&RPHULFD�,QFRUSRUDWHG %DUFOD\V�*OREDO�)LQDQFLDO�6HUYLFHV�&RQIHUHQFH 6HSWHPEHU��������� &XUW�)DUPHU 3UHVLGHQW� �&KLHI�([HFXWLYH�2IILFHU 0XQHHUD�&DUU &KLHI�)LQDQFLDO�2IILFHU 6DIH�+DUERU�6WDWHPHQW Any statements in this presentation that are not historical facts are forward-looking statements as defined in the Private Securities Litigation Reform Act of 1995. Words such as “anticipates,” “believes,” “contemplates,” “feels,” “expects,” “estimates,” “seeks,” “strives,” “plans,” “intends,” “outlook,” “forecast,” “position,” “target,” “mission,” “assume,” “achievable,” “potential,” “strategy,” “goal,” “aspiration,” “opportunity,” “initiative,” “outcome,” “continue,” “remain,” “maintain,” “on track,” “trend,” “objective,” “looks forward,” “projects,” “models” and variations of such words and similar expressions, or future or conditional verbs such as “will,” “would,” “should,” “could,” “might,” “can,” “may” or similar expressions, as they relate to Comerica or its management, are intended to identify forward-looking statements. These forward-looking statements are predicated on the beliefs and assumptions of Comerica's management based on information known to Comerica's management as of the date of this presentation and do not purport to speak as of any other date. Forward-looking statements may include descriptions of plans and objectives of Comerica's management for future or past operations, products or services, and forecasts of Comerica's revenue, earnings or other measures of economic performance, including statements of profitability, business segments and subsidiaries as well as estimates of credit trends and global stability. Such statements reflect the view of Comerica's management as of this date with respect to future events and are subject to risks and uncertainties. Should one or more of these risks materialize or should underlying beliefs or assumptions prove incorrect, Comerica's actual results could differ materially from those discussed. Factors that could cause or contribute to such differences are changes in general economic, political or industry conditions; changes in monetary and fiscal policies; operational, systems or infrastructure failures; reliance on other companies to provide certain key components of business infrastructure; cybersecurity risks; whether Comerica may achieve opportunities for revenue enhancements and efficiency improvements under the GEAR Up initiative, or changes in the scope or assumptions underlying the GEAR Up initiative; Comerica's ability to maintain adequate sources of funding and liquidity; the effects of more stringent capital requirements; declines or other changes in the businesses or industries of Comerica's customers; unfavorable developments concerning credit quality; changes in regulation or oversight; heightened legislative and regulatory focus on cybersecurity and data privacy; fluctuations in interest rates and their impact on deposit pricing; transitions away from LIBOR towards new interest rate benchmarks; reductions in Comerica's credit rating; damage to Comerica's reputation; Comerica's ability to utilize technology to efficiently and effectively develop, market and deliver new products and services; competitive product and pricing pressures among financial institutions within Comerica's markets; the interdependence of financial service companies; the implementation of Comerica's strategies and business initiatives; changes in customer behavior; management's ability to maintain and expand customer relationships; the effectiveness of methods of reducing risk exposures; the effects of catastrophic events including, but not limited to, hurricanes, tornadoes, earthquakes, fires, droughts and floods; the impacts of future legislative, administrative or judicial changes to tax regulations; any future strategic acquisitions or divestitures; management's ability to retain key officers and employees; the impact of legal and regulatory proceedings or determinations; losses due to fraud; the effects of terrorist activities and other hostilities; changes in accounting standards; the critical nature of Comerica's accounting policies; controls and procedures failures; and the volatility of Comerica’s stock price. Comerica cautions that the foregoing list of factors is not all-inclusive. For discussion of factors that may cause actual results to differ from expectations, please refer to our filings with the Securities and Exchange Commission. In particular, please refer to “Item 1A. Risk Factors” beginning on page 12 of Comerica's Annual Report on Form 10-K for the year ended December 31, 2018. Forward-looking statements speak only as of the date they are made. Comerica does not undertake to update forward-looking statements to reflect facts, circumstances, assumptions or events that occur after the date the forward-looking statements are made. For any forward-looking statements made in this presentation or in any documents, Comerica claims the protection of the safe harbor for forward-looking statements contained in the Private Securities Litigation Reform Act of 1995. 2

&RPHULFD��'ULYHUV�RI�RXU�6XFFHVV 285�0,66,21 285�9,6,21 :H�ZLOO�DFKLHYH�EDODQFHG�JURZWK� � 7R�EHFRPH�WKH�KLJKHVW�SHUIRUPLQJ�� SURILWDELOLW\ E\�GHOLYHULQJ�D�KLJKHU� PRVW�UHVSHFWHG� �PRVW�GHVLUHG� OHYHO�RI�EDQNLQJ�WKDW�QXUWXUHV�OLIHORQJ� EDQN�LQ�WKH�PDUNHWV�ZH�VHUYH�� UHODWLRQVKLSV�ZLWK�XQZDYHULQJ� LQWHJULW\� �ILQDQFLDO�SUXGHQFH� 5(68/76�,1�683(5,25�3(5)250$1&( 5HWXUQ�RQ�$VVHWV 5HWXUQ�RQ�(TXLW\ (IILFLHQF\�5DWLR (36�*URZWK �4�� �4�� �4�� �<7'���YV�<7'�� 1.68% 16.41% 58.59% 17.34% 1.30% 49.65% 10.92% 6.94% CMA Peers CMA Peers CMA Peers CMA Peers Source for peer data: S&P Global Market Intelligence, see list of peers on slide 10; Peer efficiency ratio excludes CFR as data was not available 3 &RPHULFD��.H\�6WUHQJWKV Well positioned to manage through cycles $�/($',1*�%$1.�)25�%86,1(66 !���� $WWUDFWLYH��'LYHUVH�*HRJUDSK\ RI�ORDQV�DUH� ���&RPPHUFLDO�OHQGHU����RI�WRWDO�ORDQV � ���LQ�ELOORQV���4���DYHUDJH &RPSOHPHQWHG�E\�5HWDLO�%DQN� � FRPPHUFLDO :HDOWK�0DQDJHPHQW California 5(/$7,216+,3�%$1.,1*�675$7(*<� ���� Michigan RI�GHSRVLWV�DUH� $12.7 $18.9 'HHS�H[SHUWLVH�LQ�VSHFLDOW\�EXVLQHVVHV QRQLQWHUHVW� 25% 37% /RQJ�WHQXUHG�HPSOR\HHV EHDULQJ Loans $51.0 *52:7+�23325781,7,(6 �� 3RVLWLRQHG�LQ�IDVWHU�JURZLQJ� ORDQ Other Markets Texas JURZWK $10.7 PDUNHWV� �LQGXVWULHV� $8.7 17% 21% +,*+/<�()),&,(17 ������ *($5�8S�OHYHUDJHG�WHFKQRORJ\��LQFUHDVHG� HIILFLHQF\�UDWLR Michigan FDSDFLW\�WR�VXSSRUW�JURZWK California $19.8 $16.3 36% 62/,'�&5(',7�0(75,&6 30% ���ESV� Deposits &RQVHUYDWLYH�XQGHUZULWLQJ 13$�/RDQV $55.0 'LYHUVH�SRUWIROLR Other 2 Texas $10.2 $8.7 67521*�&$3,7$/ 16% ������� 18% 6XSSRUWV�IXWXUH�JURZWK� &(7� 5HGXFHG�VKDUH�FRXQW�E\���� 6/30/19 unless otherwise noted; comparisons shown 2Q19 vs. 2Q18 Ⴠ 1Source: S&P Global Market Intelligence; based on 6/30/19 regulatory data for domestic financial holding companies using C&I loans Ⴠ 2Consists of Other Markets ($7.8B) & Finance/ Other ($2.4B) 4

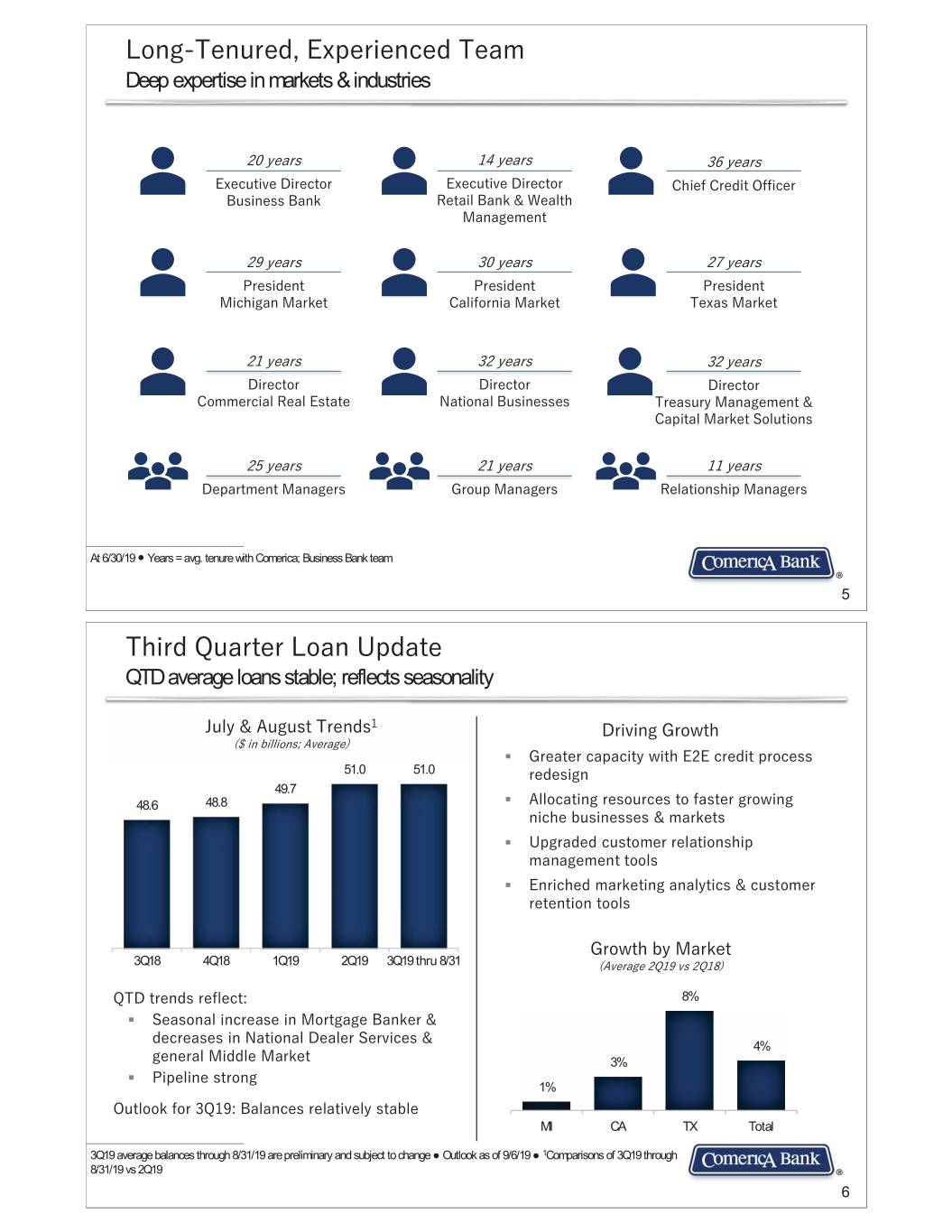

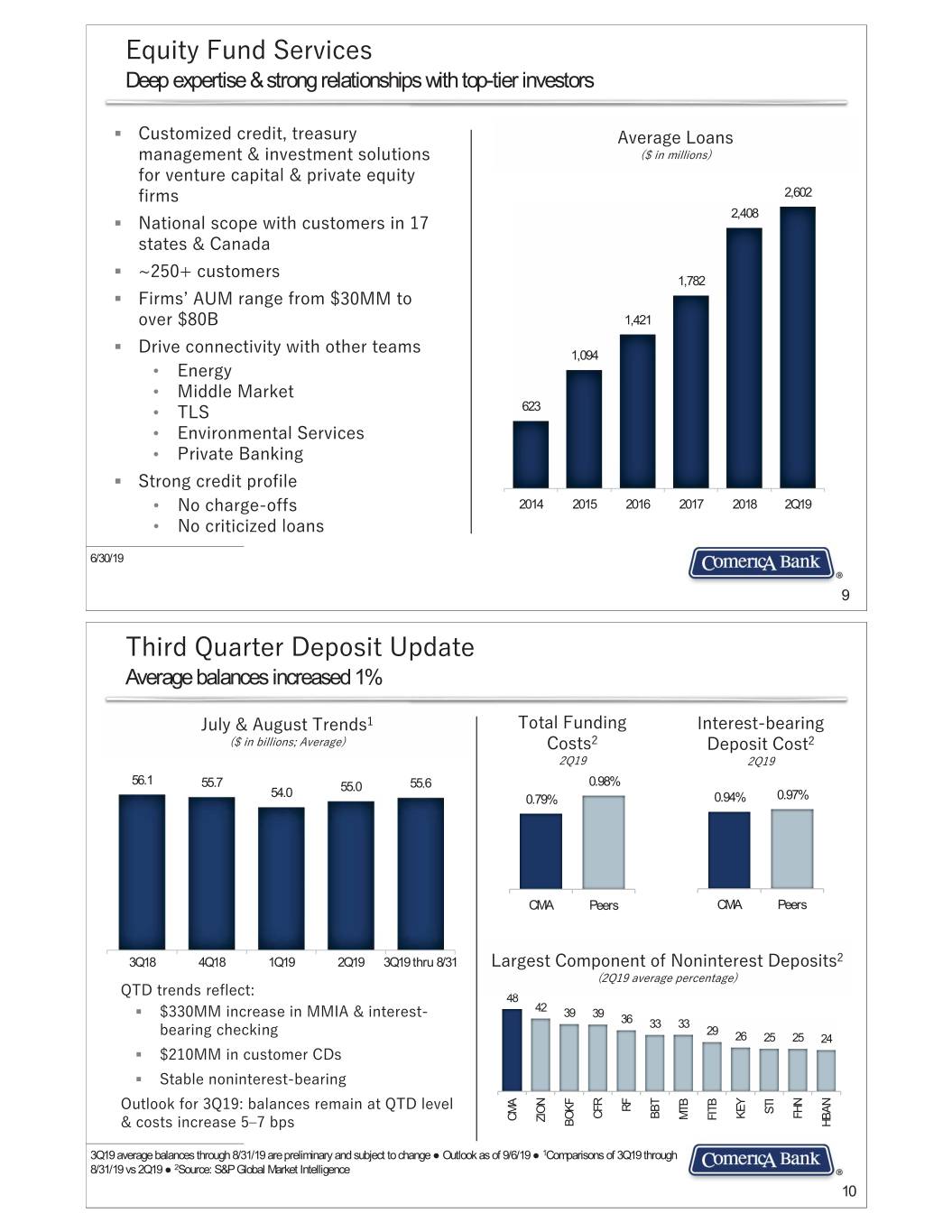

/RQJ�7HQXUHG��([SHULHQFHG�7HDP Deep expertise in markets & industries ���\HDUV ���\HDUV ���\HDUV ([HFXWLYH�'LUHFWRU ([HFXWLYH�'LUHFWRU &KLHI�&UHGLW�2IILFHU %XVLQHVV�%DQN 5HWDLO�%DQN� �:HDOWK� 0DQDJHPHQW ���\HDUV ���\HDUV ���\HDUV 3UHVLGHQW 3UHVLGHQW 3UHVLGHQW 0LFKLJDQ�0DUNHW &DOLIRUQLD�0DUNHW 7H[DV�0DUNHW ���\HDUV ���\HDUV ���\HDUV�\ 'LUHFWRU 'LUHFWRU 'LUHFWRU &RPPHUFLDO�5HDO�(VWDWH 1DWLRQDO�%XVLQHVVHV 7UHDVXU\�0DQDJHPHQW� &DSLWDO�0DUNHW�6ROXWLRQV ���\HDUV ���\HDUV ���\HDUV 'HSDUWPHQW�0DQDJHUV *URXS�0DQDJHUV 5HODWLRQVKLS�0DQDJHUV At 6/30/19 Ⴠ Years = avg. tenure with Comerica; Business Bank team 5 7KLUG�4XDUWHU�/RDQ�8SGDWH QTD average loans stable; reflects seasonality -XO\� �$XJXVW�7UHQGV� 'ULYLQJ�*URZWK ���LQ�ELOOLRQV��$YHUDJH ƒ *UHDWHU�FDSDFLW\�ZLWK�(�(�FUHGLW�SURFHVV� 51.0 51.0 UHGHVLJQ 49.7 48.6 48.8 ƒ $OORFDWLQJ�UHVRXUFHV�WR�IDVWHU�JURZLQJ� QLFKH�EXVLQHVVHV� �PDUNHWV ƒ 8SJUDGHG�FXVWRPHU�UHODWLRQVKLS� PDQDJHPHQW�WRROV ƒ (QULFKHG�PDUNHWLQJ�DQDO\WLFV� �FXVWRPHU� UHWHQWLRQ�WRROV *URZWK�E\�0DUNHW 3Q18 4Q18 1Q19 2Q19 3Q19 thru 8/31 �$YHUDJH��4���YV��4�� 47'�WUHQGV�UHIOHFW� 8% ƒ 6HDVRQDO�LQFUHDVH�LQ�0RUWJDJH�%DQNHU� � GHFUHDVHV�LQ�1DWLRQDO�'HDOHU�6HUYLFHV� � 4% JHQHUDO�0LGGOH�0DUNHW 3% ƒ 3LSHOLQH�VWURQJ 1% 2XWORRN�IRU��4����%DODQFHV�UHODWLYHO\�VWDEOH MI CA TX Total 3Q19 average balances through 8/31/19 are preliminary and subject to change Ɣ Outlook as of 9/6/19 Ɣ 1Comparisons of 3Q19 through 8/31/19 vs 2Q19 6

