As filed with the Securities and Exchange Commission on April 4, 2024.

Registration No. 333-271910

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

____________________________

PRE-EFFECTIVE AMENDMENT NO. 2 TO

FORM S-1

REGISTRATION STATEMENT UNDER THE SECURITIES ACT OF 1933

____________________________

COtwo Advisors Physical European Carbon Allowance Trust

(Exact name of registrant as specified in its charter)

____________________________

Delaware | | 6221 | | 92-6338429 |

(State or other jurisdiction of

incorporation or organization) | | (Primary Standard Industrial Classification Code Number) | | (I.R.S. Employer

Identification No.) |

____________________________

COtwo Advisors LLC

140 Elm Street, Suite 6,

New Canaan, CT 06840

(203) 594-9988

(Address, including zip code, and telephone number, including area code, of registrant’s principal executive offices)

____________________________

Copies to

Eric D. Simanek, Esq.

Eversheds Sutherland (US) LLP

700 Sixth Street, N.W.

Washington, D.C. 2001

(202) 220-8412

____________________________

Approximate date of commencement of proposed sale to the public: As soon as practicable after the effective date of this Registration Statement.

If any of the securities being registered on this Form are to be offered on a delayed or continuous basis pursuant to Rule 415 under the Securities Act of 1933, check the following box. ☒

If this Form is filed to register additional securities for an offering pursuant to Rule 462(b) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ☐

If this Form is a post-effective amendment filed pursuant to Rule 462(c) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ☐

If this Form is a post-effective amendment filed pursuant to Rule 462(d) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ☐

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, smaller reporting company, or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer,” “smaller reporting company,” and “emerging growth company” in Rule 12b-2 of the Exchange Act.

Large accelerated filer | | ☐ | | Accelerated filer | | ☐ |

Non-accelerated filer | | ☒ | | Smaller reporting company | | ☒ |

| | | | | Emerging growth company | | ☒ |

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards pursuant to Section 7(a)(2)(B) of the Securities Act. ☒

The registrant hereby amends this Registration Statement on such date or dates as may be necessary to delay its effective date until the registrant shall file a further amendment which specifically states that this Registration Statement shall thereafter become effective in accordance with Section 8(a) of the Securities Act of 1933 or until this Registration Statement shall become effective on such date as the Commission, acting pursuant to said Section 8(a), may determine.

Table of Contents

The information in this preliminary prospectus is not complete and may be changed. We may not sell these securities until the registration statement filed with the Securities and Exchange Commission is effective. This preliminary prospectus is not an offer to sell these securities and it is not soliciting an offer to buy these securities in any jurisdiction where the offer or sale is not permitted.

PRELIMINARY PROSPECTUS SUBJECT TO COMPLETION, DATED APRIL 4, 2024

COTWO ADVISORS PHYSICAL EUROPEAN CARBON ALLOWANCE TRUST

The COtwo Advisors Physical European Carbon Allowance Trust (the “Trust”) will issue an indeterminate amount of COtwo Advisors Physical European Carbon Allowance Shares (the “Shares”), which represent units of fractional undivided beneficial interest in and ownership of the Trust. The investment objective of the Trust is for the Shares to reflect the performance of the price of EU Carbon Emission Allowances for stationary installations (“EUAs”), less the expenses of the Trust’s operations. The Trust is not actively managed and will not utilize leverage, derivatives or any similar arrangements to meet its investment objectives.

The Trust’s assets will consist of EUAs, which are issued via the European Union Emission Trading System (“ETS”) and permit the holder to emit one ton of carbon dioxide equivalent or other greenhouse gas. The Trust will occasionally hold cash received in connection with cash purchases or redemptions or Shares or for short periods to pay Trust expenses. All EUAs will be held at the European Union Registry (the “Union Registry”).

COtwo Advisors LLC is the sponsor of the Trust (“Sponsor”). Wilmington Trust, National Association is the trustee (“Trustee”). State Street Bank and Trust Company is the administrator (“Administrator”), transfer agent (“Transfer Agent”) and the custodian, with respect to cash (“Cash Custodian”), of the Trust. Foreside Fund Services, LLC is the order examiner (“Marketing Agent”) in connection with the creation and redemption of Baskets of Shares. The Trust is obligated to pay the Sponsor a management fee (the “Sponsor’s Management Fee”), calculated daily and paid monthly, equal to 0.79% of the Trust’s average daily net assets. From the Sponsor’s Management Fee, the Sponsor has contractually agreed to pay all of the routine operational, administrative and other ordinary expenses of the Trust, excluding interest expenses and certain litigation expenses and other non-recurring or extraordinary fees and expenses. The Sponsor has paid all of the expenses related to the organization and offering of the Shares in this prospectus, which are estimated to be approximately $145,000.

The offering of the Trust’s Shares is registered with the Securities and Exchange Commission (the “SEC”) in accordance with the Securities Act of 1933, as amended (the “Securities Act”). The Trust intends to issue Shares on a continuous basis and is registering an indeterminate number of Shares with the SEC in accordance with Rule 456(d) and 457(u).

The Shares are issued by the Trust only in one or more blocks of 50,000 Shares, called a “Basket,” in exchange for EUAs. The Trust will issue and redeem Shares in Baskets to certain registered broker-dealers who have entered into a contract with the Sponsor and Transfer Agent (“Authorized Participants”) on an ongoing basis as described in “Creation and Redemption of Shares.” [___] is the initial authorized participant (“Initial Purchaser”) and is a statutory underwriter under Section 2(a)(11) of the Securities Act. Baskets will be issued and redeemed on an ongoing basis at net asset value (“NAV”) per Share on the day that an order to create a Basket is accepted by the Transfer Agent and approved by the Marketing Agent.

Prior to this offering, there has been no public market for the Shares. The Shares of the Trust are expected to be listed for trading, subject to notice of issuance, on the NYSE Arca, Inc. (“Arca” or the “Exchange”), under the symbol “CTWO”. The market price of the Shares may be different from the NAV per Share for a number of reasons, including the supply and demand for Shares, the value of the Trust’s assets, and market conditions at the time of a transaction.

Except when aggregated in Baskets, Shares are not redeemable securities. Baskets are only redeemable by Authorized Participants.

Investors who buy or sell shares during the day from their broker may do so at a premium or discount relative to the NAV of the Trust’s total net assets due to supply and demand forces at work in the secondary trading market for shares that are closely related to, but not identical to, the same forces influencing the prices of the EUAs in which the Trust invests. Investing in the Trust involves significant risks. See “Risk Factors” beginning on page 9.

Shareholders will take no part in the management or control of the Trust and will have no voting rights with respect to the Trust, except as expressly provided for in the Trust’s Amended and Restated Declaration of Trust and Trust Agreement (“Trust Agreement”).

Neither the SEC nor any state securities commission has approved or disapproved of the securities offered in this prospectus (“Prospectus”), or determined if this Prospectus is truthful or complete. Any representation to the contrary is a criminal offense.

The Trust qualifies as an “emerging growth company” as defined in the Jumpstart Our Business Startups Act (“JOBS Act”). “Emerging growth company” does not mean the Trust is a “growth” type of investment vehicle or that it will utilize a “growth” investment strategy. However, the Trust will not take advantage of any exemptions or other relief provided to emerging growth companies under the JOBS Act. See “Emerging Growth Company Status.”

The Shares are neither interests in nor obligations of the Sponsor, the Trustee, the Administrator, the Transfer Agent, the Union Registry, the Cash Custodian, the Marketing Agent or any of their respective affiliates. The Shares are not insured or guaranteed by the Federal Deposit Insurance Corporation or any other governmental agency. The Trust is not an investment company registered under the Investment Company Act of 1940, as amended. The Trust is not a commodity pool for purposes of the Commodity Exchange Act of 1936, as amended, and the Sponsor is not subject to regulation by the Commodity Futures Trading Commission as a commodity pool operator or a commodity trading advisor.

The initial amount of EUAs required for deposit with the Trust to create Shares will be 10,000 per Basket. The Initial Purchaser, acting as a statutory underwriter in connection with the initial purchase of Shares, will deposit EUAs or cash for the purchase of at least one initial Basket of 50,000 Shares, as described in “Plan of Distribution.” The initial Basket(s) will be created at a per basket price of 10,000 EUAs and a per share price equal to 1/5 of the value of a single EUA on the purchase date. The value of the EUAs will be calculated using the value of the European Energy Exchange AG’s (“EEX”) end of day index on the price of EUAs (the “EUA End of Day Index”) that is circulated on the day of the purchase of the initial Basket. The Trust will receive all proceeds from the offering of the initial Baskets in EUAs or cash in an amount equal to the full price for the initial Baskets. The Initial Purchaser may receive commissions/fees from shareholders who purchase Shares from the initial Basket through their commission/fee-based brokerage accounts. The price per Basket that will be paid in the future by the Authorized Participants may be different than the initial Basket price.

The date of this Prospectus is [ ], 2024.

Table of Contents

TABLE OF CONTENTS

This Prospectus contains information you should consider when making an investment decision about the Shares. You may rely on the information contained in this Prospectus. The Trust and the Sponsor have not authorized any person to provide you with different information and, if anyone provides you with different or inconsistent information, you should not rely on it. This Prospectus is not an offer to sell the Shares in any jurisdiction where the offer or sale of the Shares is not permitted.

