Exhibit 99.1

| Management’s discussion and analysis | 1 |

1 | Overview | 2 |

| | 1.1 | Financial highlights | 2 |

| | 1.2 | Key corporate and business developments | 3 |

| | 1.3 | Assumptions | 4 |

2 | Consolidated financial analysis | 5 |

| | 2.1 | BCE consolidated income statements | 5 |

| | 2.2 | Customer connections | 5 |

| | 2.3 | Operating revenues | 6 |

| | 2.4 | Operating costs | 7 |

| | 2.5 | Net earnings | 8 |

| | 2.6 | Adjusted EBITDA | 8 |

| | 2.7 | Severance, acquisition and other costs | 9 |

| | 2.8 | Depreciation and amortization | 9 |

| | 2.9 | Finance costs | 9 |

| | 2.10 | Other (expense) income | 10 |

| | 2.11 | Income taxes | 10 |

| | 2.12 | Net earnings attributable to common shareholders and EPS | 10 |

3 | Business segment analysis | 11 |

| | 3.1 | Bell Wireless | 11 |

| | 3.2 | Bell Wireline | 15 |

| | 3.3 | Bell Media | 19 |

4 | Financial and capital management | 21 |

| | 4.1 | Net debt | 21 |

| | 4.2 | Outstanding share data | 21 |

| | 4.3 | Cash flows | 22 |

| | 4.4 | Post-employment benefit plans | 23 |

| | 4.5 | Financial risk management | 24 |

| | 4.6 | Credit ratings | 25 |

| | 4.7 | Liquidity | 25 |

5 | Quarterly financial information | 26 |

6 | Regulatory environment | 27 |

7 | Business risks | 28 |

8 | Accounting policies, financial measures and controls | 30 |

| | 8.1 | Our accounting policies | 30 |

| | 8.2 | Non-GAAP financial measures and key performance indicators (KPIs) | 34 |

| | 8.3 | Controls and procedures | 36 |

| Consolidated financial statements | 37 |

| Consolidated income statements | 37 |

| Consolidated statements of comprehensive income | 38 |

| Consolidated statements of financial position | 39 |

| Consolidated statements of changes in equity | 40 |

| Consolidated statements of cash flows | 41 |

| Notes to consolidated financial statements | 42 |

| Note 1 | Corporate information | 42 |

| Note 2 | Basis of presentation and significant accounting policies | 42 |

| Note 3 | Adoption of IFRS 15 | 43 |

| Note 4 | Business acquisitions and dispositions | 49 |

| Note 5 | Segmented information | 50 |

| Note 6 | Operating costs | 51 |

| Note 7 | Severance, acquisition and other costs | 51 |

| Note 8 | Other (expense) income | 52 |

| Note 9 | Earnings per share | 52 |

| Note 10 | Debt | 52 |

| Note 11 | Post-employment benefit plans | 53 |

| Note 12 | Financial assets and liabilities | 53 |

| Note 13 | Share capital | 55 |

| Note 14 | Share-based payments | 55 |

| BCE Inc. 2018 FIRST QUARTER SHAREHOLDER REPORT |

|

| | | |

| | MD&A | |

| Management’s discussion and analysis |

In this management’s discussion and analysis of financial condition and results of operations (MD&A),we,us,our,BCE andthe companymean, as the context may require, either BCE Inc. or, collectively, BCE Inc., Bell Canada, their subsidiaries, joint arrangements and associates.Bellmeans, as the context may require, either Bell Canada or, collectively, Bell Canada, its subsidiaries, joint arrangements and associates.MTSmeans, as the context may require, until March 17, 2017, either Manitoba Telecom Services Inc. or, collectively, Manitoba Telecom Services Inc. and its subsidiaries; andBell MTSmeans, from March 17, 2017, the combined operations of MTS and Bell Canada in Manitoba.

All amounts in this MD&A are in millions of Canadian dollars, except where noted. Please refer to section 8.2,Non-GAAP financial measures and key performance indicators (KPIs)on pages 34 to 36 for a list of defined non-GAAP financial measures and KPIs.

Please refer to BCE’s unaudited consolidated financial statements for the first quarter of 2018 (Q1 2018 Financial Statements) when reading this MD&A. We also encourage you to read BCE’s MD&A for the year ended December 31, 2017 dated March 8, 2018 (BCE 2017 Annual MD&A). In preparing this MD&A, we have taken into account information available to us up to May 2, 2018, the date of this MD&A, unless otherwise stated.

As required by International Financial Reporting Standards (IFRS), effective January 1, 2018, we have adopted IFRS 15, Revenue from Contracts with Customers, as described in section 8.1,Our accounting policies, retrospectively to each period in 2017 previously reported. We have also reclassified some amounts from previous periods to make them consistent with the presentation for the current period. As a result of the adoption of IFRS 15, we have also updated certain of our assumptions set out in the BCE 2017 Annual MD&A.

You will find more information about us, including BCE’s annual information form for the year ended December 31, 2017 dated March 8, 2018 (BCE 2017 AIF) and recent financial reports, including the BCE 2017 Annual MD&A, on BCE’s website atBCE.ca, on SEDAR atsedar.comand on EDGAR atsec.gov.

Please also refer to BCE’s press release announcing its results for the first quarter of 2018 to be issued on May 3, 2018, available on BCE’s website atBCE.ca, on SEDAR atsedar.comand on EDGAR atsec.gov.

This MD&A comments on our business operations, performance, financial position and other matters for the three months (Q1) ended March 31, 2018 and 2017.

| CAUTION REGARDING FORWARD-LOOKING STATEMENTS |

This MD&A, and in particular, but without limitation, the section and sub-sections entitledAssumptions, section 1.2,Key corporate and business developments, section 3.1,Bell Wireless – Key business developments, section 3.2,Bell Wireline – Key business developments, section 3.3,Bell Media – Key business developments, and section 6,Regulatory environment, contain forward-looking statements. These forward-looking statements include, without limitation, statements relating to our network deployment plans and related capital investments, BCE’s 2018 annualized common share dividend, BCE’s business outlook, objectives, plans and strategic priorities, and other statements that do not refer to historical facts. A statement we make is forward-looking when it uses what we know and expect today to make a statement about the future. Forward-looking statements are typically identified by the wordsassumption,goal,guidance,objective,outlook,project,strategy,target, and other similar expressions or future or conditional verbs such asaim,anticipate,believe,could,expect,intend,may,plan,seek,should,striveandwill. All such forward-looking statements are made pursuant to the safe harbour provisions of applicable Canadian securities laws and of the United States (U.S.)Private Securities Litigation Reform Act of 1995.

Unless otherwise indicated by us, forward-looking statements in this MD&A describe our expectations as at May 2, 2018 and, accordingly, are subject to change after that date. Except as may be required by Canadian securities laws, we do not undertake any obligation to update or revise any forward-looking statements, whether as a result of new information, future events or otherwise.

Forward-looking statements, by their very nature, are subject to inherent risks and uncertainties and are based on several assumptions both general and specific, which give rise to the possibility that actual results or events could differ materially from our expectations expressed in, or implied by, such forward-looking statements and that our business outlook, objectives, plans and strategic priorities may not be achieved. As a result, we cannot guarantee that any forward-looking statement will materialize and we caution you against relying on any of these forward-looking statements. Forward-looking statements are presented in this MD&A for the purpose of assisting investors and others in understanding our objectives, strategic priorities and business outlook as well as our anticipated operating environment. Readers are cautioned, however, that such information may not be appropriate for other purposes.

We have made certain economic, market and operational assumptions in preparing the forward-looking statements contained in this MD&A and, in particular, but without limitation, the forward-looking statements contained in the previously mentioned sections of this MD&A. These assumptions include, without limitation, the assumptions described in the various sections of this MD&A entitledAssumptions, which sections are incorporated by reference in this cautionary statement. We believe that our assumptions were reasonable at May 2, 2018. If our assumptions turn out to be inaccurate, our actual results could be materially different from what we expect.

Important risk factors including, without limitation, competitive, regulatory, economic, financial, operational, technological and other risks that could cause actual results or events to differ materially from those expressed in, or implied by, the previously-mentioned forward looking statements and other forward-looking statements contained in this MD&A, include, but are not limited to, the risks described or referred to in section 6,Regulatory environment, and section 7,Business risks, which sections are incorporated by reference in this cautionary statement.

We caution readers that the risks described in the previously mentioned section and in other sections of this MD&A are not the only ones that could affect us. Additional risks and uncertainties not currently known to us or that we currently deem to be immaterial may also have a material adverse effect on our financial position, financial performance, cash flows, business or reputation. Except as otherwise indicated by us, forward-looking statements do not reflect the potential impact of any special items or of any dispositions, monetizations, mergers, acquisitions, other business combinations or other transactions that may be announced or that may occur after May 2, 2018. The financial impact of these transactions and special items can be complex and depends on facts particular to each of them. We therefore cannot describe the expected impact in a meaningful way, or in the same way we present known risks affecting our business.

BCE Inc. 2018 FIRST QUARTER SHAREHOLDER REPORT 1 |

|

| | | | |

1 | MD&A | Overview | |

As required by IFRS, effective January 1, 2018, we have adopted IFRS 15, Revenue from Contracts with Customers, as described in section 8.1, Our accounting policies, retrospectively to each period in 2017 previously reported. We have also reclassified some amounts from previous periods to make them consistent with the presentation for the current period.

