in the remote rural areas. Currently most hyperscale datacentres are located in highly fiberized connected areas (urban) in all countries in Southeast Asia, which give rise to a digital divide between urban and rural, resulting in lack of digital transformation in rural communities, especially in e-commerce which involves cloud services. With our Edge processing mobile datacentre located in rural areas using satellite connectivity, all issues and challenges pertaining to speed of processing and security faced by rural folks will be overcome with the incorporation of smart or digital villages powered by our edge datacentres (“Cloud”). We believe that our services to data centre operators will greatly expand their market into remote rural areas.

Ground Station Facility Hosting Services

Ground Station as a Service (or “GSaaS”) is one of the commercial services to offer for satellite services providers and operators. Based on our roll out plan, GSaaS is the first step for Angkasa-X into the space economy. The availability of ground station services is a major step in creating an affordable, global space-connected networks. Ground Station as a Service (GSaaS) is a solution for customers looking to connect to their satellites at a reasonable cost without incurring capital expenditures in building the infrastructure on the ground segment to receive and transmit satellite signals. Customers can concentrate on building the satellite and the application layer (if required) while knowing their ground station services are already available for use. The potential customers for Ground Station Service as follow:

| | ● | Customers with Earth Observation satellites, both in commercial and public sectors; and |

| | ● | Internet Service Providers, who rely on satellite communications both for primary and backup use. |

We expect to own the ground station and lease it to target customers be in the telecommunication or ground station industries. We will enter into contracts with our customers for a period of multiple years and bill our customers monthly for the rendering this hosting service. Most of the customers in this service tend to renew their contract as they cannot afford to have downtime in the connectivity to the satellite.

For further information, please see the section titled “Business – Our Services” contained elsewhere in this prospectus.

Our Strategy

One of our key strategies is to develop a regional presence in the ASEAN region. Angkasa-X will partner up with telecommunication companies, technology solution providers and applications development companies to perform research and development on the next generation solutions and applications that uses Satellite-as-a-Service. Angkasa-X will form partnerships with telecommunication companies, mobile network operators, Internet service providers and satellite services providers to market our Satellite-Services to the underserved and unserved remote rural communities in the ASEAN region.

We intend to grow our business and create shareholder value through the following strategic initiatives:

Build integrated ground station hosting facilities, satellite connectivity and related services with group of companies within ASEAN; and to develop a regional presence via company organic growth and inorganic strategic acquisitions and partnerships.

Angkasa-X plans to develop a Space Tech Ecosystem (“STE”) in Penang Malaysia, nurturing the next generation of talent and development of the first Asian satellite technology and supply-chain ecosystem. We can do this by utilizing our in-house engineering team capabilities to design and develop new technologies, products, solutions and services with technological innovation.