The Shares are not registered for public sale in any jurisdiction other than the United States.

i

Table of Contents

STATEMENT REGARDING FORWARD-LOOKING STATEMENTS

This Prospectus includes statements which relate to future events or future performance. In some cases, you can identify such forward-looking statements by terminology such as “may,” “will,” “should,” “expect,” “plan,” “anticipate,” “believe,” “estimate,” “predict,” “potential” or the negative of these terms or other comparable terminology. All statements (other than statements of historical fact) included in this Prospectus that address activities, events or developments that may occur in the future, including such matters as changes in asset prices and market conditions (for EUAs and the Shares), the Trust’s operations, the Sponsor’s plans and references to the Trust’s future success and other similar matters are forward-looking statements. These statements are only predictions. Actual events or results may differ materially. These statements are based upon certain assumptions and analyses made by the Sponsor on the basis of its perception of historical trends, current conditions and expected future developments, as well as other factors it believes are appropriate in the circumstances. Whether or not actual results and developments will conform to the Sponsor’s expectations and predictions, however, is subject to a number of risks and uncertainties, including the special considerations discussed in this Prospectus, general economic, market and business conditions, changes in laws or regulations, including those concerning taxes, made by governmental authorities or regulatory bodies, and other world economic and political developments. See “Risk Factors.” Consequently, all the forward-looking statements made in this Prospectus are qualified by these cautionary statements, and there can be no assurance that the actual results or developments the Sponsor anticipates will be realized or, even if substantially realized, that they will result in the expected consequences to, or have the expected effects on, the Trust’s operations or the value of the Shares. Moreover, neither the Sponsor, nor any other person assumes responsibility for the accuracy or completeness of the forward-looking statements. Neither the Trust nor the Sponsor undertakes an obligation to publicly update or conform to actual results any forward-looking statement, whether as a result of new information, future developments or otherwise, except as required by law.

ii

Table of Contents

PROSPECTUS SUMMARY

The following is only a summary of this Prospectus and, while it contains material information about the Trust, it does not contain or summarize all of the information about the Trust and the Shares contained in this Prospectus that is material and that may be important to you. You should read this entire Prospectus, including “Risk Factors” beginning on page 9, and the material incorporated by reference herein before making an investment decision about the Shares.

European Union Carbon Emission Allowances (“EUAs”)

The European Union Emissions Trading System (“EU ETS”) is a “cap and trade” system that caps the total volume of greenhouse gas (“GHG”) emissions from installations and aircraft operators responsible for around 40% of European Union (“EU”) GHG emissions. The EU ETS is administered by the EU Commission, which issues a predefined amount of EUAs through auctions or free allocation. EUAs entitle the holder to emit one ton of carbon dioxide equivalent or other GHG. Entities covered by the EU ETS are required to surrender each year sufficient EUAs to cover all their emissions for the previous year.

In 2012, EU ETS operations were centralized into a single EU registry operated by the EU Commission (the “Union Registry”), which covers all countries participating in the EU ETS. The Union Registry is an online database that holds accounts for all entities covered by the EU ETS as well as for participants (such as the Trust) not covered under the EU ETS. An account must be opened in the Union Registry in order to transact in EUAs and the Union Registry is at all times responsible for holding the EUAs. The EU ETS is the largest cap and trade system in the world and covers more than 11,000 power stations and industrial plants in 31 countries, and flights between airports of participating countries.

The Trust

COtwo Advisors Physical European Carbon Allowance Trust (the “Trust”) was formed as a Delaware statutory trust on January 12, 2023. The Trust is governed by the Amended and Restated Declaration of Trust and Trust Agreement (“Trust Agreement”) dated November 27, 2023 between COtwo Advisors LLC (the “Sponsor”) and Wilmington Trust, National Association (the “Trustee”). The Trust will issue common units of beneficial interest, or “Shares,” which represent units of fractional undivided beneficial interest in the Trust’s net assets. The Trust’s assets will consist of EUAs and cash, the unit of account within the EU ETS as described in the preceding paragraphs. The Trust may hold cash temporarily in connection with cash purchases and redemptions of Shares (see “Creation and Redemption of Shares,” below) and it also will occasionally hold cash for short periods to pay the Sponsor’s Management Fee and any other Trust expenses and liabilities not assumed by the Sponsor (see “Description of the Trust”, below). The Trust will not hold any assets other than EUAs or cash.

The investment objective of the Trust is for the Shares to reflect the performance of the price of EUAs, less the expenses of the Trust’s operations. The EUAs will be held at the Union Registry. The value of EUAs will be reported on the Trust’s website daily, measured as described below in “Calculating NAV”.

Shares are issued by the Trust only in blocks of 50,000 Shares called “Baskets” in exchange for EUAs or cash from certain registered broker-dealers (“Authorized Participants”). See “Creation and Redemption of Shares” for requirements to qualify as an Authorized Participant. Baskets will be redeemed by the Trust in exchange for the amount of EUAs or cash corresponding to their redemption value. The Trust issues and redeems Baskets on an ongoing basis at net asset value (“NAV”) per Share to Authorized Participants who have entered into a contract with the Sponsor and the Transfer Agent.

The amount of EUAs represented by each Share will decrease over the life of the Trust because of the sale of EUAs necessary to pay the Sponsor’s Management Fee and any other Trust expenses and the disregarding of fractions of an EUA smaller than one EUA for purposes of computing the Basket Deposit (as defined below). Without increases in the price of EUAs sufficient to compensate for the above decreases, the price of the Shares will also decline and you will lose money on your investment in the Shares. For example, assuming that the Trust has $100 million in total assets represented by EUAs and Trust fees and expenses are 1% of the Trust’s total assets, if the price of EUAs decreases by 0.8% then the Trust’s total assets after paying Trust fees and expenses would be $98.2 million, $99 million if the price of EUAs remains flat and $101 million if the price of EUAs increased by 2%. Assuming that the Trust had 100,000

1

Table of Contents

Shares outstanding in the above scenario, the NAV per Share would decrease from $990 per Share to $982 per Share if the price of EUAs decreased by $0.8%, remain at $990 per Share if the price of EUAs remained flat, and increase to $101 per share if the price of EUAs increased by 2%.

Individual Shares will not be redeemed by the Trust, but are expected to be listed for trading, subject to notice at issuance, on the Exchange under the symbol “CTWO.” The material terms of the Trust and the Shares are discussed in greater detail under the sections “Description of the Trust” and “Description of the Shares.” Shareholders will take no part in the management or control of the Trust and will have no voting rights with respect to the Trust, except as expressly provided for in the Trust Agreement. The Trust is not a registered investment company under the Investment Company Act of 1940, as amended (“1940 Act”), and is not required to register with the Securities and Exchange Commission thereunder. The Trust is not a commodity pool for purposes of the Commodity Exchange Act of 1936, as amended, and the Trust and the Sponsor are not subject to regulation by the Commodity Futures Trading Commission as a commodity pool operator or a commodity trading advisor.

Secondary market purchases and sales of Shares are subject to customary brokerage commissions and charges.

The market price of the Shares may not be identical to the NAV per Share. The intra-day indicative value per Share is based on the prior day’s final NAV per Share, adjusted every 15 seconds throughout the day to reflect the continuous price changes of the Trust’s EUAs holdings, to provide a continuously updated indicative intra-day value per Share during the EUAs’ trading day. The intra-day indicative value per Share is calculated by using the prior day’s closing NAV per share of the Trust as a base and updating that value throughout the trading day to reflect changes in the most recently reported mid-point of the bid/ask spread of spot EUAs traded on the EEX. All major exchanges that trade EUAs or Daily EUA Futures (as defined below) provide real time pricing information to the general public through data vendors such as Bloomberg. The trading prices for EUAs and the daily EUA End of Day Index value and historical EUA End of Day Index values will also be disseminated by on-line subscription services or by one or more major market data vendors during the NYSE Arca Core Trading Session of 9:30 a.m. to 4:00 p.m. E.T. In addition, there is a gap in time at the end of each day during which the Trust’s shares are traded on the NYSE Arca, but real-time trading prices for EUAs are not available. During such gaps in time the intra-day indicative value per Share will be calculated based on the end of day price of EUAs immediately preceding the trading session. The indicative intra-day value per Share will be calculated by ISS STOXX GmbH (“ISS STOXX”). The Trust is not involved in or responsible for the calculation or dissemination of the indicative intra-day value per Share and makes no warranty as to the accuracy of the indicative intra-day value per Share.

The Trust’s Service Providers

The Sponsor

The Sponsor is a Delaware limited liability company. The Shares are neither interests in nor obligations of, and are not guaranteed by, the Sponsor, its member(s), or any of its affiliates.

The Sponsor arranged for the creation of the Trust and is responsible for the ongoing registration of the Shares for their public offering in the United States and the listing of Shares on the Exchange. The Sponsor will develop a marketing plan for the Trust, will prepare marketing materials regarding the Shares of the Trust, and will exercise the marketing plan of the Trust on an ongoing basis. The Sponsor has agreed to pay all operating expenses (except for interest expenses and certain litigation expenses and other non-recurring or extraordinary fees and expenses) out of the Sponsor’s unified management fee.

The Sponsor’s officers, directors and employees, do not devote their time exclusively to the Trust. These persons are, or may in the future be, directors, officers or employees of other entities, which may compete with the Trust for their services. They could have a conflict between their responsibilities to the Trust and to those other entities. The Sponsor believes that it has sufficient personnel, time, and working capital to discharge its responsibilities in a fair manner and that these persons’ conflicts should not impair their ability to provide services to the Trust. In addition, the Sponsor and Trustee may agree to amend the Trust Agreement, including to increase the Sponsor’s Management Fee, without shareholder consent. Any amendment will become effective on a date to be determined by the Sponsor in its sole discretion. The Sponsor shall determine the contents, manner and time of notice of any material Trust Agreement amendment. Such notice may be provided on the Trust’s website, prospectus supplement, post-effective amendment or through a current report on Form 8-K and/or in the Trust’s annual or quarterly reports within a reasonable time of a material amendment.

