5

(continued)

Second Quarter Recap

GAAP

Non-GAAP

Three Months Ended March 31, 2004

As Reported

Adjustments

Adjusted

(in millions, except per share data)

Loss on divestiture of business

12,125

(a)

(12,125)

-

Operating Income

49,514

$

61,639

$

Loss on early extinguishment of debt

3,146

(b)

(3,146)

-

Interest expense, net

9,662

9,662

Income before income taxes

36,706

51,977

Incomes taxes

6,533

(c)

10,485

17,018

Net Income

30,173

$

34,959

$

Weighted Avg. Shares Outstanding, Diluted

170,901

(d)

170,901

Diluted earnings per common share

0.19

$

(d)

0.22

$

(a)

(b)

(c)

(d)

See footnote (a) on Profit and Loss Statement for conversion calculation

Excludes the loss on divestiture which arose from expenses associated with the sale of certain assets and liabilities and all of the operations

of IOS Capital on March 31, 2004. Loss on divestiture of business, net of taxes, for the three months ended March 31, 2004 was $7,548

Excludes the tax benefit recognized on the reversal of a valuation allowance against net operating losses of IOS Capital as a result of the tax

gain on IOSC sale to GE of $4,720 and taxes related to (a) and (b) above

Excludes the loss from the early extinguishment of debt which arose primarily from the write-off of unamortized costs related to the 2002

credit facility. Loss from early extinguishment of debt, net of taxes, for the three months ended March 31, 2004 was $1,958

Second Quarter Highlights

Growth platforms beginning to yield results in each strategic area:

Equipment: improving mix, but market remains competitive

Aftermarket: color and high-end B&W fueling positive aftermarket results

Document Services: Outsourcing, Professional Services improving trends

Efficiency initiatives driving early benefits in selected areas

e-IKON - supply chain

Early Six Sigma benefits in the quarter

Improved Canadian performance drives tax benefit of $2.6 million in quarter

Financial flexibility objectives achieved

Exiting captive leasing business in U.S. and Canada

Business model simplified; capital structure transformed

Sale proceeds being deployed to improve long-term earnings stream and

return value to shareholders

6

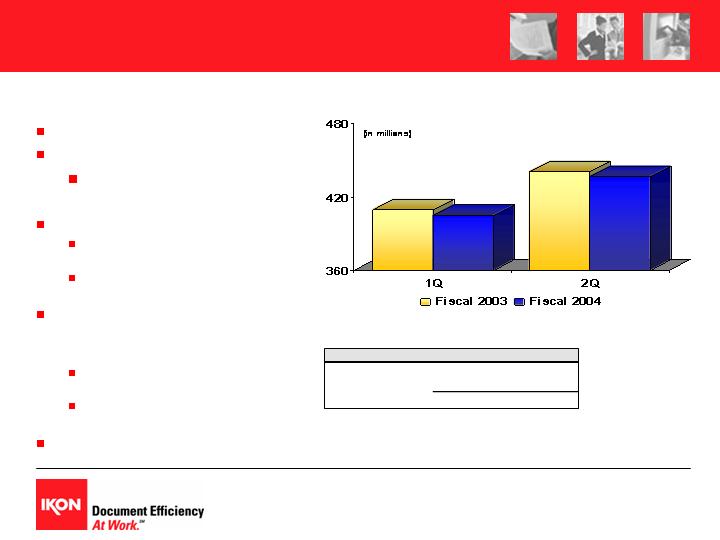

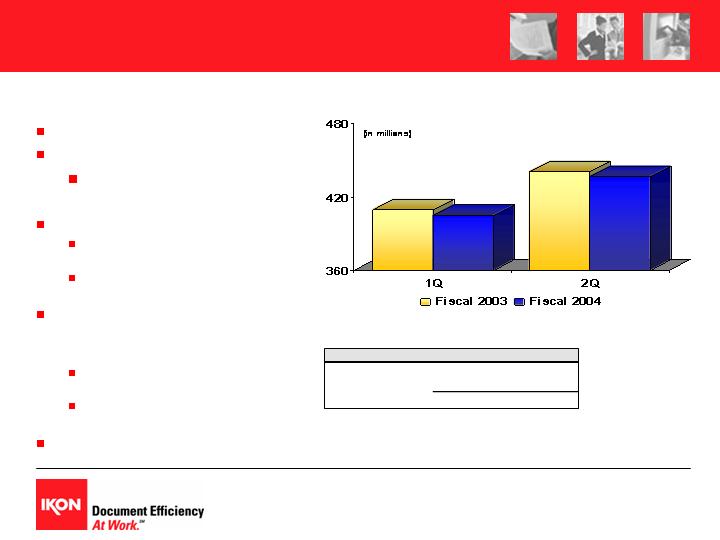

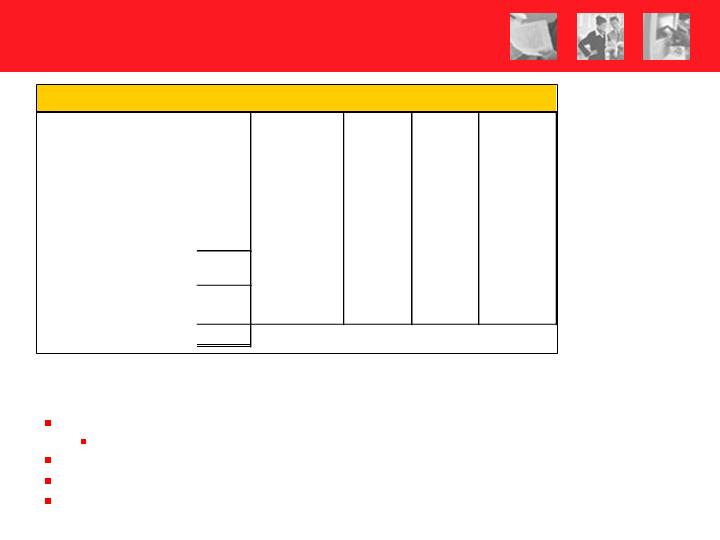

Revenue Trends Improving

Blended growth for three strategic areas

of business

Services mix will continue to strengthen;

54% at quarter end

Finance income will begin to decline in

the third quarter

7

8

(continued)

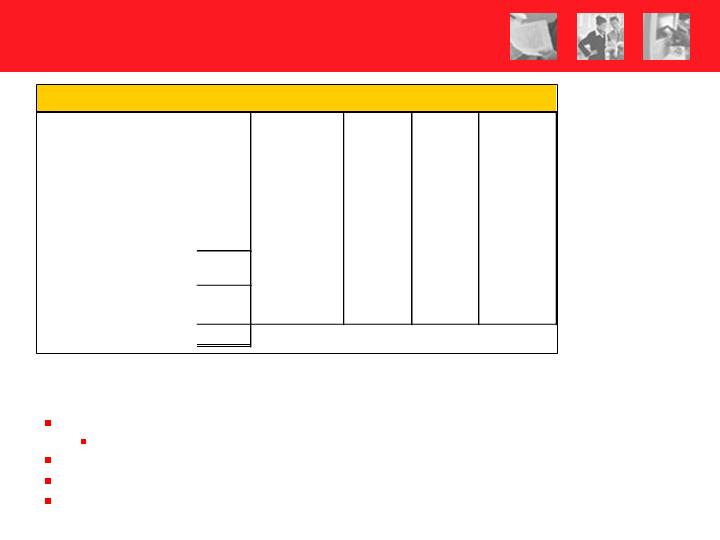

Revenue Trends Improving

Year Over Year Revenue Growth

% of

(Note: not in financial reporting format)

Revenue

1Q03

2Q03

3Q03

4Q03

1Q04

2Q04

Mix

Equipment

-3%

-3%

-4%

4%

-1%

-1%

37%

Aftermarket (service & supplies)

-2%

-4%

-1%

-4%

-6%

2%

35%

Document Services

0%

-2%

-2%

-1%

7%

2%

19%

Blended Revenue growth(decline)

-2%

-3%

-2%

0%

-1%

1%

91%

Technology hardware

-58%

-54%

-60%

-51%

-39%

-25%

1%

Divested, downsized services

-78%

-64%

-49%

3%

n/a

n/a

0%

Finance

2%

4%

5%

4%

4%

1%

8%

Total Revenue growth(decline)

-6.1%

-5.3%

-5.0%

-1.3%

-1.8%

0.4%

100%

Foreign currency translation

0.9%

1.5%

1.6%

1.2%

1.9%

2.2%

Equipment Trends

Sequential growth of 8%

Year over year decline of 1%

Office, analog declines

offsetting color and production

Color revenues up 62%

IKON CPP8050, co-branded

with Konica-Minolta, successful

Canon and Ricoh product

refreshes also driving demand

Installed base of higher-end

Seg. 6 Canon iR110/iR150s

continues to grow

20% increase in placements (yr-

yr)

