BENDA PHARMACEUTICAL, INC.

Room 13, Floor 25, Sunny New World Tower,

No. 231 Xin Hua Road, Jianghan District,

Wuhan, Hubei, PRC. Post Code: 430015

January 22, 2008

VIA REGULAR MAIL

AND EDGAR

John L. Krug

Staff Attorney, Division of Corporation Finance

Mail Stop 6010

Securities and Exchange Commission

100 F. Street N.E.

Washington, D.C. 20549

| | Re: | Benda Pharmaceutical, Inc. |

| | | Registration Statement Form SB-2 Amendment No. 1 Filed November 8, 2007 File No. 333-143633 |

Dear Mr. Krug:

We are in receipt of your comment letter dated December 7, 2007 regarding the above referenced filing. As requested in your letter, we provide responses to the questions raised by the Staff. For your convenience, the matters are listed below, followed by the Company’s responses, which are reflected in the attached Amendment No. 2 to Form SB-2.

FORM SB-2

General

| | 1. | For each of the comments addressed below, please revise your financial statements accordingly, as applicable. |

Answer: Please note that the financial statements have been revised to address each of the comments below.

| | 2. | Please provide the September 30, 2007 financial statements and related financial information as required by Item 310(g) of Regulation S-B. The comments below on Form 10-Q should be addressed in Form SB-2 also. |

Answer: Please note that the SB-2 has been revised to provide the September 30, 2007 financial statements and related financial information as required by Item 310(g).

| | 3. | We note that you are shares registered to Super Pioneer, Yaojin Wang, and Huimin Zhang. As these selling shareholders have the option to require you to redeem these shares, it appears that the private placement has not been completed and therefore you cannot register the resale of these shares at this time. Please revise to remove the shares from the registration statement or provide us with an analysis supporting your determination that the private placement has been completed. |

Answer: Please note that the Form SB-2 has been revised to remove the shares registered to Super Pioneer, Yaojin Wang and Huimin Zhang.

| | 4. | We note your response to comment 1 and reissue the comment. We have not received the graphics you indicate you provided separately. |

Answer: Please note that the graphics have been provided supplementally.

| | 5. | We note your response to comment 3 and reissue the comment. We can not locate where you have filed the interview and a copy of this interview was not provided with your filing. |

Answer: Please note that a transcript of the interview has been filed as an exhibit to the Form SB-2.

| | 6. | We note your response to comment 4 and we note your website contains your November 5, 2007 press release pertaining to revenues for 2008 which continues to indicate your forward looking statements will fall within a safe harbor. As the information has been on your website for more than three month and you have continued to disseminate this information, it should be included in your registration statement. Please revise to include the information along with all the assumptions your projections are based on and sources for market and industry information. Additionally, revise your registration statement to specifically not that your forward looking statements do not fall within the safe harbor. |

Answer: Please note that all statements indicated that our forward looking statements will fall within a safe harbor have been deleted from our website and prospectus, as well as our financial projections for 2008.

| | 7. | We note your have not provided a response to comment 5. Please provide your response and revise your prospectus accordingly. |

Answer: Please note that the offering should not be considered a primary offering as the Form SB-2 has been amended to reduce the total amount of shares being registered to 76,955,406, so that we registering no more than one third of the pre-offering outstanding shares held by non-affiliates for each Selling Stockholder.

The following is our analysis: (i) the total number of shares outstanding prior to the offering was 71,002,846; (ii) the total number of shares owned by affiliates prior to the offering was 47,160,702; therefore, (iii) the total number of shares owned by non-affiliates prior to the offering was 23,842,144. One third of the pre-offering shares held by non-affiliates is 7,947,381. As per the amended Form SB-2, no Selling Stockholder is registering more than 7,947,381 shares.

The following table demonstrates the analysis in tabular format and the list of Selling Stockholders found on pages 28 and 29 of the SB-2 shows that none of the Selling Stockholders is registering more than one third of the pre-offering outstanding shares held by non-affiliates:

| Total Shares OutstandingPrior to Offering | | | 71,002,846 | |

| Minus | | | Minus | |

| Shares Owned by Affiliates | | | 47,160,702 | |

| Equals | | | Equals | |

| Total Pre-Offering Shares Held by Non-Affiliates | | | 23,842,144 | |

One Third of Pre-Offering Shares Held by Non-Affiliates | | | 7,947,381 | |

Additionally, as defined in Rule 405 which governs the definition of an affiliate in Rule 415, an “affiliate” is “a person that directly, or indirectly through one or more intermediaries, controls or is controlled by, or is under common control with, the person specified.” The selling shareholders do not control any facet of the company’s business or decision-making authority. Accordingly, none of the Selling Stockholders is an affiliate of the Company nor had any prior relationship with the Company before the offering. Additionally, no relationships exist between the Selling Stockholders.

Shenzhen SiBiono Gene Tech Co., Ltd., page 8

| | 8. | We note the payment due to certain SiBiono shareholders was not paid in full by the April 30, 2007 due date and had not been paid by June 30, 2007. We also note the payment due toYaojin Wang and Huimin Zhang were not paid in full by the June 30, 2007 due date. Please expand the discussion to describe the ramifications, if any, as a result of the failure to make the required payments when due. We may have additional comments. |

Answer: Please be advised that the Form SB-2 has been revised to disclose that the payment to Yaojing Wang and Huiman Zhang, the original individual shareholders of SiBiono, had been all settled as of September 30, 2007. However, there is an approximately $1.47 million outstanding balance to original shareholders, Shenzhen Yuanxing Gene City Development Co., Ltd. (“Yuanxing’) and Shenzhen Yuanzheng Investment Development Co., Ltd. (“Yuanzheng’). After the discussion with the Yuanxing and Yuanzhen, they orally agree that the outstanding balance could be settled in the earlier 2008 without penalty payment.

