| UNITED STATES |

| SECURITIES AND EXCHANGE COMMISSION |

| Washington, D.C. 20549 |

| FORM N-CSR |

| CERTIFIED SHAREHOLDER REPORT OF REGISTERED MANAGEMENT |

| INVESTMENT COMPANIES |

| Investment Company Act file number 811-524 |

| The Dreyfus/Laurel Funds Trust |

| (Exact name of Registrant as specified in charter) |

| c/o The Dreyfus Corporation |

| 200 Park Avenue |

| New York, New York 10166 |

| (Address of principal executive offices) (Zip code) |

| |

| Mark N. Jacobs, Esq. |

| 200 Park Avenue |

| New York, New York 10166 |

| (Name and address of agent for service) |

| |

| Registrant's telephone number, including area code: (212) 922-6000 |

| Date of fiscal year end: | | 12/31 |

| Date of reporting period: | | 12/31/2006 |

The following N-CSR relates only to the Registrant’s series listed below and does not affect the other series of the Registrant, which have different fiscal year ends and, therefore, different N-CSR reporting requirements. Separate N-CSR Forms will be filed for these series, as appropriate.

| Dreyfus Premier Core Value Fund |

| Dreyfus Premier Limited Term High Yield Fund |

| Dreyfus Premier Managed Income Fund |

Item 1. Reports to Stockholders.

| Dreyfus Premier |

| Core Value Fund |

ANNUAL REPORT December 31, 2006

Save time. Save paper. View your next shareholder report online as soon as it’s available. Log into www.dreyfus.com and sign up for Dreyfus eCommunications. It’s simple and only takes a few minutes.

The views expressed in this report reflect those of the portfolio manager only through the end of the period covered and do not necessarily represent the views of Dreyfus or any other person in the Dreyfus organization. Any such views are subject to change at any time based upon market or other conditions and Dreyfus disclaims any responsibility to update such views.These views may not be relied on as investment advice and, because investment decisions for a Dreyfus fund are based on numerous factors, may not be relied on as an indication of trading intent on behalf of any Dreyfus fund.

Not FDIC-Insured • Not Bank-Guaranteed • May Lose Value

| Contents |

| |

| | | THE FUND |

| |

|

| 2 | | A Letter from the CEO |

| 3 | | Discussion of Fund Performance |

| 6 | | Fund Performance |

| 8 | | Understanding Your Fund’s Expenses |

| 8 | | Comparing Your Fund’s Expenses |

| With Those of Other Funds |

| 9 | | Statement of Investments |

| 13 | | Statement of Assets and Liabilities |

| 14 | | Statement of Operations |

| 15 | | Statement of Changes in Net Assets |

| 18 | | Financial Highlights |

| 24 | | Notes to Financial Statements |

| 34 | | Report of Independent Registered |

| | | Public Accounting Firm |

| 35 | | Important Tax Information |

| 36 | | Board Members Information |

| 38 | | Officers of the Fund |

| |

| FOR MORE INFORMATION |

|

| | | Back Cover |

The Fund

| Dreyfus Premier |

| Core Value Fund |

A LETTER FROM THE CEO

Dear Shareholder:

We are pleased to present this annual report for Dreyfus Premier Core Value Fund, covering the 12-month period from January 1, 2006, through December 31, 2006.

2006 proved to be a good year for the financial markets.Virtually all sectors and capitalization ranges of the U.S. equity markets generated strong returns, especially over the second half of the year.A number of positive factors contributed to the markets’ gains in 2006, including an expanding domestic economy, subdued inflation, stabilizing interest rates, rising productivity and robust corporate profits.

In our analysis, 2006 provided an excellent reminder of the need for a long-term investment perspective. Adopting too short a time frame proved costly for some investors last year, as chasing recent winners often meant buying the next month’s losers. Indeed, history shows that reacting to near-term developments with extreme shifts in strategy rarely is the right decision.We believe that a better course of action is to set a portfolio mix to meet future goals, while attempting to ignore short term market fluctuations in favor of a longer-term view.

For information about how the fund performed during the reporting period, as well as market perspectives, we have provided a Discussion of Fund Performance given by the fund’s portfolio manager.

Thank you for your continued confidence and support.We wish you good health and prosperity in 2007.

2

DISCUSSION OF FUND PERFORMANCE

Brian Ferguson, Portfolio Manager

How did Dreyfus Premier Core Value Fund perform relative to its benchmark?

For the 12-month period ended December 31, 2006, Dreyfus Premier Core Value Fund produced total returns of 21.00% for its Class A shares, 20.12% for its Class B shares, 20.07% for its Class C shares, 21.26% for its Class R shares, 20.67% for its Class T shares and 21.11% for its Institutional shares.1 In comparison, the fund’s benchmark, the Russell 1000 Value Index, produced a total return of 22.25% for the same period.2 The fund’s previous benchmark, the S&P 500/Citigroup Value Index, achieved a total return of 20.80% for the same period.3

Stock prices generally rose in 2006, primarily due to strong corporate earnings in a growing U.S. economy.The fund’s returns were slightly lower than the Russell 1000 Value Index as a result of attractive results from the consumer discretionary and information technology sectors. Furthermore, the fund’s returns were in line with the S&P 500/Citigroup Value Index primarily due to strong performance in information technology and industrials sectors.

What is the fund’s investment approach?

The fund invests primarily in large-cap companies that are considered undervalued based on traditional measures, such as price-to-earnings ratios. When choosing stocks, we use a “bottom-up” stock selection approach, focusing on individual companies, rather than a “top-down” approach that forecasts market trends. We also focus on a company’s relative value, financial strength, sales and earnings momentum and likely catalysts that could ignite the stock price.

What other factors influenced the fund’s performance?

The U.S. stock market ended 2006 with double-digit gains, as investors remained hopeful regarding the strength of corporate earnings despite mixed economic signals, such as volatile energy prices and cooling hous-

| | DISCUSSION OF FUND PERFORMANCE (continued)

|

ing markets.The market rallied particularly strongly over the second half of the year, when an uneventful hurricane season and warm weather in many parts of the United States contributed to a decline in energy prices, giving relief to inflation worries. In addition, after more than two years of steady rate hikes, the Federal Reserve Board refrained from raising short-term interest rates over the second half of the year. In this environment, stock prices rose as U.S. companies continued to report healthy earnings and mergers-and-acquisitions activity increased.

A successful stock selection strategy in the consumer discretionary sector contributed significantly to the fund’s relative performance during the reporting period, with particularly strong results coming from media giants News Corp., which was sold during the reporting period, and Walt Disney. News Corp. prospered amid better results from Fox News, anticipation of a spin-off of its Sky Italia unit and the acquisition of MySpace.com.Walt Disney rose in the wake of successful cost control measures, improved profit margins from its theme parks and stronger results from its television and film businesses. Conversely, the fund held no shares of Viacom, where results fell short of expectations. Finally, the fund benefited from its relatively light holdings of homebuilders, which saw their financial results deteriorate in a slowing housing market.

The fund’s investments in the information technology sector also fared relatively well. Broadband equipment maker Cisco Systems gained value due to a general increase in broadband usage and expectations of greater corporate demand for its products. Computer and printer maker Hewlett Packard, helmed by new management, gained market share in a variety of product areas, and consulting firm Accenture benefited from higher levels of outsourcing and corporate spending.

On the other hand, some disappointments detracted from the fund’s relative performance. In the financials sector, the fund did not participate as fully as the benchmark in strong returns from real estate investment trusts, and our emphasis on lagging insurance companies detracted from performance. For example, Genworth Financial was pressured by concerns regarding its long-term care and mortgage insurance businesses, as well as its former parent’s move to divest its remaining stake in the com-

4

pany. In the health care sector, the fund’s results were hurt by relatively light exposure to drug developer Merck & Co., which was sold during the reporting period, and which rose as legal concerns diminished and research & development prospects improved. Shares of medical products maker Boston Scientific, which were eventually sold during the reporting period, declined due to merger integration issues and concerns regarding low reimbursement policies by Medicare and other insurers.

What is the fund’s current strategy?

We have continued to rely on our bottom-up stock selection process, as we believe it to be an effective method of identifying attractively valued stocks under a variety of market conditions.We have continued to find attractive values in traditionally defensive areas, including the consumer staples sector and the homebuilding and retail industries within the consumer discretionary sector. Information technology stocks remain attractive to us, largely due to the ongoing boom in Internet demand.While in the past we have found attractive opportunities in the energy area, we recently reduced our emphasis on the sector due to the possible effects of recent warmer weather and shifting supply-and-demand influences on commodity prices.

January 16, 2007

| 1 | | Total return includes reinvestment of dividends and any capital gains paid, and does not take into |

| | | consideration the maximum initial sales charges in the case of Class A and Class T shares or the |

| | | applicable contingent deferred sales charges imposed on redemptions in the case of Class B and |

| | | Class C shares. Had these charges been reflected, returns would have been lower. Past performance |

| | | is no guarantee of future results. Share price and investment return fluctuate such that upon |

| | | redemption, fund shares may be worth more or less than their original cost. |

| | | Part of the fund’s recent performance is attributable to positive returns from its initial public |

| | | offering (IPO) investments. There can be no guarantee that IPOs will have or continue to |

| | | have a positive effect on fund performance. |

| 2 | | SOURCE: LIPPER INC. — Reflects the reinvestment of dividends and, where applicable, |

| | | capital gain distributions.The Russell 1000 Value Index is an unmanaged index which measures |

| | | the performance of those Russell 1000 companies with lower price-to-book ratios and lower |

| | | forecasted growth values. |

| 3 | | SOURCE: LIPPER INC. — Reflects the reinvestment of dividends and, where applicable, |

| | | capital gain distributions.The S&P 500/Citigroup Value Index calculates growth and value in |

| | | separate dimensions. Style scores are calculated taking standardized measures of 3 growth factors |

| | | and 4 value factors for each constituent. Combined, the growth and value indices are exhaustive, |

