SAFE, RELIABLE NATURAL GAS AT OUR CORE … AND SO MUCH MORE Key Business Initiatives Update October 20, 2016

Regarding Forward Looking Statements Certain statements contained in this presentation are forward-looking statements within the meaning of Section 27A of the Securities Act of 1933, as amended, Section 21E of the Securities Exchange Act of 1934, as amended, and the Private Securities Litigation Reform Act of 1995. New Jersey Resources (NJR or the Company) cautions readers that the assumptions forming the basis for forward-looking statements include many factors that are beyond NJR’s ability to control or estimate precisely, such as estimates of future market conditions and the behavior of other market participants. Words such as “anticipates,” “estimates,” “expects,” “projects,” “may,” “will,” “intends,” “plans,” “believes,” “should” and similar expressions may identify forward-looking statements and such forward-looking statements are made based upon management’s current expectations, assumptions and beliefs as of this date concerning future developments and their potential effect upon NJR. There can be no assurance that future developments will be in accordance with management’s expectations or that the effect of future developments on NJR will be those anticipated by management. Forward-looking statements in this presentation include, but are not limited to, certain statements regarding future New Jersey Natural Gas Company (NJNG) customer growth, future capital plans and expenditures and infrastructure investments, the effect of the federal Production Tax Credit (PTC) and federal Investment Tax Credit (ITC) extension on NJRCEV, the effect of Solar Renewable Energy Certificate (SRECs) prices, supply, hedges and generation on NJRCEV, the long-term outlook for NJR Clean Energy Ventures Corporation (NJCEV), diversification of NJRCEV’s strategy, NJRCEV’s future solar and wind projects, the base rate case and future rate case proceedings, and the PennEast Pipeline project. The factors that could cause actual results to differ materially from NJR’s expectations, assumptions and beliefs include, but are not limited to, weather and economic conditions; changes in the rate of NJNG’s customer growth; volatility of natural gas and other commodity prices; changes in rating agency requirements and/or credit ratings; the impact of volatility in the credit markets; the ability to comply with debt covenants; the impact to the asset values and resulting higher costs and funding obligations of NJR's pension and post- employment benefit plans as a result of downturns in the financial markets, lower discount rates, revised actuarial assumptions or impacts associated with the Patient Protection and Affordable Care Act; accounting effects and other risks associated with hedging activities and use of derivatives contracts; commercial and wholesale credit risks, including the availability of creditworthy customers and counterparties and liquidity in the wholesale energy trading market; the ability to obtain governmental and regulatory approvals, land-use rights, electrical grid connection and/or financing for the construction, development and operation of NJR’s non-regulated energy investments and NJNG’s planned infrastructure projects in a timely manner; risks associated with the management of the company's joint ventures, partnerships and investment in a master limited partnership; risks associated with our investments in renewable energy projects, including the availability of regulatory and tax incentives, the availability of viable projects and NJR's eligibility for ITCs and PTCs, the future market for Solar Renewable Energy Certificates (SRECs) and operational risks related to projects in service; timing of qualifying for ITCs and PTCs due to delays or failures to complete planned solar and wind energy projects; the level and rate at which NJNG's costs and expenses are incurred and the extent to which they are allowed to be recovered from customers through the regulatory process, including through the base rate case filing; access to adequate supplies of natural gas and dependence on third-party storage and transportation facilities for natural gas supply; operating risks incidental to handling, storing, transporting and providing customers with natural gas; risks related to our employee workforce; the regulatory and pricing policies of federal and state regulatory agencies; the costs of compliance with present and future environmental laws, including potential climate change-related legislation; risks related to changes in accounting standards; the disallowance of recovery of environmental-related expenditures and other regulatory changes; environmental-related and other litigation and other uncertainties; risks related to cyber-attack or failure of information technology systems; and the impact of natural disasters, terrorist activities, and other extreme events on our operations and customers. The aforementioned factors are detailed in the “Risk Factors” section of our Annual Report on Form 10- K filed with the Securities and Exchange Commission (SEC) on November 24, 2015, which is available on the SEC’s website at sec.gov. Information included in this presentation is representative as of today only and while NJR periodically reassesses material trends and uncertainties affecting NJR's results of operations and financial condition in connection with its preparation of management's discussion and analysis of results of operations and financial condition contained in its Quarterly and Annual Reports filed with the SEC, NJR does not, by including this statement, assume any obligation to review or revise any particular forward-looking statement referenced herein in light of future events. 2 Key Business Initiatives Update

Disclaimer Regarding Non‐GAAP Financial Measures This presentation includes the non-GAAP measure, Net Financial Earnings (NFE). As an indicator of the Company’s operating performance, this measure should not be considered an alternative to, or more meaningful than, GAAP measures, such as cash flow, net income, operating income or earnings per share. NFE excludes unrealized gains or losses on derivative instruments related to the Company’s unregulated subsidiaries and certain realized gains and losses on derivative instruments related to natural gas that has been placed into storage at NJR Energy Services (NJRES), net of applicable tax adjustments, as described below. Volatility associated with the change in value of these financial and physical commodity contracts is reported in the income statement in the current period. In order to manage its business, NJR views its results without the impacts of the unrealized gains and losses, and certain realized gains and losses, caused by changes in value of these financial instruments and physical commodity contracts prior to the completion of the planned transaction because it shows changes in value currently as opposed to when the planned transaction ultimately is settled. An annual estimated effective tax rate is calculated for NFE purposes and any necessary quarterly tax adjustment is applied to NJRCEV, as such adjustment is related to tax credits generated by NJRCEV. Management uses NFE as a supplemental measure to other GAAP results to provide a more complete understanding of the Company’s performance. Management believes this non-GAAP measure is more reflective of the Company’s business model, provides transparency to investors and enables period-to-period comparability of financial performance. In providing fiscal 2016 earnings guidance, management is aware that there could be differences between reported GAAP earnings and NFE due to matters such as, but not limited to, the positions of our energy-related derivatives. Management is not able to reasonably estimate the aggregate impact of these items on reported earnings and therefore is not able to provide a reconciliation to the corresponding GAAP equivalent for its operating earnings guidance without unreasonable efforts. For a full discussion of our non-GAAP financial measures, please see NJR’s most recent Form 10-K, Item 7. This information has been provided pursuant to the requirements of SEC Regulation G. 3 Key Business Initiatives Update

Our Goals for Today Review our base rate case settlement Provide an update on our Southern Reliability Link (SRL) project Review SREC market fundamentals Discuss the impact of the ITC/PTC extensions Provide capital spending and financing plans through fiscal 2019 4 Key Business Initiatives Update

Base Rate Case Approved by NJBPU on September 23, 2016; new base rates effective October 1, 2016 – $45 million revenue increase Required as part of SAFE I infrastructure investment program Provided cash recovery for SAFE I and NGV expenditures Provided a competitive cost of capital of 6.9 percent with an ROE of 9.75 percent and a higher equity component of 52.5 percent Approved $157.5 million SAFE II program with annual recovery mechanism Retained opportunity to recover SRL project costs subject to a future rate filing Base rate case is required to be filed no later than November 2019 5 Key Business Initiatives Update

