- COKE Dashboard

- Financials

- Filings

-

Holdings

-

Transcripts

- ETFs

- Insider

- Institutional

- Shorts

-

DEF 14A Filing

Coca-Cola Consolidated (COKE) DEF 14ADefinitive proxy

Filed: 26 Mar 18, 12:00am

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

Proxy Statement Pursuant to Section 14(a) of

the Securities Exchange Act of 1934

Filed by the Registrant ☒

Filed by a Party other than the Registrant ☐

Check the appropriate box:

| ☐ | Preliminary Proxy Statement |

| ☐ | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

| ☒ | Definitive Proxy Statement |

| ☐ | Definitive Additional Materials |

| ☐ | Soliciting Material Pursuant to §240.14a-12 |

COCA-COLA BOTTLING CO. CONSOLIDATED

(Name of Registrant as Specified In Its Charter)

(Name of Person(s) Filing Proxy Statement, if other than the Registrant)

Payment of Filing Fee (Check the appropriate box):

| ☒ | No fee required. |

| ☐ | Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11. |

| (1) | Title of each class of securities to which transaction applies: |

| (2) | Aggregate number of securities to which transaction applies: |

| (3) | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule0-11 (set forth the amount on which the filing fee is calculated and state how it was determined): |

| (4) | Proposed maximum aggregate value of transaction: |

| (5) | Total fee paid: |

| ☐ | Fee paid previously with preliminary materials. |

| ☐ | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. |

| (1) | Amount Previously Paid: |

| (2) | Form, Schedule or Registration Statement No.: |

| (3) | Filing Party: |

| (4) | Date Filed: |

COCA-COLA BOTTLING CO. CONSOLIDATED

Notice of Annual Meeting

and

Proxy Statement

2018 Annual Meeting of Stockholders

May 15, 2018

Coca-Cola Bottling Co. Consolidated

4100 Coca-Cola Plaza

Charlotte, North Carolina 28211

March 26, 2018

Dear Stockholder:

On behalf of the Board of Directors and the management of Coca-Cola Bottling Co. Consolidated (the “Company”), I invite you to attend the 2018 Annual Meeting of Stockholders (the “Annual Meeting”). The Annual Meeting will be held at 9:00 a.m., Eastern Time, on Tuesday, May 15, 2018 at the Company’s Corporate Center located at 4100 Coca-Cola Plaza, Charlotte, North Carolina 28211. Details regarding admission to the Annual Meeting and the business to be conducted are described in the accompanying Notice of 2018 Annual Meeting of Stockholders and Proxy Statement.

Whether or not you plan to attend the Annual Meeting in person, I strongly encourage you to vote as soon as possible to ensure that your shares are represented at the meeting. The accompanying Proxy Statement explains more about voting. Please read it carefully.

Thank you for your continued support.

Sincerely,

J. Frank Harrison, III

Chairman and Chief Executive Officer

COCA-COLA BOTTLING CO. CONSOLIDATED

4100 Coca-Cola Plaza

Charlotte, North Carolina 28211

(704)557-4400

Notice of 2018 Annual Meeting of Stockholders

March 26, 2018

To Stockholders of Coca-Cola Bottling Co. Consolidated:

The 2018 Annual Meeting of Stockholders (the “Annual Meeting”) of Coca-Cola Bottling Co. Consolidated (the “Company”) will be held at 9:00 a.m., Eastern Time, on Tuesday, May 15, 2018 at the Company’s Corporate Center located at 4100 Coca-Cola Plaza, Charlotte, North Carolina 28211, for the purpose of voting on the following matters:

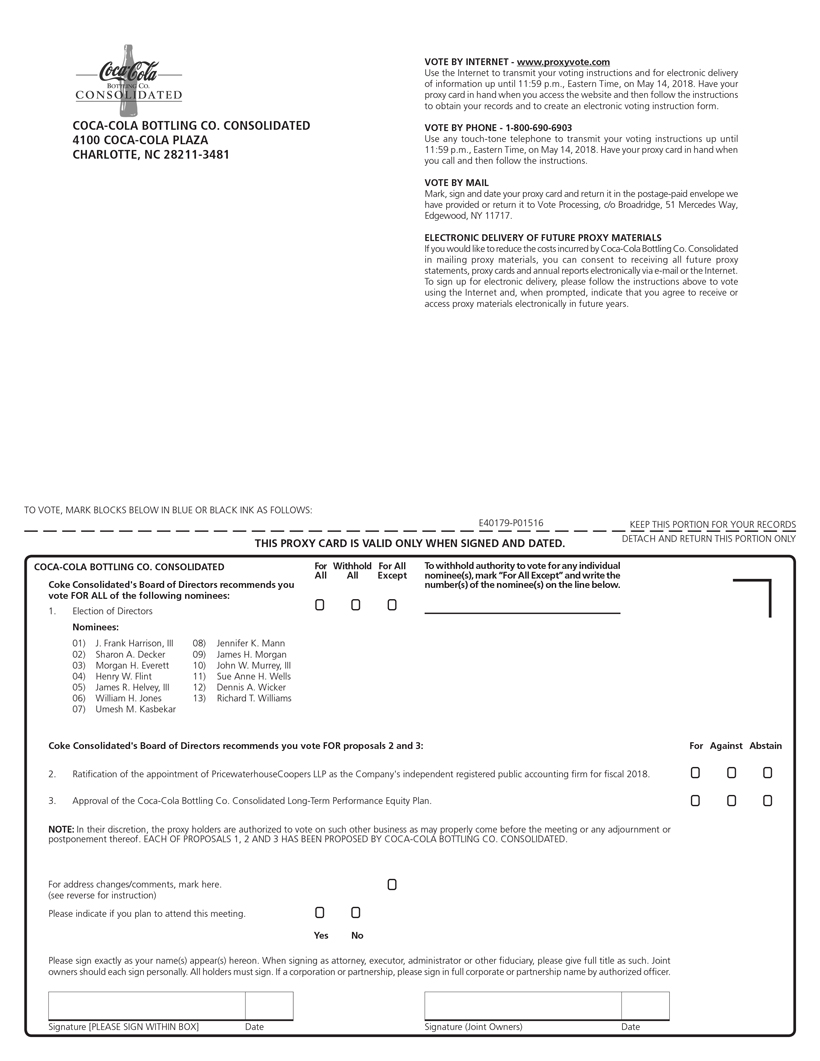

| 1. | To elect the 13 directors nominated by the Board of Directors; |

| 2. | To ratify the appointment of PricewaterhouseCoopers LLP as the Company’s independent registered public accounting firm for fiscal 2018; |

| 3. | To approve the Coca-Cola Bottling Co. Consolidated Long-Term Performance Equity Plan; and |

| 4. | To transact such other business as may properly come before the Annual Meeting or any adjournment or postponement thereof. |

The Board of Directors unanimously recommends that you vote “FOR” items 1, 2 and 3. The proxy holders will use their discretion to vote on other matters that may properly arise at the Annual Meeting or any adjournment or postponement thereof.

Only stockholders of record as of the close of business on March 19, 2018 will be entitled to vote at the Annual Meeting.

Your vote is important. Whether or not you plan to attend the Annual Meeting, you are encouraged to vote as soon as possible to ensure that your shares are represented at the meeting. If you received a paper copy of the proxy materials by mail, you may vote your shares by proxy using one of the following methods: (i) vote via the Internet; (ii) vote by telephone; or (iii) complete, sign, date and return your proxy card in the postage-paid envelope provided. If you received only a Notice of Internet Availability of Proxy Materials by mail, you may vote your shares by proxy at the Internet site address listed on your Notice. If you hold your shares through an account with a bank, broker or similar organization, please follow the instructions you receive from the holder of record to vote your shares.

