Exhibit D

DESCRIPTION OF CANADA

Table of Contents

| | | | |

| | | Page | |

| |

General Information | | | 3 | |

The Canadian Economy | | | 5 | |

External Trade | | | 11 | |

Balance of Payments | | | 13 | |

Foreign Exchange and International Reserves | | | 15 | |

Government Finances | | | 16 | |

Debt Record | | | 25 | |

Monetary and Banking System | | | 26 | |

Claims and Other | | | 31 | |

Tables and Supplementary Information | | | 32 | |

Unless otherwise indicated, dollar amounts hereafter in this document are expressed in Canadian dollars. On December 8, 2020, the daily average rate of the Bank of Canada for conversion of Canadian dollars (“$”) to United States dollars (“U.S.$”) was USD 1.00 = CAD 1.2808.

2

Certain information contained in the Exhibit has been extracted or compiled from public official documents of Canada, which include statistical data subject to revision. Canada is sometimes referred to as the “Government of Canada” or the “Government” in this Exhibit.

CANADA

GENERAL INFORMATION

Area and Population

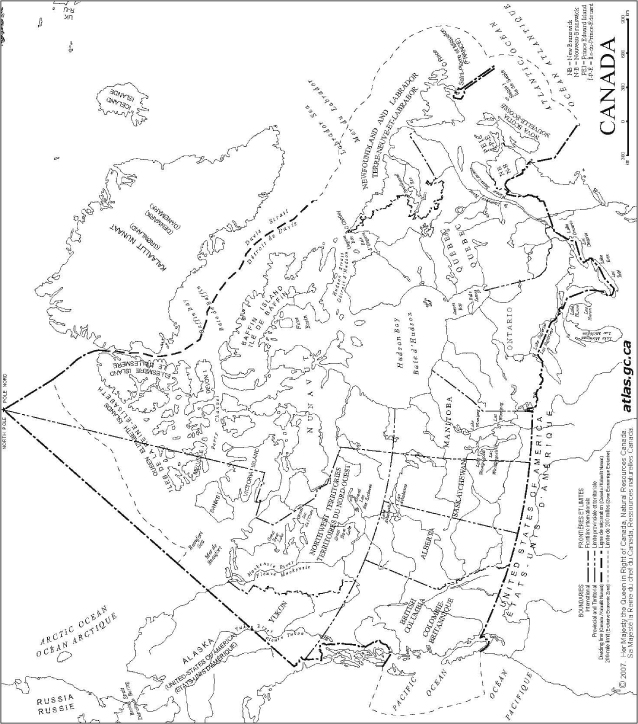

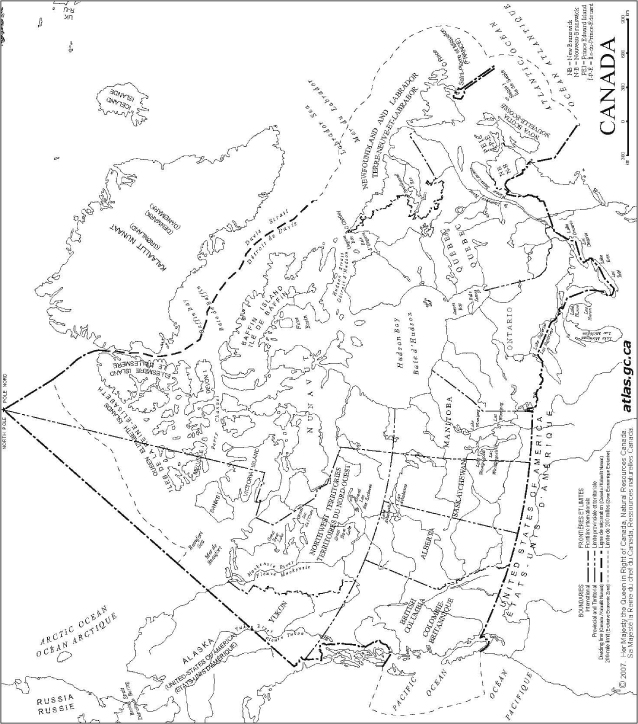

Canada is the second largest country in the world, with an area of 9,984,670 square kilometers of which about 891,163 square kilometers are covered by fresh water. The occupied farm land is about 7% and the commercial forest land is about 30% of the total area. The population on July 1, 2020 was estimated to be 38.0 million. Over two thirds of Canada’s population lives in metropolitan areas of which Toronto, Montreal and Vancouver are the largest. Most of Canada’s population lives within 200 kilometers of the United States border.

Form of Government

Canada is a federal state composed of ten provinces and three territories. In 1867, the United Kingdom Parliament adopted the British North America Act, which established the Canadian federation comprised of, at that time, the Provinces of Ontario, Québec, Nova Scotia and New Brunswick. Since then, six additional provinces (Manitoba, British Columbia, Prince Edward Island, Saskatchewan, Alberta and Newfoundland and Labrador), along with the Yukon Territory, the Northwest Territories and the territory of Nunavut (which was carved out of the Northwest Territories on April 1, 1999), have become parts of Canada.

The British North America Act (which has been renamed the Constitution Act, 1867) gave the Parliament of Canada legislative power in relation to a number of matters including all matters not assigned exclusively to the legislatures of the provinces. These powers now include matters such as defense, the raising of money by any mode or system of taxation, the regulation of trade and commerce, the public debt, money and banking, interest, bills of exchange and promissory notes, navigation and shipping, extra-provincial transportation, aerial navigation and, with some exceptions, telecommunications. The provincial legislatures have exclusive jurisdiction in such areas as education, municipal institutions, property and civil rights, administration of justice, direct taxation for provincial purposes and other matters of purely provincial or local concern.

The executive power of the federal Government is vested in the Queen, represented by the Governor General, whose powers are exercised on the advice of the federal Cabinet, which is responsible to the House of Commons. The legislative branch at the federal level, Parliament, consists of the Crown, the Senate and the House of Commons. The Senate has 105 seats. There are 24 seats each for the Maritime Provinces (Prince Edward Island, Nova Scotia and New Brunswick), Québec, Ontario and the Western Provinces (Manitoba, Saskatchewan, Alberta and British Columbia), six for Newfoundland and Labrador and one each for the three territories (Nunavut, Northwest Territories and Yukon). Senators are appointed by the Governor General on the advice of the federal Cabinet and hold office until age 75. The House of Commons has 338 members, elected by voters in single-member constituencies. The leader of the political party that gains the most seats in each general election is usually invited by the Governor General to be Prime Minister and to form the Government. The Prime Minister selects the members of the federal Cabinet from among the members of the House of Commons and the Senate (in practice almost entirely from the former). The House of Commons is elected for a period of five years. Since May 2007, the Canada Elections Act requires that a general election be held on a fixed date: the third Monday of October in the fourth calendar year following the previous general election. However, the law does not prevent the Governor General from dissolving Parliament at another date. The date of a general election is set by the Governor in Council.

The most recent general election was held on October 21, 2019. As a result of that election the Liberal Party of Canada formed the Government. As of October 5, 2020, the distribution of seats in the House of Commons is as follows: the Liberal Party of Canada has 154 seats, the Conservative Party of Canada has 121 seats, the Bloc Québécois has 32 seats, the New Democratic Party has 24 seats, and the Green Party of Canada has three seats. There is one independent seat and two vacant seats.

The executive power in each province is vested in the Lieutenant Governor, appointed by the Governor General on the advice of the federal Cabinet. The Lieutenant Governor’s powers are exercised on the advice of the provincial cabinet, which is responsible to the legislative assembly. Each provincial legislature is composed of a Lieutenant Governor and a legislative assembly and, depending on the province, members of provincial legislative assemblies are elected for four or five years. The practice of selecting the provincial premier and the provincial cabinet in each province follows that described for the federal level, as does dissolution of a legislature.

The judicial branch of government in Canada is composed of an integrated set of courts created by federal and provincial law. At the federal level there are two principal courts, the Supreme Court of Canada which is the highest appeal court in Canada and the Federal Court of Canada which, among other things, deals with federal revenue laws and claims involving the Government. Judges of the two federally constituted courts and those of the provincial superior and county courts are appointed by the Governor General on the advice of the federal Cabinet and hold office during good behavior until age 70 or 75. Judges of the magistrates courts (commonly known as provincial courts) are appointed by the provincial government and usually hold office until age 65 or 70.

3

Constitutional Reform

In April 1982, Her Majesty the Queen proclaimed the Constitution Act, 1982, terminating British legislative jurisdiction over Canada’s Constitution. The Constitution Act, 1982 provides that Canada’s Constitution may be amended pursuant to an amending formula contained therein and contains the Canadian Charter of Rights and Freedoms, including the linguistic rights of Canada’s two major language groups.

The government of Québec did not sign the constitutional agreement which led to the repatriation of the Canadian Constitution and the proclamation of the Constitution Act, 1982. Although Québec is legally bound by the Constitution Act, 1982, the government of Québec set out five conditions for accepting the legal legitimacy of the Act. Discussions on those principles led on April 30, 1987 at Meech Lake to a unanimous agreement by First Ministers on principles respecting each of Québec’s conditions.

A constitutional resolution to give effect to the Meech Lake Accord was adopted by Parliament and eight provinces before the deadline for ratification on June 23, 1990. In the absence of ratification by Newfoundland and Manitoba, the amendment was not adopted. In the wake of this event, the most extensive series of public consultations on constitutional matters ever to occur in Canada began through the work of both provincial and federal commissions and committees, among other things. Recommendations produced by this process were then assessed by a series of multilateral negotiations involving the federal, provincial and territorial governments and four national Aboriginal organizations, held from April to July 1992. Agreement was reached on a wide range of constitutional issues through the multilateral process which led to a First Ministers’ Conference held in Charlottetown in August 1992.

The Charlottetown Accord was an extensive package of reforms agreed upon by the federal, provincial and territorial governments and the four Aboriginal organizations. On October 26, 1992, Canadians were asked in a referendum if they agreed that the Constitution of Canada should be renewed on the basis of the Charlottetown agreement. A majority of Canadians in a majority of the provinces, including a majority in Québec and a majority of Status Indians living on reserves, declined to provide such a mandate. Consequently, governments set aside the constitutional issue and announced their intention to concentrate on social and economic initiatives that do not require constitutional change.

Québec

In September 1994, the Parti Québécois was elected, and its platform called for Québec’s accession to independence. On October 30, 1995, the government of Québec held a consultative referendum under provincial law, seeking a mandate to secede from Canada and proclaim Québec’s independence, after having made a formal offer of a new economic and political partnership between Québec and the rest of Canada. The government’s proposal was rejected by a vote of 50.6% against and 49.4% in favour, with a participation rate of 93%. While all sides accepted the 1995 referendum results, the Parti Québécois has not abandoned the goal of achieving independence for Québec.

