UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 20-F

(Mark One)

| ☐ | REGISTRATION STATEMENT PURSUANT TO SECTION 12(b) OR 12(g) OF THE SECURITIES EXCHANGE ACT OF 1934 |

or

| ☒ | ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the fiscal year ended December 31, 2023

or

| ☐ | TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

or

| ☐ | SHELL COMPANY REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

Date of event requiring this shell company report

For the transition period from ___________________________ to ___________________________

Commission file number 333-268366

ANGKASA-X HOLDINGS CORP.

(Exact name of Registrant as specified in its charter)

(Translation of Registrant’s name into English)

British Virgin Islands

(Jurisdiction of incorporation or organization)

11-06,Tower A, Ave 3, Vertical Business Suite

Jalan Kerinchi Bangsar South, 59200

Kuala Lumpur, Malaysia

(Address of principal executive offices)

Dato’ Dr. Kok Wah Seah, Chief Executive Officer

11-06, Tower A, Ave 3, Vertical Business Suite

Jalan Kerinchi Bangsar South, 59200

Kuala Lumpur, Malaysia

Telephone: +603-2242 1288 Email: ipo@angkasa-x.com

(Name, Telephone, E-mail and/or Facsimile number and Address of Company Contact Person)

Securities registered or to be registered pursuant to Section 12(b) of the Act.

| Title of each class | | Name of each exchange on which registered |

| Ordinary shares, par value $0.0001 per share | | Not applicable |

Securities registered or to be registered pursuant to Section 12(g) of the Act.

(Title of Class)

Securities for which there is a reporting obligation pursuant to Section 15(d) of the Act.

(Title of Class)

Indicate the number of outstanding shares of each of the issuer’s classes of capital or common stock as of the close of the period covered by the annual report.

The number of outstanding ordinary shares, par value $0.0001 per share, is 229,000,001 as of December 31, 2023

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act.

If this report is an annual or transition report, indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934.

Note – Checking the box above will not relieve any registrant required to file reports pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934 from their obligations under those Sections.

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days.

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files).

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or an emerging growth company. See definition of “large accelerated filer, “accelerated filer,” and “emerging growth company” in Rule 12b-2 of the Exchange Act.

| Large accelerated filer ☐ | | Accelerated filer ☐ | | Non-accelerated filer ☒ |

| | | | | Emerging growth company ☒ |

If an emerging growth company that prepares its financial statements in accordance with U.S. GAAP, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards† provided pursuant to Section 13(a) of the Exchange Act.

† The term “new or revised financial accounting standard” refers to any update issued by the Financial Accounting Standards Board to its Accounting Standards Codification after April 5, 2012.

Indicate by check mark whether the registrant has filed a report on and attestation to its management’s assessment of the effectiveness of its internal control over financial reporting under Section 404(b) of the Sarbanes-Oxley Act (15 U.S.C. 7262(b)) by the registered public accounting firm that prepared or issued its audit report. ☐

If securities are registered pursuant to Section 12(b) of the Act, indicate by check mark whether the financial statements of the registrant included in the filing reflect the correction of an error to previously issued financial statements. ☐

Indicate by check mark whether any of those error corrections are restatements that required a recovery analysis of incentive-based compensation received by any of the registrant’s executive officers during the relevant recovery period pursuant to §240.10D-1(b). ☐

Indicate by check mark which basis of accounting the registrant has used to prepare the financial statements included in this filing:

| U.S. GAAP ☒ | | International Financial Reporting Standards as issued by the International Accounting Standards Board ☐ | | Other ☐ |

If “Other” has been checked in response to the previous question, indicate by check mark which financial statement item the registrant has elected to follow. ☐ Item 17 ☐ Item 18

If this is an annual report, indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). ☐ Yes ☒ No

(APPLICABLE ONLY TO ISSUERS INVOLVED IN BANKRUPTCY PROCEEDINGS DURING THE PAST FIVE YEARS)

Indicate by check mark whether the registrant has filed all documents and reports required to be filed by Sections 12, 13 or 15(d) of the Securities Exchange Act of 1934 subsequent to the distribution of securities under a plan confirmed by a court. ☐ Yes ☐ No

INTRODUCTORY NOTES

Use of Certain Defined Terms

Unless otherwise indicated or the context requires otherwise, references in this Annual Report on Form 20-F to:

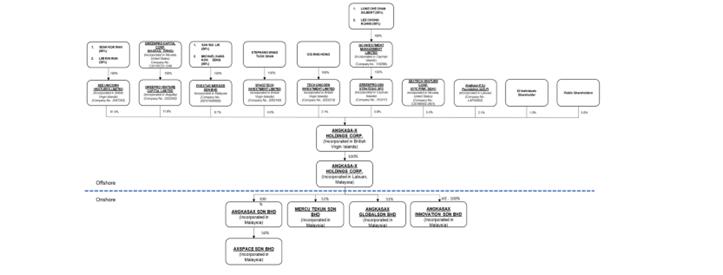

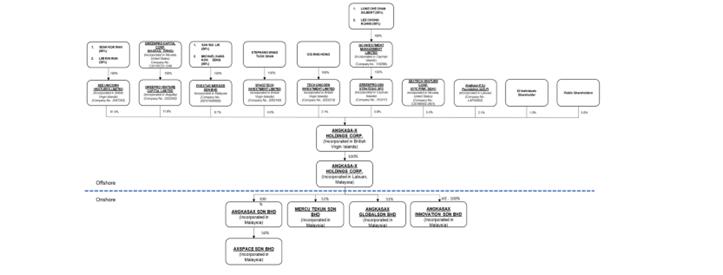

● “AXLB” refers to Angkasa-X Holdings Corp., our wholly-owned subsidiary in Labuan, Malaysia;

● “AXSB” refers to AngkasaX Sdn. Bhd., our wholly-owned subsidiary in Malaysia;

● “AXSpace” refers to AXSpace Sdn. Bhd., our 50% equity interest subsidiary in Malaysia;

● “AXGlobal” refers to AngkasaX Global Sdn. Bhd., our 51% equity interest subsidiary in Malaysia;

● “AngkasaX Innovation”, “AXI” or “VIE” refers to AngkasaX Innovation Sdn. Bhd., our variable interest entity;

● “BIMP-EAGA” refers to Brunei Darussalam–Indonesia–Malaysia–Philippines East ASEAN Growth Area, is a cooperation initiative established by Brunei Darussalam, Indonesia, Malaysia and the Philippines, to spur development in remote and less developed areas in the four participating Southeast Asian countries;

● “Board” refers to the Company’s Board of Directors;

● “BVI” refers to the British Virgin Islands;

● “Exchange Act” refers to the Securities Exchange Act of 1934, as amended;

● “Mercu Tekun” refers to Mercu Tekun Sdn. Bhd., our subsidiary in Malaysia;

● “MYR” or “Ringgit Malaysia” refer to the lawful currency of Malaysia;

● “Report” refers to this annual report on Form 20-F;

● “SEC” refers so the United States Securities and Exchange Commission;

● “Securities Act” refers to the Securities Act of 1933, as amended;

● “shares,” “Shares” or “Ordinary Shares” refers to the Ordinary Shares of Angkasa-X Holdings Corp., with par value of US$ 0.0001 per share;

● “VIE Agreements” refers to a series of contractual arrangements, including the Equity Pledge Agreement, Equity Option Agreement, Shareholders’ Voting Rights Proxy Agreement, Business Cooperation Agreement and Consultation and Services Agreement, between Angkasa-X Holdings Corp. and our VIE;

● “we”, “us,” “our company,” “our,” “Company,” “our business,” “AXBVI” and “Angkasa-X” refer to Angkasa-X Holdings Corp., a British Virgin Islands holding company;

● “$” and “U.S. Dollars” refer to the lawful currency of the United States of America; and

● all discrepancies in any table between the amounts identified as total amounts and the sum of the amounts listed therein are due to rounding.

