| UNITED STATES |

| SECURITIES AND EXCHANGE COMMISSION |

| Washington, D.C. 20549 |

| CERTIFIED SHAREHOLDER REPORT OF REGISTERED MANAGEMENT |

| INVESTMENT COMPANIES |

| Investment Company Act file number | | 811-524 |

| The Dreyfus/Laurel Funds Trust |

| (Exact name of Registrant as specified in charter) |

| c/o The Dreyfus Corporation |

| 200 Park Avenue |

| New York, New York 10166 |

| (Address of principal executive offices) (Zip code) |

| |

| Mark N. Jacobs, Esq. |

| 200 Park Avenue |

| New York, New York 10166 |

| (Name and address of agent for service) |

| Registrant's telephone number, including area code: | | (212) 922-6000 |

| Date of fiscal year end: | | 12/31 | | |

| Date of reporting period: | | 12/31/04 | | |

SSL-DOCS2 70128344v14

| | | | | FORM N-CSR |

| Item 1. | | Reports to Stockholders. | | |

| Dreyfus Premier |

| Core Value Fund |

| ANNUAL REPORT December 31, 2004 |

Save time. Save paper. View your next shareholder report online as soon as it’s available. Log into www.dreyfus.com and sign up for Dreyfus eCommunications. It’s simple and only takes a few minutes.

The views expressed in this report reflect those of the portfolio manager only through the end of the period covered and do not necessarily represent the views of Dreyfus or any other person in the Dreyfus organization. Any such views are subject to change at any time based upon market or other conditions and Dreyfus disclaims any responsibility to update such views.These views may not be relied on as investment advice and, because investment decisions for a Dreyfus fund are based on numerous factors, may not be relied on as an indication of trading intent on behalf of any Dreyfus fund.

Not FDIC-Insured • Not Bank-Guaranteed • May Lose Value

| Contents |

| |

| | | THE FUND |

| |

|

| 2 | | Letter from the Chairman |

| 3 | | Discussion of Fund Performance |

| 6 | | Fund Performance |

| 8 | | Understanding Your Fund’s Expenses |

| 8 | | Comparing Your Fund’s Expenses |

| With Those of Other Funds |

| 9 | | Statement of Investments |

| 14 | | Statement of Assets and Liabilities |

| 15 | | Statement of Operations |

| 16 | | Statement of Changes in Net Assets |

| 19 | | Financial Highlights |

| 25 | | Notes to Financial Statements |

| 34 | | Report of Independent Registered |

| | | Public Accounting Firm |

| 35 | | Important Tax Information |

| 36 | | Board Members Information |

| 38 | | Officers of the Fund |

| FOR MORE INFORMATION |

|

| | | Back Cover |

| Dreyfus Premier |

| Core Value Fund |

LETTER FROM THE CHAIRMAN

We are pleased to present this annual report for Dreyfus Premier Core Value Fund, covering the 12-month period from January 1, 2004, through December 31, 2004. Inside, you’ll find valuable information about how the fund was managed during the reporting period, including a discussion with the fund’s portfolio manager, Brian Ferguson, portfolio manager and member of the Large Cap Value Team of The Boston Company Asset Management.

2004 represented the second consecutive year of positive stock market performance. Unlike the 2003 rally, however, in which most stocks rose as general business conditions improved, 2004’s market performance largely reflected the strengths and weaknesses of individual companies and industries. As a result, fundamental research and professional judgment became more important determinants of mutual fund performance in 2004.

What’s ahead for stocks in 2005? No one knows for certain. Positive influences remain in place, including moderately expanding U.S. and global economies and low inflation. Nonetheless, a number of risks — such as rising short-term interest rates, currency fluctuations and generally slowing corporate earnings — could threaten the market environment.

As always, we urge our shareholders to view the stock market from a long-term perspective, measured in years rather than weeks or months. One of the best ways to ensure a long-term perspective is to establish an investment plan with the help of your financial advisor, and review it periodically to track your progress toward your financial goals.

Thank you for your continued confidence and support.

DISCUSSION OF FUND PERFORMANCE

| Brian Ferguson, Portfolio Manager |

| Large Cap Value Team |

How did Dreyfus Premier Core Value Fund perform relative to its benchmark?

For the 12-month period ended December 31, 2004, Dreyfus Premier Core Value Fund produced total returns of 11.41% for its Class A Shares, 10.62% for its Class B Shares, 10.62% for its Class C Shares, 11.53% for its Institutional shares, 11.69% for its Class R Shares and 11.14% for its Class T Shares.1 In comparison, the fund’s benchmark, the S&P 500/BARRA Value Index, produced a total return of 15.71% for the same period.2

We attribute the fund’s performance to the stock market’s strength over the final months of 2004, which stood in stark contrast to its relatively sluggish performance earlier in the year. Although the fund benefited from the positive contributions produced by a number of individual stocks and market sectors, its returns underperformed the S&P 500/BARRA Value Index.The fund’s underperformance in 2004 was primarily due to its emphasis on technology stocks, which lagged the averages amid lackluster customer demand, and its relatively light exposure to energy stocks, which prevented the portfolio from participating fully in the sector’s gains when gas and oil prices surged higher.

We are pleased to announce that on April 5, 2004, the Large Cap Value Team of The Boston Company Asset Management, an affiliate of The Dreyfus Corporation, started managing the fund. Each committee member is also an employee of The Dreyfus Corporation.

What is the fund’s investment approach?

The fund invests primarily in large-cap value companies that are considered undervalued based on traditional measures, such as price-to-earnings ratios. When choosing stocks, we use a “bottom-up” stock selection approach, focusing on individual companies, rather than a

The Fund 3

DISCUSSION OF FUND PERFORMANCE (continued)

|

“top-down” approach that forecasts market trends.We also focus on a company’s relative value, financial strength, sales and earnings momentum and likely catalysts that could ignite the stock price.

What other factors influenced the fund’s performance?

U.S. stock prices rose only modestly during the first 10 months of the reporting period, primarily because investors were worried about the sustainability of the economic recovery amid sluggish labor markets, rising interest rates, higher oil prices and the insurgency in Iraq. By the fourth quarter of 2004, however, the resolution of the U.S. presidential election lifted a cloud of uncertainty from the economy and market, and most stocks rallied strongly throughout the end of the year.

While we are pleased that a number of the fund’s individual stocks and market sectors participated significantly in the market’s strength, its returns lagged the S&P 500/BARRA Value Index. That’s because the fund’s bottom-up security selection strategy resulted in heavier exposure in technology stocks than the benchmark.The fund’s performance was hindered by two of its semiconductor holdings, Intel and Fairchild Semiconductor, which declined sharply when profits fell due to higher costs associated with research-and-development activities and investments in new plants. In addition, the fund’s relative performance suffered as a result of its relatively light holdings within the energy group, which benefited from rising oil and gas prices and comprised one of the S&P 500/BARRA Value Index’s stronger-performing sectors during the year.

A handful of stocks in other sectors also provided disappointing results. In the health care sector, drug distributor Cardinal Health suffered when allegations of accounting irregularities led to the departure of the company’s Chief Financial Officer.The fund’s media holdings were hurt when advertising spending, as a whole, failed to meet analysts’ expectations, despite advertisers’ historical tendency to spend heavily during the Olympics and U.S. elections.

On the other hand, the fund enjoyed strong returns from a number of its investments during the reporting period. For instance, the fund

received particularly robust returns from the utilities sector, where wireless communications companies such as AT&T Wireless Services and Sprint benefited from improving business fundamentals and industry consolidation. Electric utilities also posted solid gains, most notably TXU and power producers Exelon and Entergy.

In the capital goods area, the fund received strong contributions from its positions in wireless handset manufacturer Ericsson L.M., diversified industrial products manufacturer Eaton Corporation and aerospace giant Boeing, whose stock price rose due to a positive inflection point in the commercial aerospace business cycle.

What is the fund’s current strategy?

While we have continued to rely on our “bottom-up” stock selection strategy to identify attractively valued stocks, as of the end of the reporting period we have focused on companies that we believe should benefit from higher levels of corporate capital spending. Accordingly, the fund ended 2004 with greater exposure than the benchmark to the capital goods, consumer services, consumer non-durables and technology areas. Conversely, the fund has less exposure than the benchmark to the basic materials, health care, utilities and financial sectors. In our view, this positioning will allow the fund to benefit from continued economic growth in the next phase of the business cycle.