*HQHUDO�0LGGOH�0DUNHW�%DQNLQJ Good momentum in key markets 7H[DV�/RDQV &DOLIRUQLD�/RDQV 0LFKLJDQ�/RDQV� ���LQ�ELOOLRQV��$YHUDJH ���LQ�ELOOLRQV��$YHUDJH ���LQ�ELOOLRQV��$YHUDJH 5.5 5.3 5.2 5.3 5.3 4.2 4.2 4.3 4.1 4.1 +2% 2.4 2.3 2.3 2.2 2.2 +2% +7% +2% +4% +6% 2Q18 3Q18 4Q18 1Q19 2Q19 2Q18 3Q18 4Q18 1Q19 2Q19 2Q18 3Q18 4Q18 1Q19 2Q19 �����*'3�JURZWK��4��4��� �����*'3�JURZWK��4��4� �����*'3�JURZWK��4��4� ���ODUJHVW�*'3�LQ�8�6�� ���ODUJHVW�*'3�LQ�8�6�� ����ODUJHVW�*'3�LQ�8�6�� %XLOGLQJ�GHHS��HQGXULQJ�UHODWLRQVKLSV /HYHUDJH�H[SHUWLVH�LQ�GLYHUVH�LQGXVWULHV ƒ 5REXVW�SURGXFW�VXLWH������SURGXFWV� ƒ 0DQXIDFWXULQJ SHU�UHODWLRQVKLS ƒ /RJLVWLFV ƒ f����RI�FXVWRPHUV�KDYH�GHSRVLW� ƒ 6WHHO� DFFRXQWV ƒ %HHU� �ZLQH�GLVWULEXWRUV ƒ $YHUDJH�FXVWRPHU�WHQXUH�f���\HDUV ƒ &RQVWUXFWLRQ� �LQGXVWULDO�HTXLSPHQW 6/30/19 Ɣ 1Source U.S. Bureau of Economic Analysis: Percent change in real GDP based on 1Q19 vs. 4Q19; ranking based on 1Q19 GDP 7 &RPPHUFLDO�5HDO�(VWDWH�%XVLQHVV�/LQH Long history of working with well established, proven developers 0DMRULW\�+LJK�*URZWK�0DUNHWV� 3ULPDULO\�/RZHU�5LVN�0XOWLIDPLO\� ���LQ�PLOOLRQV��3HULRG�HQG��EDVHG�RQ�ORFDWLRQ�RI�SURSHUW\ ���LQ�PLOOLRQV��3HULRG�HQG Retail Michigan Commercial 10% Office 5% 13% 8% Single Family Other 6% 15% Total California Total Other 46% $4,833 Multifamily $4,833 5% 50% Land Carry Texas 5% 34% Multi use 3% &5(�/RDQ�*URZWK ��RI�7RWDO�/RDQV� 9HU\�6WURQJ�&UHGLW�4XDOLW\ ���LQ�ELOOLRQV��$YHUDJH �3HULRG�HQG ƒ !����RI�QHZ�FRPPLWPHQWV�IURP�H[LVWLQJ� 17% FXVWRPHUV 5.3 5.5 ƒ 6XEVWDQWLDO�XSIURQW�HTXLW\�UHTXLUHG 11% ƒ ����RI�SRUWIROLR�LV�FRQVWUXFWLRQ� �LQFOXGHV� +3% UREXVW�PRQLWRULQJ ƒ ����&ULWLFL]HG�ORDQV�� ƒ ��00�QRQDFFUXDO������� ƒ 1R�VLJQLILFDQW�QHW�FKDUJH�RIIV�VLQFH����� 2Q18 2Q19 CMA Peers 6/30/19 Ⴠ 1Excludes CRE line of business loans not secured by real estate Ⴠ 2Source for peer data: S&P Global Market Intelligence, see slide 10 for list of peers; based on regulatory data Ⴠ 3Criticized loans are consistent with regulatory defined Special Mention, Substandard & Doubtful categories 8

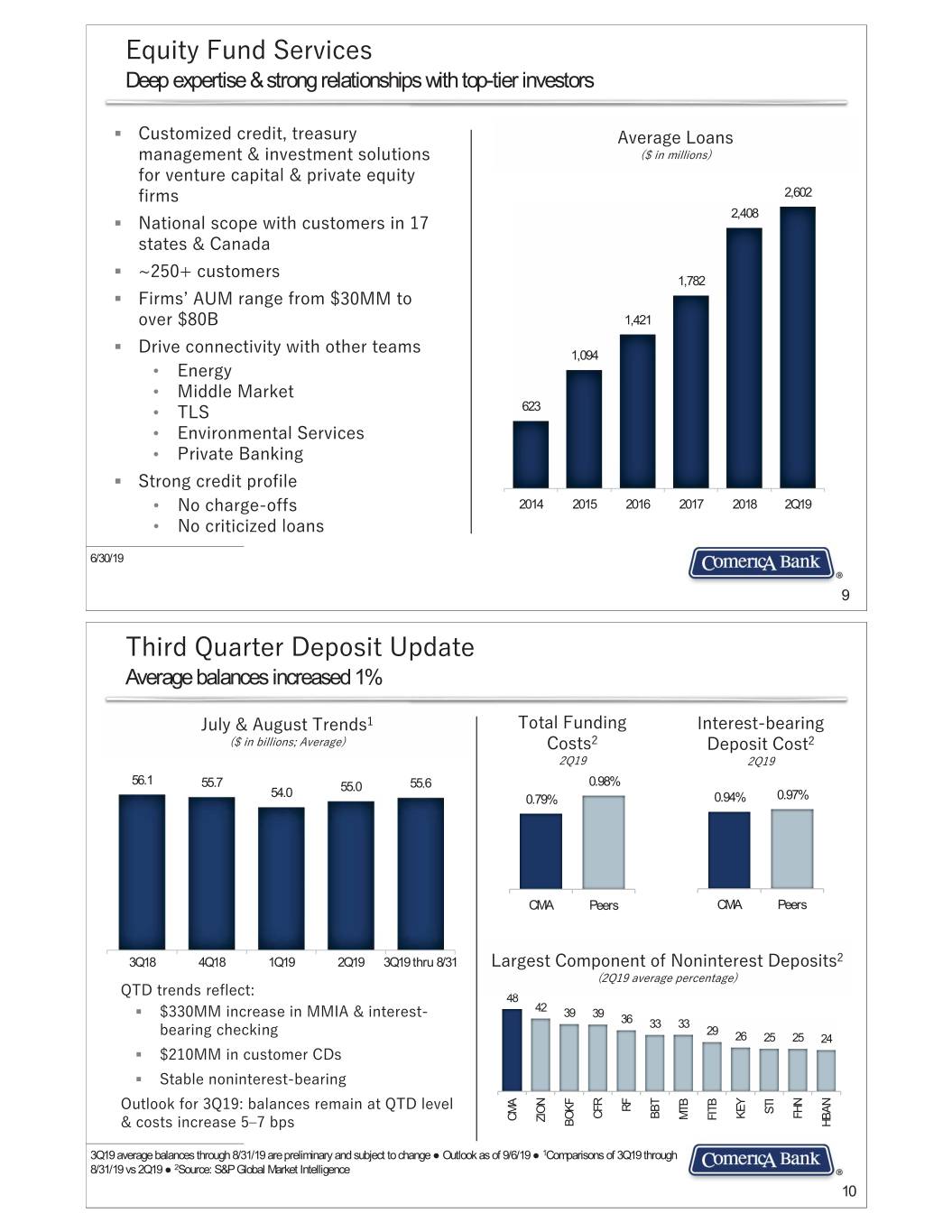

(TXLW\�)XQG�6HUYLFHV Deep expertise & strong relationships with top-tier investors ƒ &XVWRPL]HG�FUHGLW��WUHDVXU\� $YHUDJH�/RDQV PDQDJHPHQW� �LQYHVWPHQW�VROXWLRQV� ���LQ�PLOOLRQV IRU�YHQWXUH�FDSLWDO� �SULYDWH�HTXLW\� ILUPV 2,602 2,408 ƒ 1DWLRQDO�VFRSH�ZLWK�FXVWRPHUV�LQ���� VWDWHV� �&DQDGD ƒ f�����FXVWRPHUV� 1,782 ƒ )LUPVb�$80�UDQJH�IURP����00�WR� RYHU����% 1,421 ƒ 'ULYH�FRQQHFWLYLW\�ZLWK�RWKHU�WHDPV� 1,094 • (QHUJ\ • 0LGGOH�0DUNHW • 7/6 623 • (QYLURQPHQWDO�6HUYLFHV • 3ULYDWH�%DQNLQJ ƒ 6WURQJ�FUHGLW�SURILOH • 1R�FKDUJH�RIIV 2014 2015 2016 2017 2018 2Q19 • 1R�FULWLFL]HG�ORDQV 6/30/19 9 7KLUG�4XDUWHU�'HSRVLW�8SGDWH Average balances increased 1% -XO\� �$XJXVW 7UHQGV� 7RWDO�)XQGLQJ� ,QWHUHVW�EHDULQJ� ���LQ�ELOOLRQV��$YHUDJH &RVWV� 'HSRVLW�&RVW� �4�� �4�� 56.1 55.7 55.6 0.98% 54.0 55.0 0.79% 0.94% 0.97% CMA Peers CMA Peers 3Q18 4Q18 1Q19 2Q19 3Q19 thru 8/31 /DUJHVW�&RPSRQHQW�RI�1RQLQWHUHVW�'HSRVLWV� ��4���DYHUDJH�SHUFHQWDJH 47'�WUHQGV�UHIOHFW�� 48 ƒ ����00�LQFUHDVH�LQ�00,$� �LQWHUHVW� 42 39 39 36 33 33 EHDULQJ�FKHFNLQJ 29 26 25 25 24 ƒ ����00�LQ�FXVWRPHU�&'V ƒ 6WDEOH�QRQLQWHUHVW�EHDULQJ� 2XWORRN�IRU��4����EDODQFHV�UHPDLQ�DW�47'�OHYHO� RF STI CFR BBT FHN KEY MTB FITB CMA ZION BOKF �FRVWV�LQFUHDVH��t��ESV HBAN 3Q19 average balances through 8/31/19 are preliminary and subject to change Ɣ Outlook as of 9/6/19 Ɣ 1Comparisons of 3Q19 through 8/31/19 vs 2Q19 Ɣ 2Source: S&P Global Market Intelligence 10

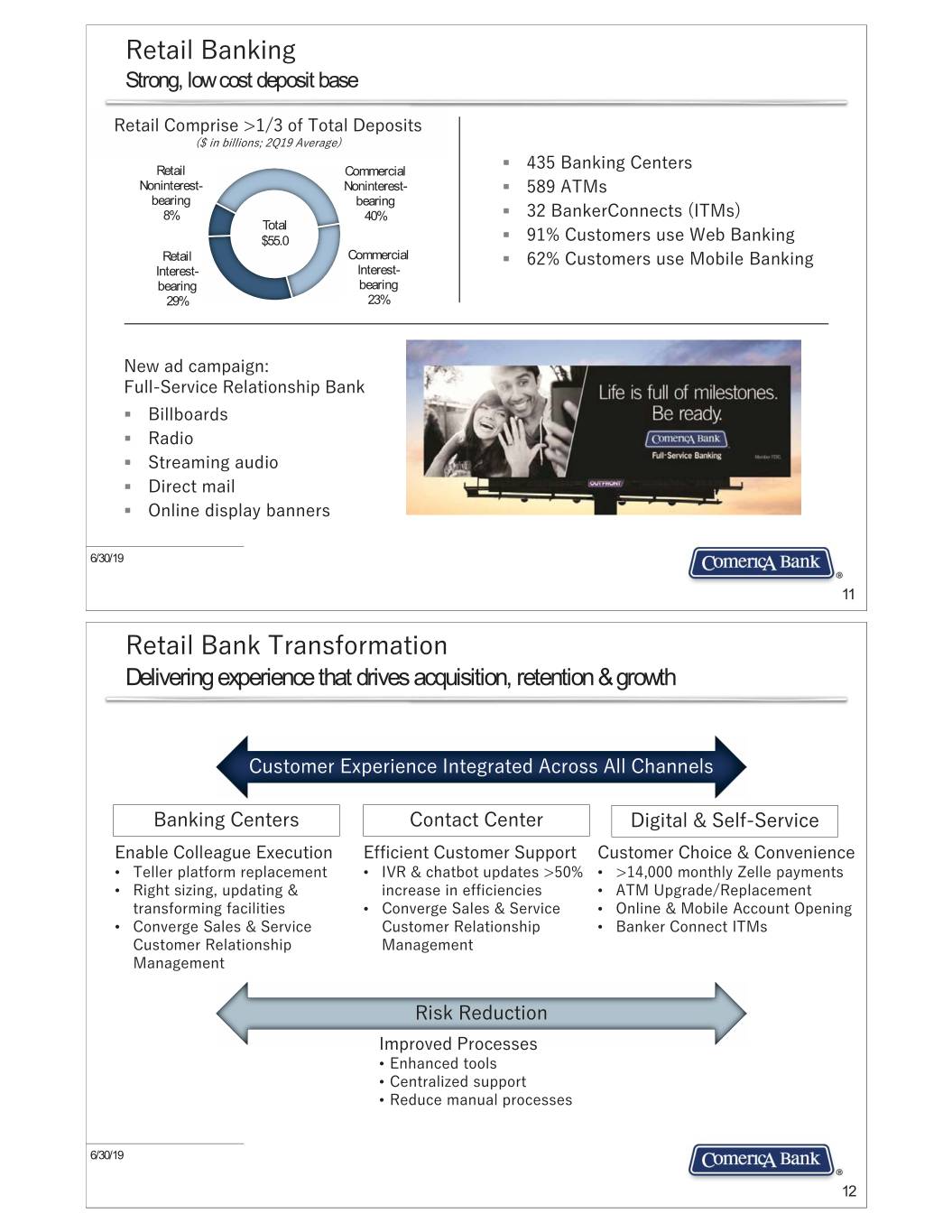

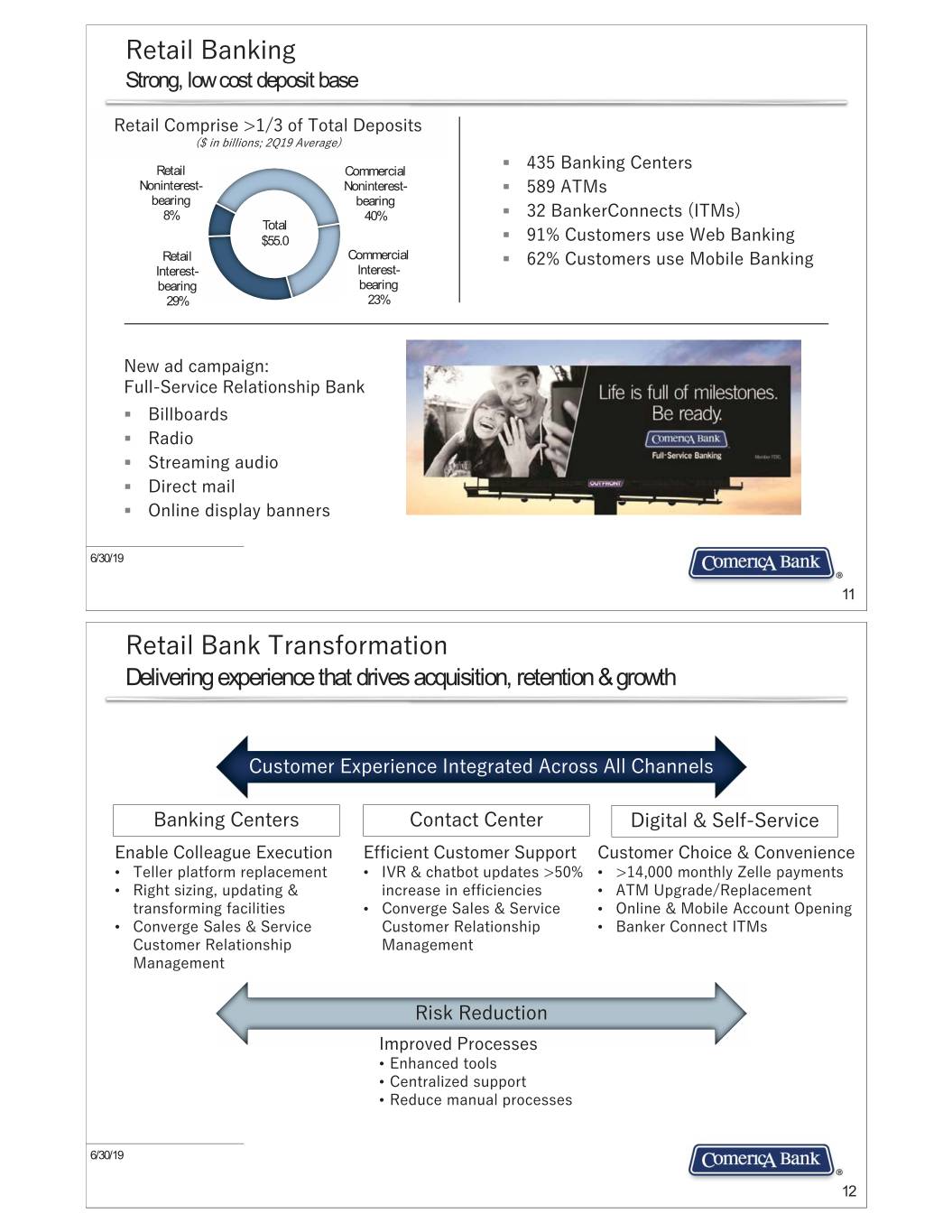

5HWDLO�%DQNLQJ Strong, low cost deposit base 5HWDLO &RPSULVH�!����RI�7RWDO�'HSRVLWV ���LQ�ELOOLRQV���4���$YHUDJH Retail Commercial ƒ ����%DQNLQJ�&HQWHUV Noninterest- Noninterest- ƒ ����$70V bearing bearing 8% 40% ƒ ���%DQNHU&RQQHFWV �,70V Total $55.0 ƒ ����&XVWRPHUV�XVH�:HE�%DQNLQJ Retail Commercial ƒ ����&XVWRPHUV�XVH�0RELOH�%DQNLQJ� Interest- Interest- bearing bearing 29% 23% 1HZ�DG�FDPSDLJQ�� )XOO�6HUYLFH�5HODWLRQVKLS�%DQN� ƒ %LOOERDUGV ƒ 5DGLR� ƒ 6WUHDPLQJ�DXGLR ƒ 'LUHFW�PDLO ƒ 2QOLQH�GLVSOD\�EDQQHUV� 6/30/19 11 5HWDLO�%DQN�7UDQVIRUPDWLRQ Delivering experience that drives acquisition, retention & growth &XVWRPHU�([SHULHQFH�,QWHJUDWHG�$FURVV�$OO�&KDQQHOV %DQNLQJ�&HQWHUV &RQWDFW�&HQWHU 'LJLWDO� �6HOI�6HUYLFH (QDEOH�&ROOHDJXH�([HFXWLRQ (IILFLHQW�&XVWRPHU�6XSSRUW &XVWRPHU�&KRLFH� �&RQYHQLHQFH • 7HOOHU�SODWIRUP�UHSODFHPHQW • ,95� �FKDWERW�XSGDWHV�!���� • !�������PRQWKO\�=HOOH SD\PHQWV • 5LJKW�VL]LQJ��XSGDWLQJ� � LQFUHDVH�LQ�HIILFLHQFLHV� • $70�8SJUDGH�5HSODFHPHQW WUDQVIRUPLQJ�IDFLOLWLHV • &RQYHUJH�6DOHV� �6HUYLFH� • 2QOLQH� �0RELOH�$FFRXQW�2SHQLQJ� • &RQYHUJH�6DOHV� �6HUYLFH� &XVWRPHU�5HODWLRQVKLS� • %DQNHU�&RQQHFW�,70V &XVWRPHU�5HODWLRQVKLS� 0DQDJHPHQW 0DQDJHPHQW 5LVN�5HGXFWLRQ ,PSURYHG�3URFHVVHV • (QKDQFHG�WRROV • &HQWUDOL]HG�VXSSRUW • 5HGXFH�PDQXDO�SURFHVVHV 6/30/19 12