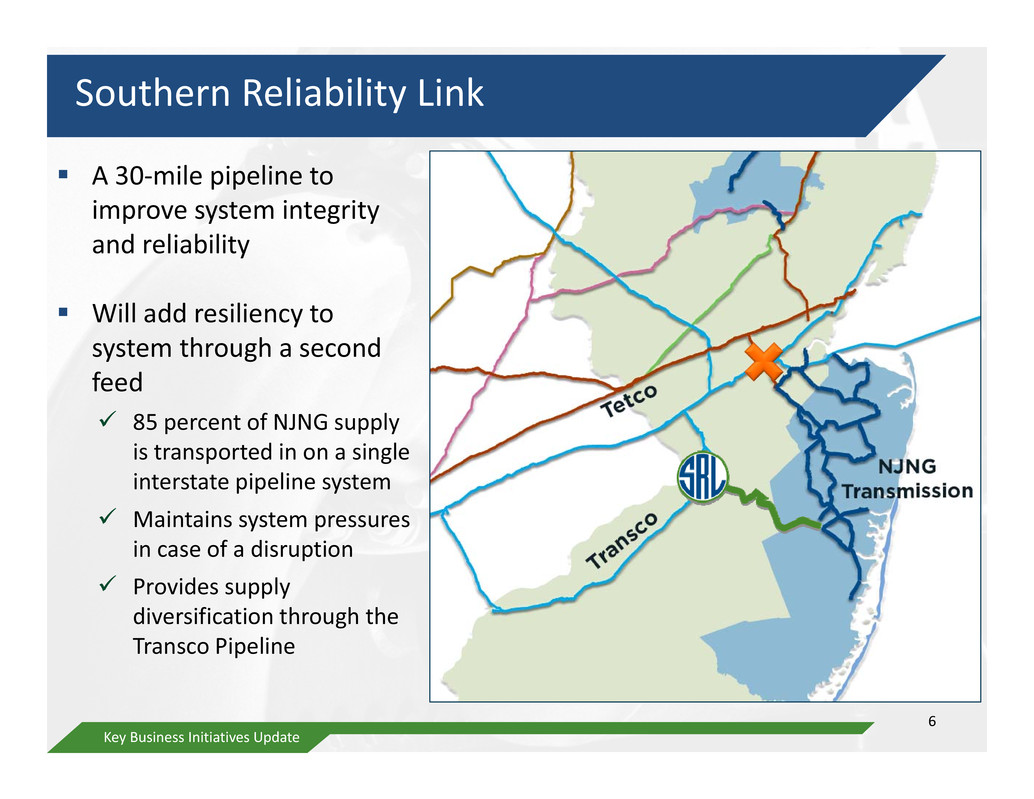

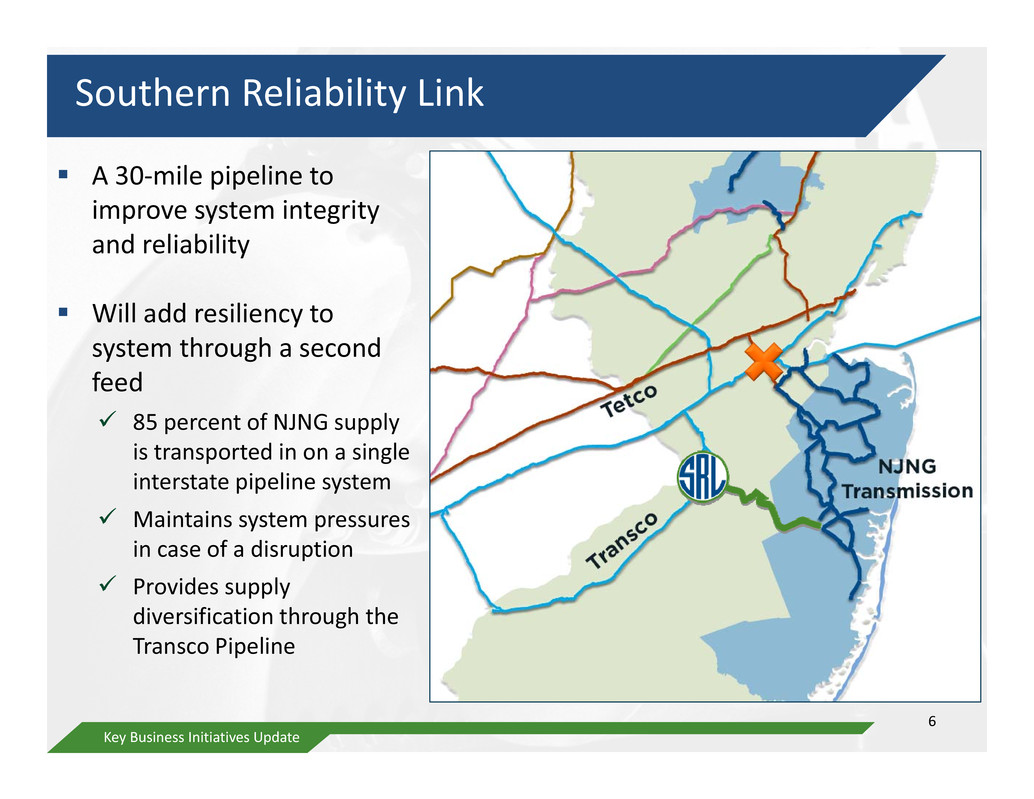

Southern Reliability Link A 30‐mile pipeline to improve system integrity and reliability Will add resiliency to system through a second feed 85 percent of NJNG supply is transported in on a single interstate pipeline system Maintains system pressures in case of a disruption Provides supply diversification through the Transco Pipeline 6 Key Business Initiatives Update

SRL: Progress to Date Approvals Received: • NJBPU Construction, operation and route designation approved in January 2016 Finding that SRL is necessary for the safety, welfare and convenience of the public in March 2016 • NJ Department of Environmental Protection (DEP) Flood Hazard Permit‐by‐Rule • Pinelands Commission Certificate‐of‐Filing issued Remaining Permits: • DEP Wetlands and Coastal Area Facility Review Act (CAFRA) permits on schedule for approval • Road opening permits Rate treatment will be requested in future rate proceeding Key Business Initiatives Update 7