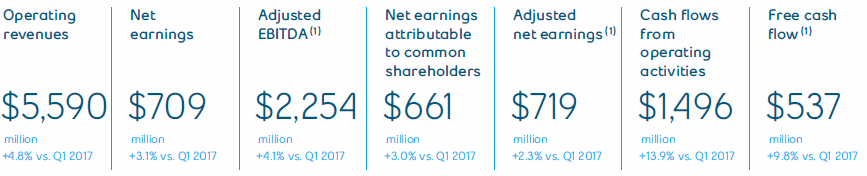

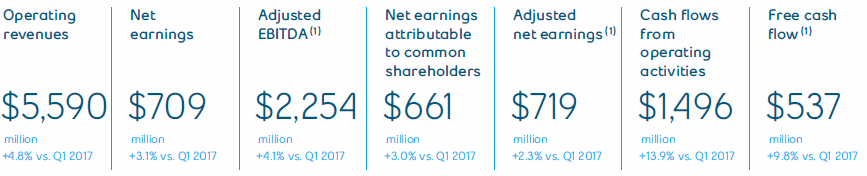

BCE Q1 2018 SELECTED QUARTERLY INFORMATION

| BCE INCOME STATEMENTS – SELECTED INFORMATION |

| Q1 2018 | | Q1 2017 | | $ CHANGE | | % CHANGE | |

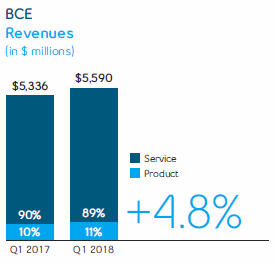

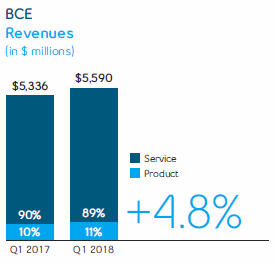

Operating revenues | | | | | | | | |

Service | 4,964 | | 4,811 | | 153 | | 3.2 | % |

Product | 626 | | 525 | | 101 | | 19.2 | % |

Total operating revenues | 5,590 | | 5,336 | | 254 | | 4.8 | % |

Operating costs | (3,336 | ) | (3,170 | ) | (166 | ) | (5.2 | %) |

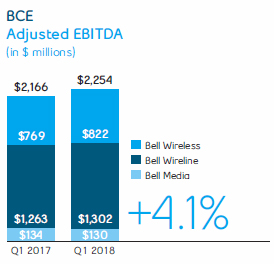

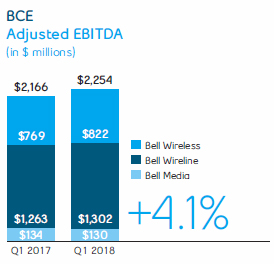

Adjusted EBITDA | 2,254 | | 2,166 | | 88 | | 4.1 | % |

Adjusted EBITDA margin(1) | 40.3 | % | 40.6 | % | | | (0.3 | ) pts |

Net earnings attributable to: | | | | | | | | |

Common shareholders | 661 | | 642 | | 19 | | 3.0 | % |

Preferred shareholders | 36 | | 31 | | 5 | | 16.1 | % |

Non-controlling interest | 12 | | 15 | | (3 | ) | (20.0 | %) |

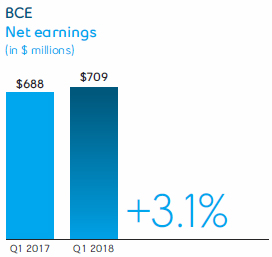

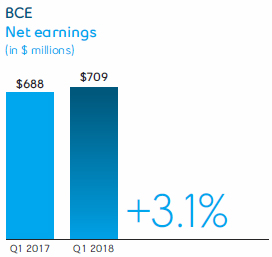

Net earnings | 709 | | 688 | | 21 | | 3.1 | % |

Adjusted net earnings | 719 | | 703 | | 16 | | 2.3 | % |

Net earnings per common share (EPS) | 0.73 | | 0.73 | | – | | – | |

Adjusted EPS(1) | 0.80 | | 0.80 | | – | | – | |

| (1) | Adjusted EBITDA, adjusted EBITDA margin, adjusted net earnings, adjusted EPS and free cash flow are non-GAAP financial measures and do not have any standardized meaning under IFRS. Therefore, they are unlikely to be comparable to similar measures presented by other issuers. See section 8.2,Non-GAAP financial measures and key performance indicators (KPIs) – Adjusted EBITDA and adjusted EBITDA margin, Adjusted net earnings and adjusted EPSandFree cash flow and dividend payout ratioin this MD&A for more details, including reconciliations to the most comparable IFRS financial measure. |

| (2) | At the beginning of Q1 2018, we adjusted our postpaid wireless subscriber base to remove 16,116 subscribers with a corresponding increase to our high-speed Internet subscribers to reflect the transfer of fixed wireless Internet subscribers. |

| (3) | At the beginning of Q1 2018, our high-speed Internet subscriber base was increased by 19,835, our Internet protocol television (IPTV) by 14,599 and our residential NAS by 23,441, mainly as a result of a small acquisition made in the quarter. |

| (4) | As of January 1, 2018, business NAS was removed from our NAS subscriber base due to its declining relevance as a KPI given migrations from voice to Internet protocol (IP) result in NAS losses without a corresponding decline in revenues. Previously reported periods were retroactively adjusted. |

| 2 BCE Inc. 2018 FIRST QUARTER SHAREHOLDER REPORT |

|

| | | | |

| | 1 | MD&A | Overview |

| BCE STATEMENTS OF CASH FLOWS – SELECTED INFORMATION |

| Q1 2018 | | Q1 2017 | | $ CHANGE | | % CHANGE | |

Cash flows from operating activities | 1,496 | | 1,313 | | 183 | | 13.9 | % |

Capital expenditures | (931 | ) | (852 | ) | (79 | ) | (9.3 | %) |

Free cash flow | 537 | | 489 | | 48 | | 9.8 | % |

| Q1 2018 FINANCIAL HIGHLIGHTS |

BCE delivered revenue growth of 4.8%, compared to Q1 2017, resulting from higher service revenues of 3.2%, coupled with increased product revenues of 19.2%. The growth was driven by higher wireless and wireline revenues, while Bell Media revenues remained relatively stable year over year. The growth continues to be led by our wireless segment, increasing 10.1% year over year despite a $14 million retroactive regulatory impact from the recent Canadian Radio-television and Telecommunications Commission (CRTC) decision on wholesale wireless domestic roaming rates in Q1 2018. Both our wireless and wireline segments were favourably impacted by the acquisition of MTS on March 17, 2017. The increase in our wireline segment also reflected the continued growth in Internet and IPTV, moderated by the ongoing erosion in voice, satellite TV and legacy data revenues including continued but diminishing pressures in our business market. Product revenues grew as a result of the increased sales mix of premium devices and higher volumes in our wireless segment, the contribution from the acquisition of MTS, as well as greater demand from the government sector.

Net earnings increased by 3.1% in the first quarter of 2018, compared to the same period last year, due to higher adjusted EBITDA, as growing revenues more than offset an increase in operating costs, and lower severance, acquisition and other costs, partly offset by higher depreciation and amortization expense and higher other expense mainly as a result of net mark-to-market losses on derivatives used to economically hedge equity settled share-based compensation plans.

Q1 2018 adjusted EBITDA was up 4.1%, compared to last year, mainly due to service revenue flow-through including the unfavourable retroactive impact of the recent CRTC decision of $14 million in Q1 2018, the contribution from the acquisition of MTS and continued disciplined cost containment, which was moderated by higher pension expense due to a gain realized in Q1 2017 and escalating content and programming costs.

BCE’s EPS of $0.73 in Q1 2018 remained stable compared to the same period last year.

Excluding the impact of severance, acquisition and other costs, net mark-to-market (losses) gains on derivatives used to economically hedge equity settled share-based compensation plans, net (losses) gains on investments, early debt redemption costs and impairment charges, adjusted net earnings in the first quarter of 2018 was $719 million, or $0.80 per common share, compared to $703 million, or $0.80 per common share, for the same period last year.

Cash flows from operating activities in the first quarter of 2018 increased by $183 million, compared to Q1 2017, due mainly to improved working capital, lower acquisition and other costs paid and higher adjusted EBITDA.

Free cash flow in Q1 2018 increased by $48 million, compared to the same period last year, due to higher cash flows from operating activities excluding acquisition and other costs paid, partly offset by higher capital expenditures.

| 1.2Key corporate and business developments |

COMMON SHARE DIVIDEND INCREASE

On February 7, 2018, BCE’s board of directors approved a 5.2%, or 15 cents per share, increase in the annual common share dividend from $2.87 per share to $3.02 per share, effective with BCE’s 2018 first quarter dividend paid on April 15, 2018 to common shareholders of record on March 15, 2018. This dividend increase represents BCE’s 14th increase to its annual common share dividend since the fourth quarter of 2008, representing a 107% overall increase.

| COMPLETION OF NORMAL COURSE ISSUER BID |

On February 8, 2018, BCE announced a normal course issuer bid (NCIB) program under which BCE could purchase for cancellation up to 3.5 million common shares, subject to a maximum aggregate purchase price of $175 million, during the twelve-month period starting February 13, 2018 and ending no later than February 12, 2019. On March 13, 2018, BCE completed its NCIB program, having repurchased and cancelled 3,085,697 common shares, at an average price of $56.71 per share, for a total cost of $175 million. The repurchase of common shares was conducted for the purpose of offsetting share dilution resulting from the exercise of stock options.

BCE Inc. 2018 FIRST QUARTER SHAREHOLDER REPORT 3 |

|

| | | | |

1 | MD&A | Overview | |

| PUBLIC DEBT OFFERINGS AND REDEMPTIONS |

On March 12, 2018, Bell Canada completed a public offering of $500 million of medium term notes (MTN) debentures pursuant to its MTN program. The $500 million Series M-47 MTN debentures will mature on March 12, 2025 and carry an annual interest rate of 3.35%. The MTN debentures are fully and unconditionally guaranteed by BCE Inc. The net proceeds of the offering were used to fund the early redemption in April 2018 of Bell Canada’s $300 million principal amount of 5.52% Series M-33 debentures due February 26, 2019 and for the repayment of other short-term debt.

On March 29, 2018, Bell Canada completed a public offering of US $750 million of Series US-1 Notes. The Notes will mature on April 1, 2048 and carry an annual interest rate of 4.464%. This financing represents the first public debt issuance by Bell Canada in the U.S. market in more than 20 years. The Notes are fully and unconditionally guaranteed by BCE Inc. The net proceeds of the offering were used to fund the early redemption in April 2018 of Bell Canada’s $200 million principal amount of 4.59% Series 9 medium term notes due October 1, 2018 and will be used to fund the early redemption in May 2018 of Bell Canada’s $400 million principal amount of 3.50% Series M-28 debentures due September 10, 2018, as well as for general corporate purposes.

| BELL NAMED ONE OF CANADA’S BEST DIVERSITY EMPLOYERS |

For the second year in a row, Bell has been named one of Canada’s Best Diversity Employers in Mediacorp’s 2018 report on workplace diversity and inclusion. The award recognizes Bell’s commitment to providing an inclusive and accessible workplace that reflects Canada’s diversity and highlights our wide range of initiatives to support women, persons with disabilities, Aboriginal people, visible minorities and other groups.

