* Less than 1%.

Herbert M. Sandler and Marion O. Sandler are husband and wife. Bernard A. Osher is the brother of Mrs. Sandler. The business address for Mr. and Mrs. Sandler is 1901 Harrison Street, Oakland, California 94612.

The members of the Audit Committee are Kenneth T. Rosen (Chair), Jerry Gitt, and Maryellen C. Herringer. The principal function of the Audit Committee is to assist the Board of Directors in overseeing the financial reporting process and the internal and the independent outside audits of the Company. During 2005, the Audit Committee had four regular meetings and met by telephone between regular meetings eight times. The report of the Audit Committee with respect to the year 2005 is on page 8 below.

Compensation and Stock Option Committee

The members of the Compensation and Stock Option Committee are Patricia A. King (Chair), Antonia Hernandez, and Kenneth T. Rosen. The principal functions of the Compensation and Stock Option Committee are to approve and evaluate the executive officer compensation plans and policies of the Company, to determine the compensation of the Company’s senior executive officers, to review the compensation of the non-management directors, and to oversee the administration of the Company’s compensation plans. During 2005, the Compensation and Stock Option Committee had three regular meetings. The report of the Compensation and Stock Option Committee with respect to the year 2005 begins on page 9 below.

Nominating and Corporate Governance Committee

The members of the Nominating and Corporate Governance Committee are Maryellen C. Herringer (Chair), Jerry Gitt, and Leslie Tang Schilling. The principal functions of the Nominating and Corporate Governance Committee are to consider and recommend qualified individuals as nominees for the position of Director, to review and reassess the adequacy of the Company’s Corporate Governance Guidelines, and to lead the Board of Directors in an annual review of its performance. During 2005, the Nominating and Corporate Governance Committee had three regular meetings and met by telephone between regular meetings one time.

Executive Committee

The members of the Executive Committee are Herbert M. Sandler (Chair) and Marion O. Sandler. The Executive Committee has any of the powers and authority of the Board of Directors in the intervals between meetings of the Board of Directors, subject to the control of the Board of Directors and subject to limitations under the Company’s by-laws, Delaware law, and the Executive Committee’s Charter. The Executive Committee does not schedule regular meetings and takes actions by unanimous written consent, which actions are subsequently reviewed and acted upon by the full Board of Directors.

Determinations about Director Independence

The Board of Directors has determined that Jerry Gitt, Antonia Hernandez, Maryellen C. Herringer, Patricia A. King, Kenneth T. Rosen, and Leslie Tang Schilling satisfy the independence standards of the New York Stock Exchange’s corporate governance rules and, therefore, a majority of the Directors and each member of the Audit Committee, the Compensation and Stock Option Committee, and the Nominating and Corporate Governance Committee is independent of management and the Company. In addition, each of the Audit Committee members satisfies the independence standards set forth in Rule 10A-3 under the Securities Exchange Act of 1934.

In making these determinations, the Board of Directors evaluated whether a Director had any direct or indirect material relationships with the Company that could interfere with the exercise of the Director’s independence from management and the Company, and whether a Director did not satisfy any of the NYSE’s bright-line tests that would automatically disqualify a Director from being regarded as independent.

In addition, the Board of Directors considered, among others factors, whether a Director, or an organization with which the Director is affiliated, has entered into any commercial, consulting, or similar contracts with the Company; whether a Director receives any compensation from the Company other than the Director fees described below under “Director Compensation;” whether the Director has ever been employed by the Company and, if so, the duration and circumstances relating to such employment; and whether the Company and/or any of its affiliates makes substantial charitable contributions to organizations with which a Director is affiliated.

As described in the Company’s Corporate Governance Guidelines adopted by the Board of Directors, a Director will be considered independent, absent other circumstances, as long as the aggregate contributions from the Company and/or its affiliates to a nonprofit organization that employs a Director, or an immediate family member of a Director, do not exceed the greater of $1 million or 2% of the annual consolidated gross revenues of the nonprofit organization. In addition, a Director will be considered independent, absent other circumstances, if a Director serves or is designated to serve as a non-compensated trustee of a trust established by an executive officer or another Director of the Company.

5

Other than being Directors and stockholders of the Company, the independent Directors have no material relationships with the Company. The Board of Directors also has determined that the following relationships do not affect the independence of the applicable Directors: the Company makes annual contributions of $15,000 to the Fisher Center for Real Estate and Urban Economics, University of California, Berkeley, which Prof. Rosen chairs; Ms. Herringer is designated to serve as one of three non-compensated trustees of trusts established by Mr. and Mrs. Sandler for the benefit of their descendants; and Mr. Gitt previously served as a director of the Atlas Funds and Atlas Insurance Trust, registered investment companies that are affiliates of the Company’s subsidiary registered investment adviser and broker-dealer, Atlas Advisers, Inc. and Atlas Securities, Inc.

Determinations about Audit Committee Financial Expertise

The Securities and Exchange Commission requires that boards of directors of stock exchange listed companies determine whether one or more of their audit committee members qualify as “audit committee financial experts.” Under the SEC’s rules, an audit committee financial expert is an individual who has obtained the attributes described below by means of certain experience or education.

The SEC requires that an audit committee financial expert have the following attributes: an understanding of generally accepted accounting principles (GAAP) and financial statements; the ability to assess the general application of GAAP in connection with the accounting for estimates, accruals, and reserves; experience preparing, auditing, analyzing, or evaluating financial statements that present a breadth and level of complexity of accounting issues that are generally comparable to the breadth and complexity of issues that can reasonably be expected to be raised by the Company’s financial statements, or experience actively supervising one or more persons engaged in these activities; an understanding of internal controls and procedures for financial reporting; and an understanding of audit committee functions.

The SEC’s rules also require that, in order to qualify as an audit committee financial expert, the individual have obtained these attributes through education and experience as, or supervision of, a principal financial officer, principal accounting officer, controller, principal accountant, auditor, or person performing similar functions; experience overseeing or assessing the performance of companies or public accountants with respect to the preparation, auditing, or evaluation of financial statements; or other relevant experience.