IKON distributing over 80% of

these products for Canon

Stronger mix strengthens

future aftermarket

9

Equipment Revenue Mix

FY ‘01

FY ‘02

FY '03

YTD'04

B&W segment 1-4

76%

70%

63%

62%

B&W segment 5-6, color

24%

30%

37%

38%

TOTAL

100%

100%

100%

100%

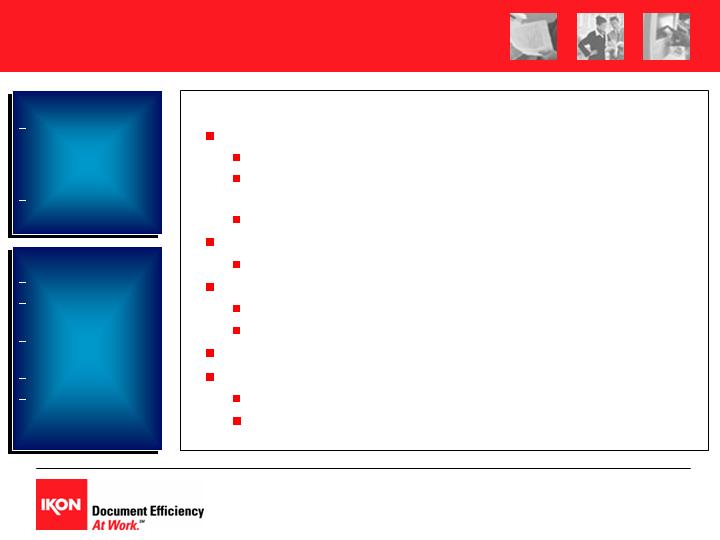

Growth Platforms

Executing operational priorities

National account revenues up over 100% from prior year

Increased level of wins in 2nd Qtr., including largest win yet

Building pipeline of equipment, aftermarket and services

potential

National account revenues 8% of total revenues for 2nd Qtr.

Metro markets gaining share

Above average growth in equipment revenues in 2nd Qtr.

