| ITEM 1. | REPORTS TO STOCKHOLDERS. |

The Alger Funds

| Shareholders’ Letter (Unaudited) | October 31, 2022 |

Dear Shareholders,

Steering into Stability

The late MIT economist and Nobel laureate Paul Samuelson acknowledged that “good questions outrank easy answers.” The uncertainty around inflation has complicated the market environment since the beginning of 2022, and is expected to continue in the months ahead. Reflecting on the fiscal year, Russia’s invasion of Ukraine sparked a surge in commodity prices into the summer, exacerbating inflation around the world. Consequently, interest rates continued their climb seven months into the Federal Reserve’s (the Fed) hiking cycle, making mortgage rates and consumer finance products more expensive across the economy. Moreover, the Fed increased the Federal Funds rate by 75 basis points in each of June, July and September 2022, ending the third quarter of 2022, with a target rate of 3.25%. Hopes of the Fed pivoting or reversing its tightening policy were dampened after an August speech by Fed chair Jerome Powell, where he argued that restoring price stability will require a restrictive policy for some time and may bring pain to households and businesses.

These higher interest rates have been a headwind for longer duration stocks, as investors discount cash flows further into the future, pushing down the valuations of many of these companies to levels not seen since the COVID-19 crash of 2020, or the financial crisis of 2008-2009. And, while valuation multiples of many of these companies have decreased considerably, we believe their growth rates should buoy them, even in a weakening economy. How high will the Fed ultimately push interest rates? We can’t know for certain, but we believe that valuations of such long duration stocks have compressed to the point where they have diverged from fundamentals and we remain confident in the long-term trajectory of such companies, rather than the short-term vicissitudes of the economy.

As a result of the rotations described above, value stocks outperformed growth stocks during the past twelve months, with the Russell 3000 Value Index down -7.25%, outperforming the Russell 3000 Growth Index which fell to -24.67%.

Navigating a Weakening Economy

Over the past thirteen tightening cycles, we have only experienced three soft landings (i.e., a cyclical slowdown in economic growth that avoids a recession). Among those soft landings, all three experienced approximately 300 basis points of rate hikes – specifically in 1984, 1994-1995 and 2020. As of this writing, the Fed is hiking approximately 450 basis points on its target policy rate, and as a result, we feel it is unlikely the Fed can successfully achieve tighter financial conditions while avoiding a recession (i.e., a soft landing).

Moreover, the Conference Board’s Index of Leading Economic Indicators – a composite of economic information from areas like housing, building permits and durable goods orders – has historically proven to be a strong predictor of recessions, particularly when the index moves into negative territory. In August 2022, that index moved into negative territory, flashing a warning light that the U.S. economy might be heading into recession in the next few months.

As a result of the foregoing, our current expectation is that the United States will enter – or perhaps has already entered – a recession. As of the writing of this letter, the Fed has continued to tighten financial conditions via its interest rate increases and the roll-off of debt from its balance sheet. Further, the broader money supply growth is decelerating and appears to be heading into its first outright contraction since 1938, which is likely to slow economic activity all on its own.

International Markets Also Struggle

Concerns about interest rates, inflation and the Russian invasion of Ukraine extended beyond the United States. Investors also assessed the spread of COVID-19 in China. Among non-U.S. equities, emerging markets significantly underperformed with the MSCI Emerging Markets Index declining -30.73% during the fiscal 12-month reporting period. Within the index, the Utilities sector was the only sector to generate positive performance, as investors focused on companies that they perceived as having recession resistant fundamentals that provide a relatively high return of cash to shareholders. Consumer Discretionary, Healthcare and Energy were among the worst performing sectors. The selloff also included developed markets with the MSCI EAFE Index declining -22.62%. From a broader perspective, the MSCI ACWI Index declined -19.58%.

What Has Happened

Typically, we tend to see two phases when entering a recession, where companies in phase one experience valuation compression, followed by slower earnings growth in phase two:

Phase One

Higher interest rates lead to compressed valuations of long duration assets. As in the bond market, where interest rate changes impact long-term bonds more than short-term notes, long duration stocks, having more of their cashflows further into the future, are impacted more by rising rates. The best example of this would be small-cap growth stocks, which are generally perceived as long duration assets. However, we believe that long duration, small-cap growth stock valuations may have reached a floor, at least on a relative basis, as of this writing.

Phase Two

Corporate earnings tend to decline during recessions, although consensus expectations for the S&P 500 Index show earnings growth in 2023, as of this writing. That means that there may be a period of downward earnings revisions as we move into the new year. While the Treasury bond market appears to have priced in a recession, it remains to be seen whether equities will agree.

Not All Stocks Are Equal

In 2020, at the height of the pandemic, value stocks saw earnings decline while growth stocks as a group held up better, and small-cap growth stocks actually posted earnings increases. This is because small growth fundamentals, in general, tend to hold up better in a recession. Fortunately, over the last three recessions, growth stock earnings have declined less than half as much as value stock earnings. There are, in our view, three reasons for this trend:

| ● | Growth stocks tend to have better balance sheets and less leverage, resulting in lower interest expenses. Having less interest expense means that a negative change to the topline (i.e., sales) may be less magnified on the bottom line. So, better balance sheets and lower interest expense help companies when revenues are not growing. |

| ● | Growth stocks tend to have higher operating leverage, where higher margins generally help a company’s fundamental resiliency (i.e., companies with low variable costs tend to experience margin stability during periods of economic stress). |

| ● | Growth stock fundamentals tend to be driven by market share gains, whereas value stock fundamentals tend to be more closely tied to the performance of the overall economy. For example, if a company is gaining market share, even in a stagnant or contracting market, it can post earnings-per-share (EPS). We have observed this in many sectors of the economy. Historically, innovative companies have shown growth during recessions. We saw it with personal computers in the early 1990s and smartphones and online advertising during the global financial crisis of 2008-2009, and with the continued steady growth of software during the COVID-19 crash of 2020. |

During 2022, long duration stocks have dramatically underperformed the broader stock market, while companies with higher dividends and share repurchases have held up better. Unfortunately, this explains why some of the Alger strategies, which are comprised of higher growth, longer duration companies, have underperformed in 2022. Moreover, strategies tied to smaller growth companies with longer durations have seen relative valuation multiples drop to their lowest levels in nearly a quarter century. While it is certainly frustrating for shareholders to see performance fall to such levels, we believe that this may create a favorable opportunity going forward. The last time that small-cap growth traded this cheaply was in 2001, and these stocks went on to outperform the S&P 500 Index by more than 20% over the following two years.

Going Forward

We continue to believe that unprecedented levels of innovation, such as healthcare advancements in genetic science, and digital technologies including artificial intelligence, e-commerce, streaming entertainment, and cloud computing are providing opportunities for leading companies to reward investors by generating long-term earnings growth. We will continue to focus on conducting in-depth fundamental research as we seek leaders of innovation rather than taking short-term bets on the fickle nature of investor sentiment. We believe doing so is the best strategy for helping our valued shareholders reach their investment goals.

Portfolio Matters

Alger Capital Appreciation Fund

The Alger Capital Appreciation Fund returned -34.88% for the fiscal year ended October 31, 2022, compared to the -24.60% return of the Russell 1000 Growth Index. During the reporting period, the largest sector weightings were Information Technology and Consumer Discretionary. The largest sector overweight was Healthcare and the largest underweight was Consumer Staples.

Contributors to Performance

The Communication Services and Real Estate sectors provided the largest contributions to relative performance. Regarding individual positions, UnitedHealth Group Incorporated; Vertex Pharmaceuticals Incorporated; McKesson Corporation; Humana Inc.; and Eli Lilly and Company were among the top contributors to absolute performance.

UnitedHealth is an integrated healthcare benefits company. Alger believes UnitedHealth Group’s vertical integration of insurance benefits, primary care services, pharmacy services, and data analytics along with its size and scale make it unique in the healthcare services universe in effectively addressing rising healthcare costs for its customers. Shares contributed to performance during the period, as the company announced strong operating results driven by a better-than-expected medical loss ratio (MLR). Management also noted that utilization is returning in pockets, citing senior preventative care as a standout while pediatric and ER visits remain below trend, implying a favorable Medicaid MLR.

Detractors from Performance

The Information Technology and Consumer Discretionary sectors were the were the most significant detractors from relative performance. Regarding individual positions, Microsoft Corporation; Amazon.com, Inc.; Alphabet Inc.; Tesla Inc.; and Advanced Micro Devices, Inc. were among the top detractors from absolute performance.

