UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 10-Q

| x | QUARTERLY REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the quarterly period ended June 30, 2010

| o | TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the transition period from ______to______.

BENDA PHARMACEUTICAL, INC.

(Exact name of registrant as specified in Charter

| Delaware | | 000-16397 | | 41-2185030 |

(State or other jurisdiction of incorporation or organization) | | (Commission File No.) | | (IRS Employee Identification No.) |

Taibei Mingju, 4th Floor,

6 Taibei Road, Wuhan, Hubei Province, 430015, PRC

(Address of Principal Executive Offices)

+86 (27) 85494916

(Issuer Telephone number)

(Former Name or Former Address if Changed Since Last Report)

Check whether the issuer (1) has filed all reports required to be filed by Section 13 or 15(d) of the Exchange Act during the preceding 12 months (or for such shorter period that the issuer was required to file such reports), and (2)has been subject to such filing requirements for the past 90 days. Yes x No o

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). Yes o No o

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer or a smaller reporting company filer. See definition of “accelerated filer” and “large accelerated filer” in Rule 12b-2 of the Exchange Act (Check one):

Large Accelerated Filer o Accelerated Filer o Non-Accelerated Filer o Smaller Reporting Company x

Indicate by check mark whether the registrant is a shell company as defined in Rule 12b-2 of the Exchange Act.

Yes o No x

State the number of shares outstanding of each of the issuer’s classes of common equity, as of August 23, 2010: 105,155,355 shares of common stock.

BENDA PHARMACEUTICAL, INC.

FORM 10-Q

June 30, 2010

INDEX

| PART I— FINANCIAL INFORMATION | | |

| | | | |

| Item 1. | Financial Statements | | 3 |

| Item 2. | Management’s Discussion and Analysis of Financial Condition | | 16 |

| Item 3. | Quantitative and Qualitative Disclosures About Market Risk | | 21 |

| Item 4T. | Control and Procedures | | 21 |

| | | | |

| PART II— OTHER INFORMATION | | |

| | | | |

| Item 1 | Legal Proceedings | | 22 |

| Item 2. | Unregistered Sales of Equity Securities and Use of Proceeds | | 24 |

| Item 3. | Defaults Upon Senior Securities | | 24 |

| Item 4. | (Removed and Reserved) | | 25 |

| Item 5. | Other Information | | 25 |

| Item 6. | Exhibits | | 25 |

| | | | |

| SIGNATURE | | 26 |

PART I—FINANCIAL INFORMATION

Item 1. Financial Information

Benda Pharmaceutical, Inc.

Consolidated Balance Sheets

(unaudited)

| | | June 30, 2010 | | | December 31, 2009 | |

| Assets | | | | | | |

| Current Assets | | | | | | |

| Cash and cash equivalents | | $ | 1,166,037 | | | $ | 191,095 | |

| Trade receivables, net of allowance of doubtful accounts of $5,456,178 and $5,202,311, respectively | | | 13,390,698 | | | | 12,405,018 | |

| Advance for inventory purchase | | | 1,781,200 | | | | 2,110,857 | |

| Note receivables | | | - | | | | 81,426 | |

| Inventories | | | 3,581,104 | | | | 2,038,987 | |

| Due from related parties, short term | | | 30,337 | | | | 30,861 | |

| Prepaid expenses and other current assets | | | 1,336,780 | | | | 1,720,237 | |

| Total current assets | | | 21,286,156 | | | | 18,578,481 | |

| | | | | | | | | |

| Due from related parties, long term | | | 3,068,092 | | | | 3,032,726 | |

| Property and equipments, net | | | 28,278,038 | | | | 28,658,131 | |

| Investment | | | 117,496 | | | | - | |

| Intangible assets, net | | | 6,362,021 | | | | 6,629,501 | |

| Restricted cash | | | 5,798,023 | | | | 4,409,334 | |

| Other assets | | | 2,294,486 | | | | 2,285,581 | |

| Total Assets | | $ | 67,204,312 | | | $ | 63,593,754 | |

| | | | | | | | | |

| Liabilities & Shareholders' Equity | | | | | | | | |

| Current Liabilities | | | | | | | | |

| Accounts payable | | $ | 1,649,975 | | | $ | 902,079 | |

| Customer deposit | | | 1,536,128 | | | | 1,507,147 | |

| Other payable | | | 4,595,197 | | | | 4,547,558 | |

| Accrued liabilities | | | 7,493,695 | | | | 6,175,538 | |

| Convertible notes | | | 7,260,000 | | | | 7,260,000 | |

| Short-term debt | | | 14,845,254 | | | | 11,598,066 | |

| Accrued VAT and other taxes | | | 719,378 | | | | 795,013 | |

| Acquisition price payable | | | 1,428,286 | | | | 1,422,743 | |

| Wages payable | | | 370,248 | | | | 1,187,075 | |

| Due to related parties, short term | | | 2,810,667 | | | | 2,791,447 | |

| Redeemable common stock, 2,049,560 shares at $3.6 per share | | | 7,376,366 | | | | 7,376,366 | |

| Total current liabilities | | | 50,085,194 | | | | 45,563,032 | |

| Government grant payable | | | 1,796,411 | | | | 1,789,439 | |

| Due to related parties, long-term | | | 118,662 | | | | 118,202 | |

| Deferred tax liability | | | 753,833 | | | | 778,026 | |

| Total liabilities | | | 52,754,100 | | | | 48,248,699 | |

| | | | | | | | | |

| Shareholders' Equity | | | | | | | | |

| Preferred stock, $0.001 par value; 5,000,000 shares authorized; | | | | | | | | |

| None issued and outstanding | | | - | | | | - | |

| Common stock, $0.001 par value; 150,000,000 shares authorized; 105,155,355 shares issued and outstanding | | | 105,155 | | | | 105,155 | |

| Additional paid in capital | | | 22,108,427 | | | | 22,108,427 | |

| Accumulated deficit | | | (18,583,734 | ) | | | (17,481,559 | ) |

| Statutory surplus reserve fund | | | 2,642,775 | | | | 2,642,775 | |

| Accumulative other comprehensive income | | | 6,605,932 | | | | 6,268,111 | |

| Shares issuable for services | | | 503,860 | | | | 503,860 | |

| Total Benda Pharmaceutical, Inc.'s Shareholers' Equity | | | 13,382,415 | | | | 14,146,769 | |

| Noncontrolling Interest | | | 1,067,797 | | | | 1,198,286 | |

| Total Shareholders' Equity | | | 14,450,212 | | | | 15,345,055 | |

| Total Liabilities & Shareholders' Equity | | $ | 67,204,312 | | | $ | 63,593,754 | |

The accompany notes are an integral part of these consolidated financial statements.

Benda Pharmaceutical, Inc.

Consolidated Statements of Operations

(unaudited)

| | | SIX MONTHS ENDED | | | THREE MONTHS ENDED | |

| | | JUNE 30 | | | JUNE 30 | |

| | | | | | (Restated) | | | | | | (Restated) | |

| | | 2010 | | | 2009 | | | 2010 | | | 2009 | |

| Revenue | | $ | 10,159,849 | | | $ | 11,440,412 | | | $ | 6,019,234 | | | $ | 5,924,609 | |

| Cost of goods sold | | | (5,765,317 | ) | | | (6,699,079 | ) | | | (3,423,872 | ) | | | (3,556,288 | ) |

| Gross profit | | | 4,394,532 | | | | 4,741,333 | | | | 2,595,362 | | | | 2,368,321 | |

| Selling expenses | | | (1,365,017 | ) | | | (1,016,366 | ) | | | (725,051 | ) | | | (622,173 | ) |

| General and administrative expenses | | | (1,443,088 | ) | | | (4,021,657 | ) | | | (718,621 | ) | | | (2,900,850 | ) |

| Depreciation and Amortization Expense | | | (816,970 | ) | | | (445,782 | ) | | | (392,864 | ) | | | (222,953 | ) |

| Research and development expenses | | | (765,282 | ) | | | (118,083 | ) | | | (374,352 | ) | | | 183,601 | |

| Total operating expenses | | | (4,390,357 | ) | | | (5,601,888 | ) | | | (2,210,888 | ) | | | (3,562,375 | ) |

| Operating income / (loss) | | | 4,175 | | | | (860,555 | ) | | | 384,474 | | | | (1,194,054 | ) |

| | | | | | | | | | | | | | | | | |

| Interest Expense | | | (728,768 | ) | | | (1,633,247 | ) | | | (358,801 | ) | | | (362,866 | ) |

| Other Income (expense) | | | (11,565 | ) | | | 45,776 | | | | (81,842 | ) | | | 62,965 | |

| Government subsidies | | | - | | | | 26,383 | | | | (5,103 | ) | | | 11 | |

| Loss before income taxes | | | (736,158 | ) | | | (2,421,643 | ) | | | (61,272 | ) | | | (1,493,944 | ) |

| Income taxes | | | (316,595 | ) | | | (57,235 | ) | | | (243,342 | ) | | | 231,564 | |

| Net Loss | | | (1,052,753 | ) | | | (2,478,878 | ) | | | (304,614 | ) | | | (1,262,380 | ) |

| Less: Net gain (loss) attributable to the noncontrolling Interests | | | 49,422 | | | | (230,892 | ) | | | 30,933 | | | | (20,738 | ) |

| Net loss attributable to Benda Pharmaceutical, Inc. | | $ | (1,102,175 | ) | | $ | (2,247,986 | ) | | $ | (335,547 | ) | | $ | (1,241,642 | ) |

| | | | | | | | | | | | | | | | | |

| Other Comprehensive Loss | | | | | | | | | | | | | | | | |

| Foreign currency translation gain (loss) | | | 157,910 | | | | (310,411 | ) | | | 199,322 | | | | 118,028 | |

| Comprehensive Loss | | | (894,843 | ) | | | (2,789,289 | ) | | | (105,292 | ) | | | (1,144,352 | ) |

| Comprehensive gain (loss) attributable to the noncontrolling interest | | | (130,489 | ) | | | (230,892 | ) | | | 48,152 | | | | (30,606 | ) |

| Comprehensive loss attributable to Benda Pharmaceutical, Inc. | | $ | (764,354 | ) | | $ | (2,558,397 | ) | | $ | (153,444 | ) | | $ | (1,113,746 | ) |

| | | | | | | | | | | | | | | | | |

| Net loss per share - basic and diluted | | | | | | | | | | | | | | | | |

| Net loss attributable to Benda Pharmaceutical, Inc. | | $ | (0.01 | ) | | $ | (0.02 | ) | | $ | (0.00 | ) | | $ | (0.01 | ) |

| Weighted average shares outstanding - basic and diluted | | | 105,155,355 | | | | 105,155,355 | | | | 105,155,355 | | | | 105,155,355 | |

The accompany notes are an integral part of these consolidated financial statements.

