| UNITED STATES |

| SECURITIES AND EXCHANGE COMMISSION |

| Washington, D.C. 20549 |

| |

| |

| FORM N-CSR |

| |

| CERTIFIED SHAREHOLDER REPORT OF REGISTERED MANAGEMENT |

| INVESTMENT COMPANIES |

| |

| Investment Company Act file number 811-524 |

| |

| | | The Dreyfus/Laurel Funds Trust |

| | | (Exact name of Registrant as specified in charter) |

| |

| |

| | | c/o The Dreyfus Corporation |

| | | 200 Park Avenue |

| | | New York, New York 10166 |

| (Address of principal executive offices) (Zip code) |

| |

| | | Mark N. Jacobs, Esq. |

| | | 200 Park Avenue |

| | | New York, New York 10166 |

| | | (Name and address of agent for service) |

| |

| Registrant's telephone number, including area code: (212) 922-6000 |

| |

| Date of fiscal year end: | | 12/31 |

| |

| Date of reporting period: | | 12/31/2005 |

| |

| The following N-CSR relates only to the Registrant’s series listed below and does not affect the other series |

| of the Registrant, which | | have different fiscal year ends and, therefore, different N-CSR reporting |

| requirements. Separate N-CSR Forms will be filed for these series, as appropriate. |

| |

| |

| Dreyfus Premier Core Value Fund |

| Dreyfus Premier Limited Term High Yield Fund |

| Dreyfus Premier Managed Income Fund |

-1-

| Item 1. | | Reports to Stockholders. |

Save time. Save paper. View your next shareholder report online as soon as it’s available. Log into www.dreyfus.com and sign up for Dreyfus eCommunications. It’s simple and only takes a few minutes.

The views expressed in this report reflect those of the portfolio manager only through the end of the period covered and do not necessarily represent the views of Dreyfus or any other person in the Dreyfus organization. Any such views are subject to change at any time based upon market or other conditions and Dreyfus disclaims any responsibility to update such views.These views may not be relied on as investment advice and, because investment decisions for a Dreyfus fund are based on numerous factors, may not be relied on as an indication of trading intent on behalf of any Dreyfus fund.

Not FDIC-Insured • Not Bank-Guaranteed • May Lose Value

| Contents |

| |

| | | THE FUND |

| |

|

| 2 | | Letter from the Chairman |

| 3 | | Discussion of Fund Performance |

| 6 | | Fund Performance |

| 8 | | Understanding Your Fund’s Expenses |

| 8 | | Comparing Your Fund’s Expenses |

| With Those of Other Funds |

| 9 | | Statement of Investments |

| 13 | | Statement of Assets and Liabilities |

| 14 | | Statement of Operations |

| 15 | | Statement of Changes in Net Assets |

| 18 | | Financial Highlights |

| 24 | | Notes to Financial Statements |

| 32 | | Report of Independent Registered |

| | | Public Accounting Firm |

| 33 | | Important Tax Information |

| 34 | | Information About the Review and |

| | | Approval of the Fund’s Investment |

| | | Management Agreement |

| 39 | | Board Members Information |

| 41 | | Officers of the Fund |

| FOR MORE INFORMATION |

|

| | | Back Cover |

| Dreyfus Premier |

| Core Value Fund |

LETTER FROM THE CHAIRMAN

We are pleased to present this annual report for Dreyfus Premier Core Value Fund, covering the 12-month period from January 1, 2005, through December 31, 2005. Inside, you’ll find valuable information about how the fund was managed during the reporting period, including a discussion with Brian Ferguson, portfolio manager and member of the Large Cap Value Team of The Boston Company Asset Management.

Stocks generally absorbed both good and bad news in 2005 to post modestly positive total returns. On the plus side, an expanding U.S. economy and low inflation helped support corporate earnings in most industry groups. Negative influences included rising short-term interest rates and escalating energy prices, which many analysts feared might erode corporate profits. In addition, hurricanes Katrina, Rita and Wilma disrupted economic activity along the Gulf Coast.

We expect the U.S. economy to continue its moderate expansion in 2006, fueled in part by a rebound in corporate capital spending and exports. The labor market likely will remain relatively strong while inflation should stay low, supporting consumers’ real incomes. Risks in the new year include the possible end of the boom in the housing market, where we believe prices are more likely to stall than plunge.

As always, we encourage you to speak with your financial consultant about how these and other market forces may affect your investments. Thank you for your continued confidence and support.

| The Dreyfus Corporation |

| January 17, 2006 |

DISCUSSION OF FUND PERFORMANCE

Brian Ferguson, Portfolio Manager, Large Cap Value Team

How did Dreyfus Premier Core Value Fund perform relative to its benchmark?

For the 12-month period ended December 31, 2005, Dreyfus Premier Core Value Fund produced total returns of 5.18% for its Class A shares, 4.47% for its Class B shares, 4.43% for its Class C shares, 5.45% for its Class R shares, 4.95% for its Class T shares and 5.33% for its Institutional shares.1 In comparison, the fund’s benchmark, the S&P 500/BARRA Value Index, produced a total return of 6.33% for the same period.2

A growing economy and solid corporate earnings helped stocks advance modestly in 2005, despite widespread concerns regarding high energy prices and rising interest rates. The fund’s returns were roughly in line with the S&P 500/BARRA Value Index,as relatively strong performance in the consumer discretionary, consumer staples and financial sectors was undercut by lagging performance in materials and health care stocks.

What is the fund’s investment approach?

The fund invests primarily in large-cap value companies that are considered undervalued based on traditional measures, such as price-to-earnings ratios. When choosing stocks, we use a “bottom-up” stock selection approach, focusing on individual companies, rather than a “top-down” approach that forecasts market trends.We also focus on a company’s relative value, financial strength, sales and earnings momentum and likely catalysts that could ignite the stock price.

What other factors influenced the fund’s performance?

Despite steady economic growth and rising corporate earnings, returns from the U.S. stock market were limited during much of 2005 by investors’ concerns regarding rising interest rates and volatile energy prices.The Federal Reserve Board (the “Fed”) raised short-term interest rates at each of eight scheduled meetings during the year, driving the

The Fund 3

DISCUSSION OF FUND PERFORMANCE (continued)

|

overnight federal funds rate from 2.25% to 4.25% . Contrary to historical norms, however, these moves did not cause longer-term bond yields to rise significantly, helping to contain corporate borrowing costs and support profit margins.While sharply higher energy costs threatened to erode earnings of industrial companies that use oil and gas in their manufacturing processes, other market sectors — most notably energy and utilities — benefited from higher commodity prices.Toward the end of the year, energy prices moderated and investors began to look forward to the end of the Fed’s rate hikes, resulting in a modest market rally.

Our stock selection strategy in the consumer discretionary sector contributed significantly to the fund’s 2005 performance. The fund particularly benefited from its lack of exposure to U.S. auto manufacturers, such as General Motors and Ford, which struggled due to high labor costs and greater foreign competition. The fund also benefited from relatively light exposure to newspaper publishers that were weakened by competition from online media for advertising dollars. The relatively defensive consumer staples sector performed well for the fund, as food and tobacco giant Altria Group rose in an improved litigation environment. Another consumer staples holding, Colgate-Palmolive, gained ground on prospects of better earnings growth.

The fund’s performance also was bolstered by our stock selection strategy in the financials sector. Property and casualty insurance companies, such as Chubb and ACE, performed well when pricing power improved in the wake of Hurricane Katrina.The fund also largely avoided weakness among regional banks, which were weighed down by rising interest rates and a slowdown in mortgage originations.The telecommunications sector represented another positive contributor to the fund’s performance, primarily due to our emphasis on wireless companies and relatively light exposure to regional land-line providers.

Relative performance in some other sectors, however, was more disappointing. In the health care area, medical supplies maker Boston Scientific saw its stock decline in the aftermath of a safety-related recall of its surgical stents.The materials sector also was a laggard for the fund, as paper manufacturers were pressured by lower pricing dynamics.

As energy prices surged, the fund’s relatively heavy exposure to the energy sector contributed to overall returns, but the fund’s energy gains trailed the benchmark’s as a result of our greater emphasis on integrated oil companies, such as Exxon Mobil. Oil and gas refiners, as well as exploration and production companies, produced higher returns for the benchmark.

What is the fund’s current strategy?