As at the date of this MD&A, our forward-looking statements set out in the BCE 2017 Annual MD&A, as updated or supplemented in this MD&A, are based on certain assumptions including, without limitation, the following economic and market assumptions as well as the various assumptions referred to under the sub-sections entitled Assumptions set out in section 3, Business segment analysis of this MD&A.

ASSUMPTIONS ABOUT THE CANADIAN ECONOMY

- Lower economic growth, given the Bank of Canada’s most recent estimated growth in Canadian gross domestic product of 2.0% in 2018, representing a slight decrease from the earlier estimate of 2.2%.

- Employment gains expected to slow in 2018, as the overall level of business investment is expected to remain soft

- Interest rates expected to increase modestly in 2018

- Canadian dollar expected to remain at near current levels. Further movements may be impacted by the degree of strength of the U.S. dollar, interest rates and changes in commodity prices

MARKET ASSUMPTIONS

- A higher level of wireline and wireless competition in consumer, business and wholesale markets

- Higher, but slowing, wireless industry penetration and smartphone adoption

- A soft media advertising market, due to variable demand, and continued escalation of costs to secure TV programming

- Ongoing linear TV subscriber erosion, due to growing cord-cutter and cord-never customer segments

| 4 BCE Inc. 2018 FIRST QUARTER SHAREHOLDER REPORT |

|

| | | | |

| | 2 | MD&A | Consolidated financial analysis |

| 2 Consolidated financial analysis |

This section provides detailed information and analysis about BCE’s performance in Q1 2018 compared with Q1 2017. It focuses on BCE’s consolidated operating results and provides financial information for our Bell Wireless, Bell Wireline and Bell Media business segments. For further discussion and analysis of our business segments, refer to section 3,Business segment analysis.

As required by IFRS, effective January 1, 2018, we have adopted IFRS 15, Revenue from Contracts with Customers, as described in section 8.1,Our accounting policies, retrospectively to each period in 2017 previously reported. We have also reclassified some amounts from previous periods to make them consistent with the presentation for the current period.

| 2.1 BCE consolidated income statements |

| Q1 2018 | | Q1 2017 | | $ CHANGE | | % CHANGE | |

Operating revenues | | | | | | | | |

Service | 4,964 | | 4,811 | | 153 | | 3.2 | % |

Product | 626 | | 525 | | 101 | | 19.2 | % |

Total operating revenues | 5,590 | | 5,336 | | 254 | | 4.8 | % |

Operating costs | (3,336 | ) | (3,170 | ) | (166 | ) | (5.2 | %) |

Adjusted EBITDA | 2,254 | | 2,166 | | 88 | | 4.1 | % |

Adjusted EBITDA margin | 40.3 | % | 40.6 | % | | | (0.3 | ) pts |

Severance, acquisition and other costs | – | | (84 | ) | 84 | | 100.0 | % |

Depreciation | (780 | ) | (724 | ) | (56 | ) | (7.7 | %) |

Amortization | (212 | ) | (185 | ) | (27 | ) | (14.6 | %) |

Finance costs | | | | | | | | |

Interest expense | (240 | ) | (234 | ) | (6 | ) | (2.6 | %) |

Interest on post-employment benefit obligations | (17 | ) | (18 | ) | 1 | | 5.6 | % |

Other (expense) income | (61 | ) | 17 | | (78 | ) | n.m. | |

Income taxes | (235 | ) | (250 | ) | 15 | | 6.0 | % |

Net earnings | 709 | | 688 | | 21 | | 3.1 | % |

Net earnings attributable to: | | | | | | | | |

Common shareholders | 661 | | 642 | | 19 | | 3.0 | % |

Preferred shareholders | 36 | | 31 | | 5 | | 16.1 | % |

Non-controlling interest | 12 | | 15 | | (3 | ) | (20.0 | %) |

Net earnings | 709 | | 688 | | 21 | | 3.1 | % |

Adjusted net earnings | 719 | | 703 | | 16 | | 2.3 | % |

EPS | 0.73 | | 0.73 | | – | | – | |

Adjusted EPS | 0.80 | | 0.80 | | – | | – | |

n.m.: not meaningful

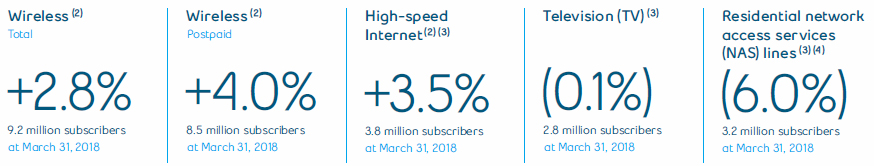

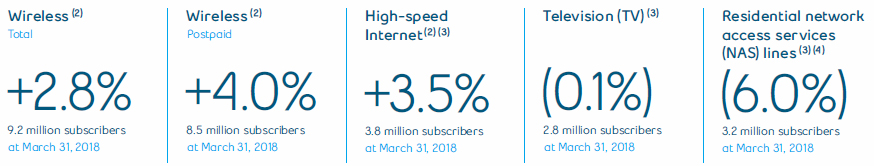

TOTAL BCE CONNECTIONS

| Q1 2018 | | Q1 2017 | | % CHANGE | |

Wireless subscribers(1) | 9,195,048 | | 8,946,476 | | 2.8 | % |

Postpaid(1) | 8,471,021 | | 8,144,936 | | 4.0 | % |

High-speed Internet subscribers(1)(2) | 3,845,739 | | 3,717,270 | | 3.5 | % |

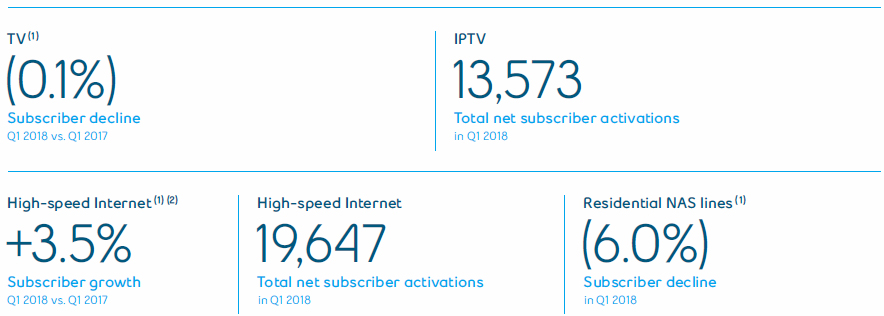

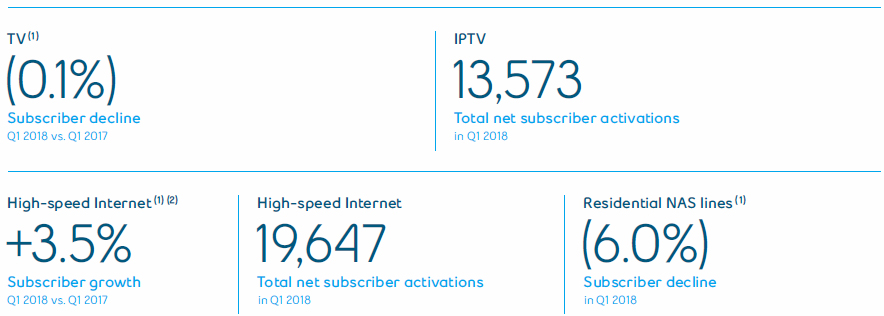

TV (Satellite and IPTV subscribers)(2) | 2,834,418 | | 2,837,353 | | (0.1 | %) |

IPTV(2) | 1,578,489 | | 1,465,007 | | 7.7 | % |

Total growth services | 15,875,205 | | 15,501,099 | | 2.4 | % |

Wireline residential NAS lines(2) | 3,197,216 | | 3,399,981 | | (6.0 | %) |

Total services(3) | 19,072,421 | | 18,901,080 | | 0.9 | % |

| (1) | At the beginning of Q1 2018, we adjusted our postpaid wireless subscriber base to remove 16,116 subscribers with a corresponding increase to our high-speed Internet subscribers to reflect the transfer of fixed wireless Internet subscribers. |

| (2) | At the beginning of Q1 2018, our high-speed Internet subscriber base was increased by 19,835, our IPTV by 14,599 and our residential NAS by 23,441, mainly as a result of a small acquisition made in the quarter. |

| (3) | As of January 1, 2018, business NAS was removed from our NAS subscriber base due to its declining relevance as a KPI given migrations from voice to IP result in NAS losses without a corresponding decline in revenues. Previously reported periods were retroactively adjusted. |

BCE Inc. 2018 FIRST QUARTER SHAREHOLDER REPORT 5 |

|

| | | | |

2 | MD&A | Consolidated financial analysis | |

BCE NET ACTIVATIONS (LOSSES)

| Q1 2018 | | Q1 2017 | | % CHANGE | |

Wireless subscribers | 44,377 | | 672 | | n.m. | |

Postpaid | 68,487 | | 35,782 | | 91.4 | % |

High-speed Internet subscribers | 19,647 | | 14,989 | | 31.1 | % |

TV (Satellite and IPTV subscribers) | (12,481 | ) | (15,663 | ) | 20.3 | % |

IPTV | 13,573 | | 22,402 | | (39.4 | %) |

Total growth services | 51,543 | | (2 | ) | n.m. | |

Wireline residential NAS lines | (57,533 | ) | (73,421 | ) | 21.6 | % |

Total services | (5,990 | ) | (73,423 | ) | 91.8 | % |

n.m.: not meaningful

BCE added 51,543 net new customer connections to its growth services in Q1 2018, a significant improvement over the net losses of 2 customers experienced in the first quarter of 2017. This was comprised of:

- 68,487 postpaid wireless customers, and the net loss of 24,110 prepaid wireless customers

- 19,647 high-speed Internet customers

- 13,573 IPTV customers and 26,054 satellite TV net customer losses

Residential NAS net losses were 57,533 in Q1 2018, an improvement of 21.6% over Q1 2017.

Total BCE customer connections across all services increased by 0.9% in Q1 2018 compared to last year, driven by a higher growth services customer base, offset in part by the ongoing erosion in residential NAS lines.