We believe that Microsoft is a Positive Dynamic Change beneficiary of corporate America’s transformative digitization. Microsoft’s enterprise cloud product, Azure, is rapidly growing and accruing market share. This high unit volume growth is a primary driver of the company’s higher share price, but Microsoft’s operating execution has enabled notable margin expansion. Additionally, investors appreciate Microsoft’s strong free cash flow generation and its return of cash to shareholders in the form of dividends and share repurchases. Microsoft’s shares detracted from performance during the period because the company slightly missed analysts’ estimates. However, Microsoft has shown that despite consumer, advertising, and small and medium sized business weakness, the company’s main business, the digitization of corporate America, continues to grow. We believe the secular forces of cloud adoption (Azure and Office 365) remain resilient, and the company’s commercial bookings growth attests to the continued demand for digital transformation.

Alger 35 Fund

The Alger 35 Fund generated a -39.09% return during the fiscal year ended October 31, 2022, compared to the -14.61% return of the S&P 500 Index. During the reporting period, the largest sector weightings were Information Technology and Healthcare. The largest sector overweight was Information Technology and the largest underweight was Financials.

Contributors to Performance

The Industrials and Materials sectors provided the largest contributions to relative performance. Regarding individual positions, Toast, Inc.; McKesson Corporation; HEICO Corporation; 908 Devices Inc.; and Palo Alto Networks, Inc. were among the top contributors to absolute performance.

HEICO is the leading non-original equipment manufacturer supplier of aircraft replacement parts and electronics for high-tech niche applications. HEICO is a high-quality growth company with a resilient business model and the ability to differentiate its products through superior design aimed to meet the most stringent customer requirements. HEICO combines this focus on organic product development with a robust acquisition program, which has resulted in a successful long-term track record of value creation. Shares contributed to performance as the company reported strong operating results during the period, driven by the recovery in commercial aerospace aftermarket business, as air travel continued to rebound from pandemic led declines. The company is also executing well and delivering strong operating margins, offsetting the inflationary pressures on cost.

Detractors from Performance

The Information Technology and Healthcare sectors were the most significant detractors from relative performance. Regarding individual positions, Shopify, Inc.; Amazon.com, Inc.; Block, Inc.; Advanced Micro Devices, Inc.; and Upstart Holdings, Inc. were among the top detractors from absolute performance.

Shopify provides a full-service, cloud-based software platform for small- and medium-sized businesses to establish and conduct e-commerce operations. Shopify’s solutions enable merchants to run their businesses across a multitude of channels by facilitating merchants’ ability to manage products and inventory, process orders and payments, build customer relationships, automate marketing campaigns and leverage analytics and reporting. Shopify is an innovation-led company that is generating high unit volume growth as it benefits from the positive dynamic change of consumer adoption of e-commerce. The company also generates attractive free cash flow. Shopify’s share price declined during the reporting period after the company announced it would reinvest gross profits into research and development, hire more engineers and salespeople, and introduce new marketing programs in order to expedite its growth. The level of investment was more than many investors had contemplated, which hurt the performance of Shopify shares.

Alger Growth & Income Fund

The Alger Growth & Income Fund returned -11.53% for the fiscal year ended October 31, 2022, compared to the -14.61% return of the S&P 500 Index. During the reporting period, the largest sector weightings were Information Technology and Healthcare. The largest sector overweight was Financials and the largest underweight was Consumer Discretionary.

Contributors to Performance

The Consumer Discretionary and Information Technology sectors provided the largest contributions to relative performance. Regarding individual positions, Chevron Corporation; UnitedHealth Group Incorporated; Exxon Mobil Corporation; AbbVie, Inc.; and Eli Lilly and Company were among the top contributors to absolute performance. Shares of UnitedHealth Group Incorporated contributed to performance in response to developments identified in the Alger Capital Appreciation Fund discussion.

Detractors from Performance

The Financials and Real Estate sectors were the most significant detractors from relative performance. Regarding individual positions, Microsoft Corporation; Alphabet Inc.; Meta Platforms Inc.; and Amazon.com, Inc. were among the top detractors from absolute performance. Shares of Microsoft detracted from performance in response to developments identified in the Alger Capital Appreciation Fund discussion.

Alger Mid Cap Growth Fund

The Alger Mid Cap Growth Fund returned -39.13% for the fiscal year ended October 31, 2022, compared to the -28.94% return of the Russell Midcap Growth Index. Effective August 1, 2022, Brandon Geisler became a portfolio manager of the Fund. Brandon is a Senior Vice President with over 21 years of investment experience. Before joining Alger, Brandon was a Partner, Managing Director of Research, Portfolio Manager and Senior Securities Analyst for Marsico Capital Management, where he managed several billion dollars in large and mid cap U.S., global and focused growth portfolios for mutual fund, institutional and high net worth clients. During the reporting period, the largest sector weightings were Information Technology and Healthcare. The largest sector overweight was Energy and the largest underweight was Information Technology.

Contributors to Performance

The Consumer Discretionary and Information Technology sectors provided the largest contributions to relative performance. Regarding individual positions, Diamondback Energy, Inc.; AutoZone, Inc.; McKesson Corporation; BJ’s Wholesale Club Holdings, Inc.; and HEICO Corporation were among the top contributors to absolute performance. Shares of HEICO contributed to performance in response to developments identified in the Alger 35 Fund discussion.

Detractors from Performance

The Financials and Healthcare sectors were the most significant detractors from relative performance. Regarding individual positions, Upstart Holdings, Inc.; Generac Holdings Inc.; MongoDB, Inc.; SVB Financial Group; and Natera, Inc. were among the top detractors from absolute performance.

Natera is a specialty lab providing genetic testing services in reproductive health, oncology and transplant. Non-invasive prenatal testing (NIPT), part of the company’s reproductive health franchise, has generated the majority of revenue historically; however, we believe Natera’s oncology business has potential to contribute toward a larger share of revenue as customers increasingly adopt these tests following positive insurance reimbursement decisions and favorable clinical trial results. Natera shares detracted from performance after the publication of what we believe was a largely unfounded short report by Hindenburg Research. The company also lost a false advertisement lawsuit brought by CareDx, and high-growth, high-valuation companies were out of favor with investors during the fiscal reporting period. We believe many of the allegations in the short report regarding sales and the company’s relationship with a third-party billing vendor are irrelevant to Natera’s outlook and its oncology franchise, which we view as the company’s key growth engine.

Alger Mid Cap Focus Fund

The Alger Mid Cap Focus Fund generated a -42.27% return for the fiscal year ended October 31, 2022, compared to the -28.94% return of the Russell Midcap Growth Index. During the reporting period, the largest sector weightings were Information Technology and Healthcare. The largest sector overweight was Healthcare and the largest underweight was Financials.

Contributors to Performance

The Communication Services and Utilities sectors provided the largest contributions to relative performance. Regarding individual positions, Constellation Energy Corporation; Enphase Energy, Inc.; Natera, Inc.; Vocera Communications, Inc.; and Vertex Pharmaceuticals Incorporated were among the top contributors to absolute performance.

Vertex is a biotech company that has revolutionized the treatment of cystic fibrosis (CF). It introduced the first drugs that treat the underlying disease (vs. the symptoms) which has not only led to the company providing treatment to many CF patients, but also has created a strong foothold in the space. Vertex’s shares drove contributed to performance as a competing developmental product for CF seems to be less imminent – according to Vertex management – and perhaps less effective than previously thought. Further, management announced pipeline progress in early-stage developments related to kidney, diabetes, and opioid pain management, creating opportunity for additional growth and diversified end markets.

Detractors from Performance

The Information Technology and Industrials sectors were the most significant detractors from relative performance. Regarding individual positions, Herc Holdings, Inc.; Avantor, Inc.; Generac Holdings Inc.; Signature Bank; and Confluent Inc. were among the top detractors from absolute performance.

Confluent is pioneering a new category of data infrastructure focused on data in motion (being transferred among locations) for software developers and enterprises. Confluent was founded by the original creators of event streaming company Apache Kafka and it is a large contributor to the open-source community and a leading commercial vendor behind Kafka. Confluent is designed to be the connective tissue by having real-time data from multiple sources constantly streamed across the enterprise for real-time analysis and data processing, powering smarter, faster and more modern digital applications. The company’s cloud service is the only cloud-native Apache Kafka solution, a fully managed service that is serverless, infinitely scalable, elastic and secure. The stock detracted from performance during the period because its revenue growth slowed. Cloud revenue recognition is consumption-based and Confluent stated that its fourth quarter 2021 was impacted by the holidays and workloads being shut off.

Alger Weatherbie Enduring Growth Fund

The Alger Weatherbie Enduring Growth Fund returned -26.50% from its December 17, 2021, inception date to October 31, 2022, compared to the -23.65% return of the Russell Midcap Growth Index. During the reporting period, the largest sector weightings were Industrials and Information Technology. The largest sector overweight was Industrials and the largest underweight was Information Technology. The Fund had no exposure to the Consumer Staples, Materials or Utilities sectors.