2

Table of Contents

The Trustee

The Trustee, a national banking association, acts as the trustee of the Trust as required to create a Delaware statutory trust in accordance with the Trust Agreement and the Delaware Statutory Trust Act (“DSTA”). See “The Trustee.”

The Administrator

The Administrator is State Street Bank and Trust Company. The Administrator is generally responsible for the day-to-day administration and operation of the Trust, including: (1) valuing the Trust’s EUAs and calculating the net asset value and net asset value per share of the Trust; (2) supplying pricing information to the Sponsor for the Trust’s website; and (3) receiving and reviewing reports on the custody of and transactions in cash and EUAs from the Cash Custodian and the Union Registry, respectively, and taking such other actions in connection with the custody of cash as the Sponsor instructs. The general role and responsibilities of the Administrator are discussed in greater detail under the section “The Administrator.”

The Transfer Agent

The Transfer Agent is State Street Bank and Trust Company. Pursuant to the Transfer Agency and Service Agreement between the Trust and the Transfer Agent, the Transfer Agent serves as the Trust’s transfer agent and agent in connection with certain other activities as provided under the Transfer Agency and Service Agreement. The Transfer Agent’s responsibilities include: (1) receiving and processing orders from Authorized Participants for the creation and redemption of Baskets; and (2) coordinating the processing of orders from Authorized Participants with the Marketing Agent, the Trust, the Cash Custodian and The Depository Trust Company (“DTC”). See “The Transfer Agent.”

The Marketing Agent

Foreside Fund Services, LLC is the Marketing Agent. The Marketing Agent’s responsibilities include: (1) working with the Transfer Agent to review and accept or reject orders placed by Authorized Participants with the Transfer Agent; (2) reviewing and approving all sales and marketing materials for compliance with applicable laws, and filing such materials with FINRA as required by the Securities Act of 1933, as amended (the “Securities Act”), and the rules promulgated thereunder, and (3) facilitating arrangements between the Sponsor, the Transfer Agent and broker-dealers for the purchase and redemption of Baskets. All such sales and marketing materials must be approved, in writing, by the Marketing Agent prior to use.

Custodial Arrangements

State Street Bank and Trust Company is the custodian (the “Cash Custodian”) of the cash held by the Trust and has entered into the Cash Custody Agreement in connection therewith. All EUAs held by the Trust will be held and maintained in the Union Registry. See “The Cash Custodian” and “EUAs and the Carbon Credit Industry-Registry Accounts.”

Trust Objective

The investment objective of the Trust is for the Shares to reflect the performance of the price of EUAs, less the expenses of the Trust’s operations. The Trust intends to achieve this objective by investing substantially all of its assets in EUAs. The Trust will invest in EUAs on a non-discretionary basis (i.e., without regard to whether the value of EUAs is rising or falling over any particular period). As a result, the Trust will not attempt to speculatively sell EUAs at times when its price is high or speculatively acquire EUAs at low prices in the expectation of future price increases, nor will the Trust attempt to avoid losses or hedge exposure arising from the risk of changes in the price of EUAs.

The Trust may purchase or sell EUAs in connection with the purchase (creation) or redemption of Baskets by Authorized participants. For a creation in cash, the Authorized Participant will deliver the cash to the Trust’s account at the Cash Custodian, which the Sponsor will then use to purchase EUAs from a third party selected by the Sponsor who (1) is not the Authorized Participant and (2) will not be acting as an agent, nor at the direction, of the Authorized Participant with respect to the delivery of EUAs to the Trust (such third party, a “Liquidity Provider”). For a redemption in cash, the Sponsor shall arrange for the EUAs represented by the Basket to be sold to a Liquidity Provider selected by the Sponsor and the cash proceeds distributed from the Trust’s account at the Cash Custodian to the Authorized Participant

3

Table of Contents

in exchange for its Shares. In the case of “in-kind” creation or redemption orders for Shares, Authorized Participants may deliver or direct the delivery of EUAs by third parties, or take delivery or direct the taking of delivery of EUAs by third parties.

In addition to selling EUAs to distribute cash to Authorized Participants redeeming Shares, the Trust may sell EUAs to pay certain expenses not assumed by the Sponsor (described below), including the Sponsor’s Management Fee, which may be facilitated by one or more Liquidity Providers. All EUAs will be held in the Union Registry. The Transfer Agent will facilitate the processing of purchase and sale orders in Baskets from the Trust.

Summary Risk Factors

An investment in the Shares is speculative and involves a high degree of risk. There is no assurance the Trust will achieve its investment objective or avoid substantial losses. A potential shareholder should not invest in the Shares unless he or she can afford to lose the entire investment. Before investing in the Shares, a potential shareholder should be aware of the various risks of investing in the Trust, including those described below. Additional risks and uncertainties not presently known by the Trust or not presently deemed material by the Trust may also impair the Trust’s operations and performance. The summary risk factors set forth below are intended to highlight certain risks of investing in the Trust. A more extensive discussion of these risks appears beginning on page 9 in “Risk Factors.”

The Trust relies on the existence of cap and trade regimes and related markets to give EUAs value. Cap and trade regimes are new and based on scientific principles that are subject to debate. Cap and trade regimes have arisen primarily due to relative international consensus with respect to scientific evidence indicating a correlative relationship between the rise in global temperatures and extreme weather events, on the one hand, and the rise in GHG emissions in the atmosphere, on the other hand. If this consensus were to break down, cap and trade regimes and the value of the Trust may be negatively affected.

Scientists are still debating whether the rise in atmospheric GHGs is caused by human activity such as GHG emissions generated through the burning of fossil fuels, as well as the acceptable level of GHG concentrations in the atmosphere. If the science supporting the relationship or the acceptable level of GHG concentrations is discredited or proved to be incorrect or inaccurate, it may negatively affect cap and trade regimes and the value of the Trust.

There is no assurance that cap and trade regimes will continue to exist. cap and trade may not prove to be an effective method of reduction in GHG emissions. As a result or due to other factors, cap and trade regimes may be terminated or may not be renewed upon their expiration. The EU ETS is organized into a number of phases, each which a predetermined duration. Currently, the EU ETS is in Phase IV. There can be no assurance that the EU ETS will enter into a new phase as scheduled.

New technologies may arise that may diminish or eliminate the need for cap and trade markets. Ultimately, the cost of emissions credits is determined by the cost of actually reducing emissions levels. If the price of credits becomes too high, it will be more economical for companies to develop or invest in green technologies, thereby suppressing the demand for credits and adversely affecting the price of the Trust.

Cap and trade regimes set emission limits (i.e., the right to emit a certain quantity of GHG emissions), which can be allocated or auctioned to the parties in the mechanism up to the total emissions cap. This allocation may be larger or smaller than is needed for a stable price of credits and can lead to large price volatility, which could affect the value of the Trust. Depending upon the industries of end users of EUAs, unpredictable demand for their products and services can affect the value of GHG emissions credits. For example, very mild winters or very cool summers can decrease demand for electric utilities and therefore require fewer carbon credits to offset reduced production and GHG emissions.

The ability of the GHG emitting companies to pass on the cost of emissions credits to consumers can affect the price of the EUAs. If the price of emissions can be passed on to the end customer with little impact upon consumer demand, it is likely that industries may continue emitting and purchase any shortfall in the market at the prevailing price. If, however, the producer is unable to pass on the cost, it may be incentivized to reduce production in order to decrease its need for offsetting emissions credits, which could adversely affect the price of EUAs and the Trust.

4

Table of Contents

Regulatory risk related to changes in regulation and enforcement of cap and trade regimes could also adversely affect market behavior. If fines or other penalties for non-compliance are not enforced, incentives to purchase GHG credits will deteriorate, which could result in a decline in the price of emissions credits and a drop in the value of the Trust. In addition, as cap and trade markets develop, new regulation with respect to these markets may arise, which could have a negative effect on the value and liquidity of the cap and trade markets and the Trust.

If the Sponsor and the Trust are unable to raise sufficient funds so that revenues generated from the Sponsor’s Management Fee can cover Trust expenses, the Trust may be forced to terminate and investors may lose all or part of their investment. Assuming the Trust’s ordinary operating expenses amount to $100,000 in a year, the Trust would have to raise approximately $13,000,000 in assets for the Sponsor’s Management Fee to cover trust expenses. Likewise, if the annual ordinary operating expenses of the Trust amount to $200,000 or $300,000, the Trust would have to raise approximately $25,000,000 and $38,000,000, respectively, in assets in order for the Sponsor’s Management Fee to cover Trust expenses. While the Sponsor is not able to cover Trust expenses indefinitely, there is no minimum amount of Trust assets below which the Sponsor would automatically terminate the Trust.

Principal Offices

The offices of the Trust and the Sponsor are located at 140 Elm Street, Suite 6, New Canaan, CT 06840 and the Trust’s telephone number is (203) 594-9988. The office of the Trustee is located at 1100 North Market Street, Wilmington, Delaware 19890. The offices of the Administrator, Transfer Agent and Cash Custodian are located at One Lincoln Street, Boston, Massachusetts 02110. The offices of the Marketing Agent are located at Three Canal Plaza, Suite 100, Portland, Maine 04101. The offices of the Dutch Emissions Authority, which administers the Dutch section of the Union Registry are located at PO Box 91503, 2509 EC The Hague, The Netherlands.