FORWARD-LOOKING INFORMATION

This Report and the documents incorporated by reference into this Report contain forward-looking statements. These forward-looking statements are based on current expectations and beliefs and involve numerous risks and uncertainties that could cause actual results to differ materially from expectations. These forward-looking statements should not be relied upon as predictions of future events, and we cannot assure you that the events or circumstances reflected in these statements will be achieved or will occur. You can identify forward-looking statements by the use of forward-looking terminology including “anticipates,” “believes,” “continue,” “could,” “design,” “estimates,” “expects,” “intends,” “may,” “plans,” “potentially,” “predict,” “pro forma” “seeks,” “should,” “will” or the negative of these words and phrases or other variations of these words and phrases or comparable terminology.

All statements other than statements of historical fact are statements that could be deemed forward-looking statements. For example, forward-looking statements include any statements of the plans, strategies and objectives of management for future operations, including the execution of integration and restructuring plans and the anticipated timing of filings; any statements concerning proposed new products or developments; any statements regarding future economic conditions or performance; statements of belief and any statement of assumptions underlying any of the foregoing.

For a discussion of the factors that may cause our actual results, performance or achievements to differ materially from any future results, performance or achievements expressed or implied in such forward-looking statements, see the section titled “Item 3. Key Information — D. Risk Factors.” Those risks are not exhaustive. We operate in a rapidly evolving environment. New risk factors emerge from time to time, and it is impossible for our management to predict all risk factors, nor can we assess the impact of all factors on our business or the extent to which any factor, or combination of factors, may cause actual results to differ from those contained in any forward-looking statement. We do not undertake any obligation to update or revise the forward-looking statements except as required under applicable law.

These forward-looking statements include, but are not limited to, statements concerning the following:

| | ● | growth strategies: |

| | ● | future business development, results of operations and financial condition; |

| | ● | any statement concerning the attraction and retention of highly qualified personnel; |

| | ● | our ability to attract and retain users and customers and generate revenue and profit from our customers; |

| | ● | any statements concerning the Company’s financial performance; |

| | ● | any statements regarding expectations concerning the Company’s relationships and actions with third parties; and |

| | ● | future regulatory, judicial and legislative changes in the Company’s industry. |

You should not rely upon forward-looking statements as predictions of future events. We cannot assure you that the events and circumstances reflected in the forward-looking statements will be achieved or occur.

All forward-looking statements in this Report are current only as of the date on which the statements were made, or in the case of a document incorporated by reference, as of the date of that document. Except as required by law, we do not undertake any obligation to update publicly any forward-looking statements for any reason after the date of this Report or to conform these statements to actual results or to changes in expectations.

PART I

Item 1. Identity of Directors, Senior Management and Advisers

Not applicable.

Item 2. Offer Statistics and Expected Timetable

Not applicable.

Item 3. Key Information

The following table presents the selected consolidated financial information for our Company.

| | | Year ended

Dec 31, 2023 | | | Year ended

Dec 31, 2022 | |

| | | (Audited) | | | (Audited) | |

| | | | | | | | | |

| Revenue | | $ | 198,740 | | | $ | 515,348 | |

| Cost of revenue | | $ | (63,350 | ) | | $ | (276,042 | ) |

| Gross Profit | | $ | 135,390 | | | $ | 239,306 | |

| | | | | | | | | |

| Other income | | | | | | | | |

| Unrealised gain from foreign exchange | | $ | - | | | $ | 119 | |

| Other income | | $ | 5,093 | | | $ | 1,066 | |

| | | $ | 5,093 | | | $ | 1,185 | |

| | | | | | | | | |

| Operating expenses: | | | | | | | | |

| General and administrative expenses | | $ | (1,748,690 | ) | | $ | (1,299,748 | ) |

| Realised loss from foreign exchange | | $ | (17,913 | ) | | $ | (13,773 | ) |

| Unrealised loss from foreign exchange | | $ | (17,975 | ) | | $ | - | |

| Total operating expenses | | $ | (1,784,578 | ) | | $ | (1,313,521 | ) |

| | | | | | | | | |

| Loss from operations | | $ | (1,644,095 | ) | | $ | (1,073,030 | ) |

| | | | | | | | | |

| Finance cost | | $ | (30,397 | ) | | $ | (22,703 | ) |

| | | | | | | | | |

| Loss before income tax expense | | $ | (1,674,492 | ) | | $ | (1,095,733 | ) |

| | | | | | | | | |

| Income tax expense | | $ | (12,409 | ) | | $ | (32 | ) |

| | | | | | | | | |

| Net loss for the year | | $ | (1,686,901 | ) | | $ | (1,095,765 | ) |

| | | | | | | | | |

| Other comprehensive (loss) | | | | | | | | |

| - Foreign exchange translation adjustment | | $ | (47 | ) | | $ | (37,637 | ) |

| | | | | | | | | |

| Total comprehensive loss for the year | | $ | (1,686,948 | ) | | $ | (1,133,402 | ) |

| | | | | | | | | |

| Net loss for the year attributable to | | | | | | | | |

| Owners of the Company | | $ | (1,673,877 | ) | | $ | (1,136,815 | ) |

| Non-controlling interests | | $ | (13,024 | ) | | $ | 41,050 | |

| | | $ | (1,686,901 | ) | | $ | (1,095,765 | ) |

| | | | | | | | | |

| Total comprehensive loss for the year attributable to | | | | | | | | |

| Owners of the Company | | $ | (1,672,466 | ) | | $ | (1,174,422 | ) |

| Non-controlling interests | | $ | (14,482 | ) | | $ | 41,020 | |

| | | $ | (1,686,948 | ) | | $ | (1,133,402 | ) |

| | | | | | | | | |

| Weighted average number of common shares outstanding – basic and diluted | | $ | 229,000,001 | | | $ | 229,000,001 | |

| | | | | | | | | |

| Net loss per common share- basic and diluted | | $ | (0.0074 | ) | | $ | (0.0048 | ) |

BALANCE SHEET

| | | 2023 | | | 2022 | |

| | | (Audited) | | | (Audited) | |

| Current assets | | $ | 92,819 | | | $ | 94,015 | |

| Total assets | | $ | 1,866,916 | | | $ | 1,283,345 | |

| Current liabilities | | $ | 3,162,031 | | | $ | 990,482 | |

| Long term liabilities | | $ | 463,944 | | | $ | 469,437 | |

| Share capital | | $ | 22,900 | | | $ | 22,900 | |

| Total stockholders’ equity (deficit) | | $ | (1,759,059 | ) | | $ | (176,574 | ) |

| B. | Capitalization and indebtedness |

Not applicable.

| C. | Reasons for the offer and use of proceeds |

Not applicable.

Risks Related to Our Business and Industry

We are exposed to the risks of an economic recession, credit and capital markets volatility and economic and financial crisis, which could adversely affect the demand for our services, our business operations and expansion plans and our ability to mitigate its impact and provide timely information to our investors and the SEC.

We are exposed to the risk of a global recession or a recession in one or more of our key markets, credit and capital markets volatility and an economic or financial crisis, or otherwise, which could result in reduced consumption or sales prices of our services which, in turn, could result in lower revenue and reduced profit. Our financial condition and results of operations, as well as our future prospects, would likely be hindered by an economic downturn in any of our key markets.