Benda Pharmaceutical, Inc.

Consolidated Statements of Cash Flows

(unaudited)

| | | SIX MONTHS ENDED JUNE 30, | |

| | | 2010 | | | 2009 | |

| | | | | | (Restated) | |

| Cash Flows From Operating Activities | | | | | | |

| Net loss | | $ | (1,052,753 | ) | | $ | (2,478,878 | ) |

| Adjustments to reconcile net loss to net cash used in operating activities: | | | | | | | | |

| Loss on disposals of fixed assets | | | 4,551 | | | | - | |

| Bad debt provision | | | 233,311 | | | | 2,808,862 | |

| Inventory written down to net realizable value | | | - | | | | 124,239 | |

| Depreciation, including amounts in cost of sales | | | 1,137,628 | | | | 980,389 | |

| Amortization of intangible assets | | | 293,023 | | | | 352,313 | |

| Amortization of debt issuance costs | | | - | | | | 55,485 | |

| Amortization of convertible notes discount | | | - | | | | 864,049 | |

| Changes in operating assets and liabilities: | | | | | | | | |

| Trade receivables | | | (1,218,991 | ) | | | (1,502,651 | ) |

| Advance for inventory purchase | | | (131,891 | ) | | | (1,064,488 | ) |

| Other receivables | | | (185,597 | ) | | | (581,974 | ) |

| Prepaid expenses and other current assets | | | 1,158,459 | | | | - | |

| Inventories | | | (1,542,117 | ) | | | (500,178 | ) |

| Accounts payable | | | 2,066,053 | | | | 1,289,366 | |

| Customer deposit | | | 28,981 | | | | 42,796 | |

| Other payable | | | 25,694 | | | | 411,112 | |

| Wages payable | | | (816,827 | ) | | | 74,841 | |

| Accrued taxes | | | (229,539 | ) | | | (369,977 | ) |

| Net cash provided by (used in) operating activities | | | (230,015 | ) | | | 505,306 | |

| | | | | | | | | |

| Cash Flows From Investing Activities | | | | | | |

| Investment in joint venture | | | (117,496 | ) | | | - | |

| Purchases of property and equipment and construction-in-progress | | | (662,535 | ) | | | (456,065 | ) |

| Collection of notes receivable | | | 81,426 | | | | 154,691 | |

| Net cash used in investing activities | | | (698,605 | ) | | | (301,374 | ) |

| | | | | | | | | |

| Cash Flows From Financing Actives | | | | | | | | |

| Proceeds and repayments of borrowings under related parties, net | | | (15,162 | ) | | | - | |

| Proceeds and repayments of borrowings under short term debt | | | 1,880,444 | | | | (123,064 | ) |

| Net cash provided by (used in) financing activities | | | 1,865,282 | | | | (123,064 | ) |

| Effect of exchange rate changes on cash | | | 38,280 | | | | 897,706 | |

| Net increase in cash and cash equivalents | | | 974,942 | | | | 978,574 | |

| | | | | | | | | |

| Cash and cash equivalents, beginning of period | | | 191,095 | | | | 584,266 | |

| | | | | | | | | |

| Cash and cash equivalents, end of period | | $ | 1,166,037 | | | $ | 1,562,840 | |

| | | | | | | | | |

| Supplemental Disclosure of Cash Flow Information | | | | | | | | |

| Cash paid for interest | | $ | 99,035 | | | $ | 253,139 | |

| Cash paid for income taxes | | $ | 343,255 | | | $ | 788,511 | |

The accompany notes are an integral part of these consolidated financial statements

Benda Pharmaceutical, Inc.

Notes to Consolidated Financial Statements

(Amounts expressed in U.S. Dollars)

1. Organization

Benda Pharmaceutical, Inc. (“Benda”) is a corporation organized under Delaware Law and headquartered in Hubei Province, the People’s Republic of China (“PRC”).

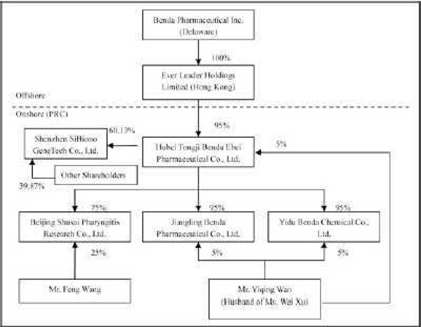

Ever Leader Holdings Limited (“Ever Leader”), a wholly owned subsidiary of Benda, is a company incorporated under the laws of Hong Kong SAR.

Ever Leader owns 95% of the issued and outstanding capital of Hubei Tongji Benda Ebei Pharmaceutical Co. Ltd. (“Benda Ebei”), a Sino-Foreign Equity Joint Venture company incorporated under the laws of PRC. Mr. Yiqing Wan owns 5% of the issued and outstanding capital stock of Benda Ebei. Benda Ebei owns: (i) 95% of the issued and outstanding capital stock of Jiangling Benda Pharmaceutical Co. Ltd., (“Jiangling Benda”) a company formed under the laws of PRC; (ii) 95% of the issued and outstanding capital stock of Yidu Benda Chemical Co. Ltd., (“Yidu Benda”) a company incorporated under the laws of PRC; and (iii) 75% of the issued and outstanding capital stock of Beijing Shusai Pharyngitis Research Co. Ltd., (“Beijing Shusai”) a company incorporated under the laws of PRC. Mr. Yiqing Wan owns: (i) 5% of the issued and outstanding capital stock of Jingling Benda; and (ii) 5% of the issued and outstanding capital stock of Yidu Benda. Mr. Feng Wang owns 25% of the issued and outstanding capital stock of Beijing Shusai.

On April 5, 2007, Benda Ebei entered into an Equity Transfer Agreements with Shenzhen Yuanzheng Investment Development Co., Ltd. and Shenzhen Yuanxing Gene City Development Co., Ltd., the shareholders of Shenzhen SiBiono GeneTech Co., Ltd (“SiBiono”), to purchase 27.57% and 30% respectively of the shares of SiBiono’s common stock for total consideration of RMB 60 million due and payable on or before April 30, 2007. On June 11, 2007, Benda Ebei entered into an Equity Transfer Agreement with Huimin Zhang and Yaojin Wang, the individual shareholders of SiBiono, to purchase 1.6% and 0.96% respectively of the shares of SiBiono’s common stock for total consideration of RMB 2.56 million due and payable on or before June 30, 2007. Altogether, the total consideration for 60.13% shares of SiBiono’s common stock was RMB 62.56 million or $8.58 million. As of June 30, 2010 an accumulated amount, approximately RMB 52.83 million or $7.16 million was paid leaving a balance of RMB 9.73 million or $1.42 million.

Benda, Ever Leader, Benda Ebei, Jiangling Benda, Yidu Benda, Beijing Shusai and SiBiono shall be referred to herein collectively as the “Company”. The Company is engaged principally in the business of identifying, discovering, developing, and manufacturing conventional medicines, active pharmaceuticals, bulk chemicals (or pharmaceutical immediates), and Traditional Chinese Medicines (“TCM”) for the treatment of some of the most widespread common ailments and diseases (e.g. common cold, diabetes, and cancer).

As of June 30, 2010, the organization and ownership structure of the Company is as follows:

Going Concern

The accompanying consolidated financial statements have been prepared assuming that the Company will continue as a going concern. As reflected in the accompanying consolidated financial statements, the Company has recurring losses and has a working capital deficiency at June 30, 2010. These conditions raise substantial doubt as to the Company’s ability to continue as a going concern.

While the Company is attempting to produce sufficient revenues, the Company’s cash position may not be enough to support the Company’s daily operations. Management intends to raise additional funds by way of a public or private offering. Management believes that the actions presently being taking to further implement its business plan and generate sufficient revenues provide the opportunity for the Company to continue as a going concern. While the Company believes in the viability of its strategy to increase revenues and in its ability to raise additional funds, there can be no assurance to that effect. The ability of the Company to continue as a going concern is dependent upon the Company’s ability to further implement its business plan and generate sufficient revenues. The financial statements do not include any adjustments that might be necessary if the Company is unable to continue as a going concern.

2. Basis of Preparation

The accompanying unaudited consolidated financial statements of the Company have been prepared in accordance with accounting principles generally accepted in the United States of America and rules of the Securities and Exchange Commission, and should be read in conjunction with the audited financial statements and notes thereto contained in the Company’s annual report on Form 10-K for the year ended December 31, 2009 filed with the SEC on May 18, 2010. In the opinion of management, all adjustments, consisting of normal recurring adjustments, necessary for a fair presentation of financial position and the results of operations for the interim periods presented have been reflected herein. The results of operations for interim periods are not necessarily indicative of the results to be expected for the full year. Notes to the consolidated financial statements which would substantially duplicate the disclosure contained in the audited financial statements as reported in the 2009 annual report on Form 10-K have been omitted.

These consolidated financial statements include the accounts of Benda, Ever Leader, Benda Ebei, Jiangling Benda, Yidu Benda, Beijing Shusai and Sibiono. All significant inter-company balances and transactions have been eliminated in the consolidation.