Emerging Growth Company Status

The Trust is an “emerging growth company,” as defined in the JOBS Act, and is eligible to take advantage of certain exemptions from various reporting requirements that are applicable to other public companies that are not “emerging growth companies” including, but not limited to, not being required to comply with the auditor attestation requirements of Section 404 of the Sarbanes-Oxley Act of 2002 and reduced disclosure obligations that are not otherwise applicable to the Trust. In addition, Section 107 of the JOBS Act also provides that an “emerging growth company” can take advantage of the extended transition period provided in Section 7(a)(2)(B) of the Securities Act, for complying with new or revised accounting standards. In other words, an “emerging growth company” can delay the adoption of certain accounting standards until those standards would otherwise apply to private companies. However, the Trust is choosing to “opt out” of such extended transition period, and as a result, will comply with new or revised accounting standards on the relevant dates on which adoption of such standards is required for non-emerging growth companies. Section 107 of the JOBS Act provides that the decision to opt out of the extended transition period for complying with new or revised accounting standards is irrevocable.

5

Table of Contents

THE OFFERING

Offering | | The Shares represent units of fractional undivided beneficial interest in the net assets of the Trust. |

Use of proceeds | | Proceeds received by the Trust in the form of deposits from the issuance of Baskets consist of either EUAs or cash. Deposits of cash are held by the Cash Custodian and will be used to purchase the applicable amount of EUAs. The Trust’s EUAs are at all times maintained in the Union Registry. Such deposits are held by the Trust until (i) delivered to Authorized Participants or sold for cash in connection with redemptions of Baskets or (ii) EUAs are sold for cash or transferred to the Sponsor in-kind to pay the Sponsor’s Management Fee or other Trust expenses and liabilities not assumed by the Sponsor, is any. |

Ticker Symbol | | CTWO |

CUSIP | | 222067 100 |

Creation and Redemption | | The Trust issues “Baskets,” each equal to 50,000 Shares, to Authorized Participants in exchange for EUAs or cash. Conversely, the Trust delivers EUAs or cash in exchange for Baskets surrendered to it for redemption by Authorized Participants. The Trust issues and redeems Baskets on a continuous basis only to Authorized Participants. Baskets are only issued or redeemed in exchange for the amount of EUAs or cash determined by the Administrator on each day that the Exchange is open for regular trading based on the combined net asset value of the Shares included in the Baskets being created or redeemed. For a cash creation, the Authorized Participant will deliver the cash to the Trust’s account at the Cash Custodian, which the Sponsor will then use to purchase EUAs from a Liquidity Provider. For a cash redemption, the Sponsor shall arrange for the EUAs represented by the Basket to be sold to a Liquidity Provider selected by the Sponsor and the cash proceeds distributed from the Trust’s account at the Cash Custodian to the Authorized Participant in exchange for its Shares. In the case of “in-kind” creation or redemption orders for Shares, Authorized Participants may deliver or direct the delivery of EUAs by third parties, or take delivery or direct the taking of delivery of EUAs by third parties. No Shares are issued unless the Trust confirms that it has been allocated the corresponding amount of EUAs or cash. |

| | | The initial amount of EUAs or cash required for deposit with the Trust to create Shares will be the value of 10,000 EUAs per Basket. |

| | | Fees are assessed in connection with the creation and redemption of Baskets by Authorized Participants. See “Creation and Redemption of Shares” for more details. |

Net Asset Value | | Net asset value means the total assets of the Trust including, but not limited to, all EUAs and cash (if any) less total liabilities of the Trust, each determined on the basis of generally accepted accounting principles. |

6

Table of Contents

| | The Administrator determines the NAV of the Trust on each day that the Exchange is open for regular trading, as promptly as practical after 4:00 PM E.T. The net asset value of the Trust is the aggregate value of the Trust’s assets less its estimated accrued but unpaid liabilities (which include accrued expenses). In determining the Trust’s net asset value, the Administrator values the EUAs held by the Trust based on the EUA End of Day Index value as established by the European Energy Exchange AG (“EEX”). The value of the EUA End of Day Index is published daily on the EEX website. The Administrator converts the value of Euro denominated assets into the U.S. dollar equivalent using published foreign currency exchange prices by an independent pricing vendor. The Administrator also determines the NAV per Share. |

Trust Fees and Expenses | | The Trust’s only ordinary recurring expenses are expected to be the Sponsor’s Management Fee, paid monthly in arrears, in an amount equal to 0.79% per annum of the daily NAV of the Trust. In exchange for the Management Fee, the Sponsor has agreed to assume all routine operational, administrative and other ordinary expenses of the Trust, including, but not limited to, each of the Trustee’s, Administrator’s, Cash Custodian’s, Transfer Agent’s and Marketing Agent’s monthly fee and out-of-pocket expenses and expenses reimbursable in connection with such service provider’s respective agreement; the marketing support fees and expenses; exchange listing fees; SEC registration fees; printing and mailing costs; maintenance expenses for the Trust’s website; audit fees and expenses; and routine legal expenses. The routine ordinary expenses assumed by the Sponsor on behalf of the Trust are not subject to any caps. The Sponsor also paid the costs of the Trust’s organization and the initial sale of the Shares. The Trust will be responsible for reimbursing the Sponsor or its affiliates for paying all the extraordinary fees and expenses, if any, of the Trust. Extraordinary fees and expenses are fees and expenses which are non-recurring and unusual in nature, such as legal claims and liabilities, litigation costs or indemnification or other unanticipated expenses. Such extraordinary fees and expenses, by their nature, are unpredictable in terms of timing and amount. The Trust will either (i) cause the Sponsor to receive EUAs from the Trust in such quantity as may be necessary to pay the Management Fee or (ii) sell EUAs in such quantity as may be necessary to permit payment in cash of the Management Fee and other Trust expenses and liabilities not assumed by the Sponsor, if any. |

Organization and Offering Expenses | | The Sponsor will be responsible for paying all of the expenses incurred in connection with organizing the Trust as well as the expenses incurred in connection with the offering of the Trust’s Shares. |

Extraordinary Fees and Expenses | | The Trust will be responsible for paying, or for reimbursing the Sponsor or its affiliates for paying, all the extraordinary fees and expenses, if any, of the Trust. Extraordinary fees and expenses are fees and expenses which are non-recurring and unusual in nature, such as legal claims and liabilities, litigation costs or indemnification or other unanticipated expenses. Extraordinary fees and expenses also include material expenses which are not currently anticipated obligations of the Trust. Such extraordinary fees and expenses, by their nature, are unpredictable in terms of timing and amount. |

7

Table of Contents

Tax Considerations | | A shareholder will be treated, for U.S. federal tax purposes, as if it directly owns a pro rata share of the Trust’s assets and directly receives that share of any Trust income and incurs that share of the Trust’s expenses. Shareholders of the Trust will be subject to U.S. federal income tax on their allocable share of the Trust’s taxable income, whether or not they receive cash distributions. Each delivery, transfer or sale of EUAs by the Trust to pay the Trust’s expenses, such as the Sponsor’s Management Fee, could be a taxable event to shareholders. See “Federal Income Tax Consequences — Taxation of U.S. Shareholders” and “Purchases by Employee Benefit Plans.” |

Suspension of Issuance,

Transfers and Redemptions | |

The Sponsor may suspend the delivery or registration of transfers of Shares, or may refuse a particular deposit or transfer at any time, if the Sponsor considers it advisable or necessary for any reason. Redemptions by Authorized Participants of Shares may and, on the direction of the Sponsor, shall, be generally suspended or particularly rejected by the Transfer Agent or Marketing Agent (1) during any period in which regular trading on the Exchange, the New York Stock Exchange, EEX, ICE Endex or other exchange material to the valuation or operation of the Fund is closed, or when trading is suspended or restricted on such exchanges in EUAs or Daily EUA Futures, other than customary weekend or holiday closings, or trading of Shares on the Exchange is suspended or restricted, (2) the order is not in proper form as determined by the Trust, Transfer Agent or Marketing Agent, or (3) during an emergency as a result of which delivery, disposal or evaluation of EUAs is not reasonably practicable. In the event that the Sponsor intends to suspend or postpone redemptions, it will provide shareholders with notice in a prospectus supplement and/or through a current report on Form 8-K or in the Trust’s annual or quarterly reports. In addition, the Trust will reject a redemption order if the fulfillment of the order might be unlawful or if, as a result of the redemption, the number of remaining outstanding Shares would be reduced to fewer than the number of Shares in one Basket. See “Creation and Redemption of Shares — Rejection of purchase orders” and “Creation and Redemption of Shares — Suspension or rejection of redemption orders.”

|

Termination Events | | The Trust will terminate and liquidate if certain events occur. See “Description of the Trust — Termination of the Trust.” |

Authorized Participants | | Authorized Participants may create and redeem Baskets. |

| | | Each Authorized Participant must: (1) be a registered broker-dealer and a member in good standing with the Financial Industry Regulatory Authority (“FINRA”); (2) be a participant in DTC; and (3) have entered into an agreement with the Sponsor and the Transfer Agent (the “Authorized Participant Agreement”). The Authorized Participant Agreement provides the procedures for the creation and redemption of Baskets. A list of the current Authorized Participants can be obtained from the Administrator or the Sponsor. |

Clearance and Settlement | | The Shares will be evidenced by one or more global certificates that the Trust will issue to DTC. The Shares are issued only in book-entry form. Shareholders may hold their Shares through DTC, if they are participants in DTC, or indirectly through entities that are participants in DTC. |

8

Table of Contents

RISK FACTORS

Before making an investment decision, you should consider carefully the risks described below, as well as the other information included in this prospectus.

Risks Related to the Trust’s Investments

Because the Shares are created to reflect the price of the EUAs held by the Trust, the market price of the Shares may be as unpredictable as the price of EUAs has historically been. This creates the potential for losses, regardless of whether you hold Shares for the short-, mid- or long-term.