Prof. Rosen has actively supervised principal financial officers, principal accounting officers, controllers, public accountants, auditors, or persons performing similar functions, including through his past experience as Chairman of Lend Lease Rosen Real Estate Securities, a registered investment advisor. He is also Professor Emeritus of Business Administration and Chairman of the Fisher Center for Real Estate and Urban Economics at the University of California, Berkeley, and Chairman of a real estate and mortgage market consulting firm. Prof. Rosen also chairs the audit committee of Avatar Holdings Inc., a public company.

Mr. Gitt has more than 25 years of experience as one of the nation's leading securities analysts covering thrifts, banks, and other financial institutions. As a securities analyst, Mr. Gitt was responsible for analyzing financial statements for thrifts and financial services companies and regularly attended meetings with senior management to ask questions and conduct due diligence about their companies’ performance and vulnerabilities. Mr. Gitt retired from Merrill Lynch & Co. in 2000 as First Vice President for Equity Research. He is a former Certified Public Accountant, and he has a B.S. in Finance from the University of California, Berkeley and an M.S. in Finance from the University of California, Los Angeles.

Ms. Herringer has relevant experience as a former partner in the corporate and business law departments at two of the nation’s major corporate law firms in which she advised clients (including chief executive officers, underwriters, principal financial officers, principal accounting officers, and other persons performing similar functions) about securities laws, corporate transactions, corporate governance, and other matters. She also served previously as Senior Vice President and General Counsel of Transamerica and as an Executive Vice President and General Counsel of APL Limited. The internal audit function at APL reported to Ms. Herringer during part of her tenure there. Ms. Herringer is also a member of the audit committees of two other public companies, ABM Industries Incorporated and PG&E Corporation.

6

The Board of Directors has determined that, based on the factors and experience discussed above, all three Audit Committee members qualify as audit committee financial experts. The Board of Directors also has determined that each member of the Audit Committee possesses various other attributes that are particularly relevant to the Audit Committee performing its financial oversight function. These attributes are described in the Company’s Corporate Governance Guidelines and evaluated annually by the Company’s Nominating and Corporate Governance Committee, and include possessing the highest standards of personal and professional integrity; understanding sound business practices; having strong analytical skills and being financially literate to be able to ask sophisticated questions relevant to the Company’s activities and gauge the quality of the answers; and understanding the Company’s business, including the unique issues and risks in the banking, housing, mortgage lending, real estate, and related industries. The Board of Directors has determined that the Audit Committee members have developed, over time, valuable insights into the Company to enable them to fulfill their roles as Directors and members of the Audit Committee.

Board Nominations

Each year the Nominating and Corporate Governance Committee reviews with the Board of Directors the composition of the Board of Directors as a whole and makes a recommendation whether to renominate the Directors whose terms expire at the upcoming Annual Meeting. The Committee also discusses periodically whether to consider any new persons to be added to the Board of Directors. In assessing qualifications for nominees, the Nominating and Corporate Governance Committee expects candidates to meet the qualifications described in the Committee’s charter and the Company’s Corporate Governance Guidelines, including having high ethical standards and the competence, experience, and integrity required of a director of a federal savings bank by the regulations of the Office of Thrift Supervision. In addition, the Nominating and Corporate Governance Committee considers, among other factors, whether a candidate understands financial statements and reports, has experience with housing and real estate markets, has other professional experiences that would be beneficial to the Company, has knowledge of community affairs (including in markets served by the Company), and/or would qualify as an independent director under NYSE and other applicable regulations. The Nominating and Corporate Governance Committee recommended to the Board of Directors the three nominees for election as Class I Directors at the 2006 Annual Meeting.

The Nominating and Corporate Governance Committee will consider stockholder recommendations for nominees who, in the committee’s determination, meet the qualifications referred to in the preceding paragraph. A stockholder or stockholder group can recommend a nominee by sending a letter addressed to the Corporate Secretary at the Company’s headquarters at 1901 Harrison Street, Oakland, California 94612. The letter should identify the nominee, including contact information and other biographical information that would help the Nominating and Corporate Governance Committee assess the nominee’s qualifications. The letter should also provide information about the number of shares of the Company’s stock held by the stockholder or stockholder group making the recommendation and the length of time those shares have been held. The Corporate Secretary will promptly forward stockholder recommendations to the Chair of the Nominating and Corporate Governance Committee.

Communications with Directors

Stockholders wishing to communicate with one or more Directors, including the presiding Director of the non-management Directors or the non-management Directors as a group, should send written correspondence addressed to the Director(s), care of the Corporate Secretary at the Company’s headquarters at 1901 Harrison Street, Oakland, California 94612. The Corporate Secretary, or his or her designee, will forward such communications to the relevant Director(s) or as otherwise instructed by the Director(s). Stockholders are encouraged to interact with Directors at the Annual Meetings of Stockholders. The Company expects Directors to attend the Annual Meetings, absent scheduling or other similar conflicts. All of the Directors then serving on the Board of Directors attended the 2005 Annual Meeting.

7

Director Compensation

The only compensation or remuneration that non-management Directors receive from the Company are an annual retainer and fees for attending regular Board of Directors and committee meetings. During 2005, the non-management Directors received an annual retainer of $28,000, paid monthly on a pro rata basis, and a fee of $4,000 for each regular Board of Directors meeting attended. In addition, for each regular committee meeting the Chair of the Audit Committee received $4,000, each of the other members of the Audit Committee received $3,500, the Chairs of the Nominating and Corporate Governance Committee and the Compensation and Stock Option Committee received $2,500, and each of the other members of those committees received $1,500. In addition, Directors received $250 per half hour for telephone meetings of the Board of Directors and committees.

Other Corporate Governance Matters

The non-management Directors meet in executive session without management at each regular meeting of the Board of Directors. At least once a year, the independent Directors also meet separately from the other Directors. The non-management Directors determine who will preside at the executive sessions, and they have selected Kenneth T. Rosen as their presiding Director during 2005 and again for 2006.