European expansion; new cities delivering new revenues

New cities contributing to performance

6 Pan European account wins year to date

Outsourcing gaining vertical strengths

Professional Services

Continues to outperform

New platform will leverage IKON’s channel, services strengths

Goals

Grow share of

equipment market

to expand

aftermarket base

Strengthen

services mix

Priorities

Supplier integration

National accounts,

metro markets

Product mix: color

& high-end

Europe expansion

Services

expansion

10

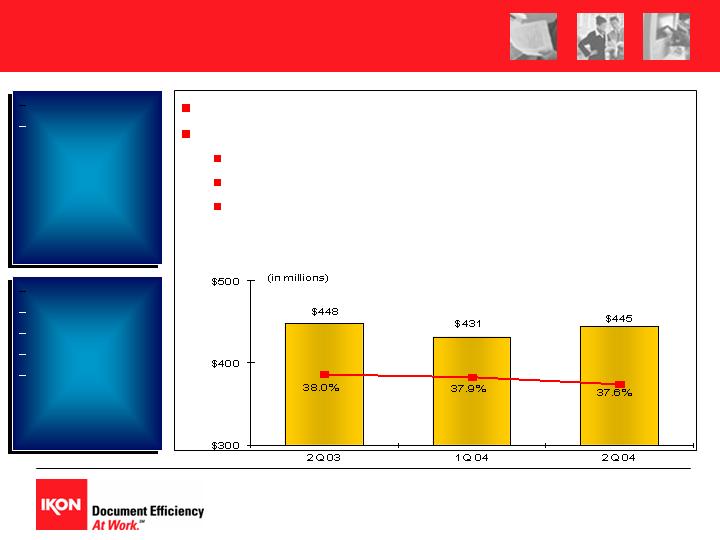

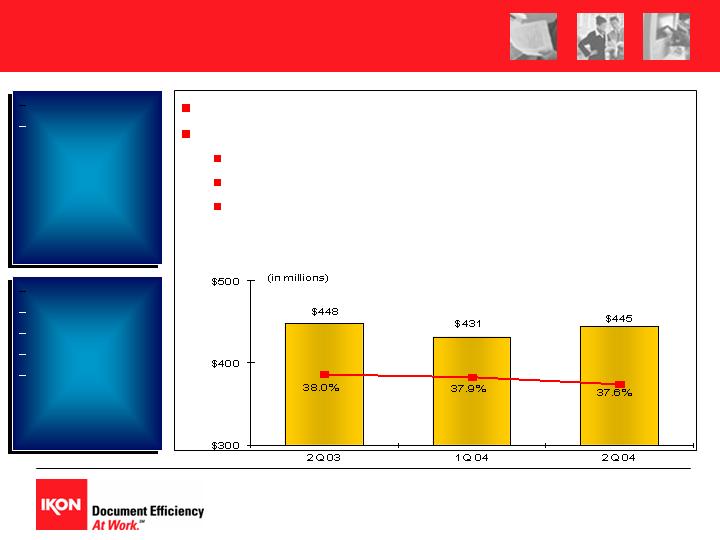

Gross Margins

Gross margins declined 40 basis points (bp) to 37.6%

Gross profit relatively flat due to services mix benefit

Net Sales – market competitiveness; customer mix

Services - revenue and productivity improvements

Finance - benefiting from rate reductions

Goals

Maintain gross

margins: offset

equipment pricing

with improved mix

& services

Priorities

e-IKON

Six Sigma

Sales effectiveness

Asset management

11

Selling & Administrative

$5.3 million increase from prior year

Foreign currency hit was more than year-to-year change

Pension and other benefits, insurance continue to be

headwinds

Headcount reductions are leveling off

Funding second wave of structural improvements

Goals

Achieve an S&A

expense-to-

revenue ratio of

less than 30%

long-term

Fund critical long-

term investments

Priorities

e-IKON

Six Sigma

Sales effectiveness

Asset management

32.4%

33.1%

32.0%

12

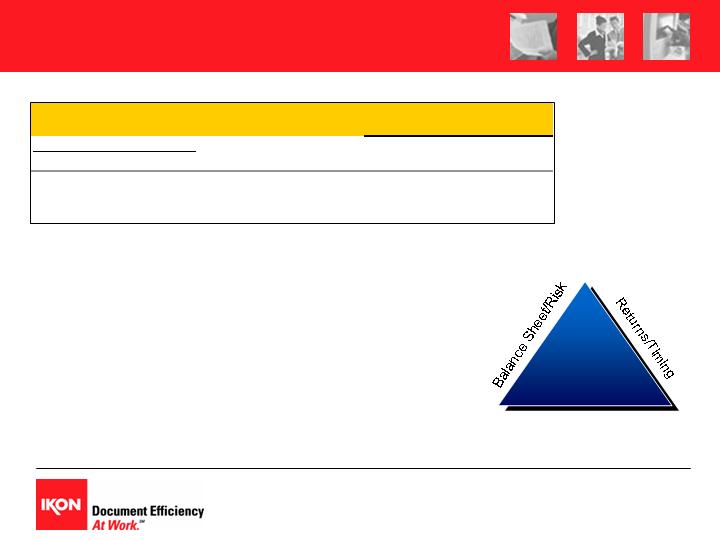

Strengthened Financial Position

March 31, 2004

Exiting lease financing in the U.S. and Canada

Closed IOSC/GE transaction for U.S. leasing business

Continues lease financing through GE Commercial Finance

under the tradename IKON Financial ServicesSM

Signed definitive agreement for Canadian lease portfolio

Improved flexibility for share repurchases and acquisitions

$250 million share repurchase authorized by Board

Strengthened financial position:

Cash balance as of 3/31/04: $853 million

Debt to capital ratio will continue to trend down

April 28, 2004

Successful tender for $250 million, 7.25% 2008 Notes

Goals

Strengthen balance

sheet

Improve financial

flexibility

Priorities

Monetize value

created in IOS

Capital to achieve

financial flexibility,

simplify business

model, and fund

new growth

opportunity

Continue to

improve coverage

& debt ratios

13

IOSC/GE transaction

Bill Urkiel

Senior Vice President & CFO

14

Transaction overview & strategic

implications

Cash: proceeds and uses to date

Financial implications to P&L

Capital structure

Cash flow dynamics

Transaction Highlights

IKON transitions out of U.S. and Canadian leasing business

Strategic alliance with GE Commercial Finance for lease financing in

the U.S. and Canada

U.S. leasing: Asset Purchase & Program Agreement – closed 3/31/04

GE purchased certain assets and liabilities of IOS Capital’s portfolio

Future lease originations through GE as preferred lease-financing source

Financing profits partially replaced with origination fees, volume fee & profit-sharing

