“The World First Gene Therapy Approved to Launch in China. Experts recognize Gendicine is a milestone of biotechnology development, drives the progress of gene therapy research and application and makes great contribution to the improvement of human health”.

| | | | | | | | | | |

| Products ($ Million) | | Revenue | | | | Gross Profit | | Gross Profit % | |

| VB1 Methiouine | | | 0.07 | | | 0.01 | | | 0.06 | | | 79.89 | % |

| Troxerutin Injection | | | 0.13 | | | 0.04 | | | 0.09 | | | 70.06 | % |

| A Shusai-A Injection | | | 2.04 | | | 0.71 | | | 1.34 | | | 65.41 | % |

| B Suzheng-B Injection | | | 3.24 | | | 1.33 | | | 1.92 | | | 59.10 | % |

| Huitening Injection | | | 0.64 | | | 0.38 | | | 0.26 | | | 40.38 | % |

| Yidingshu Injection | | | 2.93 | | | 1.88 | | | 1.05 | | | 35.86 | % |

| Lincomycin Injection | | | 1.27 | | | 0.84 | | | 0.44 | | | 34.47 | % |

| Inosine Injection | | | 0.06 | | | 0.04 | | | 0.02 | | | 32.90 | % |

| Xujing | | | 2.78 | | | 1.89 | | | 0.90 | | | 32.23 | % |

| | | | 13.18 | | | 7.11 | | | 6.07 | | | 46.06 | % |

Furthermore, as of December 31, 2007, SiBiono, a subsidiary of the Company, was acquired on April 1, 2007, and focused on the production of high margin medicine as well, which is known as Gendicine. For the reporting period nine months ended December 31, 2007, SiBiono sold out 21,020 vials of Gendicine which generated $5.56 MM while the average gross margin is about 90%.

| | 4. | The discussion in the prospectus should be expanded to identify the location, sponsor, and purpose of the "Gene Therapy for Tumors" event. Please indicate the number of vials that have been shipped and the number of vials that had been paid for, respectively, out of the 16,000 vials sold on September 9, 2007. We may have additional comments. |

Answer: Please note that the prospectus has been amended under the section “Milestones of SiBiono” to disclose that the sponsor was the Chinese Academy of Medical Sciences and the China Pharmaceutical Biotechnology Association, China’s large annual medical biotechnology conference run from September 7 - 10 in Qing Dao, Shandong Province. In conjunction with the national conference, Benda’s subsidiary SiBiono held a national forum discussing “Gene Therapy for Tumors” on September 9, 2007. Approximately 600 leading Chinese doctors attended SiBiono’s forum, representing 26 different provinces and over 200 Tier I Chinese hospitals (Tier I hospitals offer the best medical services in China; there are currently 775 Tier I hospitals in China).

The main purpose of the forum was to allow 15 national renowned medical experts to share their experiences in the effective application of Gendicine® to maximize its treatment efficacy.

As of December 31, 2007, SiBiono has already achieved 86% of the 16,000 vials order, of which we have already shipped about 13,760 vials of Gendicine. Starting from January 1 to February 25, 2008, another 733 vials out of the 16,000 vials order had shipped.

| | 5. | We note your response to comment 6 and reissue the comment. For the reasons previously stated, the registration statement should be revised to include the information along with the assumptions your projections are based upon and the sources for market and industry information. Additionally, revise your registration statement to specifically note that your forward looking statements do not fall within the safe harbor. |

Answer: The Company respectfully requests that the Company not be required to include the projections for 2007 and 2008 in the Form S-1. The projections have been removed from the Company’s website and further retracted in a November 2007 press release. The Company believes that to include the projected information going forward would no longer be helpful to the public, as such numbers are no longer anticipated for the reasons set forth below.

Overhaul and restructuring of SFDA: due to this incident, the Company’s businesses have been affected in the following aspects:

| | a) | Benda Ebei - until now, there is no approval for the new drug in PRC. In our prospectus, we state that Benda Ebei has already submitted the new drug certificate applications for Qiweiben Capsule and Yan Long Anti-cancer Oral Liquid; however they are still pending. Benda Ebei cannot estimate when the new drug certificate could be obtained. In the original forecast of 2008, the estimated revenue of Qiweiben Capsule and Yan Long Anti-cancer Oral Liquid is Rmb21 MM and Rmb53 MM; |

| | b) | BJ Shusai - due to the overhaul and restructuring of SFDA, the alliance and co-operation between the company and the local hospitals is not allowed anymore. In the original forecast of 2008, the estimated revenue of BJ Shuai is about Rmb41 MM; |

| | c) | Jiangling Benda - the company original thought the Jiangling Benda can resume its production in the 2H of 2007; however as a matter of fact, Jiangling Benda only obtains the GMP certificate (Ribavirin) until recently, April 9, 2008. The major reason for the delay of obtaining GMP certificate is due to the fact that SFDA delays its examination process. In the original forecast of 2008, it assumes that Jiangling Benda could operate in its fully scale with revenue Rmb119 MM. We now know that it is unrealistic for Jiangling Benda to achieve it; |

| | d) | Yidu Benda - the company is unexpected to receive the notice from the environmental agency on January 12, 2007 and the company has to use almost one year to fix the problem (water waste system). In the past, the related government department pays less attention on the environmental issue, therefore the company cannot anticipate that there would be a strong requirement to cease Yidu’s operation until the environmental requirement is fulfilled. |

| | e) | ALL these, overhaul / restructuring of SFDA and the new requirement of environment are out of the company’s control and the company can only make the estimation within the limited resources. Therefore, the company cannot release financial guidance and estimation anymore since there are a lot of issues are out of the company’s control. Futhermore, for the reasons set forth above, the Company has decided not to release any projections going forward. |

| | 6. | We note your response to comment 7 and reissue the comment with respect to the existence of a primary offering. In this regard, we note the number of shares offered for sale in the aggregate exceeds one third of the number of shares held by non-affiliates of the registrant. The criterion is the number of shares in the aggregate not on an individual selling shareholder basis. At least nine shareholders are each selling more than 10% of the number of shares held by non-affiliates. Please revise the disclosure to reflect that the offering is a primary offering or reduce the number of shares to be sold. |