We remain committed to our “bottom-up” stock selection process, which we believe is an effective method to identify attractively valued stocks under a variety of market conditions.We have found a number of attractive opportunities in the energy sector, which we believe may continue to benefit from high commodity prices.We also have emphasized relatively defensive consumer staples stocks over the more economically sensitive consumer discretionary sector. In the financials area, we still favor insurers, which historically have been relatively insensitive to rising interest rates, over regional banks. We also are optimistic about a rebound in capital spending among businesses, which could benefit business conditions in the industrials and technology sectors.

| 1 | | Total return includes reinvestment of dividends and any capital gains paid, and does not take into |

| | | consideration the maximum initial sales charges in the case of Class A and Class T shares or the |

| | | applicable contingent deferred sales charges imposed on redemptions in the case of Class B and |

| | | Class C shares. Had these charges been reflected, returns would have been lower. Past performance |

| | | is no guarantee of future results. Share price and investment return fluctuate such that upon |

| | | redemption, fund shares may be worth more or less than their original cost. |

| 2 | | SOURCE: LIPPER INC. — Reflects the reinvestment of dividends and, where applicable, |

| | | capital gain distributions.The S&P 500/BARRA Value Index is a capitalization-weighted |

| | | index of all the stocks in the Standard & Poor’s 500 Composite Price Index (“S&P 500 |

| | | Index”) that have low price-to-book ratios.The S&P 500 Index is a widely accepted, unmanaged |

| | | index of U.S. stock market performance. |

The Fund 5

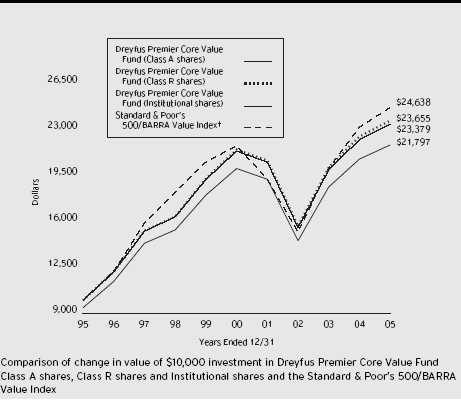

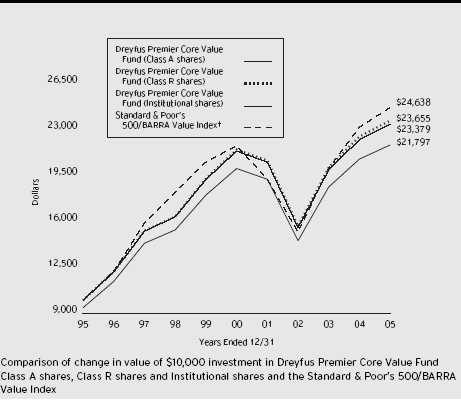

| † Source: Lipper Inc. |

| Past performance is not predictive of future performance. |

| The above graph compares a $10,000 investment made in Class A shares, Institutional shares and Class R shares of |

| Dreyfus Premier Core Value Fund on 12/31/95 to a $10,000 investment made in the Standard & Poor’s |

| 500/BARRA Value Index (the “Index”) on that date. All dividends and capital gain distributions are reinvested. |

| Performance for Class B, Class C and Class T shares will vary from the performance of Class A, Institutional and |

| Class R shares shown above due to differences in charges and expenses. |

| The fund’s performance shown in the line graph takes into account the maximum initial sales charge on Class A |

| shares and all other applicable fees and expenses for Class A shares, Institutional shares and Class R shares.The |

| Index is a capitalization-weighted index of all the stocks in the S&P 500 that have low price-to-book ratios.The |

| Index does not take into account charges, fees and other expenses. Further information relating to fund performance, |

| including expense reimbursements, if applicable, is contained in the Financial Highlights section of the prospectus and |

| elsewhere in this report. |

| Average Annual Total Returns as of 12/31/05 | | | | | | |

| |

| | | Inception | | | | | | | | From |

| | | Date | | 1 Year | | 5 Years | | 10 Years | | Inception |

| |

| |

| |

| |

| |

|

| Class A shares | | | | | | | | | | |

| with maximum sales charge (5.75%) | | | | (0.86)% | | 0.53% | | 8.10% | | |

| without sales charge | | | | 5.18% | | 1.73% | | 8.75% | | |

| Class B shares | | | | | | | | | | |

| with applicable redemption charge † | | 1/16/98 | | 0.47% | | 0.60% | | — | | 5.29%†† |

| without redemption | | 1/16/98 | | 4.47% | | 0.98% | | — | | 5.29%†† |

| Class C shares | | | | | | | | | | |

| with applicable redemption charge ††† | | 1/16/98 | | 3.43% | | 0.98% | | — | | 5.11% |

| without redemption | | 1/16/98 | | 4.43% | | 0.98% | | — | | 5.11% |

| Class R shares | | | | 5.45% | | 1.99% | | 8.99% | | |

| Institutional shares | | | | 5.33% | | 1.84% | | 8.86% | | |

| Class T shares | | | | | | | | | | |

| with applicable sales charge (4.5%) | | 8/16/99 | | 0.23% | | 0.55% | | — | | 2.72% |

| without sales charge | | 8/16/99 | | 4.95% | | 1.48% | | — | | 3.46% |

Past performance is not predictive of future performance.The fund’s performance shown in the graph and table does not reflect the deduction of taxes that a shareholder would pay on fund distributions or the redemption of fund shares.

| † | | The maximum contingent deferred sales charge for Class B shares is 4%. After six years Class B shares convert to |

| | | Class A shares. |

| †† | | Assumes the conversion of Class B shares to Class A shares at the end of the sixth year following the date |

| | | of purchase. |

| ††† | | The maximum contingent deferred sales charge for Class C shares is 1% for shares redeemed within one year of the |

| | | date of purchase. |

The Fund 7

U N D E R S TA N D I N G YO U R F U N D ’ S E X P E N S E S ( U n a u d i t e d )

As a mutual fund investor, you pay ongoing expenses, such as management fees and other expenses. Using the information below, you can estimate how these expenses affect your investment and compare them with the expenses of other funds.You also may pay one-time transaction expenses, including sales charges (loads) and redemption fees, which are not shown in this section and would have resulted in higher total expenses. For more information, see your fund’s prospectus or talk to your financial adviser.

Review your fund’s expenses

The table below shows the expenses you would have paid on a $1,000 investment in Dreyfus Premier Core Value Fund from July 1, 2005 to December 31, 2005. It also shows how much a $1,000 investment would be worth at the close of the period, assuming actual returns and expenses.

| Expenses and Value of a $1,000 Investment |

| assuming actual returns for the six months ended December 31, 2005 |

| | | Class A | | Class B | | Class C | | Class R | | Class T | | Institutional |

| |

| |

| |

| |

| |

| |

|

| Expenses paid | | | | | | | | | | | | |

| per $1,000 † | | $ 5.97 | | $ 9.85 | | $ 9.85 | | $ 4.68 | | $ 7.26 | | $ 5.45 |

| Ending value | | | | | | | | | | | | |

| (after expenses) | | $1,059.70 | | $1,056.00 | | $1,056.00 | | $1,061.00 | | $1,058.70 | | $1,060.60 |

COMPARING YOUR FUND’S EXPENSES WITH THOSE OF OTHER FUNDS (Unaudited)

Using the SEC’s method to compare expenses

The Securities and Exchange Commission (SEC) has established guidelines to help investors assess fund expenses. Per these guidelines, the table below shows your fund’s expenses based on a $1,000 investment, assuming a hypothetical 5% annualized return. You can use this information to compare the ongoing expenses (but not transaction expenses or total cost) of investing in the fund with those of other funds.All mutual fund shareholder reports will provide this information to help you make this comparison. Please note that you cannot use this information to estimate your actual ending account balance and expenses paid during the period.

| Expenses and Value of a $1,000 Investment |

| assuming a hypothetical 5% annualized return for the six months ended December 31, 2005 |

| | | Class A | | Class B | | Class C | | Class R | | Class T | | Institutional |

| |

| |

| |

| |

| |

| |

|

| Expenses paid | | | | | | | | | | | | |

| per $1,000 † | | $ 5.85 | | $ 9.65 | | $ 9.65 | | $ 4.58 | | $ 7.12 | | $ 5.35 |

| Ending value | | | | | | | | | | | | |

| (after expenses) | | $1,019.41 | | $1,015.63 | | $1,015.63 | | $1,020.67 | | $1,018.15 | | $1,019.91 |

| † | | Expenses are equal to the fund’s annualized expense ratio of 1.15% for Class A, 1.90% for Class B, 1.90% for |

| | | Class C, .90% for Class R, 1.40% for Class T and 1.05% for Institutional multiplied by the average account |

| | | value over the period, multiplied by 184/365 (to reflect the one-half year period). |

STATEMENT OF INVESTMENTS

December 31, 2005

|

| Common Stocks—99.7% | | Shares | | Value ($) |

| |

| |

|

| Banking—12.9% | | | | |

| Bank of America | | 527,736 | | 24,355,016 |

| Citigroup | | 607,433 | | 29,478,723 |

| Wachovia | | 231,500 | | 12,237,090 |

| Washington Mutual | | 176,600 | | 7,682,100 |

| Wells Fargo & Co. | | 244,300 | | 15,349,369 |

| | | | | 89,102,298 |

| Basic Industries—2.0% | | | | |

| Bowater | | 98,200 | | 3,016,704 |

| Dow Chemical | | 68,400 | | 2,997,288 |

| E I Du Pont de Nemours & Co. | | 90,195 | | 3,833,288 |

| Rohm & Haas | | 82,800 | | 4,009,176 |

| | | | | 13,856,456 |

| Beverages & Tobacco—2.4% | | | | |

| Altria Group | | 220,200 | | 16,453,344 |

| Broadcasting & Publishing—1.0% | | | | |

| Time Warner | | 380,300 | | 6,632,432 |

| Capital Goods—8.6% | | | | |

| Boeing | | 74,700 | | 5,246,928 |

| Cooper Industries, Cl. A | | 50,500 | | 3,686,500 |

| Eaton | | 78,300 | | 5,253,147 |

| Emerson Electric | | 112,360 | | 8,393,292 |

| General Electric | | 303,700 | | 10,644,685 |

| Tyco International | | 441,200 | | 12,733,032 |

| United Technologies | | 242,800 | | 13,574,948 |

| | | | | 59,532,532 |

| Consumer Cyclical—1.0% | | | | |

| Johnson Controls | | 95,600 | | 6,970,196 |

| Consumer Non-Durables—4.1% | | | | |

| Cadbury Schweppes, ADR | | 129,800 | | 4,970,042 |

| Campbell Soup | | 151,000 | | 4,495,270 |

| Colgate-Palmolive | | 205,600 | | 11,277,160 |

| Estee Lauder Cos., Cl. A | | 113,900 | | 3,813,372 |

| General Mills | | 68,180 | | 3,362,638 |

| | | | | 27,918,482 |

The Fund 9

STATEMENT OF INVESTMENTS (continued)