Certain amounts in the consolidated financial statements for the prior year have been reclassified to conform to the presentation of the current year.

The preparation of financial statements in conformity with US GAAP requires management to make estimates and assumptions that affect the reported amounts of assets and liabilities and disclosure of contingent assets and liabilities at the date of the financial statements, and the reported amounts of revenue and expenses during the reporting period. Actual results when ultimately realized could differ from those estimates.

3. Restatement

On May 12, 2010, the Company discovered that its financial statements for the year ended December 31, 2008 and 2007, and the quarterly periods within the year 2007 to 2009 should not be relied upon due to multiple errors found in the accounting treatment of a business combination transaction completed in March 2007 resulting in adjustment of assets and liabilities to fair market value. The Company also adjusted certain other assets and intangible assets due to errors in the accounting treatment of these assets resulting in additional expenses for the prior periods. To correct the above noted errors, the Company has restated the accompanying Consolidated Statements of Operations and Cash Flows for the three and six months period ended June 30, 2009, and the notes to the consolidated financial statements. The impact to the June 30, 2009 Balance Sheet is not presented here. The following is a summary items affected by the corrections described above:

| | | SIX MONTH ENDED JUNE 30, 2009 | |

| | | As previously reported | | | Adjustments | | | As Restated | |

| | | | | | | | | | |

| Revenue | | $ | 11,440,412 | | | $ | - | | | $ | 11,440,412 | |

| Cost of goods sold | | | (6,699,079 | ) | | | - | | | | (6,699,079 | ) |

| Gross profit | | | 4,741,333 | | | | - | | | | 4,741,333 | |

| Selling expenses | | | (1,016,366 | ) | | | - | | | | (1,016,366 | ) |

| General and administrative expenses | | | | | | | | | | | | |

| Bad debts | | | (2,808,862 | ) | | | - | | | | (2,808,862 | ) |

| Depreciation and amortization expense | | | (458,695 | ) | | | 12,913 | | | | (445,782 | ) b |

| Inventory wirtten down to net realizable value | | | (124,239 | ) | | | - | | | | (124,239 | ) |

| Other general and administrative expenses | | | (1,088,417 | ) | | | (139 | ) | | | (1,088,556 | ) a |

| Research and development expenses | | | (118,083 | ) | | | - | | | | (118,083 | ) |

| Total operating expenses | | | (5,614,662 | ) | | | 12,774 | | | | (5,601,888 | ) |

| Operating loss | | | (873,329 | ) | | | 12,774 | | | | (860,555 | ) |

| Other income (expenses) | | | | | | | | | | | | |

| Government subsidies / grants | | | 26,383 | | | | - | | | | 26,383 | |

| Interest income | | | 85,192 | | | | - | | | | 85,192 | |

| Interest expenses | | | (1,718,439 | ) | | | - | | | | (1,718,439 | ) |

| Other income | | | 45,776 | | | | - | | | | 45,776 | |

| Net loss before income taxes | | | (2,434,417 | ) | | | 12,774 | | | | (2,421,643 | ) |

| Income taxes | | | (84,412 | ) | | | 27,177 | | | | (57,235 | ) c |

| Net loss | | | (2,518,829 | ) | | | 39,951 | | | | (2,478,878 | ) c |

| Less: Net loss attributable to the noncontrolling interests | | | (202,574 | ) | | | (28,318 | ) | | | (230,892 | ) c |

| Net loss attributable to Benda Pharmaceutical, Inc. | | $ | (2,316,255 | ) | | $ | 68,269 | | | $ | (2,247,986 | ) |

| Other Comprehensive Loss | | | | | | | | | | | | |

| Foreign currency translation loss | | | (51,784 | ) | | | (258,627 | ) | | | (310,411 | ) c |

| Comprehensive Loss | | | (2,570,613 | ) | | | (218,676 | ) | | | (2,789,289 | ) |

| Comprehensive loss attributable to the noncontrolling interest | | | (202,574 | ) | | | (28,318 | ) | | | (230,892 | ) c |

| Comprehensive loss attributable to Benda Pharmaceutical, Inc. | | $ | (2,368,039 | ) | | $ | (190,358 | ) | | $ | (2,558,397 | ) |

| | | | | | | | | | | | | |

| Net loss per share - basic and diluted | | | | | | | | | | | | |

| Net loss attributable to Benda Pharmaceutical, Inc. | | $ | (0.02 | ) | | | | | | $ | (0.02 | ) |

| Weighted average shares outstanding - basic and diluted | | | 105,155,355 | | | | | | | | 105,155,355 | |

Benda Pharmaceutical, Inc.

Consolidated Statements of Cash Flows

(unaudited)

| | | SIX MONTHS ENDED JUNE 30, 2009 | |

| | | As previously reported | | | Adjustments | | | As Restated | |

| Cash Flows From Operating Activities | | | | | | | | | |

| Net loss | | $ | (2,518,829 | ) | | $ | 39,951 | | | $ | (2,478,878 | ) c |

| Adjustments to reconcile net loss to net cash provided by operating activities: | | | | | | | - | | | | | |

| Bad debt provision | | | 2,808,862 | | | | - | | | | 2,808,862 | |

| Inventory written down to net realizable value | | | 124,239 | | | | - | | | | 124,239 | |

| Depreciation, including amounts in cost of sales | | | 980,389 | | | | - | | | | 980,389 | |

| Amortization of intangible assets | | | 365,225 | | | | (12,912 | ) | | | 352,313 | b |

| Amortization of debt issuance costs | | | 55,485 | | | | - | | | | 55,485 | |

| Amortization of convertible notes discount | | | 864,049 | | | | - | | | | 864,049 | |

| Changes in operating assets and liabilities: | | | | | | | | | | | | |

| Trade receivables | | | (1,494,650 | ) | | | (8,001 | ) | | | (1,502,651 | ) d |

| Other receivables | | | (2,335 | ) | | | (579,639 | ) | | | (581,974 | ) d |

| Advance for inventory purchase | | | - | | | | (1,064,488 | ) | | | (1,064,488 | ) d |

| Inventories | | | (500,177 | ) | | | (1 | ) | | | (500,178 | ) d |

| Prepaid expenses and other current assets | | | (453,153 | ) | | | 453,153 | | | | - | d |

| Accounts payable | | | 1,818,056 | | | | 59 | | | | 1,818,115 | d |

| Accrued taxes | | | (628,603 | ) | | | 258,626 | | | | (369,977 | ) d |

| Net cash provided by operating activities | | | 1,418,558 | | | | (913,252 | ) | | | 505,306 | |

| Cash Flows From Investing Activities | | | | | | | - | | | | | |

| Collection of notes receivable | | | | | | | 154,691 | | | | 154,691 | d |

| Purchases of property and equipment and construction-in-progress | | | (456,065 | ) | | | - | | | | (456,065 | ) |

| Net cash used in investing activities | | | (456,065 | ) | | | 154,691 | | | | (301,374 | ) |

| Cash Flows From Financing Actives | | | | | | | | | | | | |

| Proceeds and repayments of borrowings under short term debt | | | 146,685 | | | | (269,749 | ) | | | (123,064 | ) d |

| Proceeds and repayments of borrowings under related parties | | | (99,366 | ) | | | 99,366 | | | | - | d |

| Proceeds and repayments of borrowings under government debts payable | | | (94,450 | ) | | | 94,450 | | | | - | d |

| Repayments of borrowings under bank loans, net | | | (20,441 | ) | | | 20,441 | | | | - | d |

| Net cash used in financing activities | | | (67,572 | ) | | | (55,492 | ) | | | (123,064 | ) |

| Effect of exchange rate changes on cash | | | (10,795 | ) | | | 908,501 | | | | 897,706 | c |

| Net increase in cash and cash equivalents | | | 884,126 | | | | 94,448 | | | | 978,574 | |

| Cash and cash equivalents, beginning of period | | | 569,019 | | | | 15,247 | | | | 584,266 | c |

| Cash and cash equivalents, end of period | | $ | 1,453,145 | | | $ | 109,695 | | | $ | 1,562,840 | |

a – These are minor reclassifications between G&A expense items.

b - When SiBiono was acquired at March 31, 2007, the assets and liabilities of SiBiono were not fair valued at March 31, 2007. The differences in these items are due to the difference between the fair value per valuation and book value at March 31, 2007.

c – The combination of other adjustments above.

d – Due to minor reclassifications between asset and liability items.

4. Inventories

The Company’s inventories were comprised as follows:

| | | June 30, 2010 | | | December 31, 2009 | |

| Raw materials | | $ | 2,228,261 | | | $ | 489,348 | |

| Packing materials | | | 368.025 | | | | 290,601 | |

| Other materials / supplies | | | 67,482 | | | | 83,247 | |

| Finished goods | | | 869.084 | | | | 588,604 | |

| Work-in-process | | | 57,550 | | | | 596,449 | |

| Total inventories at cost | | | 3,590,402 | | | | 2,048,249 | |

| | | | | | | | | |

| Less: Reserves on inventories | | | (9,298 | ) | | | (9,262 | ) |

| | | | | | | | | |

| Total inventories, net | | $ | 3,581,104 | | | $ | 2,038,987 | |

5. Short-term debt

The Company’s short term debt was comprised as follows:

| | | June 30, 2010 | | | December 31, 2009 | |

| Ebei - one year bank loan due in October 2010, bear interest at 9% per annum, secured by Ebei Benda’s Machinery. | | $ | 440,610 | | | $ | 438,900 | |

| | | | | | | | | |

| Ebei- bank acceptance notes from SHPudong Development Bank with redemption dates various from one to six months subsequent to year end, secured by buildings, machinery and equipment of Benda Ebei and Jiangling Benda. | | | 10,310,641 | | | | 8,160,503 | |

| | | | | | | | | |

| Ebei - Five-month loan from Shenzhen Shourenben Enterprise Consulting (SZ) Co., Ltd. matured in May 2010, bearing monthly interest at 1% and unsecured. Loan is currently in default. | | | 533,931 | | | | - | |

| | | | | | | | | |

| Sibiono - Three loans from Shourenben Enterprise Consulting (SZ) Co., Ltd. due in June 2011, bearing monthly interest at 1.5% and unsecured. | | | 279,053 | | | | 21,945 | |

| | | | | | | | | |

| Sibiono- three-year bank loan due in April 2008 bearing annual interest at 6.366%. Loan is currently in default. See (a) below for more detail. | | | 2,987,279 | | | | 2,976,718 | (a) |

| | | | | | | | | |

| Jiangling- One-year bank loan from Hubei Province Rural Credit due in April 2011, bearing annual interest at 7.2% and secured by a third party commercial loan guarantee company. | | | 293,740 | | | | - | |

| | | $ | 14,845,254 | | | $ | 11,598,066 | |

(a) SiBiono – Bank Loan in default

As of June 30, 2010 and December 31, 2009, Sibiono, had an outstanding bank loan for the amount of $2,987,279 and $2,976,718, respectively, which was used primarily to fund construction in progress projects and for general working capital purposes. The loan carries annual interest rate of 6.366% and matured in April 2008. The loan is personally guaranteed by Zhaohui Peng, the former Chairman and a shareholder of SiBiono and is collateralized by Sibiono’s land use right.