By Order of the Board of Directors,

E. Beauregarde Fisher III

Executive Vice President, General Counsel and Secretary

Important Notice Regarding the Availability of Proxy Materials

for the Annual Meeting of Stockholders To Be Held on May 15, 2018:

The Notice of Annual Meeting and Proxy Statement and the 2017 Annual Report to Stockholders

are available atwww.proxyvote.com.

| Page | ||||||||

| 1 | ||||||||

| 6 | ||||||||

| 7 | ||||||||

| 9 | ||||||||

| 9 | ||||||||

| 14 | ||||||||

| 14 | ||||||||

| 14 | ||||||||

| 15 | ||||||||

| 15 | ||||||||

| 17 | ||||||||

| 17 | ||||||||

| 18 | ||||||||

| 19 | ||||||||

| 20 | ||||||||

| 30 | ||||||||

| 30 | ||||||||

| 31 | ||||||||

| 32 | ||||||||

| 43 | ||||||||

| 2017 Summary Compensation Table | 43 | |||||||

| 2017 Grants of Plan-Based Awards | 46 | |||||||

| Outstanding Equity Awards at FiscalYear-End 2017 | 47 | |||||||

| 2017 Option Exercises and Stock Vested | 47 | |||||||

| 2017 Defined Benefit Plans | 47 | |||||||

| 2017 Nonqualified Deferred Compensation | 50 | |||||||

| 2017 Potential Payments Upon Termination or Change of Control | 52 | |||||||

| Pay Ratio Disclosure | 55 | |||||||

| 55 | ||||||||

| 56 | ||||||||

| 57 | ||||||||

| 57 | ||||||||

| 57 | ||||||||

| 57 | ||||||||

| Ratification of the Appointment of Independent Registered Public Accounting Firm | 59 | |||||||

| 59 | ||||||||

| 60 | ||||||||

i

PROXY STATEMENT

The Board of Directors (the “Board”) of Coca-Cola Bottling Co. Consolidated (“Coke Consolidated” or the “Company”) is providing these materials to you in connection with the 2018 Annual Meeting of Stockholders (the “Annual Meeting”). The Annual Meeting will be held at 9:00 a.m., Eastern Time, on Tuesday, May 15, 2018 at Coke Consolidated’s Corporate Center located at 4100 Coca-Cola Plaza, Charlotte, North Carolina 28211.

Why am I receiving these materials?

You have received these materials because the Board is soliciting your proxy to vote your shares at the Annual Meeting. This Proxy Statement includes information that Coke Consolidated is required to provide you under the Securities and Exchange Commission rules and regulations (the “SEC rules”) and is designed to assist you in voting your shares.

What is a proxy?

The Board is asking for your proxy. This means you authorize persons selected by the Company to vote your shares at the Annual Meeting in the way that you instruct. All shares represented by valid proxies received and not revoked before the Annual Meeting will be voted in accordance with the stockholder’s specific voting instructions.

Why did I receive aone-page notice regarding Internet availability of proxy materials instead of a full set of proxy materials?

The SEC rules allow companies to choose the method for delivery of proxy materials to stockholders. For most stockholders, the Company has elected to mail a notice regarding the availability of proxy materials on the Internet (the “Notice of Internet Availability”), rather than sending a full set of these materials in the mail. The Notice of Internet Availability, or a full set of the proxy materials (including the Proxy Statement and form of proxy), as applicable, was sent to stockholders beginning March 26, 2018, and the proxy materials were posted on the investor relations portion of the Company’s website, www.cokeconsolidated.com, and on the website referenced in the Notice of Internet Availability on the same day. Utilizing this method of proxy delivery expedites receipt of proxy materials by the Company’s stockholders and lowers the cost of the Annual Meeting. If you would like to receive a paper ore-mail copy of the proxy materials, you should follow the instructions in the Notice of Internet Availability for requesting a copy.

What is included in these materials?

These materials include:

| • | the Notice of Annual Meeting and Proxy Statement; and |

| • | the 2017 Annual Report to Stockholders, which contains the Company’s audited consolidated financial statements. |

If you received a paper copy of these materials by mail, these materials also include the proxy card or voting instruction form for the Annual Meeting.

1

What items will be voted on at the Annual Meeting?

There are three proposals scheduled to be voted on at the Annual Meeting:

| • | the election of the 13 directors nominated by the Board; |

| • | the ratification of the appointment of PricewaterhouseCoopers LLP as the Company’s independent registered public accounting firm for fiscal 2018; and |

| • | the approval of the Coca-Cola Bottling Co. Consolidated Long-Term Performance Equity Plan. |

The Board is not aware of any other matters to be brought before the Annual Meeting. If other matters are properly raised at the Annual Meeting, the proxy holders may vote any shares represented by proxy in their discretion.

What are the Board’s voting recommendations?

The Board unanimously recommends that you vote your shares:

| • | “FOR” the election of each of the 13 directors nominated by the Board; |

| • | “FOR” the ratification of the appointment of PricewaterhouseCoopers LLP as the Company’s independent registered public accounting firm for fiscal 2018; and |

| • | “FOR”the approval of the Coca-Cola Bottling Co. Consolidated Long-Term Performance Equity Plan. |

Who can attend the Annual Meeting?

Admission to the Annual Meeting is limited to:

| • | stockholders of record as of the close of business on March 19, 2018; |

| • | holders of valid proxies for the Annual Meeting; and |

| • | invited guests. |

Admission to the Annual Meeting will be on a first-come, first-served basis. Each stockholder may be asked to present valid photo identification, such as a driver’s license or passport, and proof of stock ownership as of the record date for admittance.

When is the record date and who is entitled to vote?

The Board set March 19, 2018 as the record date. As of the record date, there were 7,141,447 shares of Coke Consolidated Common Stock outstanding and 2,213,018 shares of Coke Consolidated Class B Common Stock outstanding. Each share of Common Stock outstanding on the record date is entitled to one vote and each share of Class B Common Stock outstanding on the record date is entitled to 20 votes on any matter properly presented at the Annual Meeting.

What is a stockholder of record?

A stockholder of record or registered stockholder is a stockholder whose ownership of Coke Consolidated stock is reflected directly on the books and records of the Company’s transfer agent, American Stock Transfer & Trust Company, LLC. If you hold Coke Consolidated stock through an account with a bank, broker or similar organization, you are considered the beneficial owner of shares held in street name and are not a stockholder of record. For shares held in street name, the stockholder of record is your bank, broker or similar organization. Coke Consolidated only has access to ownership records for the registered shares. If you are not a stockholder of record and you wish to attend the Annual Meeting, the Company will require additional documentation to evidence your stock ownership as of the record date, such as a copy of your brokerage account statement, a letter from your bank, broker or other nominee, or a copy of your voting instruction form or Notice of Internet Availability.

2

How do I vote?

You may vote by any of the following methods:

| • | In person. Stockholders of record and beneficial owners of shares held in street name may vote in person at the Annual Meeting. If you hold shares in street name, you must also obtain a legal proxy from the stockholder of record (e.g., your bank, broker or other nominee) to vote in person at the Annual Meeting. |

| • | By telephone or via the Internet. Stockholders of record may vote by proxy, by telephone or via the Internet, by following the instructions included in the proxy card or Notice of Internet Availability provided or the instructions you receive bye-mail. If you are a beneficial owner of shares held in street name, your ability to vote by telephone or via the Internet depends on the voting procedures of the stockholder of record (e.g., your bank, broker or other nominee). Please follow the directions included in the voting instruction form or Notice of Internet Availability provided to you by the stockholder of record. |

| • | By mail. Stockholders of record and beneficial owners of shares held in street name may vote by proxy by completing, signing, dating and returning the proxy card or voting instruction form provided. |

How can I revoke my proxy or change my vote?

Stockholders of record. You may revoke your proxy or change your vote at any time prior to the taking of the vote at the Annual Meeting by (i) submitting a written notice of revocation to the Company’s Secretary atCoca-Cola Bottling Co. Consolidated, 4100 Coca-Cola Plaza, Charlotte, North Carolina 28211; (ii) delivering a proxy bearing a later date using any of the voting methods described in the immediately preceding Q&A, including by telephone or via the Internet, and until the applicable deadline for each method specified in the accompanying proxy card or Notice of Internet Availability; or (iii) attending the Annual Meeting and voting in person. Attendance at the Annual Meeting will not cause your previously granted proxy to be revoked unless you specifically make that request or vote in person at the meeting. For all methods of voting, the last vote cast will supersede all previous votes.

Beneficial owners of shares held in street name. You may change or revoke your voting instructions by following the specific directions provided to you by the stockholder of record (e.g., your bank, broker or other nominee), or, if you have obtained a legal proxy from the stockholder of record, by attending the Annual Meeting and voting in person.

What happens if I vote by proxy and do not give specific voting instructions?

Stockholders of record. If you are a stockholder of record and you vote by proxy, by telephone, via the Internet or by completing, signing, dating and returning a proxy card, without giving specific voting instructions, then the proxy holders will vote your shares in the manner recommended by the Board on all matters presented in this Proxy Statement and as the proxy holders may determine in their discretion for any other matters properly presented for a vote at the Annual Meeting.

Beneficial owners of shares held in street name. If you are a beneficial owner of shares held in street name and do not provide the organization that holds your shares with specific voting instructions, under the rules of various national and regional securities exchanges, the organization that holds your shares may generally vote on “routine” matters but cannot vote on“non-routine” matters. If the organization that holds your shares does not receive instructions from you on how to vote your shares on a“non-routine” matter, the organization that holds your shares will inform the inspector of election that it does not have the authority to vote on that matter with respect to your shares. This is referred to as a “brokernon-vote.”