| 1 | | Total return includes reinvestment of dividends and any capital gains paid, and does not take into |

| | | consideration the maximum initial sales charges in the case of Class A and Class T shares or the |

| | | applicable contingent deferred sales charges imposed on redemptions in the case of Class B and |

| | | Class C shares. Had these charges been reflected, returns would have been lower. Past performance |

| | | is no guarantee of future results. Share price and investment return fluctuate such that upon |

| | | redemption, fund shares may be worth more or less than their original cost. |

| 2 | | SOURCE: LIPPER INC. — Reflects the reinvestment of dividends and, where applicable, |

| | | capital gain distributions.The S&P 500/BARRA Value Index is a capitalization-weighted |

| | | index of all the stocks in the Standard & Poor’s 500 Composite Price Index (“S&P 500 |

| | | Index”) that have low price-to-book ratios.The S&P 500 Index is a widely accepted, unmanaged |

| | | index of U.S. stock market performance. |

The Fund 5

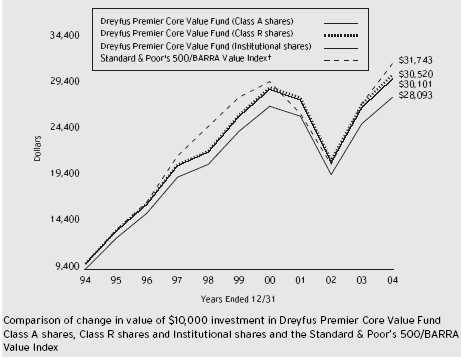

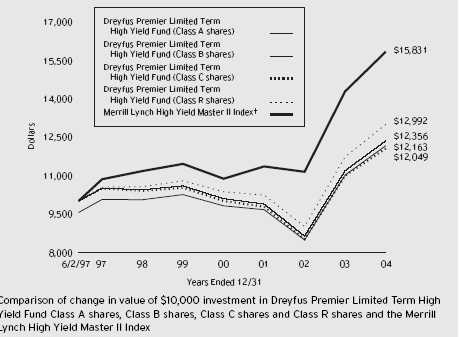

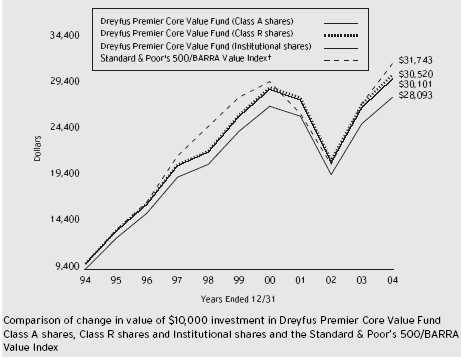

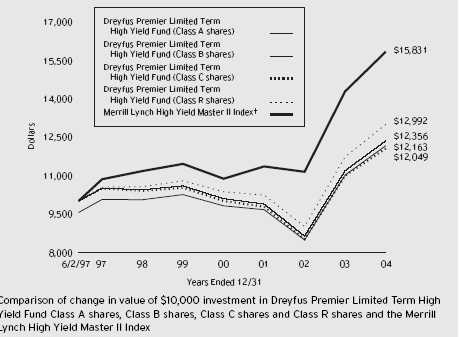

| † Source: Lipper Inc. |

| Past performance is not predictive of future performance. |

| The above graph compares a $10,000 investment made in Class A shares, Institutional shares and Class R shares of |

| Dreyfus Premier Core Value Fund on 12/31/94 to a $10,000 investment made in the Standard & Poor’s |

| 500/BARRA Value Index (the “Index”) on that date. All dividends and capital gain distributions are reinvested. |

| Performance for Class B, Class C and Class T shares will vary from the performance of Class A, Institutional and |

| Class R shares shown above due to differences in charges and expenses. |

| The fund’s performance shown in the line graph takes into account the maximum initial sales charge on Class A |

| shares and all other applicable fees and expenses for Class A shares, Institutional shares and Class R shares.The |

| Index is a capitalization-weighted index of all the stocks in the S&P 500 that have low price-to-book ratios.The |

| Index does not take into account charges, fees and other expenses. Further information relating to fund performance, |

| including expense reimbursements, if applicable, is contained in the Financial Highlights section of the prospectus and |

| elsewhere in this report. |

| Average Annual Total Returns as of 12/31/04 | | | | | | |

| |

| | | Inception | | | | | | | | From |

| | | Date | | 1 Year | | 5 Years | | 10 Years | | Inception |

| |

| |

| |

| |

| |

|

| Class A shares | | | | | | | | | | |

| with maximum sales charge (5.75%) | | | | 5.02% | | 1.66% | | 10.88% | | |

| without sales charge | | | | 11.41% | | 2.87% | | 11.54% | | |

| Class B shares | | | | | | | | | | |

| with applicable redemption charge † | | 1/16/98 | | 6.62% | | 1.74% | | — | | 5.30%†† |

| without redemption | | 1/16/98 | | 10.62% | | 2.10% | | — | | 5.30%†† |

| Class C shares | | | | | | | | | | |

| with applicable redemption charge ††† | | 1/16/98 | | 9.62% | | 2.09% | | — | | 5.20% |

| without redemption | | 1/16/98 | | 10.62% | | 2.09% | | — | | 5.20% |

| Class R shares | | | | 11.69% | | 3.13% | | 11.80% | | |

| Institutional shares | | | | 11.53% | | 2.97% | | 11.65% | | |

| Class T shares | | | | | | | | | | |

| with applicable sales charge (4.5%) | | 8/16/99 | | 6.15% | | 1.66% | | — | | 2.31% |

| without sales charge | | 8/16/99 | | 11.14% | | 2.60% | | — | | 3.18% |

Past performance is not predictive of future performance.The fund’s performance shown in the graph and table does not reflect the deduction of taxes that a shareholder would pay on fund distributions or the redemption of fund shares.

| † | | The maximum contingent deferred sales charge for Class B shares is 4%.After six years Class B shares convert to |

| | | Class A shares. |

| †† | | Assumes the conversion of Class B shares to Class A shares at the end of the sixth year following the date of |

| | | purchase. |

| ††† | | The maximum contingent deferred sales charge for Class C shares is 1% for shares redeemed within one year of the |

| | | date of purchase. |

The Fund 7

U N D E R S TA N D I N G YO U R F U N D ’ S E X P E N S E S ( U n a u d i t e d )

As a mutual fund investor, you pay ongoing expenses, such as management fees and other expenses. Using the information below, you can estimate how these expenses affect your investment and compare them with the expenses of other funds.You also may pay one-time transaction expenses, including sales charges (loads) and redemption fees, which are not shown in this section and would have resulted in higher total expenses. For more information, see your fund’s prospectus or talk to your financial adviser.

Review your fund’s expenses

The table below shows the expenses you would have paid on a $1,000 investment in Dreyfus Premier Core Value Fund from July 1, 2004 to December 31, 2004. It also shows how much a $1,000 investment would be worth at the close of the period, assuming actual returns and expenses.

| Expenses and Value of a $1,000 Investment |

| assuming actual returns for the six months ended December 31, 2004 |

| | | Class A | | Class B | | Class C | | Class R | | Class T | | Institutional |

| |

| |

| |

| |

| |

| |

|

| Expenses paid | | | | | | | | | | | | |

| per $1,000 † | | $ 6.02 | | $ 9.93 | | $ 9.93 | | $ 4.72 | | $ 7.33 | | $ 5.50 |

| Ending value | | | | | | | | | | | | |

| (after expenses) | | $1,083.30 | | $1,079.40 | | $1,079.40 | | $1,084.70 | | $1,082.00 | | $1,083.90 |

| COMPARING YOUR FUND’S EXPENSES |

| WITH THOSE OF OTHER FUNDS (Unaudited) |

Using the SEC’s method to compare expenses

The Securities and Exchange Commission (SEC) has established guidelines to help investors assess fund expenses. Per these guidelines, the table below shows your fund’s expenses based on a $1,000 investment, assuming a hypothetical 5% annualized return. You can use this information to compare the ongoing expenses (but not transaction expenses or total cost) of investing in the fund with those of other funds.All mutual fund shareholder reports will provide this information to help you make this comparison. Please note that you cannot use this information to estimate your actual ending account balance and expenses paid during the period.

| Expenses and Value of a $1,000 Investment |

| assuming a hypothetical 5% annualized return for the six months ended December 31, 2004 |

| | | Class A | | Class B | | Class C | | Class R | | Class T | | Institutional |

| |

| |

| |

| |

| |

| |

|

| Expenses paid | | | | | | | | | | | | |

| per $1,000 † | | $ 5.84 | | $ 9.63 | | $ 9.63 | | $ 4.57 | | $ 7.10 | | $ 5.33 |

| Ending value | | | | | | | | | | | | |

| (after expenses) | | $1,019.36 | | $1,015.58 | | $1,015.58 | | $1,020.61 | | $1,018.10 | | $1,019.86 |

- Expenses are equal to the fund’s annualized expense ratio of 1.15% for Class A, 1.90% for Class B, 1.90% for Class C, .90% for Class R, 1.40% for Class T and 1.05% for Institutional multiplied by the average account value over the period, multiplied by 184/366 (to reflect the one-half year period).

STATEMENT OF INVESTMENTS

December 31, 2004

|

| Common Stocks—99.5% | | Shares | | Value ($) |

| |

| |

|

| Banking—15.6% | | | | |

| Bank of America | | 572,536 | | 26,903,467 |

| Citigroup | | 631,033 | | 30,403,169 |

| Countrywide Financial | | 124,300 | | 4,600,343 |

| Fannie Mae | | 99,100 | | 7,056,911 |

| Freddie Mac | | 184,100 | | 13,568,170 |

| PNC Financial Services Group | | 78,500 | | 4,509,040 |

| SunTrust Banks | | 59,800 | | 4,418,024 |

| U.S. Bancorp | | 382,300 | | 11,973,636 |

| Wachovia | | 340,800 | | 17,926,080 |

| Wells Fargo & Co. | | 134,800 | | 8,377,820 |

| | | | | 129,736,660 |

| Basic Industries—3.1% | | | | |

| Bowater | | 93,900 | | 4,128,783 |

| China Steel, ADR | | 7 a | | 158 |

| Dow Chemical | | 165,300 | | 8,184,003 |

| E. I. du Pont de Nemours | | 86,695 | | 4,252,389 |

| International Paper | | 220,000 | | 9,240,000 |

| | | | | 25,805,333 |

| Beverages & Tobacco—.8% | | | | |

| Altria Group | | 115,500 | | 7,057,050 |

| Brokerage—9.0% | | | | |

| Goldman Sachs Group | | 165,800 | | 17,249,832 |

| J.P. Morgan Chase & Co. | | 601,500 | | 23,464,515 |

| Merrill Lynch | | 208,050 | | 12,435,149 |

| Morgan Stanley | | 383,200 | | 21,275,264 |

| | | | | 74,424,760 |

| Broadcasting & Publishing—1.6% | | |

| Time Warner | | 677,500 b | | 13,170,600 |

| Capital Goods—12.0% | | | | |

| Boeing | | 264,200 | | 13,677,634 |

| Eaton | | 69,800 | | 5,050,728 |

| Emerson Electric | | 64,260 | | 4,504,626 |

| General Electric | | 664,900 | | 24,268,850 |

The Fund 9

S T A T E M E N T O F I N V E S T M E N T S (continued)

