Comerica Incorporated Fourth Quarter 2013 Financial ReviewJanuary 17, 2014 Safe Harbor Statement 2 Any statements in this presentation that are not historical facts are forward-looking statements as defined in the Private Securities LitigationReform Act of 1995. Words such as “anticipates,” “believes,” “contemplates,” “feels,” “expects,” “estimates,” “seeks,” “strives,” “plans,” “intends,”“outlook,” “forecast,” “position,” “target,” “mission,” “assume,” “achievable,” “potential,” “strategy,” “goal,” “aspiration,” “opportunity,” “initiative,”“outcome,” “continue,” “remain,” “maintain,” “on course,” “trend,” “objective,” “looks forward” and variations of such words and similar expressions,or future or conditional verbs such as “will,” “would,” “should,” “could,” “might,” “can,” “may” or similar expressions, as they relate to Comerica or itsmanagement, are intended to identify forward-looking statements. These forward-looking statements are predicated on the beliefs andassumptions of Comerica's management based on information known to Comerica's management as of the date of this presentation and do notpurport to speak as of any other date. Forward-looking statements may include descriptions of plans and objectives of Comerica's managementfor future or past operations, products or services, and forecasts of Comerica's revenue, earnings or other measures of economic performance,including statements of profitability, business segments and subsidiaries, estimates of credit trends and global stability. Such statements reflectthe view of Comerica's management as of this date with respect to future events and are subject to risks and uncertainties. Should one or more ofthese risks materialize or should underlying beliefs or assumptions prove incorrect, Comerica's actual results could differ materially from thosediscussed. Factors that could cause or contribute to such differences are changes in general economic, political or industry conditions; changes inmonetary and fiscal policies, including the interest rate policies of the Federal Reserve Board; volatility and disruptions in global capital and creditmarkets; changes in Comerica's credit rating; the interdependence of financial service companies; changes in regulation or oversight; unfavorabledevelopments concerning credit quality; any future acquisitions or divestitures; the effects of more stringent capital or liquidity requirements;declines or other changes in the businesses or industries of Comerica's customers; the implementation of Comerica's strategies and businessmodels; Comerica's ability to utilize technology to efficiently and effectively develop, market and deliver new products and services; operationaldifficulties, failure of technology infrastructure or information security incidents; changes in the financial markets, including fluctuations in interestrates and their impact on deposit pricing; competitive product and pricing pressures among financial institutions within Comerica's markets;changes in customer behavior; management's ability to maintain and expand customer relationships; management's ability to retain key officersand employees; the impact of legal and regulatory proceedings or determinations; the effectiveness of methods of reducing risk exposures; theeffects of terrorist activities and other hostilities; the effects of catastrophic events including, but not limited to, hurricanes, tornadoes, earthquakes,fires, droughts and floods; changes in accounting standards and the critical nature of Comerica's accounting policies. Comerica cautions that theforegoing list of factors is not exclusive. For discussion of factors that may cause actual results to differ from expectations, please refer to ourfilings with the Securities and Exchange Commission. In particular, please refer to “Item 1A. Risk Factors” beginning on page 13 of Comerica'sAnnual Report on Form 10-K for the year ended December 31, 2012 and "Item 1A. Risk Factors" beginning on page 68 of the Corporation'sQuarterly Report on Form 10-Q for the quarter ended June 30, 2013. Forward-looking statements speak only as of the date they are made.Comerica does not undertake to update forward-looking statements to reflect facts, circumstances, assumptions or events that occur after the datethe forward-looking statements are made. For any forward-looking statements made in this presentation or in any documents, Comerica claimsthe protection of the safe harbor for forward-looking statements contained in the Private Securities Litigation Reform Act of 1995.

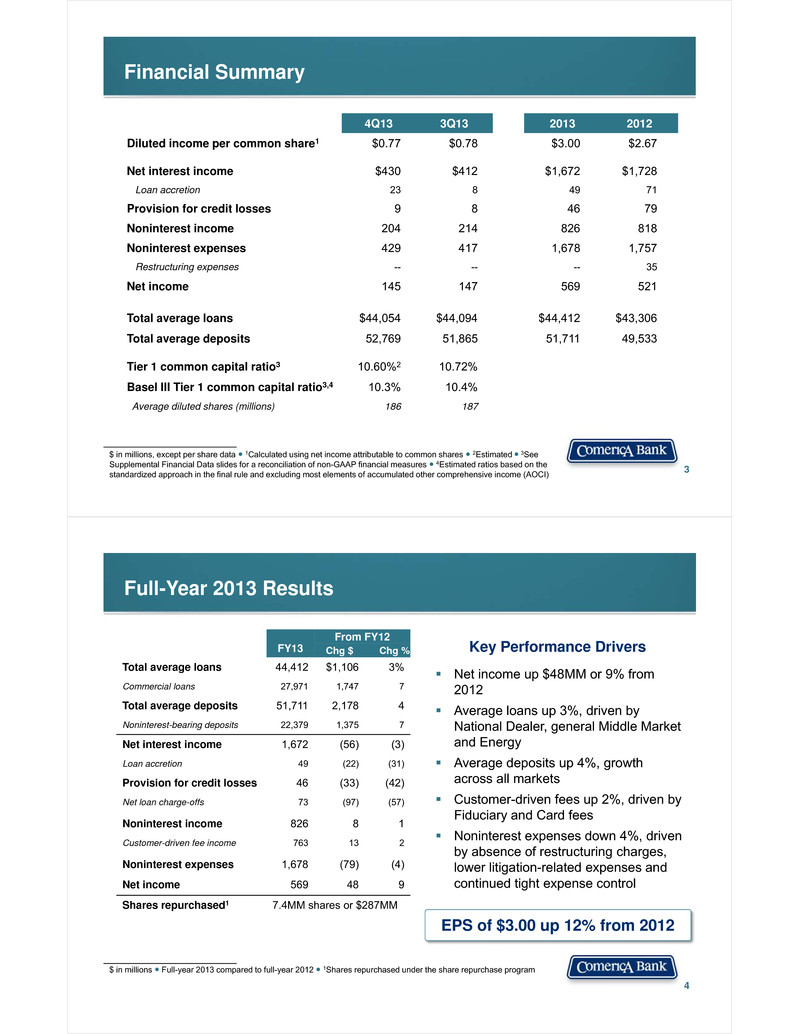

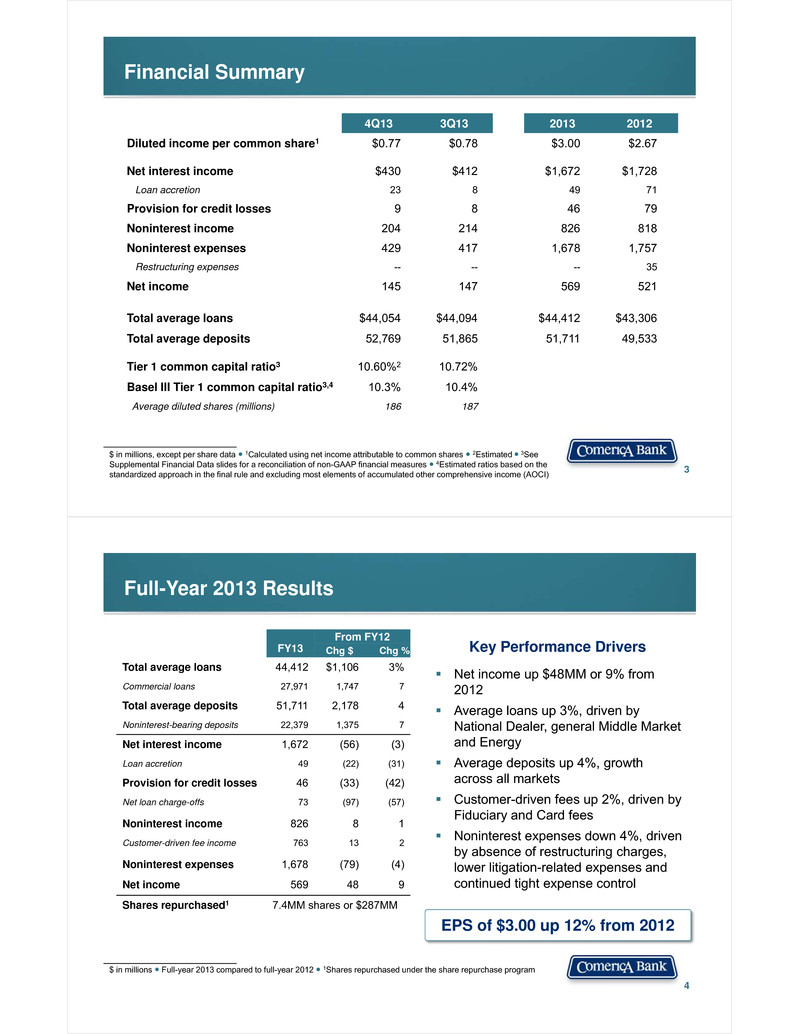

Financial Summary 3 4Q13 3Q13 2013 2012 Diluted income per common share1 $0.77 $0.78 $3.00 $2.67 Net interest income $430 $412 $1,672 $1,728 Loan accretion 23 8 49 71 Provision for credit losses 9 8 46 79 Noninterest income 204 214 826 818 Noninterest expenses 429 417 1,678 1,757 Restructuring expenses -- -- -- 35 Net income 145 147 569 521 Total average loans $44,054 $44,094 $44,412 $43,306 Total average deposits 52,769 51,865 51,711 49,533 Tier 1 common capital ratio3 10.60%2 10.72% Basel III Tier 1 common capital ratio3,4 10.3% 10.4% Average diluted shares (millions) 186 187 $ in millions, except per share data ● 1Calculated using net income attributable to common shares ● 2Estimated ● 3See Supplemental Financial Data slides for a reconciliation of non-GAAP financial measures ● 4Estimated ratios based on the standardized approach in the final rule and excluding most elements of accumulated other comprehensive income (AOCI) Full-Year 2013 Results 4 $ in millions ● Full-year 2013 compared to full-year 2012 ● 1Shares repurchased under the share repurchase program Net income up $48MM or 9% from 2012 Average loans up 3%, driven by National Dealer, general Middle Market and Energy Average deposits up 4%, growth across all markets Customer-driven fees up 2%, driven by Fiduciary and Card fees Noninterest expenses down 4%, driven by absence of restructuring charges, lower litigation-related expenses and continued tight expense control EPS of $3.00 up 12% from 2012 FY13 From FY12Chg $ Chg %Total average loans 44,412 $1,106 3% Commercial loans 27,971 1,747 7 Total average deposits 51,711 2,178 4 Noninterest-bearing deposits 22,379 1,375 7 Net interest income 1,672 (56) (3) Loan accretion 49 (22) (31) Provision for credit losses 46 (33) (42) Net loan charge-offs 73 (97) (57) Noninterest income 826 8 1 Customer-driven fee income 763 13 2 Noninterest expenses 1,678 (79) (4) Net income 569 48 9 Shares repurchased1 7.4MM shares or $287MM Key Performance Drivers

