UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

Proxy Statement Pursuant to Section 14(a) of the

Securities Exchange Act of 1934

Filed by the Registrantx Filed by a Party other than the Registrant¨

Check the appropriate box:

| ¨ | Preliminary Proxy Statement |

| ¨ | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

| x | Definitive Proxy Statement |

| ¨ | Definitive Additional Materials |

| ¨ | Soliciting Material Pursuant to §240.14a-12 |

Lufkin Industries, Inc.

(Name of Registrant as Specified In Its Charter)

(Name of Person(s) Filing Proxy Statement, if other than the Registrant)

Payment of Filing Fee (Check the appropriate box):

| ¨ | Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11. |

| | (1) | Title of each class of securities to which transaction applies: |

| | (2) | Aggregate number of securities to which transaction applies: |

| | (3) | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined): |

| | (4) | Proposed maximum aggregate value of transaction: |

| ¨ | Fee paid previously with preliminary materials. |

| ¨ | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. |

| | (1) | Amount Previously Paid: |

| | (2) | Form, Schedule or Registration Statement No.: |

LUFKIN INDUSTRIES, INC.

Lufkin, Texas

NOTICE OF ANNUAL MEETING OF SHAREHOLDERS

To Be Held May 3, 2006

TO THE SHAREHOLDERS OF LUFKIN INDUSTRIES, INC.:

Notice is hereby given that the Annual Meeting of Shareholders of Lufkin Industries, Inc., a Texas corporation (the “Company”), will be held at the Museum of East Texas, 503 North Second, Lufkin, Texas 75901, on the 3rd day of May, 2006, at 9:00 a.m. local time, for the following purposes:

| | 1. | To elect one director to the Company’s board to serve until the annual shareholders’ meeting held in 2008 or until a successor has been elected and qualified; and |

| | 2. | To elect three directors to the Company’s board to serve until the annual shareholders’ meeting held in 2009 or until their successors have been elected and qualified; and |

| | 3. | To transact such other business as may properly come before the meeting or any adjournments thereof. |

Only shareholders of record at the close of business on March 6, 2006, are entitled to notice of and to vote at the meeting.

You are kindly requested to mark, sign, date and return the enclosed proxy promptly, regardless of whether you expect to attend the meeting, in order to ensure a quorum. If you are present at the meeting, and wish to do so, you may revoke the proxy and vote in person.

It is sincerely hoped that it will be possible for you to personally attend the meeting.

|

|

| |

| /s/ PAUL G. PEREZ |

| Secretary |

March 31, 2006

LUFKIN INDUSTRIES, INC.

P. O. Box 849

Lufkin, Texas 75902

PROXY STATEMENT

GENERAL INFORMATION

The accompanying proxy is solicited by the Board of Directors of Lufkin Industries, Inc. (the “Company”) for use at the Annual Meeting of Shareholders to be held on May 3, 2006, and any adjournments thereof. The annual meeting will be held at 9:00 a.m., local time, at the Museum of East Texas, 503 North Second, Lufkin, Texas 75901. When such proxy is properly executed and returned, the shares it represents will be voted at the meeting in accordance with the directions noted thereon; or if no direction is indicated, it will be voted in favor of the proposals set forth in the notice attached to this Proxy Statement.

Each shareholder of the Company giving a proxy has the unconditional right to revoke his or her proxy at any time prior to its exercise, either in person at the Annual Meeting of Shareholders or by oral or written notice to the Company addressed to Secretary, Lufkin Industries, Inc., P. O. Box 849, Lufkin, Texas 75902, phone number (936) 634-2211. A shareholder entitled to vote for the election of directors can withhold authority to vote for all nominees for director or can withhold authority to vote for certain nominees for director. Abstentions from the proposal to elect directors are treated as votes against the particular proposal. Broker non-votes on any of such matters are treated as shares as to which voting power has been withheld by the beneficial holders of those shares and, therefore, as shares not entitled to vote on the proposal as to which there is the broker non-vote.

In addition to the solicitation of proxies by use of this Proxy Statement, directors, officers and employees of the Company may solicit the return of proxies by mail, personal interview, telephone or facsimile. Officers and employees of the Company will not receive additional compensation for their solicitation efforts, but they will be reimbursed for any out-of-pocket expenses incurred. Brokerage houses and other custodians, nominees and fiduciaries will be requested, in connection with the stock registered in their names, to forward solicitation materials to the beneficial owners of such stock.

All costs of preparing, printing, assembling and mailing the Notice of Annual Meeting of Shareholders, this Proxy Statement, the enclosed form of proxy and any additional materials, as well as the cost of forwarding solicitation materials to the beneficial owners of stock and all other costs of solicitation, will be borne by the Company. The approximate date on which this Proxy Statement and form of proxy will first be sent to shareholders is March 31, 2006.

Computershare Investor Services, LLC, as a responsibility as the Company’s transfer agent, collects and informs the Company of all proxy votes tallied for each issue listed in the proxy statement.

QUORUM AND VOTING SECURITIES

At the close of business on March 6, 2006, which is the record date for the determination of shareholders of the Company entitled to receive notice of and to vote at the annual meeting or any adjournments thereof, the Company had 14,756,291 shares of common stock, $1.00 par value (the “Common Stock”) outstanding. Each share of Common Stock is entitled to one vote upon each of the matters to be voted on at the meeting. Shareholders do not have cumulative voting rights.

The presence, either in person or by proxy, of holders of a majority of the outstanding shares of Common Stock is necessary to constitute a quorum at the Annual Meeting. The affirmative vote of the holders of a

1

majority of the Common Stock present in person or by proxy at the meeting and entitled to vote is required for the election of directors in Proposal Number 1. Withholding authority to vote for a director nominee and broker non-votes in the election of directors will not affect the outcome of the election of directors.

PROPOSAL NO. 1: ELECTION OF DIRECTORS

The Board of Directors has nominated and urges you to vote FOR the election of the three directors who have been nominated to serve a three-year term of office as Class III Directors and one director who has been nominated to serve a two year term of office as a Class II Director. Proxies solicited hereby will be so voted unless shareholders specify otherwise in their proxies. The affirmative vote of the holders of a majority of the Common Stock present in person or by proxy at the meeting and entitled to vote is required for approval of this Proposal.

The Company’s Fourth Restated Articles of Incorporation (the “Articles”) divide the Board of Directors, with respect to terms of office, into three classes, designated as Class I, Class II and Class III. Each class of directors is to be elected to serve a three-year term and is to consist of, as nearly as possible, one-third of the members of the entire Board. In accordance with the Company’s Bylaws, the Company’s Board of Directors is currently set at nine members, with a minimum of seven and a maximum of 15 members required. The Board of Directors has affirmatively determined that each of Messrs. J. F. Anderson, Ms. S. V. Baer, S. W. Henderson, III, J. T. Jongebloed, J. H. Lollar, B. H. O’Neal, H. J. Trout, Jr., and T. E. Wiener are independent under Rule 4200(a)(15) of the NASDAQ Marketplace Rules. Mr. D. V. Smith is not independent under Rule 4200(a)(15) of the NASDAQ Marketplace Rules as he currently serves as the Chief Executive Officer and President of the Company.

The term of office of each of the Class III Directors expires at the time of the 2006 Annual Meeting of Shareholders, or as soon thereafter as their successors are elected or qualified. Mr. S. W. Henderson, Mr. J. F. Anderson and Mr. D. V. Smith have been nominated to serve a three-year term as Class III Directors. Ms. Baer was elected in 2005 as a Class II Director with a term that expires in 2008. Ms. Baer was recommended to Lufkin by an executive search firm. The firm used criteria provided by the Nominating Committee. Each of the nominees has consented to be named in this Proxy Statement and to serve as a director, if elected.

It is intended that the proxies solicited hereby will be voted FOR the election of the nominees for director listed below, unless authority to do so has been withheld. If, at the time of the 2006 Annual Meeting of Shareholders, any of the nominees should be unable or decline to serve, the discretionary authority provided in the proxy will be used to vote for a substitute or substitutes designated by the Board of Directors. The Board of Directors has no reason to believe that any substitute nominee or nominees will be required.