The Board of Directors has adopted Corporate Governance Guidelines and codes of conduct and ethics for Directors, financial officers, and employees that are available, along with Board of Directors committee charters, from the Investor Information/Corporate Governance and Ethics links on the Company’s website atwww.gdw.com. Printed copies of these guidelines, codes, and charters are also available to any stockholder who submits a written request to the Company at 1901 Harrison Street, Oakland, California 94612, Attention: Corporate Secretary.

REPORT OF THE AUDIT COMMITTEE

Management has primary responsibility for the Company’s financial statements and the reporting process, including the Company’s system of internal controls. The Company’s independent outside auditors are responsible for performing an audit of the Company’s consolidated financial statements in accordance with the standards of the Public Company Accounting Oversight Board (United States). This audit serves as the basis for the auditors’ opinion included in the annual report to stockholders addressing whether the financial statements fairly present the Company’s financial position, results of operations, and cash flows in conformity with accounting principles generally accepted in the United States. The Audit Committee’s responsibility is to assist the Board of Directors in monitoring and overseeing these processes.

In this context, the Audit Committee has reviewed and discussed the Company’s 2005 audited financial statements with management and the independent outside auditors. The Audit Committee has discussed with the auditors the matters required to be discussed by Statement on Auditing Standards No. 61(Communication with Audit Committees). The auditors have provided the Audit Committee the written disclosures and the letter required by Independence Standards Board Standard No. 1(Independence Discussions with Audit Committees), and the Audit Committee has discussed with the auditors that firm’s independence from the Company. The Audit Committee also has considered whether the auditors’ provision of non-audit services to the Company is compatible with the auditors’ independence.

Based on these reviews and discussions, the Audit Committee recommended to the Board of Directors, and the Board of Directors has approved, that the audited financial statements be included in the Company’s Annual Report on Form 10-K for the year ended December 31, 2005 for filing with the Securities and Exchange Commission.

Submitted by the Audit Committee:

Kenneth T. Rosen, Chair

Jerry Gitt

Maryellen C. Herringer

8

REPORT OF THE COMPENSATION AND STOCK OPTION COMMITTEE

ON EXECUTIVE COMPENSATION

The Compensation and Stock Option Committee’s primary functions are to review, and to recommend for approval by the Board of Directors, the salaries and other compensation of the Company’s executive officers, and to administer the Company’s cash bonus and stock incentive plans.

During 2005, the Committee met (a) with respect to the Company’s Chief Executive Officers, to (i) review and recommend to the independent Directors on the Board of Directors the salaries of the CEOs for 2005, (ii) determine the cash bonus awards payable to the CEOs under the terms of the Company’s Incentive Bonus Plan for the Company’s 2004 performance, and (iii) set the specific Company performance criteria to which cash bonus awards would be payable to the CEOs for 2005 under the Incentive Bonus Plan; (b) with respect to the Company’s President, to review and recommend to the Board of Directors his salary for the period from May 1, 2005 through April 30, 2006; and (c) with respect to the Company’s Senior Executive Vice President, to (i) review and recommend to the Board of Directors his the salary for the period from May 1, 2005 through December 31, 2005 and (ii) set the specific Company performance criteria to which a cash bonus award would be payable to the Senior Executive Vice President for 2005 under the Incentive Bonus Plan.

In January 2006, the Committee met to (a) certify the Company’s 2005 performance under the Incentive Bonus Plan, (b) determine the amount of incentive awards payable to the CEOs and the Senior Executive Vice President for 2005, (c) review and recommend to the independent Directors the salaries of the CEOs, (d) review and recommend to the Board of Directors the salary of the Senior Executive Vice President for 2006, and (e) set specific performance criteria and payout tables under the Incentive Bonus Plan for 2006.

Compensation Goals and Criteria

The Committee’s goals were to provide compensation that (a) reflects both the Company’s and the executives’ performance, (b) compares reasonably with compensation in the relevant market, and (c) attracts and retains high quality executives. In evaluating compensation for the CEOs, the President and the Senior Executive Vice President (the “Senior Executive Officers”), the Committee compared the Company’s performance, according to the criteria set forth below, to the performance of a peer group and the compensation of the Company’s Senior Executive Officers to the compensation of executives in the peer group. The Committee selected a peer group consisting of the top performing regional bank holding companies with between $50 billion and $200 billion in assets as of December 31, 2004 and a primary bank operating subsidiary with a rating from Moody’s of Aa3 or better and from Standard and Poor’s of AA- or better (Bank of New York Company, Inc., Fifth Third Bancorp, State Street Corp., SunTrust Banks, Inc., and U.S. Bancorp), and the holding company for the nation’s largest savings association (Washington Mutual, Inc.).

The criteria according to which the Committee compared the performance of the Company to the peers included the following: total assets, net earnings, return on average equity, return on average assets, capital levels, the ratio of non-performing assets and troubled debt restructured to period-end loans, the ratio of net charge-offs to average loans and leases, loan loss coverage, the ratio of general and administrative expenses to interest income and other income, the ratio of non-interest expenses to pretax earnings, and the ratio of pretax earnings to net interest income and non-interest income.

Additional factors considered by the Committee in evaluating compensation included: compliance with long-term plans and budgets, attainment of positive regulatory examination ratings by the Company and its operating subsidiaries, World Savings Bank, FSB and World Savings Bank, FSB (Texas), attainment of regulatory capital standards by the operating subsidiaries, strategic accomplishments of the Company, and the general assessment of the executives by peers, equity analysts, and others.

With respect to total compensation, the Committee considered annual compensation of the Company’s Senior Executive Officers relative to executives in the peer group for the period 2002 through 2004, including (i) salary, bonuses, and other forms of cash compensation and (ii) equity-based compensation, including restricted stock and stock options. The Committee concluded that while exact comparisons could not be made, the compensation of the Company’s Senior Executive Officers was reasonable in light of the Company’s performance and the compensation of peer group executives.

9

The cash compensation of the Company’s other executive officers is determined through annual reviews by their respective managers. In the annual review process, the manager considers the officer’s individual performance in his or her area of responsibility and assesses the officer’s contribution to the performance of the Company. Recommendations for salary adjustments are reviewed by the Committee and recommended to the Board for approval.