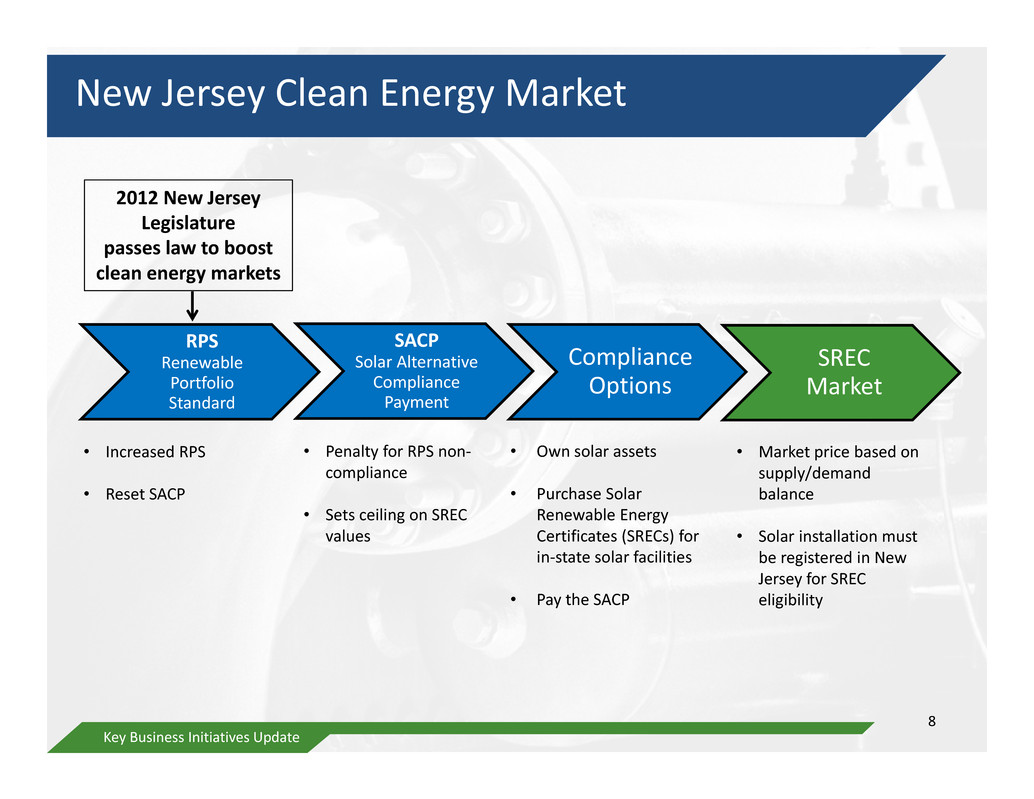

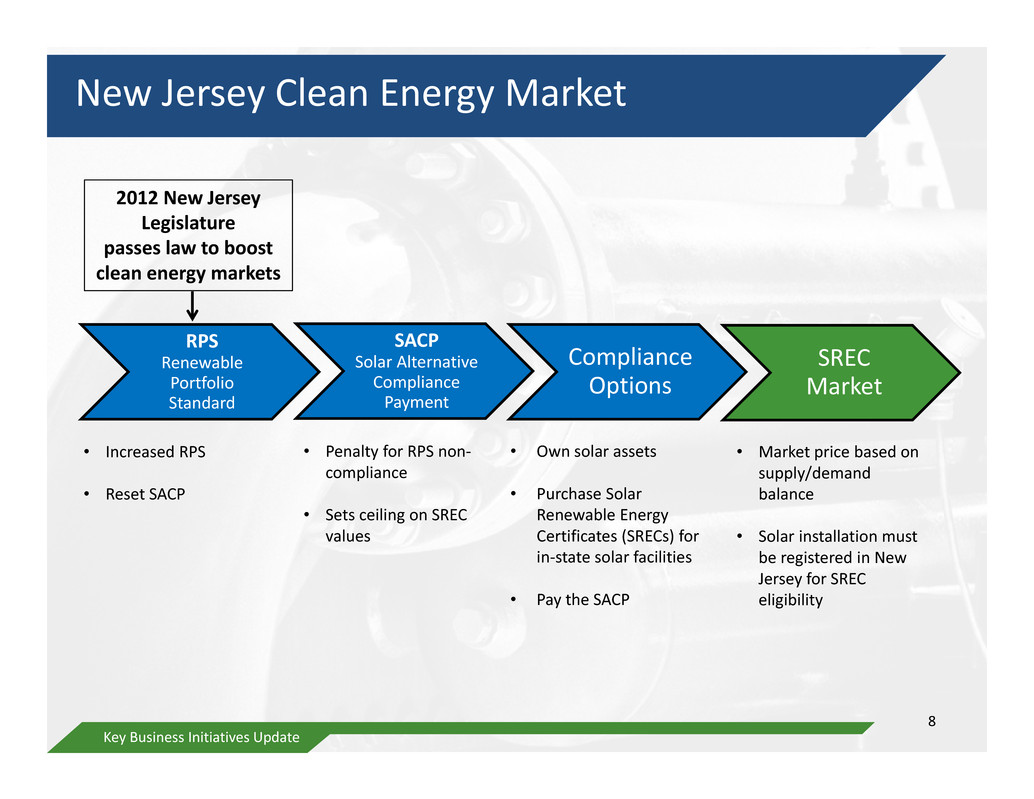

New Jersey Clean Energy Market RPS Renewable Portfolio Standard SACP Solar Alternative Compliance Payment Compliance Options SREC Market • Increased RPS • Reset SACP • Penalty for RPS non‐ compliance • Sets ceiling on SREC values • Own solar assets • Purchase Solar Renewable Energy Certificates (SRECs) for in‐state solar facilities • Pay the SACP • Market price based on supply/demand balance • Solar installation must be registered in New Jersey for SREC eligibility 2012 New Jersey Legislature passes law to boost clean energy markets 8 Key Business Initiatives Update

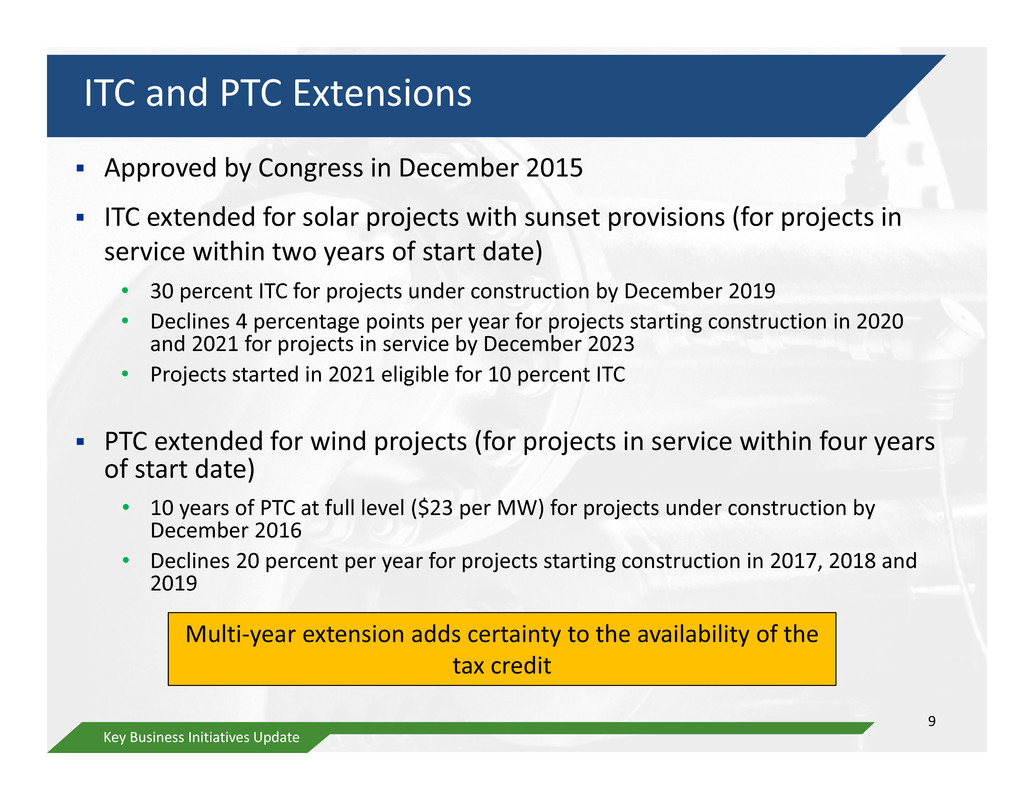

ITC and PTC Extensions Key Business Initiatives Update 9 Approved by Congress in December 2015 ITC extended for solar projects with sunset provisions (for projects in service within two years of start date) • 30 percent ITC for projects under construction by December 2019 • Declines 4 percentage points per year for projects starting construction in 2020 and 2021 for projects in service by December 2023 • Projects started in 2021 eligible for 10 percent ITC PTC extended for wind projects (for projects in service within four years of start date) • 10 years of PTC at full level ($23 per MW) for projects under construction by December 2016 • Declines 20 percent per year for projects starting construction in 2017, 2018 and 2019 Multi‐year extension adds certainty to the availability of the tax credit

