JPMorgan Chase & Co. (JPM) 8-KOther Events

Filed: 11 Apr 06, 12:00am

INVESTOR PRESENTATION

A P R I L 1 0 , 2 0 0 6

Acquisition of Bank of New York’s consumer, small-

business and middle-market banking businesses in

exchange for JPMorgan Chase’s corporate trust business

This presentation contains forward-looking statements within the meaning of the Private Securities

Litigation Reform Act of 1995. Such statements are based upon the current beliefs and expectations of

JPMorgan Chase’s management and are subject to significant risks and uncertainties. Actual results

may differ from those set forth in the forward-looking statements. Factors that could cause this

difference—many of which are beyond the firm’s control—include the following: changes in local,

national or international economic or market conditions that affect the retail banking business or the

corporate trust business; changes in the financial performance of the business JPMorgan Chase is

purchasing or the business it is selling; regulatory or legal issues, such as unanticipated difficulties in

securing the regulatory or other approvals or consents required in connection with the transactions;

difficulties or delays in converting the businesses between the parties’ information systems, or any

inability to integrate the business being purchased as fully, or in as timely or cost-efficient a manner,

as is expected; and costs associated with the transaction, or employee or customer attrition, are

greater than expected. Additional factors that could cause JPMorgan Chase’s results to differ

materially from those described in the forward-looking statements are discussed in Part 1, Item 1A:

Risk Factors, and under the heading “Forward-looking Statements” in the firm’s Annual Report on Form

10-K for the year ended December 31, 2005. There is no assurance that any list of risks and

uncertainties or risk factors is complete. The Annual Report is on file with the Securities and Exchange

Commission and available at the Securities and Exchange Commission’s Internet site

(http://www.sec.gov).

2

Strategic rationale

Acquisition of BK’s consumer, small-business and middle-market

banking significantly enhances Tri-state franchise

High-quality customer and deposit base

Expands presence in attractive suburban locations

Balanced opportunity - cost savings and significant opportunity to

grow BK branches

Exchange of Corporate Trust business provides unique opportunity for

each institution to strategically improve its businesses, in a

financially compelling way

Continued focus on growing our industry-leading securities services

and cash management businesses, which are unaffected by the sale

3

Transaction overview

Key terms

1 Excluding ADR, escrow and commercial paper businesses

2 Tied to certain new account openings at Chase

Taxable gain subject to like-kind exchange treatment for suitable

assets and liabilities

Tax:

Late Q3 or Q4 2006

Expected closing:

Subject to customary regulatory approvals

Regulatory approvals:

Purchase Agreement and Transition Services Agreement executed

Agreements:

Extensive due diligence completed

Due diligence:

JPM and BK to swap Trust (premium of $2.15bn) and Retail

(premium of $2.30bn) businesses

JPM to pay BK $150mm cash for difference in premium, plus a

potential contingent payment of up to $50mm2

Valuation & consideration:

JPM acquires BK’s consumer, small business and middle market

units (BK’s Retail & Middle Market Banking segment)

JPM sells to BK corporate trust business1

Businesses exchanged:

4

Financial impact to JPM

Estimated $600-$700mm after-tax gain at closing

Estimated earnings impact to JPM immaterial in 2007; modestly accretive in 2008

Swap of businesses with roughly equivalent 2005 earnings -- approximately

$250mm

Expect cost savings to be partially offset by investments to upgrade and grow

BK franchise

Preliminary transaction-related costs of up to $100mm after-tax expected by

end of 2007

GAAP earnings negatively affected by CDI amortization

Cash earnings accretive immediately

Modest impact to capital

Tier 1 ratio reduced by an estimated 15bps

Intangible assets increase by approximately $1.6 billion

5

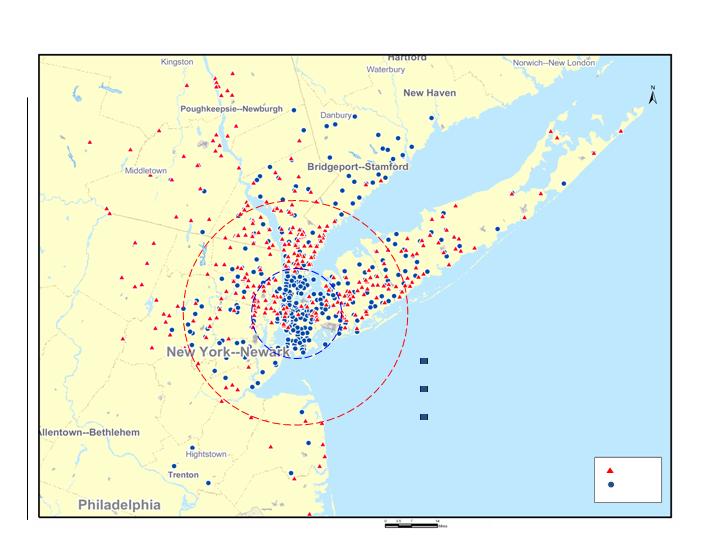

New York is a very attractive banking market

Top 15 MSAs by Retail Deposits

Source: SNL Financial as of June 30, 2005

Note: Retail deposits in each MSA estimated by subtracting from total deposits any

balances exceeding $500mm in a single branch. Per branch metrics based on

Active branches with non-zero deposit balances.

6

Household Income: $87,481

27% higher than national average

Projected deposit growth: $61 billion

over next 5 years

3.6x higher than average of other top

15 MSAs

Deposits per branch: $83 million

73% higher than national average

More than 1 million households with

investable assets between $250,000 and

$1 million

4x more than average of other top 15

MSAs

New York MSA in Perspective

MSA

Deposits

($mm)

Deposit growth

2000

-

2005

($mm)

CAGR

2000

-

2005

(%)

New York

429,714

101,586

5.5

Los Angeles

237,331

76,829

8.1

Chicago

177,334

43,255

5.8

Miami

110,557

34,322

7.7

San Francisco

103,765

27,631

6.4

Philadelphia

99,591

23,541

5.5

Bos

ton

93,174

22,931

5.8

Washington, DC

84,539

26,988

8.0

Dallas

63,867

16,056

6.0

Atlanta

62,712

18,963

7.5

Houston

60,433

14,623

5.7

Detroit

60,318

7,544

2.7

Seattle

45,147

14,462

8.0

San Diego

44,828

17,375

10.3

San Jose

43,055

11,996

6.8

Acquisition significantly enhances Tri-state franchise

Small Business

100,000 small business clients

$3.6 billion in deposits

$0.7 billion in loans

What We Are Acquiring

Middle Market

2,000 middle market clients

$1.6 billion in deposits

$2.9 billion in middle market and

commercial real estate loans

Consumer Banking

600,000 consumer clients

338 branches; 400 ATMs

238 branches in New York

117 in Northern suburbs1

85 on Long Island

36 in New York City

93 in New Jersey

7 in Connecticut

$9.3 billion in deposits

$4.2 billion in loans

1 Includes Westchester, Rockland, Putnam, and Dutchess counties

7

Our Proforma Positioning in NY Tri-state

#1 with more than 750 branches1

#1 with deposits of approx. $80bn1

BK branches located in priority areas

based upon projected growth

BK

JPM

12 miles

30 miles

Suburban franchise complements city leadership

1 Source: Company data. Proforma branches and deposits as of 3/31/06. Assumes 50

branch closures. Ranking based on SNL data as of 6/30/05.