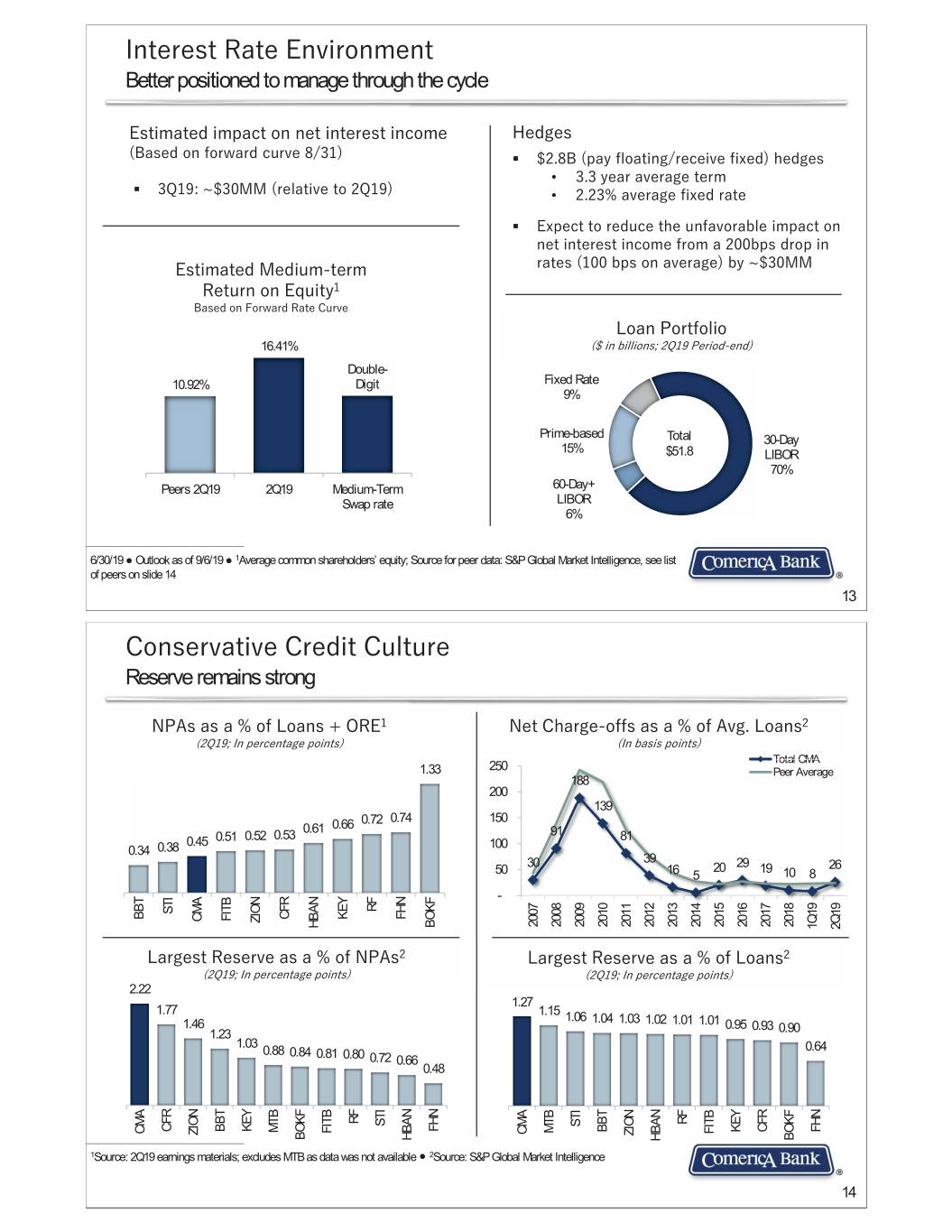

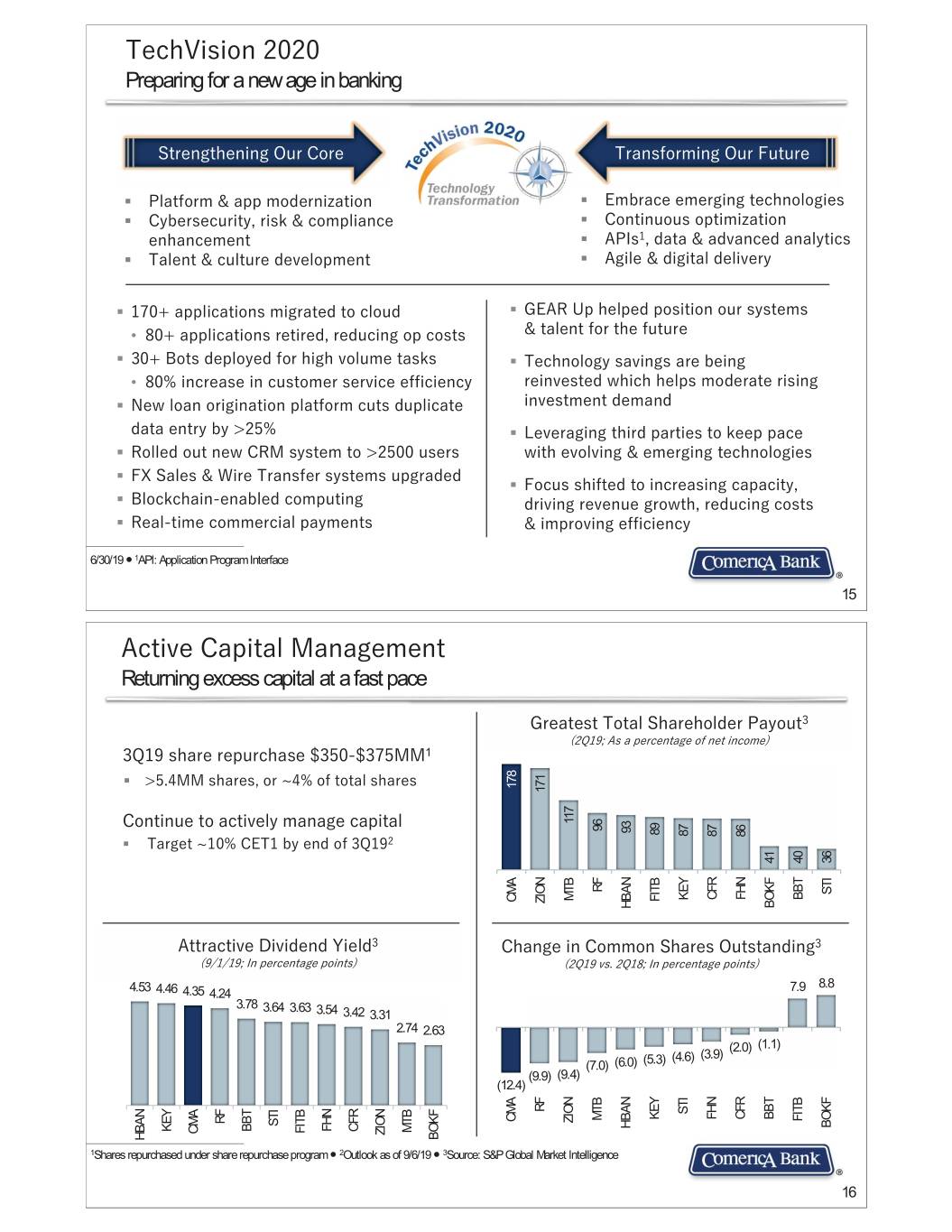

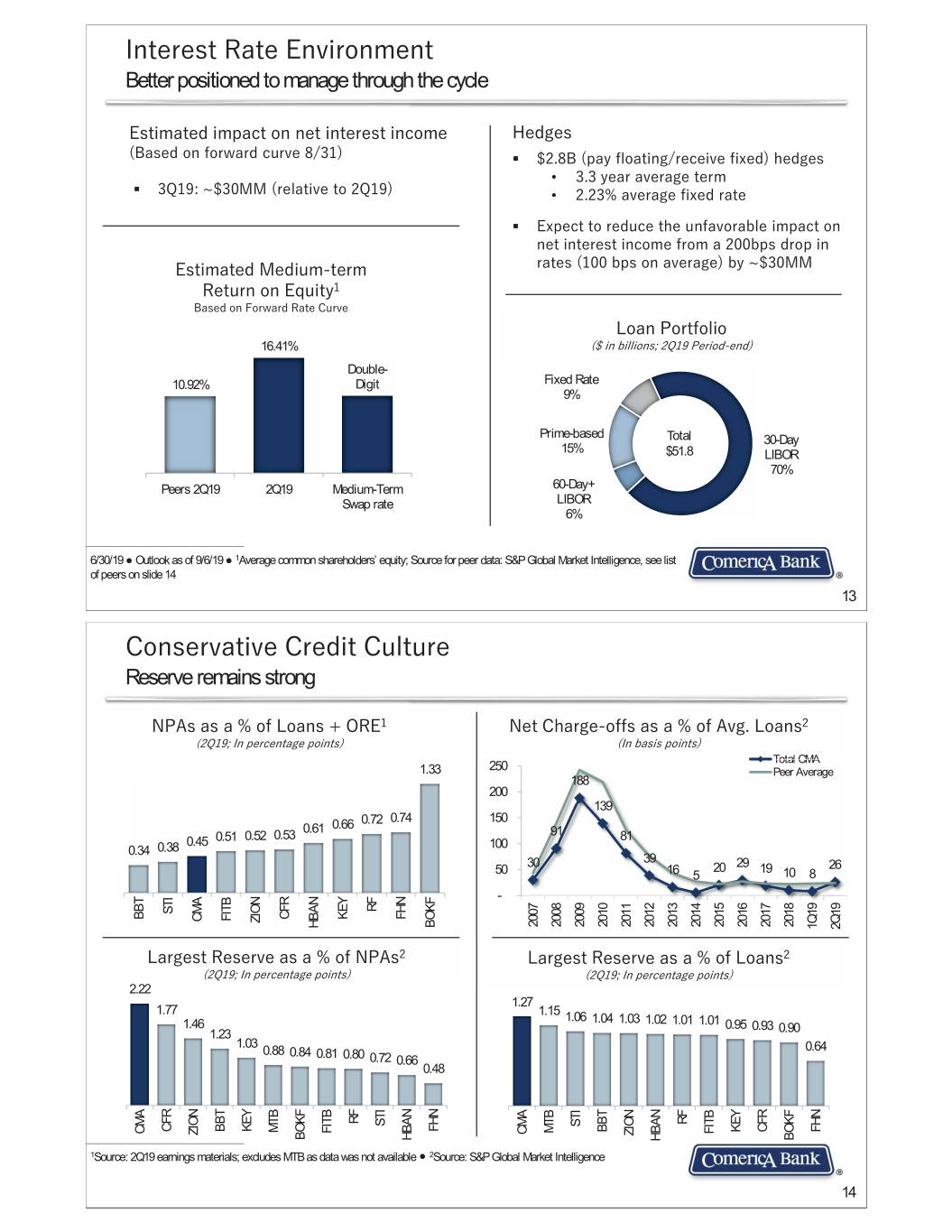

,QWHUHVW�5DWH�(QYLURQPHQW Better positioned to manage through the cycle (VWLPDWHG�LPSDFW�RQ�QHW�LQWHUHVW�LQFRPH� +HGJHV �%DVHG�RQ�IRUZDUG�FXUYH����� ƒ ����%��SD\�IORDWLQJ�UHFHLYH�IL[HG �KHGJHV • ����\HDU�DYHUDJH�WHUP� ƒ �4����f���00��UHODWLYH�WR��4�� • ������DYHUDJH�IL[HG�UDWH ƒ ([SHFW�WR�UHGXFH�WKH�XQIDYRUDEOH�LPSDFW�RQ� QHW�LQWHUHVW�LQFRPH�IURP�D����ESV�GURS�LQ� (VWLPDWHG�0HGLXP�WHUP� UDWHV������ESV�RQ�DYHUDJH �E\�f���00 5HWXUQ�RQ�(TXLW\� %DVHG�RQ�)RUZDUG�5DWH�&XUYH /RDQ�3RUWIROLR 16.41% ���LQ�ELOOLRQV���4�� 3HULRG�HQG Double- 10.92% Digit Fixed Rate 9% Prime-based Total 30-Day 15% $51.8 LIBOR 70% Peers 2Q19 2Q19 Medium-Term 60-Day+ Swap rate LIBOR 6% 6/30/19 Ɣ Outlook as of 9/6/19 Ɣ 1Average common shareholders’ equity; Source for peer data: S&P Global Market Intelligence, see list of peers on slide 14 13 &RQVHUYDWLYH�&UHGLW�&XOWXUH Reserve remains strong 13$V�DV�D���RI�/RDQV���25(� 1HW�&KDUJH�RIIV�DV�D���RI�$YJ��/RDQV� ��4����,Q�SHUFHQWDJH�SRLQWV �,Q�EDVLV�SRLQWV TotalTotal CMA 1.33 250 Peer Average 188 200 139 0.72 0.74 150 0.61 0.66 0.51 0.52 0.53 91 81 0.45 100 0.34 0.38 39 30 20 29 19 26 50 16 5 10 8 - RF STI CFR BBT FHN KEY FITB CMA ZION 2007 2008 2009 2010 2011 2012 2013 2014 2015 2016 2017 2018 BOKF HBAN 1Q19 2Q19 /DUJHVW�5HVHUYH�DV�D���RI�13$V� /DUJHVW�5HVHUYH�DV�D���RI�/RDQV� ��4����,Q�SHUFHQWDJH�SRLQWV ��4����,Q�SHUFHQWDJH�SRLQWV 2.22 1.27 1.77 1.15 1.06 1.04 1.03 1.46 1.02 1.01 1.01 0.95 0.93 1.23 0.90 1.03 0.64 0.88 0.84 0.81 0.80 0.72 0.66 0.48 RF RF STI STI CFR BBT FHN KEY BBT FHN CFR KEY MTB MTB FITB FITB CMA CMA ZION ZION BOKF BOKF HBAN HBAN 1Source: 2Q19 earnings materials; excludes MTB as data was not available Ⴠ 2Source: S&P Global Market Intelligence 14