What do the ITC/PTC Extensions Mean for NJR Clean Energy Ventures? ITC • Grid‐connected projects, previously uneconomic, now viable • Increases future pipeline of commercial, net‐metered projects • Improves previously‐planned residential solar economics PTC • Expands markets where wind is competitive with wholesale power • Stabilizes development cycle • Increases project pipeline for future development Key Business Initiatives Update 10

SREC Market Fundamentals Supply • Number of SRECs available to satisfy RPS Determined based on actual solar generation in NJ Demand • RPS establishes requirement • Basic Generation Service (BGS) auction identifies specific Load Serving Entities (LSEs) and is a significant driver of demand • LSEs procure SRECs to establish compliance with RPS • Auction occurs annually in early February • Two common buying periods Leading up to, and during, BGS auction Leading up to compliance Key Business Initiatives Update 11

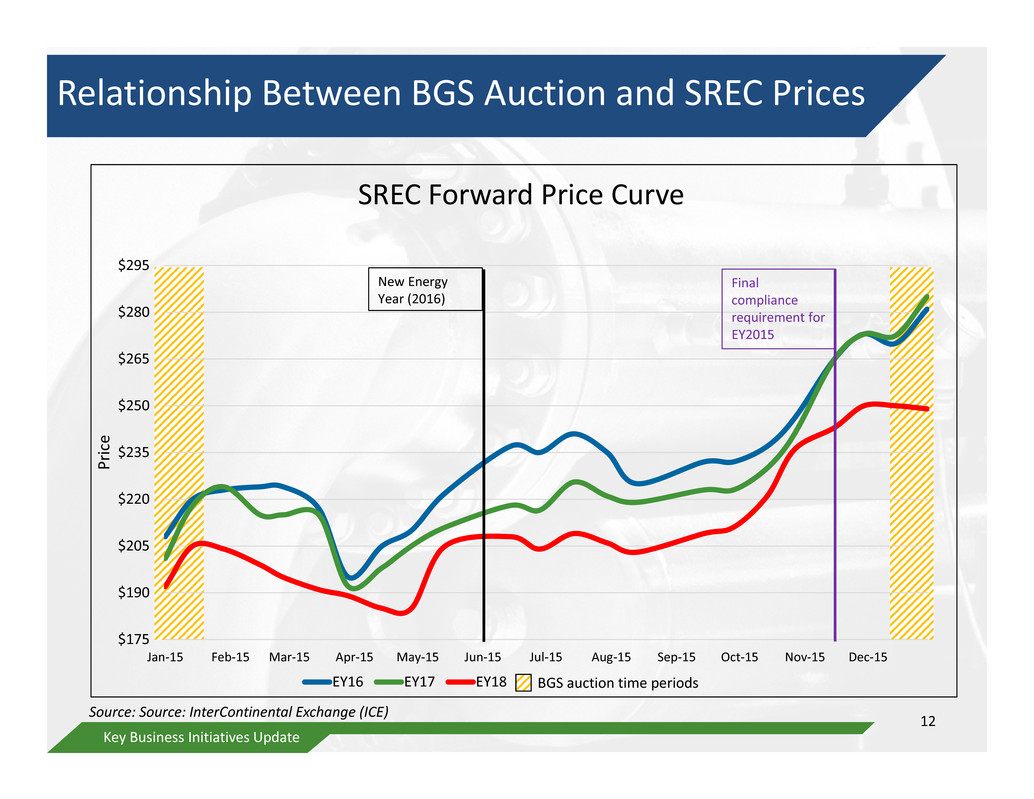

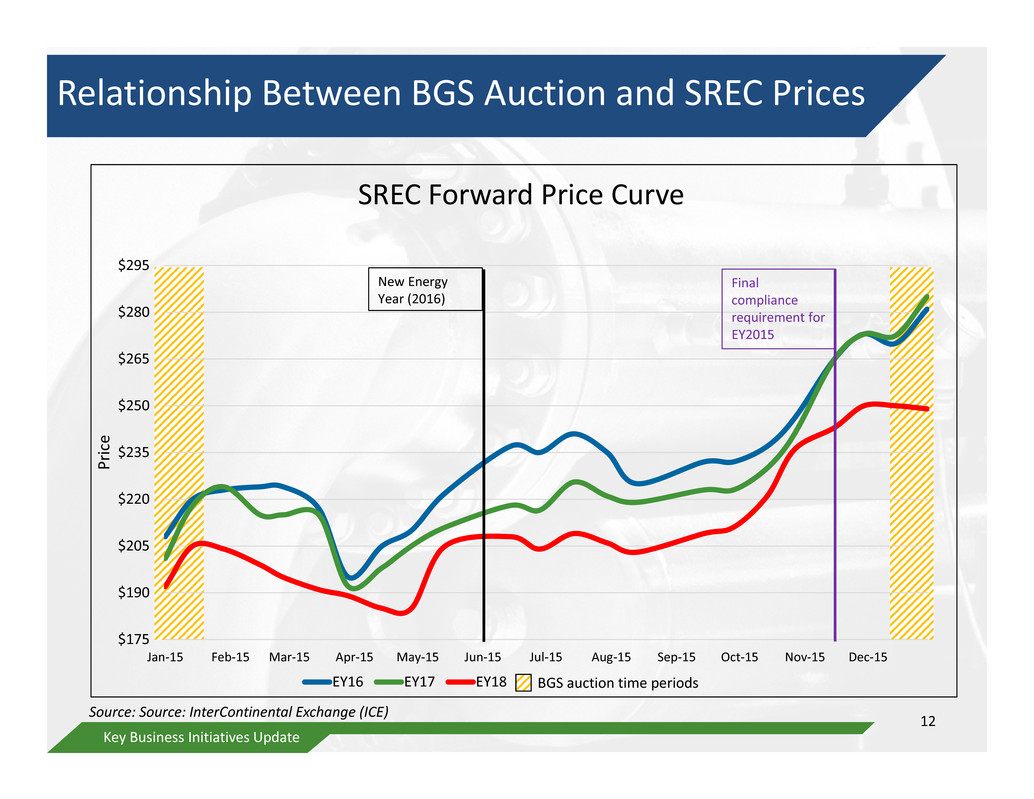

Relationship Between BGS Auction and SREC Prices $175 $190 $205 $220 $235 $250 $265 $280 $295 Jan‐15 Feb‐15 Mar‐15 Apr‐15 May‐15 Jun‐15 Jul‐15 Aug‐15 Sep‐15 Oct‐15 Nov‐15 Dec‐15 P r i c e SREC Forward Price Curve EY16 EY17 EY18 Final compliance requirement for EY2015 New Energy Year (2016) Key Business Initiatives Update 12 Source: Source: InterContinental Exchange (ICE) BGS auction time periods