Answer: Please note that the total number of shares offered for sale in the aggregate has been reduced to equal one third of the number of shares held by non-affiliates of the registrant based on the following calculations.

| Total Shares Outstanding | 100,803,509 |

| Minus | Minus |

| Shares Owned by Affiliates | 47,160,702 |

| Equals | Equals |

| Total Pre-Offering Shares Held by Non-Affiliates | 53,642,807 |

One Third of Pre-Offering Shares Held by Non-Affiliates | 17,880,936 |

| | 7. | As we noted in comment 5 in our correspondence dated August 1, 2007, if you disagree with our analysis, you were requested to advise the staff of the company's basis for determining that the transaction is appropriately characterized as a transaction that is eligible to be made under Rule 415(a)(1)(i). In your analysis, you were requested to address a number of points, among any other relevant factors. The following are the points that were not addressed in your response to prior comment 5: |

| | a. | The number of selling shareholders and the percentage of the overall offering made by each shareholder; |

| | b. | The date on which and the manner in which each selling shareholder received the shares and/or the overlying securities; |

| | c. | The dollar value of the shares registered in relation to the proceeds that the company received from the selling shareholders for the securities, excluding amounts of the proceeds that are returned (or will be returned) to the selling shareholders and/or their affiliates in fees or other payments; |

| | d. | The discount at which the selling shareholders will purchase the common shares underlying any convertible securities (or any related security, such as a warrant or option) upon conversion or exercise; and |

| | e. | Whether or not any of the selling shareholders is in the business of buying and selling securities. |

Answer: The Company respectfully advises the staff that it has analyzed and determined that the transactions being registered on the new Form S-1 are appropriately characterized as secondary offerings that are eligible to be made on a shelf basis under Rule 415(a)(1)(i) for the following reasons:

Rule 415(a)(1)(i) provides that:

“(a) Securities may be registered for an offering to be made on a continuous or delayed basis in the future. Provided, that:

(1) The registration statement pertains only to:

(i) Securities which are to be offered or sold solely by or on behalf of a person or persons other than the registrant, a subsidiary of the registrant or a person of which the registrant is a subsidiary…”

The Company believes it satisfies Rule 415(a)(1)(i) because it is registering securities on behalf of persons other than the Company, a subsidiary of the Company or a person of which the Company is a subsidiary.

The Nature and Size of the Transactions

All of the shares being registered for resale under the new S-1 were issued pursuant to valid and customary Section 4(2) private placement transactions negotiated at arms’ length to a select number of accredited investors with passive investment intent. All of the private placements have been completed and are not ongoing. None of the shares were issued or are issuable pursuant to any form of equity line arrangement. Only a total of one third of the outstanding shares held by non-affiliates or 17,880,936 shares are being registered in the S-1 by the selling shareholders. Only one selling shareholder is registering greater than 10% of the non-affiliate outstanding shares, equal to approximately 14%. All other selling shareholders are registering under 5% each of the non-affiliate outstanding shares.

Of the approximately 17.9 million shares being registered for resale under the new S-1, only approximately 2.1 million of them represent actual shares of common stock outstanding as of the date hereof. The remaining 15.8 million shares are merely issuable upon exercise of warrants, all of which are currently out-of-the-money. This means that, absent an increase in the Company’s trading price and trading volume, these investors will remain, at full economic risk for loss of their investment and such shares might never be issued or ever resold under the S-1.

The Warrants were issued to the Selling Security Holders in a private placement offering which closed on November 15, 2006. The Warrants were issued in transactions exempt from the registration requirements of the 1933 Act under Section 4(2) of the 1933 Act to persons reasonably believed to be "accredited investors" as defined in Regulation D under the 1933 Act. Pursuant to the terms of the subscription agreement under which the Common Stock and related Warrants were issued, we agreed to file this registration statement in order to permit those investors to sell the shares underlying the Warrants. We are also registering a further 2,106,561 shares of common stock, of which 29,968 shares were issued in January 2006 to two shareholders for services rendered; 295,378 were purchased in January and March of 2006 and are now held by two shareholders; 169,241 were issued on November 15, 2006 for services rendered in connection with the Financing and Acquisition of Ever Leader; and 1,611,974 were issued to eleven shareholders in exchange for their Ever Leader shares

Interpretation 29 of Section D, Rule 415, Form S-3, provides that “the question of whether an offering styled a secondary one is really on behalf of the issuer is a difficult one, not merely a question of who received the proceeds. Consideration should be given to how long the selling shareholders have held the shares, the circumstances under which they received them, their relationship to the issuer, the amount of shares involved, whether the sellers are in the business of underwriting securities, and finally, whether under all the circumstances, it appears that the seller is acting as a conduit for the issuer.”

The Company’s analysis of these factors, as used to reach its determination as to a valid secondary offering, follows:

1. How long the selling shareholders have held the shares:

Approximately 15.8 million shares underlying warrants are being registered on the amended S-1 as part of the November 2006 Financing. These selling shareholders have held such warrants for one and a half years. Given that the exercise price of the warrants ($0.555 per share) is currently significantly below the recent trading price of the common stock, the Company believes it is unlikely that the selling shareholders can or will convert to common stock and sell shares pursuant to the registration statement in the near future, thereby extending their likely holding period with respect to the Company’s securities. Additionally, each of these selling stockholders has advised the Company that it purchased or acquired the shares in the ordinary course of business and that at the time of the purchase of the shares to be resold hereunder, it had no agreements or understandings, directly or indirectly, with any person to distribute the securities. The other approximately 2.1 million shares have also all been held for over one and half years.

2. Circumstances under which the investors received their shares:

As described above, the majority of the selling shareholders received their shares pursuant to valid and completed private placement transactions. The investors have been at market risk for their entire investment since the date of their respective private placement closings. None of the shares were issued in connection with an equity line arrangement. The Company will receive no proceeds from the resale of any of the shares by the selling stockholders. The investors could not, after they paid for and acquired their shares in the private placements, immediately turn around and sell them in the public market. The certificates representing the securities issued in the private placements all bear restrictive legends restricting transfer absent registration or the availability of an exemption from registration.