"We have previously had an explosion at our Yidu Plant.. " page 11.

| | 9. | We note the plant has been closed since January 2007. Elsewhere in the same discussion you indicate the plant was closed in November 2005. Please expand the discussion to indicate when it was reopened after November 2005 and why it was closed in January. In addition, please, explain why you believe the closure is temporary since it has been closed for almost a year. |

Answer: Please note that the disclosure has been revised to clarify that the Yidu plant was closed on November 11, 2005 for approximately one month. The plant was subsequently closed again in January 2007 to improve the waste water treatment systems. The reference to the closure being temporary has been removed.

Selling Security Holders, page 27

| 10. | It appears that KI Equity is an affiliate of Keating Securities LLC, a registered broker dealer. Please revise to include the representations requested by former comment 47 or state that KI Equity is an underwriter. |

Answer: Please note that the Form SB-2 has been revised to include the representations requested by former comment 47 in reference to KI Equity.

| | 11. | We cannot locate the tabular disclosure you indicate has been included in the prospectus in response to comments 49-59. Please advise or provide this information in your next amendment. |

Answer: Please note that he tabular disclosure in response to comments 49-59 has been included in the Form SB-2 under “The Offering.”

Conflicts of Interest, page 38,

| | 12. | We note your response to comment 64 and reissue the comment. Although your supplemental response states there are no known conflicts of interest, the disclosure in this section indicates there were such conflicts at December 31, 2006 and may continue to exist. As previously requested, please describe these conflicts. |

Answer: Please note that section entitled “Conflicts of Interest” has been removed from the prospectus, as the Company is not currently aware of any such conflicts.

Business, page 51

| | 13. | We note your response to comment 72. Please update the discussion to the most recent date practicable. For example, although the amendment was filed in November 2007, you state in the prospectus the Ribavarin workshop is expected pass GMP certification in October and the comprehensive workshop will apply for GMP certification at the end of October. |

Answer: Please note that the Form SB-2 has been revised to disclose that to date, the new facilities of Jiangling Benda had been installed and tested. The application of GMP certificate was submitted in December 2007. We are expecting the final approval of the GMP certificate would be obtained in February 2008.

| | 14. | We note your response to comment 75. Please clarify in the disclosure whether the Jiangling facility has been continuously closed since the renovation began in July 2004. |

Answer: Please be advised that the Form SB-2 has been revised to clarify that the Jiangling plant ceased operation in July 1, 2004 to comply with GMP standards. Jiangling plant reopened on August 10, 2007 and has been producing Ribose, the only product that does not require GMP approval. We are waiting for GMP certification to recommence production of the other products.

| | 15. | We note your response to comment 76 and reissue the comment. Please expand the discussion to briefly explain whether and how the SFDA regulation process may differ from that of the FDA. If the SFDA approves a drug, can SFDA approval be utilized to obtain FDA approval for the same drug? |

Answer: Please note that the Form SB-2 has been revised to expand the discussion to explain how the SFDA regulation process differs from that of the FDA. The discussion has also been expanded to disclose that he approval of a drug by SFDA does not guarantee the approval by FDA. However, drugs approved by SFDA can be exempted from certain steps in US clinical trials before applying for FDA.

| 16. | We note your response to comment 77 and reissue the comment. We could not locate the detailed discussion of the PRC regulatory regime and the specific procedures and process, if any, for government approval of your products prior to the sale of your products to the public. |

Answer: Please note that a more detailed discussion of the PRC regulatory regime and the specific procedures and process for government approval has been included in the section “SFDA Compared to the FDA.”

Benda Ebel Products, page 57

| 17. | We note your response to comment 78 and reissue the comment. Please provide more specific information concerning the pharmacological experiment that is the basis for the statement pertaining to the analgesic effect of Shusai-A Nefopam Hydrochloride, its non-addictive qualities and that there are no known side-effects. For example, who conducted the experiment, who paid for the experiment, when was the experiment conducted, how many participants were there, for how long were the drugs administered, the extent of any follow up studies, has the experiment been published and, if so, where and when were the results published, and whether the experiment has been duplicated. |

Answer:Please note that the disclosure has been revised to provide the following more specific information concerning the pharmacological experiment:

The chemical name of this product is Nefopam hydrochloride. It mainly contains: 5-Methyl-1-Phenyl-3,4,5,6-Tetrahydrocannabinol-1H-2,5-benzoxazocine, fenazoxine hydrochloride. It is a new type of Non-narcotic analgesics which has the function of low-grade Antipyretic and muscle relaxants. Its chemical structure belongs to O-methyl benzene ring of diphenhydramine, so it does not have the attribute of Non-steroidal anti-inflammatory drugs, nor Opioid receptor agonist. It is effective for middle-grade and heavy-grade pain. Intramuscular injecting 20mg of Nefopam hydrochloride equals to intramuscular injecting 12mg morphine. It has light effectiveness on respiration inhibition. It has no inhibition on circulatory system. It has no tolerance or dependence. It can be rapidly oral absorbed, Tmax 1-3 hours, and it has obvious effect while first pass. T1/2 4-8 hours, the binding rate of plasma protein is 71%-76%. It is metabolied by liver to lose its pharmacological activities. Most of it will be excreted through kidney. The prototype drug will be less than 5% and only a little will be excreted along with excretion. It is used for pain-killing after operation, cancer pain, and acute pain. It is also used for visceral smooth muscle cramps such as acute gastritis, in-biliary ascariasis, ureterolithiasis.

The clinical trials were conducted in 1993, instructed by Doctor Guozhong, Peng. Ebei plant paid for all clinical trial expenses. It passed the clinical trials in 6 clinical institutes including the provincial hospital of Hebei, the second and the forth hospital attached Hebei School of Medicine, Bethune international peace hospital and etc. The efficacy rate is around 80% for all 374 cases examined. There is no follow up results.

| | 18. | We note your response to comment 79 and reissue the comment. We cannot locate your response in the prospectus. Please advise or revise. |

Answer: Please note that the response has been included in the prospectus.