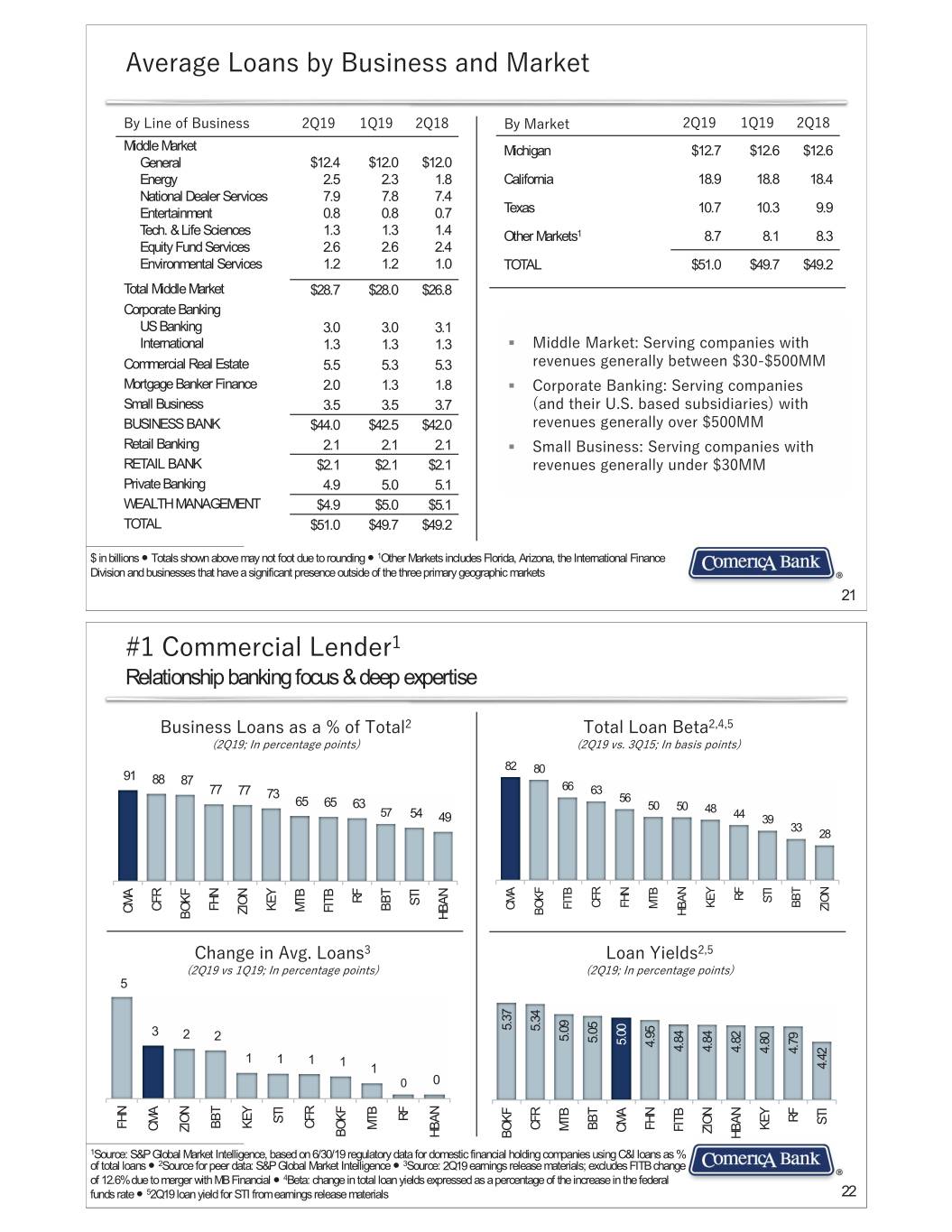

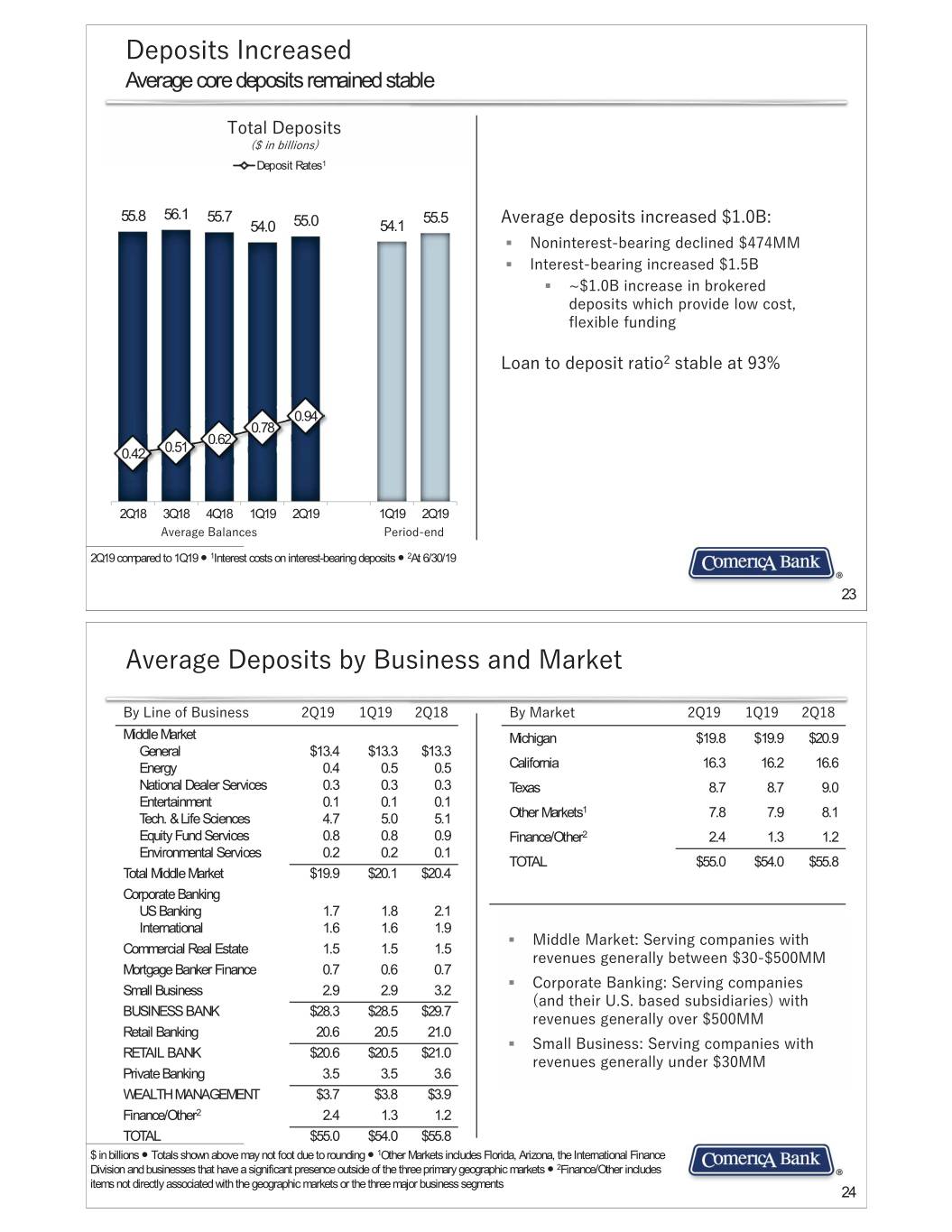

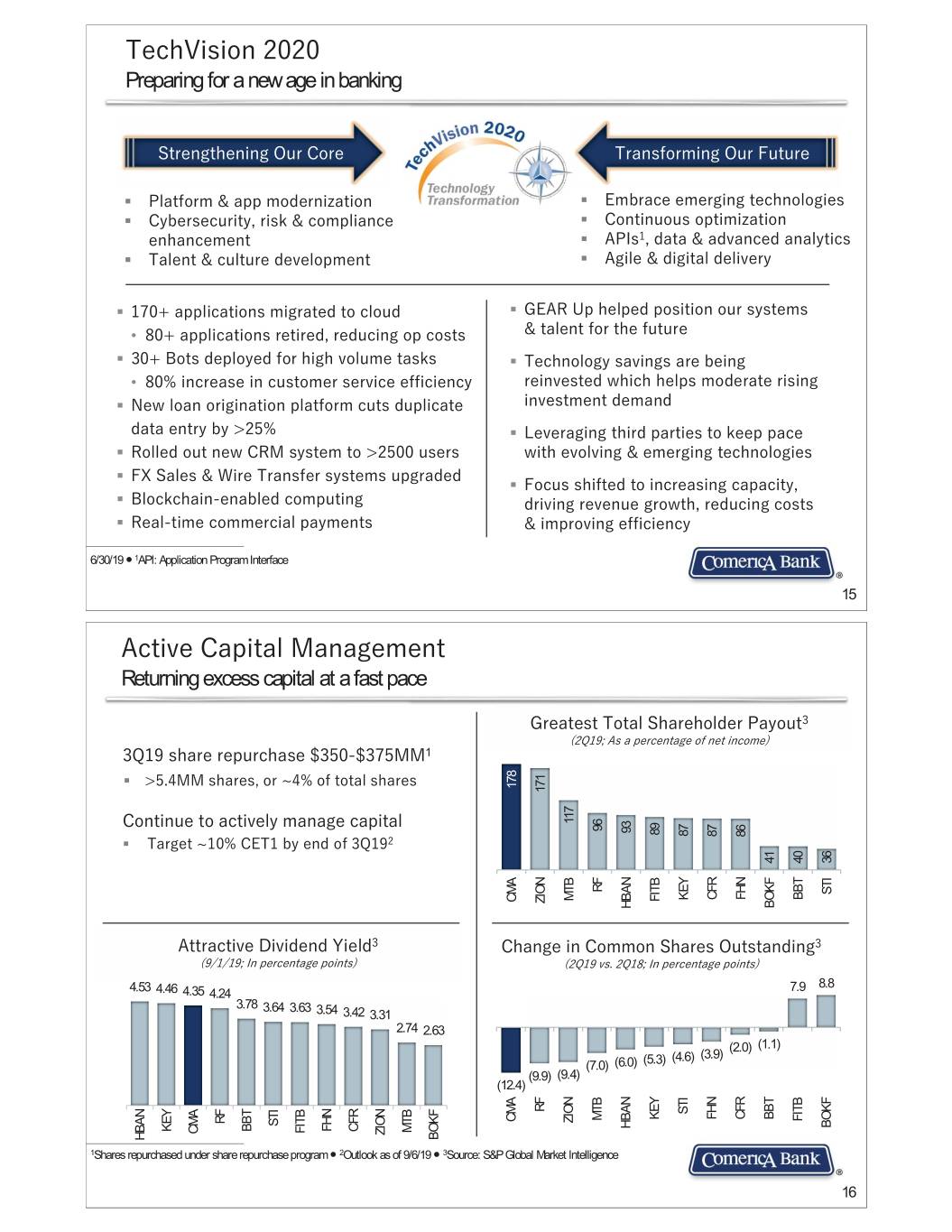

7HFK9LVLRQ ���� Preparing for a new age in banking 6WUHQJWKHQLQJ�2XU�&RUH 7UDQVIRUPLQJ�2XU�)XWXUH ƒ 3ODWIRUP� �DSS�PRGHUQL]DWLRQ ƒ (PEUDFH�HPHUJLQJ�WHFKQRORJLHV ƒ &\EHUVHFXULW\��ULVN� �FRPSOLDQFH� ƒ &RQWLQXRXV�RSWLPL]DWLRQ HQKDQFHPHQW�� ƒ $3,V���GDWD� �DGYDQFHG�DQDO\WLFV� ƒ 7DOHQW� �FXOWXUH�GHYHORSPHQW ƒ $JLOH� �GLJLWDO�GHOLYHU\ ƒ �����DSSOLFDWLRQV�PLJUDWHG�WR�FORXG� ƒ *($5�8S�KHOSHG�SRVLWLRQ�RXU�V\VWHPV� • ����DSSOLFDWLRQV�UHWLUHG��UHGXFLQJ�RS�FRVWV �WDOHQW�IRU�WKH�IXWXUH ƒ ����%RWV�GHSOR\HG�IRU�KLJK�YROXPH�WDVNV ƒ 7HFKQRORJ\�VDYLQJV�DUH�EHLQJ� • ����LQFUHDVH�LQ�FXVWRPHU�VHUYLFH�HIILFLHQF\ UHLQYHVWHG�ZKLFK�KHOSV�PRGHUDWH�ULVLQJ� ƒ 1HZ�ORDQ�RULJLQDWLRQ�SODWIRUP�FXWV�GXSOLFDWH� LQYHVWPHQW�GHPDQG�� GDWD�HQWU\�E\�!��� ƒ /HYHUDJLQJ�WKLUG�SDUWLHV�WR�NHHS�SDFH� ƒ 5ROOHG�RXW�QHZ�&50�V\VWHP�WR�!�����XVHUV ZLWK�HYROYLQJ� �HPHUJLQJ�WHFKQRORJLHV� ƒ );�6DOHV� �:LUH�7UDQVIHU�V\VWHPV�XSJUDGHG ƒ )RFXV�VKLIWHG�WR�LQFUHDVLQJ�FDSDFLW\�� ƒ %ORFNFKDLQ�HQDEOHG�FRPSXWLQJ GULYLQJ�UHYHQXH�JURZWK��UHGXFLQJ�FRVWV� ƒ 5HDO�WLPH�FRPPHUFLDO�SD\PHQWV �LPSURYLQJ�HIILFLHQF\ 6/30/19 Ⴠ 1API: Application Program Interface 15 $FWLYH�&DSLWDO�0DQDJHPHQW Returning excess capital at a fast pace *UHDWHVW�7RWDO�6KDUHKROGHU�3D\RXW� ��4����$V�D�SHUFHQWDJH�RI�QHW�LQFRPH �4���VKDUH�UHSXUFKDVH����������001 . >5.4MM shares, or ~4% of total shares 178 171 &RQWLQXH�WR�DFWLYHO\�PDQDJH�FDSLWDO 117 96 93 89 87 87 86 ƒ 7DUJHW�f����&(7��E\�HQG�RI��4��� 41 40 36 RF STI CFR FHN BBT KEY MTB FITB CMA ZION BOKF HBAN $WWUDFWLYH�'LYLGHQG�<LHOG� &KDQJH�LQ�&RPPRQ�6KDUHV�2XWVWDQGLQJ� ���������,Q�SHUFHQWDJH�SRLQWV ��4���YV���4����,Q�SHUFHQWDJH�SRLQWV 4.53 7.9 8.8 4.46 4.35 4.24 3.78 3.64 3.63 3.54 3.42 3.31 2.74 2.63 (2.0) (1.1) (4.6) (3.9) (7.0) (6.0) (5.3) (9.9) (9.4) (12.4) RF STI FHN CFR BBT KEY MTB FITB CMA ZION RF STI BOKF HBAN BBT FHN CFR KEY MTB FITB CMA ZION BOKF HBAN 1Shares repurchased under share repurchase program Ⴠ 2Outlook as of 9/6/19 Ⴠ 3Source: S&P Global Market Intelligence 16

:HOO�3RVLWLRQHG�IRU�WKH�)XWXUH Provided superior shareholder returns in 2Q19 5HWXUQ�RQ�$VVHWV� ��4����,Q�SHUFHQWDJH�SRLQWV $�/($',1*�%$1.�)25�%86,1(66 1.68 1.60 1.55 LONGO HISTORYHISS OR 1.40 1.36 5(/$7,216+,3�%$1.,1*�675$7(*<� 1.35 1.25 1.24 1.19 1.14 1.11 1.11 1.08 NIMBLEMB E SSIZEE $74B IN ASSETS RF *52:,1*�5(9(18( STI FHN BBT CFR KEY MTB FITB CMA ZION BOKF HBAN 5HWXUQ�RQ�(TXLW\� +,*+/<�()),&,(17 ��4����$YHUDJH�FRPPRQ�HTXLW\��,Q�SHUFHQWDJH�SRLQWV 62/,'�&5(',7�0(75,&6 16.41 12.69 12.29 12.11 12.11 11.99 11.99 11.31 11.31 10.95 9.79 10.48 10.28 9.34 8.91 67521*�&$3,7$/ RF STI CFR BBT FHN KEY MTB FITB CMA ZION BOKF HBAN 1Source for peer data: S&P Global Market Intelligence 17 $SSHQGL[

6HFRQG�4XDUWHU������5HVXOWV Revenue growth & expense discipline drove efficiency ratio under 50% &KDQJH�)URP .H\�4R4�3HUIRUPDQFH�'ULYHUV �PLOOLRQV��H[FHSW�SHU�VKDUH�GDWD �4�� �4�� �4�� �4�� �4�� $YHUDJH�ORDQV $50,963 49,677 49,225 $1,286 $1,738 ƒ 6WURQJ ORDQ�JURZWK $YHUDJH�GHSRVLWV 54,995 53,996 55,830 999 (835) ƒ &RUH�GHSRVLWV�VWDEOH 1HW�LQWHUHVW�LQFRPH $603 606 590 $(3) $13 ƒ 3UH�WD[�SUH�SURYLVLRQ�QHW�UHYHQXH�� 3URYLVLRQ�IRU�FUHGLW�ORVVHV 44 (13) (29) 57 73 H[FOXGLQJ��4�����00�VHFXULWLHV� ORVV��LQFUHDVHG����00� 1RQLQWHUHVW�LQFRPH� 250 238 248 12 2 $GMXVWHG�� 250 246 248 4 2 ƒ 1HW�LQWHUHVW�LQFRPH�DLGHG�E\�ORDQ� 1RQLQWHUHVW�H[SHQVHV 424 433 448 (9) (24) JURZWK�ZKLFK�ZDV�PRUH�WKDQ� $GMXVWHG�� 424 433 437 (9) (13) RIIVHW�E\�KLJKHU�IXQGLQJ�FRVWV 3URYLVLRQ�IRU�LQFRPH�WD[ 87 85 93 2 (6) ƒ &UHGLW�UHPDLQV�VROLG��3URYLVLRQ� 1HW�LQFRPH 298 339 326 (41) (28) GULYHQ�E\�ORDQ�JURZWK� �(QHUJ\� UHVHUYHV (DUQLQJV�SHU�VKDUH� $1.94 2.11 1.87 $(0.17) $0.07 $GMXVWHG���� 1.94 2.08 1.90 (0.14) 0.04 ƒ 6ROLG�QRQLQWHUHVW LQFRPH�JURZWK $YHUDJH�GLOXWHG�VKDUHV 153.2 159.5 173.6 (6.3) (20.4) ƒ ([SHQVHV�GHFOLQHG�RYHU��� � 52( 16.41% 18.44% 16.40% ƒ 5HSXUFKDVHG����00�VKDUHV��� 52$� 1.68 1.97 1.85 UHWXUQHG�����00�WR�VKDUHKROGHUV� (IILFLHQF\�5DWLR� 49.65 50.81 53.24 �EX\EDFN� �GLYLGHQG 2Q19 compared to 1Q19 Ⴠ 11Q19 included $8MM loss related to repositioning of securities portfolio Ɣ 2See Reconciliation of Non-GAAP Financial Measures slide Ⴠ 3Diluted earnings per common share Ⴠ 4Return on average common shareholders’ equity Ⴠ 5Return on Average assets Ⴠ 6Noninterest expenses as a percentage of net interest income and noninterest income excluding net gains (losses) from securities and a derivative contract tied to the conversion rate of Visa Class B shares. Ⴠ 72Q19 repurchases under the share repurchase program 19 6WURQJ�/RDQ�*URZWK Average loans increased $1.3B, or 3% 7RWDO�/RDQV $YHUDJH�ORDQV�LQFUHDVHG�����% ���LQ�ELOOLRQV Loan Yields ������00�0RUWJDJH�%DQNHU 51.8 ������00�*HQHUDO�0LGGOH�0DUNHW 51.0 50.3 49.7 ������00�&RPPHUFLDO�5HDO�(VWDWH 49.2 48.8 48.6 ������00�(QHUJ\ � ����00�3ULYDWH�%DQNLQJ /RDQ�\LHOGV�LPSDFWHG�E\�ORZHU�/,%25��OHDVH� 5.07 4.90 5.00 UHVLGXDO�DGMXVWPHQW� �PL[�VKLIW�LQ�SRUWIROLR 4.74 4.63 /RDQ�&RPPLWPHQWV ���LQ�ELOOLRQV� 3HULRG�HQG 53.1 53.2 51.1 51.8 52.9 2Q18 3Q18 4Q18 1Q19 2Q19 1Q19 2Q19 $YHUDJH�%DODQFHV 3HULRG�HQG� 2Q18 3Q18 4Q18 1Q19 2Q19 2Q19 compared to 1Q19 20

