UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

Schedule 14f-1

Information Statement

Pursuant to Section 14(f) of the

Securities Exchange Act of 1934

and Rule 14f-1 Promulgated Thereunder

APPLIED SPECTRUM TECHNOLOGIES, INC.

(Exact name of registrant as specified in charter)

Delaware

(State or other Jurisdiction of Incorporation or Organization)

000-16397 (Commission File Number) | | 41-2185030 (IRS Employer Identification No.) |

936A Beachland Boulevard, Suite 13 Vero Beach, FL, 32963 (Address of Principal Executive Offices and zip code) |

(772) 231-7544

(Registrant's telephone

number, including area code)

(Former name or former address, if changed since last report)

November 1, 2006

APPLIED SPECTRUM TECHNOLOGIES, INC.

INFORMATION STATEMENT

PURSUANT TO SECTION 14(f) OF THE

SECURITIES EXCHANGE ACT OF 1934

AND RULE 14f-1 PROMULGATED THEREUNDER

THIS INFORMATION STATEMENT IS BEING PROVIDED FOR INFORMATIONAL PURPOSES ONLY. NO VOTE OR OTHER ACTION OF THE STOCKHOLDERS OF APPLIED SPECTRUM TECHNOLOGIES, INC. IS REQUIRED IN CONNECTION WITH THIS INFORMATION STATEMENT. NO PROXIES ARE BEING SOLICITED AND YOU ARE REQUESTED NOT TO SEND A PROXY TO APPLIED SPECTRUM TECHNOLOGIES, INC.

INTRODUCTION

This Information Statement is being furnished to stockholders of record as of October 25, 2006, of the outstanding shares of common stock, no par value (the “Common Stock”) of Applied Spectrum Technologies, Inc., a Delaware corporation (“Applied Spectrum”), pursuant to Section 14(f) of the Securities Exchange Act of 1934 (the “Exchange Act”) and Rule 14f-1 promulgated thereunder, in connection with the issuance of certain shares of Common Stock pursuant to a Share Exchange Agreement dated September 7, 2006 (“Exchange Agreement”) with KI Equity Partners III, LLC, a Delaware limited liability company (“KI Equity”), Ever Leader Holdings Limited, a company incorporated under the laws of Hong Kong SAR ("Ever Leader"), and each of the equity owners of Ever Leader (the “Ever Leader Shareholders”).

Under the terms of the Exchange Agreement, Applied Spectrum will, at closing of the exchange transaction (“Closing”), acquire all of the outstanding capital stock and ownership interests of Ever Leader (the “Interests”) from the Ever Leader Shareholders, and the Ever Leader Shareholders will transfer and contribute all of their Interests to Applied Spectrum. In exchange, Applied Spectrum will issue to the Ever Leader Shareholders 64,942,360 shares of Common Stock of Applied Spectrum.

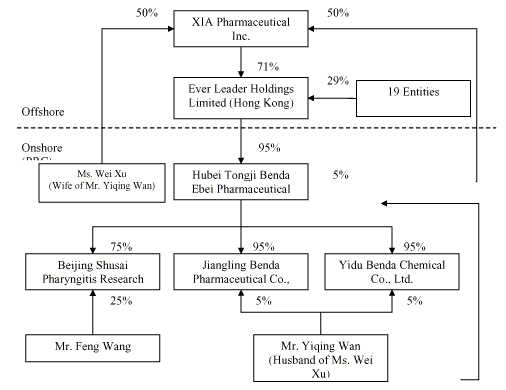

Ever Leader owns 95% of the issued and outstanding capital stock of Hubei Tongji Benda Ebei Pharmaceutical Co., Ltd., a China-Foreign Equity Joint Venture company incorporated under the laws of the People’s Republic of China (“Benda Ebei”). Mr. Yiqing Wan owns 5% of the issued and outstanding capital stock of Benda Ebei. Benda Ebei owns: (i) 95% of the issued and outstanding capital stock of Jiangling Benda Pharmaceutical Co., Ltd., a company formed under the laws of the People’s Republic of China (“Jiangling Benda”); (ii) 95% of the issued and outstanding capital stock of Yidu Benda Chemical Co., Ltd., a company incorporated under the laws of the People’s Republic of China (“Yidu Benda”); and (iii) 75% of the issued and outstanding capital stock of Beijing Shusai Pharyngitis Research Co., Ltd., a company incorporated under the laws of the People’s Republic of China (“Beijing Shusai”). Mr. Yiqing Wan owns: (i) 5% of the issued and outstanding capital stock of Jiangling Benda; and (ii) 5% of the issued and outstanding capital stock of Yidu Benda. Mr. Feng Wang owns 25% of the issued and outstanding capital stock of Beijing Shusai. Ever Leader, Benda Ebei, Jiangling Benda, Yidu Benda, and Beijing Shusai shall be referred to herein collectively as "Benda." Benda is principally engaged in the development, manufacturing and distribution of medicines, active pharmaceutical ingredients and pharmaceutical intermediaries.

Following completion of the exchange transaction (the “Exchange”), Ever Leader will become a wholly-owned subsidiary of Applied Spectrum.

The Exchange Agreement is included as Exhibit 2.1 to Applied Spectrum’s Current Report on Form 8-K dated September 7, 2006, and filed with the Securities and Exchange Commission (“SEC” or “Commission”) on September 7, 2006. The Exchange Agreement is the legal document that governs the Exchange and the other transactions contemplated by the Exchange Agreement. The discussion of the Exchange Agreement set forth herein is qualified in its entirety by reference to this Exhibit 2.1.

The Exchange Agreement provides that Applied Spectrum's sole officer and director, Kevin R. Keating, will resign his respective position as an officer of the Company effective as of the Closing Date (as defined in the Exchange Agreement). However, Kevin R. Keating will remain on the Board of Directors until KI Equity designates an independent director to take Kevin R. Keatings position on the board. The following persons will be appointed to Applied Spectrum’s board effective as of the Closing Date:

| · | Yiqing Wan, Ever Leader's current Chief Executive Officer |

| · | Ruilu Song, a current Vice President of Ever Leader |

| · | Jingbo Wu, a current Vice President of Ever Leader |

Each of these newly-appointed directors of Applied Spectrum is described in more detail below.

This Information Statement is being furnished pursuant to Section 14(f) of the Exchange Act, and Rule 14f-1 promulgated thereunder. No action is required by the stockholders of Applied Spectrum in connection with this Information Statement. However, Section 14(f) of the Exchange Act of 1934 and Rule 14f-1 promulgated thereunder require the mailing to Applied Spectrum’s stockholders of record of the information set forth in this Information Statement at least 10 days prior to the date a change in a majority of Applied Spectrum’s directors occurs (otherwise than at a meeting of Applied Spectrum’s stockholders). Accordingly, the Closing of the transactions contemplated under the Exchange Agreement and the resulting change in a majority of Applied Spectrum’s directors will not occur until at least 10 days following the filing and mailing of this Information Statement. This Information Statement will be first mailed to Applied Spectrum’s stockholders of record on or about November 1, 2006.

PROPOSED CHANGE IN CONTROL TRANSACTION

On September 7, 2006, Applied Spectrum entered into the Exchange Agreement with KI Equity, Ever Leader and the Ever Leader Shareholders. Under the Exchange Agreement, Applied Spectrum will acquire all of the Interests from the Ever Leader Shareholders, and the Ever Leader Shareholders will transfer and contribute all of their Interests to Applied Spectrum. In exchange, Applied Spectrum will issue to the Ever Leader Shareholders 64,942,360 shares of Common Stock of Applied Spectrum. Following the Closing of the Exchange, Ever Leader will continue as a wholly-owned subsidiary of Applied Spectrum.