The purchase of our services is closely linked to general economic conditions, with levels of consumption tending to rise during periods of rising per capita income and fall during periods of declining per capita income. Additionally, per capita consumption is inversely related to the sale prices of our services.

Besides moving in concert with changes in per capita income, purchase of our services also increases or decreases in accordance with changes in disposable income.

Any decrease in disposable income resulting from an increase in inflation, income taxes, the cost of living, unemployment levels, political or economic instability or other factors would likely adversely affect the demand for our services.

Capital and credit market volatility, such as that experienced in recent years, may result in downward pressure on share prices and the credit capacity of issuers. Potential changes in social, political, regulatory and economic conditions may be significant drivers of capital and credit market volatility. The continuation or worsening of the levels of market disruption and volatility seen in the recent past could have an adverse effect on us. For example, any state wide lockdown, quarantine, or travel ban will likely affect our operating business.

We have commenced limited operations in our business.

We were incorporated in the BVI on January 22, 2021. We have commenced limited business operations. Accordingly, we have no way to evaluate the likelihood that our business will be successful. Potential investors should be aware of the difficulties normally encountered by new satellite technology companies and the high rate of failure of such enterprises. The likelihood of success must be considered in light of the problems, expenses, difficulties, complications and delays encountered in connection with the operations that we plan to undertake. These potential problems include, but are not limited to, unanticipated problems relating to the ability to generate sufficient cash flow to operate our business, and additional costs and expenses that may exceed current estimates. We recognize that if we are not successful in implementing our business plan, we will not be able to continue business operations. There is limited history upon which to base any assumption as to the likelihood that we will prove successful.

We rely on a limited number of manufacturers for many of our products and devices. If we are unable to, or cannot find third parties to, manufacture a sufficient quantity of our products and devices at a reasonable price, the prospects for our business will be negatively impacted.

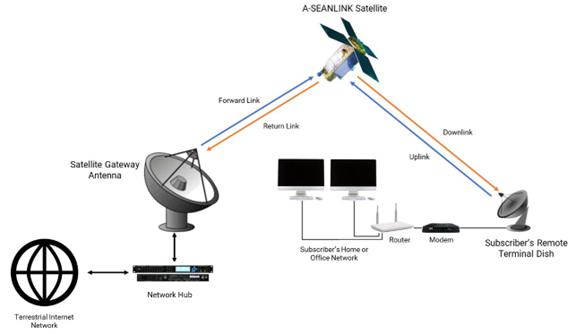

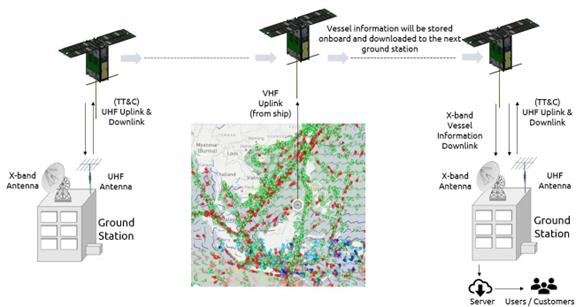

In order for our business to operate and successfully deliver our services, we require all components of the satellite systems, both in the space and on ground terminal to integrate seamlessly and efficiently.

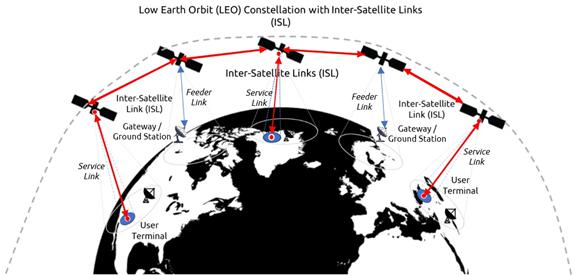

Therefore, our A-SEANLINK Satellite Constellation requires leading-edge satellites design and manufacturing, such as GPS receiver or electronic phase array antennas capable of acquiring and tracking LEO satellites. The development, manufacture and availability on a timely basis of electronics components, materials and parts are critical to the successful commercial operation of our system. Currently, we rely on limited numbers of manufacturers to procure these components in order to produce the devices that we market and sell.

We may experience in-orbit satellite failures or degradations in performance that could impair the commercial performance of our satellites, which could lead to lost revenue, an increase in our cash operating expenses, lower operating income or lost backlog.

Satellites utilize highly complex technology and operate in the harsh environment of space and, accordingly, are subject to significant operational risks while in orbit. These risks include malfunctions, commonly referred to as anomalies, that have occurred in our satellites and the satellites of other operators as a result of:

| | ● | the satellite manufacturer’s error, whether due to the use of new and largely unproven technology or due to a design, manufacturing or assembly defect that was not discovered before launch; |

| | | |

| | ● | Problems with the power systems of the satellites, including: |

| | ○ | circuit failures or other array degradation causing reductions in the power output of the solar arrays on the satellites, which could cause us to lose some of our capacity, require us to forego the use of some transponders initially and to turn off additional transponders in later years; and/or |

| | | |

| | ○ | failure of the cells within the batteries, be it due to extreme temperatures or corrosion or lack of care, the batteries are not properly functioning during the daily eclipse periods which occur for brief periods of time during two 40-day periods around March 21 and September 21 of each year; and/or |

| | ● | problems with the control systems of the satellites, including: |

| | ○ | failure of the primary and/or backup satellite control processor (“SCP”); and |

| | | |

| | ○ | failure of electronic propulsion system that maintains the spacecraft’s proper in-orbit position; and/or |

| | ● | general failures resulting from operating satellites in the harsh space environment, such as premature component failure or wear out, including: |

| | ○ | failure of one or more gyroscope and/or associated electronics that are used to provide satellite attitude information during maneuvers. |

We may experience anomalies in each of the categories described above in the future. Although we can work closely with the satellite manufacturers to determine and eliminate the cause of these anomalies in new satellites and provide for on-satellite backups for certain critical components to minimize or eliminate service disruptions in the event of failure, we may experience anomalies in the future, whether of the types described above or arising from the failure of other systems or components. These anomalies can manifest themselves in scale from minor reductions of equipment redundancy to marginal reductions in capacity to complete satellite failure.

Any single anomaly or series of anomalies could materially and adversely affect our operations, our revenues, our relationships with our customers and our ability to attract new customers for our satellite services. In particular, future anomalies may result in the loss of individual transponders on a satellite, a group of transponders on that satellite or the entire satellite, depending on the nature of the anomaly and the availability of on-satellite backups. Anomalies and our estimates of their future effects may also cause a reduction of the expected service life of a satellite and contracted backlog. Anomalies may also cause a reduction of the revenue generated by that satellite or the recognition of an impairment loss, and in some circumstances could lead to claims from third parties for damages, if a satellite experiencing an anomaly were to cause physical damage to another satellite, create interference to the transmissions on another satellite, cause other satellite operators to incur expenses to avoid such physical damage or interference or lower operating income as a result of an impairment charge. Finally, the occurrence of anomalies may adversely affect our ability to insure our satellites at commercially reasonable premiums, if at all. While some anomalies are covered by insurance policies, others are not or may not be covered.

We may experience a launch failure or other satellite damage or destruction during launch, which could result in a total or partial satellite loss. A new satellite could also fail to achieve its designated orbital location after launch. Any such loss of a satellite could negatively impact our business plans and could reduce our revenue.