|

| Common Stocks (continued) | | Shares | | Value ($) |

| |

| |

|

| Consumer Services—7.3% | | | | |

| CCE Spinco | | 2,300 a | | 30,130 |

| Clear Channel Communications | | 356,000 | | 11,196,200 |

| Comcast, Cl. A | | 104,300 a | | 2,707,628 |

| CVS | | 176,500 | | 4,663,130 |

| Kohl’s | | 49,000 a | | 2,381,400 |

| McDonald’s | | 209,800 | | 7,074,456 |

| News, Cl. A | | 422,000 | | 6,562,100 |

| Omnicom Group | | 102,900 | | 8,759,877 |

| Walt Disney | | 279,700 | | 6,704,409 |

| | | | | 50,079,330 |

| Energy—12.9% | | | | |

| Apache | | 46,600 | | 3,193,032 |

| BP, ADR | | 94,900 | | 6,094,478 |

| Chevron | | 196,900 | | 11,178,013 |

| ConocoPhillips | | 262,720 | | 15,285,050 |

| Devon Energy | | 75,500 | | 4,721,770 |

| Exxon Mobil | | 498,232 | | 27,985,691 |

| Halliburton | | 52,900 | | 3,277,684 |

| Marathon Oil | | 111,700 | | 6,810,349 |

| NRG Energy | | 85,000 a | | 4,005,200 |

| Schlumberger | | 68,000 | | 6,606,200 |

| | | | | 89,157,467 |

| Financial Services—22.6% | | | | |

| ACE | | 72,200 | | 3,858,368 |

| Allstate | | 56,400 | | 3,049,548 |

| American International Group | | 202,493 | | 13,816,097 |

| AON | | 116,600 | | 4,191,770 |

| Capital One Financial | | 91,800 | | 7,931,520 |

| Chubb | | 78,500 | | 7,665,525 |

| Countrywide Financial | | 122,500 | | 4,188,275 |

| Freddie Mac | | 153,200 | | 10,011,620 |

| Genworth Financial, Cl. A | | 367,195 | | 12,697,603 |

| Goldman Sachs Group | | 53,560 | | 6,840,148 |

| JPMorgan Chase & Co. | | 565,000 | | 22,424,850 |

| Merrill Lynch & Co. | | 241,650 | | 16,366,955 |

| Common Stocks (continued) | | Shares | | Value ($) |

| |

| |

|

| Financial Services (continued) | | | | |

| Morgan Stanley | | 63,500 | | 3,602,990 |

| PMI Group | | 193,300 | | 7,938,831 |

| PNC Financial Services Group | | 62,200 | | 3,845,826 |

| Prudential Financial | | 97,000 | | 7,099,430 |

| St. Paul Travelers Cos. | | 230,300 | | 10,287,501 |

| SunTrust Banks | | 67,200 | | 4,889,472 |

| XL Capital, Cl. A | | 73,030 | | 4,920,761 |

| | | | | 155,627,090 |

| Health Care—6.2% | | | | |

| Abbott Laboratories | | 182,800 | | 7,207,804 |

| Boston Scientific | | 131,900 a | | 3,230,231 |

| Medco Health Solutions | | 65,800 a | | 3,671,640 |

| Pfizer | | 528,500 | | 12,324,620 |

| WellPoint | | 105,600 a | | 8,425,824 |

| Wyeth | | 176,200 | | 8,117,534 |

| | | | | 42,977,653 |

| Retail Trade—.5% | | | | |

| TJX Cos. | | 153,600 | | 3,568,128 |

| Technology—8.1% | | | | |

| Accenture, Cl. A | | 247,300 | | 7,139,551 |

| Automatic Data Processing | | 259,800 | | 11,922,222 |

| Fairchild Semiconductor International | | 198,300 a | | 3,353,253 |

| Hewlett-Packard | | 419,900 | | 12,021,737 |

| International Business Machines | | 103,400 | | 8,499,480 |

| Microsoft | | 370,800 | | 9,696,420 |

| Motorola | | 125,000 | | 2,823,750 |

| | | | | 55,456,413 |

| Telecommunications—.9% | | | | |

| Sprint Nextel | | 258,250 | | 6,032,720 |

| Transportation—1.5% | | | | |

| Union Pacific | | 128,700 | | 10,361,637 |

| Utilities—7.7% | | | | |

| Alltel | | 76,395 | | 4,820,525 |

| AT&T | | 732,600 | | 17,941,374 |

| Constellation Energy Group | | 77,300 | | 4,452,480 |

The Fund 11

STATEMENT OF INVESTMENTS (continued)

|

| Common Stocks (continued) | | Shares | | Value ($) |

| |

| |

|

| Utilities (continued) | | | | |

| Edison International | | 87,800 | | 3,828,958 |

| Entergy | | 46,300 | | 3,178,495 |

| Exelon | | 98,965 | | 5,259,000 |

| FPL Group | | 78,200 | | 3,249,992 |

| PG & E | | 175,000 | | 6,496,000 |

| Vodafone Group, ADR | | 167,100 | | 3,587,637 |

| | | | | 52,814,461 |

| Total Common Stocks | | | | |

| (cost $595,155,116) | | | | 686,540,639 |

| |

| |

|

| | | Principal | | |

| Short-Term Investment—.7% | | Amount ($) | | Value ($) |

| |

| |

|

| Commercial Paper; | | | | |

| General Electric, | | | | |

| 4.20%, 1/3/2006 | | | | |

| (cost $4,734,000) | | 4,734,000 | | 4,734,000 |

| |

| |

|

| Total Investments (cost $599,889,116) | | 100.4% | | 691,274,639 |

| Liabilities, Less Cash and Receivables | | (.4%) | | (2,534,787) |

| Net Assets | | 100.0% | | 688,739,852 |

ADR—American Depository Receipts.

a Non-income producing.

|

| Portfolio Summary (Unaudited)† | | | | |

| |

| | | Value (%) | | | | Value (%) |

| |

| |

| |

|

| Financial Services | | 22.6 | | Consumer Services | | 7.3 |

| Energy | | 12.9 | | Health Care | | 6.2 |

| Banking | | 12.9 | | Consumer Non-Durables | | 4.1 |

| Capital Goods | | 8.6 | | Other | | 10.0 |

| Technology | | 8.1 | | | | |

| Utilities | | 7.7 | | | | 100.4 |

| |

| † Based on net assets. | | | | | | |

| See notes to financial statements. | | | | |

STATEMENT OF ASSETS AND LIABILITIES

December 31, 2005

| | | | | | | | | | | Cost | | Value |

| |

| |

| |

| |

| |

| |

|

| Assets ($): | | | | | | | | | | | | |

| Investments in securities—See Statement of Investments | | 599,889,116 | | 691,274,639 |

| Cash | | | | | | | | | | | | 19,252 |

| Receivable for investment securities sold | | | | | | | | 551,665 |

| Dividends and interest receivable | | | | | | | | 1,019,910 |

| Receivable for shares of Beneficial Interest subscribed | | | | | | 220,603 |

| | | | | | | | | | | 693,086,069 |

| |

| |

| |

| |

| |

|

| Liabilities ($): | | | | | | | | | | | | |

| Due to The Dreyfus Corporation and affiliates—Note 3(b) | | | | | | 780,289 |

| Payable for investment securities purchased | | | | | | | | 277,461 |

| Payable for shares of Beneficial Interest redeemed | | | | | | 3,288,467 |

| | | | | | | | | | | | | 4,346,217 |

| |

| |

| |

| |

| |

| |

|

| Net Assets ($) | | | | | | | | | | 688,739,852 |

| |

| |

| |

| |

| |

|

| Composition of Net Assets ($): | | | | | | | | |

| Paid-in capital | | | | | | | | | | | | 569,242,000 |

| Accumulated undistributed investment income—net | | | | | | 69,556 |

| Accumulated net realized gain (loss) on investments | | | | | | 28,042,773 |

| Accumulated net unrealized appreciation | | | | | | | | |

| (depreciation) on investments | | | | | | | | 91,385,523 |

| |

| |

| |

| |

|

| Net Assets ($) | | | | | | | | | | 688,739,852 |

| |

| |

| |

| |

| |

|

| |

| |

| Net Asset Value Per Share | | | | | | | | |

| | | Class A | | Class B | | Class C | | Class R | | Class T | | Institutional |

| |

| |

| |

| |

| |

| |

|

| Net Assets ($) | | 556,016,879 | | 64,238,945 20,563,775 | | 4,739,550 | | 2,840,191 | | 40,340,512 |

| Shares | | | | | | | | | | | | |

| Outstanding | | 17,718,530 | | 2,080,940 | | 666,555 | | 151,120 | | 90,533 | | 1,286,201 |

| |

| |

| |

| |

| |

| |

|

| Net Asset Value | | | | | | | | | | |

| Per Share ($) | | 31.38 | | 30.87 | | 30.85 | | 31.36 | | 31.37 | | 31.36 |

See notes to financial statements.