Contributors to Performance

The Information Technology and Industrials sectors provided the largest contributions to relative performance. Regarding individual positions, Paylocity Holding Corp.; Vertex, Inc.; Insulet Corporation; Ollie’s Bargain Outlet Holdings Inc.; and Waste Connections, Inc. were among the top contributors to absolute performance.

Paylocity is a leading software-as-a-service company that provides cloud-based payroll and human capital management in underserved small- to mid-size markets. Most new sales activity covers employers with 50 to 500 employees. Shares contributed to performance during the period as the company reported strong fiscal fourth-quarter earnings, which were generated by improving product demand. Sales momentum was also strong with a 28% year-over-year increase during the period, exceeding consensus expectations. In another positive development, the time required to establish initial meetings, receive decisions from potential clients and complete implementations have all returned to normal following previous challenges resulting from the COVID-19 pandemic.

Detractors from Performance

The Financials and Energy sectors were the most significant detractors from relative performance. Regarding individual positions, Signature Bank; Upstart Holdings, Inc.; FirstService Corp; HubSpot, Inc.; and Nevro Corp. were the top detractors from absolute performance.

FirstService is a leading provider of property management services to owners and homeowners associations of community and high-rise properties, as well as the provider of branded services such as California Closets and CertaPro Painters for residential homeowners. Services also include home restoration after fires, flooding or other events. FirstService continues to extend its significant scale advantage as it provides higher quality and greater breadth of services than its competition, while using its free cash and strong balance sheet to continue to make what we believe are attractive value-enhancing acquisitions. FirstService’s share price declined during the early 2022 market turmoil due in part to inflation concerns. While the company’s fourth quarter results met analyst expectations, wage inflation was a notable headwind during the period. However, management reported improved employee retention and more favorable conditions for filling open positions. FirstService’s residential business has continued to grow faster than the overall market, and the company’s branded services continue to experience strong demand in home improvement and other areas, which we believe should help offset a tougher near-term year-over-year comparison in restoration services.

Alger Weatherbie Specialized Growth Fund

The Alger Weatherbie Specialized Growth Fund generated a -42.03% return during the fiscal year ended October 31, 2022, compared to the -27.38% return of the Russell 2500 Growth Index. During the reporting period, the largest sector weightings were Information Technology and Industrials. The largest sector overweight was Financials and the largest underweight was Information Technology. The Fund had no exposure to Consumer Staples or Utilities sectors.

Contributors to Performance

The Information Technology and Communication Services sectors provided the largest contributions to relative performance. Regarding individual positions, Impinj, Inc.; Glaukos Corp; Wingstop, Inc.; Aerie Pharmaceuticals, Inc.; and Apria, Inc. were among the top contributors to absolute performance.

Impinj engages in the development and sale of RAIN, a radio frequency identification solution. Its platform allows inventory management, patient safety, asset tracking and item authentication for the retail, healthcare, supply chain and logistics, hospitality, food and beverage, and industrial manufacturing industries. Shares contributed to performance during the period as the company reported better-than-expected operating results. Further, company revenues are now beginning to pull through to profitability.

Detractors from Performance

The Financials and Industrials sectors were the most significant detractors from relative performance. Regarding individual positions, SiteOne Landscape Supply, Inc.; Latham Group Inc.; Chegg, Inc.; Natera, Inc.; and Progyny, Inc. were among the top detractors from absolute performance. Shares of Natera detracted from performance in response to developments identified in the Alger Mid Cap Growth Fund discussion.

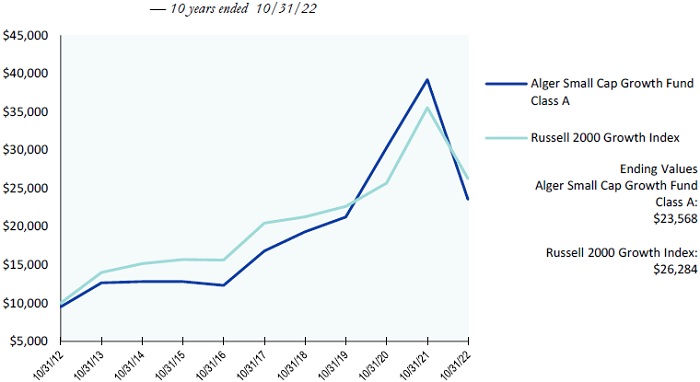

Alger Small Cap Growth Fund

The Alger Small Cap Growth Fund returned -39.87% for the fiscal year ended October 31, 2022, compared to the -26.02% return of the Russell 2000 Growth Index. During the reporting period, the largest sector weightings were Healthcare and Information Technology. The largest sector overweight was Healthcare and the largest underweight was Industrials.

Contributors to Performance

The Real Estate and Financials sectors provided the largest contributions to relative performance. Regarding individual positions, Vocera Communications, Inc.; BJ’s Wholesale Club Holdings, Inc.; Magnolia Oil & Gas Corp.; HealthEquity Inc.; and HEICO Corporation were among the top contributors to absolute performance.

BJ’s Wholesale Club operates membership club stores primarily located on the east coast, with a particular concentration in the Northeast. Of BJ’s merchandise sales, about 71% is “grocery” and 14% is “general-merchandise.” The company has a much higher grocery mix than Costco. Moreover, BJ’s sells a significant amount of gas, which is roughly 15% of total sales. Gas sales are boosted by BJ’s 10- to 20-cent discount per gallon compared to the average gas station, which helps drive traffic when gas prices rise to high levels. The club store model does particularly well in times of high inflation as consumers visit the club to seek value, because BJ’s products are priced approximately 25% below traditional grocery stores. Further, with a large grocery mix, BJ’s is well positioned to pass on higher product costs to the consumer. The stock outperformed during the period as investors shifted to defensive stocks, and club-store models like BJ’s were favored. Nearly half of BJ’s operating profit comes from recurring membership income, which could be viewed as a more stable cash flow stream versus other business models. Additionally, BJ’s posted strong second quarter results, where positive key performance indicators around membership growth and retention exceeded consensus expectations. Management execution continues to improve as the company remains less exposed to inventory, supply chain, and labor issues than other retailers and grocers. Over the past few years, BJ’s has significantly improved its operations and execution, as investors expect to see the company holding on to its pandemic gains. Despite its better execution and ability to raise prices to mitigate rising cost pressures, BJ’s trades at a significant discount to Costco while generating similar revenue and earnings growth.

Detractors from Performance

The Healthcare and Information Technology sectors were the most significant detractors from relative performance. Regarding individual positions, Neogen Corporation; Joint Corp; HubSpot, Inc.; NanoString Technologies, Inc.; and Bio-Techne Corporation were among the top detractors from absolute performance.

Neogen develops, manufactures and markets a diverse line of products for food and animal safety. Food safety products include diagnostic test kits and complementary products sold to food producers and processors to detect dangerous and/or unintended substances in human food and animal feed. Animal safety products include pharmaceuticals, rodenticides, disinfectants, vaccines, veterinary instruments, topicals, diagnostic products and genomic testing that are used worldwide. Neogen’s detraction from performance was primarily attributable to concerns over the integration of the 3M Food Safety business, the largest M&A deal the company has ever completed.

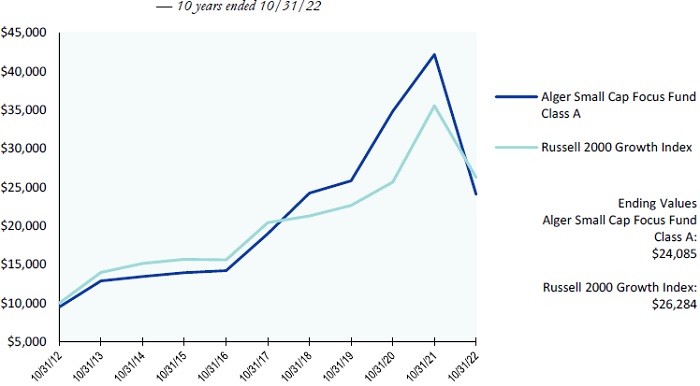

Alger Small Cap Focus Fund

The Alger Small Cap Focus Fund returned -42.88% during the fiscal year ended October 31, 2022, compared to the -26.02% return of the Russell 2000 Growth Index. During the reporting period, the largest sector weightings were Healthcare and Information Technology. The largest sector overweight was Healthcare and the largest underweight was Consumer Discretionary. The Fund had no exposure to Materials, Real Estate or Utilities.

Contributors to Performance

The Consumer Discretionary and Real Estate sectors provided the largest contributions to relative performance. Regarding individual positions, RBC Bearings Incorporated; Shockwave Medical, Inc.; HealthEquity Inc; Evolent Health Inc.; and Viper Energy Partners LP were among the top contributors to absolute performance.