In September 1996, the Government of Canada referred a series of legal questions to the Supreme Court of Canada with a view to clarifying, at both domestic and international law, whether the government of Québec has the right to secede from Canada unilaterally. On August 20, 1998, the Supreme Court rendered judgment, ruling that the government of Québec cannot, under either the Constitution of Canada or international law, legally effect the unilateral secession of Québec from Canada. The Supreme Court also stated that, if a clear majority of Québecers were to clearly and unambiguously express their will to secede, the federal and provincial governments in Canada would then have a constitutional obligation to enter into negotiations to address the potential act of secession as well as its possible terms should, in fact, secession proceed.

On June 29, 2000, the Government of Canada enacted a law to give effect to the requirement for clarity set out in the opinion of the Supreme Court. That law requires the House of Commons to assess, prior to any future referendum on the secession of a province, whether the referendum question made clear that the province would cease to be part of Canada and become an independent country. The law further requires that, after the vote itself, the House of Commons also assess whether there appeared to be a clear majority in support of the question. Only if both these conditions were met would the Government of Canada be authorized to enter into negotiations which might lead to the constitutional amendments required to effect secession.

In the provincial election of October 1, 2018, the Coalition avenir Québec party was elected, replacing the Quebec Liberal Party which had been in power (majority) since April 2014, and formed a majority government having obtained 74 out of 125 seats in Quebec’s National Assembly (37.4% of the votes cast), as compared to 31 seats (24.8% of the votes cast) for the official opposition Quebec Liberal Party, ten seats (17.1% of the votes cast) for the Parti Québécois party and ten seats (16.1% of the votes cast) for the Québec solidaire party.

4

THE CANADIAN ECONOMY1

General

The key economic indicators for the Canadian economy and the Government of Canada consolidated statement of operations and accumulated deficit are presented in the following tables.

KEY ECONOMIC INDICATORS

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | For the 2020 quarter ended

(year-over-year) | | | | |

| | | September | | | June | | | March | | | 2019 | | | 2018 | | | 2017 | | | 2016 | | | 2015 | |

Real GDP annual percentage change (1) | | | -5.2 | | | | -12.5 | | | | -0.3 | | | | 1.9 | | | | 2.4 | | | | 3.0 | | | | 1.0 | | | | 0.7 | |

Nominal GDP annual percentage change (2) | | | -3.7 | | | | -13.2 | | | | 0.4 | | | | 3.6 | | | | 4.2 | | | | 5.7 | | | | 1.8 | | | | -0.2 | |

GDP Implicit Price Index (2)(3) | | | 1.5 | | | | -0.9 | | | | 0.7 | | | | 1.7 | | | | 1.8 | | | | 2.6 | | | | 0.7 | | | | -0.8 | |

Consumer Price Index (total items) (3)(4) | | | 0.3 | | | | 0.0 | | | | 1.8 | | | | 1.9 | | | | 2.3 | | | | 1.6 | | | | 1.4 | | | | 1.1 | |

Industrial Product Price Index (3) | | | -2.2 | | | | -4.8 | | | | -0.9 | | | | -0.1 | | | | 3.9 | | | | 3.1 | | | | -0.2 | | | | -0.8 | |

Unemployment Rate (percent) (5) | | | 10.0 | | | | 13.0 | | | | 6.3 | | | | 5.7 | | | | 5.8 | | | | 6.3 | | | | 7.0 | | | | 6.9 | |

Trade Balance (in millions of dollars) | | | -8,189 | | | | -7,455 | | | | -14,038 | | | | -36,872 | | | | -42,196 | | | | -46,929 | | | | -47,776 | | | | -49,066 | |

Source: Statistics Canada.

| (1) | At market prices, chained 2012 dollars, and seasonally adjusted. |

| (3) | Annual percentage changes. |

| (4) | Year-over-year growth rates for CPI are not based on seasonally adjusted data. |

| (5) | Unemployment levels are calculated using the difference between labor force and employment for the quarters. |

GOVERNMENTOF CANADA – CONSOLIDATED STATEMENTOF OPERATIONSAND ACCUMULATED DEFICIT

(in millions of dollars)

| | | | | | | | | | | | | | | | | | | | |

| | | For the years ended March 31, | |

| | | 2020 | | | 2019 | | | 2018 | | | 2017 | | | 2016 | |

Total revenues | | | 334,131 | | | | 332,218 | | | | 311,216 | | | | 290,868 | | | | 292,608 | |

Total program expenses, excluding net actuarial losses | | | 338,467 | | | | 314,555 | | | | 297,936 | | | | 278,689 | | | | 263,568 | |

Public debt charges | | | 24,447 | | | | 23,266 | | | | 21,889 | | | | 21,232 | | | | 21,837 | |

Annual surplus or deficit (-) before net actuarial losses | | | -28,783 | | | | -5,603 | | | | -8,609 | | | | -9,053 | | | | 7,203 | |

Net actuarial losses | | | -10,609 | | | | -8,361 | | | | -10,352 | | | | -9,904 | | | | -10,064 | |

Annual deficit | | | -39,392 | | | | -13,964 | | | | -18,961 | | | | -18,957 | | | | -2,861 | |

Accumulated deficit at end of year | | | -721,360 | | | | -685,450 | | | | -671,254 | | | | -651,540 | | | | -634,440 | |

Source: Public Accounts of Canada 2020 (Volume 1, Table 1.1).

Note: see page 18 for additional details and information.

| 1 | Quarterly and semi-annual figures or changes are based upon seasonally adjusted data, except where otherwise indicated. All percentage changes are compounded at annual rates. For percentage changes over more than one year, the method of computation includes growth over the entire period indicated. Unless otherwise specified, all growth rates on page 7 are calculated using real GDP at basic prices, constant 2012 dollars. |

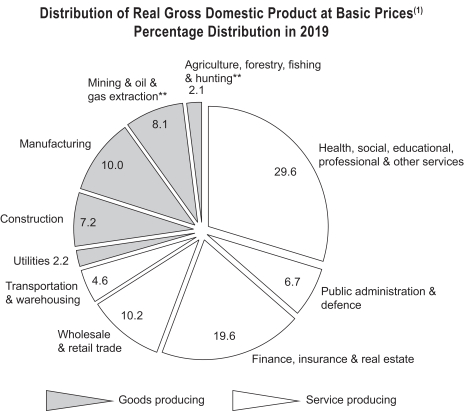

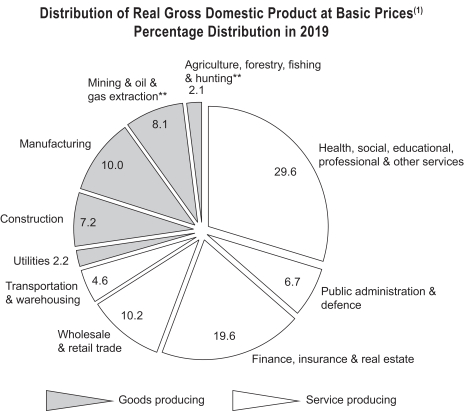

The chart below shows the distribution of real gross domestic product (“GDP”) at basic prices (2012 constant dollars) in 2019, which is indicative of the structure of the economy.

Source: Statistics Canada, Gross Domestic Product by Industry.

Note: Total may not add to 100% due to rounding and rebasing.

| (1) | GDP is a measure of production originating within the geographic boundaries of Canada, regardless of whether factors of production are Canadian or non-resident owned, whereas gross national product (“GNP”) measures the value of Canada’s total production of goods and services – that is, the earnings of all Canadian owned factors of production. Quantitatively, GDP is obtained from GNP by adding investment income paid to non-residents and deducting investment income received from non-residents. GDP at basic prices represents the value added by each of the factors of production and is equivalent to GDP at market prices less net taxes on products. These differences can cause discrepancies in levels and growth rates of GDP at basic prices on pages 5 and 6 and GDP at market prices on pages 7 and 8. |

| ** | The agriculture, forestry, fishing, and hunting; and mining and oil and gas extraction sectors both include support activities. |

The volume of industry and sector output in the following discussion provides “constant dollar” measures of the contribution of each industry to GDP at basic prices. The share of service-producing industries in real GDP was 70.5% in 2019 while the remaining 29.5% was attributed to goods-producing industries.

5

The following table shows the composition of Canada’s real GDP at basic prices (2012 constant dollars) by sector in 2019 and over the 2015-2019 period.

REAL GROSS DOMESTIC PRODUCT AT BASIC PRICES BY INDUSTRY

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | (For the years ended December 31,) | |

| | | 2019 | | | 2018 | | | 2017 | | | 2016 | | | 2015 | | | 2010 | | | 2019 | | | 2015 | | | 2010 | |

| | | | | | (millions of 2012 dollars) | | | (percentage distribution(3)) | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Agriculture (1) | | | 36,175 | | | | 33,423 | | | | 32,505 | | | | 31,698 | | | | 29,472 | | | | 24,314 | | | | 1.8 | | | | 1.6 | | | | 1.5 | |

Forestry, fishing and hunting | | | 4,801 | | | | 5,112 | | | | 5,110 | | | | 5,179 | | | | 5,520 | | | | 4,923 | | | | 0.2 | | | | 0.3 | | | | 0.3 | |

Mining and oil and gas extraction | | | 160,537 | | | | 161,367 | | | | 151,162 | | | | 137,737 | | | | 138,548 | | | | 118,732 | | | | 8.1 | | | | 7.6 | | | | 7.3 | |

Manufacturing | | | 198,962 | | | | 199,070 | | | | 192,917 | | | | 188,847 | | | | 189,177 | | | | 174,675 | | | | 10.0 | | | | 10.4 | | | | 10.7 | |

Construction | | | 142,734 | | | | 142,999 | | | | 139,994 | | | | 135,332 | | | | 141,540 | | | | 120,684 | | | | 7.2 | | | | 7.8 | | | | 7.4 | |

Utilities | | | 43,080 | | | | 42,599 | | | | 41,811 | | | | 41,355 | | | | 40,378 | | | | 38,120 | | | | 2.2 | | | | 2.2 | | | | 2.3 | |

Transportation and warehousing | | | 90,617 | | | | 89,492 | | | | 86,419 | | | | 81,232 | | | | 79,273 | | | | 67,804 | | | | 4.6 | | | | 4.4 | | | | 4.2 | |

Wholesale and retail trade | | | 202,428 | | | | 199,884 | | | | 194,852 | | | | 189,088 | | | | 185,806 | | | | 166,594 | | | | 10.2 | | | | 10.2 | | | | 10.2 | |

Finance, insurance and real estate | | | 389,461 | | | | 378,992 | | | | 371,231 | | | | 355,491 | | | | 345,895 | | | | 297,158 | | | | 19.6 | | | | 19.0 | | | | 18.3 | |