|

The Fund 13

STATEMENT OF OPERATIONS

Year Ended December 31, 2005

|

| Investment Income ($): | | |

| Income: | | |

| Cash dividends (net of $50,270 foreign taxes withheld at source) | | 16,401,586 |

| Interest | | 170,954 |

| Income from securities lending | | 34,803 |

| Total Income | | 16,607,343 |

| Expenses: | | |

| Management fee—Note 3(a) | | 6,967,779 |

| Distribution and service fees—Note 3(b) | | 2,475,527 |

| Interest expense—Note 2 | | 22,240 |

| Loan commitment fees—Note 2 | | 5,867 |

| Total Expenses | | 9,471,413 |

| Investment Income—Net | | 7,135,930 |

| |

|

| Realized and Unrealized Gain (Loss) on Investments—Note 4 ($): |

| Net realized gain (loss) on investments | | 96,968,863 |

| Net unrealized appreciation (depreciation) on investments | | (66,603,353) |

| Net Realized and Unrealized Gain (Loss) on Investments | | 30,365,510 |

| Net Increase in Net Assets Resulting from Operations | | 37,501,440 |

See notes to financial statements.

|

STATEMENT OF CHANGES IN NET ASSETS

| | | Year Ended December 31, |

| |

|

| | | 2005 | | 2004 |

| |

| |

|

| Operations ($): | | | | |

| Investment income—net | | 7,135,930 | | 6,301,118 |

| Net realized gain (loss) on investments | | 96,968,863 | | 71,568,294 |

| Net unrealized appreciation | | | | |

| (depreciation) on investments | | (66,603,353) | | 8,014,588 |

| Net Increase (Decrease) in Net Assets | | |

| Resulting from Operations | | 37,501,440 | | 85,884,000 |

| |

| |

|

| Dividends to Shareholders from ($): | | | | |

| Investment income—net: | | | | |

| Class A shares | | (6,671,140) | | (4,697,408) |

| Class B shares | | (261,483) | | (149,699) |

| Class C shares | | (82,006) | | (41,992) |

| Class R shares | | (450,170) | | (549,414) |

| Class T shares | | (25,630) | | (14,243) |

| Institutional shares | | (498,400) | | (347,200) |

| Net realized gain on investments: | | | | |

| Class A shares | | (3,000,559) | | — |

| Class B shares | | (351,900) | | — |

| Class C shares | | (112,649) | | — |

| Class R shares | | (29,847) | | — |

| Class T shares | | (15,252) | | — |

| Institutional shares | | (216,644) | | — |

| Total Dividends | | (11,715,680) | | (5,799,956) |

The Fund 15

STATEMENT OF CHANGES IN NET ASSETS (continued)

|

| | | Year Ended December 31, |

| |

|

| | | 2005 | | 2004 |

| |

| |

|

| Beneficial Interest Transactions ($): | | | | |

| Net proceeds from shares sold: | | | | |

| Class A shares | | 41,179,970 | | 59,592,432 |

| Class B shares | | 2,182,340 | | 6,208,956 |

| Class C shares | | 2,154,740 | | 4,440,112 |

| Class R shares | | 6,465,122 | | 7,087,324 |

| Class T shares | | 330,242 | | 813,497 |

| Institutional shares | | 430,423 | | 804,835 |

| Dividends reinvested: | | | | |

| Class A shares | | 8,340,534 | | 4,081,538 |

| Class B shares | | 542,997 | | 129,596 |

| Class C shares | | 146,513 | | 31,529 |

| Class R shares | | 479,481 | | 549,093 |

| Class T shares | | 39,548 | | 13,773 |

| Institutional shares | | 696,125 | | 336,538 |

| Cost of shares redeemed: | | | | |

| Class A shares | | (147,388,521) | | (98,384,063) |

| Class B shares | | (18,785,780) | | (14,428,736) |

| Class C shares | | (4,377,438) | | (7,117,650) |

| Class R shares | | (54,381,780) | | (14,874,540) |

| Class T shares | | (577,204) | | (422,625) |

| Institutional shares | | (3,325,634) | | (5,872,389) |

| Increase (Decrease) in Net Assets | | | | |

| from Beneficial Interest Transactions | | (165,848,322) | | (57,010,780) |

| Total Increase (Decrease) in Net Assets | | (140,062,562) | | 23,073,264 |

| |

| |

|

| Net Assets ($): | | | | |

| Beginning of Period | | 828,802,414 | | 805,729,150 |

| End of Period | | 688,739,852 | | 828,802,414 |

| Undistributed investment income—net | | 69,556 | | 922,455 |

| | | Year Ended December 31, |

| |

|

| | | 2005 | | 2004 |

| |

| |

|

| Capital Share Transactions: | | | | |

| Class A a | | | | |

| Shares sold | | 1,359,291 | | 2,113,462 |

| Shares issued for dividends reinvested | | 269,242 | | 141,041 |

| Shares redeemed | | (4,810,155) | | (3,501,287) |

| Net Increase (Decrease) in Shares Outstanding | | (3,181,622) | | (1,246,784) |

| |

| |

|

| Class B a | | | | |

| Shares sold | | 72,352 | | 218,548 |

| Shares issued for dividends reinvested | | 17,579 | | 4,398 |

| Shares redeemed | | (628,712) | | (518,703) |

| Net Increase (Decrease) in Shares Outstanding | | (538,781) | | (295,757) |

| |

| |

|

| Class C | | | | |

| Shares sold | | 71,987 | | 159,821 |

| Shares issued for dividends reinvested | | 4,750 | | 1,071 |

| Shares redeemed | | (146,406) | | (256,515) |

| Net Increase (Decrease) in Shares Outstanding | | (69,669) | | (95,623) |

| |

| |

|

| Class R | | | | |

| Shares sold | | 211,002 | | 252,461 |

| Shares issued for dividends reinvested | | 15,771 | | 19,085 |

| Shares redeemed | | (1,741,923) | | (527,483) |

| Net Increase (Decrease) in Shares Outstanding | | (1,515,150) | | (255,937) |

| |

| |

|

| Class T | | | | |

| Shares sold | | 10,988 | | 28,795 |

| Shares issued for dividends reinvested | | 1,273 | | 471 |

| Shares redeemed | | (18,835) | | (14,698) |

| Net Increase (Decrease) in Shares Outstanding | | (6,574) | | 14,568 |

| |

| |

|

| Institutional Shares | | | | |

| Shares sold | | 14,298 | | 28,607 |

| Shares issued for dividends reinvested | | 22,474 | | 11,656 |

| Shares redeemed | | (109,530) | | (207,544) |

| Net Increase (Decrease) in Shares Outstanding | | (72,758) | | (167,281) |

| a | | During the period ended December 31, 2005, 152,245 Class B shares representing $4,558,620 were |

| | | automatically converted to 149,654 Class A shares and during the period ended December 31, 2004, 92,290 |

| | | Class B shares representing $2,541,700 were automatically converted to 90,750 Class A shares. |

| See notes to financial statements. |

The Fund 17

The following tables describe the performance for each share class for the fiscal periods indicated. All information (except portfolio turnover rate) reflects financial results for a single fund share.Total return shows how much your investment in the fund would have increased (or decreased) during each period assuming you had reinvested all dividends and distributions.These figures have been derived from the fund’s financial statements.

| | | | | Year Ended December 31, | | |

| |

| |

| |

|

| Class A Shares | | 2005 | | 2004 | | 2003 | | 2002 | | 2001 |

| |

| |

| |

| |

| |

|

| Per Share Data ($): | | | | | | | | | | |

| Net asset value, beginning of period | | 30.34 | | 27.44 | | 21.57 | | 28.62 | | 30.93 |

| Investment Operations: | | | | | | | | | | |

| Investment income—net a | | .30 | | .24 | | .17 | | .10 | | .17 |

| Net realized and unrealized gain | | | | | | | | | | |

| (loss) on investments | | 1.26 | | 2.88 | | 5.86 | | (7.06) | | (1.46) |

| Total from Investment Operations | | 1.56 | | 3.12 | | 6.03 | | (6.96) | | (1.29) |

| Distributions: | | | | | | | | | | |

| Dividends from investment | | | | | | | | | | |

| income—net | | (.35) | | (.22) | | (.16) | | (.09) | | (.16) |

| Dividends from net realized | | | | | | | | | | |

| gain on investments | | (.17) | | — | | — | | — | | (.86) |

| Total Distributions | | (.52) | | (.22) | | (.16) | | (.09) | | (1.02) |

| Net asset value, end of period | | 31.38 | | 30.34 | | 27.44 | | 21.57 | | 28.62 |

| |

| |

| |

| |

| |

|

| Total Return (%) b | | 5.18 | | 11.41 | | 28.09 | | (24.36) | | (4.04) |

| |

| |

| |

| |

| |

|

| Ratios/Supplemental Data (%): | | | | | | | | | | |

| Ratio of total expenses | | | | | | | | | | |

| to average net assets | | 1.15 | | 1.15 | | 1.15 | | 1.15 | | 1.15 |

| Ratio of net investment income | | | | | | | | | | |

| to average net assets | | .99 | | .86 | | .71 | | .41 | | .58 |

| Portfolio Turnover Rate | | 55.95 | | 74.98 | | 54.58 | | 67.21 | | 68.77 |

| |

| |

| |

| |

| |

|

| Net Assets, end of period ($ X 1,000) | | 556,017 | | 634,007 | | 607,633 | | 504,371 | | 695,054 |

| a | | Based on average shares outstanding at each month end. |

| b | | Exclusive of sales charge. |

See notes to financial statements.