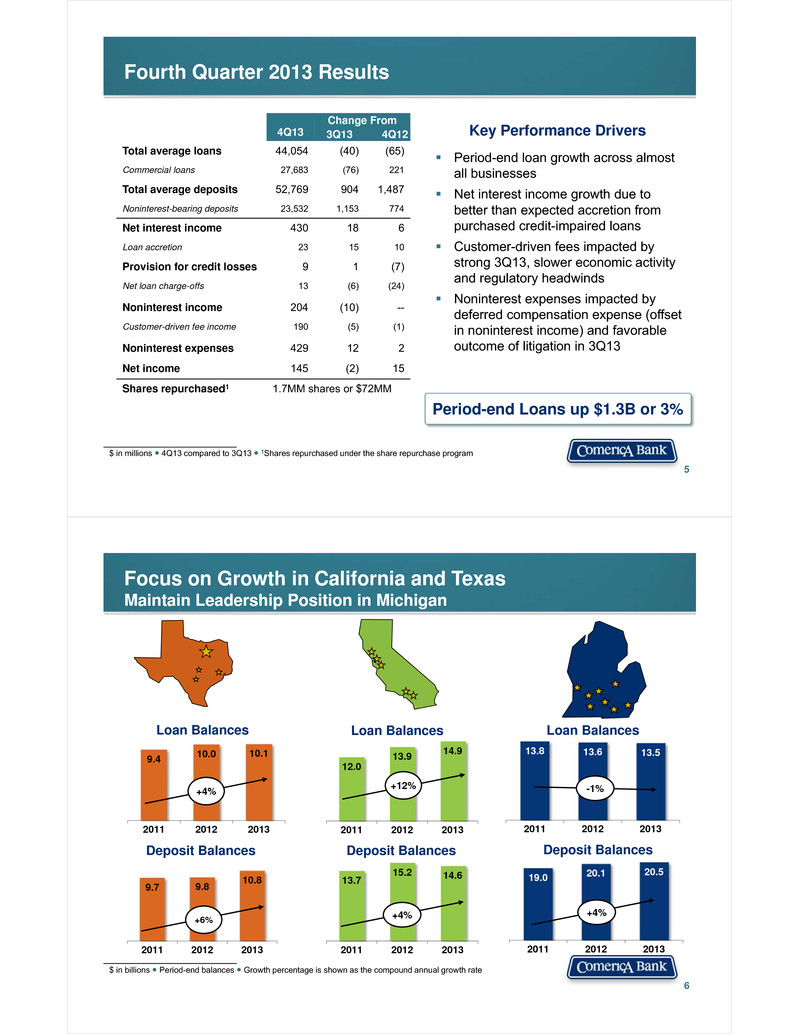

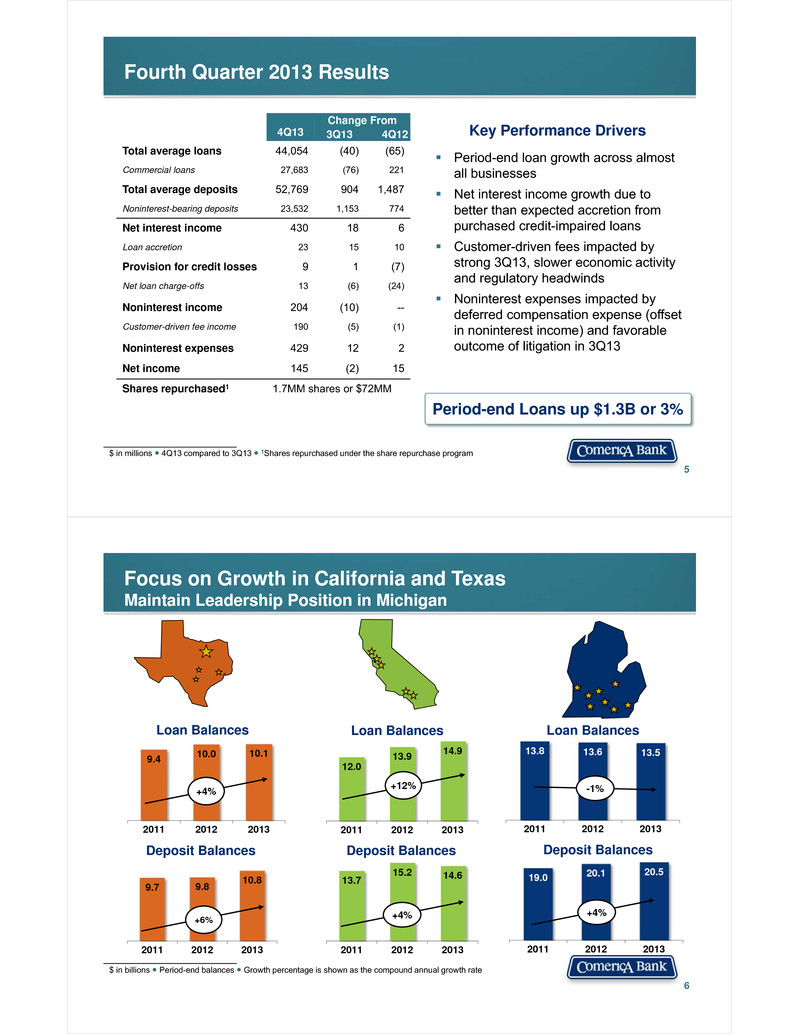

Fourth Quarter 2013 Results 5 $ in millions ● 4Q13 compared to 3Q13 ● 1Shares repurchased under the share repurchase program Key Performance Drivers Period-end loan growth across almost all businesses Net interest income growth due to better than expected accretion from purchased credit-impaired loans Customer-driven fees impacted by strong 3Q13, slower economic activity and regulatory headwinds Noninterest expenses impacted by deferred compensation expense (offset in noninterest income) and favorable outcome of litigation in 3Q13 4Q13 Change From3Q13 4Q12Total average loans 44,054 (40) (65) Commercial loans 27,683 (76) 221 Total average deposits 52,769 904 1,487 Noninterest-bearing deposits 23,532 1,153 774 Net interest income 430 18 6 Loan accretion 23 15 10 Provision for credit losses 9 1 (7) Net loan charge-offs 13 (6) (24) Noninterest income 204 (10) -- Customer-driven fee income 190 (5) (1) Noninterest expenses 429 12 2 Net income 145 (2) 15 Shares repurchased1 1.7MM shares or $72MM Period-end Loans up $1.3B or 3% Focus on Growth in California and TexasMaintain Leadership Position in Michigan 6 9.4 10.0 10.1 2011 2012 2013 Loan Balances 9.7 9.8 10.8 2011 2012 2013 Deposit Balances 12.0 13.9 14.9 2011 2012 2013 Loan Balances 13.7 15.2 14.6 2011 2012 2013 Deposit Balances 13.8 13.6 13.5 2011 2012 2013 Loan Balances 19.0 20.1 20.5 2011 2012 2013 Deposit Balances +4% +4% -1% $ in billions ● Period-end balances ● Growth percentage is shown as the compound annual growth rate +4% +6% +12%

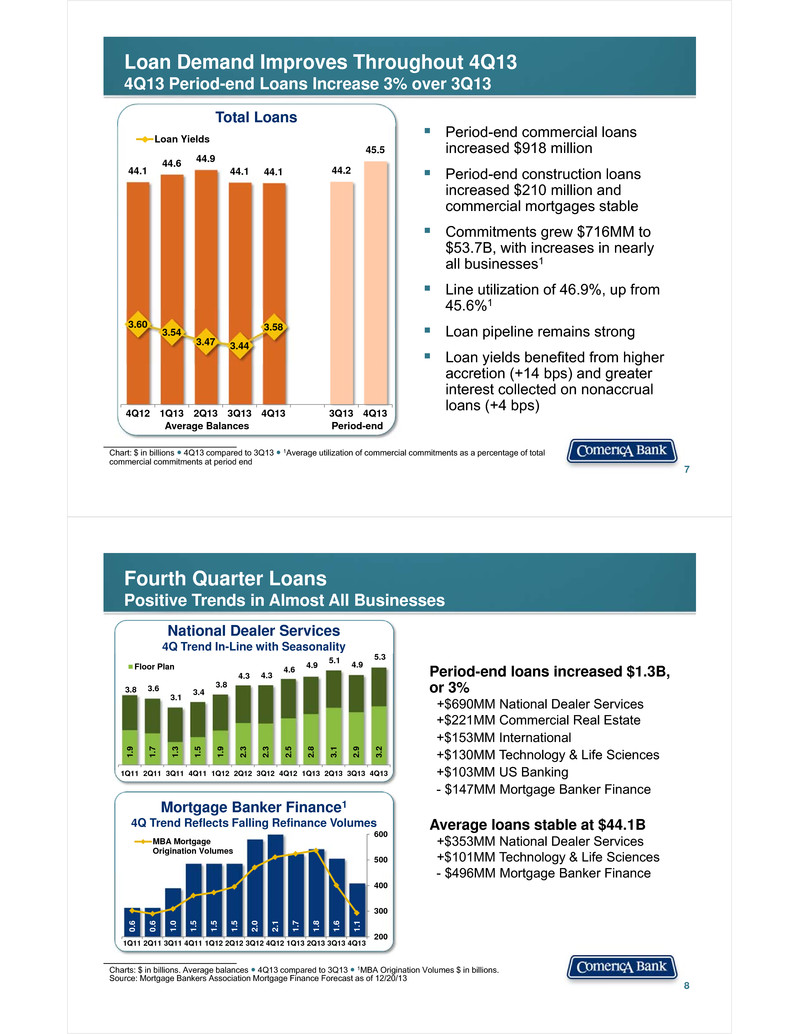

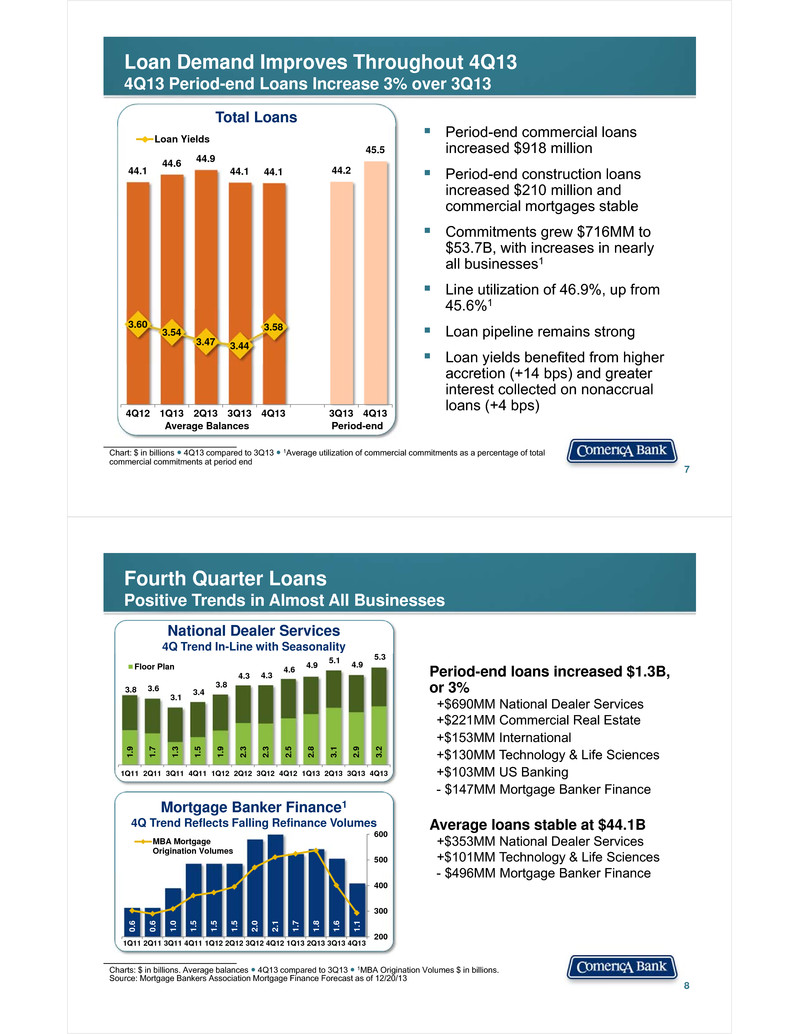

Loan Demand Improves Throughout 4Q134Q13 Period-end Loans Increase 3% over 3Q13 44.1 44.6 44.9 44.1 44.1 44.2 45.5 3.60 3.54 3.47 3.44 3.58 4Q12 1Q13 2Q13 3Q13 4Q13 3Q13 4Q13 Loan Yields 7 Chart: $ in billions ● 4Q13 compared to 3Q13 ● 1Average utilization of commercial commitments as a percentage of total commercial commitments at period end Total Loans Average Balances Period-end Period-end commercial loans increased $918 million Period-end construction loans increased $210 million and commercial mortgages stable Commitments grew $716MM to $53.7B, with increases in nearly all businesses1 Line utilization of 46.9%, up from 45.6%1 Loan pipeline remains strong Loan yields benefited from higher accretion (+14 bps) and greater interest collected on nonaccrual loans (+4 bps) Fourth Quarter LoansPositive Trends in Almost All Businesses 8 Charts: $ in billions. Average balances ● 4Q13 compared to 3Q13 ● 1MBA Origination Volumes $ in billions. Source: Mortgage Bankers Association Mortgage Finance Forecast as of 12/20/13 1.9 1.7 1.3 1.5 1.9 2.3 2.3 2.5 2.8 3.1 2.9 3.2 3.8 3.6 3.1 3.4 3.8 4.3 4.3 4.6 4.9 5.1 4.9 5.3 1Q11 2Q11 3Q11 4Q11 1Q12 2Q12 3Q12 4Q12 1Q13 2Q13 3Q13 4Q13 Floor Plan National Dealer Services4Q Trend In-Line with Seasonality Mortgage Banker Finance14Q Trend Reflects Falling Refinance Volumes 0.6 0.6 1.0 1.5 1.5 1.5 2.0 2.1 1.7 1.8 1.6 1.1 200 300 400 500 600 1Q11 2Q11 3Q11 4Q11 1Q12 2Q12 3Q12 4Q12 1Q13 2Q13 3Q13 4Q13 MBA MortgageOrigination Volumes Period-end loans increased $1.3B, or 3%+$690MM National Dealer Services+$221MM Commercial Real Estate+$153MM International+$130MM Technology & Life Sciences+$103MM US Banking- $147MM Mortgage Banker Finance Average loans stable at $44.1B +$353MM National Dealer Services+$101MM Technology & Life Sciences- $496MM Mortgage Banker Finance