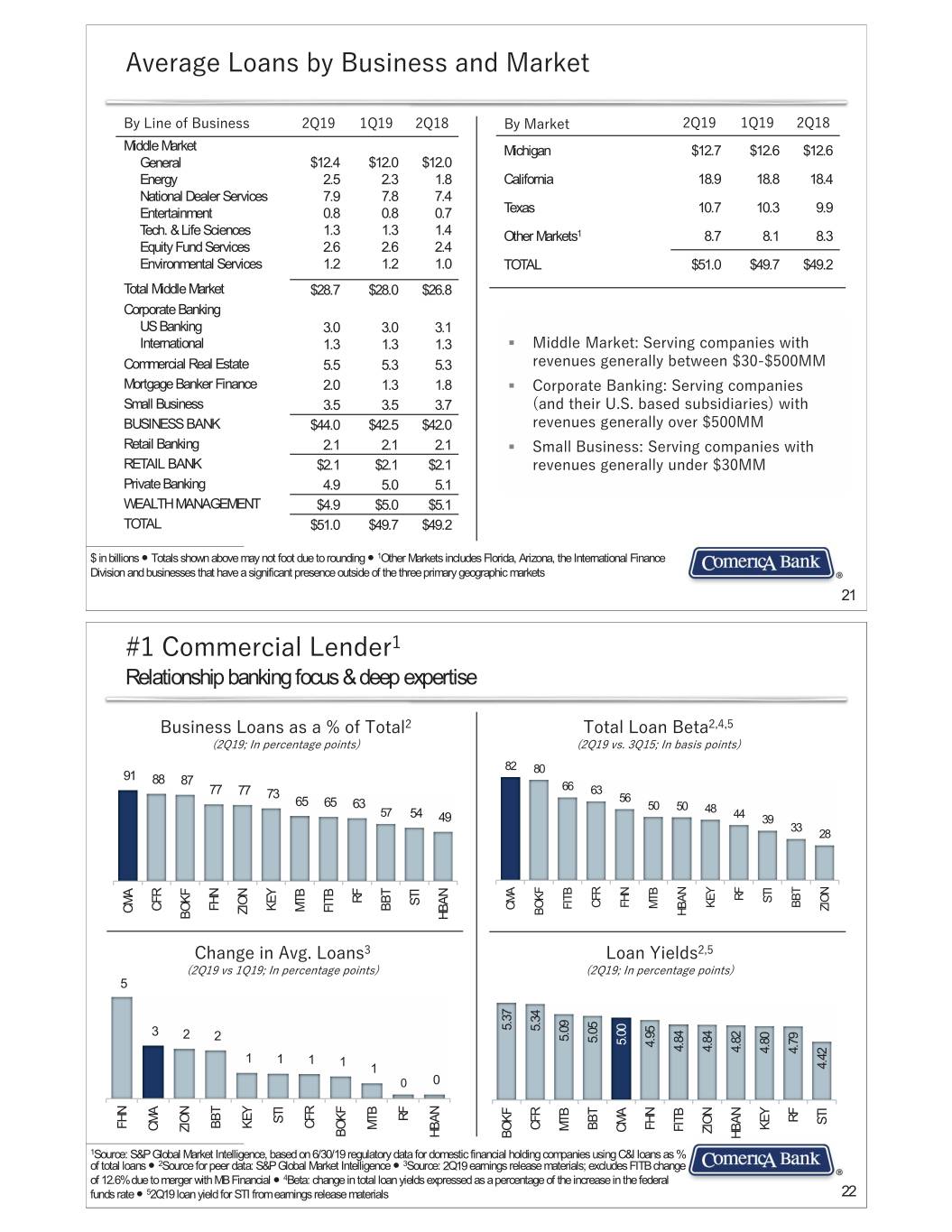

$YHUDJH�/RDQV�E\�%XVLQHVV�DQG�0DUNHW� %\�/LQH�RI�%XVLQHVV �4�� �4�� �4�� %\�0DUNHW �4�� �4�� �4�� Middle Market Michigan $12.7 $12.6 $12.6 General $12.4 $12.0 $12.0 Energy 2.5 2.3 1.8 California 18.9 18.8 18.4 National Dealer Services 7.9 7.8 7.4 Entertainment 0.8 0.8 0.7 Texas 10.7 10.3 9.9 Tech. & Life Sciences 1.3 1.3 1.4 Other Markets1 8.7 8.1 8.3 Equity Fund Services 2.6 2.6 2.4 Environmental Services 1.2 1.2 1.0 TOTAL $51.0 $49.7 $49.2 Total Middle Market $28.7 $28.0 $26.8 Corporate Banking US Banking 3.0 3.0 3.1 International 1.3 1.3 1.3 ƒ 0LGGOH�0DUNHW��6HUYLQJ�FRPSDQLHV�ZLWK� Commercial Real Estate 5.5 5.3 5.3 UHYHQXHV�JHQHUDOO\�EHWZHHQ���������00 Mortgage Banker Finance 2.0 1.3 1.8 ƒ &RUSRUDWH�%DQNLQJ��6HUYLQJ�FRPSDQLHV� Small Business 3.5 3.5 3.7 �DQG�WKHLU�8�6��EDVHG�VXEVLGLDULHV �ZLWK� BUSINESS BANK $44.0 $42.5 $42.0 UHYHQXHV�JHQHUDOO\�RYHU�����00 Retail Banking 2.1 2.1 2.1 ƒ 6PDOO�%XVLQHVV��6HUYLQJ�FRPSDQLHV�ZLWK� RETAIL BANK $2.1 $2.1 $2.1 UHYHQXHV�JHQHUDOO\�XQGHU����00 Private Banking 4.9 5.0 5.1 WEALTH MANAGEMENT $4.9 $5.0 $5.1 TOTAL $51.0 $49.7 $49.2 $ in billions Ⴠ Totals shown above may not foot due to rounding Ⴠ 1Other Markets includes Florida, Arizona, the International Finance Division and businesses that have a significant presence outside of the three primary geographic markets 21 ���&RPPHUFLDO�/HQGHU� Relationship banking focus & deep expertise %XVLQHVV�/RDQV�DV�D���RI�7RWDO� 7RWDO�/RDQ�%HWD����� ��4����,Q�SHUFHQWDJH�SRLQWV ��4���YV���4����,Q�EDVLV�SRLQWV 82 80 91 88 87 77 77 66 63 73 56 65 65 63 50 50 57 48 54 49 44 39 33 28 RF STI RF STI CFR FHN BBT KEY MTB FITB CMA CFR FHN BBT KEY ZION MTB FITB CMA ZION BOKF HBAN BOKF HBAN &KDQJH�LQ�$YJ��/RDQV� /RDQ�<LHOGV��� ��4���YV��4����,Q�SHUFHQWDJH�SRLQWV ��4����,Q�SHUFHQWDJH�SRLQWV 5 5.37 3 2 5.34 2 5.09 5.05 5.00 4.95 4.84 4.84 4.82 4.80 4.79 1 1 1 1 1 4.42 0 0 RF RF STI STI BBT CFR FHN KEY MTB CFR BBT FHN KEY CMA MTB FITB ZION CMA ZION BOKF HBAN BOKF HBAN 1Source: S&P Global Market Intelligence, based on 6/30/19 regulatory data for domestic financial holding companies using C&I loans as % of total loans Ⴠ 2Source for peer data: S&P Global Market Intelligence Ⴠ 3Source: 2Q19 earnings release materials; excludes FITB change of 12.6% due to merger with MB Financial Ⴠ 4Beta: change in total loan yields expressed as a percentage of the increase in the federal funds rate Ⴠ 52Q19 loan yield for STI from earnings release materials 22

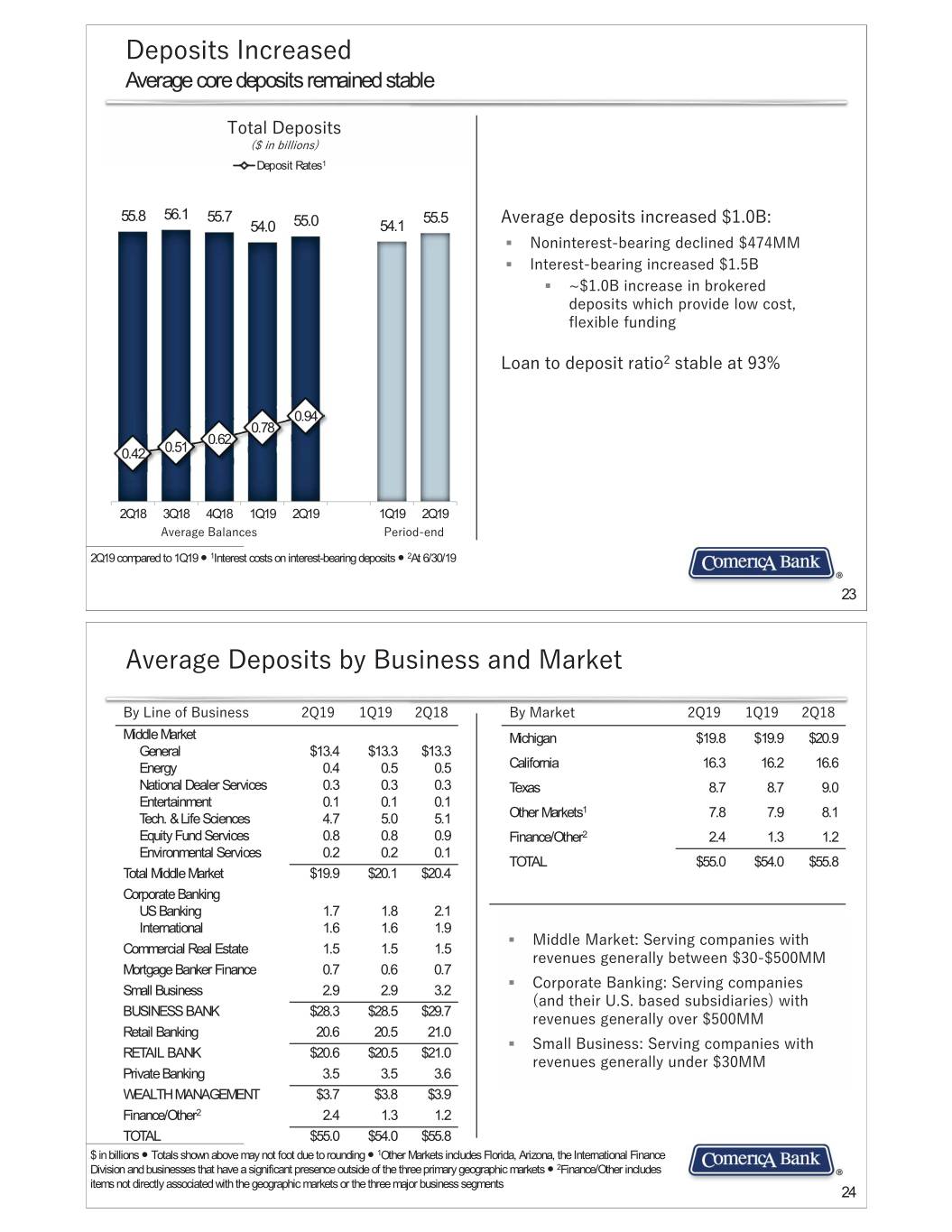

'HSRVLWV�,QFUHDVHG Average core deposits remained stable 7RWDO�'HSRVLWV ���LQ�ELOOLRQV Deposit Rates1 55.8 56.1 55.7 55.5 $YHUDJH�GHSRVLWV�LQFUHDVHG�����%� 54.0 55.0 54.1 ƒ 1RQLQWHUHVW�EHDULQJ�GHFOLQHG�����00 ƒ ,QWHUHVW�EHDULQJ�LQFUHDVHG�����%� ƒ f����%�LQFUHDVH�LQ�EURNHUHG� GHSRVLWV�ZKLFK�SURYLGH�ORZ�FRVW�� IOH[LEOH�IXQGLQJ /RDQ�WR�GHSRVLW�UDWLR� VWDEOH�DW���� 0.94 0.78 0.62 0.42 0.51 2Q18 3Q18 4Q18 1Q19 2Q19 1Q19 2Q19 $YHUDJH�%DODQFHV 3HULRG�HQG� 2Q19 compared to 1Q19 Ⴠ 1Interest costs on interest-bearing deposits Ⴠ 2At 6/30/19 23 $YHUDJH�'HSRVLWV�E\�%XVLQHVV�DQG�0DUNHW %\�/LQH�RI�%XVLQHVV �4�� �4�� �4�� %\�0DUNHW �4�� �4�� �4�� Middle Market Michigan $19.8 $19.9 $20.9 General $13.4 $13.3 $13.3 Energy 0.4 0.5 0.5 California 16.3 16.2 16.6 National Dealer Services 0.3 0.3 0.3 Texas 8.7 8.7 9.0 Entertainment 0.1 0.1 0.1 1 Tech. & Life Sciences 4.7 5.0 5.1 Other Markets 7.8 7.9 8.1 Equity Fund Services 0.8 0.8 0.9 Finance/Other2 2.4 1.3 1.2 Environmental Services 0.2 0.2 0.1 TOTAL $55.0 $54.0 $55.8 Total Middle Market $19.9 $20.1 $20.4 Corporate Banking US Banking 1.7 1.8 2.1 International 1.6 1.6 1.9 ƒ 0LGGOH�0DUNHW��6HUYLQJ�FRPSDQLHV�ZLWK� Commercial Real Estate 1.5 1.5 1.5 UHYHQXHV�JHQHUDOO\�EHWZHHQ���������00 Mortgage Banker Finance 0.7 0.6 0.7 Small Business 2.9 2.9 3.2 ƒ &RUSRUDWH�%DQNLQJ��6HUYLQJ�FRPSDQLHV� �DQG�WKHLU�8�6��EDVHG�VXEVLGLDULHV �ZLWK� BUSINESS BANK $28.3 $28.5 $29.7 UHYHQXHV�JHQHUDOO\�RYHU�����00 Retail Banking 20.6 20.5 21.0 ƒ 6PDOO�%XVLQHVV��6HUYLQJ�FRPSDQLHV�ZLWK� RETAIL BANK $20.6 $20.5 $21.0 UHYHQXHV�JHQHUDOO\�XQGHU����00 Private Banking 3.5 3.5 3.6 WEALTH MANAGEMENT $3.7 $3.8 $3.9 Finance/Other2 2.4 1.3 1.2 TOTAL $55.0 $54.0 $55.8 $ in billions Ⴠ Totals shown above may not foot due to rounding Ⴠ 1Other Markets includes Florida, Arizona, the International Finance Division and businesses that have a significant presence outside of the three primary geographic markets Ⴠ 2Finance/Other includes items not directly associated with the geographic markets or the three major business segments 24