The consummation of the Exchange is contingent on a minimum of $10,000,000 (or such lesser amount as mutually agreed to by Ever Leader and the placement agent) being subscribed for, and funded into escrow, by certain accredited and institutional investors (“Investors”) for the purchase of shares of Applied Spectrum Common Stock (the “Common Shares”) promptly after the closing of the Exchange under terms and conditions approved by Applied Spectrum’s board of directors immediately following the Exchange (“Financing”). The closing of the Financing will occur immediately following the conclusion of the Exchange.

No assurances can be given that the Financing or the Exchange will be completed. Further, in the event the Financing is completed, there can be no assurance that that the gross proceeds will be at least $10,000,000. For purposes of this Information Statement, it is assumed that the Financing will be completed with gross proceeds of $12,000,000, the maximum amount under the Financing.

The issuance of the Common Shares to the Ever Leader Shareholders is intended to be exempt from registration under the Securities Act of 1933, as amended (the “Securities Act”), pursuant to Regulation S promulgated thereunder and under the Securities Act pursuant to Section 4(2) thereof and such other available exemptions. As such, the Common Shares may not be offered or sold in the United States unless they are registered under the Securities Act, or an exemption from the registration requirements of the Securities Act is available. No registration statement covering these securities has been or is expected to be filed with the SEC or with any state securities commission in respect of the Exchange or the Financing. However, as a condition to the Financing, it is expected that Applied Spectrum will agree to register for public re-sale the shares of Applied Spectrum’s common stock issued to the Investors in the Financing. In addition, Applied Spectrum has agreed to register for public re-sale after the Exchange: (i) 2,400,000 shares of our Common Stock held by various parties, (ii) 4,481,302 shares of our Common Stock held by KI Equity; and (iii) 423,294 shares of our Common Stock held by the principals of Anslow & Jaclin, LLP to be issued after Closing for legal services rendered to the Company in connection with the Exchange and Financing.

Applied Spectrum is presently authorized under its Articles of Incorporation to issue 150,000,000 shares of common stock, $.001 par value per share, and 5,000,000 shares of preferred stock, $.001 par value per share. As of the date of this Information Statement, Applied Spectrum has 5,354,091 shares of its common stock issued and outstanding, and no shares of preferred stock issued and outstanding. However, subject to the completion of the Exchange, Applied Spectrum will issue 706,195 shares of Applied Spectrum’s common stock to certain finders immediately prior to the Closing for services as a consultant to Applied Spectrum in connection with the Exchange (“Consultant Shares”). Accordingly, for purposes of this Information Statement, all references to Applied Spectrum’s outstanding common stock and Applied Spectrum’s shareholders will include the Consultant Shares and the consultants, respectively.

Under the terms of the Exchange Agreement, all of the outstanding Interests of Ever Leader will be exchanged for 64,942,360 shares of Common Stock of Applied Spectrum. As a condition to the Closing of the Exchange, KI Equity and the Ever Leader Shareholders will enter into a voting agreement (“Voting Agreement”) to vote their Applied Spectrum shares in favor of the Corporate Actions. Immediately following the exchange transaction, the Ever Leader Shareholders together with the Investors (assuming gross proceeds from the Financing of $12,000,000) will own 93.75% of the total combined voting power of all classes of Applied Spectrum’s outstanding stock entitled to vote.

Accordingly, upon completion of the Exchange and the Financing (assuming gross proceeds from the Financing of $12,000,000), the Ever Leader Shareholders will own 64,942,360 shares of Common Stock of Applied Spectrum, the Investors will receive 25,961,760 shares of Applied Spectrum’s common stock and warrants to purchase an additional 25,961,760 shares of Applied Spectrum’s common stock (the “Warrants”), and the current Applied Spectrum stockholders will own 5,354,091 shares of Applied Spectrum’s common stock. Upon the exercise of the Warrants, the Ever Leader Shareholders together with the Investors (assuming the Investors elect to exercise all of their Warrants) will own approximately 93.1% of the total outstanding shares of Applied Spectrum’s common stock, and the current Applied Spectrum stockholders will own approximately 4.3% of the total outstanding shares of Applied Spectrum’s common stock.

Effective as of the Closing of the Exchange, and subject to applicable regulatory requirements, including the preparation, filing and distribution to the Applied Spectrum stockholders of this Information Statement at least ten (10) days prior to Closing, Applied Spectrum’s sole officer will resign such position, but will remain as a director until such time as an independent director is appointed to replace him, and Applied Spectrum’s board will appoint as directors:

| · | Yiqing Wan, Ever Leader's current Chief Executive Officer (the “Managing Director”) |

| · | Ruilu Song, a current Vice President of Ever Leader |

| · | Jingbo Wu, a current Vice President of Ever Leader |

Additional information concerning Yiqing Wan, Ruilu Song, Jingbo Wu, and Hulian Song is set forth below.

On or about November 8, 2006, Yiqing Wan shall be appointed as Vice President of Applied Spectrum, and shall hold such office until the Closing. At Closing, Mr. Wan will resign his position as Vice President and be appointed Chief Executive Officer of Applied Spectrum.

An independent director will be designated by KI Equity to serve as a director for the one year period following Closing (“KI Equity Director”). Within ninety (90) days after the Closing, three persons selected by the Management Director and the KI Equity Director shall be appointed to the board of directors, which directors shall be independent directors (“Independent Directors”), and Ruilu Song, Jingbo Wu and Huilian Song shall resign upon such appointment. The Voting Agreement will require KI Equity and the Ever Leader Shareholders to vote their Applied Spectrum shares for the above director designees.

Ever Leader has also agreed that, within 90 days following the Closing, Applied Spectrum’s board of directors will satisfy the independence, audit and compensation committee and other corporate governance requirements under the Sarbanes-Oxley Act of 2002 (the "SOX Act"), the rules and regulations promulgated by the SEC, and the requirements of either NASDAQ or American Stock Exchange (“AMEX”) as selected by Applied Spectrum, whether or not Applied Spectrum’s common stock is listed or quoted, or qualifies for listing or quotation, on such national exchanges.

At or prior to the Closing, Applied Spectrum will also enter into a certain financial advisory agreement with Keating Securities, LLC (“Keating Securities”), a registered broker-dealer, under which Keating Securities will be compensated by Applied Spectrum for its advisory services rendered to Applied Spectrum in connection with the Exchange. The transaction advisory fee will be $395,000, with the payment thereof being subject to the Closing of the Exchange. This fee will be paid in full at the Closing of the Exchange.

Applied Spectrum’s completion of the transactions contemplated under the Exchange Agreement are subject to the satisfaction of certain contingencies including, without limitation, the delivery of U.S. GAAP audited annual, interim reviewed and pro forma financial information of Benda (on a consolidated basis) acceptable to Applied Spectrum, compliance with regulatory requirements, and the completion of the Financing. Consummation of the exchange transaction is also conditioned upon, among other things: (i) execution by KI Equity and the Ever Leader Stockholders of the Voting Agreement; (ii) continued quotation of Applied Spectrum’s common stock on the NASD Over-the-Counter Electronic Bulletin Board (“OTC BB”); (iii) receipt of all required licenses, permits, certificates and approvals by the government authorities; (iv) delivery of legal opinions from Benda’s Hong Kong legal counsels satisfactory to Applied Spectrum, and (v) execution of an aftermarket support agreement between Applied Spectrum and After Market Support, LLC (“AMS”), with such terms and conditions as mutually acceptable to Ever Leader, Applied Spectrum, and AMS.