Public administration | | | 133,345 | | | | 130,104 | | | | 126,663 | | | | 124,344 | | | | 122,186 | | | | 121,260 | | | | 6.7 | | | | 6.7 | | | | 7.5 | |

Health, social, educational, professional and other services | | | 588,176 | | | | 572,423 | | | | 559,307 | | | | 549,311 | | | | 542,231 | | | | 492,156 | | | | 29.6 | | | | 29.8 | | | | 30.3 | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Total (2) | | | 1,990,316 | | | | 1,955,465 | | | | 1,901,971 | | | | 1,839,614 | | | | 1,820,026 | | | | 1,626,420 | | | | 100.0 | | | | 100.0 | | | | 100.0 | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Source: Statistics Canada, Industry Accounts Division.

| (1) | Agriculture includes support activities for agriculture, forestry, fishing and hunting. |

| (2) | May not add to total due to rounding. |

| (3) | May not add to total due to rebasing. |

The share of service-producing industries in real GDP at basic prices increased from 70.4% in 2010 to 70.5% in 2019. The fastest growing industry in the services sector has been transportation and warehousing, which grew at an average annual growth rate of 3.3% between 2010 and 2019, compared to an average annual growth rate of 2.3% for total service sector real GDP at basic prices (2012 constant dollars). The goods-producing sector constituted 29.5% of real GDP at basic prices in 2019, down from 29.6% in 2010. A decrease was most evident in forestry, fishing and hunting, with its share decreasing from 0.3% in 2010 to 0.2% in 2019, as the forestry industry faced competitive pressures arising from U.S. imposed tariffs on softwood lumber in 2019.

Real GDP at market prices grew by 0.7% in 2015, 1.0% in 2016, 3.0% in 2017, 2.4% in 2018 and 1.9% in 2019. The rebound since mid-2016 has been supported by stronger household consumption and investment. The COVID-19 pandemic began disrupting global economic activity in 2020, causing a severe reduction in economic activity. Canada’s real GDP registered a year-over-year decline of 0.3% in the first quarter of 2020, followed by a decline of 12.5% and 5.2% in the second and third quarters of 2020, respectively.

Manufacturing was the largest goods-producing industry in Canada by GDP in 2019. Manufacturing output increased by 0.7% in 2015. While in 2016 output fell by 0.2%, it rose again by 2.2% and 3.2%, in 2017 and 2018, respectively. Growth in manufacturing output from 2015 to 2019 was the highest in machinery manufacturing (a 15.8% increase), non-metallic mineral product manufacturing (a 13.3% increase) and chemical manufacturing (a 12.1% increase) sectors. In 2020, the year-over-year growth in manufacturing output decreased by 4.7%, 20.9% and 5.0% in the first, second and third quarter, respectively.

Mining and oil and gas extraction was the second largest goods-producing industry by GDP in 2019. Output from mining and oil and gas extraction declined by 2.0% and 0.6% in 2015 and 2016, respectively. In 2017, output from mining and oil and gas extraction rose 9.7%, followed by an increase of 6.8% in 2018, followed by a decline of 0.5% in 2019 due to cuts in production and investment. Over the 2015-2019 period, the sector’s real GDP increased by 15.9%, as oil and gas, which makes up almost 70% of the sector, increased by 19.3%. Support activities for mining and oil and gas extraction increased by 7.4% while mining and quarrying activities decreased by 3.1% over the 2015-2019 period. In 2020, year-over-year output growth in the mining and oil and gas extraction sector increased 0.5% in the first quarter, followed by a decrease of 18.1% and 16.6% in the second and third quarter, respectively.

The construction sector was the third largest goods-producing sector in Canada in 2019. Construction output fell by 1.9% and 4.4% in 2015 and 2016, respectively. Construction output then gained 3.4% in 2017 and 2.1% in 2018 but declined by 0.2% in 2019. Construction growth from 2015 to 2019 was led by non-residential building construction, residential building construction and repair construction, which increased by 9.4%, 5.9% and 5.4%, respectively. Engineering and other construction activities fell 1.5% over the same period. Overall construction output increased on a year-over-year basis by 2.7% in the first quarter of 2020 but decreased 10.3% and 3.8% in the second and third quarter, respectively.

Although the share of agricultural output2 in total real GDP was only 1.8% in 2019, agriculture is a significant contributor to foreign exchange earnings. Wheat is Canada’s principal agricultural crop and one of its largest export products by value. The wheat crop was 27.6 tonnes in 2015, 32.1 million tonnes in 2016, 30.4 million tonnes in 2017, 32.4 million tonnes in 2018 and 32.7 million tonnes in 2019. Statistics Canada estimates wheat production will be 35.7 million tonnes in 2020.

| 2 | Agriculture includes support activities for agriculture and forestry, fishing and hunting. |

6

Gross Domestic Income and Expenditure3

Nominal GDP at market prices was about $2.3 trillion in 2019. After edging down 0.2% in 2015, nominal GDP returned to growth of 1.8% in 2016, 5.7% in 2017 and 4.2% in 2018 and 3.6% in 2019. On a year-over-year basis, nominal GDP increased by 0.4% in the first quarter, but declined by 13.2% and 3.7% in the second and third quarters of 2020, respectively.

GROSS DOMESTIC INCOME AND EXPENDITURE

| | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | First 3 quarters (1) | | | For the years ended December 31, | |

| | | 2020 | | | 2019 | | | 2019 | | | 2018 | | | 2017 | | | 2016 | | | 2015 | |

| | | (millions of dollars) | |

Income | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Compensation of employees | | | 1,145,879 | | | | 1,169,048 | | | | 1,176,732 | | | | 1,126,948 | | | | 1,069,956 | | | | 1,026,483 | | | | 1,026,846 | |

Gross operating surplus | | | 576,952 | | | | 604,903 | | | | 606,115 | | | | 593,352 | | | | 571,830 | | | | 526,024 | | | | 505,167 | |

Gross mixed income | | | 278,324 | | | | 269,657 | | | | 271,871 | | | | 260,461 | | | | 252,569 | | | | 244,403 | | | | 235,365 | |

Taxes less subsidies and residual error | | | 171,409 | | | | 256,172 | | | | 255,994 | | | | 250,407 | | | | 246,286 | | | | 228,625 | | | | 223,063 | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Gross Domestic Income | | | 2,172,564 | | | | 2,299,780 | | | | 2,310,712 | | | | 2,231,168 | | | | 2,140,641 | | | | 2,025,535 | | | | 1,990,441 | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Expenditure | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Final consumption expenditure | | | 1,740,077 | | | | 1,807,319 | | | | 1,816,232 | | | | 1,755,173 | | | | 1,684,247 | | | | 1,610,954 | | | | 1,566,215 | |

Household final consumption | | | 1,214,537 | | | | 1,293,480 | | | | 1,299,307 | | | | 1,259,088 | | | | 1,209,153 | | | | 1,153,668 | | | | 1,122,079 | |

Government final consumption | | | 491,600 | | | | 478,652 | | | | 481,525 | | | | 462,371 | | | | 443,184 | | | | 426,335 | | | | 415,561 | |

Non-profit institution final consumption | | | 33,940 | | | | 35,187 | | | | 35,400 | | | | 33,714 | | | | 31,910 | | | | 30,951 | | | | 28,575 | |

Gross fixed capital formation | | | 497,871 | | | | 513,340 | | | | 514,911 | | | | 503,355 | | | | 485,847 | | | | 461,262 | | | | 474,732 | |

Business gross fixed capital formation | | | 403,927 | | | | 420,400 | | | | 421,696 | | | | 412,276 | | | | 400,453 | | | | 382,196 | | | | 395,432 | |

Residential structures | | | 176,025 | | | | 166,589 | | | | 168,597 | | | | 165,942 | | | | 165,542 | | | | 154,961 | | | | 143,946 | |

Non-residential structures and machinery and equipment | | | 187,924 | | | | 212,161 | | | | 211,218 | | | | 204,585 | | | | 194,974 | | | | 190,851 | | | | 214,697 | |

Intellectual property product | | | 39,977 | | | | 41,649 | | | | 41,881 | | | | 41,749 | | | | 39,937 | | | | 36,384 | | | | 36,789 | |

Government gross fixed capital formation | | | 91,661 | | | | 90,623 | | | | 90,885 | | | | 88,722 | | | | 83,074 | | | | 76,854 | | | | 76,344 | |

Non-profit institution gross fixed capital formation | | | 2,283 | | | | 2,317 | | | | 2,330 | | | | 2,357 | | | | 2,320 | | | | 2,212 | | | | 2,956 | |

Investment in inventories | | | -25,863 | | | | 18,172 | | | | 16,284 | | | | 14,283 | | | | 18,284 | | | | -228 | | | | -577 | |

Exports (goods and services) | | | 628,897 | | | | 739,887 | | | | 737,500 | | | | 721,679 | | | | 673,326 | | | | 638,095 | | | | 633,955 | |

Imports (goods and services) | | | 668,473 | | | | 778,561 | | | | 774,372 | | | | 763,874 | | | | 720,254 | | | | 685,868 | | | | 683,019 | |

Residual error and estimate | | | 55 | | | | -376 | | | | 157 | | | | 552 | | | | -809 | | | | 1,320 | | | | -865 | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Gross Domestic Expenditure | | | 2,172,564 | | | | 2,299,780 | | | | 2,310,712 | | | | 2,231,168 | | | | 2,140,641 | | | | 2,025,535 | | | | 1,990,441 | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Gross Domestic Expenditure in Chained 2012 Dollars | | | 1,972,472 | | | | 2,098,368 | | | | 2,102,304 | | | | 2,063,887 | | | | 2,014,933 | | | | 1,955,488 | | | | 1,936,100 | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Source: Statistics Canada, National Income and Expenditure Accounts.

| (1) | Seasonally adjusted, annual rates. |

| 3 | Year-over-year growth rates for nominal GDP at market prices are based on seasonally adjusted data. |

7

Economic Developments and Main Risks to the Economy4

Real GDP grew by 0.7% in 2015, 1.0% in 2016, 3.0% in 2017, 2.4% in 2018 and 1.9% in 2019. The rebound between mid-2016 and 2019 was supported by stronger consumption and investment. Canada’s real GDP registered year-over-year declines of 0.3%, 12.5% and 5.2% in the first three quarters of 2020, respectively.

Real household spending rose 2.3% in 2015, 1.9% in 2016, 3.8% in 2017, 2.5% in 2018 and 1.6% in 2019. Year-over-year growth in household spending fell 1.4%, 15.0% and 4.5% in the first three quarters of 2020, respectively.