The loan is in default since the maturity date. During 2008, SiBiono was sued for default on the bank loan and judgment has been made requiring Sibiono to repay the loan principle amount and related interest. The loan is collateralized by Sibiono’s land use right, the judgment agreed that the lender bank can apply for government permission to sell the land use right owned by Sibiono to repay the debt. Sibiono’s management is actively seeking ways to refinance this loan, currently the lender bank has not exercised its rights on the land use right.

6. Related Party Transactions

Due from related parties at June 30, 2010 and December 31, 2009 were comprised as follows:

| | Relationship | | June 30, 2010 | | | December 31, 2009 | |

| Current | | | | | | | |

| Qin Yu | Vice president | | | | | | |

| Shenzhen SiBiono | | | $ | 1,488 | | | $ | 2,024 | |

| Xiaoji Zhang | Minority shareholder | | | | | | | | |

| Shenzhen SiBiono | | | | 5,445 | | | | 5,423 | |

| Hua Xu | General Manager's Sister | | | | | | | | |

| Shenzhen SiBiono | | | | 22,815 | | | | 22,726 | |

| Rong He | Manager | | | | | | | | |

| Shenzhen SiBiono | | | | 589 | | | | 688 | |

| | | | $ | 30,337 | | | $ | 30,861 | |

| Non current | | | | | | | | | |

| Yiqing Wan | CEO & Director | | | | | | | | |

| Ever Leader | | | $ | 647,872 | | | $ | 646,586 | |

| Benda Ebei | | | | 546,494 | | | | 520,712 | |

| Hubei Benda Science and Technology Co. Ltd | Controlled by CEO | | | | | | | | |

| Yidu Benda | | | | 1,610,665 | | | | 1,602,950 | |

| Ever Leader | | | | 230,674 | | | | 230,216 | |

| Feng Wang | Minority shareholder | | | | | | | | |

| Beijing Shusai | | | | 32,387 | | | | 32,262 | |

| | | | $ | 3,068,092 | | | $ | 3,032,726 | |

The balance owned by the Yiqing Wan, CEO & Director, and the Company under his control, totaled $ 3,035,705 and $3,000,464 as of June 30, 2010 and December 31, 2009, respectively. This is a violation of Section 402 of the Sarbanes-Oxley Act of 2002 which prohibits personal loans to executives.

Due to related parties at June 30, 2010 and December 31, 2009 were comprised as follows:

| | Relationship | | June 30, 2010 | | | December 31, 2009 | |

| Current | | | | | | | |

| Wei Xu | VP, CEO's Spouse & Director | | | | | | |

| Shenzhen SiBiono | | | $ | 295,894 | | | $ | 234,569 | |

| Everleader | | | | 1,416,289 | | | | 1,356,172 | |

| BPMA | | | | 36,184 | | | | 36,184 | |

| Hubei Benda Science and Technology Co. Ltd | Controlled by CEO | | | | | | | | |

| Benda Ebei | | | | 28,639 | | | | 28,528 | |

| Jiangliang Benda | | | | 781,093 | | | | 793,864 | |

| Beijing Shusai | | | | 14,166 | | | | 14,111 | |

| SiBiono Zhongjia Gene Tech (SZ) Co., Ltd. | Associate company | | | | | | | | |

| Shenzhen SiBiono | | | | - | | | | 103,948 | |

| Yiqing, Wan | CEO & Director | | | | | | | | |

| Shenzhen SiBiono | | | | 233,577 | | | | 224,071 | |

| Pong, Tsiaohuei | Shareholder & Chairman | | | | | | | | |

| Shenzhen SiBiono | | | | 4,825 | | | | - | |

| | | | $ | 2,810, 667 | | | $ | 2,791,447 | |

| Non current | | | | | | | | | |

| Wei Xu | VP, CEO's Spouse & Director | | | | | | | | |

| Benda Ebei | | | $ | 23,988 | | | $ | 23,894 | |

| Beijing Shusai | | | | 65,593 | | | | 65,339 | |

| Yiqing, Wan | CEO & Director | | | | | | | | |

| Yidu Benda | | | | 561 | | | | 559 | |

| Hui Xu | Manager | | | | | | | | |

| Benda Ebei | | | | 28,520 | | | | 28,410 | |

| | | | $ | 118,662 | | | $ | 118,202 | |

Except for the loans from the shareholder Wei Xu by Everleader which bears interest rate at 12% per annum, unsecure and matures within six months, the above advances bear no interest and the above loans due to related parties are unsecured, non-interest bearing and are not convertible into equity. Proceeds from the above loans were used primarily for general working capital purposes, among which the current portion does not have definitive terms and for those portions which are long-term debts in nature, is expected to be repaid by the Company in over 12-month period.

7. Equity Investment

Sibiono and North American Gene Diagnostics and Therapeutics Ltd. (HK) entered into a business agreement to set up Shenzhen Sibiono Zhongjia Gene Technology Ltd. (Zhongjia) during June 2009. The business license of the new joint entity was obtained in January 2010 and Sibiono made the capital contribution of approximately $117,000 (RMB 800,000) in February 2010. The new entity's legal representative is Mr. Wan, Yiqing. The registered capital is approximately $292,500 (RMB 2 million). Sibiono's share of the registered capital is 40% (RMB 800,000), the other party’s share is 60% (RMB 1.2 million).

Zhongjia did not have significant operations during the six months period ended June 30, 2010.

8. Segment Information

The Company states the segment information according to the requirement stated in ASC 280-10-50. The Company produces five different categories of products and each category of product is produced in different subsidiaries or operation plants. The details are stated as follows:

| | 1. | Benda Ebei produces conventional medicines which including branded and generic medicines; |

| | 2. | Jiangling Benda produces active pharmaceutical ingredients, APIs; |

| | 3. | Yidu Benda produces bulk chemicals; |

| | 4. | Beijing Shusai produces pharyngitis killer therapy; and |

| | 5. | SiBiono produces gene therapy medicines, Gendicine. |

Since each subsidiary produces the corresponding products by using the production facilities of each subsidiary, therefore according to the requirement stated ASC 280-10-50, the Company reports the segment information according to the un-identical products that produced in each subsidiary.

Selected financial information for each of these segments for the six and three months ended June 30, 2010 and 2009 were as follows:

| | | SIX MONTHS ENDED | | | THREE MONTHS ENDED | |

| | | JUNE 30, | | | JUNE 30, | |

| Branded/Generic medicine segment | | 2010 | | | 2009 | | | 2010 | | | 2009 | |

| Revenue from external customers | | $ | 7,511,357 | | | $ | 8,729,686 | | | $ | 4,695,789 | | | $ | 4,369,227 | |

| Cost of sales | | | (4,808,016 | ) | | | (5,549,051 | ) | | | (2,887,792 | ) | | | (2,889,269 | ) |

| Gross profit | | | 2,703,341 | | | | 3,180,635 | | | | 1,807,997 | | | | 1,479,958 | |

| Gross margin | | | 36 | % | | | 36 | % | | | 39 | % | | | 34 | % |

| Research and development | | | (682,109 | ) | | | (2,301 | ) | | | (341,148 | ) | | | (2,155 | ) |

| Selling expense | | | (834,022 | ) | | | (413,312 | ) | | | (444,726 | ) | | | (210,843 | ) |

| General and administrative expense | | | (516,227 | ) | | | (1,976,544 | ) | | | (352,705 | ) | | | (2,005,398 | ) |

| Segment contribution | | $ | 670,983 | | | $ | 788,478 | | | $ | 669,418 | | | $ | (738,438 | ) |

| Contribution margin | | | 9 | % | | | 0 | % | | | 14 | % | | | -17 | % |

| Total assets, segment | | $ | 28,994,673 | | | $ | 21,586,163 | | | $ | 28,994,673 | | | $ | 21,586,163 | |

| | | SIX MONTHS ENDED | | | THREE MONTHS ENDED | |

| | | JUNE 30, | | | JUNE 30, | |

| Active pharmaceutical ingredients segment | | 2010 | | | 2009 | | | 2010 | | | 2009 | |

| Revenue from external customers | | $ | 1,011,248 | | | $ | 790,062 | | | $ | 374,181 | | | $ | 367,801 | |

| Cost of sales | | | (801,509 | ) | | | (967,595 | ) | | | (455,599 | ) | | | (545,989 | ) |

| Gross profit | | | 209,739 | | | | (177,533 | ) | | | (81,418 | ) | | | (178,188 | ) |

| Gross margin | | | 21 | % | | | -22 | % | | | -22 | % | | | -48 | % |

| Research and development | | | - | | | | (73 | ) | | | - | | | | (73 | ) |

| Selling expense | | | (20,288 | ) | | | (14,725 | ) | | | (9,711 | ) | | | (10,810 | ) |