Tax Deductibility of Executive Compensation

Section 162(m) of the Internal Revenue Code limits the federal income tax deductibility of compensation paid to the Company’s two CEOs and to each of the other three most highly compensated executive officers. The Company generally may deduct compensation paid to an executive officer only to the extent that any such compensation in excess of $1 million during the relevant fiscal year is based on the attainment of performance goals determined by a compensation committee of the board of directors. The Company’s Incentive Bonus Plan is designed to assure that certain cash compensation is performance-based and therefore deductible. The Incentive Bonus Plan was approved at the 2002 Annual Meeting. Non-qualified stock options granted under the Company’s 1996 Stock Option Plan and 2005 Stock Incentive Plan qualify as performance-based under Section 162(m). Even without the provisions of Section 162(m), however, incentive stock options granted under the Company’s 1996 Stock Option Plan or the 2005 Stock Incentive Plan generally would not entitle the Company to a tax deduction. Awards of stock grants, stock units, and stock appreciation rights under the 2005 Stock Incentive Plan would be deductible by the Company.

2005 Compensation for the Chief Executive Officers

The primary components of the CEOs’ annual compensation are salary and bonus. Since 2003, the CEOs’ annual salaries have remained at $900,000. The CEOs’ bonuses have been performance-based awards made pursuant to the Company’s Incentive Bonus Plan. In setting possible bonus payments at the outset of each year, the Committee establishes specific performance standards for the Company, and determines bonus payments that would be payable based upon the actual performance of the Company, in that year. Historically, the Company has performed at levels that would have resulted in bonuses that would have increased the CEOs’ total annual cash compensation (salary plus bonus) at a rate greater than 5% per year. However, in response to the stated desire of the CEOs to limit any increase in their total annual cash compensation to no more than 5% over the previous year, the Committee has exercised its discretion under the Incentive Bonus Plan to limit actual bonus amounts paid to the CEOs.

The Incentive Bonus Plan performance standards established by the Committee for the Company in 2005 included return on average assets, return on average equity, diluted earnings per share, the ratio of general and administrative expenses to average assets, and the ratio of non-performing assets to total assets. In January 2006, the Committee met to certify the Company’s 2005 performance and to determine the amount of cash bonus awards payable to the CEOs for 2005 under the Incentive Bonus Plan. At that time, the Committee also reviewed the salaries of the Company’s CEOs for 2006 and recommended to the independent Directors that continuation of the 2005 salaries was appropriate in light of the Company’s performance and the existence of the Incentive Bonus Plan. During the year ended December 31, 2005, the Company’s results exceededall five of the performance standards, and the Company substantially exceeded the aggregate performance target, previously established by the Committee. As a result of the Company’s performance during 2005 and the CEOs’ desire to limit any increase in their total annual cash compensation to no more than 5% over the previous year, the Committee confirmed a cash bonus to each CEO for 2005 under the Incentive Bonus Plan in the amount of $614,313.

Submitted by the Compensation and Stock Option Committee:

Patricia A. King, Chair

Antonia Hernandez

Kenneth T. Rosen

10

BENEFICIAL OWNERSHIP

Section 16(a) Beneficial Ownership Reporting Compliance

Section 16(a) of the Securities Exchange Act of 1934 requires the Company’s executive officers and Directors, along with persons who beneficially own more than 10% of the Company’s Common Stock, to file reports of ownership and changes in ownership with the Securities and Exchange Commission.

Based on a review of copies of filed ownership reports, all of the Company’s executive officers, Directors (whose ownership of the Company’s Common Stock is shown on pages 3 and 4) and greater than 10% beneficial owners filed all reports required by Section 16(a) on a timely basis during 2005.

Securities Ownership of Certain Beneficial Owners and Management

The following table identifies the beneficial ownership, as of the dates indicated, of each stockholder, in addition to Herbert M. Sandler and Marion O. Sandler (whose ownership of the Company’s Common Stock is shown on pages 3 and 4), known to the Company to beneficially own more than 5% of the Company’s Common Stock. The table also identifies the beneficial ownership, as of February 28, 2006, of each of the executive officers of the Company named in the Summary Compensation Table on page 13 who are not also Directors of the Company. The business address of each executive officer named below is 1901 Harrison Street, Oakland, California 94612.

Name and Address of Beneficial Owner | | Amount and Nature

of Beneficial

Ownership | | Percent of

Class |

Davis Selected Advisers, L.P.

2949 East Elvira Road, Suite 101

Tucson, AZ 85706 | | 36,207,089(1) | | 11.8% |

| | | | |

FMR Corp

82 Devonshire Street

Boston, MA 02109 | | 25,562,105(2) | | 8.3% |

| | | | |

Dodge & Cox

555 California Street, 40th Floor

San Francisco, CA 94104 | | 19,526,113(3) | | 6.4% |

| | | | |

Russell W. Kettell

President, Chief Financial Officer, and Treasurer of the

Company and Senior Executive Vice President and Chief

Financial Officer of World Savings Bank, FSB | | 2,387,320(4) | | * |

| | | | |

James T. Judd

Senior Executive Vice President of the Company and

President and Chief Operating Officer of

World Savings Bank, FSB | | 60,000 | | * |

| | | | |

Gary R. Bradley

Executive Vice President of the Company and

World Savings Bank, FSB | | 189,000(5) | | * |

_______________

* Less than 1%.