| Common Stocks (continued) | | Shares | | | | Value ($) |

| |

| |

| |

|

| Capital Goods (continued) | | | | | | |

| Nokia, ADR | | 526,000 | | | | 8,242,420 |

| Tyco International | | 627,400 | | | | 22,423,276 |

| United Technologies | | 183,900 | | | | 19,006,065 |

| Xerox | | 137,950 | | b | | 2,346,530 |

| | | | | | | 99,520,129 |

| Consumer Durables—.5% | | | | | | |

| Koninklijke (Royal) Philips Electronics | | | | | | |

| (New York Shares) | | 154,100 | | | | 4,083,650 |

| Consumer Non-Durables—4.3% | | | | | | |

| Coca-Cola | | 99,100 | | | | 4,125,533 |

| Colgate-Palmolive | | 163,200 | | | | 8,349,312 |

| General Mills | | 90,000 | | | | 4,473,900 |

| Jones Apparel Group | | 103,700 | | | | 3,792,309 |

| Kimberly-Clark | | 69,000 | | | | 4,540,890 |

| Kraft Foods, Cl. A | | 183,900 | | | | 6,548,679 |

| Newell Rubbermaid | | 173,300 | | c | | 4,192,127 |

| | | | | | | 36,022,750 |

| Consumer Services—11.3% | | | | | | |

| Advance Auto Parts | | 129,900 | | b | | 5,674,032 |

| Clear Channel Communications | | 407,100 | | | | 13,633,779 |

| DST Systems | | 173,900 | | b | | 9,063,668 |

| Liberty Media, Cl. A | | 1,185,080 | | b | | 13,012,178 |

| Liberty Media International, Cl. A | | 86,134 | | b | | 3,981,975 |

| McDonald’s | | 268,200 | | | | 8,598,492 |

| News, Cl. A | | 362,400 | | | | 6,762,384 |

| Omnicom Group | | 164,900 | | | | 13,904,368 |

| Safeway | | 327,300 | | b | | 6,460,902 |

| Viacom, Cl. B | | 344,400 | | | | 12,532,716 |

| | | | | | | 93,624,494 |

| Energy—11.8% | | | | | | |

| Apache | | 115,000 | | c | | 5,815,550 |

| BP, ADR | | 194,000 | | | | 11,329,600 |

| Common Stocks (continued) | | Shares | | Value ($) |

| |

| |

|

| Energy (continued) | | | | |

| ChevronTexaco | | 182,900 | | 9,604,079 |

| ConocoPhillips | | 162,060 | | 14,071,670 |

| Exxon Mobil | | 723,332 | | 37,077,998 |

| Schlumberger | | 122,200 | | 8,181,290 |

| Total SA, ADR | | 107,500 | | 11,807,800 |

| | | | | 97,887,987 |

| Health Care—4.4% | | | | |

| Boston Scientific | | 215,500 b | | 7,661,025 |

| Caremark Rx | | 181,700 b | | 7,164,431 |

| Medco Health Solutions | | 136,700 b | | 5,686,720 |

| PacifiCare Health Systems | | 37,100 b | | 2,096,892 |

| Pfizer | | 126,000 | | 3,388,140 |

| Schering-Plough | | 212,300 | | 4,432,824 |

| WellPoint | | 49,800 b | | 5,727,000 |

| | | | | 36,157,032 |

| Insurance—7.3% | | | | |

| ACE | | 51,100 | | 2,184,525 |

| Allstate | | 97,500 | | 5,042,700 |

| American International Group | | 165,193 | | 10,848,224 |

| Genworth Financial, Cl. A | | 305,795 | | 8,256,465 |

| Hartford Financial Services Group | | 108,900 | | 7,547,859 |

| PMI Group | | 275,000 | | 11,481,250 |

| Prudential Financial | | 269,700 | | 14,822,712 |

| | | | | 60,183,735 |

| Merchandising—.6% | | | | |

| Dollar General | | 222,900 | | 4,629,633 |

| Technology—7.1% | | | | |

| Automatic Data Processing | | 267,900 | | 11,881,365 |

| Fairchild Semiconductor, Cl. A | | 250,200 b | | 4,068,252 |

| Hewlett-Packard | | 208,400 | | 4,370,148 |

| International Business Machines | | 84,900 | | 8,369,442 |

The Fund 11

S T A T E M E N T O F I N V E S T M E N T S (continued)

| Common Stocks (continued) | | Shares | | Value ($) |

| |

| |

|

| Technology (continued) | | | | |

| Microsoft | | 579,200 | | 15,470,432 |

| Oracle | | 726,100 b | | 9,962,092 |

| SunGard Data Systems | | 160,700 b | | 4,552,631 |

| | | | | 58,674,362 |

| Telecommunications—1.8% | | | | |

| Sprint (FON Group) | | 608,950 | | 15,132,408 |

| Transportation—.3% | | | | |

| Union Pacific | | 32,600 | | 2,192,350 |

| Utilities—8.0% | | | | |

| ALLTEL | | 123,495 | | 7,256,566 |

| Dominion Resources | | 61,600 | | 4,172,784 |

| Edison International | | 142,200 | | 4,554,666 |

| Entergy | | 112,300 | | 7,590,357 |

| Exelon | | 198,100 | | 8,730,267 |

| PG&E | | 135,500 | | 4,509,440 |

| PPL | | 86,800 | | 4,624,704 |

| TXU | | 38,700 | | 2,498,472 |

| Verizon Communications | | 444,656 | | 18,013,015 |

| Vodafone Group, ADR | | 161,800 | | 4,430,084 |

| | | | | 66,380,355 |

| Total Common Stocks | | | | |

| (cost $666,694,412) | | | | 824,683,288 |

| |

| |

|

| | | Principal | | |

| Short-Term Investments—.7% | | Amount ($) | | Value ($) |

| |

| |

|

| Commercial Paper; | | | | |

| General Electric Capital, | | | | |

| 2.17%, 1/3/2005 | | | | |

| (cost $6,008,000) | | 6,008,000 | | 6,008,000 |

| Investment of Cash Collateral | | | | |

| for Securities Loaned—1.3% | | Shares | | Value ($) |

| |

| |

|

| Registered Investment Company; | | | | |

| Dreyfus Institutional Cash Advantage Fund | | | | |

| (cost $10,312,500) | | | | 10,312,500 d | | 10,312,500 |

| |

| |

| |

|

| |

| Total Investments (cost $683,014,912) | | 101.5% | | 841,003,788 |

| |

| Liabilities, Less Cash and Receivables | | (1.5%) | | (12,201,374) |

| |

| Net Assets | | | | 100.0% | | 828,802,414 |

| |

| ADR—American Depository Receipt. | | | | |

| a | | Security exempt from registration under Rule 144A of the Securities Act of 1933.This security may be resold in |

| | | transaction exempt from registration, normally to qualified institutional buyers.This security has been determined to be |

| | | liquid by the Board of Trustees.At December 31, 2004, this security amounted to $158. | | |

| b | | Non-income producing. | | | | | | |

| c | | All or a portion of these securities are on loan.At December 31, 2004, the total market value of the fund’s securities |

| | | on loan is $10,007,677 and the total market value of the collateral held by the fund is $10,312,500. |

| d | | Investment in affiliated money market mutual funds. | | | | |

| |

| |

| |

|

| |

| |

| |

| Portfolio Summary (Unaudited) † | | | | |

| |

| | | | | Value (%) | | | | Value (%) |

| |

| |

| |

| |

|

| Banking | | 15.6 | | Consumer Non-Durables | | 4.3 |

| Capital Goods | | 12.0 | | Basic Industries | | 3.1 |

| Energy | | 11.8 | | Short Term/ | | |

| Consumer Services | | 11.3 | | Money Market Investments | | 2.0 |

| Brokerage | | 9.0 | | Telecommunications | | 1.8 |

| Utilities | | 8.0 | | Broadcasting & Publishing | | 1.6 |

| Insurance | | 7.3 | | Other | | 2.2 |

| Technology | | 7.1 | | | | |

| Health Care | | 4.4 | | | | 101.5 |

| |

| † | | Based on net assets. | | | | | | |

| See notes to financial statements. | | | | |

The Fund 13

| STATEMENT OF ASSETS AND LIABILITIES |

| December 31, 2004 |

| | | Cost | | Value |

| |

| |

|

| Assets ($): | | | | |

| Investments in securities—See Statement of | | | | |

| Investments (including securities on loan, | | | | |

| valued at $10,007,677)—Note 1(b): | | | | |

| Unaffiliated issuers | | 672,702,412 | | 830,691,288 |

| Affiliated issuers | | 10,312,500 | | 10,312,500 |

| Receivable for investment securities sold | | | | 3,518,061 |

| Dividends and interest receivable | | | | 1,136,354 |

| Receivable for shares of Beneficial Interest subscribed | | 182,206 |

| | | | | 845,840,409 |

| |

| |

|

| Liabilities ($): | | | | |

| Due to The Dreyfus Corporation and affiliates—Note 3(b) | | 937,877 |

| Cash overdraft due to Custodian | | | | 45,748 |

| Liability for securities on loan—Note 1(b) | | | | 10,312,500 |

| Payable for investment securities purchased | | | | 1,566,257 |

| Payable for shares of Beneficial Interest redeemed | | 4,175,613 |

| | | | | 17,037,995 |

| |

| |

|

| Net Assets ($) | | | | 828,802,414 |

| |

| |

|

| Composition of Net Assets ($): | | | | |

| Paid-in capital | | | | 735,090,322 |

| Accumulated undistributed investment income—net | | 922,455 |

| Accumulated net realized gain (loss) on investments | | (65,199,239) |

| Accumulated net unrealized appreciation | | | | |

| (depreciation) on investments | | | | 157,988,876 |

| |

| |

|

| Net Assets ($) | | | | 828,802,414 |

| Net Asset Value Per Share | | | | | | | | |

| | | Class A | | Class B | | Class C | | Class R | | Class T | | Institutional |