Nominating/Governance Committee Policy on Director Candidates

The Nominating/Governance Committee considers candidates for Board membership suggested by its members and other Board members, as well as management and shareholders. The Committee has also retained a third-party executive search firm to identify candidates upon request of the Nominating/Governance Committee from time to time. A shareholder who wishes to recommend a prospective nominee for the Board should notify the Company’s Corporate Secretary or any member of the Nominating/Governance Committee in writing at Lufkin Industries, Inc., P.O. Box 849, Lufkin, Texas 75902, including whatever supporting material the shareholder considers appropriate. The Nominating/Governance Committee will also consider whether to nominate any person nominated by a shareholder pursuant to the provisions of the Company’s bylaws relating to shareholder nominations.

Description of Nominating/Governance Committee’s Selection Process of Director Candidates

The Nominating/Governance Committee utilizes a variety of methods for identifying and evaluating nominees for director. The Nominating/Governance Committee regularly assesses the appropriate size of the Board and whether any vacancies on the Board are expected due to retirement or otherwise. In the event that vacancies are

2

anticipated, or otherwise arise, the Nominating/Governance Committee considers various potential candidates for director. Candidates may come to the attention of the Nominating/Governance Committee through current Board members, professional search firms, management, shareholders or other persons. When a professional search firm is retained it must become familiar with the Company and its business. Furthermore, it must then clearly understand the skill sets, experience and education the Board is seeking in a prospective member. The firm then must utilize its resources to find and present suitable candidates. The Committee may emphasize certain requirements depending on the Board position to be filled. Industry experience may be favored over financial, legal, sales or other areas of expertise when filling a board position. These candidates are evaluated at regular or special meetings of the Nominating/Governance Committee and may be considered at any point during the year. The Nominating/Governance Committee considers properly submitted shareholder nominations for candidates for the Board. Following verification of the shareholder status of persons proposing candidates, recommendations are aggregated and considered by the Nominating/Governance Committee at a regularly scheduled meeting, which is generally the first or second meeting prior to the issuance of the proxy statement for the Company’s annual meeting. If any materials are provided by a shareholder in connection with the nomination of a director candidate, such materials are forwarded to the Nominating/Governance Committee. The Nominating/Governance Committee also reviews materials provided by professional search firms or other parties in connection with a nominee who is not proposed by a shareholder. In evaluating such nominations, the Nominating/Governance Committee seeks to achieve a balance of knowledge, experience and capability on the Board.

Nominating/Governance Committee’s Minimum Director Candidate Qualifications

In evaluating recommended nominees for a position on the Company’s Board of Directors, the Nominating/Governance Committee considers, at a minimum, the following factors:

| | 1. | The candidate shall be an individual who has demonstrated integrity and ethics in his/her personal and professional life. |

| | 2. | The candidate shall be prepared to represent the interests of all shareholders. |

| | 3. | The candidate has familiarity with business matters and an ability to grasp and analyze financial data. |

| | 4. | The candidate shall not have any material personal, financial or professional interest in any present or potential competitor of the Company. |

| | 5. | The candidate’s knowledge, skills and experience in light of prevailing business conditions and the knowledge, skills and experience possessed by other members of the Board. |

| | 6. | The candidate fulfills the needs of the Company with respect to the particular talents and experience of the directors. |

| | 7. | Personal business experience in a leadership position within one of the markets served by the Company should be a criteria by one or more of the Board’s directors. |

| | 8. | The candidate has the ability and willingness to dedicate sufficient time, energy and attention to the performance of his or her duties, including participation in Board and committee meetings. |

Nominees for Director

The nominees for Class III Directors, if elected, whose term of office will expire in 2009, and certain additional information with respect to each of them, are as follows:

Douglas V. Smith, Chairman of the Board, Chief Executive Officer and President of the Company. Age 63. Mr. Smith was elected President and Chief Executive Officer of the Company in January 1993 and Chairman of the Board in May 1995. He was also elected as a director in January 1993.

Simon W. Henderson, III, Manager of his own investments. Age 72. Mr. Henderson has been a director of the Company since 1971 and currently serves as a member of the Executive Committee, the Compensation Committee and the Nominating/Governance Committee.

3

John F. Anderson, Manager of his own investments. Age 63. Mr. Anderson has been a director of the Company since 2003 and currently serves as a member of the Executive Committee and the Pension Committee.

The nominee for Class II Director, if elected, whose term of office will expire in 2008, and certain additional information with respect to her, is as follows:

Suzanne V. Baer, formerly Executive Vice President, Chief Financial Officer of Energy Partners from 2001 to 2005. Age 58. She became a director of the Company in 2005 and serves as a member of the Audit and Pension Committees.

AUDIT COMMITTEE

Report of the Audit Committee

The Audit Committee assists the Board in overseeing matters relating to the accounting and financial reporting practices of the Company, the adequacy of its internal controls and the quality and integrity of its financial statements. The Audit Committee’s functions include making recommendations concerning the engagement of independent auditors, reviewing with the independent auditors the plan and results of the auditing engagement, reviewing the scope and results of the Company’s procedures for internal auditing, reviewing professional services provided by the independent auditors, reviewing the independence of the independent auditors, considering the range of audit and non-audit fees and reviewing the adequacy of the Company’s internal accounting controls. As set forth in the Audit Committee Charter, management of the Company is responsible for the preparation, presentation and integrity of the Company’s financial statements, internal controls and for the procedures designed to assure compliance with accounting standards and applicable laws and regulations. The independent auditors, Deloitte & Touche LLP, are responsible for auditing both the Company’s financial statements and internal controls over financial reporting in accordance with the auditing standards of the Public Company Accounting Oversight Board (United States).

In performing its oversight function, the Audit Committee reviewed and discussed with management and the independent auditors the Company’s interim financial statements as well as the Company’s annual financial statements and the independent auditor’s examination and report on the Company’s annual financial statements. The Audit Committee has discussed with the independent auditors the matters required to be discussed by generally accepted auditing standards, including those described in Statement of Auditing Standards No. 61, as amended, “Communication with Audit Committees,” as currently in effect. We reviewed and discussed the Company’s compliance with Section 404 of the Sarbanes-Oxley Act of 2002, including the Public Company Accounting Oversight Board’s (PCAOB) Auditing Standard No. 2 regarding the audit of internal control over financial reporting. The Audit Committee has also received the written disclosures and the letter from the independent auditors required by Independence Standards Board Standard No. 1, “Independence Discussions with Audit Committees.” The Audit Committee also discussed with the auditors any relationships that may impact their objectivity and independence and satisfied itself as to the auditors’ independence. The Company annually reviews any relationship between management and all directors and its independent registered public accounting firm and reviews any issues with outside counsel. In 2005, there were no outside relationships existing between management and all directors and the Company’s independent registered public accounting firm.

The Audit Committee reviewed the Company’s audited financial statements and internal control over financial reporting for the year ended December 31, 2005, and discussed them with management and the independent auditors. Based on the aforementioned review and discussions, the Audit Committee recommended to the Board of Directors that the Company’s audited financial statements be included in its Annual Report on Form 10-K for the fiscal year ended December 31, 2005, for filing with the Securities and Exchange Commission.

The Audit Committee has considered whether the provision of non-audit services by the Company’s independent auditors is compatible with maintaining auditor independence and concluded no conflict existed.

4

The Audit Committee’s policy is that the committee will pre-approve all audit services and permitted non-audit services to be performed for the Company by its independent auditors. The Audit Committee may delegate authority to pre-approve audit services, other than the audit of the Company’s annual financial statements, and permitted non-audit services to one or more Audit Committee members, provided that the decisions made pursuant to this delegated authority must be presented to the full Audit Committee at its next scheduled meeting. The Audit Committee has adopted procedures for the pre-approval of services by the Company’s independent auditor. The Audit Committee will, on an annual basis, retain the independent audit firm and pre-approve the scope of all audit services and specified audit-related services. The Chair of the Audit Committee or the full Audit Committee must pre-approve the firm’s review of any registration statements containing or incorporating by reference the firm’s audit report and the provision of any related consent and the preparation and delivery of any comfort letters. Any permitted non-audit services must be pre-approved by either the Chair or the full Audit Committee. In fiscal years 2005 and 2004, 100 percent of the services provided to the Company by the independent auditors were pre-approved in compliance with the policies described above. The Audit Committee has selected Deloitte & Touche LLP as its independent auditor for 2006. Deloitte & Touche LLP, independent registered public accounting firm, audited the Company’s consolidated financial statements and internal controls over financial reporting for the fiscal year ended December 31, 2005, and have advised the Company that it will have a representative at the May 3, 2006 Annual Meeting of Shareholders who will be available to respond to appropriate questions. Such representative will be permitted to make a statement if they desire to do so.