| General and administrative expense | | | (258,620 | ) | | | (321,009 | ) | | | (139,778 | ) | | | (59,826 | ) |

| Segment contribution | | $ | (69,169 | ) | | $ | (513,340 | ) | | $ | (230,907 | ) | | $ | (248,897 | ) |

| Contribution margin | | | -7 | % | | | -65 | % | | | -62 | % | | | -68 | % |

| Total assets, segment | | $ | 13,239,029 | | | $ | 12,873,740 | | | $ | 13,239,029 | | | $ | 12,873,740 | |

| | | SIX MONTHS ENDED | | | THREE MONTHS ENDED | |

| | | JUNE 30, | | | JUNE 30, | |

| Bulk chemicals segment | | 2010 | | | 2009 | | | 2010 | | | 2009 | |

| Revenue from external customers | | $ | 2,274 | | | $ | - | | | $ | 2,274 | | | $ | - | |

| Cost of sales | | | - | | | | - | | | | - | | | | - | |

| Gross profit | | | 2,274 | | | | - | | | | 2,274 | | | | - | |

| Gross margin | | | 100 | % | | | 0 | % | | | 100 | % | | | 0 | % |

| Research and development | | | - | | | | - | | | | - | | | | - | |

| Selling expense | | | - | | | | - | | | | - | | | | - | |

| General and administrative expense | | | (291,881 | ) | | | (208,448 | ) | | | (144,739 | ) | | | (107,999 | ) |

| Segment contribution | | $ | (289,607 | ) | | $ | (208,448 | ) | | $ | (142,465 | ) | | $ | (107,999 | ) |

| Contribution margin | | | 0 | % | | | 0 | % | | | 0 | % | | | 0 | % |

| Total assets, segment | | $ | 8,263,877 | | | $ | 8,904,719 | | | $ | 8,263,877 | | | $ | 8,904,719 | |

| | | SIX MONTHS ENDED | | | THREE MONTHS ENDED | |

| | | JUNE 30, | | | JUNE 30, | |

| Pharynigitis killer therapy segment | | 2010 | | | 2009 | | | 2010 | | | 2009 | |

| Revenue from external customers | | $ | - | | | $ | - | | | $ | - | | | $ | - | |

| Cost of sales | | | - | | | | - | | | | - | | | | - | |

| Gross profit | | | - | | | | - | | | | - | | | | - | |

| Gross margin | | | 0 | % | | | 0 | % | | | 0 | % | | | 0 | % |

| Research and development | | | - | | | | - | | | | - | | | | - | |

| Selling expense | | | - | | | | - | | | | - | | | | - | |

| General and administrative expense | | | (10,079 | ) | | | (14,475 | ) | | | (5,046 | ) | | | (7,229 | ) |

| Segment contribution | | $ | (10,079 | ) | | $ | (14,475 | ) | | $ | (5,046 | ) | | $ | (7,229 | ) |

| Contribution margin | | | 0 | % | | | 0 | % | | | 0 | % | | | 0 | % |

| Total assets, segment | | $ | 78,054 | | | $ | 97,875 | | | $ | 78,054 | | | $ | 97,875 | |

| | | SIX MONTHS ENDED | | | THREE MONTHS ENDED | |

| | | JUNE 30, | | | JUNE 30, | |

| Gendicine (Ad-p53) segment | | 2010 | | | 2009 | | | 2010 | | | 2009 | |

| Revenue from external customers | | $ | 1,634,970 | | | $ | 1,920,664 | | | $ | 946,990 | | | $ | 1,187,581 | |

| Cost of sales | | | (155,792 | ) | | | (182,433 | ) | | | (80,481 | ) | | | (121,030 | ) |

| Gross profit | | | 1,479,178 | | | | 1,738,231 | | | | 866,509 | | | | 1,066,551 | |

| Gross margin | | | 90 | % | | | 91 | % | | | 92 | % | | | 90 | % |

| Research and development | | | (83,173 | ) | | | (115,709 | ) | | | (33,204 | ) | | | 185,829 | |

| Selling expense | | | (510,707 | ) | | | (588,331 | ) | | | (270,614 | ) | | | (400,520 | ) |

| General and administrative expense | | | (596,281 | ) | | | (1,474,721 | ) | | | (312,458 | ) | | | (737,235 | ) |

| Segment contribution | | $ | 289,017 | | | $ | (440,530 | ) | | $ | 250,233 | | | $ | 114,625 | |

| Contribution margin | | | 18 | % | | | 0 | % | | | 26 | % | | | 10 | % |

| Total assets, segment | | $ | 15,392,632 | | | $ | 14,766,550 | | | $ | 15,392,632 | | | $ | 14,766,550 | |

| | | SIX MONTHS ENDED | | | THREE MONTHS ENDED | |

| | | JUNE 30, | | | JUNE 30, | |

| | | 2010 | | | 2009 | | | 2010 | | | 2009 | |

| Total revenue from external customers | | $ | 10,159,849 | | | $ | 11,440,412 | | | $ | 6,019,234 | | | $ | 5,924,609 | |

| Cost of sales | | | (5,765,317 | ) | | | (6,699,079 | ) | | | (3,423,872 | ) | | | (3,556,288 | ) |

| Gross profit | | | 4,394,532 | | | | 4,741,333 | | | | 2,595,362 | | | | 2,368,321 | |

| Gross margin | | | 43 | % | | | 41 | % | | | 43 | % | | | 40 | % |

| Research and development | | | (765,282 | ) | | | (118,083 | ) | | | (374,352 | ) | | | 183,601 | |

| Selling expense | | | (1,365,017 | ) | | | (1,016,368 | ) | | | (725,051 | ) | | | (622,173 | ) |

| General and administrative expense | | | (1,673,088 | ) | | | (3,995,197 | ) | | | (954,726 | ) | | | (2,911,266 | ) |

| Segment contribution | | $ | 591,145 | | | $ | (388,315 | ) | | $ | 541,233 | | | $ | (981,517 | ) |

| Contribution margin | | | 6 | % | | | -3 | % | | | 9 | % | | | -17 | % |

| Total assets, segment | | $ | 65,968,265 | | | $ | 58,229,047 | | | $ | 65,968,265 | | | $ | 58,229,047 | |

The results of the total consolidated net profit before income taxes for the reporting periods are as follows:

| | | SIX MONTHS ENDED | | | THREE MONTHS ENDED | |

| | | JUNE 30, | | | JUNE 30, | |

| | | 2010 | | | 2009 | | | 2010 | | | 2009 | |

| Total segment contribution | | $ | 591,145 | | | $ | (388,315 | ) | | $ | 541,233 | | | $ | (981,517 | ) |

| Unallocated amounts: | | | | | | | | | | | | | | | | |

| Government subsidies / grants | | | - | | | | 26,384 | | | | - | | | | 12 | |

| Other income/(expenses) | | | (330,961 | ) | | | (122,170 | ) | | | (233,209 | ) | | | (104,981 | ) |

| Other corporate expenses | | | (996,342 | ) | | | (1,937,542 | ) | | | (369,296 | ) | | | (407,458 | ) |

| Total net loss before noncontrolling interest and income taxes | | $ | (736,158 | ) | | $ | (2,421,643 | ) | | $ | (61,272 | ) | | $ | (1,493,944 | ) |

The other corporate expenses per the above table for the six and three months ended June 30, 2010 and 2009 composed of the following events:

| | | SIX MONTHS ENDED | | | THREE MONTHS ENDED | |

| | | JUNE 30, | | | JUNE 30, | |

| | | 2010 | | | 2009 | | | 2010 | | | 2009 | |

| Wages and salaries | | $ | 130,000 | | | $ | 195,016 | | | $ | 65,000 | | | $ | 71,683 | |

| Audit and accounting | | | 35,906 | | | | 49,997 | | | | 35,906 | | | | 49,997 | |

| Consulting fee | | | 9,742 | | | | 6,216 | | | | (23,168 | ) | | | 3,124 | |

| Investor relation, transfer agent and filing fees | | | - | | | | 2,720 | | | | - | | | | - | |

| Director renumeration | | | 45,000 | | | | 45,000 | | | | 22,500 | | | | 22,500 | |

| Legal fee | | | 366,002 | | | | 104,567 | | | | 61,551 | | | | 61,048 | |

| Taxes and levies | | | - | | | | - | | | | - | | | | (1,810 | ) |

| Interest expense | | | 409,372 | | | | 1,465,301 | | | | 207,434 | | | | 194,920 | |

| Miscellaneous | | | 320 | | | | 68,725 | | | | 73 | | | | 5,996 | |

| Total | | $ | 996,342 | | | $ | 1,937,542 | | | $ | 369,296 | | | $ | 407,458 | |

For the details of information of this particular, it should be read in conjunction with the management discussion and analysis section.