Proposals 1 and 3, the election of directors and the approval of the Coca-Cola Bottling Co. Consolidated Long-Term Performance Equity Plan, respectively, are“non-routine” matters. Consequently, without your voting

3

instructions, the organization that holds your shares cannot vote your shares on these proposals. Proposal 2, the ratification of the appointment of PricewaterhouseCoopers LLP as the Company’s independent registered public accounting firm for fiscal 2018, is considered a “routine” matter.

What is the voting requirement to approve each of the proposals?

| • | Proposal 1, Election of Directors. Directors shall be elected by a plurality of the votes cast (meaning that the 13 director nominees who receive the highest number of votes cast “for” their election will be elected as directors). There is no cumulative voting with respect to the election of directors. |

| • | Proposal 2, Ratification of the Appointment of Independent Registered Public Accounting Firm. Ratification of the appointment of PricewaterhouseCoopers LLP as the Company’s independent registered public accounting firm for fiscal 2018 requires the affirmative vote of a majority of the total votes of all shares of Coke Consolidated Common Stock and Class B Common Stock present in person or represented by proxy and entitled to vote on the proposal at the Annual Meeting (meaning that of the total votes of all shares of Coke Consolidated Common Stock and Class B Common Stock represented at the Annual Meeting and entitled to vote, a majority of them must be voted “for” the proposal for it to be approved). |

| • | Proposal 3, Approval of the Coca-Cola Bottling Co. Consolidated Long-Term Performance Equity Plan. Approval of the Coca-Cola Bottling Co. ConsolidatedLong-Term Performance Equity Plan requires the affirmative vote of a majority of the total votes of all shares of Coke Consolidated Common Stock and Class B Common Stock present in person or represented by proxy and entitled to vote on the proposal at the Annual Meeting (meaning that of the total votes of all shares of Coke Consolidated Common Stock and Class B Common Stock represented at the Annual Meeting and entitled to vote, a majority of them must be voted “for” the proposal for it to be approved). |

| • | Other Items. Approval of any other matters requires the affirmative vote of a majority of the total votes of all shares of Coke Consolidated Common Stock and Class B Common Stock present in person or represented by proxy and entitled to vote on the proposal at the Annual Meeting (meaning that of the total votes of all shares of Coke Consolidated Common Stock and Class B Common Stock represented at the Annual Meeting and entitled to vote, a majority of them must be voted “for” the proposal for it to be approved). |

What is the quorum for the Annual Meeting? How are withhold votes, abstentions and brokernon-votes treated?

The presence, in person or by proxy, of the holders of a majority of the votes eligible to be cast by the holders of Coke Consolidated Common Stock and Class B Common Stock voting together as a class is necessary for the transaction of business at the Annual Meeting. Your shares are counted as being present if you vote in person at the Annual Meeting, by telephone, via the Internet, or by submitting a properly executed proxy card or voting instruction form by mail. Abstentions and brokernon-votes are counted as present for the purpose of determining a quorum for the Annual Meeting; however, brokernon-votes are not counted as present for the purpose of determining a quorum for Proposal 1, the election of directors.

With respect to Proposal 1, the election of directors, only “for” and “withhold” votes may be cast. Brokernon-votes are not considered votes cast for the foregoing purpose and will have no effect on the outcome of the proposal. Withhold votes will also have no effect on the outcome of the proposal.

With respect to Proposals 2 and 3, the ratification of the appointment of PricewaterhouseCoopers LLP as the Company’s independent registered public accounting firm for fiscal 2018 and the approval of the Coca-Cola Bottling Co. Consolidated Long-Term Performance Equity Plan, respectively, you may vote “for” or “against” the proposals, or you may “abstain” from voting on the proposals. An abstention will be counted as a vote present in person or represented by proxy at the Annual Meeting and entitled to vote on the proposals and will have the

4

same effect as a vote “against” the proposals, and a brokernon-vote will not be considered entitled to vote on these proposals and will therefore have no effect on their outcome. As discussed above, because Proposal 2, the ratification of the appointment of PricewaterhouseCoopers LLP as the Company’s independent registered public accounting firm for fiscal 2018, is considered a “routine” matter, we do not expect any brokernon-votes with respect to this proposal.

Who pays for solicitation of proxies?

The Company is paying the cost of soliciting proxies and will reimburse its transfer agent, brokerage firms, financial institutions and other custodians, nominees, fiduciaries and holders of record for their reasonableout-of-pocket expenses for sending proxy materials to stockholders and obtaining their proxies. In addition to soliciting the proxies by mail and the Internet, certain of the Company’s directors, officers and employees, without compensation, may solicit proxies personally or by telephone, facsimile ande-mail. The Company has retained Broadridge Financial Solutions, Inc. to aid in the solicitation of proxies with respect to shares of Coke Consolidated stock held by brokers, financial institutions, and other custodians, nominees, fiduciaries and holders of record for a fee of approximately $1,000, plus expenses.

What are the expected voting results?

The Company expects each of the proposals of the Board to be approved by the stockholders. The Board has been informed that J. Frank Harrison, III intends to vote an aggregate of 2,212,716 shares of Coke Consolidated Class B Common Stock (representing 44,254,320 votes and an aggregate of 86.1% of the total voting power of Coke Consolidated Common Stock and Class B Common Stock together as of the record date):

| • | “FOR” the election of each of the 13 directors nominated by the Board; |

| • | “FOR” the ratification of the appointment of PricewaterhouseCoopers LLP as the Company’s independent registered public accounting firm for fiscal 2018; and |

| • | “FOR”the approval of the Coca-Cola Bottling Co. Consolidated Long-Term Performance Equity Plan. |

Where can I find the voting results of the Annual Meeting?

The Company will announce preliminary or final voting results at the Annual Meeting and publish final results in a Current Report on Form8-K filed with the Securities and Exchange Commission (the “SEC”) within four business days of the completion of the meeting.

5

Security Ownership of Directors and Executive Officers

The table below shows the number of shares of Coke Consolidated Common Stock and Class B Common Stock beneficially owned as of March 19, 2018 by each director, nominee for director, named executive officer and all directors and executive officers as a group. As of March 19, 2018, a total of 7,141,447 shares of Common Stock and 2,213,018 shares of Class B Common Stock were outstanding. Information about the beneficial ownership of the Common Stock and Class B Common Stock owned by Mr. Harrison is shown on page 7.

Name | Class | Number of Shares and Nature of Beneficial Ownership | Percentage of Class | |||||||

Sharon A. Decker | Common Stock | 0 | * | |||||||

Morgan H. Everett | Common Stock | 0 | (1) | * | ||||||

Henry W. Flint | Common Stock | 0 | * | |||||||

James R. Helvey, III | Common Stock | 0 | * | |||||||

William H. Jones | Common Stock | 100 | (2) | * | ||||||

Umesh M. Kasbekar | Common Stock | 0 | * | |||||||

Jennifer K. Mann | Common Stock | 0 | * | |||||||

James H. Morgan | Common Stock | 0 | * | |||||||

John W. Murrey, III | Common Stock | 1,000 | * | |||||||

Sue Anne H. Wells | Common Stock | 0 | (3) | * | ||||||

Dennis A. Wicker | Common Stock | 0 | * | |||||||

Richard T. Williams | Common Stock | 0 | * | |||||||

Clifford M. Deal, III | Common Stock | 0 | * | |||||||

James E. Harris | Common Stock | 0 | * | |||||||

David M. Katz | Common Stock | 0 | * | |||||||

Directors and executive officers as a group | Common Stock | 1,100 | * | |||||||

| * | Less than 1% of the outstanding shares of such class. |

| (1) | Excludes 535,178 shares of Class B Common Stock held by the JFH Family Limited Partnership—FH1 and 78,596 shares of Class B Common Stock held by a trust of which Ms. Everett is one of the beneficiaries. Ms. Everett has a pecuniary interest in these shares, but does not have voting or investment power with respect to these shares. |

| (2) | Held jointly with his spouse. |

| (3) | Excludes 535,178 shares of Class B Common Stock held by the JFH Family Limited Partnership—SW1 and 78,595 shares of Class B Common Stock held by a trust for the benefit of Dr. Wells. Dr. Wells has a pecuniary interest in these shares, but does not have voting or investment power with respect to these shares. |

6

The following table provides information about the beneficial ownership of Coke Consolidated Common Stock and Class B Common Stock as of March 19, 2018 by each person known by the Company to beneficially own more than 5% of the outstanding shares of Coke Consolidated Common Stock or Class B Common Stock as of such date:

Name and Address of Beneficial Owner | Class | Number of Shares and Nature of Beneficial Ownership | Percentage of Class(1) | Total Votes | Percentage of Total Votes(1) | |||||||||