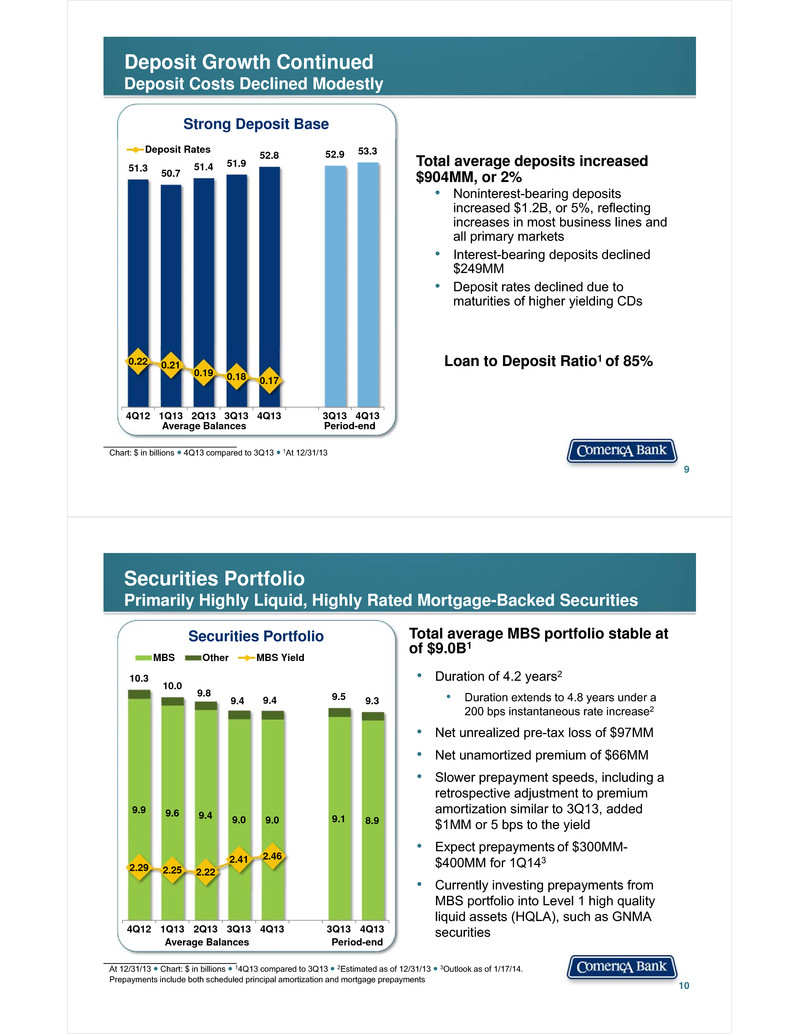

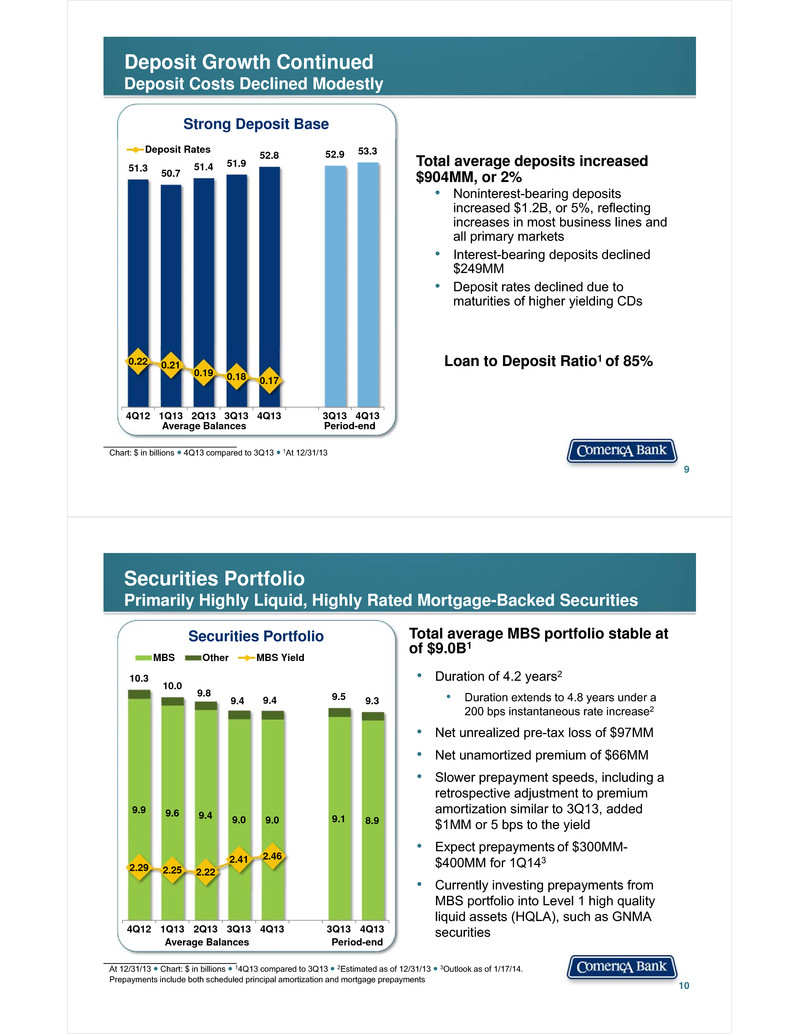

51.3 50.7 51.4 51.9 52.8 52.9 53.3 0.22 0.21 0.19 0.18 0.17 4Q12 1Q13 2Q13 3Q13 4Q13 3Q13 4Q13 Deposit Rates Deposit Growth ContinuedDeposit Costs Declined Modestly 9 Chart: $ in billions ● 4Q13 compared to 3Q13 ● 1At 12/31/13 Total average deposits increased $904MM, or 2%• Noninterest-bearing deposits increased $1.2B, or 5%, reflecting increases in most business lines and all primary markets• Interest-bearing deposits declined $249MM• Deposit rates declined due to maturities of higher yielding CDs Loan to Deposit Ratio1 of 85% Strong Deposit Base Average Balances Period-end Securities Portfolio Securities PortfolioPrimarily Highly Liquid, Highly Rated Mortgage-Backed Securities 10 At 12/31/13 ● Chart: $ in billions ● 14Q13 compared to 3Q13 ● 2Estimated as of 12/31/13 ● 3Outlook as of 1/17/14.Prepayments include both scheduled principal amortization and mortgage prepayments 9.9 9.6 9.4 9.0 9.0 9.1 8.9 10.3 10.0 9.8 9.4 9.4 9.5 9.3 2.29 2.25 2.22 2.41 2.46 4Q12 1Q13 2Q13 3Q13 4Q13 3Q13 4Q13 MBS Other MBS Yield Total average MBS portfolio stable at of $9.0B1 • Duration of 4.2 years2 • Duration extends to 4.8 years under a 200 bps instantaneous rate increase2• Net unrealized pre-tax loss of $97MM• Net unamortized premium of $66MM • Slower prepayment speeds, including a retrospective adjustment to premium amortization similar to 3Q13, added $1MM or 5 bps to the yield• Expect prepayments of $300MM-$400MM for 1Q143• Currently investing prepayments from MBS portfolio into Level 1 high quality liquid assets (HQLA), such as GNMA securities Average Balances Period-end

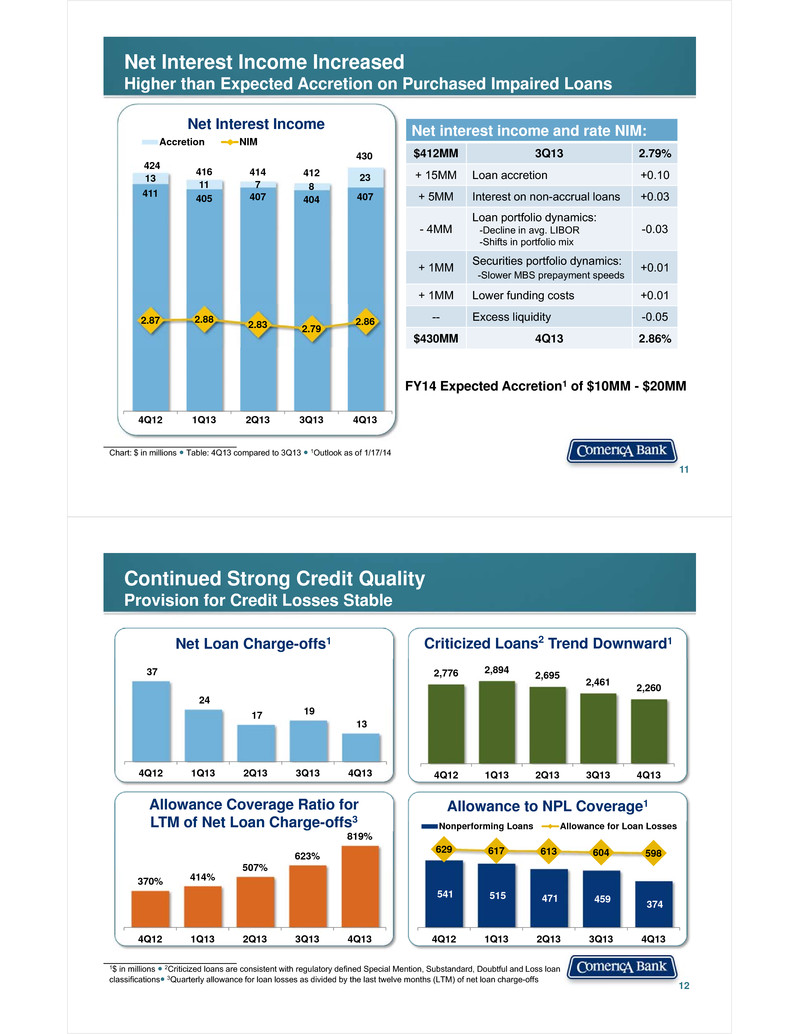

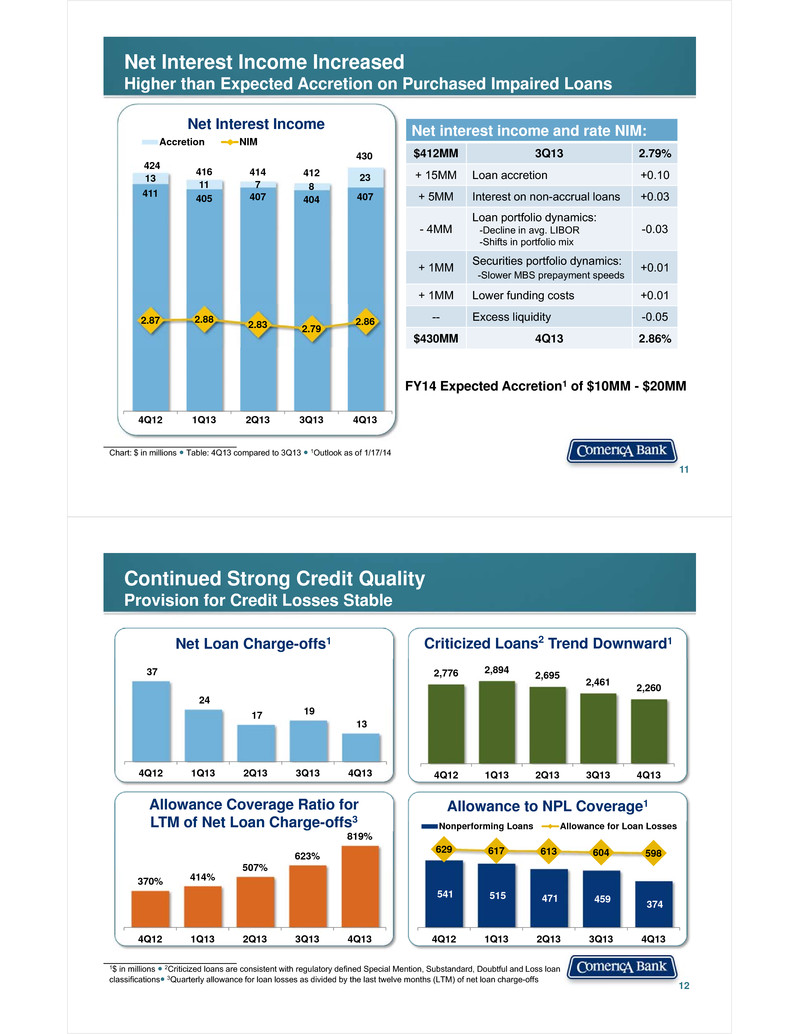

Net Interest Income IncreasedHigher than Expected Accretion on Purchased Impaired Loans 11 Chart: $ in millions ● Table: 4Q13 compared to 3Q13 ● 1Outlook as of 1/17/14 Net Interest Income Net interest income and rate NIM: $412MM 3Q13 2.79% + 15MM Loan accretion +0.10 + 5MM Interest on non-accrual loans +0.03 - 4MM Loan portfolio dynamics:-Decline in avg. LIBOR-Shifts in portfolio mix -0.03 + 1MM Securities portfolio dynamics:-Slower MBS prepayment speeds +0.01 + 1MM Lower funding costs +0.01 -- Excess liquidity -0.05 $430MM 4Q13 2.86% FY14 Expected Accretion1 of $10MM - $20MM 411 405 407 404 407 13 11 7 8 23 424 416 414 412 430 2.87 2.88 2.83 2.79 2.86 4Q12 1Q13 2Q13 3Q13 4Q13 Accretion NIM 541 515 471 459 374 629 617 613 604 598 4Q12 1Q13 2Q13 3Q13 4Q13 Nonperforming Loans Allowance for Loan Losses 37 24 17 19 13 4Q12 1Q13 2Q13 3Q13 4Q13 Continued Strong Credit QualityProvision for Credit Losses Stable 12 1$ in millions ● 2Criticized loans are consistent with regulatory defined Special Mention, Substandard, Doubtful and Loss loan classifications● 3Quarterly allowance for loan losses as divided by the last twelve months (LTM) of net loan charge-offs Allowance to NPL Coverage1 2,776 2,894 2,695 2,461 2,260 4Q12 1Q13 2Q13 3Q13 4Q13 Net Loan Charge-offs1 370% 414% 507% 623% 819% 4Q12 1Q13 2Q13 3Q13 4Q13 Allowance Coverage Ratio for LTM of Net Loan Charge-offs3 Criticized Loans2 Trend Downward1