This report of the Audit Committee shall not be deemed incorporated by reference by any general statement incorporating by reference this Proxy Statement into any filing under the Securities Act of 1933 or the Securities Exchange Act of 1934 except to the extent that the Company specifically incorporates this information by reference, and shall not otherwise be deemed filed under such acts.

The following members of the Audit Committee have delivered the foregoing report:

John H. Lollar, Chairman

S. V. Baer

B. H. O’Neal

J. T. Jongebloed

Independent Public Accountants

Aggregate fees incurred by the Company for the years ended December 31, 2005 and 2004 for services performed by the Company’s principal accounting firm, Deloitte & Touche LLP, the member firms of Deloitte Touche Tohmatsu, and their respective affiliates (collectively, the “Deloitte Entities”):

| | | | | | |

| | | 2005 | | 2004 |

Audit Fees(a) | | $ | 732,000 | | $ | 693,000 |

Audit-Related Fees(b) | | | 67,152 | | | 54,800 |

| | | | | | |

Subtotal Audit and Audit Related | | | 799,152 | | | 747,800 |

Tax Fees(c) | | | 213,438 | | | 233,080 |

All Other Fees | | | 0 | | | 0 |

| | | | | | |

Total Fees | | $ | 1,012,590 | | $ | 980,880 |

| | | | | | |

| (a) | Includes fees billed and expected to be billed for the audit of the Company’s annual financial statements and internal control over financial reporting, reviews of the Company’s quarterly financial statements, and foreign statutory audits. |

| (b) | Includes fees for the audits of the Company’s employee benefit plans and consultation on certain financial accounting and reporting matters. |

5

| (c) | Includes tax compliance fees for assistance with federal, state and foreign income tax returns and audits, and various tax planning and consultation matters. |

The fees incurred by the Company with respect to independent auditors during 2005 and 2004 contain no consulting-related work.

COMPANY INFORMATION

INFORMATION ABOUT CURRENT AND CONTINUING DIRECTORS

Information about Mr. Henderson, Mr. Anderson, and Mr. Smith can be found above under “Nominees for Director” as Class III Directors whose term of office, if elected, will continue after the meeting and expire in 2009. Information about Ms. Baer, if elected, can be found under “Nominees for Director” as Class II Directors whose term of office will continue after the meeting and expire in 2008.

The Class I Directors, whose present term of office as directors will continue after the meeting and expire in 2007, and certain additional information with respect to each of them, are as follows:

John H. Lollar, Managing Partner of Newgulf Exploration, L.P. since 1996. Age 67. Mr. Lollar was formally Chairman, President and Chief Executive Officer of Cabot Oil and Gas Corporation. He is a director of Plains Exploration and Production Company, Inc. He became a director of the Company in 1997 and currently serves as Chairman of the Audit Committee and as a member of the Compensation Committee.

Bob H. O’Neal, formerly President of Stewart & Stevenson Services, Inc. Age 71. Mr. O’Neal became a director in 1992 and currently serves as Chairman of the Compensation Committee and as a member of the Nominating/Governance Committee and Audit Committee.

Thomas E. Wiener, Attorney at law since 1968 to present. Age 65. Mr. Wiener became a director of the Company in 1987 and currently serves on the Executive Committee, Nominating/Governance Committee and the Pension Committee.

The Class II Directors, whose present term of office as directors will continue after the meeting and expire in 2008, and certain additional information with respect to each of them, are as follows:

H. J. Trout, Jr., Manager of his own investments. Age 61. Mr. Trout has been a director of the Company since 1980 and serves as Chairman of the Pension Committee and as a member of the Executive Committee and the Nominating/Governance Committee.

J. T. Jongebloed, formerly Chairman, President & Chief Executive Officer of Pool Energy Services, Inc. from 1978 to 1999. Age 64. He became a director of the Company in 2002 and serves as Chairman of the Nominating/Governance Committee and as a member of the Audit Committee and the Compensation Committee.

Board Committees

Executive Committee

The Board of Directors has a standing Executive Committee. The Executive Committee is comprised of Messrs. D. V. Smith, Chairman, J. F. Anderson, S. W. Henderson, III, H. J. Trout, Jr. and T. E. Wiener. The purpose of this committee is to advise management during intervals between Board meetings.

Audit Committee

The Board of Directors has a separately-designated Audit Committee established in accordance with section 3(a)(58)(A) of the Exchange Act. The Audit Committee is currently comprised of Messrs. J. H. Lollar, Chairman,

6

B. H. O’Neal, J. T. Jongebloed and Ms. S. V. Baer. The Board of Directors has determined that J. H. Lollar, S. V. Baer, B. H. O’Neal and J. T. Jongebloed are “audit committee financial experts” as defined by the Securities and Exchange Commission. Messrs. J. H. Lollar, B.H. O’Neal and J. T. Jongebloed in addition to serving as Chief Executive Officers of major organizations have had financial education and training. Ms. S. V. Baer in addition to being a C.P.A., has served in several corporate executive positions including Chief Financial Officer and Treasurer positions. All the members of the Audit Committee are independent (as independence is defined in Exchange Act Rule 10A-3(b)(1), as well as the independence requirements of NASDAQ Marketplace Rule 4200(a)(15)). The Audit Committee has a written charter adopted by the Board. It is available on the Company’s website atwww.lufkin.com. The charter requires the Committee to reassess and report to the Board on the adequacy of the charter on an annual basis.

The Audit Committee is, among other things, responsible for:

| | • | | appointing, replacing, compensating and overseeing the work of the independent auditor; |

| | • | | reviewing the services proposed by the independent auditor for the coming year and approving in advance all audit, audit-related, tax and permissible non-audit services to be performed by the independent auditor; |

| | • | | separately meeting with the independent auditors, the internal auditors and management with respect to the status and results of their activities; |

| | • | | reviewing with the chief executive officer, the chief financial officer, and the general counsel the Company’s disclosure controls and procedures and management’s conclusions about the efficacy of such disclosure controls and procedures; |

| | • | | reviewing, approving and discussing with management and the independent auditors the annual and quarterly financial statements, the annual report to stockholders, and the Form 10-K; and |

| | • | | reviewing earnings, press releases, as well as financial information and earnings guidance provided to analysts and rating agencies. |

The Audit Committee has the authority to investigate any matter brought to its attention with full access to all books, records, facilities and personnel of the Company, and to retain outside legal, accounting or other consultants.

Compensation Committee

The Board of Directors has a standing Compensation Committee which is currently comprised of Messrs. B. H. O’Neal, Chairman, S. W. Henderson, III, J. T. Jongebloed and J. H. Lollar. The Compensation Committee is composed solely of directors who satisfy all criteria for independence under applicable law and NASDAQ Marketplace Rule 4200(a)(15) and who, in the opinion of the Board, are free of any relationship that would interfere with their exercise of independent judgment as members of the Committee.

This Committee is, among other things, responsible for:

| | • | | making recommendations to the Board and to the boards of subsidiaries on all matters of policy and procedures relating to executive compensation; |

| | • | | establishing the chief executive officer’s compensation level based on the Board’s performance evaluation of the chief executive officer; |

| | • | | approving the compensation of the other executive officers, and reviewing the succession plan relating to positions held by the other executive officers; |

| | • | | recommending to the Board and administering the incentive compensation plans and equity-based plans of the Company; and |

7

| | • | | reviewing and recommending the amount and method of compensation for members of the Board. |

The Charter of the Compensation Committee is available on the Company’s website atwww.lufkin.com.

Pension Committee

The Board of Directors has a standing Pension Committee. The Pension Committee is currently comprised of Messrs. H. J. Trout, Jr., Chairman, J. F. Anderson, T. E. Wiener, and Ms. S. V. Baer. The purpose of this committee’s responsibilities is to review the performance and administration of the Company’s Pension Plan.