| | | containing the full market capitalization of the S&P 500. |

The Fund 5

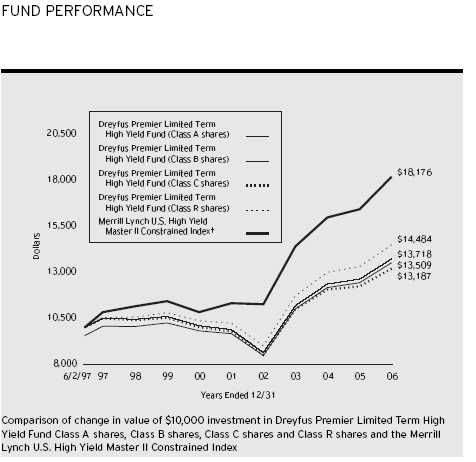

FUND PERFORMANCE

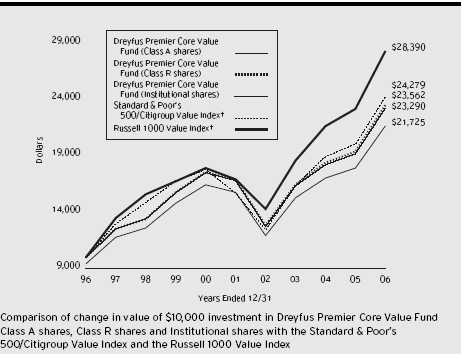

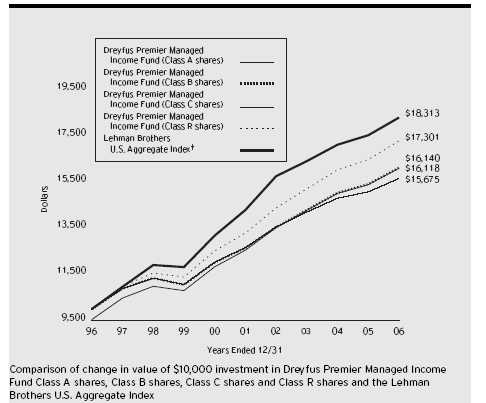

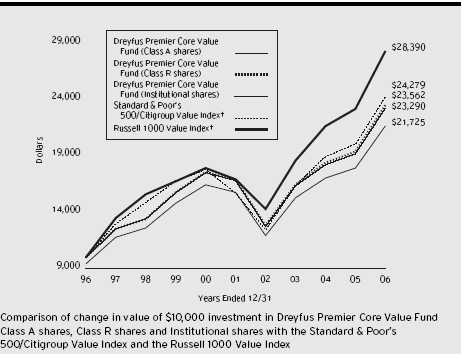

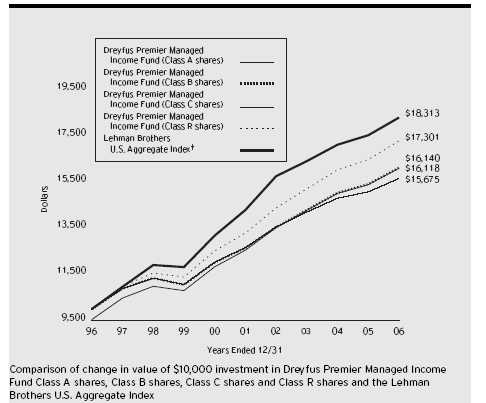

| † Source: Lipper Inc. |

| Past performance is not predictive of future performance. |

| Part of the fund’s recent performance is attributable to positive returns from its initial public offering (IPO) investments. |

| There can be no guarantee that IPOs will have or continue to have a positive effect on fund performance. |

| The above graph compares a $10,000 investment made in Class A shares, Institutional shares and Class R shares of |

| Dreyfus Premier Core Value Fund on 12/31/96 to a $10,000 investment made in the Russell 1000 Value Index (the |

| “Russell Index”) and the Standard & Poor’s 500/Citigroup Value Index (the “S&P 500/Citigroup Value Index”) on |

| that date. All dividends and capital gain distributions are reinvested. Performance for Class B, Class C and Class T |

| shares will vary from the performance of Class A, Institutional and Class R shares shown above due to differences in |

| charges and expenses. |

| In December 2005, Standard & Poor’s 500 replaced the S&P/BARRA Value Index with the S&P/Citigroup Value |

| Index. In October 2006, the fund’s benchmark was changed from the S&P 500/Citigroup Value Index to the |

| Russell 1000 Value Index because the Russell 1000 Value Index is expected to more accurately reflect the fund’s |

| investment approach. |

| The fund’s performance shown in the line graph takes into account the maximum initial sales charge on Class A shares |

| and all other applicable fees and expenses for Class A shares, Institutional shares and Class R shares.The Russell 1000 |

| Value Index is an unmanaged index, which measures the performance of those Russell 1000 companies with lower price- |

| to-book ratios and lower forecasted growth values.The S&P/Citigroup Value Index is a market capitalization weighted |

| index representing the value stocks in the S&P 500 Index. All of the stocks in the S&P 500 Index are allocated into |

| value or growth sub-indexes. Stocks that do not have pure value or growth characteristics have their market capitalizations |

| distributed between the value and growth indexes.The S&P 500 Index is a widely accepted, unmanaged index of U.S. |

| stock market performance. Both indices are unmanaged, do not incur fees and other expenses, and cannot be invested in |

| directly. Further information relating to fund performance, including expense reimbursements, if applicable, is contained in |

| the Financial Highlights section of the prospectus and elsewhere in this report. |

6

| Average Annual Total Returns as of 12/31/06 | | | | | | |

| |

| | | | | Inception | | | | | | | | From |

| | | | | Date | | 1 Year | | 5 Years | | 10 Years | | Inception |

| |

| |

| |

| |

| |

| |

|

| Class A shares | | | | | | | | | | |

| with maximum sales charge (5.75%) | | | | 14.06% | | 5.30% | | 8.07% | | |

| without sales charge | | | | 21.00% | | 6.56% | | 8.71% | | |

| Class B shares | | | | | | | | | | |

| with applicable redemption charge † | | 1/16/98 | | 16.12% | | 5.47% | | — | | 6.94%†† |

| without redemption | | 1/16/98 | | 20.12% | | 5.79% | | — | | 6.94%†† |

| Class C shares | | | | | | | | | | |

| with applicable redemption charge ††† | | 1/16/98 | | 19.07% | | 5.76% | | — | | 6.68% |

| without redemption | | 1/16/98 | | 20.07% | | 5.76% | | — | | 6.68% |

| Class R shares | | | | 21.26% | | 6.82% | | 8.95% | | |

| Class T shares | | | | | | | | | | |

| with applicable sales charge (4.5%) | | 8/16/99 | | 15.24% | | 5.32% | | — | | 4.98% |

| without sales charge | | 8/16/99 | | 20.67% | | 6.29% | | — | | 5.64% |

| Institutional shares | | | | 21.11% | | 6.68% | | 8.82% | | |

| |

| Past performance is not predictive of future performance.The fund’s performance shown in the graph and table does not |

| reflect the deduction of taxes that a shareholder would pay on fund distributions or the redemption of fund shares. |

| † | | The maximum contingent deferred sales charge for Class B shares is 4%. After six years Class B shares convert to |

| | | Class A shares. | | | | | | | | | | |

| †† | | Assumes the conversion of Class B shares to Class A shares at the end of the sixth year following the date of |

| | | purchase. | | | | | | | | | | |

| ††† | | The maximum contingent deferred sales charge for Class C shares is 1% for shares redeemed within one year of the |

| | | date of purchase. | | | | | | | | | | |

UNDERSTANDING YOUR FUND’S EXPENSES(Unaudited)

As a mutual fund investor, you pay ongoing expenses, such as management fees and other expenses. Using the information below, you can estimate how these expenses affect your investment and compare them with the expenses of other funds.You also may pay one-time transaction expenses, including sales charges (loads) and redemption fees, which are not shown in this section and would have resulted in higher total expenses. For more information, see your fund’s prospectus or talk to your financial adviser.

Review your fund’s expenses

The table below shows the expenses you would have paid on a $1,000 investment in Dreyfus Premier Core Value Fund from July 1, 2006 to December 31, 2006. It also shows how much a $1,000 investment would be worth at the close of the period, assuming actual returns and expenses.

| Expenses and Value of a $1,000 Investment | | | | | | |

| assuming actual returns for the six months ended December 31, 2006 | | | | |

| | | Class A | | Class B | | Class C | | Class R | | Class T | | Institutional |

| |

| |

| |

| |

| |

| |

|

| Expenses paid | | | | | | | | | | | | |

| per $1,000 † | | $ 6.24 | | $ 10.29 | | $ 10.29 | | $ 4.89 | | $ 7.59 | | $ 5.70 |

| Ending value | | | | | | | | | | | | |

| (after expenses) | | $1,152.70 | | $1,148.50 | | $1,148.20 | | $1,153.90 | | $1,151.20 | | $1,153.30 |

| COMPARING YOUR FUND’S EXPENSES |

| WITH THOSE OF OTHER FUNDS (Unaudited) |

Using the SEC’s method to compare expenses

The Securities and Exchange Commission (SEC) has established guidelines to help investors assess fund expenses. Per these guidelines, the table below shows your fund’s expenses based on a $1,000 investment, assuming a hypothetical 5% annualized return. You can use this information to compare the ongoing expenses (but not transaction expenses or total cost) of investing in the fund with those of other funds.All mutual fund shareholder reports will provide this information to help you make this comparison. Please note that you cannot use this information to estimate your actual ending account balance and expenses paid during the period.

| Expenses and Value of a $1,000 Investment | | | | | | |

| assuming a hypothetical 5% annualized return for the six months ended December 31, 2006 |

| | | Class A | | Class B | | Class C | | Class R | | Class T | | Institutional |

| |

| |

| |

| |

| |

| |

|

| Expenses paid | | | | | | | | | | | | |

| per $1,000 † | | $ 5.85 | | $ 9.65 | | $ 9.65 | | $ 4.58 | | $ 7.12 | | $ 5.35 |

| Ending value | | | | | | | | | | | | |

| (after expenses) | | $1,019.41 | | $1,015.63 | | $1,015.63 | | $1,020.67 | | $1,018.15 | | $1,019.91 |

| † Expenses are equal to the fund’s annualized expense ratio of 1.15% for Class A, 1.90% for Class B, 1.90% for |

| Class C, .90% for Class R, 1.40% for Class T and 1.05% for Institutional multiplied by the average account |

| value over the period, multiplied by 184/365 (to reflect the one-half year period). | | | | |

8

| STATEMENT OF INVESTMENTS |

| December 31, 2006 |

| Common Stocks—99.9% | | Shares | | Value ($) |

| |

| |

|

| Banking—9.8% | | | | |

| Bank of America | | 448,626 | | 23,952,142 |

| Bank of New York | | 85,100 | | 3,350,387 |

| Capital One Financial | | 115,700 | | 8,888,074 |

| PNC Financial Services Group | | 49,000 | | 3,627,960 |

| SunTrust Banks | | 39,800 | | 3,361,110 |

| U.S. Bancorp | | 194,900 | | 7,053,431 |

| Wachovia | | 157,700 | | 8,981,015 |

| Wells Fargo & Co. | | 211,200 | | 7,510,272 |

| | | | | 66,724,391 |

| Consumer Discretionary—8.2% | | | | |

| Comcast, Cl. A | | 82,300 a | | 3,483,759 |

| Federated Department Stores | | 73,400 | | 2,798,742 |

| Gap | | 175,700 | | 3,426,150 |

| Johnson Controls | | 60,900 | | 5,232,528 |

| Lowe’s Cos. | | 109,470 | | 3,409,991 |

| Marriott International, Cl. A | | 72,590 | | 3,463,995 |

| McDonald’s | | 147,400 | | 6,534,242 |

| News, Cl. A | | 304,000 | | 6,529,920 |

| Omnicom Group | | 74,000 | | 7,735,960 |

| Time Warner | | 300,300 | | 6,540,534 |

| TJX Cos. | | 143,610 | | 4,095,757 |

| Toll Brothers | | 74,630 a | | 2,405,325 |

| | | | | 55,656,903 |

| Consumer Staples—9.8% | | | | |

| Altria Group | | 223,800 | | 19,206,516 |

| Cadbury Schweppes, ADR | | 166,500 | | 7,147,845 |

| Clorox | | 53,100 | | 3,406,365 |

| Colgate-Palmolive | | 51,157 | | 3,337,483 |

| Dean Foods | | 176,700 a | | 7,470,876 |

| Kraft Foods, Cl. A | | 124,600 | | 4,448,220 |

| Procter & Gamble | | 262,000 | | 16,838,740 |

| SUPERVALU | | 122,550 | | 4,381,162 |

| | | | | 66,237,207 |

| Energy—13.2% | | | | |

| Anadarko Petroleum | | 74,100 | | 3,224,832 |

| Chesapeake Energy | | 107,800 | | 3,131,590 |

| Chevron | | 201,600 | | 14,823,648 |

The Fund 9

STATEMENT OF INVESTMENTS (continued)