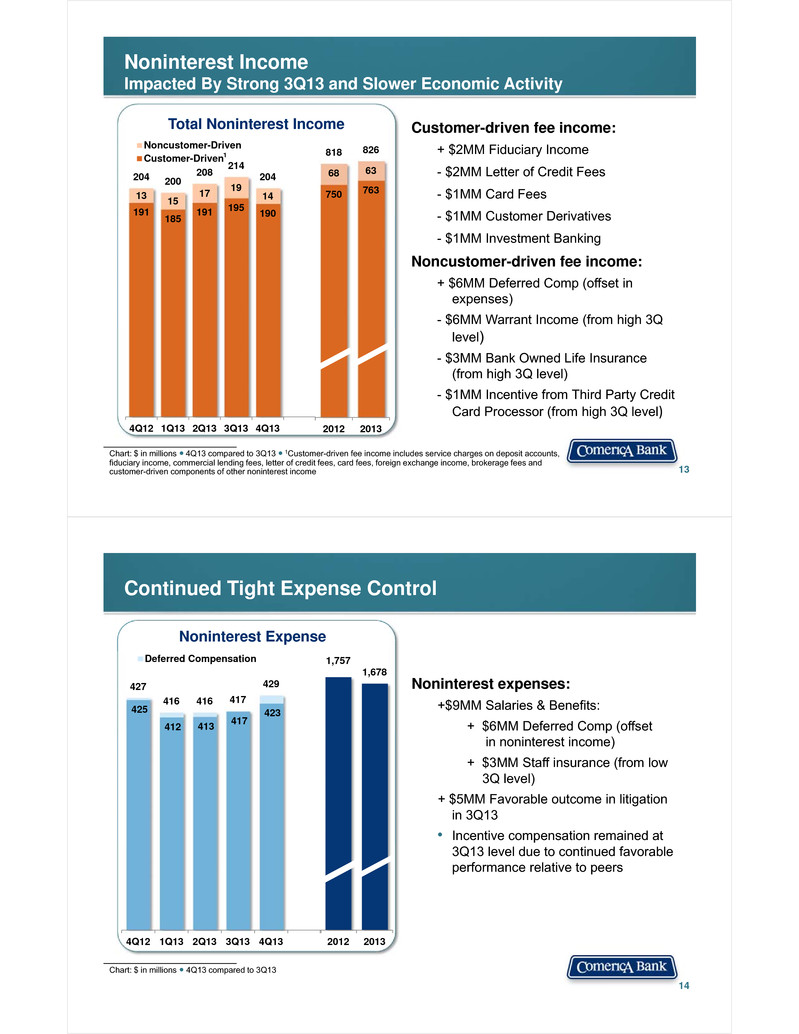

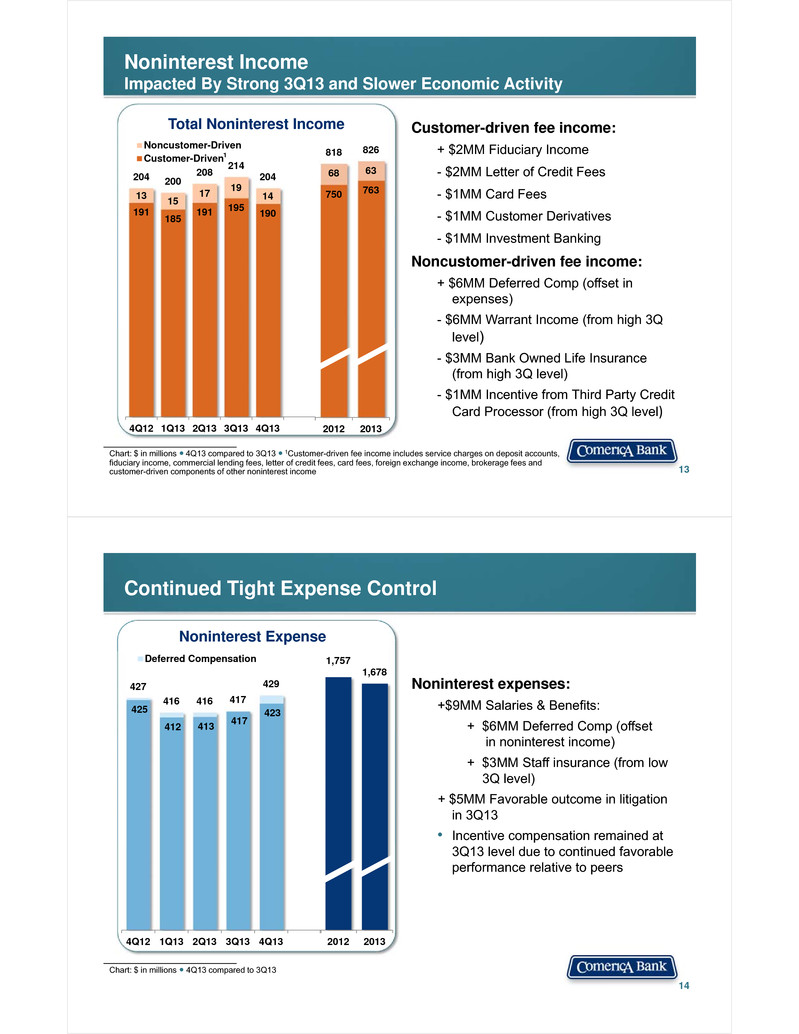

Noninterest IncomeImpacted By Strong 3Q13 and Slower Economic Activity 13 Total Noninterest Income Chart: $ in millions ● 4Q13 compared to 3Q13 ● 1Customer-driven fee income includes service charges on deposit accounts, fiduciary income, commercial lending fees, letter of credit fees, card fees, foreign exchange income, brokerage fees and customer-driven components of other noninterest income 191 185 191 195 190 13 15 17 19 14 204 200 208 214 204 4Q12 1Q13 2Q13 3Q13 4Q13 Noncustomer-DrivenCustomer-Driven Customer-driven fee income: + $2MM Fiduciary Income - $2MM Letter of Credit Fees - $1MM Card Fees - $1MM Customer Derivatives - $1MM Investment Banking Noncustomer-driven fee income: + $6MM Deferred Comp (offset in expenses)- $6MM Warrant Income (from high 3Q level) - $3MM Bank Owned Life Insurance (from high 3Q level)- $1MM Incentive from Third Party Credit Card Processor (from high 3Q level) 1 750 763 68 63 818 826 2012 2013 Continued Tight Expense Control Noninterest Expense 425 412 413 417 423 427 416 416 417 429 4Q12 1Q13 2Q13 3Q13 4Q13 Deferred Compensation Noninterest expenses: +$9MM Salaries & Benefits:+ $6MM Deferred Comp (offset in noninterest income)+ $3MM Staff insurance (from low 3Q level)+ $5MM Favorable outcome in litigation in 3Q13• Incentive compensation remained at 3Q13 level due to continued favorable performance relative to peers Chart: $ in millions ● 4Q13 compared to 3Q13 14 1,757 1,678 2012 2013

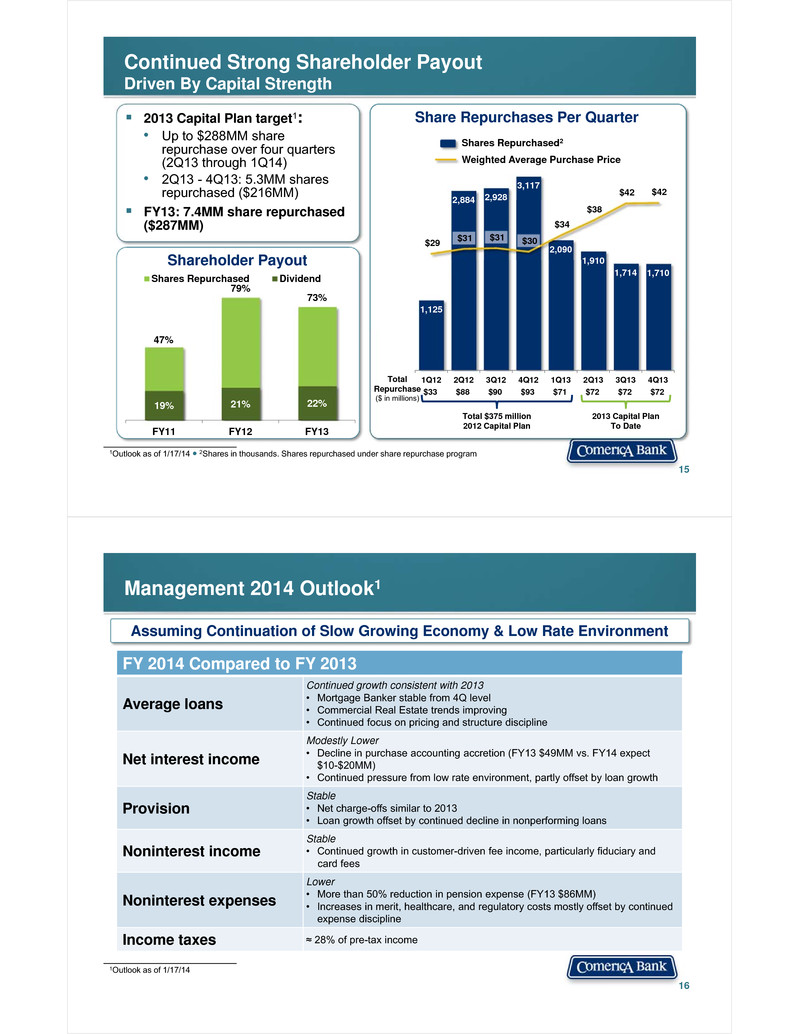

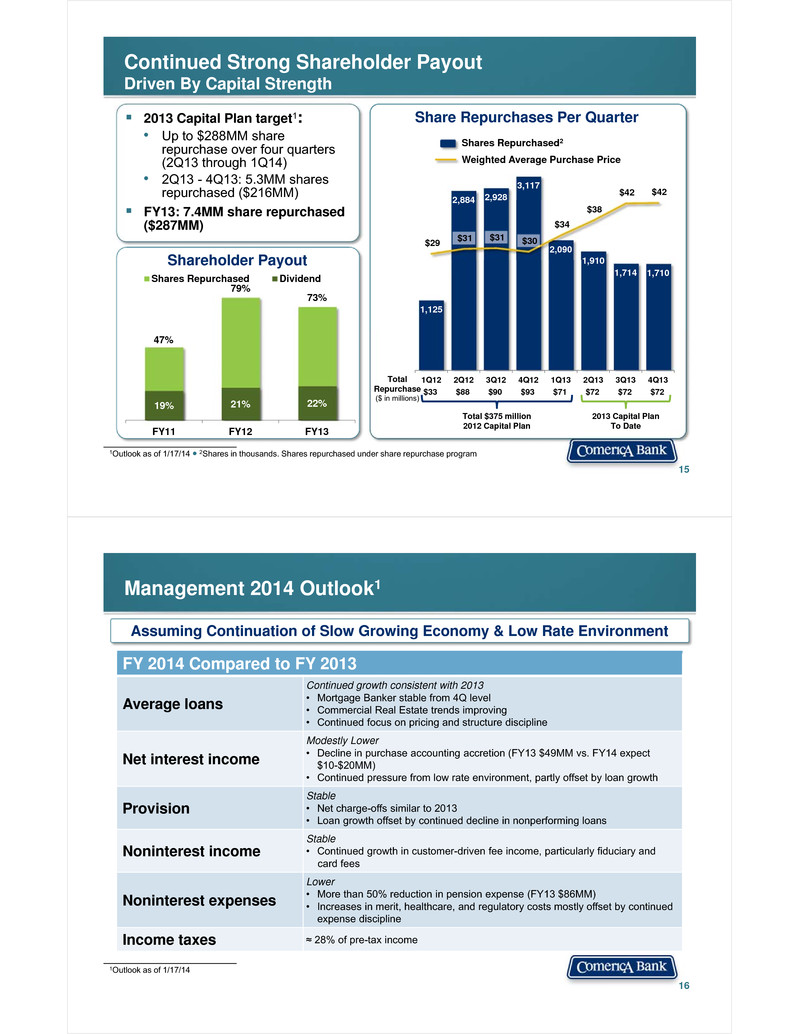

Continued Strong Shareholder PayoutDriven By Capital Strength 15 1,125 2,884 2,928 3,117 2,090 1,910 1,714 1,710 $29 $31 $31 $30 $34 $38 $42 $42 1Q12 2Q12 3Q12 4Q12 1Q13 2Q13 3Q13 4Q13 Share Repurchases Per Quarter Shares Repurchased2 Weighted Average Purchase Price $33 $88 $90 $93 $71 $72 $72 $72 Total $375 million2012 Capital Plan 2013 Capital Plan To Date 2013 Capital Plan target1:• Up to $288MM share repurchase over four quarters (2Q13 through 1Q14)• 2Q13 - 4Q13: 5.3MM shares repurchased ($216MM) FY13: 7.4MM share repurchased ($287MM) Total Repurchase ($ in millions) Shareholder Payout 47% 79% 73% 19% 21% 22% FY11 FY12 FY13 Shares Repurchased Dividend 1Outlook as of 1/17/14 ● 2Shares in thousands. Shares repurchased under share repurchase program Management 2014 Outlook1 16 FY 2014 Compared to FY 2013 Average loans Continued growth consistent with 2013• Mortgage Banker stable from 4Q level • Commercial Real Estate trends improving• Continued focus on pricing and structure discipline Net interest income Modestly Lower• Decline in purchase accounting accretion (FY13 $49MM vs. FY14 expect $10-$20MM)• Continued pressure from low rate environment, partly offset by loan growth Provision Stable• Net charge-offs similar to 2013• Loan growth offset by continued decline in nonperforming loans Noninterest income Stable• Continued growth in customer-driven fee income, particularly fiduciary andcard fees Noninterest expenses Lower• More than 50% reduction in pension expense (FY13 $86MM)• Increases in merit, healthcare, and regulatory costs mostly offset by continued expense disciplineIncome taxes ≈ 28% of pre-tax income 1Outlook as of 1/17/14 Assuming Continuation of Slow Growing Economy & Low Rate Environment