J. Frank Harrison, III, J. Frank Harrison Family, LLC and three Harrison Family Limited Partnerships, as a group 4100 Coca-Cola Plaza Charlotte, North Carolina 28211 | Common Stock Class B Common | | 2,212,716(2) 2,212,716(3) | (4) | 23.7% 99.99% | 44,254,320 | 86.1% | |||||||

The Coca-Cola Company | Common Stock | 2,482,165(5) | 34.8% | 2,482,165 | 4.8% | |||||||||

BlackRock, Inc. | Common Stock | 589,737(6) | 8.3% | 589,737 | 1.1% | |||||||||

FMR LLC | Common Stock | 488,975(7) | 6.8% | 488,975 | 1.0% | |||||||||

The Vanguard Group, Inc. | Common Stock | 452,925(8) | 6.3% | 452,925 | 0.9% | |||||||||

| (1) | A total of 7,141,447 shares of Common Stock and 2,213,018 shares of Class B Common Stock were outstanding on March 19, 2018. The percentage of Common Stock owned by J. Frank Harrison, III shown in this column assumes conversion of all 2,212,716 shares of Class B Common Stock beneficially owned as described below in Footnote 3 that are convertible into shares of Common Stock. The percentages of Common Stock owned by The Coca-Cola Company and the other persons identified in the table that owned more than 5% of the outstanding shares of Common Stock as of March 19, 2018 do not assume such conversion has occurred. |

| (2) | Consists of 2,212,716 shares of Class B Common Stock beneficially owned as described below in Footnote 3 that are convertible into shares of Common Stock. |

| (3) | Consists of (i) a total of 1,605,534 shares of Class B Common Stock held by the JFH Family Limited Partnership—FH1, the JFH Family Limited Partnership—SW1 and the JFH Family Limited Partnership—DH1 (collectively, the “Harrison Family Limited Partnerships”), as to which Mr. Harrison in his capacity as the Consolidated Stock Manager of the J. Frank Harrison Family, LLC (the general partner of each of the Harrison Family Limited Partnerships) has sole voting and investment power; (ii) 235,786 shares of Class B Common Stock held by certain trusts established for the benefit of certain relatives of the late J. Frank Harrison, Jr. as to which Mr. Harrison has sole voting and investment power; and (iii) 371,396 shares of Class B Common Stock held directly by Mr. Harrison as to which he has sole voting and investment power. |

| (4) | The trusts described above in clause (ii) of Footnote 3 have the right to acquire 292,386 shares of Class B Common Stock from Coke Consolidated in exchange for an equal number of shares of Common Stock. In the event of such an exchange, Mr. Harrison would have sole voting and investment power over the shares of Class B Common Stock. The trusts do not own any shares of Common Stock with which to make the exchange, and any purchase of Common Stock would require approval by the trustees of the trusts. Accordingly, the table does not include shares related to this exchange right. |

7

| (5) | This information is based upon a Schedule 13D/A filed jointly with the SEC by The Coca-Cola Company, The Coca-Cola Trading Company LLC, Coca-Cola Oasis LLC and Carolina Coca-Cola Bottling Investments, Inc. on October 4, 2017. The Schedule 13D/A reports that such entities have shared voting and investment power over all of such shares. |

| (6) | This information is based upon a Schedule 13G filed with the SEC by BlackRock, Inc. (“BlackRock”) on February 1, 2018. The Schedule 13G reports that BlackRock has sole voting power over 579,007 shares, shared voting power over no shares and sole investment power over all of such shares. |

| (7) | This information is based upon a Schedule 13G/A filed jointly with the SEC by FMR LLC (“FMR”) and Abigail P. Johnson on February 13, 2018. The Schedule 13G/A reports that FMR has sole voting power over 260,278 shares, shared voting power over no shares and sole investment power over all of such shares. Members of the Johnson family, including Abigail P. Johnson (a director, the Chairman and the Chief Executive Officer of FMR), are the predominant owners, directly or through trusts, of Series B voting common shares of FMR, representing 49% of the voting power of FMR. The Johnson family group and all other Series B shareholders have entered into a shareholders’ voting agreement under which all Series B voting common shares will be voted in accordance with the majority vote of Series B voting common shares. Accordingly, through their ownership of voting common shares and the execution of the shareholders’ voting agreement, members of the Johnson family may be deemed, under the Investment Company Act of 1940 (the “Investment Company Act”), to form a controlling group with respect to FMR. Neither FMR nor Abigail P. Johnson has the sole power to vote or direct the voting of the shares owned directly by the various investment companies registered under the Investment Company Act (the “Fidelity Funds”) advised by Fidelity Management & Research Company (“FMR Co.”), a wholly owned subsidiary of FMR, which power resides with the Fidelity Funds’ Boards of Trustees. FMR Co. carries out the voting of the shares under written guidelines established by the Fidelity Funds’ Boards of Trustees. |

| (8) | This information is based upon a Schedule 13G/A filed with the SEC by The Vanguard Group, Inc. (“Vanguard”) on February 9, 2018. The Schedule 13G/A reports that Vanguard has sole voting power over 9,262 shares, shared voting power over 1,154 shares, sole investment power over 442,962 shares and shared investment power over 9,963 shares. Vanguard Fiduciary Trust Company, a wholly owned subsidiary of Vanguard, is the beneficial owner of 8,809 shares as a result of its serving as investment manager of collective trust accounts, and Vanguard Investments Australia, Ltd., also a wholly owned subsidiary of Vanguard, is the beneficial owner of 1,607shares as a result of its serving as investment manager of Australian investment offerings. |

8

Proposal 1: Election of Directors

The Board currently consists of 13 members. On the recommendation of the Executive Committee, the Board has nominated the 13 persons listed below for election as directors at the Annual Meeting. If elected, each nominee will serve until his or her term expires at the 2019 Annual Meeting of Stockholders or until his or her successor is duly elected and qualified. Each nominee has agreed to be named in this Proxy Statement and to serve if elected.

All of the nominees are currently serving as directors. Except for Richard T. Williams, who was elected to the Board in August 2017, all of the nominees were elected to the Board at the 2017 Annual Meeting of Stockholders. Mr. Williams was recommended to the Executive Committee by the Company’s Chairman and Chief Executive Officer.

Although the Company knows of no reason why any of the nominees would not be able to serve, if any nominee is unavailable for election, the proxy holders intend to vote your shares for any substitute nominee proposed by the Board. At the Annual Meeting, proxies cannot be voted for a greater number of individuals than the 13 nominees named in this Proxy Statement.

The Board unanimously recommends that you vote “FOR” the election of each of the 13 nominees listed below.

Unless a proxy is marked to give a different direction, the persons named in the proxy will vote“FOR” the election of each of the 13 nominees listed below.

Listed below are the 13 persons nominated for election to the Board. The following paragraphs include information about each director nominee’s business background, as furnished to the Company by the nominee, and additional experience, qualifications, attributes or skills that led the Board to conclude that the nominee should serve on the Board.

Name | Age | Principal Occupation | Director Since | |||||||

J. Frank Harrison, III | 63 | Chairman of the Board and Chief Executive Officer of Coke Consolidated | 1986 | |||||||

Sharon A. Decker | 61 | Chief Operating Officer, Tryon Equestrian Partners, Carolina Operations | 2001 | |||||||

Morgan H. Everett | 36 | Vice President of Coke Consolidated | 2011 | |||||||

Henry W. Flint | 63 | President and Chief Operating Officer of Coke Consolidated | 2007 | |||||||

James R. Helvey, III | 59 | Managing Partner, Cassia Capital Partners, LLC | 2016 | |||||||

William H. Jones | 62 | Chancellor, Columbia International University | 2011 | |||||||

Umesh M. Kasbekar | 60 | Vice Chairman of the Board of Coke Consolidated | 2016 | |||||||

Jennifer K. Mann | 45 | Senior Vice President and Chief People Officer and Chief of Staff for the President and Chief Executive Officer,The Coca-Cola Company | 2017 | |||||||

James H. Morgan | 70 | Chairman, Covenant Capital LLC | 2008 | |||||||

John W. Murrey, III | 75 | Assistant Professor, Appalachian School of Law (Retired) | 1993 | |||||||

Sue Anne H. Wells | 64 | Educator and Founder, Chattanooga Girls Leadership Academy | 2016 | |||||||

Dennis A. Wicker | 65 | Partner, Nelson Mullins Riley & Scarborough LLP | 2001 | |||||||

Richard T. Williams | 64 | Vice President of Corporate Community Affairs, Duke Energy Corporation (Retired) | 2017 | |||||||

9

J. Frank Harrison, III

Mr. Harrison is Chairman of the Board and Chief Executive Officer of Coke Consolidated. Mr. Harrison served as Vice Chairman of the Board from November 1987 through his election as Chairman in December 1996 and was appointed as Chief Executive Officer in May 1994. He was first employed by the Company in 1977 and has previously served as a Division Sales Manager and as a Vice President.