Canadian leasing: Definitive Agreement – expected to close by 6/30/04

GE to purchase lease receivable portfolio of approximately $177 million

Future lease originations through GE as preferred lease-financing source

Financing profits partially replaced with origination fees of 3%

IKON retains certain lease assets and liabilities

Asset-backed receivables and related debt; other leases

$678 million of unsecured IOS Capital debt

5% convertible Notes; 7.25% 2008 Notes; escrowed 9.75% 2004 Notes

15

16

Analysis of Cash Proceeds

in millions

Realized

Expected

as of

Future

Transaction Related Proceeds

3/31/04

Sources

Total

Initial proceeds received at closing

1,505

$

1,505

$

Post-closing receivable

177

$

177

Canadian proceeds, net of related debt

90

90

Net cash after retained run-off, debt and tax liabilities

226

226

Combined proceeds

1,505

$

493

$

1,998

$

Initial payment: $1.5 billion

Balance sheet contains $177 million

receivable

Closing of Canadian transaction expected by

6/30/04

Net cash from retained assets realized

through 2007

(continued)

Analysis of Cash Proceeds

17

Shareholders/Bondholders

Value

Creation

* All EPS projections based on 3/31 diluted share count of 170 million shares

in millions

18

Preliminary Use of Proceeds

Announced

Use of Proceeds

By 3/31/04

as of 4/29/04

Embedded in Pro-Forma P&L

Conduit paydown

(796)

$

Tender for $250 million, June 2008 Notes, net of tax benefit

(267)

$

Deferred taxes due 6/15/04

(285)

Pension contribution, net of tax benefit

(47)

Tender for $250 million in 7.25% 2008 Notes improves

balance sheet and pro-forma earnings baseline for

2005 - approx. $.07 per diluted share*

$285M reflects deferred taxes triggered by sale to GE

(no P&L impact)

Advanced pension contribution improves under-funded

status, reduces future cash contributions; and

improves pro-forma earnings baseline for 2005 –

approx. $.01 per diluted share*

Preliminary Use of Proceeds

(continued)

19

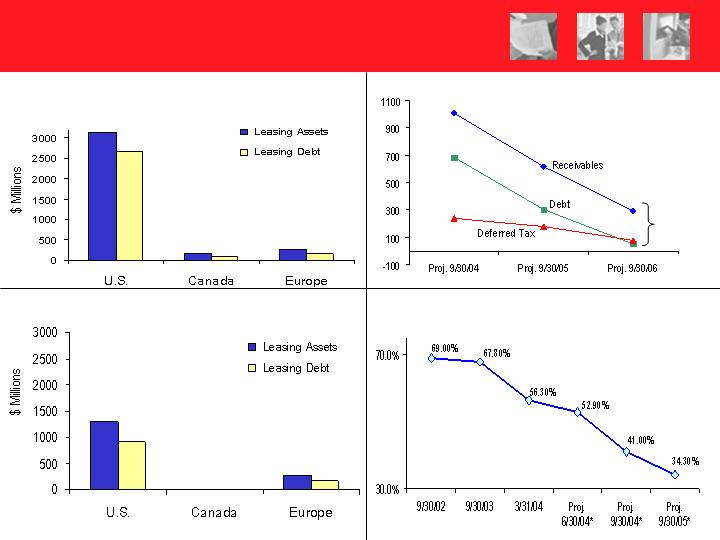

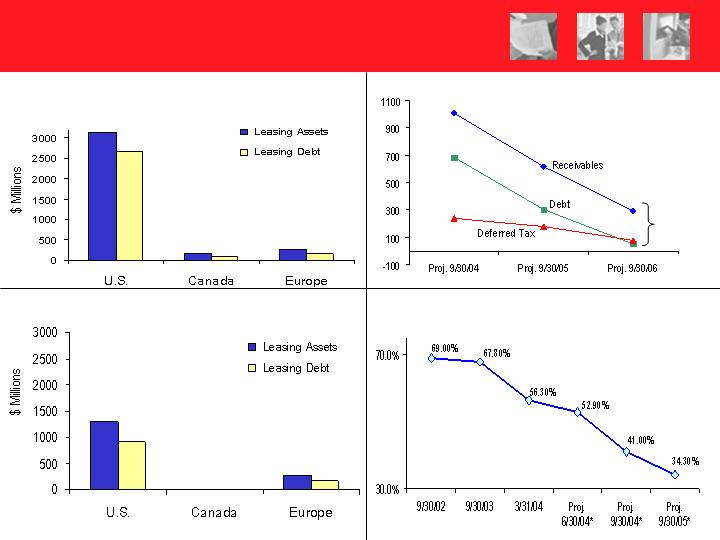

Leasing Assets vs. Debt: Prior to Sale

Retained Asset Profile

Projected Total debt to capital ratio

* Assumes constant equity and Europe levels

Retained U.S. Portfolio: Run Off

Net LT cash

benefit =

$226 M

Leasing Assets vs. Debt: After 3/31/04

Gone

7/1/04

Stays

Retained

$1.3 B

Retained

$0.9 M, 69%

$3.1 B

$2.7* B, 87%

$.27 B

$.18 B

$.07 B

$.15 B

$.27 B

$.15 B

* $678 was reclassified to non-lease financing as a result of the IOSC/GE transaction