(1) | Includes 36,207,089 shares with sole voting and sole dispositive power as of December 31, 2005, based upon SEC Schedule 13G/A filed on February 14, 2006. |

11

(2) | Includes 25,562,105 shares with sole dispositive power and 2,340,035 shares with sole voting power as of December 31, 2005, based upon SEC Schedule 13G/A filed on February 14, 2006. |

(3) | Includes 19,526,113 shares with sole dispositive power, 18,111,713 shares with sole voting power and 229,300 shares with shared voting power as of December 31, 2005, based upon SEC Schedule 13G/A filed on February 3, 2006. |

(4) | Includes 507,400 shares that Mr. Kettell may acquire upon exercise of employee stock options exercisable as of February 28, 2006, or within 60 days thereafter. |

(5) | Includes 118,850 shares that Mr. Bradley may acquire upon exercise of employee stock options exercisable as of February 28, 2006, or within 60 days thereafter. |

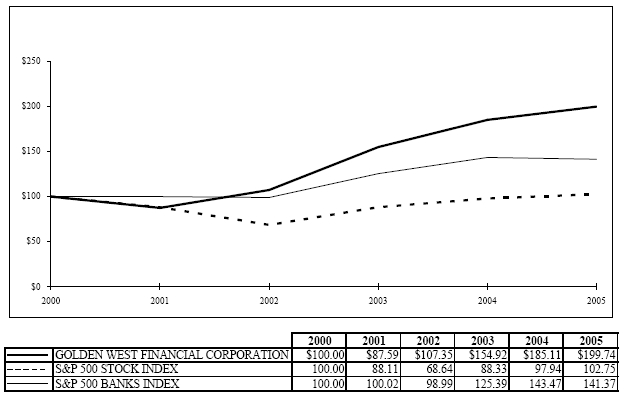

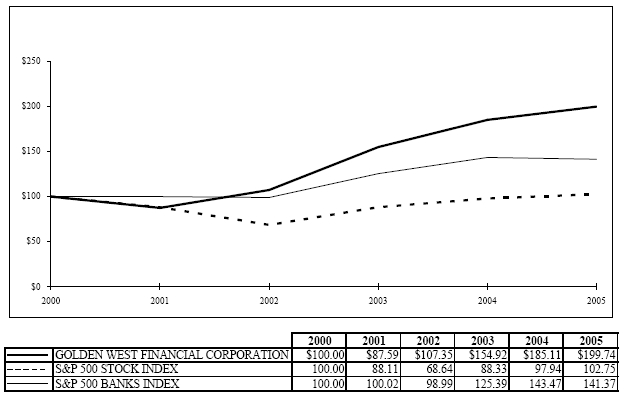

PERFORMANCE GRAPH

The graph below compares the cumulative total stockholder return (stock price appreciation plus reinvested dividends) on the Company’s Common Stock against the cumulative total stockholder return of the Standard & Poor’s 500 Stock Index and the Standard & Poor’s 500 Banks Index for the five years ended December 31, 2005. The graph assumes an initial investment of $100 on December 31, 2000 in each of the Company’s Common Stock, the S&P 500 Stock Index, and the S&P 500 Banks Index and that all dividends were reinvested.

12

EXECUTIVE COMPENSATION

Compensation of Executive Officers

The compensation paid to each of the two Chief Executive Officers and to the three other most highly compensated executive officers of the Company for services in all capacities to the Company and its subsidiaries is set forth below:

SUMMARY COMPENSATION TABLE

For the Years Ended December 31, 2005, 2004, and 2003

| | | Annual Compensation | | Long Term Compensation | | |

Name and Principal Position | | Year | | Salary | | Bonus(1) | | Other Annual

Compensation(2) | | Options

(# of Shares)(3) | | All Other

Compensation(4) |

HERBERT M. SANDLER | 2005 | | $900,000 | | $614,313 | | $10,063 | | — | | $6,300 |

Chairman of the Board and | 2004 | | 900,000 | | 542,202 | | 9,384 | | — | | 6,150 |

Chief Executive Officer of | 2003 | | 900,000 | | 473,526 | | 10,450 | | 100,000 | | 5,834 |

the Company and | | | | | | | | | | | |

World Savings Bank, FSB | | | | | | | | | | | |

| | | | | | | | | | | |

MARION O. SANDLER | 2005 | | 900,000 | | 614,313 | | 7,837 | | — | | 6,300 |

Chairman of the Board and | 2004 | | 900,000 | | 542,202 | | 7,111 | | — | | 6,150 |

Chief Executive Officer of | 2003 | | 900,000 | | 473,526 | | 8,497 | | 100,000 | | 5,834 |

the Company and | | | | | | | | | | | |

World Savings Bank, FSB | | | | | | | | | | | |

| | | | | | | | | | | |

RUSSELL W. KETTELL | 2005 | | 813,192 | | — | | 7,137 | | 50,000 | | 6,300 |

President, Chief Financial | 2004 | | 774,468 | | — | | 7,605 | | — | | 6,150 |

Officer, and Treasurer of the | 2003 | | 737,558 | | — | | 6,548 | | 100,000 | | 5,834 |

Company and Senior | | | | | | | | | | | |

Executive Vice President | | | | | | | | | | | |

and Chief Financial Officer | | | | | | | | | | | |

of World Savings Bank,FSB | | | | | | | | | | | |

| | | | | | | | | | | |

JAMES T. JUDD | 2005 | | 577,004 | | 318,613 | | 4,779 | | 50,000 | | 405,770 |

Senior Executive Vice | 2004 | | 852,968 | | — | | 5,411 | | — | | 406,150 |

President of the Company | 2003 | | 812,352 | | — | | 7,870 | | 100,000 | | 105,834 |

and President and Chief | | | | | | | | | | | |

Operating Officer of | | | | | | | | | | | |

World Savings Bank, FSB | | | | | | | | | | | |

| | | | | | | | | | | |

GARY R. BRADLEY | 2005 | | 486,162 | | — | | 132,905 | | 35,000 | | 6,300 |

Executive Vice President | 2004 | | 440,964 | | — | | 10,220 | | — | | 6,150 |

of the Company and | 2003 | | 419,964 | | — | | 7,303 | | 24,000 | | 5,834 |

World Savings Bank, FSB | | | | | | | | | | | |

| | | | | | | | | | | | |

(1) | Amounts shown are the performance-based bonuses awarded pursuant to the Company’s stockholder-approved Incentive Bonus Plan. |