Yidu Benda Products, page 57

| 19. | We note your response to comment 80. As currently written, there is no indication that Pfizer has purchased any of your products, merely that Pfizer is a customer of one of your customers. Unless you can document that the sales to Pfizer are material and that Pfizer is a direct customer of yours, you should delete any such reference to Pfizer. |

Answer: Please note that all references to Pfizer have been removed from the prospectus.

| | 20. | We note your response to comment 81 and reissue the comment. Please update the discussion to the most recent date practicable. You state you were ordered to finish the improvements and be compliant by June 30, 2007; however you have not indicated you finished the improvements and were compliant by such date. Please indicate when you received oral notification you passed the required examination and when the feasibility studies were submitted. |

Answer: Please note that the prospectus has been updated to disclose that Yidu plant passed environmental check from Yichang Environmental Bureau on September 25, 2007 and safety check from Yichang Safety Bureau on October 10, 2007. The two bureaus will conduct final on spot check in January 2008. Once Yidu plant passes the two final checks, they can immediately start full operations.

Active Pharmaceutical Ingredients, page 59

| | 21. | Please update the discussion pertaining to the reestablishment of supply relationships and the plant reopening. |

Answer: Please note that the Form SB-2 has been revised to disclose that Jiangling Plant is primarily engaged in producing Ribose, a bulk chemical which does not require GMP approval and Active Pharmaceutical Ingredients (API) which need GMP approval. Jiangling plant re-opened on August 10, 2007 and started producing Ribose. The sales of Ribose began in October 2007. Jiangling expects to receive GMP approval by the end of February 2008. Though Jiangling plant ceased operation in the past few years, it has been in consistent talk with old customers and attended national API conference. Nine sales professionals attended the national API conference in November 2007 and notified the old customers that Jiangling plant will start to produce API soon and received good feedback from those old customers.

Status of Publicly Announced New Products/Services, page 61

| 22. | We note your response to comment 83. Please expand the discussion in the prospectus to indicate that the company can obtain the license for the new medicine and the production license only after completion of the clinical experiments. |

Answer: Please note that the discussion has been expanded in the prospectus to indicate that the company can obtain the license for the new medicine and the production license only after completion of the clinical experiments.

| | 23. | We note your response to comment 85. We also note that the detail you provided in your supplemental response, e.g. experts' technological evaluation, is not included in the prospectus. Please revise the disclosure in the prospectus to include the detail provided in your supplemental response. |

Answer: Please note that the supplemental response previously provide has been included in the Form SB-2.

Planned Pharyngitis Clinics as of December 31, 2006, page 66

| 24. | We note your response to comment 92. Please update the information in the chart as of the most recent date practicable. In this regard, we note the number of pending openings and the May 2007 estimated openings for China Aerospace Center Hospital, Beijing Ming Zhu Hospital, and Henan Xin Hua Hospital. |

Answer: Please note that the Form SB-2 has been amended to disclose that due to the restructuring of SFDA, the related policies of SFDA have changed such that the local hospitals are not allowed to co-operate with third parties. These changes have caused us to discontinue our plans of setting of Pharyngitis Clinics. The management of the company is seeking and considering other alternatives to launch this particular drug, however up to now there is no definite plan yet.

Oiweiben Capsule

Clinical Experiments, page 67

| 25. | We note your response to comment 94. Please include the detail of your supplemental response in the discussion in the prospectus. |

Answer: Please note that the prospectus has been revised to include the detailed supplemental response.

Yan Long Anti-Cancer Oral Liquid, page 67

| 26. | We note your response to comment 99 and reissue the comment. What is your basis for your statements regarding effectiveness of the drug against the cancers indicated? It appears the drug is used to help patients withstand chemotherapy treatment, not a first line treatment for the disease. In addition, please clarify how the reference at the bottom of page 67 to survivals studied in 1998 pertaining to the years 1990-1993 are relevant to the discussion. In this regard, we note the study pertained to lung cancer whereas lung cancer is not among the list of cancers for which Yan Long Anti-Cancer Oral Liquid is described as being effective. In addition, since the supplemental information you provided indicates only two of the thirty patients had no recurring and distracting symptoms after three years, please advise why you believe such data supports your conclusion of effectiveness of your product. |

Answer: Please note that the reference to “1998” has been corrected to refer to “1989”, and the disclosure has been revised to disclose that the clinical trials tested the drugs affect on liver cancer as opposed to lung cancer as previously stated. Please note that the Form SB-2 has been revised in response to the comment as follows:

Yanlong Anti-cancer Oral Liquid is a kind of pure mixture contains Chinese traditional medicine such as: Baiying, Morel, Salvia, Gentiana, Angelica, etc.

Starting in 1989, Yanlong anti-cancer oral liquid was given to 30 patients with primary liver cancer for the clinical trails. The number of the survivals for the year of 1990, 1991, 1992 and 1993 were 23, 17, 11 and 8 respectively. By March 2004, among the eight surviving patients, two do not have any signs of recurrence, three take care of themselves but are still physically weak, three regressed and returned to the hospital for treatment. I n this clinical research, the survival rate of the patients observed for over 14 years reached 26.67%.

| 27. | We note your response to comment 100 and reissue the comment. It does not appear that the agreement with Dr. Yan Li has been filed as an exhibit. |

Answer: Please note that the agreement with Dr. Li has been filed as an exhibit to the Form SB-2.

| 28. | We note your response to comment 103 and reissue the comment. Please update the discussion to clarify whether the Yidu plant resumed production on or about July 1, 2007. |

Answer: Please note that the discussion has been revised to clarify that the Yidu plant did not resume production on July 1, 2007. Rather, we expect production to resume in the first quarter of 2008.