The directors of Applied Spectrum and Ever Leader have each approved the Exchange Agreement and the transactions contemplated under the Exchange Agreement.

The parties expect the closing of the transactions under the Exchange Agreement and the Financing to occur on or about November 14, 2006. However, there can be no assurances that the exchange transaction or the Financing will be completed.

The Exchange Agreement may be terminated as follows: (i) by mutual written consent, (ii) by either party if the exchange transaction is not consummated by November 30, 2006, (iii) by either party if the exchange transaction is prohibited by issuance of an order, decree or ruling, and (iv) by either party if the other is in material breach of any representation, warranty, covenant or agreement.

On September 7, 2006, in its Current Report on Form 8-K dated September 7, 2006, Applied Spectrum reported the execution of the Exchange Agreement to acquire Ever Leader.

Kevin R. Keating is the sole officer and a director of Applied Spectrum. Kevin R. Keating is the father of Timothy J. Keating, the principal member of Keating Investments, LLC. Keating Investments, LLC is the managing member of KI Equity, which is the majority stockholder of Applied Spectrum, Keating Securities, LLC, the registered broker-dealer affiliate of Keating Investments, LLC, and After Market Support, LLC (“AMS”). Kevin R. Keating is not affiliated with and has no equity interest in Keating Investments, LLC, KI Equity, AMS or Keating Securities, LLC and disclaims any beneficial interest in the shares of Applied Spectrum’s common stock owned by KI Equity. Similarly, Keating Investments, LLC, KI Equity, AMS and Keating Securities, LLC disclaim any beneficial interest in the shares of Applied Spectrum’s common stock currently owned by Kevin R. Keating.

VOTING SECURITIES

Applied Spectrum’s common stock is the only class of equity securities that is currently outstanding and entitled to vote at a meeting of Applied Spectrum’s stockholders. Each share of common stock entitles the holder thereof to one vote. As of November 1, 2006, 5,354,091 shares of Applied Spectrum’s common stock were outstanding.

APPLIED SPECTRUM’S BUSINESS

Applied Spectrum is currently a public “shell” company with nominal assets whose sole business has been to identify, evaluate and investigate various companies with the intent that, if such investigation warrants, a reverse merger transaction be negotiated and completed pursuant to which Applied Spectrum would acquire a target company with an operating business with the intent of continuing the acquired company’s business as a publicly held entity.

BENDA’S BUSINESS

Benda is a mid-sized Chinese pharmaceutical company that identifies, discovers, develops and manufactures both conventional medications and Traditional Chinese Medicines (“TCMs”) for the treatment of some of the largest common ailments and diseases (e.g., common cold, diabetes, cancer).

Benda has three core operating companies:

| · | Yidu Benda develops, manufactures and sells bulk chemicals (or pharmaceutical intermediates), which are the raw materials used to make “Active Pharmaceutical Ingredients” (“APIs”). About 11.8 per cent of the bulk chemicals that we produce in 2004 were used for our own medicines. The remainder was sold in the market to unrelated parties. Yidu Benda did not sell to related Benda companies in 2005. |

| · | Jiangling Benda develops, manufactures and sells APIs, which are one of the two components of any capsules, tablets and fluids that are pharmaceutically active. An API is the substance in a drug that produces the desired medicinal effect. The “excipient” is the inert material that holds the API (such as gelatin or water). About 3.7 per cent of the APIs that we produce in 2004 were used to produce some of our finished medicines. The remainder was sold in the market to unrelated parties. Jiangling Benda did not sell to related Benda companies in 2005. |

| · | Benda Ebei develops, manufactures and sells (a) conventional finished medicines, which are non-patented, branded, proprietary small volume injection solutions (vials) used for a variety of treatments including hepatitis; and (b) Traditional Chinese Medicines (“TCMs”), which are herb-based and natural medicines used in TCM therapies (via our newly formed subsidiary Beijing Shusai). Some of the medicines we produce are of our own origination and protected from competition by certificates issued by China’s State Food and Drug Administration (“SFDA”)1. |

Benda distributes its high value, branded medicines, through agents who sell them to hospitals that administer them to patients. Benda sells generics to medical wholesalers for resale to hospitals. The company sells its Over the Counter (“OTC”) medicines to wholesalers specializing in selling to retail chain drug stores. The APIs are typically sold to large drug manufacturers under long-term supply contracts. The bulk chemicals are purchased by other Chinese drug companies.

1 The Chinese government agency, SFDA, is analogous to the Food and Drug Administration (“FDA”) in the United States. Unlike the FDA, however, the SFDA provides intellectual property and competitive protection to certain classes of approved drugs.

The business of Benda involves a number of risks and uncertainties that could cause the actual results of either company to differ materially from those estimated by management from time to time. Potential risks and uncertainties, include, but are not limited to, such factors as fluctuations in demand for Benda’s products, Benda’s cost of manufacturing and raw materials, conditions and trends in the pharmaceutical market, additions or departures of key personnel, Benda’s ability to attract and maintain customers and strategic business relationships, Benda’s ability to develop and/or obtain approval for existing and new products, the impact of competitive products and pricing, growth in target markets, the adequacy of Benda’s liquidity and financial strength to support its growth, and other information that may be detailed from time to time in Applied Spectrum’s filings with the United States Securities and Exchange Commission should the exchange transaction contemplated by the Exchange Agreement be completed.

DIRECTORS AND OFFICERS

On December 14, 2005, Norwood Venture Corp., a Delaware corporation ("Norwood") entered into a Securities Purchase Agreement with KI Equity, as amended (the "Purchase Agreement") under which KI Equity agreed to purchase and Norwood agreed to sell an aggregate of 2,281,302 shares of common stock ("Shares") of Applied Spectrum, representing approximately 77.2% of our outstanding shares of common stock, to KI Equity at a price of $175,000.

The closing of the transactions under the Purchase Agreement occurred on December 29, 2005 ("Closing"). Effective as of the Closing, Mark R. Littell resigned as Chief Executive Officer and Chief Financial Officer of Applied Spectrum, and Kevin R. Keating was appointed President, Secretary, Treasurer and a director of Applied Spectrum. Mark R. Littell had been the Chief Executive Officer, Chief Financial Officer and a Director of Applied Spectrum since January 1998. Since May 1988, Mr. Littell has been the President and controlling stockholder of Norwood.

The Purchase Agreement contemplated that Mark R. Littell would continue as a director of Applied Spectrum following the Closing until such time as Applied Spectrum complied with Section 14(f) of the Securities Exchange Act of 1934, as amended, and Rule 14f-1 promulgated under the Exchange Act. The information statement under Rule 14f-1 was filed with the SEC on December 15, 2005 and mailed to Applied Spectrum's stockholders on December 19, 2005. Accordingly, effective December 30, 2005, Mark R. Littell resigned as a director of Applied.

The following table sets forth the names, positions and ages of executive officers and directors of Applied Spectrum. All directors serve until the next annual meeting of stockholders or until their successors are elected and qualified. Officers are elected by the board of directors and their terms of office are, except to the extent governed by employment contract, at the discretion of the board of directors. There is no family relationship between any director, executive officer or person nominated or chosen by Applied Spectrum to become a director or executive officer.