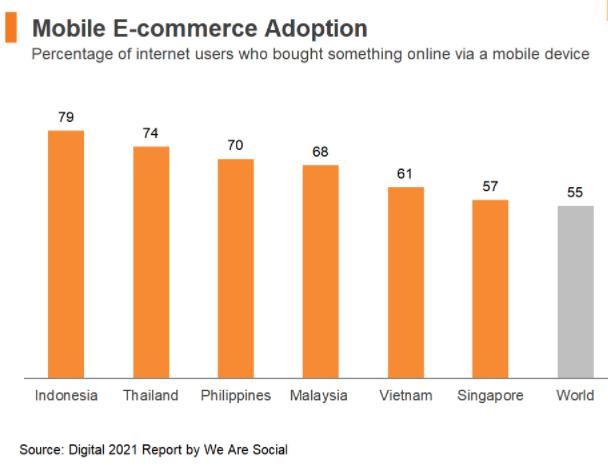

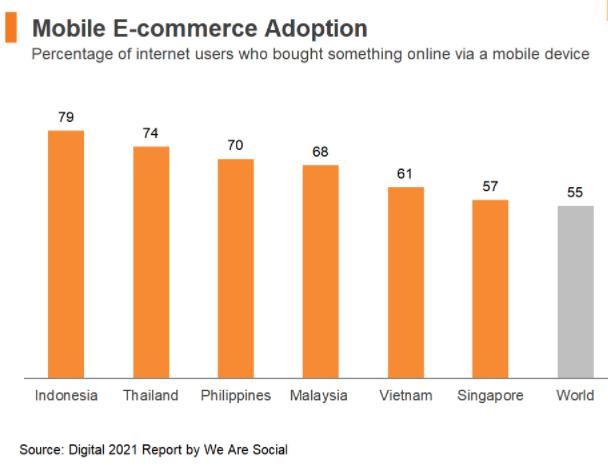

Angkasa-X also plans to deploy Edge mobile datacentres around the rural areas of Southeast Asia countries where internet connectivity is inadequate. These Edge mobile datacentres in the rural areas will be connected to hyperscale datacentres via Angkasa-X LEO satellites, enabling digital transformation and providing more job opportunities in the rural areas where users in the rural areas are able to enjoy the benefits of internet connection such as setting up their own online business and enjoying ecommerce services, eLearning services, eGovernment services etc. Our end goal for this development is to improve the living standards in rural areas by providing social inclusive services.

Angkasa-X is also collaborating with USM to build a Space Technology Centre supporting design and development of 6U CubeSat, assembly, integration and testing (“AIT”) of 6U CubeSats, including mission control for satellite operation. The professional satellite engineering course provided by Angkasa-X and USM shall utilise the Angkasa-X Ground Station antenna farm for satellite data receiving operations.

Angkasa-X has submitted applications and received certificates of approval from the Malaysian Communications and Multimedia Commission (“MCMC”) for the Network Service Providers (“NSP”) and Network Facilities Providers (“NFP”) licenses which authorizes Angkasa-X to operate the satellite ground station to receive and transmit signals to any satellites in orbit.

Angkasa-X shall be providing Ground Station as a Service (GSaaS), a solution for customers looking to connect to their satellites at a reasonable cost without incurring capital expenditures in building the infrastructure on the ground segment to receive and transmit satellite signals. Customers can concentrate on building the satellite and the application layer (if required) while knowing their ground station services are already available for use.

Through Angkasa-X’s joint venture company AXSpace Sdn. Bhd., Angkasa-X will operate a converged GEO-LEO integrated satellite network and services platform in Penang, Malaysia. This satellite network will provide innovative integrated satellite-services such as video streaming and vehicle infotainment services to be rolled out in ASEAN countries.

AXSpace targets to roll out satellite broadcasting via a combination of satellite and terrestrial cellular (supplemental) connectivity through its network to deliver high-quality, low-cost, live, and on-demand multimedia and data services in coming years. AXSpace plans to set up a GEO-LEO Joint Service Platform (“JSP”) to roll out this new satellite service.

One of Angkasa-X’s key strategies is to develop a regional presence in the ASEAN region. Our company will collaborate with Technology solution providers and applications development companies to research and develop the next generation solutions and applications that uses our Satellite-Services.

This initiative will see the formation of Penang Space Tech Hub, an initiative which aims to achieve (i) the set-up of SpaceTech Industry Ecosystem in Penang, Malaysia; (ii) to nurture Penang into a supply chain and distribution hub of global satellite technologies for the ASEAN market; (iii) recruit global satellite technology providers to set up research and development and localization of production centres in Penang which will accelerate technology transfer and foreign direct investments into Malaysia.

For further information, please see the section titled “Business – Our Strategy” contained elsewhere in this prospectus.

Leveraging on acquisition expertise, strong management team and access to capital to identify attractive growth opportunities.

Angkasa-X founders, Dr. Seah Kok Wah and Dr. Lim Kin Wan (the “Founders”), who are also our Chief Executive Officer (“CEO”), Chief Financial Officer (“CFO”) and Chief Operating Officer (“COO”) respectively, have over 30 years’ expertise and experience in identifying, acquiring and integrating value-added businesses in the Information and Communications Technology (“ICT”) industry. We believe that these Founders’ experience and expertise, our access to capital and the in-depth industry knowledge of our senior management team will position the Company to strategically acquire or partner with related businesses that can enhance our market position, create synergies and fully leverage our existing marketing and supply-chain capabilities, which we believe will allow us to deliver sustained profitable growth and maximize shareholder value. In analysing such opportunities. We will consider the following factors:

| | ● | Potential for growth, indicated by new technology, anticipated market expansion or new technologies, products, solutions and services; |

| | ● | Competitive position as compared to other firms of similar size and experience within the industry segment as well as within the industry as a whole; |

| | ● | Strength and diversity of management, either in place or scheduled for recruitment; |

| | ● | Capital requirements and anticipated availability of required funds or resources, to be provided by the Company or from operations, through the sale of additional securities, through joint ventures or similar arrangements or from other sources; |

| | ● | The cost of participation by our Company as compared to the perceived tangible and intangible values and potentials; |

| | ● | The extent to which the business opportunity can be advanced; and |

| | ● | The accessibility of required management expertise, personnel, raw materials, services, professional assistance and other required items. |

Further information about our management team is under the section titled “Director, Management and Corporate Governance” contained elsewhere in this prospectus.

