| UNITED STATES |

| SECURITIES AND EXCHANGE COMMISSION |

| Washington, D.C. 20549 |

| FORM N-CSR |

| |

| CERTIFIED SHAREHOLDER REPORT OF REGISTERED MANAGEMENT |

| INVESTMENT COMPANIES |

Investment Company Act file number 811-524

|

| The Dreyfus/Laurel Funds Trust |

| (Exact name of Registrant as specified in charter) |

| c/o The Dreyfus Corporation |

| 200 Park Avenue |

| New York, New York 10166 |

| (Address of principal executive offices) (Zip code) |

| |

| Michael A. Rosenberg, Esq. |

| 200 Park Avenue |

| New York, New York 10166 |

| (Name and address of agent for service) |

| |

| Registrant's telephone number, including area code: (212) 922-6000 |

| Date of fiscal year end: | | 10/31 |

| Date of reporting period: | | 10/31/2007 |

The following N-CSR relates only to the series of the Registrant listed below, and does not affect the other series of the Registrant, which have different fiscal year ends and, therefore, different N-CSR reporting requirements. Separate N-CSR Forms will be filed for those series, as appropriate.

Dreyfus Premier 130/30 Growth Fund

Dreyfus Premier Global Equity Income Fund

Dreyfus Premier International Bond Fund

|

FORM N-CSR

Item 1. Reports to Stockholders.

Save time. Save paper. View your next shareholder report online as soon as it’s available. Log into www.dreyfus.com and sign up for Dreyfus eCommunications. It’s simple and only takes a few minutes.

The views expressed in this report reflect those of the portfolio manager only through the end of the period covered and do not necessarily represent the views of Dreyfus or any other person in the Dreyfus organization. Any such views are subject to change at any time based upon market or other conditions and Dreyfus disclaims any responsibility to update such views.These views may not be relied on as investment advice and, because investment decisions for a Dreyfus fund are based on numerous factors, may not be relied on as an indication of trading intent on behalf of any Dreyfus fund.

Not FDIC-Insured • Not Bank-Guaranteed • May Lose Value

| | | Contents |

| |

| | | THE FUND |

| |

|

| 2 | | Discussion of Fund Performance |

| 4 | | Understanding Your Fund’s Expenses |

| 4 | | Comparing Your Fund’s Expenses |

| | | With Those of Other Funds |

| 5 | | Statement of Investments |

| 9 | | Statement of Securities Sold Short |

| 10 | | Statement of Assets and Liabilities |

| 11 | | Statement of Operations |

| 12 | | Statement of Cash Flows |

| 13 | | Statement of Changes in Net Assets |

| 14 | | Financial Highlights |

| 15 | | Notes to Financial Statements |

| 23 | | Report of Independent Registered |

| | | Public Accounting Firm |

| 24 | | Information About the Review and Approval |

| | | of the Fund’s Management Agreement |

| 28 | | Board Members Information |

| 30 | | Officers of the Fund |

| | | FOR MORE INFORMATION |

| |

|

| | | Back Cover |

| Dreyfu Premier |

| 130/30 Growth Fund |

DISCUSSION OF FUND PERFORMANCE

For the period between October 18, 2007, and October 31, 2007 Warren Chiang, CFA, Prabhu Palani, CFA, and Wesley Boggs, Portfolio Managers

Please note, due to the short period of existence since the fund’s inception on October 18, 2007, through the annual reporting period ended October 31, 2007, the discussion of fund performance is limited and will be discussed more extensively in the next semiannual report dated April 30, 2008.

Fund Performance Overview

Despite bouts of heightened volatility stemming from a domestic credit crisis and a slowing U.S. economy, large-cap growth stocks posted respectable returns due to generally healthy corporate earnings and robust global economic growth.

From the fund’s inception on October 18, 2007, through the end of the reporting period on October 31, 2007, Dreyfus Premier 130/30 Growth Fund produced total returns of –0.24% for Class A shares, –0.24% for Class C shares, –0.24 for Class I shares and –0.24% for Class T shares.1 In comparison, the Russell 1000 Growth Index produced a total return of 1.53% for the same period.2

The Fund’s Investment Approach

The fund seeks capital appreciation. The fund normally invests at least 80% of its net assets in equity securities. The fund intends to take both long and short positions in stocks chosen through a quantitatively-driven investment process. The fund’s portfolio managers apply a systematic, quantitative investment approach designed to identify and exploit relative misevaluations primarily within the U.S stock market.Active investment decisions to take long or short posi-

2

tions in individual securities are driven by this quantitative investment process. The portfolio managers use a proprietary valuation model that identifies and ranks stocks based on a long-term relative valuation model that utilizes forward looking estimates of risk and return, an earnings sustainability model that gauges how well earnings forecasts are likely to reflect changes in future cash flows, and a set of behavioral factors, including earnings revisions and share buy-backs.

The Fund’s Current Strategy

We try to find new opportunities by using a quantitative approach in which all investments decisions are based primarily on valuation and relative value.The investment approach is sector-neutral and holdings are purchased from a large-cap universe of stocks.

November 15, 2007

| 1 | | Total return includes reinvestment of dividends and any capital gains paid, and does not take into |

| | | consideration the maximum initial sales charges in the case of Class A and Class T shares, or the |

| | | applicable contingent deferred sales charges imposed on redemptions in the case of Class C shares. |

| | | Had these charges been reflected, returns would have been lower. Past performance is no guarantee |

| | | of future results. Share price and investment return fluctuate such that upon redemption, fund |

| | | shares may be worth more or less than their original cost. Return figures provided reflect the |

| | | absorption of certain fund expenses by The Dreyfus Corporation pursuant to an agreement in |

| | | effect until October 31, 2008. Had these expenses not been absorbed, the fund’s returns would |

| | | have been lower. |

| 2 | | SOURCE: Bloomberg. – Reflects reinvestment of net dividends and, where applicable, capital |

| | | gain distributions.The Russell 1000 Growth Index is a widely accepted, unmanaged large-cap |

| | | index that measures the performance of those Russell 1000 Index companies with higher price-to- |

| | | book ratios and higher forecasted growth values. |

The Fund 3

UNDERSTANDING YOUR FUND’S EXPENSES (Unaudited)

As a mutual fund investor, you pay ongoing expenses, such as management fees and other expenses. Using the information below, you can estimate how these expenses affect your investment and compare them with the expenses of other funds.You also may pay one-time transaction expenses, including sales charges (loads) and redemption fees, which are not shown in this section and would have resulted in higher total expenses. For more information, see your fund’s prospectus or talk to your financial adviser.

Review your fund’s expenses

The table below shows the expenses you would have paid on a $1,000 investment in Dreyfus Premier 130/30 Growth Fund from October 18, 2007 (commencement of operations) to October 31, 2007. It also shows how much a $1,000 investment would be worth at the close of the period, assuming actual returns and expenses.

| Expenses and Value of a $1,000 Investment | | | | | | |

| assuming actual returns for the period ended October 31, 2007† | | | | |

| | | Class A | | Class C | | Class I | | Class T |

| |

| |

| |

| |

|

| Expenses paid per $1,000 †† | | $ .61 | | $ .90 | | $ .52 | | $ .71 |

| Ending value (after expenses) | | $997.60 | | $997.60 | | $997.60 | | $997.60 |

| COMPARING YOUR FUND’S EXPENSES |

| WITH THOSE OF OTHER FUNDS (Unaudited) |

Using the SEC’s method to compare expenses

The Securities and Exchange Commission (SEC) has established guidelines to help investors assess fund expenses. Per these guidelines, the table below shows your fund’s expenses based on a $1,000 investment, assuming a hypothetical 5% annualized return. You can use this information to compare the ongoing expenses (but not transaction expenses or total cost) of investing in the fund with those of other funds.All mutual fund shareholder reports will provide this information to help you make this comparison. Please note that you cannot use this information to estimate your actual ending account balance and expenses paid during the period.

| Expenses and Value of a $1,000 Investment | | | | | | | | |

| assuming a hypothetical 5% annualized return for the period ended October 31, 2007† | | |

| | | Class A | | Class C | | Class I | | | | Class T |

| |

| |

| |

| |

| |

|

| Expenses paid per $1,000 †† | | $ .61 | | $ .90 | | $ .52 | | $ | | .71 |

| Ending value (after expenses) | | $1,001.30 | | $1,001.02 | | $1,001.40 | | $1,001.21 |

| † From October 18, 2007 (commencement of operations) to October 31, 2007. | | | | | | |

Expenses are equal to the fund’s annualized expense ratio of 1.60% for Class A, 2.35% for Class C, 1.35% for Class I and 1.85% for Class T, multiplied by the average account value over the period, multiplied by 14/365 (to reflect the one-half year period).