20

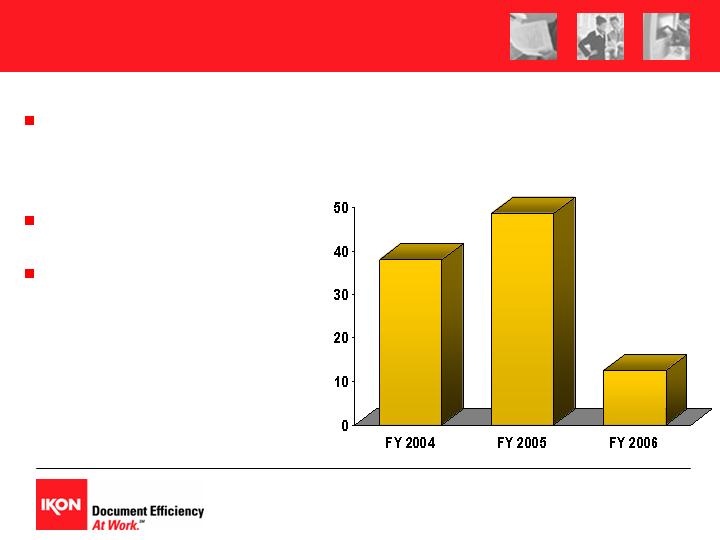

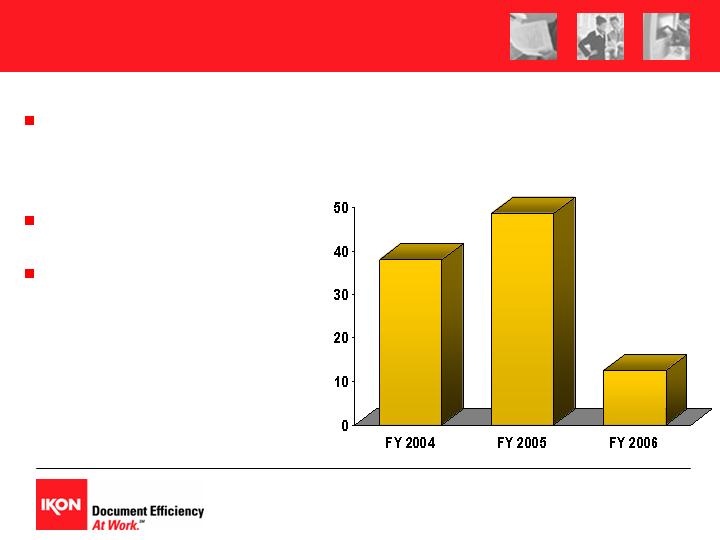

Retained Asset Run-Off

Approximately $100 million

in operating income to be

recognized 4/1/04 –

9/30/06

IKON pays GE to service

portfolio over run-off period

NOTE: estimates can

change based on activity

within portfolio as a result

of upgrades, cancellations,

buyouts, etc.

(in millions)

38%

13%

49%

21

* Includes Canada based on expected close date of June 30, 2004;

22

Deal Related Adjustments

* Net

New Fees,

Combined

(in millions)

Leasing

Profit-Sharing

Adjustments

& Rental

and

4/1 to 9/30

Consolidated Statement of Income

Activities

Investments

Impact to P&L

Net sales

45

32

77

Services

(26)

28

2

Finance income

(127)

(127)

Revenues

(108)

60

(48)

Cost of goods sold

57

57

Services costs

(10)

(10)

Finance interest expense

(52)

(52)

Costs and Expenses

(5)

0

(5)

Gross Profit

(103)

60

(43)

Selling and administrative

(39)

(39)

Operating income

(64)

60

(4)

Interest expense, net

18

(10)

8

Income from continuing operations

before taxes on income

(82)

70

(12)

Pro-Forma P&L FY

’04**

Assumes limited investment

* Canada based on expected close date of June 30, 2004

** Excludes loss on divestiture and related tax benefit, and losses on early extinguishment of debt; assumes use of proceeds identified on slide 15