At March 31, 2018, BCE customer connections totaled 19,072,421 and consisted of the following:

- 9,195,048 wireless subscribers, up 2.8% compared to Q1 2017, and included 8,471,021 postpaid wireless subscribers, an increase of 4.0% compared to the prior year

- 3,845,739 high-speed Internet subscribers, 3.5% higher year over year

- 2,834,418 total TV subscribers, down 0.1% compared to Q1 2017, and included 1,578,489 IPTV customers, up 7.7% year over year

- 3,197,216 residential NAS lines, a decline of 6.0% compared to Q1 2017

| Q1 2018 | | Q1 2017 | | $ CHANGE | | % CHANGE | |

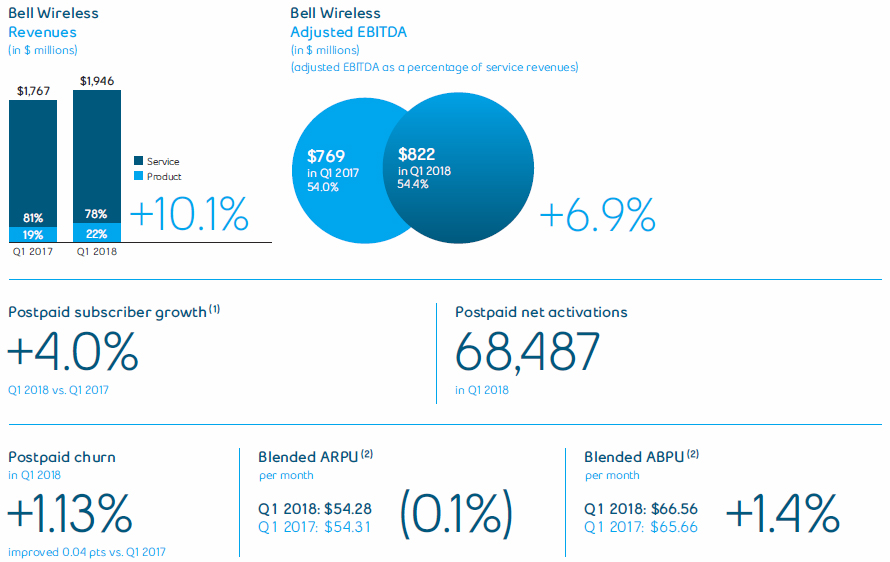

Bell Wireless | 1,946 | | 1,767 | | 179 | | 10.1 | % |

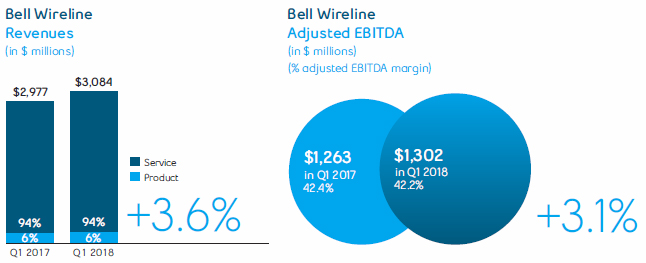

Bell Wireline | 3,084 | | 2,977 | | 107 | | 3.6 | % |

Bell Media | 749 | | 751 | | (2 | ) | (0.3 | %) |

Inter-segment eliminations | (189 | ) | (159 | ) | (30 | ) | (18.9 | %) |

Total BCE operating revenues | 5,590 | | 5,336 | | 254 | | 4.8 | % |

BCE

Total operating revenues at BCE grew by 4.8% in Q1 2018, compared to Q1 2017, driven by growth in both our Bell Wireless and Bell Wireline segments, while our Bell Media segment remained relatively stable compared to last year. This consisted of service revenues of $4,964 million in Q1 2018, which increased by 3.2% year over year, and product revenues of $626 million, which grew by 19.2% compared to last year.

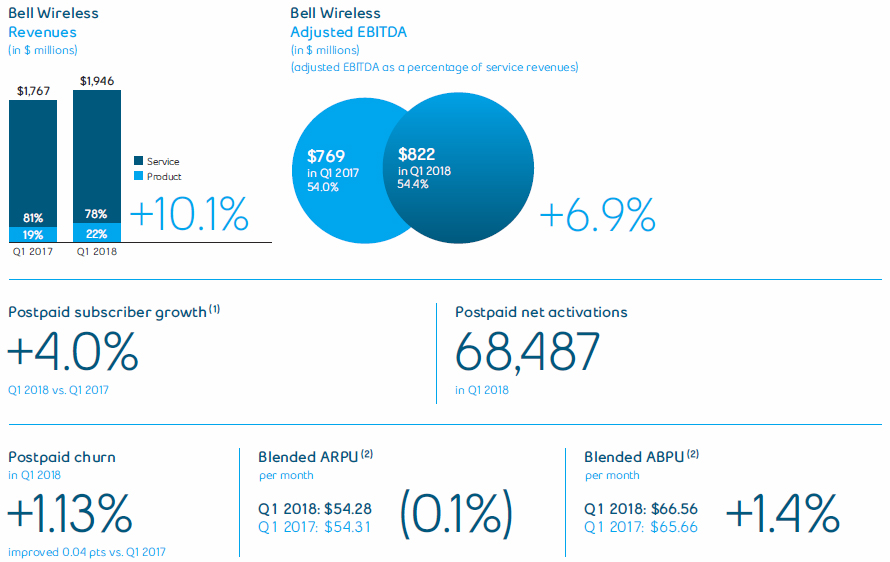

BELL WIRELESS

Bell Wireless operating revenues grew 10.1% in Q1 2018, compared to Q1 2017, due to both higher service revenues of 6.1% and product revenues of 26.9%. Excluding the unfavourable retroactive impact of the recent CRTC decision on wholesale wireless domestic roaming rates of $14 million in Q1 2018, operating revenues and service revenues increased by 10.9% and 7.1%, respectively, in Q1 2018, compared to the same period in 2017. The increase in service revenues reflected the continued growth in our postpaid subscriber base and the contribution from the acquisition of MTS on March 17, 2017, as blended average revenue per user (ARPU) remained relatively unchanged compared to last year. The higher year-over-year product revenues were driven by greater premium devices in our sales mix resulting in a higher allocation to product revenues and higher sales volumes driven by increased number of gross activations and device upgrades along with the contribution from the acquisition of MTS.

| 6 BCE Inc. 2018 FIRST QUARTER SHAREHOLDER REPORT |

|

| | | | |

| | 2 | MD&A | Consolidated financial analysis |

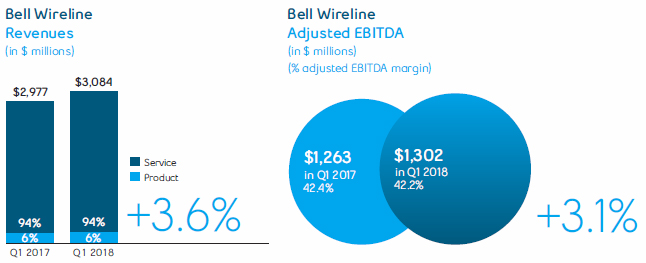

BELL WIRELINE

Bell Wireline operating revenues increased by 3.6% in the first quarter of 2018, compared to last year, driven by service revenue growth of 3.5% and product revenue growth of 4.3%. The increase in service revenues was driven by the contribution from Bell MTS, growth in Internet and IPTV subscribers, higher household ARPU, greater IP-based services revenue and the acquisition of AlarmForce Industries Inc. (AlarmForce) on January 5, 2018. This was moderated by the ongoing erosion in our voice, satellite TV and legacy data services, along with increased residential customer acquisition, retention and bundle discounts to match aggressive offers from cable competitors. The increase in product revenues was attributable to the contribution from the acquisition of MTS, and higher sales of telecommunication equipment mainly due to greater demand from the government sector, offset in part by lower sales of consumer electronics at The Source (Bell) Electronics Inc. (The Source).

BELL MEDIA

Bell Media operating revenues decreased by 0.3% in Q1 2018, compared to Q1 2017, driven by lower advertising revenues mainly due to continued general market softness and declines in audience levels impacting our TV and radio platforms as well as an ongoing shift in customer spending to over-the-top (OTT) and digital platforms. The shift in advertising dollars to the main broadcaster of the PyeongChang 2018 Winter Olympics also unfavourably impacted advertising revenues across both conventional and specialty TV. The year-over-year decline in advertising revenues was moderated by growth in our digital TV properties and higher out-of-home (OOH) advertising revenues mainly as a result of increased demand on digital faces. Subscriber revenues increased in Q1 2018, compared to last year, mainly due to the growth in our subscriber base from our CraveTV and TV Everywhere GO Products and contract renewals with TV distributors.

| Q1 2018 | | Q1 2017 | | $ CHANGE | | % CHANGE | |

Bell Wireless | (1,124 | ) | (998 | ) | (126 | ) | (12.6 | %) |

Bell Wireline | (1,782 | ) | (1,714 | ) | (68 | ) | (4.0 | %) |

Bell Media | (619 | ) | (617 | ) | (2 | ) | (0.3 | %) |

Inter-segment eliminations | 189 | | 159 | | 30 | | 18.9 | % |

Total BCE operating costs | (3,336 | ) | (3,170 | ) | (166 | ) | (5.2 | %) |

| (1) | Cost of revenues includes costs of wireless devices and other equipment sold, network and content costs, and payments to other carriers. |

| (2) | Labour costs (net of capitalized costs) include wages, salaries and related taxes and benefits, post-employment benefit plans service cost, and other labour costs, including contractor and outsourcing costs. |

| (3) | Other operating costs include marketing, advertising and sales commission costs, bad debt expense, taxes other than income taxes, information technology (IT) costs, professional service fees and rent. |

BCE

Total BCE operating costs grew by 5.2% in Q1 2018, compared to Q1 2017, due to increases in both our Bell Wireless and Bell Wireline segments, while Bell Media costs remained relatively stable year over year.