4

| STATEMENT OF INVESTMENTS |

| October 31, 2007 |

| Common Stocks—128.5% | | Shares | | Value ($) |

| |

| |

|

| Consumer Discretionary—22.3% | | | | |

| Coach | | 1,200 a,b | | 43,872 |

| Darden Restaurants | | 1,100 b | | 47,300 |

| Harman International Industries | | 50 b | | 4,210 |

| Harrah’s Entertainment | | 50 b | | 4,412 |

| Home Depot | | 1,800 b | | 56,718 |

| J.C. Penney | | 800 b | | 44,992 |

| Newell Rubbermaid | | 1,600 b | | 46,656 |

| News, Cl. A | | 2,600 b | | 56,342 |

| NutriSystem | | 1,500 a,b | | 45,150 |

| OfficeMax | | 1,400 b | | 44,310 |

| Omnicom Group | | 1,000 b | | 50,980 |

| Polo Ralph Lauren | | 700 b | | 48,160 |

| Snap-On | | 900 | | 44,919 |

| Starwood Hotels & Resorts Worldwide | | 800 | | 45,488 |

| Station Casinos | | 50 | | 4,490 |

| Time Warner | | 2,600 | | 47,476 |

| Walt Disney | | 1,600 b | | 55,408 |

| | | | | 690,883 |

| Consumer Staples—11.3% | | | | |

| Clorox | | 600 b | | 37,542 |

| ConAgra Foods | | 1,800 b | | 42,714 |

| Del Monte Foods | | 4,300 b | | 44,462 |

| Kroger | | 1,700 b | | 49,963 |

| McCormick & Co. | | 1,300 b | | 45,539 |

| Wal-Mart Stores | | 1,600 | | 72,336 |

| Walgreen | | 1,500 | | 59,475 |

| | | | | 352,031 |

| Energy—9.8% | | | | |

| Dresser-Rand Group | | 1,100 a,b | | 42,570 |

| Murphy Oil | | 200 b | | 14,726 |

| NRG Energy | | 100 a,b | | 4,566 |

| Schlumberger | | 50 b | | 4,829 |

| Smith International | | 700 b | | 46,235 |

| St. Mary Land & Exploration | | 700 b | | 29,652 |

| Sunoco | | 600 | | 44,160 |

The Fund 5

STATEMENT OF INVESTMENTS (continued)

| Common Stocks (continued) | | Shares | | | | Value ($) |

| |

| |

| |

|

| Energy (continued) | | | | | | |

| Transocean | | 500 | | a,b | | 59,685 |

| Valero Energy | | 800 | | | | 56,344 |

| | | | | | | 302,767 |

| Financial—12.8% | | | | | | |

| Ambac Financial Group | | 700 | | b | | 25,781 |

| American International Group | | 700 | | b | | 44,184 |

| Assurant | | 800 | | b | | 46,752 |

| Fifth Third Bancorp | | 1,400 | | b | | 43,792 |

| Genworth Financial, Cl. A | | 1,500 | | b | | 40,950 |

| Merrill Lynch & Co. | | 700 | | b | | 46,214 |

| Moody’s | | 1,000 | | b | | 43,720 |

| Morgan Stanley | | 700 | | b | | 47,082 |

| ProLogis | | 100 | | b | | 7,174 |

| Simon Property Group | | 50 | | b | | 5,206 |

| W.R. Berkley | | 1,500 | | b | | 45,135 |

| | | | | | | 395,990 |

| Health Care—16.9% | | | | | | |

| Amgen | | 300 | | a,b | | 17,433 |

| Bristol-Myers Squibb | | 2,300 | | b | | 68,977 |

| Cardinal Health | | 800 | | b | | 54,424 |

| Celgene | | 100 | | a,b | | 6,600 |

| Dade Behring Holdings | | 50 | | b | | 3,846 |

| Endo Pharmaceuticals Holdings | | 1,300 | | a,b | | 38,090 |

| Genentech | | 200 | | a,b | | 14,826 |

| Genzyme | | 100 | | a,b | | 7,597 |

| Health Net | | 900 | | a,b | | 48,249 |

| Medtronic | | 1,300 | | b | | 61,672 |

| Merck & Co. | | 700 | | b | | 40,782 |

| Schering-Plough | | 2,000 | | b | | 61,040 |

| Watson Pharmaceuticals | | 1,500 | | a | | 45,840 |

| WellPoint | | 700 | | a | | 55,461 |

| | | | | | | 524,837 |

| Industrial—16.3% | | | | | | |

| Boeing | | 800 | | b | | 78,872 |

| Cooper Industries, Cl. A | | 800 | | b | | 41,912 |

| Copart | | 1,200 | | a,b | | 46,056 |

6

| Common Stocks (continued) | | Shares | | Value ($) |

| |

| |

|

| Industrial (continued) | | | | |

| Emerson Electric | | 700 b | | 36,589 |

| GATX | | 1,100 b | | 45,067 |

| Hertz Global Holdings | | 2,100 a,b | | 45,528 |

| Hubbell, Cl. B | | 800 b | | 44,000 |

| Pall | | 1,200 b | | 48,084 |

| Pitney Bowes | | 100 b | | 4,004 |

| Precision Castparts | | 400 b | | 59,924 |

| SPX | | 500 b | | 50,650 |

| Waste Management | | 100 | | 3,639 |

| | | | | 504,325 |

| Information Technology—21.9% | | | | |

| Adobe Systems | | 1,200 a,b | | 57,480 |

| Agilent Technologies | | 1,300 a,b | | 47,905 |

| Applied Materials | | 900 b | | 17,478 |

| Automatic Data Processing | | 1,200 b | | 59,472 |

| BMC Software | | 1,500 a,b | | 50,760 |

| CA | | 800 b | | 21,160 |

| Ciena | | 1,000 a,b | | 47,860 |

| Cognizant Technology Solutions, Cl. A | | 1,000 a,b | | 41,460 |

| Google, Cl. A | | 50 a | | 35,350 |

| Intel | | 2,500 | | 67,250 |

| MEMC Electronic Materials | | 800 a,b | | 58,576 |

| National Instruments | | 1,300 b | | 42,172 |

| QUALCOMM | | 1,700 b | | 72,641 |

| Red Hat | | 2,200 a,b | | 47,498 |

| WebMD Health, CL. A | | 300 a | | 13,791 |

| | | | | 680,853 |

| Materials—4.6% | | | | |

| Allegheny Technologies | | 50 b | | 5,108 |

| Freeport-McMoRan Copper & Gold | | 100 b | | 11,768 |

| International Paper | | 1,300 b | | 48,048 |

| Monsanto | | 700 b | | 68,341 |

| Newmont Mining | | 100 b | | 5,086 |

| Vulcan Materials | | 50 | | 4,276 |

| | | | | 142,627 |

The Fund 7

STATEMENT OF INVESTMENTS (continued)