RBC Bearings is a leading manufacturer of highly engineered precision bearings that are integral to the production and operation of most machines, aircraft and mechanical systems. These products reduce wear and tear for moving parts, facilitate proper power transmission, reduce damage and energy loss caused by friction, and control pressure and flow. RBC focuses on highly technical, regulated and engineered bearings products for specialized markets that require sophisticated design, testing and manufacturing capabilities. In November 2021, RBC completed the acquisition of ABB’s Dodge mechanical power transmission business. It is the largest acquisition in RBC’s history, and we believe it is highly transformative. The transaction has created a leading manufacturer with strong brand recognition for mission-critical, premium performance bearings and motion control products for original equipment manufacturers (OEMs) and the industrial aftermarket. The combined company has a more diversified end market, including additional industries such as food and beverage, warehousing, general machinery and the construction and mining aftermarket. The combined company also has greater aftermarket exposure, which tends to generate recurring revenues. Shares contributed to performance as the company benefitted from a recovery in its commercial aerospace OEM business as aircraft production at Boeing and Airbus is increasing, and demand for products remains strong. The company is also able to offset inflationary pressures on cost and has demonstrated solid operating leverage despite a challenging environment.

Detractors from Performance

The Healthcare and Information Technology sectors were the most significant detractors from relative performance. Regarding individual positions, Heska Corporation; CryoPort, Inc.; Herc Holdings, Inc.; Everbridge, Inc.; and Guidewire Software, Inc. were among the top detractors from absolute performance.

Heska Corporation sells diagnostic tools and specialty products to the animal health market. Specifically, Heska sells blood testing and supplies, digital imaging products, software and single-use products primarily for cats and dogs. The company also offers private label vaccines and pharmaceutical production primarily for cattle and other small mammals. Shares of Heska detracted from performance largely due to an industry-wide slowdown in the animal health market. The company reported lower than expected earnings results due to weakness in vet visitation trends. Consequently, management lowered forward expectations given the difficult macroeconomic outlook.

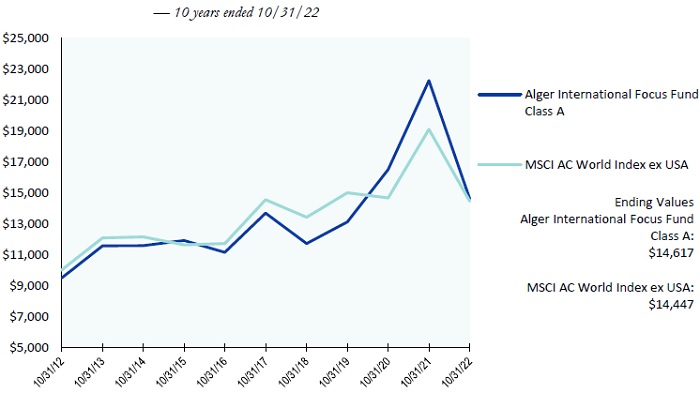

Alger International Focus Fund

The Alger International Focus Fund recorded a -34.27% return for the fiscal year ended October 31, 2022, compared to the -24.35% return of the MSCI ACWI ex USA Index. During the reporting period, the largest sector weightings were Consumer Discretionary and Industrials. The largest sector overweight was Consumer Discretionary and the largest underweight was Financials.

Contributors to Performance

The Energy and Communication Services sectors provided the largest contributions to relative performance. From a country perspective, Brazil, Germany, and Japan were among the top contributors to relative performance. The Fund’s lack of exposure to Russia and Poland also contributed to relative performance. Regarding individual positions, Schlumberger NV; Arezzo Industria e Comercio S.A.; VERBIO Vereinigte BioEnergie AG; Alfen NV; and Keyence Corporation were among the top contributors to absolute performance.

VERBIO Vereinigte BioEnergie is a leading producer of the complete range of biofuels (biodiesel, bioethanol and biomethane) and by-products at the industrial scale. The company benefits from environmental protection tailwinds and an increasing effort to curb greenhouse gas emissions globally. VERBIO saw an increase in revenues during the period, primarily driven by higher sales prices of both biodiesel and bioethanol. Moreover, the Russia-Ukraine conflict continues to highlight Europe’s increasing need for energy independence. With biomethane serving as a direct substitute for natural gas, there is heightened investor focus on VERBIO’s ability to scale and serve as a potential solution to the ongoing energy crisis.

Detractors from Performance

The Healthcare and Industrials sectors detracted from relative performance, while Switzerland, Norway, Australia and Singapore were among countries that detracted from relative performance. Regarding individual positions, Aker Carbon Capture ASA; PolyPeptide Group AG; Eurofins Scientific Societe Europeenne; ASML Holding NV; and PUMA SE were among the top detractors from absolute performance.

PolyPeptide is a contract development and manufacturing organization focusing on proprietary and generic good manufacturing practice grade peptides used by pharmaceutical and biotech companies in approved pharmaceutical products, drugs in clinical development as well as in generic products. Shares detracted from performance during the period as the company experienced rising cost inflation that could not be passed on in the short-term, leading to meaningful margin compression. However, the company clarified its price cost model and provided greater visibility of purchase orders heading into the end of 2022. Consequently, PolyPeptide’s management stated that they expect the full benefit of its current pricing and contractual changes to come through in 2023.

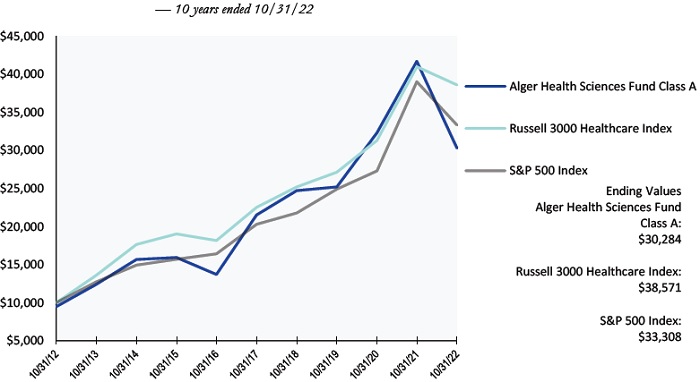

Alger Health Sciences Fund

The Alger Health Sciences Fund returned -27.31% for the fiscal year ended October 31, 2022, compared to the -14.61% return of the S&P 500 Index and the -5.82% return of the Russell 3000 Healthcare Index.

Contributors to Performance

Regarding individual positions, McKesson Corporation; Prometheus Biosciences, Inc.; Acadia Healthcare Company, Inc.; Vertex Pharmaceuticals Incorporated; and AbbVie, Inc. were among the top contributors to absolute performance. Shares of Vertex Pharmaceuticals contributed to performance in response to developments identified in the Alger Mid Cap Focus Fund discussion.

Detractors from Performance

Regarding individual positions, InMode Ltd.; Edwards Lifesciences Corporation; Catalent Inc.; Azenta, Inc.; and Inspire Medical Systems, Inc. were among the top detractors from absolute performance.

InMode designs, develops, manufactures and commercializes innovative minimally invasive and non-invasive aesthetic medical products. InMode’s platforms harness novel radio frequency (RF) technology for emerging minimally invasive procedures that bridge the gap between temporary treatments like facials and more invasive surgical procedures like facelifts across several specialty categories such as plastic surgery, gynecology, dermatology, ophthalmology and otolaryngology (ear, nose and throat care). The aesthetics market experienced strong tailwinds coming out of the COVID-19 pandemic. These tailwinds include the “Zoom effect,” or dissatisfaction with one’s personal appearance after viewing one’s own face on Zoom, which resulted in more people deciding to undergo aesthetic procedures. De-stigmatization of aesthetics procedures, aided by social media platforms, has also supported InMode’s results. However, the stock price declined during the period, in part due to a rotation out of long duration names. Some investors also feared a wallet share shift away from aesthetics and have concerns about InMode’s exposure to international markets due to Russia’s invasion of Ukraine; however, our research suggests the company’s revenue exposure to Europe is minimal.

I thank you for putting your trust in Alger.

Sincerely,

Daniel C. Chung, CFA

Chief Executive Officer

Fred Alger Management, LLC

Investors cannot invest directly in an index. Index performance does not reflect the deduction for fees, expenses, or taxes.

This report and the financial statements contained herein are submitted for the general information of shareholders of the funds. This report is not authorized for distribution to prospective investors in a fund unless preceded or accompanied by an effective prospectus for the fund. Performance of funds discussed above other than the Alger 35 Fund and the Alger Mid Cap Focus Fund represents the return of Class A shares prior to the deduction of any sales charges and includes the reinvestment of any dividends or distributions. Performance for the Alger 35 Fund represents Class Z shares. Performance for the Alger Mid Cap Focus Fund represents Class I shares.