3. The Investors’ relationship to the issuer:

The majority of the selling stockholders in the new S-1 are either private investment funds, individual investors or placement agents. Mr. Micek who is a former member of the Company’s Board of Directors, along with his children, invested a total de minimus amount, in the November 2006 private placement on the same terms as the outside investors. Kevin Keating, the company’s former officer and director is also registering a de minimus amount of shares totaling 14,984. Our legal counsel is registering a total of 63,426 by three members of the law firm, and several of the selling shareholders is affiliated with another selling shareholder. However, no affiliated parties are registering more than a total of 5% of the total outstanding stock of the Company held by non-affiliates. Each of them are long-term, private investors, whose investments have been at market risk for a substantial period of time. All selling shareholders have held the shares or warrants for at least one and a half years. Accordingly, the Company respectfully submits that none of the shares being registered for resale under the new S-1 are being sold by or on behalf of the Company.

4. The amount of shares involved:

See the Company’s discussion above under the heading “The Size of the Transaction.”

5. Whether the sellers are in the business of underwriting securities.

All of the selling stockholders in the new S-1 are either private investment funds, individual investors or placement agents. Except as disclosed below, to the Company’s knowledge and based on inquiry, none of selling stockholders is a registered broker-dealer. Only a handful of the selling shareholders an affiliate of a broker-dealer. Keating Investments, LLC, the placement agent for the November 2006 Financing, is a registered broker-dealer. Each of the selling stockholders has advised the Company that it purchased or acquired the shares in the ordinary course of business and that at the time of the purchase of the shares to be resold hereunder, it had no agreements or understandings, directly or indirectly, with any person to distribute the securities. No issuance of shares covered by this registration were conditioned on the prior effectiveness of a registration statement or otherwise on the selling stockholder’s ability to resell the underlying shares

6. Whether under all the circumstances it appears that the seller is acting as a conduit for the issuer:

Given the nature of the private placement transactions pursuant to which the shares were issued and the characteristics of the investors who purchased the shares, as described above, the Company respectfully submits that no selling stockholder is acting as a conduit or “alter ego” of the Company. Instead, this registration is simply a secondary offering being registered as required by the controlling documents relating to the Company’s private placement transactions. Acting as a conduit for the offer and sale of the Company’s securities would not be in the best interests of the selling stockholders, as they would currently be unable to sell the shares of common stock and those shares issuable upon exercise of their warrants for a comparable price in the market. The market for the Company’s common stock is thin, and unable to support the sale of so many shares.

| | 8. | We note your response to comment 7 that no relationships exist between the selling shareholders. In this regard we note the following: |

| | a. | A number of shareholders are identified as affiliates of a broker dealer, however it is unclear whether they are affiliated with the same or a limited number of broker dealers; |

| | b. | Messrs. Anslow and Jaclin are partners and are selling the shares individually; and |

| | c. | Three sellers are named Keating, there are two selling entities with the names Anima S.G.R.p.A., two Excaliber Limited Partnerships, two Jayhawk Private Equity Funds, two selling shareholders named Hollmann, five shareholders with the last name Micek, two selling shareholders with the name Rothstein, three shareholders named Xu, two shareholders named Wang, and 11 shareholders who obtained their shares apparently in connection with a transaction involving Ever Leader. |

Answer: Please see the Company’s response to Comment 7.

| | 9. | We also note in response to comment 7 you state none of the selling shareholders is an affiliate nor had any prior relationship with the Company before the offering. In this regard, we note John Micek is a director and Kevin Keating was at one time the company's sole officer and director. Please advise or revise the disclosure as necessary. |

Answer: Please see the Company’s response to Comment 7.

We have previously had an explosion at our Yidu Plant..., page 16

| | 10. | Please tell us the basis for your belief that you will be able to reopen in the first quarter of 2008. Alternatively, delete this statement. |

Answer: Please note that the statement has been deleted from the registration statement.

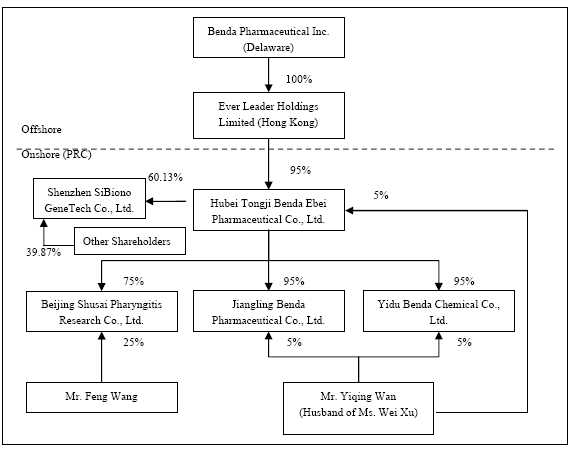

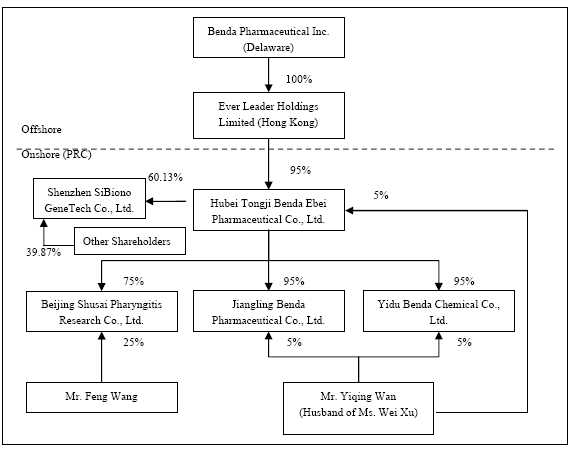

Reorganization and Revised Ownership Structure, page 57

| | 11. | The chart on page 61 pertaining to the organizational chart after the acquisition of SiBiono is not legible. Please revise. |

Answer: Please note that the chart on page 61 has been revised accordingly.