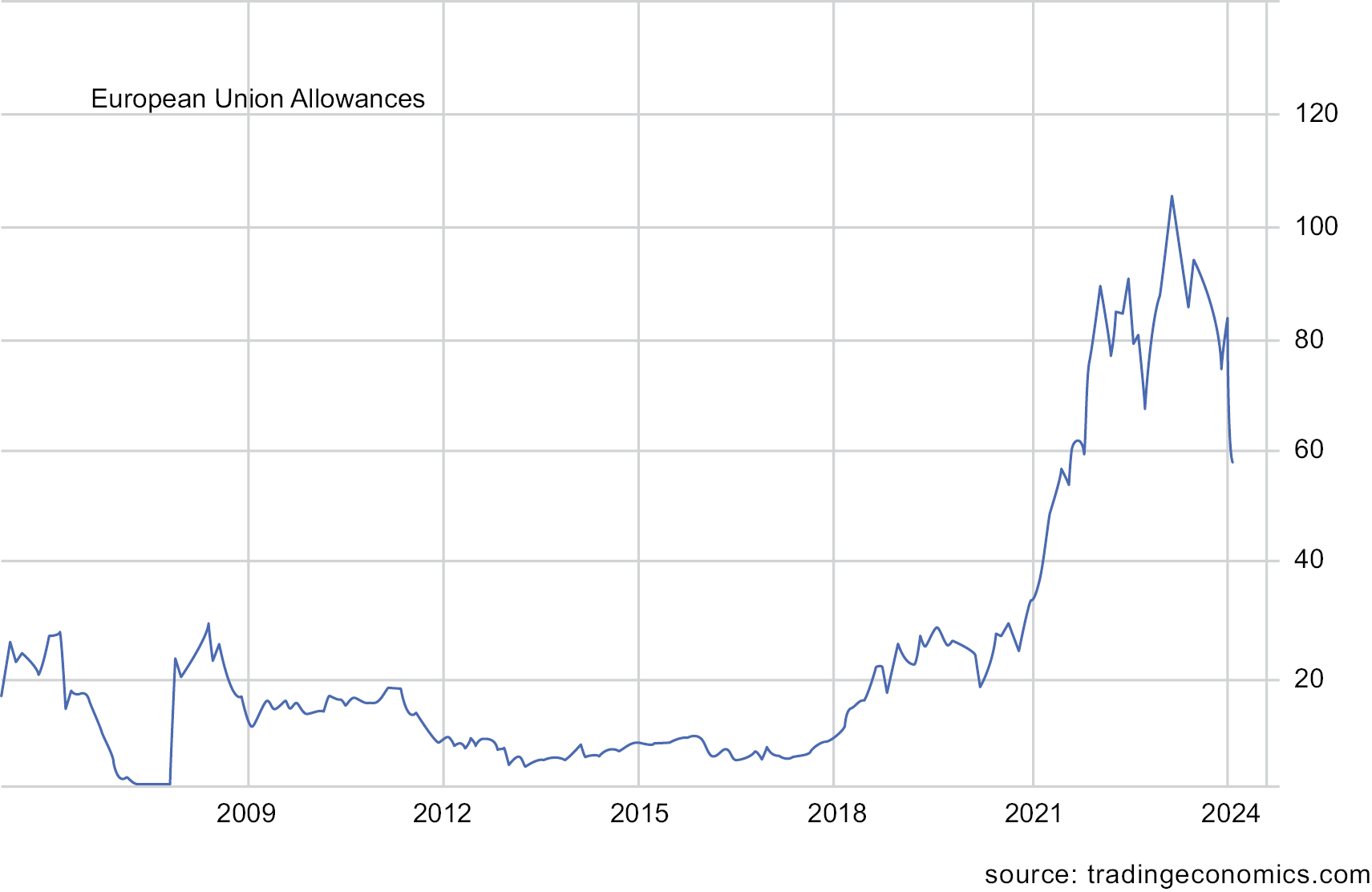

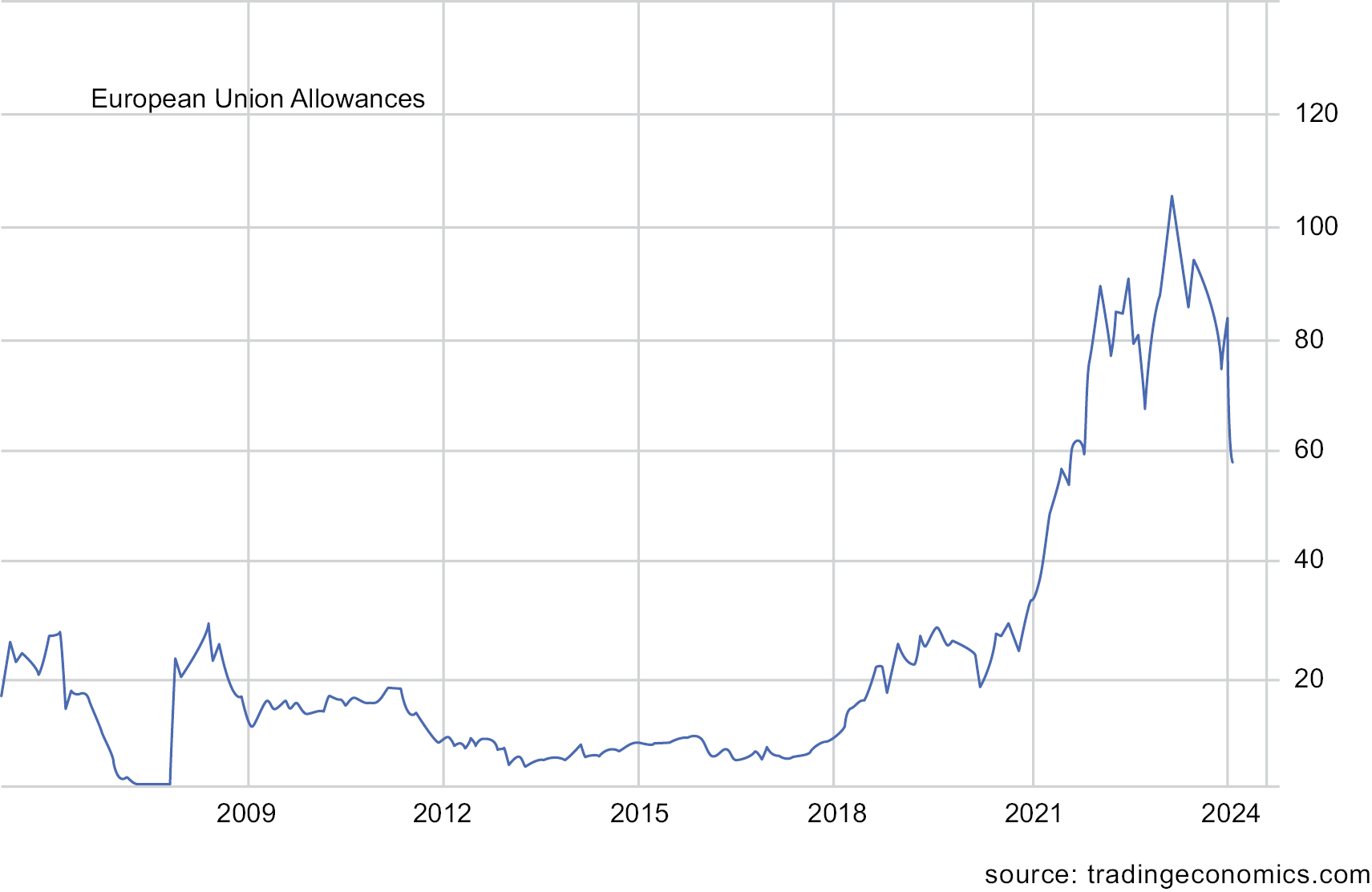

Shares are created to reflect, at any given time, the market price of EUAs owned by the Trust at that time, less the Trust’s expenses and liabilities. Because the value of Shares depends on the price of EUAs, it is subject to fluctuations similar to those affecting EUA prices. Although the price of EUAs has increased steadily since 2018, the price has also fluctuated widely (between €15 and €96 per EUA) in response to certain events including the COVID-19 pandemic and the Ukraine War. If EU ETS continues to be characterized by the wide fluctuations that it has shown in the past several years, the price of the Shares may change widely and in an unpredictable manner. This exposes shareholders to potential losses if they need to sell their Shares at a time when the price of an EUA is lower than it was when the shareholder made its investment in Shares. Even if a shareholder is able to hold Shares for the mid- or long-term the shareholder may never realize a profit, because EU ETS has historically experienced extended periods of flat prices, and has only recently (since 2018) seen consistent prices above €20 per Carbon Credit.

The price of EUAs is affected by numerous factors beyond the Trust’s control, including the following:

(a) Global or regional political, economic, environmental or financial events and situations (including pandemics, such as COVID-19) that depress economic activity may weaken demand for EUAs, and thus cause their price to fall. Very mild winters or very cool summers can decrease demand for electricity and therefore cause utilities to purchase fewer EUAs thus causing their price to fall.

(b) Investors’ expectations with respect to the future rates of inflation and movements in world equity, financial, environmental, commodity and property markets, and returns available in other investment markets may impact the extent to which investors allocate capital to investments in EUAs.

(c) The activities and emissions of energy-intensive sectors (including manufacturing facilities, oil refineries, power stations and, aviation) may impact the demand for EUAs; specifically, weaker activity in such sectors may reduce the demand for EUAs and cause their price to fall.

(d) The relevant rules of cap and trade programs outside the EU (including how allowances are made available to operators or market participants, such as free allocations or auctions) and links put in place between mandatory cap and trade programs and voluntary schemes (enabling carbon allowances of one mandatory program or voluntary scheme to be used for the purposes of another mandatory program or voluntary scheme) may impact the supply of EUAs; for example, if entities are able to purchase carbon allowances from other programs or voluntarily schemes, this could increase the supply of EUAs, and thus reduce their price.