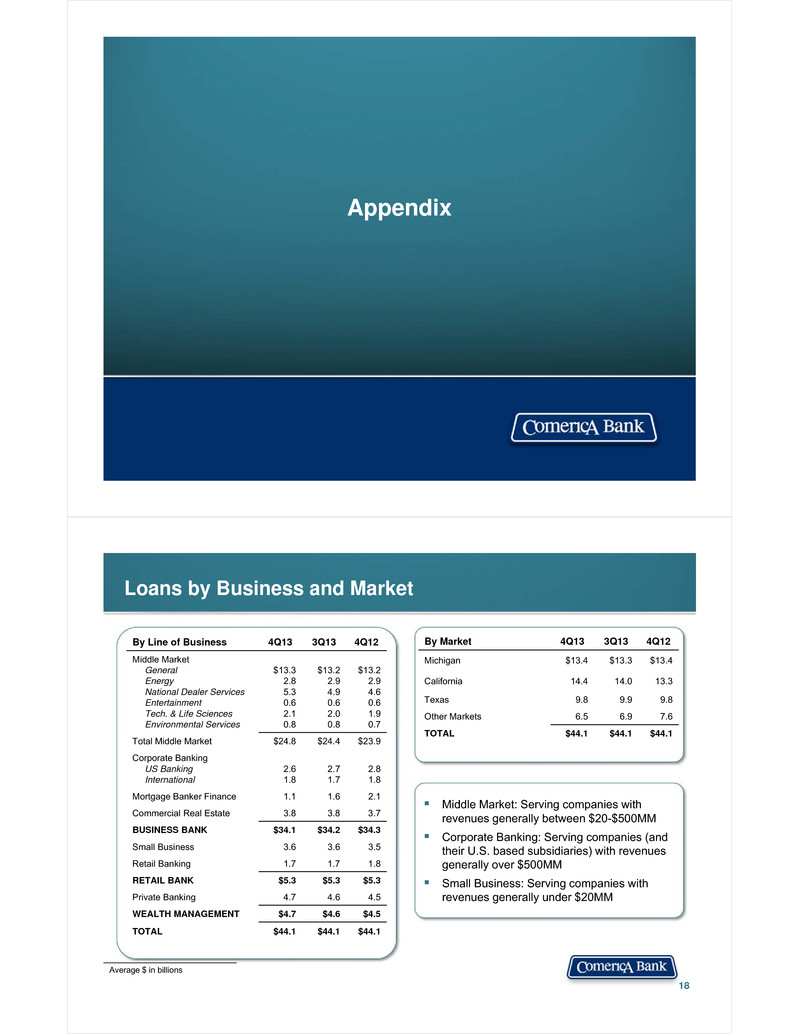

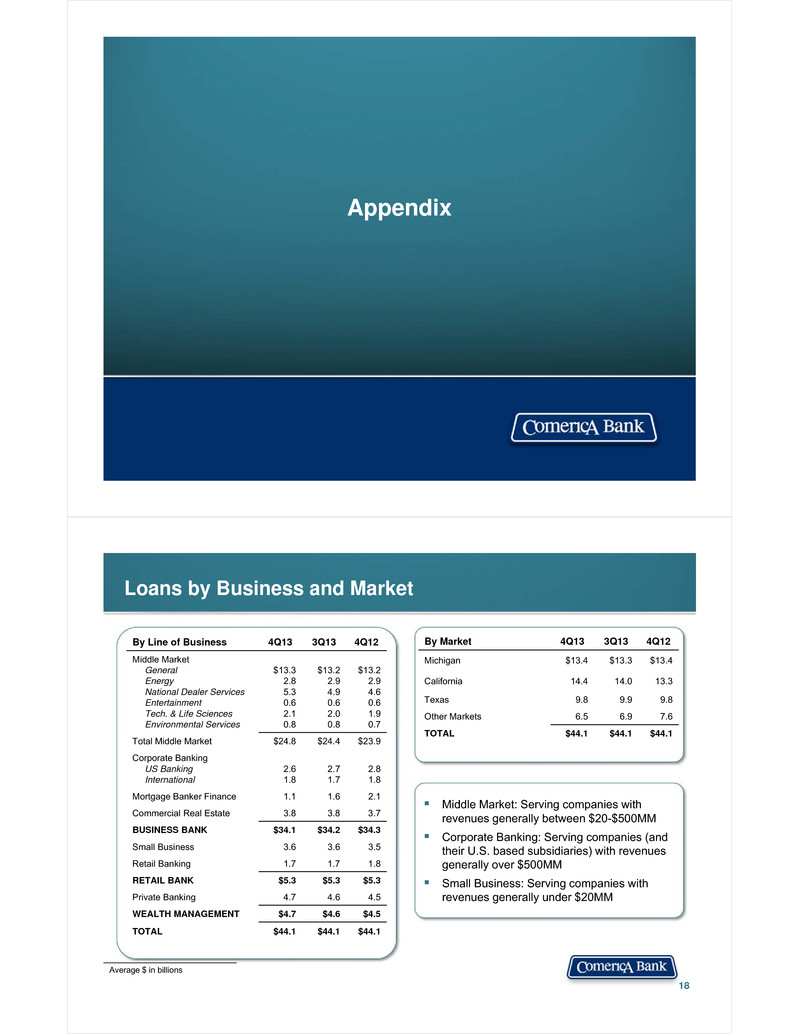

Appendix Loans by Business and Market 18 Middle Market: Serving companies with revenues generally between $20-$500MM Corporate Banking: Serving companies (and their U.S. based subsidiaries) with revenues generally over $500MM Small Business: Serving companies with revenues generally under $20MM Average $ in billions By Line of Business 4Q13 3Q13 4Q12 Middle MarketGeneralEnergyNational Dealer ServicesEntertainmentTech. & Life SciencesEnvironmental Services $13.32.85.30.62.10.8 $13.22.94.90.62.00.8 $13.22.94.60.61.90.7 Total Middle Market $24.8 $24.4 $23.9 Corporate BankingUS BankingInternational 2.61.8 2.71.7 2.81.8 Mortgage Banker Finance 1.1 1.6 2.1 Commercial Real Estate 3.8 3.8 3.7 BUSINESS BANK $34.1 $34.2 $34.3 Small Business 3.6 3.6 3.5 Retail Banking 1.7 1.7 1.8 RETAIL BANK $5.3 $5.3 $5.3 Private Banking 4.7 4.6 4.5 WEALTH MANAGEMENT $4.7 $4.6 $4.5 TOTAL $44.1 $44.1 $44.1 By Market 4Q13 3Q13 4Q12 Michigan $13.4 $13.3 $13.4 California 14.4 14.0 13.3 Texas 9.8 9.9 9.8 Other Markets 6.5 6.9 7.6 TOTAL $44.1 $44.1 $44.1