Benda Ebei Products, Page 62

| | 12. | We note your response to comment 17, however we are unable to locate the requested discussion concerning how long the drugs were administered, whether the experiment has been duplicated, and whether the experiment has been published and, if so, where and when were the results published. Please advise or revise. |

Answer: Shusai-A Nefopam Hydrochloride, has been used for more than 30 years in China and proven a safety, effective, mature and stable drug; and because of that it is recorded in the State Promulgated Pharmacopoeia of PRC. Thus, there is no need for us to perform duplicated experiment anymore. The drug registered number in SFDA of Shusai-A Nefopam Hydrochloride is H42021041.

| | 13. | We note your response to comment 18, however we are not able to locate this disclosure. Please provide us with a page reference telling us where you have discussed the pharmacological experiment, whether the experiment was similar to clinical trials required by the FDA in order to obtain FDA approval, and any standards applicable to these types of pharmacological experiments. Please note that these standards should be described and if there are no such standards, this information should be noted. |

Answer: Please note that the disclosure is set forth under the section entitled “Principal Products” on page 60 of the prospectus.

Yidu Benda Products, page 63

| | 14. | We note your response to comment 20 and reissue the comment in part. Please revise the discussion to indicate when the feasibility studies were submitted. In addition, the penultimate sentence of this section refers to anticipated acceptance of the systems in January 2007. Should the reference be to January 2008 and, if so, has acceptance been received and full plant operations initiated? Please advise or revise. |

Answer: Please note that the prospectus has been updated to clarify the current status of Yidu Benda as follows:

| | 1. | On September 25, and October 1, 2007, Yidu Benda had passed the environmental assessment and safety assessment by the Yichang Environmental Protection Bureau and Yichang Safety Supervision Bureau These two bureaus have issued “Environmental Influence Report” and “Safety Assessment Report” in November and December of 2007, respectively. |

| | 2. | Yichang Environmental Protection Bureau issued an approval document, (Document Number: Yichang Environmental Audit [2007] No. 111) and permitted the trial production of Yidu Benda. |

| | 3. | In addition, Yidu Benda had also passed the examinations conducted by Yichang Public Security Bureau, Yichang Lightning Protection Institute and Yichang Special Equipment Inspection and Test Institute, in terms of the fire apparatus and facilities, lightning protection and static proof facilities etc. |

In conclusion, Yidu Benda is allowed and permitted on the trail production scale.

Active Pharmaceutical Ingredients, page 64

| | 15. | We note your response to comment 21 and reissue the comment. Your current presentation is confusing. In the first paragraph, you state you have temporarily closed the Jiangling plant for renovation and to obtain GMP approval. In the second paragraph you state the Jiangling plant reopened in August 2007 and started producing Ribose. Elsewhere, you indicate GM? approval is required to produce API and that such approval is anticipated by the end of February 2008. Axe you currently producing Ribose at the plant, but not currently producing API at the plant? Please revise to clarify. |

Answer: Please note that the prospectus has been updated to clarify the current status as follows:

| | 1. | Jiangling Benda was re-opened in August 2007; |

| | 2. | The products that are planned to be produced in Jiangling Benda are as follows: |

| | a) | Ribavirin API (Anti-virus) |

| | b) | Asarin API (Antibiotic) |

| | c) | Levofloxacin (Antibiotic) |

| | 3. | These four products are classified as API whereas the production of Ribavirin, Asarin and Levofloxacin need to obtain GMP approval, however the production of Ribose does not need the GMP approval. |

| | 4. | Currently, Jiangling Benda only produces Ribose and which is a kind of API. |

Industry and Competitive Factors, page 74

| | 16. | Please delete your statement that you expect to receive approval by the end of February 2008. If you have a basis for your expectation, you may state that you expect a response by the end of February 2008. However, it is inappropriate to say you expect approval. |

Answer: Please note that the statement has been deleted from the prospectus.

Management's Discussion and Analysis, page 76 Results of Operations, page 76

Operating Income/(Loss), page 78

| | 17. | Refer to your response to our comment 32. Please provide additional disclosure, similar to that provided in your response, with regards to why items a) to e) are "one-time" charges. |

Answer: The company should have deleted the wordings “one-time” charges in the Management’s Discussion and Analysis so as to avoid any confusion. This approach was also be adopted in the reporting period year ended December 31, 2007.

Please refer to the amended Management’s Discussion and Analysis, Operating Income / (Loss) section for the reporting periods nine months ended September 30, 2007 and 2006, for the changes made in an amendment to Form 10-QSB.

Critical Accounting Policies, page 81

| | 18. | Refer to your response to our comment 33 and we reissue our comment in part. With regards to the Estimates Effecting Accounts Receivable and Inventories, please quantify the effect on the financial statements of changes in estimates in each year presented or explicitly state that changes in estimates were not material. If material changes in estimates have been recognized, fully explain the new information that became available and why that information could not be anticipated at the date the original estimate was made. |

Answer: The following statement has been amended in the Estimates Effecting Accounts Receivable and Inventories:

The preparation of our consolidated financial statement requires management to make estimated and assumptions that affect our reporting of assets and liabilities (and contingent assets and liabilities). However, it is explicated that the changes in estimation were not material in the preparation of our consolidation financial statement.

Please refer to the amended Management’s Discussion and Analysis, Estimates Affecting Accounts Receivables and Inventories section for the reporting periods nine months ended September 30, 2007 and 2006 in an amendment to Form 10-QSB for the changes made.

Benda Pharmaceutical Inc. Financial Statements for the period ended September 30, 2007

| | 19. | Refer to your response to our comment 36 and we reissue our comment. We did not note any supplemental letter provided supplementally thus we reissue our comment. Have your auditors confirm to us that they traveled to China as part of the audit, or, if they did not travel to China, have them explain to us how they completed the audit without traveling to China. |

Answer: Please note that the letter from the auditor confirming their travel to China as part of the audit is attached to this letter as an exhibit.

| | 20. | Refer to your response to our comment 38 and we reissue our comment. Since you are in the business of identifying, discovering, developing, and manufacturing conventional medicines, active pharmaceuticals, bulk chemicals and traditional Chinese medicines for the treatment of aliments and diseases, it would appear that the amortization of intangible assets such as your drug permits, patents, licenses and technology formulas related to the products currently being sold would be classified as cost of goods sold. Please revise your classification of these expenses, or revise your financial statements to remove your gross profit presentation, or clarify for us why a revision is not necessary. |

Answer: Please note that the Company has reallocated the amortization of intangible assets and depreciation for the reporting period Nine months and Three months ended September 30, 2007 and 2006. This approach has also been adopted for the preparation of the financial statements for year ended December 31, 2007 and onwards.