Enhance our ability to attract, incentivize and retain talented professionals.

Angkasa-X believes our success greatly depends on our ability to attract, incentivize and retain talented professionals. We have hired a team of professional engineers with doctorate qualifications in space engineering, electrical and electronics engineering. Some of our engineering team members have practical experiences in the satellite system architecture design. With a view to maintaining and improving our competitive advantage in the market, we plan to implement a series of initiatives to attract additional and retain mid to high-level personnel, including formulating a market-oriented employee compensation structure and implementing a standardized multi-level performance review mechanism.

Commitment to research and development.

We plan to invest in research and development centres focused in the satellite communication industry. We plan to increase our investment in research and development activities to ensure that the satellites we launch provide the highest throughput and longer latency that match the market demand. In order to ensure the development of the satellites that fit these criteria, we will implement a structured process through research, design, develop and test on the functionality of the satellite to final validation. Specifically, we work closely with the research and development team and monitor closely based on our requirements on satellite design.

For further information, please see the section titled “Business – Our Strategy” contained elsewhere in this prospectus.

Our Competitive Strengths

We believe that we have the following competitive strengths which differentiate us from our competitors and will contribute to our ongoing success.

We have formed strong relationships with our strategic partners

We have formed strategic partnerships in collaboration with several strategic partners from different sectors such as global technology service providers, space education providers, and non-profit organizations (“NPOs”). In addition, we have entered into collaboration with several electrical and electronics (“E&E”) ecosystem partners in sourcing satellites components in Malaysia. Further information of these partnerships is available in the section title “Business – Supply Chain Management Ecosystem” contained elsewhere in this prospectus.

Angkasa-X has entered into an understanding to collaborate with HallBru Tech, which is supported and facilitated by BIMP-EAGA via the Brunei Darussalam BIMP-EAGA Business Council (“BDBEBC”) in developing the ASEAN Space Economy. The Brunei Darussalam–Indonesia–Malaysia–Philippines East ASEAN Growth Area, or BIMP-EAGA, is a cooperation initiative established in 1994 to spur development in remote and less developed areas in the four participating Southeast Asian countries1.

1 https://bimp-eaga.asia/

We, through our subsidiary, AXSpace Sdn. Bhd. (“AX Space”), a joint venture company between Silkwave Asia Sdn. Bhd. and AngkasaX Sdn. Bhd., intend to provide GEO-LEO integrated satellite network infrastructure in the South East Asia Region. Services to be provided through AX Space includes Satellite In-Vehicle Mobile Multimedia Infotainment that combines mobile satellite broadcasting and supplemental terrestrial cellular connectivity through its innovative Converged™ network to deliver high-quality, low-cost, live, and on-demand multimedia and data services.

We are in discussions for a collaboration with the Malaysian Space Agency (“MYSA”), the national space agency of Malaysia, to allow us to perform Assemble, Integration and Testing (“AIT”) activities of our satellites utilizing MYSA’s AIT facilities located in Banting, Malaysia. All materials that we had sourced through our VIE company, AngkasaX Innovation Sdn. Bhd. will form the relevant satellite components in assembling of Angkasa-X’s LEO satellites. Once our satellite prototype has passed through system integration, integrity and legitimacy tests will be conducted as part of the due diligence in ensuring our satellite has fulfilled the pre-requisites before we begin mass production and launching satellites into orbit.

In addition, we are actively seeking collaboration opportunities with Gilmour Space Technology, an Australian-based company that specializes in launch services, and both the parties are in the process of finalizing a Launch Services Agreement. This strategic partnership aims to leverage the strengths and expertise of both entities to enhance our and their capabilities in the field of space exploration and launch services, potentially leading to significant advancements in the space industry within the Asia-Pacific region.

For further information, please see the section titled “Business – Our Competitive Strengths” contained elsewhere in this prospectus.