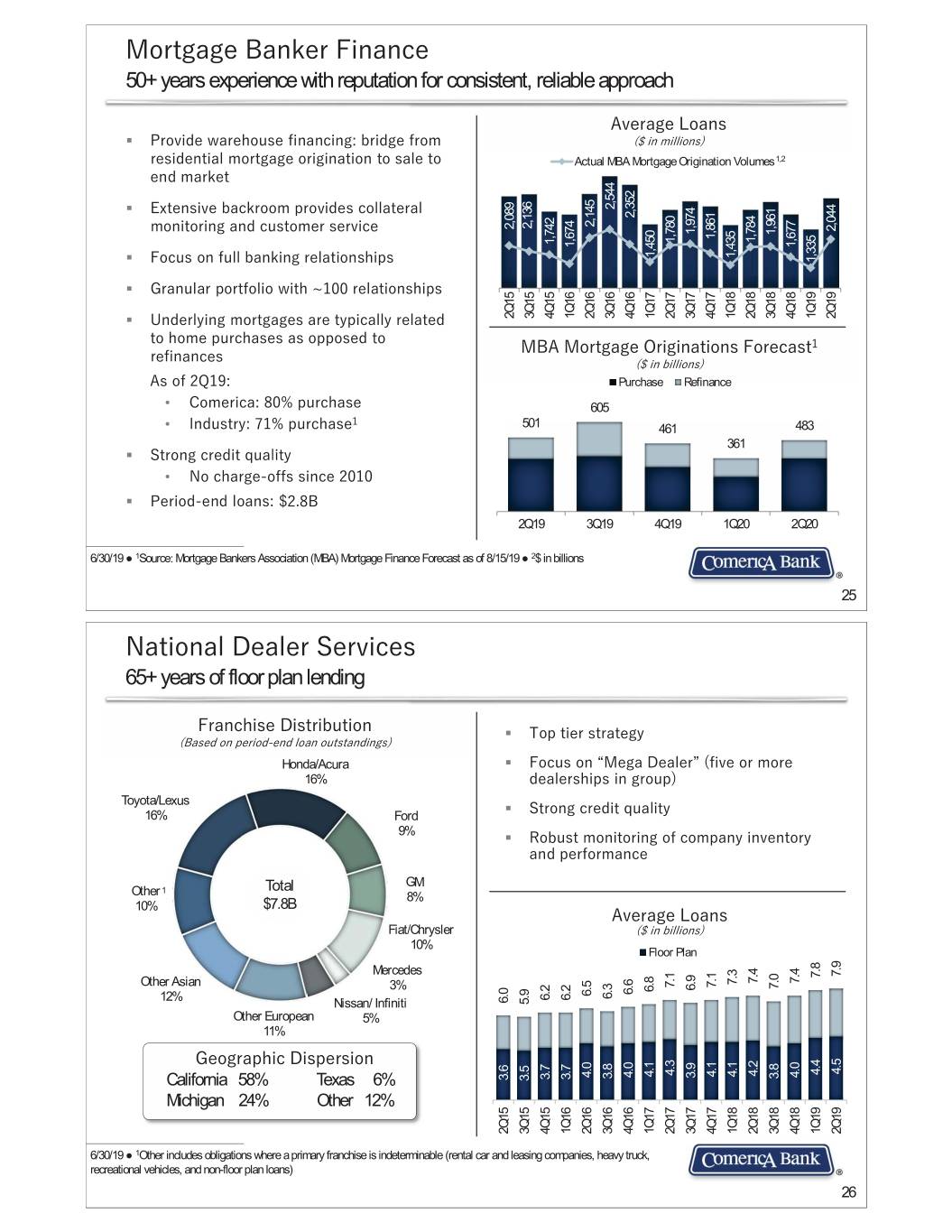

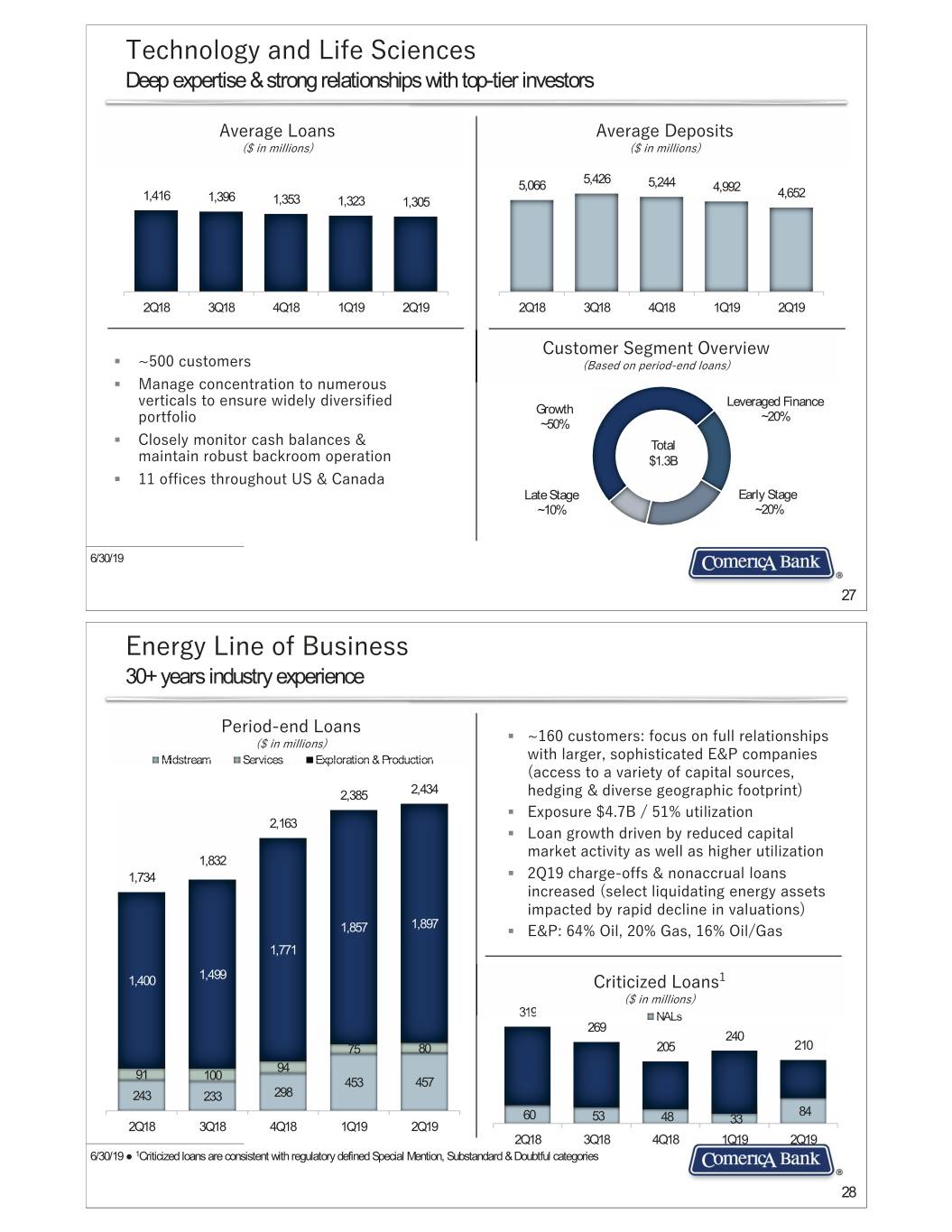

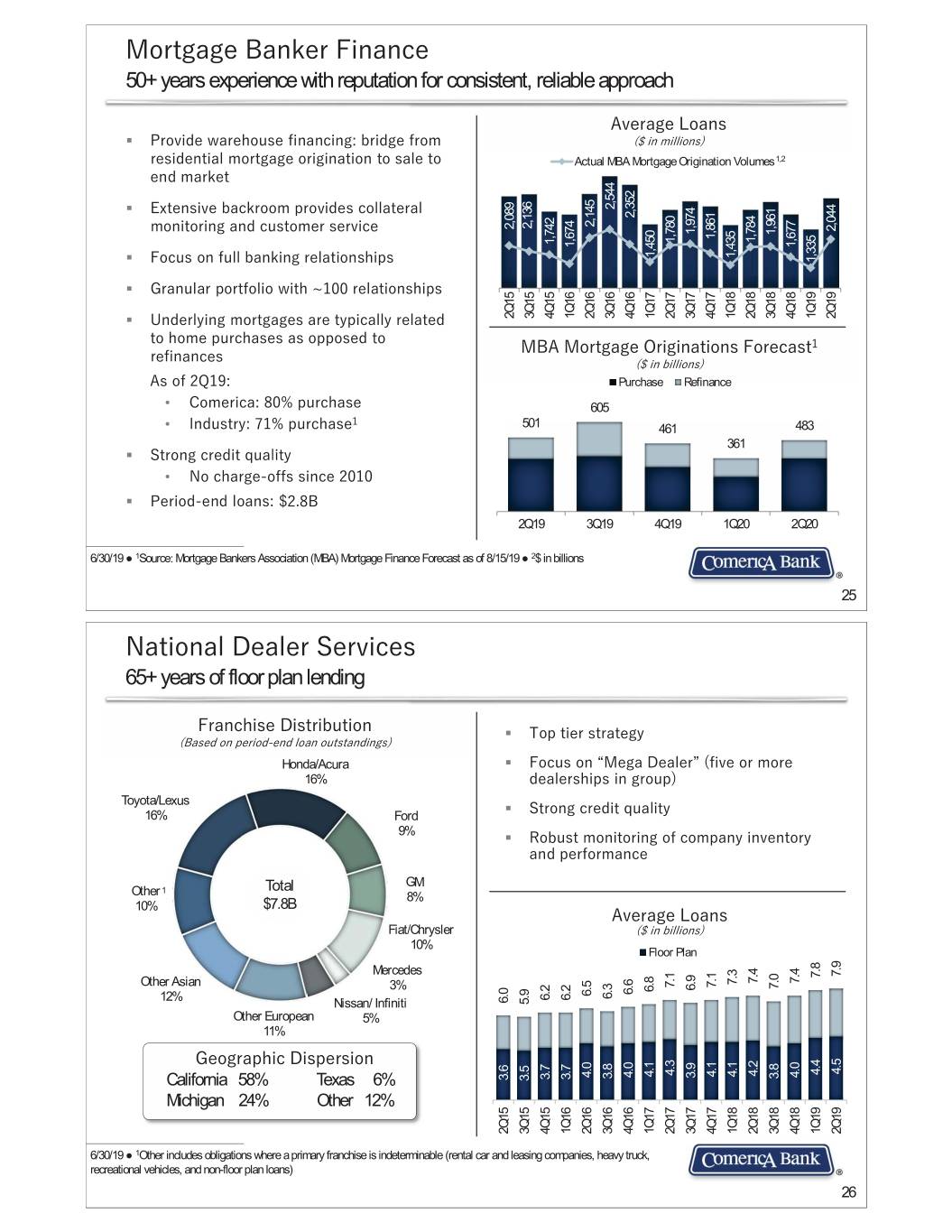

0RUWJDJH�%DQNHU�)LQDQFH 50+ years experience with reputation for consistent, reliable approach $YHUDJH�/RDQV ƒ 3URYLGH�ZDUHKRXVH�ILQDQFLQJ��EULGJH�IURP� ���LQ�PLOOLRQV UHVLGHQWLDO�PRUWJDJH�RULJLQDWLRQ�WR�VDOH�WR� Actual MBA Mortgage Origination Volumes 1,2 HQG�PDUNHW ƒ ([WHQVLYH�EDFNURRP�SURYLGHV�FROODWHUDO� 2,544 2,352 2,145 2,136 2,089 2,044 PRQLWRULQJ�DQG�FXVWRPHU�VHUYLFH 1,974 1,961 1,861 1,784 1,780 1,742 1,677 1,674 1,450 1,435 ƒ )RFXV�RQ�IXOO�EDQNLQJ�UHODWLRQVKLSV 1,335 ƒ *UDQXODU�SRUWIROLR�ZLWK�f����UHODWLRQVKLSV ƒ 8QGHUO\LQJ�PRUWJDJHV�DUH�W\SLFDOO\�UHODWHG� 2Q15 3Q15 4Q15 1Q16 2Q16 3Q16 4Q16 1Q17 2Q17 3Q17 4Q17 1Q18 2Q18 3Q18 4Q18 1Q19 2Q19 WR�KRPH�SXUFKDVHV�DV�RSSRVHG�WR� 0%$�0RUWJDJH�2ULJLQDWLRQV�)RUHFDVW� UHILQDQFHV ���LQ�ELOOLRQV $V�RI��4���� Purchase Refinance • &RPHULFD������SXUFKDVH� 605 � • ,QGXVWU\������SXUFKDVH 501 461 483 361 ƒ 6WURQJ�FUHGLW�TXDOLW\ • 1R�FKDUJH�RIIV�VLQFH����� ƒ 3HULRG�HQG�ORDQV������% 2Q19 3Q19 4Q19 1Q20 2Q20 6/30/19 Ɣ 1Source: Mortgage Bankers Association (MBA) Mortgage Finance Forecast as of 8/15/19 Ɣ 2$ in billions 25 1DWLRQDO�'HDOHU�6HUYLFHV 65+ years of floor plan lending )UDQFKLVH�'LVWULEXWLRQ ƒ 7RS�WLHU�VWUDWHJ\ �%DVHG�RQ�SHULRG�HQG�ORDQ�RXWVWDQGLQJV Honda/Acura ƒ )RFXV�RQ�n0HJD�'HDOHU|��ILYH�RU�PRUH� 16% GHDOHUVKLSV�LQ�JURXS Toyota/Lexus 16% Ford ƒ 6WURQJ�FUHGLW�TXDOLW\ 9% ƒ 5REXVW�PRQLWRULQJ�RI�FRPSDQ\�LQYHQWRU\� DQG�SHUIRUPDQFH GM 1 Total Other 8% 10% $7.8B $YHUDJH�/RDQV Fiat/Chrysler ���LQ�ELOOLRQV 10% Floor Plan Mercedes 7.9 7.8 7.4 7.4 7.3 Other Asian 7.1 7.1 7.0 6.9 3% 6.8 6.6 6.5 6.3 6.2 6.2 12% 6.0 Nissan/ Infiniti 5.9 Other European 5% 11% *HRJUDSKLF�'LVSHUVLRQ 4.5 4.4 4.3 4.2 4.1 4.1 4.1 4.0 4.0 4.0 3.9 3.8 3.8 3.7 3.7 3.6 California 58% Texas 6% 3.5 Michigan 24% Other 12% 2Q15 3Q15 4Q15 1Q16 2Q16 3Q16 4Q16 1Q17 2Q17 3Q17 4Q17 1Q18 2Q18 3Q18 4Q18 1Q19 2Q19 6/30/19 Ɣ 1Other includes obligations where a primary franchise is indeterminable (rental car and leasing companies, heavy truck, recreational vehicles, and non-floor plan loans) 26

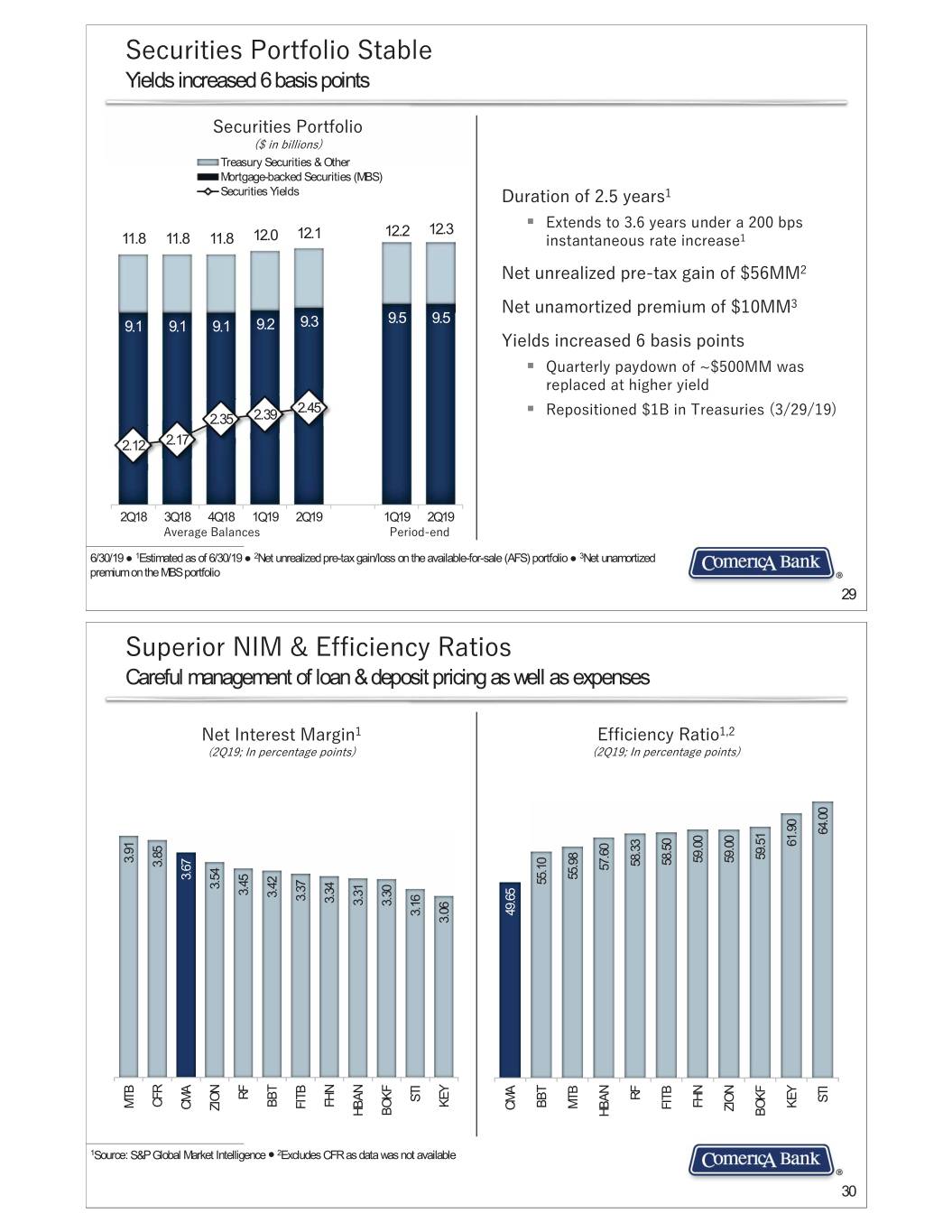

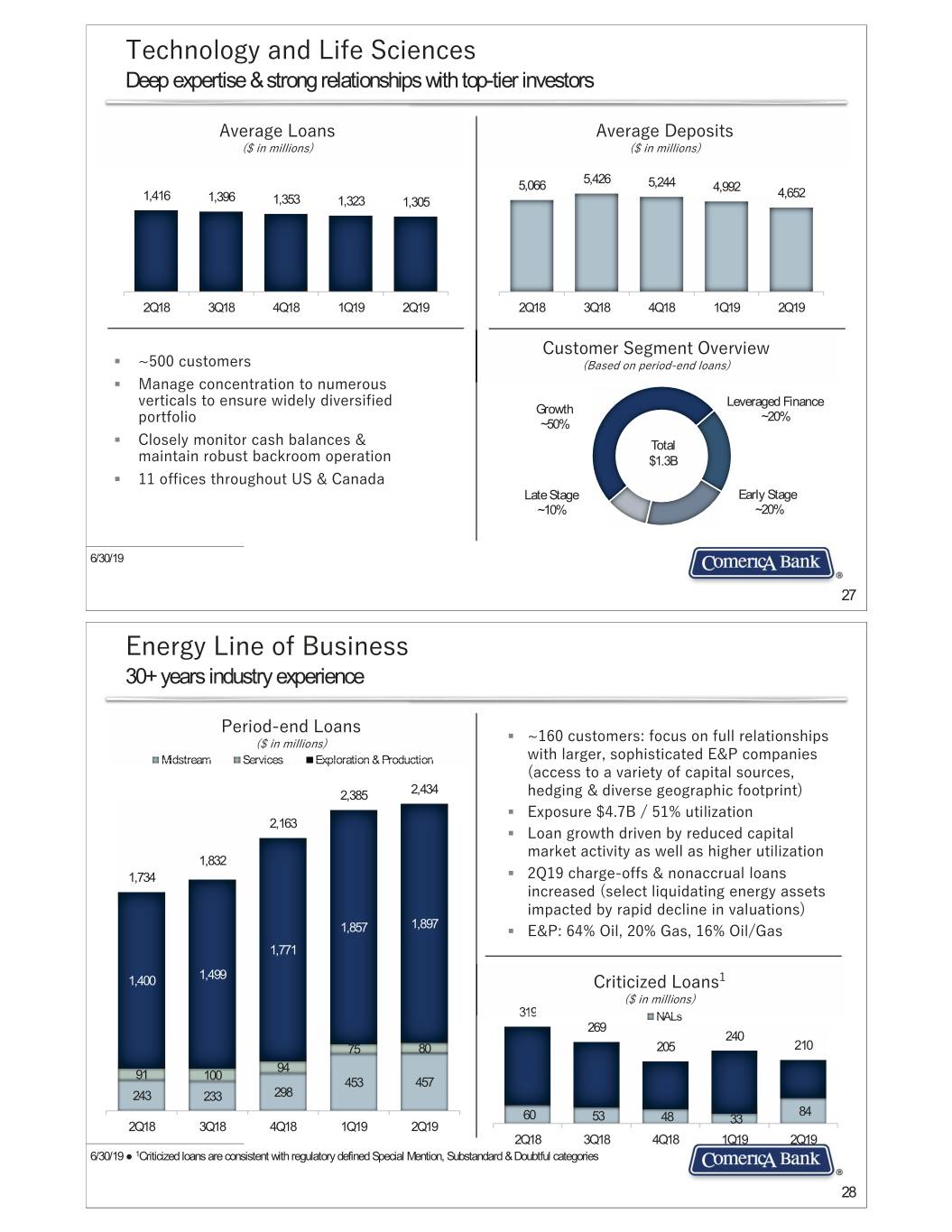

7HFKQRORJ\�DQG�/LIH�6FLHQFHV Deep expertise & strong relationships with top-tier investors $YHUDJH�/RDQV $YHUDJH�'HSRVLWV ���LQ�PLOOLRQV ���LQ�PLOOLRQV 5,426 5,066 5,244 4,992 4,652 1,416 1,396 1,353 1,323 1,305 2Q18 3Q18 4Q18 1Q19 2Q19 2Q18 3Q18 4Q18 1Q19 2Q19 &XVWRPHU�6HJPHQW�2YHUYLHZ ƒ f����FXVWRPHUV� �%DVHG�RQ�SHULRG�HQG�ORDQV ƒ 0DQDJH�FRQFHQWUDWLRQ�WR�QXPHURXV� YHUWLFDOV�WR�HQVXUH�ZLGHO\�GLYHUVLILHG� Leveraged Finance Growth ~20% SRUWIROLR ~50% ƒ &ORVHO\�PRQLWRU�FDVK�EDODQFHV� Total PDLQWDLQ�UREXVW�EDFNURRP�RSHUDWLRQ $1.3B ƒ ���RIILFHV�WKURXJKRXW�86� �&DQDGD Late Stage Early Stage ~10% ~20% 6/30/19 27 (QHUJ\�/LQH�RI�%XVLQHVV 30+ years industry experience 3HULRG�HQG�/RDQV� ƒ ���LQ�PLOOLRQV f����FXVWRPHUV��IRFXV�RQ�IXOO�UHODWLRQVKLSV� Midstream Services Exploration & Production ZLWK�ODUJHU��VRSKLVWLFDWHG�( 3�FRPSDQLHV� �DFFHVV�WR�D�YDULHW\�RI�FDSLWDO�VRXUFHV�� 2,385 2,434 KHGJLQJ� �GLYHUVH�JHRJUDSKLF�IRRWSULQW ƒ ([SRVXUH����7% ������XWLOL]DWLRQ� 2,163 ƒ /RDQ�JURZWK�GULYHQ�E\�UHGXFHG�FDSLWDO� PDUNHW�DFWLYLW\�DV�ZHOO�DV�KLJKHU�XWLOL]DWLRQ� 1,832 Mixed 1,734 ƒ �4���FKDUJH�RIIV� �QRQDFFUXDO�ORDQV�18% LQFUHDVHG��VHOHFW�OLTXLGDWLQJ�HQHUJ\�DVVHWV� LPSDFWHG�E\�UDSLG�GHFOLQH�LQ�YDOXDWLRQV 1,897 1,857 ƒ ( 3������2LO������*DV������2LO�*DV 1,771 1,400 1,499 &ULWLFL]HG�/RDQV� ���LQ�PLOOLRQV 313199 NALsNALs 269 240 75 80 205 210 94 91 100 453 457 243 233 298 84 60 53 48 33 2Q18 3Q18 4Q18 1Q19 2Q19 2Q18 3Q18 4Q18 1Q19 2Q19 6/30/19 Ɣ 1Criticized loans are consistent with regulatory defined Special Mention, Substandard & Doubtful categories 28