The following table shows the reconciliation between the segments assets and the total assets for the six and three months ended June 30, 2010 and 2009:

| | | SIX MONTHS ENDED | | | THREE MONTHS ENDED | |

| | | JUNE 30, | | | JUNE 30, | |

| | | 2010 | | | 2009 | | | 2010 | | | 2009 | |

| Total assets, segment | | $ | 65,968,265 | | | $ | 58,229,047 | | | $ | 65,968,265 | | | $ | 58,229,047 | |

| | | | | | | | | | | | | | | | | |

| Total assets of corporate: | | | | | | | | | | | | | | | | |

| Cash and cash equivalent | | | 11,738 | | | | 16,148 | | | | 11,738 | | | | 16,148 | |

| Prepaid expesnes and deposit | | | 231 | | | | 232 | | | | 231 | | | | 232 | |

| Due from related parties | | | 644,917 | | | | 660,322 | | | | 644,917 | | | | 660,322 | |

| Construction-in-progress capitalized interest | | | 579,161 | | | | - | | | | 579,161 | | | | - | |

| Total assets | | $ | 67,204,312 | | | $ | 58,905,749 | | | $ | 67,204,312 | | | $ | 58,905,749 | |

The following table shows how the noncontrolling interest for the six months ended June 30, 2010 and 2009 was derived:

| | | Six Months Ended June 30, 2010 | |

| | | Benda | | | Jiangling | | | Yidu | | | Beijing | | | Shenzhen | | | | |

| | | Ebei | | | Benda | | | Benda | | | Shusai | | | SiBiono | | | Total | |

| Segment operating profit / (loss) | | $ | 670,983 | | | | (69,169 | ) | | | (289,607 | ) | | | (10,079 | ) | | | 289,017 | | | $ | 591,145 | |

| Interest income/ (expenses) | | | (184,067 | ) | | | (19,166 | ) | | | 1 | | | | - | | | | (116,164 | ) | | | (319,396 | ) |

| Other income / (expenses) | | | (55,170 | ) | | | (3,417 | ) | | | - | | | | - | | | | (7,970 | ) | | | (66,557 | ) |

| Income taxes | | | (343,787 | ) | | | - | | | | - | | | | - | | | | 27,192 | | | | (316,595 | ) |

| Income / (loss) before noncontrolling interest | | $ | 87,959 | | | | (91,752 | ) | | | (289,606 | ) | | | (10,079 | ) | | | 192,075 | | | $ | (111,403 | ) |

| | | | | | | | | | | | | | | | | | | | | | | | | |

| Noncontrolling interest percentage | | | 5.00 | % | | | 5.00 | % | | | 5.00 | % | | | 25.00 | % | | | 39.87 | % | | | | |

| Noncontrolling interest | | $ | (5,570 | ) | | | (4,588 | ) | | | (14,480 | ) | | | (2,520 | ) | | | 76,580 | | | $ | 49,422 | |

| | | Six Months Ended June 30, 2009 | |

| | | Benda | | | Jiangling | | | Yidu | | | Beijing | | | Shenzhen | | | | |

| | | Ebei | | | Benda | | | Benda | | | Shusai | | | SiBiono | | | Total | |

| Segment operating profit / (loss) | | $ | 788,478 | | | | (513,340 | ) | | | (208,448 | ) | | | (14,475 | ) | | | (440,530 | ) | | $ | (388,315 | ) |

| Interest income/ (expenses) | | | (80,272 | ) | | | (258 | ) | | | 3 | | | | - | | | | (87,419 | ) | | | (167,946 | ) |

| Other income / (expenses) | | | 199,556 | | | | 99 | | | | 1,979 | | | | - | | | | 58,695 | | | | 260,329 | |

| Government subsidy | | | - | | | | 26,383 | | | | - | | | | - | | | | - | | | | 26,383 | |

| Income taxes | | | (84,412 | ) | | | - | | | | - | | | | - | | | | 27,177 | | | | (57,235 | ) |

| Income / (loss) before noncontrolling interest | | $ | 823,350 | | | | (487,116 | ) | | | (206,466 | ) | | | (14,475 | ) | | | (442,077 | ) | | $ | (326,784 | ) |

| | | | | | | | | | | | | | | | | | | | | | | | | |

| Noncontrolling interest percentage | | | 5.00 | % | | | 5.00 | % | | | 5.00 | % | | | 25.00 | % | | | 39.87 | % | | | | |

| Noncontrolling interest | | $ | (16,339 | ) | | | (24,356 | ) | | | (10,323 | ) | | | (3,619 | ) | | | (176,255 | ) | | $ | (230,892 | ) |

Item 2. Management’s Discussion and Analysis or Plan of Operation

The following discussion and analysis should be read in conjunction with the information contained in the unaudited condensed consolidated financial statements of the Company and the related notes thereto, appearing elsewhere herein, and in conjunction with the Management’s Discussion and Analysis of Financial Condition and Results of Operations set forth in the Company’s Annual Report on Form 10-K for the year ended December 31, 2009, filed with the Securities and Exchange Commission (“SEC”).

Forward Looking Information

This Quarterly Report on Form 10-Q (the “Report”) contains certain “forward-looking statements” within the meaning of Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Exchange Act of 1934, as amended, that are based on management’s exercise of business judgment as well as assumptions made by, and information currently available to, management. When used in this document, the words “may”, " will”, “anticipate”, “believe”, “estimate”, “expect”, “intend”, and words of similar import, are intended to identify any forward-looking statements. You should not place undue reliance on these forward-looking statements. These statements reflect our current view of future events and are subject to certain risks and uncertainties, as noted in the Company’s Report on Form 10-K, filed with the SEC, and as noted below. Should one or more of these risks or uncertainties materialize, or should underlying assumptions prove incorrect, our actual results could differ materially from those anticipated in these forward-looking statements. We undertake no obligation, and do not intend, to update, revise or otherwise publicly release any revisions to these forward-looking statements to reflect events or circumstances after the date hereof, or to reflect the occurrence of any unanticipated events. Although we believe that our expectations are based on reasonable assumptions, we can give no assurance that our expectations will materialize.

Critical Accounting Policies

Accounting policies discussed in this section are those that we consider to be most critical to an understanding of our financial statements because they inherently involve significant judgment and uncertainties. For all of these estimates, we caution that future events rarely develop exactly as forecast, and the best estimates routinely require adjustment.

Revenue Recognition

Among the most important accounting policies affecting the Group’s consolidated financial statements is its policy of recognizing revenue. Under this policy, all of the following criteria must be met in order for us to recognize revenue:

1. Persuasive evidence of an arrangement exists;

2. Delivery has occurred or services have been rendered;

3. The seller's price to the buyer is fixed or determinable; and

4. Collectibility is reasonably assured.

The majority of the Company's revenue results from sales contracts with distributors and revenue is recorded upon the shipment of goods. Management conducts credit background checks for new customers as a means to reduce the subjectivity of assuring collectibility. Sales are presented net of value added tax (VAT). No return allowance is made as products returns are insignificant based on historical experience.

Operational Results

The Six Months and Three Months Ended June 30, 2010 and 2009

Benda Pharmaceutical, Inc.

Consolidated Statements of Operations

Net Revenue:

The Company has five core operating segments: Benda Ebei, Jiangling Benda, Yidu Benda, Beijing Shusai and SiBiono. Benda Ebei manufactures branded/generic medicines; Jiangling Benda manufactures active pharmaceutical ingredients (API); Yidu Benda manufactures bulk chemicals; Beijing Shusai operates and distributes Pharyngitis Killer Therapy; and SiBiono is a gene therapy company dedicated to the development, manufacturing and commercialization of gene therapy product, Gedicine.

Net revenue decreased by $1.2 million (or 11.19%) to $10.2 million for the six months ended June 30, 2010 from $11.4 million for the six months ended June 30, 2009 and increased by $0.1 million (or 1.69%) to $6 million for the three months ended June 30, 2010 from $5.9 million for the three months ended June 30, 2009. Decrease in revenue is principally attributed to the following factors:

| 1. | One of Benda’s subsidiaries, Benda Ebei’s net revenue decreased $1.2 million (or 13.96%) to $7.5 million for the six months ended June 30, 2010 from $8.7 million for the six months ended June 30, 2009 and increased by $0.4 million (or 9.3%) to $4.7 million for the three months ended June 30, 2010 from $4.3 million for the three months ended June 30, 2009. It was mainly due to maintenance activity during the three months ended June 30, 2010, no such activity in the same period during 2009. |

| 2. | One of Benda’s subsidiaries, Jiangling Benda, achieved $1 million and $0.79 million for the six months ended June 30, 2010 and 2009, and $0.374 million and $0.368 million for the three months ended June 30, 2010 and 2009, respectively. |

Jiangling Benda plans to produce four types of active pharmaceutical ingredients and they are Ribavirin, Asarin, Levofloxacin and Ribose whereas the production of Ribose does not require the GMP certificate, but the production of the other three products do require the GMP certificate.

On April 9, 2008, Jiangling Benda received the approved GMP Certificate from the Chinese State Food and Drug Administration ("SFDA") which authorized the production of Ribavrin. The other two products, Asarin and Levolfozacin, are still under the stage of GMP certificate approving process. Management could not estimate the exact timing for obtaining those certificates.

| 3. | One of Benda’s subsidiaries, Yidu Benda ceased operations due to the plant closing in mid January 2007 to upgrade its waster water treatment system to comply with new environmental standards enforced by PRC local government. |

Yidu Benda completed its upgrading of the waster water system and passed the government’s verification and testing of equipment in October 2007. It is now permitted for the testing on actual production process. Once the actual products are produced, then the environmental government bodies will re-test the production results. Management cannot estimate the exact timing for obtaining the final approval on the actual production process. Furthermore, management is searching for new products to be produced in Yidu Benda with higher profit margins.

| 4. | One of Benda’s subsidiaries, Beijing Shusai was incorporated on July 15, 2006. China’s State Food and Drug Administration (SFDA) recently experienced an overhaul in its policies and regulatory systems in an effort to fight against corruption in Chinese pharmaceutical industry. Beijing Shusai’s operation has been adversely affected by this recent policy changes which prohibits some state-owned hospitals from forming alliances with private companies. Management cannot estimate that such situation could be resolved in the coming future. |

| 5. | One of Benda’s subsidiaries, SiBiono, net revenue decreased $0.3 million (or 15.8%) to $1.6 million for the six months ended June 30, 2010 from $1.9 million the six months ended June 30, 2009 and decreased by $0.24 million (or 20.2%) to $0.95 million for the three months ended June 30, 2010 from $1.19 million for the three months ended June 30, 2009. The decrease in net revenue is mainly due to the fact that SiBiono previously underwent a process of re-engineering of the production department during the year of 2010. |

SiBiono GMP - On October 16, 2003, SiBiono successfully obtained a New Drug License from the State Food & Drug Administration of China (SFDA), and then, in April 4, 2004, SiBiono obtained “Manufacture Certificate” and “Certificate of GMP for Pharmaceutical Product”, so far being fully qualified for the market launch of Recombinant Human Ad-p53 Injection, trademarked as Gendicine ® in China. Gendicine ® is the commercialized gene therapy product approved in the PRC government agency. On May 19, 2008, SiBiono received an official notice from the PRC State of SFDA in which it mentioned that during the random inspection performed by the PRC State of SFDA on April 8 to April 10, 2008, the PRC State of SFDA discovered there were several production procedures that did not meet the requirement stated in GMP, thus it required SiBiono to perform necessary improvements in order to fulfill the GMP requirements and the PRC State of SFDA collected back the distributed GMP certificate until the necessary improvements being carried out and passed the examination that conducted by SFDA. On June 10, 2008, SiBiono received another official notice from Guangdong Province SFDA and they demanded the same requirements as stated in the official notice which issued by the PRC State of SFDA dated on May 19, 2008. On November 24, 2008, SiBiono received another official notice from Guangdong Province SFDA which mentioned that after the examination conducted by Shenzhen City SFDA, the Guangdong Province SFDA consent SiBiono to carry out production on a trial basis. It further required SiBiono strictly to follow the requirements of GMP to organize trial production and follow the procedures to apply for GMP Certificate verification.