BELL WIRELESS

Bell Wireless operating costs increased by 12.6% in the first quarter of 2018, compared to the same period last year, as a result of:

- Higher product cost of goods sold due to greater sales volumes and higher handset costs

- The acquisition of MTS on March 17, 2017

- Higher advertising expense due to the PyeongChang 2018 Winter Olympics

- Greater labour costs to support the growth of the business

- Increased network operating costs driven by the expansion of network capacity to support subscriber growth and increased data consumption

These factors were partially offset by:

BCE Inc. 2018 FIRST QUARTER SHAREHOLDER REPORT 7 |

|

| | | | |

2 | MD&A | Consolidated financial analysis | |

BELL WIRELINE

Bell Wireline operating costs increased by 4.0% in Q1 2018, compared to Q1 2017, as a result of:

- Higher expenses from the acquisition of MTS and AlarmForce

- Greater pension expense due to a gain in Q1 2017 on post-employment benefit expense related to an alignment of certain Bell Aliant Inc. (Bell Aliant) defined benefit (DB) pension plans with those of Bell Canada

- Increased programming and content costs in our TV business from contractual rate increases

- Higher advertising expense in our residential market due to the PyeongChang 2018 Winter Olympics

These factors were partially offset by:

- Decreased labour costs resulting from workforce reductions, savings from lower call volumes and improved call handle times, as well as vendor contract savings

- Lower payments to other carriers driven by reduced sales of international long distance minutes

BELL MEDIA

Bell Media operating costs increased by 0.3% in Q1 2018, compared to the same period last year, as a result of:

- Continued escalation of programming and content costs relating to sports rights and content expansion for CraveTV

- Higher OOH expenses resulting from the increased demand on digital faces

These factors were partially offset by:

- Regulatory fee reductions

- Lower labour costs driven mainly by workforce reductions

Net earnings increased by 3.1% in the first quarter of 2018, compared to the same period last year, due to higher adjusted EBITDA, as growing revenues more than offset an increase in operating costs, and lower severance, acquisition and other costs, partly offset by higher depreciation and amortization expense and higher other expense mainly as a result of net mark-to-market losses on derivatives used to economically hedge equity settled share-based compensation plans.

| Q1 2018 | | Q1 2017 | | $ CHANGE | | % CHANGE | |

Bell Wireless | 822 | | 769 | | 53 | | 6.9 | % |

Bell Wireline | 1,302 | | 1,263 | | 39 | | 3.1 | % |

Bell Media | 130 | | 134 | | (4 | ) | (3.0 | %) |

Total BCE adjusted EBITDA | 2,254 | | 2,166 | | 88 | | 4.1 | % |

BCE

BCE’s adjusted EBITDA increased by 4.1% in Q1 2018, compared to Q1 2017, as a result of growth in both our Bell Wireless and Bell Wireline segments, offset in part by a decline in our Bell Media segment. The adjusted EBITDA margin declined from 40.6% in Q1 2017 to 40.3% in Q1 2018, reflecting a $14 million retroactive regulatory impact from the recent CRTC decision on wholesale wireless domestic roaming rates in Q1 2018.

The growth in adjusted EBITDA was driven by higher wireless, Internet and IPTV revenues, the contribution from the acquisitions of MTS and continued effective cost containment. This was offset in part by the continued erosion in our voice, satellite TV and legacy data revenues, higher pension expense due to a gain realized in Q1 2017, regulatory pressures in our Bell Wireless segment, as well as higher programming and content costs.

| 8 BCE Inc. 2018 FIRST QUARTER SHAREHOLDER REPORT |

|

| | | | |

| | 2 | MD&A | Consolidated financial analysis |

BELL WIRELESS

Bell Wireless adjusted EBITDA increased by 6.9% in Q1 2018, compared to the same period last year. Excluding the unfavourable retroactive impact of $14 million related to the recent CRTC decision on wholesale wireless domestic roaming rates, adjusted EBITDA grew 8.7% year over year. This increase reflected the growth in operating revenues and the overall contribution from the acquisition of MTS, which more than offset the higher year-over-year operating expenses, mainly higher product cost of goods sold, advertising, labour and network operating costs. This resulted in an improvement to adjusted EBITDA margin, based on wireless operating service revenues of 0.4 pts to 54.4% in Q1 2018, compared to the 54.0% in Q1 2017. Additionally, a higher proportion of low-margin product sales in our total revenues base led to a decline of 1.3 pts in total adjusted EBITDA margin to 42.2% in Q1 2018, compared to 43.5% in Q1 2017.

BELL WIRELINE

Bell Wireline adjusted EBITDA grew by 3.1% in the first quarter of 2018, compared to the same period last year, driven by the contribution from the acquisition of MTS, growth in Internet and IPTV revenues, and continued effective cost containment. This growth was moderated by the continued erosion of voice, satellite TV and legacy data revenues, including continued but diminishing pressures in our business market and higher pension expense as a result of a gain in Q1 2017 relating to post-employment benefit expense.

BELL MEDIA

Bell Media adjusted EBITDA decreased by 3.0% in Q1 2018, compared to Q1 of the previous year, due to lower operating revenues along with an increase in operating expenses primarily from escalating programming and content costs, moderated by regulatory fee reductions and lower labour costs.

| 2.7Severance, acquisition and other costs |

2018

Severance, acquisition and other costs were nil in the first quarter of 2018.

2017

Severance, acquisition and other costs of $84 million in the first quarter of 2017 included:

- Severance costs related to workforce reduction initiatives of $31 million

- Acquisition and other costs of $53 million in Q1 2017, including transaction costs, such as legal and financial advisory fees, related to completed or potential acquisitions, as well as a loss on sale of spectrum licences to Xplornet Communications Inc. relating to the MTS acquisition

| 2.8Depreciation and amortization |

DEPRECIATION

Depreciation in Q1 2018 increased by $56 million, compared to Q1 2017, mainly due to the acquisition of MTS and a higher asset base as we continued to invest in our broadband and wireless networks as well as our IPTV service.

AMORTIZATION

Amortization in Q1 2018 increased by $27 million, compared to Q1 2017, due mainly to the acquisition of MTS and a higher asset base.

INTEREST EXPENSE

Interest expense in the first quarter of 2018 increased by $6 million, compared to the same period last year, mainly as a result of higher average debt levels due in part to the acquisition of MTS, partly offset by lower average interest rates.

INTEREST ON POST-EMPLOYMENT BENEFIT OBLIGATIONS

Interest on our post-employment benefit obligations is based on market conditions that existed at the beginning of the year. On January 1, 2018, the discount rate was 3.6% compared to 4.0% on January 1, 2017.

In the first quarter of 2018, interest expense decreased by $1 million, compared to the same period last year, due to a lower discount rate partly offset by a higher post-employment benefit obligation at the beginning of the year.

The impacts of changes in market conditions during the year are recognized in the other comprehensive income (loss) (OCI).

BCE Inc. 2018 FIRST QUARTER SHAREHOLDER REPORT 9 |

|

| | | | |

2 | MD&A | Consolidated financial analysis | |

| 2.10Other (expense) income |

2018

Other expense of $61 million included net mark-to-market losses on derivatives used to economically hedge equity settled share-based compensation plans, partly offset by income from our equity investments.

2017

Other income of $17 million in the first quarter of 2017 included net mark-to-market gains on derivatives used to economically hedge equity settled share-based compensation plans and U.S. dollar purchases and income from our equity investments, partly offset by losses on retirements and disposals of property, plant and equipment and intangible assets and losses on investments.

Income taxes of $235 million in the first quarter of 2018 decreased by $15 million, compared to the same period last year, due mainly to a higher value of uncertain tax positions favourably resolved in Q1 2018 compared to Q1 2017 and lower taxable income.

| 2.12Net earnings attributable to common shareholders and EPS |

Net earnings attributable to common shareholders of $661 million in the first quarter of 2018 increased by $19 million, compared to the same period last year, due to higher adjusted EBITDA, as growing revenues more than offset an increase in operating costs, and lower severance, acquisition and other costs, partly offset by higher depreciation and amortization expense and higher other expense mainly as a result of net mark-to-market losses on derivatives used to economically hedge equity settled share-based compensation plans.

BCE’s EPS of $0.73 in Q1 2018 remained stable compared to the same period last year.

Excluding the impact of severance, acquisition and other costs, net mark-to-market (losses) gains on derivatives used to economically hedge equity settled share-based compensation plans, net (losses) gains on investments, early debt redemption costs and impairment charges, adjusted net earnings in the first quarter of 2018 was $719 million, or $0.80 per common share, compared to $703 million, or $0.80 per common share, for the same period last year.

| 10 BCE Inc. 2018 FIRST QUARTER SHAREHOLDER REPORT |

|

| | | | |

| | 3 | MD&A | Business segment analysis

Bell Wireless |

| 3 Business segment analysis |

KEY BUSINESS DEVELOPMENTS

BELL IS THE FIRST WIRELESS PROVIDER IN CANADA TO ACHIEVE GIGABIT LTE SPEEDS

Bell successfully tested Gigabit LTE-A in Mississauga, Ontario and will roll out its enhanced network to locations throughout Canada in 2018 as smartphones that support these advanced speeds come to market. To boost Long-term Evolution (LTE) Advanced (LTE-A) speeds to the Gigabit (Gb) level, Bell is employing a combination of carrier aggregation and 4X4 Multiple Input Multiple Output (MIMO) technology to increase spectrum efficiency and multiply capacity. Bell will also support Licensed Assisted Access (LAA) technology to aggregate unlicensed 5 Gigahertz (GHz) spectrum with LTE in licensed bands to provide higher transfer speeds. At the end of Q1 2018, Bell reached 87% coverage of the population with broadband LTE-A mobile service with plans to expand the footprint to approximately 92% of Canadians by the end of 2018.

LUCKY MOBILE LOW-COST WIRELESS SERVICE AVAILABLE IN MANITOBA AND SASKATCHEWAN

Bell expanded the availability of Lucky Mobile, Canada’s new low-cost prepaid wireless service, to residents of Manitoba and Saskatchewan. Launched initially in Ontario, Alberta and British Columbia in December, Lucky Mobile puts budget-conscious Canadians in complete control of their mobile services with simple, no surprises prepaid plans starting at just $20 for unlimited local calling with no long-term commitment. Lucky Mobile offers service in 19 zones covering most major cities across the country, now including Winnipeg, Regina and Saskatoon. Data access is included with certain plans.

BELL CONDUCTS SUCCESSFUL WTTH CUSTOMER TRIALS

In February 2018, Bell successfully completed wireless-to-the-home (WTTH) trials in the 3.5 GHz and 28 GHz spectrum bands leveraging Huawei’s innovative technologies that will play a part in bringing Fifth Generation (5G) speeds to rural communities. The trials were conducted in the small Ontario communities of Orangeville, Feversham and Bethany to test and refine the capabilities of WTTH services for rural areas. Bell plans to roll out service in more than 20 other Ontario and Québec communities this year. WTTH technology is new fixed wireless technology that will take full advantage of 5G to deliver high-speed Internet service to residents in smaller and underserved communities.