Mr. Harrison brings extensive business, managerial and leadership experience to the Board. With over 40 years of experience with Coke Consolidated, Mr. Harrison provides the Board with a vital understanding and appreciation of the Company’s business. His strong leadership skills have been demonstrated through his service as Chief Executive Officer since 1994 and as Chairman of the Board since 1996. He is also the controlling stockholder of Coke Consolidated and, as a member of the founding family of Coke Consolidated, maintains a unique position within the Coca-Cola system.

Sharon A. Decker

Ms. Decker is Chief Operating Officer of Tryon Equestrian Partners, Carolina Operations, an investment group responsible for the development and operation of a premiere sports complex and resort in western North Carolina. Prior to holding this position, she served as President of NURAY Media, a multi-media conservation, preservation and restoration company, from January 2015 until August 2015. Ms. Decker served as Secretary of Commerce for the State of North Carolina from January 2013 until December 2014. Prior to that, she was Chief Executive Officer of The Tapestry Group, a faith basednon-profit organization, since September 2004, and Chief Executive Officer of North Washington Street Properties, a community redevelopment company, since October 2004. Ms. Decker served as President of The Tanner Companies, a direct seller of women’s apparel, from August 2002 to September 2004. From August 1999 to July 2002, she was President of Doncaster, a division of The Tanner Companies. Ms. Decker was President and Chief Executive Officer of the Lynnwood Foundation, which created and managed a conference facility and leadership institute, from 1997 until 1999. From 1980 until 1997, she served Duke Energy Corporation, an electric power holding company, in a number of capacities, including as Corporate Vice President and Executive Director of the Duke Power Foundation. Ms. Decker currently serves on the board of directors of SCANA Corporation, a diversified utility company, and was a director of Family Dollar Stores, Inc., a discount retailer, until 2015.

Ms. Decker brings to the Board a unique and valuable perspective from the numerous executive and leadership positions she has held across a broad range of fields, includingnon-profit organizations and large public companies. Ms. Decker’s diverse executive experience and extensive experience serving on multiple boards qualify her to serve as a member of the Board.

Morgan H. Everett

Ms. Everett is Vice President of Coke Consolidated, a position she has held since January 2016. Prior to that, she was the Community Relations Director of Coke Consolidated, a position she held from January 2009 to December 2015. She has been an employee of Coke Consolidated since October 2004. Ms. Everett graduated from Southern Methodist University with a B.A. in Communications in 2003, and she is a member of the founding family of Coke Consolidated.

Ms. Everett’s past service to Coke Consolidated, including experience in the operations of Coke Consolidated, and her education qualify her to serve as a member of the Board. Ms. Everett’s service on the Board also adds to the diversity of the Board in both demographics and perspective.

Henry W. Flint

Mr. Flint is President and Chief Operating Officer of Coke Consolidated, positions he has held since August 2012. Mr. Flint served as Vice Chairman of the Board of Coke Consolidated from April 2007 to August 2012.

10

Prior to that, he was Executive Vice President and Assistant to the Chairman from July 2004 to April 2007. Mr. Flint also served as Secretary of Coke Consolidated from March 2000 to August 2012. Mr. Flint wasCo-Managing Partner of the law firm of Kennedy Covington Lobdell & Hickman, L.L.P. from January 2000 to July 2004, a firm with which he was associated since 1980. Mr. Flint received his J.D. from the University of Virginia School of Law and his M.B.A. from the University of Virginia Darden School of Business.

Mr. Flint’s long-standing service to Coke Consolidated and his managerial expertise make him a valuable member of the Board and qualify him for service on the Board. Mr. Flint’s graduate business degree and legal background provide the Board a valuable perspective on many of the issues the Company faces and make him a valuable addition to a well-rounded Board.

James R. Helvey, III

Mr. Helveyco-founded Cassia Capital Partners, LLC, a registered investment advisor, in 2011 and has served as a managing partner since its formation. From 2005 to 2011, Mr. Helvey was a partner and the Risk Management Officer for CMT Asset Management Limited, a private investment firm. From 2003 to 2004, Mr. Helvey was a candidate for the United States Congress in the 5th District of North Carolina. Mr. Helvey served as Chairman and Chief Executive Officer of Cygnifi Derivatives Services, LLC, an online derivatives services provider, from 2000 to 2002. From 1985 to 2000, Mr. Helvey was employed by J.P. Morgan & Co., serving in a variety of capacities, including as Chair of J.P. Morgan’s Liquidity Committee, Vice Chairman of J.P. Morgan’s Risk Management Committee, Global Head of Derivative Counterparty Risk Management, head of the swap derivative trading business in Asia and head of short-term interest rate derivatives and foreign exchange forward trading in Europe. Mr. Helvey graduated magna cum laude with honors from Wake Forest University. Mr. Helvey was also a Fulbright Scholar at the University of Cologne in Germany and received a Master’s degree in international finance and banking from Columbia University, School of International and Public Affairs, where he was an International Fellow. Mr. Helvey is a director of Computer Task Group, Inc., a publicly traded information technology solutions and services company, Verger Capital Management, LLC and Piedmont Federal Savings Bank, and has also served on the boards of Wake Forest University and the Wake Forest Baptist Medical Center. Mr. Helvey was a director of Pike Corporation, an energy solutions provider, from 2005 to 2014, where he served as Lead Independent Director, Chairman of the Audit Committee and Chairman of the Compensation Committee.

Mr. Helvey’s experience in international business and finance, executive management and as a director of other organizations brings a valuable and necessary perspective to the Board and qualifies him to serve as a member of the Board.

William H. Jones

Dr. Jones serves as Chancellor of Columbia International University, a position he has held since July 2017. Dr. Jones served as President of Columbia International University from 2007 to 2017. Prior to accepting the role of President, Dr. Jones served in senior roles as Provost and Senior Vice President of Columbia International University, where he has also taught since 1990. Dr. Jones also serves as President of the International Leadership Team of Crossover Communications International and served as a member of the Board of Trustees and Finance Committee of the South Carolina Independent Colleges and Universities from 2007 until 2017.

Dr. Jones’ demonstrated leadership skills, board experience, academic credentials and success in managing an academic institution qualify him for service on the Board. Dr. Jones’ strong character and experience in matters of ethics also qualify him for service on the Board.

Umesh M. Kasbekar

Mr. Kasbekar is Vice Chairman of the Board of Coke Consolidated, a position he has held since January 2016. Mr. Kasbekar previously served as Secretary of the Company from August 2012 until May 2017 and as Senior Vice President, Planning and Administration from June 2005 to December 2015. Prior to that, he was Vice President, Planning, a position he was appointed to in December 1988.

11

Mr. Kasbekar has served Coke Consolidated for over 30 years in various positions in the Company’s accounting, finance, distribution, manufacturing, corporate planning and administrative functions, providing him with an essential understanding of the Company’s business and history as well as significant knowledge of the beverage industry. Mr. Kasbekar’s industry expertise and his years of experience with Coke Consolidated make him a valuable member of the Board.

Jennifer K. Mann

Ms. Mann is Senior Vice President and Chief People Officer as well as Chief of Staff for the President and Chief Executive Officer of The Coca-Cola Company, positions she has held since May 2017 and October 2015, respectively. Prior to holding these positions, she served as Global General Manager of the Global Coca-Cola Freestyle platform from July 2012 until September 2015. In this role, she accelerated global expansion and led development across the Coca-Cola system for the innovative Freestyle fountain dispensers. Ms. Mann joined The Coca-Cola Company in 1997 as a Manager in the National Customer Support division of Coca-Cola North America, and has held numerous roles in strategy, marketing and operations over the course of her career at The Coca-Cola Company, including Director of McDonald’s Customer & Consumer Operations, Director of Good Answer, and Vice President of Foodservice &On-Premise Strategy and Marketing for Coca-Cola Refreshments USA, Inc.

Ms. Mann’s diverse experience in strategy, marketing, operations and innovation as well as her position with The Coca-Cola Company and knowledge of the Coca-Cola system and the beverage industry qualify her to serve as a member of the Board.