| Common Stocks (continued) | | Shares | | Value ($) |

| |

| |

|

| Technology—9.9% | | | | |

| Apple | | 100 a,b | | 18,995 |

| Cisco Systems | | 900 a,b | | 29,754 |

| Dell | | 2,500 a,b | | 76,500 |

| Hewlett-Packard | | 1,900 b | | 98,192 |

| International Business Machines | | 200 | | 23,224 |

| Microsoft | | 1,600 b | | 58,896 |

| | | | | 305,561 |

| Telecommunication Services—2.7% | | | | |

| Qwest Communications International | | 5,300 a,b | | 38,054 |

| US Cellular | | 500 a | | 47,075 |

| | | | | 85,129 |

| |

| |

|

| |

| Total Investments (cost $3,989,519) | | 128.5% | | 3,985,003 |

| Liabilities, Less Cash and Receivables | | (28.5%) | | (884,357) |

| Net Assets | | 100.0% | | 3,100,646 |

| a | | Non-income producing security. |

| b | | Partially held by a broker as collateral for open short positions. |

| Portfolio Summary | | (Unaudited) † | | | | |

| |

| | | Value (%) | | | | Value (%) |

| |

| |

| |

|

| Consumer Discretionary | | 22.3 | | Technology | | 9.9 |

| Information Technology | | 21.9 | | Energy | | 9.8 |

| Health Care | | 16.9 | | Materials | | 4.6 |

| Industrial | | 16.3 | | Telecommunication Services | | 2.7 |

| Financial | | 12.8 | | | | |

| Consumer Staples | | 11.3 | | | | 128.5 |

| † Based on net assets. |

| See notes to financial statements. |

8

| STATEMENT OF SECURITIES SOLD SHORT |

| October 31, 2007 |

| Common Stocks—29.8% | | Shares | | Value ($) |

| |

| |

|

| Consumer Discretionary—9.0% | | | | |

| Career Education | | 1,400 a | | 50,036 |

| Circuit City Stores | | 5,700 | | 45,201 |

| Dillards, Cl. A | | 2,100 | | 48,363 |

| Hearst—Argyle Television | | 1,900 | | 42,370 |

| Panera Bread, Cl. A | | 100 a | | 4,099 |

| Sears Holdings | | 300 a | | 40,437 |

| Toll Brothers | | 2,100 a | | 48,111 |

| | | | | 278,617 |

| Consumer Staples—1.4% | | | | |

| Smithfield Foods | | 1,500 a | | 43,005 |

| Energy—1.6% | | | | |

| Newfield Exploration | | 900 a | | 48,456 |

| Financial—3.8% | | | | |

| Fidelity National Financial | | 2,700 | | 41,553 |

| First American | | 1,300 | | 39,130 |

| Philadelphia Consolidated Holding | | 900 a | | 36,720 |

| | | | | 117,403 |

| Health Care—2.1% | | | | |

| Health Management Associates, Cl. A | | 7,000 | | 46,270 |

| Pediatrix Medical Group | | 300 a | | 19,650 |

| | | | | 65,920 |

| Industrial—6.0% | | | | |

| General Cable | | 600 a | | 43,194 |

| Ingersoll—Rand, Cl. A | | 900 | | 45,315 |

| J.B. Hunt Transport Services | | 500 | | 13,860 |

| Roper Industries | | 600 | | 42,486 |

| Timken | | 1,200 | | 39,912 |

| | | | | 184,767 |

| Information Technology—3.8% | | | | |

| Fair Issac | | 1,300 | | 49,296 |

| Iron Mountain | | 1,300 a | | 45,149 |

| Micron Technology | | 2,300 a | | 24,173 |

| | | | | 118,618 |

| Materials—1.4% | | | | |

| Dow Chemical | | 1,000 | | 45,040 |

| Telecommunication Services—.7% | | | | |

| Sprint Nextel | | 1,300 | | 22,230 |

| Total Securities Sold Short (cost $922,445) | | 29.8% | | 924,056 |

| a Non-income producing security |

| See notes to financial statements. |

The Fund 9

| STATEMENT OF ASSETS AND LIABILITIES |

| October 31, 2007 |

| | | | | | | Cost | | Value |

| |

| |

| |

| |

|

| Assets ($): | | | | | | | | |

| Investments in securities—See Statement of Investments | | 3,989,519 | | 3,985,003 |

| Cash | | | | | | | | 40,515 |

| Dividends receivable | | | | | | | | 1,136 |

| Due from The Dreyfus Corporation and affiliates—Note 2(d) | | | | 25,602 |

| | | | | | | | | 4,052,256 |

| |

| |

| |

| |

|

| Liabilities ($): | | | | | | | | |

| Securities sold short, at value (proceeds $922,445) | | | | |

| —See Statement of Securities Sold Short | | | | | | 924,056 |

| Due to Broker | | | | | | | | 119 |

| Accrued expenses | | | | | | | | 27,435 |

| | | | | | | | | 951,610 |

| |

| |

| |

| |

|

| Net Assets ($) | | | | | | | | 3,100,646 |

| |

| |

| |

| |

|

| Composition of Net Assets ($): | | | | | | | | |

| Paid-in capital | | | | | | | | 3,106,773 |

| Accumulated net unrealized appreciation (depreciation) | | | | |

| on investments and securities sold short | | | | | | (6,127) |

| |

| |

| |

|

| Net Assets ($) | | | | | | | | 3,100,646 |

| |

| |

| |

| |

|

| |

| |

| Net Asset Value Per Share | | | | | | | | |

| | | Class A | | Class C | | Class I | | Class T |

| |

| |

| |

| |

|

| Net Assets ($) | | 2,202,912 | | 299,187 | | 299,302 | | 299,245 |

| Shares Outstanding | | 176,661 | | 24,000 | | 24,000 | | 24,000 |

| |

| |

| |

| |

|

| Net Asset Value Per Share ($) | | 12.47 | | 12.47 | | 12.47 | | 12.47 |

See notes to financial statements.

10

| STATEMENT OF OPERATIONS |

| From October 18, 2007 (commencement of operations) to October 31, 2007 |

| Investment Income ($): | | |

| Income: | | |

| Cash dividends | | 1,136 |

| Expenses: | | |

| Management fee—Note 2(a) | | 988 |

| Auditing fees | | 18,500 |

| Prospectus and shareholders’ reports | | 4,458 |

| Custodian fees—Note 2(d) | | 875 |

| Legal fees | | 600 |

| Shareholder servicing costs—Note 2(d) | | 344 |

| Trustees’ fees and expenses—Note 2(b) | | 142 |

| Distribution fees—Note 2(c) | | 113 |

| Interest expense—Note 2(e) | | 119 |

| Registration fees | | 95 |

| Miscellaneous | | 3,972 |

| Total Expenses | | 30,206 |

| Less—expense reimbursement from | | |

| The Dreyfus Corporation due to undertaking—Note 2(a) | | (28,254) |

| Net Expenses | | 1,952 |

| Investment (Loss)—Net | | (816) |

| |

|

| Realized and Unrealized Gain (Loss) on Investments—Note 3 ($): |

| Net realized gain (loss) on investments | | 25 |

| Net unrealized appreciation (depreciation) on investments | | (6,127) |

| Net Realized and Unrealized Gain (Loss) on Investments | | (6,102) |

| Net (Decrease) in Net Assets Resulting from Operations | | (6,918) |

See notes to financial statements.

The Fund 11

| STATEMENT OF CASH FLOWS |

| From October 18, 2007 (commencement of operations) to October 31, 2007 |

| Cash Flows from Operating Activities ($): | | | | |

| Operating expenses paid | | (1,664) |

| Paid from The Dreyfus Corporation | | 1,664 | | — |

| |

| |

|

| Cash Flows from Investing Activities ($): | | | | |

| Purchases of portfolio securities | | (3,994,244) |

| Proceeds from sales of portfolio securities | | 4,750 | | |

| Proceeds from securities sold short | | 922,445 | | (3,067,049) |

| |

| |

|

| Cash Flows from Financing Activites ($): | | | | |

| Net Beneficial Interest transactions | | | | 3,107,564 |

| Increase in cash | | | | 40,515 |

| Cash at beginning of period | | | | — |

| Cash at end of period | | | | 40,515 |

| |

| |

|

| Reconciliation of Net Increase in Net Assets Resulting | | |

| from Operations to Net Cash Provided by Operating Activities | | |

| Net decrease in Net Assets Resulting from Operations | | | | (6,918) |

| |

| |

|

| Adjustments to reconcile net increase in net assets resulting | | |

| from operations to net cash used by operating activities ($): | | |

| Increase in administrative and accrued expenses | | | | 27,435 |

| Increase in due from The Dreyfus Corporation | | | | (25,602) |

| Net realized gains on investments | | | | (25) |

| Net unrealized depreciation on investments | | | | 6,127 |

| Increase in dividends and interest receivable | | | | (1,017) |

| Net Cash Provided by Operating Activities | | | | — |

See notes to financial statements.

12

STATEMENT OF CHANGES IN NET ASSETS

From October 18, 2007 (commencement of operations) to October 31, 2007

| Operations ($): | | |

| Investment (loss)—net | | (816) |

| Net realized gain (loss) on investments | | 25 |

| Net unrealized appreciation (depreciation) on investments | | (6,127) |

| Net Increase (Decrease) in Net Assets | | |

| Resulting from Operations | | (6,918) |

| |

|

| Beneficial Interest Transactions ($): | | |

| Net proceeds from shares sold: | | |

| Class A | | 2,207,564 |

| Class C | | 300,000 |

| Class I | | 300,000 |

| Class T | | 300,000 |

| Increase (Decrease) in Net Assets from | | |

| Beneficial Interest Transactions | | 3,107,564 |

| Total Increase (Decrease) in Net Assets | | 3,100,646 |

| |

|

| Net Assets ($): | | |

| End of Period | | 3,100,646 |

| |

|

| Capital Share Transactions (Shares): | | |

| Class A | | |

| Shares sold | | 176,661 |

| Net Increase (Decrease) in Shares Outstanding | | 176,661 |

| |

|

| Class C | | |

| Shares sold | | 24,000 |

| Net Increase (Decrease) in Shares Outstanding | | 24,000 |

| |

|

| Class I | | |

| Shares sold | | 24,000 |

| Net Increase (Decrease) in Shares Outstanding | | 24,000 |

| |

|

| Class T | | |

| Shares sold | | 24,000 |

| Net Increase (Decrease) in Shares Outstanding | | 24,000 |

See notes to financial statements.

The Fund 13

FINANCIAL HIGHLIGHTS

The following table describes the performance for each share class for the period from October 18, 2007 (commencement of operations) to October 31, 2007. All information (except portfolio turnover rate) reflects financial results for a single fund share. Total return shows how much your investment in the fund would have increased (or decreased) during the period, assuming you had reinvested all dividends and distributions.These figures have been derived from the fund’s financial statements.

| | | Class A | | Class C | | Class I | | Class T |

| | | Shares | | Shares | | Shares | | Shares |

| |

| |

| |

| |

|

| Per Share Data ($): | | | | | | | | |

| Net asset value, beginning of period | | 12.50 | | 12.50 | | 12.50 | | 12.50 |

| Investment Operations: | | | | | | | | |

| Investment (loss)—net a | | (.00)b | | (.01) | | (.00)b | | (.00)b |

| Net realized and unrealized | | | | | | | | |

| gain (loss) on investments | | (.03) | | (.02) | | (.03) | | (.03) |

| Total from Investment Operations | | (.03) | | (.03) | | (.03) | | (.03) |

| Net asset value, end of period | | 12.47 | | 12.47 | | 12.47 | | 12.47 |

| |

| |

| |

| |

|

| Total Return (%) c | | (.24) | | (.24) | | (.24) | | (.24) |

| |

| |

| |

| |

|

| Ratios/Supplemental Data (%): | | | | | | | | |

| Ratio of total expenses | | | | | | | | |

| to average net assets d | | 25.89 | | 26.52 | | 25.52 | | 26.02 |

| Ratio of net expenses | | | | | | | | |

| to average net assets d | | 1.60 | | 2.35 | | 1.35 | | 1.85 |

| Ratio of net investment (loss) | | | | | | | | |

| to average net assets d | | (.63) | | (1.38) | | (.38) | | (.88) |

| Portfolio Turnover Rate c | | .12 | | .12 | | .12 | | .12 |

| |

| |

| |

| |

|

| Net Assets, end of period ($ x 1,000) | | 2,203 | | 299 | | 299 | | 299 |

| a | | Based on average shares outstanding at each month end. |

| b | | Amount represents less than $.01. |

| c | | Not annualized. |

| d | | Annualized. |

| See notes to financial statements. |

14

NOTES TO FINANCIAL STATEMENTS

NOTE 1—Significant Accounting Policies:

Dreyfus Premier 130/30 Growth Fund (the “fund”) is a separate diversified series of The Dreyfus/Laurel Funds Trust (the “Trust”), which is registered under the Investment Company Act of 1940, as amended (the “Act”), as an open-end management investment company and operates as a series company currently offering eight series, including the fund which commenced operations on October 18, 2007.The fund’s investment objective seeks capital appreciation.The Dreyfus Corporation (the “Manager” or “Dreyfus”) serves as the fund’s investment adviser. Dreyfus is wholly-owned subsidiary of The Bank of New York Mellon Corporation (“BNY Mellon”). Mellon Capital Management Corporation (“Mellon Capital”) an affiliate of BNY Mellon, serves as the fund’s sub-investment adviser.

MBSC Securities Corporation (the “Distributor”), a wholly-owned subsidiary of Dreyfus is the distributor of the fund’s shares.The fund is authorized to issue an unlimited number of shares of Beneficial Interest in each of the following classes of shares: Class A, Class C, Class I and Class T. Class A and Class C shares are sold primarily to retail investors through financial intermediaries and bear a distribution fee and/or service fee. Class A shares are sold with a front-end sales charge, while Class C shares are subject to a contingent deferred sales charge (“CDSC”). Class I shares are sold primarily to bank trust departments and other financial service providers (including Mellon Bank, N.A. and its affiliates) acting on behalf of customers having a qualified trust or investment account or relationship at such institution, and bear no distribution or service fees. Class I shares are offered without a front-end sales charge or CDSC. Each class of shares has identical rights and privileges, except with respect to distribution and service fees and voting rights on matters affecting a single class. Income, expenses (other than expenses attributable to a specific class), and realized and unrealized gains or losses on investments are allocated to each class of shares based on its relative net assets.

The Fund 15

NOTES TO FINANCIAL STATEMENTS (continued)

As of October 31, 2007, MBC Investments Corp., an indirect subsidiary of BNY Mellon, held 168,000 Class A shares and all of the outstanding Class C, Class I and Class T shares of the fund.

The Trust accounts separately for the assets, liabilities and operations of each series. Expenses directly attributable to each series are charged to that series’ operations; expenses which are applicable to all series are allocated among them on a pro rata basis.

The fund’s financial statements are prepared in accordance with U.S. generally accepted accounting principles, which may require the use of management estimates and assumptions. Actual results could differ from those estimates.

The fund enters into contracts that contain a variety of indemnifications. The fund’s maximum exposure under these arrangements is unknown.The fund does not anticipate recognizing any loss related to these arrangements.

(a) Portfolio valuation: Investments in securities (including options) are valued at the last sales price on the securities exchange or national securities market on which such securities are primarily traded. Securities listed on the National Market System for which market quotations are available are valued at the official closing price or, if there is no official closing price that day, at the last sale price. Securities not listed on an exchange or the national securities market, or securities for which there were no transactions, are valued at the average of the most recent bid and asked prices, except for open short positions, where the asked price is used for valuation purposes. Bid price is used when no asked price is available. Registered open-end investment companies that are not traded on an exchange are valued at their net asset value. When market quotations or official closing prices are not readily available, or are determined not to reflect accurately fair value, such as when the value of a security has been significantly affected by events after the close of the exchange or market on which the security is principally traded (for example, a foreign exchange or market), but before the fund

16

calculates its net asset value, the fund may value these investments at fair value as determined in accordance with the procedures approved by the Board of Trustees. Fair valuing of securities may be determined with the assistance of a pricing service using calculations based on indices of domestic securities and other appropriate indicators, such as prices of relevant ADR’s and futures contracts. For other securities that are fair valued by the Board of Trustees, certain factors may be considered such as: fundamental analytical data, the nature and duration of restrictions on disposition, an evaluation of the forces that influence the market in which the securities are purchased and sold, and public trading in similar securities of the issuer or comparable issuers. Financial futures are valued at the last sales price.

The Financial Accounting Standards Board (“FASB”) released Statement of Financial Accounting Standards No. 157 “Fair Value Measurements” (“FAS 157”). FAS 157 establishes an authoritative definition of fair value, sets out a framework for measuring fair value, and requires additional disclosures about fair-value measurements.The application of FAS 157 is required for fiscal years beginning after November 15, 2007 and interim periods within those fiscal years. Management does not believe that the application of this standard will have a material impact on the financial statements of the fund.

(b) Securities transactions and investment income: Securities transactions are recorded on a trade date basis. Realized gains and losses from securities transactions are recorded on the identified cost basis. Dividend income is recognized on the ex-dividend date and interest income, including, where applicable, accretion of discount and amortization of premium on investments, is recognized on the accrual basis.

The fund has an arrangement with the custodian bank whereby the fund receives earnings credits from the custodian when positive cash balances are maintained, which are used to offset custody fees. For financial reporting purposes, the fund includes net earnings credits as an expense offset in the Statement of Operations.

The Fund 17

NOTES TO FINANCIAL STATEMENTS (continued)

(c) Affiliated issuers: Investments in other investment companies advised by Dreyfus are defined as “affiliated” in the Act.

(d) Concentration of risk: The fund enters into short sales. Short sales involve selling a security the fund does not own in anticipation that the security’s price will decline. Short sales may involve substantial risk and “leverage.”The fund may be required to buy the security sold short at a time when the security has appreciated in value, thus resulting in a loss to the fund. Short positions in stocks involve more risk than long positions in stocks. In theory, stocks sold short have unlimited risk.

(e) Dividends to shareholders: Dividends are recorded on the ex-dividend date. Dividends from investment income-net and dividends from net realized capital gains, if any, are normally declared and paid annually, but the fund may make distributions on a more frequent basis to comply with the distribution requirements of the Internal Revenue Code of 1986, as amended (the “Code”).To the extent that net realized capital gains can be offset by capital loss carryovers, it is the policy of the fund not to distribute such gains. Income and capital gain distributions are determined in accordance with income tax regulations, which may differ from U.S. generally accepted accounting principles.

(f) Federal income taxes: It is the policy of the fund to continue to qualify as a regulated investment company, if such qualification is in the best interests of its shareholders, by complying with the applicable provisions of the Code, and to make distributions of taxable income sufficient to relieve it from substantially all federal income and excise taxes.

The FASB released FASB Interpretation No. 48 “Accounting for Uncertainty in Income Taxes” (FIN 48). FIN 48 provides guidance for how uncertain tax positions should be recognized, measured, presented and disclosed in the financial statements. FIN 48 requires the evaluation of tax positions taken or expected to be taken in the course of preparing the fund’s tax returns to determine whether the tax positions are “more-likely-than-not” of being sustained by the applicable tax authority. Tax positions not deemed to meet the more-likely-than-not threshold would

18

be recorded as a tax benefit or expense in the current year.Adoption of FIN 48 is required for fiscal years beginning after December 15,2006 and is to be applied to all open tax years as of the effective date. Management does not believe that the application of this standard will have a material impact on the financial statements of the fund.

At October 31, 2007, the components of accumulated earnings on a tax basis were as follows: unrealized depreciation $6,127.

During the period ended October 31, 2007, as a result of permanent book to tax differences, primarily due to the tax treatment for net operating losses, the fund increased accumulated undistributed investment income-net by $816, decreased accumulated net realized gain (loss) on investments by $25 and decreased paid-in capital by $791. Net assets and net asset value per share were not affected by this reclassification.

NOTE 2—Investment Management Fee and Other Transactions With Affiliates:

(a) Pursuant to an Investment Management agreement between the Manager and the Trust, the Trust has agreed to pay the Manager a management fee computed at the annual rate of .85% of the value of the fund’s average daily net assets and is payable monthly.The Manager has contractually agreed, until October 31, 2008, to waive receipt of its fees and/or assume the expenses of the fund so that annual fund operating expenses (excluding Rule 12b-1 fees, shareholder services fees, taxes, interest, brokerage commissions, commitments fees on borrowings (such as interest charged by the fund’s prime broker, substitute dividend expenses on securities sold short and, extraordinary expenses) do not exceed 1.25% .The expense reimbursement, pursuant to the undertaking, amounted to $28,254 during the period ended October 31, 2007.

Pursuant to a Sub-Investment Advisory Agreement between Dreyfus and Mellon Capital, Dreyfus pays Mellon Capital an annual fee of 0.41% of the value of the fund’s average net assets, payable monthly.