This Committee is, among other things, responsible for:

| | • | | reviewing the quarterly results of the Pension Plan investments; |

| | • | | reviewing the quarterly investment allocations; |

| | • | | receiving a quarterly overview by the Plan Advisor of fund performance and any recommendations for other investment opportunities; |

| | • | | providing to the Plan Advisor any investment or allocation modifications to meet investment goals or comply with the investment policy; |

| | • | | insuring compliance with all applicable laws and regulations; and |

| | • | | reviewing pension benefits provided by the Company. |

Nominating/Governance Committee

The Board of Directors has a standing Nominating/Governance Committee. The Nominating/Governance Committee is comprised of Messrs. J. T. Jongebloed, Chairman, B. H. O’Neal, S. W. Henderson, III, H. J. Trout, Jr., and T. E. Wiener. The Nominating/Governance Committee is composed solely of “independent directors” as defined in NASDAQ Marketplace Rule 4200(a)(15). The Committee’s primary purpose is to discharge the Board’s responsibility related to public policy matters, the development and implementation of a set of corporate governance principles, the identification of individuals qualified to become board members and the review of the qualifications and make-up of the Board membership.

The Committee is, among other things, responsible for:

| | • | | reviewing and making recommendations to the Board concerning the appropriate size and composition of the Board, including candidates for election or re-election as directors, the criteria to be used for the selection of candidates for election as directors, the appropriate skills and characteristics required of Board members in the context of the current make-up of the Board, the composition and functions of the Board committees, and all matters relating to the development and effective functioning of the Board; |

| | • | | considering and recruiting candidates to fill positions on the Board; |

| | • | | considering nominees recommended by stockholders for election as directors; |

| | • | | reviewing and making recommendations to the Board of each Board committee’s membership and committee chairpersons including, without limitation, a determination of whether one or more Audit Committee members qualifies as an “audit committee financial expert” in accordance with applicable law; |

| | • | | assessing and recommending overall corporate governance practices; |

| | • | | establishing the process and administering the evaluation of the Board; |

| | • | | reviewing public issues identified by management and the Company’s efforts in addressing these public issues through research, analysis, lobbying efforts and participation in business and government programs; |

8

| | • | | reviewing and approving codes of conduct applicable to directors, officers and employees; and |

| | • | | reviewing the Company’s policy statement on stockholders’ rights plans and reporting any recommendations to the Board. |

The charter of the Nominating/Governance Committee is available to shareholders atwww.lufkin.com.

Directors’ Meetings and Compensation

During 2005, the Audit Committee had five meetings, the Compensation Committee had two meetings, the Executive Committee had two meetings, the Pension Committee had four meetings, the Nominating/Governance Committee had four meetings and the Board of Directors had four meetings. During 2005, each continuing member of the Board of Directors attended 75% or more of the meetings of the Board of Directors and the committees of which he/she was a member. As required by NASDAQ Marketplace Rules, the Company’s independent directors have regularly scheduled executive sessions.

During 2005, in addition to the $24,000 annual retainer, directors received $1,500 for each meeting of the Board of Directors and $1,500 for each committee meeting that they attended with the exception of Audit Committee meetings, which paid directors $2,000 for each meeting. In 2005, the Audit Committee Chairman received a retainer of $5,000 and the Compensation Committee, Pension Committee and Nominating/Governance Committee Chairmen each received a retainer of $1,000. In addition, each director receives a 10,000 share stock option grant on the date of his election to the Board of Directors and options to purchase 2,000 shares each year thereafter as long as he or she continues on the Board.

Director Attendance at Company Annual Meetings

It is the policy of the Company’s Board of Directors that directors are strongly encouraged to attend all annual shareholder meetings. In 2005, all directors attended the annual meeting of shareholders.

Code of Ethics for Senior Financial Officers of the Company

For years, the Company has had policies regarding conflicts of interest and securities law compliance. The Company has adopted a Code of Ethics for Senior Financial Officers of the Company that reflects these longstanding policies and contains additional policy initiatives. The Company requires all its senior financial officers, including the Company’s principal executive officer, principal financial officer and principal accounting officer, to adhere to the Code of Ethics for Senior Financial Officers of the Company in addressing the legal and ethical issues encountered in conducting their work. The Code of Ethics for Senior Financial Officers of the Company requires that senior financial officers avoid conflicts of interest, comply with securities laws and other legal requirements and conduct business in an honest and ethical manner. The Company conveys to its senior financial officers both their obligations and responsibilities under and the importance of the Code of Ethics for Senior Financial Officers of the Company.

The Company has established procedures for receiving, retaining and treating complaints received regarding accounting, internal accounting controls or auditing matters and for the confidential and anonymous submission by employees of concerns regarding questionable accounting or auditing matters. The Company has also adopted a written Code of Conduct that is applicable to all employees of the Company, including the Senior Financial Officers, and all Directors. The Company has made available to stockholders the Code of Ethics for Senior Financial Officers of the Company and the Code of Conduct on its website atwww.lufkin.com or a copy can be obtained by writing to the Company Secretary, P.O. Box 849, Lufkin, Texas 75902. Any amendment to, or waiver from, the Code of Ethics for Senior Financial Officers of the Company or the Code of Conduct will be disclosed in a current report on Form 8-K within four business days of such amendment or waiver as required by the NASDAQ Marketplace Rules.

9

Shareholder Communications with the Board

Any shareholder wishing to communicate with the Board of Directors may do so by writing to the Board of Directors at the Company’s principal address of P.O. Box 849, Lufkin, Texas 75902. Any shareholder communication so addressed, unless clearly of a marketing nature, will be delivered unopened to the director to whom it is addressed or to the Chairman of the Board if addressed to the Board of Directors.

INFORMATION ABOUT CURRENT EXECUTIVE OFFICERS

The following information is submitted with respect to the executive officers of the Company:

| | | | | | |

Name | | Position with Company | | Age | | Executive Officer

Since |

D. V. Smith | | Chairman, President & Chief Executive Officer | | 63 | | 1993 |

S. H. Semlinger | | Vice President—Trailer | | 52 | | 1992 |

J. F. Glick | | Vice President—Power Transmission | | 53 | | 1994 |

L. M. Hoes | | Vice President—Oil Field | | 59 | | 1996 |

P. G. Perez | | Vice President/General Counsel & Secretary | | 60 | | 1996 |

R. D. Leslie | | Vice President/Treasurer/Chief Financial Officer | | 60 | | 1999 |

There is no significant family relationship either by blood, marriage or adoption among the directors, director nominees or executive officers of the Company.

All of the executive officers of the Company have been employed by the Company for more than five years in the same or similar positions. The executive officers of the Company serve at the request of the Board of Directors of the Company. The term of office for all executive officers expires at the next annual meeting of the Board of Directors of the Company.

EXECUTIVE COMPENSATION

Report of the Compensation Committee

The Compensation Committee of the Board of Directors of Lufkin Industries, Inc. (the “Committee”) is pleased to present the 2005 report on executive compensation. This report of the Committee documents the components of the Company’s executive officer compensation program and describes the basis on which the compensation program determinations were made by the Committee with respect to the executive officers of the Company, including the executive officers that are named in the compensation tables. The Committee meets regularly and is comprised entirely of non-employee, independent directors. The duty of the Committee is to review compensation levels of members of management, as well as administer the Company’s various incentive plans including its annual bonus plan and its stock option plan. The Committee reviews in detail, with the Board of Directors, all aspects of compensation for all of the Company’s senior officers. In order to provide this review, the Committee reviewed all components of the CEO’s and named executive officer’s compensation, including base salary, bonus, accumulated (realized and unrealized) stock options and the dollar value to the executive and cost to the Company of all perquisites and other personal benefits. Additionally, the earnings and accumulated payout obligations under the Company’s non-qualified deferred compensation program was reviewed by the Committee. Also reviewed was the funding status and projected payout of the supplemental retirement plan provided to the CEO. The review of all relevant components of compensation in the aggregate provides the Committee with a value of an individual’s total compensation. This value can then be evaluated by the Committee along with Company performance and market comparisons in order to make compensation decisions. The Committee was provided with relevant compensation information prior to their actual meetings in order for them to review and comment on the various issues.