Household savings as a percentage of personal disposable income was 4.5% in 2015, 2.0% in 2016 and 2017, 0.8% in 2018 and 1.4% in 2019. The household saving rates were respectively 5.9%, 27.5% and 14.6% (annual rates) in the first three quarters of 2020.

Real non-residential structures, machinery and equipment investment fell by 11.3% and 12.3% in 2015 and 2016, respectively. Real non-residential structures, machinery and equipment investment then returned to growth of 1.9% in 2017, 3.1% in 2018 and 1.1% in 2019. On a year-over-year basis, non-residential structures, machinery and equipment investment decreased 3.9%, 18.9% and 14.8% in the first three quarters of 2020, respectively. Real intellectual property products investment contracted 11.5% and 1.7% in 2015 and 2016, respectively. In 2017 and 2018, real intellectual property products investment rose 8.8% and 5.2%, respectively, before declining 1.9% in 2019. On a year-over-year basis, intellectual property products investment decreased 1.1%, 9.7% and 4.4% in the first three quarters of 2020.

Housing starts were 195.5 thousand units in 2015, 197.9 thousand units in 2016, 219.8 thousand units in 2017, 212.8 thousand units in 2018 and 208.7 thousand units in 2019. Over the first three quarters of 2020, housing starts averaged an annual level of 212.5 thousand units.

Real government final consumption grew 1.4% in 2015, 1.8% in 2016, 2.1% in 2017, 2.9% in 2018 and 2.0% in 2019. The year-over-year growth in government spending on goods and services grew 1.0% in the first quarter of 2020. Growth however decreased 2.7% in the second quarter and remained unchanged at 0.0% in the third quarter of 2020.

In current dollar terms, the trade balance in goods and services (on a balance of payments basis) was a deficit of $49.1 billion in 2015. The deficit then decreased slightly over the next four years, to $47.8 billion in 2016, $46.9 billion in 2017, $42.2 billion in 2018 and $36.9 billion in 2019. In the first three quarters of 2020, the average trade deficit in goods and services was $48.9 billion at annual rates.

The COVID-19 pandemic has brought about the deepest and fastest recession, globally, since the Great Depression. While many advance economies saw strong rebounds in economic activity over the summer months, the Canadian economic outlook remains uncertain. Globally, weak demand for crude oil exports continue to weigh on global oil prices and Canadian production and oil workers, while prospects for global oil demand remain uncertain due to travel restrictions and remote working. Domestically, the recovery has been uneven and partial, as certain sectors remain disproportionately affected by public health restrictions and weaker demand due to COVID-19 – including hotels, travel, entertainment and restaurants. Extraordinary measures taken by the Government of Canada continue to support households and businesses facing hardship, providing income support and access to credit. Nonetheless, high levels of indebtedness among households and businesses pose a key downside risk to the economy.

| 4 | In this section all figures, except the savings rates and the trade balance, are reported in real terms and growth rates are calculated from GDP at market prices, chained 2012 dollars, seasonally adjusted at annual rates unless otherwise noted. |

8

Prices and Costs

The GDP implicit price deflator declined by 0.8% in 2015, increased 0.7% in 2016, 2.6% in 2017, 1.8% in 2018 and 1.7% in 2019. The year-over-year change in the implicit price deflator grew 0.7% in the first quarter of 2020, declined 0.9% in the second quarter and rose 1.5% in the third quarter of 2020.

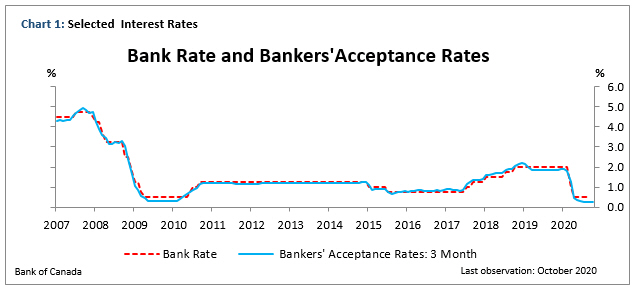

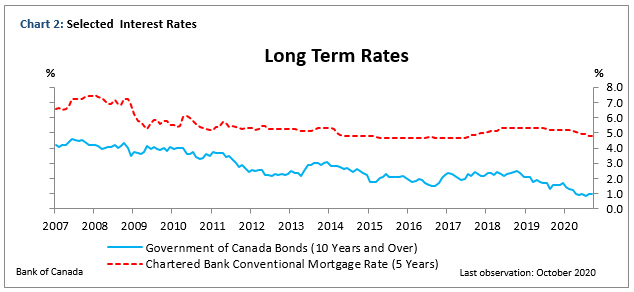

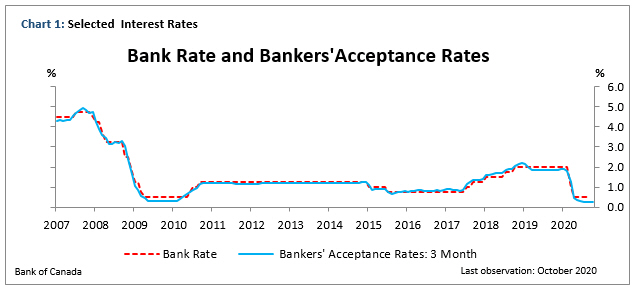

Since the introduction of inflation-targeting into monetary policy in 1991, annual increases in the consumer price index (“CPI”) have remained almost entirely within the 1% to 3% target range. Total CPI rose 1.1% in 2015, 1.4% in 2016, 1.6% in 2017, 2.3% in 2018 and 1.9% in 2019. On a year-over-year basis, total CPI increased 1.8% in the first quarter of 2020, remained unchanged in the second quarter, and increased 0.3% in the third quarter of 20205.

PRICE DEVELOPMENTS

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | GDP

Implicit

Price Index

(1) | | | Consumer Price Index | | | Industrial

Product

Price

Index | |

For the years ended December 31, | | Total | | | Food | | | Total

excluding

Food | | | Energy | | | Total excluding

Food and

Energy | | | Shelter | |

| | | (annual percentage changes) | |

2015 | | | -0.8 | | | | 1.1 | | | | 3.7 | | | | 0.6 | | | | -9.6 | | | | 1.8 | | | | 1.3 | | | | -0.8 | |

2016 | | | 0.7 | | | | 1.4 | | | | 1.5 | | | | 1.4 | | | | -3.0 | | | | 1.9 | | | | 1.6 | | | | -0.2 | |

2017 | | | 2.6 | | | | 1.6 | | | | 0.1 | | | | 1.9 | | | | 5.3 | | | | 1.6 | | | | 1.8 | | | | 3.1 | |

2018 | | | 1.8 | | | | 2.3 | | | | 1.8 | | | | 2.3 | | | | 6.7 | | | | 1.9 | | | | 1.8 | | | | 3.9 | |

2019 | | | 1.7 | | | | 1.9 | | | | 3.4 | | | | 1.7 | | | | -2.2 | | | | 2.0 | | | | 2.5 | | | | -0.1 | |

| | | | | | | | |

2019Q4 | | | 3.3 | | | | 2.1 | | | | 3.4 | | | | 1.9 | | | | 1.2 | | | | 1.9 | | | | 2.6 | | | | -0.4 | |

2020Q1 | | | 0.7 | | | | 1.8 | | | | 2.6 | | | | 1.6 | | | | -0.4 | | | | 1.8 | | | | 2.2 | | | | -0.9 | |

2020Q2 | | | -0.9 | | | | 0.0 | | | | 3.0 | | | | -0.5 | | | | -17.3 | | | | 1.0 | | | | 1.3 | | | | -4.8 | |

2020Q3 | | | 1.5 | | | | 0.3 | | | | 1.9 | | | | 0.0 | | | | -6.8 | | | | 0.6 | | | | 1.6 | | | | -2.2 | |

Source: Statistics Canada.

| (1) | This implicit price index is based on seasonally adjusted data. |

| 5 | Year-over-year growth rates for CPI are not based on seasonally adjusted data. |

9

Labor Market

The following table shows labor market characteristics for the periods indicated.

LABOR MARKET CHARACTERISTICS(1) (2)

(thousands of persons)

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | Canada | | | Atlantic Provinces | | | Quebec | |

For the years ended December 31, | | Labor

Force | | | Employ-

ment | | | Unemploy-

ment Rate | | | Labor

Force | | | Employ-

ment | | | Unemploy-

ment Rate | | | Labor

Force | | | Employ-

ment | | | Unemploy-

ment Rate | |

| | | (thousands) | | | (percent) | | | (thousands) | | | (percent) | | | (thousands) | | | (percent) | |

2015 | | | 19,278 | | | | 17,947 | | | | 6.9 | | | | 1,233 | | | | 1,109 | | | | 10.0 | | | | 4,434 | | | | 4,097 | | | | 7.6 | |

2016 | | | 19,441 | | | | 18,080 | | | | 7.0 | | | | 1,224 | | | | 1,102 | | | | 10.0 | | | | 4,448 | | | | 4,133 | | | | 7.1 | |

2017 | | | 19,663 | | | | 18,416 | | | | 6.3 | | | | 1,219 | | | | 1,100 | | | | 9.7 | | | | 4,496 | | | | 4,223 | | | | 6.1 | |

2018 | | | 19,813 | | | | 18,658 | | | | 5.8 | | | | 1,223 | | | | 1,111 | | | | 9.2 | | | | 4,510 | | | | 4,262 | | | | 5.5 | |

2019 | | | 20,200 | | | | 19,056 | | | | 5.7 | | | | 1,233 | | | | 1,127 | | | | 8.5 | | | | 4,510 | | | | 4,340 | | | | 5.1 | |

| | | | | | | | | |

2019Q4 | | | 20,279 | | | | 19,125 | | | | 5.7 | | | | 1,232 | | | | 1,126 | | | | 8.6 | | | | 4,587 | | | | 4,345 | | | | 5.3 | |

2020Q1 | | | 20,111 | | | | 18,842 | | | | 6.3 | | | | 1,225 | | | | 1,118 | | | | 8.7 | | | | 4,557 | | | | 4,290 | | | | 5.9 | |

2020Q2 | | | 19,192 | | | | 16,696 | | | | 13.0 | | | | 1,164 | | | | 1,009 | | | | 13.3 | | | | 4,407 | | | | 3,800 | | | | 13.8 | |

2020Q3 | | | 20,157 | | | | 18,136 | | | | 10.0 | | | | 1,213 | | | | 1,082 | | | | 10.8 | | | | 4,594 | | | | 4,202 | | | | 8.5 | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | Ontario | | | Prairie Provinces | | | British Columbia | |

For the years ended December 31, | | Labor

Force | | | Employ-

ment | | | Unemploy-

ment Rate | | | Labor

Force | | | Employ-

ment | | | Unemploy-

ment Rate | | | Labor

Force | | | Employ-

ment | | | Unemploy-

ment Rate | |

| | | (thousands) | | | (percent) | | | (thousands) | | | (percent) | | | (thousands) | | | (percent) | |