| | | | | | | Year Ended December 31, | | |

| | | |

| |

| |

|

| Class B Shares | | 2005 | | 2004 | | 2003 | | 2002 | | 2001 |

| |

| |

| |

| |

| |

|

| Per Share Data ($): | | | | | | | | | | |

| Net asset value, beginning of period | | 29.83 | | 27.02 | | 21.27 | | 28.33 | | 30.68 |

| Investment Operations: | | | | | | | | | | |

| Investment income (loss)—net a | | .07 | | .02 | | (.01) | | (.08) | | (.07) |

| Net realized and unrealized gain | | | | | | | | | | |

| (loss) on investments | | 1.26 | | 2.85 | | 5.77 | | (6.98) | | (1.42) |

| Total from Investment Operations | | 1.33 | | 2.87 | | 5.76 | | (7.06) | | (1.49) |

| Distributions: | | | | | | | | | | |

| Dividends from investment | | | | | | | | | | |

| income—net | | (.12) | | (.06) | | (.01) | | — | | (.00)b |

| Dividends from net realized | | | | | | | | | | |

| gain on investments | | (.17) | | — | | — | | — | | (.86) |

| Total Distributions | | (.29) | | (.06) | | (.01) | | — | | (.86) |

| Net asset value, end of period | | 30.87 | | 29.83 | | 27.02 | | 21.27 | | 28.33 |

| |

| |

| |

| |

| |

|

| Total Return (%) c | | 4.47 | | 10.62 | | 27.12 | | (24.92) | | (4.79) |

| |

| |

| |

| |

| |

|

| Ratios/Supplemental Data (%): | | | | | | | | | | |

| Ratio of total expenses | | | | | | | | | | |

| to average net assets | | 1.90 | | 1.90 | | 1.90 | | 1.90 | | 1.90 |

| Ratio of net investment income (loss) | | | | | | | | | | |

| to average net assets | | .24 | | .10 | | (.04) | | (.33) | | (.24) |

| Portfolio Turnover Rate | | 55.95 | | 74.98 | | 54.58 | | 67.21 | | 68.77 |

| |

| |

| |

| |

| |

|

| Net Assets, end of period ($ X 1,000) | | 64,239 | | 78,154 | | 78,780 | | 62,820 | | 68,123 |

| |

| a | | Based on average shares outstanding at each month end. | | | | | | | | |

| b | | Amount represents less than $.01 per share. | | | | | | | | |

| c | | Exclusive of sales charge. | | | | | | | | | | |

| See notes to financial statements. | | | | | | | | | | |

The Fund 19

FINANCIAL HIGHLIGHTS (continued)

|

| | | | | | | Year Ended December 31, | | |

| | | |

| |

| |

|

| Class C Shares | | 2005 | | 2004 | | 2003 | | 2002 | | 2001 |

| |

| |

| |

| |

| |

|

| Per Share Data ($): | | | | | | | | | | |

| Net asset value, beginning of period | | 29.83 | | 27.02 | | 21.27 | | 28.34 | | 30.68 |

| Investment Operations: | | | | | | | | | | |

| Investment income (loss)—net a | | .07 | | .02 | | (.01) | | (.08) | | (.06) |

| Net realized and unrealized gain | | | | | | | | | | |

| (loss) on investments | | 1.24 | | 2.85 | | 5.77 | | (6.99) | | (1.42) |

| Total from Investment Operations | | 1.31 | | 2.87 | | 5.76 | | (7.07) | | (1.48) |

| Distributions: | | | | | | | | | | |

| Dividends from investment | | | | | | | | | | |

| income—net | | (.12) | | (.06) | | (.01) | | — | | (.00)b |

| Dividends from net realized | | | | | | | | | | |

| gain on investments | | (.17) | | — | | — | | — | | (.86) |

| Total Distributions | | (.29) | | (.06) | | (.01) | | — | | (.86) |

| Net asset value, end of period | | 30.85 | | 29.83 | | 27.02 | | 21.27 | | 28.34 |

| |

| |

| |

| |

| |

|

| Total Return (%) c | | 4.43 | | 10.62 | | 27.12 | | (24.95) | | (4.75) |

| |

| |

| |

| |

| |

|

| Ratios/Supplemental Data (%): | | | | | | | | | | |

| Ratio of total expenses | | | | | | | | | | |

| to average net assets | | 1.90 | | 1.90 | | 1.90 | | 1.90 | | 1.90 |

| Ratio of net investment income (loss) | | | | | | | | | | |

| to average net assets | | .24 | | .10 | | (.04) | | (.32) | | (.24) |

| Portfolio Turnover Rate | | 55.95 | | 74.98 | | 54.58 | | 67.21 | | 68.77 |

| |

| |

| |

| |

| |

|

| Net Assets, end of period ($ X 1,000) | | 20,564 | | 21,958 | | 22,480 | | 20,819 | | 23,612 |

| |

| a | | Based on average shares outstanding at each month end. | | | | | | | | |

| b | | Amount represents less than $.01 per share. | | | | | | | | |

| c | | Exclusive of sales charge. | | | | | | | | | | |

| See notes to financial statements. | | | | | | | | | | |

| | | | | Year Ended December 31, | | |

| |

| |

| |

|

| Class R Shares | | 2005 | | 2004 | | 2003 | | 2002 | | 2001 |

| |

| |

| |

| |

| |

|

| Per Share Data ($): | | | | | | | | | | |

| Net asset value, beginning of period | | 30.33 | | 27.43 | | 21.56 | | 28.62 | | 30.92 |

| Investment Operations: | | | | | | | | | | |

| Investment income—net a | | .38 | | .31 | | .22 | | .17 | | .23 |

| Net realized and unrealized gain | | | | | | | | | | |

| (loss) on investments | | 1.25 | | 2.88 | | 5.87 | | (7.08) | | (1.44) |

| Total from Investment Operations | | 1.63 | | 3.19 | | 6.09 | | (6.91) | | (1.21) |

| Distributions: | | | | | | | | | | |

| Dividends from investment | | | | | | | | | | |

| income—net | | (.43) | | (.29) | | (.22) | | (.15) | | (.23) |

| Dividends from net realized | | | | | | | | | | |

| gain on investments | | (.17) | | — | | — | | — | | (.86) |

| Total Distributions | | (.60) | | (.29) | | (.22) | | (.15) | | (1.09) |

| Net asset value, end of period | | 31.36 | | 30.33 | | 27.43 | | 21.56 | | 28.62 |

| |

| |

| |

| |

| |

|

| Total Return (%) | | 5.45 | | 11.69 | | 28.43 | | (24.18) | | (3.80) |

| |

| |

| |

| |

| |

|

| Ratios/Supplemental Data (%): | | | | | | | | | | |

| Ratio of total expenses | | | | | | | | | | |

| to average net assets | | .90 | | .90 | | .90 | | .90 | | .90 |

| Ratio of net investment income | | | | | | | | | | |

| to average net assets | | 1.25 | | 1.09 | | .95 | | .67 | | .78 |

| Portfolio Turnover Rate | | 55.95 | | 74.98 | | 54.58 | | 67.21 | | 68.77 |

| |

| |

| |

| |

| |

|

| Net Assets, end of period ($ X 1,000) | | 4,740 | | 50,536 | | 52,723 | | 40,320 | | 46,555 |

| |

| a Based on average shares outstanding at each month end. | | | | | | | | |

| See notes to financial statements. | | | | | | | | | | |

The Fund 21

FINANCIAL HIGHLIGHTS (continued)

|

| | | | | | | Year Ended December 31, | | |

| | | |

| |

| |

|

| Class T Shares | | 2005 | | 2004 | | 2003 | | 2002 | | 2001 |

| |

| |

| |

| |

| |

|

| Per Share Data ($): | | | | | | | | | | |

| Net asset value, beginning of period | | 30.33 | | 27.43 | | 21.57 | | 28.63 | | 30.93 |

| Investment Operations: | | | | | | | | | | |

| Investment income—net a | | .23 | | .18 | | .11 | | .05 | | .07 |

| Net realized and unrealized gain | | | | | | | | | | |

| (loss) on investments | | 1.26 | | 2.87 | | 5.85 | | (7.07) | | (1.42) |

| Total from Investment Operations | | 1.49 | | 3.05 | | 5.96 | | (7.02) | | (1.35) |

| Distributions: | | | | | | | | | | |

| Dividends from investment | | | | | | | | | | |

| income—net | | (.28) | | (.15) | | (.10) | | (.04) | | (.09) |

| Dividends from net realized | | | | | | | | | | |

| gain on investments | | (.17) | | — | | — | | — | | (.86) |

| Total Distributions | | (.45) | | (.15) | | (.10) | | (.04) | | (.95) |

| Net asset value, end of period | | 31.37 | | 30.33 | | 27.43 | | 21.57 | | 28.63 |