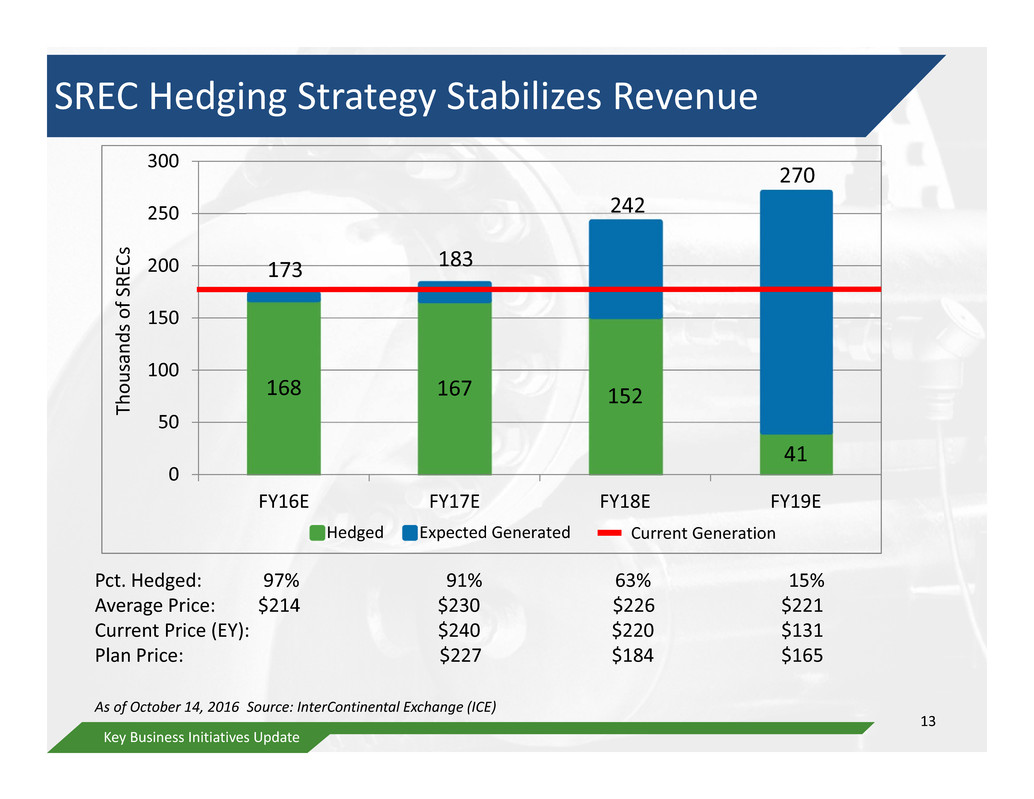

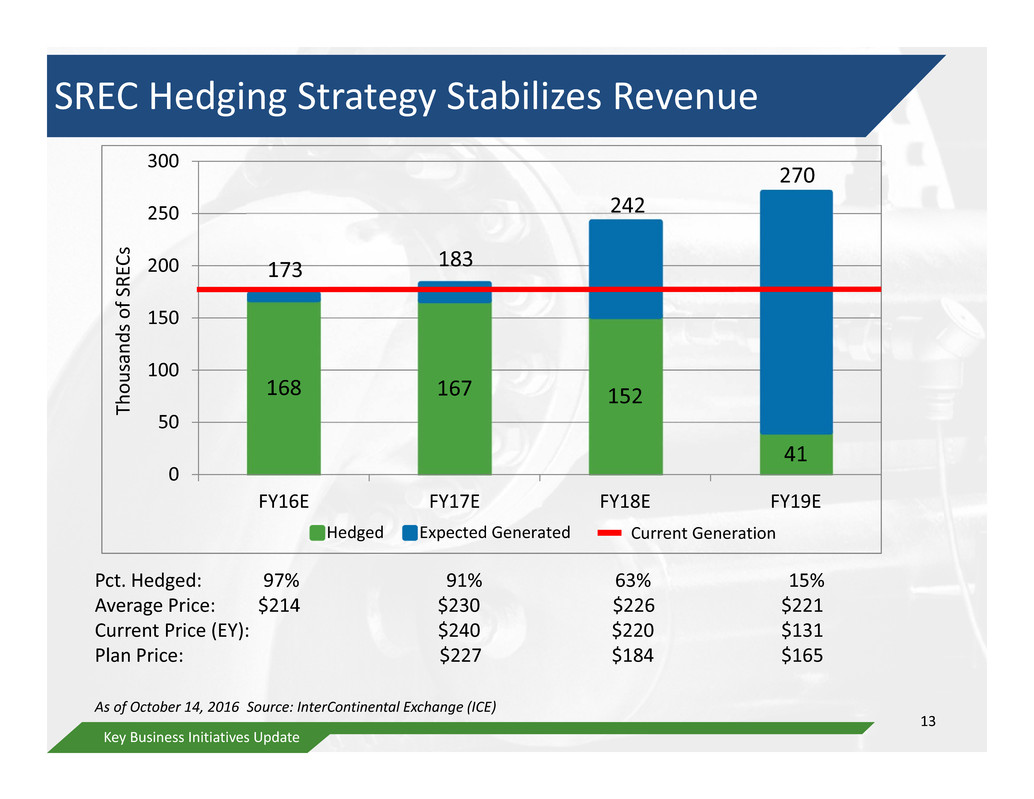

SREC Hedging Strategy Stabilizes Revenue 168 167 152 41 173 183 242 270 0 50 100 150 200 250 300 FY16E FY17E FY18E FY19E T h o u s a n d s o f S R E C s Hedged Expected Generated Current Generation Pct. Hedged: 97% 91% 63% 15% Average Price: $214 $230 $226 $221 Current Price (EY): $240 $220 $131 Plan Price: $227 $184 $165 13 As of October 14, 2016 Source: InterContinental Exchange (ICE) Key Business Initiatives Update