(2) | Except for Gary R. Bradley in 2005, amounts shown are the cash reimbursement for income taxes on account of certain fringe benefits provided to such individuals. With respect to Mr. Bradley in 2005, in addition to $22,986 of reimbursement for income taxes on account of certain fringe benefits, Mr. Bradley received $109,919 for relocation expenses, including, among other things, $57,147 in shipping expenses. |

(3) | Options granted are under the Company’s stockholder-approved 1996 Stock Option Plan. |

(4) | Except for James T. Judd, amounts shown are the Company’s contributions on behalf of each of the executive officers to the Company’s 401(k) plan. With respect to Mr. Judd, in addition to the Company’s 401(k) plan contributions in the amounts of $5,770 (2005), $6,150 (2004), and $5,834 (2003), the Company made payments to Mr. Judd pursuant to deferred compensation agreements in the amounts of $400,000 (2005), $400,000 (2004), and $100,000 (2003). |

13

Transactions

In the ordinary course of its business, World Savings Bank, FSB from time to time relocates employees from one part of the country to another. World Savings may facilitate the relocation of these employees by bearing certain moving expenses and may, when an employee has been unable to promptly sell his or her former home after listing it for sale, purchase the employee’s former home. A home purchase may be in excess of $60,000.

During 2005, Gary R. Bradley was relocated from Texas to California. Mr. Bradley is an Executive Vice President of the Company and World Savings Bank, FSB. In addition to bearing certain of Mr. Bradley’s relocation expenses, World Savings also purchased Mr. Bradley’s home in Texas for $850,000. The purchase price, which was formally established by the Group Senior Vice President of World Savings with overall responsibility for valuing residential real estate acquired by the Company, was determined by taking the lowest value of several appraisals of the home.

Indebtedness

The following table sets forth information relating to all loans outstanding to each individual who was a Director or executive officer of the Company during 2005:

Name | | Highest

Indebtedness

Since Dec. 31, 2004 | | Unpaid

Balance as of

Feb. 28, 2006 | | Range of

Interest Rates

from Jan. 1, 2005

to Feb. 28, 2006 |

Carl M. Andersen | | $234,112 | | $223,248 | | 3.260 to 4.596% |

William C. Nunan | | 218,020 | | 0 | | 2.960 to 4.190% |

Carl M. Andersen is a Group Senior Vice President and the Tax Director of the Company and World Savings Bank, FSB. Mr. Andersen’s loan is secured by a first deed of trust on his single-family residence. William C. Nunan is a Group Senior Vice President and the Chief Accounting Officer of the Company and World Savings Bank, FSB. Mr. Nunan’s loan, which was fully paid off in February 2006, also was secured by his home.

In the ordinary course of its business as a residential real estate lender, World Savings Bank, FSB may from time to time enter into real estate loans in excess of $60,000 with immediate family members of Directors and executive officers of the Company. Any such loans would be made on substantially the same terms, including interest rates and collateral, as those prevailing at the time for comparable residential real estate loans, and would not involve more than the normal risk of collectability or present other unfavorable features.

Deferred and Retirement Compensation

The Company has entered into deferred compensation agreements with three of its five most highly compensated executive officers: Gary R. Bradley, James T. Judd, and Russell W. Kettell.

The Company’s agreements with these officers provide for benefits payable in monthly or semi-monthly installments over ten years commencing at age 65 or upon the earlier death of the employee (paid to his or her beneficiary). The agreements contain vesting schedules that provide for full vesting by ages ranging from 58 to 65, depending upon the officer’s age at the time the agreement was executed, or immediately upon the death of the officer. The vesting schedules generally provide that one-third of the benefits vest during the first half of the vesting period and two-thirds vest during the second half.

As of December 31, 2005, Mr. Bradley was 47.2% vested in an agreement that provides for him to receive aggregate annual payments of $300,000 for a ten year period; Mr. Judd was fully vested in an agreement pursuant to which he receives aggregate annual payments of $100,000 for a ten year period, which agreement had $100,000 of total benefits remaining; Mr. Judd was fully vested in a second agreement pursuant to which he receives aggregate annual payments of $300,000 for a ten year period, which agreement had $2,400,000 of total benefits remaining; and Mr. Kettell was fully vested in an agreement that provides for him to receive aggregate annual payments of $375,000 for a ten year period, which agreement had $3,750,000 of total remaining benefits.

14

The Company carries life insurance policies in amounts estimated to be sufficient to cover its obligations under these agreements. If assumptions as to mortality, future policy dividends, and other factors are realized, the Company will recover an amount equal to all retirement payments under the agreements, plus the premiums on the insurance contracts and the interest that could have been earned on the use of the premium payments.

Stock Options

The Company did not grant any stock options to the two Chief Executive Officers during 2005. The Company granted stock options to the other three most highly compensated executive officers of the Company during 2005, as shown below:

OPTION GRANTS TABLE

Option Grants for the Year Ended December 31, 2005

| | Individual Grants | | |

| | | Number of

Securities

Underlying

Options | | % of Total

Options Granted

to Employees in | | Exercise or

Base Price | | Expiration | | Potential Realizable Value at

Assumed Annual Rates of Stock

Price Appreciation for Option

Term |

Name | | | Granted (#) | | Fiscal Year | | ($/Share) | | Date | | 5% | | 10% |

Herbert M. Sandler | | 0 | | — | | — | | — | | — | | — |

Marion O. Sandler | | 0 | | — | | — | | — | | — | | — |

Russell W. Kettell | | 50,000 | | 2.51% | | $65.69 | | 7/13/2015 | | $2,065,604 | | $5,234,647 |

James T. Judd | | 50,000 | | 2.51% | | 65.69 | | 7/13/2015 | | 2,065,604 | | 5,234,647 |

Gary R. Bradley | | 35,000 | | 1.76% | | 65.69 | | 7/13/2015 | | 1,445,923 | | 3,664,253 |

The Company did not grant any stock appreciation rights or other equity-based compensation to the two Chief Executive Officers or the other three most highly compensated executive officers of the Company during 2005.