| |

| |

| |

| |

| |

|

| Total Return (%) b | | 4.95 | | 11.14 | | 27.72 | | (24.53) | | (4.28) |

| |

| |

| |

| |

| |

|

| Ratios/Supplemental Data (%): | | | | | | | | | | |

| Ratio of total expenses | | | | | | | | | | |

| to average net assets | | 1.40 | | 1.40 | | 1.40 | | 1.40 | | 1.40 |

| Ratio of net investment income | | | | | | | | | | |

| to average net assets | | .74 | | .65 | | .45 | | .21 | | .25 |

| Portfolio Turnover Rate | | 55.95 | | 74.98 | | 54.58 | | 67.21 | | 68.77 |

| |

| |

| |

| |

| |

|

| Net Assets, end of period ($ X 1,000) | | 2,840 | | 2,945 | | 2,264 | | 1,567 | | 1,132 |

| |

| a | | Based on average shares outstanding at each month end. | | | | | | | | |

| b | | Exclusive of sales charge. | | | | | | | | | | |

| See notes to financial statements. | | | | | | | | | | |

| | | | | Year Ended December 31, | | |

| |

| |

| |

|

| Institutional Shares | | 2005 | | 2004 | | 2003 | | 2002 | | 2001 |

| |

| |

| |

| |

| |

|

| Per Share Data ($): | | | | | | | | | | |

| Net asset value, beginning of period | | 30.32 | | 27.42 | | 21.55 | | 28.60 | | 30.90 |

| Investment Operations: | | | | | | | | | | |

| Investment income—net a | | .33 | | .27 | | .19 | | .13 | | .20 |

| Net realized and unrealized | | | | | | | | | | |

| gain (loss) on investments | | 1.26 | | 2.88 | | 5.87 | | (7.07) | | (1.45) |

| Total from Investment Operations | | 1.59 | | 3.15 | | 6.06 | | (6.94) | | (1.25) |

| Distributions: | | | | | | | | | | |

| Dividends from investment | | | | | | | | | | |

| income—net | | (.38) | | (.25) | | (.19) | | (.11) | | (.19) |

| Dividends from net realized | | | | | | | | | | |

| gain on investments | | (.17) | | — | | — | | — | | (.86) |

| Total Distributions | | (.55) | | (.25) | | (.19) | | (.11) | | (1.05) |

| Net asset value, end of period | | 31.36 | | 30.32 | | 27.42 | | 21.55 | | 28.60 |

| |

| |

| |

| |

| |

|

| Total Return (%) | | 5.33 | | 11.53 | | 28.25 | | (24.28) | | (3.96) |

| |

| |

| |

| |

| |

|

| Ratios/Supplemental Data (%): | | | | | | | | | | |

| Ratio of total expenses | | | | | | | | | | |

| to average net assets | | 1.05 | | 1.05 | | 1.05 | | 1.05 | | 1.05 |

| Ratio of net investment income | | | | | | | | | | |

| to average net assets | | 1.09 | | .96 | | .81 | | .51 | | .70 |

| Portfolio Turnover Rate | | 55.95 | | 74.98 | | 54.58 | | 67.21 | | 68.77 |

| |

| |

| |

| |

| |

|

| Net Assets, end of period ($ X 1,000) | | 40,341 | | 41,202 | | 41,848 | | 37,174 | | 58,557 |

| |

| a Based on average shares outstanding at each month end. | | | | | | | | |

| See notes to financial statements. | | | | | | | | | | |

The Fund 23

NOTES TO FINANCIAL STATEMENTS

NOTE 1—Significant Accounting Policies:

Dreyfus Premier Core Value Fund (the “fund”) is a separate diversified series of The Dreyfus/Laurel Funds Trust (the “Trust”) which is registered under the Investment Company Act of 1940, as amended (the “Act”), as an open-end management investment company and operates as a series company currently offering five series, including the fund. The fund’s investment objective is to seek long-term capital growth.The Dreyfus Corporation (the “Manager” or “Dreyfus”) serves as the fund’s investment manager. The Manager is a wholly-owned subsidiary of Mellon Financial Corporation (“Mellon Financial”).

Dreyfus Service Corporation (the “Distributor”), a wholly-owned subsidiary of the Manager, is the distributor of the fund’s shares. The fund is authorized to issue an unlimited number of shares of Beneficial Interest in each of the following classes of shares: Class A, Class B, Class C, Class R, Class T and Institutional shares. Class A, Class B, Class C and Class T shares are sold primarily to retail investors through financial intermediaries and bear a distribution fee and/or service fee. Class A and Class T shares are subject to a front-end sales charge, while Class B and Class C shares are subject to a contingent deferred sales charge (“CDSC”). Class B shares automatically convert to Class A shares after six years. Class R shares are sold primarily to bank trust departments and other financial service providers (including Mellon Financial and its affiliates) acting on behalf of customers having a qualified trust or investment account or relationship at such institution, and bear no distribution or service fees. Class R and Institutional shares are offered without a front-end sales charge or CDSC. Institutional shares are offered only to those customers of certain financial planners and investment advisers who held shares of a predecessor class of the fund as of April 4, 1994, and bear a distribution fee. Each class of shares has identical rights and privileges, except with respect to the distribution and service fees and voting rights on matters affecting a single class. Income, expenses (other than expenses attributable to a specific class), and realized and unrealized gains or losses on investments are allocated to each class of shares based on its relative net assets.

The fund’s financial statements are prepared in accordance with U.S. generally accepted accounting principles, which may require the use of management estimates and assumptions. Actual results could differ from those estimates.

(a) Portfolio valuation: Investments in securities are valued at the last sales price on the securities exchange or national securities market on which such securities are primarily traded. Securities listed on the National Market System, for which market quotations are available are valued at the official closing price or, if there is no official closing price that day, at the last sale price. Securities not listed on an exchange or the national securities market, or securities for which there were no transactions, are valued at the average of the most recent bid and asked prices. Bid price is used when no asked price is available. Investments in registered investment companies are valued at their net asset value. When market quotations or official closing prices are not readily available, or are determined not to reflect accurately fair value, such as when the value of a security has been significantly affected by events after the close of the exchange or market on which the security is principally traded (for example, a foreign exchange or market), but before the fund calculates its net asset value, the fund may value these investments at fair value as determined in accordance with the procedures approved by the Board of Trustees. Fair valuing of securities may be determined with the assistance of a pricing service using calculations based on indices of domestic securities and other appropriate indicators, such as prices of relevant ADR’s and futures contracts. For other securities that are fair valued by the Board of Trustees, certain factors may be considered such as: fundamental analytical data, the nature and duration of restrictions on disposition, an evaluation of the forces that influence the market in which the securities are purchased and sold, and public trading in similar securities of the issuer or comparable issuers. Investments denominated in foreign currencies are translated to U.S. dollars at the prevailing rates of exchange. Forward currency exchange contracts are valued at the forward rate.

The Fund 25

NOTES TO FINANCIAL STATEMENTS (continued)

|

(b) Securities transactions and investment income: Securities transactions are recorded on a trade date basis. Realized gain and loss from securities transactions are recorded on the identified cost basis. Dividend income is recognized on the ex-dividend date and interest income, including, where applicable, accretion of discount and amortization of premium on investments, is recognized on the accrual basis.

Pursuant to a securities lending agreement with Mellon Bank, N.A., an affiliate of the Manager, the fund may lend securities to qualified institutions.At origination, all loans are secured by collateral of at least 102% of the value of U.S. securities loaned and 105% of the value of foreign securities loaned. Collateral equivalent to at least 100% of the market value of securities on loan will be maintained at all times. Cash collateral is invested in certain money market mutual funds managed by the Manager. The fund will be entitled to receive all income on securities loaned, in addition to income earned as a result of the lending transaction. Although each security loaned is fully collateralized, the fund would bear the risk of delay in recovery of, or loss of rights in, the securities loaned should a borrower fail to return the securities in a timely manner.

(c) Affiliated issuers: Investments in other investment companies advised by the Manager are defined as “affiliated” in the Act.

(d) Foreign currency transactions: The fund does not isolate that portion of the results of operations resulting from changes in foreign exchange rates on investments from the fluctuations arising from changes in the market prices of securities held. Such fluctuations are included with the net realized and unrealized gain or loss from investments.

Net realized foreign exchange gains or losses arise from sales and maturities of short-term securities, sales of foreign currencies, currency gains or losses realized on securities transactions and the difference between the amount of dividends, interest, and foreign withholding taxes recorded on the fund’s books and the U.S. dollar equivalent of the amounts actually received or paid. Net unrealized foreign exchange gains and losses arise from changes in the value of assets and

liabilities other than investments in securities, resulting from changes in exchange rates. Such gains and losses are included with net realized and unrealized gain or loss on investments.

(e) Dividends to shareholders: Dividends are recorded on the ex-dividend date. Dividends from investment income-net are declared and paid on a quarterly basis. Dividends from net realized capital gain are normally declared and paid annually, but the fund may make distributions on a more frequent basis to comply with the distribution requirements of the Internal Revenue Code of 1986, as amended (the “Code”). To the extent that net realized capital gain can be offset by capital loss carryovers, if any, it is the policy of the fund not to distribute such gain. Income and capital gain distributions are determined in accordance with income tax regulations, which may differ from U.S. generally accepted accounting principles.