On July 14, 2009, SiBiono obtained the final approved GMP Certificate, in order words, the SFDA allowed SiBiono to resume its production and sales.

Cost of Goods Sold

Cost of goods sold decreased $0.93 million (or 13.88%) to $5.77 million for the six months ended June 30, 2010 from $6.70 million for the six months ended June, 2009 and decreased by $0.13 million (or 3.65%) to $3.43 million for the three months ended June 30, 2010 from $3.56 million for the three months ended June 30, 2009, primarily due to the decrease in sales volume in Benda Ebei.

Gross Profit

Gross profit decreased $0.35 million (or 7.4%) to $4.39million for the six months ended June 30, 2010 from $4.74 million for the six months ended June 30, 2009 and increased by $0.22 million (or 9.28%) to $2.59 million for the three months ended June 30, 2010 from $2.37 million for the three months ended June 30, 2009, which was mainly due to the decrease in sales volume of Gendicine which has a high gross profit margin.

Selling Expenses:

Selling expenses increased $0.35 million (or 34.31%) to $1.37 million for the six months ended June 30, 2010 from $1.02 million the six months ended June 30, 2010 and increased by $0.1 million (or 15.87%) to $0.73 million for the three months ended June 30, 2010 from $0.63 million for the three months ended June 30, 2009, primarily due to the increased promotion efforts made by the management.

General and Administrative Expenses:

General and administrative decreased $2.58 million (or 64.18%) to $1.44 million for the six months ended June 30, 2010 from $4.02 million for the six months ended June 30, 2009 and decreased by $2.18 million (or 75.17%) to $0.72 million for the three months ended June 30, 2010 from $2.9 million for the three months ended June 30, 2009, primarily due to less bad debt expense incurred in 2010.

Operating Income / (Loss):

The Company had an operating income of $4,175 for the six months and an operating loss of $0.38 million for the three months ended June 30, 2010, while the operating loss from comparative period for 2009 was $0.86 million and $1.19 million respectively.

Interest Expense:

Interest expense was $0.73 million and $1.63 million for the six months ended June 30, 2010 and 2009 respectively, while interest expense was $0.36 million for the three months ended June 30, 2010 and 2009 respectively. The decrease is mainly due to the amortization of debt discount related to the convertible note during the first quarter of 2009 while there was no such expense in the same period of 2010.

Income Taxes:

Benda is subject to Delaware, United State of America tax, but no provision for income taxes was made for the six months ended June 30, 2010 and 2009 as Benda did not have reportable taxable income for the period.

Ever Leader, a wholly owned subsidiary of Benda, is subject to Hong Kong tax, but no provisions for income taxes was made for the six months ended June 30, 2010 and 2009 as Ever Leader did not have reportable taxable income for the periods.

Benda Ebei was registered as a Sino-Foreign Equity Joint Venture on May 26, 2004 and is subject to the tax laws applicable to Sino-Foreign Equity Joint Ventures in the PRC. Benda Ebei, starting from 2005, is fully exempt from PRC enterprise income tax for two years starting from the first profit-making year, followed by a 50% reduction in the state income taxes, for the following three years, commencing from the first profitable year.

Jiangling Benda and Yidu Benda are cross-municipal investment entities and enjoy the same tax treatment as Sino-Foreign Joint Ventures, starting from 2005, and were therefore exempt from PRC enterprise income tax for two years starting from the first profit-making year, followed by a 50% reduction in the state income taxes, for the following three years, commencing from the first profitable year. Cross-municipal investments entities refer to entities that are incorporated in one municipal region but have investments in another municipal region.

The exemption periods for Benda Ebei, Jiangling Benda and Yidu Benda expired in the year of 2006, after which they are subject to a 50% reduction in state income taxes, at 18%; whereas the full income tax rate is 33%. The remaining tax holidays will expire in 2010.

However, starting and effective from January 1, 2008, the full income tax rate changed from 33% to 25% according to the new PRC taxation regulations. Therefore these subsidiaries are subject to the regular full income tax rate at 25% after the tax holidays expire in 2010.

According to the new taxation regulations starting and effective from January 1, 2008, Beijing Shusai is subject to the full income tax rate of 25%.

According to the new taxation regulations starting and effective from January 1, 2008, SiBiono, which is located in Shenzhen, a Special Economic District of PRC, is subject to the full income tax rate of 25% gradually in five years as following:

| Year | | Tax rate | |

| 2008 | | | 18 | % |

| 2009 | | | 20 | % |

| 2010 | | | 22 | % |

| 2011 | | | 24 | % |

| 2012 and thereafter | | | 25 | % |

Benda Ebei recorded $343,787 income tax for the six months ended June 30, 2010 and $256,942 income tax for the three months ended June 30, 2010.

LIQUIDITY AND CAPITAL RESOURCES

Net cash provided by the operating activities was negative $0.23 million for the six months ended June 30, 2010, while for the six months ended June 30, 2009 was positive $0.51 million.

| a) | Non-cash operating activities, reconciliation items to net loss |

For the six months ended June 30, 2009, an amount about $5.19 million non-cash operating activities was reconciled back to the net loss and which mainly included amortization of debt discount and debt issue cost, bad debt provision, amortization of intangible assets, and depreciation.

However, for the six months ended June 30, 2010, about $1.67 million of non-cash operating activities was reconciled back to the net loss and summarized as follows:

1. Factors: $1.1 million incurred on depreciation; and $0.29 million incurred on amortization of intangible assets.

The net amount of trade receivable was increased by $1.2 million for the six months ended June 30, 2010. Management acknowledges that the net balance of the trade receivable, as of June 30, 2010, was a significant asset to the company. However, management believes that the above situation is temporarily due to the following reasons:

| a) | Customers whom have sales relationships with our company are all relatively big business wholesale enterprises and they have all passed the examination of GMP Certificate so that collectability from those is out of question; |

| b) | Management realized that it did affect the cash flow situation of the company; therefore the company will put more efforts to reduce the balance of trade receivables. |

For the six months ended June 30, 2010 and 2009, the amount spent in investing activities were $0.7 million and $0.3 million respectively. The investing activities were relatively small for the reporting periods.

Financing cash inflow was $1.87 million for the six months ended June 30, 2010, while the financing cash outflow was $0.12 million for the six months ended June 30, 2009.

Item 3. Quantitative and Qualitative Disclosures About Market Risk

The Company is subject to certain market risks, including changes in interest rates and currency exchange rates. The Company does not undertake any specific actions to limit those exposures.

Item 4T. Evaluation of Disclosure Controls and Procedures

a) Evaluation of Disclosure Controls. Our Chief Executive Officer and Chief Accounting Officer evaluated the effectiveness of our disclosure controls and procedures as of the end of our first fiscal quarter 2010 pursuant to Rule 13a-15(b) of the Securities and Exchange Act. Disclosure controls and procedures are controls and other procedures that are designed to ensure that information required to be disclosed by us in the reports that we file or submit under the Exchange Act is recorded, processed, summarized and reported within the time periods specified in the SEC’s rules and forms. Disclosure controls and procedures include, without limitation, controls and procedures designed to ensure that information required to be disclosed by us in the reports that we file under the Exchange Act is accumulated and communicated to our management, as appropriate to allow timely decisions regarding required disclosure. Based on his evaluation, our Chief Executive Officer and Chief Accounting Officer concluded that our disclosure controls and procedures were not effective as of June 30, 2010 due the following factors:

1. There is a risk of management override given that our officers have a high degree of involvement in our day to day operations.

2. Significant errors were found in our prior years accounting treatments that require restatements of our prior years filed financial statements.

3. There is personal loan to executives which is a violation of Section 402 of the Sarbanes-Oxley Act of 2002

Management is currently evaluating remediation plans for the above control deficiencies.

It should be noted that any system of controls, however well designed and operated, can provide only reasonable, and not absolute, assurance that the objectives of the system are met. In addition, the design of any control system is based in part upon certain assumptions about the likelihood of future events. Because of these and other inherent limitations of control systems, there can be no assurance that any design will succeed in achieving its stated goals under all potential future conditions

(b) Changes in internal control over financial reporting. There have been no changes in our internal control over financial reporting that occurred during the first fiscal quarter that has materially affected, or is reasonably likely to materially affect, our internal control over financial reporting. Our management team will continue to evaluate our internal control over financial reporting in 2010 as we implement our Sarbanes Oxley Act testing.

PART II - OTHER INFORMATION

Item 1. Legal Proceedings.

| 1. | On November 23, 2006, Benda Ebei entered into an Equity Transfer Agreement with Xiaozhi Zhang (“Zhang”), to purchase approximately 6.24% of SiBiono’s common stock for a total consideration of Rmb12.48 million (Rmb6.24 million in cash and shares of our common stock equal to Rmb6.24 million) (or $1.71 million) which was due and payable on or before March 31, 2007. |

Due to the fact that the signed agreement on November 23, 2006 was not practically executable according to the PRC regulations, Benda Ebei asked Zhang to terminate the signed agreement and sign a new agreement that was feasible under PRC regulations with essentially the same terms.