10

The Committee has retained the services of a national compensation consulting firm to assist the Committee in connection with the performance of its various duties. Such firm provides advice to the Committee with respect to how compensation paid by the Company to its senior officers compares to compensation paid by other companies. Members of the Committee review compensation surveys provided by the consulting firm as well as surveys provided by other sources.

Based on this review, the Committee finds the CEO and the named executive officers total compensation in the aggregate to be reasonable and not excessive. It should be noted that when the Committee considers any component of the CEO and named executive officer’s total compensation, the aggregate amounts and mix of all the components, including accumulated (realized and unrealized) stock options, are taken into consideration in the Committee’s decisions. In addition, it is the Committee’s practice to make most compensation decisions a two-step process over the course of their meetings during the year.

Prior to the first meeting of the year, the Committee chairman distributes updated compensation information to the members and confers with them on key topics. The chairman meets with the compensation consultants to review reports and surveys to determine the direction of trends and to examine peer companies. Communications between the chairman and members prior to a meeting provides them an opportunity to comment and discuss compensation issues and concerns. At the meeting, the material is again reviewed, the consultant may be questioned further and additional discussion takes place, after which a vote is taken.

Executive Compensation Program Philosophy

The design of the Company’s executive compensation program is based on three fundamental principles. First, compensation must support the concept of pay for performance, that is, compensation awards are directly related to the financial results of the Company, to increasing shareholders’ value and to individual contributions and accomplishments. As a result, a portion of an executive officer’s compensation is “at risk” with annual bonus compensation, at target levels, amounting to approximately 35% of total cash compensation.

The second principle of the program is that it should offer compensation opportunities competitive with those provided by other comparable industrial companies. It is essential that the Company be able to retain and reward its executives who are critical to the long-term success of the Company’s diversified and complex businesses.

The final principle is that the compensation program must provide a direct link between the long-term interests of the executives and the shareholders. Through the use of stock-based incentives, the Committee focuses the attention of executives on managing the Company from the perspective of an owner with an equity stake.

Compensation Plan Components

Base Salary. The Committee has established base salary levels for the Company’s executive officers that are generally comparable to similar executive positions in companies of similar size and complexity as the Company. The Company obtains comparative salary information from published market surveys and from a national compensation consulting firm. The comparative data is from industrial companies of a comparable size in revenue during this period. The Company’s salaries were competitive with the market at the fiftieth percentile in these comparisons. As part of its responsibilities, the Committee approves all salary changes for the Company’s officers and bases individual salary changes on a combination of factors such as the performance of the executive, salary level relative to the competitive market, the salary increase budget for the Company, level of responsibility and the recommendation of the Chief Executive Officer. In accordance with its review process, the Committee approves base salary increases for those officers whose salary level and performance warranted an adjustment. Base salary increases approved for these officers in 2005 averaged 5.2% over 2004 levels.

Incentive Compensation. The Company’s performance, or that of a division or business unit, as the case may be, for purposes of compensation decisions, is measured under the annual bonus plan against goals established at

11

the start of the year by the Committee. In each instance, the goals consisted in most part of making budgeted sales and expense levels, as well as subjective individual performance goals. The plan allows the committee to use their business experience and judgment in making bonus determinations. The Committee will examine the Company’s return on equity from operational earnings as well as EBITD objectives with individual evaluations and recommendations made by the CEO. After reviewing this information, the Committee voted on its decision. Bonus awards are made as a percentage of a participant’s base salary and can range from a minimum of 8% to a maximum of 48%.

Chief Executive Officer Compensation. Mr. Smith’s base salary for 2005 was $450,000 and he received a bonus of $550,000. These amounts were determined by the Compensation Committee as a part of a three-year employment contract that began on January 1, 1999. In reviewing CEO compensation, the Committee looks for leadership performance and the potential to enhance shareholder value. Other important factors are the demonstration of a strong capital structure and cash flow. During the past year while experiencing significant growth, the Company had no long term debt and increased its cash reserves. Equally important is the level of leadership demonstrated for the corporate governance initiatives. The Committee also believed that a 38.1% increase in annual revenues and a 191.3% increase in reported earnings per share were important CEO compensation performance considerations. These factors in the aggregate were the basis for the Committee’s discussion and decisions regarding CEO compensation. The term of the contract automatically extends for an additional year on each anniversary of the contract and currently expires on December 31, 2008. The Committee believes that the contract is competitive and that the employment contract is critical to attract and retain the best-qualified executives.

Stock Options. During 2005, the Committee also made stock option grants to the CEO and to each of the senior officers of the Company. Each of those officers received stock options, which were based on his responsibilities and relative position in the Company. The number of stock options granted to officers is based upon a percentage of base pay. Dividing the grant price into the stated percentage of base pay will approximate the number of options granted. In 2005, 94,058 shares of stock options were granted to the Company’s officers, which compares to 146,862 shares granted to officers in 2004. Of the options granted to officers, 54,558 shares of stock options were granted to Mr. Smith in 2005 compared to 70,262 granted to him in 2004. The Committee’s policy is to make stock option grants annually and for the purpose of tying a portion of the employees’ compensation to the long-term performance of the Company’s Common Stock. By making such grants, the Committee feels that these grants help senior officers’ interests coincide with those of the shareholders.

Internal Pay Equity. In the process of reviewing each component separately, and in the aggregate, the committee receives from the Company’s human resource department a spreadsheet which illustrates the “internal pay equity” within the Company. This spreadsheet reveals the relationship between each management level of compensation within the Company (e.g. between the CEO and chief financial officer and other named executive officers, and then between the CEO and the lower levels of executives). The comparison includes all components of compensation (as previously described). The Committee believes that the relative difference between CEO compensation and the compensation of the Company’s other executives has not increased significantly and is appropriate.

No member of the Committee is a former or current officer or employee of the Company or any of its subsidiaries. The following members of the Compensation Committee have delivered the foregoing report:

B. H. O’Neal, Chairman

S. W. Henderson, III

J. H. Lollar

J. T. Jongebloed

The foregoing report shall not be deemed to be filed with the Securities and Exchange Commission except to the extent the Company specifically incorporates such items by reference into a filing under the Securities Act of 1933 or Securities Exchange Act of 1934.

12

Compensation of Executive Officers

The following table sets forth information with respect to the Chief Executive Officer and the four most highly compensated executive officers of the Company as to whom the total annual salary and bonus for the year ended December 31, 2005, exceeded $100,000.

SUMMARY COMPENSATION TABLE

| | | | | | | | | | | | | |

| | | Annual Compensation | | Long-Term Compensation Awards | | |

Name and Principal Position | | Year | | Salary ($) | | Bonus ($)(1) | | Securities

Underlying

Options/SARs (#)(3) | | All Other Compensation ($)(2) |

Douglas V. Smith | | 2005 | | $ | 450,000 | | $ | 550,000 | | 54,558 | | $ | 34,502 |

President and | | 2004 | | | 430,000 | | | 315,000 | | 70,262 | | | 30,247 |

Chief Executive Officer | | 2003 | | | 410,000 | | | 225,000 | | 91,928 | | | 25,278 |

| | | | | |

Larry M. Hoes | | 2005 | | | 232,308 | | | 141,120 | | 9,500 | | | 15,215 |

Vice President | | 2004 | | | 217,466 | | | 105,000 | | 18,000 | | | 14,237 |

| | 2003 | | | 208,293 | | | 90,000 | | 27,000 | | | 12,544 |

| | | | | |

John F. Glick | | 2005 | | | 196,538 | | | 118,080 | | 7,500 | | | 10,892 |

Vice President | | 2004 | | | 188,315 | | | 45,000 | | 15,400 | | | 10,707 |

| | 2003 | | | 181,970 | | | 42,000 | | 23,000 | | | 10,903 |

| | | | | |

Scott H. Semlinger | | 2005 | | | 184,077 | | | 66,000 | | 7,500 | | | 9,430 |

Vice President | | 2004 | | | 178,822 | | | 25,000 | | 14,400 | | | 9,274 |

| | 2003 | | | 173,808 | | | 20,000 | | 22,000 | | | 8,737 |

| | | | | |

Robert D. Leslie | | 2005 | | | 186,538 | | | 112,320 | | 7,500 | | | 11,994 |

Vice President, Treasurer and | | 2004 | | | 172,466 | | | 80,000 | | 14,600 | | | 10,973 |

Chief Financial Officer | | 2003 | | | 157,425 | | | 65,000 | | 22,000 | | | 8,583 |

| (1) | Annual bonus amounts are earned and accrued during the years indicated, and paid in the first quarter of the following year. |

| (2) | All Other Compensation consists of the Company’s contribution to the Thrift Plan. |

| (3) | Reflects shares underlying options after the 2-for-1 Stock Split effective April 19, 2005. |

Stock Option Plans

The Company has a stock option plan (the “2000 Plan”), pursuant to which options to purchase shares of the Company’s stock are outstanding. The purpose of the 2000 Plan is to advance the best interests of the Company by providing those persons who have substantial responsibility for the management and growth of the Company with additional incentive by increasing their proprietary interest in the success of the Company. All options for stock are granted by the Compensation Committee. The term of the Company’s previous stock option plan (the “1990 Plan”) expired in 2000 and no future grants of awards under the 1990 Plan will be allowed. However, awards that have been issued prior to the expiration of the 1990 Plan but that have not expired will still be honored by the Company.