| |

| |

| |

| |

| |

| |

|

| Net Assets ($) | | 634,007,300 | | 78,153,749 | | 21,958,470 | | 50,535,844 | | 2,945,060 | | 41,201,991 |

| Shares | | | | | | | | | | | | |

| Outstanding | | 20,900,152 | | 2,619,721 | | 736,224 | | 1,666,270 | | 97,107 | | 1,358,959 |

| |

| |

| |

| |

| |

| |

|

| Net Asset Value | | | | | | | | | | |

| Per Share ($) | | 30.34 | | 29.83 | | 29.83 | | 30.33 | | 30.33 | | 30.32 |

See notes to financial statements.

|

STATEMENT OF OPERATIONS

Year Ended December 31, 2004

|

| Investment Income ($): | | |

| Income: | | |

| Cash dividends (net of $209,149 foreign taxes withheld at source) | | 16,039,764 |

| Interest | | 136,875 |

| Income from securities lending | | 79,929 |

| Total Income | | 16,256,568 |

| Expenses: | | |

| Management fee—Note 3(a) | | 7,329,969 |

| Distribution and service fees—Note 3(b) | | 2,617,704 |

| Loan commitment fees—Note 2 | | 7,777 |

| Total Expenses | | 9,955,450 |

| Investment Income—Net | | 6,301,118 |

| |

|

| Realized and Unrealized Gain (Loss) on Investments—Note 4 ($): |

| Net realized gain (loss) on investments | | 71,568,294 |

| Net unrealized appreciation (depreciation) on investments | | 8,014,588 |

| Net Realized and Unrealized Gain (Loss) on Investments | | 79,582,882 |

| Net Increase in Net Assets Resulting from Operations | | 85,884,000 |

See notes to financial statements.

|

The Fund 15

STATEMENT OF CHANGES IN NET ASSETS

| | | Year Ended December 31, |

| |

|

| | | 2004 | | 2003 |

| |

| |

|

| Operations ($): | | | | |

| Investment income—net | | 6,301,118 | | 4,486,434 |

| Net realized gain (loss) on investments | | 71,568,294 | | 2,244,365 |

| Net unrealized appreciation | | | | |

| (depreciation) on investments | | 8,014,588 | | 171,665,107 |

| Net Increase (Decrease) in Net Assets | | |

| Resulting from Operations | | 85,884,000 | | 178,395,906 |

| |

| |

|

| Dividends to Shareholders from ($): | | | | |

| Investment income—net: | | | | |

| Class A shares | | (4,697,408) | | (3,672,165) |

| Class B shares | | (149,699) | | (42,807) |

| Class C shares | | (41,992) | | (12,034) |

| Class R shares | | (549,414) | | (431,331) |

| Class T shares | | (14,243) | | (8,129) |

| Institutional shares | | (347,200) | | (294,312) |

| Total Dividends | | (5,799,956) | | (4,460,778) |

| |

| |

|

| Beneficial Interest Transactions ($): | | | | |

| Net proceeds from shares sold: | | | | |

| Class A shares | | 59,592,432 | | 69,547,747 |

| Class B shares | | 6,208,956 | | 11,334,683 |

| Class C shares | | 4,440,112 | | 9,950,055 |

| Class R shares | | 7,087,324 | | 6,484,312 |

| Class T shares | | 813,497 | | 466,996 |

| Institutional shares | | 804,835 | | 674,229 |

| | | Year Ended December 31, |

| |

|

| | | 2004 | | 2003 |

| |

| |

|

| Beneficial Interest Transactions ($) (continued): | | |

| Dividends reinvested: | | | | |

| Class A shares | | 4,081,538 | | 3,178,046 |

| Class B shares | | 129,596 | | 36,527 |

| Class C shares | | 31,529 | | 9,238 |

| Class R shares | | 549,093 | | 431,021 |

| Class T shares | | 13,773 | | 8,023 |

| Institutional shares | | 336,538 | | 285,477 |

| Cost of shares redeemed: | | | | |

| Class A shares | | (98,384,063) | | (101,503,555) |

| Class B shares | | (14,428,736) | | (11,884,065) |

| Class C shares | | (7,117,650) | | (12,880,056) |

| Class R shares | | (14,874,540) | | (5,795,921) |

| Class T shares | | (422,625) | | (246,690) |

| Institutional shares | | (5,872,389) | | (5,373,560) |

| Increase (Decrease) in Net Assets | | | | |

| from Beneficial Interest Transactions | | (57,010,780) | | (35,277,493) |

| Total Increase (Decrease) in Net Assets | | 23,073,264 | | 138,657,635 |

| |

| |

|

| Net Assets ($): | | | | |

| Beginning of Period | | 805,729,150 | | 667,071,515 |

| End of Period | | 828,802,414 | | 805,729,150 |

| Undistributed investment income—net | | 922,455 | | 421,293 |

The Fund 17

STATEMENT OF CHANGES IN NET ASSETS (continued)

|

| | | Year Ended December 31, |

| |

|

| | | 2004 | | 2003 |

| |

| |

|

| Capital Share Transactions: | | | | |

| Class A a | | | | |

| Shares sold | | 2,113,462 | | 2,953,000 |

| Shares issued for dividends reinvested | | 141,041 | | 134,142 |

| Shares redeemed | | (3,501,287) | | (4,326,654) |

| Net Increase (Decrease) in Shares Outstanding | | (1,246,784) | | (1,239,512) |

| |

| |

|

| Class B a | | | | |

| Shares sold | | 218,548 | | 486,046 |

| Shares issued for dividends reinvested | | 4,398 | | 1,655 |

| Shares redeemed | | (518,703) | | (525,823) |

| Net Increase (Decrease) in Shares Outstanding | | (295,757) | | (38,122) |

| |

| |

|

| Class C | | | | |

| Shares sold | | 159,821 | | 452,412 |

| Shares issued for dividends reinvested | | 1,071 | | 421 |

| Shares redeemed | | (256,515) | | (599,607) |

| Net Increase (Decrease) in Shares Outstanding | | (95,623) | | (146,774) |

| |

| |

|

| Class R | | | | |

| Shares sold | | 252,461 | | 271,825 |

| Shares issued for dividends reinvested | | 19,085 | | 18,131 |

| Shares redeemed | | (527,483) | | (237,711) |

| Net Increase (Decrease) in Shares Outstanding | | (255,937) | | 52,245 |

| |

| |

|

| Class T | | | | |

| Shares sold | | 28,795 | | 20,540 |

| Shares issued for dividends reinvested | | 471 | | 338 |

| Shares redeemed | | (14,698) | | (10,977) |

| Net Increase (Decrease) in Shares Outstanding | | 14,568 | | 9,901 |

| |

| |

|

| Institutional Shares | | | | |

| Shares sold | | 28,607 | | 29,399 |

| Shares issued for dividends reinvested | | 11,656 | | 12,070 |

| Shares redeemed | | (207,544) | | (240,152) |

| Net Increase (Decrease) in Shares Outstanding | | (167,281) | | (198,683) |

| a | | During the period ended December 31, 2004, 92,290 Class B shares representing $2,541,700 were automatically |

| | | converted to 90,750 Class A shares and during the period ended December 31, 2003, 33,502 Class B shares |

| | | representing $773,643 were automatically converted to 32,995 Class A shares. |

| See notes to financial statements. |

The following tables describe the performance for each share class for the fiscal periods indicated.All information (except portfolio turnover rate) reflects financial results for a single fund share.Total return shows how much your investment in the fund would have increased (or decreased) during each period assuming you had reinvested all dividends and distributions.These figures have been derived from the fund’s financial statements.