The performance data quoted represents past performance, which is not an indication or guarantee of future results.

Standardized performance results can be found on the following pages. The investment return and principal value of an investment in a fund will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. Current performance may be lower or higher than the performance quoted. For performance data current to the most recent month-end, visit us at www.alger.com or call us at (800) 992-3863.

The views and opinions of the funds’ management in this report are as of the date of the Shareholders’ Letter and are subject to change at any time subsequent to this date. There is no guarantee that any of the assumptions that formed the basis for the opinions stated herein are accurate or that they will materialize. Moreover, the information forming the basis for such assumptions is from sources believed to be reliable; however, there is no guarantee that such information is accurate. Any securities mentioned, whether owned in a fund or otherwise, are considered in the context of the construction of an overall portfolio of securities and therefore reference to them should not be construed as a recommendation or offer to purchase or sell any such security. Inclusion of such securities in a fund and transactions in such securities, if any, may be for a variety of reasons, including, without limitation, in response to cash flows, inclusion in a benchmark, and risk control. The reference to a specific security should also be understood in such context and not viewed as a statement that the security is a significant holding in a fund. Please refer to the Schedules of Investments for each fund which is included in this report for a complete list of fund holdings as of October 31, 2022. Securities mentioned in the Shareholders’ Letter, if not found in the Schedules of Investments, may have been held by the funds during the fiscal 12-month period ended October 31, 2022.

Risk Disclosures

Alger Capital Appreciation Fund

Investing in the stock market involves risks, including the potential loss of principal. Growth stocks may be more volatile than other stocks as their prices tend to be higher in relation to their companies’ earnings and may be more sensitive to market, political, and economic developments. Local, regional or global events such as environmental or natural disasters, war, terrorism, pandemics, outbreaks of infectious diseases and similar public health threats, recessions, or other events could have a significant impact on investments. A significant portion of assets may be invested in securities of companies in related sectors, and may be similarly affected by economic, political, or market events and conditions and may be more vulnerable to unfavorable sector developments. Foreign securities involve special risks including currency fluctuations, inefficient trading, political and economic instability, and increased volatility.

Alger 35 Fund

Investing in the stock market involves risks, including the potential loss of principal. Growth stocks may be more volatile than other stocks as their prices tend to be higher in relation to their companies’ earnings and may be more sensitive to market, political, and economic developments. Local, regional or global events such as environmental or natural disasters, war, terrorism, pandemics, outbreaks of infectious diseases and similar public health threats, recessions, or other events could have a significant impact on investments. A significant portion of assets may be invested in securities of companies in related sectors, and may be similarly affected by economic, political, or market events and conditions and may be more vulnerable to unfavorable sector developments. Investing in companies of small and medium capitalizations involves the risk that such issuers may have limited product lines or financial resources, lack management depth, or have limited liquidity. Foreign securities involve special risks including currency fluctuations, inefficient trading, political and economic instability, and increased volatility. The Fund is classified as a “non-diversified fund” under federal securities laws because it can invest in fewer individual companies than a diversified fund. Assets may be focused in a small number of holdings, making them susceptible to risks associated with a single economic, political or regulatory event than a more diversified portfolio. Active trading may increase transaction costs, brokerage commissions, and taxes, which can lower the return on investment.

Alger Growth & Income Fund

Investing in the stock market involves risks, including the potential loss of principal. Growth stocks may be more volatile than other stocks as their prices tend to be higher in relation to their companies’ earnings and may be more sensitive to market, political, and economic developments. Local, regional or global events such as environmental or natural disasters, war, terrorism, pandemics, outbreaks of infectious diseases and similar public health threats, recessions, or other events could have a significant impact on investments. A significant portion of assets may be invested in securities of companies in related sectors, and may be similarly affected by economic, political, or market events and conditions and may be more vulnerable to unfavorable sector developments. Income-producing securities may cut or fail to declare dividends due to market downturns or for other reasons. At times, the Fund may hold a large cash position, which may underperform relative to equity securities.

Alger Mid Cap Growth Fund

Investing in the stock market involves risks, including the potential loss of principal. Growth stocks may be more volatile than other stocks as their prices tend to be higher in relation to their companies’ earnings and may be more sensitive to market, political, and economic developments. Local, regional or global events such as environmental or natural disasters, war, terrorism, pandemics, outbreaks of infectious diseases and similar public health threats, recessions, or other events could have a significant impact on investments. A significant portion of assets may be invested in securities of companies in related sectors, and may be similarly affected by economic, political, or market events and conditions and may be more vulnerable to unfavorable sector developments. Investing in companies of medium capitalizations involves the risk that such issuers may have limited product lines or financial resources, lack management depth, or have limited liquidity. Foreign securities involve special risks including currency fluctuations, inefficient trading, political and economic instability, and increased volatility. Active trading may increase transaction costs, brokerage commissions, and taxes, which can lower the return on investment. At times, the Fund may hold a large cash position, which may underperform relative to equity securities.

Alger Mid Cap Focus Fund

Investing in the stock market involves risks, including the potential loss of principal. Growth stocks may be more volatile than other stocks as their prices tend to be higher in relation to their companies’ earnings and may be more sensitive to market, political, and economic developments. Local, regional or global events such as environmental or natural disasters, war, terrorism, pandemics, outbreaks of infectious diseases and similar public health threats, recessions, or other events could have a significant impact on investments. Investing in companies of medium capitalizations involves the risk that such issuers may have limited product lines or financial resources, lack management depth, or have limited liquidity. Assets may be focused in a small number of holdings, making them susceptible to risks associated with a single economic, political or regulatory event than a more diversified portfolio. A significant portion of assets may be invested in securities of companies in related sectors or industries, and may be similarly affected by economic, political, or market events and conditions and may be more vulnerable to unfavorable sector or industry developments. The Fund is classified as a “non-diversified fund” under federal securities laws because it can invest in fewer individual companies than a diversified fund. Foreign securities involve special risks including currency fluctuations, inefficient trading, political and economic instability, and increased volatility. Active trading may increase transaction costs, brokerage commissions, and taxes, which can lower the return on investment. At times, the Fund may hold a large cash position, which may underperform relative to equity securities.

Alger Weatherbie Enduring Growth Fund

Investing in the stock market involves risks, including the potential loss of principal. Growth stocks may be more volatile than other stocks as their prices tend to be higher in relation to their companies’ earnings and may be more sensitive to market, political, and economic developments. Local, regional or global events such as environmental or natural disasters, war, terrorism, pandemics, outbreaks of infectious diseases and similar public health threats, recessions, or other events could have a significant impact on investments. A significant portion of assets may be invested in securities of companies in related sectors, and may be similarly affected by economic, political, or market events and conditions and may be more vulnerable to unfavorable sector developments. Weatherbie Capital, LLC’s use of an environmental, social, and governance (“ESG”) rating agency to implement the investment strategy may result in the selection or exclusion of securities for reasons other than financial performance and the strategy may underperform strategies that do not utilize an ESG rating agency or employ another type of ESG investment strategy. In evaluating a particular issuer’s ESG rating, as well as the account’s weighted average ESG rating, Weatherbie Capital, LLC relies exclusively on the ESG rating agency and, therefore, is dependent upon information and data from the ESG rating agency that may be incomplete or inaccurate, or that may present conflicting information and data with respect to an issuer than other third party ESG data providers utilized throughout the industry. Investing in companies of medium capitalizations involves the risk that such issuers may have limited product lines or financial resources, lack management depth, or have limited liquidity. Assets may be focused in a small number of holdings, making them susceptible to risks associated with a single economic, political or regulatory event than a more diversified portfolio. Investing in new issues involves special risks including lack of trading history, limited information and availability, and volatility. Cash positions may underperform relative to equity and fixed-income securities. Active trading may increase transaction costs, brokerage commissions, and taxes, which can lower the return on investment. The Fund is classified as a “non-diversified fund” under federal securities laws because it can invest in fewer individual companies than a diversified fund.

Alger Weatherbie Specialized Growth Fund

Investing in the stock market involves risks, including the potential loss of principal. Growth stocks may be more volatile than other stocks as their prices tend to be higher in relation to their companies’ earnings and may be more sensitive to market, political, and economic developments. Local, regional or global events such as environmental or natural disasters, war, terrorism, pandemics, outbreaks of infectious diseases and similar public health threats, recessions, or other events could have a significant impact on investments. A significant portion of assets may be invested in securities of companies in related sectors, and may be similarly affected by economic, political, or market events and conditions and may be more vulnerable to unfavorable sector developments. Investing in companies of small and medium capitalizations involves the risk that such issuers may have limited product lines or financial resources, lack management depth, or have limited liquidity. Assets may be focused in a small number of holdings, making them susceptible to risks associated with a single economic, political or regulatory event than a more diversified portfolio. Foreign securities and emerging markets involve special risks including currency fluctuations, inefficient trading, political and economic instability, and increased volatility.