The Fund 19

NOTES TO FINANCIAL STATEMENTS (continued)

(b) Each Trustee receives $45,000 per year, plus $6,000 for each joint Board meeting of The Dreyfus/Laurel Funds, Inc., The Trust and The Dreyfus/Laurel Tax-Free Municipal Funds, (collectively the “Dreyfus/Laurel Funds”) attended, $2,000 for separate in-person committee meetings attended which are not held in conjunction with a regularly scheduled Board meeting and $1,500 for Board meetings and separate committee meetings attended that are conducted by telephone and is reimbursed for travel and out-of-pocket expenses.With respect to Board meetings, the Chairman of the Board receives an additional 25% of such compensation (with the exception of reimbursable amounts). With respect to compensation committee meetings, the Chair of the compensation committee receives $900 per meeting and, with respect to audit committee meetings, the Chair of the audit committee receives $1,350 per meeting. In the event that there is an in-person joint meeting of the Dreyfus/Laurel Funds and Dreyfus High Yield Strategies Fund, the $2,000 or $1,500 fee, as applicable, will be allocated between the Dreyfus/Laurel Funds and Dreyfus High Yield Strategies Fund. These fees and expenses are changed and allocated to each series based on net assets.

(c) Under the Distribution Plan (the “Plan”) adopted pursuant to Rule 12b-1 under the Act, Class C and Class T shares pay the Distributor for distributing their shares at an annual rate of .75% of the value of the average daily net assets of Class C shares and .25% of the value of the average daily net assets of Class T shares. During the period ended October 31, 2007, Class C and Class T shares were charged $85 and $28, pursuant to the Plan.

(d) Under the Shareholder Services Plan, Class A, Class C and Class T shares pay the Distributor at an annual rate of .25% of the value of their average daily net assets for the provision of certain services.The services provided may include personal services relating to shareholder accounts, such as answering shareholder inquiries regarding the fund and providing reports and other information, and services related to the maintenance of shareholder accounts. The Distributor may make payments to Service Agents (a securities dealer, financial

20

institution or other industry professional) in respect of these services. The Distributor determines the amounts to be paid to Service Agents. During the period ended October 31, 2007, Class A, Class C and Class T shares were charged $206, $28 and $28, respectively, pursuant to the Shareholder Services Plan.

The fund compensates Dreyfus Transfer, Inc., a wholly-owned subsidiary of Dreyfus, under a transfer agency agreement for providing personnel and facilities to perform transfer agency services for the fund. During the period ended October 31, 2007, the fund was charged $12 pursuant to the transfer agency agreement.

The fund compensates Mellon Bank, N.A., an affiliate of Dreyfus, under a custody agreement for providing custodial services for the fund. During the period ended October 31, 2007, the fund was charged $875 pursuant to the custody agreement.

During the period ended October 31, 2007, the fund was charged $402 for services performed by the Chief Compliance Officer.

The components of “Due from The Dreyfus Corporation and affiliates” in the Statement of Assets and Liabilities consist of: an expense reimbursement of $28,254, which is offset by management fees $988, Rule 12b-1 distribution plan fees $113, shareholder services plan fees $262, custodian fees $875, chief compliance officer fees $402 and transfer agency per account fees $12.

(e) Prime broker fees charged on the fund are included in interest expense.

NOTE 3—Securities Transactions:

The following summarizes the aggregate amount of purchases and sales of investment securities and securities sold short, excluding short-term securities, during the period ended October 31, 2007:

| | | Purchases ($) | | Sales ($) |

| |

| |

|

| Long transactions | | 3,994,244 | | 4,750 |

| Short sale transactions | | — | | 922,445 |

| Total | | 3,994,244 | | 927,195 |

The Fund 21

NOTES TO FINANCIAL STATEMENTS (continued)

The fund is engaged in short-selling which obligates the fund to replace the security borrowed by purchasing the security at current market value.The fund would incur a loss if the price of the security increases between the date of the short sale and the date on which the fund replaces the borrowed security. The fund would realize a gain if the price of the security declines between those dates. Until the fund replaces the borrowed security, the fund will maintain daily a segregated account with a broker or custodian, of permissible liquid assets sufficient to cover its short position. Securities sold short at October 31, 2007, and their related market values and proceeds are set forth in the Statement of Securities Sold Short.

At October 31, 2007, the cost of investments for federal income tax purposes was $3,989,519; accordingly, accumulated net unrealized depreciation on investments was $4,516, consisting of $90,793 gross unrealized appreciation and $95,309 gross unrealized depreciation.

22

| REPORT OF INDEPENDENT REGISTERED |

| PUBLIC ACCOUNTING FIRM |

The Board of Trustees and Shareholders of The Dreyfus/Laurel Funds Trust:

We have audited the accompanying statement of assets and liabilities of Dreyfus Premier 130/30 Growth Fund (the “Fund”) of The Dreyfus/Laurel Funds Trust, including the statements of investments and securities sold short, as of October 31, 2007, and the related statements of operations, cash flows, changes in net assets, and the financial highlights for the period from October 18, 2007 (commencement of operations) to October 31, 2007.These financial statements and financial highlights are the responsibility of the Fund’s management. Our responsibility is to express an opinion on these financial statements and financial highlights based on our audit.

We conducted our audit in accordance with the standards of the Public Company Accounting Oversight Board (United States).Those standards require that we plan and perform the audit to obtain reasonable assurance about whether the financial statements and financial highlights are free of material misstatement. An audit includes examining, on a test basis, evidence supporting the amounts and disclosures in the financial statements. Our procedures included confirmation of securities owned as of October 31, 2007, by correspondence with the custodian.An audit also includes assessing the accounting principles used and significant estimates made by management, as well as evaluating the overall financial statement presentation.We believe that our audit provides a reasonable basis for our opinion.

In our opinion, the financial statements and financial highlights referred to above present fairly, in all material respects, the financial position of Dreyfus Premier 130/30 Growth Fund of The Dreyfus/Laurel Funds Trust as of October 31, 2007, results of its operations, its cash flows, changes in its net assets and its financial highlights for the period from October 18, 2007 to October 31, 2007, in conformity with U.S. generally accepted accounting principles.

| | New York, New York

December 20, 2007

|

The Fund 23

| INFORMATION ABOUT THE REVIEW AND APPROVAL |

| OF THE FUND’S MANAGEMENT AGREEMENT (Unaudited) |

At a meeting of the fund’s Board of Trustees held on April 25-26, 2007, the Board considered the approval, through its renewal date of April 4, 2009, of the fund’s Management Agreement (“Management Agreement”), pursuant to which the Manager will provide the fund with investment advisory services and administrative services and the Sub-Investment Advisory Agreement between the Manager and Mellon Capital Management Corporation (“Mellon Capital”), an affiliate of the Manager, with respect to the fund, pursuant to which Mellon Capital provides day-to-day management of the fund’s investments subject to the Manager’s oversight.The Board members, none of whom are “interested persons” (as defined in the Investment Company Act of 1940, as amended) of the fund, were assisted in their review by independent legal counsel and met with counsel in executive session separate from representatives of the Manager and Mellon Capital.

Analysis of Nature, Extent and Quality of Services Provided to the Fund.The Board members considered information previously provided to them in a presentation from representatives of the Manager regarding services provided to other funds in the Dreyfus fund complex, and representatives of the Manager confirmed that there had been no material changes in this information. The Board also discussed the nature, extent and quality of the services to be provided to the fund pursuant to its Management Agreement and by Mellon Capital pursuant to the Sub-Investment Advisory Agreement. The Board members also referenced information provided and discussions at previous meetings regarding the relationships the Manager has with various intermediaries and the different needs of each, the diversity of distribution among the funds in the Dreyfus fund complex, and the Manager’s corresponding need for broad, deep and diverse resources to be able to provide ongoing shareholder services to the different distribution channels.

The Board members considered the Manager’s and Mellon Capital’s research and portfolio management capabilities. The Board members also considered that the Manager also provides oversight of day-to-day fund operations,including fund accounting and administration and assis-

24

tance in meeting legal and regulatory requirements, and the Manager’s extensive administrative, accounting and compliance infrastructure, as well as the Manager’s supervisory activities over Mellon Capital.

Comparative Analysis of the Fund’s Performance and Management Fee and Expense Ratio. As the fund had not yet commenced operations, the Board members were not able to review the fund’s performance. The Board discussed with representatives of the Manager the portfolio management team and the fund’s investment objective and policies.

The Board members reviewed and placed significant emphasis on comparisons of the proposed advisory fee to those of funds in the Lipper Long/Short Equity Funds category. The fund’s contractual management fee was below the ranges of the average and median contractual advisory or adviser/administration fees of the funds in the category (both with and without any fee waivers and reimbursements). The fund’s total expense ratio (as limited through October 31, 2008 by agreement with the Manager) was below the average and median for the category (net of any fee waivers and reimbursements).

