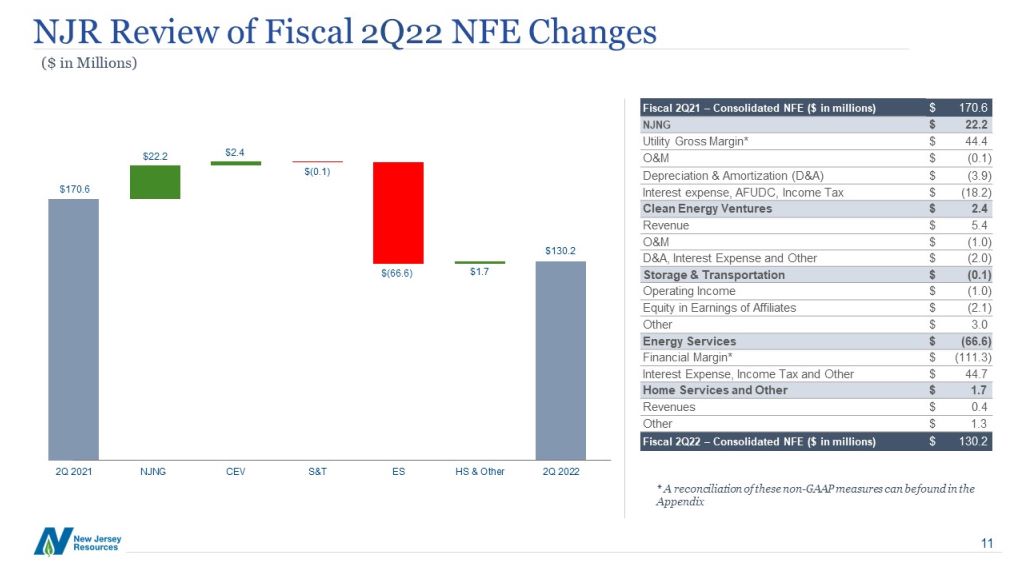

Other Reconciliation of Non-GAAP Measures ($ in 000s) NJNG Utility Gross MarginNJNG's utility gross margin is defined as operating revenues less natural gas purchases, sales tax, and regulatory rider expenses. This measure differs from gross margin as presented on a GAAP basis as it excludes certain operations and maintenance expense and depreciation and amortization. Energy Services Financial MarginFinancial margin removes the timing differences associated with certain derivative and hedging transactions. Financial margin differs from gross margin as defined on a GAAP basis as it excludes certain operations and maintenance expense and depreciation and amortization expenses as well as the effects of derivatives instruments on earnings. (Unaudited) Three Months Ended Six Months Ended March 31, March 31, 2022 2021 2022 2021 A reconciliation of gross margin, the closest GAAP financial measurement, to utility gross margin is as follows: Operating revenues $ 463,812 $ 310,167 $ 738,584 $ 505,896 Less: Natural gas purchases 215,223 118,452 339,817 177,761 Operating and maintenance (1) 26,748 26,281 39,889 51,106 Regulatory rider expense 30,910 18,413 47,581 29,114 Depreciation and amortization 23,344 19,475 46,237 38,644 Gross margin 167,587 127,546 265,060 209,271 Add: Operating and maintenance (1) 26,748 26,281 39,889 51,106 Depreciation and amortization 23,344 19,475 46,237 38,644 Utility gross margin $ 217,679 $ 173,302 $ 351,186 $ 299,021 A reconciliation of gross margin, the closest GAAP financial measurement, to financial margin is as follows: Operating revenues $ 412,645 $ 462,569 $ 781,889 $ 692,046 Less: Natural Gas purchases 411,146 330,280 689,833 504,117 Operating and maintenance (1) 3,978 20,924 7,247 24,608 Depreciation and amortization 32 13 60 55 Gross margin (2,511) 111,352 84,749 163,266 Add: Operating and maintenance (1) 3,978 20,924 7,247 24,608 Depreciation and amortization 32 13 60 55 transactions 40,446 29,348 (45,201) (9,433) Effects of economic hedging related to natural gas inventory 1,155 (7,209) 24,732 (14,741) Financial margin $ 43,100 $ 154,428 $ 71,587 $ 163,755 (1) Excludes certain selling, general and administrative expenses