James H. Morgan

Mr. Morgan has served as Chairman of Covenant Capital LLC, an investment management firm, since February 2015, after previously serving in that capacity from 2001 to 2008. Mr. Morgan also served as Chairman of Krispy Kreme Doughnuts, Inc., a leading branded specialty retailer and wholesaler of premium quality sweet treats and complementary products, from January 2005 to August 2016. He served as Executive Chairman of Krispy Kreme from June 2014 to January 2015, as Chief Executive Officer from January 2008 to June 2014 and as President from April 2012 to June 2014. Mr. Morgan also served as President of Krispy Kreme from January 2008 to November 2011 and as Vice Chairman of Krispy Kreme from March 2004 to January 2005. Previously, Mr. Morgan served as a consultant for Wachovia Securities, Inc., a securities and investment banking firm, from January 2000 to May 2001. From April 1999 to December 1999, Mr. Morgan was Chairman and Chief Executive Officer of Wachovia Securities, Inc. Mr. Morgan was employed by Interstate/Johnson Lane, an investment banking and brokerage firm, from 1990 to 1999 in various capacities, including as Chairman and Chief Executive Officer. Mr. Morgan is a director of Lowe’s Companies, Inc., a home improvement retailer, and was a director of Krispy Kreme Doughnuts, Inc. from 2000 to 2017.

As the current Chairman of Covenant Capital LLC and a former executive at several major public and private companies, Mr. Morgan provides the Board with significant leadership and executive experience. Mr. Morgan’s proven leadership capability and his extensive knowledge of the complex financial and operational issues facing large companies qualify him to serve as a member of the Board.

John W. Murrey, III

Mr. Murrey was an Assistant Professor at Appalachian School of Law in Grundy, Virginia from August 2003 until his retirement in May 2013. Mr. Murrey was of counsel to the law firm of Shumacker Witt Gaither & Whitaker, P.C., in Chattanooga, Tennessee until December 2002, a firm with which he was associated since 1970. Mr. Murrey is a director of The Dixie Group, Inc., a carpet manufacturer, and previously was a director of U.S. Xpress Enterprises, Inc., a truckload carrier, from 2003 until 2007.

12

Mr. Murrey’s longstanding quality service as a member of the Board, as well as his significant experience serving on the boards of directors of other companies, give him an understanding of the role of a board of directors and qualify him to serve on the Board. Mr. Murrey’s legal background also adds to the diversity of the Board.

Sue Anne H. Wells

Dr. Wellsco-founded the Chattanooga Girls Leadership Academy (“CGLA”), a single-gender public charter school providing young women with a rigorous college preparatory education focused on science, technology, engineering, the arts and mathematics, in 2009 and has served as an educator with CGLA since its formation. She is also the owner of Mustang Leadership Partners, an organization dedicated to the protection, preservation and sustainment of the wild American mustang. Dr. Wells currently serves on the boards of the University of Tennessee at Chattanooga, CGLA, the Young Women’s Leadership Academy Foundation, ArtsBuild, The National Mentoring Partnership, Inc. and the Public Education Foundation of Chattanooga, and previously served as a board member of Girls Inc. of Chattanooga and the Siskin Children’s Institute. Dr. Wells graduated from Middlebury College with a M.A. in French and received a Ph.D. in French from the University of North Carolina at Chapel Hill.

Dr. Wells’ extensive service as a director of other organizations and leadership experience qualify her for service on the Board. Dr. Wells is also a member of the founding family of Coke Consolidated and holds a significant pecuniary interest in the stock of Coke Consolidated.

Dennis A. Wicker

Mr. Wicker has been a partner in the law firm of Nelson Mullins Riley & Scarborough LLP in its Raleigh, North Carolina office since November 2009. He served as Lt. Governor of the State of North Carolina from 1993 to 2001. Mr. Wicker also previously served as Chairman of the State Board of Community Colleges and as Chairman of North Carolina’s Technology Council. Mr. Wicker currently serves on the board of directors of First Bancorp, a bank holding company, and is a member of the Campbell Law School Board of Visitors. Mr. Wicker was a director of Air T, Inc., an air transportation services company, until 2013.

Mr. Wicker’s leadership skills, years of high quality service on the Board, service on the boards of directors of First Bancorp and Air T, Inc. and experience in public service qualify him for service on the Board.

Richard T. Williams

Mr. Williams served as Vice President of Corporate Community Affairs of Duke Energy Corporation, an electric power holding company, and President of the Duke Energy Foundation, anon-profit philanthropic organization, from March 2012 and March 2007, respectively, until his retirement in December 2015. From May 2008 until March 2012, Mr. Williams served as Vice President, Environmental, Health & Safety of Duke Energy Corporation and as Vice President, Enterprise Field Services from January 2006 until May 2008. Mr. Williams currently serves on the boards of HomeTrust Bancshares, Atrium Health (formerly Carolinas HealthCare System), Hope Haven, Inc., Communities in Schools of NC, Project LIFT, Central Piedmont Community College Board of Trustees and the National Association of Corporate Directors—Carolinas Chapter. Mr. Williams previously served on the board ofUNC-Chapel Hill Board of Trustees from 1999 until 2007 (chair, 2003-2005), UNC HealthCare System from 2008 until 2012, Greater Charlotte YMCA from 2004 until 2014 (chair, 2011-2013), the Mint Museum from 2004 until 2014 (chair, 2011-2013) and Bank of Commerce, Charlotte from 2008 until 2014.

Mr. Williams’ experience as a former long-standing executive with Duke Energy Corporation, his executive leadership skills and his extensive service as a director for a multitude of entities, bothnon-profit andfor-profit, qualify him to serve as a member of the Board.

13

Coke Consolidated is party to an Amended and Restated Stock Rights and Restrictions Agreement, dated February 19, 2009, with The Coca-Cola Company and J. Frank Harrison, III. Under the agreement,The Coca-Cola Company has the right to designate one person for nomination to the Board, and Mr. Harrison and trustees of certain trusts established for the benefit of certain relatives of the late J. Frank Harrison, Jr. have agreed to vote shares of Coke Consolidated stock that they control for the election of such designee. Ms. Mann has been The Coca-Cola Company’s designee on the Board since May 2017.

J. Frank Harrison, III and Sue Anne H. Wells are siblings. J. Frank Harrison, III and Morgan H. Everett are father and daughter. Morgan H. Everett is the niece of Sue Anne H. Wells. In accordance with the operating agreement of the J. Frank Harrison Family, LLC and certain trusts established for the benefit of certain relatives of the late J. Frank Harrison, Jr., Mr. Harrison intends to vote the shares of Coke Consolidated stock owned or controlled by such entities for the election of Dr. Wells to the Board. Mr. Harrison also intends to vote these shares for the election of Ms. Everett to the Board.

Coke Consolidated is governed by the Board and its various committees. The Board and its committees have general oversight responsibility for the affairs of the Company. In exercising its fiduciary duties, the Board represents and acts on behalf of the Company’s stockholders.

The Board determines the independence of its members based on the standards specified by The NASDAQ Stock Market (“NASDAQ”). The Board is not required to be comprised of a majority of independent directors because Coke Consolidated qualifies as a “controlled company” under the NASDAQ listing standards. Coke Consolidated qualifies as a controlled company because more than 50% of its voting power is controlled by the Chairman and Chief Executive Officer (the “Controlling Stockholder”). NASDAQ adopted its “controlled company” rule in recognition of the fact that a majority stockholder may control the selection of directors and certain key decisions of a company through his or her ownership rights.

In conducting its review of director independence, the Board, except as noted below, considered all transactions, relationships or arrangements between each director (and his or her immediate family members and affiliates) and each of Coke Consolidated, its management and its independent registered public accounting firm in each of the most recent three completed fiscal years, including the following transactions, relationships and arrangements all of which are within the NASDAQ independence standards.

Name | Matter(s) Considered | |

Sharon A. Decker | Ordinary course sponsorship agreements and beverage sales to Tryon International Equestrian Center, an affiliate of Tryon Equestrian Partners. Ms. Decker is Chief Operating Officer of Tryon Equestrian Partners’ Carolina Operations. | |

William H. Jones | Ordinary course beverage sales to Columbia International University and affiliates of Columbia International University. Dr. Jones is the Chancellor of Columbia International University. | |

James H. Morgan | Ordinary course beverage sales, the lease of excess warehouse space at Coke Consolidated’s Roanoke, Virginia facility and the provision of transportation and transportation related services to Krispy Kreme Doughnuts, Inc., of which Mr. Morgan was a director until February 2017, Chairman until August 2016 and an executive officer until January 2015. |

14

The Board did not consider transactions with entities in which a director or immediate family member served only as a trustee or director because the Board believes that the nature of the separate relationships the Company and the director or an immediate family member each have with these organizations would not interfere with the exercise of independent judgment in carrying out the responsibilities of an independent director. The Board also did not consider de minimis amounts of entertainment of directors paid for by employee-directors or executive officers.

Based on its review, the Board has determined that the following seven directors and director nominees, comprising more thanone-half of the Board, are independent: Sharon A. Decker, James R. Helvey, III, William H. Jones, James H. Morgan, John W. Murrey, III, Dennis A. Wicker and Richard T. Williams. The Board also has determined that each member of the Audit Committee and the Compensation Committee (see membership information below under “—Board Committees”) is independent.