EXPANDED LINEUP OF INTERNET OF THINGS APPLICATIONS

Bell expanded its extensive lineup of innovative Internet of Things (IoT) applications, which enable the interconnection of a range of devices and applications that send and receive data. Building on our other IoT collaborations such as our Smart City pilot with the city of Kingston and Connected Cars partnership with Hyundai and Kia, Bell is taking the lead in this strategic growth market and leveraging our network strengths and broad wireless and business solutions expertise.

- Bell is working with Echologics, an industry leader in leak detection technology, to implement a water management solution for Medicine Hat, Alberta based on our Smart City platform. The system will include more than 150 smart nodes throughout the city connected over Bell’s broadband wireless network to monitor water infrastructure for leaks and provide data to support decision-making about the municipal water system.

- Bell is integrating systems developed by Icicle Technologies into our IoT platform to offer a comprehensive production management solution for Canada’s food industry. Leveraging our unparalleled connectivity, the solution will reduce waste and improve food safety by monitoring temperature and air quality, enhancing traceability and providing real-time operational data.

BCE Inc. 2018 FIRST QUARTER SHAREHOLDER REPORT 11 |

|

| | | | |

3 | MD&A | Business segment analysis

Bell Wireless | |

| FINANCIAL PERFORMANCE ANALYSIS |

Q1 2018 PERFORMANCE HIGHLIGHTS

| (1) | At the beginning of Q1 2018, we adjusted our postpaid wireless subscriber base to remove 16,116 subscribers with a corresponding increase to our high-speed Internet subscribers to reflect the transfer of fixed wireless Internet subscribers. |

| (2) | Our Q1 2018 blended ARPU and blended average billing per user (ABPU) were adjusted to exclude the unfavourable retroactive impact of the recent CRTC decision on wholesale wireless domestic roaming rates of $14 million. See section 8.2,Non-GAAP financial measures and key performance indicators (KPIs) – KPIsin this MD&A for more details, including our definition of ABPU. |

BELL WIRELESS RESULTS

REVENUES

| Q1 2018 | | Q1 2017 | | $ CHANGE | | % CHANGE | |

External service revenues | 1,500 | | 1,415 | | 85 | | 6.0 | % |

Inter-segment service revenues | 12 | | 10 | | 2 | | 20.0 | % |

Total operating service revenues | 1,512 | | 1,425 | | 87 | | 6.1 | % |

External product revenues | 434 | | 341 | | 93 | | 27.3 | % |

Inter-segment product revenues | – | | 1 | | (1 | ) | (100.0 | %) |

Total operating product revenues | 434 | | 342 | | 92 | | 26.9 | % |

Total Bell Wireless revenues | 1,946 | | 1,767 | | 179 | | 10.1 | % |

Bell Wireless operating revenuesgrew 10.1% in Q1 2018, compared to Q1 2017, due to both higher service revenues of 6.1% and product revenues of 26.9%. Excluding the unfavourable retroactive impact of the recent CRTC decision on wholesale wireless domestic roaming rates of $14 million, operating revenues and service revenues increased by 10.9% and 7.1%, respectively, in Q1 2018, compared to the same period in 2017.

- Service revenuegrowth reflected a higher year-over-year postpaid subscriber base and the contribution from the acquisition of MTS on March 17, 2017, as blended ARPU remained relatively unchanged compared to last year.

- Product revenuesgrew by 26.9% in Q1 2018, compared to the same period in 2017, due to greater premium devices in our sales mix resulting in a greater allocation to product revenues and higher sales volumes driven by increased number of gross activations and device upgrades along with the contribution from the acquisition of MTS.

| 12 BCE Inc. 2018 FIRST QUARTER SHAREHOLDER REPORT |

|

| | | | |

| | 3 | MD&A | Business segment analysis

Bell Wireless |

OPERATING COSTS AND ADJUSTED EBITDA

| Q1 2018 | | Q1 2017 | | $ CHANGE | | % CHANGE | |

Operating costs | (1,124 | ) | (998 | ) | (126 | ) | (12.6 | %) |

Adjusted EBITDA | 822 | | 769 | | 53 | | 6.9 | % |

Total adjusted EBITDA margin | 42.2 | % | 43.5 | % | | | (1.3 | ) pts |

Adjusted EBITDA margin (service revenues) | 54.4 | % | 54.0 | % | | | 0.4 | pts |

Bell Wireless operating costsincreased by 12.6% in the first quarter of 2018, compared to the same period last year, as a result of:

- Higher product cost of goods sold due to greater sales volumes and higher handset costs

- The acquisition of MTS on March 17, 2017

- Higher advertising expense due to the PyeongChang 2018 Winter Olympics

- Greater labour costs to support the growth of the business

- Increased network operating costs driven by the expansion of network capacity to support subscriber growth and increased data consumption

These factors were partially offset by:

Bell Wireless adjusted EBITDAincreased by 6.9% in Q1 2018, compared to the same period last year. Excluding the unfavourable retroactive impact of $14 million related to the recent CRTC decision on wholesale wireless domestic roaming rates, adjusted EBITDA grew 8.7% year over year. This increase reflected the growth in operating revenues and the overall contribution from the acquisition of MTS, which more than offset the higher year-over-year operating expenses, mainly higher product cost of goods sold, advertising, labour and network operating costs. This resulted in an improvement to adjusted EBITDA margin, based on wireless operating service revenues of 0.4 pts to 54.4% in Q1 2018, compared to the 54.0% in Q1 2017. Additionally, a higher proportion of low-margin product sales in our total revenues base led to a decline of 1.3 pts in total adjusted EBITDA margin to 42.2% in Q1 2018, compared to 43.5% in Q1 2017.

BELL WIRELESS OPERATING METRICS

| Q1 2018 | | Q1 2017 | | CHANGE | | % CHANGE | |

Blended ARPU ($/month)(1) | 54.28 | | 54.31 | | (0.03 | ) | (0.1 | %) |

Blended ABPU ($/month)(1) | 66.56 | | 65.66 | | 0.90 | | 1.4 | % |

Gross activations | 404,790 | | 348,452 | | 56,338 | | 16.2 | % |

Postpaid | 347,319 | | 296,616 | | 50,703 | | 17.1 | % |

Prepaid | 57,471 | | 51,836 | | 5,635 | | 10.9 | % |

Net activations (losses) | 44,377 | | 672 | | 43,705 | | n.m. | |

Postpaid | 68,487 | | 35,782 | | 32,705 | | 91.4 | % |

Prepaid | (24,110 | ) | (35,110 | ) | 11,000 | | 31.3 | % |

Blended churn % (average per month) | 1.31 | % | 1.36 | % | | | 0.05 | pts |

Postpaid | 1.13 | % | 1.17 | % | | | 0.04 | pts |

Prepaid | 3.40 | % | 3.29 | % | | | (0.11 | ) pts |

Subscribers(2) | 9,195,048 | | 8,946,476 | | 248,572 | | 2.8 | % |

Postpaid(2) | 8,471,021 | | 8,144,936 | | 326,085 | | 4.0 | % |

Prepaid | 724,027 | | 801,540 | | (77,513 | ) | (9.7 | %) |

| n.m.: not meaningful |

| (1) | Our Q1 2018 blended ARPU and ABPU were adjusted to exclude the unfavourable retroactive impact of the recent CRTC decision on wholesale wireless domestic roaming rates of $14 million. |

| (2) | At the beginning of Q1 2018, we adjusted our postpaid wireless subscriber base to remove 16,116 subscribers with a corresponding increase to our high-speed Internet subscribers to reflect the transfer of fixed wireless Internet subscribers. |

Blended ARPU, excluding the unfavourable retroactive impact of the recent CRTC decision on wholesale wireless domestic roaming rates, of $54.28 in Q1 2018, remained essentially flat compared to the same period in 2017. This was driven by a higher proportion of postpaid customers in our total subscriber base, the flow-through of 2017 pricing changes and increased demand for larger data plans due to greater data consumption from e-mail, web browsing, social networking, mobile banking, messaging, mobile TV, and entertainment services such as video streaming, music downloads and gaming. Greater data consumption driven by the higher speeds enabled by the continued expansion of our LTE and LTE-A networks, also favourably impacted blended ARPU. This was offset by lower overage due to greater take rate of plans with higher data usage thresholds, lower ARPU from the long-term mobile services contract with Shared Services Canada and the dilutive impact on blended ARPU from the ramp up in our new low-cost prepaid mobile service, Lucky Mobile, as well as the unfavourable impact of the shift in handset mix to more premium devices which resulted in a greater allocation to product revenues.

Blended ABPUis a new KPI that we are introducing which approximates the average amount billed to customers on a monthly basis and is the same as blended ARPU prior to the adoption of IFRS 15. Blended ABPU, excluding the unfavourable retroactive impact of the recent CRTC decision on wholesale wireless domestic roaming rates, of $66.56 in Q1 2018, increased by 1.4% compared to the same period in 2017. The increase in blended ABPU was similarly impacted by the items affecting ARPU. However, since ABPU is based on average billing, it is not unfavorably impacted by the shift in handset mix to more premium devices which resulted in a greater allocation to product revenues.

BCE Inc. 2018 FIRST QUARTER SHAREHOLDER REPORT 13 |

|

| | | | |

3 | MD&A | Business segment analysis

Bell Wireless | |

Total gross wireless activations increased by 16.2% in the first quarter of 2018, compared to Q1 2017, due to both higher postpaid and prepaid gross activations.

- Postpaid gross activationsincreased by 17.1% in this quarter, reflecting our mobile network speed and technology leadership, effective sales execution across our retail channels, the on-boarding of customers from a long-term mobile services contract win with Shared Services Canada, and the contribution from the acquisition of MTS.

- Prepaid gross activationsincreased by 10.9% in Q1 2018, driven by the contribution from Lucky Mobile, our new low-cost prepaid mobile service, and Bell MTS

Blended wireless churnof 1.31% improved by 0.05 pts in Q1 2018, compared to the same period in 2017, due to lower postpaid churn, partially offset by higher prepaid churn.

- Postpaid churnof 1.13% improved by 0.04 pts this quarter, driven by greater business customer deactivations in Q1 2017 and the favourable impact of our ongoing investment in network speeds and customer retention

- Prepaid churnof 3.40% increased by 0.11 pts in Q1 2018, due to relatively stable deactivations over a declining subscriber base

Postpaid net activationsincreased by 91.4% in the first quarter of 2018, compared to Q1 2017, due to an increase in gross activations, partially offset by an increase in customer deactivations and lower migrations from prepaid services.

Prepaid net customer lossesimproved by 31.3% in Q1 2018, compared to the same period last year, due to an increase in gross activations and lower migrations to postpaid services.