Name | | Age | | Position | | Term |

| Kevin R. Keating (1) | | 66 | | President, Treasurer, Secretary and Director | | 1 Year |

| (1) | Mr. Keating became President, Secretary, Treasurer, and a director effective December 29, 2005. |

Kevin R. Keating, President, Secretary, Treasurer and a director of Applied Spectrum, is an investment executive and for the past twelve years has been the Branch Manager of the Vero Beach, Florida, office of Brookstreet Securities Corporation. Brookstreet is a full-service, national network of independent investment professionals. Mr. Keating services the investment needs of private clients with special emphasis on equities. For more than 40 years, he has been engaged in various aspects of the investment brokerage business. Mr. Keating began his Wall Street career with the First Boston Company in New York in 1965. From 1967 through 1974, he was employed by several institutional research boutiques where he functioned as Vice President Institutional Equity Sales. From 1974 until 1982, Mr. Keating was the President and Chief Executive Officer of Douglas Stewart, Inc., a New York Stock Exchange member firm. Since 1982, he has been associated with a variety of firms as a registered representative servicing the needs of individual investors. Mr. Keating is also the manager and sole member of Vero Management, LLC, which has a management agreement with Applied Spectrum.

COMMITTEES OF BOARD OF DIRECTORS

Audit Committee and Audit Committee Financial Expert

Applied Spectrum is not a "listed company" under SEC rules and is therefore not required to have an audit committee comprised of independent directors. Applied Spectrum does not currently have an audit committee, however, for certain purposes of the rules and regulations of the SEC, Applied Spectrum's board of directors is deemed to be its audit committee. Applied Spectrum's board of directors has determined that its members do not include a person who is an "audit committee financial expert" within the meaning of the rules and regulations of the SEC. The board of directors has determined that each of its members is able to read and understand fundamental financial statements and has substantial business experience that results in that member's financial sophistication. Accordingly, the board of directors believes that each of its members have the sufficient knowledge and experience necessary to fulfill the duties and obligations that an audit committee would have.

No Code of Ethics

A code of ethics relates to written standards that are reasonably designed to deter wrongdoing and to promote:

| · | Honest and ethical conduct, including the ethical handling of actual or apparent conflicts of interest between personal and professional relationships; |

| · | Full, fair, accurate, timely and understandable disclosure in reports and documents that are filed with, or submitted to, the SEC and in other public communications made by an issuer; |

| · | Compliance with applicable governmental laws, rules and regulations; |

| · | The prompt internal reporting of violations of the code to an appropriate person or persons identified in the code; and |

| · | Accountability for adherence to the code. |

Applied Spectrum has not adopted a code of ethics that applies to the Chief Executive Officer and Chief Financial Officer because it has no meaningful operations. Applied Spectrum does not believe that a formal written code of ethics is necessary at this time.

Conflicts of Interest

Certain conflicts of interest existed at September 30, 2005 and may continue to exist between Applied Spectrum and its officers and directors due to the fact that each has other business interests to which they devote their primary attention. Each officer and director may continue to do so notwithstanding the fact that management time should be devoted to the business of Applied Spectrum.

Certain conflicts of interest may exist between Applied Spectrum and its management, and conflicts may develop in the future. Applied Spectrum has not established policies or procedures for the resolution of current or potential conflicts of interest between Applied Spectrum, its officers and directors or affiliated entities. There can be no assurance that management will resolve all conflicts of interest in favor of Applied Spectrum, and conflicts of interest may arise that can be resolved only through the exercise by management their best judgment as may be consistent with their fiduciary duties. Management will try to resolve conflicts to the best advantage of all concerned, but there may be times when an acquisition opportunity is given to another entity to the disadvantage of Applied Spectrum’s stockholders and for which there will be no recourse. As part of the Exchange, Applied Spectrum will engage Keating Securities, LLC, an affiliate of Keating Investments, LLC, the managing member of Applied Spectrum’s controlling stockholder, to act as a financial advisor in connection with the Exchange for which it will earn a $395,000 advisory fee upon the Closing.

Board Meetings and Committees

Directors may be paid their expenses, if any, of attendance at such meeting of the Board of Directors, and may be paid a fixed sum for attendance at each meeting of the Board of Directors or a stated salary as Director. No such payment shall preclude any Director from serving Applied Spectrum in any other capacity and receiving compensation therefore except as otherwise provided under applicable law. Except as set forth below, no compensation has been paid to the Directors. The Board of Directors may designate from among its members an executive committee and one or more other committees. No such committees are currently appointed or in place.

Applied Spectrum is not a "listed company" under SEC rules and is therefore not required to have a compensation committee or a nominating committee. Applied Spectrum does not currently have a compensation committee. Kevin R. Keating is Applied Spectrum’s sole officer acting as President, Secretary and Treasurer. Applied Spectrum has no employees, and any compensation for directors and officers must be approved by the Board of Directors.

Applied Spectrum neither has a nominating committee for persons to be proposed as directors for election to the Board of Directors nor a formal method of communicating nominees from shareholders. Applied Spectrum does not have any restrictions on shareholder nominations under its certificate of incorporation or by-laws. The only restrictions are those applicable generally under Delaware law and the federal proxy rules. Currently, the entire Board of Directors decides on nominees, on the recommendation of one or more members of the Board of Directors. None of the members of the Board of Directors are "independent." The Board of Directors will consider suggestions from individual shareholders, subject to evaluation of the person's merits. Stockholders may communicate nominee suggestions directly to any of the Board members, accompanied by biographical details and a statement of support for the nominees. The suggested nominee must also provide a statement of consent to being considered for nomination. Although there are no formal criteria for nominees, Applied Spectrum’s Board of Directors believes that persons should be actively engaged in business endeavors, have a financial background, and be familiar with acquisition strategies and money management.

Because the management and the sole director of Applied Spectrum are the same person, the Board of Directors has determined not to adopt a formal methodology for communications from shareholders on the belief that any communication would be brought to the Board's attention by virtue of the co-extensive capacities served by Kevin R. Keating. Applied Spectrum does not have a policy regarding the attendance of board members at the annual meeting of shareholders.

APPLIED SPECTRUM EXECUTIVE COMPENSATION SUMMARY

The following Executive Compensation Chart highlights the compensation for Applied Spectrum’s executive officers. No other executive officers received salary and bonus in excess of $100,000 for the prior three fiscal years.

| | | | | | | Long Term Compensation | | | | |

| | | | | Annual Compensation | | Awards | | Payouts | | | | |

| Name and Principal Position | | | Year | | | Salary ($) | | | Bonus ($) | | | Other Annual Compensation ($) | | | Restricted Stock Award(s) ($) | | | Securities Underlying Options/ SARs (#) (#) | | | LTIP Payouts ($) | | | All Other Compensation ($) | |

| Mark R. Littell (former CEO and President) (1) | | | 2005 2004 2003 | | $ $ $ | 0 0 0 | | $ $ $ | 0 0 0 | | $ $ $ | 0 0 0 | | | N/A N/A N/A | | | N/A N/A N/A | | | N/A N/A N/A | | | N/A N/A N/A | |

| | | | | | | | | | | | | | | | | | | | | | | | | | |

Kevin R. Keating (former President, Secretary and Treasurer) (2) | | | 2006 2005 2004 | | $ $ $ | 0 0 0 | | $ $ $ | 0 0 0 | | $ $ $ | 0 0 0 | | | 100,000 shares (3) N/A N/A | | | N/A N/A N/A | | | N/A N/A N/A | | $ | 0 N/A N/A | |