Industry and Competitive Factors, page 69

| | 29. | We note your response to comment 106. The discussion on page 69 indicates you will apply for GMP certification by October 2007. Your supplemental response indicates you will apply for GMP certification by the end of 2007. Please revise the discussion to update the status of the application for GMP certification. |

Answer: Please note that the prospectus has been revised to disclose that the GMP application was submitted in December 2007, and we expect to receive approval by the end of February 2008.

| | 30. | We note your response to comment 108. We can not locate the revision to the prospectus to the effect the company will begin exporting the product once it has obtained FDA approval. Please advise or revise. |

Answer: Please note that the prospectus has been revised to disclose that we will begin exporting the product once it has obtained FDA approval.

Research and Development Activities During the Prior Two Fiscal Years, page 72

| | 31. | We note your response to comment 111 and reissue the comment in part. You have indicated in your supplemental response that the agreements have been filed as exhibits. It does not appear that any such material agreements have been filed as exhibits. Please advise or file such agreements as exhibits with your next amendment. |

Answer: Please note that the only written agreement is with College of Chemistry and Life Science of China Three Gorges University which been filed as an exhibit to the Form SB-2.

Management's Discussion and Analysis, page 76 Results of Operations, page 76

Operating Income/(Loss), page 78

| | 32. | Please disclose why you believe items a) to e) mentioned under general and administrative expenses are "one-time" charges, specifically the consulting and professional fees, late filing fee penalty, and cash bonus or revise your disclosure accordingly. |

Answer: Please note that the following response to this comment will be incorporated into on amendment to Form 10-QSB for the period ending June 30, 2007:

The following reasons state the rationale behind why the items a) to e) mentioned under general and administrative expenses are “one-time” charge:

| | a) | $240,000 finder fee to China Hi-Tech Funds Co. Ltd. - such fee was only incurred when the company successfully raised funds through reverse merger dated on Nov 15, 2006, thus the company deems it as non-recurrent expenditure item. |

| | b) | $68,000 amortization expense of the placement agent commission related to debt issue costs, (Refer to note 20 of Note to Consolidated Financial Statements for details); - such expense was only associated because of the issuance of convertible promissory notes and the company realized that this expenditure was non-current in nature, thus such expenses was treated as one-time charge. |

| | c) | $8 MM consulting and professional fees, (Refer to note 16 of Note to Consolidated Financial Statements for details); - such fees were only raised because of the acquisition of SiBiono which was taken place in April 2007. |

In connection with the acquisition of SiBiono, the company entered into a Financial Consultancy Agreement with Super Pioneer International Limited (“Super Pioneer”) and Technical Consultancy Agreements with Yiaojin Wang (“Wang”) and Humin Zhang (“Zhang”) for financial and technical consultancy services to be rendered. Pursuant to the Financial and Technical Consultancy Agreements (the “Agreements”), the Company agreed to issue an aggregate of 2,189,560 shares of its common stock to Super Pioneer, Wang and Zhang within three months from the date of the Agreements. Super Pioneer, Wang and Zhang also agreed to refrain from selling shares of the Company’s common stock for a period of twelve months from the date of the issuance of the shares (the “Lock-up Period”). Within three months from expiration of the Lock-up Period, in the event that the public trading price of the Company’s common stock has not reach $3.60 per share and the Company’s common stock has not been listed on either the NASDAQ or AMEX stock exchanges, Super Pioneer, Wang, and Zang will have the option to require the Company to redeem an aggregate 2,049,560 shares of the Company’s common stock owned by Super Pioneer, Wang, and Zhang at a price of $3.60 per share.

Therefore because of the above stated fact, the company realized the above mentioned common shares issued to Super Pioneer, Wang and Zhang one-time charge consulting and professional fee.

| | d) | $120K resale registration late filing penalty - such penalty was only incurred because of the late filing of the resale registration statement and there would be no penalties after the registration statement get effective, thus the company realizes it as non-recurrent expenditure item. |

| | e) | $173K cash bonus - such bonus was to compensate Yiqing Wan, CEO and co-founder and Wei Xu, Vice President and co-founder, for the period September 2006 to April 2007 since they did not have any formal compensation scheme before the reverse merger was taken place. Thus, after their compensation schemes were approved by the Board on April 2007, no more cash bonus will be incurred. |

Critical Accounting Policies, page 86 Revenue Recognition, page 86

| 33. | Refer to your response to our comment 126. It does not appear that you have made any changes to the filing in response to this comment thus we reissue our comment. It appears that you have merely selected certain accounting policies and repeated those policies here. The intent of identifying critical policies is to identify those that require material assumptions and estimates which if different assumptions and estimates were made would materially affect the financial statements. Revise this disclosure accordingly. For example, we note you identify revenue recognition as a critical policy. Explain how this policy requires significant estimates. If you believe this is a critical policy expand the disclosure for this policy and all other identified policies to quantify the effect on the financial statements of changes in estimates in each year presented or explicitly state that changes in estimates were not material. If material changes in estimate have been recognized, fully explain the new information that became available and why that information could not be anticipated at the date the original estimate was made. |

Answer: Please note that the Critical Accounting Policies have been revised in accordance with the above comment.

Liquidity and Capital Resources, page 84

| | 34. | Refer to your response to our comment 127. On page 77, you indicate that the improvement to the waster water treatment system for the Yidu Benda plant has been completed. Please revise your disclosure accordingly. |

Answer:Please note that the response to this comment will be incorporated into on amendment to Form 10-QSB for the period ending June 30, 2007.