Representatives of the Manager reviewed with the Board members the fees paid to the Manager or its affiliates by the only mutual fund managed by the Manager or its affiliates included in the Lipper Long/Short Equity Funds category (the “Similar Fund”). Representatives of the Manager provided the Board members with fee information for other accounts managed by Mellon Capital with similar policies and strategies as the fund (the “Similar Accounts”).The Manager’s representatives explained the nature of the Similar Accounts and the differences, from Mellon Capital’s perspective, in providing services to certain of the Similar Accounts as compared to managing and providing services to the fund.The Board members analyzed differences in fees paid to the Manager or Mellon Capital and discussed the relationship of the advisory fees paid in light of the services to be provided.The Board members considered the relevance of the fee information provided for the Similar Fund and Similar Accounts to evaluate the appropri-

The Fund 25

| INFORMATION ABOUT THE REVIEW AND APPROVAL OF THE |

| FUND’S MANAGEMENT AGREEMENT (Unaudited) (continued) |

ateness and reasonableness of the fund’s management fee and sub-investment advisory fee.The Board acknowledged that differences in fees paid by the Similar Accounts seemed to be consistent with the services to be provided.

The Board considered the proposed fee to Mellon Capital in relation to the fee to be paid to the Manager and the respective services to be provided by Mellon Capital and the Manager. The Board also noted that Mellon Capital’s fee would be paid by the Manager and not the fund.

Analysis of Profitability and Economies of Scale. As the fund had not yet commenced operations, the Manager’s representatives were not able to review the dollar amount of expenses allocated and profit received by the Manager.The Board members also considered potential benefits to the Manager or Mellon Capital from acting as investment adviser and sub-investment adviser, respectively, and noted the possibility of future soft dollar arrangements with respect to trading the fund’s portfolio.The Board also considered whether the fund would be able to participate in any economies of scale that the Manager may experience in the event that the fund attracts a large amount of assets. The Board members noted the uncertainty of the estimated asset levels and discussed the renewal requirements for advisory agreements and their ability to review the management fee annually after an initial term of the Management Agreement.

At the conclusion of these discussions, the Board agreed that it had been furnished with sufficient information to make an informed business decision with respect to approving the fund’s Management Agreement and Sub-Investment Advisory Agreement. Based on the discussions and considerations as described above, the Board made the following conclusions and determinations.

- The Board concluded that the nature, extent and quality of the ser- vices to be provided by the Manager and Mellon Capital are adequate and appropriate.

26

- The Board concluded that the fee to be paid by the fund to the Manager was reasonable, in light of the services to be provided, com- parative expense and advisory fee information, and benefits anticipated to be derived by the Manager or Mellon Capital from its relationship with the fund and that the fee to be paid by the Manager to Mellon Capital is reasonable and appropriate.

- The Board determined that since the fund had not commenced oper- ations, economies of scale were not a factor, but, to the extent that material economies of scale are not shared with the fund in the future, the Board would seek to do so in connection with future renewals.

The Board members considered these conclusions and determinations, and, without any one factor being dispositive, the Board determined that approval of the fund’s Management Agreement and Sub-Investment Advisory Agreement was in the best interests of the fund and its shareholders.

The Fund 27

BOARD MEMBERS INFORMATION (Unaudited)

Joseph S. DiMartino (64) Chairman of the Board (1999)

| Principal Occupation During Past 5 Years: |

| • Corporate Director and Trustee |

| Other Board Memberships and Affiliations: |

| • The Muscular Dystrophy Association, Director |

| • Century Business Services, Inc., a provider of outsourcing functions for small and medium size |

| companies, Director |

| • The Newark Group, a provider of a national market of paper recovery facilities, paperboard |

| mills and paperboard converting plants, Director |

| • Sunair Services Corporation, a provider of certain outdoor-related services to homes and |

| businesses, Director |

| No. of Portfolios for which Board Member Serves: 165 |

| James M. Fitzgibbons (73) |

| Board Member (1994) |

| Principal Occupation During Past 5 Years: |

| • Chairman of the Board, Davidson Cotton Company (1998-2002) |

| Other Board Memberships and Affiliations: |

| • Bill Barrett Company, an oil and gas exploration company, Director |

| No. of Portfolios for which Board Member Serves: 26 |

J. Tomlinson Fort (79) Board Member (1994)

| Principal Occupation During Past 5 Years: |

| • Retired (2005-present) |

| • Of Counsel, Reed Smith LLP (1998-2005) |

| Other Board Memberships and Affiliations: |

| • Allegheny College, Emeritus Trustee |

| • Pittsburgh Ballet Theatre,Trustee |

| • American College of Trial Lawyers, Fellow |

| No. of Portfolios for which Board Member Serves: 26 |

Kenneth A. Himmel (61) Board Member (1994)

| Principal Occupation During Past 5 Years: |

| • President and CEO,Related Urban Development,a real estate development company (1996-present) |

| • President and CEO, Himmel & Company, a real estate development company (1980-present) |

| • CEO, American Food Management, a restaurant company (1983-present) |

| No. of Portfolios for which Board Member Serves: 26 |

28

| Stephen J. Lockwood (60) |

| Board Member (1994) |

| Principal Occupation During Past 5 Years: |

| • Chairman of the Board, Stephen J. Lockwood and Company LLC, an investment company |

| (2000-present) |

| No. of Portfolios for which Board Member Serves: 26 |

| Roslyn M. Watson (58) |

| Board Member (1994) |

| Principal Occupation During Past 5 Years: |

| • Principal,Watson Ventures, Inc., a real estate investment company (1993-present) |

| Other Board Memberships and Affiliations: |

| • American Express Bank, Director |

| • The Hyams Foundation Inc., a Massachusetts Charitable Foundation,Trustee |

| • National Osteoporosis Foundation,Trustee |

| No. of Portfolios for which Board Member Serves: 26 |

| Benaree Pratt Wiley (61) |

| Board Member (1998) |

| Principal Occupation During Past 5 Years: |

| • Principal,The Wiley Group, a firm specializing in strategy and business development |

| (2005-present) |

| • President and CEO,The Partnership, an organization dedicated to increasing the representa- |

| tion of African Americans in positions of leadership, influence and decision-making in |

| Boston, MA (1991-2005) |

| Other Board Memberships and Affiliations: |

| • Boston College,Trustee |

| • Blue Cross Blue Shield of Massachusetts, Director |

| • Commonwealth Institute, Director |

| • Efficacy Institute, Director |

| • PepsiCo African-American, Advisory Board |

| • The Boston Foundation, Director |

| • Harvard Business School Alumni Board, Director |

| No. of Portfolios for which Board Member Serves: 36 |

Once elected all Board Members serve for an indefinite term, but achieve Emeritus status upon reaching age 80.The address of the Board Members and Officers is in c/o The Dreyfus Corporation, 200 Park Avenue, New York, New York 10166. Additional information about the Board Members is available in the fund’s Statement of Additional Information which can be obtained from Dreyfus free of charge by calling this toll free number: 1-800-554-4611.

Francis P. Brennan, Emeritus Board Member

The Fund 29

OFFICERS OF THE FUND (Unaudited)

| J. DAVID OFFICER, President since |

| December 2006. |

Chief Operating Officer,Vice Chairman and a Director of the Manager, and an officer of 82 investment companies (comprised of 165 portfolios) managed by the Manager. He is 59 years old and has been an employee of the Manager since April 1998.

| PHILLIP N. MAISANO, Executive Vice |

| President since July 2007. |

Chief Investment Officer,Vice Chair and a director of the Manager, and an officer of 82 investment companies (comprised of 165 portfolios) managed by the Manager. Mr. Maisano also is an officer and/or Board member of certain other investment management subsidiaries of The Bank of New York Mellon Corporation, each of which is an affiliate of the Manager. He is 60 years old and has been an employee of the Manager since November 2006. Prior to joining the Manager, Mr. Maisano served as Chairman and Chief Executive Officer of EACM Advisors, an affiliate of the Manager, since August 2004, and served as Chief Executive Officer of Evaluation Associates, a leading institutional investment consulting firm, from 1988 until 2004.

| MICHAEL A. ROSENBERG, Vice President |

| and Secretary since August 2005. |

Associate General Counsel of the Manager, and an officer of 83 investment companies (comprised of 182 portfolios) managed by the Manager. He is 47 years old and has been an employee of the Manager since October 1991.

| JAMES BITETTO, Vice President and |

| Assistant Secretary since August 2005. |

Associate General Counsel and Secretary of the Manager, and an officer of 83 investment companies (comprised of 182 portfolios) managed by the Manager. He is 41 years old and has been an employee of the Manager since December 1996.

| JONI LACKS CHARATAN, Vice President |

| and Assistant Secretary since |

| August 2005. |

Associate General Counsel of the Manager, and an officer of 83 investment companies (comprised of 182 portfolios) managed by the Manager. She is 51 years old and has been an employee of the Manager since October 1988.

| JOSEPH M. CHIOFFI, Vice President and |

| Assistant Secretary since August 2005. |

Associate General Counsel of the Manager, and an officer of 83 investment companies (comprised of 182 portfolios) managed by the Manager. He is 45 years old and has been an employee of the Manager since June 2000.

| JANETTE E. FARRAGHER, Vice President |

| and Assistant Secretary since |

| August 2005. |

Associate General Counsel of the Manager, and an officer of 83 investment companies (comprised of 182 portfolios) managed by the Manager. She is 44 years old and has been an employee of the Manager since February 1984.

| JOHN B. HAMMALIAN, Vice President and |

| Assistant Secretary since August 2005. |

Associate General Counsel of the Manager, and an officer of 83 investment companies (comprised of 182 portfolios) managed by the Manager. He is 44 years old and has been an employee of the Manager since February 1991.

| ROBERT R. MULLERY, Vice President and |

| Assistant Secretary since August 2005. |

Associate General Counsel of the Manager, and an officer of 83 investment companies (comprised of 182 portfolios) managed by the Manager. He is 55 years old and has been an employee of the Manager since May 1986.