Satellites are subject to certain risks related to failed launches. Launch failures result in significant delays in the deployment of satellites because of the need both to construct replacement satellites, which can take 24 months or longer, and to obtain other launch opportunities. Such significant delays could materially and adversely affect our operations and our revenue. In addition, significant delays could give customers who have purchased or reserved capacity on that satellite a right to terminate their service contracts relating to the satellite. We may not be able to accommodate affected customers on other satellites until a replacement satellite is available. A customer’s termination of its service contracts with us as a result of a launch failure would reduce our contracted backlog. Delay caused by launch failures may also preclude us from pursuing new business opportunities and undermine our ability to implement our business strategy.

Launch vehicles may also under-perform, in which case the satellite may still be placed into service by using its onboard propulsion systems to reach the desired orbital location, resulting in a reduction in its service life. In addition, if we were not able to obtain launch insurance on reasonable terms and a launch failure were to occur, we would directly suffer substantial loss of the cost of the satellite or related cost.

Our customized hardware and software may be difficult and expensive to service, upgrade or replace.

Some of the hardware and software we use in operations is significantly customized and tailored to meet our requirements and specifications and could be difficult and expensive to service, upgrade or replace. Although we expect to maintain inventories of some spare parts, it nonetheless may be difficult, expensive or impossible to obtain replacement parts for the hardware due to a limited number of those parts being manufactured to our requirements and specifications. Also, our business plan contemplates updating or replacing some of the hardware and software in our network as technology advances, but the complexity of our requirements and specifications may present us with technical and operational challenges that complicate or otherwise make it expensive or infeasible to carry out such upgrades and replacements. If we are not able to suitably service, upgrade or replace our equipment, our ability to provide our services and therefore to generate revenue could be harmed.

Technological developments or other changes in our industry could render our satellites, or any of their components, less competitive or obsolete, which may seriously harm our business.

Our industry is characterized by rapidly evolving technology. These technological developments require us to integrate new technology into our satellites. Our competitors may develop or acquire alternative and competing technologies, which could allow them to create new and disruptive imaging satellites or other associated technology. The risk from the introduction of superior competing satellite technologies is particular exacerbated in our industry as it can take months to years to deploy any new satellites. As a result, if any technological change renders our satellites obsolete, even if we are able to develop and deploy new technologies to compete, it would take substantial time until such satellites are operational. As a result of the foregoing, we may need to invest significant resources in research and development to maintain our market position, keep pace with technological changes and compete effectively. Our failure to improve our satellites in a timely manner may seriously harm our business. Even though we are not selling the satellite peripherals and components/devices including equipment on board but the components are essential in providing the services rendered to subscribers. This is similar to telecommunication towers and equipment on the ground. If these equipment fail to operate in good order, the subscribers to mobile telecommunication will not be able to have communication/connectivity.

We are heavily dependent on our customers. Due to the high level of competition in our industry, we might fail to retain our customers, which would harm our financial condition and operating results.

We are heavily dependent for purchases of our services by telecommunication companies serving the rural area. These telecommunication companies operate in a very competitive environment. For the twelve months ended December 31, 2023, we were heavily dependent on one customer, SECM Sdn Bhd, which accounted for 48.0% of our total revenue. For the twelve months ended December 31, 2022 we were heavily dependent on one customer, SECM Sdn Bhd, which accounted for 82.7% of our total revenue. The business of marketing internet connectivity services is highly competitive and sensitive, which may rapidly capture a significant share of the market. In addition, we anticipate that we will be subject to increasing competition in the future. Some of these competitors have longer operating histories, significantly greater financial, technical, service development, marketing and sales resources, greater name recognition, larger established customer bases and better-developed distribution channels than we do. Our present or future competitors may be able to develop products that are comparable or superior to those we offer, adapt more quickly than we do to new technologies, evolving industry trends and standards or customer requirements, or devote greater resources to the development, promotion and sale of their products than we do. Accordingly, we may not be able to compete effectively in our markets and competition may intensify.

On July 1 2020, D’Amante (M) Sdn. Bhd. And Mercu Tekun Sdn. Bhd. (“MTSB”) entered into a project management, engineering consultancy and services agreement, wherein D’Amante (M) Sdn. Bhd. engaged MTSB to jointly provide project management, engineering consultancy and services in relation to the design, supply, delivery, integration, testing and commissioning of Multi-Mission Satellite Data Reception and Oceanography Data Processing System, in accordance to an award/appointment given by the Government of Malaysia to D’Amante (M) Sdn. Bhd. Under this agreement, D’Amante (M) Sdn. Bhd. agreed to pay MTSB a total consideration of RM750,000.00 for the consultancy and services stated therein.

On August 9 2021, SECM Sdn. Bhd. and MTSB entered into a service agreement wherein SECM Sdn. Bhd. engaged MTSB to provide deliverables for the installation works for C-Band Weather Radar for preparation of construction works for C-Band radar system for Meteorological Department of Malaysia for a total consideration of RM867,940,00 in accordance to the terms therein.

On April 15 2022, SECM Sdn. Bhd. and MTSB entered into another service agreement wherein SECM Sdn. Bhd. engaged MTSB to provide deliverables for the installation works for C-Band Weather Radar for preparation of construction works for C-Band radar system for Meteorological Department of Malaysia for a total consideration of RM1,365,311.80 in accordance to the terms therein.

If we are unable to maintain relationships with our launch partners or enter into relationships with new launch partners to secure our launch schedule, we may be unable to reach our targeted annual launch rate, which could have an adverse effect on our ability to grow our business.

We do not own or operate our own launch vehicles. We rely on third party launch partners to launch our satellites. Part of our strategy involves increasing our launch cadence and reaching over 500 satellites launched. Our ability to achieve such launch cadence targets will depend on our ability to maintain our relationships with our launch partners and add new launch partners in the future. We are currently in discussions with multiple rocket launcher companies including US-based companies such as Momentus Inc and SpaceX. We expect to enter into a variety of arrangements with various launch partners to secure our launch schedule. We may in the future experience delays in our efforts to secure additional launch partners. Challenges as a result of regulatory processes or in the ability of our partners to secure the necessary permissions to establish launch sites could delay our ability to achieve our target cadence and could adversely affect our business.

We are dependent on third-party launch vehicles to deliver our systems, products, and technologies into space. If the number of companies offering launch services or the number of launches does not grow in the future or there is a consolidation among companies who offer these services, this could result in a shortage of space on these launch vehicles, which may cause delays in our ability to meet our customers’ needs. Additionally, a shortage of space available on launch vehicles may cause prices to increase or cause delays in our ability to meet our needs. Either of these situations could have a material adverse effect on our results of operations and financial condition.

Our officers and directors have other business interests, which may limit the amount of time they can devote to our Company and potentially create conflicts of interest.

Our Chairman, Chief Executive Officer and director, Dato’ Dr. Kok Wah Seah, our Chief Financial Officer, Chief Operating Officer and director, Dr. Kin Wan Lim, and our independent non-executive director, Dato’ Wan Peng Ng have other business interests, which may lead to periodic interruptions of our business operations. Dr. Seah and Dr. Lim can respectively dedicate approximately 45 hours per week to the operation of our Company, but are prepared to devote more time if necessary.

A natural disaster could diminish our ability to provide communications services.

Natural disasters could damage or destroy our ground stations, resulting in a disruption of service to our customers. We currently do not have the technology to safeguard our antennas and protect our ground stations during natural disasters such as thunderstorms, and the collateral effects of such disasters such as flooding may impair the functioning of our ground equipment. If a future natural disaster impairs or destroys any of our ground facilities, we may be unable to provide service to our customers in the affected area for a period of time.