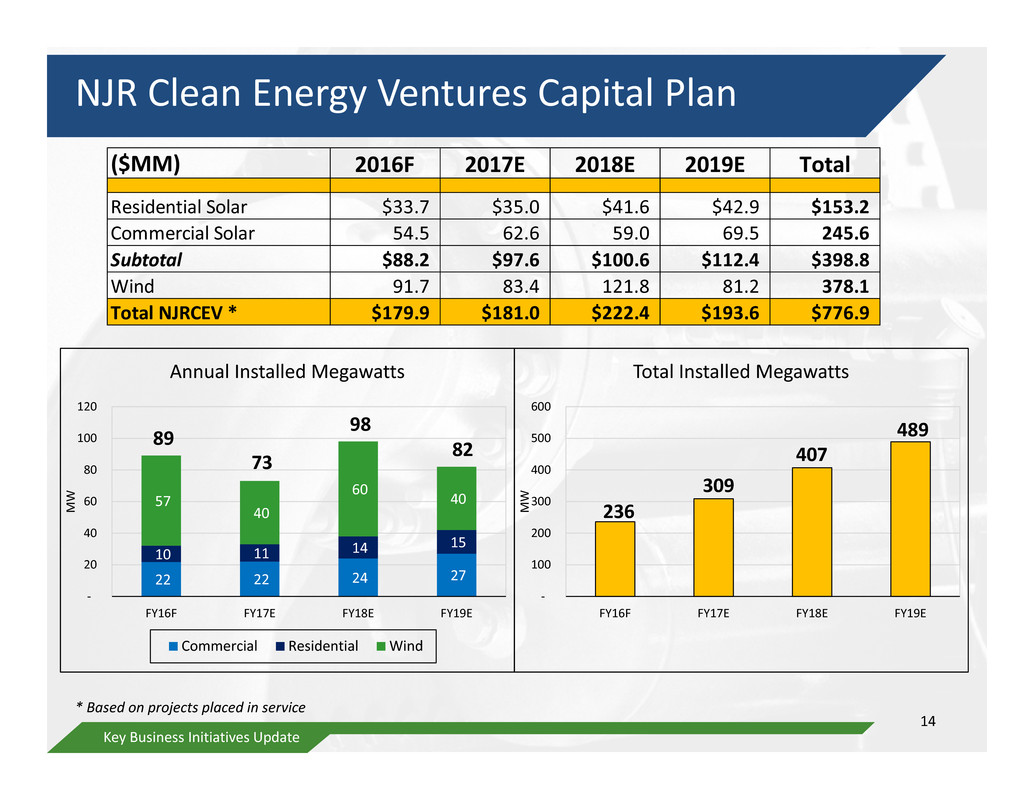

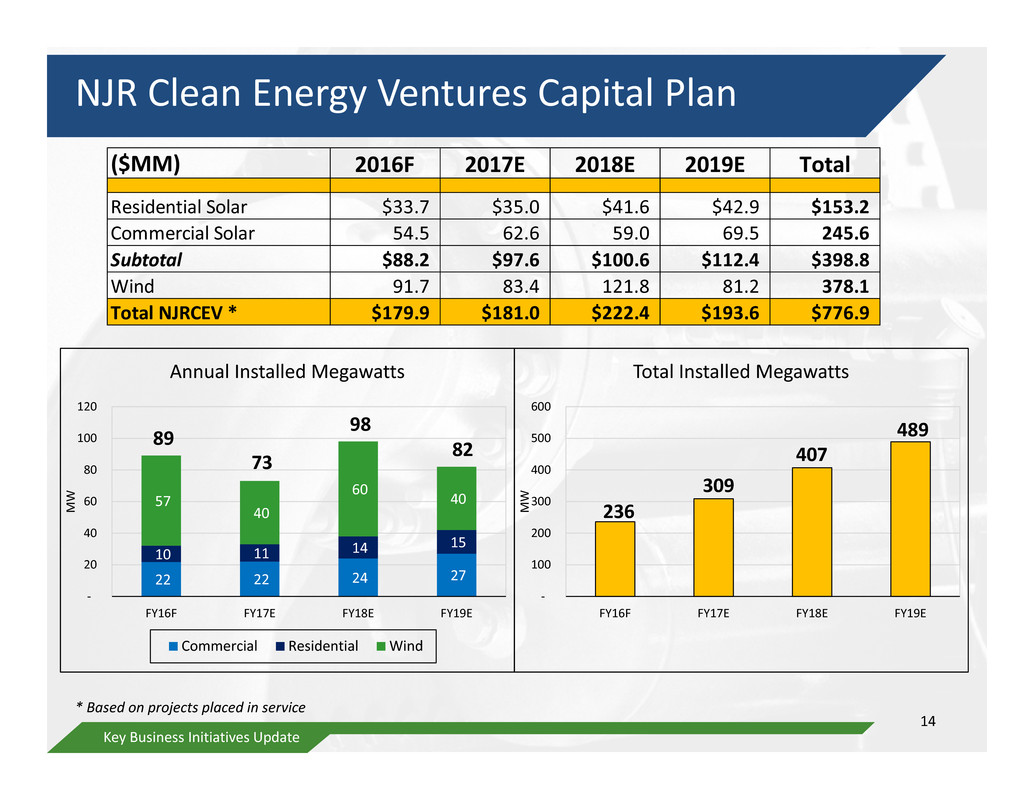

NJR Clean Energy Ventures Capital Plan Key Business Initiatives Update ($MM) 2016F 2017E 2018E 2019E Total Residential Solar $33.7 $35.0 $41.6 $42.9 $153.2 Commercial Solar 54.5 62.6 59.0 69.5 245.6 Subtotal $88.2 $97.6 $100.6 $112.4 $398.8 Wind 91.7 83.4 121.8 81.2 378.1 Total NJRCEV * $179.9 $181.0 $222.4 $193.6 $776.9 14 22 22 24 27 10 11 14 15 57 40 60 40 89 73 98 82 ‐ 20 40 60 80 100 120 FY16F FY17E FY18E FY19E M W Annual Installed Megawatts Commercial Residential Wind * Based on projects placed in service 236 309 407 489 ‐ 100 200 300 400 500 600 FY16F FY17E FY18E FY19E M W Total Installed Megawatts