(e) The rate of progress in the innovation, introduction and expansion of technologies and techniques in the reduction of emissions of greenhouse gases (or the capture and storage thereof). Advances in technologies for the reduction of greenhouse gases may result in companies being able to reduce their greenhouse gas emissions more quickly and cheaply, thus needing to purchase fewer EUAs which may cause the price of EUAs to fall.

(f) The use by governments of different policies to encourage or require the reduction of emissions of greenhouse gases (or the capture and storage thereof) or for other environmental goals may reduce the incentive for companies to purchase EUAs (as against taking other actions), thus causing the price of EUAs to fall.

9

Table of Contents

(g) Lobbyist, political or governmental goals or policies with respect to climate change and the imposition of environmental plans or climate goals such as achieving carbon neutrality may impact the demand for EUAs. If government environmental or climate goals or policies are perceived to be weaker or less credible this may reduce the demand for EUAs and may cause their price to fall.

(h) The cost and implications of non-compliance with the EU ETS (including both monetary and non-monetary penalties on operators subject to EU ETS for failure to surrender sufficient EUAs) may impact an operator’s willingness to pay for EUAs if the penalties associated with non-compliance are less costly than purchasing EUAs. These penalties (and any costs associated with them) may impose an implicit price ceiling on EUAs. Lower penalties and costs may result in lower Carbon Credit prices.

(i) Investment and trading activities of hedge funds, commodity funds and other speculators may impact the demand for EUAs. For example, lower demand for EUAs from speculators may cause the demand for EUAs to be lower than otherwise and thus may cause their price to fall.

(j) Interest rates and currency exchange rates, particularly the strength of and confidence in the Euro may impact the demand for EUAs. A reduction in the strength of, or confidence in, the Euro may reduce demand for assets denominated in that currency and thus may cause the price of those assets, including EUAs, to fall.

(k) The ability of the GHG emitting companies to pass on the cost of emissions credits to consumers can affect the price of the EUAs. If the producer is unable to pass on the cost, it may be incentivized to reduce production in order to decrease its need for offsetting emissions credits, which could adversely affect the price of EUAs and the Trust.

Conversely, several factors may trigger a temporary increase in the price of EUAs prior to your investment in the Shares. If that is the case, you may be buying Shares at prices affected by the temporarily high prices of EUAs, and you may incur losses when the causes for the temporary increase disappear.

Legal or Regulatory Risks Relating to Changes to a Cap and Trade Program

Regulatory risk related to changes in regulation and enforcement of cap and trade regimes could also adversely affect market behavior. If fines or other penalties for non-compliance are not enforced, incentives to purchase GHG credits may deteriorate, which could result in a decline in the price of emissions credits and a drop in the value of the Trust. In addition, as cap and trade markets develop, new regulation with respect to these markets may arise, which could have a negative effect on the value and liquidity of the cap and trade markets and the Trust.

EUAs can only be traded in accordance with the EU ETS, which was established pursuant to the EU ETS Directive and Registries Regulation. Changes in these and other laws and regulations (or prospective changes to any of them) may affect the market value and liquidity of EUAs, the market value and liquidity of the Trust’s Shares, and the ability of the Trust to continue to offer its Shares.

The laws and regulations governing the operation of and access to the EU ETS may be amended and this may affect, without limitation:

(a) the ability of the Trust to buy, sell, transfer or hold EUAs;

(b) the cap or allocation of the number of EUAs available, for example, a higher cap or allocation of EUAs would increase their supply, and may also reduce demand for EUAs and thereby cause the price of EUAs and the value of the Trust’s Shares to fall; and

(c) the operational aspects of the effective transfer of EUAs, and therefore the operations relating to the redemption of the Trust’s Shares, for example, changes to operations could slow settlement of redemptions of the Trust’s Shares, exposing redeeming Authorized Participants, and shareholders, to possible falls in price for an extended period of time.

10

Table of Contents

Abandonment, termination or non-renewal of an EUA trading scheme may cause the price of EUAs to fall (potentially to zero).

EUAs have no use outside of the cap and trade program under which they can be allocated and traded. There is no assurance that any particular cap and trade program, including the EU ETS, will continue to exist. Cap and trade programs may not prove to be an effective method of reduction in greenhouse gas emissions. As a result or due to other factors, a cap and trade program may be terminated or may not be renewed upon its expiration.

If it was announced that the EU ETS would terminate or not be renewed then this could result in reduced demand for EUAs and the liquidation or termination of the Trust. The announcement and other steps taken in relation to the termination or non-renewal could also reduce the demand for EUAs, thereby causing the price of EUAs and the value of the Trust’s Shares to fall (potentially to zero). The termination of a cap and trade program outside of the EU ETS could impact the longevity and stability of other cap and trade programs across the globe, and influence other governments to support similar terminations. One or all of these events, in turn, could cause investors in the Trust to suffer a loss of some or all of their investment.

Cap and trade regimes and related markets are new and based on scientific principles that are subject to debate. Cap and trade regimes have arisen primarily due to relative international consensus with respect to scientific evidence indicating a correlative relationship between the rise in global temperatures and extreme weather events, on the one hand, and the rise in Greenhouse Gas (“GHG”) emissions in the atmosphere, on the other hand. If this consensus were to break down, cap and trade regimes and the value of the Trust may be negatively affected.

Scientists are still debating whether the rise in atmospheric GHGs is caused by human activity such as GHG emissions generated through the burning of fossil fuels, as well as the acceptable level of GHG concentrations in the atmosphere. If the science supporting the relationship or the acceptable level of GHG concentrations is discredited or proved to be incorrect or inaccurate, it may negatively affect cap and trade regimes and the value of the Trust.

There is no assurance that cap and trade regimes will continue to exist. Cap and trade may not prove to be an effective method of reduction in GHG emissions. As a result or due to other factors, cap and trade regimes may be terminated or may not be renewed upon their expiration. The EU ETS is organized into a number of phases, each which a predetermined duration. Currently, the EU ETS is in Phase IV. There can be no assurance that the EU ETS will enter into a new phase as scheduled.

New technologies may arise that may diminish or eliminate the need for cap and trade markets. Ultimately, the cost of emissions credits is determined by the cost of actually reducing emissions levels. If the price of credits becomes too high, it will be more economical for companies to develop or invest in green technologies, thereby suppressing the demand for credits and adversely affecting the price of the Trust.

Future governmental decisions may have significant impact on the price of EUAs, which may result in a significant decrease or increase in the net asset value of the Trust.