The independent members of the Board meet at least twice each year in executive session without the other directors.

The Board does not have a general policy regarding the separation of the roles of Chairman and Chief Executive Officer, or CEO. The Company’s Amended and RestatedBy-laws (the“By-laws”) permit these positions to be held by the same person, and the Board believes that it is in the best interests of Coke Consolidated to retain flexibility in determining whether to separate or combine the roles of Chairman and CEO based on the Company’s circumstances at a particular time.

Mr. Harrison currently serves as both the Chairman of the Board and the CEO of Coke Consolidated. The Board has determined that it is appropriate for Mr. Harrison to serve as both Chairman and CEO (i) in recognition of Mr. Harrison’s ownership of a controlling equity interest in Coke Consolidated and unique position within the Company and the Coca-Cola system and (ii) because it provides an efficient structure that permits the Company to present a unified vision to its constituencies.

In March 2018, the Board appointed Mr. Wicker to serve as Lead Independent Director. The Lead Independent Director (i) presides over all meetings of the independent directors in executive session, (ii) serves as a liaison between the Chairman of the Board and the independent directors, (iii) has authority to call meetings of the independent directors and (iv) serves as a contact person to facilitate communications between employees, stockholders and others with the independent directors.

The Board has a standing Audit Committee, Compensation Committee and Executive Committee. Committee members and committee chairs are appointed by the Board. The members of these committees are identified in the following table:

15

Director | Audit Committee | Compensation Committee | Executive Committee | |||

| J. Frank Harrison, III | Chairman | |||||

| Sharon A. Decker | X | X | ||||

| Morgan H. Everett | ||||||

| Henry W. Flint | X | |||||

| James R. Helvey, III | X | |||||

| William H. Jones | X | |||||

| Umesh M. Kasbekar | ||||||

| Jennifer K. Mann | ||||||

| James H. Morgan | Chairman | X | X | |||

| John W. Murrey, III | ||||||

| Sue Anne H. Wells | ||||||

| Dennis A. Wicker | X | Chairman | X | |||

| Richard T. Williams |

Each committee of the Board functions pursuant to a written charter adopted by the Board. A copy of each committee charter is available on the investor relations portion of the Company’s website,www.cokeconsolidated.com.

The following table provides information about the operation and key functions of each of the three standing Board committees:

Committee | Key Functions and Additional Information | Number of Meetings in Fiscal 2017 | ||

Audit Committee | • Assists the Board in its oversight of (i) the Company’s accounting and financial reporting processes, (ii) the integrity of the Company’s financial statements, (iii) the Company’s compliance with legal and regulatory requirements, (iv) the qualifications and independence of the Company’s independent registered public accounting firm and (v) the performance of the Company’s independent registered public accounting firm and internal audit function. • Appoints, compensates, retains and oversees the Company’s independent registered public accounting firm. • Reviews and discusses with the Company’s independent registered public accounting firm the annual and quarterly financial statements and earnings releases. • Considers and approves all auditing services, internal control-related services and permittednon-auditing services proposed to be provided by the Company’s independent registered public accounting firm. • Assists the Board in its oversight of enterprise risk management. • Reviews and approves or ratifies related person transactions. • Monitors the adequacy of the Company’s reporting and internal controls. • Reports regularly to the Board. • The Board has determined that Messrs. Helvey and Morgan are “audit committee financial experts” within the meaning of the SEC rules and that Messrs. Helvey and Morgan are each “independent” as that term is defined under Rule10A-3(b)(1) of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), and the NASDAQ independence standards. | 7 |

16

Committee | Key Functions and Additional Information | Number of Meetings in Fiscal 2017 | ||

Compensation Committee | • Administers the executive compensation plans. • Reviews and establishes the compensation of the executive officers and makes recommendations to the Board concerning executive compensation. • Reviews and approves the compensation of the members of the Board. • Reviews and approves employment offers and arrangements, severance arrangements, retirement arrangements, change in control arrangements and other benefits for each executive officer. • Oversees regulatory compliance and risk regarding compensation matters. • Appoints individuals to serve as members of the Corporate Benefits Committee for the broad-based employee health and welfare and retirement benefit plans sponsored by the Company and receives periodic reports from such committee regarding its significant actions. • Reports regularly to the Board. | 2 | ||

Executive Committee | • Assists the Board in handling matters that need to be addressed before the next scheduled Board meeting. • Identifies, evaluates and recommends director candidates to the Board. • Reports regularly to the Board. | 1 |

The Board may also establish other committees from time to time as it deems necessary.

The Board held five meetings during fiscal 2017. Each incumbent director attended 75% or more of the aggregate number of meetings of the Board and committees of the Board on which the director served during fiscal 2017. Absent extenuating circumstances, each director is required to attend the Company’s annual meeting of stockholders. 11of the Company’s 12 directors in office at the time, including all of the Company’s current directors who were then directors, attended the 2017 Annual Meeting of Stockholders.

The Board does not have a standing Nominating Committee comprised solely of independent directors. The Board is not required to have such a committee because Coke Consolidated qualifies as a “controlled company” under the NASDAQ listing standards as further described under “—Director Independence” beginning on page 14.

The Board has delegated to the Executive Committee the responsibility for identifying, evaluating and recommending director candidates to the Board, subject to the final approval of the Controlling Stockholder who is also a member of the Executive Committee. Because Coke Consolidated is a controlled company and all director candidates must be acceptable to the Controlling Stockholder, the Board has approved the following nomination and appointment process to provide the Company’s constituencies with a voice in the identification of candidates for nomination and appointment.

In identifying potential director candidates, the Executive Committee may seek input from other directors, executive officers, employees, community leaders, business contacts, third-party search firms and any other sources deemed appropriate by the Executive Committee. The Executive Committee will also consider director candidates appropriately recommended by stockholders.

17

In evaluating director candidates, the Executive Committee does not set specific minimum qualifications that must be met by a director candidate. Rather, the Executive Committee considers the following factors in addition to any other factors deemed appropriate by the Executive Committee:

| • | whether the candidate is of the highest ethical character and shares the values of the Company; |

| • | whether the candidate’s reputation, both personal and professional, is consistent with the Company’s image and reputation; |

| • | whether the candidate possesses expertise or experience that will benefit the Company and is desirable given the current makeup of the Board; |

| • | whether the candidate represents a diversity of viewpoints, backgrounds, experiences or other demographics; |

| • | whether the candidate is “independent” as defined by the applicable NASDAQ listing standards and other applicable laws, rules or regulations regarding independence; |

| • | whether the candidate is eligible to serve on the Audit Committee or other Board committees under the applicable NASDAQ listing standards and other applicable laws, rules or regulations; |

| • | whether the candidate is eligible by reason of any legal or contractual requirements affecting the Company or its stockholders; |

| • | whether the candidate is free from conflicts of interest that would interfere with the candidate’s ability to perform the duties of a director or that would violate any applicable listing standard or other applicable law, rule or regulation; |

| • | whether the candidate’s service as an executive officer of another company or on the boards of directors of other companies would interfere with the candidate’s ability to devote sufficient time to discharge his or her duties as a director; and |

| • | if the candidate is an incumbent director, the director’s overall service to the Company during the director’s term, including the number of meetings attended, the level of participation and the overall quality of performance of the director. |

Diversity is one of the various factors the Executive Committee may consider in identifying director nominees, but the Executive Committee does not have a formal policy regarding board diversity. All director candidates, including candidates appropriately recommended by stockholders, are evaluated in accordance with the process described above. The Executive Committee will not recommend any potential director candidate that is not acceptable to the Controlling Stockholder.

Stockholder Recommendations of Director Candidates

Stockholders may recommend director candidates to be considered for the Company’s 2019 Annual Meeting of Stockholders by submitting the candidate’s name in accordance with provisions of theBy-laws, which require advance notice to the Company and certain other information. Written notice must be received by the Company’s Secretary at Coca-Cola Bottling Co. Consolidated, 4100 Coca-Cola Plaza, Charlotte, North Carolina 28211 not earlier than January 15, 2019 and not later than February 14, 2019; provided, however, that if the date of the 2019 Annual Meeting of Stockholders is more than 30 days before or more than 60 days after May 15, 2019, notice by the stockholder to be timely must be so delivered or received not earlier than the close of business on the 120th day prior to the date of the 2019 Annual Meeting of Stockholders and not later than the close of business on the later of the 90th day prior to such annual meeting or the 10th day following the day on which public announcement of the date of such meeting is first made by the Company.