However, Zhang refused to sign the new agreement and applied to the Shenzhen Arbitration Commission (the “Commission”) in April 2007 for enforcement of the original agreement. Zhang requested the Commission to require Benda Ebei to pay for the total consideration, penalty for late payment and the related legal and arbitration expenses.

On November 27, 2007, Shenzhen Arbitration Commission determined that:

| 1. | Benda Ebei should pay for the consideration of Rmb 6.24 million, equal to 50% of the total consideration set forth in the Equity Transfer Agreement. For the other 50% of the total consideration which was supposed to be settled in the form of issuing common stock, since Zhang did not make an arbitration request on how to execute the arrangement, the Arbitration Commission did not make an award on this particular part. |

| 2. | Benda Ebei should pay for the penalty of Rmb 46,800; |

| 3. | Benda Eebi should pay for legal and arbitration expenses of Rmb 268,971. |

On May 22, 2008, Benda Ebei applied to Shenzhen People Court to terminate above mentioned arbitration. The termination is based on the ground that Xiaozhi Zhang does not own all 6.24% of SiBiono’s common stock. In fact, he only owns 3.28% of SiBiono’s stock. The application has been accepted by Shenzhen People Court and is waiting for its further investigation.

| 2. | SiBiono patents - on January 29, 2008, SiBiono entrusted Grandall Legal Group Shenzhen Law Firm to issue a legal letter to Zhaohui Peng, one of the shareholders of Sibiono and the inventor of Gendicine, demanding that he transfer all the title of patents to SiBiono. |

On June 18, 1999, during the formation of SiBiono, Zhaohui Peng transferred the rights to the patent “A new method for manufacturing recombinant adenovirus” and related research results to SiBiono as a payment for the registered capital. In return, Zhaohui Peng was granted 32.03% of the common stock of SiBiono.

From 1999 to 2007, SiBiono successfully obtained various technology funds from various government technology agencies to support the further research and development activities of Gendicine. Due to this significant funding obtained by SiBiono, Sibiono developed five additional patents which are summarized as follows:

| | | | | Countries / | | Application | | Publication | | Approved Patent | | Name of Patent | | Name of | | Patent | |

| Item | | Patent name | | Date | | Number (1) | | Number (2) | | Number (3) | | Inventor (6) | | Applicant (6) | | Assignees | |

| 1 | | A new method for manufacturing recombinant adenovirus | | | | | | | | | | | | | | | |

| | | A | | China | | 98123346.5 | | CN1228474A | | ZL98123346.5 | | Peng | | Peng | | SiBiono | |

| | | | | Date | | 1998/12/14 | | 1999/9/15 | | 2002/7/3 | | | | | | | |

| 2 | | A recombinant constructed by a virus vector and a human tumor suppressor gene and its use | | | | | | | | | | | | | | | |

| | | A | | China | | 02115228.4 | | CN1401778A | | ZL02115228.4 | | Peng / Zhang | | Peng / Zhang | | Peng / Zhang | |

| | | | | Date | | 2002/5/8 | | 2003/3/12 | | 2004/11/24 | | | | | | | |

| | | B | | PCT | (4) | 5 | | WO2004/078987A1 | | Not Approved | | Peng / Zhang | | Peng / Zhang | | N/A | |

| | | | | Date | | 2004/3/8 | | 2004/9/16 | | N/A | | | | | | | |

| 3 | | Recombinant gene medicine of adenovirus vector and and gene p54 for treating proloferative diseases | | | | | | | | | | | | | | | |

| | | A | | China | | 03125129.3 | | CN1471977A | | ZL03125129.3 | | Peng / Zhang | | Peng / Zhang | | Peng / Zhang | |

| | | | | Date | | 2003/5/10 | | 2004/2/4 | | 2007/7/25 | | | | | | | |

| | | B | | PCT | (4) | 8 | | WO2004/104204A1 | | Not Approved | | Peng / Zhang | | Peng / Zhang | | N/A | |

| | | | | Date | | 2004/5/9 | | 2004/12/2 | | N/A | | | | | | | |

| 4 | | The application of recombinant adenoviral p53 as cancer vaccine (tentative title) | | | | | | | | | | | | | | | |

| | | A | | China | | 200510002779.1 | | CN1679641A | | ZL200510002779.1 | | Peng / Zhang | | Peng / Zhang | | Peng / Zhang | |

| | | | | Date | | 2005/1/26 | | 2005/10/12 | | 2007/8/29 | | | | | | | |

| | | B | | PCT | (4) | 1 | | WO2006/079244A1 | | Not Approved | | Peng / Zhang | | Peng / Zhang | | N/A | |

| | | | | Date | | 2005/1/26 | | 2006/8/3 | | N/A | | | | | | | |

| | | C | | US | (5) | 11/075035 | | 2005/0281785A1 | | Not Approved | | Peng / Zhang | | Unidentified Yet | | N/A | |

| | | | | Date | | 2005/3/7 | | 2005/12/22 | | N/A | | | | | | | |

| 5 | | Human Embryonic Kidney (HEK) sub-clone cell line | | | | | | | | | | | | | | | |

| | | A | | China | | 03126889.7 | | CN1513985A | | Not Approved | | Peng / Zhang | | Peng / Zhang | | N/A | |

| | | | | Date | | 2003/6/13 | | 2004/7/21 | | N/A | | | | | | | |

| | | B | | PCT | (4) | 7 | | WO2004/111239 | | Not Approved | | Peng / Zhang | | Peng / Zhang | | N/A | |

| | | | | Date | | 2004/5/9 | | 2004/12/23 | | N/A | | | | | | | |

| 6 | | The complex of polypeptide liposome and human VGEF gene, and its use and human VGEF gene, and its use | | | | | | | | | | | | | | | |

| | | A | | China | | 02134321.7 | | CN1389269A | | Not Approved | | Peng / Zhang / Zhu | | Peng / Zhang / Zhu | | N/A | |

| | | | | Date | | 2002/7/4 | | 2003/1/8 | | N/A | | | | | | | |

Note:

| (1) | Application number is obtained when application is submitted; |

| (2) | Publication number is obtained after the first phase examination; |

| (3) | Approved patent number is obtained after the final examination; |

| (4) | PCT is referred to an International Patent Organization in Paris; |

| (5) | US is referred to the application is made in United States of America alone; |

| (6) | Peng is referred to Zhaohui Peng; Zhang is referred to Xiaozhi Zhang; Zhu is referred to Jinya Zhu. |

As indicated in the above table, Item 1, the patent “A new method for manufacturing recombinant adenovirus” had been assigned to SiBiono; however, the other approved patents (item 2 through item 4) in PRC still have not been assigned to SiBiono. The Group believes that all the above mentioned patents should be rightfully transferred to SiBiono, a subsidiary of the Group. Accordingly, the above mentioned legal letter was issued on this ground.

On August 27, 2008, the Group through its subsidiary, SiBiono filed an application to the Guongdong Province Shenzhen City (Middle) Peoples’ Court and demand Zhaozhu Peng to transfer back all the mentioned patents that mentioned in above to SiBiono. The case has been accepted by the Court and is waiting for its further investigation.

| 3. | Excalibur Limited Partnership and Excalibur Limited Partnership II (the "Plaintiffs") filed a motion for summary judgment in lieu of a complaint pursuant to CPLR § 3213 (the "Motion") with the Supreme Court of the State of New York (the "Court"), alleging that the Company has been delinquent on the payment of an aggregate sum of $600,000 and accrued interest and costs arising from the Convertible Promissory Notes that were issued to the Plaintiffs in April 2007 in connection with a $7,560,000 private placement. Pursuant to the motion, the Plaintiffs requested that the Court (1) enter summary judgment in favor of Excalibur Limited Partnership (“Excalibur Limited”) in the amount of $390,000 plus all accrued interest and costs, and, (2) enter summary judgment in favor of Excalibur Small Cap Opportunities LP (“Excalibur Small Cap”) in the amount of $210,000 and accrued interest and costs. On July 29, 2009, the Court entered a judgment against the Company in favor of the Plaintiffs in the amount of $674,251.65 in connection with the Convertible Promissory Notes issued to the Plaintiffs in April 2007 in a private placement. |

On March 4, 2009, the Company received a Notice and Default and Payment Demand letter (the "Default Letter") from Pope Investments LLC ("Pope") in connection with its convertible promissory note in the amount of $5,520,000 (the "Note") purchased in our April 2007 private placement offering. The Default Letter provided notice of default based on the Company's failure to make a required interest payment on the Note by February 20, 2009. The Default Letter further demanded full payment of all interest, liquidated damages and accrued interest thereon in the amount of $130,364.37 by March 14, 2009, or Pope will accelerate the maturity date of the full principal amount of the Note. On April 7, 2009, the Company received further Default Letters and Payment Demand from Pope, Excalibur Limited and Excalibur Small Cap demanding payment in full of the balance of the Notes, which matured on March 28, 2009. The Company was notified on June 15, 2009, that on May 11, 2009 Pope filed a motion for summary judgment in lieu of a complaint against us pursuant to CPLR § 3213 (the “Motion”) with the Supreme Court of the State of New York (the “Court”), alleging that the Company has been delinquent on the payment of an aggregate sum of $5,520,000 and accrued interest and costs arising from the Note that the Company issued to Pope in April 2007. Pursuant to the motion, the Plaintiffs requested that the Court enter summary judgment in favor of Plaintiff in the amount of $5,994,617.53 constituting principal and interest, plus costs.

On June 23, 2009, the Company filed an Affidavit in Opposition to Motion for Summary Judgment in Lieu of Complaint with the Court requesting that Plaintiff’s Motion be denied. On October 14, 2009, this motion was denied, and the court entered a judgment in favor of Pope in the amount of $5,520,000 plus interest.