| Common Stocks (continued) | | Shares | | Value ($) |

| |

| |

|

| Energy (continued) | | | | |

| ConocoPhillips | | 226,720 | | 16,312,504 |

| Devon Energy | | 48,000 | | 3,219,840 |

| EOG Resources | | 58,500 | | 3,653,325 |

| Exxon Mobil | | 357,682 | | 27,409,172 |

| Hess | | 68,440 | | 3,392,571 |

| Marathon Oil | | 73,800 | | 6,826,500 |

| Valero Energy | | 142,700 | | 7,300,532 |

| | | | | 89,294,514 |

| Financial—24.1% | | | | |

| Ambac Financial Group | | 38,400 | | 3,420,288 |

| American International Group | | 142,193 | | 10,189,550 |

| AON | | 133,600 | | 4,721,424 |

| Chubb | | 115,200 | | 6,095,232 |

| CIT Group | | 66,700 | | 3,719,859 |

| Citigroup | | 512,313 | | 28,535,834 |

| Countrywide Financial | | 96,600 | | 4,100,670 |

| Equity Residential | | 64,700 | | 3,283,525 |

| Franklin Resources | | 40,160 | | 4,424,427 |

| Freddie Mac | | 128,900 | | 8,752,310 |

| Genworth Financial, Cl. A | | 206,255 | | 7,055,984 |

| Goldman Sachs Group | | 19,660 | | 3,919,221 |

| JPMorgan Chase & Co. | | 404,800 | | 19,551,840 |

| Lincoln National | | 108,100 | | 7,177,840 |

| Merrill Lynch & Co. | | 156,650 | | 14,584,115 |

| MetLife | | 115,000 | | 6,786,150 |

| Morgan Stanley | | 97,900 | | 7,971,997 |

| PMI Group | | 119,800 | | 5,650,966 |

| Prudential Financial | | 63,600 | | 5,460,696 |

| St. Paul Travelers Cos. | | 65,800 | | 3,532,802 |

| Washington Mutual | | 101,800 | | 4,630,882 |

| | | | | 163,565,612 |

| Health Care—8.6% | | | | |

| Abbott Laboratories | | 164,500 | | 8,012,795 |

| Amgen | | 44,300 a | | 3,026,133 |

| Baxter International | | 111,590 | | 5,176,660 |

| Bristol-Myers Squibb | | 103,000 | | 2,710,960 |

| Pfizer | | 647,360 | | 16,766,624 |

10

| Common Stocks (continued) | | Shares | | Value ($) |

| |

| |

|

| Health Care (continued) | | | | |

| Sanofi-Aventis, ADR | | 94,700 | | 4,372,299 |

| Thermo Fisher Scientific | | 83,300 a | | 3,772,657 |

| WellPoint | | 73,000 a | | 5,744,370 |

| Wyeth | | 174,100 | | 8,865,172 |

| | | | | 58,447,670 |

| Industrial—6.4% | | | | |

| Eaton | | 41,800 | | 3,140,852 |

| General Electric | | 625,060 | | 23,258,483 |

| Honeywell International | | 72,100 | | 3,261,804 |

| Lockheed Martin | | 41,200 | | 3,793,284 |

| Tyco International | | 221,900 | | 6,745,760 |

| Union Pacific | | 36,670 | | 3,374,373 |

| | | | | 43,574,556 |

| Information Technology—7.1% | | | | |

| Accenture, Cl. A | | 266,700 | | 9,849,231 |

| Automatic Data Processing | | 96,200 | | 4,737,850 |

| Cisco Systems | | 248,300 a | | 6,786,039 |

| Hewlett-Packard | | 277,100 | | 11,413,749 |

| International Business Machines | | 40,000 | | 3,886,000 |

| Microsoft | | 120,700 | | 3,604,102 |

| NCR | | 94,400 a | | 4,036,544 |

| Sun Microsystems | | 748,100 a | | 4,054,702 |

| | | | | 48,368,217 |

| Materials—1.9% | | | | |

| Dow Chemical | | 94,300 | | 3,766,342 |

| E.I. du Pont de Nemours & Co. | | 71,295 | | 3,472,779 |

| Phelps Dodge | | 20,000 | | 2,394,400 |

| Rohm & Haas | | 65,500 | | 3,348,360 |

| | | | | 12,981,881 |

| Telecommunications—5.8% | | | | |

| Alltel | | 45,895 | | 2,775,730 |

| AT & T | | 599,300 | | 21,424,975 |

| BellSouth | | 138,200 | | 6,510,602 |

| Sprint Nextel | | 124,450 | | 2,350,860 |

| Verizon Communications | | 170,600 | | 6,353,144 |

| | | | | 39,415,311 |

The Fund 11

| | STATEMENT OF INVESTMENTS (continued)

|

| Common Stocks (continued) | | Shares | | Value ($) |

| |

| |

|

| Utilities—5.0% | | | | | | |

| Constellation Energy Group | | 72,900 | | 5,020,623 |

| Edison International | | | | 69,300 | | 3,151,764 |

| Entergy | | | | 36,400 | | 3,360,448 |

| Exelon | | | | 102,765 | | 6,360,126 |

| FPL Group | | | | 61,600 | | 3,352,272 |

| Mirant | | | | 116,800 a | | 3,687,376 |

| NRG Energy | | | | 73,000 a | | 4,088,730 |

| Questar | | | | 59,400 | | 4,933,170 |

| | | | | | | | | 33,954,509 |

| Total Common Stocks | | | | | | |

| (cost $551,327,600) | | | | | | 678,220,771 |

| |

| |

| |

|

| |

| Other Investment—.8% | | | | |

| |

| |

|

| Registered Investment Company; | | | | |

| Dreyfus Institutional Preferred | | | | |

| Plus Money Market Fund | | | | |

| (cost $5,145,000) | | | | 5,145,000 b | | 5,145,000 |

| |

| |

| |

|

| |

| Total Investments (cost $556,472,600) | | 100.7% | | 683,365,771 |

| Liabilities, Less Cash and Receivables | | (.7%) | | (4,781,302) |

| Net Assets | | | | 100.0% | | 678,584,469 |

| |

| ADR—American Depository Receipts | | | | |

| a | | Non-income producing security. | | | | |

| b | | Investment in affiliated money market mutual fund. | | | | |

| |

| |

| |

|

| |

| |

| |

| Portfolio Summary | | (Unaudited) † | | | | |

| | | | | Value (%) | | | | Value (%) |

| |

| |

| |

| |

|

| Financial | | 24.1 | | Industrial | | 6.4 |

| Energy | | 13.2 | | Telecommunications | | 5.8 |

| Banking | | 9.8 | | Utilities | | 5.0 |

| Consumer Staples | | 9.8 | | Materials | | 1.9 |

| Health Care | | 8.6 | | Money Market Investment | | .8 |

| Consumer Discretionary | | 8.2 | | | | |

| Information Technology | | 7.1 | | | | 100.7 |

| |

| † | | Based on net assets. | | | | | | |

| See notes to financial statements. | | | | |

12

| STATEMENT OF ASSETS AND LIABILITIES |

| December 31, 2006 |

| | | | | | | | | Cost Value |

| |

| |

| |

| |

|

| Assets ($): | | | | | | | | |

| Investments in securities—See Statement of Investments | | |

| Unaffiliated issuers | | | | | | 551,327,600 678,220,771 |

| Affiliated isuuers | | | | | | 5,145,000 5,145,000 |

| Cash | | | | | | | | 15,621 |

| Dividends and interest receivable | | | | 922,162 |

| Receivable for shares of Beneficial Interest subscribed | | 13,699 |

| | | | | | | | | 684,317,253 |

| |

| |

| |

| |

|

| Liabilities ($): | | | | | | | | |

| Due to The Dreyfus Corporation and affiliates—Note 3(b) | | 732,744 |

| Payable for investment securities purchased | | | | 4,263,510 |

| Payable for shares of Beneficial Interest redeemed | | 736,039 |

| Interest payable—Note 2 | | | | | | 491 |

| | | | | | | | | 5,732,784 |

| |

| |

| |

| |

|

| Net Assets ($) | | | | | | | | 678,584,469 |

| |

| |

| |

| |

|

| Composition of Net Assets ($): | | | | |

| Paid-in capital | | | | | | | | 542,615,686 |

| Accumulated undistributed investment income—net | | 490,141 |

| Accumulated net realized gain (loss) on investments | | 8,585,471 |

| Accumulated net unrealized appreciation | | | | |

| (depreciation) on investments | | | | 126,893,171 |

| |

| |

|

| Net Assets ($) | | | | | | | | 678,584,469 |

| |

| |

| |

| |

|

| |

| |

| Net Asset Value Per Share | | | | |

| | | Class A | | Class B | | Class C | | Class R Class T Institutional |

| |

| |

| |

| |

|

| Net Assets ($) | | 548,601,357 | | 55,112,194 | | 20,918,808 | | 6,011,852 3,434,272 44,505,986 |

| Shares | | | | | | | | |

| Outstanding | | 17,141,289 | | 1,755,014 | | 666,708 | | 187,986 107,342 1,391,474 |

| |

| |

| |

| |

|

| Net Asset Value | | | | | | |

| Per Share ($) | | 32.00 | | 31.40 | | 31.38 | | 31.98 31.99 31.98 |

See notes to financial statements.

| STATEMENT OF OPERATIONS |

| Year Ended December 31, 2006 |

| Investment Income ($): | | |

| Income: | | |

| Cash dividends: | | |

| Unaffiliated issuers | | 15,632,024 |

| Affiliated issuers | | 157,402 |

| Interest | | 36,007 |

| Income from securities lending | | 2,503 |

| Total Income | | 15,827,936 |

| Expenses: | | |

| Management fee—Note 3(a) | | 6,111,130 |

| Distribution and service fees—Note 3(b) | | 2,236,994 |

| Interest expense—Note 2 | | 8,469 |

| Loan commitment fees—Note 2 | | 5,281 |

| Total Expenses | | 8,361,874 |

| Investment Income—Net | | 7,466,062 |

| |

|

| Realized and Unrealized Gain (Loss) on Investments—Note 4 ($): |

| Net realized gain (loss) on investments | | 85,435,127 |

| Net unrealized appreciation (depreciation) on investments | | 35,507,648 |

| Net Realized and Unrealized Gain (Loss) on Investments | | 120,942,775 |

| Net Increase in Net Assets Resulting from Operations | | 128,408,837 |

See notes to financial statements.