2015 | | | 7,426 | | | | 6,923 | | | | 6.8 | | | | 3,727 | | | | 3,511 | | | | 5.8 | | | | 2,458 | | | | 2,306 | | | | 6.2 | |

2016 | | | 7,490 | | | | 7,000 | | | | 6.5 | | | | 3,746 | | | | 3,466 | | | | 7.5 | | | | 2,532 | | | | 2,380 | | | | 6.0 | |

2017 | | | 7,580 | | | | 7,128 | | | | 6.0 | | | | 3,768 | | | | 3,499 | | | | 7.2 | | | | 2,601 | | | | 2,467 | | | | 5.1 | |

2018 | | | 7,673 | | | | 7,242 | | | | 5.6 | | | | 3,791 | | | | 3,548 | | | | 6.4 | | | | 2,617 | | | | 2,494 | | | | 4.7 | |

2019 | | | 7,891 | | | | 7,453 | | | | 5.6 | | | | 3,820 | | | | 3,577 | | | | 6.4 | | | | 2,685 | | | | 2,559 | | | | 4.7 | |

| | | | | | | | | |

2019Q4 | | | 7,954 | | | | 7,525 | | | | 5.4 | | | | 3,824 | | | | 3,577 | | | | 6.5 | | | | 2,682 | | | | 2,551 | | | | 4.9 | |

2020Q1 | | | 7,901 | | | | 7,422 | | | | 6.1 | | | | 3,784 | | | | 3,515 | | | | 7.1 | | | | 2,644 | | | | 2,497 | | | | 5.5 | |

2020Q2 | | | 7,469 | | | | 6,546 | | | | 12.4 | | | | 3,621 | | | | 3,129 | | | | 13.6 | | | | 2,532 | | | | 2,211 | | | | 12.7 | |

2020Q3 | | | 7,906 | | | | 7,078 | | | | 10.5 | | | | 3,773 | | | | 3,372 | | | | 10.6 | | | | 2,671 | | | | 2,403 | | | | 10.0 | |

Source: Statistics Canada, The Labour Force Survey.

| (1) | Annual employment levels are based on not seasonally adjusted data, while quarterly employment levels are based on seasonnally adjusted data. |

| (2) | Unemployment levels are calculated using the difference between labor force and employment for the quarters. |

Employment increased by 0.8% in 2015, 0.7% in 2016, 1.9% in 2017, 1.3% in 2018 and 2.1% in 2019. Over the first three quarters of 2020, employment declined 6.9% on an annualized basis. Meanwhile, the labor force increased by 0.8% in 2015, 0.8% in 2016, 1.1% in 2017, 0.8% in 2018 and 2.0% in 2019. Over the first three quarters of 2020, the labor force has declined 0.8% on an annualized basis. The unemployment rate was 6.9% in 2015, and 7.0% in 2016, then declined to 6.3% in 2017, 5.8% in 2018 and 5.7% in 2019. Over the first three quarters of 2020, the unemployment rate has averaged 9.7%. All provinces saw significant decreases in unemployment rates between 2016 and 2019. However, regional differences do exist; the unemployment rate in the Atlantic Provinces (currently 10.8%) has been consistently higher than the national average since 2014. In addition, the unemployment rate in the Prairie Provinces was relatively low in 2013 and 2014, but rose considerably during the oil price shock in 2015 and 2016, and remains above the national average in 2020.

Employment in the service sector accounts for 79.2% of total employment, same as in 2019. Within the service sector, the largest employment subsectors are health care and social assistance, and retail trade. Employment in the goods sector, which makes up 20.8% of Canadian employment, is led by the manufacturing and construction subsectors. The subsector that grew the most in terms of employment share from 2016 to 2020 was professional, scientific and technical services, while accommodation and food services contracted the most in terms of employment share.

SHAREOF TOTAL EMPLOYMENTBY SECTOR

(in percentages)

| | | | | | | | | | | | | | | | | | | | |

| | | For the years ended December 31, | |

| | | 2020(1) | | | 2019 | | | 2018 | | | 2017 | | | 2016 | |

Total, all industries | | | 100.0 | | | | 100.0 | | | | 100.0 | | | | 100.0 | | | | 100.0 | |

Goods-producing sector | | | 20.8 | | | | 20.8 | | | | 21.1 | | | | 21.0 | | | | 21.2 | |

Agriculture | | | 1.6 | | | | 1.5 | | | | 1.5 | | | | 1.5 | | | | 1.6 | |

Forestry and logging with support activities | | | 0.3 | | | | 0.2 | | | | 0.3 | | | | 0.3 | | | | 0.3 | |

Fishing, hunting and trapping | | | 0.1 | | | | 0.1 | | | | 0.1 | | | | 0.1 | | | | 0.1 | |

Mining, quarrying, and oil and gas extraction | | | 1.3 | | | | 1.4 | | | | 1.5 | | | | 1.4 | | | | 1.5 | |

Utilities | | | 0.8 | | | | 0.7 | | | | 0.8 | | | | 0.7 | | | | 0.8 | |

Construction | | | 7.6 | | | | 7.7 | | | | 7.7 | | | | 7.7 | | | | 7.7 | |

Manufacturing | | | 9.2 | | | | 9.1 | | | | 9.3 | | | | 9.4 | | | | 9.4 | |

Services-producing sector | | | 79.2 | | | | 79.2 | | | | 78.9 | | | | 79.0 | | | | 78.8 | |

Wholesale trade | | | 3.4 | | | | 3.3 | | | | 3.5 | | | | 3.7 | | | | 3.8 | |

Retail trade | | | 11.4 | | | | 11.6 | | | | 11.5 | | | | 11.6 | | | | 11.4 | |

Transportation and warehousing | | | 5.3 | | | | 5.4 | | | | 5.3 | | | | 5.1 | | | | 5.0 | |

Finance, insurance, real estate and leasing | | | 6.9 | | | | 6.3 | | | | 6.3 | | | | 6.4 | | | | 6.2 | |

Professional, scientific and technical services | | | 8.6 | | | | 8.2 | | | | 7.9 | | | | 7.9 | | | | 7.7 | |

Business, building and other support services | | | 4.0 | | | | 4.1 | | | | 4.2 | | | | 4.1 | | | | 4.2 | |

Educational services | | | 7.3 | | | | 7.2 | | | | 7.1 | | | | 7.0 | | | | 7.0 | |

Health care and social assistance | | | 13.6 | | | | 13.1 | | | | 12.9 | | | | 12.9 | | | | 12.9 | |

Information, culture and recreation | | | 3.8 | | | | 4.1 | | | | 4.2 | | | | 4.3 | | | | 4.3 | |

Accommodation and food services | | | 5.2 | | | | 6.4 | | | | 6.6 | | | | 6.6 | | | | 6.7 | |

Other services | | | 4.1 | | | | 4.3 | | | | 4.3 | | | | 4.2 | | | | 4.3 | |

Public administration | | | 5.6 | | | | 5.3 | | | | 5.2 | | | | 5.2 | | | | 5.1 | |

| Source: | Statistics Canada, The Labour Force Survey. |

10

EXTERNAL TRADE

Canada has continued to work towards implementing its trade goals of freer and more open markets based on internationally agreed rules and practices at multilateral, regional and bilateral levels, and is the only G7 country to have concluded trade agreements with all other G7 countries. At the multilateral level, Canada continues to be an active member of the World Trade Organization (“WTO”) and continues to fully participate in multilateral trade negotiations as well as ongoing discussions related to potential WTO reform initiatives, including through the Ottawa Group. At the regional level, the Canada-United States-Mexico Agreement (“CUSMA”) entered into force between Canada, the U.S. and Mexico on July 1, 2020. The CUSMA preserves the essential benefits of the NAFTA, including existing tariff commitments, and incorporates new and updated provisions that seek to address 21st century trade issues. Additionally, it preserves the use of binational panels to resolve disputes on countervailing and anti-dumping duty matters. However, under the CUSMA, the investor-state-dispute settlement (“ISDS”) mechanism (a mechanism that allows for a foreign investor from one party to file a claim against the host party when their investment has been affected in a manner that violates the protections under the agreement) does not apply between Canada and the U.S., and the current ISDS mechanism will be eliminated after a three-year transition period. Canada will continue to have an ISDS mechanism with Mexico via the Comprehensive and Progressive Agreement for Trans-Pacific Partnership (“CPTPP”). Separate side letters to the CUSMA, which took effect on November 30, 2018, limit the ability of the United States to impose tariffs on automobiles and auto parts from Canada and Mexico under Section 232 of the Trade Expansion Act of 1962. To ensure the Agreement remains relevant, effective and beneficial for North America there will be a review period every six years. After each review, the parties can agree to extend the Agreement for another 16 years from the date of that review. To further ensure predictable North American trade, Canada and the United States reached an agreement on May 17, 2019, to eliminate all tariffs the United States imposed under Section 232 on Canadian imports of steel and aluminum, and all countermeasures Canada imposed in response to the Section 232 action taken by the United States.

The CPTPP is a free trade agreement among Canada and Australia, Brunei, Chile, Japan, Malaysia, Mexico, New Zealand, Peru, Singapore and Vietnam, which entered into force on December 30, 2018. Canada was among the first six countries to ratify the agreement, along with Australia, Japan, Mexico, New Zealand, and Singapore. On January 14, 2019, the CPTPP also became effective with respect to Vietnam. As a result, Canada now benefits from expanded preferential market access to CPTPP countries that have ratified the agreement.

At the bilateral level, Canada has implemented bilateral free trade agreements with the following countries: Chile, Columbia, Costa Rica, Honduras, Israel, Jordan, Korea, Panama, Peru, Ukraine, and the European Free Trade Association (Norway, Switzerland, Iceland and Liechtenstein). In addition, provisional application of the Comprehensive Economic and Trade Agreement (“CETA”) between Canada and the European Union, with its Member States, began in September 2017. The CETA will enter definitively into force once all Member States of the EU ratify the text according to their respective domestic constitutional requirements. However, the UK will cease to be a party to the CETA as of the end of December 31, 2020; the recently-concluded Canada-UK Trade Continuity Agreement would substantively replicate the CETA on a bilateral basis, with implementation work underway in both countries.

Canada is also committed to expanding and diversifying trade with large, fast-growing markets and regional groupings, such as the Pacific Alliance (Chile, Colombia, Mexico and Peru), the Mercosur trade bloc (Argentina, Brazil, Paraguay and Uruguay), and the 10 countries of the Association of Southeast Asian Nations (Brunei, Cambodia, Indonesia, Lao PDR, Malaysia, Myanmar, Philippines, Singapore, Thailand, Vietnam).