The following table summarizes the amount of amortization of intangible assets and depreciation stated in the general and administrative expenses that should be reallocated back to cost of goods for the reporting periods nine months and three months ended September 30, 2007 and 2006:

The Company analyses the nature of the intangible assets which including the drugs permits, patents, licenses and technology formulas and identifies which intangible assets are being used in the production. This is the basis for the Company to make the above adjustment.

The Company also analyses the amount of depreciation stated in general and administrative expenses and corresponding adjustment has to put through, i.e. reallocate back the depreciation expenses back to cost of goods sold as those expenses are related to the fixed assets that being used in the production.

The above mentioned analysis is also carefully executed for the preparation of the financial statements for year ended December 31, 2007 and onwards.

Please refer to the amended Consolidated Statements of Operations of Consolidated Financial Statements for the reporting periods nine months ended September 30, 2007 and 2006 on amended Form 10-QSB for the changes made.

Note I. Organization, page 107

| | 21. | Please update this information for the period ended September 30, 2007. |

Answer: As of September 30, 2007, the organization and ownership structure of the Company is as follows:

Please refer to the amended Consolidated Financial Statements for the reporting periods nine months ended September 30, 2007 and 2006, Note 1 in an amended Form 10-QSB for the changes made.

Note 4. Significant Accounting Policies, page 107 Revenue Recognition, Page 108

| | 22. | Please revise your revenue recognition policy to be consistent with the revenue recognition policy disclosed under critical accounting policies on page 81. |

Answer: Please refer to the amended Consolidated Financial Statements for the reporting periods nine months ended September 30, 2007 and 2006, Note 1 in an amended Form 10-QSB for the changes made.

Note 8. Property and Equipment, page 113

| | 23. | Refer to your response to our comment 52. We do not believe it is appropriate to cease recording depreciation expense for Yidu Benda during the improvement to the waste water treatment system since the assets continue to depreciate. Please revise your financial statements accordingly. In addition, include disclosure with regards to the capitalization of depreciation costs and quantify the amount. |

Answer: After the Company made the analysis regarding the depreciation expenses for the reporting period year ended December 31, 2007, we find out that there is inappropriateness for saying that Yidu Benda cease recording depreciation expense during the improvement of the waste water treatment system. As a matter of fact, the fixed assets of Yidu Benda are still subjected to depreciation charges.

The following table shows the analysis of depreciation expenses of all the subsidiaries that incurred for the year of 2007, on the Group’s basis. In which there is only a slightly difference between the deprecation calculated and depreciation being reported in the consolidated financial statements:

| | | Original Cost | | | | | | | | | | | |

| | | December 31, 2006 | | | | Average | | | | | | Depreciation Calculated | | Depreciation Reported | | Difference | |

| Building | | $ | 4,682,848 | | | 11,344,960 | | | 8,013,904 | | | 5 | % | | 25 | | | 304,522 | | | 234,758 | | | 69,764 | |

| Property and equipment | | | 8,280,735 | | | 19,544,311 | | | 13,912,523 | | | 5 | % | | 13 | | | 1,057,351 | | | 1,169,804 | | | (112,453 | ) |

| Office equipment | | | 16,660 | | | 36,837 | | | 26,748 | | | 5 | % | | 5 | | | 5,082 | | | 4,330 | | | 752 | |

| Motor vehicle | | | 69,253 | | | 264,155 | | | 166,704 | | | 5 | % | | 5 | | | 31,674 | | | 37,291 | | | (5,617 | ) |

| Total property and equipments | | $ | 13,049,495 | | | 31,190,262 | | | 22,119,879 | | | | | | | | | 1,398,629 | | | 1,446,183 | | | (47,554 | ) |

The above table shows the calculation of depreciation expenses for the year ended December 31, 2007. The difference between the depreciation calculated and depreciation reported was due to the changes of foreign exchange. In other word, the appropriate depreciation expenses for the reporting period has been charged and reported. The same calculation test is also stated in the amended Consolidated Financial Statements for the reporting period nine months ended September 30, 2007 and 2006, Note 8. Please refer to the amended Note in the amended Form 10-QSB for the details. The company will make a careful analysis onwards.

The weighted average useful lives are used as the base for the calculation of depreciation as the estimated useful lives for buildings and property and equipments are varies from 20 to 30 years and 10 to 15 years, respectively.

The total depreciation expense was $1,446,185 and $718,387 for the year ended December 31, 2007 and 2006, respectively and is broken down as follows:

| | | December 31, | | December 31, | |

| | | 2007 | | 2006 | |

| Cost of sales | | $ | 1,112,221 | | $ | 585,640 | |

| Operating expense | | | 333,964 | | | 132,747 | |

| Total depreciation expense | | $ | 1,446,185 | | $ | 718,387 | |

| | 24. | Refer to your response to our comment 53. Accumulated amounts of depreciation from SiBiono should not be carried over in a purchase business combination. It is unclear how the accumulated amount was carried over but not accounted for Please clarify. Disclose a roll forward of accumulated depreciation and amortization showing the current period expense amounts and all other changes from December 31, 2006 to September 30, 2007 (or December 31, 2007). You should address accumulated amortization also. |

Answer: Please note that the Company has amended the Notes on property and equipments and intangible assets accordingly. Please refer to the amended Note 8 and 9 of the Consolidated Financial Statements for the reporting periods nine months ended September 30, 2007 and 2006 in an amended Form 10-QSB. The same presentation approach is also adopted for the preparation of Consolidated Financial Statements for the year ended December 31, 2007 and 2006.