14

STATEMENT OF CHANGES IN NET ASSETS

| | | Year Ended December 31, |

| |

|

| | | 2006 | | 2005 |

| |

| |

|

| Operations ($): | | | | |

| Investment income—net | | 7,466,062 | | 7,135,930 |

| Net realized gain (loss) on investments | | 85,435,127 | | 96,968,863 |

| Net unrealized appreciation | | | | |

| (depreciation) on investments | | 35,507,648 | | (66,603,353) |

| Net Increase (Decrease) in Net Assets | | |

| Resulting from Operations | | 128,408,837 | | 37,501,440 |

| |

| |

|

| Dividends to Shareholders from ($): | | | | |

| Investment income—net: | | | | |

| Class A shares | | (6,116,596) | | (6,671,140) |

| Class B shares | | (207,125) | | (261,483) |

| Class C shares | | (72,968) | | (82,006) |

| Class R shares | | (76,497) | | (450,170) |

| Class T shares | | (26,990) | | (25,630) |

| Institutional shares | | (518,978) | | (498,400) |

| Net realized gain on investments: | | | | |

| Class A shares | | (84,798,475) | | (3,000,559) |

| Class B shares | | (8,849,926) | | (351,900) |

| Class C shares | | (3,240,011) | | (112,649) |

| Class R shares | | (870,947) | | (29,847) |

| Class T shares | | (495,795) | | (15,252) |

| Institutional shares | | (6,663,598) | | (216,644) |

| Total Dividends | | (111,937,906) | | (11,715,680) |

| |

| |

|

| Beneficial Interest Transactions ($): | | | | |

| Net proceeds from shares sold: | | | | |

| Class A shares | | 33,450,766 | | 41,179,970 |

| Class B shares | | 1,510,935 | | 2,182,340 |

| Class C shares | | 2,094,368 | | 2,154,740 |

| Class R shares | | 1,340,569 | | 6,465,122 |

| Class T shares | | 701,874 | | 330,242 |

| Institutional shares | | 867,944 | | 430,423 |

STATEMENT OF CHANGES IN NET ASSETS (continued)

| | | Year Ended December 31, |

| |

|

| | | 2006 | | 2005 |

| |

| |

|

| Beneficial Interest Transactions ($) (continued): | | |

| Dividends reinvested: | | | | |

| Class A shares | | 79,114,953 | | 8,340,534 |

| Class B shares | | 8,203,108 | | 542,997 |

| Class C shares | | 2,610,615 | | 146,513 |

| Class R shares | | 944,387 | | 479,481 |

| Class T shares | | 504,754 | | 39,548 |

| Institutional shares | | 7,044,317 | | 696,125 |

| Cost of shares redeemed: | | | | |

| Class A shares | | (133,374,410) | | (147,388,521) |

| Class B shares | | (20,355,944) | | (18,785,780) |

| Class C shares | | (4,756,622) | | (4,377,438) |

| Class R shares | | (1,104,642) | | (54,381,780) |

| Class T shares | | (686,496) | | (577,204) |

| Institutional shares | | (4,736,790) | | (3,325,634) |

| Increase (Decrease) in Net Assets | | | | |

| from Beneficial Interest Transactions | | (26,626,314) | | (165,848,322) |

| Total Increase (Decrease) in Net Assets | | (10,155,383) | | (140,062,562) |

| |

| |

|

| Net Assets ($): | | | | |

| Beginning of Period | | 688,739,852 | | 828,802,414 |

| End of Period | | 678,584,469 | | 688,739,852 |

| Undistributed investment income—net | | 490,141 | | 69,556 |

16

| | | Year Ended December 31, |

| |

|

| | | 2006 | | 2005 |

| |

| |

|

| Capital Share Transactions: | | | | |

| Class A a | | | | |

| Shares sold | | 1,027,585 | | 1,359,291 |

| Shares issued for dividends reinvested | | 2,488,150 | | 269,242 |

| Shares redeemed | | (4,092,976) | | (4,810,155) |

| Net Increase (Decrease) in Shares Outstanding | | (577,241) | | (3,181,622) |

| |

| |

|

| Class B a | | | | |

| Shares sold | | 47,312 | | 72,352 |

| Shares issued for dividends reinvested | | 262,866 | | 17,579 |

| Shares redeemed | | (636,104) | | (628,712) |

| Net Increase (Decrease) in Shares Outstanding | | (325,926) | | (538,781) |

| |

| |

|

| Class C | | | | |

| Shares sold | | 65,670 | | 71,987 |

| Shares issued for dividends reinvested | | 83,675 | | 4,750 |

| Shares redeemed | | (149,192) | | (146,406) |

| Net Increase (Decrease) in Shares Outstanding | | 153 | | (69,669) |

| |

| |

|

| Class R | | | | |

| Shares sold | | 40,533 | | 211,002 |

| Shares issued for dividends reinvested | | 29,734 | | 15,771 |

| Shares redeemed | | (33,401) | | (1,741,923) |

| Net Increase (Decrease) in Shares Outstanding | | 36,866 | | (1,515,150) |

| |

| |

|

| Class T | | | | |

| Shares sold | | 21,515 | | 10,988 |

| Shares issued for dividends reinvested | | 15,865 | | 1,273 |

| Shares redeemed | | (20,571) | | (18,835) |

| Net Increase (Decrease) in Shares Outstanding | | 16,809 | | (6,574) |

| |

| |

|

| Institutional Shares | | | | |

| Shares sold | | 27,122 | | 14,298 |

| Shares issued for dividends reinvested | | 221,572 | | 22,474 |

| Shares redeemed | | (143,421) | | (109,530) |

| Net Increase (Decrease) in Shares Outstanding | | 105,273 | | (72,758) |

| |

| a During the period ended December 31, 2006, 192,361 Class B shares representing $6,138,847 were |

| automatically converted to 189,051 Class A shares and during the period ended December 31, 2005, 152,245 |

| Class B shares representing $4,558,620 were automatically converted to 149,654 Class A shares. |

| See notes to financial statements. | | | | |

FINANCIAL HIGHLIGHTS

The following tables describe the performance for each share class for the fiscal periods indicated. All information (except portfolio turnover rate) reflects financial results for a single fund share.Total return shows how much your investment in the fund would have increased (or decreased) during each period assuming you had reinvested all dividends and distributions.These figures have been derived from the fund’s financial statements.

| | | | | | | Year Ended December 31, | | |

| | | |

| |

| |

|

| Class A Shares | | 2006 | | 2005 | | 2004 | | 2003 | | 2002 |

| |

| |

| |

| |

| |

|

| Per Share Data ($): | | | | | | | | | | |

| Net asset value, beginning of period | | 31.38 | | 30.34 | | 27.44 | | 21.57 | | 28.62 |

| Investment Operations: | | | | | | | | | | |

| Investment income—net a | | .38 | | .30 | | .24 | | .17 | | .10 |

| Net realized and unrealized | | | | | | | | | | |

| gain (loss) on investments | | 5.94 | | 1.26 | | 2.88 | | 5.86 | | (7.06) |

| Total from Investment Operations | | 6.32 | | 1.56 | | 3.12 | | 6.03 | | (6.96) |

| Distributions: | | | | | | | | | | |

| Dividends from investment income—net | | (.37) | | (.35) | | (.22) | | (.16) | | (.09) |

| Dividends from net realized | | | | | | | | | | |

| gain on investments | | (5.33) | | (.17) | | — | | — | | — |

| Total Distributions | | (5.70) | | (.52) | | (.22) | | (.16) | | (.09) |

| Net asset value, end of period | | 32.00 | | 31.38 | | 30.34 | | 27.44 | | 21.57 |

| |

| |

| |

| |

| |

|

| Total Return (%) b | | 21.00 | | 5.18 | | 11.41 | | 28.09 | | (24.36) |

| |

| |

| |

| |

| |

|

| Ratios/Supplemental Data (%): | | | | | | | | | | |

| Ratio of total expenses | | | | | | | | | | |

| to average net assets | | 1.15 | | 1.15 | | 1.15 | | 1.15 | | 1.15 |

| Ratio of net investment income | | | | | | | | | | |

| to average net assets | | 1.17 | | .99 | | .86 | | .71 | | .41 |

| Portfolio Turnover Rate | | 44.73 | | 55.95 | | 74.98 | | 54.58 | | 67.21 |

| |

| |

| |

| |

| |

|

| Net Assets, end of period ($ X 1,000) | | 548,601 | | 556,017 | | 634,007 | | 607,633 | | 504,371 |

| |

| a | | Based on average shares outstanding at each month end. | | | | | | | | |

| b | | Exclusive of sales charge. | | | | | | | | | | |

| See notes to financial statements. | | | | | | | | | | |

18

| | | | | | | Year Ended December 31, | | |

| | | |

| |

| |

|

| Class B Shares | | 2006 | | 2005 | | 2004 | | 2003 | | 2002 |

| |

| |

| |

| |

| |

|

| Per Share Data ($): | | | | | | | | | | |

| Net asset value, beginning of period | | 30.87 | | 29.83 | | 27.02 | | 21.27 | | 28.33 |

| Investment Operations: | | | | | | | | | | |

| Investment income (loss)—net a | | .13 | | .07 | | .02 | | (.01) | | (.08) |

| Net realized and unrealized | | | | | | | | | | |

| gain (loss) on investments | | 5.85 | | 1.26 | | 2.85 | | 5.77 | | (6.98) |

| Total from Investment Operations | | 5.98 | | 1.33 | | 2.87 | | 5.76 | | (7.06) |

| Distributions: | | | | | | | | | | |

| Dividends from investment income—net | | (.12) | | (.12) | | (.06) | | (.01) | | — |

| Dividends from net realized | | | | | | | | | | |

| gain on investments | | (5.33) | | (.17) | | — | | — | | — |

| Total Distributions | | (5.45) | | (.29) | | (.06) | | (.01) | | — |

| Net asset value, end of period | | 31.40 | | 30.87 | | 29.83 | | 27.02 | | 21.27 |

| |

| |

| |

| |

| |

|

| Total Return (%) b | | 20.12 | | 4.47 | | 10.62 | | 27.12 | | (24.92) |

| |

| |

| |

| |

| |

|

| Ratios/Supplemental Data (%): | | | | | | | | | | |

| Ratio of total expenses | | | | | | | | | | |

| to average net assets | | 1.90 | | 1.90 | | 1.90 | | 1.90 | | 1.90 |

| Ratio of net investment income | | | | | | | | | | |

| (loss)to average net assets | | .42 | | .24 | | .10 | | (.04) | | (.33) |

| Portfolio Turnover Rate | | 44.73 | | 55.95 | | 74.98 | | 54.58 | | 67.21 |

| |

| |

| |

| |

| |

|

| Net Assets, end of period ($ X 1,000) | | 55,112 | | 64,239 | | 78,154 | | 78,780 | | 62,820 |

| a | | Based on average shares outstanding at each month end. | | | | | | | | |

| b | | Exclusive of sales charge. | | | | | | | | | | |

| See notes to financial statements. | | | | | | | | | | |

| | FINANCIAL HIGHLIGHTS (continued)