The following table shows, as to the Chief Executive Officer and the four most highly compensated executive officers of the Company, information about option grants in the last year. The Company does not grant any Stock Appreciation Rights.

13

OPTION/SAR GRANTS IN LAST FISCAL YEAR

| | | | | | | | | | | | | | | | | | |

Individual Grants | | Potential Realizable Value at Assumed Annual Rates of Stock Price Appreciation For Option Term |

Name | | Number of

Securities

Underlying

Options/SARs Granted (#)(1) | | | Percent of Total Options Granted to Employees in 2005 | | | Exercise

or Base

Price ($/Sh)(2) | | | Expiration Date | | 5% | | 10% |

Douglas V. Smith(3) | | 54,558 | (5) | | 26 | % | | $ | 20.62 | (5) | | 02/09/2015 | | $ | 707,498 | | $ | 1,792,938 |

Larry M. Hoes(4) | | 9,500 | | | 9 | % | | | 46.70 | | | 11/01/2015 | | | 279,009 | | | 707,064 |

John F. Glick(4) | | 7,500 | | | 7 | % | | | 46.70 | | | 11/01/2015 | | | 220,270 | | | 558,208 |

Scott H. Semlinger(4) | | 7,500 | | | 7 | % | | | 46.70 | | | 11/01/2015 | | | 220,270 | | | 558,208 |

Robert D. Leslie(4) | | 7,500 | | | 7 | % | | | 46.70 | | | 11/01/2015 | | | 220,270 | | | 558,208 |

| (1) | The options were granted for a term of ten years subject to earlier termination in certain events related to termination of employment. |

| (2) | The exercise price and tax withholding obligations related to exercise may be paid by delivery of already owned shares or by offset of the underlying shares, subject to certain conditions. |

| (3) | Options are exercisable 1/3, 2/3 on February 9, 2006, with full vesting occurring on February 9, 2007. |

| (4) | Options granted are exercisable in 25% increments on each of November 1, 2006, 2007, 2008 and 2009. |

| (5) | Reflects 2-for-1 Stock Split effective on April 19, 2005. |

The following table presents information concerning exercises of stock options during 2005 and the unexercised options held at the end of 2005 by the Chief Executive Officer and the other four most highly compensated officers.

AGGREGATED OPTION/SAR EXERCISES IN LAST FISCAL YEAR

AND FY-END OPTION/SAR VALUES

| | | | | | | | | | | | |

| | | Shares Acquired on Exercise (#)(2) | | Value Realized ($) | | Number of Securities Underlying Unexercised Options/SARs at 12/31/05(#)(2) | | Value of Unexercised In-the-Money Options/SARs at 12/31/05($)(1) |

Name | | | | Exercisable | | Unexercisable | | Exercisable | | Unexercisable |

Douglas V. Smith | | 348,858 | | 9,897,254 | | 83,213 | | 41,607 | | 2,683,174 | | 1,341,604 |

Larry M. Hoes | | 16,800 | | 622,064 | | 19,150 | | 41,650 | | 687,353 | | 1,152,926 |

John F. Glick | | 29,300 | | 756,680 | | 2,250 | | 34,450 | | 83,003 | | 963,829 |

Scott H. Semlinger | | 26,150 | | 574,872 | | 20,750 | | 33,200 | | 754,807 | | 921,444 |

Robert D. Leslie | | 12,575 | | 354,829 | | 6,250 | | 33,000 | | 233,863 | | 913,225 |

| (1) | Values are based on the difference between the exercise price of the options and the closing price of $49.87 per share of Common Stock on the last trading day of 2005. The actual value, if any, of the unexercised options will depend on the market price of the Common Stock at the time of exercise of the options. |

| (2) | Reflects shares acquired on exercise and underlying options at December 31, 2005 after the 2-for-1 Stock Split effective on April 19, 2005. |

14

Retirement Plan

The Company maintains a noncontributory defined benefit pension plan covering substantially all U.S. based employees, including its executive officers. The Company’s Retirement Plan for Employees (the “Qualified Plan”) is a defined benefit plan, qualified under Section 401 of the Internal Revenue Code, which provides benefits based on an employee’s years of service and covered compensation. Covered compensation consists of Salary and Bonus as set forth in the Summary Compensation Table on page 13 of this Proxy Statement. The benefits are based on the average of the highest five consecutive years of covered compensation received during the last ten years of service. Benefits are estimated on straight-life annuity computations and do reflect offsets for primary Social Security benefits. Under the Code, the maximum amount of compensation that can be considered by a tax-qualified plan is $220,000, subject to annual adjustments. In addition, the Code limits the maximum amount of benefits that may be paid under such a plan. Accordingly, the Company has adopted an unfunded, nonqualified plan (“Restoration Plan”) to provide supplemental retirement benefits to covered executives. The Restoration Plan benefit is based on the same benefit formula for the Qualified Plan except that it does not limit the amount of a participant’s compensation or maximum benefit. The Company also maintains an additional nonqualified plan (“SERP”) for Mr. Smith, which credits him with an additional 0.5 years of service for each year of service credited to him under the Qualified Plan. The benefits calculated under the Restoration Plan and SERP are offset by the participant’s benefit payable under the Qualified Plan. The following table shows the annual benefits payable upon retirement at age 65 for various compensation and years of credited service combinations under these plans. Payment of the specified retirement benefits is contingent upon continuation of the plans in their present form until the employee retires. Directors who are not, or who have not been, employees of the Company will not receive benefits under the plans. The years of credited service for the persons named in the Summary Compensation Table are: Mr. Smith, 13 years (plus an additional 6.5 years under the SERP); Mr. Hoes, nine years; Mr. Glick, 11 years; Mr. Semlinger, 30 years; and Mr. Leslie, 13 years.

| | | | | | | | | | | | | | | |

| | | Years of Service |

Remuneration | | 15 | | 20 | | 25 | | 30 | | 35 |

$125,000 | | $ | 32,369 | | $ | 43,827 | | $ | 55,286 | | $ | 66,744 | | $ | 66,744 |

