|

| |

| |

Investor Fact Sheet NYSE: NJR |

|

| |

| NJR CONTACTS: | |

| JOANNE FAIRECHIO, DIRECTOR, INVESTOR RELATIONS | 732-378-4967 |

| DENNIS PUMA, DIRECTOR, INVESTOR RELATIONS | 732-938-1229 |

| JAMES KENT, TREASURER | 732-938-1093 |

November 13, 2015

NEW JERSEY NATURAL GAS COMPANY 2015 BASE RATE CASE

SUMMARY

Filing Driven By Significant Infrastructure Investments to Ensure Safe and Reliable Service

OVERVIEW

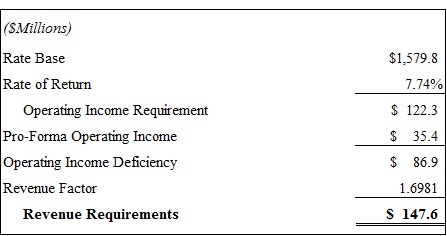

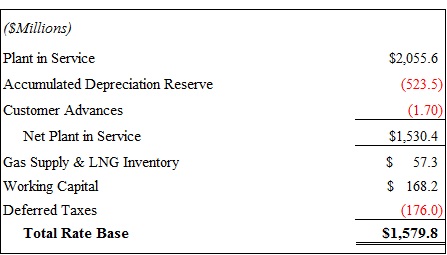

Today, New Jersey Natural Gas Company (NJNG) filed a base rate case with the New Jersey Board of Public Utilities (BPU), its first case since 2008 and only the second filing since 1993. NJNG is seeking a $148 million increase in its delivery rates based on a return on rate base of 7.74 percent and a return on equity of 11 percent. The proposed increase reflects a 53.65 percent common equity component.

THE NEED FOR A BASE RATE CASE

Like all utilities, NJNG’s incremental capital and operating costs associated with its growing rate base investment resulting from continued customer growth, infrastructure programs and general system renewal and reinforcement has resulted in an erosion of its return on capital. Between 2008 and 2015, NJNG invested more than $800 million in its natural gas transmission and distribution system. Since the conclusion of the 2007 case, NJNG and the BPU have collaborated on infrastructure programs which produced jobs while enhancing system safety, such as the Accelerated Infrastructure Programs (AIP) I and II (approved April 2009 and March 2011, respectively) and the Safety Acceleration and Facility Enhancement Program (SAFE) (approved October 2012). As part of the approval for SAFE as well as the New Jersey Reinvestment in Facility Enhancements (NJ RISE) program, NJNG agreed to file a base rate case no later than November 15, 2015.

Recovery for additional capital projects such as the Howell Liquefaction Project, which is in the construction phase and NJNG expects to be operational by April 2016, Southern Reliability Link (SRL), which NJNG plans to place into service by the end of 2016, and deferred costs from Superstorm Sandy were also included in the filing.

Calculating Revenue Requirement

Calculating Rate Base

Overall Cost of Capital and Rate of Return

|

| | | | |

| ($ Millions) | Amount | Percent | Embedded Cost | Weighted Cost |

| Long-term Debt | $ 743.2 | 46.35% | 3.97% | 1.84% |

| Common Equity | 860.4 | 53.65% | 11.00% | 5.90% |

| Total | $1,603.6 | 100.00% | | 7.74% |

THE BASE RATE CASE PROCESS IN NEW JERSEY

Base rate cases in New Jersey are a judicial proceeding, with the burden on the public utility to prove that its request is justified. The test-year period for measuring income at current rates began on July 1, 2015. The test year, after adjustments proposed by NJNG, should reflect as closely as possible the conditions NJNG will face when the rates being established will be in effect. The adjustments to the test period are intended to normalize the actual costs and also reflect known and measureable changes anticipated to occur. This request will be thoroughly reviewed and tested. Only after the review process is concluded, will the BPU make a decision.

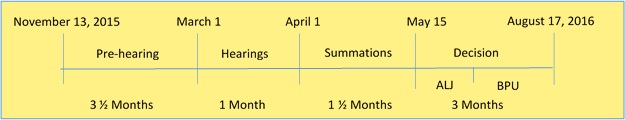

As illustrated in the timeline below, a rate case, by statute, in New Jersey, is a nine-month process from the filing date to completion; however 10-12 months is not unusual. Most cases are settled throughout the state in a “black box” settlement. NJNG has not litigated a base rate case since 1990.

WHAT TO EXPECT

Recent history in New Jersey through base rate cases and other programs suggest the BPU recognizes the importance of strong public utilities, balanced with a realistic view of overall weighted capital costs. The table below shows recent decisions for both NJNG’s programs as well as recent base rate cases for other public utilities in the state.