| | | | | | | | | | | | | | | | | | | | | | | | | | |

| Yiqing Wan, CEO (4) | | | 2006 | | $ | 150,000 | | $ | 0 | | $ | 0 | | | N/A | | | N/A | | | N/A | | | N/A | |

| | | | | | | | | | | | | | | | | | | | | | | | | | |

| Wei Xu, Vice President (4) | | | 2006 | | $ | 120,000 | | $ | 0 | | $ | 0 | | | N/A | | | N/A | | | N/A | | | N/A | |

| | | | | | | | | | | | | | | | | | | | | | | | | | |

| Hui Long, Vice President (4) | | | 2006 | | $ | 100,000 | | $ | 0 | | $ | 0 | | | N/A | | | N/A | | | N/A | | | N/A | |

| | | | | | | | | | | | | | | | | | | | | | | | | | |

| Daping Gu, Vice President (4) | | | 2006 | | $ | 100,000 | | $ | 0 | | $ | 0 | | | N/A | | | N/A | | | N/A | | | N/A | |

| | | | | | | | | | | | | | | | | | | | | | | | | | |

| Ruilu Song, Vice President (4) | | | 2006 | | $ | 100,000 | | $ | 0 | | $ | 0 | | | N/A | | | N/A | | | N/A | | | N/A | |

| | | | | | | | | | | | | | | | | | | | | | | | | | |

| Jingbo Wu, Vice President (4) | | | 2006 | | $ | 100,000 | | $ | 0 | | $ | 0 | | | N/A | | | N/A | | | N/A | | | N/A | |

| (1) | Mark R. Littell resigned as APSP' Chairman, Chief Executive Officer, President and Chief Financial Officer on December 30, 2005. |

| (2) | Kevin R. Keating was appointed as APSP’s President, Secretary, Treasurer and Director on December 30, 2005. |

| (3) | On January 4, 2006, APSP issued 100,000 shares of its common stock to Kevin R. Keating for services rendered to APSP valued at $5,000, or $0.05 per share. |

| (4) | As of the Closing, the Company will execute employment agreements with each of its executive officers. The employment agreements will be for terms of three years, except for Yiqing Wan, whose term will be five years. The employment agreements will provide for annual salaries and annual bonuses in amounts not less than the amounts set forth in the table above. |

Except as set forth above, there was no other compensation paid to Mark R. Littell or Kevin R. Keating during the fiscal year ended September 30, 2005, nor the subsequent periods thereafter. There were no option grants to Mark R. Littell during the fiscal year ended September 30, 2005.

We did not pay any compensation to any director in the year ended September 30, 2005.

On January 4, 2006, Applied Spectrum issued 100,000 shares of its common stock to Kevin R. Keating, the current sole officer and director of Applied Spectrum, for services rendered to Applied Spectrum, valued at $5,000, or $.05 per share. Mr. Keating became an officer and director of Applied Spectrum effective December 29, 2005.

NEW DIRECTORS AND OFFICERS

The Exchange Agreement provides that, on the Closing Date, Applied Spectrum’s current sole officer and director, Kevin R. Keating will resign his position as an officer of the Company, but shall remain on the board until an independent director has been designated to replace him, and shall appoint the following persons as executive officers and directors of Applied Spectrum.

Name | | Age | | Position |

| Yiqing Wan | | 45 | | Chief Executive Officer and Chairman |

| | | | | |

| Wei Xu | | 44 | | Vice President of Operations |

| | | | | |

| Hui Long | | 46 | | Vice President of Technology |

| | | | | |

| Daping Gu | | 59 | | Vice President of Marketing |

| | | | | |

| Ruilu Song | | 64 | | Vice President and Director |

| | | | | |

| Jingbo Wu | | 45 | | Vice President and Director |

| | | | | |

| Kevin R. Keating | | 66 | | Director |

| | | | | |

| Huilan Song | | 43 | | Director |

| | | | | |

Yiqing Wan, Chairman and Chief Executive Officer. Mr. Wan will became our Chairman and Chief Executive Officer upon Closing. Before founding Benda Ebei, Mr. Wan was Chairman of Zhanjiang Jinhui Pharmaceutical Corp. (from 1995 to 1998), Chairman of Shandong Jinhai Real Estate Development Co. (from 1992 to 1995), Manager of Hainan Pharmaceutical Co. Ltd Guangzhou Division (from 1990 to 1992), and Director of Yichang No.4 Drug Plant (from 1982 to 1990). Mr. Wan has held a range of operational and executive positions in a number of pharmaceutical enterprises for more than two decades and developed significant management experience in production planning and implementation and in product marketing. Mr. Wan earned B.S. degree in Biological Engineering from Sanxia University in 1982.

Wei Xu, Vice President of Operations. Ms. Xu will be appointed as Vice President of Operations upon Closing. Ms. Xu has over 20 years of experience in the medical industry and in public relations with Chinese government departments and organizations. From 2002 to present, she served as Chairperson of a related company, Hubei Benda Science and Technology Co., Ltd. Prior to such time, she was General Manager at the Zhanjiang Jinhui Pharmaceutical Co., Ltd (from 1995 to 1998) and Manager at the Hainan Pharmaceutical Co., Ltd., Guangzhou Division (from 1991 to 1995). Ms. Xu holds an M.B.A. from Beijing University. She received her certificate of completion of Master courses in General Medicines from Peking University in 2005.

Huilian Song, Director. Ms. Huilian Song, a US citizen, will become our Director upon Closing. Ms. Song received her undergraduate education from Xiangfan University from 1984 to 1988. From 1989 to 1991, she studied ESL and Computer courses in City College of the City University of New York. Starting from January 2003, Ms. Song has been serving as a director and Vice President of China Hi-Tech Fund, a VC firm based in Shenzhen, PRC. Her responsibilities are administration and human resources.

From 1999 to 2003, Ms. Song worked as computer technician in Fabrikant & Son Corp., a jewelry company based in New York City. From 1994 to 1999, she worked as order processor and office clerk for Welland International, Inc., an importer and wholesaler of footwear and leather goods, based in New York City. From 1988 to 1989, she was a history teacher in Xiangfan Police Academy.

Daping Gu, Vice President of Marketing. Mr. Gu will be appointed as Vice President of Marketing upon Closing. Mr. Gu became the general director of Hubei Yidu Benda Chemical Co., Ltd in 2002. He was formerly the supply and marketing section chief of Wuhan Medicine Supply Co., Ltd. (from 1981 to 1984), the vice general manager of Hubei Medicine Supply Co., Ltd. (from 1984 to 1996), and the general manager of Hubei Pharmaceutical Co. Ltd. (from 1996 to 2002). Mr. Gu brings 25 years of experience in marketing medical products. He earned a B.A. in Business Administration from Hubei University in 1987.

Ruilu Song, Director, Vice President. Mr. Song will become our Director, and Vice President upon Closing. Mr. Song became the General Manager of Ebei Pharmaceutical Corp. in 1999. He was also the general manager of Wuhan Technologies Trust and Investment Co. (from 1995 to 1999) and the director of Hubei Province Science Committee Financial Division. (from 1985 to 1995). Mr. Song received B.S. in organic chemical synthesis from Beijing Chemical University in 1966 and was granted senior engineer qualification of technology management in 1993.

Jingbo Wu, Director, Vice President. Mr. Wu will become our Director and Vice President upon Closing. Prior to this position, he was the deputy general manager of Ebei Pharmaceutical Corp. (from 2000 to 2001) and the deputy general manager of Zhejiang Jinhui Pharmaceutical Co. Ltd. (from 1999 to 2000). Mr. Wu received certification of graduation in Business Administration from Wuhan University in 1995.