|

| | | | | | | Year Ended December 31, | | |

| | | |

| |

| |

|

| Class C Shares | | 2006 | | 2005 | | 2004 | | 2003 | | 2002 |

| |

| |

| |

| |

| |

|

| Per Share Data ($): | | | | | | | | | | |

| Net asset value, beginning of period | | 30.85 | | 29.83 | | 27.02 | | 21.27 | | 28.34 |

| Investment Operations: | | | | | | | | | | |

| Investment income (loss)—net a | | .14 | | .07 | | .02 | | (.01) | | (.08) |

| Net realized and unrealized | | | | | | | | | | |

| gain (loss) on investments | | 5.84 | | 1.24 | | 2.85 | | 5.77 | | (6.99) |

| Total from Investment Operations | | 5.98 | | 1.31 | | 2.87 | | 5.76 | | (7.07) |

| Distributions: | | | | | | | | | | |

| Dividends from investment income—net | | (.12) | | (.12) | | (.06) | | (.01) | | — |

| Dividends from net realized | | | | | | | | | | |

| gain on investments | | (5.33) | | (.17) | | — | | — | | — |

| Total Distributions | | (5.45) | | (.29) | | (.06) | | (.01) | | — |

| Net asset value, end of period | | 31.38 | | 30.85 | | 29.83 | | 27.02 | | 21.27 |

| |

| |

| |

| |

| |

|

| Total Return (%) b | | 20.07 | | 4.43 | | 10.62 | | 27.12 | | (24.95) |

| |

| |

| |

| |

| |

|

| Ratios/Supplemental Data (%): | | | | | | | | | | |

| Ratio of total expenses | | | | | | | | | | |

| to average net assets | | 1.90 | | 1.90 | | 1.90 | | 1.90 | | 1.90 |

| Ratio of net investment income | | | | | | | | | | |

| (loss) to average net assets | | .42 | | .24 | | .10 | | (.04) | | (.32) |

| Portfolio Turnover Rate | | 44.73 | | 55.95 | | 74.98 | | 54.58 | | 67.21 |

| |

| |

| |

| |

| |

|

| Net Assets, end of period ($ X 1,000) | | 20,919 | | 20,564 | | 21,958 | | 22,480 | | 20,819 |

| |

| a | | Based on average shares outstanding at each month end. | | | | | | | | |

| b | | Exclusive of sales charge. | | | | | | | | | | |

| See notes to financial statements. | | | | | | | | | | |

20

| | | | | Year Ended December 31, | | |

| |

| |

| |

|

| Class R Shares | | 2006 | | 2005 | | 2004 | | 2003 | | 2002 |

| |

| |

| |

| |

| |

|

| Per Share Data ($): | | | | | | | | | | |

| Net asset value, beginning of period | | 31.36 | | 30.33 | | 27.43 | | 21.56 | | 28.62 |

| Investment Operations: | | | | | | | | | | |

| Investment income—net a | | .46 | | .38 | | .31 | | .22 | | .17 |

| Net realized and unrealized | | | | | | | | | | |

| gain (loss) on investments | | 5.95 | | 1.25 | | 2.88 | | 5.87 | | (7.08) |

| Total from Investment Operations | | 6.41 | | 1.63 | | 3.19 | | 6.09 | | (6.91) |

| Distributions: | | | | | | | | | | |

| Dividends from investment income—net | | (.46) | | (.43) | | (.29) | | (.22) | | (.15) |

| Dividends from net realized | | | | | | | | | | |

| gain on investments | | (5.33) | | (.17) | | — | | — | | — |

| Total Distributions | | (5.79) | | (.60) | | (.29) | | (.22) | | (.15) |

| Net asset value, end of period | | 31.98 | | 31.36 | | 30.33 | | 27.43 | | 21.56 |

| |

| |

| |

| |

| |

|

| Total Return (%) | | 21.26 | | 5.45 | | 11.69 | | 28.43 | | (24.18) |

| |

| |

| |

| |

| |

|

| Ratios/Supplemental Data (%): | | | | | | | | | | |

| Ratio of total expenses | | | | | | | | | | |

| to average net assets | | .90 | | .90 | | .90 | | .90 | | .90 |

| Ratio of net investment income | | | | | | | | | | |

| to average net assets | | 1.42 | | 1.25 | | 1.09 | | .95 | | .67 |

| Portfolio Turnover Rate | | 44.73 | | 55.95 | | 74.98 | | 54.58 | | 67.21 |

| |

| |

| |

| |

| |

|

| Net Assets, end of period ($ X 1,000) | | 6,012 | | 4,740 | | 50,536 | | 52,723 | | 40,320 |

| |

| a Based on average shares outstanding at each month end. | | | | | | | | |

| See notes to financial statements. | | | | | | | | | | |

FINANCIAL HIGHLIGHTS (continued)

| | | | | | | Year Ended December 31, | | |

| | | |

| |

| |

|

| Class T Shares | | 2006 | | 2005 | | 2004 | | 2003 | | 2002 |

| |

| |

| |

| |

| |

|

| Per Share Data ($): | | | | | | | | | | |

| Net asset value, beginning of period | | 31.37 | | 30.33 | | 27.43 | | 21.57 | | 28.63 |

| Investment Operations: | | | | | | | | | | |

| Investment income—net a | | .30 | | .23 | | .18 | | .11 | | .05 |

| Net realized and unrealized | | | | | | | | | | |

| gain (loss) on investments | | 5.94 | | 1.26 | | 2.87 | | 5.85 | | (7.07) |

| Total from Investment Operations | | 6.24 | | 1.49 | | 3.05 | | 5.96 | | (7.02) |

| Distributions: | | | | | | | | | | |

| Dividends from investment income—net | | (.29) | | (.28) | | (.15) | | (.10) | | (.04) |

| Dividends from net realized | | | | | | | | | | |

| gain on investments | | (5.33) | | (.17) | | — | | — | | — |

| Total Distributions | | (5.62) | | (.45) | | (.15) | | (.10) | | (.04) |

| Net asset value, end of period | | 31.99 | | 31.37 | | 30.33 | | 27.43 | | 21.57 |

| |

| |

| |

| |

| |

|

| Total Return (%) b | | 20.67 | | 4.95 | | 11.14 | | 27.72 | | (24.53) |

| |

| |

| |

| |

| |

|

| Ratios/Supplemental Data (%): | | | | | | | | | | |

| Ratio of total expenses | | | | | | | | | | |

| to average net assets | | 1.40 | | 1.40 | | 1.40 | | 1.40 | | 1.40 |

| Ratio of net investment income | | | | | | | | | | |

| to average net assets | | .93 | | .74 | | .65 | | .45 | | .21 |

| Portfolio Turnover Rate | | 44.73 | | 55.95 | | 74.98 | | 54.58 | | 67.21 |

| |

| |

| |

| |

| |

|

| Net Assets, end of period ($ X 1,000) | | 3,434 | | 2,840 | | 2,945 | | 2,264 | | 1,567 |

| |

| a | | Based on average shares outstanding at each month end. | | | | | | | | |

| b | | Exclusive of sales charge. | | | | | | | | | | |

| See notes to financial statements. | | | | | | | | | | |

22

| | | | | Year Ended December 31, | | |

| |

| |

| |

|

| Institutional Shares | | 2006 | | 2005 | | 2004 | | 2003 | | 2002 |

| |

| |

| |

| |

| |

|

| Per Share Data ($): | | | | | | | | | | |

| Net asset value, beginning of period | | 31.36 | | 30.32 | | 27.42 | | 21.55 | | 28.60 |

| Investment Operations: | | | | | | | | | | |

| Investment income—net a | | .42 | | .33 | | .27 | | .19 | | .13 |

| Net realized and unrealized | | | | | | | | | | |

| gain (loss) on investments | | 5.94 | | 1.26 | | 2.88 | | 5.87 | | (7.07) |

| Total from Investment Operations | | 6.36 | | 1.59 | | 3.15 | | 6.06 | | (6.94) |

| Distributions: | | | | | | | | | | |

| Dividends from investment income—net | | (.41) | | (.38) | | (.25) | | (.19) | | (.11) |

| Dividends from net realized | | | | | | | | | | |

| gain on investments | | (5.33) | | (.17) | | — | | — | | — |

| Total Distributions | | (5.74) | | (.55) | | (.25) | | (.19) | | (.11) |

| Net asset value, end of period | | 31.98 | | 31.36 | | 30.32 | | 27.42 | | 21.55 |

| |

| |

| |

| |

| |

|

| Total Return (%) | | 21.11 | | 5.33 | | 11.53 | | 28.25 | | (24.28) |

| |

| |

| |

| |

| |

|

| Ratios/Supplemental Data (%): | | | | | | | | | | |

| Ratio of total expenses | | | | | | | | | | |

| to average net assets | | 1.05 | | 1.05 | | 1.05 | | 1.05 | | 1.05 |

| Ratio of net investment income | | | | | | | | | | |

| to average net assets | | 1.28 | | 1.09 | | .96 | | .81 | | .51 |

| Portfolio Turnover Rate | | 44.73 | | 55.95 | | 74.98 | | 54.58 | | 67.21 |

| |

| |

| |

| |

| |

|

| Net Assets, end of period ($ X 1,000) | | 44,506 | | 40,341 | | 41,202 | | 41,848 | | 37,174 |

| |

| a Based on average shares outstanding at each month end. | | | | | | | | |

| See notes to financial statements. | | | | | | | | | | |

NOTES TO FINANCIAL STATEMENTS

NOTE 1—Significant Accounting Policies:

Dreyfus Premier Core Value Fund (the “fund”) is a separate diversified series of The Dreyfus/Laurel Funds Trust (the “Trust”) which is registered under the Investment Company Act of 1940, as amended (the “Act”), as an open-end management investment company and operates as a series company offering six series, including the fund, as of the date of this report. The fund’s investment objective is to seek long-term capital growth.The Dreyfus Corporation (the “Manager” or “Dreyfus”) serves as the fund’s investment manager. The Manager is a wholly-owned subsidiary of Mellon Financial Corporation (“Mellon Financial”).

On December 4, 2006, Mellon Financial and The Bank of New York Company, Inc. announced that they had entered into a definitive agreement to merge. The new company will be called The Bank of New York Mellon Corporation. As part of this transaction, Dreyfus would become a wholly-owned subsidiary of The Bank of New York Mellon Corporation.The transaction is subject to certain regulatory approvals and the approval of The Bank of New York Company, Inc.’s and Mellon Financial’s shareholders, as well as other customary conditions to closing. Subject to such approvals and the satisfaction of the other conditions, Mellon Financial and The Bank of New York Company, Inc. expect the transaction to be completed in the third quarter of 2007.