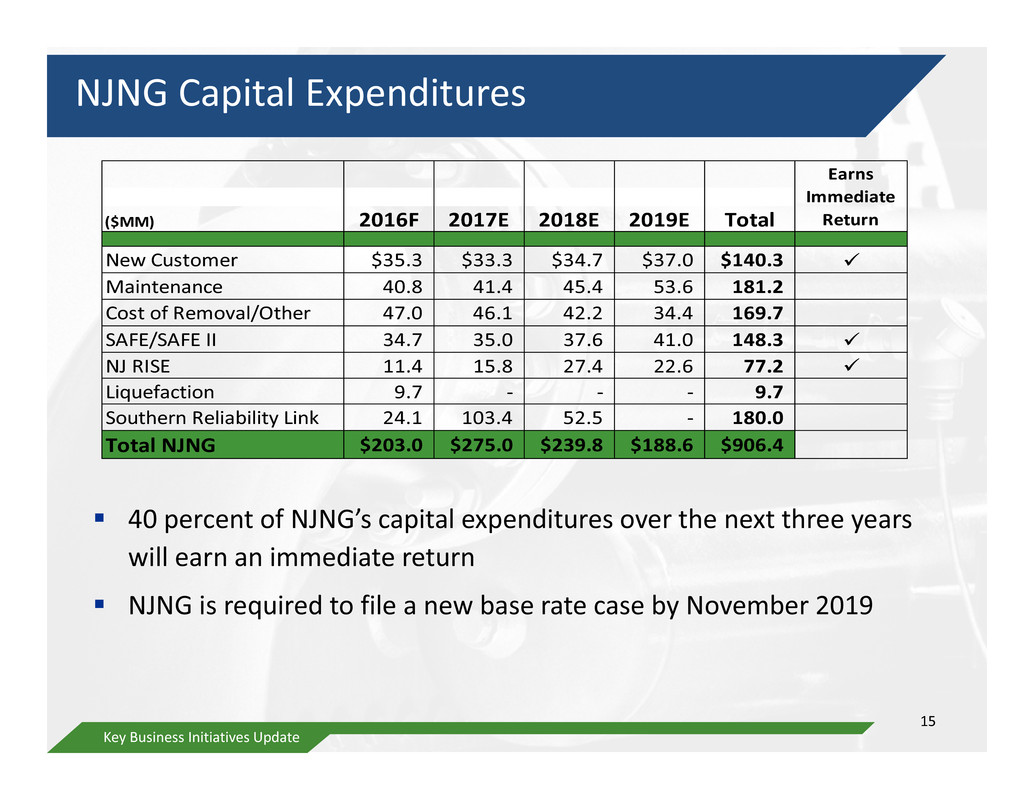

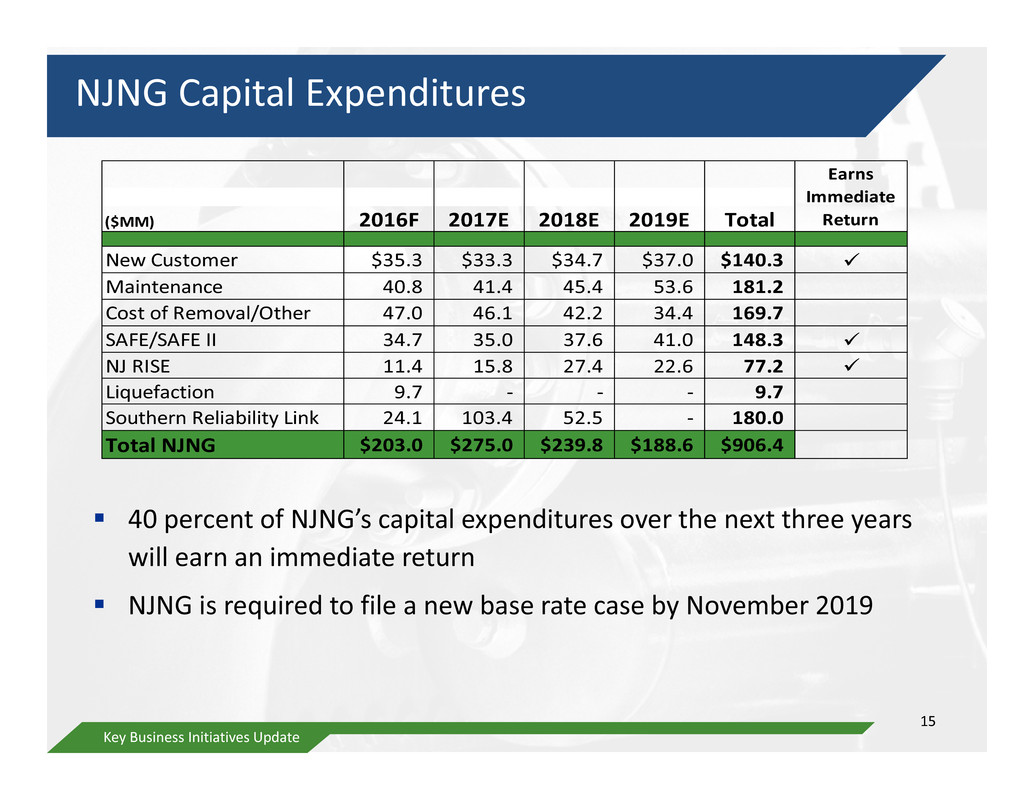

NJNG Capital Expenditures Key Business Initiatives Update 15 40 percent of NJNG’s capital expenditures over the next three years will earn an immediate return NJNG is required to file a new base rate case by November 2019 ($MM) 2016F 2017E 2018E 2019E Total New Customer $35.3 $33.3 $34.7 $37.0 $140.3 Maintenance 40.8 41.4 45.4 53.6 181.2 Cost of Removal/Other 47.0 46.1 42.2 34.4 169.7 SAFE/SAFE II 34.7 35.0 37.6 41.0 148.3 NJ RISE 11.4 15.8 27.4 22.6 77.2 Liquefaction 9.7 ‐ ‐ ‐ 9.7 Southern Reliability Link 24.1 103.4 52.5 ‐ 180.0 Total NJNG $203.0 $275.0 $239.8 $188.6 $906.4 Earns Immediate Return