150,000 | | | 39,244 | | | 52,994 | | | 66,744 | | | 80,494 | | | 80,494 |

175,000 | | | 46,119 | | | 62,161 | | | 78,202 | | | 94,244 | | | 94,244 |

200,000 | | | 52,994 | | | 71,327 | | | 89,661 | | | 107,994 | | | 107,994 |

225,000 | | | 59,869 | | | 80,494 | | | 101,119 | | | 121,744 | | | 121,744 |

250,000 | | | 66,744 | | | 89,661 | | | 112,577 | | | 135,494 | | | 135,494 |

300,000 | | | 80,494 | | | 107,994 | | | 135,494 | | | 162,994 | | | 162,994 |

350,000 | | | 90,244 | | | 126,327 | | | 158,411 | | | 190,494 | | | 190,494 |

400,000 | | | 107,994 | | | 144,661 | | | 181,327 | | | 217,994 | | | 217,994 |

450,000 | | | 121,744 | | | 162,994 | | | 204,244 | | | 245,494 | | | 245,494 |

500,000 | | | 135,494 | | | 181,327 | | | 227,161 | | | 272,994 | | | 272,994 |

550,000 | | | 149,244 | | | 199,661 | | | 250,077 | | | 300,494 | | | 300,494 |

600,000 | | | 162,994 | | | 217,994 | | | 272,994 | | | 327,994 | | | 327,994 |

650,000 | | | 176,744 | | | 236,327 | | | 295,911 | | | 355,494 | | | 355,494 |

700,000 | | | 190,494 | | | 254,661 | | | 318,827 | | | 382,994 | | | 382,994 |

750,000 | | | 204,244 | | | 272,994 | | | 341,744 | | | 410,494 | | | 410,494 |

15

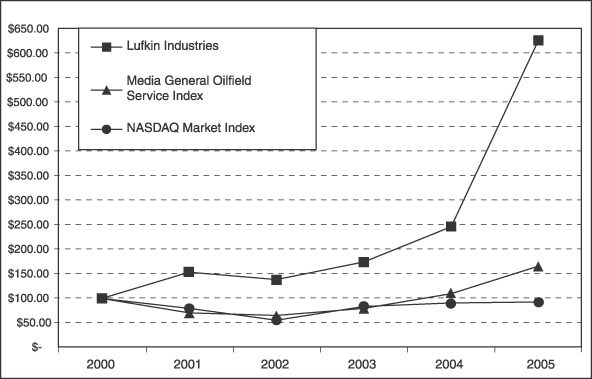

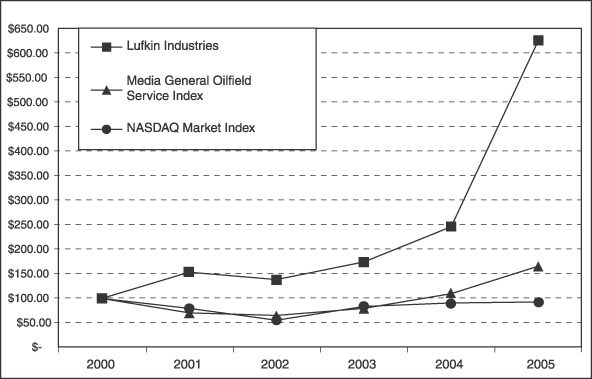

Performance Graph

The following performance graph compares the performance of the Company’s common stock to the NASDAQ Market Value Index and to the Media General Oilfield Services Index (which includes the Company) for the last five years. The graph assumes that the value of the investment in the Company’s common stock and each index was $100 at December 31, 2000 and reinvestment of dividends.

COMPARISON OF CUMULATIVE TOTAL RETURN OF ONE OR MORE

COMPANIES, PEER GROUPS, INDUSTRY INDEXES AND/OR BROAD MARKETS

| | | | | | | | | | | | |

| | | Fiscal Year Ending |

Company/Index/Market | | 12/29/2000 | | 12/31/2001 | | 12/31/2002 | | 12/31/2003 | | 12/31/2004 | | 12/30/2005 |

Lufkin Industries | | 100.00 | | 153.62 | | 138.19 | | 174.47 | | 245.73 | | 625.71 |

Media General Oilfield Service Index | | 100.00 | | 70.41 | | 65.51 | | 79.92 | | 109.68 | | 165.76 |

NASDAQ Market Index | | 100.00 | | 79.71 | | 55.60 | | 83.60 | | 90.63 | | 92.62 |

The performance graph will not be deemed incorporated by reference by any general statement incorporating by reference this Proxy Statement into any filing under the Securities Act of 1933, as amended, or the Securities Exchange Act of 1934, as amended, except to the extent that the Company specifically incorporates this information by reference.

Compensation Committee Interlocks and Insider Participation

Messrs. B. H. O’Neal, S. W. Henderson, III, J. T. Jongebloed and J. H. Lollar served as the members of the Company’s Compensation Committee during 2005. During 2005, no executive officer of the Company served as (i) a member of the compensation committee (or other board committee performing equivalent functions or, in

16

the absence of any such committee, the entire board of directors) of another entity, one of whose executive officers served on the Compensation Committee of the Company, (ii) a director of another entity, one of whose executive officers served on the Compensation Committee of the Company or its subsidiaries or (iii) a member of the compensation committee (or other board committee performing equivalent functions or, in the absence of any such committee, the entire board of directors) of another entity, one of whose executive officers served on the Board of Directors of the Company.

During 2005, no member of the compensation committee (or board committee performing equivalent functions) (i) was an officer or employee of the Company or any of its subsidiaries, (ii) was formerly an officer of the Company or any of its subsidiaries or (iii) had any business relationship or conducted any transactions with the Company.

Employment Contract and Change in Control Arrangements

Employment Contract

The Company has entered into an employment agreement with Mr. Smith that currently expires December 31, 2008. The employment agreement provides for a minimum annual salary of $450,000 and a maximum annual bonus opportunity for each year which shall not be less than one hundred percent (100%) of his salary for the bonus year, subject to review annually by the Compensation Committee. The employee agreement also provides that Mr. Smith will: (i) be provided a special pension benefit as discussed above under “Executive Compensation-Retirement Plan” that the Compensation Committee, in its sole discretion, may direct at any time on or after Mr. Smith’s retirement or death that the actuarial equivalent present value of such benefit (or remaining benefit if already in pay status) be paid in a lump sum (by check); (ii) be provided a company automobile for personal and business use, including any related maintenance and insurance expense for the automobile; (iii) be reimbursed for business and entertainment expenses, including fees to industry and professional organizations, costs of business development and costs reasonably incurred as a result of Mr. Smith’s wife accompanying him on business travel; (iv) be reimbursed certain club membership fees and dues; (v) be provided an annual physical examination to be conducted by a doctor or clinic of Mr. Smith’s choice in Lufkin or Houston, Texas; (vi) be provided at no cost to Mr. Smith term life insurance coverage equal to twice his annual salary; and (vii) be reimbursed up to $3,000 per year in tax preparation expenses.

If Mr. Smith’s employment is terminated due to death or disability, he (or his estate) will be entitled to: (i) receive salary and benefit coverages for a period of six months from and after the termination date; (ii) a bonus payment equal to the minimum bonus amount prorated to reflect the actual number of full weeks worked during the year in which Mr. Smith was terminated; (iii) the special pension discussed above. If Mr. Smith is terminated without cause (as defined in the employment agreement), he will be entitled to receive: (w) a lump sum cash payment equal to the total salary that would have been paid for the remainder of the term based on a salary rate that is equal to the greater of the rate in effect at the effective date of the employment agreement and the date of termination; (x) a lump sum payment equal to the annual bonuses that would have been paid to him for the remainder of the term of the agreement based on the bonus rate paid to Mr. Smith for the last full fiscal year; (y) the special pensions discussed above; and (z) benefits for the reminder of the period for which salary is paid. Further, if any of these benefits noted in (z) can no longer be provided by the Company as a matter of law, the Company will pay Mr. Smith an amount equal to the economic value of the discontinued benefit. If Mr. Smith is terminated for cause (as defined in the employment agreement), he will only be entitled to salary and any benefits accrued as of the termination date and his right to any other benefits will be determined under the applicable plans, programs or other coverages of the Company. Mr. Smith would receive benefits similar to a for cause termination if he terminated his employment voluntarily.

Change in Control Agreements

The Company has also entered into a severance agreement with Mr. Smith that provides for severance benefits to be paid to him following a change in control of the Company (as defined in the severance agreement)

17

or a termination of his employment. Maximum severance benefits available at December 31, 2005, would be approximately $3,000,000 payable in a lump sum, such amount representing three times the highest salary and the highest bonus received by Mr. Smith during the previous three years. He also would be paid a lump sum amount equal to the actuarial difference in benefit he would have earned if he remained employed minus the benefit actually accrued under the Company’s retirement plans. In addition, Mr. Smith would be eligible for normal employee benefits for three years, the value of which cannot be reasonably determined due to the elective nature of these benefits.