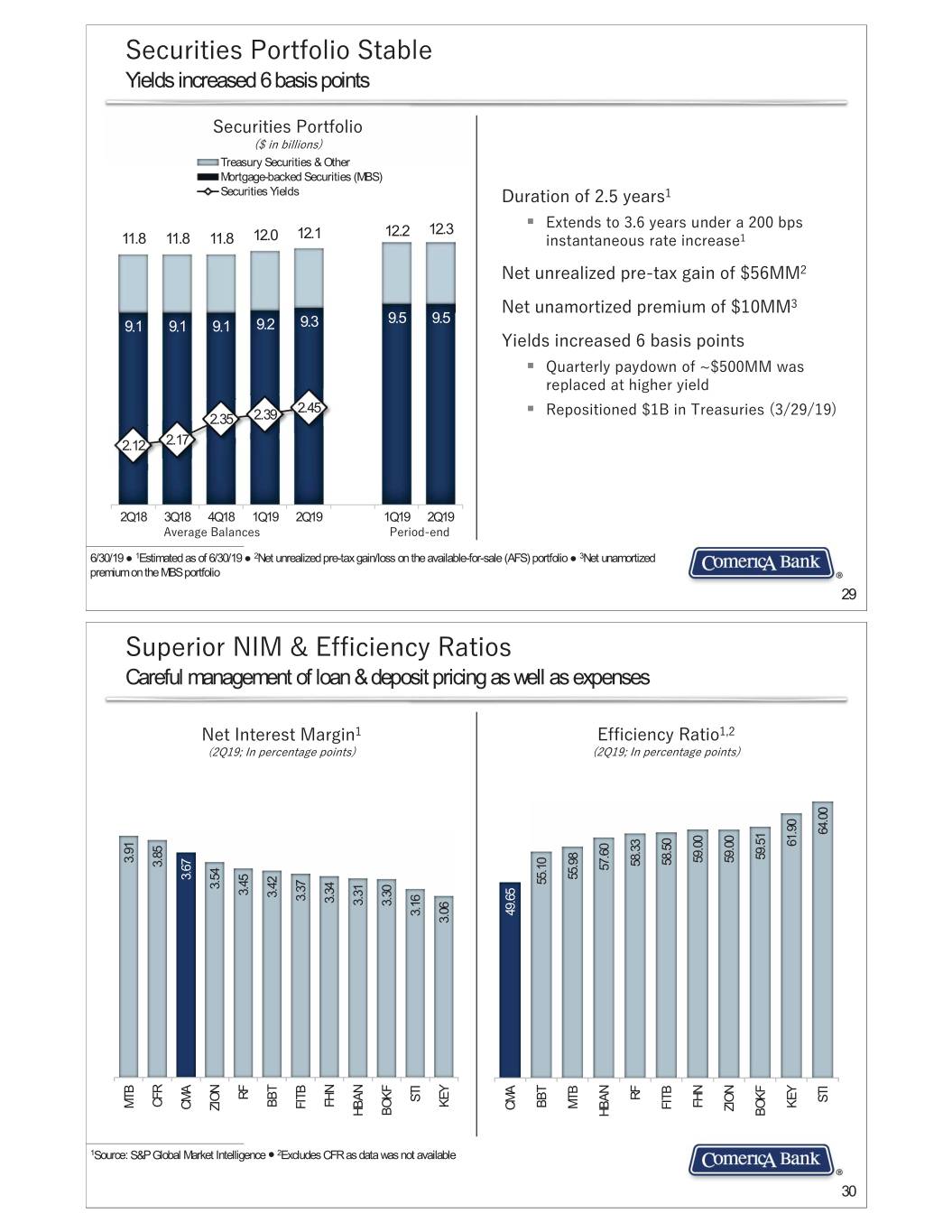

6HFXULWLHV�3RUWIROLR�6WDEOH� Yields increased 6 basis points 6HFXULWLHV�3RUWIROLR ���LQ�ELOOLRQV Treasury Securities & Other Mortgage-backed Securities (MBS) Securities Yields 'XUDWLRQ�RI�����\HDUV�� ƒ ([WHQGV�WR���� \HDUV�XQGHU�D�����ESV� 12.1 12.2 12.3 11.8 11.8 11.8 12.0 LQVWDQWDQHRXV�UDWH�LQFUHDVH� 1HW�XQUHDOL]HG�SUH�WD[�JDLQ�RI����00� 1HW�XQDPRUWL]HG�SUHPLXP�RI����00� 9.5 9.5 9.1 9.1 9.1 9.2 9.3 <LHOGV�LQFUHDVHG���EDVLV�SRLQWV ƒ 4XDUWHUO\�SD\GRZQ�RI�f����00�ZDV� UHSODFHG�DW�KLJKHU�\LHOG 2.45 ƒ 5HSRVLWLRQHG���%�LQ�7UHDVXULHV��������� 2.35 2.39 2.12 2.17 2Q18 3Q18 4Q18 1Q19 2Q19 1Q19 2Q19 $YHUDJH�%DODQFHV 3HULRG�HQG� 6/30/19 Ɣ 1Estimated as of 6/30/19 Ɣ 2Net unrealized pre-tax gain/loss on the available-for-sale (AFS) portfolio Ɣ 3Net unamortized premium on the MBS portfolio 29 6XSHULRU�1,0� �(IILFLHQF\�5DWLRV Careful management of loan & deposit pricing as well as expenses 1HW�,QWHUHVW�0DUJLQ� (IILFLHQF\�5DWLR��� ��4����,Q�SHUFHQWDJH�SRLQWV ��4��� ,Q�SHUFHQWDJH�SRLQWV 64.00 61.90 59.51 59.00 59.00 3.91 58.50 58.33 3.85 57.60 55.98 3.67 55.10 3.54 3.45 3.42 3.37 3.34 3.31 3.30 49.65 3.16 3.06 RF RF STI STI CFR FHN BBT KEY BBT FHN KEY MTB MTB FITB FITB CMA CMA ZION ZION BOKF BOKF HBAN HBAN 1Source: S&P Global Market Intelligence Ⴠ 2Excludes CFR as data was not available 30

1HW�,QWHUHVW�,QFRPH�6WDEOH Loan growth more than offset by higher funding costs 1HW�,QWHUHVW�,QFRPH ���LQ�PLOOLRQV NIM $606MM 1Q19 3.79% 614 + 14MM Loans: - 0.02 606 603 590 599 + 16MM Higher balances +0.02 + 6MM 1 additional day -- - 4MM Lower LIBOR -0.02 - 2MM Lease residual adj. -0.01 - 1MM Hedges -0.01 - 1MM Portfolio mix shift -- 3.79 + 3MM Securities: + 0.01 3.70 3.67 Higher yield 3.62 3.60 - 15MM Deposits: - 0.09 - 8MM Higher balances -0.05 - 7MM Higher rates -0.04 -5MM Wholesale funding: -0.02 Higher level $603MM 2Q19 3.67% 2Q18 3Q18 4Q18 1Q19 2Q19 2Q19 compared to 1Q19 31 &UHGLW�4XDOLW\�5HPDLQV�6ROLG Provision reflects loan growth & decline in value of select energy assets $OORZDQFH�IRU�&UHGLW�/RVVHV � ���LQ�PLOOLRQV ƒ ���00�LQ�QHW�FKDUJH�RIIV RU����ESV Allowance for Loan Losses as a % of Total Loans ƒ 1RQDFFUXDO�ORDQV��� ESV�RI�WRWDO�ORDQV 711 697 701 677 688 ƒ $///�13/�FRYHUDJH����[ 1.36 1.35 1.34 ƒ 3URYLVLRQ�LQFUHDVHG����00�RYHU��4�� 1.29 1.27 • /RDQ�JURZWK� • 6HOHFW�OLTXLGDWLQJ�HQHUJ\�DVVHWV� LPSDFWHG�E\�UDSLG�GHFOLQH�LQ�YDOXDWLRQV 2Q18 3Q18 4Q18 1Q19 2Q19 &ULWLFL]HG�/RDQV� $ in millions Total ���LQ�PLOOLRQV Energy Ex-Energy NALsNAL CriticizedCitii d as a % of fT Total t lL Loans Total PE loans $2,434 $49,367 $51,801 % of total 5% 95% 100% 1,948 1,765 1,806 1 1,670 1,548 Criticized 210 1,738 1,948 Ratio 8.6% 3.5% 3.8% Nonaccrual 84 140 224 3.6 3.8 3.5 3.4 3.1 Ratio 3.5% 0.3% 0.4% 2 254 230 221 191 224 Net charge-offs 25 8 33 Ratio N/M 0.06% 0.26% 2Q18 3Q18 4Q18 1Q19 2Q19 6/30/19 Ɣ1Criticized loans are consistent with regulatory defined Special Mention, Substandard, & Doubtful categories Ɣ 2Net credit-related charge-offs; ratio shown as a % of average loans Ɣ N/M = Not meaningful 32

1RQLQWHUHVW�,QFRPH�,QFUHDVHG Card fees continue to grow 1RQLQWHUHVW�,QFRPH� 1RQLQWHUHVW�LQFRPH�LQFUHDVHG���00� ���LQ�PLOOLRQV �H[FOXGLQJ���00�6HFXULWLHV�ORVVHV�LQ��4�� Securities losses due to repositioning ����00�)LGXFLDU\�LQFRPH ����00�&DUG� 254 248 250 246 250 ����00�%DQN�RZQHG�OLIH�LQVXUDQFH 20 8 234 238 � ��00�'HIHUUHG�&RPS��RIIVHW�LQ�QRQLQWHUHVW�H[SHQVH *URZLQJ�&DUG�)HHV ���LQ�PLOOLRQV 65 64 63 60 61 2Q18 3Q18 4Q18 1Q19 2Q19 2Q18 3Q18 4Q18 1Q19 2Q19 2Q19 compared to 1Q19 Ɣ 1See Reconciliation of Non-GAAP Financial Measures slide 33 1RQLQWHUHVW�([SHQVH�'HFOLQHG Disciplined cost management drives efficiency ratio1 under 50% 1RQLQWHUHVW�([SHQVH� ���LQ�PLOOLRQV Restructuring Efficiency Ratio 1RQLQWHUHVW�H[SHQVH�GHFOLQHG���00� � ���00�6DODULHV� �EHQHILWV 448 452 448 � �4���DQQXDO�VWRFN�FRPS� � 433 11 12 14 424 KLJKHU�SD\UROO�WD[HV 440 ��0HULW�LQFUHDVHV 437 434 433 424 ��2QH�DGGLWLRQDO�GD\ � 'HIHUUHG�&RPS��RIIVHW�LQ�QRQLQWHUHVW�LQFRPH �����00�$GYHUWLVLQJ� �����00�/HJDO�����4���UHFRYHULHV �����00�2XWVLGH�SURFHVVLQJ 53.2% 52.9% 51.9% 50.8% 49.7% 2Q18 3Q18 4Q18 1Q19 2Q19 2Q19 compared to 1Q19 Ⴠ 1Noninterest expenses as a percentage of net interest income & noninterest income excluding net gains (losses) from securities & a derivative contract tied to the conversion rate of Visa Class B shares Ɣ 2See Reconciliation of Non-GAAP 3 Financial Measures slide Ɣ Included in other noninterest expenses 34