30

| JEFF PRUSNOFSKY, Vice President and |

| Assistant Secretary since August 2005. |

Associate General Counsel of the Manager, and an officer of 83 investment companies (comprised of 182 portfolios) managed by the Manager. He is 42 years old and has been an employee of the Manager since October 1990.

| JAMES WINDELS, Treasurer since |

| November 2001. |

Director – Mutual Fund Accounting of the Manager, and an officer of 83 investment companies (comprised of 182 portfolios) managed by the Manager. He is 49 years old and has been an employee of the Manager since April 1985.

| ROBERT ROBOL, Assistant Treasurer |

| since December 2002. |

Senior Accounting Manager – Money Market and Municipal Bond Funds of the Manager, and an officer of 83 investment companies (comprised of 182 portfolios) managed by the Manager. He is 43 years old and has been an employee of the Manager since October 1988.

| ROBERT SALVIOLO, Assistant Treasurer |

| since July 2007. |

Senior Accounting Manager – Equity Funds of the Manager, and an officer of 83 investment companies (comprised of 182 portfolios) managed by the Manager. He is 40 years old and has been an employee of the Manager since June 1989.

| ROBERT SVAGNA, Assistant Treasurer |

| since December 2002. |

Senior Accounting Manager – Equity Funds of the Manager, and an officer of 83 investment companies (comprised of 182 portfolios) managed by the Manager. He is 40 years old and has been an employee of the Manager since November 1990.

| GAVIN C. REILLY, Assistant Treasurer |

| since December 2005. |

Tax Manager of the Investment Accounting and Support Department of the Manager, and an officer of 83 investment companies (comprised of 182 portfolios) managed by the Manager. He is 39 years old and has been an employee of the Manager since April 1991.

| JOSEPH W. CONNOLLY, Chief Compliance |

| Officer since October 2004. |

Chief Compliance Officer of the Manager and The Dreyfus Family of Funds (83 investment companies, comprised of 182 portfolios). From November 2001 through March 2004, Mr. Connolly was first Vice-President, Mutual Fund Servicing for Mellon Global Securities Services. In that capacity, Mr. Connolly was responsible for managing Mellon’s Custody, Fund Accounting and Fund Administration services to third-party mutual fund clients. He is 50 years old and has served in various capacities with the Manager since 1980, including manager of the firm’s Fund Accounting Department from 1997 through October 2001.

| WILLIAM GERMENIS, Anti-Money |

| Laundering Compliance Officer since |

| July 2002. |

Vice President and Anti-Money Laundering Compliance Officer of the Distributor, and the Anti-Money Laundering Compliance Officer of 79 investment companies (comprised of 178 portfolios) managed by the Manager. He is 37 years old and has been an employee of the Distributor since October 1998.

The Fund 31

NOTES

Save time. Save paper. View your next shareholder report online as soon as it’s available. Log into www.dreyfus.com and sign up for Dreyfus eCommunications. It’s simple and only takes a few minutes.

The views expressed in this report reflect those of the portfolio manager only through the end of the period covered and do not necessarily represent the views of Dreyfus or any other person in the Dreyfus organization. Any such views are subject to change at any time based upon market or other conditions and Dreyfus disclaims any responsibility to update such views.These views may not be relied on as investment advice and, because investment decisions for a Dreyfus fund are based on numerous factors, may not be relied on as an indication of trading intent on behalf of any Dreyfus fund.

Not FDIC-Insured • Not Bank-Guaranteed • May Lose Value

| Contents |

| |

| | | THE FUND |

| |

|

| 2 | | Discussion of Fund Performance |

| 4 | | Understanding Your Fund’s Expenses |

| 4 | | Comparing Your Fund’s Expenses |

| With Those of Other Funds |

| 5 | | Statement of Investments |

| 9 | | Statement of Assets and Liabilities |

| 10 | | Statement of Operations |

| 11 | | Statement of Changes in Net Assets |

| 12 | | Financial Highlights |

| 13 | | Notes to Financial Statements |

| 22 | | Report of Independent Registered |

| | | Public Accounting Firm |

| 23 | | Information About the Review and |

| | | Approval of the Fund’s Investment |

| Management Agreement |

| 27 | | Board Members Information |

| 29 | | Officers of the Fund |

| FOR MORE INFORMATION |

|

| | | Back Cover |

The Fund

| Dreyfus Premier |

| Global Equity |

| Income Fund |

DISCUSSION OF FUND PERFORMANCE

For the period between October 18, 2007 and October 31, 2007 as provided by James Harries, Portfolio Manager, Newton Capital Management Limited is the Sub-Investment Adviser

Please note, due to the short period of existence since the fund’s inception on October 18, 2007, through the annual reporting period ended October 31, 2007, the discussion of fund performance is limited and will be discussed more extensively in the next semiannual report dated April 30, 2008.

Fund and Market Performance Overview

The fund was launched on October 18, 2007, and therefore the period under review is very short. Over that time the fund performed strongly relative to world equity markets.This was a result of strong stock selection and asset allocation.

From the fund’s inception on October 18, 2007, through the end of the reporting period on October 31, 2007, Dreyfus Premier Global Equity Income Fund produced total returns of 5.04% for Class A shares, 4.96% for Class C shares, 5.04% for Class I shares and 5.04% for Class T shares.1 In comparison, the FTSEX World Index, the fund’s benchmark, produced a total return of 2.02% for the same period.2

The Fund’s Investment Approach

The fund seeks total return (consisting of capital appreciation and income). The fund normally invests at least 80% of its assets in equity securities.The fund seeks to focus on dividend-paying stocks of companies located in developed capital markets.The fund ordinarily invests in at least in three countries, and, at times, may invest a substantial portion of its assets in a single country.The fund’s portfolio manager will typically purchase stocks that, at the time of purchase, have a yield of at least 50% more than the yield of the FTSE World Index. In choosing stocks, the portfolio manager considers key trends to global

2

economic variables, such as gross domestic product, inflation and interest rates; investment themes, such as changing demographics, the impact of new technologies and the globalization of industries and brands; relative values of equity securities, bonds and cash; company fundamentals; and long-term trends in currency movements.

The entire portfolio was established in the period under review. The fund has limited exposure to the U.S. equity market and currency which allows it to have greater exposure to countries and currencies that we perceive to offer better value. Companies did well during the short period in areas including Brazilian oil, Hong Kong conglomerates and U.S. pharmaceuticals.

The Fund’s Current Strategy

The fund draws on Newton’s global thematic investment process to try to achieve its investment objective. Key overweights during the period included, telecommunications, oil and gas and mining. Sectors that had limited exposure within the fund included banks and retailers.

November 15, 2007

| 1 | | Total return includes reinvestment of dividends and any capital gains paid, and does not take into |

| | | consideration the maximum initial sales charges in the case of Class A and Class T shares, or the |

| | | applicable contingent deferred sales charges imposed on redemptions in the case of Class C shares. |

| | | Had these charges been reflected, returns would have been lower. Past performance is no guarantee |

| | | of future results. Share price and investment return fluctuate such that upon redemption, fund |

| | | shares may be worth more or less than their original cost. Return figures provided reflect the |

| | | absorption of certain fund expenses by The Dreyfus Corporation pursuant to an agreement in |

| | | effect until October 31, 2008. Had these expenses not been absorbed, the fund’s returns would |

| | | have been lower. |

| 2 | | SOURCE: Bloomberg. – Reflects reinvestment of dividends and, where applicable, capital gain |

| | | distributions.The FTSE World Index is a widely accepted, unmanaged free-float market |

| | | capitalization-weighted index that is designed to measure the performance of 90% of the |

| | | world’s investable stocks issued by large and mid-cap companies in developed and advanced |

| | | emerging markets. |

The Fund 3

UNDERSTANDING YOUR FUND’S EXPENSES (Unaudited)

As a mutual fund investor, you pay ongoing expenses, such as management fees and other expenses. Using the information below, you can estimate how these expenses affect your investment and compare them with the expenses of other funds.You also may pay one-time transaction expenses, including sales charges (loads) and redemption fees, which are not shown in this section and would have resulted in higher total expenses. For more information, see your fund’s prospectus or talk to your financial adviser.