The company would like to illustrate Note 8, Property and Equipments and Note 9, Intangible Assets of the Consolidated Financial Statements for the year ended December 31, 2007 and 2006, in order to answer the above question. Note 8 and Note 9 are stated as follows:

Note 8. Property and Equipments

The Group’s property and equipment at December 31, 2007 and December 31, 2006 were comprised as follows:

| | | | | Addition | | Disposal | | | | December 31, 2007 | |

| Buildings | | $ | 2,227,710 | | | 6,108,113 | | | (19,835 | ) | | 542,138 | | $ | 8,858,126 | |

| Machinery and equipment | | | 3,941,187 | | | 10,571,781 | | | (302,952 | ) | | 1,050,151 | | | 15,260,167 | |

| Office equipment | | | 10,672 | | | 18,766 | | | (491 | ) | | (185 | ) | | 28,762 | |

| Motor Vehicles | | | 32,971 | | | 182,597 | | | - | | | (9,316 | ) | | 206,252 | |

| Cost | | | 6,212,540 | | | 16,881,257 | | | (323,278 | ) | | 1,582,788 | | | 24,353,307 | |

| Less: Accumulated Depreciation | | | | | | | | | | | | | | | | |

| Buildings | | $ | (875,351 | ) | | (234,758 | ) | | 5,098 | | | (70,331 | ) | $ | (1,175,343 | ) |

| Machinery and equipment | | | (1,837,222 | ) | | (1,169,806 | ) | | 106,028 | | | (171,321 | ) | | (3,072,321 | ) |

| Office equipment | | | (4,558 | ) | | (4,330 | ) | | 61 | | | 926 | | | (7,901 | ) |

| Motor Vehicles | | | (7,129 | ) | | (37,291 | ) | | - | | | (2,027 | ) | | (46,447 | ) |

| Accumulated Depreciation | | | (2,724,260 | ) | | (1,446,185 | ) | | 111,187 | | | (242,753 | ) | | (4,302,012 | ) |

| Construction in progress | | $ | 10,184,787 | | | (4,478,528 | ) | | - | | | 518,316 | | $ | 6,224,575 | |

| Total property and equipment, net | | $ | 13,673,067 | | | 10,956,544 | | | (212,091 | ) | | 1,858,351 | | $ | 26,275,871 | |

The table above shows the fixed assets movement during the year of 2007. In which, the net book value of SiBiono’s fixed assets was recorded as the addition in the year of 2007 when the acquisition was taken place and effective on April 1, 2007. The accumulated depreciation from SiBiono as of March 31, 2007 was not carried forward. As of March 31, 2007, the net book value of SiBiono’s fixed assets was approximately $6.9 million, in which $183K was accounted for buildings; $1.6 million was accounted for machinery and equipment; $5.7K was accounted for office equipment; $18.5K was accounted for motor vehicles; and $5.1 million was accounted for construction in progress at original cost.

The deprecation expense for the year ended December 31, 2007 was calculated as follows:

| | | Original Cost | | | | | | | | | | | |

| | | December 31, 2006 | | December 31, 2007 | | Average | | | | | | Depreciation Calculated | | Depreciation Reported | | Difference | |

| Building | | $ | 4,682,848 | | | 11,344,960 | | | 8,013,904 | | | 5 | % | | 25 | | | 304,522 | | | 234,758 | | | 69,764 | |

| Property and equipment | | | 8,280,735 | | | 19,544,311 | | | 13,912,523 | | | 5 | % | | 13 | | | 1,057,351 | | | 1,169,804 | | | (112,453 | ) |

| Office equipment | | | 16,660 | | | 36,837 | | | 26,748 | | | 5 | % | | 5 | | | 5,082 | | | 4,330 | | | 752 | |

| Motor vehicle | | | 69,253 | | | 264,155 | | | 166,704 | | | 5 | % | | 5 | | | 31,674 | | | 37,291 | | | (5,617 | ) |

| Total property and equipments | | $ | 13,049,495 | | | 31,190,262 | | | 22,119,879 | | | | | | | | | 1,398,629 | | | 1,446,183 | | | (47,554 | ) |

The above table shows the calculation of depreciation expenses for the year ended December 31, 2007. The difference between the depreciation calculated and depreciation reported was due to the changes of foreign exchange translation.

The weighted average useful lives are used as the base for the calculation of depreciation as the estimated useful lives for buildings and property and equipments are varies from 20 to 30 years and 10 to 15 years, respectively.

The total depreciation expense was $1,446,185 and $718,387 for the year ended December 31, 2007 and 2006, respectively and is broken down as follows:

| | | December 31, | | December 31, | |

| | | 2007 | | 2006 | |

| Cost of sales | | $ | 1,112,221 | | $ | 585,640 | |

| Operating expense | | | 333,964 | | | 132,747 | |

| Total depreciation expense | | $ | 1,446,185 | | $ | 718,387 | |

It is noted that the original cost used for depreciation calculation is different from the consolidated original cost. It is due to the fact that when Ever Leader acquired Benda Ebei in November 2005, a negative goodwill of $7,924,763 was resulted. The negative goodwill was recognized as reduction of the fair values of acquired fixed assets and intangible assets at $6,836,955 and $1,087,808, respectively. As a result, the consolidated costs of fixed assets are reduced by this $6,836,955. The table below shows the reconciliation between the total of the original cost of all subsidiaries and the consolidated original costs:

| | | December 31, | | December 31, | |

| | | 2007 | | 2006 | |

| Original cost of all subsidiaries | | $ | 31,190,262 | | $ | 13,049,495 | |

| Less: negative goodwill | | | (6,836,955 | ) | | (6,836,955 | ) |

| Consolidated original cost | | $ | 24,353,307 | | $ | 6,212,540 | |

Note 9. Intangible Assets

The Group’s intangible assets at December 31, 2007 and December 31, 2006 were comprised as follows:

| | | | | Addition | | | | December 31, 2007 | |

| Land-use rights | | $ | 1,068,036 | | | 1,656,038 | | | 151,722 | | $ | 2,875,796 | |

| Drugs permits and licenses | | | 1,055,893 | | | 1,316,700 | | | 192,403 | | | 2,564,996 | |

| Technology formulas | | | 679,700 | | | 474,012 | | | 66,452 | | | 1,220,164 | |

| Patent | | | - | | | 1,619,180 | | | 66,739 | | | 1,685,919 | |

Cost | | | 2,803,630 | | | 5,065,930 | | | 477,316 | | | 8,346,875 | |

| | | | | | | | | | | | | | |

| Land-use rights | | $ | (150,465 | ) | | (64,877 | ) | | (13,038 | ) | $ | (228,380 | ) |

| Drugs permits and licenses | | | (1,085,471 | ) | | (229,765 | ) | | (84,348 | ) | | (1,399,584 | ) |

| Technology formulas | | | (66,210 | ) | | (80,757 | ) | | (7,896 | ) | | (154,863 | ) |

| Patent | | | - | | | (197,092 | ) | | (7,955 | ) | | (205,047 | ) |

| Accumulated amortization | | | (1,302,146 | ) | | (572,491 | ) | | (113,237 | ) | | (1,987,874 | ) |

| | | | | | | | | | | | | | |

| Total intangible assets, net | | $ | 1,501,483 | | | 4,493,439 | | | 364,079 | | $ | 6,359,000 | |

The table above shows the intangible assets movement during the year of 2007. In which, the net book value of SiBiono’s intangible assets was recorded as the addition in the year of 2007 when the acquisition was taken place and effective on April 1, 2007. In order words, the accumulated amortization from SiBiono, as of March 31, 2007 was not carried forward. As of March 31, 2007, the net book value of SiBiono’s intangible assets was approximately $1.97 million, in which $353K was accounted for land use rights; $1.62 million was accounted for patents.