Sales of our services are subject to changing consumer preferences; if we do not correctly anticipate such changes, our sales and profitability may decline.

The internet connectivity coverage that we provide impacts us and the internet connection industry as a whole. These include, among others, preferences for convenient, greater connection, and better value services. The success of our business depends on the internet connectivity coverage from the satellite we provide. Our competitiveness therefore depends on our ability to predict and quickly resolve any bad connections at any area we provide, exploiting profitable opportunities for services development without alienating our existing consumer base or focusing excessive resources or attention on unprofitable or short-lived trends. If we are unable to respond on a timely and appropriate basis to the connection issue, our sales volumes and margins could be adversely affected.

Our limited operating history makes it difficult to evaluate our future prospects and the risks and challenges we may encounter.

Our limited operating history makes it difficult to evaluate our future prospects and the risks and challenges it may encounter. Risks and challenges we have faced or expects to face include its ability to:

| | ● | forecast our revenue and budget for and manage our expenses; |

| | ● | attract new customers and retain existing customers; |

| | ● | effectively manage our growth and business operation, including planning for and managing capital expenditures for our current and future space and space-related systems and services, managing our supply chain and supplier relationships related to our current and future product and service offerings, and integrating acquisitions; |

| | ● | anticipate and respond to macroeconomic changes and changes in the markets in which it operates; |

| | ● | maintain and enhance the value of its reputation and brand; |

| | ● | develop and protect intellectual property; and |

| | ● | hire, integrate and retain talented people at all levels of its organization. |

If we fail to address the risks and difficulties that we face, including those associated with the challenges listed above as well as those described elsewhere in this “Risk Factors” section, our business, financial condition and results of operations could be adversely affected. Further, because we have limited historical financial data and operate in a rapidly evolving market, any predictions about our future revenue and expenses may not be as accurate as they would be if we had a longer operating history or operated in a more developed market. We will encounter risks and uncertainties frequently experienced by growing companies with limited operating histories in rapidly changing industries. If our assumptions regarding these risks and uncertainties, which we use to plan and operate our business, are incorrect or change, or if we do not address these risks successfully, our results of operations could differ materially from its expectations and its business, financial condition and results of operations could be adversely affected.

We have incurred significant losses since inception, we expect to incur losses in the future, and we may not be able to achieve or maintain profitability.

We have incurred significant losses since our inception. While we have generated limited revenue to date, we have not yet achieved production level satellite manufacturing, launch and data activities, and it is difficult for us to predict our future operating results. As a result, our losses may be larger than anticipated, and we may not achieve profitability when expected, or at all, and even if we do, we may not be able to maintain or increase profitability.

We expect our operating expenses to increase over the next several years as we commence production level satellite manufacturing and satellite launch activities, continue to refine and streamline our design and manufacturing processes, make technical improvements, increase our launch cadence, hire additional employees and initiate research and development efforts relating to new products and technologies, including our space services business. These efforts may be more costly than we expect and may not result in increased revenue or growth in our business. Any failure to increase our revenue sufficiently to keep pace with our investments and other expenses could prevent us from achieving or maintaining profitability or positive cash flow. Furthermore, if our future growth and operating performance fail to meet investor or analyst expectations, or if we have future negative cash flow or losses resulting from our investment in acquiring customers or expanding our operations, this could have a material adverse effect on our business, financial condition and results of operations.

To maximize our potential for future growth and achieve our expected revenues, we need to manage growth in our current operations.

In order to maximize potential growth in our current and potential markets, we believe that we must expand our sourcing and marketing operations. This expansion will place a significant strain on our management and on our operational, accounting, and information systems. We expect that as we continue to grow, we will need to improve our financial controls, operating procedures, and management information systems to handle increased operations. We will also need to effectively train, motivate, and manage our employees. Failure to manage our growth could disrupt our operations and ultimately prevent us from generating the revenues we expect.

We cannot assure you that our acquisition growth strategy will be successful.

In addition to our organic growth strategy, we also expect to grow through strategic acquisitions. We cannot assure you that our acquisitions will be successful or that we will have the funds to pursue any acquisitions. Further, even if we are able to complete strategic acquisitions, as expected, we will face challenges such as integration of systems, personnel and corporate culture that may impact our ability to successfully integrate acquired businesses into our overall corporate structure, which would negatively impact our business, operations and financial performance.

If we are not able to implement our strategies to achieve our business objectives, our business operations and financial performance will be adversely affected.

Our business plan and growth strategy are based on currently prevailing circumstances and the assumption that certain circumstances will or will not occur, as well as the inherent risks and uncertainties involved in various stages of development. However, there is no assurance that we will be successful in implementing our strategies or that our strategies, even if implemented, will lead to the successful achievement of our objectives. If we are not able to successfully implement our strategies, our business operations and financial performance will be adversely affected.

Any funding we raise through the future sale of our Ordinary Shares will result in dilution to existing shareholders and funding through bank loans will increase our liabilities.

We plan to raise capital in order to fund our growth plans in the future and anticipate doing so through further stock issuances. Such stock issuances will cause stockholders’ interests in our Company to be diluted. Such dilution is likely to negatively affect the value of investors’ shares if our revenues and earnings do not grow commensurately. Alternate sources of finance, such as obtaining commercial loans, assuming those loans would be available, will increase the Company’s liabilities and future cash commitments.

Any failure of our satellite components to comply with safety requirements set by the government may adversely affect our results from operations.

We currently obtain our components from third parties. We may fail to ensure the supplied goods to be in compliance with safety regulation and rules set by the government, which may, in turn, results in losing our customers which would adversely affect our revenues and stockholder value.

Any disruptions in our information technology systems could harm our business and reduce our profitability.

We rely on our information technology infrastructure and systems such as servers, desktops, network equipment, etc. for communication with our customers, as well as our satellite components supplier. Our performance depends on the availability of accurate and timely data and other information from key software applications to aid day-to-day business and decision-making processes. We may be adversely affected if our controls designed to manage information technology operational risks fail to contain such risks. If we do not allocate and effectively manage the resources necessary to build and sustain the proper technology infrastructure and to maintain the related automated and manual control processes, we could be subject to adverse effects, including billing and collection errors, business disruptions, in particular concerning security breaches. Any disruption caused by failings in our information technology infrastructure equipment or of communication networks, could delay or otherwise impact our day-to-day business and decision-making processes and negatively impact our performance. In addition, we are reliant on third parties to service parts of our information technology infrastructure. Failure on their part to provide good and timely service may have an adverse impact on our information technology network. Furthermore, we do not control the facilities or operations of our suppliers. An interruption of operations at any of their or our facilities or any failure by them to deliver on their contractual commitments may have an adverse effect on our business, financial condition and results of operations.

Significant uncertainties and numerous types of risks are associated with our business, including our ASEANSAT and A-SEANLINK satellite constellations. We may ultimately choose to not proceed with our planned A-SEANLINK satellite constellations or we may proceed with this project and it may not be successful, either of which events could have a material adverse effect on our business prospects and financial conditions.

There are numerous risks and uncertainties associated with our business, including the planned development of a LEO satellite constellation network that consists of hundreds of satellites of which require substantial capital outlay and our Company may not be able to raise sufficient capital to fund its additional ASEANSAT constellations and A-SEANLINK satellite constellations. Additionally, even if our Company is successful in raising sufficient capital to fund A-SEANSAT and A-SEANLINK satellite constellations and the constellations do not operate as expected or commercially unsuccessful, this could result in a material adverse effect on our business prospects and financial condition.