Financial Statements

| | 35. | Please revise pages 99 and 100 to reference the correct financial statement period you are providing in the filing (i.e. the reference should read the six months ended June 30, 2007 and 2006 not March 31, 2007 and 2006). |

Answer: Please note that the prospectus has been revised to refer to the correct financial statement periods provided in the filing.

| | 36. | Refer to your response to our comment 130. We did not note any supplemental letter provided supplementally thus we reissue our comment. Have your auditors confirm to us that they traveled to China as part of the audit, or, if they did not travel to China, have them explain to us how they completed the audit without traveling to China. |

Answer: Please be advised that a letter from the auditors confirming that they traveled to China as part of the audit, has been included herein supplementally.

| | 37. | Refer to your response to our comment 133. Please revise the balance sheet caption "Receivables, net" to "Trade Receivables, net" for the period ended June 30, 2007 as well as the caption used in Statement of Cash Flows. |

Answer: Please note that the response to this comment will be incorporated into an amendment to Form 10-QSB for the period ending June 30, 2007.

| | 38. | Refer to your response to our comment 137. Please explain to us why you include a line item called "Gross profit" when this appears to exclude certain items such as amortization that might be considered "Cost of goods sold." We believe amortization of intangible assets related to acquired developed products such as your drug permits, licenses and technology formulas, and patents should be included in cost of goods sold. Please revise accordingly, revise the financial statements to remove your gross profit presentation or clarify to us why a revision in not necessary. |

Answer: Please note that the components of the amortization of intangible assets were related to the land-used right, drug permits and licenses and technology formulas; all those expenses incurred were general and administrative expenses in nature, therefore the company amortized those expenses in general and administrative expenses and not included in the cost of goods sold.

Note 6, Inventories, page 110

| | 39. | Please disclose what the reserve on work-in-progress relates to as of the quarter ended June 30, 2007. Tell us why a reserve was not warranted in an earlier period. Include a discussion in Management's Discussion and Analysis as well. |

Answer: Please note that the following response to this comment will be incorporated into an amendment to Form 10-QSB for the period ending June 30, 2007:

The provision of reserve was resulted from the manufacturing process of Gendicine, SiBiono’s sole product and SiBiono was acquired by the company in April 2007.

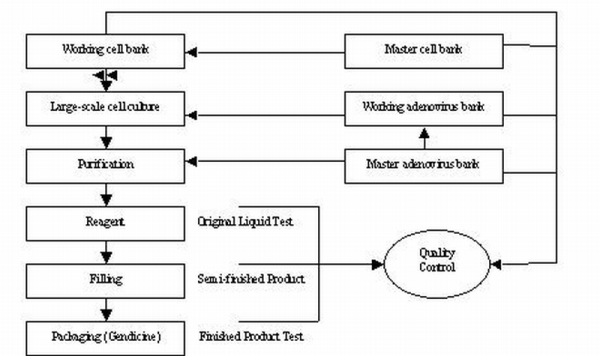

The following chart shows the manufacturing process of Gendicine (Ad-p53):

In the production process of finished goods, Gendicine, several working steps are needed: (i) large-scale culturing of adenovirus from master adenovirus bank; (ii) culturing of cell from master cell bank; (iii) purification. The whole process including step (i) to step (iii) takes approximately twenty-four days to make reagent (“original liquid”). This particular liquid can only be stored for approximately five years. It takes approximately another seven days for mixing and bottling original liquid to finished goods which is known as Gendicine.

Therefore, up to the stage of reagent, all the related production costs are treated as work-in-progress. The major components of those production costs are: (i) direct labor; (ii) direct materials; (iii) power; (iv) supplies and other materials and (v) manufacturing overheads.

Before acquisition, as of March 31, 2007, the accumulated units of original liquid produced was 198,075 and which could be converted to approximately 226,736 vials of Gendicine. However, the accumulated vials of Gendicine sold throughout the years 2004 to three months quarter ended March 31, 2007 were only approximately 18,424 vials. Thus the accumulated production costs, approximately $4,080,644 were remained as work in process as of three months quarter ended March 31, 2007.

Furthermore, due to the special feature of the original liquid which can only be stored for five years, and most of the original liquid was produced in the year of 2004, thus the provision of reserve on work in progress was $3,696,083 as of three month quarter ended March 31, 2007.

After the acquisition with the effective date April 1, 2007, the same accounting treatment was adopted for the treatment of the provision of reserve on work in progress. As of June 30, 2007, the provision of reserve on work in progress was $3,736,848.

Note 9, Goodwill and Acquisition Cost Payable, page 112

| 40. | Please clarify what the acquisition cost payable relates to for the quarter ended June 30, 2007 and when the balance is expected to be paid. The acquisition of SiBiono should be described in the notes including the total consideration, the nature of the consideration and the entire purchase price allocation. |

Answer: Please note that the following response to this comment will be incorporated into an amendment to Form 10-QSB for the period ending June 30, 2007:

FASB 141 requires all acquisitions must be accounted for by allocating the acquisition consideration to the assets acquired based upon the fair market value of those assets. Consideration value that cannot be allocated to the acquired assets must be assigned to goodwill. In addition, it also requires eliminating the pooling treatment and eliminating the amortization of goodwill. FASB 142 requires that a company carrying goodwill on its books must revalue the assets acquired in a business combination. It there is an overall decline in the value of the acquired assets, then earlier booked goodwill is deemed “impaired” and must be written down. FASB 142 requires a two step impairment test. The fair value of a reporting unit is first compared to its carrying value, including goodwill. Then the implied fair value of the goodwill is compared to the carrying value of the goodwill. If the fair value is lower, it is considered to be impaired.

As of June 30, 2007, there was an amount approximately $7 million was recorded as goodwill. Since SiBiono was turned to profitable in the six months ended June 30, 2007, therefore no impairment would be provided.

The total consideration for the acquisition of SiBiono is Rmb62.56 million or approximately $8.22 million. The form of the consideration payment is by cash. As of June 30, 2007, an accumulated amount, approximately Rmb49.25 million or approximately $6.47 million was paid and leaving a balance approximately $1.75 million as acquisition cost payable. The remaining balance would be settled gradually in the first quarter of 2008 after the discussion with the original shareholders of SiBiono.