Dreyfus Service Corporation (the “Distributor”), a wholly-owned subsidiary of the Manager, is the distributor of the fund’s shares.The fund is authorized to issue an unlimited number of shares of Beneficial Interest in each of the following classes of shares: Class A, Class B, Class C, Class R, Class T and Institutional shares. Class A, Class B, Class C and Class T shares are sold primarily to retail investors through financial intermediaries and bear a distribution fee and/or service fee. Class A and Class T shares are subject to a front-end sales charge, while Class B and Class C shares are subject to a contingent deferred sales charge (“CDSC”). Class B shares automatically convert to Class A shares after six years. Class R shares are sold primarily to bank trust departments

24

and other financial service providers (including Mellon Financial and its affiliates) acting on behalf of customers having a qualified trust or investment account or relationship at such institution, and bear no distribution or service fees. Class R and Institutional shares are offered without a front-end sales charge or CDSC. Institutional shares are offered only to those customers of certain financial planners and investment advisers who held shares of a predecessor class of the fund as of April 4, 1994, and bear a distribution fee. Each class of shares has identical rights and privileges, except with respect to the distribution and service fees and voting rights on matters affecting a single class. Income, expenses (other than expenses attributable to a specific class), and realized and unrealized gains or losses on investments are allocated to each class of shares based on its relative net assets.

Effective March 1, 2006, Class A shares of the fund may be purchased at net asset value (“NAV”) without payment of a sales charge:

- By qualified investors who (i) purchase Class A shares directly through the Distributor, and (ii) have, or whose spouse or minor children have, beneficially owned shares and continuously maintained an open account directly through the Distributor in a Dreyfus-managed fund, including the fund, or a Founders Asset Management LLC

(“Founders”) managed fund since on or before February 28, 2006. Founders is a wholly-owned subsidiary of the Distributor. - With the cash proceeds from an investor’s exercise of employment- related stock options, whether invested in the fund directly or indi- rectly through an exchange from a Dreyfus-managed money market fund, provided that the proceeds are processed through an entity that has entered into an agreement with the Distributor specifically relat- ing to processing stock options. Upon establishing the account in the fund or the Dreyfus-managed money market fund, the investor and the investor’s spouse and minor children become eligible to purchase Class A shares of the fund at NAV, whether or not using the proceeds of the employment-related stock options.

NOTES TO FINANCIAL STATEMENTS (continued)

- By members of qualified affinity groups who purchase Class A shares directly through the Distributor, provided that the qualified affinity group has entered into an affinity agreement with the Distributor.

Effective March 1, 2006, Class A and Class T shares of the fund may be purchased at NAV without payment of a sales charge:

- For Dreyfus-sponsored IRA “Rollover Accounts” with the distribu- tion proceeds from qualified and non-qualified retirement plans or a Dreyfus-sponsored 403(b)(7) plan, provided that, in the case of a qualified or non-qualified retirement plan, the rollover is processed through an entity that has entered into an agreement with the Distributor specifically relating to processing rollovers. Upon estab- lishing the Dreyfus-sponsored IRA rollover account in the fund, the shareholder becomes eligible to make subsequent purchases of Class A or Class T shares of the fund at NAV in such account.

Effective June 1, 2006, the fund no longer offers Class B shares, except in connection with dividend reinvestment and permitted exchanges of Class B shares.

The fund’s financial statements are prepared in accordance with U.S. generally accepted accounting principles, which may require the use of management estimates and assumptions. Actual results could differ from those estimates.

(a) Portfolio valuation: Investments in securities are valued at the last sales price on the securities exchange or national securities market on which such securities are primarily traded. Securities listed on the National Market System, for which market quotations are available are valued at the official closing price or, if there is no official closing price that day, at the last sale price. Securities not listed on an exchange or the national securities market, or securities for which there were no transactions, are valued at the average of the most recent bid and asked prices. Bid price is used when no asked price is available. Registered open-ended investment companies that are not traded on an exchange are valued at their NAV. When market quotations or official closing prices are not readily available, or are determined not to reflect accu-

26

rately fair value, such as when the value of a security has been significantly affected by events after the close of the exchange or market on which the security is principally traded (for example, a foreign exchange or market), but before the fund calculates its NAV, the fund may value these investments at fair value as determined in accordance with the procedures approved by the Board of Trustees. Fair valuing of securities may be determined with the assistance of a pricing service using calculations based on indices of domestic securities and other appropriate indicators, such as prices of relevant ADR’s and futures contracts. For other securities that are fair valued by the Board of Trustees, certain factors may be considered such as: fundamental analytical data, the nature and duration of restrictions on disposition, an evaluation of the forces that influence the market in which the securities are purchased and sold, and public trading in similar securities of the issuer or comparable issuers. Investments denominated in foreign currencies are translated to U.S. dollars at the prevailing rates of exchange. Forward currency exchange contracts are valued at the forward rate.

On September 20, 2006, the Financial Accounting Standards Board (FASB) released Statement of Financial Accounting Standards No. 157 “Fair Value Measurements” (“FAS 157”). FAS 157 establishes an authoritative definition of fair value, sets out a framework for measuring fair value, and requires additional disclosures about fair-value measurements. The application of FAS 157 is required for fiscal years beginning after November 15, 2007 and interim periods within those fiscal years. Management does not believe that the application of this standard will have a material impact on the financial statements of the fund.

(b) Securities transactions and investment income: Securities transactions are recorded on a trade date basis. Realized gain and loss from securities transactions are recorded on the identified cost basis. Dividend income is recognized on the ex-dividend date and interest income, including, where applicable, accretion of discount and amortization of premium on investments, is recognized on the accrual basis.

| | NOTES TO FINANCIAL STATEMENTS (continued)

|

Pursuant to a securities lending agreement with Mellon Bank, N.A., an affiliate of the Manager, the fund may lend securities to qualified institutions. It is the fund’s policy, that at origination, all loans are secured by collateral of at least 102% of the value of U.S. securities loaned and 105% of the value of foreign securities loaned. It is the fund’s policy that collateral equivalent to at least 100% of the market value of securities on loan is maintained at all times. Cash collateral is invested in certain money market mutual funds managed by the Manager. The fund is entitled to receive all income on securities loaned, in addition to income earned as a result of the lending transaction. Although each security loaned is fully collateralized, the fund bears the risk of delay in recovery of, or loss of rights in, the securities loaned should a borrower fail to return the securities in a timely manner.

(c) Affiliated issuers: Investments in other investment companies advised by the Manager are defined as “affiliated” in the Act.

(d) Foreign currency transactions: The fund does not isolate that portion of the results of operations resulting from changes in foreign exchange rates on investments from the fluctuations arising from changes in the market prices of securities held. Such fluctuations are included with the net realized and unrealized gain or loss from investments.

Net realized foreign exchange gains or losses arise from sales and maturities of short-term securities, sales of foreign currencies, currency gains or losses realized on securities transactions and the difference between the amount of dividends, interest, and foreign withholding taxes recorded on the fund’s books and the U.S. dollar equivalent of the amounts actually received or paid. Net unrealized foreign exchange gains and losses arise from changes in the value of assets and liabilities other than investments in securities, resulting from changes in exchange rates. Such gains and losses are included with net realized and unrealized gain or loss on investments.

(e) Dividends to shareholders: Dividends are recorded on the ex-dividend date. Dividends from investment income-net are declared

28

and paid on a quarterly basis. Dividends from net realized capital gain, if any, are normally declared and paid annually, but the fund may make distributions on a more frequent basis to comply with the distribution requirements of the Internal Revenue Code of 1986, as amended (the “Code”).To the extent that net realized capital gain can be offset by capital loss carryovers, if any, it is the policy of the fund not to distribute such gain. Income and capital gain distributions are determined in accordance with income tax regulations, which may differ from U.S. generally accepted accounting principles.

(f) Federal income taxes: It is the policy of the fund to continue to qualify as a regulated investment company, if such qualification is in the best interests of its shareholders, by complying with the applicable provisions of the Code, and to make distributions of taxable income sufficient to relieve it from substantially all federal income and excise taxes.

On July 13, 2006, the FASB released FASB Interpretation No. 48 “Accounting for Uncertainty in Income Taxes” (FIN 48). FIN 48 provides guidance for how uncertain tax positions should be recognized, measured, presented and disclosed in the financial statements. FIN 48 requires the evaluation of tax positions taken or expected to be taken in the course of preparing the fund’s tax returns to determine whether the tax positions are “more-likely-than-not” of being sustained by the applicable tax authority.Tax positions not deemed to meet the more-likely-than-not threshold would be recorded as a tax benefit or expense in the current year. Adoption of FIN 48 is required for fiscal years beginning after December 15, 2006 and is to be applied to all open tax years as of the effective date. Management does not believe that the application of this standard will have a material impact on the financial statements of the fund.

At December 31, 2006, the components of accumulated earnings on a tax basis were as follows: undistributed ordinary income $2,577,146, undistributed capital gains $6,848,897 and unrealized appreciation $126,542,740.

| | NOTES TO FINANCIAL STATEMENTS (continued)

|

The tax character of distributions paid to shareholders during the fiscal periods ended December 31, 2006 and December 31, 2005 were as follows: ordinary income $20,615,240 and $7,988,829 and long-term capital gains $91,322,666 and $3,726,851, respectively.

During the period ended December 31, 2006, as a result of permanent book to tax differences, primarily due to the tax treatment for real estate investment trusts, the fund decreased accumulated undistributed investment income-net by $26,323 and increased accumulated net realized gain (loss) on investments by the same amount. Net assets were not affected by this reclassification.

NOTE 2—Bank Line of Credit:

The fund participates with other Dreyfus-managed funds in a $350 million redemption credit facility (“the Facility”) to be utilized for temporary or emergency purposes, including the financing of redemptions. In connection therewith, the fund has agreed to pay commitment fees on its pro rata portion of the Facility. Interest is charged to the fund based on prevailing market rates in effect at the time of borrowing.

The average daily amount of borrowings outstanding under the Facility during the period ended December 31, 2006, was $152,600 with a related weighted average annualized interest rate of 5.55% .

NOTE 3—Investment Management Fee and Other Transactions With Affiliates:

(a) Pursuant to an Investment Management agreement with the Manager, the Manager provides or arranges for one or more third parties and/or affiliates to provide investment advisory, administrative, custody, fund accounting and transfer agency services to the fund.The Manager also directs the investments of the fund in accordance with its investment objective, policies and limitations. For these services, the fund is contractually obligated to pay the Manager a fee, calculated daily and paid monthly, at the annual rate of .90% of the value of the fund’s average daily net assets. Out of its fee, the Manager pays all of

30

the expenses of the fund except brokerage fees, taxes, interest, commitment fees, Rule 12b-1 distribution fees and expenses, service fees and expenses of non-interested Trustees (including counsel fees) and extraordinary expenses. In addition, the Manager is required to reduce its fee in an amount equal to the fund’s allocable portion of fees and expenses of the non-interested Trustees (including counsel fees). Each Trustee receives $45,000 per year, plus $6,000 for each joint Board meeting of The Dreyfus/Laurel Funds, Inc.,The Dreyfus/Laurel Tax-Free Municipal Funds and the Trust (collectively, the “Dreyfus/Laurel Funds”) attended, $2,000 for separate in-person committee meetings attended which are not held in conjunction with a regularly scheduled Board meeting and $1,500 for Board meetings and separate committee meetings attended that are conducted by telephone and is reimbursed for travel and out-of-pocket expenses. With respect to Board meetings, the Chairman of the Board receives an additional 25% of such compensation (with the exception of reimbursable amounts). With respect to compensation committee meetings, the Chair of the compensation committee receives $900 per meeting and, with respect to audit committee meetings, the Chair of the audit committee receives $1,350 per meeting. In the event that there is an in-person joint committee meeting or a joint telephone meeting of the Dreyfus/Laurel Funds and Dreyfus High Yield Strategies Fund, the $2,000 or $1,500 fee, as applicable, will be allocated between the Dreyfus/Laurel Funds and Dreyfus High Yield Strategies Fund. These fees and expenses are charged and allocated to each series based on net assets. Amounts required to be paid by the Trust directly to the non-interested Trustees, that would be applied to offset a portion of the management fee payable to the Manager, are in fact paid directly by the Manager to the non-interested Trustees.