Hui Long, Vice President of Technology. Mr. Long will be appointed as Vice President of Technology upon Closing. Mr. Long has held senior technical and production management positions with pharmaceutical enterprises for approximately 20 years. He was formerly the Chief of Technical Division of Sanxia Pharmaceutical Co., Ltd and the deputy general manager of Zhanjiang Jinhui Pharmaceuticals Co. Ltd. Mr. Long earned a B.S. in Biological Engineering from Sanxia University in 1982.

To the best of Applied Spectrum’s knowledge, none of the proposed officers or directors intended to be appointed following the Closing, including any of their affiliates, currently beneficially own any equity securities or rights to acquire any securities of Applied Spectrum, and no such persons have been involved in any transaction with Applied Spectrum or any of its directors, executive officers or affiliates that is required to be disclosed pursuant to the rules and regulations of the SEC, other than with respect to the transactions that have been described herein. To the best of Applied Spectrum’s knowledge, none of the proposed officers and directors intended to be appointed following the Closing have been convicted in a criminal proceeding, excluding traffic violations or similar misdemeanors, nor have they been a party to any judicial or administrative proceeding during the past five years, except for matters that were dismissed without sanction or settlement, that resulted in a judgment, decree or final order enjoining the person from future violations of, or prohibiting activities subject to, federal or state securities laws, or a finding of any violation of federal or state securities laws.

BENDA’S EXECUTIVE COMPENSATION SUMMARY

The following Executive Compensation Chart highlights the compensation for Benda’s executive officers. No other executive officers received salary and/or bonus in excess of $100,000 for the prior three fiscal years ended December 31, 2003, 2004 and 2005.

| | | | | | | Long Term Compensation | | | |

| | | | | Annual Compensation | | Awards | | Payouts | | | |

| Name and Principal Position | | Year | | Salary ($) | | Bonus ($) | | Other Annual Compensation ($) | | Restricted Stock Award(s) ($) | | Securities Underlying Options/ SARs (#) | | LTIP Payouts ($) | | All Other Compensation ($) | |

| Mr. Yiqing Wan, Chief Executive Officer | | | 2005 2004 2003 | | $ | 8,777 — — | | $ | 5,851 — — | | | N/A N/A N/A | | | N/A N/A N/A | | | N/A N/A N/A | | | N/A N/A N/A | | | N/A N/A N/A | |

| | | | | | | | | | | | | | | | | | | | | | | | | | |

Ms. Wei Xu, Vice President of operations | | | 2005 2004 2003 | | $ | 8,777 — — | | $ | 5,851 — — | | | N/A N/A N/A | | | N/A N/A N/A | | | N/A N/A N/A | | | N/A N/A N/A | | | N/A N/A N/A | |

| | | | | | | | | | | | | | | | | | | | | | | | | | |

Mr. Hui Long, Vice President of Technology | | | 2005 2004 2003 | | $ | 5,266 — — | | $ | 2,048 — — | | | N/A N/A N/A | | | N/A N/A N/A | | | N/A N/A N/A | | | N/A N/A N/A | | | N/A N/A N/A | |

| | | | | | | | | | | | | | | | | | | | | | | | | | |

Mr. Daping Gu, Vice President of Marketing | | | 2005 2004 2003 | | $ | 5,266 — — | | $ | 2,048 — — | | | N/A N/A N/A | | | N/A N/A N/A | | | N/A N/A N/A | | | N/A N/A N/A | | | N/A N/A N/A | |

| | | | | | | | | | | | | | | | | | | | | | | | | | |

Mr. Ruilu Song, Vice President and Director | | | 2005 2004 2003 | | $ | 5,266 — — | | $ | 2,048 — — | | | N/A N/A N/A | | | N/A N/A N/A | | | N/A N/A N/A | | | N/A N/A N/A | | | N/A N/A N/A | |

| | | | | | | | | | | | | | | | | | | | | | | | | | |

Mr. Jingbo Wu, Vice President and Director | | | 2005 2004 2003 | | $ | 5,266 — — | | $ | 2,048 — — | | | N/A N/A N/A | | | N/A N/A N/A | | | N/A N/A N/A | | | N/A N/A N/A | | | N/A N/A N/A | |

Employment Agreements

As of the Closing, the Company will execute employment agreements with each of its executive officers, specifically, Yiqing Wan, its Chief Executive Officer; Wei Xu, its Vice President of Operations; Hui Long, its Vice President of Technology; Daping Gu, its Vice President of Marketing; Ruilu Song, its Vice Presidnet and Jingbo Wu, its Vice President. The employment agreements will be for terms of three years, except for Yiqing Wan, whose term will be five years. The employment agreements will provide for annual salaries and annual bonuses in amounts not less than the amounts set forth in the table above.

Stock Option Grants

Benda does not have stock options issued or outstanding and does not maintain any stock option or equity incentive plans.

Director Compensation

No directors of Benda received any compensation for their service on the board.

LEGAL PROCEEDINGS

We are not involved in any lawsuit outside the ordinary course of business, the disposition of which would have a material effect upon either our results of operations, financial position, or cash flows.

Ever Leader, Benda Ebei, Jiangling Benda, Yidu Benda and Beijing Shusai are not involved in any lawsuit outside the ordinary course of business, the disposition of which would have a material effect upon either the company’s results of operations, financial position, or cash flows.

SECURITY OWNERSHIP OF

CERTAIN BENEFICIAL OWNERS AND MANAGEMENT

The following table sets forth certain information regarding Applied Spectrum’s common stock beneficially owned on November 1, 2006, for (i) each shareholder Applied Spectrum knows to be the beneficial owner of 5% or more of its outstanding common stock, (ii) each of Applied Spectrum’s executive officers and directors, and (iii) all executive officers and directors as a group. In general, a person is deemed to be a "beneficial owner" of a security if that person has or shares the power to vote or direct the voting of such security, or the power to dispose or to direct the disposition of such security. A person is also deemed to be a beneficial owner of any securities of which the person has the right to acquire beneficial ownership within 60 days. To the best of Applied Spectrum’s knowledge, all persons named have sole voting and investment power with respect to such shares, except as otherwise noted. Except as set forth in this Information Statement, there are not any pending or anticipated arrangements that may cause a change in control of Applied Spectrum. At November 1, 2006, 5,354,091 shares of Applied Spectrum’s common stock were outstanding.

| Name | | Number of Shares Beneficially Owned | | Percent of Shares | |

Kevin R. Keating 936A Beachland Boulevard, Suite 13 Vero Beach, Florida 32963 | | | 100,000(1 | ) | | 1.2 | % |

| | | | | | | | |

KI Equity Partners III, LLC c/o Timothy J. Keating, Manager 5251 DTC Parkway, Suite 1090 Greenwood Village, Colorado 80111 | | | 4,481,302(2 | ) | | 83.7 | % |

| | | | | | | | |

| All Executive Officers and Directors as a group | | | 100,000 | | | 1.2 | % |

| (1) | Kevin R. Keating is not affiliated with and has no equity interest in KI Equity Partners III, LLC (“KI Equity”) and disclaims any beneficial interest in the shares of APSP’s common stock owned by KI Equity. |

| (2) | Timothy J. Keating is the manager of KI Equity and exercises sole voting and investment control over such shares. KI Equity is not owned by or affiliated with Kevin R. Keating and disclaims any beneficial interest in the shares of Applied Spectrum's common stock owned by Kevin R. Keating. |

The following table sets forth certain information regarding Applied Spectrum’s common stock beneficially owned on November 1, 2006, for (i) each stockholder known to be the beneficial owner of 5% or more of Applied Spectrum’s outstanding common stock, (ii) each executive officer and director, and (iii) all executive officers and directors as a group, on a pro forma basis to reflect the transactions contemplated by the Exchange Agreement, assuming the closing of the Exchange, and the issuance of Common Shares issued to Investors under the Financing based on gross proceeds of $12,000,000 and the exercise of the Warrants, were completed as of such date. The information contained in the following table is provided for disclosure purposes only as there can be no assurance that the transactions contemplated by the Exchange Agreement will be completed or that the actual ownership will be as set forth therein based on the assumptions used. At Closing, Applied Spectrum intends to file a Current Report on Form 8-K which will include an updated beneficial ownership table for Applied Spectrum to reflect the actual results of the completion of the transactions under the Exchange Agreement and the Equity Financing.