Experienced management team and Board with a proven track record

Our founders and management team have extensive experience in the Telecommunication, Information Technology, Computer Science and Satellite Engineering industries. Our management team is complemented by an experienced board of directors and a team of Satellite Engineering experts, which include several individuals with a proven track record in successfully acquiring and managing information and communication technology (“ICT”) businesses.

Each of our board of directors and our senior management has more than 25 years of ICT industry experiences. Both of our CEO and COO have experience in managing public-listed ICT companies during their careers. Our team of engineers has extensive satellite engineering experience.

Further information about our management team is available under the section title “Director, Management and Corporate Governance” contained elsewhere in this prospectus.

We have strong talent team to perform research, design, develop and test of satellite

Angkasa-X has hired a team of professional engineers, consisting of multiple doctorate qualifications in space engineering and electrical and electronics engineering. Several of our engineering team members have over 10 years’ practical experiences in the satellite system architecture design under AngkasaX group. In collaboration with USM, our satellite design and engineering team officers will lead a team of experienced professors who specialize in Satellite Engineering to develop and enhance the specification of our satellite in AngkasaX Innovation Sdn. Bhd.. Our satellite design and engineering team consists of individuals who have experience in designing Malaysia’s second remote sensing satellite, Razak Sat-1 and Malaysia’s first nanosatellite, UiTMSAT-1.

Further information about our management team is available under the section title “Director, Management and Corporate Governance” contained elsewhere in this prospectus.

Limited competition with natural barriers to entry

Entry into the Satellite as a Service (“SaaS”) market requires a significant financial investment. Angkasa-X has entered into a Financial Advisory Agreement with Bank of Asia (“BOA”) for the purpose of long term financing on the development and launching of Angkasa-X’s satellites.

In addition, acceptance as a member to International Telecommunication Union (“ITU”) is the first step before anyone can file for application of orbital slot and radio-frequency spectrum. With the endorsement of the Malaysian Communications and Multimedia Commission (“MCMC”), Angkasa-X is currently an ITU Radiocommunication (ITU-R) member accorded by ITU starting from August 23, 2021.

For further information, please see the section titled “Business – Our Competitive Strengths” contained elsewhere in this prospectus.

Talent Development for satellite and space related engineering together with leading science university collaborator

Through our VIE company AngkasaX Innovation Sdn. Bhd., Angkasa-X has entered into an understanding to collaborate with Universiti Sains Malaysia (“USM”) and Digital Penang Sdn. Bhd., a government agency owned by the State of Penang, to develop space and satellite technology talent in Penang by offering space and satellite related professional engineering course, set up a satellite research and development laboratory in USM, and jointly setting up a Space Tech & Satellite Supply-chain Ecosystem in three phases. The ultimate objectives associated with this collaboration is to develop satellite engineering talent expertise, design, research and development on satellite technology for countries in ASEAN.

For further information, please see the section titled “Business – Our Competitive Strengths” contained elsewhere in this prospectus.

Recent Developments

On December 23, 2021, Angkasa-X’s VIE company AngkasaX Innovation Sdn. Bhd, has successfully completed its crowdfunding fundraising exercise on the Malaysia licensed Equity Crowdfunding (“ECF”) platform and successfully raised $670,897.

The foregoing description of the subscription agreements is not complete and is qualified in its entirety by the full text of the subscription agreements, a form of which is filed herewith as Exhibit 10.12 and incorporated into this Registration Statement by reference.

We have relied on the exemptions from registration under Section 4(a)(2) of the Securities Act of 1933, as amended (the “Securities Act”), and Regulation S under the Securities Act for purposes of the private placements of the Ordinary Shares. The Ordinary Shares have not been registered under the Securities Act or any applicable securities laws of any state of the United States and may not be offered or sold in the United States or to, or for the account or benefit of, U.S. persons (as defined in Regulation S under the Securities Act) or persons in the United States absent registration or an applicable exemption from such registration requirements.

On February 14, 2023, the Sabah State Government of Malaysia announced and approved a feasibility study on the proposed Sabah International Space Launch Industrial Centre (“SLIC”), which aims to establish a space launching facility in Sabah, Malaysia. The study, expected to take about a year, will assess factors such as environmental impact and project suitability. If successfully developed, the SLIC could position Sabah as a leading state in aerospace knowledge and technology transfer, create high-paying job opportunities, and contribute to economic prosperity in the region. At that time, Sabah will become the 16th space launching facility in the world and Malaysia will become the ninth country to possess one.