(f) Federal income taxes: It is the policy of the fund to continue to qualify as a regulated investment company, if such qualification is in the best interests of its shareholders, by complying with the applicable provisions of the Code, and to make distributions of taxable income sufficient to relieve it from substantially all federal income and excise taxes.

At December 31, 2005, the components of accumulated earnings on a tax basis were as follows: undistributed ordinary income $69,556, undistributed capital gains $28,596,726 and unrealized appreciation $90,831,570.

The tax character of distributions paid to shareholders during the fiscal periods ended December 31, 2005 and December 31, 2004 were as follows: ordinary income $7,988,829 and $5,799,956 and long-term capital gains $3,726,851 and $0, respectively.

NOTE 2—Bank Line of Credit:

|

The fund participates with other Dreyfus-managed funds in a $350 million redemption credit facility (“the Facility”) to be utilized for temporary or emergency purposes, including the financing of redemp-

The Fund 27

NOTES TO FINANCIAL STATEMENTS (continued)

|

tions. In connection therewith, the fund has agreed to pay commitment fees on its pro rata portion of the Facility. Interest is charged to the fund based on prevailing market rates in effect at the time of borrowing.

The average daily amount of borrowings outstanding under the Facility during the period ended December 31, 2005, was $496,600 with a related weighted average annualized interest rate of 4.48% .

NOTE 3—Investment Management Fee and Other Transactions With Affiliates:

(a) Pursuant to an Investment Management agreement with the Manager, the Manager provides or arranges for one or more third parties and/or affiliates to provide investment advisory, administrative, custody, fund accounting and transfer agency services to the fund.The Manager also directs the investments of the fund in accordance with its investment objective, policies and limitations. For these services, the fund is contractually obligated to pay the Manager a fee, calculated daily and paid monthly, at the annual rate of .90% of the value of the fund’s average daily net assets. Out of its fee, the Manager pays all of the expenses of the fund except brokerage fees, taxes, interest, commitment fees, Rule 12b-1 distribution fees and expenses, service fees, fees and expenses of non-interested Trustees (including counsel fees) and extraordinary expenses. In addition, the Manager is required to reduce its fee in an amount equal to the fund’s allocable portion of fees and expenses of the non-interested Trustees (including counsel fees). Effective October 1, 2005, each Trustee receives $45,000 per year, plus $6,000 for each joint Board meeting of The Dreyfus/Laurel Funds, Inc., The Dreyfus/Laurel Tax-Free Municipal Funds, and the Trust (collectively, the “Dreyfus/Laurel Funds”) attended, $2,000 for separate in-person committee meetings attended which are not held in conjunction with a regularly scheduled Board meeting and $1,500 for Board meetings and separate committee meetings attended that are conducted by telephone and is reimbursed for travel and out-of-pocket expenses.With respect to Board meetings, the Chairman of the Board receives an additional 25% of such compensation (with the

exception of reimbursable amounts). With respect to compensation committee meetings, the Chair of the compensation committee receives $900 per meeting and, with respect to audit committee meetings, the Chair of the audit committee receives $1,350 per meeting. In the event that there is an in-person joint committee meeting or a joint telephone meeting of the Dreyfus/Laurel Funds and the Dreyfus High Yield Strategies Fund, the $2,000 or $1,500 fee, as applicable, will be allocated between the Dreyfus/Laurel Funds and the Dreyfus High Yield Strategies Fund. Prior to October 1, 2005, each Trustee received $40,000 per year, plus $5,000 for each joint Board meeting of the Dreyfus/Laurel Funds attended, $2,000 for separate committee meetings attended which were not held in conjunction with a regularly scheduled Board meeting and $500 for Board meetings and separate committee meetings attended that were conducted by telephone and was reimbursed for travel and out-of-pocket expenses.The Chairman of the Board received an additional 25% of such compensation (with the exception of reimbursable amounts). In the event that there was a joint committee meeting of the Dreyfus/Laurel Funds and Dreyfus High Yield Strategies Fund, the $2,000 fee was allocated between the Dreyfus/Laurel Funds and Dreyfus High Yield Strategies Fund.These fees and expenses are charged and allocated to each series based on net assets. Amounts required to be paid by the Trust directly to the non-interested Trustees, that would be applied to offset a portion of the management fee payable to the Manager, are in fact paid directly by the Manager to the non-interested Trustees.

During the period ended December 31, 2005, the Distributor retained $28,184 and $756 from commissions earned on sales of the fund’s Class A and Class T shares, respectively, and $200,428 and $2,055 from contingent deferred sales charges on redemptions on the fund’s Class B and Class C shares, respectively.

(b) Under separate Distribution Plans (the “Plans”) adopted pursuant to Rule 12b-1 under the Act, Class A shares and Institutional shares may pay annually up to .25% and ..15%, respectively, of the value of

The Fund 29

NOTES TO FINANCIAL STATEMENTS (continued)

|

their average daily net assets to compensate the Distributor for shareholder servicing activities and expenses primarily intended to result in the sale of Class A shares and Institutional shares. Class B, Class C and Class T shares pay the Distributor for distributing their shares at an aggregate annual rate of .75% of the value of the average daily net assets of Class B and Class C shares, and .25% of the value of average daily net assets of Class T shares.The Distributor may pay one or more agents in respect of advertising, marketing and other distribution services for Class T shares and determines the amounts, if any, to be paid to agents and the basis on which such payments are made. Class B, Class C and Class T shares are also subject to a service plan adopted pursuant to Rule 12b-1 (the “Service Plan”), under which Class B, Class C and Class T shares pay the Distributor for providing certain services to the holders of their shares a fee at the annual rate of .25% of the value of the average daily net assets of Class B, Class C and Class T shares, respectively. During the period ended December 31, 2005, Class A, Class B, Class C, Class T and Institutional shares were charged $1,492,402, $524,854, $156,637, $7,218 and $60,035, respectively, pursuant to their respective Plans. During the period ended December 31, 2005, Class B, Class C and Class T shares were charged $174,951, $52,212 and $7,218, respectively, pursuant to the Service Plan.

Under its terms, the Plans and Service Plan shall remain in effect from year to year, provided such continuance is approved annually by a vote of majority of those Trustees who are not “interested persons” of the Trust and who have no direct or indirect financial interest in the operation of or in any agreement related to the Plans or Service Plan.

The components of Due to The Dreyfus Corporation and affiliates in the Statement of Assets and Liabilities consist of: management fees $568,425, Rule 12b-1 distribution plan fees $191,807 and shareholder services plan fees $20,057.

(c) The Trust and the Manager have received an exemptive order from the SEC which, among other things, permits the fund to use cash collateral received in connection with lending the fund’s securities and other uninvested cash to purchase shares of one or more registered money market mutual funds advised by the Manager in excess of the limitations imposed by the Act.

NOTE 4—Securities Transactions:

The aggregate amount of purchases and sales of investment securities, excluding short-term securities, during the period ended December 31, 2005, amounted to $428,166,715 and $596,640,678, respectively.

At December 31, 2005, the cost of investments for federal income tax purposes was $600,443,069; accordingly, accumulated net unrealized appreciation on investments was $90,831,570, consisting of $108,517,356 gross unrealized appreciation and $17,685,786 gross unrealized depreciation.

The Fund 31

REPORT OF INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM

The Board of Trustees and Shareholders The Dreyfus/Laurel Funds Trust:

We have audited the accompanying statement of assets and liabilities, of Dreyfus Premier Core Value Fund (the “Fund”) of The Dreyfus/ Laurel Funds Trust, including the statement of investments as of December 31, 2005, and the related statement of operations for the year then ended, the statement of changes in net assets for each of the years in the two-year period then ended, and the financial highlights for each of the years in the five-year period then ended.These financial statements and financial highlights are the responsibility of the Fund’s management. Our responsibility is to express an opinion on these financial statements and financial highlights based on our audits.

We conducted our audits in accordance with standards of the Public Company Accounting Oversight Board (United States). Those standards require that we plan and perform the audit to obtain reasonable assurance about whether the financial statements and financial highlights are free of material misstatement. An audit also includes examining, on a test basis, evidence supporting the amounts and disclosures in the financial statements. Our procedures included confirmation of securities owned as of December 31, 2005, by correspondence with the custodian and broker. An audit also includes assessing the accounting principles used and significant estimates made by management, as well as evaluating the overall financial statement presentation.We believe that our audits provide a reasonable basis for our opinion.

In our opinion, the financial statements and financial highlights referred to above present fairly, in all material respects, the financial position of Dreyfus Premier Core Value Fund of The Dreyfus/Laurel Funds Trust as of December 31, 2005, the results of its operations for the year then ended, the changes in its net assets for each of the years in the two-year period then ended, and the financial highlights for each of the years in the five-year period then ended, in conformity with U.S. generally accepted accounting principles.

New York, New York

February 17, 2006

|

IMPORTANT TAX INFORMATION (Unaudited)

For federal tax purposes, the fund hereby designates $.1701 per share as a long-term capital gain distribution paid on December 28, 2005. The fund also hereby designates 100% of the ordinary dividends paid during the fiscal year ended December 31, 2005 as qualifying for the corporate dividends received deduction. For the fiscal year ended December 31, 2005, certain dividends paid by the fund may be subject to a maximum tax rate of 15%, as provided for by the Jobs and Growth Tax Relief Reconciliation Act of 2003. Of the distributions paid during the fiscal year, $7,988,829 represents the maximum amount that may be considered qualified dividend income. Shareholders will receive notification in January 2006 of the percentage applicable to the preparation of their 2005 income tax returns.