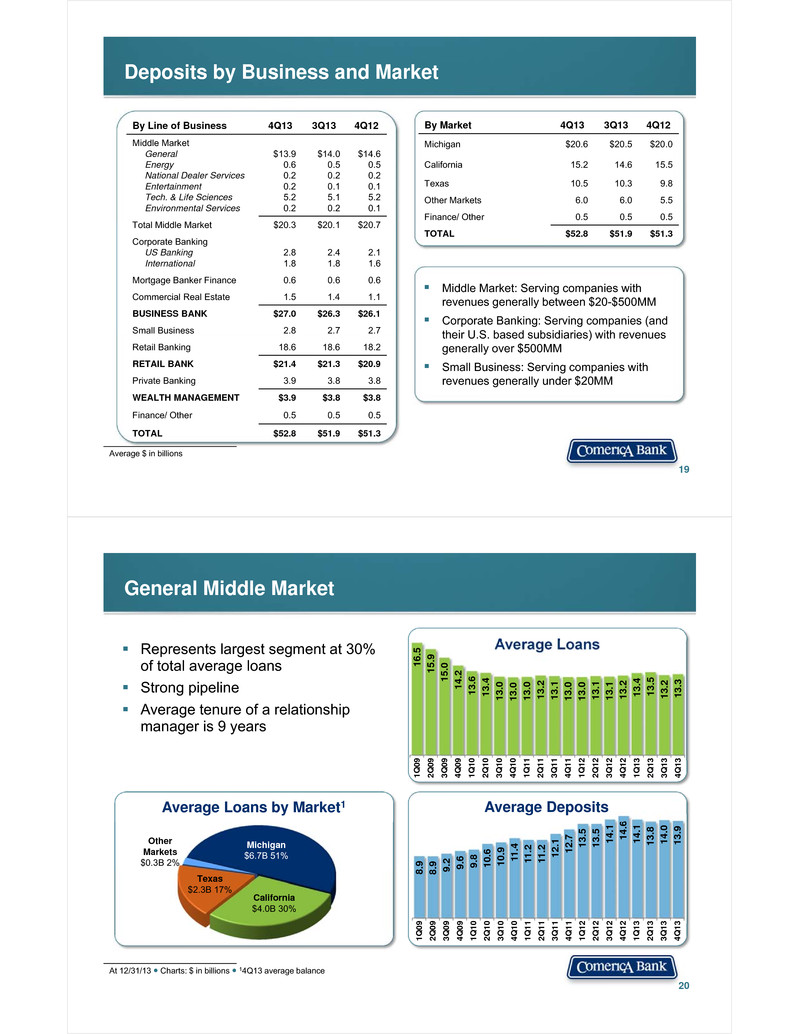

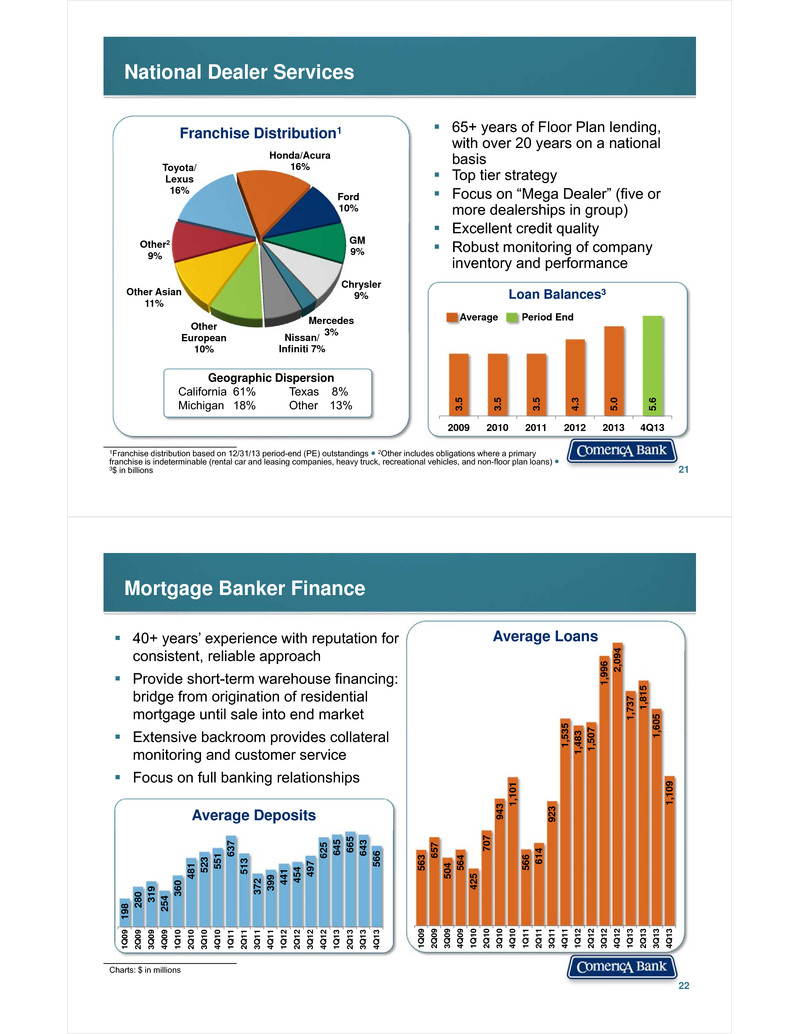

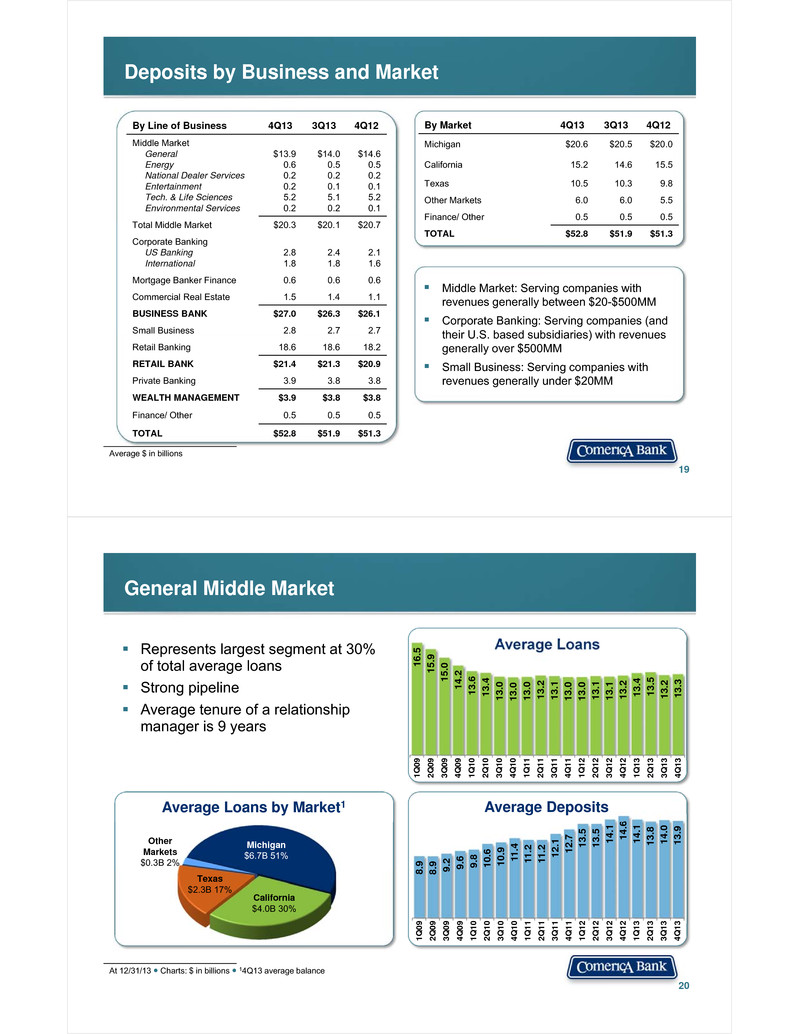

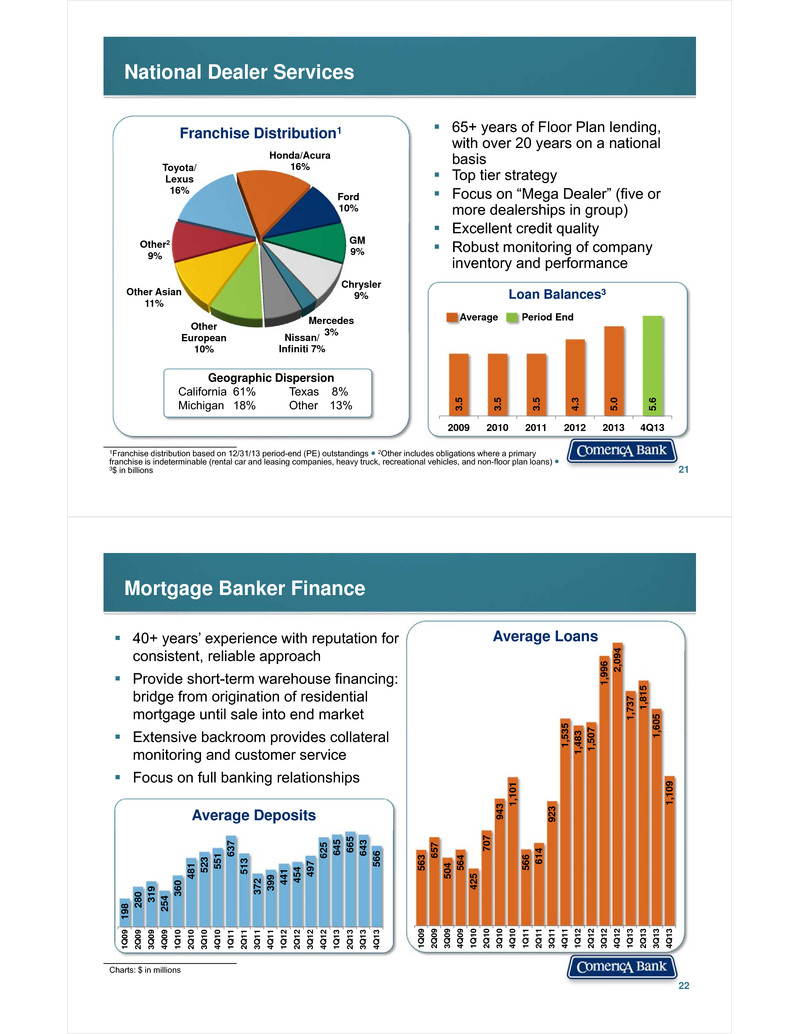

Deposits by Business and Market 19 Middle Market: Serving companies with revenues generally between $20-$500MM Corporate Banking: Serving companies (and their U.S. based subsidiaries) with revenues generally over $500MM Small Business: Serving companies with revenues generally under $20MM Average $ in billions By Line of Business 4Q13 3Q13 4Q12 Middle MarketGeneralEnergyNational Dealer ServicesEntertainmentTech. & Life SciencesEnvironmental Services $13.90.60.20.25.20.2 $14.00.50.20.15.10.2 $14.60.50.20.15.20.1 Total Middle Market $20.3 $20.1 $20.7 Corporate BankingUS BankingInternational 2.81.8 2.41.8 2.11.6 Mortgage Banker Finance 0.6 0.6 0.6 Commercial Real Estate 1.5 1.4 1.1 BUSINESS BANK $27.0 $26.3 $26.1 Small Business 2.8 2.7 2.7 Retail Banking 18.6 18.6 18.2 RETAIL BANK $21.4 $21.3 $20.9 Private Banking 3.9 3.8 3.8 WEALTH MANAGEMENT $3.9 $3.8 $3.8 Finance/ Other 0.5 0.5 0.5 TOTAL $52.8 $51.9 $51.3 By Market 4Q13 3Q13 4Q12 Michigan $20.6 $20.5 $20.0 California 15.2 14.6 15.5 Texas 10.5 10.3 9.8 Other Markets 6.0 6.0 5.5 Finance/ Other 0.5 0.5 0.5 TOTAL $52.8 $51.9 $51.3 20 General Middle Market At 12/31/13 ● Charts: $ in billions ● 14Q13 average balance 8.9 8.9 9.2 9.6 9.8 10 .6 10.9 11. 4 11.2 11.2 12 .1 12.7 13 .5 13.5 14. 1 14.6 14.1 13.8 14.0 13.9 1Q0 9 2Q0 9 3Q0 9 4Q0 9 1Q1 0 2Q1 0 3Q1 0 4Q1 0 1Q1 1 2Q1 1 3Q1 1 4Q1 1 1Q1 2 2Q1 2 3Q1 2 4Q1 2 1Q1 3 2Q1 3 3Q1 3 4Q1 3 Average Loans Average Deposits 16.5 15.9 15.0 14.2 13.6 13.4 13.0 13.0 13.0 13.2 13.1 13.0 13.0 13.1 13.1 13.2 13. 4 13.5 13.2 13.3 1Q0 9 2Q0 9 3Q0 9 4Q0 9 1Q1 0 2Q1 0 3Q1 0 4Q1 0 1Q1 1 2Q1 1 3Q1 1 4Q1 1 1Q1 2 2Q1 2 3Q1 2 4Q1 2 1Q1 3 2Q1 3 3Q1 3 4Q1 3 Represents largest segment at 30% of total average loans Strong pipeline Average tenure of a relationship manager is 9 years California$4.0B 30% Texas$2.3B 17% Michigan$6.7B 51% Other Markets$0.3B 2% Average Loans by Market1

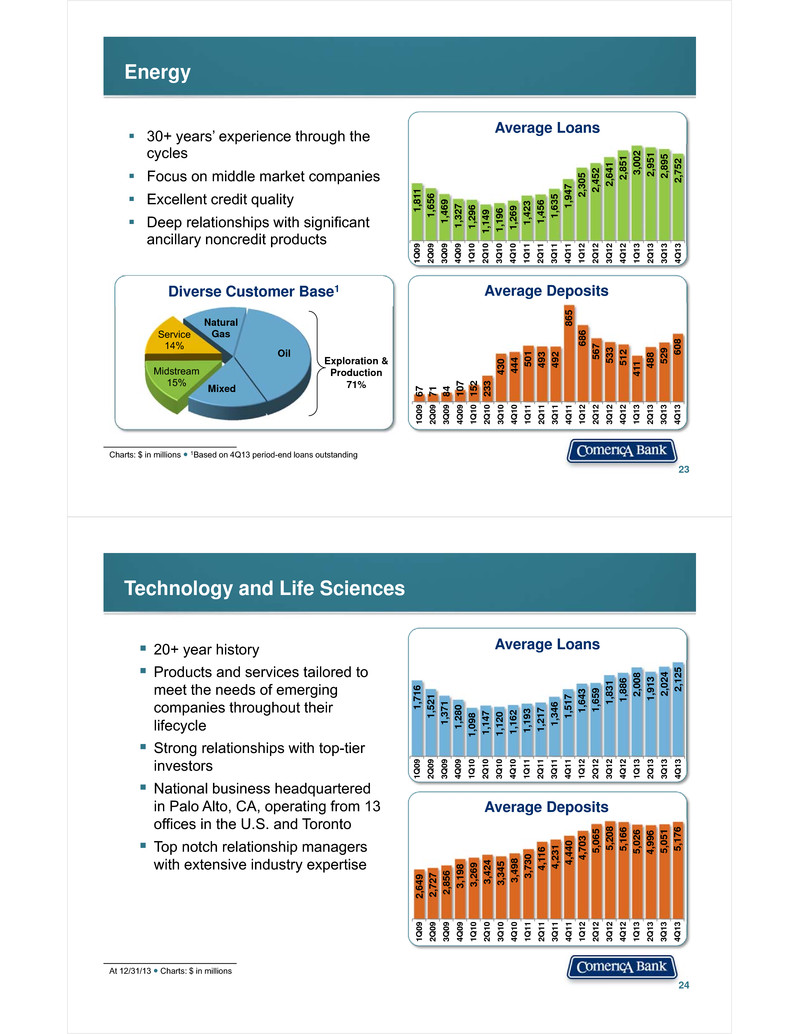

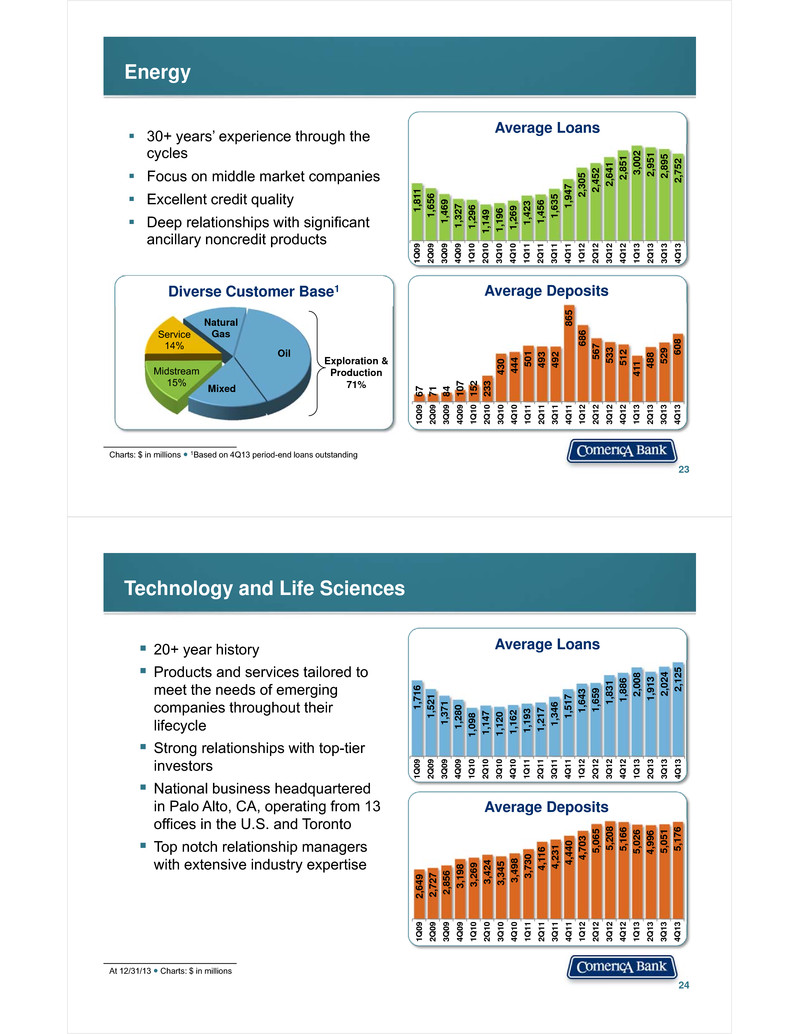

National Dealer Services 21 Toyota/Lexus16% Honda/Acura 16% Ford 10% GM 9% Chrysler 9% Mercedes 3%Nissan/ Infiniti 7% Other European 10% Other Asian 11% Other29% 65+ years of Floor Plan lending, with over 20 years on a national basis Top tier strategy Focus on “Mega Dealer” (five or more dealerships in group) Excellent credit quality Robust monitoring of company inventory and performance Geographic DispersionCalifornia 61% Texas 8%Michigan 18% Other 13% 3.5 3.5 3.5 4.3 5.0 5.6 2009 2010 2011 2012 2013 4Q13 Loan Balances3 Average Period End 1Franchise distribution based on 12/31/13 period-end (PE) outstandings ● 2Other includes obligations where a primary franchise is indeterminable (rental car and leasing companies, heavy truck, recreational vehicles, and non-floor plan loans) ● 3$ in billions Franchise Distribution1 Mortgage Banker Finance 40+ years’ experience with reputation for consistent, reliable approach Provide short-term warehouse financing: bridge from origination of residential mortgage until sale into end market Extensive backroom provides collateral monitoring and customer service Focus on full banking relationships Average Deposits 198 2 80 319 254 3 60 4 81 523 551 637 513 372 399 44 1 454 49 7 62 5 645 665 643 566 1Q0 9 2Q0 9 3Q0 9 4Q0 9 1Q1 0 2Q1 0 3Q1 0 4Q1 0 1Q1 1 2Q1 1 3Q1 1 4Q1 1 1Q1 2 2Q1 2 3Q1 2 4Q1 2 1Q1 3 2Q1 3 3Q1 3 4Q1 3 563 6 57 504 56 4 425 707 943 1 ,101 566 61 4 923 1,53 5 1,48 3 1,50 7 1,99 6 2,09 4 1,73 7 1,81 5 1,60 5 1,10 9 1Q0 9 2Q0 9 3Q0 9 4Q0 9 1Q1 0 2Q1 0 3Q1 0 4Q1 0 1Q1 1 2Q1 1 3Q1 1 4Q1 1 1Q1 2 2Q1 2 3Q1 2 4Q1 2 1Q1 3 2Q1 3 3Q1 3 4Q1 3 Average Loans Charts: $ in millions 22