Information about exercises of stock options by these individuals during 2005 and certain information about unexercised stock options is set forth below:

OPTION EXERCISES AND YEAREND VALUE TABLE

Aggregated Option Exercises in the Year Ended December 31, 2005 and

December 31, 2005 Yearend Option Values

| | Shares

Acquired on | | Value | | Number of Securities Underlying

Unexercised Options at

December 31, 2005 (#) | | Value of Unexercised

In-the-Money Options at

December 31, 2005(2) |

Name | | | Exercise (#) | | Realized(1) | | Exercisable | | Unexercisable | | Exercisable | | Unexercisable |

Herbert M. Sandler | | 360,000 | | $20,414,923 | | 555,000 | | 100,000 | | $27,272,094 | | $2,348,000 |

Marion O. Sandler | | 360,000 | | 20,210,725 | | 555,000 | | 100,000 | | 27,272,094 | | 2,348,000 |

Russell W. Kettell | | 77,100 | | 4,249,118 | | 542,400 | | 150,000 | | 27,030,637 | | 2,363,500 |

James T. Judd | | 80,000 | | 3,200,400 | | 0 | | 150,000 | | 0 | | 2,363,500 |

Gary R. Bradley | | 38,650 | | 1,889,249 | | 129,350 | | 59,000 | | 6,502,870 | | 574,370 |

| | | | | | | | | | | | | |

_______________

(1) | Market value of underlying securities at exercise date less the option price. |

(2) | Market value of unexercised “in-the-money” options at yearend ($66.00 per share) less the option price of such options. |

15

INDEPENDENT OUTSIDE AUDITORS’ FEES

Deloitte & Touche LLP provides audit and audit-related services to the Company, and its affiliate, Deloitte Tax LLP, provides tax services to the Company. The following is a summary of the fees billed to the Company by Deloitte & Touche LLP and Deloitte Tax LLP for services rendered for the years ended December 31, 2005 and 2004:

| | 2005 | | 2004 | |

Audit Fees For services rendered for the audit of the Company’s yearend financial statements, including the audit of management’s assessment of the effectiveness of the Company’s internal control over financial reporting as required by the Sarbanes-Oxley Act of 2002; the attestation of management’s assessment of the internal controls of the Company’s subsidiary federal savings banks as required by the Federal Deposit Insurance Corporation Improvement Act of 1991; the reviews of the Company’s quarterly interim financial statements; and the reviews of registration statements and issuances of comfort letters in connection with the Company’s debt offerings | | $1,225,345 | | $1,097,945 | |

Audit-Related Fees For services rendered for the audits of the Company’s employee benefit plans; and, in 2004, the coordination of the processes for the documentation and testing of the Company’s internal control over financial reporting | | 21,000 | | 140,500 | |

Tax Fees For services rendered for federal, state, and local tax compliance and planning; the licensing of software for enterprise zone credit determinations; and, in 2004, the reviews of federal and state tax returns | | 29,097 | | 82,412 | (1) |

All other Fees None | | 0 | | 0 | |

| | | | | |

Total | | $1,275,442 | | $1,320,857 | |

_______________

(1) | Includes a one-time payment of $25,000 to Deloitte Tax LLP in 2004 in connection with the termination of an engagement relating to the filing of amended Florida tax returns for the years 1996-1999. The engagement, which was entered into during 2000, was terminated following the publication by the SEC of a letter by its Chief Accountant, dated May 21, 2004, clarifying what constitutes a contingent fee arrangement for tax services. |

Audit Committee Pre-Approval Policy

All services performed by the independent outside auditors for the Company in 2005 were pre-approved by the Audit Committee in accordance with its pre-approval policy. The policy describes the audit, audit-related, tax, and other services permitted to be performed by the independent outside auditors, subject to the Audit Committee’s prior approval of the services and related fees. Requests for the independent outside auditors to perform services are submitted jointly by both management and the independent outside auditors. Any pre-approved services that would exceed 120% of the initially approved fee amount require specific additional pre-approval by the Audit Committee. At each of its regular committee meetings, the Audit Committee reviews summaries of the pre-approved services being provided, along with the related fees being charged, by the independent outside auditors.

16

STOCKHOLDER PROPOSALS FOR NEXT ANNUAL MEETING

Securities and Exchange Commission Proxy Rule 14a-8 specifies when a company must include a stockholder proposal in its proxy statement and identify the proposal in its proxy relating to the company’s annual meeting. This rule provides that submission of a proposal does not guarantee its inclusion. In accordance with Rule 14a-8, stockholder proposals intended to be presented at the Company’s 2007 Annual Meeting must be received by the Company no later than November 10, 2006 in order to be included in the Company’s Proxy Statement and proxy relating to the 2007 Annual Meeting. If a stockholder fails to submit a proposal by that date, the Company will not be required to provide any information about the proposal in its Proxy Statement or in the form of proxy.

If a stockholder intends to submit a proposal at the Company’s 2007 Annual Meeting, which proposal is not intended to be included in the Company’s Proxy Statement and proxy relating to that meeting, the stockholder should submit the proposal to the Company no later than January 24, 2007. If a stockholder fails to submit a proposal by that date, the proxy holders designated in the proxy relating to that meeting will be allowed to use their discretionary voting authority if the proposal is raised at the meeting. Proposals should be addressed to the Company at 1901 Harrison Street, Oakland, California 94612, Attention: Corporate Secretary.

GOLDEN WEST FINANCIAL CORPORATION

Oakland, California

March 10, 2006

17

GOLDEN

WEST

FINANCIAL

CORPORATION

1901 HARRISON STREET

OAKLAND, CA 94612

VOTE BY INTERNET -www.proxyvote.com

Use the Internet to transmit your voting instructions and for electronic delivery of information up until 11:59 P.M. Eastern Time the day before the cut-off date or meeting date. Have your proxy card in hand when you access the web site and follow the instructions to obtain your records and to create an electronic voting instruction form.

ELECTRONIC DELIVERY OF FUTURE SHAREHOLDER COMMUNICATIONS

If you would like to reduce the costs incurred by Golden West Financial Corporation mailing proxy materials, you can consent to receiving all future proxy statements, proxy cards and annual reports electronically via e-mail or the Internet. To sign up for electronic delivery, please follow the instructions above to vote using the Internet and, when prompted, indicate that you agree to receive or access shareholder communications electronically in future years.