As of December 31, 2007, the cost of intangible assets was increased by $5,065,930 which was mainly composed of the followings:

| | a) | Due to the acquisition of SiBiono, two items were included: (1) patent, the innovation and research results of Genedicine, with cost $1,619,180; (2) land use right with a total area 20,574 square meters, with cost $352,505 |

| | b) | Benda Ebei purchased a land use right with total purchase cost Rmb 9.9 million (or $1.3 million). During the year ended December 31, 2007, an amount Rmb 6.71 million (or $0.92 million) was paid. |

| | c) | Benda Ebei purchased a license for a new drug, which is a kind of anti-virus product in nature with total purchase cost Rmb 10 million (or $1.30 million). During the year ended December 31, 2007, an amount Rmb 9 million (or $1.20 million) was paid. |

| | d) | In May 2007, SiBiono enter into a co-operation agreement with DNAVEC, a Japanese gene therapy research institute. Under the terms of the agreement, DNAVEC will leverage SiBiono’s proven gene therapy manufacturing platform and will transfer the exclusive development and distribution rights of SeV-Gag in China to SiBiono. The total purchase cost Rmb 2 million and the full amount was paid during year ended December 31, 2007 for obtaining such exclusive right. |

| | e) | In July 2004, Yidu Benda entered into a co-operation agreement with Sanxia University Chemical Science Research Institute. Under the terms of the agreement, Sanxia University Chemical Science Research Institute will improve the existing product L-Methionine and transfer the exclusive development and distribution rights of L-Methionine to Yidu Benda. The total purchase cost Rmb1.6 million and $0.15 million was paid in the Year of 2006 for obtaining such exclusive right and recognized as intangible assets as of December 31, 2007. |

The amortization expense for the year ended December 31, 2007 was calculated as follows:

| | | Original Cost | | | | | | | | | |

| | | | | | | Average | | | | Amortization Calculated | | Amortization Reported | | Difference | |

| Land-use rights | | $ | 1,615,068 | | | 3,450,771 | | | 2,532,919 | | | 40 | | $ | 63,323 | | | 64,877 | | | (1,554 | ) |

| Drugs permits and licenses | | | 1,596,666 | | | 3,077,830 | | | 2,337,248 | | | 10 | | | 233,725 | | | 229,765 | | | 3,960 | |

| Technology formulas | | | 679,705 | | | 1,220,164 | | | 949,935 | | | 10 | | | 94,993 | | | 80,757 | | | 14,236 | |

| Patent | | | - | | | 1,685,919 | | | 1,685,919 | | | 6 | | | 210,740 | | | 197,092 | | | 13,648 | |

| Total Intangible assets | | $ | 3,891,438 | | | 9,434,683 | | | 7,506,020 | | | | | $ | 602,781 | | | 572,491 | | | 30,290 | |

The above table shows the calculation of amortization expenses for the year ended December 31, 2007. The difference between the amortization calculated and amortization reported was due to the changes of foreign exchange translation.

From the above calculation table, the patent, $1.68 million, was acquired in during the acquisition of SiBiono. It is amortized over the remaining useful lives, 6 years, whereas the original useful lives are 10 years.

The total amortization expense was $572,491 and $254,990 for the year ended December 31, 2007 and 2006, respectively and is broken down as follows:

| | | December 31, | | December 31, | |

| | | 2007 | | 2006 | |

| Cost of sales | | $ | 430,810 | | $ | 158,375 | |

| Operating expense | | | 141,681 | | | 96,615 | |

| Total amortization expense | | $ | 572,491 | | $ | 254,990 | |

As mentioned in Note 8, the original cost used for amortization calculation is different from the consolidated original cost. It is due to the fact that when Ever Leader acquired Benda Ebei in November 2005, a negative goodwill of $7,924,763 was resulted. The negative goodwill was recognized as reduction of the fair values of acquired fixed assets and intangible assets at $6,836,955 and $1,087,808, respectively. As a result, the consolidated costs of fixed assets are reduced by this $6,836,955. The table below shows the reconciliation between the total of the original cost of all subsidiaries and the consolidated original costs:

| | | December 31, | | December 31, | |

| | | 2007 | | 2006 | |

| Original cost of all subsidiaries | | $ | 9,434,683 | | $ | 3,891,438 | |

| Less: negative goodwill | | | (1,087,808 | ) | | (1,087,808 | ) |

| Consolidated original cost | | $ | 8,346,875 | | $ | 2,803,630 | |

| | 25. | Provide us your computation of depreciation expense for the year ended December 31, 2007. Since the amount of depreciation on the statement of operations is the same as the amount on the cash flow statement it appears no depreciation expense was included in cost of sales. Please explain why not or revise the financial statements as necessary. |

Answer: The computation of depreciation expenses for the year ended December 31, 2007 is shown in the following table:

| | | Original Cost | | | | | | | | | | | |

| | | | | | | Average | | | | | | | | | | Difference | |

Building | | $ | 4,682,848 | | | 11,344,960 | | | 8,013,904 | | | 5 | % | | 25 | | | 304,522 | | | 234,758 | | | 69,764 | |

Property and equipment | | | 8,280,735 | | | 19,544,311 | | | 13,912,523 | | | 5 | % | | 13 | | | 1,057,351 | | | 1,169,804 | | | (112,453 | ) |

Office equipment | | | 16,660 | | | 36,837 | | | 26,748 | | | 5 | % | | 5 | | | 5,082 | | | 4,330 | | | 752 | |

Motor vehicle | | | 69,253 | | | 264,155 | | | 166,704 | | | 5 | % | | 5 | | | 31,674 | | | 37,291 | | | (5,617 | ) |

| Total property and equipments | | $ | 13,049,495 | | | 31,190,262 | | | 22,119,879 | | | | | | | | | 1,398,629 | | | 1,446,183 | | | (47,554 | ) |

The above table shows the calculation of depreciation expenses for the year ended December 31, 2007. The difference between the depreciation calculated and depreciation reported was due to the changes of foreign exchange translation.