Note 10. Restricted Cash and Bank Indebtedness, page 112

| | 41. | Please clarify why you have bank indebtedness of $836,539. As of June 30, 2007, your balance sheet indicates a cash and cash equivalents balance of $1,986,585. |

Answer: Please note that the following response to this comment will be incorporated into an amendment to Form 10-QSB for the period ending June 30, 2007:

The bank indebtedness was resulted from the acquisition of SiBiono with the effective date April 1, 2007. The reasons for causing bank indebtedness were stated as follows:

| 1. | Among the cash and cash equivalents balances of SiBiono were composed of two parts; (i) unrestricted cash, which were generated from either operations, or loans from bank and financial institutions, or invested capital; (ii) restricted cash, which were obtained from the various government technology agencies as long term debt payable (see note 12 for the related details). |

| 2. | The cash obtained from the various government technology agencies as long term debt payable could only be dedicated to the related project’s research and development activities and purchase of fixed assets and construction in progress, therefore the cash balances for that part will be classified as restricted cash. |

| 3. | Therefore, due to the above reasons, SiBiono relocated the balances of restricted cash from the cash and cash equivalents balances for the reporting periods. |

| 4. | However, since the balance of the restricted cash was larger than the balance of cash and cash equivalents balances, thus bank indebtedness were resulted for the reporting periods. |

Due to the above reasons, SiBiono relocated the balances of restricted cash from the cash and cash equivalents balances with an amount $1,304,972 as of quarter ended June 30, 2007. However, since the balances of the restricted cash were larger than the balance of cash and cash equivalents balances, thus bank indebtedness were resulted with an amount $836,539 as of June 30, 2007.

Note 13. Pension and Employment Liabilities, page 1114

| | 42. | Refer to your response to our comment 139. Please quantify in the disclosure the amounts contributed to the state sponsored retirement plan for all periods presented in relation to the percentages disclosed. |

Answer: Please note that the following response to this comment will be incorporated into an amendment to Form 10-QSB for the period ending June 30, 2007:

As stipulated by the relevant laws and regulations for enterprises operating in the PRC, the Company is required to maintain a welfare plan for all of its employees who are residents of the PRC. Based on the wages payable and according to the labor law of the PRC, the Company accrues 14%, 2%, and 1.5% on a monthly basis, for employees’ welfare, labor union fees, and education and training programs, respectively. As of June 30, 2007, the company had accumulated approximately $287,347 for the employees’ welfare, approximately $41,050 for labor union fees and $30,787 for education and training programs.

Note 20. Long Term Convertible Promissory Note, page 117

| | 43. | Refer to your response to our comment 141. Disclose the price of your common stock on the measurement date. |

Answer: Please note that the price of the common stock was measured at $1.65 as of March 28, 2007, the closing price of the company’s share price stated in OTC Bulletin Board.

| | 44. | Refer to your response to our comment 142. Confirm to us and explicitly disclose that the registration rights agreement permits settlement in unregistered shares upon exercise of your warrants, if true. Also, disclose how the unregistered shares will be valued. EITF 00-19 requires that if an issuer has more than one settlement alternative and one of the settlement alternatives includes a penalty that could be avoided by the issuer under one of the other settlement alternatives (i.e. settling in registered shares), the issuer must disregard the uneconomic settlement alternative. Please revise or advise. |

Answer: Please note that there is no cash settlement requirement in the event the Company cannot deliver Registered Shares.

| | 45. | Explain how you analyzed the Performance Threshold in your accounting of the long term convertible promissory note. |

Answer: In our accounting for the Long Term Converible Promissory Note, our analysis of the Performance Threshold had no effect because of the cap of the debt discounted and beneficial conversion feature as calculated in accordance with EITF 98-5.

Note 17. Segment Information, page 121

| | 46. | Refer to your response to our comment 144. We did not note any changes made to the filing in response to our comment thus we reissue our comment. Please provide revenues by distinct product or classes of products as required by paragraph 37 of SFAS 131. Refer to page 56 tinder the caption "Principal Products." |

Answer: Please note that the following response to this comment will be incorporated into an amendment to Form 10-QSB for the period ending June 30, 2007:

The company states the segment information according to the requirement stated in paragraph 37 of SFAS 131. The company produces five different categories of products and each category of product is produced in different subsidiaries or operation plants. The details are stated as follows:

a) Benda Ebei produces conventional medicines which including banded and generic medicines;

b) Jiangling Benda produces active pharmaceutical ingredients, APIs;

c) Yidu Benda produces bulk chemicals;

d) Beijing Shusai produces pharyngitis killer therapy; and

e) SiBiono produces gene therapy medicines, Gendicine.

Therefore, according to the requirement stated in paragraph of SFAS 131, the company reports the segment information according to the un-identical products that produced in each subsidiary.

| 47. | Refer to your response to our comment 145. Pease disclose total assets for each of your five reportable segments as required by paragraph 27 of FAS 131. In addition, please tell us why total assets per your table does not reconcile to total assets per the balance sheet at June 30, 2007 revise accordingly. |

Answer: Please note that the following response to this comment will be incorporated into an amendment to Form 10-QSB for the period ending June 30, 2007:

Since five different categories of products are produced in five difference subsidiaries or operation plants, therefore according to the requirement stated in paragraph 27 of FSAS 131, the company reports the total assets for each of the reportable segments according to the total assets of each subsidiary. Revised reconciliation has been made in the Notes to financial statements.

| 48. | Refer to your response to our comment 146. We did not note any changes made to the filing related to our comment thus we reissue or comment. Please provide a description of differences from the last annual report in the basis of segmentation or in the basis of measurement of segment profit or loss. Refer to paragraph 33 (e) of FAS 131. |

Answer: Previously, it was stated that there were changes in segment assets, basis or segmentation or the way in which segment profit was measured for the quarter ended March 31, 2007 and 2006. However, such statement is not a correct statement. As a matter of fact, there is no change in the segment profit measurement for the reporting period, thus the company simply deleted the inappropriate statement made.