Assuming (i) the completion of the Exchange, (ii) gross proceeds from the Financing of $12,000,000, and (iii) the exercise of the Investor and Agent Warrants, occurred as of November 1, 2006, Applied Spectrum expects to have 125,522,342 shares of common stock outstanding.

Name of Beneficial Owner | | Amount of Beneficial Ownership | | Percent of Beneficial Ownership (5) | | Amount of Beneficial Ownership After Offering(6) | | Percent of Beneficial Ownership After Offering(6) | |

| XIA Pharmaceutical Inc. (1) | | | 46,187,136 (3 | ) | | 65.05 | % | | 46,187,136 | | | 36.80 | % |

| | | | | | | | | | | | | | |

| Moveup Investments Limited (4) | | | 4,230,865 | | | 5.96 | % | | 4,230,865 | | | 3.37 | % |

| | | | | | | | | | | | | | |

| Hui Long (1) | | | 0 | | | 0 | | | 0 | | | 0 | |

| | | | | | | | | | | | | | |

| Daping Gu (1) | | | 0 | | | 0 | | | 0 | | | 0 | |

| | | | | | | | | | | | | | |

| Ruilu Song (1) | | | 0 | | | 0 | | | 0 | | | 0 | |

| | | | | | | | | | | | | | |

| Jingbo Wu (1) | | | 0 | | | 0 | | | 0 | | | 0 | |

| | | | | | | | | | | | | | |

| Huilian Song (1) | | | 0 | | | 0 | | | 0 | | | 0 | |

| | | | | | | | | | | | | | |

KI Equity Partners III, LLC c/o Timothy J. Keating, Manager 5251 DTC Parkway, Suite 1090 Greenwood Village, Colorado 80111-2739 | | | 4,481,302 (2 | ) | | 6.31 | % | | 4,481,302 | | | 3.57 | % |

| | | | | | | | | | | | | | |

| All Executive Officers and Directors as a group (7 persons) | | | 46,187,136 | | | 65.05 | % | | 46,187,136 | | | 36.80 | % |

| (1) | Address is c/o Changjiang Tower, 23rd Floor, No. 1 Minquan Road, Wuhan, Hubei Province, PRC. |

| | |

| (2) | KI Equity has agreed to vote its shares of our Common Stock to (i) elect a person designated by KI Equity from time to time (the “KI Equity Designate”) to our board for a period of one year following the Closing; and (ii) elect such other persons that may be designated by Yiqing Wan as the management director and KI Equity Designate from time to time to fill any vacant position on the board of directors (other than the KI Equity Designate). |

| (3) | Yiqing Wan and Wei Xu each have a 50% equity ownership in XIA Pharmaceutical Inc. They are both our executive officers and Yiqing Wan is a director. In addition, they are husband and wife. |

| | |

| (4) | Shaoping Lu is the beneficial owner of Moveup Investments Limited. |

| (5) | Based on 71,002,646 shares issued and outstanding as of the Closing of the Exchange. |

| | |

| (6) | Assumes maximum offering is sold and includes Agent Warrants. Based on 125,522,342 shares issued and outstanding. |

CERTAIN RELATIONSHIPS AND RELATED TRANSACTIONS

Applied Spectrum

Kevin R. Keating

Keating Securities, LLC (the “Placement Agent”) acted as placement agent in connection with the Financing. For their services, the Placement Agent received a commission equal to 7.5% of the gross proceeds or approximately $900,000 from the offering and a non-accountable expense allowance equal to 1.5% of the gross proceeds or approximately $180,000. In addition, the Placement Agent received, for nominal consideration, five-year warrants to purchase 2,596,176 shares of our common stock, or 10% of the number of shares of Common Stock sold in the offering, at an exercise price of $0.555 (“Placement Agent Warrants”). The Placement Agent Warrants will have registration rights similar to the registration rights afforded to the purchasers of the Units. APSP also paid for the out-of-pocket expenses incurred by the Placement Agent and all purchasers in the amount of approximately $100,000.

At or prior to the Closing, pursuant to the terms of the Exchange Agreement, Applied Spectrum will enter into a certain financial advisory agreement with Keating Securities, LLC ("Keating Securities"), a registered broker-dealer, under which Keating Securities will be compensated by Applied Spectrum for its advisory services rendered to Applied in connection with the Exchange Agreement. The transaction advisory fee will be $395,000. This fee shall be paid upon the Closing of the Exchange Agreement.

Kevin R. Keating is the father of Timothy J. Keating, the principal member of Keating Investments, LLC. Keating Investments, LLC is the managing member of KI Equity, which is the majority stockholder of Applied Spectrum. Keating Investments, LLC is also the managing member and 100% owner of Keating Securities, LLC, a registered broker-dealer. Kevin R. Keating is not affiliated with and has no equity interest in Keating Investments, LLC, KI Equity, or Keating Securities, LLC and disclaims any beneficial interest in the shares of Applied Spectrum's common stock owned by KI Equity. Similarly, Keating Investments, LLC, KI Equity and Keating Securities, LLC disclaim any beneficial interest in the shares of Applied Spectrum's common stock currently owned by Kevin R. Keating.

Effective January 1, 2006, Applied Spectrum entered into a contract with Vero Management, L.L.C. ("Vero") for managerial and administrative services. Vero has not been engaged to provide, and Vero does not render, legal, accounting, auditing, investment banking or capital formation services. Kevin R. Keating, the sole director of Applied Spectrum, is the manager of Vero. The term of the contract is for one year, but the contract may be terminated at any time. In consideration of the services provided, Vero is paid $2,500 for each month in which services are rendered.

Mark R. Littell and Norwood

In connection with the Purchase Agreement, Mark R. Littell and Norwood entered into an agreement releasing Applied from any and all claims they have against Applied.

During 2006, Norwood paid an accrued legal expense on behalf of Applied in the amount of $1,568, which was recorded as additional paid-in capital.

In connection with the Purchase Agreement, Applied Spectrum paid Norwood approximately $18,936 for consulting services rendered by it to Applied Spectrum.

Other than the above transactions or otherwise set forth in this Information Statement or in any reports filed by Applied Spectrum with the SEC, Applied Spectrum has not entered into any material transactions with any director, executive officer, and nominee for director, beneficial owner of five percent or more of its common stock, or family members of such persons. Applied Spectrum is not a subsidiary of any company.