We may in the future invest significant resources into developing new service offerings and exploring the application of our proprietary technologies for other uses and these opportunities may never materialize.

While our primary focus for the foreseeable future will be on commencing our commercial launch activities, increasing our launch cadence, and fully expanding our satellite operations center, we may also invest significant resources into developing new technologies, services, products, and offerings. However, we may not realize the expected benefits of these investments. These anticipated technologies are also unproven and these products or technologies may never materialize or be commercialized in a way that would allow us to generate ancillary revenue streams. Relatedly, if such technologies become viable offerings in the future, we may be subject to competition from our competitors within the commercial launch and satellite industries, some of which may have substantially greater monetary and knowledge resources than we have and expect to have in the future to devote to the development of these technologies. Such competition or any limitations on our ability to take advantage of such technologies could impact our market share, which could have a material adverse effect on our business, financial condition, and results of operations.

Such research and development initiatives may also have a high degree of risk and involve unproven business strategies and technologies with which we have limited operating or development experience. They may involve claims and liabilities (including, but not limited to, personal injury claims), expenses, regulatory challenges, and other risks that we may not be able to anticipate. There can be no assurance that customer demand for such initiatives will exist or be sustained at the levels that we anticipate, or that any of these initiatives will gain sufficient traction or market acceptance to generate sufficient revenue to offset any new expenses or liabilities associated with these new investments. Further, any such research and development efforts could distract management from current operations and would divert capital and other resources from our more established offerings and technologies. Even if we were to be successful in developing new services, offerings or technologies, regulatory authorities may subject us to new rules or restrictions in response to our innovations that may increase our expenses or prevent us from successfully commercializing new products, services, offerings, or technologies.

We are dependent on senior management and other highly qualified personnel and we cannot assure their retention.

Our success depends, in part, on the continued services of key members of our senior management and other personnel, including engineers, manufacturing and quality assurance, design, finance, marketing, sales and support personnel. Our senior management’s’ knowledge of the market, our business and the Company is a key strength of our business, which knowledge cannot be easily replaced or replicated. The success of our business strategy and our future growth also depend on our ability to attract, train, retain and motivate skilled engineer, managerial, sales, administration, development and operating personnel.

We cannot assure that our existing personnel will be adequate or qualified to execute our business strategy, or that we will be able to hire or retain experienced, qualified employees to execute this strategy. The loss of one or more of our senior management or operating personnel, or the failure to attract and retain additional key personnel, could have a material adverse effect on our business, financial condition and results of operations. Further, any inability to recruit, develop and retain qualified employees may result in high employee turnover and may force us to pay significantly higher wages, which may harm our profitability.

Our customer contracts may be terminated by our customers at any time for convenience as well as other provisions permitting the customers to discontinue contract performance for cause (for example, if we do not achieve certain milestones on a timely basis). If our contracts are terminated or if we experience any other contract-related risks, our results of operations may be adversely impacted.

We are subject to a variety of contract-related risks. Some of our customer contracts, potentially including those with the government, include provisions allowing the customers to terminate their contracts for convenience, with a termination penalty for at least the amounts already paid, or to terminate the contracts for cause (for example, if we do not achieve certain milestones on a timely basis). Customers that terminate such contracts may also be entitled to a pro rata refund of the amount of the customer’s deposit.

Part of our strategy is to market our satellite as a service to key government customers. We expect that we may derive limited revenue from contracts with MYSA and the Malaysian government, and may enter into further contracts with the foreign governments in the future, and this subjects us to statutes and regulations applicable to companies doing business with the foreign government. These government contracts customarily contain provisions which give the government substantial rights and remedies, many of which are not typically found in commercial contracts, and which are unfavorable to contractors. For instance, most government agencies include provisions that allow the government to unilaterally terminate or modify contracts for convenience, in which case the counterparty to the contract may generally recover only its incurred or committed costs and settlement expenses and profit on work completed prior to the termination. If the government terminates a contract for default, the defaulting party may be liable for any extra costs incurred by the government in procuring undelivered items from another source.

Our customers may not be creditworthy.

Our business is subject to the risks of non-payment and non-performance by our customers. Our customers include telecommunication companies, enterprises and the government serving rural communities. We manage our exposure to credit risk through credit analysis and monitoring procedures, and may use letters of credit, prepayments and guarantees. However, these procedures and policies cannot fully eliminate customer credit risk, and to the extent our policies and procedures prove to be inadequate, it could negatively affect our financial condition and results of operations. In addition, some of our customers may be highly leveraged and subject to their own operating and regulatory risks and, even if our credit review and analysis mechanisms work properly, we may experience financial losses in our dealings with such parties. We do not maintain credit insurance to insure against customer credit risk. If our customers fail to fulfil their contractual obligations, it may have an adverse effect on our business, financial condition and results of operation.

Failure to protect our brand names, trademarks, intellectual property rights, and any assertions by third parties of infringement, misappropriation or other violations by us of their intellectual property rights could result in significant costs and could materially affect our business.

Our trademarks are currently pending registration.

Our component suppliers own their product brand names. We cannot be certain that the actions our suppliers have taken or will take in the future will be adequate to prevent violation of their proprietary rights.

We regard our intellectual property, trade secrets and proprietary technologies as important to the success of our business. We have developed certain ideas, processes, and methods that contribute to our success and competitive position that we consider to be trade secrets. We protect our trade secrets by keeping them confidential through the use of internal and external controls, including contractual protections with employees, contractors, customers and vendors. Trade secrets can be protected for an indefinite period so long as their secrecy is maintained, but we can provide no assurances that such secrecy will be maintained due to factors outside of the Company’s control.

While we have not yet obtained registration for our intellectual property in all markets in which we do business or may do business in the future, and we may have difficulty in registering, or enforcing an exclusive right to use, our intellectual property in those jurisdictions. The intellectual property laws and enforcement practices of certain non-U.S. jurisdictions may not protect our intellectual property rights to the same extent as the laws of the United States. In addition, there can be no assurance that the efforts we have taken to protect our intellectual property and proprietary rights will be effective, and if we are unable to protect our intellectual property from unauthorized use, our ability to exploit our proprietary technology or our brand image may be harmed.

Litigation may be necessary to defend us against claimed infringement of the rights of third parties. Adverse publicity, legal action or other factors which we have no control over could lead to substantial erosion in the value of the brands, which could lead to decreased consumer demand and could have a material adverse effect on our business, financial condition and results of operations.

Failures in our technology infrastructure could damage our business, reputation and brand and substantially harm our business and results of operations.

If our main data center were to fail, or if we were to suffer an interruption or degradation of services at our main data center, we could lose important manufacturing and technical data, which could harm our business. Our facilities are vulnerable to damage or interruption from, floods, fires, cyber security attacks, power losses, telecommunications failures, and similar events. In the event that our or any third-party provider’s systems or service abilities are hindered by any of the events discussed above, our ability to operate may be impaired. A decision to close the facilities without adequate notice, or other unanticipated problems, could adversely impact our operations. Any of the aforementioned risks may be augmented if our or any third-party provider’s business continuity and disaster recovery plans prove to be inadequate. The facilities also could be subject to break-ins, computer viruses, sabotage, intentional acts of vandalism and other misconduct. Any security breach, including personal data breaches, or incident, including cybersecurity incidents, that we experience could result in unauthorized access to, misuse of or unauthorized acquisition of our or our customers’ data, the loss, corruption or alteration of this data, interruptions in our operations or damage to our computer hardware or systems or those of our customers. Moreover, negative publicity arising from these types of disruptions could damage our reputation. We have yet to secure a business interruption insurance to compensate us for losses that may occur as a result of any events that cause interruptions in our service. Significant unavailability of our services due to attacks could cause users to cease using our services and materially and adversely affect our business, prospects, financial condition, and results of operations.