23

* Net

New Fees,

FY 2004

(in millions)

1st Half

Leasing

Profit-Sharing

Preliminary

Fiscal 2004

& Rental

and

Pro-Forma

Consolidated Statement of Income

x 2, tax @ 37.75%

Activities

Investments

as of 4/29/04

Net sales

1,927

$

45

32

2,004

$

Services

2,320

(26)

28

2,322

Finance income

395

(127)

268

Revenues

4,642

(108)

60

4,594

Costs and Expenses

2,890

(5)

0

2,885

Gross Profit

1,752

(103)

60

1,709

Selling and administrative

1,519

(39)

1,480

Operating income

233

(64)

60

229

Interest expense, net

39

18

(10)

47

Income from continuing operations

before taxes on income

194

(82)

70

182

Income taxes (@ 37.75%)

73

69

Income from continuing operations

121

$

113

$

Net Income (as adjusted for tax effected

convertible interest)

130

$

122

$

Diluted Shares (@ 3/31/04

170

170

Diluted EPS

0.76

$

0.72

$

Shareholders/Bondholders

Value

Creation

24

Additional Use of Proceeds

Announced

Other

Use of Proceeds

By 3/31/04

as of 4/29/04

Future

Embedded in Pro-Forma P&L

Conduit paydown

(796)

$

Tender for $250 million, June 2008 Notes, net of tax benefit

(267)

$

Deferred taxes due 6/15/04

(285)

Pension contribution, net of tax benefit

(47)

Dependent on price, timing, & other factors

Share repurchase authorization up to $250 million

(250)

$

Debt reduction, acquisitions, other investments

(250)

Improve short-term cash position

(100)

Share repurchases expected over next 18 to

24 months

No formal commitment to the dollar amounts

within each of these categories

Actions dependent on business conditions,

and price, timing and other factors

Additional Use of Proceeds

(continued)

25

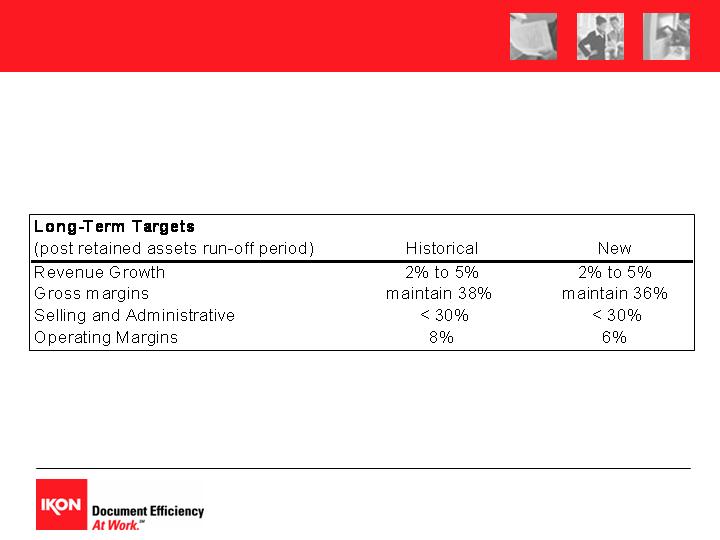

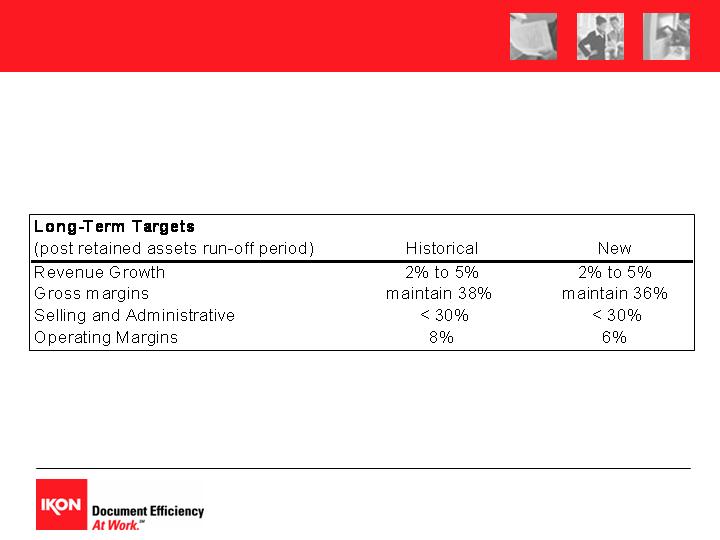

FY ’04 Expectations &

Long-Term Targets

All figures assume current diluted share count and exclude any additional actions such as

share or debt repurchases, acquisitions, etc.