Alger Small Cap Growth Fund

Investing in the stock market involves risks, including the potential loss of principal. Growth stocks may be more volatile than other stocks as their prices tend to be higher in relation to their companies’ earnings and may be more sensitive to market, political, and economic developments. Local, regional or global events such as environmental or natural disasters, war, terrorism, pandemics, outbreaks of infectious diseases and similar public health threats, recessions, or other events could have a significant impact on investments. A significant portion of assets may be invested in securities of companies in related sectors or industries, and may be similarly affected by economic, political, or market events and conditions and may be more vulnerable to unfavorable sector or industry developments. Investing in companies of small capitalizations involves the risk that such issuers may have limited product lines or financial resources, lack management depth, or have limited liquidity. At times, the Fund may hold a large cash position, which may underperform relative to equity securities.

Alger Small Cap Focus Fund

Investing in the stock market involves risks, including the potential loss of principal. Growth stocks may be more volatile than other stocks as their prices tend to be higher in relation to their companies’ earnings and may be more sensitive to market, political, and economic developments. Local, regional or global events such as environmental or natural disasters, war, terrorism, pandemics, outbreaks of infectious diseases and similar public health threats, recessions, or other events could have a significant impact on investments. A significant portion of assets may be invested in securities of companies in related sectors or industries, and may be similarly affected by economic, political, or market events and conditions and may be more vulnerable to unfavorable sector or industry developments. Investing in companies of small capitalizations involves the risk that such issuers may have limited product lines or financial resources, lack management depth, or have limited liquidity. Assets may be focused in a small number of holdings, making them susceptible to risks associated with a single economic, political or regulatory event than a more diversified portfolio. Foreign securities involve special risks including currency fluctuations, inefficient trading, political and economic instability. At times, the Fund may hold a large cash position, which may underperform relative to equity securities.

Alger International Focus Fund

Investing in the stock market involves risks, including the potential loss of principal. Growth stocks may be more volatile than other stocks as their prices tend to be higher in relation to their companies’ earnings and may be more sensitive to market, political, and economic developments. Local, regional or global events such as environmental or natural disasters, war, terrorism, pandemics, outbreaks of infectious diseases and similar public health threats, recessions, or other events could have a significant impact on investments. A significant portion of assets may be invested in securities of companies in related sectors, and may be similarly affected by economic, political, or market events and conditions and may be more vulnerable to unfavorable sector developments. Assets may be focused in a small number of holdings, making them susceptible to risks associated with a single economic, political or regulatory event than a more diversified portfolio. Foreign securities and emerging markets involve special risks including currency fluctuations, inefficient trading, political and economic instability, and increased volatility. Investing in companies of small capitalizations involves the risk that such issuers may have limited product lines or financial resources, lack management depth, or have limited liquidity. Active trading may increase transaction costs, brokerage commissions, and taxes, which can lower the return on investment.

Alger Health Sciences Fund

Investing in the stock market involves risks, including the potential loss of principal. Growth stocks may be more volatile than other stocks as their prices tend to be higher in relation to their companies’ earnings and may be more sensitive to market, political, and economic developments. Local, regional or global events such as environmental or natural disasters, war, terrorism, pandemics, outbreaks of infectious diseases and similar public health threats, recessions, or other events could have a significant impact on investments. A significant portion of assets will be invested in healthcare companies, which may be significantly affected by competition, innovation, regulation, and product obsolescence, and may be more volatile than the securities of other companies. A significant portion of assets may be invested in securities of companies in related industries, and may be similarly affected by economic, political, or market events and conditions and may be more vulnerable to unfavorable industry developments. Investing in companies of small capitalizations involves the risk that such issuers may have limited product lines or financial resources, lack management depth, or have limited liquidity. Private placements are offerings of a company’s securities not registered with the SEC and not offered to the public, for which limited information may be available. Such investments are generally considered to be illiquid. Foreign securities involve special risks including currency fluctuations, inefficient trading, political and economic instability, and increased volatility. Active trading may increase transaction costs, brokerage commissions, and taxes, which can lower the return on investment. At times, the Fund may hold a large cash position, which may underperform relative to equity securities.

For a more detailed discussion of the risks associated with a fund, please see the prospectus.

Before investing, carefully consider a fund’s investment objective, risks, charges, and expenses. For a prospectus and summary prospectus containing this and other information or for The Alger Funds’ most recent month-end performance data, visit www.alger.com, call (800) 992-3863 or consult your financial advisor. Read the prospectus and summary prospectus carefully before investing.

Distributor: Fred Alger & Company, LLC

NOT FDIC INSURED. NOT BANK GUARANTEED. MAY LOSE VALUE.

Definitions:

| ● | Price-to-earnings is the ratio for valuing a company that measures its current share price relative to its earnings per share (EPS). |

| ● | The Russell 3000 Growth Index combines the large-cap Russell 1000 Growth, the small-cap Russell 2000 Growth and the Russell Microcap Growth Index. It includes companies that are considered more growth oriented relative to the overall market as defined by Russell’s leading style methodology. The Russell 3000 Growth Index is constructed to provide a comprehensive, unbiased, and stable barometer of the growth opportunities within the broad market. |

| ● | The Russell Microcap Growth Index measures the performance of the microcap growth segment of the US equity market. It includes Russell Microcap companies with relatively higher price-to-book ratios, higher I/B/E/S forecast medium term (2 year) growth and higher sales per share historical growth (5 years). |

| ● | The Russell 3000 Value Index measures the performance of the broad value segment of the US equity value universe. It includes those Russell 3000 companies with lower price-to-book ratios and lower forecasted growth values. The Russell 3000 Value Index is constructed to provide a comprehensive, unbiased and stable barometer of the broad value market. |

| ● | The MSCI ACWI Index is a free float-adjusted market capitalization weighted index that is designed to measure the equity market performance of developed and emerging markets. The MSCI ACWI captures large and mid cap representation across developed markets and 26 emerging markets countries. |

| ● | The MSCI ACWI ex USA Index captures large- and mid-cap representation across developed markets countries (excluding the US) and emerging markets countries. The index covers approximately 85% of the global equity opportunity set outside the US. |

| ● | The MSCI Emerging Markets Index is a free float-adjusted market capitalization index that is designed to measure equity market performance in the global emerging markets. |

| ● | The MSCI EAFE Index is designed to represent the performance of large and mid-cap securities across developed markets, including countries in Europe, Australasia and the Far East, excluding the U.S. and Canada. |

| ● | The Russell 1000 Growth Index measures the performance of the large-cap growth segment of the U.S. equity universe. It includes those Russell 1000 companies with higher growth earning potential as defined by Russell’s leading style methodology. The Russell 1000 Growth Index is constructed to provide a comprehensive and unbiased barometer for the large-cap growth segment. |

| ● | The S&P 500 Index is an unmanaged index considered representative of large-cap growth stocks. |

| ● | The Russell Midcap Growth Index measures the performance of the mid-cap growth segment of the U.S. equity universe. It includes those Russell Midcap Index companies with higher growth earning potential as defined by Russell’s leading style methodology. The Russell Midcap Growth Index is constructed to provide a comprehensive and unbiased barometer of the mid-cap growth market. |

| ● | The Russell 2500 Growth Index measures the performance of the small to mid-cap growth segment of the U.S. equity universe. It includes those Russell 2500 companies with higher growth earning potential as defined by Russell’s leading style methodology. The Russell 2500 Growth Index is constructed to provide a comprehensive and unbiased barometer of the small to mid-cap growth market. |

| ● | The Russell 2000 Growth Index measures the performance of the small-cap growth segment of the U.S. equity universe. It includes those Russell 2000 companies with higher growth earning potential as defined by Russell’s leading style methodology. The Russell 2000 Growth Index is constructed to provide a comprehensive and unbiased barometer for the small-cap growth segment. |

| ● | The Russell 3000 Healthcare Index is an unmanaged index that measures the performance of those companies in the Russell 3000 Index involved in the medical services or healthcare field. Also included are companies involved in research, development and production of pharmaceuticals and biotechnology. |

ALGER CAPITAL APPRECIATION FUND

Fund Highlights Through October 31, 2022 (Unaudited)

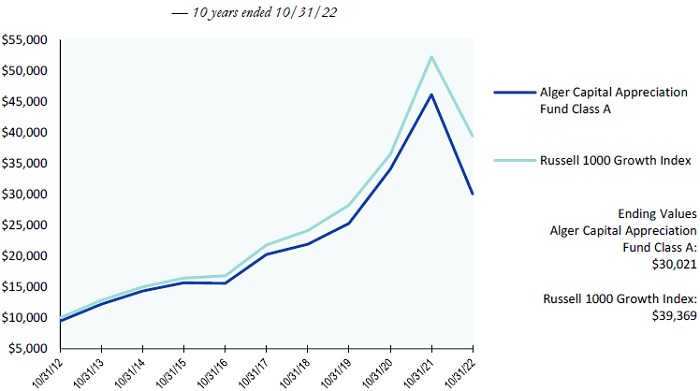

HYPOTHETICAL $10,000 INVESTMENT IN CLASS A SHARES

The chart above illustrates the change in value of a hypothetical $10,000 investment made in the Alger Capital Appreciation Fund Class A shares, with a maximum sales charge of 5.25%, and the Russell 1000 Growth Index (an unmanaged index of common stocks) for the ten years ended October 31, 2022. Figures for the Alger Capital Appreciation Fund Class A shares and the Russell 1000 Growth Index include reinvestment of dividends. Figures for the Alger Capital Appreciation Fund Class A shares also include reinvestment of capital gains. Performance for Alger Capital Appreciation Fund Class C and Class Z shares will vary from the results shown above due to differences in expenses and sales charges those classes bear. Investors cannot invest directly in any index. Index performance does not reflect deduction for fees, expenses, or taxes.