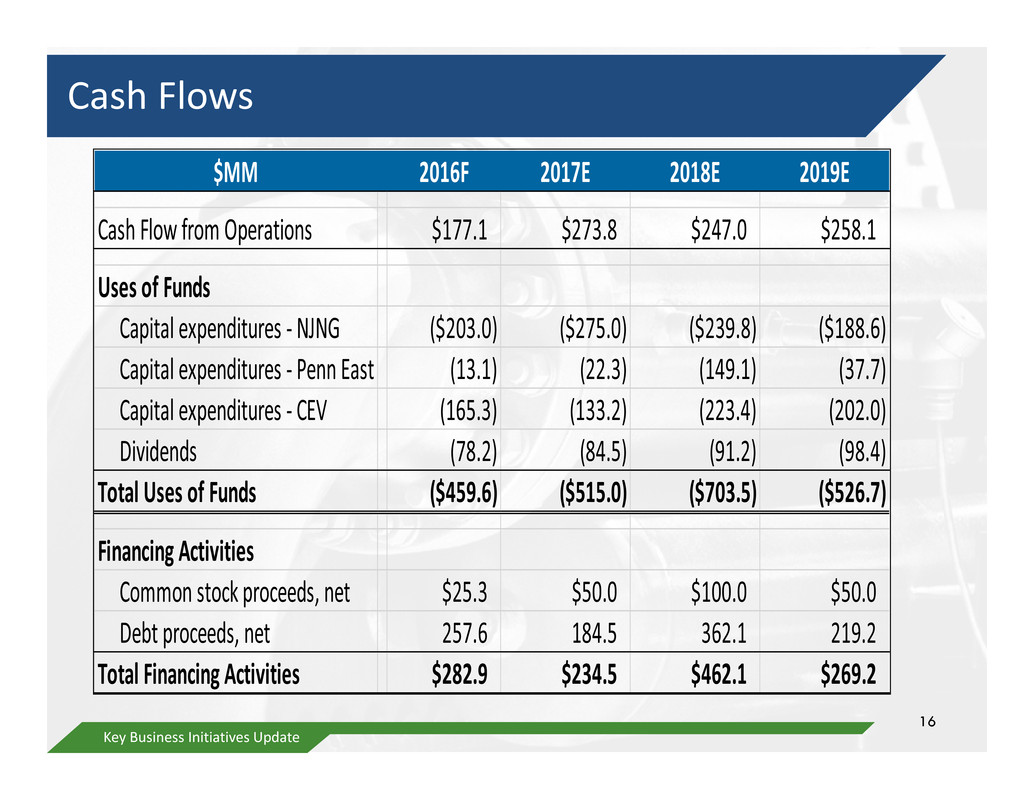

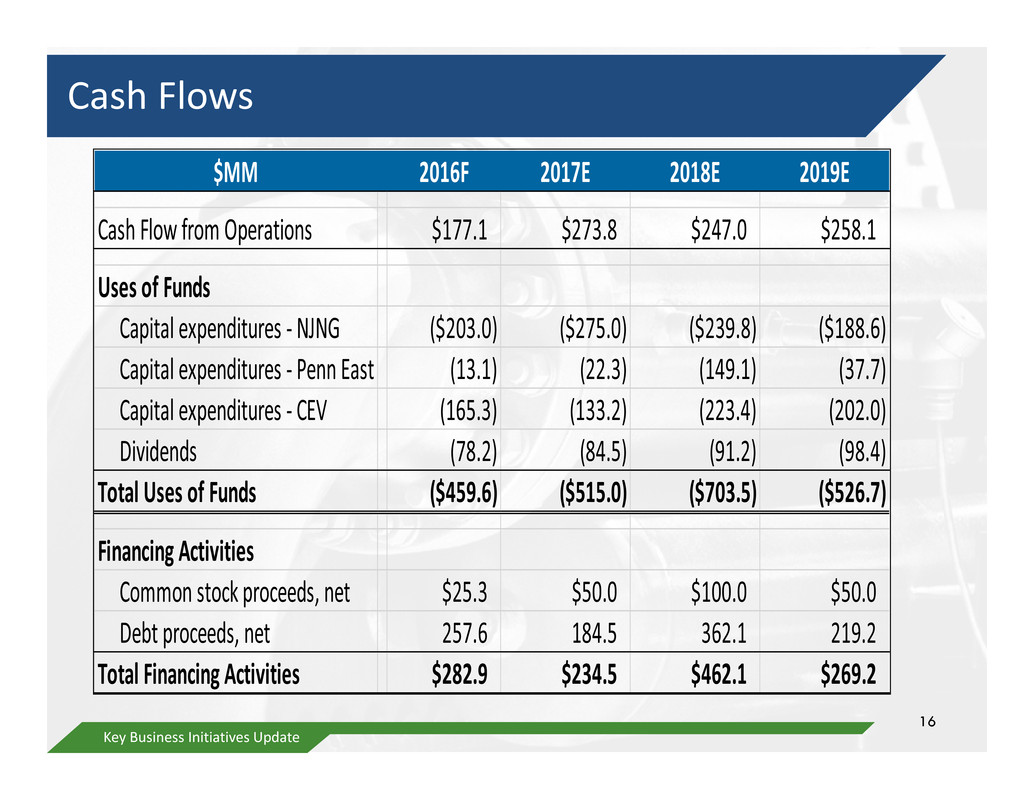

Cash Flows 16 Key Business Initiatives Update $MM 2016F 2017E 2018E 2019E Cash Flow from Operations $177.1 $273.8 $247.0 $258.1 Uses of Funds Capital expenditures ‐ NJNG ($203.0) ($275.0) ($239.8) ($188.6) Capital expenditures ‐ Penn East (13.1) (22.3) (149.1) (37.7) Capital expenditures ‐ CEV (165.3) (133.2) (223.4) (202.0) Dividends (78.2) (84.5) (91.2) (98.4) Total Uses of Funds ($459.6) ($515.0) ($703.5) ($526.7) Financing Activities Common stock proceeds, net $25.3 $50.0 $100.0 $50.0 Debt proceeds, net 257.6 184.5 362.1 219.2 Total Financing Activities $282.9 $234.5 $462.1 $269.2

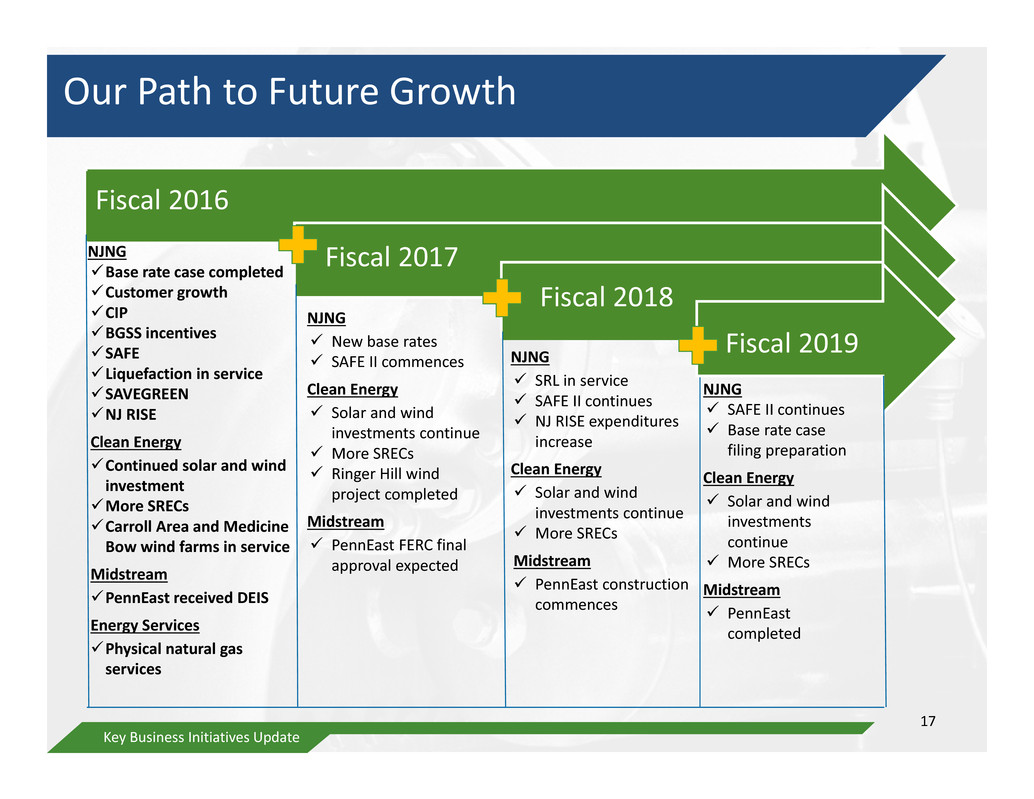

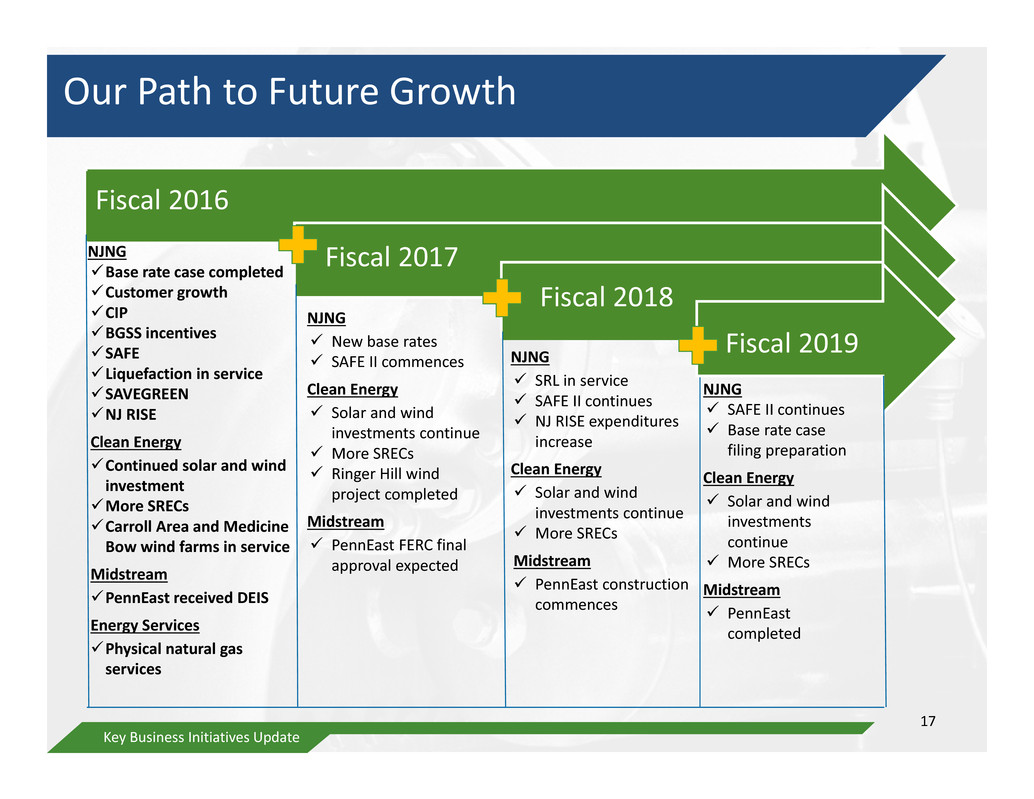

Our Path to Future Growth Fiscal 2016 NJNG Base rate case completed Customer growth CIP BGSS incentives SAFE Liquefaction in service SAVEGREEN NJ RISE Clean Energy Continued solar and wind investment More SRECs Carroll Area and Medicine Bow wind farms in service Midstream PennEast received DEIS Energy Services Physical natural gas services Fiscal 2017 NJNG New base rates SAFE II commences Clean Energy Solar and wind investments continue More SRECs Ringer Hill wind project completed Midstream PennEast FERC final approval expected Fiscal 2018 NJNG SRL in service SAFE II continues NJ RISE expenditures increase Clean Energy Solar and wind investments continue More SRECs Midstream PennEast construction commences Fiscal 2019 NJNG SAFE II continues Base rate case filing preparation Clean Energy Solar and wind investments continue More SRECs Midstream PennEast completed 17 Key Business Initiatives Update

SAFE, RELIABLE NATURAL GAS AT OUR CORE … AND SO MUCH MORE Key Business Initiatives Update October 20, 2016