We are subject to many hazards and operational risks that can disrupt our business, including interruptions or disruptions in service at our primary facilities, which could have a material adverse effect on our business, financial condition, and results of operations.

Our operations are subject to many hazards and operational risks inherent to our business, including general business risks, product liability and damage to third parties, our infrastructure or properties that may be caused by fires, floods and other natural disasters, power losses, telecommunications failures, terrorist attacks, human errors and similar events. Additionally, our satellite assembly operations are hazardous at times and may expose us to safety risks, including environmental risks and health and safety hazards to our employees or third parties.

Moreover, our operations are entirely based in Malaysia, where our assembly-integration-testing facilities, administrative offices, and engineering functions are located. Any significant interruption due to any of the above hazards and operational to the operation of our facilities, including from weather conditions, growth constraints, performance by third-party providers (such as electric, utility or telecommunications providers), failure to properly handle and use hazardous materials, failure of computer systems, power supplies, fuel supplies, infrastructure damage, disagreements with the owners of the land on which our facilities are located could result in delays or cancellation of our planned commercial satellite launches and, as a result, could have a material adverse effect on our business, financial condition and results of operations.

In addition, we do not have any insurance coverage to cover our liabilities related to such hazards or operational risks. Moreover, we may not be able to maintain adequate insurance in the future at rates we consider reasonable and commercially justifiable, and insurance may not continue to be available on terms as favorable as our current arrangements. The occurrence of a significant uninsured claim, or a claim in excess of the insurance coverage limits maintained by us, could harm our business, financial condition and results of operations.

Adverse publicity stemming from any incident involving us or our competitors, could have a material adverse effect on our business, financial condition and results of operations.

We are at risk of adverse publicity stemming from any public incidents involving the Company, our people or our brand. If any of our launch partners’ vehicles or our satellites or those of one of our competitors were to be involved in a public incident, accident or catastrophe, this could create an adverse public perception of satellite launch or manufacturing activities could cause a material adverse effect on our business, financial conditions and results of operations. Further, if our launch partners’ vehicles were to be involved in a public incident, accident or catastrophe, we could be exposed to significant reputational harm or potential legal liability.

Our international operations subject us to operational and financial risks.

We plan to provide services to our clients in the ASEAN countries. Accordingly, our business is subject to various risks resulting from differing legal, political, social and regulatory requirements, economic conditions and unforeseeable developments in these markets, including:

| | ● | changes in tariffs, trade restrictions, trade agreements, and taxations; |

| | ● | difficulties in managing or overseeing foreign operations and agents; |

| | ● | different liability standards; |

| | ● | political instability; |

| | ● | differing economic cycles; |

| | ● | adverse economic conditions; |

| | ● | unexpected changes in regulatory environments, currency exchange rate fluctuations, |

| | ● | inability to collect payments or seek recourse under or comply with ambiguous or vague commercial or other laws; |

| | ● | changes in distribution and supply channels, foreign exchange controls and restrictions on repatriation of funds, and difficulties in attracting and retaining qualified management and employees. |

We must comply with complex and evolving tax regulations in the various jurisdictions in which we operate, which subjects us to international tax compliance risks. Some tax jurisdictions in which we operate have complex and subjective rules regarding income tax, value-added tax, sales or excise tax and transfer tax. From time to time, our foreign subsidiaries are subject to tax audits and may be required to pay additional taxes, interest or penalties should the taxing authority assert different interpretations, or different allocations or valuations of our services which could be material and could reduce our income and cash flow from our international subsidiaries.

The occurrence or consequences of any of these factors may restrict our ability to operate in the affected region and/or decrease the profitability of our operations in that region.

As we continue to expand our business internationally, we expose the Company to increased risk of loss from foreign currency fluctuations, as well as longer accounts receivable payment cycles. Foreign currency fluctuations could result in currency translation exchange gains or losses or could affect the book value of our assets and liabilities. Furthermore, we may experience unanticipated changes to our income tax liabilities resulting from changes in geographical income mix and changing international tax legislation. We have limited control over these risks, and if we do not correctly anticipate changes in international economic and political conditions, we may not alter our business practices in time to avoid adverse effects.

Changes in accounting standards and subjective assumptions, estimates and judgments by management related to complex accounting matters could significantly affect our financial results.

Generally accepted accounting principles and related accounting pronouncements, implementation guidelines and interpretations with regard to a wide range of matters that are relevant to our business, including but not limited to revenue recognition, estimating valuation allowances and accrued liabilities (including allowances for returns, and doubtful accounts), accounting for income taxes, valuation of long-lived and intangible assets and goodwill, and loss contingencies, are highly complex and involve many subjective assumptions, estimates and judgments by our management. Changes in these rules or their interpretation or changes in underlying assumptions, estimates or judgments by our management could significantly change our reported or expected financial performance, and could have a material adverse effect on our business.

We may engage in future acquisitions, which may be expensive and time consuming and which we may not realize anticipated benefits from.

Our business strategy is largely based on our ability to grow through acquisitions of further businesses to build an integrated group. Consummating acquisitions of related businesses, or our failure to integrate such businesses successfully into our existing businesses, could result in unanticipated expenses and losses. Furthermore, we may not be able to realize any of the anticipated benefits from these acquisitions.

We anticipate that any future acquisitions we may pursue as part of our business strategy may be partially financed through additional debt or equity. If new debt is added to current debt levels, or if we incur other liabilities, including contingent liabilities, in connection with an acquisition, the debt or liabilities could impose additional constraints and requirements on our business and operations, which could materially adversely affect our financial condition and results of operation. In addition, to the extent our Ordinary Shares are used for all or a portion of the consideration to be paid for future acquisitions, dilution may be experienced by existing shareholders.

In connection with our completed and future acquisitions, the process of integrating acquired operations into our existing group operations, may result in unforeseen operating difficulties and may require significant financial resources that would otherwise be available for the ongoing development or expansion of existing operations. Some of the other risks associated with acquisitions include:

| | ● | potentially dilutive issuances of our securities, the incurrence of debt and contingent liabilities and amortization expenses related to intangible assets with indefinite useful lives, which could adversely affect our results of operations and financial condition; |

| | ● | the possibility that the due diligence process in any such acquisition may not completely identify material issues associated with product quality, product architecture, product development, intellectual property issues, key personnel issues or legal and financial contingencies, including any deficiencies in internal controls and procedures and the costs associated with remedying such deficiencies; |

| | ● | the possible adverse effect of such acquisitions on existing relationships with third party partners and suppliers of technologies and services; |

| | ● | unexpected losses of key employees or customers of the acquired company; |

| | ● | conforming the acquired company’s standards, processes, procedures and controls with our operations; |

| | ● | coordinating new product and process development; |

| | ● | difficulty in predicting and responding to issues related to product transition such as development, distribution and client support; |

| | ● | hiring additional management and other critical personnel; |

| | ● | the possibility that staffs or clients of the acquired company might not accept new ownership and may transition to different technologies or attempt to renegotiate contract terms or relationships, including maintenance or support agreements; |

| | ● | difficulty in integrating acquired operations due to geographical distance and language and cultural differences; |

| | ● | the possibility that acquired assets become impaired, requiring us to take a charge to earnings which could be significant; and |

| | ● | increasing the scope, geographic diversity and complexity of our current operations. |

In addition, general economic and market conditions or other factors outside of our control could make our operating strategies difficult or impossible to implement. Any failure to implement these operational improvements successfully and/or the failure of these operational improvements to deliver the anticipated benefits could have a material adverse effect on our results of operations and financial condition.