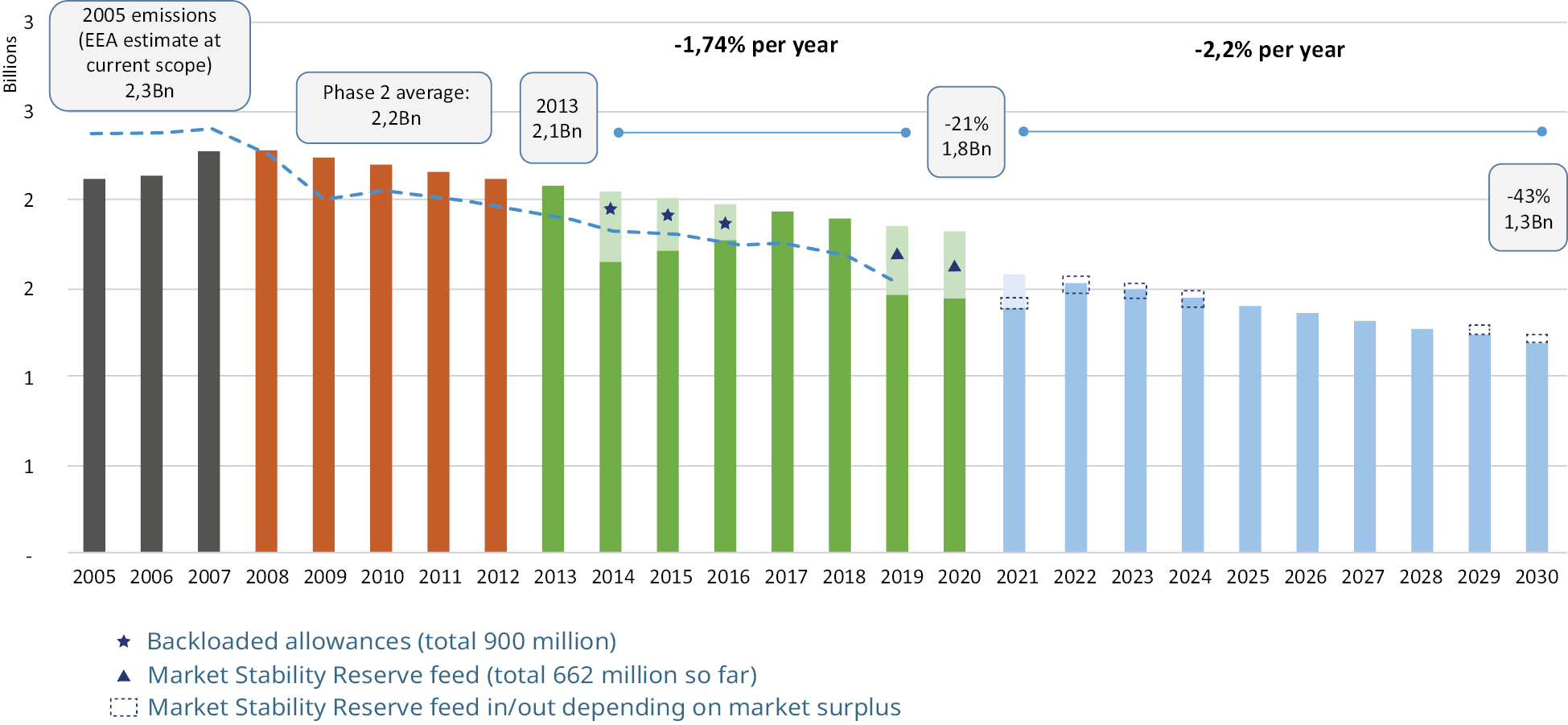

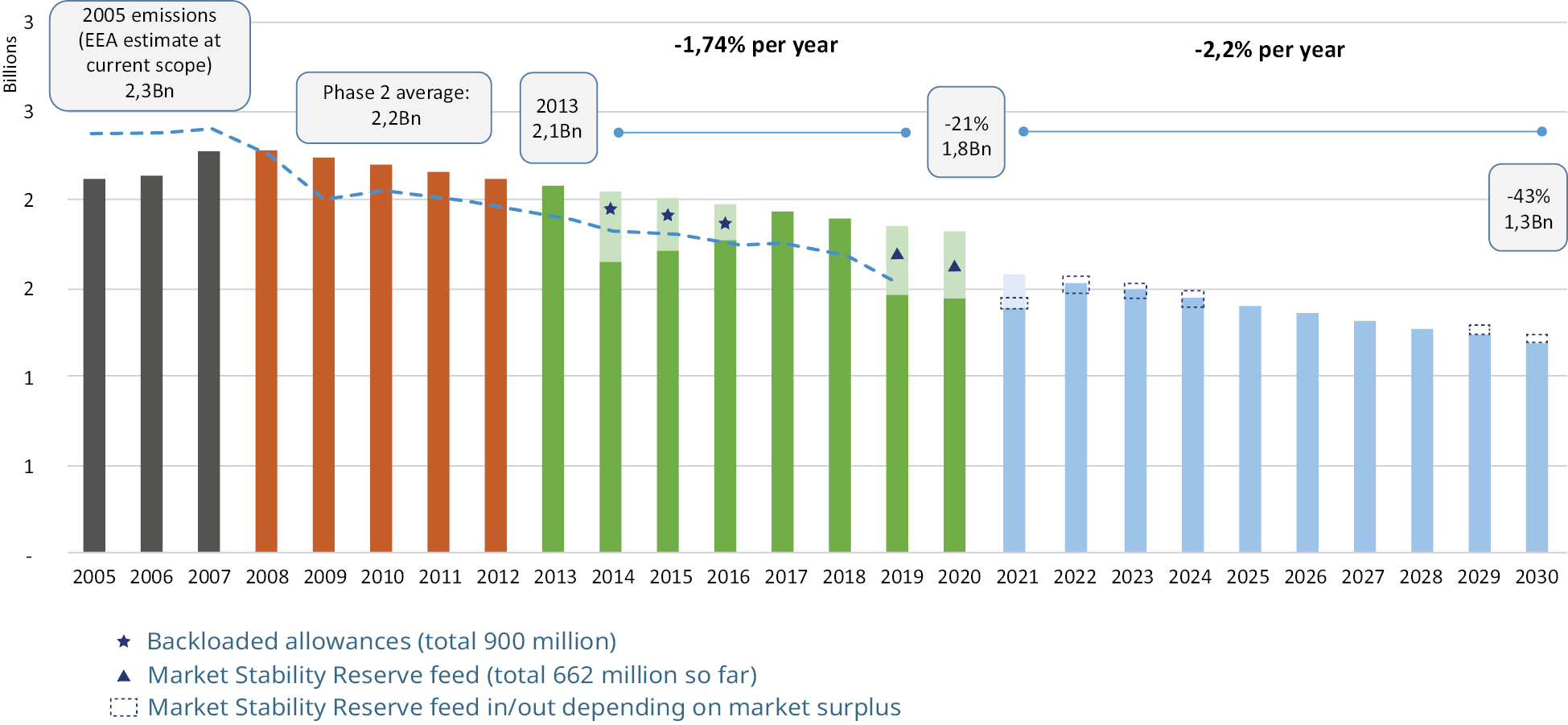

Generally, EUA prices reflect the supply and demand of available EUAs. The availability of EUAs is determined by the EU parliament together with the EU member nation representatives. As such, decisions by the EU and its member nations have a significant impact on the supply and demand of EUAs. The EU ETS is organized into a number of phases with pre-determined durations, but extenuating circumstances can result in changes to the phase plans. For example, the global economic crisis of 2008 occurred at the beginning of Phase II, which lasted from 2008 to 2012. Even though the cap on EUAs had been reduced for Phase II, the economic downturn of 2008 resulted in an unexpected reduction in emissions, which in turn resulted in a surplus of EUAs (and low Carbon Credit prices) throughout Phase II. In response to this surplus, the EU held back the auction of approximately 900 million EUAs, and implemented the Market Stability Reserve (“MSR”). The MSR is a system under which EUAs are added to, or removed from, the market based on certain thresholds in order to avoid extreme surpluses or shortages. After the implementation of the MSR, the price of EUAs has steadily increased. More recently, in December 2022, the European parliament and EU country representatives provisionally agreed on a Carbon Border Adjustment Mechanism (“CBAM”) that would require certain importers to the EU to essentially pay a tax that equates to the price of EUAs they would have needed to buy under the EU ETS if their product was produced in the EU. It is unclear what, if any, impacts CBAM may have on the price of EUAs. Future governmental decisions may have an impact on the supply and demand and price of EUAs, which may result in a significant decrease or increase in the net asset value of the Trust.

11

Table of Contents

Because the Trust is not a diversified investment, it may be more volatile than other investments.

An investment in the Trust is not intended as a complete investment plan. Because the Trust only holds EUAs or cash, an investment in the Trust may be more volatile than an investment in a more broadly diversified portfolio. Accordingly, the NAV may be more volatile than another investment vehicle with a more broadly diversified portfolio and may fluctuate substantially over time. An investment in the Trust may be deemed speculative, therefore investors should review closely the objective and strategy, the investment and operating restrictions and the redemption provisions of the Trust as outlined herein and familiarize themselves with the risks associated with an investment in the Trust.

War and other geopolitical events, including but not limited to the war between Russia and Ukraine, outbreaks or public health emergencies (as declared by the World Health Organization), the continuation or expansion of war or other hostilities, or a prolonged government shutdown may cause volatility in the price of EUAs. These events are unpredictable and may lead to extended periods of price volatility.

The operations of the Trust, the exchanges, brokers and counterparties with which the Trust interacts, and the markets in which the Trust does business could be severely disrupted in the event of a major terrorist attack, cyber-attack, data breach, outbreak or public health emergency as declared by the World Health Organization (such as the spread of the novel coronavirus known as COVID-19), or the continuation or expansion of war or other hostilities.

In late February 2022, Russia launched an invasion of Ukraine, significantly amplifying already existing geopolitical tensions among Russia and other countries in the region and in the west. The responses of countries and political bodies to Russia’s actions, the larger overarching tensions, and Ukraine’s military response and the potential for wider conflict may increase financial market volatility generally, have severe adverse effects on regional and global economic markets, and cause volatility in the price of EUAs and the share price of the Trust. The conflict in Ukraine, along with global political fallout and implications including sanctions, shipping disruptions, collateral war damage, and a potential expansion of the conflict beyond Ukraine’s borders, has and could continue to disturb the EUAs market. Russia has historically been the primary supplier of natural gas to Europe. After the invasion of Ukraine, Russia cut off much of the gas it was supplying to Europe and several supply pipelines were damaged. This shortage of gas caused European countries to seek other natural gas suppliers, and to seek alternative energy sources such as coal, which may increase emissions in the short term and require the purchase of EUAs. This disruption in the energy supply caused volatility in the Carbon Credit market. The duration and extent of the Carbon Credit market volatility is unknown and impossible to predict. Future acts of war or geopolitical events in Europe, or countries economically tied to Europe may cause volatility in the Carbon Credit markets. These events are unpredictable and may lead to extended periods of price volatility.

Global terrorist attacks, anti-terrorism initiatives, and political unrest, as well as the adverse impact the COVID-19 pandemic has had on the global markets and economy, continue to fuel concerns. For example, the COVID-19 pandemic may continue to adversely impact the level of services currently provided by the EU and its member nations, could weaken the European economy, and interfere with Carbon Credit markets that rely upon data published by EU governmental agencies. The types of events discussed above, including the COVID-19 pandemic, are highly disruptive to economies and markets and have recently led, and may continue to lead, to increased market volatility and significant market losses.

More generally, a climate of uncertainty and panic, including the contagion of the COVID-19 virus and other infectious viruses or diseases, may adversely affect global, regional, and local economies and reduce the availability of potential investment opportunities, and increases the difficulty of performing due diligence and modeling market conditions, potentially reducing the accuracy of financial projections. Under these circumstances, the Trust may have difficulty achieving its investment objective which may adversely impact performance. Further, such events can be highly disruptive to economies and markets, significantly disrupt the operations of individual companies (including, but not limited to, the Sponsor and third party service providers), sectors, industries, markets, securities and commodity exchanges, currencies, interest and inflation rates, credit ratings, investor sentiment, and other factors affecting the value of the Trust’s assets. These factors could cause substantial market volatility, exchange trading suspensions and closures that could impact the ability of the Trust to complete redemptions and otherwise affect Trust performance and Trust trading in the secondary market. A widespread crisis may also affect the global economy in ways that cannot necessarily be foreseen at the current time. How long such events will last and whether they will continue or recur cannot be predicted. Impacts from these events could have significant impact on the Trust’s performance, resulting in losses for shareholders of the Trust. The current and future global economic impact may cause the underlying assumptions and expectations of the Trust to become outdated quickly or inaccurate, resulting in significant losses.