Natural Gas Oil Mixed Midstream15% Service14% Energy 23 Average Loans Average Deposits 30+ years’ experience through the cycles Focus on middle market companies Excellent credit quality Deep relationships with significant ancillary noncredit products Exploration & Production 71% Charts: $ in millions ● 1Based on 4Q13 period-end loans outstanding 1,81 1 1,65 6 1,46 9 1,32 7 1,29 6 1,14 9 1,19 6 1,26 9 1,42 3 1,45 6 1,63 5 1,94 7 2,30 5 2,45 2 2,64 1 2,85 1 3,00 2 2,95 1 2,89 5 2,75 2 1Q0 9 2Q0 9 3Q0 9 4Q0 9 1Q1 0 2Q1 0 3Q1 0 4Q1 0 1Q1 1 2Q1 1 3Q1 1 4Q1 1 1Q1 2 2Q1 2 3Q1 2 4Q1 2 1Q1 3 2Q1 3 3Q1 3 4Q1 3 67 71 84 107 152 233 430 444 50 1 493 492 865 686 567 533 512 411 48 8 529 60 8 1Q0 9 2Q0 9 3Q0 9 4Q0 9 1Q1 0 2Q1 0 3Q1 0 4Q1 0 1Q1 1 2Q1 1 3Q1 1 4Q1 1 1Q1 2 2Q1 2 3Q1 2 4Q1 2 1Q1 3 2Q1 3 3Q1 3 4Q1 3 Diverse Customer Base1 Technology and Life Sciences 20+ year history Products and services tailored to meet the needs of emerging companies throughout their lifecycle Strong relationships with top-tier investors National business headquartered in Palo Alto, CA, operating from 13 offices in the U.S. and Toronto Top notch relationship managers with extensive industry expertise Average Loans Average Deposits 1,71 6 1,52 1 1,37 1 1,28 0 1,09 8 1,14 7 1,12 0 1,16 2 1,19 3 1,21 7 1,34 6 1,51 7 1,64 3 1,65 9 1,83 1 1,88 6 2,00 8 1,91 3 2,02 4 2,12 5 1Q0 9 2Q0 9 3Q0 9 4Q0 9 1Q1 0 2Q1 0 3Q1 0 4Q1 0 1Q1 1 2Q1 1 3Q1 1 4Q1 1 1Q1 2 2Q1 2 3Q1 2 4Q1 2 1Q1 3 2Q1 3 3Q1 3 4Q1 3 2,64 9 2,72 7 2,85 6 3,19 8 3,26 9 3,42 4 3,34 5 3,49 8 3,73 0 4,11 6 4,23 1 4,44 0 4,70 3 5,06 5 5,20 8 5,16 6 5,02 6 4,99 6 5,05 1 5,17 6 1Q0 9 2Q0 9 3Q0 9 4Q0 9 1Q1 0 2Q1 0 3Q1 0 4Q1 0 1Q1 1 2Q1 1 3Q1 1 4Q1 1 1Q1 2 2Q1 2 3Q1 2 4Q1 2 1Q1 3 2Q1 3 3Q1 3 4Q1 3 At 12/31/13 ● Charts: $ in millions 24

25 6,84 3 6,65 2 6,36 5 6,04 5 5,74 4 5,37 4 5,09 6 4,75 4 4,42 8 4,03 4 4,43 6 4,57 7 4,36 5 4,30 5 3,92 4 3,72 7 3,69 3 3,79 1 3,75 2 3,74 1 1Q0 9 2Q0 9 3Q0 9 4Q0 9 1Q1 0 2Q1 0 3Q1 0 4Q1 0 1Q1 1 2Q1 1 3Q1 1 4Q1 1 1Q1 2 2Q1 2 3Q1 2 4Q1 2 1Q1 3 2Q1 3 3Q1 3 4Q1 3 Commercial MortgagesReal Estate ConstructionCommercial & Other 160+ years experience with focus on well-established developers, primarily in our footprint Provide construction and mini-perm mortgage financing Real Estate Construction average loans up for the past 5 quarters 4,444 4,753 4,796 4,926 5,238 4Q12 1Q13 2Q13 3Q13 4Q13 +18% At 12/31/13 ● Charts: $ in millions ● 1Includes CRE line of business loans not secured by real estate ● 2Based on period-end commitments Average Loans Commitments2 Commercial Real Estate Line of Business 1 Shared National Credit Relationships 26 Approximately 860 borrowers Strategy: Pursue full relationships with ancillary business Comerica is agent for approximately 16% Adhere to same credit underwriting standards as rest of loan book Credit quality mirrors total portfolio Commercial Real Estate$0.6B 6% Corporate $2.6B 28% General$2.1B 22% National Dealer $0.4B 4% Energy$2.6B 28% Entertainment$0.2B 3% Tech. & Life Sciences$0.3B 3% Environmental Services $0.4B 4% Mortgage Banker$0.2B 2% December 31, 2013: $9.4B Period-end outstandings as of 12/31/13 ● Shared National Credit (SNC): Facilities greater than $20 million shared by three or more federally supervised financial institutions which are reviewed by regulatory authorities at the agent bank level. = Total Middle Market (64%)

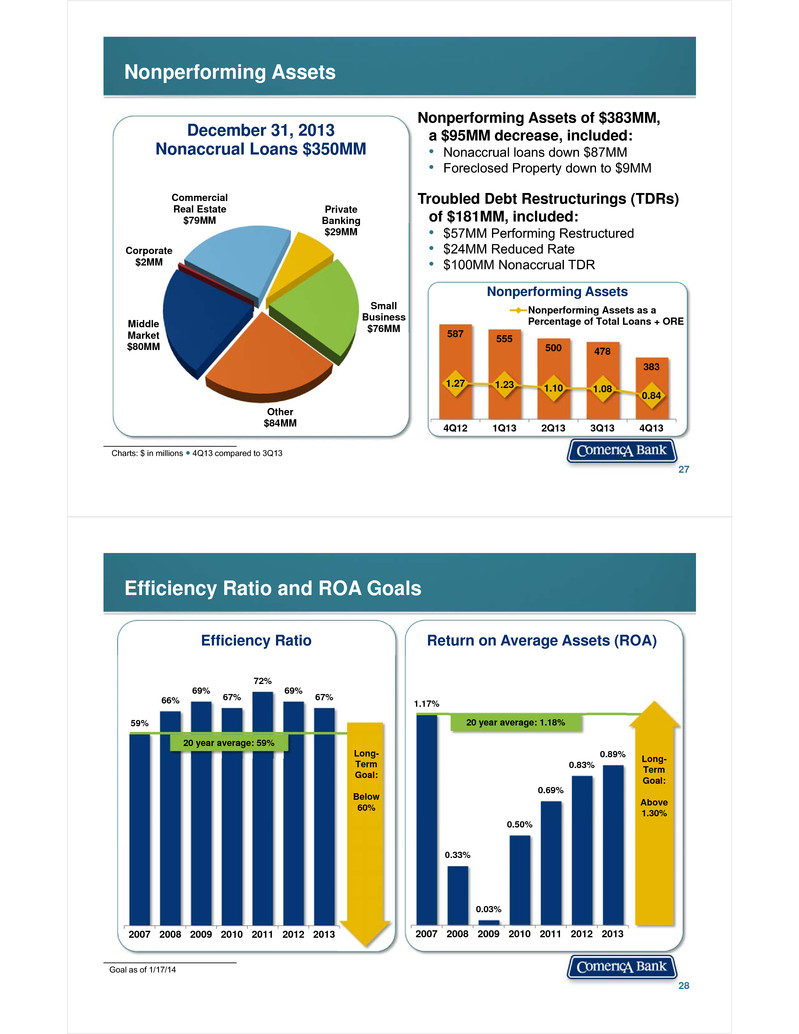

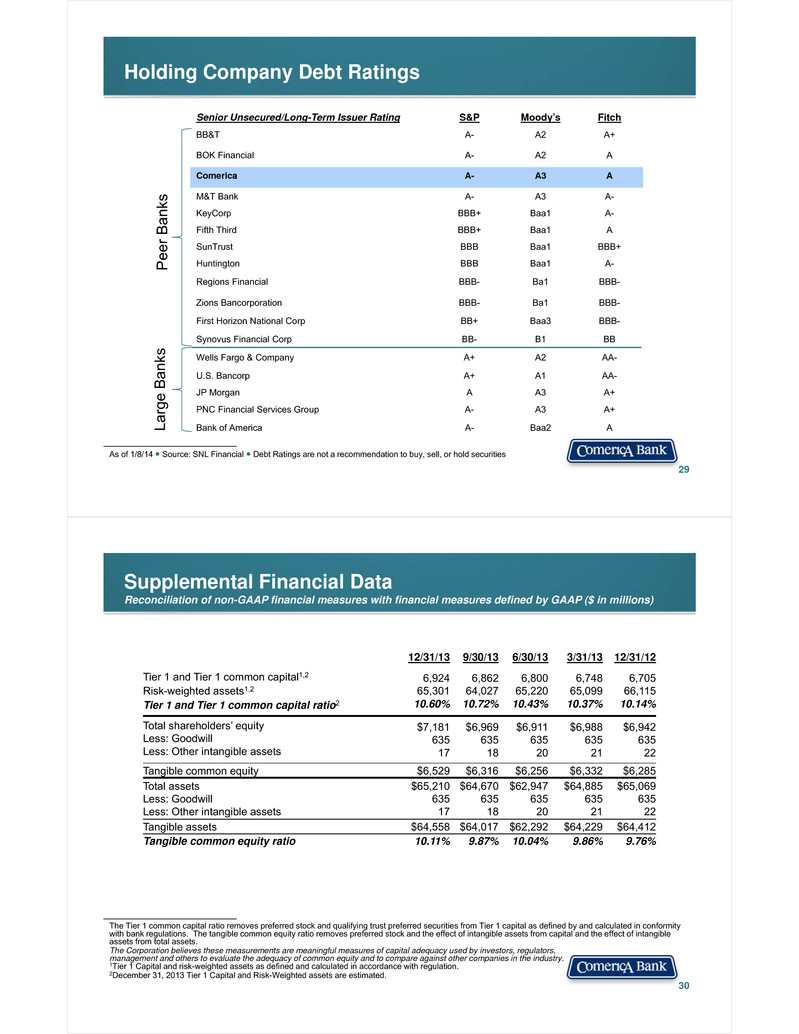

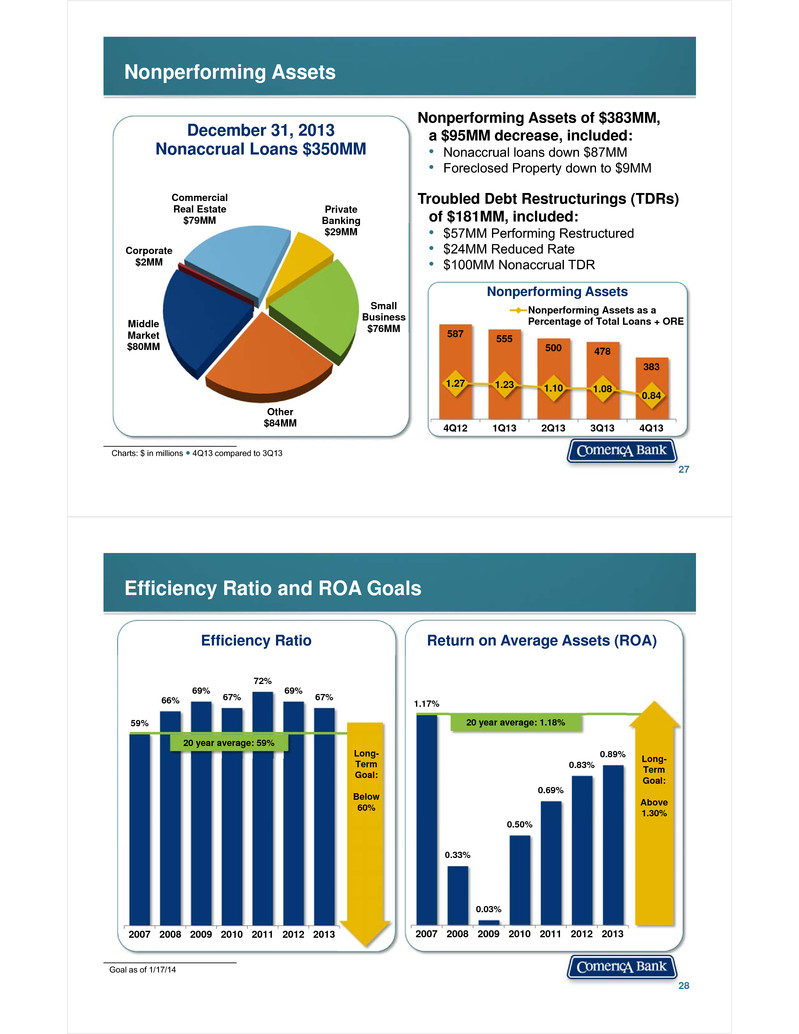

Charts: $ in millions ● 4Q13 compared to 3Q13 Nonperforming Assets of $383MM, a $95MM decrease, included:• Nonaccrual loans down $87MM • Foreclosed Property down to $9MM Troubled Debt Restructurings (TDRs) of $181MM, included:• $57MM Performing Restructured• $24MM Reduced Rate • $100MM Nonaccrual TDR December 31, 2013Nonaccrual Loans $350MM Middle Market$80MM Corporate $2MM Commercial Real Estate$79MM Private Banking$29MM Small Business$76MM Other$84MM 27 Nonperforming Assets Nonperforming Assets 587 555 500 478 383 1.27 1.23 1.10 1.08 0.84 4Q12 1Q13 2Q13 3Q13 4Q13 Nonperforming Assets as aPercentage of Total Loans + ORE Efficiency Ratio and ROA Goals 28 Goal as of 1/17/14 Efficiency Ratio Return on Average Assets (ROA) 59% 66% 69% 67% 72% 69% 67% 2007 2008 2009 2010 2011 2012 2013 20 year average: 59% 1.17% 0.33% 0.03% 0.50% 0.69% 0.83% 0.89% 2007 2008 2009 2010 2011 2012 2013 20 year average: 1.18% Long-TermGoal: Above 1.30% Long-TermGoal: Below 60%