Merchandise and Service Trade

The following table sets forth the composition of Canadian trade for the periods indicated.

THE COMPOSITIONOF CANADIAN MERCHANDISE TRADE

(Balance of Payments Basis)

| | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | First 3 quarters (1) | | | For the years ended December 31, | |

| | | 2020 | | | 2019 | | | 2019 | | | 2018 | | | 2017 | | | 2016 | | | 2015 | |

| | | ( in millions of dollars) | |

Value of Exports | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Farm, fishing & intermediate food products | | | 32,658 | | | | 29,113 | | | | 37,989 | | | | 39,735 | | | | 38,913 | | | | 38,311 | | | | 38,476 | |

Energy products | | | 53,638 | | | | 85,925 | | | | 114,065 | | | | 111,109 | | | | 96,809 | | | | 74,139 | | | | 85,218 | |

Metal ores & non-metallic minerals | | | 15,415 | | | | 16,215 | | | | 20,865 | | | | 19,259 | | | | 16,082 | | | | 13,930 | | | | 16,785 | |

Metal & non-metallic mineral products | | | 47,738 | | | | 48,010 | | | | 65,296 | | | | 64,568 | | | | 61,632 | | | | 55,519 | | | | 56,057 | |

Basic & industrial chemical, plastic & rubber products | | | 22,184 | | | | 25,631 | | | | 34,212 | | | | 35,006 | | | | 32,774 | | | | 31,110 | | | | 32,702 | |

Forestry products & building & packaging materials | | | 30,278 | | | | 32,264 | | | | 42,377 | | | | 47,197 | | | | 43,777 | | | | 42,123 | | | | 39,919 | |

Industrial machinery, equipment & parts | | | 26,181 | | | | 31,244 | | | | 41,309 | | | | 39,354 | | | | 37,081 | | | | 35,195 | | | | 36,007 | |

Electronic & electrical equipment & parts | | | 19,599 | | | | 22,661 | | | | 30,011 | | | | 29,404 | | | | 28,396 | | | | 28,203 | | | | 27,586 | |

Motor vehicles & parts | | | 53,379 | | | | 70,654 | | | | 93,130 | | | | 90,429 | | | | 93,161 | | | | 98,449 | | | | 88,762 | |

Aircraft & other transportation equipment & parts | | | 17,215 | | | | 20,515 | | | | 28,043 | | | | 25,742 | | | | 22,756 | | | | 23,594 | | | | 25,359 | |

Consumer goods | | | 52,886 | | | | 52,915 | | | | 70,705 | | | | 66,554 | | | | 62,913 | | | | 66,182 | | | | 62,709 | |

Other (2) | | | 12,366 | | | | 12,985 | | | | 17,262 | | | | 16,842 | | | | 15,969 | | | | 15,546 | | | | 14,469 | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Total Exports (3) | | | 383,536 | | | | 448,132 | | | | 595,263 | | | | 585,199 | | | | 550,262 | | | | 522,301 | | | | 524,046 | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Value of Imports | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Farm, fishing & intermediate food products | | | 15,984 | | | | 15,958 | | | | 21,227 | | | | 20,299 | | | | 19,444 | | | | 19,134 | | | | 18,447 | |

Energy products | | | 17,618 | | | | 27,649 | | | | 37,420 | | | | 38,101 | | | | 33,385 | | | | 28,236 | | | | 32,280 | |

Metal ores & non-metallic minerals | | | 12,233 | | | | 10,787 | | | | 14,176 | | | | 14,372 | | | | 12,377 | | | | 10,028 | | | | 9,279 | |

Metal & non-metallic mineral products | | | 35,898 | | | | 29,705 | | | | 39,576 | | | | 41,457 | | | | 40,901 | | | | 41,591 | | | | 43,727 | |

Basic & industrial chemical, plastic & rubber products | | | 30,832 | | | | 33,889 | | | | 44,972 | | | | 47,323 | | | | 43,090 | | | | 39,677 | | | | 40,274 | |

Forestry products & building & packaging materials | | | 19,010 | | | | 20,314 | | | | 26,894 | | | | 26,873 | | | | 25,464 | | | | 24,529 | | | | 24,746 | |

Industrial machinery, equipment & parts | | | 44,275 | | | | 52,745 | | | | 69,388 | | | | 68,190 | | | | 62,798 | | | | 61,050 | | | | 62,688 | |

Electronic & electrical equipment & parts | | | 49,418 | | | | 54,229 | | | | 72,155 | | | | 71,311 | | | | 67,627 | | | | 64,509 | | | | 64,792 | |

Motor vehicles & parts | | | 60,775 | | | | 87,627 | | | | 115,046 | | | | 113,830 | | | | 113,410 | | | | 107,955 | | | | 101,296 | |

Aircraft & other transportation equipment & parts | | | 15,039 | | | | 20,517 | | | | 26,417 | | | | 23,849 | | | | 20,899 | | | | 19,238 | | | | 21,839 | |

Consumer goods | | | 92,109 | | | | 94,401 | | | | 125,424 | | | | 121,410 | | | | 115,709 | | | | 112,881 | | | | 111,048 | |

Other (2) | | | 15,041 | | | | 15,849 | | | | 21,013 | | | | 20,316 | | | | 19,301 | | | | 18,521 | | | | 18,267 | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Total Imports (3) | | | 408,231 | | | | 463,669 | | | | 613,706 | | | | 607,330 | | | | 574,406 | | | | 547,349 | | | | 548,682 | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Source: Statistics Canada, Canadian International Merchandise Trade.

| (2) | Other includes special transactions trade and other balance of payments adjustments |

| (3) | May not add due to rounding. |

Canada is one of the world’s leading trading nations. Canada’s exports have always reflected the country’s high endowment in natural resources. While Canada’s exports have diversified over time, commodities still remain an important part of Canada’s exports. In 2019, energy products accounted for 19.2% of Canada’s merchandise exports, followed by both motor vehicles and parts at 15.6% and consumer goods at 11.9%. Together, these components represented 46.7% of total merchandise exports in 2019.

Canada and the United States are each other’s most important trading partners, reflecting the physical proximity of the two countries and their close economic and financial relationship. In 2019, trade with the United States accounted for 74.5% of the value of Canada’s merchandise exports and 63.9% of the value of Canada’s merchandise imports. According to the United States Census Bureau, trade with Canada accounted for 17.8% of the United States’ exports and 12.8% of its imports in 2019. These shares are little changed on a year-to-date basis up to and including September 2020.

11

The following table presents the geographical distribution of Canadian merchandise exports and merchandise imports for the periods indicated.

GEOGRAPHICAL DISTRIBUTIONOF CANADIAN MERCHANDISE TRADE

(Balance of Payments Basis)

| | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | First 3 quarters | | | For the years ended December 31, | |

| | | 2020 | | | 2019 | | | 2019 | | | 2018 | | | 2017 | | | 2016 | | | 2015 | |

Exports(1) | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

United States | | | 72.0 | | | | 74.5 | | | | 74.5 | | | | 73.9 | | | | 74.7 | | | | 75.2 | | | | 75.7 | |

Japan | | | 2.5 | | | | 2.2 | | | | 2.2 | | | | 2.3 | | | | 2.2 | | | | 2.1 | | | | 1.9 | |

United Kingdom | | | 3.6 | | | | 3.3 | | | | 3.4 | | | | 2.9 | | | | 3.4 | | | | 3.4 | | | | 3.2 | |

European Union(2) | | | 5.3 | | | | 4.8 | | | | 4.9 | | | | 5.0 | | | | 4.5 | | | | 4.6 | | | | 4.3 | |

Other | | | 16.5 | | | | 15.2 | | | | 15.0 | | | | 15.9 | | | | 15.1 | | | | 14.6 | | | | 14.9 | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | 100.0 | % | | | 100.0 | % | | | 100.0 | % | | | 100.0 | % | | | 100.0 | % | | | 100.0 | % | | | 100.0 | % |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Imports(1) | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

United States | | | 62.6 | | | | 64.0 | | | | 63.9 | | | | 64.4 | | | | 64.6 | | | | 65.7 | | | | 66.3 | |

Japan | | | 1.7 | | | | 2.0 | | | | 2.0 | | | | 2.1 | | | | 2.4 | | | | 2.2 | | | | 2.0 | |

United Kingdom | | | 1.7 | | | | 1.3 | | | | 1.4 | | | | 1.4 | | | | 1.4 | | | | 1.4 | | | | 1.6 | |

European Union(2) | | | 9.1 | | | | 9.2 | | | | 9.4 | | | | 9.1 | | | | 8.5 | | | | 8.2 | | | | 8.1 | |

Other | | | 24.9 | | | | 23.5 | | | | 23.3 | | | | 23.1 | | | | 23.1 | | | | 22.5 | | | | 22.1 | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | 100.0 | % | | | 100.0 | % | | | 100.0 | % | | | 100.0 | % | | | 100.0 | % | | | 100.0 | % | | | 100.0 | % |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Source: Statistics Canada, Canadian International Merchandise Trade.

| (1) | May not add to total due to rounding. |

| (2) | Excludes the United Kingdom. |

The following table presents volume and price indices of Canada’s merchandise trade for the periods indicated.

MERCHANDISE TRADE INDICES

(Balance of Payments Basis)

| | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | First 3 quarters | | | For the years ended December 31, | |

| | | 2020 | | | 2019 | | | 2019 | | | 2018 | | | 2017 | | | 2016 | | | 2015 | |

| | | ( 2012 = 100 ) | |

Indices of physical volume | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Exports | | | 107.3 | | | | 118.9 | | | | 118.6 | | | | 117.5 | | | | 114.1 | | | | 113.2 | | | | 112.7 | |

Imports | | | 103.1 | | | | 115.0 | | | | 114.4 | | | | 113.5 | | | | 110.2 | | | | 105.1 | | | | 105.3 | |

| | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Indices of prices | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Exports | | | 102.6 | | | | 109.3 | | | | 109.0 | | | | 108.0 | | | | 104.3 | | | | 99.7 | | | | 100.7 | |

Imports | | | 111.0 | | | | 113.2 | | | | 112.9 | | | | 112.6 | | | | 109.9 | | | | 109.7 | | | | 109.7 | |

Terms of trade(1) | | | 92.4 | | | | 96.5 | | | | 96.5 | | | | 96.0 | | | | 94.9 | | | | 90.9 | | | | 91.8 | |

Source: Statistics Canada, Canadian International Merchandise Trade.

| (1) | Index of price of exports divided by index of price of imports multiplied by 100. |

Over the first three quarters of 2020, the service sector accounted for 18.8% of total exports and 18.6% of total imports (seasonally adjusted). Service exports are mainly comprised of commercial services (70.7%), travel services (16.1%), transportation services (12.0%) and general government services (1.2%). On the import side, commercial services, travel services, transportation services and general government services accounted for 65.2%, 15.0%, 18.6% and 1.1% of total service imports, respectively. In 2019, the United States was Canada’s largest services trading partner, accounting for 53.6% and 54.2% of total service exports and imports, respectively.