| | | | | Year Ended December 31, | | |

| |

| |

| |

|

| Class A Shares | | 2004 | | 2003 | | 2002 | | 2001 | | 2000 |

| |

| |

| |

| |

| |

|

| Per Share Data ($): | | | | | | | | | | |

| Net asset value, beginning of period | | 27.44 | | 21.57 | | 28.62 | | 30.93 | | 30.83 |

| Investment Operations: | | | | | | | | | | |

| Investment income—net a | | .24 | | .17 | | .10 | | .17 | | .24 |

| Net realized and unrealized | | | | | | | | | | |

| gain (loss) on investments | | 2.88 | | 5.86 | | (7.06) | | (1.46) | | 3.04 |

| Total from Investment Operations | | 3.12 | | 6.03 | | (6.96) | | (1.29) | | 3.28 |

| Distributions: | | | | | | | | | | |

| Dividends from investment income—net | | (.22) | | (.16) | | (.09) | | (.16) | | (.23) |

| Dividends from net realized | | | | | | | | | | |

| gain on investments | | — | | — | | — | | (.86) | | (2.95) |

| Total Distributions | | (.22) | | (.16) | | (.09) | | (1.02) | | (3.18) |

| Net asset value, end of period | | 30.34 | | 27.44 | | 21.57 | | 28.62 | | 30.93 |

| |

| |

| |

| |

| |

|

| Total Return (%) b | | 11.41 | | 28.09 | | (24.36) | | (4.04) | | 11.21 |

| |

| |

| |

| |

| |

|

| Ratios/Supplemental Data (%): | | | | | | | | | | |

| Ratio of total expenses | | | | | | | | | | |

| to average net assets | | 1.15 | | 1.15 | | 1.15 | | 1.15 | | 1.15 |

| Ratio of net investment income | | | | | | | | | | |

| to average net assets | | .86 | | .71 | | .41 | | .58 | | .79 |

| Portfolio Turnover Rate | | 74.98 | | 54.58 | | 67.21 | | 68.77 | | 88.70 |

| |

| |

| |

| |

| |

|

| Net Assets, end of period ($ X 1,000) | | 634,007 | | 607,633 | | 504,371 | | 695,054 | | 634,410 |

| a | | Based on average shares outstanding at each month end. |

| b | | Exclusive of sales charge. |

| See notes to financial statements. |

The Fund 19

FINANCIAL HIGHLIGHTS (continued)

|

| | | | | | | Year Ended December 31, | | |

| | | |

| |

| |

|

| Class B Shares | | 2004 | | 2003 | | 2002 | | 2001 | | 2000 |

| |

| |

| |

| |

| |

|

| Per Share Data ($): | | | | | | | | | | |

| Net asset value, beginning of period | | 27.02 | | 21.27 | | 28.33 | | 30.68 | | 30.64 |

| Investment Operations: | | | | | | | | | | |

| Investment income (loss)—net a | | .02 | | (.01) | | (.08) | | (.07) | | .01 |

| Net realized and unrealized | | | | | | | | | | |

| gain (loss) on investments | | 2.85 | | 5.77 | | (6.98) | | (1.42) | | 3.01 |

| Total from Investment Operations | | 2.87 | | 5.76 | | (7.06) | | (1.49) | | 3.02 |

| Distributions: | | | | | | | | | | |

| Dividends from investment income—net | | (.06) | | (.01) | | — | | (.00)b | | (.03) |

| Dividends from net realized | | | | | | | | | | |

| gain on investments | | — | | — | | — | | (.86) | | (2.95) |

| Total Distributions | | (.06) | | (.01) | | — | | (.86) | | (2.98) |

| Net asset value, end of period | | 29.83 | | 27.02 | | 21.27 | | 28.33 | | 30.68 |

| |

| |

| |

| |

| |

|

| Total Return (%) c | | 10.62 | | 27.12 | | (24.92) | | (4.79) | | 10.39 |

| |

| |

| |

| |

| |

|

| Ratios/Supplemental Data (%): | | | | | | | | | | |

| Ratio of total expenses | | | | | | | | | | |

| to average net assets | | 1.90 | | 1.90 | | 1.90 | | 1.90 | | 1.90 |

| Ratio of net investment income | | | | | | | | | | |

| (loss) to average net assets | | .10 | | (.04) | | (.33) | | (.24) | | .03 |

| Portfolio Turnover Rate | | 74.98 | | 54.58 | | 67.21 | | 68.77 | | 88.70 |

| |

| |

| |

| |

| |

|

| Net Assets, end of period ($ X 1,000) | | 78,154 | | 78,780 | | 62,820 | | 68,123 | | 17,209 |

| |

| a | | Based on average shares outstanding at each month end. | | | | | | | | |

| b | | Amount represents less than $.01 per share. | | | | | | | | |

| c | | Exclusive of sales charge. | | | | | | | | | | |

| See notes to financial statements. | | | | | | | | | | |

| | | | | | | Year Ended December 31, | | |

| | | |

| |

| |

|

| Class C Shares | | 2004 | | 2003 | | 2002 | | 2001 | | 2000 |

| |

| |

| |

| |

| |

|

| Per Share Data ($): | | | | | | | | | | |

| Net asset value, beginning of period | | 27.02 | | 21.27 | | 28.34 | | 30.68 | | 30.64 |

| Investment Operations: | | | | | | | | | | |

| Investment income (loss)—net a | | .02 | | (.01) | | (.08) | | (.06) | | .00b |

| Net realized and unrealized | | | | | | | | | | |

| gain (loss) on investments | | 2.85 | | 5.77 | | (6.99) | | (1.42) | | 3.02 |

| Total from Investment Operations | | 2.87 | | 5.76 | | (7.07) | | (1.48) | | 3.02 |

| Distributions: | | | | | | | | | | |

| Dividends from investment income—net | | (.06) | | (.01) | | — | | (.00)b | | (.03) |

| Dividends from net realized | | | | | | | | | | |

| gain on investments | | — | | — | | — | | (.86) | | (2.95) |

| Total Distributions | | (.06) | | (.01) | | — | | (.86) | | (2.98) |

| Net asset value, end of period | | 29.83 | | 27.02 | | 21.27 | | 28.34 | | 30.68 |

| |

| |

| |

| |

| |

|

| Total Return (%) c | | 10.62 | | 27.12 | | (24.95) | | (4.75) | | 10.35 |

| |

| |

| |

| |

| |

|

| Ratios/Supplemental Data (%): | | | | | | | | | | |

| Ratio of total expenses | | | | | | | | | | |

| to average net assets | | 1.90 | | 1.90 | | 1.90 | | 1.90 | | 1.90 |

| Ratio of net investment income | | | | | | | | | | |

| (loss) to average net assets | | .10 | | (.04) | | (.32) | | (.24) | | .01 |

| Portfolio Turnover Rate | | 74.98 | | 54.58 | | 67.21 | | 68.77 | | 88.70 |

| |

| |

| |

| |

| |

|

| Net Assets, end of period ($ X 1,000) | | 21,958 | | 22,480 | | 20,819 | | 23,612 | | 3,459 |

| |

| a | | Based on average shares outstanding at each month end. | | | | | | | | |

| b | | Amount represents less than $.01 per share. | | | | | | | | |

| c | | Exclusive of sales charge. | | | | | | | | | | |

| See notes to financial statements. | | | | | | | | | | |

The Fund 21

FINANCIAL HIGHLIGHTS (continued)

|

| | | | | Year Ended December 31, | | |

| |

| |

| |

|

| Class R Shares | | 2004 | | 2003 | | 2002 | | 2001 | | 2000 |

| |

| |

| |

| |

| |

|

| Per Share Data ($): | | | | | | | | | | |

| Net asset value, beginning of period | | 27.43 | | 21.56 | | 28.62 | | 30.92 | | 30.82 |

| Investment Operations: | | | | | | | | | | |

| Investment income—net a | | .31 | | .22 | | .17 | | .23 | | .32 |

| Net realized and unrealized | | | | | | | | | | |

| gain (loss) on investments | | 2.88 | | 5.87 | | (7.08) | | (1.44) | | 3.04 |

| Total from Investment Operations | | 3.19 | | 6.09 | | (6.91) | | (1.21) | | 3.36 |

| Distributions: | | | | | | | | | | |

| Dividends from investment income—net | | (.29) | | (.22) | | (.15) | | (.23) | | (.31) |

| Dividends from net realized | | | | | | | | | | |

| gain on investments | | — | | — | | — | | (.86) | | (2.95) |

| Total Distributions | | (.29) | | (.22) | | (.15) | | (1.09) | | (3.26) |

| Net asset value, end of period | | 30.33 | | 27.43 | | 21.56 | | 28.62 | | 30.92 |

| |

| |

| |

| |

| |

|

| Total Return (%) | | 11.69 | | 28.43 | | (24.18) | | (3.80) | | 11.49 |

| |

| |

| |

| |

| |

|

| Ratios/Supplemental Data (%): | | | | | | | | | | |

| Ratio of total expenses | | | | | | | | | | |

| to average net assets | | .90 | | .90 | | .90 | | .90 | | .90 |

| Ratio of net investment income | | | | | | | | | | |

| to average net assets | | 1.09 | | .95 | | .67 | | .78 | | 1.03 |

| Portfolio Turnover Rate | | 74.98 | | 54.58 | | 67.21 | | 68.77 | | 88.70 |

| |

| |

| |

| |

| |

|

| Net Assets, end of period ($ X 1,000) | | 50,536 | | 52,723 | | 40,320 | | 46,555 | | 1,138 |

| |

| a Based on average shares outstanding at each month end. | | | | | | | | |

| See notes to financial statements. | | | | | | | | | | |

| | | | | | | Year Ended December 31, | | |

| | | |

| |

| |

|

| Class T Shares | | 2004 | | 2003 | | 2002 | | 2001 | | 2000 |

| |

| |

| |

| |

| |

|

| Per Share Data ($): | | | | | | | | | | |

| Net asset value, beginning of period | | 27.43 | | 21.57 | | 28.63 | | 30.93 | | 30.84 |

| Investment Operations: | | | | | | | | | | |

| Investment income—net a | | .18 | | .11 | | .05 | | .07 | | .17 |

| Net realized and unrealized | | | | | | | | | | |

| gain (loss) on investments | | 2.87 | | 5.85 | | (7.07) | | (1.42) | | 3.03 |

| Total from Investment Operations | | 3.05 | | 5.96 | | (7.02) | | (1.35) | | 3.20 |

| Distributions: | | | | | | | | | | |

| Dividends from investment income—net | | (.15) | | (.10) | | (.04) | | (.09) | | (.16) |