The notice must contain certain information about the nominee and the stockholder submitting the nomination, as set forth in theBy-laws, including (i) as to each person whom the stockholder proposes to nominate for election or reelection as a director, such nominee’s name, age, business address and, if known, residence address,

18

principal occupation or employment, the class and number of shares of any capital stock of the Company which are beneficially owned by such person and all information relating to such person that is required to be disclosed in solicitations of proxies for election of directors or is otherwise required by the SEC rules promulgated under the Exchange Act, and (ii) as to the stockholder giving the notice and any Stockholder Associated Person (as defined in theBy-laws), the name and address of such stockholder and any Stockholder Associated Person, as they appear on the Company’s books, the class or series and number of shares of the Company which are directly or indirectly owned beneficially and of record by such stockholder or Stockholder Associated Person and any option, warrant, convertible security, stock appreciation right or similar right with an exercise or conversion privilege or a settlement payment or mechanism at a price related to any class or series of shares of the Company or with a value derived in whole or in part from the value of any class or series of shares of the Company, whether or not such instrument or right shall be subject to settlement in the underlying class or series of capital stock of the Company or otherwise (a “Derivative Instrument”) directly or indirectly owned beneficially by such stockholder or Stockholder Associated Person, and any other direct or indirect opportunity of such stockholder or Stockholder Associated Person to profit or share in any profit derived from any increase or decrease in the value of the shares of the Company, any proxy, contract, arrangement, understanding or relationship pursuant to which such stockholder or Stockholder Associated Person has a right to vote any shares of any security of the Company, any short interest of such stockholder or Stockholder Associated Person in any security of the Company (for purposes of theBy-laws, a person shall be deemed to have a short interest in a security if such person directly or indirectly, through any contract, arrangement, understanding, relationship or otherwise, has the opportunity to profit or share in any profit derived from any decrease in the value of the subject security), any rights to dividends on the shares of the Company owned beneficially by such stockholder or any Stockholder Associated Person that are separated or separable from the underlying shares of the Company, any proportionate interest in shares of the Company or Derivative Instruments held, directly or indirectly, by a general or limited partnership in which such stockholder or Stockholder Associated Person is a general partner or, directly or indirectly, beneficially owns an interest in a general partner, and any performance-related fees (other than an asset-based fee) that such stockholder or any Stockholder Associated Person is entitled to receive, either directly or indirectly, based on any increase or decrease in the value of shares of the Company or Derivative Instruments. A stockholder who is interested in recommending a director candidate should request a copy of theBy-laws by writing to the Company’s Secretary at Coca-Cola Bottling Co. Consolidated, 4100 Coca-Cola Plaza, Charlotte, North Carolina 28211.

Policy for Review of Related Person Transactions

Coke Consolidated’s Code of Business Conduct includes the Company’s policy regarding the review and approval of certain related person transactions. In accordance with the Code of Business Conduct, all material transactions or conflicts of interest involving members of the Board or the Company’s executive officers must be reported to and approved by the Audit Committee. Under the Code of Business Conduct, a material conflict of interest does not include any employment relationship involving a director, executive officer or immediate family member of a director or executive officer and any related compensation solely resulting from that employment relationship if the relationship and the related compensation have been approved by the Compensation Committee of the Board.

For purposes of the Code of Business Conduct, any related person transaction that is required to be reported in the Company’s proxy statements under the SEC rules is deemed to be a “material” transaction and must be reported to and approved by the Audit Committee. Management determines whether a transaction is a material transaction that requires approval by the Audit Committee. The Audit Committee has approved each of the related person transactions described below under “—Related Person Transactions.”

In the course of its review and, if appropriate, approval or ratification of a related person transaction, the Audit Committee considers the relevant facts and circumstances, including the material terms of the transaction, risks, benefits, costs, availability of other comparable services or products and, if applicable, the impact on a director’s independence.

The Board also forms special committees from time to time for the purpose of approving certain related person transactions.

19

System Transformation Transactions with The Coca-Cola Company

The Company’s business consists primarily of the production, marketing and distribution of nonalcoholic beverages of The Coca-Cola Company, which is the sole owner of the secret formulas under which the primary components of its soft drink products, either concentrate or syrup, are manufactured. Accordingly, the Company routinely engages in various transactions with The Coca-Cola Company and its affiliates. As of March 19, 2018, The Coca-Cola Company owned approximately 35% of Coke Consolidated’s outstanding Common Stock, which represented approximately 5% of the total voting power of Coke Consolidated Common Stock and Class B Common Stock voting together. The Coca-Cola Company owned approximately 27% of Coke Consolidated’s outstanding Common Stock and Class B Common Stock on a combined basis as of March 19, 2018.

The Company recently concluded a series of transactions with The Coca-Cola Company and Coca-Cola Refreshments USA, Inc. (“CCR”), a wholly owned subsidiary of The Coca-Cola Company, which were initiated in April 2013 as part of The Coca-Cola Company’s multi-year refranchising of its North American bottling territories (the “System Transformation”). Through several asset purchase and asset exchange transactions with The Coca-Cola Company and CCR, the Company significantly expanded its distribution and manufacturing operations through the acquisition and exchange of distribution territories and regional manufacturing facilities. The Company now distributes, markets and manufactures beverages in territories spanning 14 states and the District of Columbia, and operates a total of 13 manufacturing facilities.

The following table summarizes the distribution territories and regional manufacturing facilities acquired from CCR in the System Transformation:

Completed System Transformation Transactions | Definitive Agreement Date | Acquisition / Exchange Date | Net Cash Purchase Price ($ in millions) | |||||

Johnson City and Morristown, Tennessee | May 7, 2014 | May 23, 2014 | $ | 12.2 | ||||

Knoxville, Tennessee | August 28, 2014 | October 24, 2014 | 30.9 | |||||

Cleveland and Cookeville, Tennessee | December 5, 2014 | January 30, 2015 | 13.2 | |||||

Louisville, Kentucky and Evansville, Indiana | December 17, 2014 | February 27, 2015 | 18.0 | |||||

Paducah and Pikeville, Kentucky | February 13, 2015 | May 1, 2015 | 7.0 | |||||

Lexington, Kentucky(1) | October 17, 2014 | May 1, 2015 | 15.3 | |||||

Norfolk, Fredericksburg and Staunton, Virginia and Elizabeth City, North Carolina | September 23, 2015 | October 30, 2015 | 26.7 | |||||

Annapolis, Maryland Make-Ready Center | September 23, 2015 | October 30, 2015 | 5.4 | |||||

Easton and Salisbury, Maryland, Richmond and Yorktown, Virginia and Sandston, Virginia Regional Manufacturing Facility | September 23, 2015 | January 29, 2016 | 75.9 | |||||

Alexandria, Virginia and Capitol Heights and La Plata, Maryland | September 23, 2015 | April 1, 2016 | 34.8 | |||||

Baltimore, Hagerstown and Cumberland, Maryland and Baltimore and Silver Spring, Maryland Regional Manufacturing Facilities | September 23, 2015 | April 29, 2016 | 68.5 | |||||

Cincinnati, Dayton, Lima and Portsmouth, Ohio and Louisa, Kentucky and Cincinnati, Ohio Regional Manufacturing Facility | September 1, 2016 | October 28, 2016 | 99.7 | |||||

Anderson, Fort Wayne, Lafayette, South Bend and Terre Haute, Indiana | September 1, 2016 | January 27, 2017 | 32.1 | |||||

Bloomington and Indianapolis, Indiana and Columbus and Mansfield, Ohio and Indianapolis and Portland, Indiana Regional Manufacturing Facilities | September 1, 2016 | March 31, 2017 | 104.6 | |||||

Akron, Elyria, Toledo, Willoughby and Youngstown, Ohio and Twinsburg, Ohio Regional Manufacturing Facility | April 13, 2017 | April 28, 2017 | 87.9 | (2) | ||||

20

Completed System Transformation Transactions | Definitive Agreement Date | Acquisition / Exchange Date | Net Cash Purchase Price ($ in millions) | |||||||

Little Rock and West Memphis, Arkansas and Memphis, Tennessee and West Memphis, Arkansas Regional Manufacturing Facilities(3) | September 29, 2017 | October 2, 2017 | 15.9 | (2) | ||||||

Memphis, Tennessee | September 29, 2017 | October 2, 2017 | 39.6 | (2) | ||||||

| (1) | Acquired in an asset exchange transaction for distribution territory previously served by the Company in and around Jackson, Tennessee. |

| (2) | Cash purchase price amounts are subject to a final post-closing adjustment in accordance with the terms of the applicable definitive agreement and, as a result, may either increase or decrease. |

| (3) | Acquired in an asset exchange transaction for distribution territory previously served by the Company in portions of southern Alabama, southeastern Mississippi, southwestern Georgia and northwestern Florida and in and around Somerset, Kentucky and a regional manufacturing facility previously owned by the Company in Mobile, Alabama. |

2017 System Transformation Transactions

The System Transformation transactions completed with CCR during fiscal 2017 are described below.