Recently, we are actively seeking collaboration opportunities with Gilmour Space Technology, an Australian-based company that specializes in launch services, and both the parties are in the process of finalizing a Launch Services Agreement. This strategic partnership aims to leverage the strengths and expertise of both entities to enhance our and their capabilities in the field of space exploration and launch services, potentially leading to significant advancements in the space industry within the Asia-Pacific region.

Summary Risk Factors

Investing in our Ordinary Shares entails a high degree of risk as more fully described in the “Risk Factors” section of this prospectus. You should carefully consider such risks before deciding to invest in our ordinary shares. These risks include, among others:

Risks Related to Our Business and Industry

| ● | We are exposed to the risks of an economic recession, credit and capital markets volatility and economic and financial crisis as a result of the COVID-19 virus pandemic, which could adversely affect the demand for our services, our business operations and expansion plans and our ability to mitigate its impact and provide timely information to our investors and the SEC. |

| ● | We have commenced limited operations in our business. |

| ● | We rely on a limited number of manufacturers for many of our products and devices. If we are unable to, or cannot find third parties to, manufacture a sufficient quantity of our products and devices at a reasonable price, the prospects for our business will be negatively impacted. |

| ● | We may experience in-orbit satellite failures or degradations in performance that could impair the commercial performance of our satellites, which could lead to lost revenue, an increase in our cash operating expenses, lower operating income or lost backlog. |

| ● | We may experience a launch failure or other satellite damage or destruction during launch, which could result in a total or partial satellite loss. A new satellite could also fail to achieve its designated orbital location after launch. Any such loss of a satellite could negatively impact our business plans and could reduce our revenue. |

| ● | Our customized hardware and software may be difficult and expensive to service, upgrade or replace. |

| ● | Technological developments or other changes in our industry could render our satellites, or any of their components, less competitive or obsolete, which may seriously harm our business. |

| ● | We are heavily dependent on our customers. Due to the high level of competition in our industry, they might fail to retain their customers, which would harm our financial condition and operating results. |

| ● | If we are unable to maintain relationships with our launch partners or enter into relationships with new launch partners, we may be unable to reach our targeted annual launch rate, which could have an adverse effect on our ability to grow our business. |

| ● | A natural disaster could diminish our ability to provide communications service. |

| ● | Sales of our services are subject to changing consumer preferences; if we do not correctly anticipate such changes, our sales and profitability may decline. |

| ● | Our limited operating history makes it difficult to evaluate our future prospects and the risks and challenges we may encounter. |

| ● | We have incurred significant losses since inception, we expect to incur losses in the future, and we may not be able to achieve or maintain profitability. |

| ● | To maximize our potential for future growth and achieve our expected revenues, we need to manage growth in our current operations. |

| ● | We cannot assure you that our acquisition growth strategy will be successful. |

| ● | If we are not able to implement our strategies to achieve our business objectives, our business operations and financial performance will be adversely affected. |

| ● | Any funding we raise through the future sale of our Ordinary Shares will result in dilution to existing shareholders and funding through bank loans will increase our liabilities. |

| ● | Any failure of our products to comply with safety requirements set by government may adversely affect our results from operations. |

| ● | Any disruptions in our information technology systems could harm our business and reduce our profitability. |

| ● | High uncertainties and numerous types of risks are associated with our business, including the planned A-SEANSAT and A-SEANLINK satellite constellation. We may ultimately choose to not proceed with the project or we may proceed with the project and it may not be successful, either of which could have a material adverse effect on our business prospects and financial condition. |

| ● | We may in the future invest significant resources in developing new service offerings and exploring the application of our proprietary technologies for other uses and those opportunities may never materialize. |

| ● | We are dependent upon senior management and other highly qualified personnel and we cannot assure their retention. |

| ● | Our customer contracts may be terminated by the customer at any time for convenience as well as other provisions permitting the customer to discontinue contract performance for cause (for example, if we do not achieve certain milestones on a timely basis). If our contracts are terminated or if we experience any other contract-related risks, our results of operations may be adversely impacted. |

| ● | Our customers may not be creditworthy. |

| ● | Failure to protect our brand names, trademarks, intellectual property rights, and any assertions by third parties of infringement, misappropriation or other violations by us of their intellectual property rights could result in significant costs and could materially affect our business. |

| ● | Failures in our technology infrastructure could damage our business, reputation and brand and substantially harm our business and results of operations. |