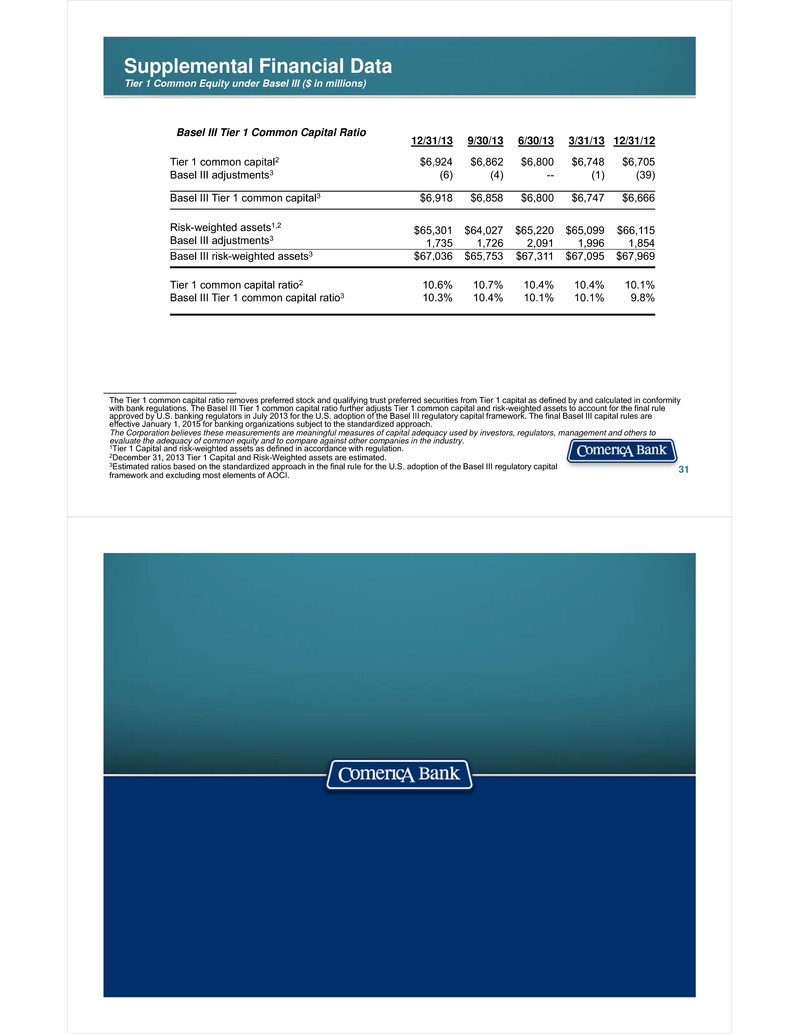

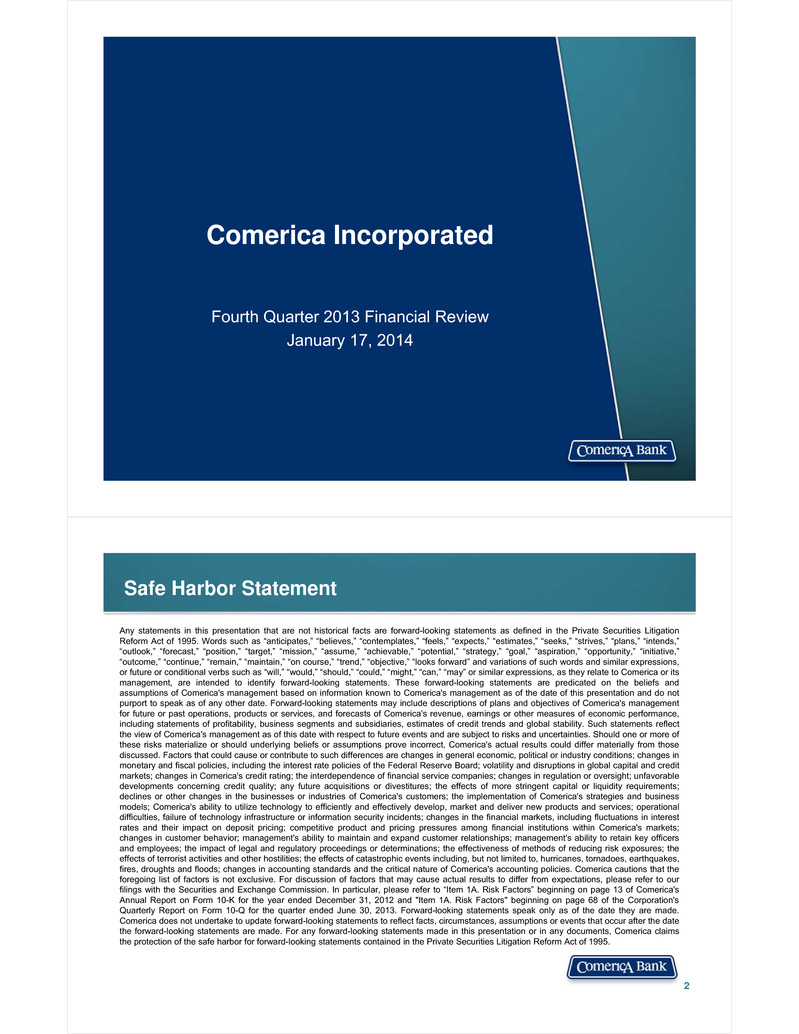

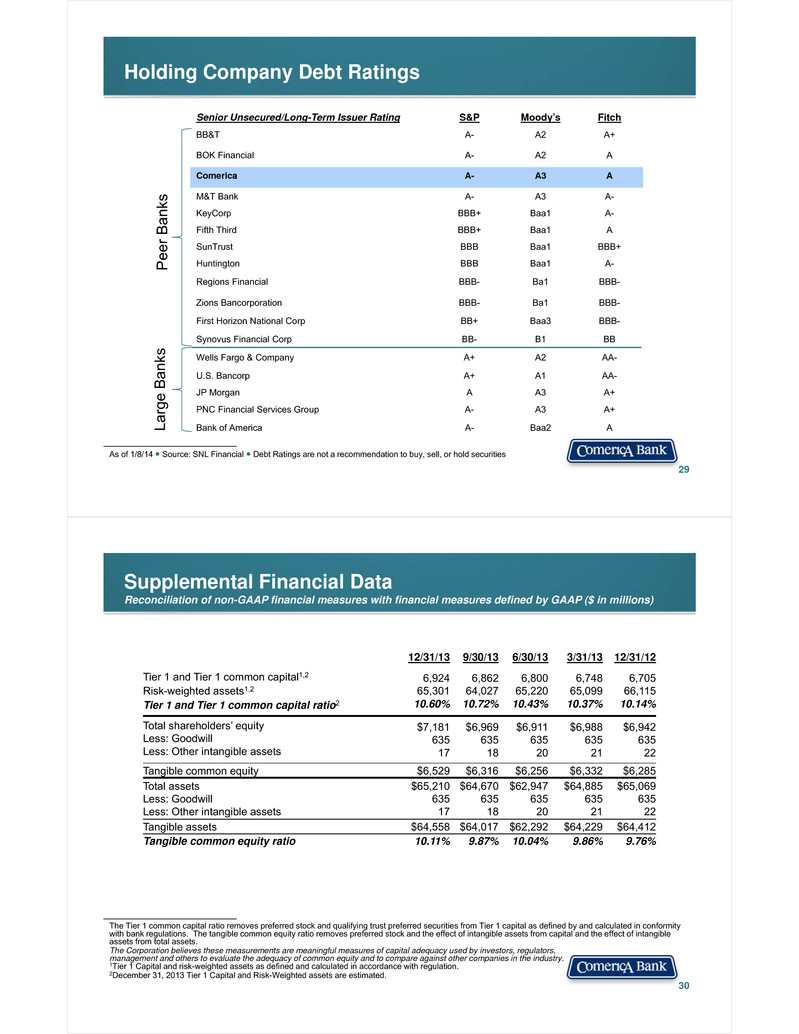

Senior Unsecured/Long-Term Issuer Rating S&P Moody’s Fitch BB&T A- A2 A+ BOK Financial A- A2 A Comerica A- A3 A M&T Bank A- A3 A- KeyCorp BBB+ Baa1 A- Fifth Third BBB+ Baa1 A SunTrust BBB Baa1 BBB+ Huntington BBB Baa1 A- Regions Financial BBB- Ba1 BBB- Zions Bancorporation BBB- Ba1 BBB- First Horizon National Corp BB+ Baa3 BBB- Synovus Financial Corp BB- B1 BB Wells Fargo & Company A+ A2 AA- U.S. Bancorp A+ A1 AA- JP Morgan A A3 A+ PNC Financial Services Group A- A3 A+ Bank of America A- Baa2 A Holding Company Debt Ratings 29 Pee r Ba nks Larg e Ba nks As of 1/8/14 ● Source: SNL Financial ● Debt Ratings are not a recommendation to buy, sell, or hold securities Supplemental Financial DataReconciliation of non-GAAP financial measures with financial measures defined by GAAP ($ in millions) 30 12/31/13 9/30/13 6/30/13 3/31/13 12/31/12 Tier 1 and Tier 1 common capital1,2Risk-weighted assets1,2Tier 1 and Tier 1 common capital ratio2 6,92465,30110.60% 6,86264,02710.72% 6,80065,22010.43% 6,74865,09910.37% 6,70566,11510.14% Total shareholders’ equityLess: GoodwillLess: Other intangible assets $7,18163517 $6,96963518 $6,91163520 $6,98863521 $6,94263522 Tangible common equity $6,529 $6,316 $6,256 $6,332 $6,285Total assetsLess: GoodwillLess: Other intangible assets $65,21063517 $64,67063518 $62,94763520 $64,88563521 $65,06963522Tangible assets $64,558 $64,017 $62,292 $64,229 $64,412Tangible common equity ratio 10.11% 9.87% 10.04% 9.86% 9.76% The Tier 1 common capital ratio removes preferred stock and qualifying trust preferred securities from Tier 1 capital as defined by and calculated in conformity with bank regulations. The tangible common equity ratio removes preferred stock and the effect of intangible assets from capital and the effect of intangible assets from total assets.The Corporation believes these measurements are meaningful measures of capital adequacy used by investors, regulators, management and others to evaluate the adequacy of common equity and to compare against other companies in the industry.1Tier 1 Capital and risk-weighted assets as defined and calculated in accordance with regulation.2December 31, 2013 Tier 1 Capital and Risk-Weighted assets are estimated.

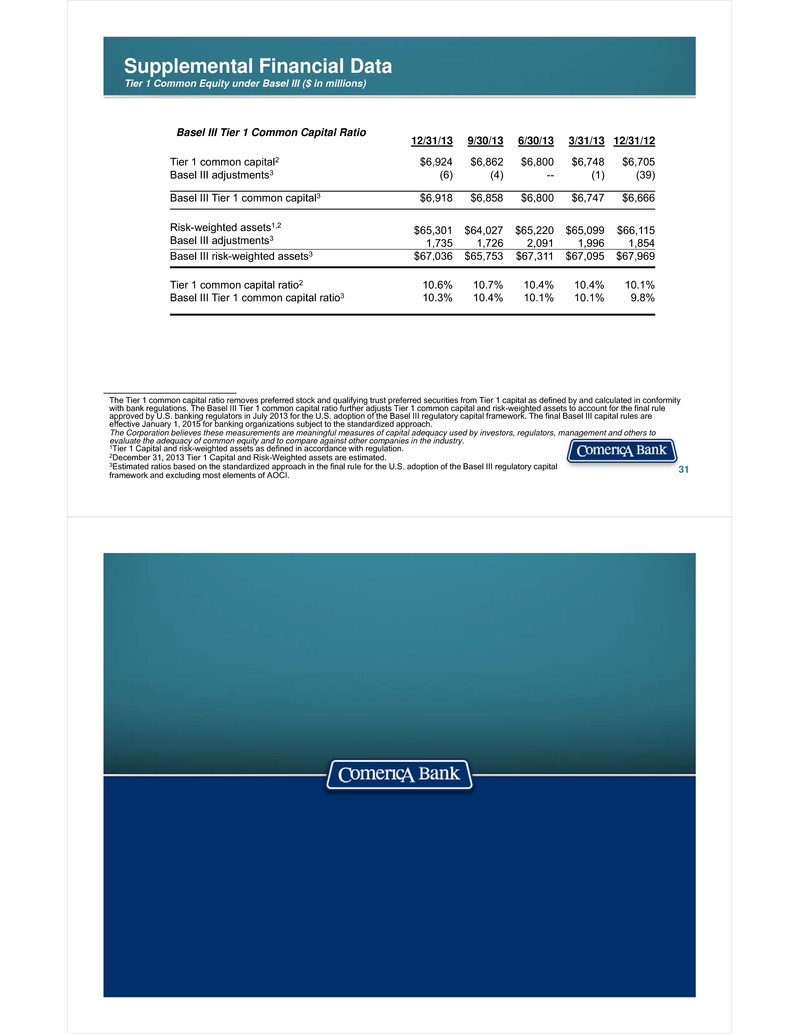

Supplemental Financial DataTier 1 Common Equity under Basel III ($ in millions) 31 The Tier 1 common capital ratio removes preferred stock and qualifying trust preferred securities from Tier 1 capital as defined by and calculated in conformity with bank regulations. The Basel III Tier 1 common capital ratio further adjusts Tier 1 common capital and risk-weighted assets to account for the final rule approved by U.S. banking regulators in July 2013 for the U.S. adoption of the Basel III regulatory capital framework. The final Basel III capital rules are effective January 1, 2015 for banking organizations subject to the standardized approach. The Corporation believes these measurements are meaningful measures of capital adequacy used by investors, regulators, management and others to evaluate the adequacy of common equity and to compare against other companies in the industry.1Tier 1 Capital and risk-weighted assets as defined in accordance with regulation.2December 31, 2013 Tier 1 Capital and Risk-Weighted assets are estimated.3Estimated ratios based on the standardized approach in the final rule for the U.S. adoption of the Basel III regulatory capital framework and excluding most elements of AOCI. Basel III Tier 1 Common Capital Ratio 12/31/13 9/30/13 6/30/13 3/31/13 12/31/12 Tier 1 common capital2Basel III adjustments3 $6,924(6) $6,862(4) $6,800-- $6,748(1) $6,705(39) Basel III Tier 1 common capital3 $6,918 $6,858 $6,800 $6,747 $6,666 Risk-weighted assets1,2Basel III adjustments3 $65,3011,735 $64,0271,726 $65,2202,091 $65,0991,996 $66,1151,854Basel III risk-weighted assets3 $67,036 $65,753 $67,311 $67,095 $67,969 Tier 1 common capital ratio2Basel III Tier 1 common capital ratio3 10.6%10.3% 10.7%10.4% 10.4%10.1% 10.4%10.1% 10.1%9.8%