We may face significant competition for acquisition opportunities.

There may be significant competition in some or all of the acquisition opportunities that we may explore. Such competition may for example come from strategic buyers, sovereign wealth funds, special purpose acquisition companies and public and private investment funds, many of which are well established and have extensive experience in identifying and completing acquisitions. A number of these competitors may possess greater technical, financial, human and other resources than us. We cannot assure investors that we will be successful against such competition. Such competition may cause us to be unsuccessful in executing any acquisition or may result in a successful acquisition being made at a significantly higher price than would otherwise have been the case.

Any due diligence conducted by us in connection with potential future acquisition may not reveal all relevant considerations or liabilities of the target business, which could have a material adverse effect on our financial condition or results of operations.

We intend to conduct due diligence as we deem reasonably practicable and appropriate based on the facts and circumstances applicable to any potential acquisition. The objective of the due diligence process will be to identify material issues which may affect the decision to proceed with any one particular acquisition target or the consideration payable for an acquisition. We also intend to use information revealed during the due diligence process to formulate our business and operational planning for, and our valuation of, any target company or business. While conducting due diligence and assessing a potential acquisition, we may rely on publicly available information, if any, information provided by the relevant target company to the extent such company is willing or able to provide such information and, in some circumstances, third party investigations.

There can be no assurance that the due diligence undertaken with respect to potential acquisitions will reveal all relevant facts that may be necessary to evaluate such acquisition including the determination of the price we may pay for acquisition target or to formulate a business strategy. Furthermore, the information provided during due diligence may be incomplete, inadequate or inaccurate. As part of the due diligence process, we will also make subjective judgments regarding the results of operations, financial condition and prospects of a potential target. For example, the due diligence we conducted in connection with the AngkasaX Sdn. Bhd. acquisition may not have been complete, adequate or accurate and may not have uncovered all material issues and liabilities to which we are now subject. If the due diligence investigation fails to correctly identify material issues and liabilities that may be present in a target company or business, or if we consider such material risks to be commercially acceptable relative to the opportunity, and we proceed with an acquisition, we may subsequently incur substantial impairment charges or other losses.

In addition, following an acquisition, including the AngkasaX Sdn. Bhd. acquisition, we may be subject to significant, previously undisclosed liabilities of the acquired business that were not identified during due diligence and which could contribute to poor operational performance, undermine any attempt to restructure the acquired company or business in line with our business plan and have a material adverse effect on our financial condition and results of operations.

We are subject to negative impacts of changes in political and governmental conditions.

Our operations are subject to the influences of significant political, governmental, and similar changes and our ability to respond to them, including:

| | ● | changes in political conditions and in governmental policies; |

| | ● | changes in and compliance with international and domestic laws and regulations; and |

| | ● | wars, civil unrest, acts of terrorism, and other conflicts. |

We may be subject to negative impacts of catastrophic events.

A disruption or failure of our systems or operations in the event of a major earthquake, weather event, cyber-attack, heightened security measures, actual or threatened, terrorist attack, strike, civil unrest, pandemic or other catastrophic event could cause delays in providing services or performing other critical functions. A catastrophic event that results in the destruction or disruption of any of our critical business or information systems could harm our ability to conduct normal business operations and adversely impact our operating results.

We may incur liabilities that are not covered by insurance.

While we seek to maintain appropriate levels of insurance, not all claims are insurable and we may experience major incidents of a nature that are not covered by insurance. We presently do not have insurance through our warehouse operators for our satellites while they are warehoused and direct insurance to cover our satellites while they are in transit. Our warehouse is to house our components for assembly including storage of assembled satellites before shipping out to launch. We do not have other insurances that cover, among other things, employee-related accidents and injuries, other property damage and liability deriving from our activities.

We are a holding company whose principal source of operating cash is the income received from our subsidiaries.

We are dependent on the income generated by our subsidiaries in order to make distributions and dividends on the Ordinary Shares. We have not received and do not have any present plan to receive dividends paid by our Malaysia subsidiaries, but we have discretion as to whether such dividends are paid, subject to applicable statutory and contractual restrictions, including Malaysia regulations which may govern the ability of our Malaysia subsidiary to pay dividends to us. The amounts of distributions and dividends, if any, which may be paid to us from our operating subsidiaries will depend on many factors, including such subsidiary’s results of operations and financial condition, limits on dividends under applicable law, its constitutional documents, documents governing any indebtedness, and other factors which may be outside our control. If our operating subsidiaries do not generate sufficient cash flow, we may be unable to make distributions and dividends on the Ordinary Shares.

Our significant shareholders have considerable influence over our corporate matters.

Each of See Unicorn Ventures Limited, GreenPro Venture Capital Limited, Fivestar Merger Sdn. Bhd., SEATech Ventures Corp. holds 65%, 12%, 6% and 6% respectively, of our issued and outstanding Ordinary Shares. Each of them, either collectively (which would aggregate into a controlling interest in us) or individually, will hold considerable influence over corporate matters requiring shareholder approval, such as electing directors and approving material mergers, acquisitions or other business combination transactions. This concentrated control will limit your ability to influence corporate matters and could also discourage others from pursuing any potential merger, takeover or other change of control transactions, which could have the effect of depriving the holders of our Ordinary Shares of the opportunity to sell their shares at a premium over the prevailing market price.

Our significant shareholders may have potential conflicts of interest with us, which may materially and adversely affect our business and financial condition.

Because our significant shareholders have, either collectively or individually, considerable influence over our corporate matters, their interests may differ from the interests of our Company as a whole. These shareholders could, for example, appoint directors and management without the requisite experience, relations or knowledge to steer our company properly because of their affiliations or loyalty, and such actions may materially and adversely affect our business and financial condition. Currently, we do not have any arrangements to address potential conflicts of interest between these shareholders and our Company. If we cannot resolve any conflict of interest or dispute between us and the shareholders, we would have to rely on legal proceedings, which could result in the disruption of our business and subject us to substantial uncertainty as to the outcome of any such legal proceedings.

Our education business is heavily dependent on our partner’s brand recognition and market reputation.

We believe that our success is heavily dependent on the market recognition of our partner, Universiti Sains Malaysia’s brand and reputation. As we continue to expand our business and services, it may become difficult to maintain the quality and consistency of the services it offers, which in turn may undermine customers’ confidence in our brand name.

A variety of factors can potentially impact our reputation, such as customer satisfaction with USM’s educational content or syllabus, information technology solutions they provide and negative press. If our reputation is damaged, our customers may stop using our services and our business could be materially and adversely affected.

We cannot assure you that we are able to monitor its promotion and marketing activities effectively and the promotion of our brand may not be successful as we expect. If we are unable to maintain or sustain our reputation and brand recognition, we may also be unable to maintain or expand our customer base, which may have a material and adverse effect on our business, financial condition and results of operations.

We may not be able to maintain or increase our fee level for educational services.

Our results of operations are affected by the pricing we charge for our services. We determine our fees with Universiti Sains Malaysia primarily based on the demand for our educational content, the cost of our operations, the fees charged by our competitors, our pricing strategy to gain market shares and general educational market’s supply and demand in Malaysia. We cannot guarantee that we will be able to maintain or increase our fee level in the future without adversely affecting the demand for our educational content services.