Benda

Advances from Related Parties

Advances to related parties at June 30, 2006 and December 31, 2005 are comprised as follows:

| | | June 30, 2006 | | December 31, 2005 | |

| Yiqing Wan | | $ | 209,220 | | $ | 207,333 | |

The above advances bear no interest and are due December 31, 2012.

Loans from related parties at June 30, 2006 and December 31, 2005 are comprised as follows:

| | | June 30, 2006 | | December 31, 2005 | |

| Hubei Benda Science and Technology Development Co., Ltd. | | $ | 967,862 | | $ | 1,207,435 | |

| Wei Xu | | $ | 877,761 | | $ | 869,842 | |

| Total | | $ | 1,845,623 | | $ | 2,077,277 | |

The above loans are unsecured, non-interest bearing, not convertible into equity, and are due on December 31, 2012. Proceeds from the above loans were used primarily for general working capital purposes.

Reorganization Related Transactions

Ever Leader was incorporated in Hong Kong on October 29, 2005 for the purpose of functioning as an off-shore holding company to obtain ownership interests in various Benda entities that were previously owned, either directly or indirectly, by Wan and Xu. Ms. Mo Mo Hon (“Hon”), a Hong Kong SAR resident, is the sole registered shareholder of Ever Leader, holding the single issued and outstanding share of Ever Leader in trust for Xu.

Pursuant to three separate Equity Transfer Agreements entered into in November of 2005 among Ever Leader, Benda Science, Xu, and Wan, Ever Leader obtained a 95% ownership interest in Benda Ebei in exchange for a commitment to pay $2,298,434 in aggregate consideration to Benda Science, Wan, and Xu. The $2,298,434 acquisition price represented 95% of the $2,419,404 of registered capital of Benda Ebei, but was not representative of the fair value of the assets acquired or liabilities assumed. Specifically, as transfers of ownership interests in PRC entities to offshore holding companies for zero or nominal consideration is prohibited by the Chinese Government (regardless of whether these PRC entities and offshore holding companies are directly or indirectly owned and controlled by the same individual or individuals), an amount equal to 95% of the value of the registered capital of Benda Ebei was established for purposes of the transfer of the 95% ownership interest in Benda Ebei (directly and indirectly 100% owned and controlled by Wan and Xu) to Ever Leader (beneficially 100% owned and controlled by Xu).

Pursuant to an Equity Transfer Agreement entered into on December 3, 2005 among Benda Ebei, Benda Science, and Wan, Benda Science transferred and assigned its 90% ownership interest in Jiangling Benda to Benda Ebei and Wan transferred and assigned a 5% ownership interest in Jiangling Benda to Benda Ebei (for zero consideration as Benda Ebei and Jiangling Benda were both directly and indirectly 100% owned and controlled by Wan and Xu).

Pursuant to a second Equity Transfer Agreement entered into on December 4, 2005 among Benda Ebei, Benda Science, and Wan, Benda Science transferred and assigned its 90% ownership interest in Yidu Benda to Benda Ebei and Wan transferred and assigned a 5% ownership interest in Yidu Benda to Benda Ebei (for zero consideration as Benda Ebei and Yidu Benda were both directly and indirectly 100% owned and controlled by Wan and Xu).

The organization and ownership structure of the Company subsequent to the consummation of the reorganization as summarized in the paragraphs above is as follows:

In July of 2006, Benda Ebei invested approximately $112,500 for a 75% ownership interest in Beijing Shusai, with the remaining 25% owned by an unrelated PRC individual. Beijing Shusai, a PRC limited liability company, was incorporated on June 15, 2006 and commenced primary operations in July 2006, operating two clinics in Beijing, PRC.

On September 5, 2006, Ever Leader increased its number of authorized shares of common stock from 10,000 to 1,000,000 and effected a 100 to 1 stock split, resulting in Hon (the original sole registered shareholder of Ever Leader holding one share in trust for Xu) receiving 99 additional shares in the Company.

On September 5, 2006, Ever Leader transferred and assigned 711,202 shares of common stock to Xia Pharmaceutical, Inc. (“XIA”), an offshore holding company incorporated in the British Virgin Islands (“BVI”) that is 100% owned and controlled by Wan and Xu.

On September 5, 2006, Ever Leader issued 288,698 shares of common stock to 19 entities (some of whom are considered related parties) at par value. Additionally, Hon transferred and assigned her ownership interest in her 100 shares of Ever Leader to one of these entities.

The organization and ownership structure of the Company subsequent to the consummation of the reorganization as summarized in the paragraphs above is as follows:

DISCLOSURE REGARDING PREVIOUS AUDITORS

On September 22, 2006, Moen & Company LLP (“Moen”), the auditors that audited Ever Leader’s financial statements and notes for the years ending December 31, 2005 and 2004, lost its status as a participating audit firm in the Canadian Public Accountability Board’s (“CPAB”) oversight program for failing to implement the CPAB’s oversight program set out in paragraph 11.1 of the CPAB’s By-law No. 1. As a result of this, Moen is no longer eligible to audit the financial statements of entities that are reporting issuers under provincial securities legislation in Canada. In addition, the CPAB carried out a quality inspection of Moen in 2005 and issued its final inspection report on August 25, 2005. The report made numerous recommendations to Moen to address weaknesses in the firm’s system of quality control of deficiencies in specific audit engagements. The CPAB conducted follow up visits to Moen in late November 2005, early March 2006 and early May 2006 and concluded that the recommendations in the CPAB report to Moen had not been implemented. Moen's loss of its status as a participating audit firm in the CPAB oversight program has been publicly disclosed, including, without limitation, through CPAB's assessment of Moen available on the CPAB web site. Moen's loss of its status as a participating audit firm in the CPAB oversight program may result in a negative perception of Ever Leader's financial statements for such years and we may be required by the Investors or U.S. regulatory authorities to have such financial statements audited by another accounting firm in connection with the Closing or the registration of securities issued in the Financing. If we are required to obtain such an audit of such financial statements, our Closing and/or registration statement in connection with the registration of securities issued in the Financing may be delayed.

SECTION 16(a) BENEFICIAL OWNERSHIP REPORTING COMPLIANCE

Section 16(a) of the Securities Exchange Act of 1934, as amended, requires Applied Spectrum’s directors and executive officers, and persons who beneficially own more than 10% of a registered class of Applied Spectrum’ equity securities, to file reports of beneficial ownership and changes in beneficial ownership of Applied Spectrum’s securities with the SEC on Forms 3 (Initial Statement of Beneficial Ownership), 4 (Statement of Changes of Beneficial Ownership of Securities) and 5 (Annual Statement of Beneficial Ownership of Securities). Directors, executive officers and beneficial owners of more than 10% of Applied Spectrum’s common stock are required by SEC regulations to furnish Applied Spectrum with copies of all Section 16(a) forms that they file. Except as otherwise set forth herein, based solely on review of the copies of such forms furnished to Applied Spectrum, or written representations that no reports were required, Applied Spectrum believes that for the fiscal year ended September 30, 2005 beneficial owners complied with the Section 16(a) filing requirements applicable to them in that each officer, director and beneficial owner of 10% or more of Applied Spectrum’s securities filed a Form 3 with the SEC and has had no change of ownership since such filing.

SIGNATURE

In accordance with Section 13 or 15(d) of the Exchange Act, the Registrant caused this Report to be signed on its behalf by the undersigned, thereunto duly authorized.

| | | |

| | APPLIED SPECTRUM TECHNOLOGIES, INC.(Registrant) |

|

|

|

| By: | /s/ Kevin R. Keating |

| |

Name: Kevin R. Keating |

| Title: President |