* Excludes special charges related to losses from early extinguishment of debt, loss on divestiture of business, and the $4.7 million tax benefit

associated with the divestiture.

26

Fiscal 2004 Expectations*

Full year

$.70 to $.75 per diluted share

Third quarter

$.15 to $.18 per diluted share

Full year growth rate assumptions:

Net Sales, Services

(1%) to 1%

Finance

(30%)

* Excludes special charges related to losses from early extinguishment of debt, loss on divestiture of business, and the $4.7 million tax benefit associated

with the divestiture.

FY ‘04 Expectations and

Long-Term Targets

(continued)

27

CASH DYNAMICS

Sources & Uses of Free Cash Flow

Fiscal 2004 Expectations – Free Cash Flow

Cash from operations ($240) to ($250)M

Includes $285M deferred tax on gain; $75M pension contribution

Less: capital expenditures*, net of proceeds * $70 M

Plus: lease collections*, net of lease additions * $290 to $310 M

Free Cash Flow $0 to ($30) M

* Reported in Investing on Cash Flow Statement; leasing additions would only be generated by European leasing prospectively

28

(in millions)

Deal Changes

Beyond

SOURCES / USES

FY 2003

Fiscal 2004

Fiscal 2005

Fiscal 2006

Run-Off Period

Net Income (GAAP)

116

$

pro-forma

Depreciation and Amortization

112

less $16M depr.

Changes in operating assets & liab.

(7)

Provision for A/R

14

Provision for Lease Default

68

1/2 yr. source

Europe only

Europe only

Europe only

Provision for deferred taxes

72

significant use

use

use

neutral

Other items & special charges

65

Cash From Operations

440

Capital expenditures

(68)

Original IKON Free Cash Flow

372

Changes in finance receivables

(171)

becomes source

source

source

Europe only

Free Cash Flow

201

$

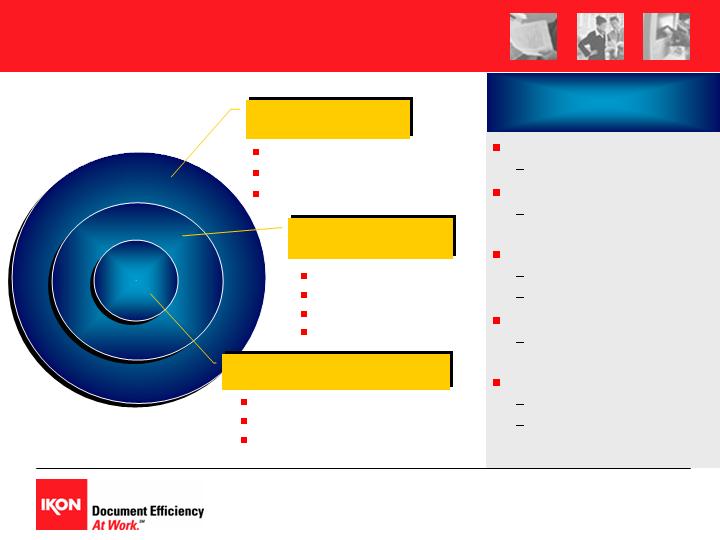

Strategic Goals

and Priorities

Long-term

Goals

Revenues

2% to 5% growth

Gross Margin

Maintain with stronger

services mix

S&A to Revenue < 30%

$40M+ structural savings

2%+ revenue growth

Operating Margins

Expand by 2 points from

core baseline of 4%

Cash\Capital Structure

Alternative uses of cash

30% to 35% debt-to-

capital ratio

Expansion

Core Growth

Operating Leverage

e-IKON

Six Sigma

Asset Management

Supplier Integration

Customer segmentation

National & Metros

Color

Europe

Managed Services

Professional Services

Services

Strength

450+

acquisitions

to 1 company

Channel

Development

29

Value Proposition

Leading market positions

Strong vendor relationships

Business model aligns with industry and customer

trends

Strong recurring revenue mix

Creating operating leverage and differentiation

Improving financial position

Strong, consistent cash flows

30

Investor Conference

31

Analysts and institutional investors:

Please join us...

For:

IKON’s 2004 Investor Conference

When:

May 25, 2004

Time:

2:00 p.m. – 5:00 p.m. (1:30 check-in)

(will be webcast live)

Where: Millennium Broadway Hotel & Conference Center

New York, NY

Please register! email TRAwichhart@IKON.com