Benda Pharmaceutical. Inc. Financial Statements for the years ended December 31. 2006 and 2005

Note 1. Organization and Principal Activities, page 131

Reorganization and Revised Ownership Structure, page 132

| | 49. | Refer to your response to our comment 132. Refer to paragraph D12 of FAS 141 which states that "the entity that receives the net assets or the equity interests shall initially recognize the assets and liabilities transferred at their carrying amounts in the accounts of the transferring entity at the date of transfer." In this regard, disclose here in the notes to the audited financial statements how the $2,298,434 consideration was allocated. |

Answer: Please note that Note 1 has been revised to disclose that:

In November of 2005, Everleader aquired a 95% ownership interest in Benda Ebei for a payable of $2,298,434 . The amount payable was equal to 95% of the carrying amount of the transferred assets and liabilities of Benda Ebei on the date of transfer, which also represented the value that Ever Leader recorded these assets and liabilities acquired on its books. There was no goodwill generated by this transaction. The following is an allocation of the $2,298,434 purchase price:

Current Assets | | | |

| Cash and cash equivalents | | $ | 200,455 | |

| Trade receivables, net | | | 2,154,860 | |

| Other receivable | | | 27,913 | |

| Inventories | | | 163,599 | |

| Prepaid expenses and deposits | | | 310,360 | |

Total current assets | | $ | 2,857,186 | |

Non-current Assets | | | | |

| Property and equipments, net | | | 989,713 | |

| Investment in Affiliated Companies | | | 1,611,215 | |

| Intangible assets & Deferred Charges | | | 177,159 | |

Total non-current assets | | $ | 2,778,087 | |

Total Assets | | $ | 5,635,273 | |

Current Liabilities | | | | |

| Accounts payable and accrued liabilities | | | 520,685 | |

| Various taxes payable | | | 88,416 | |

| Bank loans payable | | | 1,519,145 | |

| S/T loans payable | | | 23,552 | |

| Wages payable | | | 47,564 | |

Total current liabilities | | $ | 2,199,361 | |

Non-current Liabilities | | | | |

| Due to related parties (L/T) | | | 1,137,478 | |

Total liabilities | | $ | 3,336,839 | |

Net assets | | $ | 2,298,434 | |

Amended Form 8-K filed June 15, 2007 and June 18, 2007

Management's Discussion and Analysis or Plan of Operations of Shenzhen Sibiono Genetech Co., Ltd,

Year ended December 31. 2006 compared to December 31, 2005

Net Revenue

| | 50. | Refer to your response to our comment 149. Confirm whether or not you continue to provide these discounts. Quantify the total amount of discounts provided in 2006 and 2005, and in 2007, if applicable. Tell us why additional disclosure in the registration statement is not warranted. |

Answer: The selling price of Gendicine was decided according to the market demand, especially in the stage of promotion. Although the company lowered the selling price by 25% from the average selling price $252 per vial in the year of 2005 to the average selling price $189 per vial in the year of 2006, the company does not has any intention to continue this policy.

Since the company simply directly lowered the selling price, instead of giving sales discount, the company could not quantity the discounted provided in 2005, 2006 and 2007. The company does not have any intention to disclose any information regarding the selling price of Gendicine. As mentioned in above, the selling price is market-driven. If there are any significant changes in the selling price caused by any factors in future, the company will fully disclose same.

Form 10-Q for the quarter ended September 30, 2007 Financial Statements

| | 51. | On your balance sheet and cash flow statement, please correct your balances that show amounts carried out to the cent. |

Answer: Please note that the revision to the balance sheet and cash flow statement has been made to correct the balances that show amounts carried out to the cent.

| 52. | Please tell us why you have negative expense on your Consolidated Statements of Operations for bad debt and depreciation expense. Also disclose why depreciation expense for the nine months ended September 30, 2007 is lower than for the nine months ended September 30, 2006 when property and equipment subject to depreciation has increased significantly or revise the financial statements as necessary. |

Answer: Please note that the bad debt expenses for the nine months quarter ended September 30, 2007 was $502,273 while the bad debt expenses for the six months quarter ended June 30, 2007 was $776,859, the difference was $274,586. The major reason for the negative expense for the bad debt was due to the fact that the provision of bad debt of Benda Ebei, the company’s subsidiary, was decreased from $324,275 as of June 30, 2007 to $67,568 as of Sept 30, 2007, the difference was $256,707. The decreased was mainly due to the fact that during the reporting periods, Benda Ebei put much efforts to collect the trade receivables, thus the company reduced the amount of provision made accordingly.

The depreciation expenses for the nine months quarter ended September 30, 2007 was $337,982 while the depreciation expenses for six months quarter ended June 30, 2007 was $355,231, the difference was $$17,249. The major reasons for the negative expense for depreciation were due to the following events:

| | 1. | Yidu Benda, the company’s subsidiary, ceased its operation starting from January 2007 due to the environmental issue, therefore after serious consideration, the company ceased to make depreciation expense for Yidu Benda for three months ended September 30, 2007 as according to the matching principle. |

| | 2. | For the nine months ended September 30, 2006, since there was idle capacity of production facilities in Benda Ebei, the company’s subsidiary, thus the majority of deprecation was not capitalized as inventory cost but directly expensed off as general and administrative expenses. For the nine months ended September 30, 2007, such idle capacity of production facilities was greatly utilized, thus relatively low deprecation was charged to general and administrative expenses. |

| 53. | Please explain why accumulated depreciation of property and equipment and accumulated amortization of intangible assets increased from December 31, 2006 to September 30, 2007 by a greater amount than depreciation and amortization expense for the nine months ended September 30, 2007. Accumulated amounts from SiBiono should not be carried over in a purchase business combination. |

Answer: Please note that the increase of accumulated deprecation of property and equipment and accumulated amortization of intangible assets from December 31, 2006 to September 30,2007 is greater than the depreciation and amortization expense for the nine months ended September 30,2007 because of the facts that:

| | a) | Depreciation of Benda Ebei and SiBiono with amount of $ 483,452 was capitalized as inventory cost not expensed off in general and administrative expenses; |

| | b) | Accumulated deprecation from Sibiono as of March 31, 2007 was $1,105,631 which was carried over due to acquisition but not be reflected in consolidation statement of operations. |

| 54. | Minority interest fluctuates greatly as a percentage of income/loss before minority interest and income tax. Use of segment profit/loss and your ownership percentage does not fully explain the amount of minority interest, Provide disclosure which explains the amount of minority interest in each period for which a statement of operations is provided. |