VOTE BY PHONE - 1-800-690-6903

Use any touch-tone telephone to transmit your voting instructions up until 11:59 P.M. Eastern Time the day before the cut-off date or meeting date. Have your proxy card in hand when you call and then follow the instructions.

VOTE BY MAIL

Mark, sign and date your proxy card and return it in the postage-paid envelope we have provided or return it to Golden West Financial Corporation, c/o ADP, 51 Mercedes Way, Edgewood, NY 11717.

| | |

| TO VOTE, MARK BLOCKS BELOW IN BLUE OR BLACK INK AS FOLLOWS: | GOLDW1 | KEEP THIS PORTION FOR YOUR RECORDS |

| |

| | | DETACH AND RETURN THIS PORTION ONLY |

THIS PROXY CARD IS VALID ONLY WHEN SIGNED AND DATED. |

GOLDEN WEST FINANCIAL CORPORATION

| | | | | | | | | | | | | |

| The Board of Directors recommends a vote "For All" the director nominees and "For" the selection of Deloitte & Touche as auditors. | | | | | | | | |

| | | | | | | | | | | | | |

| 1. | ELECTION OF DIRECTORS.

Nominees:

01) Maryellen C. Herringer

02) Kenneth T. Rosen

03) Herbert M. Sandler | | | For

All

¨ | Withhold

For All

¨ | For All

Except

¨ | | To withhold authority to vote for a nominee, mark “For All Except” and write the nominee’s name on the line below.

_______________________________________ | |

| (If you wish to cumulate votes for Directors, see below) | | | | | | | | For | Against | Abstain |

| | | | | | | | | | | |

| 2. | RATIFICATION OF THE SELECTION OF DELOITTE & TOUCHE LLP to serve as the Company`s independent outside auditors for the year ending December 31, 2006. | ¨ | ¨ | ¨ |

| | | | |

| 3. | To vote on any other matters that may properly come before the meeting according to the best judgment and discretion of the person voting the proxy. | | | |

| | | | | | | | | | | | |

| | | | | | | | | | | | |

| Please date and sign below exactly as your name or names appear on this proxy. If more than one name appears, all should sign. Joint owners should each sign personally. Corporate proxies should be signed in full corporate name by an authorized officer and attested. Persons signing in a fiduciary capacity should indicate their full names in such capacity. | | | |

| | | | | | | | | | | | |

If you wish to cumulate votes for Directors, do NOT mark "For All", "Withhold All" or "For All Except" above, but check the box at right and indicate, next to each desired nominee's name above, the percentages of your votes you wish to allocate, not to exceed 100%. | ¨ | | | | | | | |

| | | | | | | | | | | | |

| | Yes | No | | | | | | | | | |

| | | | | | | | | | | |

Please indicate if you plan to attend the Annual Meeting in person. | ¨ | ¨ | | | | | | | | | |

| | | | | | | | | | | | |

| | | | | | |

| | | | |

| |

| Signature [PLEASE SIGN WITHIN BOX] | Date | | Signature (Joint Owner) | Date | |

NOTICE OF ANNUAL MEETING OF STOCKHOLDERS

OF

GOLDEN WEST FINANCIAL CORPORATION

The Annual Meeting of Stockholders of Golden West Financial Corporation will be held on the fourth floor of the Company’s headquarters located at 1901 Harrison Street, Oakland, California on Wednesday, May 3, 2006, commencing at 11:00 a.m. Pacific Time, for the following purposes:

| 1) | To elect three Directors to hold office for three-year terms and until their successors are duly elected and qualified;

|

| 2) | To ratify the selection of independent outside auditors; and

|

| 3) | To transact other business as may properly come before the meeting or any adjournments or postponements thereof. |

The close of business on March 2, 2006 is the record date for determining the stockholders entitled to vote at this meeting or any adjournments or postponements of this meeting. A list of stockholders entitled to vote will be available at the time and place of the meeting and, during ten days prior to the meeting, at the office of the Secretary of Golden West Financial Corporation, 1901 Harrison Street, Oakland, California.

| By order of the Board of Directors

|

|

|

| MICHAEL ROSTER |

| Executive Vice President and Secretary |

Oakland, California

March 10, 2006

IMPORTANT: | We want to assure that you are represented at the meeting. Please complete, date, sign and mail the enclosed proxy promptly in the return envelope, which we have provided. |

| | | |

| GOLDEN | PROXY SOLICITED BY THE BOARD OF DIRECTORS |

| WEST | |

| FINANCIAL | The undersigned hereby appoints Russell W. Kettell, Michael Roster and Marion O. Sandler, or any of them, each with power of substitution, as proxies of the undersigned to attend the Annual Meeting of Stockholders of Golden West Financial Corporation (the “Company”), to be held on the fourth floor of the Company’s headquarters located at 1901 Harrison Street, Oakland, California on May 3, 2006, commencing at 11:00 a.m. Pacific Time, and any adjournments or postponements thereof, and to vote the number of shares of Common Stock of the Company which the undersigned would be entitled to vote if personally present on the matters stated on the reverse side. If you are going to cumulate votes for Directors, you may not vote by Internet or phone; instead you must return this card. |

| CORPORATION |

|

| |

| |

| |

| |

| |

THIS PROXY WILL BE VOTED IN ACCORDANCE WITH INSTRUCTIONS GIVEN. IN THE ABSENCE OF SUCH INSTRUCTIONS, THIS PROXY WILL BE VOTED

(1) FOR ALL NOMINEES LISTED FOR THE ELECTION OF DIRECTORS, AND

(2) FOR THE RATIFICATION OF THE SELECTION OF DELOITTE & TOUCHE AS THE COMPANY'S AUDITORS.

|

| |

| |

| |

| |

| |

| |

| |

Stockholders are Urged to Complete, Sign and Return This Proxy Promptly in the Enclosed Envelope. |

| |

| (CONTINUED AND TO BE SIGNED ON REVERSE SIDE) |

| |