POST RATE CASE

In addition, NJNG requested extension of its SAFE program to replace 276 miles of remaining unprotected steel main and associated services. If approved, this $200 million capital investment program will be completed over the five years subsequent to the resolution of the rate case and further enhance the safety of NJNG’s system, as well as benefit local and state economies Through SAFE, NJNG has replaced approximately 203 miles of unprotected steel and cast iron main and over 25,000 services to date. NJNG is on track to replace a total of 275 miles of such facilities and will have eliminated 100 percent of its cast iron main by the end of December 2015.

FORWARD LOOKING STATEMENTS

This investor fact sheet contains forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995. NJR cautions readers that the assumptions forming the basis for forward-looking statements include many factors that are beyond NJR’s ability to control or estimate precisely, such as estimates of future market conditions and the behavior of other market participants. Words such as “anticipates,” “estimates,” “expects,” “projects,” “may,” “will,” “intends,” “plans,” “believes,” “should” and similar expressions may identify forward-looking information and such forward-looking statements are made based upon management’s current expectations and beliefs as of this date concerning future developments and their potential effect upon NJR. There can be no assurance that future developments will be in accordance with management’s expectations or that the effect of future developments on NJR will be those anticipated by management. Forward-looking information in this release includes, but is not limited to, certain statements regarding estimated capital expenditures in fiscal 2016 and beyond by NJNG, including those related to SAFE and NJ RISE, NJNG’s base rate case filing, , and NJNG’s liquefaction and SRL projects,.

The factors that could cause actual results to differ materially from NJR’s expectations include, but are not limited to, weather and economic conditions; the ability to obtain governmental and regulatory approvals, land-use rights, electrical grid connection and/or financing for the construction, development and operation of NJNG’s planned infrastructure projects in a timely manner; the level and rate at which NJNG's costs and expenses are incurred and the extent to which they are allowed to be recovered from customers through the regulatory process, including through the base rate case filing; operating risks incidental to handling, storing, transporting and providing customers with natural gas; the regulatory and pricing policies of federal and state regulatory agencies; the costs of compliance with present and future environmental laws; environmental-related and other litigation and other uncertainties; and the impact of natural disasters, terrorist activities, and other extreme events on our operations and customers. The aforementioned factors are detailed in the “Risk Factors” sections of our Annual Report on Form 10-K filed on November 25, 2014, as filed with the Securities and Exchange Commission (SEC), which is available on the SEC’s website at sec.gov. Information included in this release is representative as of today only, and while NJR periodically reassesses material trends and uncertainties affecting NJR's results of operations and financial condition in connection with its preparation of management's discussion and analysis of results of operations and financial condition contained in its Quarterly and Annual Reports filed with the SEC, NJR does not, by including this statement, assume any obligation to review or revise any particular forward-looking statement referenced herein in light of future events.

ABOUT NEW JERSEY RESOURCES

New Jersey Resources (NYSE: NJR) is a Fortune 1000 company that provides safe and reliable natural gas and clean energy services, including transportation, distribution and asset management. With annual revenues in excess of $3 billion, NJR is comprised of five primary businesses:

| |

| • | New Jersey Natural Gas is NJR’s principal subsidiary that operates and maintains over 7,000 miles of natural gas transportation and distribution infrastructure to serve over half a million customers in New Jersey’s Monmouth, Ocean and parts of Burlington, Morris and Middlesex counties. |

| |

| • | NJR Energy Services manages a diversified portfolio of natural gas transportation and storage assets and provides physical natural gas services to its customers across North America. |

| |

| • | NJR Clean Energy Ventures invests in, owns and operates solar and onshore wind projects with a total capacity of over 130 megawatts, providing residential and commercial customers with low-carbon solutions. |

| |

| • | NJR Midstream serves customers from local distributors and producers to electric generators and wholesale marketers through its equity ownership in a natural gas storage facility and its stake in Dominion Midstream Partners, L.P. |

| |

| • | NJR Home Services provides heating, central air conditioning, standby generators, solar and other indoor and outdoor comfort products to residential homes and businesses throughout New Jersey and serves approximately 116,500 service contract customers. |

NJR and its nearly 1,000 employees are committed to helping customers save energy and money by promoting conservation and encouraging efficiency through Conserve to Preserve® and initiatives such as The SAVEGREEN Project® and The Sunlight Advantage®.

For more information about NJR:

Visit www.njresources.com.

Follow us on Twitter @NJNaturalGas.

“Like” us on facebook.com/NewJerseyNaturalGas.

Download our free NJR investor relations app for iPad, iPhone and Android.