The following tables present respectively the shares of total service exports and imports by sector and by country for the periods indicated.

SHAREOF TOTAL SERVICE EXPORTSAND IMPORTSBY SECTOR (1)

(in percentages)

| | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | First 3 quarters | | | For the years ended December 31, | |

| | | 2020 | | | 2019 | | | 2019 | | | 2018 | | | 2017 | | | 2016 | | | 2015 | |

Exports | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Travel services | | | 16.1 | | | | 26.9 | | | | 26.7 | | | | 26.0 | | | | 26.4 | | | | 25.9 | | | | 23.9 | |

Transportation services | | | 12.0 | | | | 13.4 | | | | 13.3 | | | | 13.3 | | | | 14.2 | | | | 14.1 | | | | 14.3 | |

Commercial services | | | 70.7 | | | | 58.5 | | | | 58.7 | | | | 59.4 | | | | 58.1 | | | | 58.7 | | | | 60.3 | |

General government services | | | 1.2 | | | | 1.3 | | | | 1.2 | | | | 1.3 | | | | 1.4 | | | | 1.4 | | | | 1.4 | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | 100.0 | % | | | 100.0 | % | | | 100.0 | % | | | 100.0 | % | | | 100.0 | % | | | 100.0 | % | | | 100.0 | % |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Imports | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Travel services | | | 15.0 | | | | 29.1 | | | | 29.5 | | | | 28.6 | | | | 31.0 | | | | 31.3 | | | | 32.3 | |

Transportation services | | | 18.6 | | | | 20.2 | | | | 20.2 | | | | 20.3 | | | | 19.9 | | | | 19.5 | | | | 19.7 | |

Commercial services | | | 65.2 | | | | 49.7 | | | | 49.4 | | | | 50.1 | | | | 48.2 | | | | 48.3 | | | | 47.1 | |

General government services | | | 1.1 | | | | 1.0 | | | | 1.0 | | | | 1.0 | | | | 0.9 | | | | 0.9 | | | | 0.9 | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | 100.0 | % | | | 100.0 | % | | | 100.0 | % | | | 100.0 | % | | | 100.0 | % | | | 100.0 | % | | | 100.0 | % |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Source: Statistics Canada.

| (1) | In current prices, seasonally adjusted at annual rates. May not add to total due to rounding. |

SHAREOF TOTAL SERVICE EXPORTSAND IMPORTSBY COUNTRY (1)

(in percentages)

| | | | | | | | | | | | | | | | | | | | |

| | | 2019 | | | 2018 | | | 2017 | | | 2016 | | | 2015 | |

Exports | | | | | | | | | | | | | | | | | | | | |

United States | | | 53.6 | | | | 54.7 | | | | 55.2 | | | | 55.1 | | | | 54.9 | |

Japan | | | 1.4 | | | | 1.3 | | | | 1.5 | | | | 1.5 | | | | 1.8 | |

Europe(2) | | | 13.5 | | | | 13.9 | | | | 13.0 | | | | 14.0 | | | | 13.5 | |

United Kingdom | | | 5.2 | | | | 5.3 | | | | 5.2 | | | | 5.8 | | | | 5.7 | |

Others | | | 26.2 | | | | 24.8 | | | | 25.1 | | | | 23.6 | | | | 24.2 | |

| | | | | | | | | | | | | | | | | | | | |

| | | 100.0 | % | | | 100.0 | % | | | 100.0 | % | | | 100.0 | % | | | 100.0 | % |

| | | | | | | | | | | | | | | | | | | | |

Imports | | | | | | | | | | | | | | | | | | | | |

United States | | | 54.2 | | | | 54.0 | | | | 54.6 | | | | 54.8 | | | | 54.9 | |

Japan | | | 1.9 | | | | 1.8 | | | | 1.6 | | | | 1.8 | | | | 1.7 | |

Europe(2) | | | 15.6 | | | | 15.9 | | | | 15.7 | | | | 15.5 | | | | 15.0 | |

United Kingdom | | | 4.9 | | | | 5.1 | | | | 5.7 | | | | 5.4 | | | | 5.5 | |

Others | | | 23.4 | | | | 23.2 | | | | 22.5 | | | | 22.5 | | | | 23.0 | |

| | | | | | | | | | | | | | | | | | | | |

| | | 100.0 | % | | | 100.0 | % | | | 100.0 | % | | | 100.0 | % | | | 100.0 | % |

| | | | | | | | | | | | | | | | | | | | |

Source: Statistics Canada.

| (1) | In current prices. May not add to total due to rounding. |

| (2) | Excludes United Kingdom. Includes Austria, Belgium, Denmark, France, Finland, Germany, Greece, Ireland, Italy, Luxembourg, Netherlands, Norway, Poland, Portugal, Russia, Spain, Sweden, Switzerland, Turkey, and Other Europe in and not in Organisation for Economic Co-operation and Development (OECD). |

12

BALANCE OF PAYMENTS

The following table presents the balance of international payments for the periods indicated.

CANADIAN BALANCEOF INTERNATIONAL PAYMENTS

| | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | First 3 quarters (1) | | | For the years ended December 31, | |

| | | 2020 | | | 2019 | | | 2019 | | | 2018 | | | 2017 | | | 2016 | | | 2015 | |

| | | ( in millions of dollars ) | |

Current and Capital Account | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Current account receipts | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Goods and services | | | 466,505 | | | | 554,268 | | | | 737,500 | | | | 721,679 | | | | 673,325 | | | | 638,093 | | | | 633,954 | |

Goods | | | 380,316 | | | | 449,088 | | | | 598,167 | | | | 587,512 | | | | 550,525 | | | | 522,301 | | | | 525,313 | |

Services | | | 97,736 | | | | 109,745 | | | | 139,333 | | | | 134,167 | | | | 122,800 | | | | 115,792 | | | | 108,641 | |

Primary income | | | 86,189 | | | | 105,180 | | | | 149,213 | | | | 135,981 | | | | 116,567 | | | | 97,904 | | | | 92,424 | |

Secondary Income | | | 9,914 | | | | 10,915 | | | | 15,285 | | | | 13,696 | | | | 11,951 | | | | 13,248 | | | | 10,928 | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Total receipts | | | 574,157 | | | | 674,929 | | | | 901,998 | | | | 871,356 | | | | 801,843 | | | | 749,245 | | | | 737,306 | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | |

Current account payments | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Goods and services | | | 503,202 | | | | 586,363 | | | | 774,371 | | | | 763,875 | | | | 720,254 | | | | 685,868 | | | | 683,020 | |

Goods | | | 409,326 | | | | 464,712 | | | | 613,527 | | | | 607,344 | | | | 575,024 | | | | 547,349 | | | | 549,065 | |

Services | | | 93,867 | | | | 121,652 | | | | 160,844 | | | | 156,532 | | | | 145,229 | | | | 138,519 | | | | 133,956 | |

Primary income | | | 94,100 | | | | 117,105 | | | | 157,282 | | | | 142,794 | | | | 125,270 | | | | 110,561 | | | | 108,733 | |

Secondary income | | | 13,388 | | | | 13,533 | | | | 17,730 | | | | 16,910 | | | | 16,317 | | | | 15,370 | | | | 15,122 | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Total payments | | | 610,689 | | | | 717,000 | | | | 949,383 | | | | 923,579 | | | | 861,840 | | | | 811,799 | | | | 806,875 | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | |

Current account balance | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Goods and services | | | -36,697 | | | | -32,095 | | | | -36,871 | | | | -42,196 | | | | -46,929 | | | | -47,776 | | | | -49,066 | |

Goods | | | -29,010 | | | | -15,623 | | | | -15,361 | | | | -19,832 | | | | -24,499 | | | | -25,048 | | | | -23,751 | |

Services | | | -7,687 | | | | -16,472 | | | | -21,510 | | | | -22,365 | | | | -22,429 | | | | -22,728 | | | | -25,315 | |

Primary income | | | 3,636 | | | | -7,360 | | | | -8,069 | | | | -6,814 | | | | -8,703 | | | | -12,656 | | | | -16,310 | |

Secondary income | | | -3,473 | | | | -2,618 | | | | -2,445 | | | | -3,214 | | | | -4,366 | | | | -2,121 | | | | -4,193 | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Total balance | | | -36,533 | | | | -42,072 | | | | -47,385 | | | | -52,224 | | | | -59,998 | | | | -62,553 | | | | -69,569 | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | |

Capital account balance | | | -48 | | | | -89 | | | | -89 | | | | -76 | | | | -76 | | | | -91 | | | | -106 | |

| | | | | | | |

Financial Account (2) | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Net lending/net borrowing, from financial account | | | -41,824 | | | | -47,584 | | | | -51,160 | | | | -45,315 | | | | -57,308 | | | | -60,130 | | | | -66,240 | |

| | | | | | | |

Net acquisition of financial assets | | | 736 | | | | 148,362 | | | | 264,716 | | | | 169,443 | | | | 222,974 | | | | 195,661 | | | | 211,100 | |

Canadian direct investment abroad | | | 41,741 | | | | 76,146 | | | | 101,127 | | | | 80,790 | | | | 101,944 | | | | 89,558 | | | | 106,456 | |

Canadian portfolio investment | | | -2,640 | | | | 11,526 | | | | 32,960 | | | | 57,532 | | | | 84,657 | | | | 12,885 | | | | 60,108 | |

Foreign debt securities | | | 5,393 | | | | 23,384 | | | | 27,485 | | | | 50,376 | | | | 16,028 | | | | -7,122 | | | | 34,745 | |

Foreign equity and investment fund shares | | | 2,751 | | | | -11,857 | | | | 5,475 | | | | 7,156 | | | | 68,629 | | | | 20,006 | | | | 25,363 | |

Official international reserves | | | 515 | | | | -978 | | | | -1,716 | | | | -2,004 | | | | 1,053 | | | | 7,481 | | | | 10,933 | |

Other Canadian investment | | | -38,879 | | | | 61,667 | | | | 132,345 | | | | 33,125 | | | | 35,320 | | | | 85,737 | | | | 33,602 | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Net incurrence of liabilities | | | 42,561 | | | | 195,946 | | | | 315,877 | | | | 214,758 | | | | 280,282 | | | | 255,791 | | | | 277,340 | |

Foreign direct investment in Canada | | | 32,501 | | | | 49,794 | | | | 59,914 | | | | 55,940 | | | | 32,606 | | | | 45,215 | | | | 76,272 | |