ALGER CAPITAL APPRECIATION FUND

Fund Highlights Through October 31, 2022 (Unaudited) (Continued)

PERFORMANCE COMPARISON AS OF 10/31/22

AVERAGE ANNUAL TOTAL RETURNS

| 1 YEAR | 5 YEARS | 10 YEARS | |

| Class A | (38.30)% | 7.03% | 11.62% |

| Class C | (35.83)% | 7.39% | 11.39% |

| Class Z | (34.67)% | 8.55% | 12.60% |

| Russell 1000 Growth Index | (24.60)% | 12.59% | 14.69% |

The performance data quoted represents past performance, which is not an indication or a guarantee of future results. The Fund’s average annual total returns include changes in share price and reinvestment of dividends and capital gains. Class A returns reflect the maximum initial sales charge and Class C returns reflect the applicable contingent deferred sales charge. The chart and table above do not reflect the deduction of taxes that a shareholder would have paid on Fund distributions or on the redemption of Fund shares. Investment return and principal will fluctuate and the Fund’s shares, when redeemed, may be worth more or less than their original cost. Current performance may be higher or lower than the performance quoted. For updated performance, visit us at www.alger.com or call us at (800) 992-3863.

ALGER 35 FUND

Fund Highlights Through October 31, 2022 (Unaudited)

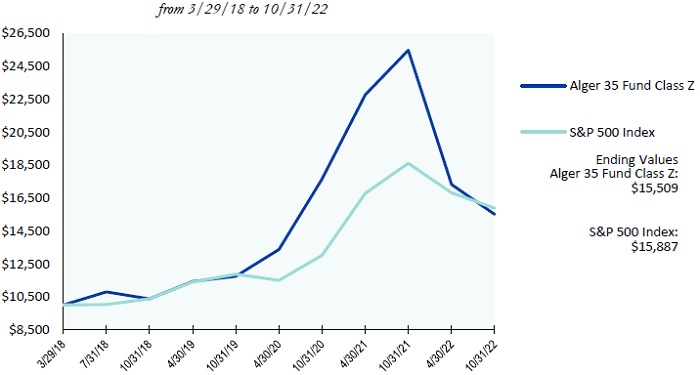

HYPOTHETICAL $10,000 INVESTMENT IN CLASS Z SHARES

The chart above illustrates the change in value of a hypothetical $10,000 investment made in the Alger 35 Fund Class Z shares and the S&P 500 Index (an unmanaged index of common stocks) from March 29, 2018, the inception date of the Alger 35 Fund Class Z shares, through October 31, 2022. Effective May 7, 2021, Class P shares of the Alger 35 Fund were reclassified as Class Z shares. The reclassified Class Z shares have the same annual returns as the Class P shares because the shares are invested in the same portfolio of securities and the reclassified Class Z shares have the same expenses as the Fund’s Class P shares. Historical performance prior to May 7, 2021 is that of the Fund’s Class P shares. Figures for the Alger 35 Fund Class Z shares and the S&P 500 Index include reinvestment of dividends. Figures for the Alger 35 Fund Class Z shares also include reinvestment of capital gains. Investors cannot invest directly in any index. Index performance does not reflect deduction for fees, expenses, or taxes.

ALGER 35 FUND

Fund Highlights Through October 31, 2022 (Unaudited) (Continued)

PERFORMANCE COMPARISON AS OF 10/31/22

AVERAGE ANNUAL TOTAL RETURNS

| Since | |||

| 1 YEAR | 5 YEARS | inception | |

| Class Z (Inception 3/29/18) | (39.09)% | n/a | 10.03% |

| S&P 500 Index | (14.61)% | n/a | 10.61% |

The performance data quoted represents past performance, which is not an indication or a guarantee of future results. The Fund’s average annual total returns include changes in share price and reinvestment of dividends and capital gains. Effective May 7, 2021, Class P shares of the Alger 35 Fund were reclassified as Class Z shares. The reclassified Class Z shares have the same annual returns as the Class P shares because the shares are invested in the same portfolio of securities and the reclassified Class Z shares have the same expenses as the Fund’s Class P shares. Historical performance prior to May 7, 2021 is that of the Fund’s Class P shares. The chart and table above do not reflect the deduction of taxes that a shareholder would have paid on Fund distributions or on the redemption of Fund shares. Investment return and principal will fluctuate and the Fund’s shares, when redeemed, may be worth more or less than their original cost. Current performance may be higher or lower than the performance quoted. For updated performance, visit us at www.alger. com or call us at (800) 992-3863.

ALGER GROWTH & INCOME FUND

Fund Highlights Through October 31, 2022 (Unaudited)

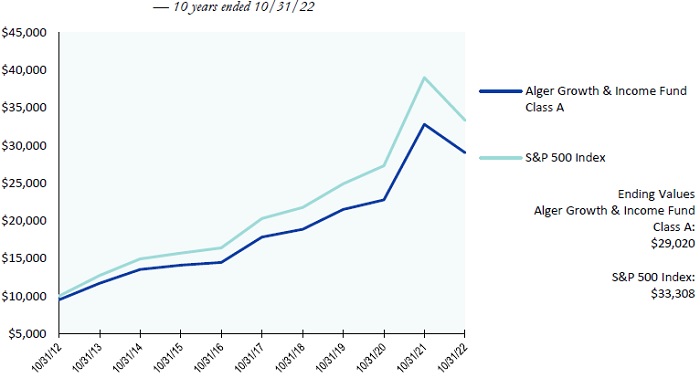

HYPOTHETICAL $10,000 INVESTMENT IN CLASS A SHARES

The chart above illustrates the change in value of a hypothetical $10,000 investment made in the Alger Growth & Income Fund Class A shares, with a maximum sales charge of 5.25%, and the S&P 500 Index (an unmanaged index of common stocks) for the ten years ended October 31, 2022. Figures for the Alger Growth & Income Fund Class A shares and the S&P 500 Index include reinvestment of dividends. Figures for the Alger Growth & Income Fund Class A shares also include reinvestment of capital gains. Performance for the Alger Growth & Income Fund Class C and Class Z shares will vary from the results shown above due to differences in expenses and sales charges those classes bear. Investors cannot invest directly in any index. Index performance does not reflect deduction for fees, expenses, or taxes.

ALGER GROWTH & INCOME FUND

Fund Highlights Through October 31, 2022 (Unaudited) (Continued)

PERFORMANCE COMPARISON AS OF 10/31/22

AVERAGE ANNUAL TOTAL RETURNS

| 1 YEAR | 5 YEARS | 10 YEARS | |

| Class A | (16.17)% | 9.06% | 11.24% |

| Class C | (13.03)% | 9.42% | 11.00% |

| Class Z | (11.25)% | 10.63% | 12.18% |

| S&P 500 Index | (14.61)% | 10.44% | 12.79% |

The performance data quoted represents past performance, which is not an indication or a guarantee of future results. The Fund’s average annual total returns include changes in share price and reinvestment of dividends and capital gains. Class A returns reflect the maximum initial sales charge and Class C returns reflect the applicable contingent deferred sales charge. The chart and table above do not reflect the deduction of taxes that a shareholder would have paid on Fund distributions or on the redemption of Fund shares. Investment return and principal will fluctuate and the Fund’s shares, when redeemed, may be worth more or less than their original cost. Current performance may be higher or lower than the performance quoted. For updated performance, visit us at www.alger.com or call us at (800) 992-3863.