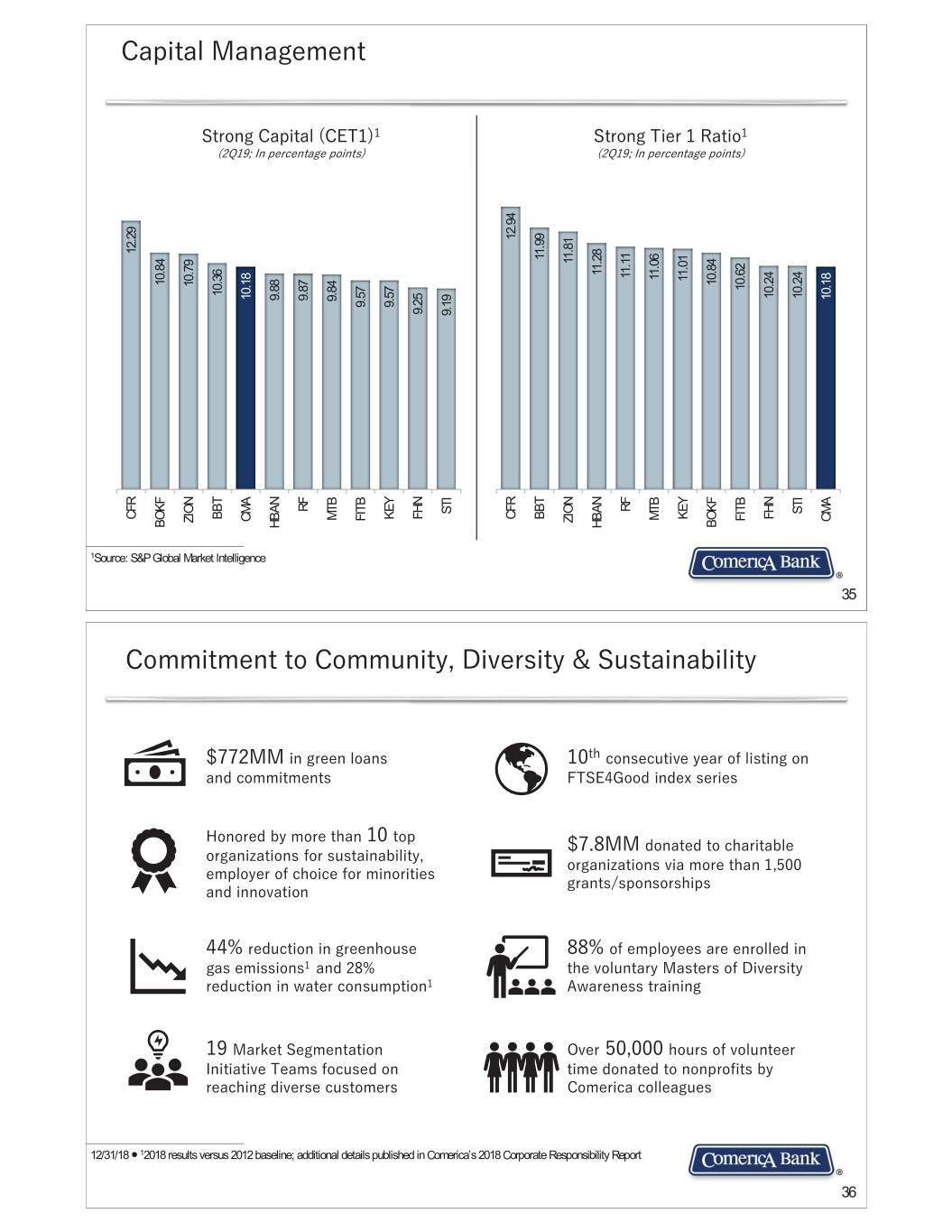

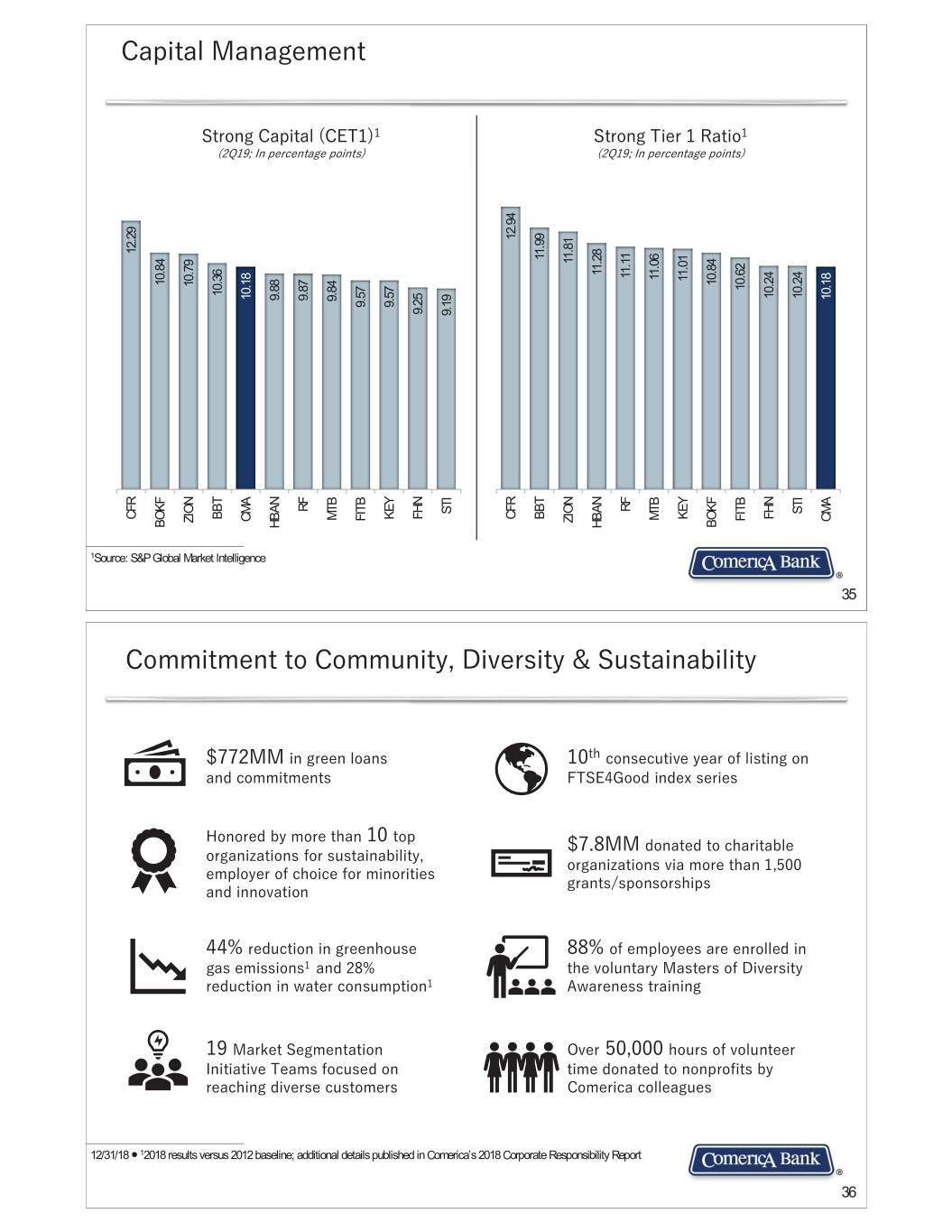

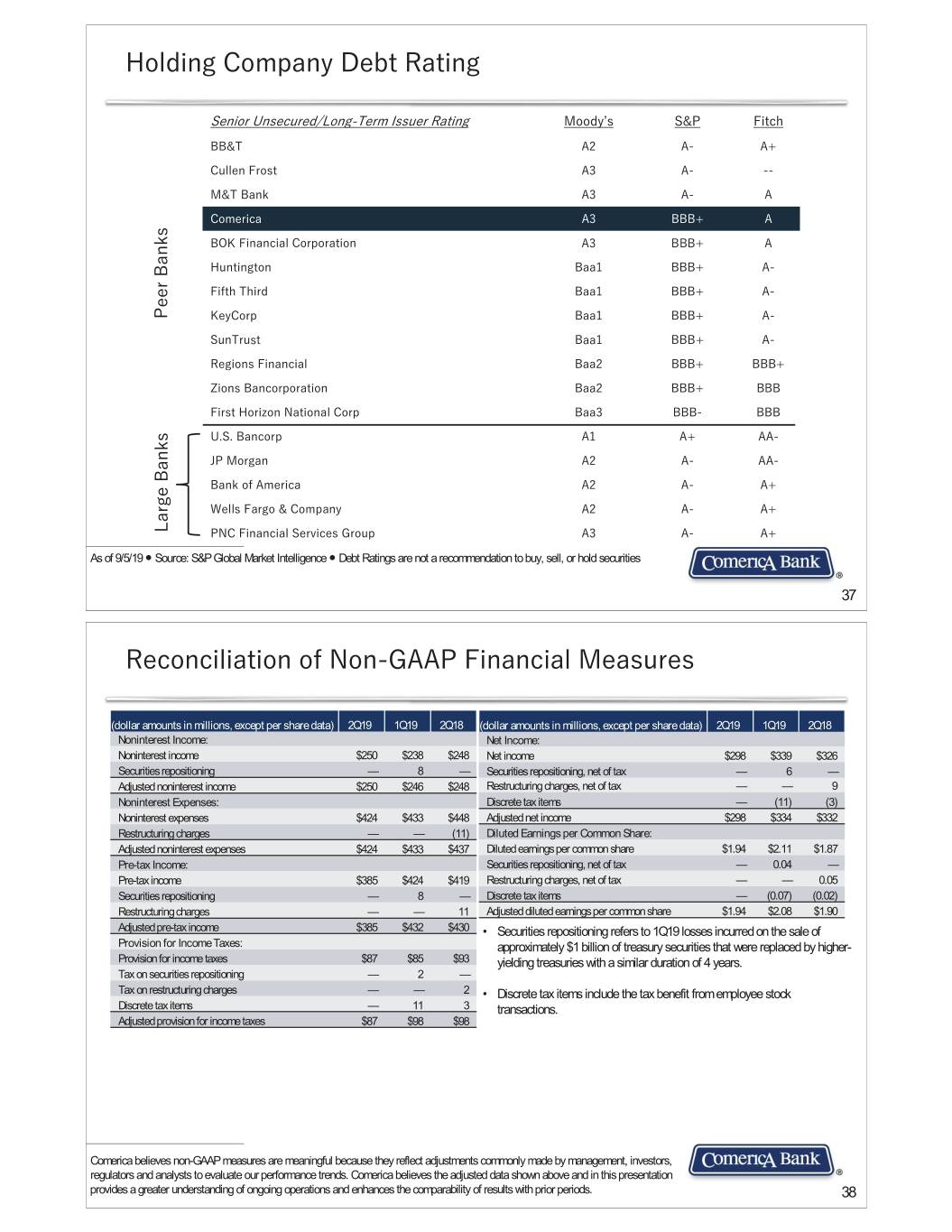

&DSLWDO�0DQDJHPHQW 6WURQJ�&DSLWDO��&(7� � 6WURQJ�7LHU���5DWLR� ��4����,Q�SHUFHQWDJH�SRLQWV ��4����,Q�SHUFHQWDJH�SRLQWV 12.94 12.29 11.99 11.99 11.81 11.81 11.28 11.28 11.11 11.06 11.06 11.01 11.01 10.84 10.84 10.79 10.62 10.36 10.24 10.24 10.18 10.18 9.88 9.87 9.84 9.57 9.57 9.25 9.19 RF RF STI STI BBT FHN FHN CFR BBT KEY CFR KEY MTB MTB FITB FITB CMA CMA ZION ZION BOKF BOKF HBAN HBAN 1Source: S&P Global Market Intelligence 35 &RPPLWPHQW�WR�&RPPXQLW\��'LYHUVLW\� �6XVWDLQDELOLW\ ����00�LQ�JUHHQ�ORDQV� ��WK FRQVHFXWLYH�\HDU�RI�OLVWLQJ�RQ� DQG�FRPPLWPHQWV )76(�*RRG�LQGH[�VHULHV +RQRUHG�E\�PRUH�WKDQ��� WRS� ����00�GRQDWHG�WR�FKDULWDEOH� RUJDQL]DWLRQV�IRU�VXVWDLQDELOLW\�� RUJDQL]DWLRQV�YLD�PRUH�WKDQ������� HPSOR\HU�RI�FKRLFH�IRU�PLQRULWLHV� JUDQWV�VSRQVRUVKLSV DQG�LQQRYDWLRQ ����UHGXFWLRQ�LQ�JUHHQKRXVH� ����RI�HPSOR\HHV�DUH�HQUROOHG�LQ� JDV�HPLVVLRQV���DQG����� WKH�YROXQWDU\�0DVWHUV�RI�'LYHUVLW\� UHGXFWLRQ�LQ�ZDWHU�FRQVXPSWLRQ� $ZDUHQHVV�WUDLQLQJ ���0DUNHW�6HJPHQWDWLRQ� 2YHU ������ KRXUV�RI�YROXQWHHU� ,QLWLDWLYH�7HDPV�IRFXVHG�RQ� WLPH�GRQDWHG�WR�QRQSURILWV�E\� UHDFKLQJ�GLYHUVH�FXVWRPHUV &RPHULFD�FROOHDJXHV 12/31/18 Ⴠ 12018 results versus 2012 baseline; additional details published in Comerica’s 2018 Corporate Responsibility Report 36

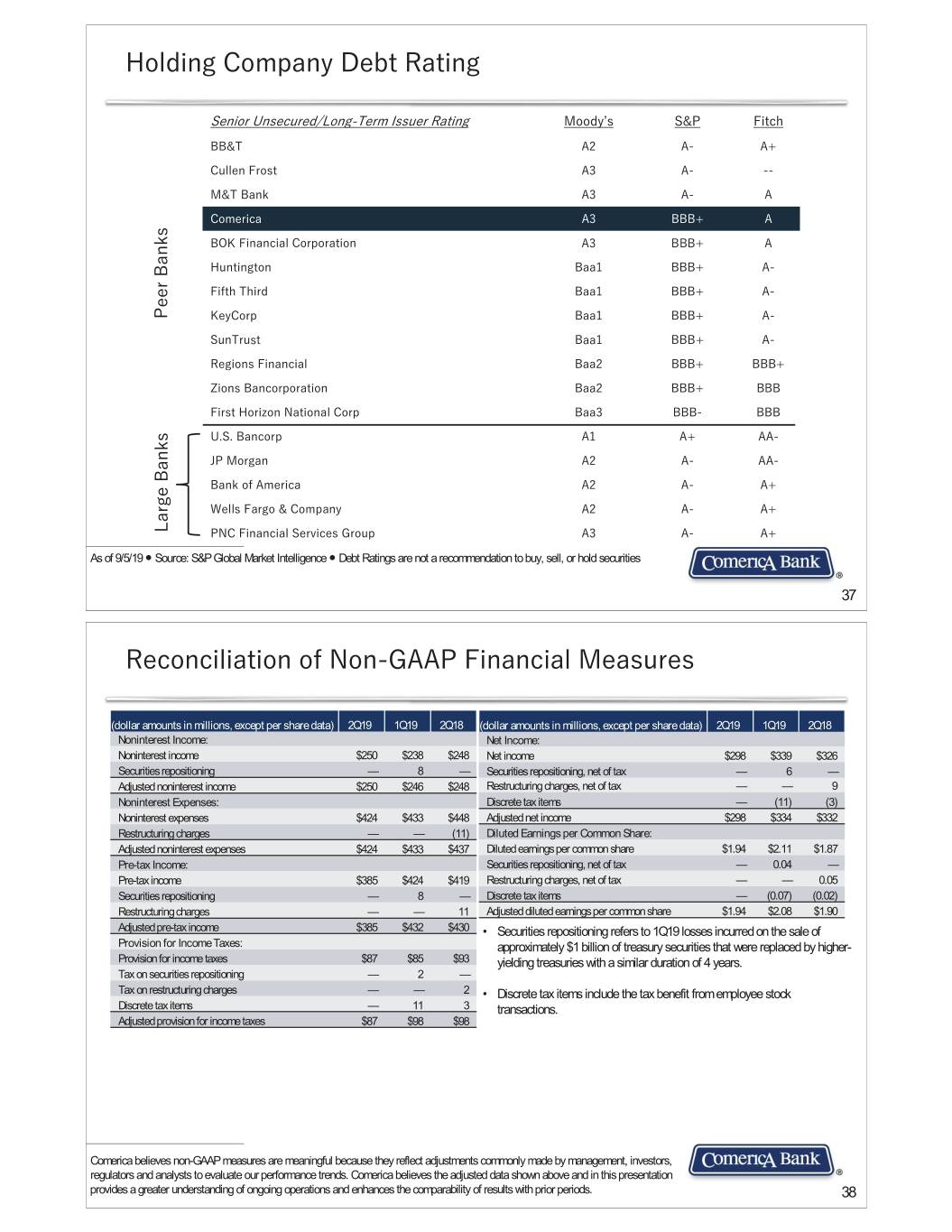

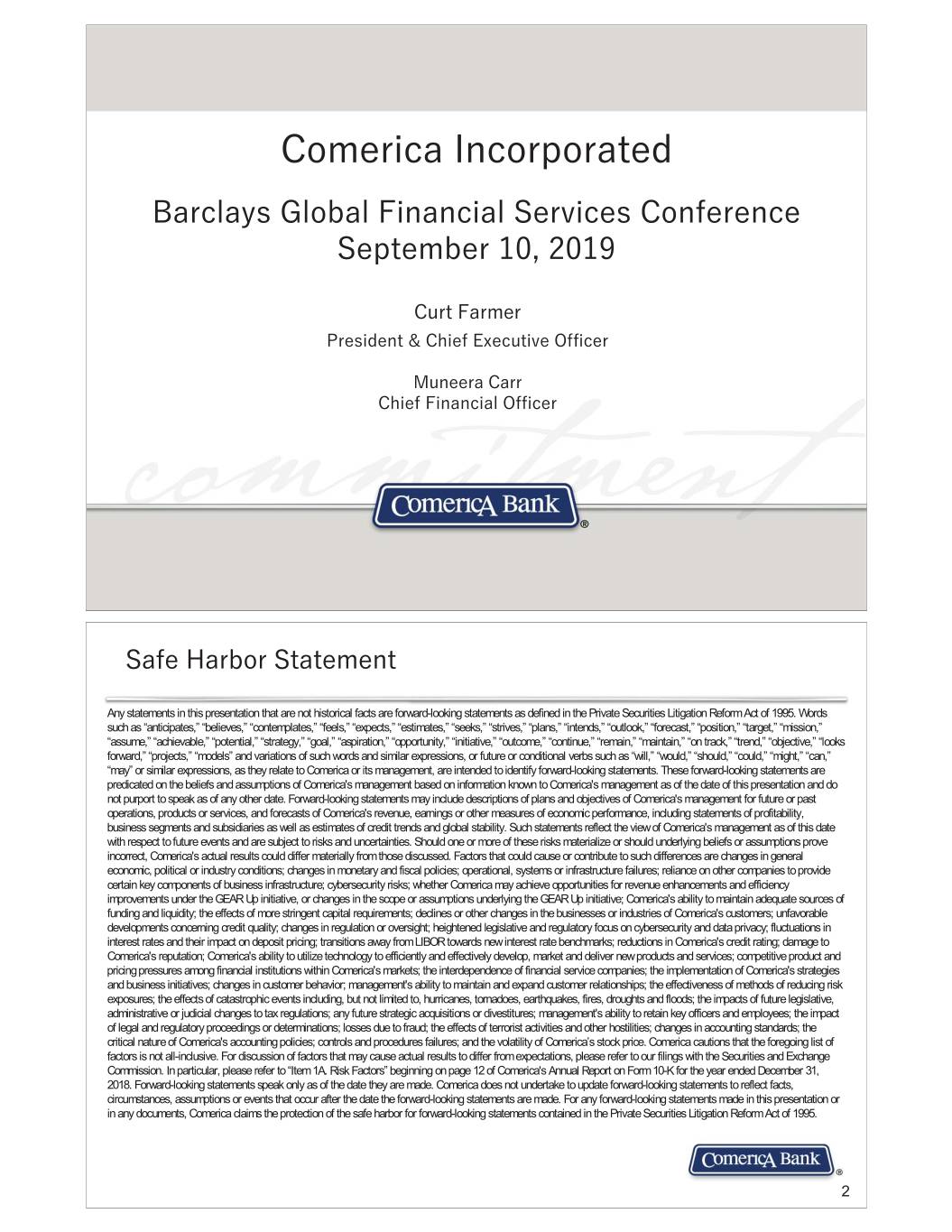

+ROGLQJ�&RPSDQ\�'HEW�5DWLQJ 6HQLRU�8QVHFXUHG�/RQJ�7HUP�,VVXHU�5DWLQJ 0RRG\bV 6 3 )LWFK %% 7 $� $� $� &XOOHQ )URVW $� $� �� 0 7�%DQN $� $� $ &RPHULFD $� %%%� $ %2. )LQDQFLDO�&RUSRUDWLRQ $� %%%� $ +XQWLQJWRQ %DD� %%%� $� )LIWK 7KLUG %DD� %%%� $� 3HHU�%DQNV .H\&RUS %DD� %%%� $� 6XQ7UXVW %DD� %%%� $� 5HJLRQV�)LQDQFLDO %DD� %%%� %%%� =LRQV�%DQFRUSRUDWLRQ %DD� %%%� %%% )LUVW�+RUL]RQ�1DWLRQDO�&RUS %DD� %%%� %%% 8�6��%DQFRUS $� $� $$� -3�0RUJDQ $� $� $$� %DQN�RI�$PHULFD $� $� $� :HOOV�)DUJR� �&RPSDQ\ $� $� $� /DUJH�%DQNV 31&�)LQDQFLDO�6HUYLFHV�*URXS $� $� $� As of 9/5/19 Ⴠ Source: S&P Global Market Intelligence Ⴠ Debt Ratings are not a recommendation to buy, sell, or hold securities 37 5HFRQFLOLDWLRQ�RI�1RQ�*$$3�)LQDQFLDO�0HDVXUHV (dollar amounts in millions, except per share data) 2Q19 1Q19 2Q18 (dollar amounts in millions, except per share data) 2Q19 1Q19 2Q18 Noninterest Income: Net Income: Noninterest income $250 $238 $248 Net income $298 $339 $326 Securities repositioning — 8 — Securities repositioning, net of tax — 6 — Adjusted noninterest income $250 $246 $248 Restructuring charges, net of tax — — 9 Noninterest Expenses: Discrete tax items — (11) (3) Noninterest expenses $424 $433 $448 Adjusted net income $298 $334 $332 Restructuring charges — — (11) Diluted Earnings per Common Share: Adjusted noninterest expenses $424 $433 $437 Diluted earnings per common share $1.94 $2.11 $1.87 Pre-tax Income: Securities repositioning, net of tax — 0.04 — Pre-tax income $385 $424 $419 Restructuring charges, net of tax — — 0.05 Securities repositioning — 8 — Discrete tax items — (0.07) (0.02) Restructuring charges — — 11 Adjusted diluted earnings per common share $1.94 $2.08 $1.90 Adjusted pre-tax income $385 $432 $430 • Securities repositioning refers to 1Q19 losses incurred on the sale of Provision for Income Taxes: approximately $1 billion of treasury securities that were replaced by higher- Provision for income taxes $87 $85 $93 yielding treasuries with a similar duration of 4 years. Tax on securities repositioning — 2 — Tax on restructuring charges — — 2 • Discrete tax items include the tax benefit from employee stock Discrete tax items — 11 3 transactions. Adjusted provision for income taxes $87 $98 $98 Comerica believes non-GAAP measures are meaningful because they reflect adjustments commonly made by management, investors, regulators and analysts to evaluate our performance trends. Comerica believes the adjusted data shown above and in this presentation provides a greater understanding of ongoing operations and enhances the comparability of results with prior periods. 38