| Dividends from net realized | | | | | | | | | | |

| gain on investments | | — | | — | | — | | (.86) | | (2.95) |

| Total Distributions | | (.15) | | (.10) | | (.04) | | (.95) | | (3.11) |

| Net asset value, end of period | | 30.33 | | 27.43 | | 21.57 | | 28.63 | | 30.93 |

| |

| |

| |

| |

| |

|

| Total Return (%) b | | 11.14 | | 27.72 | | (24.53) | | (4.28) | | 10.89 |

| |

| |

| |

| |

| |

|

| Ratios/Supplemental Data (%): | | | | | | | | | | |

| Ratio of total expenses | | | | | | | | | | |

| to average net assets | | 1.40 | | 1.40 | | 1.40 | | 1.40 | | 1.40 |

| Ratio of net investment income | | | | | | | | | | |

| to average net assets | | .65 | | .45 | | .21 | | .25 | | .57 |

| Portfolio Turnover Rate | | 74.98 | | 54.58 | | 67.21 | | 68.77 | | 88.70 |

| |

| |

| |

| |

| |

|

| Net Assets, end of period ($ X 1,000) | | 2,945 | | 2,264 | | 1,567 | | 1,132 | | 154 |

| |

| a | | Based on average shares outstanding at each month end. | | | | | | | | |

| b | | Exclusive of sales charge. | | | | | | | | | | |

| See notes to financial statements. | | | | | | | | | | |

The Fund 23

FINANCIAL HIGHLIGHTS (continued)

|

| | | | | Year Ended December 31, | | |

| |

| |

| |

|

| Institutional Shares | | 2004 | | 2003 | | 2002 | | 2001 | | 2000 |

| |

| |

| |

| |

| |

|

| Per Share Data ($): | | | | | | | | | | |

| Net asset value, beginning of period | | 27.42 | | 21.55 | | 28.60 | | 30.90 | | 30.81 |

| Investment Operations: | | | | | | | | | | |

| Investment income—net a | | .27 | | .19 | | .13 | | .20 | | .27 |

| Net realized and unrealized | | | | | | | | | | |

| gain (loss) on investments | | 2.88 | | 5.87 | | (7.07) | | (1.45) | | 3.04 |

| Total from Investment Operations | | 3.15 | | 6.06 | | (6.94) | | (1.25) | | 3.31 |

| Distributions: | | | | | | | | | | |

| Dividends from investment income—net | | (.25) | | (.19) | | (.11) | | (.19) | | (.27) |

| Dividends from net realized | | | | | | | | | | |

| gain on investments | | — | | — | | — | | (.86) | | (2.95) |

| Total Distributions | | (.25) | | (.19) | | (.11) | | (1.05) | | (3.22) |

| Net asset value, end of period | | 30.32 | | 27.42 | | 21.55 | | 28.60 | | 30.90 |

| |

| |

| |

| |

| |

|

| Total Return (%) | | 11.53 | | 28.25 | | (24.28) | | (3.96) | | 11.30 |

| |

| |

| |

| |

| |

|

| Ratios/Supplemental Data (%): | | | | | | | | | | |

| Ratio of total expenses | | | | | | | | | | |

| to average net assets | | 1.05 | | 1.05 | | 1.05 | | 1.05 | | 1.05 |

| Ratio of net investment income | | | | | | | | | | |

| to average net assets | | .96 | | .81 | | .51 | | .70 | | .89 |

| Portfolio Turnover Rate | | 74.98 | | 54.58 | | 67.21 | | 68.77 | | 88.70 |

| |

| |

| |

| |

| |

|

| Net Assets, end of period ($ X 1,000) | | 41,202 | | 41,848 | | 37,174 | | 58,557 | | 63,473 |

| |

| a Based on average shares outstanding at each month end. | | | | | | | | |

| See notes to financial statements. | | | | | | | | | | |

NOTES TO FINANCIAL STATEMENTS

NOTE 1—Significant Accounting Policies:

Dreyfus Premier Core Value Fund (the “fund”) is a separate diversified series of The Dreyfus/Laurel Funds Trust (the “Trust”) which is registered under the Investment Company Act of 1940, as amended (the “Act”), as an open-end management investment company and operates as a series company currently offering three series, including the fund. The fund’s investment objective is to seek long-term capital growth. The Dreyfus Corporation (the “Manager” or “Dreyfus”) serves as the fund’s investment manager.The Manager is a wholly-owned subsidiary of Mellon Financial Corporation (“Mellon Financial”).

Dreyfus Service Corporation (the “Distributor”), a wholly-owned subsidiary of the Manager, is the distributor of the fund’s shares.The fund is authorized to issue an unlimited number of shares of Beneficial Interest in each of the following classes of shares: Class A, Class B, Class C, Class R, Class T and Institutional shares. Class A, Class B, Class C and Class T shares are sold primarily to retail investors through financial intermediaries and bear a distribution fee and/or service fee. Class A and Class T shares are subject to a front-end sales charge, while Class B and Class C shares are subject to a contingent deferred sales charge (“CDSC”). Class B shares automatically convert to Class A shares after six years. Class R shares are sold primarily to bank trust departments and other financial service providers (including Mellon Financial and its affiliates) acting on behalf of customers having a qualified trust or investment account or relationship at such institution, and bear no distribution or service fees. Class R and Institutional shares are offered without a front-end sales charge or CDSC. Institutional shares are offered only to those customers of certain financial planners and investment advisers who held shares of a predecessor class of the fund as of April 4, 1994, and bear a distribution fee. Each class of shares has identical rights and privileges, except with respect to the distribution and service fees and voting rights on matters affecting a single class. Income, expenses (other than expenses attributable to a specific class), and realized and unrealized gains or losses on investments are allocated to each class of shares based on its relative net assets.

The Fund 25

NOTES TO FINANCIAL STATEMENTS (continued)

|

The fund’s financial statements are prepared in accordance with U.S. generally accepted accounting principles, which may require the use of management estimates and assumptions. Actual results could differ from those estimates.

(a) Portfolio valuation: Investments in securities are valued at the last sales price on the securities exchange or national securities market on which such securities are primarily traded. Securities listed on the National Market System, for which market quotations are available are valued at the official closing price or, if there is no official closing price that day, at the last sale price. Securities not listed on an exchange or the national securities market, or securities for which there were no transactions, are valued at the average of the most recent bid and asked prices. Bid price is used when no asked price is available. Investments in registered investment companies are valued at their net asset value. When market quotations or official closing prices are not readily available, or are determined not to reflect accurately fair value, such as when the value of a security has been significantly affected by events after the close of the exchange or market on which the security is principally traded (for example, a foreign exchange or market), but before the fund calculates its net asset value, the fund may value these investments at fair value as determined in accordance with the procedures approved by the Board of Trustees. Fair valuing of securities may be determined with the assistance of a pricing service using calculations based on indices of domestic securities and other appropriate indicators, such as prices of relevant ADR’s and futures contracts. For other securities that are fair valued by the Board of Trustees, certain factors may be considered such as: fundamental analytical data, the nature and duration of restrictions on disposition, an evaluation of the forces that influence the market in which the securities are purchased and sold, and public trading in similar securities of the issuer or comparable issuers. Investments denominated in foreign currencies are translated to U.S. dollars at the prevailing rates of exchange. Forward currency exchange contracts are valued at the forward rate.

(b) Securities transactions and investment income: Securities transactions are recorded on a trade date basis. Realized gain and loss from securities transactions are recorded on the identified cost basis. Dividend income is recognized on the ex-dividend date and interest income, including, where applicable, accretion of discount and amortization of premium on investments, is recognized on the accrual basis.

Pursuant to a securities lending agreement with Mellon Bank, N.A., an affiliate of the Manager, the fund may lend securities to qualified institutions.At origination, all loans are secured by collateral of at least 102% of the value of U.S. securities loaned and 105% of the value of foreign securities loaned. Collateral equivalent to at least 100% of the market value of securities on loan will be maintained at all times. Cash collateral is invested in certain money market mutual funds managed by the Manager. The fund will be entitled to receive all income on securities loaned, in addition to income earned as a result of the lending transaction. Although each security loaned is fully collateralized, the fund would bear the risk of delay in recovery of, or loss of rights in, the securities loaned should a borrower fail to return the securities in a timely manner.

(c) Affiliated issuers: Investments in other investment companies advised by the Manager are defined as “affiliated” in the Act.

(d) Foreign currency transactions: The fund does not isolate that portion of the results of operations resulting from changes in foreign exchange rates on investments from the fluctuations arising from changes in the market prices of securities held. Such fluctuations are included with the net realized and unrealized gain or loss on investments.

Net realized foreign exchange gains or losses arise from sales and maturities of short-term securities, sales of foreign currencies, currency gains or losses realized on securities transactions and the difference between the amount of dividends, interest, and foreign withholding taxes recorded on the fund’s books and the U.S. dollar equivalent of the

The Fund 27

NOTES TO FINANCIAL STATEMENTS (continued)

|

amounts actually received or paid. Net unrealized foreign exchange gains and losses arise from changes in the value of assets and liabilities other than investments in securities, resulting from changes in exchange rates. Such gains and losses are included with net realized and unrealized gain or loss on investments.