The Fund 33

INFORMATION ABOUT THE REVIEW AND APPROVAL OF THE

FUND’S INVESTMENT MANAGEMENT AGREEMENT (Unaudited)

At a meeting of the Trust’s Board of Trustees held on October 26 and 27, 2005, the Board considered the re-approval, through its annual renewal date of April 4, 2006, of the fund’s Investment Management Agreement (“Management Agreement”), pursuant to which the Manager provides the fund with investment advisory and administrative services.The Board members, none of whom are “interested persons” (as defined in the Investment Company Act of 1940, as amended) of the fund were assisted in their review by independent legal counsel and met with counsel in executive session separate from representatives of the Manager.

Analysis of Nature, Extent and Quality of Services Provided to the Fund. The Board members reviewed information previously provided to them in a presentation from representatives of the Manager at the March 29 and 30, 2005 Board meetings regarding services provided to the fund and other funds in the Dreyfus fund complex, and discussed the nature, extent and quality of the services provided to the fund pursuant to its Management Agreement. The Manager’s representatives reviewed the fund’s distribution of accounts and the relationships the Manager has with various intermediaries and the different needs of each.The Manager’s representatives noted the diversity of distribution of the fund as well as among the funds in the Dreyfus fund complex, and the Manager’s corresponding need for broad, deep, and diverse resources to be able to provide ongoing shareholder services to each of the fund’s distribution channels.The Board also reviewed the number of shareholder accounts in the fund, as well as the fund’s asset size.

The Board members also considered the Manager’s research and portfolio management capabilities and that the Manager also provides oversight of day-to-day fund operations, including fund accounting and administration and assistance in meeting legal and regulatory requirements. The Board members also considered the Manager’s extensive administrative, accounting and compliance infrastructure.

Comparative Analysis of the Fund’s Performance and Management Fee and Expense Ratio. The Board members reviewed the fund’s per-

formance, management fee and expense ratio and placed significant emphasis on comparisons to a group of comparable funds and Lipper category averages, as applicable. The group of comparable funds was previously approved by the Board for this purpose, and was prepared using a Board-approved selection methodology that was based, in part, on selecting non-affiliated funds reported in the same Lipper category as the fund.The Board members discussed the results of the comparisons for various periods ended September 30, 2005, and noted that the fund’s total return performance was lower than the comparison group averages for the one-, three-, five- and ten-year periods. The Board also noted that the fund’s total return performance was lower than the Lipper category averages for the three-, five- and ten-year periods, but was higher than the Lipper category average for the one-year period, noting that the fund’s one-year total return performance rankings in the comparison group and Lipper category had improved since January 31, 2005, the period the Board reviewed in connection with its consideration of the renewal of the fund’s Management Agreement at the March 29 and 30, 2005 Board meeting.The Board noted the portfolio management change that occurred in April 2004.

The Board members also discussed the fund’s management fee and expense ratio and reviewed the range of management fees and expense ratios in the comparison group and the expense ratio averages of the comparison group and Lipper category.The fund was the only fund in the comparison group of funds with a “unitary fee” structure. The Board members noted that the fund’s expense ratio was lower than the comparison group and Lipper category averages.

Representatives of the Manager reviewed with the Board members the fees paid to the Manager or its affiliates by mutual funds managed by the Manager or its affiliates with similar investment objectives, policies and strategies, and included in the same Lipper category, as the fund, or in the “Large-Cap Value Variable Insurance Products” category of Lipper (the “Similar Funds”), and by other accounts managed by the Manager with similar investment objectives, policies and strategies as

The Fund 35

I N FO R M AT I O N A B O U T T H E R E V I E W A N D A P P R OVA L O F T H E F U N D ’ S M A N A G E M E N T I N V E S T M E N T A G R E E M E N T ( U n a u d i t e d ) ( c o n t i n u e d )

the fund (collectively with the Similar Funds, the “Similar Accounts”). The Manager’s representatives explained the nature of the Similar Accounts and the differences, from the Manager’s perspective, in providing services to such Similar Accounts as compared to managing and providing services to the fund. The Manager’s representatives also reviewed the costs associated with distribution through intermediaries. The Board analyzed differences in fees paid to the Manager and discussed the relationship of the fees paid in light of the Manager’s performance and the services provided, noting the fund’s “unitary fee” structure. The Board members considered the relevance of the fee information provided for the Similar Accounts to evaluate the appropriateness and reasonableness of the fund’s management fee.The Board acknowledged that differences in fees paid by the Similar Accounts seemed to be consistent with the services provided.

Analysis of Profitability and Economies of Scale. The Manager’s representatives reviewed the dollar amount of expenses allocated and profit received by the Manager and the method used to determine such expenses and profit.The Board considered information prepared by an independent consulting firm regarding the Manager’s approach to allocating costs to, and determining the profitability of, individual funds and the entire Dreyfus mutual fund complex. The Manager’s representatives stated that the methodology had also been reviewed by an independent registered public accounting firm which, like the consultant, found the methodology to be reasonable.The consulting firm also analyzed where any economies of scale might emerge in connection with the management of the fund.The Board members evaluated the analysis in light of the relevant circumstances for the fund, including the recent decline in assets, and the extent to which economies of scale would be realized as the fund grows and whether fee levels reflect these economies of scale for the benefit of fund investors.The Board members also considered potential benefits to the Manager from acting as investment adviser and noted the soft dollar arrangements with respect to trading the fund’s portfolio.

It was noted that the Board members should consider the Manager’s profitability with respect to the fund as part of their evaluation of whether the fee under the Management Agreement bears a reasonable relationship to the mix of services provided by the Manager, including the nature, extent and quality of such services. The Board further noted that a discussion of economies of scale is predicated on increasing assets and that, if a fund’s assets had been decreasing, the possibility that the Manager may have realized any economies of scale would be less. It also was noted that the profitability percentage for managing the fund was within ranges determined by appropriate court cases to be reasonable given the services rendered and given the fund’s overall performance and generally superior service levels provided.

At the conclusion of these discussions, each of the Independent Trustees expressed the opinion that he or she had been furnished with sufficient information to make an informed business decision with respect to continuation of the fund’s Management Agreement. Based on the discussions and considerations as described above, the Board made the following conclusions and determinations.

- The Board concluded that the nature, extent and quality of the ser- vices provided by the Manager are adequate and appropriate.

- While the Board was concerned with the fund’s total return per- formance, the Board believed the Manager was seeking to improve it; it noted the change in portfolio managers in April 2004 and the fund’s improved one-year total return performance rankings in its comparison group and Lipper category.

- The Board concluded that the fee paid by the fund to the Manager was reasonable in light of comparative performance and expense and advisory fee information, cost of services provided and profits to be realized and benefits derived or to be derived by the Manager from its relationship with the fund.

The Fund 37

I N FO R M AT I O N A B O U T T H E R E V I E W A N D A P P R OVA L O F T H E F U N D ’ S M A N A G E M E N T I N V E S T M E N T A G R E E M E N T ( U n a u d i t e d ) ( c o n t i n u e d )

- The Board determined that the economies of scale which may accrue to the Manager and its affiliates in connection with the man- agement of the fund had been adequately considered by the Manager in connection with the management fee rate charged to the fund and that, to the extent in the future it were to be deter- mined that material economies of scale had not been shared with the fund, the Board would seek to have those economies of scale shared with the fund.

The Board members considered these conclusions and determinations, along with information received on a routine and regular basis throughout the year, and, without any one factor being dispositive, the Board determined that re-approval of the fund’s Management Agreement was in the best interests of the fund and its shareholders and that the Management Agreement would be renewed through its annual renewal period, April 4, 2006.

BOARD MEMBERS INFORMATION (Unaudited)

| Joseph S. DiMartino (62) |

| Chairman of the Board (1995) |

| Principal Occupation During Past 5 Years: |

| • Corporate Director and Trustee |

| Other Board Memberships and Affiliations: |

| • The Muscular Dystrophy Association, Director |

| • Levcor International, Inc., an apparel fabric processor, Director |

| • Century Business Services, Inc., a provider of outsourcing functions for small and medium size |

| companies, Director |

| • The Newark Group, a provider of a national market of paper recovery facilities, paperboard |

| mills and paperboard converting plants, Director |

| • Sunair Services Corporation, engages in the design, manufacture and sale of high frequency |

| systems for long-range voice and data communications, as well as providing certain outdoor- |

| related services to homes and businesses, Director |

| No. of Portfolios for which Board Member Serves: 193 |

| ——————— |

| James Fitzgibbons (71) |

| Board Member (1994) |

| Principal Occupation During Past 5 Years: |

| • Chairman of the Board, Davidson Cotton Company (1998-2002) |

| Other Board Memberships and Affiliations: |

| • Bill Barrett Company, an oil and gas exploration company, Director |

| No. of Portfolios for which Board Member Serves: 23 |

| ——————— |

| J. Tomlinson Fort (77) |

| Board Member (1987) |

| Principal Occupation During Past 5 Years: |

| • Retired; Of Counsel, Reed Smith LLP (1998-2004) |

| Other Board Memberships and Affiliations: |

| • Allegheny College, Emeritus Trustee |