During the period ended December 31, 2006, the Distributor retained $20,016 and $598 from commissions earned on sales of the fund’s Class A and Class T shares, respectively, and $139,670 and $4,023 from CDSC on redemptions on the fund’s Class B and Class C shares, respectively.

| | NOTES TO FINANCIAL STATEMENTS (continued)

|

(b) Under separate Distribution Plans (the “Plans”) adopted pursuant to Rule 12b-1 under the Act, Class A shares and Institutional shares may pay annually up to .25% and ..15%, respectively, of the value of their average daily net assets to compensate the Distributor for shareholder servicing activities and expenses primarily intended to result in the sale of Class A shares and Institutional shares. Class B, Class C and Class T shares pay the Distributor for distributing their shares at an aggregate annual rate of .75% of the value of the average daily net assets of Class B and Class C shares, and .25% of the value of average daily net assets of Class T shares.The Distributor may pay one or more agents in respect of advertising, marketing and other distribution services for Class T shares and determines the amounts, if any, to be paid to agents and the basis on which such payments are made. Class B, Class C and Class T shares are also subject to a service plan adopted pursuant to Rule 12b-1 (the “Service Plan”), under which Class B, Class C and Class T shares pay the Distributor for providing certain services to the holders of their shares a fee at the annual rate of .25% of the value of the average daily net assets of Class B, Class C and Class T shares, respectively. During the period ended December 31, 2006, Class A, Class B, Class C, Class T and Institutional shares were charged $1,375,700, $435,235, $152,038, $7,563 and $63,138 respectively, pursuant to their respective Plans. During the period ended December 31, 2006, Class B, Class C and Class T shares were charged $145,078, $50,679 and $7,563, respectively, pursuant to the Service Plan.

Under its terms, the Plans and Service Plan shall remain in effect from year to year, provided such continuance is approved annually by a vote of majority of those Trustees who are not “interested persons” of the Trust and who have no direct or indirect financial interest in the operation of or in any agreement related to the Plans or Service Plan.

32

The components of Due to The Dreyfus Corporation and affiliates in the Statement of Assets and Liabilities consist of: management fees $537,658, Rule 12b-1 distribution plan fees $177,616 and shareholder services plan fees $17,470.

(c) The Trust and the Manager have received an exemptive order from the SEC which, among other things, permits the fund to use cash collateral received in connection with lending the fund’s securities and other uninvested cash to purchase shares of one or more registered money market mutual funds advised by the Manager in excess of the limitations imposed by the Act.

NOTE 4—Securities Transactions:

The aggregate amount of purchases and sales of investment securities, excluding short-term securities, during the period ended December 31, 2006, amounted to $302,908,351 and $431,854,661, respectively.

At December 31, 2006, the cost of investments for federal income tax purposes was $556,823,031; accordingly, accumulated net unrealized depreciation on investments was $126,542,740 consisting of $131,102,585 gross unrealized appreciation and $4,559,845 gross unrealized depreciation.

| REPORT OF INDEPENDENT REGISTERED |

| PUBLIC ACCOUNTING FIRM |

| The Board of Trustees and Shareholders of |

| The Dreyfus/Laurel Funds Trust: |

We have audited the accompanying statement of assets and liabilities of Dreyfus Premier Core Value Fund (the “Fund”) of The Dreyfus/Laurel Funds Trust, including the statement of investments as of December 31, 2006, and the related statement of operations for the year then ended, the statements of changes in net assets for each of the years in the two-year period then ended, and the financial highlights for each of the years in the five-year period then ended.These financial statements and financial highlights are the responsibility of the Fund’s management. Our responsibility is to express an opinion on these financial statements and financial highlights based on our audits.

We conducted our audits in accordance with standards of the Public Company Accounting Oversight Board (United States).Those standards require that we plan and perform the audit to obtain reasonable assurance about whether the financial statements and financial highlights are free of material misstatement. An audit also includes examining, on a test basis, evidence supporting the amounts and disclosures in the financial statements. Our procedures included confirmation of securities owned as of December 31, 2006, by correspondence with the custodian and brokers. An audit also includes assessing the accounting principles used and significant estimates made by management, as well as evaluating the overall financial statement presentation.We believe that our audits provide a reasonable basis for our opinion.

In our opinion, the financial statements and financial highlights referred to above present fairly, in all material respects, the financial position of Dreyfus Premier Core Value Fund of The Dreyfus/Laurel Funds Trust as of December 31, 2006, and the results of its operations for the year then ended, the changes in its net assets for each of the years in the two-year period then ended, and the financial highlights for each of the years in the five-year period then ended, in conformity with U.S. generally accepted accounting principles.

| New York, New York |

| February 16, 2007 |

34

IMPORTANT TAX INFORMATION (Unaudited)

For federal tax purposes, the fund hereby designates $1.3460 per share as a long-term capital gain paid on March 31, 2006, and also designates $3.2750 per share as a long-term capital gain distribution and $.7100 per share as a short-term capital gain distribution paid on December 21, 2006.The fund also hereby designates 62.12% of the ordinary dividends paid during the fiscal year ended December 31, 2006 as qualifying for the corporate dividends received deduction. For the fiscal year ended December 31, 2006, certain dividends paid by the fund may be subject to a maximum tax rate of 15%, as provided for by the Jobs and Growth Tax Relief Reconciliation Act of 2003. Of the distributions paid during the fiscal year, $15,390,132 represents the maximum amount that may be considered qualified dividend income. Shareholders will receive notification in January 2007 of the percentage applicable to the preparation of their 2006 income tax returns.

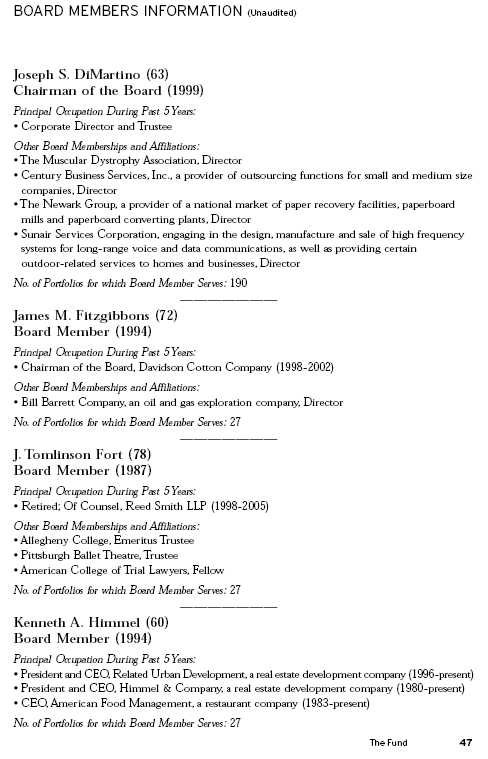

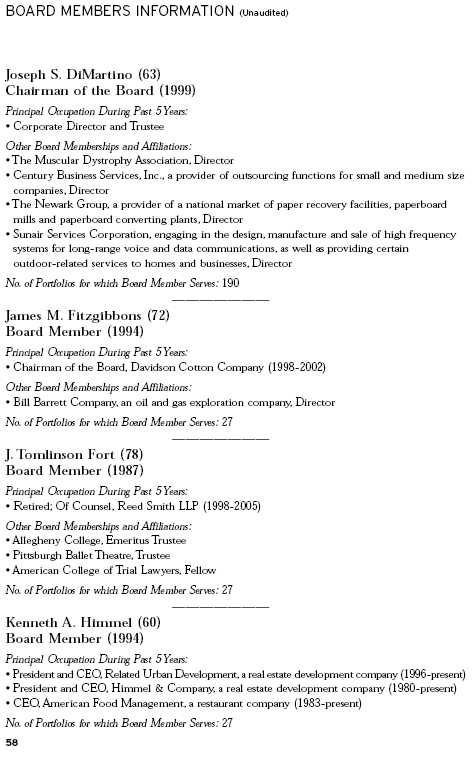

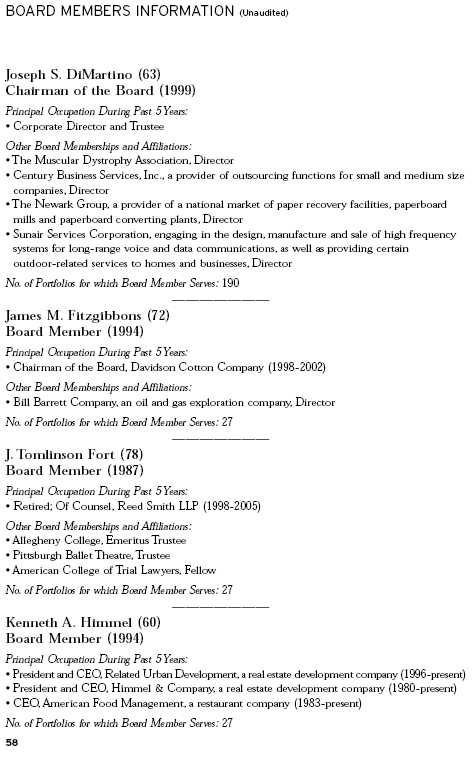

BOARD MEMBERS INFORMATION (Unaudited)

| Joseph S. DiMartino (63) |

| Chairman of the Board (1995) |

| Principal Occupation During Past 5 Years: |

| • Corporate Director and Trustee |

Other Board Memberships and Affiliations:

- The Muscular Dystrophy Association, Director

- Century Business Services, Inc., a provider of outsourcing functions for small and medium size companies, Director

- The Newark Group, a provider of a national market of paper recovery facilities, paperboard mills and paperboard converting plants, Director

- Sunair Services Corporation, engaging in the design, manufacture and sale of high frequency systems for long-range voice and data communications, as well as providing certain outdoor-related services to homes and businesses, Director

No. of Portfolios for which Board Member Serves: 190

———————

| James M. Fitzgibbons (72) |

| Board Member (1994) |

| Principal Occupation During Past 5 Years: |

| • Chairman of the Board, Davidson Cotton Company (1998-2002) |

| Other Board Memberships and Affiliations: |

| • Bill Barrett Company, an oil and gas exploration company, Director |

No. of Portfolios for which Board Member Serves: 27

———————

| J. Tomlinson Fort (78) |

| Board Member (1987) |

| Principal Occupation During Past 5 Years: |

| • Retired; Of Counsel, Reed Smith LLP (1998-2005) |

Other Board Memberships and Affiliations:

- Allegheny College, Emeritus Trustee

- Pittsburgh Ballet Theatre,Trustee

- American College of Trial Lawyers, Fellow

No. of Portfolios for which Board Member Serves: 27

———————

| Kenneth A. Himmel (60) |

| Board Member (1994) |

Principal Occupation During Past 5 Years:

- President and CEO,Related Urban Development,a real estate development company (1996-present)

- President and CEO, Himmel & Company, a real estate development company (1980-present)

- CEO, American Food Management, a restaurant company (1983-present)

No. of Portfolios for which Board Member Serves: 27

36

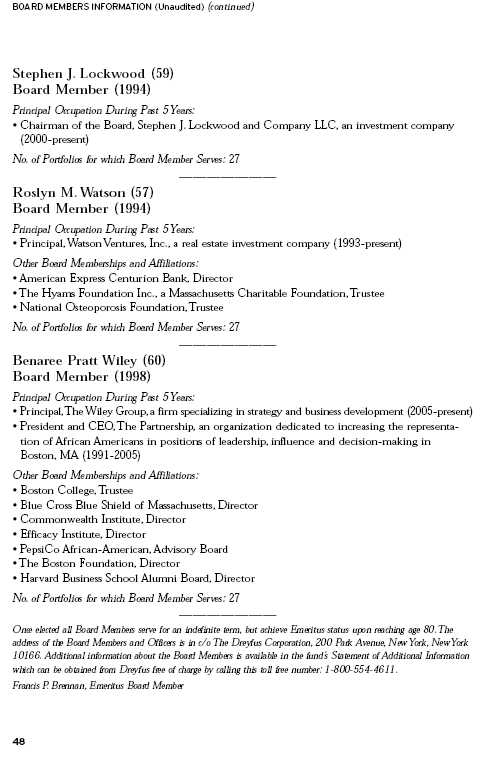

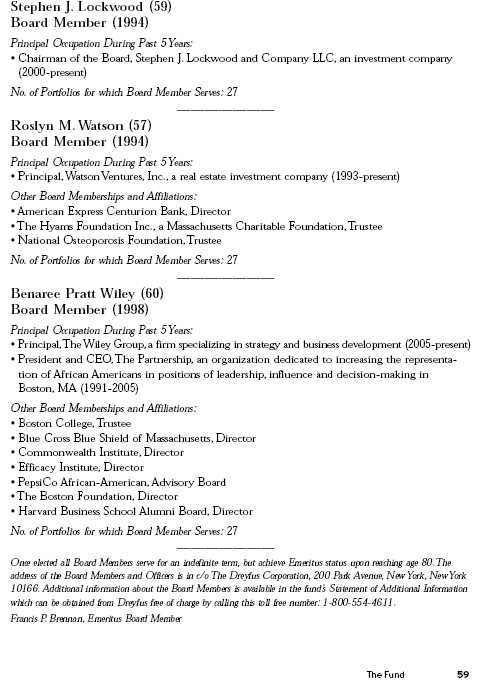

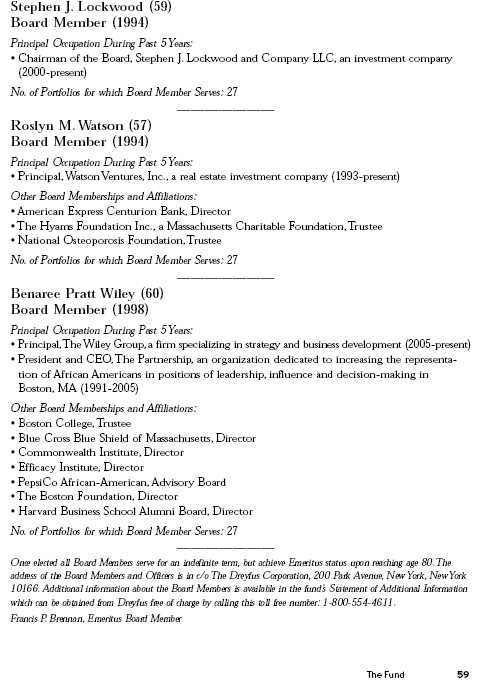

| Stephen J. Lockwood (59) |

| Board Member (1994) |

Principal Occupation During Past 5 Years:

- Chairman of the Board, Stephen J. Lockwood and Company LLC, an investment company (2000-present)

No. of Portfolios for which Board Member Serves: 27

———————

| Roslyn M. Watson (57) |

| Board Member (1994) |

| Principal Occupation During Past 5 Years: |

| • Principal,Watson Ventures, Inc., a real estate investment company (1993-present) |

Other Board Memberships and Affiliations:

- American Express Centurion Bank, Director

- The Hyams Foundation Inc., a Massachusetts Charitable Foundation,Trustee

- National Osteoporosis Foundation,Trustee

No. of Portfolios for which Board Member Serves: 27

———————

| Benaree Pratt Wiley (60) |

| Board Member (1998) |

Principal Occupation During Past 5 Years:

- Principal,The Wiley Group, a firm specializing in strategy and business development (2005-present)

- President and CEO,The Partnership, an organization dedicated to increasing the representa- tion of African Americans in positions of leadership, influence and decision-making in Boston, MA (1991-2005)

Other Board Memberships and Affiliations:

- Boston College,Trustee

- Blue Cross Blue Shield of Massachusetts, Director

- Commonwealth Institute, Director

- Efficacy Institute, Director

- PepsiCo African-American, Advisory Board

- The Boston Foundation, Director

- Harvard Business School Alumni Board, Director

No. of Portfolios for which Board Member Serves: 27

———————

Once elected all Board Members serve for an indefinite term, but achieve Emeritus status upon reaching age 80.The address of the Board Members and Officers is in c/o The Dreyfus Corporation, 200 Park Avenue, New York, New York 10166. Additional information about the Board Members is available in the fund’s Statement of Additional Information which can be obtained from Dreyfus free of charge by calling this toll free number: 1-800-554-4611.

Francis P. Brennan, Emeritus Board Member

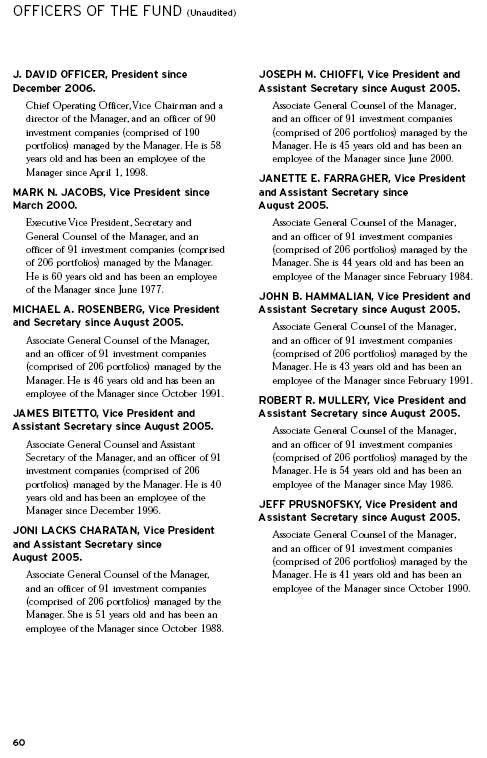

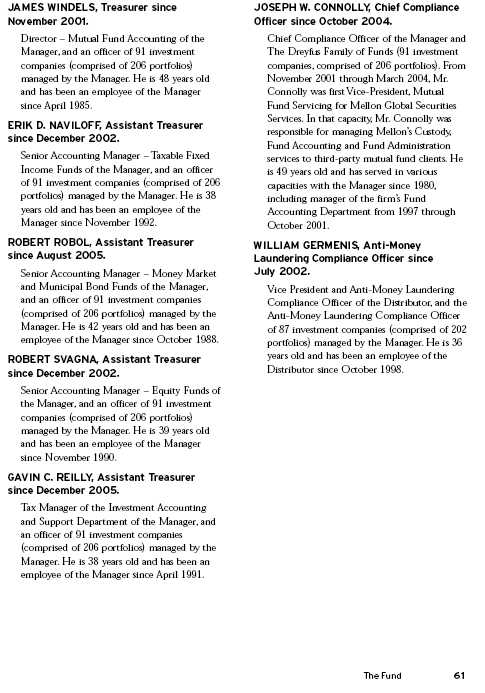

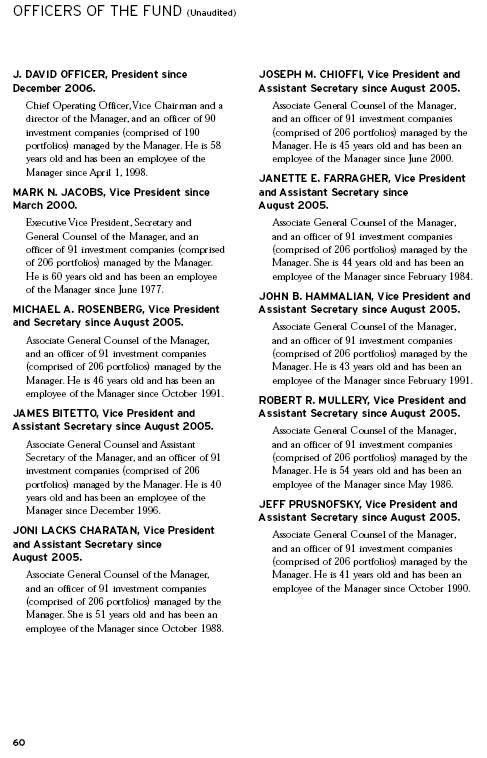

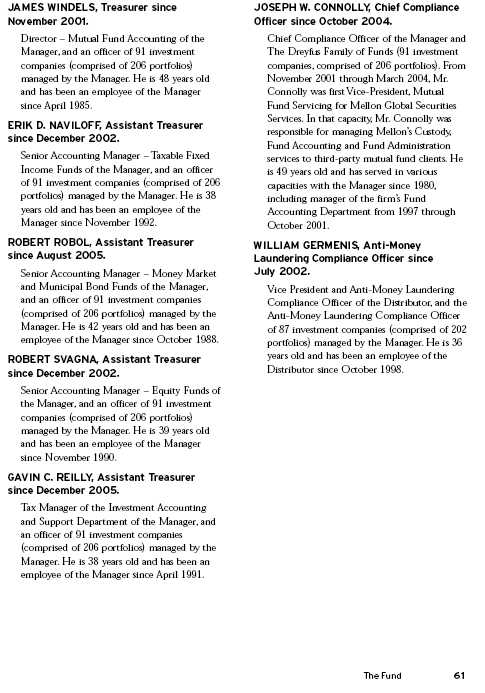

OFFICERS OF THE FUND (Unaudited)

| J. DAVID OFFICER, President since |

| December 2006. |

Chief Operating Officer,Vice Chairman and a director of the Manager, and an officer of 90 investment companies (comprised of 190 portfolios) managed by the Manager. He is 58 years old and has been an employee of the Manager since April 1, 1998.

| MARK N. JACOBS, Vice President since |

| March 2000. |