(e) Forward currency exchange contracts: The fund enters into forward currency exchange contracts in order to hedge its exposure to changes in foreign currency exchange rates on its foreign portfolio holdings and to settle foreign currency transactions. When executing forward currency exchange contracts, the fund is obligated to buy or sell a foreign currency at a specified rate on a certain date in the future. With respect to sales of forward currency exchange contracts, the fund would incur a loss if the value of the contract increases between the date the forward contract is opened and the date the forward contract is closed.The fund realizes a gain if the value of the contract decreases between those dates. With respect to purchases of forward currency exchange contracts, the fund would incur a loss if the value of the contract decreases between the date the forward contract is opened and the date the forward contract is closed.The fund realizes a gain if the value of the contract increases between those dates.The fund is also exposed to credit risk associated with counter party nonperformance on these forward currency exchange contracts which is typically limited to the unrealized gain on each open contract. At December 31, 2004, there were no open forward currency exchange contracts.

(f) Dividends to shareholders: Dividends are recorded on the ex-dividend date. Dividends from investment income-net are declared and paid on a quarterly basis. Dividends from net realized capital gain, if any, are normally declared and paid annually, but the fund may make distributions on a more frequent basis to comply with the distribution requirements of the Internal Revenue Code of 1986, as amended (the “Code”).To the extent that net realized capital gain can be offset by

capital loss carryovers, it is the policy of the fund not to distribute such gain. Income and capital gain distributions are determined in accordance with income tax regulations, which may differ from U.S. generally accepted accounting principles.

(g) Federal income taxes: It is the policy of the fund to continue to qualify as a regulated investment company, if such qualification is in the best interests of its shareholders, by complying with the applicable provisions of the Code, and to make distributions of taxable income sufficient to relieve it from substantially all federal income and excise taxes.

At December 31, 2004, the components of accumulated earnings on a tax basis were as follows: undistributed ordinary income $922,455, accumulated capital losses $64,270,696 and unrealized appreciation $157,060,333.

The accumulated capital loss carryover is available to be applied against future net securities profits, if any, realized subsequent to December 31, 2004. If not applied, $51,019,444 of the carryover expires in fiscal 2010 and $13,251,252 expires in fiscal 2011.

The tax character of distributions paid to shareholders during the fiscal periods ended December 31, 2004 and December 31, 2003 were as follows: ordinary income $5,799,956 and $4,460,778, respectively.

NOTE 2—Bank Line of Credit:

|

The fund participates with other Dreyfus-managed funds in a $350 million redemption credit facility (“the Facility”) to be utilized for temporary or emergency purposes, including the financing of redemptions. In connection therewith, the fund has agreed to pay commitment fees on its pro rata portion of the Facility. Interest is charged to the fund based on prevailing market rates in effect at the time of borrowings. During the period ended December 31, 2004, the fund did not borrow under the Facility.

The Fund 29

NOTES TO FINANCIAL STATEMENTS (continued)

|

NOTE 3—Investment Management Fee and Other Transactions With Affiliates:

(a) Pursuant to an Investment Management agreement with the Manager, the Manager provides or arranges for one or more third parties and/or affiliates to provide investment advisory, administrative, custody, fund accounting and transfer agency services to the fund. The Manager also directs the investments of the fund in accordance with its investment objective, policies and limitations. For these services, the fund is contractually obligated to pay the Manager a fee, calculated daily and paid monthly, at the annual rate of .90% of the value of the fund’s average daily net assets. Out of its fee, the Manager pays all of the expenses of the fund except brokerage fees, taxes, interest, commitment fees, Rule 12b-1 distribution fees and expenses, service fees, fees and expenses of non-interested Trustees (including counsel fees) and extraordinary expenses. In addition, the Manager is required to reduce its fee in an amount equal to the fund’s allocable portion of fees and expenses of the non-interested Trustees (including counsel fees). Each Trustee receives $40,000 per year, plus $5,000 for each joint Board meeting of The Dreyfus/Laurel Funds, Inc., The Dreyfus/Laurel Tax-Free Municipal Funds, and the Trust (the “Dreyfus/Laurel Funds”) attended, $2,000 for separate committee meetings attended which are not held in conjunction with a regularly scheduled board meeting and $500 for Board meetings and separate committee meetings attended that are conducted by telephone and is reimbursed for travel and out-of-pocket expenses. The Chairman of the Board receives an additional 25% of such compensation (with the exception of reimbursable amounts). These fees are charged and allocated to each series based on net assets. In the event that there is a joint committee meeting of the Dreyfus/Laurel Funds and the Dreyfus High Yield Strategies Fund, the $2,000 fee will be allocated between the Dreyfus/Laurel Funds and the Dreyfus High Yield Strategies Fund. Amounts required to be paid by the Trust directly to the non-interested Trustees, that would be applied to offset a portion of the management fee payable to the Manager, are in fact paid directly by the Manager to the non-interested Trustees.

During the period ended December 31, 2004, the Distributor retained $70,881 and $2,422 from commissions earned on sales of the fund’s Class A and Class T shares, respectively, and $194,071 and $9,741 from contingent deferred sales charges on redemptions on the fund’s Class B and Class C shares, respectively.

(b) Under separate Distribution Plans (the “Plans”) adopted pursuant to Rule 12b-1 under the Act,Class A shares and Institutional shares may pay annually up to .25% and .15%, respectively, of the value of their average daily net assets to compensate the Distributor for shareholder servicing activities and expenses primarily intended to result in the sale of Class A shares and Institutional shares. Class B, Class C and Class T shares pay the Distributor for distributing their shares at an aggregate annual rate of .75% of the value of the average daily net assets of Class B and Class C shares, and .25% of the value of average daily net assets of Class T shares.The Distributor may pay one or more agents in respect of advertising, marketing and other distribution services for Class T shares and determines the amounts, if any, to be paid to agents and the basis on which such payments are made. Class B, Class C and Class T shares are also subject to a service plan adopted pursuant to Rule 12b-1 (the “Service Plan”), under which Class B, Class C and Class T shares pay the Distributor for providing certain services to the holders of their shares a fee at the annual rate of .25% of the value of the average daily net assets of Class B, Class C and Class T shares,respectively.During the period ended December 31,2004, Class A, Class B, Class C, Class T and Institutional shares were charged $1,541,045, $585,739, $166,166, $6,537 and $61,045, respectively, pursuant to their respective Plans. During the period ended December 31, 2004,Class B,Class C and Class T shares were charged $195,246,$55,389 and $6,537, respectively, pursuant to the Service Plan.

Under its terms, the Plans and Service Plan shall remain in effect from year to year, provided such continuance is approved annually by a vote of majority of those Trustees who are not “interested persons” of the Trust and who have no direct or indirect financial interest in the operation of or in any agreement related to the Plans or Service Plan.

The Fund 31

NOTES TO FINANCIAL STATEMENTS (continued)

|

The components of Due to The Dreyfus Corporation and affiliates in the Statement of Assets and Liabilities consist of: management fees $699,575, Rule 12b-1 distribution plan fees $215,243 and shareholder services plan fees $23,059.

(c) The Company and the Manager have received an exemptive order from the SEC which, among other things, permits the fund to use cash collateral received in connection with lending the fund’s securities and other uninvested cash to purchase shares of one or more registered money market mutual funds advised by the Manager in excess of the limitations imposed by the Act.

NOTE 4—Securities Transactions:

|

The aggregate amount of purchases and sales of investment securities, excluding short-term securities, during the period ended December 31, 2004, amounted to $597,472,843 and $643,411,684, respectively.

At December 31, 2004, the cost of investments for federal income tax purposes was $683,943,455; accordingly, accumulated net unrealized appreciation on investments was $157,060,333, consisting of $164,791,966 gross unrealized appreciation and $7,731,633 gross unrealized depreciation.

In early 2004, two purported class and derivative actions were filed against Mellon Financial, Mellon Bank, N.A., Dreyfus, Founders Asset Management LLC, and certain directors of the Dreyfus Funds and the Dreyfus Founders Funds (together, the “Funds”). In September 2004, plaintiffs served a Consolidated Amended Complaint (the “Amended Complaint”) on behalf of a purported class of all persons who acquired interests in any of the Funds between January 30, 1999 and November 17, 2003, and derivatively on behalf of the Funds. The Amended Complaint in the newly styled In re Dreyfus Mutual Funds Fee Litigation also named the Distributor, Premier Mutual Fund

Services, Inc. and two additional Fund directors as defendants and alleges violations of the Investment Company Act of 1940, the Investment Advisers Act of 1940, the Pennsylvania Unfair Trade Practices and Consumer Protection Law and common-law claims. Plaintiffs seek to recover allegedly improper and excessive Rule 12b-1 and advisory fees allegedly charged to the Funds for marketing and distribution services. More specifically, plaintiffs claim, among other things, that 12b-1 fees and directed brokerage were improperly used to pay brokers to recommend the Funds over other funds, and that such payments were not disclosed to investors. In addition, plaintiffs assert that economies of scale and soft-dollar benefits were not passed on to the Funds. Plaintiffs further allege that 12b-1 fees were improperly charged to certain of the Funds that were closed to new investors.The Amended Complaint seeks compensatory and punitive damages, rescission of the advisory contracts, and an accounting and restitution of any unlawful fees, as well as an award of attorneys’ fees and litigation expenses. As noted, some of the claims in this litigation are asserted derivatively on behalf of the Funds that have been named as nominal defendants.With respect to such derivative claims, no relief is sought against the Funds. Dreyfus believes the allegations to be totally without merit and intends to defend the action vigorously. Defendants filed motions to dismiss the Amended Complaint on November 12, 2004, and those motions are pending.

Additional lawsuits arising out of these circumstances and presenting similar allegations and requests for relief may be filed against the defendants in the future. Neither Dreyfus nor the Funds believe that any of the pending actions will have a material adverse effect on the Funds or Dreyfus’ ability to perform its contract with the Funds.