The Company entered into severance agreements with Messrs. Hoes, Glick, Semlinger, Leslie and Perez. The agreements provide that each year they will automatically extend for one additional year unless either party provides written notice of its intention to terminate the agreement. Pursuant to the agreements, if a change in control (as defined in the severance agreements) occurs while the executive is employed by the Company, the Company will continue to employ the executive for the period commencing on the effective date of the change in control and ending on the earlier of the second anniversary of the effective date or the first day of the month coinciding with or following the executive’s normal retirement date (the “Protection Period”). During the Protection Period, the executive will be entitled to (i) a monthly base salary at least equal to the highest monthly base salary paid during the 36 months immediately preceding the month of the change in control (subject to increases consistent with those granted to other executives), (ii) an annual bonus at least equal to the highest annual bonus paid with respect to the three years immediately preceding the year of the change of control, (iii) continued participation, with his family if applicable, in all incentive, savings, retirement and welfare benefit plans or programs of the Company and (iv) fringe benefits, support staff, paid vacation and reimbursement of reasonable expenses.

If, during the Protection Period, the executive’s employment is terminated by the Company without cause (as defined in the severance agreements) or by the executive for good reason (as defined in the severance agreements), or if the executive remains in the employ of the Company through the first anniversary of the effective date and terminates his employment for any reason during the 30 days following such first anniversary, the executive will be entitled to the following:

| | • | | a lump sum payment equal to the aggregate of (A) his base salary through the termination date, paid at the highest rate in effect at any time during the period commencing 90 days prior to the effective date of the change of control and ending on the termination date (the “Highest Base Salary”), (B) a pro rated portion of the higher of the annual bonus paid (I) with respect to the last fiscal year (if any) ending during the Protection Period or (II) with respect to the last fiscal year ending prior to the change of control (the “Recent Bonus”), (C) twice the sum of the Highest Base Salary and the Recent Bonus and (D) any deferred compensation or accrued vacation not yet paid by the Company; |

| | • | | a lump sum retirement benefit equal to the difference between the actuarial equivalent of (A) the benefit he would have received under all retirement plans had he remained employed for the remainder of the Protection Period and (B) the benefit actually accrued under all retirement plans; and |

| | • | | for the remainder of the Protection Period or such longer period as such plans or programs may provide, continued benefits, with his family if applicable, under the most favorable (as described in the severance agreements) plans or programs of the Company. |

If the executive’s employment is terminated due to death or disability during the Protection Period, the executive (or his estate) will be entitled to the following:

| | • | | a lump sum payment equal to the aggregate of (A) his Highest Base Salary through the termination date, (B) a pro rated portion of the annual bonus paid with respect to the prior year and (C) any deferred compensation or accrued vacation not yet paid by the Company; and |

| | • | | benefits, with his family if applicable, under the most favorable (as described in the severance agreements) death or disability plans or programs of the Company. |

18

If the executive terminates his employment other than as described above, he will be entitled to his Highest Base Salary through the termination date, a pro rated portion of the annual bonus paid with respect to the prior year, any deferred compensation or accrued vacation not yet paid by the Company and any other benefits accrued as of the termination date. Finally, if the Company terminates the executive for cause (as defined in the severance agreement), the executive will be entitled to only his Highest Base Salary through the termination date and any deferred compensation not yet paid by the Company. In the event that it is determined that any payment or distribution by the Company to or for the benefit of any of the above-named executives, pursuant to his severance agreement or otherwise, would be subject to the excise tax imposed by the Internal Revenue Code, then the executive will be entitled to receive an additional payment in an amount such that after payment by the executive of all taxes, including the taxes on such additional payment, the executive retains an amount of the additional payment equal to the amount of the taxes imposed.

SECURITY OWNERSHIP OF CERTAIN BENEFICIAL OWNERS AND MANAGEMENT

The following table reflects the beneficial ownership of the Company’s Common Stock as of March 6, 2006, with respect to (i) the directors and nominees for director; (ii) each executive officer named in the Summary Compensation Table and (iii) the Company’s directors and executive officers as a group. All share numbers set forth in the table reflect the number of shares held after the Company’s two-for-one stock split that was effective on April 19, 2005.

| | | | | | | | | |

Name of Beneficial Owner | | Direct

Ownership(1) | | Exercisable

Options(2) | | Number of Shares Owned Beneficially | | Percent of Class | |

John F. Anderson | | 38,932 | | 4,000 | | 42,932 | | * | |

Suzanne V. Baer | | 0 | | 10,000 | | 10,000 | | * | |

John F. Glick | | 5,800 | | 2,250 | | 8,050 | | * | |

Simon W. Henderson, III(3) | | 234,642 | | 8,000 | | 242,642 | | 1.6 | % |

Larry M. Hoes | | 0 | | 19,150 | | 19,150 | | * | |

James T. Jongebloed | | 0 | | 16,000 | | 16,000 | | * | |

Robert D. Leslie | | 0 | | 6,250 | | 6,250 | | * | |

John H. Lollar | | 10,000 | | 4,000 | | 14,000 | | * | |

Bob H. O’Neal | | 1,000 | | 12,000 | | 13,000 | | * | |

Scott H. Semlinger | | 710 | | 16,750 | | 17,460 | | * | |

Douglas V. Smith | | 26,000 | | 118,300 | | 144,300 | | 1.0 | % |

H. J. Trout, Jr. | | 421,604 | | 2,000 | | 423,604 | | 2.9 | % |

Thomas E. Wiener | | 35,510 | | 16,000 | | 51,510 | | * | |

Directors and Executive Officers as a group (13 persons) | | 778,198 | | 241,700 | | 1,019,898 | | 6.9 | % |

| * | Indicates ownership of less than one percent of the outstanding shares of Common Stock of the Company. |

| (1) | Each director, nominee for director and executive officer listed above possesses sole voting and investment powers as to all the shares listed as being beneficially owned by such person. |

| (2) | This column shows shares covered by stock options that are currently exercisable or will be exercisable within 60 days of March 6, 2006. |

| (3) | The shares listed above include 127,198 shares held in various trusts and a family limited partnership over which Mr. Henderson shares investment and voting control. |

19

Five Percent Beneficial Owners

The following table lists each person the Company knows to be an owner of more than 5% of the Company’s Common Stock as of March 6, 2006. All share numbers set forth in the table reflect the number of shares held after the Company’s two-for-one stock split that was effective on April 19, 2005.

| | | | | |

Name and Address of Beneficial Owner | | Amount and Nature of

Beneficial Ownership | | Percent

of Class | |

Barclays Global Investors, NA(2) | | 1,108,905 | | 7.58 | % |

45 Fremont Street 17th Floor | | | | | |

San Francisco, CA 94105 | | | | | |

| (1) | This information was obtained from a Schedule 13G filed on January 26, 2006, filed by Barclays Global Investors, NA, which is an investment advisor registered under the Investment Advisors Act of 1940. Barclays Global Investors NA reported sole voting power as to 1,018,927 shares, shared voting power as to zero shares, sole dispositive power as to 1,108,905 shares and shared dispositive power as to zero shares. |

Section 16(a) Beneficial Ownership Reporting Compliance

Section 16(a) of the Securities Exchange Act requires the Company’s officers and directors, and persons who own more than 10% of a registered class of the Company’s equity securities, to file reports of ownership and changes of ownership on Forms 3, 4 and 5 with the Securities and Exchange Commission. Officers, directors and greater-than-10% shareowners are required by regulations promulgated by the Securities and Exchange Commission to furnish the Company with copies of all Forms 3, 4 and 5 they file.

Based solely upon a review of Forms 3 and 4 and amendments thereto reported by the Company during fiscal 2005 and upon a review of Forms 5 and amendments thereto reported by the Company with respect to fiscal 2005, or upon written representations received by the Company from certain reporting persons that no Forms 5 were required for those persons, the Company believes that no director, executive officer or greater-than-10% shareholder failed to file on a timely basis the reports required by Section 16(a) of the Exchange Act during, or with respect to, fiscal 2005 except (i) Mr. S. W. Henderson, a director, did not timely file a Form 4 relating to one transaction involving the purchase of shares, (ii) Mr. L. M. Hoes, an executive officer, did not timely file a Form 4 relating to one transaction involving the sale of shares, and (iii) Mr. S. H. Semlinger, an executive officer, failed to report one transaction in a Form 4 that was otherwise timely filed. Mssrs. S. W. Henderson, III and L. M. Hoes subsequently filed the required reports with the Securities and Exchange Commission and Mr. S. H. Semlinger subsequently amended his original Form 4 to include the omitted transactions.

PROPOSALS OF SHAREHOLDERS