Foreign portfolio investment | | | 102,284 | | | | 36,818 | | | | 36,165 | | | | 52,944 | | | | 181,875 | | | | 150,160 | | | | 106,351 | |

Canadian debt securities | | | 128,742 | | | | 35,317 | | | | 38,562 | | | | 27,551 | | | | 126,244 | | | | 98,767 | | | | 94,627 | |

Canadian equity and investment fund shares | | | -26,460 | | | | 1,501 | | | | -2,397 | | | | 25,393 | | | | 55,631 | | | | 51,393 | | | | 11,724 | |

Other foreign investment | | | -92,224 | | | | 109,335 | | | | 219,798 | | | | 105,875 | | | | 65,801 | | | | 60,417 | | | | 94,717 | |

| | | | | | | |

Discrepancy (net errors and omissions) | | | -5,243 | | | | -5,422 | | | | -3,687 | | | | 6,984 | | | | 2,765 | | | | 2,514 | | | | 3,435 | |

Source: Statistics Canada, Canada’s Balance of International Payments.

| (1) | Year-to-date (not annualized). Current and capital account data are seasonally adjusted. Financial account data are not seasonally adjusted. |

| (2) | For the Financial Account, transactions are recorded on a net basis. A plus sign denotes an increase in investment and a minus sign denotes a decrease in investment. |

The current account deficit was $48.7 billion (seasonally adjusted, annualized level) in the first three quarters of 2020. Over the last five years, the three main components of the current account have evolved as follows:

| (1) | Merchandise trade registered a deficit of $23.8 billion in 2015, $25.0 billion in 2016 and 2017, $19.8 billion in 2018 and $15.4 billion in 2019. In the first three quarters of 2020, merchandise trade showed an average deficit of $38.7 billion (annualized level). |

| (2) | The service account deficit narrowed from $25.3 billion in 2015 to $21.5 billion in 2019. The services deficit averaged $10.3 billion (annualized level) in the first three quarters of 2020. |

| (3) | The deficit on primary income narrowed from $16.3 billion in 2015 to $8.1 billion in 2019. The primary income deficit averaged $4.8 billion (annualized level) in the first three quarters of 2020. |

Canada registered a net financial account inflow (net borrowing) of $45.3 billion and $51.2 billion in 2018 and 2019, respectively. The net inflow was $55.8 billion in the first three quarters of 2020 (annualized level).

Non-resident net purchases of Canadian securities6 were $106.4 billion in 2015. The amount of Canadian securities purchased by non-residents since has decreased, reaching $36.2 billion in 2019. In the first three quarters of 2020, portfolio investment from abroad increased significantly to $136.4 billion (annualized level). Foreign direct investment was $76.3 billion in 2015, $45.2 billion in 2016, $32.6 billion in 2017, $55.9 billion in 2018 and $59.9 billion in 2019.

Foreign direct investment in 2019 was led by manufacturing, trade and transportation, and other industries. In the first three quarters of 2020, foreign direct investment was $43.3 billion (annualized level).

| 6 | Canadian securities include Canadian bonds, money market instruments, equity and investment fund shares. |

13

The table below provides a breakdown of foreign direct investment in Canada for the periods indicated.

FOREIGN DIRECT INVESTMENTIN CANADA

| | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | First 3 quarters (1) | | | For the years ended December 31, | |

| | | 2020 | | | 2019 | | | 2019 | | | 2018 | | | 2017 | | | 2016 | | | 2015 | |

| | | (in millions of dollars) | |

All countries | | | 32,225 | | | | 49,171 | | | | 63,470 | | | | 49,552 | | | | 29,550 | | | | 47,796 | | | | 56,057 | |

United States | | | 10,318 | | | | 27,003 | | | | 27,659 | | | | 21,970 | | | | 16,397 | | | | 24,744 | | | | 41,386 | |

All other countries | | | 21,906 | | | | 22,168 | | | | 35,811 | | | | 27,583 | | | | 13,153 | | | | 23,052 | | | | 14,672 | |

All industries | | | 32,225 | | | | 49,171 | | | | 63,470 | | | | 49,552 | | | | 29,550 | | | | 47,796 | | | | 56,057 | |

Energy and mining (2) | | | -4,699 | | | | 18,061 | | | | 20,425 | | | | 5,651 | | | | -4,883 | | | | 10,800 | | | | 3,030 | |

Manufacturing | | | 5,736 | | | | 17,041 | | | | 19,105 | | | | 15,791 | | | | 10,682 | | | | 4,356 | | | | 3,482 | |

Trade and transportation (3) | | | 7,903 | | | | -856 | | | | 271 | | | | 4,408 | | | | 11,978 | | | | 11,647 | | | | 9,230 | |

Finance and Insurance | | | 2,284 | | | | 4,368 | | | | 7,510 | | | | 2,544 | | | | 4,541 | | | | 9,183 | | | | 219 | |

Management of companies and enterprises | | | 10,111 | | | | 1,780 | | | | 7,730 | | | | 5,439 | | | | -66 | | | | 5,088 | | | | 13,971 | |

Other industries (4) | | | 10,889 | | | | 8,777 | | | | 8,428 | | | | 15,720 | | | | 7,297 | | | | 6,724 | | | | 26,125 | |

Source: Statistics Canada, Canada’s Balance of International Payments.

Totals may not add up due to rounding.

| (1) | Year-to-date (not annualized). |

| (2) | This combines the North American Industry Classification System (NAICS) codes 21 and 22. |

| (3) | This combines the North American Industry Classification System (NAICS) codes 41, 44, 45, 48 and 49. |

| (4) | This combines the North American Industry Classification System (NAICS) codes 11, 23, 51, 53, 54, 56, 61, 62, 71, 72, 81 and 91. |

14

FOREIGN EXCHANGE AND INTERNATIONAL RESERVES

Since May 31, 1970, the Canadian dollar has been allowed to float so that the rate of exchange is determined by conditions of supply and demand in the market. Since then, the Canadian dollar has floated between a low of 61.79 U.S. cents in January 2002 and a high of 110.30 U.S. cents in November 2007. The Canadian dollar closed 2019 at an average rate price of 76.99 U.S. cents. From the beginning of 2020 through to September 30, the Canadian dollar average rate price ranged between 68.98 and 77.10 U.S. cents. The Canadian dollar average rate price on September 30, 2020 was 74.97 U.S. cents.

EXCHANGE RATE FOR THE CANADIAN DOLLAR

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | 2020 through September 30 | | | For the years ended December 31, | |

| | 2019 | | | 2018 | | | 2017 | | | 2016 | | | 2015 | | | 2014 | | | 2013 | | | 2012 | | | 2011 | | | 2010 | | | 2009 | |

| | | (in U.S. cents) | |

High | | | 77.10 | | | | 76.99 | | | | 81.38 | | | | 82.45 | | | | 80.19 | | | | 85.62 | | | | 94.44 | | | | 101.88 | | | | 103.71 | | | | 106.30 | | | | 100.69 | | | | 97.55 | |

Low | | | 68.98 | | | | 73.53 | | | | 73.30 | | |

| 72.76

|

| | | 68.21 | | | | 71.41 | | | | 85.68 | | | | 93.14 | | | | 95.76 | | | | 93.83 | | | | 92.18 | | | | 76.53 | |

Source: Bank of Canada.

Canada does not have foreign exchange controls. Foreign exchange operations conducted by the Bank of Canada on behalf of the Minister of Finance are directed toward the maintenance of orderly conditions in the foreign exchange market in Canada through the purchase or sale of United States dollars for Canadian dollars. The following table shows Canada’s official international reserves on the dates indicated.

CANADA’S OFFICIAL INTERNATIONAL RESERVES

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | At

September 30,

2020 | | | At December 31, | |

| | 2019 | | | 2018 | | | 2017 | | | 2016 | | | 2015 | | | 2014 | | | 2013 | | | 2012 | | | 2011 | | | 2010 | | | 2009 | |

| | | (in millions of U.S. dollars) | |

Total | |

| 90,157

|

| | | 85,297 | | | | 83,926 | | | | 86,625 | | | | 82,718 | | | | 79,753 | | | | 74,700 | | | | 71,937 | | | | 68,546 | | | | 65,819 | | | | 57,151 | | | | 54,357 | |

Source: Department of Finance.

As of September 30, 2020, Canada’s official international reserves stood at U.S.$90,157 million equivalent. The total was composed of U.S.$51,347 million held in U.S. dollar denominated assets, U.S.$15,520 million equivalent in euro denominated assets, U.S.$6,427 million equivalent in pound sterling assets, U.S.$4,022 million equivalent in yen denominated assets, U.S.$8,719 million in Special Drawing Rights (“SDRs”) and U.S.$4,122 million in the form of the reserve position in the International Monetary Fund (“IMF”).

Beginning in 1978, transactions relating to foreign currency debt undertaken for reserve management purposes have had an important effect on the level of official reserves. The “Canada Bills” program was launched in October 1986. Under this program, U.S. dollar-denominated short-term notes are issued in the United States money market. There were U.S.$5,919 million of Canada Bills outstanding on September 30, 2020. The “Canada Notes” program was launched in June 2010. Canada Notes are interest-bearing marketable notes that mature not less than nine months from their date of issue. As of September 30, 2020, there were U.S.$100 million of Canada Notes outstanding. A Euro Medium-Term Notes (EMTN) program was launched in October 2011. EMTNs are interest bearing, foreign currency medium-term notes issued outside the United States and Canada and maturities can range from short-term to long-term. As of September 30, 2020, there were Euro 150 million of EMTNs outstanding. As of September 30, 2020, U.S.$9,000 million in foreign currency denominated bonds remained outstanding comprised of three U.S. dollar global bond issues.

15

GOVERNMENT FINANCES

Introduction

The financial structure of the Government of Canada rests on a constitutional and statutory framework dating back to the British North America Act, 1867. That Act, which has been renamed the Constitution Act, 1867, gave constitutional foundation to the principles of financing that are basic to responsible government, while other necessary financial administrative machinery and procedures were established by subsequent legislation, most notably the Financial Administration Act. The proclamation in 1982 of the Constitution Act, 1982 terminated British legislative jurisdiction over Canada’s Constitution in accordance with an amending formula that permits amendment of the Constitution without resorting to the Parliament of the United Kingdom.

Within the confines of the Constitution, the authority of Parliament is supreme. Ultimate control of the public purse and the financial structure of the Government rests with Parliament. This is reflected in the fundamental principles that no tax shall be imposed and no money shall be spent without the authority of Parliament, and that expenditures shall be made only for the purposes authorized by Parliament.

Public money received by the Government is deposited in the Consolidated Revenue Fund of Canada. Withdrawals of public money out of the Consolidated Revenue Fund may not be made without the authority of Parliament.