Answer: The following table shows how the minority interest for nine months ended September 30, 2007 was derived:

| | | NINE MONTHS ENDED | |

| | | September 30, 2007 | |

| | | Benda | | Jiangling | | Yidu | | Beijing | | | | | |

| | Ebei | | Benda | | Benda | | Shusai | | SiBiono | | Total | |

Segment profit | | $ | 3,153,071 | | | (61,786 | ) | | (542,093 | ) | | (85,392 | ) | | 1,635,415 | | $ | 4,099,215 | |

| Loss on disposal of assets | | | - | | | (3,278 | ) | | (5,120 | ) | | - | | | - | | | (8,398 | ) |

| Interest income/ (expenses) | | | (45,895 | ) | | 90 | | | (2,620 | ) | | (21 | ) | | (96,247 | ) | | (144,693 | ) |

| Other income / (expenses) | | | (2,879 | ) | | (14,268 | ) | | 2,638 | | | (1,303 | ) | | (1,907 | ) | | (17,719 | ) |

| Prior year adjustment | | | - | | | - | | | - | | | - | | | 131,083 | | | 131,083 | |

| Government subsidies | | | - | | | - | | | - | | | - | | | 1,690,974 | | | 1,690,974 | |

Income before minority interest | | $ | 3,104,297 | | | (79,242 | ) | | (547,195 | ) | | (86,716 | ) | | 3,359,318 | | $ | 5,750,462 | |

| | | | | | | | | | | | | | | | | | | | |

| MI percentage | | | 5 | % | | 10 | % | | 10 | % | | 29 | % | | 42.88 | % | | | |

| MI interest | | $ | 155,215 | | | (7,726 | ) | | (53,352 | ) | | (24,931 | ) | | 1,440,358 | | $ | 1,509,564 | |

The following table shows how the minority interest for nine months ended September 30, 2006 was derived:

| | | NINEMONTHS ENDED |

| | | September 30, 2006 |

| | | Benda | | Jiangling | | Yidu | | Beijing | | | |

| | Ebei | | Benda | | Benda | | Shusai | | Total | |

Segment profit | | $ | 2,072,858 | | | (168,666 | ) | | 1,819,388 | | | (41,480 | ) | $ | 3,682,100 | |

| Loss on disposal of assets | | | | | | (248,209 | ) | | | | | | | | (248,209 | ) |

| Interest income / (expenses) | | | (97,325 | ) | | (68 | ) | | (20,900 | ) | | 21 | | | (118,272 | ) |

| Other income / (expenses) | | | (3,654 | ) | | 787 | | | 844 | | | 589 | | | (1,434 | ) |

Income before minority interest | | $ | 1,971,879 | | | (416,156 | ) | | 1,799,332 | | | (40,870 | ) | $ | 3,314,185 | |

| | | | | | | | | | | | | | | | | |

| MI percentage | | | 5 | % | | 10 | % | | 10 | % | | 29 | % | | 42.88 | % |

| MI interest | | $ | 98,594 | | | (40,575 | ) | | 175,435 | | | (11,750 | ) | $ | 221,703 | |

| 55. | Disclose in Note 19 the expenses incurred in the quarters ended September 30, 2006 and 2007 also. Consider using tabular format for all periods. |

Answer: Please be advised that the footnote has been amended as follows:

For the reporting periods, nine months ended September 30, 2007 and 2006 and three months ended September 30, 2007 and 2006, the amount of other general and administrative expenses was $1,751,759, $391,632, $777,620, and $115,271 respectively. The following table shows the major events that included:

| | | Nine Months Ended | | Three Months Ended | |

| | September 30 | | September 30 | |

| | 2007 | | 2006 | | 2007 | | 2006 | |

| Audit services fee | | $ | 265,608 | | | 64,191 | | $ | 57,670 | | | 5,794 | |

| Advertisement expenses | | | 48,818 | | | - | | | 33,965 | | | 7,874 | |

| Postage, courier and printing expenses | | | 20,226 | | | - | | | - | | | - | |

| Legal services fee and related expenses | | | 148,979 | | | - | | | 68,302 | | | | |

| Office expenses | | | 258,047 | | | 60,982 | | | 115,968 | | | 6,939 | |

| Salary and wages | | | 482,316 | | | 132,889 | | | 257,716 | | | 39,702 | |

| Conferences and related expenses | | | 32,479 | | | 13,800 | | | 12,329 | | | 13,800 | |

| Consultation services fee | | | 47,054 | | | - | | | - | | | | |

| Rental and utilities | | | 43,510 | | | 9,623 | | | 14,736 | | | 13,576 | |

| Filing, investor relationship activity expenses | | | 92,641 | | | - | | | 26,788 | | | | |

| Travel and transportation expenses | | | 205,159 | | | 44,138 | | | 121,403 | | | 11,993 | |

| Total | | $ | 1,644,837 | | | 325,623 | | $ | 708,877 | | | 99,678 | |

Exhibit 31.1 and 31.2

| | 56. | Paragraph 4(d) should read "internal control over financial reporting" not "financing reporting." |

Answer: Please note that Paragraph 4(d) of the exhibits will be revised in all future filings.

We trust that this response letter satisfactorily responds to the Comment Letter. If there are any questions, please call our legal counsel Richard I. Anslow, of Anslow & Jaclin, LLP at (732) 409-1212. Your assistance in this matter is appreciated.

Very truly yours,

BENDA PHARMACEUTICAL, INC.

| | | | |

| BY: /s/ Yiqing Wan | | | |

Yiqing Wan | | | |