Wireless subscribersat March 31, 2018 totaled 9,195,048, up 2.8% from 8,946,476 subscribers reported at the end of Q1 2017. At the beginning of Q1 2018, we adjusted our postpaid wireless subscriber base to remove 16,116 subscribers with a corresponding increase to our high-speed Internet subscribers to reflect the transfer of fixed wireless Internet subscribers. The proportion of Bell Wireless customers subscribing to postpaid services increased to 92% in Q1 2018 from 91% in Q1 2017.

As at the date of this MD&A, our forward-looking statements set out in the BCE 2017 Annual MD&A, as updated or supplemented in this MD&A, are based on certain assumptions including, without limitation, the following assumptions and the assumptions referred to in each of the other business segment discussions set out in this section 3,Business segment analysis, as well as the economic and market assumptions referred to in section 1.3,Assumptions, of this MD&A.

- Maintain our market share of incumbent wireless postpaid net additions

- Continued adoption of smartphone devices, tablets and data applications, as well as the introduction of more Fourth Generation (4G) LTE and LTE-A devices and new data services

- Higher product cost of goods sold, driven by a higher sales mix of premium devices, increased new customer activations and more customer device upgrades attributable to a higher number of off-contract subscribers due to earlier expiries under two-year contracts

- Wireless revenue growth driven by postpaid subscriber base expansion and a higher volume of handset sales

- Expansion of the LTE-A network coverage to approximately 92% of the Canadian population

- Ability to monetize increasing data usage and customer subscriptions to new data services

- Ongoing technological improvements by handset manufacturers and from faster data network speeds that allow customers to optimize the use of our services

- No material financial, operational or competitive consequences of changes in regulations affecting our wireless business

| 14 BCE Inc. 2018 FIRST QUARTER SHAREHOLDER REPORT |

|

| | | | |

| | 3 | MD&A | Business segment analysis

Bell Wireline |

KEY BUSINESS DEVELOPMENTS

ALL-FIBRE NETWORK LAUNCHED IN THE CITY OF TORONTO

On April 5, 2018, Bell announced that its all-fibre optic broadband network is on in Toronto, enabling fast Internet speeds, advanced TV and business connectivity to a majority of homes and business locations. The $1.5 billion Toronto fibre project is part of Bell’s reinvention of its network footprint with next-generation broadband fibre connections. Bell fibre-to-the-premise (FTTP) service now delivers Internet access speeds of up to 1 Gb per second (Gpbs) with symmetrical upload and download speeds. Fully symmetrical speeds are available at all FTTP Internet speed tiers including up to a Gb, where top upload speed is currently 940 megabits per second (Mbps). Uploads are expected to increase to a full Gb next year when commercial modem technology catches up to fibre network capabilities in 2019. Speeds are expected to increase ultimately to 40 Gbps and beyond in the future. Bell began the Toronto project in 2015, working closely with the city of Toronto and Toronto Hydro and employing innovative installation techniques and new heavy equipment to roll out the network as efficiently and quickly as possible. The build consists of more than 10,000 kilometres of new fibre installed to date on approximately 90,000 Bell and Toronto Hydro poles and underground via more than 10,000 manhole access points, as well as technology enhancements to 27 Bell central offices throughout the city.

BELL BROADBAND INNOVATION IN RESIDENTIAL INTERNET AND TV

In January 2018, we introduced an exclusive Whole Home Wi-Fi service that combines wireless fidelity (Wi-Fi) access points, called Plume pods, with the cloud-based networking intelligence of Bell’s Home Hub 3000 modem to learn how households use the Internet and ensure all devices receive the strongest signal and fastest speeds possible. Initially available to qualifying customers in Ontario and Québec, Whole Home Wi-Fi also offers mobile remote management including parental control over every Wi-Fi connected device.

In the first quarter of 2018, we also announced the extension of our partnership with Ericsson to deliver the next generation Fibe TV experience. The multiyear agreement will leverage Ericsson’s next generation, cloud-based MediaFirst platform to enable an even more personalized and converged multiscreen TV experience for Fibe TV customers.

ALT TV AVAILABLE ON AMAZON FIRE TV STICK

Bell became the first Canadian TV provider to offer an app on Amazon’s streaming media player. Alt TV customers can now access over 500 live and on demand channels on their big screens with the Amazon Fire TV Stick. The innovative Alt TV service requires no traditional subscription, installation or set-top box to watch TV on smartphones, laptops, tablets or traditional TV. Bell Fibe TV and satellite TV customers can also access their content on the Fibe TV app via the Fire TV Stick, which simply plugs into a TV’s high-definition multimedia interface port.

ENHANCED CLOUD SERVICES FOR BUSINESS

Bell now offers access to Amazon Web Services as part of our leading lineup of cloud solutions for Canadian businesses. Bell Cloud Connect provides flexible cloud computing and storage solutions from Bell and partners like Microsoft, IBM, and now Amazon over Bell’s broadband networks, offering unrivalled reliability, faster speeds and enhanced security with private end-to-end connections. With 28 data centres across the country, Bell is Canada’s largest provider of secure and reliable hosting and storage services that support the digital transformation of business.

| FINANCIAL PERFORMANCE ANALYSIS |

Q1 2018 PERFORMANCE HIGHLIGHTS

BCE Inc. 2018 FIRST QUARTER SHAREHOLDER REPORT 15 |

|

| | | | |

3 | MD&A | Business segment analysis

Bell Wireline | |

| (1) | At the beginning of Q1 2018, our high-speed Internet subscriber base was increased by 19,835, our IPTV by 14,599 and our residential NAS by 23,441, mainly as a result of a small acquisition made in the quarter. |

| (2) | At the beginning of Q1 2018, we adjusted our high-speed Internet subscriber base to add 16,116 subscribers with a corresponding decrease to our postpaid wireless subscribers to reflect the transfer of fixed wireless Internet subscribers. |

BELL WIRELINE RESULTS

REVENUES

| Q1 2018 | | Q1 2017 | | $ CHANGE | | % CHANGE | |

Data | 1,820 | | 1,719 | | 101 | | 5.9 | % |

Voice | 950 | | 981 | | (31 | ) | (3.2 | %) |

Other services | 63 | | 44 | | 19 | | 43.2 | % |

Total external service revenues | 2,833 | | 2,744 | | 89 | | 3.2 | % |

Inter-segment service revenues | 59 | | 49 | | 10 | | 20.4 | % |

Total operating service revenues | 2,892 | | 2,793 | | 99 | | 3.5 | % |

Data | 104 | | 99 | | 5 | | 5.1 | % |

Equipment and other | 88 | | 85 | | 3 | | 3.5 | % |

Total external product revenues | 192 | | 184 | | 8 | | 4.3 | % |

Inter-segment product revenues | – | | – | | – | | – | |

Total operating product revenues | 192 | | 184 | | 8 | | 4.3 | % |

Total Bell Wireline revenues | 3,084 | | 2,977 | | 107 | | 3.6 | % |

Bell Wireline operating revenuesincreased by 3.6% in Q1 2018, compared to Q1 2017, as a result of growth in data, other services and product revenues, moderated by the continued decline in voice revenue.

Bell Wireline operating service revenuesincreased by 3.5% in the first quarter of 2018, compared to the same period last year, due to the acquisition of MTS and AlarmForce, growth in Internet and IPTV subscribers, higher household ARPU and greater IP-based services revenue. This was offset in part by continued erosion in our voice, satellite TV and legacy data services, along with increased residential customer acquisition, retention and bundle discounts to match aggressive offers from cable competitors.

- Data revenuesincreased by 5.9% in Q1 2018, compared to Q1 2017, attributable to the contribution from the acquisition of MTS, growth in Internet and IPTV subscribers together with rate increases, as well as higher IP-based services revenue. This was moderated by increased acquisition, retention and bundle discounts on residential services as a result of aggressive offers from cable competitors, the ongoing decline in our satellite TV subscriber base, as well as continued legacy data erosion due in part to migrations to IP-based services and competitive pricing pressures within our business and wholesale markets.

- Voice revenuesdecreased by 3.2% in Q1 2018, compared to the same period last year, driven by ongoing NAS line erosion from technological substitution to wireless and Internet-based services, large business customer conversions to IP-based data services, as well as competitive pricing pressures, which unfavourably impacted local and access and long distance revenues. Additionally, ongoing long distance rate pressures in our residential market from customer adoption of premium rate plans and fewer sales of international long distance minutes in our wholesale market, further pressured long distance revenues. This was offset in part by the contribution from the acquisition of MTS and rate increases.

- Other services revenuesincreased by 43.2% in Q1 2018, compared to the same period last year, due to the contribution from the acquisitions of AlarmForce and MTS

Bell Wireline product revenuesincreased by 4.3% in Q1 2018, compared to Q1 2017, due to the contribution from the acquisition of MTS and higher sales of telecommunication equipment mainly due to greater demand from the government sector, offset in part by lower sales of consumer electronics at The Source.

| 16 BCE Inc. 2018 FIRST QUARTER SHAREHOLDER REPORT |

|

| | | | |

| | 3 | MD&A | Business segment analysis

Bell Wireline |

OPERATING COSTS AND ADJUSTED EBITDA

| Q1 2018 | | Q1 2017 | | $ CHANGE | | % CHANGE | |

Operating costs | (1,782 | ) | (1,714 | ) | (68 | ) | (4.0 | %) |

Adjusted EBITDA | 1,302 | | 1,263 | | 39 | | 3.1 | % |

Adjusted EBITDA margin | 42.2 | % | 42.4 | % | | | (0.2 | ) pts |

Bell Wireline operating costsgrew by 4.0% in Q1 2018, compared to the same period last year, driven by:

- Higher expenses from the acquisitions of MTS and AlarmForce

- Greater pension expense due to a gain in Q1 2017 on post-employment benefit expense related to an alignment of certain Bell Aliant DB pension plans with those of Bell Canada

- Increased programming and content costs in our TV business from contractual rate increases

- Higher advertising expense in our residential market due to the PyeongChang 2018 Winter Olympics

These factors were partially offset by:

- Decreased labour costs resulting from workforce reductions, savings from lower call volumes and improved call handle times, as well as vendor contract savings

- Lower payments to other carriers driven by reduced sales of international long distance minutes

Bell Wireline adjusted EBITDAincreased by 3.1% in Q1 2018, compared to Q1 2017, whereas adjusted EBITDA margin decreased to 42.2% in Q1 2018 compared to 42.4% in Q1 2017. The year-over-year increase in adjusted EBITDA was attributable to:

- The contribution from the acquisition of MTS

- Continued growth in Internet and IPTV revenues in a highly competitive environment

- Effective cost containment

These factors were partially offset by:

- The ongoing erosion of voice, satellite TV and legacy data revenues, including continued but diminishing pressures in our business market

- Higher pension expense as a result of a gain in Q1 2017 relating to post-employment benefit expense due to an alignment of certain Bell Aliant DB pension plans with those of Bell Canada

BELL WIRELINE OPERATING METRICS

DATA

High-speed Internet

| Q1 2018 | | Q1 2017 | | CHANGE | | % CHANGE | |

High-speed Internet net activations | 19,647 | | 14,989 | | 4,658 | | 31.1 | % |

High-speed Internet subscribers(1)(2) | 3,845,739 | | 3,717,270 | | 128,469 | | 3.5 | % |

| (1) | At the beginning of Q1 2018, our high-speed Internet subscriber base was increased by 19,835, mainly as a result of a small acquisition made in the quarter. |

| (2) | At the beginning of Q1 2018, we adjusted our high-speed Internet subscriber base to add 16,116 subscribers with a corresponding decrease to our postpaid wireless subscribers to reflect the transfer of fixed wireless Internet subscribers. |

High-speed Internet subscriber net activationsgrew by 31.1% in Q1 2018, compared to Q1 2017, driven by lower deactivations reflecting the benefit of our fibre-to-the-home (FTTH) footprint expansion, higher net activations from Home Internet service by Virgin Mobile Canada, greater retail gross activations in our FTTH footprint, pull-through from Alt TV and the contribution from the acquisition of MTS. The growth was partly offset by aggressive offers from cable competitors in both our retail and wholesale markets.

High-speed Internet subscribersat March 31, 2018 totaled 3,845,739 up 3.5% from the end of Q1 of last year. At the beginning of Q1 2018, our high-speed Internet subscriber base was increased by 19,835, mainly as a result of a small acquisition made in the quarter. We further adjusted our subscriber base to add 16,116 subscribers with a corresponding decrease to our postpaid wireless subscribers to reflect the transfer of fixed wireless Internet subscribers.

TV

| Q1 2018 | | Q1 2017 | | CHANGE | | % CHANGE | |

Net subscriber (losses) activations | (12,481 | ) | (15,663 | ) | 3,182 | | 20.3 | % |

IPTV | 13,573 | | 22,402 | | (8,829 | ) | (39.4 | %) |

Total subscribers(1) | 2,834,418 | | 2,837,353 | | (2,935 | ) | (0.1 | %) |

IPTV(1) | 1,578,489 | | 1,465,007 | | 113,482 | | 7.7 | % |

| (1) | At the beginning of Q1 2018, our IPTV subscriber base was increased by 14,599 as a result of a small acquisition made in the quarter. |

IPTV net subscriber activationsdecreased by 39.4% in Q1 2018, compared to Q1 2017, attributable to increased deactivations resulting from aggressive residential offers for service bundles from cable competitors, particularly in our non-FTTH footprint, a greater number of retail customers coming off promotional offers, greater substitution of traditional TV services with OTT services, lower customer migrations from satellite TV, the impact of maturing Fibe TV markets, as well as lower footprint expansion in 2018. This was mitigated in part by higher activations from the launch of Fibe Alt TV on May 15, 2017, our application-based live TV streaming service.

Satellite TV net subscriber lossesimproved by 31.6% in Q1 2018, compared to prior year, driven by fewer residential deactivations and migrations reflecting a more mature subscriber base geographically better-suited for satellite TV service, and a lower number of customers coming off promotional offers, partly offset by aggressive residential promotional offers from cable competitors, primarily in our non-FTTH footprint.

BCE Inc. 2018 FIRST QUARTER SHAREHOLDER REPORT 17 |

|

| | | | |

3 | MD&A | Business segment analysis

Bell Wireline | |

Total TV net subscriber losses(IPTV and satellite TV combined) improved by 3,182 in Q1 2018, compared to Q1 2017, resulting from fewer satellite TV net losses, offset in part by lower IPTV net activations.

IPTV subscribersat March 31, 2018 totaled 1,578,489, up 7.7% from 1,465,007 subscribers reported at the end of Q1 2017. At the beginning of Q1 2018, our IPTV subscriber base was increased by 14,599, as a result of a small acquisition made in the quarter.

Satellite TV subscribersat March 31, 2018 totaled 1,255,929, down 8.5% from 1,372,346 subscribers at the end of Q1 2017.

Total TV subscribers(IPTV and satellite TV combined) at March 31, 2018 were 2,834,418, representing a modest decline of 0.1% since Q1 2017. At the beginning of Q1 2018, our total TV subscriber base was increased by 14,599, as a result of a small acquisition made in the quarter.

Voice

| Q1 2018 | | Q1 2017 | | CHANGE | | % CHANGE | |

Residential NAS lines(1) | 3,197,216 | | 3,399,981 | | (202,765 | ) | (6.0 | %) |

Residential NAS net losses | (57,533 | ) | (73,421 | ) | 15,888 | | 21.6 | % |

| (1) | At the beginning of Q1 2018, our residential NAS subscriber base was increased by 23,441 as a result of a small acquisition made in the quarter. |

Residential NAS net lossesimproved by 21.6% in Q1 2018, compared to Q1 2017, resulting from fewer customer deactivations reflecting a reduced number of retail customers coming off of promotional offers and greater pull-through from our IPTV service bundle offers. This was offset in part by aggressive competitive offers from cable TV providers, continued wireless and Internet-based technology substitution and the inclusion of Bell MTS net losses.

Residential NAS subscribersat March 31, 2018 totaled 3,197,216, down 6.0% from 3,399,981 subscribers reported at the end of Q1 2017. This represents a significant increase in the NAS erosion rate compared to the 1.9% erosion experienced in the first quarter of 2017, mainly attributable to the year-over-year increase in subscribers in Q1 2017 from the acquisition of MTS. At the beginning of Q1 2018, our residential NAS subscriber base was increased by 23,441, as a result of a small acquisition made in the quarter.

As at the date of this MD&A, our forward-looking statements set out in the BCE 2017 Annual MD&A, as updated or supplemented in this MD&A, are based on certain assumptions including, without limitation, the following assumptions and the assumptions referred to in each of the other business segment discussions set out in this section 3,Business segment analysis, as well as the economic and market assumptions referred to in section 1.3,Assumptions, of this MD&A.

- Positive full-year adjusted EBITDA growth

- Continued growth in residential IPTV and Internet subscribers

- Increasing wireless and Internet-based technological substitution

- Residential services household ARPU growth from increased penetration of multi-product households and price increases

- Aggressive residential service bundle offers from cable TV competitors in our local wireline areas

- Continued large business customer migration to IP-based systems

- Ongoing competitive repricing pressures in our business and wholesale markets

- Continued competitive intensity in our small and mid-sized business markets as cable operators and other telecom competitors continue to intensify their focus on business customers

- Traditional high-margin product categories challenged by large global cloud and OTT providers of business voice and data solutions expanding into Canada with on-demand services

- Ongoing deployment of direct fibre and growing consumption of OTT TV services and on-demand streaming video, as well as the proliferation of devices, such as tablets, that consume vast quantities of bandwidth, will require considerable ongoing capital investment

- Accelerating customer adoption of OTT services resulting in downsizing of TV packages

- Realization of cost savings related to management workforce attrition and retirements, lower contracted rates from our suppliers, reduction of traffic that is not on our network and operating synergies from the integration of MTS

- No material financial, operational or competitive consequences of changes in regulations affecting our wireline business

| 18 BCE Inc. 2018 FIRST QUARTER SHAREHOLDER REPORT |

|

| | | | |

| | 3 | MD&A | Business segment analysis

Bell Media |

KEY BUSINESS DEVELOPMENTS

BELL MEDIA SUPPORTS FAIRPLAY CANADA PROPOSAL TO ADDRESS CONTENT THEFT

On January 29, 2018, FairPlay Canada, a coalition of more than 25 companies and organizations representing Canadian artists, content creators, unions, guilds, producers, performers, broadcasters, distributors, and exhibitors, filed an application asking the CRTC to take action to address the theft of digital content by illegal piracy websites. Currently in Canada there is an absence of effective legal recourses to combat online content theft. Under the FairPlay Canada proposal, the CRTC would establish an Independent Piracy Review Agency (IPRA) to consider applications identifying piracy sites, hear evidence from all sides, conduct a hearing if necessary, and make recommendations to the CRTC on which sites should be addressed. If the CRTC followed the IPRA’s recommendation, all Internet service providers would then be required to disable access to the identified sites, making it more difficult for them to reach Canadians. Bell Media is a member of FairPlay Canada and proud to support its efforts to modernize the tools that are available to protect all stakeholders in Canada’s creative industries.

BELL MEDIA RECOGNIZED FOR EXCELLENCE IN PROGRAMMING

Bell Media and its production partners were honoured with 52 awards by the Academy of Canadian Cinema and Television at the recent annual Canadian Screen Awards, which recognizes excellence in Canadian film, TV and digital media productions. Showcasing its ongoing commitment to creating exceptional original Canadian content, Bell Media and its partners took home 33 TV and digital awards, with wins in major categories including Best National Newscast for the CTV National News with Lisa Laflamme, Best Live Entertainment Special, Best Talk Program or Series, Best Factual Series, and Best Reality/Competition Program or Series for The Amazing Race Canada. TSN garnered a total of seven awards, more than all other sports broadcasters combined, including Best Live Sports Event for the 2016 Major League Soccer Cup. Bell Media-supported films won 19 awards, including Best Motion Picture, Performance by an Actress in a Leading Role, Performance by an Actor in a Supporting Role and Achievement in Direction.

BELL MEDIA TO ACQUIRE MAJORITY INTEREST IN PINEWOOD TORONTO STUDIOS

On March 29, 2018, Bell Media entered into an agreement to acquire a majority stake in Pinewood Toronto Studios, in partnership with Comweb Studio Holdings, Castlepoint and the city of Toronto. Pinewood Toronto Studios is one of the largest purpose-built production studios in Canada and the preferred choice for domestic and international producers of film and TV content in Toronto.

EXCLUSIVE DEAL FOR WORLDWIDE DISTRIBUTION OF CTV’S THE LAUNCH