8

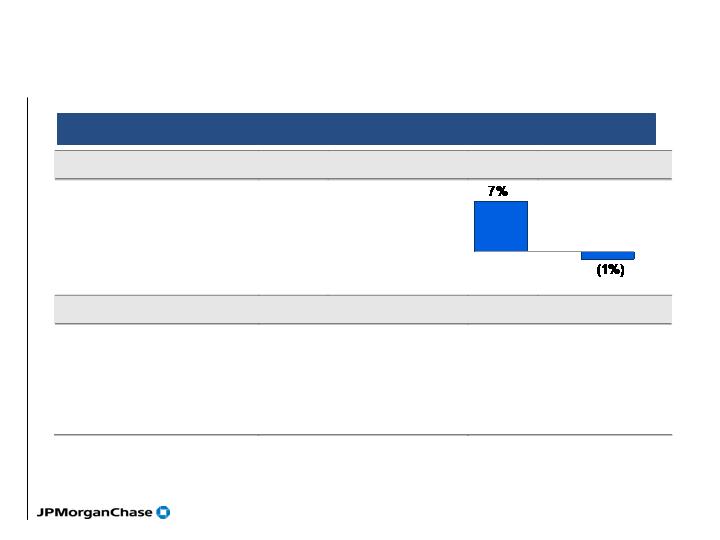

9

1 Statistics based on internal sources for 2005

Production Statistics

Substantial growth opportunity

2005 vs. 2004

–

Tri

-

state

JPM

BK

Checking account growth

1

JPM

vs

BK

1

National

sales

(

per branch

)

Tri

-

state

sales

(p

er branch

)

Investment Sales

3x higher

4.5x higher

Credit Cards

25x higher

35x higher

Home Equity

4x higher

7x h

igher

Mortgage

3x higher

3x higher

Retain attractive & industry leading securities

services and cash management businesses

Corporate Trust business sold includes: Trustee and paying agent for CDO & ABS/MBS,

Municipal, Corporate debt, Loan agency services, Document management1

Emphasis remains on strategic and high-value securities services and cash management

businesses

Significant growth potential

Meaningful links to other lines of business

Critical to servicing client needs

#1 in assets under custody with $11.2 trillion

#1 in U.S. Dollar Clearing, ACH Originations, CHIPS and Fedwire

Invest in key areas of strategic growth in the Securities Services arena

Fund administration and accounting

Investment operations outsourcing

Alternative investment services build out

Use strategic acquisitions to add new products, extend client base and grow

international

1 Excludes ADR, escrow and commercial paper businesses

10

Summary

Financially compelling transaction

Significantly enhances retail leadership position in

Tri-state market

Unwavering commitment to invest in and grow

securities services and cash management businesses

11

Appendix

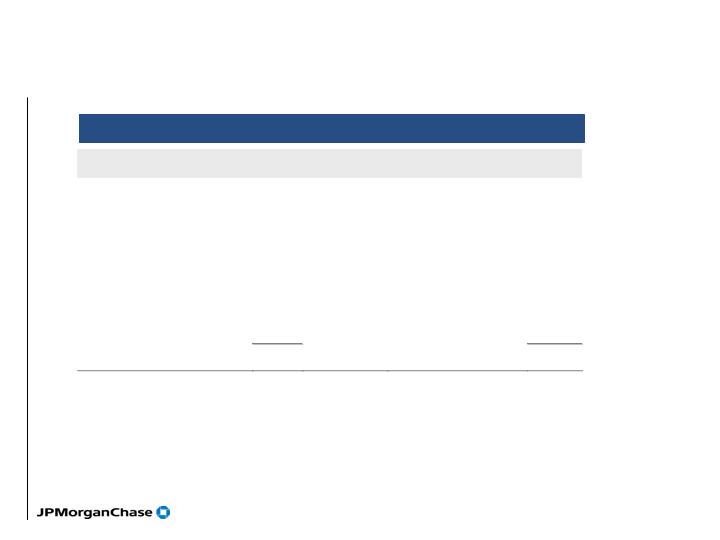

Loan and deposit mix

13

Acquired Loans and Deposits as of December 2005 ($ in billions)

Loans

Deposits

Consumer

$

4.2

Noninterest bearing

$5.5

Mortgage

1.

3

DDA

2.

2

Home Equity

2.

9

Savings

6.

1

Small Business

0.7

Time

0.

7

Middle Market &

Commercial Real Estate

2

.

9

Total

$7.

8

Total

$1

4

.

5