12

Table of Contents

Trading on exchanges outside the United States is generally not subject to U.S. regulation and may result in different or diminished investor protections.

To the extent that the Trust places trades on exchanges outside the United States, trading on such exchanges is generally not regulated by any U.S. governmental agency and may involve certain risks not applicable to trading on U.S. exchanges, including different or diminished investor protections. Investors could incur substantial losses from trading on foreign exchanges which such investors would not have otherwise been subject had the Trust’s trading been limited to U.S. markets.

The Trust will face currency exchange rate risk.

The Trust will invest in EUAs which are denominated in Euros. Changes in currency exchange rates and the relative value of the Euro will affect the value of the Trust’s investments and the value of your Shares. Because the Trust’s NAV is determined in U.S. dollars, the Trust’s NAV could decline if the Euro depreciates against the U.S. dollar, even if the value of the EUAs held by the Trust, denominated in Euros, increases. Currency exchange rates can be extremely volatile and can change quickly and unpredictably. As a result, the value of the Trust’s investments may change quickly and without warning and the Trust may lose money.

As the above chart shows, throughout the past approximately 50 years the relationship between the U.S. dollar and the Euro has shifted dramatically. The relationship between the two currencies generally tracks the relative performance of the two economies and may react as one country’s (or currency zone’s) economy is outperforming the other. These periods of outperformance can cause dramatic swings in the relative value of the currencies. There have been periods during which the U.S. dollar depreciated by almost 50% against the Euro (2002 – 2009) as well as periods during which the U.S. dollar appreciated by similar proportions (1980 – 1984). These movements have tended to revert towards the historical

13

Table of Contents

average exchange rate of 1.194 Euro/U.S. dollar. As the Trust’s NAV is calculated in U.S. dollars, the Trust’s NAV may change, even if the Euro denominated value of the Trust’s assets do not, based upon currency exchange rate fluctuations. There will be periods when exchange rate fluctuations benefit the Trust, such as when the Euro is appreciating relative to the U.S. dollar, and periods when exchange rate fluctuations negatively impact the Trust, such as when the U.S. dollar appreciates relative to the Euro. Currency exchange rate fluctuations are beyond the control of the Trust and the Trust will not hedge against their impact. As of March 8, 2024, the exchange rate was 1.0943 Euro/U.S. dollar.

There are no position limits or accountability levels on EUAs, which, despite the large trading volume of EUAs, could theoretically allow a single investor or a group of investors to exert significant influence on the price of EUAs.

Unlike with certain commodity interests traded on designated contract markets, there are no position limits on the maximum net long or net short EUA futures contracts that any single investor or group of investors under common trading control may hold, own or control. Additionally, there are no accountability levels over which the exchanges on which EUA futures contracts are traded may exercise greater scrutiny and control over an investor’s or group of investors’ positions. While this theoretically could allow a single investor or group of investors to exert significant influence over the price of EUAs, and in the extreme case, “corner the market,” this is mitigated and made unlikely by the large daily trading volume of EUAs, which on January 31, 2023 for example, amounted to approximately 5.8 million EUAs, between the spot and futures markets, combined. Should there be any serious supply issues with regard to EUAs and the price of EUAs rises above a certain level, the MSR would likely increase the auction supply of EUAs in order to moderate the price of EUAs.

The fragmented nature of data regarding the EU carbon market and the lack of a centralized market monitoring of the EU carbon market may make it more difficult to identify potential market manipulation and abusive practices.

Due to the existing legal framework, data regarding the EU carbon market is fragmented, with each available dataset having a specific scope regarding the counterparties and types of instruments covered. Additionally, while all EU ETS operations have been centralized in the Union Registry since 2012, there is no centralized market monitoring of the EU Carbon Market and is instead largely conducted by individual EU member states, namely Germany, Netherlands and Norway. As a result of this lack of centralized market monitoring of the EU carbon market at the EU level, tools to detect and deter fraudulent or manipulative trading activities (such as market manipulation, front-running of trades, and “wash-trading”) may not be available to or employed by EUA markets or may not exist at all.

As a result of reduced oversight, these schemes may be more prevalent in EUA markets than in the general market for financial products. The potential consequences of the EUA market’s failure or failure to prevent market manipulation could adversely affect the value of the Shares. Any market abuse, and a loss of investor confidence in EUAs, may adversely impact pricing trends in EUA markets broadly, as well as an investment in Shares of the Trust.

Risks Related to the Trust’s Structure

The amount of EUAs represented by each Share will decrease over the life of the Trust due to the sale of EUAs necessary to pay the Sponsor’s Management Fee and Trust expenses. Without increases in the price of EUAs sufficient to compensate for that decrease, the price of the Shares will also decline and you will lose money on your investment in Shares.

Because the Trust does not have any income, it needs to sell EUAs to cover its expenses. Even if there are no expenses other than those assumed by the Sponsor, and there are no other liabilities of the Trust, the Trust will still need to sell EUAs to pay the Sponsor’s Management Fee. The result of these sales is a decrease in the amount of EUAs represented by each Share. New EUAs, received in exchange for new Shares issued by the Trust, do not reverse this trend.

A decrease in the amount of EUAs represented by each Share results in a decrease in its price even if the price of EUAs has not changed. To retain the Share’s original price, the price of EUAs has to increase. Without that increase, the lesser amount of EUAs represented by the Share will have a correspondingly lower price. If these increases do not occur, or are not sufficient to counter the lesser amount of EUAs represented by each Share, you will sustain losses on your investment in Shares.

14

Table of Contents

An increase in the Trust expenses not assumed by the Sponsor, or the existence of unexpected liabilities affecting the Trust, will force the Trust to sell larger amounts of EUAs, and will result in a more rapid decrease of the amount of EUAs represented by each Share and a corresponding decrease in its value.

The amount of EUAs represented by each Share will decrease over the life of the Trust due to the disregarding of fractions of an EUA smaller than one EUA for purposes of computing the Basket Deposit (as defined below). Without increases in the price of EUAs sufficient to compensate for that decrease, the price of the Shares will also decline and you will lose money on your investment in Shares.

Due to changes in the Trust’s NAV attributable to sales of EUAs to pay fund expenses, the Basket Deposit, calculated as described in “Determination of Required Deposits,” below, may include fractional EUAs. The Trust’s policy is to disregard such fractional amounts because they are deemed to represent de minimis amounts relative to the value of a Basket. Because the Trust will not receive EUAs equal to the full value of a Basket, the interest on each of the existing shareholders of the Trust will be slightly diluted with the issuance of new Baskets. The dilution will be equal to the value of the disregarded fractional EUA, divided equally over all of the existing Shares prior to the creation. The dilution of a Share’s value will never amount to the value of one EUA, divided by the total number of Shares. To retain the Share’s original price, the price of EUAs has to increase. Without that increase, the lesser amount of EUAs represented by the Share will have a correspondingly lower price. If these increases do not occur, or are not sufficient to counter the lesser amount of EUAs represented by each Share, you will sustain losses on your investment in Shares.

The Trust is a passive investment vehicle. This means that the value of your Shares may be adversely affected by Trust losses that, if the Trust had been actively managed, it might have been possible to avoid.

The Trust will seek to hold EUAs during periods in which daily changes in the price of EUAs are flat or declining as well as when they are rising, and will not actively manage the Trust based on any other discretionary criteria. For example, if the Trust’s EUAs are declining in value, the Trust will not close out such positions, except during rebalancing periods or for creation and redemption orders in accordance with its investment objective. Any decrease in value of the Trust’s EUA positions will result in a decrease in the NAV and likely will result in a decrease in the market price of the Shares.

The Trust will not take defensive positions to protect against declining Carbon Credit prices, which could cause a decline to the value of the Trust’s Shares.

The Trust’s sole assets will be EUAs, regardless of the Sponsor’s views on expected EUA price movements. The Trust will not take a defensive position if EUA prices decline or if the Sponsor expects prices to decline. The Trust’s performance will be highly sensitive to Carbon Credit prices changes and the value of the Trust’s Shares will decrease as Carbon Credit prices fall.

An investment in the Trust may be adversely affected by competition from other methods of investing in EUAs.

The Trust competes with other financial vehicles, including exchange traded products registered outside of the U.S. and investment companies registered under the Investment Company Act of 1940, as amended (the “1940 Act”), such as mutual funds, exchange traded funds (“ETFs”), and closed-end funds that gain exposure to EUAs through investments in futures contracts or other derivatives. Market and financial conditions, and other conditions beyond the Sponsor’s control, may make it more attractive to invest in other financial vehicles, which could affect the market capitalization of the Trust and reduce the NAV. To the extent existing ETFs or other exchange traded vehicles tracking Carbon Credit markets represent a significant proportion of demand for EUAs, large redemptions of the securities of these ETFs or other exchange traded vehicles could negatively affect Carbon Credit prices and the price and NAV.

The Trust may be forced to sell EUAs earlier than anticipated if expenses are higher than expected.

The Trust may be forced to sell EUAs earlier than anticipated if the Trust’s expenses are higher than estimated. Such accelerated sales may result in a reduction of the NAV and the value of the Shares.

15

Table of Contents

The Trust could terminate at any time and cause the liquidation and potential loss of an investor’s investment and could upset the overall maturity and timing of an investor’s investment portfolio.

The Trust may terminate at any time, regardless of whether the Trust has incurred losses, subject to the terms of the Trust Agreement. However, no level of losses will require the Sponsor to terminate the Trust. The Trust’s termination would cause the liquidation and potential loss of an investor’s investment. Termination could also negatively affect the overall maturity and timing of an investor’s investment portfolio.