The Fund 33

| REPORT OF INDEPENDENT REGISTERED |

| PUBLIC ACCOUNTING FIRM |

We have audited the accompanying statement of assets and liabilities, of Dreyfus Premier Core Value Fund (the “Fund”) of The Dreyfus/Laurel Funds Trust, including the statement of investments as of December 31, 2004, and the related statement of operations for the year then ended, the statements of changes in net assets for each of the two years in the period then ended, and the financial highlights for each of the five years in the period then ended.These financial statements and financial highlights are the responsibility of the Fund’s management. Our responsibility is to express an opinion on these financial statements and financial highlights based on our audits.

We conducted our audits in accordance with the standards of the Public Company Accounting Oversight Board (United States).Those standards require that we plan and perform the audit to obtain reasonable assurance about whether the financial statements and financial highlights are free of material misstatement. An audit includes examining, on a test basis, evidence supporting the amounts and disclosures in the financial statements. Our procedures included confirmation of securities owned as of December 31, 2004, by correspondence with the custodian.As to securities purchased and sold but not yet received or delivered, we performed other appropriate auditing procedures.An audit also includes assessing the accounting principles used and significant estimates made by manage-ment,as well as evaluating the overall financial statement presentation.We believe that our audits provide a reasonable basis for our opinion.

In our opinion, the financial statements and financial highlights referred to above present fairly, in all material respects, the financial position of Dreyfus Premier Core Value Fund of The Dreyfus/Laurel Funds Trust as of December 31, 2004 and the results of its operations for the year then ended, the changes in its net assets for each of the two years in the period then ended, and its financial highlights for each of the five years in the period then ended, in conformity with U.S. generally accepted accounting principles.

| New York, New York |

| February 18, 2005 |

IMPORTANT TAX INFORMATION (Unaudited)

For federal tax purposes, the fund hereby designates 55.47% of the ordinary dividends paid during the fiscal year ended December 31, 2004 as qualifying for the corporate dividends received deduction and also for the fiscal year ended December 31, 2004, certain dividends paid by the fund may be subject to a maximum tax rate of 15%, as provided for by the Jobs and Growth Tax Relief Reconciliation Act of 2003. Of the distributions paid during the fiscal year, $5,799,955 represents the maximum amount that may be considered qualified dividend income. Shareholders will receive notification in January 2005 of the percentage applicable to the preparation of their 2004 income tax returns.

The Fund 35

BOARD MEMBERS INFORMATION (Unaudited)

| Joseph S. DiMartino (61) |

| Chairman of the Board (1999) |

| Principal Occupation During Past 5 Years: |

| • Corporate Director and Trustee |

| | Other Board Memberships and Affiliations:

|

- The Muscular Dystrophy Association, Director

- Levcor International, Inc., an apparel fabric processor, Director

- Century Business Services, Inc., a provider of outsourcing functions for small and medium size companies, Director

- The Newark Group, a provider of a national market of paper recovery facilities, paperboard mills and paperboard converting plants, Director

- Azimuth Trust, an institutional asset management firm, Member of Board of Managers and Advisory Board

| No. of Portfolios for which Board Member Serves: 186 |

| ——————— |

| James Fitzgibbons (70) |

| Board Member (1994) |

Principal Occupation During Past 5 Years:

- Chairman of the Board, Davidson Cotton Company (1998-2002)

Other Board Memberships and Affiliations:

- Bill Barrett Company, an oil and gas exploration company, Director

| No. of Portfolios for which Board Member Serves: 23 |

| ——————— |

| J. Tomlinson Fort (76) |

| Board Member (1987) |

Principal Occupation During Past 5 Years:

• Retired; Of Counsel, Reed Smith LLP (1998-2004)

| | Other Board Memberships and Affiliations:

|

- Allegheny College, Emeritus Trustee

- Pittsburgh Ballet Theatre,Trustee

- American College of Trial Lawyers, Fellow

| No. of Portfolios for which Board Member Serves: 23 |

| ——————— |

| Kenneth A. Himmel (58) |

| Board Member (1994) |

| | Principal Occupation During Past 5 Years:

|

- President and CEO,Related Urban Development,a real estate development company (1996-present)

- President and CEO, Himmel & Company, a real estate development company (1980-present)

- CEO, American Food Management, a restaurant company (1983-present)

| | No. of Portfolios for which Board Member Serves: 23

|

| Stephen J. Lockwood (57) |

| Board Member (1994) |

| | Principal Occupation During Past 5 Years:

|

- Chairman of the Board, Stephen J. Lockwood and Company LLC, an investment company (2000-present)

- Chairman of the Board and CEO, LDG Reinsurance Corporation (1977-2000)

| | Other Board Memberships and Affiliations:

|

- BDML Holdings, an insurance company, Chairman of the Board

- Affiliated Managers Group, an investment management company, Director

| No. of Portfolios for which Board Member Serves: 23 |

| ——————— |

| Roslyn Watson (55) |

| Board Member (1994) |

Principal Occupation During Past 5 Years:

- Principal,Watson Ventures, Inc., a real estate investment company (1993-present)

| | Other Board Memberships and Affiliations:

|

- American Express Centurion Bank, Director

- The Hyams Foundation Inc., a Massachusetts Charitable Foundation,Trustee

- National Osteoporosis Foundation,Trustee

| No. of Portfolios for which Board Member Serves: 23 |

| ——————— |

| Benaree Pratt Wiley (58) |

| Board Member (1998) |

| | Principal Occupation During Past 5 Years:

|

- President and CEO,The Partnership, an organization dedicated to increasing the representation of African Americans in positions of leadership, influence and decision-making in Boston, MA (1991-present)

| | Other Board Memberships and Affiliations:

|

- Boston College, Associate Trustee

- The Greater Boston Chamber of Commerce, Director

- Mass. Development, Director

- Commonwealth Institute, Director

- Efficacy Institute, Director

- PepsiCo African-American, Advisory Board

- The Boston Foundation, Director

- Harvard Business School Alumni Board, Director

| No. of Portfolios for which Board Member Serves: 23 |

| ——————— |

Once elected all Board Members serve for an indefinite term.The address of the Board Members and Officers is in c/o The Dreyfus Corporation, 200 Park Avenue, New York, New York 10166.Additional information about the Board Members is available in the fund’s Statement of Additional Information which can be obtained from Dreyfus free of charge by calling this toll free number: 1-800-554-4611.

| Ruth Marie Adams, Emeritus Board Member |

| Francis P. Brennan, Emeritus Board Member |

The Fund 37

OFFICERS OF THE FUND (Unaudited)

STEPHEN E. CANTER, President since March 2000.

Chairman of the Board, Chief Executive Officer and Chief Operating Officer of the Manager, and an officer of 92 investment companies (comprised of 185 portfolios) managed by the Manager. Mr. Canter also is a Board member and, where applicable, an Executive Committee Member of the other investment management subsidiaries of Mellon Financial Corporation, each of which is an affiliate of the Manager. He is 59 years old and has been an employee of the Manager since May 1995.

STEPHEN R. BYERS, Executive Vice President since November 2002.

Chief Investment Officer,Vice Chairman and a director of the Manager, and an officer of 92 investment companies (comprised of 185 portfolios) managed by the Manager. Mr. Byers also is an officer, director or an Executive Committee Member of certain other investment management subsidiaries of Mellon Financial Corporation, each of which is an affiliate of the Manager. He is 51 years old and has been an employee of the Manager since January 2000. Prior to joining the Manager, he served as an Executive Vice President-Capital Markets, Chief Financial Officer and Treasurer at Gruntal & Co., L.L.C.

MARK N. JACOBS, Vice President since March 2000.

Executive Vice President, Secretary and General Counsel of the Manager, and an officer of 93 investment companies (comprised of 201 portfolios) managed by the Manager. He is 58 years old and has been an employee of the Manager since June 1977.

STEVEN F. NEWMAN, Secretary since March 2000.

Associate General Counsel and Assistant Secretary of the Manager, and an officer of 93 investment companies (comprised of 201 portfolios) managed by the Manager. He is 55 years old and has been an employee of the Manager since July 1980.

JAMES BITETTO, Assistant Secretary since October 2004.

Assistant General Counsel and Assistant Secretary of the Manager, and an officer of 4 investment companies (comprised of 23 portfolios) managed by the Manager. He is 38 years old and has been an employee of the Manager since December 1996.

JEFF PRUSNOFSKY, Assistant Secretary since March 2000.

Associate General Counsel of the Manager, and an officer of 26 investment companies (comprised of 88 portfolios) managed by the Manager. He is 39 years old and has been an employee of the Manager since October 1990.

MICHAEL A. ROSENBERG, Assistant Secretary since March 2000.

Associate General Counsel of the Manager, and an officer of 90 investment companies (comprised of 194 portfolios) managed by the Manager. He is 44 years old and has been an employee of the Manager since October 1991.

JAMES WINDELS, Treasurer since November 2001.

Director – Mutual Fund Accounting of the Manager, and an officer of 93 investment companies (comprised of 201 portfolios) managed by the Manager. He is 46 years old and has been an employee of the Manager since April 1985.

RICHARD CASSARO, Assistant Treasurer since August 2003.

Senior Accounting Manager – Equity Funds of the Manager, and an officer of 26 investment companies (comprised of 102 portfolios) managed by the Manager. He is 44 years old and has been an employee of the Manager since September 1982.

ERIK D. NAVILOFF, Assistant Treasurer since December 2002.

Senior Accounting Manager – Taxable Fixed Income Funds of the Manager, and an officer of 19 investment companies (comprised of 75 portfolios) managed by the Manager. He is 36 years old and has been an employee of the Manager since November 1992.