Review your fund’s expenses

The table below shows the expenses you would have paid on a $1,000 investment in Dreyfus Premier Global Equity Income Fund from October 18, 2007 (commencement of operations) to October 31, 2007. It also shows how much a $1,000 investment would be worth at the close of the period, assuming actual returns and expenses.

| Expenses and Value of a $1,000 Investment | | | | | | | | | | |

| assuming actual returns for the period ended October 31, 2007 † | | | | | | | | |

| | | Class A | | Class C | | | | Class I | | | | Class T |

| |

| |

| |

| |

| |

| |

|

| Expenses paid per $1,000 †† | | $ .59 | | $ .88 | | $ | | .49 | | $ | | .69 |

| Ending value (after expenses) | | $1,050.40 | | $1,049.60 | | $1,050.40 | | $1,050.40 |

| COMPARING YOUR FUND’S EXPENSES |

| WITH THOSE OF OTHER FUNDS (Unaudited) |

Using the SEC’s method to compare expenses

The Securities and Exchange Commission (SEC) has established guidelines to help investors assess fund expenses. Per these guidelines, the table below shows your fund’s expenses based on a $1,000 investment, assuming a hypothetical 5% annualized return. You can use this information to compare the ongoing expenses (but not transaction expenses or total cost) of investing in the fund with those of other funds.All mutual fund shareholder reports will provide this information to help you make this comparison. Please note that you cannot use this information to estimate your actual ending account balance and expenses paid during the period.

| Expenses and Value of a $1,000 Investment | | | | | | | | |

| assuming a hypothetical 5% annualized return for the period ended October 31, 2007 † | | |

| | | Class A | | Class C | | Class I | | | | Class T |

| |

| |

| |

| |

| |

|

| Expenses paid per $1,000 †† | | $ .58 | | $ .86 | | $ .48 | | $ | | .67 |

| Ending value (after expenses) | | $1,001.34 | | $1,001.05 | | $1,001.44 | | $1,001.25 |

| † | | From October 18, 2007 (commencement of operations) to October 31, 2007. |

| †† | | Expenses are equal to the fund’s annualized expense ratio of 1.50% for Class A, 2.25% for Class C, 1.25% for |

| | | Class I and 1.75% for Class T; multiplied by the average account value over the period, multiplied by 14/365 (to |

| | | reflect the actual days since inception). |

4

| STATEMENT OF INVESTMENTS |

| October 31, 2007 |

| Common Stocks—95.7% | | Shares | | Value ($) |

| |

| |

|

| Australia—4.5% | | | | |

| Telstra (Installment Receipts) | | 47,804 | | 142,733 |

| Brazil—10.1% | | | | |

| Companhia de Saneamento de Minas Gerais | | 3,300 | | 61,766 |

| Natura Cosmeticos | | 4,400 | | 52,707 |

| Petroleo Brasileiro, ADR (Preferred) | | 892 | | 74,205 |

| Tele Norte Leste Participacoes, ADR | | 2,737 | | 59,667 |

| Terna Participacoes | | 3,395 | | 66,477 |

| | | | | 314,822 |

| Canada—1.3% | | | | |

| Fording Canadian Coal Trust | | 1,107 | | 40,482 |

| France—5.1% | | | | |

| AXA | | 1,270 | | 56,762 |

| Societe Generale | | 280 | | 46,984 |

| Total | | 714 | | 57,547 |

| | | | | 161,293 |

| Germany—6.3% | | | | |

| Deutsche Post | | 3,664 | | 110,960 |

| Deutsche Wohnen | | 629 | | 27,876 |

| E.ON | | 307 | | 59,980 |

| | | | | 198,816 |

| Hong Kong—4.0% | | | | |

| Hopewell Highway Infrastructure | | 82,000 | | 77,544 |

| Swire Pacific, Cl. A | | 3,500 | | 50,118 |

| | | | | 127,662 |

| Italy—1.9% | | | | |

| ENI | | 1,618 | | 59,052 |

| Malaysia—2.6% | | | | |

| Bursa Malaysia | | 17,500 | | 83,131 |

The Fund 5

STATEMENT OF INVESTMENTS (continued)

| Common Stocks (continued) | | Shares | | Value ($) |

| |

| |

|

| Netherlands—4.3% | | | | |

| Royal Dutch Shell, Cl. A | | 1,391 | | 60,881 |

| Unilever | | 2,325 | | 75,394 |

| | | | | 136,275 |

| Norway—1.8% | | | | |

| NYA | | 1,717 | | 58,071 |

| Philippines—1.2% | | | | |

| First Gen | | 27,900 | | 38,950 |

| Russia—2.9% | | | | |

| Evraz Group, GDR | | 1,033 | | 77,504 |

| Uralkali, GDR | | 590 a | | 14,809 |

| | | | | 92,313 |

| Singapore—7.7% | | | | |

| DBS Group Holdings | | 3,000 | | 46,889 |

| Fortune REIT | | 24,000 | | 18,144 |

| Mapletree Logistics Trust | | 37,000 | | 30,877 |

| Parkway Holdings | | 19,000 | | 55,071 |

| Singapore Post | | 38,000 | | 32,255 |

| Singapore Technologies Engineering | | 23,000 | | 60,859 |

| | | | | 244,095 |

| South Korea—4.0% | | | | |

| Korea Exchange Bank | | 1,742 | | 29,021 |

| LG Telecom | | 8,924 a | | 97,347 |

| | | | | 126,368 |

| Spain—2.1% | | | | |

| Clinica Baviera | | 876 | | 31,388 |

| Telefonica | | 1,011 | | 33,370 |

| | | | | 64,758 |

| Switzerland—1.0% | | | | |

| Compagnie Financiere Richemont, Cl. A | | 445 | | 31,767 |

| Taiwan—3.1% | | | | |

| High Tech Computer | | 2,000 | | 41,541 |

6

| Common Stocks (continued) | | Shares | | Value ($) |

| |

| |

|

| Taiwan (continued) | | | | |

| Taiwan Semiconductor Manufacturing | | 28,000 | | 55,885 |

| | | | | 97,426 |

| Thailand—6.8% | | | | |

| Advanced Info Service | | 21,300 | | 60,117 |

| Bangkok Expressway | | 38,900 | | 30,577 |

| Banpu Public | | 4,600 | | 65,025 |

| Siam Commercial Bank | | 19,900 | | 59,684 |

| | | | | 215,403 |

| United Kingdom—15.2% | | | | |

| Admiral Group | | 1,504 | | 32,037 |

| Antofagasta Holdings | | 3,419 | | 58,099 |

| BP | | 4,778 | | 61,844 |

| Cable & Wireless | | 21,768 | | 88,067 |

| Immarsat | | 3,476 | | 36,761 |

| KT& G, GDR | | 1,422 b | | 57,150 |

| Old Mutual | | 13,120 | | 50,303 |

| Smiths Group | | 1,377 | | 32,232 |

| Vodafone Group | | 15,529 | | 60,877 |

| | | | | 477,370 |

| United States—9.8% | | | | |

| Altria Group | | 620 | | 45,217 |

| AT & T | | 767 | | 32,053 |

| Bristol-Myers Squibb | | 1,345 | | 40,337 |

| Eli Lilly & Co. | | 679 | | 36,768 |

| Merck & Co. | | 840 | | 48,938 |

| Pfizer | | 1,540 | | 37,899 |

| Reynolds American | | 1,072 | | 69,069 |

| | | | | 310,281 |

| Total Common Stocks | | | | |

| (cost $2,825,874) | | | | 3,021,068 |

The Fund 7

STATEMENT OF INVESTMENTS (continued)

| Preferred Stocks—1.5% | | Shares | | Value ($) |

| |

| |

|

| Italy | | | | |

| Unipol | | | | |

| (cost $42,870) | | 13,375 | | 47,846 |

| |

| |

|

| Total Investments (cost $2,868,744) | | 97.2% | | 3,068,914 |

| Cash and Receivables (Net) | | 2.8% | | 88,443 |

| Net Assets | | 100.0% | | 3,157,357 |

| ADR—American Depository Receipts |

| GDR—Global Depository Receipts |

| a Non-income producing security. |

| b Security is exempt from registration under Rule 144A of the Securities Act of 1933.This security may be resold in |

| transactions exempt from registration, normally to qualified institutional buyers. At October 31, 2007, this security |

| amounted to $57,150 or 1.8% of net assets. |

| Portfolio Summary | | (Unaudited) † | | | | |

| |

| | | Value (%) | | | | Value (%) |

| |

| |

| |

|

| Telecommunications | | 19.3 | | Consumer Goods | | 9.5 |

| Financial | | 17.8 | | Health Care | | 7.9 |

| Oil & Gas | | 11.8 | | Utilities | | 7.2 |

| Industrial | | 10.9 | | Technology | | 3.1 |

| Materials | | 9.7 | | | | 97.2 |

| † Based on net assets. |

| See notes to financial statements. |

8

| STATEMENT OF ASSETS AND LIABILITIES |

| October 31, 2007 |

| | | Cost | | Value |

| |

| |

|

| Assets ($): | | | | |

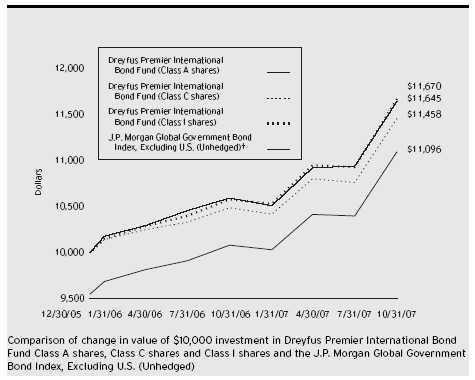

| Investments in securities-See Statement of Investments | | 2,868,744 | | 3,068,914 |