ALGER MID CAP GROWTH FUND*

Fund Highlights Through October 31, 2022 (Unaudited)

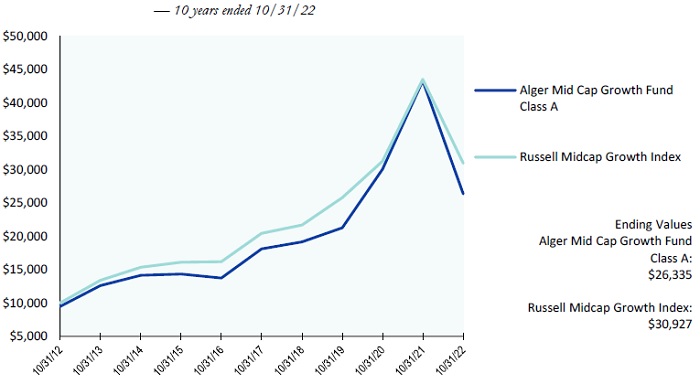

HYPOTHETICAL $10,000 INVESTMENT IN CLASS A SHARES

The chart above illustrates the change in value of a hypothetical $10,000 investment made in the Alger Mid Cap Growth Fund Class A shares, with a maximum sales charge of 5.25%, and the Russell Midcap Growth Index (an unmanaged index of common stocks) for the ten years ended October 31, 2022. Figures for the Alger Mid Cap Growth Fund Class A shares and Russell Midcap Growth Index include reinvestment of dividends. Figures for the Alger Mid Cap Growth Fund Class A shares also include reinvestment of capital gains. Performance for the Alger Mid Cap Growth Fund Class B, Class C and Class Z shares will vary from the results shown above due to differences in expenses and sales charges those classes bear. Investors cannot invest directly in any index. Index performance does not reflect deduction for fees, expenses, or taxes.

ALGER MID CAP GROWTH FUND*

Fund Highlights Through October 31, 2022 (Unaudited) (Continued)

PERFORMANCE COMPARISON AS OF 10/31/22

AVERAGE ANNUAL TOTAL RETURNS

| 1 YEAR | 5 YEARS | 10 YEARS | |

| Class A | (42.33)% | 6.62% | 10.17% |

| Class B | (40.99)% | 7.40% | 10.26% |

| Class C | (39.95)% | 6.93% | 9.87% |

| Russell Midcap Growth Index | (28.94)% | 8.66% | 11.95% |

| 1 YEAR | 5 YEARS | Since inception | |

| Class Z (Inception 5/28/15) | (38.95)% | 8.10% | 7.51% |

| Russell Midcap Growth Index | (28.94)% | 8.66% | 8.54% |

The performance data quoted represents past performance, which is not an indication or a guarantee of future results. The Fund’s average annual total returns include changes in share price and reinvestment of dividends and capital gains. Class A returns reflect the maximum initial sales charge and Class B and C returns reflect the applicable contingent deferred sales charge. The chart and table above do not reflect the deduction of taxes that a shareholder would have paid on Fund distributions or on the redemption of Fund shares. Investment return and principal will fluctuate and the Fund’s shares, when redeemed, may be worth more or less than their original cost. Current performance may be higher or lower than the performance quoted. For updated performance, visit us at www.alger.com or call us at (800) 992-3863.

| * | Pursuant to the U.S. Securities and Exchange Commission’s rules on Fair Fund and Disgorgement Plans, the Alger Mid Cap Growth Fund received a Fair Fund distribution of $9,346,397 on September 10, 2021, which contributed approximately 0.60% and 0.31% to its five and ten year annual returns, respectively. |

ALGER MID CAP FOCUS FUND

Fund Highlights Through October 31, 2022 (Unaudited)

HYPOTHETICAL $10,000 INVESTMENT IN CLASS I SHARES

The chart above illustrates the change in value of a hypothetical $10,000 investment made in the Alger Mid Cap Focus Fund Class I shares and the Russell Midcap Growth Index (an unmanaged index of common stocks) from June 14, 2019, the inception date of the Alger Mid Cap Focus Fund Class I shares, through October 31, 2022. Figures for the Alger Mid Cap Focus Fund Class I shares and the Russell Midcap Growth Index include reinvestment of dividends. Figures for the Alger Mid Cap Focus Fund Class I shares also include reinvestment of capital gains. Performance for the Alger Mid Cap Focus Fund Class A, C, Y and Z shares will vary from the results shown above due to differences in the expenses and sales charges that those classes bear. Investors cannot invest directly in any index. Index performance does not reflect deduction for fees, expenses, or taxes.

ALGER MID CAP FOCUS FUND

Fund Highlights Through October 31, 2022 (Unaudited) (Continued)

PERFORMANCE COMPARISON AS OF 10/31/22

AVERAGE ANNUAL TOTAL RETURNS

| Since | |||

| 1 YEAR | 5 YEARS | inception | |

| Class I (Inception 6/14/19) | (42.28)% | n/a | 9.81% |

| Class Z (Inception 6/14/19) | (42.10)% | n/a | 10.11% |

| Russell Midcap Growth Index | (28.94)% | n/a | 6.50% |

| Since | |||

| 1 YEAR | 5 YEARS | inception | |

| Class Y (Inception 2/26/21) | (42.07)% | n/a | (21.94)% |

| Russell Midcap Growth Index | (28.94)% | n/a | (11.05)% |

| Since | |||

| 1 YEAR | 5 YEARS | inception | |

| Class A (Inception 7/29/21) | (45.31)% | n/a | (31.64)% |

| Class C (Inception 7/29/21) | (43.29)% | n/a | (29.22)% |

| Russell Midcap Growth Index | (28.94)% | n/a | (20.98)% |

The performance data quoted represents past performance, which is not an indication or a guarantee of future results. The Fund’s average annual total returns include changes in share price and reinvestment of dividends and capital gains. Class A returns reflect the maximum initial sales charge and Class C returns reflect the applicable contingent deferred sales charge. The chart and table above do not reflect the deduction of taxes that a shareholder would have paid on Fund distributions or on the redemption of Fund shares. Investment return and principal will fluctuate and the Fund’s shares, when redeemed, may be worth more or less than their original cost. Current performance may be higher or lower than the performance quoted. For updated performance, visit us at www.alger.com or call us at (800) 992-3863.

ALGER WEATHERBIE ENDURING GROWTH FUND

Fund Highlights Through October 31, 2022 (Unaudited)

HYPOTHETICAL $10,000 INVESTMENT IN CLASS A SHARES

The chart above illustrates the change in value of a hypothetical $10,000 investment made in the Alger Weatherbie Enduring Growth Fund Class A shares, with a maximum sales charge of 5.25%, and the Russell Midcap Growth Index (an unmanaged index of common stocks) from December 17, 2021, the inception date of the Alger Weatherbie Enduring Growth Fund, through October 31, 2022. Figures for the Alger Weatherbie Enduring Growth Fund Class A shares and Russell Midcap Growth Index include reinvestment of dividends. Figures for the Alger Weatherbie Enduring Growth Fund Class A shares also include reinvestment of capital gains. Performance for Alger Weatherbie Enduring Growth Fund Class C, Class I, Class Y and Class Z shares will vary from the results shown above due to differences in expenses and sales charges those classes bear. Investors cannot invest directly in any index. Index performance does not reflect deduction for fees, expenses, or taxes.

ALGER WEATHERBIE ENDURING GROWTH FUND

Fund Highlights Through October 31, 2022 (Unaudited) (Continued)

PERFORMANCE COMPARISON AS OF 10/31/22

AVERAGE ANNUAL TOTAL RETURNS

| Since | |||

| 1 YEAR | 5 YEARS | inception | |

| Class A (Inception 12/17/21) | n/a | n/a | (30.33)% |

| Class C (Inception 12/17/21) | n/a | n/a | (27.63)% |

| Class I (Inception 12/17/21) | n/a | n/a | (26.40)% |

| Class Y (Inception 12/17/21) | n/a | n/a | (26.20)% |

| Class Z (Inception 12/17/21) | n/a | n/a | (26.20)% |

| Russell Midcap Growth Index | n/a | n/a | (23.65)% |

The performance data quoted represents past performance, which is not an indication or a guarantee of future results. The Fund’s average annual total returns include changes in share price and reinvestment of dividends and capital gains. The chart and table above do not reflect the deduction of taxes that a shareholder would have paid on Fund distributions or on the redemption of Fund shares. Investment return and principal will fluctuate and the Fund’s shares, when redeemed, may be worth more or less than their original cost. Current performance may be higher or lower than the performance quoted. For updated performance, visit us at www.alger.com or call us at (800) 992-3863.

ALGER WEATHERBIE SPECIALIZED GROWTH FUND

Fund Highlights Through October 31, 2022 (Unaudited)

HYPOTHETICAL $10,000 INVESTMENT IN CLASS A SHARES