The weighted average useful lives are used as the base for the calculation of depreciation as the estimated useful lives for buildings and property and equipments are varies from 20 to 30 years and 10 to 15 years, respectively.

The total depreciation expense was $1,446,185 and $718,387 for the year ended December 31, 2007 and 2006, respectively and is broken down as follows:

| | | December 31, | | December 31, | |

| | | 2007 | | 2006 | |

| Cost of sales | | $ | 1,112,221 | | $ | 585,640 | |

| Operating expense | | | 333,964 | | | 132,747 | |

| Total depreciation expense | | $ | 1,446,185 | | $ | 718,387 | |

The corresponding amendment of the consolidated statements of cash flows has been made in the Consolidated Financial Statements for the reporting period nine months ended September 30, 2007 and 2006. Please refer to Note 8 and 9 for further details.

Note 9. Goodwill and Acquisition Cost Payable

| | 26. | You should disclose the last paragraph of response 40 in the registration statement (total consideration for SiBiono). Jn addition, disclose the complete purchase price allocation for SiBiono, that is, how the $8.22 million was recorded in the financial statements. Finally, the cash paid for SiBiono should be reported as, a single amount on the statement of cash flows to distinguish the acquisition from normal capital expenditures. |

Answer: Please note that the total consideration for the acquisition is Rmb62.56 million (or $8.22 million). The form of the consideration payment is by cash. As of September 30, 2007, an accumulated amount approximately Rmb51.5 million (or $6.75 million) was paid and leaving a balance $1.47 million as acquisition cost payable.

Please refer to the amended Consolidated Financial Statements for the reporting periods nine months ended September 30, 2007 and 2006, Note 10 in amended Form 10-QSB for changes made.

Note 11. Restricted Cash and Bank Indebtedness, page 115

| | 27. | Refer to your response to our comment 40. Please clarify in the filing what you mean by "The remaining balance would be settled gradually in 2008 after the discussion with the original shareholders of SiBiono." Please be as detailed as possible in your revised disclosure. |

Answer: This statement will be deleted in the amendment. Please refer to the Consolidated Financial Statement for the reporting periods nine months ended September 30, 2007 and 2006 in amended Form 10-QSB.

Note 24. Commitments and Contingencies, page 123

| | 28. | As the court has issued judgment against the company, an accrual of a liability should be accounted for in accordance with FAS 5. Please disclose the amount accrued and where the amount is classified related to the litigation or disclose why nothing has been recorded. |

Answer: Please note that the amendment is reflected in the amended Consolidated Financial Statements, Note 14. Please refer to it for details.

Note 25. Segment Information, page 123

| | 29. | Refer to your response to our comment 46 and we reissue our comment. Please provide revenues by distinct product or classes of products as required by paragraph 37 of SFAS 131. For example, on page 56 under the caption "Principal Products", you indicate that Yidu Benda has four bulk chemical products (TCA, L-methionine, TAA and Tetraacetyl). We would expect to see total revenues for each of those three products as well has for the other products listed on page 56 to meet the disclosure requirement under paragraph 37 of FAS 131. Please revise accordingly. |

Answer: Since each subsidiary produces the corresponding products by using the same production facilities of each subsidiary, therefore according to the requirement stated in paragraph of SFAS 131, the Group reports the segment information according to the un-identical products that produced in each subsidiary.

| | 30. | In the table showing the results of the consolidated net profit before income taxes for the reporting period, please revise the caption "total consolidated profit before income taxes" to correspond with the caption used in the financial statements (operating income/(loss)). |

Answer: Please refer to Notes 25 of the Consolidated Financial Statement for the reporting periods nine months ended September 30, 2007 and 2006 in amended Form 10-QSB for the changes made.

| | 31. | Refer to your response to our comment 54. Please provide the disclosure presented in your response in the financial statements. |

Answer: The following table shows how the minority interest for nine months ended September 30, 2007 and 2006 was derived:

| | | Nine Month Ended September 30, 2007 | |

| | | Benda | | Jiangling | | Yidu | | Beijing | | | | | |

| | | Ebei | | Benda | | Benda | | Shusai | | SiBiono | | Total | |

Segment operating profit / (loss) | | $ | 3,103,016 | | | (61,786 | ) | | (542,093 | ) | | (85,392 | ) | | 1,635,415 | | $ | 4,049,160 | |

| Loss on disposal of assets | | | - | | | (3,278 | ) | | (5,120 | ) | | - | | | - | | | (8,398 | ) |

| Interest income / (expenses) | | | (45,895 | ) | | 90 | | | (2,620 | ) | | (21 | ) | | (96,247 | ) | | (144,693 | ) |

| Other income / (expenses) | | | (2,879 | ) | | (14,268 | ) | | 2,638 | | | (1,303 | ) | | (1,907 | ) | | (17,719 | ) |

| Prior year adjustment | | | - | | | - | | | - | | | - | | | 131,083 | | | 131,083 | |

| Government subsidies | | | - | | | - | | | - | | | - | | | 1,690,974 | | | 1,690,974 | |

Income before minority interest | | $ | 3,054,242 | | | (79,242 | ) | | (547,195 | ) | | (86,716 | ) | | 3,359,318 | | $ | 5,700,407 | |

| | | | | | | | | | | | | | | | | | | | |

| MI percentage | | | 5.00 | % | | 9.75 | % | | 9.75 | % | | 28.75 | % | | 42.88 | % | | | |

| MI interest | | $ | 152,712 | | | (7,726 | ) | | (53,352 | ) | | (24,931 | ) | | 1,440,358 | | $ | 1,507,061 | |